As filed with the Securities and Exchange Commission on January 21, 2025.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-11

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

SUNRISE REALTY TRUST, INC.

(Exact name of registrant as specified in its charter)

Sunrise Realty Trust, Inc.

525 Okeechobee Blvd., Suite 1650

West Palm Beach, FL 33401

(561) 530-3315

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brian Sedrish

Sunrise Realty Trust, Inc.

525 Okeechobee Blvd., Suite 1650

West Palm Beach, FL 33401

(561) 530-3315

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | | |

C. Brophy Christensen, Esq. Jeeho M. Lee, Esq. O’Melveny & Myers LLP 1301 Avenue of the Americas New York, New York 10019 (212) 326-2000 | Joseph A. Herz, Esq. Brian N. Wheaton, Esq. Greenberg Traurig, LLP One Vanderbilt Avenue New York, New York 10017 (212) 801-9200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| | | Emerging growth company | ☒ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 21, 2025.

PROSPECTUS

5,500,000 Shares

Sunrise Realty Trust, Inc.

Common Stock

Sunrise Realty Trust, Inc. (the “Company”) is offering 5,500,000 shares of its common stock. Our common stock is listed on The Nasdaq Capital Market under the symbol “SUNS.” The last reported sale price of our common stock on January 17, 2025 was $14.14 per share.

We are externally managed by Sunrise Manager LLC (our “Manager”). As of December 31, 2024, our affiliated persons (as defined in Form S-11 under the Securities Act of 1933, as amended (the “Securities Act”)) beneficially own (as determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”)) an aggregate of 2,058,487 shares of our common stock, or approximately 16.46% of our common stock upon completion of this offering (or 15.44% if the underwriters exercise their option to purchase additional shares in full), not including any purchases in this offering by our affiliated persons. Certain of our directors and officers (the “Affiliated Investors”) have indicated an interest in purchasing up to $ million in shares of common stock in this offering at the public offering price. If the Affiliated Investors purchase shares in this offering, these affiliates of ours will beneficially own additional shares of our common stock.

We believe we have been organized and operated and we intend to elect, and continue to operate in a manner that will enable us to qualify, to be taxed as a real estate investment trust for U.S. federal income tax purposes (a “REIT”), commencing with our taxable year ended December 31, 2024. To assist us in complying with certain U.S. federal income tax requirements applicable to REITs, among other purposes, shares of our common stock are subject to restrictions on ownership and transfer including, subject to certain exceptions, a 4.9% ownership limit in value or number of shares, whichever is more restrictive. Our Board of Directors (our “Board” or “Board of Directors”), in its sole discretion, may exempt (prospectively or retroactively) shareholders from this ownership limit and Leonard M. Tannenbaum, who also serves as our Executive Chairman, has been granted an exemption allowing him to own up to 29.9% of our common stock. See “Description of Capital Stock—Ownership Limitations and Exceptions.”

We are an “emerging growth company” as defined under the U.S. federal securities laws and, as such, are subject to reduced public company reporting requirements. Investing in our common stock involves risks. See “Risk Factors” beginning on page 36 of this prospectus. The most significant risks relating to your investment in our common stock include the following: •we have limited history of operating as an independent company, and our historical financial information is not necessarily representative of the results that we would have achieved as a separate, publicly-traded company and may not be a reliable indicator of our future results;

•our ability to identify a successful business and investment strategy and execute on our strategy;

•the ability of our Manager to locate suitable loan opportunities for us and to monitor and actively manage our portfolio and implement our investment strategy;

•our ability to meet the expected ranges of originations and repayments;

•the allocation of loan opportunities to us by our Manager;

•changes in general economic conditions, in our industry and in the commercial finance and commercial real estate markets;

•the state of the U.S. economy generally or in the specific geographic regions in which we operate, including as a result of the impact of natural disasters;

•the impact of a protracted decline in the liquidity of credit markets on our business;

•the amount, collectability and timing of our cash flows, if any, from our loans;

•losses that may be exacerbated due to the concentration of our portfolio in a limited number of loans and borrowers;

•the departure of any of the executive officers or key personnel supporting and assisting us from our Manager or its affiliates;

•impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters;

•the impact of a changing interest rate environment;

•our ability to maintain our exemption from registration under the Investment Company Act (as defined below); and

•our ability to qualify and maintain our qualification as a REIT.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | | | | | | |

| Price to

Public | | Underwriting Discounts and Commissions (1)(2) | | Proceeds to

Company |

| Per Share | $ | | $ | | $ |

| Total | $ | | $ | | $ |

___________________________

(1)See “Underwriting” for additional disclosure regarding of the compensation payable to the underwriters.

(2)The underwriters will not receive a discount on any of our shares of common stock purchased by the Affiliated Investors.

We have granted the underwriters the right to purchase up to an additional 825,000 shares of common stock at the public offering price less the underwriting discount and commission to cover over-allotments within 30 days after the date of this prospectus.

Certain Affiliated Investors have indicated an interest in purchasing up to $ million in shares of common stock in this offering at the public offering price. Because this indication of interest is not a binding agreement or commitment to purchase, the Affiliated Investors could determine to purchase more, less or no shares of common stock in this offering, or the underwriters could determine to sell more, less or no shares to the Affiliated Investors. The underwriters will not receive a discount on any of our shares of common stock purchased by the Affiliated Investors.

The underwriters expect to deliver the shares of common stock to the purchasers on , 2025.

Bookrunning Managers

| | | | | | | | | | | | | | | | | | | | |

| RAYMOND JAMES | | KEEFE, BRUYETTE & WOODS A Stifel Company | | BTIG | | OPPENHEIMER & CO. |

Co-Lead Managers

| | | | | | | | |

| B. RILEY SECURITIES | | A.G.P. |

Co-Manager

| | | | | | | | |

| SEAPORT GLOBAL SECURITIES |

|

The date of this prospectus is , 2025.

TABLE OF CONTENTS

IMPORTANT INFORMATION ABOUT THIS PROSPECTUS

We and the underwriters have not authorized anyone to provide you with information or to make any representations other than those contained in this prospectus, or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We have not, and the underwriters have not, authorized anyone to provide you with any other information, and we take no responsibility for, and provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, the shares only under circumstances and in jurisdictions where offers and sales are permitted and we are not making an offer to sell, or seeking offers to buy, the shares under any circumstances or in any jurisdiction in which the person making such offer, solicitation or sale is not qualified to do so or to anyone to whom it is unlawful to make an offer, solicitation or sale. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only, regardless of the time of delivery of this prospectus or any sale of the shares. Our business, financial condition, results of operations and growth prospects may have changed since that date.

ROUNDING

We have made rounding adjustments to some of the figures included, in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

MARKET AND INDUSTRY DATA

We use market data and industry forecasts and projections throughout this prospectus, and in particular in “Prospectus Summary” and “Business.” We have obtained the market data from certain third-party sources of information, including publicly available industry publications and subscription-based publications. Industry forecasts are based on industry surveys and the preparer’s expertise in the industry and there can be no assurance that any of the industry forecasts will be achieved. Any industry forecasts are based on data (including third-party data), models and experience of various professionals and are based on various assumptions, all of which are subject to change without notice. None of such data and forecasts was prepared specifically for us. No third-party source that has prepared such information has reviewed or passed upon our use of the information in this prospectus, and no third-party source is quoted or summarized in this prospectus as an expert. We believe these data are reliable, but we have not independently verified the accuracy of this information. While we are not aware of any misstatements regarding the market data presented herein, industry forecasts and projections involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications and reports.

NON-GAAP METRICS

This prospectus contains “non-GAAP financial measures,” including distributable earnings, within the meaning of Regulation G promulgated by the SEC. Non-GAAP financial measures are financial measures that are not presented in accordance with generally accepted accounting principles in the U.S. (“GAAP”) and this prospectus therefore includes a reconciliation of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP.

We use certain non-GAAP financial measures, some of which are included in this prospectus, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors and shareholders to assess the overall performance of our business using the same tools that our management uses to evaluate our past performance and prospects for future performance.

While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. It does not contain all of the information that may be important to you and your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus.

Unless the context otherwise requires, the terms “Company,” “SUNS,” “we,” “us” or “our” in this prospectus refer to Sunrise Realty Trust, Inc. and the terms “shares” or “common stock” refer to shares of our common stock, $0.01 par value per share.

Overview

Sunrise Realty Trust, Inc. is a real estate focused debt fund, actively pursuing opportunities to finance transitional commercial real estate projects located across the Southern U.S. SUNS is an integral part of the platform of affiliated asset managers under the Tannenbaum Capital Group (“TCG”). SUNS is led by a veteran team of commercial real estate investment professionals and its external manager, Sunrise Manager LLC (our “Manager”), which, alongside other TCG platform asset managers pursuing similar or adjacent opportunities, are supported by the marketing, reporting, legal and other non-investment support services provided by the team of professionals within the TCG platform. Our and our Manager’s relationship with TCG provide us with investment opportunities through a robust relationship network of commercial real estate owners, operators and related businesses as well as significant back-office personnel to assist in management of loans.

Our focus is on originating and investing in secured commercial real estate (“CRE”) loans and providing capital to high-quality borrowers and sponsors with transitional business plans collateralized by CRE assets with opportunities for near-term value creation, as well as recapitalization opportunities. SUNS intends to further diversify its investment portfolio, targeting investments in senior mortgage loans, mezzanine loans, B-notes, commercial mortgage-backed securities (“CMBS”) and debt-like preferred equity securities across CRE asset classes. We intend for SUNS’ investment mix to include loans secured by high quality residential (including multi-family, condominiums and single-family residential communities), retail, office, hospitality, industrial, mixed-use and specialty-use real estate. As of December 31, 2024, SUNS’ portfolio of loans had an aggregate outstanding principal of approximately $132.6 million.

Our investment focus includes originating or acquiring loans backed by single assets or portfolios of assets that typically have (i) an investment hold size of approximately $15-100 million, secured by CRE assets, including transitional or construction projects, across diverse property types, (ii) a duration of approximately 2-5 years, (iii) interest rates that are determined periodically on the basis of a floating base lending rate (e.g., SOFR) plus a credit spread, (iv) a loan-to-value (“LTV”) ratio of no greater than approximately 75% on an individual investment basis and (v) no more than approximately 75% loan-to-value across the portfolio, in each case, at the time of origination or acquisition, and are led by experienced borrowers and well-capitalized sponsors with high quality business plans. Our loans typically feature origination fees and/or exit fees. We target a portfolio net internal rate of return (“IRR”) in the low-teens, which we believe may increase to the mid-teens after including total interest and other revenue from the portfolio, including loans funded from drawing on our leverage, net of our interest expense from our portfolio lenders. We are also targeting a near- to mid-term target capitalization of one-third equity, one-third secured debt availability and one-third unsecured debt. We do not expect to be

fully drawn on our secured debt availability and, as a result, we are targeting an expected leverage ratio of 1.5:1 debt-to-equity.

As of December 31, 2024, we had a potentially actionable pipeline of approximately $1.2 billion of commercial real estate deal commitments under review by our Manager, and have signed non-binding term sheets for approximately $341.7 million of commitments from a pool of approximately $31.8 billion CRE deals sourced by our Manager and its affiliates. We are in varying stages of our review and have not completed our due diligence process with respect to the transactions we are currently reviewing and for which we have signed term sheets. As a result, there can be no assurance that we will move forward with any of these potential investments.

In July 2024, we separated from Advanced Flower Capital Inc. (f/k/a AFC Gamma, Inc. “AFC”) through a Spin-Off transaction. The separation was effected by the transfer of AFC’s commercial real estate portfolio, from AFC to us and the distribution of all of the outstanding shares of our common stock to all of AFC’s shareholders of record as of the close of business on July 8, 2024. As a result of the Spin-Off, we are now an independent, public company trading under the symbol “SUNS” on the Nasdaq Capital Market.

We are an externally managed Maryland corporation and intend to elect to be taxed as a REIT under Section 856 of the Internal Revenue Code of 1986, as amended (the “Code”), commencing with our taxable year ended December 31, 2024. We believe our organization and current and proposed method of operation will enable us to qualify as a REIT. However, no assurances can be given that our beliefs or expectations will be fulfilled, since qualification as a REIT depends on our continuing to satisfy numerous asset, income, distribution and other tests described under “U.S. Federal Income Tax Considerations—Taxation,” which in turn depends, in part, on our operating results and ability to obtain financing. We also intend to operate our business in a manner that will permit us to maintain our exemption from registration under the Investment Company Act.

Target Investments and Portfolio

We invest in transitional CRE assets located in the Southern U.S., including ground-up development and recapitalization transactions, with an emphasis on direct origination of loans with borrowers. We typically invest in loans that have the following characteristics:

•target deal size of $15 million to $250 million;

•investment hold size of $15 million to $100 million;

•secured by CRE assets, including transitional or construction projects, across diverse property types;

•located primarily within markets in the Southern U.S. benefiting from economic tailwinds with growth potential;

•interest rates that are determined periodically on the basis of a floating base lending rate (e.g., SOFR) plus a credit spread;

•no more than approximately 75% loan-to-value on an individual investment basis and no more than approximately 75% loan-to-value across the portfolio, in each case, at the time of origination or acquisition;

•duration of approximately 2-5 years;

•origination fees and/or exit fees;

•significant downside protections; and

•experienced borrowers and well-capitalized sponsors with high quality business plans.

The allocation of capital among our target assets will depend on prevailing market conditions at the time we invest and may change over time in response to changes in prevailing market conditions, including with respect to interest rates and general economic and credit market conditions as well as local economic conditions in markets where we are active.

Southern U.S.

Our investments are primarily concentrated in those states/districts that SUNS considers to be part of the Southern U.S. Those states/districts include AL, AR, DE, FL, GA, KY, LA, MD, MS, NC, OK, SC, TN, TX, VA, WV and D.C. Within its targeted geographic region, we expect that the following states, which are and are expected to continue exhibiting above average population and employment growth, will represent a greater share of the overall geographic exposure: GA, FL, NC, SC, TN and TX.

Market Opportunity

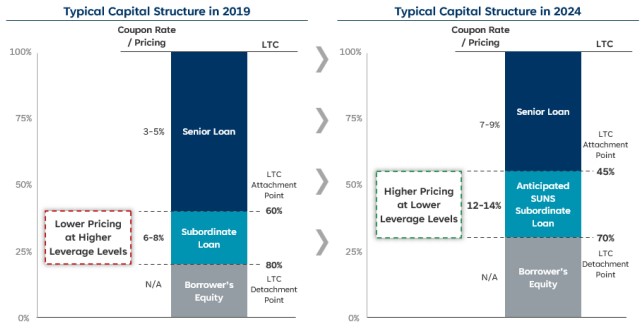

We plan to capitalize on developments in CRE credit markets where non-bank lenders have provided an increasing share of CRE financings as a result of the capital shortage caused by the development, rehabilitation and re-capitalization of assets across the U.S., and particularly in the Southern U.S. We believe this shift is caused by two recent changes: (1) substantially lower amounts of bank capital being made available for transitional real estate assets due to tighter lending parameters, regulatory requirements and portfolio issues; and (2) dislocations and declining liquidity caused by the rapid rise in interest rates that began in March 2022. We believe that this represents a paradigm shift relative to the low interest rate environment observed over the past ten years, which was characterized by an abundance of cheap capital. We believe that non-bank lenders can take advantage of banks’ recent retrenchment and lack of capital, as well as the current interest rate environment, to generate higher returns with lower leverage levels. Additionally, we are not burdened by the same regulatory hurdles facing traditional lenders, which we believe will better allow us to structure attractive credit positions without taking undue risk or excessive leverage.

We intend to focus on the Southern U.S. due to: (1) positive demographic trends, including accelerated migration patterns resulting from COVID-19 and the resulting shortage in residential and commercial real estate supply; and (2) our local presence, knowledge and network of brokers and sponsors in these markets.

Large and Deep Addressable Market Facing Dislocations

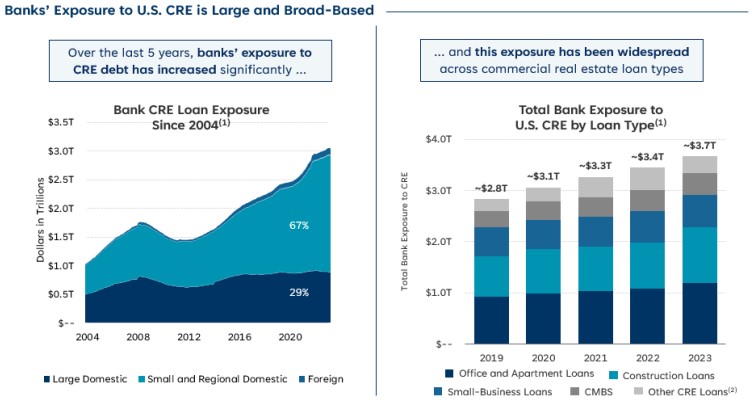

Since 2018, banks have significantly increased their issuance of CRE loans. According to the Federal Deposit Insurance Corporation (the “FDIC”), over the last five years, banks’ exposure to U.S. CRE markets has risen approximately $1 trillion in aggregate, nearing $4 trillion in total, with bank investments broadly distributed across CRE loan types. The current environment of higher interest rates and declining liquidity has caused severe issues across these loan portfolios.

Historically, for CRE projects, higher interest rates typically result in: (1) decreased valuations; (2) lower occupancy rates; (3) construction/development delays; and (4) reduced liquidity (i.e., fewer options for borrowers). Each of these changes increases the default risk of CRE loans on bank balance sheets, and as these effects typically happen in tandem, the impact is magnified. For example, many CRE loans have short terms with balloon payments and in a higher rate environment, refinancing these loans becomes challenging and expensive. In an environment

of declining valuations and occupancy rates, however, borrowers of these loans have even less ability to secure favorable refinancing terms, further increasing default risk.

___________________________

(1)Newmark Research Data.

(2)Other CRE Loans include real-estate investor loans and other assets linked to commercial properties.

Banks entered 2023 facing new regulations (Basel III), an office sector crash, rising interest rates and declining liquidity, forcing them to curtail their lending activity. Regional bank turmoil and sustained rate hikes in 2023 further amplified bank retrenchment from CRE lending and forced some lenders to liquidate existing loan portfolios to improve balance sheet liquidity. In addition, higher rates coupled with the slowdown in the structured credit markets (warehouse lines and CLOs) has eroded lender margins, causing some to exit.

With banks and other traditional lenders halting lending or unable to bridge funding gaps due to lower leverage targets, we believe that there is a large and immediate need for capital from non-traditional capital providers to support transitional CRE business plans. CRE is a capital intensive asset class with a consistent need for debt financing for development, rehabilitation and recapitalizations. We believe that the U.S. CRE debt market is capable of delivering predictable income streams with significant downside protection through an economic cycle.

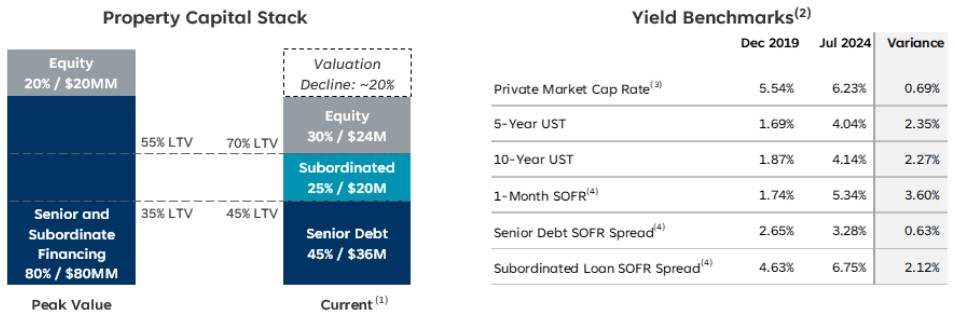

Further, the current environment of elevated interest rates combined with reduced CRE valuations present compelling lending opportunities. Declines in real estate values reduce new lender risk in the form of lower LTV ratios: originated loans placed at approximately 70% LTV (based on valuations as of July 2024) represent approximately 55% LTV of peak asset valuations. In addition, higher benchmark rates (Treasury Rate and SOFR) as well as elevated spreads

enhance net interest margins, which we believe results in greater opportunity for outsized returns.

___________________________

*Based on management estimates. Provided for illustrative purposes only and does not reflect the terms of any specific capital structure.

(1)Valuation decline based on Green Street Commercial Property Price Index as of July 2024 (~20% decline from recent peak).

(2)Source: Cushman & Wakefield, Green Street Advisors.

(3)Source: Average of apartment, industrial, office, self-storage, senior housing, single-family rental, and strip center sectors.

(4)LIBOR used for Dec 2019; SOFR used for July 2024.

We believe that, in times of dislocation, the risk-adjusted returns available in the U.S. CRE debt market offer an attractive investment opportunity and support an allocation from opportunistic investors.

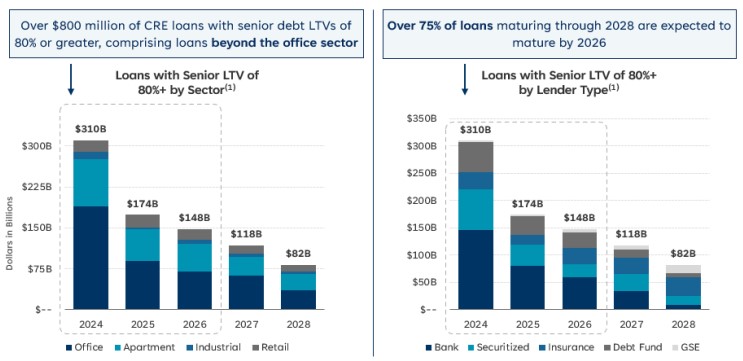

High Volume of Near-Term CRE Loan Maturities

CRE debt transactions are typically financed with short duration loans, which amplifies the need for a consistent supply of fresh capital for both new originations and rollover financings. We expect that a high volume of near-term maturing debt will lead to substantial demand for CRE debt capital. According to S&P Global, over $2.1 trillion in loans across CRE sectors are set to

mature in 2025 and 2026, with approximately $832 billion of loans carrying senior debt LTVs of 80% or greater maturing from 2024 through 2028.

___________________________

(1)Green Street, NCREIF, RCA, Trepp, MBA, Newmark Research. Loans with an estimated senior debt LTV of 80% or greater are potentially troubled. The loans are marked-to-market using an average of cumulative changes in the Dow Jones REIT sector price indices, REIT sector enterprise value indices and Green Street sector CPPI.

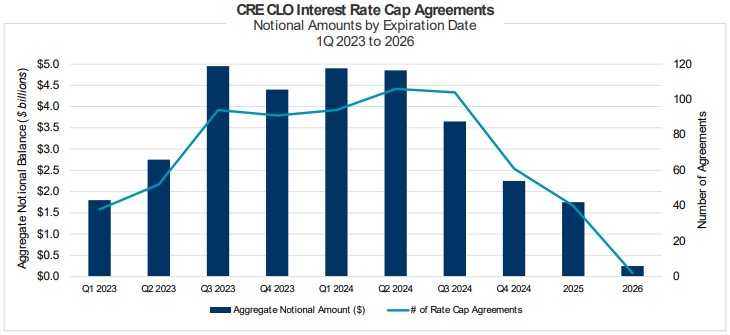

The actions of bank regulators have enabled banks and other lenders to extend maturing loans rather than force repayments that may result in capital impairment. The rapid rise in interest rates from March 2022 to September 2023, coupled with this backlog of refinancing needs, is causing banks to seek repayment to recover capital and shore up liquidity. Additionally, many loans contain rate caps which are naturally expiring as loan terms come due (see chart below from Cred-iq.com). The currently elevated interest rates have made purchasing these caps, previously struck at low levels, uneconomical. We believe that the most pressing gap is for subordinate financings, as we believe banks who are continuing to lend look to reduce leverage levels. Maturing loans, plus expiring rate caps, will create opportunities for alternative lenders who can bridge the gap and offer borrowers gap financing to complete their capitalizations. We anticipate that lenders who can take advantage of this dislocation will be able to generate equity-

like returns with debt-like risk, with leverage levels significantly below where they have been over the last decade.

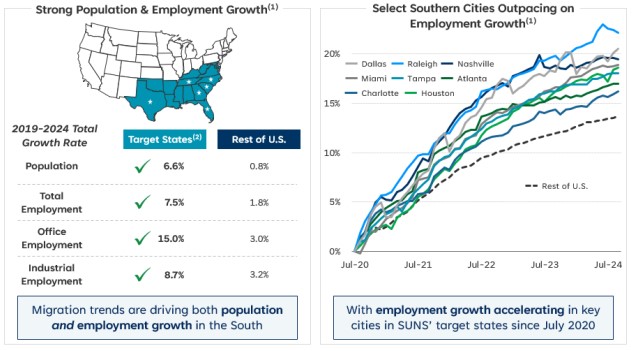

Migration Patterns and Business Growth Driving Demand for CRE in the Southern U.S.

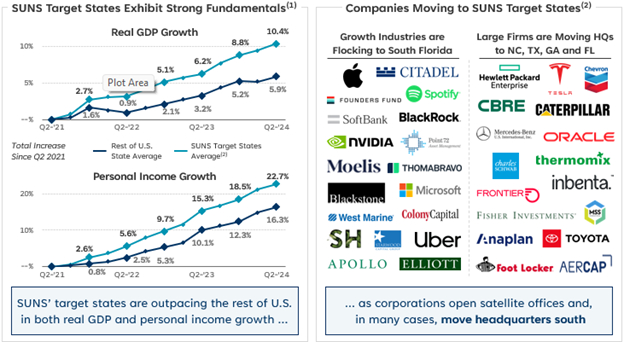

According to the 2022 Allied US Migration Report, population and employment migration to the Southern U.S. has long been occurring, but COVID-19 has accelerated this growth. These trends have caused the Southern U.S. to benefit from increased population, employment and real GDP growth, as per the U.S. Bureau of Economic Analysis.

___________________________

(1)U.S. Census Bureau Data; CoStar Market Data; Federal Reserve Bank of St. Louis

(2)Target states include: FL, TX, NC, SC, TN, and GA.

Personal income growth in our target states is outpacing the U.S. average, largely due to corporations moving to the Southern U.S.

___________________________

(1)U.S. Bureau of Economic Analysis; Federal Reserve Bank of St. Louis.

(2)Target states include: FL, TX, NC, SC, TN, and GA.

We expect these migration and growth trends to continue for the foreseeable future given the favorable business environment, climate, taxes, access to intellectual capital and lower fixed expenses available in the Southern U.S.

COVID-19’s acceleration of pre-existing migration patterns and business growth in the Southern U.S. has driven increased unmet demand for CRE in the Southern U.S. We anticipate that the CRE supply lag in the Southern U.S. will worsen in the coming years due to the reduced access to capital from traditional CRE lenders discussed above, which we believe will provide a consistent flow of investment opportunities in our target states and investment types.

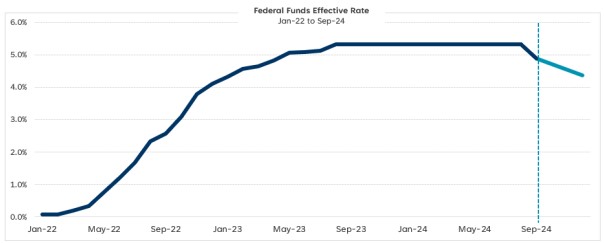

Higher Rates and Decreased Competition

From March 2022 to July 2023, the Federal Reserve embarked on an aggressive rate hiking cycle, ending a four-decade bond bull market characterized by cheap and abundant capital. Credit markets have experienced tremendous disruption, including the failure of Silicon Valley Bank and Signature Bank in Spring 2023; the iShares 20 Plus Year Treasury Bond ETF is off over 46% from its all time closing high in 2020 (as of October 25, 2024). Implied bank lending rates suggest that an elevated rate environment (especially relative to the recent decade) will persist into 2025 (see chart below from the Federal Reserve Bank of St. Louis). As a result, it is

anticipated that borrowers will have difficulty refinancing oversized debt tranches and servicing the cost of new debt capital.

___________________________

Source: Federal Reserve Bank of St. Louis

We believe that this market environment bodes well for lenders who can provide subordinated debt tranches and serve as “rescue capital” where borrowers otherwise would be required to support existing equity investments. We believe that many borrowers will prefer to utilize mezzanine loans and/or debt-like preferred equity securities to plug gaps.

Historically, many lenders relied upon high degrees of low-cost leverage, enabling them to compete aggressively on pricing offered to borrowers. These relatively highly-levered lenders have pulled back due to: (1) their inability to access the aforementioned cheap financing in the current market environment; and (2) portfolio issues that resulted from their aggressive use of leverage. We believe that lenders with capital to deploy and more conservative leverage profiles, like our company, will be able to take advantage of these dynamics to obtain better pricing at lower leverage points than has existed over the last several years. Additionally, highly leveraged lenders may become sources of deal flow if they are forced to sell positions to cover margin calls or investor redemptions.

Potential Opportunities for Immediate Deployment

Our opportunity set is expected to encompass the following categories, with the volume of each dependent on currently elevated interest rates declining at the expected rates, the supply of fresh capital that enters the CRE lending space, and continued migration trends to the Southern U.S. We believe the following will be the most actionable areas of focus over the next several years:

1.New loan originations for well-capitalized sponsors with high-quality business plans that would have borrowed at lower rates and higher leverage levels over the last decade;

2.Recapitalization transactions of high-quality assets for borrowers with maturing loans or rate cap expirations, who in addition to refinancing existing lenders may need incremental capital to satisfy further repositioning and carrying costs, or may need additional time to achieve lease-up or other milestones prior to receiving permanent financing or engaging in an asset sale;

3.Special situations investments where equity investors may seek portfolio-level liquidity and we can provide a loan backed by a diversified portfolio of quality assets at acceptable leverage levels; and

4.Banks or other lenders seeking to sell existing loans to generate liquidity, the selling of which may be involuntary due to capital calls or investor redemptions and may be done at a discount to par.

We believe that the current market climate will produce a robust pipeline of quality lending opportunities in markets in the Southern U.S. experiencing strong growth and demand tailwinds characterized by:

1.Conservative leverage levels;

2.Improved lender protections; and

3.Higher absolute returns relative to the last decade.

Our investment portfolio is expected to comprise a spectrum of CRE asset classes, including high quality multifamily, condominiums, industrial, office, retail, hospitality, mixed-use and specialty-use real estate, as well as investments including refinancings for later-and-transitional-stage assets and ground-up development.

Attractive Risk-Adjusted Return Profile

We believe that our strategy of taking advantage of declining liquidity in the CRE credit markets, combined with investing in geographies with favorable demographic tailwinds, should provide our investors a strong degree of downside protection combined with attractive risk-adjusted returns. We anticipate that recapitalization transactions driven by maturing loans or interest rate cap expirations will allow us to invest into deals that have been relatively de-risked. As an example, we may have the opportunity to invest in assets where the primary risk is lease-up of a property, as opposed to day one ground-up development risk. In these situations, equity and potentially other tranches (mezzanine, preferred equity) may be subordinated to our tranche, which may allow us to generate attractive returns with a significant cushion below.

Our ground-up development loans are expected to be secured by collateral located in Southern U.S. geographies with strong demographic and demand tailwinds. In new build or rehabilitation projects, in addition to these tailwinds, we also expect to require that borrowers contribute increased levels of equity, reducing our leverage detachment point, further enhancing credit quality. The increased levels of equity are expected to provide strong downside protection for our company, as our loans are anticipated to carry reduced loan to value ratios than were observed in our target markets as recently as a year and a half ago. As demonstrated by the below

chart (from Green Street Advisors as of October 2024), historically, impairment in CRE values has been limited to the first 0-40% of the capital structure.

___________________________

Source: Green Street Advisors as of October 2024

As a result of the forces impacting CRE capital markets, including increased interest rates, lower availability of capital, and higher equity requirements, we believe that providers of subordinated debt capital will be able to consistently command mid-teens returns at lower LTV levels than were required over the last decade. These tranches provide better downside protection and more closely resemble senior leverage as compared with the prior ten years.

___________________________

Source: Based on management estimates. Provided for illustrative purposes only and does not reflect the terms of any specific capital structure.

We believe that traditional lenders are structurally challenged and will continue to pull back from the market, which will provide us with the opportunity to achieve our targeted returns for several years to come.

Investment Objective

We will seek to generate strong risk-adjusted returns by originating and investing in CRE assets located in the Southern U.S., including ground-up development and recapitalization transactions, with an emphasis on direct origination of loans with borrowers. Returns are

anticipated to be generated through a combination of current and/or accrued interest payments, origination and exit fees, servicing fees, minimum multiple-of-capital payments and extension and other fees. We intend to primarily invest in senior mortgage loans, mezzanine loans, B-notes, CMBS and debt-like preferred equity securities across CRE asset classes.

We will seek to lend to experienced borrowers in order to: (i) finance acquisitions, (ii) refinance existing indebtedness, (iii) fund value-add and transitional business plans, or (iv) provide portfolio-level liquidity solutions directly or via purchases of existing loans. We expect that our investments will typically have the following characteristics:

•target deal size of $15 million to $250 million;

•investment hold size of $15 million to $100 million;

•secured by CRE assets, including transitional or construction projects, across diverse property types;

•located primarily within markets in the Southern U.S. benefiting from economic tailwinds with growth potential;

•interest rates that are determined periodically on the basis of a floating base lending rate (e.g., SOFR) plus a credit spread;

•no more than approximately 75% LTV on an individual investment basis and no more than approximately 75% LTV across the portfolio, in each case, at the time of origination or acquisition;

•duration of approximately 2-5 years;

•origination fees and/or exit fees;

•significant downside protections; and

•experienced borrowers and well-capitalized sponsors with high quality business plans.

Our portfolio of investments will target low-teens net IRR, which we aim to be in the mid-teens after including total interest and other revenue from the portfolio, including loans funded from drawing on our leverage, net of our interest expense from our portfolio lenders. We are targeting an expected leverage ratio of 1.5:1 debt-to-equity.

Our investment mix will likely include high quality residential (including multifamily, condominiums and single-family residential communities), industrial, office, retail, hospitality, mixed-use and specialty-use real estate.

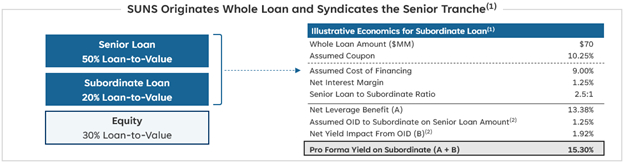

Our investment program will primarily include senior mortgage loans, mezzanine loans, B-notes, CMBS and debt-like preferred equity securities. We may originate or purchase the above types of investments and hold them to maturity. We may also originate a whole loan and subsequently create a mezzanine loan by partnering with a senior lender (likely a national or regional bank, or an insurance company), who will acquire the senior portion of the loan from us. We believe that this structure would allow us to deliver enhanced returns to our investors while

providing competitive financing rates to our borrowers. An example of this structure is shown below.

___________________________

(1)Based on an assumed thirty-six (36) month term, fully-funded at close and annual compounding for yield calculation. Based on management estimates. Provided for illustrative purposes only and does not reflect the terms of any specific loan or borrower.

(2)The entire 1.25% original issue discount (OID) is being allocated exclusively to the subordinate tranche, amounting to 4.375% of its $20 million balance.

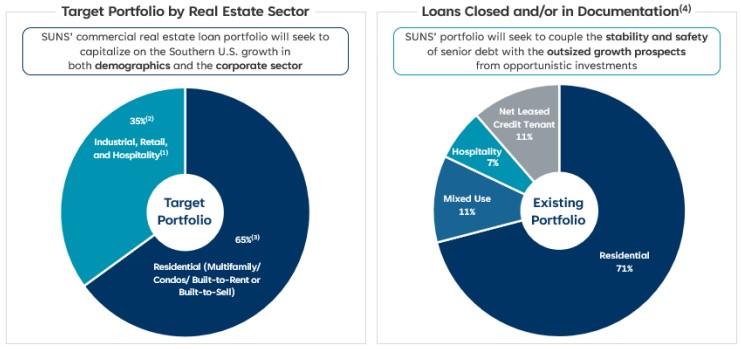

The following charts summarize our target portfolio by property and transaction types.

___________________________

(1)May include mixed-use and specialty-use properties.

(2)Anticipated to comprise approximately 25%-50% of the portfolio. Provided for illustrative purposes only. No assurances can be given that SUNS will achieve the indicated portfolio diversification or returns.

(3)Anticipated to comprise approximately 50%-75% of the portfolio. Provided for illustrative purposes only. No assurances can be given that SUNS will achieve the indicated portfolio diversification or returns.

(4)Includes loans in documentation stage; SUNS is in varying stages of negotiation and has not completed its due diligence process with respect to projects that have not closed. As a result, there can be no assurance that these potential investments will be completed on the terms described above or at all. A component of these loans may be held through one or more affiliated co-investors.

The allocation of capital among our target assets will depend on prevailing market conditions at the time we invest and may change over time in response to changes in prevailing market conditions, including with respect to interest rates and general economic and credit market conditions as well as local economic conditions in markets where we are active.

Key Differentiating Factors

We believe that there is an immediate opportunity to capitalize on CRE market dislocations and declining liquidity, converging with migration trends to the Southern U.S. These

opportunities are outlined below along with our view of our competitive advantages in identifying meaningful investment opportunities.

Unique Market Opportunity: A rapid rise in interest rates has caused significant impairment and disruption to the CRE capital markets. Legacy portfolio issues have caused banks and other traditional CRE lenders to retrench from CRE, and elevated interest rates have drained liquidity from the CRE capital markets. $2.0 trillion of looming CRE maturities by 2026 will have to be addressed, and capital providers with liquidity and speed of execution will be better positioned to take advantage of this market dislocation. In addition, we believe that there is a supply-demand imbalance in the Southern U.S. for CRE. COVID-19 sped up migration inflows to the Southern U.S. as market dislocations simultaneously began to halt new supply, worsening any supply-demand imbalance further. We anticipate that this supply lag will persist for the foreseeable future.

Experience and Strategic Presence: We believe that our size and institutional infrastructure, as well as our management team’s expertise in transitional real estate, distressed debt and recapitalizations; cycle-tested track record in CRE credit; deep knowledge of the Southern U.S. CRE market; and deep network of relationships across CRE markets will differentiate our company in making CRE debt investments in the Southern U.S. We maintain a strategic local presence in the Southern U.S., with our headquarters in West Palm Beach, Florida, which we believe will enhance our sourcing capabilities and local market knowledge.

Diversified Portfolio: We intend to build a diversified portfolio of CRE investments that combines the upside potential from higher-yielding investments, including mezzanine loans, B-notes, CMBS, subordinate credit and debt-like preferred equity securities, with the relative safety of a stable pool of senior mortgage loans, which we believe will maximize risk-adjusted returns for our shareholders.

TCG Platform: Our and our Manager’s relationship with TCG provide us with investment opportunities through a robust relationship network of commercial real estate owners, operators and related businesses as well as significant back-office personnel to assist in management of loans.

Strong Underlying Collateral: Our debt investments will primarily be secured by real estate assets that are expected to be diversified across asset classes, including high quality residential (including multifamily, condominiums and single-family residential communities), industrial, office, retail, hospitality, mixed-use and specialty-use real estate.

Underwriting and Investment Process

We believe that our Manager’s rigorous investment process on our behalf enables us to make investments with potential for value creation as it seeks to provide capital to strong sponsors with readily executable business plans while endeavoring to implement significant downside

protections. Our investment process includes, but is not limited, to the origination, underwriting, investment committee review, legal documentation and post-closing steps outlined below.

| | | | | | | | | | | | | | | | | | | | |

| Origination | | Underwriting | | Investment Committee | | Legal Documentation and Post-Closing |

•Direct origination platform works to create enhanced yields by originating and structuring investments, as well as implementing enhanced controls •Platform drives increased deal flow, which provides for improved deal selectivity •Allows for specific portfolio construction and a focus on higher quality investment opportunities | | •Disciplined underwriting process leads to a highly selective approach •Underwriting team focuses on collateral and sponsor analysis, business plan review and exit strategy •Other tools that we frequently use to verify data, include but are not limited to: appraisals, comparable analyses, environmental reports, site visits, and background checks | | •Focused on managing credit risk through comprehensive investment review process •The investment committee must approve each investment before commitment papers are issued •Members of the investment committee include: Leonard M. Tannenbaum and Brian Sedrish | | •Investment team works alongside external counsel to negotiate creditor agreements and other applicable agreements •Emphasis is placed on financial covenants and a limitation of actions that may be adverse to lenders •Portfolio is proactively managed to monitor ongoing performance and loan covenant compliance |

We require a significant amount of information from each of our borrowers and on any guarantors, typically including: ownership structure charts; the borrower’s and related entities’ governing documents; a list of judgments, liens, and criminal convictions against key personnel/management; a list of pending or threatened claims/litigation by or against the borrower or its guarantor(s) including the status of any claim; information about other liabilities, including loans, foreclosures and bankruptcies; lending and banking references; recent certificates of good standing for all loan party entities; and other background information such as Google, credit and Lexis/Nexis searches. We also conduct financial due diligence on borrowers including, but not limited to, reviewing: audited or certified annual financial statements for the previous year, including monthly financial statements (where available); a detailed operating budget for the forward looking year; a list of any non-recurring/extraordinary revenues or expenses for current and prior fiscal years; details of corporate overhead or other corporate eliminations; balance sheet, within 30 days of closing; the last three (3) months of bank deposits; a capitalization table; proof of insurance policies; and resumes and net worth of key personnel/management. Additionally, we conduct extensive due diligence on properties owned or leased by its borrowers and any related guarantors.

Our Manager

We are externally managed and advised by our Manager, a registered investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), and an affiliate of Leonard M. Tannenbaum and Robyn Tannenbaum. Our Manager is beneficially owned 67.8% by Leonard M. Tannenbaum, our Executive Chairman, 8.8% by Robyn Tannenbaum, our President, and 18.4% by Tannenbaum family members and trusts, as of December 31, 2024, and Brian Sedrish, our Chief Executive Officer, is expected to be granted approximately 7.0% ownership in

connection with this offering, which is expected to further increase relative to the amount of equity capital raised by the Company. The executive offices of our Manager are located at 525 Okeechobee Blvd., Suite 1650, West Palm Beach, FL 33401 and the telephone number of our Manager’s executive offices is (561) 530-3315. Our Manager entered into an administrative services agreement (the “Administrative Services Agreement”) with TCG Services LLC (“TCG Services”), that sets forth the terms on which TCG Services provides certain administrative services, including providing personnel, office facilities, information technology and other equipment and legal, accounting, human resources, clerical, bookkeeping and record keeping services at such facilities and other services that are necessary or useful for us. TCG Services is an affiliate of our Manager and Leonard Tannenbaum, our Executive Chairman, and Robyn Tannenbaum, our President. Our Manager also entered into a Services Agreement (the “Services Agreement”) with SRT Group LLC (“SRT Group”), an affiliate of our Manager, Leonard M. Tannenbaum, Robyn Tannenbaum, Brian Sedrish and Brandon Hetzel. The Services Agreement sets forth the terms on which SRT Group will provide investment personnel to us.

As of December 31, 2024, our Manager, through the Administrative Services Agreement with TCG Services and the Services Agreement with SRT Group, has access to the services of over 30 professionals, including six investment professionals. The investment personnel provided by our Manager and the investment committee members of our Manager have over 60 years of combined investment management experience and are a valuable resource to us.

Our Management Agreement and Fee Waiver

On February 22, 2024, we and our Manager entered into a management agreement (the “Management Agreement”), effective upon the listing of our common stock. Pursuant to the Management Agreement, the Manager manages the loans and day-to-day operations of the Company, subject at all times to the further terms and conditions set forth in the Management Agreement and such further limitations or parameters as may be imposed from time to time by the Company’s Board.

The Manager receives base management fees (the “Base Management Fees”) that are calculated and payable quarterly in arrears, in an amount equal to 0.375% of the Company’s Equity (as defined in the Management Agreement), subject to certain adjustments, less 50% of the aggregate amount of any other fees (“Outside Fees”), including any agency fees relating to the Company’s loans, but excluding the Incentive Compensation (as defined below) and any diligence fees paid to and earned by the Manager and paid by third parties in connection with the Manager’s due diligence of potential loans.

In addition to the Base Management Fees, the Manager is entitled to receive incentive compensation (the “Incentive Compensation” or “Incentive Fees”) with respect to each fiscal quarter (or portion thereof that the Management Agreement is in effect) based upon the Company’s achievement of targeted levels of Core Earnings. “Core Earnings” is defined in the Management Agreement as, for a given period, the net income (loss) for such period, computed in accordance with GAAP, excluding (i) non-cash equity compensation expense, (ii) Incentive Compensation, (iii) depreciation and amortization, (iv) any unrealized gains or losses or other non-cash items that are included in net income for the applicable reporting period, regardless of whether such items are included in other comprehensive income or loss, or in net income and (v) one-time events pursuant to changes in GAAP and certain non-cash charges, in each case after discussions between the Manager and the Company’s independent directors and approved by a majority of the independent directors.

From time to time, the Manager may waive fees it would otherwise be entitled to under the terms of the Management Agreement. The Manager intends to waive (i) the inclusion of the net proceeds from this offering in the Company’s Equity for purposes of calculating the management fee until the earlier of (a) December 31, 2025 and (b) the quarter in which the total amount of the net proceeds of this offering have been utilized to fund loans in our portfolio and (ii) an additional $1.0 million in fees.

For additional information, see “Our Manager and Our Management Agreement.”

Key Financial Measures and Indicators

As a commercial real estate finance company, we believe the key financial measures and indicators for our business are Distributable Earnings (as defined below), book value per share and dividends declared per share.

Distributable Earnings

In addition to using certain financial metrics prepared in accordance with GAAP to evaluate our performance, we also use Distributable Earnings to evaluate our performance, excluding the effects of certain transactions and GAAP adjustments we believe are not necessarily indicative of our current loan activity and operations. Distributable Earnings is a measure that is not prepared in accordance with GAAP. We use these non-GAAP financial measures both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors and shareholders to assess the overall performance of our business using the same tools that our management uses to evaluate our past performance and prospects for future performance. The determination of Distributable Earnings is substantially similar to the determination of Core Earnings under our Management Agreement, provided that Core Earnings is a component of the calculation of any Incentive Compensation earned under the Management Agreement for the applicable time period, and thus, Core Earnings is calculated without giving effect to Incentive Compensation expense, while the calculation of Distributable Earnings accounts for any Incentive Compensation earned for such time period.

We define Distributable Earnings as, for a specified period, the net income (loss) computed in accordance with GAAP, excluding (i) stock-based compensation expense, (ii) depreciation and amortization, (iii) any unrealized gains, losses or other non-cash items recorded in net income (loss) for the period, regardless of whether such items are included in other comprehensive income or loss, or in net income (loss); provided that Distributable Earnings does not exclude, in the case of investments with a deferred interest feature (such as OID, debt instruments with PIK interest and zero coupon securities), accrued income that we have not yet received in cash, (iv) increase (decrease) in provision for current expected credit losses, (v) TRS (income) loss, net of any dividends received from TRS and (vi) one-time events pursuant to changes in GAAP and certain non-cash charges, in each case after discussions between our Manager and our independent directors and after approval by a majority of such independent directors.

We believe providing Distributable Earnings on a supplemental basis to our net income as determined in accordance with GAAP is helpful to shareholders in assessing the overall performance of our business. As a REIT, we are required to distribute at least 90% of our annual REIT taxable income, subject to certain adjustments, and to pay tax at regular corporate rates to the extent that we annually distribute less than 100% of such taxable income. Given these requirements and our belief that dividends are generally one of the principal reasons that

shareholders invest in our common stock, we generally intend to attempt to pay dividends to our shareholders in an amount at least equal to such REIT taxable income, if and to the extent authorized by our Board. Distributable Earnings is one of many factors considered by our Board in authorizing dividends and, while not a direct measure of net taxable income, over time, the measure can be considered a useful indicator of our dividends.

Distributable Earnings is a non-GAAP financial measure and should not be considered as a substitute for GAAP net income. We caution readers that our methodology for calculating Distributable Earnings may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, our reported Distributable Earnings may not be comparable to similar measures presented by other REITs.

The following table provides a reconciliation of GAAP net income to Distributable Earnings:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

September 30, | | Period from August 28, 2023 to September 30, | | Nine months ended

September 30, | | Period from August 28, 2023 to September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net income | $ | 1,738,363 | | | $ | 7,767 | | | $ | 5,014,451 | | | $ | 7,767 | |

| Adjustments to net income: | | | | | | | |

| Stock-based compensation expense | 160,139 | | | — | | | 160,139 | | | — | |

| Depreciation and amortization | — | | | — | | | — | | | — | |

| Unrealized (gains) losses, or other non-cash items | — | | | — | | | — | | | — | |

| (Decrease) increase in provision for current expected credit losses | (47,527) | | | — | | | 24,327 | | | — | |

| TRS (income) loss | — | | | — | | | — | | | — | |

| One-time events pursuant to changes in GAAP and certain non-cash charges | — | | | — | | | — | | | — | |

Distributable earnings | $ | 1,850,975 | | | $ | 7,767 | | | $ | 5,198,917 | | | $ | 7,767 | |

| Basic weighted average shares of common stock outstanding | 6,800,500 | | | 6,889,032 | | | 6,800,500 | | | 6,889,032 | |

Distributable earnings per basic weighted average share | $ | 0.27 | | | $ | 0.00 | | | $ | 0.76 | | | $ | 0.00 | |

Book Value Per Share

We believe that book value per share is helpful to shareholders in evaluating our growth as we scale our equity capital base and continue to invest in our target investments. The book value per share of our common stock as of September 30, 2024 and December 31, 2023 was approximately $16.19 and $4.53, respectively, on a post-split share basis. The September 30, 2024 book value per share of our common stock includes a reduction in book value due to the declaration of the fourth quarter dividend, declared on August 14, 2024. The book value per share of our Common Stock as of September 30, 2024 would have been $16.61, absent the declaration of the fourth quarter dividend.

Dividends Declared Per Share

In August 2024, we declared a partial quarter cash dividend of $0.21 per common share for the quarter ending September 30, 2024, which was paid on October 15, 2024 to shareholders of record as of September 30, 2024, and a regular cash dividend of $0.42 per common share for the quarter ending December 31, 2024, which is payable on January 15, 2025 to shareholders of record as of December 31, 2024.

Updates to Our Portfolio During the Third Quarter of 2024

In July 2024, we and an affiliate entered into a senior secured mortgage loan for a total aggregate commitment amount of approximately $35.2 million for the refinance of an active adult multi-family residential rental development in southwest Austin, Texas. We committed a total of approximately $14.1 million and the affiliate committed the remaining approximately $21.1 million. The senior secured loan was issued at a discount of 1.0% and matures in three years. At closing, we funded approximately $11.4 million and the affiliate funded approximately $17.0 million. The loan bears interest at a rate of SOFR plus 4.25%, with a rate index floor of 4.75%. The senior secured loan is secured by a deed of trust on the property and any deposit and reserve accounts established by the terms of the senior secured loan. The proceeds of the senior secured loan will be used to, among other things, fund the completion of construction and other reserves and refinance existing debt.

In July 2024, we and an affiliate entered into a senior secured mortgage loan for a total aggregate commitment amount of $42.0 million for the refinance of a luxury hotel component of a 20-story mixed-use project in San Antonio, Texas. We committed a total of approximately $27.3 million, and the affiliate committed the remaining $14.7 million. The senior secured loan was issued at a discount of 1.0% and matures in three years. At closing, we funded approximately $25.0 million and the affiliate funded approximately $13.5 million. The senior secured loan bears interest at a rate of SOFR plus 6.35%, with a rate index floor of 4.50%. The senior secured loan is secured by a first-priority mortgage on the property and a security interest in all of the equity interests held by the borrower. The proceeds of the senior secured loan will be used to, among other things, fund the completion of reserves and refinance existing debt.

In August 2024, we and an affiliate entered into amendments to the existing secured mezzanine and senior loan credit agreements for the mixed-use property in Houston, Texas. The amendments, among other things, (i) extended the maturity date on both loans from November 2024 to February 2026, (ii) modified the senior loan interest rate from floating (3.48% plus SOFR, SOFR floor of 4.0%) to fixed 12.5% and (iii) included a $12.0 million upsize to the senior loan, of which we have commitments for $6.0 million and the affiliate co-investor has commitments for the rest.

In August 2024, we, along with our affiliates, entered into a $75.00 million senior secured revolving loan and a $85.00 million senior mortgage loan for a total aggregate commitment amount of $160.00 million for the construction of a master-planned single-family residential home community and property development in Palm Beach Gardens, Florida. We committed a total of approximately $18.75 million and $21.25 million to the revolving loan and mortgage loan, respectively, and funded $8.77 million and $18.76 million towards each respective loan at close. Affiliates committed the remaining $56.25 million and $63.75 million towards the revolving loan and mortgage loan, funding $26.32 million and $56.29 million, respectively, at close. The revolving loan and mortgage loan were each issued at a discount of 1.25%. The revolving loan bears interest at a rate of SOFR plus 6.25%, with a rate index floor of 4.00%, and unused fee of 2.00%. The proceeds of the revolving loan will be used to, among other things, fund the

completion of reserves, fund home construction costs and refinance existing debt. The mortgage loan bears an interest rate of SOFR plus 8.25%, with a rate index floor of 4.00%. The proceeds of the mortgage loan will be used to, among other things, fund the completion of construction and other reserves and refinance existing debt. The mortgage loan and the revolving loan each mature in three years. The loans are each secured by senior first mortgage lien on the property and a security interest in all of the equity interests held by the borrower.

Spin-Off

On February 22, 2024, AFC announced a plan to separate into two independent, publicly traded companies—one focused on providing institutional loans to state law compliant cannabis operators in the United States, the other an institutional CRE lender focused on the Southern U.S. Prior to the Spin-Off, the Company held AFC’s CRE portfolio as a wholly-owned subsidiary of AFC. On July 9, 2024, AFC completed the separation of its CRE portfolio through the spin-off of the Company from AFC (the “Spin-Off”) through a pro-rata distribution of all of the outstanding shares of our common stock to all of AFC’s shareholders of record as of the close of business on July 8, 2024 (the “Record Date”). AFC’s shareholders of record as of the Record Date received one share of our common stock for every three shares of AFC common stock held as of the Record Date. AFC retained no ownership interest in us following the Spin-Off. Prior to the Spin-Off, AFC contributed approximately $114.8 million to us in connection with the Spin-Off, comprised of its CRE portfolio and cash.

In connection with the Spin-Off, we entered into several agreements with AFC that govern the relationship between us and AFC following the Spin-Off, including a separation and distribution agreement (the “Separation and Distribution Agreement”) and a tax matters agreement (the “Tax Matters Agreement”). These agreements provide for the allocation between AFC and us of the assets, liabilities and obligations (including, among others, investments, property and tax-related assets and liabilities) of AFC and its subsidiaries attributable to periods prior to, at and after the Spin-Off. Moreover, concurrent with the completion of the Spin-Off on July 9, 2024, our Management Agreement became effective. Our Manager also entered into the Administrative Services Agreement.

Effective July 1, 2024, Jodi Hanson Bond and James Fagan resigned from AFC’s Board of Directors and joined our Board of Directors. Additionally, Alexander Frank was appointed as a director of the Company and remains a director of AFC. In addition, effective July 1, 2024, Leonard M. Tannenbaum was appointed our Executive Chairman (and remains Chairman of AFC) and Brian Sedrish was appointed as our Chief Executive Officer and as a member of our Board of Directors. Brandon Hetzel continued in his role as our Chief Financial Officer and Treasurer (and remains the Chief Financial Officer and Treasurer of AFC), and Robyn Tannenbaum continued in her role as our President (and remains the President and Chief Investment Officer of AFC).

During the three and nine months ended September 30, 2024, we incurred approximately $0.0 million and $0.6 million, respectively, related to Spin-Off costs, which are recorded within professional fees in the unaudited interim statements of operations.

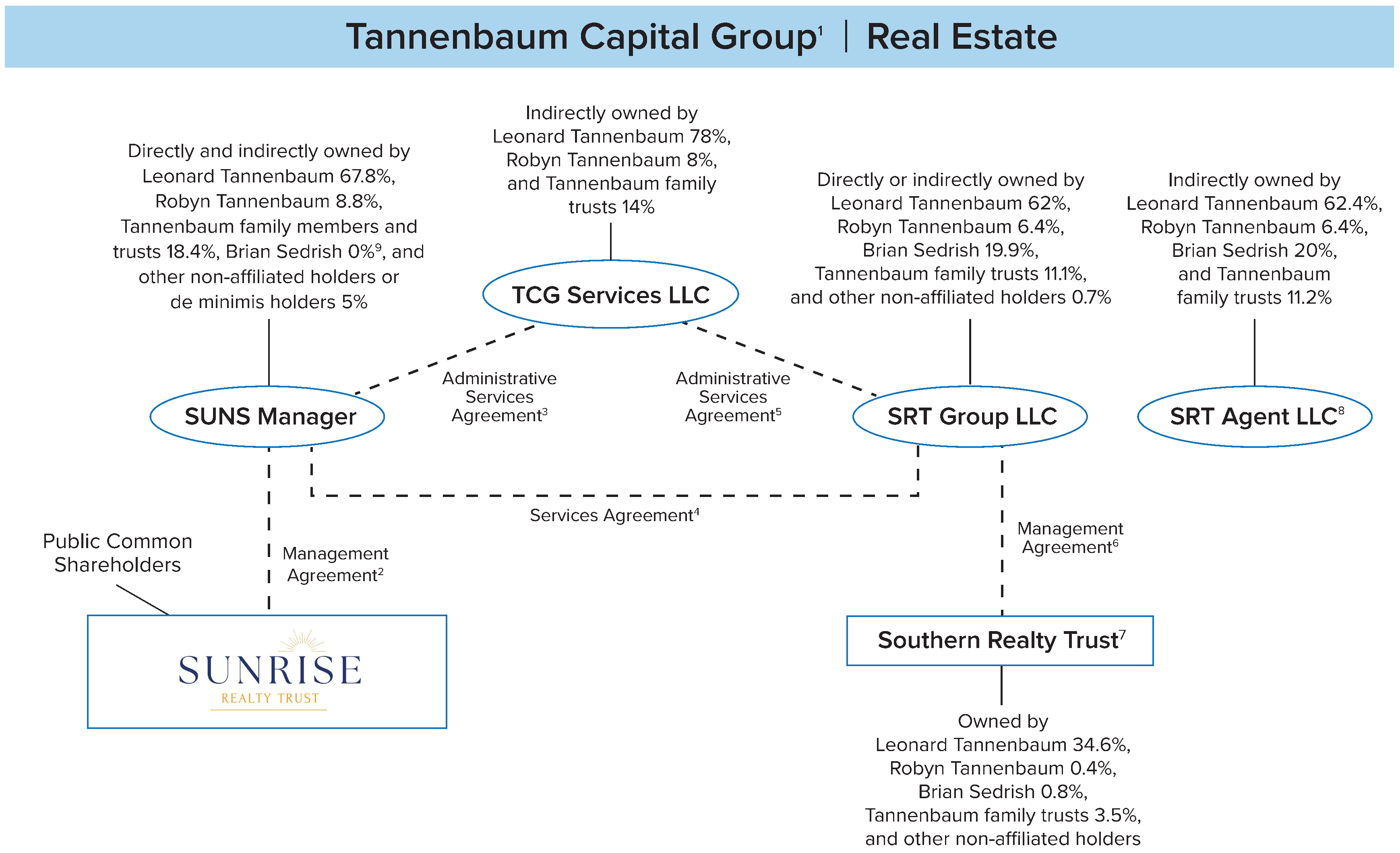

Organizational Chart

The ownership percentages shown in the below chart is as of December 31, 2024.

___________________________

(1)Tannenbaum Capital Group (“TCG”) is a platform for real estate and private credit focused asset managers and lenders, including Sunrise Realty Trust, Inc. (“SUNS”) and Southern Realty Trust, Inc. (“SRT”). TCG’s team of professionals provides services to the asset managers that are part of the TCG platform, including marketing, reporting, legal and other non-investment support services. Leonard Tannenbaum has a 78% interest in TCG and Robyn Tannenbaum has a 8% interest in TCG.

(2)Represents contractual relationship pursuant to which SUNS Manager provides investment advisory and related services to SUNS.

(3)Represents contractual relationship pursuant to which TCG Services LLC provides administrative personnel and services to SUNS’ Manager.

(4)Represents contractual relationship pursuant to which SRT Group LLC provides investment personnel and services to SUNS’ Manager.

(5)Represents contractual relationship pursuant to which TCG Services LLC provides administrative personnel and services to SRT Group LLC.

(6)Represents contractual relationship pursuant to which SRT Group LLC provides investment advisory and related services to SRT.

(7)Brian Sedrish is the Chief Executive Officer, a member of the investment committee, and a board member of SRT. Leonard Tannenbaum is a member of the investment committee and Executive Chairman of the board of directors of SRT. Robyn Tannenbaum is the Head of Capital Markets of SRT.

(8)Serves as the agent for certain loans of SUNS.

(9)Brian Sedrish, our Chief Executive Officer, is expected to be granted approximately 7.0% ownership in connection with this offering, which is expected to further increase relative to the amount of equity capital raised by the Company.

Recent Developments

Updates to Our Portfolio Subsequent to September 30, 2024

In November 2024, we and affiliated co-investors entered into a whole loan (the “Whole Loan”) consisting of an aggregate of $96.0 million in loan commitments. The property securing the loan is a development site and related condominium project located in Fort Lauderdale, Florida. The proceeds are expected to be used to commence and facilitate construction. We committed a total of $30.0 million and affiliated co-investors committed $60.0 million, with the remaining $6.0 million committed by an unaffiliated investor (the “Originating Lender”). At closing, we funded approximately $3.6 million, the affiliated co-investors funded approximately $7.2 million and the Originating Lender funded approximately $0.7 million. The Whole Loan is split into a Senior Loan and Mezzanine Loan, each with two A-Notes ($62.4 million of the total commitment amount) and two B-Notes ($33.6 million of the total commitment amount, of which $6.0 million was committed by the Originating Lender). The A-Notes bear interest at a rate of SOFR plus 4.75%, with a rate index floor of 4.75%, of which we currently hold approximately $20.8 million. The B-Notes bear interest at a rate of SOFR plus 11.00%, with a rate index floor of 4.75%, of which we currently hold approximately $9.2 million. The A-Notes and B-Notes were issued at a discount of 1.0% and mature in 26 months, subject to two, six-month extension options. As of December 31, 2024, the outstanding principal balance on the Whole Loan was approximately $3.9 million and the cash interest rate was 11.7%.

In November 2024, we and an affiliated co-investor also entered into a $26.0 million subordinate loan (the “Subordinate Loan”). The property securing the loan is a development site and related multifamily project located in Miami, Florida. The proceeds are expected to be used to commence and facilitate construction. We committed a total of $13.0 million and the affiliated co-investor committed the remaining $13.0 million. The Subordinate Loan bears interest at a rate of 13.25% per annum, was issued at a discount of 1.0% and matures in 36 months, subject to one, six-month extension option. As of December 31, 2024, the outstanding principal balance on the Subordinate Loan was approximately $0.1 million and the cash interest rate was 13.25%.

In December 2024, we and an affiliated co-investor entered into a $57.0 million senior secured loan for the refinance of a luxury boutique hotel located in Austin, Texas. We committed a total of approximately $32.0 million, and the affiliate committed the remaining $25.0 million. The senior secured loan was issued at a discount of 1.25% and matures in three years. At closing, we funded approximately $29.9 million and the affiliate funded approximately $23.4 million. The senior secured loan bears interest at a rate of SOFR plus 5.50%, with a rate index floor of 4.00%. The senior secured loan is secured by a first-priority fee and leasehold deed of trust on the property. The proceeds of the senior secured loan will be used to, among other things, refinance existing debt and fund reserves. As of December 31, 2024, the outstanding principal balance on the senior secured loan was approximately $29.9 million and the cash interest rate was 9.9%.

Loan and Security Agreement with East West Bank

On November 6, 2024, the Company entered into the Loan and Security Agreement (the “Revolving Credit Agreement”) by and among the Company, the lenders party thereto, and East West Bank, as administrative agent, joint lead arranger, joint book runner, co-syndication agent and co-documentation agent (“East West Bank”). The Revolving Credit Agreement provides for a senior secured revolving credit facility (the “Revolving Credit Facility”) that contains initial aggregate commitments of $50.0 million from one or more FDIC-insured banking institutions, which may be borrowed, repaid and redrawn (subject to a borrowing base based on eligible loan

obligations held by the Company and subject to the satisfaction of other conditions provided under the Revolving Credit Agreement). As of December 31, 2024, we had an aggregate of $123.8 million outstanding under our Revolving Credit Facility. Interest is payable on the Revolving Credit Facility in cash in arrears at the rate per annum equal to the greater of (i) SOFR plus two and three quarters of one percent (2.75%) and (ii) the floor of 5.38%, provided, however, that the interest rate will increase by an additional twenty five basis points (0.25%) during any Increase Rate Month (as defined in the Revolving Credit Agreement). The Revolving Credit Facility matures on November 8, 2027.

The Company is required to pay certain fees to the agent and the lenders under the Revolving Credit Agreement, including a $75,000 agent fee payable to the agent and a 0.25% per annum loan fee payable ratably to the lenders, in each case, payable on the closing date and on the annual anniversary thereafter. Commencing on the six-month anniversary of the closing date, the Revolving Credit Facility has an unused line fee of 0.25% per annum, payable semi-annually in arrears. Based on the terms of the Revolving Credit Agreement, the unused line fee is waived if our average revolver usage exceeds the minimum amount required per the Revolving Credit Agreement.

The amount of total commitments under the Revolving Credit Facility may be increased to up to $200.0 million in aggregate, subject to available borrowing base and lenders’ willingness to provide additional commitments. The Revolving Credit Facility is guaranteed by certain material subsidiaries of the Company and is secured by substantially all assets of the Company and certain of its material subsidiaries; provided that upon the meeting of certain conditions, the facility will be secured only by certain assets of the Company comprising of or relating to loan obligations designed for inclusion in the borrowing base. In addition, the Company is subject to various financial and other covenants, including a liquidity and debt service coverage ratio covenant.

On December 9, 2024, the Company entered into Amendment Number One to Loan and Security Agreement, by and among the Company, the lenders party thereto and East West Bank, pursuant to which, among other things, the aggregate commitment was temporarily increased until January 8, 2025 to the sum of (i) $50 million plus (ii) the lesser of $75 million and the aggregate amount of funds maintained in the Company’s borrowing base cash account. Following January 8, 2025, the aggregate commitment automatically reverted back to $50 million.

On December 30, 2024, the Company entered into Amendment Number Two to Loan and Security Agreement, by and among the Company, Sunrise Realty Trust Holdings I LLC and East West Bank, pursuant to which, among other things, the parties agreed to additional representations, covenants and other amendments to maintain its REIT status and limit the use of participation interests in any underlying obligor loan receivables secured as collateral.

We may use a portion of the net proceeds received from this offering to repay amounts outstanding under the Revolving Credit Facility. As of January 10, 2025, we had an aggregate of approximately $16.2 million outstanding under our Revolving Credit Facility.

Relationships

Certain of the lenders and their affiliates may in the future engage in investment banking, commercial banking and other financial advisory and commercial dealings with the Company and its affiliates.

SRTF Revolving Credit Facility