- AMTM Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Amentum (AMTM) DEF 14ADefinitive proxy

Filed: 21 Jan 25, 4:22pm

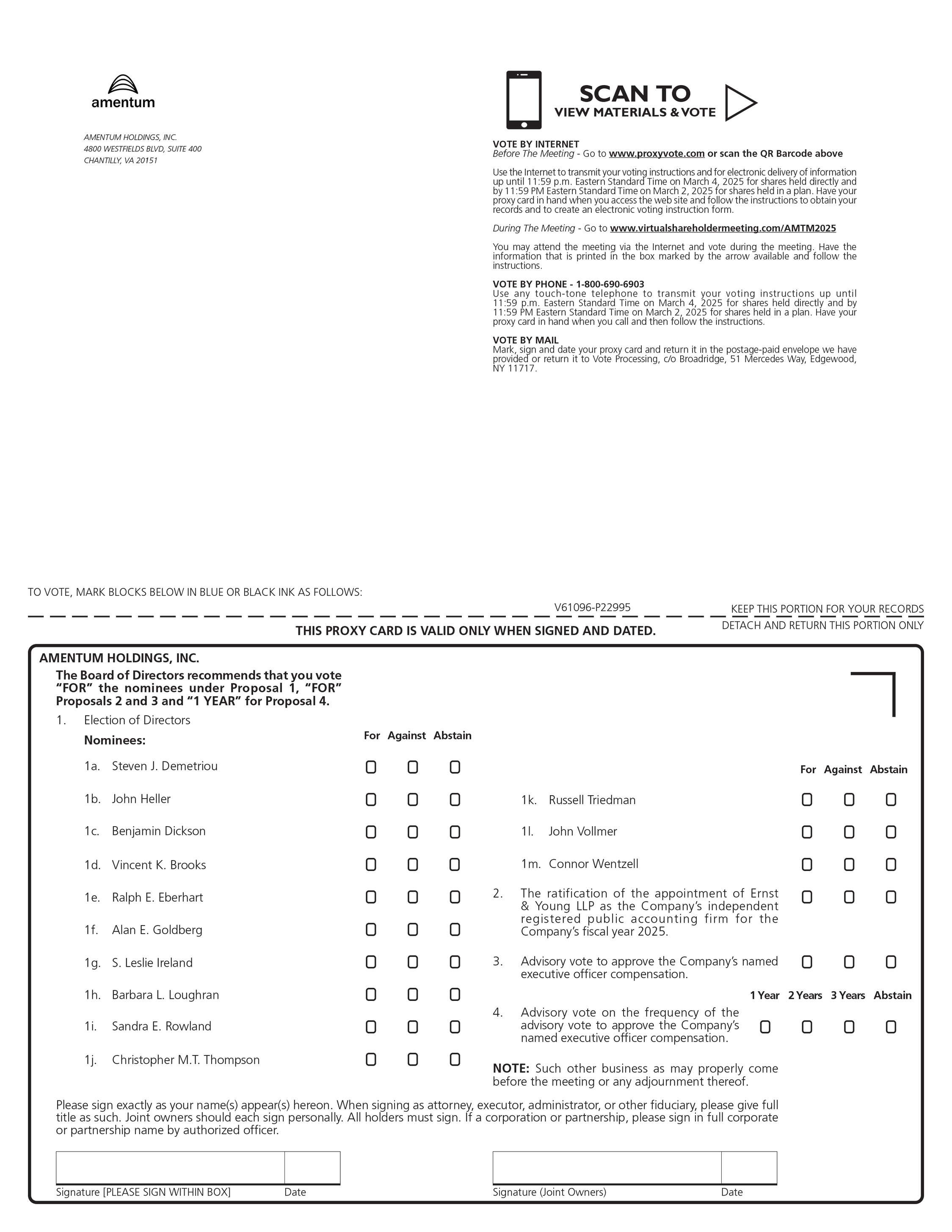

Time and Date: | 11:00 a.m. (EST), March 5, 2025 |

Place: | *Virtual meeting at www.virtualshareholdermeeting.com/AMTM2025 |

Agenda: | 1.The election of thirteen director nominees named in the proxy statement; |

2.The ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the Company’s fiscal year 2025; | |

3. A non-binding advisory vote on the compensation paid to the Company’s named executive officers for fiscal year 2024, as disclosed in the proxy statement; and | |

4. A non-binding, advisory vote on the frequency of future advisory votes to approve named executive officer compensation. | |

In addition to the foregoing, the Annual Meeting will include the transaction of such other business as may properly come before the meeting, or any adjournment(s), continuation(s), rescheduling(s) or postponement(s) thereof. | |

The Board of Directors recommends that you vote “FOR” the nominees under Proposal 1, “FOR” Proposals 2 and 3, and “ONE YEAR” for Proposal 4. | |

Record Date: | Only holders of record of the Company’s common stock on January 7, 2025 will be entitled to vote at the Annual Meeting. |

Date of Distribution: | The proxy materials or a Notice of Internet Availability are first being sent to stockholders on January 21, 2025. |

Proxy Voting: | Your vote is important. Whether or not you plan to virtually attend the Annual Meeting, you may access electronic voting via the Internet or the automated telephone voting feature, both of which are described on your enclosed proxy card, or you may sign, date, and return the proxy card in the envelope provided. |

Proposal | Description | Board's Voting Recommendation | Page Reference |

No. 1 | Election of thirteen director nominees named in this proxy statement | FOR each director nominee | |

No. 2 | Ratification of appointment of Ernst & Young LLP ("EY") as the Company's independent registered accounting firm for fiscal year 2025 | FOR | |

No. 3 | A non-binding advisory vote on the compensation paid to the Company’s named executive officers for fiscal year 2024, as disclosed in the proxy statement | FOR | |

No. 4 | A non-binding, advisory vote on the frequency of future advisory votes to approve named executive officer compensation | ONE YEAR |

Vote by Internet | Vote by Telephone | Vote by Mail |

|  |  |

Visit proxyvote.com and follow the instructions provided in the Notice | Call the phone number located on the proxy card or the Notice | If you request printed copies of the proxy materials by mail, by filling out the proxy card included with the materials |

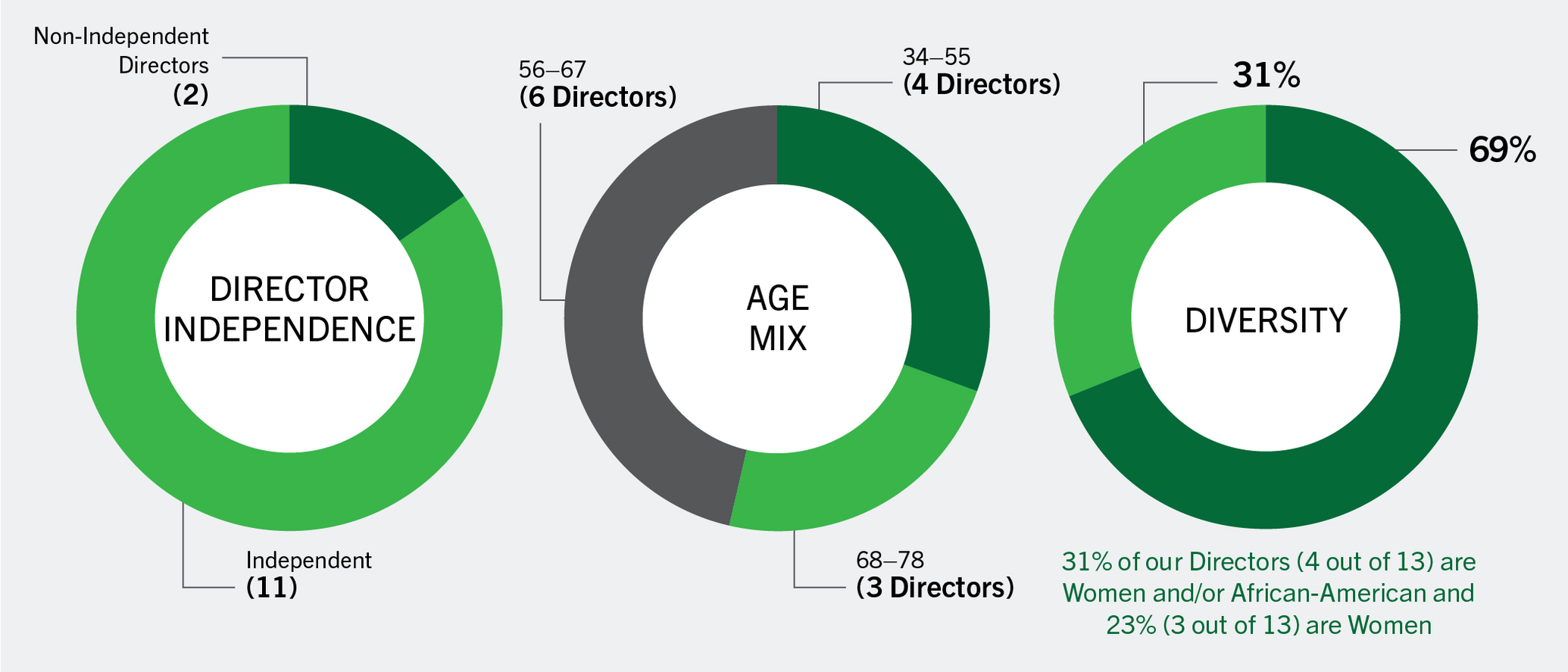

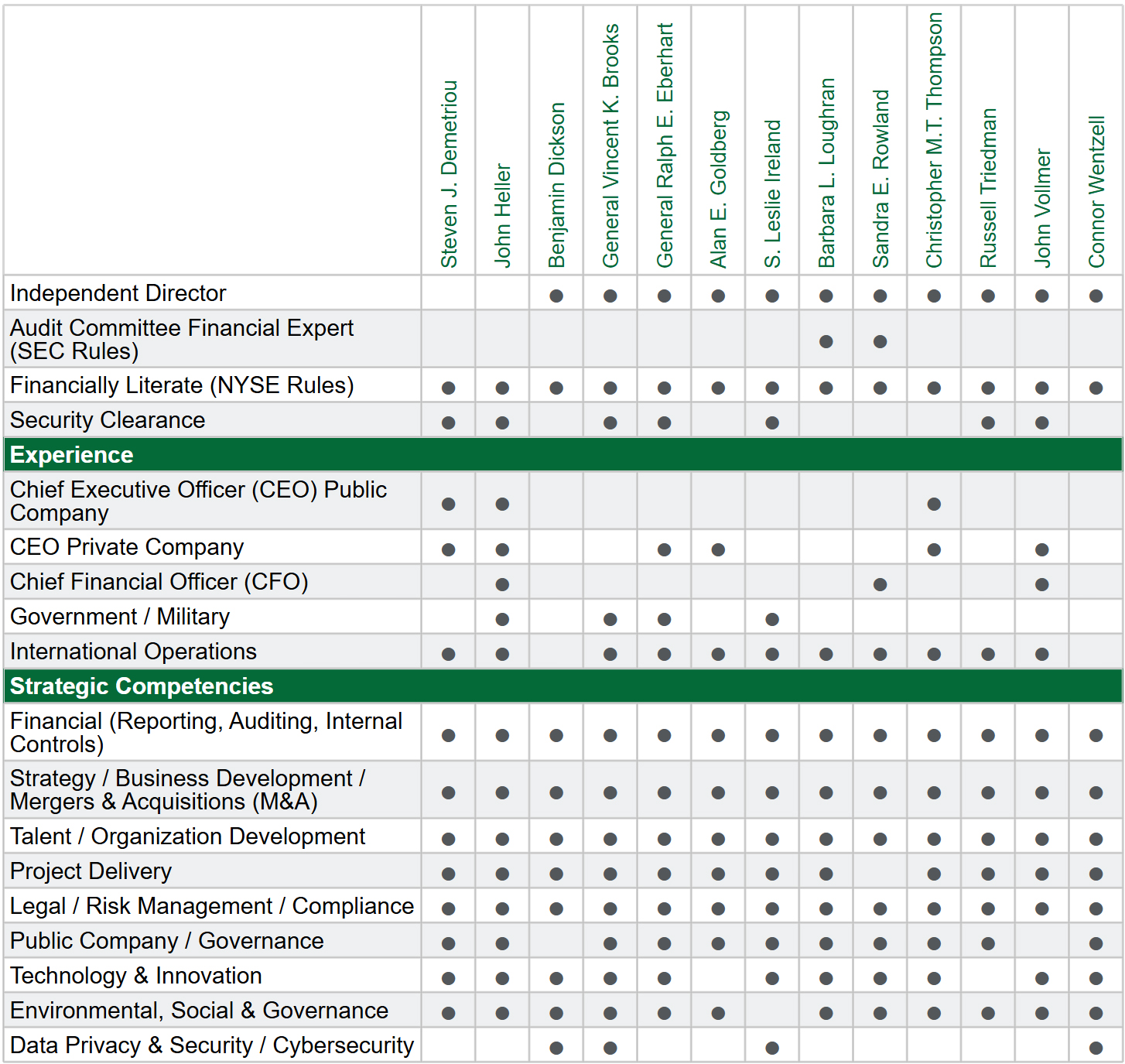

Name | Director Since | Independent | Committee Membership | |||||

Audit | Compensation | Nominating & Governance | ||||||

2024 Director Nominees | ||||||||

Steven J. Demetriou1 | 2024 | |||||||

John Heller2 | 2024 | |||||||

Benjamin Dickson3 | 2024 | I | M | |||||

General Vincent K. Brooks | 2024 | I | M | M | ||||

General Ralph E. Eberhart | 2024 | I | M | |||||

Alan E. Goldberg | 2024 | I | ||||||

S. Leslie Ireland | 2024 | I | M | M | ||||

Barbara L. Loughran | 2024 | I | M | C | ||||

Sandra E. Rowland | 2024 | I | C | |||||

Christopher M.T. Thompson | 2024 | I | ||||||

Russell Triedman | 2024 | I | C | M | ||||

John Vollmer | 2024 | I | ||||||

Connor Wentzell | 2024 | I | M | |||||

C Committee Chair I Independent Director M Member | ||||||||

Director | Principal Occupation, Business Experience and Other Directorships Held |

Steven (Steve) J. Demetriou | ||

| Steve Demetriou is the executive chair of the board of directors of Amentum. He joined Jacobs Solutions Inc. (Jacobs) as CEO in 2015. In 2016, he became chair and chief executive officer of Jacobs. In January 2023, upon retiring as chief executive officer, he continued as the executive chair of Jacobs’ board of directors, where he served until the closing of Amentum’s merger with Jacobs’ Critical Mission Solutions and Cyber and Intelligence businesses. During his tenure as CEO, Mr. Demetriou steered a profound reshaping of Jacobs’ business portfolio, operations and culture. Under his leadership, the company accelerated profitable growth and transformed into a leading, next- generation solutions provider by tackling some of the world’s biggest challenges for thriving cities, resilient environments, mission-critical outcomes, operational advancement, scientific discovery, and cutting-edge manufacturing. Mr. Demetriou’s broad international business perspectives are the product of more than 35 years in leadership and senior management roles across a wide range of industries. This includes serving as president and CEO of Noveon Inc. (2001-2004) and chairman and CEO of Aleris Corporation (2004-2015). He holds a Bachelor of Science degree in chemical engineering from Tufts University. In addition to serving on Amentum’s board, Mr. Demetriou also serves on the boards of FirstEnergy Corp. and Arcosa Inc. Specific qualifications, experience, skills, and expertise include: •Public company CEO, Executive Chair, and directorship experience; •Core business skills, including financial and strategic planning; and •Deep understanding of our Company, its history, and culture. | |

Age: 66 Director since 2024 Executive Chair | ||

Director | Principal Occupation, Business Experience and Other Directorships Held |

John Heller | ||

| As the chief executive officer for Amentum, John Heller’s responsibilities include planning and directing the strategy and execution of the operating activities for all 53,000 employees in approximately 80 countries around the world. Prior to the Amentum-Jacobs’ Critical Mission Solutions business merger, Mr. Heller was the chief executive officer of the legacy Amentum company since 2022, where he led the company’s integration of two multi-billion dollar acquisitions. Under his leadership, Amentum transformed into an industry- leading provider of engineering, system integration, and project management services to the U.S. government and partners. Before his role at Amentum, Mr. Heller served as chief executive officer and president at PAE from 2013 to 2021. Prior to that, he served as senior vice president and chief operating officer of Engility Corporation after the company was spun off from L-3 Communications from 2012 to 2013. He also held several leadership positions at Harris Corporation from 2007 to 2012, including president of Harris IT Services, served as CEO of Netco, Inc., a Cerberus Capital Management portfolio company from 2004 to 2006, and held the president and chief operating officer role at Multimax, Inc. from 2006 to 2007. Mr. Heller started his career in the U.S. Army serving in various leadership positions as a logistics officer. He then attended graduate business school and joined Deloitte Consulting. Following a decade in the consulting field, Mr. Heller attained his first CEO position at Rentport, Inc., a portfolio company of Catterton Partners (now L Catterton), a venture capital and private equity firm. Mr. Heller graduated from the U.S. Military Academy at West Point and earned a master’s degree in business administration from the University of Pittsburgh. Today he serves on their Chancellor’s Global Advisory Council. In recognition of his achievements and contributions in the field of business, Mr. Heller was also named the university’s Katz Graduate School Distinguished Alumni Honoree. As part of his support to the government services industry, Mr. Heller also serves as the Vice-chair for the Professional Services Council board of directors and executive committee. Mr. Heller is a well-recognized leader in the government contracting industry, being awarded 2024 CEO of the Year by WashingtonExec and 2024 ACG CEO of the Year; he has been in the Washington100 list of top executives multiple times over his career. Specific qualifications, experience, skills, and expertise include: •Operating and management experience, including as the CEO of public and privately owned companies; •Core business skills, including financial and strategic planning; and •Deep understanding of our Company, its history, and culture. | |

Age: 62 Director since 2024 Chief Executive Officer | ||

Director | Principal Occupation, Business Experience and Other Directorships Held |

Benjamin Dickson | ||

| Benjamin Dickson is the lead independent director on Amentum’s board of directors. He currently serves as a managing director of American Securities LLC, which he joined in 2011. He is a former member of the board of managers of the general partner of Amentum Joint Venture LP. Mr. Dickson has extensive experience serving as a director of private companies. In addition to serving on the board of Amentum, Mr. Dickson serves on the board of directors of several current American Securities LLC portfolio companies, including serving as chairman of the board of directors of NAPA and SimonMed and as a director of The Aspen Group. Prior to joining American Securities LLC, Mr. Dickson served as the director of corporate development at Active Interest Media, as an investment professional with GTCR and Wind Point Partners, and as a management consultant with McKinsey & Company. Mr. Dickson holds Bachelor of Science degrees in accounting and finance from Indiana University's Kelley School of Business and a Master of Business Administration degree from Northwestern University's Kellogg School of Management. He brings more than 18 years of private equity investing and director experience. Specific qualifications, experience, skills, and expertise include: •Private equity investing and directorship experience; •Operating and management experience; and •Core business skills, including financial and strategic planning. | |

Age: 43 Director since 2024 Lead Independent Director Committee: •Compensation | ||

Director | Principal Occupation, Business Experience and Other Directorships Held |

General Vincent K. Brooks (U.S. Army, retired) | ||

| General Vincent K. Brooks is a member of Amentum’s board of directors and has served as a principal of WestExec Advisors LLC since 2020. He served on the Jacobs board of directors from 2020 until the closing of Amentum’s merger with Jacobs’ Critical Mission Solutions and Cyber and Intelligence businesses. He is a former four-star general in the United States Army, from which he retired in 2019. He served as commander of Korean and U.S. combined forces in the Republic of Korea from 2016 to 2018 and held numerous high-level command and staff positions within the armed forces from 1980 to 2019. He currently serves as a director of Verisk Analytics Inc. and as the chair of the nominating and corporate governance committee of Diamondback Energy Inc. General Brooks also serves as vice chair of the Gary Sinise Foundation, is a life member of the Council on Foreign Relations, is a visiting senior fellow at Harvard Kennedy School Belfer Center for Science and International Affairs and a distinguished fellow at the University of Texas at Austin Clements Center for National Security and Strauss Center for International Security and Law. He previously served as a member of the CIA Director’s External Advisory Board, as a member of the Defense Advisory Committee on Diversity and Inclusion, as the Class of 1951 Distinguished Chair for the Study of Leadership at the U.S. Military Academy at West Point, and as the Chair and President of the Korea Defense Veterans Association. General Brooks holds a Bachelor of Science degree in engineering from the U.S. Military Academy at West Point and a master’s degree in military art and science from the U.S. Army School of Advanced Military Studies at Fort Leavenworth, Kansas. General Brooks brings to our board of directors valuable leadership skills and expertise developed through his military service. His areas of expertise include leadership in complex organizations, inclusion and diversity, national security, international relations, military operations, combating terrorism, and countering the proliferation of weapons of mass destruction. Specific qualifications, experience, skills, and expertise include: •Significant government experience, particularly in national security, international relations, and military operations; •Operating and management experience; and •Public company directorship and committee experience. | |

Age: 66 Director since 2024 Independent Committees: •Audit •Nominating & Governance | ||

Director | Principal Occupation, Business Experience and Other Directorships Held |

General Ralph E. (Ed) Eberhart (U.S. Air Force, retired) | ||

| General Ralph E. Eberhart is a member of Amentum’s board of directors and served on the board of directors of Jacobs from 2012 until the closing of Amentum’s merger with Jacobs’ Critical Mission Solutions and Cyber and Intelligence businesses. General Eberhart is a former four star general in the United States Air Force, a rank he held from 1997 to 2005. General Eberhart also held numerous high-level command and staff positions within the Air Force and the Department of Defense from 1968 to 2005. He is a former commander of the U.S. Northern Command, North American Aerospace Defense Command, U.S. Space Command, Air Force Space Command, Air Combat Command & U.S. Forces, Japan. He also served as vice chief of the United States Air Force. He has served as the chair of the board of VSE Corp. since 2019 and has served on its board since 2007. He also serves on the board of Segs4Vets. In the past, General Eberhart previously served as the chair of the board of Triumph Group, Inc. and on the boards of TERMA North America Inc. and Rockwell Collins. General Eberhart is the chair of the American Air Museum in Britain, serves on the board of trustees of Palmer Land Conservancy and is a trustee of the Air Force Academy Endowment. He is a member of the Council of Foreign Relations and the Colorado Thirty Group. General Eberhart brings extensive leadership skills developed through his military service. General Eberhart holds a Bachelor of Science degree in political science from the United States Air Force Academy and a master’s degree in political science from Troy State University. His 36-year military career provides our board of directors with valuable insights and knowledge into leadership, government and military issues. Specific qualifications, experience, skills, and expertise include: •Significant government experience, particularly in military operations; •Public and private company directorship and committee experience; and •Operating and management experience. | |

Age: 78 Director since 2024 Independent Committee: •Compensation | ||

Alan E. Goldberg | ||

| Alan Goldberg is a member of the board of directors of Amentum and is the co- founder and chief executive officer of Lindsay Goldberg, positions he has held since the firm’s inception in 2001. Prior to co-founding Lindsay Goldberg, he held several leadership positions at Morgan Stanley, including serving as chairman and chief executive officer of Morgan Stanley Private Equity. Mr. Goldberg has extensive experience serving as a director on the boards of directors of private and public companies, including most recently serving as a director on the boards of directors of Reign Research Holdings and Stelco Holdings Inc. (TSX: STLC). Mr. Goldberg holds a Bachelor of Arts degree in economics and philosophy and a Master of Business Administration degree from New York University, and a Juris Doctor degree from Yeshiva University. He brings more than 40 years of investing and public and private company director experience in the industrials, professional services and healthcare industries to our board of directors. Specific qualifications, experience, skills, and expertise include: •Private and public company directorship experience; •Expertise in the financial, industrial, professional services, and healthcare industries; and •Core business skills, including financial and strategic planning. | |

Age: 70 Director since 2024 Independent | ||

Director | Principal Occupation, Business Experience and Other Directorships Held |

S. Leslie Ireland | ||

| Leslie Ireland is a member of the board of directors of Amentum and served in the U.S. Intelligence Community for approximately 31 years. In her final assignment in federal service, Ms. Ireland was the Assistant Secretary for Intelligence and Analysis of the U.S. Department of the Treasury, and the National Intelligence Manager for Threat Finance for the Office of the Director of National Intelligence. Before joining the Treasury in 2010, Ms. Ireland was the daily intelligence briefer for President Barack Obama. She also served as the Iran Mission Manager, responsible for overseeing the intelligence process on Iran for the entire U.S. government. Ms. Ireland worked at the Central Intelligence Agency for 25 years in positions of increasing responsibility, including work on assignments focused on the Middle East and weapons of mass destruction. She retired from federal service in November 2016. Ms. Ireland has served as a director of Citigroup Inc. since October 2017. In addition, she serves on the board of the Stimson Center, a non-profit organization. She is a member of the Cyber Advisory Board for the CEO of Chubb Insurance and Chubb’s Executive Management Team. She is also a member of Tapestry Networks Cyber Risk Director Network. Ms. Ireland holds a bachelor’s degree from Franklin & Marshall College and a master’s degree from Georgetown University. She brings more than 30 years of in-depth experience in the Intelligence Community to our board of directors. Specific qualifications, experience, skills, and expertise include: •Significant government experience, particularly in national security and the Intelligence Community; •Public company and not-for-profit organization directorship experience; and •Core business skills, including financial and strategic planning. | |

Age: 65 Director since 2024 Independent Committees: •Audit •Compensation | ||

Barbara (Barb) L. Loughran | ||

| Barb Loughran is a member of the board of directors of Amentum and served on the board of directors of Jacobs from 2019 until the closing of Amentum’s merger with Jacobs’ Critical Mission Solutions and Cyber and Intelligence businesses. Most recently she served as Jacobs’ audit committee chair and on the enterprise risk & ESG committee. Previously, Ms. Loughran was a partner at PricewaterhouseCoopers LLP (PwC) until 2018, serving global public company clients across a wide range of industries. Additionally, she served as a partner in PwC’s national office working with the Securities and Exchange Commission and clients as they accessed the capital markets and responded to regulatory requirements. Ms. Loughran has also been on the board of Armstrong World Industries since 2019, serving as audit committee chair and on the nominating, governance & sustainability and finance committees. Ms. Loughran holds a bachelor’s degree from Franklin & Marshall College and a Master of Business Administration degree from the University of Pennsylvania’s Wharton School. Ms. Loughran brings more than 35 years of global experience working with Fortune 500 executives and boards as they navigate strategic, transformational and operational issues. Her broad industry experience brings our board of directors in-depth knowledge in the professional services, industrial, engineering and consumer products industries. Specific qualifications, experience, skills, and expertise include: •Expertise in the professional services, industrial, engineering and consumer products industries; •Public company directorship and audit committee experience; and •Core business skills, including accounting, financial and strategic planning. | |

Age: 61 Director since 2024 Independent Committees: •Audit •Nominating & Governance (Chair) | ||

Director | Principal Occupation, Business Experience and Other Directorships Held |

Sandra E. Rowland | ||

| Sandra Rowland is a member of the board of directors of Amentum. From 2020 to 2023, Ms. Rowland served as senior vice president and chief financial officer of Xylem Inc., a leading water technology company, during which she played a central role in the company’s $7.5 billion acquisition and integration of Evoqua Water Technologies Corp., and served as a senior advisor from 2023 to 2024. From 2015 to 2020, Ms. Rowland served as executive vice president, and chief financial officer of Harman International Industries Inc., a global leader in connected car and audio solutions. She was instrumental in Samsung Electronics’ acquisition of Harman, a NYSE publicly traded Fortune 500/S&P 500 Company in 2017. From 2012 to 2014, Ms. Rowland led corporate development and investor relations. Earlier in her career, Ms. Rowland held various financial leadership positions at Eastman Kodak Company and PricewaterhouseCoopers LLP. Ms. Rowland currently serves on the board of directors and the audit and human resources committees of Oshkosh Corporation, a leading innovator of purpose- built vehicles and equipment. She also serves as board member and chair of the audit committee of Fortifi Food Processing Solutions, a portfolio company of KKR & Company Inc. Ms. Rowland holds a bachelor’s degree in economics and business from Lafayette College and a Master of Business Administration degree from the University of Rochester’s William E. Simon School of Business. She brings more than 30 years of experience in financial strategy, investor relations, mergers and acquisitions, and accounting and finance operations to our board of directors. Specific qualifications, experience, skills, and expertise include: •Expertise in finance and accounting operations, financial strategy, investor relations, and mergers and acquisitions; •Public company directorship and audit committee experience; and •Core business skills, including financial and strategic planning. | |

Age: 53 Director since 2024 Independent Committee: •Audit (Chair) | ||

Director | Principal Occupation, Business Experience and Other Directorships Held |

Christopher M.T. Thompson | ||

| Christopher Thompson is a member of the board of directors of Amentum and served on the board of Jacobs from 2012 and from 2020 as Lead Independent Director until the closing of Amentum’s merger with Jacobs’ Critical Mission Solutions and Cyber and Intelligence businesses. Mr. Thompson has served on the boards of directors of Royal Gold Inc. from 2013 to 2020, Golden Star Resources Ltd. from 2010 to 2015, and Teck Resources Limited from 2003 to 2014. Additionally, from 2002 to 2005, he served as chairman of the World Gold Council and from 1998 to 2005, he served as director, chairman and chief executive officer of Gold Fields Ltd., a gold mining company. Earlier in his career, Mr. Thompson founded and led the formation of Castle Group Inc., a manager of institutionally funded venture capital partnerships that invested in the development of new gold mines globally, from 1985 to 1998. Prior to his experience at Castle Group Inc., Mr. Thompson was a mining analyst, partner and director of Gordon Securities in Toronto from 1978 to 1982. In addition, from 1971 to 1978, he worked for the Anglo American Corporation in South Africa and Canada as assistant divisional manager of the Gold Division and, subsequently, the Finance Division. He has also served on private boards of directors and engaged with the community, including, from 2013 to 2017, as a member of the board of directors of The Colorado School of Mines Foundation, and from 1998 to 2002, as a member of the board of directors and vice president of the South African Chamber of Mines and a member of the board of directors of Business Against Crime South Africa. Mr. Thompson holds a bachelor’s degree in law and economics from Rhodes University in South Africa, and a master’s degree in business management from Bradford University in the United Kingdom. He has an extensive background in international operations, finance and strategic leadership in a range of industries, including investments and mining. Mr. Thompson brings valuable insight and independent leadership to our board of directors regarding the day- to-day operations of large global organizations, risk management and corporate best practices. Specific qualifications, experience, skills, and expertise include: •Public and private company CEO and directorship experience; •Expertise in finance, risk management, and global businesses; and •Core business skills, including financial and strategic planning. | |

Age: 76 Director since 2024 Independent | ||

Director | Principal Occupation, Business Experience and Other Directorships Held |

Russell Triedman | ||

| Russell Triedman is a member of the board of directors of Amentum and a managing partner at Lindsay Goldberg, which he joined at its inception in 2001. He is a former member of the board of managers of the general partner of Amentum Joint Venture LP. Mr. Triedman has extensive experience serving as a director of private and public companies and serves in such roles at companies owned by Lindsay Goldberg funds. Mr. Triedman holds a Bachelor of Science degree in applied mathematics and economics from Brown University and a Juris Doctor degree from the University of Chicago Law School. He brings more than 25 years of investing and director experience in the industrials, government contracting, and other professional services industries to our board of directors. Specific qualifications, experience, skills, and expertise include: •Public and private company directorship experience; •Private equity investing experience; and •Core business skills, including financial and strategic planning. | |

Age: 55 Director since 2024 Independent Committees: •Compensation (Chair) •Nominating & Governance | ||

John Vollmer | ||

| John Vollmer is a member of the board of directors of Amentum and the former chairman and member of the board of managers of the general partner of Amentum Joint Venture LP. Previously, Mr. Vollmer served as chief executive officer of Amentum from 2020 to 2022, as president of the AECOM Management Services Group from 2016 to 2020, and as group and executive vice president and chief operating officer of URS Corporation Federal Services from 2009 to 2015. Additionally, he is a director on the board of directors of Yellow Ribbon Fund Inc., a 501(c)(3) non-profit organization that supports wounded service members and their families. Mr. Vollmer graduated from Flagler College with a degree in business economics. He brings more than 40 years of experience working with military and other federal agency clients providing IT, communications and command and control solutions globally to our board of directors. Specific qualifications, experience, skills, and expertise include: •Chief executive officer and chief operating officer experience; •Understanding of government contracting; and •Deep understanding of our Company, its history, and culture. | |

Age: 67 Director since 2024 Independent | ||

Director | Principal Occupation, Business Experience and Other Directorships Held |

Connor Wentzell | ||

| Connor Wentzell is a member of the board of directors of Amentum. Mr. Wentzell currently serves as a principal of American Securities LLC, which he joined in 2014. He is a former member of the board of managers of the general partner of Amentum Joint Venture LP. He also serves as a director of American Securities LLC portfolio companies, including currently serving as a director of Learning Care Group and previously serving as a director of Blue Bird Corporation (NASDAQ: BLBD). Prior to joining American Securities LLC, Mr. Wentzell worked at Evercore Partners from 2012 to 2014. Mr. Wentzell holds a Bachelor of Arts degree in economics from Harvard University and a Masters of Business Administration degree from the University of Pennsylvania’s Wharton School of Business. He brings more than 10 years of private equity investing and director experience in the government services, aerospace and defense, and financial services industries to our board of directors. Specific qualifications, experience, skills, and expertise include: •Private equity investing and directorship experience; •Expertise in the aerospace & defense and financial services industries; and •Core business skills, including financial and strategic planning. | |

Age: 34 Director since 2024 Independent Committee: •Nominating & Governance | ||

The Board of Directors recommends a vote FOR each of the director nominees. |

Board Member | Independent | Audit Committee | Compensation Committee | Nominating & Governance Committee | ||

Steven J. Demetriou | ||||||

John Heller | ||||||

Benjamin Dickson | I | M | ||||

General Vincent K. Brooks | I | M | M | |||

General Ralph E. Eberhart | I | M | ||||

Alan E. Goldberg | I | |||||

S. Leslie Ireland | I | M | M | |||

Barbara L. Loughran | I | M F | C | |||

Sandra E. Rowland | I | C F | ||||

Christopher M.T. Thompson | I | |||||

Russell Triedman | I | C | M | |||

John Vollmer | I | |||||

Connor Wentzell | I | M | ||||

C Chair F Financial Expert I Independent M Member | ||||||

Component | Amount through 3/5/25 |

Board Cash Retainer1 | $62,500 |

Equity Award2 | $95,000 |

Lead Independent Director Additional Retainer | $50,000 |

Committee Chair Additional Retainer | $12,500 |

Name | Shares Beneficially Owned | Percentage of Common Stock |

Directors | ||

General Vincent K. Brooks1 | 6,966 | * |

Steven J. Demetriou1, 2 | 678,566 | * |

Benjamin Dickson | 0 | —% |

General Ralph E. Eberhart1 | 26,439 | * |

Alan E. Goldberg1, 3 | 43,893,904 | 18.04% |

John Heller1 | 91,794 | * |

S. Leslie Ireland | 0 | —% |

Barbara L. Loughran | 0 | —% |

Sandra E. Rowland | 0 | —% |

Christopher M.T. Thompson1, 4 | 17,447 | * |

Russell Triedman | 0 | —% |

John Vollmer1 | 391,341 | * |

Connor Wentzell | 0 | —% |

Other named executive officers | ||

Stephen A. Arnette1 | 20,786 | * |

Travis B. Johnson1 | 0 | —% |

Sean Mullen1 | 0 | —% |

All directors and executive officers as a group (19 persons)1 | 45,418,042 | 18.67% |

Name and Address | Shares Beneficially Owned | Percentage of Common Stock |

Lindsay Goldberg1 c/o Lindsay Goldberg LLC 630 Fifth Avenue, 30th Floor New York, New York 10111 | 43,893,904 | 18.04% |

ASP Amentum Investco LP, a Delaware limited partnership, ASP Manager Corp., a Delaware corporation, and American Securities LLC, a Delaware limited liability company (collectively, the "American Securities Parties")2 c/o American Securities LLC 590 Madison Avenue, 38th Floor New York, New York 10022 | 43,893,904 | 18.04% |

The Vanguard Group3 100 Vanguard Boulevard Malvern, Pennsylvania 19355 | 14,013,274 | 9.14%6 |

Jacobs Solutions Inc. and Jacobs Engineering Group Inc.4 1999 Bryan Street Suite 3500 Dallas, TX 75201 | 18,247,663 | 7.50% |

Blackrock, Inc.5 50 Hudson Yards New York, New York 10001 | 8,915,088 | 5.8%7 |

|  |  |  |  |

Steven J. Demetriou | John Heller | Stephen A. Arnette | Travis B. Johnson | Sean Mullen |

Executive Chairman | Chief Executive Officer | Chief Operating Officer | Chief Financial Officer | Chief Growth Officer |

WHAT WE DO | WHAT WE DON'T DO |

üRequire our executives and directors to satisfy meaningful stock ownership requirements | üNo offer of excessive executive perks and benefits |

üAnnually assess our peer group for benchmarking executive compensation levels and practices | üNo single trigger change in control |

üRegularly review our executive talent, performance, deployments, and succession plans | üNo hedging or pledging of Amentum securities |

üAlign executive pay with short- and long-term performance | üNo defined benefit pension plan for named executive officers |

üRegularly evaluate policies and programs to test their market competitiveness, ensure consistency to organizational objectives, and alignment with standards of good governance | üNo speculative trading of Amentum stock |

üLimit excessive compensation for executives by setting compensation caps and restricting excessive perks and non-monetary benefits | |

üEngage with an independent compensation consultant performing no work for Amentum other than that for Amentum's Compensation Committee |

Groups Involved in Determining Executive Compensation | Roles |

Compensation Committee | •Develop, amend, and approve executive compensation programs to remain consistent with our values and philosophy, support the recruitment and retention of executive talent, and help achieve business objectives •Determine and approve the appropriate level of compensation for all executive officers •Determine and approve short- and long-term incentive plan design and performance targets for all executive officers •Evaluate our CEO's performance •Select the independent compensation consultant and determine the scope of the consultant’s engagement |

Board of Directors | •Appoint executive officers |

Chief Executive Officer | •Evaluate performance for the executive officers, other than himself, and make compensation recommendations to the Compensation Committee |

Independent Compensation Consultant | •Provide expert input on market trends and broader developments in executive compensation, as well as assess the extent to which the Company's compensation programs, policies, and practices align with the Company’s business and talent strategies, and investor expectations •Analyze the prevailing executive compensation structure and plan designs, and help the Compensation Committee assess the appropriateness of our compensation program in the context of aligning executive officer interests with those of our strategy and our shareholder interests |

Fiscal Year 2024 Peer Group | Fiscal Year 2025 Peer Group |

AECOM (ACM) | AECOM (ACM) |

CACI INTERNATIONAL, INC (CACI) | BOOZ ALLEN HAMILTON (BAH) |

DXC TECHNOLOGY (DXC) | CACI INTERNATIONAL, INC (CACI) |

HUNTINGTON INGALLS INDUSTRIES (HII) | DXC TECHNOLOGY (DXC) |

KBR, INC (KBR) | FLUOR (FLR) |

L3HARRIS TECHNOLOGIES, INC (LHX) | HUNTINGTON INGALLS INDUSTRIES (HII) |

LEIDOS HOLDINGS, INC (LDOS) | JACOBS (J) |

MAXIMUS, INC (MMS) | KBR, INC (KBR) |

PARSONS CORPORATION (PSN) | L3HARRIS TECHNOLOGIES, INC (LHX) |

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION (SAIC) | LEIDOS HOLDINGS, INC (LDOS) |

TEXTRON, INC (TXT) | MAXIMUS, INC (MMS) |

PARSONS CORPORATION (PSN) | |

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION (SAIC) | |

TEXTRON, INC (TXT) | |

V2X (VVX) |

Legacy Amentum for Fiscal Year 2024 | Legacy Jacobs for Fiscal Year 2024 | |

John Heller | Steven J. Demetriou | |

Travis B. Johnson | Steve A. Arnette | |

Sean Mullen |

Legacy Amentum for Fiscal Year 2024 | Legacy Jacobs for Fiscal Year 2024 | |

Base salary | Base salary | |

Short-Term Incentive Plan (STIP) | Leadership Performance Plan (LPP) | |

Long-term Equity Incentives | Long-term Equity Incentives |

Legacy Amentum for Fiscal Year 2024 | Legacy Jacobs for Fiscal Year 2024 | |||

Name | Salary | Name | Salary | |

John Heller | $1,200,000 | Steven J. Demetriou | $1,250,000 | |

Travis B. Johnson | $580,000 | Stephen A. Arnette1 | $750,000 | |

Sean Mullen | $450,039 | |||

Legacy Amentum for Fiscal Year 2024 | Legacy Jacobs for Fiscal Year 2024 | |||

Name | STIP Target (% of Salary) | Name | LPP Target (% of Salary) | |

John Heller | 130% | Steven J. Demetriou | 100% | |

Travis B. Johnson | 100% | Stephen A. Arnette | 100% | |

Sean Mullen | 75% | |||

Legacy Amentum for Fiscal Year 2024 | Legacy Jacobs for Fiscal Year 2024 | |

Awards were at risk and tied to the achievement of pre-set financial and operational goals. | Awards were at risk and tied to the achievement of pre-set financial and operational goals. | |

Legacy Amentum used STI Adjusted EBITDA, weighted 75%, and Days Sales Outstanding (DSO), weighted 25%, as its performance measures to reflect the cash flow and operating profit priorities of the business and the elements of performance that executives could most directly impact, as follows: •See Appendix A to this proxy statement for a reconciliation of STI Adjusted EBITDA to the most directly comparable financial measure calculated and presented in accordance with GAAP •Payouts were adjusted for performance between discrete points | The bonus opportunity was split equally between Jacobs and CMS objectives for Mr. Demetriou and was based solely on CMS objectives for Mr. Arnette. | |

In addition to financial performance measures, the award may also be adjusted for individual achievement of performance goals that include specific financial and non-financial objectives. | Jacobs and CMS used Operating Profit, weighted 60%, Average Gross Profit Remaining Performance Obligation/ Backlog (RPO) Growth, weighted 15%, DSO, weighted 10%, EBITDA Margin, weighted 10%, and GHG Emissions from Business Travel, weighted 5%. |

Legacy Amentum for Fiscal Year 2024 | Legacy Jacobs for Fiscal Year 2024 | |

Fiscal year 2024 goals and results yielded a payout of 106% of target payout based on STI Adjusted EBITDA of $640M and DSO of 65.0 days as shown below: | For fiscal year 2024, Mr. Demetriou earned 104.4% of his target award and Mr. Arnette earned 85.2% of his target award, with the resulting payouts shown below: |

STI Adjusted EBITDA ($MM) | DSO (Days) | Payout | Name | Fiscal Year 2024 Annual Cash Incentive Target | Annual Cash Incentive Payout | Annual Cash Incentive Paid | ||

Weighting | 75% | 25% | Steven J. Demetriou | $1,250,000 | 104% | $1,306,422 | ||

Maximum | $755 | 51.2 | 200% | Stephen A. Arnette | $600,000 | 85% | $511,203 | |

Target | $629 | 64.0 | 100% | |||||

Threshold | $566 | 70.4 | 75% | |||||

For fiscal year 2024, the Compensation Committee determined that Mr. Heller would receive an award commensurate with company financial performance, Mr. Johnson would receive an upward adjustment to 150% of target, and Mr. Mullen would receive an upward adjustment to 125% of target to reflect significant integration and Transaction contributions. Resulting awards by individual NEO are shown below: | (Please refer to the Jacobs FY2024 Proxy filed on December 16, 2024 with the Securities and Exchange Commission (the “Jacobs 2024 Proxy”) for more details on the Jacobs plan components and achievement of the applicable goals.) |

Name | Fiscal Year 2024 Annual Cash Incentive Target | Annual Cash Incentive Payout | Annual Cash Incentive Paid |

John Heller | $1,495,178 | 106% | $1,586,384 |

Travis B. Johnson | $572,521 | 150% | $858,781 |

Sean Mullen | $332,849 | 125% | $416,061 |

Legacy Amentum for Fiscal Year 2024 | Legacy Jacobs for Fiscal Year 2024 | |

Equity compensation was not a component of fiscal year 2024 compensation for Messrs. Heller, Johnson and Mullen because Legacy Amentum did not grant additional equity awards in fiscal year 2024. A more complete explanation of Amentum’s equity program prior to its public offering is described in the Section titled, “Long-Term Equity Incentives before Fiscal Year 2024." | •Messrs. Demetriou and Arnette were granted equity in FY2024 under the Jacobs Stock Incentive Plan. Mr. Demetriou was granted 100% RSUs which vested on September 18, 2024 in recognition of his Executive Chair role. Mr. Arnette was granted 60% PSUs and 40% RSUs, vesting over 4 years in equal annual installments, consistent with other Jacobs executives. •The target value of these grants is shown in the table below: |

Name | Fiscal Year 2024 Annual Target Performance-Based RSU Grant | Fiscal Year 2024 Annual Target Time- Based RSU Grant | ||

Steven J. Demetriou | $— | $2,750,001 | ||

Stephen A. Arnette | $900,090 | $599,923 |

(Please refer to the Jacobs 2024 Proxy for more details on the Jacobs Equity Plan and grants to Messrs. Demetriou and Arnette.) |

Name | FY24 Annual Target Performance-Based RSU Grant | FY24 Annual Target Time-Based RSU Grant |

John Heller | $— | $— |

Steven J. Demetriou | $— | $2,750,001 |

Stephen A. Arnette | $900,090 | $599,923 |

Travis B. Johnson | $— | $— |

Sean Mullen | $— | $— |

Name | FY25 Base Salary | FY25 STIP (as % of Base) | FY25 STIP Target | FY25 Annual Target Performance-Based RSU Grant | FY25 Annual Target Time- Based RSU Grant | FY25 Total Target Compensation |

John Heller | $1,225,000 | 140% | $1,715,000 | $3,275,000 | $3,275,000 | $9,490,000 |

Steven J. Demetriou | $1,250,000 | 100% | $1,250,000 | $— | $2,500,000 | $5,000,000 |

Stephen A. Arnette | $750,000 | 100% | $750,000 | $1,050,000 | $1,050,000 | $3,600,000 |

Travis B. Johnson | $650,000 | 100% | $650,000 | $1,000,000 | $1,000,000 | $3,300,000 |

Sean Mullen | $473,000 | 75% | $354,750 | $400,000 | $400,000 | $1,627,750 |

Adjusted EBITDA | DSO | Net Debt Reduction | |

Weighting | 65% | 20% | 15% |

Form of 2024 Equity Grants | Weight | Performance and Vesting Periods |

PSUs | 50% | 3-year performance period |

RSUs | 50% | 3-year ratable vesting |

3-Year Cumulative Adjusted EBITDA | 3-Year Cumulative Free Cash Flow | |

Weighting | 50% | 50% |

NEO | Launch Grant Value |

John Heller | $1,000,000 |

Steven J. Demetriou | $— |

Stephen A. Arnette | $750,000 |

Travis B. Johnson | $750,000 |

Sean Mullen | $500,000 |

Executive Officers | Ownership Guidelines |

Executive Chair | 6x annual base salary |

Chief Executive Officer | 6x annual base salary |

Other executive officers | 3x annual base salary |

Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($) | Stock Awards ($)2 | Option Awards ($) | Non-Equity Incentive Plan Compensation ($)3 | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($)4 | Total ($) |

John Heller Chief Executive Officer | 2024 | 1,165,385 | — | — | — | 1,586,384 | — | 30,710 | 2,782,479 |

Steven J. Demetriou1 Executive Chairman | 2024 | 1,250,000 | — | 2,750,001 | — | 1,306,422 | — | 44,962 | 5,351,385 |

Stephen A. Arnette1 Chief Operating Officer | 2024 | 586,154 | — | 1,500,013 | — | 511,203 | — | 61,602 | 2,658,972 |

Travis B. Johnson Chief Financial Officer | 2024 | 571,923 | 500,000 | — | — | 858,781 | — | 32,945 | 1,963,649 |

Sean Mullen Chief Growth Officer | 2024 | 443,300 | 350,000 | — | — | 416,061 | — | 24,603 | 1,233,964 |

Name | Executive Perquisite ($)1 | Qualified Company Contributions to 401(k) ($)2 | Executive Medical and Wellness Contributions ($) | Employer Paid Insurance Premiums ($) | Other ($)3 | Total ($) |

John Heller | — | 10,350 | 11,400 | 7,417 | 1,543 | 30,710 |

Steven J. Demetriou | 20,639 | 15,525 | 5,771 | 48 | 2,979 | 44,962 |

Stephen A. Arnette | 32,404 | 12,075 | 13,597 | 3,526 | — | 61,602 |

Travis B. Johnson | 1,750 | 15,940 | 8,300 | 6,955 | — | 32,945 |

Sean Mullen | — | 13,711 | 5,150 | 5,742 | — | 24,603 |

Estimated Possible Payouts Under Non-Equity Incentive Plan Awards1 | Estimated Future and Possible Payouts Under Equity Incentive Plan Awards2 | All Other Stock Awards; Number of Shares or Stock Units3 | Grant Date Fair Value of Stock and Option Awards ($)4 | ||||||

Name | Grant Date | Threshold ($) | Target ($) | Max ($) | Threshold ($) | Target ($) | Max ($) | ||

John Heller | — | 1,121,384 | 1,495,178 | 2,990,356 | — | — | — | — | — |

Steven J. Demetriou | — | 312,500 | 1,250,000 | 2,500,000 | — | — | — | — | — |

11/15/2023 | — | — | — | — | — | — | 20,073 | 2,750,001 | |

Stephen A. Arnette | — | 150,000 | 600,000 | 1,200,000 | — | — | — | — | — |

11/15/2023 | — | — | — | 224,954 | 900,090 | 1,800,180 | 4,379 | 599,923 | |

Travis B. Johnson | — | 429,391 | 572,521 | 1,145,042 | — | — | — | — | — |

Sean Mullen | — | 249,637 | 332,849 | 665,698 | — | — | — | — | — |

Stock Awards | |||||

Name | Grant Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights that Have Not Vested ($) |

John Heller | — | — | — | — | — |

Steven J. Demetriou | 9/27/241 | 43,396 | 1,195,772 | — | — |

Stephen A. Arnette | 9/27/241 | 1,178 | 32,460 | — | — |

9/27/242 | 521 | 14,356 | — | — | |

9/27/243 | 4,038 | 111,267 | — | — | |

9/27/244 | 10,106 | 278,470 | — | — | |

9/27/245 | 17,273 | 475,956 | — | — | |

9/27/246 | 3,681 | 101,430 | — | — | |

9/27/246 | 4,596 | 126,642 | — | — | |

9/27/247 | 10,984 | 302,663 | — | — | |

9/27/247 | 10,395 | 286,433 | — | — | |

Travis B. Johnson | — | — | — | — | — |

Sean Mullen | — | — | — | — | — |

Option Awards | Stock Awards | |||

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($) |

John Heller1 | — | — | 7,157 | 153,947 |

Steven J. Demetriou2 | — | — | 201,382 | 27,914,198 |

Stephen A. Arnette3 | — | — | 17,169 | 2,448,677 |

Travis B. Johnson | — | — | — | — |

Sean Mullen | — | — | — | — |

Name | Executive Contributions During Last Fiscal Year ($) | Aggregate Earnings During Last Fiscal Year($) | Aggregate Withdrawals/ Distributions During Last Fiscal Year ($) | Aggregate Balance at Last Fiscal Year End ($) |

John Heller | — | — | — | — |

Steven J. Demetriou1 | — | 101,411 | — | 535,048 |

Stephen A. Arnette | — | — | — | — |

Travis B. Johnson | — | — | — | — |

Sean Mullen | — | — | — | — |

Name | Cash Severance ($) | Prorated Bonus ($) | Benefit Continuation ($)1 | Long Term Disability ($)2 | Outplacement Services ($)3 | Equity With Accelerated Vesting ($)4 | Total ($) |

John Heller | |||||||

Death/Disability | — | 1,586,384 | — | 300,000 | — | — | 1,886,384 |

Retirement | — | 1,586,384 | — | — | — | — | 1,586,384 |

Change-in-Control | — | — | — | — | — | — | — |

Qualifying Termination On or After Change-In-Control | 4,900,345 | 1,586,384 | 399,953 | — | 15,000 | — | 6,901,682 |

Involuntary Termination | 3,675,259 | 1,586,384 | 386,123 | — | 15,000 | — | 5,662,766 |

Voluntary Resignation | — | — | — | — | — | — | — |

Termination for Cause | — | — | — | — | — | — | — |

Steven J. Demetriou | |||||||

Death/Disability | — | 1,306,422 | — | 300,000 | — | 1,195,772 | 2,802,194 |

Retirement | — | 1,306,422 | — | — | — | 1,195,772 | 2,502,194 |

Change-in-Control | — | — | — | — | — | — | — |

Qualifying Termination On or After Change-In-Control | 5,000,000 | 1,306,422 | 68,304 | — | 15,000 | 1,195,772 | 7,585,498 |

Involuntary Termination | 3,750,000 | 1,306,422 | 59,478 | — | 15,000 | 1,195,772 | 6,326,673 |

Voluntary Resignation | — | — | — | — | — | — | — |

Termination for Cause | — | — | — | — | — | — | — |

Stephen A. Arnette | |||||||

Death/Disability | — | 511,203 | — | 300,000 | — | 1,729,676 | 2,540,879 |

Retirement | — | 511,203 | — | — | — | 1,729,676 | 2,240,879 |

Change-in-Control | — | — | — | — | — | — | — |

Qualifying Termination On or After Change-In-Control | 1,800,000 | 511,203 | 59,478 | — | 15,000 | 1,729,676 | 4,115,357 |

Involuntary Termination | 1,800,000 | 511,203 | 59,478 | — | 15,000 | 1,729,676 | 4,115,357 |

Voluntary Resignation | — | — | — | — | — | — | — |

Termination for Cause | — | — | — | — | — | — | — |

Travis B. Johnson | |||||||

Death/Disability | — | 858,781 | — | 300,000 | — | — | 1,158,781 |

Retirement | — | 858,781 | — | — | — | — | 858,781 |

Change-in-Control | — | — | — | — | — | — | — |

Qualifying Termination On or After Change-In-Control | 2,107,785 | 858,781 | 137,620 | — | 15,000 | — | 3,119,186 |

Involuntary Termination | 2,107,785 | 858,781 | 137,620 | 15,000 | — | 3,119,186 | |

Voluntary Resignation | — | — | — | — | — | — | — |

Termination for Cause | — | — | — | — | — | — | — |

Sean Mullen | |||||||

Death/Disability | — | 416,061 | — | 270,024 | — | — | 686,085 |

Retirement | — | 416,061 | — | — | — | — | 416,061 |

Change-in-Control | 2,000,000 | — | — | — | — | — | 2,000,000 |

Qualifying Termination On or After Change-In-Control | 880,384 | 416,061 | 209,135 | — | 15,000 | — | 1,520,580 |

Involuntary Termination | 880,384 | 416,061 | 209,135 | — | 15,000 | — | 1,520,580 |

Voluntary Resignation | — | — | — | — | — | — | — |

Termination for Cause | — | — | — | — | — | — | — |

Year | Summary Compensation Table Total for CEO1 | Compensation actually paid to CEO1 | Average Summary Compensation Table Total for other NEOs2,3 | Average Summary Compensation actually paid to other NEOs2,3 | TSR4 | Peer Group TSR4 | Net Income (in $MM)5 | Adjusted EBITDA (in $MM)6 |

2024 | 2,782,479 | 2,782,479 | 2,801,993 | 2,801,993 | n/a | n/a | -82 | 1,052 |

Item and Value Added (Deducted) | FY2024 |

For CEO: | |

Summary Compensation Table Total | $2,782,479 |

- Summary Compensation Table “Option Awards” column value | $— |

- Summary Compensation Table “Stock Awards” column value | $— |

+ year-end fair value of outstanding and unvested equity awards granted in the fiscal year | $— |

+/- change in fair value of outstanding and unvested equity awards granted in prior years | $— |

+ vest date fair value of equity awards granted in the covered year | $— |

+/- change in fair value of prior-year equity awards vested in the fiscal year | $— |

Compensation Actually Paid | $2,782,479 |

Item and Value Added (Deducted) | FY2024 |

For Non-CEO named executive officers: | |

Summary Compensation Table Total | $2,801,993 |

- Summary Compensation Table “Option Awards” column value | $— |

- Summary Compensation Table “Stock Awards” column value | $— |

+ year-end fair value of outstanding and unvested equity awards granted in the fiscal year | $— |

+/- change in fair value of outstanding and unvested equity awards granted in prior years | $— |

+ vest date fair value of equity awards granted in the covered year | $— |

+/- change in fair value of prior-year equity awards vested in the fiscal year | $— |

Compensation Actually Paid | $2,801,993 |

FY24 Most Important Financial Measures | FY25 Most Important Financial Measures |

STI Adjusted EBITDA | Adjusted EBITDA |

Days Sales Outstanding (DSO) | Days Sales Outstanding (DSO) |

Free Cash Flow (FCF) | |

Net Debt Reduction |

(Amounts in thousands) | FY2024 | FY2023 | |

Audit fees1 | $6,959 | $4,276 | |

Audit-related fees2 | 1,671 | 39 | |

Tax fees3 | 617 | 679 | |

All other fees4 | 51 | 17 | |

Total5 | $9,298 | $5,011 | |

The Board of Directors recommends a vote FOR ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm for the Company for fiscal year 2025. | ||

The Board of Directors recommends a vote FOR the approval, on an advisory basis, of the compensation paid to our named executive officers in fiscal year 2024 as disclosed in this proxy statement. |

The Board of Directors recommends a vote for the option of ONE YEAR for the frequency of future advisory votes to approve executive compensation. | ||

Proposal | Description | Board's Voting Recommendation | Page Reference |

No. 1 | Election of thirteen director nominees named in this proxy statement | FOR each director nominee | |

No. 2 | Ratification of appointment of EY as the Company's independent registered accounting firm for fiscal year 2025 | FOR | |

No. 3 | A non-binding, advisory vote on the compensation paid to the Company’s named executive officers for fiscal year 2024, as disclosed in the proxy statement | FOR | |

No. 4 | A non-binding, advisory vote on the frequency of future advisory votes to approve named executive officer compensation | ONE YEAR |

For The Fiscal Year Ended September 27, 2024 | |

(Amounts in millions) | |

Net loss attributable to common shareholders | $(82) |

Depreciation expense | 23 |

Amortization of intangibles | 228 |

Interest expense and other, net | 438 |

(Benefit) provision for income taxes | (40) |

EBITDA (non-GAAP) | 567 |

Acquisition, transaction and integration costs | 62 |

Non-cash GAAP expense (gain) | (69) |

Loss on extinguishment of debt | 45 |

Utilization of fair market value adjustments | (5) |

Share-based compensation | 18 |

STI Adjustments | 22 |

STI Adjusted EBITDA (non-GAAP) | $640 |

For the Year Ended September 27, 2024 | For the Year Ended September 29, 2023 | ||

(Amounts in millions) | |||

Pro forma revenues | $13,858 | $13,371 | |

Pro forma net income (loss) attributable to common shareholders | $32 | $(145) | |

Depreciation expense | 37 | 45 | |

Amortization of intangibles | 499 | 592 | |

Interest expense and other, net | 345 | 348 | |

(Benefit) provision for income taxes | 37 | 4 | |

EBITDA (non-GAAP) | 950 | 844 | |

Acquisition, transaction and integration costs | 62 | 39 | |

Non-cash GAAP expense (gain) | — | 117 | |

Loss on extinguishment of debt | 45 | — | |

Utilization of fair market value adjustments | (15) | (35) | |

Share-based compensation | 10 | 21 | |

Pro Forma Adjusted EBITDA (non-GAAP) | $1052 | $986 | |

Pro Forma Adjusted EBITDA Margin (non-GAAP) | 7.6% | 7.4% |