November 30, 2010

| | Crucell N.V. Schedule TO-T filed on November 12, 2010 Filed by JJC Acquisition Company B.V. and Johnson & Johnson File No. 005-51066 | |

Dear Ms. Chalk:

On behalf of Johnson & Johnson and JJC Acquisition Company B.V. (“JJC Acquisition” and, together with Johnson & Johnson, the “Filing Persons”), we are writing to respond to the comments set forth in the letter of the Staff (the “Staff”) of the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”) dated November 23, 2010, providing comments to the Schedule TO filed by the Filing Persons with the Commission on November 12, 2010 (the “Schedule TO”) in connection with the proposed tender offer (the “Offer”) by JJC Acquisition for all of the issued and outstanding shares in Crucell N.V. (“Crucell”), that we did not address in our letter to you dated November 29, 2010.

For the convenience of the Staff, each of the Staff’s comments is reproduced below in its entirety in italics and is followed by the corresponding response

of the Filing Persons. Capitalized terms used and not defined herein have the meanings ascribed to them in the Offer Document filed as Exhibit 99(a)(1)(A) to the Schedule TO.

Schedule TO-T

Exhibit 99(a)(1)(A)-Offer to Purchase

General

1. We note that you will seek shareholder approval of certain corporate governance and other matters at two separate meetings of Crucell shareholders, one to occur before the expiration of the offer and another after. For our information and in order to clarify certain Dutch legal requirements necessitating these approvals, please briefly explain in your response letter why these matters must be approved by shareholders and what the impact will be on the bidder’s ability to integrate Crucell after the offer. For example, why is it necessary for shareholders to approve the transfer of the business of Crucell to the Offeror or its Affiliate? How is this different from the position an Offeror would be in after purchasing a majority stake in a target in a US offer? We may have additional comments after reviewing your response.

Response:

The Offer EGM

The Offer EGM and the Post Offer EGM are separate meetings requiring separate shareholder action under Dutch law.

Dutch law requires that a company that is the subject of an offer convene an extraordinary general meeting before the expiration of any offer in order to inform shareholders of the terms and conditions of the offer. The Offer EGM therefore fulfils this Dutch legal requirement. Also, at the Offer EGM, as is customary in Dutch tender offer practice, Crucell shareholders will be requested to adopt, in accordance with the Dutch Civil Code and subject to the Offer being declared unconditional, the following governance resolutions necessary to facilitate the Offer:

● certain amendments to Crucell’s articles of association (pursuant to clause 2:121 of the Dutch Civil Code); and

● the reconstitution of the Crucell Supervisory Board to include 9 designees of the Offeror and 2 incumbent Crucell Supervisory Board members.

The actions contemplated by the governance resolutions, while taken at the Offer EGM, will only become effective upon the Offer being declared unconditional. These actions are necessary in order to permit the Offeror to exercise some modicum of control over Crucell during the period from the closing of the Offer to the consummation of the post-tender offer steps that will provide the Offeror with ownership of 100% of the interests in Crucell. This is consistent with the mechanics implemented in U.S. tender offers where, upon closing of the tender offer, the subject company agrees to reconstitute its board of directors in order to provide the offeror with majority board representation at the subject company during the period from the closing of the offer to the subsequent squeeze-out of the shares that were not tendered into the offer. The difference here is that in the Netherlands, those actions require approval at a shareholders meeting, while in the United States those actions can be taken without a shareholder meeting.

The Post Offer EGM

The means by which an offeror may acquire full ownership of a company and/or its business after the completion of a tender offer is quite different under Dutch law and U.S. law. For example, an offeror is not able pursue a “short-form” merger under Dutch law upon the acquisition of 90% of the issued and outstanding share capital of a company. Additionally, if an offeror acquires between 50% and 90% of the issued and outstanding share capital of a company, there is no statutory “long-form” merger available under Dutch law to cash-out the shares that are not tendered in an offer.

Accordingly, it is common in Dutch tender offer practice to contemplate one or more transactions to achieve this result, as has been done in this Offer. The most straight-forward manner by which the Offeror may acquire the outstanding shares of minority shareholders following the closing of the Offer is through statutory buy-out proceedings. Such proceedings, however, can only be initiated if the Offeror acquires at least 95% of the issued and outstanding share capital of Crucell. If the Offeror acquires less than 95% of the issued and outstanding share capital of Crucell, it must effectuate some other post-tender offer settlement restructuring to acquire full ownership of Crucell and/or its business. The Offeror and Crucell have agreed that the most feasible post-tender offer settlement restructuring alternative is the Asset Sale.

Under Dutch law, shareholder approval is required to pursue any post-tender offer settlement restructuring other than the statutory buy-out, including the Asset Sale. Specifically, pursuant to clause 2:107a of the Dutch Civil Code, shareholders have the authority, at a general meeting of shareholders, to approve board decisions concerning a significant change of identity or character of a company or business, such as transfers of the entire business to a third party as is contemplated by the Asset Sale. If the Asset Sale is pursued (i.e., because the Offeror has not acquired sufficient shares to utilize the statutory buy-out), the Post Offer EGM must be convened to approve the resolution of the Crucell Management Board to enter into the Asset Sale.

3. As you know, the offer must remain open for at least twenty U.S. business days from the date of the offer materials are published, sent or given to target shareholders. See Rule 14e-1(a). Note that December 24th and December 31st will not be considered business days this year, given that the SEC and EDGAR will be closed on those dates. In addition, your offer is set to expire at 11:30 a.m. on an unspecified date; since “business day” is defined in our rules to extend from 12:01 a.m. through 12:00 midnight Eastern Time, please ensure that the offer period is open for the full twenty U.S. business days as that term is defined in Rule 13e-4(a)(3).

Response:

We acknowledge the Staff’s comment and will ensure that the Offer period is open for 20 U.S. business days at minimum. We also respectfully submit that Section 7.25.1 of the Offer Document contains disclosure specifying that the Offeror is required to keep the Offer open for acceptance for a period of at least 55 days, and in any event not less than the full 20 U.S. business days as defined in Rule 14d-1(g) of the Exchange Act, which sets forth the same requirements as Rule 13e-4(a)(3) of the Exchange Act.

4. Consider reducing the number of defined terms in your offer document. On the first page of the offer materials alone, you define 19 terms. Some of the defined terms seem self-evident and unnecessary, such as defining bidder “Johnson & Johnson” as “Johnson & Johnson,” or using separate defined terms for “Acceptance Closing Date,” “Acceptance Closing Time,” and “Acceptance Period.”

Response:

We have taken this comment under advisement and have revised the Offer Document to reflect your suggestions.

5. We note that bidder JJC Acquisition Company is a wholly owned direct subsidiary of Cilag Holding AG, which is itself a subsidiary of bidder Johnson & Johnson. Tell us why you have not included Cilag as a bidder, or revise to include it.

Response:

We acknowledge the Staff’s comment and have revised the Schedule TO and the Offer Document to include Cilag Holding AG as an offeror.

Questions and Answers about the Offer and Granting Proxies―Does the Offeror have the Financial Resources to Make Payment?, page 2

6. You state that one of the Offeror’s affiliates may provide the Offeror with sufficient funds to purchase tendered Shares. Any entity that provides funding for the Offer may need to be included as a bidder on the Schedule TO, in which case, it would have to provide and disseminate all of the disclosure required by that Schedule. This might also necessitate an extension of the offer period, depending on when it occurred. Please confirm your understanding in your response letter.

Response:

Johnson & Johnson, as the ultimate parent company of the Offeror and the Offeror’s affiliates, has full control over the funds within the Johnson & Johnson Group and will ensure that sufficient funds are readily available to purchase shares tendered into the Offer. Johnson & Johnson has been included as an offeror in the Schedule TO and the Offer Document, and the relevant disclosure regarding Johnson & Johnson required by that Schedule will be disseminated to Crucell’s shareholders. Additionally, cash is fungible, and Johnson & Johnson directs the movement of cash among its affiliated companies for a myriad of operational, financing and other reasons in the normal course of its business, including the funding of acquisitions. Accordingly, information regarding any potential movement of funds among the Johnson & Johnson Group would be impractical to provide in advance and, we respectfully submit, would be confusing to shareholders. Shareholders have been ensured certainty of funds in respect of the aggregate cash consideration payable in the Offer by the Offeror in the Offer Document.

Can the Offer be extended and under what circumstances?, page 3

7. For changes other than a change in the offer price, we note your disclosure that the Acceptance Period may only be extended once, absent extenuating circumstances. In your response letter, tell us what you will do if the US rules would require an extension of the offer period but Dutch rules would not permit such an extension. We may have further comments.

Response:

As described in Section 6.4 (The Acceptance Period and Extension of the Acceptance Period) of the Offer Document, the Acceptance Period may be extended more than once if the AFM grants dispensation for further extensions, which will only be given in exceptional circumstances. In the event that U.S. rules would require an extension of the Acceptance Period but Dutch rules would not permit such an extension, we intend to request such a dispensation from the AFM to allow for the required extension. If the AFM refused to grant such a dispensation, we would respectfully request relief from the SEC and would provide the SEC with sufficient time to consider the request. Under those circumstances, we believe that the SEC would have grounds to grant the Offeror an exemption from such a requirement to extend the Offer, should it agree to do so.1 If the Offeror would be unable to obtain relief from either the AFM or the SEC, the Offeror would allow the Offer to lapse and would subsequently commence a new offer.

1 The SEC will consider any applications for exemptions beyond those provided by Tier II status on a case-by-case basis to address direct conflicts between the U.S. laws and practice and those of the home jurisdiction of the target company. See Cross-Border Tender and Exchange Offers, Business Combinations and Rights Offerings, Release No. 33-7759 (Oct. 22, 1999). See also Banco Bilbao Vizcaya Argentaria, S.A., SEC No-Action Letter (Mar. 9, 2001) (no-action relief under Rule 14d-10 granted where “Colombian regulations do not permit the Offer Time to be changed, while an extension of the U.S. Offer period might be required under applicable U.S. rules and regulations”).

What are the most significant conditions to the Offer?, page 5

8. You disclose that if certain other offer conditions are satisfied, the 95% minimum tender condition will be reduced to 80%. In your response letter, tell us how mechanically you will handle the reduction in the minimum tender condition, including how and when you will make this change, how you will notify shareholders, whether withdrawal rights will exist after such reduction, etc. See the guidance on reducing or waiving a minimum tender condition in a cross-border offer provided in Release No. 33-8957 (September 19, 2008).

Response:

In response to the Staff’s comment, we note that the Offer Document discloses that the minimum acceptance condition is 80% in the event that (x) the Favourable IRS Ruling is obtained by Johnson & Johnson and (y) Proxies are received in respect of at least 80% of the Shares that will allow the Offeror to vote, at the Post Offer EGM, in favour of the Asset Sale that may be pursued as a Post Closing Restructuring following the consummation of the Offer. Shareholders are made aware, and should assume, as of the commencement of the Offer that if the events in subclauses (x) and (y) above are satisfied, the minimum acceptance condition is 80% on the Announcement Date. This occurs by the very terms of the minimum acceptance condition itself, which terms were agreed to in advance by Crucell and the Offeror (as set forth in the Merger Agreement and in the Offer Document) so that the minimum acceptance condition would not have to be reduced or waived under these circumstances. Said differently, the application of the 80% condition in lieu of the 95% condition is an express term of the Offer that tendering shareholders are aware of at the time they tender their shares into the Offer, and the application of the 80% condition is not the result of a waiver or amendment to the terms of the Offer.

Therefore, we note that the conditions set forth in Section II.C.5 of Release No. 33-8957 (September 19, 2008) are inapplicable to the Offer, since such conditions only apply to a waiver or reduction of the minimum acceptance condition. As stated above, given the minimum acceptance condition (including the circumstances under which the condition is 95% and the circumstances under which it is 80%) is disclosed to the shareholders in the Offer Document at the commencement of the Offer and given that the reduction to 80% occurs automatically pursuant to the terms of the minimum acceptance condition itself upon the occurrence of the above-specified events (under which events neither the Offeror nor Crucell would be able to prevent the automatic reduction without further amendment), the Offeror would not be waiving or reducing the minimum acceptance condition by announcing that the minimum acceptance condition is 80% on the Announcement Date.

Shareholders will be notified if the minimum acceptance condition is 80% on the Announcement Date. As disclosed in the Offering Document, the Offeror will notify shareholders by making a public announcement on the Announcement Date, in accordance with article 16, paragraph 1 of the Decree.

We also respectfully note that shareholders may withdraw any shares tendered pursuant to the Offer at any time prior to the Acceptance Closing Time and the Offer Document informed shareholders that such withdrawal rights will not apply during any Subsequent Offering Period.

If I decide not to tender, what will happen to my Shares?, page 9

9. Quantify how much less shareholders may receive in the Asset Sale and subsequent liquidation than by tendering into the offer.

Response:

The Business Purchase Agreement provides that the Offeror shall procure, if necessary by making adjustments to the purchase price, that the purchase price payable to Crucell shall be sufficient to pay out EUR 24.75 per share to the shareholders per issued and outstanding share, without interest, but subject to dividend withholding or other taxes, if any. The Business Purchase Agreement further provides that the Offeror shall arrange for adequate steps and/or transactions to result in the payment to the then-existing minority shareholders of a cash amount per share equal to the Offer price, without interest, but subject to any applicable dividend withholding or other tax. Accordingly, any manner in which the then-existing minority shareholders receive the cash amount equal to the Offer price would still be subject to any applicable withholding or other tax, and it is for this reason only that the Offer Document references that shareholders may receive less in the Asset Sale and a subsequent liquidation. For example, if in connection with the Asset Sale it is decided that Crucell will be dissolved and liquidated with the then-existing minority shareholders receiving cash in an amount equal to the Offer price, Netherlands dividend withholding tax would nonetheless be due at a rate of 15% to the extent that the liquidation proceeds exceed the average paid-in capital of those Shares as recognized for purposes of Netherlands dividend withholding tax. The amount withheld will vary from shareholder to shareholder and may be recoverable for some shareholders based on their individual circumstances. As a result, the Offeror is unable to quantify the amount any particular shareholder may receive in respect of a liquidation following the Asset Sale.

Accordingly, even though the Offeror will pay shareholders the same amount per share in the Asset Sale and subsequent liquidation as shareholders would be paid in exchange for tendering their shares into the Offer, the Offer Document advises shareholders that they may receive less in the Asset Sale and a subsequent liquidation and further advises shareholders to consult their tax advisors to ascertain the tax consequences applicable to them. However, in response to the Staff’s comment, we have included a cross-reference to Section 12.1.6 (Asset Sale Pursuant to the Business Purchase Agreement) of the Offer Document in those areas where the Offer Document highlights that shareholders may receive less in the Asset Sale followed by a liquidation than they would by tendering their shares into the Offer.

If I want to accept the Offer, must I also vote in favour of the Governance Resolutions at the Offer EGM and/or grant a Proxy for the matters to be voted on at the Post Offer EGM?, page 15

10. Your disclosure indicates that by accepting the offer, a shareholder will be deemed to concurrently grant a proxy with respect to those tendered shares. Explain in your response letter, with a view to additional disclosure if necessary, what will happen if a tendering shareholder is not the record holder with respect to the shares tendered. We would have concerns under the all-holders provisions in Rule 14d-10 if providing a proxy were a condition to tendering the offer.

Response:

As described in more detail in Section 6.5 (Solicitation of Proxies) of the Offer Document, granting a Proxy to the Offeror is not a condition to shareholders tendering their shares into the Offer. Shareholders are actually provided with the ability to opt out of granting a Proxy and still tender their shares. Additionally, since the record date for the Post Offer EGM to which the proxies will apply will be set as of the third business day following the Acceptance Period, all shareholders tendering their shares will be record holders with respect to the shares tendered.

Accordingly, the mechanics for both tendering shares and granting proxies are in compliance with the all-holders provisions under Rule 14d-10 as the Offer “is open to all security holders of the class of securities subject to the tender offer”.

Restrictions, page 17

11. While you are not required to disseminate the offer materials into any foreign jurisdiction, tenders must be accepted from all shareholders wherever located. See guidance in Release No. 33-8957 (September 19, 2008). In addition, it is inappropriate to require tendering shareholders in other jurisdictions to certify to compliance with applicable local law. Please revise and confirm your understanding.

Response:

We acknowledge the Staff’s comment and have revised the disclosure in Section 1 (Restrictions) of the Offer Document.

Background of the Offer, page 70

12. It appears from the discussion of the negotiations between the parties leading up to the offer and the prior relationship between Johnson & Johnson and Crucell that the parties may have exchanged confidential non-public information concerning Crucell. If so, please disclose or explain why any such non-public financial forecasts, projections or other information is not material to shareholders and disclosure is not required. If the financial forecasts and projections received are those disclosed in the Shareholders’ Circular to be distributed by Crucell, so advise in your response.

Response:

As explained above in response to the Staff’s Comment #2, Johnson & Johnson and Crucell did not exchange confidential non-public information concerning the business of Crucell or an acquisition of Crucell during their existing collaboration relationship beyond that related to the substance of the collaboration agreement. In connection with Johnson & Johnson's evaluation as to whether it wanted to initiate discussions regarding the acquisition of Crucell, Johnson & Johnson was provided with additional information, including financial information, of the form and type that are customarily provided to any potential acquiror considering whether to engage in an acquisition of a company. Johnson & Johnson conducted due diligence, and requested information, consistent with any due diligence process it would normally conduct when considering whether to engage in a business combination transaction.

Johnson & Johnson notes that in Section 10.2 (Prospective Financial Information) of Crucell’s Shareholders’ Circular (which constitutes a part of the Solicitation/Recommendation Statement of Crucell on Schedule 14D-9), Crucell has provided its shareholders with summary financial projections for the fiscal years 2010 through 2015 (the “Crucell Published Projections”). At the outset of Johnson & Johnson’s due diligence review, on June 30, 2010, Crucell provided Johnson & Johnson with a set of financial projections for the same periods (the “June 2010 Projections”) and also for a longer range into the future (as discussed below in the next paragraph). The June 2010 Projections differ somewhat from the Crucell Published Projections. Crucell has advised Johnson & Johnson that the Crucell Published Projections constitute those financial projections that were updated by Crucell management based on the most recent information available to Crucell management as of October 2010 and were utilized by the Crucell Boards in their deliberations with respect to the transaction. Accordingly, Crucell has advised Johnson & Johnson that the Crucell Published Projections supersede in their entirety any prior sets of projections that were provided to Johnson & Johnson during its due diligence investigation with respect to the transaction. Accordingly, and on this basis, Johnson & Johnson does not believe that the financial projections that were provided to it several months before Crucell entered into the Merger Agreement (and have been superseded by the updated Crucell Published Projections) are material to Crucell shareholders or required to be disclosed in the Offer Document.

As stated above, at the time Johnson & Johnson received the June 2010 Projections, Johnson & Johnson was also provided with a longer range of forecasts and projections compared to the Crucell Published Projections. However, this prospective financial information covered multiple years well into the future (over 10 years into the future), and therefore this information by its nature is inherently speculative and unreliable. In addition, this prospective information relates to products that are currently in the development stage by Crucell and have not yet been introduced into the market, and given the risks and uncertainties related to the research, clinical testing and commercialization of development-stage products, Johnson & Johnson believes that any forecasts prepared by Crucell for products in development constitute nothing more than speculation. Accordingly, Johnson & Johnson did not rely on this additional financial information and does not believe that such additional information is material information of Crucell. Further, Johnson & Johnson believes that the disclosure of this information would be misleading to investors given the extremely long future period to which it purports to relate, as well as to the inherently speculative and unreliable nature of the assumptions that went into the preparation of this information.

Substantiation of the Offer Price, page 74

13. You list the types of analyses you performed in establishing the offer price. Revise to include the results of those analyses. For example, on page 74, you note that you performed a discounted cash flow analysis using a weighted average cost of capital of 11% to 12%, but you don’t indicate what that analysis yielded.

Response:

We respectfully submit that the above-referenced disclosure regarding the analyses performed was only included in the Offer Document to comply with Dutch law, and this level of disclosure has been reviewed and deemed acceptable by the AFM. We note that disclosure of the analyses performed by a bidder in establishing the price it was willing to pay in an offer is not required pursuant to the items in Schedule TO. (It should be noted that the Schedule 14D-9 and associated Shareholders’ Circular (including the Position Statement) of Crucell contain detailed disclosure of the reasons supporting the Crucell Supervisory Board and Management Board reasons for recommending the Offer to Crucell shareholders, including detailed summaries of the financial analyses conducted by the Crucell financial advisors.) Accordingly, we believe that it is not necessary to revise the above-referenced disclosure to comply with the disclosure requirements under Schedule TO.

Rationale for the Offer, page 76

14. You disclose that after the offer, “the long-term incentives of Crucell cannot continue in their current form” and that you “will discuss how to address the fact that equity will no longer be available.” You also state that you intend to retain Crucell’s senior management team after the offer. If members of senior management may have the opportunity to participate as stakeholders in Johnson & Johnson going forward, please provide more detailed disclosure about the possible parameters of what they may receive.

Response:

The above-referenced disclosure is only included in the Offer Document to comply with Dutch law. There are currently no set plans for, or agreements in place with, Crucell management.

In the ordinary course of business, Crucell has offered long-term compensation tied to Crucell’s publicly traded equity. Since Crucell will no longer have publicly traded shares once it is delisted from Euronext Amsterdam, the Swiss Exchange and Nasdaq, such long-term compensation arrangements will no longer be possible. Just as in Johnson & Johnson’s past acquisitions of other companies, Johnson & Johnson will transition Crucell’s employees, including Crucell senior management, into compensation and incentive payment arrangements (similar to those provided to other Johnson & Johnson employees) in accordance with Johnson & Johnson’s compensation practices as in effect from time to time. And, as is the case with Johnson & Johnson’s existing compensation and incentive arrangements, those plans may be tied to Johnson & Johnson’s publicly traded equity. However, as stated above, Johnson & Johnson does not have any plans or agreements in place with Crucell management regarding these matters.

_______________

For your convenience, we have enclosed a copy of the Schedule TO as amended.

As requested by the Staff in the closing comments of the Comment Letter, attached hereto as Annex A is a written acknowledgement from Johnson & Johnson, Cilag Holding AG and JJC Acquisition Company B.V.

_______________

If you have any questions regarding the contents of this letter, please do not hesitate to contact me at the above number.

| | | Sincerely, | |

| | |

Damien R. Zoubek | |

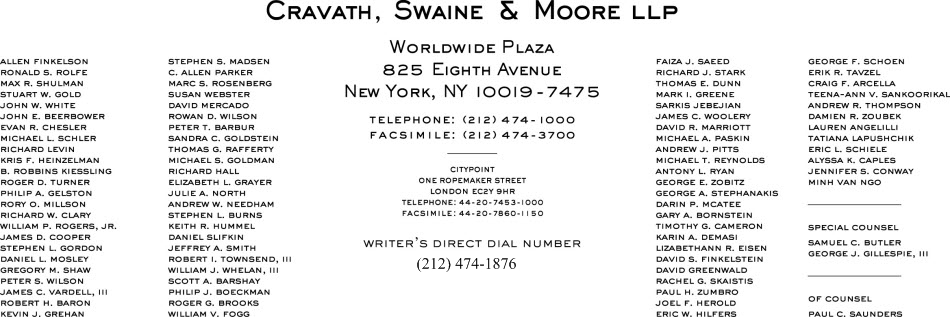

Christina Chalk, Esq.

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, D.C. 20549

Copy to:

Eric Jung, Esq.

Johnson & Johnson

One Johnson & Johnson Plaza

New Brunswick, NJ 08933

| | VIA EDGAR, FACSIMILE AND FEDERAL EXPRESS |

Each of the undersigned hereby acknowledges that in connection with the Schedule TO-T filed November 12, 2008 (File No. 005-51066):

| ● | Each of the undersigned is responsible for the adequacy and accuracy of the disclosure in its filings with the Securities and Exchange Commission (the “Commission”); |

| ● | Comments of the Staff of the Commission or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| ● | The undersigned may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the Federal securities laws of the United States. |

| | JOHNSON & JOHNSON, | |

| | | | |

| | By: | /s/ Douglas Chia | |

| | | Name: Douglas Chia | |

| | | Title: Secretary | |

| | | | |

| | CILAG HOLDING AG, | |

| | | | |

| | By: | /s/ Heinz Schmid | |

| | | Name: Heinz Schmid | |

| | | Title: Director | |

| | | | |

| | | | |

| | By: | /s/ Pascal Hoorn | |

| | | Name: Pascal Hoorn | |

| | | Title: Director | |

| | | | |

| | JJC ACQUISITION COMPANY B.V., | |

| | | | |

| | By: | /s/ Henno Meijerink | |

| | | Name: Henno Meijerink | |

| | | Title: Director | |

| | | | |