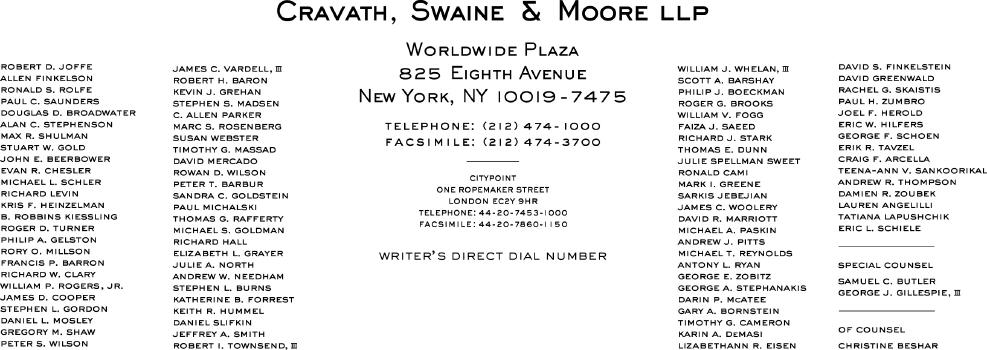

[Letterhead of]

CRAVATH, SWAINE & MOORE LLP

[New York Office]

(212) 474-1964

December 16, 2008

Omrix Biopharmaceuticals, Inc.

Schedule TO-C filed November 24, 2008

Schedule TO-T filed November 25, 2008

Schedule TO-T/A filed December 1, 2008

Filed by Binder Merger Sub, Inc. and Johnson & Johnson

SEC File No. 5-82558

Dear Ms. Griffith:

On behalf of Johnson & Johnson (“J&J”) and Binder Merger Sub, Inc. (“Merger Sub”), this letter responds to your letter dated December 12, 2008 (the “Comment Letter”) providing comments to the Schedule TO-C filed with the Securities and Exchange Commission (the “Commission”) by J&J and Merger Sub on November 24, 2008 and the Schedule TO-T filed with the Commission by J&J and Merger Sub on November 25, 2008 (as amended, the “Schedule TO”). For your convenience, each comment from the Comment Letter has been reproduced below, followed by J&J’s and Merger Sub’s response to such comment. Capitalized terms defined in the Schedule TO and used in the following responses without definition have the meanings specified in the Schedule TO.

Schedule TO-C

| 1. | Refer to the press release filed November 24, 2008, in your Schedule TO-C. Your press release refers to the safe harbor protections for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, which do not apply to statements made in connection with a tender offer. See Section 21E(b)(2)(C) of the Securities Exchange Act of 1934. Please do not refer to the safe harbor provisions in future press releases or other communications relating to this tender offer. |

J&J and Merger Sub acknowledge the staff’s comment and will refrain from making such references in future press releases and other communications relating to this tender offer.

Schedule TO-T

General

| 2. | At the commencement of the offer, Johnson & Johnson Development Corporation (“JJDC”), a subsidiary of Parent, had a $5 million cash investment in Omrix, and Ethicon, Inc., a wholly owned subsidiary of Parent, was party to a development agreement to develop certain of Omrix’s biosurgery products. In view of these relationships, and of the fact that Johnson & Johnson and Omrix have discussed the possibility of Parent’s acquiring Seller in the past, please advise us what consideration you have given to the application of Rule 13e-3 to this transaction. |

J&J and Merger Sub considered the application of Rule 13e-3 (including the matters set forth in the foregoing comment) and determined that this transaction is not a Rule 13e-3 transaction because neither J&J nor Merger Sub (nor any other subsidiary of J&J, including JJDC and Ethicon) is an “affiliate” of Omrix as defined under Rule 13e-3(a)(1); none of J&J or any of its subsidiaries controls, is controlled by, or is under common control with, Omrix. J&J and Merger Sub do not believe that the matters referred to in the foregoing comment (each of which is addressed separately below) are, individually or collectively, sufficient to confer “control” within the meaning of Rule 13e-3(a)(1).

JJDC, in connection with its $5 million cash investment in Omrix in July 2004, acquired 435,257 Shares and warrants to acquire an additional 36,364 Shares, which together represent only approximately 2.58% of the total number of Shares as of November 20, 2008.1 The Shares and warrants to purchase Shares held by JJDC neither entitle JJDC to any representation on Omrix’s board of directors nor otherwise provide JJDC with any ability to influence the management decisions of Omrix, other than JJDC’s right to vote the Shares held by it in its capacity as the holder of such Shares. J&J and Merger Sub do not believe that, as a general matter, the right to vote 2.58% of the Shares of Omrix is sufficient to confer “control” within the meaning of Rule 13e-3(a)(1). This is particularly true in light of the fact that the Chief Executive Officer of Omrix (together with two entities that are controlled by him) beneficially owns approximately 16% of the total number of Shares, and that at least three institutional holders also beneficially own more than 5% of the total number of Shares (based on publicly available information), thus materially diluting any influence JJDC’s relatively small shareholdings would otherwise provide.

____________________________

| | 1 As disclosed on page 1 of the Offer to Purchase, Omrix has advised J&J that, as of November 20, 2008, 17,130,332 Shares were issued and outstanding, 1,090,909 Shares were reserved for issuance under Omrix’s equity plans, and 38,903 Shares were reserved for issuance upon the exercise of outstanding warrants, for a total of 18,260,144 Shares. |

Ethicon’s development agreement and distribution and supply agreement with Omrix2, which were entered into in September 2003 and cover the development and distribution of certain of Omrix’s products, are commercial arrangements that were entered into by the parties through arms’-length negotiations. None of the provisions in the development agreement or the distribution and supply agreement provide J&J, Ethicon or any other subsidiary of J&J with power to control or influence the operations of Omrix beyond the contractual right to enforce the commercial terms relating to the development and distribution of specified products, and neither agreement grants or purports to grant Ethicon any rights with respect to the election of directors of Omrix or the selection or decision-making of Omrix management. Furthermore, the terms of the agreements do not prohibit Omrix from entering into strategic transactions with other third parties, and such agreements permit Omrix to assign such agreements to a company acquiring all or substantially all of Omrix’s assets or voting stock without Ethicon’s prior consent.

J&J and Merger Sub do not believe that, as a general matter, prior preliminary contacts regarding possible acquisition transactions confer “control” within the meaning of Rule 13e-3(a)(1). In any event, based on further review and as noted in the response to staff comment 5 below, J&J and Omrix have determined that no negotiations or material contacts regarding an acquisition of Omrix by J&J (other than the present transaction) occurred during the two years prior to the date of the Schedule TO filing.

In addition, the contemplated second-step merger in the transaction (as described in the Offer to Purchase) will be undertaken in accordance with Rule 13e-3(g)(1)(i).

In sum, for the foregoing reasons, J&J and Merger Sub have determined that they are not “affiliates” of Omrix within the meaning of Rule 13e-3, and therefore that this transaction is not subject to Rule 13e-3.

| 3. | We note that Johnson & Johnson has signed the Schedule TO and is listed as a filing person. Please revise the cover of the Schedule TO to clarify that Johnson & Johnson is a bidder and not merely the parent of Binder Merger Sub. |

J&J and Merger Sub acknowledge the staff’s comment and have revised the cover of their Schedule TO filing in accordance therewith.

Offer to Purchase

Certain Information Concerning Parent and Purchaser, page 12

| 4. | Please explain whether Ethicon is contractually obligated to make future payments in respect of research and development expenses, milestone and transfer payments. State what impact the tender offer is expected to have on these payments. |

____________________________

| | 2 Copies of the development agreement and the distribution and supply agreement (and amendments thereto) have been publicly filed by Omrix as Exhibits 10.4, 10.5, 10.6 and 10.7 to Omrix’s registration statement on Form S-1, filed January 18, 2006. |

Under the development agreement between Ethicon and Omrix, Ethicon is contractually obligated to pay Omrix all of the development costs and one-half of the labor costs relating to the research and development of products covered by the development agreement, as well as certain milestone payments contingent on the first sales of products covered by the development agreement or the receipt of certain regulatory or marketing clearances for such products. Under the distribution and supply agreement between Ethicon and Omrix, Ethicon is contractually obligated to pay Omrix certain additional milestone payments, as well as periodic transfer payments for the purchase of products by Ethicon from Omrix. Under the agreements, Ethicon paid to Omrix approximately $27.1 million during fiscal year 2007 (including $4.0 million in milestone payments, $9.9 million in research and development payments and $13.2 million in transfer payments) and expects to pay approximately $32.7 million during fiscal year 2008 (including $8.8 million in research and development payments and $23.9 million in transfer payments). Two contractual milestone payments totaling $2.75 million related to the fibrin pad program and the product revenue targets remain under one of the agreements. Future research and development payments and transfer payments would be based on the level of research and development activity and product supply needs, respectively. Given the contingent nature of these future payments, it is not possible to quantify them with certainty, or to determine with certainty whether and when such payments may ultimately be payable.

Upon the completion of the tender offer and the subsequent merger, both Ethicon and Omrix will be wholly owned subsidiaries of J&J, and the development agreement and the distribution and supply agreement will become intercompany arrangements within the consolidated J&J organization. J&J will therefore have the ability to unilaterally determine, after the completion of the tender offer and the subsequent merger, whether to terminate or amend such agreements or maintain such agreements in place, based on tax and other considerations relevant to the J&J organization. While no final determination in this regard has yet been made, it is currently contemplated that such agreements will remain in force through the respective terms of the contracts.

J&J and Merger Sub have revised the disclosure on page 13 of the Offer to Purchase to clarify the information describe above.

Background of the Offer, page 14

| 5. | Describe in greater detail the nature and timing of the general preliminary discussions between Seller and Parent regarding the possibility of an acquisition (see Item 1005(b) and (c) of Regulation M-A), and identify the person or persons who initiated each discussion (see also the Instruction to paragraphs (b) and (c) of Item 1005). |

Based on further review, J&J and Merger Sub have determined that, during the two years prior to the date of the Schedule TO filing, Omrix and J&J did not in fact engage in any negotiations or material contacts regarding an acquisition of Omrix by J&J or any other transaction that is required to be disclosed by Item 1005(b) or (c) of Regulation M-A, other than with respect to the present transaction (all of which negotiations and material contacts in connection with the present transaction are currently disclosed in the “Background of the Offer” section of the Offer to Purchase). J&J and Merger Sub have revised the disclosure on page 14 of the Offer to Purchase in accordance with the information described above.3

__________________________

| | 3 The amendment to the Schedule TO may provide additional disclosure regarding any contacts between J&J and Omrix prior to such two-year period, to the extent appropriate. |

| 6. | Provide further detail concerning the price that Purchaser offered for the securities. We note that on August 26, 2008, you proposed a price of $25.00 per share, which you subsequently raised to $29.00 per share, and then revised back to $25.00 after the market break. Please disclose the reasons for the revised offer price. |

Given the competitive bidding process, J&J raised its proposed price for Omrix to $29.00 per share on September 8, 2008 based on information that was then available to J&J, as well as more Omrix-favorable assumptions made with respect to information that had not yet been made available by Omrix, recognizing that (and communicating to Omrix through its financial advisor that) the increased offer price would be subject to the validation of J&J’s assumptions in further due diligence, including with respect to information included in a data room to which J&J had not yet been provided access. The assumptions made by J&J included those with respect to Omrix’s capital expansion plans and the period of overcapacity likely to result from such plans, the manufacturing process and relationships between Omrix’s product lines in terms of Omrix’s total cost structure, the level of investment required to upgrade Omrix’s information, infrastructure and control systems to integrate such systems with J&J’s and the overall risks relating to the business integration and the immunotherapy product line. After completing its further due diligence, J&J determined that those more favorable assumptions underlying its September 8, 2008 proposal could not be supported, and therefore reduced its proposed price for Omrix to $25.00 per share on October 22, 2008.

J&J and Merger Sub have revised the disclosure on pages 16 and 17 of the Offer to Purchase to further clarify the basis and limitations of its $29.00 per share proposal as described above, including by adding additional detail regarding the underlying assumptions.

Miscellaneous, page 36

| 7. | You state in the first paragraph of this section that the offer “is not being made to (nor will tenders be accepted from or on behalf of) holders of shares in any jurisdiction in which the making of the Offer or the acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction.” The all-holders provision in Rule 14d-10 requires that your tender offer be open to all target security holders, including persons located in foreign jurisdictions. While you are not required to disseminate the offer materials in jurisdictions outside of the United States, the statement in your parenthetical, which states that tenders from security holders in certain jurisdictions will not be accepted, is impermissible. See Section II.G.1 of Release No. 34 58597. To the extent that you intended to limit your offer solely in reliance on Rule 14-10(b)(2), please clarify that in your response, but otherwise please revise to ensure compliance with Rule 14d-10. |

J&J and Merger Sub acknowledge the staff’s comment and have revised the disclosure by deleting the parenthetical “(nor will tenders be accepted from or on behalf of)” from page 36 of the Offer to Purchase.

_______________

Please note that, in addition to changes responsive to the staff’s comments above, J&J and Merger Sub have also made additional changes to the Schedule TO filing to conform the disclosure therein to certain changes made by Omrix to its Schedule 14D-9 filing based on the Commission’s comment letter to David Fox, Esq. of Skadden, Arps, Slate, Meagher & Flom LLP dated December 12, 2008.

As requested by the staff in the closing comments of the Comment Letter, attached hereto as Annex A is a written acknowledgement from J&J and Merger Sub.

If you have any questions regarding the contents of this letter, please do not hesitate to contact me at the above number.

| | Sincerely, Robert I. Townsend, Esq. |

Ms. Julia E. Griffith

Special Counsel

U.S. Securities and Exchange Commission

Office of Mergers & Acquisitions

100 F Street, N.E.

Washington, D.C. 20549-3628

Copy to:

Allen Kim, Esq.

Johnson & Johnson

One Johnson & Johnson Plaza

New Brunswick, NJ 08933

FEDERAL EXPRESS

Annex A

Each of the undersigned hereby acknowledges that in connection with the Schedule TO-C filed November 24, 2008, the Schedule TO-T filed November 25, 2008 and the Schedule TO-T/A filed December 1, 2008 (File No. 5-82558):

| | ● | Each of the undersigned is responsible for the adequacy and accuracy of the disclosure in its filings with the Securities and Exchange Commission (the “Commission”); |

| | | |

| | ● | Comments of the staff of the Commission or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| | | |

| | ● | The undersigned may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the Federal securities laws of the United States. |

JOHNSON & JOHNSON |

| by_______________________________ | |

Name: Title: |

BINDER MERGER SUB, INC. |

| by_______________________________ | |

Name: Title: |

[Draft--12/15/08]