| | FOR THE YEAR ENDED DECEMBER 31, 2009

MARCH 8, 2010 | |

annual information form

TABLE OF CONTENTS

| Introduction | | 01 |

| Corporate Structure | | 01 |

| General Development of the Business | | 02 |

| | Strategy | | 02 |

| | Activities and Events | | 02 |

| Description of the Business | | 04 |

| | General | | 04 |

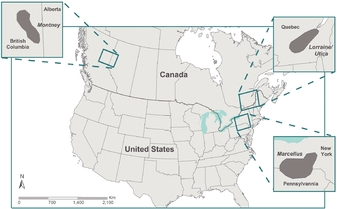

| | North America | | 05 |

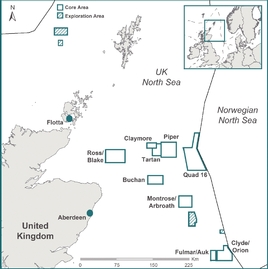

| | UK | | 07 |

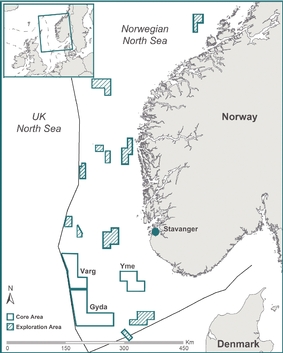

| | Scandinavia | | 08 |

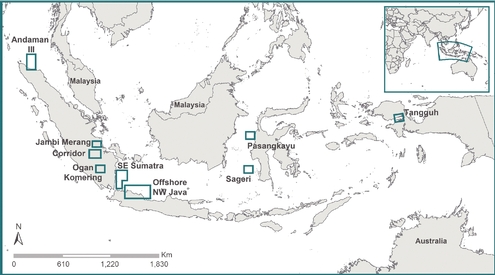

| | Southeast Asia | | 09 |

| | Other | | 11 |

| | Exploration | | 12 |

| | Productive Wells | | 15 |

| | Acreage | | 16 |

| | Production | | 17 |

| | Drilling Activity | | 20 |

| | Reserves Information | | 24 |

| | Other Oil and Gas Information | | 27 |

| | Additional Information | | 41 |

| | Competitive Conditions | | 41 |

| | Corporate Responsibility and Environmental Protection | | 41 |

| | Employees | | 42 |

| Description of Capital Structure | | 43 |

| Market for the Securities of the Company | | 45 |

| Dividends | | 45 |

| Directors and Officers | | 46 |

| Audit Committee Information | | 51 |

| Legal Proceedings | | 51 |

| Risk Factors | | 52 |

| Transfer Agents and Registrars | | 57 |

| Interests of Experts | | 57 |

| Forward-Looking Information | | 57 |

| Note Regarding Reserves Data and Other Oil and Gas Information | | 59 |

| Exchange Rate Information | | 60 |

| Abbreviations | | 60 |

| Additional Information | | 61 |

| Schedule A – Report on Reserves Data by Talisman's Internal Qualified Reserves Evaluator | | 62 |

| Schedule B – Report of Management and Directors on Oil and Gas Disclosure | | 63 |

| Schedule C – Audit Committee Information | | 65 |

INTRODUCTION

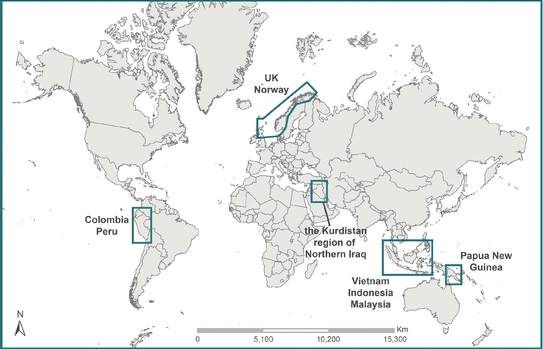

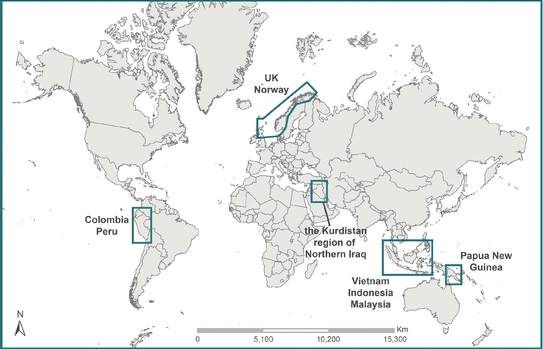

This document is the Annual Information Form of Talisman Energy Inc. for the year ended December 31, 2009. Talisman is a global, diversified, upstream oil and gas company headquartered in Canada whose main business activities include exploration, development, production, transportation and marketing of crude oil, natural gas and natural gas liquids. Talisman's three main operating areas are North America, the North Sea and Southeast Asia. Talisman also has a portfolio of international exploration opportunities. Talisman is listed on both the Toronto and New York stock exchanges under the symbol "TLM".

Unless the context indicates otherwise, references in this Annual Information Form to "Talisman" or the "Company" include, for reporting purposes only, the direct or indirect subsidiaries of Talisman Energy Inc. and partnership interests held by Talisman Energy Inc. and its subsidiaries. Such use of "Talisman" or the "Company" to refer to these other legal entities and partnership interests does not constitute a waiver by Talisman Energy Inc. or such entities or partnerships of their separate legal status, for any purpose.

Information related to the presentation of reserves data and other oil and gas information, as well as applicable exchange rates and abbreviations, is located at the end of this Annual Information Form.

Readers are directed to the "Forward-Looking Information" section contained in this Annual Information Form.

CORPORATE STRUCTURE

Talisman Energy Inc. is incorporated under theCanada Business Corporations Act. The Company's registered and head office is located at Suite 2000, 888-3rd Street SW, Calgary, Alberta, T2P 5C5.

The following table lists the material operating subsidiaries owned directly or indirectly by Talisman, their jurisdictions of incorporation and the percentage of voting securities beneficially owned, controlled or directed by Talisman as at December 31, 2009.

| Name of Subsidiary | | Jurisdiction of

Incorporation/Formation | | Percentage of Voting

Securities Owned 1 | |

|

| Talisman Energy Canada 2 | | Alberta | | 100% | |

| | |

|

| Talisman Energy Norge AS | | Norway | | 100% | |

| | |

|

| Talisman Energy (UK) Limited | | England and Wales | | 100% | |

| | |

|

| Transworld Petroleum (UK) Limited | | England and Wales | | 100% | |

| | |

|

| Talisman North Sea Limited | | England and Wales | | 100% | |

| | |

|

| Talisman (Corridor) Ltd | | Barbados | | 100% | |

| | |

|

| Talisman Malaysia Limited | | Barbados | | 100% | |

| | |

|

| Talisman Energy USA Inc. 3 | | Delaware | | 100% | |

| | |

|

| Talisman Energy Investments Norge AS 4 | | Norway | | 100% | |

| | |

|

| Talisman Energy Alpha Limited | | England and Wales | | 100% | |

|

Notes:

- 1.

- With the exception of Talisman Energy (UK) Limited, none of the above subsidiaries have any non-voting securities outstanding. All of the non-voting securities of Talisman Energy (UK) Limited are directly held by Talisman Energy Inc.

- 2.

- Talisman Energy Canada is an Alberta general partnership which currently carries on substantially all of Talisman's conventional Canadian oil and gas operations.

- 3.

- Talisman Energy USA Inc. was formerly named Fortuna Energy Inc.

- 4.

- Talisman Energy Investments Norge AS was formerly named Talisman Production Norge AS.

The above table does not include all of the subsidiaries of Talisman. The assets, sales and operating revenues of unnamed operating subsidiaries individually did not exceed 10% and, in the aggregate, did not exceed 20% of the total consolidated assets or total consolidated sales and operating revenues, respectively, of Talisman, as at and for the year ended December 31, 2009.

TALISMAN ENERGYANNUAL INFORMATION FORM 1

GENERAL DEVELOPMENT OF THE BUSINESS

Strategy

Talisman's main objective is safe, profitable growth.

The three main elements of Talisman's business strategy are:

- 1.

- Establish long-term profitable growth

Management believes that shale gas development in North America will be the main near-term growth engine for the Company, augmented by activities in Southeast Asia.

- 2.

- Reposition the international exploration portfolio for renewal

Talisman's international exploration portfolio is directed toward high impact prospects which, if successful, will support the ongoing renewal of the Company.

- 3.

- Focus the portfolio to generate cash for reinvestment

The Company will maximize the value of existing assets through efficient operations, in order to generate cash for growth opportunities elsewhere in the portfolio. Non-strategic mature assets will be sold to both focus the portfolio and generate cash to accelerate the strategy.

Talisman also views safe operations as its top priority and has set the objective of being a top quartile performer in this area. For additional information on Talisman's commitment to safety, communities and the environment, please see the Company's Corporate Responsibility Report available on the Company's corporate website at www.talisman-energy.com.

Activities and Events

During the past three years, Talisman has developed its business through a combination of exploration, development, and acquisitions and dispositions as described below.

North America

In 2007, Talisman sold non-core assets in Canada which collectively were producing approximately 114 mmcf/d (19 mboe/d) and to which Talisman attributed proved reserves of 222 bcfe (37 mmboe) as at December 31, 2006.

Talisman also completed the sale of its indirect 1.25% interest in Syncrude Canada to Canadian Oil Sands Limited in 2007.

In March 2008, Talisman acquired RSX Energy Inc., a publicly traded company whose principal natural gas assets were located in the Outer Foothills and Peace River Arch areas of northern Alberta.

In June 2008, Talisman sold 100% of its non-strategic operations in the Lac La Biche area of Alberta. The assets related to these operations were producing approximately 29 mmcfe/d (5 mboe/d) and had proved reserves of 67 bcfe (11 mmboe) attributable to them as at December 31, 2007.

Talisman sold its interest in Lease 10 of the Athabasca oil sands in July 2008. These lands did not have any associated production or reserves.

Throughout 2008, Talisman acquired approximately 320,000 net acres of land prospective for shale gas through a combination of Crown purchases and acquisitions from other companies. The land acquired includes acreage in the Montney play in northeastern British Columbia and the Marcellus play in New York and Pennsylvania.

In June 2009, Talisman sold its Cutbank Complex midstream assets in west central Alberta.

Also in June 2009, Talisman sold non-core Saskatchewan assets, which were producing approximately 8.5 mboe/d of net production and to which Talisman attributed proved reserves of 22 mmboe as at December 31, 2008.

In November 2009, Talisman sold non-core oil and gas producing assets in the Southern Alberta Foothills, which were producing approximately 5 mboe/d of net production and to which Talisman attributed proved reserves of 30 mmboe as at December 31, 2008.

2TALISMAN ENERGYANNUAL INFORMATION FORM

In November 2009, Talisman announced that it added 170,000 net acres of Tier 1 shale gas acreage in the Pennsylvania Marcellus and the Montney shale plays. The Company now holds approximately 386,000 net acres of Tier 1 land in these two areas, with the potential for 4,800 net drilling locations. The Company defines "Tier 1" acreage as top quality acreage with an expected breakeven of approximately $4/mcf. The Company also announced it was moving the Pennsylvania Marcellus shale play and parts of the Montney shale play into commercial development.

Also in November 2009, Talisman announced its decision to reorganize its North American business into two main businesses: Shale and Conventional. As a result of this decision, certain lands prospective for shale gas in British Columbia, Alberta and Quebec have been transferred from Talisman Energy Canada to Talisman Energy Inc.

Talisman is evaluating the sale of additional non-core conventional assets in North America in order to provide funds for reinvestment and shift its North American base towards the shale business which, within Talisman's portfolio, generates higher returns. These assets were producing approximately 40,000 boe/d as at December 31, 2009.

UK

In November 2007, Talisman entered into an agreement to sell the Beatrice oilfield licence interest and to lease the Beatrice oilfield infrastructure and Nigg oil terminal. The sale and lease were completed in November 2008. Talisman's production from Beatrice in 2008 averaged approximately 1 mboe/d. Proved reserves attributed to these assets as at December 31, 2007 were 18 mmboe.

On December 31, 2007, Talisman completed the sale of its entire non-operated interests in the UK North Sea Brae assets. Talisman attributed 14 mmboe of proved reserves to the Brae assets as at December 31, 2007.

In January 2009, Talisman disposed of its entire non-operated interests in the Dutch sector of the North Sea. Talisman's production from the fields in 2008 averaged approximately 3 mboe/d and proved reserves attributed to these assets as at December 31, 2008 were approximately 11 mmboe.

Scandinavia

In June 2008, Talisman completed the sale of a subsidiary which held an interest in the Siri field in the Danish sector of the North Sea. Talisman's production from the Siri field in 2007 averaged 2.6 mboe/d. Talisman attributed 2 mmboe of proved reserves to this field as at December 31, 2007.

In January 2009, Talisman announced that it had achieved first production from the Rev field in the Norway sector of the North Sea, which it operates with a 70% interest.

In December 2009, Talisman completed the sale of a 10% interest in the Yme field.

Southeast Asia

On December 31, 2007, Talisman purchased all the shares of CNOOC Wiriagar Overseas Limited (now Talisman Wiriagar Overseas Limited), which owned a 3.06% interest in the Tangguh LNG project in Indonesia.

In July 2008, Talisman announced that it had achieved first gas from the Northern Fields in Block PM-3 CAA/46-Cai-Nuoc in Malaysia/Vietnam. First oil from the Northern Fields commenced in March 2009.

In November 2009, Talisman acquired an additional interest in the Offshore North West Java PSC block in Indonesia, thereby increasing its working interest to 5%.

Talisman and its working interest partners approved the sanctioning of the Kitan development in December 2009 and are awaiting the joint Timor Leste/Australia Authority to approve the project.

In January 2010, Talisman acquired joint operatorship and a 25% interest in the onshore Jambi Merang block in Indonesia.

Other

In May 2009, Talisman divested its interests in Trinidad and Tobago.

In 2009, the Company entered into an agreement to dispose of its remaining interests in Tunisia.

TALISMAN ENERGYANNUAL INFORMATION FORM 3

Exploration

In March 2007, Talisman successfully bid on a 100% working interest in the deepwater Sageri Block in Indonesia.

In June 2008, Talisman entered into agreements with the Kurdistan Regional Government (KRG) in Iraq for interests in Blocks K44 and K39. Talisman has a 40% non-operated interest in Block K44. It also has a two-year seismic option agreement on Block K39, following which it will have the option to enter into a PSC as operator of the block with a 60% working interest.

In July 2008, Talisman was awarded 100% and 60% working interests in two Joint Study Agreements in the Makassar Strait in Indonesia.

In September 2008, Talisman entered into a farm-in agreement regarding Blocks 133 and 134 offshore Vietnam to gain a 38% working interest in the blocks. The amended licence was approved by the Government of Vietnam in February 2009.

In September 2008, Talisman was awarded a 50% non-operated interest in Block CPE-6 and a 50% operated interest in Block CPE-8 in the Eastern Heavy Oil Bid Round in Colombia. Talisman was awarded a 30% working interest in exploration Block CPO-12 in December 2008 and a 100% working interest in Block CPO-9 in January 2009. Following year-end and subject to governmental approval, Talisman entered into a farm-out agreement with a third party in Block CPO-9 with the Company retaining a 45% working interest.

In 2007, Talisman acquired Occidental Petrolera del Peru, LLC, acquiring a 25% operated interest in Block 64 and a 40% operated interest in Block 103 in Peru. Talisman was awarded a 55% operated interest in Block 134 as a result of the 2007 Peru Bid Round. In April 2009, Talisman was awarded a 55% working interest in Block 158 in Peru.

In June 2009, Talisman entered into a PSC for the K9 Block in the Kurdistan region of northern Iraq with a 55% interest. Talisman has entered into an agreement to acquire an additional 5% interest, subject to government approval.

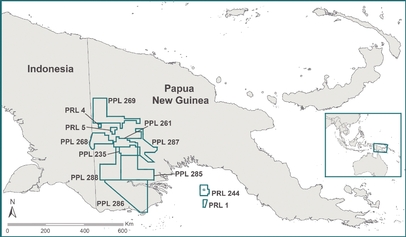

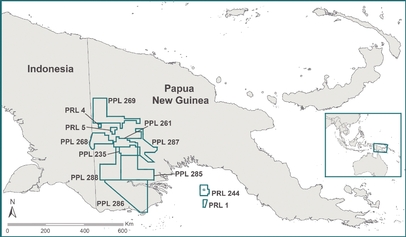

In August 2009, as part of its gas aggregation strategy in Papua New Guinea, Talisman acquired Rift Oil plc to acquire a 100% working interest in two exploration licences. In September 2009, Talisman entered into a farm-in agreement for two licenses held by New Guinea Energy Limited. Also in September 2009, Talisman acquired a 50% working interest in two licenses from Horizon Oil Limited. In December 2009, Talisman acquired Papua Petroleum Limited giving the Company a 49% working interest in four exploration licences. Subject to regulatory approval, Talisman will have interests in 12 blocks in Papua New Guinea covering in excess of 8 million net acres.

In October 2009, Talisman was awarded a 70% working interest in two offshore Sabah blocks (SB 309 and SB 310) in Malaysia.

In November 2009, Talisman signed a PSC for a 100% interest in the Andaman III exploration block in the North Sumatra Basin of Indonesia.

In November 2009, Talisman was awarded a 100% working interest in a new Joint Study Agreement in the West Papua region of eastern Indonesia.

DESCRIPTION OF THE BUSINESS

General

Talisman is one of the largest Canadian-based independent oil and gas producers. Talisman's main business activities include exploration, development, production, transportation and marketing of crude oil, natural gas and natural gas liquids.

Talisman has a diversified, global portfolio of oil and gas assets. The Company believes this portfolio will provide growth from shale gas development in North America, project developments in Southeast Asia, and its international exploration portfolio. Talisman investigates strategic acquisitions, dispositions and other business opportunities on an ongoing basis, some of which may be material. In connection with any such transaction, the Company may incur debt or issue equity securities.

The Company's activities are conducted in five geographic segments: North America, UK, Scandinavia, Southeast Asia, and Other. The North America segment includes operations in Canada and the United States. The Southeast Asia segment includes exploration and operations in Indonesia, Malaysia, Vietnam and Australia and exploration activities in Papua New Guinea. The Other segment includes operations in Algeria and exploration activities in Peru, Colombia and the Kurdistan region of northern Iraq.

4TALISMAN ENERGYANNUAL INFORMATION FORM

Talisman's aggregate production for the year ended December 31, 2009 was 425,000 boe/d (including discontinued operations), comprised of 168,000 boe/d from North America, 89,000 boe/d from the UK, 44,000 boe/d from Scandinavia, 108,000 boe/d from Southeast Asia and 16,000 boe/d from other areas.

In 2010, Talisman plans to spend approximately $5.2 billion on exploration, development and corporate activities, including non-cash lease costs of $300 million. The Company has the flexibility to adjust its capital spending to pursue opportunities and respond to a changing economic outlook.

All information in this Annual Information Form relating to assets owned or held by Talisman is as of December 31, 2009, unless otherwise indicated. All production numbers for 2009 include production from assets which were sold in the year, until the date of completion of the sale.

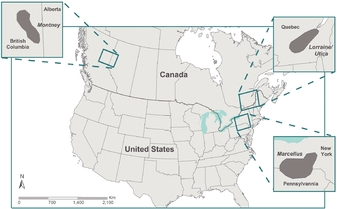

North America

Talisman's objective in North America is to become a leading, returns-focused shale gas producer. Talisman uses the term "shale" to refer to projects, plays or activities to extract natural gas and natural gas liquids from shale formations, which generally require stimulation techniques. Consistent with the strategic objectives noted in "General Development of the Business – Strategy", management believes that these shale gas plays provide new and longer term growth opportunities for Talisman due to their material size and relatively low risk investment. In 2009, the Company's North American operations concentrated on strategy implementation and, specifically, on developing and piloting projects for its shale gas plays.

In November 2009, Talisman reorganized its North American operations into two distinct businesses, Shale and Conventional, and announced the acceleration of its shale programs in North America. As a result of this decision, certain lands prospective for shale gas in British Columbia, Alberta and Quebec have been transferred from Talisman Energy Canada to Talisman Energy Inc. The new organizational structure has been designed to allow Talisman to effectively operate its new shale gas business model.

Talisman intends to focus its spending in North America on shale gas plays where Talisman has built significant landholdings. As part of its business strategy, Talisman continually investigates options for both strategic divestitures and acquisitions that would increase its focus on building significant shale gas projects. Talisman also continues to review options to cycle capital from its portfolio of conventional assets, including additional sales, depending on market conditions.

Shale

The Company spent approximately $1.4 billion on shale natural gas activities in 2009. The current focus is on piloting and developing

|

|

the holdings in the Pennsylvania Marcellus, Montney, and Lorraine/Utica shales. Annualized sales production from these shale properties totaled 34 mmcfe/d (5 mboe/d) in 2009. As at December 31, 2009, Talisman held interests in approximately 2 million net acres of land which it considers to be prospective for shale gas.

Highlights of the continued shale gas strategy in 2009 included drilling 95 gross (66 net) pilot and development wells and the acquisition of significant amounts of additional share acreage. In January 2010, the Company announced it would spend $1.6 billion on shale programs, ramping up development in the Pennsylvania Marcellus shale play and parts of the Montney shale play. Over 200 development and pilot wells are planned in 2010. |

Marcellus Shale

Talisman's Marcellus shale play, located in New York and Pennsylvania, remains the major area of investment in 2010. The main area of focus will be in Pennsylvania. In November 2009, the Company announced that it added 90,000 Tier 1 acreage in the Marcellus in Pennsylvania. The Company now holds 218,000 Tier 1 net acres with approximately 1,800 net drilling locations.

The Company plans to drill up to 170 net wells in the Pennsylvania Marcellus in 2010, up from 45.5 in 2009. The Company expects to exit 2010 with production between 250-300 mmcf/d, up from 65 mmcf/d at the end of 2009. The majority of the Marcellus wells

TALISMAN ENERGYANNUAL INFORMATION FORM 5

for 2010 have been permitted, and the Company has secured sufficient egress capacity, water access and disposal for its 2010 plans.

In New York, the state continues to review its environmental assessment procedures and regulations for operations. This is effectively preventing all horizontal drilling activities at this time.

Montney Shale

Talisman's Montney shale play provides Talisman with many opportunities at different states of maturity. In November 2009, Talisman announced that it doubled its Tier 1 landholdings in the Montney shale, adding more than 80,000 net acres. Talisman now holds 168,000 Tier 1 net acres with approximately 3,000 net drilling locations.

Talisman drilled 16 gross (15 net) wells during the year. Talisman intends to move the Farrell Creek and Greater Cypress areas to commercial development in early 2010. The Company plans to drill 25 horizontal development wells and build or expand processing facilities. In addition, Talisman expects to drill 10-15 net pilot wells to continue to delineate the play.

Lorraine/Utica

Talisman's Lorraine/Utica lands are located in the Quebec lowlands along the St. Lawrence River, where the Company now holds a total of 756,000 net acres. In 2009, vertical wells which were drilled to complete the land earning requirements were tested with encouraging results. The Company drilled two horizontal wells in Quebec during 2009 and is currently drilling a third horizontal well. Talisman plans to drill a fourth horizontal well this year and intends to test all four wells in 2010.

Conventional

Talisman's conventional assets in North America are focused in the following areas: tight gas in the Outer Foothills and the Edson/Bigstone/Wild River/WestWhitecourt areas; deep gas in the Foothills of Monkman B.C. and Alberta Foothills; and oil operations in Alberta/Saskatchewan in the Chauvin and Shaunavon fields. Talisman continued to develop its conventional assets throughout 2009 with exploration and development spending of $424 million, resulting in net sales production of 976 mmcfe/d (163 mboe/d). In total, 64 gross (39 net) wells were drilled in 2009.

To reflect the Company's focus on material shale development, Talisman will concentrate its 2010 conventional spending on the projects with the highest expected returns, as well as any existing commitments, maintenance and completion of current projects. Talisman expects that 2010 conventional exploration and development spending of approximately $270 million will focus in the Chauvin, Ojay and Wild River areas. The Company is examining the sale of a number of gas-weighted properties, currently producing an aggregate of 40,000 boe/d. Although management believes these are high quality assets, they cannot effectively compete for capital within Talisman's portfolio.

Infrastructure and Midstream

In 2009, Talisman sold its interests in certain midstream assets in west central Alberta and southwest Saskatchewan. The specific assets sold include the Cutbank and Musreau facilities and connected gas gathering systems and the Freefight/Crane Lake facilities located in southwest Saskatchewan.

Talisman's remaining midstream operations include approximately 700 km of gathering systems in Western Canada including Central Foothills, Erith, Lynx and Palliser, plus three operated gas plants (Edson, Berland West and Boundary Lake). The Company's midstream assets support many areas in the Company's Conventional division, including Alberta Foothills, Bigstone/Wild River and greater Edson. Total 2009 through-put (adjusted for sale) averaged 416 mmcf/d while generating revenues in custom processing and transportation.

6TALISMAN ENERGYANNUAL INFORMATION FORM

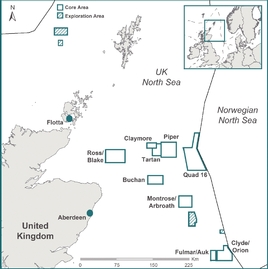

UK

Talisman's plan for the North Sea is to establish the region as a stable, cash generating business through the medium term. Talisman is the leading independent operator in the UK. In the UK, the objective is to hold production at between 80,000 - 90,000 boe/d through the end of the decade.

|

|

Talisman has two core operating areas in the UK: the Northern Business Area ("NBA") and the Central Business Area ("CBA"). In January 2009, Talisman disposed of its non-operated interests in the Netherlands as part of its strategic objective to focus the Company's portfolio of assets.

In 2009, production in the UK averaged 89,000 boe/d. UK production accounted for 21% of the Company's production worldwide in 2009. The primary focus in the UK is oil, with oil and liquids contributing 96% of UK production. As at year-end 2009, Talisman operated approximately 81% of its UK production.

In 2010, Talisman's capital program in the UK is comprised of $85 million of exploration spending and $800 million of development spending. Talisman's 2010 UK drilling program includes participation in one exploration well and up to four development wells.

|

Northern Business Area (NBA)

Talisman's principal operating areas in the NBA include Claymore, Piper (including Tweedsmuir), Tartan and Quad 16. These four principal operating areas encompass a total of 23 fields. Talisman currently holds interests ranging from 5% to 100% in the NBA fields, as well as in a number of production facilities and pipelines, including an 80% interest in the Flotta Terminal. Of the 23 fields, 16 are operated (with interests ranging from 37% to 100%) and seven are non-operated (with interests ranging from 5% to 15%).

In 2009, the Tweedsmuir Phase 3 water injection development project was completed. In 2010, the Company plans to drill a well north of Tweedsmuir to test a northern extension of the field. The development of the Burghley field was progressed with a development well drilled, and the subsea and topside facilities will be completed in 2010. Burghley is expected to come onstream towards the end of 2010. The Company also expects to restart development drilling at Claymore in 2010 and begin the first phase of an upgrade project to the Claymore compressors.

In 2009, production from the NBA averaged 49,000 boe/d, which accounted for approximately 55% of total UK production. Also in 2009, Talisman participated in drilling five development wells in the NBA. In 2010, Talisman plans to participate in drilling three development wells and complete the drilling of an exploration well that was drilling over year-end 2009.

Central Business Area (CBA)

Talisman's principal operating areas in the CBA include Montrose/Arbroath, Fulmar, Auk, Clyde, Ross/Blake and Buchan. These principal operating areas encompass a total of 23 fields. Talisman currently holds interests ranging from 7% to 100% in the CBA fields, as well as in a number of production facilities and pipelines. Of the 23 fields, 18 are operated (with interests ranging from 25% to 100%) and five are non-operated (with interests ranging from 7% to 54%).

In 2009, Talisman progressed the Auk North development, drilling and completing two wells. Auk North is expected to come onstream in 2011. The Auk South redevelopment is in the early stages with detailed engineering ongoing and first production expected in 2012.

In 2009, production from the CBA averaged 40,000 boe/d, which accounted for 45% of total UK production. Talisman participated in two successful and one unsuccessful exploration wells and two development wells in 2009. Talisman plans to participate in drilling one development well in 2010.

TALISMAN ENERGYANNUAL INFORMATION FORM 7

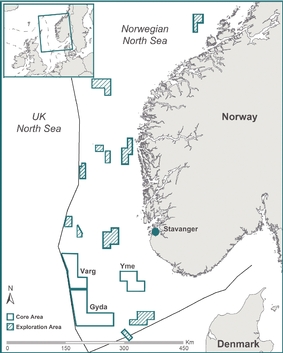

Scandinavia

Talisman expects production in Scandinavia will grow when the Yme project comes onstream later in 2010. Longer term, Talisman aims to sustain Scandinavia production at around 35,000 - 45,000 boe/d through exploitation opportunities within existing producing fields, the possible development of the Grevling discovery and through exploration.

|

|

Talisman's principal operating areas in Scandinavia are the Southern North Sea Area and the Mid North Sea Area, which encompass a total of 10 fields.

In 2009, production in Scandinavia averaged 44,000 boe/d, accounting for 18% of the Company's production worldwide. The primary focus in Scandinavia is oil, with oil and liquids contributing 78% of Scandinavia production. As at year-end 2009, Talisman operated approximately 66% of its Scandinavia production.

In 2010, Talisman plans to spend $70 million on exploration and $850 million on development (including a non-cash capitalized lease related to the Yme field of approximately $300 million). Talisman's 2010 drilling program includes participation in up to three exploration and appraisal wells and a 10 well development program in the Varg, Gyda and Brage fields in 2010. |

Southern North Sea Area

In the Southern North Sea Area, Talisman holds interests in the Blane, Gyda and Yme operated fields of 18%, 61% and 60%, respectively, as well as a 10% interest in the non-operated Tambar East field.

The Yme development continued during the year, with ongoing construction of the topsides facility. First oil from Yme is expected in the second half of 2010. In December 2009, Talisman completed the sale of a 10% interest of the Yme field.

In 2009, production from the Southern North Sea Area averaged 8,000 boe/d, which accounted for 18% of total Scandinavian production. Talisman participated in two unsuccessful exploration wells and three development wells at Yme in 2009. Talisman plans to participate in up to seven development wells and one exploration well in 2010.

Mid North Sea Area

In the Mid North Sea Area, Talisman holds interests in the operated Varg and Rev fields of 65% and 70%, respectively, and interests in four non-operated fields (with interest ranging between 1% and 35%) as well as a number of production facilities and pipelines in other areas of the Norwegian Continental Shelf.

In January 2009, the Rev field commenced production. The Rev field produces from two sub sea production wells and is tied back to a third party host facility in the UK sector of the North Sea. A third producing well was brought onstream later in September 2009. Rev produced approximately 12,000 boe/d during 2009.

In 2009, production from the area averaged 36,000 boe/d, which accounted for 82% of total Scandinavian production. Also in 2009, Talisman participated in six development wells with a further three wells drilling over year-end 2009. Three successful and one unsuccessful exploration wells were also drilled in the area in 2009. Talisman plans to participate in drilling one exploration well, one appraisal well and three development wells in 2010.

8TALISMAN ENERGYANNUAL INFORMATION FORM

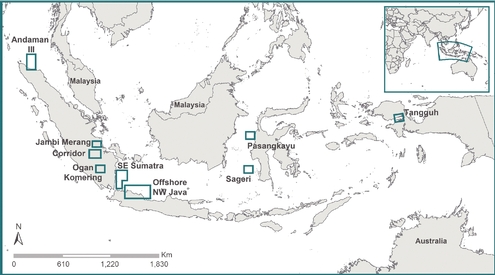

Southeast Asia

Southeast Asia is expected to continue as a growth area, with new projects coming onstream over the medium term and significant exploration upside.

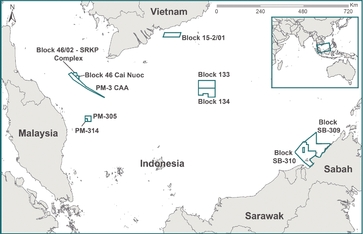

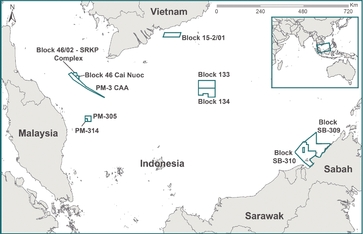

Talisman has interests in Indonesia, Malaysia, Vietnam, Australia and Papua New Guinea. In 2009, Southeast Asia production averaged 108,000 boe/d, which accounted for 25% of the Company's production worldwide. As at year-end 2009, Talisman operated approximately 34% of its Southeast Asia production.

In 2010, Talisman plans to increase capital spending in Southeast Asia to approximately $1.1 billion with $780 million directed to development spending.

Indonesia

Talisman's Indonesian assets include onshore interests at Corridor, Ogan Komering and Jambi Merang as well as offshore interests in Southeast Sumatra, Offshore Northwest Java, Tangguh and extensive exploration acreage at Pasangkayu, Sageri and Andaman III. Talisman also has an indirect 6% interest in the Grissik to Duri pipeline and in the Grissik to Singapore pipeline.

The Company's 2010 activities in Indonesia will focus primarily on the Corridor PSC. Exploration activities in Pasangkayu, Sageri and Andaman III are described in the "Exploration" section.

|

|

Talisman has a 36% non-operated interest in the Corridor PSC and field production facilities. There are three major buyers of Corridor gas. Gas production from Corridor began in 1998 with gas sales to PT Caltex Pacific Indonesian at the Duri oilfield. Gas sales commenced in September 2003 to Gas Supply Pte. Ltd., located in Singapore, under the terms of a 20-year gas sales agreement. The sale of gas to PT Perusahaan Gas Negara (Persero), Tbk., made pursuant to a 17-year gas sales agreement, began at 50 mmcf/d gross sales gas from Corridor in October 2007 and averaged 243 mmcf/d gross sales gas in 2009. |

In 2009, production from the Corridor PSC was 56,000 boe/d, which accounted for approximately 52% of Southeast Asia production. Talisman expects that capital spending in 2010 in Corridor will be approximately $65 million and plans to participate in the drilling of two development wells. The process to sanction Suban Phase 3 was initiated in 2008 and will continue in 2010.

On December 31, 2007, Talisman purchased all the shares of an entity which held a 3.06% interest in the Tangguh LNG Project. This project is located in Papua in Indonesia. Two LNG trains came onstream in mid-2009. Exposure to this project allows Talisman the opportunity to evaluate current technologies for LNG, which may add value in monetizing Talisman's gas reserves in other areas.

In Indonesia, Talisman participated in one successful and two unsuccessful exploration wells in 2009 with one other exploration well drilling over year-end 2009. Twenty-three development wells were also drilled in 2009.

In 2010, Talisman plans to spend approximately $154 million in Indonesia with $83 million directed to development spending. Talisman plans to participate in two exploration wells in the Makassar Strait and 29 development wells in 2010.

TALISMAN ENERGYANNUAL INFORMATION FORM 9

Malaysia

Talisman holds a 41% operated interest in Block PM-3 CAA between Malaysia and Vietnam and associated production facilities. In addition, Talisman holds a 33% interest in Block 46-Cai Nuoc adjacent to PM-3 CAA and a 60% interest in each of Block PM-305 and Block PM-314. In Block PM-3 CAA, Talisman is progressing developments referred to as the "Southern Fields" and the "Northern Fields". Talisman also holds a 70% working interest in two offshore Sabah blocks which were awarded in 2009.

|

|

In Southern Fields, Phase 1a of an IOR scheme which was initiated in 2008 included the drilling of five oil development wells and one water injection well in 2009. Results from Phase 1a of the IOR scheme have exceeded expectations. The 2010 plan includes the drilling of five development oil wells and three water injection wells for the next IOR phase.

In Northern Fields, first oil commenced in late March 2009 and ramped up to 25,000 bbls/d (gross) in August 2009 as more oil wells came onstream. Dry gas facilities were commissioned in the third quarter of 2009. In 2009, some deeper zones were plugged to alleviate the problem of higher mercury levels in gas and condensate, pending the commission of the mercury removal facility. A Mercury Removal Unit was sanctioned as a mitigation measure in mid-2009 with a commissioning period of late 2010 to early 2011. |

In 2009, Malaysia production averaged 32,000 boe/d, which accounted for 29% of total Southeast Asia production. One unsuccessful exploration well and 17 development wells were drilled in Malaysia in 2009.

In 2010, Talisman plans to spend approximately $237 million in Malaysia with $221 million directed to development spending including platform upgrades. Talisman plans to drill two exploration and appraisal wells and 16 development wells in 2010, of which eight wells will be drilled in the Northern Fields and the other eight in Southern Fields.

Vietnam

Talisman holds a 30% interest in Block 46/02 and in the joint operating company which operates that block. Block 46/02 lies adjacent to PM-3 CAA/46-Cai Nuoc. Talisman also holds a 60% interest in Block 15-2/01 and in the joint operating company which operates that block. Block 15-2/01 lies in the Cuu Long Basin, the predominant oil producing basin in Vietnam. The Company also holds a 38% operated interest in offshore Blocks 133 and 134 in the Nam Con Son Basin.

In 2009, the Government of Vietnam approved reserves assessments for the Hai Su Trang ("HST") and Hai Su Den ("HSD") fields within Block 15-2/01. A declaration of commerciality occurred in early 2009. The Company drilled one successful and two unsuccessful appraisal wells in this block with a further appraisal well drilling over the 2009 year-end.

In 2009, Vietnam production averaged 5,000 bbls/d from Block 46/02, which accounted for approximately 4% of Southeast Asia production.

Australia

Talisman holds non-operated interests in the Laminaria and Corallina fields and the Joint Petroleum Development Area 06-105 (JPDA 06-105) in Australia/East Timor. In 2009, production in Australia averaged 5,000 bbls/d, which accounted for 5% of total Southeast Asia production.

In early 2008, Talisman participated in the successful Kitan-1 exploration well in JPDA 06-105 offshore Australia. A Declaration of Commerciality was made in April 2008 and the Development Area was approved in May 2008. Talisman and its working interest partners approved the sanctioning of the Kitan development in December 2009 and are awaiting the joint Timor Leste/Australia Authority to approve the project.

In 2010, Talisman plans to spend approximately $124 million in Australia, $78 million of which will be aimed at progressing the Kitan development project in the JPDA 06-105 and a majority of the remaining amount will be directed towards drilling one infill well in the Corallina field.

10TALISMAN ENERGYANNUAL INFORMATION FORM

Papua New Guinea

In Papua New Guinea, the Company sees the opportunity to aggregate significant discovered and prospective onshore gas resources.

|

|

In August 2009, as part of its gas aggregation strategy in Papua New Guinea, Talisman acquired Rift Oil PLC to acquire a 100% working interest in two exploration licences. In September 2009, Talisman entered into a farm-in agreement for two licenses held by New Guinea Energy Limited. Also in September 2009, Talisman acquired a 50% working interest in two licenses from Horizon Oil Limited. In December 2009, Talisman acquired Papua Petroleum Limited giving Talisman a 49% working interest in four exploration licenses. Subject to regulatory approval, Talisman has interests in 12 blocks in Papua New Guinea with an areal extent covering in excess of 8 million net acres.

|

|

|

In 2010, Talisman plans to spend $200 million, $85 million |

| of which will be directed towards drilling one development well and conducting studies to develop monetization options in relation to the Company's gas aggregation strategy in Papua New Guinea. In addition, the Company will participate in up to four exploration and appraisal wells. |

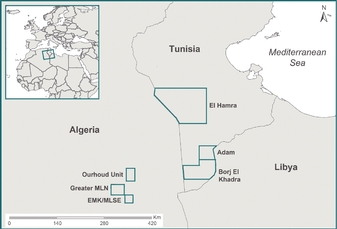

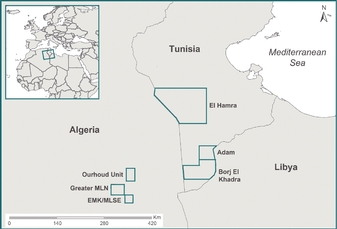

Other

Talisman's other producing interests during 2009 included operations in Algeria, Tunisia and Trinidad and Tobago. Talisman disposed of its interests in Trinidad and Tobago in May 2009. Talisman's properties in Algeria, Tunisia and Trinidad and Tobago (until sold in May 2009) averaged 16,000 boe/d, accounting for 4% of the Company's production worldwide during 2009.

Algeria

Talisman holds a 35% non-operated interest in Block 405a under a PSC with Algeria's national oil company. Through its participation in Block 405a, Talisman currently holds a 35% interest in the Greater Menzel Lejmat North fields and the Menzel Lejmat Southeast field, a 2% interest in the unitized Ourhoud field, and a 9% interest in the EMK field.

|

|

Talisman has signed a Framework Agreement for the joint construction and operation of shared process facilities for the EMK field plus four other fields located in Block 208 and Block 212 (collectively, the "El Merk Project").

In 2009, five development wells were drilled in Algeria. In 2010, Talisman's capital program in Algeria is expected to be approximately $115 million and includes plans to participate in 13 wells. The El Merk Project was sanctioned in February 2009. The EMK unit will be jointly developed with fields located in neighbouring Block 208. First oil is planned in the first quarter of 2012. |

Tunisia

Talisman holds a 5% non-operated interest in the Adam concession portion of the Borj El Khadra permit and a 10% interest in the remainder of the permit. Talisman satisfied its farm-in commitment in the EI Hamra permit in 2009 and relinquished its interest in the permit in 2010. In 2009, three exploration wells (two of which were unsuccessful and a third was suspended pending future tie-in) and two development wells were drilled in Tunisia. In 2009, the Company entered into an agreement to dispose of its remaining interests in Tunisia.

TALISMAN ENERGYANNUAL INFORMATION FORM 11

Exploration

Talisman has developed an international exploration strategy which it believes will contribute to the renewal of the Company through the discovery of significant new prospects and plays. The Company defines significant as having the potential to produce 30,000 - 50,000 boe/d or more. In addition, the exploration program will support existing core areas.

In 2010, Talisman's capital program for exploration activities is expected to be approximately $700 million. In aggregate, Talisman's 2010 exploration drilling program includes participation in up to 20 exploration wells, of which six wells were drilling over year-end 2009.

The focus areas for exploration are as follows:

Southeast Asia

Talisman expects that exploration spending in 2010 in Southeast Asia will be approximately $280 million, with participation in drilling 10 exploration wells, two of which were drilling over year-end 2009.

Vietnam

The Company drilled one successful and two unsuccessful appraisal wells in Block 15-2/01, with a further appraisal well drilling over the 2009 year-end.

In 2008, Talisman entered into a farm-in agreement regarding Block 133 and Block 134 offshore Vietnam to obtain a 38% working interest in the blocks. The amended licence was approved by the Government of Vietnam in February 2009.

In 2010, Talisman expects to acquire a seismic program in Blocks 133 and 134 in Vietnam.

Indonesia

In 2009, the Company participated in drilling three exploration wells in the Southeast Sumatra PSC, one of which was successful and two of which were unsuccessful. The Company also completed a number of seismic acquisitions in the Makassar Strait and will commence a drilling program in 2010.

In 2009, Talisman was awarded a 100% interest in the Andaman III exploration block in the North Sumatra Basin of Indonesia.

Talisman plans to drill two wells in 2010 in the Pasangkayu Block in the Makassar Strait, and prepare for a well in the Sageri Block in 2011. Talisman will also acquire seismic in the Andaman III Block in the North Sumatra Basin. The Company estimates Indonesia exploration spending to be approximately $70 million in 2010.

12TALISMAN ENERGYANNUAL INFORMATION FORM

Malaysia

In 2009, one unsuccessful exploration well was drilled in Block PM-305. Talisman was also awarded a 70% working interest in two offshore Sabah blocks in 2009.

The Company expects exploration spending to be approximately $15 million in 2010, which includes seismic interpretation of the Sabah blocks and two exploration and appraisal wells in PM-3 CAA.

Australia and Papua New Guinea

In 2010, Talisman plans to spend $6 million in Australia primarily evaluating exploration opportunities in proximity to both the Kitan discovery and Talisman's producing Laminaria and Corallina fields.

In Papua New Guinea, Talisman plans to spend approximately $115 million on drilling up to four exploration and appraisal wells in the onshore blocks, as well as completing seismic acquisitions across various blocks with a view to identifying suitable drilling candidates for subsequent years.

UK

The role of exploration in the UK is to maintain an exploration portfolio which can support a sustainable exploration program designed to deliver the Company's objectives in the North Sea.

In 2009, Talisman was awarded three exploration blocks in the central North Sea in the 25 th Licensing Round. The Company successfully followed up on the Cayley discovery made in late 2007, with discoveries at Godwin and Shaw in 2009. The Company is currently drilling a well in the Tweedsmuir area and will commence the Halley appraisal program later in the year. UK exploration spending in 2010 will be approximately $85 million.

Scandinavia

In 2009, the Company participated in drilling six exploration and appraisal wells, three of which were successful. Talisman is continuing to execute its exploration program in the North Sea with two exploration wells planned in 2010, along with an appraisal well to the Grevling discovery made in 2009. Talisman expects that Norway exploration spending in 2010 will be approximately $70 million.

In 2009, Talisman was awarded two additional blocks in the southern portion of the Norwegian North Sea. Talisman was also awarded a 25% participating interest in production license PL531 in the Barents Sea in the 20 th Licence Round. Also in 2009, Talisman successfully swapped acreage in the central North Sea for an interest in two production licences (PL490 and PL491) in the Barents Sea.

Colombia

In Colombia, Talisman has an active exploration program in the Llanos region, one of Colombia's proven hydrocarbon basins. In 2009, Talisman made a gas condensate discovery in the Niscota Block in the Andes Foothills. Talisman is currently drilling a well in the Foreland with another well planned for later in the year. The Company plans to commence the appraisal program to the 2009 Huron discovery in the Niscota Block and also complete a number of seismic acquisitions over blocks awarded in recent bid rounds. Talisman expects that exploration spending in 2010 in Colombia will be approximately $80 million.

Peru

Talisman has an interest in 4.8 million net acres of exploration acreage in the Marañon Basin. The Company's exploration program in 2009 focused on evaluating a light oil discovery at Situche in Block 64 which continued over year-end 2009. In 2009, Talisman was awarded a 55% working interest in Block 158.

The Company plans to drill an exploration well in Block 101 and complete seismic acquisitions in Block 64 and Blocks 134 and 158. Talisman expects that exploration spending in 2010 in Peru will be approximately $60 million.

Kurdistan region of northern Iraq

In 2008, Talisman entered into agreements with the Kurdistan Regional Government within Iraq for interests in Blocks K44 and K39. Talisman has a 40% non-operated interest in Block K44 and a two-year seismic option agreement on Block K39.

TALISMAN ENERGYANNUAL INFORMATION FORM 13

In 2009, Talisman entered into a PSC for Block K9 with a 55% interest. Talisman has entered into an agreement to acquire an additional 5% interest, subject to government approval.

Talisman expects that exploration spending in 2010 in the Kurdistan region of northern Iraq will be approximately $80 million. The Company's first exploration well in Block K44 was suspended. The Company is currently drilling a second exploration well in Block K44 which recently discovered a significant amount of gas condensate and is currently drilling towards deeper targets. The third well of a three-well commitment is planned for 2010. The Company is evaluating the possible conversion of Block K39 into a PSC following the expiry of a seismic option agreement in 2010. A seismic acquisition in Block K9 will complete the exploration program in 2010.

Poland

In February 2010, Talisman entered into a farm-in arrangement with San Leon Energy PLC and its subsidiary ("San Leon") to be assigned up to a 60% interest in the subsidiary's two current and one pending Baltic Gas Shale play concessions in Poland. This agreement allows Talisman to leverage its North American shale gas expertise in a prospective area which is proximate to European gas markets. In 2010, Talisman expects to participate in seismic acquisition to prepare for up to a six well drilling program in 2011 and 2012.

Alaska

Talisman holds over one million net acres with interests ranging from 50% to 100% in land across the National Petroleum Reserve – Alaska and Alaska Foothills. The Company has announced that these assets are for sale.

14TALISMAN ENERGYANNUAL INFORMATION FORM

Productive Wells

Year ended December 31, 2009

| | Productive Wells 1,2

Oil Wells

| | Productive Wells 1,2

Gas Wells

| | Productive Wells 1,2

Total Wells

|

| Property | | Gross | | Net | | Gross | | Net | | Gross | | Net | |

|

| North America 3 | | | | | | | | | | | | | |

| | |

|

| | Conventional | | 2,082 | | 1,635.0 | | 3,852 | | 2,324.9 | | 5,934 | | 3,959.9 | |

| | |

|

| | Shale | | – | | – | | 102 | | 51.2 | | 102 | | 51.2 | |

|

| Total North America | | 2,082 | | 1,635.0 | | 3,954 | | 2,376.1 | | 6,036 | | 4,011.1 | |

|

| United Kingdom | | | | | | | | | | | | | |

| | |

|

| | Northern Business Area | | 213 | | 83.2 | | 2 | | 0.9 | | 215 | | 84.1 | |

| | |

|

| | Central Business Area | | 123 | | 95.1 | | – | | – | | 123 | | 95.1 | |

|

| Total UK | | 336 | | 178.3 | | 2 | | 0.9 | | 338 | | 179.2 | |

|

| Scandinavia | | | | | | | | | | | | | |

| | |

|

| | Norway | | | | | | | | | | | | | |

| | |

|

| | | Southern North Sea | | 27 | | 15.8 | | – | | – | | 27 | | 15.8 | |

| | |

|

| | | Mid North Sea | | 68 | | 25.6 | | 11 | | 2.8 | | 79 | | 28.4 | |

|

| Total Scandinavia | | 95 | | 41.4 | | 11 | | 2.8 | | 106 | | 44.2 | |

|

| Southeast Asia | | | | | | | | | | | | | |

| | |

|

| | Indonesia | | | | | | | | | | | | | |

| | |

|

| | | Corridor PSC | | 90 | | 32.4 | | 32 | | 11.3 | | 122 | | 43.7 | |

| | |

|

| | | Other Indonesia 4 | | 1,858 | | 243.4 | | 96 | | 6.1 | | 1,954 | | 249.5 | |

| | |

|

| | Malaysia | | 70 | | 29.7 | | 37 | | 15.2 | | 107 | | 44.9 | |

| | |

|

| | Vietnam | | 11 | | 6.0 | | 2 | | 0.6 | | 13 | | 6.6 | |

| | |

|

| | Australia | | 10 | | 3.6 | | – | | – | | 10 | | 3.6 | |

| | |

|

| | Papua New Guinea | | – | | – | | 3 | | 1.5 | | 3 | | 1.5 | |

|

| Total Southeast Asia | | 2,039 | | 315.1 | | 170 | | 34.7 | | 2,209 | | 349.8 | |

|

| Other | | | | | | | | | | | | | |

| | |

|

| | Algeria | | 102 | | 10.6 | | 4 | | 1.4 | | 106 | | 12.0 | |

| | |

|

| | Tunisia | | 19 | | 1.0 | | – | | – | | 19 | | 1.0 | |

| | |

|

| | Rest of World 5 | | – | | – | | – | | – | | – | | – | |

|

| Total Other | | 121 | | 11.6 | | 4 | | 1.4 | | 125 | | 13.0 | |

|

| Total Worldwide | | 4,673 | | 2,181.4 | | 4,141 | | 2,415.9 | | 8,814 | | 4,597.3 | |

|

Notes:

- 1.

- "Productive wells" means producing wells or wells mechanically capable of production.

- 2.

- One or more completions in the same borehole is counted as one well. A well is classified as an oil well if one of the multiple completions in a well is an oil completion. Includes wells containing multiple completions as follows: 274 gross oil wells; 1,025 gross gas wells; 136.6 net oil wells and 646.5 net gas wells.

- 3.

- As a result of the reorganization of Talisman's North American operations into two distinct businesses, Shale and Conventional, certain of Talisman's properties referred to in prior years as "other unconventional" areas (including Outer Foothills, the Montney Core and Montney Expansion) now form part of Talisman's conventional division.

- 4.

- Other Indonesia includes suspended and shut-in wells in the Corridor Technical Assistance Contract, the Ogan Komering PSC, Southeast Sumatra PSC and Offshore North West Java PSC.

- 5.

- Rest of World includes Colombia, Peru and the Kurdistan region of northern Iraq.

TALISMAN ENERGYANNUAL INFORMATION FORM 15

Acreage

Year ended December 31, 2009

(thousand acres)

| | Developed 1

| | Undeveloped

| | Total

|

| Property | | Gross | | Net | | Gross | | Net | | Gross | | Net | |

|

| North America 2 | | | | | | | | | | | | | |

| | |

|

| | Shale | | 12.2 | | 7.5 | | 2,680.6 | | 1,999.9 | | 2692.8 | | 2,007.4 | |

| | |

|

| | Conventional 3 | | 1,981.0 | | 1,188.9 | | 3,975.7 | | 2,825.0 | | 5,956.7 | | 4,013.9 | |

| | |

|

| | Frontier 4 | | 3.8 | | 0.5 | | 7,494.1 | | 4,320.0 | | 7,497.9 | | 4,320.5 | |

|

| Total North America | | 1,997.0 | | 1,196.9 | | 14,150.4 | | 9,144.9 | | 16,147.4 | | 10,341.8 | |

|

| United Kingdom | | | | | | | | | | | | | |

| | |

|

| | Northern Business Area | | 107.1 | | 67.4 | | 380.4 | | 177.4 | | 487.5 | | 244.8 | |

| | |

|

| | Central Business Area | | 162.6 | | 120.7 | | 386.7 | | 202.7 | | 549.3 | | 323.4 | |

| | |

|

| | Other United Kingdom | | – | | – | | 65.7 | | 57.4 | | 65.7 | | 57.4 | |

|

| Total UK | | 269.7 | | 188.1 | | 832.8 | | 437.5 | | 1,102.5 | | 625.6 | |

|

| Scandinavia | | | | | | | | | | | | | |

| | |

|

| | Southern North Sea | | 77.5 | | 28.4 | | 569.3 | | 129.3 | | 646.8 | | 157.7 | |

| | |

|

| | Mid North Sea | | 45.1 | | 31.9 | | 1,178.0 | | 584.9 | | 1,223.1 | | 616.8 | |

| | |

|

| | Other Scandinavia 5 | | – | | – | | 393.8 | | 83.9 | | 393.8 | | 83.9 | |

|

| Total Scandinavia | | 122.6 | | 60.3 | | 2,141.1 | | 798.1 | | 2,263.7 | | 858.4 | |

|

| Southeast Asia | | | | | | | | | | | | | |

| | |

|

| | Indonesia | | | | | | | | | | | | | |

| | |

|

| | | Corridor PSC | | 150.5 | | 54.2 | | 407.6 | | 146.7 | | 558.1 | | 200.9 | |

| | |

|

| | | Other Indonesia 6 | | 504.0 | | 62.8 | | 9,182.8 | | 3,721.1 | | 9,686.8 | | 3,783.9 | |

| | |

|

| | Malaysia | | 281.6 | | 125.8 | | 3,510.9 | | 2,377.3 | | 3,792.5 | | 2,503.1 | |

| | |

|

| | Vietnam | | 8.9 | | 2.7 | | 4,025.3 | | 1,638.4 | | 4,034.2 | | 1,641.1 | |

| | |

|

| | Australia | | 9.2 | | 3.6 | | 371.0 | | 108.0 | | 380.2 | | 111.6 | |

| | |

|

| | Papua New Guinea 7 | | – | | – | | 12,246.2 | | 6,680.3 | | 12,246.2 | | 6,680.3 | |

|

| Total Southeast Asia | | 954.2 | | 249.1 | | 29,743.8 | | 14,671.8 | | 30,698.0 | | 14,920.9 | |

|

| Other | | | | | | | | | | | | | |

| | |

|

| | Algeria | | 196.0 | | 34.4 | | – | | – | | 196.0 | | 34.4 | |

| | |

|

| | Tunisia | | 3.9 | | 0.2 | | 804.7 | | 79.4 | | 808.6 | | 79.6 | |

| | |

|

| | Rest of World 8 | | – | | – | | 19,939.4 | | 10,221.7 | | 19,939.4 | | 10,221.7 | |

|

| Total Other | | 199.9 | | 34.6 | | 20,744.1 | | 10,301.1 | | 20,944.0 | | 10,335.7 | |

|

| Total Worldwide | | 3,543.4 | | 1,729.0 | | 67,612.2 | | 35,353.4 | | 71,155.6 | | 37,082.4 | |

|

Notes:

- 1.

- "Developed" acreage consists of acreage assigned to productive wells. Each productive shale well has been allocated 80 acres as the spacing, rather than the more traditional spacing of 640 acres used for conventional wells.

- 2.

- As a result of the reorganization of Talisman's North American operations into two distinct businesses, Shale and Conventional, certain of Talisman's properties referred to in prior years as "other unconventional" areas (including Outer Foothills, the Montney Core and Montney Expansion) now form part of Talisman's conventional division.

- 3.

- Conventional acreage is derived by subtracting total shale acreage and total frontier acreage from total acreage. Where the Company has both shale and conventional formations under one title document, acreage is counted only with respect to shale.

- 4.

- Frontier includes properties in the Northwest Territories, Nunavut, Yukon and Alaska.

- 5.

- Other Scandinavia includes exploration acreage in the Barents Sea and Denmark.

- 6.

- Other Indonesia includes the Corridor Technical Assistance Contract, the Ogan Komering PSC, Southeast Sumatra PSC, Offshore North West Java PSC, Pasangkayu PSC and Sageri PSC.

- 7.

- Excludes 1.3 million net acres which are subject to regulatory approval.

- 8.

- Rest of World includes Colombia, Peru and the Kurdistan region of northern Iraq.

16TALISMAN ENERGYANNUAL INFORMATION FORM

Production

The following tables set forth production for each of the last three fiscal years. North American production data for the years ended December 31, 2008 and December 31, 2007 does not delineate between Conventional and Shale for Canada and United States because the Company's North American operations were not organized along those lines at that time. All production figures include production from assets which were sold in the year, until the date of completion of the sale.

Year ended December 31, 2009

| | Oil & Liquids Production

(mbbls/d)

| | Natural Gas Production

(mmcf/d)

| | Total Production

(mboe/d)

| |

| Property | | Gross | | Net | | Gross | | Net | | Gross | | Net | |

|

| North America 1 | | | | | | | | | | | | | |

| | |

|

| | Canada 2,3 | | | | | | | | | | | | | |

| | |

|

| | | Conventional | | 34 | | 27 | | 717 | | 645 | | 154 | | 134 | |

| | |

|

| | | Shale | | – | | – | | 3 | | 3 | | – | | – | |

| | |

|

| | United States | | | | | | | | | | | | | |

| | |

|

| | | Conventional | | – | | – | | 52 | | 45 | | 9 | | 8 | |

| | |

|

| | | Shale | | – | | – | | 31 | | 27 | | 5 | | 5 | |

|

| Total North America | | 34 | | 27 | | 803 | | 720 | | 168 | | 147 | |

|

| UK | | | | | | | | | | | | | |

| | |

|

| | United Kingdom | | | | | | | | | | | | | |

| | |

|

| | | Northern Business Area | | 48 | | 48 | | 11 | | 11 | | 49 | | 49 | |

| | |

|

| | | Central Business Area | | 38 | | 38 | | 8 | | 8 | | 40 | | 40 | |

| | |

|

| | Netherlands | | – | | – | | – | | – | | – | | – | |

|

| Total UK | | 86 | | 86 | | 19 | | 19 | | 89 | | 89 | |

|

| Scandinavia | | | | | | | | | | | | | |

| | |

|

| | Norway | | | | | | | | | | | | | |

| | |

|

| | | Southern North Sea | | 7 | | 7 | | 8 | | 8 | | 8 | | 8 | |

| | |

|

| | | Mid North Sea | | 27 | | 27 | | 50 | | 50 | | 36 | | 36 | |

|

| Total Scandinavia | | 34 | | 34 | | 58 | | 58 | | 44 | | 44 | |

|

| Southeast Asia | | | | | | | | | | | | | |

| | |

|

| | Indonesia | | | | | | | | | | | | | |

| | |

|

| | | Corridor PSC | | 4 | | 2 | 4 | 312 | | 218 | 4 | 56 | | 38 | |

| | |

|

| | | Other Indonesia 5 | | 7 | | 3 | 4 | 18 | | 12 | 4 | 10 | | 5 | |

| | |

|

| | Malaysia | | 20 | | 12 | 4 | 73 | | 56 | 4 | 32 | | 21 | |

| | |

|

| | Vietnam | | 5 | | 4 | 4 | – | | – | | 5 | | 4 | |

| | |

|

| | Australia | | 5 | | 5 | 4 | – | | – | | 5 | | 5 | |

| | |

|

| | Papua New Guinea | | – | | – | | – | | – | | – | | – | |

|

| Total Southeast Asia | | 41 | | 26 | | 403 | | 286 | | 108 | | 73 | |

|

| Other | | | | | | | | | | | | | |

| | |

|

| | Algeria 6 | | 14 | | 7 | 6 | – | | – | | 14 | | 7 | |

| | |

|

| | Tunisia 6 | | 1 | | 1 | 6 | – | | – | | 1 | | 1 | |

| | |

|

| | Trinidad and Tobago 6 | | 1 | | 1 | 6 | – | | – | | 1 | | 1 | |

| | |

|

| | Rest of World 7 | | – | | – | | – | | – | | – | | – | |

|

| Total Other | | 16 | | 9 | | – | | – | | 16 | | 9 | |

|

| Total Worldwide | | 211 | | 182 | | 1,283 | | 1,083 | | 425 | | 362 | |

|

See footnotes on page 19.

TALISMAN ENERGYANNUAL INFORMATION FORM 17

Year ended December 31, 2008

| | Oil & Liquids Production

(mbbls/d)

| | Natural Gas Production

(mmcf/d)

| | Total Production

(mboe/d)

| |

| Property | | Gross | | Net | | Gross | | Net | | Gross | | Net | |

|

| North America | | | | | | | | | | | | | |

| | |

|

| | Canada 2,3 | | 40 | | 32 | | 783 | | 649 | | 171 | | 140 | |

| | |

|

| | United States | | – | | – | | 73 | | 63 | | 12 | | 11 | |

|

| Total North America | | 40 | | 32 | | 856 | | 712 | | 183 | | 151 | |

|

| UK | | | | | | | | | | | | | |

| | |

|

| | United Kingdom | | | | | | | | | | | | | |

| | |

|

| | | Northern Business Area | | 53 | | 53 | | 11 | | 11 | | 55 | | 55 | |

| | |

|

| | | Central Business Area | | 41 | | 41 | | 7 | | 7 | | 42 | | 42 | |

| | |

|

| | Netherlands | | – | | – | | 20 | | 20 | | 3 | | 3 | |

|

| Total UK | | 94 | | 94 | | 38 | | 38 | | 100 | | 100 | |

|

| Scandinavia | | | | | | | | | | | | | |

| | |

|

| | Norway | | | | | | | | | | | | | |

| | |

|

| | | Southern North Sea | | 10 | | 10 | | 10 | | 10 | | 12 | | 12 | |

| | |

|

| | | Mid North Sea | | 22 | | 22 | | 9 | | 9 | | 23 | | 23 | |

| | |

|

| | Denmark | | 1 | | 1 | | – | | – | | 1 | | 1 | |

|

| Total Scandinavia | | 33 | | 33 | | 19 | | 19 | | 36 | | 36 | |

|

| Southeast Asia | | | | | | | | | | | | | |

| | |

|

| | Indonesia | | | | | | | | | | | | | |

| | |

|

| | | Corridor PSC | | 4 | | 2 | 4 | 250 | | 159 | 4 | 46 | | 29 | |

| | |

|

| | | Other Indonesia 5 | | 8 | | 2 | 4 | 16 | | 12 | 4 | 11 | | 4 | |

| | |

|

| | Malaysia | | 20 | | 9 | 4 | 68 | | 52 | 4 | 31 | | 18 | |

| | |

|

| | Vietnam | | 1 | | 1 | 4 | – | | – | | 1 | | 1 | |

| | |

|

| | Australia | | 3 | | 3 | 4 | – | | – | | 3 | | 3 | |

| | |

|

| | Papua New Guinea | | – | | – | | – | | – | | – | | – | |

|

| Total Southeast Asia | | 36 | | 17 | 4 | 334 | | 223 | | 92 | | 55 | |

|

| Other | | | | | | | | | | | | | |

| | |

|

| | Algeria 6 | | 15 | | 6 | 6 | – | | – | | 15 | | 6 | |

| | |

|

| | Tunisia 6 | | 1 | | 1 | 6 | – | | – | | 1 | | 1 | |

| | |

|

| | Trinidad and Tobago 6 | | 5 | | 4 | 6 | – | | – | | 5 | | 4 | |

| | |

|

| | Rest of World 7 | | – | | – | | – | | – | | – | | – | |

|

| Total Other | | 21 | | 11 | 6 | – | | – | | 21 | | 11 | |

|

| Total Worldwide | | 224 | | 187 | | 1,247 | | 992 | | 432 | | 353 | |

|

See footnotes on page 19.

18TALISMAN ENERGYANNUAL INFORMATION FORM

Year ended December 31, 2007

| | Oil & Liquids Production

(mbbls/d)

| | Natural Gas Production

(mmcf/d)

| | Total Production

(mboe/d)

| |

| Property | | Gross | | Net | | Gross | | Net | | Gross | | Net | |

|

| North America | | | | | | | | | | | | | |

| | |

|

| | Canada 2,3 | | 43 | | 34 | | 790 | | 649 | | 175 | | 142 | |

| | |

|

| | United States | | – | | – | | 86 | | 73 | | 14 | | 12 | |

|

| Total North America | | 43 | 2 | 34 | 2 | 876 | 3 | 722 | 3 | 189 | | 154 | |

|

| UK | | | | | | | | | | | | | |

| | |

|

| | United Kingdom | | | | | | | | | | | | | |

| | |

|

| | | Mid North Sea | | 34 | | 34 | | 6 | | 6 | | 35 | | 35 | |

| | |

|

| | | Flotta Catchment Area | | 44 | | 44 | | 2 | | 2 | | 44 | | 44 | |

| | |

|

| | | Greater Fulmar Area | | 13 | | 13 | | 3 | | 3 | | 14 | | 14 | |

| | |

|

| | | Non-Operated Areas | | 11 | | 10 | | 56 | | 51 | | 20 | | 18 | |

| | |

|

| | Netherlands | | – | | – | | 21 | | 21 | | 4 | | 4 | |

|

| Total UK | | 102 | | 101 | | 88 | | 83 | | 117 | | 115 | |

|

| Scandinavia | | | | | | | | | | | | | |

| | |

|

| | Norway | | | | | | | | | | | | | |

| | |

|

| | | Gyda Area | | 7 | | 7 | | 8 | | 8 | | 8 | | 8 | |

| | |

|

| | | Varg Area | | 9 | | 9 | | – | | – | | 9 | | 9 | |

| | |

|

| | | Other Norway | | 12 | | 12 | | 6 | | 6 | | 13 | | 13 | |

| | |

|

| | Denmark | | 3 | | 3 | | – | | – | | 3 | | 3 | |

|

| Total Scandinavia | | 31 | | 31 | | 14 | | 14 | | 33 | | 33 | |

|

| Southeast Asia | | | | | | | | | | | | | |

| | |

|

| | Indonesia | | | | | | | | | | | | | |

| | |

|

| | | Corridor PSC | | 3 | | 1 | | 213 | | 144 | | 39 | | 25 | |

| | |

|

| | | Other Indonesia 5 | | 8 | | 3 | | 15 | | 11 | | 10 | | 5 | |

| | |

|

| | Malaysia | | 28 | | 14 | | 59 | | 44 | | 38 | | 21 | |

| | |

|

| | Vietnam | | – | | – | | – | | – | | – | | – | |

| | |

|

| | Australia | | 5 | | 5 | | – | | – | | 5 | | 5 | |

| | |

|

| | Papua New Guinea | | – | | – | | – | | – | | – | | – | |

|

| Total Southeast Asia | | 44 | | 23 | | 287 | | 199 | | 92 | | 56 | |

|

| Other | | | | | | | | | | | | | |

| | |

|

| | North Africa 6 | | 14 | | 8 | | – | | – | | 14 | | 8 | |

| | |

|

| | Trinidad and Tobago 6 | | 7 | | 6 | | – | | – | | 7 | | 6 | |

| | |

|

| | Rest of World 7 | | – | | – | | – | | – | | – | | – | |

|

| Total Other | | 21 | | 14 | | – | | – | | 21 | | 14 | |

|

| Total Worldwide | | 241 | | 203 | | 1,265 | | 1,018 | | 452 | | 372 | |

|

Notes:

- 1.

- As a result of the reorganization of Talisman's North American operations into two distinct businesses, Shale and Conventional, certain of Talisman's properties referred to in prior years as "other unconventional" areas (including Outer Foothills, the Montney Core and Montney Expansion) now form part of Talisman's conventional division.

- 2.

- Includes approximately 538 bbls/d, 801 bbls/d and 570 bbls/d of liquids attributable to royalty interests and net profits interests for the years ended December 31, 2009, 2008 and 2007, respectively.

- 3.

- Includes approximately 4.5 mmcf/d, 6.1 mmcf/d and 5.8 mmcf/d of gas attributable to royalty interests and net profits interests for the years ended December 31, 2009, 2008 and 2007, respectively.

- 4.

- Interests of Indonesian, Malaysian, Vietnamese and Australian governments, other than working interests or income taxes, are accounted for as royalties.

- 5.

- Other Indonesia includes the Corridor Technical Assistance Contract, the Ogan Komering PSC, Southeast Sumatra PSC, Offshore North West Java PSC, Pasangkayu PSC and Sageri PSC for the year ended December 31, 2009; the Corridor Technical Assistance Contract, the Ogan Komering PSC, Southeast Sumatra PSC, Offshore North West Java PSC, Pasangkayu PSC, and the Tangguh LNG Project for the year ended December 31, 2008; and suspended and shut-in wells in the Corridor Technical Assistance Contract, the Ogan Komering PSC, Southeast Sumatra PSC, Offshore North West Java PSC and the Tangguh LNG Project for the year ended December 31, 2007.

- 6.

- Interests of the Algerian, Tunisian and Trinidad and Tobago governments, other than working interests or income taxes, are accounted for as royalties.

- 7.

- Rest of World includes Colombia, Peru and the Kurdistan region of northern Iraq for the year ended December 31, 2009; Colombia, Peru, Qatar and the Kurdistan region of northern Iraq for the year ended December 31, 2008; and Colombia, Peru and Qatar for the year ended December 31, 2007.

TALISMAN ENERGYANNUAL INFORMATION FORM 19

Drilling Activity

The following tables set forth the number of wells 1 Talisman has drilled and tested or participated in drilling and testing, and the net 2 interest of Talisman in such wells for each of the last three fiscal years. The number of wells drilled refers to the number of wells completed at any time during the fiscal years, regardless of when drilling was initiated. North American drilling data for the years ended December 31, 2008 and December 31, 2007 does not delineate between Conventional and Shale for Canada and United States because the Company's North American operations were not organized along those lines at that time.

| Year ended | | | | Exploration

| | Development

| | Total

|

| December 31, 2009 | | | | Oil 3 | | Gas 3 | | Dry 4 | | Total | | Oil 3 | | Gas 3 | | Dry 4 | | Total | | Oil 3 | | Gas 3 | | Dry 4 | | Total | |

|

| North America | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

| | Conventional | | Gross | | 1 | | 17 | | 1 | | 19 | | 4 | | 42 | | 3 | | 49 | | 5 | | 59 | | 4 | | 68 | |

| | |

|

| | | Net | | 1.0 | | 12.9 | | 0.5 | | 14.4 | | 1.7 | | 23.8 | | 1.8 | | 27.3 | | 2.7 | | 36.7 | | 2.3 | | 41.7 | |

|

| | Shale | | Gross | | – | | 33 | | – | | 33 | | – | | 62 | | – | | 62 | | – | | 95 | | – | | 95 | |

| | |

|

| | | Net | | – | | 30.8 | | – | | 30.8 | | – | | 35.3 | | – | | 35.3 | | – | | 66.1 | | – | | 66.1 | |

|

| UK | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

| | United Kingdom | | Gross | | 2 | | – | | 1 | | 3 | | 7 | | – | | – | | 7 | | 9 | | – | | 1 | | 10 | |

| | |

|

| | | Net | | 1.2 | | – | | 1.0 | | 2.2 | | 2.6 | | – | | – | | 2.6 | | 3.8 | | – | | 1.0 | | 4.8 | |

|

| | Netherlands | | Gross | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | |

| | |

|

| | | Net | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | |

|

| Scandinavia | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

| | Norway | | Gross | | 2 | | 1 | | 3 | | 6 | | 8 | | – | | – | | 8 | | 10 | | 1 | | 3 | | 14 | |

| | |

|

| | | Net | | 0.4 | | 0.3 | | 1.2 | | 1.9 | | 4.0 | | – | | – | | 4.0 | | 4.4 | | 0.3 | | 1.2 | | 5.9 | |

|

| Southeast Asia | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

| | Indonesia | | Gross | | 1 | | – | | 2 | | 3 | | 18 | | 4 | | 1 | | 23 | | 19 | | 4 | | 3 | | 26 | |

| | |

|

| | | Net | | 0.1 | | – | | 0.2 | | 0.3 | | 3.0 | | 0.2 | | 0.1 | | 3.3 | | 3.1 | | 0.2 | | 0.3 | | 3.6 | |

|

| | Malaysia | | Gross | | – | | – | | 1 | | 1 | | 11 | | 6 | | – | | 17 | | 11 | | 6 | | 1 | | 18 | |

| | |

|

| | | Net | | – | | – | | 0.6 | | 0.6 | | 4.7 | | 2.5 | | – | | 7.2 | | 4.7 | | 2.5 | | 0.6 | | 7.8 | |

|

| | Vietnam | | Gross | | 1 | | – | | 2 | | 3 | | 1 | | – | | – | | 1 | | 2 | | – | | 2 | | 4 | |

| | |

|

| | | Net | | 0.6 | | – | | 1.2 | | 1.8 | | 0.3 | | – | | – | | 0.3 | | 0.9 | | – | | 1.2 | | 2.1 | |

|

| | Australia | | Gross | | – | | – | | – | | – | | 1 | | – | | – | | 1 | | 1 | | – | | – | | 1 | |

| | |

|

| | | Net | | – | | – | | – | | – | | 0.3 | | – | | – | | 0.3 | | 0.3 | | – | | – | | 0.3 | |

|

| Other | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

| | North Africa 5 | | Gross | | – | | – | | 2 | | 2 | | 7 | | – | | – | | 7 | | 7 | | – | | 2 | | 9 | |

| | |

|

| | | Net | | – | | – | | 0.9 | | 0.9 | | 0.3 | | – | | – | | 0.3 | | 0.3 | | – | | 0.9 | | 1.2 | |

|

| | Trinidad and Tobago | | Gross | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | |

| | |

|

| | | Net | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | | – | |

|

| | Rest of World 6 | | Gross | | – | | 1 | | – | | 1 | | – | | – | | – | | – | | – | | 1 | | – | | 1 | |

| | |

|

| | | Net | | – | | 0.3 | | – | | 0.3 | | – | | – | | – | | – | | – | | 0.3 | | – | | 0.3 | |

|

| Total | | Gross | | 7 | | 52 | | 12 | | 71 | | 57 | | 114 | | 4 | | 175 | | 64 | | 166 | | 16 | | 246 | |

| | |

|

| | | Net | | 3.3 | | 44.3 | | 5.6 | | 53.2 | | 16.9 | | 61.8 | | 1.9 | | 80.6 | | 20.2 | | 106.1 | | 7.5 | | 133.8 | |

|

See footnotes on page 22.

20TALISMAN ENERGYANNUAL INFORMATION FORM

| Year ended | | | | Exploration

| | Development

| | Total

|

| December 31, 2008 | | | | Oil 3 | | Gas 3 | | Dry 4 | | Total | | Oil 3 | | Gas 3 | | Dry 4 | | Total | | Oil 3 | | Gas 3 | | Dry 4 | | Total | |

|

| North America | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

| | Canada | | Gross | | 22 | | 72 | | 1 | | 95 | | 116 | | 164 | | – | | 280 | | 138 | | 236 | | 1 | | 375 | |

| | |

|

| | | Net | | 19.6 | | 52.5 | | 0.6 | | 72.7 | | 71.1 | | 112.2 | | – | | 183.3 | | 90.7 | | 164.7 | | 0.6 | | 256.0 | |

|

| | United States | | Gross | | – | | 46 | | 2 | | 48 | | – | | 4 | | – | | 4 | | – | | 50 | | 2 | | 52 | |

| | |

|

| | | Net | | – | | 20.0 | | 1.9 | | 21.9 | | – | | 1.9 | | – | | 1.9 | | – | | 21.9 | | 1.9 | | 23.8 | |

|

| UK | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

| | United Kingdom 7 | | Gross | | 2 | | 1 | | 2 | | 5 | | 12 | | – | | – | | 12 | | 14 | | 1 | | 2 | | 17 | |

| | |

|

| | | Net | | 1.1 | | 0.6 | | 0.9 | | 2.6 | | 4.7 | | – | | – | | 4.7 | | 5.8 | | 0.6 | | 0.9 | | 7.3 | |

|

| | Netherlands | | Gross | | – | | – | | – | | – | | – | | 2 | | – | | 2 | | – | | 2 | | – | | 2 | |

| | |

|

| | | Net | | – | | – | | – | | – | | – | | 0.2 | | – | | 0.2 | | – | | 0.2 | | – | | 0.2 | |

|

| Scandinavia | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

| | Norway | | Gross | | – | | – | | 4 | | 4 | | 7 | | 1 | | 1 | | 9 | | 7 | | 1 | | 5 | | 13 | |

| | |

|

| | | Net | | – | | – | | 1.4 | | 1.4 | | 3.1 | | 0.7 | | 0.6 | | 4.4 | | 3.1 | | 0.7 | | 2.0 | | 5.8 | |

|

| | Denmark | | Gross | | – | | – | | – | | – | | 2 | | – | | – | | 2 | | 2 | | – | | – | | 2 | |

| | |

|

| | | Net | | – | | – | | – | | – | | 0.6 | | – | | – | | 0.6 | | 0.6 | | – | | – | | 0.6 | |

|

| Southeast Asia | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

| | Indonesia | | Gross | | – | | 1 | | 2 | | 3 | | 28 | | 15 | | – | | 43 | | 28 | | 16 | | 2 | | 46 | |

| | |

|

| | | Net | | – | | 0.1 | | 0.6 | | 0.7 | | 3.6 | | 0.4 | | – | | 4.0 | | 3.6 | | 0.5 | | 0.6 | | 4.7 | |

|

| | Malaysia | | Gross | | – | | – | | 1 | | 1 | | 4 | | 15 | | 1 | | 20 | | 4 | | 15 | | 2 | | 21 | |

| | |

|

| | | Net | | – | | – | | 0.8 | | 0.8 | | 1.6 | | 6.2 | | 0.4 | | 8.2 | | 1.6 | | 6.2 | | 1.2 | | 9.0 | |

|

| | Vietnam | | Gross | | 1 | | 1 | | 1 | | 3 | | 6 | | – | | – | | 6 | | 7 | | 1 | | 1 | | 9 | |

| | |

|

| | | Net | | 1.0 | | 1.0 | | 1.0 | | 3.0 | | 1.8 | | – | | – | | 1.8 | | 2.8 | | 1.0 | | 1.0 | | 4.8 | |

|

| | Australia | | Gross | | 2 | | – | | – | | 2 | | – | | 1 | | 1 | | 2 | | 2 | | 1 | | 1 | | 4 | |

| | |

|

| | | Net | | 0.5 | | – | | – | | 0.5 | | – | | 0.3 | | 0.3 | | 0.6 | | 0.5 | | 0.3 | | 0.3 | | 1.1 | |

|

| Other | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

| | North Africa 5 | | Gross | | 3 | | – | | – | | 3 | | 6 | | – | | – | | 6 | | 9 | | – | | – | | 9 | |

| | |

|

| | | Net | | 0.3 | | – | | – | | 0.3 | | 0.2 | | – | | – | | 0.2 | | 0.5 | | – | | – | | 0.5 | |

|

| | Rest of World 6 | | Gross | | – | | – | | 1 | | 1 | | – | | – | | – | | – | | – | | – | | 1 | | 1 | |

| | |

|

| | | Net | | – | | – | | 1.0 | | 1.0 | | – | | – | | – | | – | | – | | – | | 1.0 | | 1.0 | |

|

| Total | | Gross | | 30 | | 121 | | 14 | | 165 | | 181 | | 202 | | 3 | | 386 | | 211 | | 323 | | 17 | | 551 | |

| | |

|

| | | Net | | 22.5 | | 74.2 | | 8.2 | | 104.9 | | 86.7 | | 121.9 | | 1.3 | | 209.9 | | 109.2 | | 196.1 | | 9.5 | | 314.8 | |

|

See footnotes on page 22.

TALISMAN ENERGYANNUAL INFORMATION FORM 21

| Year ended | | | | Exploration

| | Development

| | Total