QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.2

NOTICE OF MEETING AND

MANAGEMENT PROXY CIRCULAR

Annual meeting of shareholders

May 1, 2013

NOTICE OF ANNUAL GENERAL MEETING

NOTICE IS HEREBY GIVEN that the annual meeting of the common shareholders (the "Meeting") of TALISMAN ENERGY INC. (the "Company") will be held in theMacleod Hall, South Building, Lower Level of the Calgary TELUS Convention Centre, 120 - 9th Avenue SE, Calgary, Alberta, Canada, onWednesday, May 1, 2013 at 11:00 a.m.(Mountain Daylight Time) for the following purposes:

- 1.

- to receive the annual report and the consolidated financial statements of the Company for the year ended December 31, 2012 together with the report of the auditor thereon;

- 2.

- to elect the directors for the ensuing year;

- 3.

- to appoint the auditor for the ensuing year;

- 4.

- to vote, on an advisory basis, on the acceptance of the Company's approach to executive compensation, as described in the Management Proxy Circular accompanying this Notice of Meeting; and

- 5.

- to transact such further and other business as may properly come before the Meeting or any adjournment thereof.

The procedures by which shareholders may exercise their right to vote with respect to matters at the Meeting will vary depending on whether a shareholder is a registered shareholder (that is, a shareholder who holds common shares directly in his, her or its own name and is entered on the register of common shareholders), or a non-registered shareholder (that is, a shareholder who holds common shares through an intermediary such as a bank, trust company, securities dealer or broker).

YOUR VOTE IS IMPORTANT. Registered holders of common shares unable to attend the Meeting in person are requested to complete the enclosed Form of Proxy and return it in the envelope provided to the Company's transfer agent and registrar, Computershare Trust Company of Canada, 100 University Avenue, Toronto, Ontario, M5J 2Y1 no later than 11:00 a.m. (Mountain Daylight Time) on April 29, 2013, or two business days preceding any adjournment of the Meeting. Alternatively, telephone and Internet voting options are available. Please see the Form of Proxy for more details. Non-registered shareholders are advised to refer to the Company's Management Proxy Circular and to the Voting Instruction Form for instructions relevant to them. Late proxies may be accepted or rejected by the Chairman of the Meeting at his sole discretion; the Chairman of the Meeting is under no obligation to accept or reject a late proxy. The Chairman of the Meeting may waive or extend the proxy cut-off without notice.

DATED at Calgary, Alberta, this 6th day of March, 2013.

BY ORDER OF THE BOARD

C. Tamiko Ohta

Vice President, Legal and Corporate Secretary

Full instructions explaining the process for a shareholder to attend the Meeting in person are set out in the Management Proxy Circular accompanying this Notice of Meeting. Shareholders who have questions may call Kingsdale Shareholder Services Inc. toll-free at 1-866-581-1570 in North America or call collect at (416) 867-2272 outside North America or email at contactus@kingsdaleshareholder.com.

MANAGEMENT PROXY CIRCULAR

Table of Contents

| I. | General Proxy Information | | 01 |

|

| | Distribution of Meeting Materials | | 01 |

|

| | Questions & Answers – Voting and Proxies | | 01 |

|

| II. | Business of the Meeting | | 05 |

|

| | Election of Directors | | 05 |

|

| | Appointment of Auditor | | 15 |

|

| | Advisory Vote on Executive Compensation | | 15 |

|

| III. | Corporate Governance | | 16 |

|

| | Communications and Shareholder Engagement | | 16 |

|

| | Standards & Practices | | 17 |

|

| | Governance Principles | | 17 |

|

| | Role of the Board | | 18 |

|

| | About the Board | | 20 |

|

| | Board Committees | | 27 |

|

| IV. | Director Compensation | | 34 |

|

| | Compensation Philosophy and Program Design | | 34 |

|

| | Annual Compensation Review Process | | 34 |

|

| | Director Compensation Elements | | 35 |

|

| | Director Compensation Tables | | 37 |

|

| V. | Executive Compensation | | 39 |

|

| | Letter to Shareholders | | 40 |

|

| | Compensation Discussion and Analysis | | 44 |

|

| | Executive Compensation Tables | | 68 |

|

| VI. | Other Information | | 79 |

|

| | Securities Authorized for Issuance Under Equity Compensation Plans | | 79 |

|

| | Employee Stock Option Plan | | 79 |

|

| | Indebtedness of Directors and Officers | | 80 |

|

| | Interests of Informed Persons in Material Transactions | | 80 |

|

| | Shareholder Proposals | | 81 |

|

| | Additional Information | | 81 |

|

| | Directors' Approval | | 81 |

|

| Appendix A – Terms of Reference – Board of Directors | | 82 |

|

| Appendix B – Advisories | | 85 |

|

I. GENERAL PROXY INFORMATION

This management proxy circular (the "Circular") is furnished in connection with the solicitation of proxies by or on behalf of the management of TALISMAN ENERGY INC. (the "Company" or "Talisman") for use at the annual meeting of common shareholders of the Company (the "Meeting") and at any adjournment thereof, for the purposes set forth in the attached notice of Meeting ("Notice of Meeting"). The Meeting is to be held in theMacleod Hall, South Building, Lower Level of the Calgary TELUS Convention Centre, 120 - 9th Avenue SE, Calgary, Alberta, Canada, on Wednesday, May 1, 2013 at 11:00 a.m. (Mountain Daylight Time). Please read this Circular to obtain information about how you may participate at the Meeting either in person or through the use of proxies.

All dollar amounts in this Circular are presented in Canadian dollars ("C$"), except where otherwise indicated.

|

| Distribution of Meeting Materials | | 01 |

|

| Questions & Answers – Voting and Proxies | | 01 |

|

| | Meeting | | 01 |

|

| | Who Can Vote | | 02 |

|

| | How To Vote | | 02 |

|

| | Changing Your Vote | | 03 |

|

| | General Information | | 04 |

|

Distribution of Meeting Materials

This Circular and related Meeting materials are being sent to both registered and non-registered owners of common shares of the Company ("Common Shares"). You may receive multiple packages of Meeting materials if you hold Common Shares through more than one intermediary, or if you are both a registered shareholder and a non-registered shareholder for different shareholdings.

Should you receive multiple packages, you should repeat the steps to vote through a proxy, appoint a proxyholder or attend the Meeting, if desired, separately for each package to ensure that all the Common Shares from the various shareholdings are voted at the Meeting.

Questions & Answers – Voting and Proxies

Your vote is very important to Talisman. We encourage you to exercise your right to vote through one of the various methods outlined below.

The questions and answers below give general guidance for voting your Common Shares. Unless otherwise noted, all answers relate to both registered and non-registered shareholders. If you have any questions, you may call Kingsdale Shareholder Services Inc. ("Kingsdale") toll-free at 1-866-581-1570 in North America or call collect at (416) 867-2272 outside North America or email at contactus@kingsdaleshareholder.com.

Meeting

Q: What am I voting on?

- A:

- You will be voting on:

- •

- election of directors;

- •

- appointment of the auditor; and

- •

- acceptance, on an advisory basis, of the Company's approach to executive compensation, as described in the Circular.

Q: What if there are amendments or if other matters are brought before the Meeting?

- A:

- Your proxyholder has discretionary authority for amendments that are made to matters identified in the Notice of Meeting and other matters that may properly come before the Meeting, or any adjournment thereof. As of the date of this Circular, management of the Company is not aware of any such amendments or other matters to be presented at the Meeting; however, if any such matter is presented, your Common Shares will be voted in accordance with the best judgment of the proxyholder named in the form of proxy. Where you have not specifically appointed a person as proxyholder, a management nominee will be the proxyholder, and your Common Shares will be voted in accordance with the best judgment of the management nominee.

MANAGEMENT PROXY CIRCULAR 1

Who Can Vote

Q: Am I entitled to vote?

- A:

- You are entitled to vote if you were a holder of Common Shares as of the close of business on March 11, 2013, which is the record date for the Meeting. Each Common Share is entitled to one vote.

How To Vote

Q: How do I vote?

- A:

- How you vote depends on whether you are a registered shareholder or a non-registered shareholder. Please read carefully the voting instructions below that are applicable to you.

Q: Am I a registered shareholder?

- A:

- Only a relatively small number of shareholders of Talisman are registered shareholders. You are a registered shareholder if you hold any Common Shares: (a) in your own name and you have a share certificate; or (b) through the Direct Registration System. As a registered shareholder, you are identified on the share register maintained by the Company's registrar and transfer agent, Computershare Trust Company of Canada ("Computershare"), as being a shareholder.

Q: Am I a non-registered shareholder (also commonly referred to as a beneficial shareholder)?

- A:

- Most shareholders of Talisman are non-registered shareholders. You are a non-registered shareholder if your Common Shares are held in an account in the name of an intermediary, such as a bank, broker or trust company. You do not have a share certificate registered in your name, but your ownership interest in Common Shares is recorded in an electronic system maintained by parties other than the Company. In that case, you are not identified on the share register maintained by Computershare as being a shareholder; rather, the Company's share register shows the shareholder of your Common Shares as being the depositary or intermediary through which you own the shares.

Q: How do I vote if I am a registered shareholder?

- A:

- If you are a registered shareholder, you may vote your Common Shares in one of the following ways:

1. Attend the Meeting

If you wish to vote in person at the Meeting, do not complete or return the form of proxy included with the materials sent to you. Simply attend the Meeting and you will be entitled to vote during the course of the Meeting. When you arrive at the Meeting, please register with Computershare at the registration table.

2. By Proxy

You can vote by proxy whether or not you attend the Meeting. To vote by proxy, please complete the enclosed form of proxy and return it in accordance with the instructions provided.

You may choose the directors included on the form of proxy to be your proxyholder, oryou may appoint another person or company to be your proxyholder. The names already inserted on the form of proxy are C.R. Williamson, Chairman of the Board of Directors and a director of the Company, and H.N. Kvisle, President and Chief Executive Officer and a director of the Company. Unless you choose another person or company to be your proxyholder, you are giving these people the authority to vote your Common Shares at the Meeting or at any adjournment of the Meeting.

To appoint another person or company to be your proxyholder, you should insert the other person's name or the company's name in the space provided. If you appoint someone else, he or she must be present at the Meeting to vote your Common Shares. If you do not insert a name, the directors and officer named above are appointed to act as your proxyholder.

You may also use a different form of proxy than the one included with the materials sent to you, if you so desire. Please note that in order for your vote to be recorded, your proxy must be received by Computershare at 100 University Avenue, Toronto, Ontario, M5J 2Y1 no later than 11:00 a.m. (Mountain Daylight Time) on April 29, 2013 or two business days before any adjournment of the Meeting.

Registered shareholders may vote by proxy by any of the following means:

- •

- by mail to the address listed above (a prepaid and pre-addressed envelope is enclosed);

- •

- by hand or by courier to the address listed above;

- •

- by telephone at1-866-732-VOTE (8683); or

- •

- by Internet atwww.investorvote.com.

2 TALISMAN ENERGY

Q: How will my shares be voted?

- A:

- On the form of proxy, you can indicate how you want your proxyholder to vote your Common Shares, or you can let your proxyholder decide for you. If you have specified on the form of proxy how you want your Common Shares to be voted on a particular issue (by marking FOR, AGAINST or WITHHOLD), then your proxyholder must vote your Common Shares accordingly. If you have not specified on the form of proxy how you want your Common Shares to be voted on a particular issue, then your proxyholder can vote your shares as he or she sees fit.

Unless contrary instructions are provided, Common Shares represented by proxies received by management will be voted:

FOR the election of all individual director nominees named in this Circular;

FOR the appointment of the auditor named in this Circular; and

FOR the advisory resolution to accept the Company's approach to executive compensation, as described in the Circular.

Q: What if my Common Shares are registered in more than one name or in the name of a company?

- A:

- If the Common Shares are registered in more than one name, all registered persons must sign the form of proxy. If the Common Shares are registered in a company's name or any name other than your own, you must provide documents showing your authorization to sign the form of proxy for that company or name.

Q: How do I vote if I am a non-registered shareholder?

- A:

- If you are a non-registered shareholder, you may vote your Common Shares in one of the following ways:

1. Through your intermediary

A voting instruction form should be included with the materials sent to you. The purpose of this form is to instruct your intermediary on how to vote on your behalf. Please follow the instructions provided on the voting instruction form, and communicate your voting instructions in accordance with the voting instruction form.

If you subsequently wish to change your voting instructions, contact your intermediary to discuss whether this is possible and what procedure to follow.

2. Attend the Meeting

If you wish to vote in person at the Meeting, you should take these steps:

- •

- Insert your name in the space provided on the voting instruction form provided to you by your intermediary and sign and return it in accordance with the instructions provided. By doing so, you are instructing your intermediary to appoint you as proxyholder.

- •

- Do not otherwise complete the form, as you will be voting at the Meeting.

- •

- When you arrive at the Meeting, please register with Computershare at the registration table.

Please note that you will not be admitted to vote at the Meeting by presenting a voting instruction form.

3. Designate another person to be appointed as your proxyholder

You can choose another person (including someone who is not a shareholder of the Company) to vote for you as proxyholder. If you appoint someone else, he or she must be present at the Meeting to vote for you. If you wish to appoint a proxyholder, you should insert that person's name in the space provided on the voting instruction form provided to you by your intermediary and sign and return it in accordance with the instructions provided. By doing so, you are instructing your intermediary to appoint that person as proxyholder. When your proxyholder arrives at the Meeting, he or she should register with Computershare at the registration table.

Changing Your Vote

Q: Can I revoke my proxy or voting instructions?

- A:

- If you are aregistered shareholder of Common Shares, you may revoke your proxy by taking one of the following steps:

- •

- you may submit a new proxy to Computershare before 11:00 a.m. (Mountain Daylight Time) on April 29, 2013 or two business days before any adjournment of the Meeting; or

MANAGEMENT PROXY CIRCULAR 3

- •

- you (or your attorney, if authorized in writing) may sign a written notice of revocation addressed to the Corporate Secretary and deposited at the registered office of the Company, Suite 2000, 888 - 3rd Street SW, Calgary, Alberta, T2P 5C5, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used; or

- •

- you (or your attorney, if authorized in writing) may sign a written notice of revocation and deliver it to the Chairman of the Meeting on the day of the Meeting, or at any adjournment thereof, at which the proxy is to be used.

If you are anon-registered shareholder, you should contact your intermediary through which you hold Common Shares and obtain instructions regarding the procedure for the revocation of any voting or proxyholder instructions that you have previously provided to your intermediary.

General Information

Q: How many shares are entitled to vote?

- A:

- As of March 1, 2013, there were 1,033,845,284 Common Shares outstanding. Holders of Common Shares are entitled to one vote per Common Share on all matters to be voted upon at the Meeting. In addition to the Company's outstanding Common Shares, there are 8,000,000 First Preferred Shares, Series 1 ("Preferred Shares") outstanding as at March 1, 2013. Holders of Preferred Shares do not have the right to vote their Preferred Shares at the Meeting.

To the knowledge of the directors or executive officers of the Company, there is no single shareholder who beneficially owns, controls or directs, directly or indirectly, Common Shares carrying 10% or more of the voting rights attached to the Common Shares. Each of CDS Clearing and Depository Services Inc. and CEDE & Co. hold in excess of 10% of the Common Shares for the benefit of their respective participants.

Q: Who counts the votes?

- A:

- For any matter for which a vote is taken at the Meeting by ballot, the votes, including those cast by way of proxies, will be counted by the scrutineers appointed at the Meeting. It is expected that representatives of Computershare will act as scrutineers at the Meeting.

Q: Who is soliciting my proxy?

- A:

- Management of the Company is soliciting your proxy. Proxies will be solicited primarily by mail, but employees and agents of the Company may also use telephone or electronic means. Intermediaries will be reimbursed for their reasonable charges and expenses in forwarding proxy material to non-registered shareholders.

The Company has retained Kingsdale to assist in the solicitation of proxies for the Meeting, at a cost anticipated not to exceed $45,000 (not including disbursements).

The Company will bear the cost of all proxy solicitations on behalf of management of the Company.

Q: Who do I contact if I have questions?

- A:

- If you have any questions, you may call Kingsdale toll-free at 1-866-581-1570 in North America or call collect at (416) 867-2272 outside North America or email at contactus@kingsdaleshareholder.com.

4 TALISMAN ENERGY

II. BUSINESS OF THE MEETING

|

| Election of Directors | | 05 |

|

| | Board Renewal | | 05 |

|

| | Director Selection and Succession Planning Processes | | 06 |

|

| | Governance and Nominating Committee – Recent Activities | | 06 |

|

| | Director Profiles | | 07 |

|

| | Director Attendance | | 14 |

|

| | Majority Voting Policy | | 14 |

|

| Appointment of Auditor | | 15 |

|

| Advisory Vote on Executive Compensation | | 15 |

|

Election of Directors

The Board of Directors ("Board") is elected annually and consists of such number as fixed from time to time by resolution of the directors, such number being not less than four and not more than 20. There are currently 11 directors. The number of directors to be elected at the Meeting has been fixed at 11.

Each Board member is expected to attend Board meetings and meetings of committees of which he or she is a member and to become familiar with deliberations and decisions as soon as possible after any missed meetings. In that regard, members of the Board are expected to prepare for Board (and committee) meetings by reviewing meeting materials distributed to members of the Board in advance of such meetings. It is also expected that members of the Board will actively participate in determining and setting the Company's strategy as well as the long- and short-term goals and interests of the Company.

Management of the Company proposes to nominate for election as directors at the Meeting the persons listed in "Director Profiles". Each elected director will hold office until the next annual meeting. All proposed nominees have consented to be named in this Circular and to serve as directors if elected. Management has no reason to believe that any of the nominees will be unable to serve as directors but, should any nominee become unable to do so for any reason prior to the Meeting, the persons named in the enclosed form of proxy or voting instruction form, unless directed to withhold from voting, reserve the right to vote for other nominees at their discretion. Shareholders should note that the form of proxy or voting instruction form provides for voting for individual directors as opposed to voting for directors as a slate.

Board Renewal

The Governance and Nominating Committee is currently overseeing a Board renewal process. Board renewal and director succession continues to be a top priority of the Governance and Nominating Committee given the following:

- (a)

- In 2012, the Board determined the need for a change in the Company's strategic direction and the leadership required to effect that change. As a result, Harold N. Kvisle was appointed President and Chief Executive Officer of the Company on September 10, 2012. Mr. Kvisle is therefore no longer an independent director.

- (b)

- Following Mr. Kvisle's appointment, the Governance and Nominating Committee reviewed the composition of the Board against its long-term director succession plan. In doing so, the Governance and Nominating Committee also considered the skills and experience needed on the Board, as a whole, in order to provide oversight of the new strategic priorities of the Company.

- (c)

- As a result of this review, the Governance and Nominating Committee determined that adding an independent director with a track record of unlocking value for shareholders should be the immediate focus of its recruitment efforts. The Committee further determined that an additional director with oil and gas experience would be desirable.

- (d)

- William R. P. Dalton will turn 70 in late 2013 and pursuant to the terms of the Board Succession Policy, will be retiring from the Board at the 2014 shareholders' meeting.

The Board renewal process has led to the recent appointment of a new director and the commencement of a search for an additional director with oil and gas experience, as outlined in "Governance and Nominating Committee – Recent Activities" below.

The following sections describe the responsibilities of the Governance and Nominating Committee with respect to director succession and the approach and process by which new directors are elected or appointed to the Board, as well as recent activities of the Governance and Nominating Committee with respect to specific candidates.

MANAGEMENT PROXY CIRCULAR 5

Director Selection and Succession Planning Processes

The Governance and Nominating Committee is responsible for:

- (a)

- Establishing a long-term plan for the composition of the Board that takes into consideration the current strengths, competencies, skills and experience of Board members, retirement dates and the strategic direction of the Company as well as the competencies and skills the Board, as a whole, should possess;

- (b)

- Identifying individuals qualified to become Board members and establishing a list of potential candidates with the desired skills and experience, consistent with criteria in the long-term succession plan noted above;

- (c)

- Overseeing the process to recruit new Board members, and to recommend to the Board nominees for election to the Board; and

- (d)

- Ensuring there is a succession plan for the position of the Chairman of the Board.

The Governance and Nominating Committee believes that a board that has a broad mix of complementary skills and expertise can more effectively oversee the range of issues that arise and make more informed board decisions, particularly for a company of Talisman's size and complexity. The experience, qualifications and skills of Talisman's directors are evaluated regularly to ensure that Talisman's Board and committee composition is appropriate and essential areas of expertise are represented.

To assist in the director selection process, the Governance and Nominating Committee considers the ideal characteristics and qualifications of Board members, which takes into account the Company's governance framework and current Board composition. These include experience in: executive management, driving strategy and growth, industry knowledge, financial acumen and expertise, risk management, international operations, global capital markets, banking and M&A, responsible business practices, human resources and compensation, other public company boards, government relations, integration and stakeholder relations.

The long-term plan for the composition of the Board maintained by the Governance and Nominating Committee takes into account the results of the regular evaluation of current directors as well as the ideal characteristics and qualifications listed above.

The Governance and Nominating Committee also considers all director candidates against various personal attributes which it believes contribute to effective, functioning, governance and decision-making of the Board. These attributes and further details about the Governance and Nominating Committee's search criteria are set forth on pages 24 and 25.

The Governance and Nominating Committee identifies candidates from a number of sources, including referrals from existing directors and the Institute of Corporate Directors' directors register. Shareholder input is also considered in the identification and review of director candidates. As appropriate, the Governance and Nominating Committee will also retain the services of an external recruitment firm to add objectivity to the process and to increase the scope of the search and candidates considered.

When a position becomes available, the Governance and Nominating Committee reviews the list of potential candidates, revises it in accordance with the particular skills and experience needed to fill the position, includes any recently identified candidates and then prepares a short list. In identifying candidates and preparing a short list, the Governance and Nominating Committee also considers the diversity of the candidates.

The Chair of the Governance and Nominating Committee, the Chairman of the Board, the President and Chief Executive Officer and other directors meet with candidates to determine a candidate's experience, availability and suitability for the role. Throughout the process, the Governance and Nominating Committee provides updates to the Board and seeks input from other Board members on the candidates. Upon completion of these meetings and completion of a regulatory and independence review, the Governance and Nominating Committee recommends a candidate to the full Board of Directors. The Board considers the recommendation and determines which candidates will be put forward for election at the annual meeting of shareholders.

Governance and Nominating Committee – Recent Activities

In addition to the reviews noted above in "Board Renewal", the Governance and Nominating Committee has undertaken the following director succession and recruitment activities since September 2012:

- (a)

- Following the determination that an additional independent director with proven experience in increasing shareholder value was needed, the Committee Chair consulted extensively with the Chairman of the Board and the President and Chief Executive Officer on the qualified pool of candidates and relevant selection criteria for this candidate. Shareholder input was also considered in the selection process.

- (b)

- Mr. Brian M. Levitt was identified as a potential candidate. Mr. Levitt is currently Chairman of the Board of the TD Bank Group and non-executive co-Chair of Osler, Hoskin & Harcourt LLP. He has an extensive career which combines his background in law, business and engineering. From 1991 until its sale in 2000, Mr. Levitt served as President and subsequently Chief

6 TALISMAN ENERGY

Executive Officer of Imasco Limited, a Canadian consumer goods and services company. Mr. Levitt served as Board Chair of Domtar Corporation until its merger with Weyerhauser's white paper business in 2007, and continues to serve as a director of that company. Mr. Levitt has served as a director of numerous additional public companies in the past 20 years. Further details on Mr. Levitt are set forth on page 10.

- (c)

- Mr. Levitt was interviewed by each of the Chair of the Governance and Nominating Committee, the Chairman of the Board, the President and Chief Executive Officer, the General Counsel and members of the Committee. Independence and regulatory reviews were also conducted.

- (d)

- The Governance and Nominating Committee met to consider Mr. Levitt's candidacy against the overall composition of the Board and the long term succession plan for the Board. The Board also reviewed Mr. Levitt's skills, experience and independence and the overall composition of the Board.

- (e)

- On February 28, 2013, the Board appointed Mr. Levitt as a director of the Company to fill the existing vacancy on the Board.

- (f)

- The Committee has also engaged the services of Korn Ferry International ("Korn Ferry") to assist in the identification and selection of an additional independent director candidate with oil and gas experience. The Governance and Nominating Committee will meet with Korn Ferry to review the list of identified candidates and expects to interview between three to six candidates prior to recommending a candidate to the full Board for approval. Shareholder feedback will be again considered in the selection of this candidate. The recruitment process for this candidate is targeted for completion by the end of Q2 2013.

- (g)

- It is anticipated that an external recruitment firm will also be utilized to assist in the search for additional candidates in anticipation of Mr. Dalton's retirement from the Board.

In addition to the above, Kevin S. Dunne has reached ten years of service on the Board. As a result of this anniversary, and pursuant to the terms of the Board Succession Policy, the Governance and Nominating Committee is required to consider Mr. Dunne continuing on the Board for an additional year of service. The Committee has recommended Mr. Dunne's nomination as a director at the Meeting given his oil and gas industry experience and his contributions to the Board.

Director Profiles

The following tables set forth information with respect to each of the nominees for election as a director, including all officer positions currently held with the Company, principal occupation or employment for the past five years or more, educational qualifications, other current public company directorships (including related board committee memberships) and directorships in non-public companies, organizations or other entities that require a significant time commitment on the part of the nominee. Each of the nominees who has previously served as a director of the Company has done so since the year he or she first became a director.

MANAGEMENT PROXY CIRCULAR 7

Christiane Bergevin

Age: 501

Montreal, Quebec

Canada

Director since 2009

Independent2

2012 Vote Result

97.97% FOR

| | | Christiane Bergevin has been the Executive Vice-President, Strategic Partnerships, Office of the President, of Desjardins Group (Canadian financial cooperative institution) since August 2009. Prior to that, she was Senior Vice-President and General Manager, Corporate Projects, with SNC-Lavalin Group Inc. ("SNC-Lavalin") (engineering and construction firm). For the 18 years prior to that, Ms. Bergevin held executive finance positions with various SNC-Lavalin subsidiaries, including as President of SNC-Lavalin Capital Inc., its project finance advisory arm, between 2001 and 2008. Ms. Bergevin holds a Bachelor of Commerce degree (Honours) from McGill University and graduated from the Wharton School of Business Advanced Management Program. She has been awarded the ICD.D designation by the Institute of Corporate Directors. |

| | |

|

| | | Board/Committee Membership | | Attendance3 | | Attendance (Total) |

| | |

|

| | | Board | | 12/12 | | 100% | | | | |

| | | Governance & Nominating | | 3/3 | | 100% | | 18/18 | | 100% |

| | | Health, Safety, Environment & Corporate Responsibility | | 3/3 | | 100% | | | | |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | Fiera Capital Corporation | | Audit (Chair) |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | Board of Trade of Metropolitan Montreal | | Executive |

| | | The Canadian Chamber of Commerce | | International Strategic Advisory; Policy |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common Shares6 | |

Deferred Share

Units (DDSUs)7 | | Total of Common

Shares and DDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?9 |

| | |

|

| | | 2013 | | 2,000 | | 43,419 | | 45,419 | | $576,821 | | N/A |

| | | 2012 | | 2,000 | | 23,413 | | 25,413 | | $349,175 | | N/A |

| | | 2011 | | 2,000 | | 10,677 | | 12,677 | | $305,009 | | N/A |

| | |

|

| | | Note: In addition to the Common Shares and DDSUs, Ms. Bergevin also holds 300 First Preferred Shares Series 1. |

| | |

|

| | | Options Held10 | | | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | |

Number Granted | |

Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

Donald J. Carty, O.C.

Age: 661

Dallas, Texas

United States

Director since 2009

Independent2

2012 Vote Result

92.82% FOR

| | | Donald Carty served as Vice Chairman and Chief Financial Officer of Dell Inc. (global computer systems and services company) from January 2007 until mid-2008. From 1998 to 2003, he was the Chairman and Chief Executive Officer of AMR Corp. and American Airlines (airline transportation company). Prior to that, Mr. Carty served as President of AMR Airline Group and American Airlines. Mr. Carty was the President and Chief Executive Officer of Canadian Pacific Airlines (airline transportation company) from March 1985 to March 1987. Mr. Carty holds an undergraduate degree and an Honorary Doctor of Laws from Queen's University and a Master's degree in Business Administration from Harvard University. Mr. Carty is an Officer of the Order of Canada. |

| | |

|

| | | Board/Committee Membership | | Attendance3 | | Attendance (Total) |

| | |

|

| | | Board | | 12/12 | | 100% | | | | |

| | | Audit | | 6/6 | | 100% | | 24/24 | | 100% |

| | | Human Resources (Chair) | | 6/6 | | 100% | | | | |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | Dell Inc. | | Nil |

| | | Barrick Gold Corp. | | Audit |

| | | Canadian National Railway Co. | | Audit; Finance; Corporate Governance & Nominating; |

| | | | | Strategic Planning |

| | | Gluskin Sheff & Associates, Inc. | | Compensation, Nomination & Governance |

| | |

|

| | | Note: Mr. Carty will cease to be a director of Dell Inc. when the announced sale of that company is complete. |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | Porter Airlines Inc. (Chairman) | | Audit (Chair); Compensation |

| | | Virgin America Airlines (Chairman) | | Compensation |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common Shares6 | | Deferred Share Units (DDSUs)7 | | Total of Common

Shares and DDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?9 |

| | |

|

| | | 2013 | | 10,000 | | 36,628 | | 46,628 | | $592,176 | | N/A |

| | | 2012 | | 10,000 | | 23,019 | | 33,019 | | $453,681 | | N/A |

| | | 2011 | | 10,000 | | 11,713 | | 21,713 | | $522,415 | | N/A |

| | |

|

| | | Options Held10 | | | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | | Number Granted | | Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

See footnotes on page 13.

8 TALISMAN ENERGY

William R.P. Dalton

Age: 691

Scottsdale, Arizona

United States

Director since 2005

Independent2

2012 Vote Result

97.75% FOR

| | | William Dalton was Chief Executive of HSBC Bank plc (a British clearing bank) from 1998 to 2004, Executive Director of HSBC Holdings plc from 1998 to 2004, Global Head of Personal Financial Services for HSBC Group from 2002 to 2004 and held various positions in the Canadian operations of HSBC prior to 1998. Mr. Dalton holds a Bachelor of Commerce degree (Honours) and was awarded an Honorary Doctorate (Honorary Doctor of the University) by the University of Central England in Birmingham in 2001. Mr. Dalton is a Fellow of the Chartered Institute of Bankers of the United Kingdom and the Institute of Canadian Bankers. |

| | |

|

| | | Board/Committee Membership | | Attendance3 | | Attendance (Total) |

| | |

|

| | | Board | | 12/12 | | 100% | | | | |

| | | Audit (Chair) | | 6/6 | | 100% | | 25/25 | | 100% |

| | | Reserves | | 4/4 | | 100% | | | | |

| | | Governance & Nominating | | 3/3 | | 100% | | | | |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | HSBC USA Inc. | | Audit; Risk |

| | | HSBC Bank USA, National Association | | Audit; Risk |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | Associated Electric and Gas Insurance Services (AEGIS) | | Audit |

| | | AEGIS Managing Agency for Lloyds of London Syndicate 1225 | | Audit |

| | | United States Cold Storage Inc. | | Nil |

| | | HSBC North America Holdings Inc. | | Audit; Risk |

| | | HSBC National Bank USA | | Nil |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common Shares6 | | Deferred Share Units (DDSUs)7 | | Total of Common

Shares and DDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?9 |

| | |

|

| | | 2013 | | 0 | | 47,590 | | 47,590 | | $604,393 | | No* |

| | | 2012 | | 0 | | 33,732 | | 33,732 | | $463,478 | | Yes |

| | | 2011 | | 0 | | 24,787 | | 24,787 | | $596,375 | | N/A |

| | |

|

| | | * Due to a reduction in the Company's share price, Mr. Dalton did not meet the share ownership target for 2012. Under the Director Share Ownership Policy (refer to page 36), directors have a twelve-month grace period to reach the share ownership target. To enable Mr. Dalton to meet such target, he has elected to receive a portion of his 2013 retainer in DDSUs. |

| | |

|

| | | Options Held10 | | | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | | Number Granted | | Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

Kevin S. Dunne

Age: 641

Tortola, British Virgin

Islands

Director since 2003

Independent2

2012 Vote Result

98.16% FOR

| | | Kevin Dunne has held various international senior and executive management positions with BP plc (international integrated oil and gas company), including General Manager of Abu Dhabi Company for Onshore Oil Operations (ADCO), a BP joint venture, from 1994 to 2001, Corporate Associate President of BP Indonesia from 1991 to 1994 and Corporate Head of Strategy for the BP Group based in London from 1990 to 1991. Mr. Dunne holds a Bachelor's degree in Chemical Engineering and a Master of Science in Management degree. Mr. Dunne is a Fellow of the Institution of Chemical Engineers and a Chartered Engineer. |

| | |

|

| | | Board/Committee Membership | | Attendance3 | | Attendance (Total) |

| | |

|

| | | Board | | 12/12 | | 100% | | | | |

| | | Health, Safety, Environment & Corporate Responsibility (Chair) | | 3/3 | | 100% | | 19/19 | | 100% |

| | | Reserves | | 4/4 | | 100% | | | | |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | None | | N/A |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | None | | N/A |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common Shares6 | | Deferred Share Units (DDSUs)7 | | Total of Common

Shares and DDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?9 |

| | |

|

| | | 2013 | | 0 | | 55,712 | | 55,712 | | $707,542 | | Yes |

| | | 2012 | | 0 | | 41,670 | | 41,670 | | $572,546 | | Yes |

| | | 2011 | | 9,000 | | 32,587 | | 41,587 | | $1,000,583 | | Yes |

| | |

|

| | | Options Held10 | | | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | | Number Granted | | Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

See footnotes on page 13.

MANAGEMENT PROXY CIRCULAR 9

Harold N. Kvisle

Age: 601

Calgary, Alberta

Canada

Director since 2010

Non-Independent2

2012 Vote Result

93.47% FOR

| | | Harold Kvisle was appointed President and CEO of the Company on September 10, 2012. Mr. Kvisle was the President and Chief Executive Officer of TransCanada Corporation (pipeline and power company) or its predecessor TransCanada PipeLines Limited from May 2001 until his retirement in June 2010. Prior to his employment with TransCanada Mr. Kvisle was the President of Fletcher Challenge Energy Canada (oil and gas company) from 1990 to 1999. Mr. Kvisle has worked in the oil and gas industry since 1975 and in the utilities and power industries since 1999. Mr. Kvisle holds a Bachelor of Science with Distinction in Engineering from the University of Alberta and a Master of Business Administration from the University of Calgary. |

| | |

|

| | | Board/Committee Membership | | Attendance3 | | Attendance (Total) |

| | |

|

| | | Board | | 12/12 | | 100% | | | | |

| | | Executive | | 0/0 | | N/A | | 20/20 | | 100% |

| | | Reserves (Chair)* | | 3/3 | | 100% | | | | |

| | | Human Resources* | | 5/5 | | 100% | | | | |

| | |

|

| | | Note: Following Mr. Kvisle's appointment as President and Chief Executive Officer of the Company effective September 10, 2012, he became a non-independent director and stepped down as a member of the Reserves Committee and Human Resources Committee. His attendance on the Reserves and Human Resources Committees reflects all meetings held from January 1, 2012 to September 9, 2012. |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | ARC Resources Ltd. | | Health, Safety & Environment (Chair) |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | Nature Conservancy of Canada (Chair) | | N/A |

| | | Northern Blizzard Resources Inc. | | N/A |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common

Shares6 | | Deferred

Share Units

(DDSUs)7 | | Deferred

Share Units

(EDSUs)11 | | Total of Common

Shares, DDSUs and EDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?12 |

| | |

|

| | | 2013 | | 38,716 | | 44,378 | | 466,339 | | 549,433 | | $6,977,799 | | N/A |

| | | 2012 | | 35,000 | | 23,121 | | 0 | | 58,121 | | $798,583 | | N/A |

| | | 2011 | | 17,000 | | 6,510 | | 0 | | 23,510 | | $565,651 | | N/A |

| | |

|

| | | Options Held | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | | Number Granted | | Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

Brian M. Levitt

Age: 651

Westmount, Quebec

Canada

Independent2

| | | Brian Levitt is Chairman of the Toronto Dominion Bank and non-executive co-Chair of Osler, Hoskin & Harcourt LLP (law firm). Mr. Levitt joined Osler in 1976. In 1991, he became President and was subsequently named CEO of Imasco Limited (a Canadian consumer products and services company). Imasco was sold in 2000 and Mr. Levitt returned to Osler in 2001. Mr. Levitt holds a law degree from the University of Toronto, where he also completed his Bachelor of Applied Science degree in Civil Engineering. |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | The Toronto-Dominion Bank (Chairman) | | Corporate Governance (Chair); Human Resources |

| | | Domtar Corporation | | Finance (Chair); Nominating & Corporate Governance |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | Montreal Museum of Fine Arts (Chair) | | |

| | | C.D. Howe Institute (Vice Chair) | | |

| | | Fednav Limited | | |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common Shares6 | | Deferred Share Units (DDSUs)7 | | Total of Common

Shares and DDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?9 |

| | |

|

| | | 2013 | | 30,000 | | 0 | | 30,000 | | $381,000 | | N/A |

| | |

|

| | | Options Held10 | | | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | | Number Granted | | Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

See footnotes on page 13.

10 TALISMAN ENERGY

Lisa A. Stewart

Age: 551

Houston, Texas

United States

Director Since 2009

Independent2

2012 Vote Results

92.70% FOR

| | | Lisa Stewart became the Chief Executive Officer of Sheridan Production Partners (oil and gas production company) in September 2006. Prior to that, Ms. Stewart was President of El Paso Exploration & Production (natural gas producer) from February 2004 to August 2006. Prior to her time at El Paso, Ms. Stewart worked for Apache Corporation for 20 years beginning in 1984 in a number of capacities. Her last position with Apache was Executive Vice-President of Business Development and E&P Services. Ms. Stewart holds a Bachelor of Science in Petroleum Engineering from the University of Tulsa, where she is a member of the College of Engineering and Natural Sciences Hall of Fame. She is also a member of the Society of Petroleum Engineers and Independent Petroleum Association of America (IPAA). |

| | |

|

| | | Board/Committee Membership | | Attendance3 | | Attendance (Total) |

| | |

|

| | | Board | | 12/12 | | 100% | | | | |

| | | Human Resources | | 6/6 | | 100% | | 22/22 | | 100% |

| | | Reserves (Chair) | | 4/4 | | 100% | | | | |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | None | | N/A |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | Sheridan Production Partners (Chair) | | N/A |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common Shares6 | | Deferred Share Units (DDSUs)7 | | Total of Common

Shares and DDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?9 |

| | |

|

| | | 2013 | | 0 | | 48,235 | | 48,235 | | $612,585 | | N/A |

| | | 2012 | | 0 | | 26,539 | | 26,539 | | $364,646 | | N/A |

| | | 2011 | | 0 | | 11,854 | | 11,854 | | $285,207 | | N/A |

| | |

|

| | | Options Held10 | | | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | | Number Granted | | Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

Peter W. Tomsett

Age: 551

West Vancouver,

British Columbia

Canada

Director since 2009

Independent2

2012 Vote Result

92.55% FOR

| | | Peter Tomsett was the President and Chief Executive Officer of Placer Dome Inc. (mining company) from September 2004 to January 2006. Mr. Tomsett was with Placer Dome for 20 years in a number of capacities. Prior to becoming President and Chief Executive Officer, he was Executive Vice-President of Placer Dome Asia Pacific and Africa. Mr. Tomsett graduated with a Bachelor of Engineering in Mining Engineering from the University of New South Wales and a Master of Science in Mineral Production Management from Imperial College in London. |

| | |

|

| | | Board/Committee Membership | | Attendance3 | | Attendance (Total) |

| | |

|

| | | Board | | 12/12 | | 100% | | | | |

| | | Human Resources | | 6/6 | | 100% | | | | |

| | | Health, Safety, Environment & Corporate | | | | | | 21/21 | | 100% |

| | | Responsibility | | 3/3 | | 100% | | | | |

| | | Executive | | 0/0 | | N/A | | | | |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | Silver Standard Resources Inc. (Chairman) | | Governance |

| | | North American Energy Partners Inc. | | Compensation (Chair); Risk & HSE |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | None | | N/A |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common Shares6 | | Deferred Share Units (DDSUs)7 | | Total of Common

Shares and DDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?9 |

| | |

|

| | | 2013 | | 0 | | 49,678 | | 49,678 | | $630,911 | | N/A |

| | | 2012 | | 0 | | 27,359 | | 27,359 | | $375,913 | | N/A |

| | | 2011 | | 0 | | 11,830 | | 11,830 | | $284,630 | | N/A |

| | |

|

| | | Options Held10 | | | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | | Number Granted | | Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

See footnotes on page 13.

MANAGEMENT PROXY CIRCULAR 11

Michael T. Waites

Age: 591

Vancouver,

British Columbia

Canada

Director since 2011

Independent2

2012 Vote Result

98.10% FOR

| | | Michael Waites, President and Chief Executive Officer of Finning International Inc. (heavy equipment dealer and service company) since May 2008, announced his retirement from Finning in 2013, but will continue to serve as President and CEO until a replacement is appointed. Prior to that, Mr. Waites was Executive Vice President and Chief Financial Officer of Finning. He also served as a member of the board of directors of Finning for three years prior to his appointment as Executive Vice President and Chief Financial Officer. Prior to joining Finning in May 2006, Mr. Waites was Executive Vice President and Chief Financial Officer at Canadian Pacific Railway (railway and logistics company) since July 2000, and was also Chief Executive Officer U.S. Network of Canadian Pacific Railway. Previously, he was Vice President and Chief Financial Officer at Chevron Canada Resources (integrated oil and gas company). Mr. Waites holds a Bachelor of Arts (Honours) in Economics from the University of Calgary, a Master of Business Administration from Saint Mary's College of California, and a Masters of Arts, Graduate Studies in Economics from the University of Calgary. He has also completed the Executive Program at The University of Michigan Business School. |

| | |

|

| | | Board/Committee Membership | | Attendance3 | | Attendance (Total) |

| | |

|

| | | Board | | 11/12 | | 92% | | | | |

| | | Audit | | 6/6 | | 100% | | 21/22 | | 95% |

| | | Reserves | | 4/4 | | 100% | | | | |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | Finning International Inc. | | Environment, Health & Safety |

| | |

|

| | | Note: Mr. Waites will be retiring from Finning and will not seek re-election as a director at Finning's 2013 annual meeting of shareholders. |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | None | | N/A |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common Shares6 | | Deferred Share Units (DDSUs)7 | | Total of Common

Shares and DDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?9 |

| | |

|

| | | 2013 | | 4,100 | | 32,734 | | 36,834 | | $467,792 | | N/A |

| | | 2012 | | 4,100 | | 11,353 | | 15,453 | | $212,324 | | N/A |

| | |

|

| | | Options Held10 | | | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | | Number Granted | | Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

Charles R. Williamson

Age: 641

Sonoma, California

United States

Director since 2006

Independent2

2012 Vote Result

98.34% FOR

| | | Charles Williamson was the Executive Vice-President of Chevron Corporation (integrated oil and gas company) from August until his retirement in December 2005. From 2001 to 2005, he was Chairman and Chief Executive Officer of Unocal Corporation ("Unocal") (oil and gas exploration and development company) and held various executive positions within Unocal, including Executive Vice President, International Energy Operations and Group Vice President, Asia Operations prior to 2001. Dr. Williamson holds a Bachelor of Arts degree in Geology, a Master of Science degree in Geology and a Doctorate in Geology. |

| | |

|

| | | Board/Committee Membership | | Attendance3 | | Attendance (Total) |

| | |

|

| | | Board (Chairman) | | 12/12 | | 100% | | | | |

| | | Governance & Nominating | | 3/3 | | 100% | | 15/15 | | 100% |

| | | Executive (Chair) | | 0/0 | | N/A | | | | |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | Weyerhaeuser Company (Chairman) | | Executive |

| | | PACCAR Inc. | | Compensation; Nominating & Governance |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | Greyrock Energy Inc. | | Advisory Board |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common Shares6 | | Deferred Share

Units (DDSUs)7 | | Total of Common

Shares and DDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?9 |

| | |

|

| | | 2013 | | 0 | | 161,088 | | 161,088 | | $2,045,818 | | N/A |

| | | 2012 | | 0 | | 115,486 | | 115,486 | | $1,586,778 | | N/A |

| | | 2011 | | 0 | | 83,330 | | 83,330 | | $2,004,920 | | N/A |

| | |

|

| | | Options Held10 | | | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | | Number Granted | | Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

See footnotes on page 13.

12 TALISMAN ENERGY

Charles M. Winograd

Age: 651

Toronto, Ontario

Canada

Director since 2009

Independent2

2012 Vote Result

97.53% FOR

| | | Charles (Chuck) Winograd is Senior Managing Partner of Elm Park Credit Opportunities Fund (mid-market lending limited partnership). He is also President of Winograd Capital Inc. (external consulting and private investments firm). From 2001 to 2008, Mr. Winograd was Chief Executive Officer of RBC Capital Markets (investment bank). When RBC Dominion Securities (investment bank) acquired Richardson Greenshields in 1996, Mr. Winograd became Deputy Chairman and a director. He was appointed to the position of President and Chief Operating Officer of RBC Dominion Securities in 1998. Mr. Winograd held several executive postings in Richardson Greenshields (privately owned investment dealer) until becoming President and Chief Executive Officer in 1987 and Chairman and Chief Executive Officer in 1991. Mr. Winograd holds a Master of Business Administration degree from the University of Western Ontario and is a Chartered Financial Analyst (CFA). |

| | |

|

| | | Board/Committee Membership | | Attendance3 | | Attendance (Total) |

| | |

|

| | | Board | | 12/12 | | 100% | | | | |

| | | Audit | | 6/6 | | 100% | | 21/21 | | 100% |

| | | Governance & Nominating (Chair) | | 3/3 | | 100% | | | | |

| | |

|

| | | Other Public Board Memberships4 | | Other Public Board Committee Memberships |

| | |

|

| | | RioCan Real Estate Investment Trust | | Nominating & Governance (Chair); Investment |

| | | TMX Group Inc. (Chairman) | | Human Resources; Governance |

| | |

|

| | | Non-Public Board Memberships5 | | Non-Public Board Committee Memberships |

| | |

|

| | | Pathways to Education Canada | | Nil |

| | | Tamir Fishman (Israel) (Chairman) | | Nil |

| | | Mount Sinai Hospital | | Business Development (Chair) |

| | | James Richardson & Sons, Limited | | Compensation and Human Resources (Chair); Special Advisory Committee |

| | |

|

| | | Securities Held | | | | | | |

| | |

|

| | | Year | | Common Shares6 | | Deferred Share

Units (DDSUs)7 | | Total of Common

Shares and DDSUs | | Total Amount

at Risk8 | | Minimum Share

Ownership Met?9 |

| | |

|

| | | 2013 | | 0 | | 46,288 | | 46,288 | | $587,858 | | N/A |

| | | 2012 | | 0 | | 28,361 | | 28,361 | | $389,680 | | N/A |

| | | 2011 | | 0 | | 14,221 | | 14,221 | | $342,157 | | N/A |

| | |

|

| | | Options Held10 | | | | | | | | | | |

| | |

|

| | | Date Granted | | Expiry Date | | Number Granted | | Exercise Price | | Total Unexercised | | Value of Unexercised

Options |

| | |

|

| | | None | | | | | | | | | | |

|

- 1.

- Ages are calculated as at March 1, 2013.

- 2.

- Please see "Independence of Directors" as described on page 21.

- 3.

- The number of meetings held in 2012 by: the Board of Directors included 7 regularly scheduled meetings and 5 special meetings; the Audit Committee included 6 regularly scheduled meetings; the Human Resources Committee ("HRC") included 5 regularly scheduled meetings and 1 special meeting; the Governance and Nominating Committee included 3 regularly scheduled meetings; the Health, Safety, Environment and Corporate Responsibility ("HSECR") Committee included 3 regularly scheduled meetings; the Reserves Committee included 4 regularly scheduled meetings; and the Executive Committee did not meet in 2012.

- 4.

- Refers only to issuers that are Canadian reporting issuers or the equivalent in a foreign jurisdiction.

- 5.

- Refers to directorships of non-public companies, organizations or other entities that require a significant time commitment from the nominee listed.

- 6.

- Refers to the number of Common Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, as provided by the nominee, as of March 1, 2011, March 1, 2012 and March 1, 2013, respectively, where applicable.

- 7.

- Refers to the number of deferred share units ("DDSUs") held by the nominee under the Deferred Share Unit Plan for Non-Employee Directors (the "DDSU Plan") as described on page 36, as of March 1, 2011, March 1, 2012 and March 1, 2013, respectively, where applicable. Mr. Kvisle earned DDSUs for the period January 1, 2012 to September 9, 2012 as an independent director. Effective September 10, 2012, Mr. Kvisle became a non-independent director; as a non-independent director, Mr. Kvisle neither receives compensation as a director nor is he eligible to participate in the Director Deferred Share Unit Plan.

- 8.

- The "Total Amount at Risk" is determined by multiplying the total of Common Shares and/or DDSUs/EDSUs held by the nominee as of March 1, 2011, March 1, 2012 and March 1, 2013, respectively, where applicable, by the closing share price of the Company's Common Shares traded on the Toronto Stock Exchange ("TSX") on March 1, 2011 ($24.06), March 1, 2012 ($13.74) and March 1, 2013 ($12.70), respectively, where applicable.

- 9.

- Please see the "Director Share Ownership Policy" as described on page 36 for details on the value of Common Shares and/or DDSUs each independent nominee is required to hold.

- 10.

- None of the independent directors hold any unexercised options and no options are outstanding under the Director Stock Option Plan described on page 37. No stock options have been granted to non-executive directors since 2003. As a result of the current compensation structure for non-executive directors, the Company does not intend to grant further stock options under the Director Stock Option Plan.

- 11.

- Refers to the number of executive deferred share units ("EDSUs") held by Mr. Kvisle, as described on page 63, as of March 1, 2013.

- 12.

- Please see the "Executive Share Ownership Guidelines" as described on page 64 for details on the value of equity Mr. Kvisle is required to hold and the "Share Ownership Table" on page 71 for Mr. Kvisle's ownership level.

MANAGEMENT PROXY CIRCULAR 13

Director Attendance

In 2012, directors attended, in aggregate, 99% of Board and Committee meetings.

Board members are expected to attend Board meetings and meetings of Committees on which they are a member.

|

|

|

|

|

|

|

|

| Director | | 2012

Board Meetings

Attended1 | | 2012

Committee Meetings

Attended1 | | 2012 Combined Board and

Committee Meetings

Attended |

|

| Christiane Bergevin | | 12 of 12 | | 6 of 6 | | 18 of 18 |

|

| Donald J. Carty | | 12 of 12 | | 12 of 12 | | 24 of 24 |

|

| William R.P. Dalton | | 12 of 12 | | 13 of 13 | | 25 of 25 |

|

| Kevin S. Dunne | | 12 of 12 | | 7 of 7 | | 19 of 19 |

|

| Harold N. Kvisle | | 12 of 12 | | 8 of 8 | | 20 of 20 |

|

| Lisa A. Stewart | | 12 of 12 | | 10 of 10 | | 22 of 22 |

|

| Peter W. Tomsett | | 12 of 12 | | 9 of 9 | | 21 of 21 |

|

| Michael T. Waites | | 11 of 12 | 2 | 10 of 10 | | 21 of 22 |

|

| Charles R. Williamson | | 12 of 12 | | 3 of 3 | | 15 of 15 |

|

| Charles M. Winograd | | 12 of 12 | | 9 of 9 | | 21 of 21 |

|

- 1.

- For details on the number of Board and committee meetings attended by each director, please refer to the individual director profiles on pages 8 through 13 of this Circular.

- 2.

- Mr. Waites missed one regularly scheduled meeting due to a schedule conflict.

Additional information regarding individual directors, Board committees and the Board as a whole can be found in Sections III ("Corporate Governance") and IV ("Director Compensation") of this Circular.

Majority Voting Policy

The form of proxy or voting instruction form permits shareholders to vote "for" or to "withhold" their vote for each director nominee. The Board has adopted a majority voting policy which requires that any nominee for director who, on a ballot taken on the election of directors, has a greater number of votes withheld from voting than the number of votes received for his or her election shall tender his or her resignation to the Chairman of the Board of Directors, subject to acceptance by the Board.

In determining whether to accept the resignation, the best interests of the Corporation and all factors deemed relevant will be considered. The majority voting policy only applies to uncontested elections, meaning elections where the number of nominees for election is equal to the number of directors to be elected as set out in the management proxy circular for the particular meeting. The Governance and Nominating Committee is required to consider the resignation, having regard to the best interests of the Company and all factors considered relevant and to make a recommendation to the Board with respect to the action to be taken with respect to the resignation.

The Board is required to make its decision and announce it in a press release within 90 days of the annual meeting, including, if applicable, the reasons for rejecting a resignation offer. A director who is required to tender a resignation under the majority voting policy will not participate in the deliberations of the Governance and Nominating Committee or the Board on any resignation offers from the same meeting unless there are fewer than three directors who are not required to tender a resignation, in which event the Board will proceed in making the determination. If a resignation is accepted, the Board may fill the vacancy created by the resignation.

Shareholders should note that, as a result of the majority voting policy, a withhold vote is effectively the same as a vote against a director nominee in an uncontested election.

14 TALISMAN ENERGY

Appointment of Auditor

Shareholders will be asked at the Meeting to pass a resolution reappointing Ernst & Young LLP, Chartered Accountants, as auditor of the Company, to hold office until the next annual meeting of shareholders. To be effective, the resolution must be passed by a majority of the votes cast thereon by the shareholders at the Meeting. Ernst & Young LLP or its predecessor has been the auditor of the Company or its predecessor since 1982.

Audit Fees and Pre-Approval of Audit Services

The following table presents fees for the audits of the Company's annual Consolidated Financial Statements for 2012 and 2011 and for other services provided by Ernst & Young LLP:

|

|

|

|

|

|

| | | 2012 | | 2011 |

|

| Audit and Internal Controls Attestation Fees | | 5,460,137 | | 5,566,042 |

|

| Audit-Related Fees | | 317,573 | | 1,214,082 |

|

| Tax Fees | | 339,224 | | 540,861 |

|

| All Other Fees1 | | 796 | | 4,910 |

|

| Total | | 6,117,730 | | 7,325,895 |

|

- 1.

- Annual subscription to online accounting database.

The audit-related fees are primarily for assistance in connection with the Company's conversion to International Financial Reporting Standards, audit considerations with respect to global financial system implementation, prospectus filings, pension plan audits and attestation procedures related to cost certifications and government compliance. Tax fees are primarily for tax compliance and tax advisory services. The Audit Committee has concluded that the provision of tax services is compatible with maintaining Ernst & Young's independence.

Please see Talisman's Annual Information Form for information about specific procedures regarding the pre-approval of services provided by its external auditors, as well as the Audit Committee's terms of reference.

Advisory Vote on Executive Compensation

Shareholders will be asked at the Meeting to vote, on an advisory basis, on the acceptance of the Company's approach to executive compensation as set forth in the section entitled "Executive Compensation" in this Circular.

The Board of Directors believes that shareholders should have the opportunity to fully understand the objectives, philosophy and principles that guide the executive compensation-related decisions made by the HRC and the Board of Directors. Please see pages 40 to 43 for the Letter of Shareholders from the HRC Chair.

The Company held its first voluntary, non-binding advisory vote on executive compensation in May 2011, and again in May 2012. These votes gave shareholders the opportunity to provide feedback to the Board on the Company's approach to executive compensation. In 2011 and 2012, the Company's shareholders voted 92.92% and 87.52%, respectively, in favour of the Company's approach to executive compensation.

As part of the Company's ongoing commitment to strong corporate governance, the Board of Directors has again approved a non-binding advisory vote on executive compensation at the Meeting this year with the intention that this shareholder advisory vote will form an integral part of the Board's shareholder engagement process around executive compensation.

As the vote will be an advisory vote, the results will not be binding upon the Board of Directors. The Board, and specifically the HRC, will not be obligated to take any compensation actions, or make any adjustments to executive compensation programs or plans, as a result of the vote. The Company will disclose the results of the shareholder advisory vote as part of its report on voting results for the Meeting.

Proposed Resolution

At the Meeting, shareholders will be asked to vote on the following resolution:

BE IT RESOLVED, on an advisory basis and not to diminish the role and responsibilities of the Company's Board of Directors, the shareholders of the Company accept the Company's approach to executive compensation disclosed in the Management Proxy Circular of the Company dated March 6, 2013.

Board and Management Recommendation

The Board of Directors unanimously recommends that shareholders vote FOR the resolution.

MANAGEMENT PROXY CIRCULAR 15

III. CORPORATE GOVERNANCE

This section describes Talisman's corporate governance framework, including the structures and processes regarding the direction, management and oversight of the Company and the relationships among the Board of Directors, management, shareholders and other stakeholders.

|

| Communications and Shareholder Engagement | | 16 |

|

| | Shareholder Communications | | 16 |

|

| | Say on Pay | | 17 |

|

| Standards and Practices | | 17 |

|

| Governance Principles | | 17 |

|

| | Policy on Business Conduct and Ethics | | 17 |

|

| | Disclosure Policy | | 18 |

|

| Role of the Board | | 18 |

|

| | Board Roles and Responsibilities | | 18 |

|

| | 2012 Governance Activities of the Board | | 19 |

|

| | Management of Risk | | 19 |

|

| | Strategic Planning | | 20 |

|

| About the Board | | 20 |

|

| | Board Size | | 20 |

|

| | Position Descriptions | | 21 |

|

| | Independence of Directors | | 21 |

|

| | Other and Interlocking Directorships | | 22 |

|

| | In Camera Sessions | | 23 |

|

| | Director Orientation and Continuing Education | | 23 |

|

| | Director Qualifications, Expectations and Number of Directorships | | 24 |

|

| | Performance Assessments | | 25 |

|

| | List of Director Candidates | | 26 |

|

| | Board Succession Policy – Term Limits, Tenure and Retirement | | 26 |

|

| Board Committees | | 27 |

|

| | Reports of the Committees | | 27 |

|

Communications and Shareholder Engagement

Shareholder Communications

The Company's Board of Directors believes in the importance of regular and open dialogue with shareholders. To achieve that objective, the Board oversees the Company's communications programs to ensure that Talisman effectively communicates with and receives feedback from shareholders. From a broader perspective, the Board is responsible for ensuring that the Company has appropriate processes in place to effectively communicate with employees, government authorities, other stakeholders and the public. The Company's Investor Relations Department and Corporate and Investor Communications Department both have the specific mandate of engaging and responding in a timely manner to all inquiries received from shareholders, analysts and potential investors. Shareholder inquiries or comments are forwarded to the appropriate individual or to senior management depending on the nature of the inquiry or comments received.

Practices that the Company employs to encourage communication with shareholders include:

- •

- Conducting executive tours and participating in industry conferences, including annual investor open houses with analysts and investors;

- •

- Meeting informally with investors and analysts, in accordance with the Disclosure Policy described below;

- •

- Holding quarterly earnings calls which include open question and answer sessions. Transcripts of these calls are available on the Company's external website;

16 TALISMAN ENERGY

- •

- Maintaining an investor email address and phone number as well as a confidential ethics hotline which may be used by all shareholders;

- •

- Maintaining an external website with corporate and investor information posted on it, located at www.talisman-energy.com;

- •

- Publishing an annual report and corporate responsibility report in addition to regulatory filings and issuing news releases; and

- •

- Holding an annual general meeting in person, which is also available via webcast. Shareholders are provided with opportunities to ask questions of the Board and senior management following completion of the formal business of the meeting.

Say on Pay

The Company will again hold a non-binding advisory vote on executive compensation at the Meeting this year.

As part of the Company's ongoing commitment to strong corporate governance, the Board of Directors has again approved a non-binding advisory vote on executive compensation at the Meeting this year.

Standards & Practices

The Company's corporate governance practices satisfy all the existing guidelines for effective corporate governance established by National Instrument 58-101 and National Policy 58-201 (collectively, the "CSA Rules"), all of the New York Stock Exchange ("NYSE") corporate governance listing standards applicable to foreign private issuers and a substantial majority of the NYSE corporate governance listing standards applicable to United States companies. As required by the NYSE corporate governance listing standards, the Company has disclosed, on its website at www.talisman-energy.com, the significant differences between its corporate governance practices and the requirements applicable to US companies listed on the NYSE.

Summaries of the mandates of the Board of Directors, its committees (including position descriptions for the Chair of each committee), the Chairman and the CEO may be obtained from the Company website at www.talisman-energy.com or upon request from: Corporate and Investor Communications Department, Talisman Energy Inc., 2000, 888 - 3rd Street SW, Calgary, Alberta, T2P 5C5, or by email at tlm@talisman-energy.com.

Governance Principles

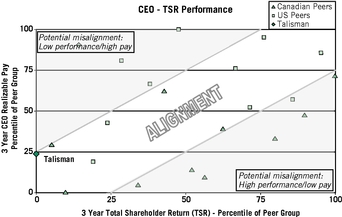

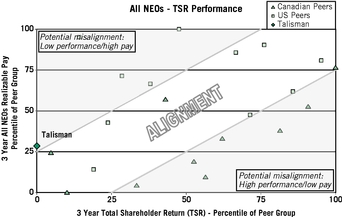

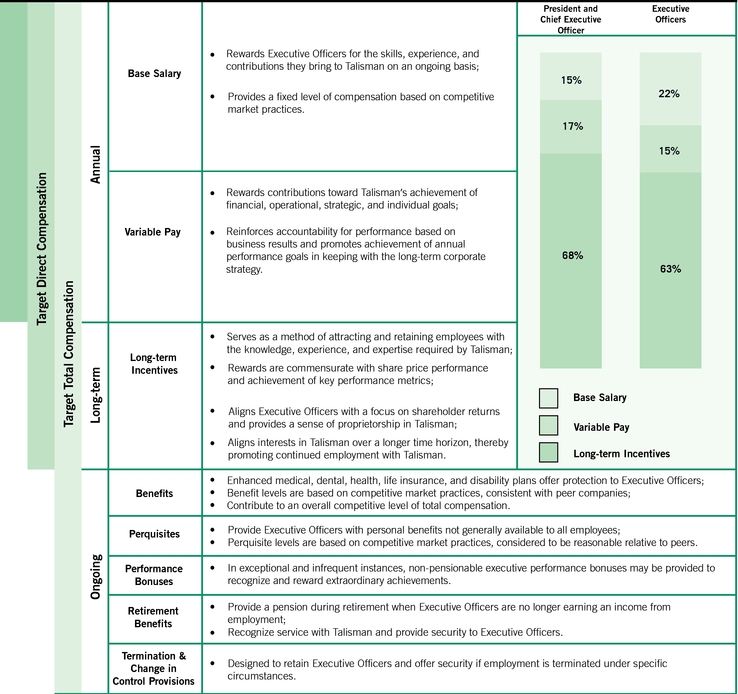

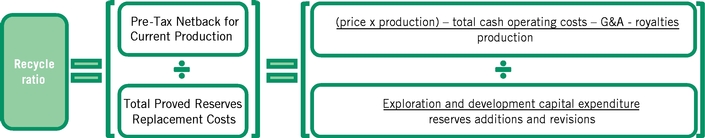

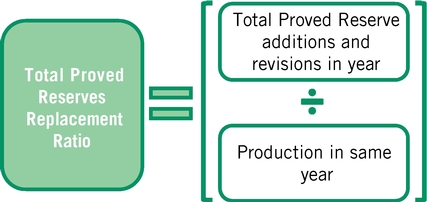

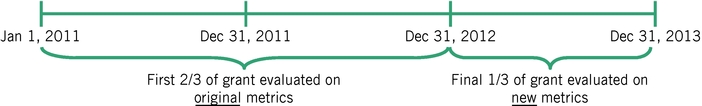

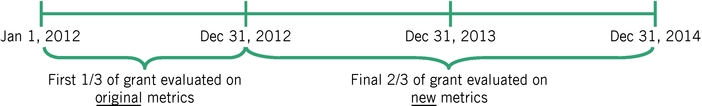

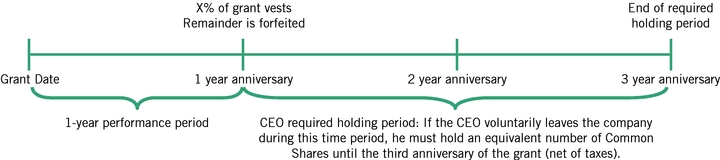

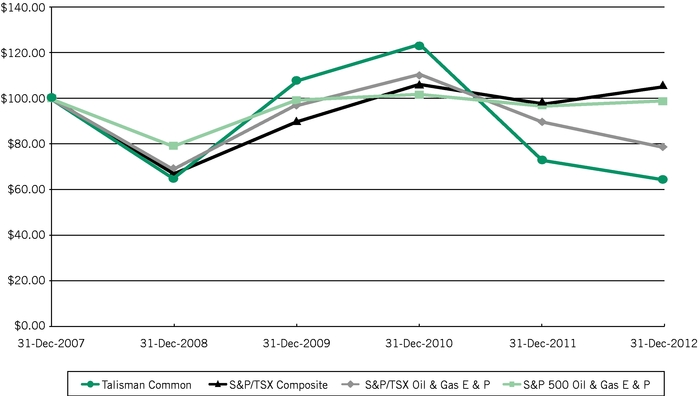

Policy on Business Conduct and Ethics