As filed with the U.S. Securities and Exchange Commission on February 7, 2025.

Registration No. 333-[•]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

AMBITIONS ENTERPRISE MANAGEMENT CO. L.L.C

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s Name into English)

____________________

Cayman Islands | | 7900 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

630 Business Village Block B

Port Saeed Deira, Dubai

United Arab Emirates

+97 142282568

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

____________________

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

____________________

Copies of all communications, including communications sent to agent for service, should be sent to:

Ying Li, Esq.

Guillaume de Sampigny, Esq.

Hunter Taubman Fischer & Li LLC

950 Third Avenue, 19th Floor

New York, NY 10022

212-530-2206 | | William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Yuning “Grace” Bai, Esq.

Ortoli Rosenstadt LLP

366 Madison Ave 3rd Floor

New York, NY 10017

212-588-0022 |

____________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box, and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box, and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION | | PRELIMINARY PROSPECTUS DATED FEBRUARY 7, 2025 |

Class A Ordinary Shares

AMBITIONS ENTERPRISE MANAGEMENT CO. L.L.C

We are offering class A ordinary shares, $0.0000001 par value per share (“Class A Ordinary Shares”) of AMBITIONS ENTERPRISE MANAGEMENT CO. L.L.C, a Cayman Islands holding company. Prior to this offering, there has been no public market for our Class A Ordinary Shares or our class B ordinary shares, par value $0.0000001 per share (“Class B Ordinary Shares”). It is currently estimated that the initial public offering price of our Class A Ordinary Share will be in the range of $4.00 and $5.00 per Class A Ordinary Share.

We have applied to list our Class A Ordinary Shares on the Nasdaq Capital Market (“Nasdaq”), under the symbol “AHMA.” At this time, Nasdaq has not yet approved our application to list our Class A Ordinary Shares. The closing of this offering is conditioned upon Nasdaq’s final approval of our listing application, and there is no guarantee or assurance that our Class A Ordinary Shares will be approved for listing on Nasdaq.

Our authorized share capital is $50,000 divided into 399,966,500,000 Class A Ordinary Shares and 100,033,500,000 Class B Ordinary Shares. As of the date of this prospectus, we have 16,500,000 Class A Ordinary Shares and 33,500,000 Class B Ordinary Shares issued and outstanding, respectively. Holders of Class A Ordinary Shares and Class B Ordinary Shares have the same rights except for voting and conversion rights. Holders of Class A Ordinary Shares and Class B Ordinary Shares shall at all times vote together as one class on all resolutions submitted to a vote by the shareholders. Each Class A Ordinary Share shall entitle the holder thereof to one vote on all matters subject to vote at general meetings of our Company, and each Class B Ordinary Share shall entitle the holder thereof to 15 votes on all matters subject to vote at general meetings of our Company. Each Class B Ordinary Share is convertible into one Class A Ordinary Share at any time at the option of the holder thereof. In no event shall Class A Ordinary Shares be convertible into Class B Ordinary Shares.

We are not an operating company but a Cayman Islands holding company with operations conducted by our subsidiaries. Investors in our Class A Ordinary Shares thus are purchasing an equity interest in a Cayman Islands holding company. We hold equity interests in our subsidiaries and do not operate business through variable interest entities. As used in this prospectus, “Ambitions,” “we,” “us,” “our,” “the Company,” or “our Company” refers to AMBITIONS ENTERPRISE MANAGEMENT CO. L.L.C. This structure involves unique risks to investors. As a holding company, we may rely on dividends from our subsidiaries for our cash requirements, including any payment of dividends to our shareholders. The ability of our subsidiaries to pay dividends to us may be restricted by the debt they incur on their own behalf or laws and regulations applicable to them.

Investing in the Class A Ordinary Shares involves risks. See section titled “Risk Factors” of this prospectus, beginning on page 11.

We are both an “emerging growth company” and a “foreign private issuer” under applicable U.S. Securities and Exchange Commission (the “SEC”) rules and will be eligible for reduced public company disclosure requirements. See section titled “Prospectus Summary — Implications of Being an ‘Emerging Growth Company’ and a ‘Foreign Private Issuer’” for additional information.

As of the date of this prospectus, our Chairman of the Board of Directors, Director, and Chief Executive Officer, Mr. Zhengang Tang, beneficially holds 12,450,000 Class A Ordinary Shares and 23,450,000 Class B Ordinary Shares, which represent 75.45% and 70%, respectively, of our issued and outstanding Class A Ordinary Shares and Class B Ordinary Shares, and collectively represent approximately 70.17% of the aggregate voting power of our issued and outstanding share capital. Following the completion of this offering, Mr. Tang will beneficially hold Class A Ordinary Shares (assuming no exercise of the over-allotment option by the underwriters) and 23,450,000 Class B Ordinary Shares, which will represent % and 70%, respectively, of our then issued and outstanding Class A Ordinary Shares and Class B Ordinary Shares, and collectively represent approximately % of the aggregate voting power of our then issued and outstanding share capital. As such, we may be deemed a “controlled company” under Nasdaq Marketplace Rules 5615(c). See “Prospectus Summary — Controlled Company.” Accordingly, Mr. Tang will have the ability to determine all matters requiring approval by shareholders, including mergers, consolidations, amendment to our memorandum and articles of association and other corporate actions that require shareholders’ approval under Cayman Islands law. See “Principal Shareholders.” As such, we will be deemed a “controlled company” under Nasdaq Marketplace Rules 5615(c). However, even if we are deemed a “controlled company,” we do not intend

Table of Contents

to avail ourselves of the corporate governance exemptions afforded to a “controlled company” under the Nasdaq Listing Rules. See “Risk Factors — Risks Relating to this Offering and the Trading Market — Our Chairman of the Board of Directors has substantial influence over our company. His interests may not be aligned with the interests of our other shareholders, and he could prevent or cause a change of control or other transactions.”

Neither the SEC nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per Share | | No Exercise of

Over-allotment

Option | | Full Exercise of

Over-allotment

Option |

Initial public offering price(1) | | $ | | | $ | | | $ | |

Underwriting discounts(2) | | $ | | | $ | | | $ | |

Proceeds to us before expenses(3) | | $ | | | $ | | | $ | |

In addition to the underwriting discounts listed above, upon closing of this offering, we have agreed to issue the Representative or its designees, up to warrants equal to 1% of the total numbers of Class A Ordinary Shares issued in the offering (including any Class A Ordinary Shares sold as a result of the exercise of the underwriters’ over-allotment option) (the “Representative’s Warrants”), exercisable at any time and from time to time, in whole or in part, during the four and a half-year period commencing six months immediately following the date of commencement of sales of the securities issued in this offering, at a per share price equal to 120% of the initial public offering price. The registration statement of which this prospectus forms a part also covers the Representative’s Warrants and the Class A Ordinary Shares issuable upon the exercise thereof.

This offering is being conducted on a firm commitment basis. We have granted the underwriters an option for a period of forty-five (45) days from the date of this prospectus to purchase up to fifteen percent (15%) of the total number of the Class A Ordinary Shares to be offered by us pursuant to this offering (excluding Class A Ordinary Shares subject to this option), solely for the purpose of covering over-allotments, at the initial public offering price less the underwriting discounts. If we complete this offering, net proceeds will be delivered to us on the closing date.

The underwriters expect to deliver the Class A Ordinary Shares against payment in U.S. dollars in New York, NY on or about , 2025.

Prospectus dated , 2025

Table of Contents

TABLE OF CONTENTS

For investors outside the United States: neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Class A Ordinary Shares and the distribution of this prospectus outside the United States.

Neither we nor the underwriters have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any amendment or supplement to this prospectus, or in any free writing prospectus we have prepared, and neither we nor the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information others may give you. Neither we nor the underwriters are making an offer to sell, or seeking offers to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date on the cover page of this prospectus, regardless of the time of delivery of this prospectus or the sale of Class A Ordinary Shares, our business, financial condition, results of operations and prospects may have changed since the date on the cover page of this prospectus.

i

Table of Contents

CONVENTIONS WHICH APPLY TO THIS PROSPECTUS

Throughout this prospectus, we use a number of key terms and provide a number of key performance indicators used by management. Unless the context otherwise requires, the following definitions apply throughout where the context so admits:

“AED” | | : | | United Arab Emirates Dirham, the lawful currency of the UAE (defined below). |

“Ambitions Dubai” | | : | | AMBITIONS ENTERPRISE MANAGEMENT CO. L.L.C, a wholly-owned subsidiary of the Company incorporated under UAE laws on October 26, 2023. |

“Amended and Restated Memorandum and Articles” | | : | | The amended and restated memorandum and articles of association of the Company as adopted by the Company on September 30, 2024. |

“Board” or “Board of Directors” | | : | | The board of Directors (defined below) of our Company (defined below). |

“Class A Ordinary Shares” | | : | | Class A ordinary shares of the Company, par value $0.0000001 per share. |

“Class B Ordinary Shares” | | : | | Class B ordinary shares of the Company, par value $0.0000001 per share. |

“Company” | | : | | AMBITIONS ENTERPRISE MANAGEMENT CO. L.L.C, an exempted company incorporated with limited liability under the laws of the Cayman Islands on November 2, 2023. |

“COVID-19” | | : | | Coronavirus disease 2019. |

“Directors” | | : | | The directors of our Company. |

“Executive Officers” | | : | | The executive officers of our Company. See “Management.” |

“Fiscal Year” or “FY” | | : | | The financial year ended or, as the case may be, ending December 31. |

“Group” | | : | | The Company and its subsidiaries. |

“GCC” | | : | | Gulf Cooperation Council. |

“Hunter Dubai” | | : | | HUNTER INTERNATIONAL TRAVEL & TOURISM L.L.C, a wholly-owned subsidiary of Ambitions Dubai incorporated under UAE laws on October 10, 2007. |

“Listing” | | : | | The listing and quotation of the Class A Ordinary Shares on Nasdaq. |

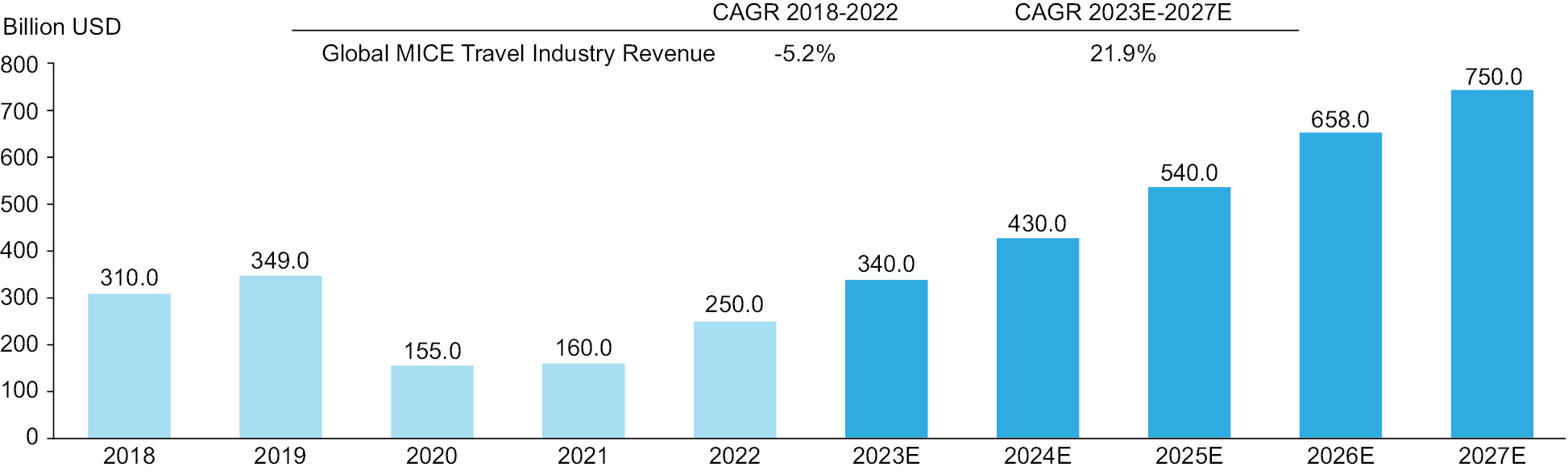

“MICE” | | : | | An acronym that stands for meetings, incentives, conferences, and exhibitions, which refers to a sector of the tourism industry that organizes, manages, and hosts events for business or academic purposes. |

“Multiple Dubai” | | : | | MULTIPLE EVENTS, a wholly-owned subsidiary of Ambitions Dubai incorporated under UAE (defined below) laws on March 16, 2008. |

“Nasdaq” | | : | | Nasdaq Capital Market. |

“Nasdaq Listing Rules” | | : | | The Nasdaq rules governing listed companies. |

“Offering” | | : | | The Offering of Class A Ordinary Shares by the underwriter on behalf of our Company for subscription at the Offering Price (defined below), subject to and on the terms and conditions set out in this prospectus. |

“Offering Price” | | : | | US$ for each Class A Ordinary Share being offered in this Offering. |

“Ordinary Share(s)” | | : | | Class A Ordinary Shares and Class B Ordinary Shares, collectively. |

“UAE” | | : | | United Arab Emirates. |

“U.S. GAAP” | | : | | Accounting principles generally accepted in the United States of America |

“US$” or “$” | | : | | U.S. dollars and cents respectively, the lawful currency of the U.S. |

ii

Table of Contents

Any discrepancies in the tables included herein between the total sum of amounts listed and the totals thereof are due to rounding. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

Unless the context otherwise requires, a reference to “Ambitions,” “we,” “our,” “us,” “our Company,” or “the Company” or their other grammatical variations is a reference to AMBITIONS ENTERPRISE MANAGEMENT CO. L.L.C. The Company, Hunter Dubai, and Multiple Dubai are collectively referred to as the “Group.”

Certain of our customers and suppliers are referred to in this prospectus by their trade names. Our contracts with these customers and suppliers are typically with an entity or entities in the relevant customer or supplier’s group of companies.

Internet site addresses in this prospectus are included for reference only and the information contained in any website, including our website, is not incorporated by reference into, and does not form part of, this prospectus.

iii

Table of Contents

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus includes trademarks, trade names and service marks, certain of which belong to us, including our logo, and others that are the property of other organizations. Solely for convenience, the trademarks, service marks, logos and trade names referred to in this prospectus are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

This prospectus contains additional trademarks, service marks and trade names of others. All such trademarks, service marks and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights, or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iv

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our Class A Ordinary Shares. For a more complete understanding of us and this Offering, you should read and carefully consider the entire prospectus, including the more detailed information set forth under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our combined financial statements and the related notes. Some of the statements in this prospectus are forward-looking statements. See section titled “Special Note Regarding Forward-Looking Statements.

Business Overview

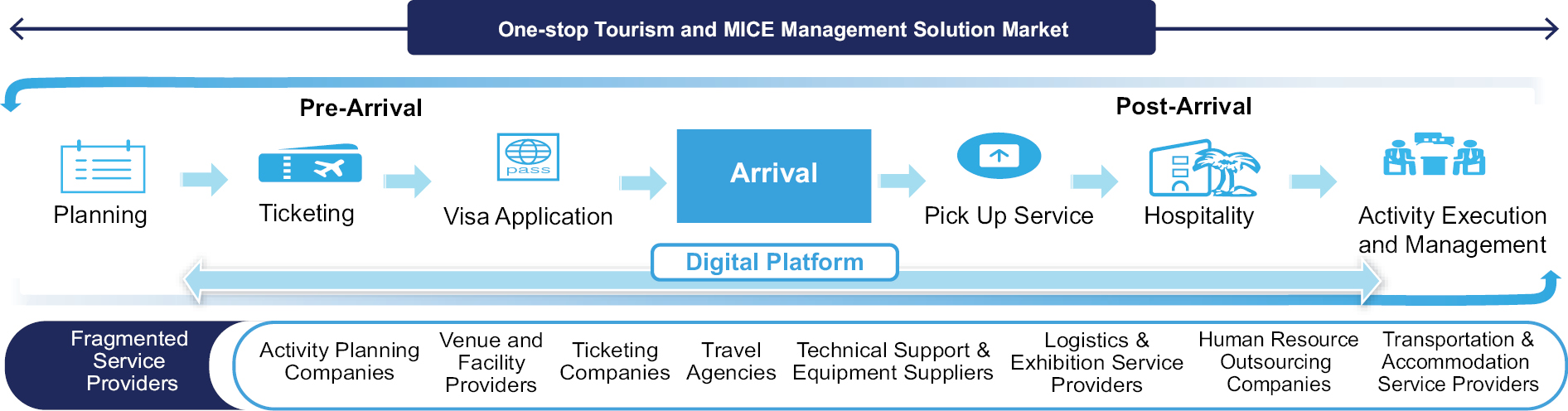

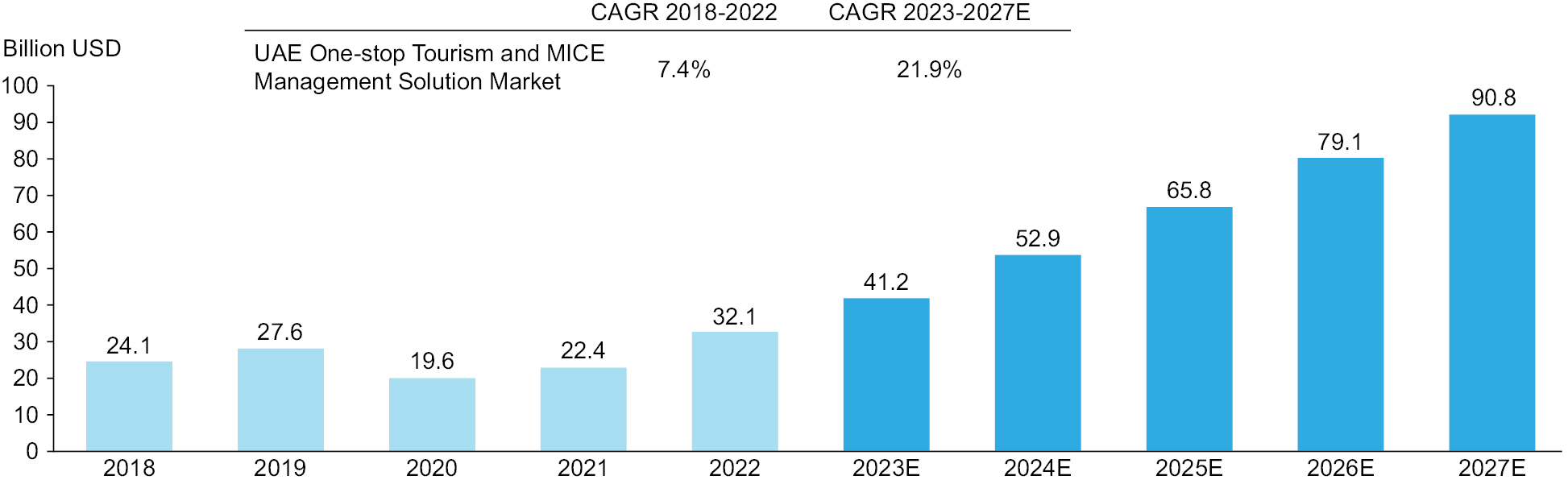

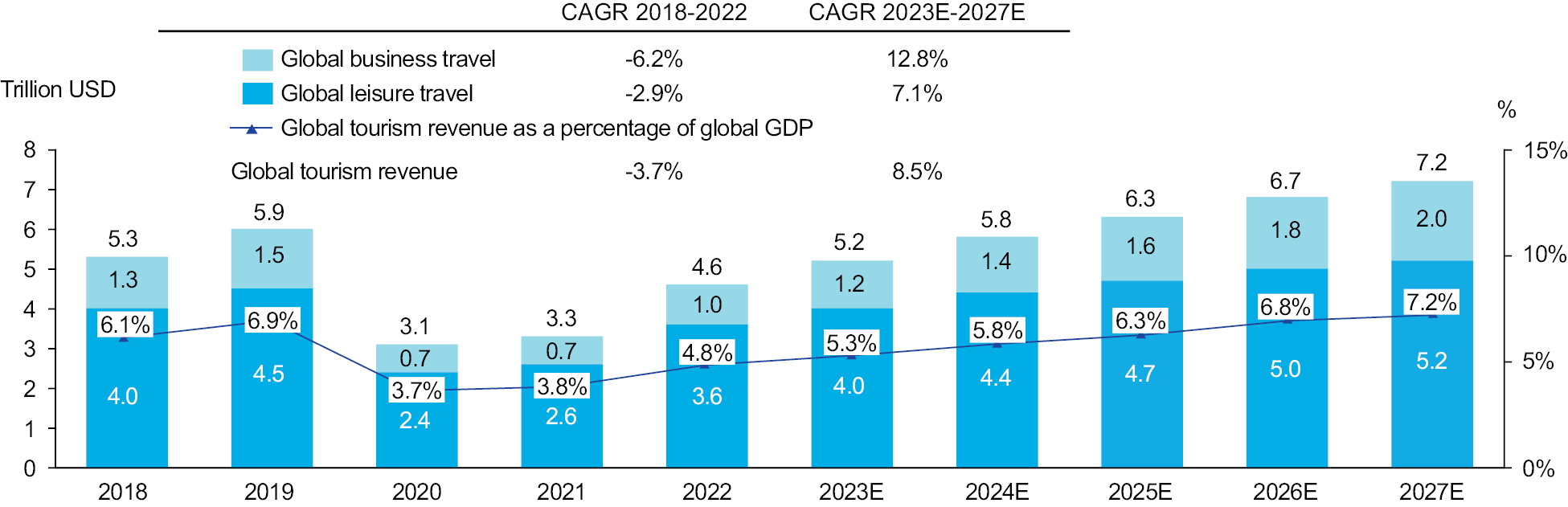

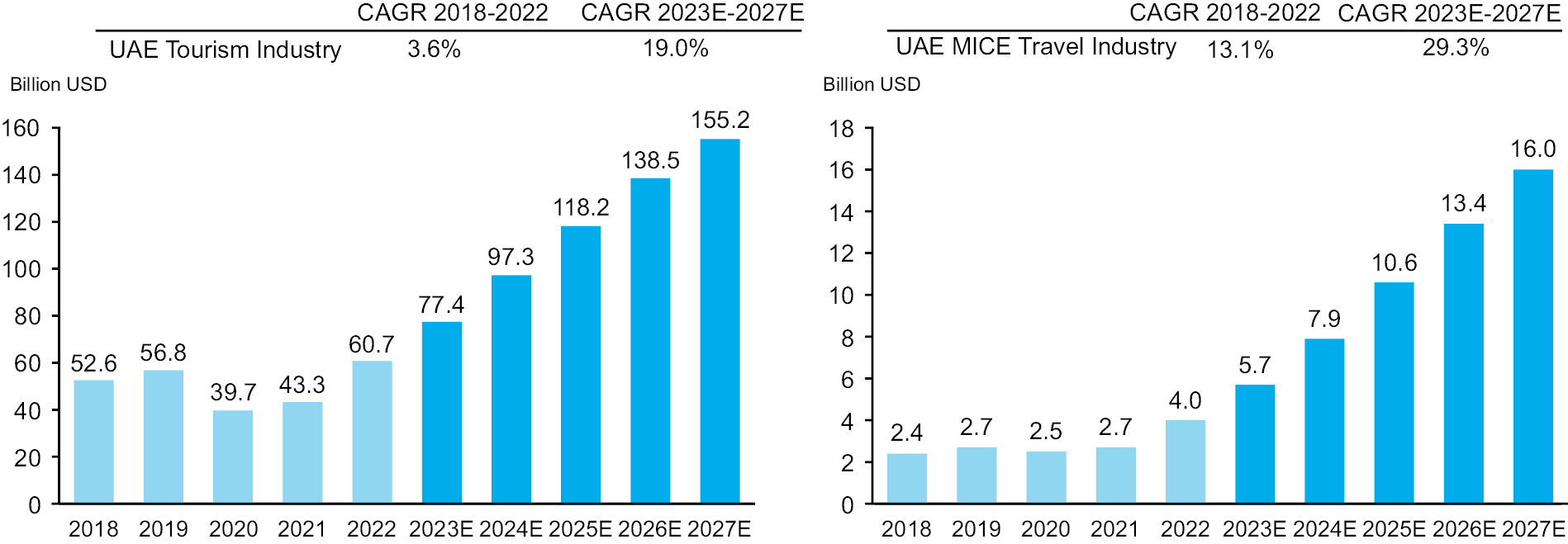

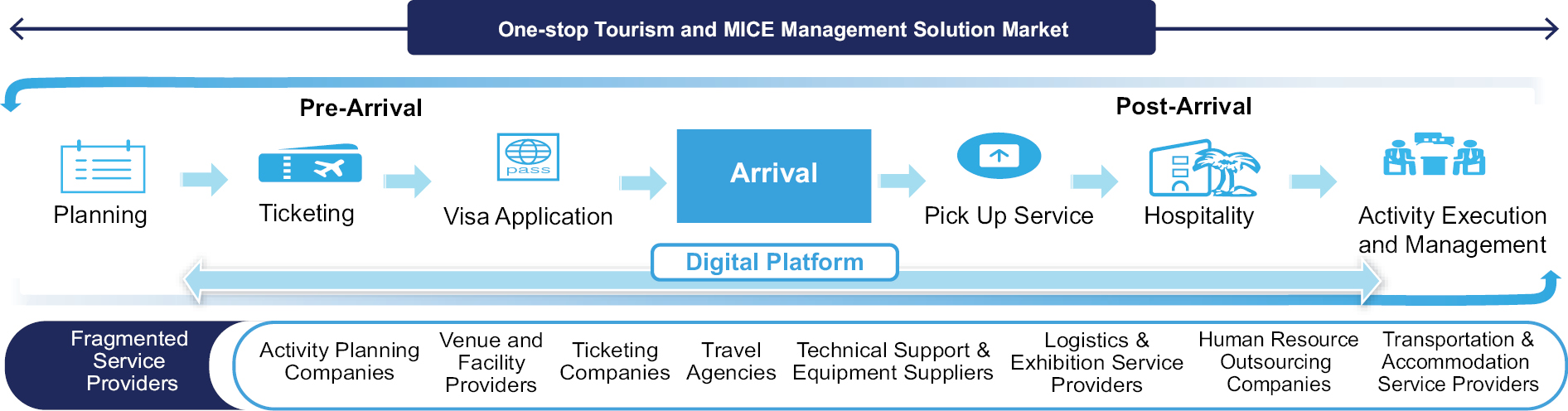

We, through our subsidiaries in the UAE, operate as a tour operator, travel agency, and provider of event planning and management services. As the tourism industry in the Middle East region is growing rapidly, our subsidiaries primarily provide two lines of services, namely, MICE management, a comprehensive coordination and organization of events, and one-stop tourism, a comprehensive travel product that is designed to provide tourists with all the necessary components of a trip in a single and convenient package, which typically include transportation, accommodations, meals, and guided tours or activities.

In the MICE management business, our subsidiaries assist their clients, mainly companies and industry associations, with the planning, organizing, and execution of various events including annual meetings, product launch conferences, product exhibitions, and staff gatherings in the UAE. They offer comprehensive services encompassing guest invitations, event website development, event applications, advertising, and overall event management and execution.

Our subsidiaries also offer their clients comprehensive one-stop tourism services. These services include flight ticket bookings, airport pick-up, hotel reservations, restaurant bookings, rental of cars and buses, arranging tickets for tourist attractions, and providing tour guides. With this comprehensive approach, our subsidiaries’ clients are relieved from the hassle of navigating multiple websites for different services, thereby saving time and streamlining the travel planning process. As of the date of this prospectus, our subsidiaries are able to provide travel services in the UAE, Jordan, Qatar, Bahrain, Kuwait, Saudi Arabia, and Oman.

Competitive Strengths

We believe the following competitive strengths are essential for our success and differentiate us from our competitors:

• A broad range of customers: Our subsidiaries serve clients across a broad spectrum of sectors, including consumer goods, technology, finance, education, and the legal industry. However, our business relies to some extent on a few major customers. Should our subsidiaries fail to maintain relationships with these key clients, or if they cannot secure replacement clients on commercially desirable terms, in a timely manner, or at all, both their business and our overall financial condition and operational results could be materially and adversely affected.

• Large-scale event planning and organizational capabilities: As of the date of this prospectus, our subsidiaries boast a dedicated team of 15 professionals specializing in MICE management. In addition to their core team, our subsidiaries engage a broad network of third-party service providers, including event venue providers, translation providers, electronic equipment providers, event material producers, and advertising companies, to offer a diverse array of services to their clients.

• Bespoke travel itinerary planning services: Our subsidiaries are dedicated to crafting personalized travel plans tailored to each group’s specific travel goals, personal preferences, budget constraints, and the unique characteristics of their chosen destination.

• Diversified selection of services: Our subsidiaries work with a range of third-party service providers to offer the customers a diverse array of experiences in accommodation, dining, and transportation. Maintaining healthy relationships with these providers is crucial to ensuring a varied selection of services.

• Experienced management team: Our company is supported by an experienced management team, whose expertise spans across management, business administration, and tourism management.

1

Table of Contents

Challenges

Set forth below are the challenges our subsidiaries face in their business operations:

• Customer concentration: Although our subsidiaries serve a broad range of customers, our business to some extent depends on a few major customers. Dependence on these customers will expose our subsidiaries to the risks of substantial losses.

• Risk of misconduct and errors by employees: Executing a large-scale event necessitates a significant number of employees, either from our subsidiaries or from third-party service providers. Consequently, our subsidiaries are exposed to the risk of misconduct and errors by both their own employees and those of third-party business partners they collaborate with.

• Seasonality: Our subsidiaries, focusing on travel-related services primarily in the Middle East, with a focus on Dubai, experience seasonal business fluctuations, particularly from June to August, due to the extreme summer weather reducing tourism and demand for outdoor events and activities.

• Dependence on third-party service providers: If our subsidiaries’ third-party service providers increase prices, underperform, or discontinue their relationships with our subsidiaries, it could lead to service disruptions, lower earnings, or higher costs, significantly harming our business and financial condition.

• Reliance on key management and personnel: The loss of and failure to replace key technical management and personnel could adversely affect multiple development efforts.

Growth Strategies

We intend to develop our business and strengthen brand loyalty by implementing the following strategies:

• extending our reach into additional regional markets;

• expanding our customer reach; and

• developing robotic solutions for enhanced tourism experience.

Risk Factors Summary

An investment in our Class A Ordinary Shares is subject to various risks, including risks relating to our business, risks relating to doing business in certain countries and regions, and risks relating to this Offering and the trading market. You should carefully consider all the information in this prospectus before making an investment in the Class A Ordinary Shares. The following list summarizes some, but not all, of these risks. Please read the information in the section entitled “Risk Factors” for a more thorough description of these and other risks.

Below is a summary of the principal risks, organized under relevant headings:

Risks Relating to Our Business

For a more detailed discussion, see “Risk Factors — Risks Relating to Our Business” beginning on page 11 of this prospectus.

• The event planning industry is highly competitive and has grown rapidly in the past few years. If our subsidiaries are unable to compete successfully, our financial condition and results of operations may be harmed. See “Risk Factors — Risks Relating to Our Business — The event planning industry is highly competitive and has grown rapidly in the past few years. If our subsidiaries are unable to compete successfully, our financial condition and results of operations may be harmed” on page 11;

• High customer concentration exposes our subsidiaries to all of the risks faced by their major customers and may subject them to significant fluctuations or declines in revenue, which may have a material adverse impact on our business, financial condition, and results of operations. See “Risk Factors — Risks Relating to Our Business — High customer concentration exposes our subsidiaries to all of the risks faced by their major customers and may subject them to significant fluctuations or declines in revenue, which may have a material adverse impact on our business, financial condition, and results of operations” on page 12;

2

Table of Contents

• Our subsidiaries use third-party services in connection with their business, and any disruption to these services could result in a disruption to their business, negative publicity, and a slowdown in the growth of their customer base, materially and adversely affecting our business, financial condition, and results of operations. See “Risk Factors — Risks Relating to Our Business — Our subsidiaries use third-party services in connection with their business, and any disruption to these services could result in a disruption to their business, negative publicity, and a slowdown in the growth of their customer base, materially and adversely affecting our business, financial condition, and results of operations” on page 12;

• Our subsidiaries have entered into a number of related party transactions in the ordinary course of their business, and may continue to enter into related party transactions in the future, which may materially and adversely affect our business, financial condition, and results of operations. See “Risk Factors — Risks Relating to Our Business — Our subsidiaries have entered into a number of related party transactions in the ordinary course of their business, and may continue to enter into related party transactions in the future, which may materially and adversely affect our business, financial condition, and results of operations” on page 13;

• The seasonality of the tourism industry in the UAE impacts our operating results. See “Risk Factors — Risks Relating to Our Business — The seasonality of the tourism industry in the UAE impacts our operating results” on page 13;

Risks Related to Doing Business in Certain Countries and Regions

• Investments in emerging markets are subject to greater risks than those in more developed markets. See “Risk Factors — Risks Related to Doing Business in Certain Countries and Regions — Investments in emerging markets are subject to greater risks than those in more developed markets” on page 16;

• The economies within the GCC region are highly dependent upon the oil and gas industry. See “Risk Factors — Risks Related to Doing Business in Certain Countries and Regions — The economies within the GCC region are highly dependent upon the oil and gas industry” on page 18;

• The economic, political, and social conditions in the GCC region, as well as government policies, laws, and regulations, could affect our business, financial condition, and results of operations. See “Risk Factors — Risks Related to Doing Business in Certain Countries and Regions — The economic, political, and social conditions in the GCC region, as well as government policies, laws, and regulations, could affect our business, financial condition, and results of operations” on page 19; and

Risks Relating to this Offering and the Trading Market

• There has been no public market for our Class A Ordinary Shares prior to this Offering, and you may not be able to resell our Class A Ordinary Shares at or above the price you pay for them, or at all. See “Risk Factors — Risks Relating to this Offering and the Trading Market — There has been no public market for our Class A Ordinary Shares prior to this Offering, and you may not be able to resell our Class A Ordinary Shares at or above the price you pay for them, or at all” on page 19;

• You will experience immediate and substantial dilution in the net tangible book value of Class A Ordinary Shares purchased. See “Risk Factors — Risks Relating to this Offering and the Trading Market — You will experience immediate and substantial dilution in the net tangible book value of Class A Ordinary Shares purchased” on page 20;

• Our Chairman of the Board of Directors has substantial influence over our company. His interests may not be aligned with the interests of our other shareholders, and he could prevent or cause a change of control or other transactions. See “Risk Factors — Risks Relating to this Offering and the Trading Market — Our Chairman of the Board of Directors has substantial influence over our company. His interests may not be aligned with the interests of our other shareholders, and he could prevent or cause a change of control or other transactions” on page 20;

• We do not intend to pay dividends in the foreseeable future. See “Risk Factors — Risks Relating to this Offering and the Trading Market — We do not intend to pay dividends in the foreseeable future” on page 22;

3

Table of Contents

• The price of our Class A Ordinary Shares could be subject to rapid and substantial volatility. Such volatility, including any stock run-ups, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Class A Ordinary Shares. See “Risk Factors — Risks Relating to this Offering and the Trading Market — The price of our Class A Ordinary Shares could be subject to rapid and substantial volatility. Such volatility, including any stock run-ups, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Class A Ordinary Shares” on page 23;

• Our management has broad discretion to determine how to use the funds raised in this Offering and may use them in ways that may not enhance our results of operations or the price of our Class A Ordinary Shares. See “Risk Factors — Risks Relating to this Offering and the Trading Market — Our management has broad discretion to determine how to use the funds raised in this Offering and may use them in ways that may not enhance our results of operations or the price of our Class A Ordinary Shares” on page 23.

• Because we are a foreign private issuer and are exempt from certain Nasdaq corporate governance standards applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer. See “Risk Factors — Risks Relating to this Offering and the Trading Market — Because we are a foreign private issuer and are exempt from certain Nasdaq corporate governance standards applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer” on page 24; and

• Because we are an “emerging growth company,” we may not be subject to requirements that other public companies are subject to, which could affect investor confidence in us and our Class A Ordinary Shares. See “Risk Factors — Risks Relating to this Offering and the Trading Market — Because we are an ‘emerging growth company,’ we may not be subject to requirements that other public companies are subject to, which could affect investor confidence in us and our Class A Ordinary Shares” on page 25.

• Our dual-class capital structure has the effect of concentrating voting control with our chief executive officer and chairman, and his interests may not be aligned with the interests of our other shareholders. See “Risk Factors — Our dual-class capital structure has the effect of concentrating voting control with our chief executive officer and chairman, and his interests may not be aligned with the interests of our other shareholders” on page 27.

• Our dual-class capital structure may adversely affect the trading market for our Class A Ordinary Shares. See “Risk Factors — Our dual-class capital structure may adversely affect the trading market for our Class A Ordinary Shares” on page 27.

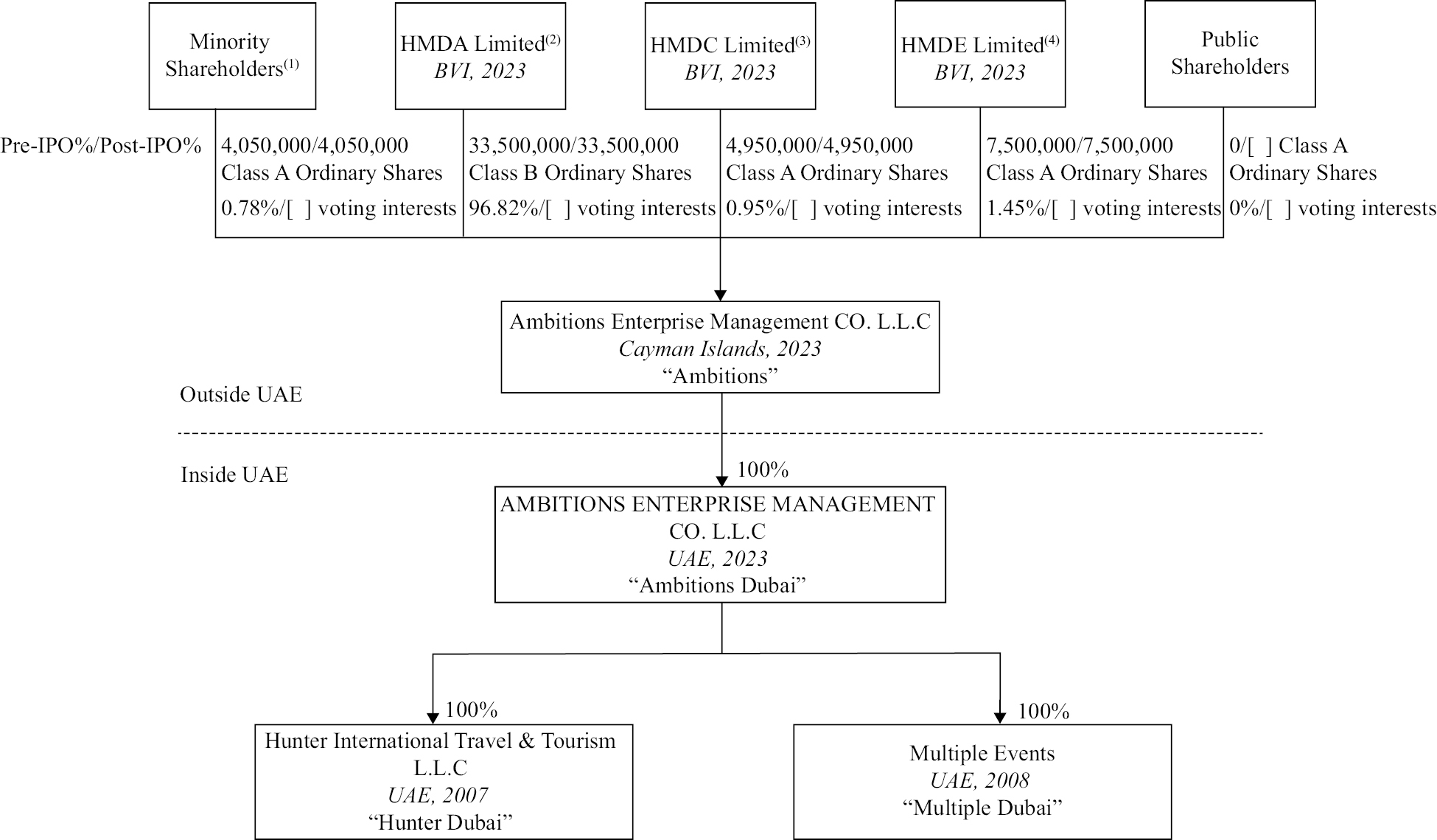

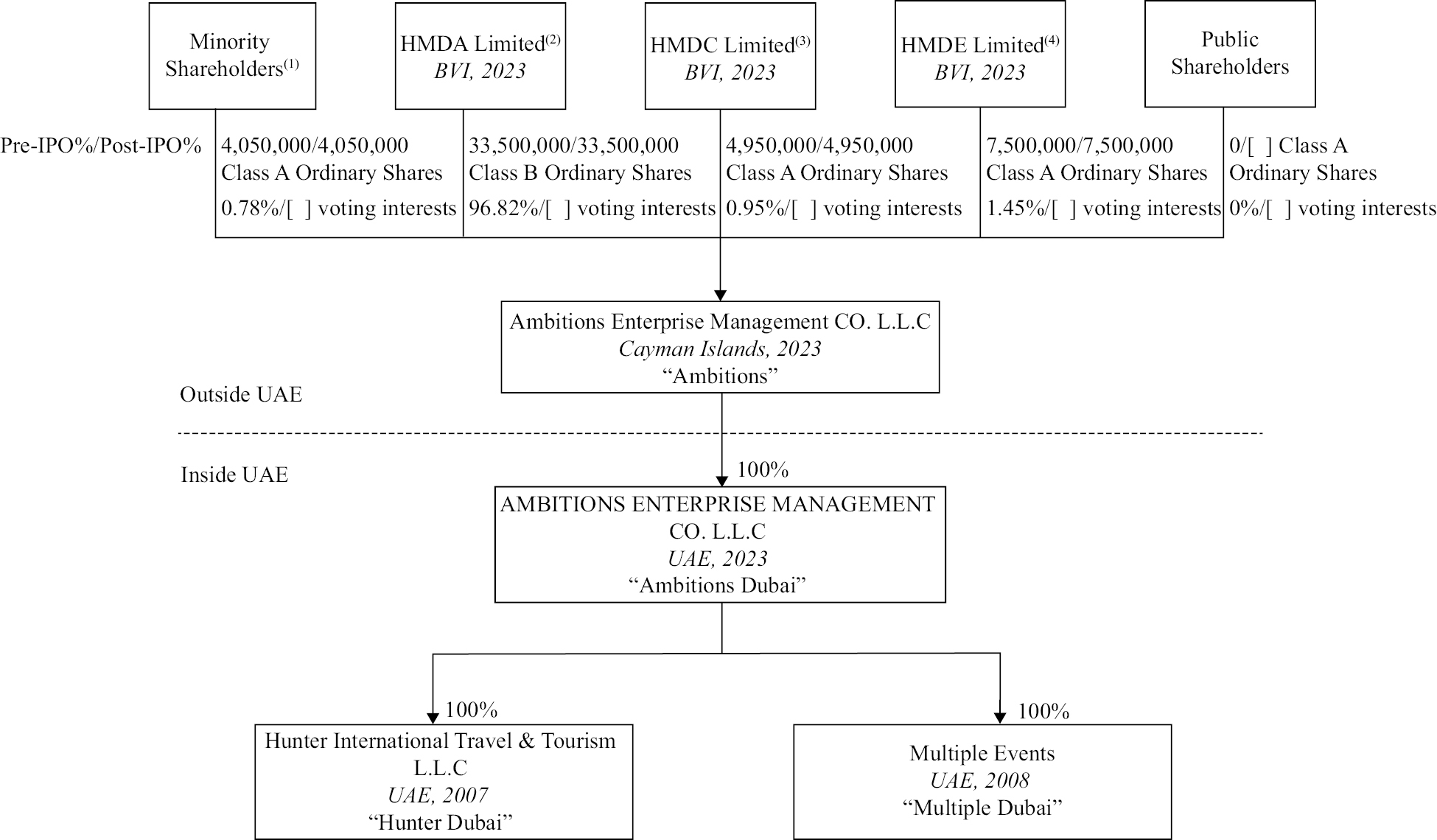

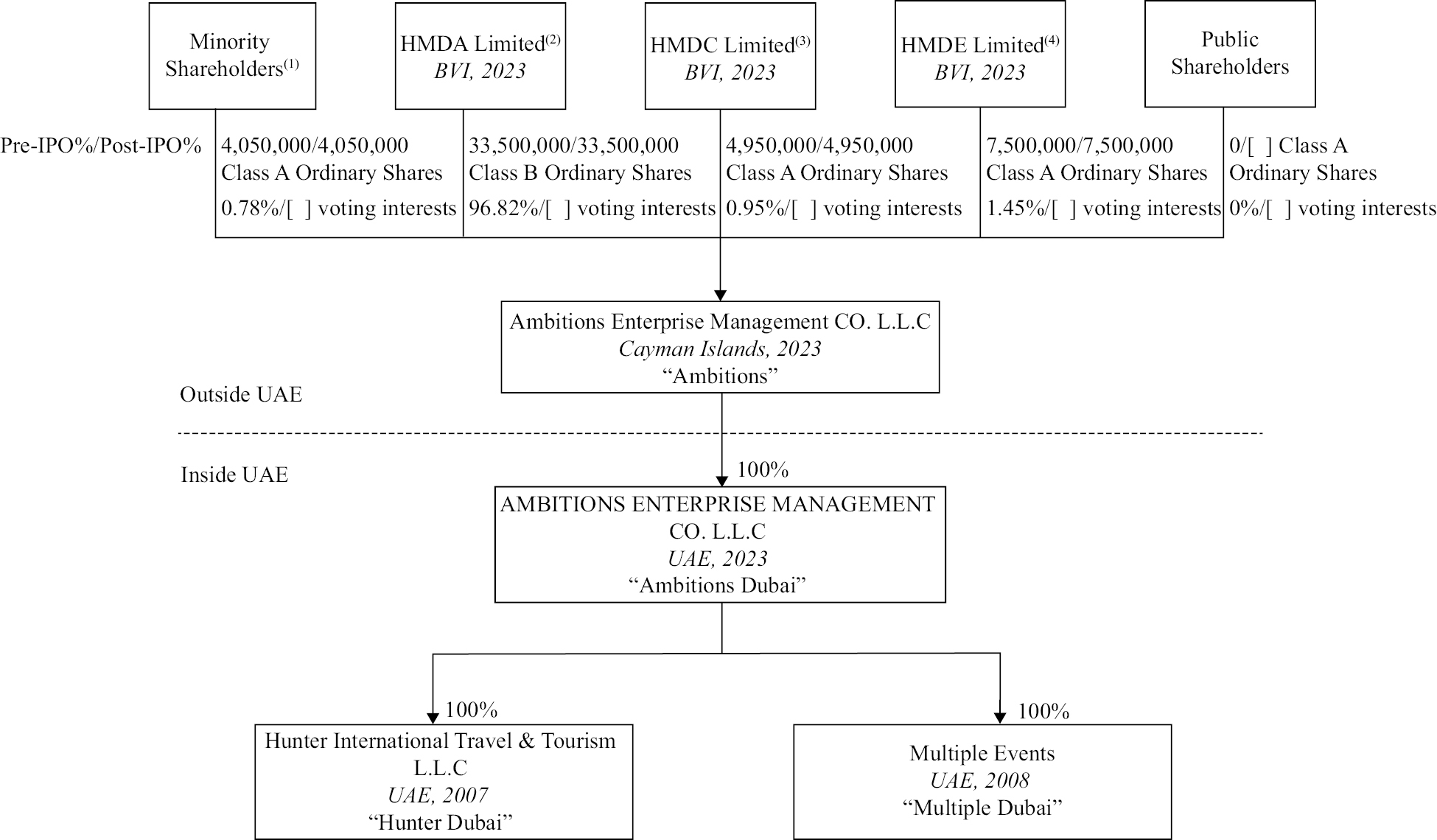

Our Corporate Structure and History

AMBITIONS ENTERPRISE MANAGEMENT CO. L.L.C was incorporated on November 2, 2023, as an exempted company with limited liability in the Cayman Islands. On October 26, 2023, Ambitions Dubai was incorporated in UAE and was acquired by the Company on December 10, 2023.

On October 10, 2007, Hunter Dubai was incorporated as a company with limited liability organized pursuant to the laws of the Emirate of Dubai.

On March 16, 2008, Multiple Dubai was incorporated as a company with limited liability organized pursuant to the laws of the Emirate of Dubai.

On November 21, 2023, Ambitions Dubai acquired 100% of the equity interests in Hunter Dubai and Multiple Dubai from their respective shareholders, for a consideration of $272 per company. Consequently, the Company became the ultimate holding company of all other entities mentioned above.

4

Table of Contents

The following diagram illustrates the ownership structure of the Company as of the date of this prospectus and upon the completion of this Offering (assuming no exercise of the over-allotment option):

Corporate Information

Our registered office is Suite #4-210, Governors Square, 23 Lime Tree Bay Avenue, PO Box 32311, Grand Cayman KY1-1209, Cayman Islands and our principal place of business is 630 Business Village, Block B, Port Saeed Deira, Dubai, UAE. The telephone number of our principal place of office is +97 142282568. Our agent for service of process in the United States is Cogency Global Inc. (“Cogency”), the address of which is 122 East 42nd Street, 18th Floor, New York, NY 10168. Our corporate website is http://www.huntertourism.net. The information contained on our website does not constitute part of this prospectus.

5

Table of Contents

Implications of Being an “Emerging Growth Company” and a “Foreign Private Issuer”

Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible, for up to five years, to take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not emerging growth companies. These exemptions include:

• the ability to include only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure;

• exemptions from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), in the assessment of our internal control over financial reporting;

• to the extent that we no longer qualify as a foreign private issuer, (i) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions from the requirement to hold a non-binding advisory vote on executive compensation, including golden parachute compensation.

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the consummation of this Offering or such earlier time that we are no longer an emerging growth company.

As a result, the information contained in this prospectus may be different from the information you receive from other public companies in which you hold shares. We do not know if some investors will find the Class A Ordinary Shares less attractive because we may rely on these exemptions. The result may be a less active trading market for the Class A Ordinary Shares, and the price of the Class A Ordinary Shares may become more volatile.

We will remain an emerging growth company until the earliest of: (1) the last day of the first fiscal year in which our annual gross revenue exceeds $1.235 billion; (2) the last day of the fiscal year following the fifth anniversary of the date of this Offering; (3) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of the Class A Ordinary Shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter; or (4) the date on which we have issued more than $1.00 billion in non-convertible debt securities during any three-year period.

Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 13(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for complying with new or revised accounting standards. The extended transition period provision only applies to companies preparing financial statements under the U.S. GAAP. Because we prepare our financial statements in accordance with U.S. GAAP, we take advantage of the aforementioned provision.

Foreign Private Issuer

Upon consummation of this Offering, we will report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

• the rules under the Exchange Act requiring domestic filers to issue financial statements prepared under the U.S. GAAP;

• the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act;

• the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and

• the rules under the Exchange Act requiring the filing with the Securities and Exchange Commission (the “SEC”) of quarterly reports on Form 10-Q containing unaudited financial and other specific information, or current reports on Form 8-K, upon the occurrence of specified significant events.

6

Table of Contents

Notwithstanding these exemptions, we will file with the SEC, within four months after the end of each fiscal year, or such applicable time as required by the SEC, an annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our Executive Officers or members of our Supervisory Board are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States, or (iii) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies are also exempt from certain more extensive executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more extensive compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer and will continue to be permitted to follow our home country practice on such matters.

Controlled Company

As of the date of this prospectus, our Chairman of the Board of Directors, Director, and Chief Executive Officer, Mr. Zhengang Tang, beneficially holds 12,450,000 Class A Ordinary Shares and 23,450,000 Class B Ordinary Shares, which represent 75.45% and 70%, respectively, of our issued and outstanding Class A Ordinary Shares and Class B Ordinary Shares, and collectively represent approximately 70.17% of the aggregate voting power of our issued and outstanding share capital. Following the completion of this offering, Mr. Tang will beneficially hold Class A Ordinary Shares (assuming no exercise of the over-allotment option by the underwriters) and 23,450,000 Class B Ordinary Shares, which will represent % and 70%, respectively, of our then issued and outstanding Class A Ordinary Shares and Class B Ordinary Shares, and collectively represent approximately % of the aggregate voting power of our then issued and outstanding share capital. Accordingly, Mr. Tang will have the ability to determine all matters requiring approval by shareholders, including mergers, consolidations, the appointment of directors, and other significant corporate actions. See “Principal Shareholders.” As such, we will be deemed a “controlled company” under Nasdaq Marketplace Rules 5615(c). As a controlled company, we are permitted to elect to rely on certain exemptions from the obligations to comply with certain corporate governance requirements, including the requirements that:

• a majority of our Board of Directors consist of independent directors;

• our director nominees be selected or recommended solely by independent directors; and

• we have a nominating and corporate governance committee and a compensation committee that are composed entirely of independent directors with a written charter addressing the purposes and responsibilities of the committees.

Although we do not intend to rely on the controlled company exemptions under the Nasdaq listing rules even if we are a controlled company, we could elect to rely on these exemptions in the future, and if so, you would not have the same protection afforded to shareholders of companies that are subject to all of the corporate governance requirements of Nasdaq. See “Risk Factors — Risks Relating to this Offering and the Trading Market — Our Chairman of the Board of Directors has substantial influence over our company. His interests may not be aligned with the interests of our other shareholders, and he could prevent or cause a change of control or other transactions.”

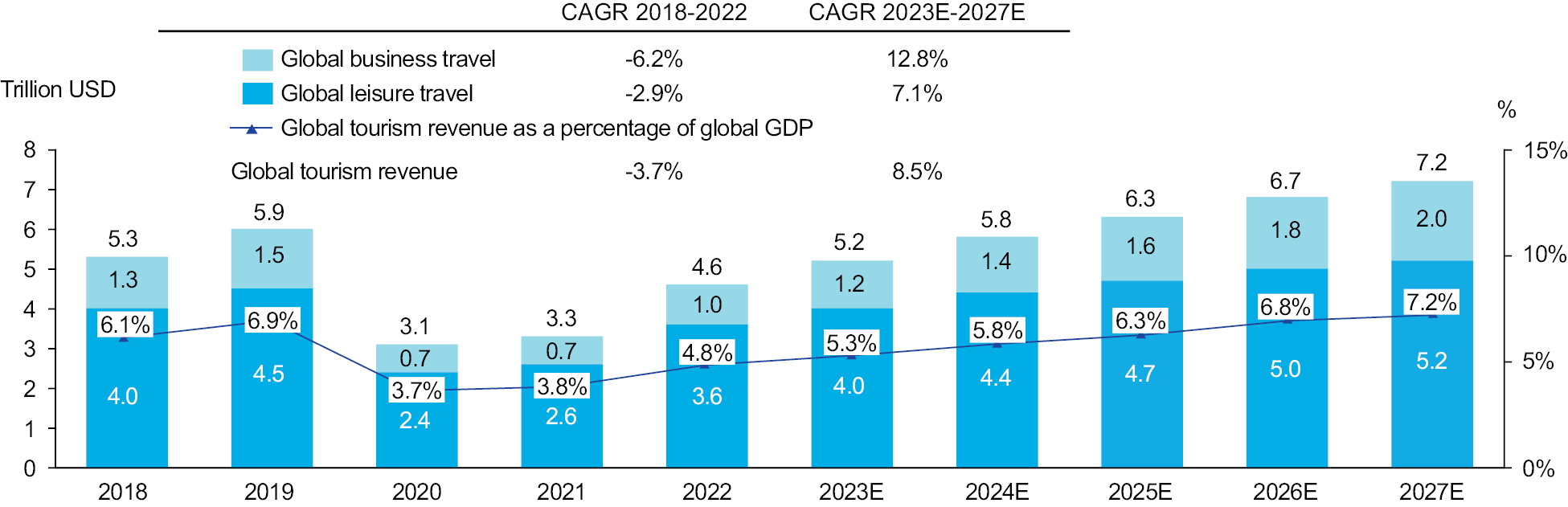

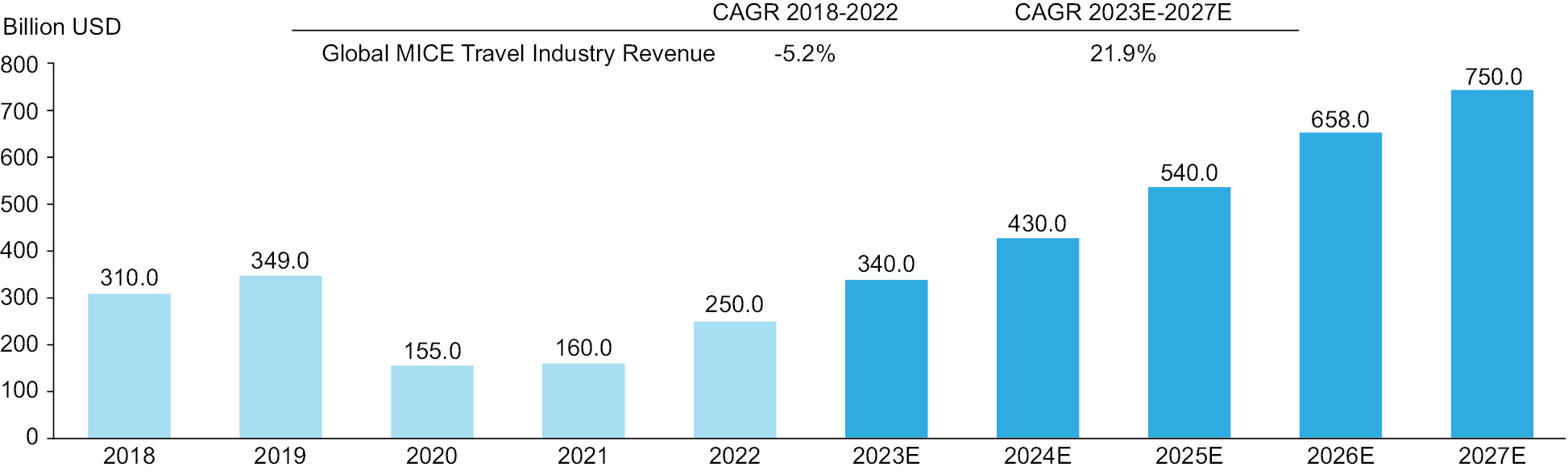

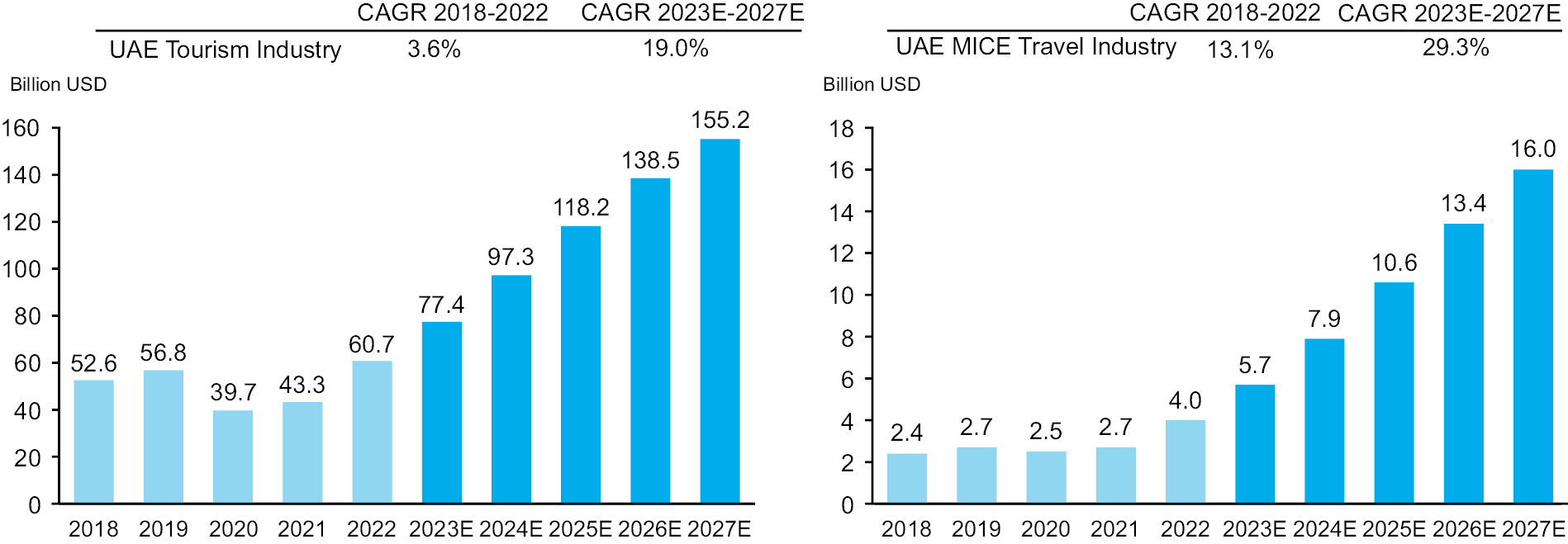

Market and Industry Data

We are responsible for the information contained in this prospectus and any free writing prospectus we prepare or authorize. This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties, as well as estimates by our management based on such data. The market data and estimates used in this prospectus involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such data and estimates. While we believe that the information from these industry publications, surveys and studies is reliable, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of important factors, including those described in the section titled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

7

Table of Contents

Impact of COVID-19

The COVID-19 pandemic restricted economic activities around the world starting in 2020. Countermeasures such as imposing restrictions on travel and business operations, limited business travel significantly below 2019 levels. In the past three years, many countries have vaccinated a substantial proportion of their population, and the spread of virus is now being contained to varying degrees in different countries. With the evolution of milder COVID-19 variants, availability of multiple vaccine booster doses, and increasing familiarity with the virus, many COVID-19 related travel restrictions have been lifted. This has led to a mild recovery from the severe declines in business travel bookings. As a result, we have seen an improvement in our transaction volume starting the second half of 2021 and continuing into the six months ended June 30, 2024. For the years ended December 31, 2024 and 2023, COVID-19 did not have a material impact on our operations.

The comprehensive effects of the COVID-19 pandemic are yet to be determined. See “Risk Factors — Risks Relating to Our Business — Pandemics and epidemics, natural disasters, terrorist activities, political unrest, and other outbreaks could disrupt our subsidiaries’ operations, which could materially and adversely affect our subsidiaries’ and our business, financial condition, and results of operations” on page 15.

Presentation of Financial and Other Information

Unless otherwise indicated, all financial information contained in this prospectus have been prepared in accordance with U.S. GAAP issued by the Financial Accounting Standards Board.

Unless otherwise noted, all translations from AED to U.S. dollars and from U.S. dollars to AED, as the case may be, in this prospectus are made at 3.6725 AEDs to US$1.00, as AED has been pegged to US dollar at 3.6725 AEDs per U.S. dollar since November 1997. We make no representation that any of the aforementioned currencies could have been, or could be, converted into any of the other aforementioned currencies, at any particular rate, the rates stated above, or at all.

We have made round adjustments to some of the figures contained in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be exact arithmetic aggregations of the figures that preceded them.

8

Table of Contents

THE OFFERING

Class A Ordinary Shares offered hereby | | Class A Ordinary Shares (or Class A Ordinary Shares if the underwriters exercise their option to purchase additional Class A Ordinary Shares in full within forty-five (45) days of the date of this prospectus). |

Offering Price: | | We expect that the Offering Price will be between $4.00 and $5.00 per Class A Ordinary Share. |

Number of Class A Ordinary Shares issued

and outstanding before this Offering: | |

16,500,000 Class A Ordinary Shares are issued and outstanding as of the date of this prospectus.

|

Number of Class A Ordinary Shares issued and outstanding immediately after this Offering: | |

Class A Ordinary Shares (or Class A Ordinary Shares if the underwriters exercises their option to purchase additional Class A Ordinary Shares in full within 45 days of the date of this prospectus).

|

Number of Class B Ordinary Shares issued

and outstanding before this Offering(1): | |

33,500,000 Class B Ordinary Shares are issued and outstanding as of the date of this prospectus.

|

Number of Class B Ordinary Shares issued and outstanding immediately after this Offering: | |

33,500,000 Class B Ordinary Shares.

|

Over-allotment: | | We have granted the underwriters an option to purchase from us, up to fifteen percent (15%) of the Class A Ordinary Shares being offered in this Offering, within 45 days of the date of this prospectus. |

Use of proceeds: | | We intend to use the proceeds from this Offering for the development of new travel itineraries, global market expansion in Europe and Australia through acquisitions of local travel agencies and establishment of new subsidiaries (as of the date of this prospectus, we have not identified any potential target companies for such acquisitions), development of travel assistance tools such as digital tourism robot, and working capital and other general corporate purposes. See “Use of Proceeds” on page 29 for more information. |

Lock-up: | | All of our directors, officers, and our principal shareholders (5% or more shareholders) have agreed with the Representative, subject to certain exceptions, not to sell, transfer, or dispose of, directly or indirectly, any of our Ordinary Shares or securities convertible into or exercisable or exchangeable for our Ordinary Shares for a period of six (6) months from the effectiveness of the registration statement of which this prospectus forms a part. We have also agreed, for a period of six (6) months from the effective date of the registration statement, of which this prospectus forms a part, not to offer, sell, transfer, or dispose of our Class A Ordinary Shares in certain ways, subject to limited exceptions. See sections titled “Shares Eligible for Future Sale” and “Underwriting” for more information. |

Listing; proposed symbol: | | We intend to list the Class A Ordinary Shares on Nasdaq under the symbol “AHMA.” At this time, Nasdaq has not yet approved our application to list our Class A Ordinary Shares. The closing of this Offering is conditioned upon Nasdaq’s final approval of our listing application, and there is no guarantee or assurance that our Class A Ordinary Shares will be approved for listing on Nasdaq. |

9

Table of Contents

Risk factors: | | See section titled “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the Class A Ordinary Shares. |

Representative’s Warrants: | | The registration statement of which this prospectus is a part also registers for sale the Representative’s Warrants to purchase Class A Ordinary Shares equal to one percent (1%) of the total number of Class A Ordinary Shares sold in this Offering, including the number of Class A Ordinary Shares upon the exercise of the underwriters’ over-allotment option, as a portion of the underwriting compensation payable to the Representative in connection with this Offering. The Representative’s Warrants will be exercisable at any time, will be subject to lock up for 180 days from the date of issuance in accordance with FINRA Rule 5510 and will expire five (5) years from the commencement of sales of this Offering. The Representative’s Warrants will be exercisable at a price equal to one hundred twenty percent (120%) of the Offering Price of the Class A Ordinary Shares sold in the Offering. Please see “Underwriting” for a description of these warrants. |

Transfer Agent | | Transhare Corporation |

Voting rights | | Each Class A Ordinary Share shall entitle the holder thereof to one vote on all matters subject to vote at general meetings of the Company. |

| | | Each Class B Ordinary Share shall entitle the holder thereof to 15 votes on all matters subject to vote at general meetings of the Company. Holders of Class A Ordinary Shares and Class B Ordinary Shares shall at all times vote together as one class on all resolutions submitted to a vote by the shareholders. Mr. Zhengang Tang, who beneficially holds 12,450,000 Class A Ordinary Shares and 23,450,000 Class B Ordinary Shares, which represent 75.45% and 70%, respectively, of our issued and outstanding Class A Ordinary Shares and Class B Ordinary Shares, and collectively represent approximately 70.17% of the aggregate voting power of our issued and outstanding share capital, and who will beneficially hold Class A Ordinary Shares (assuming no exercise of the over-allotment option by the underwriters) and 23,450,000 Class B Ordinary Shares, which will represent % and 70%, respectively, of our then issued and outstanding Class A Ordinary Shares and Class B Ordinary Shares, and collectively represent approximately % of the aggregate voting power of our then issued and outstanding share capital, will have the ability to control the outcome of matters submitted to our shareholders for approval, including the election of our directors. See “Description of Share Capital” and “Principal Shareholders.” |

10

Table of Contents

RISK FACTORS

An investment in our Class A Ordinary Shares involves a high degree of risk. Before deciding whether to invest in our Class A Ordinary Shares, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations, or cash flow could be materially and adversely affected, which could cause the trading price of our Class A Ordinary Shares to decline, resulting in a loss of all or part of your investment. The risks described below and discussed in other parts of this prospectus are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in our Class A Ordinary Shares if you can bear the risk of loss of your entire investment.

Risks Related to Our Business

Our subsidiaries’ operating history may not be indicative of their future growth or financial results and our subsidiaries may not be able to sustain their historical growth rates.

Our subsidiaries’ operating history may not be indicative of their future growth or financial results. There is no assurance that our subsidiaries will be able to grow their revenue in future periods. Their growth rates may decline for any number of possible reasons, and some of them are beyond their control, including decreasing client demand, increasing competition, declining growth of the event planning and tourism industry in general, emergence of alternative business models, or changes in government policies or general economic conditions. Our subsidiaries expect to continue to expand their offerings to and to increase their customer base. However, the execution of their expansion plan is subject to uncertainty and the number of clients may not grow at the rate they expect for the reasons stated above. If their growth rates decline, investors’ perceptions of their business and prospects may be adversely affected and the market price of our Class A Ordinary Shares could decline.

A decline in general economic conditions or a disruption of financial markets may affect tourism markets or the discretionary income of consumers, which in turn could adversely affect our profitability.

Our subsidiaries’ operations are influenced by the overall health of the economy, especially factors that directly affect tourism and leisure demand. Economic downturns, whether local or global, can lead to a reduction in consumer spending on non-essential items, including travel and leisure activities. As people experience a decrease in their disposable income during such periods, they are likely to cut back on expenses like vacations, weekend getaways, and other forms of tourism. Concurrently, corporate behavior shifts in response to economic pressures, with organizations opting for local venues for events rather than international locations. This may pose a challenge to our subsidiaries’ MICE management business, which may also adversely affect our financial condition and results of operations.

Moreover, disruptions in financial markets can lead to broader economic instability, affecting consumer confidence and spending habits. When financial markets face turbulence, potential tourists may become more cautious about their expenditures, opting to save rather than spend on travel. This shift in consumer behavior can result in a decreased demand for our subsidiaries tourism agency services, leading to a reduction in revenue for our subsidiaries, and our financial condition and results of operations may be materially and adversely affected as a result.

The event planning industry is highly competitive and has grown rapidly in the past few years. If our subsidiaries are unable to compete successfully, our financial condition and results of operations may be harmed.

The event planning industry has been developing rapidly and becoming competitive in recent years. As it is relatively easy to enter the market, there are many event planners providing services of various qualities. Competition is mainly based on rates, brand recognition, turnaround time, quality of venue, and service levels. Our subsidiaries’ clients may change their budgets and preferences and choose event planners that offer lower rates or have access to venues and facilities that our subsidiaries do not have access to, which may have an adverse effect on our subsidiaries’ competitive position and our results of operations and financial condition.

11

Table of Contents

High customer concentration exposes our subsidiaries to all of the risks faced by their major customers and may subject them to significant fluctuations or declines in revenue, which may have a material adverse impact on our business, financial condition, and results of operations.

For the six months ended June 30, 2024, there was one customer, customer D, which revenue individually represented more than 10% of the Group’s total revenue, contributing approximately 14.5% of the Group’s total revenue. For the six months ended June 30, 2023, CTG MICE Service Company Limited was the only customer which revenue individually represented more than 10% of the Group’s total revenue, contributing approximately 12.5% of the Group’s total revenue. For the year ended December 31, 2023, CTG MICE Service Company Limited and Shandong Weichai Import and Export Corporation were the two customers that accounted for more than 10% of the Company’s total revenue, accounting for 20.8% and 11.1% of our total revenue, respectively. For the year ended December 31, 2022, CTG MICE Service Company Limited was the only customer that accounted for more than 10% of the Company’s total revenue, accounting for 11.9% of our total revenue. As of June 30, 2024 and December 31, 2023, Shandong Weichai Import and Export Corporation accounted for approximately 11.3% and 19.6% of the Group’s accounts receivable. As of June 30, 2024, there was one customer, customer D, that accounted for approximately 10.1% of the Group’s accounts receivable.

Our subsidiary, Hunter Dubai entered into a service agreement with CTG MICE Service Company Limited in September 2023. The service agreement with CTG MICE Service Company Limited is different from the form of service agreement used by Hunter Dubai. Compared to the form of service agreement, the agreement with CTG MICE Service Company Limited includes more detailed information regarding travel arrangements, including the number of travelers, departure cities, arrival airports, a list of hotels, and specific requirements and scope of services for drivers and tour guides, as well as catering standards. Additionally, the agreement contains additional provisions for assistance with visa re-application in case of loss, guarantees of service quality, itinerary changes, and liabilities in the event of Hunter Dubai’s breach of contract.

Our subsidiary, Hunter Dubai, entered into a service agreement and a supplementary agreement to the service agreement (collectively, the “Shandong Weichai Service Agreements”) with Shandong Weichai Import and Export Corporation in November 2023. The Shandong Weichai Service Agreements are similar to the form of service agreement used by Hunter Dubai.

Although our subsidiaries continually seek to diversify their customer base, we cannot assure you that the proportion of the revenue contribution from these customers to our subsidiaries’ total revenue will decrease in the near future. Dependence on these customers will expose our subsidiaries to the risks of substantial losses. Specifically, any one of the following events, among others, may cause material fluctuations or declines in our subsidiaries’ revenue and have a material and adverse effect on our business, financial condition, and results of operations:

• an overall decline in the business of these clients;

• the decision by these clients to switch to our subsidiaries’ competitors;

• the reduction in the prices of our subsidiaries’ services agreed by these clients; or

• the failure or inability of any of these clients to make timely payment for our subsidiaries’ services.

If our subsidiaries fail to maintain relationships with these clients, and if they are unable to find replacement clients on commercially desirable terms or in a timely manner or at all, our business, financial condition, and results of operations may be materially and adversely affected.

Our subsidiaries use third-party services in connection with their business, and any disruption to these services could result in a disruption to their business, negative publicity, and a slowdown in the growth of their customer base, materially and adversely affecting our business, financial condition, and results of operations.

Our business depends on services provided by, and relationships with, various third parties. In particular, for the six months ended June 30, 2024, fees paid to the International Air Transport Association accounted for 24.9% of our subsidiaries’ overall purchases. For the year ended December 31, 2023, fees paid to the International Air Transport Association accounted for 24.1% of our subsidiaries’ overall purchases. For the year ended December 31, 2022, fees paid to International Air Transport Association accounted for 15.1% of our subsidiaries’ overall purchases. See “Business — Suppliers.”

12

Table of Contents

If such third parties increase the prices of their services, fail to provide their services effectively, terminate their services or agreements, or discontinue their relationships with our subsidiaries, our subsidiaries could suffer service interruptions, reduced revenue, or increased costs, any of which may have a material adverse effect on our business, financial condition, and results of operations.

Our subsidiaries have entered into a number of related party transactions in the ordinary course of their business, and may continue to enter into related party transactions in the future, which may materially and adversely affect our business, financial condition, and results of operations.

In the ordinary course of our subsidiaries’ business, they have entered into transactions with related parties. As of June 30, 2024, December 31, 2023, December 31, 2022, and December 31, 2021, the amounts due from related parties amounted to $1,222,771, $1,222,771, $1,889,946, and $1,490,543, respectively.

We cannot guarantee that our subsidiaries will not continue to enter into related party transactions in the future. In addition, there can be no assurance that they have achieved and will achieve the most favorable terms with related parties for each related party transaction. Furthermore, there can be no assurance that the above-mentioned transactions or any future related party transactions that they may enter into, individually or in the aggregate, will not have an adverse effect on our business, financial condition, and results of operations. Further, the transactions with the related parties may potentially involve conflicts of interest. Additionally, there can be no assurance that any disputes that may arise among our subsidiaries and related parties will be resolved in our subsidiaries’ favor. For details, see “Related Party Transactions.”

Misconduct and errors by our subsidiaries’ employees and the employees of third parties our subsidiaries work with could harm our business and reputation.

Our subsidiaries are exposed to many types of operational risks, including the risk of misconduct and errors by their employees and the employees of third-party business partners that our subsidiaries work with. Our business depends on our subsidiaries’ employees and third parties, such as hotels, restaurants, and shops to provide services such as accommodation, dining, and shopping. We could be materially and adversely affected if these employees or partners engage in misconduct or negligence. It is not always possible to identify and deter misconduct or errors by employees or third-party business partners, and the precautions our subsidiaries take to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses. If any of their employees or employees of third-party business partners take, convert, or misuse funds or documents, or fail to follow rules and procedures when interacting with current or prospective clients, our subsidiaries could be liable for damages and subject to regulatory actions and penalties. Our subsidiaries could also be perceived to have facilitated or participated in the illegal misappropriation of funds or documents, or the failure to follow rules and procedures, and therefore be subject to civil or criminal liability. Any of these occurrences could result in the diminished ability to operate our business, potential liability to clients, inability to attract new clients, reputational damage, regulatory intervention, and financial harm, which could negatively impact our business, financial condition, and results of operations.

The seasonality of the tourism industry in the UAE impacts our operating results.

Our subsidiaries experience seasonality in their business, especially from June to August, due to the extreme summer weather in Dubai, which leads to a decline in tourism and a reduced demand for outdoor events and activities. Consequently, our revenue during these months falls below the average of other quarters. Therefore, our operating results for a certain period within a calendar year may not correctly indicate our performance for the entire calendar year. Prospective investors should be aware of this seasonal fluctuation when making any comparison of our operating results.

Our subsidiaries do not have any business interruption or property insurance, and they may incur liabilities that are not covered by insurance, which could expose them to significant costs and business disruption.

While our subsidiaries seek to maintain appropriate levels of insurance, not all claims are insurable, and they may experience major incidents of a nature that are not covered by insurance. They do not carry any professional liability insurance. They have not purchased any property insurance or business interruption insurance.

Our subsidiaries have determined that insuring against such risks is impractical due to the high costs and challenges in obtaining such insurance on commercially reasonable terms. They consider their insurance coverage to be sufficient for their business operations. Our subsidiaries maintain an amount of insurance protection that they believe is adequate, but there can be no assurance that such insurance will continue to be available on acceptable terms or that such insurance coverage will be sufficient or effective under all circumstances and against all liabilities to which they may be subject.

13

Table of Contents

Our subsidiaries could, for example, be subject to substantial claims for damages upon the occurrence of several events within one calendar year. In addition, their insurance costs may increase over time in response to any negative development in their claim history or due to material price increases in the insurance market in general. If our subsidiaries were to incur substantial losses or liabilities due to fire, explosions, floods, other natural disasters or accidents or business interruption, their results of operations could be materially and adversely affected, which could materially and adversely affect our financial condition and results of operations as well.

Our subsidiaries may not successfully acquire and integrate other businesses, form and manage alliances, or divest businesses.

Our subsidiaries may pursue acquisitions, strategic alliances, or divestitures of some of their businesses as part of the business strategy. Our subsidiaries may not complete these transactions in a timely manner, on a cost-effective basis or at all. In addition, it may be subject to regulatory constraints or limitations or other unforeseen factors that prevent them from realizing the expected benefits. Even if they are successful in making an acquisition, the business that are acquired may not be successful or may require significantly greater resources and investments than originally anticipated. They may be unable to integrate acquisitions successfully into their existing business, and they may be unable to achieve expected gross margin improvements or efficiencies. They also could incur or assume significant debt and unknown or contingent liabilities. Their reported results of operations could be negatively affected by acquisition or disposition-related charges, amortization of expenses related to intangibles, and charges for impairment of long-term assets. They may be subject to litigation in connection with, or as a result of, acquisitions, dispositions, or alliances, including claims from terminated employees, clients, or third parties, and they may be liable for future or existing litigation and claims related to the acquired business, disposition, or alliance because either they are not indemnified for such claims or the indemnification is insufficient. These effects could cause our subsidiaries to incur significant expenses and could materially adversely affect our operating results and financial condition.

If we do not obtain substantial additional financing, including the financing sought in this Offering, our ability to execute our business plan as outlined in this prospectus will be impaired.

Our plans for business expansion and development are dependent upon our raising significant additional capital, including the capital sought in this Offering. Our plans call for significant new investments in development of new travel itineraries, global market expansion in Europe and Australia through acquisitions of local travel agencies and establishment of new subsidiaries, and development of travel assistance tools such as digital tourism robot. Management estimates that our capital needs for expansion will be approximately $5 million. Although we expect the proceeds of this Offering and our net earnings to substantially fund our planned growth and development, our management will be required to properly and carefully administer and allocate these funds. Should our capital needs be higher than estimated, or should additional capital be required after the closing of this Offering, we will be required to seek additional investments, loans, or debt financing to fully pursue our business plans. Such additional investment may not be available to us on terms that are favorable or acceptable. Should we be unable to meet our full capital needs, our ability to fully implement our business plan will be impaired.

If we cannot retain, attract, and motivate key personnel, we may be unable to effectively implement our business plan.

Our success depends in large part upon our ability to retain, attract, and motivate highly skilled management, research and development, marketing, and sales personnel. The loss of and failure to replace key technical management and personnel could adversely affect multiple development efforts. Recruitment and retention of senior management and skilled technical, sales and other personnel is very competitive, and we may not be successful in either attracting or retaining such personnel. We may lose key personnel to other high technology companies, and many larger companies with significantly greater resources than us may aggressively recruit key personnel. As part of our strategy to attract and retain key personnel, we may offer equity compensation through grants of share options, restricted share awards or restricted share units. Potential employees, however, may not perceive our equity incentives as attractive enough. In addition, due to the intense competition for qualified employees, we may be required to, and have had to, increase the level of compensation paid to existing and new employees, which could materially increase our operating expenses.

14

Table of Contents

Pandemics and epidemics, natural disasters, terrorist activities, political unrest, and other outbreaks could disrupt our subsidiaries’ operations, which could materially and adversely affect our subsidiaries’ and our business, financial condition, and results of operations.

Global pandemics, or fear of spread of contagious diseases, such as Ebola virus disease, COVID-19, Middle East respiratory syndrome, severe acute respiratory syndrome, H1N1 flu, H7N9 flu, and avian flu, as well as hurricanes, earthquakes, tsunamis, or other natural disasters could disrupt our subsidiaries’ business operations, reduce or restrict their supply of services, incur significant costs to protect their employees, or result in regional or global economic distress, which may materially and adversely affect our subsidiaries’ and our business, financial condition, and results of operations. Actual or threatened war, terrorist activities, political unrest, civil strife, and other geopolitical uncertainty could have a similar adverse effect on our subsidiaries’ and our business, financial condition, and results of operations. Any one or more of these events may impede our subsidiaries’ operating efforts and adversely affect their operating results, or even for a prolonged period of time, which could materially and adversely affect our subsidiaries’ and our business, financial condition, and results of operations.

The COVID-19 pandemic adversely affected many businesses in the world. With the spread of COVID-19, the demand for travel and the hosting of offline events were affected greatly. The extent of the impact of COVID-19 on the Company’s future financial results will be dependent on future developments, such as the length and severity of the pandemic, the potential resurgence of the pandemic, future government actions in response to the pandemic and the overall impact of the COVID-19 pandemic on the global economy and capital markets, among many other factors, all of which remain highly uncertain and unpredictable. Given this uncertainty, the Company is currently unable to quantify the expected impact of the COVID-19 pandemic on its future operations, financial condition, liquidity, and results of operations if the current situation continues.

Our subsidiaries are also vulnerable to natural disasters and other calamities. We cannot assure you that our subsidiaries are adequately protected from the effects of fire, floods, typhoons, earthquakes, power loss, telecommunications failures, break-ins, war, riots, terrorist attacks, or similar events. Any of the foregoing events may give rise to interruptions, damage to our subsidiaries’ property, breakdowns, system failures, technology platform failures, or internet failures, which could adversely affect our subsidiaries and our business, financial condition, and results of operations.

We conduct our operations in the Middle East. The current hostilities involving Israel, the Gaza Strip, and their regional neighbors may materially and adversely impact our operations.

Since 2007, we have operated as a tour operator, travel agency, and provider of event planning and management services, primarily focused on the UAE region. Many of our officers and directors reside in the UAE. Our business and operations could be influenced by the economic, political, geopolitical, and military conditions in and around the UAE.

On October 7, 2023, Hamas, a U.S. designated terrorist organization, launched a series of coordinated attacks from the Gaza Strip onto Israel. On October 8, 2023, Israel formally declared war on Hamas, and the armed conflict is ongoing as of the date of this prospectus. As of the date of this prospectus, our operations have not experienced material and adverse impacts from the current hostilities involving Israel, the Gaza Strip, and their regional neighbors, however, the ongoing conflict could lead to a decrease in tourist numbers, customs closures, and flight delays, which could materially and adversely affect our business, financial condition, and results of operations in the future.

Damage to our brand image could have a material adverse effect on our growth strategy and our business, financial condition, results of operations, and prospects.