UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23939

AB CARVAL CREDIT OPPORTUNITIES FUND

(Exact name of registrant as specified in charter)

1601 Utica Avenue South, Suite 1000

Minneapolis, MN 55416

(Address of principal executive offices) (Zip code)

Matthew Johnson

AB CarVal Investors L.P.

1601 Utica Avenue South, Suite 1000

Minneapolis, MN 55416

(Name and address of agent for service)

Registrant’s telephone number, including area code: 952-444-4780

Date of fiscal year end: June 30, 2025

Date of reporting period: December 31, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

December 31, 2024

SEMI-ANNUAL REPORT

AB CARVAL CREDIT OPPORTUNITIES FUND

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov.

The [A/B] logo and AllianceBernstein® are registered trademarks used by permission of the owner, AllianceBernstein L.P.

MANAGEMENT REPORT

February 27, 2025

This report provides certain information for the AB CarVal Credit Opportunities Fund (the “Fund”) for the annual reporting period ended December 31, 2024

Returns as of December 31, 2024

Average Annual Total Return

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | QTD | | | YTD | | | 1 Yr. | | | 3 Yr. | | | 5 Yr. | | | 10 Yr. | | | Since

Inception* | |

| AB CarVal Credit Opportunities Fund^ | | | 0.50% | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 5.33% | |

| ICE BofA US High Yield Index | | | 0.16% | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 8.05% | |

| * | The Fund commenced operations on February 23, 2024. |

| ^ | The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the Financial Highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| | The performance shown represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. For performance current to the most recent month-end, visit alliancebernstein.com. Performance assumes reinvestment of distributions and does not account for taxes. |

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

The AB CarVal Credit Opportunities Fund seeks to maximize total return, consisting of current income and capital appreciation. The Fund provides differentiated credit exposure by employing a barbell strategy between credit opportunities in both private and public credit. The current private credit focus includes specialty finance, aircraft leasing and energy transition investments. Public investments include structured products, leveraged loans and high yield bonds. Further, the Fund provides geographic diversification by sourcing opportunities in the US as well as Western Europe.

In private credit in the second half of 2024, we continued to build a robust pipeline of investment opportunities. These opportunities were spread across specialty finance, aviation leasing and energy. The specialty finance transactions were primarily in consumer and included both purchases and forward-flow agreements for loan portfolios. As banks continue to sell assets and reduce lending we will continue to seek to capitalize on this opportunity. In aviation, we remain focused on the purchase and lease of mid-life narrowbody aircraft to airlines. Returns for lessors are elevated as the supply/demand imbalance remains in place due to strong passenger demand, airline profitability and long lead times for new deliveries. In energy transition, we closed a financing for the acquisition and construction solar assets in Europe during the second quarter of 2024. These opportunities provide high current yield, low volatility, and have less correlation to public markets.

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 1 |

In public credit, spreads remained tight across structured credit, leveraged loans and high yield bonds. However, we found pockets of opportunity that were compelling alternatives to US high yield bonds. In structured credit, we continued to add to single asset single borrower commercial mortgage-backed securities with a focus on hospitality and industrial collateral. The asset class remains attractive because office weighed on the sector, dragging it down. In addition, as spreads tightened in the space, it brought about new issue opportunities that created liquidity to add exposure. We are also seeing positive risk-adjusted returns in high-quality structured products especially with new issue asset-backed securities in the consumer space in both the US and Europe. In corporate credit, we continued to add exposure to secured leveraged loans which in many cases offered a pickup to the unsecured bonds of the same issuer.

The performance of the Fund has been in line with our expectations. We believe that the Fund may significantly outperform in weaker markets, outperform from higher carry in trending markets and underperform in months where either spreads gap tighter or rates gap lower as we saw in July. Our focus is on cash-flowing assets that generate high carry and provide principal protection with upside optionality. By avoiding the draw down months, we believe the Fund will outperform over the cycle. Looking forward, we are looking to extend the rate duration of the Fund through both interest rate swaps given the exposure to floating rate assets we have and by adding more fixed rate longer duration credit investments.

| | |

| |

2 AB CarVal Credit Opportunities Fund | | ABFunds.com |

PORTFOLIO SUMMARY

December 31, 2024

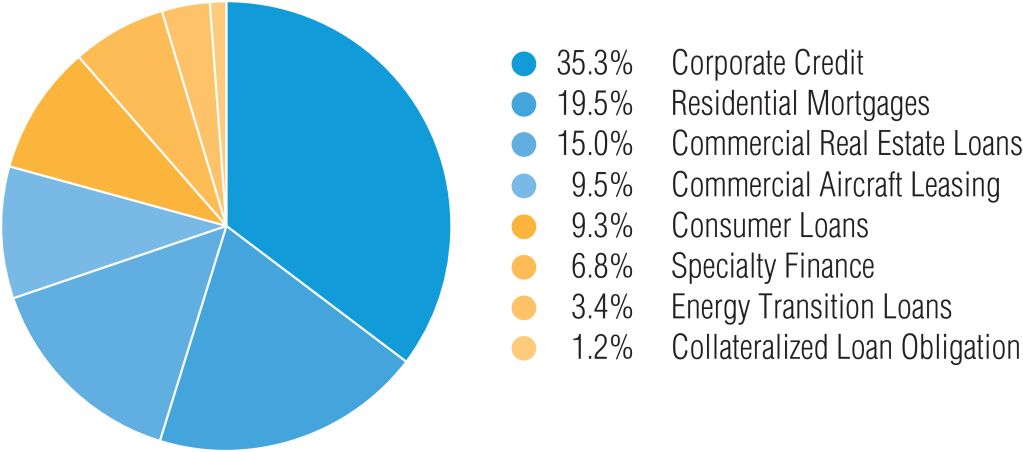

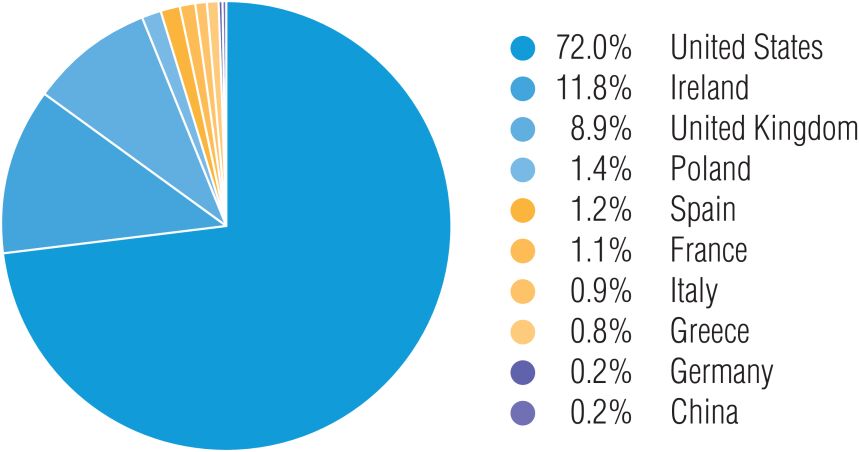

The below breakdown is based on the Investment Manager’s internal classification and is expressed as a percentage of total investment exposure (see “Consolidated Portfolio of Investments” section of the report for additional details).

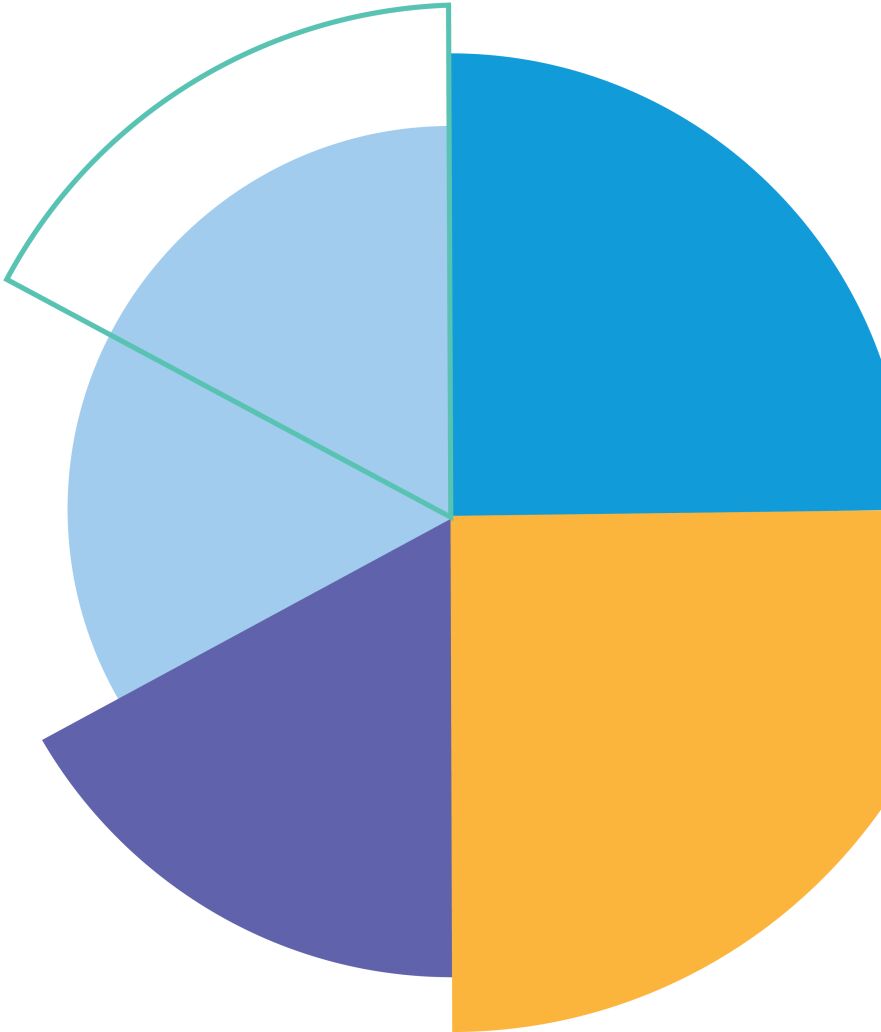

Investment Strategy

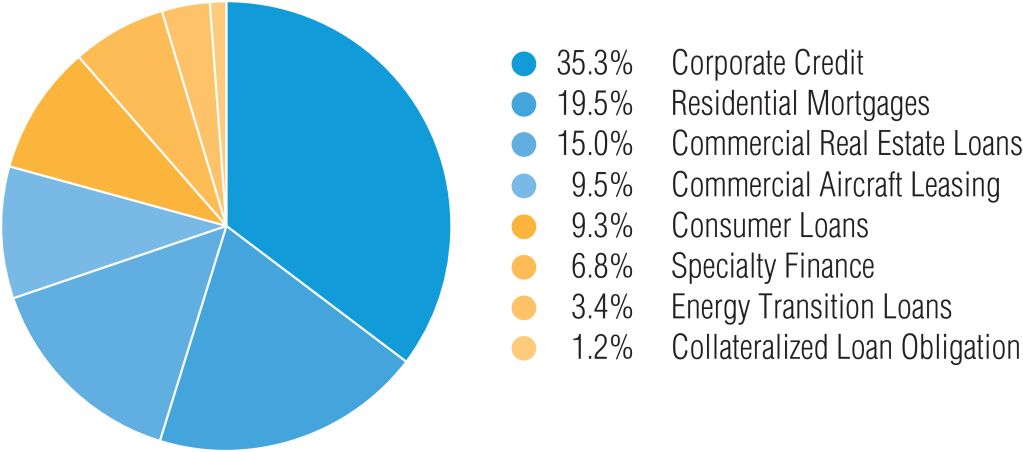

Country Breakout

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 3 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS

December 31, 2024 (unaudited)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

ASSET BACKED – 40.3% | | | | | | | | | | | | |

Bonds – 40.3% | | | | | | | | | | | | |

Alternative Energy – 0.8% | | | | | | | | | | | | |

Dividend Solar Loans LLC

Series 2019-1

5.68%, 08/22/2039(a) | | | U.S.$ | | | | 501 | | | $ | 434,705 | |

Mill City Solar Loan Ltd.

Series 2019-1

5.92%, 03/20/2043(a)(b) | | | | | | | 117 | | | | 98,533 | |

7.14%, 03/20/2043(a)(b) | | | | | | | 109 | | | | 76,284 | |

Series 2019-2GS

2.00%, 07/20/2043(a)(b) | | | | | | | 421 | | | | 282,200 | |

11.88%, 07/20/2043(a)(b)(c)(d)(k) | | | | | | | 735 | | | | 386,975 | |

Series 2020-1

13.83%, 06/20/2047(a)(b)(c)(d)(e)(k) | | | | | | | 1,189 | | | | 364,818 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,643,515 | |

| | | | | | | | | | | | |

Asset Backed Securities – 2.0% | | | | | | | | | | | | |

Nightingale CRE Ltd.

Series 2018-1

13.734%, 11/30/2025(a)(c)(d) | | | GBP | | | | 2,813 | | | | 3,495,445 | |

Turbine Engines Securitization Ltd.

Series 2013-1

5.125%, 12/13/2048(a)(c)(d) | | | U.S.$ | | | | 883 | | | | 800,123 | |

6.375%, 12/13/2048(a)(c)(d) | | | | | | | 168 | | | | 141,694 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,437,262 | |

| | | | | | | | | | | | |

Collateralized Loan Obligations – 1.1% | | | | | | | | | | | | |

ARES LXVII CLO Ltd.

Series 2022-67A, Class E

13.080% (SOFR 3 Month + 8.78%), 01/25/2036(a)(f) | | | | | | | 412 | | | | 418,240 | |

Nassau Euro CLO I DAC

Series 1X, Class C

5.586% (EURIBOR 3 Month + 2.70%), 12/15/2034(a)(f) | | | EUR | | | | 1,820 | | | | 1,899,865 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,318,105 | |

| | | | | | | | | | | | |

Commercial Loan Portfolios – 0.0% | | | | | | | | | | | | |

London Office DAC

Series 2021

0.00%, 10/22/2026(a)(c)(d) | | | GBP | | | | 0 | ** | | | 125 | |

10.330% (SONIA + 5.60%), 10/22/2026(a)(c)(d)(f) | | | | | | | 624 | | | | – 0 | – |

| | | | | | | | | | | | |

| | | | | | | | | | | 125 | |

| | | | | | | | | | | | |

Commercial Mortgage-Backed Securities – 13.3% | | | | | | | | | | | | |

Atrium Hotel Portfolio Trust

9.520%, 11/10/2029(a) | | | U.S.$ | | | | 2,680 | | | | 2,668,008 | |

| | |

| |

4 AB CarVal Credit Opportunities Fund | | ABFunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

BOCA Commercial Mortgage Trust

Series 2024, Class E

8.743% (SOFR 1 Month + 4.44%), 08/15/2041(a)(f) | | U.S.$ | | | 930 | | | $ | 928,812 | |

BX Commercial Mortgage Trust

Series 2022-CSMO, Class D

8.644% (SOFR 1 Month + 4.34%), 06/15/2027(a)(f) | | | | | 399 | | | | 401,450 | |

Series 2024

7.697% (SOFR 1 Month + 3.39%), 01/15/2042(a)(f) | | | | | 2,000 | | | | 1,994,989 | |

BX Trust

Series 2021-ARIA, Class G

7.563% (SOFR 1 Month + 3.26%), 10/15/2036(a)(f) | | | | | 2,012 | | | | 1,989,195 | |

Series 2022-PSB, Class F

11.639% (SOFR 1 Month + 7.33%), 08/15/2039(a)(f) | | | | | 510 | | | | 509,730 | |

BXSC Commercial Mortgage Trust

Series 2022-WSS, Class F

9.636% (SOFR 1 Month + 5.33%), 03/15/2035(a)(f) | | | | | 1,750 | | | | 1,730,765 | |

Commercial Mortgage Trust

Series 2024

7.927%, 12/10/2041(a) | | | | | 2,000 | | | | 1,920,396 | |

CSMC Trust

Series 2017-CHOP, Class F

8.794% (PRIME + 1.29%), 07/15/2032(a)(f) | | | | | 220 | | | | 210,254 | |

Extended Stay America Trust

Series 2021-ESH, Class G

9.420% (SOFR 1 Month + 5.11%), 07/15/2038(a)(f) | | | | | 353 | | | | 353,316 | |

GS Mortgage Securities Corp. Trust

Series 2021-ARDN, Class G

9.421% (SOFR 1 Month + 5.11%), 11/15/2036(a)(f) | | | | | 500 | | | | 475,797 | |

Series 2024-70P, Class E

9.263%, 03/10/2041(a) | | | | | 2,009 | | | | 2,045,420 | |

HIH Trust

Series 2024-61P, Class F

9.743% (SOFR 1 Month + 5.44%), 10/15/2041(a)(f) | | | | | 1,900 | | | | 1,896,818 | |

JPMorgan Chase Commercial Mortgage Securities Trust

Series 2021-HTL5, Class E

8.086% (SOFR 1 Month + 3.78%), 11/15/2038(a)(f) | | | | | 1,608 | | | | 1,594,181 | |

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 5 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Series 2021-HTL5, Class F

8.836% (SOFR 1 Month + 4.53%), 11/15/2038(a)(f) | | | U.S.$ | | | | 591 | | | $ | 579,356 | |

MTN Commercial Mortgage Trust

Series 2022-LPFL, Class F

9.595% (SOFR 1 Month + 5.29%), 03/15/2039(a)(f) | | | | | | | 2,007 | | | | 1,997,823 | |

PGA National Resort Commercial

Series 2024-RSR2, Class E

9.194% (SOFR 1 Month + 3.89%), 06/15/2039(a)(f) | | | | | | | 500 | | | | 505,450 | |

Series 2024-RSR2, Class F

8.993% (SOFR 1 Month + 4.69%), 06/15/2039(a)(f) | | | | | | | 1,375 | | | | 1,372,475 | |

SHR Trust

Series 2024-LXRY, Class E

8.756% (SOFR 1 Month + 4.45%), 10/15/2041(a)(f) | | | | | | | 700 | | | | 706,932 | |

SMRT Commercial Mortgage Trust

Series 2022-MINI, Class E

7.007% (SOFR 1 Month + 2.70%), 01/15/2039(a)(f) | | | | | | | 1,780 | | | | 1,701,715 | |

Series 2022-MINI, Class F

7.657% (SOFR 1 Month + 3.35%), 01/15/2039(a)(f) | | | | | | | 2,000 | | | | 1,891,401 | |

Tharaldson Hotel Portfolio Trust

Series 2023-THL, Class D

9.252%, 12/10/2034(a) | | | | | | | 1,386 | | | | 1,399,791 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 28,874,074 | |

| | | | | | | | | | | | |

Consumer Asset-Backed Securities – 6.5% | | | | | | | | | | | | |

BBVA Consumer Auto FTA

Series 2024-1

8.104% (EURIBOR 3 Month + 5.40%), 04/21/2037(a)(f) | | | EUR | | | | 447 | | | | 465,134 | |

FCT Eurotruck Lease

8.117% (EURIBOR 1 Month + 7.75%), 04/30/2049(c)(d)(f) | | | | | | | 380 | | | | 393,623 | |

16.617% (EURIBOR 1 Month + 5.25%), 04/30/2049(c)(d)(f) | | | | | | | 1,790 | | | | 1,854,171 | |

Foundation Finance Trust

Series 2024-2

9.35%, 03/15/2050(a) | | | U.S.$ | | | | 1,076 | | | | 1,083,881 | |

Jeronimo Funding DAC

6.112% (EURIBOR 3 Month + 3.50%), 10/25/2064(a)(f) | | | EUR | | | | 941 | | | | 913,268 | |

6.612% (EURIBOR 3 Month + 4.00%), 10/25/2064(a)(f) | | | | | | | 471 | | | | 448,127 | |

| | |

| |

6 AB CarVal Credit Opportunities Fund | | ABFunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

5.612% (EURIBOR 3 Month + 3.00%), 10/25/2064(a)(f) | | | EUR | | | | 400 | | | $ | 396,163 | |

Newday Funding Master Issuer PLC

Series 2022-2

11.711% (SONIA + 7.00%), 07/15/2030(a)(f) | | | GBP | | | | 800 | | | | 1,020,268 | |

PPC Zeus DAC

7.295% (EURIBOR 1 Month + 4.50%), 07/23/2029(a)(c)(d)(f) | | | EUR | | | | 1,517 | | | | 1,569,648 | |

SC Germany SA Compartment Consumer

Series 2022-1

8.339% (EURIBOR 1 Month + 5.50%), 10/14/2036(a)(f) | | | | | | | 631 | | | | 674,622 | |

11.339% (EURIBOR 1 Month + 8.50%), 10/14/2036(a)(f) | | | | | | | 561 | | | | 622,830 | |

Series 2024-1

7.683% (EURIBOR 1 Month + 4.80%), 01/14/2038(a)(f) | | | | | | | 354 | | | | 366,611 | |

Securitisation of Catalogue Assets Ltd.

9.438% (SONIA + 4.25%), 01/01/2027(c)(d)(f) | | | GBP | | | | 567 | | | | 713,802 | |

12.158% (SONIA + 6.97%), 01/01/2027(c)(d)(f) | | | | | | | 986 | | | | 1,242,767 | |

16.188% (SONIA + 11.00%), 01/01/2027(c)(d)(f) | | | | | | | 540 | | | | 686,639 | |

Stream Innovations Issuer Trust

Series 2024-2A

9.05%, 02/15/2045(a) | | | U.S.$ | | | | 1,500 | | | | 1,523,912 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 13,975,466 | |

| | | | | | | | | | | | |

Residential Mortgage-Backed Securities – 16.6% | | | | | | | | | | | | |

CFMT LLC

Series 2024

4.00%, 10/25/2054(a)(c)(d) | | | | | | | 1,878 | | | | 1,567,594 | |

Clavel Residential 3 DAC

Series 2023

6.173% (EURIBOR 3 Month + 3.50%), 01/28/2076(a)(f) | | | EUR | | | | 513 | | | | 526,685 | |

EFMT

Series 2024-INV2

7.689%, 10/25/2069(a)(c)(d) | | | U.S.$ | | | | 2,765 | | | | 2,660,790 | |

Mill City Mortgage Loan Trust

Series 2018-4

0.127%, 04/25/2066(a)(b)(c)(d) | | | | | | | 140 | | | | 55,146 | |

3.045%, 04/25/2066(a)(b)(c)(d) | | | | | | | 571 | | | | 286,054 | |

3.25%, 04/25/2066(a)(b) | | | | | | | 427 | | | | 317,921 | |

10.70%, 04/25/2066(a)(b)(c)(d)(e)(k) | | | | | | | 7,842 | | | | 17,217 | |

Series 2019-1

3.57%, 10/25/2069(a)(b)(c)(d) | | | | | | | 858 | | | | 445,226 | |

12.83%, 10/25/2069(a)(b)(c)(d)(e)(k) | | | | | | | 7,549 | | | | 16,339 | |

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 7 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Series 2019-GS2

0.08%, 08/25/2059(a)(b)(c)(d)(e) | | U.S.$ | | | 3,220 | | | $ | 15,682 | |

3.25%, 08/25/2059(a)(b)(c)(d) | | | | | 340 | | | | 232,154 | |

3.25%, 08/25/2059(a)(b) | | | | | 256 | | | | 206,319 | |

3.885%, 08/25/2059(a)(b)(c)(d) | | | | | 652 | | | | 367,691 | |

12.82%, 08/25/2059(a)(b)(c)(d)(e)(k) | | | | | 3,616 | | | | 64,013 | |

Series 2023-NQM1

6.123%, 10/25/2067(a)(b)(c)(d) | | | | | 462 | | | | 425,349 | |

6.123%, 10/25/2067(a)(b) | | | | | 126 | | | | 123,505 | |

Morgan Stanley Residential Mortgage Loan Trust

Series 2024

7.40%, 10/25/2069(a)(c)(d) | | | | | 1,115 | | | | 1,097,881 | |

New Residential Mortgage Loan Trust

Series 2016-1

4.988%, 03/25/2056(a)(c)(d) | | | | | 204 | | | | 132,601 | |

Series 2016-2

5.472%, 11/26/2035(a)(c)(d) | | | | | 259 | | | | 189,641 | |

Series 2018-1

5.772%, 12/25/2057(a)(c)(d) | | | | | 683 | | | | 479,861 | |

Series 2018-2

5.336%, 02/25/2058(a)(c)(d) | | | | | 2,031 | | | | 1,478,453 | |

Series 2019-2

4.768%, 12/25/2057(a)(c)(d) | | | | | 2,583 | | | | 1,650,871 | |

Series 2019-5

4.267%, 08/25/2059(a)(c)(d) | | | | | 3,022 | | | | 1,852,415 | |

Series 2019-6

4.359%, 09/25/2059(a)(c)(d) | | | | | 2,918 | | | | 1,785,779 | |

Series 2019-RPL2

4.004%, 02/25/2059(a)(c)(d) | | | | | 2,618 | | | | 1,369,659 | |

Series 2023

7.556%, 10/25/2063(a)(c)(d) | | | | | 2,000 | | | | 1,953,892 | |

PRPM LLC

Series 2023-RCF2

4.00%, 11/25/2053(a) | | | | | 1,000 | | | | 864,414 | |

Shamrock Residential

Series 2023-1

6.551% (EURIBOR 1 Month + 3.75%), 06/24/2071(a)(f) | | EUR | | | 487 | | | | 512,076 | |

8.276% (EURIBOR 1 Month + 5.50%), 06/24/2071(a)(c)(d)(f) | | | | | 326 | | | | 277,409 | |

9.276% (EURIBOR 1 Month + 6.50%), 06/24/2071(a)(c)(d)(f) | | | | | 165 | | | | 119,867 | |

10.276% (EURIBOR 1 Month + 7.50%), 06/24/2071(a)(c)(d)(f) | | | | | 348 | | | | 198,945 | |

Shamrock Residential DAC

Series 2022-2

5.526% (EURIBOR 1 Month + 2.75%), 02/24/2071(a)(f) | | | | | 679 | | | | 722,648 | |

| | |

| |

8 AB CarVal Credit Opportunities Fund | | ABFunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

6.526% (EURIBOR 1 Month + 3.75%), 02/24/2071(a)(f) | | | EUR | | | | 538 | | | $ | 582,305 | |

8.276% (EURIBOR 1 Month + 5.50%), 02/24/2071(a)(f) | | | | | | | 643 | | | | 720,579 | |

9.276% (EURIBOR 1 Month + 6.50%), 02/24/2071(a)(f) | | | | | | | 181 | | | | 207,076 | |

10.276% (EURIBOR 1 Month + 7.50%), 02/24/2071(a)(f) | | | | | | | 570 | | | | 663,057 | |

Verus Securitization Trust

7.371%, 11/25/2069(a)(c)(d) | | | U.S.$ | | | | 500 | | | | 486,815 | |

7.633%, 10/25/2069(a)(c)(d) | | | | | | | 785 | | | | 755,588 | |

8.06%, 06/25/2069(a)(c)(d) | | | | | | | 2,000 | | | | 1,949,004 | |

Series 2023-6

7.806%, 09/25/2068(a)(c)(d) | | | | | | | 1,890 | | | | 1,849,221 | |

Series 2023-INV2

8.115%, 08/25/2068(a)(c)(d) | | | | | | | 3,139 | | | | 3,095,951 | |

Series 2024-6

7.937%, 07/25/2069(a)(c)(d) | | | | | | | 1,402 | | | | 1,359,700 | |

Series 2024-7

7.85%, 09/25/2069(a)(c)(d) | | | | | | | 2,264 | | | | 2,169,415 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 35,852,808 | |

| | | | | | | | | | | | |

Total Asset Backed

(cost $87,625,935) | | | | | | | | | | | 87,101,355 | |

| | | | | |

| | | | | | | | | | | | |

CORPORATE SECURITIES – 36.3% | |

Bank Debt – 21.2% | |

Agriculture/Food – 0.9% | |

Max US Bidco, Inc.

10/02/2030(g) | | | | | | | 1,995 | | | | 1,938,457 | |

| | | | | | | | | | | | |

|

Asset Backed Securities – 0.5% | |

Lorca Holdco Ltd.

Series 2024

03/25/2031(g) | | | | | | | 992 | | | | 999,101 | |

| | | | | | | | | | | | |

|

Auto/Motor Carrier – 1.7% | |

Carnaby Inventory III LLC

07/06/2025(c)(d)(g) | | | | | | | 2,400 | | | | 2,353,200 | |

First Brands Group LLC

Series 2024

18.691% (SOFR 3 Month + 14.00%), 05/31/2025(c)(d) | | | | | | | 1,260 | | | | 1,237,068 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,590,268 | |

| | | | | | | | | | | | |

Building/Construction Products – 0.4% | | | | | | | | | | | | |

White Cap Buyer LLC

Series 2024

10/19/2029(g) | | | | | | | 933 | | | | 933,774 | |

| | | | | | | | | | | | |

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 9 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Commercial Services – 0.8% | | | | | | | | | | | | |

United Talent Agency LLC

Series 2024

8.057% (SOFR 1 Month + 3.75%), 07/07/2028(f) | | | U.S.$ | | | | 1,737 | | | $ | 1,745,559 | |

| | | | | | | | | | | | |

| | | |

Communications – 3.5% | | | | | | | | | | | | |

Arches Buyer, Inc.

Series 2021

12/06/2027(g) | | | | | | | 2,000 | | | | 1,950,560 | |

MH Sub I LLC

Series 2023

05/03/2028(g) | | | | | | | 1,597 | | | | 1,596,555 | |

Univision Communications, Inc.

Series 2022

01/31/2029(g) | | | | | | | 2,000 | | | | 1,979,639 | |

Vmed O2 U.K. Holdco 4 Ltd.

Series 2023

10/15/2031(g) | | | EUR | | | | 2,045 | | | | 2,121,663 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,648,417 | |

| | | | | | | | | | | | |

Financial Services – 3.3% | | | | | | | | | | | | |

Advisor Group, Inc.

Series 2024

08/16/2028(g) | | | U.S.$ | | | | 1,889 | | | | 1,894,108 | |

AllSpring Buyer LLC

8.137% (SOFR 3 Month + 3.25%), 11/01/2028(f) | | | | | | | 1,137 | | | | 1,137,565 | |

Series 2024

7.329% (SOFR 1 Month + 3.00%), 11/01/2030(f) | | | | | | | 500 | | | | 500,125 | |

Howden Group Holdings Ltd.

Series 2024

04/18/2030(g) | | | | | | | 995 | | | | 1,000,933 | |

Nexus Buyer LLC

Series 2024

07/31/2031(g) | | | | | | | 1,453 | | | | 1,456,401 | |

USI, Inc.

Series 2024

6.579% (SOFR 3 Month + 2.25%), 09/27/2030(f) | | | | | | | 142 | | | | 142,013 | |

VFH Parent LLC

Series 2024

06/21/2031(g) | | | | | | | 1,000 | | | | 1,001,880 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,133,025 | |

| | | | | | | | | | | | |

| | |

| |

10 AB CarVal Credit Opportunities Fund | | ABFunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Health Care – 3.2% | |

AthenaHealth Group, Inc.

Series 2022

7.607% (SOFR 1 Month + 3.25%), 02/15/2029(f) | | | U.S.$ | | | | 988 | | | $ | 989,050 | |

Centrient Holding BV

Series 2024

10/31/2027(g) | | | EUR | | | | 2,000 | | | | 2,079,034 | |

Heartland Dental LLC

Series 2024

8.812% (SOFR 1 Month + 4.50%), 04/28/2028(f) | | | U.S.$ | | | | 1,995 | | | | 1,996,431 | |

Hunter US Bidco, Inc.

08/21/2028(g) | | | | | | | 98 | | | | 96,481 | |

Phoenix Guarantor, Inc.

Series 2024

6.857% (SOFR 1 Month + 2.50%), 02/21/2031(f) | | | | | | | 142 | | | | 142,992 | |

Star Parent, Inc.

09/27/2030(g) | | | | | | | 1,627 | | | | 1,587,542 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,891,530 | |

| | | | | | | | | | | | |

Insurance – 0.9% | |

Asurion LLC

Series 2023

8.656% (SOFR 1 Month + 4.25%), 08/21/2028(f) | | | | | | | 1,995 | | | | 1,994,924 | |

| | | | | | | | | | | | |

| | | |

Leisure/Entertainment – 4.5% | | | | | | | | | | | | |

Banijay Entertainment SAS

03/01/2028(g) | | | | | | | 1,124 | | | | 1,129,533 | |

Hoya Midco LLC

Series 2022

02/03/2029(g) | | | | | | | 143 | | | | 144,372 | |

Ren10 Holding AB

Series 2024

6.629% (EURIBOR 3 Month + 3.75%), 07/31/2030(f) | | | EUR | | | | 500 | | | | 518,733 | |

Route 66 Development Authority

10/10/2030(g) | | | U.S.$ | | | | 4,075 | | | | 4,064,812 | |

Scientific Games Holdings LP

Series 2024

7.288% (SOFR 3 Month + 3.00%), 04/04/2029(f) | | | | | | | 998 | | | | 998,996 | |

Spectacle Gary Holdings LLC

Series 2021

8.707% (SOFR 1 Month + 4.25%), 12/11/2028(f) | | | | | | | 2,839 | | | | 2,827,593 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 9,684,039 | |

| | | | | | | | | | | | |

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 11 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Packaging & Containers – 0.7% | |

Radar Bidco SARL

Series 2024

8.84% (SOFR 3 Month + 4.25%), 04/04/2031(f) | | | U.S.$ | | | | 1,466 | | | $ | 1,481,498 | |

| | | | | | | | | | | | |

| | | |

Technology – 0.8% | | | | | | | | | | | | |

Genuine Financial Holdings LLC

Series 2024

8.357% (SOFR 3 Month + 4.00%), 09/27/2030(f) | | | | | | | 142 | | | | 143,460 | |

Peraton Corp.

8.207% (SOFR 1 Month + 3.75%), 02/01/2028(f) | | | | | | | 1,625 | | | | 1,508,964 | |

Virtusa Corp.

Series 2024

7.607% (SOFR 1 Month + 3.25%), 02/15/2029(f) | | | | | | | 129 | | | | 130,226 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,782,650 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 45,823,242 | |

| | | | | |

Bonds – 11.8% | |

Agriculture/Food – 0.3% | |

Albertsons Cos., Inc./Safeway, Inc./New Albertsons LP/Albertsons LLC

6.50%, 02/15/2028(a) | | | | | | | 675 | | | | 682,594 | |

| | | | | | | | | | | | |

|

Auto/Motor Carrier – 0.3% | |

Clarios Global LP/Clarios U.S. Finance Co.

6.75%, 05/15/2028(a) | | | | | | | 675 | | | | 687,103 | |

| | | | | | | | | | | | |

|

Building/Construction Products – 0.2% | |

Country Garden Holdings Co. Ltd.

3.125%, 10/22/2025(a)(h)(i) | | | | | | | 792 | | | | 79,827 | |

5.125%, 01/17/2025(a)(h)(i) | | | | | | | 2,458 | | | | 250,506 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 330,333 | |

| | | | | | | | | | | | |

Chemicals – 0.3% | |

INEOS Finance PLC

6.75%, 05/15/2028(a) | | | | | | | 300 | | | | 302,249 | |

7.50%, 04/15/2029(a) | | | | | | | 375 | | | | 384,141 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 686,390 | |

| | | | | | | | | | | | |

Communications – 0.7% | |

Jazz Securities DAC

4.375%, 01/15/2029(a) | | | | | | | 675 | | | | 636,333 | |

Telenet Finance Luxembourg Notes SARL

5.50%, 03/01/2028(a) | | | | | | | 800 | | | | 770,450 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,406,783 | |

| | | | | | | | | | | | |

| | |

| |

12 AB CarVal Credit Opportunities Fund | | ABFunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Consumer – 0.9% | |

Garda World Security Corp.

7.75%, 02/15/2028(a) | | | U.S.$ | | | | 675 | | | $ | 695,137 | |

Stonegate Pub Co. Financing PLC

9.648% (EURIBOR 3 Month + 6.63%), 07/31/2029(a)(f) | | | EUR | | | | 605 | | | | 645,908 | |

10.75%, 07/31/2029(a) | | | GBP | | | | 511 | | | | 664,053 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,005,098 | |

| | | | | | | | | | | | |

Energy – 1.3% | |

Calpine Corp.

5.125%, 03/15/2028(a) | | | U.S.$ | | | | 300 | | | | 291,042 | |

5.25%, 06/01/2026(a) | | | | | | | 125 | | | | 124,980 | |

Expand Energy Corp

6.75%, 04/15/2029(a) | | | | | | | 375 | | | | 378,866 | |

Hess Midstream Operations LP

5.50%, 10/15/2030(a) | | | | | | | 300 | | | | 289,982 | |

5.625%, 02/15/2026(a) | | | | | | | 375 | | | | 373,661 | |

KCA Deutag U.K. Finance PLC

9.875%, 12/01/2025(a) | | | | | | | 597 | | | | 597,896 | |

Tallgrass Energy Partners LP/Tallgrass Energy Finance Corp.

7.375%, 02/15/2029(a) | | | | | | | 675 | | | | 675,844 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,732,271 | |

| | | | | | | | | | | | |

Financial Services – 0.9% | |

AG Issuer LLC

6.25%, 03/01/2028(a) | | | | | | | 675 | | | | 669,056 | |

Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer

6.75%, 04/15/2028(a) | | | | | | | 375 | | | | 375,403 | |

7.00%, 01/15/2031(a) | | | | | | | 300 | | | | 301,191 | |

AmWINS Group, Inc.

4.875%, 06/30/2029(a) | | | | | | | 300 | | | | 281,825 | |

6.375%, 02/15/2029(a) | | | | | | | 375 | | | | 376,345 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,003,820 | |

| | | | | | | | | | | | |

General Manufacturing – 0.6% | |

Clydesdale Acquisition Holdings, Inc.

6.625%, 04/15/2029(a) | | | | | | | 675 | | | | 677,695 | |

TK Elevator U.S. Newco, Inc.

5.25%, 07/15/2027(a) | | | | | | | 675 | | | | 659,812 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,337,507 | |

| | | | | | | | | | | | |

Health Care – 0.9% | |

IQVIA, Inc.

5.00%, 05/15/2027(a) | | | | | | | 300 | | | | 294,528 | |

6.50%, 05/15/2030(a) | | | | | | | 375 | | | | 381,627 | |

Medline Borrower LP/Medline Co-Issuer, Inc.

6.25%, 04/01/2029(a) | | | | | | | 675 | | | | 682,142 | |

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 13 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Tenet Healthcare Corp.

6.75%, 05/15/2031 | | | U.S.$ | | | | 675 | | | $ | 682,883 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,041,180 | |

| | | | | | | | | | | | |

Industrials – 0.9% | |

Albion Financing 1 SARL/Aggreko Holdings, Inc.

6.125%, 10/15/2026(a) | | | | | | | 675 | | | | 675,155 | |

GFL Environmental, Inc.

5.125%, 12/15/2026(a) | | | | | | | 300 | | | | 298,509 | |

6.75%, 01/15/2031(a) | | | | | | | 375 | | | | 385,596 | |

TransDigm, Inc.

6.75%, 08/15/2028(a) | | | | | | | 675 | | | | 680,063 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,039,323 | |

| | | | | | | | | | | | |

Leisure/Entertainment – 2.2% | |

Banijay Entertainment SAS

8.125%, 05/01/2029(a) | | | | | | | 675 | | | | 699,802 | |

Caesars Entertainment, Inc.

7.00%, 02/15/2030(a) | | | | | | | 675 | | | | 688,041 | |

Carnival Corp.

7.625%, 03/01/2026(a) | | | | | | | 675 | | | | 675,074 | |

Light & Wonder International, Inc.

7.00%, 05/15/2028(a) | | | | | | | 300 | | | | 300,375 | |

7.50%, 09/01/2031(a) | | | | | | | 375 | | | | 386,719 | |

Scientific Games Holdings LP/Scientific Games U.S. FinCo, Inc.

6.625%, 03/01/2030(a) | | | | | | | 675 | | | | 645,568 | |

TEGNA, Inc.

4.75%, 03/15/2026(a) | | | | | | | 675 | | | | 666,415 | |

VOC Escrow Ltd.

5.00%, 02/15/2028(a) | | | | | | | 675 | | | | 656,881 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,718,875 | |

| | | | | | | | | | | | |

Miscellaneous Industries – 0.7% | |

Blackstone Mortgage Trust, Inc.

7.75%, 12/01/2029(a) | | | | | | | 139 | | | | 142,722 | |

Diebold Nixdorf, Inc.

7.75%, 03/31/2030(a) | | | | | | | 141 | | | | 144,732 | |

Goat Holdco LLC

6.75%, 02/01/2032(a) | | | | | | | 141 | | | | 139,623 | |

Gruenenthal GmbH

4.625%, 11/15/2031(a) | | | EUR | | | | 139 | | | | 145,308 | |

Iron Mountain, Inc.

6.25%, 01/15/2033(a) | | | U.S.$ | | | | 279 | | | | 277,800 | |

Planet Financial Group LLC

10.50%, 12/15/2029(a) | | | | | | | 141 | | | | 143,468 | |

Starwood Property Trust, Inc.

6.50%, 07/01/2030(a) | | | | | | | 141 | | | | 141,198 | |

| | |

| |

14 AB CarVal Credit Opportunities Fund | | ABFunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

UWM Holdings LLC

6.625%, 02/01/2030(a) | | | U.S.$ | | | | 282 | | | $ | 279,922 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,414,773 | |

| | | | | | | | | | | | |

Retailing – 1.0% | | | | | | | | | | | | |

Bellis Acquisition Co. PLC

8.125%, 05/14/2030(a) | | | GBP | | | | 1,750 | | | | 2,114,047 | |

| | | | | | | | | | | | |

| | | |

Technology – 0.3% | | | | | | | | | | | | |

Match Group Holdings II LLC

5.625%, 02/15/2029(a) | | | U.S.$ | | | | 675 | | | | 655,452 | |

| | | | | | | | | | | | |

| | | |

Transportation (Non Auto) – 0.3% | | | | | | | | | | | | |

Fortress Transportation & Infrastructure Investors LLC

7.00%, 06/15/2032(a) | | | | | | | 675 | | | | 689,195 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 25,544,744 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Shares | | | | |

Equity Investments – 3.3% | | | | | | | | | | | | |

Alternative Energy – 0.3% | | | | | | | | | | | | |

Intersect Power LLC(c)(d)(h) | | | | | | | 95,560 | | | | 530,232 | |

| | | | | | | | | | | | |

| | | |

Financial Services – 3.0% | | | | | | | | | | | | |

CVI Symmetry Holding LLC(c)(d)(h) | | | | | | | 6,579,336 | | | | 6,579,336 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,109,568 | |

| | | | | | | | | | | | |

Total Corporate Securities

(cost $79,610,442) | | | | | | | | | | | 78,477,554 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

LOAN PORTFOLIOS – 10.3% | | | | | | | | | | | | |

Equity Investments – 8.9% | | | | | | | | | | | | |

Alternative Energy – 0.8% | | | | | | | | | | | | |

Coral Reef SPV SARL(b)(c)(d)(h) | | | | | | | 1,665,979 | | | | 1,777,259 | |

| | | | | | | | | | | | |

| | | |

Commercial Loan Portfolios – 0.5% | | | | | | | | | | | | |

Powis Finance SARL(b)(c)(d)(h) | | | | | | | 945,766 | | | | 988,380 | |

| | | | | | | | | | | | |

| | | |

Commercial Real Estate Loans – 1.6% | | | | | | | | | | | | |

CVI Thompson Holdings LLC(c)(d)(h) | | | | | | | 3,561,119 | | | | 3,580,926 | |

| | | | | | | | | | | | |

| | | |

Consumer Loan Portfolios – 5.9% | | | | | | | | | | | | |

CVI CB Holdings IV LLC(b)(c)(d)(h) | | | | | | | 2,310,669 | | | | 2,562,600 | |

CVI MF Acquisition Trust II(b)(c)(d)(h) | | | | | | | 730,128 | | | | 743,059 | |

CVI OCT Acquisition Trust(b)(c)(d)(h) | | | | | | | 5,944,351 | | | | 6,050,531 | |

Kielder Funding, Ltd.(b)(c)(d)(h) | | | | | | | 2,556,645 | | | | 3,374,901 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 12,731,091 | |

| | | | | | | | | | | | |

Residential Loan Portfolios – 0.1% | | | | | | | | | | | | |

Kutxabank SA(b)(c)(d)(h) | | | | | | | 321,755 | | | | 184,977 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 19,262,633 | |

| | | | | | | | | | | | |

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 15 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Debt Investments – 1.4% | | | | | | | | | | | | |

Alternative Energy – 1.4% | | | | | | | | | | | | |

GoldenPeaks Capital

14.678% (EURIBOR 3 Month + 12.00%), 05/02/2029(c)(d)(f) | | | EUR | | | | 2,875 | | | $ | 2,968,156 | |

| | | | | | | | | | | | |

| | | |

Total Loan Portfolios

(cost $22,091,599) | | | | | | | | | | | 22,230,789 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Shares | | | | |

SPECIAL OPPORTUNITIES – 8.3% | | | | | | | | | | | | |

Equity Investments – 8.3% | | | | | | | | | | | | |

Aviation – 8.3% | | | | | | | | | | | | |

Aergo Capital Ltd.(b)(c)(d)(h)

(cost $18,105,438) | | | | | | | 18,105,438 | | | | 17,936,857 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

SHORT-TERM INVESTMENTS – 6.5% | | | | | | | | | | | | |

Investment Companies – 6.5% | | | | | | | | | | | | |

Northern Institutional Treasury Portfolio, 4.43%(j)

(cost $14,200,226) | | | | | | | 14,200,226 | | | | 14,200,226 | |

| | | | | | | | | | | | |

| | | |

Total Investments – 101.7%

(cost $221,633,640) | | | | | | | | | | | 219,946,781 | |

Other assets less liabilities – (1.7)% | | | | | | | | | | | (3,724,430 | ) |

| | | | | | | | | | | | |

| | | |

Net Assets – 100.0% | | | | | | | | | | $ | 216,222,351 | |

| | | | | |

FORWARD CURRENCY EXCHANGE CONTRACTS (see Note D)

| | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Contracts to

Deliver

(000) | | | In Exchange

For

(000) | | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

HSBC Bank Plc | | | EUR | | | | 46,871 | | | | USD | | | | 51,788 | | | | 03/19/2025 | | | $ | 3,074,283 | |

HSBC Bank Plc | | | USD | | | | 26,047 | | | | EUR | | | | 24,188 | | | | 03/19/2025 | | | | (907,879 | ) |

HSBC Bank Plc | | | GBP | | | | 11,007 | | | | USD | | | | 13,938 | | | | 06/18/2025 | | | | 175,981 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 2,342,385 | |

| | | | | |

CENTRALLY CLEARED INTEREST RATE SWAPS (see Note D)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Rate Type | | | | | | | | | | | |

Notional

Amount

(000) | | | Termination

Date | | | Payments

made

by the

Fund | | Payments

received

by the

Fund | | Payment

Frequency Paid/

Received | | Market

Value | | | Upfront

Premiums

Paid

(Received) | | | Unrealized

Appreciation

(Depreciation) | |

| USD | | | 15,700 | | | | 08/05/2027 | | | 1 Day

SOFR | | 3.496% | | Annual | | $ | (177,033 | ) | | $ | 5,354 | | | $ | (182,387 | ) |

| USD | | | 12,800 | | | | 08/05/2027 | | | 1 Day

SOFR | | 3.496% | | Annual | | | (144,294 | ) | | | 4,654 | | | | (148,948 | ) |

| | |

| |

16 AB CarVal Credit Opportunities Fund | | ABFunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Rate Type | | | | | | | | | | | |

Notional

Amount

(000) | | | Termination

Date | | | Payments

made

by the

Fund | | Payments

received

by the

Fund | | Payment

Frequency Paid/

Received | | Market

Value | | | Upfront

Premiums

Paid

(Received) | | | Unrealized

Appreciation

(Depreciation) | |

| USD | | | 45,758 | | | | 09/03/2027 | | | 1 Day

SOFR | | 3.799% | | Annual | | $ | (854,799 | ) | | $ | – 0 | – | | $ | (854,799 | ) |

| USD | | | 11,439 | | | | 09/03/2027 | | | 1 Day

SOFR | | 3.799% | | Annual | | | (213,700 | ) | | | – 0 | – | | | (213,700 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | $ | (1,389,826 | ) | | $ | 10,008 | | | $ | (1,399,834 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

CREDIT DEFAULT SWAPS (see Note D)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Swap Counterparty &

Referenced Obligation | | Fixed

Rate

(Pay)

Receive | | | Payment

Frequency | | | Implied

Credit

Spread at

December 31,

2024 | | | Notional

Amount

(000) | | | Market

Value | | | Upfront

Premiums

Paid

(Received) | | | Unrealized

Appreciation

(Depreciation) | |

Buy Contracts | |

Barclay Bank PLC | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Republic of Poland Government Bond, 06/20/2029* | | | (1.00 | %) | | | Annual | | | | 7.50 | % | | | USD | | | | 1,551 | | | $ | (26,888 | ) | | $ | (17,484 | ) | | $ | (9,404 | ) |

Republic of Poland Government Bond, 06/20/2029* | | | (1.00 | %) | | | Annual | | | | 7.50 | % | | | USD | | | | 705 | | | | (10,460 | ) | | | (7,628 | ) | | | (2,832 | ) |

Republic of Poland Government Bond, 12/20/2029* | | | (1.00 | %) | | | Annual | | | | 7.50 | % | | | USD | | | | 470 | | | | (6,549 | ) | | | (7,407 | ) | | | 858 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | $ | (43,897 | ) | | $ | (32,519 | ) | | $ | (11,378 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ** | Principal Amount less than 500. |

| (a) | Security is exempt from registration under Rule 144A or Regulation S of the Securities Act of 1933. These securities are considered restricted, but liquid and may be resold in transactions exempt from registration. At December 31, 2024, the aggregate market value of these securities amounted to $107,072,214 or 49.5% of net assets. |

| (b) | Affiliated investments. |

| (c) | Fair valued by the Adviser. |

| (d) | Security in which significant unobservable inputs (Level 3) were used in determining fair value. |

| (f) | Variable or Floating rate security. Rate shown is the rate in effect as of period end. Certain variable rate securities are not based on a published reference rate and spread, rather are determined by the issuer or agent and are based on current market conditions. Reference rate is as of reset date, which may vary by security. These securities may not indicate a reference rate and/or spread in their description. |

| (g) | This position or a portion of this position represents an unsettled loan purchase. The coupon rate will be determined at the time of settlement and will be based upon a published reference rate and spread, which was determined at the time of purchase. |

| (h) | Non-income producing security. |

| (j) | The rate shown represents the 7-day yield as of period end. |

| (k) | The subordinated notes represented are considered equity positions in the securitized vehicle. The securitized equity investments are entitled to recurring distributions which are generally equal to the excess cash flow generated from the underlying investments after payment of the contractual payments to senior debt holders and other expenses. The current estimated yield that is disclosed, calculated using amortized cost, is based on the current projections of this excess cash flow taking into account assumptions which have been made regarding |

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 17 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | expected prepayments, losses and future reinvestment rates. These assumptions are periodically reviewed and adjusted. Ultimately, the actual yield may be higher or lower than the estimated yield if actual results differ from those used for the assumptions. |

Currency Abbreviations:

EUR – Euro

GBP – Great British Pound

USD – United States Dollar

Glossary:

CLO – Collateralized Loan Obligations

EURIBOR – Euro Interbank Offered Rate

SOFR – Secured Overnight Financing Rate

SONIA – Sterling Overnight Index Average

See notes to consolidated financial statements.

| | |

| |

18 AB CarVal Credit Opportunities Fund | | ABFunds.com |

CONSOLIDATED STATEMENT OF ASSETS & LIABILITIES

December 31, 2024 (unaudited)

| | | | |

| Assets | |

Investments in securities, at value | |

Unaffiliated issuers (cost $190,584,355) | | $ | 188,939,574 | |

Affiliated issuers (cost $31,049,285) | | | 31,007,207 | |

Cash | | | 259,143 | |

Cash collateral due from broker | | | 1,895,296 | |

Foreign currencies, at value (cost $538,127) | | | 524,152 | |

Receivable for investment securities sold | | | 14,936,132 | |

Interest receivable | | | 3,848,039 | |

Unrealized appreciation on forward currency exchange contracts | | | 3,250,264 | |

Deferred offering expense | | | 647,827 | |

Receivable for capital stock sold | | | 209,976 | |

Receivable for variation margin on centrally cleared swaps | | | 160,673 | |

Receivable due from Adviser | | | 133,410 | |

Other assets | | | 1,466,843 | |

| | | | |

Total assets | | | 247,278,536 | |

| | | | |

| Liabilities | |

Payable for investment securities purchased | | | 28,587,138 | |

Unrealized depreciation on forward currency exchange contracts | | | 907,879 | |

Payable to Adviser—deferred offering costs | | | 336,403 | |

Advisory fee payable | | | 259,571 | |

Administrative fee payable | | | 179,485 | |

Trustees’ fees payable | | | 154,935 | |

Transfer Agent fee payable | | | 74,586 | |

Market value on credit default swaps (net premiums received $32,519) | | | 43,897 | |

Accrued expenses | | | 512,291 | |

| | | | |

Total liabilities | | | 31,056,185 | |

| | | | |

Net Assets | | $ | 216,222,351 | |

| | | | |

| Composition of Net Assets | |

Paid-in capital | | $ | 216,295,380 | |

Accumulated loss | | | (73,029 | ) |

| | | | |

Net Assets | | $ | 216,222,351 | |

| | | | |

Net Asset Value Per Share—unlimited shares authorized, no par value (based on 21,755,674 shares outstanding)

| | | | | | | | | | | | |

| Class | | Net Assets | | | Shares

Outstanding | | | Net Asset

Value | |

| |

| A | | $ | 10,067 | | | | 1,013 | | | $ | 9.93 | * |

| |

| Advisor | | $ | 216,192,158 | | | | 21,752,634 | | | $ | 9.94 | |

| |

| C | | $ | 10,059 | | | | 1,013 | | | $ | 9.93 | |

| |

| U | | $ | 10,067 | | | | 1,014 | | | $ | 9.93 | |

| |

| * | The maximum offering price per share for Class A shares was $10.38 which reflects a sales charge of 4.25%. |

See notes to consolidated financial statements.

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 19 |

CONSOLIDATED STATEMENT OF OPERATIONS

Six Months Ended December 31, 2024 (unaudited)

| | | | | | | | |

| Investment Income | | | | | | | | |

Interest | | $ | 6,731,880 | | | | | |

Affiliated Interest | | | 169,051 | | | | | |

Other income | | | 22,865 | | | | | |

Operational earnings on equity investments | | | 1,289,560 | | | $ | 8,213,356 | |

| | | | | | | | |

| Expenses | | | | | | | | |

Advisory fee (see Note B) | | | 1,465,397 | | | | | |

Distribution fee—Class A | | | 22 | | | | | |

Distribution fee—Class C | | | 29 | | | | | |

Distribution fee—Class U | | | 22 | | | | | |

Transfer agency—Class A | | | 3 | | | | | |

Transfer agency—Advisor | | | 71,385 | | | | | |

Transfer agency—Class C | | | 3 | | | | | |

Transfer agency—Class U | | | 3 | | | | | |

Amortization of offering expenses | | | 400,555 | | | | | |

Loan fees | | | 228,580 | | | | | |

Administrative | | | 203,081 | | | | | |

Legal | | | 160,162 | | | | | |

Audit and tax | | | 141,150 | | | | | |

Trustees’ fees | | | 91,080 | | | | | |

Registration fees | | | 40,739 | | | | | |

Printing | | | 29,219 | | | | | |

Custody and accounting | | | 10,304 | | | | | |

Miscellaneous | | | 126,277 | | | | | |

| | | | | | | | |

Total expenses before interest expense | | | 2,968,011 | | | | | |

Interest expense | | | 17,767 | | | | | |

| | | | | | | | |

Total expenses | | | 2,985,778 | | | | | |

Less: expenses waived and reimbursed by the Adviser (see Notes B) | | | (750,575 | ) | | | | |

| | | | | | | | |

Net expenses | | | | | | | 2,235,203 | |

| | | | | |

Net investment income | | | | | | | 5,978,153 | |

| | | | | |

| Realized and Unrealized Gain (Loss) on Investment and Foreign Currency Transactions | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Affiliated investment transactions | | | | | | | 1,840 | |

Unaffiliated investment transactions | | | | | | | 734,971 | |

Forward currency exchange contracts | | | | | | | (204,961 | ) |

Swaps | | | | | | | (6,891 | ) |

Foreign currency transactions | | | | | | | (213,462 | ) |

Net change in unrealized appreciation (depreciation) of: | | | | | | | | |

Affiliated Underlying Portfolios | | | | | | | (150,710 | ) |

Investments | | | | | | | (1,602,991 | ) |

Forward currency exchange contracts | | | | | | | 1,697,666 | |

Swaps | | | | | | | (1,396,873 | ) |

Foreign currency denominated assets and liabilities | | | | | | | (129,845 | ) |

| | | | | |

Net loss on investment and foreign currency transactions | | | | | | | (1,271,256 | ) |

| | | | | |

Net Increase in Net Assets from Operations | | | | | | $ | 4,706,897 | |

| | | | | |

See notes to consolidated financial statements.

| | |

| |

20 AB CarVal Credit Opportunities Fund | | ABFunds.com |

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

December 31, 2024

(unaudited) | | | February 23, 2024(a)

to June 30, 2024 | |

| Increase (Decrease) in Net Assets from Operations | | | | | | | | |

Net investment income | | $ | 5,978,153 | | | $ | 3,663,548 | |

Net realized gain (loss) on investment and foreign currency transactions | | | 311,497 | | | | (191,189 | ) |

Net change in unrealized appreciation (depreciation) of investments and foreign currency denominated assets and liabilities | | | (1,582,753 | ) | | | 725,778 | |

| | | | | | | | |

Net increase in net assets from operations | | | 4,706,897 | | | | 4,198,137 | |

Distributions to Shareholders | |

Class A | | | (358 | ) | | | – 0 | – |

Advisor Class | | | (9,574,134 | ) | | | (1,430,475 | ) |

Class C | | | (354 | ) | | | – 0 | – |

Class U | | | (358 | ) | | | – 0 | – |

| Capital Stock Transactions | | | | | | | | |

Net increase | | | 43,845,419 | | | | 174,477,577 | |

| | | | | | | | |

Total increase | | | 38,977,112 | | | | 177,245,239 | |

| Net Assets | |

Beginning of period | | | 177,245,239 | | | | – 0 | – |

| | | | | | | | |

End of period | | $ | 216,222,351 | | | $ | 177,245,239 | |

| | | | | | | | |

| (a) | Commencement of operations. |

See notes to consolidated financial statements.

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 21 |

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended December 31, 2024 (unaudited)

| | | | | | | | |

| Cash flows from operating activities | | | | | | | | |

Net increase in net assets from operations | | | | | | $ | 4,706,897 | |

Reconciliation of net increase in net assets from operations to cash provided by (used in) operating activities | | | | | | | | |

Purchases of long-term investments | | $ | (184,843,320 | ) | | | | |

Purchases of short-term investments | | | (14,200,226 | ) | | | | |

Proceeds from disposition of long-term investments | | | 123,016,821 | | | | | |

Proceeds from disposition of short-term investments | | | 45,806,048 | | | | | |

Net realized gain on investment transactions and foreign currency transactions | | | (311,497 | ) | | | | |

Net realized loss on forward currency exchange contracts | | | (204,961 | ) | | | | |

Net change in unrealized appreciation (depreciation) of investments and foreign currency denominated assets and liabilities | | | 1,582,753 | | | | | |

Net accretion of bond discount and amortization of bond premium | | | (694,583 | ) | | | | |

Increase in receivable for investments sold | | | (14,722,792 | ) | | | | |

Increase in interest receivable | | | (2,260,559 | ) | | | | |

Increase in affiliated dividends receivable | | | (147,079 | ) | | | | |

Decrease in receivable due from Adviser | | | 1,634,020 | | | | | |

Increase in deferred offering expense | | | (232,964 | ) | | | | |

Increase in other assets | | | (1,199,559 | ) | | | | |

Increase in payable for investments purchased | | | 7,785,977 | | | | | |

Decrease in advisory fee payable | | | (529,343 | ) | | | | |

Increase in administrative fee payable | | | 59,548 | | | | | |

Increase in Transfer Agent fee payable | | | 64,074 | | | | | |

Increase in Trustees’ fee payable | | | 91,080 | | | | | |

Increase in accrued expenses | | | 186,988 | | | | | |

Decrease in offering expenses payable | | | (1,178,637 | ) | | | | |

Proceeds on swaps, net | | | 516 | | | | | |

| | | | | | | | |

Total adjustments | | | | | | | (40,297,695 | ) |

| | | | | | | | |

Net cash provided by (used in) operating activities | | | | | | | (35,590,798 | ) |

| Cash flows from financing activities | | | | | | | | |

Subscriptions of capital stock, net | | | 38,243,724 | | | | | |

Cash dividends paid (net of dividend reinvestments)† | | | (3,658,485 | ) | | | | |

| | | | | | | | |

Net cash provided by (used in) financing activities | | | | | | | 34,585,239 | |

Effect of exchange rate on cash | | | | | | | (343,307 | ) |

| | | | | | | | |

Net decrease in cash | | | | | | | (1,348,866 | ) |

Cash at beginning of period | | | | | | | 5,587,964 | |

| | | | | | | | |

Cash at end of period | | | | | | $ | 4,239,098 | |

| | | | | | | | |

| Supplemental disclosure of cash flow information | | | | | | | | |

† Reinvestment of dividends | | $ | 5,916,719 | | | | | |

Interest expense paid during the period | | $ | 17,767 | | | | | |

In accordance with U.S. GAAP, the Fund has included a Statement of Cash Flows as a result of its significant investments in Level 3 securities throughout the period.

See notes to consolidated financial statements.

| | |

| |

22 AB CarVal Credit Opportunities Fund | | ABFunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2024 (unaudited)

NOTE A

Significant Accounting Policies

The AB CarVal Credit Opportunities Fund (the “Fund”) is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a non-diversified, closed-end management investment company that operates as an interval fund. The Fund commenced operations on February 23, 2024. The Fund currently offers four separate classes of shares designated as Class A Shares, Advisor Shares, Class C Shares and Class U Shares (“Shares”). The Fund may offer other additional classes of Shares in the future. The Fund’s investment objective is to seek to maximize total return, consisting of current income and capital appreciation. The Fund seeks to achieve its investment objective by investing primarily in credit-related investments, either directly or through separate investment structures or vehicles that provide the Fund with exposure to such securities (collectively, the “Credit Investments”). Under normal circumstances, the Fund will invest at least 80% its net assets plus any borrowings for investment purposes (measured at the time of purchase) in a portfolio of Credit Investments. The Credit Investments include debt securities, directly originated debt investments, syndicated debt positions acquired in the primary and secondary markets, and structured investments, where the returns are based upon the performance of underlying credit instruments, such as asset backed securitizations.

As part of the Fund’s investment strategy, the Fund may seek to gain exposure to credit investments and derivatives through investments in AB Opportunistic Credit Fund Cayman Corporation (organized under the laws of the Cayman Islands), AB Opportunistic Credit Fund Cayman Ltd. (organized under the laws of the Cayman Islands) and AB Opportunistic Credit Fund US Corporation (organized as a taxable corporation in Delaware), each a wholly-owned subsidiary of the Fund (collectively, the “Subsidiaries” and each, a “Subsidiary”). Each Subsidiary commenced operations on February 23, 2024. The Fund is the sole shareholder of each Subsidiary and it is intended that the Fund will remain the sole shareholder and will continue to control each Subsidiary.

As of December 31, 2024 net assets of the Fund were $216,222,351, of which $28,054,575, or approximately 13%, represented the Fund’s ownership of all issued shares and voting rights of the Subsidiaries. This report presents the consolidated financial statements of the Fund and the Subsidiaries. All intercompany transactions and balances have been eliminated in consolidation.

The investment adviser to the Fund is AB CarVal Investors, L.P. (the “Adviser”), an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended. Subject to the supervision of the Board of Trustees (the “Board”), the Adviser is responsible for the day-to-day management of investments for the Fund.

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 23 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

The consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the consolidated financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The Fund maintains its financial records in U.S. dollars. The following is a summary of significant accounting policies followed by the Fund.

1. Valuation of Investments

The Fund’s Board has approved pricing and valuation policies and procedures pursuant to which the Fund’s investments are valued at fair value (the “Valuation Procedures”). Among other matters, the Valuation Procedures set forth the Fund’s valuation policies and the mechanisms and processes to be employed on a daily basis to implement such policies.

The Adviser has established a Valuation Committee (the “Committee”) made up of representatives of portfolio management, fund operations, compliance and risk management which operates under the Valuation Procedures and is responsible for overseeing the pricing and valuation of all securities held in the Fund. The Committee’s responsibilities include: 1) fair value determinations (and oversight of any third parties to whom any responsibility for fair value determinations is delegated), and 2) regular monitoring of the Valuation Procedures and modification or enhancement of the Valuation Procedures (or recommendation of the modification of the Valuation Procedures) as the Committee believes appropriate. Prior to investing in any portfolio securities, and periodically thereafter, the Adviser will conduct a due diligence review of the valuation methodology utilized. Valuations are required to be supported by market data, industry-accepted third-party valuation models or other methods the Valuation Committee deems to be appropriate, including the use of internal proprietary valuation models. The Adviser periodically tests its valuations through back testing of sales by comparing the amounts realized against the most recent fair values reported, and if necessary, uses the findings to calibrate its valuation procedures.

Portfolio securities are valued at market value determined on the basis of market quotations or, if market quotations are not readily available or are unreliable, at “fair value” as determined in accordance with procedures approved by and under the oversight of the Board. Pursuant to these procedures, the Adviser serves as the Fund’s valuation designee pursuant to Rule 2a-5 under the 1940 Act. In this capacity, the Adviser is responsible, among other things, for making all fair value determinations relating to the Fund’s portfolio investments, subject to the Board’s oversight.

| | |

| |

24 AB CarVal Credit Opportunities Fund | | ABFunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

The Adviser conducts the valuation of the Fund’s investments, upon which the Fund’s net asset value (“NAV”) is based, at all times consistent with GAAP and the 1940 Act. Investments for which market quotations are readily available are valued using market quotations, which are generally obtained from independent pricing services, broker-dealers or market makers.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value as deemed appropriate by the Adviser, and in accordance with the valuation policy approved by the Board. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities.

U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs |

| | • | | Level 3—significant unobservable inputs |

The Fund’s investments in corporate securities and derivatives are primarily valued using Level 2 inputs which generally consist of vendor pricing and multiple broker quotes based on the yield, maturity, credit quality and bids or trading activity in the security or similar securities, thereby demonstrating consensus pricing. Corporate securities valued using Level 1 inputs generally represent an immaterial portion of the investment portfolio; however, they would be valued using the readily available market prices. Inputs from Level 3 are also utilized for corporate securities and derivatives, depending on the information available and characteristics of the asset type. Investments in asset backed, loan portfolios, and special opportunities are valued with Level 3 inputs primarily using a discounted cash flow analysis. This analysis takes into consideration risk adjusted

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 25 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

rates of return as applied to the cash inflows and outflows anticipated in connection with managing and/or disposing each specific investment. This analysis may include factors such as income streams, local market activity, timing, collateral, payment history, comparative sales values, and other similar factors that have or will influence the exit of the investment. However, certain structured credit and special opportunities investments may be valued using a market approach depending on the availability of broker quotes or other information. Further, certain asset backed investments may be valued using Level 2 inputs depending on the information available. All forward foreign currency contracts held at December 31, 2024 were valued using Level 2 inputs which include forward rates.

The Fund may use Special Purpose Vehicles (“SPVs”) or other similar vehicles to facilitate its investments in various strategies. The Fund will provide funding to the SPVs in a form of a loan receivable and/or an equity contribution. The SPVs, in turn purchase and own the underlying investment assets. In these instances, the Fund’s loan receivable and/or equity contributions represent the instrument that is fair valued.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of December 31, 2024:

| | | | | | | | | | | | | | | | |

Investments in

Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | |

Asset Backed | | $ | – 0 | – | | $ | 45,045,302 | | | $ | 42,056,053 | (a) | | $ | 87,101,355 | |

Corporate Securities | | | – 0 | – | | | 67,777,718 | | | | 10,699,836 | | | | 78,477,554 | |

Loan Portfolios | | | – 0 | – | | | – 0 | – | | | 22,230,789 | | | | 22,230,789 | |

Special Opportunities | | | – 0 | – | | | – 0 | – | | | 17,936,857 | | | | 17,936,857 | |

Short-Term Investments | | | 14,200,226 | | | | – 0 | – | | | – 0 | – | | | 14,200,226 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | 14,200,226 | | | | 112,823,020 | | | | 92,923,535 | (a) | | | 219,946,781 | |

Other Financial Instruments(b): | | | | | | | | | | | | | | | | |

Assets: | |

Forward Currency Exchange Contracts | | | – 0 | – | | | 3,250,264 | | | | – 0 | – | | | 3,250,264 | |

Liabilities: | |

Forward Currency Exchange Contracts | | | – 0 | – | | | (907,879 | ) | | | – 0 | – | | | (907,879 | ) |

Centrally Cleared Interest Rate Swaps | | | – 0 | – | | | (1,399,834 | ) | | | – 0 | – | | | (1,399,834 | )(c) |

Credit Default Swaps | | | – 0 | – | | | (43,897 | ) | | | – 0 | – | | | (43,897 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | 14,200,226 | | | $ | 113,721,674 | | | $ | 92,923,535 | (a) | | $ | 220,845,435 | |

| | | | | | | | | | | | | | | | |

| (a) | The Fund held securities with zero market value at period end. |

| (b) | Other financial instruments include reverse repurchase agreements and derivative instruments, such as futures, forwards, swaps, options and warrants, which are valued at market value. |

| | |

| |

26 AB CarVal Credit Opportunities Fund | | ABFunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

| (c) | Only variation margin receivable (payable) at period end is reported within the statement of assets and liabilities. This amount reflects cumulative unrealized appreciation (depreciation) on futures and centrally cleared swaps as reported in the portfolio of investments. Where applicable, centrally cleared swaps with upfront premiums are presented here at market value. |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value.

| | | | | | | | | | | | |

| | | Asset-

Backed | | | Corporate

Securities | | | Loan

Portfolios | |

Balance as of 06/30/2024 | | $ | 32,941,831 | | | $ | 4,122,659 | | | $ | 2,634,908 | |

Accrued discounts/(premiums) | | | 57,397 | | | | – 0 | – | | | – 0 | – |

Realized gain (loss) | | | 717,282 | | | | – 0 | – | | | 1,270 | |

Change in unrealized appreciation/depreciation | | | (700,710 | ) | | | (2,159 | ) | | | 301,048 | |

Purchases | | | 14,142,968 | | | | 12,197,815 | | | | 27,605,794 | |

Sales/Paydowns | | | (5,102,715 | ) | | | (5,618,479 | ) | | | (8,312,231 | ) |

Transfers in to Level 3 | | | – 0 | – | | | – 0 | – | | | – 0 | – |

Transfers out of Level 3 | | | – 0 | – | | | – 0 | – | | | – 0 | – |

| | | | | | | | | | | | |

Balance as of 12/31/2024 | | $ | 42,056,053 | | | $ | 10,699,836 | | | $ | 22,230,789 | |

| | | | | | | | | | | | |

Net change in unrealized appreciation/depreciation from investments held as of 12/31/2024 | | $ | (398,621 | ) | | $ | (2,159 | ) | | $ | 301,048 | |

| | | | | | | | | | | | |

| | | |

| | | Special

Opportunities | | | Total | | | | |

Balance as of 06/30/2024 | | $ | 14,813,252 | | | $ | 54,512,650 | | | | | |

Accrued discounts/(premiums) | | | – 0 | – | | | 57,397 | | | | | |

Realized gain (loss) | | | – 0 | – | | | 718,552 | | | | | |

Change in unrealized appreciation/depreciation | | | (290,508 | ) | | | (692,329 | ) | | | | |

Purchases | | | 8,745,743 | | | | 62,692,320 | | | | | |

Sales/Paydowns | | | (5,331,630 | ) | | | (24,365,055 | ) | | | | |

Transfers in to Level 3 | | | – 0 | – | | | – 0 | – | | | | |

Transfers out of Level 3 | | | – 0 | – | | | – 0 | – | | | | |

| | | | | | | | | | | | |

Balance as of 12/31/2024 | | $ | 17,936,857 | | | $ | 92,923,535 | | | | | |

| | | | | | | | | | | | |

Net change in unrealized appreciation/depreciation from investments held as of 12/31/2024 | | $ | (290,508 | ) | | $ | (390,240 | ) | | | | |

| | | | | | | | | | | | |

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 27 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

The following presents information about significant unobservable inputs related to the Fund’s Level 3 investments at December 31, 2024.

Quantitative Information about Level 3 Fair Value Measurements

| | | | | | | | | | |

| | | Fair

Value at

12/31/24 | | | Valuation

Technique | | Unobservable

Input | | Input Range/

Weighted

Average*** |

Asset Backed | | $ | 3,595,808 | | | Broker Quotes and/or 3rd Party Pricing Services** | | N/A | | N/A |

| | $ | 8,650,118 | | | Discounted Cash Flow | | Discount Rate | | 3.75-26.04% /8.37% |

| | $ | 29,810,002 | | | Market Comparables | | Market Spread* | | 210-757bps /442bps |

| | $ | 125 | | | Market Comparables | | Recent Transaction | | N/A |

| | | | | | | | | | |

| | $ | 42,056,053 | | | | | | | |

| | | | | | | | | | |

Corporate Securities | | $ | 3,590,268 | | | Market Comparables | | Discount Rate | | 22.70% |

| | $ | 6,579,336 | | | Market Comparables | | Recent Transaction | | |

| | $ | 530,232 | | | Discounted Cash Flow | | Discount Rate | | 14.00-20.00% / 17.52% |

| | | | | | | | | | |

| | $ | 10,699,836 | | | | | | | |

| | | | | | | | | | |

Loan Portfolios | | $ | 19,262,633 | | | Discounted Cash Flow | | Discount Rate | | 11.20-18.50% / 14.13% |

| | $ | 2,968,156 | | | Discounted Cash Flow | | Discount Rate | | 14.93% |

| | | | | | | | | | |

| | $ | 22,230,789 | | | | | | | |

| | | | | | | | | | |

Special Opportunities | | $ | 705,944 | | | Market Approach | | Recent Transaction | | N/A |

| | $ | 17,230,913 | | | Discounted Cash Flow | | Discount Rate | | 10.00-30.62% / 14.85% |

| | | | | | | | | | |

| | $ | 17,936,857 | | | | | | | |

| | | | | | | | | | |

| * | The Market Spreads are compared to related U.S. Treasuries and used to calculate the fair value. |

| ** | The valuation is based on non-binding broker quotes or market comparables where quantitative inputs are not observable. Broker quotes or market comparables have been reviewed and substantiated by the Adviser and may be adjusted for timing or other market events, if necessary. |

| *** | Represents the range of discount rates or spreads that are utilized as an input by the Adviser for purposes of generating a fair value. Weighted average excludes investments that have been marked to zero fair market value when applicable. |

Generally, a change in the assumptions used in any input in isolation may be accompanied by a change in another input. Significant changes in any of the unobservable inputs may significantly impact the fair value measurement. Significant increases (decreases) in Discount Rate and Market Spread in isolation would be expected to result in a significantly higher (lower) fair value measurement.

| | |

| |

28 AB CarVal Credit Opportunities Fund | | ABFunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

2. Organizational and Offering Costs

Organizational and offering costs of the Fund were initially paid by the Adviser on behalf of the Fund. Organizational costs may include, among other things, the cost of organizing as a Delaware statutory trust, including the cost of legal services, statutory seed audit and other fees pertaining to the Fund’s organization. Any organizational costs paid by the Adviser are recorded as a Payable to Adviser – organizational expenses in the consolidated statement of assets and liabilities. These costs are expensed as incurred by the Fund.

Offering costs may include, among other things, legal, printing and other expenses pertaining to the offering of the Fund. Any offering costs paid by the Adviser will be recorded as a Payable to Adviser – deferred offering costs in the consolidated statement of assets and liabilities and will be amortized over 12 months on a straight-line basis. Ongoing offering costs will be amortized over the shorter of the offering period or 12 months on a straight-line basis.

The Adviser will bear the Fund’s organizational costs and the offering costs associated with the Fund’s continuous offering of Shares pursuant to the expense limitation agreement, as described in Note B, between the Fund and the Adviser. The Adviser may recoup from the Fund any waived amount or reimbursed expenses with respect to the Fund pursuant to the expense limitation agreement if such recoupment does not cause the Fund to exceed the current expense limit or the expense limit in place at the time of the waiver or reimbursement, and the recoupment is made within three years from the date the amount was initially waived or reimbursed.

3. Currency Translation

Assets and liabilities denominated in foreign currencies and commitments under forward currency exchange contracts are translated into U.S. dollars at the mean rates of exchange on the reporting date of such currencies against the U.S. dollar. Purchases and sales of portfolio securities are translated into U.S. dollars at the rates of exchange prevailing when such securities were acquired or sold. Income and expenses are translated into U.S. dollars at rates of exchange prevailing when accrued.

Net realized gain or loss on foreign currency transactions represents foreign exchange gains and losses from sales and maturities of foreign fixed income investments, holding of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign investment transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains and losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation or depreciation of foreign currency denominated assets and liabilities.

| | |

| |

| ABFunds.com | | AB CarVal Credit Opportunities Fund 29 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

4. Taxes