Filed Pursuant to Rule 424(b)(5)

Registration No. 333-277384

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 27, 2024)

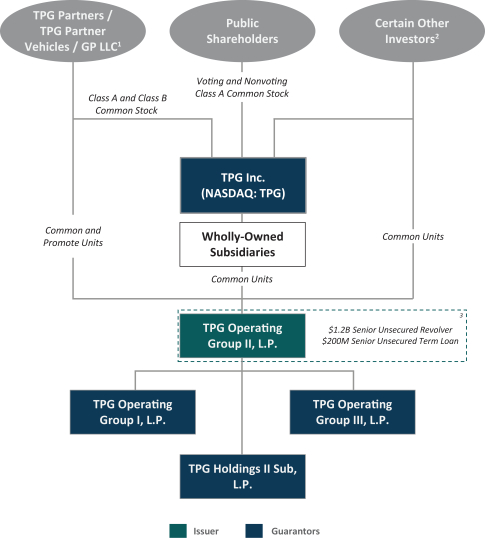

TPG Operating Group II, L.P.

$400,000,000 6.950% Fixed-Rate Junior Subordinated Notes Due 2064

Fully and unconditionally guaranteed, as described herein, by

TPG Inc.

TPG Operating Group I, L.P.

TPG Operating Group III, L.P.

TPG Holdings II Sub, L.P.

TPG Operating Group II, L.P. (the “Issuer”) is offering $400,000,000 aggregate principal amount of its 6.950% Fixed-Rate Junior Subordinated Notes due 2064 (the “notes”).

The notes will be fully and unconditionally guaranteed on a joint, several and subordinated basis by TPG Inc. (“TPG”), TPG Operating Group I, L.P. (“TOG I”), TPG Operating Group III, L.P. (“TOG III”), TPG Holdings II Sub, L.P. (“H2Sub”) and any other entity that becomes a guarantor of the notes as provided under “Description of the Notes—Guarantees” (collectively, the “Guarantors”). The Issuer and certain Guarantors are holding partnerships or companies. The notes will mature on March 15, 2064.

We intend to use the net proceeds from this offering, together with the net proceeds from the concurrent offering (as defined herein), to repay all or a portion of outstanding debt under our Senior Unsecured Revolving Credit Facility and Senior Unsecured Term Loan (each as defined herein) and for general corporate purposes. See “Use of Proceeds.”

The notes will bear interest from and including March 4, 2024 at an annual rate of 6.950%. Interest on the notes will be payable quarterly in arrears on March 15, June 15, September 15 and December 15 of each year, beginning on June 15, 2024 subject to the Issuer’s right, on one or more occasions, to defer the payment of interest on the notes for up to five consecutive years (each such period, an “optional deferral period”). During an optional deferral period, interest will continue to accrue on the notes, and deferred interest payments will accrue additional interest at a rate equal to the interest rate on the notes, compounded quarterly as of each interest payment date to the extent permitted by applicable law. See “Description of the Notes—Option to Defer Interest Payments.” The Issuer may redeem the notes at the redemption prices and times described in this prospectus supplement under “Description of the Notes—Optional Redemption of the Notes.”

The notes and the guarantees will be the Issuer’s and the Guarantors’ unsecured and subordinated obligations and will (a) be subordinate and rank junior in right of payment to all existing and future Senior Indebtedness (as defined in “Description of the Notes—Subordination”) of the Issuer or the relevant Guarantor, including indebtedness under the Credit Agreements (as defined herein), (b) rank equally in right of payment with all existing and future Parity Indebtedness (as defined in “Description of the Notes—Subordination”) of the Issuer or the relevant Guarantor, (c) be effectively subordinated to all existing and future secured indebtedness of the Issuer or the relevant Guarantor, to the extent of the value of the assets securing that indebtedness and (d) be effectively subordinated in right of payment to all existing and future indebtedness, liabilities and other obligations of each subsidiary of the Issuer or the relevant Guarantor that is not itself the Issuer or a Guarantor. See “Description of the Notes—Subordination.”

The notes will be issued in book-entry form in denominations of $25 and multiples of $25 in excess thereof.

We intend to apply to list the notes on NASDAQ Global Select Market (“NASDAQ”) under the symbol “TPGXL.” If approved for listing, we expect trading of the notes to commence within 30 days after they are first issued. For a more detailed description of the notes, see “Description of the Notes.”

Investing in the notes involves risks. See “Risk Factors” beginning on page S-24 and in the documents we have incorporated by reference herein. Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Note | | | Total | |

Price to public(1) | | $ | 25.00 | | | $ | 400,000,000 | |

Underwriting discount(2) | | $ | 0.5683 | | | $ | 9,092,500 | |

Proceeds, before expenses, to us | | $ | 24.4317 | | | $ | 390,907,500 | |

| (1) | Plus accrued interest, if any, from March 4, 2024. |

| (2) | Reflects $95,000,000 aggregate principal amount of notes sold to retail investors, for which the underwriters received an underwriting discount of $0.7875 per note, and $305,000,000 aggregate principal amount of notes sold to institutional investors, for which the underwriters received an underwriting discount of $0.5000 per note. Underwriting discount per note is calculated using a weighted average underwriting discount for retail and institutional investors. See “Underwriting (Conflicts of Interest)” for more information. |

We expect to deliver the notes to purchasers on or about March 4, 2024, only in book-entry form through the facilities of The Depository Trust Company, for the account of its participants, including Clearstream Banking S.A. and Euroclear Bank S.A./N.V.

Joint Book-Running Managers

| | | | | | | | |

| Morgan Stanley | | BofA Securities | | UBS Investment Bank | | Wells Fargo Securities | | Goldman Sachs & Co. LLC |

Co-Managers

| | | | | | | | | | | | |

| TPG Capital BD, LLC | | J.P. Morgan | | Barclays | | Deutsche Bank Securities | | HSBC | | Loop Capital Markets | | TD Securities |

| | | | | | |

| US Bancorp | | Citigroup | | SMBC Nikko | | Academy Securities | | Cabrera Capital Markets LLC | | Siebert Williams Shank | | Stern |

The date of this prospectus supplement is February 28, 2024.