As filed with the U.S. Securities and Exchange Commission on November 5, 2024.

Registration No. 333-281799

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2

FORM F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

CONCORDE INTERNATIONAL GROUP LTD

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s Name into English)

| British Virgin Islands | 7381 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

3 Ang Mo Kio Street 62, #01-49 LINK@AMK

Singapore 569139

+65 2960802

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(800)221-0102

(Names, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Louis A. Bevilacqua, Esq. Bevilacqua PLLC 1050 Connecticut Avenue, NW, Suite 500 Washington, DC 20036 (202) 869-0888 | Barry I. Grossman, Esq. Lijia Sanchez, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, New York 10105 (212) 370-1300 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED NOVEMBER 5, 2024 |

$5,000,000 Class A Ordinary Shares

| CONCORDE INTERNATIONAL GROUP LTD |

This is the initial public offering of our Class A Ordinary Shares, par value $0.00001 per share. We anticipate that the initial public offering price will be $4.00. We are offering 1,250,000 Class A Ordinary Shares, assuming an estimated initial public offering price of $4.00 per share.

Currently, no public market exists for our Class A Ordinary Shares. We plan to apply to list our Class A Ordinary Shares on the Nasdaq Capital Market under the trading symbol “CIGL”. We will not close this offering unless the Nasdaq Capital Market has approved our Class A Ordinary Shares for listing.

We have two classes of authorized Ordinary Shares, Class A Ordinary Shares and Class B Ordinary Shares. The rights of the holders of Class A Ordinary Shares and Class B Ordinary Shares are identical, except with respect to voting and conversion. The Class A Ordinary Shares generally vote together with the Class B Ordinary Shares as a group, unless otherwise prohibited by law. Each Class A Ordinary Share is entitled to one vote. Each Class B Ordinary Share is entitled to one hundred votes and is convertible into one Class A Ordinary Share. As of the date of this prospectus, our founders, the holders of our outstanding Class B Ordinary Shares, held 100% of the voting power of our outstanding share capital and are therefore our controlling shareholders. Following this offering, taking into consideration the Class A Ordinary Shares expected to be offered hereby, even if 100% of such shares are sold, our founders, some of whom are also some of our officers and directors, will retain controlling voting power in the Company based on having approximately 97.57% of all voting rights.

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, and as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company.”

We are a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings. See “Prospectus Summary — Implications of Being a Foreign Private Issuer.”

We expect be a “controlled company” under the rules of the Nasdaq Capital Market, immediately after consummation of this offering and we expect to avail ourselves of the corporate governance exemptions afforded to a “controlled company” under the rules of the Nasdaq Capital Market. See “Risk Factors — Risks Related to This Offering and Ownership of Our Class A Ordinary Shares.” If we are approved to list our Class A Ordinary Shares on the Nasdaq Capital Market, we will be a “controlled company” as defined in Nasdaq listing rules because more than 50% of our voting power will be held by Mr. Swee Kheng Chua after the offering. As a “controlled company,” we are exempt by Nasdaq listing rules from certain corporate governance requirements. Accordingly, you may not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of the Nasdaq Capital Market. See “Prospectus Summary — Implications of Being a Controlled Company.”

Investing in our Class A Ordinary Shares involves a high degree of risk. See “Risk Factors” beginning on page 13 of this prospectus for a discussion of information that should be considered in connection with an investment in our Class A Ordinary Shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | We have agreed to pay the underwriters a discount equal to 7.5% of the gross proceeds of the offering. Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1% of the initial public offering price payable to the underwriters. For other fees and expenses payable to the underwriters, we refer you to “Underwriting” beginning on page 102 for additional information regarding underwriters’ compensation. |

We have granted a 45-day option to the representative of the underwriters to purchase up to an additional Class A Ordinary Shares at the public offering price less the underwriting discount and commissions.

The underwriters expect to deliver the Class A Ordinary Shares to purchasers on or about , 2024.

The date of this prospectus is , 2024

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, nor the underwriters have authorized anyone to provide you with different information. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or any free writing prospectus, as the case may be, or any sale of Class A Ordinary Shares.

For investors outside the United States: Neither we, nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Class A Ordinary Shares and the distribution of this prospectus outside the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

i

COMMONLY USED DEFINED TERMS

Except as otherwise indicated by the context and for the purposes of this prospectus only, references in this prospectus to:

| ● | “we,” “us,” “the Company,” “our” or “our company” are to the combined business of Concorde International Group Ltd, a British Virgin Islands (“BVI”) business company incorporated on May 2, 2023, and its consolidated subsidiaries; |

| ● | “Concorde International” are to Concorde International Group Ltd, a holding company incorporated in the BVI under the BVI Business Companies Act (as amended) (the “BVI Act”) on May 2, 2023; |

| ● | “Concorde Singapore” are to Concorde International’s 100% owned subsidiary, Concorde International Group Pte Ltd a corporation formed in Singapore on June 12, 2023; |

| ● | “Concorde Security Singapore” are to Concorde Singapore’s 96.81% owned subsidiary, Concorde Security Pte Ltd, a corporation formed in Singapore on June 16, 2005; |

| ● | “Concorde Security Malaysia” are to Concorde Singapore’s 100% owned subsidiary, Concorde Security Sdn Bhd, a corporation formed in Malaysia on January 13, 2015; |

| ● | “Concorde UK” are to Concorde Singapore’s 100% owned subsidiary, Concorde Security Limited, a private company limited by shares incorporated in the United Kingdom on December 23, 2016; |

| ● | “Concorde Asia” are to Concorde Singapore’s 70% indirectly owned subsidiary, Concorde Asia Pte Ltd, a corporation formed in Singapore on October 8, 2013; |

| ● | “Berjaya Academy” are to Concorde Singapore’s 70% indirectly owned subsidiary, Berjaya Academy Pte Ltd, a corporation formed in Singapore on March 6, 2020; |

| ● | “Concorde i-Fast US” are to Concorde Singapore’s 100% owned subsidiary, Concorde i-FAST USA Inc., a corporation formed in Texas on April 25, 2024; and |

| ● | “U.S. dollars,” “dollars,” “USD” or “$” are to the legal currency of the United States. |

Our reporting currency is the US dollar. Concorde International is a holding company with no operations of its own. All of operations are conducted in Singapore through Concorde International’s operating subsidiary in Singapore, Concorde Singapore. The functional currency of Concorde Singapore is the local currency (Singapore Dollar), as it is the monetary unit of account of the principal economic environment in which the Company’s operations are conducted. All assets and liabilities of the Company’s foreign operations are translated at the current exchange rate as of the end of the period, and revenue and expenses are translated at average exchange rates in effect during the period. The gain or loss resulting from the process of translating foreign currency financial transactions into US dollars is reflected as a foreign currency cumulative translation adjustment and reported as a component of accumulated other comprehensive income (loss). Foreign currency transaction gains and losses resulting from or expected to result from transactions denominated in a currency other than the functional currency are recognized in other income (expense), net in the statement of operations. Our fiscal year end is December 31. References to a particular “fiscal year” are to our fiscal year ended December 31 of that calendar year. Our consolidated financial statements have been prepared in accordance with the International Financial Reporting Standards, or IFRS.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

We have proprietary rights to trademarks used in this prospectus that are important to our business. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are without the ®, ™ and other similar symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

This prospectus may contain additional trademarks, service marks and trade names of others. All trademarks, service marks and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other person.

ii

This summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our Class A Ordinary Shares. You should carefully read the entire prospectus, including the risks associated with an investment in our company discussed in the “Risk Factors” section of this prospectus, before making an investment decision. Some of the statements in this prospectus are forward-looking statements. See the section titled “Cautionary Statement Regarding Forward-Looking Statements.”

In this prospectus, “we,” “us,” “our,” “our company,” “the Group,” “Concorde International,” and similar references refer to Concorde International Group Ltd and its consolidated subsidiaries.

Our Company

Overview

Concorde International Group Limited is an integrated security services providers that combines physical manpower and innovative technology to deliver effective security solutions. In 2014, we were awarded “The Business Model Innovation Award” by the Singapore Manufacturing Federation. In 2015, we were awarded the “Best Innovative Use of Infocomm Technology Award” by the Singapore Infocomm Technology Federation (“SiTF”). In 2016, we were awarded the “Most Innovative Use of Infocomm Technology (Private Sector-SME) Award” by the Infocomm Media Development Authority of Singapore (“IMDA”, formerly known as Infocomm Development Authority) and the SiTF. In 2017, we were awarded the “IP Awards” by the World Intellectual Property Organization — Intellectual Property Office of Singapore (WIPO-IPOS). In addition, in 2017 The Nanyang Technological University of Singapore recognized our innovative solution by publishing it as a case study entitled “The Transformation of Concorde Security Pte Ltd” via its Nanyang Technoprenuership Center. In the same year, the Singapore Management University and Harvard Business Publishing Education also recognized our innovation by publishing a case study entitled “Main Case: The Resilience of a Disruptive Innovator: Concorde Security”. From 2018 to 2019, in recognition of our solution in transforming the industry, the IMDA approved our solutions in the Singapore government’s Industry Transformation Map Pilot Programme. From 2020 to 2021, in recognition of our technology and solutions, we were included in the “Pre-approved IT solutions vendor” under the category of security, by the IMDA. From 2022 to 2023, in recognition of our technology solution, the IMDA approved our solutions in the Singapore government’s Advanced Digital Solutions (ADS) under the Small Medium Enterprises Go Digital Programme. With these awards and recognitions, we believe we are one of the leading solution providers in Singapore. Through the integration of our patented technology solution, we help our clients reduce costs and enhance security.

Since our establishment in Singapore in 1997, we have built a track record in the professional security community by consistently providing high-quality security manpower. Recognizing manpower sustainability our ever-advancing society, in 2014, we decided to transit into a security solution services company using our innovative business model. With our patented technological innovation, we deliver a higher level of security performance while requiring fewer personnel. Traditionally, a 24-hour shift would necessitate at least three guards for coverage. Our solution involves deploying CCTV cameras, sensors, and other IoT devices at our clients’ premises to enable remote access control monitoring and management. These devices are integrated and controlled through our mobile command vehicles, known as “I-Man Facility Sprinters (IFS),” which patrol a cluster of client sites within a defined radius. This proactive approach enables swift responses to any incidents that arise. Consequently, our clients have experienced a reduction in the required on-site guards from three to two or even fewer, thanks to the efficient utilization of these technologies. The implementation of CCTV cameras, sensors, and other IoT devices has not only minimized human errors but has also decreased the overall need for additional personnel. Our specialists, tasked with operating the IFS, undergo rigorous training to efficiently handle the diverse technologies and respond adeptly to various situations. This approach not only enhances their skill sets but also contributes to a better work-life balance for our team members. As a result, we have received numerous awards in Singapore, recognizing our innovative technology and our contribution to producing the next generation of reliable security solutions. Anchored by our patented technology applications and pioneering solutions, we provide top-tier security and facilities management services to commercial, financial, industrial, and governmental customers in Singapore.

1

We offer a range of services to enhance security and safety: (1) i-Guarding Services; (2) Man-Guarding Services; and (3) Consultancy and Training Services. Our i-Guarding Services leverages technology to increase efficiency, with a mobile platform and cluster® aggregation model of higher skillset workforce. For the six months ended June 30, 2024 and 2023, our i-Guarding Services accounted for 98.59% and 98.66% of our consolidated revenues, respectively. For the fiscal years ended December 31, 2023 and 2022, our i-Guarding Services accounted for approximately 98.09% and 99.09% of our consolidated revenues, respectively. Man-Guarding Services employs trained security officers to maintain safety and deter unlawful activities. For the six months ended June 30, 2024 and 2023, our Man-Guarding Services accounted for 0.82% and 1.22% of our consolidated revenues, respectively. For the fiscal years ended December 31, 2023 and 2022, it accounted for 1.41% and 0.24% of our consolidated revenues, respectively. Consultancy and Training Services provide expert guidance tailored to clients’ needs. For the six months ended June 30, 2024 and 2023, our Consultancy and Training Services accounted for 0.59% and 0.12% of our consolidated revenues, respectively. For the fiscal years ended December 31, 2023 and 2022, it accounted for 0.50% and 0.67% of our consolidated revenues, respectively.

We have gained recognition for our disruptive innovation in the integrated monitoring of properties, assets, and building service systems. This ensures round-the-clock surveillance for complete security and operational efficiency. This achievement is made possible through our suite of intelligent security solutions, known as “I-Guarding Services.” One of our flagship services, the groundbreaking “I-Man Facility Sprinter (“IFS”),” is a mobile vehicular platform that revolutionizes security and facility maintenance services. These pioneering solutions not only improve workers’ compensation, skill sets, and working conditions but also redefine the overall business landscape of the industry.

Our company’s second flagship product is the “Intelligent Facility Authenticator (“IFA”).” The IFA is an innovative solution that leverages advanced kiosk technology to enhance security and streamline visitor management. In response to the challenges of limited manpower and rising costs, the IFA system automates the issuance of secure passes and access cards, eliminating the need for physical human interaction. It works by sending secure pass-icons to visitors, verifying their identity upon entry, and dispensing access cards with varying levels of security clearance. This technology not only enhances security within buildings but also offers efficient visitor management services, making it a game-changer in industries where kiosk adoption is increasing. Ultimately, IFA represents a significant advancement in security access control without relying on human intervention.

For the six months ended June 30, 2024 and 2023, more than 83% and 99% of our revenues were generated by annual recurring contracts, respectively. For the fiscal years ended December 31, 2023 and 2022, more than 96% and 85% of our revenues were generated by annual recurring contract, respectively. 99% of our clients were based in Singapore. For the six months ended June 30, 2024, our top two customers, People’s Association at One Tampines Hub and People’s Association at OnePunggol accounted for approximately 6% and 6% of our total revenue, respectively. For the six months ended June 30, 2023, our top two customers, Singapore University of Technology and Design and People’s Association at OnePunggol accounted for approximately 10% and 8% of our total revenue, respectively. For the fiscal year ended December 31, 2023, our revenue generated by annual recurring contract increased by 11% from 85% in fiscal year 2022 to 96% in fiscal year 2023 as we continued to focus on securing recurring contracts to ensure long-term financial stability and growth. For the fiscal year ended December 31, 2023, our top two customers, Singapore University of Technology and Design and People’s Association at OnePunggol accounted for approximately 8% and 7% of our total revenue, respectively. For the fiscal year ended December 31, 2022, our top two customers, Ceva Logistics Singapore Pte Ltd and JTC Corporation, accounted for approximately 10% and 10% of our total revenue, respectively. See “Risk Factor — Risks Related to Our Business and Industry — A significant amount of our revenue is generated from our existing long-term customers; thus, our inability to retain and maintain a good relationship with our existing customers can have a material adverse effect on our business and financial results.” and “Risk Factor — Risks Related to Our Business and Industry — We have substantial customer concentration, with a limited number of customers accounting for a substantial portion of our recent revenues.”

Our Products and Services

i-Guarding Services

In a traditional security deployment, each building or location hires at least one guard per shift. Each 24-hour shift requires at least three guards stationed at the building or location. Traditional security deployment, based solely on manpower, faces a few key challenges: (i) unreliability of guards due to human nature, as guards often fall asleep while on duty, especially during the night shift; (ii) shortages in hiring guards; and (iii) rising labor costs. Our i-Guarding services address these issues and improve the work-life balance of the guards.

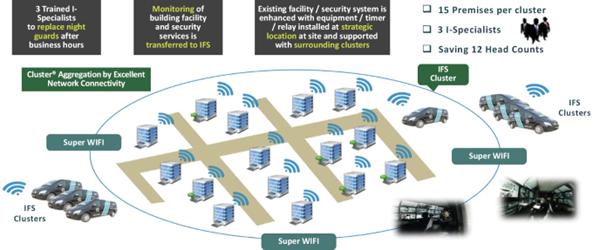

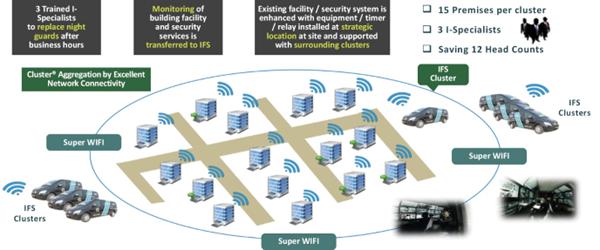

According to the diagram, our i-Guarding service consists of a mobile monitoring and response vehicle (known as the IFS) that patrols a designated radius, covering numerous buildings or locations within a 24-hour period. Each building or location installs electronic security systems that include access control systems, security monitoring cameras, and sensors that can be integrated with our IFS. As a result, instead of deploying guards at each location, these electronic security systems can be used. These systems are connected to our IFS via existing telecommunications infrastructures, including Super Wifi, 4G, or 5G networks. Should an alarm be triggered, the IFS will immediately respond via the remote command center within the vehicle and provide on-site response if the need arises. As a result, clients can reduce their reliance on manpower guards.

2

Each IFS will be manned by 3 I- specialists. This includes a driver and two security technicians. Each IFS can monitor and manage at least 15 buildings or locations within the deployment radius. This as a result increases manpower efficiency and enhance service levels due to the reduction of human errors resulting from the traditional security deployment model. Our installation and maintenance technicians, along with our customer service representatives, are dedicated to delivering a high-quality customer service experience. This commitment enhances our brand, improves customer satisfaction, increases customer retention, and accelerates the adoption of additional interactive automation solutions. The cluster® aggregation model allows a team of 3 security officers, with one of them being technically trained, to oversee a cluster of premises ranging from 5, 10, to 15 premises within a 15-minute radius.

For the six months ended June 30, 2024 and 2023, our i-Guarding Services accounted for 98.59% and 98.66% of our consolidated revenues, respectively. For the fiscal years ended December 31, 2023 and 2022, our i-Guarding Services accounted for approximately 98.09% and 99.09% of our consolidated revenues, respectively. It also encompasses the design, implementation, and installation of security systems to protect physical assets and personnel from potential threats and vulnerabilities. This includes IFA, Visitor Management Systems (“VMS”), Keys Management Systems (“KMS”), security turnstile facilities, Internet of Things (“IoT”) devices, and other smart security solutions. It involves a strategic assessment of risks, the selection and deployment of appropriate security measures, and the establishment of protocols for ongoing maintenance and monitoring. This integrated approach ensures the safety and integrity of the environment or infrastructure in question, encompassing both physical security elements such as surveillance systems, access controls, and alarm systems. The ultimate goal of a security project and installation is to mitigate risks and safeguard against unauthorized access, theft, and other security threats.

Man-Guarding Services

Our man-guarding services provides a vital layer of protection for various clients and properties. Our security officers are professionally trained and play a critical role in maintaining safety while preventing unauthorized access or unlawful activities in a given area. They offer a combination of prevention, deterrence, and response to maintain a safe and secure environment, making them an integral part of overall security measures. This service does not involve technology applications or solutions. Service contracts are signed on an annual basis, and revenues are collected and recognized on a monthly basis.

For the six months ended June 30, 2024 and 2023, our Man-Guarding Services accounted for 0.82% and 1.22% of our consolidated revenues, respectively. For the fiscal year ended December 31, 2023 and 2022, our Man-Guarding Services was approximately 1.41% and 0.24% of our total revenues, respectively.

Consultancy and Training Service

Consultancy and training services provide expert guidance and training support to clients seeking to enhance their security and safety knowledge domains. The service is structured specifically to meet the clients’ needs.

For the six months ended June 30, 2024 and 2023, our Consultancy and Training Services accounted for 0.59% and 0.12% of our consolidated revenues, respectively. For the fiscal year ended December 31, 2023 and 2022, our Consultancy and Training Service was approximately 0.50% and 0.67% respectively, of our total revenues.

3

Our Growth Strategies

We believe that implementing the following growth strategies will continue to position our company as the leader in the markets we serve:

| ● | Continue to grow our recurring revenue business. For the six months ended June 30, 2024 and 2023, our recurring revenue was approximately 83% and 98.73% of our total revenues, respectively. For the fiscal years ended December 31, 2023 and 2022, our recurring revenue was approximately 96% and 85% of our total revenues, respectively. Monthly recurring revenue allows us to achieve a more consistent and predictable income stream. In addition, it should improve our profitability as we continue to roll out more i-Guarding services. Each building or location deployed under the I-Guarding represents incremental revenues with almost the same cost levels as one IFS can service at least 15 or more buildings or locations. Serving our recurring customers should require lower acquisition and marketing costs as compared to new customers. Hence, signing on more buildings or locations will lead to increased revenues and profitability. We see significant market opportunities for our services because customers in our target markets prefer outsourced security and facilities management services that offer real-time security monitoring for continuous protection and rapid responses to security breaches and fire alarms. We intend to continue pursuing opportunities for recurring revenue by developing new and innovative products and by continuing our aggressive sales and marketing efforts. In order to build scale, we will have to continue to spend on marketing and development. As a result, this may impact our overall profitability. |

| ● | Maintain our commitment to best-in-class customer service. We are focused on fostering a culture dedicated to providing industry-leading customer service to our extensive customer base. We operate through a fleet of 5 cluster command centers in Singapore. From these mobile locations, our teams offer monitored security, interactive residential and commercial automation solutions, including installation, field service, repair, ongoing monitoring, and customer support. |

Our installation and service technicians, along with our customer service representatives, are dedicated to delivering a high-quality customer service experience. This commitment enhances our brand, improves customer satisfaction, increases customer retention, and accelerates the adoption of additional interactive automation solutions. As a result, it drives returns on new customer acquisition expenditures and enhances cash flow generation. We pride ourselves on providing on-site responses within a cluster® radius of 15 minutes of security alerts for the majority of our customers.

| ● | Maintain our high-quality customer base. We believe customer retention is also strongly correlated with the credit quality of our customers. We plan to maintain our focus on strict underwriting standards and will establish processes to evaluate potential new customers’ creditworthiness to improve our customer selection or require upfront payments for higher-risk customers. We expect that our focus on generating high-quality customers will continue to result in a portfolio of customers with attractive credit scores, thereby improving retention, decreasing credit risk exposure, and generating a strong, long-term customer portfolio that generates robust returns on new customer acquisition expenditures and drives strong cash flow generation. |

| ● | Disciplined expansion of our patented protected solution beyond Singapore. We strongly believe that there will be significant demand for our solutions due to the continuous increase in labor costs and the growing demand for high-quality security and facilities management services. Our plan is to expand our geographical coverage and export our successful business model beyond Singapore within the next 24 months. We aim to expand to Malaysia, Australia, and North America markets via partnerships with local security service provider who already have an existing customer base that needs our solution to improve service delivery and to mitigate the increasing labor costs. We have not signed up with any partners yet, but we aim to have them in place based upon the following plan. Our business plan is subject to change based on the change of global economy and other factors that may affect our business operations. |

| Market | Timeline | Estimated Cost | Source of funding | |||

| Malaysia | By Q4, 2024 | US$500,000 | Internal cashflows | |||

| North America | By Q3, 2025 | US$500,000 | Internal cashflows | |||

| Australia | By Q2, 2026 | US$500,000 | Internal cashflows |

4

Our Competitive Strengths

We believe that the following competitive strengths contribute to our success and differentiate us from our competitors:

| ● | Proven Solution that is protected by Patents. Our patent-protected solution that has been proven to reduce the need for manpower while maintaining, and even increasing, the quality of service levels for security and facilities management. |

| ● | Superior-Class Customer Service. Rather than competing purely on price, we emphasize the quality of our services, which we believe is distinguished by superior customer service. |

| ● | Deep industrial knowledge and experience. We believe that our focus on safety and security, coupled with our sales consultants, our solid reputation for and expertise in providing reliable security and monitoring services through our patent-protected business model vide our cluster® mobile command centers, our dependable product solutions, and our highly skilled installation and service capabilities, position us well to compete with both traditional and new competitors. |

Our Risks and Challenges

Our prospects should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by similar companies. Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

Risks Relating to Our Business and Industry

Risks and uncertainties related to our business and industry include, but are not limited to, the following:

| ● | A significant amount of our revenue is generated from our existing long-term customers; thus, our inability to retain and maintain a good relationship with our existing customers can have a material adverse effect on our business and financial results. |

| ● | We currently report our financial results under IFRS, which differs in certain significant respect from U.S. generally accepted accounting principles. |

| ● | Our independent registered public accounting firm expressed substantial doubt regarding our ability to continue as a going concern for the fiscal year ended December 31, 2022. Our ability to continue as a going concern requires that we obtain sufficient funding to finance our operations. |

| ● | A critical part of our success was driven by introducing and providing innovative and cost-saving security services. If our new products and services are not successful, it could have a material adverse effect on our business. |

| ● | The proper and efficient functioning of our computer, data backup, information technology, telecom and processing systems, and our monitoring stations are essential to our business. |

| ● | As a security service provider, we are exposed to greater risk of liability for employee acts or omissions or system failure, than may be inherent in other businesses. |

| ● | Our monitoring security facilities will call the police and fire departments when emergencies arise. If the police and fire departments fail or delay responding to our calls, our business and reputation could be adversely affected. |

| ● | From time to time, we are subject to claims for infringing, misappropriating or otherwise violating the intellectual property rights of others and will be subject to such claims in the future, which could have an adverse effect on our business and operations. |

| ● | Our inability to acquire necessary intellectual property or adequately protect our intellectual property could adversely affect our business and results of operation. |

| ● | Reliance on external security vendors may increase our operational and financial risks. |

5

Risks Relating to Regulatory Compliance

Risks and uncertainties related to our regulatory compliance, but are not limited to, the following:

| ● | Increasing legislative and regulatory initiatives on cybersecurity and data privacy regulations could adversely impact our business and financial results. |

| ● | As we expand globally, we will be subject to more regulation by various governmental agencies. |

Risks Relating to This Offering and Ownership of Our Class A Ordinary Shares

Risks and uncertainties related to this offering and our Class A Ordinary Shares include, but are not limited to, the following:

| ● | Our dual class voting structure has the effect of concentrating the voting control to holders of our Class B Ordinary Shares, which will limit or preclude your ability to influence corporate matters, and your interests may conflict with the interests of these shareholders. It may also adversely affect the trading market for our Class A Ordinary Shares due to exclusion from certain stock market indices and depress the trading price of our Class A Ordinary Shares. |

| ● | There has not been a public market for our Class A Ordinary Shares before this offering, and if an active trading market does not develop, you may not be able to resell our shares at or above the price you paid, or at all. |

| ● | Our lack of effective internal controls over financial reporting may affect our ability to accurately report our financial results or prevent fraud, which may affect the market for and price of our Class A Ordinary Shares. |

| ● | Nasdaq Capital Market may apply additional and more stringent criteria for our initial and continued listing because our insiders will hold a large portion of our listed securities. |

| ● | The initial public offering price for our Class A Ordinary Shares may not be indicative of prices that will prevail in the trading market and such market prices may be volatile. |

| ● | In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition, and results of operations. You should consider the risks discussed in “Risk Factors” and elsewhere in this prospectus before investing in our Class A Ordinary Shares. |

Our Corporate Structure

Set forth below is our organizational chart as of the date of this prospectus:

6

Concorde International was incorporated in the British Virgin Islands on May 2, 2023. Our registered office in the British Virgin Islands is at Conyers Trust Company (BVI) Limited of Commerce House, Wickhams Cay 1, PO Box 3140, Road Town, Tortola, British Virgin Islands VG1110. Our principal executive office is at 3 Ang Mo Kio Street 62, #01-49 LINK@AMK, Singapore 569139. Our telephone number at this location is +65 2960802.

Concorde International was incorporated to acquire and hold, indirectly, Concorde Security Pte Ltd (Singapore), Concorde Security Sdn Bhd (Malaysia), Concorde Security Limited (UK), Concorde Asia Pte Ltd (Singapore) and Berjaya Academy Pte Ltd (Singapore).

Concorde International Group Pte Ltd (Singapore) was incorporated on June 12, 2023. It is a holding company and a 100% owned subsidiary of Concorde International. Its registered office is at 3 Ang Mo Kio Street 62, #01-49 LINK@AMK, Singapore 569139.

Dual Class Structure

Under our current memorandum and articles of association, we are authorized to issue up to a maximum of 350,000,000 ordinary shares of with a par value of US$0.00001 each comprising (i) 250,000,000 Class A Ordinary Shares with a par value of US$0.00001 each; and (b) 100,000,000 Class B Ordinary Shares with a par value US$0.00001 each. Class B Ordinary Shares are entitled to one hundred votes per share on proposals requiring or requesting shareholder approval, unless prohibited by law. Class A Ordinary Shares are entitled to one vote on any such matter. Other than as to voting and conversion rights, Class B Ordinary Shares and Class A Ordinary Shares have the same rights and rank pari passu with one another, including the rights to dividends and other capital distribution. Each Class B Ordinary Share is convertible into one Class A Ordinary Share at any time by the holder thereof. Class A Ordinary Shares are not convertible into Class B Ordinary Shares under any circumstances.

In this offering, we are offering Class A Ordinary Shares. Our founders, some of whom are also our officers and directors, own 20,888,886 Class B Ordinary Shares which entitles them to 2,088,888,600 votes. Our founders have aggregate voting power of 100% prior to the consummation of the offering contemplated by this prospectus. Following this offering, taking into consideration the 1,250,000 Class A Ordinary Shares expected to be offered hereby, even if 100% of such shares are sold, our founders will retain controlling voting power in the Company based on having approximately 97.57% of all voting rights. This concentrated control may limit or preclude the ability of others to influence corporate matters including significant business decisions for the foreseeable future.

Corporate Information

Our website can be found at www.concordesecurity.com. The information contained on our website is not a part of this prospectus, nor is such content incorporated by reference herein, and should not be relied upon in determining whether to make an investment in our Class A Ordinary Shares.

Recent Developments

Convertible Notes Financing

On June 10, 2024, Softbank Robotics Singapore Pte Ltd (“Softbank”) subscribed to a USD1,000,000 convertible note with a 24-month maturity period with the Company. The Note shall be convertible to the Company’s Class A Ordinary Shares at a conversion price that is equal to the higher of (i) the price per share paid by investors for Class A Ordinary Shares in the Company’s initial public offering or (ii) a 15% discount to the volume weighted average price during the sixty-day period prior to the date of notice of conversion is given to the Company at Softbank’s sole discretion after one year from the date of issuance.

Singapore Subsidiary’s Loan with Oversea-Chinese Banking Corporation Limited (OCBC)

On May 28, 2024, Concorde Security Pte Ltd, our 96.81% owned subsidiary, secured a SGD1.5 million loan from OCBC at a preferential interest rate for general working capital and to refinance an existing loan with a higher interest rate. This loan is guaranteed by Concorde International Group Pte Ltd, our 100% owned subsidiary, Swee Kheng Chua and Ping Ping Lim.

On June 14, 2024, Concorde Security Pte Ltd secured a term loan of SGD500,000 from OCBC, at an interest rate of 3.5% per annum over the Bank’s prevailing Cost of Funds. This loan is guaranteed by Concorde International Group Pte Ltd, our 100% owned subsidiary, and Swee Kheng Chua and Ping Ping Lim.

On June 25, 2024, Concorde Security Pte Ltd entered into a call option agreement annexed to the term loan, which grants OCBC the option to subscribe for shares at a 20% discount to the IPO price or the trade sale price. OCBC shall be entitled to subscribe up to (i) 20% of enlarged ordinary share capital of the Grantor, or (ii) SGD500,000, whichever is lower. Concorde Security Pte Ltd has issued a total of 1,542,748 shares with a capital of SGD 4,070,000. The rights to exercise this option will occur at the time of an IPO or trade sale.

7

Class B Ordinary Shares Issuances

On March 18, 2024, we issued 20,788,886 Class B Ordinary Shares to members of our Board, executive officers or their affiliates and existing shareholders, at an issue price of $0.00001 per share, for a total consideration of $208.

On March 6, 2020, Berjaya Academy Pte. Ltd. issued 100,000 Ordinary Shares to Poh San Koh, who held them in a representative capacity for Swee Kheng Chua. On January 10, 2022, Poh San Koh transferred the 100,000 shares to Sharifah Noriati Binte Said Omar. On November 1, 2023, 100,000 shares were transferred from Sharifah Noriati Binte Said Omar to Concorde International Group Pte Ltd (Singapore) for 1 Singapore Dollar. The shares were held by Sharifah Noriati Binte Said Omar in a representative capacity for Swee Kheng Chua. On March 14, 2024, the Company re-designated and reclassified the 100,000 authorized shares to 100,000 Class B Ordinary Shares.

All of the shares were sold to members of our Board, executive officers or their affiliates and existing shareholders, in reliance upon (i) the exemption contained in Section 4(a)(2) of the Securities Act, and Rule 506(b) of Regulation D promulgated thereunder, and applicable state securities laws, or (ii) the provisions of Regulation S promulgated under the Securities Act.

The following table presents the amounts of Class B Ordinary Shares that were issued as of the date of this prospectus and aggregate purchase prices paid by the members of our Board, executive officers or their affiliates and existing shareholders. The terms of these purchases were the same for all purchasers of our Class B Ordinary Shares.

| Shareholder | Class B Common Shares | Aggregate Purchase Price Paid | ||||||

| Swee Kheng Chua(1) | 18,000,000 | $ | 180 | |||||

| Terence Wing Khai Yap(2) | 250,000 | $ | 2.5 | |||||

| Sze Yin Ong(3) | 46,296 | $ | 0.46296 | |||||

| Sharifah Noriati Binte Said Omar(4) | 185,185 | $ | 1.85185 | |||||

| Ping Ping Lim(5) | 377,775 | $ | 3.77775 | |||||

| Jia Wei Chua(6) | 14,815 | $ | 0.14815 | |||||

| Meang Fai Pang(7) | 14,815 | $ | 0.14815 | |||||

| Weilekai Investments Pte Ltd(8) | 2,000,000 | $ | 20 | |||||

| (1) | Swee Kheng Chua, our Chief Executive Officer and Director. |

| (2) | Terence Wing Khai Yap, our Director. |

| (3) | Sze Yin Ong, our Chief Financial Officer. |

| (4) | Ms. Sharifah Noriati Binte Said Omar serves as a nominee director at Berjaya Academy Pte Ltd, our 70% owned subsidiary, as well as Concorde Security Pte Ltd (Singapore), our 96.81% owned subsidiary, and Concorde Asia Pte Ltd (Singapore), our 70% owned subsidiary. |

| (5) | Ping Ping Lim, Swee Kheng Chua’s spouse. |

| (6) | Jia Wei Chua, Swee Kheng Chua’s son. |

| (7) | Meang Fai Pang, freelance contractor of the Company and a close associate of Swee Kheng Chua. |

| (8) | Weilekai Investments Pte Ltd is a Singapore company, 50% owned by Swee Kheng Chua and 50% owned by Ping Ping Lim, Spouse of Swee Kheng Chua. Swee Kheng Chua is deemed to beneficially own the Class B Ordinary Shares owned by Weilekai Investments Pte Ltd and has sole voting and dispositive powers over its shares. Weilekai Investments Pte Ltd’s business address is 3 Ang Mo Kio Street 62 #01-49 LINK@AMK Singapore 569139. |

Implications of Being an Emerging Growth Company

Upon the completion of this offering, we will qualify as an “emerging growth company” under the Jumpstart Our Business Act of 2012, as amended, or the JOBS Act. As a result, we will be permitted to, and intend to, rely on exemptions from certain disclosure requirements. These provisions include exemption from the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act of 2002 in the assessment of the emerging growth company’s internal control over financial reporting. In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

8

We will remain an emerging growth company until (for the first five fiscal years after the initial public offering is completed) the earliest of the following occurs: (i) our total annual gross revenues are $1.235 billion or more (ii) we have issued more than $1 billion in non-convertible debt in the past three years or (iii) we become a “large accelerated filer,” as defined in the Securities Exchange Act of 1934, which we refer to as the “Exchange Act,” Rule 12b-2. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

Implications of Being a Foreign Private Issuer

Once the registration statement of which this prospectus is a part is declared effective by the SEC, we will become subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements we will file certain reports with the SEC. As a foreign private issuer, we will not be subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we will be subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, although we report our financial results on a quarterly basis, we will not be required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also will have four months after the end of each fiscal year to file our annual reports with the SEC and we will not be required to file current reports as frequently or promptly as U.S. domestic reporting companies. We also present our financial statements pursuant to International Financial Reporting Standards, or IFRS. Furthermore, our officers, directors and principal shareholders will be exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we will also not be subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private issuer, we will be permitted, and intend to follow, certain home country corporate governance practices instead of those otherwise required under Nasdaq Marketplace Rules for domestic U.S. issuers. These exemptions and leniencies will reduce the frequency and scope of information and protections available to you in comparison to those applicable to a U.S. domestic reporting companies.

Implications of Being a Controlled Company

The “controlled company” exception to rules of the Nasdaq Capital Market provides that a company of which more than 50% of the voting power is held by an individual, group or another company, a “controlled company,” need not comply with certain requirements of the corporate governance rules of the Nasdaq Capital Market. As of the date of this prospectus, Swee Kheng Chua, the Chief Executive Officer and a director of the Company, beneficially owned an aggregate of 20,392,590 Class B Ordinary Shares (including 18,000,000 Class B Ordinary Shares owned directly by Swee Kheng Chua; 377,775 Class B Ordinary Shares beneficially owned by Ping Ping Lim, Swee Kheng Chua’s spouse; 14,815 Class B Ordinary Shares beneficially owned by Jia Wei Chua, Swee Kheng Chua’s son, as they live in the same household; and 2,000,000 Class B Ordinary Shares beneficially owned by Weilekai Investments Pte Ltd.), which represents approximately 97.62% of the voting power of our outstanding ordinary shares. Following this offering, Mr. Chua will control approximately 97.57% of the voting power of our outstanding ordinary shares if all the Class A Ordinary Shares being offered are sold (or 97.56% of our outstanding voting power if the underwriters’ option to purchase additional shares is exercised in full). Accordingly, if we obtain listing on the Nasdaq Capital Market, we will be a “controlled company” within the meaning of the corporate governance rules of the Nasdaq Capital Market. Controlled companies are exempt from the corporate governance rules of the Nasdaq Capital Market requiring that listed companies have (i) a majority of the board of directors consist of “independent” directors under the listing standards of the Nasdaq Capital Market, (ii) a nominating/corporate governance committee composed entirely of independent directors and a written nominating/corporate governance committee charter meeting the requirements of the Nasdaq Capital Market, and (iii) a compensation committee composed entirely of independent directors and a written compensation committee charter meeting the requirements of the Nasdaq Capital Market. We currently utilize and presently intend to continue to utilize these exemptions. As a result, we may not have a majority of independent directors, our nomination and corporate governance committee and compensation committee may not consist entirely of independent directors and such committees may not be subject to annual performance evaluations. Accordingly, you may not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of the Nasdaq Capital Market. See “Management.”

9

The Offering

| Shares offered | Class A Ordinary Shares, assuming an estimated initial public offering price of $4.00 per share | |

| Ordinary Shares outstanding immediately before the offering | Zero Class A Ordinary Share and 20,888,886 Class B Ordinary Shares. Our Class B Ordinary Shares will become convertible at the option of the holder into Class A Ordinary Shares on a 1:1 basis following this offering. Class A Ordinary Shares are entitled to one (1) vote per share, and Class B Ordinary Shares are entitled to one hundred (100) vote per share. See “Description of Share Capital” for more information. | |

| Ordinary Shares outstanding immediately after the offering | 1,250,000 Class A Ordinary Shares (or 1,437,500 Class A Ordinary Shares if the underwriters exercise the over-allotment option in full) and 20,888,886 Class B Ordinary Shares. | |

| Over-allotment option | We have granted to the underwriters a 45-day option to purchase from us up to an additional 15% of the Class A Ordinary Shares sold in the offering (187,500 additional shares, assuming an estimated initial public offering price of $4.00 per share) at the initial public offering price, less the underwriting discounts and commissions. | |

| Use of proceeds | We expect to receive net proceeds of approximately $5 million from this offering, assuming an estimated initial public offering price of $4.00 per share, and no exercise of the underwriters’ over-allotment option, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We plan to use the net proceeds of this offering for purchase and rollout of electric vehicular mobile command centers, research and development activities, regional market development and exploration of new markets, product development, working capital and general corporate purposes. See “Use of Proceeds” for more information on the use of proceeds. | |

| Risk factors | Investing in our Class A Ordinary Shares involves a high degree of risk and purchasers of our Class A Ordinary Shares may lose part or all of their investment. See “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in our Class A Ordinary Shares. |

10

| Lock-up | We have agreed with the underwriters, not to, during a period of 180 days after the closing of this offering, (i) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of our capital stock or any securities convertible into or exercisable or exchangeable for shares of our capital stock; (ii) file or cause to be filed any registration statement with the Commission relating to the offering of any shares of our capital stock or any securities convertible into or exercisable or exchangeable for shares of our capital stock; (iii) complete any offering of our debt securities, other than entering into a line of credit with a traditional bank, or (iv) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of our capital stock, whether any such transaction described in clause (i), (ii), (iii) or (iv) above is to be settled by delivery of shares of our capital stock or such other securities, in cash or otherwise.

Additionally, our officers, directors and each holder of two percent (2%) or more of the Company’s issued and outstanding Ordinary Shares of the effective date of the Registration Statement (and all holders of securities exercisable for or convertible into Ordinary Shares) entered into “lock-up” agreements pursuant to which such persons and entities shall agree, for a period of 180 days after the closing of this offering, that they shall not offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of our capital stock or any securities convertible into or exercisable or exchangeable for shares of our capital stock, subject to customary exceptions. | |

| Proposed Nasdaq Capital Market trading symbols | We intend to apply to list our Class A Ordinary Shares on the Nasdaq Capital Market under the trading symbols “CIGL”, and we will not close this offering unless the Nasdaq Capital Market has approved our Class A Ordinary Shares for listing. | |

| Transfer Agent | Vstock Transfer, LLC. The address for VStock Transfer, LLC is 18 Lafayette Place, Woodmere, New York, 11598, and the telephone number is 212 828-8436. |

The number of Class A Ordinary Shares outstanding immediately following this offering is based on zero shares outstanding as of the date of this prospectus.

11

Summary Consolidated Financial Information

The following selected historical financial information should be read in conjunction with, and it is qualified in its entirety by reference to, our audited consolidated financial statements as of and for the years ended December 31, 2023, 2022 and the related notes thereto, our unaudited consolidated financial statements as of June 30, 2024 and for the six months ended June 30, 2024 and 2023 and the related notes thereto, and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in the prospectus.

The following summary consolidated statements of profit or loss and other comprehensive income information for the years ended December 31, 2023 and 2022 and the following related summary consolidated statements of financial position data as of December 31, 2023 and 2022, have been derived from our audited consolidated financial statements as of and for the years ended December 31, 2023 and 2022, included elsewhere in this prospectus. The following summary consolidated statements of profit or loss and other comprehensive income information for the six months ended June 30, 2024 and 2023, and the following related summary consolidated statements of financial position data as of June 30, 2024, have been derived from our unaudited consolidated financial statements as of June 30, 2024 and for the six months ended June 30, 2024 and 2023, included elsewhere in this prospectus.

Our financial statements are prepared and presented in accordance with IFRS. Our historical results for any period are not necessarily indicative of our future performance.

| For the Six Months Ended | For the Year Ended | |||||||||||||||

| June 30, 2024 | June 30, 2023 | December 31, 2023 | December 31, 2022 | |||||||||||||

| Consolidated Statements of Profit or Loss and Other Comprehensive Income | $ | $ | $ | $ | ||||||||||||

| Revenue | 5,393,844 | 5,635,287 | 10,655,993 | 5,006,345 | ||||||||||||

| Cost of revenue | 3,939,891 | 3,915,725 | 7,662,024 | 3,648,637 | ||||||||||||

| Operating expenses | 1,520,584 | 681,958 | 1,955,820 | (2,291,856 | ) | |||||||||||

| (Loss)/Profit from operations | (66,631 | ) | 1,037,604 | 1,038,149 | (934,148 | ) | ||||||||||

| Other income (expenses) | 206,788 | 118,326 | 236,911 | 205,201 | ||||||||||||

| Finance costs | (95,085 | ) | (67,897 | ) | (149,626 | ) | (75,033 | ) | ||||||||

| Net profit/(loss) before tax | 45,072 | 1,088,033 | 1,125,434 | (803,980 | ) | |||||||||||

| Net profit/(loss) per share | ||||||||||||||||

| basic and diluted | (0.01 | ) | 9.44 | 9.61 | (7.83 | ) | ||||||||||

| Weighted average number of shares outstanding | ||||||||||||||||

| basic and diluted | 11,979,363 | 100,000 | 100,000 | 100,000 | ||||||||||||

| As of June 30, | As of December 31, | |||||||||||

| 2024 | 2023 | 2022 | ||||||||||

| Consolidated Statements of Financial Position Data | $ | $ | $ | |||||||||

| Cash | 2,270,438 | 956,975 | 441,278 | |||||||||

| Current assets | 7,299,487 | 5,287,321 | 4,050,813 | |||||||||

| Total assets | 10,562,266 | 8,550,581 | 7,103,192 | |||||||||

| Current liabilities | 4,929,159 | 3,514,897 | 3,059,866 | |||||||||

| Total liabilities | 8,010,402 | 5,848,005 | 5,492,869 | |||||||||

| Shareholders’ equity | 2,551,864 | 2,702,577 | 1,610,323 | |||||||||

| Total liabilities and shareholders’ equity | 10,562,266 | 8,550,581 | 7,103,192 | |||||||||

12

An investment in our Class A Ordinary Shares involves a high degree of risk. Before deciding whether to invest in our Class A Ordinary Shares, you should carefully consider the risks described below, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes. If any of these risks actually occur, our subsidiaries’ business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of our Class A Ordinary Shares to decline, resulting in a loss of all or part of your investment. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect us and our subsidiaries’ business. You should only consider investing in our Class A Ordinary Shares if you can bear the risk of losing your entire investment.

Risks Relating to Our Business and Industry

A significant amount of our revenue is generated from our existing long-term customers; thus, our inability to retain and maintain a good relationship with our existing customers can have a material adverse effect on our business and financial results.

As of the date of this prospectus, our main line of revenue is generated from providing security services by monitoring properties, assets and building systems under 24/7 surveillance, ensuring security and business efficiency for our customers. A significant driver of our growth is our recurring revenue business in which customers who contracted to purchase our products and services and are required to pay monthly fees. As such, our ability to maintain our existing significant customer base is important to our long-term profitability. For the fiscal year ended December 31, 2022, Ceva Logistics Singapore Pte Ltd and JTC Corporation each represented approximately 10% of our total net revenues, the loss or material reduction of business, either due to a reduction in demand from one or more of our significant customers, such as industrial and commercial customers, or our inability to timely meet any elevated level of customer demand for various reasons, the lack of success of sales initiatives or changes in customer preferences or loyalties for our products and services related to any such significant customer could have a material adverse impact on our business. This requires that we minimize our rate of customer disconnects, or attrition, which can increase as a result of factors such as problems experienced with our product or service quality, customer service, customer non-pay, unfavorable general economic conditions, and the preference for lower pricing of competitors’ products and services over ours. If attrition rates were to rise significantly, we may be required to accelerate the depreciation and amortization expense for, or to impair, certain of our assets, including with respect to customer relationships, which would cause a material adverse effect on our financial condition and results of operations.

We currently report our financial results under IFRS, which differs in certain significant respect from U.S. generally accepted accounting principles.

We report our financial statements under IFRS. There have been and there may in the future be certain significant differences between IFRS and United States generally accepted accounting principles, or U.S. GAAP, including differences related to revenue recognition, intangible assets, share-based compensation expense, income tax and earnings per share. As a result, our financial information and reported earnings for historical or future periods could be significantly different if they were prepared in accordance with U.S. GAAP. In addition, we do not intend to provide a reconciliation between IFRS and U.S. GAAP unless it is required under applicable law. As a result, you may not be able to meaningfully compare our financial statements under IFRS with those companies that prepare financial statements under U.S. GAAP.

Our independent registered public accounting firm expressed substantial doubt regarding our ability to continue as a going concern for the fiscal year ended December 31, 2022. Our ability to continue as a going concern requires that we obtain sufficient funding to finance our operations.

As of December 31, 2022, the Company’s operating losses raise substantial doubt about the Company’s ability to continue as a going concern. This indicates the existence of a material uncertainty which may cast significant doubt over our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our profit generating operations in the future and/or obtaining the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they become due.

As of December 31, 2023, our audited financial statements were prepared on the assumption that we would continue as a going concern. The Company’s ability to continue as a going concern is dependent upon the Company’s profit generating operations in the future and/or obtaining the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they become due.

If we are unable to continue in operational existence for the foreseeable future, we may be unable to discharge our liabilities in the normal course of business and adjustments may have to be made to reflect the situation that assets may need to be realized other than in the normal course of business and at amounts which could differ significantly from the amounts at which they are currently recorded in the statement of financial position. In addition, we may have to include adjustments to the carrying amounts and classification of assets, liabilities, and reported expenses. No such adjustments have been made to these financial statements.

If we seek additional financing to fund our business activities in the future and there remains substantial doubt about our ability to continue as a going concern, investors or other financing sources may be unwilling to provide additional funding to us on commercially reasonable terms or at all. Further, if we cannot continue as a going concern, we may be forced to discontinue operations and liquidate our assets and may receive less than the value at which those assets are carried on our audited financial statements, which would cause our shareholders to lose all or a part of their investment.

13

We have substantial customer concentration, with a limited number of customers accounting for a substantial portion of our recent revenues.

Historically, we have derived a significant portion of our revenues from our top five customers. For the six months ended June 30, 2024, our top two customers, People’s Association at One Tampines Hub and People’s Association at OnePunggol accounted for approximately 6% and 6% of our total revenue, respectively. For the six months ended June 30, 2023, our top two customers, Singapore University of Technology and People’s Association at OnePunggol accounted for approximately 10% and 8% of our total revenue, respectively. For the fiscal year ended December 31, 2023, our top two customers, Singapore University of Technology and Design and People’s Association at OnePunggol accounted for approximately 8% and 7% of our total revenue, respectively. In the fiscal year ended December 31, 2022, our top five customers accounted for approximately 36% of our revenue. Specifically, our top five customers contributed approximately 10%, 10%, 6%, 5%, and 5% of our total revenue, respectively.

There are inherent risks whenever a large percentage of total revenues are concentrated on a limited number of customers. It is not possible for us to predict the future level of demand for our services that will be generated by these customers. In addition, revenues from these larger customers may fluctuate from time to time based on the commencement and completion of projects, the timing of which may be affected by market conditions or other facts, some of which may be outside of our control. Further, some of our contracts with these larger customers permit them to terminate our services at any time (subject to notice and certain other provisions). If any of these customers experience declining or delayed sales due to market, economic or competitive conditions, we could be pressured to reduce the prices we charge for our services which could have an adverse effect on our margins and financial position, and could negatively affect our revenues and results of operations and/or trading price of our Class A Ordinary Shares. If any of these largest customers terminates our services, such termination would negatively affect our revenues and results of operations and/or trading price of our Class A Ordinary Shares.

If we fail to attract, retain and engage appropriately qualified employees, including employees in key positions, our operations and profitability may be harmed. In addition, changes in market compensation rates may adversely affect our profitability.

One of the key products we offer is a suite of smart security solutions called “I-Guarding Services”. The first of these solutions is our patented IFS, a mobile vehicular platform providing security and facility maintenance services. Our I-Guarding Services offer high-quality and advanced technological products and services for our customers and require a highly trained and engaged workforce. As a result, we rely on our ability to attract, train and retain sufficient numbers of qualified employees. Specifically, because employees become more productive and skillful as they gain experience, market demand for such employees will become more competitive and retaining those individuals is very important for our success, especially as we expand and grow our market. Further, failure to recruit or retain qualified employees in the future may impair our efficiency and effectiveness and our ability to pursue growth opportunities. A significant amount of turnover of our executive team or other employees in key positions, such as Chief Executive Officer, Chief Financial Officer, and Chief Operating Officer may negatively impact our operations. Factors that affect our ability to maintain sufficient numbers of qualified employees include, for example, employee engagement, our reputation, unemployment rates, competition from other employers, availability of qualified personnel and our ability to offer appropriate compensation and benefit packages. If we are unable to attract, train and retain sufficient numbers of qualified employees, our business, financial condition, cash flows or results of operations could be adversely affected.

We operate in a competitive labor market and there is a risk that market increases in compensation and employer-provided benefits could have a material adverse effect on our profitability. We may also be subject to continued market pressure to increase employee hourly wage rates and increased cost pressure on employer-provided benefits. Our need to implement corresponding adjustments within our labor model and compensation and benefit packages could have a material adverse impact to the profitability of our business.

A critical part of our success was driven by introducing and providing innovative and cost-saving security services. If our new products and services are not successful, it could have a material adverse effect on our business.

A critical part of our business success was driven by introducing and providing innovative and cost-saving security services for our customers. As of the date of this prospectus, we are offering products and services including I-Guarding Services, Man-Guarding Services, Consultancy and Training Services, etc. To stay competitive in the market, we believe we must continue to develop and commercialize new products and services that meet the varied and evolving needs of our customers in order to continue to grow our business. While we devote significant effort and resources to the research and development of new products, we cannot guarantee the new products and services we may launch in the future will be well received by our customers. In addition, the speed of development by our competitors and new market entrants is increasing. We cannot provide any assurance that any new product or service will be successfully commercialized in a timely manner, if ever, or, if commercialized, will result in returns greater than our investment. Investment in a product or service could divert our attention and resources from other projects that become more commercially viable in the market. We also cannot provide any assurance that any new product or service will be accepted by the market. In addition, new products and services may present new and difficult technological and intellectual property challenges that may subject us to claims or complaints if our customers experience service failures or other quality issues. To the extent our new products and services are not successful, it could have a material adverse effect on our business, financial condition, cash flow or results of operations.

14

The proper and efficient functioning of our computer, data backup, information technology, telecom and processing systems, and our monitoring stations are essential to our business.