Investor Presentation Third Quarter 2024

Disclaimer This presentation (the “Presentation”) is provided for informational purposes only and has been prepared to provide interested parties with certain information about Logistic Properties of the Americas and its subsidiaries (collectively, “LPA”) and for no other purpose. This Presentation is not a prospectus, product disclosure statement or any other offering or disclosure document under any other law. The information contained herein is of a general background nature and does not purport to be exhaustive, all-inclusive or complete. This Presentation does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase, any equity, debt or other financial instruments of LPA. No such offering of equity or debt securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom. No representations or warranties, express or implied are given in, or in respect of, the accuracy or completeness of this Presentation or any other information (whether written or oral) that has been or will be provided to you. To the fullest extent permitted by law, LPA disclaims any and all liability for any loss or damage (whether foreseeable or not) suffered or incurred by any person or entity as a result of anything contained or omitted from this Presentation and such liability is expressly disclaimed. The viewer of this Presentation agrees that it shall not seek to sue or otherwise hold LPA or any of its respective directors, officers, employees, affiliates, agents, advisors or representatives liable in any respect for the provision of this Presentation, the information contained in this Presentation, or the omission of any information from this Presentation. Viewers of this Presentation should each make their own evaluation of LPA and of the relevance and adequacy of the information provided in this Presentation and should make such other investigations as they deem necessary before making an investment decision. Nothing herein should be construed as legal, financial, tax or other advice. You should consult your own advisers concerning any legal, financial, tax or other considerations concerning anything described herein, and, by accepting this Presentation, you confirm that you are not relying solely upon the information contained herein to make any investment decision. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. Forward-Looking Statements This Presentation contains certain forward-looking information which may not be included in future public filings or investor guidance. The inclusion of forward-looking financial information or metrics in this Presentation should not be construed as a commitment by LPA to provide guidance on such information in the future. Certain statements in this Presentation may be considered forward-looking statements. Forward- looking statements include, without limitation, statements about future events or LPA’s future financial or operating performance. For example, statements regarding anticipated growth in the industry in which LPA operates and anticipated growth in demand for LPA’s products and solutions, the anticipated size of LPA’s addressable market and other metrics are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “pro forma,” “may,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. These forward-looking statements regarding future events and the future results of LPA are based on current expectations, estimates, forecasts, and projections about the industry in which LPA operates, as well as the beliefs and assumptions of LPA’s management. These forward-looking statements are only predictions and are subject to known and unknown risks, uncertainties, assumptions and other factors beyond LPA’s control that are difficult to predict because they relate to events and depend on circumstances that will occur in the future. They are neither statements of historical fact nor promises or guarantees of future performance. Therefore, LPA’s actual results may differ materially and adversely from those expressed or implied in any forward-looking statements and LPA therefore cautions against relying on any of these forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by LPA and its management, are inherently uncertain and are inherently subject to risks variability and contingencies, many of which are beyond LPA’s control. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (i) the possibility of any economic slowdown or downturn in real estate asset values or leasing activity or in the geographic markets where LPA operates; (ii) LPA’s ability to manage growth; (iii) LPA’s ability to continue to comply with applicable listing standards of NYSE American; (iv) changes in applicable laws, regulations, political and economic developments; (v) the possibility that LPA may be adversely affected by other economic, business and/or competitive factors; (vi) LPA’s estimates of expenses and profitability; (vii) the outcome of any legal proceedings that may be instituted against LPA and (viii) other risks and uncertainties set forth in the filings by LPA with the U.S. Securities and Exchange Commission (the “SEC”). There may be additional risks that LPA does not presently know or that LPA currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Any forward-looking statements made by or on behalf of LPA speak only as of the date they are made. Except as otherwise required by applicable law, LPA disclaims any obligation to publicly update or revise any forward-looking statements to reflect any changes in their respective expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. Accordingly, you should not place undue reliance on forward-looking statements due to their inherent uncertainty. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Industry and Market Data This Presentation also contains estimates and other statistical data made by independent parties which they believe to be reliable and by LPA relating to market size and growth and other data about LPA’s industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of the future performance of the markets in which LPA operates are necessarily subject to a high degree of uncertainty and risk. LPA has not independently verified the accuracy or completeness of the independent parties’ information. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of such independent information. Trademarks LPA owns or has rights to various trademarks, service marks and trade names used is connection with the operation of its business. This Presentation may also contain trademarks, service marks, trade names and copyrights of other companies or third parties, which are the property of their respective owners. LPA’s use thereof does not imply an affiliation with, or endorsement by, the owners of such trademarks, service marks, trade names and copyrights. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM or symbols, but LPA will assert, to the fullest extent under applicable law, the rights of the applicable owners to these trademarks, service marks, trade names and copyrights. Financial Measures Certain financial information contained herein is unaudited and is based on internal records and/or estimates. The Presentation also contains unaudited alternative financial measures that are measures of financial performance not calculated in accordance with generally accepted accounting principles in the United States (or international financial reporting standards (“IFRS”)) and should not be considered as replacements or alternatives to net income or loss, cash flow from operations or other measures of operating performance or liquidity of LPA. These alternative financial measures should be viewed in addition to, and not as a substitute for, analysis of LPA’s results reported in accordance with IFRS or otherwise. Notwithstanding these limitations, and in conjunction with other accounting and financial information available, LPA’s management considers the alternative financial measures contained in this presentation (including EBITDA, EBITDA margin, Net Debt, Net Operating Income (NOI), Cash NOI, Same-Property NOI, Same-Property Cash NOI, Enterprise Value, Equity Value, FFO, AFFO, Yield-to-cost, and Return on Equity (ROE)) reasonable indicators for comparisons between LPA and LPA’s principal competitors on the market. These alternative financial measures are used by market participants for comparative analysis, albeit with certain limitations as analytical tools, of the results of businesses in the sector and as indicators of LPA’s capacity to generate cash flows. Nevertheless, alternative financial measures do not have any standardized meaning and therefore may not be comparable to similar measures presented by other companies. You should review LPA’s financial statements and additional information included in its filings with the SEC.

3 Development and construction(2) of properties in the land bank DEVELOPER Asset ownership on a long-term basis OWNER Leasing and management(3) of assets MANAGER Logistic Properties of the Americas is a leading developer, owner, acquirer and manager of logistic and industrial real estate of international quality in Central and South America. LPA is one of the few, internally managed, vertically-integrated and institutional platforms operating across the region (1). Acquisition of stabilized assets ACQUIRER Notes: (1) LPA believes most of the real estate companies and funds in Costa Rica, Colombia and Peru do not focus exclusively on the industrial segment (they have a presence in retail, hotels, etc.) and do not have a regional presence; (2) Construction is outsourced to construction companies; (3) Relationship with tenants and administration of logistics parks

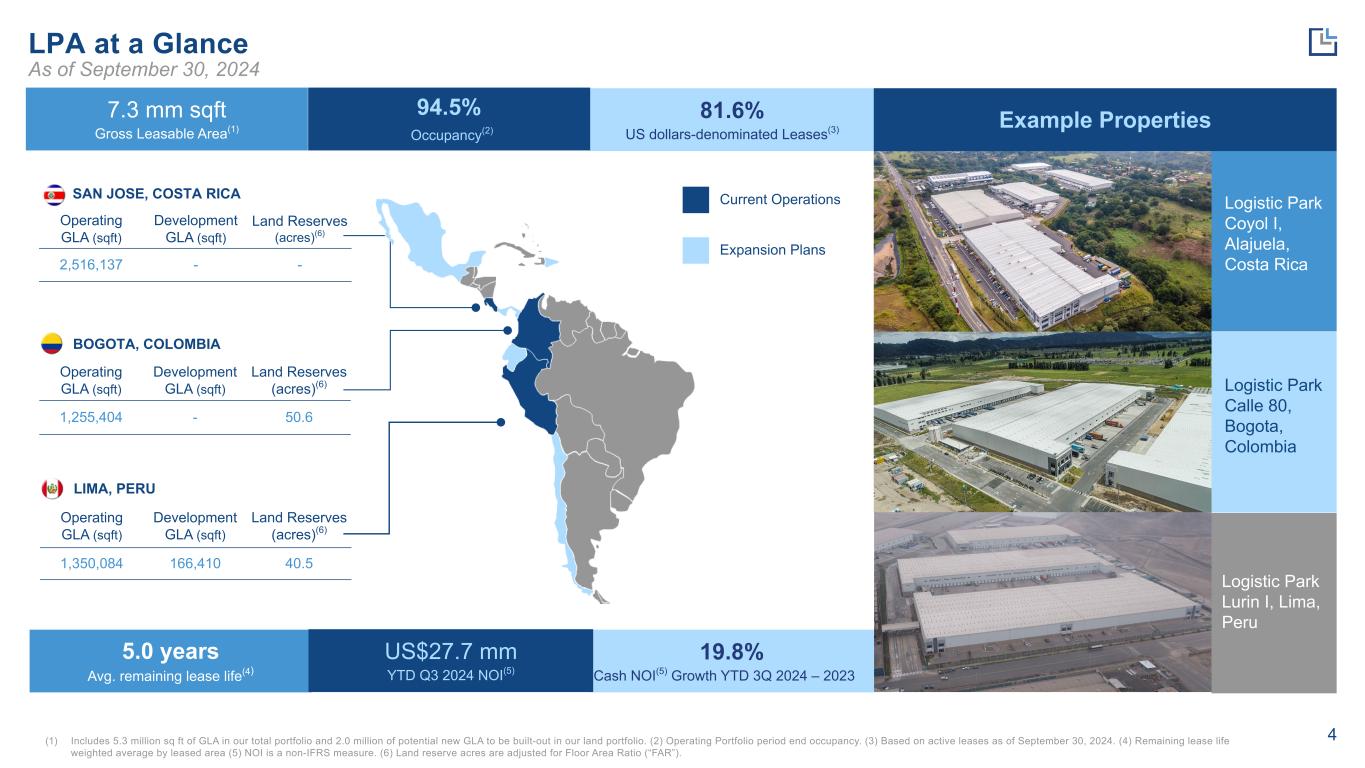

4 LIMA, PERU Operating GLA (sqft) Development GLA (sqft) Land Reserves (acres)(6) 1,350,084 166,410 40.5 BOGOTA, COLOMBIA Operating GLA (sqft) Development GLA (sqft) Land Reserves (acres)(6) 1,255,404 - 50.6 SAN JOSE, COSTA RICA Operating GLA (sqft) Development GLA (sqft) Land Reserves (acres)(6) 2,516,137 - - 7.3 mm sqft Gross Leasable Area(1) 81.6% US dollars-denominated Leases(3) 5.0 years Avg. remaining lease life(4) 19.8% Cash NOI(5) Growth YTD 3Q 2024 – 2023 Current Operations Expansion Plans Logistic Park Coyol I, Alajuela, Costa Rica Logistic Park Calle 80, Bogota, Colombia Logistic Park Lurin I, Lima, Peru (1) Includes 5.3 million sq ft of GLA in our total portfolio and 2.0 million of potential new GLA to be built-out in our land portfolio. (2) Operating Portfolio period end occupancy. (3) Based on active leases as of September 30, 2024. (4) Remaining lease life weighted average by leased area (5) NOI is a non-IFRS measure. (6) Land reserve acres are adjusted for Floor Area Ratio (“FAR”). LPA at a Glance As of September 30, 2024 94.5% Occupancy(2) Example Properties US$27.7 mm YTD Q3 2024 NOI(5) Logistic Park Lurin I, Li a, Peru

5 Natural Light Fire Protection System: NFPA Clear Height: 39 ft Floor Capacity: 0.5-0.7 Tons/sqft LPA Develops Facilities to meet U.S. Institutional Standards Facility Specs Interiors Distance between Columns: optimized

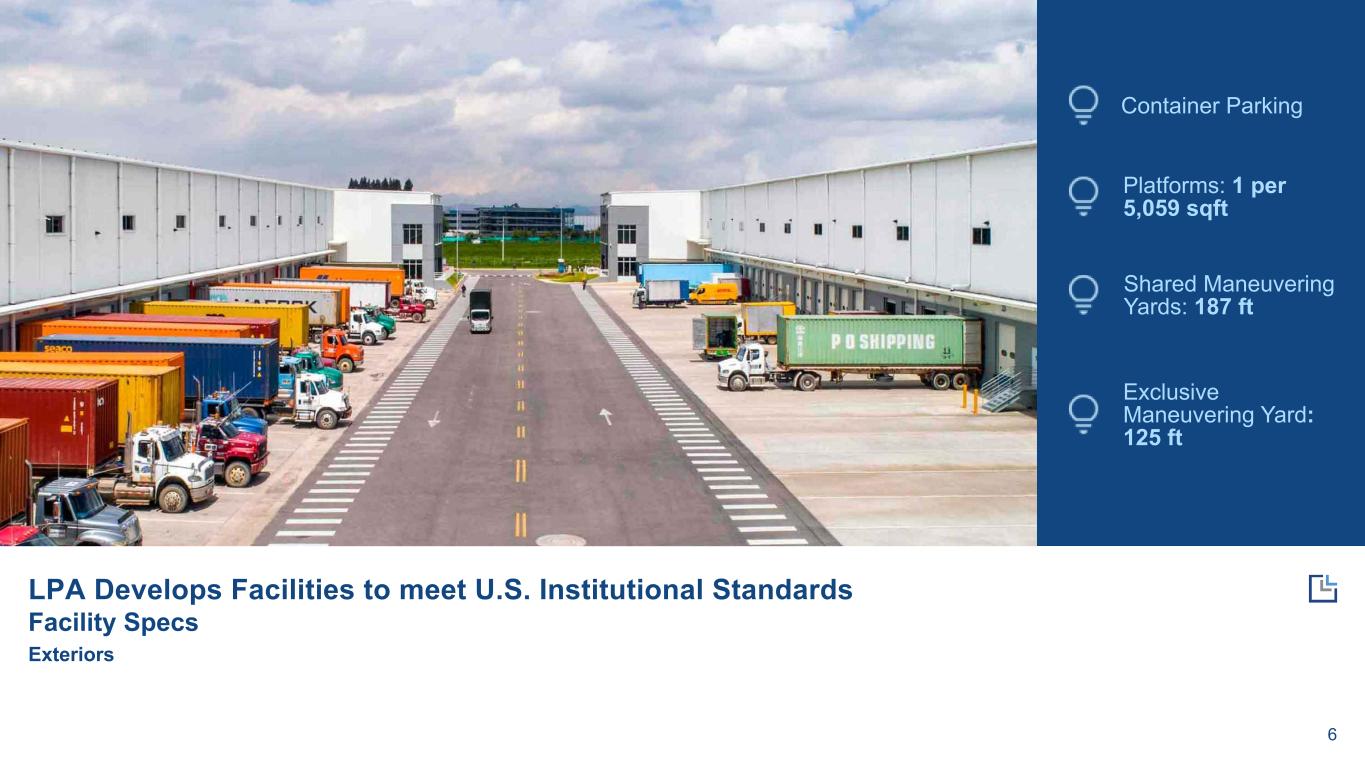

6 Container Parking Platforms: 1 per 5,059 sqft Shared Maneuvering Yards: 187 ft Exclusive Maneuvering Yard: 125 ft LPA Develops Facilities to meet U.S. Institutional Standards Facility Specs Exteriors

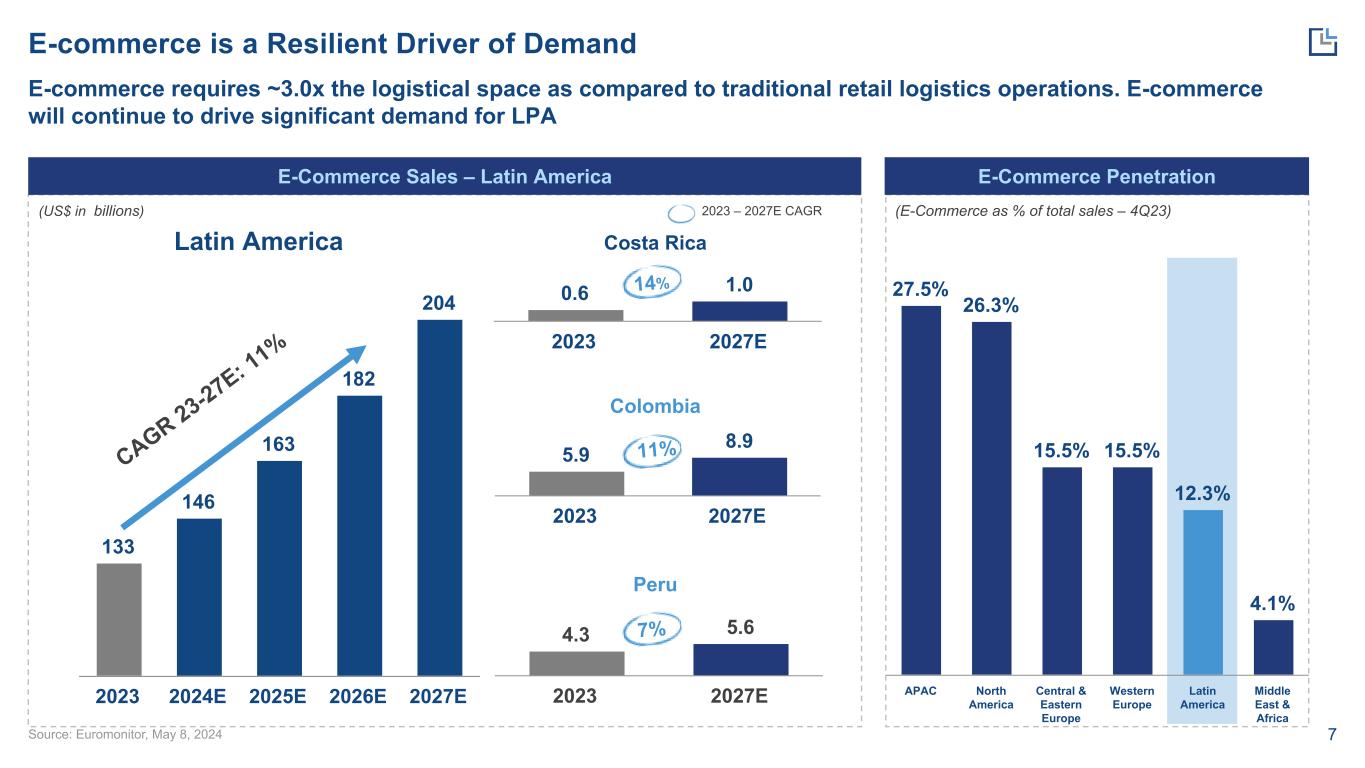

7 4.3 5.6 2023 2027E CAGR 23-27E: 1 1% 133 146 163 182 204 2023 2024E 2025E 2026E 2027E 0.6 1.0 2023 2027E 11% E-commerce is a Resilient Driver of Demand E-commerce requires ~3.0x the logistical space as compared to traditional retail logistics operations. E-commerce will continue to drive significant demand for LPA Source: Euromonitor, May 8, 2024 E-Commerce Penetration (E-Commerce as % of total sales – 4Q23)(US$ in billions) 2023 – 2027E CAGR Latin America Costa Rica 14% E-Commerce Sales – Latin America Peru 7% 27.5% 26.3% 15.5% 15.5% 12.3% 4.1% APAC North America Central & Eastern Europe Western Europe Latin America Middle East & Africa Colombia 5.9 8.9 2023 2027E

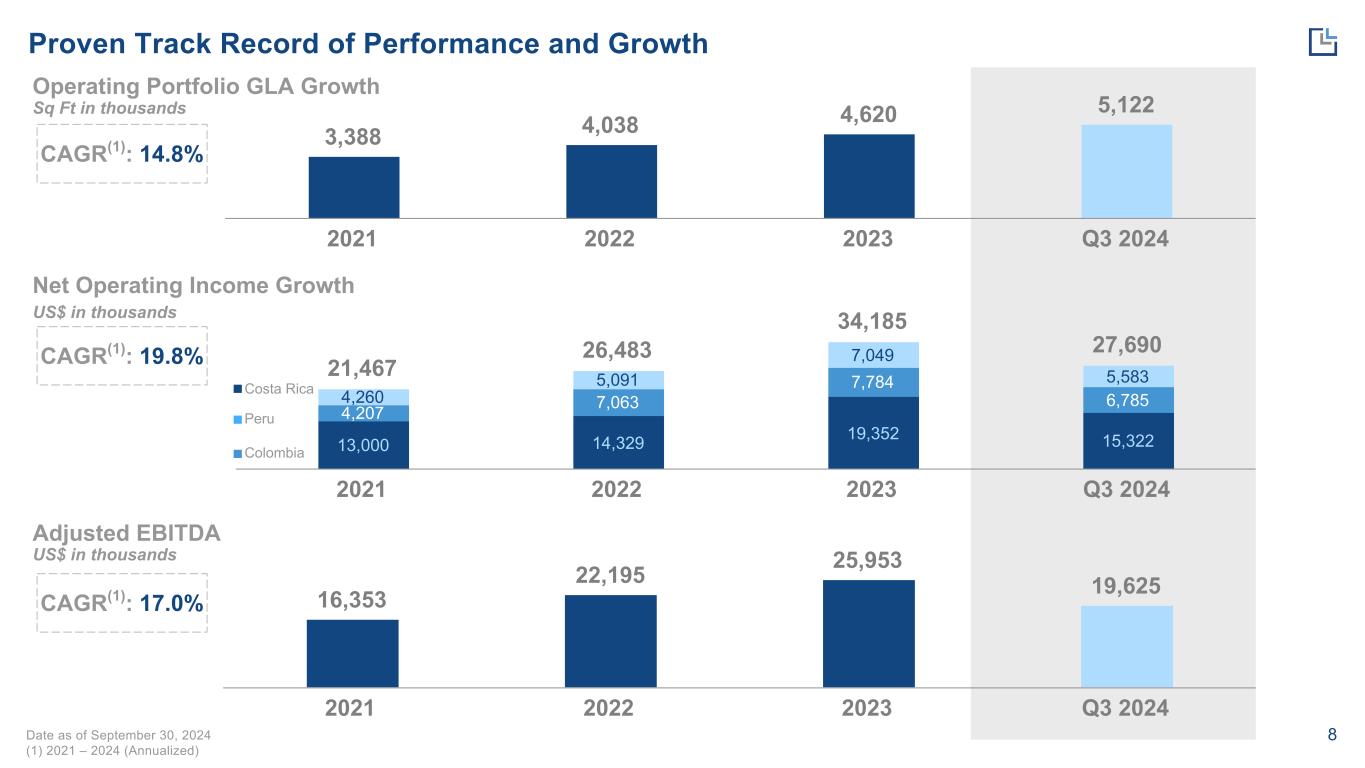

8 Colombia Proven Track Record of Performance and Growth Net Operating Income Growth Date as of September 30, 2024 (1) 2021 – 2024 (Annualized) Operating Portfolio GLA Growth Adjusted EBITDA US$ in thousands Sq Ft in thousands CAGR(1): 14.8% US$ in thousands CAGR(1): 19.8% CAGR(1): 17.0% 3,388 4,038 4,620 5,122 2021 2022 2023 Q3 2024 16,353 22,195 25,953 19,625 2021 2022 2023 Q3 2024 21,467 26,483 34,185 27,690 13,000 14,329 19,352 15,322 4,207 7,063 7,784 6,7854,260 5,091 7,049 5,583 2021 2022 2023 Q3 2024 Costa Rica Peru

9 Coveted Tenant Relationships LPA’s differentiated Class A product and geographic diversification make it the ideal partner to large multinationals and respected regional / local players Logistic Services Consumer Goods and Distribution Retailer (including E-Commerce) Manufacturing and Other

10 81.6% 18.4%18.4% 19.7%56.6% 5.3%19.6% 37.2% 27.5% 15.7% Operations Customer Concentration and Lease Expiration Analysis Lease Breakdown as Measured by Total Portfolio NER Customer Type Contractual Rent Increases Amount of Leases by Currency As of September 30, 2024 Top 10 Customers as % of Net Effective Rent % of Net Effective Rent Total Square Feet 1 Alicorp 8.0 % 437,370 2 Kuehne + Nagel 7.2 % 384,777 3 Samsung 6.8 % 200,209 4 Pequeño Mundo 5.2 % 270,572 5 Yichang 4.0 % 220,875 6 Natura & Co 3.8 % 206,785 7 CEVA 3.8 % 219,734 8 Indurama 3.5 % 191,684 9 PriceSmart 3.4 % 167,831 10 IKEA 3.0 % 185,548 Total 48.7% 2,485,385 Lease Expirations Net Effective Rent % of Currency Year Occupied Sq Ft Annualized (US$ in millions) % of Total $/Sq Ft COP USD 2024 65,068 0.6 1.6 % $ 9.22 — % 100.0 % 2025 376,747 2.6 6.6 % $ 6.90 16.0 % 84.0 % 2026 321,905 2.4 6.1 % $ 7.46 23.5 % 76.5 % 2027 957,051 6.9 17.5 % $ 7.21 38.5 % 61.5 % 2028 707,748 5.1 12.9 % $ 7.21 14.2 % 85.8 % Thereafter 2,550,958 21.8 55.3 % $ 8.55 15.0 % 85.0 % Total 4,979,477 39.4 100.0 % $ 7.92 19.4 % 80.6 % Logistic Services Consumer Goods Distribution Retailer Manufacturing and Other COL-CPI US-CPI Constant Escalator Other USD COP

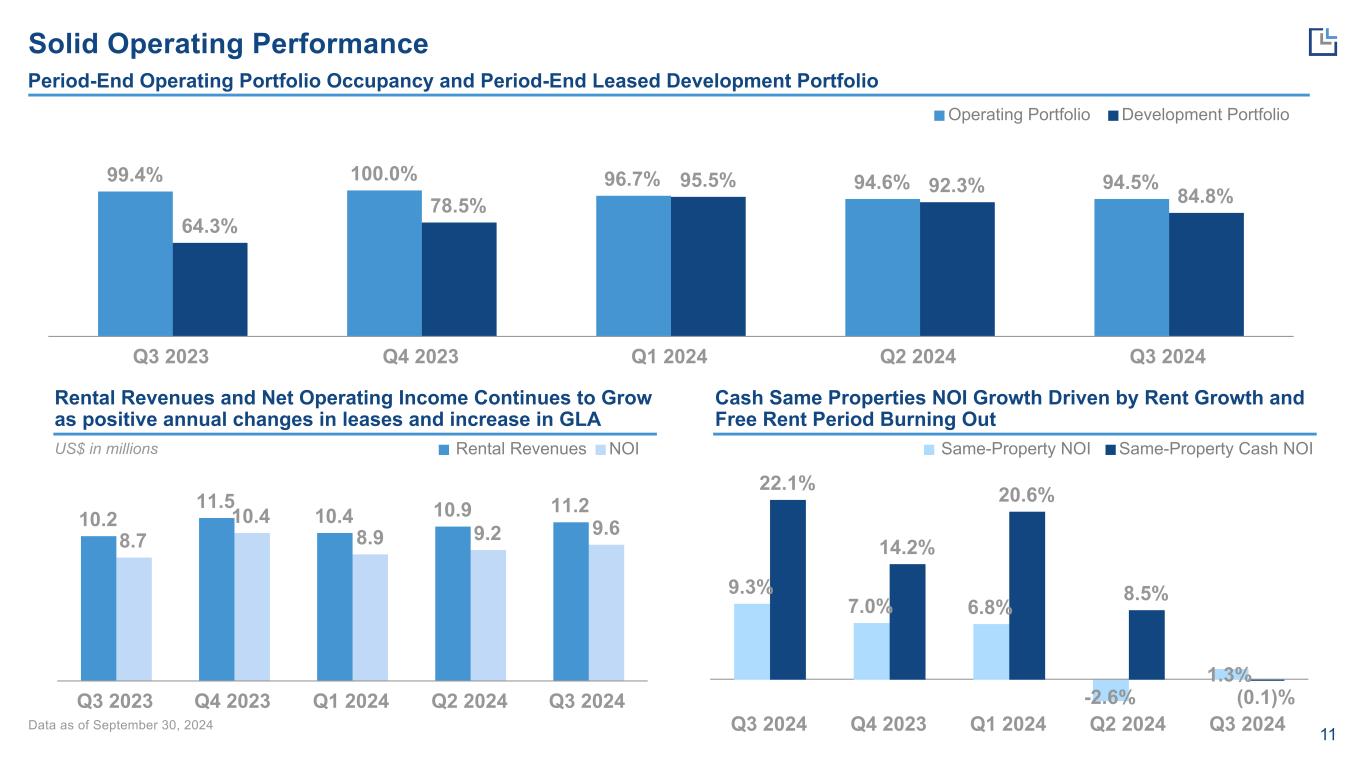

11 10.2 11.5 10.4 10.9 11.2 8.7 10.4 8.9 9.2 9.6 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Rental Revenues and Net Operating Income Continues to Grow as positive annual changes in leases and increase in GLA Cash Same Properties NOI Growth Driven by Rent Growth and Free Rent Period Burning Out Solid Operating Performance Period-End Operating Portfolio Occupancy and Period-End Leased Development Portfolio Data as of September 30, 2024 99.4% 100.0% 96.7% 94.6% 94.5% 64.3% 78.5% 95.5% 92.3% 84.8% Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Operating Portfolio Development Portfolio US$ in millions Rental Revenues NOI 9.3% 7.0% 6.8% -2.6% 1.3% 22.1% 14.2% 20.6% 8.5% (0.1)% Q3 2024 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Same-Property NOI Same-Property Cash NOI

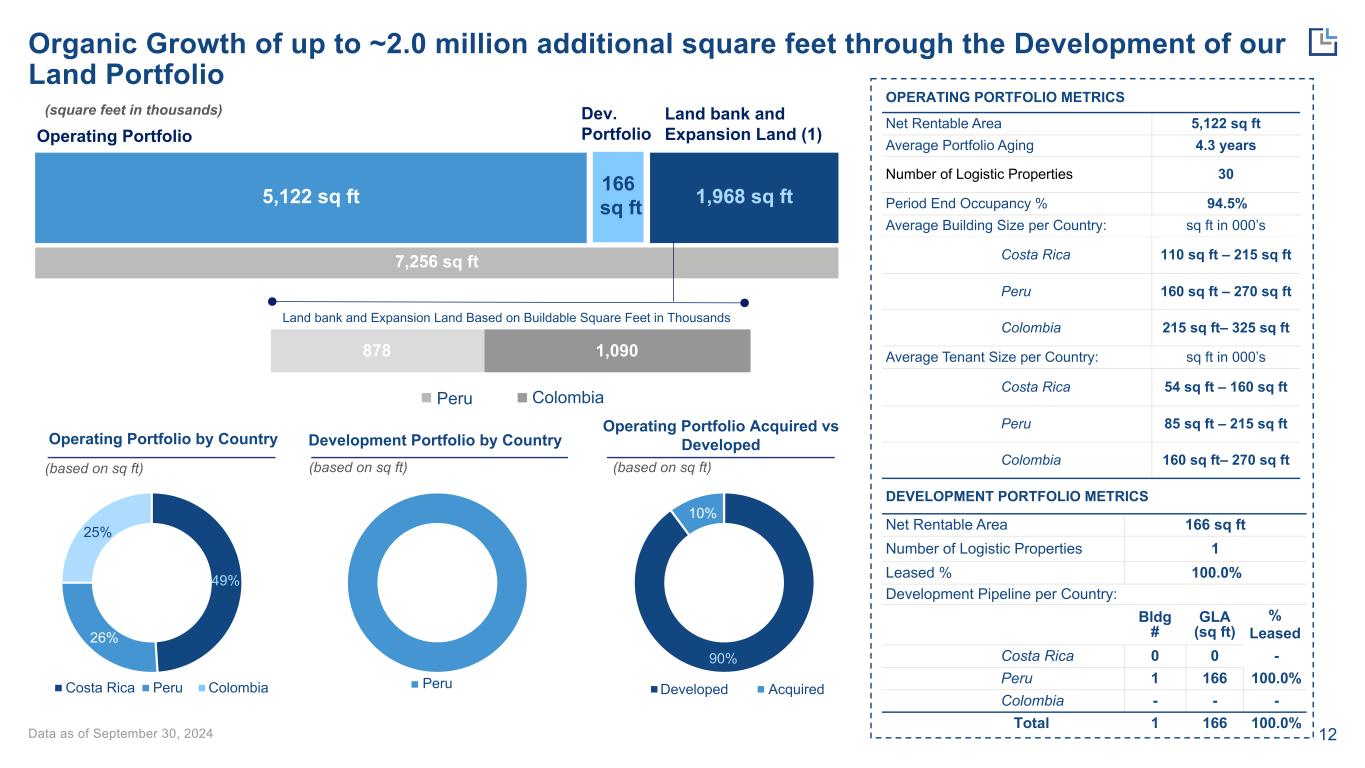

12 90% 10% 878 1,090 Data as of September 30, 2024 Organic Growth of up to ~2.0 million additional square feet through the Development of our Land Portfolio 5,122 sq ft 166 sq ft 1,968 sq ft 7,256 sq ft Operating Portfolio Dev. Portfolio Land bank and Expansion Land (1) (square feet in thousands) Operating Portfolio by Country Development Portfolio by Country Operating Portfolio Acquired vs Developed (based on sq ft) (based on sq ft) (based on sq ft) OPERATING PORTFOLIO METRICS Net Rentable Area 5,122 sq ft Average Portfolio Aging 4.3 years Number of Logistic Properties 30 Period End Occupancy % 94.5% Average Building Size per Country: sq ft in 000’s Costa Rica 110 sq ft – 215 sq ft Peru 160 sq ft – 270 sq ft Colombia 215 sq ft– 325 sq ft Average Tenant Size per Country: sq ft in 000’s Costa Rica 54 sq ft – 160 sq ft Peru 85 sq ft – 215 sq ft Colombia 160 sq ft– 270 sq ft DEVELOPMENT PORTFOLIO METRICS Net Rentable Area 166 sq ft Number of Logistic Properties 1 Leased % 100.0% Development Pipeline per Country: Bldg # GLA (sq ft) % Leased Costa Rica 0 0 - Peru 1 166 100.0% Colombia - - - Total 1 166 100.0% 49% 26% 25% Land bank and Expansion Land Based on Buildable Square Feet in Thousands Peru Colombia Costa Rica Peru Colombia Peru Developed Acquired

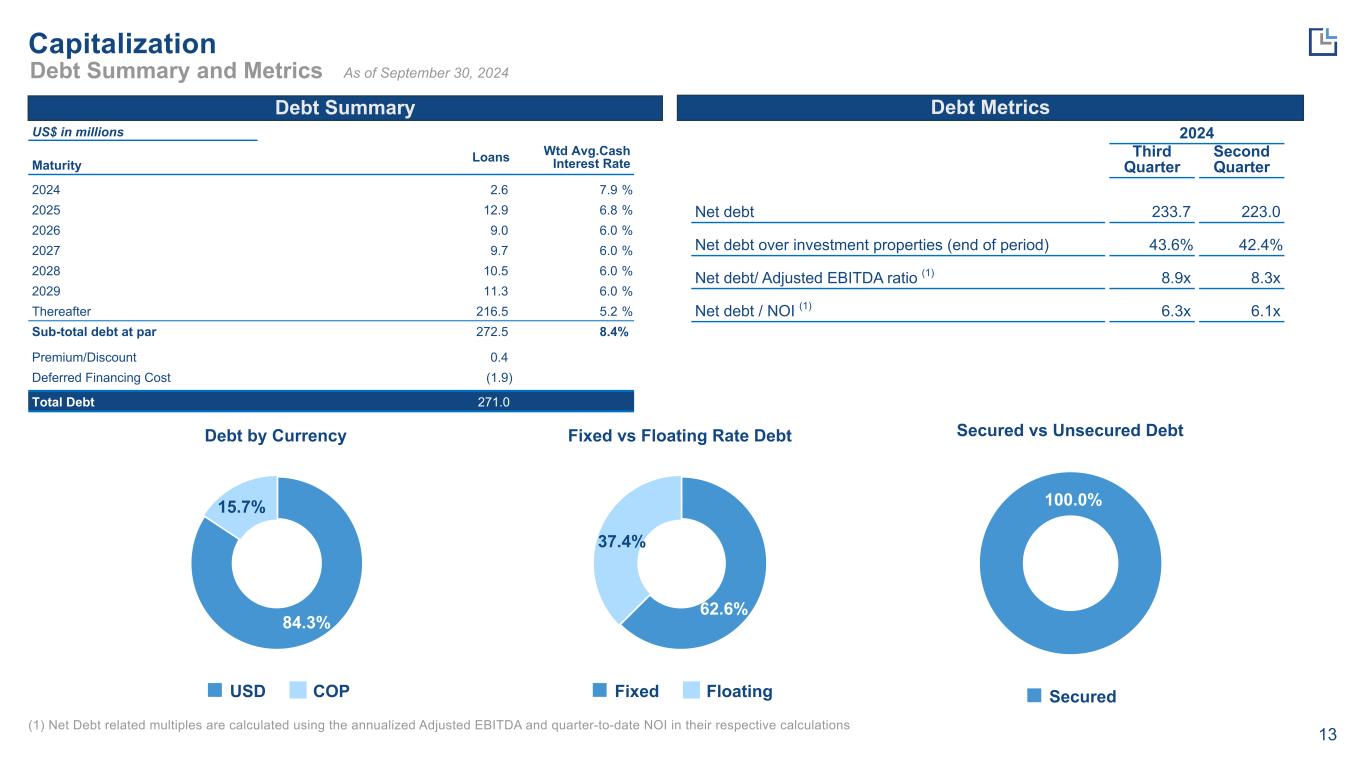

13 Capitalization Debt Summary and Metrics Debt Summary Debt Metrics As of September 30, 2024 (1) Net Debt related multiples are calculated using the annualized Adjusted EBITDA and quarter-to-date NOI in their respective calculations Debt by Currency 84.3% 15.7% USD COP Fixed vs Floating Rate Debt 62.6% 37.4% Fixed Floating Secured vs Unsecured Debt 100.0% Secured US$ in millions Maturity Loans Wtd Avg.Cash Interest Rate 2024 2.6 7.9 % 2025 12.9 6.8 % 2026 9.0 6.0 % 2027 9.7 6.0 % 2028 10.5 6.0 % 2029 11.3 6.0 % Thereafter 216.5 5.2 % Sub-total debt at par 272.5 8.4% Premium/Discount 0.4 Deferred Financing Cost (1.9) Total Debt 271.0 2024 Third Quarter Second Quarter Net debt 233.7 223.0 Net debt over investment properties (end of period) 43.6 % 42.4 % Net debt/ Adjusted EBITDA ratio (1) 8.9x 8.3x Net debt / NOI (1) 6.3x 6.1x

14 Strong Focus on Sustainability We believe our ESG commitment is institutionalized in LPA’s corporate culture Social Governance Warehouses comply with highest standards of efficiency and environmental sustainability by means of EDGE certification – EDGE certification (sponsored by the IFC and World Bank), promotes the development of sustainable buildings with savings of at least 20% of potable water, electricity consumption and carbon footprint levels compared with conventional buildings All of LPA’s projects are managed through the Ecological Blue Flag Program (Bandera Azul), an award that acknowledges effort and volunteer work seeking to improve social and environmental conditions Internally managed - alignment of interests Board of Directors with extensive experience and adequate representation of shareholders Committees led by independent members Transparency through defined policies and regulations Protection mechanisms for minority shareholders Defined investment criteria Long-term incentive program prepared for managers Human Capital: professional development policies, training programs, annual bonus, feedback and annual review Value Chain: strict supplier selection criteria, suppliers code of conduct and databases, sustainable procurement practices, sustainable use of facilities manual for tenants, open communications channels Deep understanding of client needs – strategic partners in growth Community: sustainable business and community strategy, “Bandera Azul Ecológica” environmental program, corporate volunteering & environmental education Environmental

15LPA Coyol 1 Logistic Park, Costa Rica Appendix

16 Strong Focus on Sustainability She CEO and CFO have a combined track record of 30+ years and are complemented by local managers with deep knowledge of their respective markets Country Manager, Costa Rica Luis Conejo • 5 years with LPA • Previously Client Relationship Manager at Vivicon • 15+ years of experience, 7 years with LPA • Principal in the Investment Team at Jaguar Growth Partners, a global private equity firm • Significant experience in real estate operating companies. • Led and executed multiple M&A transactions in the region • International investment banking experience (J.P. Morgan) • MBA from Columbia Business School in New York City and B.S. and M.Sc. in Economics from Universidad Javeriana in Bogota Esteban Saldarriaga Annette Fernández • 15+ years of industry experience, 6 years with LPA • Previously VP of Financial Operations and Investor Relations for FIBRA Prologis • 5 years at PwC. • B.S. in Accounting from University of Puerto Rico CEO COO Guillermo Zarco Country Manager, Colombia • 6 years with LPA • Previously Logistics Portfolio Manager at Terranum Alvaro Chinchayan Country Manager, Peru • 7 years with LPA • Previously Project Manager at PECSA and General Manager at Papelera Alfa Paul Smith • 15+ years of experience as a CFO of public and private companies • Experienced in financial structuring. Closed transactions in asset-heavy and asset-light businesses • Led and executed multiple M&A transactions in the region, consulting experience from McKinsey & Co. • MBA from Harvard Business School and B.S. in Accounting and Finance from Universidad Panamericana in Guadalajara, Mexico CFO Esteba l a riaga ith LPA has extensive industrial and real estate experience in Central and South America

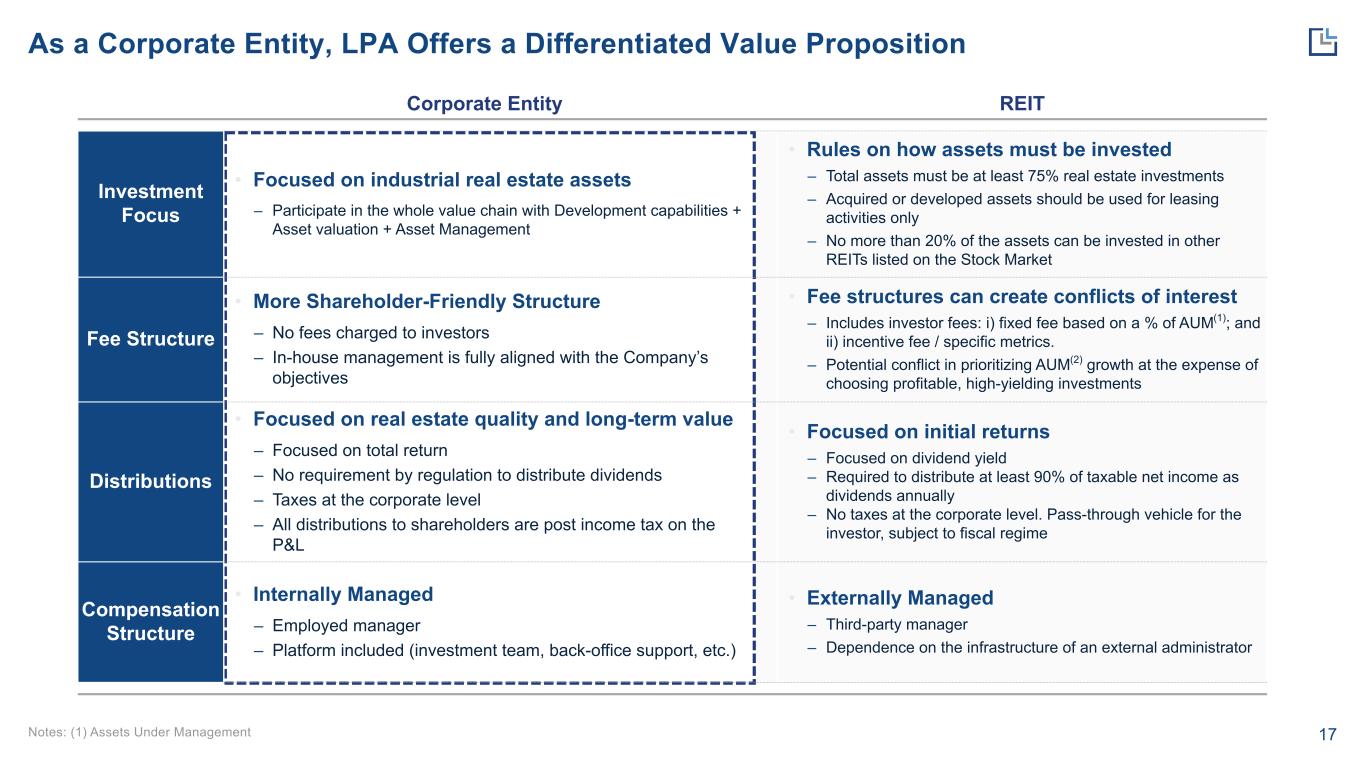

17 As a Corporate Entity, LPA Offers a Differentiated Value Proposition Notes: (1) Assets Under Management Corporate Entity REIT Investment Focus • Focused on industrial real estate assets – Participate in the whole value chain with Development capabilities + Asset valuation + Asset Management • Rules on how assets must be invested – Total assets must be at least 75% real estate investments – Acquired or developed assets should be used for leasing activities only – No more than 20% of the assets can be invested in other REITs listed on the Stock Market Fee Structure • More Shareholder-Friendly Structure – No fees charged to investors – In-house management is fully aligned with the Company’s objectives • Fee structures can create conflicts of interest – Includes investor fees: i) fixed fee based on a % of AUM(1); and ii) incentive fee / specific metrics. – Potential conflict in prioritizing AUM(2) growth at the expense of choosing profitable, high-yielding investments Distributions • Focused on real estate quality and long-term value – Focused on total return – No requirement by regulation to distribute dividends – Taxes at the corporate level – All distributions to shareholders are post income tax on the P&L • Focused on initial returns – Focused on dividend yield – Required to distribute at least 90% of taxable net income as dividends annually – No taxes at the corporate level. Pass-through vehicle for the investor, subject to fiscal regime Compensation Structure • Internally Managed – Employed manager – Platform included (investment team, back-office support, etc.) • Externally Managed – Third-party manager – Dependence on the infrastructure of an external administrator

18 Definitions Please refer to LPA financial statements as prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board and filed with the Security and Exchange Commission (“SEC”) and other public reports for further information about LPA and LPA business. “YTD (Year to Date)” period starting from the beginning of the current year up to the current date, used to measure the performance over this period. Adjusted EBITDA. LPA defines Adjusted EBITDA as profit (loss) for the period excluding (a) interest income from affiliates, (b) financing costs, (c) income tax expense, (d) depreciation and amortization, (e) investment property valuation gain, (f) gain or loss on disposition of asset held for sale, (g) share-based payment, (h) one-time cash bonus related to the Business Combination, (i) listing expense, (j) other income, (k) other expenses, and (l) net foreign currency gain or loss. Management uses Adjusted EBITDA to measure and evaluate the operating performance of LPA’s business, which consists of developing, leasing and managing industrial properties, before LPA’s cost of capital and income tax expense. Adjusted EBITDA is a measure commonly used in LPA’s industry, and it presents Adjusted EBITDA to supplement investor understanding of its operating performance. LPA’s management believes that Adjusted EBITDA provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles and fair value adjustments of LPA’s assets. Cash Net Operating Income (Cash NOI) LPA defines Cash NOI as NOI adjusted for straight-line rental revenue during the relevant period. Debt Metrics. We evaluate the following debt metrics to monitor the strength and flexibility of our capital structure and evaluate the performance of our management. Investors can utilize these metrics to make a determination about our ability to service or refinance our debt. Net Debt LPA defines Net Debt as LPA’s total debt (defined as long term debt plus long-term debt—current portion) less cash, cash equivalents and restricted cash. Net Debt to Profit (Loss) represents Net Debt divided by Profit (Loss) for the period. Net Debt to Adjusted EBITDA This metric represents Net Debt divided by Adjusted EBITDA. LPA’s management believes that this ratio is useful because it provides investors with information on LPA’s ability to repay debt, compared to LPA’s performance as measured using Adjusted EBITDA. Net Debt to Net Operating Income (NOI) This metric represents Net Debt divided by NOI. LPA’s management believes that this ratio is useful because it provides investors with information on LPA’s ability to repay debt, compared to LPA’s performance as measured using NOI. Net Debt to Investment Properties This metric represents Net Debt divided by Investment Properties (end of period value). LPA believes that this ratio is useful because it shows the degree in which Net Debt has been used to finance LPA’s assets. Development Portfolio Represents industrial properties that are under development and properties that are developed but have not met Stabilization. Development Yield This metric is calculated for development properties as Stabilized NOI divided by TEI. Estimated Build Out (TEI and sq ft) This metric represents the estimated TEI and finished square feet available for lease upon completion of an industrial building on existing parcels of land. Estimated Value Creation This metric represents the value that we expect to create through our development and leasing activities. We calculate Estimated Value Creation by estimating the Stabilized NOI that the property will generate and applying a stabilized capitalization rate applicable to that property. Estimated Value Creation is calculated as the amount by which the value exceeds our TEI, including closing costs and taxes. Funds From Operations, or FFO LPA calculates FFO as profit for the period, excluding (a) investment property valuation gain and (b) gain on disposition of asset held for sale. LPA calculates FFO (as defined by LPA) as FFO, excluding (a) share- based payment, (b) one-time cash bonus related to the Business Combination, (c) listing expense, (d) other income and (e) other expenses. LPA defines Adjusted FFO as FFO (as defined by LPA), excluding (a) depreciation and amortization, (b) non-cash financing costs, (c) interest income from affiliates, (d) unrealized foreign currency gain or loss and (e) straight-line rental revenue. FFO (as defined by LPA) and Adjusted FFO (collectively, “FFO Measures”) These non-IFRS measures help analyze the operating results of LPA’s assets and operations. LPA’s management believes that FFO Measures are useful to investors as supplemental performance measures because they exclude the effects of certain items which can create significant earnings volatility, as well as certain noncash items, but which do not directly relate to LPA’s ongoing business operations or cash flow generation. LPA’s management believes FFO Measures can facilitate comparisons of operating performance between periods, while also providing an indication of future earnings potential. However, since FFO Measures do not capture the level of capital expenditures or maintenance and improvements required to sustain the operating performance of properties, which has a material economic impact on operating results, LPA’s management believes the usefulness of FFO Measures as measures of performance may be limited. LPA’s computation of FFO Measures may not be comparable to FFO measures reported by other real estate companies that define or interpret the FFO definition differently. Fair Market Value (FMV) Represents the value of a property based on current market conditions and appraised by a certified third party. Valuation methodology used by the third-party appraiser for the valuation of the assets and the factors which are part of the approaches, at the end we will present the ranges of the rates such as the market rents used for the entire portfolio. There are three basic approaches to value: • Income Approach • Discounted Cash Flow Method • Direct Comparison Approach • Cost Approach In practice, an approach to value is included or omitted based on its applicability to the property type being valued and the quality and quantity of information available. Income Approach The Income Approach reflects the subject’s income-producing capabilities. This approach assumes that value is created by expected income. Since the investment is expected to be acquired by an investor who would be willing to pay to receive an income stream plus reversion value from a property over a period, the Income Approach is used as the primary approach to value. The two common valuation techniques are the Discounted Cash Flow (DCF) Method and the Direct Capitalization Method.

19 Definitions Return on Cost This is calculated on development properties as Stabilized rental revenue divided by TEI. Same-Property Our Same-Property metrics are non-IFRS financial measures, which are commonly used in the real estate industry and expected from the financial community, on both a net-effective and cash basis. We evaluate the performance of the operating properties we own and manage using a “Same-Property” analysis because the population of properties in this analysis is consistent from period to period, which allows us to analyze our ongoing business operations. The Same-Property population for a given period includes the operating properties that were owned during the entirety of that period and the corresponding prior year period. Properties developed or acquired are excluded from the Same-Property population until they are held in the operating portfolio for the entirety of both such periods, and properties that sold during such periods are also excluded from the Same-Property population. We have defined the Same-Property portfolio, for the nine months ended September 30, 2024, as those properties that were owned by LPA as of January 1, 2023 and have been in operations throughout the same nine-month periods in both 2023 and 2024. We believe the factors that affect lease rental income, rental recoveries, property operating expenses and NOI in the Same-Property portfolio are generally the same as for our total operating portfolio. We use the following Same-Property metrics to valuate the performance of our operating properties: Same-Property NOI LPA defines Same Property NOI as NOI less non same-property NOI and adjusted for constant currency. LPA evaluates the performance of the properties it owns using a Same Property NOI, and LPA’s management believes that Same Property NOI is helpful to investors and management as a supplemental performance measure because it includes the operating performance from the population of properties that is consistent from period-to-period, thereby eliminating the effects of changes in the composition of LPA’s portfolio on performance. When used in conjunction with IFRS financial measures, Same Property NOI is a supplemental measure of operating performance that LPA’s management believes is a useful measure to evaluate the performance and profitability of LPA investment properties Same-Property Cash NOI LPA defines Same Property Cash NOI as Cash NOI less non same-property cash NOI and adjusted for constant currency. The same property population for a given period includes the operating properties that were owned during the entirety of that period and the corresponding prior year period. Properties developed or acquired are excluded from the same property population until they are held in the operating portfolio for the entirety of both such periods, and properties that sold during such periods are also excluded from the same property population. Stabilization LPA defines stabilization as the earlier of the point at which a developed property has been completed for one year, or when it reaches a 90% occupancy rate. Stabilized NOI This metric is the estimated twelve months of potential gross rental revenue (base rent, including above or below market rents plus operating expense reimbursements) multiplied by 95% to adjust income to a stabilized vacancy factor of 5%, minus estimated operating expenses. Total Expected Investment (“TEI”) This represents total estimated cost of development or expansion, including land, development and leasing costs. TEI is based on current projections and is subject to change. Total Portfolio is comprised of the Operating Portfolio and Development Portfolio. Discounted Cash Flow Method Using this valuation method, future cash flows forecasted over an investment horizon, together with the proceeds of a deemed disposition at the end of the holding period. This method allows for modeling any uneven revenues or costs associated with lease up, rental growth, vacancies, leasing commissions, tenant inducements and vacant space costs. These future financial benefits are discounted to a present value at an appropriate discount rate based on market transactions. • A discount rate applicable to future cash flows and determined primarily by the risk associated with income, and • A capitalization rate used to obtain the future value of the property based on estimated future market conditions. These rates are determined based on: • The constant interviews we have with the developers, brokers, clients and active players in the market to know their expectation of IRR (before debt or without leverage). • Mainly the real transactions in the market are analyzed. Since we are a leading company in the real estate sector we have extensive experience in most purchase transactions and we have the details of these before and during the purchase, which allows us to have a solid base when selecting our rates. Direct Capitalization Method This method involves capitalizing a fully leased net operating income estimate by an appropriate yield. This approach is best utilized with stabilized assets, where there is little volatility in the net income and the growth prospects are also stable. It is most commonly used with single tenant investments or stabilized investments. Direct Comparison Approach The Direct Comparison Approach utilizes sales of comparable properties, adjusting for differences to estimate a value for the subject property. This approach is developed in a simplified method to establish a range of unit prices for market comparable sales. This method is typically developed to support the Income Approach rather than to conclude on a value. Cost Approach The Cost Approach is based on the principle of substitution - that a prudent and rational person would pay no more for a property than the cost to construct a similar and competitive property - assuming no undue delay in the process. The Cost Approach tends to set the upper limit of value before depreciation is considered. Gross Leasable Area (GLA). The total floor area designed for tenant occupancy and exclusive use, including basements, mezzanines, and upper floors. Net Effective Rent (“NER”) This amount is calculated at the beginning of the lease using estimated total cash base rent to be received over the term and annualized. The NER per square foot number is calculated by dividing the annualized net effective rent by the occupied square feet of the lease. Net Operating Income (“NOI”) LPA defines NOI as profit for the period excluding (a) other revenue (which primarily relates to development fee revenue), (b) general and administrative expenses, (c) listing expense, (d) investment property valuation gain, (e) interest income from affiliates, (f) financing costs, (g) net foreign currency gain or loss, (h) other income, (i) gain on disposition of asset held for sale, (j) other expenses, and (k) income tax expense. Operating Portfolio This includes stabilized industrial properties. Assets held for sale are excluded from the portfolio.

www.lpamericas.com