Filed by Heramba Electric plc

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Project Energy Reimagined Acquisition Corp.

Commission File No. 001-40972

Date: February 16, 2024

1 Investor Presentation February 2024

Disclaimer 2 About this Presentation This investor presentation (this “Presentation”) is provided for informational purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between Project Energy Reimagined Acquisition Corp. (“PERAC”) and Heramba GmbH (together with its direct and indirect subsidiaries (including, for the avoidance of doubt, Kiepe Electric (“Kiepe” or “Kiepe Electric”), collectively, the “Company” or “Heramba”)) and for no other purpose. No representations or warranties, express or implied, are given in, or respect of, this Presentation. To the fullest extent permitted by law, in no circumstance will Heramba, PERAC or any of their respective present or former subsidiaries, shareholders, affiliates, representatives, partners, members, directors, officers, employees, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. This Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Heramba or the Business Combination. Viewers of this Presentation should each make their own evaluation of Heramba and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Important Additional Information About the Business Combination and Where to Find It This Presentation does not contain all the information that should be considered concerning the Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. In connection with the Business Combination, Heramba and PERAC, through Heramba Electric plc (“Holdco”), have filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form F - 4 (File No. 333 - 275903) (the “Registration Statement”), which contains a preliminary proxy statement/prospectus that will constitute (i) a proxy statement relating to the Business Combination in connection with PERAC’s solicitation of proxies for the vote by PERAC’s shareholders regarding the Business Combination and related matters, as described in the Registration Statement, and (ii) a prospectus relating to, among other things, the offer of the securities to be issued by Holdco in connection with the Business Combination. After the Registration Statement has been declared effective, PERAC will mail the definitive proxy statement/prospectus and other relevant documents to its shareholders as of the record date established for voting on the Business Combination. INVESTORS AND SECURITY HOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS, AND ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY OTHER RELATED DOCUMENTS FILED WITH THE SEC BY PERAC OR HOLDCO WHEN THEY BECOME AVAILABLE, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT HERAMBA, PERAC, HOLDCO AND THE BUSINESS COMBINATION, INCLUDING WITH RESPECT TO THE PRO FORMA IMPLIED ENTERPRISE VALUE OF THE COMBINED COMPANY. Investors and security holders may obtain free copies of the Registration Statement, proxy statement/prospectus and any amendments or supplements thereto and other related documents filed with the SEC by PERAC or Holdco (in each case, when available) through the website maintained by the SEC at www.sec.gov. These documents (when available) can also be obtained free of charge from PERAC upon written request to PERAC at: Project Energy Reimagined Acquisition Corp., 1280 El Camino Real, Suite 200, Menlo Park, California 94025. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY, NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE BUSINESS COMBINATION PURSUANT TO WHICH ANY SECURITIES ARE TO BE OFFERED OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Disclaimer (Cont’d) 3 Cautionary Statement Regarding Forward - Looking Statements Certain statements included in this Presentation that are not historical facts are forward - looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or events that are not statements of historical matters. These forward - looking statements include, but are not limited to, statements regarding market opportunity, Heramba’s acquisition of Kiepe Electric, and the consummation of the Business Combination and related transactions. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Heramba, PERAC and Holdco management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Heramba, PERAC and Holdco. These forward - looking statements are subject to a number of risks and uncertainties, including (i) changes in domestic and foreign business, market, financial, political and legal conditions; (ii) the inability of the parties to successfully or timely consummate the Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company, the expected benefits of the Business Combination or that the approval of the shareholders of PERAC is not obtained, that redemptions by shareholders of PERAC reduce the funds in trust or available to the combined company following the Business Combination, any of the other conditions to closing are not satisfied or that events or other circumstances give rise to the termination of the business combination agreement relating to the Business Combination; (iii) changes to the structure of the Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining the necessary regulatory approvals; (iv) the ability to meet stock exchange listing standards following the consummation of the Business Combination; (v) the risk that the Business Combination disrupts current plans and operations of Heramba as a result of the announcement and consummation of the Business Combination; (vi) failure to realize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (vii) costs related to the Business Combination; (viii) changes in applicable law or regulations; (ix) the outcome of any legal proceedings that may be instituted against Heramba, PERAC or Holdco; (x) the effects of competition on Heramba’s future business; (xi) the ability of PERAC, Heramba or Holdco to issue equity or equity - linked securities or obtain debt financing in connection with the Business Combination or in the future; (xii) the enforceability of Heramba’s intellectual property rights, including its copyrights, patents, trademarks and trade secrets, and the potential infringement on the intellectual property rights of others; and (xiii) those factors discussed under the heading “Risk Factors” in PERAC’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2022, filed with the SEC on April 7, 2023, and any subsequent Quarterly Reports on Form 10 - Q, and other documents filed, or to be filed, by PERAC and/or Holdco, with the SEC. If any of these risks materialize or the assumptions of Heramba, PERAC and Holdco management prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be additional risks that none of Heramba, PERAC nor Holdco presently know or that Heramba, PERAC or Holdco currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect Heramba’s, PERAC’s or Holdco’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Heramba, PERAC and Holdco anticipate that subsequent events and developments may cause Heramba’s, PERAC’s or Holdco’s assessments to change. However, while Heramba, PERAC and Holdco may elect to update these forward - looking statements at some point in the future, Heramba, PERAC and Holdco specifically disclaim any obligation to do so. Nothing in this Presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved. Accordingly, undue reliance should not be placed upon the forward - looking statements.

Disclaimer (Cont’d) 4 Participants in Solicitation Heramba, PERAC and Holdco and their respective directors and certain of their respective executive officers, other members of management and employees, under SEC rules, may be considered participants in the solicitation of proxies with respect to the Business Combination. Information about the directors and executive officers of PERAC is included in PERAC’s Annual Report on Form 10 - K, filed with the SEC on April 7, 2023, which is available free of charge at the SEC’s website at www.sec.gov. Additional information regarding the participants in the proxy solicitation and a description of their direct interests, by security holdings or otherwise, will be set forth in the Registration Statement, and the proxy statement/prospectus included therein, and other related materials to be filed with the SEC regarding the Business Combination by PERAC or Holdco. Shareholders, potential investors and other interested persons should read the Registration Statement, proxy statement/prospectus and any amendments or supplements thereto and other related documents filed with the SEC by PERAC or Holdco (in each case, when available) carefully before making any voting or investment decisions. These documents, when available, can be obtained free of charge from the sources indicated above. No Offer or Solicitation This Presentation is for informational purposes only and is not intended to and shall not constitute an offer to sell or exchange, or the solicitation of an offer to sell, exchange, buy or subscribe for any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), or pursuant to an exemption from the Securities Act, and otherwise in accordance with applicable law. No Assurances There can be no assurance that the Business Combination will be completed, nor can there be any assurance, if the Business Combination is completed, that the potential benefits of the Business Combination will be realized.

Disclaimer (Cont’d) 5 Financial Information; Non - IFRS Financial Measures The financial information and data contained herein have been prepared based on the historical financial statements of Kiepe Electric for the periods presented. Kiepe Electric’s independent auditor has not reviewed or performed any procedures on the financial results included in this Presentation. Accordingly, there may be material differences between the presentation of the financial information and data included in this Presentation and in the Registration Statement. This Presentation includes certain financial measures not presented in accordance with international financial reporting standards (“IFRS”), including, but not limited to, EBITDA and EBITDA Margin, in each case presented on a non - IFRS basis, and certain ratios and other metrics derived therefrom. Kiepe Electric defines EBITDA as earnings before interest expense, taxes, depreciation, amortization and EBITDA Margin as EBITDA divided by revenues. These non - IFRS financial measures are not measures of financial performance in accordance with IFRS and may exclude items that are significant in understanding and assessing Kiepe Electric’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under IFRS. You should be aware that Kiepe Electric’s presentation of these measures may not be comparable to similarly - titled measures used by other companies. Kiepe Electric believes these non - IFRS measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to its financial condition and results of operations. Kiepe Electric believes that these non - IFRS financial measures provide an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing its financial measures with other similar companies, many of which present similar non - IFRS financial measures to investors. These non - IFRS financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non - IFRS financial measures. Industry and Market Data This Presentation has been prepared by Heramba and PERAC and includes market data and other statistical information from third - party sources, including independent industry publications, governmental publications and other published independent sources. Some data is also based on the estimates of Heramba and PERAC, which are derived from their review of internal sources as well as the third - party sources described above. None of Heramba, PERAC or any of their respective representatives or affiliates has independently verified the information and cannot guarantee its accuracy and completeness. Trademarks and Trade Names Heramba and PERAC own or have rights to various trademarks, service marks, trade names and copyrights that they use in connection with the operation of their respective businesses. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with Heramba or PERAC, or an endorsement or sponsorship by or of Heramba or PERAC. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ©, TM or SM symbols, but such references are not intended to indicate, in any way, that Heramba, PERAC or the applicable rights owner will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

6 “We help cities shift seamlessly to green mobility by supplying reliable, modular and integrated electrical products”

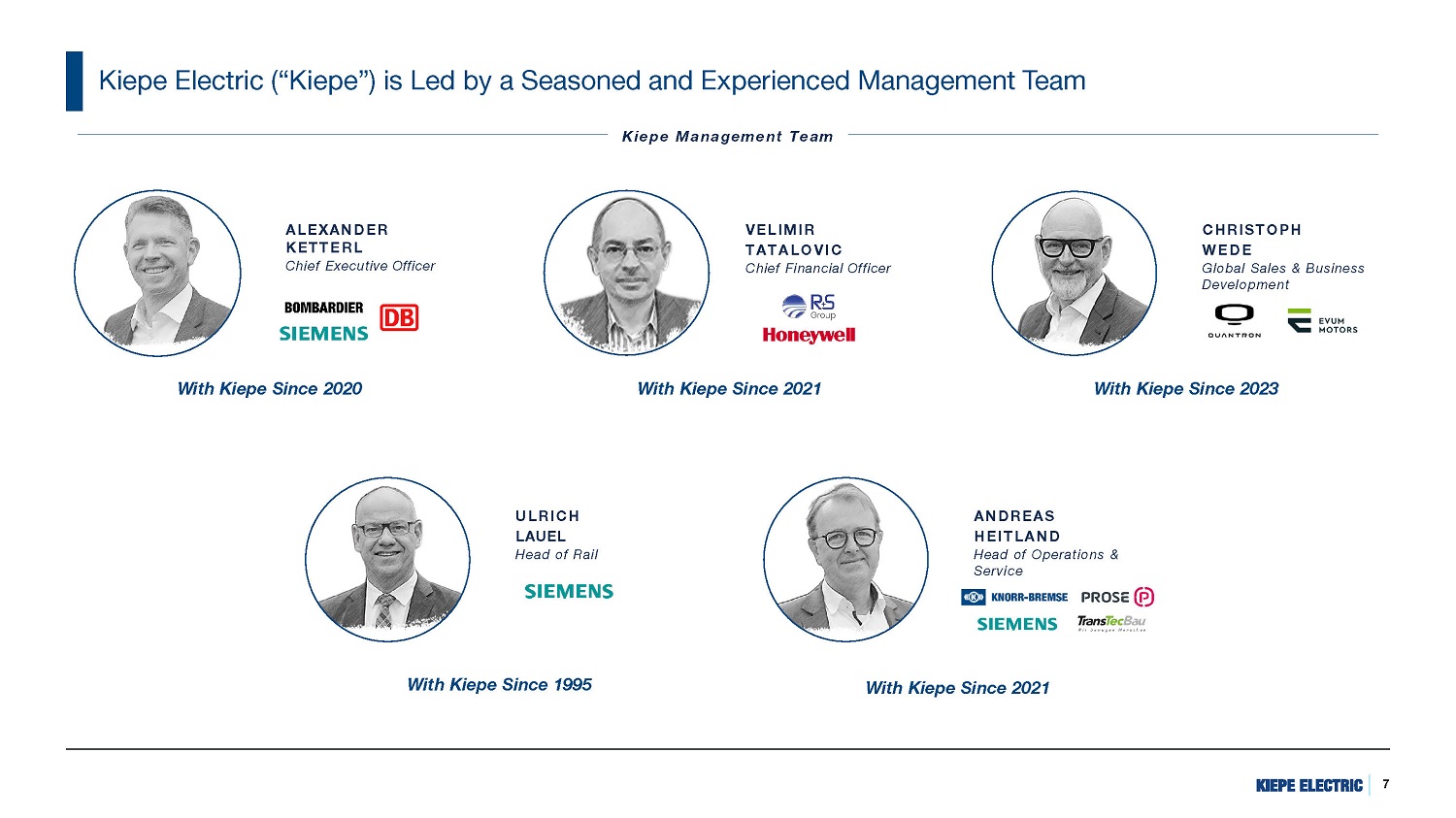

Kiepe Electric (“Kiepe”) is Led by a Seasoned and Experienced Management Team ALEXANDER KETTERL Chief Executive Officer With Kiepe Since 2020 With Kiepe Since 2021 With Kiepe Since 2023 With Kiepe Since 1995 With Kiepe Since 2021 Kiepe Management Team VELIMIR TATALOVIC Chief Financial Officer CHRISTOPH WEDE Global Sales & Business Development ULRICH LAUEL Head of Rail ANDREAS HEITLAND Head of Operations & Service 7

Project Energy Reimagined Acquisition Corp. (“SPAC”) – Management Team & Board of Directors SRINATH NARAYANAN Chief Executive Officer & Director S A N J AY MEHTA President & Director PRAKASH RAMACHANDRAN Chief Financial Officer & Director DAVID ROBERTS Chief Operating Officer MICHAEL BROWNING Chairman of the Board of Directors ERIC SPIEGEL Director NINA JENSEN Director DR. KA T H Y LIU Head of Technology Strategy TIM DUMMER Head of Business Strategy Management Team Board of Directors 8

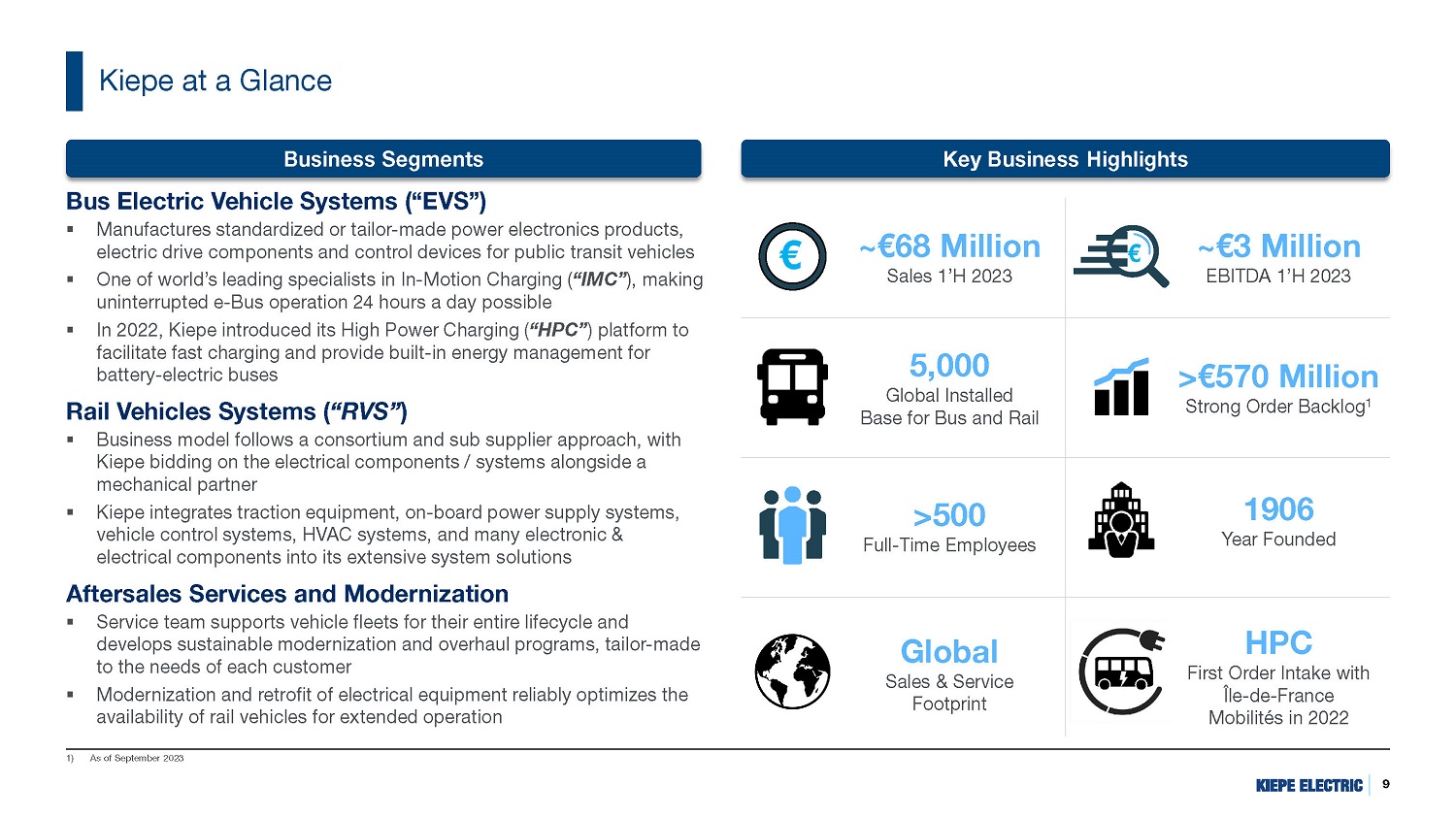

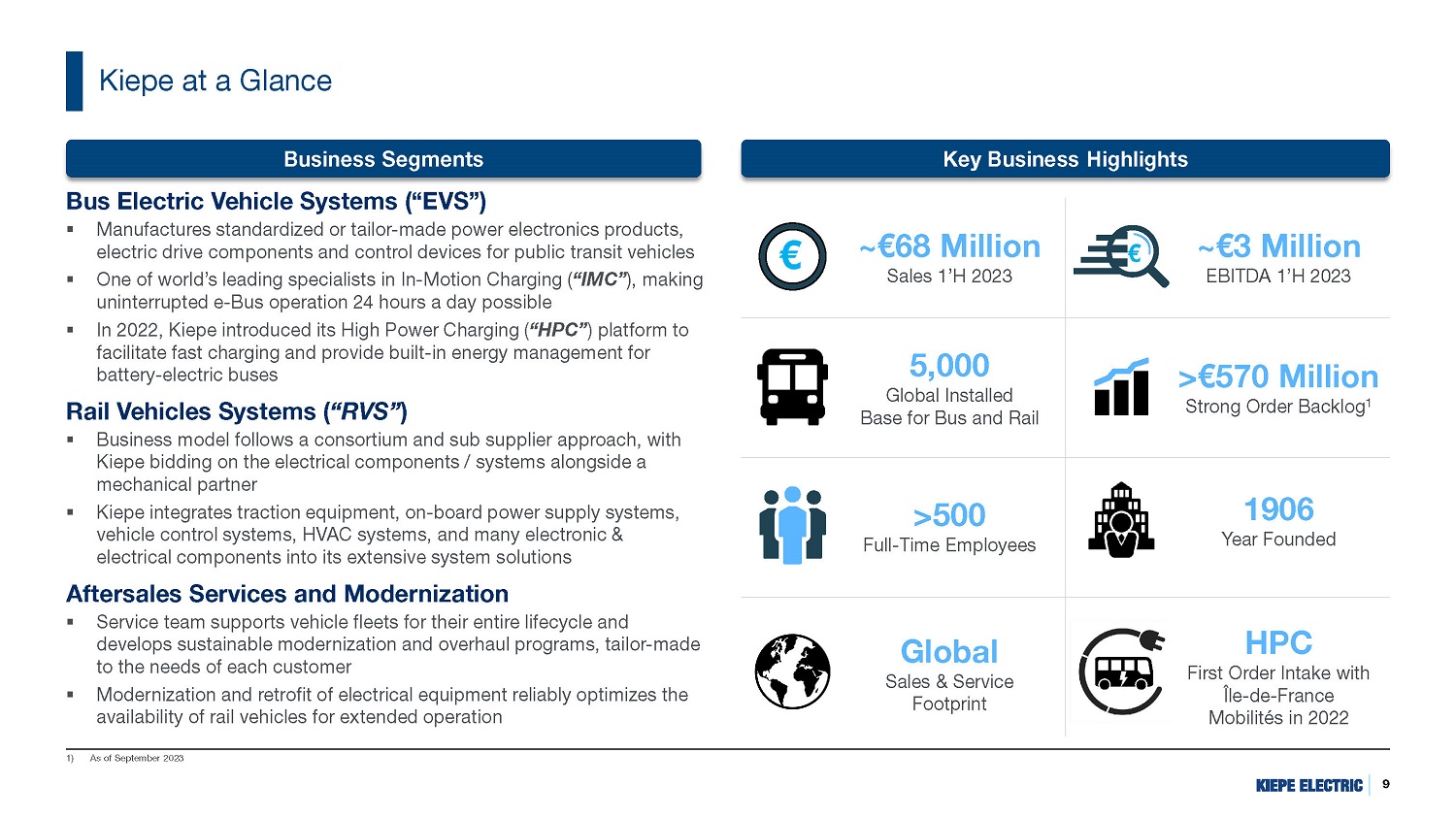

Kiepe at a Glance ▪ Manufactures standardized or tailor - made power electronics products, electric drive components and control devices for public transit vehicles ▪ One of world’s leading specialists in In - Motion Charging ( “IMC” ), making uninterrupted e - Bus operation 24 hours a day possible ▪ In 2022, Kiepe introduced its High Power Charging ( “HPC” ) platform to facilitate fast charging and provide built - in energy management for battery - electric buses Rail Vehicles Systems ( “RVS” ) ▪ Business model follows a consortium and sub supplier approach, with Kiepe bidding on the electrical components / systems alongside a mechanical partner ▪ Kiepe integrates traction equipment, on - board power supply systems, vehicle control systems, HVAC systems, and many electronic & electrical components into its extensive system solutions Aftersales Services and Modernization ▪ Service team supports vehicle fleets for their entire lifecycle and develops sustainable modernization and overhaul programs, tailor - made to the needs of each customer ▪ Modernization and retrofit of electrical equipment reliably optimizes the availability of rail vehicles for extended operation 1) As of September 2023 € ~€3 Million EBITDA 1’H 2023 € ~€68 Million Sales 1’H 2023 >€570 Million Strong Order Backlog 1 5,000 Global Installed Base for Bus and Rail 1906 Year Founded >500 Full - Time Employees HPC First Order Intake with Île - de - France Mobilités in 2022 Global Sales & Service Footprint Key Business Highlights Business Segments Bus Electric Vehicle Systems (“EVS”) 9

10 Powering the Era of Sustainable Mass Transit IMC e - Bus Platform Paris HPC e - Bus First e - Bus in 1950 SFM 2 mHPC 3 HPC Platform ICC 1 Cybersecurity 1 TRACK RECORD with more than 70 years of experience REAL PRODUCTS in past, present and future 2 Outstanding operational PERFORMANCE 3 Continuous INNOVATIONS 4 Strong CUSTOMER base 5 300 Vehicles 153 Vehicles 1000+ Vehicles in North America Rail e - Bus Modernization Charging 20,000 km Performance Test Extreme Weather Conditions Fleet Mileage Vancouver 100M+ Steep Inclines Cologne, Germany Hannover, Germany 1) ICC – Intelligent Current Collector 2) SFM – Smart Fleet Management 3) mHPC – Mobile High Power Charger

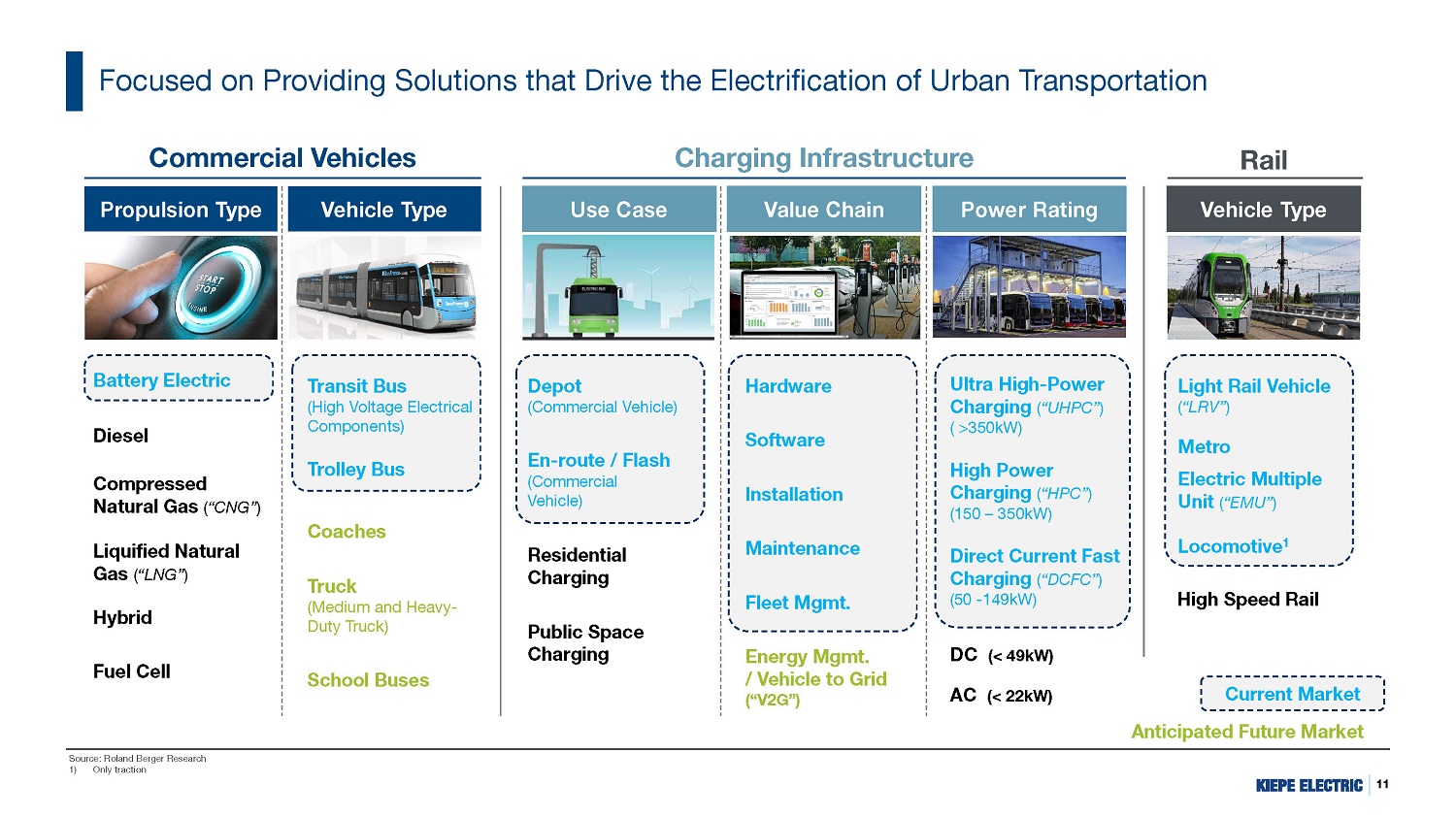

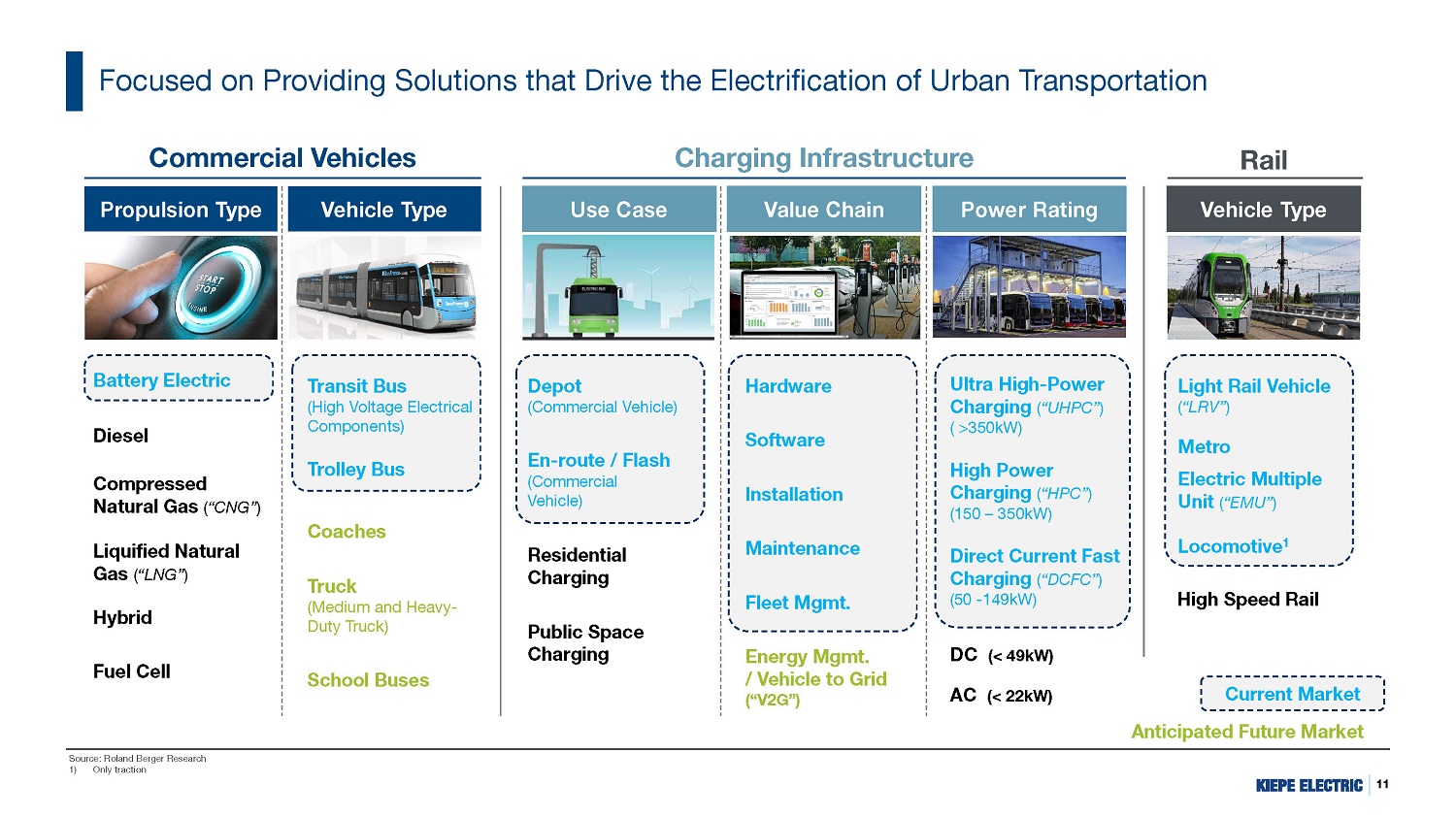

11 Focused on Providing Solutions that Drive the Electrification of Urban Transportation Propulsion Type Vehicle Type Vehicle Type Use Case Value Chain Power Rating Battery Electric Diesel Compressed Natural Gas ( “CNG” ) Liquified Natural Gas ( “LNG” ) Hybrid Fuel Cell Transit Bus (High Voltage Electrical Components) Trolley Bus Truck (Medium and Heavy - Duty Truck) School Buses Coaches Light Rail Vehicle ( “LRV” ) Metro Electric Multiple Unit ( “EMU” ) Locomotive 1 High Speed Rail Depot (Commercial Vehicle) En - route / Flash (Commercial Vehicle) Residential Charging Public Space Charging Hardware Software Installation Maintenance Fleet Mgmt. Energy Mgmt. / Vehicle to Grid (“V2G”) Ultra High - Power Charging ( “UHPC” ) ( > 350 kW) High Power Charging ( “HPC” ) (150 – 350kW) Direct Current Fast Charging ( “DCFC” ) (50 - 149kW) DC (< 49kW) AC (< 22kW) Commercial Vehicles Charging Infrastructure Rail Current Market Anticipated Future Market Source: Roland Berger Research 1) Only traction

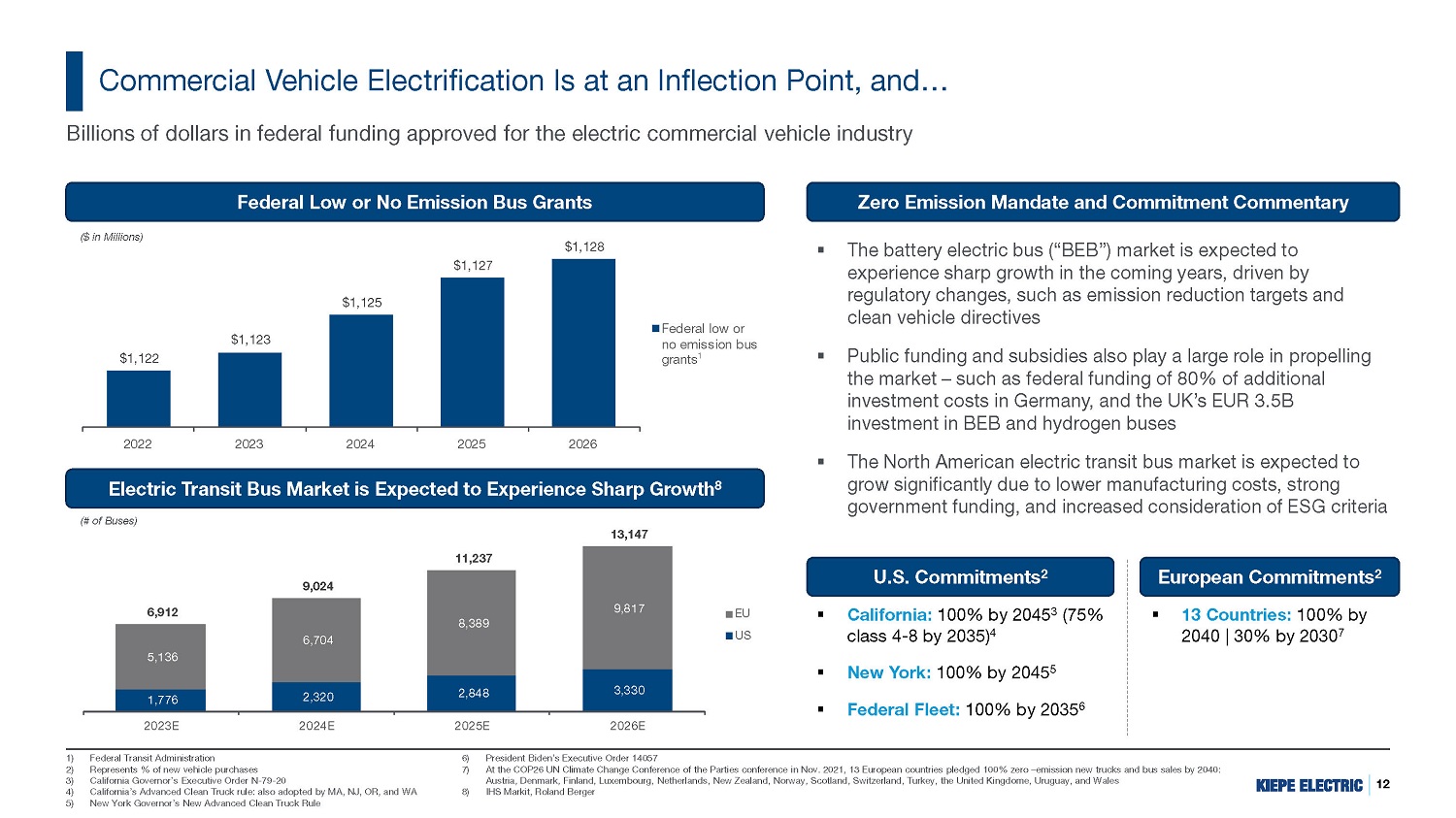

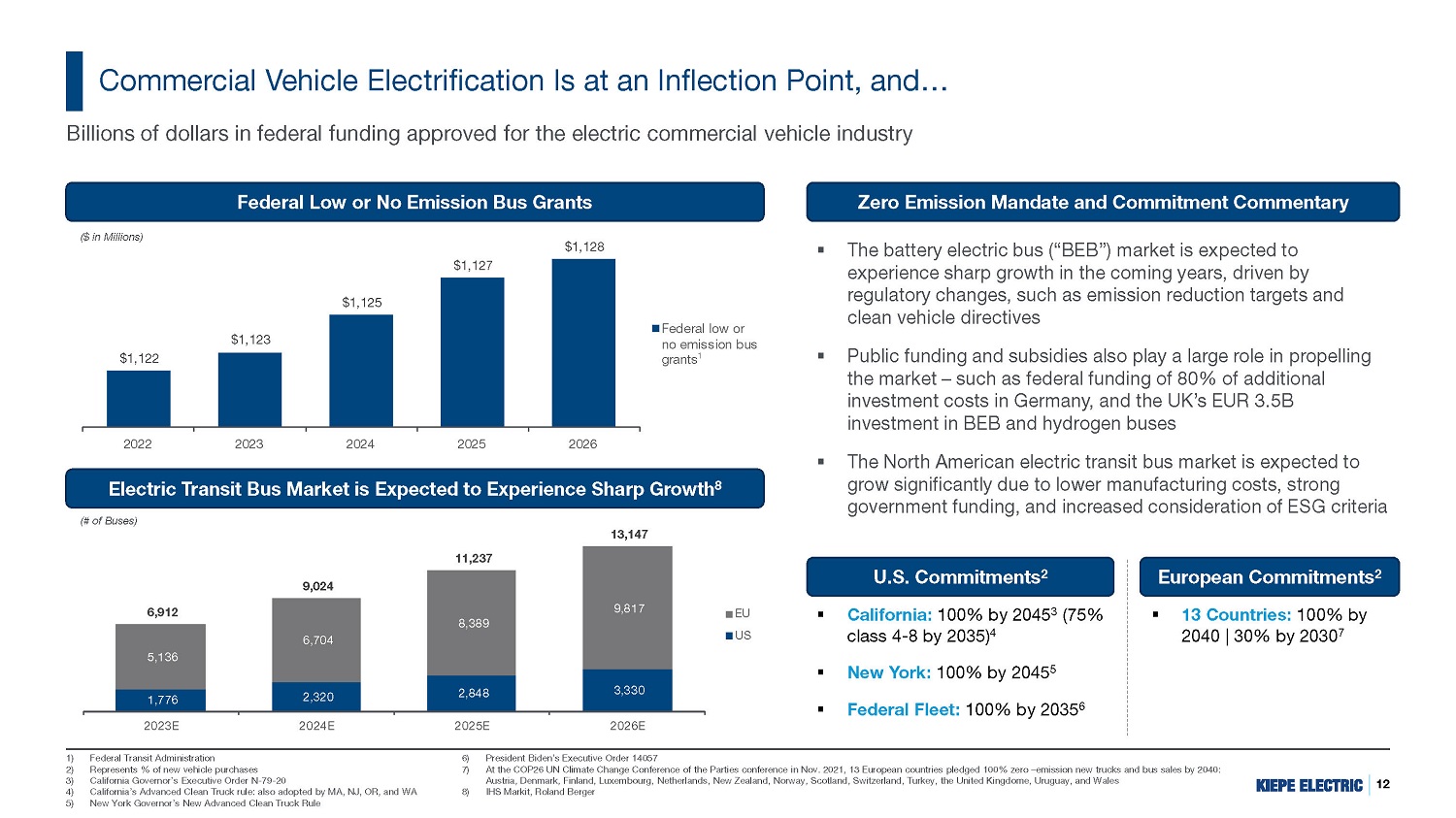

12 Commercial Vehicle Electrification Is at an Inflection Point, and… 2023E 2024E 1) Federal Transit Administration 2) Represents % of new vehicle purchases 3) California Governor’s Executive Order N - 79 - 20 4) California’s Advanced Clean Truck rule: also adopted by MA, NJ, OR, and WA 5) New York Governor’s New Advanced Clean Truck Rule Billions of dollars in federal funding approved for the electric commercial vehicle industry Federal Low or No Emission Bus Grants Zero Emission Mandate and Commitment Commentary Electric Transit Bus Market is Expected to Experience Sharp Growth 8 $1,122 $1,123 $1,125 $1,127 $1,128 2022 2023 2024 2025 2026 Federal low or no emission bus grants 1 ($ in Millions) ▪ The battery electric bus (“BEB”) market is expected to experience sharp growth in the coming years, driven by regulatory changes, such as emission reduction targets and clean vehicle directives ▪ Public funding and subsidies also play a large role in propelling the market – such as federal funding of 80% of additional investment costs in Germany, and the UK’s EUR 3.5B investment in BEB and hydrogen buses ▪ The North American electric transit bus market is expected to grow significantly due to lower manufacturing costs, strong government funding, and increased consideration of ESG criteria 1,776 2,320 2,848 3,330 5,136 6,704 8,389 9,817 6,912 9,024 11,237 13,147 2025E 2026E EU US ▪ California: 100% by 2045 3 (75% class 4 - 8 by 2035) 4 ▪ New York: 100% by 2045 5 ▪ Federal Fleet: 100% by 2035 6 ▪ 13 Countries: 100% by 2040 | 30% by 2030 7 (# of Buses) U.S. Commitments 2 European Commitments 2 6) President Biden’s Executive Order 14057 7) At the COP26 UN Climate Change Conference of the Parties conference in Nov. 2021, 13 European countries pledged 100% zero – emission new trucks and bus sales by 2040: Austria, Denmark, Finland, Luxembourg, Netherlands, New Zealand, Norway, Scotland, Switzerland, Turkey, the United Kingdome, Uruguay, and Wales 8) IHS Markit, Roland Berger

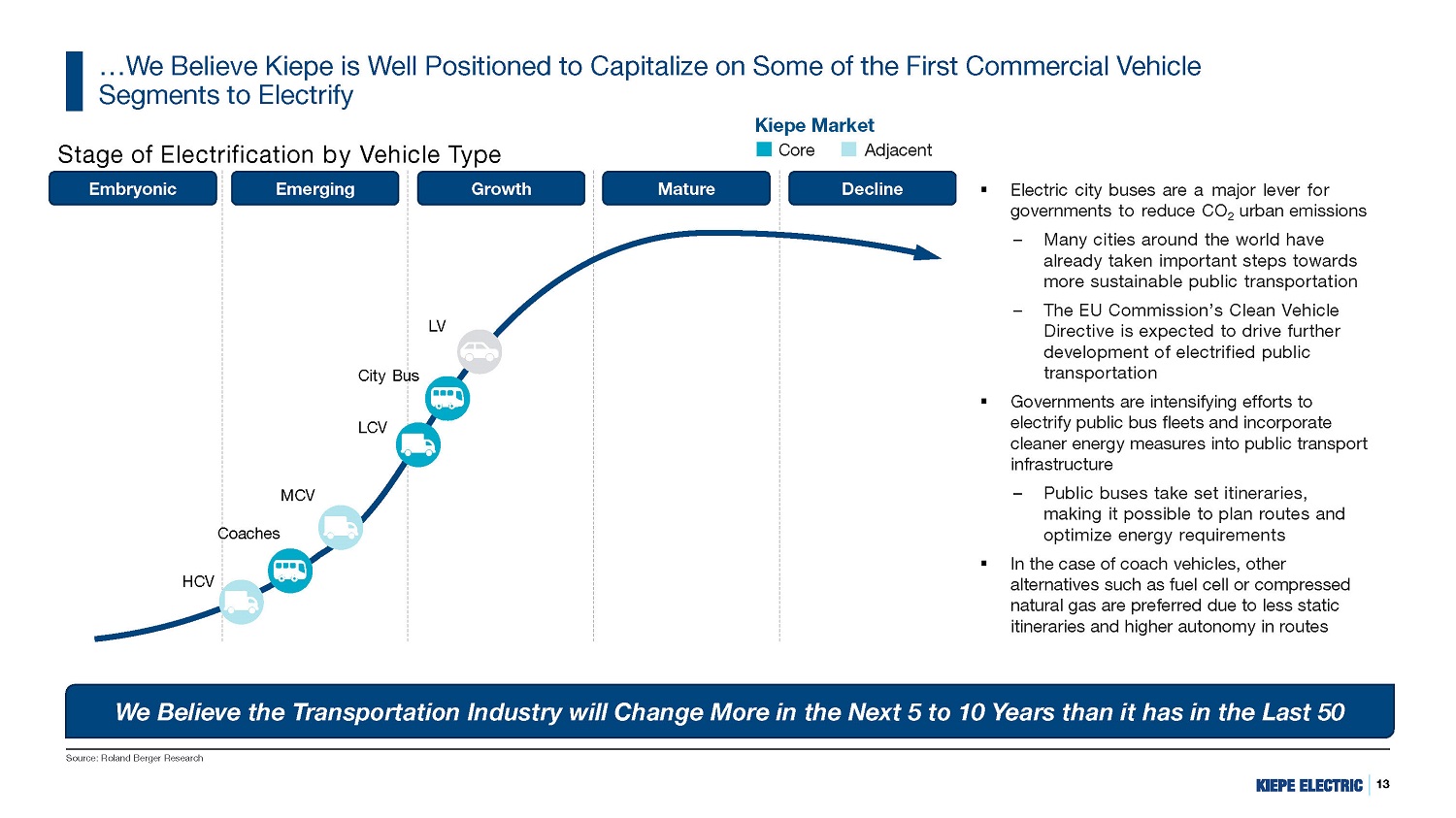

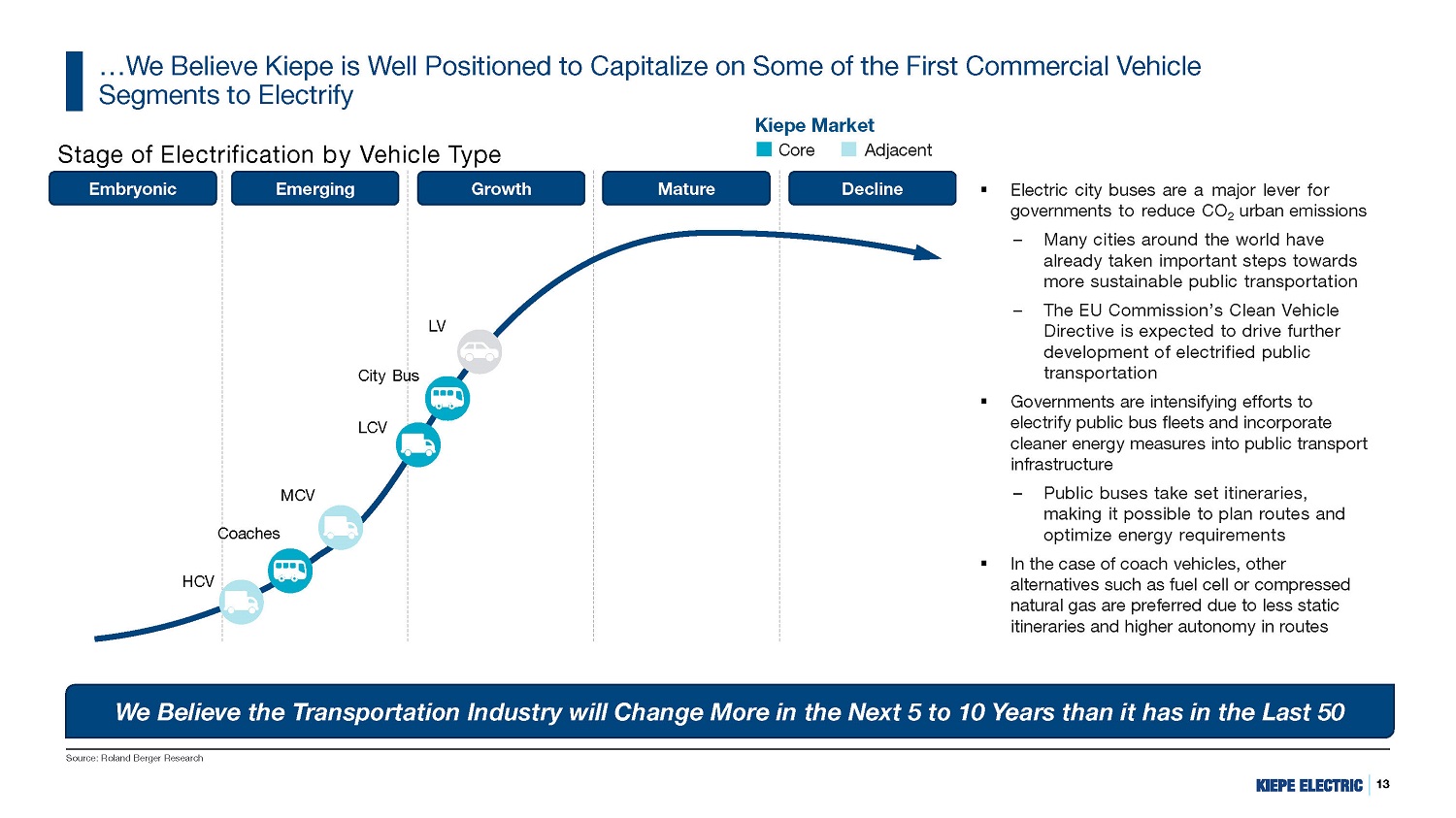

…We Believe Kiepe is Well Positioned to Capitalize on Some of the First Commercial Vehicle Segments to Electrify Source: Roland Berger Research ▪ Electric city buses are a major lever for governments to reduce CO 2 urban emissions – Many cities around the world have already taken important steps towards more sustainable public transportation – The EU Commission’s Clean Vehicle Directive is expected to drive further development of electrified public transportation ▪ Governments are intensifying efforts to electrify public bus fleets and incorporate cleaner energy measures into public transport infrastructure – Public buses take set itineraries, making it possible to plan routes and optimize energy requirements ▪ In the case of coach vehicles, other alternatives such as fuel cell or compressed natural gas are preferred due to less static itineraries and higher autonomy in routes LCV LV City Bus HCV MCV Core Adjacent Coaches Stage of Electrification by Vehicle Type Embryonic Emerging Growth Mature Decline We Believe the Transportation Industry will Change More in the Next 5 to 10 Years than it has in the Last 50 13 Kiepe Market

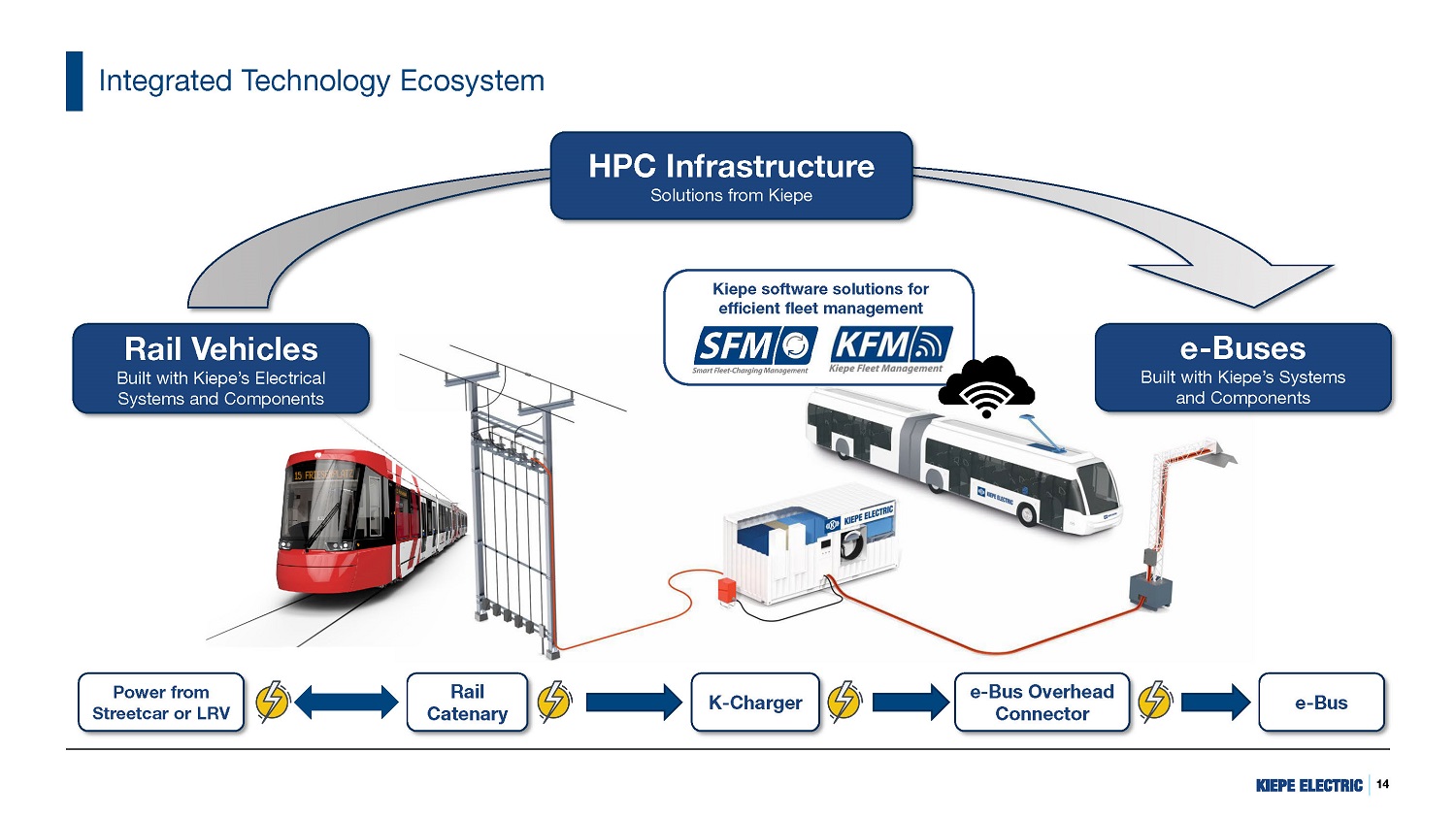

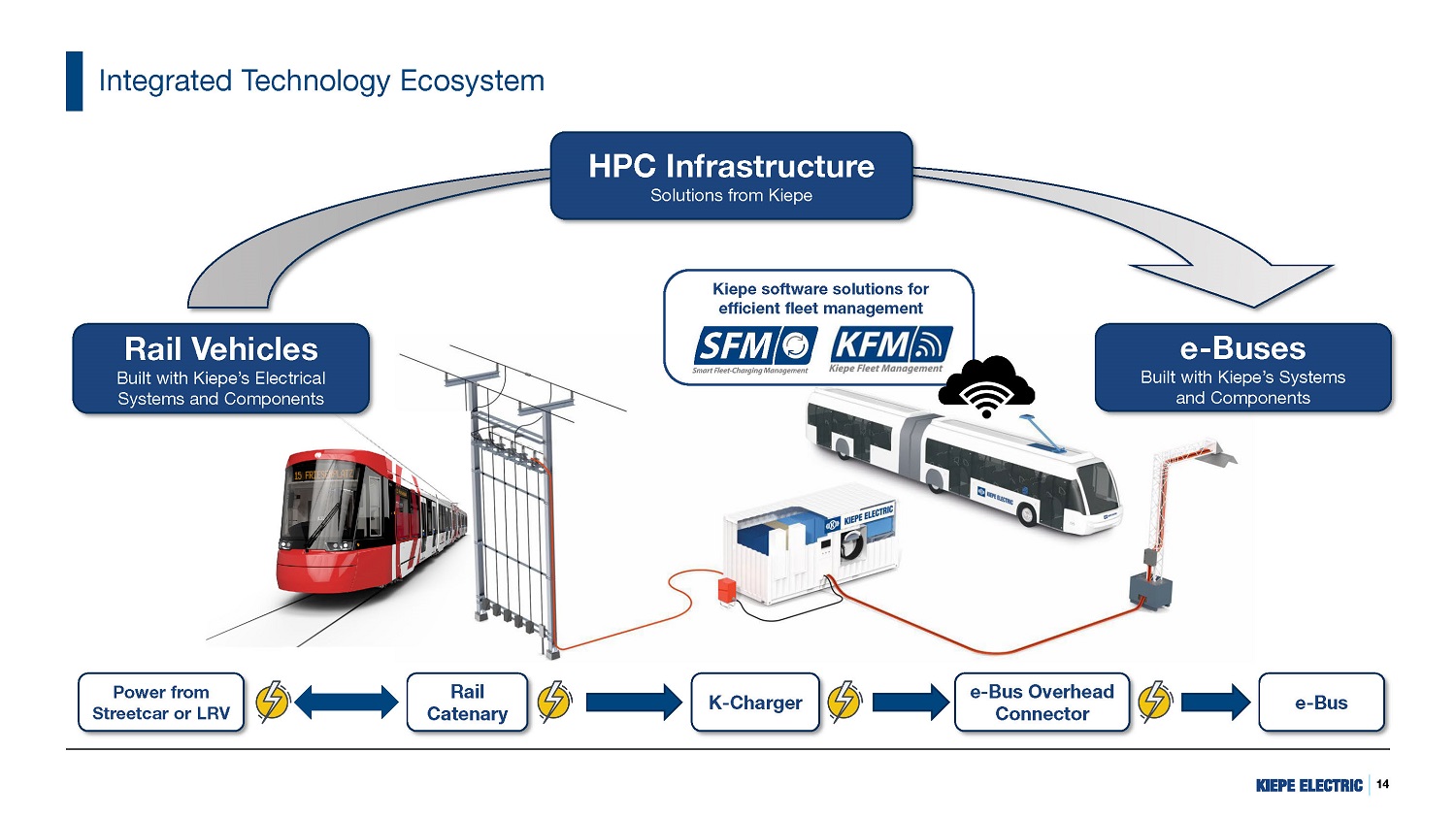

Integrated Technology Ecosystem HPC Infrastructure Solutions from Kiepe e - Buses Built with Kiepe’s Systems and Components Rail Vehicles Built with Kiepe’s Electrical Systems and Components Power from Streetcar or LRV Rail Catenary K - Charger e - Bus e - Bus Overhead Connector Kiepe software solutions for efficient fleet management 14

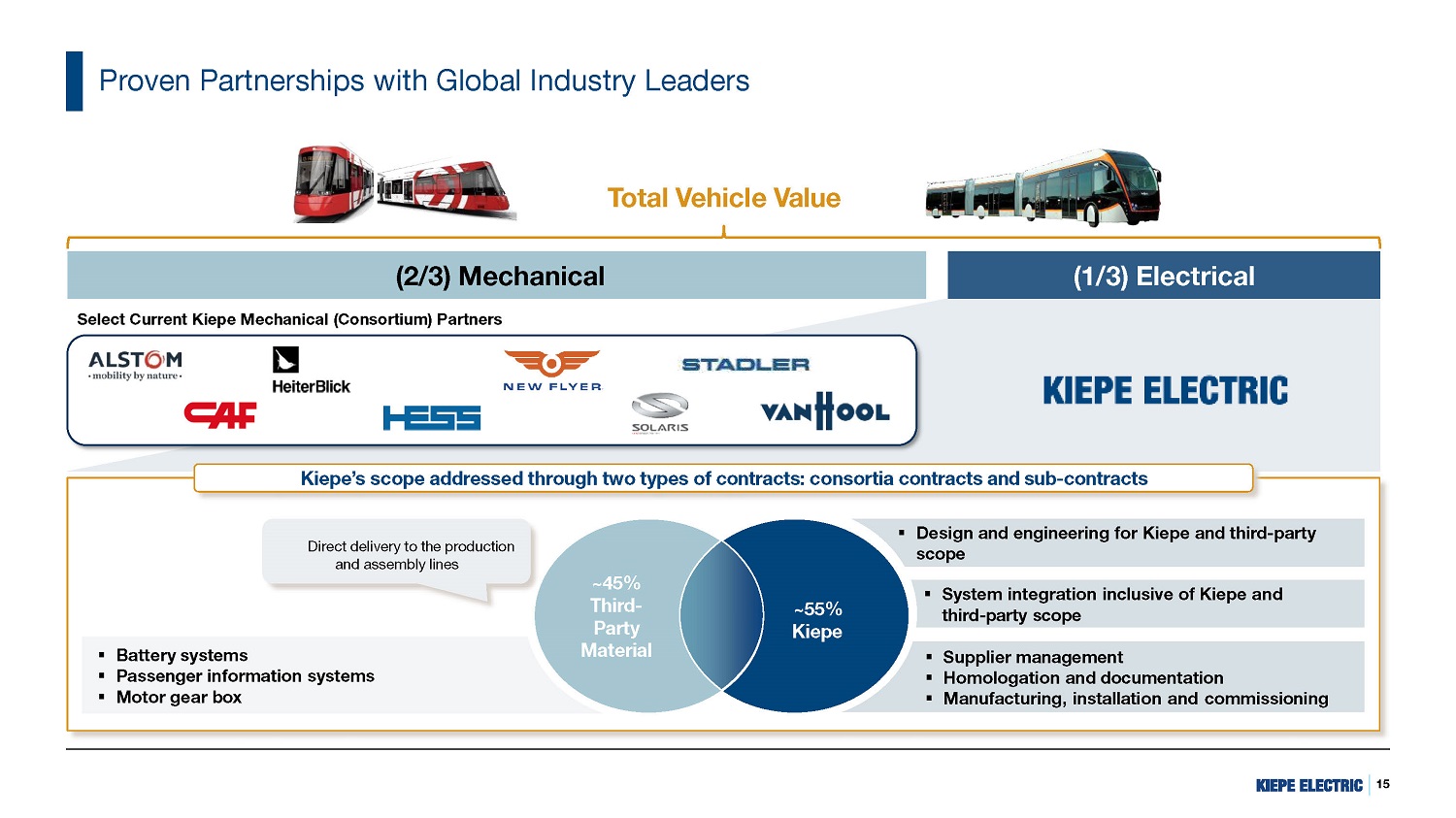

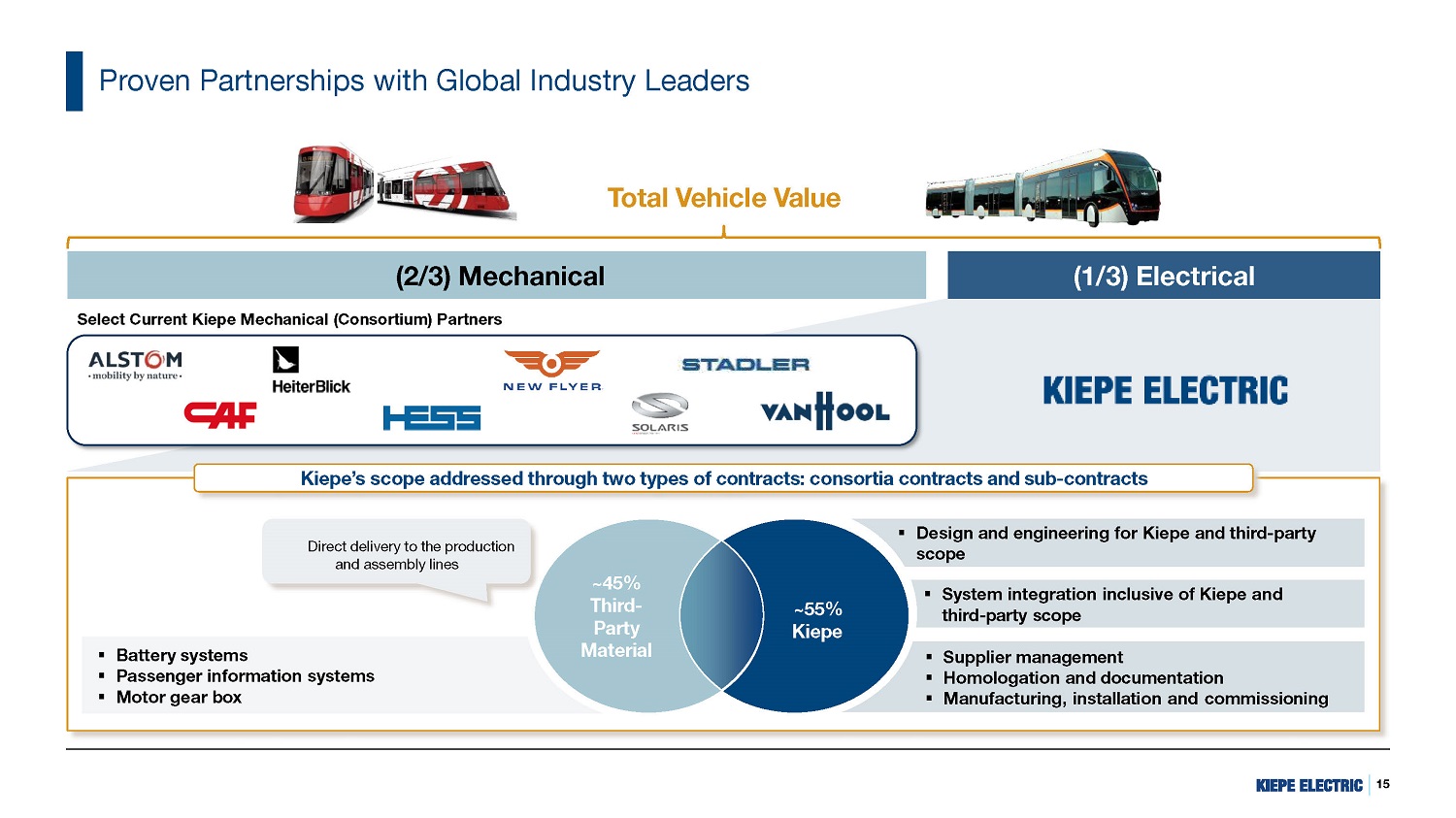

Proven Partnerships with Global Industry Leaders Total Vehicle Value (2/3) Mechanical ▪ Design and engineering for Kiepe and third - party scope ▪ System integration inclusive of Kiepe and third - party scope ▪ Supplier management ▪ Homologation and documentation ▪ Manufacturing, installation and commissioning ▪ Battery systems ▪ Passenger information systems ▪ Motor gear box ~55% Kiepe ~45% Third - Party Material Direct delivery to the production and assembly lines (1/3) Electrical Select Current Kiepe Mechanical (Consortium) Partners Kiepe’s scope addressed through two types of contracts: consortia contracts and sub - contracts 15

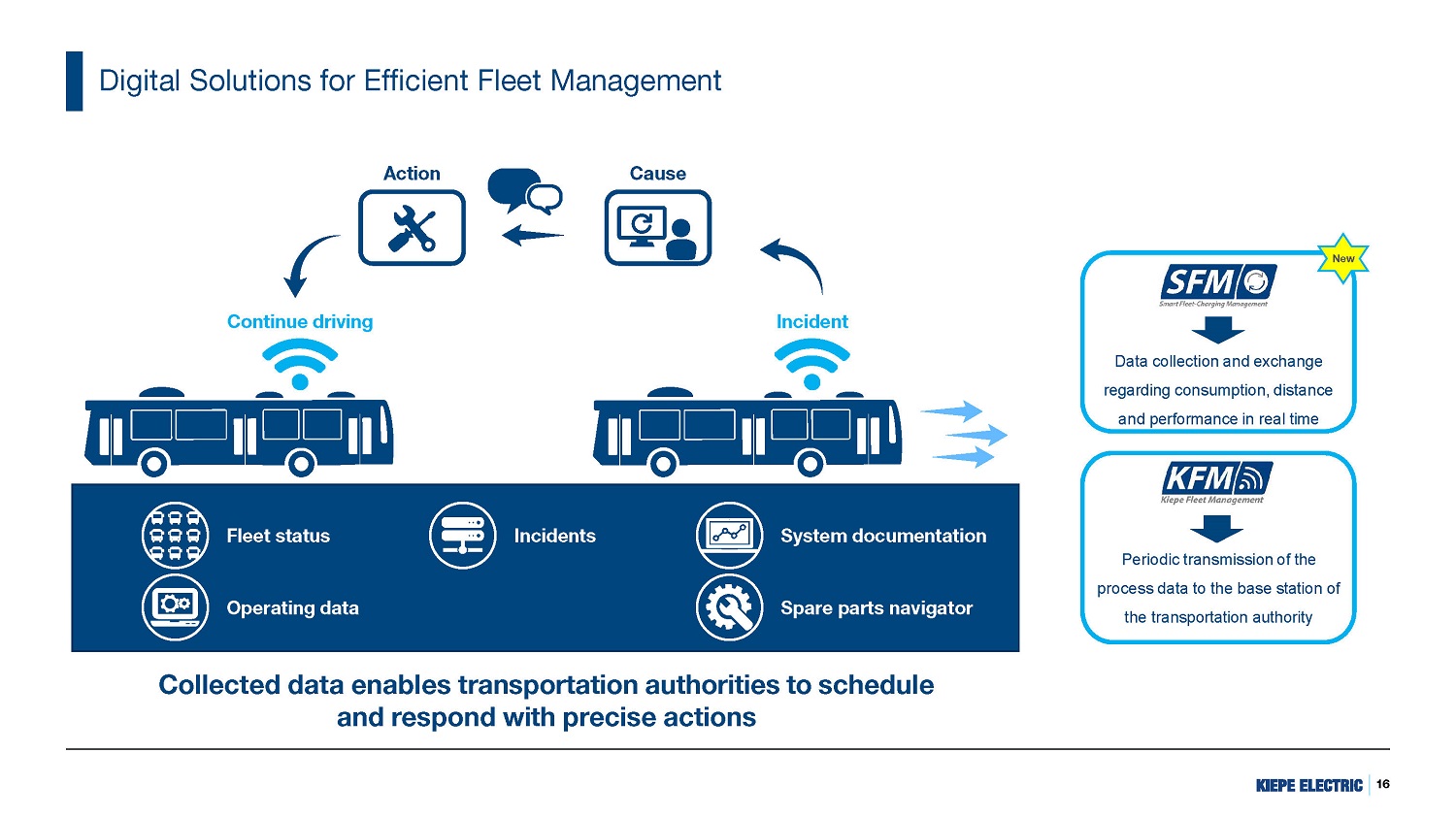

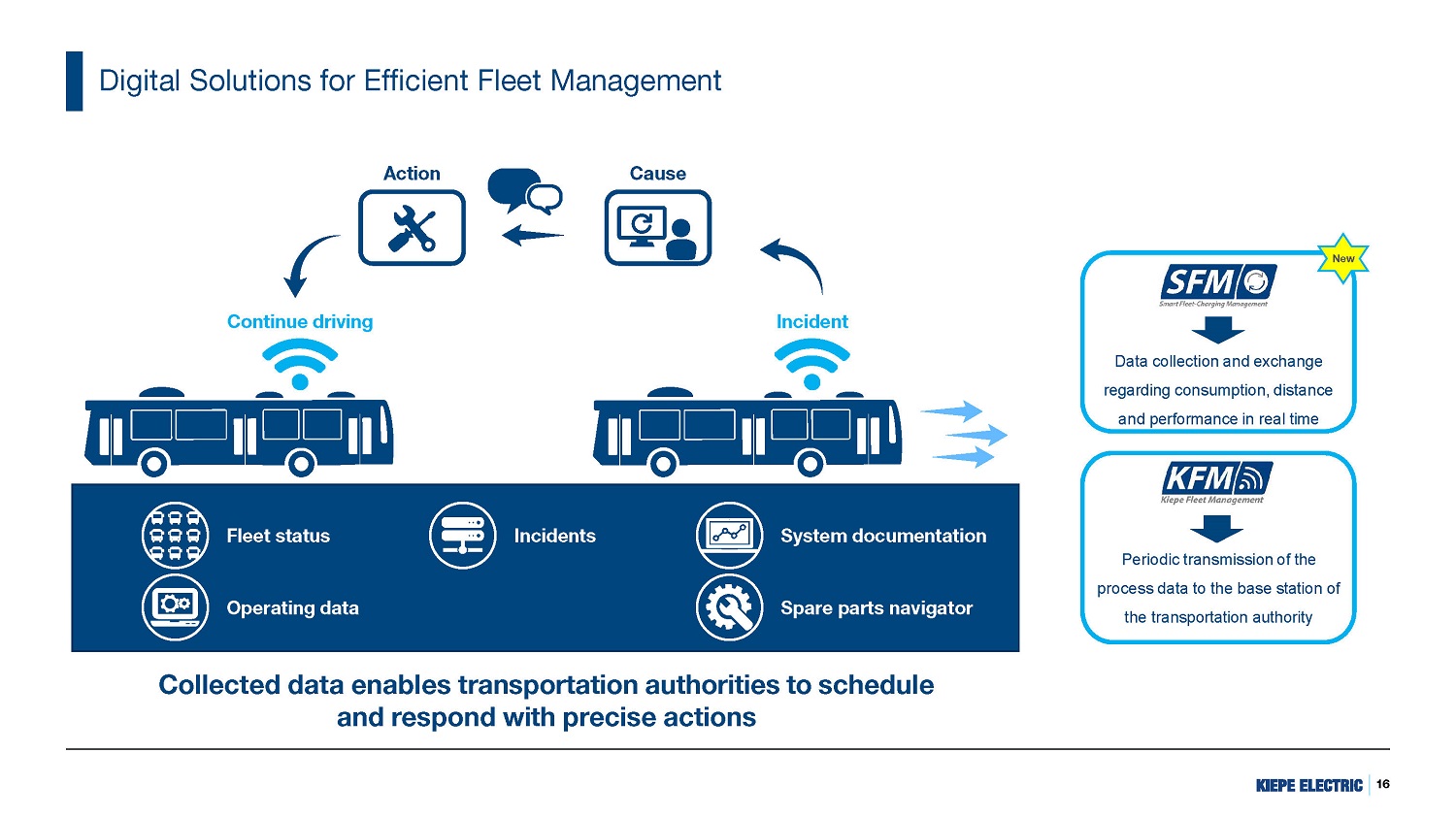

Digital Solutions for Efficient Fleet Management Collected data enables transportation authorities to schedule and respond with precise actions Data collection and exchange regarding consumption, distance and performance in real time Periodic transmission of the process data to the base station of the transportation authority Fleet status Operating data 16 Incidents System documentation Spare parts navigator Continue driving Incident Action Cause New

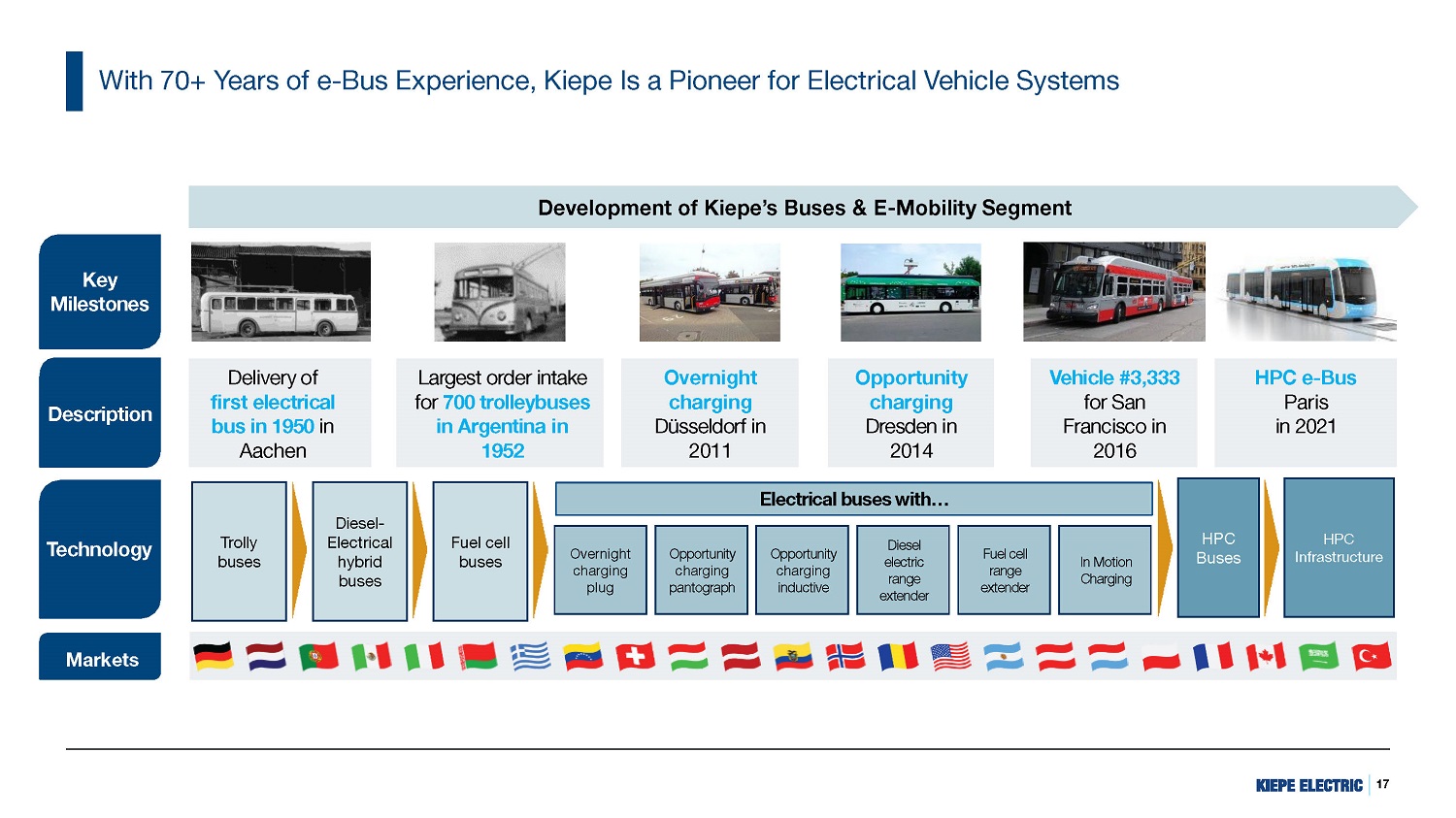

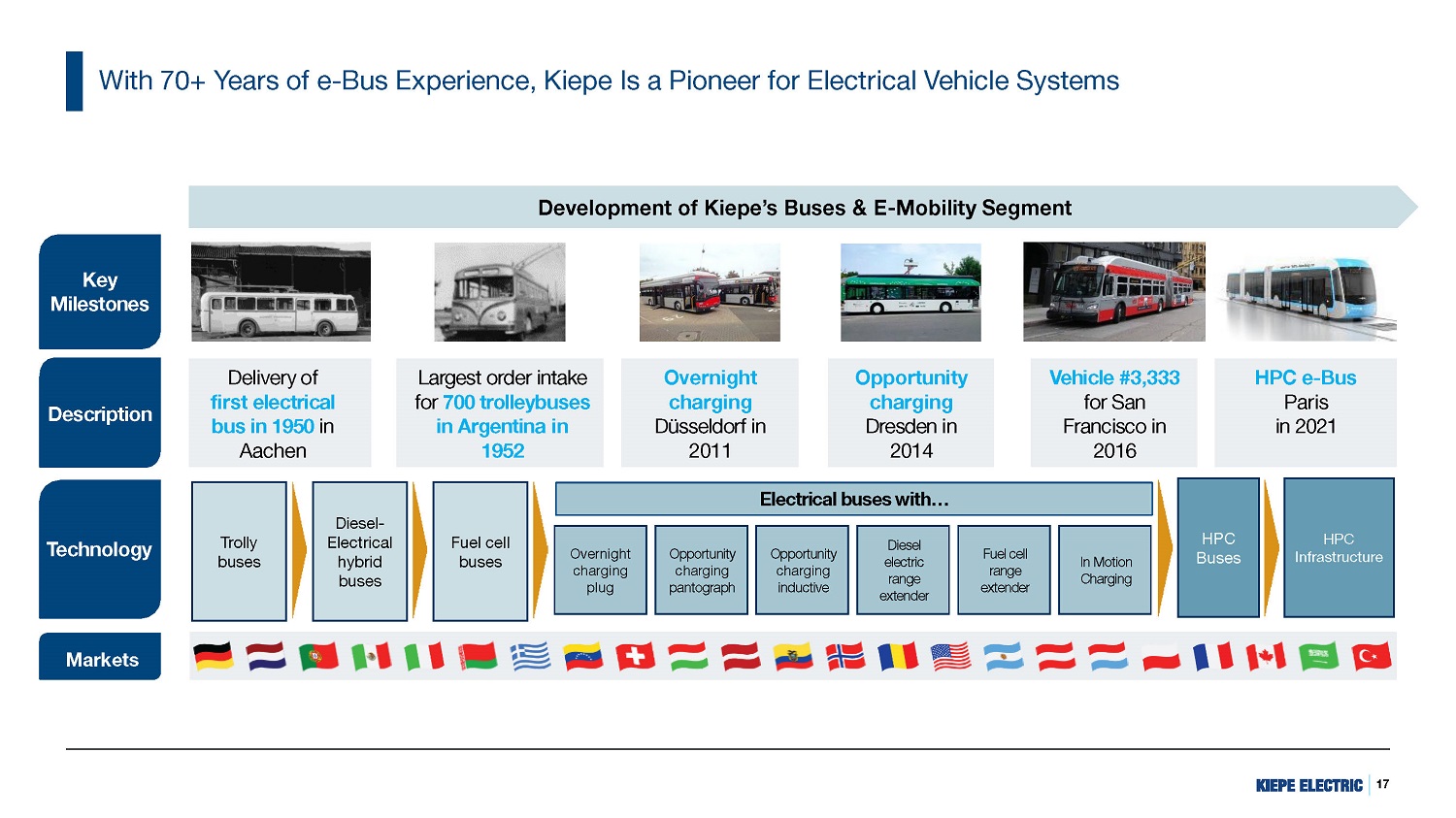

With 70+ Years of e - Bus Experience, Kiepe Is a Pioneer for Electrical Vehicle Systems Development of Kiepe’s Buses & E - Mobility Segment Technology Key Milestones Delivery of first electrical bus in 1950 in Aachen Description Largest order intake for 700 trolleybuses in Argentina in 1952 Vehicle #3,333 for San Francisco in 2016 HPC e - Bus Paris in 2021 Overnight charging Düsseldorf in 2011 Opportunity charging Dresden in 2014 Electrical buses with… Trolly buses 17 Diesel - Electrical hybrid buses Fuel cell buses HPC Buses HPC Infrastructure Overnight charging plug Opportunity charging pantograph Opportunity charging inductive Diesel electric range extender Fuel cell range extender In Motion Charging Markets

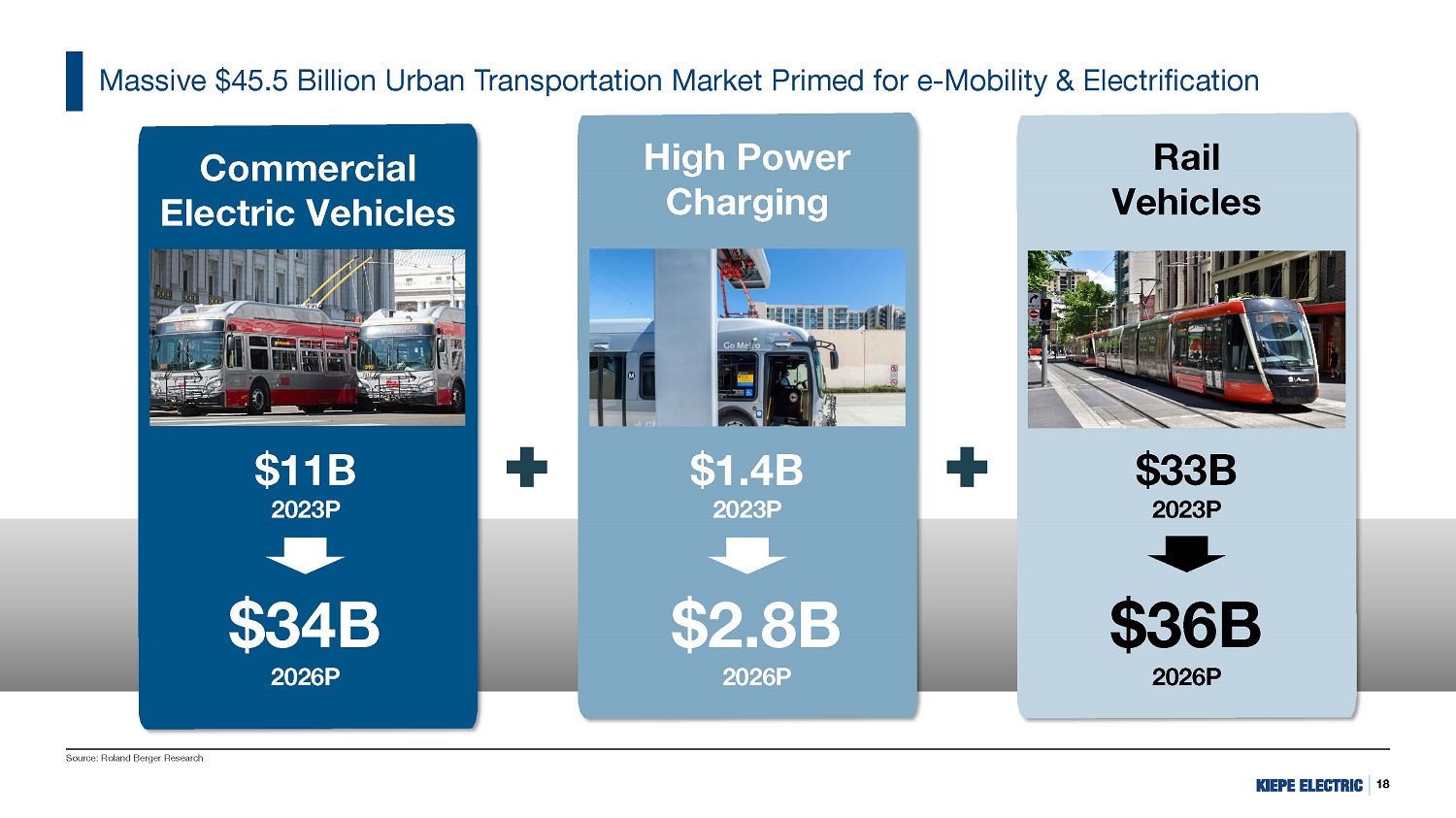

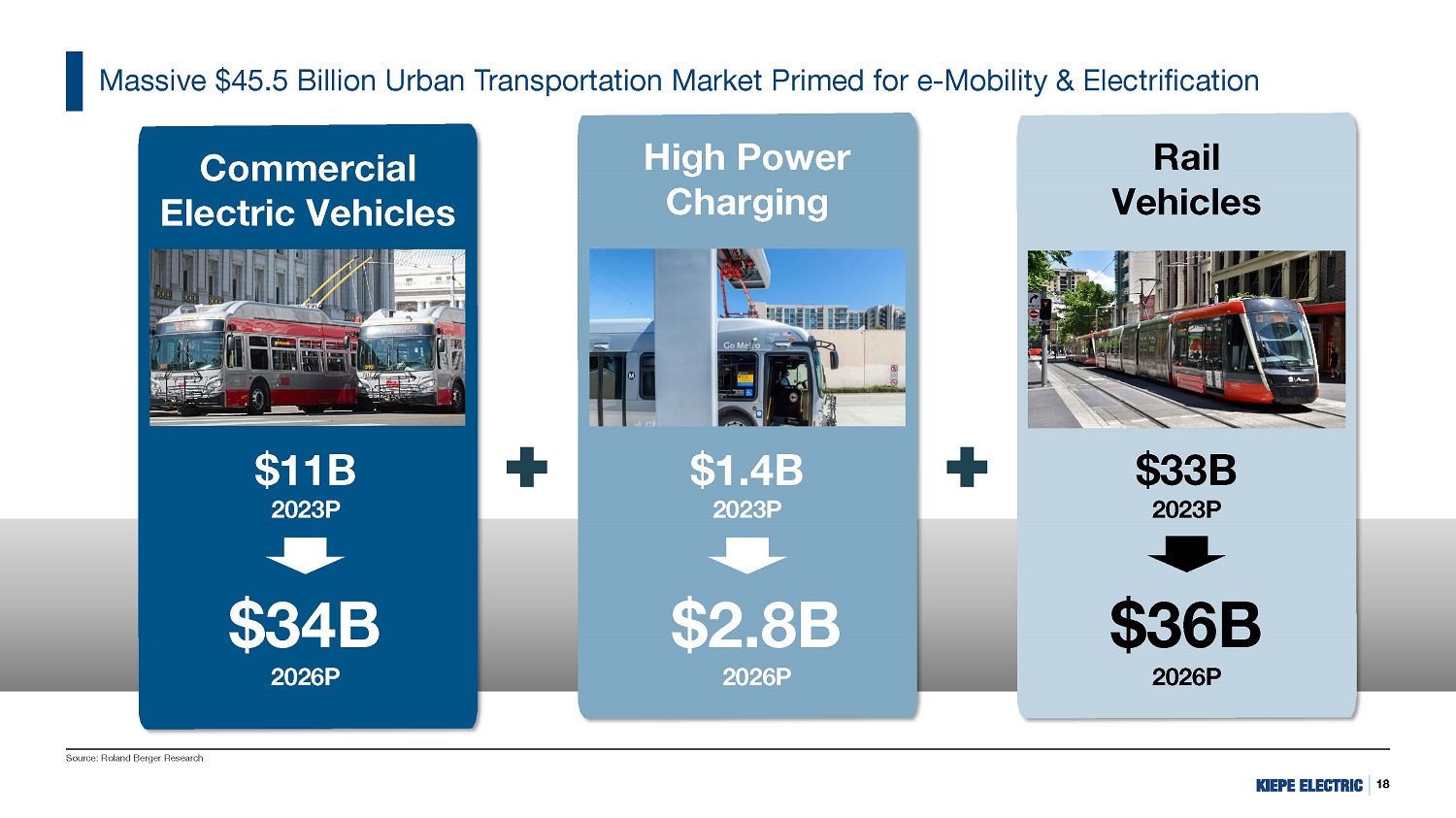

Massive $45.5 Billion Urban Transportation Market Primed for e - Mobility & Electrification High Power Charging Commercial Electric Vehicles Rail Vehicles $11B 2023P 18 $34B 2026P $1.4B 2023P $2.8B 2026P $33B 2023P $36B 2026P Source: Roland Berger Research

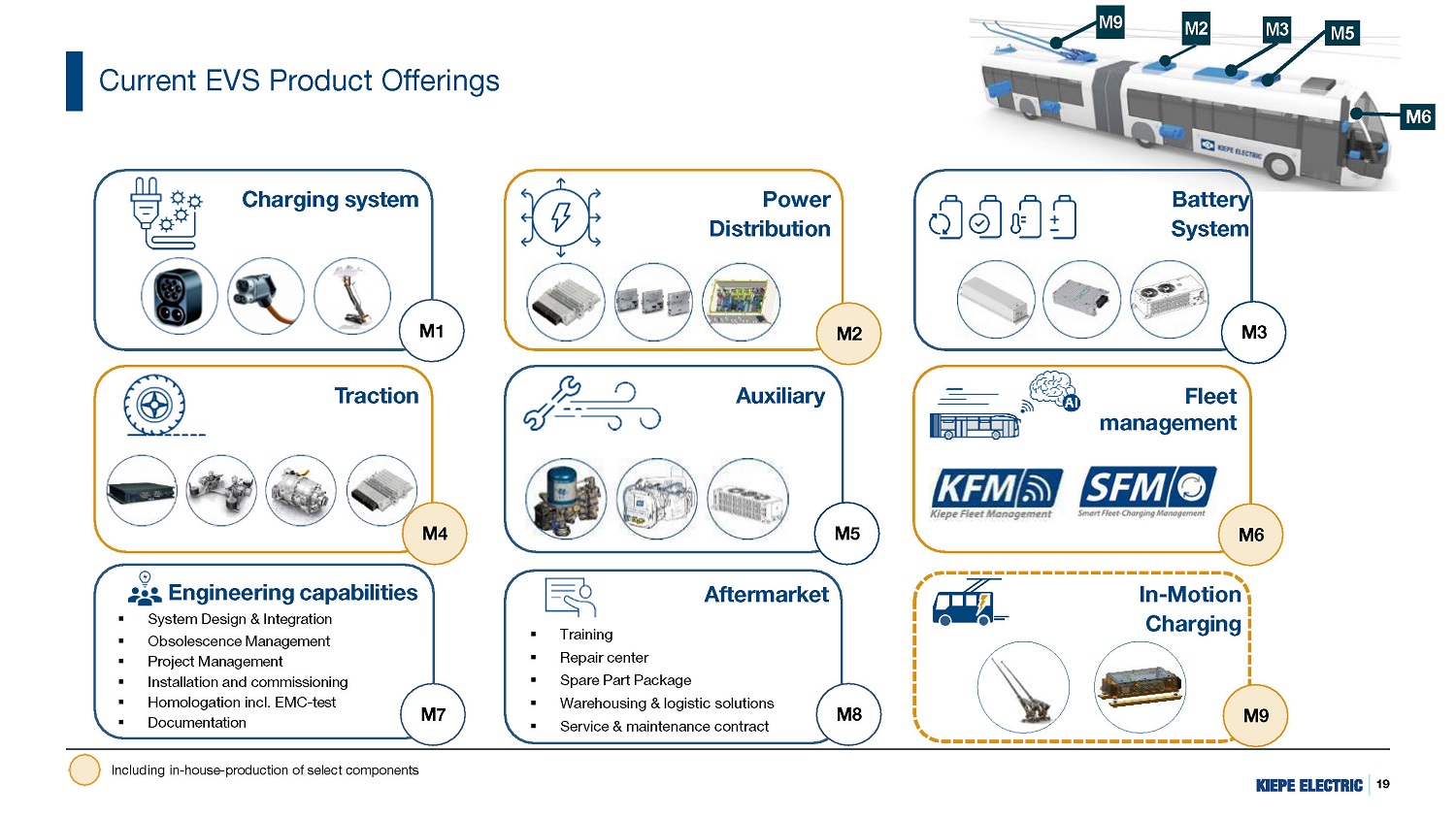

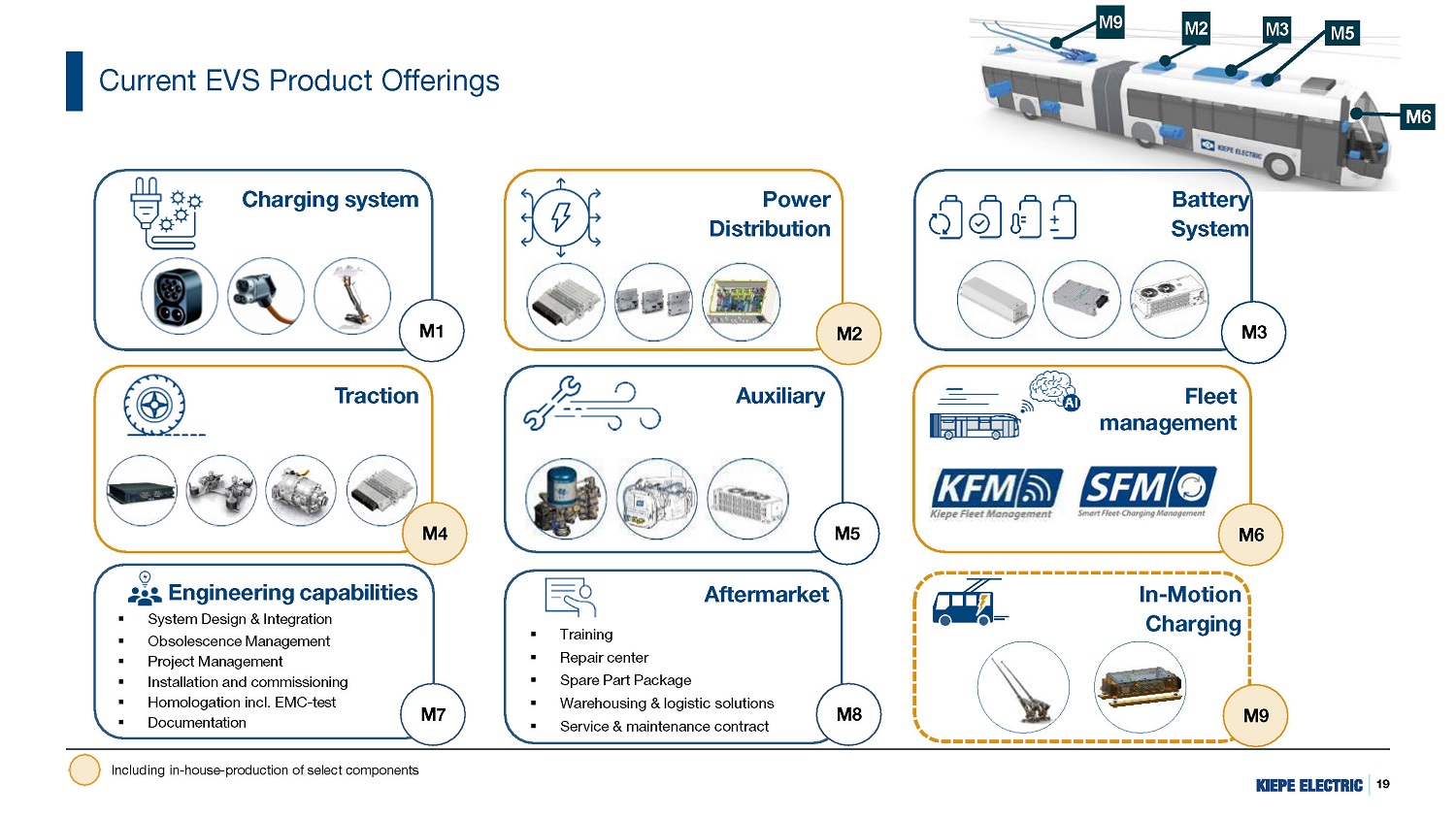

Current EVS Product Offerings M6 M3 M2 M9 M5 M1 M4 M2 M3 M9 ▪ Training ▪ Repair center ▪ Spare Part Package ▪ Warehousing & logistic solutions ▪ Service & maintenance contract M8 M7 Charging system Power Distribution Battery System Traction Engineering capabilities ▪ System Design & Integration ▪ Obsolescence Management ▪ Project Management ▪ Installation and commissioning ▪ Homologation incl. EMC - test ▪ Documentation Auxiliary Fleet management M6 Aftermarket In - Motion Charging M5 Including in - house - production of select components 19

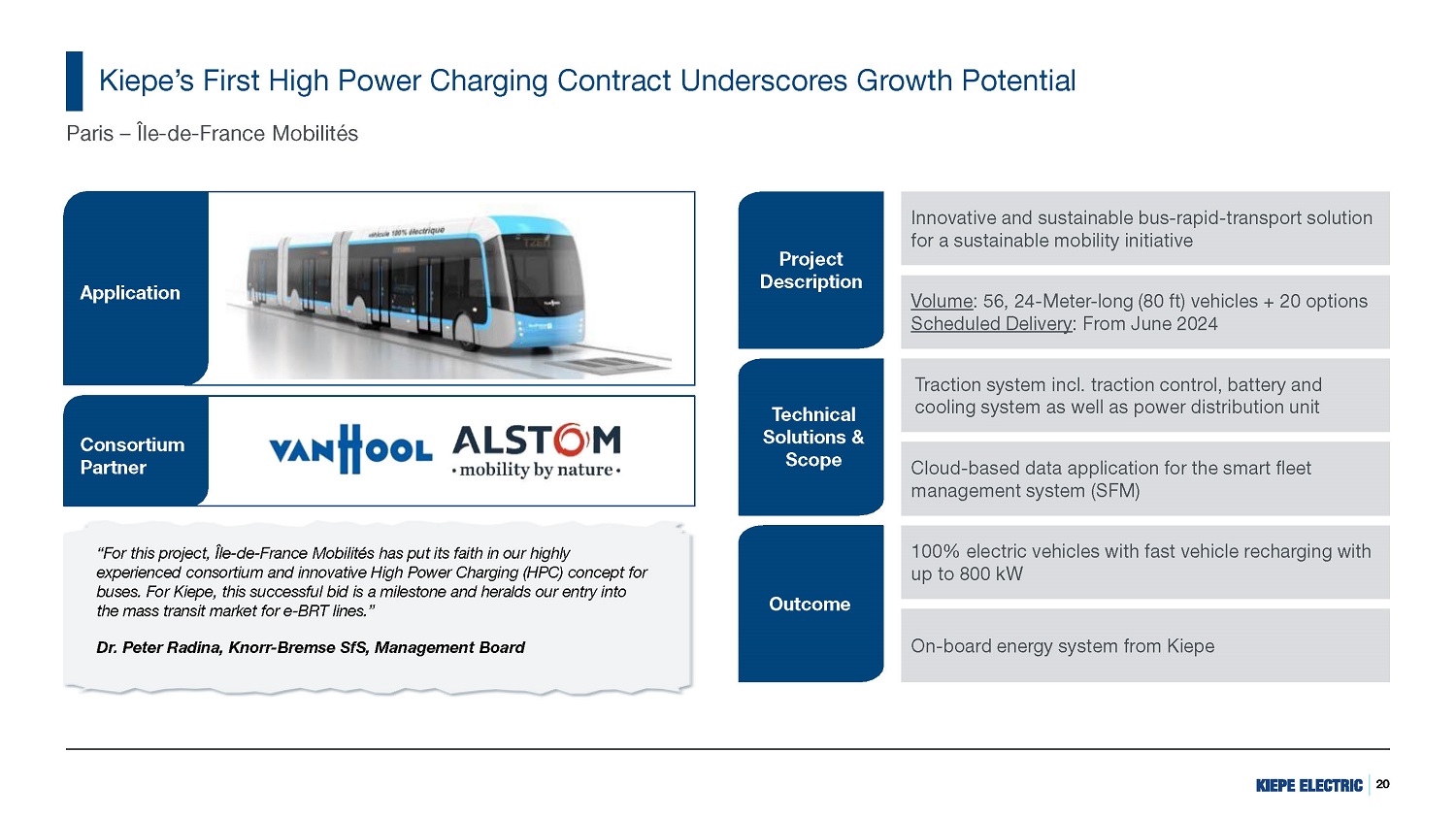

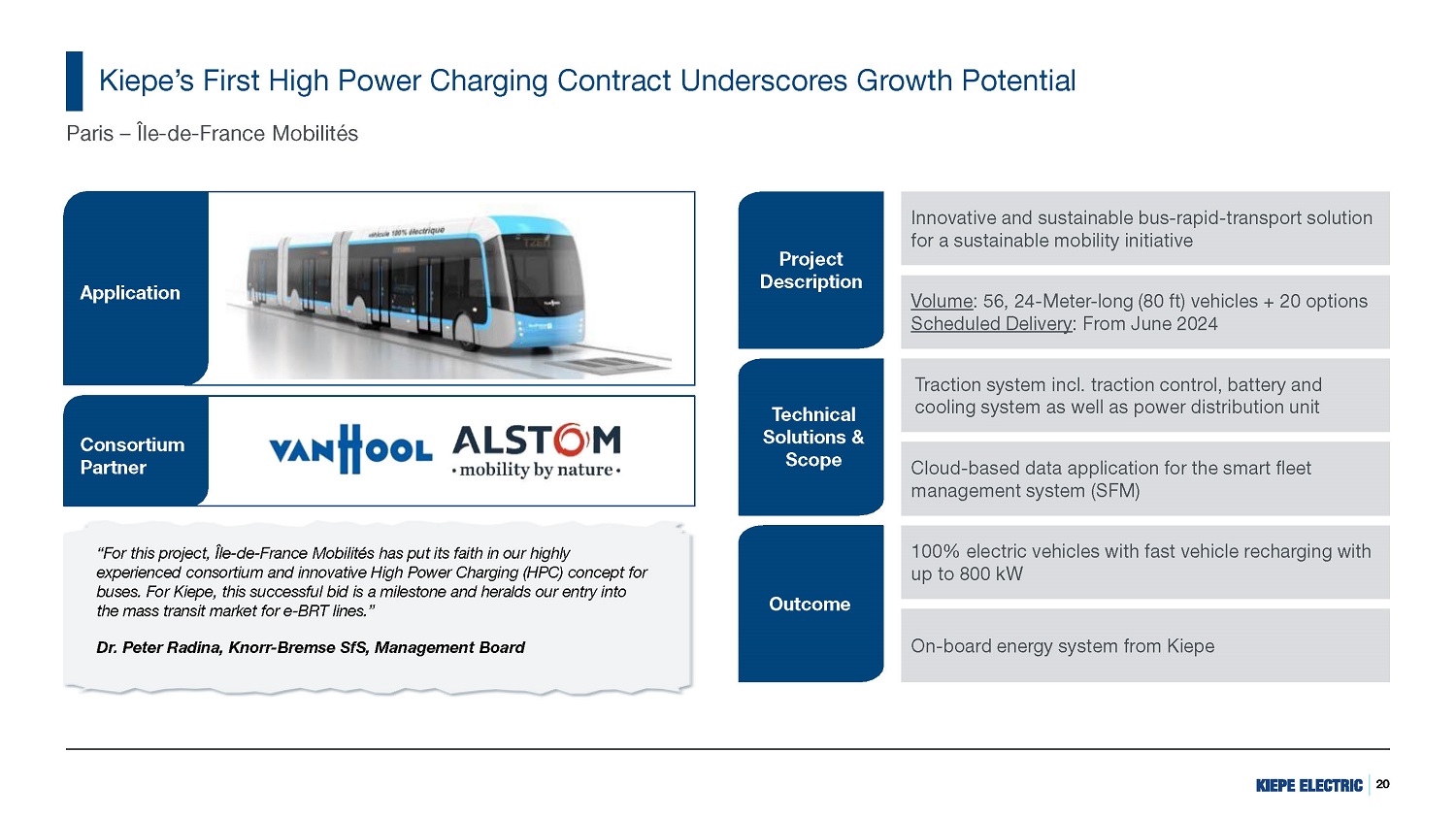

Kiepe’s First High Power Charging Contract Underscores Growth Potential Paris – Île - de - France Mobilités “For this project, Île - de - France Mobilités has put its faith in our highly experienced consortium and innovative High Power Charging (HPC) concept for buses. For Kiepe, this successful bid is a milestone and heralds our entry into the mass transit market for e - BRT lines.” Dr. Peter Radina, Knorr - Bremse SfS, Management Board Innovative and sustainable bus - rapid - transport solution for a sustainable mobility initiative Volume : 56, 24 - Meter - long (80 ft) vehicles + 20 options Scheduled Delivery : From June 2024 Traction system incl. traction control, battery and cooling system as well as power distribution unit Cloud - based data application for the smart fleet management system (SFM) 100% electric vehicles with fast vehicle recharging with up to 800 kW On - board energy system from Kiepe Project Description Outcome Application Consortium Partner Technical Solutions & Scope 20

Kiepe’s RVS Segment: Founding and History Technology Strong track record of providing reliable customer - specific electrical systems for rail vehicles Development of Kiepe’s RVS Segment Key Milestones Description Traction converter main line applications New cyber secure CAN and Ethernet TCMS Leipzig in Cologne in Loco Vossloh Houston in Karlsruhe in Hannover in Project EMU 2021 2020 since 2015 2012 2012 2011 Protos in 2007 Cam Controller 21 Electro - pneumatic contactor control GTO Traction Inverter CAN data bus TCMS IGBT traction inverter Energy storage (EDLC) Markets

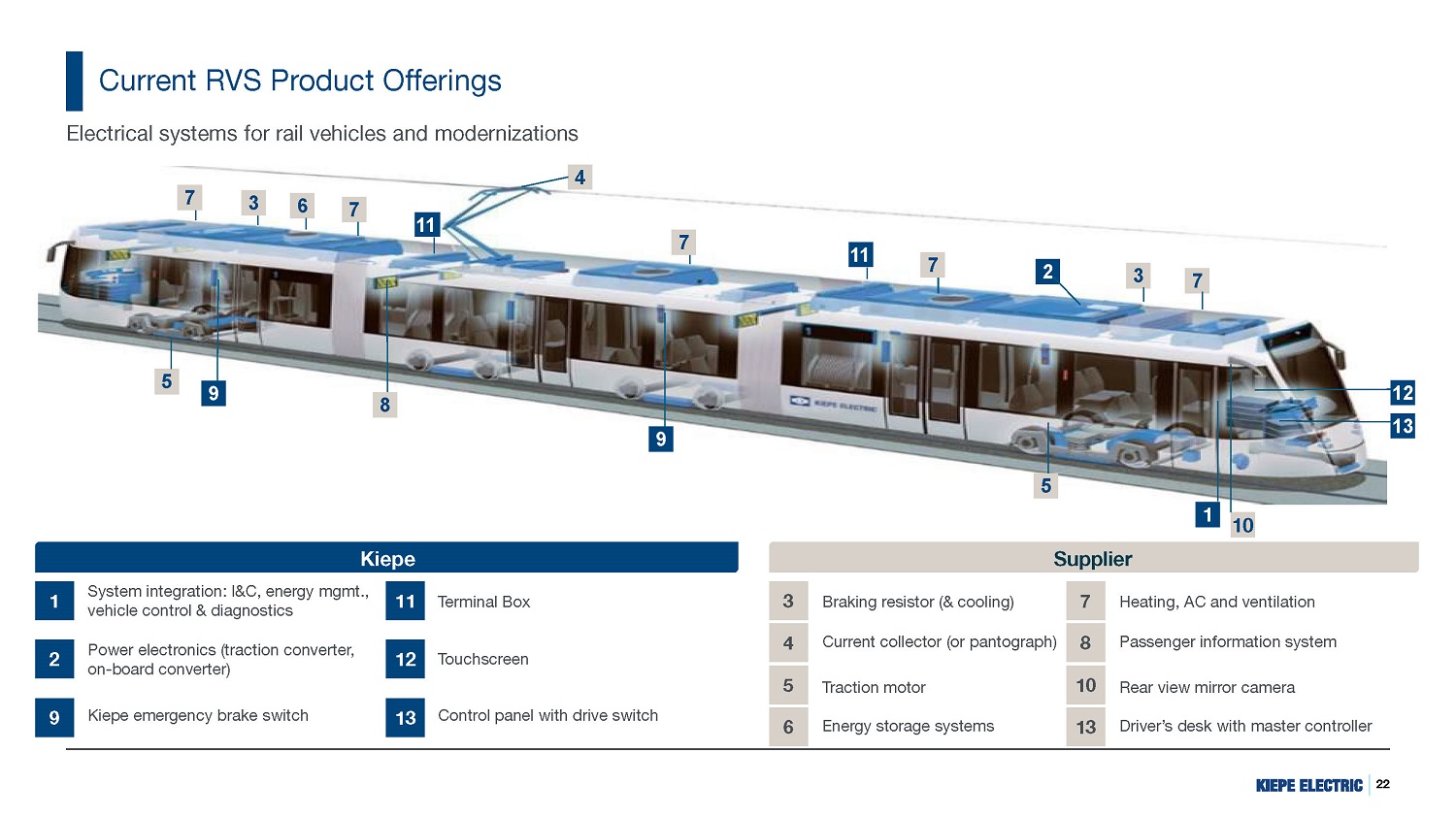

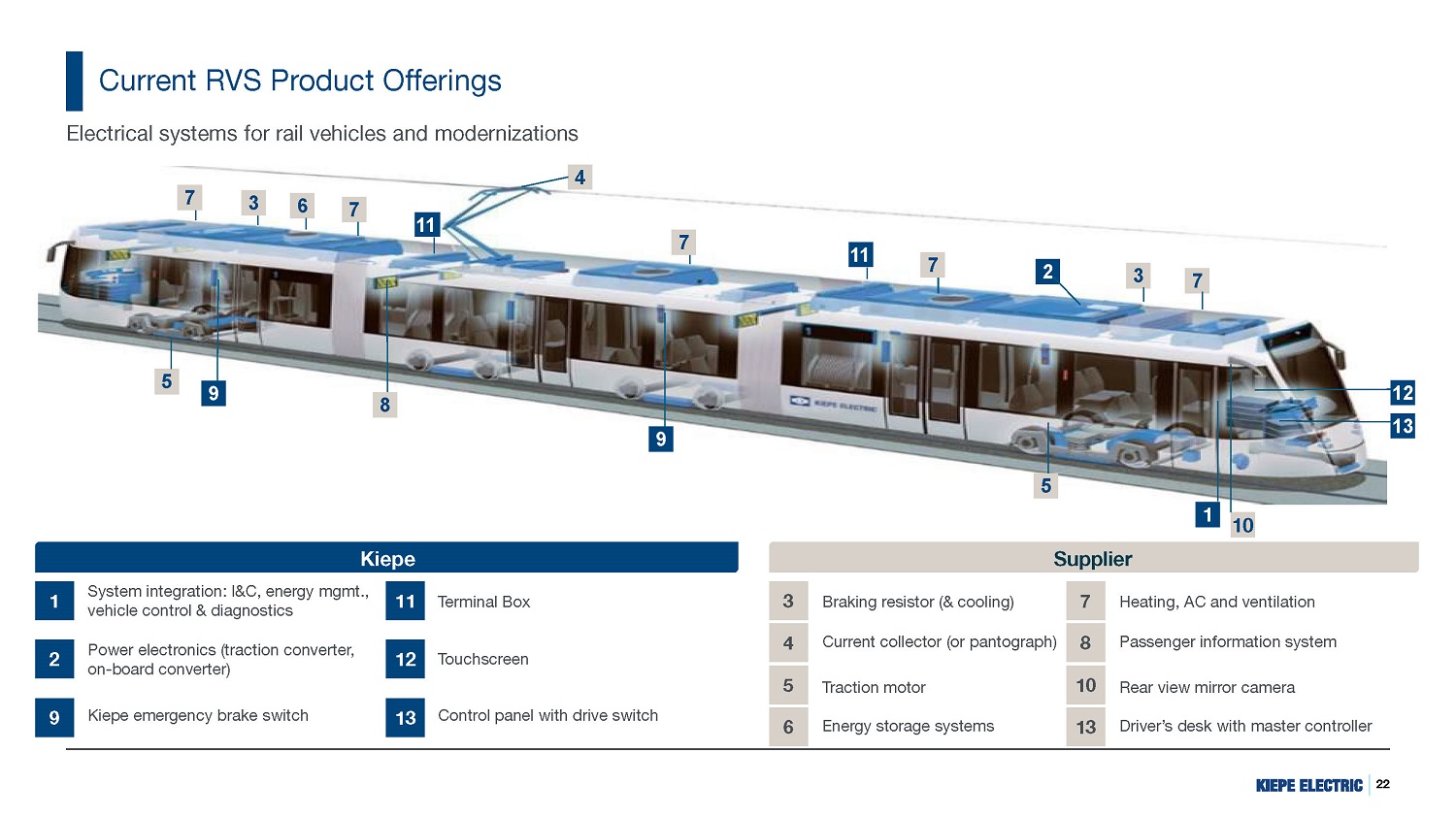

Current RVS Product Offerings Electrical systems for rail vehicles and modernizations 4 6 11 2 3 7 13 10 1 5 9 8 9 5 7 7 3 7 7 12 11 Kiepe Supplier 22 1 2 9 System integration: I&C, energy mgmt., vehicle control & diagnostics Power electronics (traction converter, on - board converter) Kiepe emergency brake switch 11 12 13 Terminal Box Touchscreen Control panel with drive switch 3 4 5 6 Braking resistor (& cooling) Current collector (or pantograph) Traction motor Energy storage systems 7 8 10 13 Heating, AC and ventilation Passenger information system Rear view mirror camera Driver’s desk with master controller

Kiepe Electric Charging Solutions Address Needs of Various End - Markets Multiple Fast - Charging Solutions City Catenary High Power Charger (cHPC) 600, 750 VDC Upon demand 100 – 300 kW Panto, CCS Supply Battery Charging Point Power Interface to Vehicle Mobile High - Power Charging (mHPC) 3x400 VAC, 8kVA (CEE 125A Socket) LTO, 100 – 200 kWh 150, 300, up to 800 kW Panto, CCS 3x400 VAC, 8kVA (CEE 125A Socket) LTO, 200 – 400 kWh 150, 300, up to 800 kW Panto, CCS Supply Battery Charging Point Power Interface to Vehicle Fast charging of battery train via 3 rd rail LTO, 200 – 400 kWh 1,000 – 1,500 kWh 3 rd rail, 750 VDC Construction eBus Rail eBus 23 Construction Machines 3 rd Rail City High Power Charger Ceiling - Mounted Charger Depot Catenary 600VDC 750VDC Cabinet Charger eBus (Battery Bus)

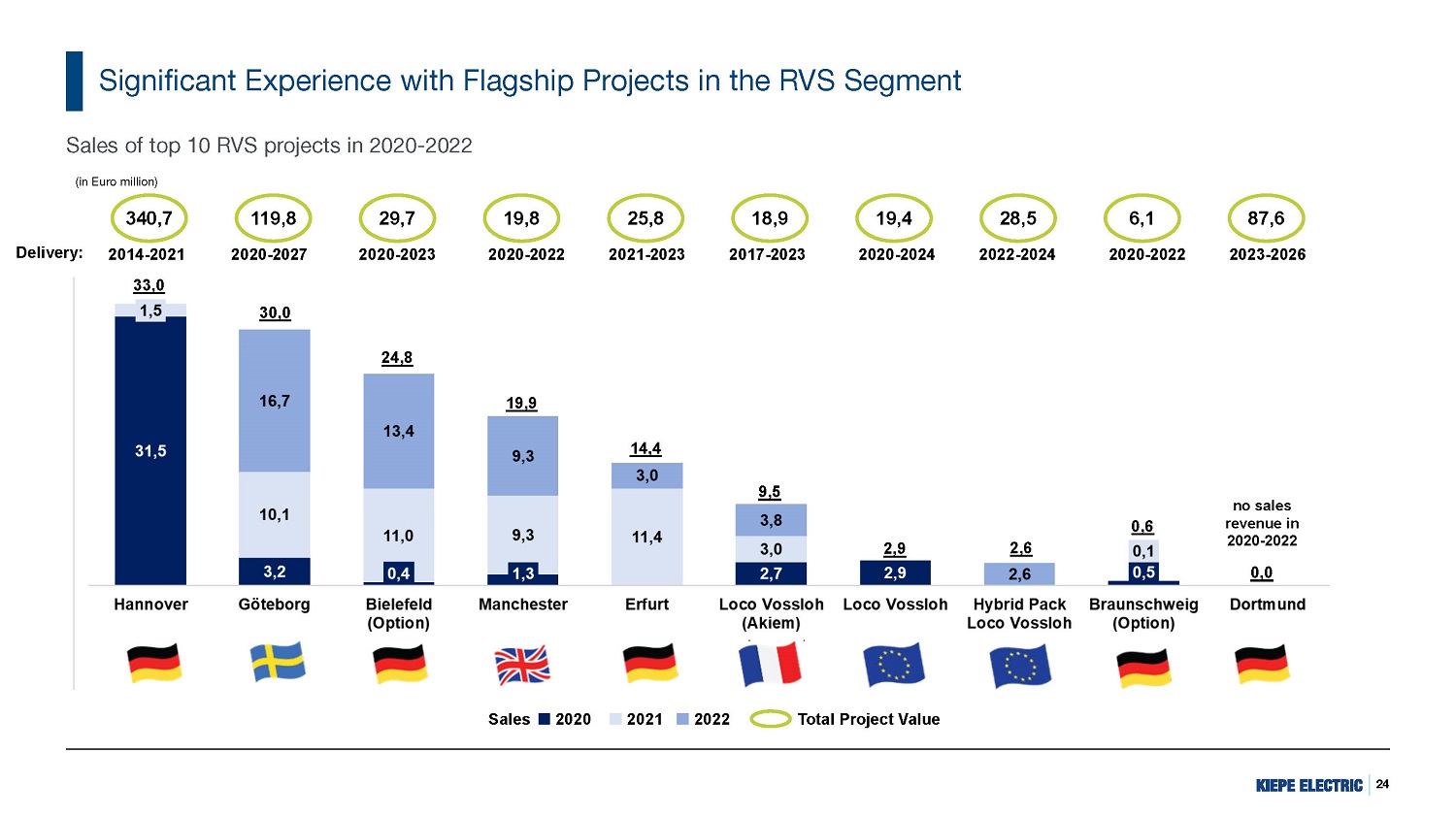

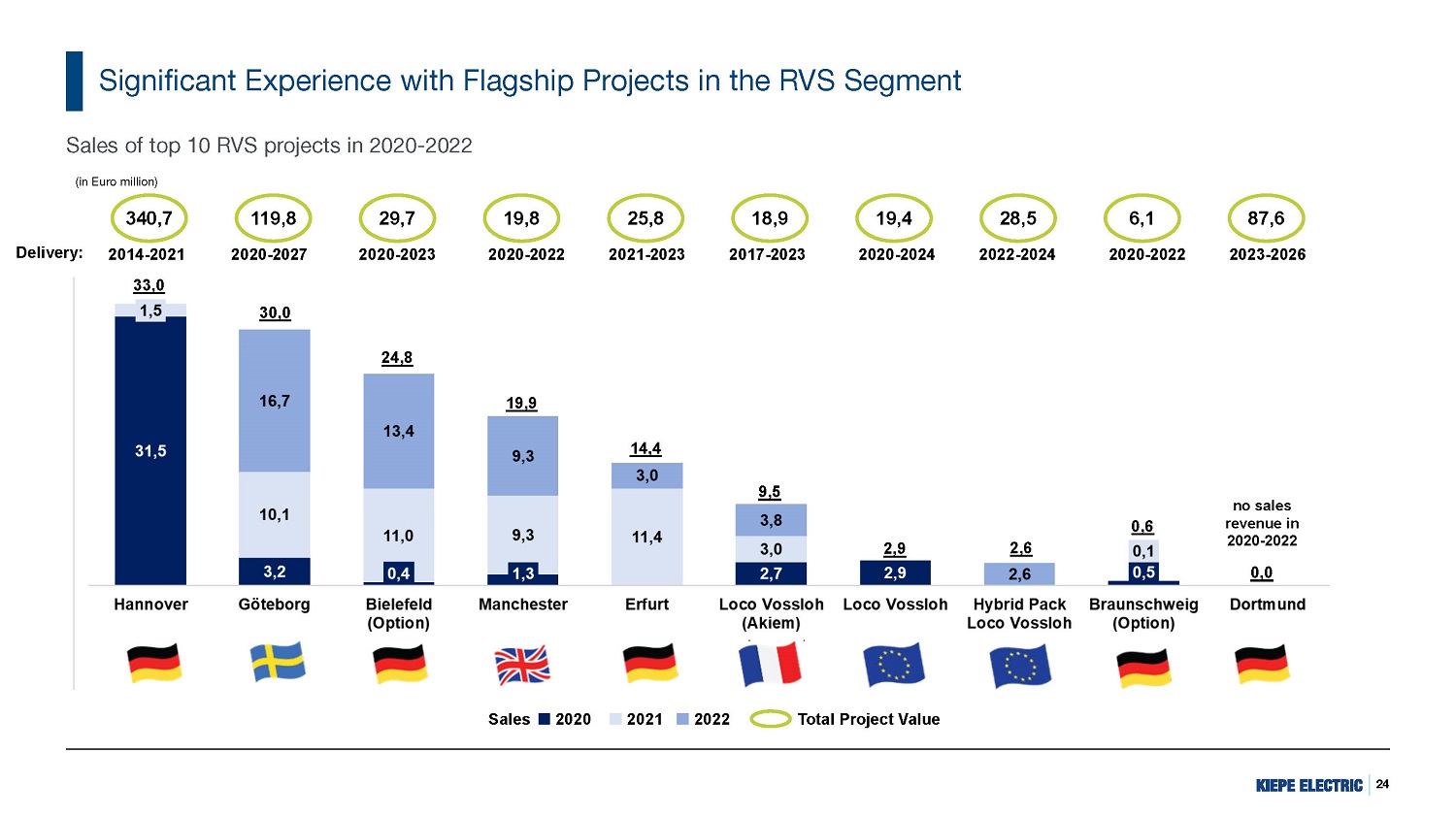

Significant Experience with Flagship Projects in the RVS Segment Sales of top 10 RVS projects in 2020 - 2022 (in Euro million) 119,8 2020 - 2027 19,8 2020 - 2022 25,8 2021 - 2023 18,9 2017 - 2023 19,4 2020 - 2024 6,1 2020 - 2022 87,6 2023 - 2026 28,5 2022 - 2024 29,7 2020 - 2023 30,0 24,8 19,9 14,4 9,5 2,9 0,6 2,6 0,0 no sales revenue in 2020 - 2022 340,7 2014 - 2021 33,0 Delivery: Sales 2020 2021 2022 Total Project Value 24

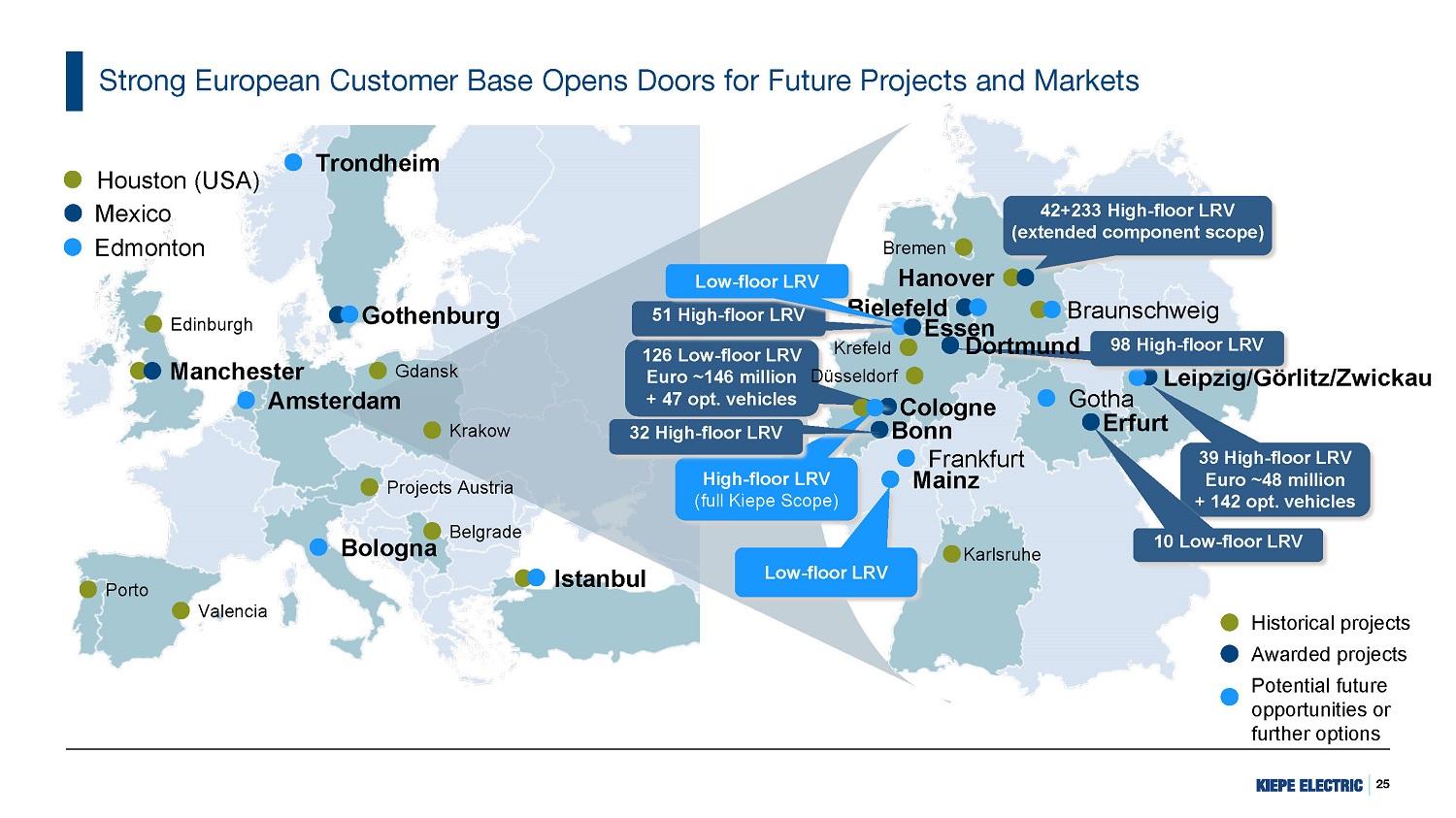

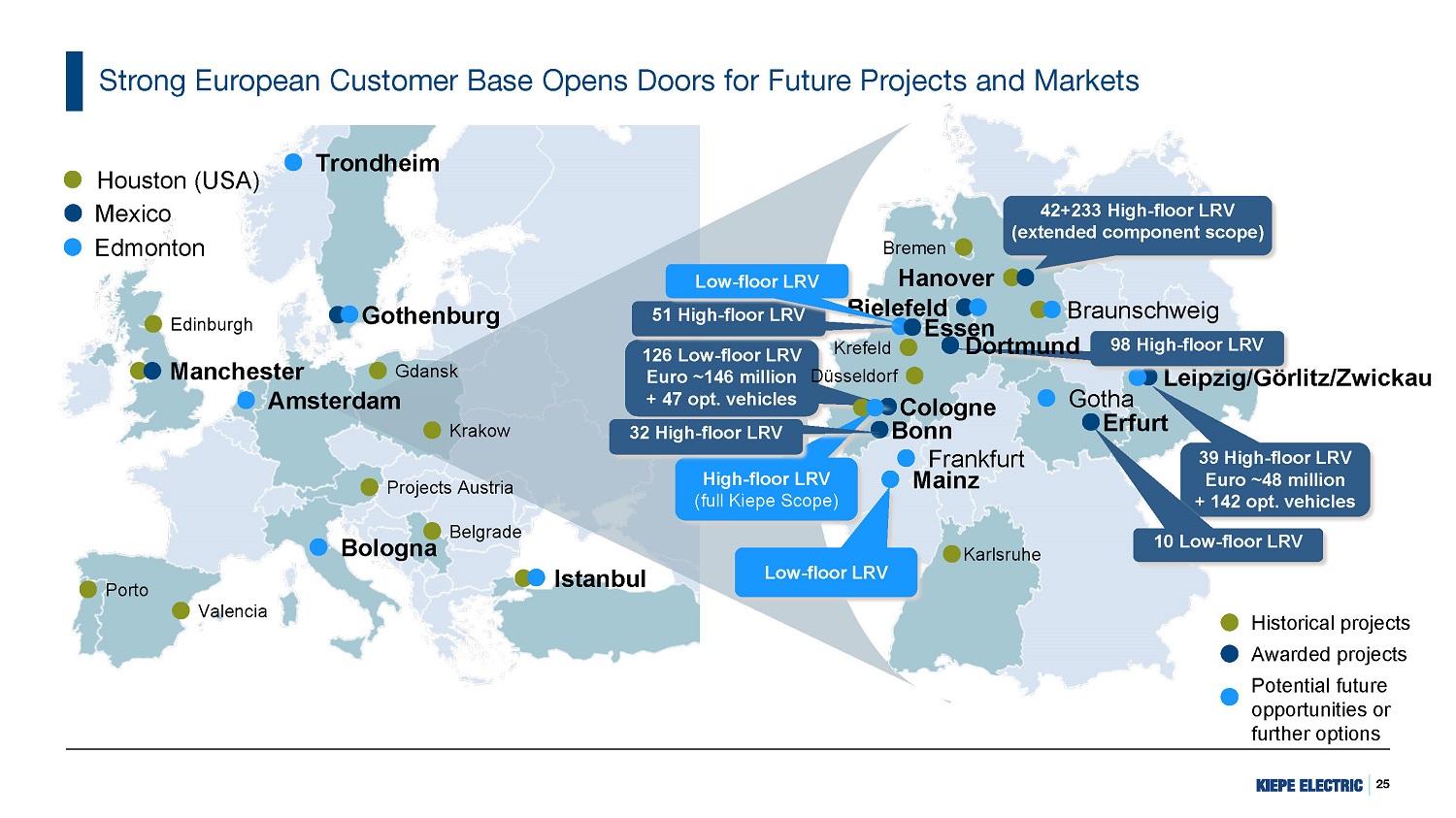

Strong European Customer Base Opens Doors for Future Projects and Markets Historical projects Awarded projects Potential future opportunities or further options Gothenburg Erfurt Braunschweig Projects Austria Leipzig/Görlitz/Zwickau 39 High - floor LRV Euro ~48 million + 142 opt. vehicles 42+233 High - floor LRV (extended component scope) Porto Bremen Hanover Bielefeld Krefeld Düsseldorf Karlsruhe Edinburgh Krakow Valencia Istanbul Belgrade Bologna High - floor LRV (full Kiepe Scope) Manchester 126 Low - floor LRV Euro ~146 million + 47 opt. vehicles 32 High - floor LRV Gdansk Amsterdam Houston (USA) Mexico Edmonton Low - floor LRV 10 Low - floor LRV 98 High - floor LRV Dortmund Gotha Cologne Bonn Frankfurt Mainz Trondheim Essen Low - floor LRV 51 High - floor LRV 25

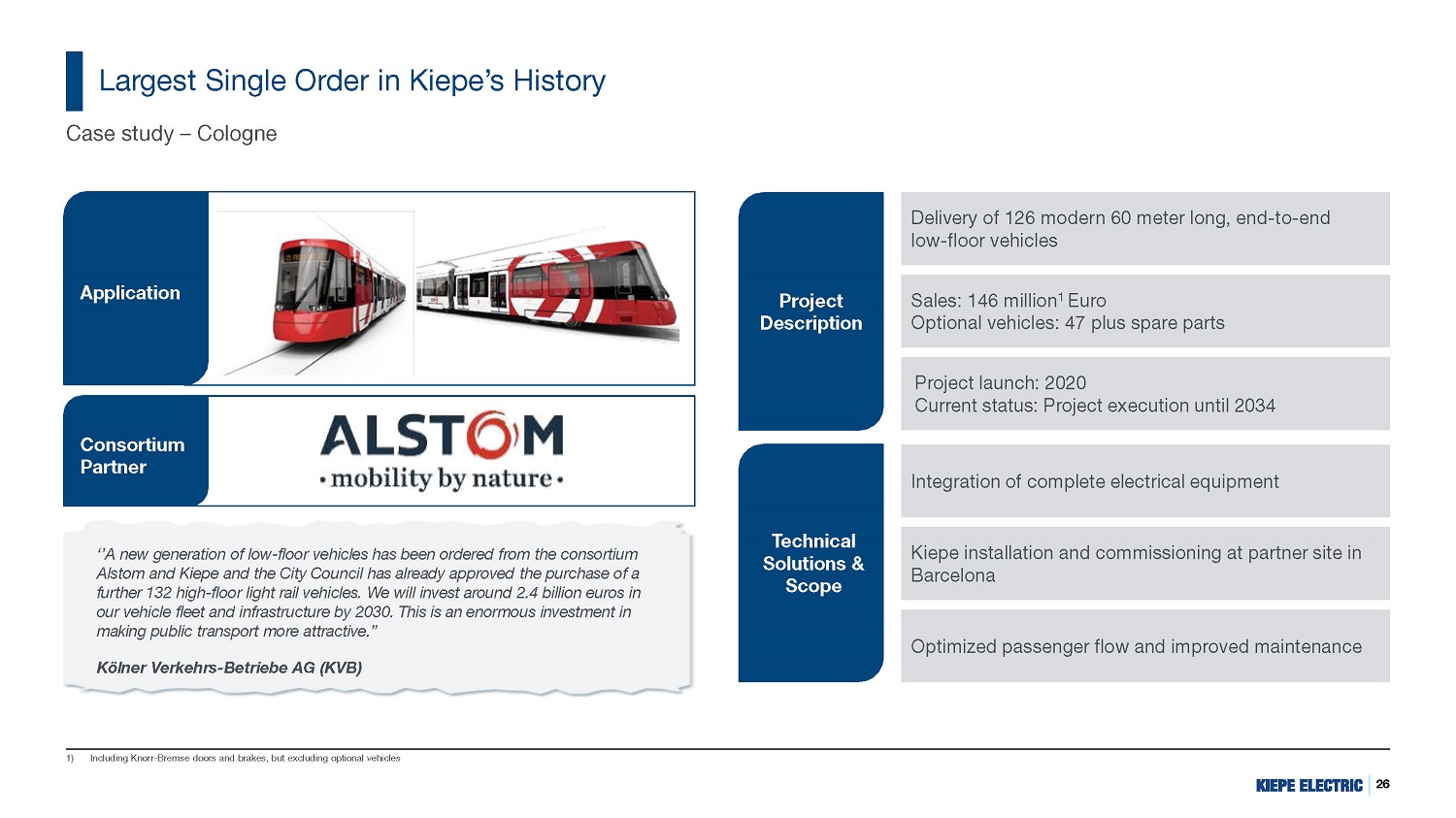

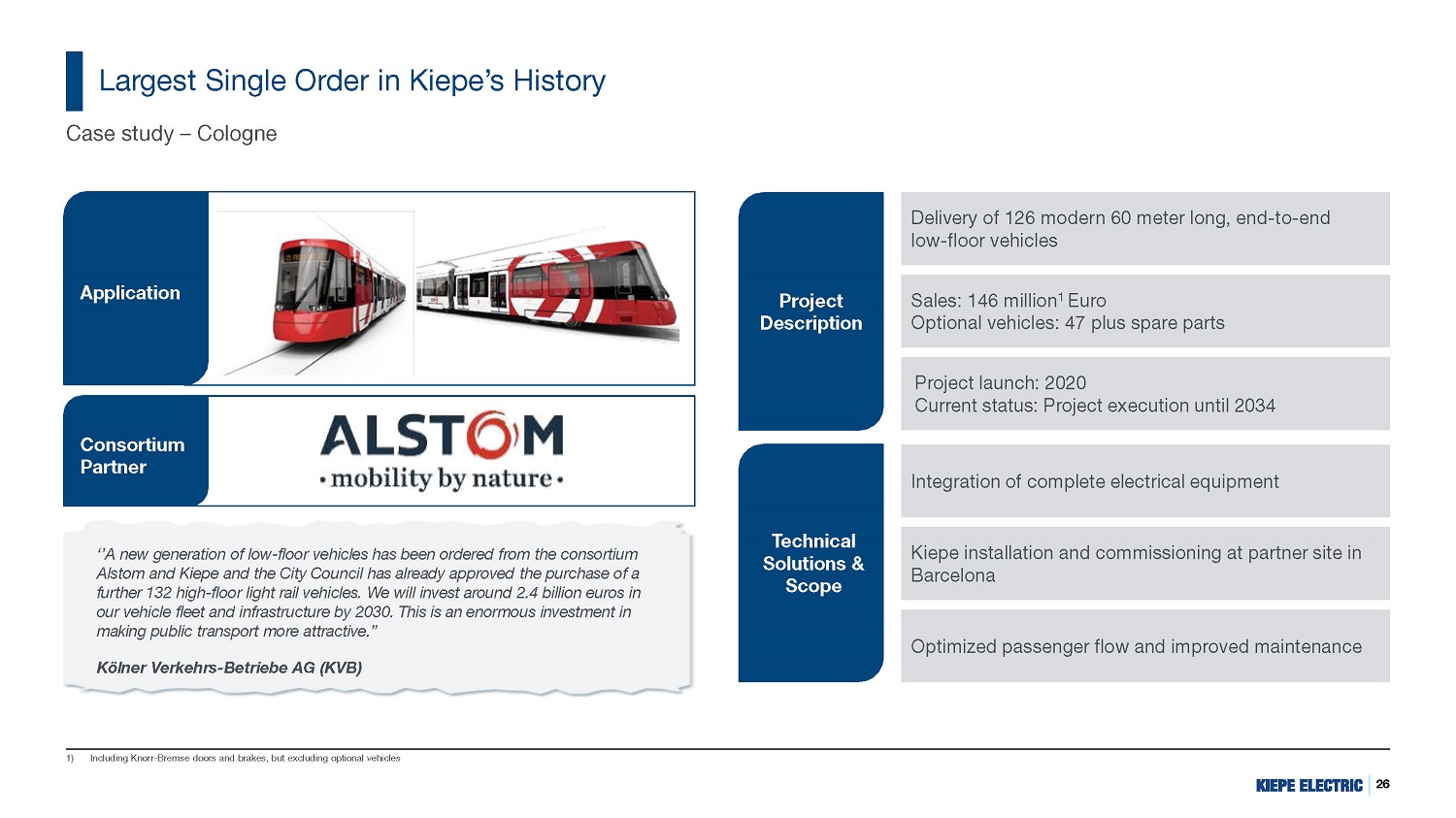

Largest Single Order in Kiepe’s History 1) Including Knorr - Bremse doors and brakes, but excluding optional vehicles Case study – Cologne ‘’A new generation of low - floor vehicles has been ordered from the consortium Alstom and Kiepe and the City Council has already approved the purchase of a further 132 high - floor light rail vehicles. We will invest around 2.4 billion euros in our vehicle fleet and infrastructure by 2030. This is an enormous investment in making public transport more attractive.” Kölner Verkehrs - Betriebe AG (KVB) Application Consortium Partner Delivery of 126 modern 60 meter long, end - to - end low - floor vehicles Sales: 146 million 1 Euro Optional vehicles: 47 plus spare parts Project launch: 2020 Current status: Project execution until 2034 Project Description Integration of complete electrical equipment Kiepe installation and commissioning at partner site in Barcelona Optimized passenger flow and improved maintenance Technical Solutions & Scope 26

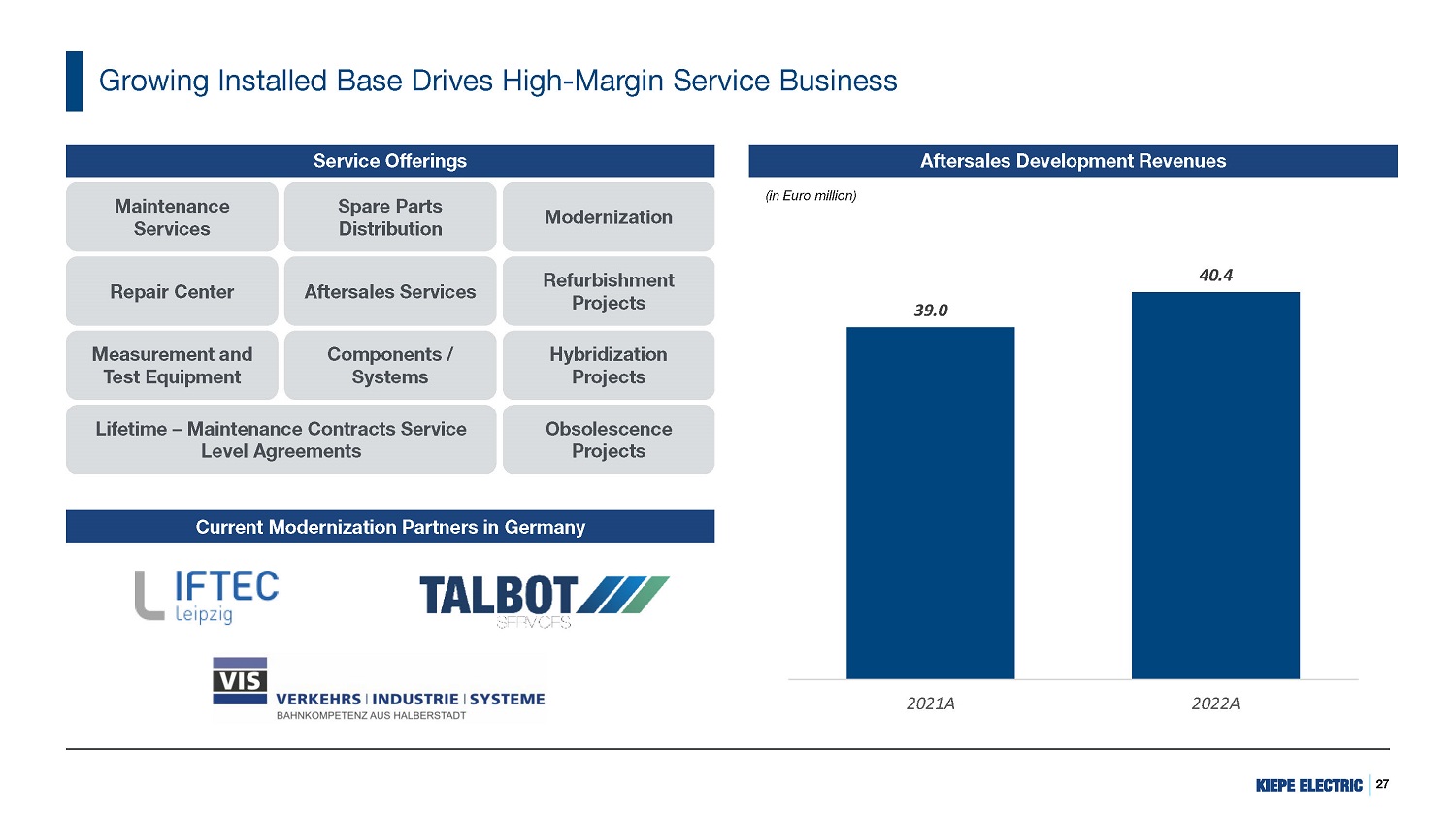

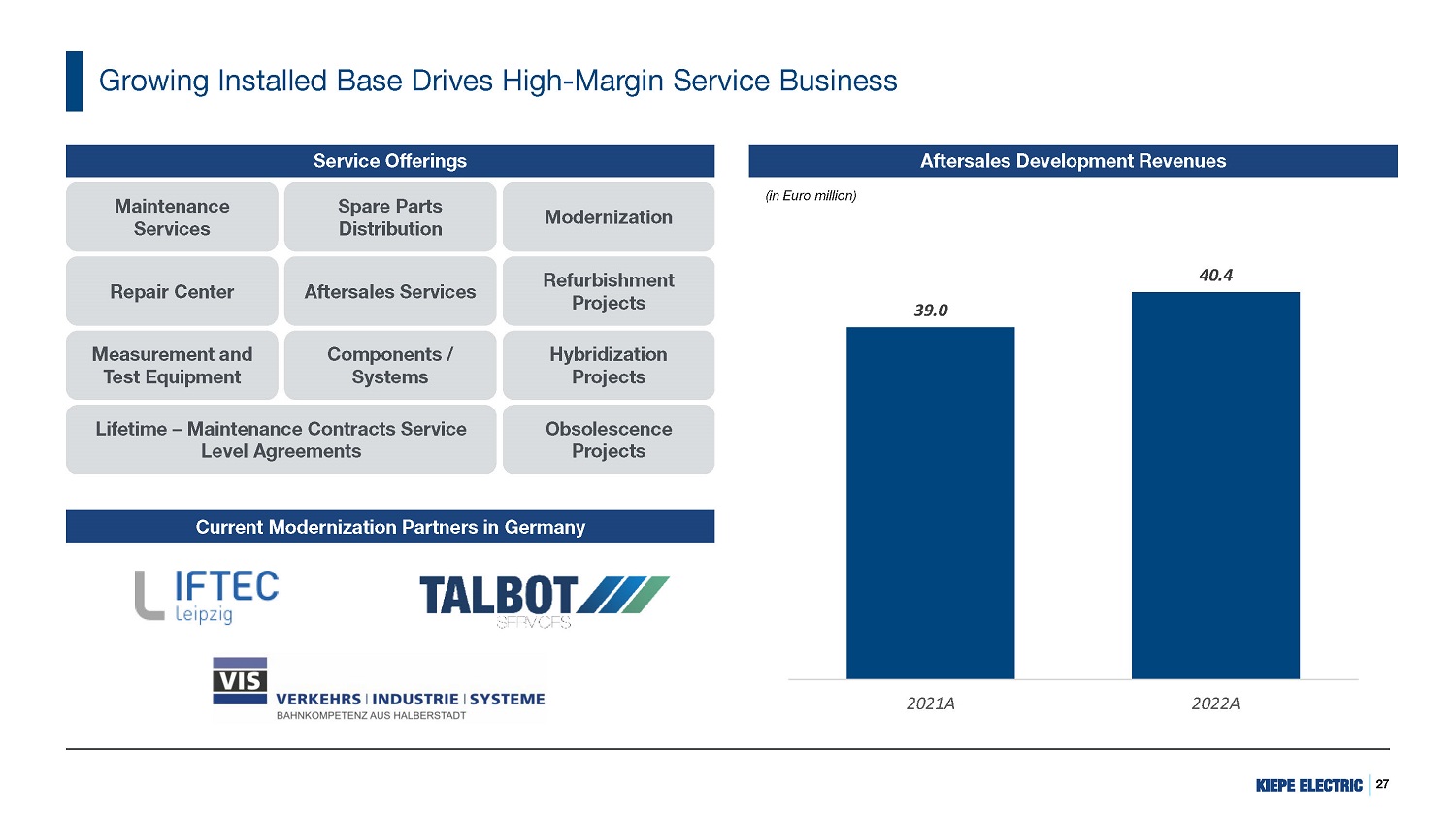

Growing Installed Base Drives High - Margin Service Business Current Modernization Partners in Germany Service Offerings Maintenance Services Spare Parts Distribution Modernization Repair Center Aftersales Services Refurbishment Projects Measurement and Test Equipment Components / Systems Hybridization Projects Lifetime – Maintenance Contracts Service Level Agreements Obsolescence Projects Aftersales Development Revenues (in Euro million) 39.0 27 40.4 2021A 2022A

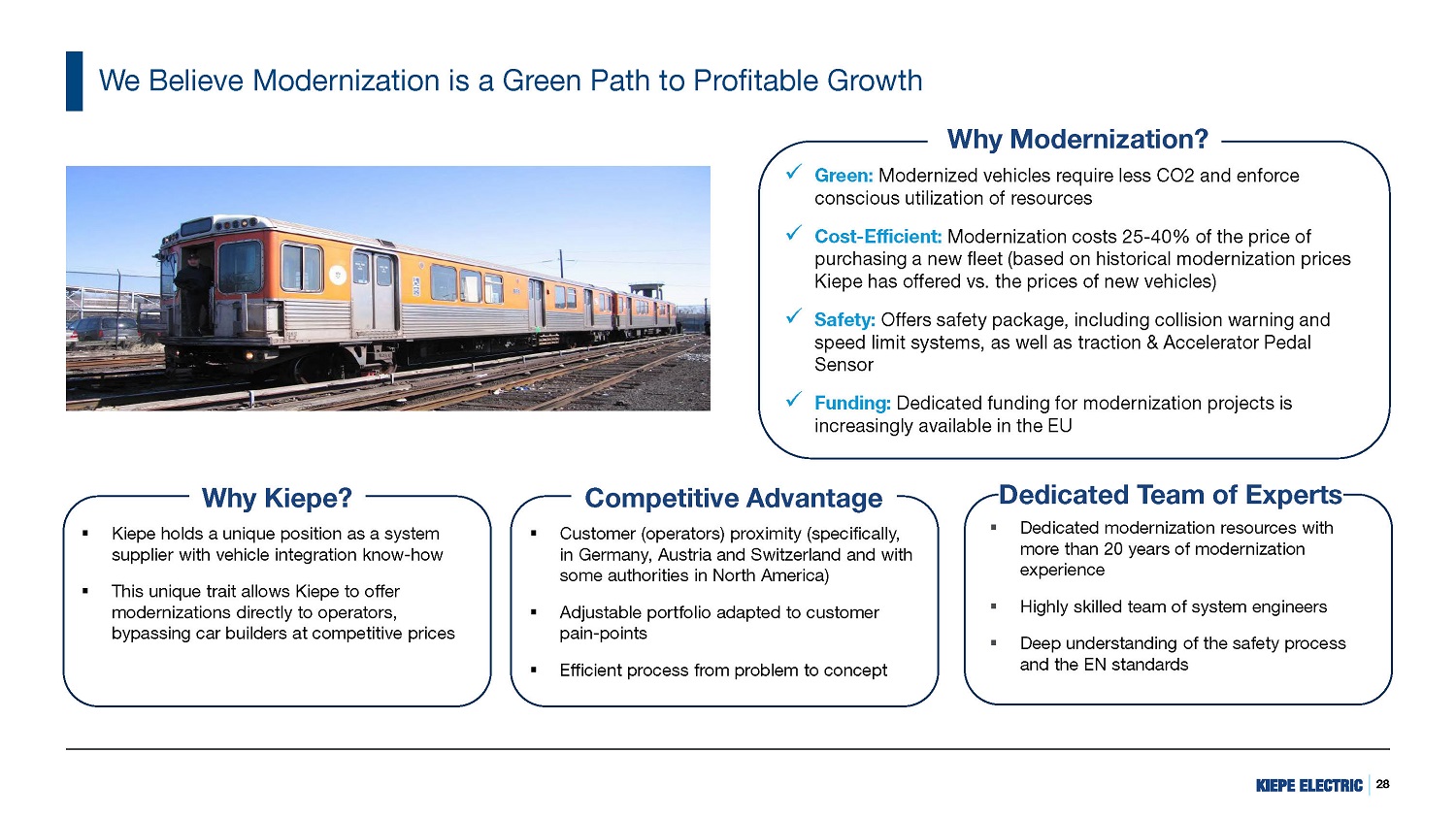

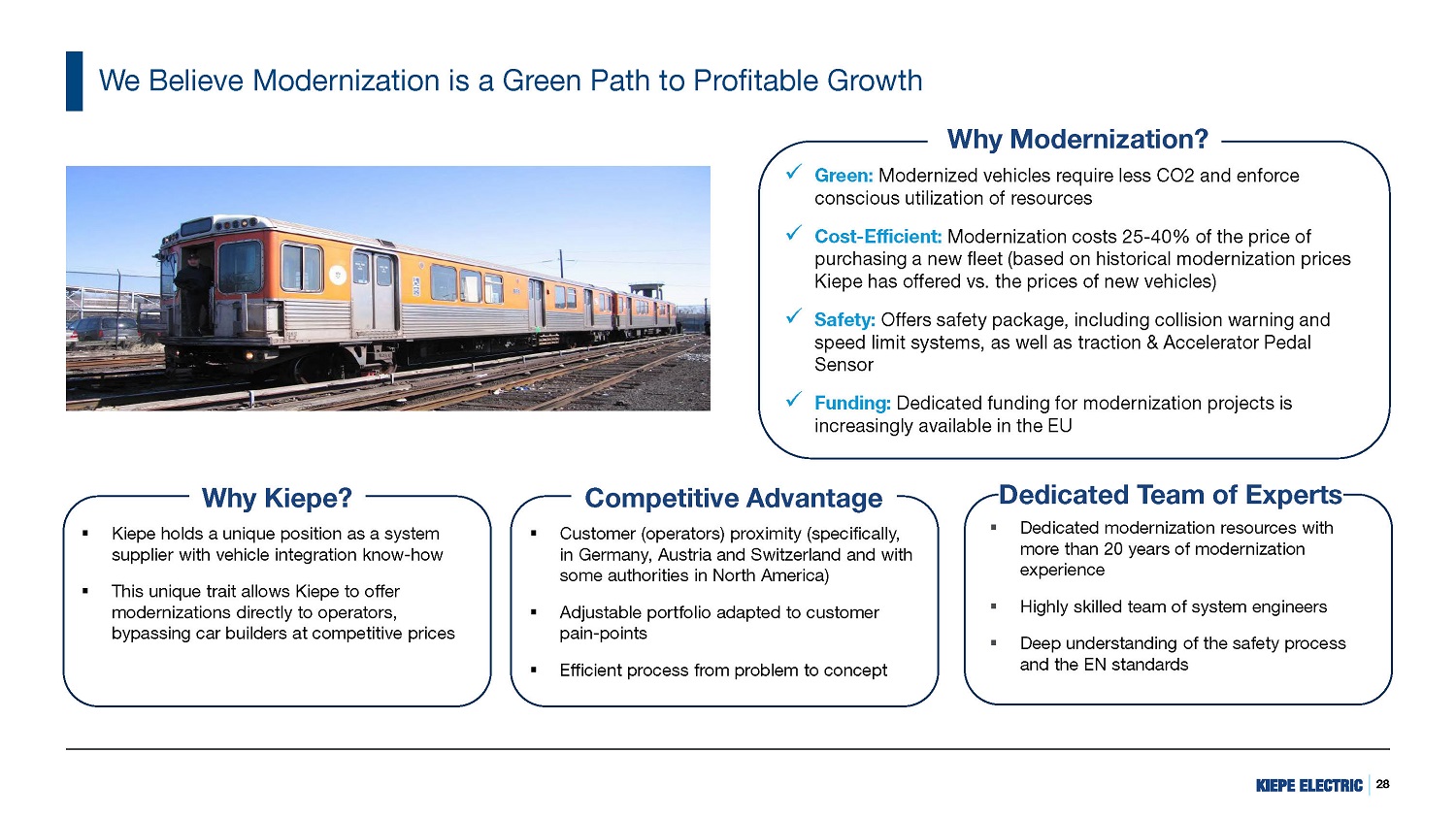

We Believe Modernization is a Green Path to Profitable Growth Why Modernization? x Green: Modernized vehicles require less CO2 and enforce conscious utilization of resources x Cost - Efficient: Modernization costs 25 - 40% of the price of purchasing a new fleet (based on historical modernization prices Kiepe has offered vs. the prices of new vehicles) x Safety: Offers safety package, including collision warning and speed limit systems, as well as traction & Accelerator Pedal Sensor x Funding: Dedicated funding for modernization projects is increasingly available in the EU Competitive Advantage ▪ Customer (operators) proximity (specifically, in Germany, Austria and Switzerland and with some authorities in North America) ▪ Adjustable portfolio adapted to customer pain - points ▪ Efficient process from problem to concept Why Kiepe? ▪ Kiepe holds a unique position as a system supplier with vehicle integration know - how ▪ This unique trait allows Kiepe to offer modernizations directly to operators, bypassing car builders at competitive prices Dedicated Team of Experts 28 ▪ Dedicated modernization resources with more than 20 years of modernization experience ▪ Highly skilled team of system engineers ▪ Deep understanding of the safety process and the EN standards

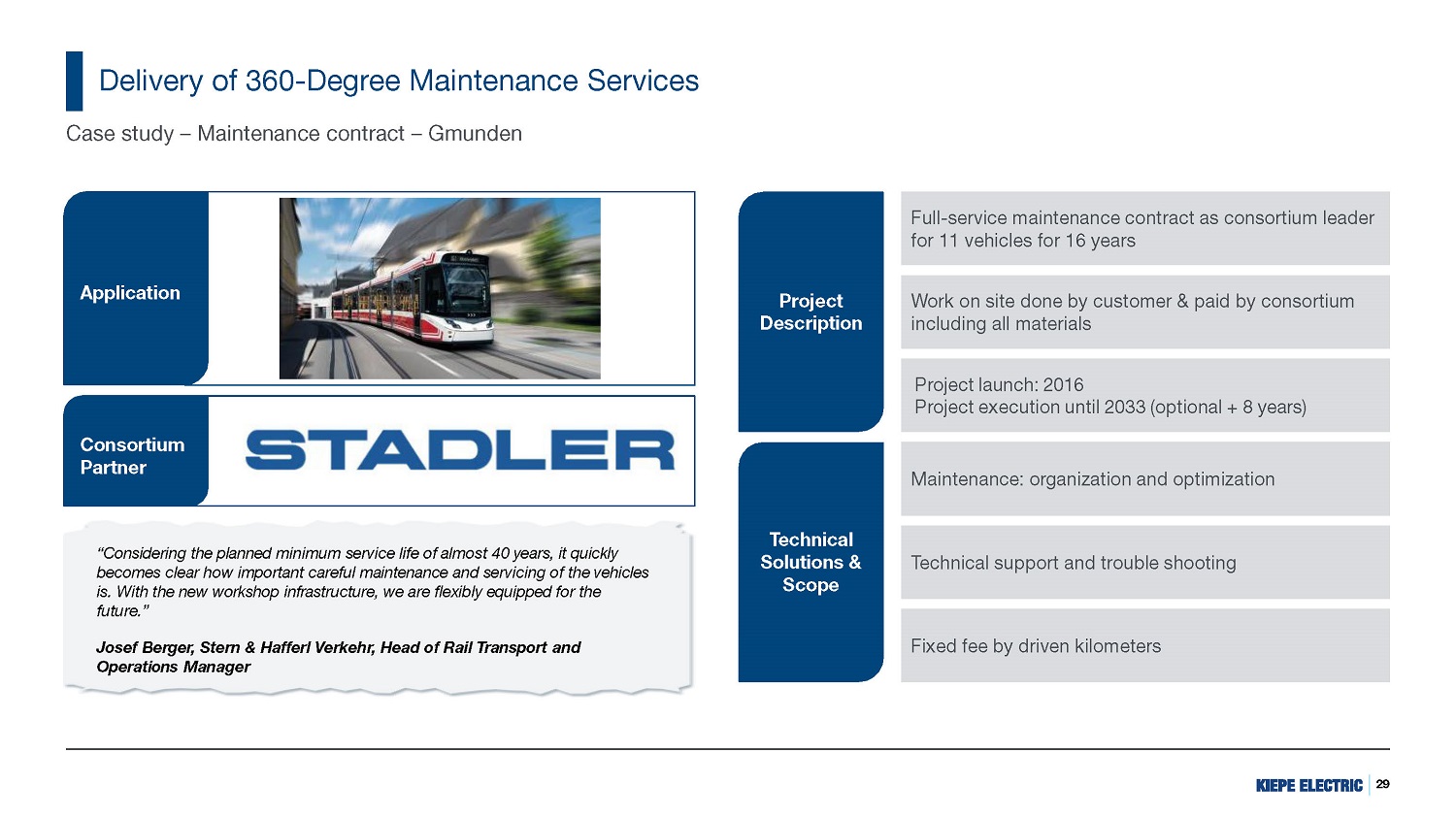

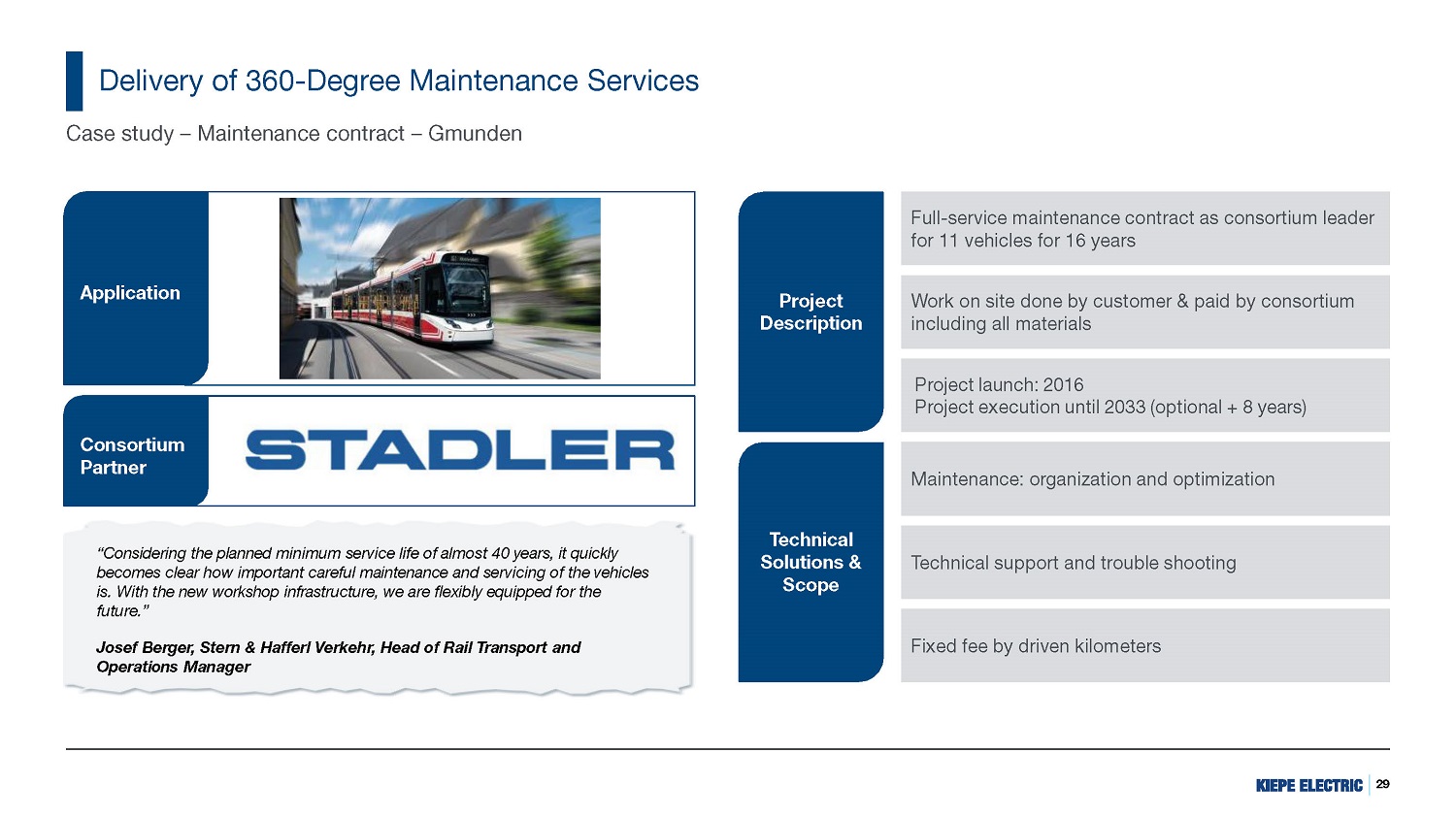

Delivery of 360 - Degree Maintenance Services Case study – Maintenance contract – Gmunden “Considering the planned minimum service life of almost 40 years, it quickly becomes clear how important careful maintenance and servicing of the vehicles is. With the new workshop infrastructure, we are flexibly equipped for the future.” 29 Josef Berger, Stern & Hafferl Verkehr, Head of Rail Transport and Operations Manager Full - service maintenance contract as consortium leader for 11 vehicles for 16 years Work on site done by customer & paid by consortium including all materials Project launch: 2016 Project execution until 2033 (optional + 8 years) Maintenance: organization and optimization Technical support and trouble shooting Fixed fee by driven kilometers Project Description Technical Solutions & Scope Application Consortium Partner

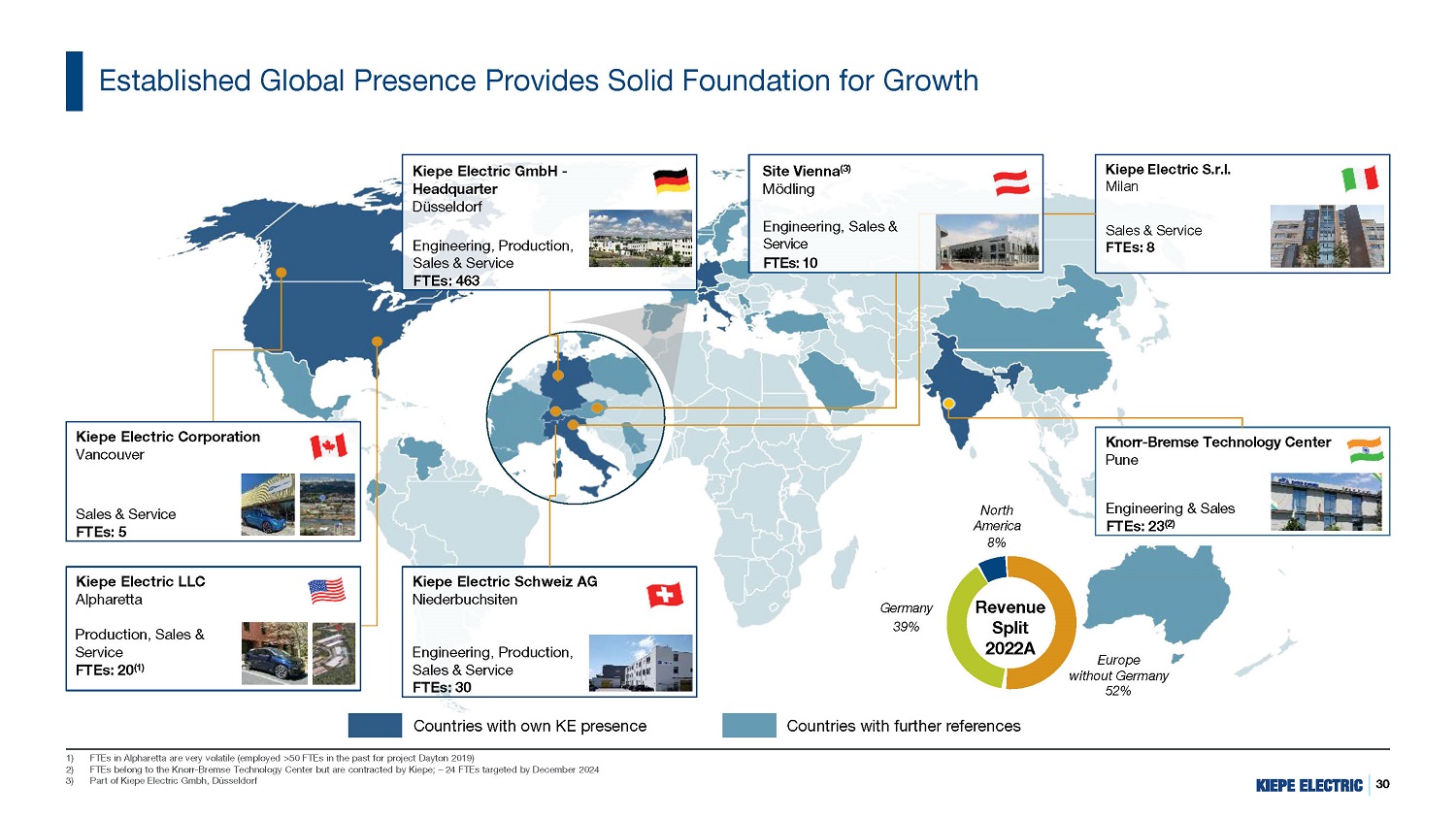

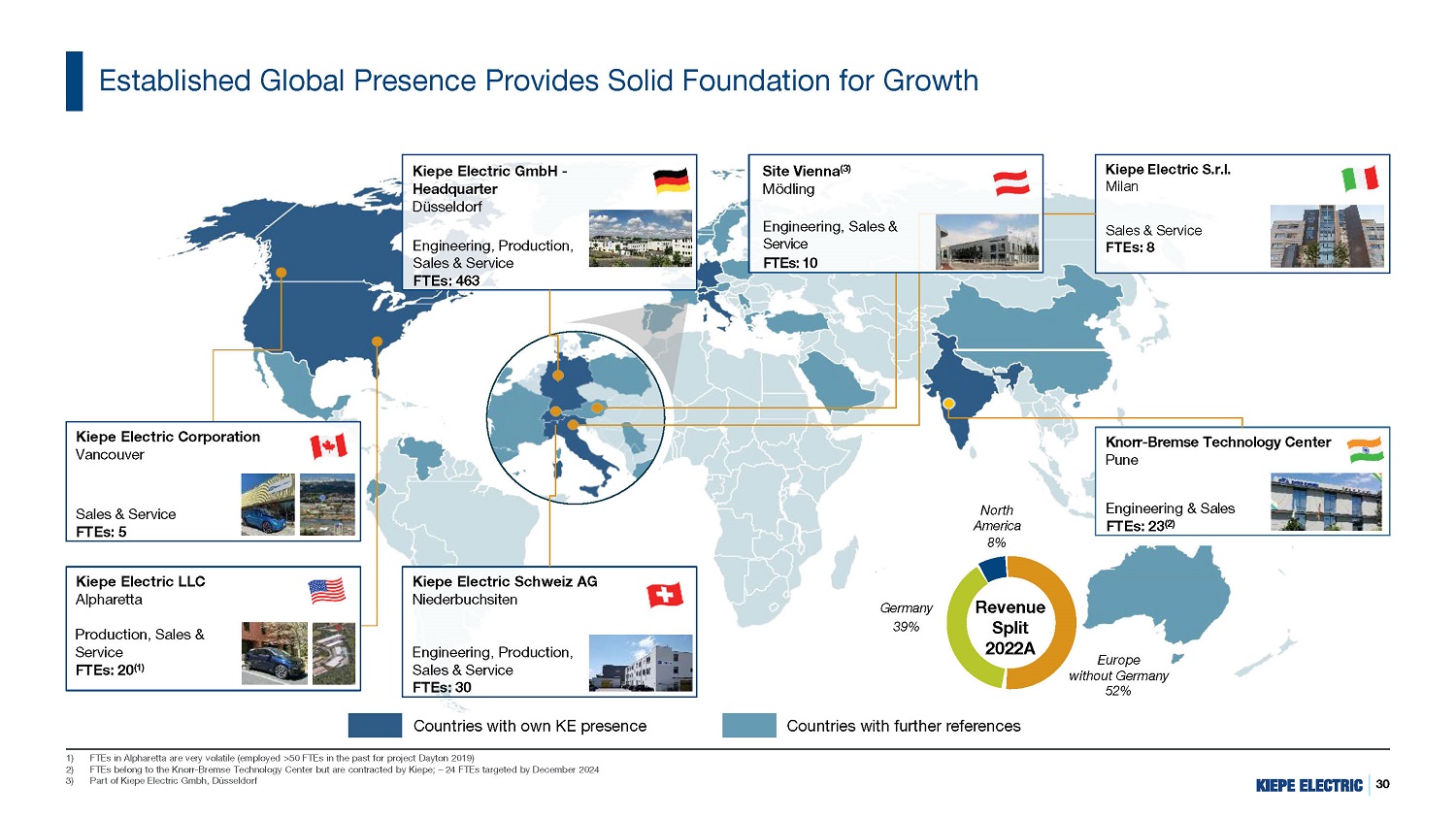

30 Established Global Presence Provides Solid Foundation for Growth 1) FTEs in Alpharetta are very volatile (employed >50 FTEs in the past for project Dayton 2019) 2) FTEs belong to the Knorr - Bremse Technology Center but are contracted by Kiepe; – 24 FTEs targeted by December 2024 3) Part of Kiepe Electric Gmbh, Düsseldorf Kiepe Electric LLC Alpharetta Production, Sales & Service FTEs: 20 (1) Kiepe Electric Schweiz AG Niederbuchsiten Engineering, Production, Sales & Service FTEs: 30 Kiepe Electric GmbH - Headquarter Düsseldorf Engineering, Production, Sales & Service FTEs: 463 Kiepe Electric Corporation Vancouver Sales & Service FTEs: 5 Kiepe Electric S.r.l. Milan Sales & Service FTEs: 8 Knorr - Bremse Technology Center Pune Engineering & Sales FTEs: 23 (2) Site Vienna (3) Mödling Engineering, Sales & Service FTEs: 10 Germany 39% Europe without Germany 52% North America 8% Revenue Split 2022A Countries with own KE presence Countries with further references

Kiepe’s Growth Vision Provide “One - Stop - Shop” e - mobility solution to OEMs in North America New business opportunities in charging solutions with existing power supply infrastructure 1 Expand e - Bus business in North America with existing and new partners 2 3 Hybridization (Battery Solutions) of existing rail diesel multiple unit fleets 5 Add additional functionalities for AI driven Fleet & Energy Management Software that works across Kiepe and Non - Kiepe fleets 4 “We help cities to shift seamlessly to green mobility by supplying reliable, modular & integrated electrical products” 31

€ 109,265 € 119,788 2021A 2022A € 58,335 € 67,605 1H 2022 1H 2023 Strong, Robust Revenue Base and Trajectory Due to Favorable Growth Drivers 1’H’2022 and 2023 Revenue FY 2021 and 2022 Revenue € in 000s € in 000s 32

2023 Revenue Growth 16% 15% 3% 194% 188% 45% 4% NA 79% 70% 53% 50% 7% 5% 1% - 2% - 4% Median: 15 % Selected Comparable Public Companies Source: S&P CapIQ as of February 9, 2024 3.4x 0.5x 0.5x 16.4x 14.5x 4.0x 2.6x 1.8x 13.0x 9.1x 7.1x 6.2x 2.8x 2.0x 1.9x 1.2x 1.0x 3.0x 0.5x 0.4x 5.0x 2.5x 1.4x 1.2x NA 12.1x 7.2x 6.1x 5.9x 1.9x 1.8x 1.2x 1.1x 0.6x 2022 EV / Revenue 2023 EV / Revenue Median: 2 . 8 x Median: 1 . 9 x Rail Electrification EV Charging & Batteries Balance of Systems, Inverters, and Other Electrical Components 33

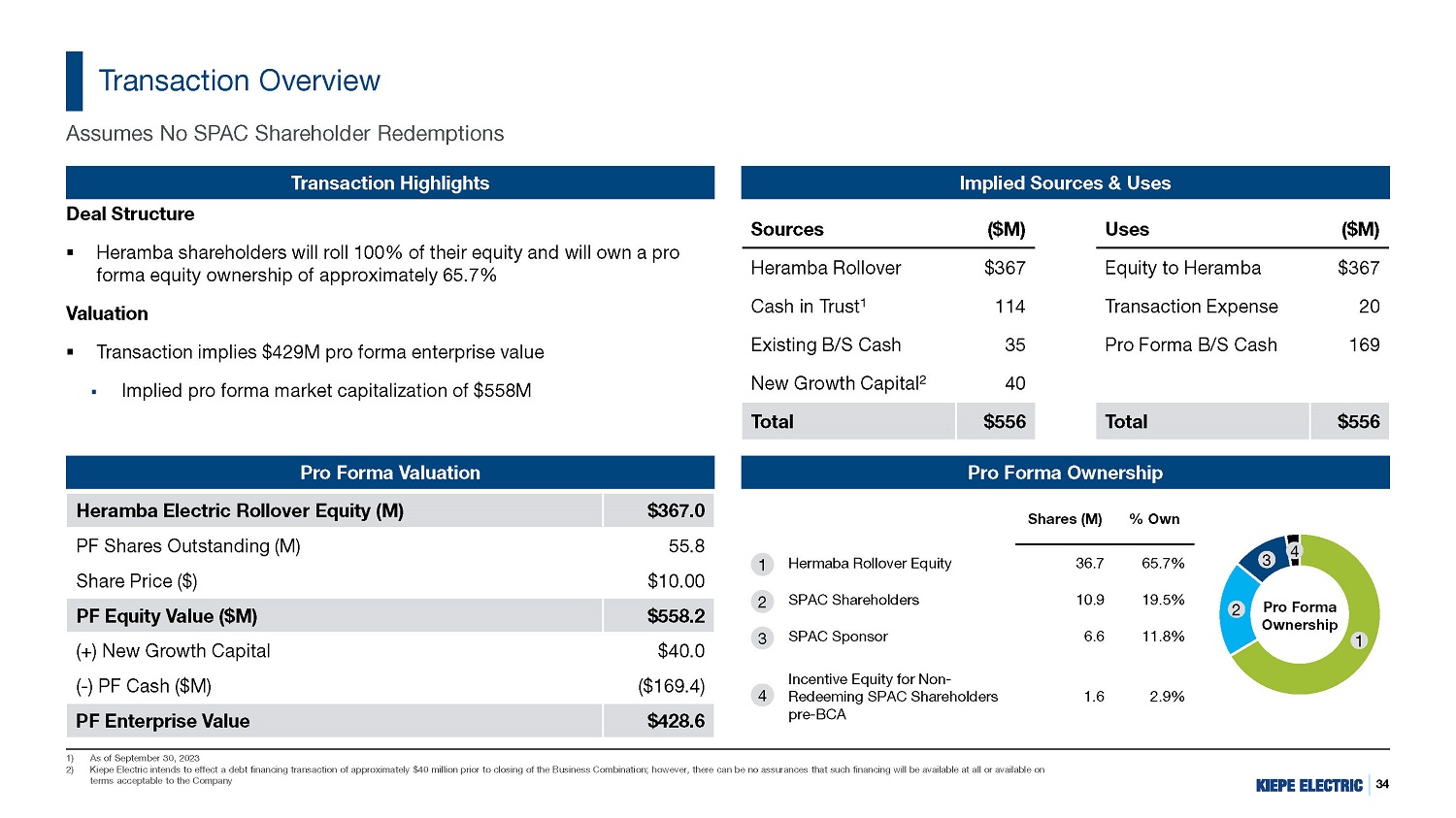

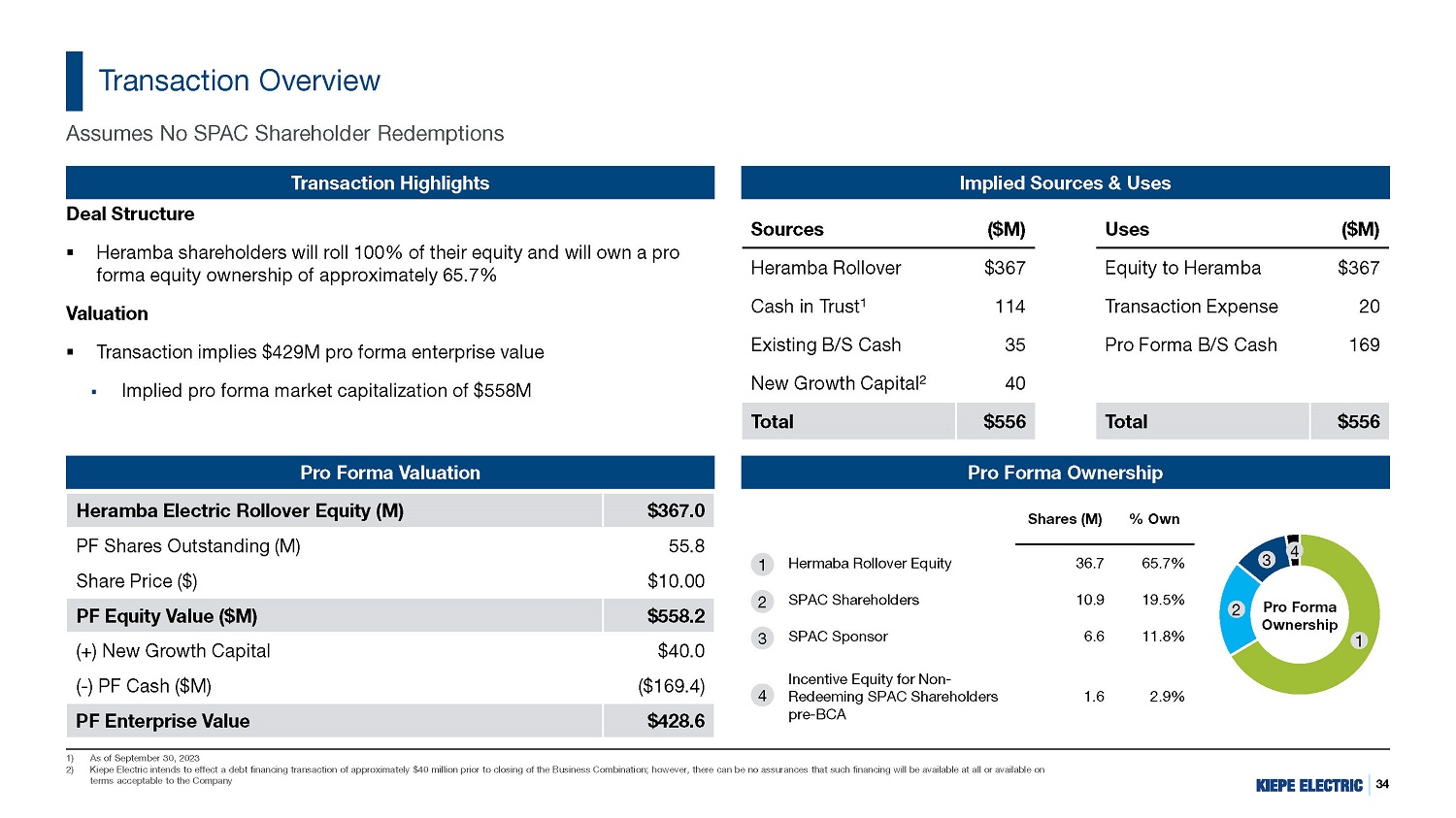

34 Transaction Overview Pro Forma Ownership Pro Forma Valuation $367.0 Heramba Electric Rollover Equity (M) 55.8 PF Shares Outstanding (M) $10.00 Share Price ($) $558.2 PF Equity Value ($M) $40.0 (+) New Growth Capital ($169.4) ( - ) PF Cash ($M) $428.6 PF Enterprise Value Implied Sources & Uses Deal Structure ▪ Heramba shareholders will roll 100% of their equity and will own a pro forma equity ownership of approximately 65.7% Valuation ▪ Transaction implies $429M pro forma enterprise value ▪ Implied pro forma market capitalization of $558M Transaction Highlights Assumes No SPAC Shareholder Redemptions ($M) Sources $367 Heramba Rollover 114 Cash in Trust 1 35 Existing B/S Cash 40 New Growth Capital 2 $556 Total ($M) Uses $367 Equity to Heramba 20 Transaction Expense 169 Pro Forma B/S Cash $556 Total % Own Shares (M) 65.7% 36.7 Hermaba Rollover Equity 19.5% 10.9 SPAC Shareholders 11.8% 6.6 SPAC Sponsor Incentive Equity for Non - 2.9% 1.6 Redeeming SPAC Shareholders pre - BCA Pro Forma Ownership 1 2 3 4 1 2 3 4 1) As of September 30, 2023 2) Kiepe Electric intends to effect a debt financing transaction of approximately $40 million prior to closing of the Business Combination; however, there can be no assurances that such financing will be available at all or available on terms acceptable to the Company

Key Investment Highlights Innovative product and service portfolio 3 1 Attractive growth market driven by growing trend of emission - free public transport 2 Enables green public transport in cities around the globe 5 Resilient business model with strong recurring revenues 6 Entrepreneurial and experienced management team 4 35 Global footprint combined with local client access

Kiepe – READY to START Our Product and System portfolio is prepared for a strong PERFORMANCE in e - mobility. We are ready and have the potential to be a LEADER in e - mobility. 36

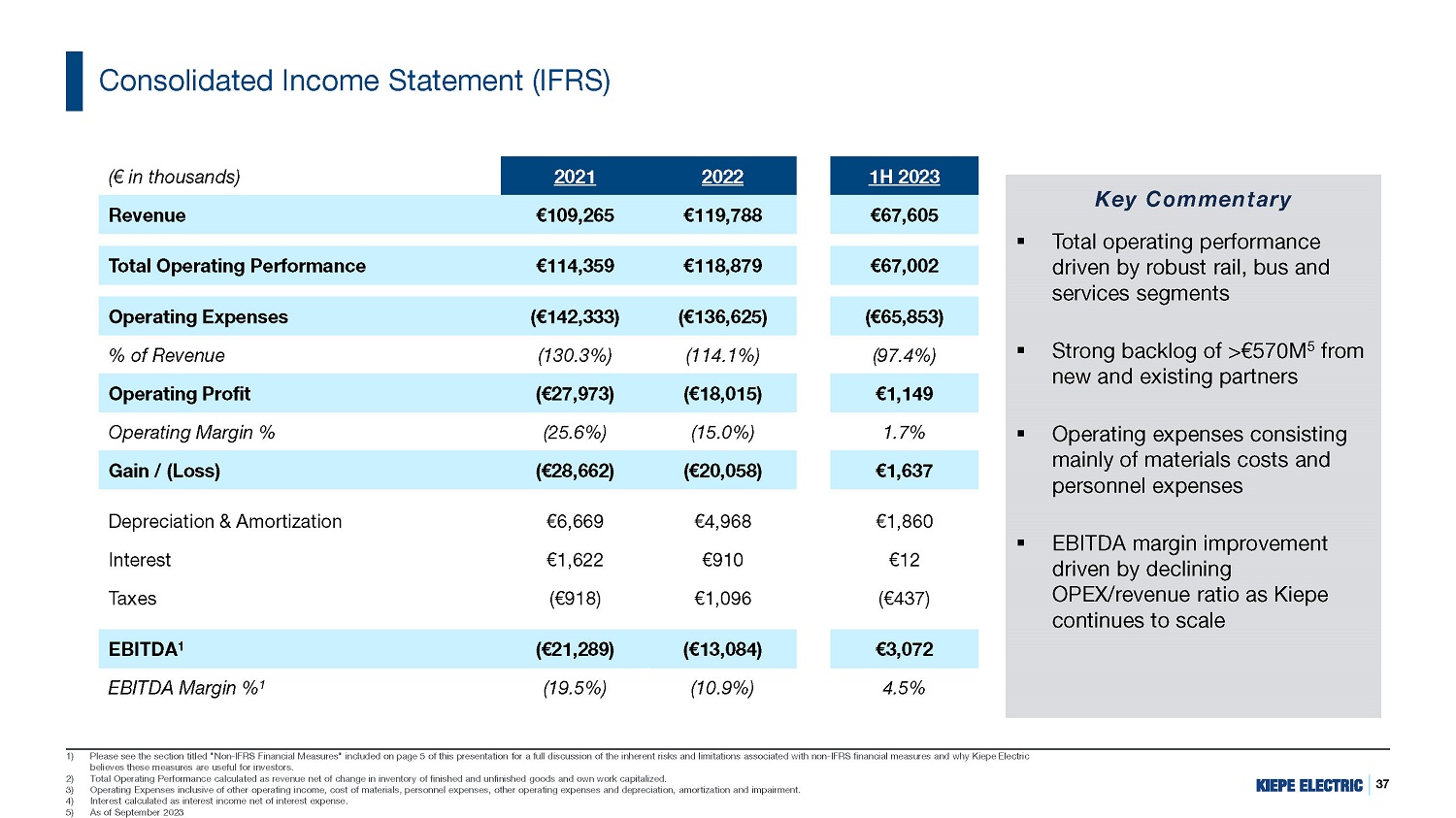

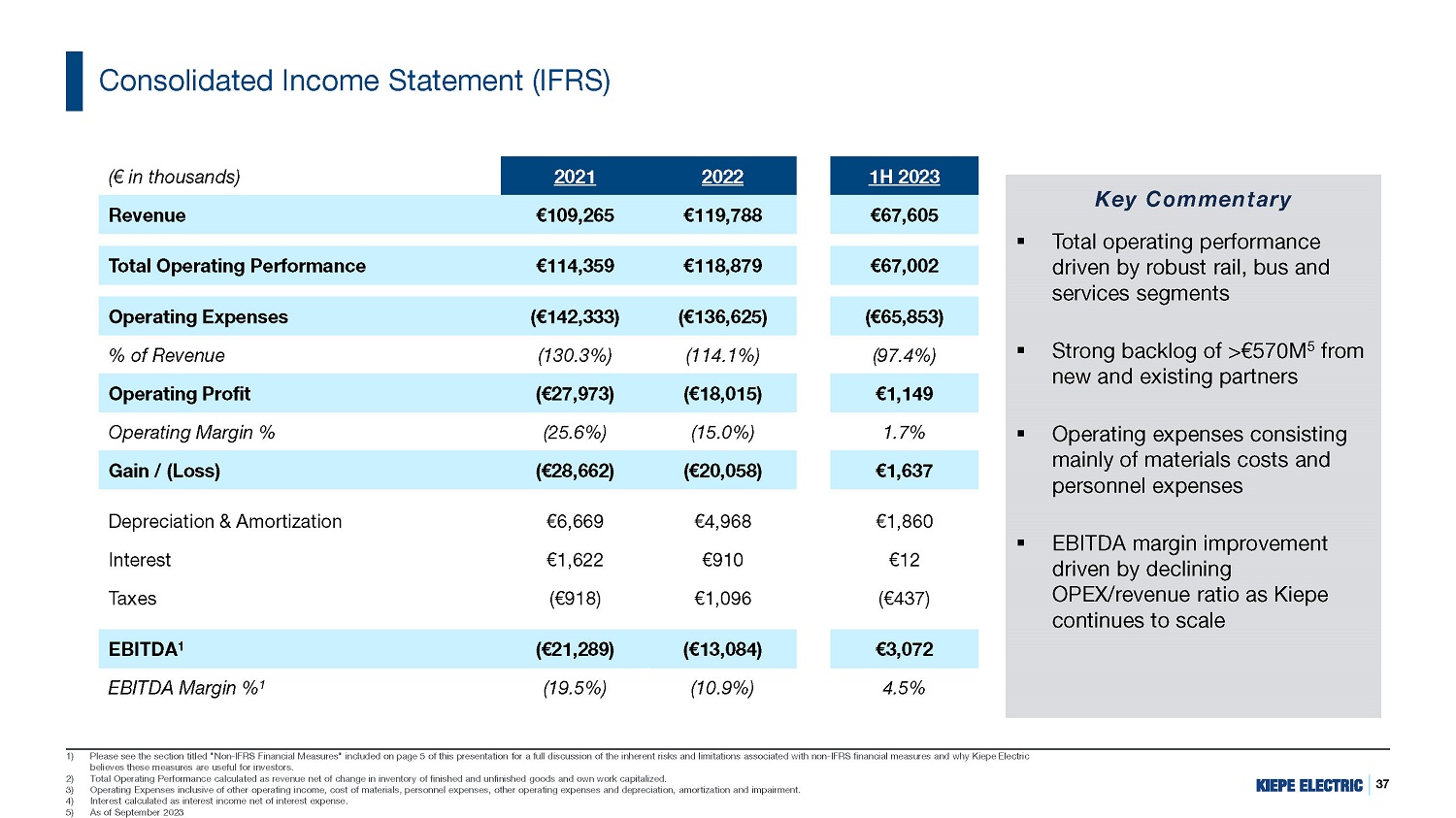

37 Consolidated Income Statement (IFRS) 1H 2023 2022 2021 (€ in thousands) €67,605 €119,788 €109,265 Revenue €67,002 €118,879 €114,359 Total Operating Performance (€65,853) (€136,625) (€142,333) Operating Expenses (97.4%) (114.1%) (130.3%) % of Revenue €1,149 (€18,015) (€27,973) Operating Profit 1.7% (15.0%) (25.6%) Operating Margin % €1,637 (€20,058) (€28,662) Gain / (Loss) €1,860 €4,968 €6,669 Depreciation & Amortization €12 €910 €1,622 Interest (€437) €1,096 (€918) Taxes €3,072 (€13,084) (€21,289) EBITDA 1 4.5% (10.9%) (19.5%) EBITDA Margin % 1 Key Commentary ▪ Total operating performance driven by robust rail, bus and services segments ▪ Strong backlog of >€570M 5 from new and existing partners ▪ Operating expenses consisting mainly of materials costs and personnel expenses ▪ EBITDA margin improvement driven by declining OPEX/revenue ratio as Kiepe continues to scale 1) Please see the section titled "Non - IFRS Financial Measures" included on page 5 of this presentation for a full discussion of the inherent risks and limitations associated with non - IFRS financial measures and why Kiepe Electric believes these measures are useful for investors. 2) Total Operating Performance calculated as revenue net of change in inventory of finished and unfinished goods and own work capitalized. 3) Operating Expenses inclusive of other operating income, cost of materials, personnel expenses, other operating expenses and depreciation, amortization and impairment. 4) Interest calculated as interest income net of interest expense. 5) As of September 2023