Six Months ended December 31, 2022 and December 31, 2023

Revenue and other operating income. We have not yet commenced natural gas production. Therefore, we did not realize any revenue and other operating income during the six months ended December 31, 2022 and December 31, 2023, respectively.

Compensation and benefits, including stock based compensation. Compensation and benefits, including stock based compensation, decreased by $1.9 million during the six months ended December 31, 2023, as compared to the six months ended December 31, 2022 due primarily to a short term incentive bonus paid to employees during the six months ended December 31, 2022 which did not recur in the six months ended December 31, 2023.

Consultancy, legal and professional fees. Consultancy, legal and professional fees decreased by $0.2 million during the six months ended December 31, 2023, as compared to the six months ended December 31, 2022 due primarily to increased consultancy, legal and professional fees spend subsequent to significant capital raising activities, and related transactions, in the period ended December 31, 2022.

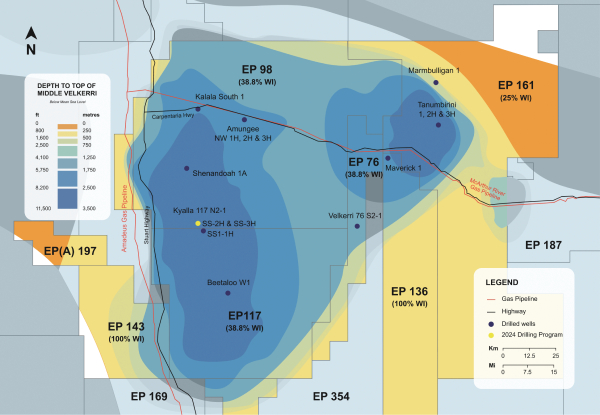

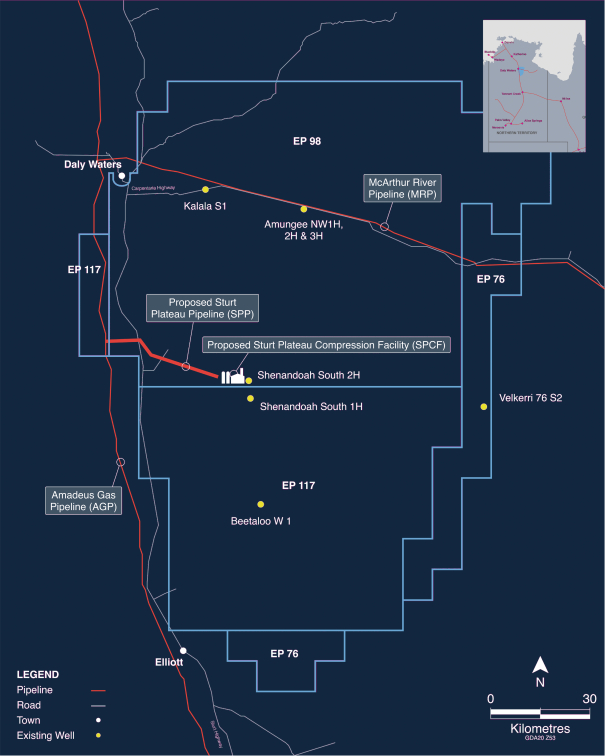

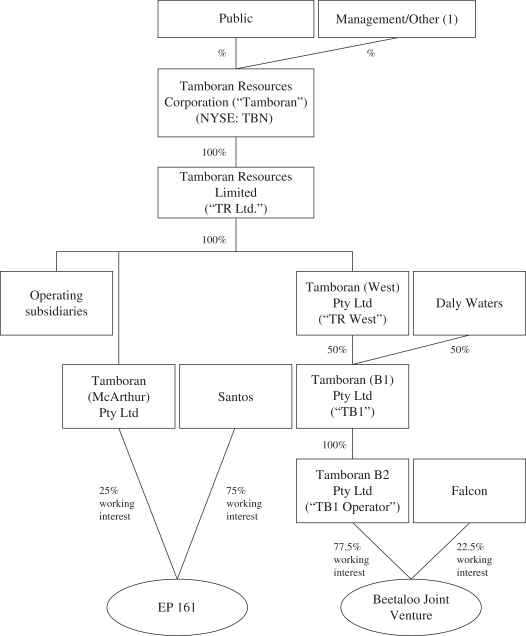

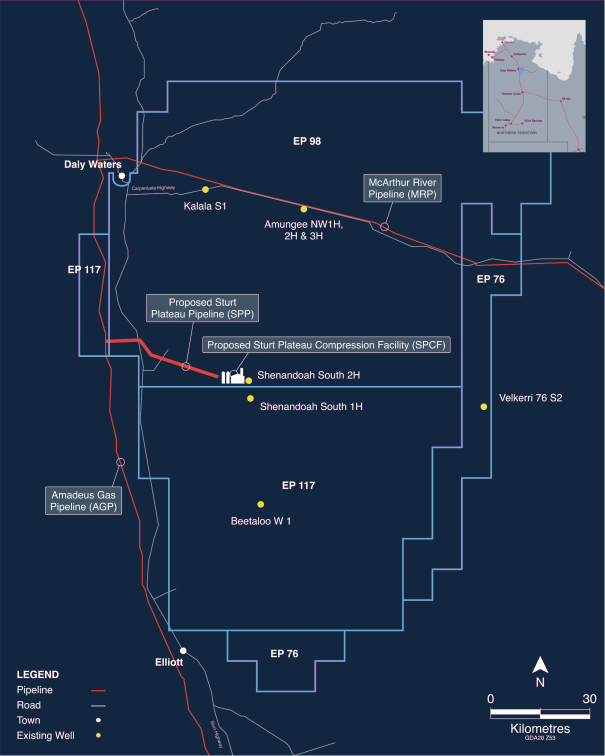

Accretion of asset retirement obligations expense. For the six months ended December 31, 2023, an expense for accretion of asset retirement obligations of $0.4 million was recognized. The recognition of such an expense was due to the accretion of asset retirement obligation liabilities in relation to all EPs, inclusive of EPs 76, 98, 117, 136 and 161 for the full six months ended December 31, 2023, including for the two new wells drilled during the period.

Exploration expense. Exploration expense increased by $2.0 million during the six months ended December 31, 2023, as compared to the six months ended December 31, 2022 due to expenses associated with drilling our SS1H and A3H wells. Our exploration expense consisted of costs related to topographical, geographical and geophysical studies and other indirect expenditure during the six months ended December 31, 2022 and December 31, 2023.

General and administrative. General and administrative costs increased by $0.2 million during the six months ended December 31, 2023, as compared to the six months ended December 31, 2022 due primarily to increased insurance costs during the period. Our general and administrative expense consisted of the following during the six months ended December 31, 2022 and December 31, 2023: expenses related to travel, insurance, and office and administrative fees.

Interest Income. Interest income increased by $0.2 million during the six months ended December 31, 2023, as compared to the six months ended December 31, 2022 due to interest received from term deposits during the period.

Foreign currency translation. In the six months ended December 31, 2023, we recognized a foreign currency translation gain of $8.3 million, primarily due to strengthening of Australian Dollar as of December 31, 2023 as compared to July 1, 2023. In the six months ended December 31, 2022, we recognized a foreign currency translation gain of $6.0 million, primarily due to the acquisition of assets from Origin Energy amounting to $81.9 million on November 9, 2023 and significant strengthening of Australian Dollar from that date to December 31, 2022. Foreign exchange gains and losses resulting from the settlement of foreign currency transactions and from the translation at fiscal year-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized on our income statement.

Income Tax Expense. We have no income tax expense due to operating losses incurred for the six months ended December 31, 2022 and December 31, 2023. We have provided a full valuation allowance on our net deferred tax asset because management has determined that it is more-likely-than-not that we will not earn income sufficient to realize the deferred tax assets during a foreseeable future period. Management will continue to assess the potential for realizing deferred tax assets based upon income forecast data and the feasibility of future tax planning strategies and may record adjustments to the valuation allowance against deferred tax assets in future periods, as appropriate, that could have a material impact on the statement of operations.

74