Filed Pursuant to Rule 424(b)(5)

Reg No.: 333-278583 and 333-278583-01

PROSPECTUS SUPPLEMENT

(To Prospectus dated April 9, 2024)

BlackRock Funding, Inc.

Guaranteed on a senior unsecured basis by BlackRock, Inc.

$800,000,000 4.600% NOTES DUE 2027

$500,000,000 4.900% NOTES DUE 2035

$1,200,000,000 5.350% NOTES DUE 2055

The 4.600% Notes due 2027 (the “2027 notes”) will bear interest at the rate of 4.600% per year and will mature on July 26, 2027. The 4.900% Notes due 2035 (the “2035 notes”) will bear interest at the rate of 4.900% per year and mature on January 8, 2035. The 5.350% Notes due 2055 (the “2055 notes”) will bear interest at the rate of 5.350% per year and mature on January 8, 2055. The 2027 notes, the 2035 notes and the 2055 notes are referred to collectively as the “notes.”

Interest on the 2027 notes will be payable semi-annually in arrears on January 26 and July 26 of each year, beginning on January 26, 2025 (payable following business day, January 27, 2025). Interest on the 2035 notes and 2055 notes will be payable semi-annually in arrears on January 8 and July 8 of each year, beginning on January 8, 2025.

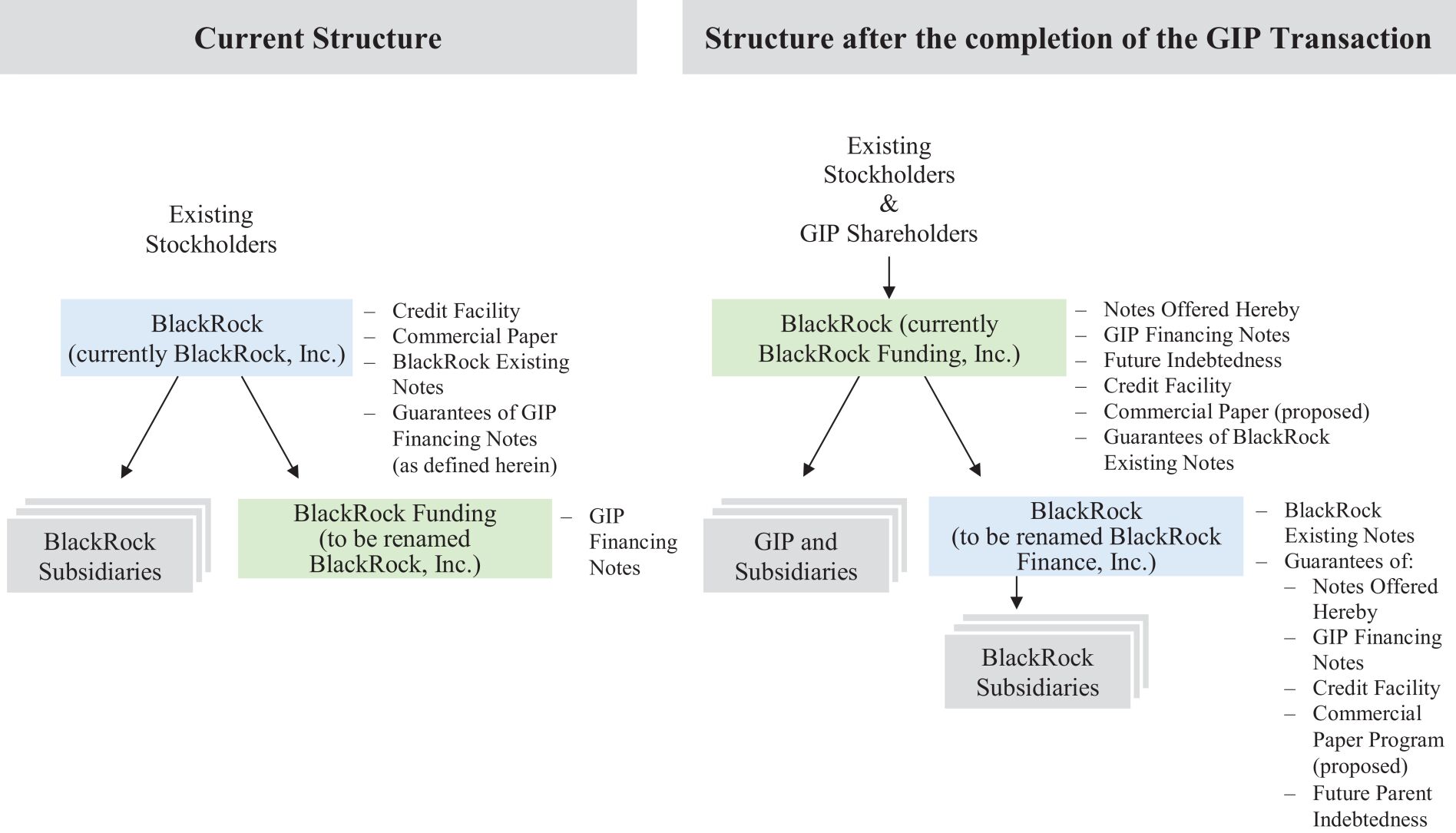

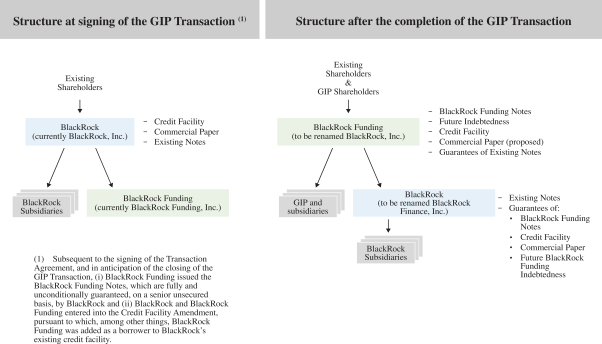

The notes will be issued by BlackRock Funding, Inc. (“BlackRock Funding”), which is currently a direct wholly owned subsidiary of BlackRock, Inc. (“BlackRock”). The notes will be BlackRock Funding’s unsecured and unsubordinated debt obligations and will be fully and unconditionally guaranteed (the “note guarantees”), on a senior unsecured basis by BlackRock. The notes and the note guarantees will rank equally in right of payment with all of BlackRock Funding and BlackRock’s other unsubordinated indebtedness, respectively, from time to time outstanding.

BlackRock Funding may redeem the notes of each series, in whole or in part, at any time at the redemption prices described under “Description of the Notes—Optional Redemption of the Notes.”

The net proceeds of this offering are intended to be used to fund a portion of the cash consideration for BlackRock’s proposed acquisition of the business and assets of Preqin Holding Limited, a private company limited by shares registered in England and Wales (“Preqin”), and its subsidiaries by the indirect acquisition, through one of BlackRock’s wholly owned subsidiaries, of 100% of the shares of Preqin (which is referred to herein as the “Preqin Transaction”). The Preqin Transaction has not been completed as of the date of this prospectus supplement. We currently expect the Preqin Transaction to close before year-end 2024. The closing of the Preqin Transaction is subject to customary conditions, including, among others, the receipt of specified regulatory approvals, and we cannot guarantee that the Preqin Transaction will be completed on a timely basis, on the terms described herein, or at all. This offering is not conditioned upon the completion of the Preqin Transaction, which, if completed, will occur subsequent to the closing of this offering. However, if (i) the Preqin Transaction is not consummated on or before the later of (x) September 2, 2025 and (y) the date that is five business days after any later date upon which “Completion” may occur under the terms of the Preqin Transaction Agreement (as defined herein) (including any such later date as mutually agreed upon by the parties to the Preqin Transaction Agreement) (the “Special Mandatory Redemption End Date”) or (ii) BlackRock Funding notifies the trustee under the indenture that BlackRock will not pursue consummation of the Preqin Transaction, BlackRock Funding will be required to redeem all outstanding 2027 notes (the “Special Mandatory Redemption”), at a special mandatory redemption price equal to 101% of the aggregate principal amount of the 2027 notes, plus accrued and unpaid interest, if any, to, but excluding, the Special Mandatory Redemption Date (as defined herein). The proceeds from this offering will not be deposited into an escrow account pending completion of the Preqin Transaction or any Special Mandatory Redemption, nor will BlackRock Funding be required to grant any security interest or other lien on those proceeds to secure any redemption of the notes. See “Description of the Notes—Special Mandatory Redemption.”

The notes will not be listed on any securities exchange. Currently, there is no public market for the notes.

Investing in the notes involves risks, including those described in the “Risk Factors” section beginning on page S-10 of this prospectus supplement and the section entitled “Risk Factors” beginning on page 20 of BlackRock’s Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated by reference into this prospectus supplement.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Per

2027 Note | | | 2027 Notes

Total | | | Per

2035 Note | | | 2035 Notes

Total | | | Per

2055 Note | | | 2055 Notes

Total | |

Public Offering Price(1) | | | 99.997 | % | | $ | 799,976,000 | | | | 99.599 | % | | $ | 497,995,000 | | | | 99.720 | % | | $ | 1,196,640,000 | |

Underwriting Discount | | | 0.250 | % | | $ | 2,000,000 | | | | 0.450 | % | | $ | 2,250,000 | | | | 0.750 | % | | $ | 9,000,000 | |

Proceeds, before Expenses, to BlackRock Funding, Inc. | | | 99.747 | % | | $ | 797,976,000 | | | | 99.149 | % | | $ | 495,745,000 | | | | 98.970 | % | | $ | 1,187,640,000 | |

| (1) | Plus accrued interest from July 26, 2024. |

Interest on the notes will accrue from July 26, 2024.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the notes to purchasers in book-entry form only through the facilities of The Depository Trust Company (“DTC”) and its participants, including Clearstream Banking, société anonyme (“Clearstream”), and Euroclear Bank, S.A./N.V. (“Euroclear”), on or about July 26, 2024, which is the seventh U.S. business day following the date of this prospectus supplement. See “Underwriting—Delayed Settlement” in this prospectus supplement.

Joint Book-Running Managers

| | | | | | | | | | | | |

| Morgan Stanley | | | | J.P. Morgan | | | | BofA Securities | | | | Wells Fargo Securities |

| | | | | | | | | | | | | | | | |

| | | | Barclays | | | | Deutsche Bank Securities | | | | HSBC | | | | |

| | | | BNP PARIBAS | | | | Citigroup | | | | Goldman Sachs & Co. LLC | | | | |

Senior Co-Managers

| | | | | | |

| RBC Capital Markets | | ICBC Standard | | Loop Capital Markets | | Mischler Financial Group, Inc. |

| | | | | | | | |

| Mizuho | | SOCIETE GENERALE | | BBVA | | NatWest Markets | | TD Securities |

| | | | |

| US Bancorp | | COMMERZBANK | | ING | | Natixis | | SMBC Nikko |

Co-Managers

| | | | |

| Academy Securities | | Cabrera Capital Markets LLC | | CastleOak Securities, L.P. |

| | |

| R. Seelaus & Co., LLC | | Ramirez & Co., Inc. | | Siebert Williams Shank |

Prospectus Supplement dated July 17, 2024