As filed with the U.S. Securities and Exchange Commission on February 12, 2025.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Kabushiki Kaisha Robot Consulting

(Exact name of registrant as specified in its charter)

Robot Consulting Co., Ltd.

(Translation of Registrant’s name into English)

| Japan | | 7370 | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Le Graciel Building 2, 6th Floor

5-22-6 Shinbashi, Minato Ward

Tokyo, 105-0005, Japan

+81 3-6280-547

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(800) 221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

Ying Li, Esq. Lisa Forcht, Esq. Hunter Taubman Fischer & Li LLC 950 Third Avenue, 19th Floor New York, NY 10022 (212) 530-2206 | | Michael J. Blankenship, Esq. Winston & Strawn LLP 800 Capitol Street, Suite 2400 Houston, Texas 77002 (713) 651-2600 |

Approximate date of commencement of proposed sale to the public: Promptly after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement on Form F-1 (File No. 333-) contains disclosure that will be circulated as two separate final prospectuses, as set forth below.

| | ● | Public offering prospectus. A prospectus (the “Public Offering Prospectus”) to be used for the public offering of 2,500,000 American depositary shares representing 2,500,000 Ordinary Shares of the Company (the “Public Offering ADSs”), through the underwriters named on the cover page of the Public Offering Prospectus. |

| | | |

| | ● | Resale prospectus. A prospectus (the “Resale Prospectus”) to be used for the offer and potential resale by Spirit Advisors LLC, (the “Selling Shareholder”) of 1,800,000 American depositary shares representing 1,800,000 Ordinary Shares of the Company (the “Selling Shareholder ADSs”), to be sold by the Selling Shareholder concurrently with our initial public offering and from time to time thereafter, at prevailing market prices, prices related to prevailing market prices, or privately negotiated prices. The Selling Shareholder owns Ordinary Shares of Robot Consulting Co., Ltd. (the “Registrant”) prior to this offering, which will be converted into Selling Shareholder ADSs effective immediately following the effective time of this registration statement. |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| | ● | it contains different outside and inside front covers and back cover pages; among other things, the identification of the underwriters and related compensation for the Public Offering ADSs will only be included in the Public Offering Prospectus and the Selling Shareholder ADSs will be listed on the outside and inside front covers of the Resale Prospectus without identification of the underwriters and related compensation information; |

| | | |

| | ● | it contains different “Offering” sections in the Prospectus Summary section relating to the offering of the Public Offering ADSs and the Selling Shareholder ADSs, as applicable; such Offering section included in the Public Offering Prospectus will summarize the offering of the Public Offering ADSs and such Offering section included in the Resale Prospectus will summarize the offering of the Selling Shareholder ADSs; |

| | | |

| | ● | it contains different “Use of Proceeds” sections, with the Use of Proceeds section included in the Resale Prospectus only indicating that the Registrant will not receive any proceeds from the sale of the Selling Shareholder ADSs by the Selling Shareholder that occurs pursuant to this registration statement; |

| | | |

| | ● | it does not contain the Capitalization and Dilution sections included in the Public Offering Prospectus; |

| | | |

| | ● | a “Selling Shareholder” section is only included in the Resale Prospectus; |

| | | |

| | ● | the “Underwriting” section from the Public Offering Prospectus is not included in the Resale Prospectus and the “Plan of Distribution” section is included only in the Resale Prospectus; and |

| | | |

| | ● | it does not contain the “Legal Matters” section and does not include a reference to counsel for the underwriters. |

The Company has included in this registration statement a set of alternate pages after the back-cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the Selling Shareholder.

The Selling Shareholder has represented to the Company that it will consider selling some or all of the Selling Shareholder ADSs registered pursuant to this registration statement immediately after the pricing of the public offering, as requested by the underwriters for the public offering in order to create an orderly, liquid market for the American depositary shares (“ADSs”). As a result, the sales of our ADSs registered in this registration statement will result in two offerings by the Registrant taking place concurrently or sequentially, which could affect the price and liquidity of, and demand for, our ADSs. This risk and other risks are included in “Risk Factors” in each of the Public Offering Prospectus and the Resale Prospectus.

The information in this preliminary prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED FEBRUARY 12, 2025

Robot Consulting Co., Ltd.

American Depositary Shares

Representing 2,500,000 Ordinary Shares

This is a firm commitment initial public offering of the American depositary shares (the “ADSs”) representing our ordinary shares (“Ordinary Shares”). We are offering 2,500,000 ADSs and each ADS represents one Ordinary Share. Prior to this offering, there has been no public market for the ADSs or our Ordinary Shares. We expect the initial public offering price of the ADSs to be in the range of US$4.00 to US$6.00 per ADS. We are also registering up to 1,800,000 ADSs (the “Selling Shareholder ADSs”), each representing one Ordinary Share, for resale by Spirit Advisors LLC (the “Selling Shareholder” or “Spirit Advisors”), pursuant to the Resale Prospectus. This prospectus will not be used for the offering and sale of Selling Shareholder ADSs, and the Resale Prospectus will not be used for sale of the ADSs offered by us in this initial public offering.

The sale of the Selling Shareholder ADSs in the resale offering is conditioned upon the successful completion of the sale of ADSs by the Company in the underwritten primary offering. The sales price to the public of the Selling Shareholder ADSs will initially be fixed at the initial public offering price of the ADSs offered in this prospectus. Following listing of our ADSs on the Nasdaq Capital Market (“Nasdaq”), the per ADS offering price of the Selling Shareholder ADSs to be sold by the Selling Shareholder may be sold at prevailing market prices, prices related to prevailing market prices, or privately negotiated prices. We will not receive any of the proceeds from the sale of the ADSs by the Selling Shareholder.

We have applied to list the ADSs on Nasdaq under the symbol “LAWR.” It is a condition to the closing of this offering that the ADSs are approved for listing on Nasdaq. At this time, Nasdaq has not approved our application to list the ADSs and there is no guarantee or assurance that the ADSs will be approved for listing on Nasdaq.

Investing in the ADSs involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 9 to read about factors you should consider before buying the ADSs.

We are an “emerging growth company” as defined under the federal securities laws and will be subject to reduced public company reporting requirements. Please read the disclosures beginning on page 3 of this prospectus for more information.

Following the completion of this offering, Mr. Hidetoshi Yokoyama, our chairman and representative director, will beneficially own approximately 63.64% of the aggregate voting power of our issued and outstanding Ordinary Shares, assuming no exercise of the over-allotment option of Craft Capital Management LLC and D. Boral Capital LLC, as representatives of the several underwriters in this offering (collectively, the “Representative”), or approximately 63.15%, assuming full exercise of the Representative’s over-allotment option, based on an assumed IPO price of US$4.00 per ADS, which is the low end of the range set forth on the cover page of the Public Offering Prospectus. As such, we will be deemed to be a “controlled company” under Nasdaq Listing Rule 5615(c). However, even if we are deemed to be a “controlled company,” we do not intend to avail ourselves of the corporate governance exemptions afforded to a “controlled company” under the Nasdaq Listing Rules but will follow the corporate governance standards of our home country, Japan, as permitted by Nasdaq Listing Rules. See “Risk Factors” and “Management—Controlled Company.”

| | | Per ADS | | | Total Without

Over-

Allotment

Option | | | Total With

Over-

Allotment

Option | |

| Initial public offering price | | $ | [●] | | | $ | [●] | | | $ | [●] | |

| Underwriters’ discounts(1) | | $ | [●] | | | $ | [●] | | | $ | [●] | |

| Proceeds to our company before expenses(2) | | $ | [●] | | | $ | [●] | | | $ | [●] | |

| (1) | Represents underwriting discounts equal to (i) 8.5% per ADS, which is the underwriting discount we have agreed to pay on investors in this offering introduced directly or indirectly by the underwriters, and (ii) 5.0% per ADS, which is the underwriting discount we have agreed to pay on investors in this offering introduced by us. Underwriting discounts to be paid by us are calculated based on the assumption that no investors in this offering are introduced by us. |

| | |

| (2) | In addition to the underwriting discounts listed above, we have agreed to: (i) reimburse the underwriters for certain expenses and (ii) provide a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to the Representative. See “Underwriting” for additional information regarding total underwriter compensation. |

The underwriters expect to deliver the ADSs against payment in U.S. dollars in New York, New York on or about [●], 2025.

Neither the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| D. Boral Capital | | Craft Capital Management LLC |

Prospectus dated [●], 2025

TABLE OF CONTENTS

About this Prospectus

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the ADSs offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is current only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations, and prospects may have changed since that date.

Our functional currency is the Japanese yen (“JPY” or “¥”), the legal currency of Japan. The terms “dollar” or “$” refer to U.S. dollars, the legal currency of the United States. Our financial statements are presented in JPY. Convenience translations included in this prospectus are based on the exchange rate of JPY to U.S. dollars of ¥143.25=$1.00, at the exchange rate set forth in the H10 statistical release of the Federal Reserve Board on September 30, 2024. Historical and current exchange rate information may be found at https://www.federalreserve.gov/releases/h10/. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of U.S. dollars, which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

Conventions that Apply to this Prospectus

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| | ● | “ADRs” are to the American Depositary Receipts that may evidence the ADSs; |

| | | |

| | ● | “ADSs” are to the American Depositary Shares, each of which represents one Ordinary Share; |

| | | |

| | ● | “AI” are to artificial intelligence; |

| | | |

| | ● | “API” are to application programming interface; |

| | | |

| | ● | “Certified Consultant” are to a certified social insurance and labor consultant (Shakai Hoken Roumu Shi, or Sharoushi), an expert in personnel and labor management who, once he or she passed the national examination, is qualified to provide consultation, guidance, and other services relating to employment, social insurance, and labor laws and regulations in Japan, as well as labor dispute resolutions, pursuant to the Certified Social Insurance and Labor Consultant Act (Act No. 89 of 1968, as amended); |

| | | |

| | ● | “Certified Consultant Corporation” are to a special corporation similar to an unlimited partnership under the Commercial Code of Japan, whose members are limited to Certified Consultants who are jointly and severally liable to third parties; |

| | | |

| | ● | “CJK Group” are to CJK Group Inc., an Arizona corporation which provides legal outsourcing services in the U.S. and Japan; |

| | | |

| | ● | “FINRA” are to the Financial Industry Regulatory Authority; |

| | | |

| | ● | “METI” are to the Ministry of Economy, Trade, and Industry of Japan; |

| | | |

| | ● | “metaverse” or “Metaverse” are to a highly immersive virtual environment where participating users may gather to interact with one another regardless of physical location; |

| | | |

| | ● | “MHLW” are to the Ministry of Health, Labor, and Welfare of Japan; |

| | | |

| | ● | “Ordinary Shares” are to the ordinary shares of Robot Consulting; |

| | | |

| | ● | “Robot Consulting,” “we,” “us,” “our,” “our Company,” or the “Company” are to Robot Consulting Co., Ltd., a joint-stock corporation with limited liability organized under Japanese law; |

| | | |

| | ● | “Robot Lawyer” are to our upcoming product, named Robot Bengoshi in Japanese, which enables users to pose metaverse-related legal questions through its chat interface powered by third-party generative AI; |

| | | |

| | ● | “SEC” are to the U.S. Securities and Exchange Commission; and |

| | | |

| | ● | “U.S. dollars,” “USD,” “$,” and “US$” are to the legal currency of the United States. |

Unless the context indicates otherwise, all information in this prospectus assumes no exercise by the Representative of its over-allotment option.

On February 5, 2024, our shareholders approved a 1-for-1,000 share split of its issued and outstanding Ordinary Shares. In connection with the share split, the total number of outstanding Ordinary Shares on such date increased from 7,035 to 7,035,000.

On December 19, 2024, the Company’s board of directors approved (i) a 1-for-6 share split of its issued and outstanding Ordinary Shares, and (ii) the increase of the number of authorized shares from 28,000,000 to 168,000,000. In connection with the share split, the total number of outstanding Ordinary Shares on such date increased from 7,035,000 to 42,210,000. Such share split and increase of the number of authorized shares became effective on January 7, 2025.

Unless otherwise indicated, all share amounts and per share amounts in this prospectus have been presented to give effect to (i) the 1-for-1000 share split of our Ordinary Shares which became effective on February 5, 2024, (ii) the increase of the number of authorized shares from 28,000,000 to 168,000,000, which became effective on January 7, 2025, and (iii) the 1-for-6 share split of our Ordinary Shares, which became effective on January 7, 2025.

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements included elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in the ADSs, discussed under “Risk Factors,” before deciding whether to buy the ADSs.

Overview

We are a platform service provider focusing on human resource solutions with an intention to expand into legal technology and the metaverse. Our current major product is “Labor Robot,” a cloud-based human resource management system launched in September 2022. Labor Robot helps users track employee attendance and sales orders and journalize accounting items. Additionally, we provide the information relating to grant (Joseikin) applications with MHLW, which will provide grants to small and medium-sized businesses to enhance their working conditions and employee welfare. Labor Robot also facilitates users in evaluating the types of grants they may be eligible for. In addition, we connect users interested in applying for grants with Certified Consultants. In addition to grant applications, we also support users who want to apply for a subsidy (Hojokin) with METI for the information technology (IT) system installation subsidy by connecting users interested in applying for a subsidy with our partners specializing in subsidy applications.

The number of Labor Robot users grew significantly to 261 users as of March 31, 2023, and to 483 users as of March 31, 2024, with 222 new users added during the fiscal year ended March 31, 2024. The number of Labor Robot users grew further to 513 as of September 30, 2024, with 30 new users added during the six months ended September 30, 2024. Labor Robot users are the users of Labor Robot who directly purchase Labor Robot from us and the users who purchase it from Nac Co., Ltd, a Japanese conglomerate that operates a water server business, sells and rental dust control products, provides architectural consulting, and manufactures and sells beauty product manufacturing (“Nac”).

The largest distributor contributing to the increased numbers of Labor Robot users is Nac. Nac is a listed company in Japan that has connections with small and medium-sized businesses, who serve as our target customers. Under the distribution agreement between us and Nac, Nac has agreed to act as our primary distributor, and we have agreed to provide support to Nac’s customers in applying for IT system installation subsidies with METI. In practice, Nac directly enters into the Labor Robot licensing or sales agreement with its customers, and we receive 7% of the total sales price (including tax) of Labor Robot that Nac sold to its customers in the prior month, which we recognize as revenue from the sales of Labor Robot. This arrangement enables us to increase exposure of Labor Robot to our target customers through Nac’s pipeline. We obtained 3 and 75 new Labor Robot users through this arrangement during the six months ended September 30, 2024 and 2023, respectively, representing 10.0% and 65.2% of new users acquired during the six months ended September 30, 2024 and 2023, respectively. The total accumulated number of Labor Robot users derived from Nac was 310 and 284 for the six months ended September 30, 2024 and 2023, respectively. We obtained 98 and 209 new Labor Robot users through this arrangement during the fiscal years ended March 31, 2024 and 2023, respectively, representing 44.14% and 80.1% of new users acquired during the fiscal years ended March 31, 2024 and 2023, respectively. The total accumulated number of Labor Robot users derived from Nac were 307 and 209 for the fiscal years ended March 31, 2024 and 2023, respectively. However, we receive only 7% of the original Labor Robot’s price from Nac, as opposed to the full price we usually obtain from users directly purchasing Labor Robot from us. The percentage of the revenue derived from Nac’s customers was 4.2% and 18.3% of the total revenue of the Company for the six months ended September 30, 2024 and 2023, respectively. The percentage of the revenue derived from Nac’s customers was 1.5% and 8.21% of the total revenue of the Company for the fiscal years ended March 31, 2024 and 2023, respectively. See “Business—Our Marketing Channel.”

While we plan to continue expanding the customer base for Labor Robot through our distribution agents, we also aim to create more software and services related to digital transformation, legal technology, and the metaverse. For example, we plan to launch “Robot Lawyer,” which will enable users to pose metaverse-related legal questions on certain metaverse platforms through Robot Lawyer’s chat interface powered by ChatGPT’s API (the “Chatbot”), and will allow users to (i) search legal precedents through a search engine integrating AI to enhance search quality, and (ii) will provide users with lawyer matching services for further legal consultation. As of the date of this prospectus, our current products do not include any AI technology; however, we are endeavoring to incorporate third-party generative AI technology, such as ChatGPT, into our Robot Lawyer software. See “Business—Research and Development.”

In addition to Labor Robot, we also provide consulting and support services relating to digital transformation to small and medium-sized businesses. During the fiscal year ended March 31, 2024, our services included (i) e-learning services, (ii) e-commerce store set-up services, and (iii) software installation services, while during the fiscal year ended March 31, 2023, we provided only IT system installation subsidy application consulting and support services. Additionally, during the fiscal year ended March 31, 2023, we provided advertising services and outsourcing services to a certain Certified Consultant. The revenue from our products and services, excluding the sales of Labor Robot, accounted for 83.2% and 66.6% of our total revenue during the six months ended September 30, 2024, and 2023, respectively. The revenue from our products and services, excluding the sales of Labor Robot, accounted for 89.16% and 81.48% of our total revenue during the fiscal years ended March 31, 2024, and 2023, respectively. We plan to use proceeds from these services to further expand Labor Robot’s business and develop new products and services. While we have ceased providing IT system installation subsidy application consulting and support services, e-commerce store set-up services, advertising services, and outsourcing services, in order to focus our efforts on the expansion of sales of our Labor Robot, e-learning services, and software installation services, a determination as to whether such services may resume in the future has yet to be made. During the six months ended September 30, 2024 and 2023, the percentage of revenue accounted for by such discontinued products and services was nil and 66.6%, respectively, and the percentage of revenue accounted for by those products and services we continued to offer during such periods was 100.0% and 33.4%, respectively. During the fiscal years ended March 31, 2024 and 2023, the percentage of revenue accounted for by such discontinued products and services was 48.48% and 81.48%, respectively, and the percentage of revenue accounted for by those products and services we continued to offer during such periods was 51.52% and 18.52%, respectively.

Competitive Strengths

We believe the following competitive strengths are essential for our success and differentiate us from our competitors:

| | ● | Growing a labor management platform for small and medium-sized enterprises; |

| | ● | Strong and expansive connection with distribution agents and effective marketing strategy; and |

| | | |

| | ● | Experienced management team. |

Growth Strategies

We intend to develop our business by implementing the following strategies:

| | ● | Continue to approach Labor Robot’s prospective clients through seminars held by our distributor agents; |

| | | |

| | ● | Collaboration with CJK Group to launch “Junior Lawyer X” in the U.S. market; and |

| | | |

| | ● | Expansion into metaverse business in Japan through “Robot Lawyer.” |

Corporate Information

Our headquarters are located at Le Graciel Building 2, 6th Floor 5-22-6 Shinbashi, Minato Ward, Tokyo 105-0005, Japan and our phone number is +81 3-6280-547. Our website address is https://robotconsulting.net/. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus or the registration statement of which it forms a part. Our agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, NY 10168.

Corporate History and Structure

Robot Consulting was incorporated in Minato Ward, Tokyo, Japan on April 17, 2020, as a joint-stock corporation (kabushiki kaisha) with limited liability.

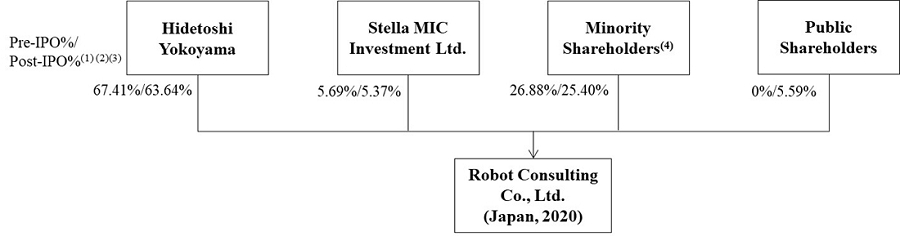

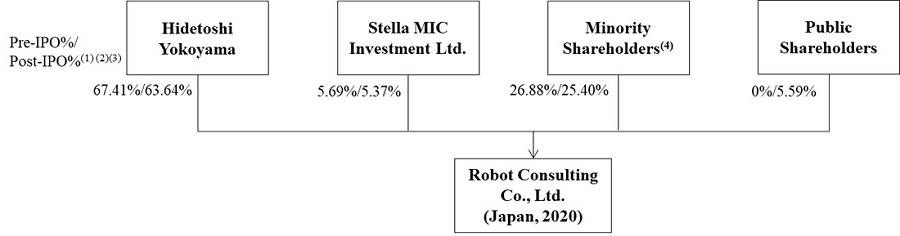

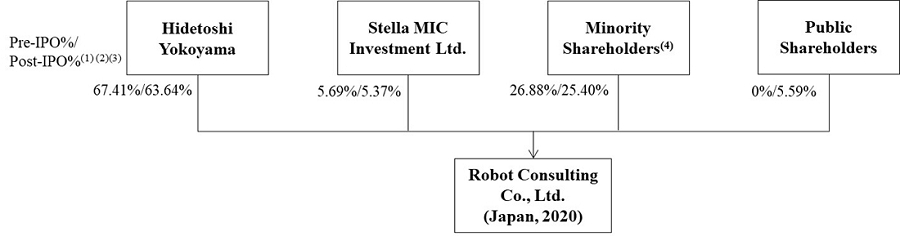

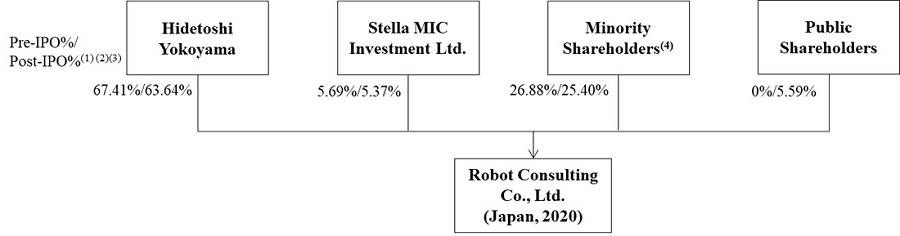

The following chart illustrates our corporate structure upon completion of this offering based on 42,210,000 Ordinary Shares outstanding as of the date of this prospectus and 2,500,000 ADSs to be sold in this offering, assuming no exercise by the Representative of its over-allotment option, and the percentage of post-IPO equity interests held by public shareholders does not include the 1,800,000 Selling Shareholder ADSs. For more details on our corporate history, please refer to “Corporate History and Structure.”

Notes: All percentages reflect the equity interests held by the shareholders.

| | (1) | The pre-IPO percentages are based upon 42,210,000 Ordinary Shares issued and outstanding as of the date of this prospectus and the post-IPO percentages are based on 44,710,000 Ordinary Shares issued and outstanding after this offering, assuming no exercise of the over-allotment option. |

| | | |

| | (2) | On February 5, 2024, our shareholders approved a share split of the 7,035 outstanding Ordinary Shares at a ratio of 1:1000, which became effective on February 5, 2024, resulting in 7,027,965 Ordinary Shares being issued after the share split. |

| | | |

| | (3) | On December 19, 2024, the Company’s board of directors approved a 1-for-6 share split of its issued and outstanding Ordinary Shares. The total number of outstanding Ordinary Shares increased from 7,035,000 to 42,210,000 as a result of such share split, which became effective on January 7, 2025. |

| | | |

| | (4) | Represents 11,358,000 Ordinary Shares held by 39 record shareholders of our Company, each of which holds less than 5% of our Ordinary Shares as of the date of this prospectus. |

Implications of Our Being an “Emerging Growth Company”

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

| | ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| | | |

| | ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as the “compensation discussion and analysis”; |

| | | |

| | ● | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| | | |

| | ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency,” and “say-on-golden-parachute” votes); |

| | | |

| | ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure; |

| | | |

| | ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and |

| | | |

| | ● | will not be required to conduct an evaluation of our internal control over financial reporting until our second annual report on Form 20-F following the completion of this offering. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions until we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an “emerging growth company” at the end of the fiscal year in which the fifth anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended (the “Securities Act”) occurred, if we have more than $1.235 billion in annual revenue, have $700 million or more in market value of the ADSs held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| | ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

| | ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; |

| | | |

| | ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| | | |

| | ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material non-public information; |

| | | |

| | ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and |

| | | |

| | ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

As a foreign private issuer, Nasdaq corporate governance rules allow us to follow corporate governance practice in our home country, Japan, with respect to appointments to our board of directors and committees. We intend to follow home country practice, as permitted by Nasdaq. See “Risk Factors — Risks Relating to this Offering and the Trading Market — Because we are a foreign private issuer and intend to take advantage of exemptions from certain Nasdaq corporate governance standards applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer” beginning on page 29 of this prospectus. Accordingly, you would not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of Nasdaq.

Controlled Company

Upon completion of this offering, Mr. Hidetoshi Yokoyama, our chairman and representative director, will beneficially own approximately 63.64% of the aggregate voting power of our issued and outstanding Ordinary Shares, assuming no exercise of the Representative’s over-allotment option, or approximately 63.11%, assuming full exercise of the Representative’s over-allotment option. As a result, we will be deemed to be a “controlled company” for the purpose of the Nasdaq listing rules. As a controlled company, we are permitted to elect to rely on certain exemptions from the obligations to comply with certain corporate governance requirements, including the requirements that:

| | ● | a majority of our board of directors consist of independent directors; |

| | | |

| | | our director nominees be selected or recommended solely by independent directors; and |

| | | |

| | ● | we have a nominating and corporate governance committee and a compensation committee that are composed entirely of independent directors with a written charter addressing the purposes and responsibilities of the committees. |

As a foreign private issuer, however, Nasdaq corporate governance rules allow us to follow corporate governance practice in our home country, Japan, with respect to appointments to our board of directors and committees. We intend to follow home country practice as permitted by Nasdaq, rather than rely on the “controlled company” exception to the corporate governance rules. See “Risk Factors—Risks Relating to this Offering and the Trading Market—Because we are a foreign private issuer and intend to take advantage of exemptions from certain Nasdaq corporate governance standards applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer.” Accordingly, you would not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of Nasdaq.

Summary of Risk Factors

Investing in the ADSs involves significant risks. You should carefully consider all of the information in this prospectus before making an investment in the ADSs. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more fully in the section titled “Risk Factors.”

Risks Related to Our Business and Industry

Risks and uncertainties related to our business include, but are not limited to, the following:

| | ● | we have a history of operating losses and will likely incur substantial additional expenses and operating losses in the future. We may continue to be unprofitable for an extended period of time. Management has concluded that there is, and the report of our independent registered public accounting firm contains an explanatory paragraph that expresses, substantial doubt about our ability to continue as a going concern (see the disclosure beginning on page 9 of this prospectus); |

| | | |

| | ● | our limited operating history makes it difficult to evaluate our results of operations and prospects (see the disclosure beginning on page 9 of this prospectus); |

| | | |

| | ● | we have experienced rapid growth in recent periods. If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service or adequately address competitive challenges (see the disclosure beginning on page 10 of this prospectus); |

| | | |

| | ● | during the last two fiscal years, we derived a substantial majority of our revenues from consulting and support services, advertising services, and outsourcing services. While we will not provide advertising services, outsourcing services, and certain consulting and support services going forward, our efforts to increase the sales of the remaining services, as well as Labor Robot and our other products, may not succeed and may reduce our revenue growth rate (see the disclosure beginning on page 11 of this prospectus); |

| | | |

| | ● | we depend on a cloud storage service provider to operate Labor Robot and any disruption in the operation of the cloud storage service provider could adversely affect our business (see the disclosure beginning on page 12 of this prospectus); |

| | | |

| | ● | we are still heavily relying on third-party software development vendors to build our products (see the disclosure beginning on page 12 of this prospectus); and |

| | | |

| | ● | our business could be adversely affected if our customers are not satisfied with the deployment services provided by us or our Certified Consultant partners (see the disclosure beginning on page 14 of this prospectus). |

Risks Relating to this Offering and the Trading Market

In addition to the risks described above, we are subject to general risks and uncertainties related to this offering and the trading market of the ADSs, including, but are not limited to, the following:

| | ● | an active trading market for the ADSs may not develop (see the risk factor beginning on page 21 of this prospectus); |

| | | |

| | ● | you will experience immediate and substantial dilution in the net tangible book value of the Ordinary Shares underlying the ADSs purchased in this offering (see the risk factor beginning on page 22 of this prospectus); |

| | | |

| | ● | after the completion of this offering, share ownership will remain concentrated in the hands of our management, who will continue to be able to exercise a direct or indirect controlling influence on us (see the risk factor beginning on page 23 of this prospectus); |

| | | |

| | ● | the sale or availability for sale of substantial amounts of the ADSs, as well as future issuances of the ADSs or Ordinary Shares or securities convertible into, or exercisable or exchangeable for, ADSs or Ordinary Shares, could adversely affect their market price (see the risk factor beginning on page 23 of this prospectus); |

| | | |

| | ● | the market price of the ADSs may be volatile or may decline regardless of our operating performance, and you may not be able to resell your ADSs at or above the IPO price (see the risk factor beginning on page 23 of this prospectus); |

| | ● | we may experience extreme stock price volatility unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares or the ADSs (see risk factor beginning on page 25 of this prospectus); |

| | | |

| | ● | we do not intend to pay dividends for the foreseeable future (see the risk factor beginning on page 26 of this prospectus); |

| | | |

| | ● | rights of shareholders under Japanese law may be different from rights of shareholders in other jurisdictions (see the risk factor beginning on page 27 of this prospectus); and |

| | | |

| | ● | as holders of ADSs, you may have fewer rights than holders of our Ordinary Shares and must act through the depositary to exercise those rights (see the risk factor beginning on page 27 of this prospectus). |

THE OFFERING

| Securities offered by us | | 2,500,000 ADSs, representing 2,500,000 Ordinary Shares |

| | | |

| Over-allotment option | | We have granted to the Representative an option, exercisable within 45 days from the closing of this offering, to purchase up to an aggregate of 375,000 additional ADSs. |

| | | |

| Price per ADS | | We currently estimate that the IPO price will be in the range of US$4.00 to US$6.00 per ADS. |

| | | |

| Securities offered by Selling Shareholder pursuant to the Resale Prospectus | | 1,800,000 ADSs |

| | | |

| Ordinary Shares outstanding prior to completion of this offering(1) | |

42,210,000 Ordinary Shares |

| | | |

| ADSs outstanding immediately after this offering(1) | | 2,500,000 ADSs, assuming no exercise of the Representative’s over-allotment option and not including the Selling Shareholder ADSs |

| | | |

| | | 2,875,000 ADSs, assuming full exercise of the Representative’s over-allotment option and not including the Selling Shareholder ADSs |

| | | |

| Ordinary Shares outstanding immediately after this offering(1) | | 44,710,000 Ordinary Shares, assuming no exercise of the Representative’s over-allotment option |

| | | |

| | | 45,085,000 Ordinary Shares, assuming full exercise of the Representative’s over-allotment option |

| Listing | | We have applied to have the ADSs listed on Nasdaq. The closing of this offering is conditioned upon Nasdaq’s approval of the listing of the ADSs on Nasdaq, and there is no guarantee or assurance that the ADSs will be approved for listing on Nasdaq. |

| | | |

| Proposed ticker symbol | | “LAWR” |

| | | |

| The ADSs | | Each ADS represents one Ordinary Share. |

| | | |

| | | The depositary or its nominee will be the holder of the Ordinary Shares underlying the ADSs and you will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary, and all holders and beneficial owners of ADSs issued thereunder. |

| | | |

| | | We do not expect to pay dividends in the foreseeable future. If, however, we declare dividends on our Ordinary Shares, the depositary will distribute the cash dividends and other distributions it receives on our Ordinary Shares after deducting its fees and expenses in accordance with the terms set forth in the deposit agreement. |

| | | |

| | | You may surrender your ADSs to the depositary to withdraw the Ordinary Shares underlying your ADSs. The depositary will charge you a fee for such exchange. |

| | | |

| | | We may amend or terminate the deposit agreement for any reason without your consent. Any amendment that imposes or increases fees or charges or which materially prejudices any substantial existing right you have as an ADS holder will not become effective as to outstanding ADSs until 30 days after notice of the amendment is given to ADS holders. If an amendment becomes effective, you will be bound by the deposit agreement as amended if you continue to hold your ADSs. |

| | | |

| | | To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, which will be filed as an exhibit to the registration statement of which this prospectus forms a part. |

| | | |

| Depositary | | The Bank of New York Mellon |

| | | |

| Use of proceeds | | We estimate that we will receive aggregate net proceeds of approximately $7.1 million (or $8.4 million if the Representative exercises its option to purchase additional ADSs in full) from this offering, based on the assumed IPO price of $4.00 per ADS, representing the low point of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for (i) recruiting talent and increasing the number of employees, (ii) investing in the research and development of our new and existing products, (iii) investing in equipment and facilities, including expanding our office to accommodate additional employees, and (iv) working capital and general corporate proposes. See “Use of Proceeds” on page 34 for more information. |

| Lock-up | | We have agreed not to, during the period commencing November 4, 2024 and ending the earlier of 12 months and the closing of this offering, and for a period of 180 days from the date of this prospectus, offer, issue, sell, contract to sell, encumber, grant any option for the sale of, or otherwise dispose of, except in this offering, any of our shares of capital stock or any securities convertible into or exercisable or exchangeable for, or that represent the right to receive, our shares of capital stock or any such substantially similar securities (other than pursuant to employee stock option plans existing on, or upon the conversion or exchange of convertible or exchangeable securities outstanding as of, the date such lock-up agreement was executed), without the prior written consent of the underwriters. Furthermore, each of our directors, officers, and any other holders of five percent (5%) or more of the outstanding Ordinary Shares as of the date of effectiveness of the registration statement of which this prospectus forms a part, have also entered into a similar lock-up agreement for a period of 180 days after the closing of this offering, subject to certain exceptions, with respect to any shares of capital stock of the Company or any securities convertible into or exercisable or exchangeable for shares of the capital stock of the Company. |

| | | |

| Risk factors | | The ADSs offered hereby involve a high degree of risk. You should read “Risk Factors,” beginning on page 9 for a discussion of factors to consider before deciding to invest in the ADSs. |

| | | |

| Payment and Settlement | | The underwriters expect to deliver the ADSs against payment therefor through the facilities of the Depository Trust Company (“DTC”) on [●], 2025. |

| | (1) | The pre-IPO percentages are based upon 42,210,000 Ordinary Shares issued and outstanding as of the date of this prospectus and the post-IPO percentages are based on 44,710,000 Ordinary Shares issued and outstanding after this offering, assuming no exercise of the over-allotment option. |

RISK FACTORS

An investment in the ADSs involves a high degree of risk. Before deciding whether to invest in the ADSs, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of the ADSs to decline, resulting in a loss of all or part of your investment. The risks described below and discussed in other parts of this prospectus are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in the ADSs if you can bear the risk of loss of your entire investment.

Risks Related to Our Business and Industry

We have a history of operating losses and will likely incur substantial additional expenses and operating losses in the future. We may continue to be unprofitable for an extended period of time. Management has concluded that there is, and the report of our independent registered public accounting firm contains an explanatory paragraph that expresses, substantial doubt about our ability to continue as a “going concern.”

We had a loss of JPY277,671 thousand ($1.9 million) and JPY235,683 thousand ($1.6 million) for the six months ended September 30, 2024 and 2023, respectively. This operating loss has resulted in an accumulated deficit of JPY1,525,471 thousand ($10.6 million) and JPY821,517 thousand ($5.7 million) as of September 30, 2024 and 2023, respectively. We had a loss of JPY661,966 thousand ($4.4 million) and JPY478,633 thousand ($3.2 million) for the fiscal years ended March 31, 2024 and 2023, respectively. This operating loss has resulted in an accumulated deficit of JPY1,247,800 thousand ($8.3 million) and JPY585,834 thousand ($3.9 million) as of March 31, 2024 and 2023, respectively. These factors raise substantial doubt regarding our ability to continue as a going concern.

We may consider obtaining additional financing in the future through the issuance of our Ordinary Shares, through other equity or debt financings, or other means. However, we are dependent upon its ability to obtain new revenue generating customer contracts, secure equity and/or debt financing and there are no assurances that we will be successful. As a result of the above, there is material uncertainty related to events or conditions that may cast significant doubt (or raise substantial doubt as contemplated by PCAOB standards) on our ability to continue as a going concern, and therefore, that we may be unable to realize our assets and discharge our liabilities in the normal course of business. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. If we were not able to continue as a going concern, or if there were continued doubt about our ability to do so, the value of your investment would be materially and adversely affected.

Our limited operating history makes it difficult to evaluate our results of operations and prospects.

We have only been in operation since 2020 and, therefore, have limited operating history with respect to each of our principal products. We commenced selling our Labor Robot in September 2022. The number of Labor Robot users grew to 261 users as of March 31, 2023, and to 483 users as of March 31, 2024, with 222 new users added during the fiscal year ended March 31, 2024. The number of Labor Robot users further grew to 513 as of September 30, 2024, with 30 new users added during the six months ended September 30, 2024. While we concurrently provide e-learning services and software installation services, we promote Labor Robot as our principal product. During the six months ended September 30, 2024 and 2023, the percentage of revenue accounted for by such discontinued products and services was nil and 66.6%, respectively. During the fiscal years ended March 31, 2024 and 2023, the percentage of revenue that accounted for the products and services we ceased to operate was 48.48% and 81.48%, respectively. Since we have terminated products and services which had significantly generated revenue during the last two fiscal years, our future success will require us to further expand our customer and user base and scale up the sales of Labor Robot, e-learning services, software installation services, and our new products. Our business model and ability to attract more customers are unproven. To address the risks, we must, among other things, continue to (i) expand our sales and distribution channel, (ii) maintain and further develop business relationships with our existing and potential customers, and (iii) improve public relations and brand awareness and enhance customer loyalty. We cannot assure you that we will be successful in addressing such risks. Although we have experienced revenue growth, given that we discontinued products and services which had significantly generated revenues during the last two fiscal years, we cannot assure you that our revenue will increase at previous rates or at all, or that we will be able to operate profitably in future periods. Our limited operating history makes the prediction of future results of operations difficult, and therefore, past revenue growth experienced by us should not be taken as indicative of the rate of revenue growth, if any, that can be expected in the future. We believe that period to period comparisons of our operating results are not meaningful and that the results for any period should not be relied upon as an indication of future performance. You should consider our business and prospects in light of the risks, uncertainties, expenses, and challenges that we will face as an early-stage company seeking to sell new products in a volatile and challenging market.

The markets in which we participate are intensely competitive, and if we do not compete effectively, our operating results could be adversely affected.

The markets for human resource and financial management platforms, business-to-business e-learning, and other digital transformation-related consulting services for small and medium-sized businesses in Japan are highly competitive, with relatively low barriers to entry. Our primary competitors in the Japanese market for Labor Robot are Yayoi Co., Ltd. (“Yayoi”) and freee K.K. (“freee”), well-established providers of human resource and financial management platforms, which have long-standing relationships with many customers. Other competitors include Jobcan, operated by Donuts Co., Ltd. and SmartHR. Inc. Prospective customers may be hesitant to adopt a cloud-based platform such as ours and may prefer to upgrade the more familiar applications offered by these vendors that are deployed on their premises. For other services, our competitors include WriteUp Co., Ltd., a company listed on the Tokyo Stock Exchange, which similarly offers products and services, including AI-related e-learning courses and grant and subsidy application support for small and medium-sized businesses.

These competitors are larger companies and have greater brand recognition, much longer operating histories, larger marketing budgets and significantly greater resources than we do. These vendors, as well as other competitors, may offer products and services on a stand-alone basis at a low price or bundled as part of a larger product sale. In order to take advantage of customer demand for their products and services, they may have greater capacity to expand their products and services through acquisitions and organic development.

We also face competition from large national and overseas cloud-based accounting platform service providers have also started to enter into the Japanese market, such as QuickBooks. We may also face competition from a variety of vendors of cloud-based and on premises software applications that address only a portion of one of our applications. In addition, other companies that provide cloud-based applications in different target markets, such as Salesforce.com and NetSuite, may develop applications or acquire companies that operate in our target markets, and some potential customers may elect to develop their own internal applications. With the introduction of new technologies and market entrants, we expect this competition to intensify in the future.

Many of our competitors are able to devote greater resources to the development, promotion and sale of their products and services. Furthermore, our current or potential competitors may be acquired by third parties with greater available resources and the ability to initiate or withstand substantial price competition. In addition, many of our competitors have established marketing relationships, access to larger customer bases and major distribution agreements with consultants, system integrators and resellers. Our competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their product offerings or resources. If our competitors’ products, services, or technologies become more accepted than our products or services, if they are successful in bringing their products or services to market earlier than ours, or if their products or services are more technologically capable than ours, then our revenues could be adversely affected. In addition, some of our competitors may offer their products and services at a lower price. If we are unable to achieve our target pricing levels, our operating results would be negatively affected. Pricing pressures and increased competition could result in reduced sales, reduced margins, losses or a failure to maintain or improve our competitive market position, any of which could adversely affect our business.

We have experienced rapid growth in recent periods. If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service or adequately address competitive challenges.

We have recently experienced a period of rapid growth in the number of users for Labor Robot. In particular, since the launch of Labor Robot in September 2022, our user base increased from zero to 261 as of March 31, 2023, and further to 483 users as of March 31, 2024, with 222 new users added during the fiscal year ended March 31, 2024. The number of Labor Robot users further grew to 513 as of September 30, 2024, with 30 new users added during the six months ended September 30, 2024. We anticipate that we will significantly expand our operations and headcount in the near term. This growth has placed, and future growth will place, a significant strain on our management, administrative, operational and financial infrastructure. Our success will depend in part on our ability to manage this growth effectively. To manage the expected growth of our operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. Failure to effectively manage growth could result in difficulty or delays in deploying customers, declines in quality or customer satisfaction, increases in costs, difficulties in introducing new features or other operational difficulties, and any of these difficulties could adversely impact our business performance and results of operations.

If the market for cloud-based accounting and human resource software develops more slowly than we expect or declines, our business could be adversely affected.

The cloud-based accounting and human resource software market is not as mature as the market for on premises enterprise software, especially in the Japanese market. See “Business—Market Opportunity.” It is uncertain whether cloud-based software for enterprise will achieve and sustain high levels of customer demand and market acceptance. Our success will depend to a substantial extent on the widespread adoption of cloud computing in general, and of human resource and financial management services in particular.

Many enterprises have invested substantial personnel and financial resources to integrate traditional enterprise software into their businesses, and therefore may be reluctant or unwilling to migrate to cloud-based software. It is difficult to predict customer adoption rates and demand for our products, the future growth rate and size of the cloud-based software market, or the entry of competitive products. The expansion of the cloud-based software market depends on a number of factors, including the cost, performance, and perceived value associated with cloud-based software, as well as the ability of cloud-based software companies to address security and privacy concerns. If other cloud-based software providers experience security incidents, loss of customer data, disruptions in delivery or other problems, the market for cloud-based software products as a whole, including our products, may be negatively affected. If cloud-based software does not achieve widespread adoption, or there is a reduction in demand for cloud-based software caused by a lack of customer acceptance, technological challenges, weakening economic conditions, security or privacy concerns, competing technologies and products, decreases in corporate spending or otherwise, it could result in decreased revenues and our business could be adversely affected.

During the last two fiscal years, we derived a substantial majority of our revenues from consulting and support services, advertising services, and outsourcing services. While we will not provide advertising services, outsourcing services, and certain consulting and support services going forward, our efforts to increase the sales of the remaining services, as well as Labor Robot and our other products, may not succeed and may reduce our revenue growth rate.

During the last two fiscal years, we derived a substantial majority of our revenues from consulting and support services, advertising services, and outsourcing services, while endeavoring to increase the sales of Labor Robot, our principal product. While we have decided not to provide advertising services, outsourcing services, and certain consulting and support services, including IT system installation subsidy application consulting and support services and e-commerce store set-up services as of the fiscal year beginning April 1, 2024, we have determined to focus our efforts on expanding the sales of e-learning services, software installation services, and Labor Robot. Any factor adversely affecting sales of the remaining services and Labor Robot, including market acceptance, product competition, performance and reliability, reputation, price competition, and economic and market conditions, could adversely affect our business and operating results. Our participation in the markets for the products and services we are developing or have just launched, such as e-learning services and metaverse-related services, is relatively new, and it is uncertain whether these areas will ever result in significant revenues for us. Further, the introduction of new products and services beyond these markets may not be successful.

If we are not able to provide successful enhancements, new features and modifications, our business could be adversely affected.

If we are unable to provide enhancements and new features for Labor Robot, our current services, or new products and services we may develop in the future that achieve market acceptance or that keep pace with rapid technological developments, our business could be adversely affected. For example, we are focused on enhancing the features and functionality of Labor Robot to improve their utility to larger user base. The success of enhancements, new features and products depends on several factors, including the timely completion, introduction and market acceptance of the enhancements or new features or products. Failure in this regard may significantly impair our revenue growth. We may not be successful in either developing these modifications and enhancements or in bringing them to market in a timely fashion. Furthermore, uncertainties about the trends in digital transformation, AI, and the metaverse, the timing and nature of new network platforms or technologies, or modifications to existing platforms or technologies, could increase our research and development expenses. Any failure of our products and services to operate effectively with future digital transformation trends, network platforms or technologies could reduce the demand for our products and services, result in user dissatisfaction and adversely affect our business.

If our security measures are breached or unauthorized access to user data is otherwise obtained, Labor Robot may be perceived as not being secure, customers may reduce the use of or stop using our products and services and we may incur significant liabilities.

Labor Robot and e-learning service involve the storage and transmission of customers’ proprietary information, including personal or identifying information regarding their employees, customers and suppliers, as well as their finance and payroll data. As a result, unauthorized access or security breaches could result in the loss of information, litigation, indemnity obligations and other liability. On May 10, 2024, we adopted a comprehensive information security policy that established internal rules regarding information asset management, including authorization for, and access to, digital storage and physical premise storing information, infrastructure operation and management, and software development management and vendor selection security procedures. The policy also established an information security committee responsible for formulating, monitoring, and reviewing our information security measures and relevant guidelines. The current committee consists of Mr. Tomoya Suzuki, our director and chief technology officer, serving as the information security manager; Mr. Amit Takur, our director and chief executive officer, serving as the information security inspector; and Mr. Tomoya Matsuura, our executive officer. According to the policy, the information security manager monitors relevant cybersecurity threats and trends in personal information protection and timely report them to the information security committee. Our information security inspector shall review this policy’s implementation annually and report his findings to the information security committee. Based on these findings, the committee shall formulate necessary improvement plans. In the event of a cybersecurity incident, Mr. Hidetoshi Yokoyama, our representative director, assumes the top leadership role, and Mr. Tomoya Suzuki acts as an incident response manager. Regardless of the policy, we have always used our best efforts to maintain appropriate service agreements with our third-party software vendors and cloud service providers to maintain the uninterrupted use of our products and services and protect customers’ data. We also endeavor to ensure through these agreements that the cloud services are sufficiently isolated, and the data are securely stored with necessary encryptions. Our chief technology officer and head of management are responsible for monitoring the execution of these agreements.

Although we have security measures in place to protect customer information and prevent data loss and other security breaches, if these measures are breached as a result of third-party actions, employee errors, malfeasance or otherwise, and someone obtains unauthorized access to customers’ data, our reputation could be damaged, our business may suffer and we could incur significant liability. Because we fully rely on our cloud service providers to maintain the server’s cybersecurity, we may be unable to timely or adequately address cybersecurity threats sufficiently and efficiently without the providers’ support. See “—We depend on a cloud storage service provider to operate Labor Robot and any disruption in the operation of the cloud storage service provider could adversely affect our business.” If someone obtains unauthorized access to customers’ data or we lose customers’ data, our reputation could be damaged, our business may suffer and we could incur significant liability. Because the techniques used to obtain unauthorized access or sabotage systems change frequently and generally are not identified until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. Any or all of these issues could negatively affect our ability to attract new customers, result in reputational damage or subject us to third-party lawsuits, regulatory fines or other action or liability, which could adversely affect our operating results.

We depend on a cloud storage service provider to operate Labor Robot and any disruption in the operation of the cloud storage service provider could adversely affect our business.

We host Labor Robot and serve all of its users by using Amazon Web Services (“AWS”), whose data center is located in the region called AWS Tokyo Region, which includes Tokyo and Chiba. We also host our e-learning services with IT Bee Inc., a Japanese corporation providing one-stop services for consultancy, development, and operation of e-learning products. While we control and have access to our files and data that are located in AWS, we do not control the operation of these facilities. Since the cloud server is located at our cloud storage service provider’s facilities, we fully rely on the provider’s service support to maintain the server and its infrastructure, including cybersecurity protection and recovery resulting from server failure. The server performance may also temporarily deteriorate since hosting infrastructure is also employed to serve the significant number of our cloud storage service provider’s users. Our cloud storage service provider has no obligation to renew a cloud storage service agreement with us on commercially reasonable terms, or at all. If we are unable to renew the agreement on commercially reasonable terms, or if our cloud storage service provider is acquired, we may be required to transfer our servers and other infrastructure to new data center facilities, and we may incur significant costs and possible service interruption in connection with doing so.

Any problems faced by our cloud storage service provider, with the telecommunications network providers with whom we or they contract, or with the systems by which our telecommunications providers allocate capacity among their customers, including us, could adversely affect the experience of our customers. Our cloud storage service provider may decide to terminate their service without adequate notice. In addition, any financial difficulties, such as bankruptcy, faced by our cloud storage service provider or any of the service providers with whom we or it contract may have negative effects on our business, the nature and extent of which are difficult to predict. Additionally, if our cloud storage service provider is unable to keep up with our growing needs for capacity, this could have an adverse effect on our business. Any changes in third-party service levels at our cloud storage service provider’s server or any errors, defects, disruptions, or other performance problems with our products could adversely affect our reputation and may damage customers’ stored files or result in lengthy interruptions in our services. Interruptions in our services might reduce our revenues, subject us to potential liability, or adversely affect our future sales.

Furthermore, our accounting features in Labor Robot may play an important role in its users’ financial projections, reporting and compliance programs. Although we clearly indicate in the Labor Robot software licensing agreement that we are not liable for any damages arising from the use of Labor Robot, any interruption in our service may affect the availability, accuracy or timeliness of these programs and could damage our reputation, cause users to terminate their use of our software, require us to indemnify users against certain losses and prevent us from gaining additional business from current or future users.

We are still heavily relying on third-party software development vendors to build our products.

During the six months ended September 30, 2024 and 2023, we spent 10.2% and 18.8% of our supply costs to outsource the software development of our products and services to third-party vendors, respectively. During the fiscal years ended March 31, 2024 and 2023, we spent 8.7% and 28.8% of our supply cost to outsource the software development of our products and services to third-party vendors, respectively. As we train our focus on legal technology and metaverse-related business, we are building our research and development team and hiring more engineers. Nevertheless, our team is still small, and we might need to incur substantial costs to develop additional features in Labor Robot or to develop new products or services. When negotiating development outsourcing agreements, we might be unable to have our software development vendors transfer the intellectual property rights to us. We may need to obtain licenses from such vendors, which may restrict the use of software and prevent us from further developing new intellectual properties based on the existing software. Moreover, if we are unsuccessful in obtaining the intellectual property rights to such software, we may not be able to prevent such software from being made available to our competitors. These restrictions and limitations may affect our ability to rapidly introduce new features in our products, and therefore could adversely affect the competitiveness of our products and services.

We plan to incorporate AI technologies into some of our products and services, which may present operational and reputational risks.

As of the date of this prospectus, we have not incorporated AI technologies into our products; however, we intend to incorporate AI technologies into our future products and services. Specifically, we plan to use API connecting Robot Lawyer with large language models (LLMs), such as ChatGPT. See “Business—Our Growth Strategies— Expansion into metaverse business in Japan through ‘Robot Lawyer,’” and “Business—Research and Development.” We also invested in the development of Junior Lawyer X by CJK Group, where CJK Group employs AI technology in designing Junior Lawyer X. See “Business—Our Growth Strategies— Collaboration with CJK Group to launch ‘Junior Lawyer X’ in the U.S. market.”

As with many innovations, there are associated risks involved in utilizing AI technology. Although we believe that overall testing results of our products are improving and show promise, no assurance can be provided that our use of such AI will eventually produce the intended results. Even if it could produce such intended results, we cannot guarantee that such AI will not produce errors going forward. AI, particularly generative AI, has been known to produce false or “hallucinatory” inferences or outputs. AI can also present ethical issues and may subject us to new or heightened legal, regulatory, ethical, or other challenges. Inappropriate or controversial data practices by developers and end-users, or other factors adversely affecting public opinion of AI, could impair the acceptance of AI solutions, including those incorporated in our products and services. If the AI tools that we use are deficient, inaccurate, or controversial, we could incur operational inefficiencies, competitive harm, legal liability, brand or reputational harm, or other adverse impacts on our business and financial results.

Additionally, CJK Group has incorporated machine learning models in its Junior Lawyer X. If the machine learning models are incorrectly designed, the data CJK Group uses to train them is incomplete, inadequate, or biased in some way, or CJK Group does not have sufficient rights to use the data on which its machine learning models rely, the performance of Junior Lawyer X and the profit we may earn from the profit-sharing scheme could suffer.