Overview

Sunrise Realty Trust, Inc. is a real estate focused debt fund, actively pursuing opportunities to finance transitional commercial real estate projects located across the Southern U.S. SUNS is an integral part of the platform of affiliated asset managers under the Tannenbaum Capital Group (“TCG”). SUNS is led by a veteran team of commercial real estate investment professionals and its external manager, Sunrise Manager LLC (our “Manager”), which, alongside other TCG platform asset managers pursuing similar or adjacent opportunities, are supported by the marketing, reporting, legal and other non-investment support services provided by the team of professionals within the TCG platform. Our and our Manager’s relationship with TCG provide us with investment opportunities through a robust relationship network of commercial real estate owners, operators and related businesses as well as significant back-office personnel to assist in management of loans.

Our focus is on originating and investing in secured commercial real estate (“CRE”) loans and providing capital to high-quality borrowers and sponsors with transitional business plans collateralized by CRE assets with opportunities for near-term value creation, as well as recapitalization opportunities. SUNS intends to further diversify its investment portfolio, targeting investments in senior mortgage loans, mezzanine loans, B-notes, commercial mortgage-backed securities (“CMBS”) and debt-like preferred equity securities across CRE asset classes. We intend for SUNS’ investment mix to include loans secured by high quality residential (including multi-family, condominiums and single-family residential communities), retail, office, hospitality, industrial, mixed-use and specialty-use real estate. As of December 31, 2024, SUNS’ portfolio of loans had an aggregate outstanding principal of approximately $132.6 million.

Our investment focus includes originating or acquiring loans backed by single assets or portfolios of assets that typically have (i) an investment hold size of approximately $15-100 million, secured by CRE assets, including transitional or construction projects, across diverse property types, (ii) a duration of approximately 2-5 years, (iii) interest rates that are determined periodically on the basis of a floating base lending rate (e.g., SOFR) plus a credit spread, (iv) a loan-to-value (“LTV”) ratio of no greater than approximately 75% on an individual investment basis and (v) no more than approximately 75% loan-to-value across the portfolio, in each case, at the time of origination or acquisition, and are led by experienced borrowers and well-capitalized sponsors with high quality business plans. Our loans typically feature origination fees and/or exit fees. We target a portfolio net internal rate of return (“IRR”) in the low-teens, which we believe may increase to the mid-teens after including total interest and other revenue from the portfolio, including loans funded from drawing on our leverage, net of our interest expense from our portfolio lenders. We are also targeting a near- to mid-term target capitalization of one-third equity, one-third secured debt availability and one-third unsecured debt. We do not expect to be fully drawn on our secured debt availability and, as a result, we are targeting an expected leverage ratio of 1.5:1 debt-to-equity.

As of December 31, 2024, we had a potentially actionable pipeline of approximately $1.2 billion of commercial real estate deal commitments under review by our Manager, and have signed non-binding term sheets for approximately $341.7 million of commitments from a pool of approximately $31.8 billion CRE deals sourced by our Manager and its affiliates. To date, we have closed on each non-binding term sheet we have executed. However, we are in varying stages of our review and have not completed our due diligence process with respect to the transactions we are currently reviewing and for which we have signed term sheets. As a result, there can be no assurance that we will move forward with any of these potential investments.

In July 2024, we separated from Advanced Flower Capital Inc. (f/k/a AFC Gamma, Inc. “AFC”) through a Spin-Off transaction. The separation was effected by the transfer of AFC’s commercial real estate portfolio, from AFC to us and the distribution of all of the outstanding shares of our common stock to all of AFC’s shareholders of record as of the close of business on July 8, 2024. As a result of the Spin-Off, we are now an independent, public company trading under the symbol “SUNS” on the Nasdaq Capital Market.

We are an externally managed Maryland corporation and intend to elect to be taxed as a REIT under Section 856 of the Internal Revenue Code of 1986, as amended (the “Code”), commencing with our taxable year ended December 31, 2024. We believe our organization and current and proposed method of operation will enable us to qualify as a REIT. However, no assurances can be given that our beliefs or expectations will be fulfilled, since qualification as a REIT depends on our continuing to satisfy numerous asset, income, distribution and other tests

described under “U.S. Federal Income Tax Considerations—Taxation,” which in turn depends, in part, on our operating results and ability to obtain financing. We also intend to operate our business in a manner that will permit us to maintain our exemption from registration under the Investment Company Act.

Target Investments and Portfolio

We invest in transitional CRE assets located in the Southern U.S., including ground-up development and recapitalization transactions, with an emphasis on direct origination of loans with borrowers. We typically invest in loans that have the following characteristics:

•target deal size of $15 million to $250 million;

•investment hold size of $15 million to $100 million;

•secured by CRE assets, including transitional or construction projects, across diverse property types;

•located primarily within markets in the Southern U.S. benefiting from economic tailwinds with growth potential;

•interest rates that are determined periodically on the basis of a floating base lending rate (e.g., SOFR) plus a credit spread;

•no more than approximately 75% loan-to-value on an individual investment basis and no more than approximately 75% loan-to-value across the portfolio, in each case, at the time of origination or acquisition;

•duration of approximately 2-5 years;

•origination fees and/or exit fees;

•significant downside protections; and

•experienced borrowers and well-capitalized sponsors with high quality business plans.

The allocation of capital among our target assets will depend on prevailing market conditions at the time we invest and may change over time in response to changes in prevailing market conditions, including with respect to interest rates and general economic and credit market conditions as well as local economic conditions in markets where we are active.

Southern U.S.

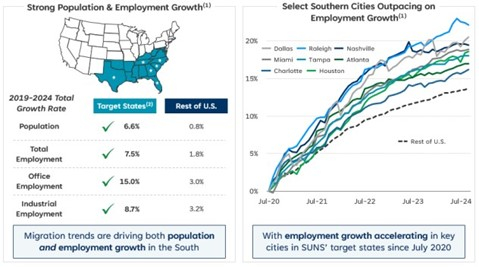

Our investments are primarily concentrated in those states/districts that SUNS considers to be part of the Southern U.S. Those states/districts include AL, AR, DE, FL, GA, KY, LA, MD, MS, NC, OK, SC, TN, TX, VA, WV and D.C. Within its targeted geographic region, we expect that the following states, which are and are expected to continue exhibiting above average population and employment growth, will represent a greater share of the overall geographic exposure: GA, FL, NC, SC, TN and TX.

Market Opportunity

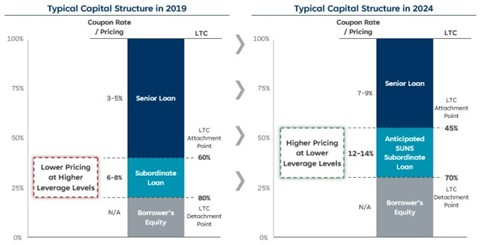

We plan to capitalize on developments in CRE credit markets where non-bank lenders have provided an increasing share of CRE financings as a result of the capital shortage caused by the development, rehabilitation and re-capitalization of assets across the U.S., and particularly in the Southern U.S. We believe this shift is caused by two recent changes: (1) substantially lower amounts of bank capital being made available for transitional real estate assets due to tighter lending parameters, regulatory requirements and portfolio issues; and (2) dislocations and declining liquidity caused by the rapid rise in interest rates that began in March 2022. We believe that this represents a paradigm shift relative to the low interest rate environment observed over the past ten years, which was characterized by an abundance of cheap capital. We believe that non-bank lenders can take advantage of banks’ recent retrenchment and lack of capital, as well as the current interest rate environment, to generate higher returns with lower leverage levels. Additionally, we are not burdened by the same regulatory hurdles facing traditional

lenders, which we believe will better allow us to structure attractive credit positions without taking undue risk or excessive leverage.

We intend to focus on the Southern U.S. due to: (1) positive demographic trends, including accelerated migration patterns resulting from COVID-19 and the resulting shortage in residential and commercial real estate supply; and (2) our local presence, knowledge and network of brokers and sponsors in these markets.

Large and Deep Addressable Market Facing Dislocations

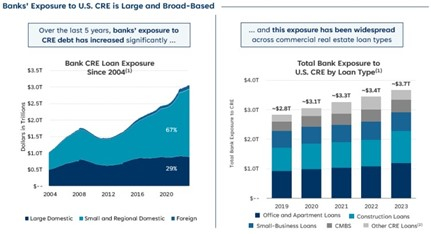

Since 2018, banks have significantly increased their issuance of CRE loans. According to the Federal Deposit Insurance Corporation (the “FDIC”), over the last five years, banks’ exposure to U.S. CRE markets has risen approximately $1 trillion in aggregate, nearing $4 trillion in total, with bank investments broadly distributed across CRE loan types. The current environment of higher interest rates and declining liquidity has caused severe issues across these loan portfolios.

Historically, for CRE projects, higher interest rates typically result in: (1) decreased valuations; (2) lower occupancy rates; (3) construction/development delays; and (4) reduced liquidity (i.e., fewer options for borrowers). Each of these changes increases the default risk of CRE loans on bank balance sheets, and as these effects typically happen in tandem, the impact is magnified. For example, many CRE loans have short terms with balloon payments and in a higher rate environment, refinancing these loans becomes challenging and expensive. In an environment of declining valuations and occupancy rates, however, borrowers of these loans have even less ability to secure favorable refinancing terms, further increasing default risk.

___________________

(1)Newmark Research Data.

(2)Other CRE Loans include real-estate investor loans and other assets linked to commercial properties.

Banks entered 2023 facing new regulations (Basel III), an office sector crash, rising interest rates and declining liquidity, forcing them to curtail their lending activity. Regional bank turmoil and sustained rate hikes in 2023 further amplified bank retrenchment from CRE lending and forced some lenders to liquidate existing loan portfolios to improve balance sheet liquidity. In addition, higher rates coupled with the slowdown in the structured credit markets (warehouse lines and CLOs) has eroded lender margins, causing some to exit.

With banks and other traditional lenders halting lending or unable to bridge funding gaps due to lower leverage targets, we believe that there is a large and immediate need for capital from non-traditional capital providers to support transitional CRE business plans. CRE is a capital intensive asset class with a consistent need for debt financing for development, rehabilitation and recapitalizations. We believe that the U.S. CRE debt market is capable of delivering predictable income streams with significant downside protection through an economic cycle.

Further, the current environment of elevated interest rates combined with reduced CRE valuations present compelling lending opportunities. Declines in real estate values reduce new lender risk in the form of lower LTV

ratios: originated loans placed at approximately 70% LTV (based on valuations as of July 2024) represent approximately 55% LTV of peak asset valuations. In addition, higher benchmark rates (Treasury Rate and SOFR) as well as elevated spreads enhance net interest margins, which we believe results in greater opportunity for outsized returns.

____________________

*Based on management estimates. Provided for illustrative purposes only and does not reflect the terms of any specific capital structure.

(1)Valuation decline based on Green Street Commercial Property Price Index as of July 2024 (~20% decline from recent peak).

(2)Source: Cushman & Wakefield, Green Street Advisors.

(3)Source: Average of apartment, industrial, office, self-storage, senior housing, single-family rental, and strip center sectors.

(4)LIBOR used for Dec 2019; SOFR used for July 2024.

We believe that, in times of dislocation, the risk-adjusted returns available in the U.S. CRE debt market offer an attractive investment opportunity and support an allocation from opportunistic investors.

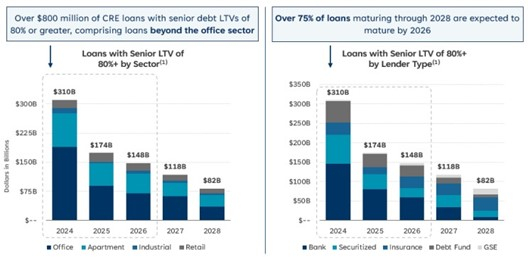

High Volume of Near-Term CRE Loan Maturities

CRE debt transactions are typically financed with short duration loans, which amplifies the need for a consistent supply of fresh capital for both new originations and rollover financings. We expect that a high volume of near-term maturing debt will lead to substantial demand for CRE debt capital. According to S&P Global, over $2.1 trillion in loans across CRE sectors are set to mature in 2025 and 2026, with approximately $832 billion of loans carrying senior debt LTVs of 80% or greater maturing from 2024 through 2028.

___________________

(1)Green Street, NCREIF, RCA, Trepp, MBA, Newmark Research. Loans with an estimated senior debt LTV of 80% or greater are potentially troubled. The loans are marked-to-market using an average of cumulative changes in the Dow Jones REIT sector price indices, REIT sector enterprise value indices and Green Street sector CPPI.

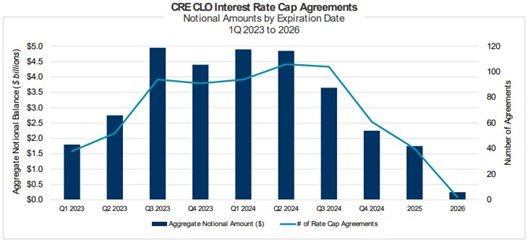

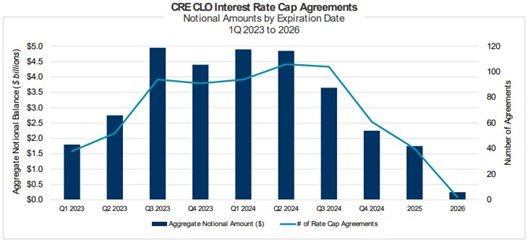

The actions of bank regulators have enabled banks and other lenders to extend maturing loans rather than force repayments that may result in capital impairment. The rapid rise in interest rates from March 2022 to September 2023, coupled with this backlog of refinancing needs, is causing banks to seek repayment to recover capital and shore up liquidity. Additionally, many loans contain rate caps which are naturally expiring as loan terms come due (see chart below from Cred-iq.com). The currently elevated interest rates have made purchasing these caps, previously struck at low levels, uneconomical. We believe that the most pressing gap is for subordinate financings, as we believe banks who are continuing to lend look to reduce leverage levels. Maturing loans, plus expiring rate caps, will create opportunities for alternative lenders who can bridge the gap and offer borrowers gap financing to complete their capitalizations. We anticipate that lenders who can take advantage of this dislocation will be able to generate equity-like returns with debt-like risk, with leverage levels significantly below where they have been over the last decade.

Migration Patterns and Business Growth Driving Demand for CRE in the Southern U.S.

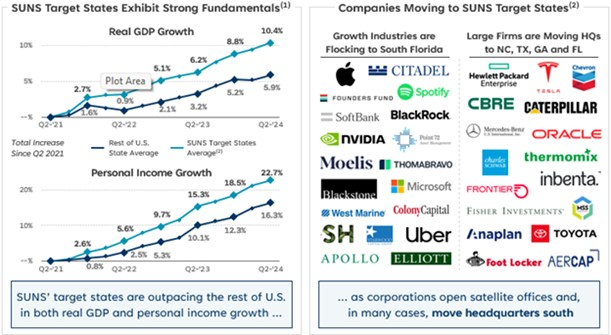

According to the 2022 Allied US Migration Report, population and employment migration to the Southern U.S. has long been occurring, but COVID-19 has accelerated this growth. These trends have caused the Southern U.S. to benefit from increased population, employment and real GDP growth, as per the U.S. Bureau of Economic Analysis.

___________________

(1)U.S. Census Bureau Data; CoStar Market Data; Federal Reserve Bank of St. Louis

(2)Target states include: FL, TX, NC, SC, TN, and GA.

Personal income growth in our target states is outpacing the U.S. average, largely due to corporations moving to the Southern U.S.

___________________

(1)U.S. Bureau of Economic Analysis; Federal Reserve Bank of St. Louis.

(2)Target states include: FL, TX, NC, SC, TN, and GA.

We expect these migration and growth trends to continue for the foreseeable future given the favorable business environment, climate, taxes, access to intellectual capital and lower fixed expenses available in the Southern U.S.

COVID-19’s acceleration of pre-existing migration patterns and business growth in the Southern U.S. has driven increased unmet demand for CRE in the Southern U.S. We anticipate that the CRE supply lag in the Southern U.S. will worsen in the coming years due to the reduced access to capital from traditional CRE lenders discussed above, which we believe will provide a consistent flow of investment opportunities in our target states and investment types.

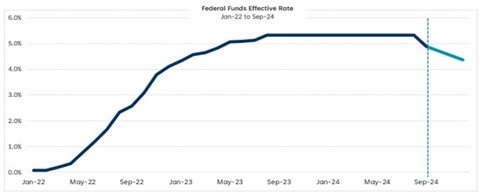

Higher Rates and Decreased Competition

From March 2022 to July 2023, the Federal Reserve embarked on an aggressive rate hiking cycle, ending a four-decade bond bull market characterized by cheap and abundant capital. Credit markets have experienced tremendous disruption, including the failure of Silicon Valley Bank and Signature Bank in Spring 2023; the iShares 20 Plus Year Treasury Bond ETF is off over 46% from its all time closing high in 2020 (as of October 25, 2024). Implied bank lending rates suggest that an elevated rate environment (especially relative to the recent decade) will

persist into 2025 (see chart below from the Federal Reserve Bank of St. Louis). As a result, it is anticipated that borrowers will have difficulty refinancing oversized debt tranches and servicing the cost of new debt capital.

__________________

Source: Federal Reserve Bank of St. Louis

We believe that this market environment bodes well for lenders who can provide subordinated debt tranches and serve as “rescue capital” where borrowers otherwise would be required to support existing equity investments. We believe that many borrowers will prefer to utilize mezzanine loans and/or debt-like preferred equity securities to plug gaps.

Historically, many lenders relied upon high degrees of low-cost leverage, enabling them to compete aggressively on pricing offered to borrowers. These relatively highly-levered lenders have pulled back due to: (1) their inability to access the aforementioned cheap financing in the current market environment; and (2) portfolio issues that resulted from their aggressive use of leverage. We believe that lenders with capital to deploy and more conservative leverage profiles, like our company, will be able to take advantage of these dynamics to obtain better pricing at lower leverage points than has existed over the last several years. Additionally, highly leveraged lenders may become sources of deal flow if they are forced to sell positions to cover margin calls or investor redemptions.

Potential Opportunities for Immediate Deployment

Our opportunity set is expected to encompass the following categories, with the volume of each dependent on currently elevated interest rates declining at the expected rates, the supply of fresh capital that enters the CRE lending space, and continued migration trends to the Southern U.S. We believe the following will be the most actionable areas of focus over the next several years:

1.New loan originations for well-capitalized sponsors with high-quality business plans that would have borrowed at lower rates and higher leverage levels over the last decade;

2.Recapitalization transactions of high-quality assets for borrowers with maturing loans or rate cap expirations, who in addition to refinancing existing lenders may need incremental capital to satisfy further repositioning and carrying costs, or may need additional time to achieve lease-up or other milestones prior to receiving permanent financing or engaging in an asset sale;

3.Special situations investments where equity investors may seek portfolio-level liquidity and we can provide a loan backed by a diversified portfolio of quality assets at acceptable leverage levels; and

4.Banks or other lenders seeking to sell existing loans to generate liquidity, the selling of which may be involuntary due to capital calls or investor redemptions and may be done at a discount to par.

We believe that the current market climate will produce a robust pipeline of quality lending opportunities in markets in the Southern U.S. experiencing strong growth and demand tailwinds characterized by:

1.Conservative leverage levels;

2.Improved lender protections; and

3.Higher absolute returns relative to the last decade.

Our investment portfolio is expected to comprise a spectrum of CRE asset classes, including high quality multifamily, condominiums, industrial, office, retail, hospitality, mixed-use and specialty-use real estate, as well as investments including refinancings for later-and-transitional-stage assets and ground-up development.

Attractive Risk-Adjusted Return Profile

We believe that our strategy of taking advantage of declining liquidity in the CRE credit markets, combined with investing in geographies with favorable demographic tailwinds, should provide our investors a strong degree of downside protection combined with attractive risk-adjusted returns. We anticipate that recapitalization transactions driven by maturing loans or interest rate cap expirations will allow us to invest into deals that have been relatively de-risked. As an example, we may have the opportunity to invest in assets where the primary risk is lease-up of a property, as opposed to day one ground-up development risk. In these situations, equity and potentially other tranches (mezzanine, preferred equity) may be subordinated to our tranche, which may allow us to generate attractive returns with a significant cushion below.

Our ground-up development loans are expected to be secured by collateral located in Southern U.S. geographies with strong demographic and demand tailwinds. In new build or rehabilitation projects, in addition to these tailwinds, we also expect to require that borrowers contribute increased levels of equity, reducing our leverage detachment point, further enhancing credit quality. The increased levels of equity are expected to provide strong downside protection for our company, as our loans are anticipated to carry reduced loan to value ratios than were observed in our target markets as recently as a year and a half ago. As demonstrated by the below chart (from Green Street Advisors as of October 2024), historically, impairment in CRE values has been limited to the first 0-40% of the capital structure.

___________________

Source: Green Street Advisors as of October 2024

As a result of the forces impacting CRE capital markets, including increased interest rates, lower availability of capital, and higher equity requirements, we believe that providers of subordinated debt capital will be able to

consistently command mid-teens returns at lower LTV levels than were required over the last decade. These tranches provide better downside protection and more closely resemble senior leverage as compared with the prior ten years.

__________________

Source: Based on management estimates. Provided for illustrative purposes only and does not reflect the terms of any specific capital structure.

We believe that traditional lenders are structurally challenged and will continue to pull back from the market, which will provide us with the opportunity to achieve our targeted returns for several years to come.

Investment Objective

We will seek to generate strong risk-adjusted returns by originating and investing in CRE assets located in the Southern U.S., including ground-up development and recapitalization transactions, with an emphasis on direct origination of loans with borrowers. Returns are anticipated to be generated through a combination of current and/or accrued interest payments, origination and exit fees, servicing fees, minimum multiple-of-capital payments and extension and other fees. We intend to primarily invest in senior mortgage loans, mezzanine loans, B-notes, CMBS and debt-like preferred equity securities across CRE asset classes.

We will seek to lend to experienced borrowers in order to: (i) finance acquisitions, (ii) refinance existing indebtedness, (iii) fund value-add and transitional business plans, or (iv) provide portfolio-level liquidity solutions directly or via purchases of existing loans. We expect that our investments will typically have the following characteristics:

•target deal size of $15 million to $250 million;

•investment hold size of $15 million to $100 million;

•secured by CRE assets, including transitional or construction projects, across diverse property types;

•located primarily within markets in the Southern U.S. benefiting from economic tailwinds with growth potential;

•interest rates that are determined periodically on the basis of a floating base lending rate (e.g., SOFR) plus a credit spread;

•no more than approximately 75% LTV on an individual investment basis and no more than approximately 75% LTV across the portfolio, in each case, at the time of origination or acquisition;

•duration of approximately 2-5 years;

•origination fees and/or exit fees;

•significant downside protections; and

•experienced borrowers and well-capitalized sponsors with high quality business plans.

Our portfolio of investments will target low-teens net IRR, which we aim to be in the mid-teens after including total interest and other revenue from the portfolio, including loans funded from drawing on our leverage, net of our interest expense from our portfolio lenders. We are targeting an expected leverage ratio of 1.5:1 debt-to-equity.

Our investment mix will likely include high quality residential (including multifamily, condominiums and single-family residential communities), industrial, office, retail, hospitality, mixed-use and specialty-use real estate.

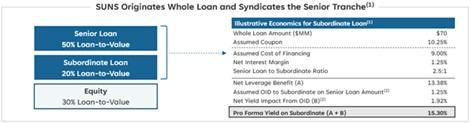

Our investment program will primarily include senior mortgage loans, mezzanine loans, B-notes, CMBS and debt-like preferred equity securities. We may originate or purchase the above types of investments and hold them to maturity. We may also originate a whole loan and subsequently create a mezzanine loan by partnering with a senior lender (likely a national or regional bank, or an insurance company), who will acquire the senior portion of the loan from us. We believe that this structure would allow us to deliver enhanced returns to our investors while providing competitive financing rates to our borrowers. An example of this structure is shown below.

___________________

(1)Based on an assumed thirty-six (36) month term, fully-funded at close and annual compounding for yield calculation. Based on management estimates. Provided for illustrative purposes only and does not reflect the terms of any specific loan or borrower.

(2)The entire 1.25% original issue discount (OID) is being allocated exclusively to the subordinate tranche, amounting to 4.375% of its $20 million balance.

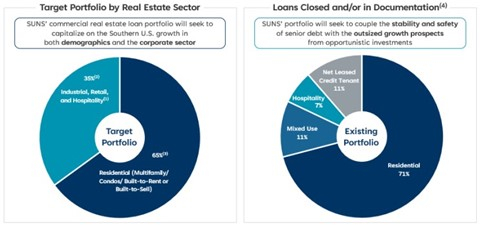

The following charts summarize our target portfolio by property and transaction types.

__________________

(1)May include mixed-use and specialty-use properties.

(2)Anticipated to comprise approximately 25%-50% of the portfolio. Provided for illustrative purposes only. No assurances can be given that SUNS will achieve the indicated portfolio diversification or returns.

(3)Anticipated to comprise approximately 50%-75% of the portfolio. Provided for illustrative purposes only. No assurances can be given that SUNS will achieve the indicated portfolio diversification or returns.

(4)Includes loans in documentation stage; SUNS is in varying stages of negotiation and has not completed its due diligence process with respect to projects that have not closed. As a result, there can be no assurance that these potential investments will be completed on the terms described above or at all. A component of these loans may be held through one or more affiliated co-investors.

The allocation of capital among our target assets will depend on prevailing market conditions at the time we invest and may change over time in response to changes in prevailing market conditions, including with respect to interest rates and general economic and credit market conditions as well as local economic conditions in markets where we are active.

Key Differentiating Factors

We believe that there is an immediate opportunity to capitalize on CRE market dislocations and declining liquidity, converging with migration trends to the Southern U.S. These opportunities are outlined below along with our view of our competitive advantages in identifying meaningful investment opportunities.

Unique Market Opportunity: A rapid rise in interest rates has caused significant impairment and disruption to the CRE capital markets. Legacy portfolio issues have caused banks and other traditional CRE lenders to retrench from CRE, and elevated interest rates have drained liquidity from the CRE capital markets. $2.0 trillion of looming CRE maturities by 2026 will have to be addressed, and capital providers with liquidity and speed of execution will be better positioned to take advantage of this market dislocation. In addition, we believe that there is a supply-demand imbalance in the Southern U.S. for CRE. COVID-19 sped up migration inflows to the Southern U.S. as market dislocations simultaneously began to halt new supply, worsening any supply-demand imbalance further. We anticipate that this supply lag will persist for the foreseeable future.

Experience and Strategic Presence: We believe that our size and institutional infrastructure, as well as our management team’s expertise in transitional real estate, distressed debt and recapitalizations; cycle-tested track record in CRE credit; deep knowledge of the Southern U.S. CRE market; and deep network of relationships across CRE markets will differentiate our company in making CRE debt investments in the Southern U.S. We maintain a strategic local presence in the Southern U.S., with our headquarters in West Palm Beach, Florida, which we believe will enhance our sourcing capabilities and local market knowledge.

Diversified Portfolio: We intend to build a diversified portfolio of CRE investments that combines the upside potential from higher-yielding investments, including mezzanine loans, B-notes, CMBS, subordinate credit and debt-like preferred equity securities, with the relative safety of a stable pool of senior mortgage loans, which we believe will maximize risk-adjusted returns for our shareholders.

TCG Platform: Our and our Manager’s relationship with TCG provide us with investment opportunities through a robust relationship network of commercial real estate owners, operators and related businesses as well as significant back-office personnel to assist in management of loans.

Strong Underlying Collateral: Our debt investments will primarily be secured by real estate assets that are expected to be diversified across asset classes, including high quality residential (including multifamily, condominiums and single-family residential communities), industrial, office, retail, hospitality, mixed-use and specialty-use real estate.

Our Manager

We are externally managed and advised by our Manager, a registered investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), and an affiliate of Leonard M. Tannenbaum and Robyn Tannenbaum. Our Manager is beneficially owned 67.8% by Leonard M. Tannenbaum, our Executive Chairman, 8.8% by Robyn Tannenbaum, our President, and 18.4% by Tannenbaum family members and trusts, as of December 31, 2024, and Brian Sedrish, our Chief Executive Officer, is expected to be granted approximately 7.0% ownership in connection with this offering, which is expected to further increase relative to the amount of equity capital raised by the Company. The executive offices of our Manager are located at 525 Okeechobee Blvd., Suite 1650, West Palm Beach, FL 33401 and the telephone number of our Manager’s executive offices is (561) 530-3315. Our Manager entered into an administrative services agreement (the “Administrative Services Agreement”) with TCG Services LLC (“TCG Services”), that sets forth the terms on which TCG Services provides certain administrative services,

including providing personnel, office facilities, information technology and other equipment and legal, accounting, human resources, clerical, bookkeeping and record keeping services at such facilities and other services that are necessary or useful for us. TCG Services is an affiliate of our Manager and Leonard Tannenbaum, our Executive Chairman, and Robyn Tannenbaum, our President. Our Manager also entered into a Services Agreement (the “Services Agreement”) with SRT Group LLC (“SRT Group”), an affiliate of our Manager, Leonard M. Tannenbaum, Robyn Tannenbaum, Brian Sedrish and Brandon Hetzel. The Services Agreement sets forth the terms on which SRT Group will provide investment personnel to us.

As of December 31, 2024, our Manager, through the Administrative Services Agreement with TCG Services and the Services Agreement with SRT Group, has access to the services of over 30 professionals, including six investment professionals. The investment personnel provided by our Manager and the investment committee members of our Manager have over 60 years of combined investment management experience and are a valuable resource to us.

Our Management Agreement and Fee Waiver

From time to time, the Manager may waive fees it would otherwise be entitled to under the terms of the Management Agreement. The Manager intends to waive (i) the inclusion of the net proceeds from this offering in the Company’s Equity for purposes of calculating the management fee until the earlier of (a) December 31, 2025 and (b) the quarter in which the total amount of the net proceeds of this offering have been utilized to fund loans in our portfolio and (ii) an additional $1.0 million in fees.

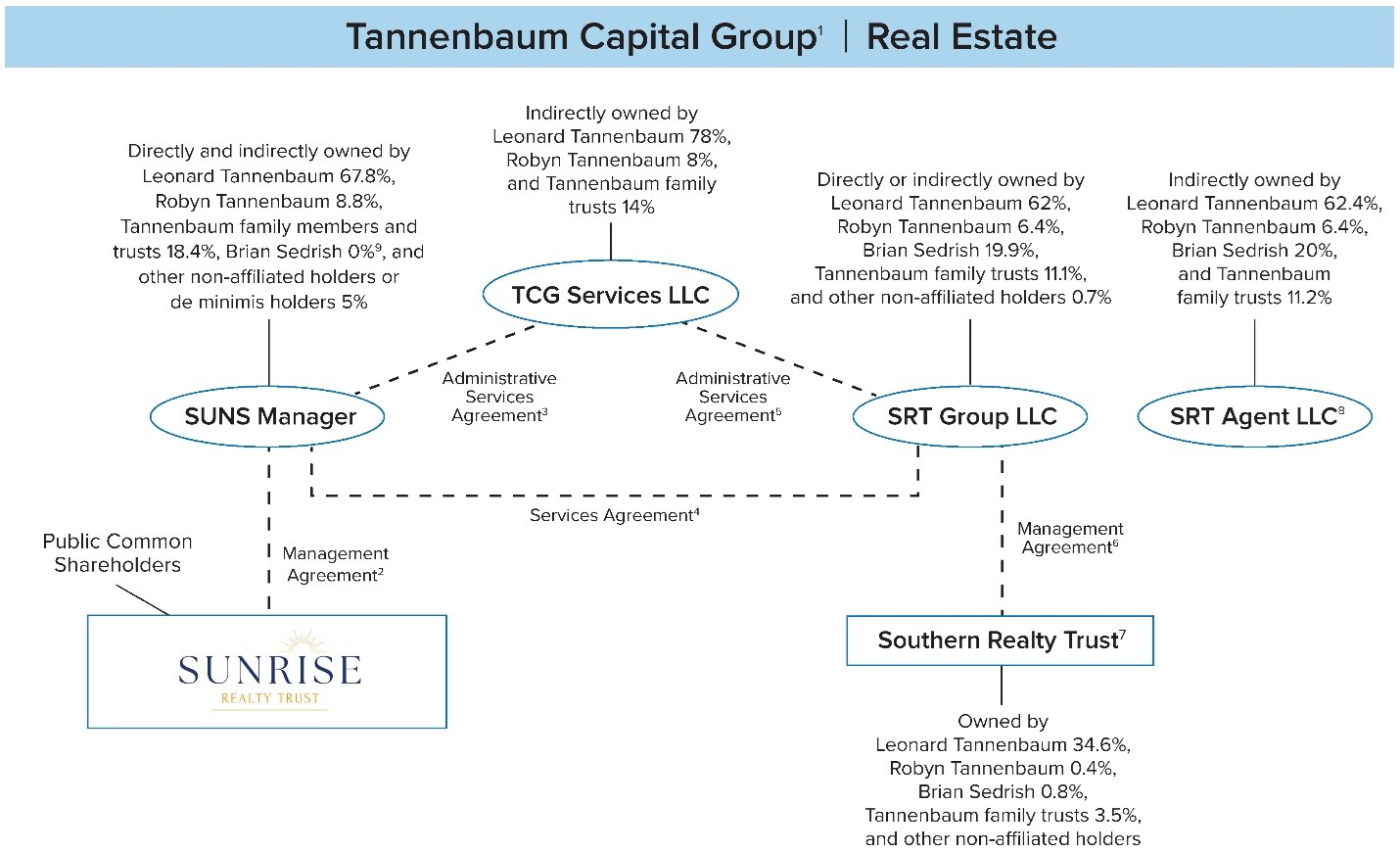

The ownership percentages shown in the below chart is as of December 31, 2024.

__________________

(1)Tannenbaum Capital Group (“TCG”) is a platform for real estate and private credit focused asset managers and lenders, including Sunrise Realty Trust, Inc. (“SUNS”) and Southern Realty Trust, Inc. (“SRT”). TCG’s team of professionals provides services to the asset managers that are part of the TCG platform, including marketing, reporting, legal and other non-investment support services. Leonard Tannenbaum has a 78% interest in TCG and Robyn Tannenbaum has a 8% interest in TCG.

(2)Represents contractual relationship pursuant to which SUNS Manager provides investment advisory and related services to SUNS.

(3)Represents contractual relationship pursuant to which TCG Services LLC provides administrative personnel and services to SUNS’ Manager.

(4)Represents contractual relationship pursuant to which SRT Group LLC provides investment personnel and services to SUNS’ Manager.

(5)Represents contractual relationship pursuant to which TCG Services LLC provides administrative personnel and services to SRT Group LLC.

(6)Represents contractual relationship pursuant to which SRT Group LLC provides investment advisory and related services to SRT.

(7)Brian Sedrish is the Chief Executive Officer, a member of the investment committee, and a board member of SRT. Leonard Tannenbaum is a member of the investment committee and Executive Chairman of the board of directors of SRT. Robyn Tannenbaum is the Head of Capital Markets of SRT.

(8)Serves as the agent for certain loans of SUNS.

(9)Brian Sedrish, our Chief Executive Officer, is expected to be granted approximately 7.0% ownership in connection with this offering, which is expected to further increase relative to the amount of equity capital raised by the Company.

Recent Developments

Updates to Our Portfolio Subsequent to September 30, 2024

In November 2024, we and affiliated co-investors entered into a whole loan (the “Whole Loan”) consisting of an aggregate of $96.0 million in loan commitments. The property securing the loan is a development site and related condominium project located in Fort Lauderdale, Florida. The proceeds are expected to be used to commence and facilitate construction. We committed a total of $30.0 million and affiliated co-investors committed $60.0 million, with the remaining $6.0 million committed by an unaffiliated investor (the “Originating Lender”). At closing, we funded approximately $3.6 million, the affiliated co-investors funded approximately $7.2 million and the Originating Lender funded approximately $0.7 million. The Whole Loan is split into a Senior Loan and Mezzanine Loan, each with two A-Notes ($62.4 million of the total commitment amount) and two B-Notes ($33.6 million of the total commitment amount, of which $6.0 million was committed by the Originating Lender). The A-Notes bear interest at a rate of SOFR plus 4.75%, with a rate index floor of 4.75%, of which we currently hold approximately $20.8 million. The B-Notes bear interest at a rate of SOFR plus 11.00%, with a rate index floor of 4.75%, of which we currently hold approximately $9.2 million. The A-Notes and B-Notes were issued at a discount of 1.0% and mature in 26 months, subject to two, six-month extension options. As of December 31, 2024, the outstanding principal balance on the Whole Loan was approximately $3.9 million and the cash interest rate was 11.7%.

In November 2024, we and an affiliated co-investor also entered into a $26.0 million subordinate loan (the “Subordinate Loan”). The property securing the loan is a development site and related multifamily project located in Miami, Florida. The proceeds are expected to be used to commence and facilitate construction. We committed a total of $13.0 million and the affiliated co-investor committed the remaining $13.0 million. The Subordinate Loan bears interest at a rate of 13.25% per annum, was issued at a discount of 1.0% and matures in 36 months, subject to one, six-month extension option. As of December 31, 2024, the outstanding principal balance on the Subordinate Loan was approximately $0.1 million and the cash interest rate was 13.25%.

In December 2024, we and an affiliated co-investor entered into a $57.0 million senior secured loan for the refinance of a luxury boutique hotel located in Austin, Texas. We committed a total of approximately $32.0 million, and the affiliate committed the remaining $25.0 million. The senior secured loan was issued at a discount of 1.25% and matures in three years. At closing, we funded approximately $29.9 million and the affiliate funded approximately $23.4 million. The senior secured loan bears interest at a rate of SOFR plus 5.50%, with a rate index floor of 4.00%. The senior secured loan is secured by a first-priority fee and leasehold deed of trust on the property. The proceeds of the senior secured loan will be used to, among other things, refinance existing debt and fund reserves. As of December 31, 2024, the outstanding principal balance on the senior secured loan was approximately $29.9 million and the cash interest rate was 9.9%.

Our Manager or an affiliated fund has executed the following non-binding term sheets for loans for which we expect to fund a portion of the commitment amount in accordance with our allocation policy and we expect an affiliated co-investor to fund most of the remaining portion of the loans.

•A senior secured mortgage loan consisting of an aggregate of approximately $72.7 million in loan commitments. The property securing the loan is the development site and related net leased credit tenant project located in New Orleans, Louisiana. Additional collateral includes a first-priority pledge of 100% of the equity interests in the Borrower, a first-priority collateral assignment of all Property rents, accounts and reserves, and other customary collateral. The proceeds are expected to be used to commence and facilitate the construction of the property.

•A senior secured mortgage loan consisting of an aggregate of approximately $225.0 million in loan commitments. The property securing the loan is a Class-A multifamily rental property located in Hallandale Beach, Florida. Additional collateral includes a first-priority pledge of 100% of the equity interests in the Borrower, a first-priority collateral assignment of all property rents, accounts and reserves, and other customary collateral. The proceeds are expected to be used for the refinancing and condominium conversion of the property.

•Note-on-note financing consisting of approximately $44.0 million in loan commitments. The proceeds are to be used to finance the acquisition of a senior mortgage loan, which is secured by a mixed-use project featuring senior living, medical office, and retail located in Aventura, FL. Additional collateral includes a first priority security interest in all cashflows from the senior mortgage loan, security documentation governing the underlying senior mortgage loan, a first priority pledge of 100% of the equity interests from the Borrower of the note-on-note financing.

Loan and Security Agreement with East West Bank

On November 6, 2024, the Company entered into the Loan and Security Agreement (the “Revolving Credit Agreement”) by and among the Company, the lenders party thereto, and East West Bank, as administrative agent, joint lead arranger, joint book runner, co-syndication agent and co-documentation agent (“East West Bank”). The Revolving Credit Agreement provides for a senior secured revolving credit facility (the “Revolving Credit Facility”) that contains initial aggregate commitments of $50.0 million from one or more FDIC-insured banking institutions, which may be borrowed, repaid and redrawn (subject to a borrowing base based on eligible loan obligations held by the Company and subject to the satisfaction of other conditions provided under the Revolving Credit Agreement). As of December 31, 2024, we had an aggregate of $123.8 million outstanding under our Revolving Credit Facility. Interest is payable on the Revolving Credit Facility in cash in arrears at the rate per annum equal to the greater of (i) SOFR plus two and three quarters of one percent (2.75%) and (ii) the floor of 5.38%, provided, however, that the interest rate will increase by an additional twenty five basis points (0.25%) during any Increase Rate Month (as defined in the Revolving Credit Agreement). The Revolving Credit Facility matures on November 8, 2027.

The Company is required to pay certain fees to the agent and the lenders under the Revolving Credit Agreement, including a $75,000 agent fee payable to the agent and a 0.25% per annum loan fee payable ratably to the lenders, in each case, payable on the closing date and on the annual anniversary thereafter. Commencing on the six-month anniversary of the closing date, the Revolving Credit Facility has an unused line fee of 0.25% per annum, payable semi-annually in arrears. Based on the terms of the Revolving Credit Agreement, the unused line fee is waived if our average revolver usage exceeds the minimum amount required per the Revolving Credit Agreement.

The amount of total commitments under the Revolving Credit Facility may be increased to up to $200.0 million in aggregate, subject to available borrowing base and lenders’ willingness to provide additional commitments. The Revolving Credit Facility is guaranteed by certain material subsidiaries of the Company and is secured by substantially all assets of the Company and certain of its material subsidiaries; provided that upon the meeting of certain conditions, the facility will be secured only by certain assets of the Company comprising of or relating to loan obligations designed for inclusion in the borrowing base. In addition, the Company is subject to various financial and other covenants, including a liquidity and debt service coverage ratio covenant.

On December 9, 2024, the Company entered into Amendment Number One to Loan and Security Agreement, by and among the Company, the lenders party thereto and East West Bank, pursuant to which, among other things, the aggregate commitment was temporarily increased until January 8, 2025 to the sum of (i) $50 million plus (ii) the lesser of $75 million and the aggregate amount of funds maintained in the Company’s borrowing base cash account. Following January 8, 2025, the aggregate commitment automatically reverted back to $50 million.

On December 30, 2024, the Company entered into Amendment Number Two to Loan and Security Agreement, by and among the Company, Sunrise Realty Trust Holdings I LLC and East West Bank, pursuant to which, among other things, the parties agreed to additional representations, covenants and other amendments to maintain its REIT status and limit the use of participation interests in any underlying obligor loan receivables secured as collateral.

We may use a portion of the net proceeds received from this offering to repay amounts outstanding under the Revolving Credit Facility. As of January 10, 2025, we had an aggregate of approximately $16.2 million outstanding under our Revolving Credit Facility.

SRTF Revolving Credit Facility

On November 6, 2024, in conjunction with the entry by the Company into the Revolving Credit Facility, we terminated the unsecured revolving credit agreement (the “Credit Agreement”) dated September 26, 2024, by and between us, as borrower, and SRT Finance LLC, as agent and lender. Upon execution of the Revolving Credit Facility, the lenders’ commitments under the Credit Agreement were terminated and the liability of the Company and its subsidiaries with respect to their obligations under the Credit Agreement was discharged.

On December 9, 2024, the Company entered into a new unsecured revolving credit agreement (the “SRTF Credit Agreement”), by and among the Company, as borrower, the lenders party thereto from time to time, and SRT Finance LLC, as agent and lender. SRT Finance LLC is indirectly owned by Leonard M. Tannenbaum, Executive Chairman of the Company's Board of Directors, and Robyn Tannenbaum, President of the Company, along with their family members and associated family trusts. The SRTF Credit Agreement provides for an unsecured revolving credit facility (the “SRTF Credit Facility”) with a $75.0 million commitment, which may be borrowed, repaid and redrawn, subject to a draw fee and the other conditions provided in the SRTF Credit Agreement. Interest is payable on the SRTF Credit Facility at a rate per annum equal to 8.00%. The SRTF Credit Facility matures on the earlier of (i) May 31, 2028 and (ii) the date of the closing of any Refinancing Indebtedness (as defined in the SRTF Credit Agreement) with an aggregate principal amount equal to or greater than $75.0 million. Commencing on January 1, 2026, the Company is required to pay an annual fee equal to 1.00% of the aggregate commitments ratably to the lenders, payable on the first business day of each calendar year; provided that the fee due and payable on January 3, 2028 will be pro rated on the basis of a year of 360 days for the actual number of days elapsed from and including January 1, 2028 until and excluding May 31, 2028.

As of January 10, 2025, we had no amounts outstanding under our SRTF Credit Facility.

Relationships

Certain of the lenders and their affiliates may in the future engage in investment banking, commercial banking and other financial advisory and commercial dealings with the Company and its affiliates.

The Company also updated its Risk Factors to include the below.

Risks Related to Our Business and Growth Strategy

The estimates of market opportunity and forecasts of market growth included in this registration statement may prove to be inaccurate. Even if the market in which we compete achieves the forecasted growth, our business could fail to grow at similar rates, if at all.

The CRE market estimates and growth forecasts are uncertain and based on assumptions and estimates that may be inaccurate. Our addressable market depends on a number of factors, including the fluctuation of interest rates, changes in the competitive landscape, volume of near-term CRE loan maturities, migration to the Southern U.S. and changes in economic conditions. Even if the market in which we compete meets the size estimates and growth rates we forecast, our business could fail to grow at similar rates, if at all.

Construction loans involve an increased risk of loss.

We invest in loans which fund the construction of commercial properties. As of December 31, 2024, approximately 27% of the aggregate outstanding principal amount of our portfolio of loans fund the construction of commercial properties. If we fail to fund our entire commitment on a construction loan or if a borrower otherwise fails to complete the construction of a project, there could be adverse consequences associated with the loan, including, but not limited to: a loss of the value of the property securing the loan, especially if the borrower is unable to raise funds to complete it from other sources; a borrower’s claim against us for failure to perform under the loan documents; increased costs to the borrower that the borrower is unable to pay; a bankruptcy filing by the borrower;

and abandonment by the borrower of the collateral for the loan. The occurrence of such events may have a negative impact on our results of operations. Other loan types may also include unfunded future obligations that could present similar risks.

Interest rate fluctuations could increase our financing costs, which could lead to a significant decrease in our results of operations, cash flows and the market value of our investments.

Our primary interest rate exposures will relate to the financing cost of our debt. To the extent that our financing costs will be determined by reference to floating rates, the amount of such costs will depend on a variety of factors, including, without limitation, (i) for collateralized debt, the value and liquidity of the collateral, and for non-collateralized debt, our credit, (ii) the level and movement of interest rates, and (iii) general market conditions and liquidity. In a period of rising interest rates, our interest expense on floating-rate debt would increase, while any additional interest income we earn on our floating-rate investments may not compensate for such increase in interest expense.

At the same time, the interest income we earn on our fixed-rate investments would not change and the market value of our fixed-rate investments would decrease. Similarly, in a period of declining interest rates, our interest income on floating-rate investments would decrease, while any decrease in the interest we are charged on our floating-rate debt may not compensate for such decrease in interest income and interest we are charged on our fixed-rate debt would not change. Any such scenario could materially and adversely affect us. If, as a result of lower interest rates our interest income declines at a higher rate than the decline in our financing costs, our results of operations and ability to make distributions to our shareholders would be negatively impacted.

Our indebtedness may affect our ability to operate our business, and may have a material adverse effect on our financial condition and results of operations.

The restrictive covenants in our Revolving Credit Facility and SRTF Credit Facility impact the way in which we conduct our business because of financial and operating covenants. Given the restrictive covenants in our Revolving Credit Facility and SRTF Credit Facility, our indebtedness could have significant adverse consequences to us, such as:

•limiting our ability to satisfy our financial obligations;

•limiting our ability to obtain additional financing to fund our working capital needs, acquisitions, capital expenditures or other debt service requirements or for other purposes;

•limiting our ability to use operating cash flow in other areas of our business because we must dedicate a substantial portion of these funds to service debt;

•limiting our ability to compete with other companies who are not as highly leveraged, as we may be less capable of responding to adverse economic and industry conditions;

•restricting us from making strategic acquisitions, developing properties or exploiting business opportunities;

•covenants in the agreements governing our and our subsidiaries’ existing and future indebtedness;

•exposing us to potential events of default (if not cured or waived) under financial and operating covenants contained in our or our subsidiaries’ debt instruments that could have a material adverse effect on our business, financial condition and operating results;

•increasing our vulnerability to a downturn in general economic conditions; and

•limiting our ability to react to changing market conditions in our industry and in our borrowers’ industries.

We may not be able to generate sufficient cash flow to meet our debt service obligations.

Our ability to make payments on our outstanding debt, and to fund our operations, working capital and capital expenditures, depends on our ability to generate cash in the future. To a certain extent, our cash flow is subject to

general economic, industry, financial, competitive, operating, legislative, regulatory and other factors, many of which are beyond our control.

We cannot assure you that our business will generate sufficient cash flow from operations or that future sources of cash will be available to us in an amount sufficient to enable us to pay amounts due on our indebtedness, including the Revolving Credit Facility and the SRTF Credit Facility, or to fund our other liquidity needs. Additionally, if we incur additional indebtedness in connection with future acquisitions or development projects or for any other purpose, our debt service obligations could increase.

We may need to refinance all or a portion of our indebtedness, including the Revolving Credit Facility and the SRTF Credit Facility, on or before maturity. Our ability to refinance our indebtedness or obtain additional financing will depend on, among other things:

•our financial condition and market conditions at the time; and

•restrictions in the agreements governing our indebtedness.

As a result, we may not be able to refinance any of our indebtedness, including the Revolving Credit Facility and SRTF Credit Facility, on commercially reasonable terms, or at all. If we do not generate sufficient cash flow from operations, and additional borrowings or refinancings or proceeds of asset sales or other sources of cash are not available to us, we may not have sufficient cash to enable us to meet all of our obligations, including payments on the Revolving Credit Facility and SRTF Credit Facility. Accordingly, if we cannot service our indebtedness, we may have to take actions such as seeking additional equity or delaying capital expenditures, or strategic acquisitions and alliances, any of which could have a material adverse effect on our operations. We cannot assure you that we will be able to effect any of these actions on commercially reasonable terms, or at all.

The “taxable mortgage pool” rules may increase the taxes that we or our shareholders may incur, and may limit the manner in which we effect future securitizations.

Securitizations by us or our subsidiaries could result in the creation of taxable mortgage pools, or TMPs, for U.S. federal income tax purposes. As a result, we could have “excess inclusion income.” Certain categories of shareholders, such as non-U.S. shareholders eligible for treaty or other benefits, shareholders with net operating losses, and certain tax-exempt shareholders that are subject to unrelated business income tax, could be subject to increased taxes on a portion of their dividend income from us that is attributable to any excess inclusion income. In addition, to the extent that our common stock is owned by tax-exempt “disqualified organizations,” such as certain government-related entities and charitable remainder trusts that are not subject to tax on unrelated business taxable income, or UBTI, we may incur a corporate level tax on a portion of any excess inclusion income. Moreover, we could face limitations in selling equity interests in these securitizations to outside investors, or selling any debt securities issued in connection with these securitizations that might be considered to be equity interests for tax purposes. These limitations may prevent us from using certain techniques to maximize our returns from securitization transactions.

Our failure to meet the continued listing requirements of Nasdaq could result in a delisting of our common stock.

If we fail to satisfy the continued listing requirements of Nasdaq, such as the corporate governance requirements or the minimum closing bid price requirement, Nasdaq may take steps to delist our common stock. Such a delisting would likely have a negative effect on the price of our common stock and would impair your ability to sell or purchase our common stock when you wish to do so. In the event of a delisting, we can provide no assurance that any action taken by us to restore compliance with listing requirements would allow our common stock to become listed again, stabilize the market price or improve the liquidity of our common stock, prevent our common stock from dropping below the Nasdaq minimum bid price requirement or prevent future non-compliance with Nasdaq’s listing requirements.

Our Board may change our policies without shareholder approval.

Our policies, including any policies with respect to investments, leverage, financing, growth, debt and capitalization, are determined by our Board or those committees or officers to whom our Board may delegate such authority. Our Board also establishes the amount of any dividends or other distributions that we may pay to our shareholders. Our Board or the committees or officers to which such decisions are delegated have the ability to amend or revise these and our other policies at any time without shareholder vote. Accordingly, our shareholders are not entitled to approve changes in our policies.

The Company also updated its Management disclosure to include the below.

Compensation of Our Executive Officers

We do not have any employees nor do we hire any employees who are compensated directly by us. Our loans are sourced and overseen by the members of our senior team, which currently consists of over 30 professionals. including six investment professionals, through the Administrative Services Agreement with TCG Services and Services Agreement with SRT Group. Each of our executive officers, including each executive officer who serves as a director, is employed by our Manager and/or its affiliates and receives compensation for his or her services, including services performed on our behalf, from our Manager and/or its affiliates, as applicable, except we may award equity-based incentive awards for our executive officers under our 2024 Stock Incentive Plan. Instead, we pay our Manager the fees described under “Management Compensation” and we indirectly bear the costs of the compensation paid to certain of our executive officers through expense reimbursements we pay to our Manager or its affiliates, as applicable. Pursuant to our Management Agreement, we reimburse our Manager or its affiliates, as applicable, for our fair and equitable allocable share of the compensation, including annual base salary, bonus, any related withholding taxes and employee benefits, paid to (i) subject to review by the Compensation Committee of our Board, our Manager’s personnel serving as our Chief Executive Officer (except when the Chief Executive Officer serves as a member of the Investment Committee prior to the consummation of an internalization transaction of our Manager by us), Chief Legal Counsel, Chief Financial Officer, Chief Marketing Officer, Managing Director and any of our other officers based on the percentage of his or her time spent devoted to our affairs and (ii) other corporate finance, tax, accounting, internal audit, legal, risk management, operations, compliance and other non-investment personnel of our Manager and its affiliates who spend all or a portion of their time managing our affairs, with the allocable share of the compensation of such personnel described in this clause (ii) being as reasonably determined by our Manager to appropriately reflect the amount of time spent devoted by such personnel to our affairs. The service by any personnel of our Manager and its affiliates as a member of the Investment Committee will not, by itself, be dispositive in the determination as to whether such personnel is deemed “investment personnel” of our Manager and its affiliates for purposes of expense reimbursement. For additional information regarding fees paid to our Manager and our reimbursement obligations related to compensation of our executive officers, see “Management Compensation.” For additional information regarding our 2024 Stock Incentive Plan, see “2024 Stock Incentive Plan.”

The Company also updated its Certain Relationships and Related Party Transactions disclosure to include the below.

Related Party Transactions since Inception

Co-Investments with Affiliates

In January 2024, we and SRT, an affiliate of AFC and ours, purchased an aggregate of approximately $56.4 million in loan commitments in a secured mezzanine loan facility, of which approximately $28.2 million of principal has been funded by us and another approximately $28.2 million of principal has been funded by SRT. We and SRT are each 50.0% syndicate lenders in the secured mezzanine loan facility. Approximately $16.9 million was established as reserves, for the payment of interest and other costs and expenses, which is fully funded and held by an affiliated agent on the loan. The lenders have a right to convert the mezzanine loan to a first priority mortgage loan after the repayment of the existing senior loan and subject to certain other terms and conditions. The secured mezzanine loan bears interest at an annual rate of SOFR plus a 15.31% spread, subject to a SOFR floor of 2.42%. At the end of February 2024, we and SRT entered into an amendment to the secured mezzanine loan, which among

other things, (1) extended the maturity date to May 31, 2024 and (2) amended the SOFR floor from 2.42% to 4.00%. In May 2024, we and SRT entered into an amendment to the secured mezzanine loan and purchased approximately $2.5 million of the senior loan, of which approximately $1.3 million has been funded by us and another $1.3 million has been funded by SRT. The senior loan bears interest at an annual rate of SOFR plus a 3.48% spread, subject to a SOFR floor of 2.42%, and matures on November 30, 2024. The amendment to the secured mezzanine loan, among other things, (1) extended the maturity date to November 30, 2024 and (2) replenished the interest reserves held by the administrative agent on the loan in an amount of approximately $9.6 million, for the payment of interest and other costs and expenses. In August 2024, we and SRT entered into amendments to the existing secured mezzanine and senior loan credit agreements for the mixed-use property in Houston, Texas. The amendments, among other things, (i) extended the maturity date on both loans from November 2024 to February 2026, (ii) modified the senior loan interest rate from floating (3.48% plus SOFR, SOFR floor of 4.0%) to fixed 12.5% and (iii) included a $12.0 million upsize to the senior loan, of which we have commitments for $6.0 million and SRT has commitments for the rest. A wholly-owned subsidiary of SRT, Southern Realty Trust Holdings LLC, serves as the agent of this loan. Fees paid to the agent by the borrower are customary and are de minimis. As of December 31, 2024, the secured mezzanine loan balance was repaid in full and the outstanding balance relates to the senior loan.

The Company also included “Policies With Respect to Certain Activities” disclosure as copied below.

POLICIES WITH RESPECT TO CERTAIN ACTIVITIES

The following is a discussion of our investment policies and our policies with respect to certain other activities, including financing matters. These policies may be amended or revised from time to time at the discretion of our Board (which must include a majority of our independent directors), without a vote of our shareholders; provided, however, that any amendments to our investment policies are subject to the approval of our Manager. Any change to any of these policies by our Board and our Manager, however, would be made only after a thorough review and analysis of that change, in light of then-existing business and other circumstances, and then only if, in the exercise of its business judgment, our Board and our Manager believe that it is advisable to do so in our and our shareholders’ best interests. We cannot assure you that our investment objectives will be attained.

Investments in Loans and Other Lending Policies

We were founded to pursue activities in financing CRE debt investments and providing capital to high-quality borrowers and sponsors with transitional business plans collateralized by CRE assets with opportunities for near-term value creation, as well as recapitalization opportunities. Our intended investment strategy is to construct a portfolio of loans backed by single assets or portfolios that typically have (i) an investment hold size of approximately $15-100 million, secured by CRE assets, including transitional or construction projects, across diverse property types, (ii) a duration of approximately 2-5 years, (iii) interest rates that are determined periodically on the basis of a floating base lending rate (e.g., SOFR) plus a credit spread, (iv) a LTV ratio of no greater than approximately 75% on an individual investment basis and (v) no more than approximately 75% loan-to-value across the portfolio. We may also invest in other senior loans secured by real estate, equipment, value associated with licenses and/or other assets of the loan parties to the extent permitted by applicable laws and the regulations governing such loan parties. In connection with our loan activities, we may engage in the origination, syndication and servicing of loans.

We may invest in new originations or purchase participations in existing syndications, each of which may be of any credit quality, have any combination of principal and interest payment structures, and be of any size and of any lien position. The real estate securing our loans may include, among other things, high quality multi-family, condominiums, retail, office, hospitality, industrial, mixed use and specialty-use real estate. Subject to compliance with our Investment Guidelines as described in the section entitled “Our Manager and Our Management Agreement—Investment Guidelines,” there are no limitations on the amount or percentage of our total assets that may be invested in any one loan or the concentration in any one type of loan.

Our Manager utilizes a rigorous underwriting and investment process to enables us to source, screen and ultimately deploy our capital through senior secured loans and other types of loans that are consistent with our Investment Guidelines and our overall investment strategy. For more information on the principles and procedures

we employ in our underwriting and investment process in connection with the acquisition of our investment assets, see “Business—Underwriting and Investment Process.”

Investments in Real Estate or Interests in Real Estate

We intend to invest in high quality residential (including multi-family, condominiums and single-family communities), retail, office, hospitality, industrial, mixed use and specialty-use real estate.

Investments in Equity

In connection with our investments in loans, we may from time to time receive an assigned right to acquire warrants and/or equity of a borrower. We may sell any assigned rights, and the sale may be to one of our affiliates, subject to any such affiliate’s separate approval process and our related person transactions policy, or a third-party buyer on the market.

Investments in Securities of or Interests in Persons Primarily Engaged in Real Estate Activities or Other Issuers

We do not intend to underwrite or invest in any securities of other REITs, other entities engaged in real estate related activities or other issuers. Generally speaking, other than the loans described above in the section entitled “—Investments in Loans and Other Lending Policies,” we do not expect to engage in any significant investment activities with other entities. We do not intend to engage in the purchase and sale (or turnover), trading, underwriting or agency distribution of securities of other issuers.

Disposition Policy

Although we do not currently have any plans to dispose of our existing loans, we will consider doing so, subject to compliance with our Investment Guidelines, if our Manager, Investment Committee and/or Board, as applicable, determines that a sale or other disposition of our loans would be in our interests based on the price being offered for the loan, the operating performance of the loan parties, the tax consequences of the disposition and other factors and circumstances surrounding the proposed disposition.

Equity Capital and Debt Financing Policies

If our Board determines that additional capital is required or appropriate, we intend to raise such funds through offerings of equity or debt securities, entering into credit facilities and borrowing thereunder, and/or retaining cash flow (subject to the distribution requirements applicable to REITs and our desire to minimize our U.S. federal income tax obligations) or any combination of these methods. In the event that our Board determines to raise additional equity or debt capital, it has the authority, without any action by our shareholders, to issue additional common stock, preferred stock or debt securities, including senior securities, in any manner and on such terms and for such consideration as it deems appropriate, at any time, subject to compliance with applicable law and the rules and requirements for listed companies on Nasdaq. However, we do not intend to offer our securities in exchange for property. Existing shareholders will have no preemptive right to additional shares issued in any offering, and any offering might cause a dilution of investment.

We do not have a formal policy limiting the amount of debt we may incur and our Board has broad authority to approve our incurrence of debt. We will consider a number of factors in evaluating the amount of debt that we may incur, which may include, among other things, then-current economic conditions, relative costs of debt and equity capital, market values of our loans, general market conditions, outlook for the level, slope, and volatility of interest rates, the creditworthiness of our financing counterparties, fluctuations in the market price of our common stock, growth and acquisition opportunities and assumptions regarding our future cash flow. Although we are not required to maintain any particular leverage ratio, we expect to employ prudent amounts of leverage and, when appropriate, to use debt as a means of providing additional funds for the acquisition of loans, to refinance existing debt or for general corporate purposes. For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

Our Board may establish a class or series of shares of our common stock and preferred stock that could delay or prevent a merger, third-party tender offer, change of control or similar transaction or a change in incumbent management that might involve a premium price for shares of our common stock or otherwise be in the best interests of our shareholders. Additionally, preferred stock could have distribution, voting, liquidation and other rights and preferences that are senior to those of our common stock.

We may, under certain circumstances, purchase common or preferred stock in the open market or in private transactions with our shareholders, if those purchases are approved by our Board. Our Board has no present intention of causing us to repurchase any shares, and any action would only be taken in conformity with applicable federal and state laws and the applicable requirements for qualifying as a REIT.

Reporting Policies

We intend to make available to our shareholders our annual reports, including our audited financial statements. We are subject to the information reporting requirements of the Exchange Act. Pursuant to those requirements, we are required to file annual and periodic reports, proxy statements and other information, including audited financial statements certified by independent public accountants, with the SEC.

***