Exhibit 99.2

Cindy Patient warrior Pioneering CAR T in Autoimmune Diseases January 2025 Exhibit 99.2

2 This presentation contains forward - looking statements that are based on management’s beliefs and assumptions and on information currently available to management of Kyverna Therapeutics, Inc. (“Kyverna”, “we”, “our,” or the “Company”). All statements other than statements of historical facts conta ine d in this presentation are forward - looking statements. Forward looking statements include, but are not limited to, statements concerning: the Company’s future results of operations an d financial position, business strategy, drug candidates, planned preclinical studies and clinical trials, results of preclinical studies and named patient activities, ong oin g clinical trials, research and development costs, plans for manufacturing, regulatory approvals, timing and likelihood of success, as well as plans and objectives of management for futu re operations. These forward - looking statements are subject to risks and uncertainties, including the factors described under the Risk Factors section of the Company’s most rece nt Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q that the Company has filed or may subsequently file with the U.S. Securities and Exchange Commission. Actual results c ould differ materially and adversely from those anticipated or implied in the forward - looking statements. When evaluating Kyverna’s business and prospects, careful consideratio n should be given to these risks and uncertainties. These statements speak only as of the date of this presentation, and Kyverna undertakes no obligation to update or revise the se statements. This presentation also contains estimates made by independent parties relating to industry market size and other data. These est imates involve a number of assumptions and limitations and you are cautioned not to give undue weight on such estimates. We have not independently verified the accuracy or completeness of such information and we do not take any responsibility with the accuracy or completeness of such information. This presentation contains references to trademarks and marks belonging to other entities. Solely for convenience, trademarks an d trade names referred to in this presentation may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licenso r w ill not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. The Company does not intend its use or display of other companies’ trade na mes, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of the Company by any other companies. This presentation includes results from named patient activities. Named patient activities are not part of our clinical trial s f or KYV - 101 and data from investigator - initiated trials and named patient activities are reported by the relevant investigators and physicians. Such data are not obtained using a single pr otocol or designed to be aggregated or reported as study results and may be highly variable. While we do not expect to be able to use the results from these activities as the b asi s for approval in our applications for marketing approval to the U.S. Food and Drug Administration (FDA) or other foreign regulatory agencies, we believe that this strategy m ay provide additional clinical insights beyond highly focused clinical trials in specific geographies. Throughout this presentation, the Company refers to its Phase 2 trial in stiff person syndrome as a pivotal trial; however, t he FDA or other regulatory agencies may conclude that the trial is not sufficient to be registration - enabling, and the Company may be required to conduct additional trials or studies to support a Biologics License Application. Disclaimer and Forward - Looking Statements

3 LIBERATING AUTOIM MUNE PATIENTS through the CURATIVE POTENTIAL OF CELL THERAPY Robert, Patient warrior Cindy, Patient warrior Roger, Patient warrior Bryce, Patient warrior

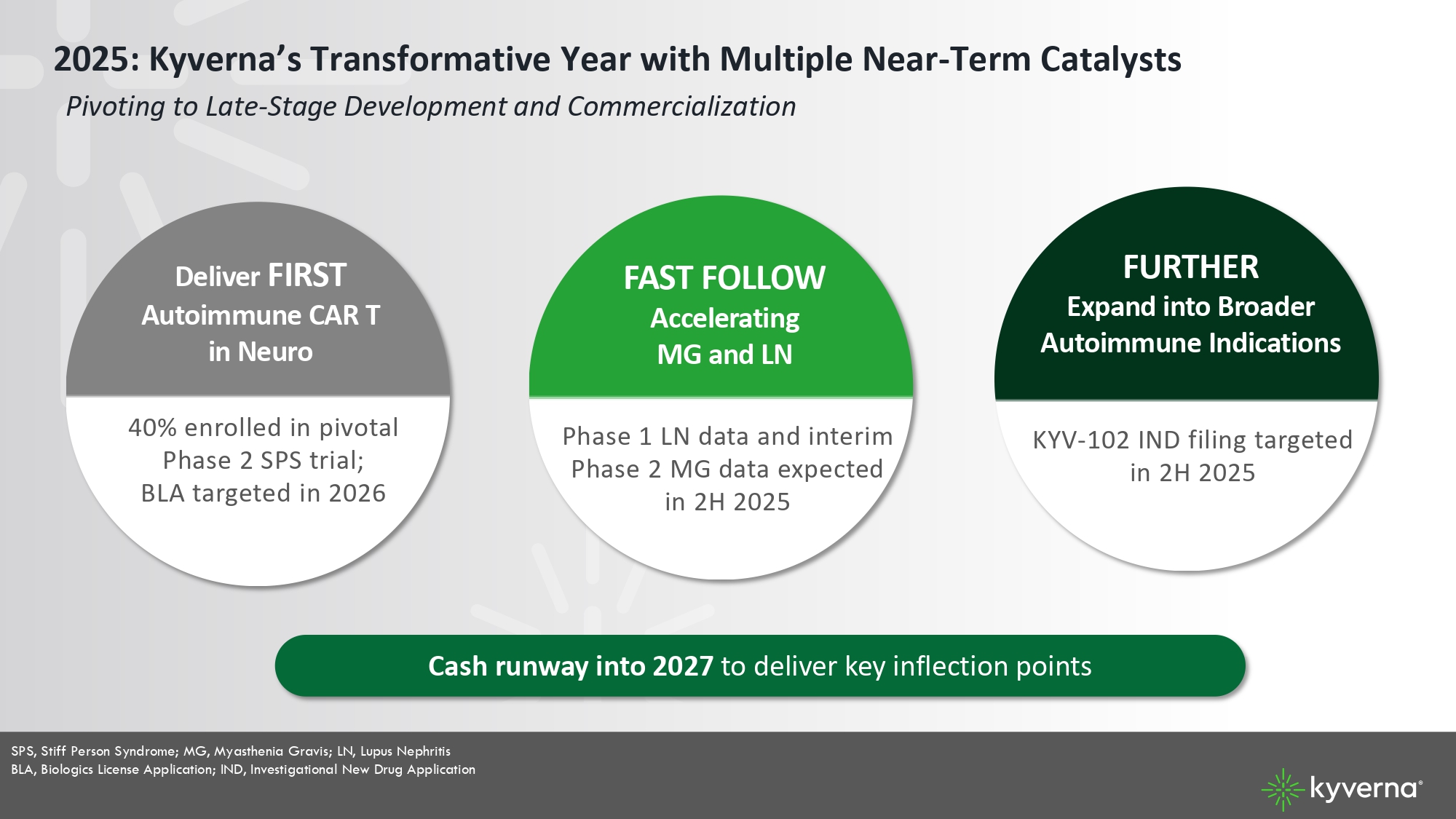

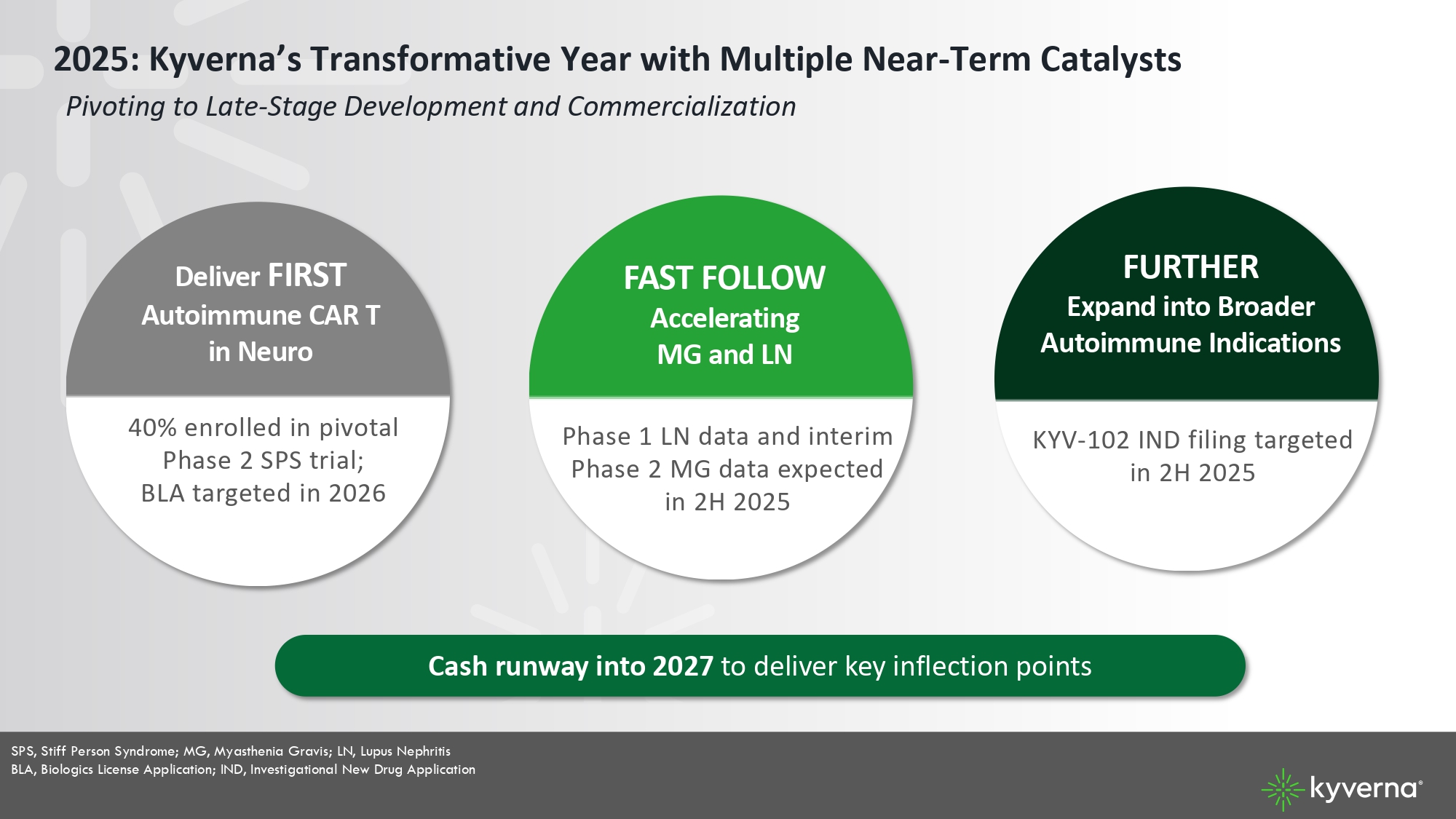

4 2025: Kyverna’s Transformative Year with Multiple Near - Term Catalysts Pivoting to Late - Stage Development and Commercialization FAST FOLLOW Accelerating MG and LN Phase 1 LN data and interim Phase 2 MG dat a expected in 2H 2025 FURTHER Expand into Broader Autoimmune Indications KYV - 102 IND filing targeted in 2H 2025 Deliver FIRST Autoimmune CAR T in Neuro SPS, Stiff Person Syndrome; MG, Myasthenia Gravis; LN, Lupus Nephritis BLA, Biologics License Application; IND, Investigational New Drug Application Cash runway into 2027 to deliver key inflection points 40% enrolled in pivotal Phase 2 SPS trial; BLA targeted in 2026

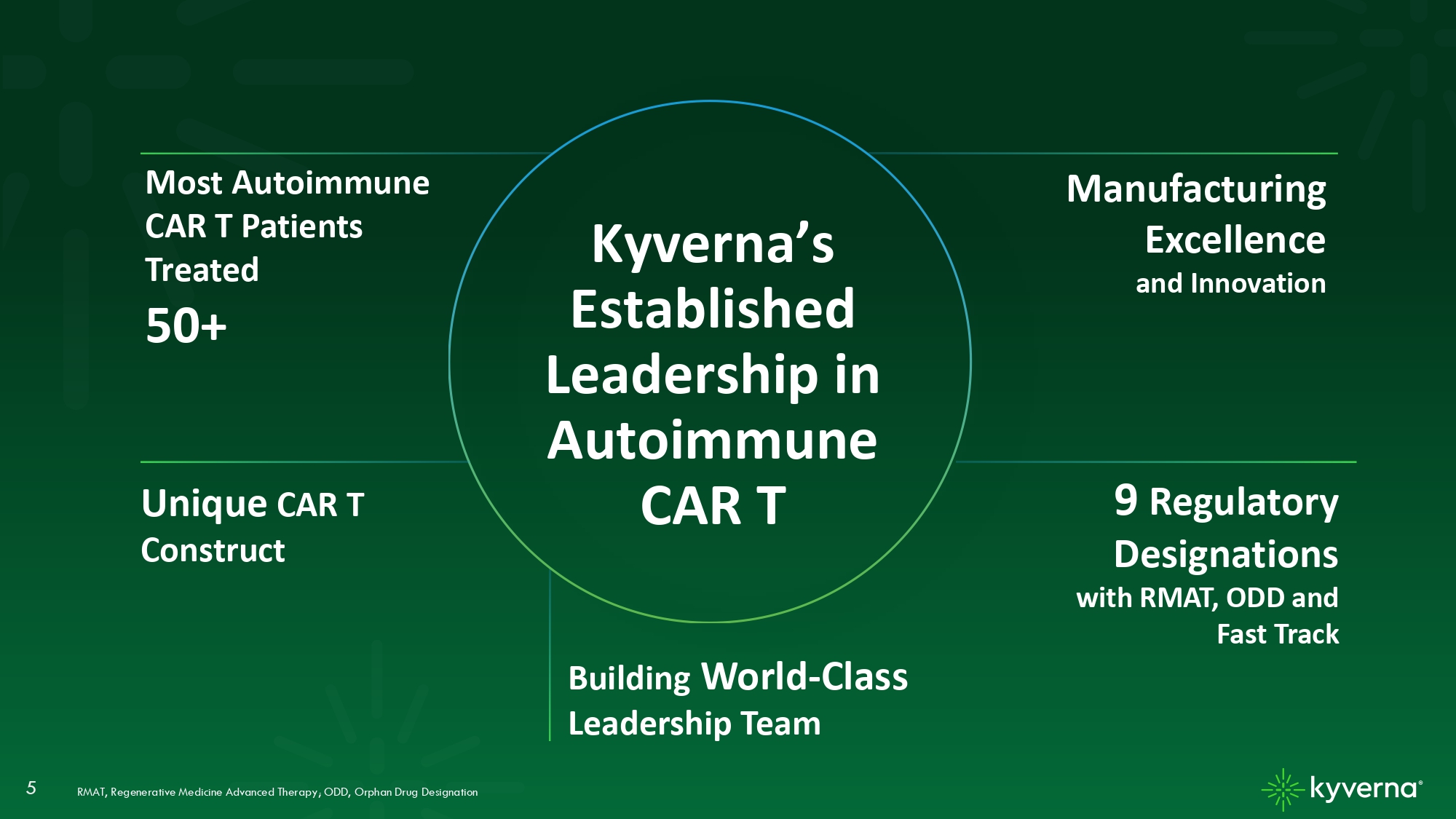

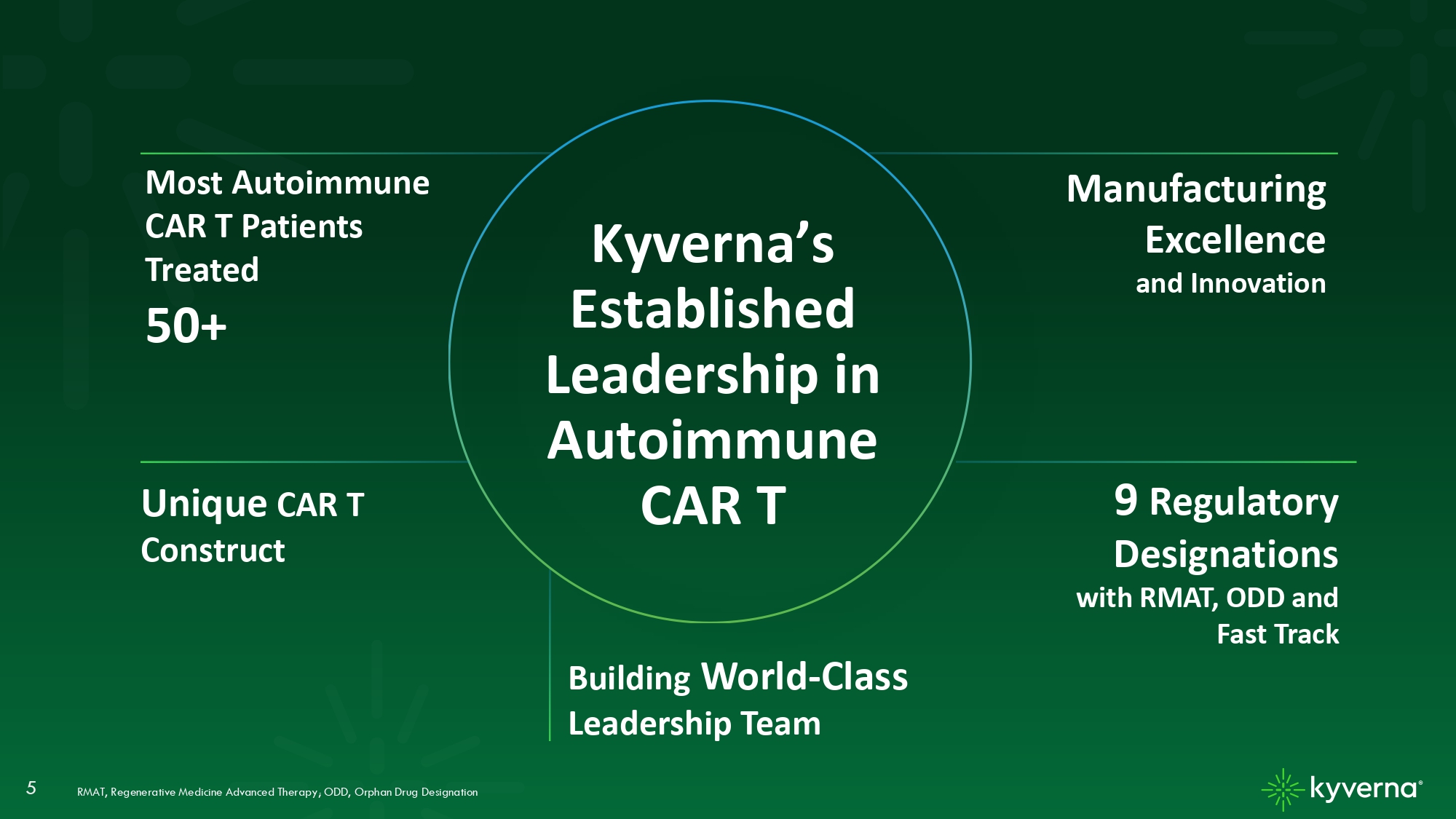

5 Manufacturing Excellence and Innovation Unique CAR T Construct RMAT, Regenerative Medicine Advanced Therapy; ODD, Orphan Drug Designation

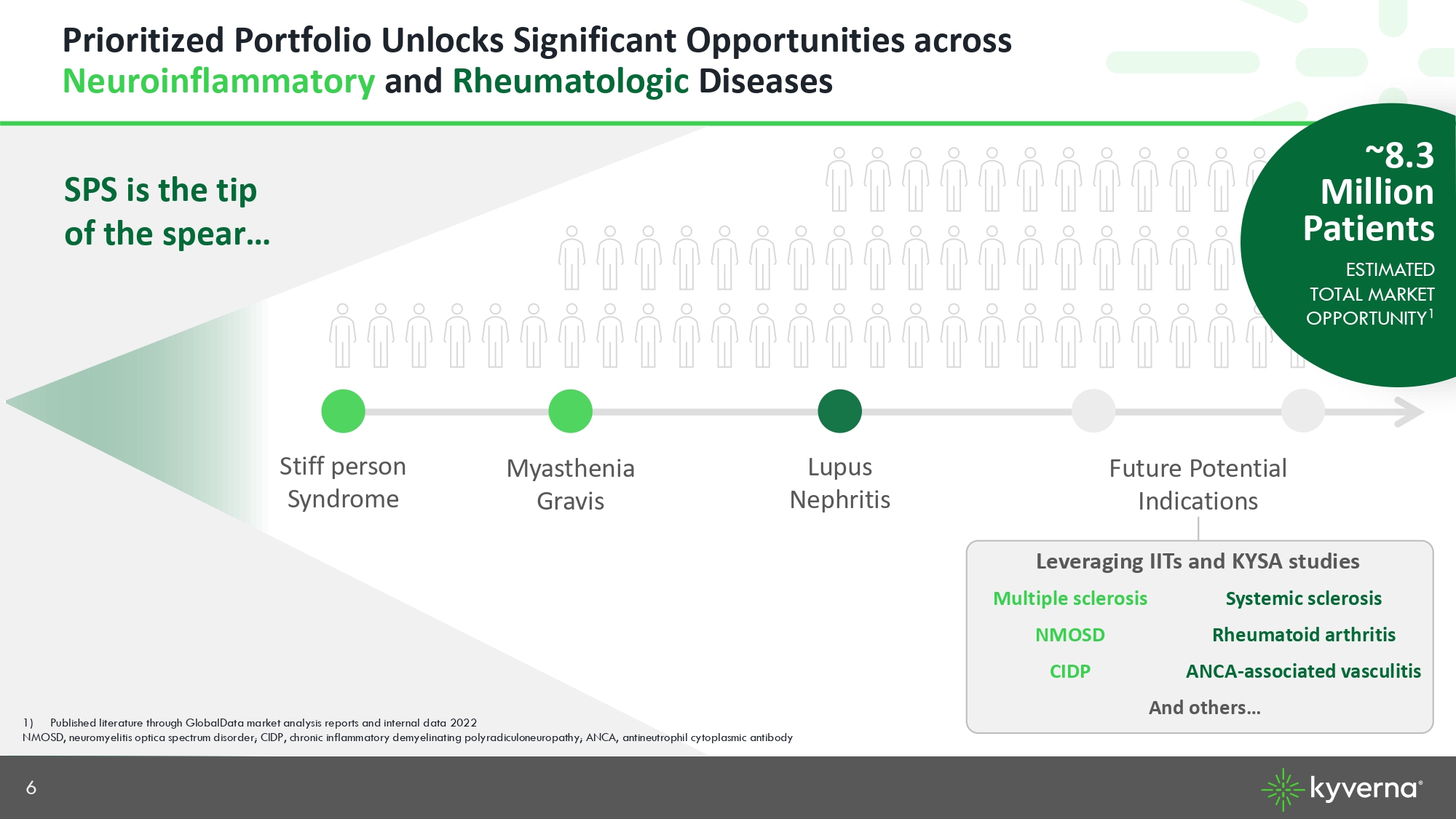

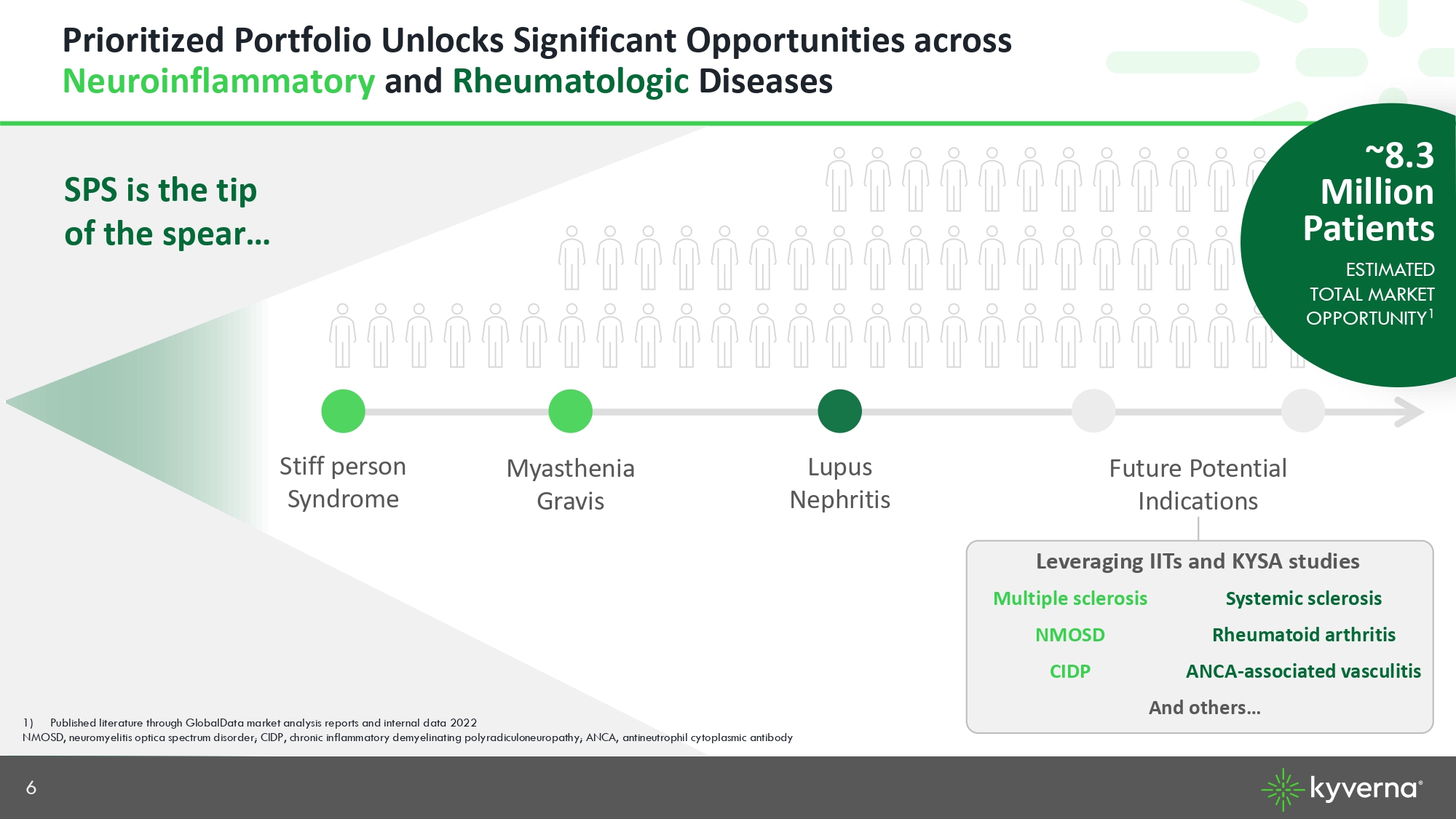

6 Prioritized Portfolio Unlocks Significant Opportunities across Neuroinflammatory and Rheumatologic Diseases Stiff person Syndrome Myasthenia Gravis Lupus Nephritis SPS is the tip of the spear… Future Potential Indications 1) Published literature through GlobalData market analysis reports and internal data 2022 NMOSD, neuromyelitis optica spectrum disorder; CIDP, chronic inflammatory demyelinating polyradiculoneuropathy; ANCA, antineu tro phil cytoplasmic antibody Leveraging IITs and KYSA studies Systemic sclerosis Multiple sclerosis Rheumatoid arthritis NMOSD ANCA - associated vasculitis CIDP And others… ~8.3 Million Patients ESTIMATED TOTAL MARKET OPPORTUNITY 1

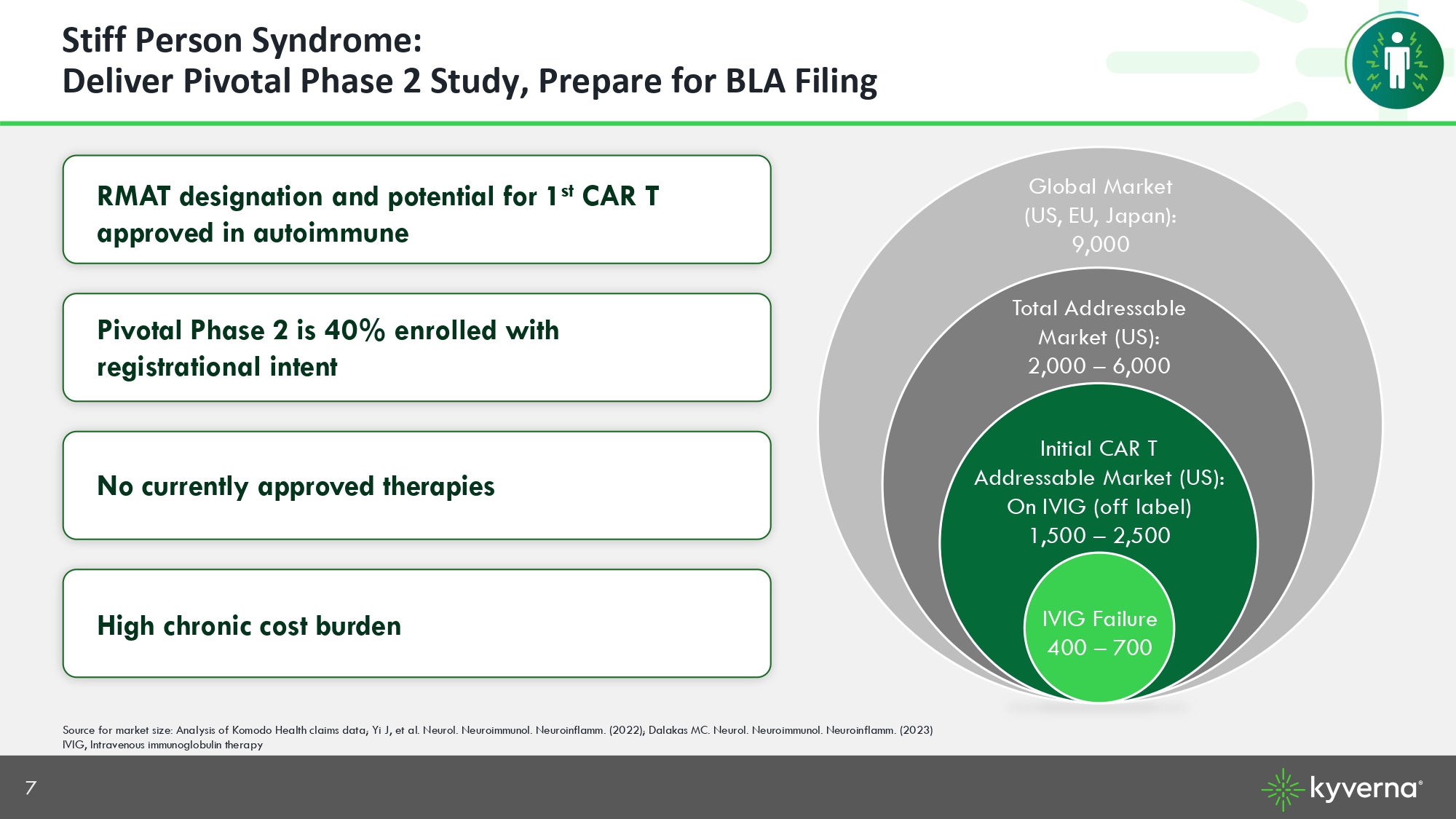

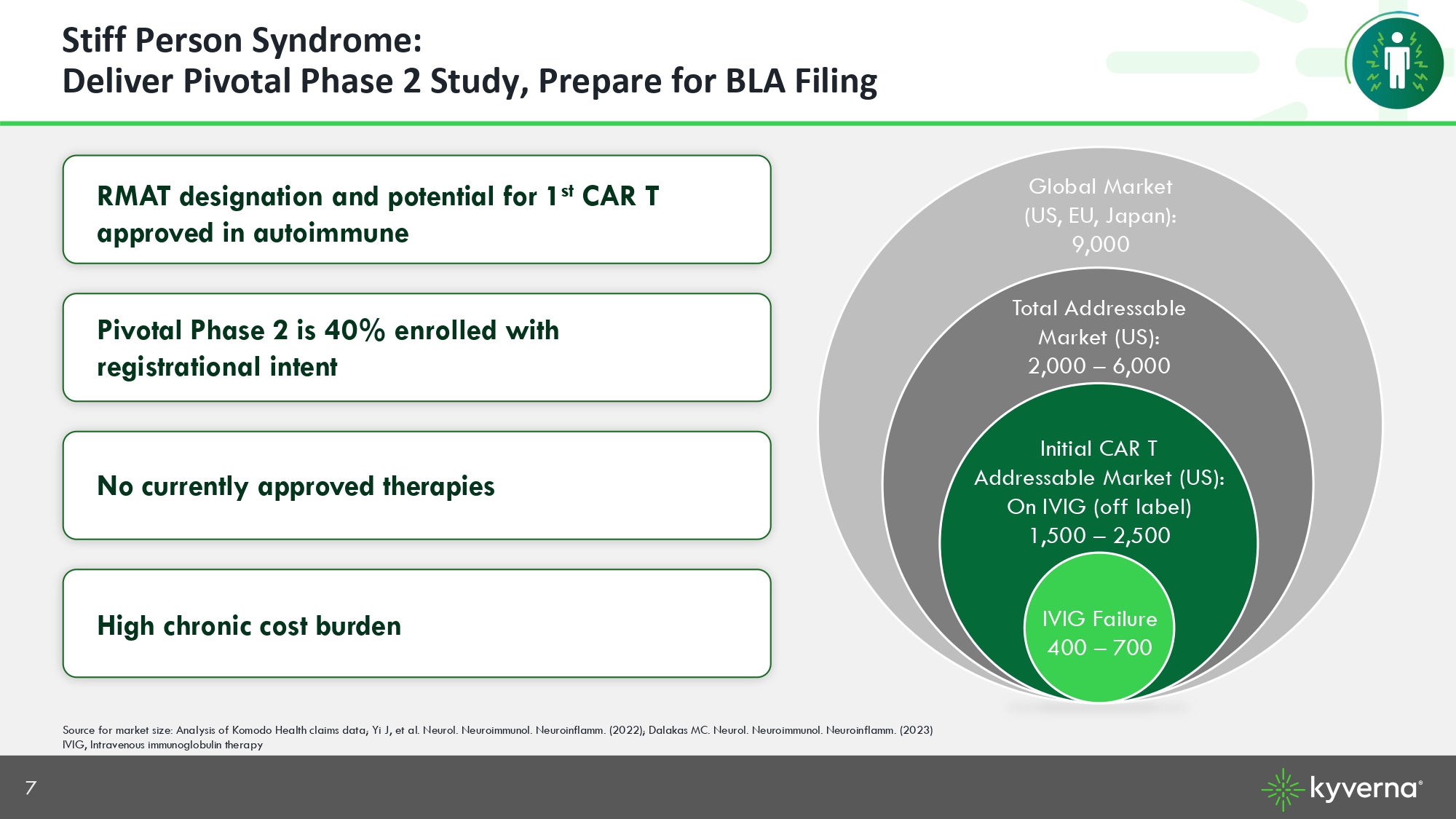

7 RMAT designation and potential for 1 st CAR T approved in autoimmune Pivotal Phase 2 is 40% enrolled with registrational intent No currently approved therapies High chronic cost burden Source for market size: Analysis of Komodo Health claims data; Yi J, et al. Neurol. Neuroimmunol. Neuroinflamm. (2022); Dalak as MC. Neurol. Neuroimmunol. Neuroinflamm. (2023) IVIG, Intravenous immunoglobulin therapy Stiff Person Syndrome: Deliver Pivotal Phase 2 Study, Prepare for BLA Filing Initial CAR T Addressable Market (US): On IVIG (off label) 1,500 – 2,500 IVIG Failure 400 – 700 Total Addressable Market (US): 2,000 – 6,000 Global Market (US, EU, Japan): 9,000

8 Previously presented at ECTRIMS KYV - 101 in SPS: Demonstrates Strong Clinical Activity and Potential for Deep Responses Kyverna Experience at Therapeutic Dose in Initial 3 Patients *Data on walking speed available for 2 of 3 patients . † Data shown for immunosuppressant and immunomodulatory agents only; does not include physiologic replacement steroids ≤7.5 mg/ day . Note: named patient data KYV - 101 therapeutic dose is 1 × 10 8 CAR T cells/ μ L. Data cutoff October 31, 2024. Reference: Updated from Kyverna Symposium at ECTRIMS, September 18, 2024. Copenhagen, Denmark. 0 1000 2000 3000 180 150 120 90 60 30 BL Anti - GAD65 (n=2) Anti - glycineR (n=1) 150 200 250 100 50 0 Elimination of Immunosuppressants † Improvement in Mobility* Reduction of Autoantibody Titers Days post - infusion Days post - infusion Mean anti - GAD65 titer, 1:x unit (SEM) Mean walking speed, m/s (SEM) Mean no. of immunosuppressants (SEM) Mean anti - glycineR titer, 1:x unit (SEM) 0 0.5 1.0 1.5 180 150 120 90 60 30 BL 0 6 0 8 After KYV - 101 Before KYV - 101 2 4

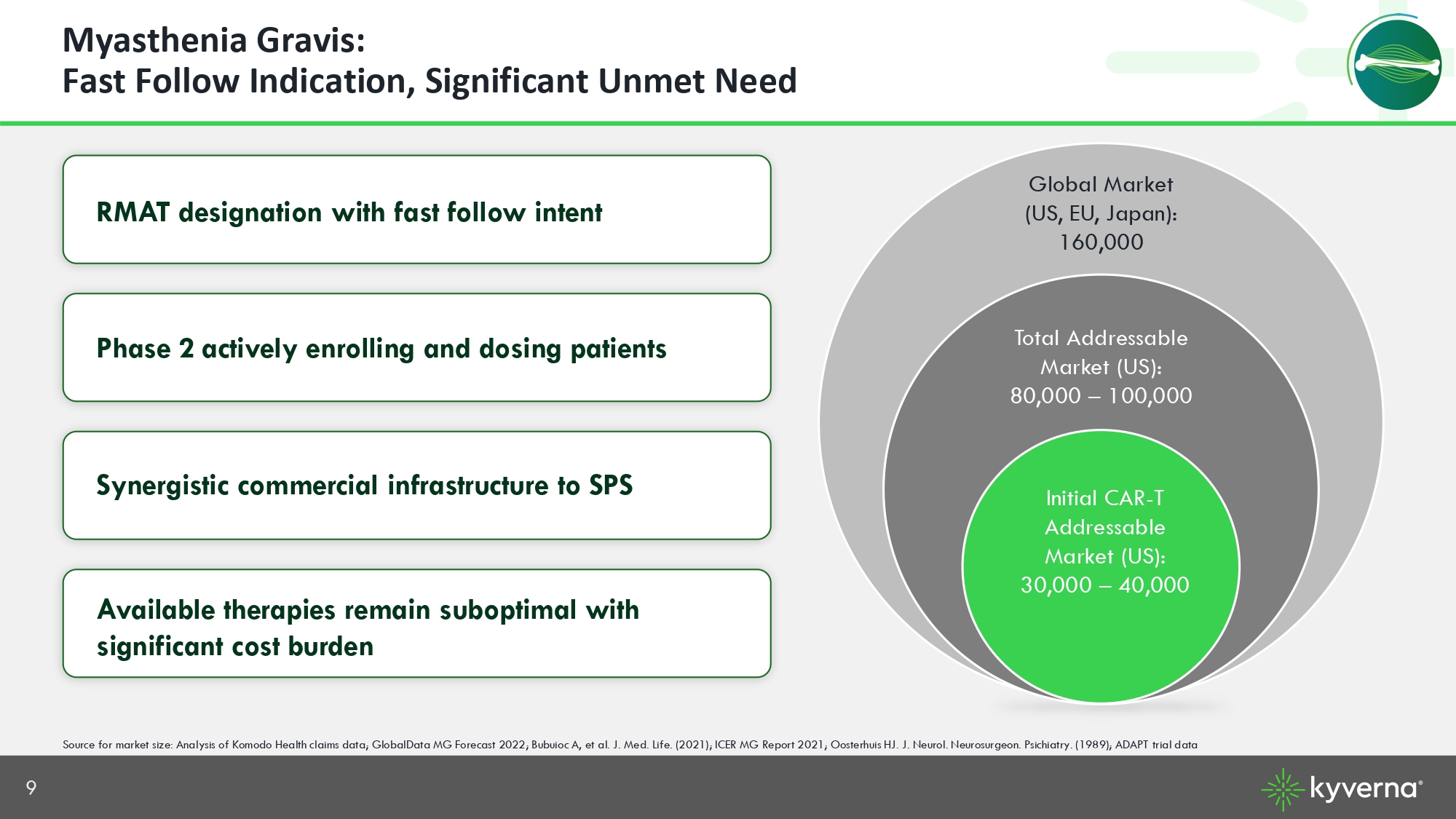

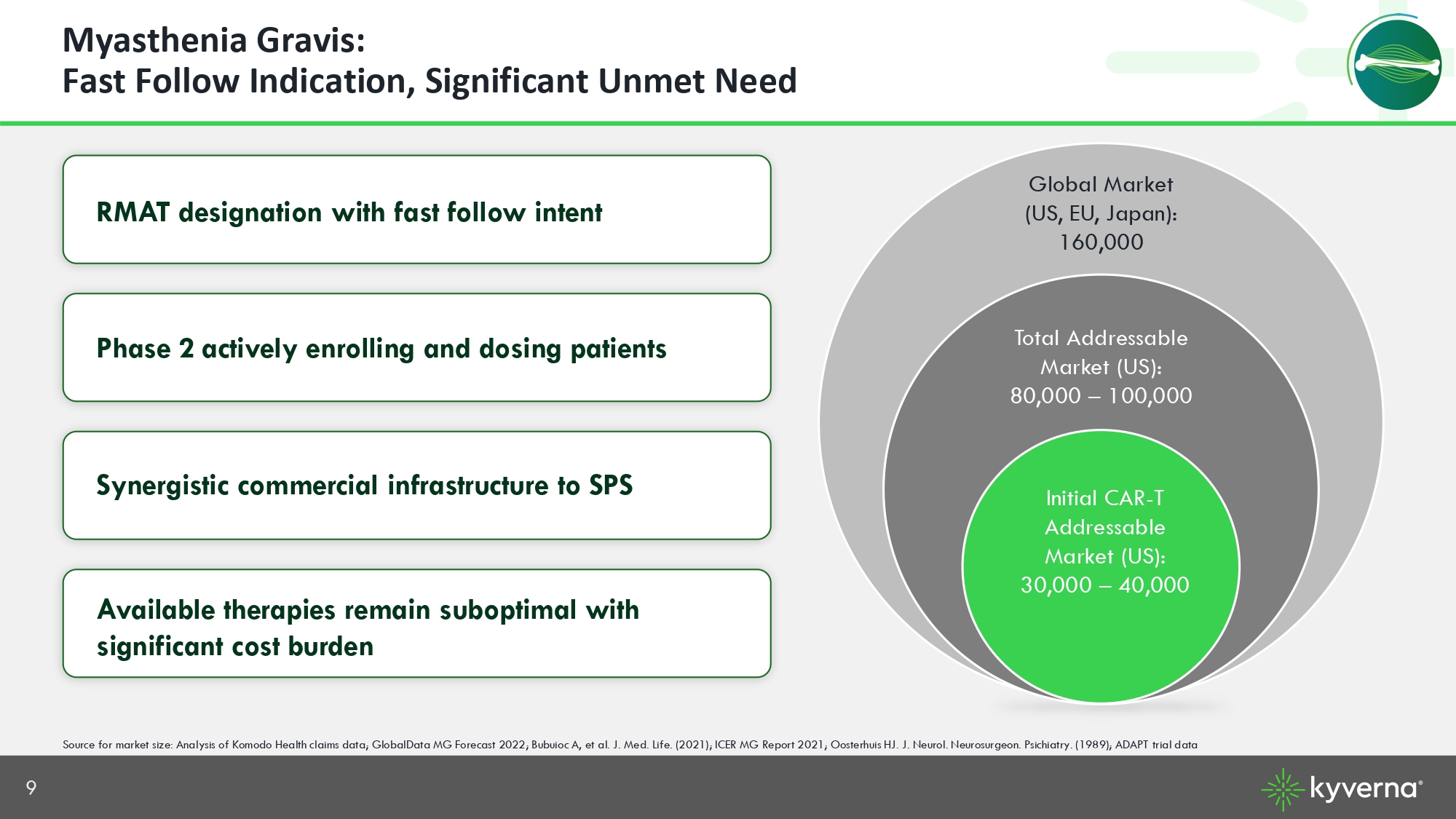

9 Myasthenia Gravis: Fast Follow Indication, Significant Unmet Need RMAT designation with fast follow intent Phase 2 actively enrolling and dosing patients Synergistic commercial infrastructure to SPS Available therapies remain suboptimal with significant cost burden Source for market size: Analysis of Komodo Health claims data; GlobalData MG Forecast 2022; Bubuioc A, et al. J. Med. Life. ( 202 1); ICER MG Report 2021; Oosterhuis HJ. J. Neurol. Neurosurgeon. Psichiatry. (1989); ADAPT trial data Initial CAR - T Addressable Market (US): 30,000 – 40,000 Total Addressable Market (US): 80, 000 – 100, 000 Global Market (US, EU, Japan): 160,000

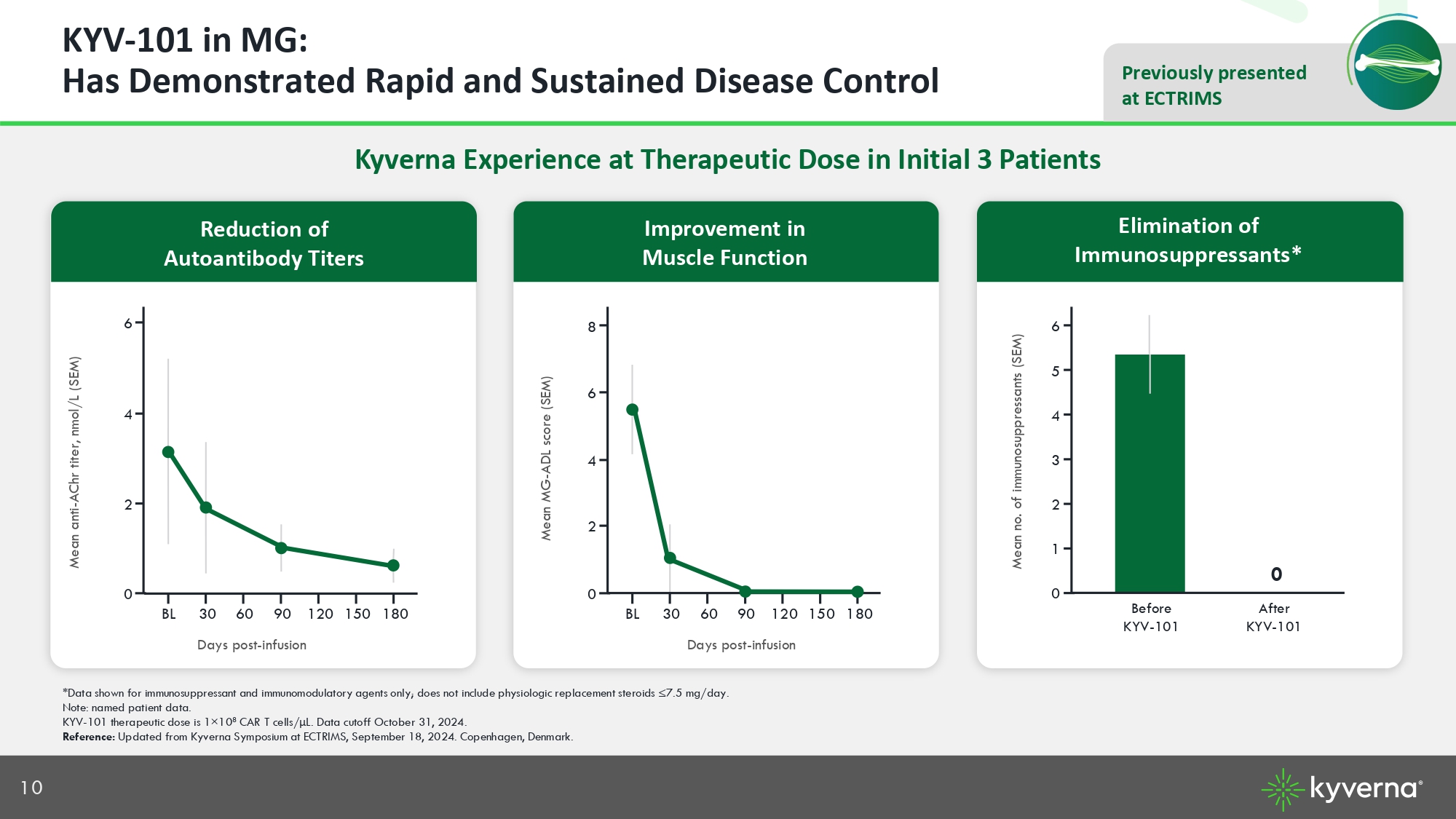

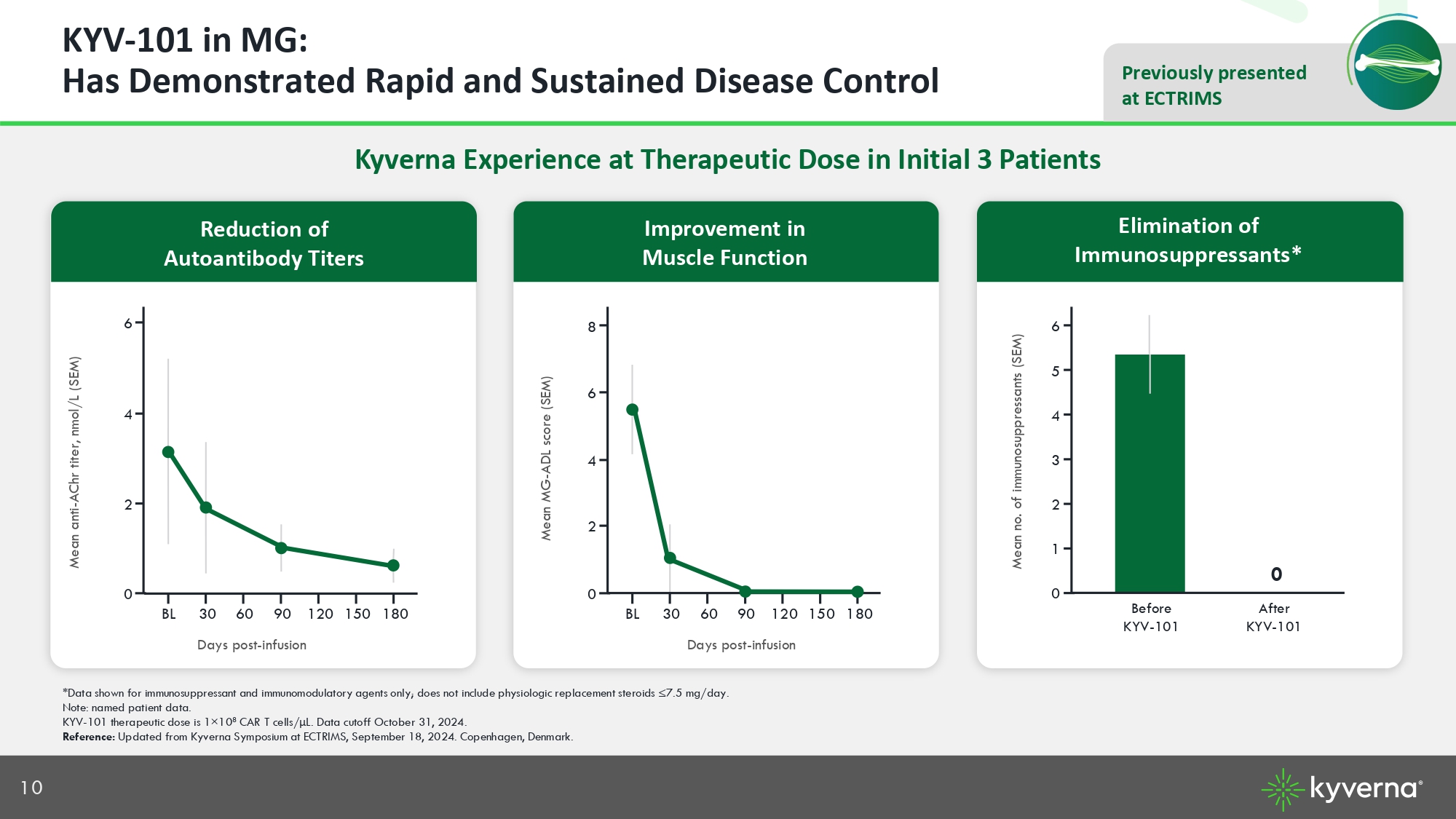

10 Previously presented at ECTRIMS KYV - 101 in MG: Has Demonstrated Rapid and Sustained Disease Control Kyverna Experience at Therapeutic Dose in Initial 3 Patients 0 2 4 6 180 150 120 90 60 30 BL *Data shown for immunosuppressant and immunomodulatory agents only; does not include physiologic replacement steroids ≤7.5 mg /da y. Note: named patient data. KYV - 101 therapeutic dose is 1 × 10 8 CAR T cells/ μ L. Data cutoff October 31, 2024. Reference: Updated from Kyverna Symposium at ECTRIMS, September 18, 2024. Copenhagen, Denmark. Elimination of Immunosuppressants* Improvement in Muscle Function Days post - infusion Days post - infusion Mean anti - AChr titer, nmol/L (SEM) Mean MG - ADL score (SEM) Mean no. of immunosuppressants (SEM) 0 2 6 8 180 150 120 90 60 30 BL 4 0 1 5 6 After KYV - 101 Before KYV - 101 2 4 3 0 Reduction of Autoantibody Titers

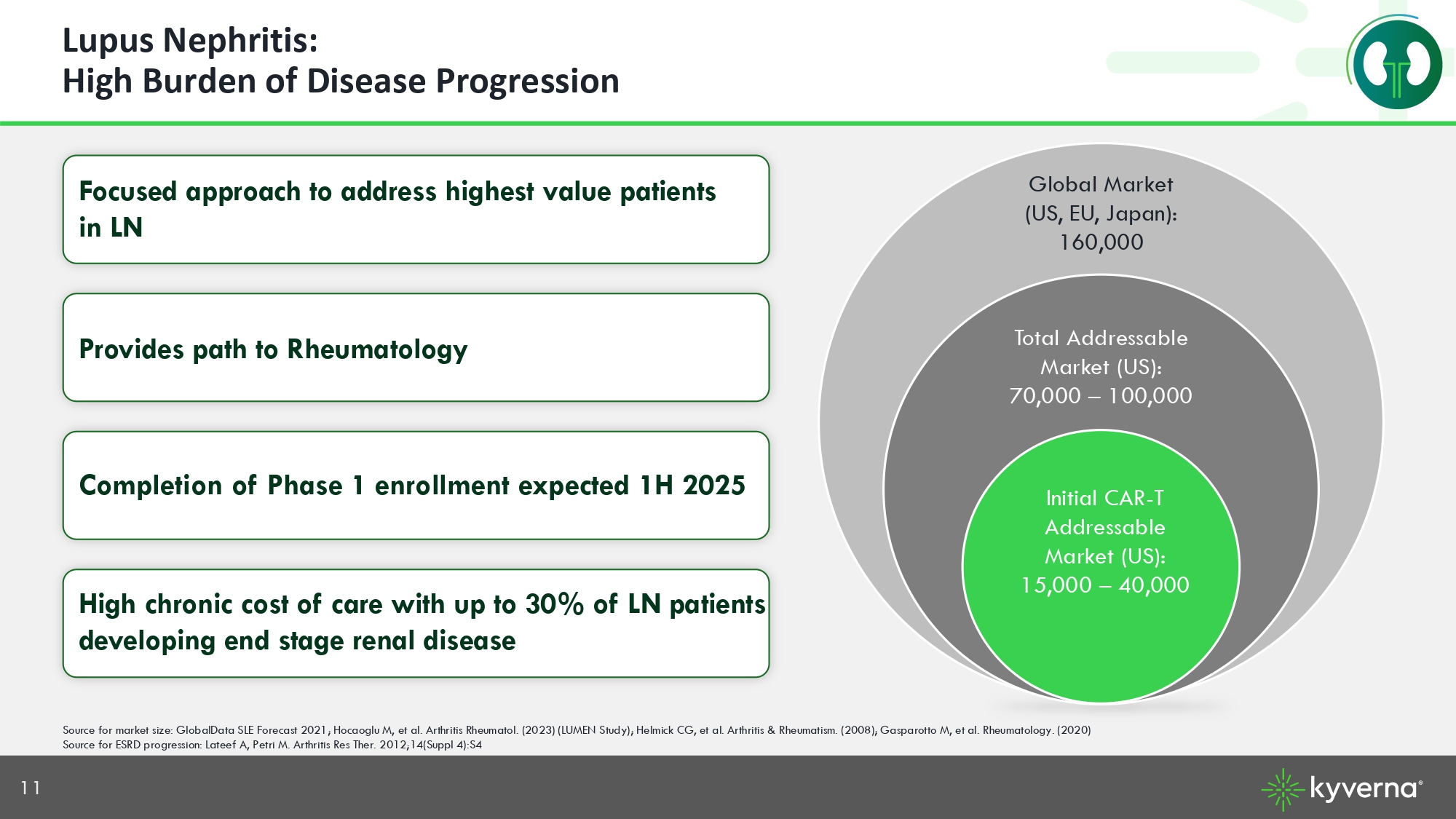

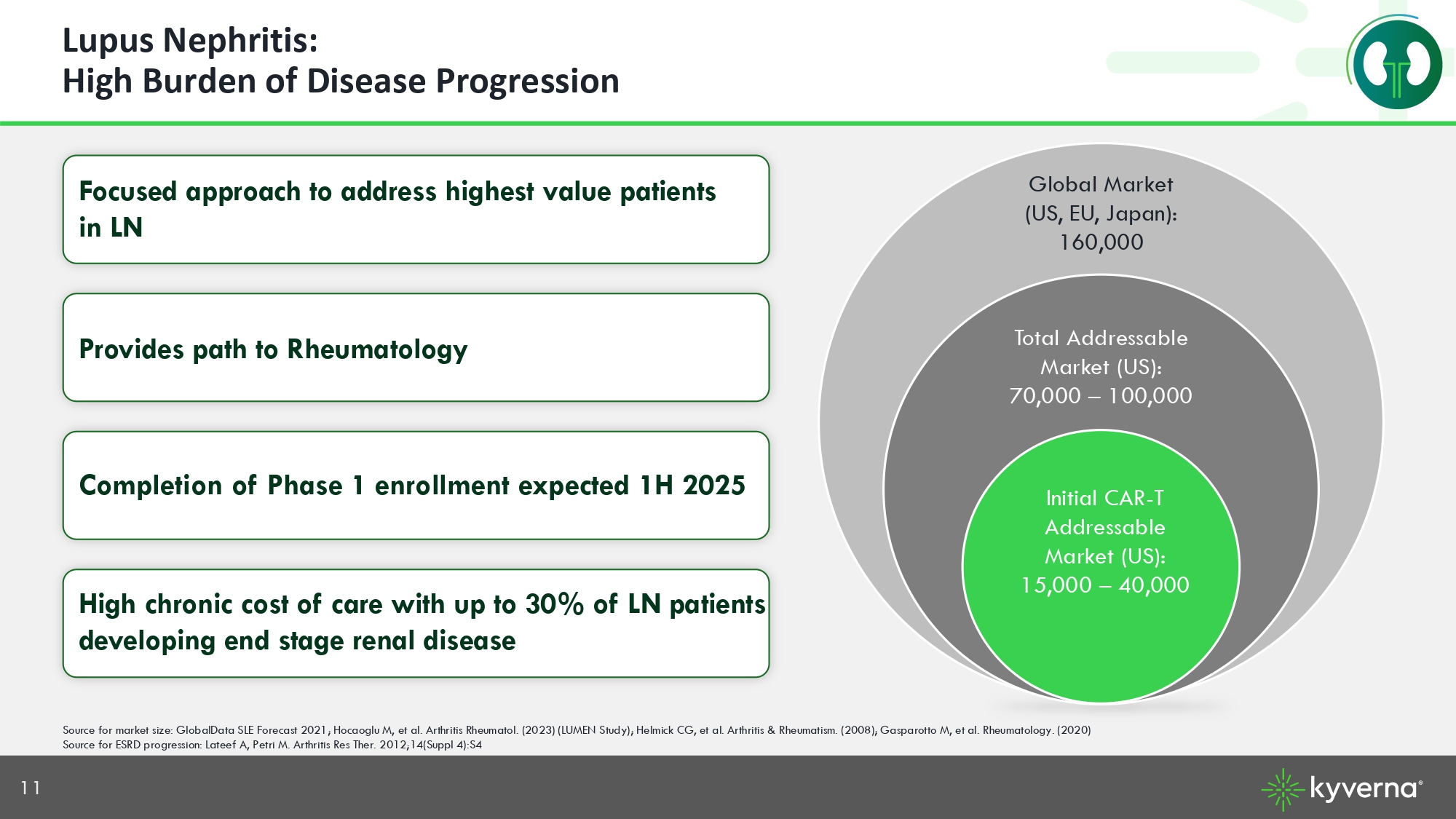

11 Lupus Nephritis: High Burden of Disease Progression Source for market size: GlobalData SLE Forecast 2021; Hocaoglu M, et al. Arthritis Rheumatol. (2023) (LUMEN Study); Helmick C G, et al. Arthritis & Rheumatism. (2008); Gasparotto M, et al. Rheumatology. (2020) Source for ESRD progression: Lateef A, Petri M. Arthritis Res Ther. 2012;14(Suppl 4):S4 Focused approach to address highest value patients in LN Provides path to Rheumatology Completion of Phase 1 enrollment expected 1H 202 5 High chronic cost of care with up to 30% of LN patients developing end stage renal disease Initial CAR - T Addressable Market (US): 15,000 – 40,000 Total Addressable Market (US): 70, 000 – 100, 000 Global Market (US, EU, Japan): 160,000

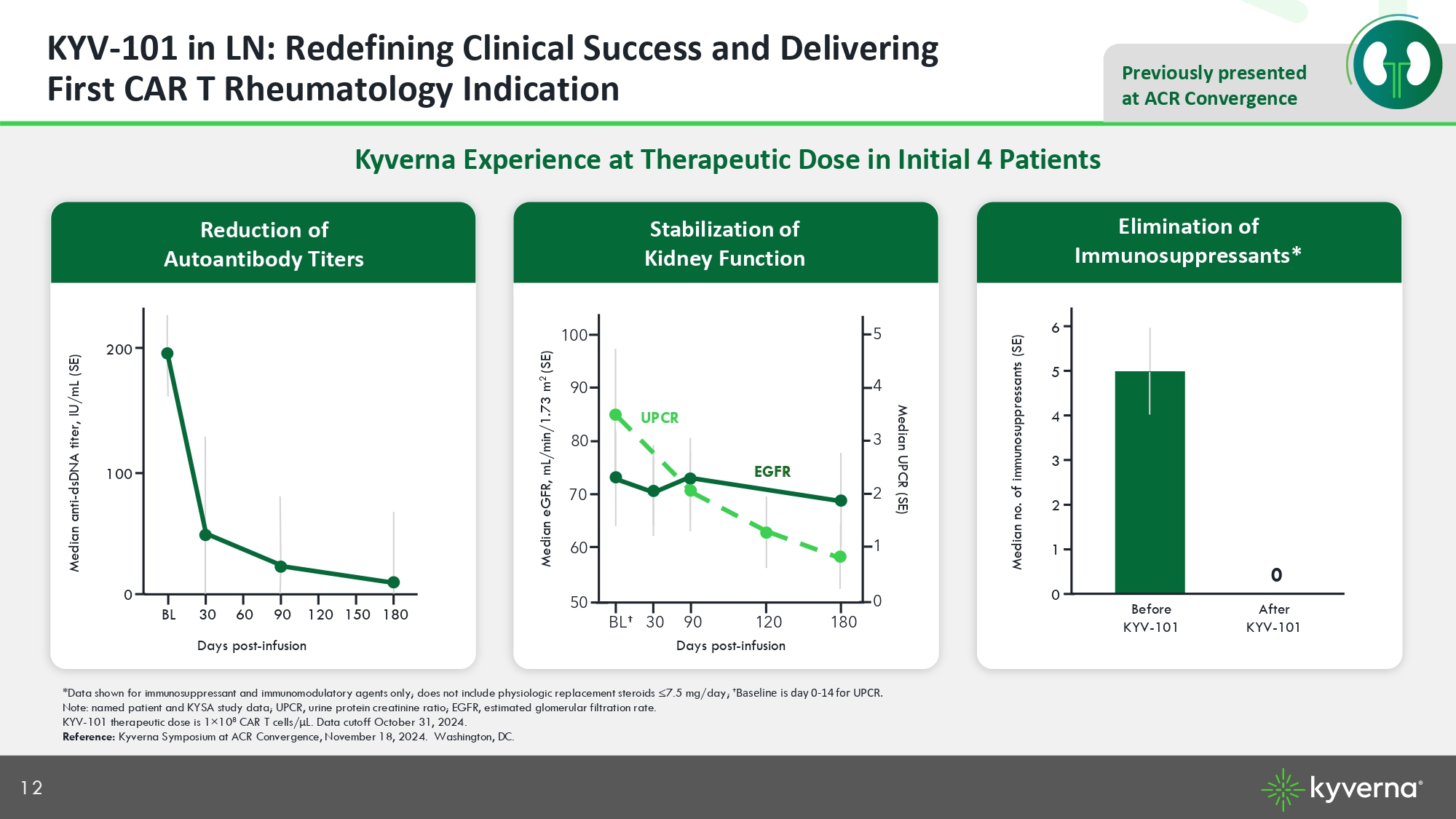

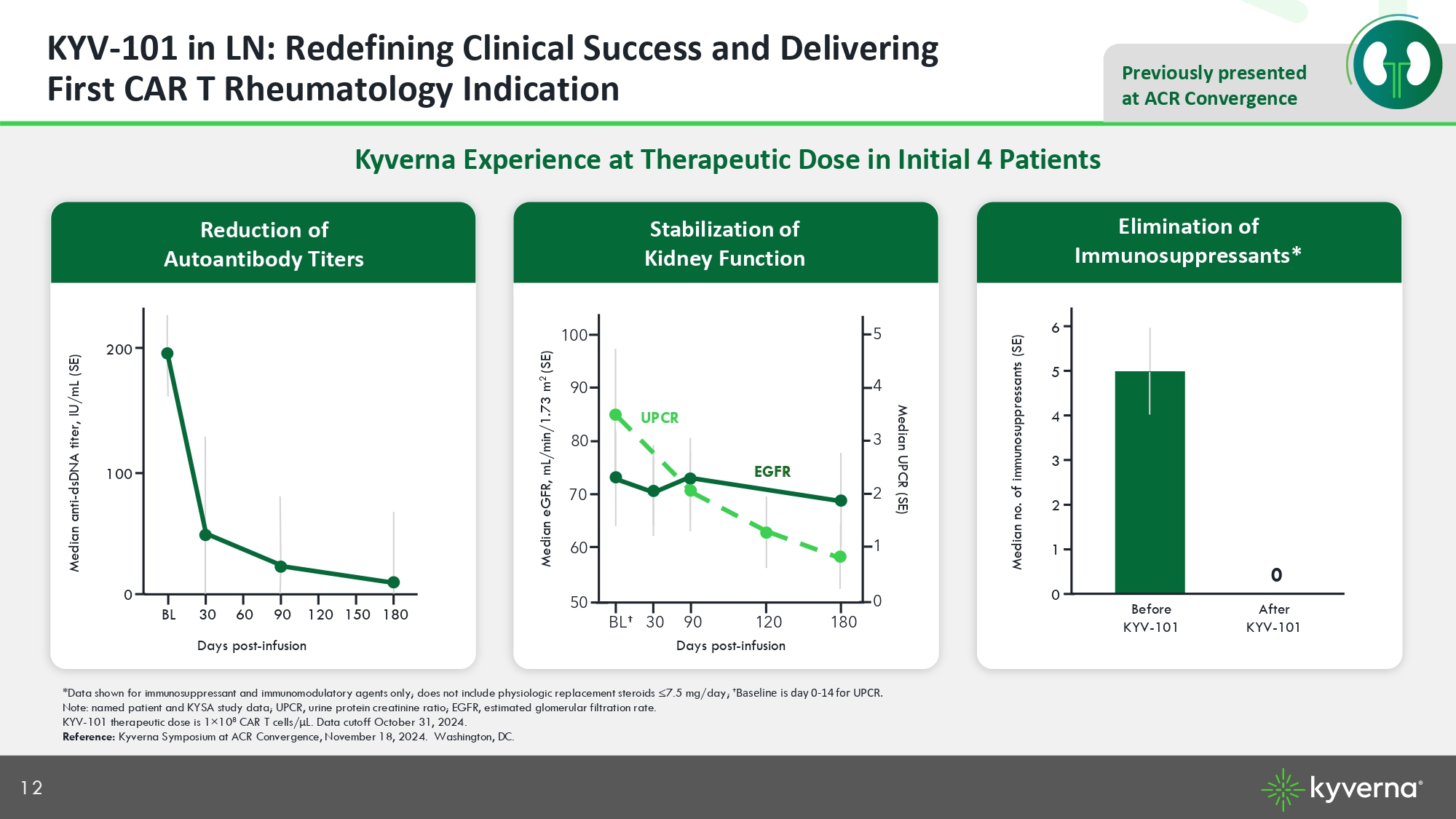

12 Previously presented at ACR Convergence KYV - 101 in LN: Redefining Clinical Success and Delivering First CAR T Rheumatology Indication Kyverna Experience at Therapeutic Dose in Initial 4 Patients Median anti - dsDNA titer, IU/mL (SE) *Data shown for immunosuppressant and immunomodulatory agents only; does not include physiologic replacement steroids ≤7.5 mg /da y; † Baseline is day 0 - 14 for UPCR. Note: named patient and KYSA study data; UPCR, urine protein creatinine ratio; EGFR, estimated glomerular filtration rate. KYV - 101 therapeutic dose is 1 × 10 8 CAR T cells/ μ L. Data cutoff October 31, 2024. Reference: Kyverna Symposium at ACR Convergence, November 18, 2024. Washington, DC. 0 100 200 180 150 120 90 60 30 BL Days post - infusion Median eGFR, mL/min/1.73 m 2 (SE) Days post - infusion Median no. of immunosuppressants (SE) 0 1 5 6 After KYV - 101 Before KYV - 101 2 4 3 0 Elimination of Immunosuppressants* Stabilization of Kidney Function Reduction of Autoantibody Titers Median UPCR (SE) 180 120 90 30 BL † 50 60 90 100 70 80 0 1 4 5 2 3 UPCR EGFR

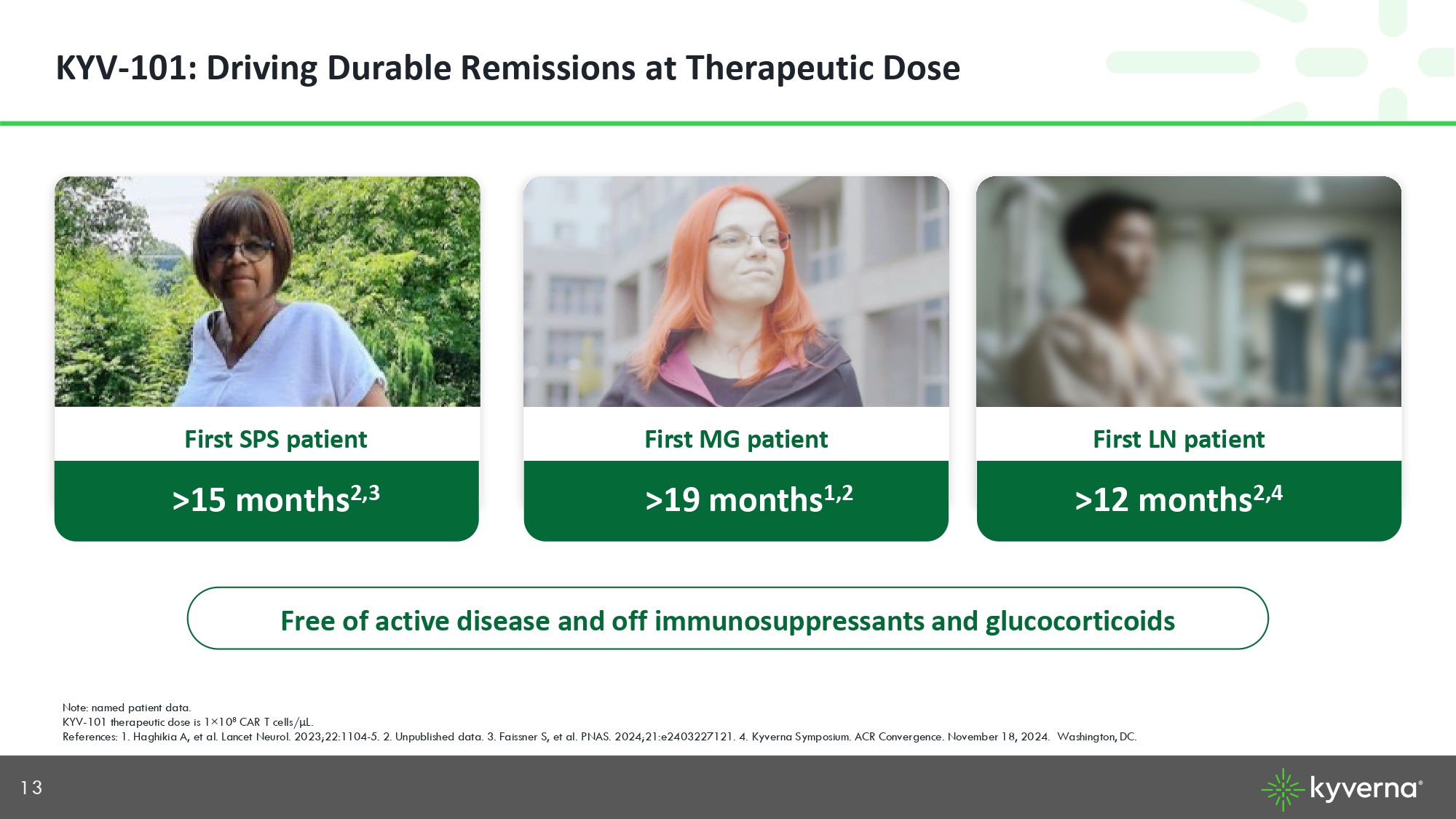

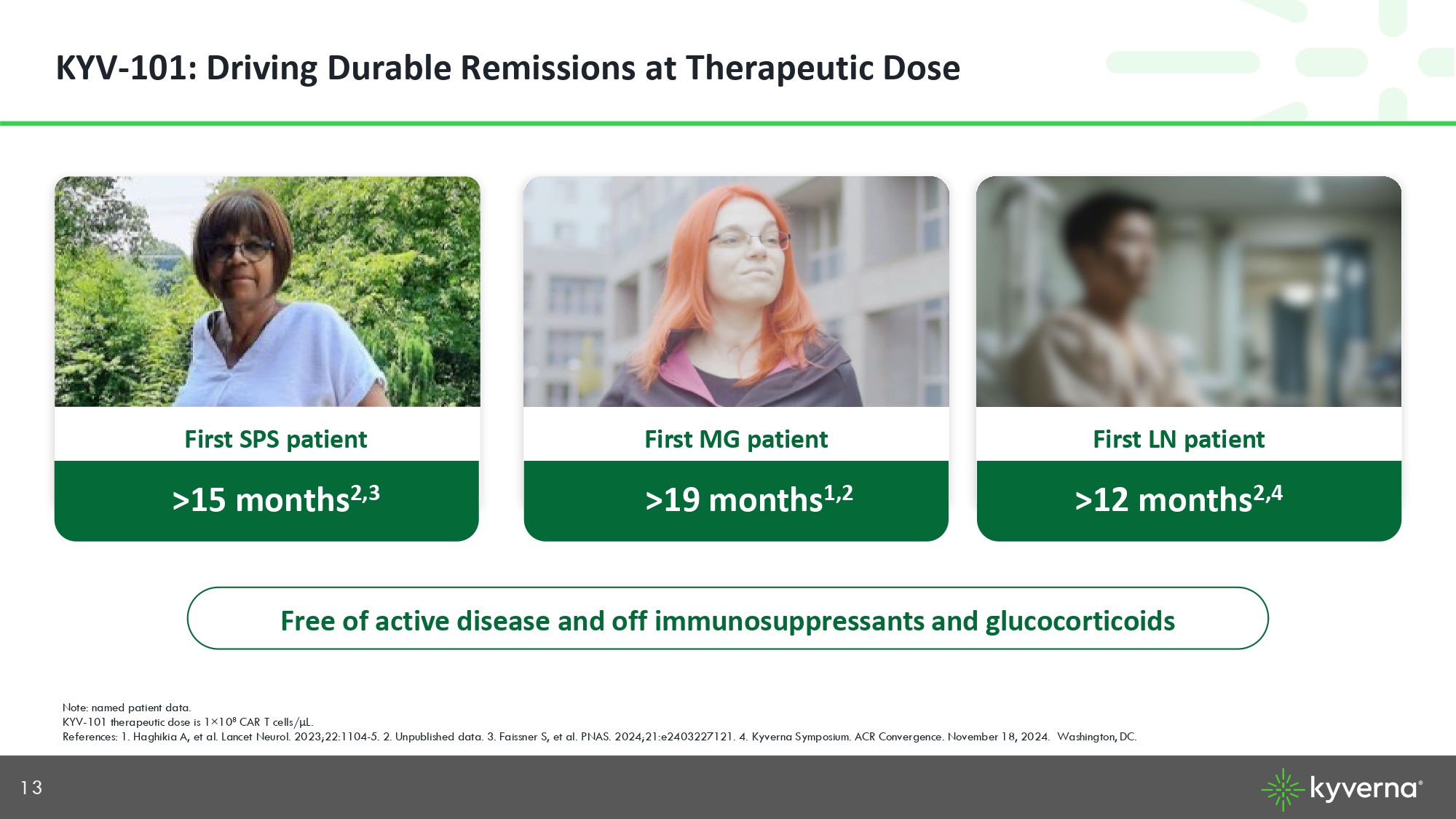

13 KYV - 101: Driving Durable Remissions at Therapeutic Dose Note: named patient data. KYV - 101 therapeutic dose is 1 × 10 8 CAR T cells/ μ L. References: 1. Haghikia A, et al. Lancet Neurol. 2023;22:1104 - 5. 2. Unpublished data. 3. Faissner S, et al. PNAS. 2024;21:e24032 27121. 4. Kyverna Symposium. ACR Convergence. November 18, 2024. Washington, DC. Free of active disease and off immunosuppressants and glucocorticoids First MG patient > >19 months 1,2 First LN patient >12 months 2,4 First SPS patient >15 months 2,3

14 Uncontrollable Myasthenia Gravis Recurrent Flares Frequent Hospitalizations Intubations Tracheostomy Feeding Tube Denise, MG Warrior

15 Dosed with KYV - 101

16

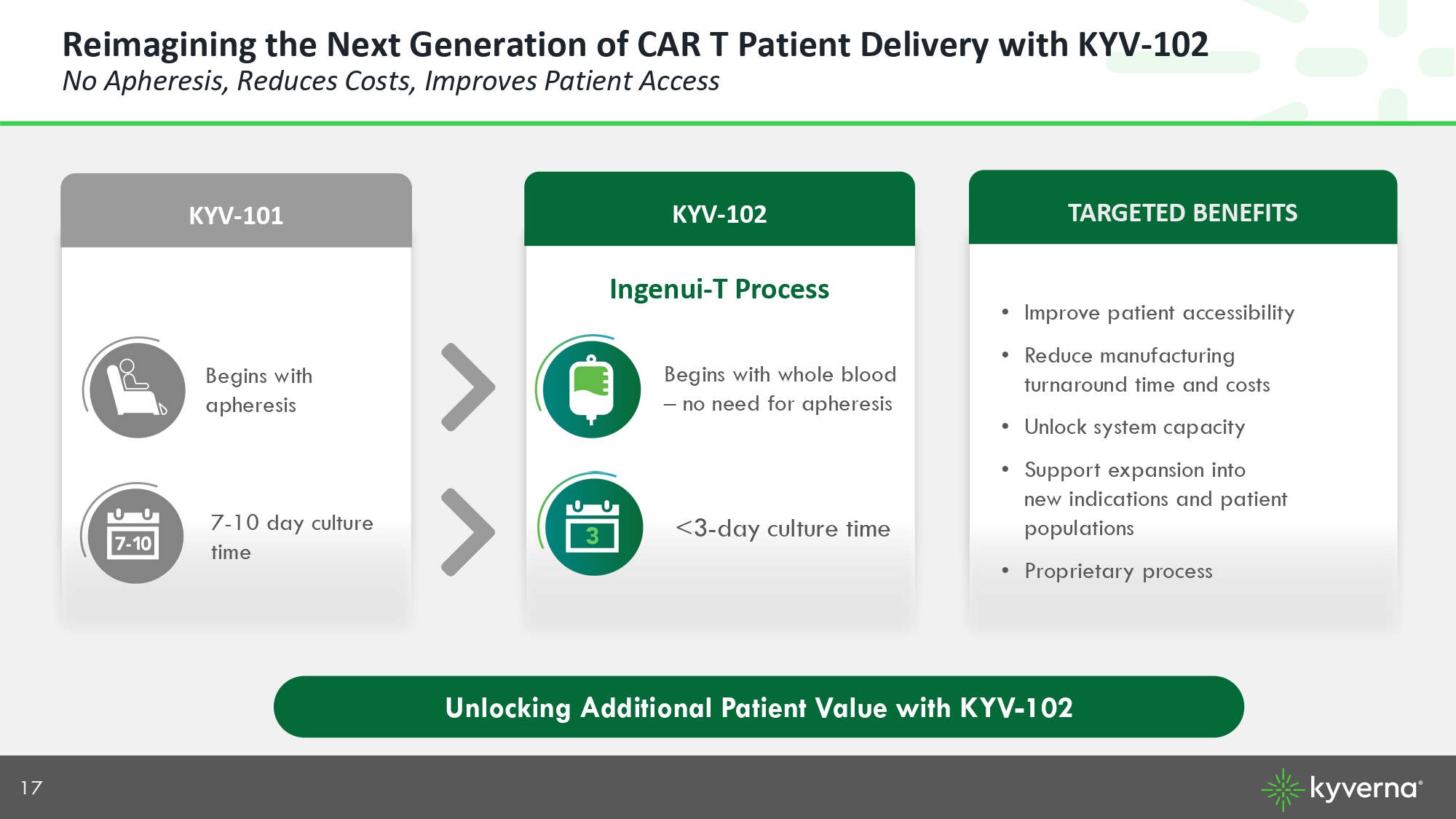

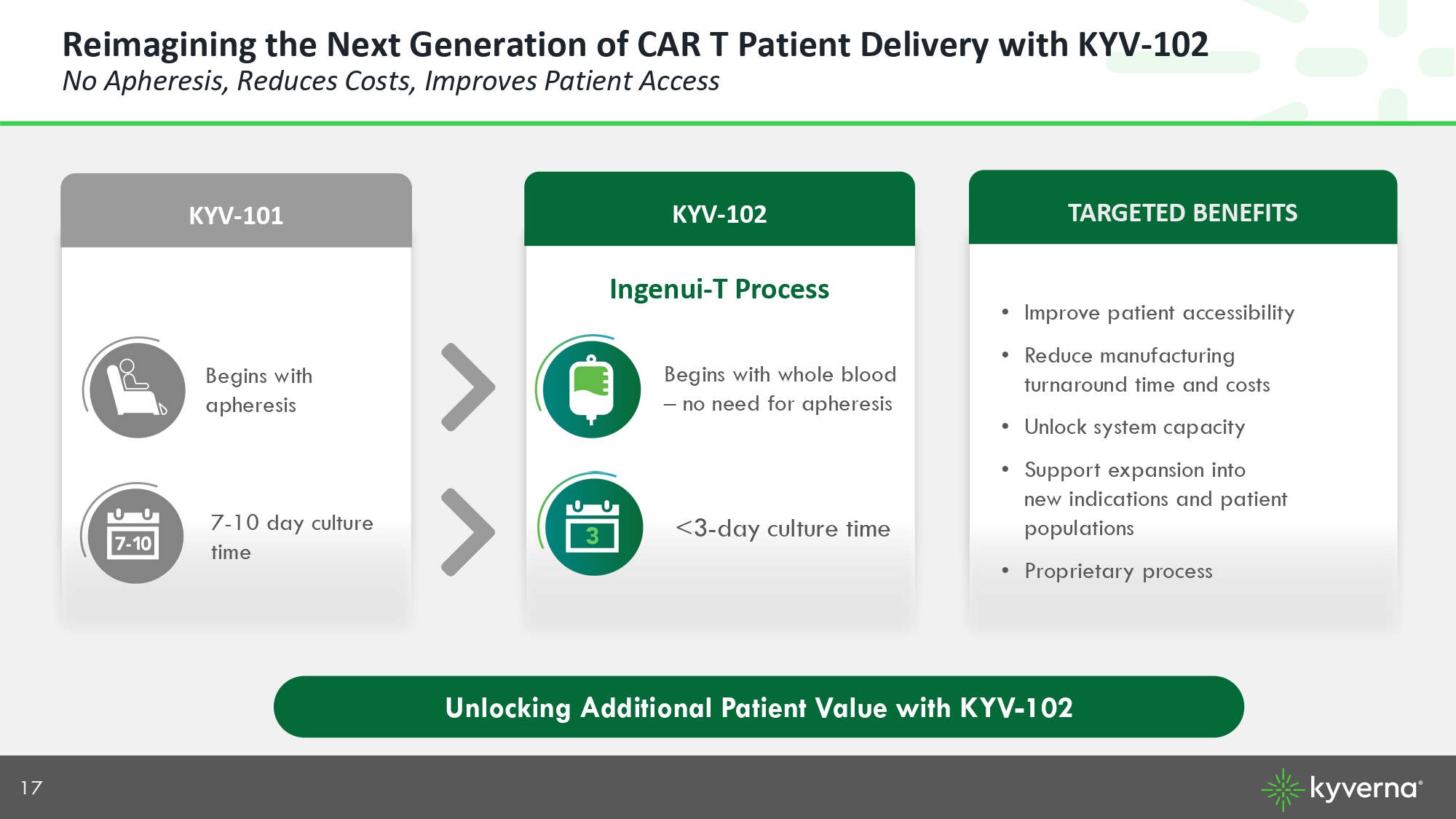

17 Reimagining the Next Generation of CAR T Patient Delivery with KYV - 102 No Apheresis, Reduces Costs, Improves Patient Access KYV - 102 KYV - 101 Begins with apheresis Begins with whole blood – no need for apheresis 7 - 10 day culture time <3 - day culture time TARGETED BENEFITS • Improve patient accessibility • Reduce manufacturing turnaround time and costs • Unlock system capacity • Support expansion into new indications and patient populations • Proprietary process Ingenui - T Process Unlocking Additional Patient Value with KYV - 102

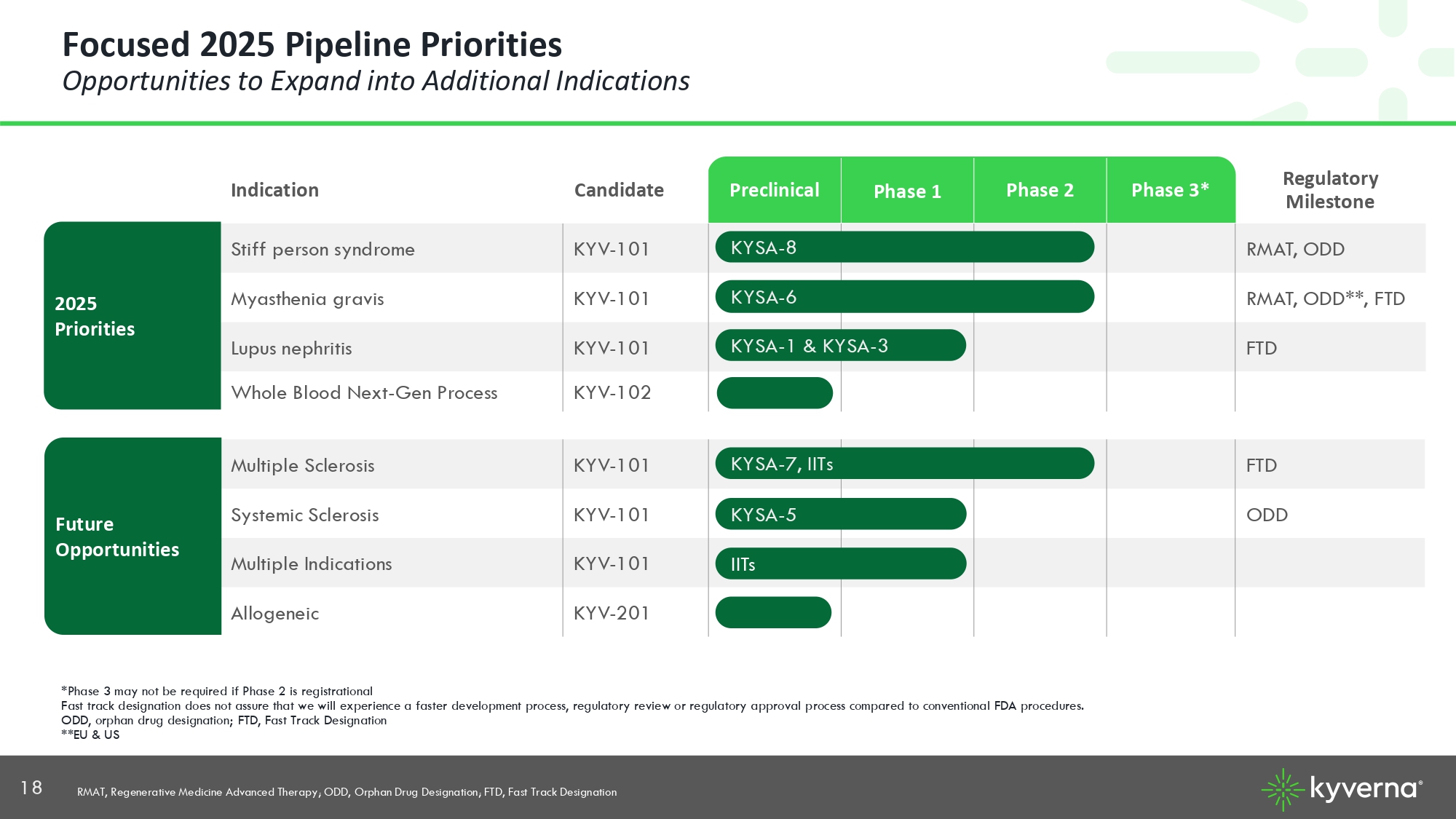

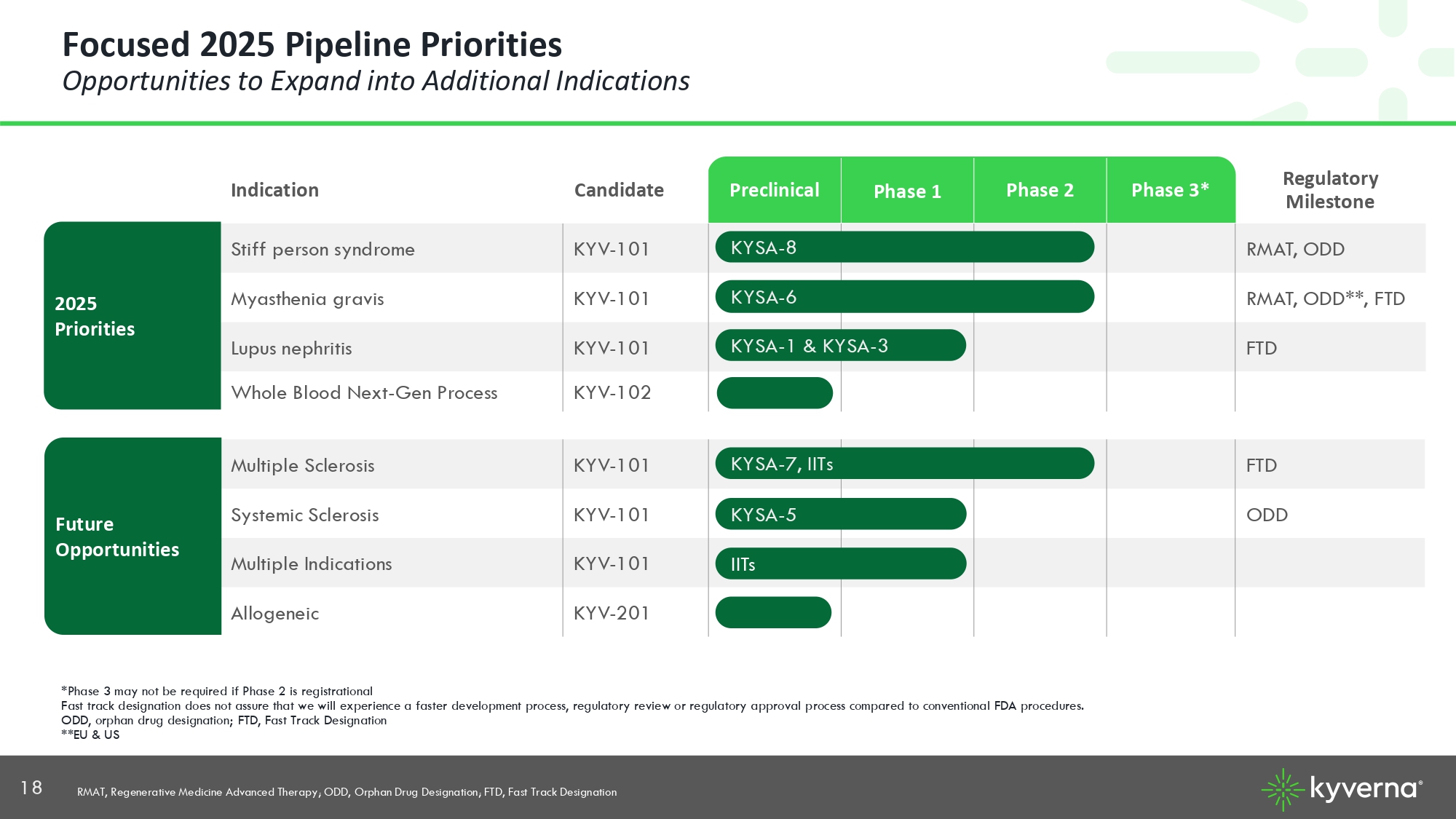

18 Regulatory Milestone Phase 3* Phase 2 Phase 1 Preclinical Candidate Indication RMAT, ODD KYV - 101 Stiff person syndrome RMAT, ODD**, FTD KYV - 101 Myasthenia gravis FTD KYV - 101 Lupus nephritis KYV - 102 Whole Blood Next - Gen Process *Phase 3 may not be required if Phase 2 is registrational Fast track designation does not assure that we will experience a faster development process, regulatory review or regulatory app roval process compared to conventional FDA procedures. ODD, orphan drug designation; FTD, Fast Track Designation **EU & US KYSA - 8 KYSA - 6 KYSA - 1 & KYSA - 3 Focused 2025 Pipeline Priorities Opportunities to Expand into Additional Indications 2025 Priorities FTD KYV - 101 Multiple Sclerosis ODD KYV - 101 Systemic Sclerosis KYV - 101 Multiple Indications KYV - 201 Allogeneic KYSA - 7, IITs KYSA - 5 IITs Future Opportunities RMAT, Regenerative Medicine Advanced Therapy; ODD, Orphan Drug Designation; FTD, Fast Track Designation

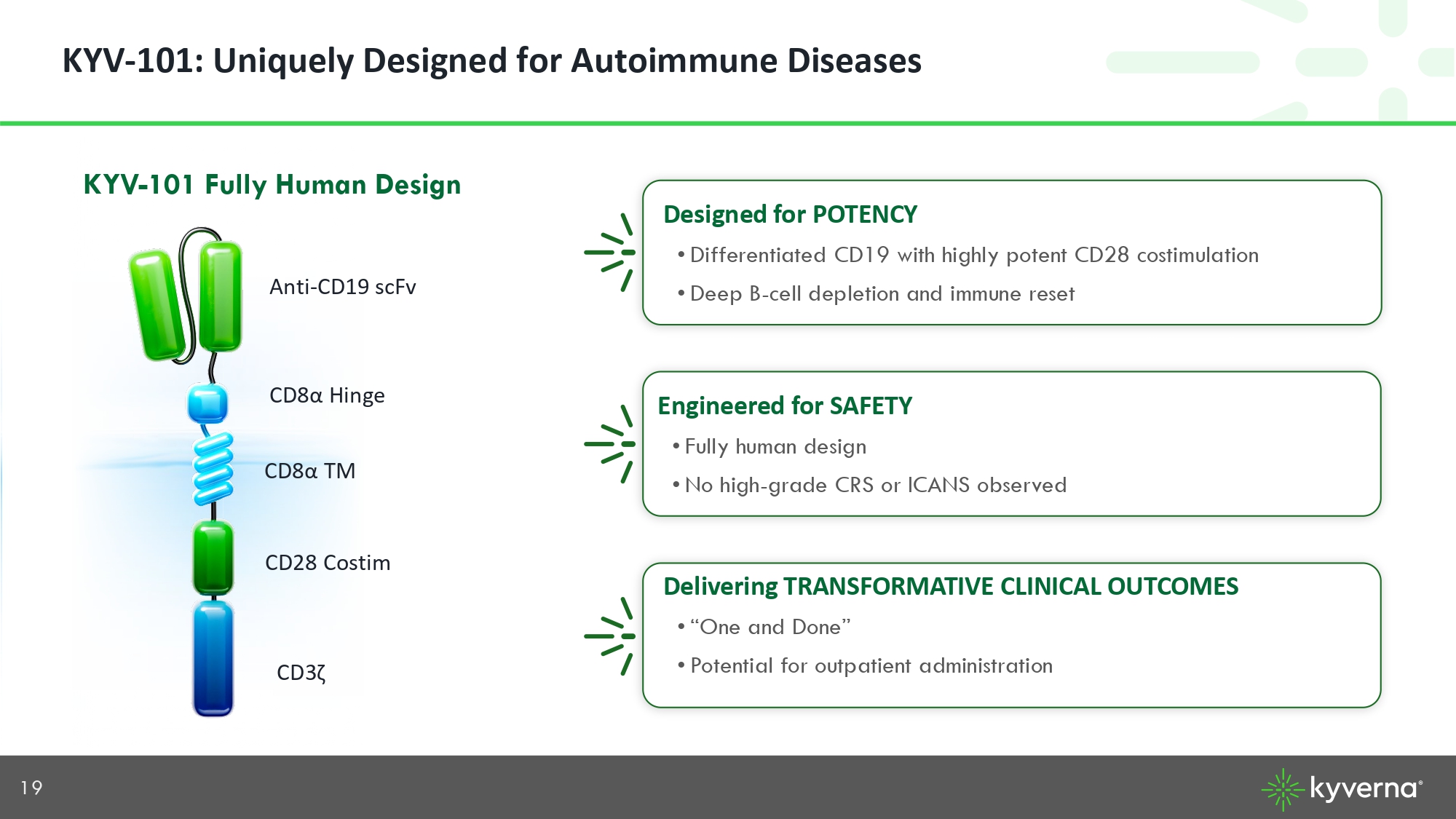

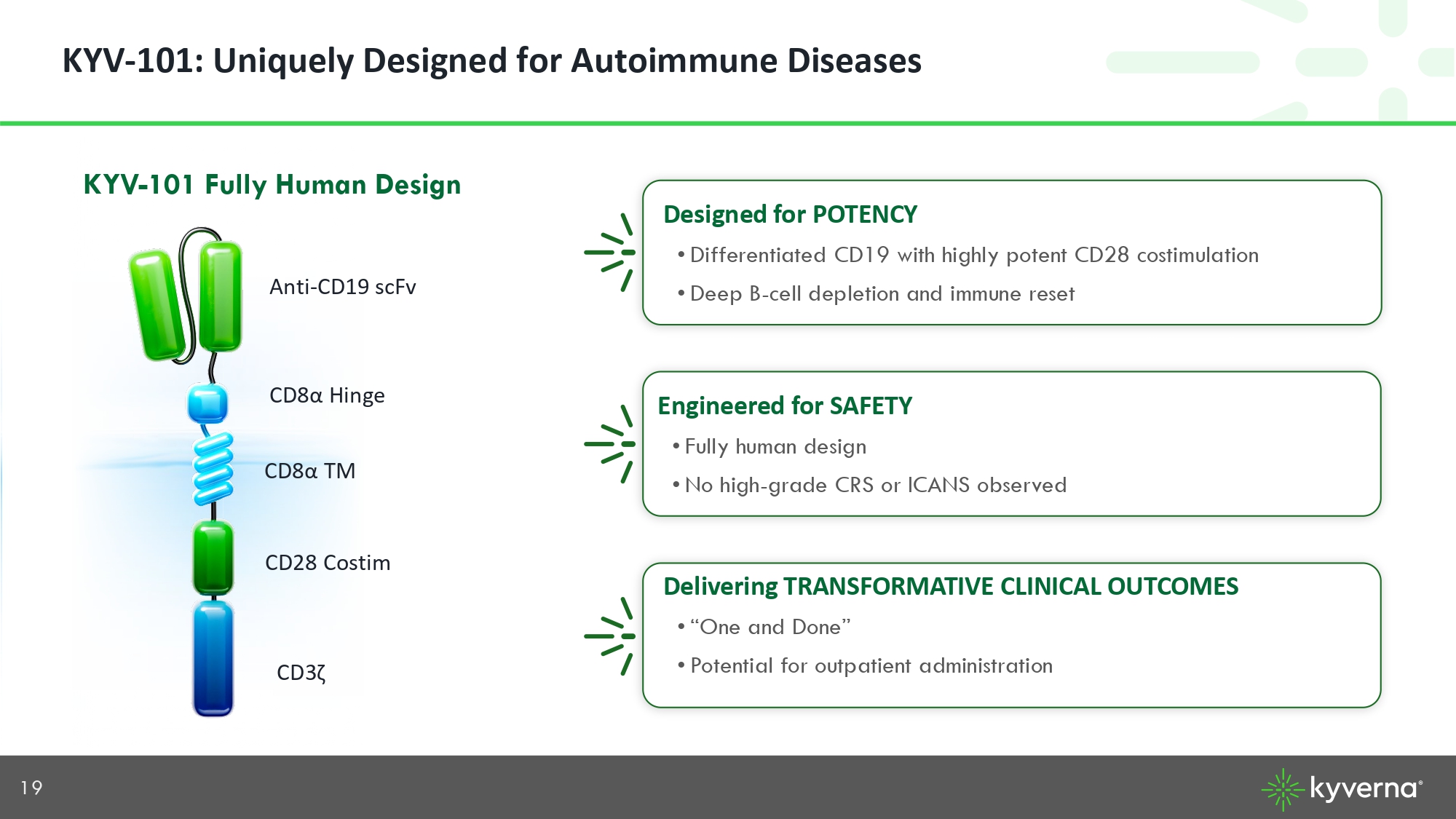

19 KYV - 101: Uniquely Designed for Autoimmune Diseases KYV - 101 Fully Human Design Anti - CD19 scFv CD8 α TM CD28 Costim CD3 ζ C D8 α Hinge Designed for POTENCY • Differentiated CD19 with highly potent CD28 costimulation • Deep B - cell depletion and immune reset Delivering TRANSFORMATIVE CLINICAL OUTCOMES • “One and Done” • Potential for outpatient administration Engineered for SAFETY • Fully human design • No high - grade CRS or ICANS observed

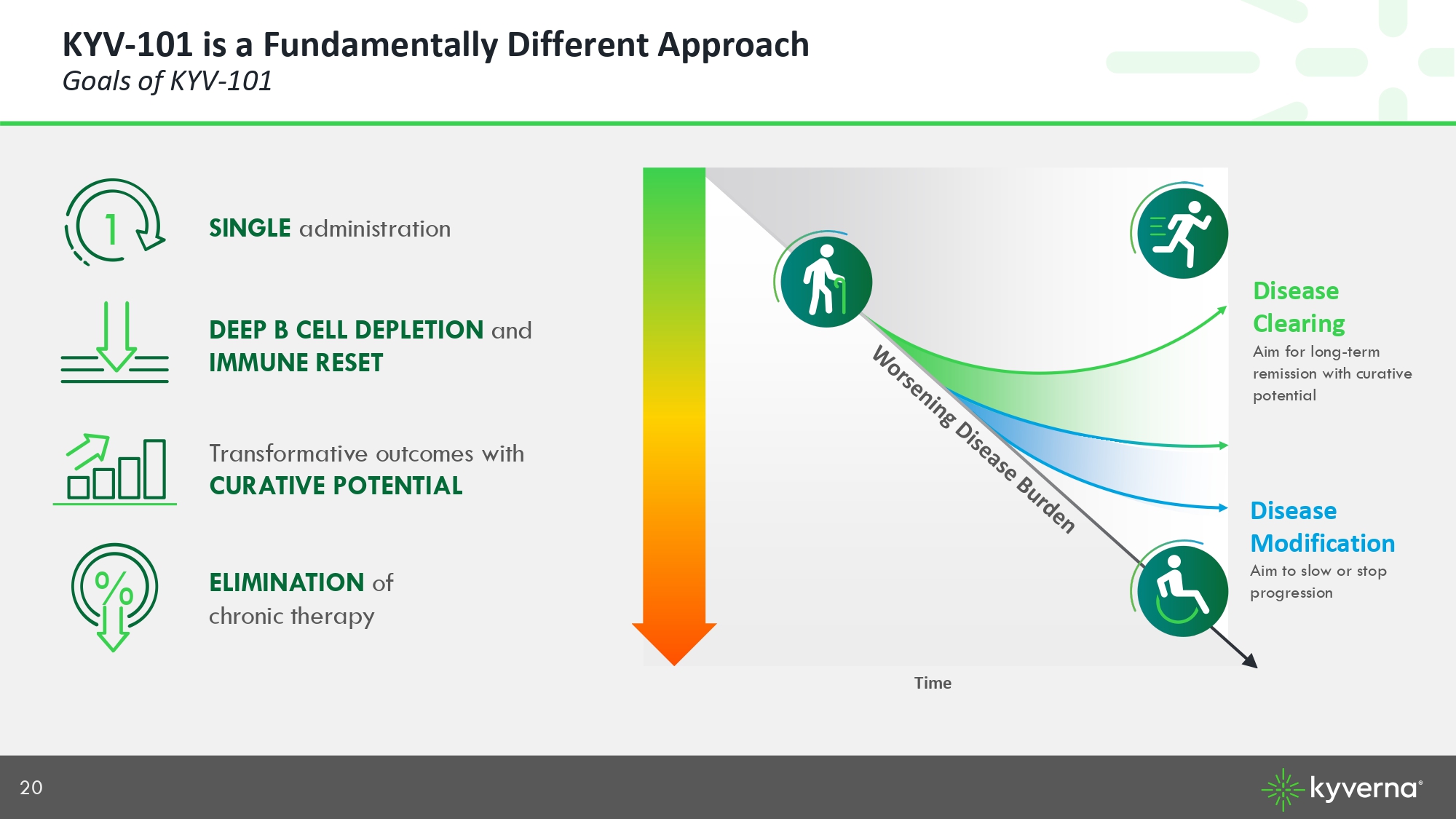

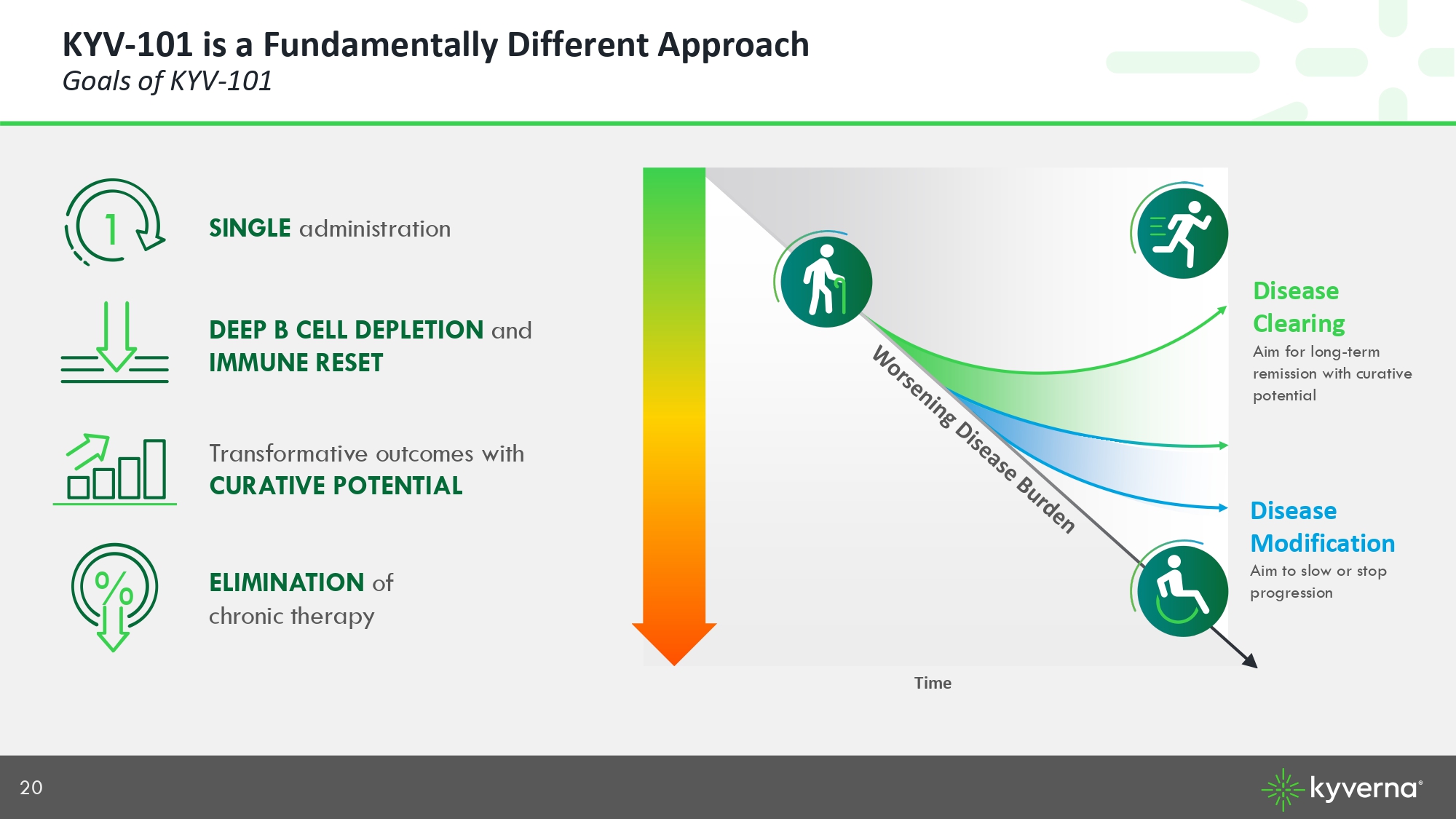

20 KYV - 101 is a Fundamentally Different Approach Goals of KYV - 101 DEEP B CELL DEPLETION and IMMUNE RESET ELIMINATION of chronic therapy % SINGLE administration 1 Transformative outcomes with CURATIVE POTENTIAL Disease Modification Aim to slow or stop progression Aim for long - term remission with curative potential Time

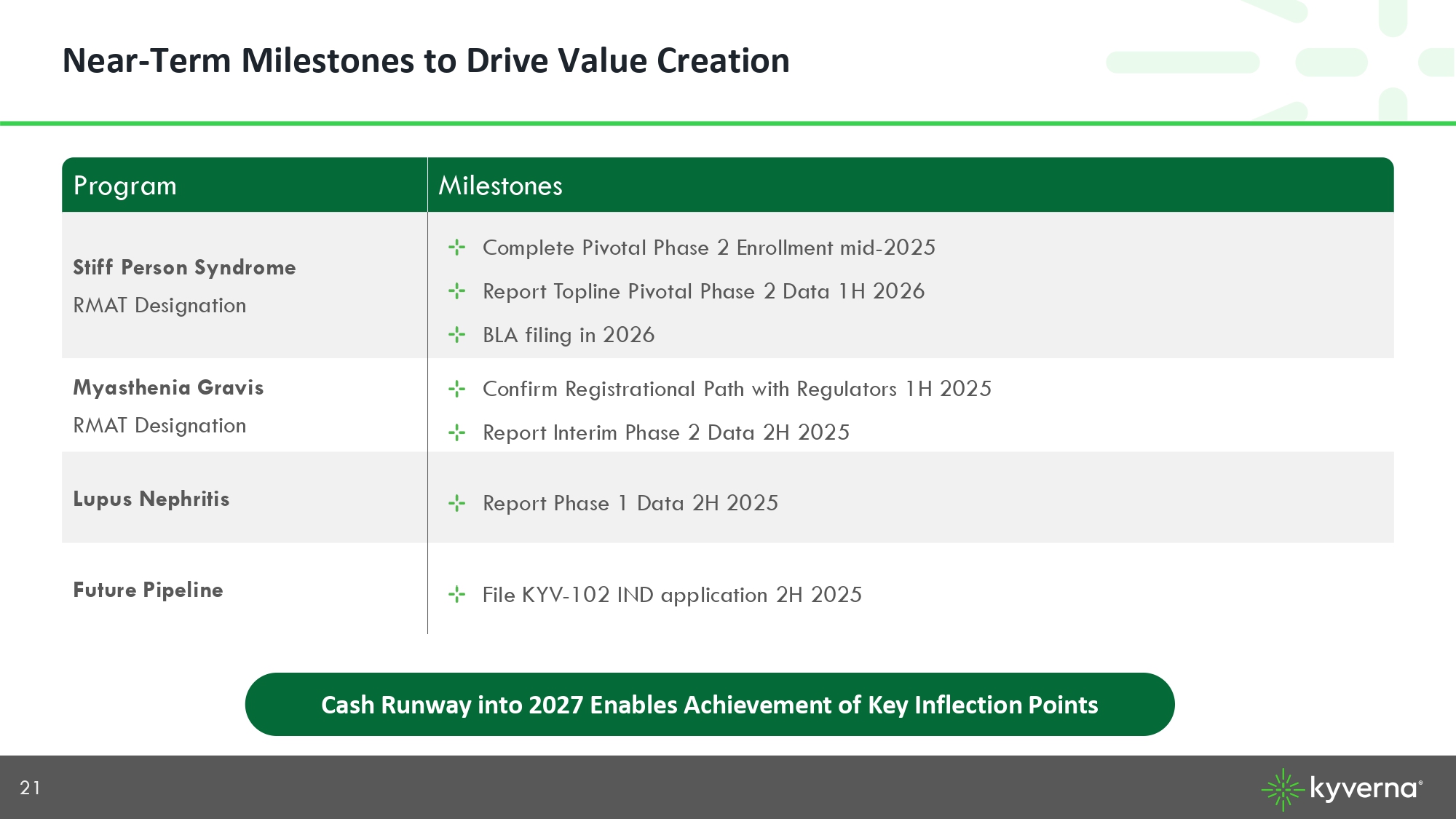

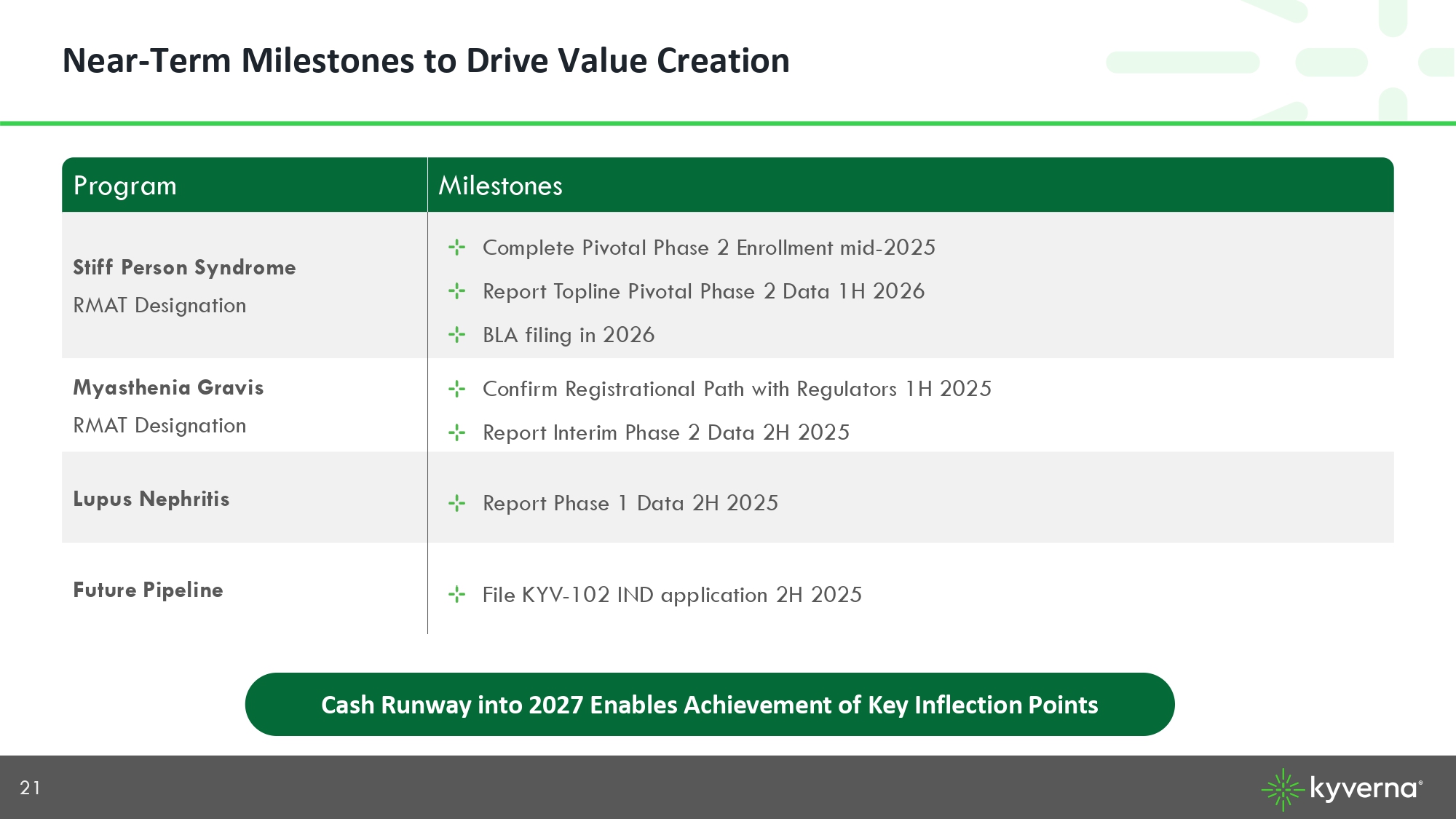

21 Near - Term Milestones to Drive Value Creation Milestones Program Complete Pivotal Phase 2 Enrollment mid - 2025 Report Topline Pivotal Phase 2 Data 1H 2026 BLA filing in 2026 Stiff Person Syndrome RMAT Designation Confirm Registrational Path with Regulators 1H 2025 Report Interim Phase 2 Data 2H 2025 Myasthenia Gravis RMAT Designation Report Phase 1 Data 2H 2025 Lupus Nephritis File KYV - 102 IND application 2H 2025 Future Pipeline Cash Runway into 2027 Enables Achievement of Key Inflection Points

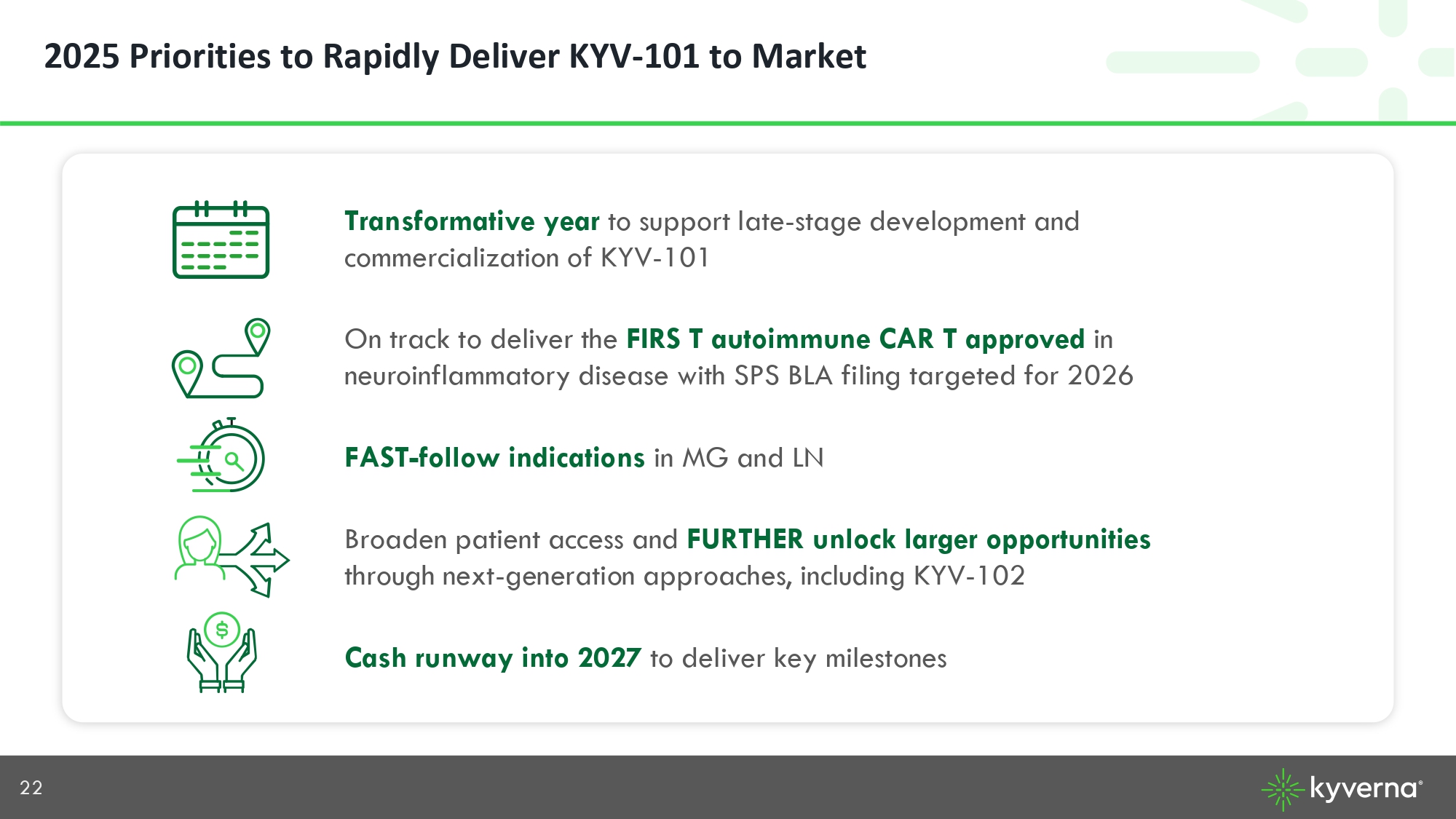

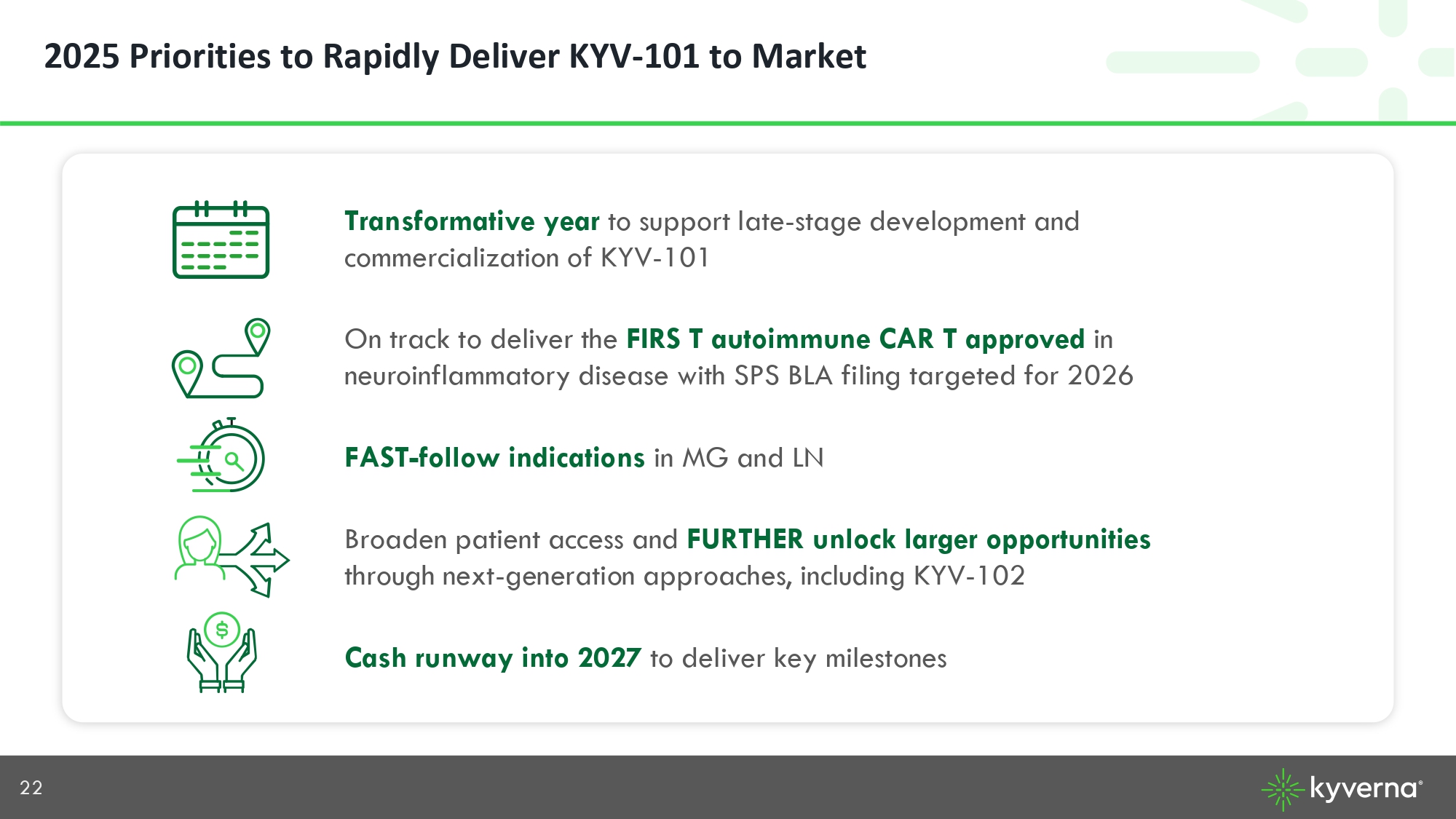

22 2025 Priorities to Rapidly Deliver KYV - 101 to Market Transformative year to support late - stage development and commercialization of KYV - 101 On track to deliver the FIRS T autoimmune CAR T approved in neuroinflammatory disease with SPS BLA filing targeted for 2026 FAST - follow indications in MG and LN Broaden patient access and FURTHER unlock larger opportunities through next - generation approaches, including KYV - 102 Cash runway into 2027 to deliver key milestones

Roger Patient warrior Appendix

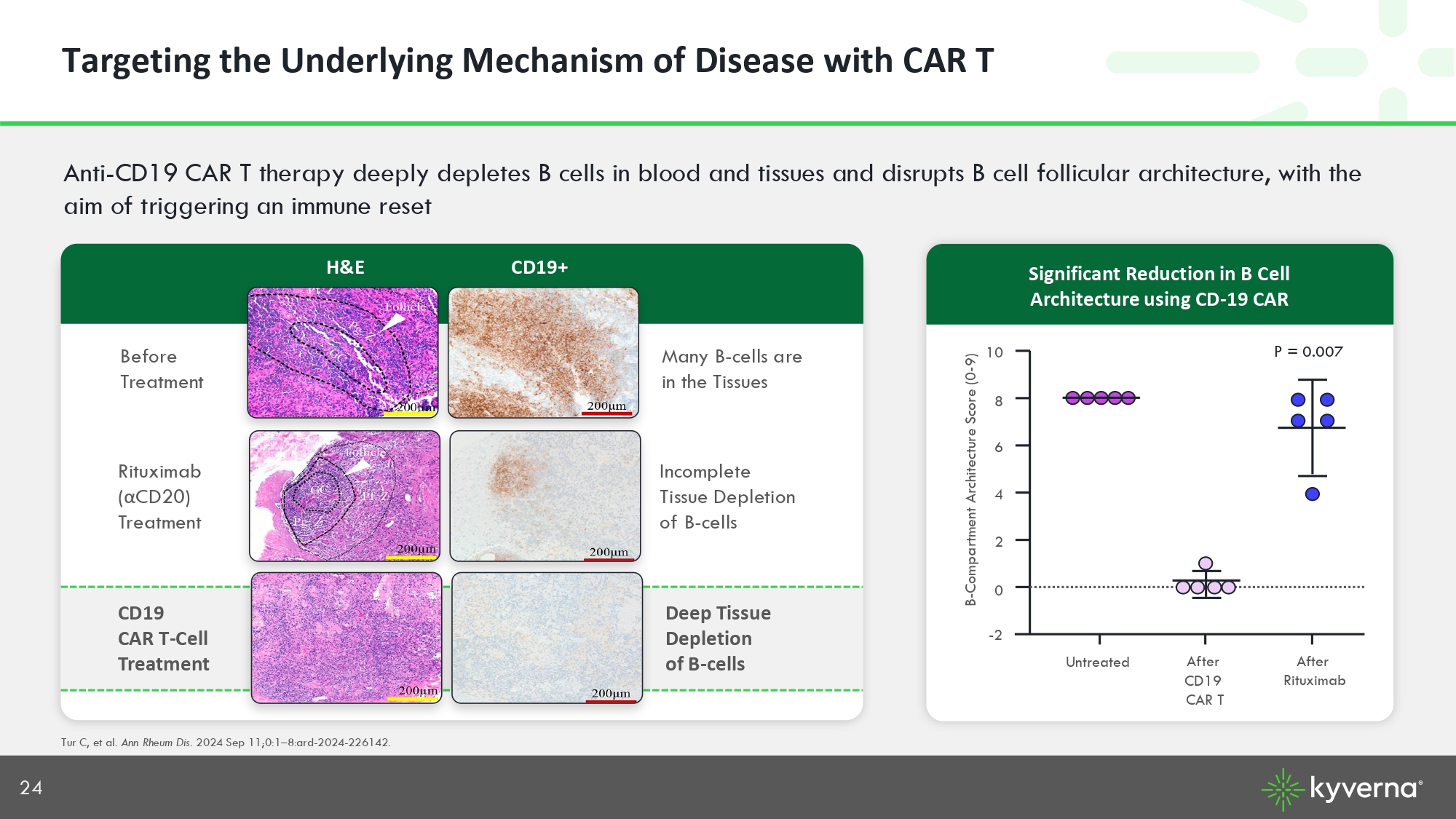

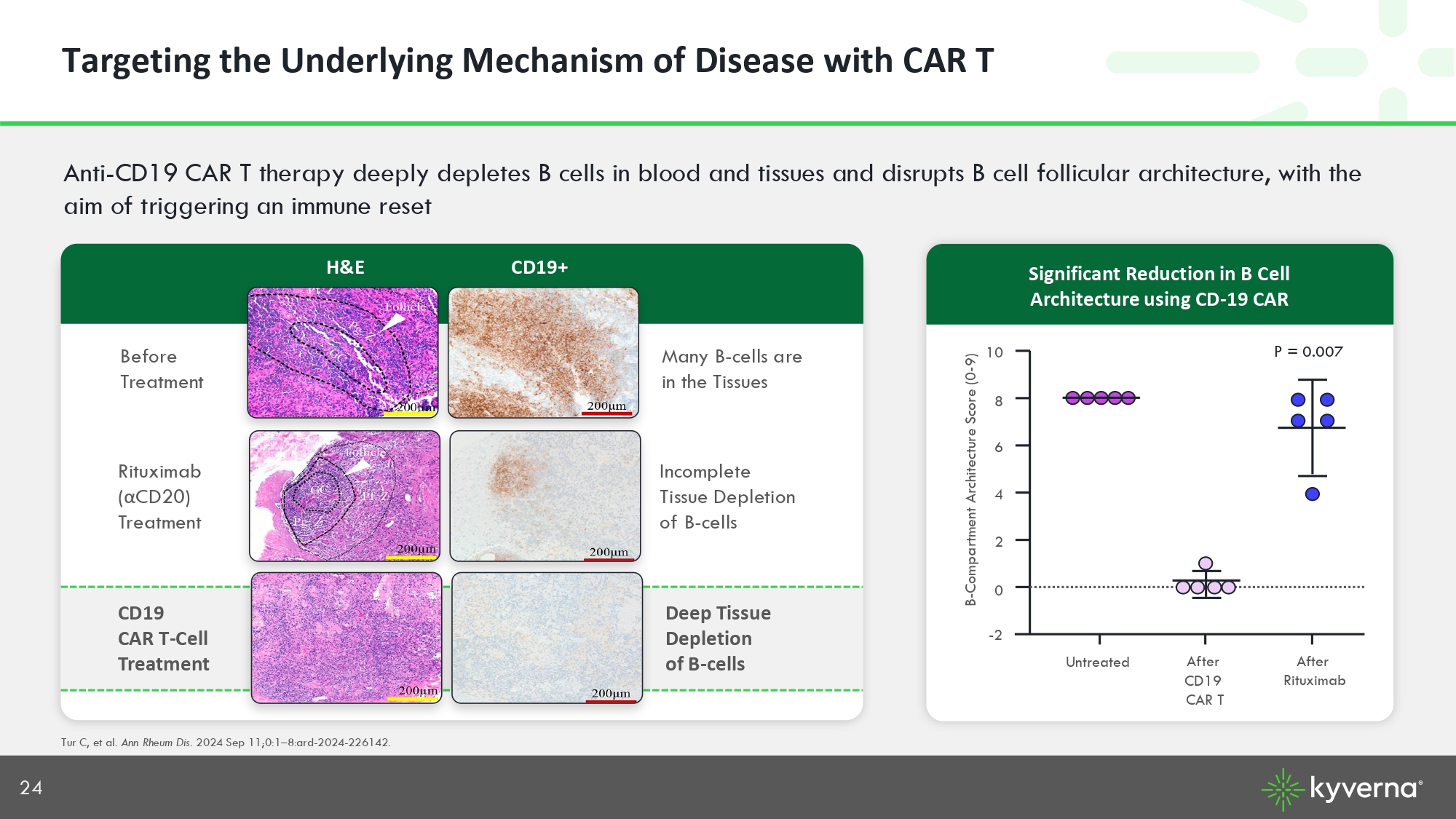

24 Anti - CD19 CAR T therapy deeply depletes B cells in blood and tissues and disrupts B cell follicular architecture, with the aim of triggering an immune reset Tur C, et al. Ann Rheum Dis. 2024 Sep 11;0:1 – 8:ard - 2024 - 226142. Before Treatment CD19+ Significant Reduction in B Cell Architecture using CD - 19 CAR - 2 Untreated After CD19 CAR T 0 2 4 6 8 10 B - Compartment Architecture Score (0 - 9) After Rituximab P = 0.007 H&E Rituximab ( α CD20) Treatment Incomplete Tissue Depletion of B - cells Many B - cells are in the Tissues Targeting the Underlying Mechanism of Disease with CAR T CD19 CAR T - Cell Treatment Deep Tissue Depletion of B - cells

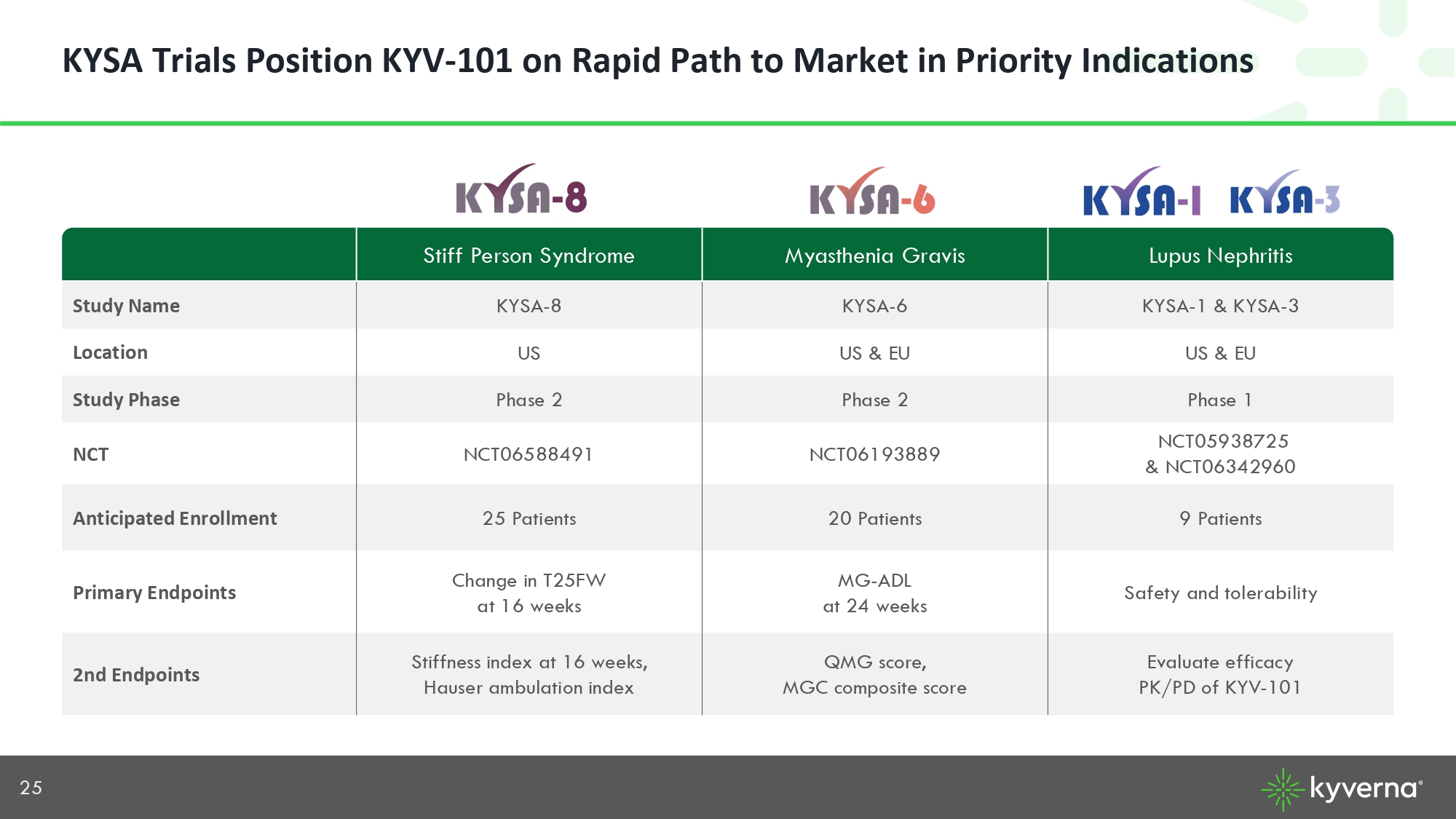

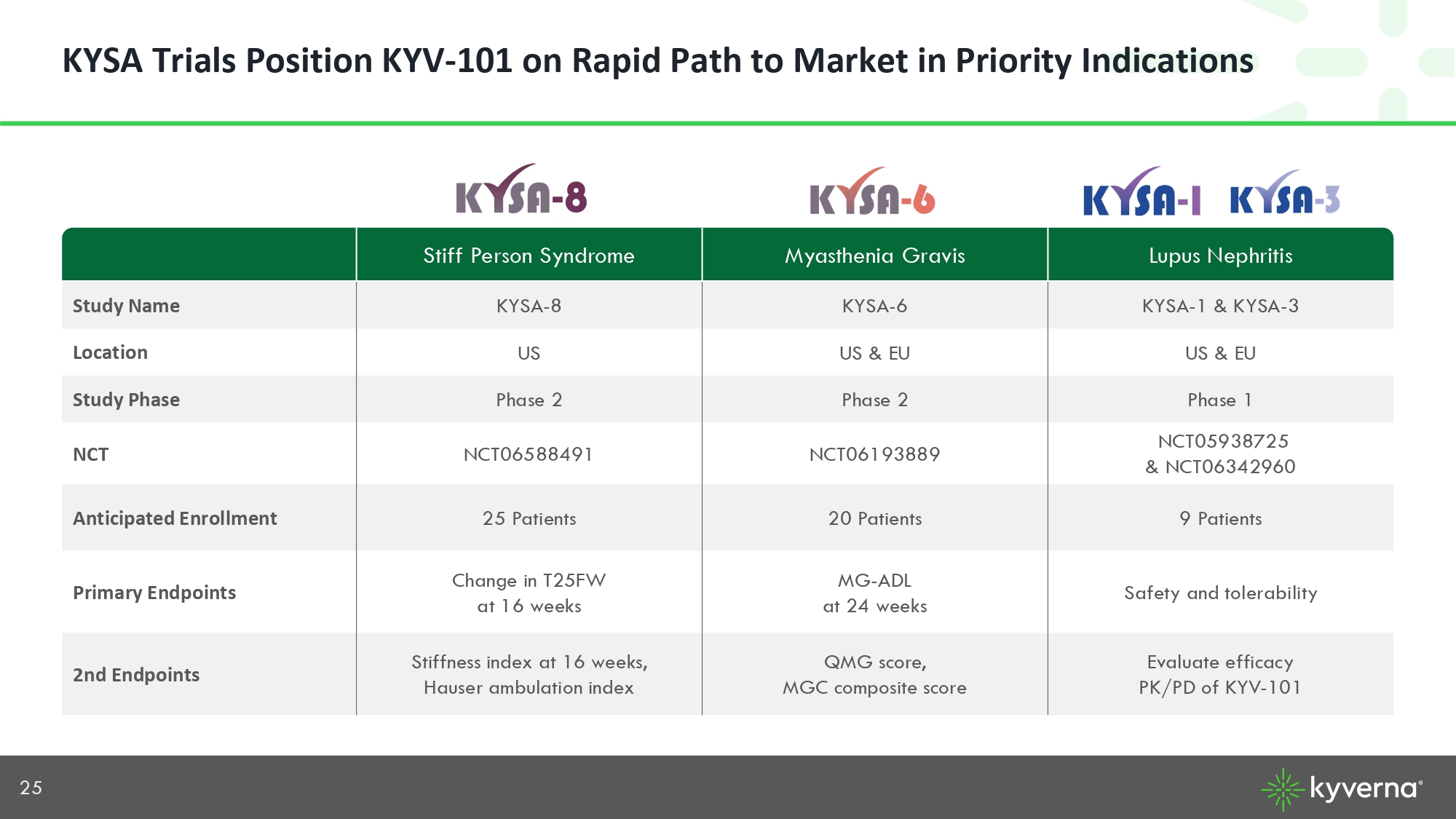

25 KYSA Trials Position KYV - 101 on Rapid Path to Market in Priority Indications Lupus Nephritis Myasthenia Gravis Stiff Person Syndrome KYSA - 1 & KYSA - 3 KYSA - 6 KYSA - 8 Study Name US & EU US & EU US Location Phase 1 Phase 2 Phase 2 Study Phase NCT05938725 & NCT 06342960 NCT06193889 NCT06588491 NCT 9 Patients 20 Patients 25 Patients Anticipated Enrollment Safety and tolerability MG - ADL at 24 weeks Change in T25FW at 16 weeks Primary Endpoints Evaluate efficacy PK/PD of KYV - 101 QMG score, MGC composite score Stiffness index at 16 weeks, Hauser ambulation index 2nd Endpoints

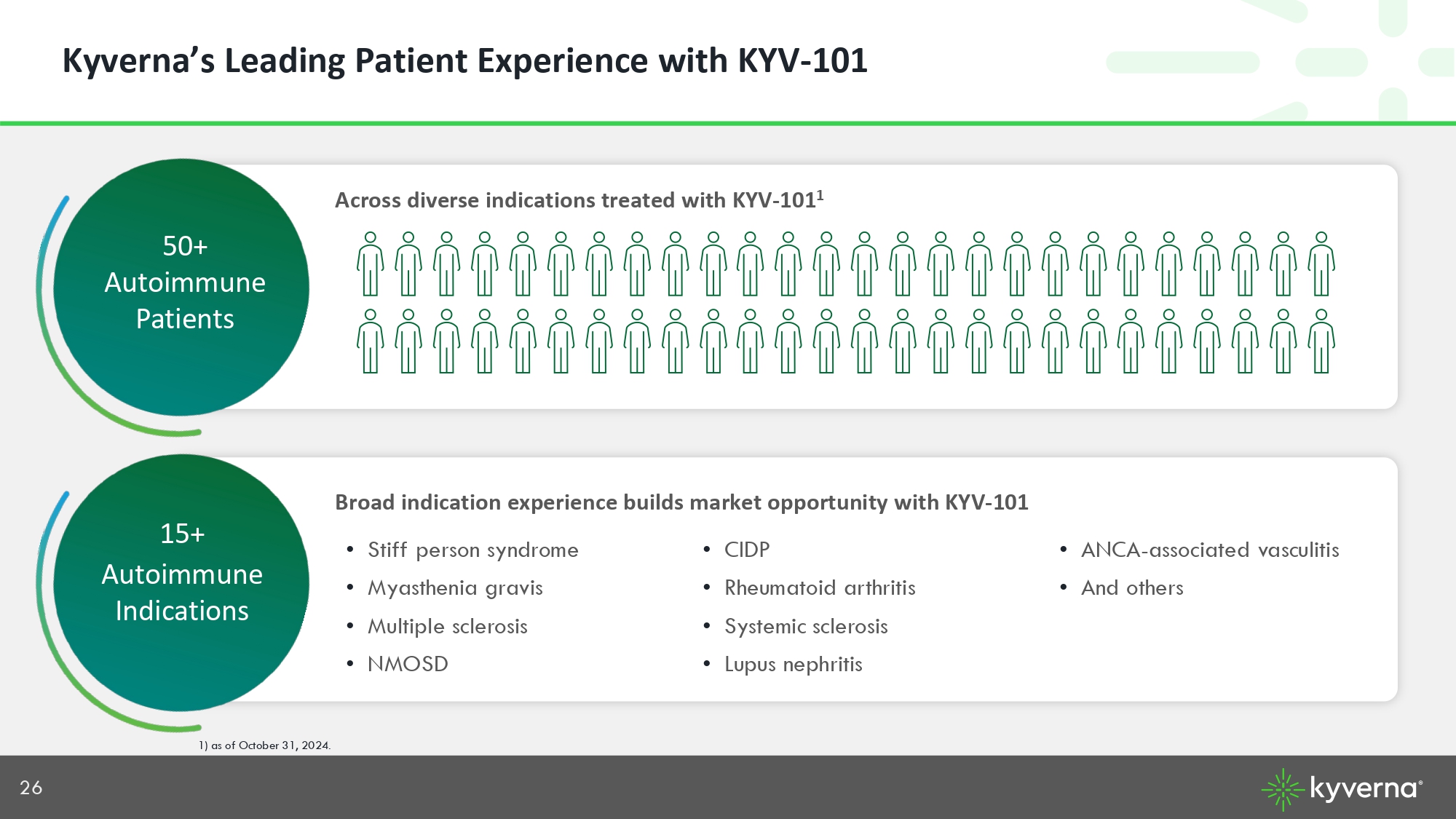

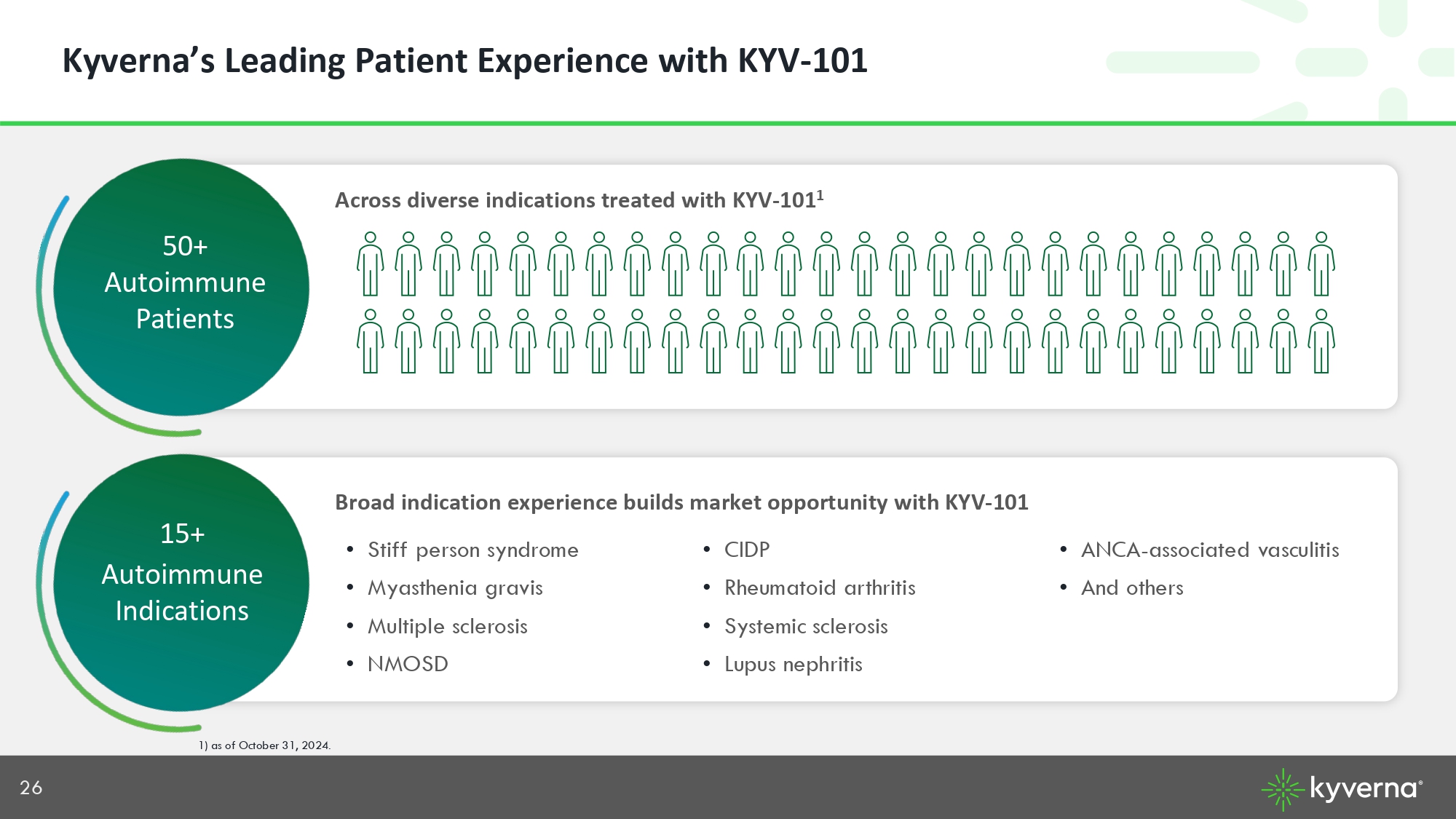

26 Kyverna’s Leading Patient Experience with KYV - 101 Across diverse indications treated with KYV - 101 1 50+ Autoimmune Patients 15+ Autoimmune Indications • Stiff person syndrome • Myasthenia gravis • Multiple sclerosis • NMOSD • CIDP • Rheumatoid arthritis • Systemic sclerosis • Lupus nephritis • ANCA - associated vasculitis • And others 1) as of October 31, 2024. Broad indication experience builds market opportunity with KYV - 101

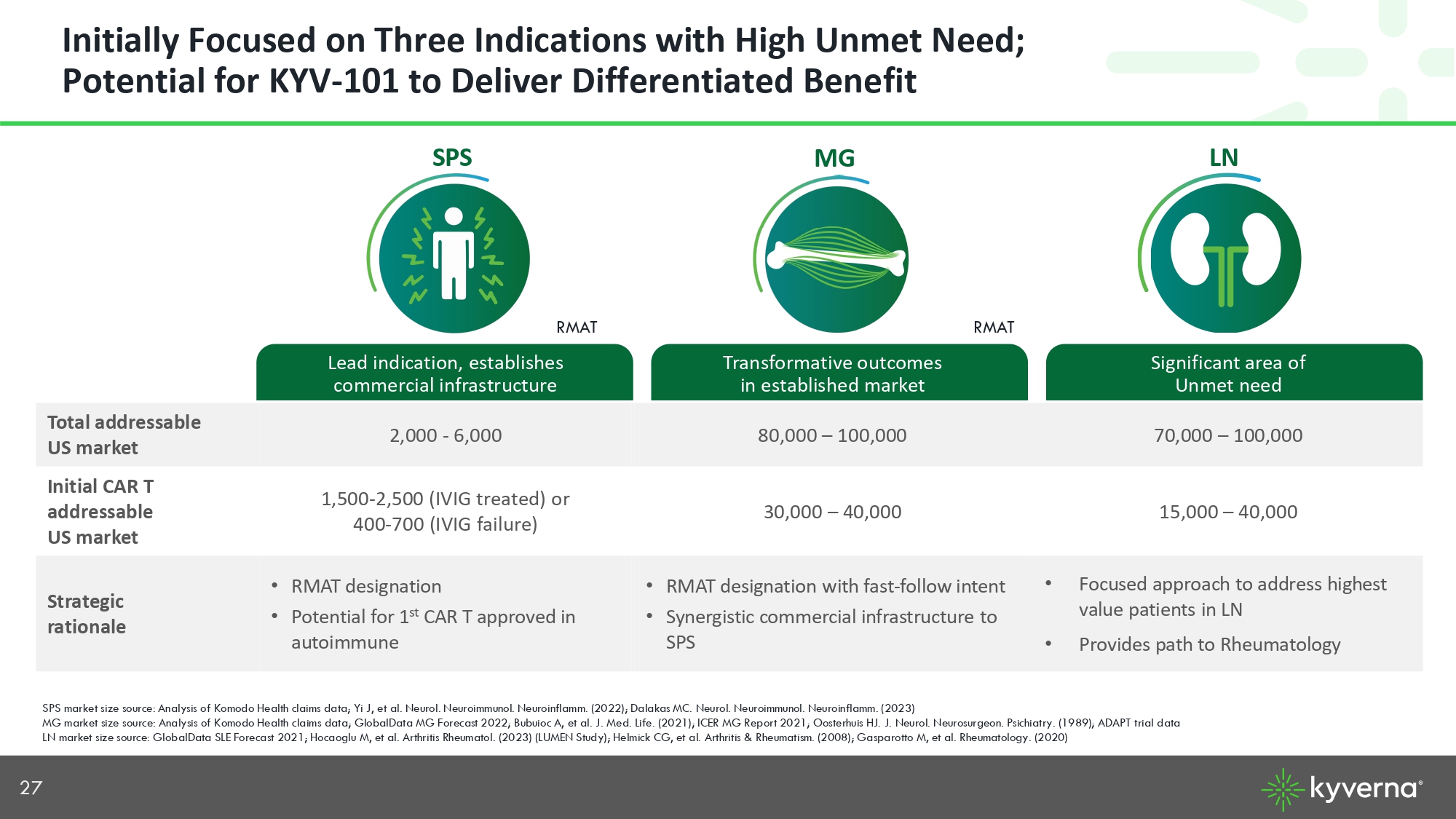

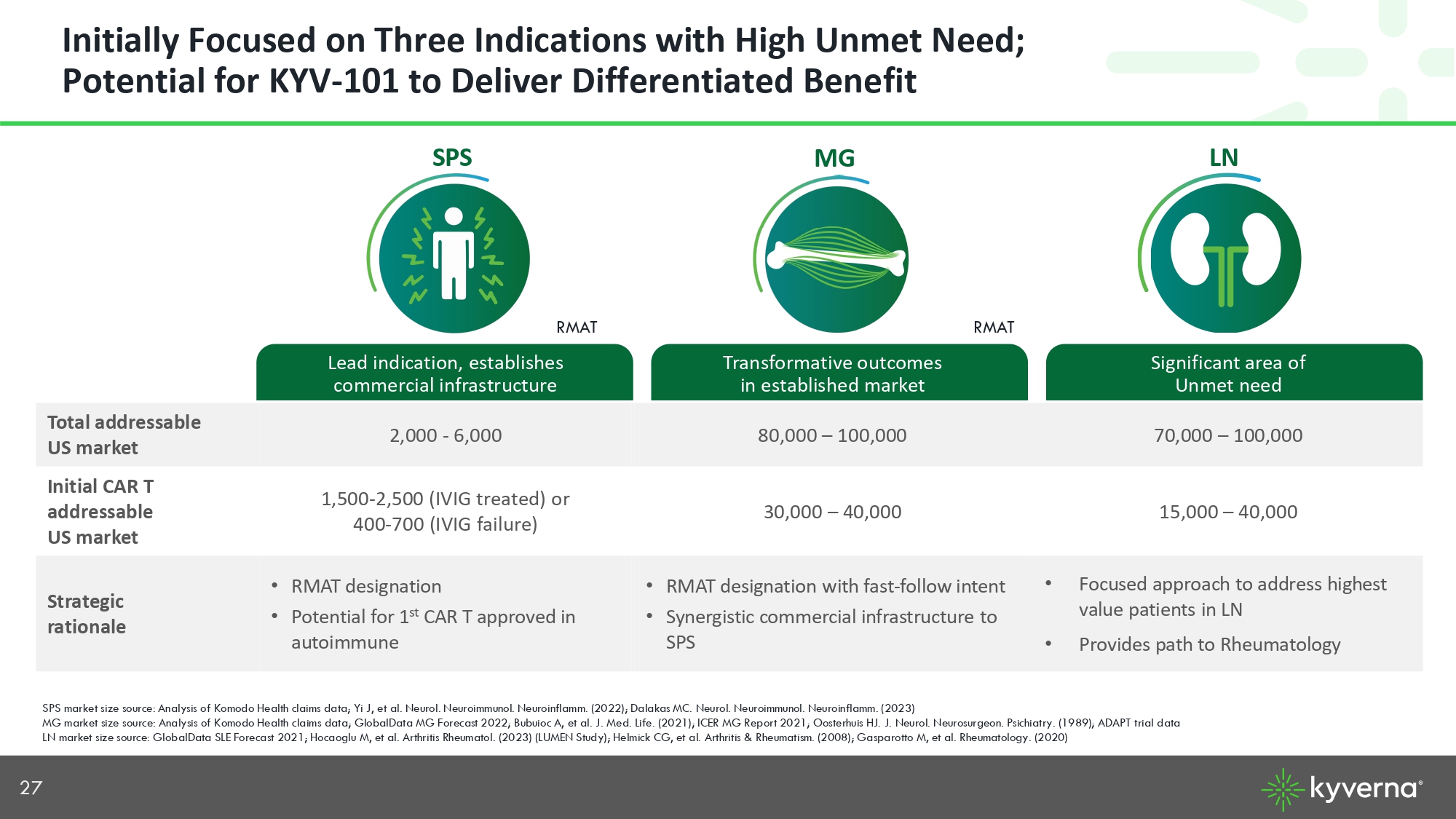

27 Initially Focused on Three Indications with High Unmet Need; Potential for KYV - 101 to Deliver Differentiated Benefit Significant area of Unmet need Transformative outcomes in established market Lead indication, establishes commercial infrastructure 70,000 – 100,000 80,000 – 100,000 2,000 - 6,000 Total addressable US market 15,000 – 40,000 30,000 – 40,000 1,500 - 2,500 (IVIG treated) or 400 - 700 (IVIG failure) Initial CAR T addressable US market • Focused approach to address highest value patients in LN • Provides path to Rheumatology • RMAT designation with fast - follow intent • Synergistic commercial infrastructure to SPS • RMAT designation • Potential for 1 st CAR T approved in autoimmune Strategic rationale RMAT RMAT MG SPS LN SPS market size source: Analysis of Komodo Health claims data; Yi J, et al. Neurol. Neuroimmunol. Neuroinflamm. (2022); Dalak as MC. Neurol. Neuroimmunol. Neuroinflamm. (2023) MG market size source: Analysis of Komodo Health claims data; GlobalData MG Forecast 2022; Bubuioc A, et al. J. Med. Life. (2 021 ); ICER MG Report 2021; Oosterhuis HJ. J. Neurol. Neurosurgeon. Psichiatry. (1989); ADAPT trial data LN market size source: GlobalData SLE Forecast 2021; Hocaoglu M, et al. Arthritis Rheumatol. (2023) (LUMEN Study); Helmick CG , e t al. Arthritis & Rheumatism. (2008); Gasparotto M, et al. Rheumatology. (2020)

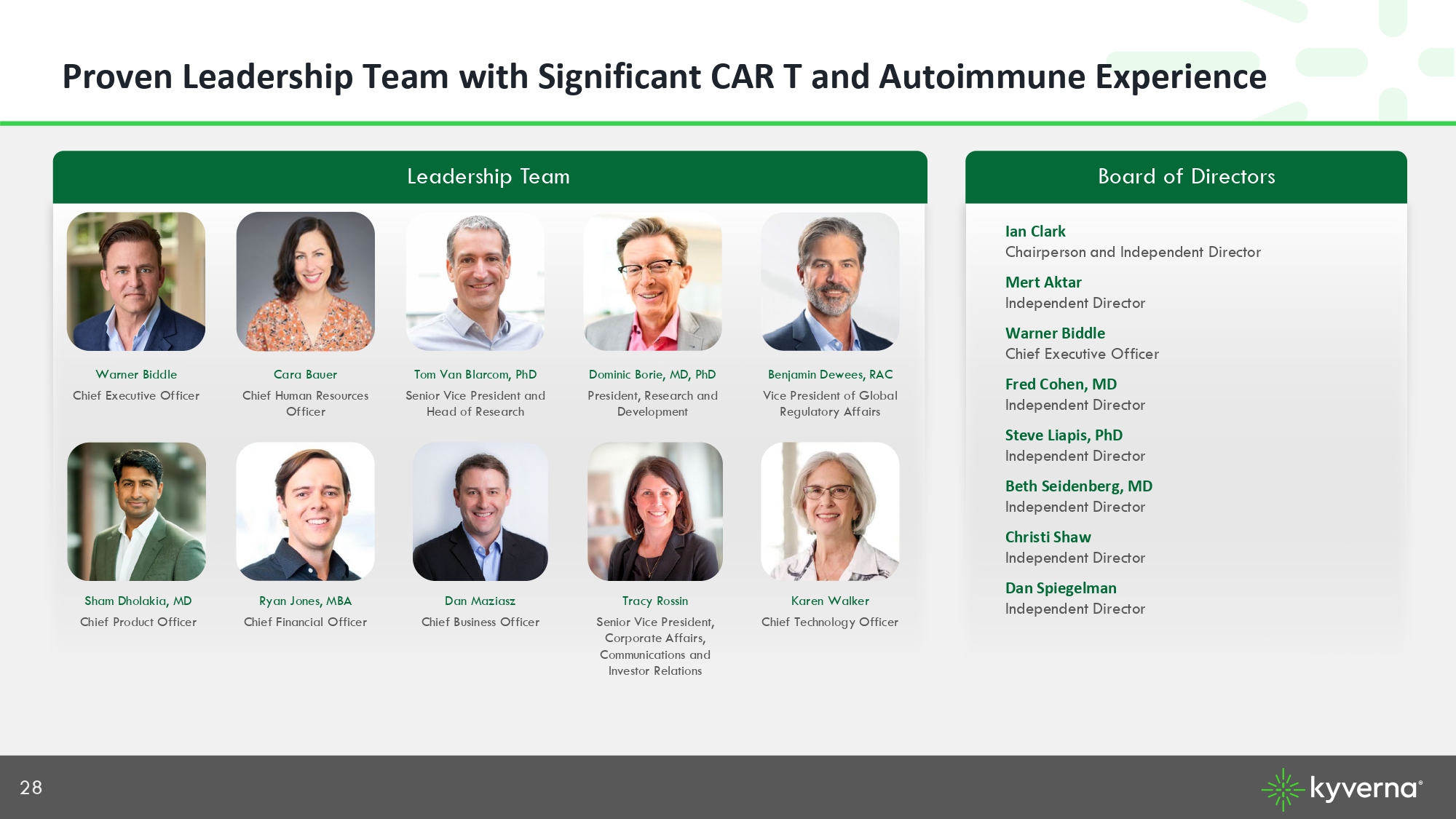

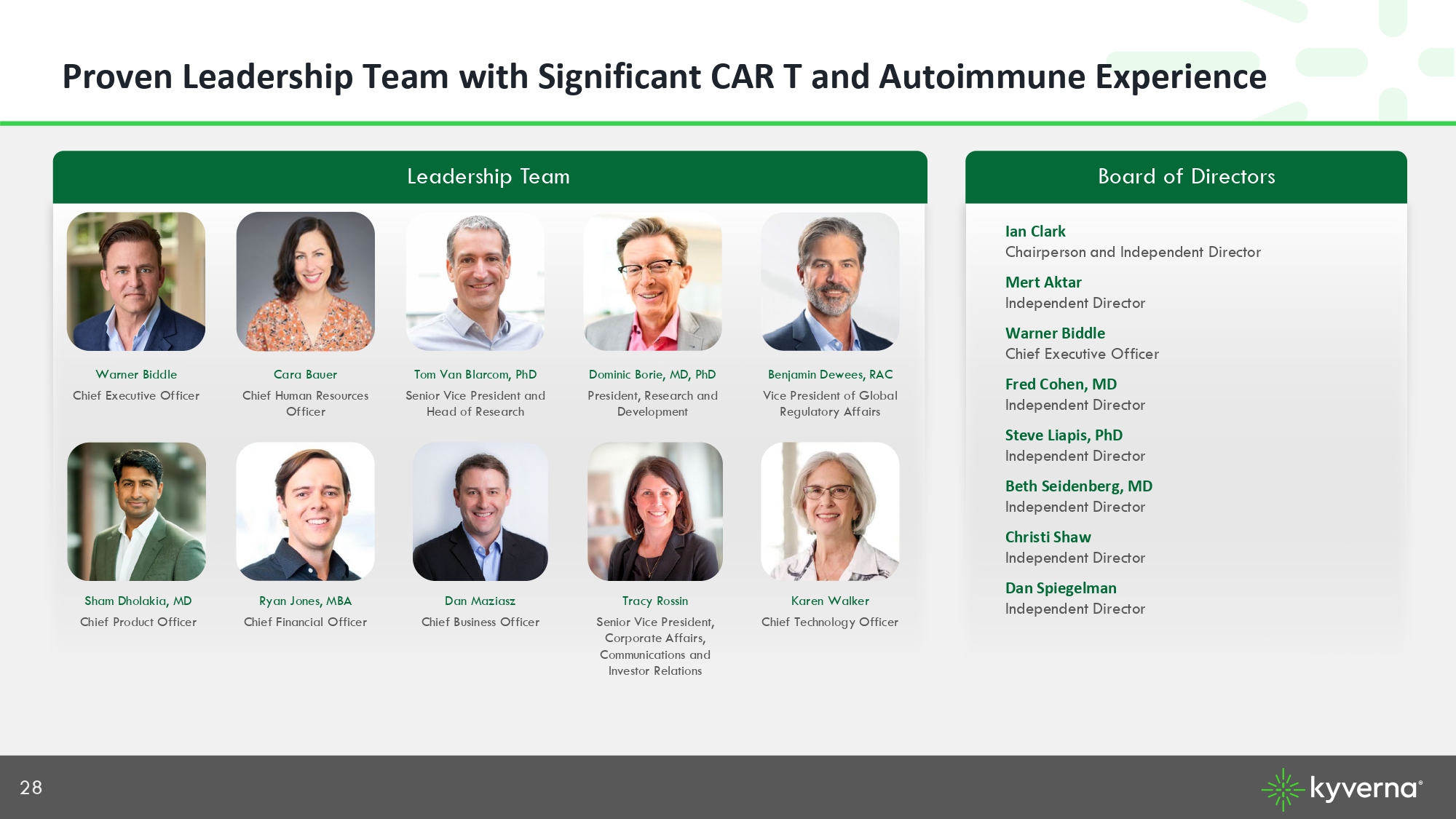

28 Cara Bauer Chief Human Resources Officer Proven Leadership Team with Significant CAR T and Autoimmune Experience Dominic Borie, MD, PhD President, Research and Development Karen Walker Chief Technology Officer Ryan Jones, MBA Chief Financial Officer Tom Van Blarcom, PhD Senior Vice President and Head of Research Benjamin Dewees, RAC Vice President of Global Regulatory Affairs Warner Biddle Chief Executive Officer Sham Dholakia, MD Chief Product Officer Dan Maziasz Chief Business Officer Tracy Rossin Senior Vice President, Corporate Affairs, Communications and Investor Relations Board of Directors Leadership Team Ian Clark Chairperson and Independent Director Mert Aktar Independent Director Warner Biddle Chief Executive Officer Fred Cohen, MD Independent Director Steve Liapis, PhD Independent Director Beth Seidenberg, MD Independent Director Christi Shaw Independent Director Dan Spiegelman Independent Director

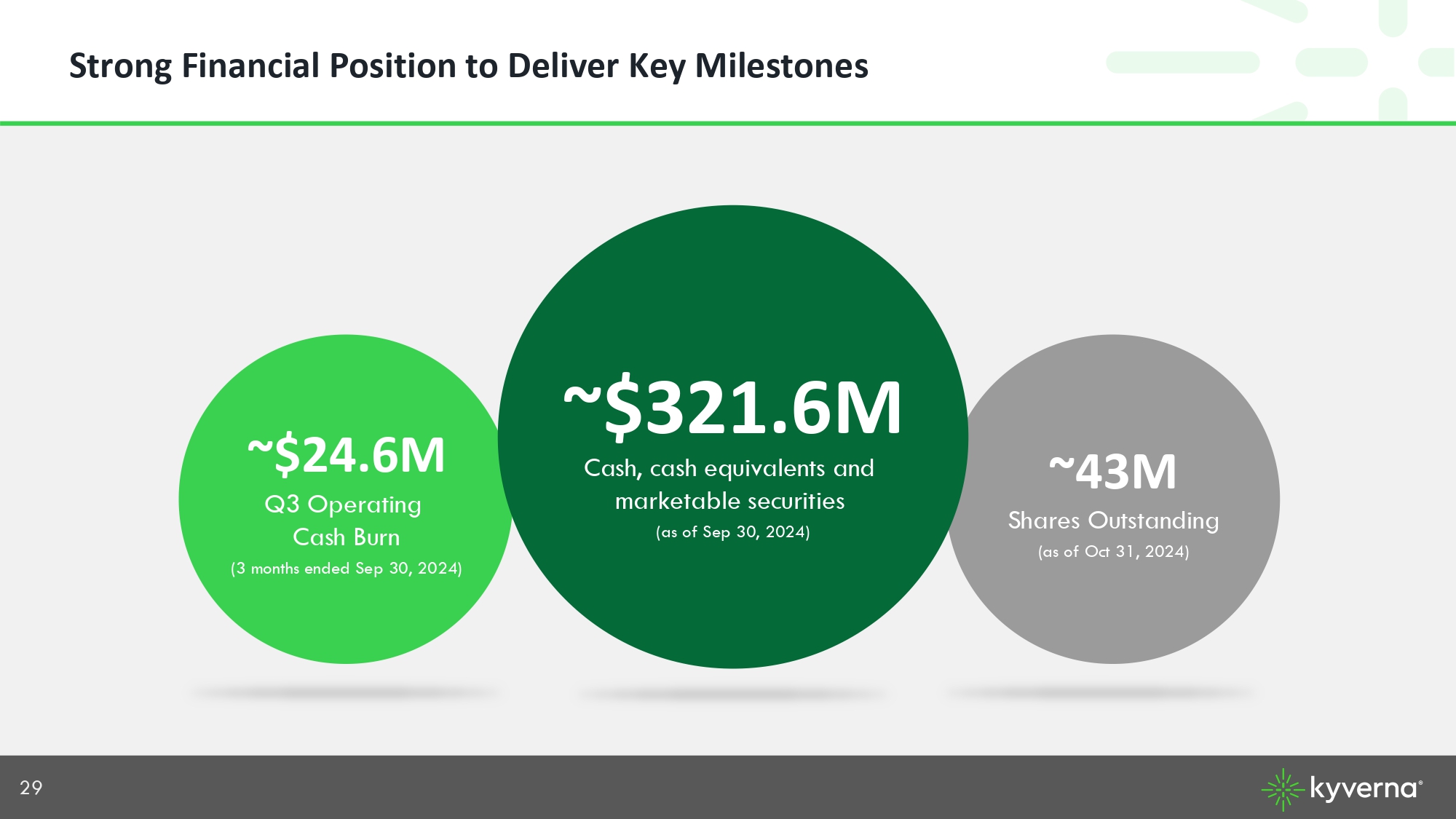

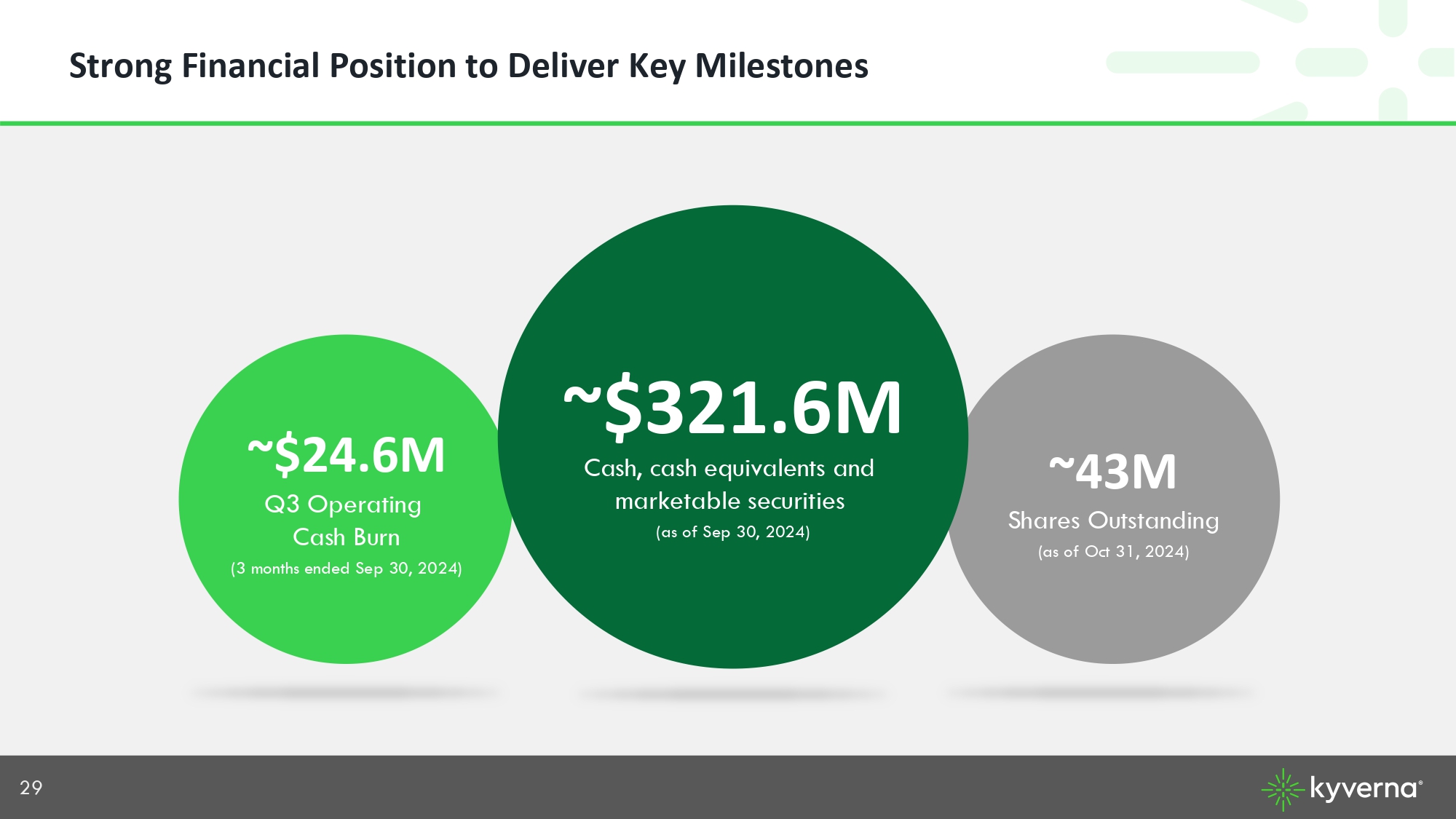

29 Strong Financial Position to Deliver Key Milestones Cash, cash equivalents and marketable securities (as of Sep 30, 2024) ~43M Shares Outstanding (as of Oct 31, 2024) ~$ 321.6M ~$24.6M Q3 Operating Cash Burn (3 months ended Sep 30, 2024)