YSX Tech. Co., Ltd Investor Presentation Issuer Free Writing Prospectus dated October 23, 2024 Filed pursuant to Rule 433 of the Securities Act of 1933, as amended Relating to Preliminary Prospectus dated September 5, 2024 Registration No. 333 - 280312 October 2024

This presentation highlights basic information about us and the offering to which this communication relates . Because it is a summary, it does not contain all of the information that you should consider before investing in our common stock . This free writing prospectus relates to the proposed public offering of Class A ordinary shares (“Ordinary Shares”) of YSX Tech . Co . , Ltd (“we”, “us”, “our,” or the “Company”) and should be read together with a registration statement (including a prospectus, which currently is in preliminary form) (the “Registration Statement”) we filed with the Securities and Exchange Commission (the “SEC”) for the offering to which this presentation relates and may be accessed through the following web link : https : //www . sec . gov/Archives/edgar/data/ 1993463 / 000110465924097327 /tm 2330896 d 13 _f 1 a . htm The Registration Statement has not yet become effective . Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more complete information about us and the offering . You may get these documents for free by visiting EDGAR on the SEC website at http : //www . sec . gov . Alternatively, we or our underwriters will arrange to send you the prospectus if you contact Kingswood Capital Partners, LLC, by ttian@kingswoodus . com, or contact YSX Tech . Co . , Ltd via email : marketing@ysxnet . com . YSX Tech Co., Ltd | Page 2 Free Writing Prospectus Statement

This presentation contains market and industry data related statements that reflect the Company’s intent, beliefs or current expectations about the future . These statements can be recognized by the use of words such as “expects,” “plans,” “will,” “estimates,” “projects,” “intends,” or words of similar meaning . These forward - looking statements are not guarantees of future performance and are based on a number of assumptions about the Company’s operations and other factors, many of which are beyond the Company’s control, and accordingly, actual results may differ materially from these forward - looking statements . Caution should be taken with respect to such statements and you should not place undue reliance on any such forward - looking statements . The Company or any of its affiliates, advisers or representatives or the underwriters has no obligation and does not undertake to revise forward - looking statements to reflect newly available information, future events or circumstances . By their nature, forward - looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and regulatory developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated . Although we believe that we have a reasonable basis for each forward - looking statement contained in this presentation, we caution you that forward - looking statements are not guarantees of future performance and that our actual results of operation, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward - looking statements contained in this presentation as a result of, among other factors, the factors referenced in the “Risk Factors” section of the prospectus contained in the registration statement on Form F - 1 (File No . 333 - 280312 ) initially filed with the Securities and Exchange Commission (the “SEC”) on June 18 , 2024 as amended thereafter, for our proposed initial public offering (the “Registration Statement”) . In addition, even if our results of operations, financial conditions and liquidity, and the development of the industries in which we operate are consistent with the forward - looking statements contained in this presentation, they may not be predictive of results or developments in future periods . Any forward - looking statement that we make in this presentation speaks only as of the date of such statement, and we undertake no obligation to update or revise publicly any of the forward - looking statements after the date hereof to conform the statements to actual results or changed expectations except as required by applicable law . This investor presentation provides basic information about the Company and the offering . Because it is only a summary, this document does not cover all the information that should be considered before investing . You should read carefully the factors described in the “Risk Factors” section of the prospectus contained in the Registration Statement to better understand the risks and uncertainties inherent in our businesses and any forward - looking statements . YSX Tech Co., Ltd | Page 3 Forward - looking Statement None of the Company, any of its affiliates, advisers or representatives, nor the underwriters have any obligation, nor do any of them undertake to revise any forward - looking statements to reflect newly available information, future events or circumstances.

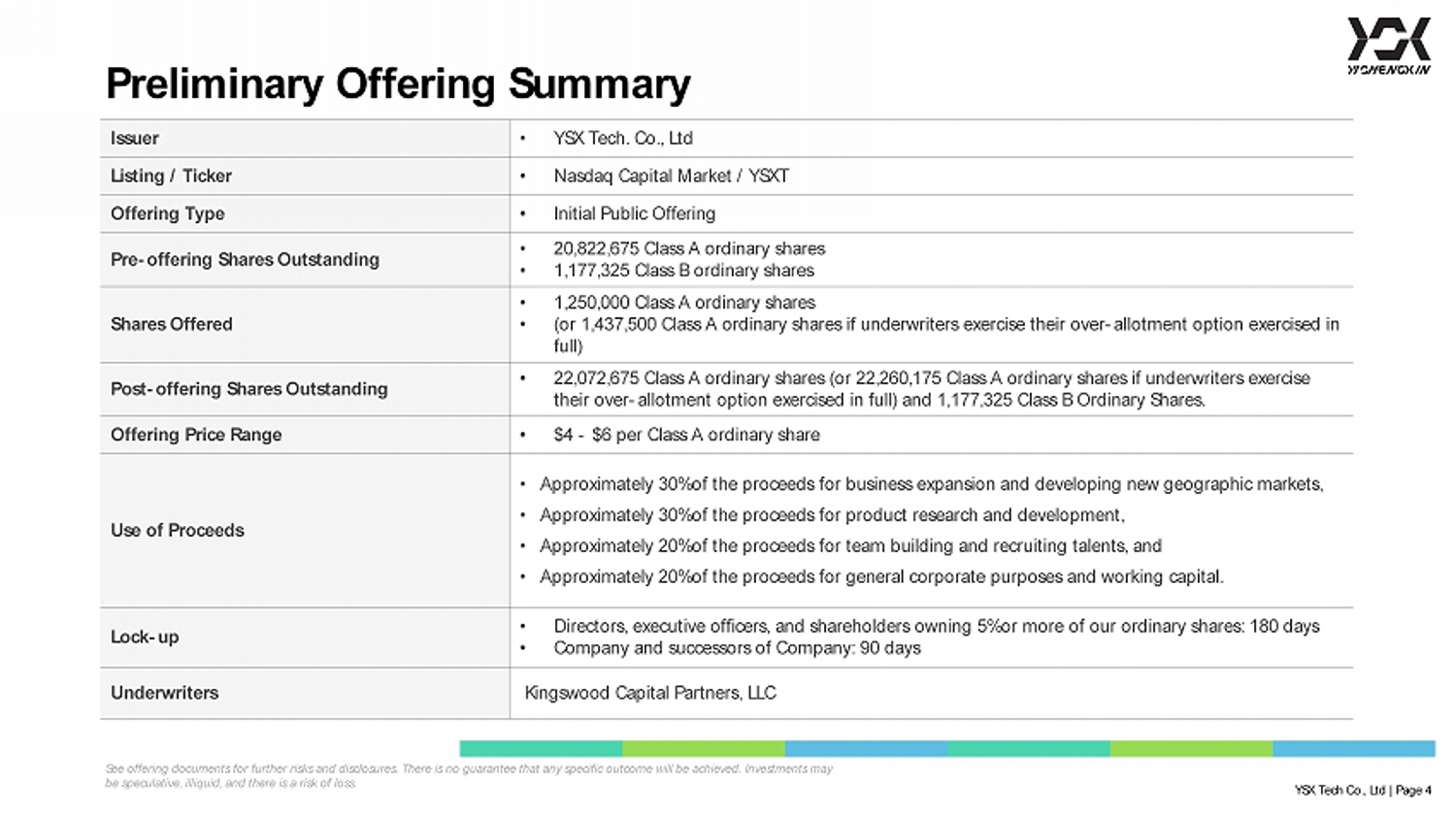

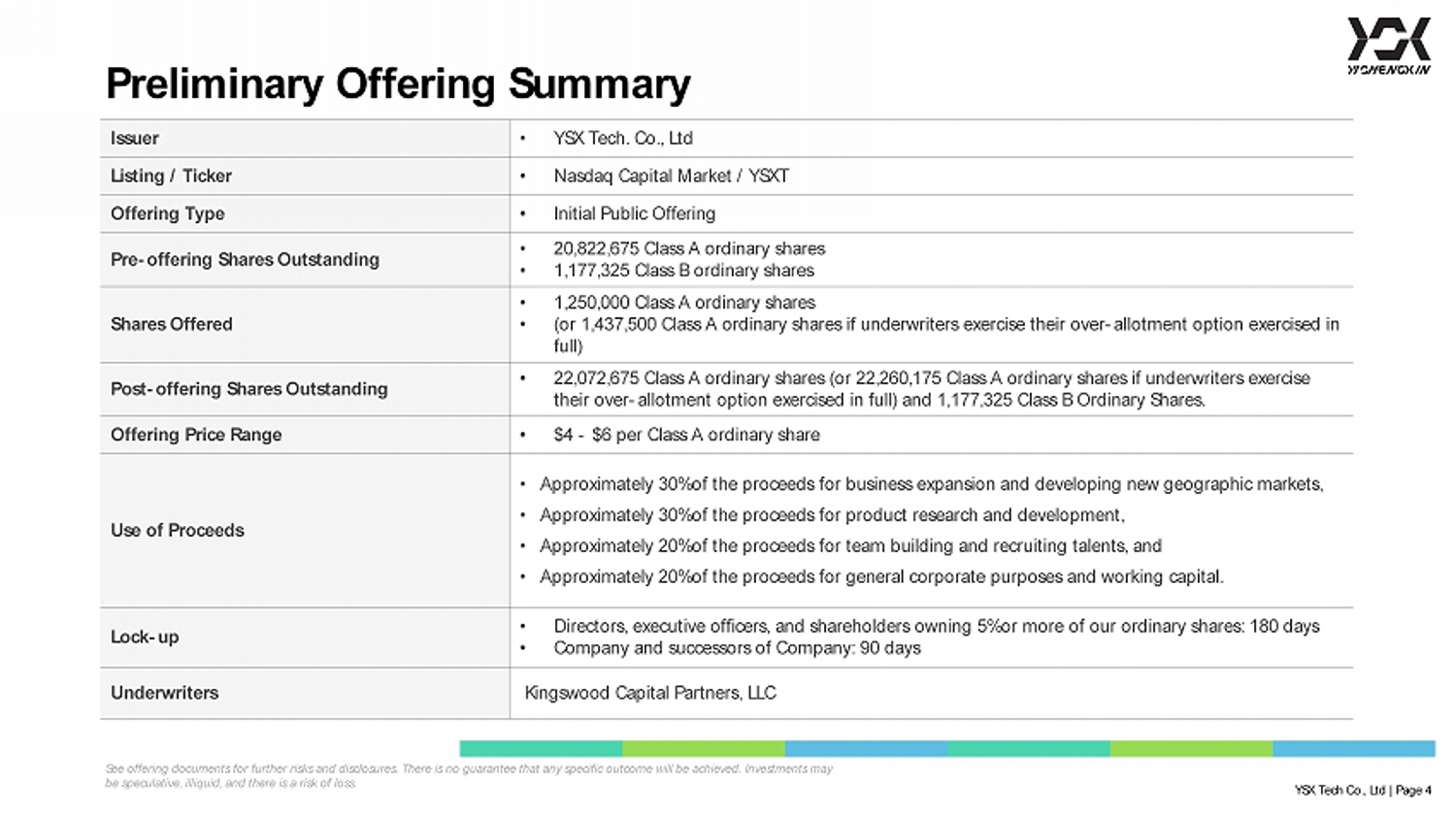

YSX Tech Co., Ltd | Page 4 Preliminary Offering Summary • YSX Tech. Co., Ltd Issuer • Nasdaq Capital Market / YSXT Listing / Ticker • Initial Public Offering Offering Type • 20,822,675 Class A ordinary shares • 1,177,325 Class B ordinary shares Pre - offering Shares Outstanding • 1,250,000 Class A ordinary shares • (or 1,437,500 Class A ordinary shares if underwriters exercise their over - allotment option exercised in full) Shares Offered • 22,072,675 Class A ordinary shares (or 22,260,175 Class A ordinary shares if underwriters exercise their over - allotment option exercised in full) and 1,177,325 Class B Ordinary Shares. Post - offering Shares Outstanding • $4 - $6 per Class A ordinary share Offering Price Range • Approximately 30% of the proceeds for business expansion and developing new geographic markets, • Approximately 30% of the proceeds for product research and development, • Approximately 20% of the proceeds for team building and recruiting talents, and • Approximately 20% of the proceeds for general corporate purposes and working capital. Use of Proceeds • Directors, executive officers, and shareholders owning 5% or more of our ordinary shares : 180 days • Company and successors of Company: 90 days Lock - up Kingswood Capital Partners, LLC Underwriters See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Table of contents Company Overview 01 Industry Overview 02 Company Highlights 03 Growth Strategies 04 Financials 05 YSX Tech Co., Ltd | Page 5 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Company Overview YSX Tech Co., Ltd | Page 6 YSX Tech See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

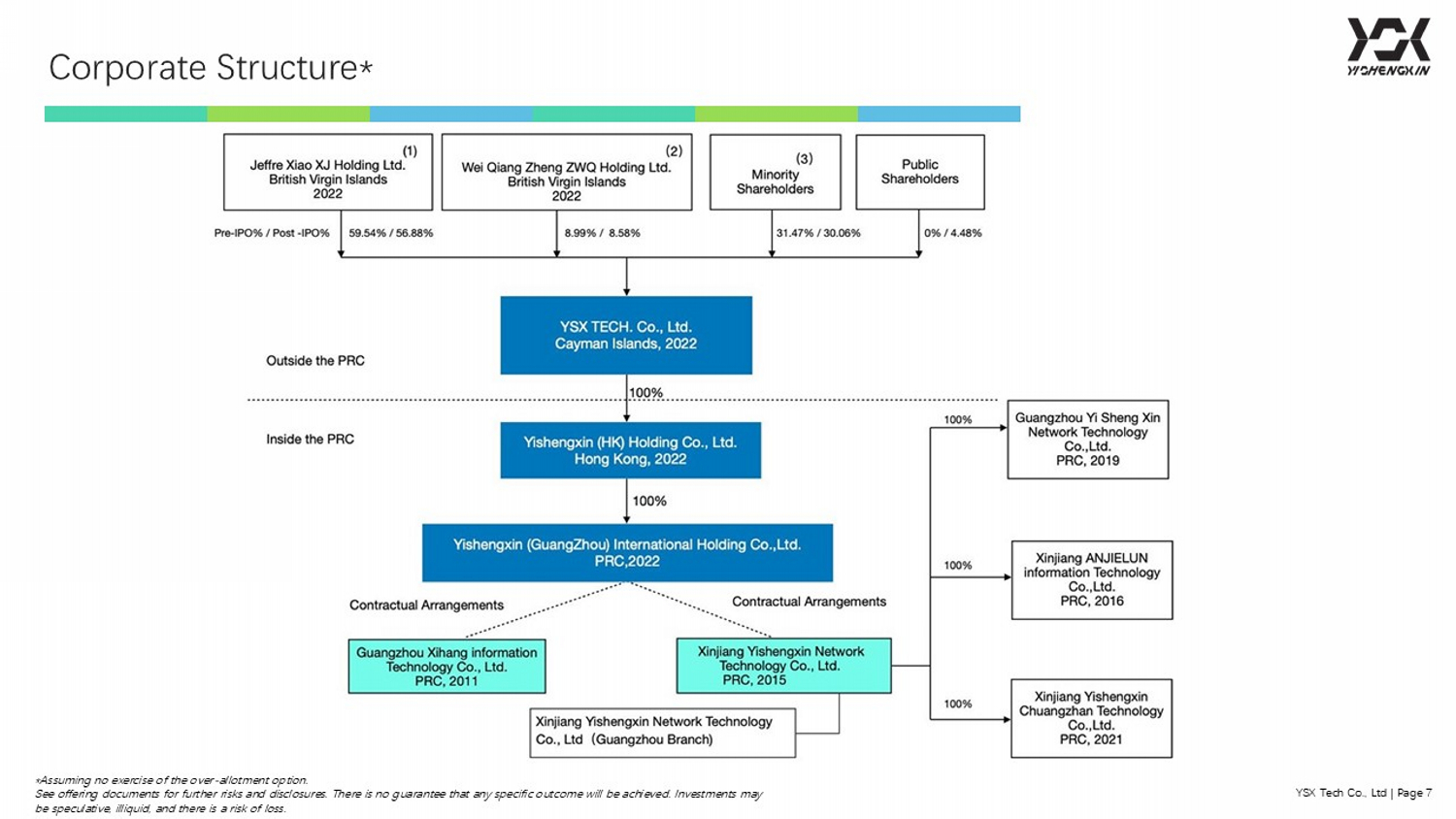

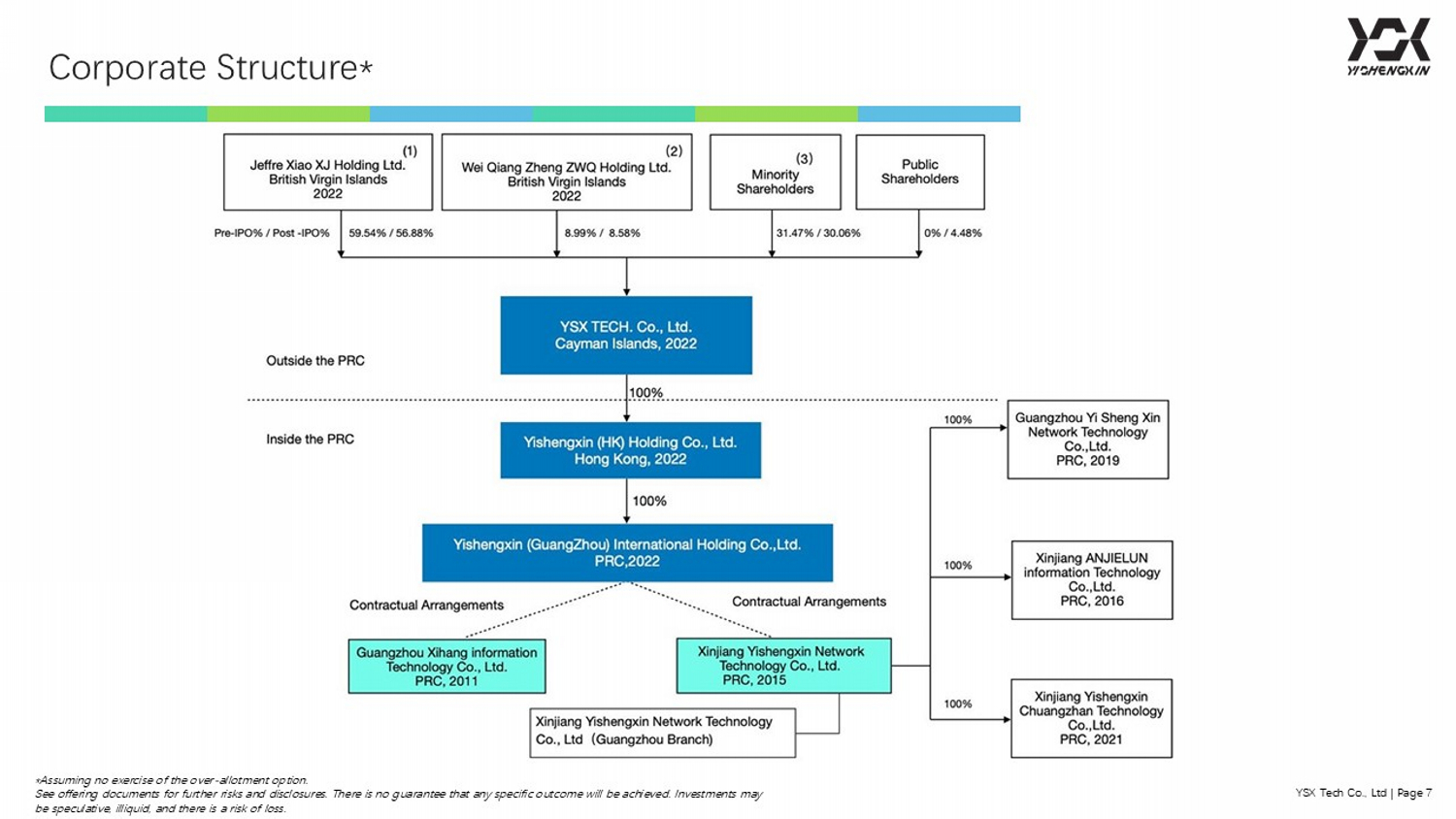

Corporate Structure* YSX Tech Co., Ltd | Page 7 *Assuming no exercise of the over - allotment option. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

In the fiscal year ended March 31, 2024, we served 49 enterprise customers, among which 25 were insurance companies or brokerages. Some of which are well - known established companies in China, such as PICC Property and Casualty Company Limited (“PICC”), China Ping An Property Insurance Co., Ltd (“Ping An”), China Pacific Insurance (Group) Co Ltd (“CPIC”), and China United Insurance Group Company Ltd (“CUIG”). Our operations primarily cover Xinjiang and Guangdong provinces, where most of our customers are located. Comprehensive Business Solutions for Insurance Companies and Brokerages • We offer comprehensive, scenario - based business solutions to enterprise customers in China, primarily insurance companies and brokerages. • We have extensive knowledge of the Chinese insurance industry and specialize in auto insurance aftermarket value - added services, software development, and customized services. Company Overview Industry Overview Company Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 8 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss. All marks are trademarks or registered trademarks of their respective owners. The display of trademarks herein does not imply th at a license of any kind has been granted.

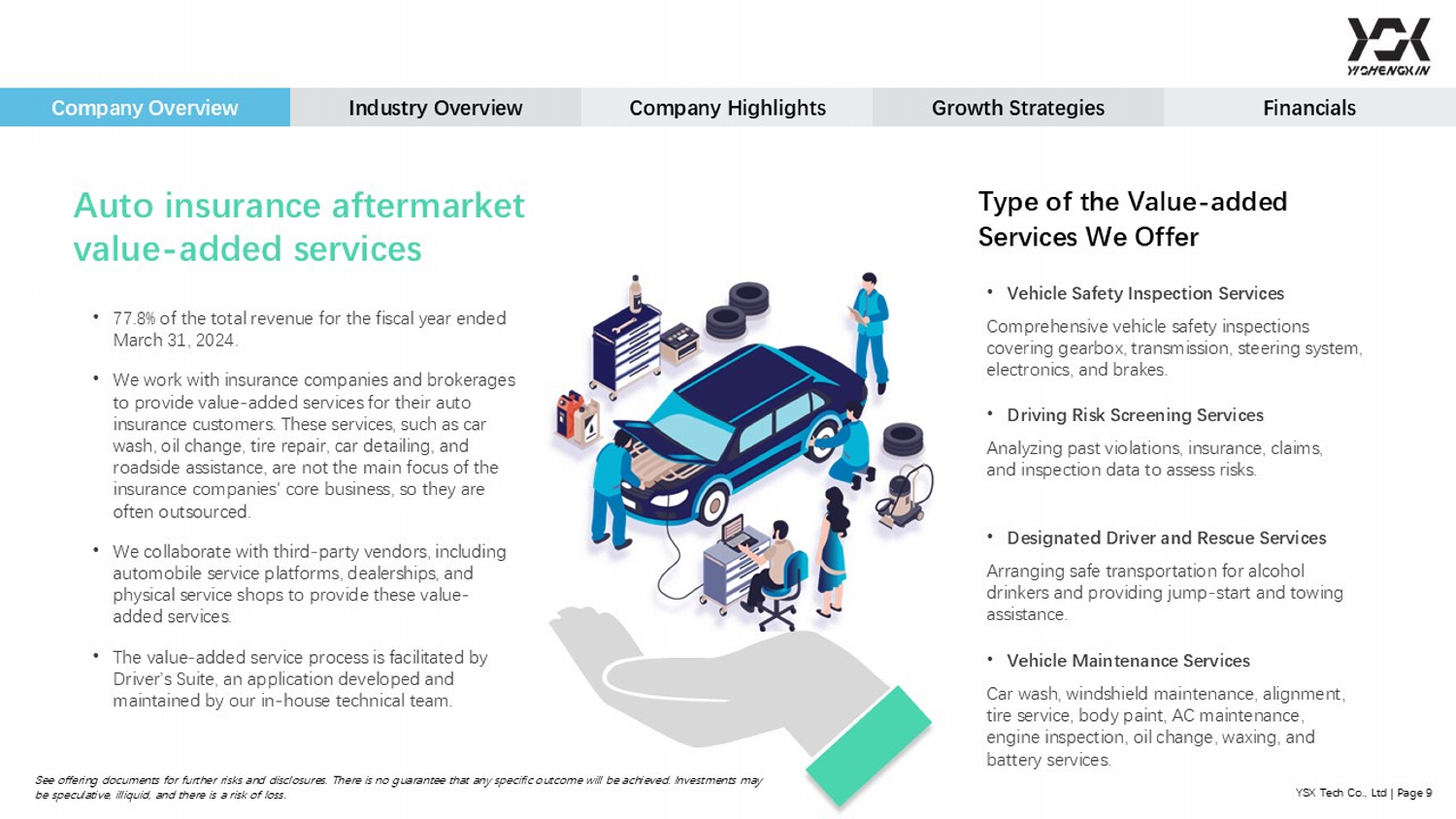

Auto insurance aftermarket value - added services • 77.8% of the total revenue for the fiscal year ended March 31, 2024. • We work with insurance companies and brokerages to provide value - added services for their auto insurance customers. These services, such as car wash, oil change, tire repair, car detailing, and roadside assistance, are not the main focus of the insurance companies' core business, so they are often outsourced. • We collaborate with third - party vendors, including automobile service platforms, dealerships, and physical service shops to provide these value - added services. • The value - added service process is facilitated by Driver’s Suite, an application developed and maintained by our in - house technical team. Arranging safe transportation for alcohol drinkers and providing jump - start and towing assistance. • Designated Driver and Rescue Services Analyzing past violations, insurance, claims, and inspection data to assess risks. • Driving Risk Screening Services Comprehensive vehicle safety inspections covering gearbox, transmission, steering system, electronics, and brakes. • Vehicle Safety Inspection Services Company Overview Industry Overview Company Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 9 Type of the Value - added Services We Offer Car wash, windshield maintenance, alignment, tire service, body paint, AC maintenance, engine inspection, oil change, waxing, and battery services. • Vehicle Maintenance Services See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Software Development and Information Technology Services Other Scenario - based Customized Services We are a service provider with strong technical capabilities. Current and past customers often contact us when they have needs for software development and information technology services, such as application development, system upgrade and maintenance. 2.1% of the total revenue for the fiscal year ended March 31, 2024. Services include customer development, product introduction, sales strategy, and organizing sales campaigns. We offer services on a case - by - case basis and may outsource certain project tasks. 20.1% of the total revenue for the fiscal year ended March 31, 2024. Company Overview Industry Overview Company Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 10 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Industry Overview YSX Tech Co., Ltd | Page 11 YSX Tech See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Compulsory motor vehicle liability insurance Commercial insurance Company Overview Industry Overview Company Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 12 Auto Insurance The Largest category of property insurance by total premium in China in 2023 821 867 790 800 810 820 830 840 850 860 870 880 2022 2023 RMB Billion Auto Insurance Premium in China +5.6% Source: China Banking and Insurance Regulatory Commission Chinese auto insurance premium has been growing steadily for the last 20 years, and was the largest category of property insurance by premium in China, that reached RMB867 billion (approximately US $12.06 billion), an increase of 5.6% compared to 2022, and accounted for 54.66% of the total premiums of property insurance in 2022. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Auto Insurance aftermarket Value - Added Services China’s Automobile Insurance Market Chinese Insurance Industry China's auto insurance after - sales service market has significant potential due to its large car ownership. Auto insurance in China includes compulsory liability insurance and commercial insurance. China's auto insurance premium income is projected to exceed $132.3 billion in 2028. In 2022, the Chinese insurance market saw a 4.6% growth, reaching approximately $710.9 billion in total premium income. Regulatory changes have encouraged insurance companies to offer aftermarket value - added services to differentiate themselves. Auto insurance has been steadily growing for the past 20 years and accounted for 54.66% of the total property insurance premiums in 2023, amounting to $12.06 billion. China's property insurance premium surpassed Japan's in 2010 and reached three times of that of Japan in 2022. China's insurance market is expected to reach $1.669 trillion by 2033. These services provide additional benefits to customers without the need to file claims. Insurance companies often rely on third - party service providers to deliver these services. The rise of new energy vehicles has contributed to this growth, with new energy vehicle insurance premiums being 21% higher than traditional fuel vehicles. Company Overview Industry Overview Company Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 13 Source: 2022 Allianz Global Insurance Development Report; China Banking and Insurance Regulatory Commission See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Company Highlights YSX Tech Co., Ltd | Page 14 YSX Tech See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

02 Strong Technical Capabilities • Having successfully developed and implemented insurance sales and order management applications, we position ourselves as enterprise service providers with strong technical capabilities. • Our in - house technical team has 8 full - time employees and is led by Ms. Ruomei Wu. • Each of our technical team members holds a college degree or above, and has extensive experience in technology and system development, as well as in - depth knowledge of the insurance industry. 01 In - depth Cooperation with Insurance Companies and Brokerage Customers • We have in - depth knowledge of the insurance industry accumulated through years of working with insurance companies and brokerages. • We have established long - term strategic relationships with many insurance companies and brokerage customers, which further help us understand the customers’ business needs and provide service solutions that are designed to meet customers’ expectations. Company Overview Industry Overview Company Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 15 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

YSX Tech 01 We have 6 issued patents and 3 pending patent applications in China. Patents 02 We have 41 registered trademarks and 5 pending trademark applications in China. Trademarks 03 We have the legal right to use 90 registered software copyrights in China. Software Copyrights Company Overview Industry Overview Company Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 16 Intellectual Property *As of the date of this presentation. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Through years of working with insurance companies and brokerages, we have developed a thorough understanding of their customers’ market positioning strategies and formed a network of qualified third - party vendors. Rich Resources YSX Tech was founded and is led by entrepreneurs who had years of experiences in the insurance and financial industries. Experienced Management Team We provide auto insurance aftermarket value - added services, software development and information technology services, and other scenario - based customized services. Diversified Services (one - stop service provider) Company Overview Industry Overview Company Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 17 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Jie Xiao Chairman and CEO, Co - Founder • Founder, Executive Director and CEO of Xinjiang Yishengxin Network Technology Co., Ltd. since July , 2015. • Executive Director and CEO of Guangzhou Yishengxin Network Technology Co., Ltd. since February 2023. • Executive Director and Chief Executive Officer for Xinjiang Yishengxin Chuangzhan Technology Co. Ltd. and Xinjiang Agilune Information Technology Co. Ltd. since July 2021. • Graduated from Hunan University with a major in Finance and Taxation in 2002. • Bachelor's degree in International Business and Economics from Lingnan College Sun Yat - sen University in 1992. Weiqiang Zheng Director Geran Xiao CFO Company Overview Industry Overview Company Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 18 • Director for Xinjiang Yishengxin Network Technology Co. Ltd. since April 2019. • Executive Director for Guangzhou Xihang Information Technology Co. Ltd. since July 2022. • Managing Partner for Guangzhou Huineng Business Management Consulting LLP since September 2017. • Manager for Yuexiu Branch of PICC Guangzhou Branch from July 1993 to June 2000. • Bachelor's degree in Business Administration from Guangzhou Yeyu University in 1996. • CFO of Xinjiang Yishengxin Network Technology Co. Ltd. since April 2022. • Supervisor for Guangzhou Kesuan Financial Consulting Co. Ltd. from June 2013 to September 2022. • Manager for the Panyu Branch Office of Guangzhou Yinzhi Financial Consulting Co., Ltd. from December 2006 to June 2013. • Graduated from Hubei University with a major in Food Safety Management Engineering in 2004. Highly Experienced Management Team See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Haozhao Lin Independent Director Nominee • Financial Officer at Shantou City Haolian Industrial Investment Co., Ltd. since June 2016. • Executive Director at Dongguan City Longda Information Technology Co., Ltd. since August 2016, and Dongguan City Fenghua Industrial Investment Co., Ltd. since April 2018. • Executive Director and Financial Officer at Dongguan City Daqian Finance and Tax Technology Co., Ltd. since October 2021. • Bachelor’s degree in Accounting from Yunyang Normal College in 2008. Xuanjun Yang Independent Director Nominee Company Overview Industry Overview Investment Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 19 • Attorney at Guangdong Banghao Law Firm since May 2017. • Bachelor’s degree in Financial Management from Jiangxi University of Finance and Economics in 2010. • Master’s degree in Economic Law from Jiangxi University of Finance and Economics in 2013. Independent Directors See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss. Meng Cao Independent Director Nominee • General manager of Shenzhen Canyu E - Commerce Co., Ltd. since January 2019. • Director at Guilishi Medical Beauty Hospital Co., Ltd. since August 2020. • Financial director of Guangzhou Hanyishen Medical Co., Ltd. since May 2022. • Director of Guangzhou Senyuanzhang Digital Technology Co., Ltd. since March 2023. • Chungwoon University with a master's degree in International Economics and Trade in 2013.

Growth Strategies YSX Tech Co., Ltd | Page 20 YSX Tech See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

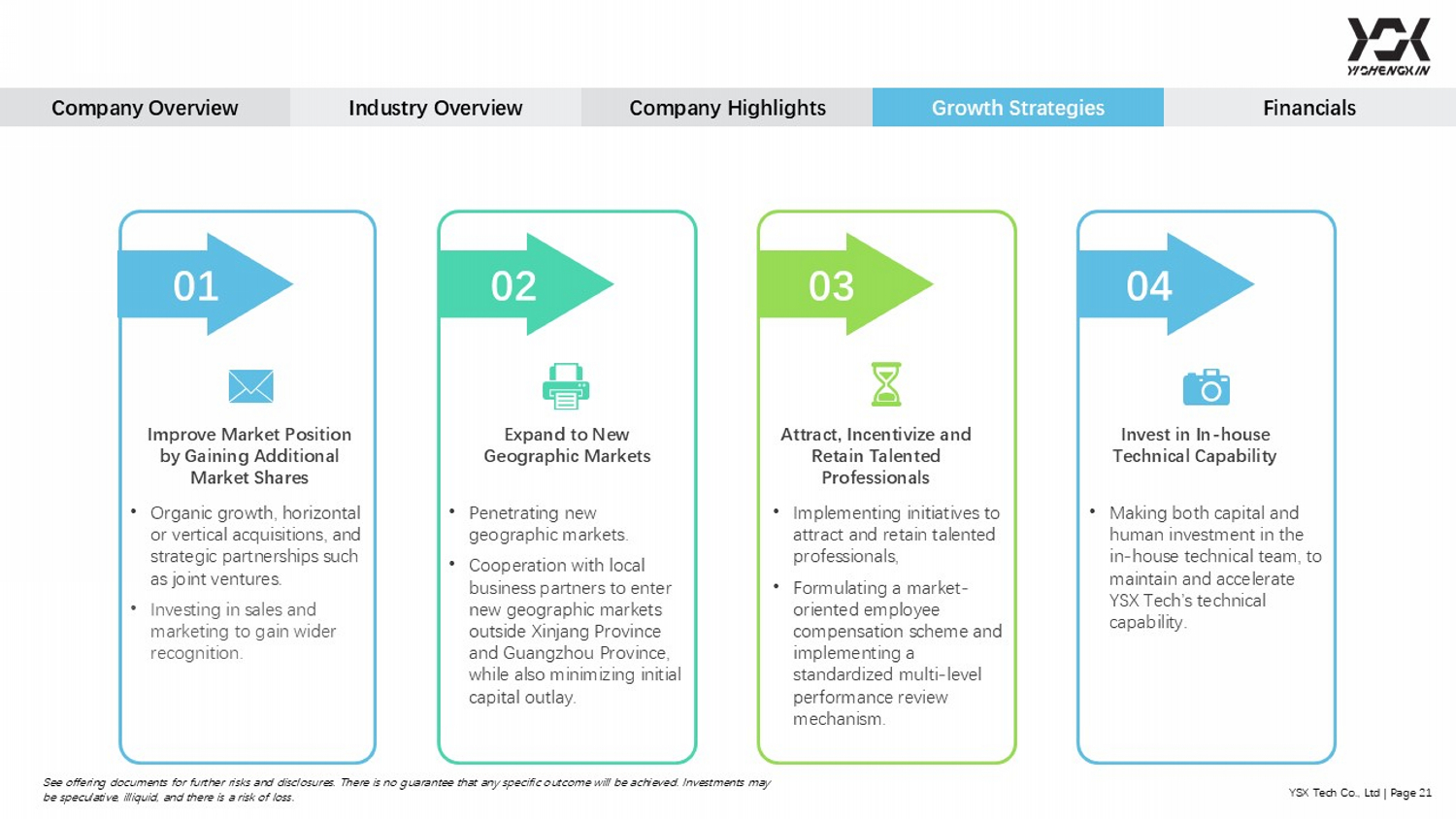

Improve Market Position by Gaining Additional Market Shares • Organic growth, horizontal or vertical acquisitions, and strategic partnerships such as joint ventures. • Investing in sales and marketing to gain wider recognition. 01 Expand to New Geographic Markets • Penetrating new geographic markets. • Cooperation with local business partners to enter new geographic markets outside Xinjang Province and Guangzhou Province, while also minimizing initial capital outlay. 02 Attract, Incentivize and Retain Talented Professionals • Implementing initiatives to attract and retain talented professionals, • Formulating a market - oriented employee compensation scheme and implementing a standardized multi - level performance review mechanism. 03 Invest in In - house Technical Capability • Making both capital and human investment in the in - house technical team, to maintain and accelerate YSX Tech’s technical capability. 04 Company Overview Industry Overview Company Highlights Growth Strategies Financials YSX Tech Co., Ltd | Page 21 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Financials YSX Tech Co., Ltd | Page 22 YSX Tech See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

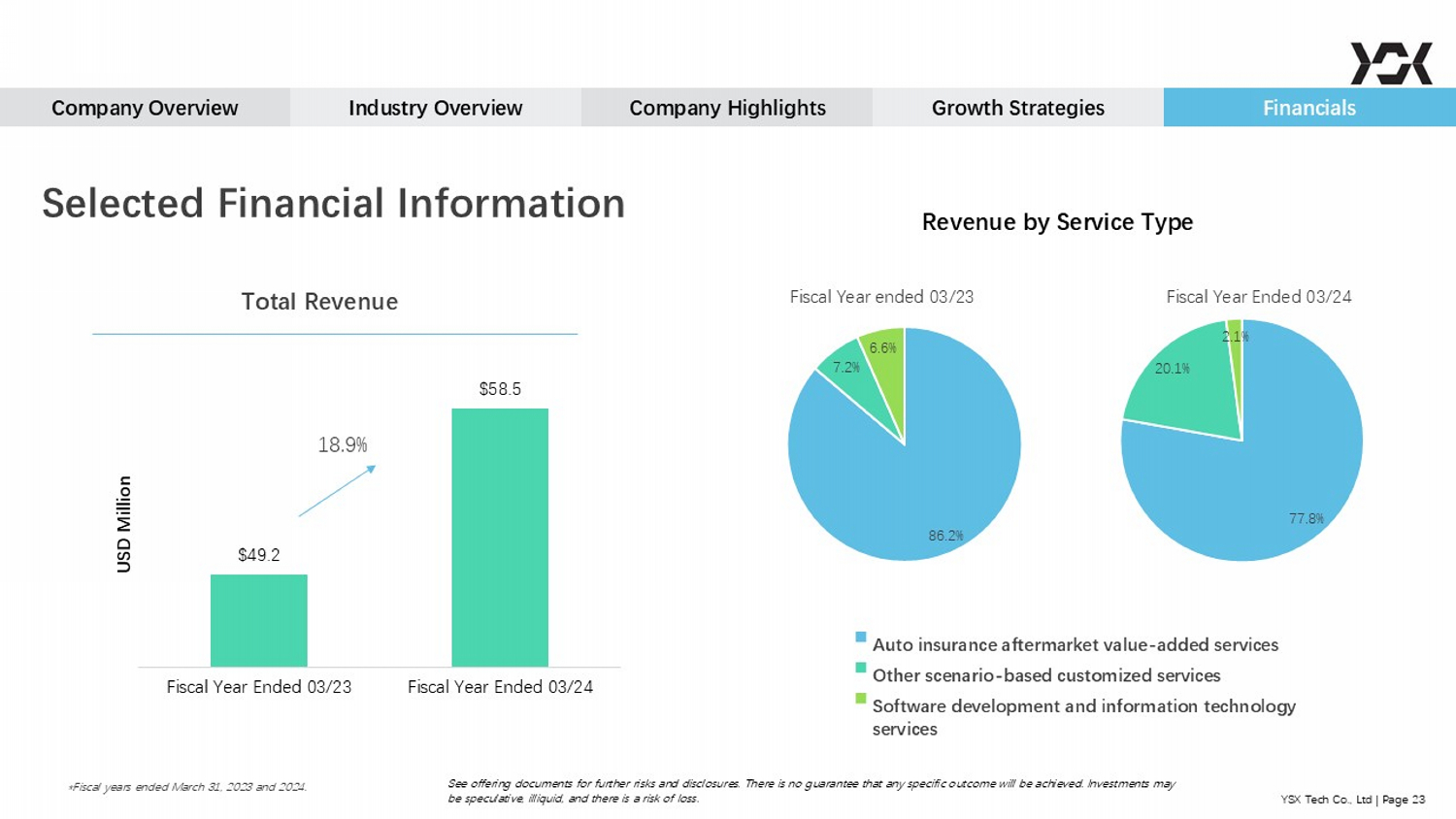

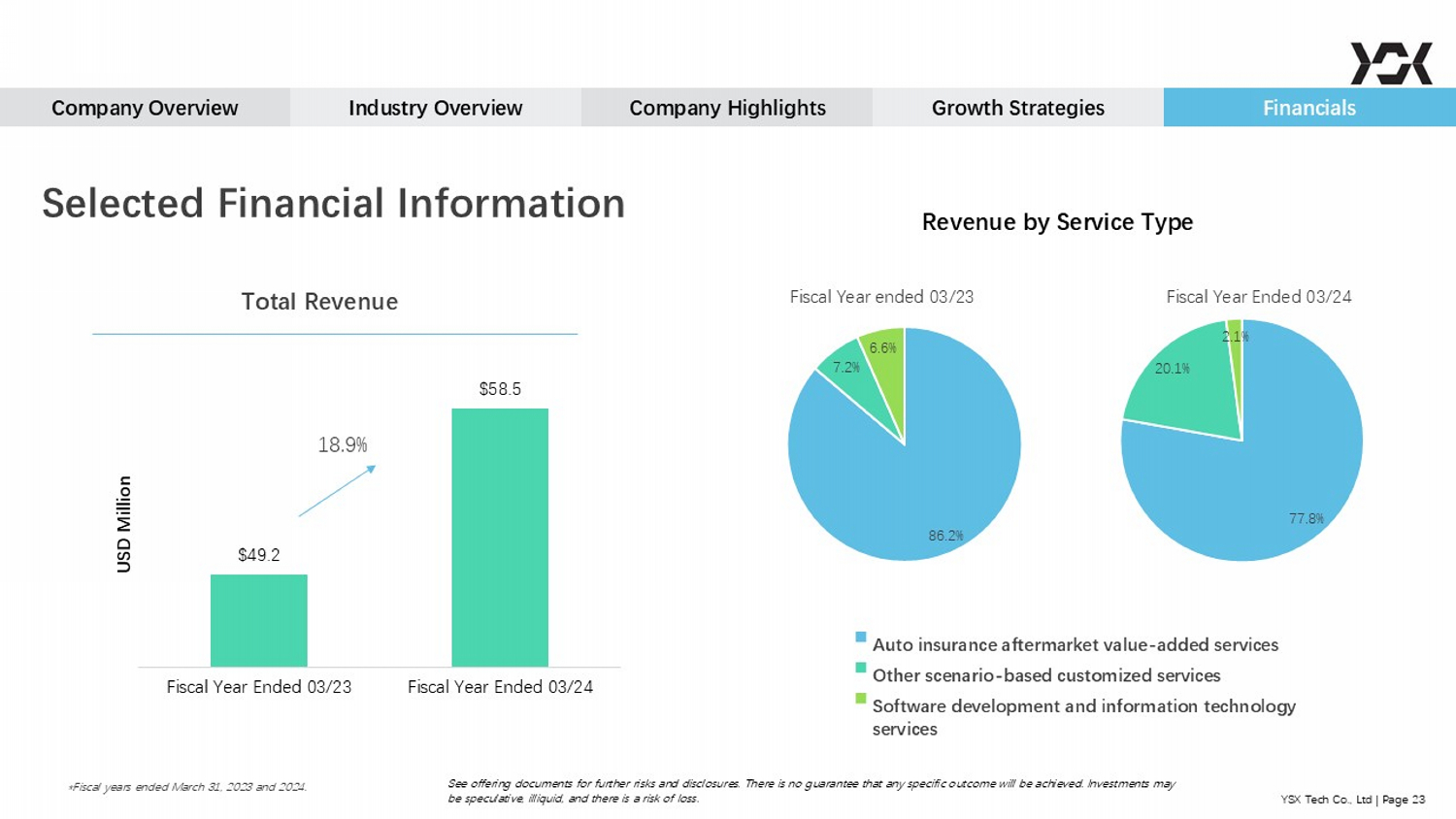

77.8% 20.1% 2.1% YSX Tech Co., Ltd | Page 23 Company Overview Industry Overview Company Highlights Growth Strategies Financials Selected Financial Information *Fiscal years ended March 31, 2023 and 2024. $49.2 $58.5 Fiscal Year Ended 03/23 Fiscal Year Ended 03/24 USD Million 18.9 % 86.2% 7.2% 6.6% Fiscal Year ended 03/23 Fiscal Year Ended 03/24 Total Revenue ▪ Auto insurance aftermarket value - added services ▪ Other scenario - based customized services ▪ Software development and information technology services Revenue by Service Type See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

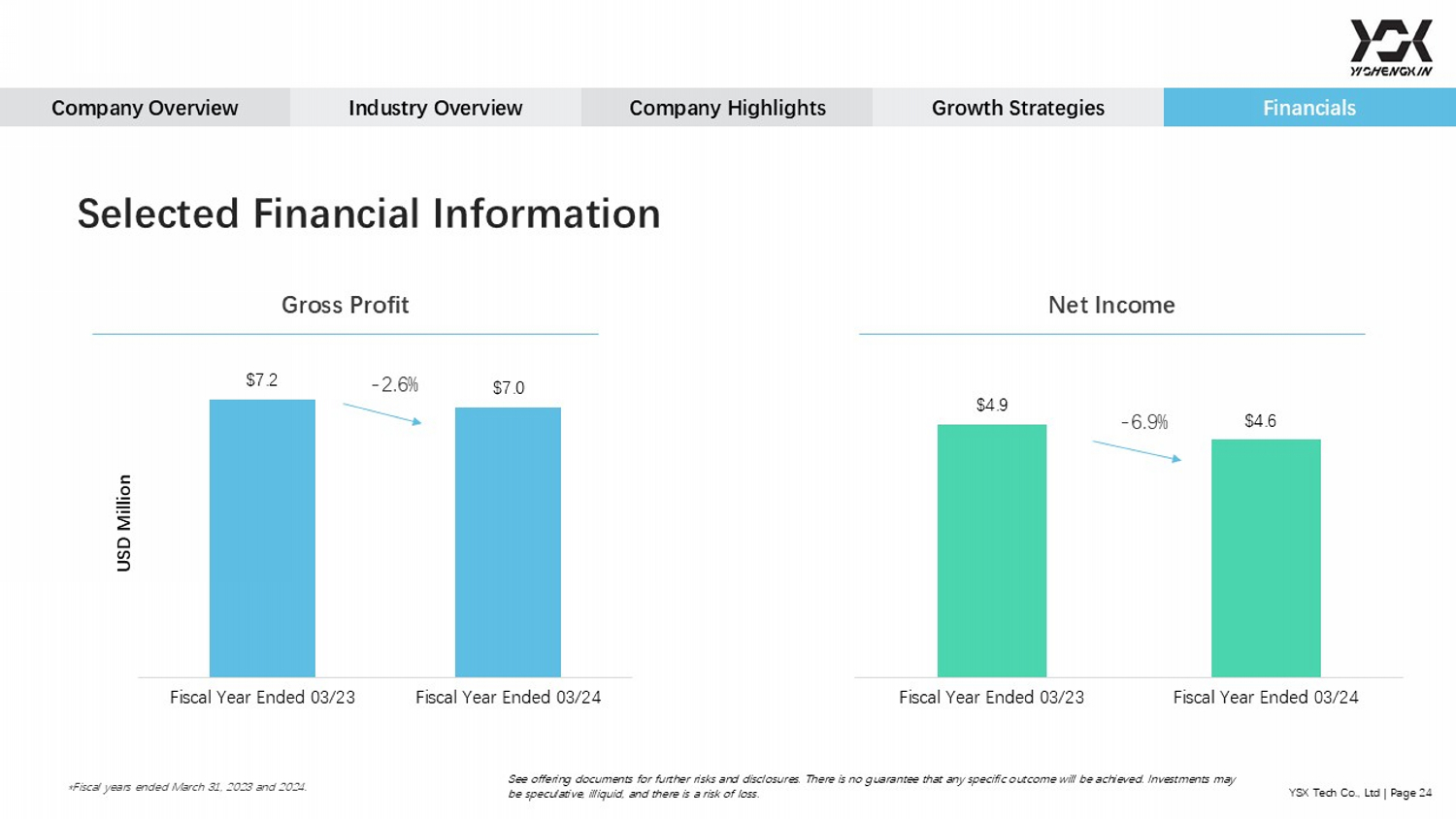

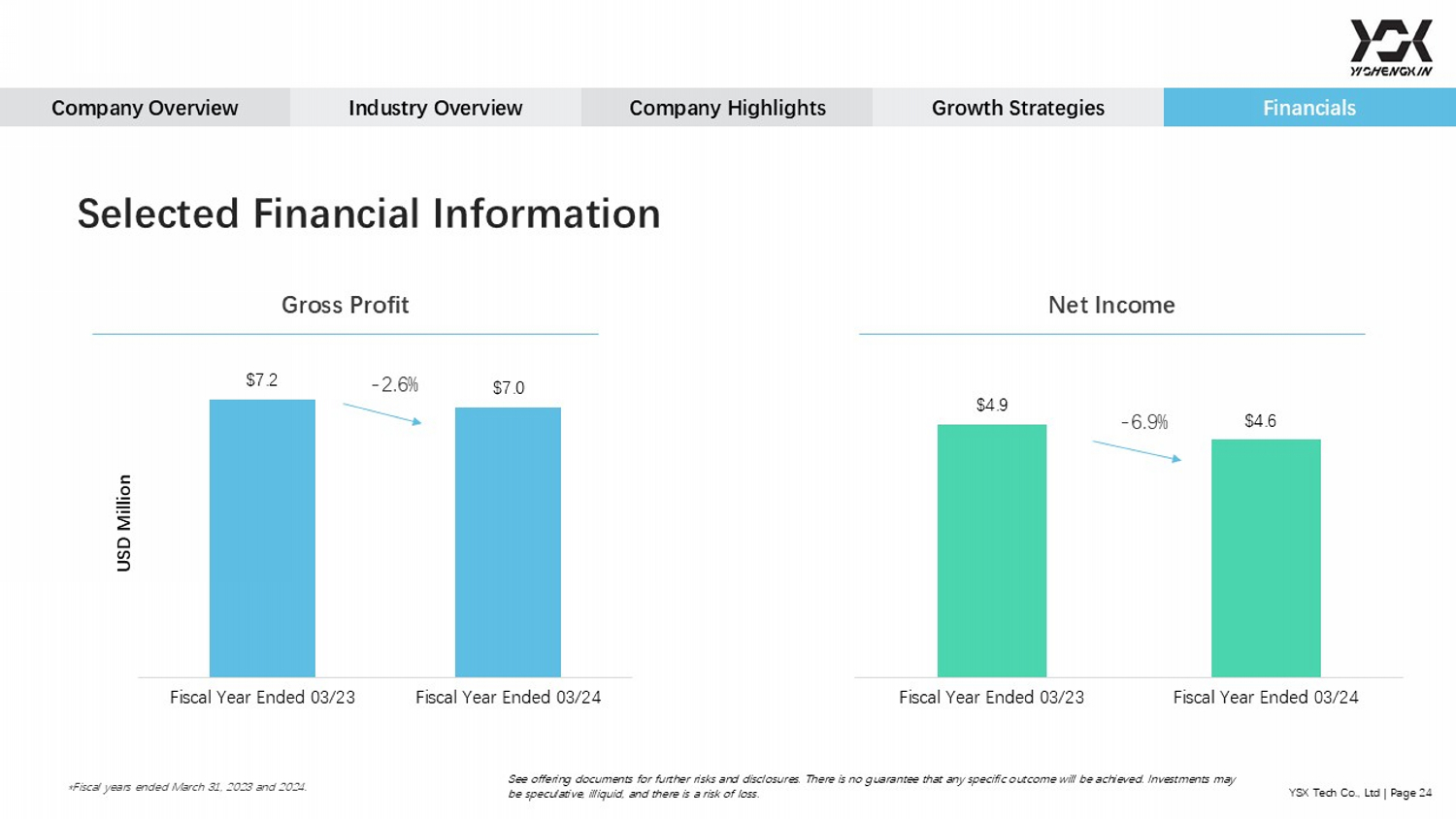

YSX Tech Co., Ltd | Page 24 Company Overview Industry Overview Company Highlights Growth Strategies Financials Selected Financial Information *Fiscal years ended March 31, 2023 and 2024. $7.2 $7.0 Fiscal Year Ended 03/23 Fiscal Year Ended 03/24 USD Million - 2.6 % $4.9 $4.6 Fiscal Year Ended 03/23 Fiscal Year Ended 03/24 - 6.9 % Gross Profit Net Income See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss.

Issuer Contact: marketing@ysxnet.com +86 (20) 2984 2002 www.ysxnet.com YSX Tech. Co., Ltd See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid, and there is a risk of loss. Investor Relations Contact: services@wealthfsllc.com +86 138 117 68599 +1 628 283 9214 Underwriter Contact: +1 732 910 9692 ttian@kingswoodus.com Kingswood Capital Partners, LLC All marks are trademarks or registered trademarks of their respective owners. The display of trademarks herein does not imply th at a license of any kind has been granted.