Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-284411

11,832,277 ORDINARY SHARES,

2,908,047 WARRANTS TO PURCHASE ORDINARY SHARES AND

2,908,047 ORDINARY SHARES UNDERLYING WARRANTS

of

TNL MEDIAGENE

This prospectus also relates to the resale from time to time by certain selling securityholders named in this prospectus or their permitted transferees (collectively, the “Selling Securityholders”) of up to 11,832,277 ordinary shares, par value $0.0001 per share, of TNL Mediagene (“TNL Mediagene Ordinary Shares”) under the Securities Act of 1933, as amended (the “Securities Act”), comprising: (a) the offer and resale of up to 2,002,222 TNL Mediagene Ordinary Shares by 3i, LP (“3i”); (b) the offer and resale of up to 8,000,000 TNL Mediagene Ordinary Shares, including 119,048 TNL Mediagene Ordinary Shares as the Tumim Commitment Shares (as defined below), by Tumim Stone Capital LLC (“Tumim”); (c) 317,601 TNL Mediagene Ordinary Shares (the “Existing PIPE Conversion Shares”) issued pursuant to the conversion of certain subordinated unsecured convertible promissory notes in aggregate principal amounts of $1,725,471 (the “2024 TNL Mediagene Convertible Notes”) and $1,000,000 (the “2024 TNL Mediagene Subordinated Unsecured Convertible Note” and together with the 2024 TNL Mediagene Convertible Notes, the “Existing PIPE Convertible Notes”) issued to certain third-party investors (each, a “Existing PIPE Convertible Note Investor”); (d) 57,849 TNL Mediagene Ordinary Shares (the “DaEX Conversion Shares”) issued pursuant to the conversion rights (the “DaEX Conversion Rights”) held by DaEx Intelligent Co., Inc. (“DaEX”), TNL Mediagene’s subsidiaries, and each of certain of DaEX’s non-controlling shareholders (the “DaEX Conversion Right Holders”); and (e) 1,454,605 TNL Mediagene Ordinary Shares (the “November PIPE Conversion Shares”), issued pursuant to the conversion of certain subordinated unsecured convertible promissory notes in aggregate principal amount of $4,355,000 (the “November PIPE Convertible Notes”) issued to certain third-party investors as well as certain members of Blue Ocean’s board of directors, management team and advisory board and other shareholders of Blue Ocean (each, a “November PIPE Convertible Note Investor”). We are also registering the offer and resale, from time to time of (i) up to 708,047 TNL Mediagene Warrants, consisting of the PIPE Warrants, issued pursuant to the Sponsor Warrant Assignment Agreements, and up to 708,047 TNL Mediagene Ordinary Shares issuable upon exercises of up to 708,047 TNL Mediagene Warrants by the Existing PIPE Convertible Note Investors and the November PIPE Convertible Note Investors or their permitted transferees; and (ii) up to 2,200,000 TNL Mediagene Warrants and up to 2,200,000 TNL Mediagene Ordinary Shares issuable upon exercises of up to 2,200,000 TNL Mediagene Warrants by Mediagene Inc., our subsidiary, or its permitted transferees. See “Selling Securityholders” for details of these securities.

On November 25, 2024, we entered into a securities purchase agreement for issuance by us of convertible notes (the “3i Note SPA”) with 3i, and on December 13, 2024, we issued and sold a convertible note in the aggregate principal amount of $4,722,222 ($4,250,000 purchase price with an original issue discount of 10%) (the “Initial Note”) under the 3i Note SPA to 3i, pursuant to which we may issue TNL Mediagene Ordinary Shares to 3i in lieu of the principal and interest payment of the Initial Note in certain circumstances described in this prospectus. We are not selling any securities under this prospectus and will not receive any of the proceeds from the resale of TNL Mediagene Ordinary Shares by 3i.

Concurrently on November 25, 2024, we entered an ordinary share purchase agreement for an equity line of credit (the “Tumim ELOC SPA”) with Tumim, pursuant to which Tumim committed to purchase, subject to certain conditions and limitations, up to $30.0 million of TNL Mediagene Ordinary Shares, at our direction from time to time, subject to the satisfaction of the terms and conditions in the Tumim ELOC SPA. On November 25, 2024, we became obligated to issue a number of TNL Mediagene Ordinary Shares (the “Tumim Commitment Shares”), to

Table of Contents

Tumim as consideration for its irrevocable commitment to purchase TNL Mediagene Ordinary Shares under the Tumim ELOC SPA. The number of Tumim Commitment Shares is calculated under the Tumim ELOC SPA by dividing (i) $450,000, by (ii) $3.78 (which is the lower of (A) the Nasdaq official closing price of the TNL Mediagene Ordinary Shares (as reflected on Nasdaq.com) of January 16, 2025 and (B) the average Nasdaq official closing price of the TNL Mediagene Ordinary Shares (as reflected on Nasdaq.com) for the five (5) consecutive trading days ending on January 16, 2025). On January 23, 2025, we have issued 119,048 TNL Mediagene Ordinary Shares as the Tumim Commitment Shares to Tumim. This prospectus also relates to the registration for offer and resale of up to 8,000,000 TNL Mediagene Ordinary Shares, consisting of the Tumim Commitment Shares and additional TNL Mediagene Shares which may be issuable to Tumim under the Tumim ELOC SPA up to $30.0 million (the “Tumim ELOC Shares”), by Tumim. We refer to the issuance of TNL Mediagene Ordinary Shares to Tumim, including the Tumim Commitment Shares and the Tumim ELOC Shares, if any, pursuant to the Tumim ELOC SPA as the “Tumim Transaction” and together with the transactions with 3i pursuant to the 3i Note SPA and Initial Note as the “3i and Tumim Transactions”. See “Summary” for a description of the 3i and Tumim Transactions and “Selling Securityholders” for additional information regarding 3i and Tumim.

We are not selling any securities under this prospectus and will not receive any of the proceeds from the resale of TNL Mediagene Ordinary Shares by Tumim. However, we may receive up to $30.0 million in gross proceeds from sales of TNL Mediagene Ordinary Shares to Tumim that we may make under the Tumim ELOC SPA from time to time after the date of this prospectus. TNL Mediagene Ordinary Shares being offered by Tumim may be issued pursuant to the Tumim ELOC SPA, whereby we have the right, but not the obligation, to sell to Tumim, and Tumim is obligated to purchase, up to $30.0 million in TNL Mediagene Ordinary Shares at a purchase price equal to 97% of the lowest daily volume-weighted average price of TNL Mediagene Ordinary Shares on Nasdaq (or any eligible substitute exchange) during the three (3) consecutive trading days immediately following the trading date on which a valid purchase notice is delivered to Tumim by us. TNL Mediagene Ordinary Shares will be sold by us to Tumim in privately negotiated transactions exempt from registration pursuant to Rule 506(b) of Regulation D under the Securities Act. See “Summary” for a description of the 3i and Tumim Transactions and “Selling Securityholders” for additional information regarding Tumim.

Our registration of the securities covered by this prospectus does not mean that either we or the Selling Securityholders will issue, offer or sell, as applicable, any of the securities. The Selling Securityholders may offer, sell or distribute all or part of the securities registered hereby for resale from time to time through public or private transactions at either prevailing market prices or at privately negotiated prices. The securities are being registered to permit the Selling Securityholders to sell the securities from time to time, in amounts, at prices and on terms determined at the time the Selling Securityholders offer and sell the securities covered by this prospectus. The Selling Securityholders may offer and sell the securities covered by this prospectus through ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of the securities offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

We will pay certain fees in connection with the registration of the securities and will not receive proceeds from the sale of the securities by the Selling Securityholders, as described in more detail in the section titled “Use of Proceeds” appearing elsewhere in this prospectus, except with respect to amounts received by the Company upon exercise of the TNL Mediagene Warrants to the extent such warrants are exercised for cash.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

TNL Mediagene Ordinary Shares are quoted on The Nasdaq Capital Market (“Nasdaq”) under the symbol “TNMG.” On February 6, 2025, the last reported trading date for TNL Mediagene Ordinary Shares, the closing price of TNL Mediagene Ordinary Shares was $2.47 per share.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, and are therefore eligible to take advantage of certain reduced reporting requirements otherwise applicable to other public companies.

Table of Contents

We are also a “foreign private issuer,” as defined in the Exchange Act and are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Investing in our securities involves a high degree of risk. Before buying any TNL Mediagene Ordinary Shares or TNL Mediagene Warrants you should carefully read the discussion of material risks of investing in such securities in “Risk Factors” beginning on page 8 of this prospectus and other risk factors contained in the documents incorporated by reference herein.

The date of this prospectus is February 14, 2025

Table of Contents

TABLE OF CONTENTS

Neither we nor the Selling Securityholders have authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we nor Selling Securityholders take any responsibility for, or provide any assurance as to the reliability of, any other information that others may give you. We and the Selling Securityholders are offering securities only in the United States and certain other jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the cover page of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities.

i

Table of Contents

For investors outside the United States: Neither we nor the Selling Securityholders have taken any action to permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

We are incorporated under the laws of the Cayman Islands and a majority of our outstanding securities is owned by non-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission (the “SEC”) we are currently, and expect to remain, eligible for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

ii

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus, which forms a part of a registration statement on Form F-1 filed with the United States Securities and Exchange Commission (the “SEC”) by TNL Mediagene, constitutes a prospectus of TNL Mediagene under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the TNL Mediagene Ordinary Shares and the TNL Mediagene Warrants. Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “TNL Mediagene” refer to TNL Mediagene (formerly “The News Lens Co., Ltd.”) together with its subsidiaries. All references in this prospectus to “Blue Ocean” refer to Blue Ocean Acquisition Corp.

MARKET, INDUSTRY, AND OTHER DATA

This prospectus contains estimates, projections and other information concerning TNL Mediagene’s industry, including market size and growth of the markets in which it participates, that are based on industry publications and reports and forecasts prepared by its management. In some cases, TNL Mediagene does not expressly refer to the sources from which these estimates and information are derived. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. Industry reports, publications, research, studies and forecasts generally state that the information they contain has been obtained from sources they believe to be reliable but that the accuracy and completeness of such information is not guaranteed. TNL Mediagene has not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which TNL Mediagene operates is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications and reports.

The sources of certain statistical data, estimates, and forecasts contained in this prospectus include internal surveys, independent industry surveys and publications, including reports by Google Analytics, Semrush Holdings Inc., Statista GmbH, the U.S. Census Bureau and Pew Research Center and other third-party research and publicly available information.

Certain estimates of market opportunity, including internal estimates of the addressable market for TNL Mediagene and forecasts of market growth, included in this prospectus may prove inaccurate. Market opportunity estimates and growth forecasts, whether obtained from third-party sources or developed internally, are subject to significant uncertainty and are based on assumptions and estimates that may prove to be inaccurate. The estimates and forecasts in this prospectus relating to the size of TNL Mediagene’s target market, market demand and adoption, capacity to address this demand, and pricing may prove to be inaccurate. The addressable market TNL Mediagene estimates may not materialize for many years, if ever, and even if the markets in which it competes meet the size estimates in this prospectus, TNL Mediagene’s business could fail to successfully address or compete in such markets, if at all.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Certain other amounts that appear in this prospectus may not sum due to rounding.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This prospectus includes trademarks, tradenames and service marks, certain of which belong to us and others that are the property of other organizations. Solely for convenience, trademarks, tradenames and service marks referred to in this prospectus appear without the ®, TM and SM symbols, but the absence of those symbols is not intended to indicate, in any way, that we will not assert our rights or that the applicable owner will not assert its rights to these trademarks, tradenames and service marks to the fullest extent under applicable law. We do not intend our use or display of other parties’ trademarks, tradenames or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

iii

Table of Contents

SELECTED DEFINITIONS

“Amended and Restated Warrant Agreement” | | means an assignment, assumption and amended and restated warrant agreement, dated as of December 4, 2024, by and among Blue Ocean, TNL Mediagene, Continental Stock Transfer & Trust Company (“Continental”), Computershare Inc. and Computershare Trust Company, N.A. (collectively with Computershare Inc., “Computershare”), pursuant to which Blue Ocean and Continental respectively assigned to TNL Mediagene and Computershare as TNL Mediagene’s warrant agent all of their rights, title, interests, and liabilities and obligations in and under the warrant agreement, dated December 2, 2021, by and between Blue Ocean and Continental. A copy of the Amended and Restated Warrant Agreement is included as Exhibit 4.1 hereto. |

“Ancillary Documents” | | means each agreement, document, instrument and/or certificate entered into in connection with the Merger Agreement or therewith and any and all exhibits and schedules thereto. |

“Apollo” | | means Apollo SPAC Fund I, L.P. and Apollo Credit Strategies Master Fund Ltd., to whom Apollo SPAC Fund I, L.P. transferred its Blue Ocean Class B Shares. |

“Blue Ocean Articles” | | means the current amended and restated memorandum and articles of association of Blue Ocean |

“Blue Ocean Class A Shares” | | means Class A ordinary shares of Blue Ocean, par value $0.0001 per share. |

“Blue Ocean Class B Shares” | | means Class B ordinary shares of Blue Ocean, par value $0.0001 per share. |

“Blue Ocean IPO” | | means the initial public offering of Blue Ocean, which was consummated on December 7, 2021. |

“Blue Ocean Ordinary Shares” | | means the Blue Ocean Class A Shares and the Blue Ocean Class B Shares. |

“Blue Ocean Private Placement Warrants” | | means an aggregate of 4,709,604 warrants of Blue Ocean, calculated by 9,225,000 warrants sold to Sponsor and Apollo in the private placements consummated concurrently with the Blue Ocean IPO, less 750,000 warrants which were forfeited pro rata by Sponsor and Apollo at the Closing Date in accordance with the Sponsor Lock-Up and Support Agreement, less 3,765,396 warrants, representing 50% of private placement warrants held by the Sponsor immediately prior to the Closing forfeited by Sponsor on the Closing Date as adjusted by the Forfeiture Ratio in accordance with the Sponsor Lock-Up and Support Agreement, each entitling its holder to purchase one Blue Ocean Class A Share at an exercise price of $11.50 per share, subject to adjustment. Blue Ocean Private Placement Warrants have been assumed by TNL Mediagene and converted into TNL Mediagene Warrants on the Closing Date upon completion of the Merger. |

“Blue Ocean Public Shareholders” | | means all holders of the Public Shares. |

“Blue Ocean Units” | | means the units of Blue Ocean issued in the Blue Ocean IPO, each consisting of one Blue Ocean Class A Share and one-half of one Public Warrant. |

iv

Table of Contents

“Blue Ocean Warrants” | | means the Public Warrants and the Blue Ocean Private Placement Warrants. |

“Cayman Companies Law” | | means the Companies Act (as amended) of the Cayman Islands. |

“Conversion” | | means the issuance of an aggregate of 4,743,749 Blue Ocean Class A Shares by Blue Ocean upon the conversion of an equal number of Founder Shares on June 21, 2024. Of the 4,743,749 Blue Ocean Class A Shares issued in the Conversion, an aggregate of 4,353,749 Blue Ocean Class A Shares was issued to the Sponsor and an aggregate of 390,000 Blue Ocean Class A Shares was issued to Norman Pearlstine, Joel Motley, Matt Goldberg, Priscilla Han, Apollo Credit Strategies Master Fund Ltd. and certain other holders of Founder Shares. The Sponsor retained one Founder Share. |

“Earn-Out Shares” | | means an aggregate of 2,726,418 TNL Mediagene Ordinary Shares issuable to the holders of Founder Shares within two years of the Closing in accordance with the Sponsor Lock-Up and Support Agreement, as part of the agreed consideration of the Merger in exchange for the 4,743,750 Founder Shares, as adjusted by the formula based on the Forfeiture Ratio in accordance with the Sponsor Lock-Up and Support Agreement. |

“Effective Time” | | means the effective time of the Merger. |

“Exchange Act” | | means the Securities Exchange Act of 1934, as amended. |

“Existing PIPE Investments” | | means, collectively, the issuance and sale of the Existing PIPE Convertible Notes, the conversion of the Existing PIPE Convertible Notes to Existing PIPE Conversion Shares pursuant to the terms thereof, and the transfer of PIPE Warrants to the Existing PIPE Convertible Note Investors pursuant to the Sponsor Warrant Assignment Agreements. |

“Forfeiture Ratio” | | means a ratio of 0.9812 used in the formulas for calculations of Blue Ocean Private Placement Warrants and Earn-Out Shares in accordance with to the Sponsor Lock-Up and Support Agreement. |

“Founder Shares” | | means an aggregate of 4,743,750 Blue Ocean Class B Shares issued by Blue Ocean to the Sponsor prior to the Blue Ocean IPO and as result of the share capitalization on December 2, 2021, and the Blue Ocean Class A Shares issued or issuable upon the conversion of such Blue Ocean Class B Shares in accordance with the Blue Ocean Articles. For the avoidance of doubt, the Founder Shares include the 4,743,749 Blue Ocean Class A Shares issued to the Sponsor, Norman Pearlstine, Joel Motley, Matt Goldberg, Priscilla Han, Apollo Credit Strategies Master Fund Ltd. and certain other shareholders of Blue Ocean in the Conversion. |

“IFRS” | | means the International Financial Reporting Standards as issued by the International Accounting Standards Board. |

“Merger Agreement” | | means the Agreement and Plan of Merger, dated as of June 6, 2023, by and among Blue Ocean, TNL Mediagene, and Merger Sub as amended by Amendment No. 1 to the Agreement and Plan of Merger dated as of May 29, 2024 and Amendment No. 2 to the Agreement and Plan of Merger, dated as of October 23, 2024, a copy of each of which is attached to this prospectus as Exhibits 2.1, 2.2 and 2.3, respectively. |

v

Table of Contents

“November PIPE Investments” | | Means, collectively, the November PIPE Convertible Notes, the conversion of the November PIPE Convertible Notes into the November PIPE Conversion Shares pursuant to the terms thereof, and the transfer of PIPE Warrants to the November PIPE Convertible Note Investors pursuant to the Sponsor Warrant Assignment Agreements. |

“PIPE Investments” | | means certain private investment in public equity (“PIPE”) transactions that TNL Mediagene and Blue Ocean entered into in connection with the Transactions prior to or substantially concurrently with the Closing, including the Existing PIPE Investments, the November PIPE Investments and the 3i and Tumim Transactions. |

“Public Shares” | | means all Blue Ocean Class A Shares issued in the Blue Ocean IPO. |

“Public Warrants” | | means the redeemable warrants of Blue Ocean issued in the Blue Ocean IPO, each entitling its holder to purchase one Blue Ocean Class A Share at an exercise price of $11.50 per share, subject to adjustment. |

“Reverse Share Split” | | means the reverse share split to cause the deemed value of the outstanding TNL Mediagene Ordinary Shares immediately prior to the Effective Time to equal $10.00 on a fully diluted basis, based on TNL Mediagene’s implied valuation immediately before the consummation of the Merger. |

“Securities Act” | | means the Securities Act of 1933, as amended. |

“Split Factor” | | means a factor of 0.11059896 used in the Reverse Share Split completed immediately prior to the Effective Time. |

“Sponsor” | | means Blue Ocean Sponsor, LLC. |

“Sponsor Lock-Up and Support Agreement” | | means an amended and restated letter agreement dated June 6, 2023, by and among Sponsor, Apollo, certain members of Blue Ocean’s board of directors, management team and advisory board and certain other shareholders of Blue Ocean, amended by the Amendment No. 1 to the Sponsor Lock-Up and Support Agreement dated October 23, 2024 by and among Sponsor, Blue Ocean and TNL Mediagene and the Amendment No. 2 to the Sponsor Lock-Up and Support Agreement dated December 3, 2024 by and among Sponsor, Blue Ocean and TNL Mediagene, a copy of each of which is attached to this prospectus as Exhibits 10.1, 10.2 and 10.3, respectively. |

“TNL Mediagene” | | means TNL Mediagene, a Cayman Islands exempted company, together as a group with its subsidiaries as the context requires |

“TNL Mediagene A&R Articles” | | means the amended and restated memorandum and articles of association of TNL Mediagene, adopted immediately prior to the Effective Time, a copy of which is included as Exhibit 3.1 hereto. |

“TNL Mediagene Ordinary Shares” | | means ordinary shares of TNL Mediagene with par value and other terms as described in the TNL Mediagene A&R Articles. |

“TNL Mediagene Warrants” | | means the warrants of TNL Mediagene into which the Blue Ocean Warrants have converted at the Effective Time, each whole warrant entitling its holder to purchase one TNL Mediagene Ordinary Share at a price of $11.50 per share, subject to adjustment. |

vi

Table of Contents

“Transactions” | | means the transactions contemplated by the Merger Agreement and the Ancillary Documents, including the Merger. |

“U.S. Dollars,” “$,” or “US$” | | means United States dollars, the legal currency of the United States. |

“U.S. GAAP” | | means generally accepted accounting principles in the United States. |

“3i and Tumim Transactions” | | means, collectively, the Securities Purchase Agreement dated November 25, 2024 between TNL Mediagene and 3i, LP (the “3i Note SPA”), a copy of which is included as Exhibit 10.4 hereto, and the Ordinary Share Purchase Agreement dated November 25, 2024 between TNL Mediagene and Tumim Stone Capital, LLC (the “Tumim ELOC SPA”), a copy of which is included as Exhibit 10.5 hereto, as well as the Initial Note under the 3i Note SPA, the Subsidiary Guarantee under the Initial Note, the 3i Note RRA and the Tumim ELOC RRA, as well as any transactions undertaken pursuant to these agreements. |

vii

Table of Contents

SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in the securities covered by this prospectus. You should read the following summary together with the more detailed information in this prospectus, any related prospectus supplement and any related free writing prospectus, including the information set forth in the section titled “Risk Factors” in this prospectus, any related prospectus supplement and any related free writing prospectus in their entirety before making an investment decision.

Overview

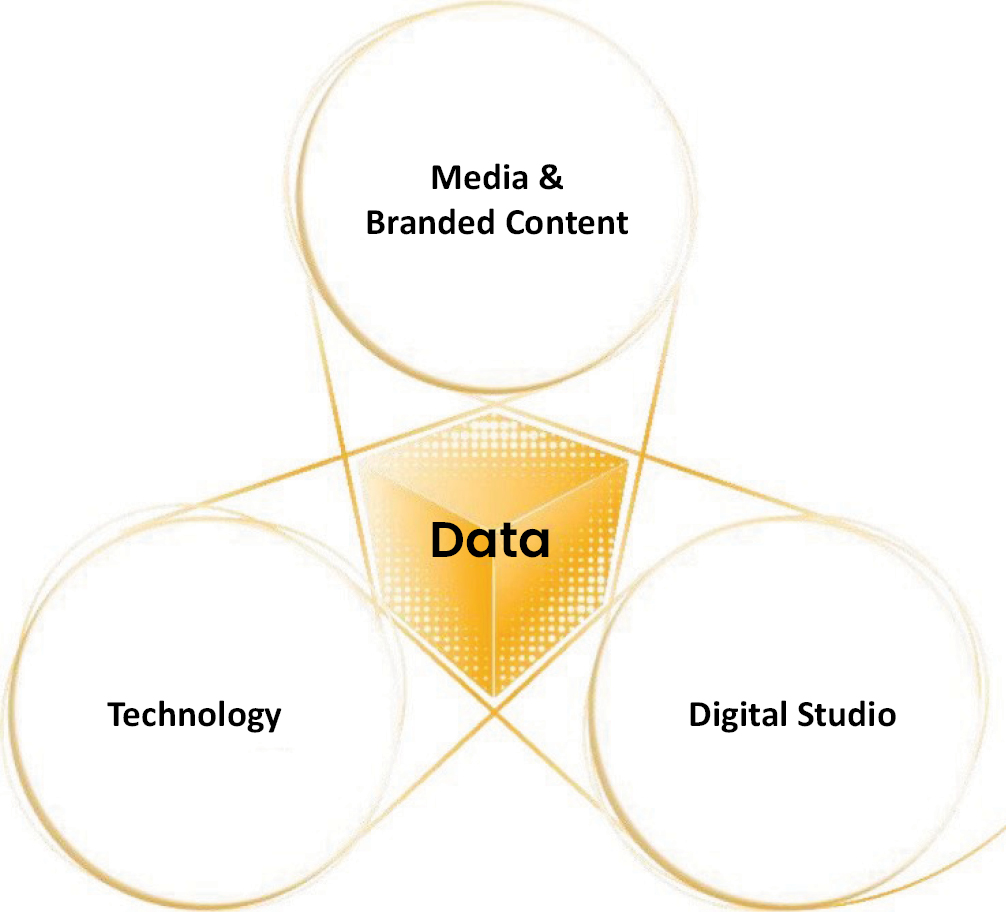

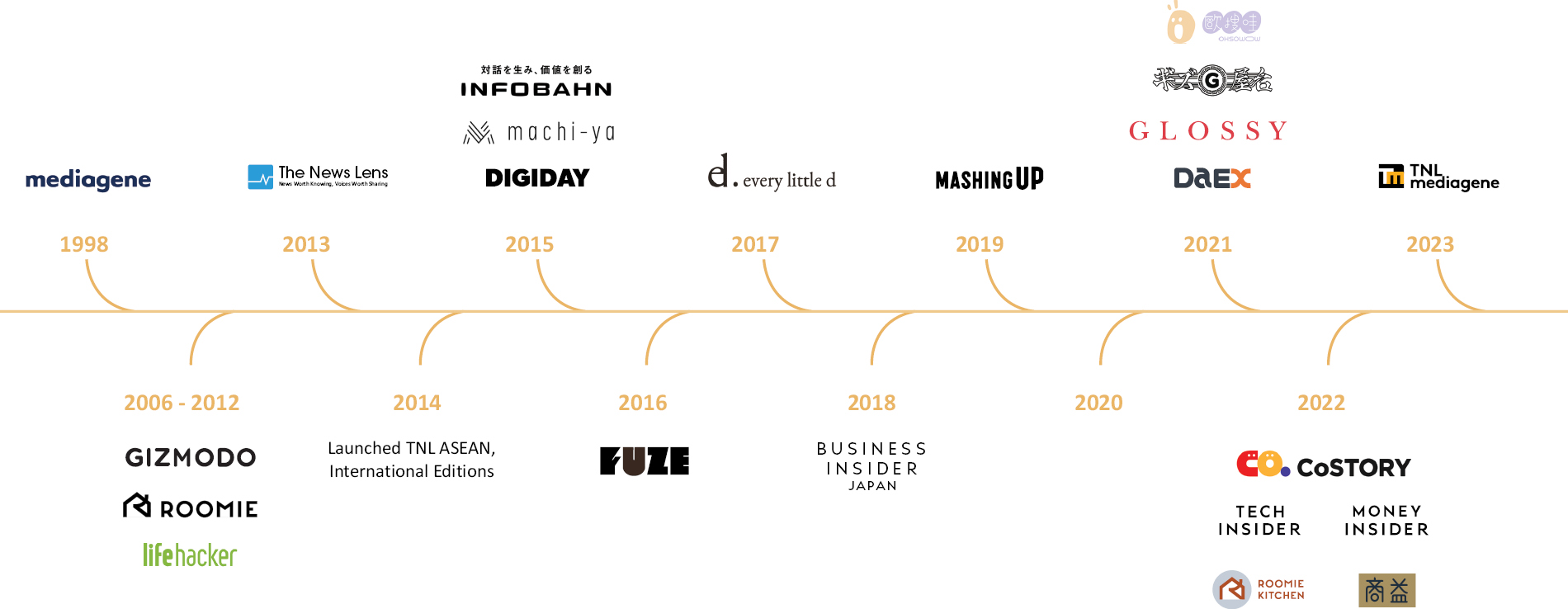

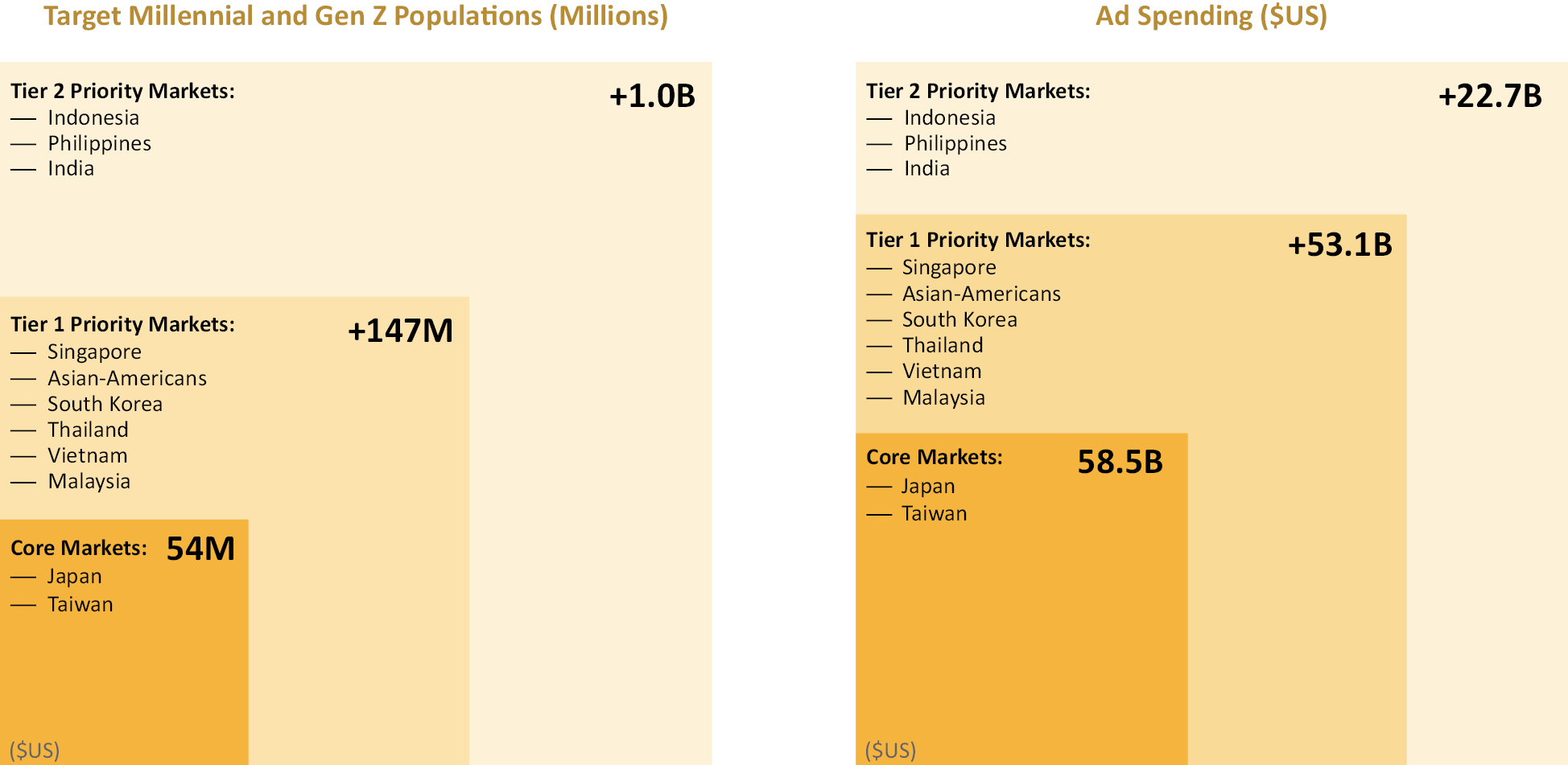

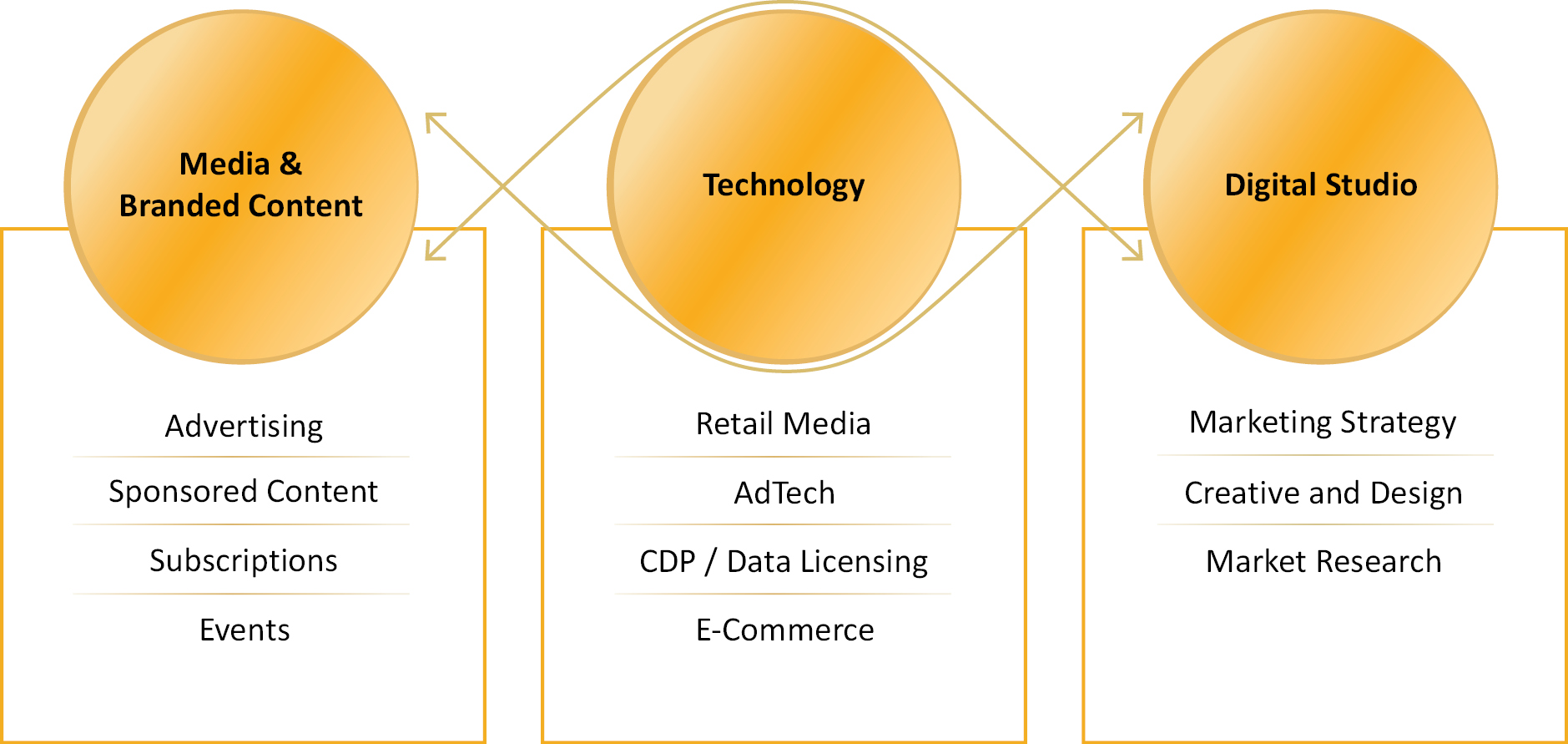

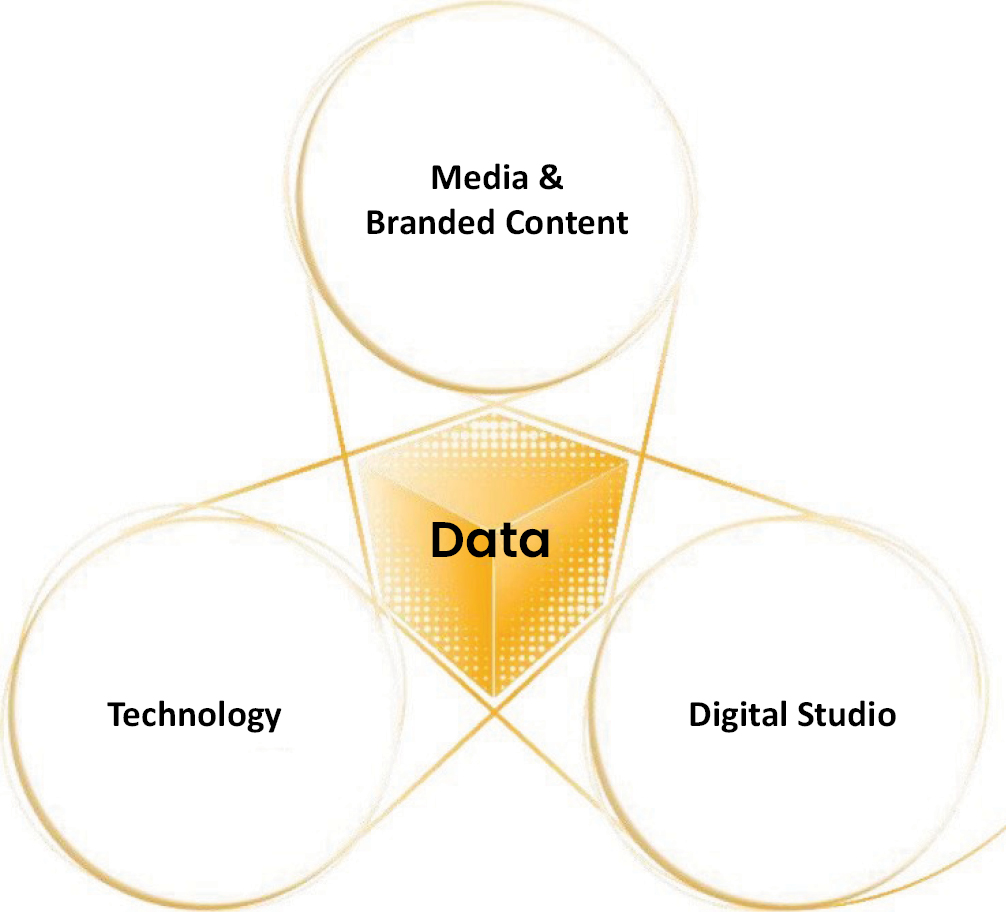

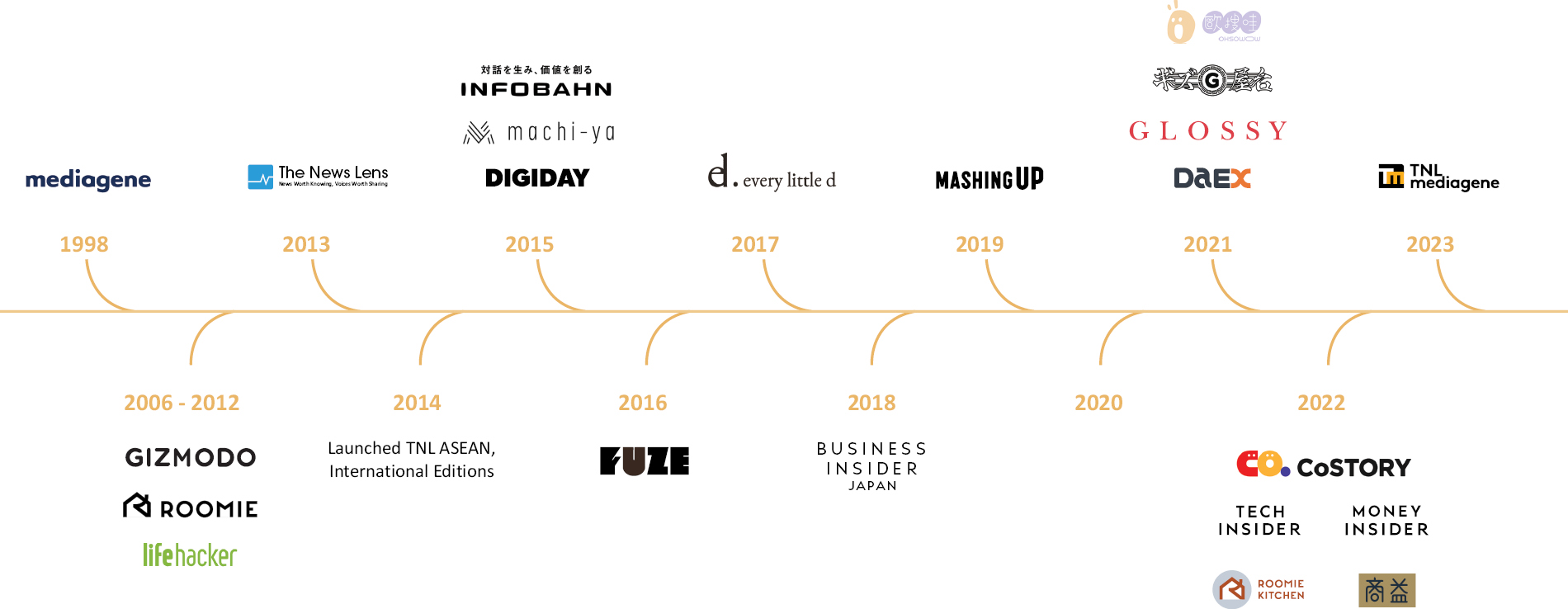

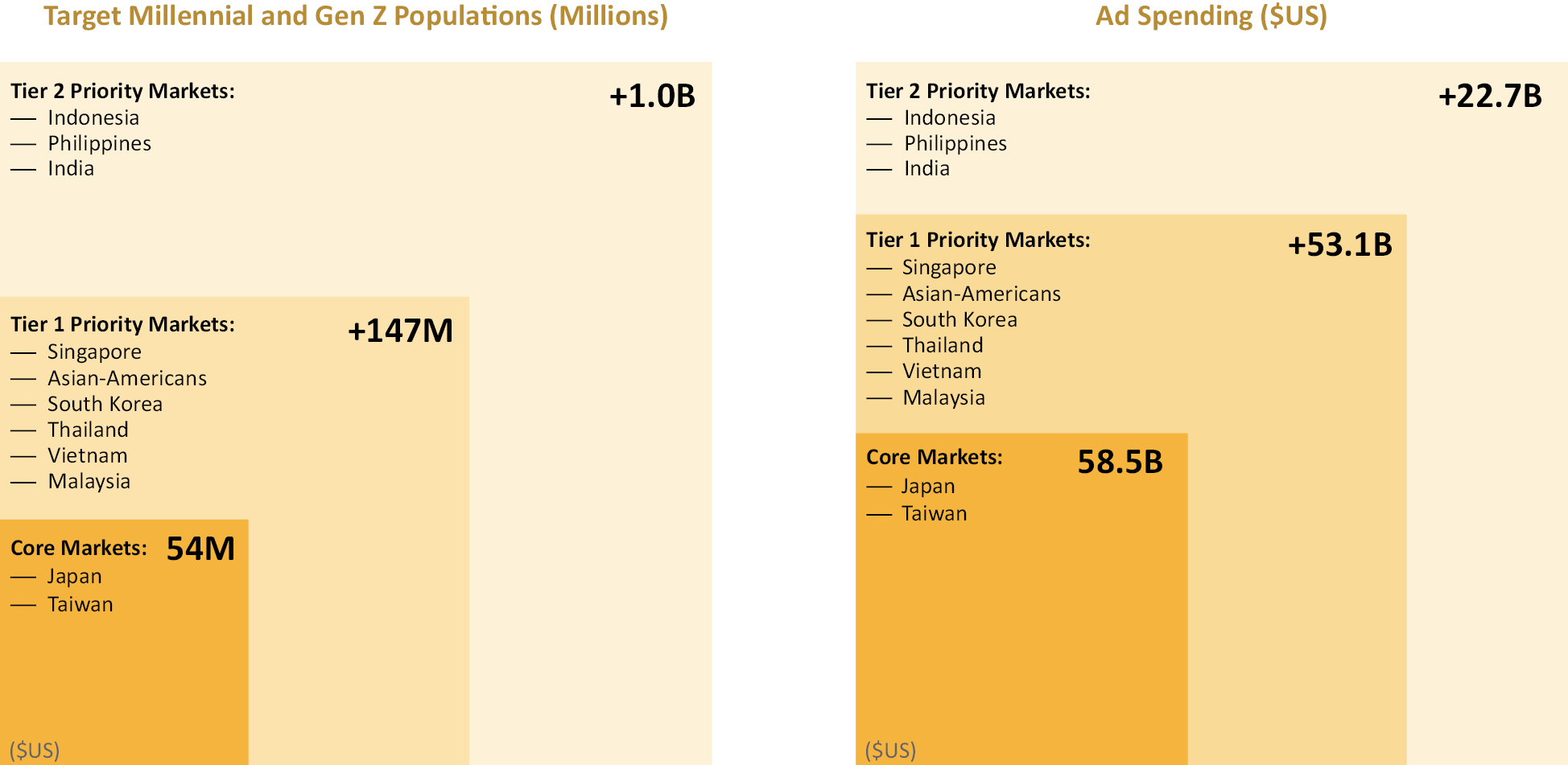

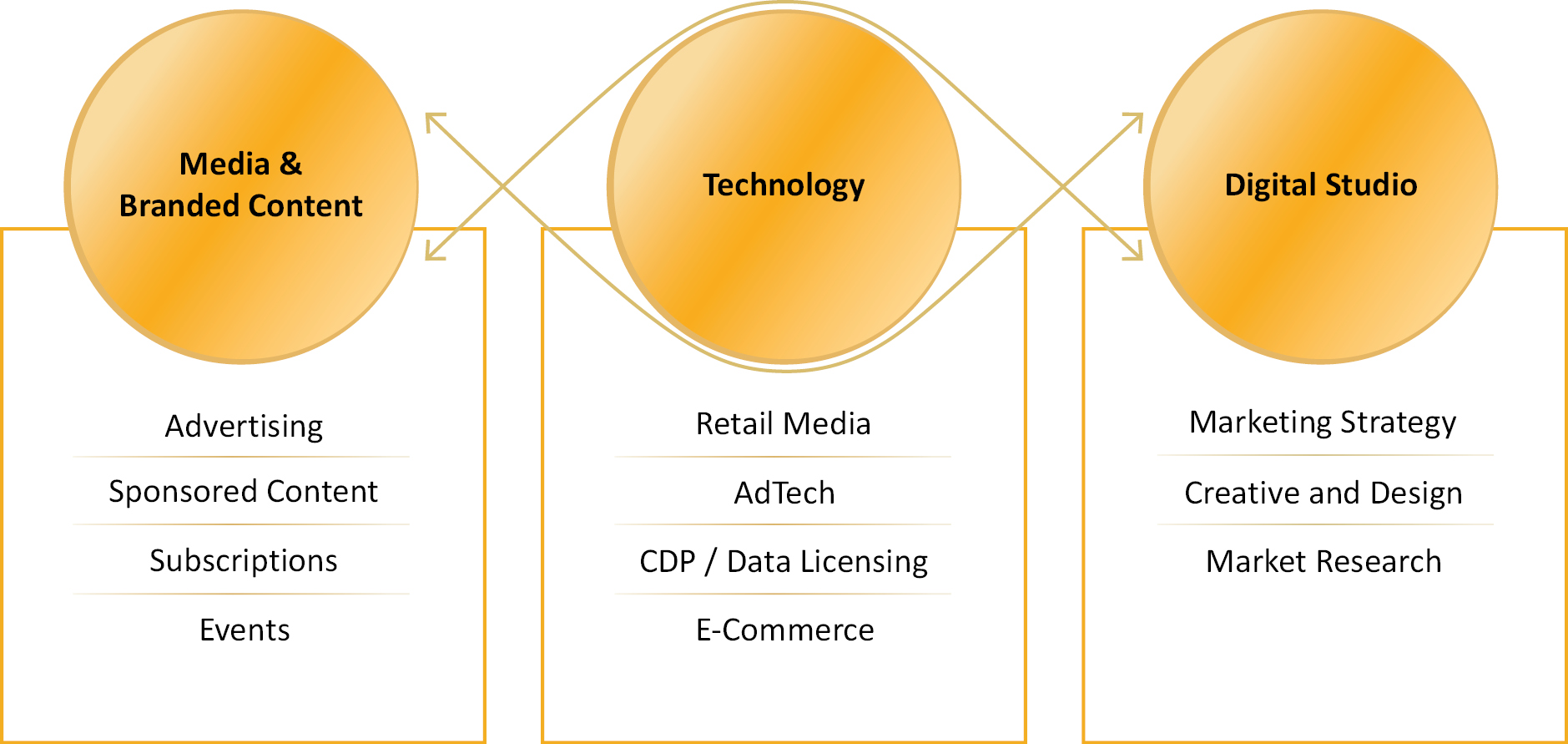

TNL Mediagene is Asia’s next-generation media company built around a portfolio of diverse and trusted digital media brands and a suite of AI-powered advertising and data analytics solutions. With data at its core, TNL Mediagene operates media, technology and digital studio businesses primarily in Japan and Taiwan, with a vision to expand into other key East and Southeast Asian markets outside of mainland China. Through its trusted digital media brands, AI-powered advertising and data analytics technology and digital studio solutions, TNL Mediagene aims to provide multinational clients with unmatched opportunities to contextually reach and engage with Millennial and Gen Z audiences across the East and Southeast Asian region, one of the largest and most attractive audience segments in the world. With its strong foundation in digital media, TNL Mediagene has prioritized collecting more and better data, developing more data-focused services and products, delivering performance advertising that gives its clients higher return on advertising spending, and achieving audience growth by strengthening its audience share in its existing content categories, expanding into new content categories and growing into new geographic markets.

Recent Developments

Completion of November PIPE

On November 22, 2024, in connection with the Merger, TNL Mediagene agreed to a private sale of certain subordinated unsecured convertible promissory notes to the November PIPE Convertible Note Investors in an aggregate principal amount of $4,355,000. Effective immediately prior to and contingent upon the closing of the Merger, the November PIPE Convertible Notes were automatically converted into 1,454,605 TNL Mediagene Ordinary Shares. Pursuant to the Sponsor Warrant Assignment Agreements with each of the November PIPE Convertible Note Investors, the Sponsor agreed to transfer to each November PIPE Convertible Note Investor, and each November PIPE Convertible Note Investor agreed to acquire, a portion of the total 708,047 PIPE Warrants. The $4,355,000 of proceeds received as a result of the sale of the November PIPE Convertible Notes have been used to pay for transaction expenses in connection with the Merger.

Completion of the Merger

On December 5, 2024, TNL Mediagene completed the previously announced Merger. Pursuant to the Merger Agreement, on December 5, 2024, Merger Sub merged with and into Blue Ocean (the “Merger”), with Blue Ocean surviving the Merger as a wholly owned subsidiary of TNL Mediagene. As a result of the Merger, and upon consummation of the Merger and the other transactions contemplated by the Merger Agreement (the “Transactions” and together with the transactions contemplated by the agreements, instruments and documents contemplated by the Merger Agreement, the “Proposed Transactions”), the shareholders of Blue Ocean became shareholders of TNL Mediagene and TNL Mediagene became a publicly listed company.

Pursuant to the Merger Agreement, immediately prior to the Effective Time, TNL Mediagene completed the Recapitalization including adopting the TNL Mediagene A&R Articles and effecting the Reverse Share Split, using the Split Factor of 0.11059896, to cause the value of the outstanding TNL Mediagene Ordinary Shares to equal an assumed value of $10.00 per share.

Pursuant to the Merger Agreement, immediately prior to the Effective Time, (1) all outstanding Blue Ocean Class B Shares, with a par value of US$0.0001, were converted into Blue Ocean Class A Shares, with a par value of US$0.0001, at a conversion ratio of 1.00, (2) all outstanding Public Shares, with a par value of US$0.0001, were exchanged with TNL Mediagene for the right to receive TNL Mediagene Ordinary Shares, with a par value of US$0.0001, at a conversion ratio of 1.00, and (3) each Blue Ocean Warrant became a warrant exercisable for

1

Table of Contents

TNL Mediagene Ordinary Shares on a conversion ratio of 1.00 and on the same terms as the original Blue Ocean Warrant. As a result of the Merger, TNL Mediagene obtained $741,839 in cash assets, representing the cash in Blue Ocean’s trust account as of the Effective Time. Change in cash (as compared to TNL Mediagene’s unaudited consolidated statement of financial position as of June 30, 2024) was a decrease of $12.8 following the redemption of $20,641,045 of Blue Ocean’s Class A Ordinary Shares. For more details, see “Unaudited Pro Forma Condensed Combined Financial Information.” This change to TNL Mediagene’s cash balance is less non-recurring transaction fees and expenses of TNL Mediagene and Blue Ocean incurred and outstanding as a result of the Merger and related transactions of $13.5 million, including the deferred underwriting commission of approximately $0.4 million in connection with the Blue Ocean IPO.

3i and Tumim Transactions

Separately, on November 25, 2024, TNL Mediagene entered into the 3i Note SPA for issuance by TNL Mediagene of convertible notes with 3i and the Tumim ELOC SPA for an equity line of credit with Tumim. On December 13, 2024, TNL Mediagene issued and sold the Initial Note under the 3i Note SPA to 3i. The Initial Note was issued in an aggregate principal amount of $4,722,222 with an original issue discount of 10%, accrues simple interest at six percent (6%) per annum until paid in full or converted pursuant to the terms thereof and will mature on the 12-month anniversary of the issue date, or December 13, 2025. The $4,250,000 of proceeds received as a result of issuance of the Initial Note have been used to pay for transaction expenses in connection with the Merger.

Concurrently with the issuance of the Initial Note on December 13, 2024, TNL Mediagene completed the closing of the Tumim ELOC SPA, pursuant to which Tumim committed to purchase, subject to certain conditions and limitations, up to $30.0 million of TNL Mediagene Ordinary Shares, at TNL Mediagene’s direction from time to time, subject to the satisfaction of the terms and conditions in the Tumim ELOC SPA. As of the date of this prospectus, TNL Mediagene has not directed Tumim to make any purchases of Ordinary Shares.

Emerging Growth Company

TNL Mediagene is, an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, TNL Mediagene is eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in their periodic reports and proxy statements, and the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. If some investors find TNL Mediagene’s securities less attractive as a result, there may be a less active trading market for TNL Mediagene’s securities and the prices of TNL Mediagene’s securities may be more volatile.

TNL Mediagene will remain an emerging growth company until the earlier of: (i) the last day of the fiscal year (a) following the fifth anniversary of the Closing Date, (b) in which TNL Mediagene has total annual gross revenue of at least $1.235 billion, or (c) in which TNL Mediagene is deemed to be a large accelerated filer, which means the market value of TNL Mediagene’s common equity that is held by non-affiliates exceeds $700 million as of the last business day of its most recently completed second fiscal quarter; and (ii) the date on which TNL Mediagene has issued more than $1.00 billion in non-convertible debt securities during the prior three-year period. References herein to “emerging growth company” have the meaning associated with it in the JOBS Act.

Foreign Private Issuer

TNL Mediagene is a foreign private issuer within the meaning of the rules under the Exchange Act and, as such, TNL Mediagene is permitted to follow the corporate governance practices of its home country, the Cayman Islands, in lieu of the corporate governance standards of Nasdaq applicable to U.S. domestic companies that are listed on the Nasdaq. For example, TNL Mediagene is not required to have a majority of the board consisting of independent directors nor have a compensation committee or regularly scheduled executive sessions with only independent directors each year. TNL Mediagene has elected to follow its home country’s corporate governance

2

Table of Contents

practices as long as it remains a foreign private issuer. As a result, TNL Mediagene’s shareholders may not have the same protection afforded to shareholders of U.S. domestic companies that are subject to Nasdaq corporate governance requirements. As a foreign private issuer, TNL Mediagene is also subject to reduced disclosure requirements and is exempt from certain provisions of the U.S. securities rules and regulations applicable to U.S. domestic issuers such as the rules regulating solicitation of proxies and certain insider reporting and short-swing profit rules. Please see “TNL Mediagene’s Management’s Discussion and Analysis of Financial Condition and Results of Operations — Foreign Private Issuer Status.”

Corporation Information

We are an exempted company limited by shares incorporated under the laws of the Cayman Islands. The mailing addresses of our principal executive offices are 4F, No. 88 Yanchang Road, Xinyi District, Taipei City 110, Taiwan and 23-2 Maruyamacho, Shibuya-ku Tokyo 150-0044 Japan. The telephone number of our principal executive office in Taiwan is +886-2-6638-5108 and the telephone number of our principal executive office in Japan is +81-(0)3-5784-6742. Our website address is https://www.tnlmediagene.com. The information on our website is not a part of this prospectus.

The SEC maintains a website at www.sec.gov which contains in electronic form each of the reports and other information that we have filed electronically with the SEC.

Our agent for service of process in the United States is Cogency Global Inc., 122 East 42nd Street, 18th Floor, New York, New York 10168.

Organization Structure

The graphic below shows the ownership structure of TNL Mediagene as of the date of this prospectus.

3

Table of Contents

Summary Risk Factors

An investment in TNL Mediagene Ordinary Shares and TNL Mediagene Warrants involves significant risks. Below is a summary of certain material risks we face, organized under relevant headings. These risks are discussed more fully under “Risk Factors.” You should carefully consider such risks before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition, results of operations or prospects could be materially and adversely affected by any of these risks:

Risks Related to TNL Mediagene’s Operations and Industry

• Adverse economic conditions in Japan, Taiwan and globally, including the potential onset of recession, could have a negative effect on TNL Mediagene’s business, results of operations, financial condition, and liquidity.

• TNL Mediagene drives a significant portion of its revenue from its relationships with the businesses to whom it provides digital media content and related advertising technology and data analytics services, including advertising and consumer data-related services, marketing services and other services.

• TNL Mediagene’s user numbers and engagement with its digital media brands and content are critical to its success.

• The market for digital advertising for brands is continuously and rapidly evolving. If this market develops more slowly or differently than TNL Mediagene expects, or TNL Mediagene fails to respond successfully to changes in the market, its business, growth prospects and financial condition could be adversely affected.

• If TNL Mediagene is unable to compete effectively with its competitors for users and advertising spend, its business and operating results could be harmed.

• TNL and Mediagene merged in May 2023 to form TNL Mediagene. TNL Mediagene may not be able to successfully integrate the two businesses and may continue to incur significant costs to integrate with and support Mediagene. TNL Mediagene also may not realize the anticipated benefits of the merger because of difficulties related to the integration, the achievement of such synergies, and other challenges faced by TNL Mediagene.

• TNL Mediagene’s financial results from period to period have fluctuated in the past and will fluctuate in the future.

• The loss of key personnel, or TNL Mediagene’s failure to attract and retain other highly qualified personnel in the future, could harm its business.

Risks Related to TNL Mediagene’s Technology, Security and Privacy

• TNL Mediagene’s ability to attract and retain advertising clients depends on its ability to collect and use data and develop tools to enable it to effectively deliver and accurately measure advertisements on its platform.

• The use of AI tools in TNL Mediagene’s business may cause us brand or reputational harm, competitive harm, or legal liability.

• TNL Mediagene derives a significant portion of its users from third-party platforms and online search engines. Changes to the standard terms, conditions and policies of these providers that link to, have distributed or may distribute its content, such as Google Search and Google Discover, could adversely affect its business.

• TNL Mediagene’s business relies on certain trademarks, copyrights and other intellectual property rights that are licensed from third-party licensors. TNL Mediagene does not control these rights and any loss of its rights to them could materially adversely affect its business.

4

Table of Contents

• TNL Mediagene depends on Amazon Web Services (“AWS”) for the vast majority of its compute, storage, data transfer and other services. Any disruption of, degradation in or interference with TNL Mediagene’s use of AWS could negatively affect its operations and harm our business, revenue and financial results.

Risks Related to TNL Mediagene Doing Business in Japan and Taiwan

• TNL Mediagene faces economic and political risks associated with doing business in Taiwan, particularly due to the geopolitical tension between Taiwan and mainland China that could negatively affect its business and hence the value of your investment.

Risks Related to Ownership of TNL Mediagene’s Securities

• A market for TNL Mediagene Ordinary Shares may not develop or be sustained, which would adversely affect the liquidity and price of TNL Mediagene’s securities.

• As TNL Mediagene is a “foreign private issuer” and intends to follow certain home country corporate governance practices, its shareholders may not have the same protections afforded to shareholders of companies that are subject to all Nasdaq corporate governance requirements.

• TNL Mediagene has identified material weaknesses in its internal control over financial reporting. If TNL Mediagene’s remediation of these material weaknesses is not effective, or if TNL Mediagene experiences additional material weaknesses or otherwise fails to maintain an effective system of internal controls in the future, TNL Mediagene may not be able to report its financial results accurately or file its periodic reports as a public company in a timely manner.

5

Table of Contents

THE OFFERING

The summary below describes the principal terms of the offering. The “Description of TNL MEDIAGENE’s Share Capital and Articles of Association” section of this prospectus contains a more detailed description of TNL Mediagene Ordinary Shares and TNL Mediagene Warrants. Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” of this prospectus.

Issuer | | TNL Mediagene |

Issuance of TNL Mediagene Ordinary

Shares | | |

TNL Mediagene Ordinary Shares offered

by us | |

2,908,047 TNL Mediagene Ordinary Shares issuable upon the exercise of 2,908,047 TNL Mediagene Warrants

|

TNL Mediagene Ordinary Shares outstanding prior to exercise of all TNL Mediagene Warrants offered | |

26,248,753 TNL Mediagene Ordinary Shares (as of February 7, 2025)

|

TNL Mediagene Ordinary Shares outstanding assuming exercise of all TNL Mediagene Warrants offered | |

29,012,878 TNL Mediagene Ordinary Shares

|

Exercise Price of TNL Mediagene Warrants | | Each TNL Mediagene Warrant entitles the holder to purchase one TNL Mediagene Ordinary Share at a price of $11.50 per share, subject to adjustment, terms and limitations as described in the Warrant Agreement, as amended by the Assignment, Assumption and Amendment Agreement. |

Use of Proceeds | | TNL Mediagene will receive up to an aggregate of approximately $33,442,541 from the exercise of 2,908,047 TNL Mediagene Warrants being offered in this prospectus, assuming the exercise in full of all such TNL Mediagene Warrants in cash. The net proceeds of the exercise of these Warrants is expected to be used for general corporate purposes. See “Use of Proceeds”. However, we do not expect to rely on the cash exercise of TNL Mediagene Warrants to fund our operations. Instead, we intend to rely on our primary sources of cash discussed elsewhere in this prospectus to continue to support our operations. See “TNL Mediagene’s Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” for additional information. The exercise price of TNL Mediagene Warrants is $11.50 per share. The likelihood that TNL Mediagene Warrant holders will exercise their TNL Mediagene Warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the trading price of TNL Mediagene Ordinary Shares. If the trading price for TNL Mediagene Ordinary Shares is less than $11.50 per share, we believe holders of TNL Mediagene Warrants will be unlikely to exercise their TNL Mediagene Warrants. As of February 6, 2025, the closing price of TNL Mediagene Ordinary Shares was $2.47. Accordingly, we believe that holders of TNL Mediagene Warrants are currently unlikely to exercise their TNL Mediagene Warrants. |

6

Table of Contents

Resale of TNL Mediagene Ordinary Shares and TNL Mediagene Warrants | | |

TNL Mediagene Ordinary Shares that may be offered and sold from time to time by the Selling Securityholders | |

Up to 11,832,277 TNL Mediagene Ordinary Shares, comprising: (a) the offer and resale of up to 2,002,222 TNL Mediagene Ordinary Shares by 3i; (b) the offer and resale of up to 8,000,000 TNL Mediagene Ordinary Shares, including 119,048 TNL Mediagene Ordinary Shares as the Tumim Commitment Shares, by Tumim; (c) the offer and resale of up to 317,601 TNL Mediagene Ordinary Shares as the Existing PIPE Conversion Shares by the Existing PIPE Convertible Note Investors; (d) the offer and resale of up to 57,849 TNL Mediagene Ordinary Shares as the DaEX Conversion Shares by the DaEX Conversion Rights Holders; and (e) the offer and resale of up to 1,454,605 TNL Mediagene Ordinary Shares as the November PIPE Conversion Shares by the November PIPE Convertible Note Investors.

|

TNL Mediagene Warrants that may be offered and sold from time to time by the Selling Securityholders | |

Up to 2,908,047 TNL Mediagene Warrants, comprising: (a) the offer and resale of up to 708,047 TNL Mediagene Warrants as the PIPE Warrants by the Existing PIPE Convertible Note Investors and the November PIPE Convertible Note Investors, or their permitted transferees; and (b) the offer and resale of up to 2,200,000 TNL Mediagene Warrants by Mediagene Inc., our subsidiary, or its permitted transferees.

|

Terms of TNL Mediagene Warrants | | Each TNL Mediagene Warrant entitles the holder to purchase one TNL Mediagene Ordinary Share at a price of $11.50 per share, subject to adjustment, terms and limitations as described in the Amended and Restated Warrant Agreement. |

Redemption | | The Warrants are redeemable in certain circumstances. See “Description of TNL Mediagene’s Share Capital and Articles of Association” |

Terms of the Offering | | The Selling Securityholders will determine when and how they will dispose of the securities being registered for resale by the Selling Securityholders registered under this prospectus. The securities offered by this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the Selling Securityholders may determine. See the section titled “Plan of Distribution”. |

Use of Proceeds | | We will receive no proceeds from the sale of the securities by the Selling Securityholders. |

Market for TNL Mediagene Ordinary Shares | | TNL Mediagene Ordinary Shares commenced trading on the Nasdaq under the symbol “TNMG”. |

Risk Factors | | Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” and elsewhere in this prospectus. |

7

Table of Contents

RISK FACTORS

You should carefully consider the risks described below together with the financial and other information contained in this prospectus, including the sections titled “Cautionary Statement Regarding Forward-Looking Statements”, “TNL Mediagene’s Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Mediagene’s Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Additional risks and uncertainties that are not presently known to TNL Mediagene or that they do not currently believe are important to an investor, if they materialize, also may adversely affect the Company. If any of the events, contingencies, circumstances or conditions described in the following risks actually occur, TNL Mediagene’s business, financial condition or results of operations could be seriously harmed. If that happens, the trading price of TNL Mediagene Ordinary Shares could decline, and you may lose part or all of the value of any TNL Mediagene Ordinary Shares that you hold.

Risks Related to TNL Mediagene’s Operations and Industry

Unless the context otherwise requires, throughout this subsection, references to “we,” “us,” and “our” refer to TNL Mediagene together as a group with its subsidiaries.

Adverse economic conditions in Japan, Taiwan and globally, including the potential onset of recession, could have a negative effect on our business, results of operations, financial condition, and liquidity.

Our primary business operations as well as our primary audience and client base are located in Japan and Taiwan. As such, our business performance, financial condition and results of operations depend largely on the performance of these economies, the outlook for which remains uncertain and involves factors beyond our control. A number of macroeconomic factors may adversely affect the Japanese and Taiwanese economies, such as:

• the possibility of a regional or global economic recession affecting Japan and Taiwan;

• the effects of tightening fiscal and monetary policy in most developed economies, including Taiwan, which could negatively affect consumer spending, credit markets and business sentiment and lead to an economic downturn;

• uncertainty regarding the extent and full effects of the monetary tightening policy that the Japanese government and the Bank of Japan recently announced;

• unfavorable developments in the exchange rate of the Japanese yen and New Taiwan Dollar and against the currencies of Japan and Taiwan’s major trading partners, including volatility triggered by cross-strait political tensions between Taiwan and China, and the Japanese yen’s continued weakness against the U.S. Dollar and other major currencies;

• rising rates of inflation in the global economy;

• instability in the global financial system following the failure of major financial institutions, including bank failures in the United States and other developed economies;

• the deterioration of political relations between Japan or Taiwan and some of its neighboring countries or any of its major trading partners, such as growing tensions with Russia and China, economic and political tensions between China and the United States including the escalation of issues related to Taiwan, the possibility of renewed conflict between North Korea and South Korea and its allies, and any act of violence, terrorism, war, armed conflict, or provocation;

• demographic headwinds in Japan and Taiwan, including population aging, labor shortages and a consequential decline in economic activity; and

• the effects of ongoing stagnation and decline in the global demand for semiconductors, on which Taiwan’s economy is heavily dependent.

8

Table of Contents

These and other factors could lead to deterioration of the Japanese or Taiwanese economy, and in turn adversely affect demand for advertising on our digital media brands or demand for our advertising technology and data analytics related services, weakening our advertising sales and related advertising technology and data analytics revenue streams. Such negative factors could also decrease demand for our e-commerce and crowdfunding products and services as well as our integrated marketing products and services. For example, global inflation leads to a decline in the spending power of consumers, which results in a reduction in the business volume of advertising clients and a corresponding reduction in demand for our advertising and related advertising technology and data analytics services. As a result, global inflation has adversely affected our revenue and may continue to do so.

Furthermore, any adverse conditions in the Japanese or Taiwanese economies could adversely affect our access to financing, making it more difficult for us to secure potentially necessary financing in the future, to fund additional acquisitions, or to carry out our expansion plans, or to make debt service payments to cover interest and principal on our debts and other obligations. The continued disruption to global economic activities including in Japan and Taiwan due to heightened geopolitical instability caused by regional conflicts including the Russian invasion of Ukraine and conflicts in the Middle East, growing inflationary pressures and tightening of monetary policy by central banks worldwide in response, recent bank failures in the United States and developed economies and the lingering effects of the COVID-19 pandemic have resulted in unstable and sluggish credit and capital markets and are expected to have a significant negative influence on overall economic conditions in Japan and Taiwan. The duration and extent of the economic influence of these factors is necessarily uncertain and may lead to further difficulties in securing necessary funds through financing in the future. These same adverse conditions may also affect our liquidity, business, financial condition, and results of operations by increasing our overall cost structure, particularly if we are unable to increase the prices we charge our clients commensurately. For example, inflation in the Japan, Taiwan and broader global economy has resulted in, and may continue to result in, higher interest rates and capital costs, increased costs of labor and other similar effects. As a result of inflation, we have experienced and may continue to experience cost increases, which, if continued, could materially adversely affect our business, results of operations, financial condition, and liquidity.

Furthermore, uncertain prospects of the overall global economy may lead our advertising and other clients to be conservative in their decision-making and discourage them from spending their resources on advertising and related advertising technology and data analytics services we offer. Adverse economic conditions globally have from time to time caused or exacerbated significant slowdowns in our industry and in the markets in which we operate. Sustained uncertainty about, or worsening of, current global economic conditions, including stagnation in advanced countries, supply chain issues and rising rates of inflation in the global economy, the continued impact of the Russian invasion of Ukraine and conflicts in the Middle East, as well as further escalation of geopolitical and trade tensions between the U.S., Japan, Taiwan and China could result in a global economic slowdown and long-term changes to global trade. Any or all of these factors could adversely affect our advertising sales, related advertising technology and data analytics revenues, e-commerce and other revenues, and could materially adversely affect our business, results of operations, financial condition, and liquidity.

Any of these or other factors arising out of adverse conditions in the Japanese or Taiwanese economy or globally, individually or in the aggregate, could have a material adverse effect on our clients, and in turn, on our business, financial condition or results of operations and result in decreases in our revenues.

We derive a significant portion of our revenue from our relationships with the businesses to whom we provide digital media content and related advertising technology and data analytics services, including advertising and consumer data-related services, marketing services and other services.

A significant portion of our revenue is currently generated from deployment of advertising on our digital media brands. As is common in the industry, our advertisers do not have long-term advertising commitments with us. Many of our advertisers spend only a relatively small portion of their overall advertising budget with us. In addition, many of our advertisers purchase our advertising services through one of several large advertising agency holding companies. Advertisers will not continue to do business with us, or they will reduce the prices they are willing to pay to advertise with us, if we do not deliver ads in an effective manner, or if they do not believe that their investment in advertising with us will generate a competitive return relative to alternatives.

9

Table of Contents

Further, we need to maintain good relationships with advertisers to provide us with a sufficient inventory of advertisements and offers. Online advertising is an intensely competitive industry. In order for our advertising business to continue to succeed, we need to continue to demonstrate the reach of our audience and the benefit to our advertising partners. Our advertising revenue could be adversely affected by a number of other factors, including:

• decreases in users and engagement with our various digital media brands;

• inability to demonstrate the value of our content to advertisers and advertising agencies or inability to measure the value of our content in a manner which advertisers and advertising agencies find useful;

• inability to increase advertiser demand and/or inventory;

• inability to help advertisers effectively target ads;

• inability to improve our analytics and measurement solutions that demonstrate the value of our content;

• the impact of new technologies that could block or obscure the display of or targeting of our content;

• decreases in the cost per ad engagement;

• loss of advertising market share to our competitors;

• need to enter into revenue sharing arrangements or other partnerships with third parties;

• adverse legal developments relating to advertising or measurement tools related to the effectiveness of advertising, including legislative and regulatory developments impacting branded content, labeling of advertising, privacy and consent requirements related to sharing of personal information and/or litigation related to any of the foregoing;

• adverse media reports or other negative publicity involving us or the digital media industry as a whole;

• changes in the way our ad products are priced;

• bad debts related to trade credit extended to certain advertisers;

• the possibility of contractual disputes between advertisers and us;

• cancellation of certain pre-paid branded advertising orders; and

• the impact of macroeconomic conditions and conditions in the advertising industry in general.

If our relationship with any advertising partners terminates for any reason, or if the commercial terms of our relationships are changed or do not continue to be renewed on favorable terms, we would need to qualify new advertising partners, which could negatively impact our revenues, at least in the short term.

Our user numbers and engagement with our digital media brands and content are critical to our success.

If we fail to increase our user numbers, or if user engagement or ad engagement declines, our revenue, business and operating results may be harmed. Our financial performance has been and will continue to be significantly determined by our success in increasing user numbers and the overall level of engagement with our content as well as increasing the number and quality of ad engagements. We anticipate that our user growth rate will eventually slow over time as the number of our users increases within an audience or geographical segment or content vertical. To the extent our growth rate slows, our success will become increasingly dependent on our ability to expand our content verticals and audience base as well as to increase levels of ad engagement and monetization on our media brands. If people do not perceive our content to be useful, reliable and entertaining, we may not be able to attract users or increase the frequency of engagement on our digital media brands and the ads that we display. There is no guarantee that we will not experience a similar erosion of our engagement levels as our user growth rate slows.

Further, maintaining and enhancing our digital media brands is an important aspect of our efforts to attract and expand our audience. Maintaining and enhancing our digital media brands will depend largely on our ability to continue to provide high-quality, entertaining, useful, reliable, relevant and innovative content, which we may not do successfully. We may introduce new content, products or terms of service or policies that our users or advertisers do

10

Table of Contents

not like, which may negatively affect our brand. We will also continue to experience media, legislative, and regulatory scrutiny of our content, which may adversely affect our reputation and brands. Maintaining and enhancing our digital media brands may require us to make substantial investments and these investments may not be successful. A number of additional factors could potentially negatively affect our user growth and engagement, including if:

• users engage with other platforms or content as an alternative to ours;

• we are unable to convince potential new users of the value, usefulness and relevance of our content;

• there is a decrease in the perceived quality of our content;

• our competitors incorporate features into their products or services that are substantially similar to ours or improve upon such features;

• we fail to introduce new and improved content or services or if we introduce new or improved content or services that are not favorably received or that negatively affect numbers of users and engagement;

• our users believe that their experience is diminished as a result of the decisions we make with respect to the frequency, relevance and prominence of ads that we display;

• changes in the third-party platforms and search engines on which we rely to deliver a majority of our users;

• technical or other problems prevent us from delivering our content or services in a rapid and reliable manner or otherwise affect the experience of our users;

• we experience service outages, data protection and security issues;

• our trademarks are exploited by others without permission;

• our users are unable to locate content that is interesting, relevant, reliable, high quality, or trustworthy to them, or otherwise find our content offensive, inappropriate or otherwise objectionable;

• there are adverse changes in our content or services that are mandated by, or that we elect to make to address, legislation, regulatory constraints or litigation, including settlements or consent decrees;

• we fail to keep pace with evolving digital media market and industry trends; or

• we do not maintain our brand image, or our reputation is damaged.

Additionally, we are exposed to media coverage in Japan, Taiwan and the East and Southeast Asia region. Negative publicity about our company, including about our content quality and reliability, changes to our content and services, privacy and security practices, labor relations, litigation, regulatory activity, and user experience with our content and services, even if inaccurate, could adversely affect our reputation and the confidence in and the use of our content and services. Such negative publicity could also have an adverse effect on the number, engagement and loyalty of our users and result in decreased revenue, which would adversely affect our business and operating results. If we are unable to increase our users or engagement, or if they decline, this could result in our content or services being less attractive to potential new users, as well as advertisers, which would have a material and adverse impact on our business, financial condition and operating results. Additionally, if we fail to successfully promote and maintain our brands or if we incur excessive expenses in this effort, our business and financial results may be adversely affected.

The market for digital advertising for brands is continuously and rapidly evolving. If this market develops more slowly or differently than we expect, or we fail to respond successfully to changes in the market, our business, growth prospects and financial condition could be adversely affected.

Our growth strategy is based on key assumptions regarding industry trends. For example, among others, our strategy is based on our expectations that:

• digital advertising spend by advertising clients will continue to rise in the East and Southeast Asia region;

• currently fragmented digital media and advertising ecosystems in the East and Southeast Asia region are ripe for consolidation;

11

Table of Contents

• advertising clients are moving away from brand advertising based on exposures and are seeking performance advertising that deliver actual purchases, primarily based on return on advertising spend;

• digital advertising is shifting from display advertising to content marketing;

• retail media will continue to rise to prominence in the digital media and advertising industry; and

• developments in data analytics and advertising technology, including the recent advancements in AI technologies, will take on more importance in the digital media and advertising industry.

In addition, changes in user and consumer behavior pose a number of challenges that could adversely affect our revenues and competitive position. For example, among others:

• we may be unable to develop new digital content and services that consumers find engaging and that achieve a high level of market acceptance;

• we may introduce new content or services, or make changes to existing content and services, which are not favorably received by our users;

• there may be changes in sentiment of our users about the quality, usefulness or relevance of our existing content or concerns related to privacy, security or other factors;

• failure to successfully manage changes implemented by social media platforms, search engines, or news aggregators, including those affecting how our content is prioritized, displayed and monetized, could affect our business; and

• our audience may increasingly use technology (such as incognito browsing) that decreases our ability to obtain a complete view of the behavior of users that engage with our content.

Our industry and business are subject to rapid and continuous changes in industry trends and technology, evolving client needs and the frequent introduction by our competitors of new and enhanced offerings. Our future success will depend on our ability to continuously enhance and improve our offerings to meet client needs, build our brand, scale our technology capabilities, add functionality to and improve the performance of our advertising and marketing solutions, while addressing technological and industry advancements. If we are unable to enhance our solutions to meet market demand in a timely manner, we may not be able to maintain our existing clients or attract new clients, and our solutions may become less competitive or obsolete. Our investments in data analytics and technologies are inherently risky and may not be successful. These investments may adversely impact our operating results in the near term and there can be no assurance as to our ability to use new and existing technologies to distinguish our content and services from those of our competitors and develop in a timely manner compelling new content and services that respond to changing industry trends and evolving client needs. Addressing recent industry trends, in particular the rise of retail media and performance advertising, presents new challenges for us, and we are investing substantial resources to evolve and adapt our businesses, pricing and organization to capture opportunities presented by such new trends in our industry. Addressing such challenges will also necessitate investing in new partnerships and advertising channels where we do not have a long or established track record of competing successfully. If we are not successful in developing and expanding our products and solutions that respond to industry trends and meet our client needs, our business, financial condition and prospects may be adversely affected.

If we are unable to compete effectively with our competitors for users and advertising spend, our business and operating results could be harmed.

Competition for users and engagement with our content, products and services is intense. We compete against many companies to attract and engage users, including companies that have greater financial resources and potentially larger user bases, and companies that offer a variety of competing Internet and mobile device-based content, products and services. Our competitors may acquire and engage users at the expense of the growth or engagement of our users, which would negatively affect our business. We believe that our ability to compete effectively for users depends upon many factors both within and beyond our control, including:

• the popularity, usefulness and reliability of our content compared to that of our competitors;

• the timing and market acceptance of our content;

12

Table of Contents

• the continued expansion and adoption of our content;

• our ability, and the ability of our competitors, to develop new content and enhancements to existing content;

• our ability, and the ability of our competitors, to attract, develop and retain influencers and creative talent;

• the frequency, relative prominence and appeal of the advertising displayed by us or our competitors;

• changes mandated by, or that we elect to make to address, legislation, regulatory constraints or litigation, including settlements and consent decrees, some of which may have a disproportionate impact on us;

• our ability to attract, retain and motivate talented employees;

• the costs of developing and procuring new content, relative to those of our competitors;

• acquisitions or consolidation within our industry, which may result in more formidable competitors; and

• our reputation and brand strength relative to our competitors.

We also face significant competition for advertiser spend. We compete against online and mobile businesses and traditional media outlets, such as television, radio and print, for advertising budgets. In determining whether to buy advertising, our advertisers will consider the demand for our content, demographics of our users, advertising rates, results observed by advertisers, and alternative advertising options. The increasing number of digital media options available, through social networking tools and news aggregation websites, has expanded consumer choice significantly, resulting in user/audience fragmentation and increased competition for advertising. In addition, some of our larger digital media competitors have substantially broader content, product or service offerings and leverage their relationships based on other products or services to gain additional share of advertising budgets. We will need to continue to innovate and improve the monetization capabilities of our media and branded content, technology and digital studio business in order to remain competitive. We believe that our ability to compete effectively for advertiser spend depends upon many factors both within and beyond our control, including:

• the size and composition of our user/audience base relative to those of our competitors;

• our ad targeting capabilities, and those of our competitors;

• our ability, and the ability of our competitors, to adapt our model to the increasing power and significance of influencers to the advertising community;

• the timing and market acceptance of our advertising content and advertising products, and those of our competitors;

• our marketing and selling efforts, and those of our competitors;

• the pricing for our advertising products and services relative to those of our competitors;

• the return our advertisers receive from our advertising products and services, and those of our competitors; and

• our reputation and the strength of our brand relative to our competitors.

If we are unable to compete effectively for users or advertiser spend for any reason, including those listed above, our business, financial condition, and operating results may be materially and adversely affected.

Changes to our existing content and services could fail to attract users and advertisers or fail to generate revenue.

We may introduce significant changes to our existing content. The success of our new content depends substantially on consumer tastes and preferences that change in often unpredictable ways. If this new content fails to engage users and advertisers, we may fail to generate sufficient revenue or operating profit to justify our investments, and our business and operating results could be adversely affected. In addition, we have launched and expect to continue to launch strategic initiatives, which do not directly generate revenue but which we believe will

13

Table of Contents

enhance our attractiveness to users and advertisers. In the future, we may invest in new content, products, services and initiatives to generate revenue, but there is no guarantee these approaches will be successful or that the costs associated with these efforts will not exceed the revenue generated. If our strategic initiatives do not enhance our ability to monetize our existing content or enable us to develop new approaches to monetization, we may not be able to maintain or grow our revenue or recover any associated development costs and our operating results could be adversely affected.

If we fail to effectively manage our growth, our business and operating results could be harmed.

The growth and expansion of our business creates significant challenges for our management, and for our operational and financial resources. We intend to continue to make substantial investments to expand our operations, engineering, content development, sales and marketing, and general and administrative organizations. We face significant competition for employees from other companies and we may not be able to hire new employees quickly enough to meet our needs. Providing our content, services and features to our users and advertisers is costly and we expect our expenses to continue to increase in the future as we broaden our geographic and audience reach and as we develop and implement new features and services that require more infrastructure. Historically, our costs increased in proportion to our revenue as we grew our business. However, as we continue to expand the business, we will need to invest in our operating expenses, such as our research and development expenses and sales and marketing expenses in order to keep pace with the growth of our business. We expect to continue to invest in our infrastructure in order to enable us to provide our digital media content and related advertising technology and data analytics services rapidly and reliably to our clients in Japan and Taiwan as well as in new markets in the East and Southeast Asia region, including in countries where we do not expect significant near-term monetization. Continued growth could also strain our ability to develop and improve our operational, financial, legal and management controls, and enhance our reporting systems and procedures. In addition, some members of our management team have limited experience managing a large cross-border business operation and may not be able to manage growth effectively. Our expenses may grow faster than our revenue, and our expenses may be greater than we anticipate. As our organization continues to grow, and we may be required to implement more complex organizational management structures, we may find it increasingly difficult to maintain certain benefits of our corporate culture, including our ability to quickly develop and launch new and innovative content, services and features. This could negatively affect our business performance.

TNL and Mediagene merged in May 2023 to form TNL Mediagene. We may not be able to successfully integrate the two businesses and may continue to incur significant costs to integrate with and support Mediagene. We also may not realize the anticipated benefits of the merger because of difficulties related to the integration, the achievement of such synergies, and other challenges faced by TNL Mediagene.