Filed by Kenvue Inc. pursuant to rule 425 under the Securities Act of 1933, as amended Subject Company: Johnson & Johnson Commission File No.: 1-3215 Today, Johnson & Johnson announced its intention to “split off” Kenvue Inc. (“Kenvue”) shares through an exchange offer. Following the completion of our initial public offering (“IPO”) in May, Johnson & Johnson remained Kenvue’s largest shareholder, owning approximately 89.6% of Kenvue’s common stock and therefore the majority of voting shares. Through the exchange offer, Johnson & Johnson intends to split off at least 80.1% of the shares of Kenvue. Once this exchange offer (including all related transactions) is consummated, referred to as the “final separation”, Johnson & Johnson will no longer be the controlling shareholder of Kenvue, and Kenvue will operate as a separate and fully independent company. Looking ahead, the final separation will mark a major moment in Kenvue’s history. It will be an important step on our journey as the world’s largest pure-play consumer health company by revenue as we continue to realize the extraordinary power of everyday care for millions of people around the world. Why a split and why now? A split-off by means of an exchange offer gives Johnson & Johnson shareholders a choice. Johnson & Johnson shareholders will have the ability to exchange all, some or none of their shares of Johnson & Johnson common stock for shares of Kenvue common stock, pursuant to the terms of the exchange offer. Notably, an exchange offer also presents an opportunity for Johnson & Johnson to acquire a large number of outstanding shares of Johnson & Johnson common stock at one time in a tax-free manner for U.S. federal income tax purposes, without reducing overall cash and financial flexibility.

What does this mean for me? • If you own Johnson & Johnson common stock in a brokerage account or other investment account: o You have the choice to participate in the exchange offer. Participation in the exchange offer is completely voluntary. If you do not wish to participate, no action is required. o You will receive additional information from your bank or broker explaining the exchange offer and the actions you need to take if you wish to opt-in to the exchange offer. • If you are a Johnson & Johnson Long-Term Incentive (LTI) award holder you will be receiving an email from Johnson & Johnson via the Our Next Step mailbox containing important information. o If you have any questions about the information provided, reach out to AskGS or attend the upcoming LTI Brochure Review Sessions—invitations to follow. o If you have questions regarding your personal LTI awards, reach out to Fidelity Stock Plan Services 800-544-9354 (United States) or click here to contact Fidelity if you are outside the United States. • If you are invested in the Johnson & Johnson stock funds in the Kenvue Savings Plan (U.S.) (commonly known as a 401(k) plan) or the Kenvue Retirement Savings Plan (Puerto Rico) as of July 19, 2023: o You have the choice to participate in the exchange offer. Participation in the exchange offer is completely voluntary. If you do not wish to participate, no action is required. o You will receive additional information from Broadridge explaining the exchange offer and the actions you need to take if you wish to opt-in to the exchange offer. o If you hold Johnson & Johnson stock fund units in the plans, note that approximately nine months following completion of the exchange offer, any remaining Johnson & Johnson stock fund units in the plans will be automatically converted to Kenvue stock fund units. o If you have any questions about your J&J Stock Fund balance in the Plans, visit the For Your Benefit website at http://fyb.jntlch.com . This list does not account for all scenarios by which a Kenvuer may hold Johnson & Johnson common stock. All Johnson & Johnson shareholders eligible to participate in the exchange offer will receive additional information about the exchange offer. Please read all information you receive about the exchange offer and consult with your bank, broker and legal and tax advisors to understand your choices and make the decision right for you. Have Questions? Topic Entity Contact info Terms and conditions of the Exchange Offer Georgeson LLC 1-866-695-6074 (in the United States) +1-781-575-2137 (all others outside the United States)

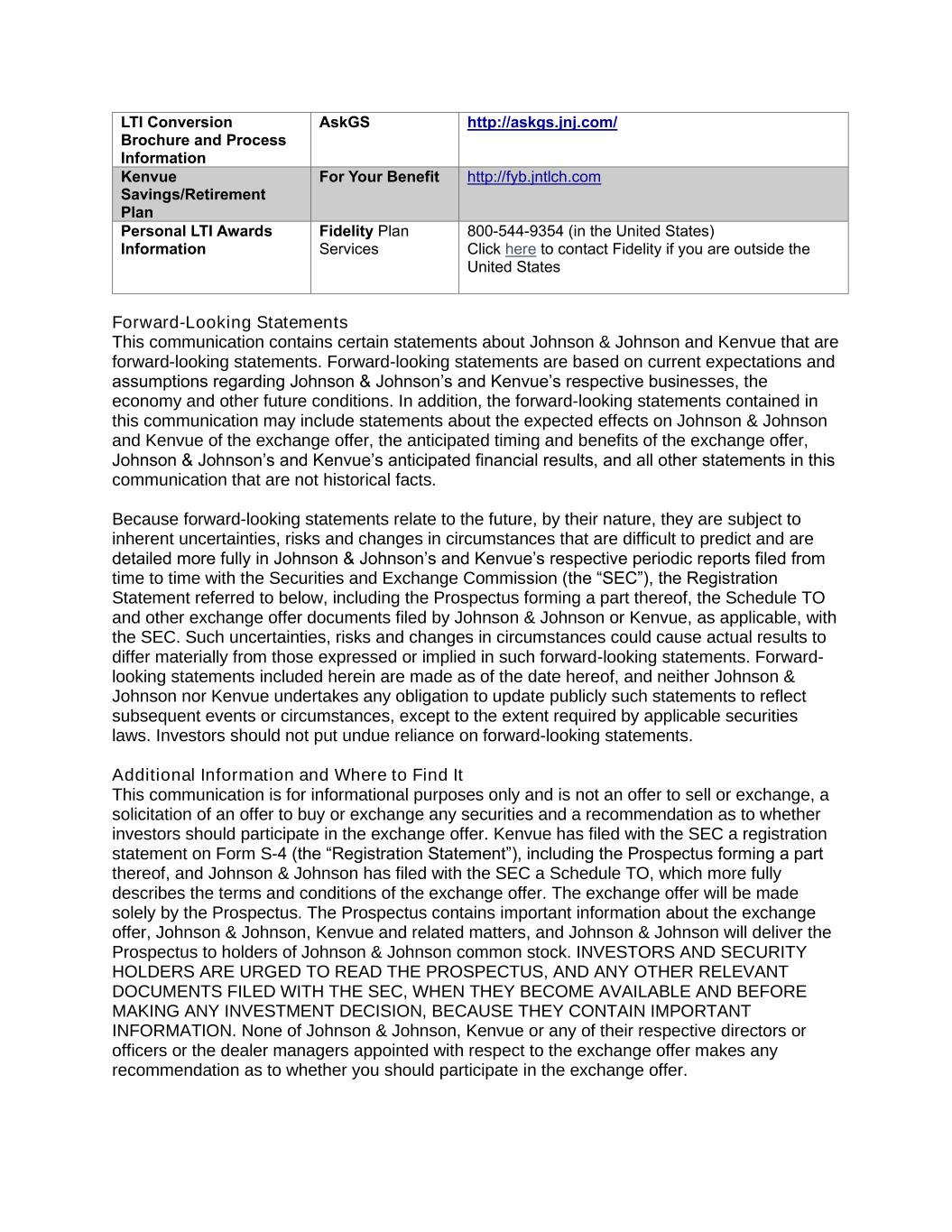

LTI Conversion Brochure and Process Information AskGS http://askgs.jnj.com/ Kenvue Savings/Retirement Plan For Your Benefit http://fyb.jntlch.com Personal LTI Awards Information Fidelity Plan Services 800-544-9354 (in the United States) Click here to contact Fidelity if you are outside the United States Forward-Looking Statements This communication contains certain statements about Johnson & Johnson and Kenvue that are forward-looking statements. Forward-looking statements are based on current expectations and assumptions regarding Johnson & Johnson’s and Kenvue’s respective businesses, the economy and other future conditions. In addition, the forward-looking statements contained in this communication may include statements about the expected effects on Johnson & Johnson and Kenvue of the exchange offer, the anticipated timing and benefits of the exchange offer, Johnson & Johnson’s and Kenvue’s anticipated financial results, and all other statements in this communication that are not historical facts. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and are detailed more fully in Johnson & Johnson’s and Kenvue’s respective periodic reports filed from time to time with the Securities and Exchange Commission (the “SEC”), the Registration Statement referred to below, including the Prospectus forming a part thereof, the Schedule TO and other exchange offer documents filed by Johnson & Johnson or Kenvue, as applicable, with the SEC. Such uncertainties, risks and changes in circumstances could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Forward- looking statements included herein are made as of the date hereof, and neither Johnson & Johnson nor Kenvue undertakes any obligation to update publicly such statements to reflect subsequent events or circumstances, except to the extent required by applicable securities laws. Investors should not put undue reliance on forward-looking statements. Additional Information and Where to Find It This communication is for informational purposes only and is not an offer to sell or exchange, a solicitation of an offer to buy or exchange any securities and a recommendation as to whether investors should participate in the exchange offer. Kenvue has filed with the SEC a registration statement on Form S-4 (the “Registration Statement”), including the Prospectus forming a part thereof, and Johnson & Johnson has filed with the SEC a Schedule TO, which more fully describes the terms and conditions of the exchange offer. The exchange offer will be made solely by the Prospectus. The Prospectus contains important information about the exchange offer, Johnson & Johnson, Kenvue and related matters, and Johnson & Johnson will deliver the Prospectus to holders of Johnson & Johnson common stock. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, WHEN THEY BECOME AVAILABLE AND BEFORE MAKING ANY INVESTMENT DECISION, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. None of Johnson & Johnson, Kenvue or any of their respective directors or officers or the dealer managers appointed with respect to the exchange offer makes any recommendation as to whether you should participate in the exchange offer.

Holders of Johnson & Johnson common stock may obtain copies of the Prospectus, the Registration Statement, the Schedule TO and other related documents, and any other information that Johnson & Johnson and Kenvue file electronically with the SEC free of charge at the SEC’s website at http://www.sec.gov. Holders of Johnson & Johnson common stock will also be able to obtain a copy of the Prospectus by clicking on the appropriate link on http://www.JNJSeparation.com. Johnson & Johnson has retained Georgeson LLC as the information agent for the exchange offer. To obtain copies of the exchange offer Prospectus and related documents, or for questions about the terms of the exchange offer or how to participate, you may contact the information agent at 1-866-695-6074 (toll-free for stockholders, banks and brokers) or +1-781- 575-2137 (all others outside the United States).