As filed with the U.S. Securities and Exchange Commission on January 3, 2025.

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EVERFRONT BIOTECH HOLDING COMPANY LIMITED

(Exact name of registrant as specified in its charter)

| British Virgin Islands | | 2834 | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

10F-1, No.130,

Songshan Rd., Xinyi Dist.,

Taipei City 110

Taiwan

+886-2-2756-3796

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

Keith Billotti F. Holt Goddard Seward & Kissel LLP One Battery Park Plaza New York, NY 10004 Tel: (212) 574-1200 | | Richard I. Anslow Charles Phillips Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105 Tel: (212) 370-1300 |

Approximate date of commencement of proposed sale to the public: Promptly after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☒

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

| Preliminary Prospectus | SUBJECT TO COMPLETION, DATED , 2025 |

Ordinary Shares

EVERFRONT BIOTECH HOLDING COMPANY LIMITED

This is an initial public offering of ordinary shares of Everfront Biotech Holding Company Limited (the “Company” or “Everfront Holding”, and when referring to the consolidated company including the Company’s subsidiaries, “we”, “us” and “our”), par value $0.01 per share (“Ordinary Shares”). We estimate that the initial public offering price will be between $ and $ per Ordinary Share.

We have reserved the symbol “EFB” for the purpose of listing our Ordinary Shares on the Nasdaq Capital Market (“Nasdaq”). This offering is contingent upon the final approval from Nasdaq for the listing of our Ordinary Shares. We will not consummate this offering if Nasdaq denies our listing application. As such, this offering may not close and our Ordinary Shares may not be approved for trading on Nasdaq.

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 7 of this prospectus to read about factors you should consider before buying Ordinary Shares.

Upon the completion of this offering, we will have Ordinary Shares issued and outstanding. Each Ordinary Share is entitled to one vote.

As of the date hereof (after giving effect to this offering), Mr. Ho-Ching Chen holds beneficial ownership of % of our outstanding Ordinary Shares pursuant to agreements in which certain of our shareholders have given Mr. Chen voting control over their shares, including in connection with the election of our directors. This means we meet the definition of a “controlled company” under the corporate governance standards of Nasdaq and thereby qualify for exemptions from certain Nasdaq corporate governance requirements. We currently expect to rely on certain of these exemptions and may in the future elect to rely on any or all of these exemptions for so long as we remain a “controlled company.” See “Management—Corporate Governance—Controlled Company Exemptions”.

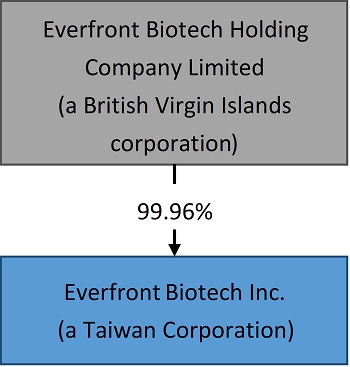

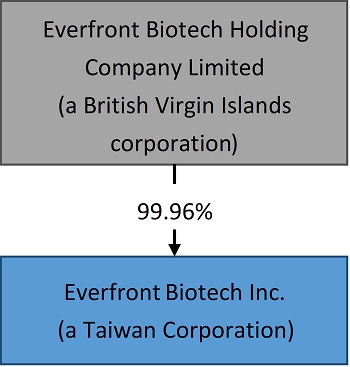

Everfront Holding is a holding company incorporated in the British Virgin Islands (“BVI”) that conducts its operations through its 99.96% owned subsidiary, Everfront Biotech Inc. (“Everfront Biotech”), in Taiwan. This is an offering of the Ordinary Shares of Everfront Holding and not equity securities of Everfront Biotech. You may never directly hold any equity interest in Everfront Holding’s operating entity.

We are an “emerging growth company” as defined under the federal securities laws and will be subject to reduced public company reporting requirements. See “Risk Factors” and “Prospectus Summary— Implications of our Being an Emerging Growth Company”.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per Ordinary Share | | | Total | |

| Initial public offering price(1) | | $ | | | | $ | | |

| Underwriting discounts and commissions(2) | | $ | | | | $ | | |

| Proceeds to us, before expenses(3) | | $ | | | | $ | | |

| (1) | Assumes an initial public offering price of $ per Ordinary Share, which is the midpoint of the range set forth on the cover page of this prospectus. For more information, see “Underwriting.” |

| (2) | We have agreed to reimburse the underwriters for certain expenses. For more information, see “Underwriting.” |

| (3) | We expect our cash expenses for this offering (including cash expenses payable to our underwriters for the underwriters’ out-of-pocket expenses) will not exceed $ , exclusive of the underwriters’ discounts. |

This offering is being conducted on a firm commitment basis. The underwriters are obligated to purchase all of the Ordinary Shares if they purchase any Ordinary Shares.

We have granted the underwriters an option for a period of up to 45 days to purchase up to an additional Ordinary Shares from us at the initial public offering price, less the underwriting discounts and commissions.

The underwriters expect to deliver the Ordinary Shares to purchasers in the offering on or about , 2025.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

Joint Book-Runners

| Roth Capital Partners | | The Benchmark Company |

Prospectus dated , 2025

TABLE OF CONTENTS

We and the underwriters have not authorized any person to give you any supplemental information or to make any representations on our behalf. You should not assume that the information contained in this prospectus or any prospectus supplement are accurate as of any date other than their respective dates, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares. This prospectus is an offer to sell only the Ordinary Shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information in this registration statement is not complete and is subject to change. No person should rely on the information contained in this document for any purpose other than participating in our proposed offering, and only the prospectus dated hereof, is authorized by us to be used in connection with our proposed offering. The preliminary prospectus will only be distributed by us and no other person has been authorized by us to use this document to offer or sell any of our securities.

Until , 2025 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| ● | “we”, or “us” in this prospectus are to Everfront Biotech Holding Company Limited, a British Virgin Islands company and its subsidiary, Everfront Biotech Inc., a company incorporated under the laws of Taiwan, unless the context otherwise indicates; |

| ● | “BVI” are to the “British Virgin Islands”; |

| ● | “BVI Act” are to the BVI Business Companies Act (Law Revision 2020) (as amended); |

| ● | the “Company” or “Everfront Holding” are to Everfront Biotech Holding Company Limited, a BVI company; |

| ● | “Everfront Biotech” are to Everfront Biotech Inc., a company incorporated under the laws of Taiwan, with limited liability; |

| ● | “$,” “dollars,” “US$” or “U.S. dollars” are to the legal currency of the United States; |

| ● | “NTD” are to the legal currency of R.O.C.; |

| ● | “U.S. GAAP” are to generally accepted accounting principles in the United States; |

| ● | “shares” or “Ordinary Shares” are to the ordinary shares of Everfront Biotech Holding Company Limited, par value $0.01 per share; and |

| ● | “R.O.C.” or “Taiwan” refers to Taiwan, the Republic of China. |

Everfront Holding does not have any material operations of its own and Everfront Holding is a holding company with operations conducted in Taiwan through its Taiwan subsidiary, Everfront Biotech, using NTD, the currency of Taiwan. Our reporting currency is NTD. This prospectus contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. All translations of NTD are calculated at the rate of NTD to US$1.00, representing the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on , 2025. No representation is made that the NTD amounts could have been, or could be, converted, realized or settled into US$ at such rate, or at any other rate.

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements included elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in Ordinary Shares, discussed under “Risk Factors” before deciding whether to buy Ordinary Shares.

Everfront Holding is a holding company incorporated in the British Virgin Islands (“BVI”) that conducts its operations through its 99.96% owned subsidiary, Everfront Biotech Inc. (“Everfront Biotech”), which is incorporated and operates in Taiwan. Everfront Holding holds no other assets and conducts no operations of its own.

Overview

We are a clinical stage biopharmaceutical company dedicated to the discovery, development and commercialization of new drugs that have potential as treatments for patients with cancers, neurodegenerative diseases and rare diseases. We are focused on new drug discovery and development, supported by our research and development (“R&D”) team established in 2010. Our team is specialized in preclinical study design, chemistry, manufacturing, and controls (“CMC”), investigational new drug (“IND”) submission, and clinical trial design and conduction. Our goal is to develop technology with the commercial potential to help people with unmet medical needs.

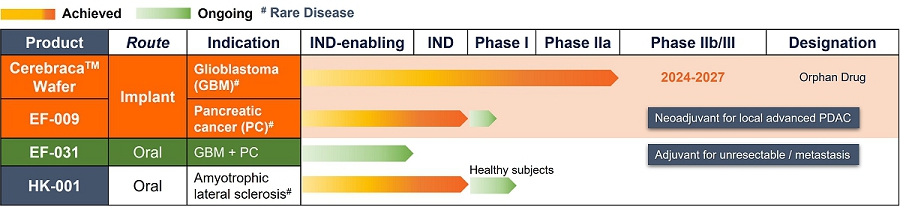

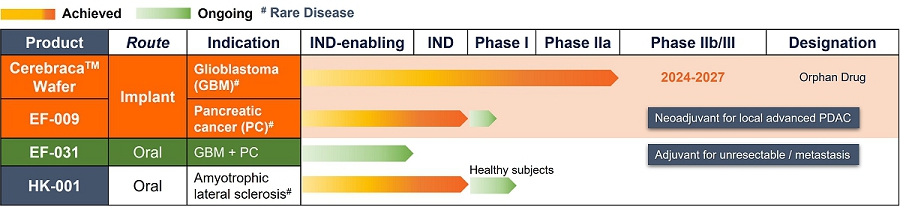

As of the date of this prospectus, we are conducting three clinical trials in Taiwan under the approval of the United States Food and Drug Administration (the “FDA”) and the Taiwan Food and Drug Administration (the “TFDA”) for the following product candidates. As of the date of this prospectus, we have no products approved for commercial sale and have never generated any revenue from product sales. Please also see the risk factor entitled “We are a cancer drug development company with a limited operating history.”

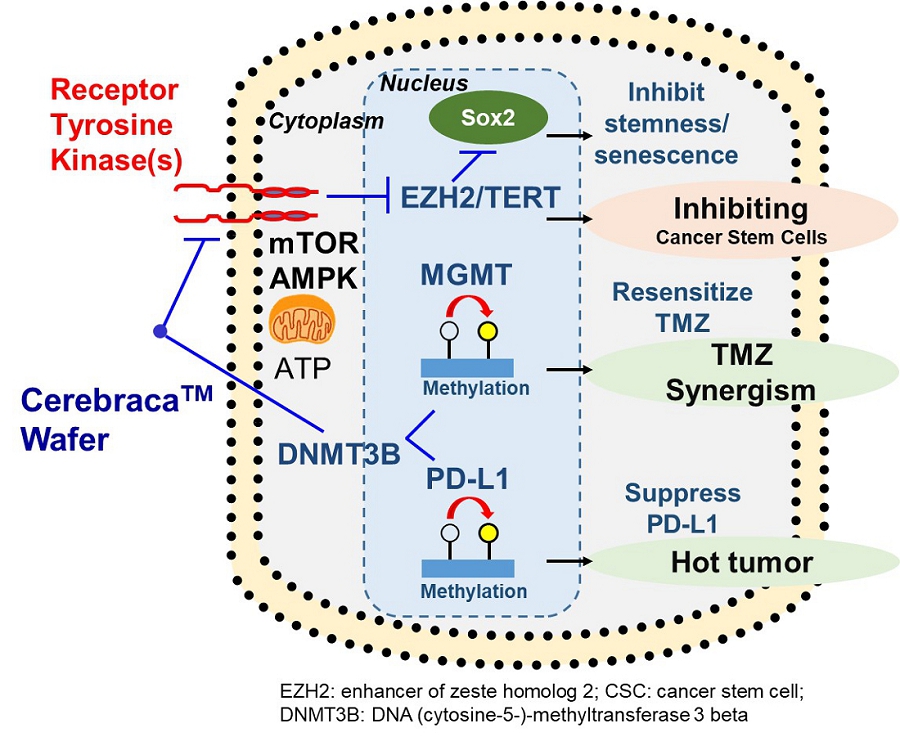

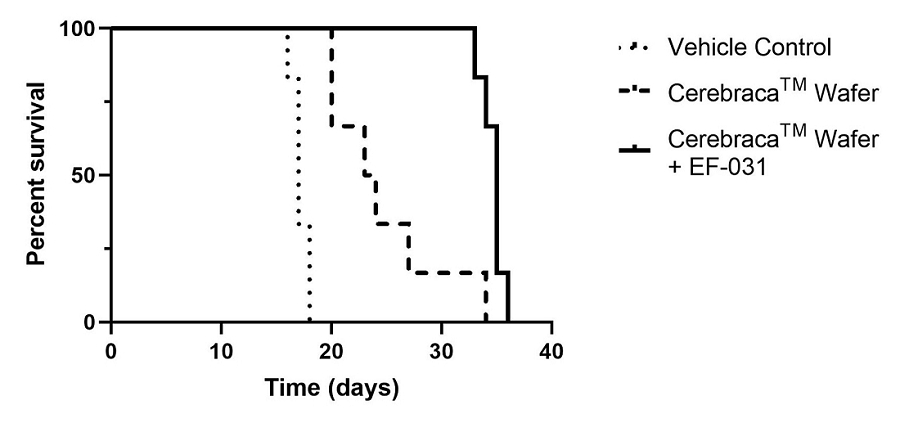

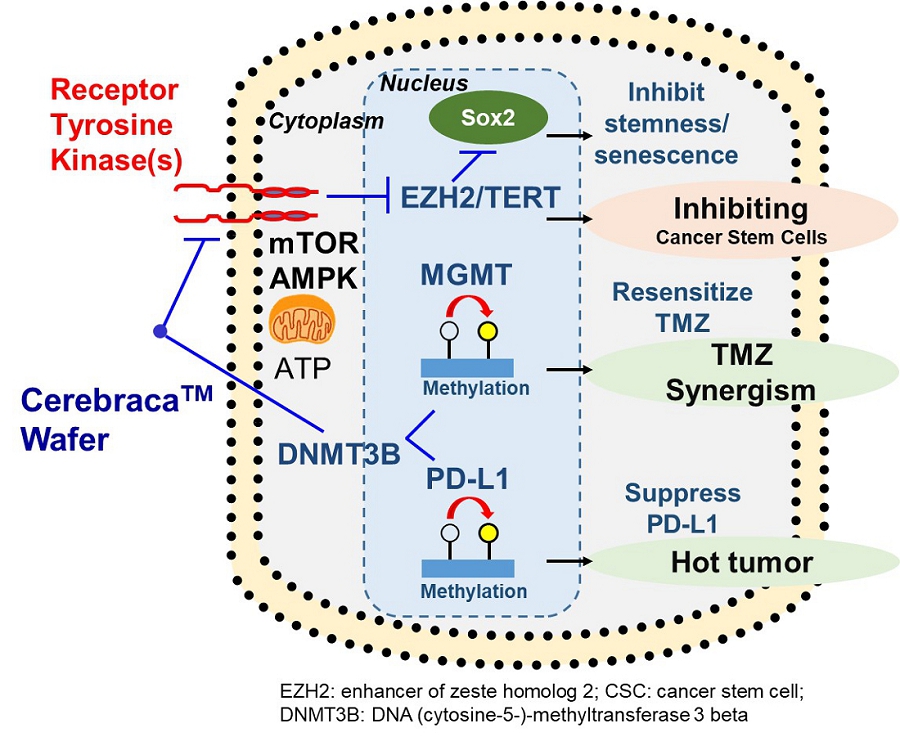

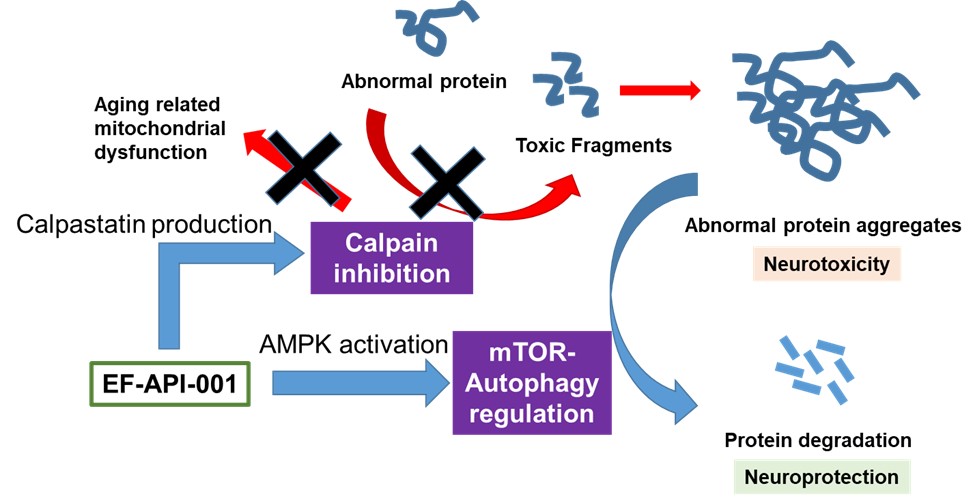

Cerebraca™ Wafer is a biodegradable implant produced according to Pharmaceutical Inspection Co-operation Scheme, or PIC/S, Good Manufacturing Practice, or GMP, standards. Cerebraca™ Wafer has been designed to treat glioblastoma (GBM) by directly implanting it into the GBM tumor margin after surgical resection. Cerebraca™ Wafer is characterized by its 30-day sustained drug release and 5-cm penetration depth observed in preclinical studies (IND128388, Module 2, Report 51904-12-708), with the intention that this will create a high drug concentration environment for treating the cancer. Cerebraca™ Wafer is a multi-functional drug with the potential to inhibit receptor tyrosine kinases (Epidermal Growth Factor Receptor, or EGFR, Axl-1 Receptor, and c-Mesenchymal-Epithelial Transition Factor Receptor, or cMet Receptor) to halt cancer stem cell proliferation. Additionally, it has the potential to improve patients’ quality of life by boosting Adenosine Triphosphate, or ATP, levels through Axl-mTOR (mammalian target of rapamycin) (Liu C-A, et al., Journal of Oncology. 2022; 2022.) inhibition and AMP-activated Protein Kinase, or AMPK, activation (Lee J-H, et al., International Journal of Molecular Science. 2021; 22(12): 6339.). Furthermore, Cerebraca™ Wafer has been designed to promote methylation of O6-Methylguanine-DNA Methyltransferase, or MGMT, and Programmed Cell Death Ligand 1, or PD-L1, promoters in order to help overcome chemotherapeutic resistance (Liu C-A, et al., Cancers. 2022; 14(4): 1051.) and transform a cold tumor microenvironment into an immune-active hotspot (Liu C-A, et al., Journal of Oncology. 2022; 2022.).

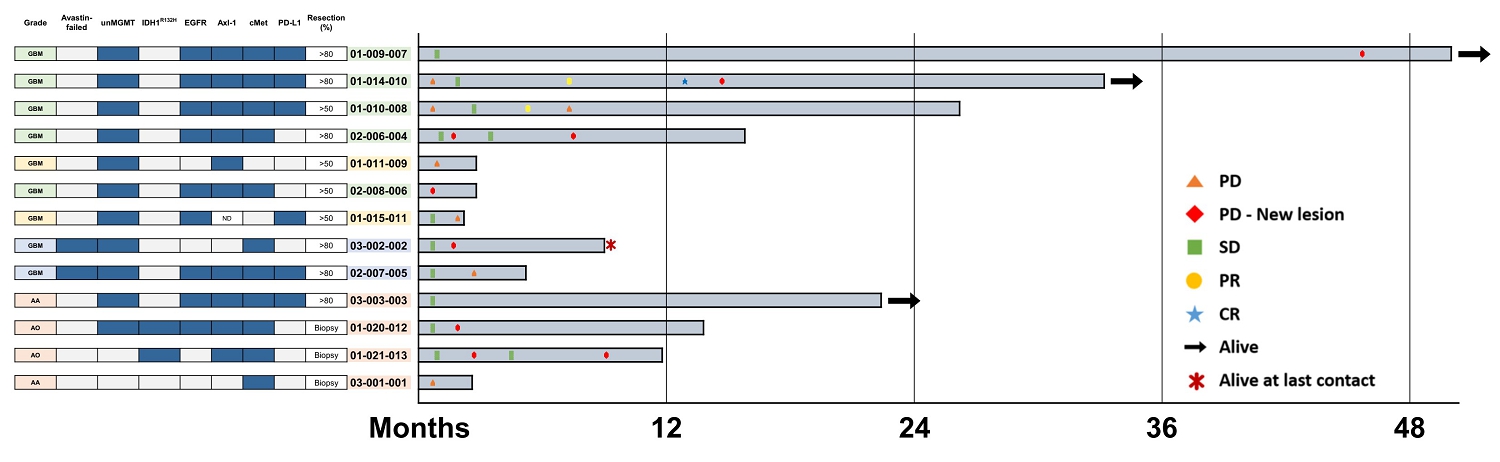

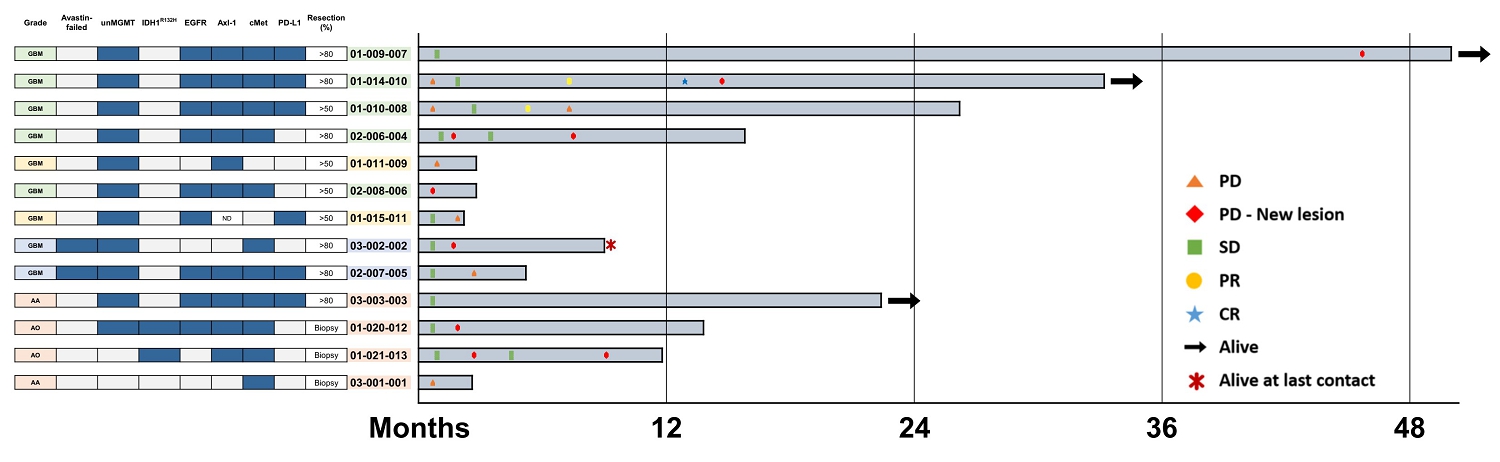

In the Phase I/IIa clinical trial, recurrent GBM patients with receptor tyrosine kinase markers (EGF receptor, Axl-1 receptor, and cMet receptor) who received surgical resection of GBM and implantation of the Cerebraca™ Wafer followed by temozolomide therapy showed a median overall survival of 26.2 months in the preliminary results. However, limited reliable biomarkers currently exist for GBM diagnosis and treatment selection. Identifying these biomarkers and developing accurate tests to detect them is crucial for personalized medicine but very challenging. In our next clinical study, we will recruit GBM patients with IDH wild-type (National Comprehensive Cancer Network, or NCCN, Guidelines Central Nervous System Cancers, Version 1.2024), and we will analyze biomarkers in a subgroup analysis. While the preliminary results of the Phase I/IIa clinical trial are encouraging, extending the median overall survival beyond 26.2 months will require biomarker identification before surgery, which may pose significant scientific and clinical challenges. This difficulty is multifaceted and can be attributed to several key factors.

| | ● | Challenge of Companion Diagnostics Development: There is currently no approved Companion Diagnostics for GBM treatment or diagnosis. |

| | ● | Limited Reliable Biomarkers: One of the primary challenges in GBM treatment is the scarcity of reliable biomarkers for diagnosis and treatment selection. |

| | ● | Heterogeneity of GBM: Identifying and targeting the specific molecular pathways involved in each patient’s tumor remains a significant challenge. |

| | ● | Treatment Resistance Mechanisms: The ability of GBM to adapt and resist treatment poses a significant hurdle in extending survival times further. |

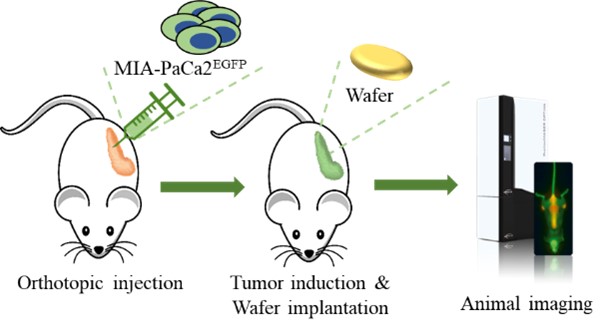

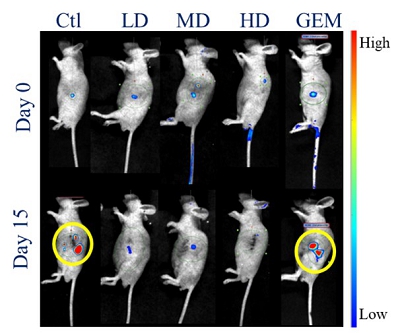

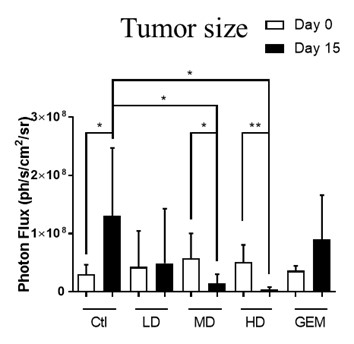

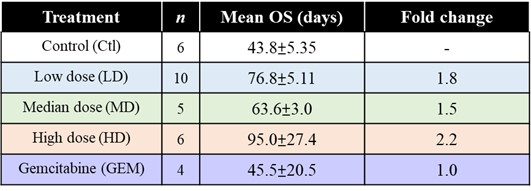

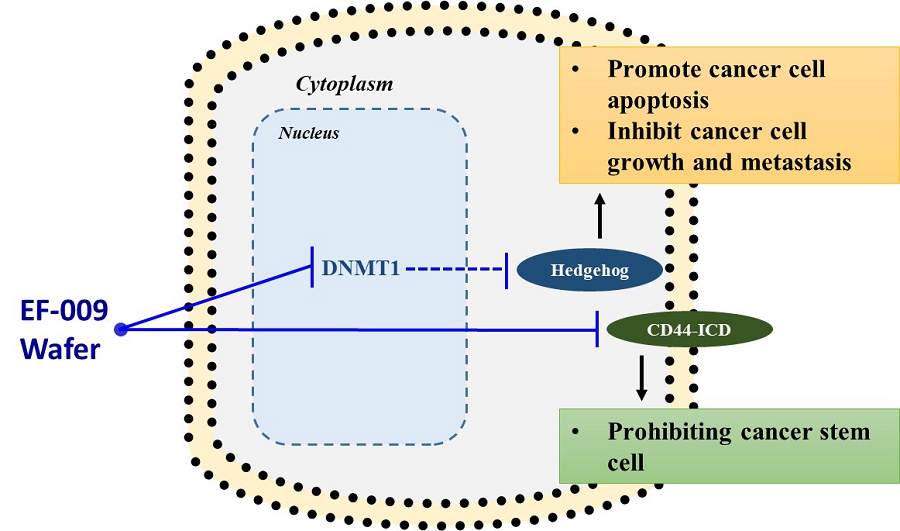

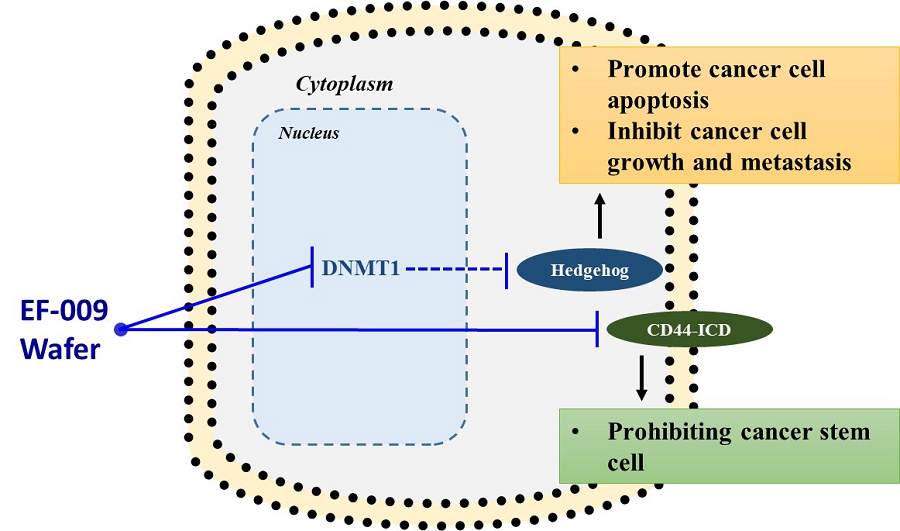

EF-009 Wafer is a biodegradable implant produced according to PIC/S GMP standards that is designed to treat pancreatic cancer by directly implanting it into the pancreatic cancer tumor margin (IND145153, Module 4, Report D06), which is intended to lead to local tumor regression. This neo-adjuvant therapy may allow patients with locally advanced pancreatic cancer to undergo tumor resection therapy. EF-009 has been designed to work by regulating DNA-methyltransferase 1, or DNMT1, and its downstream targets, Patched Domain-Containing 4, or PTCHD4, and hedgehog signaling (Huang M-H, et al., Pharmacological Research. 2019; 139: 50.), in order to help reduce pancreatic cancer growth. Additionally, our preclinical studies have demonstrated that EF-009 can have synergistic effects with existing chemotherapy drugs, including Gemcitabine, Cisplatin, 5-Fluorouracil, Irinotecan, Oxaliplatin, and Paclitaxel (Patents for cancer treatment, p.63, a combination for the treatment of cancer and its application), implying that combining EF-009 with these currently available chemotherapy drugs may help achieve improved clinical outcomes. We have received approval from both the U.S. Food and Drug Administration (“USFDA”) and Taiwan Food and Drug Administration (“TFDA”) to conduct a Phase I/IIa clinical study to evaluate the safety profile and therapeutic effects on patients with locally advanced pancreatic cancer. We have completed site selection for this study and expect to begin enrolling patients in the second quarter of 2025. Nevertheless, we will likely need to conduct a proof-of-concept study in humans to reproduce the effects observed in preclinical research. Other risks associated with using the EF-009 Wafer implant may include local inflammation caused by laparoscopic intervention and investigational product degradation, as well as surgical procedures, infection, wound bleeding, and anesthesia.

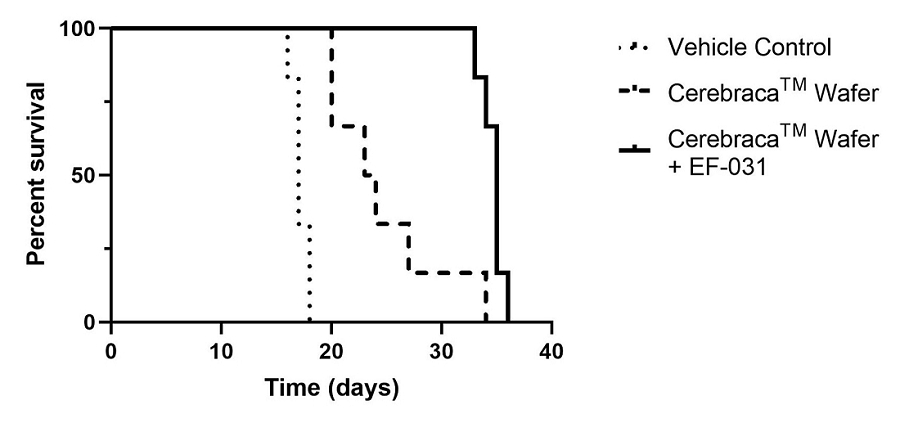

EF-031 is a soft-gel capsule formulation produced according to PIC/S GMP standards and designed to serve as a second-generation product to support the therapeutic actions of the Cerebraca™ Wafer and the EF-009 Wafer. Unlike the Cerebraca™ Wafer and the EF-009 Wafer, which require surgical implantation, EF-031 can be administered orally. In a study conducted by Pharmaron, a contract research organization (study report 51904-15-393), systemic oral administration of EF-031 revealed a 5.6 times higher concentration of EF-031 in the brain and a 64.2 times higher concentration in the pancreas compared to a plasma exposure. Nevertheless, we will likely need to conduct a proof-of-concept study in humans to replicate the effects observed in preclinical research.

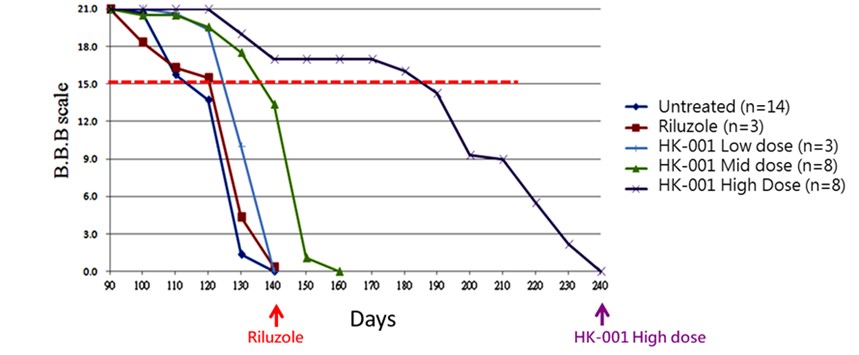

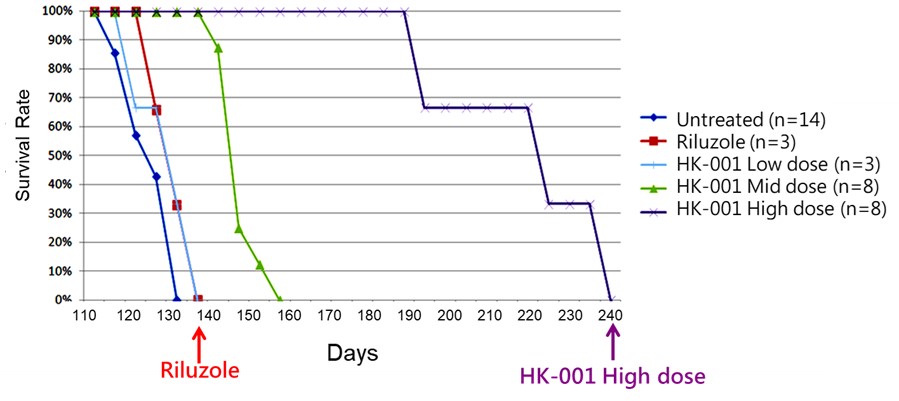

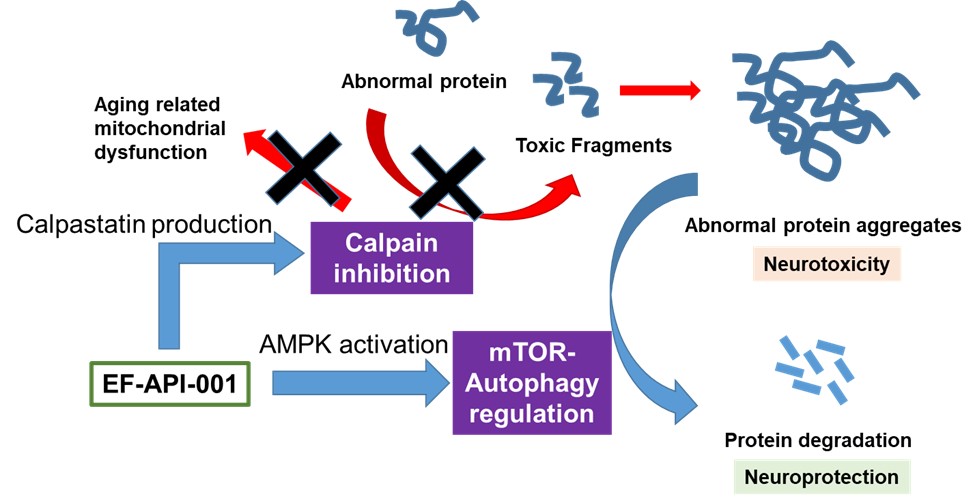

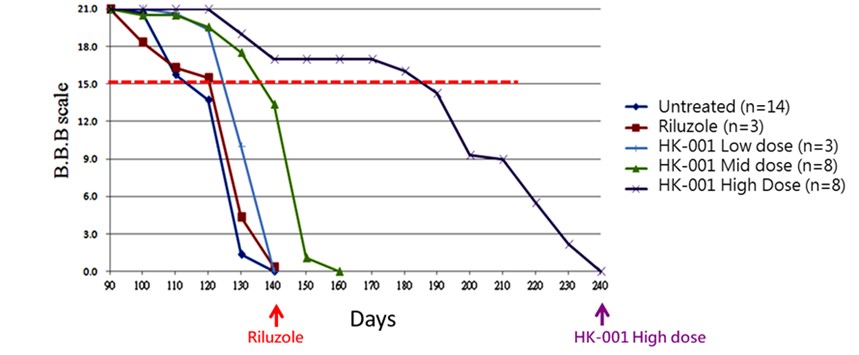

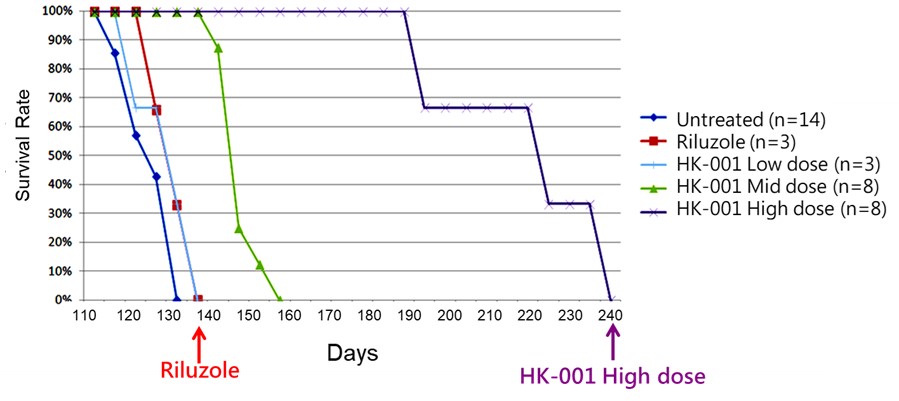

HK-001 is a soft-gel capsule formulation produced according to PIC/S GMP standards and designed for the treatment of Amyotrophic Lateral Sclerosis (ALS). Animal study results indicate that administration of HK-001 may help prolong the survival of ALS animals and delay disease progression (Hsueh K-W, et al., Neuropharmacology. 2016; 108: 152.). A Phase I clinical trial on healthy subjects is ongoing to determine the maximum tolerated dose (MTD). Nevertheless, we will likely need to conduct a proof-of-concept study in humans to replicate the effects observed in preclinical research.

Corporate Information

Our principal executive offices are 10F-1, No. 130, Songshan Rd., Xinyi Dist., Taipei City 110, Taiwan, and our telephone number is +886-2-27563796. Our registered office in the British Virgin Islands is at Portcullis Chambers, 4th Floor, Ellen Skelton Building, 3076 Sir Francis Drake Highway, Road Town, Tortola, British Virgin Islands. We maintain a website at http://www.efbiotech.com. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus.

Risk Factors Summary

An investment in our securities is subject to a number of risks, including risks related to our industry, business and corporate structure. The following summarizes some, but not all, of these risks. Please carefully consider all of the information discussed in “Risk Factors” in this prospectus beginning on page 7 for a more thorough description of these and other risks.

| | ● | We are a cancer drug development company with a limited operating history. |

| | ● | We expect our operating results to fluctuate significantly in the future as our business advances. |

| | ● | We have no products approved for commercial sale and have not generated any revenue from product sales. |

| | ● | If we fail to raise additional funds, our ability to execute our business and development strategies may be affected. |

| | ● | Raising additional capital may cause dilution to our shareholders, restrict our operations, or require us to relinquish rights to our technologies or product candidates. |

| | ● | We have never successfully completed clinical development for any of our product candidates, and we may be unable to do so. Certain of our cancer drugs are still in preclinical development and may never advance to clinical development. |

| | ● | Clinical product development involves a lengthy and expensive process, with an uncertain outcome. |

| | ● | Interim, top-line, and initial data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to confirmation, audit and verification procedures that could result in material changes in the final data. |

| | ● | We may incur additional costs or experience delays in initiating or completing, or ultimately be unable to complete, the development and commercialization of our product candidates. |

| | ● | If we experience delays or difficulties in the enrollment of patients in clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented. |

| | ● | We may not be able to replicate the results from our earlier preclinical and clinical studies in later preclinical studies and clinical trials, and this could prevent us from successfully developing, obtaining regulatory approval for and commercializing our product candidates. |

| | ● | Our growth depends on our ability to successfully develop, acquire or license new drugs. |

| | ● | Clinical trials may be subject to liability claims, which may delay or even cause our R&D plans to fail, consume our resources, cause us to incur significant liability and limit the development of our products. |

| | ● | We conduct clinical trials on some of our product candidates at locations outside the United States, approval by the FDA is critical to our development, and the FDA may not accept data from trials conducted at certain locations. |

| | ● | If clinical trials of our product candidates fail to demonstrate safety and efficacy, we may incur additional costs or delays, or ultimately fail to complete the development and commercialization of our product candidates. |

| | ● | We have no history of obtaining regulatory approval or commercialization of any new drug candidates. |

| | ● | We face substantial competition, which may result in others discovering, developing or commercializing products before, or more successfully than, we do. |

| | ● | If our current product candidates or any future product candidates do not achieve broad market acceptance, the revenue that we generate from their sales may be limited, and we may never become profitable. |

| | ● | If side effects associated with our current or future products are discovered prior to marketing and sale, we may be required to withdraw these products from the market, conduct lengthy additional clinical trials or change the labeling of our products, any of which could adversely affect our growth. |

| | ● | We may be subject to product liability claims in the future, which may consume our resources, expose us to significant liability and limit the commercialization of any products we may develop. |

| | ● | Even if our product candidates are approved for marketing, they may not be acceptable to physicians, patients, third-party payers and others in the medical community, and the market opportunity for our product candidates may be smaller than we estimate to achieve the market size required for commercial success. |

| | ● | Obtaining and enforcing pharmaceutical patents involve highly complex legal and factual questions, which, if determined adversely to us, could negatively impact our business, financial position, operations and prospects, and interrupt our research activities. |

| | ● | Developments in patent law could have a negative impact on our patent positions and business. |

| | ● | If we are unable to protect the confidentiality of our trade secrets, our business and competitive position would be harmed, respectively. |

| | ● | We and our licensors may not be able to enforce our intellectual property rights throughout the world. |

| | ● | We may seek to partner with third parties to develop and commercialize our product candidates, and if we fail to enter into such collaborations, or if such collaborations are unsuccessful, we may not be able to realize the market potential of our product candidates. |

| | ● | We are a development-stage drug discovery company and therefore face risks associated with the development of new businesses in the industry. |

| | ● | Obtaining and maintaining regulatory approval of our product candidates in one jurisdiction does not mean that we will be successful in obtaining regulatory approval of our product candidates in other jurisdictions. |

| | ● | We may seek orphan drug designation for certain of our product candidates, and we may be unsuccessful or may be unable to maintain the benefits associated with orphan drug designation, including the potential for market exclusivity. |

| | ● | If we fail to comply with environmental, health and safety laws and regulations, we could become subject to fines or penalties or incur costs that could have a material adverse effect on the success of our business. |

| | ● | We have convertible debt that will be converted into our Ordinary Shares upon the closing of this offering, which will cause immediate and substantial dilution to our shareholders. |

| | ● | There has been no public market for our Ordinary Shares prior to this offering, and if an active trading market does not develop, you may not be able to resell our Ordinary Shares at or above the price you paid, or at all. |

| | ● | As a “controlled company” under Nasdaq Listing Rules, we plan to rely on certain exemptions from Nasdaq corporate governance rules, which means our shareholders will not have the same protections afforded to shareholders of other companies. |

| | ● | Nasdaq may apply additional and more stringent criteria for our initial and continued listing because we plan to have a small public offering and we insiders will hold a large portion of our listed securities. |

| | ● | Our Ordinary Shares may be thinly traded and you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares. |

| | ● | The initial public offering price for our Ordinary Shares may not be indicative of prices that will prevail in the trading market and such market prices may be volatile. |

| | ● | Our management team has limited experience managing a public company. |

| | ● | The obligations associated with becoming a public company may strain our resources, result in more litigation and divert management’s attention from operating our business. |

| | ● | You will experience immediate and substantial dilution in the net tangible book value of Ordinary Shares purchased. |

| | ● | Substantial future sales of our Ordinary Shares or the anticipation of future sales of our Ordinary Shares in the public market could cause the price of Ordinary Shares to decline. |

| | ● | We do not intend to pay dividends for the foreseeable future. |

| | ● | If securities or industry analysts do not publish research or reports about our business, or if they publish a negative report regarding our Ordinary Shares, the price of our Ordinary Shares and trading volume could decline. |

| | ● | We may experience extreme stock price volatility unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares, and such volatility may subject us to securities litigation. |

| | ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because Everfront Holding is incorporated under British Virgin Islands law. |

| | ● | As a foreign private issuer, we are permitted to rely on certain home country rules in lieu of the corresponding corporate governance standards of the Nasdaq Listing Rules applicable to domestic U.S. issuers. This may afford less protection to holders of our shares. |

| | ● | If we cannot satisfy, or continue to satisfy, the initial listing requirements and other rules of the Nasdaq Capital Market, our securities may not be listed or may be delisted, which would negatively impact the price of our securities and your ability to sell them. |

| | ● | Because our business is conducted in New Taiwan dollars and the price of our Ordinary Shares is quoted in United States dollars, changes in currency conversion rates may affect the value of your investments. |

| | ● | We have broad discretion in the use of the net proceeds from this offering and may not use them effectively. |

| | ● | Our pre-initial public offering, or pre-IPO, shareholders will be able to sell their shares after completion of this offering subject to restrictions under Rule 144. |

| | ● | We could be deemed to be a passive foreign investment company (“PFIC”), for U.S. federal income tax purposes for any taxable year, which could result in adverse U.S. federal income tax consequences to U.S. holders of our Ordinary Shares. |

| | ● | We will be an emerging growth company within the meaning of the Securities Act upon the consummation of this offering and may take advantage of certain reduced reporting requirements. |

Implications of Being an “Emerging Growth Company”

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company, we:

| | ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; |

| | | |

| | ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis”; |

| | | |

| | ● | are not required to obtain an attestation and report from our independent registered accounting firm on its management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| | | |

| | ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute” votes); |

| | | |

| | ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer, or CEO, pay ratio disclosure; |

| | | |

| | ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and |

| | | |

| | ● | will not be required to conduct an evaluation of our internal control over financial reporting for two years. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended, herein referred to as the Securities Act, or such earlier time that we no longer meet the definition of an emerging growth company.

We will remain an emerging growth company until the earliest of: (i) the last day of the first fiscal year in which our annual gross revenue exceeds $1.235 billion; (ii) the last day of the fiscal year during which the fifth anniversary of the date of this offering occurs; (iii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of Ordinary Shares that are held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter; or (iv) the date on which we have issued more than $1.00 billion in non-convertible debt securities during any three-year period.

Implications of Being a Foreign Private Issuer

Because we are incorporated in the British Virgin Islands and more than 50% of our outstanding voting securities are not directly or indirectly held by residents of the United States, we are a “foreign private issuer” under U.S. securities laws. This means that we will be subject to reporting obligations that, to some extent, are more lenient and less frequent than those of U.S. domestic reporting companies, including the following.

| | ● | We will not be required to provide as many Exchange Act reports or provide periodic and current reports as frequently, as a domestic public company. |

| | | |

| | ● | For interim reporting, we will not be required to file quarterly reports on Form 10-Q containing unaudited financial and other specific information or current reports on Form 8-K upon the occurrence of specified significant events; instead, SEC rules will only require that we comply with our home country requirements, which are less rigorous than the rules that apply to U.S. domestic public companies. |

| | | |

| | ● | We will be required to file an annual report on Form 20-F, rather than Form 10-K, and therefore will be permitted to provide less detailed disclosure on certain issues, such as executive compensation. |

| | | |

| | ● | We will be exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information. |

| | | |

| | ● | We will be exempt from compliance with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act, including the requirement to file a proxy statement that complies with SEC rules and regulations. |

| | | |

| | ● | Section 16 of the Exchange Act, which requires insiders to file public reports of their share ownership and trading activities and establishes insider liability for profits realized from any “short-swing” trading transaction will not apply to us. |

We will cease to be a foreign private issuer, and lose the benefits of these rules, once 50% or more of our outstanding voting securities are held by U.S. residents and any of the following three conditions are true: (i) the majority of the members of our board of directors and senior management are U.S. citizens or residents; (ii) more than 50% of our assets are located in the United States; or (iii) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

In addition, because we are a foreign private issuer, the Nasdaq Listing Rules permit us to follow certain home country rules rather than the corresponding corporate governance standards of Nasdaq. The standards applicable to us may be considerably different than the standards applied to domestic U.S. issuers, including requirements to:

| | ● | have a majority of our board consist of independent directors (although all of the members of the audit committee must be independent under the Exchange Act); |

| | | |

| | ● | have a compensation committee or a nominating and corporate governance committee consisting entirely of independent directors; |

| | | |

| | ● | have regularly scheduled executive sessions with only independent directors; or |

| | | |

| | ● | have executive sessions of solely independent directors each year. |

Implications of Being a Controlled Company

As of the date hereof (after giving effect to this offering), Mr. Ho-Ching Chen holds beneficial ownership of % of our outstanding Ordinary Shares pursuant to agreements in which certain of our shareholders have given Mr. Chen voting control over their shares, including in connection with the election of our directors. For so long as these agreements provide Mr. Chen with more than 50% of the voting power for the election of our directors, we will be a “controlled company” under Nasdaq rules. As a controlled company, we will be permitted not to comply with certain of Nasdaq’s corporate governance requirements, including exemptions from the following rules:

| | ● | that a majority of our board of directors must be independent directors; |

| | ● | that we have a Compensation Committee that will determine or recommend the compensation of our executive officers and that it be composed solely of independent directors; and |

| | ● | that our director nominees must be selected or recommended solely by independent directors. |

We currently intend to rely on the controlled company exemptions in respect of our Compensation Committee and Nominating and Corporate Governance Committee, each of which will include directors that are not independent under Nasdaq Listing Rules. Further, although we do not intend to rely on the exemption in respect of a majority independent board, we will have the right to use this exemption in the future. As a result, you may not have the same protections afforded to shareholders of companies that are subject to, or voluntarily follow, these Nasdaq corporate governance requirements.

Following this offering, as long as Mr. Ho-Ching Chen maintains control over a majority of the voting power of our outstanding Ordinary Shares with respect to the election of our directors, we may utilize certain of these exemptions. Accordingly, you will not have the same protections afforded to shareholders of companies that are subject to all of the Nasdaq corporate governance requirements of Nasdaq. If we cease to be a “controlled company” and our common stock continues to be listed on Nasdaq, we will be required to comply with these provisions within the applicable transition periods.

The Offering

| Ordinary Shares in this offering | | Ordinary Shares |

| | | |

| Price per Ordinary Share | | Between $ and $ per Ordinary Share |

| | | |

| Ordinary Shares outstanding prior to completion of this offering | | 52,237,745 Ordinary Shares |

| | | |

| Ordinary Shares outstanding immediately after this offering | | Ordinary Shares |

| | | |

| Transfer Agent | | |

| | | |

| Nasdaq Capital Market symbol | | We have applied to have our Ordinary Shares listed on the Nasdaq Capital Market under the symbol “EFB”. This offering is contingent upon the final approval from Nasdaq for the listing of our Ordinary Shares on the Nasdaq Capital Market, and we will not proceed to consummate this offering if Nasdaq denies our listing application. No assurance can be given that our application will be approved. |

| | | |

| Use of proceeds | | We intend to use the proceeds from this offering for (i) Glioblastoma clinical trial expenses – Cerebraca™ Wafer Phase I/IIa; (ii) Glioblastoma clinical trial expenses – Cerebraca™ Wafer Phase IIb/III; (iii) Oncology clinical trial expenses – HK-001 / EF-031; (iv) Pancreatic cancer clinical trial expenses – EF-009 Wafer; (v) general research and development expenses; (vi) patent maintenance and application expenses; and (vii) working capital and other general corporate expenses. See “Use of Proceeds.” |

| | | |

| Lock-up | | We and all of our directors and officers and shareholders that hold 5% or more of our outstanding Ordinary Shares have agreed with the representatives of the underwriters, subject to certain exceptions, not to sell, transfer, or dispose of, directly or indirectly, any Ordinary Shares or securities convertible into or exercisable or exchangeable for Ordinary Shares for a period of six months after the closing of his offering. See “Shares Eligible for Future Sale” and “Underwriting.” |

| | | |

| Risk factors | | The Ordinary Shares offered hereby involve a high degree of risk. You should read “Risk Factors” for a discussion of factors to consider before deciding to invest in our Ordinary Shares. |

Here and elsewhere in this prospectus, we have based the number of Ordinary Shares outstanding after this offering on (1) Ordinary Shares outstanding on , 2025 and (2) our issuance and sale in this offering of the number of Ordinary Shares set forth on the cover page of this prospectus. These figures do not reflect outstanding rights to purchase Ordinary Shares under our employee benefit plan or the warrants to purchase our Ordinary Shares that we will issue to the representatives of the underwriters on the closing of this offering. See “Underwriting.”

Summary Consolidated Financial Data

We have derived the following summary consolidated financial data as of June 30, 2024 and for the six months ended June 30, 2024 and 2023 from our unaudited consolidated financial statements, which you can find elsewhere in this prospectus. We have derived the following summary consolidated financial data as of and for the years ended December 31, 2023 and 2022 from our audited consolidated financial statements, which you can find elsewhere in this prospectus. We prepared these financial statements in accordance with generally accepted accounting principles of the United States of America, or U.S. GAAP. Our historical results are not necessarily indicative of the results that may occur in the future. You should read the following summary consolidated financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements, including the notes thereto, which you can find elsewhere in this prospectus.

| | | For the Six Months Ended June 30, | | | For the Years Ended December 31, | |

| | | 2024 | | | 2023 | | | 2023 | | | 2022 | |

| | | US$ | | | US$ | | | US$ | | | US$ | |

| | | (Unaudited) | | | | |

| Revenue | | $ | - | | | $ | - | | | $ | - | | | $ | 79,908 | |

| Operating costs | | | - | | | | - | | | | - | | | | - | |

| Gross profit | | | - | | | | - | | | | - | | | | 79,908 | |

| Total operating expenses | | | 792,673 | | | | 984,599 | | | | 2,385,870 | | | | 1,783,902 | |

| Loss from operations | | | (792,673 | ) | | | (984,599 | ) | | | (2,385,870 | ) | | | (1,703,994 | ) |

| Total non-operating income, net | | | 4,961 | | | | 36,582 | | | | 92,673 | | | | 209,400 | |

| Loss before income tax | | | (787,712 | ) | | | (948,017 | ) | | | (2,293,197 | ) | | | (1,494,594 | ) |

| Income tax expense | | | - | | | | - | | | | - | | | | - | |

| Net loss | | $ | (787,712 | ) | | $ | (948,017 | ) | | $ | (2,293,197 | ) | | $ | (1,494,594 | ) |

| Basic and diluted earnings per share | | $ | (0.02 | ) | | $ | (0.02 | ) | | $ | (0.04 | ) | | $ | (0.03 | ) |

| | | As of June 30, | | | As of December 31, | |

| | | 2024 | | | 2023 | | | 2022 | |

| | | US$ | | | US$ | | | US$ | |

| Summary Consolidated Balance Sheet Data | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 432,932 | | | $ | 1,220,559 | | | $ | 548,138 | |

| Total current assets | | | 867,975 | | | | 1,690,317 | | | | 992,392 | |

| Total assets | | | 1,198,579 | | | | 2,065,005 | | | | 1,353,450 | |

| Total current liabilities | | | 2,645,751 | | | | 2,679,458 | | | | 174,696 | |

| Total liabilities | | | 2,652,479 | | | | 2,689,622 | | | | 175,893 | |

| Total stockholders’ (deficit) equity | | $ | (1,453,772 | ) | | $ | (624,638 | ) | | $ | 1,177,236 | |

RISK FACTORS

An investment in Ordinary Shares involves a high degree of risk. Before deciding whether to invest in Ordinary Shares, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of Ordinary Shares to decline, resulting in a loss of all or part of your investment. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in Ordinary Shares if you can bear the risk of loss of your entire investment.

Risks Related to Our Financial Position and Need for Additional Capital

We are a cancer drug development company with a limited operating history.

We are a cancer drug development company with a limited operating history. Biopharmaceutical product development is a highly speculative undertaking and involves a substantial degree of risk. Since our inception, we have devoted substantially all of our efforts to organizing and staffing our company, acquiring and developing intellectual property, business planning, raising capital, conducting discovery, research and development and clinical trial activities, and providing general and administrative support for these operations. We have no products approved for commercial sale and therefore have never generated any revenue from product sales, and we do not expect to in the foreseeable future. We expect to continue to incur significant expenses and operating losses over the next several years and for the foreseeable future. Our prior losses, combined with expected future losses, have had and will continue to have an adverse effect on cash and cash equivalent holdings, our shareholders’ equity and working capital. If we were to expend our cash resources more quickly than we anticipate as we advance into and through the drug development and approval process, our cash runway may be shorter than the target we may disclose from time to time.

We expect our operating results to fluctuate significantly in the future as our business advances.

The amount of our future losses is uncertain and our quarterly and annual operating results may fluctuate significantly or may fall below the expectations of investors or securities analysts, which may cause our share price to fluctuate or decline. Our quarterly and annual operating results may fluctuate significantly in the future due to a variety of factors, many of which are outside of our control and may be difficult to predict, including the following:

| ● | the timing and success or failure of on-going and future clinical trials for our product candidates or competing product candidates, or any other change in the competitive landscape of our industry, including consolidation among our competitors or partners; |

| ● | our ability to obtain INDs for our pipeline product candidates, successfully open clinical trial sites and recruit and retain subjects for clinical trials, and any delays caused by difficulties in such efforts; |

| ● | our ability to obtain regulatory approval for our product candidates, and the timing and scope of any such approvals we may receive; |

| ● | the timing and cost of, and level of investment in, research and development activities relating to our product candidates and any future product candidates and research-stage programs, which may change from time to time; |

| ● | the cost of manufacturing our product candidates and products, should they receive regulatory approval, which may vary depending on FDA, TFDA and other comparable foreign regulatory requirements, the quantity of production and the terms of our agreements with manufacturers; |

| ● | expenditures that we will or may incur to develop additional product candidates; |

| ● | the level of demand for our product candidates should they receive regulatory approval, which may vary significantly; |

| ● | the risk/benefit profile, cost and reimbursement policies with respect to our product candidates, if approved, and existing and potential future cancer drugs that compete with our product candidates; |

| ● | future accounting pronouncements or changes in our accounting policies. |

As a result, comparing our operating results on a period-to-period basis may not be meaningful. This variability and unpredictability could also result in our failing to meet the expectations of industry or financial analysts or investors for any period. If our revenue or operating results fall below the expectations of analysts or investors or below any forecasts we may provide to the market, or if the forecasts we provide to the market are below the expectations of analysts or investors, the price of our Ordinary Shares could decline substantially. Such a share price decline could occur even when we have met any previously publicly stated guidance we may provide.

We have no products approved for commercial sale and have not generated any revenue from product sales.

Our ability to become profitable depends upon our ability to generate revenue. To date, we have not generated any revenue from product sales, and we do not expect to generate any revenue from the sale of products in the near future. Our ability to generate revenue depends on a number of factors, including, but not limited to, our ability to:

| ● | successfully complete our planned preclinical studies for our EF-031 oral formulation; |

| ● | timely file INDs for our programs, and obtain clearance of these INDs to allow for commencement of such future clinical trials; |

| ● | successfully complete our Cerebraca™ Wafer and EF-009 Wafer clinical trials and any future clinical trials; |

| ● | initiate and successfully complete all safety and efficacy studies required to obtain U.S. and foreign regulatory approval for our product candidates; |

| ● | make and maintain arrangements with third-party manufacturers for clinical supply and commercial manufacturing; |

| ● | obtain and maintain patent and trade secret protection or regulatory exclusivity for our product candidates; |

| ● | launch commercial sales of our products, if and when approved, whether alone or in collaboration with others; |

| ● | obtain and maintain acceptance of our products, if and when approved, by patients, the medical community and third-party payers; |

| ● | position our products to effectively compete with other cancer drugs; |

| ● | obtain and maintain healthcare insurance coverage and adequate reimbursement for our products, if and when approved; |

| ● | enforce and defend intellectual property rights and claims; and |

| ● | maintain a continued acceptable safety profile of our products following approval. |

If we fail to raise additional funds, our ability to execute our business and development strategies may be affected.

We have limited funds, and only a small amount of service income and government subsidy income partially supports our operations. The majority of our working capital comes from capital invested by shareholders. From time to time, we may seek additional funding to provide the funds necessary to expand our R&D program and working capital. We cannot predict with 100% certainty the timing or amount of any such capital requirement.

If we do not raise sufficient funds to fund ongoing R&D activities, we may not be able to execute the intended business development plan. Even if we receive financing for near-term operations and product development, we may need additional funding in the short term. In addition, additional capital may not be available in sufficient amounts or on reasonable terms, and our ability to raise additional capital may be adversely affected by the potential deterioration in global economic conditions and subsequent disruptions. If we are unable to raise capital when required, our business, financial condition and results of operations will be materially and adversely affected and we may be forced to reduce or cease our operations.

Raising additional capital may cause dilution to our shareholders, restrict our operations, or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenue, we expect to finance our cash needs through one or a combination of private and public equity offerings, debt financings, collaborations, strategic alliances, and licensing arrangements. We do not have any committed external source of funds. The terms of any financing may adversely affect the holdings or the rights of our shareholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our Ordinary Shares to decline. To the extent that we raise additional capital through the sale of Ordinary Shares or securities convertible or exchangeable into our Ordinary Shares, the ownership interests of our existing shareholders will be diluted, and the terms of those securities may include liquidation or other preferences that may materially adversely affect your rights as a holder of our Ordinary Shares. Debt financing, if available, would increase our fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, acquiring, selling, or licensing intellectual property rights, and making capital expenditures, declaring dividends, repurchasing our Ordinary Shares, or other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to meet certain milestones in connection with debt financing and the failure to achieve such milestones by certain dates may force us to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us which could have a material adverse effect on our business, operating results, and prospects.

We also could be required to seek funds through arrangements with additional collaborators or otherwise at an earlier stage than otherwise would be desirable. If we raise funds through additional collaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our intellectual property, future revenue streams, research programs or product candidates, grant licenses on terms that may not be favorable to us or grant rights to develop and market our product candidates that we would otherwise prefer to develop and market ourselves, any of which may have a material adverse effect on our business, operating results and prospects.

Risks Related to Clinical Development of Our Product Candidates

We have never successfully completed clinical development for any of our product candidates, and we may be unable to do so. Certain of our cancer drugs are still in preclinical development and may never advance to clinical development.

We have not yet successfully completed clinical development for any of our product candidates. Completing clinical development is a costly, complex endeavor that requires that we, among other things, enroll and complete clinical trials (including large-scale, pivotal or Phase IIb/III clinical trials), obtain regulatory approvals, manufacture a commercial scale product or arrange for a third party to do so on our behalf, and conduct sales and marketing activities necessary for successful commercialization. We received FDA and TFDA clearance of one IND application for each of Cerebraca™ Wafer and EF-009 Wafer. We may not be able to file future INDs for any of our other product candidates on the timelines we expect, if at all. Further, timelines for developing and filing INDs are subject to significant uncertainties and projected timelines can be improved upon or delayed. Moreover, we cannot be sure that submission of an IND will result in either the FDA or TFDA allowing clinical trials to begin, or that, once begun, issues will not arise that require us to suspend or terminate any clinical trials. Any guidance we receive from the FDA, TFDA or other regulatory authorities is subject to change. These regulatory authorities could change their position, including on the acceptability of our trial designs or the clinical endpoints selected, which may require us to complete additional clinical trials or result in the imposition of stricter approval conditions than we currently expect. Successful completion of our clinical trials is a prerequisite to submitting a new drug application (“NDA”) to the FDA, a marketing authorization application (“MAA”) to the European Medicines Agency (“EMA”) or other marketing applications to regulatory authorities in other jurisdictions, for each product candidate and, consequently, the regulatory approval of each product candidate. While the INDs for Cerebraca™ Wafer and EF-009 Wafer were cleared by the FDA and TFDA, it is possible that an adequate number of patients may not be enrolled on a timely basis, or at all, and the studies may not be completed (and preliminary, initial or final trial results may not be available) on time. Similarly, future clinical trials may not begin on time or be completed on schedule, if at all.

If we are required to conduct additional preclinical studies or clinical trials of our product candidates beyond those that we currently contemplate, if we are unable to successfully complete clinical trials of our product candidates or other testing, if the results of these trials or tests are not positive or are only modestly positive or if there are safety and/or efficacy concerns, we may, among other things:

| ● | be delayed in obtaining regulatory approval for our product candidates; |

| ● | not obtain regulatory approval at all; |

| ● | obtain regulatory approval for indications or patient populations that are not as broad as intended or desired; |

| ● | be subject to post-marketing testing requirements; or |

| ● | have the product removed from the market after obtaining regulatory approval. |

Clinical product development involves a lengthy and expensive process, with an uncertain outcome.

Our preclinical studies, our Cerebraca™ Wafer and EF-009 Wafer clinical trials and future clinical trials may not be successful. It is impossible to predict when or if any of our product candidates will prove effective and safe in humans or will receive regulatory approval. Before obtaining regulatory approval from regulatory authorities for the sale of any product candidate, we must complete preclinical studies and then conduct extensive clinical trials to demonstrate the safety and efficacy of our product candidates in humans. Clinical testing is expensive, difficult to design and implement, can take many years to complete and outcomes are uncertain. A failure of one or more clinical trials can occur at any stage of testing. The outcome of preclinical development testing and early clinical trials may not be predictive of the success of later clinical trials, and interim or preliminary results of a clinical trial do not necessarily predict final results (or be indicative of safety and efficacy if commercialized and used in a broader population). Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that have believed their product candidates performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain regulatory approval of their product candidates.

Interim, top-line, and initial data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to confirmation, audit and verification procedures that could result in material changes in the final data.

From time to time, we may publicly disclose interim, top-line or initial data from our current and future clinical trials, which is based on a preliminary analysis of then-available data, and the results and related findings and conclusions are subject to change following a more comprehensive review of the data, including audit and verification procedures, and as results from additional clinical trial participants become available and trial participants spend additional time on therapy. We may also make assumptions, estimations, calculations and conclusions as part of our analyses of data, and we may not have received or had the opportunity to evaluate all data fully and carefully. As a result, initial, interim and top-line data should be viewed with caution until the final data are available. In addition, we may report interim analyses of only certain endpoints rather than all endpoints. Interim data from clinical trials that we may complete are subject to the risk that one or more of the clinical outcomes may materially change as patient enrollment continues and more patient data become available. Adverse differences between initial or interim data and final data could significantly harm our business prospects and may cause the price of our Ordinary Shares to fluctuate or decline.

Further, regulatory agencies and others may not accept or agree with our assumptions, estimates, calculations, conclusions or analyses or may interpret or weigh the importance of data differently, which could adversely impact the potential of a particular program, the likelihood of obtaining regulatory approval of the particular product candidate, the scope of product label, and commercialization of any approved product. In addition, the information we choose to publicly disclose regarding a particular study or clinical trial is derived from information that is typically extensive, and you or others may not agree with what we determine is material or otherwise appropriate information to include in our disclosure.

If the initial, interim or top-line data that we report differ from final or actual results, or if others, including regulatory authorities, disagree with the conclusions reached, our ability to obtain approval for, and commercialize, our product candidates may be significantly impaired, which could materially harm our business, operating results, prospects or financial condition.

We may incur additional costs or experience delays in initiating or completing, or ultimately be unable to complete, the development and commercialization of our product candidates.

We may experience delays in initiating or completing our preclinical studies or clinical trials, including as a result of delays in obtaining, or failure to obtain, the FDA’s and/or TFDA’s clearance to initiate clinical trials under future INDs. Additionally, we cannot be certain that preclinical studies or clinical trials for our product candidates will not require redesign, will enroll an adequate number of subjects on time, or will be completed on schedule, if at all. We may experience numerous unforeseen events during, or as a result of, preclinical studies and clinical trials that could delay or prevent our ability to receive regulatory approval or commercialize our product candidates, including the following:

| ● | we may receive feedback from regulatory authorities that require us to modify the design or implementation of our preclinical studies or clinical trials or to delay or terminate a clinical trial; |

| ● | regulators or institutional review boards (“IRB”), or ethics committees may delay or may not authorize us or our investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site; |

| ● | we may experience delays in reaching, or fail to reach, agreement on acceptable terms with prospective trial sites and prospective Contract Research Organizations, or CROs, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| ● | preclinical studies or clinical trials of our product candidates may fail to show safety or efficacy or otherwise produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional preclinical studies or clinical trials, or we may decide to abandon product research or development programs; |

| ● | preclinical studies or clinical trials of our product candidates may not produce differentiated or clinically significant results across tumor types or indications; |

| ● | the number of patients required for clinical trials of our product candidates may be larger than we anticipate, enrollment in these clinical trials may be slower than we anticipate or participants may drop out of these clinical trials or fail to return for post-treatment follow-up at a higher rate than we anticipate; |

| ● | our third-party contractors may fail to comply with regulatory requirements, fail to maintain adequate quality controls, be unable to provide us with sufficient product supply to conduct or complete preclinical studies or clinical trials, fail to meet their contractual obligations to us in a timely manner, or at all; |

| ● | our clinical trial sites or investigators may deviate from the clinical trial protocol or drop out of the trial, which may require that we add new clinical trial sites or investigators in order to ensure our trials generate statistically significant results; |

| ● | we may elect to, or regulators or IRBs or ethics committees may require us or our investigators to, suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements or a finding that the participants in our clinical trials are being exposed to unacceptable health risks; |

| ● | the cost of clinical trials of our product candidates may be greater than we anticipate; |

| ● | the supply or quality of our product candidates or other materials necessary to conduct clinical trials of our product candidates may be insufficient or inadequate; |

| ● | our product candidates may have undesirable side effects or other unexpected characteristics, causing us or our investigators, regulators or IRBs or ethics committees to suspend or terminate the trials, or reports may arise from preclinical or clinical testing of other cancer drugs that raise safety or efficacy concerns about our product candidates; |

| ● | regulators may revise the requirements for approving our product candidates, or such requirements may not be as we anticipate; and |

| ● | regulatory developments with respect to our competitors’ products, including any developments, litigation or public concern about the safety of such products. |

We could encounter delays if a clinical trial is suspended or terminated by us, by the IRBs of the institutions at which such trials are being conducted or by the FDA, TFDA or other regulatory authorities. Such authorities may impose such a suspension or termination or clinical hold due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements for our clinical protocols, adverse findings upon an inspection of the clinical trial operations or trial site by the FDA, TFDA or other regulatory authorities, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit from using a product, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial. Many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates. Further, the FDA or TFDA may disagree with our clinical trial design or our interpretation of data from clinical trials or may change the requirements for approval even after each has reviewed and commented on the design for our clinical trials.

Moreover, principal investigators for our current or future clinical trials may serve as scientific advisors or consultants to us from time to time and receive compensation in connection with such services. Under certain circumstances, we may be required to report some of these relationships to the FDA, TFDA or comparable foreign regulatory authorities. The FDA, TFDA or comparable foreign regulatory authority may conclude that a financial relationship between us and a principal investigator has created a conflict of interest or otherwise affected the interpretation of the study. The FDA, TFDA or comparable foreign regulatory authority may therefore question the integrity of the data generated at the applicable clinical trial site, and the utility of the clinical trial itself may be jeopardized. This could result in a delay in approval, or rejection, of our marketing applications by the FDA, TFDA or comparable foreign regulatory authority and may ultimately lead to the denial of regulatory approval of one or more of our product candidates.

Our product development costs will also increase if we experience delays in testing or regulatory approvals. We do not know whether any of our current or future clinical trials will begin as planned, or whether any of our current or future clinical trials will need to be restructured or will be completed on schedule, if at all. Significant preclinical study or clinical trial delays also could shorten any periods during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before we do, which would impair our ability to successfully commercialize our product candidates and may significantly harm our business, operating results, financial condition and prospects.

If we experience delays or difficulties in the enrollment of patients in clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented.

We may not be able to continue or initiate clinical trials for our product candidates if we are unable to locate and enroll a sufficient number of eligible patients to participate in these trials as required by the FDA, TFDA or comparable foreign regulatory authorities, or as needed to provide appropriate statistical power for a given trial. In particular, because some of the indications we are pursuing are orphan indications that have small populations, our ability to enroll eligible patients may be limited or may result in slower enrollment than we anticipate.

In addition, some of our competitors have ongoing clinical trials for product candidates that treat the same indications as do our product candidates, and patients who would otherwise be eligible for our clinical trials may choose instead to enroll in clinical trials of our competitors’ product candidates.

In addition to the competitive clinical trial environment, the eligibility criteria of our clinical trials will further limit the pool of available study participants as we will require that patients have specific characteristics that we can measure to assure their cancer is either severe enough or not too advanced to include them in a study. The process of finding patients may prove costly. We also may not be able to identify, recruit or enroll a sufficient number of patients to complete our clinical studies because of the perceived risks and benefits of the product candidates under study, the availability and efficacy of competing therapies and clinical trials, the proximity and availability of clinical trial sites for prospective patients, and the patient referral practices of physicians. If patients are unwilling to participate in our studies for any reason, the timeline for recruiting patients, conducting studies, reporting initial and final trial results and obtaining regulatory approval of potential products may be delayed.

Further, if our patient recruitment for our clinical trials proceeds more slowly than we expect, this could compromise our ability to seek designations under applicable FDA expedited review and development programs, including Breakthrough Therapy Designation and Fast Track Designation (to the extent these are available to us), or otherwise seek to accelerate clinical development and regulatory timelines. Patient enrollment may be affected by other factors, including:

| ● | the severity of the disease under investigation; |

| ● | the efforts to obtain and maintain patient consents and facilitate timely enrollment in clinical trials; |

| ● | the ability to monitor patients adequately during and after treatment; |

| ● | the ability to recruit clinical trial investigators with the appropriate competencies and experience; |

| ● | reporting of the initial results of any of our clinical trials; and |

| ● | factors we may not be able to control, including the impacts of events such as global pandemics, which may limit patients, principal investigators or staff or clinical site availability. |

We may not be able to replicate the results from our earlier preclinical and clinical studies in later preclinical studies and clinical trials, and this could prevent us from successfully developing, obtaining regulatory approval for and commercializing our product candidates.

You should not view results from our earlier preclinical studies of our programs and product candidates to be predictive of the results of subsequent preclinical studies and clinical trials. Any results from the earlier preclinical and clinical studies of our programs or our product candidates may not necessarily be predictive of the results from Later preclinical studies and clinical trials often fail to replicate or confirm the results of earlier preclinical and clinical studies for a variety of reasons, including that later studies may be more rigorous and involve a larger, more diverse patient population.

Many companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in late-stage clinical trials after achieving positive results in early-stage development, and we cannot be certain that we will not face similar setbacks. These setbacks have been caused by, among other things, preclinical and other nonclinical findings made while clinical trials were underway, or safety, pharmacokinetic or efficacy observations made in preclinical studies and clinical trials, including previously unreported adverse events. Moreover, preclinical, nonclinical and clinical data are often susceptible to varying interpretations and analyses and many companies that believed their product candidates performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain regulatory approval.

Our growth depends on our ability to successfully develop, acquire or license new drugs.