Exhibit 99.10

Strictly Private & Confidential Project Keystone Valuation Report 2023

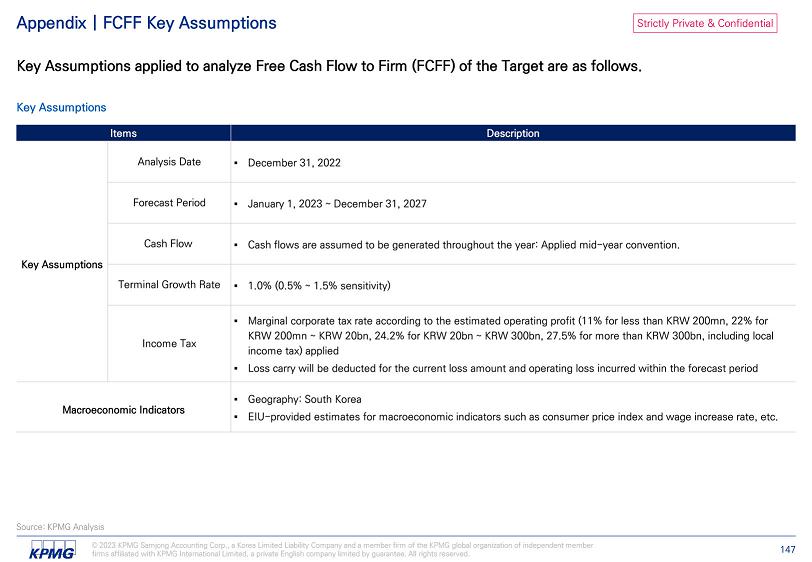

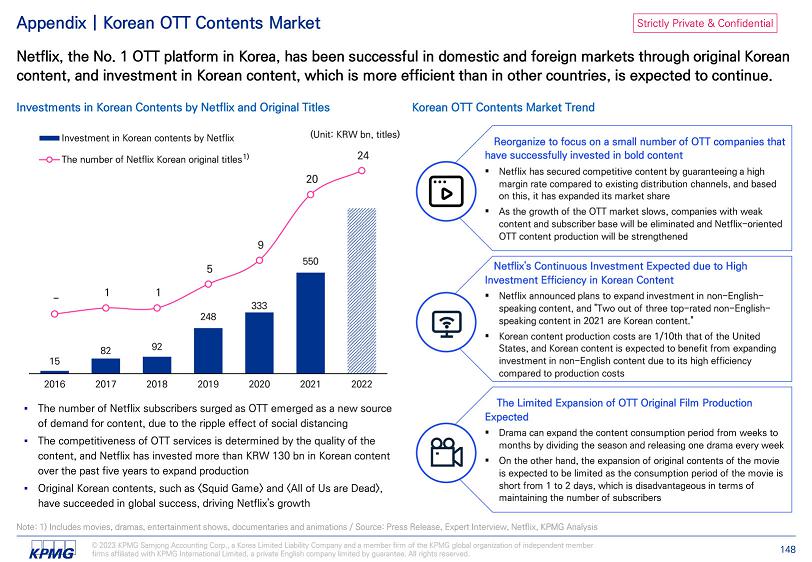

Strictly Private & Confidential © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 1 ▪ This Valuation Report (this “Material”), references to which and to any information contained herein shall be deemed to include any information, in writing or orally, supplied in connection herewith or in connection with any further enquiries, has been prepared by KPMG Samjong Accounting Corp . (“KPMG”) on behalf of K Enter Holdings Inc . (the “Company”) based on information provided by the Company which has not been independently verified by KPMG . This Material is being made available for informational purposes only and solely for use by certain potential investors (each, an “Investor”) in connection with the consideration of an acquisition of an equity ownership stake in the Company (the “Proposed Transaction”) . ▪ This Material does not purport to contain all the information that an Investor may desire in investigating the Company and is not intended to form the basis of any investment decision by an Investor . Each Investor should carry out its own investigations and analysis of the Company and of the information referred to in this Material and should consult its own advisors before proceeding with any offer . KPMG has not made an independent appraisal of any of the assets and liabilities of the Company in connection with any potential transaction . ▪ Neither the Company or KPMG nor their respective subsidiaries and affiliates, nor any of their respective directors, officers, agents, advisors or employees make any representation or warranty, explicitly or implicitly, nor shall any of them, so far as permitted by law, have any responsibility or liability whatsoever in respect of the accuracy or completeness of, or omissions from, this Material or any other document or information, written or oral, supplied at any time or in respect of any opinions or projections expressed therein or omitted therefrom . No such party is under any obligation to update this Material or correct any inaccuracies in or omissions from it which may exist or become apparent . ▪ No responsibility or liability is accepted, and any and all responsibility and liability is expressly disclaimed, so far as permitted by law, by the Company, KPMG and their respective subsidiaries and affiliates and their respective directors, officers, agents, advisors and employees for any errors, mis - statements or misrepresentations in, or omissions from, this Material or any other such document or information supplied at any time to each Investor or its advisors in the course of each Investor’s evaluation of the Company . ▪ The projected financial information, forecasts, targets, prospects, estimates and other forward - looking statements contained in this Material are based on subjective estimates and assumptions made by the Company and about circumstances and events that have not yet taken place . KPMG has relied upon the accuracy and completeness of these in preparing its analyses . Such projections, estimates, forecasts, targets, prospects and returns are not a reliable indicator of future performance, and such estimates and assumptions involve significant elements of subjective judgment and analysis which may or may not be correct . Accordingly, no representations are made by the Company, KPMG and their respective subsidiaries and affiliates or any of their respective directors, officers, agents, advisors or employees as to the accuracy of such information and there can be no assurance that the projected results are attainable or will be achieved . ▪ This Material does not constitute or form part of any transaction with the Company nor shall it constitute the basis of any contract which may be concluded for such transaction . An Investor must rely only on the representations, warranties and undertakings, if any, contained in a definitive contract and subject to such limitations and exclusions as may be specified therein . This Material is subject to the disclaimer and qualifications specified above and each Investor should make its own investigations and analysis and should not act on the basis of any matter specified, discussed or referred to in this Material . ▪ This Material does not constitute an offer or solicitation in any jurisdiction in which such offer or solicitation is not permitted under applicable law or to any person or entity that does not possess the qualifications described herein . Distribution of this Material in or from certain jurisdictions may be restricted or prohibited by law . Each Investor is required by the Company and KPMG to inform itself of and comply with all restrictions or prohibitions in such jurisdictions . Neither the Company or KPMG nor their respective subsidiaries and affiliates nor any of their respective directors, officers, agents, advisors or employees, so far as permitted by law, accepts any liability to any person in relation to the distribution or possession of this Material in or from any jurisdiction . This Material is provided to each Investor on a personal basis and the right to participate in the Proposed Transaction is personal to each Investor and may not be transferred or assigned to any other person . ▪ By its acceptance hereof, each Investor agrees not to distribute this Material to others, in whole or in part, at any time without the prior written consent of the Company and KPMG and to keep confidential all information contained herein or made available in connection with any further investigation . The contents of this Material and any other information or opinions subsequently supplied may not, without the written consent of the Company and/or KPMG be published, reproduced, copied or disclosed to any person . This Material is being delivered for information purposes only and upon the express understanding that it will be used only for the purpose set forth above . Upon request, each Investor will return promptly all materials received from the Company and KPMG, including this Material, without retaining any copies thereof . Each Investor shall be responsible for any loss suffered by the Company and its shareholders in the event of any unauthorized disclosure . ▪ Neither the issue of this Material nor any part of its contents is to be taken as any form of commitment on the part of the Company or KPMG to proceed with any transaction which may be envisaged by the issue of this Material . The Company and KPMG reserve the right to amend the proposed timetable and procedure, to negotiate with one or more Investors to the exclusion of one or more of any others without giving prior notice thereto, to terminate the procedure and to terminate any discussions and negotiations with any Investor at any time, for any reason and without giving any reasons . ▪ KPMG is a Korean limited liability company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited (“KPMG International”), a private English company limited by guarantee . KPMG International provides no client services . No member firm has any authority to obligate or bind KPMG International or any other member firm vis - à - vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm . All rights reserved . Printed in Korea . Disclaimer

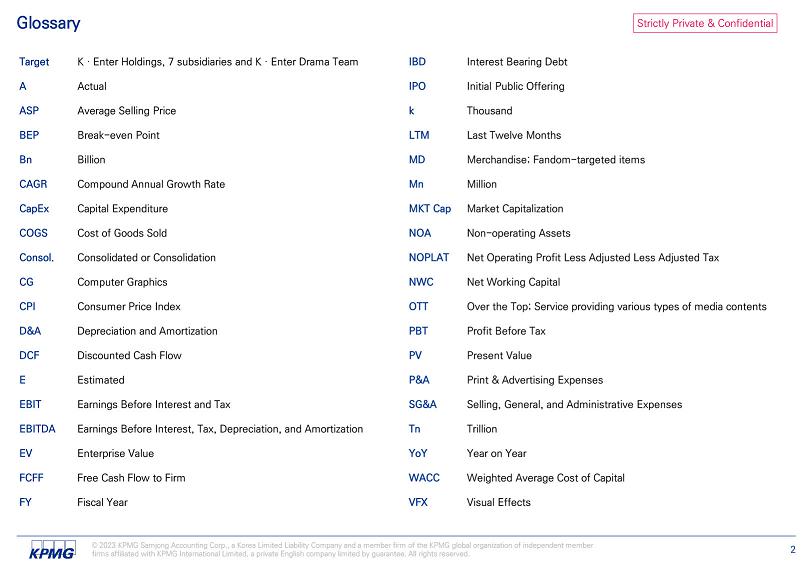

Strictly Private & Confidential © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 2 Interest Bearing Debt IBD K · Enter Holdings, 7 subsidiaries and K · Enter Drama Team Target Initial Public Offering IPO Actual A Thousand k Average Selling Price ASP Last Twelve Months LTM Break - even Point BEP Merchandise; Fandom - targeted items MD Billion Bn Million Mn Compound Annual Growth Rate CAGR Market Capitalization MKT Cap Capital Expenditure CapEx Non - operating Assets NOA Cost of Goods Sold COGS Net Operating Profit Less Adjusted Less Adjusted Tax NOPLAT Consolidated or Consolidation Consol. Net Working Capital NWC Computer Graphics CG Over the Top; Service providing various types of media contents OTT Consumer Price Index CPI Profit Before Tax PBT Depreciation and Amortization D&A Present Value PV Discounted Cash Flow DCF Print & Advertising Expenses P&A Estimated E Selling, General, and Administrative Expenses SG&A Earnings Before Interest and Tax EBIT Trillion Tn Earnings Before Interest, Tax, Depreciation, and Amortization EBITDA Year on Year YoY Enterprise Value EV Weighted Average Cost of Capital WACC Free Cash Flow to Firm FCFF Visual Effects VFX Fiscal Year FY Glossary

Contents Strictly Private & Confidential 004 Executive Summary I. 005 Valuation Summary 007 DCF Result 026 Multiple Analysis 035 Business Plan Analysis II. 036 Play Company 054 The Lamp 068 Bidangil Pictures 082 Apeitda 096 First Virtual Lab 110 Studio Anseillen 124 Solaire Partners 137 K · Enter Drama Team

Strictly Private & Confidential I. Executive Summary

Strictly Private & Confidential Valuation Summary

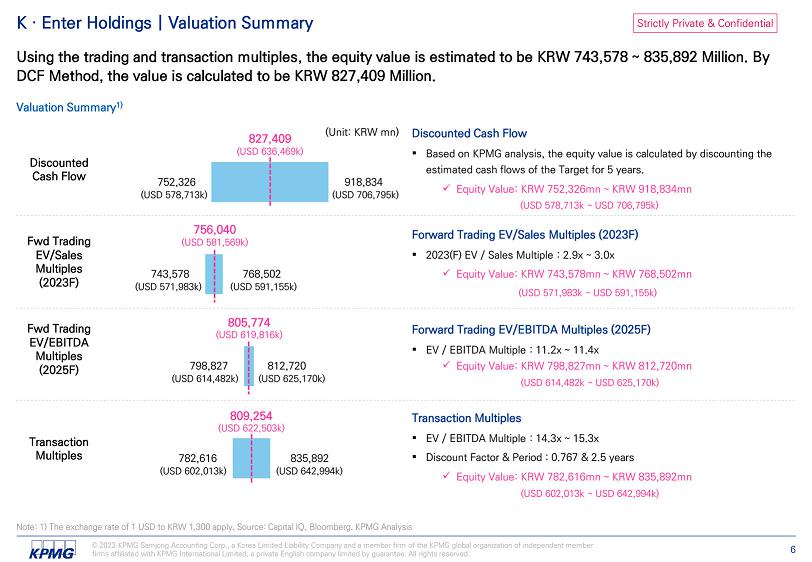

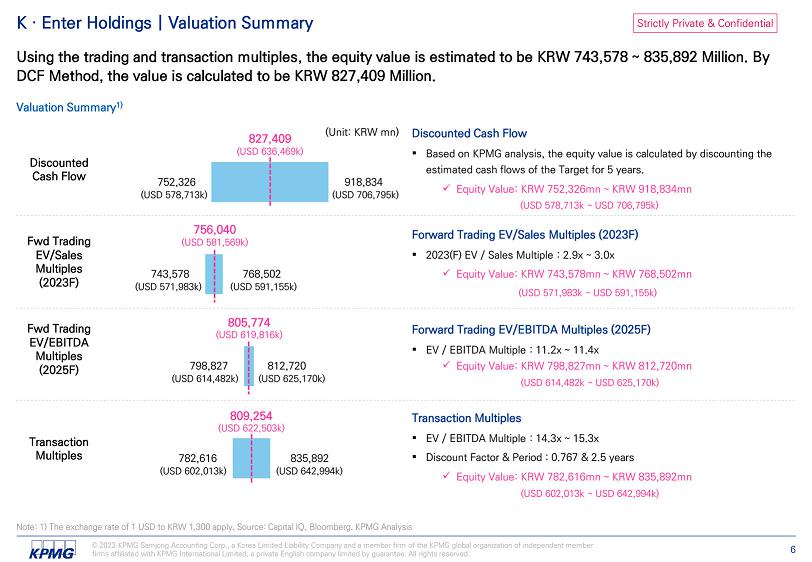

© 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. Strictly Private & Confidential 6 K · Enter Holdings | Valuation Summary Using the trading and transaction multiples, the equity value is estimated to be KRW 743,578 ~ 835,892 Million. By DCF Method, the value is calculated to be KRW 827,409 Million. Valuation Summary 1) Note: 1) The exchange rate of 1 USD to KRW 1,300 apply, Source: Capital IQ, Bloomberg, KPMG Analysis 782,616 (USD 602,013k) 798,827 (USD 614,482k) 743,578 (USD 571,983k) 752,326 (USD 578,713k) 835,892 (USD 642,994k) 812,720 (USD 625,170k) 768,502 (USD 591,155k) 918,834 (USD 706,795k) Discounted Cash Flow ▪ Based on KPMG analysis, the equity value is calculated by discounting the estimated cash flows of the Target for 5 years. x Equity Value: KRW 752,326mn ~ KRW 918,834mn (USD 578,713k ~ USD 706,795k) Discounted Cash Flow (Unit: KRW mn) Transaction Multiples ▪ EV / EBITDA Multiple : 14.3x ~ 15.3x ▪ Discount Factor & Period : 0.767 & 2.5 years x Equity Value: KRW 782,616mn ~ KRW 835,892mn (USD 602,013k ~ USD 642,994k) Transaction Multiples Fwd Trading EV/EBITDA Multiples (2025F) 827,409 (USD 636,469k) 809,254 (USD 622,503k) 805,774 (USD 619,816k) Forward Trading EV/EBITDA Multiples (2025F) ▪ EV / EBITDA Multiple : 11.2x ~ 11.4x x Equity Value: KRW 798,827mn ~ KRW 812,720mn (USD 614,482k ~ USD 625,170k) Fwd Trading EV/Sales Multiples (2023F) 756,040 (USD 581,569k) Forward Trading EV/Sales Multiples (2023F) ▪ 2023(F) EV / Sales Multiple : 2.9x ~ 3.0x x Equity Value: KRW 743,578mn ~ KRW 768,502mn (USD 571,983k ~ USD 591,155k)

Strictly Private & Confidential DCF Result

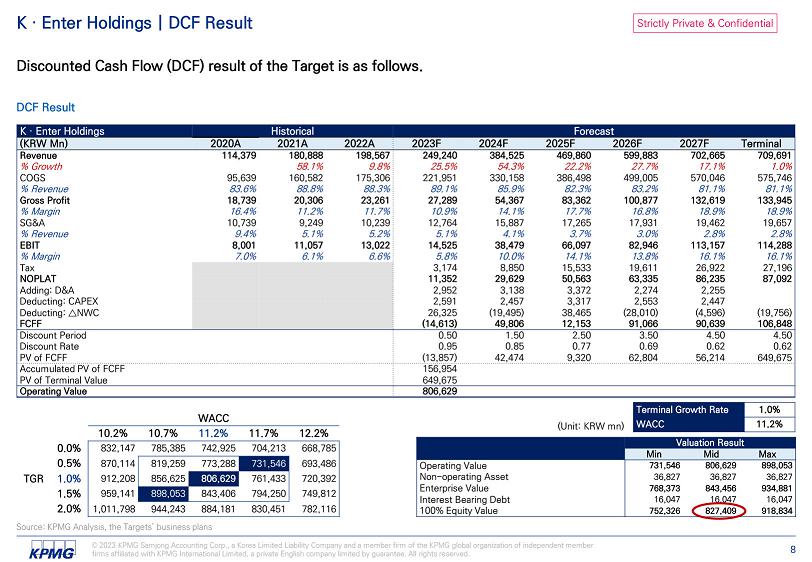

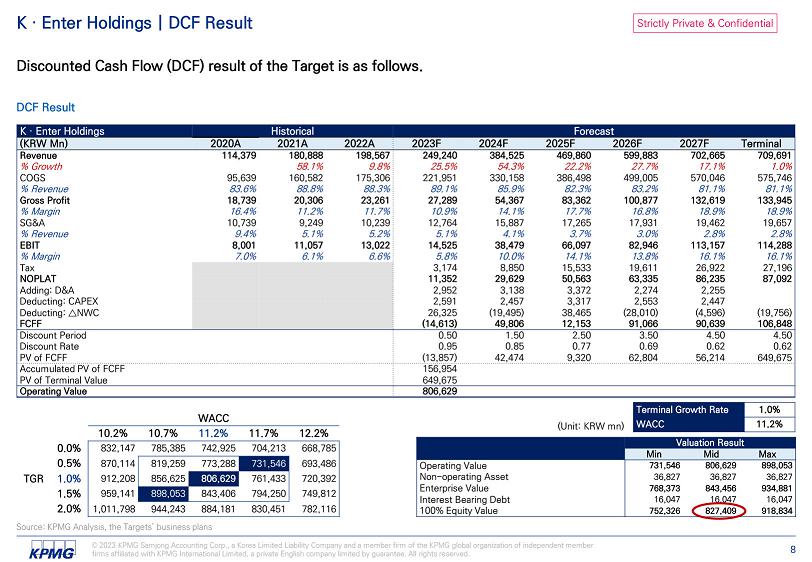

Strictly Private & Confidential K · Enter Holdings | DCF Result Discounted Cash Flow (DCF) result of the Target is as follows. DCF Result Forecast Historical K · Enter Holdings Terminal 2027F 2026F 2025F 2024F 2023F 2022A 2021A 2020A (KRW Mn) 709,691 702,665 599,883 469,860 384,525 249,240 198,567 180,888 114,379 Revenue 1.0% 17.1% 27.7% 22.2% 54.3% 25.5% 9.8% 58.1% % Growth 575,746 570,046 499,005 386,498 330,158 221,951 175,306 160,582 95,639 COGS 81.1% 81.1% 83.2% 82.3% 85.9% 89.1% 88.3% 88.8% 83.6% % Revenue 133,945 132,619 100,877 83,362 54,367 27,289 23,261 20,306 18,739 Gross Profit 18.9% 18.9% 16.8% 17.7% 14.1% 10.9% 11.7% 11.2% 16.4% % Margin 19,657 19,462 17,931 17,265 15,887 12,764 10,239 9,249 10,739 SG&A 2.8% 2.8% 3.0% 3.7% 4.1% 5.1% 5.2% 5.1% 9.4% % Revenue 114,288 113,157 82,946 66,097 38,479 14,525 13,022 11,057 8,001 EBIT 16.1% 16.1% 13.8% 14.1% 10.0% 5.8% 6.6% 6.1% 7.0% % Margin 27,196 26,922 19,611 15,533 8,850 3,174 Tax 87,092 86,235 63,335 50,563 29,629 11,352 NOPLAT 2,255 2,274 3,372 3,138 2,952 Adding: D&A 2,447 2,553 3,317 2,457 2,591 Deducting: CAPEX (19,756) (4,596) (28,010) 38,465 (19,495) 26,325 Deducting: ټ NWC 106,848 90,639 91,066 12,153 49,806 (14,613) FCFF 4.50 4.50 3.50 2.50 1.50 0.50 Discount Period 0.62 0.62 0.69 0.77 0.85 0.95 Discount Rate 649,675 56,214 62,804 9,320 42,474 (13,857) PV of FCFF 156,954 Accumulated PV of FCFF 649,675 PV of Terminal Value 806,629 Operating Value 731,546 773,288 819,259 761,433 806,629 856,625 794,250 843,406 898,053 12.2% 11.7% 11.2% 10.7% 10.2% 668,785 704,213 742,925 785,385 832,147 693,486 870,114 720,392 912,208 749,812 959,141 782,116 830,451 884,181 944,243 1,011,798 WACC 0.0% 0.5% 1.0% TGR 1.5% 2.0% 1.0% Terminal Growth Rate 11.2% WACC Valuation Result Max Mid Min 898,053 806,629 731,546 Operating Value 36,827 36,827 36,827 Non - operating Asset 934,881 843,456 768,373 Enterprise Value 16,047 16,047 16,047 Interest Bearing Debt 918,834 827,409 752,326 100% Equity Value (Unit: KRW mn) Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 8

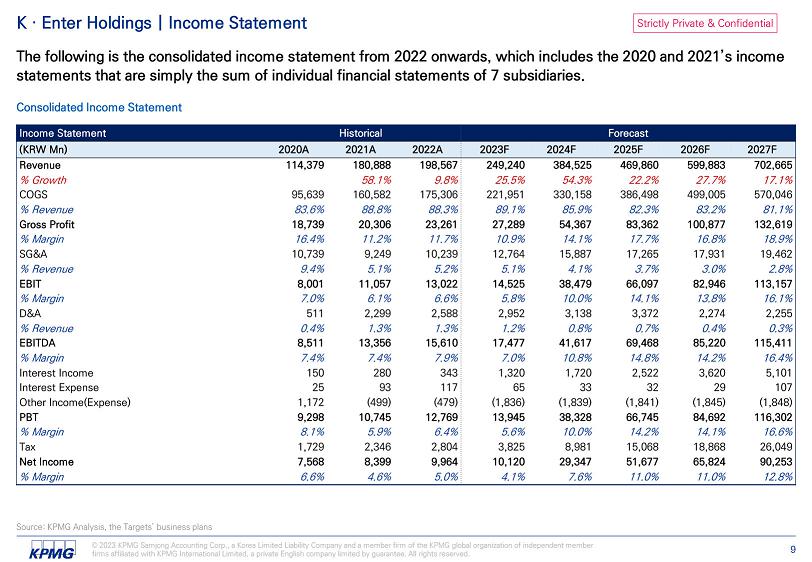

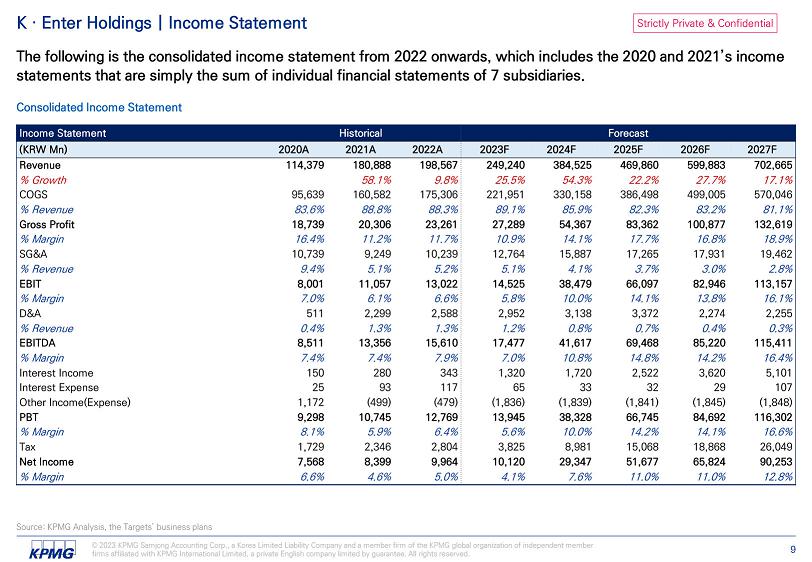

Strictly Private & Confidential Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 9 K · Enter Holdings | Income Statement The following is the consolidated income statement from 2022 onwards, which includes the 2020 and 2021’s income statements that are simply the sum of individual financial statements of 7 subsidiaries. Consolidated Income Statement Forecast Historical Income Statement 2027F 2026F 2025F 2024F 2023F 2022A 2021A 2020A (KRW Mn) 702,665 599,883 469,860 384,525 249,240 198,567 180,888 114,379 Revenue 17.1% 27.7% 22.2% 54.3% 25.5% 9.8% 58.1% % Growth 570,046 499,005 386,498 330,158 221,951 175,306 160,582 95,639 COGS 81.1% 83.2% 82.3% 85.9% 89.1% 88.3% 88.8% 83.6% % Revenue 132,619 100,877 83,362 54,367 27,289 23,261 20,306 18,739 Gross Profit 18.9% 16.8% 17.7% 14.1% 10.9% 11.7% 11.2% 16.4% % Margin 19,462 17,931 17,265 15,887 12,764 10,239 9,249 10,739 SG&A 2.8% 3.0% 3.7% 4.1% 5.1% 5.2% 5.1% 9.4% % Revenue 113,157 82,946 66,097 38,479 14,525 13,022 11,057 8,001 EBIT 16.1% 13.8% 14.1% 10.0% 5.8% 6.6% 6.1% 7.0% % Margin 2,255 2,274 3,372 3,138 2,952 2,588 2,299 511 D&A 0.3% 0.4% 0.7% 0.8% 1.2% 1.3% 1.3% 0.4% % Revenue 115,411 85,220 69,468 41,617 17,477 15,610 13,356 8,511 EBITDA 16.4% 14.2% 14.8% 10.8% 7.0% 7.9% 7.4% 7.4% % Margin 5,101 3,620 2,522 1,720 1,320 343 280 150 Interest Income 107 29 32 33 65 117 93 25 Interest Expense (1,848) (1,845) (1,841) (1,839) (1,836) (479) (499) 1,172 Other Income(Expense) 116,302 84,692 66,745 38,328 13,945 12,769 10,745 9,298 PBT 16.6% 14.1% 14.2% 10.0% 5.6% 6.4% 5.9% 8.1% % Margin 26,049 18,868 15,068 8,981 3,825 2,804 2,346 1,729 Tax 90,253 65,824 51,677 29,347 10,120 9,964 8,399 7,568 Net Income 12.8% 11.0% 11.0% 7.6% 4.1% 5.0% 4.6% 6.6% % Margin

Strictly Private & Confidential Note: 1) The exchange rate of 1 USD to KRW 1,300 apply. Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 10 K · Enter Holdings | Income Statement in USD The following is the consolidated income statement from 2022 onwards, which includes the 2020 and 2021’s income statements that are simply the sum of individual financial statements of 7 subsidiaries in USD. Consolidated Income Statement in USD Forecast Historical Income Statement 2027F 2026F 2025F 2024F 2023F 2022A 2021A 2020A (USD k) 540,511 461,448 361,431 295,788 191,723 152,744 139,144 87,984 Revenue 17.1% 27.7% 22.2% 54.3% 25.5% 9.8% 58.1% % Growth 438,497 383,850 297,306 253,968 170,732 134,851 123,525 73,569 COGS 81.1% 83.2% 82.3% 85.9% 89.1% 88.3% 88.8% 83.6% % Revenue 102,014 77,598 64,125 41,821 20,991 17,893 15,620 14,415 Gross Profit 18.9% 16.8% 17.7% 14.1% 10.9% 11.7% 11.2% 16.4% % Margin 14,971 13,793 13,281 12,221 9,818 7,876 7,115 8,261 SG&A 2.8% 3.0% 3.7% 4.1% 5.1% 5.2% 5.1% 9.4% % Revenue 87,043 63,805 50,844 29,600 11,173 10,017 8,505 6,154 EBIT 16.1% 13.8% 14.1% 10.0% 5.8% 6.6% 6.1% 7.0% % Margin 1,734 1,749 2,594 2,414 2,270 1,991 1,769 393 D&A 0.3% 0.4% 0.7% 0.8% 1.2% 1.3% 1.3% 0.4% % Revenue 88,778 65,554 53,437 32,013 13,444 12,008 10,274 6,547 EBITDA 16.4% 14.2% 14.8% 10.8% 7.0% 7.9% 7.4% 7.4% % Margin 3,924 2,784 1,940 1,323 1,016 264 216 116 Interest Income 82 22 24 25 50 90 71 19 Interest Expense (1,422) (1,419) (1,416) (1,414) (1,412) (369) (384) 901 Other Income(Expense) 89,463 65,148 51,343 29,483 10,727 9,822 8,266 7,152 PBT 16.6% 14.1% 14.2% 10.0% 5.6% 6.4% 5.9% 8.1% % Margin 20,038 14,514 11,591 6,909 2,943 2,157 1,805 1,330 Tax 69,425 50,634 39,752 22,574 7,784 7,665 6,461 5,822 Net Income 12.8% 11.0% 11.0% 7.6% 4.1% 5.0% 4.6% 6.6% % Margin

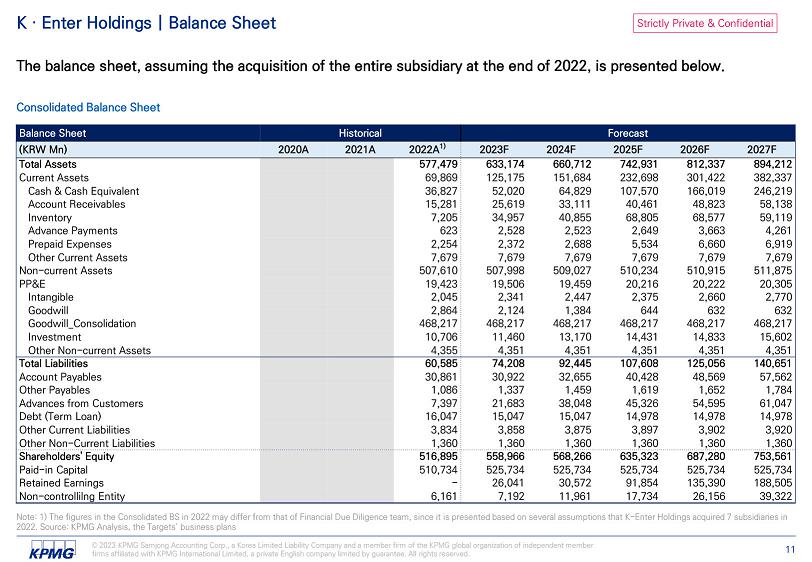

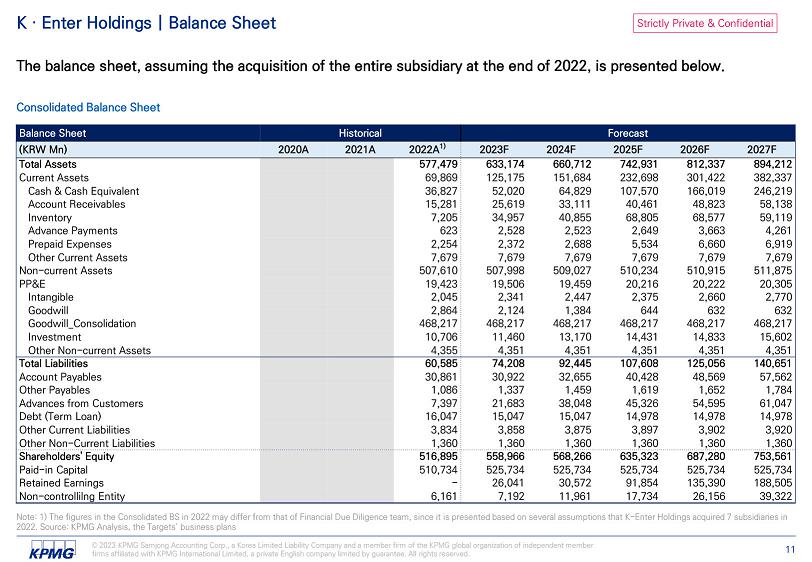

Strictly Private & Confidential Note: 1) The figures in the Consolidated BS in 2022 may differ from that of Financial Due Diligence team, since it is presented based on several assumptions that K - Enter Holdings acquired 7 subsidiaries in 2022. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 11 K · Enter Holdings | Balance Sheet The balance sheet, assuming the acquisition of the entire subsidiary at the end of 2022, is presented below. Consolidated Balance Sheet Forecast Historical Balance Sheet 2027F 2026F 2025F 2024F 2023F 2022A 1) 2021A 2020A (KRW Mn) 894,212 812,337 742,931 660,712 633,174 577,479 Total Assets 382,337 301,422 232,698 151,684 125,175 69,869 Current Assets 246,219 166,019 107,570 64,829 52,020 36,827 Cash & Cash Equivalent 58,138 48,823 40,461 33,111 25,619 15,281 Account Receivables 59,119 68,577 68,805 40,855 34,957 7,205 Inventory 4,261 3,663 2,649 2,523 2,528 623 Advance Payments 6,919 6,660 5,534 2,688 2,372 2,254 Prepaid Expenses 7,679 7,679 7,679 7,679 7,679 7,679 Other Current Assets 511,875 510,915 510,234 509,027 507,998 507,610 Non - current Assets 20,305 20,222 20,216 19,459 19,506 19,423 PP&E 2,770 2,660 2,375 2,447 2,341 2,045 Intangible 632 632 644 1,384 2,124 2,864 Goodwill 468,217 468,217 468,217 468,217 468,217 468,217 Goodwill_Consolidation 15,602 14,833 14,431 13,170 11,460 10,706 Investment 4,351 4,351 4,351 4,351 4,351 4,355 Other Non - current Assets 140,651 125,056 107,608 92,445 74,208 60,585 Total Liabilities 57,562 48,569 40,428 32,655 30,922 30,861 Account Payables 1,784 1,652 1,619 1,459 1,337 1,086 Other Payables 61,047 54,595 45,326 38,048 21,683 7,397 Advances from Customers 14,978 14,978 14,978 15,047 15,047 16,047 Debt (Term Loan) 3,920 3,902 3,897 3,875 3,858 3,834 Other Current Liabilities 1,360 1,360 1,360 1,360 1,360 1,360 Other Non - Current Liabilities 753,561 687,280 635,323 568,266 558,966 516,895 Shareholders' Equity 525,734 525,734 525,734 525,734 525,734 510,734 Paid - in Capital 188,505 135,390 91,854 30,572 26,041 - Retained Earnings 39,322 26,156 17,734 11,961 7,192 6,161 Non - controllilng Entity

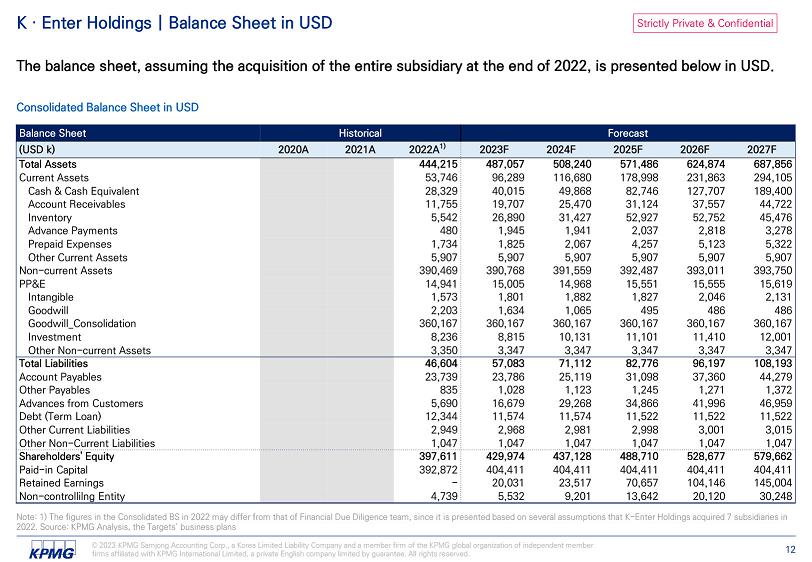

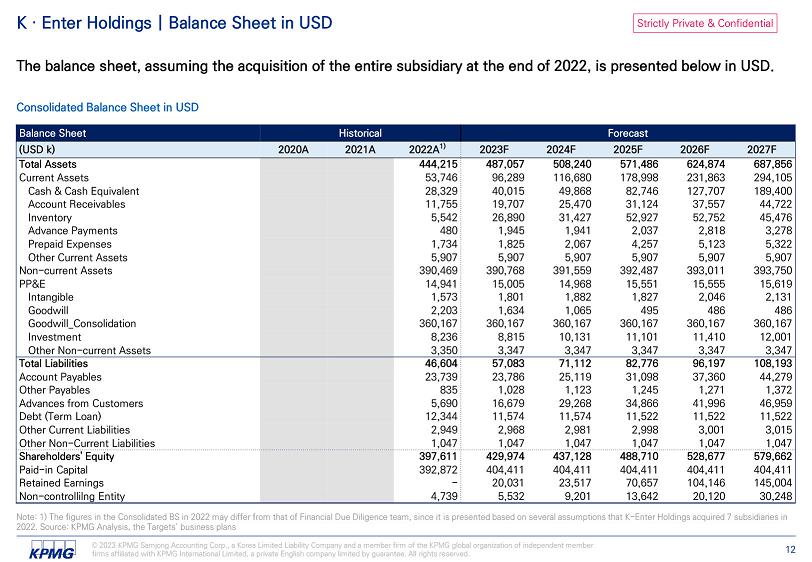

Strictly Private & Confidential Note: 1) The figures in the Consolidated BS in 2022 may differ from that of Financial Due Diligence team, since it is presented based on several assumptions that K - Enter Holdings acquired 7 subsidiaries in 2022. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 12 K · Enter Holdings | Balance Sheet in USD The balance sheet, assuming the acquisition of the entire subsidiary at the end of 2022, is presented below in USD. Consolidated Balance Sheet in USD Forecast Historical Balance Sheet 2027F 2026F 2025F 2024F 2023F 2022A 1) 2021A 2020A (USD k) 687,856 624,874 571,486 508,240 487,057 444,215 Total Assets 294,105 231,863 178,998 116,680 96,289 53,746 Current Assets 189,400 127,707 82,746 49,868 40,015 28,329 Cash & Cash Equivalent 44,722 37,557 31,124 25,470 19,707 11,755 Account Receivables 45,476 52,752 52,927 31,427 26,890 5,542 Inventory 3,278 2,818 2,037 1,941 1,945 480 Advance Payments 5,322 5,123 4,257 2,067 1,825 1,734 Prepaid Expenses 5,907 5,907 5,907 5,907 5,907 5,907 Other Current Assets 393,750 393,011 392,487 391,559 390,768 390,469 Non - current Assets 15,619 15,555 15,551 14,968 15,005 14,941 PP&E 2,131 2,046 1,827 1,882 1,801 1,573 Intangible 486 486 495 1,065 1,634 2,203 Goodwill 360,167 360,167 360,167 360,167 360,167 360,167 Goodwill_Consolidation 12,001 11,410 11,101 10,131 8,815 8,236 Investment 3,347 3,347 3,347 3,347 3,347 3,350 Other Non - current Assets 108,193 96,197 82,776 71,112 57,083 46,604 Total Liabilities 44,279 37,360 31,098 25,119 23,786 23,739 Account Payables 1,372 1,271 1,245 1,123 1,028 835 Other Payables 46,959 41,996 34,866 29,268 16,679 5,690 Advances from Customers 11,522 11,522 11,522 11,574 11,574 12,344 Debt (Term Loan) 3,015 3,001 2,998 2,981 2,968 2,949 Other Current Liabilities 1,047 1,047 1,047 1,047 1,047 1,047 Other Non - Current Liabilities 579,662 528,677 488,710 437,128 429,974 397,611 Shareholders' Equity 404,411 404,411 404,411 404,411 404,411 392,872 Paid - in Capital 145,004 104,146 70,657 23,517 20,031 - Retained Earnings 30,248 20,120 13,642 9,201 5,532 4,739 Non - controllilng Entity

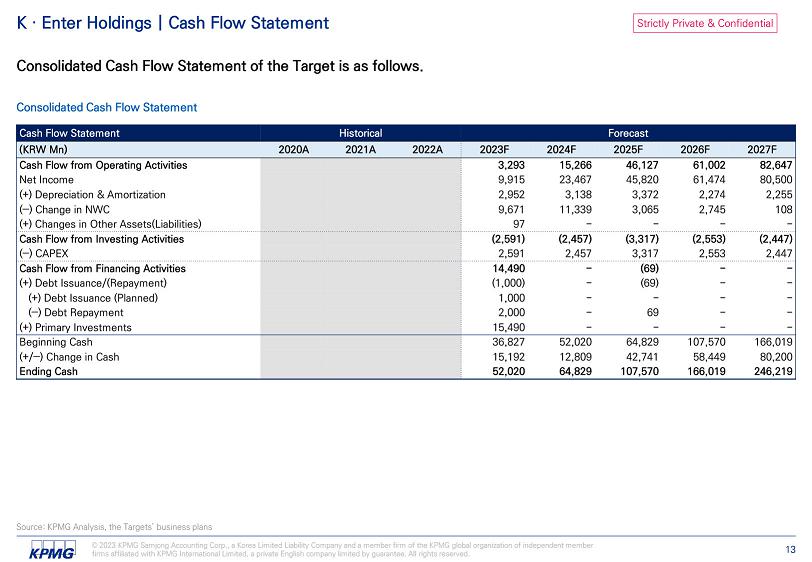

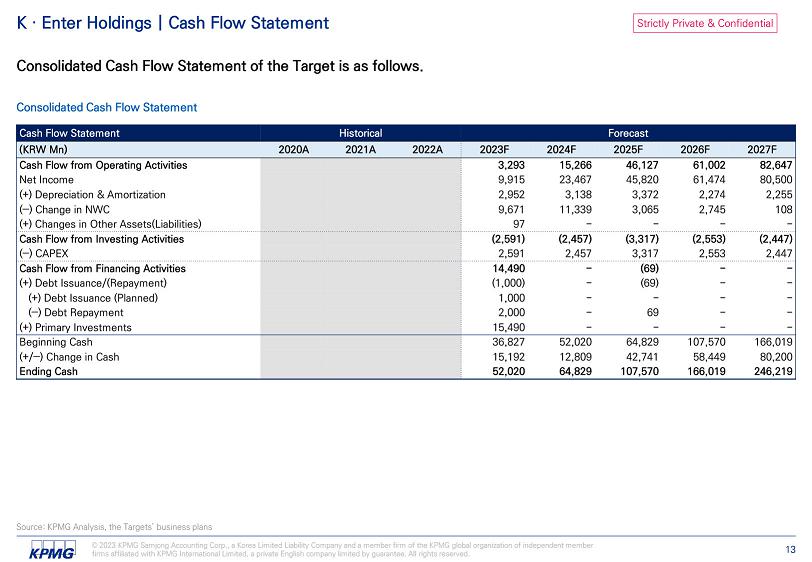

Strictly Private & Confidential Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 13 K · Enter Holdings | Cash Flow Statement Consolidated Cash Flow Statement of the Target is as follows. Consolidated Cash Flow Statement Forecast Historical Cash Flow Statement 2027F 2026F 2025F 2024F 2023F 2022A 2021A 2020A (KRW Mn) 82,647 61,002 46,127 15,266 3,293 Cash Flow from Operating Activities 80,500 61,474 45,820 23,467 9,915 Net Income 2,255 2,274 3,372 3,138 2,952 (+) Depreciation & Amortization 108 2,745 3,065 11,339 9,671 (‒) Change in NWC - - - - 97 (+) Changes in Other Assets(Liabilities) (2,447) (2,553) (3,317) (2,457) (2,591) Cash Flow from Investing Activities 2,447 2,553 3,317 2,457 2,591 (‒) CAPEX - - (69) - 14,490 Cash Flow from Financing Activities - - (69) - (1,000) (+) Debt Issuance/(Repayment) - - - - 1,000 (+) Debt Issuance (Planned) - - 69 - 2,000 (‒) Debt Repayment - - - - 15,490 (+) Primary Investments 166,019 107,570 64,829 52,020 36,827 Beginning Cash 80,200 58,449 42,741 12,809 15,192 (+/‒) Change in Cash 246,219 166,019 107,570 64,829 52,020 Ending Cash

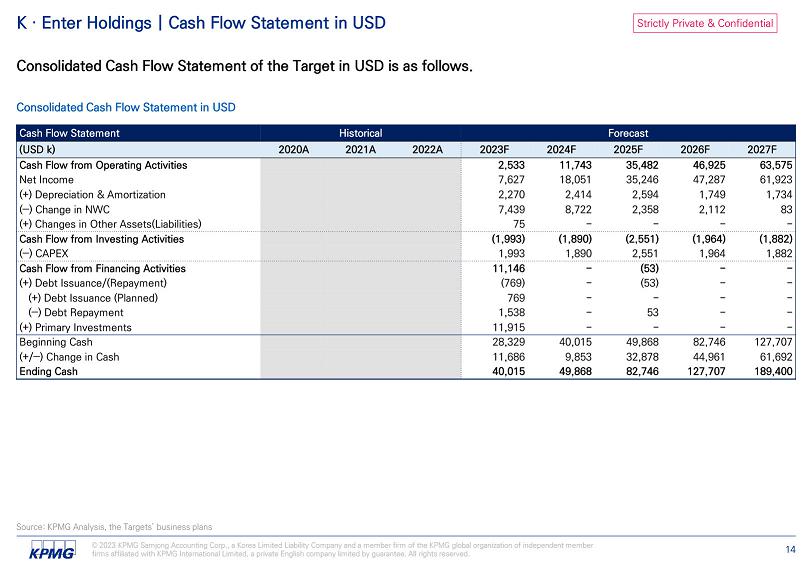

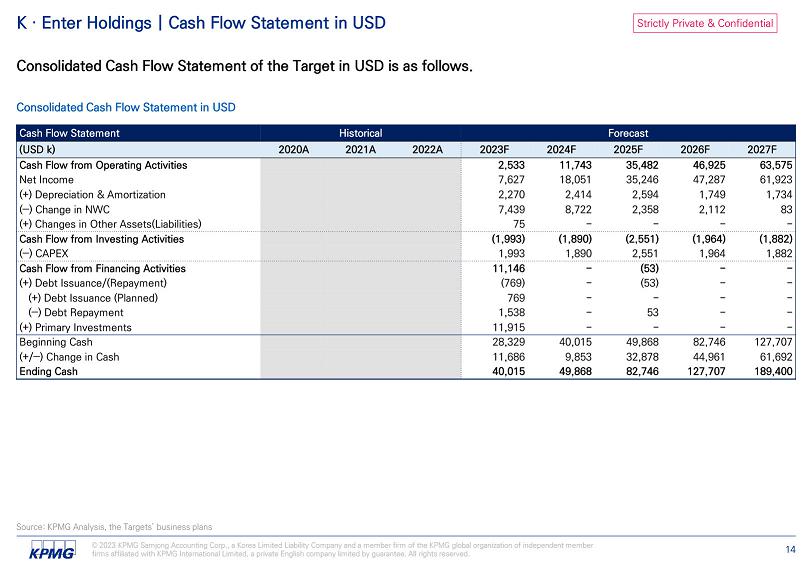

Strictly Private & Confidential Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 14 K · Enter Holdings | Cash Flow Statement in USD Consolidated Cash Flow Statement of the Target in USD is as follows. Consolidated Cash Flow Statement in USD Forecast Historical Cash Flow Statement 2027F 2026F 2025F 2024F 2023F 2022A 2021A 2020A (USD k) 63,575 46,925 35,482 11,743 2,533 Cash Flow from Operating Activities 61,923 47,287 35,246 18,051 7,627 Net Income 1,734 1,749 2,594 2,414 2,270 (+) Depreciation & Amortization 83 2,112 2,358 8,722 7,439 (‒) Change in NWC - - - - 75 (+) Changes in Other Assets(Liabilities) (1,882) (1,964) (2,551) (1,890) (1,993) Cash Flow from Investing Activities 1,882 1,964 2,551 1,890 1,993 (‒) CAPEX - - (53) - 11,146 Cash Flow from Financing Activities - - (53) - (769) (+) Debt Issuance/(Repayment) - - - - 769 (+) Debt Issuance (Planned) - - 53 - 1,538 (‒) Debt Repayment - - - - 11,915 (+) Primary Investments 127,707 82,746 49,868 40,015 28,329 Beginning Cash 61,692 44,961 32,878 9,853 11,686 (+/‒) Change in Cash 189,400 127,707 82,746 49,868 40,015 Ending Cash

Strictly Private & Confidential K · Enter Holdings | Revenue Breakdown Revenue breakdown by business sector of the Target is as follows. 169,053 166,937 204,058 242,198 283,726 12,490 28,074 34,814 43,206 54,592 61,938 132,443 182,183 257,488 301,753 2,981 5,218 6,039 6,516 6,605 2,779 51,853 42,766 50,473 55,990 249,240 384,525 469,860 599,883 702,665 2023E 2024E 2025E 2026E 2027E Revenue Breakdown by Business Sector Synergy Investment Production CG/VFX MD (Unit: KRW mn) Investment Production CG/VFX MD Synergy 2023 - 2027 CAGR 29.6% Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 15

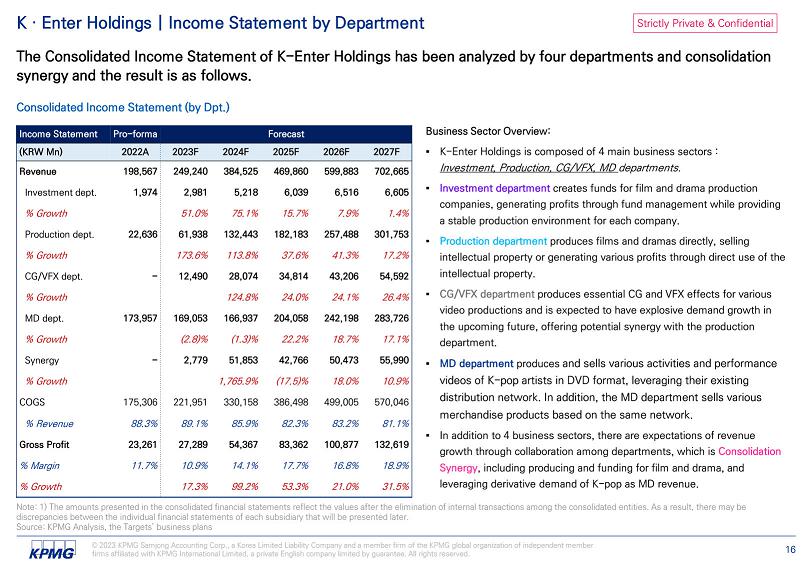

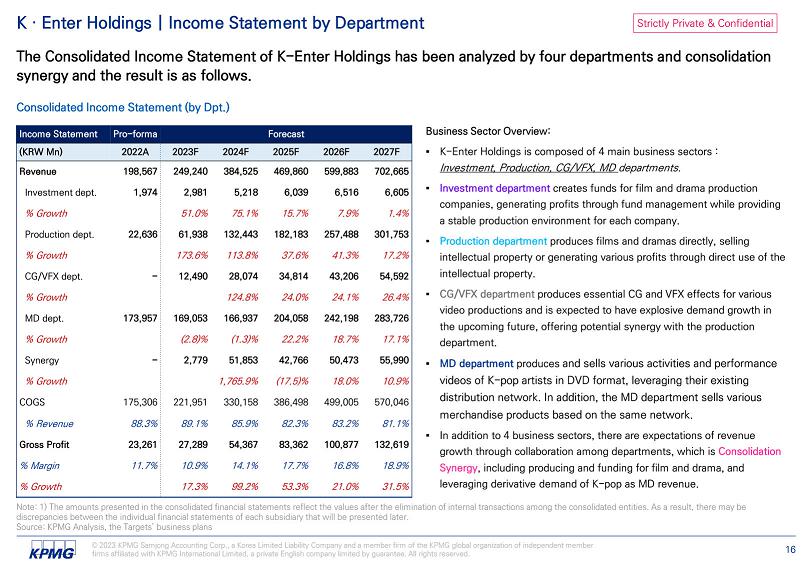

Strictly Private & Confidential ▪ Investment department creates funds for film and drama production companies, generating profits through fund management while providing a stable production environment for each company. ▪ Production department produces films and dramas directly, selling intellectual property or generating various profits through direct use of the intellectual property. ▪ CG/VFX department produces essential CG and VFX effects for various video productions and is expected to have explosive demand growth in the upcoming future, offering potential synergy with the production department. and sells various activities and performance videos of K - pop artists in DVD format, leveraging their existing distribution network. In addition, the MD department sells various merchandise products based on the same network. ▪ In addition to 4 business sectors, there are expectations of revenue growth through collaboration among departments, which is Consolidation Synergy , including producing and funding for film and drama, and leveraging derivative demand of K - pop as MD revenue. Note: 1) The amounts presented in the consolidated financial statements reflect the values after the elimination of internal transactions among the consolidated entities. As a result, there may be discrepancies between the individual financial statements of each subsidiary that will be presented later. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 16 K · Enter Holdings | Income Statement by Department The Consolidated Income Statement of K - Enter Holdings has been analyzed by four departments and consolidation synergy and the result is as follows. Consolidated Income Statement (by Dpt.) Forecast Pro - forma Income Statement 2027F 2026F 2025F 2024F 2023F 2022A (KRW Mn) 702,665 599,883 469,860 384,525 249,240 198,567 Revenue 6,605 6,516 6,039 5,218 2,981 1,974 Investment dept. 1.4% 7.9% 15.7% 75.1% 51.0% % Growth 301,753 257,488 182,183 132,443 61,938 22,636 Production dept. 17.2% 41.3% 37.6% 113.8% 173.6% % Growth 54,592 43,206 34,814 28,074 12,490 - CG/VFX dept. 26.4% 24.1% 24.0% 124.8% % Growth 283,726 242,198 204,058 166,937 169,053 173,957 MD dept. 17.1% 18.7% 22.2% (1.3)% (2.8)% % Growth 55,990 50,473 42,766 51,853 2,779 - Synergy 10.9% 18.0% (17.5)% 1,765.9% % Growth 570,046 499,005 386,498 330,158 221,951 175,306 COGS 81.1% 83.2% 82.3% 85.9% 89.1% 88.3% % Revenue 132,619 100,877 83,362 54,367 27,289 23,261 Gross Profit 18.9% 16.8% 17.7% 14.1% 10.9% 11.7% % Margin 31.5% 21.0% 53.3% 99.2% 17.3% % Growth

Strictly Private & Confidential K · Enter Holdings | Income Statement by Department (Continued) Forecast Pro - forma Income Statement 2027F 2026F 2025F 2024F 2023F 2022A (KRW Mn) 132,619 100,877 83,362 54,367 27,289 23,261 Gross Profit 18.9% 16.8% 17.7% 14.1% 10.9% 11.7% % Margin 31.5% 21.0% 53.3% 99.2% 17.3% % Growth 6,605 6,516 6,039 5,218 2,981 1,974 Investment dept. 1.4% 7.9% 15.7% 75.1% 51.0% % Growth 58,002 41,740 31,648 9,287 2,188 3,143 Production dept. 39.0% 31.9% 240.8% 324.4% (30.4)% % Growth 10,092 8,483 7,665 8,081 4,599 - CG/VFX dept. 19.0% 10.7% (5.1)% 75.7% % Growth 44,002 37,701 30,454 23,124 17,242 18,143 MD dept. 16.7% 23.8% 31.7% 34.1% (5.0)% % Growth 13,918 6,437 7,556 8,657 280 - Synergy 116.2% (14.8)% (12.7)% 2996.4% % Growth 19,462 17,931 17,265 15,887 12,764 10,239 SG&A 2.8% 3.0% 3.7% 4.1% 5.1% 5.2% % Revenue 113,157 82,946 66,097 38,479 14,525 13,022 EBIT 16.1% 13.8% 14.1% 10.0% 5.8% 6.6% % Margin 115,411 85,220 69,468 41,617 17,477 15,610 EBITDA 16.4% 14.2% 14.8% 10.8% 7.0% 7.9% % Margin The Consolidated Income Statement of K - Enter Holdings has been analyzed by four departments and consolidation synergy and the result is as follows. Consolidated Income Statement (by Dpt.) ▪ It is anticipated that K - Entertainment Holdings' revenue will increase at a CAGR of 28.8% over the next five years, driven by the increase in demand for K - pop, K - dramas, and movies. ▪ In 2023, MD sales will account for 67.8% of total revenue, whereas in 2027 it will only account for 40.4%. This is due to the explosive growth in revenue from production and synergy after 2023, which will account for 50.9% of the total in 2027. ▪ According to the consolidated financial statements, EBIT is expected to grow at a CAGR of 54.1% over the next five years from 2022 to 2027, with an estimated increase from KRW 13.0 billion in 2022 to KRW 113.2 billion in 2027. ▪ EBITDA is projected to increase at a CAGR of 49.2%, from KRW 15.6 billion in 2022 to KRW 115.4 billion in 2027. Note: 1) The amounts presented in the consolidated financial statements reflect the values after the elimination of internal transactions among the consolidated entities. As a result, there may be discrepancies between the individual financial statements of each subsidiary that will be presented later. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 17

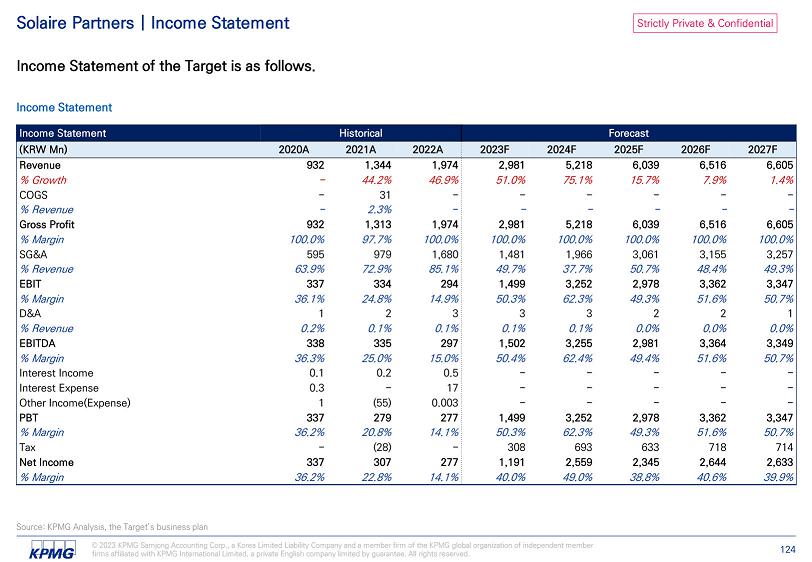

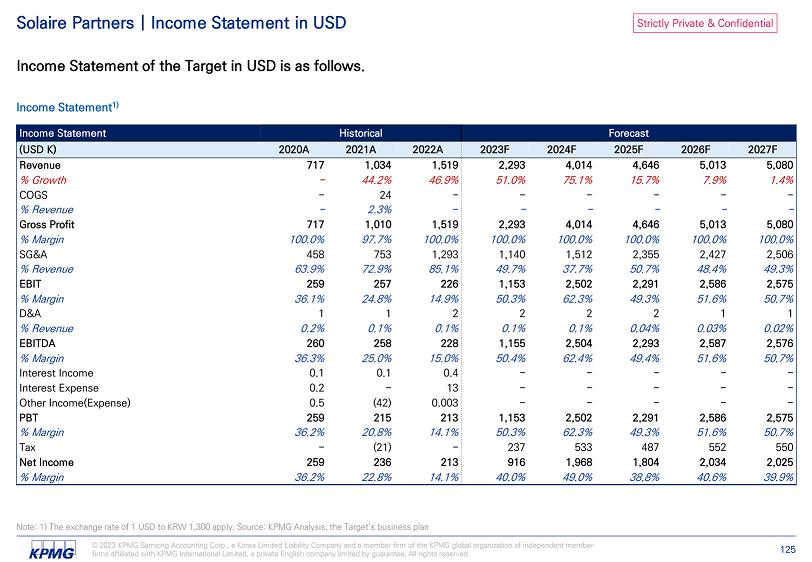

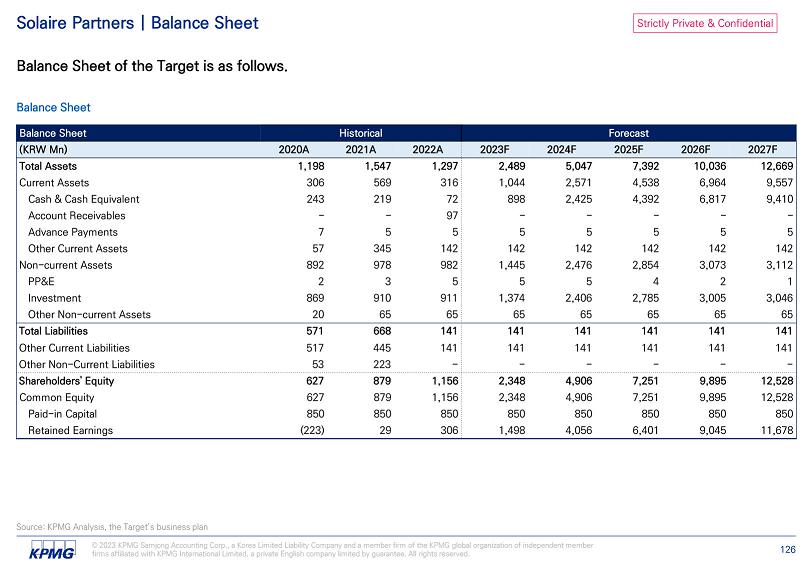

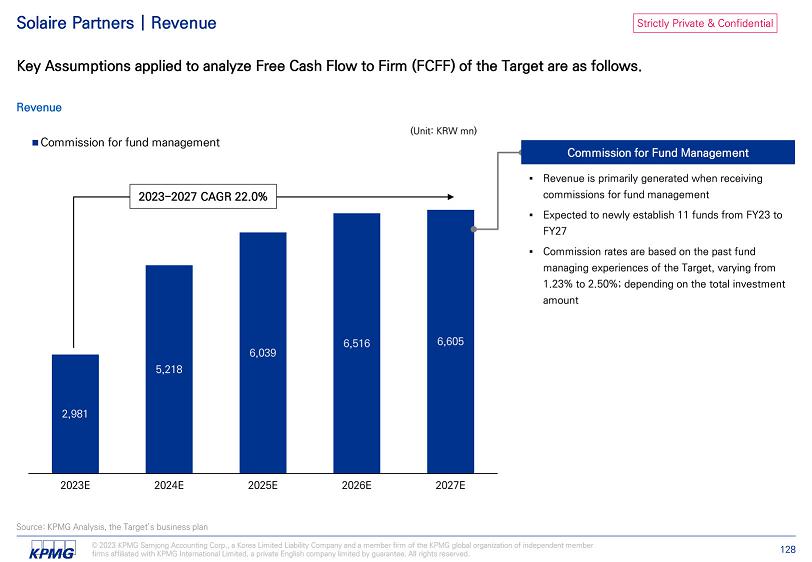

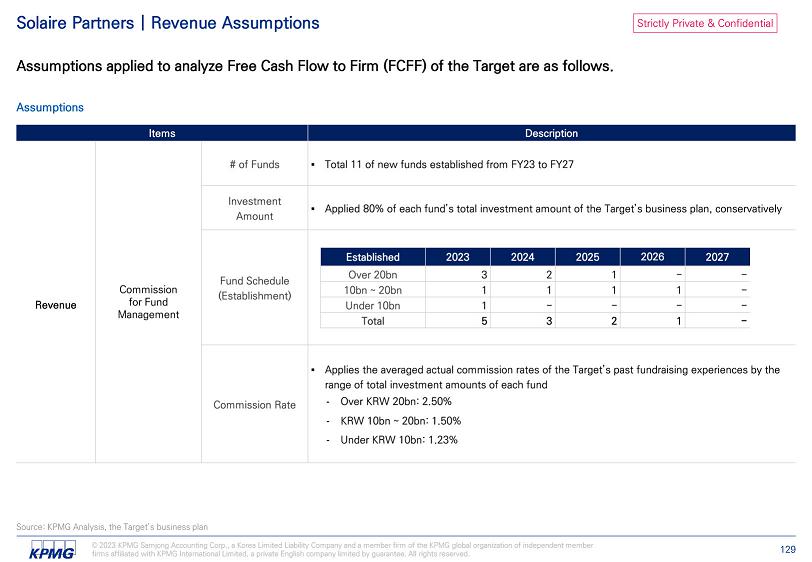

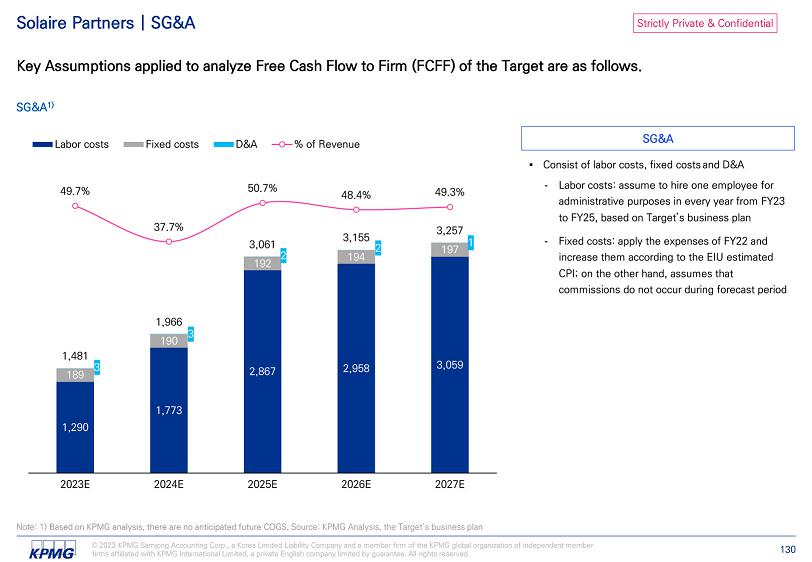

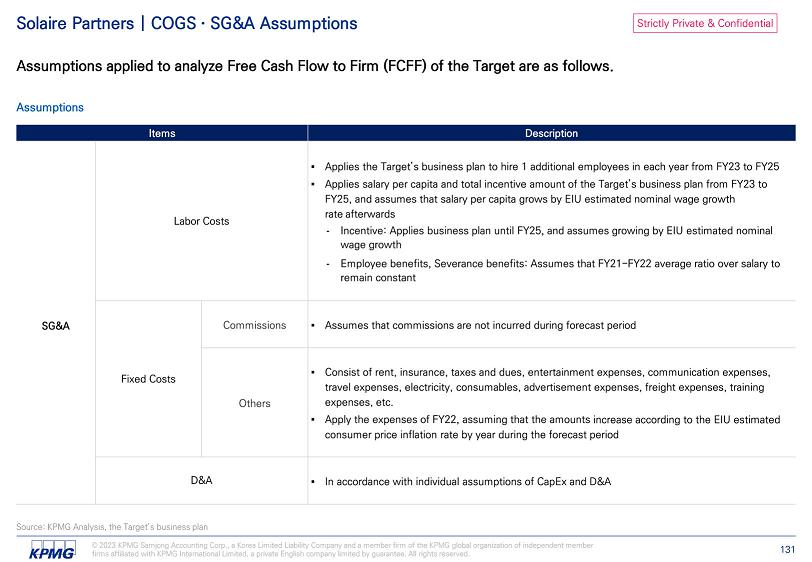

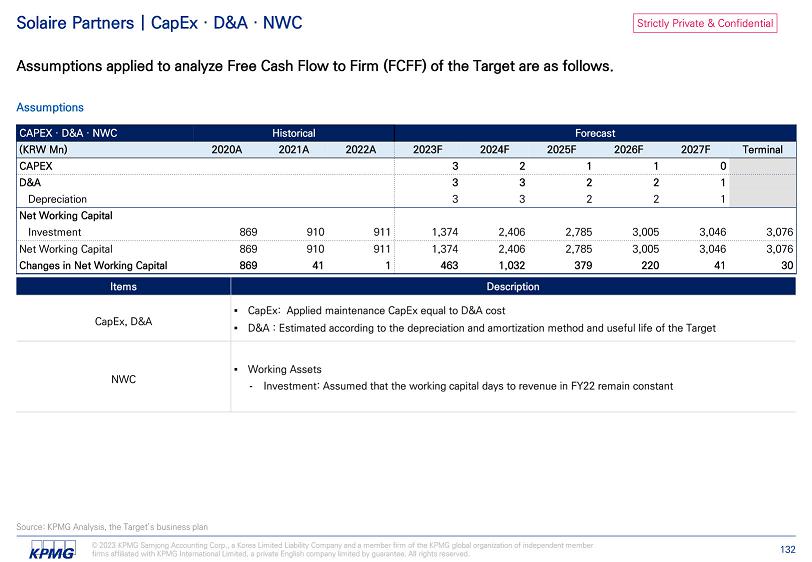

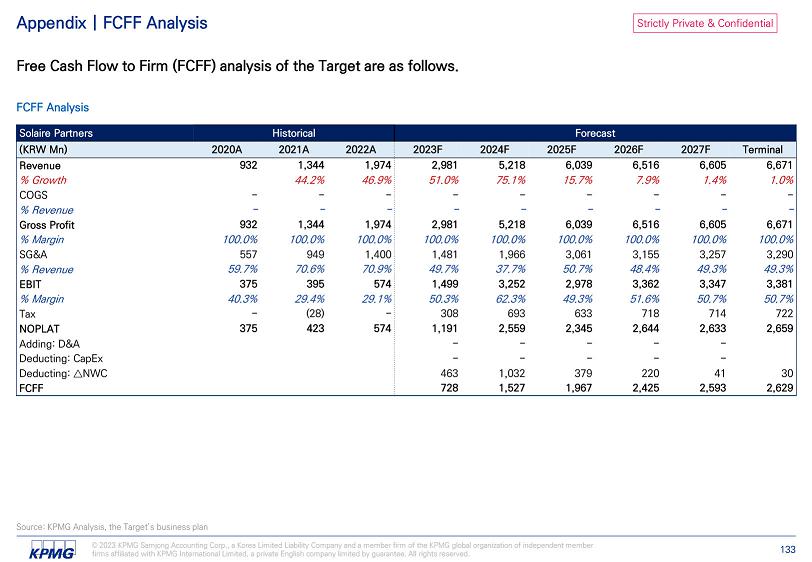

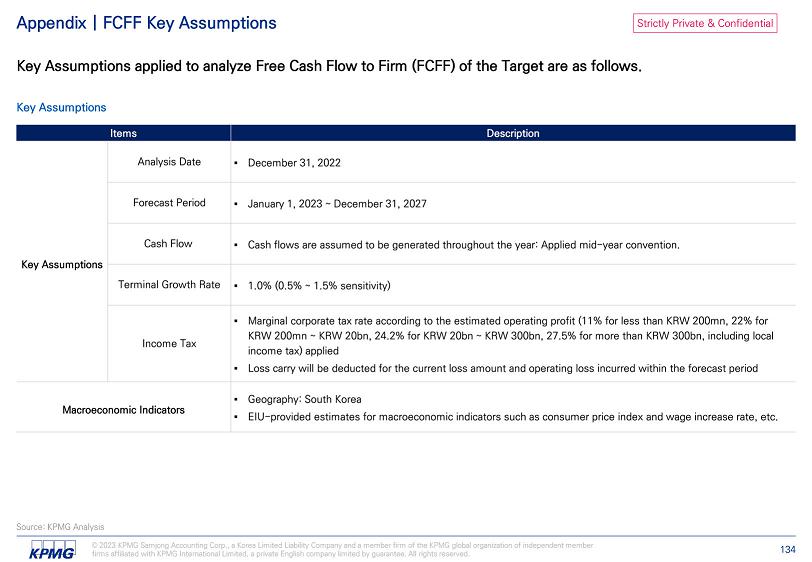

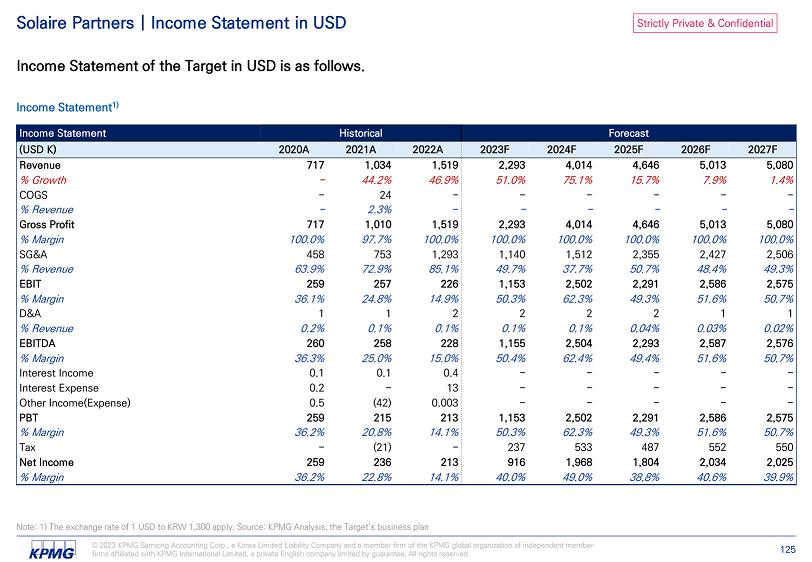

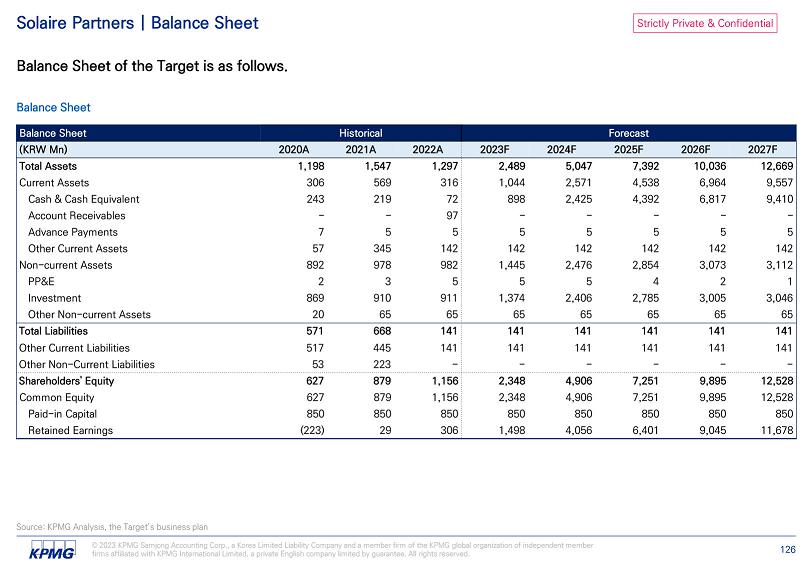

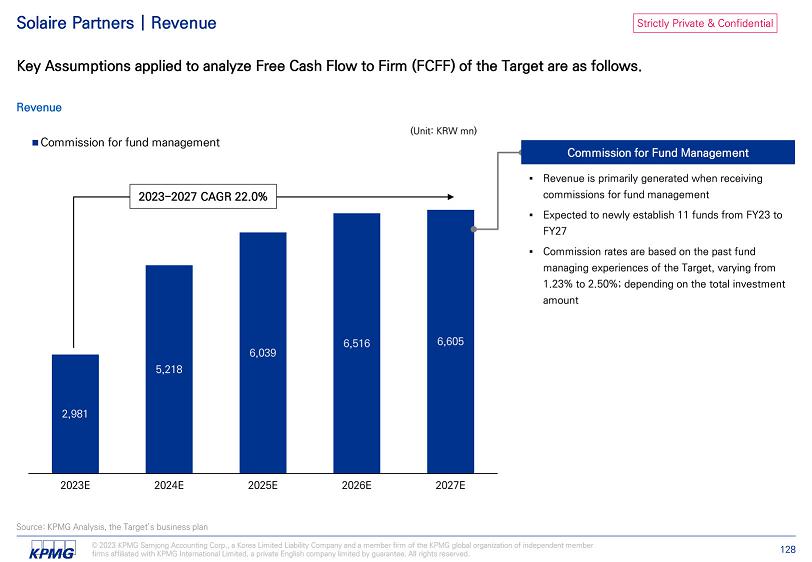

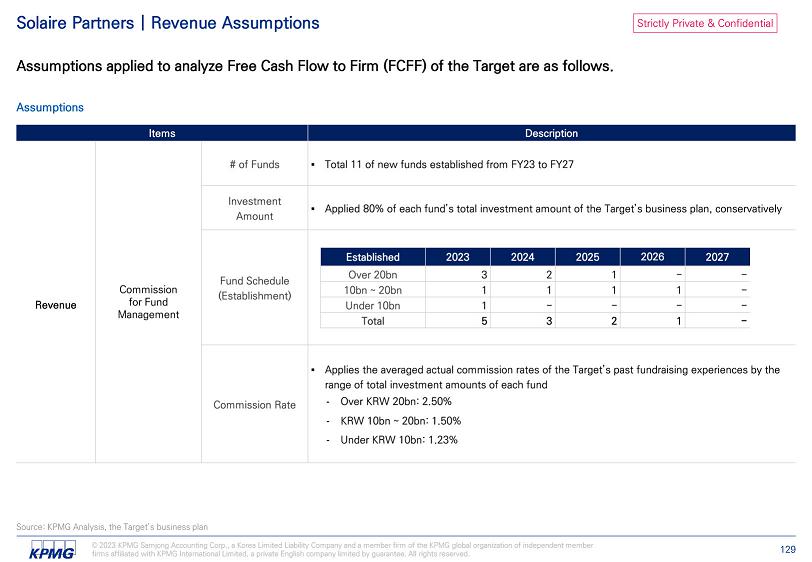

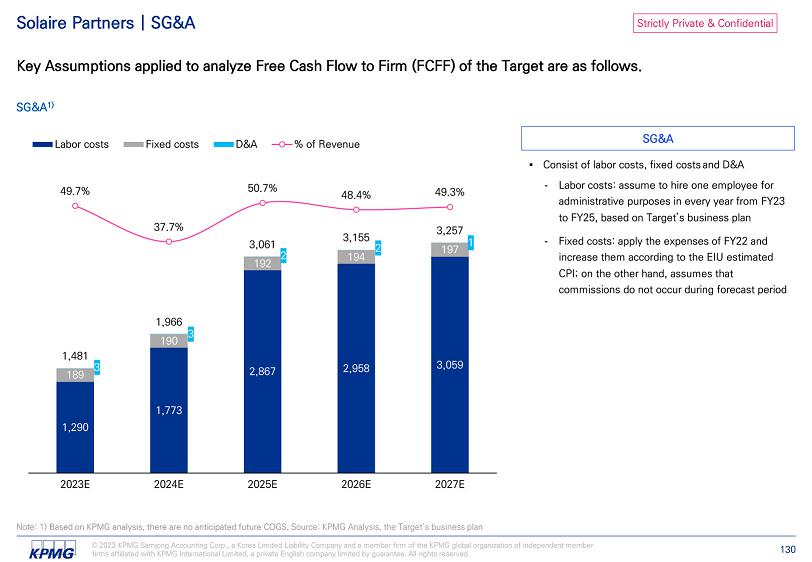

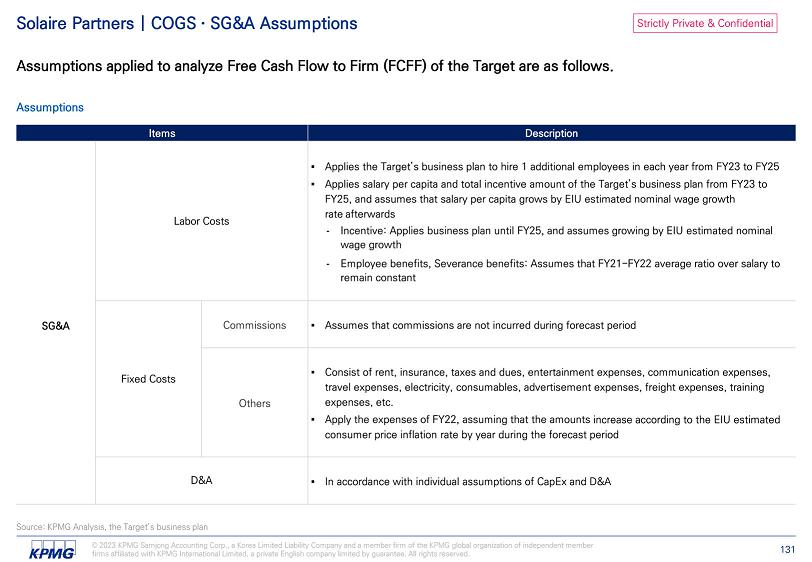

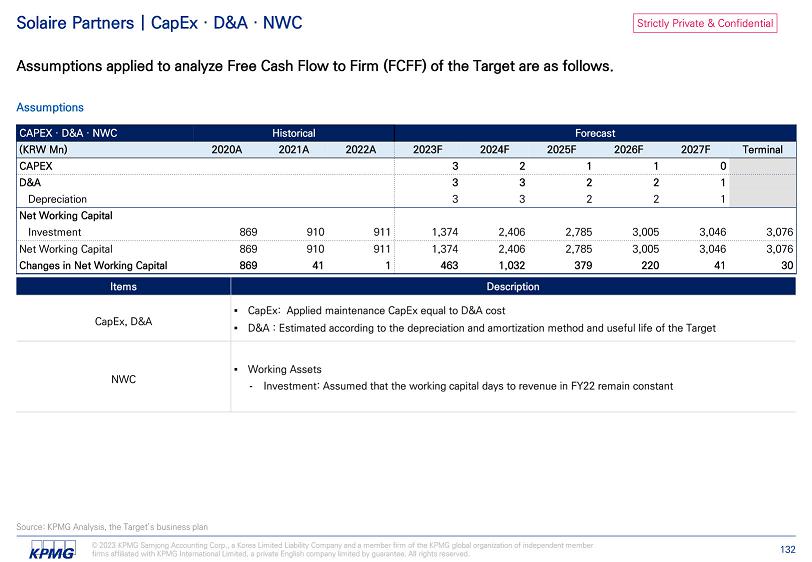

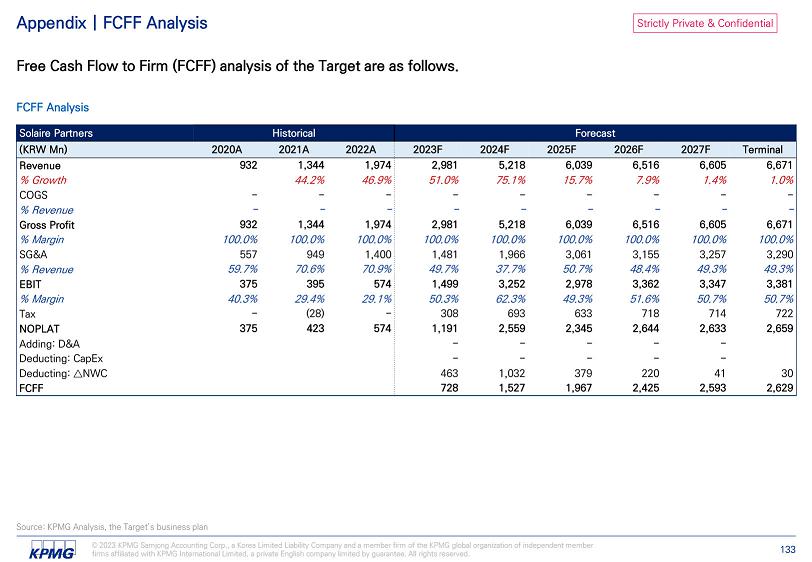

Strictly Private & Confidential K · Enter Holdings | Investment Department Forecast Pro - forma Income Statement 2027F 2026F 2025F 2024F 2023F 2022A (KRW Mn) 6,605 6,516 6,039 5,218 2,981 1,974 Revenue 1.4% 7.9% 15.7% 75.1% 51.0% % Growth - - - - - - COGS - - - - - - % Revenue 6,605 6,516 6,039 5,218 2,981 1,974 Gross Profit 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% % Margin 1.4% 7.9% 15.7% 75.1% 51.0% % Growth 3,257 3,155 3,061 1,966 1,481 1,680 SG&A 49.3% 48.4% 50.7% 37.7% 49.7% 85.1% % Revenue 3,347 3,362 2,978 3,252 1,499 294 EBIT 50.7% 51.6% 49.3% 62.3% 50.3% 14.9% % Margin 3,349 3,364 2,981 3,255 1,502 297 EBITDA 50.7% 51.6% 49.4% 62.4% 50.4% 15.0% % Margin Investment department comprises Solaire Partners, with an anticipated revenue increase at a CAGR of 27.3% and EBITDA increase at a CAGR of 62.4% for the upcoming five years. Investment Department ▪ The Investment department within K - Enter Holdings comprises Solaire Partners and derives its revenue from earning commissions for managing funds. ▪ Solaire Partners is projected to launch 11 new funds during FY23 and FY27, with 27.3% over the next five years. ▪ Commission rates for fund management services will be based on the Target's past experience, ranging from 1.23% to 2.50% depending on the total investment amount. ▪ The Investment department has no cost of goods sold (COGS) since it solely earns commissions, while salaries are classified as selling, general, and administrative (SG&A) expenses. ▪ The EBIT of the Investment department is expected to increase at a CAGR of approximately 62.6% over 5 years, from KRW 0.3 billion in 2022 to KRW 3.3 billion in 2027, while EBITDA is projected to increase at a CAGR of 62.4%, from KRW 0.3 billion in 2022 to KRW 3.3 billion in 2027. Note: 1) The amounts presented in the consolidated financial statements reflect the values after the elimination of internal transactions among the consolidated entities. As a result, there may be discrepancies between the individual financial statements of each subsidiary that will be presented later. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 18

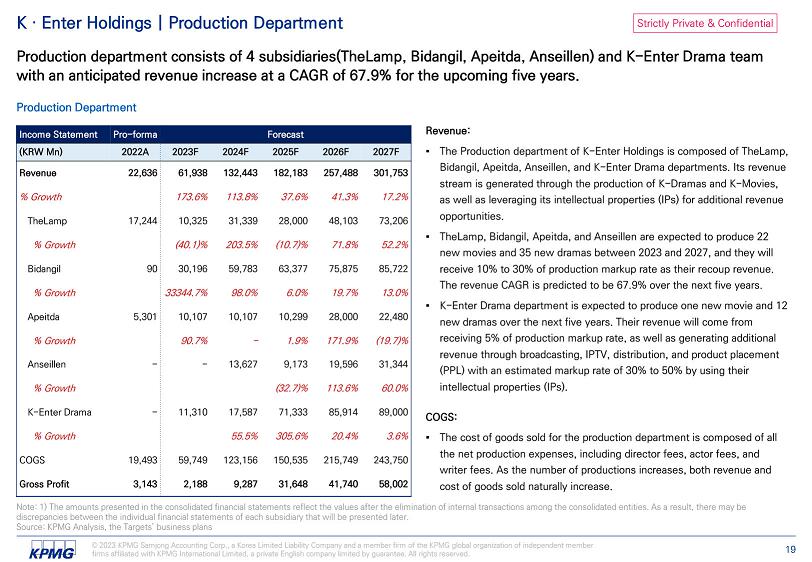

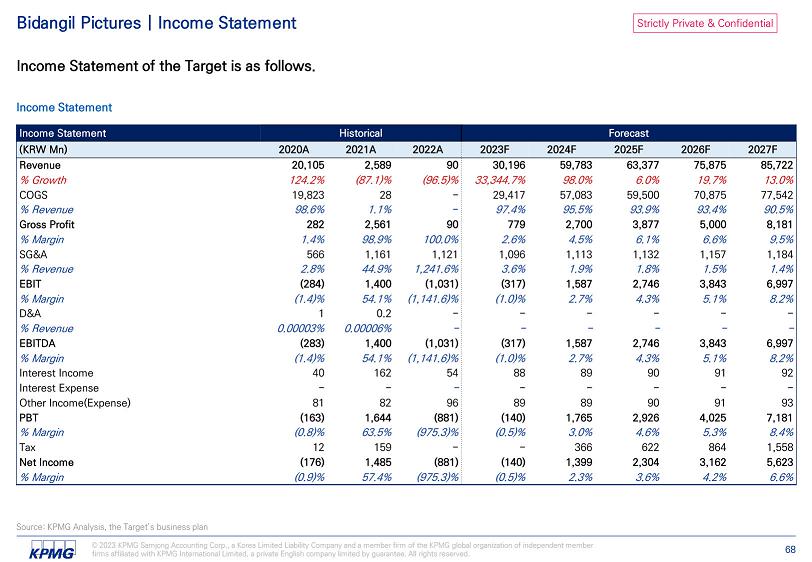

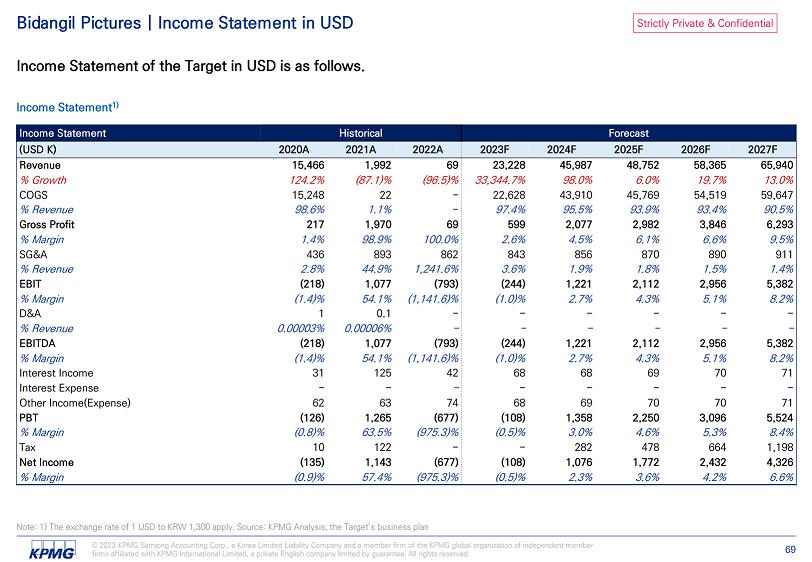

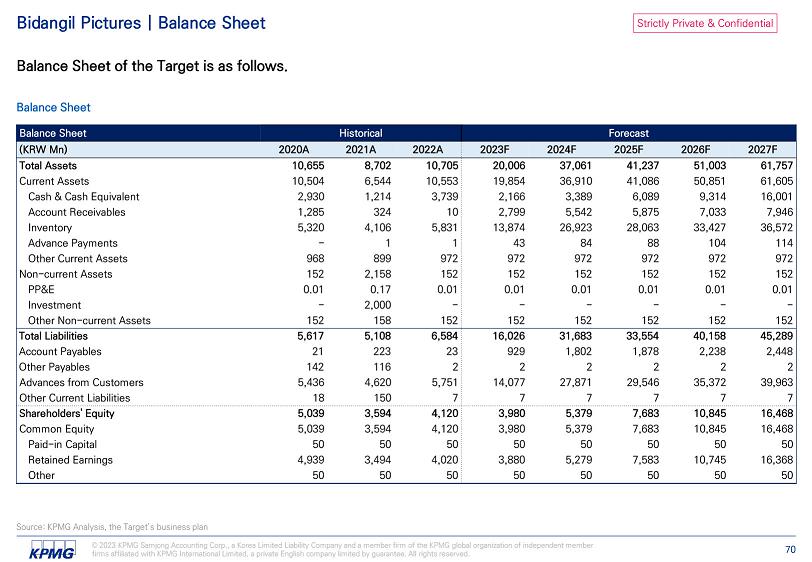

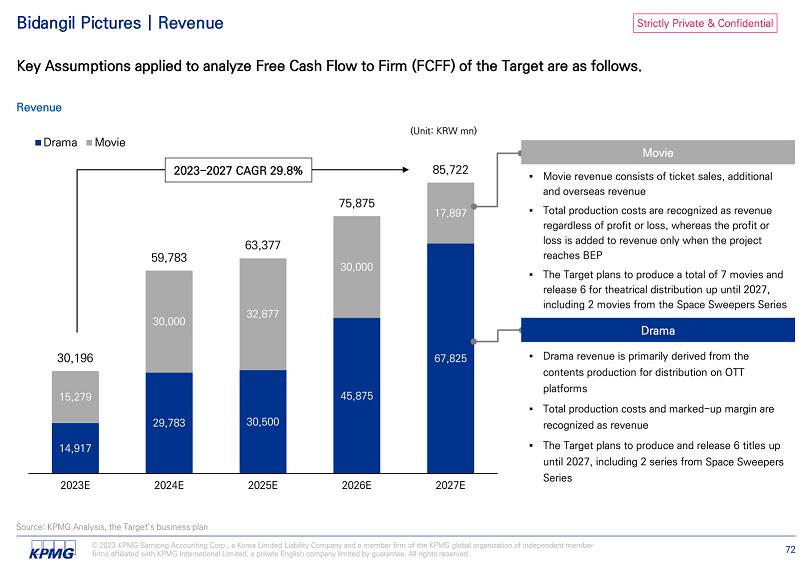

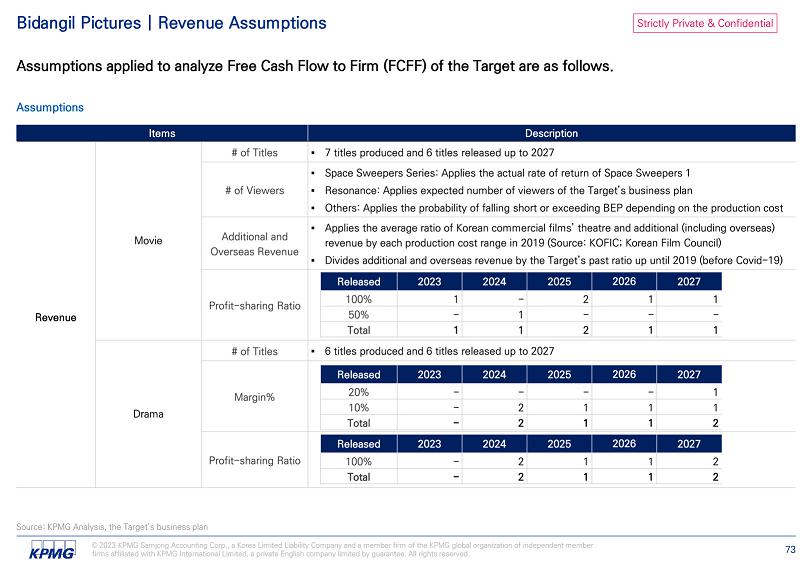

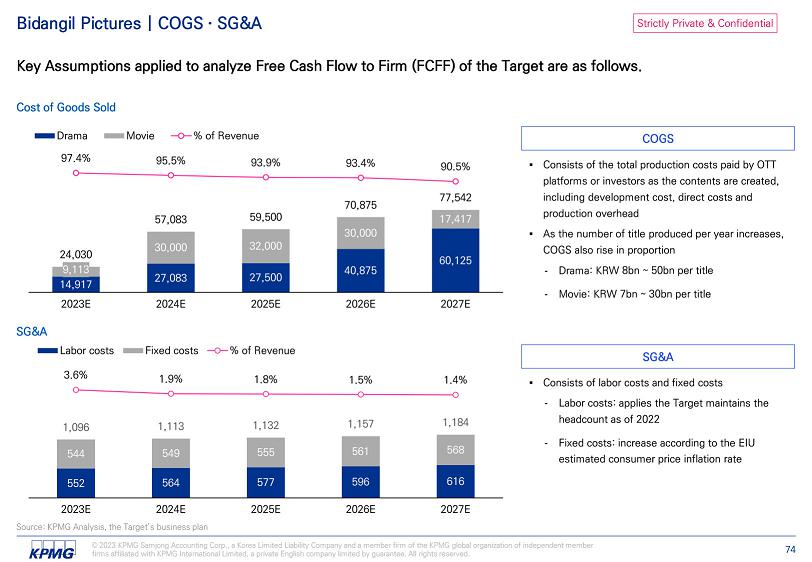

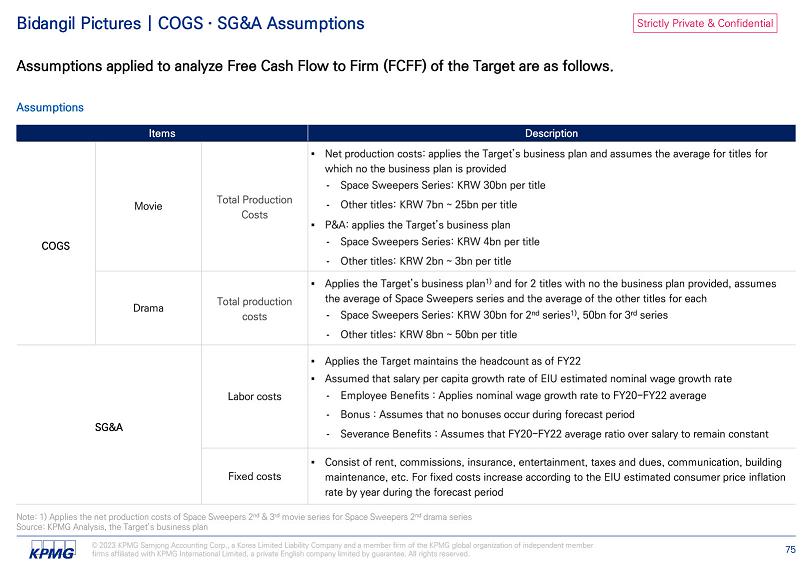

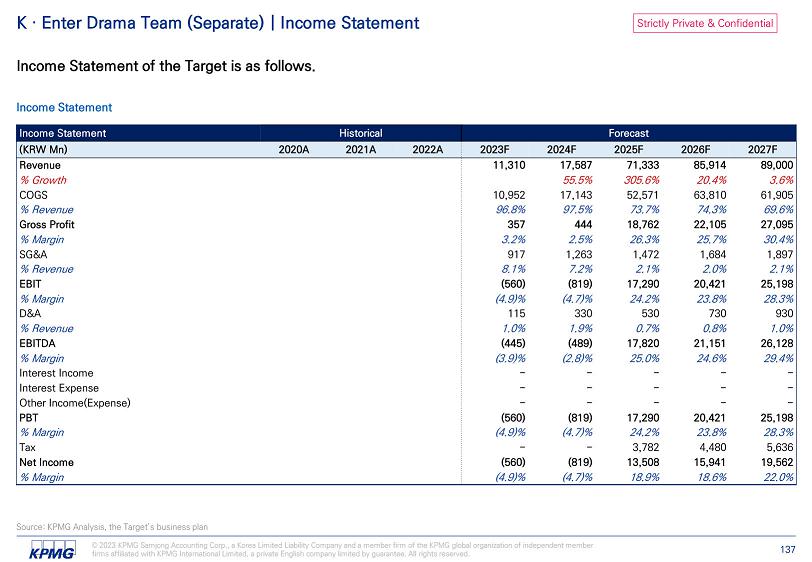

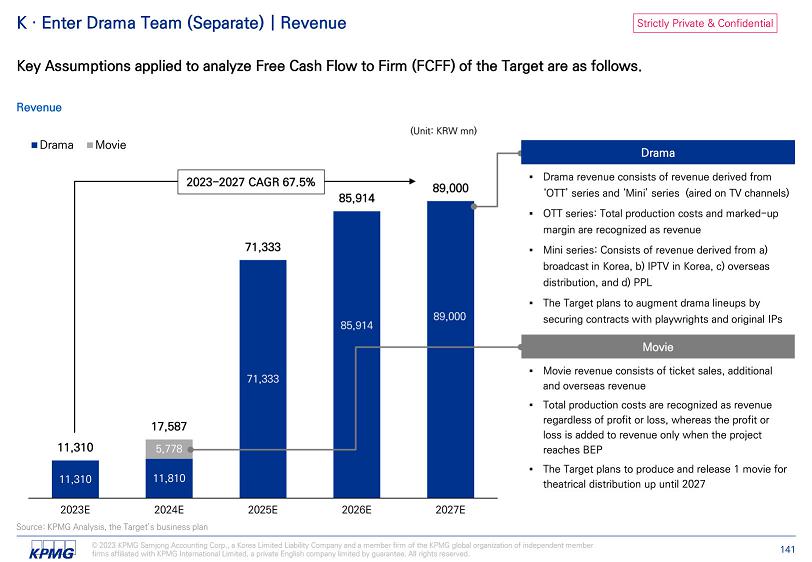

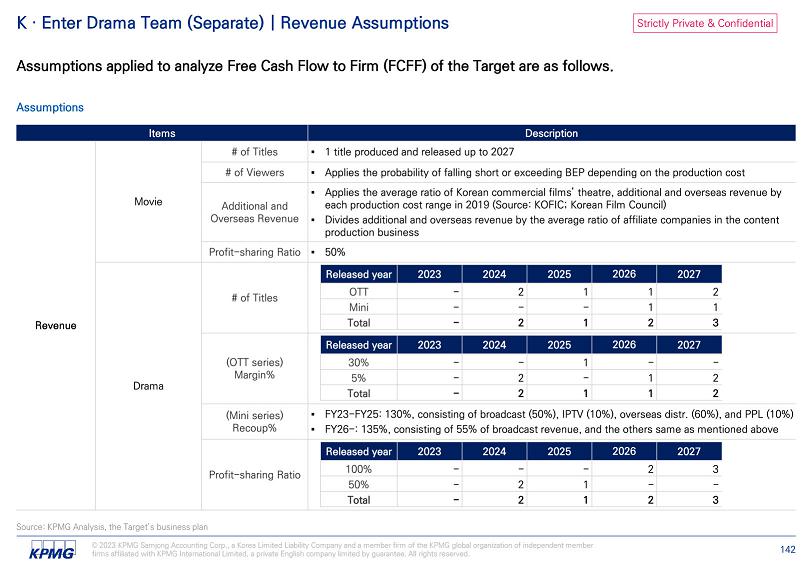

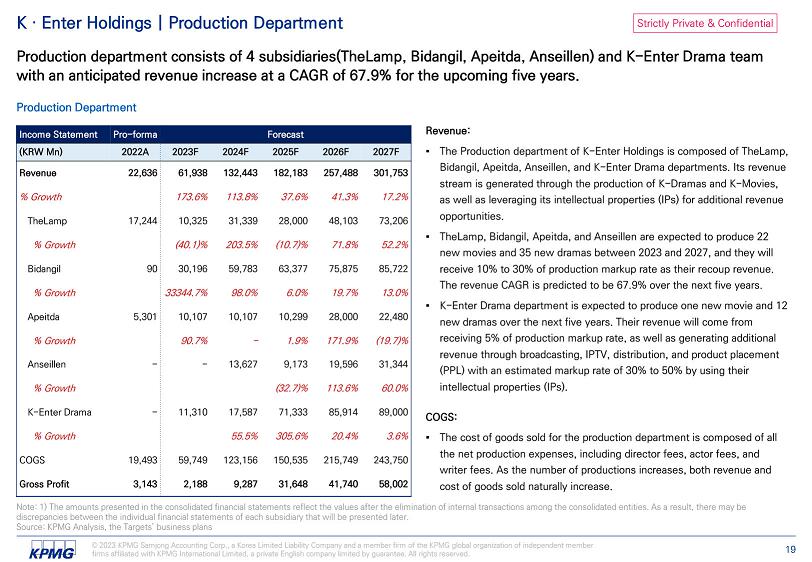

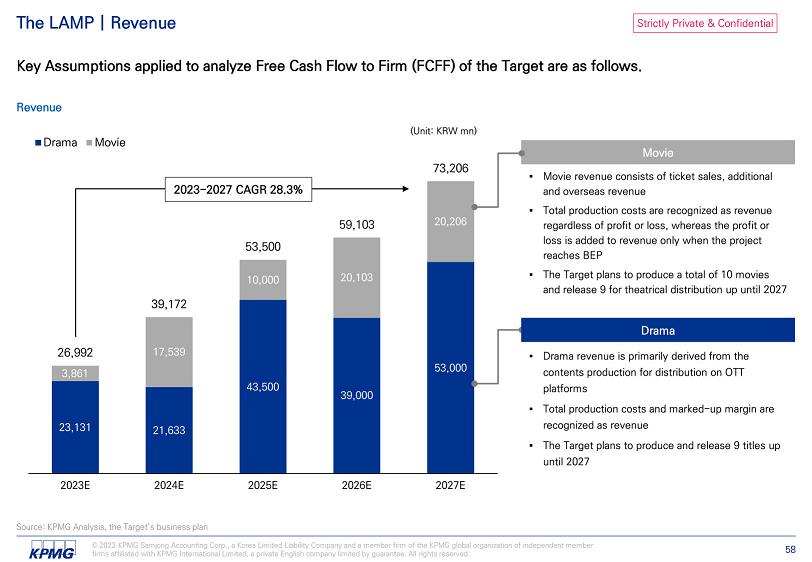

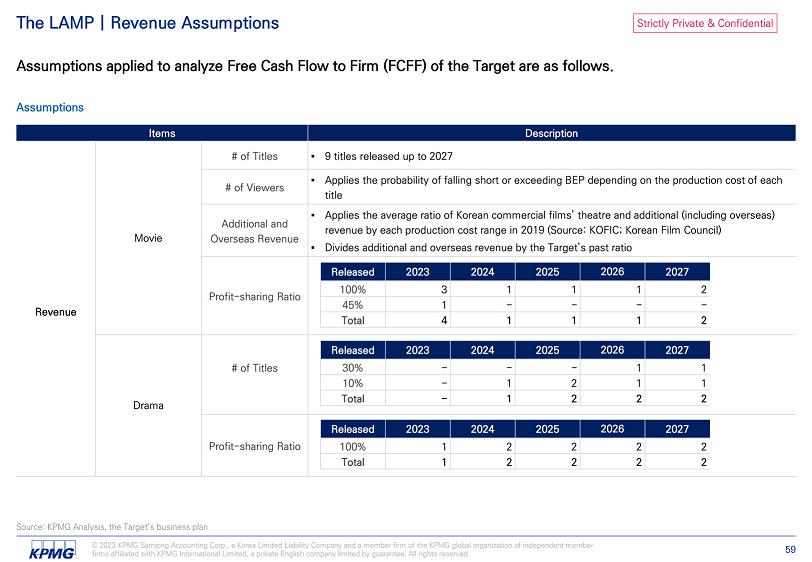

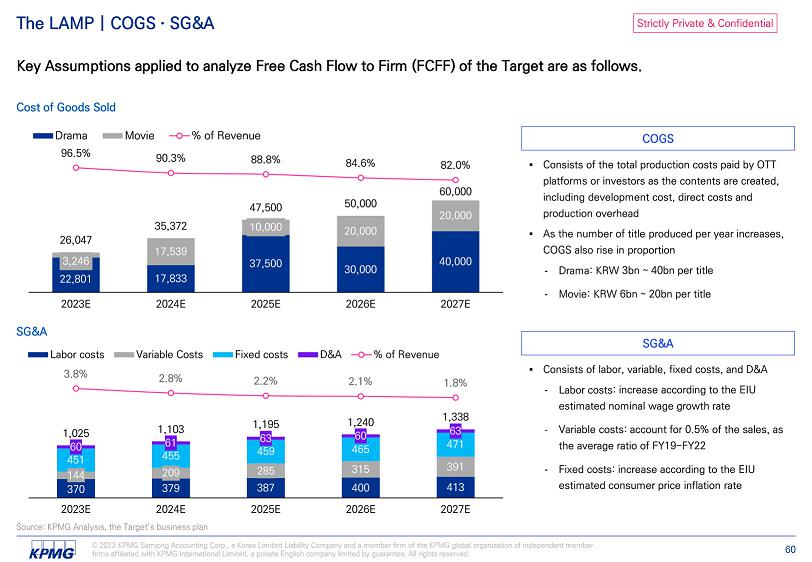

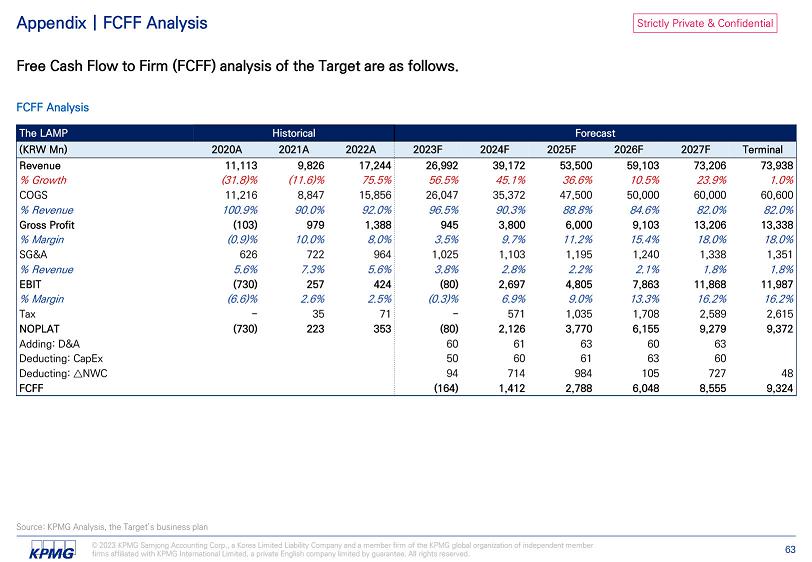

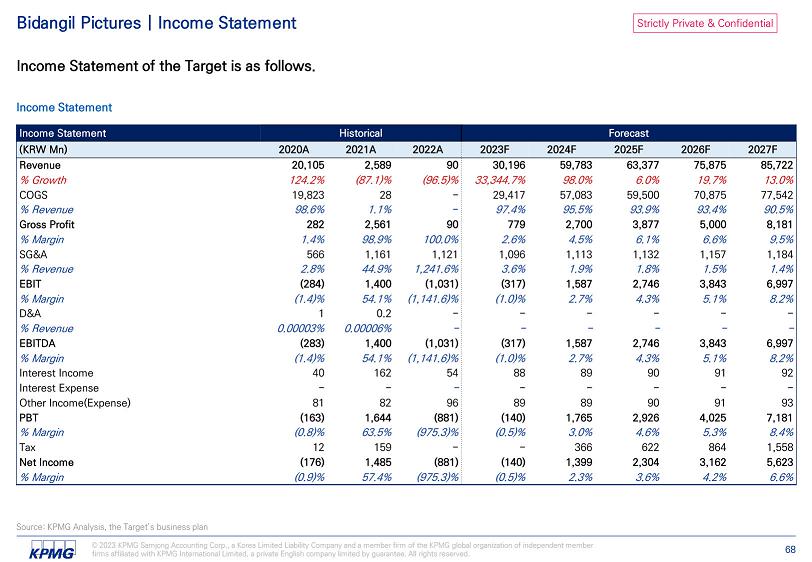

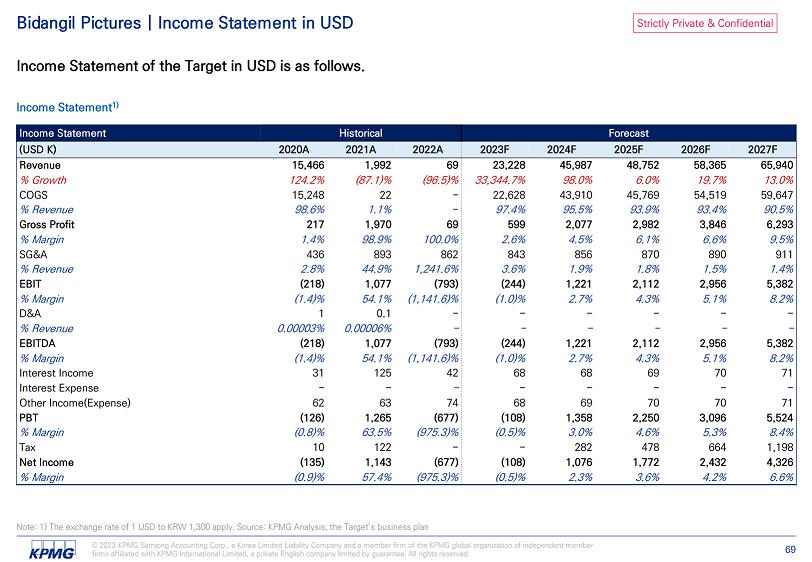

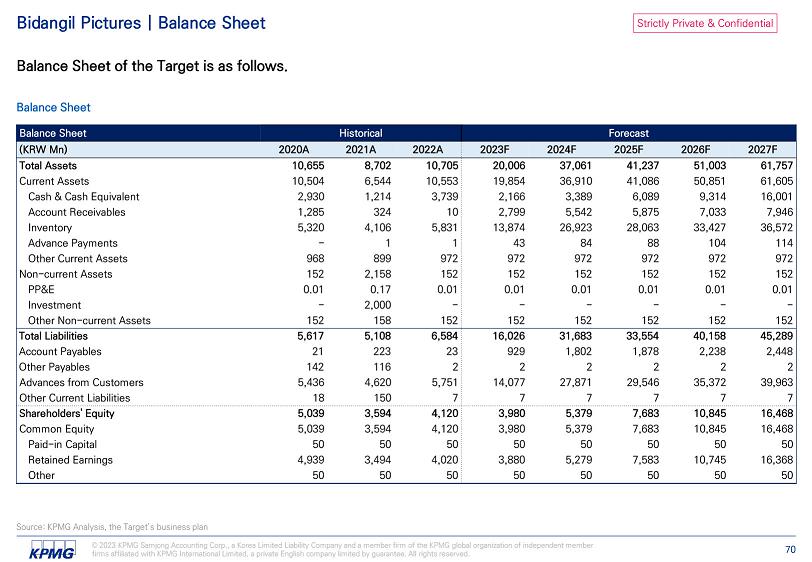

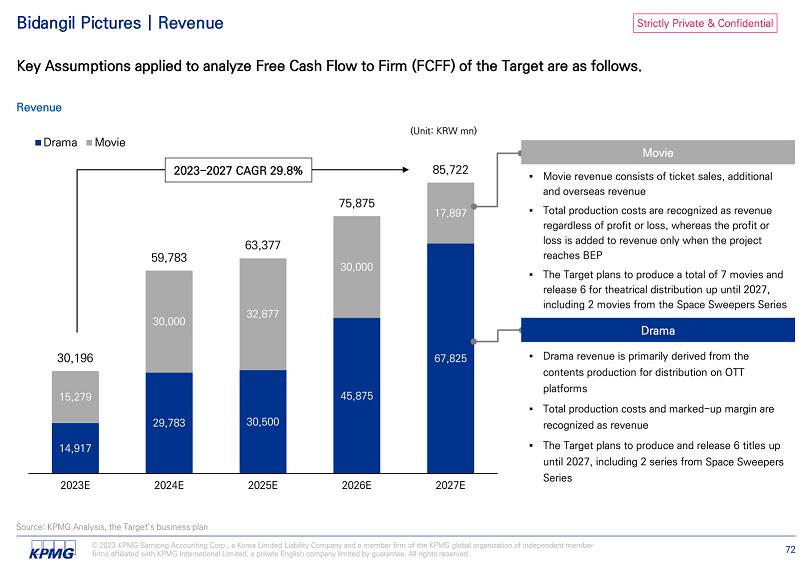

Strictly Private & Confidential K · Enter Holdings | Production Department Forecast Pro - forma Income Statement 2027F 2026F 2025F 2024F 2023F 2022A (KRW Mn) 301,753 257,488 182,183 132,443 61,938 22,636 Revenue 17.2% 41.3% 37.6% 113.8% 173.6% % Growth 73,206 48,103 28,000 31,339 10,325 17,244 TheLamp 52.2% 71.8% (10.7)% 203.5% (40.1)% % Growth 85,722 75,875 63,377 59,783 30,196 90 Bidangil 13.0% 19.7% 6.0% 98.0% 33344.7% % Growth 22,480 28,000 10,299 10,107 10,107 5,301 Apeitda (19.7)% 171.9% 1.9% - 90.7% % Growth 31,344 19,596 9,173 13,627 - - Anseillen 60.0% 113.6% (32.7)% % Growth 89,000 85,914 71,333 17,587 11,310 - K - Enter Drama 3.6% 20.4% 305.6% 55.5% % Growth 243,750 215,749 150,535 123,156 59,749 19,493 COGS 58,002 41,740 31,648 9,287 2,188 3,143 Gross Profit Production department consists of 4 subsidiaries(TheLamp, Bidangil, Apeitda, Anseillen) and K - Enter Drama team with an anticipated revenue increase at a CAGR of 67.9% for the upcoming five years. Production Department ▪ The Production department of K - Enter Holdings is composed of TheLamp, Bidangil, Apeitda, Anseillen, and K - Enter Drama departments. Its revenue stream is generated through the production of K - Dramas and K - Movies, as well as leveraging its intellectual properties (IPs) for additional revenue opportunities. ▪ TheLamp, Bidangil, Apeitda, and Anseillen are expected to produce 22 new movies and 35 new dramas between 2023 and 2027, and they will receive 10% to 30% of production markup rate as their recoup revenue. The revenue CAGR ▪ K - Enter Drama department is expected to produce one new movie and 12 new dramas over the next five years. Their revenue will come from receiving 5% of production markup rate, as well as generating additional revenue through broadcasting, IPTV, distribution, and product placement (PPL) with an estimated markup rate of 30% to 50% by using their intellectual properties (IPs). ▪ The cost of goods sold for the production department is composed of all the net production expenses, including director fees, actor fees, and writer fees. As the number of productions increases, both revenue and cost of goods sold naturally increase. Note: 1) The amounts presented in the consolidated financial statements reflect the values after the elimination of internal transactions among the consolidated entities. As a result, there may be discrepancies between the individual financial statements of each subsidiary that will be presented later. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 19

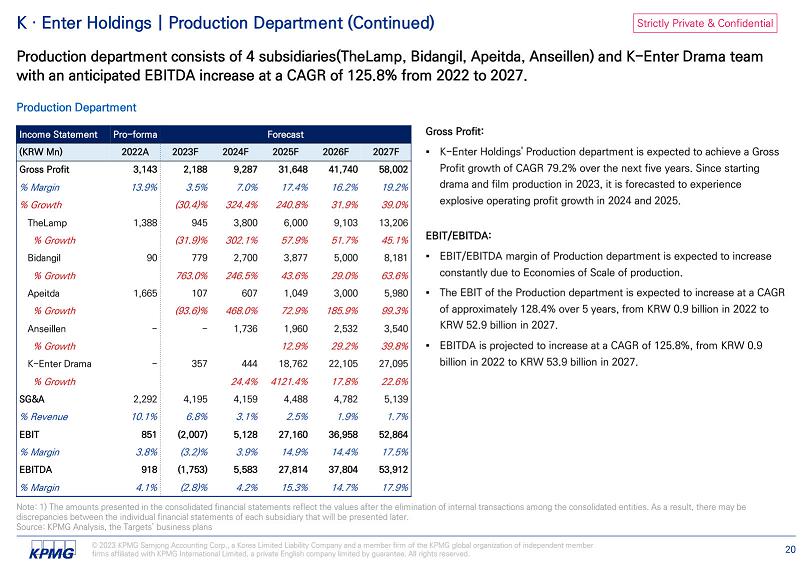

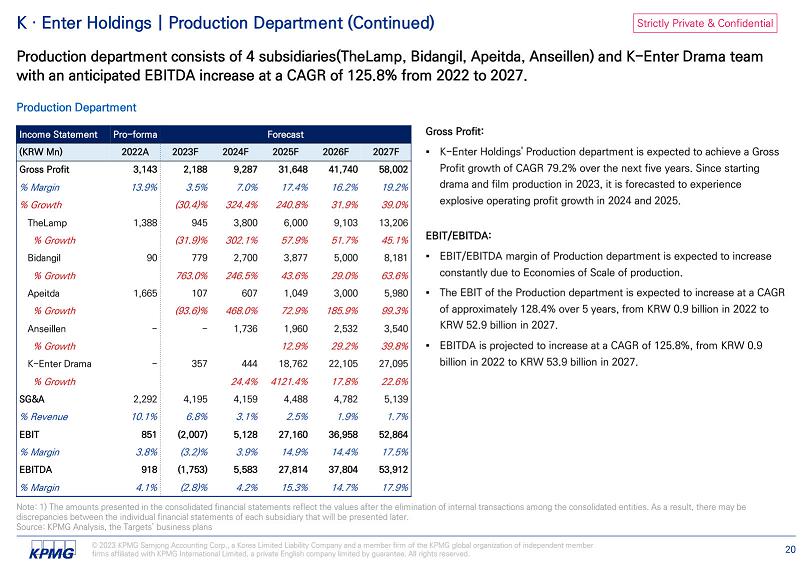

Strictly Private & Confidential K · Enter Holdings | Production Department (Continued) Forecast Pro - forma Income Statement 2027F 2026F 2025F 2024F 2023F 2022A (KRW Mn) 58,002 41,740 31,648 9,287 2,188 3,143 Gross Profit 19.2% 16.2% 17.4% 7.0% 3.5% 13.9% % Margin 39.0% 31.9% 240.8% 324.4% (30.4)% % Growth 13,206 9,103 6,000 3,800 945 1,388 TheLamp 45.1% 51.7% 57.9% 302.1% (31.9)% % Growth 8,181 5,000 3,877 2,700 779 90 Bidangil 63.6% 29.0% 43.6% 246.5% 763.0% % Growth 5,980 3,000 1,049 607 107 1,665 Apeitda 99.3% 185.9% 72.9% 468.0% (93.6)% % Growth 3,540 2,532 1,960 1,736 - - Anseillen 39.8% 29.2% 12.9% % Growth 27,095 22,105 18,762 444 357 - K - Enter Drama 22.6% 17.8% 4121.4% 24.4% % Growth 5,139 4,782 4,488 4,159 4,195 2,292 SG&A 1.7% 1.9% 2.5% 3.1% 6.8% 10.1% % Revenue 52,864 36,958 27,160 5,128 (2,007) 851 EBIT 17.5% 14.4% 14.9% 3.9% (3.2)% 3.8% % Margin 53,912 37,804 27,814 5,583 (1,753) 918 EBITDA 17.9% 14.7% 15.3% 4.2% (2.8)% 4.1% % Margin Production department consists of 4 subsidiaries(TheLamp, Bidangil, Apeitda, Anseillen) and K - Enter Drama team with an anticipated EBITDA increase at a CAGR of 125.8% from 2022 to 2027. Production Department ▪ K - Enter Holdings' Production department is expected to achieve a Gross Profit growth of CAGR 79.2% over the next five years. Since starting drama and film production in 2023, it is forecasted to experience explosive operating profit growth in 2024 and 2025. ▪ EBIT/EBITDA margin of Production department is expected to increase constantly due to Economies of Scale of production. ▪ The EBIT of the Production department is expected to increase at a CAGR of approximately 128.4% over 5 years, from KRW 0.9 billion in 2022 to KRW 52.9 billion in 2027. ▪ EBITDA is projected to increase at a CAGR of 125.8%, from KRW 0.9 billion in 2022 to KRW 53.9 billion in 2027. Note: 1) The amounts presented in the consolidated financial statements reflect the values after the elimination of internal transactions among the consolidated entities. As a result, there may be discrepancies between the individual financial statements of each subsidiary that will be presented later. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 20

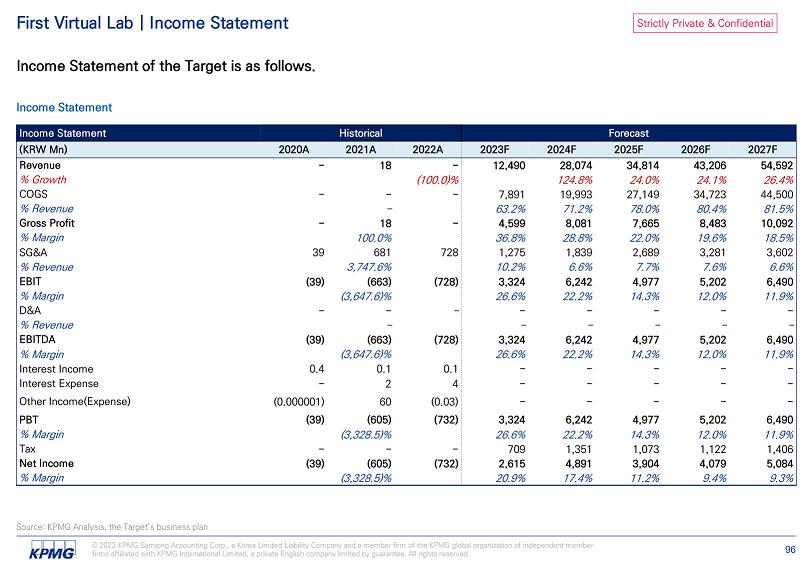

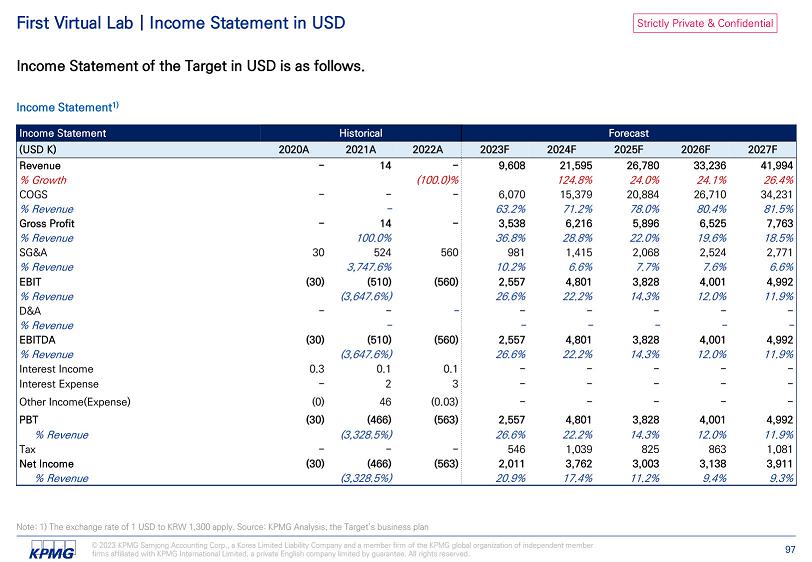

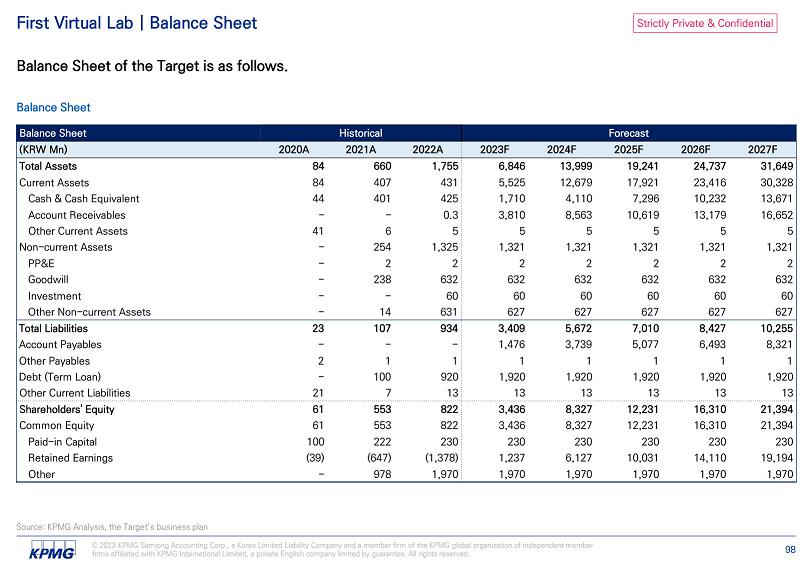

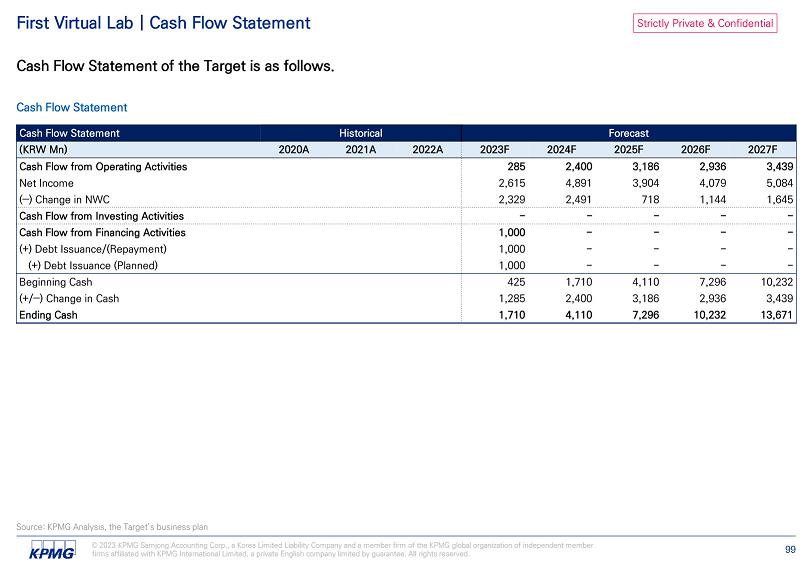

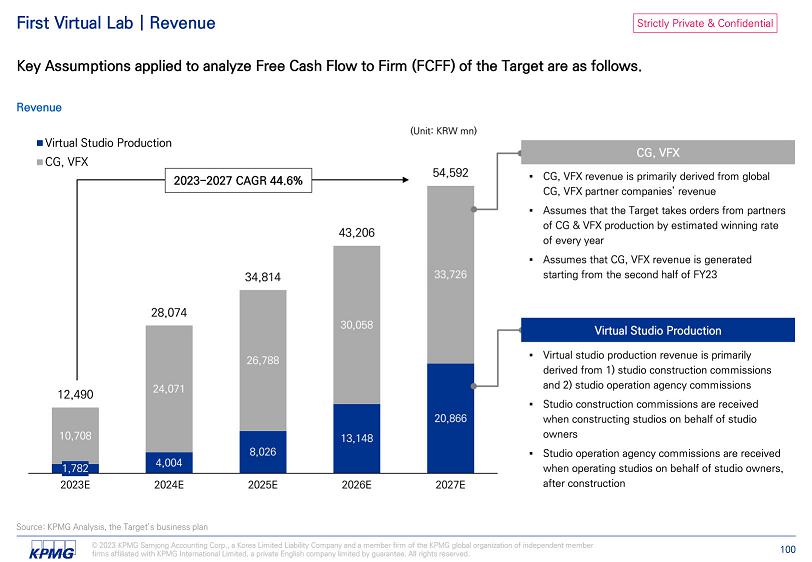

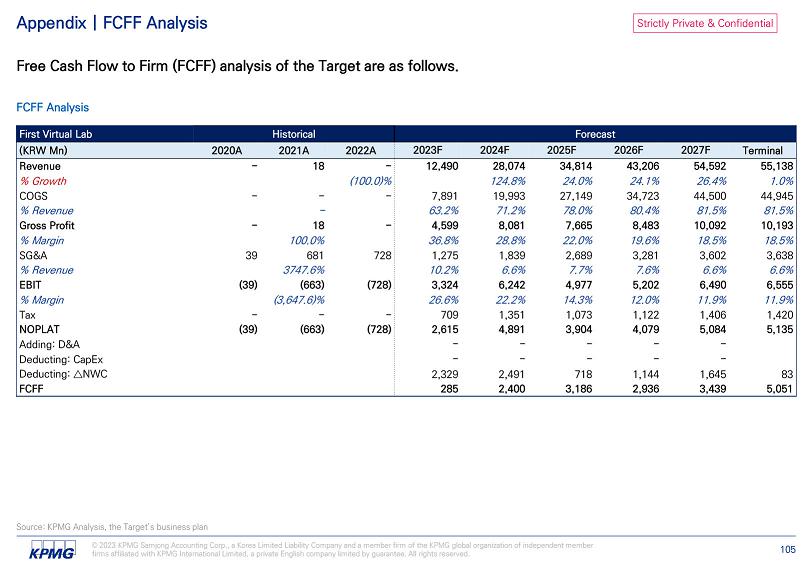

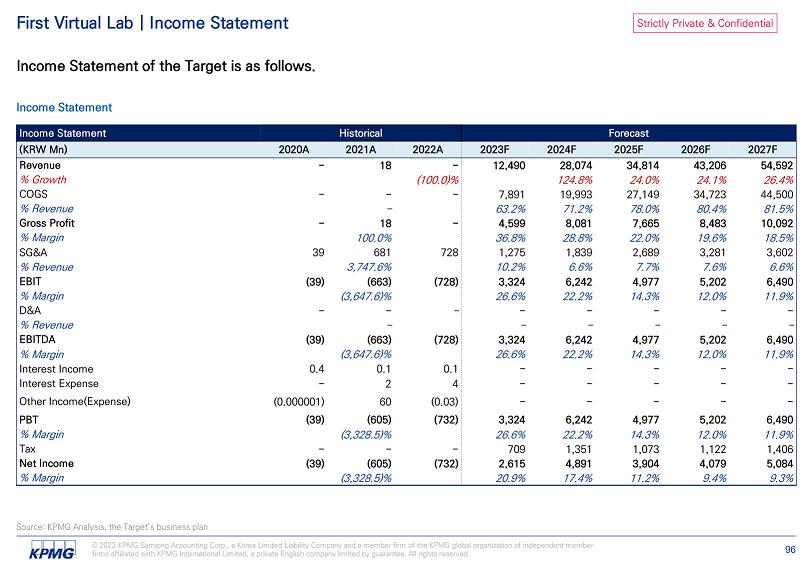

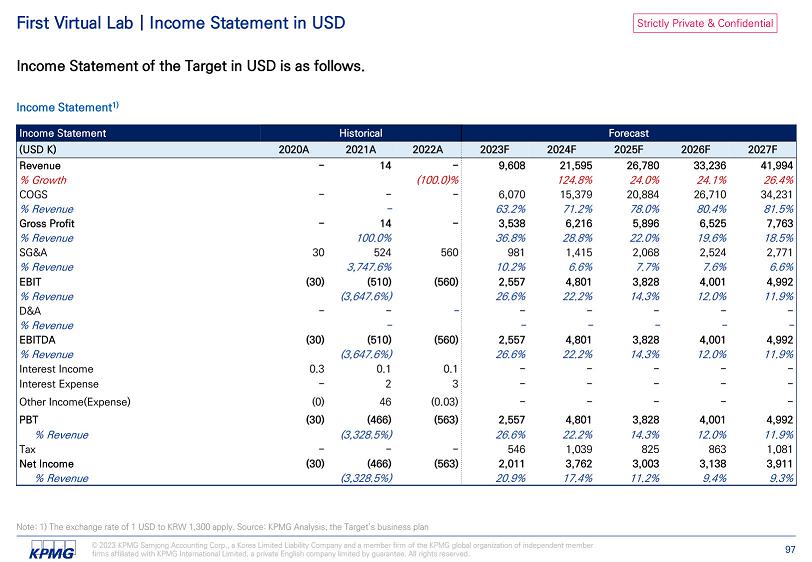

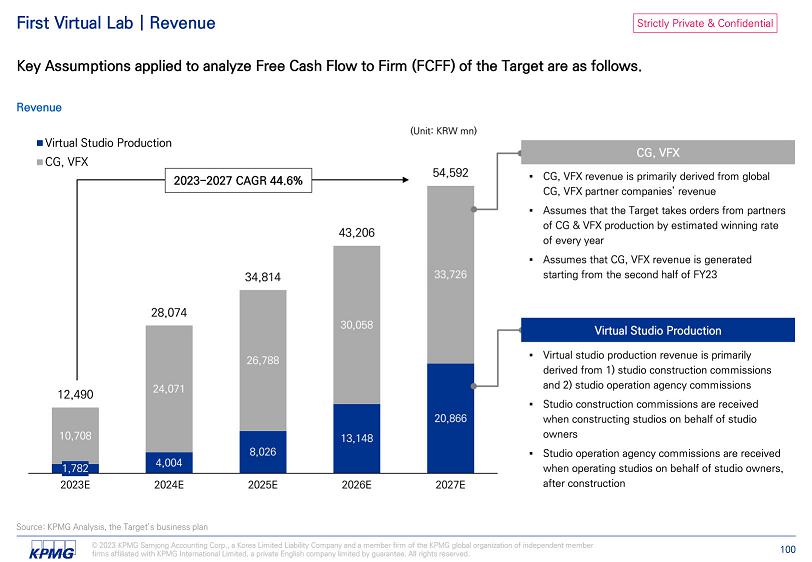

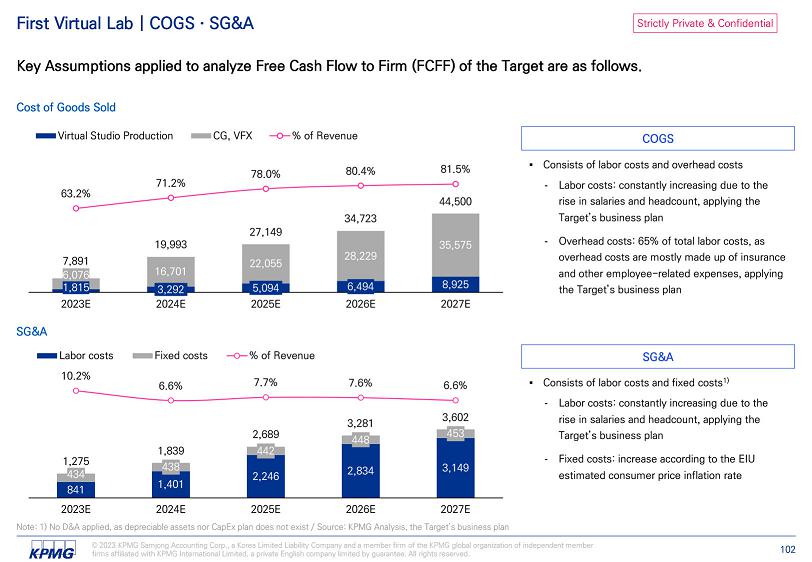

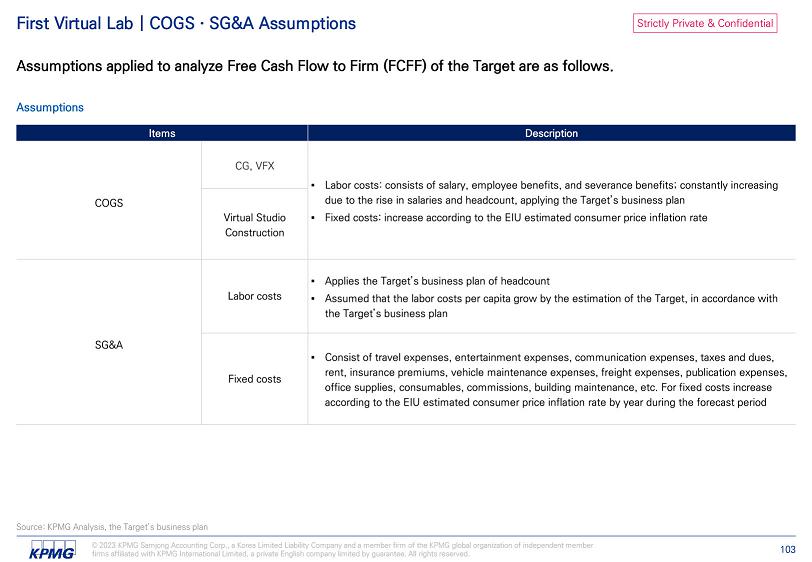

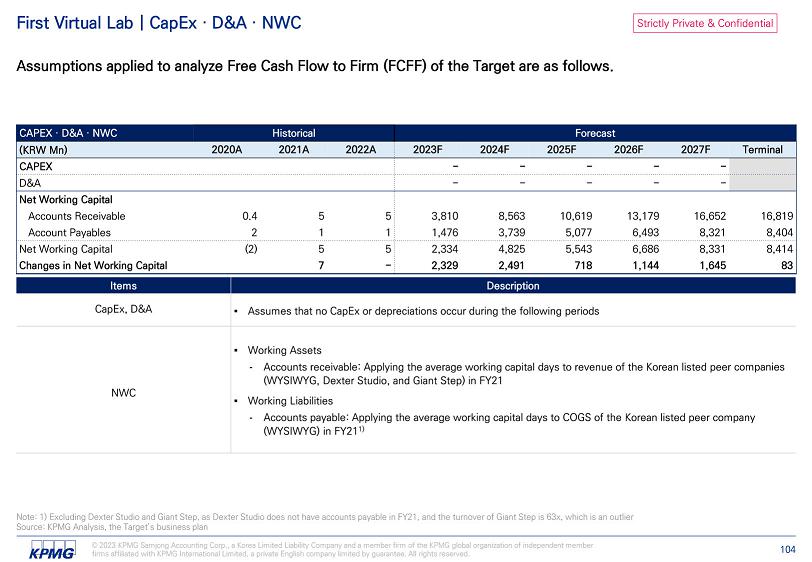

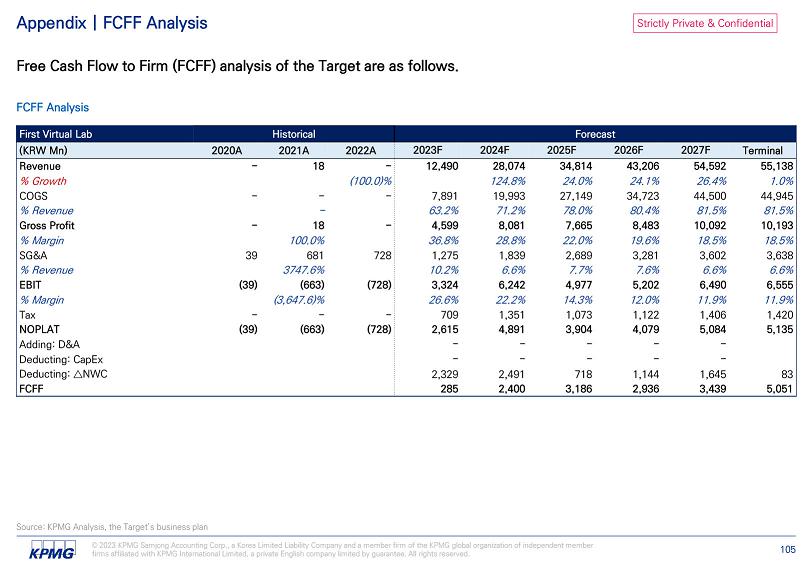

Strictly Private & Confidential K · Enter Holdings | CG/VFX Department Forecast Pro - forma Income Statement 2027F 2026F 2025F 2024F 2023F 2022A (KRW Mn) 54,592 43,206 34,814 28,074 12,490 - Revenue 26.4% 24.1% 24.0% 124.8% % Growth 44,500 34,723 27,149 19,993 7,891 - COGS 81.5% 80.4% 78.0% 71.2% 63.2% % Revenue 10,092 8,483 7,665 8,081 4,599 - Gross Profit 18.5% 19.6% 22.0% 28.8% 36.8% % Margin 19.0% 10.7% (5.1)% 75.7% % Growth 3,602 3,281 2,689 1,839 1,275 728 SG&A 6.6% 7.6% 7.7% 6.6% 10.2% % Revenue 6,490 5,202 4,977 6,242 3,324 (728) EBIT 11.9% 12.0% 14.3% 22.2% 26.6% % Margin 6,490 5,202 4,977 6,242 3,324 (728) EBITDA 11.9% 12.0% 14.3% 22.2% 26.6% % Margin CG/VFX department comprises First Virtual Lab, with an anticipated revenue increase at a CAGR of 44.6% and EBITDA increase at a CAGR of 18.2% between 2023 and 2027. Income Statement (CG/VFX Dpt.) ▪ The CG/VFX department of K - Enter Holdings comprises First Virtual Lab(FVL). The revenue of First Virtual Lab is divided into two categories: CG/VFX and virtual studio construction. ▪ The revenue from CG/VFX is generated through orders from global CG/VFX companies. As the demand for CG continues to rise not only in movies but also in dramas and other video contents, a significant increase in CG/VFX revenue is expected starting from the FY23 Q2. ▪ The revenue from virtual studio construction ▪ According to the consolidated financial statements, EBIT/EBITDA is expected to grow at a CAGR of 18.2% over the next five years from 2023 to 2027, with an estimated increase from KRW 3.3 billion in 2023 to KRW 6.5 billion in 2027. Note: 1) The amounts presented in the consolidated financial statements reflect the values after the elimination of internal transactions among the consolidated entities. As a result, there may be discrepancies between the individual financial statements of each subsidiary that will be presented later. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 21

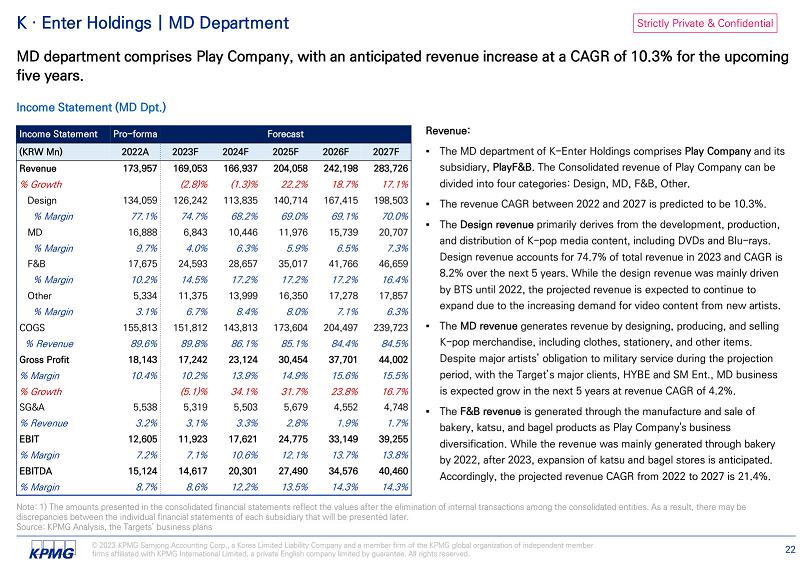

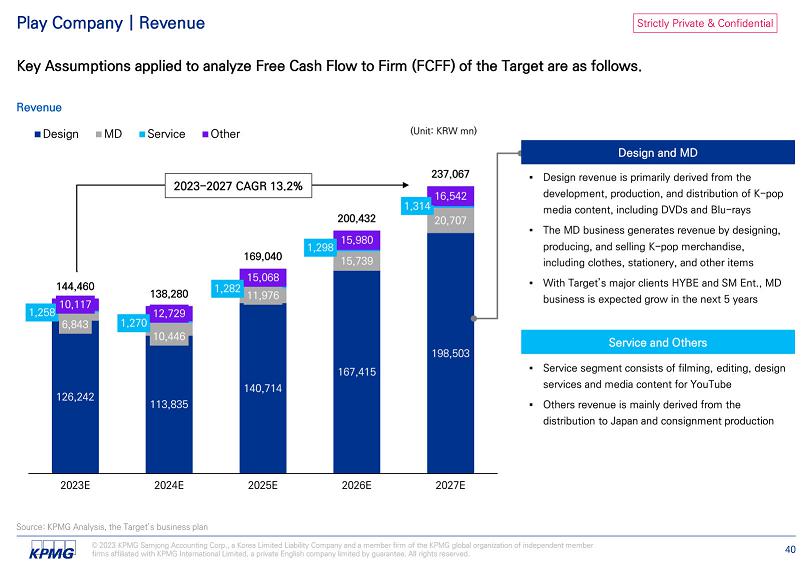

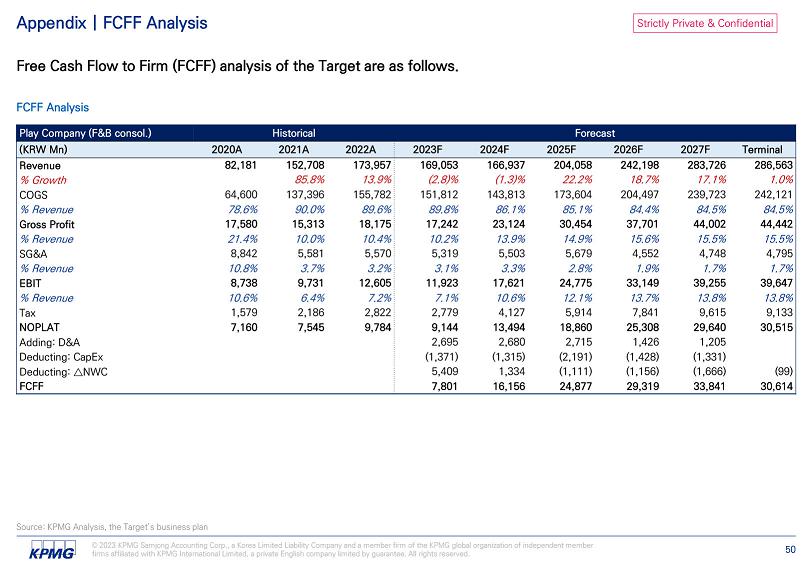

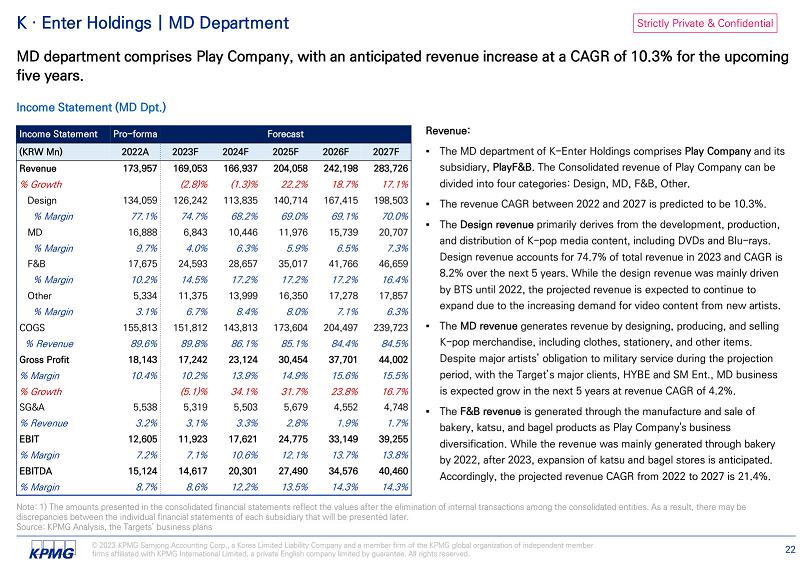

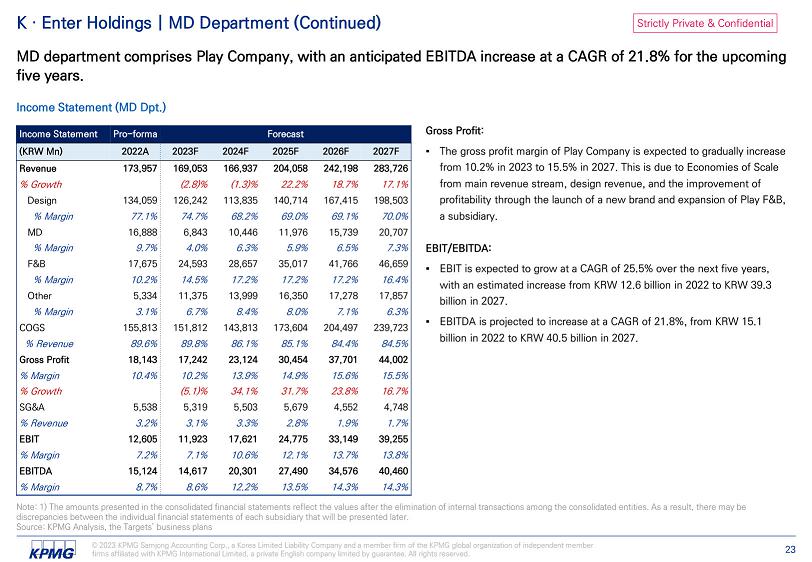

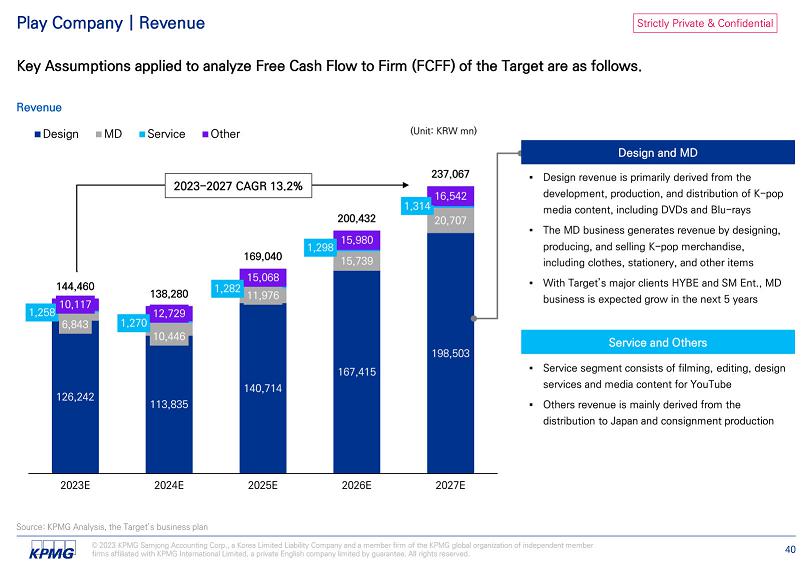

Strictly Private & Confidential MD department comprises Play Company, with an anticipated revenue increase at a CAGR of 10.3% for the upcoming five years. Income Statement (MD Dpt.) ▪ The MD department of K - Enter Holdings comprises Play Company and its subsidiary, PlayF&B. The Consolidated revenue of Play Company can be divided into four categories: Design, MD, F&B, Other. ▪ The Design revenue accounts for 74.7% of total revenue in 2023 and CAGR is 8.2% over the next 5 years. While the design revenue was mainly driven by BTS until 2022, the projected revenue is expected to continue to expand due to the increasing demand for video content from new artists. ▪ The MD revenue generates revenue by designing, producing, and selling K - pop merchandise, including clothes, stationery, and other items ▪ The F&B revenue is generated through the manufacture and sale of bakery, katsu, and bagel products as Play Company's business diversification. While the revenue was mainly generated through bakery by 2022, after 2023, expansion of katsu and bagel stores is anticipated. Accordingly, the projected revenue CAGR from 2022 to 2027 is 21.4%. Note: 1) The amounts presented in the consolidated financial statements reflect the values after the elimination of internal transactions among the consolidated entities. As a result, there may be discrepancies between the individual financial statements of each subsidiary that will be presented later. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 22 K · Enter Holdings | MD Department Forecast Pro - forma Income Statement 2027F 2026F 2025F 2024F 2023F 2022A (KRW Mn) 283,726 242,198 204,058 166,937 169,053 173,957 Revenue 17.1% 18.7% 22.2% (1.3)% (2.8)% % Growth 198,503 167,415 140,714 113,835 126,242 134,059 Design 70.0% 69.1% 69.0% 68.2% 74.7% 77.1% % Margin 20,707 15,739 11,976 10,446 6,843 16,888 MD 7.3% 6.5% 5.9% 6.3% 4.0% 9.7% % Margin 46,659 41,766 35,017 28,657 24,593 17,675 F&B 16.4% 17.2% 17.2% 17.2% 14.5% 10.2% % Margin 17,857 17,278 16,350 13,999 11,375 5,334 Other 6.3% 7.1% 8.0% 8.4% 6.7% 3.1% % Margin 239,723 204,497 173,604 143,813 151,812 155,813 COGS 84.5% 84.4% 85.1% 86.1% 89.8% 89.6% % Revenue 44,002 37,701 30,454 23,124 17,242 18,143 Gross Profit 15.5% 15.6% 14.9% 13.9% 10.2% 10.4% % Margin 16.7% 23.8% 31.7% 34.1% (5.1)% % Growth 4,748 4,552 5,679 5,503 5,319 5,538 SG&A 1.7% 1.9% 2.8% 3.3% 3.1% 3.2% % Revenue 39,255 33,149 24,775 17,621 11,923 12,605 EBIT 13.8% 13.7% 12.1% 10.6% 7.1% 7.2% % Margin 40,460 34,576 27,490 20,301 14,617 15,124 EBITDA 14.3% 14.3% 13.5% 12.2% 8.6% 8.7% % Margin

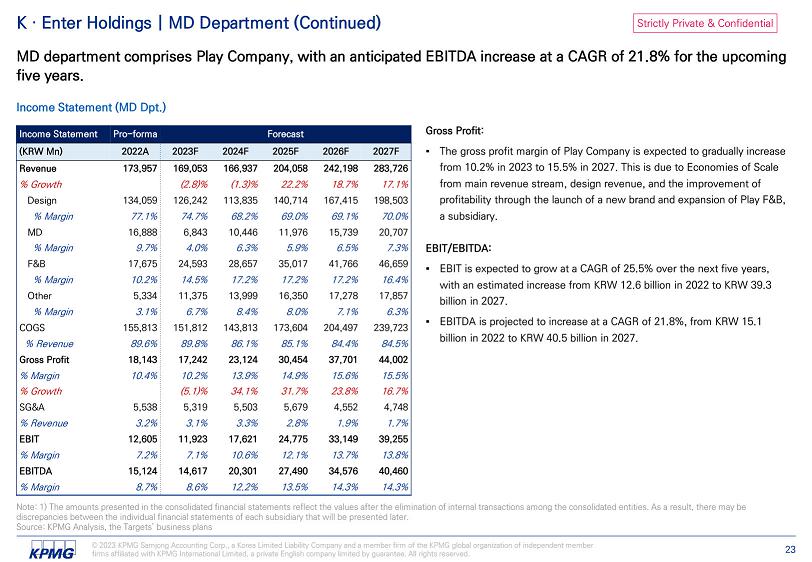

Strictly Private & Confidential K · Enter Holdings | MD Department (Continued) Forecast Pro - forma Income Statement 2027F 2026F 2025F 2024F 2023F 2022A (KRW Mn) 283,726 242,198 204,058 166,937 169,053 173,957 Revenue 17.1% 18.7% 22.2% (1.3)% (2.8)% % Growth 198,503 167,415 140,714 113,835 126,242 134,059 Design 70.0% 69.1% 69.0% 68.2% 74.7% 77.1% % Margin 20,707 15,739 11,976 10,446 6,843 16,888 MD 7.3% 6.5% 5.9% 6.3% 4.0% 9.7% % Margin 46,659 41,766 35,017 28,657 24,593 17,675 F&B 16.4% 17.2% 17.2% 17.2% 14.5% 10.2% % Margin 17,857 17,278 16,350 13,999 11,375 5,334 Other 6.3% 7.1% 8.0% 8.4% 6.7% 3.1% % Margin 239,723 204,497 173,604 143,813 151,812 155,813 COGS 84.5% 84.4% 85.1% 86.1% 89.8% 89.6% % Revenue 44,002 37,701 30,454 23,124 17,242 18,143 Gross Profit 15.5% 15.6% 14.9% 13.9% 10.2% 10.4% % Margin 16.7% 23.8% 31.7% 34.1% (5.1)% % Growth 4,748 4,552 5,679 5,503 5,319 5,538 SG&A 1.7% 1.9% 2.8% 3.3% 3.1% 3.2% % Revenue 39,255 33,149 24,775 17,621 11,923 12,605 EBIT 13.8% 13.7% 12.1% 10.6% 7.1% 7.2% % Margin 40,460 34,576 27,490 20,301 14,617 15,124 EBITDA 14.3% 14.3% 13.5% 12.2% 8.6% 8.7% % Margin MD department comprises Play Company, with an anticipated EBITDA increase at a CAGR of 21.8% for the upcoming five years. Income Statement (MD Dpt.) ▪ The gross profit margin of Play Company is expected to gradually increase from 10.2% in 2023 to 15.5% in 2027. This is due to Economies of Scale from main revenue stream, design revenue, and the improvement of profitability through the launch of a new brand and expansion of Play F&B, a subsidiary. ▪ EBIT is expected to grow at a CAGR of 25 . 5 % over the next five years, with an estimated increase from KRW 12 . 6 billion in 2022 to KRW 39 . 3 billion in 2027 . ▪ EBITDA is projected to increase at a CAGR of 21 . 8 % , from KRW 15 . 1 billion in 2022 to KRW 40 . 5 billion in 2027 . Note: 1) The amounts presented in the consolidated financial statements reflect the values after the elimination of internal transactions among the consolidated entities. As a result, there may be discrepancies between the individual financial statements of each subsidiary that will be presented later. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 23

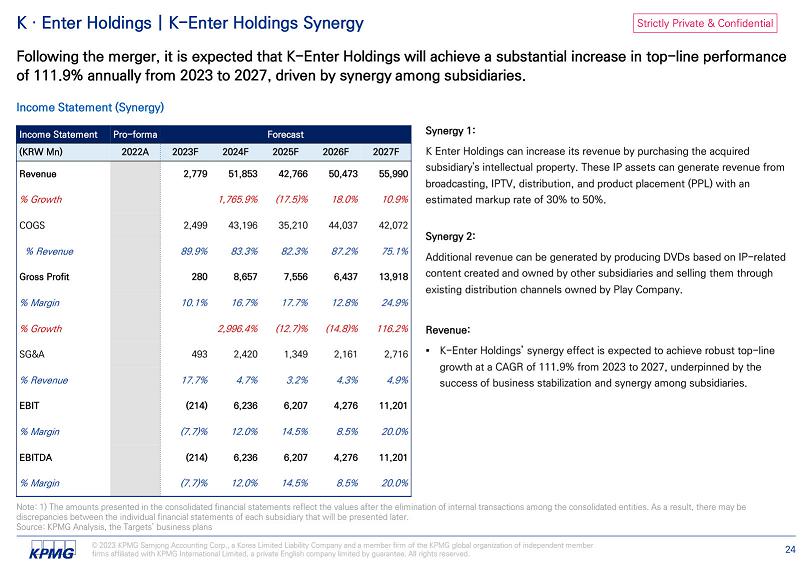

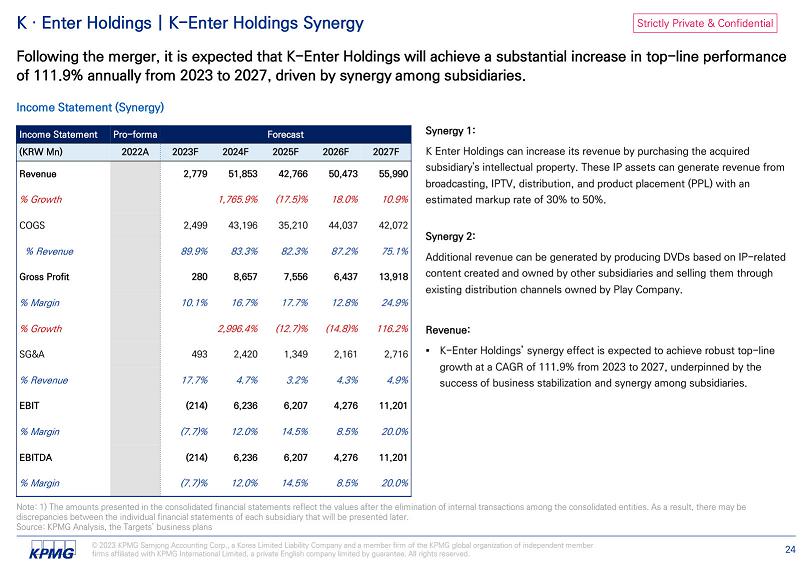

Strictly Private & Confidential K · Enter Holdings | K - Enter Holdings Synergy Forecast Pro - forma Income Statement 2027F 2026F 2025F 2024F 2023F 2022A (KRW Mn) 55,990 50,473 42,766 51,853 2,779 Revenue 10.9% 18.0% (17.5)% 1,765.9% % Growth 42,072 44,037 35,210 43,196 2,499 COGS 75.1% 87.2% 82.3% 83.3% 89.9% % Revenue 13,918 6,437 7,556 8,657 280 Gross Profit 24.9% 12.8% 17.7% 16.7% 10.1% % Margin 116.2% (14.8)% (12.7)% 2,996.4% % Growth 2,716 2,161 1,349 2,420 493 SG&A 4.9% 4.3% 3.2% 4.7% 17.7% % Revenue 11,201 4,276 6,207 6,236 (214) EBIT 20.0% 8.5% 14.5% 12.0% (7.7)% % Margin 11,201 4,276 6,207 6,236 (214) EBITDA 20.0% 8.5% 14.5% 12.0% (7.7)% % Margin Following the merger, it is expected that K - Enter Holdings will achieve a substantial increase in top - line performance of 111.9% annually from 2023 to 2027, driven by synergy among subsidiaries. Income Statement (Synergy) K Enter Holdings can increase its revenue by purchasing the acquired subsidiary's intellectual property. These IP assets can generate revenue from broadcasting, IPTV, distribution, and product placement (PPL) with an estimated markup rate of 30% to 50%. Additional revenue can be generated by producing DVDs based on IP - related content created and owned by other subsidiaries and selling them through existing distribution channels owned by Play Company. ▪ K - Enter Holdings’ synergy effect is expected to achieve robust top - line growth at a CAGR of 111.9% from 2023 to 2027, underpinned by the success of business stabilization and synergy among subsidiaries. Note: 1) The amounts presented in the consolidated financial statements reflect the values after the elimination of internal transactions among the consolidated entities. As a result, there may be discrepancies between the individual financial statements of each subsidiary that will be presented later. Source: KPMG Analysis, the Targets’ business plans © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 24

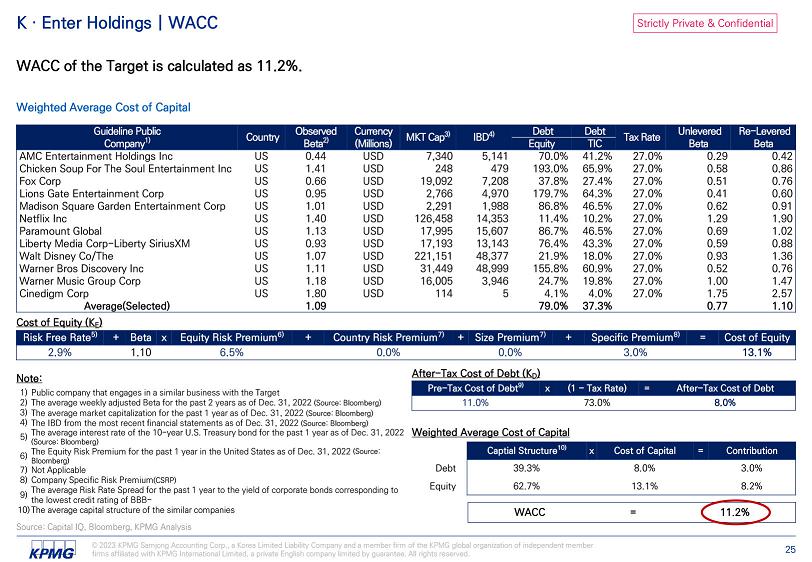

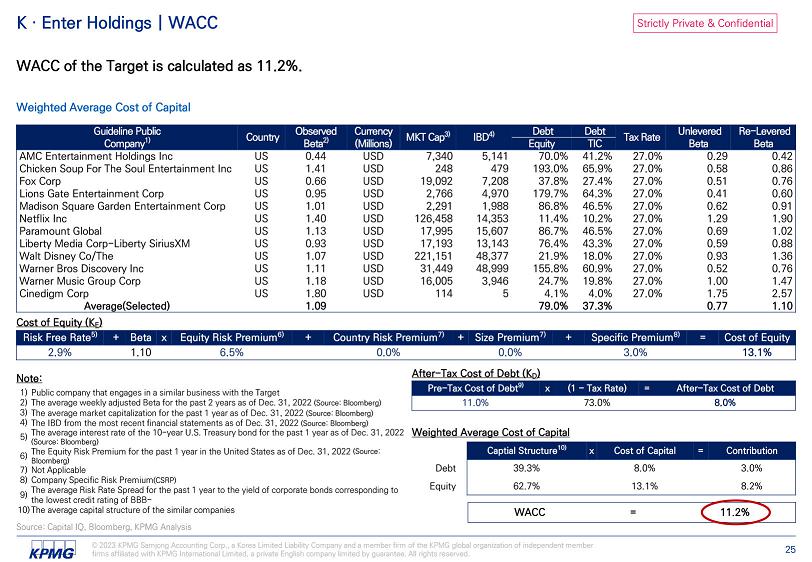

Strictly Private & Confidential K · Enter Holdings | WACC WACC of the Target is calculated as 11.2%. Weighted Average Cost of Capital Re - Levered Beta Unlevered Beta Tax Rate Debt Debt IBD 4) MKT Cap 3) Currency Observed Beta 2) Country Guideline Public TIC Equity (Millions) Company 1) 0.42 0.29 27.0% 41.2% 70.0% 5,141 7,340 USD 0.44 US AMC Entertainment Holdings Inc 0.86 0.58 27.0% 65.9% 193.0% 479 248 USD 1.41 US Chicken Soup For The Soul Entertainment Inc 0.76 0.51 27.0% 27.4% 37.8% 7,208 19,092 USD 0.66 US Fox Corp 0.60 0.41 27.0% 64.3% 179.7% 4,970 2,766 USD 0.95 US Lions Gate Entertainment Corp 0.91 0.62 27.0% 46.5% 86.8% 1,988 2,291 USD 1.01 US Madison Square Garden Entertainment Corp 1.90 1.29 27.0% 10.2% 11.4% 14,353 126,458 USD 1.40 US Netflix Inc 1.02 0.69 27.0% 46.5% 86.7% 15,607 17,995 USD 1.13 US Paramount Global 0.88 0.59 27.0% 43.3% 76.4% 13,143 17,193 USD 0.93 US Liberty Media Corp - Liberty SiriusXM 1.36 0.93 27.0% 18.0% 21.9% 48,377 221,151 USD 1.07 US Walt Disney Co/The 0.76 0.52 27.0% 60.9% 155.8% 48,999 31,449 USD 1.11 US Warner Bros Discovery Inc 1.47 1.00 27.0% 19.8% 24.7% 3,946 16,005 USD 1.18 US Warner Music Group Corp 2.57 1.75 27.0% 4.0% 4.1% 5 114 USD 1.80 US Cinedigm Corp 1.10 0.77 37.3% 79.0% 1.09 Average(Selected) Cost of Equity (K E ) Cost of Equity = Specific Premium 8) + Size Premium 7) + Country Risk Premium 7) + Equity Risk Premium 6) x Beta + Risk Free Rate 5) 13.1% 3.0% 0.0% 0.0% 6.5% 1.10 2.9% After - Tax Cost of Debt (K D ) After - Tax Cost of Debt = (1 - Tax Rate) x Pre - Tax Cost of Debt 9) 8.0% 73.0% 11.0% Weighted Average Cost of Capital Contribution = Cost of Capital x Captial Structure 10) 3.0% 8.0% 39.3% Debt 8.2% 13.1% 62.7% Equity 11.2% = WACC Note: Public company that engages in a similar business with the Target 1) The average weekly adjusted Beta for the past 2 years as of Dec. 31, 2022 (Source: Bloomberg) 2) The average market capitalization for the past 1 year as of Dec. 31, 2022 (Source: Bloomberg) 3) The IBD from the most recent financial statements as of Dec. 31, 2022 (Source: Bloomberg) 4) The average interest rate of the 10 - year U.S. Treasury bond for the past 1 year as of Dec. 31, 2022 (Source: Bloomberg) 5) The Equity Risk Premium for the past 1 year in the United States as of Dec. 31, 2022 (Source: Bloomberg) 6) Not Applicable 7) Company Specific Risk Premium (CSRP) 8) The average Risk Rate Spread for the past 1 year to the yield of corporate bonds corresponding to the lowest credit rating of BBB - 9) The average capital structure of the similar companies 10) Source: Capital IQ, Bloomberg, KPMG Analysis © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 25

Strictly Private & Confidential Multiple Analysis

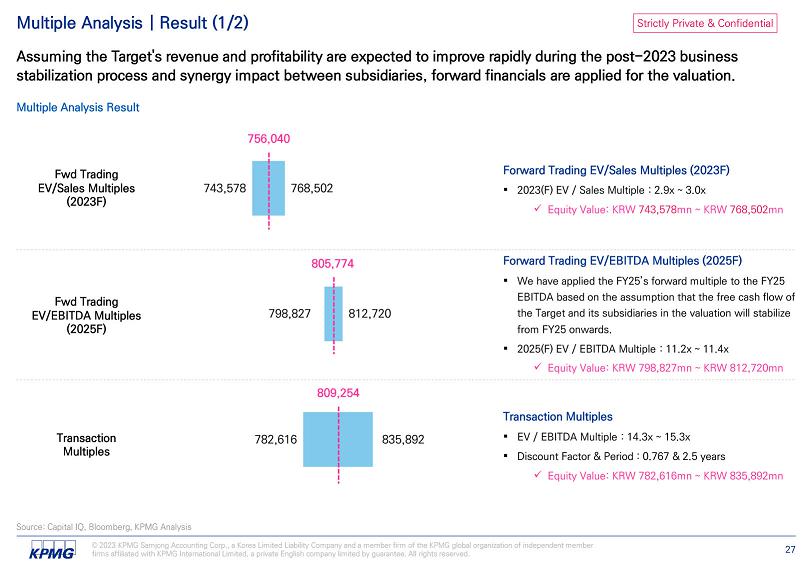

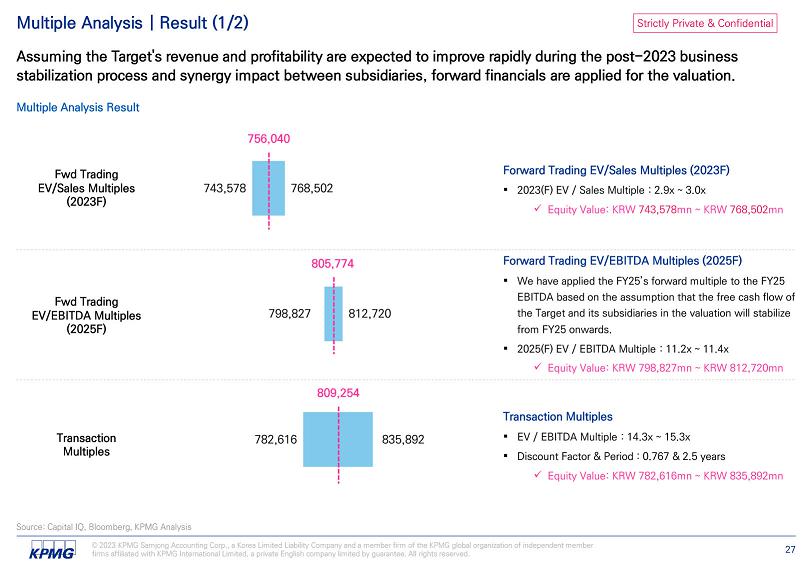

Strictly Private & Confidential 782,616 798,827 743,578 835,892 812,720 768,502 Multiple Analysis | Result (1/2) Source: Capital IQ, Bloomberg, KPMG Analysis Assuming the Target's revenue and profitability are expected to improve rapidly during the post - 2023 business stabilization process and synergy impact between subsidiaries, forward financials are applied for the valuation. Multiple Analysis Result 756,040 Fwd Trading EV/Sales Multiples (2023F) Transaction Multiples Fwd Trading EV/EBITDA Multiples (2025F) 809,254 805,774 Transaction Multiples ▪ EV / EBITDA Multiple : 14.3x ~ 15.3x ▪ Discount Factor & Period : 0.767 & 2.5 years x Equity Value: KRW 782,616mn ~ KRW 835,892mn Forward Trading EV/EBITDA Multiples (2025F) ▪ We have applied the FY25’s forward multiple to the FY25 EBITDA based on the assumption that the free cash flow of the Target and its subsidiaries in the valuation will stabilize from FY25 onwards. ▪ 2025(F) EV / EBITDA Multiple : 11.2x ~ 11.4x x Equity Value: KRW 798,827mn ~ KRW 812,720mn Forward Trading EV/Sales Multiples (2023F) ▪ 2023(F) EV / Sales Multiple : 2.9x ~ 3.0x x Equity Value: KRW 743,578 mn ~ KRW 768,502 mn © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 27

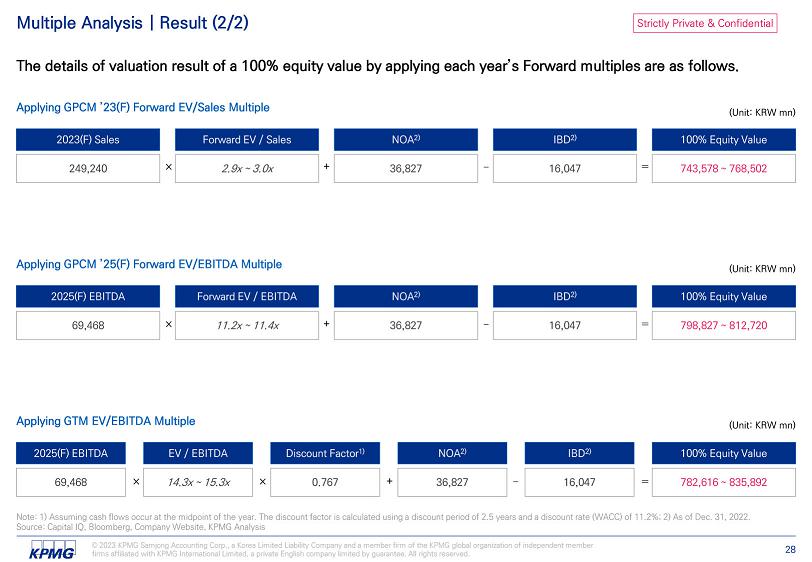

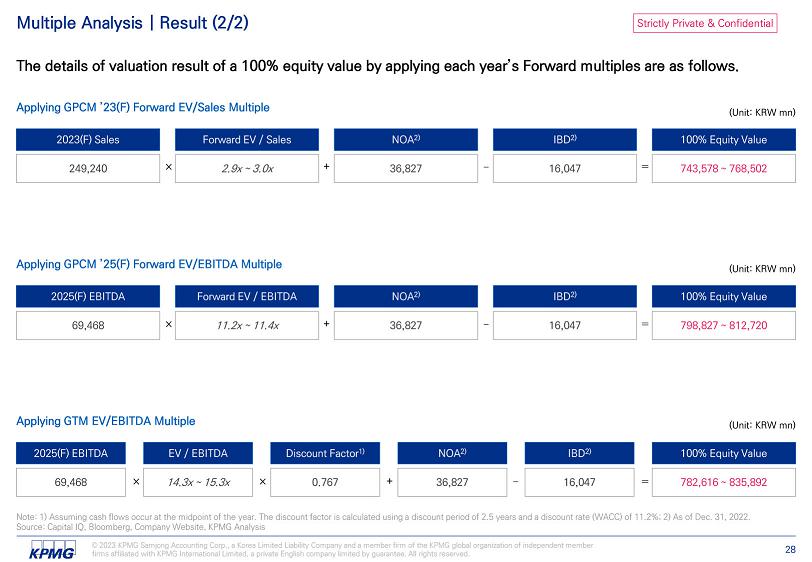

Strictly Private & Confidential Source: Capital IQ, Bloomberg, Company Website, KPMG Analysis © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 28 Multiple Analysis | Result (2/2) The details of valuation result of a 100% equity value by applying each year’s Forward multiples are as follows. Note: 1) Assuming cash flows occur at the midpoint of the year. The discount factor is calculated using a discount period of 2.5 years and a discount rate (WACC) of 11.2%; 2) As of Dec. 31, 2022. Applying GPCM ’23(F) Forward EV/Sales Multiple 100% Equity Value IBD 2) NOA 2) Forward EV / Sales 2023(F) Sales 743,578 ~ 768,502 = 16,047 ‒ 36,827 + 2.9x ~ 3.0x ൈ 249,240 (Unit: KRW mn) Applying GTM EV/EBITDA Multiple 100% Equity Value IBD 2) NOA 2) Discount Factor 1) EV / EBITDA 2025(F) EBITDA 782,616 ~ 835,892 = 16,047 ‒ 36,827 + 0.767 ൈ 14.3x ~ 15.3x ൈ 69,468 (Unit: KRW mn) Applying GPCM ’25(F) Forward EV/EBITDA Multiple 100% Equity Value IBD 2) NOA 2) Forward EV / EBITDA 2025(F) EBITDA 798,827 ~ 812,720 = 16,047 ‒ 36,827 + 11.2x ~ 11.4x ൈ 69,468 (Unit: KRW mn)

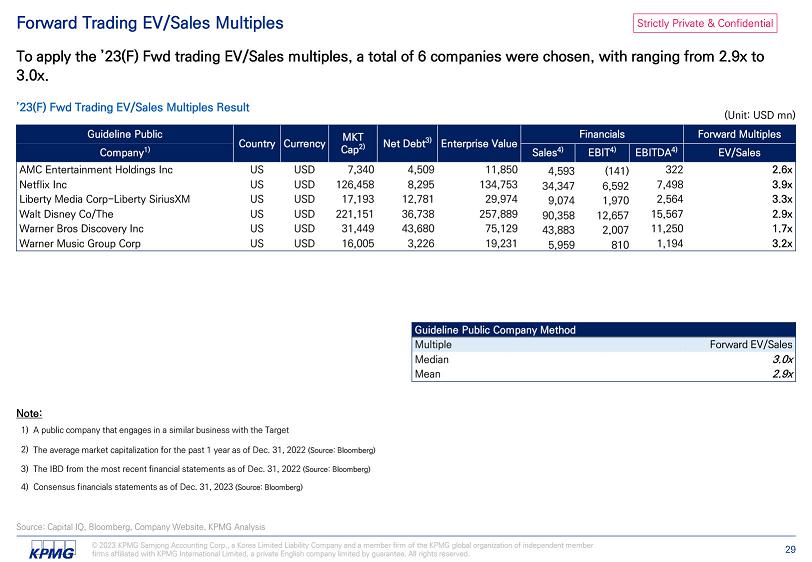

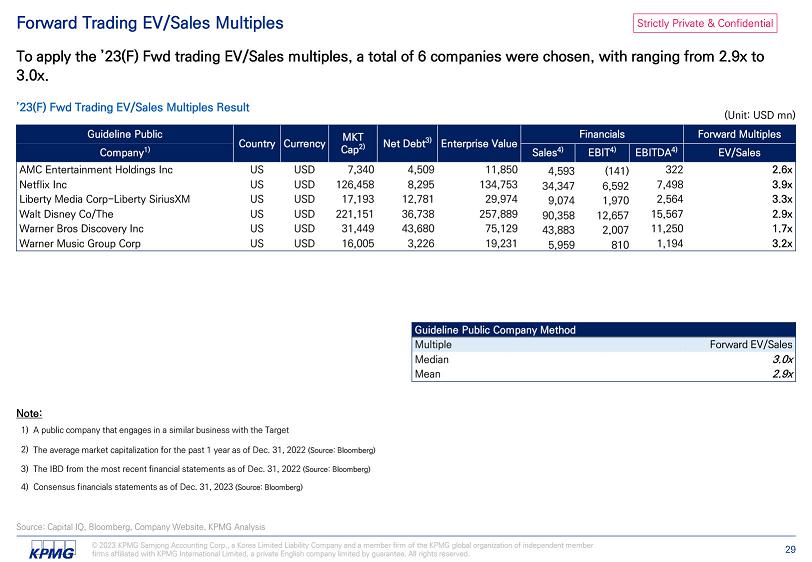

Strictly Private & Confidential Source: Capital IQ, Bloomberg, Company Website, KPMG Analysis © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 29 Forward Trading EV/Sales Multiples To apply the ’23(F) Fwd trading EV/Sales multiples, a total of 6 companies were chosen, with ranging from 2.9x to 3.0x. ’23(F) Fwd Trading EV/Sales Multiples Result Forward Multiples Financials Enterprise Value Net Debt 3) MKT Cap 2) Currency Country Guideline Public EV/Sales EBITDA 4) EBIT 4) Sales 4) Company 1) 2.6x 322 (141) 4,593 11,850 4,509 7,340 USD US AMC Entertainment Holdings Inc 3.9x 7,498 6,592 34,347 134,753 8,295 126,458 USD US Netflix Inc 3.3x 2,564 1,970 9,074 29,974 12,781 17,193 USD US Liberty Media Corp - Liberty SiriusXM 2.9x 15,567 12,657 90,358 257,889 36,738 221,151 USD US Walt Disney Co/The 1.7x 11,250 2,007 43,883 75,129 43,680 31,449 USD US Warner Bros Discovery Inc 3.2x 1,194 810 5,959 19,231 3,226 16,005 USD US Warner Music Group Corp Note: A public company that engages in a similar business with the Target 1) The average market capitalization for the past 1 year as of Dec. 31, 2022 (Source: Bloomberg) 2) The IBD from the most recent financial statements as of Dec. 31, 2022 (Source: Bloomberg) 3) Consensus financials statements as of Dec. 31, 2023 (Source: Bloomberg) 4) Guideline Public Company Method Forward EV/Sales Multiple 3.0x Median 2.9x Mean (Unit: USD mn)

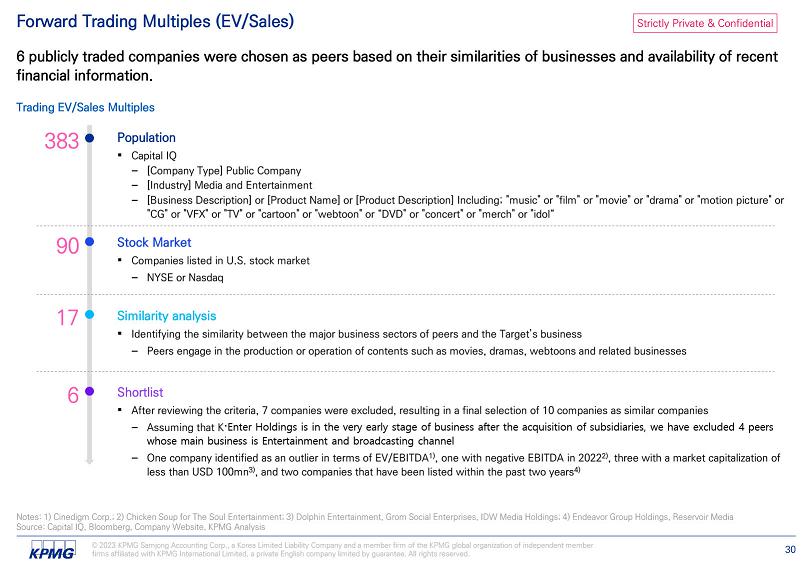

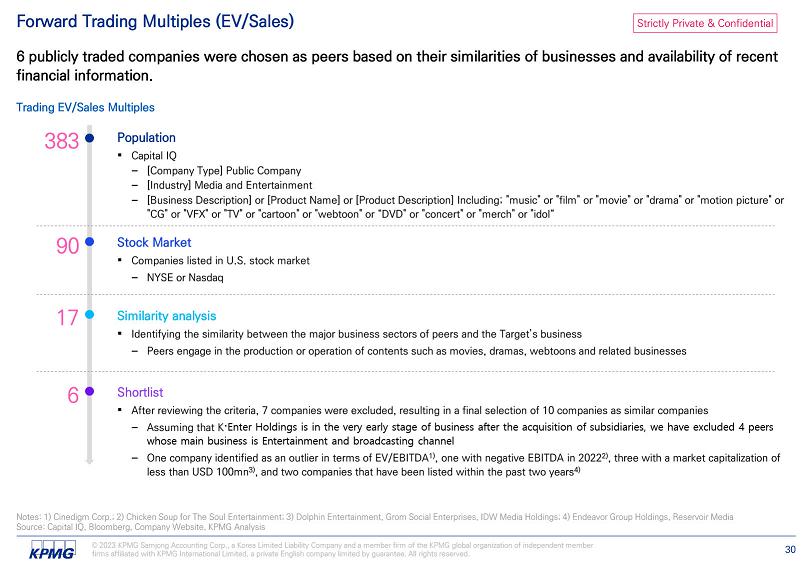

Strictly Private & Confidential Forward Trading Multiples (EV/Sales) Notes: 1) Cinedigm Corp.; 2) Chicken Soup for The Soul Entertainment; 3) Dolphin Entertainment, Grom Social Enterprises, IDW Media Holdings; 4) Endeavor Group Holdings, Reservoir Media 6 publicly traded companies were chosen as peers based on their similarities of businesses and availability of recent financial information. Trading EV/Sales Multiples Population ▪ Capital IQ ‒ [Company Type] Public Company ‒ [Industry] Media and Entertainment ‒ [Business Description] or [Product Name] or [Product Description] Including; "music" or "film" or "movie" or "drama" or "motion picture" or "CG" or "VFX" or "TV" or "cartoon" or "webtoon" or “DVD" or "concert" or "merch" or "idol“ Stock Market ▪ Companies listed in U.S. stock market ‒ NYSE or Nasdaq Similarity analysis ▪ Identifying the similarity between the major business sectors of peers and the Target’s business ‒ Peers engage in the production or operation of contents such as movies, dramas, webtoons and related businesses ▪ After reviewing the criteria, 7 companies were excluded, resulting in a final selection of 10 companies as similar companies – Assuming that K 傸呴 Enter Holdings is in the very early stage of business after the acquisition of subsidiaries , we have excluded 4 peers whose main business is Entertainment and broadcasting channel – One company identified as an outlier in terms of EV/EBITDA 1) , one with negative EBITDA in 2022 2) , three with a market capitalization of less than USD 100mn 3) , and two companies that have been listed within the past two years 4) Source: Capital IQ, Bloomberg, Company Website, KPMG Analysis © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 30

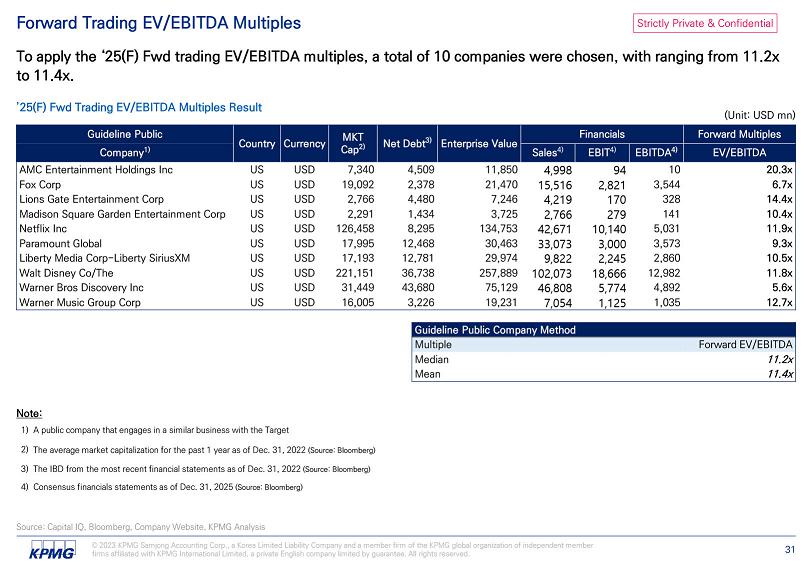

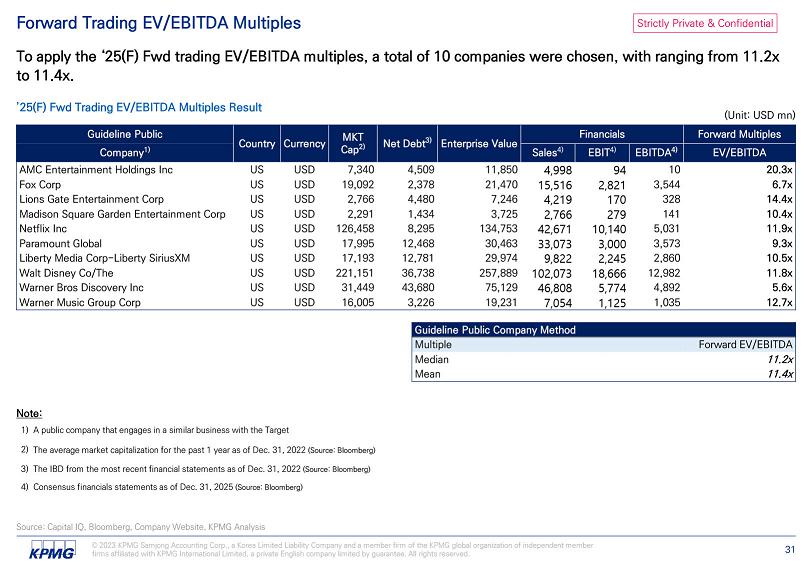

Strictly Private & Confidential Source: Capital IQ, Bloomberg, Company Website, KPMG Analysis © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 31 Forward Trading EV/EBITDA Multiples To apply the ‘25(F) Fwd trading EV/EBITDA multiples, a total of 10 companies were chosen, with ranging from 11.2x to 11.4x. ’25(F) Fwd Trading EV/EBITDA Multiples Result Forward Multiples Financials Enterprise Value Net Debt 3) MKT Cap 2) Currency Country Guideline Public EV/EBITDA EBITDA 4) EBIT 4) Sales 4) Company 1) 20.3x 10 94 4,998 11,850 4,509 7,340 USD US AMC Entertainment Holdings Inc 6.7x 3,544 2,821 15,516 21,470 2,378 19,092 USD US Fox Corp 14.4x 328 170 4,219 7,246 4,480 2,766 USD US Lions Gate Entertainment Corp 10.4x 141 279 2,766 3,725 1,434 2,291 USD US Madison Square Garden Entertainment Corp 11.9x 5,031 10,140 42,671 134,753 8,295 126,458 USD US Netflix Inc 9.3x 3,573 3,000 33,073 30,463 12,468 17,995 USD US Paramount Global 10.5x 2,860 2,245 9,822 29,974 12,781 17,193 USD US Liberty Media Corp - Liberty SiriusXM 11.8x 12,982 18,666 102,073 257,889 36,738 221,151 USD US Walt Disney Co/The 5.6x 4,892 5,774 46,808 75,129 43,680 31,449 USD US Warner Bros Discovery Inc 12.7x 1,035 1,125 7,054 19,231 3,226 16,005 USD US Warner Music Group Corp Note: A public company that engages in a similar business with the Target 1) The average market capitalization for the past 1 year as of Dec. 31, 2022 (Source: Bloomberg) 2) The IBD from the most recent financial statements as of Dec. 31, 2022 (Source: Bloomberg) 3) Consensus financials statements as of Dec. 31, 2025 (Source: Bloomberg) 4) Guideline Public Company Method Forward EV/EBITDA Multiple 11.2x Median 11.4x Mean (Unit: USD mn)

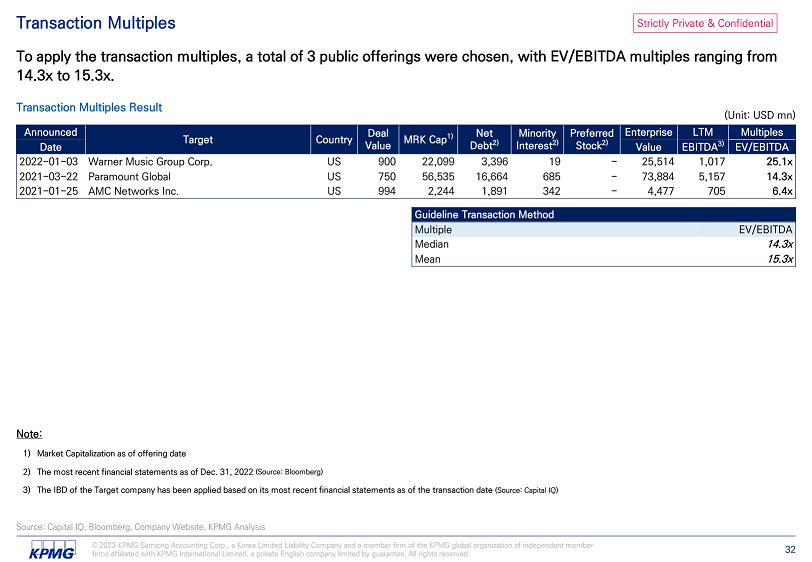

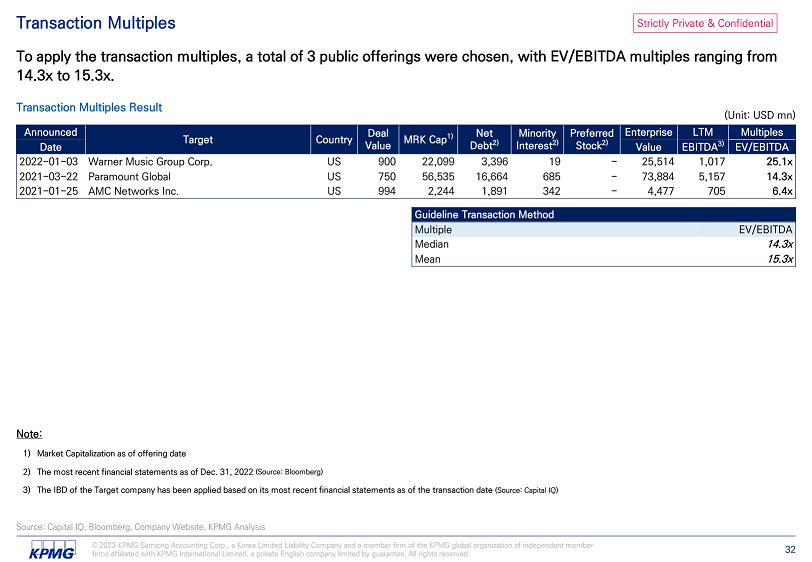

Strictly Private & Confidential Source: Capital IQ, Bloomberg, Company Website, KPMG Analysis © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 32 Transaction Multiples To apply the transaction multiples, a total of 3 public offerings were chosen, with EV/EBITDA multiples ranging from 14.3x to 15.3x. Transaction Multiples Result Multiples LTM Enterprise Preferred Stock 2) Minority Interest 2) Net Debt 2) MRK Cap 1) Deal Value Country Target Announced EV/EBITDA EBITDA 3) Value Date 25.1x 1,017 25,514 - 19 3,396 22,099 900 US Warner Music Group Corp. 2022 - 01 - 03 14.3x 5,157 73,884 - 685 16,664 56,535 750 US Paramount Global 2021 - 03 - 22 6.4x 705 4,477 - 342 1,891 2,244 994 US AMC Networks Inc. 2021 - 01 - 25 Guideline Transaction Method EV/EBITDA Multiple 14.3x Median 15.3x Mean Market Capitalization as of offering date 1) The most recent financial statements as of Dec. 31, 2022 (Source: Bloomberg) 2) The IBD of the Target company has been applied based on its most recent financial statements as of the transaction date (Source: Capital IQ) 3) Note: (Unit: USD mn)

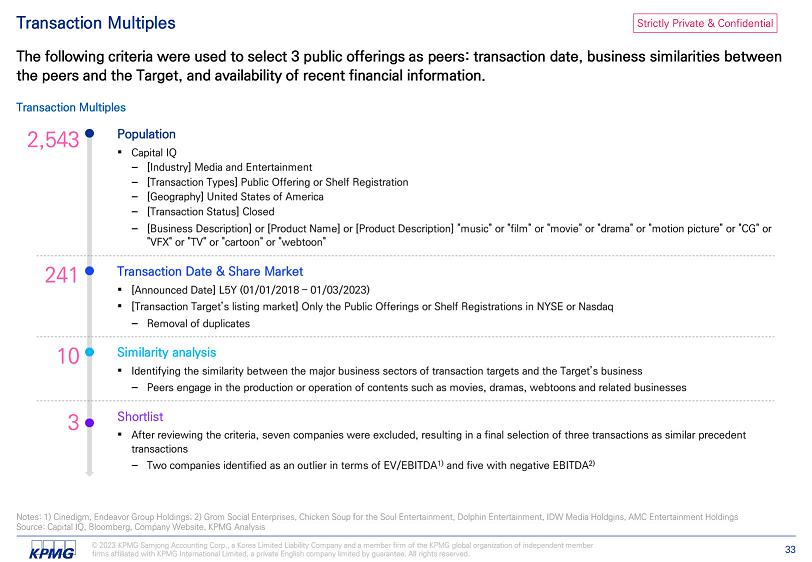

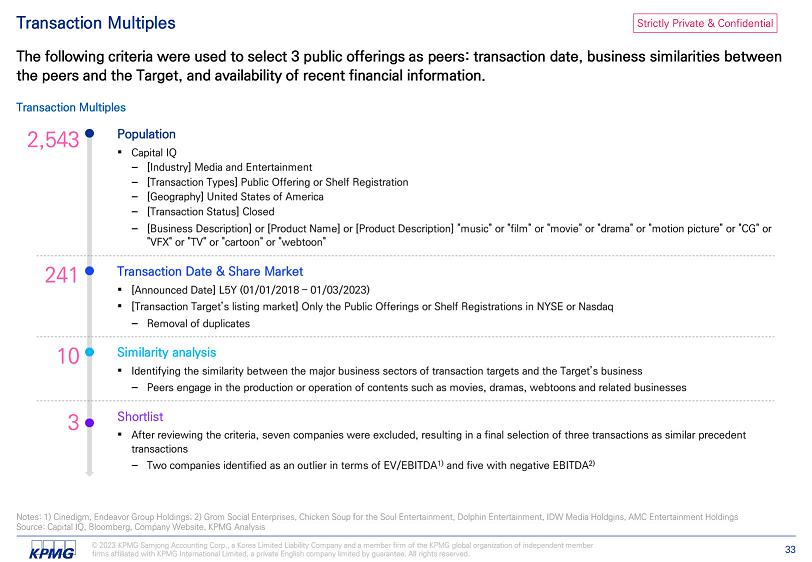

Strictly Private & Confidential Transaction Multiples Notes: 1) Cinedigm, Endeavor Group Holdings; 2) Grom Social Enterprises, Chicken Soup for the Soul Entertainment, Dolphin Entertainment, IDW Media Holdgins, AMC Entertainment Holdings The following criteria were used to select 3 public offerings as peers: transaction date, business similarities between the peers and the Target, and availability of recent financial information. Transaction Multiples Population ▪ Capital IQ ‒ [Industry] Media and Entertainment ‒ [Transaction Types] Public Offering or Shelf Registration ‒ [Geography] United States of America ‒ [Transaction Status] Closed ‒ [Business Description] or [Product Name] or [Product Description] "music" or "film" or "movie" or "drama" or "motion picture" or "CG" or "VFX" or "TV" or "cartoon" or "webtoon" Transaction Date & Share Market ▪ [Announced Date] L5Y (01/01/2018 – 01/03/2023) ▪ [Transaction Target’s listing market] Only the Public Offerings or Shelf Registrations in NYSE or Nasdaq ‒ Removal of duplicates Similarity analysis ▪ Identifying the similarity between the major business sectors of transaction targets and the Target’s business ‒ Peers engage in the production or operation of contents such as movies, dramas, webtoons and related businesses ▪ After reviewing the criteria, seven companies were excluded, resulting in a final selection of three transactions as similar precedent transactions – Two companies identified as an outlier in terms of EV/EBITDA 1) and five with negative EBITDA 2) Source: Capital IQ, Bloomberg, Company Website, KPMG Analysis © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 33

Strictly Private & Confidential II. Business Plan Analysis

Strictly Private & Confidential Play Company

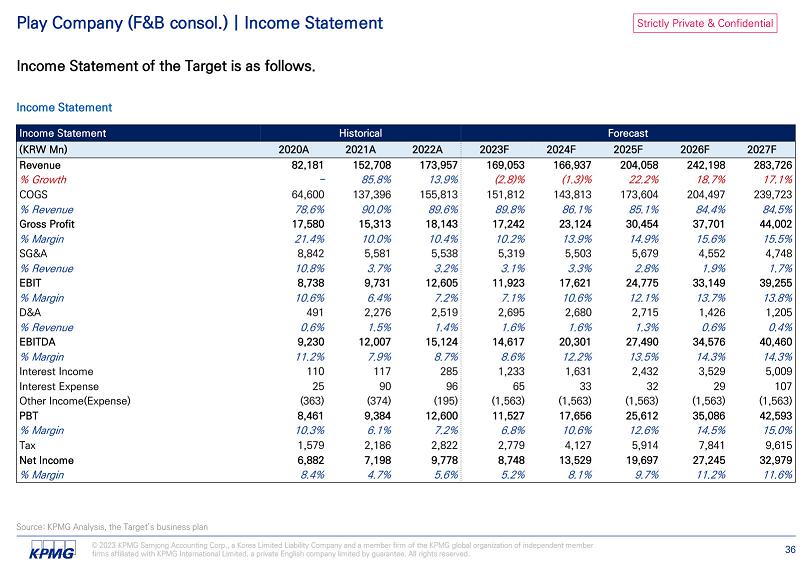

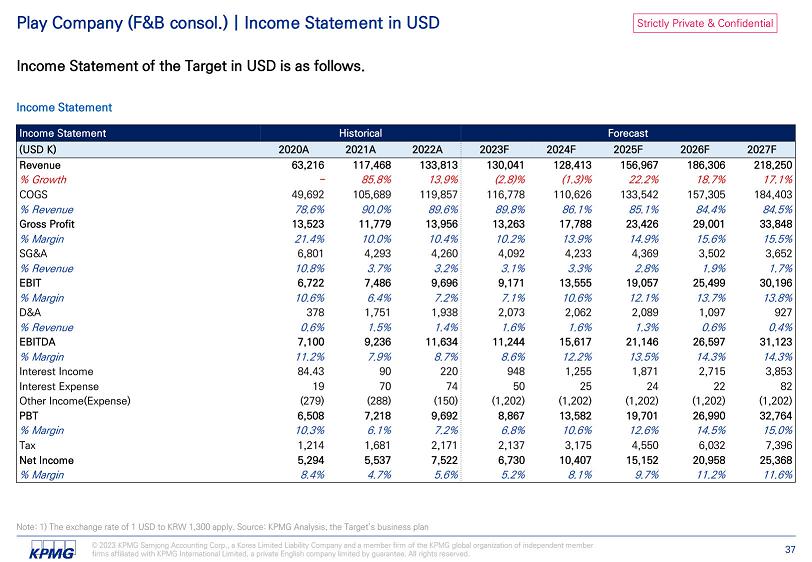

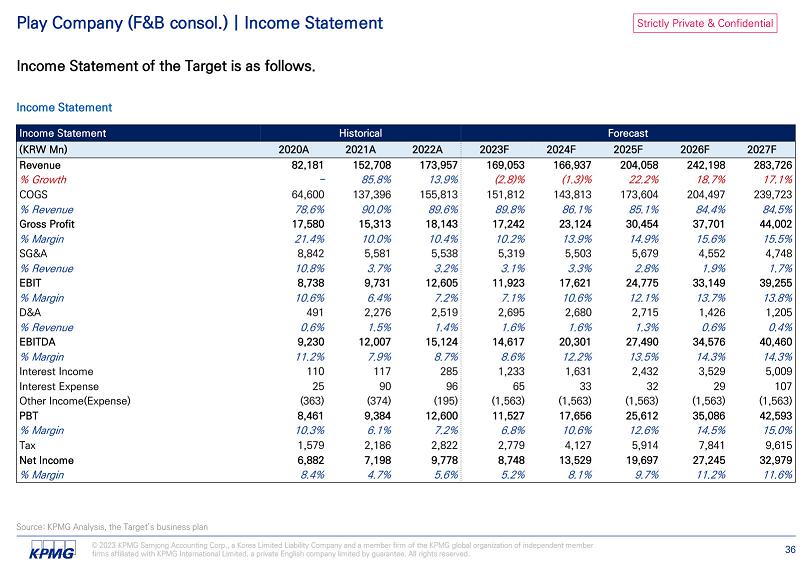

Strictly Private & Confidential © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 36 Play Company (F&B consol.) | Income Statement Income Statement of the Target is as follows. Income Statement Source: KPMG Analysis, the Target’s business plan Forecast Historical Income Statement 2027F 2026F 2025F 2024F 2023F 2022A 2021A 2020A (KRW Mn) 283,726 242,198 204,058 166,937 169,053 173,957 152,708 82,181 Revenue 17.1% 18.7% 22.2% (1.3)% (2.8)% 13.9% 85.8% - % Growth 239,723 204,497 173,604 143,813 151,812 155,813 137,396 64,600 COGS 84.5% 84.4% 85.1% 86.1% 89.8% 89.6% 90.0% 78.6% % Revenue 44,002 37,701 30,454 23,124 17,242 18,143 15,313 17,580 Gross Profit 15.5% 15.6% 14.9% 13.9% 10.2% 10.4% 10.0% 21.4% % Margin 4,748 4,552 5,679 5,503 5,319 5,538 5,581 8,842 SG&A 1.7% 1.9% 2.8% 3.3% 3.1% 3.2% 3.7% 10.8% % Revenue 39,255 33,149 24,775 17,621 11,923 12,605 9,731 8,738 EBIT 13.8% 13.7% 12.1% 10.6% 7.1% 7.2% 6.4% 10.6% % Margin 1,205 1,426 2,715 2,680 2,695 2,519 2,276 491 D&A 0.4% 0.6% 1.3% 1.6% 1.6% 1.4% 1.5% 0.6% % Revenue 40,460 34,576 27,490 20,301 14,617 15,124 12,007 9,230 EBITDA 14.3% 14.3% 13.5% 12.2% 8.6% 8.7% 7.9% 11.2% % Margin 5,009 3,529 2,432 1,631 1,233 285 117 110 Interest Income 107 29 32 33 65 96 90 25 Interest Expense (1,563) (1,563) (1,563) (1,563) (1,563) (195) (374) (363) Other Income(Expense) 42,593 35,086 25,612 17,656 11,527 12,600 9,384 8,461 PBT 15.0% 14.5% 12.6% 10.6% 6.8% 7.2% 6.1% 10.3% % Margin 9,615 7,841 5,914 4,127 2,779 2,822 2,186 1,579 Tax 32,979 27,245 19,697 13,529 8,748 9,778 7,198 6,882 Net Income 11.6% 11.2% 9.7% 8.1% 5.2% 5.6% 4.7% 8.4% % Margin

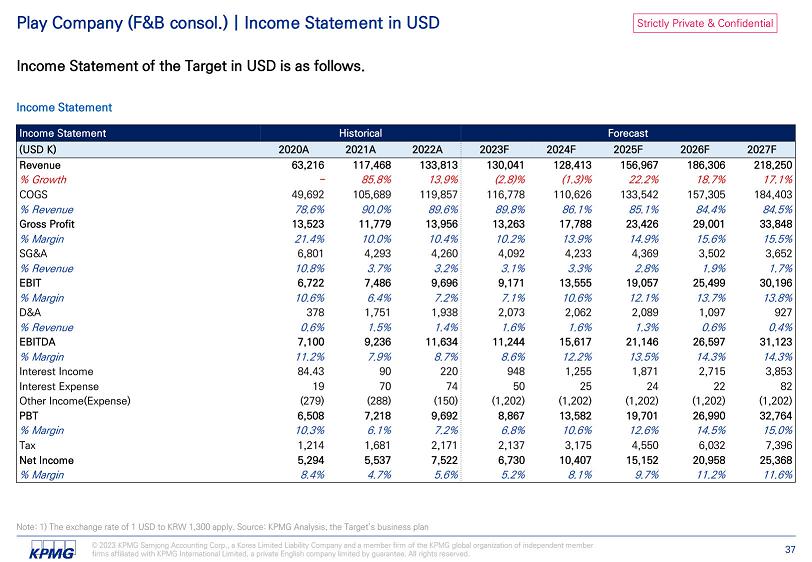

Strictly Private & Confidential © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 37 Play Company (F&B consol.) | Income Statement in USD Income Statement of the Target in USD is as follows. Income Statement Note: 1) The exchange rate of 1 USD to KRW 1,300 apply. Source: KPMG Analysis, the Target’s business plan Forecast Historical Income Statement 2027F 2026F 2025F 2024F 2023F 2022A 2021A 2020A (USD K) 218,250 186,306 156,967 128,413 130,041 133,813 117,468 63,216 Revenue 17.1% 18.7% 22.2% (1.3)% (2.8)% 13.9% 85.8% - % Growth 184,403 157,305 133,542 110,626 116,778 119,857 105,689 49,692 COGS 84.5% 84.4% 85.1% 86.1% 89.8% 89.6% 90.0% 78.6% % Revenue 33,848 29,001 23,426 17,788 13,263 13,956 11,779 13,523 Gross Profit 15.5% 15.6% 14.9% 13.9% 10.2% 10.4% 10.0% 21.4% % Margin 3,652 3,502 4,369 4,233 4,092 4,260 4,293 6,801 SG&A 1.7% 1.9% 2.8% 3.3% 3.1% 3.2% 3.7% 10.8% % Revenue 30,196 25,499 19,057 13,555 9,171 9,696 7,486 6,722 EBIT 13.8% 13.7% 12.1% 10.6% 7.1% 7.2% 6.4% 10.6% % Margin 927 1,097 2,089 2,062 2,073 1,938 1,751 378 D&A 0.4% 0.6% 1.3% 1.6% 1.6% 1.4% 1.5% 0.6% % Revenue 31,123 26,597 21,146 15,617 11,244 11,634 9,236 7,100 EBITDA 14.3% 14.3% 13.5% 12.2% 8.6% 8.7% 7.9% 11.2% % Margin 3,853 2,715 1,871 1,255 948 220 90 84.43 Interest Income 82 22 24 25 50 74 70 19 Interest Expense (1,202) (1,202) (1,202) (1,202) (1,202) (150) (288) (279) Other Income(Expense) 32,764 26,990 19,701 13,582 8,867 9,692 7,218 6,508 PBT 15.0% 14.5% 12.6% 10.6% 6.8% 7.2% 6.1% 10.3% % Margin 7,396 6,032 4,550 3,175 2,137 2,171 1,681 1,214 Tax 25,368 20,958 15,152 10,407 6,730 7,522 5,537 5,294 Net Income 11.6% 11.2% 9.7% 8.1% 5.2% 5.6% 4.7% 8.4% % Margin

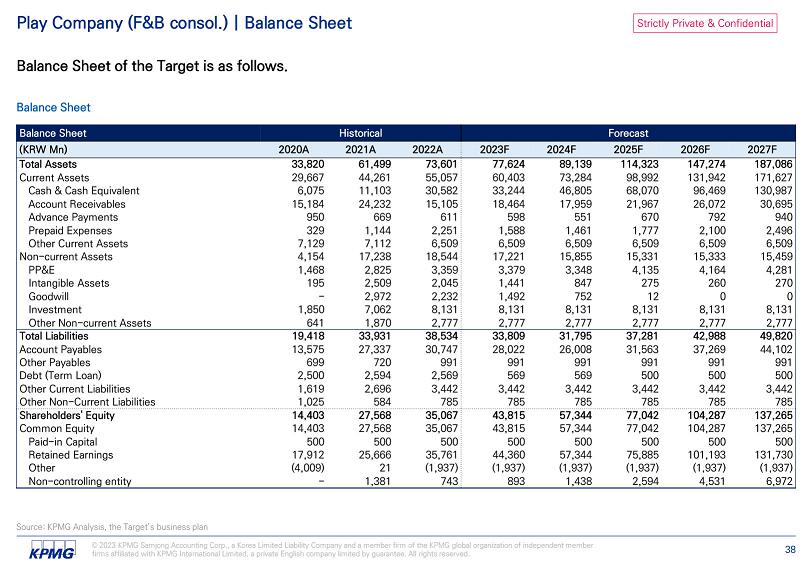

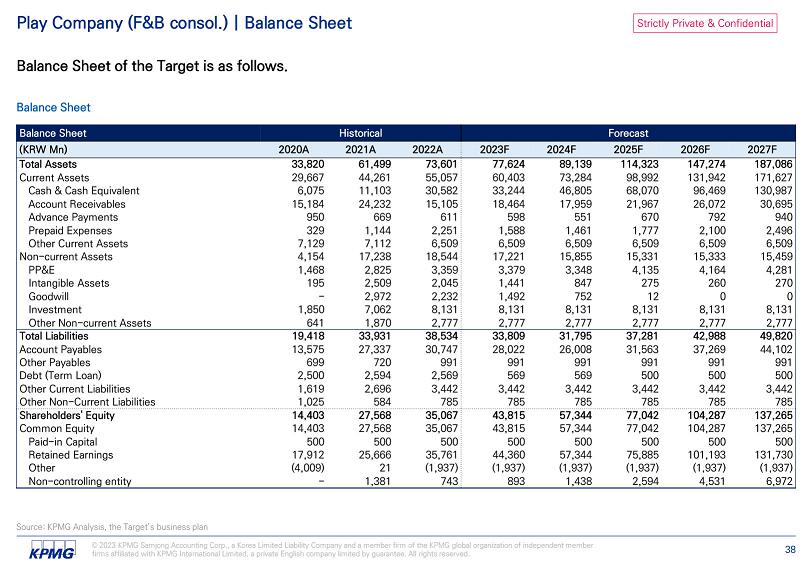

Strictly Private & Confidential Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 38 Play Company (F&B consol.) | Balance Sheet Balance Sheet of the Target is as follows. Balance Sheet Forecast Historical Balance Sheet 2027F 2026F 2025F 2024F 2023F 2022A 2021A 2020A (KRW Mn) 187,086 147,274 114,323 89,139 77,624 73,601 61,499 33,820 Total Assets 171,627 131,942 98,992 73,284 60,403 55,057 44,261 29,667 Current Assets 130,987 96,469 68,070 46,805 33,244 30,582 11,103 6,075 Cash & Cash Equivalent 30,695 26,072 21,967 17,959 18,464 15,105 24,232 15,184 Account Receivables 940 792 670 551 598 611 669 950 Advance Payments 2,496 2,100 1,777 1,461 1,588 2,251 1,144 329 Prepaid Expenses 6,509 6,509 6,509 6,509 6,509 6,509 7,112 7,129 Other Current Assets 15,459 15,333 15,331 15,855 17,221 18,544 17,238 4,154 Non - current Assets 4,281 4,164 4,135 3,348 3,379 3,359 2,825 1,468 PP&E 270 260 275 847 1,441 2,045 2,509 195 Intangible Assets 0 0 12 752 1,492 2,232 2,972 - Goodwill 8,131 8,131 8,131 8,131 8,131 8,131 7,062 1,850 Investment 2,777 2,777 2,777 2,777 2,777 2,777 1,870 641 Other Non - current Assets 49,820 42,988 37,281 31,795 33,809 38,534 33,931 19,418 Total Liabilities 44,102 37,269 31,563 26,008 28,022 30,747 27,337 13,575 Account Payables 991 991 991 991 991 991 720 699 Other Payables 500 500 500 569 569 2,569 2,594 2,500 Debt (Term Loan) 3,442 3,442 3,442 3,442 3,442 3,442 2,696 1,619 Other Current Liabilities 785 785 785 785 785 785 584 1,025 Other Non - Current Liabilities 137,265 104,287 77,042 57,344 43,815 35,067 27,568 14,403 Shareholders' Equity 137,265 104,287 77,042 57,344 43,815 35,067 27,568 14,403 Common Equity 500 500 500 500 500 500 500 500 Paid - in Capital 131,730 101,193 75,885 57,344 44,360 35,761 25,666 17,912 Retained Earnings (1,937) (1,937) (1,937) (1,937) (1,937) (1,937) 21 (4,009) Other 6,972 4,531 2,594 1,438 893 743 1,381 - Non - controlling entity

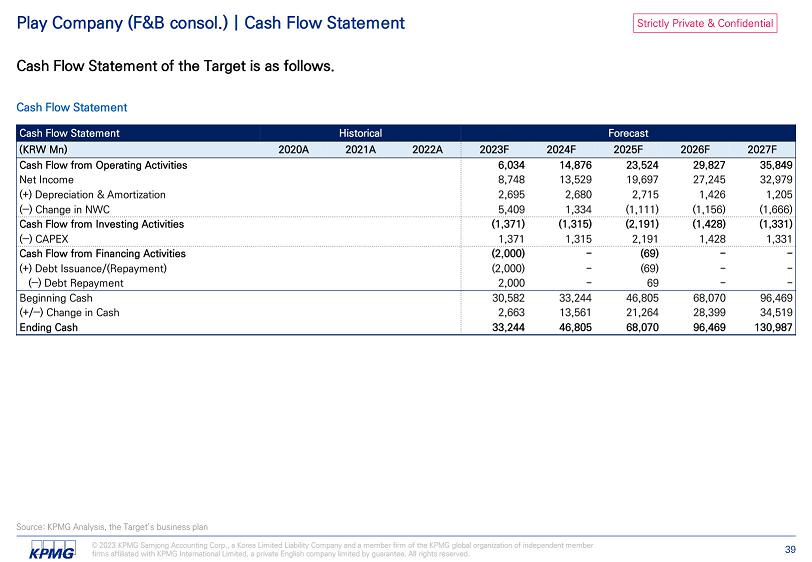

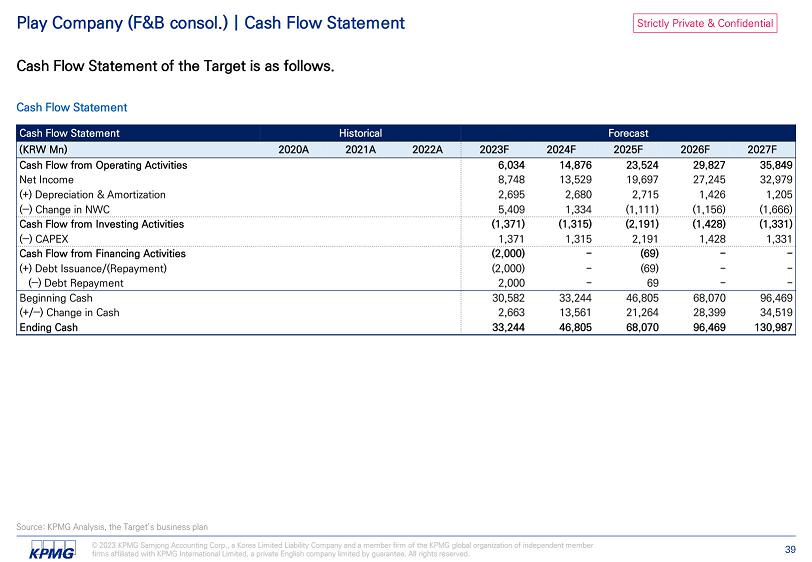

Strictly Private & Confidential Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 39 Play Company (F&B consol.) | Cash Flow Statement Cash Flow Statement of the Target is as follows. Cash Flow Statement Forecast Historical Cash Flow Statement 2027F 2026F 2025F 2024F 2023F 2022A 2021A 2020A (KRW Mn) 35,849 29,827 23,524 14,876 6,034 Cash Flow from Operating Activities 32,979 27,245 19,697 13,529 8,748 Net Income 1,205 1,426 2,715 2,680 2,695 (+) Depreciation & Amortization (1,666) (1,156) (1,111) 1,334 5,409 (‒) Change in NWC (1,331) (1,428) (2,191) (1,315) (1,371) Cash Flow from Investing Activities 1,331 1,428 2,191 1,315 1,371 (‒) CAPEX - - (69) - (2,000) Cash Flow from Financing Activities - - (69) - (2,000) (+) Debt Issuance/(Repayment) - - 69 - 2,000 (‒) Debt Repayment 96,469 68,070 46,805 33,244 30,582 Beginning Cash 34,519 28,399 21,264 13,561 2,663 (+/‒) Change in Cash 130,987 96,469 68,070 46,805 33,244 Ending Cash

Strictly Private & Confidential Play Company | Revenue Key Assumptions applied to analyze Free Cash Flow to Firm (FCFF) of the Target are as follows. Revenue 126,242 113,835 140,714 167,415 198,503 6,843 10,446 11,976 15,739 20,707 1,258 1,270 1,282 1,298 1,314 10,117 12,729 15,068 15,980 16,542 144,460 138,280 169,040 200,432 237,067 2023E 2024E 2025E 2026E 2027E Design MD Service Other (Unit: KRW mn) ▪ The MD business generates revenue by designing, producing, and selling K - pop merchandise, including clothes, stationery, and other items Design and MD Service and Others 2023 - 2027 CAGR 13.2% Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 40

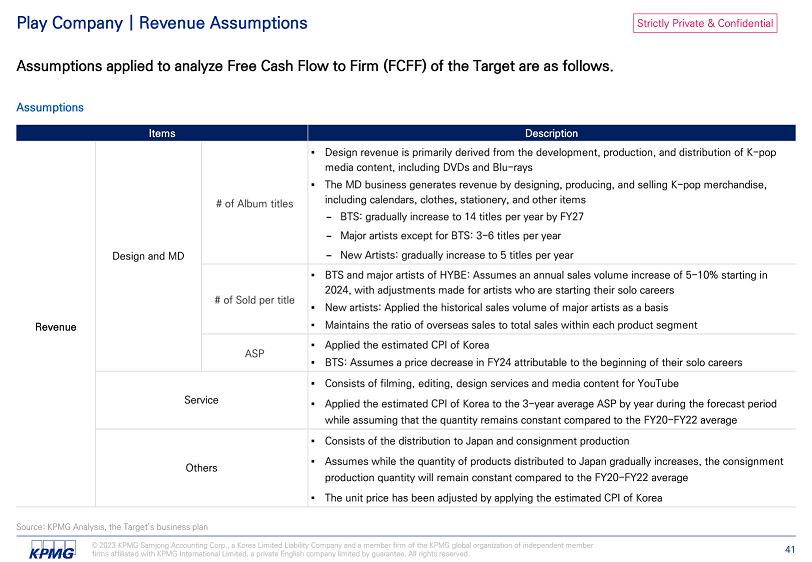

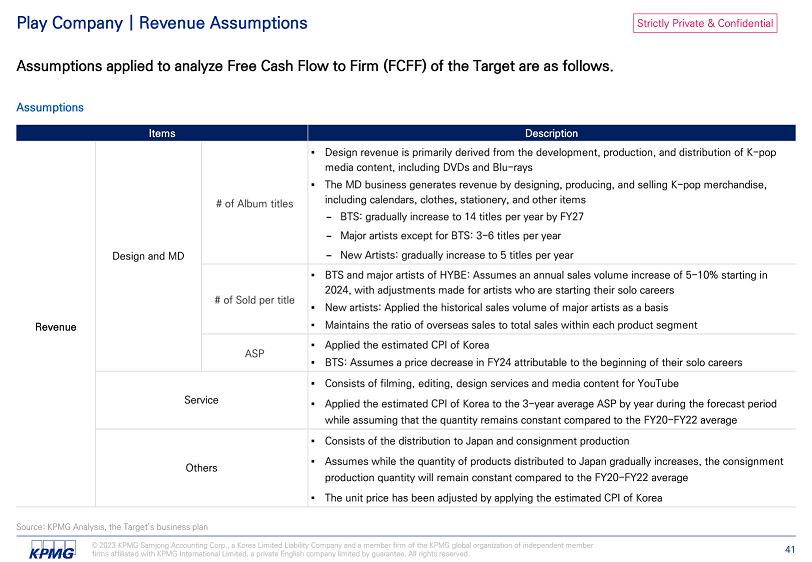

Strictly Private & Confidential Play Company | Revenue Assumptions Assumptions applied to analyze Free Cash Flow to Firm (FCFF) of the Target are as follows. Assumptions ▪ The MD business generates revenue by designing, producing, and selling K - pop merchandise, including calendars, clothes, stationery, and other items − BTS: gradually increase to 14 titles per year by FY27 − Major artists except for BTS: 3 - 6 titles per year − New Artists: gradually increase to 5 titles per year Design and MD Revenue with adjustments made for artists who are starting their solo careers ▪ Maintains the ratio of overseas sales to total sales within each product segment Service ▪ The unit price has been adjusted by applying the estimated CPI of Korea Others Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 41

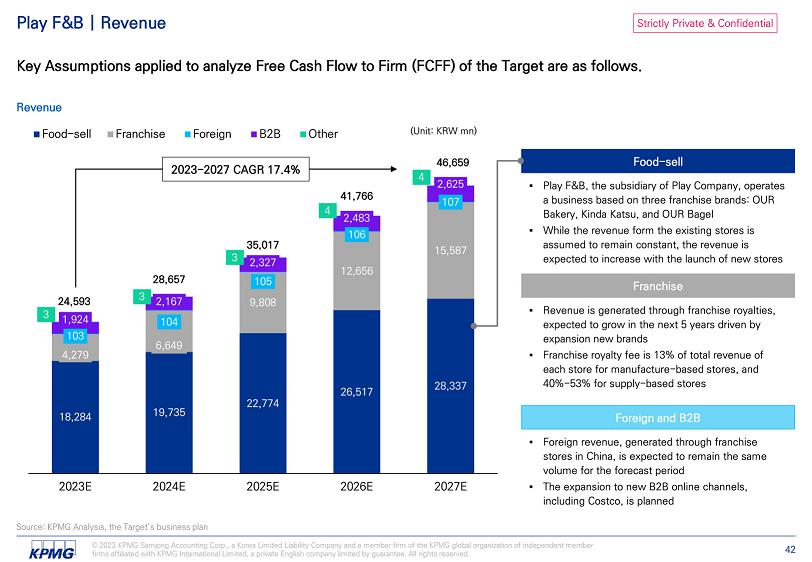

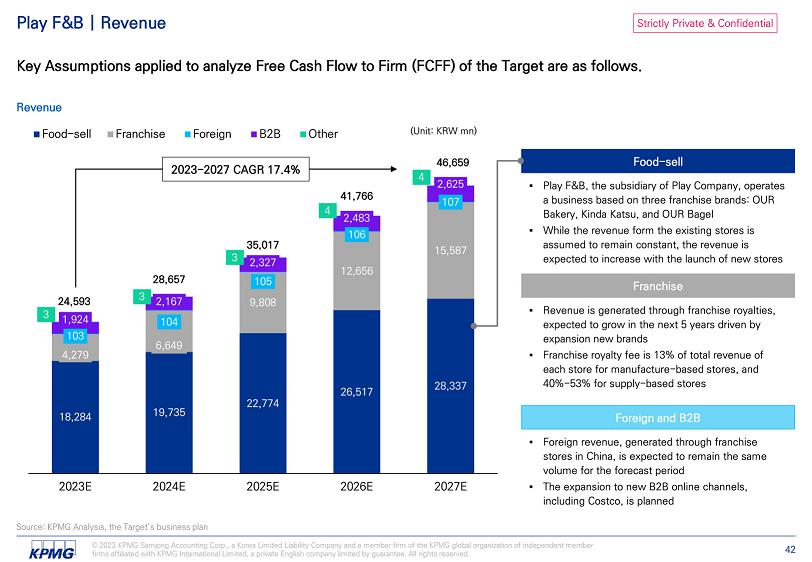

Strictly Private & Confidential Play F&B | Revenue Key Assumptions applied to analyze Free Cash Flow to Firm (FCFF) of the Target are as follows. Revenue 18,284 19,735 22,774 26,517 28,337 4,279 6,649 9,808 12,656 15,587 103 104 105 106 107 1,924 2,167 2,327 2,483 2,625 3 3 3 4 4 24,593 28,657 35,017 41,766 46,659 2023E 2024E 2025E 2026E 2027E Food - sell Franchise Foreign B2B Other (Unit: KRW mn) Franchise Food - sell Foreign and B2B 2023 - 2027 CAGR 17.4% Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 42

Strictly Private & Confidential Play F&B | Revenue Assumptions Assumptions applied to analyze Free Cash Flow to Firm (FCFF) of the Target are as follows. Assumptions ▪ Applied the estimated CPI of Korea to the monthly revenue of each store in FY22 Revenue ▪ Applied the estimated CPI of Korea to the monthly revenue of each store in FY22 Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 43

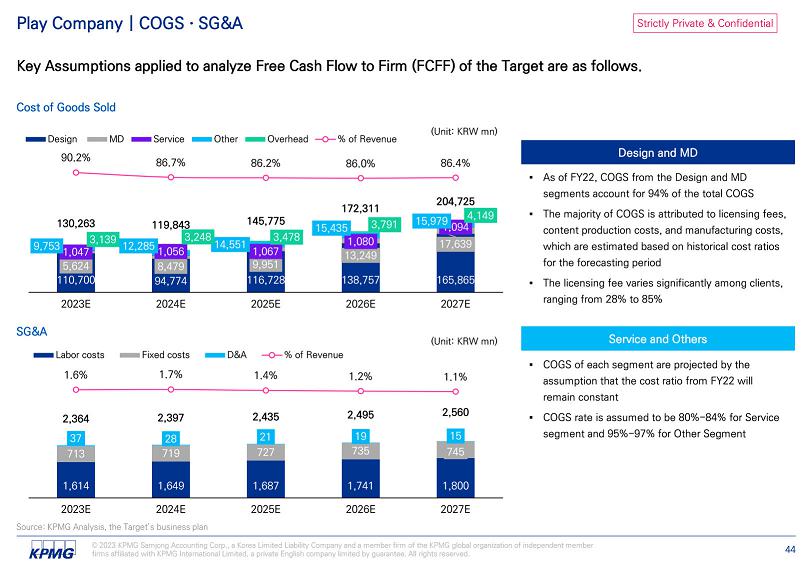

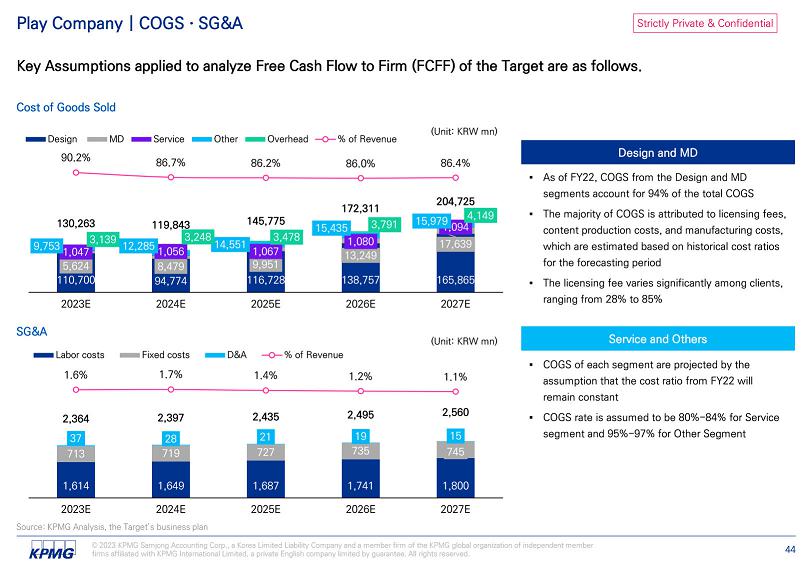

Strictly Private & Confidential Play Company | COGS · SG&A Key Assumptions applied to analyze Free Cash Flow to Firm (FCFF) of the Target are as follows. Cost of Goods Sold 110,700 116,728 138,757 165,865 5,624 8,479 94,774 9,951 13,249 17,639 1,047 1,056 1,067 1,080 1, 094 9,753 15,435 15,979 3,139 12,285 3,248 14,551 3,478 3,791 4,149 130,263 119,843 145,775 172,311 204,725 Design 90.2% 86.7% 86.2% 86.0% 86.4% 2023E 2024E 2025E 2026E 2027E MD Service Other Overhead % of Revenue SG&A 745 735 727 719 713 1,800 1,741 1,687 1,649 1,614 37 28 21 19 15 2,364 2,397 2,435 2,495 2,560 1.6% 1.7% 1.4% 1.2% 1.1% 2023E 2024E 2025E 2026E 2027E Labor costs Fixed costs D&A % of Revenue Design and MD Service and Others (Unit: KRW mn) Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 44 (Unit: KRW mn)

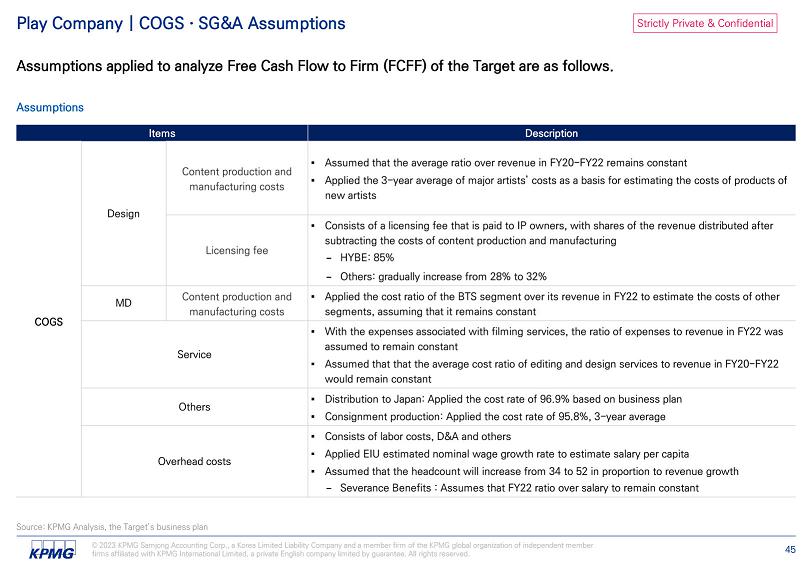

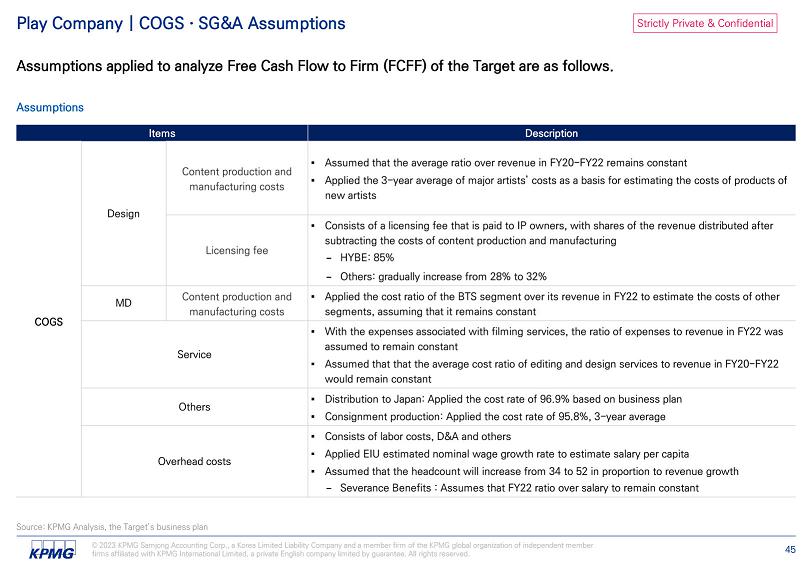

Strictly Private & Confidential Play Company | COGS · SG&A Assumptions Assumptions applied to analyze Free Cash Flow to Firm (FCFF) of the Target are as follows. Assumptions ▪ Assumed that the average ratio over revenue in FY20 - FY22 remains constant Design COGS ▪ Consists of a licensing fee that is paid to IP owners, with shares of the revenue distributed after subtracting the costs of content production and manufacturing − HYBE: 85% − Others: gradually increase from 28% to 32% ▪ Applied the cost ratio of the BTS segment over its revenue in FY22 to estimate the costs of other segments, assuming that it remains constant MD ▪ With the expenses associated with filming services, the ratio of expenses to revenue in FY22 was assumed to remain constant ▪ Assumed that that the average cost ratio of editing and design services to revenue in FY20 - FY22 would remain constant Service Others ▪ Consists of labor costs, D&A and others ▪ Applied EIU estimated nominal wage growth rate to estimate salary per capita ▪ Assumed that the headcount will increase from 34 to 52 in proportion to revenue growth − Severance Benefits : Assumes that FY22 ratio over salary to remain constant Overhead costs Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 45

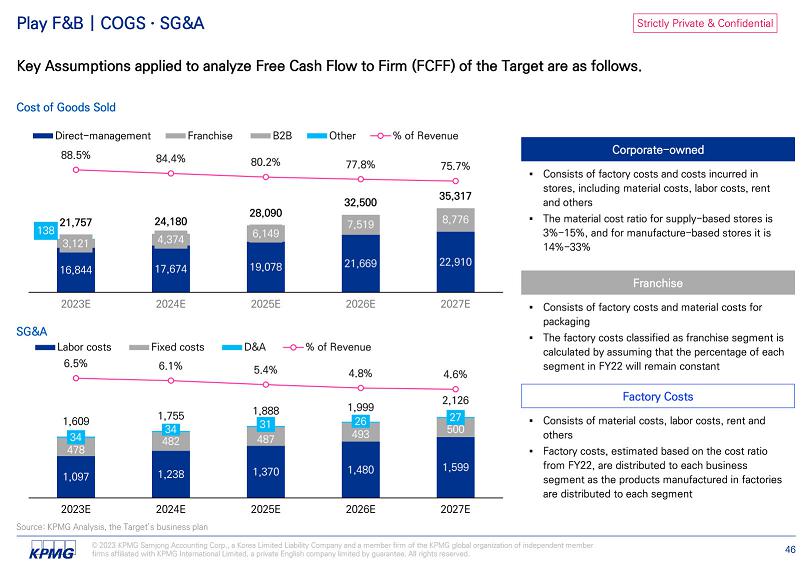

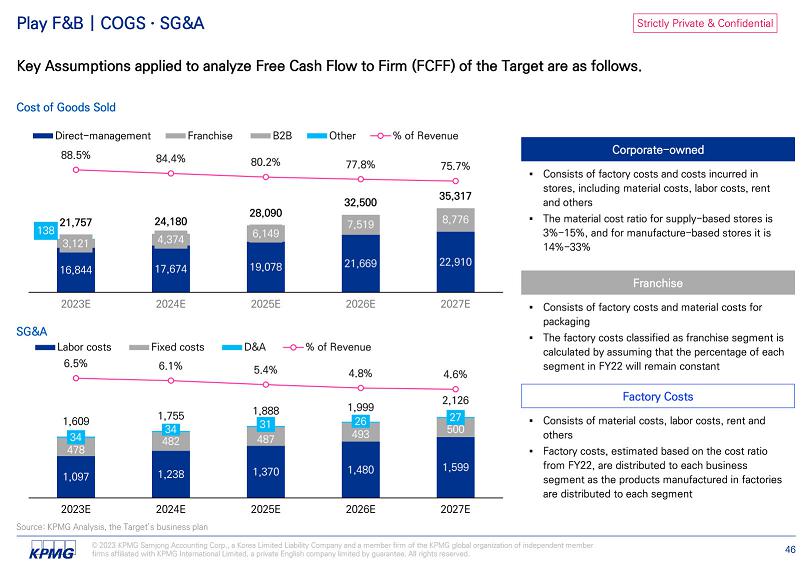

Strictly Private & Confidential Play F&B | COGS · SG&A Key Assumptions applied to analyze Free Cash Flow to Firm (FCFF) of the Target are as follows. Cost of Goods Sold 16,844 17,674 19,078 21,669 22,910 1 3,121 4,374 6,149 7,519 8,776 138 21,757 24,180 28,090 32,500 35,317 88.5% 84.4% 80.2% 77.8% 75.7% 2023E 2024E 2025E 2026E 2027E Direct - management Franchise B2B Other % of Revenue SG&A 1,097 1,238 1,370 1,480 1,599 478 482 487 493 500 34 34 31 1,609 1,755 1,888 1,999 26 2,126 27 Labor costs 6.5% Fixed costs 6.1% 5.4% 4.8% 4.6% 2023E 2024E 2025E 2026E 2027E D&A % of Revenue Franchise Corporate - owned Factory Costs Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 46

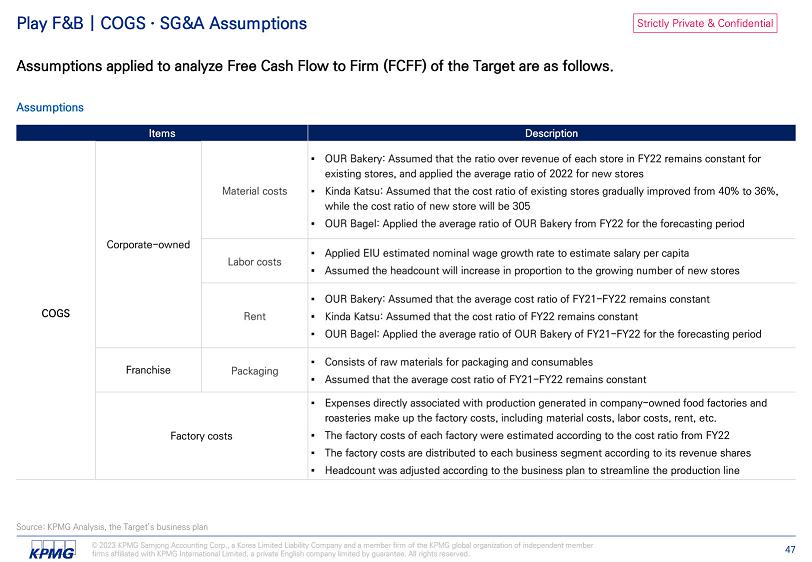

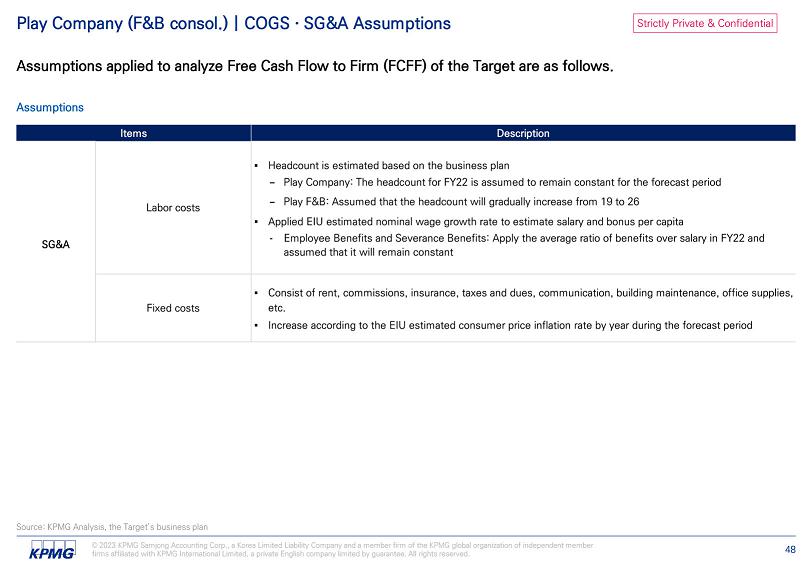

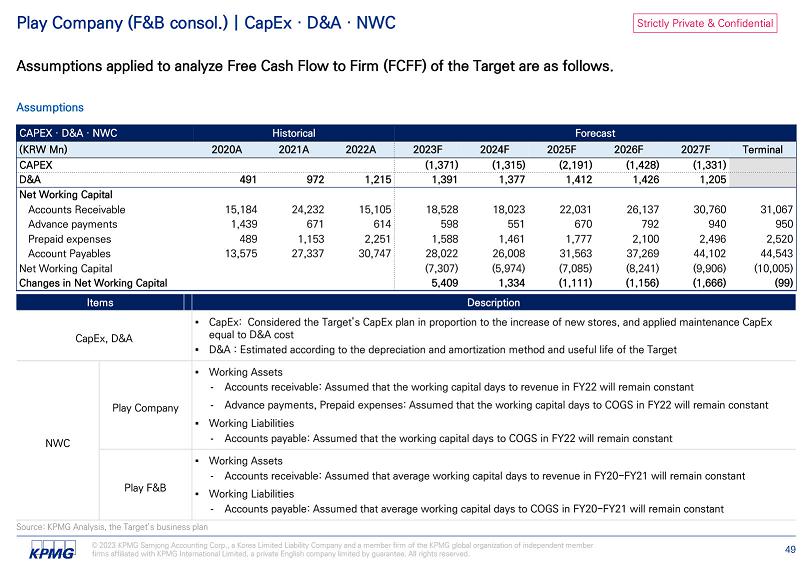

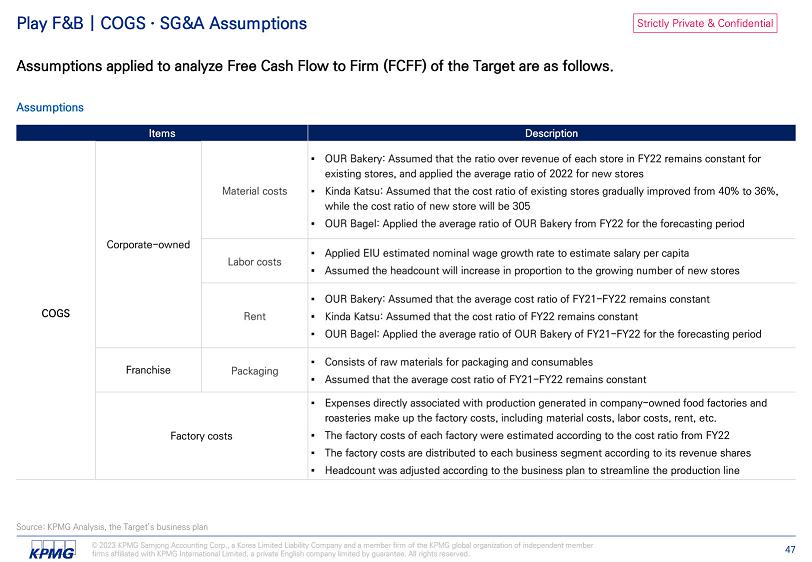

Strictly Private & Confidential Play F&B | COGS · SG&A Assumptions Assumptions applied to analyze Free Cash Flow to Firm (FCFF) of the Target are as follows. Assumptions ▪ OUR Bakery: Assumed that the ratio over revenue of each store in FY22 remains constant for existing stores, and applied the average ratio of 2022 for new stores ▪ Kinda Katsu: Assumed that the cost ratio of existing stores gradually improved from 40% to 36%, while the cost ratio of new store will be 305 ▪ OUR Bagel: Applied the average ratio of OUR Bakery from FY22 for the forecasting period Corporate - owned COGS ▪ Applied EIU estimated nominal wage growth rate to estimate salary per capita ▪ Assumed the headcount will increase in proportion to the growing number of new stores ▪ OUR Bakery: Assumed that the average cost ratio of FY21 - FY22 remains constant ▪ Kinda Katsu: Assumed that the cost ratio of FY22 remains constant ▪ OUR Bagel: Applied the average ratio of OUR Bakery of FY21 - FY22 for the forecasting period ▪ Consists of raw materials for packaging and consumables ▪ Assumed that the average cost ratio of FY21 - FY22 remains constant Franchise ▪ Expenses directly associated with production generated in company - owned food factories and roasteries make up the factory costs, including material costs, labor costs, rent, etc. ▪ The factory costs of each factory were estimated according to the cost ratio from FY22 ▪ The factory costs are distributed to each business segment according to its revenue shares ▪ Headcount was adjusted according to the business plan to streamline the production line Factory costs Source: KPMG Analysis, the Target’s business plan © 2023 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 47