Filed Pursuant to Rule 424(b)(3)

No. 333-278221

PROXY STATEMENT FOR

STOCKHOLDER MEETING OF

GLOBAL STAR ACQUISITION INC.

PROSPECTUS FOR THE REGISTRATION OF

64,295,053 SHARES OF COMMON STOCK;

9,698,225 WARRANTS AND

9,698,225 RIGHTS OF

K WAVE MEDIA LTD.

To the Stockholders of Global Star Acquisition Inc.:

You are cordially invited to attend the special meeting of the Stockholders of Global Star Acquisition Inc. (“Global Star”), which will be held at 9:30 a.m., Eastern time, on February 3, 2025 (the “Special Meeting”). Global Star will be holding the Special Meeting via teleconference using the following dial-in information:

Global Star Acquisition Inc. Virtual Shareholder Meeting Information:

Meeting Date: February 3, 2025

Meeting Time: 9:30 a.m. Eastern Time

Special Meeting-meeting webpage (information, webcast, telephone access and replay):

https://www.cstproxy.com/globalstarspac/bc2025

Telephone access (listen-only):

Within the U.S. and Canada:

1 800-450-7155 (toll-free)

Outside of the U.S. and Canada:

+1 857-999-9155 (standard rates apply)

Conference ID: 7921345#

Global Star is Delaware company incorporated as a blank check company for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination with one or more businesses or entities, which Global Star refer to as a “target business.”

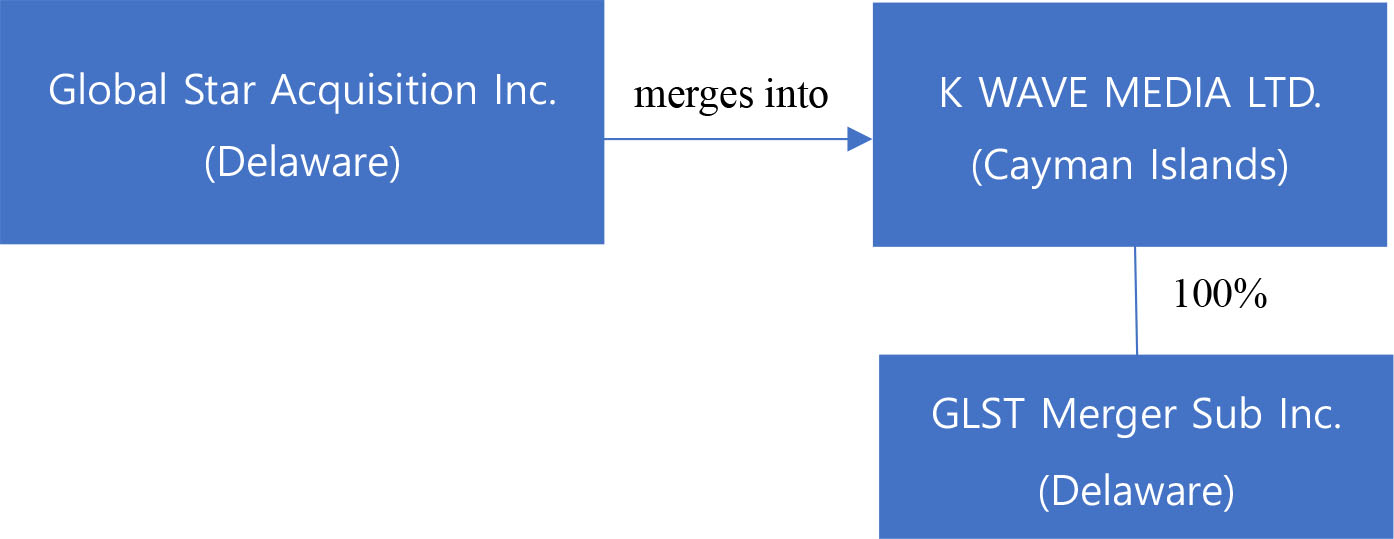

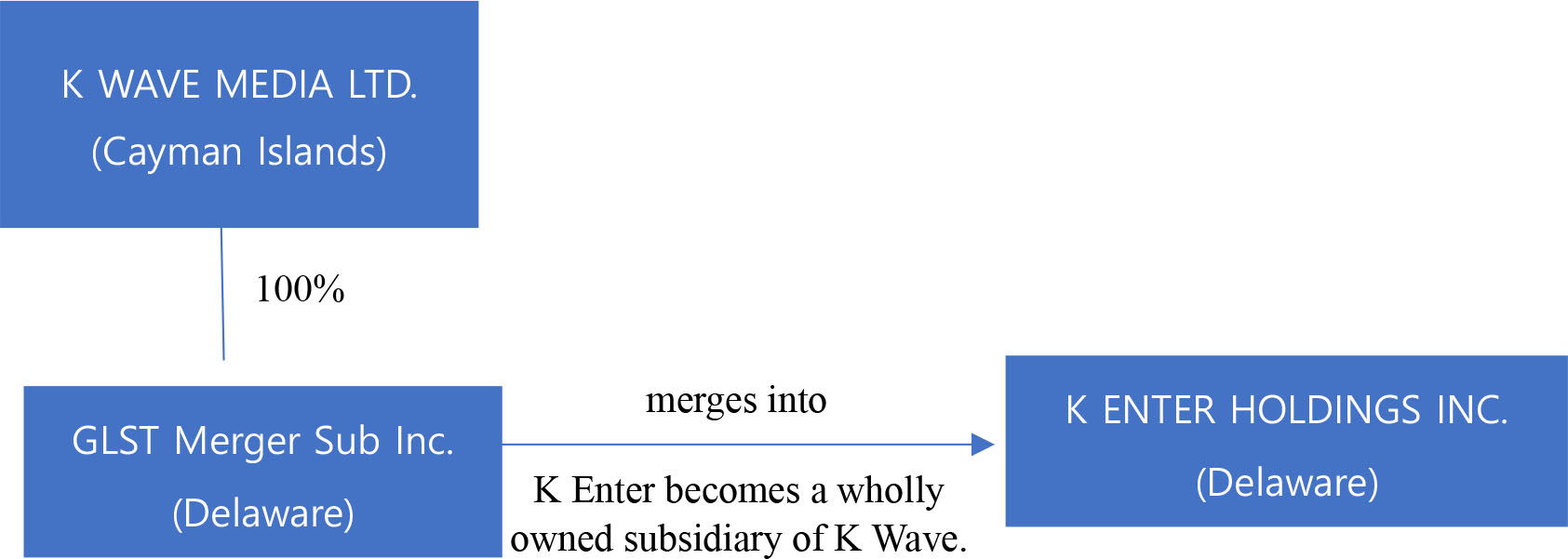

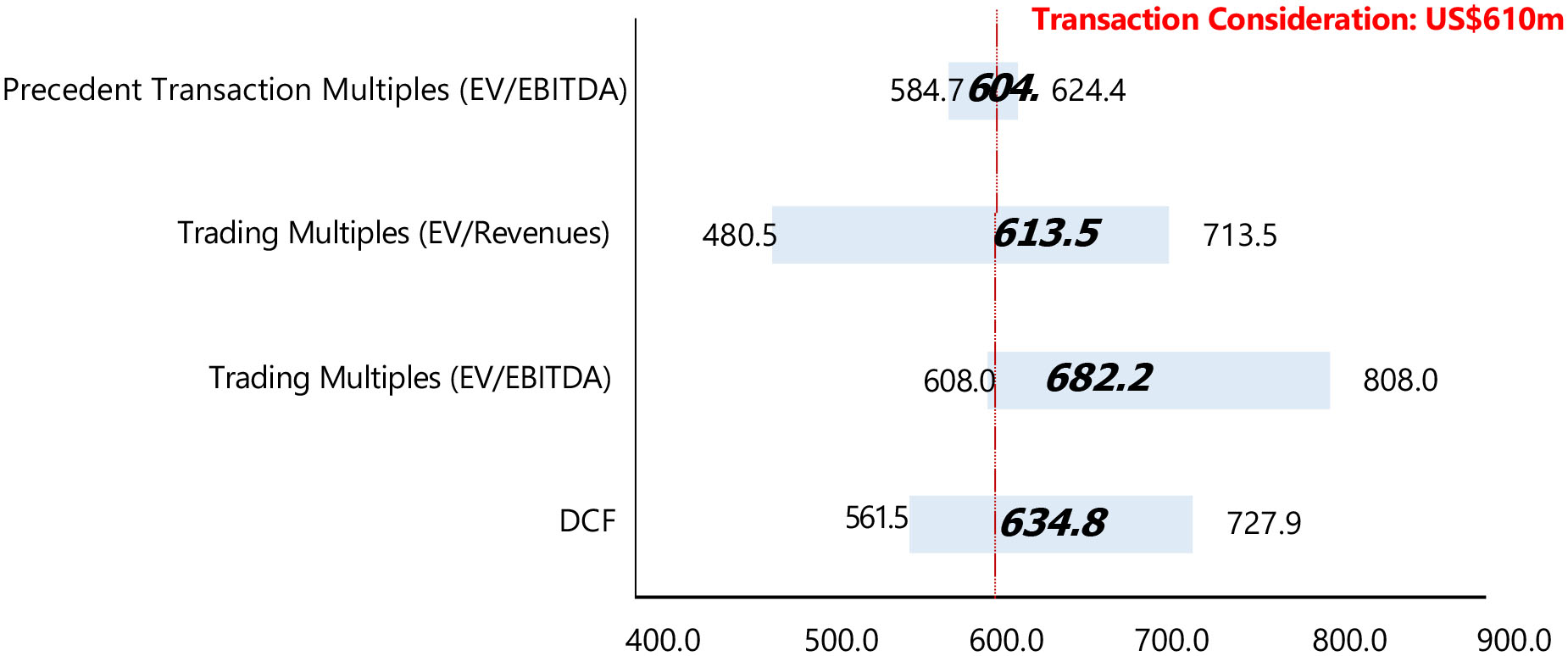

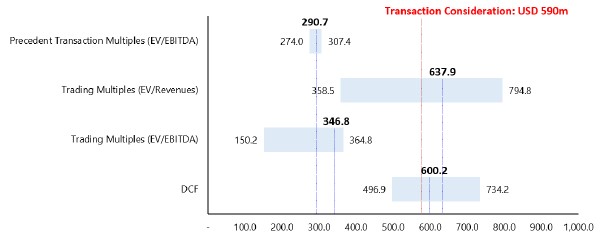

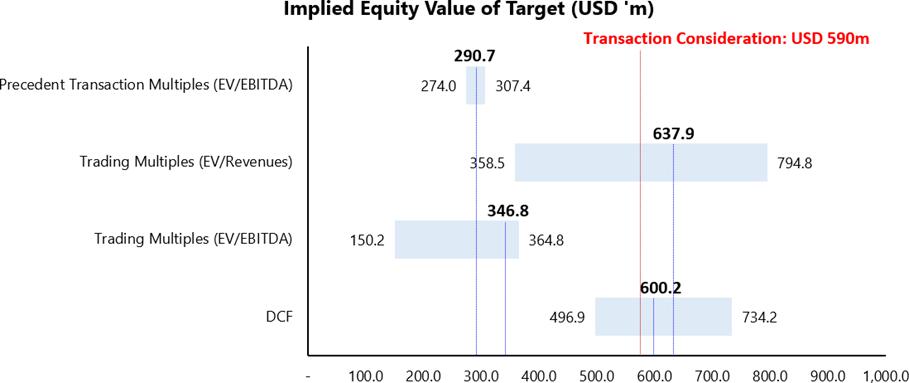

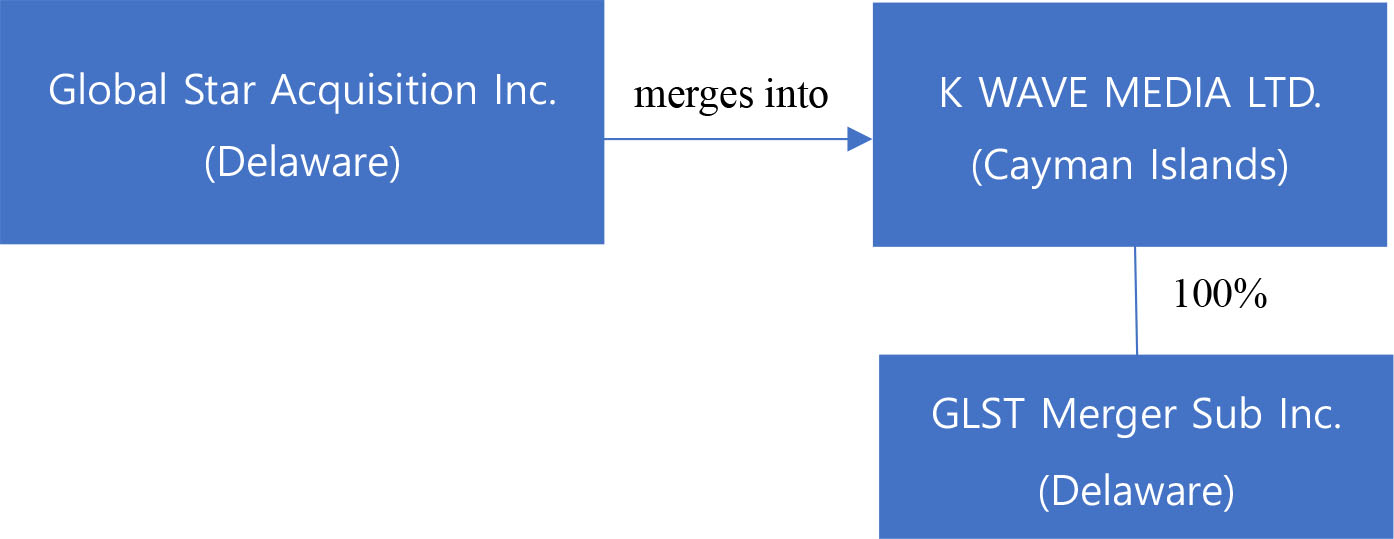

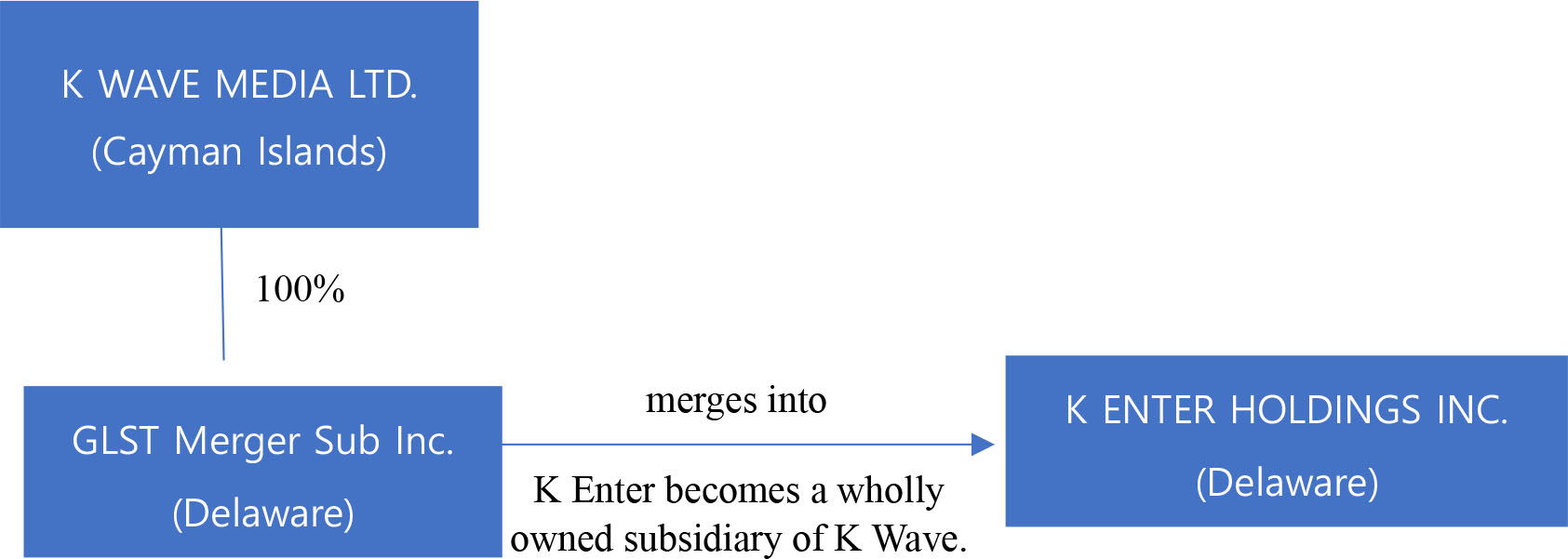

Global Star has entered into a merger agreement, dated as of June 15, 2023, as amended on March 11, 2024, June 28, 2024, July 25, 2024 and December 11, 2024 (the “Merger Agreement”), which provides for a business combination between Global Star and K Enter Holdings, Inc., a Delaware corporation (“K Enter”). Pursuant to the Merger Agreement, the business combination will be effected in two steps: (i) subject to the approval and adoption of the Merger Agreement by the stockholders of Global Star, Global Star will reincorporate to Cayman Islands by merging with and into K Wave Media Ltd, a Cayman Islands exempted company and wholly owned subsidiary of Global Star (“PubCo”), with PubCo remaining as the surviving publicly traded entity (the “Reincorporation Merger”) and (ii) one (1) business day following the Reincorporation Merger, GLST Merger Sub, Inc. (“Merger Sub”), a Delaware corporation and wholly owned subsidiary of PubCo, will be merged with and into K Enter, resulting in K Enter being a wholly owned subsidiary of PubCo (the “Acquisition Merger”). The Reincorporation Merger and the Acquisition Merger are collectively referred to herein as the “Business Combination.” On July 13, 2023, PubCo and Merger Sub executed a written joinder agreement to become parties to the Merger Agreement, accordingly, the Merger Agreement is by and among Global Star, PubCo, Merger Sub, and K Enter. The aggregate consideration for the Acquisition Merger is $590,000,000, payable in the form of 59,000,000 newly issued PubCo’s Ordinary Shares (as defined below) valued at $10.00 per share. K Enter currently has limited operations and does not presently own a controlling interest in any other entities.

At the Special Meeting, Global Star stockholders will be asked to consider and vote upon the following proposals:

Proposal 1. Reincorporation Merger — to consider and vote on a proposal to adopt and approve the merger agreement, dated as of June 15, 2023, as modified by the joinder agreement, dated July 13, 2023, the First Amendment, dated March 11, 2024, the Second Amendment, dated June 28, 2024, the Third Amendment to Merger Agreement, dated July 25, 2024 and the Fourth Amendment to Merger Agreement, dated December 11, 2024 (the “Merger Agreement”), by and among Global Star Acquisition Inc., a Delaware corporation (“Global Star”), K Enter Holdings Inc., a Delaware corporation (“K Enter”), K Wave Media Ltd., a Cayman Islands exempted company (“PubCo”) and GLST Merger Sub, Inc., a Delaware corporation (“Merger Sub”), to effect Global Star’s initial business combination pursuant to which, among other things, (1) Global Star will merge with and into PubCo that is a wholly owned subsidiary of Global Star, with PubCo being the surviving corporation in such merger, thereby consummating a change in Global Star’s domicile from a Delaware corporation to a Cayman Islands exempted company (the “Reincorporation Merger”). Global Star refers to this as the “Reincorporation Merger Proposal” or “Proposal No. 1;” A copy of the Merger Agreement is attached to the accompanying proxy statement as Annex A;

Proposal 2. Acquisition Merger — to consider and vote on a proposal to adopt and approve the subsequent merger set forth in the Merger Agreement, pursuant to which the K Enter will merge with and into Merger Sub that is a wholly owned subsidiary of PubCo, with K Enter as the surviving corporation in such merger, thereby consummating PubCo’s acquisition, through its Merger Sub, of K Enter (the “Acquisition Merger”), and, after giving effect to the Acquisition Merger, K Enter being a wholly owned subsidiary of PubCo. Global Star refers to this as the “Acquisition Merger Proposal” or “Proposal No. 2;” The Reincorporation Merger, the Acquisition Merger and such other transactions contemplated by the Merger Agreement are hereinafter collectively referred as the “Business Combination” and Proposals 1 and 2 are collectively referred to as the “Business Combination Proposals”.

Proposal 3. The Governance Proposal — to consider and vote, on a non-binding advisory basis, on four separate governance proposals relating to the following material differences between Global Star’s current amended and restated certificate of incorporation (the “GLST Charter”) and PubCo’s Amended and Restated Memorandum and Articles of Association (the “PubCo Charter”). These four separate governance proposals are collectively referred to as the “Governance Proposal”:

a. through the Reincorporation Merger, Global Star shall merge with and into PubCo and Global Star, the Delaware corporation, shall cease to exist and PubCo shall be the surviving company and the name of the surviving company will be “K Wave Media, Ltd.”;

b. following the Reincorporation Merger the authorized shares of the surviving corporation shall change from (i) 100,000,000 shares of Global Star Class A Common Stock, 10,000,000 shares of Global Star Class B Common Stock and 1,000,000 shares of preferred stock to (ii) $100,000 divided into 990,000,000 PubCo Ordinary Shares and 10,000,000 PubCo Preference Shares;

c. deleting the forum selection provision providing for concurrent jurisdiction in the Court of Chancery and the federal district court for the District of Delaware for claims arising under the Securities Act and the PubCo Charter adopts the Cayman Islands as the exclusive forum for certain shareholder litigation; provided, however, that this exclusive forum provision shall not apply to any action or suits brought to enforce any liability or duty created by the United States Securities Act of 1933, as amended, the Exchange Act, or any claim for which the federal district courts of the United States of America are, as a matter of the laws of the United States, the sole and exclusive forum for determination of such a claim; and

d. deleting the election to not be governed by Section 203 of the DGCL and limiting certain corporate takeovers by interested shareholders.

A copy of the form of PubCo’s Amended and Restated Memorandum and Articles of Association is attached to this proxy statement/ prospectus as Annex B. Global Star refers to this as the “Governance Proposal” or “Proposal No. 3;”

Proposal 4. Election of Directors of PubCo Proposal — to consider and vote on a proposal to approve PubCo’s Board of Directors (the “PubCo Board”) in regards to the following persons: Pyeung Ho Choi, Young Jae Lee, Tan Chin Hwee, Ted Kim, Han Jae Kim, Hyung Seok Cho and Tae Woo Kim to serve on PubCo’s Board of Directors. Global Star refers to this as the “Director Proposal” or “Proposal No. 4;”;

Proposal 5. The PubCo 2023 Equity Incentive Plan Proposal — to consider and vote on a proposal to approve PubCo’s 2023 Equity Incentive Plan (the “Incentive Plan”). Global Star refers to this as the “Incentive Plan Proposal” or “Proposal No. 5.” A copy of the Incentive Plan is attached to the accompanying proxy statement as Annex C.

Proposal 6. The Adjournment Proposal — to approve a proposal to adjourn the Special Meeting under certain circumstances, which is more fully described in the accompanying proxy statement/prospectus. Global Star refers to this as the “Adjournment Proposal” or “Proposal No. 6” and, together with the Reincorporation Merger Proposal, the Acquisition Merger Proposal, and the Incentive Plan Proposal, the “Proposals.”

Upon the closing of the Acquisition Merger, (i) each share of K Enter capital stock, if any, that is owned by Company or Merger Sub (or any other subsidiary of Company) or K Enter (as treasury stock or otherwise), will automatically be cancelled and retired without any conversion, (ii) each share of K Enter preferred stock issued and outstanding shall be deemed converted into shares of K Enter common stock, (iii) each share of K Enter common stock issued and outstanding, including shares of K Enter common stock deemed outstanding as a result of the mandatory conversion of K Enter preferred stock, shall be converted into the right to receive a number of PubCo Ordinary Shares equal to the Conversion Ratio, and (iv) each share of Merger Sub common stock issued and outstanding shall be converted into and become one newly issued, fully paid and nonassessable share of K Enter common stock. Conversion Ratio means the quotient obtained by dividing (a) 59,000,000 PubCo Ordinary Shares, by (b) the Aggregate Fully Diluted K Enter Common Shares. Aggregate Fully Diluted K Enter Common Shares means the sum of (a) all shares of K Enter common stock that are issued and outstanding immediately prior to the Closing; plus (b) the aggregate shares of K Enter common stock issuable upon conversion of all shares of K Enter preferred stock that are issued and outstanding immediately prior to the Closing; plus (c) the aggregate shares of K Enter common stock issuable upon full conversion, exercise or exchange of any other securities of K Enter outstanding immediately prior to the Closing directly or indirectly convertible into or exchangeable or exercisable for K Enter.

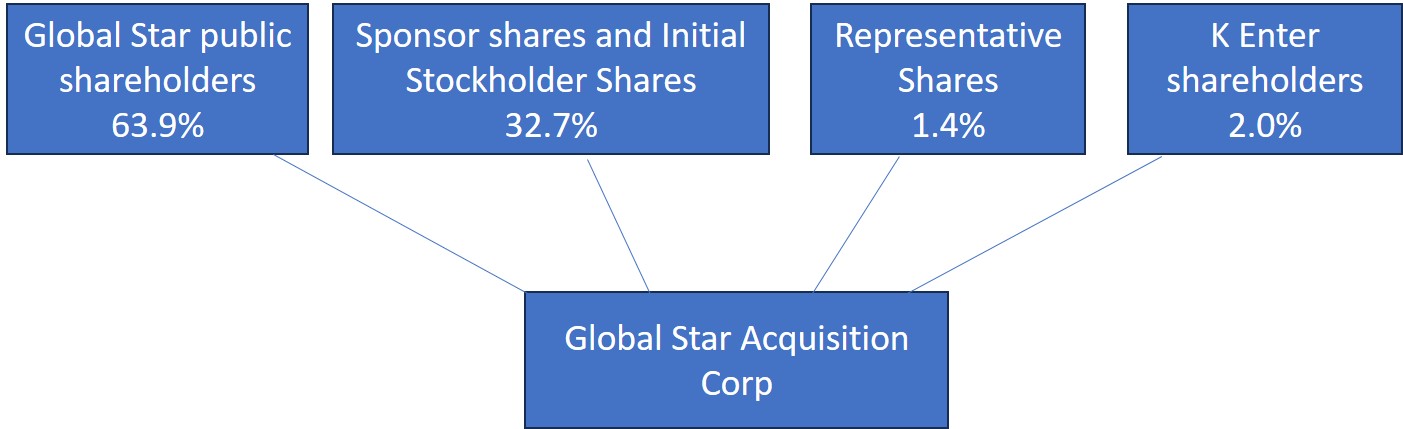

It is anticipated that, upon consummation of the Business Combination, Global Star’s public stockholders will own approximately 3.3% of the issued PubCo Ordinary Shares, the Sponsor (as defined below) and Initial Stockholders will own approximately 4.5% of the issued PubCo Ordinary Shares, and K Enter’s current stockholders will own approximately 92.2% of the issued PubCo Ordinary Shares. These relative percentages assume that (i) none of Global Star’s existing public stockholders exercise their redemption rights, as discussed herein; and (ii) there is no exercise or conversion of PubCo Warrants. The exercise of the PubCo Warrants by some, but not all, of the warrant holders will result in dilution to the former Global Star public stockholders not exercising such PubCo Warrants.

If any of Global Star’s existing public stockholders exercise their redemption rights, the anticipated percentage ownership of Global Star’s existing stockholders will be reduced. For example, if 25% of Global Star’s public stockholders exercise their redemption rights, then the PubCo Ordinary Shares would be owned 92.6% by the K Enter stockholders, 2.8% by the former Global Star public stockholders and 4.6% by the Sponsor and Initial Stockholders. Further, if 25% of Global Star’s public stockholders exercise their redemption rights and all of the Global Star warrants and convertible securities are exercised, then the PubCo Ordinary Shares would be owned 79.7% by the K Enter stockholders, 2.4% by the former Global Star public stockholders and 4.0% by the Sponsor and Initial Stockholders Alternatively, if 100% of Global Star’s public stockholders exercise their redemption rights, then the PubCo Ordinary Share would be owned 93.9% by the K Enter stockholders, 1.4% by the former Global Star public stockholders and 4.7% by the Sponsor and Initial Stockholders. Likewise, if 100% of Global Star’s public stockholders exercise their redemption rights and all of the Global Star warrants and convertible securities are exercised, then the PubCo Ordinary Shares would be owned 80.7% by the K Enter stockholders, 1.3% by the former Global Star public stockholders and 4.1% by the Sponsor and Initial Stockholders No stockholder will have a controlling interest in PubCo. Further, both Global Star and K Enter have agreed to use their best efforts to complete a $50 million PIPE Financing that would result in further dilution, but the amount of such dilution cannot be determined until the terms of the PIPE Financing have been negotiated. You should read “Summary of the Proxy Statement/Prospectus — The Business Combination and the Merger Agreement” and “Unaudited Pro Forma Condensed Combined Financial Statements” for further information.

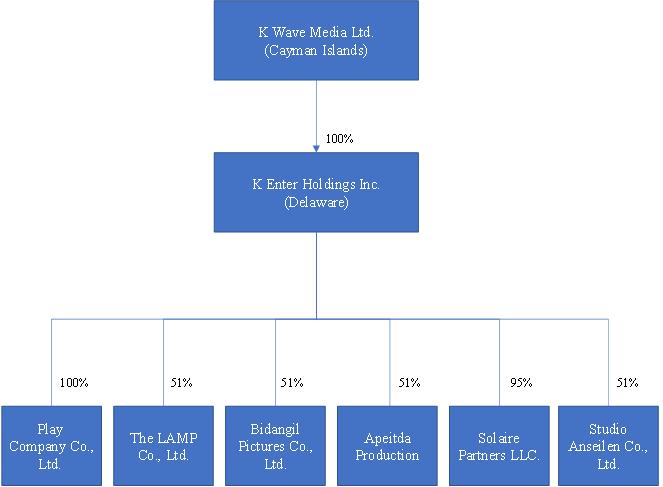

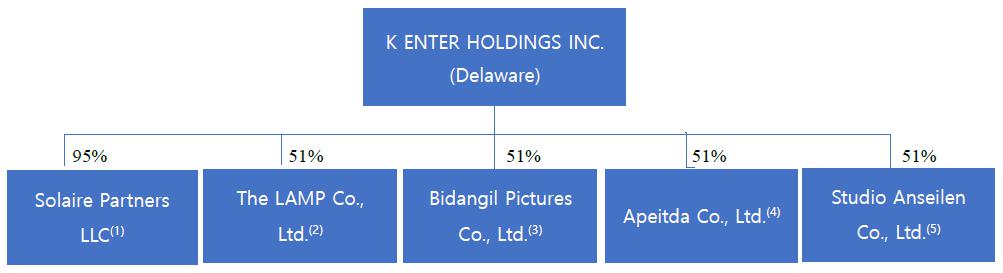

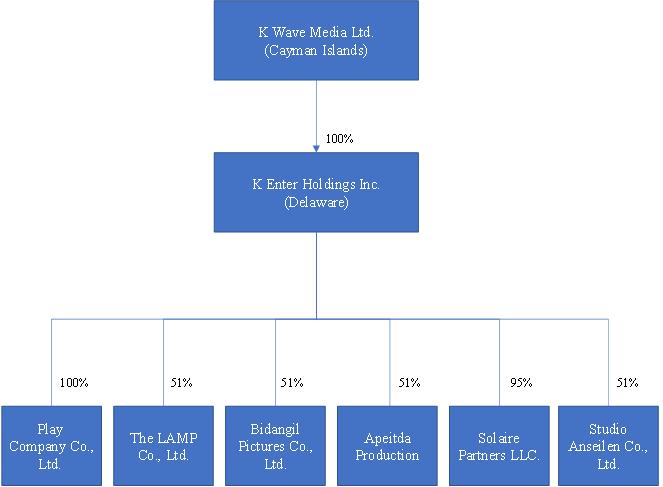

The closing of the business combination is subject to certain conditions, including K Enter’s acquisition of the controlling equity interests of the Six Korean Entities. K Enter currently has limited operations and does not presently own a controlling interest in any other entities. For more information, see the questions and answers titled “When is the acquisition of the Six Korean Entities expected to occur?” and “What if there are material developments or changes relating to the acquisition by K Enter of the Six Korean Entities prior to the Special Meeting?” and “What if K Enter’s acquisition of the Six Korean Entities does not occur prior to the Special Meeting?” in the Section titled “Questions and Answers about the Business Combination and the Special Meeting” beginning on page 6.

K Enter’s acquisition of the Six Korean Entities is a closing condition to the Business Combination, and while this condition can be waived, Global Star does not currently intend to waive this condition. K Enter expects to close the acquisitions of the controlling equity interests of the Six Korean Entities within 24 to 72 hours after this proxy statement/prospectus on Form F-4 is declared effective by the U.S. Securities and Exchange Commission (“SEC”). In addition, Global Star will not mail proxy materials to its shareholders for the Special Meeting until after K Enter closes the acquisitions of the controlling equity interests of all of the Six Korean Entities. PubCo shall include the date that K Enter completes the acquisitions of the controlling equity interests of all Six Korean Entities in its Form 424B3 Prospectus to be filed with the SEC after this proxy statement/prospectus on Form F-4 is declared effective by the SEC.

In the event that K Enter does not complete the acquisitions of the controlling equity interests of all of the Six Korean Entities, PubCo will file a post-effective amendment to its Registration Statement on Form F-4 (the “Post-Effective Amendment”) disclosing that K Enter did not complete its contemplated acquisitions of the controlling equity interests of all of the Six Korean Entities (and the material information concerning such event) and Global Star will not mail proxy materials to its shareholders for the Special Meeting (or hold its Special Meeting) until after the Post-Effective Amendment is declared effective by the SEC. Global Star’s shareholders will not be able to vote for or against the Business Combination until after they receive a definitive proxy statement, which will only be mailed after the later of (i) the successful consummation of the acquisition of the controlling interests of all of the Six Korean Entities or (ii) the declaration of effectiveness by the SEC of the Post-Effective Amendment.

As of January 3, 2025, K Enter completed the acquisitions of the controlling equity interests of each of the Six Korean Entities.

Global Star’s Initial Stockholders and the Sponsor, who as of the record date, owned 2,798,225 shares of GLST Common Stock, or approximately 69.1% of the issued and outstanding GLST Common Stock, have agreed to vote their respective shares in favor of each of the Reincorporation Merger Proposal and the Acquisition Merger Proposal and are expected to vote in favor of the Incentive Plan Proposal, the Adjournment Proposal and the Director Proposal. As a result, the affirmative vote of the shares of GLST Common Stock held by the Initial Stockholders and the Sponsor is sufficient to approve each of the Proposals.

Global Star common shares are currently listed on the Nasdaq Capital Market under the symbol “GLST.” PubCo intends to apply to list the PubCo Ordinary Shares and PubCo Warrants on the Nasdaq Stock Market under the symbols “KWM” and “KWMW” respectively, in connection with the closing of the Business Combination. Global Star cannot assure you that the PubCo Ordinary Shares and PubCo Warrants will be approved for listing on Nasdaq.

Investing in PubCo securities involves a high degree of risk. See “Risk Factors” beginning on page 36 for a discussion of information that should be considered in connection with an investment in PubCo securities.

As of January 3, 2025, there was approximately $4.3 million in Global Star’s trust account. On January 3, 2025, the last sale price of GLST Common Stock was $11.97.

Global Star’ stockholders are not entitled to exercise appraisal or dissenters rights in connection with the Business Combination. Pursuant to Global Star’s amended and restated certificate of incorporation, Global Star is providing its public stockholders with the opportunity to redeem all or a portion of their shares of GLST Common Stock at a per-share price, payable in cash, equal to the aggregate amount then on deposit in Global Star’s trust account as of two business days prior to the consummation of the Business Combination, including interest, less taxes payable, divided by the number of then outstanding shares of GLST Common Stock that were sold as part of the GLST Units in Global Star’s initial public offering (“IPO”), subject to the limitations described herein. Global Star estimates that the per-share price at which public shares may be redeemed from cash held in the trust account will be approximately $11.45 per share, subject to reduction for the payment of taxes, at the time of the Special Meeting. Global Star’s public stockholders may elect to redeem their shares even if they vote for the Reincorporation Merger or do not vote at all. Global Star has no specified maximum redemption threshold under the Global Star’s amended and restated certificate of incorporation. It is a condition to closing under the Merger Agreement, however, that Global Star has, in the aggregate, not less than $5,000,001 of net tangible assets or is otherwise exempt from the provisions of Rule 419 promulgated under the Securities Act. If redemptions by Global Star public stockholders cause Global Star to be unable to meet this closing condition, then Global Star may not be required to consummate the Business Combination, although Global Star and K Enter may, in their sole discretion, waive this condition. In the event that Global Star waives this condition, Global Star does not intend to seek additional stockholder approval or to extend the time period in which its public stockholders can exercise their redemption rights. Holders of outstanding GLST Warrants and GLST Rights do not have redemption rights in connection with the Business Combination.

Global Star is providing this proxy statement/prospectus and accompanying proxy card to its stockholders in connection with the solicitation of proxies to be voted at the Special Meeting and at any adjournments or postponements of the Special Meeting. The Sponsor and K Enter, which own approximately 19.26% and 2.0%, respectively, of GLST Common Stock as of the record date, are expected to vote their Common Stock in favor of the Reincorporation Merger Proposal and the Acquisition Merger Proposal, which transactions comprise the Business Combination, and intend to vote for the Incentive Plan Proposal and the Adjournment Proposal, although there is no agreement in place with respect to voting on those proposals.

Each stockholder’s vote is very important. Whether or not you plan to attend the Special Meeting in person, please submit your proxy card without delay. Global Star’s stockholders may revoke proxies at any time before they are voted at the meeting. Voting by proxy will not prevent a stockholder from voting in person if such stockholder subsequently chooses to attend the Special Meeting. If you are a holder of record and you attend the Special Meeting and wish to vote in person, you may withdraw your proxy and vote in person. Assuming that a quorum is present, attending the Special Meeting either in person or by proxy and abstaining from voting will have the same effect as voting against all the Proposals. And broker non-votes will have no effect on any of the Proposals.

If you sign, date and return your proxy card without indicating how you wish to vote, your proxy will be voted in favor of each of the Proposals presented at the Special Meeting. If you fail to return your proxy card or fail to instruct your bank, broker or other nominee how to vote, and do not attend the Special Meeting in person, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the Special Meeting of stockholders and, if a quorum is present, will have the effect of a vote against the Business Combination Proposal and no effect on the adjournment proposal. If you are a stockholder of record and you attend the Special Meeting and wish to vote in person, you may withdraw your proxy and vote in person.

Global Star encourages you to read this proxy statement/prospectus carefully. In particular, you should review the matters discussed under the caption “Risk Factors” beginning on page 36.

Global Star board of directors has unanimously approved the Merger Agreement and unanimously recommends that Global Star stockholders vote “FOR” approval of each of the Proposals. When you consider Global Star board of director’s recommendation of these Proposals, you should keep in mind that Global Star’s directors and officers have interests in the Business Combination that may conflict or differ from your interests as a stockholder. See the section titled “Proposals to be Considered by Global Star Stockholders: The Business Combination — Interests of Global Star’s Directors and Executive Officers in the Business Combination.”

On behalf of the Global Star board of directors, I thank you for your support and Global Star looks forward to the successful consummation of the Business Combination.

If you have any questions or need assistance voting your ordinary shares, please contact Laurel Hill Advisory Group, LLC, Global Star’s proxy solicitor, by calling (855)-414-2266, or banks and brokers can call collect at (516) 396-7902, or by emailing GLST@laurelhill.com. The notice of the stockholder meeting and the proxy statement/prospectus relating to the Business Combination will be available at https://www.cstproxy.com/globalstarspac/bc2025.

The accompanying proxy statement/prospectus provides stockholders of Global Star with detailed information about the Business Combination and other matters to be considered at the stockholder meeting of Global Star. Global Star encourages you to read the entire accompanying proxy statement/prospectus, including the Annexes and other documents referred to therein, carefully and in their entirety. In particular, when you consider the recommendation of the board of directors of Global Star to vote in favor of the proposals described in this proxy statement/prospectus, you should keep in mind that Global Star’s directors and officers have interests in the Business Combination that are different from, in addition to or may conflict with your interests as a shareholder. For instance, the Sponsor, and the officers and directors of Global Star who have invested in the Sponsor entity, will benefit from the completion of the Business Combination and may be incentivized to complete an acquisition of a less favorable target company or on terms less favorable to stockholders rather than liquidate. See the section entitled “Interests of Global Star’s Directors and Officers in the Business Combination” for a further discussion. You should also carefully consider the risk factors described in “Risk Factors” beginning on page 36 of the accompanying proxy statement/prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

The accompanying proxy statement/prospectus is dated January 7, 2025, and is first being mailed to Global Star’s stockholders on or about January 7, 2025.

GLOBAL STAR ACQUISITION INC.

1641 International Drive Unit 208

McLean, VA

NOTICE OF STOCKHOLDER MEETING

TO BE HELD ON FEBRUARY 3, 2025

TO THE STOCKHOLDERS OF GLOBAL STAR ACQUISITION INC.:

NOTICE IS HEREBY GIVEN that a meeting of the stockholders (the “stockholder meeting”) of Global Star Acquisition Inc., a Delaware corporation (“Global Star”), will be held on February 3, 2025, at 9:30 Eastern Time at https://www.cstproxy.com/globalstarspac/bc2025, unless the stockholder meeting is adjourned. Global Star also intends to hold the stockholder meeting through a “virtual” or online method. You will be able to attend the stockholder meeting online, vote and submit your questions during the stockholder meeting by visiting https://www.cstproxy.com/globalstarspac/bc2025. To register and receive access to the stockholder meeting, registered stockholders and beneficial stockholders (those holding shares through a stock brokerage account or by a bank or other holder of record) will need to follow the instructions applicable to them provided in this proxy statement/prospectus.

Proposal 1. Reincorporation Merger — to consider and vote on a proposal to adopt and approve the merger agreement, dated as of June 15, 2023, as modified by the joinder agreement, dated July 13, 2023, the First Amendment, dated March 11, 2024, the Second Amendment, dated June 28, 2024, the Third Amendment to Merger Agreement, dated July 25, 2024 and the Fourth Amendment to Merger Agreement, dated December 11, 2024 (the “Merger Agreement”), by and among Global Star Acquisition Inc., a Delaware corporation (“Global Star”), K Enter Holdings Inc., a Delaware corporation (“K Enter”), K Wave Media Ltd., a Cayman Islands exempted company (“PubCo”) and GLST Merger Sub, Inc., a Delaware corporation (“Merger Sub”), to effect Global Star’s initial business combination pursuant to which, among other things, (1) Global Star will merge with and into PubCo that is a wholly owned subsidiary of Global Star, with PubCo being the surviving corporation in such merger, thereby consummating a change in Global Star’s domicile from a Delaware corporation to a Cayman Islands exempted company (the “Reincorporation Merger”). Global Star refers to this as the “Reincorporation Merger Proposal” or “Proposal No. 1;” A copy of the Merger Agreement is attached to the accompanying proxy statement as Annex A;

Proposal 2. Acquisition Merger — to consider and vote on a proposal to adopt and approve the subsequent merger set forth in the Merger Agreement, pursuant to which the K Enter will merge with and into Merger Sub that is a wholly owned subsidiary of PubCo, with K Enter as the surviving corporation in such merger, thereby consummating PubCo’s acquisition, through its Merger Sub, of K Enter (the “Acquisition Merger”), and, after giving effect to the Acquisition Merger, K Enter being a wholly owned subsidiary of PubCo. Global Star refers to this as the “Acquisition Merger Proposal” or “Proposal No. 2;” The Reincorporation Merger, the Acquisition Merger and such other transactions contemplated by the Merger Agreement are hereinafter collectively referred as the “Business Combination” and Proposals 1 and 2 are collectively referred to as the “Business Combination Proposals”.

Proposal 3. The Governance Proposal — to consider and vote, on a non-binding advisory basis, on four separate governance proposals relating to the following material differences between Global Star’s current amended and restated certificate of incorporation (the “GLST Charter”) and PubCo’s Amended and Restated Memorandum and Articles of Association (the “PubCo Charter”). These four separate governance proposals are collectively referred to as the “Governance Proposal”:

a. through the Reincorporation Merger, Global Star shall merge with and into PubCo and Global Star, the Delaware corporation, shall cease to exist and PubCo shall be the surviving corporation and the name of the surviving corporation will be “K Wave Media, Ltd.”;

b. following the Reincorporation Merger the authorized shares of the surviving corporation shall change from (i) 100,000,000 shares of Global Star Class A Common Stock, 10,000,000 shares of Global Star Class B Common Stock and 1,000,000 shares of preferred stock to (ii) $100,000 divided into 990,000,000 PubCo Ordinary Shares and 10,000,000 PubCo Preference Shares;

c. deleting the forum selection provision providing for concurrent jurisdiction in the Court of Chancery and the federal district court for the District of Delaware for claims arising under the Securities Act and the PubCo Charter adopts the Cayman Islands as the exclusive forum for certain shareholder litigation; provided, however, that this exclusive forum provision shall not apply to any action or suits brought to enforce any liability or duty created by the United States Securities Act of 1933, as amended, the Exchange Act, or any claim for which the federal district courts of the United States of America are, as a matter of the laws of the United States, the sole and exclusive forum for determination of such a claim; and

d. deleting the election to not be governed by Section 203 of the DGCL and limiting certain corporate takeovers by interested shareholders.

A copy of the form of PubCo’s Amended and Restated Memorandum and Articles of Association is attached to this proxy statement/ prospectus as Annex B. Global Star refers to this as the “Governance Proposal” or “Proposal No. 3;”

Proposal 4. Election of Directors of PubCo Proposal — to consider and vote on a proposal to approve PubCo’s Board of Directors (the “PubCo Board”) in regards to the following persons: Pyeung Ho Choi, Young Jae Lee, Tan Chin Hwee, Ted Kim, Han Jae Kim, Hyung Seok Cho and Tae Woo Kim to serve on PubCo’s Board of Directors. Global Star refers to this as the “Director Proposal” or “Proposal No. 4;”;

Proposal 5. The PubCo 2023 Equity Incentive Plan Proposal — to consider and vote on a proposal to approve PubCo’s 2023 Equity Incentive Plan (the “Incentive Plan”). Global Star refers to this as the “Incentive Plan Proposal” or “Proposal No. 5.” A copy of the Incentive Plan is attached to the accompanying proxy statement as Annex C.

Proposal 6. The Adjournment Proposal — to approve a proposal to adjourn the Special Meeting under certain circumstances, which is more fully described in the accompanying proxy statement/prospectus. Global Star refers to this as the “Adjournment Proposal” or “Proposal No. 6” and, together with the Reincorporation Merger Proposal, the Acquisition Merger Proposal, and the Incentive Plan Proposal, the “Proposals.”

All of the proposals set forth above are sometimes collectively referred to herein as the “Proposals.” The Reincorporation Merger Proposal and the Acquisition Merger Proposal are dependent upon each other. It is important for you to note that in the event that either of the Reincorporation Merger Proposal or the Acquisition Merger Proposal is not approved, then Global Star will not consummate the Business Combination. If Global Star does not consummate the Business Combination and fails to complete an initial business combination by February 22, 2025 (or June 22, 2025 in the event Global Star extends the time it has to complete an initial business combination to the fullest extent), Global Star will be required to dissolve and liquidate.

As of December 13, 2024, there were 3,214,100 shares of GLST Common Stock issued and outstanding and entitled to vote. Only Global Star stockholders who hold shares of record as of the close of business on December 13, 2024 are entitled to vote at the Special Meeting or any adjournment of the Special Meeting. This proxy statement/prospectus is first being mailed to Global Star stockholders on or about January 7, 2025. Approval of each of the Proposals will require the affirmative vote of the holders of a majority of the issued and outstanding GLST Common Stock present and entitled to vote at the Special Meeting or any adjournment thereof. Assuming that a quorum is present, attending the Special Meeting either in person or by proxy and abstaining from voting will have the same effect as voting against the Proposals and failing to instruct your bank, brokerage firm or nominee to attend and vote your shares will have no effect on any of the Proposals.

This proxy statement/prospectus and accompanying proxy card is being provided to Global Star’s stockholders in connection with the solicitation of proxies to be voted at the stockholder meeting and at any adjournment of the stockholder meeting. Whether or not you plan to attend the stockholder meeting, all of Global Star’s stockholders are urged to read the accompanying proxy statement/prospectus, including the Annexes and other documents referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in “Risk Factors” beginning on page 36 of the accompanying proxy statement/prospectus.

After careful consideration, the board of directors of Global Star has unanimously approved the Merger Agreement and recommends that stockholders vote “FOR” the adoption of the Merger Agreement and “FOR” all other proposals presented to Global Star’s stockholders in the accompanying proxy statement/prospectus. When you consider the recommendation of these proposals by the board of directors of Global Star, you should keep in mind that Global Star’s directors and officers have interests in the Business Combination that may conflict with your interests as a shareholder. See the section entitled “Business Combination Proposals — Interests of Global Star’s Directors and Executive Officers in the Business Combination” in this proxy statement/prospectus for a further discussion of these considerations.

Pursuant to the Existing Governing Documents, a public shareholder may request that Global Star redeem all or a portion of its public shares for cash if the Business Combination is consummated. As a holder of public shares, you will be entitled to receive cash for any public shares to be redeemed only if you:

| (i) | (a) hold public shares or (b) if you hold public shares through units, you elect to separate your units into the underlying public shares, GLST Warrants and GLST Rights prior to exercising your redemption rights with respect to the public shares; |

| (ii) | submit a written request to Global Star’s transfer agent in which you (a) request that Global Star redeem all or a portion of your public shares for cash, and (b) identify yourself as the beneficial holder of the public shares and provide your legal name, phone number and address; and (c) deliver your public shares to Continental, Global Star’s transfer agent, physically or electronically through The Depository Trust Company; and |

| (iii) | deliver your certificates for public shares (if any) along with the redemption forms to Continental, Global Star’s transfer agent, physically or electronically through The Depository Trust Company (“DTC”). |

Holders must complete the procedures for electing to redeem their public shares in the manner described above prior to 5:00 pm, Eastern Time, on January 30, 2025 (two business days before the scheduled vote at the stockholder meeting) in order for their shares to be redeemed.

Holders of units must elect to separate the units into the underlying public shares, GLST Warrants and GLST Rights prior to exercising redemption rights with respect to the public shares. Public holders that hold their units in an account at a brokerage firm or bank, must notify their broker or bank that they elect to separate the units into the underlying public shares, GLST Warrants and GLST Rights, or if a holder holds units registered in its own name, the holder must contact Global Star’s transfer agent directly and instruct them to do so. The redemption rights include the requirement that a holder must identify itself in writing as a beneficial holder and provide its legal name, phone number and address to Global Star’s transfer agent in order to validly redeem its shares. Public stockholders may elect to redeem public shares regardless of if or how they vote in respect of the Business Combination Proposals and regardless of whether they hold public shares on the record date. If the Business Combination is not consummated, the public shares will be returned to the respective holder, broker or bank. If the Business Combination is consummated, and if a public shareholder properly exercises its right to redeem all or a portion of the public shares that it holds and timely delivers its shares to Global Star’s transfer agent, PubCo will redeem such public shares for a per-share price, payable in cash, equal to the pro rata portion of the trust account established at the consummation of Global Star’s initial public offering (the “Trust Account”), calculated as of two business days prior to the consummation of the Business Combination. For illustrative purposes, based on approximately $4,364,690 in the Trust Account and 380,875 shares subject to possible redemption, in each case, as of December 13, 2024, this would have amounted to approximately $11.45 per issued and outstanding public share, subject to reduction for the payment of taxes. If a holder of public shares exercises its redemption rights in full, then such holder will be electing to exchange its public shares for cash and will no longer own public shares. See “Stockholder Meeting of Global Star — Redemption Rights” in this proxy statement/prospectus for a detailed description of the procedures to be followed if you wish to redeem your public shares for cash.

On behalf of Global Star’s board of directors, I would like to thank you for your support and look forward to the successful completion of the Business Combination.

| | Sincerely, |

| | |

| | /s/ Anthony Ang |

| | Anthony Ang

Chief Executive Officer and Chairman of the Board of Directors |

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS OR THE SECURITIES TO BE ISSUED, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

The accompanying proxy statement/prospectus is dated January 7, 2025, and is first being mailed to stockholders on or about January 7, 2025.

TABLE OF CONTENTS

| ANNEX A | | MERGER AGREEMENT, FIRST AMENDMENT TO THE MERGER AGREEMENT, SECOND AMENDMENT TO THE MERGER AGREEMENT AND THIRD AMENDMENT TO THE MERGER AGREEMENT | | A-1 |

| ANNEX B | | FORM OF PUBCO’S AMENDED AND RESTATED MEMORANDUM AND ARTICLES OF ASSOCIATION | | B-1 |

| ANNEX C | | FORM OF PUBCO’S 2024 EQUITY INCENTIVE PLAN | | C-1 |

| ANNEX D | | FORM OF AMENDED AND RESTATED REGISTRATION RIGHTS AGREEMENT | | D-1 |

| ANNEX E | | FORM OF LOCK-UP AGREEMENT | | E-1 |

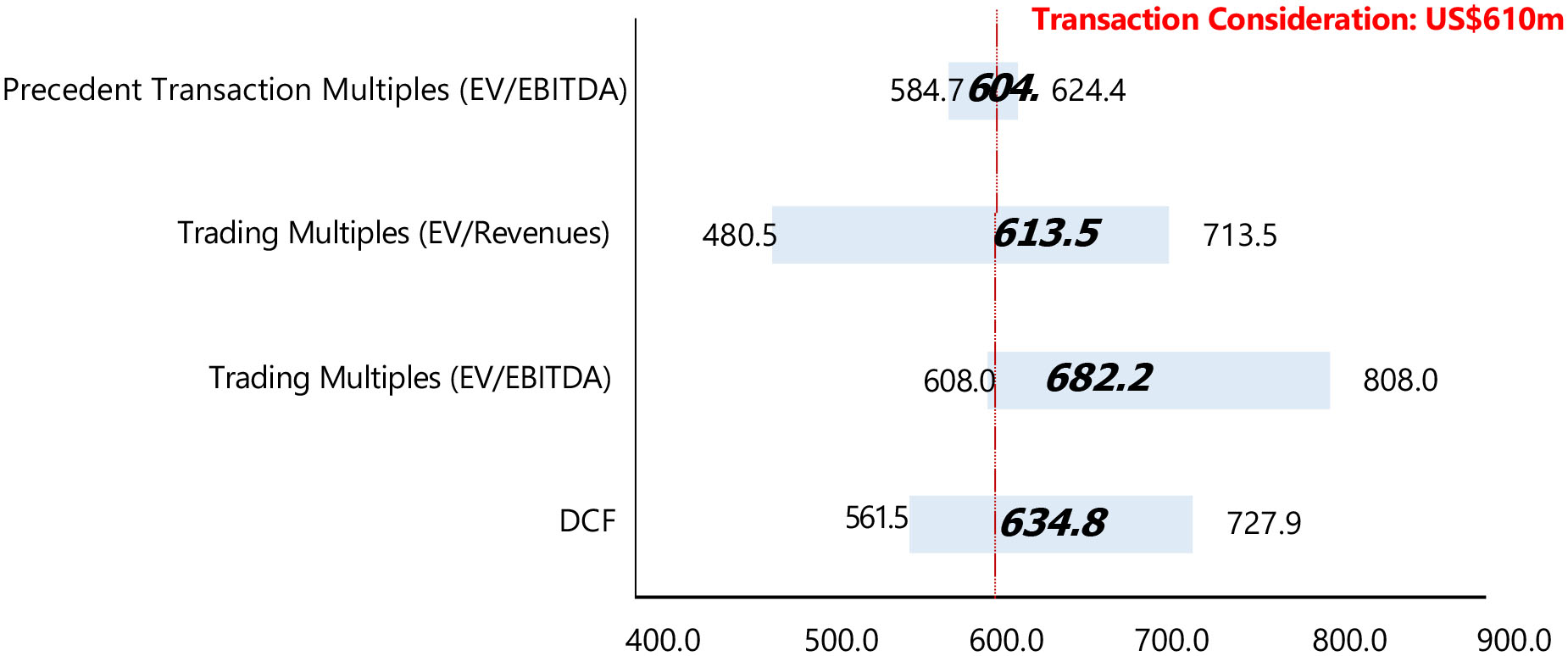

| ANNEX F | | FAIRNESS OPINION LETTER, DATED JUNE 9, 2023, BY EVEREDGE PTE, LTD. AND OPINION OF EVEREDGE PTE., LTD., DATED JUNE 9, 2023 | | F-1 |

| ANNEX G | | FAIRNESS OPINION LETTER, DATED MARCH 12, 2024, REVISED APRIL 29, 2024, BY EVEREDGE PTE, LTD AND OPINION OF EVEREDGE PTE., LTD., DATED MARCH 12, 2024, REVISED APRIL 29, 2024. | | G-1 |

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This document, which forms part of a registration statement on Form F-4 filed by PubCo (File No. 333-278221) with the SEC, constitutes a prospectus of PubCo under Section 5 of the Securities Act, with respect to the issuance of (i) the PubCo Ordinary Shares to Global Star’s stockholders, (ii) the PubCo Warrants to holders of GLST Warrants in exchange for the GLST Warrants, (iii) the PubCo Rights in exchange for the GLST Rights (iv) the PubCo Ordinary Shares underlying the PubCo Rights, (v) PubCo Ordinary Shares to the stockholders of K Enter and (vi) the investors in the PIPE Financing, if the Business Combination is consummated. This document also constitutes a notice of meeting and a proxy statement under Section 14(a) of the Exchange Act, with respect to the Special Meeting at which Global Star’s stockholders will be asked to consider and vote upon the Proposals to approve the Reincorporation Merger, the Acquisition Merger, the Incentive Plan Proposal and the Adjournment Proposal.

This proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction to or from any person to whom it is not lawful to make any such offer or solicitation in such jurisdiction.

WHERE YOU CAN FIND MORE INFORMATION

As a foreign private issuer, after the consummation of the Business Combination, PubCo will be required to file its Annual Report on Form 20-F with the SEC no later than four months following its fiscal year end. Global Star files reports, proxy statements and other information with the SEC as required by the Exchange Act. You can read Global Star’s SEC filings, including this proxy statement/prospectus, over the Internet at the SEC’s website at http://www.sec.gov.

Information and statements contained in this proxy statement/prospectus, or any annex to this proxy statement/prospectus, are qualified in all respects by reference to the copy of the relevant contract or other annex filed with this proxy statement/prospectus.

If you would like additional copies of this proxy statement/prospectus, or if you have questions about the Business Combination, you should contact Global Star’s proxy solicitor, Laurel Hill Advisory Group, LLC, individual call toll-free at (855) 414-2266 and banks and brokers call at (516) 396-7902.

All information contained in this proxy statement/prospectus relating to Global Star, PubCo and Merger Sub has been supplied by Global Star, and all such information relating to K Enter has been supplied by K Enter. Information provided by either of Global Star or K Enter does not constitute any representation, estimate or projection of the other party.

Neither Global Star, PubCo, Merger Sub nor K Enter has authorized anyone to give any information or make any representation about the Business Combination or their companies that is different from, or in addition to, that contained in this proxy statement/prospectus or in any of the materials that have been incorporated into this proxy statement/prospectus by reference. Therefore, if anyone does give you any such information, you should not rely on it. If you are in a jurisdiction where offers to exchange or sell, or solicitations of offers to exchange or purchase, the securities offered by this proxy statement/prospectus or the solicitation of proxies is unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this proxy statement/prospectus does not extend to you. The information contained in this proxy statement/prospectus speaks only as of the date of this proxy statement/prospectus unless the information specifically indicates that another date applies.

USE OF CERTAIN TERMS

Unless otherwise stated in this proxy statement/prospectus references to the following terms shall be defined as follows:

| ● | “2023 Plan” or the “Incentive Plan” refer to PubCo 2023 Share Incentive Plan; |

| ● | “Acquisition Merger” refer to the merger, described in the Merger Agreement, between K Enter and Merger Sub, whereby K Enter is the surviving corporation; |

| ● | “Business Combination” refer to the closing of the transactions contemplated by the Merger Agreement, including the Reincorporation Merger and the Acquisition Merger; |

| ● | “Closing Date” refer to the date on which the Business Combination is consummated; |

| ● | “Exchange Act” refer to the Securities Exchange Act of 1934, as amended; |

| ● | “First Amendment” refer to the First Amendment to Merger Agreement, dated March 11, 2024, by and among Global Star, K Enter, PubCo and Merger Sub; |

| | ● | “Founder Shares” means the outstanding shares of GLST Class B Common Stock held by the Sponsor, Global Star’s directors and affiliates of Global Star’s management team in the total amount of 2,140,000 shares. |

| | | |

| | ● | “Fourth Amendment” means the Fourth Amendment to Merger Agreement, dated December 11, 2024, by and among Global Star, K Enter, PubCo and Merger Sub; |

| ● | “Global Star” or “GLST” or the “Company” refer to Global Star Acquisition Inc., a Delaware corporation; |

| ● | “GLST Charter” refers to GLST’s Amended and Restated Certificate of Incorporation, filed with the Delaware Secretary of State on September 19, 2022. |

| | ● | “GLST Common Stock” refers collectively to GLST Class A Common Stock, $0.0001 par value per share and GLST Class B Common Stock, $0.0001 par value per share; |

| | ● | “GLST Class A Common Stock” are to Global Star’s Class A Common Stock, $0.0001 par value per share;, sold as part of the units in the IPO (whether they are purchased in the IPO or thereafter in the open market) |

| ● | “GLST Class B Common Stock” are to Global Star’s Class B Common Stock, $0.0001 par value per share; |

| ● | “GLST Rights” are to the rights sold as part of the units in the IPO (whether they are purchased in the IPO or thereafter in the open market). The GLST Rights entitle the holder to receive 1/10 of one share of GLST Class A Common Stock upon the consummation of the Business Combination; |

| | ● | “GLST Warrants” are to redeemable warrants sold as part of the units in the IPO (whether they are purchased in the IPO or thereafter in the open market, including warrants that may be acquired by Global Star’s sponsor or its affiliates in this offering or thereafter in the open market). The GLST Warrants entitle the holder to purchase one share of GLST Class A Common Stock for $11.50 per share; |

| | ● | “GLST Units” are to Global Star Units sold in the IPO at a price of $10 per unit (whether they are purchased in the IPO or thereafter in the open market, including warrants that may be acquired by Global Star’s sponsor or its affiliates in this offering or thereafter in the open market). The GLST Units consist of one share of Class A Common Stock, one GLST Warrant and one GLST Right; |

| ● | “IFRS” refer to International Financial Reporting Standards issued by the IFRS Foundation and the International Accounting Standards Board. |

| | ● | “Initial Stockholders” are the initial stockholders of Global Star, including Anthony Ang, Nicholas Khoo, Shan Cui, Stephen Drew, Argon Lam Chun Win, Yang Kan Chong, Hai Chwee Chew and Jukka Rannila and excluding the Sponsor. |

| | ● | “IPO” refer to the initial public offering of 8,000,000 units of Global Star consummated on September 22, 2022; |

| ● | “Joinder Agreement” refer to as the Joinder Agreement, dated July 13, 2023, entered into among PubCo, Merger Sub, Global Star and K Enter. |

| ● | “K Enter” refers to K Enter Holdings Inc., a Delaware corporation; |

| ● | “K Enter Charter” refers to K Enter’s Second Amended and Restated Certificate of Incorporation, filed with the Delaware Secretary of State on May 31, 2023. |

| ● | “K Enter Common Stock” refer to the shares of K Enter’s common stock, $0.0001 par value per share. |

| ● | “Merger Agreement” refer to the Merger Agreement, dated June 15, 2023, by and between Global Star and K Enter, as modified by the Joinder Agreement, dated July 13, 2023, the First Amendment to Merger Agreement, dated March 11, 2024, the Second Amendment to Merger Agreement, dated June 28, 2024, the Third Amendment to Merger Agreement to Merger Agreement, dated July 25, 2024 and the Fourth Amendment to Merger Agreement dated December 11, 2024; |

| ● | “Merger Sub” refer to GLST Merger Sub, Inc., a Delaware corporation; |

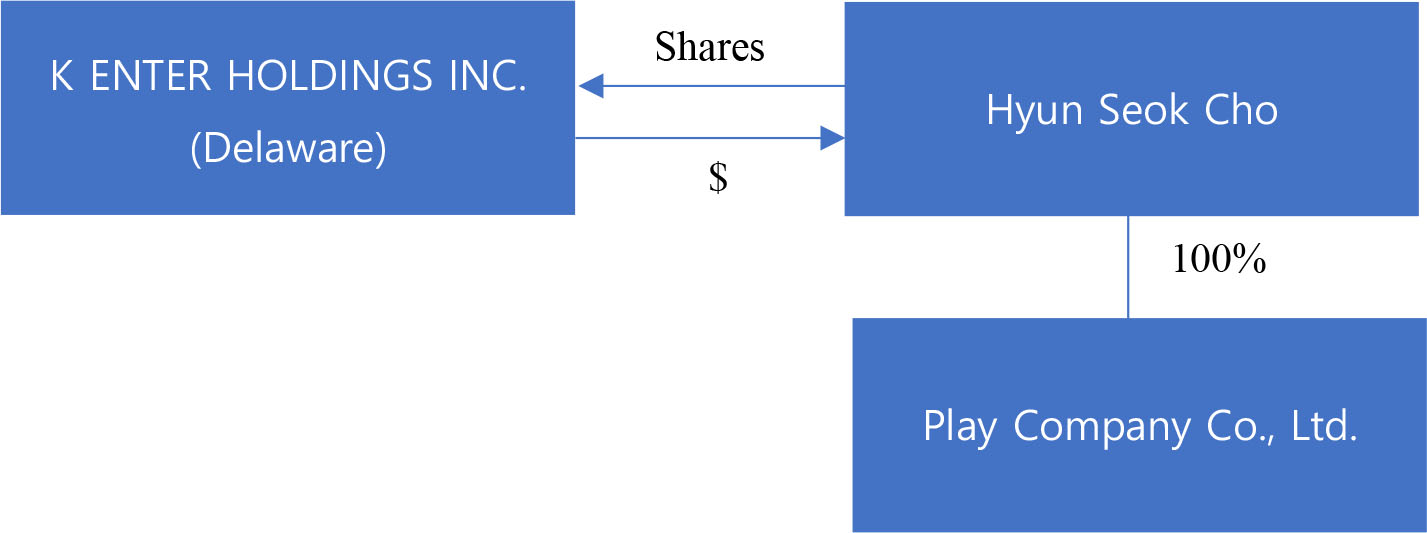

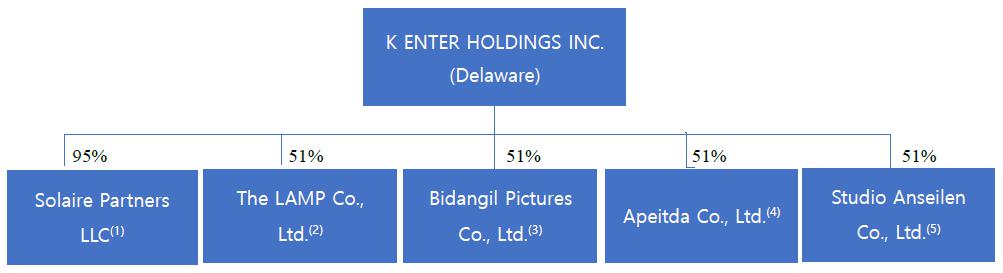

| | ● | “New K Enter” refers to K Enter after the closing of the six (6) equity purchase agreements with (1) Play Company Co., Ltd.; (2) Solaire Partners LLC; (3) Apeitda Co., Ltd.; (4) The LAMP Co., Ltd.: (5) Bidangil Pictures Co., Ltd.; and (6) Studio Anseilen Co., Ltd. |

| ● | “PIPE Financing” refers to Global Star’s plan to use its best efforts to consummate a capital raise of $50,000,000, with the assistance and cooperation of K Enter, with the closing to occur simultaneously with the closing of the Business Combination. |

| ● | “Plan of Merger” refers to the statutory plan of merger to be filed with the Registrar of Companies in the Cayman Islands to effect the Reincorporation Merger; |

| | ● | “Preferred Stock” refers to the Series A Preferred Stock and the Series A-1 Preferred Stock combined. |

| ● | “Private Rights” are to the rights sold as part of the Private Units sold in the private placement that occurred simultaneously with the closing of the IPO. The Private Rights entitle the holder to receive 1/10 of one share of GLST Class A Common Stock upon the consummation of the Business Combination; |

| ● | “Private Warrants” are to the redeemable warrants sold as part of the Private Units sold in the private placement that occurred simultaneously with the closing of the IPO. The Private Warrants entitle the holder to purchase one share of GLST Class A Common Stock for $11.50 per share; |

| ● | “Private Units” are to the private units sold in the private placement that occurred simultaneously with the closing of the IPO at $10 per unit. The Private Units consist of one share of Class A Common Stock, one Private Warrant and one Private Right; |

| ● | “PubCo” or “K Wave” or the “Registrant” refer to K Wave Media Ltd., a Cayman Islands exempted company; |

| ● | “PubCo Ordinary Shares” or “K Wave Ordinary Shares” refer to PubCo’s ordinary shares; |

| ● | “PubCo Rights” or “K Wave Rights” refer to PubCo’s rights which entitle the holder to receive 1/10 of one PubCo Ordinary Share upon the consummation of the Acquisition Merger; |

| ● | “PubCo Warrants” or “K Wave Warrants” refer to PubCo’s redeemable warrants which entitle the holder to purchase one PubCo Ordinary Share for $11.50; |

| ● | “PubCo Charter” or “K Wave Charter” refers to PubCo’s Amended and Restated Memorandum and Articles of Association, to be in effect upon the consummation of the Business Combination. |

| ● | “public shares” are to shares of Global Star Class A Common Stock sold as part of the units in the IPO (whether they are purchased in this offering or thereafter in the open market); |

| ● | “Reincorporation Merger” refer to the merger, described in the Merger Agreement, between Global Star and PubCo, whereby PubCo is the surviving corporation. |

| | ● | “Representative” refer to EF Hutton, division of Benchmark Investments LLC, the underwriter for the Global Star initial public offering, now known as D. Boral Capital LLC. |

| | | |

| | ● | “Second Amendment” refer to the Second Amendment to Merger Agreement, dated June 28, 2024, by an among Global Star, K Enter, PubCo and Merger Sub; |

| | | |

| | ● | “Series A Preferred Stock” refer to the shares of K Enter’s Series A Convertible Preferred Stock, $0.0001 par value per share. |

| | | |

| | ● | “Series A-1 Preferred Stock” refer to the shares of K Enter’s Series A-1 Convertible Preferred Stock, $0.0001 par value per share. |

| | | |

| | ● | “Sponsor” refer to Global Star Acquisition 1 LLC; |

| ● | “Seven Korean Entities” refers to (1) Play Company Co., Ltd., (2) Solaire Partners LLC, (3) Apeitda Co., Ltd., (4)The LAMP Co., Ltd., (5) Bidangil Pictures Co., Ltd., (6) Studio Anseilen Co., Ltd. and (7) First Virtual Lab Inc., collectively; |

| ● | “Six Korean Entities” refers to (1) Play Company Co., Ltd., (2) Solaire Partners LLC, (3) Apeitda Co., Ltd., (4)The LAMP Co., Ltd., (5) Bidangil Pictures Co., Ltd., and (6) Studio Anseilen Co., Ltd., collectively; |

| | ● | “Third Amendment” refer to the Third Amendment to Merger Agreement, dated July 25, 2024, by an among Global Star, K Enter, PubCo and Merger Sub; |

| ● | “US Dollars,” “$,” or “US$” refer to the legal currency of the United States; and |

| ● | “U.S. GAAP” refer to accounting principles generally accepted in the United States. |

QUESTIONS AND ANSWERS ABOUT THE BUSINESS COMBINATION AND THE SPECIAL MEETING

| Q: | What is the purpose of this document? |

| A: | Global Star is proposing to consummate the Business Combination. The Business Combination consists of the Reincorporation Merger and the Acquisition Merger, each of which are described in this proxy statement/prospectus. In addition, the Merger Agreement is attached to this proxy statement/prospectus as Annex A, and is incorporated into this proxy statement/prospectus by reference. This proxy statement/prospectus contains important information about the Business Combination and the other matters to be acted upon at the Special Meeting. You are encouraged to carefully read this proxy statement/prospectus, including “Risk Factors” and all the annexes hereto. |

Approval of the Reincorporation Merger and the Acquisition Merger will each require the affirmative vote of the holders of a majority of the issued and outstanding GLST Common Stock present and entitled to vote at the Special Meeting or any adjournment thereof.

| Q: | What is being voted on at the Special Meeting? |

| A: | Below are the Proposals that the Global Star’s stockholders are being asked to vote on: |

| ● | The Reincorporation Merger Proposal to approve the Reincorporation Merger; |

| ● | The Acquisition Merger Proposal to approve the Acquisition Merger; |

| ● | The Governance Proposal to approve, on a non-binding advisory basis, four separate governance proposals relating to material differences between Global Star’s current amended and restated certificate of incorporation and PubCo’s Amended and Restated Memorandum and Articles of Incorporation; |

| | ● | The Director Proposal to elect the following persons: Pyeung Ho Choi, Young Jae Lee, Tan Chin Hwee, Ted Kim, Han Jae Kim, Hyung Seok Cho and Tae Woo Kim to serve on PubCo’s Board of Directors; |

| ● | The Incentive Plan Proposal to approve PubCo’s Incentive Plan; and |

| ● | The Adjournment Proposal to approve the adjournment of the Special Meeting in the event Global Star does not receive the requisite stockholder vote to approve the above Proposals. |

Approval of each of the Proposals requires the affirmative vote of the holders of a majority of the issued and outstanding GLST Common Stock present and entitled to vote at the Special Meeting or any adjournment thereof;.

| Q: | Will Global Star or K Enter be raising any financing in connection with the Business Combination? |

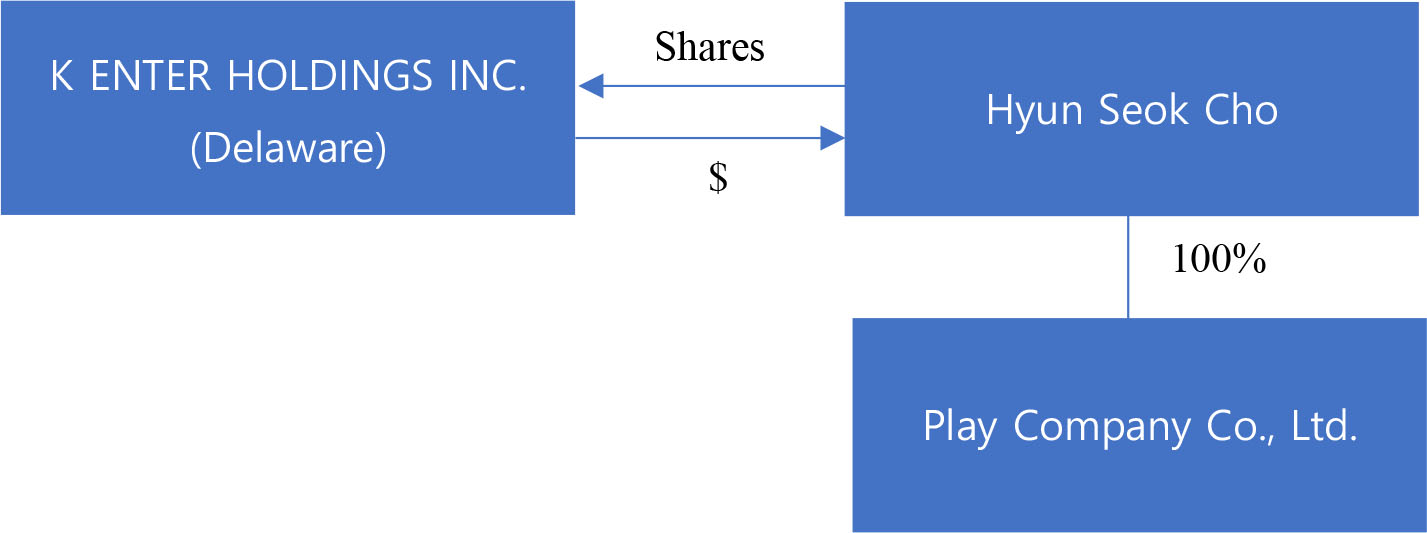

| A: | Global Star and K Enter intend to use their best efforts to raise $50 million in a PIPE financing transaction or pre-PIPE financing transaction (i.e., a capital raise by K Enter prior to the Business Combination) in connection with the closing of the Business Combination. The PIPE or pre-PIPE financing may take the form of equity financing or debt financing, including convertible debt. A PIPE or pre-PIPE financing is not a condition to the closing of the Business Combination. If successful in securing such a financing, the proceeds of the financing will be used by PubCo to fund its working capital for operations and to fund future acquisitions by PubCo. In the event Global Star is able to secure a PIPE or pre-PIPE financing, such financing will have a dilutive effect on the shareholders of PubCo. Currently, Global Star has not received any commitments for a PIPE financing and there can be no assurances that Global Star will be able to consummate a PIPE or pre-PIPE financing in connection with the Business Combination. If Global Star and K Enter are unable to raise a PIPE or pre-PIPE Financing prior to the closing of the Business Combination, PubCo will fund its working capital from cash flow from operations and PubCo plans to use its best efforts to complete a capital raise of $20 million to $50 million through a public or private equity offering or a debt offering following the closing of the Business Combination. However, there can be no assurances that PubCo will be able to raise additional capital through a public or private equity or debt offering following the closing of the Business Combination. K Enter will not require a capital raise to complete the acquisitions of the controlling interests of the Six Korean Entities because the only consideration to be tendered by K Enter to consummate the closing of the acquisitions of the controlling interests of the Six Korean Entities is shares of common stock of K Enter. Pursuant to the share purchase agreement between K Enter and the current owner of Play Company, PubCo is required to pay to the current owner of Play Company (i) a payment of 18.1 billion won (approximately $13.2 million within three months of the closing of the Business Combination, (ii) a payment of 9.05 billion won (approximately $6.57 million) by January 31, 2025 and (iii) a payment of 9.05 billion won (approximately $6.57 million) by January 31, 2026. Due to the fact that Global Star has approximately $13 million dollars in its trust account, absent a capital raise before or after the closing of the Business Combination, PubCo may not have sufficient funds to make the post-closing payments to the current owner of Play Company. If PubCo does not have the available cash to make the required payment to the current owner of Play Company, PubCo may negotiate with the current owner of Play Company to modify the post-closing payments or to extend the due dates for the post-closing payments. Global Star and K Enter believe that funds from the operations may not be sufficient to pay the second and third payments timely. Therefore, a capital raise post-completion of the Business Combination may become necessary. Also, the failure to raise adequate PIPE financing will delay PubCo’s ability to invest in new media content, which will adversely impact revenues and cash flow during 2024 and 2025. |

| Q: | Are any of the proposals conditioned on one another? |

| A: | Yes, the Reincorporation Merger Proposal and the Acquisition Merger Proposal are dependent upon each other. It is important for you to note that in the event that either of the Reincorporation Merger Proposal or the Acquisition Merger Proposal is not approved, Global Star will not consummate the Business Combination. If Global Star does not consummate the Business Combination and fails to complete an initial business combination by February 22, 2025 (unless Global Star elects to extend the time it has to complete the initial business combination to June 22, 2025), Global Star will be required to dissolve and liquidate. Adoption of the Adjournment Proposal is not conditioned upon the adoption of any of the other Proposals. |

| Q: | Do any of Global Star’s directors or officers have interests that may conflict with my interests with respect to the Business Combination? |

| A: | Global Star’s directors and officers may have interests in the Business Combination that are different from your interests as a stockholder. Global Star’s Sponsor and officers and directors purchased 2,300,000 shares of GLST Class B Common Stock, which we refer to herein as “Founder Shares,” for an aggregate purchase price of $25,000 and 498,225 Private Units for which they paid an aggregate purchase price of $4,982,250. Specifically: the Sponsor owns 2,798,225 shares of GLST Common Stock; Anthony Ang and Ted Kim beneficially own 1,640,000 shares of GLST Common Stock by virtue of serving as the managing members of the Sponsor, and Mr. Ang also owns 300,000 shares of GLST Common Stock directly; Nicholas Khoo owns 50,000 shares of GLST Common Stock; and Stephen Drew owns 20,000 shares of GLST Common Stock. In addition, on July 12, 2023, the Sponsor sold 160,000 Founder Shares to K Enter for $1,600,000. Thereafter, the Sponsor loaned the $1.6 million to Global Star in exchange for an unsecured, non-interest-bearing promissory note, $1.5 million of which will be converted into 150,000 Global Star Units in connection with the completion of the Business Combination. Stephen Drew, a director of Global Star served as a director of K Enter Holdings, Inc. from January 3, 2023 to April 25, 2023. Also, Ted Kim, the manager of the Sponsor and a co-founder and director of K Enter, owns 19,564 shares or 10.12% of the shares of common stock of K Enter based on the shares of K Enter to be issued and outstanding immediately prior to the closing of the Business Combination through his ownership and control of Global Fund LLC, which owns 12,000 shares, and Lodestar USA, Inc., which owns 7,564 shares. Further, Global Star officers and directors collectively own shares of common stock of K Enter representing approximately 8,537 shares or 4.3% of the outstanding shares of K Enter common stock based on the shares of K Enter to be issued and outstanding immediately prior to the closing of the Business Combination. Specifically, Stephen Drew owns 6,000 shares of K Enter common stock, Yang Kan Chong owns 1,337 shares of K Enter common stock, Jukka Rannila, beneficially through Assai OY, owns 600 shares of K Enter common stock. Nicholas Aaron Khoo, the Company’s Chief Operating Officer, owns 600 shares of K Enter common stock, prior to the closing of the Business Combination. All of such investments will expire worthless if a business combination is not consummated; on the other hand, if a business combination is consummated, such investments could earn a positive rate of return on their overall investment in the combined company, even if other holders of Global Star’s common stock experience a negative rate of return. |

In addition, if the Trust Account is liquidated, including in the event Global Star is unable to complete an initial business combination within the required time period, the Sponsor has agreed to indemnify Global Star to the extent any claims by a third party for services rendered or products sold to us, or any claims by a prospective target business with which Global Star has discussed entering into an acquisition agreement, reduce the amount of funds in the Trust Account to below the lesser of (i) $10.25 per public share and (ii) the actual amount per public share held in the Trust Account as of the date of the liquidation of the Trust Account, if less than $10.25 per public share is then held in the Trust Account due to reductions in the value of the trust assets, less taxes payable, (y) shall not apply to any claims by a third party or a target which executed a waiver of any and all rights to the monies held in the Trust Account (whether or not such waiver is enforceable) and (z) shall not apply to any claims under the Company’s indemnity of the underwriters of Global Star’s IPO against certain liabilities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”), but only if such a third party or target business has not executed a waiver of any and all rights to seek access to the Trust Account.

Further, none of Global Star’s officers or directors has received any cash compensation for services rendered to the Company, and all of the current members of Global Star’s Board are expected to continue to serve as directors at least through the date of the special meeting to vote on a business combination and may even continue to serve following any business combination and receive compensation thereafter.

The exercise of Global Star’s directors’ and officers’ discretion in agreeing to changes or waivers in the terms of the Business Combination may result in a conflict of interest when determining whether such changes or waivers are appropriate and in Global Star stockholders’ best interests.

| Q: | When and where is the Special Meeting? |

| A: | The Special Meeting will take place on February 3, 2025, at 9:30 a.m., Eastern Time. Global Star will be holding its Special Meeting as a teleconference using the following dial-in information: |

| | 1 800-450-7155 | |

| | US Toll Free | |

| | | |

| | +1 857-999-9155 | |

| | International Toll | |

| | | |

| | 7921345# | |

| | Participant Passcode | |

| Q: | Who may vote at the Special Meeting? |

| A: | Only holders of record of GLST Class A Common Stock and GLST Class B Common Stock as of the close of business on December 13, 2024 (the record date) may vote at the Special Meeting. As of December 13, 2024, there were 994,100 shares of GLST Class A Common Stock and 2,300,000 shares of GLST Class B Common Stock outstanding and entitled to vote. Please see the section titled “The Special Meeting — Record Date; Who is Entitled to Vote” for further information. |

| Q: | What is the quorum requirement for the Special Meeting? |

| A: | Shareholders representing a majority of the shares of capital stock issued and outstanding as of the record date and entitled to vote at the Special Meeting must be present in person or represented by proxy in order to hold the Special Meeting and conduct business. This is called a quorum. GLST Common Stock will be counted for purposes of determining if there is a quorum if the stockholder (i) is present and entitled to vote at the meeting, or (ii) has properly submitted a proxy card or voting instructions through a broker, bank or custodian. In the absence of a quorum, the Special Meeting will be adjourned to the next business day at the same time and place or to such other time and place as the directors may determine. |

| Q: | What vote is required to approve the Proposals? |

| A: | Approval of the Reincorporation Merger Proposal and the Acquisition Merger Proposal will require the affirmative vote of the holders of sixty-five percent (65%) of the issued and outstanding GLST Common Stock. Approval of the Governance Proposal, the Incentive Plan Proposal and the Adjournment Proposal will require the affirmative vote of the holders of a majority of the issued and outstanding GLST Common Stock present and entitled to vote at the Special Meeting or any adjournment thereof. Under the Director Proposal, directors are elected by a plurality of the votes cast. Since the Reincorporation Merger Proposal and the Acquisition Merger Proposal require the affirmative vote of a majority sixty-five percent (65%) of the issued and outstanding GLST Common Stock, abstaining from voting or failing to instruct your bank, brokerage firm or nominee to attend and vote your shares will have the same effect as voting “AGAINST” these Proposals; however, abstaining from voting or failing to instruct your bank, brokerage firm or nominee to attend and vote your shares will have no effect on any of the Director Election Proposal, the Incentive Plan Proposal or the Adjournment Proposal. |

| Q: | How will the Initial Stockholders and the Sponsor vote? |

| A: | Global Star’s Initial Stockholders and the Sponsor, who as of the record date, owned 2,798,225 shares of GLST Common Stock, or approximately 69.1% of the issued and outstanding GLST Common Stock, have agreed to vote their respective shares in favor of each of the Reincorporation Merger Proposal and the Acquisition Merger Proposal and are expected to vote in favor of the Incentive Plan Proposal, the Adjournment Proposal and the Director Proposal. As a result, the affirmative vote of the shares of GLST Common Stock held by the Initial Stockholders and the Sponsor is sufficient to approve each of the Proposals. |

| Q: | What do I need to do now? |

| A: | Global Star urges you to read carefully and consider the information contained in this proxy statement/prospectus, including the annexes, and consider how the Business Combination will affect you as a Global Star stockholder. You should vote as soon as possible in accordance with the instructions provided in this proxy statement/prospectus and on the enclosed proxy card. |

| Q: | Do I need to attend the Special Meeting to vote my shares? |

| A: | No. You are invited to attend the Special Meeting to vote on the Proposals described in this proxy statement/prospectus. However, you do not need to attend the Special Meeting to vote your GLST Common Stock. Instead, you may submit your proxy by signing, dating and returning the applicable enclosed proxy card in the pre-addressed postage paid envelope. Your vote is important. Global Star encourages you to vote as soon as possible after carefully reading this proxy statement/prospectus. |

| Q: | Am I required to vote against the Reincorporation Merger and the Acquisition Merger Proposal in order to have my GLST Common Stock redeemed? |

| A: | No. You are not required to vote against the Reincorporation Merger Proposal and the Acquisition Merger Proposal in order to have the right to demand that Global Star redeem your GLST Common Stock for cash equal to your pro rata share of the aggregate amount then on deposit in the trust account (including interest earned on your pro rata portion of the trust account, net of taxes payable) before payment of deferred underwriting commissions. These redemption rights in respect of the GLST Common Stock are sometimes referred to herein as “redemption rights.” If the Business Combination is not completed, holders of GLST Common Stock electing to exercise their redemption rights will not be entitled to receive such payments and their GLST Common Stock will be returned to them. |

| Q: | How do I exercise my redemption rights? |

| A: | If you are a public stockholder and you seek to have your shares redeemed, you must (i) demand, no later than 5:00 p.m., Eastern time on January 30, 2025 (two business days before the Special Meeting), that Global Star redeem your shares for cash, and (ii) submit your request in writing to Global Star’s transfer agent, at the address listed at the end of this section and deliver your shares to Global Star’s transfer agent (physically, or electronically using the DWAC (Deposit/Withdrawal At Custodian) system) at least two business days prior to the vote at the Special Meeting. |

Any corrected or changed written demand of redemption rights must be received by Global Star’s transfer agent two business days prior to the Special Meeting. No demand for redemption will be honored unless the holder’s shares have been delivered (either physically or electronically) to the transfer agent at least two business days prior to the vote at the Special Meeting.

Public stockholders may seek to have their shares redeemed regardless of whether they vote for or against the Business Combination and whether or not they are holders of GLST Common Stock as of the record date. Any public stockholder who holds GLST Common Stock on or before January 30, 2025 (two (2) business days before the Special Meeting) will have the right to demand that his, her or its shares be redeemed for a pro rata share of the aggregate amount then on deposit in the trust account, less any taxes then due but not yet paid, at the consummation of the Business Combination. If you have questions regarding the certification of your position or delivery of your shares, please contact:

Continental Stock Transfer & Trust Company

1 State Street, 30th Floor

New York, NY 10004

Attn. Mark Zimkind

E-mail: spacredemptions@continentalstock.com

| A: | If you were a holder of record of GLST Common Stock on December 13, 2024, the record date for the Special Meeting, you may vote with respect to the Proposals in person at the Special Meeting, or by submitting a proxy by mail so that it is received prior to 9:30 a.m. Eastern Time on February 3, 2025, in accordance with the instructions provided to you under the section titled “The Special Meeting.” If you hold your shares in “street name,” which means your shares are held of record by a broker, bank or other nominee, your broker or bank or other nominee may provide voting instructions (including any telephone or Internet voting instructions). You should contact your broker, bank or nominee in advance to ensure that votes related to the shares you beneficially own will be properly counted. In this regard, you must provide the record holder of your shares with instructions on how to vote your shares or, if you wish to attend the Special Meeting and vote in person, obtain a proxy from your broker, bank or nominee. |

| Q: | If my shares are held in “street name” by my bank, brokerage firm or nominee, will they automatically vote my shares for me? |

| A: | No. Under Nasdaq rules, your broker, bank or nominee cannot vote your GLST Common Stock with respect to non-discretionary matters unless you provide instructions on how to vote in accordance with the information and procedures provided to you by your broker, bank or nominee. Global Star believes the Proposals are non-discretionary and, therefore, your broker, bank or nominee cannot vote your GLST Common Stock without your instruction. Broker non-votes will not be considered present for the purposes of establishing a quorum and will have no effect on the Proposals. If you do not provide instructions with your proxy, your bank, broker or other nominee may submit a proxy card expressly indicating that it is NOT voting your GLST Common Stock; this indication that a bank, broker or nominee is not voting your GLST Common Stock is referred to as a “broker non-vote.” Your bank, broker or other nominee can vote your GLST Common Stock only if you provide instructions on how to vote. You should instruct your broker to vote your GLST Common Stock in accordance with directions you provide. |

| Q: | What if I abstain from voting or fail to instruct my bank, brokerage firm or nominee? |

| A: | Global Star will count a properly executed proxy marked “ABSTAIN” with respect to a particular Proposal as present for the purposes of determining whether a quorum is present at the Special Meeting of Global Star stockholders. For purposes of approval, an abstention on any Proposals will have the same effect as a vote “AGAINST” such Proposal. |

| Q: | What happens if I sell my GLST Common Stock before the Special Meeting? |

| A: | The record date for the Special Meeting is earlier than the date that the Business Combination is expected to be consummated. If you transfer your GLST Common Stock after the record date, but before the Special Meeting, unless the transferee obtains from you a proxy to vote those shares, you would retain your right to vote at the Special Meeting. However, you would not be entitled to receive any PubCo Ordinary Shares following the consummation of the Business Combination because only Global Star’s stockholders at the time of the consummation of the Business Combination will be entitled to receive PubCo Ordinary Shares in connection with the Business Combination. |

| Q: | Will I experience dilution as a result of the Business Combination? |

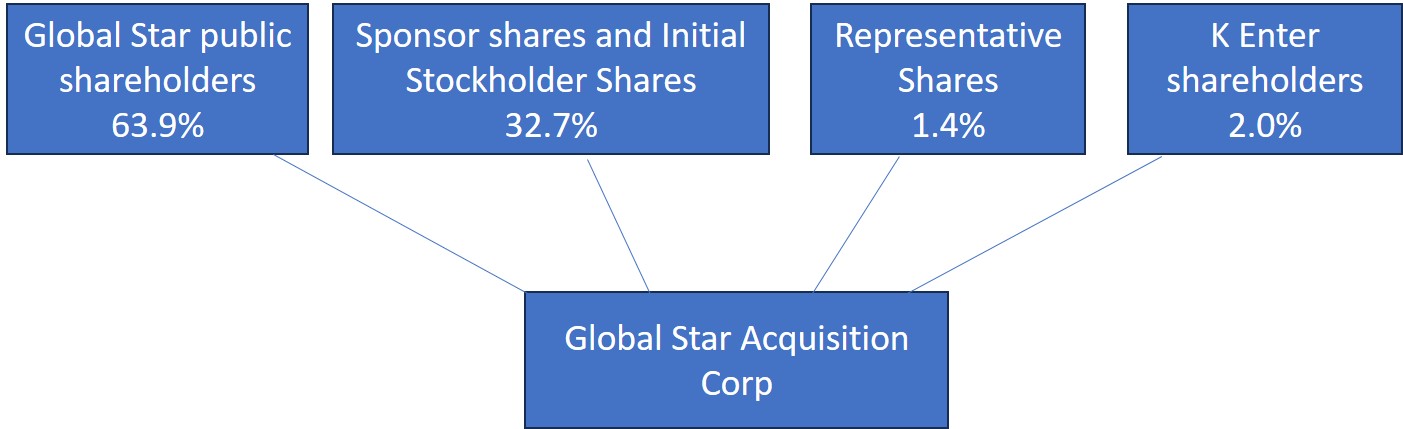

| A: | Prior to the Business Combination, Global Star’s public stockholders who hold shares issued in the IPO own approximately 28.1% of Global Star’s issued and outstanding shares of common stock. After giving effect to the Business Combination and to (i) the issuance of the 59,000,000 PubCo Ordinary Shares in the Acquisition Merger and excluding the 5,900,000 PubCo Ordinary Shares reserved and authorized for issuance under the Incentive Plan upon closing; (ii) the issuance of up to 1,137,006 PubCo Ordinary Shares to the Global Star stockholders in connection with the Reincorporation Merger (assuming there are no Global Star stockholders who exercise their redemption rights); (iii) issuance of up to 920,000 PubCo Ordinary Shares are issued upon conversion of the PubCo Rights); (iv) assuming no exercise of the PubCo Warrants, Global Star’s current public stockholders will own approximately 3.3% of the issued share capital of PubCo. |

Stockholders exercising their redemption rights will retain their Global Star warrants, which will automatically convert into PubCo Warrants. As of the record date for the Special Meeting, there are 9,200,000 Global Star warrants outstanding with an aggregate market value of $276,000 based on the closing price as of January 3, 2025. The future exercise of these warrants will result in dilution to Public Stockholders. Stockholders exercising their redemption rights also will retain their public rights, each of which will automatically convert into one-tenth of a share of PubCo common stock upon the closing of the Business Combination.

Each Global Star Right will automatically convert into one PubCo Right in connection with the Reincorporation Merger. Each 10 PubCo Rights will convert into one PubCo Ordinary Share in connection with the Acquisition Merger. In order to receive a single PubCo Ordinary Share, a rights holder must hold 10 PubCo Rights. There will be no issuance of fractional PubCo Ordinary Shares and those holding fewer than 10 PubCo Rights will not be entitled to receive any PubCo Ordinary Shares.

The following summarizes the pro forma shares of K Wave ordinary shares issued and outstanding immediately after the Business Combination, presented under the five scenarios listed below:

| | | No Additional Redemptions | | | 25% Redemptions | | | 50% Redemptions | | | 75% Redemptions | | | Maximum Redemptions | |

| | | Shares | | | % | | | Shares | | | % | | | Shares | | | % | | | Shares | | | % | | | Shares | | | % | |