“CREST” are to the system for the paperless settlement of trades in securities and the holding of uncertificated securities operated by Euroclear in accordance with the Relevant System of which Euroclear is the “Operator” (as such term is defined in the CREST Regulations);

“CREST Regulations” are to the Uncertificated Securities Regulations 2001 (SI 2001 No. 3755), as amended from time to time;

“Depositary” are to Computershare Investor Services PLC, the issuer of the U.K. DIs;

“DGCL” are to the Delaware General Corporation Law, as in effect from time to time;

“DTR” are to the Disclosure Guidance and Transparency Rules produced by the FCA and forming part of the FCA Handbook;

“Effective Time” are to 12:01 a.m. Eastern Time (5:01 a.m. U.K. Time) on August 1, 2024;

“ESPP” are to the Ferguson Group Employee Share Purchase Plan 2021;

“FCA” are to the Financial Conduct Authority;

“Ferguson Articles” are to Ferguson plc’s Articles of Association, as currently in effect;

“Ferguson Board” are to the board of directors of Ferguson plc;

“Ferguson Employee Share Plans” are to the Omnibus Plan, the LTIP, the POSP, the OSP and the ESPP, together;

“Ferguson Governing Documents” are to Ferguson plc’s Memorandum and Articles of Association, as currently in effect;

“Ferguson Shareholders” are to the holders of Ferguson Shares;

“Ferguson Shares” are to the ordinary shares, par value 10 pence per share, of Ferguson plc;

“GBP” or “£” are to U.K. pounds sterling;

“Jersey” are to the Bailiwick of Jersey;

“Jersey Companies Law” are to Companies (Jersey) Law 1991, as amended, modified, or re-enacted from time to time;

“LSE” are to the London Stock Exchange;

“LTIP” are to the Ferguson Group Long Term Incentive Plan 2019;

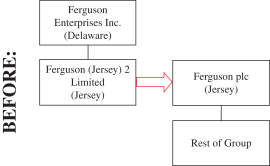

“Merger” are to the merger of Ferguson plc and Merger Sub under Part 18B (Mergers) of the Jersey Companies Law, with Ferguson plc surviving the merger and becoming a direct, wholly owned subsidiary of New TopCo and Merger Sub ceasing to exist, pursuant to the terms and subject to the conditions provided in the Merger Agreement;

“Merger Agreement” are to the Merger Agreement, dated as of February 29, 2024, by and among New TopCo, Merger Sub and Ferguson plc (as it may be amended from time to time), a copy of which is attached to this proxy statement/prospectus as Annex A;

“Merger Proposal” are to the proposal to approve the Merger Agreement, pursuant to which, among other things, Merger Sub will merge with and into Ferguson plc in accordance with Part 18B (Mergers) of the Jersey Companies Law, with Ferguson plc surviving the Merger as a direct, wholly owned subsidiary of New TopCo and Merger Sub ceasing to exist, on the terms of and subject to the conditions of the Merger Agreement, as more fully described elsewhere in this proxy statement/prospectus;

“Merger Record Time” are to 6:00 p.m. Eastern Time on July 31, 2024;

“Merger Sub” are to Ferguson (Jersey) 2 Limited, a newly formed Jersey incorporated private limited company and direct, wholly owned subsidiary of New TopCo;

“Morrow Sodali” are to Morrow Sodali LLC, Ferguson’s proxy solicitor for the Special Meeting;

“NED Plan” are to the Ferguson Non-Employee Director Incentive Plan 2022;

“New TopCo” are to Ferguson Enterprises Inc., a Delaware corporation;

“New TopCo Board” are to the board of directors of New TopCo;

“New TopCo Common Stock” are to the shares of common stock, par value $0.0001 per share, of New TopCo;

“New TopCo Preferred Stock” are to the shares of preferred stock, par value $0.0001 per share, of New TopCo;

ii