As filed with the Securities and Exchange Commission on February 25, 2025.

Registration No. 333-284446

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 1 to

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Flybondi Holdings plc

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant name into English)

| | |

England and Wales | 4512 | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | (Primary Standard Industrial

Classification Code Number) | (I.R.S. Employer

Identification Number) |

Av. Costanera Rafael Obligado 1221

Complejo Costa Salguero

C1425 CABA

Argentina

Tel: +54 11 39884021

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Continental Corporate Services, Inc.

908 Pompton Avenue

Unit A2

Cedar Grove, NJ 07009

Tel: (973) 542-0313

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Barry Grossman, Esq.

Jonathan Deblinger, Esq.

Anthony Ain, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas

New York, New York 10105 United States

Tel: (212) 370-1300 | Laurence Applegate DWF Law LLP 20 Fenchurch Street London EC3M 3AG United Kingdom Tel: +44 333 320 2220 | Alan Annex, Esq. Thomas R. Martin, Esq. Sami B. Ghneim, Esq.

Greenberg Traurig, P.A.

333 S.E. 2nd Avenue

Miami, FL 33131 United States

Tel: (305) 579-0739 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective and on completion of the business combination described in the enclosed proxy statement/prospectus.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer)☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF CO-REGISTRANTS

| | | |

Exact Name of Co-Registrant in its Charter | State or Other Jurisdiction of Incorporation or Organization | Primary Standard Industrial Classification Code Number | I.R.S. Employer Identification Number |

Flybondi Limited(1)(2) | England and Wales | 4512 | Not Applicable |

| | | |

| | | |

(1) Flybondi Limited has the following principal executive office:

Av. Costanera Rafael Obligado 1221

Complejo Costa Salguero

C1425 CABA

Argentina

Tel: +54 11 39884021

(2) The agent for service for Flybondi Limited is:

Continental Corporate Services, Inc.

908 Pompton Avenue

Unit A2

Cedar Grove, NJ 07009

Tel: (973) 542-0313

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This proxy statement/prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

PRELIMINARY PROXY STATEMENT/PROSPECTUS

SUBJECT TO COMPLETION, DATED FEBRUARY 25, 2025

PROSPECTUS FOR

UP TO 33,237,670 ORDINARY SHARES,

10,700,000 WARRANTS TO PURCHASE ORDINARY SHARES AND

10,700,000 ORDINARY SHARES UNDERLYING WARRANTS OF

FLYBONDI HOLDINGS PLC

INTEGRAL ACQUISITION CORPORATION 1

1330 Avenue of the Americas, 23rd Floor

New York, NY 10019

Dear Integral Acquisition Corporation 1 Stockholders:

You are cordially invited to attend the special meeting of stockholders (the “Special Meeting”) of Integral Acquisition Corporation 1, a Delaware corporation (“Integral”), which will be held via live webcast on [●], 2025 at [●], Eastern time. The Special Meeting can be accessed by visiting https://www.cstproxy.com/[●], where you will be able to listen to the meeting live and vote during the meeting. Please note that you will only be able to access the Special Meeting by means of remote communication. Please have your control number, which can be found on your proxy card, to join the Special Meeting. If you do not have a control number, please contact Continental Stock Transfer and Trust Company, Integral’s transfer agent.

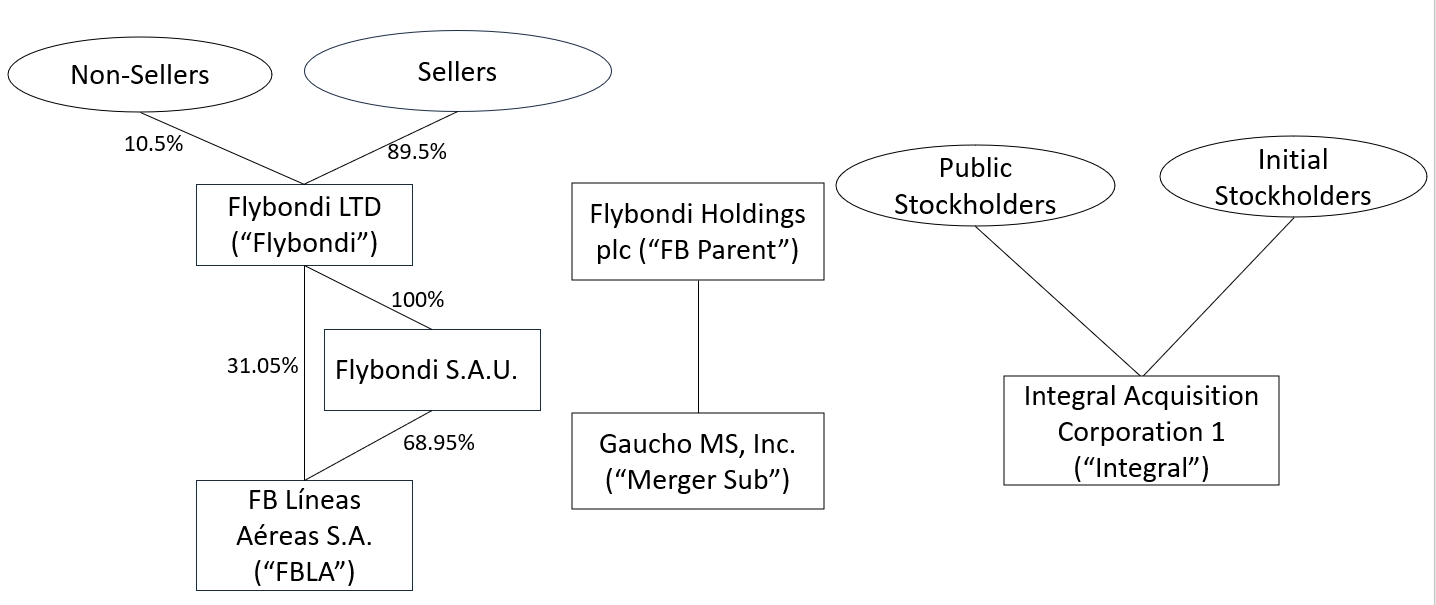

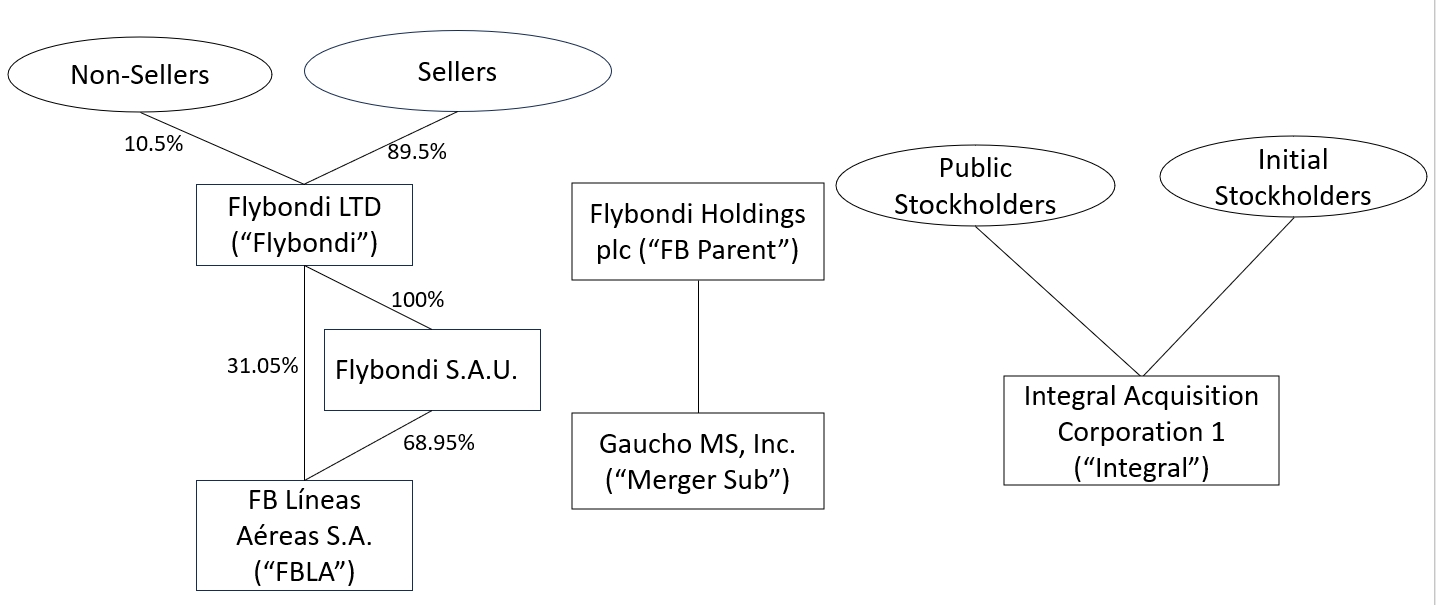

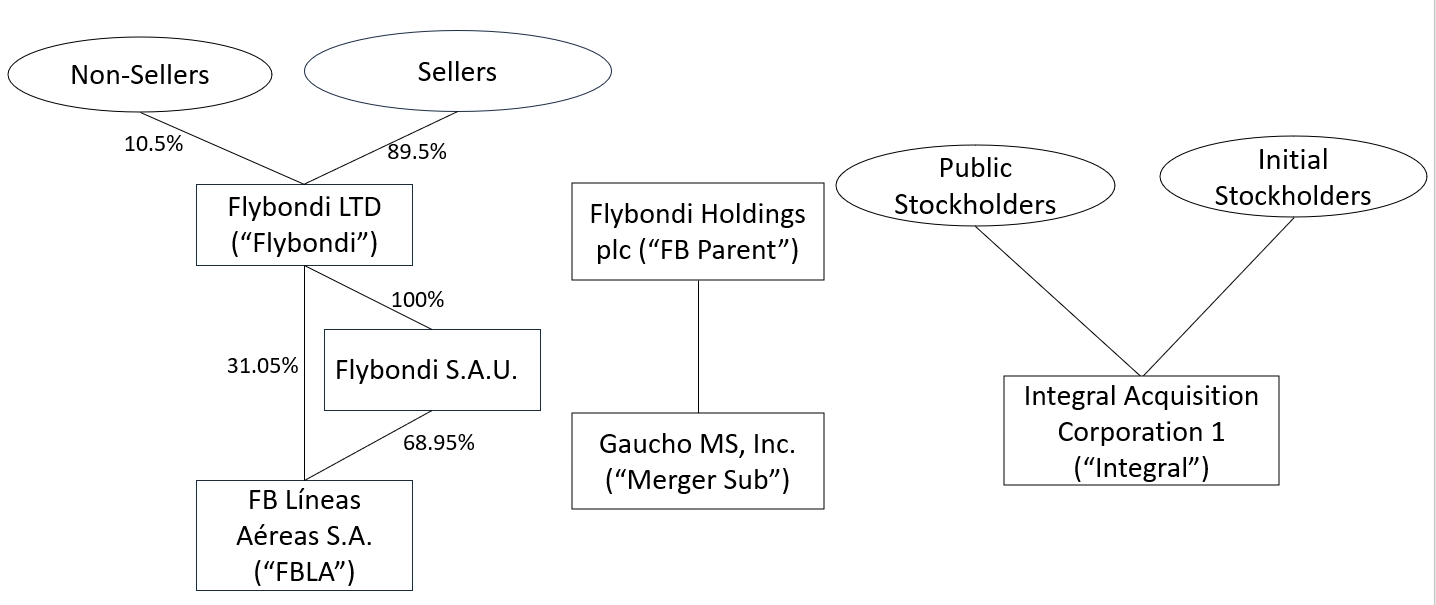

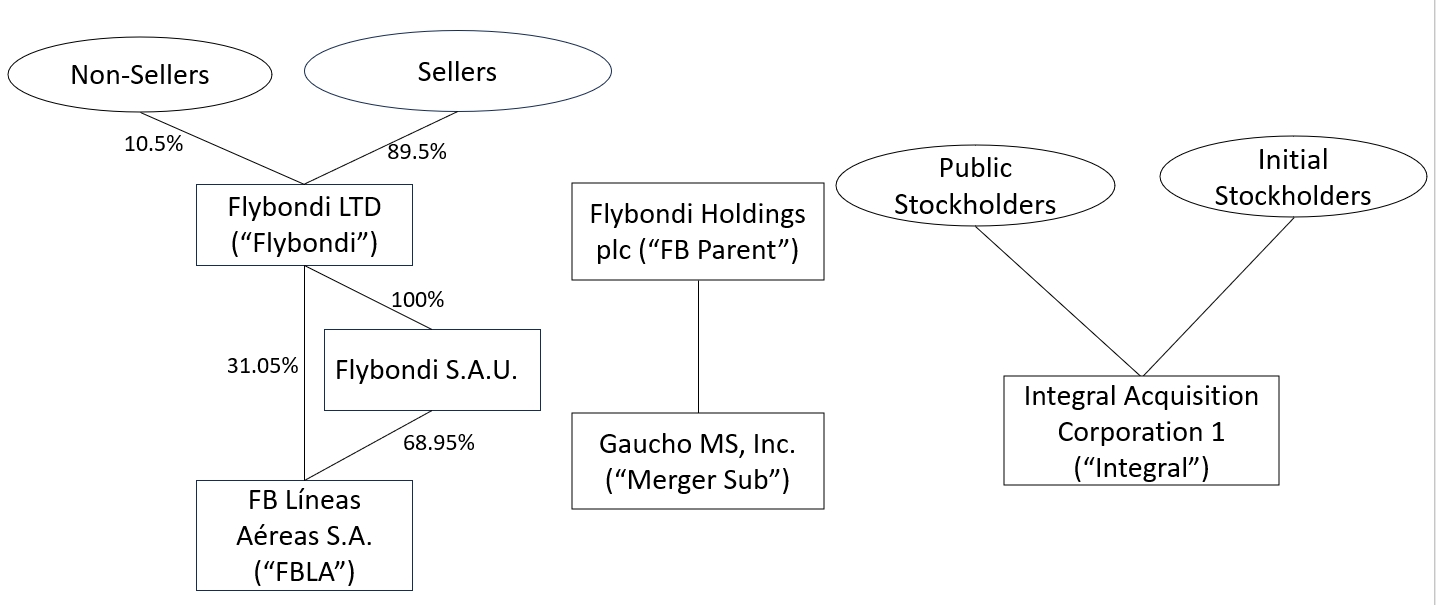

At the Special Meeting, in addition to the other proposals described in this proxy statement/prospectus, Integral’s stockholders (“Integral Stockholders”) will be asked to consider and vote upon a proposal to approve and adopt the Business Combination Agreement, dated as of October 19, 2023 (as may be amended, supplemented, or otherwise modified from time to time, the “Business Combination Agreement”), by and among Integral, Flybondi Holdings plc, a public limited company incorporated under the laws of England and Wales (“FB Parent”), Gaucho MS, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of FB Parent (“Merger Sub”), Flybondi Limited, a limited company incorporated under the laws of England and Wales (“Flybondi”), and certain holders of Flybondi’s outstanding shares that have executed the Business Combination Agreement (the “Signing Sellers”), and the business combination contemplated thereby (together with the other transactions related thereto, the “Business Combination”). After the date of the Business Combination Agreement, other holders of Flybondi’s outstanding shares and/or options (collectively, the “Joining Sellers” and, together with the Signing Sellers, the “Sellers”) may join the Business Combination Agreement by executing and delivering to Integral, FB Parent and Flybondi a joinder agreement (a “Seller Joinder”).

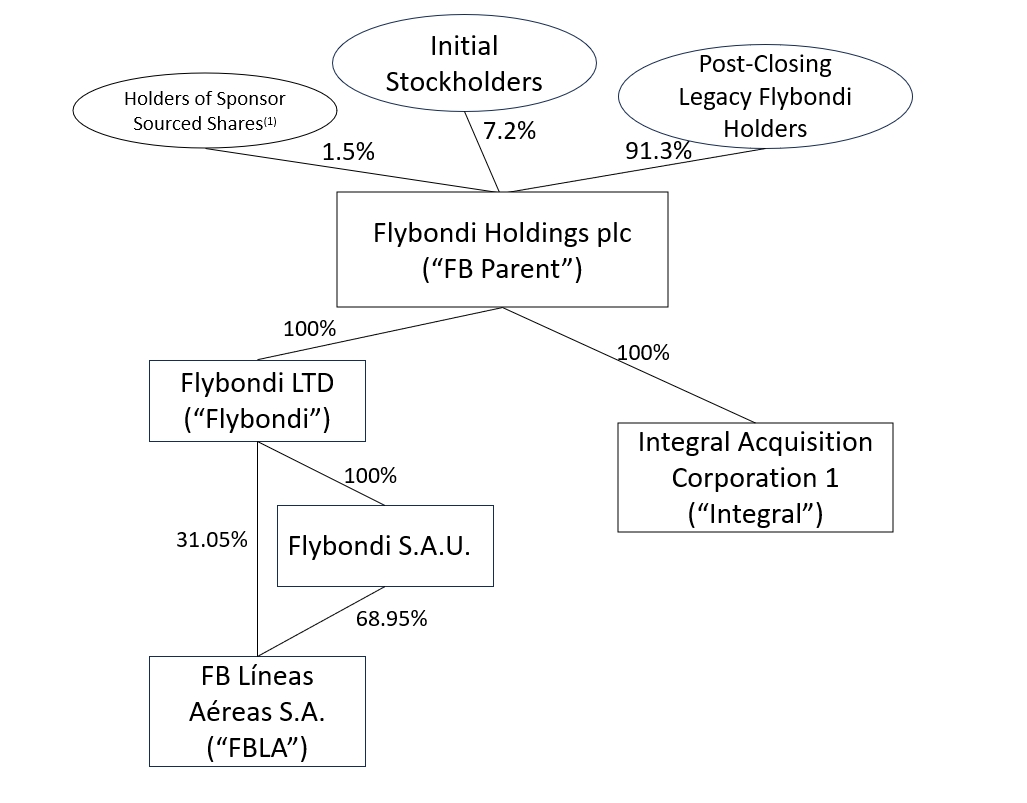

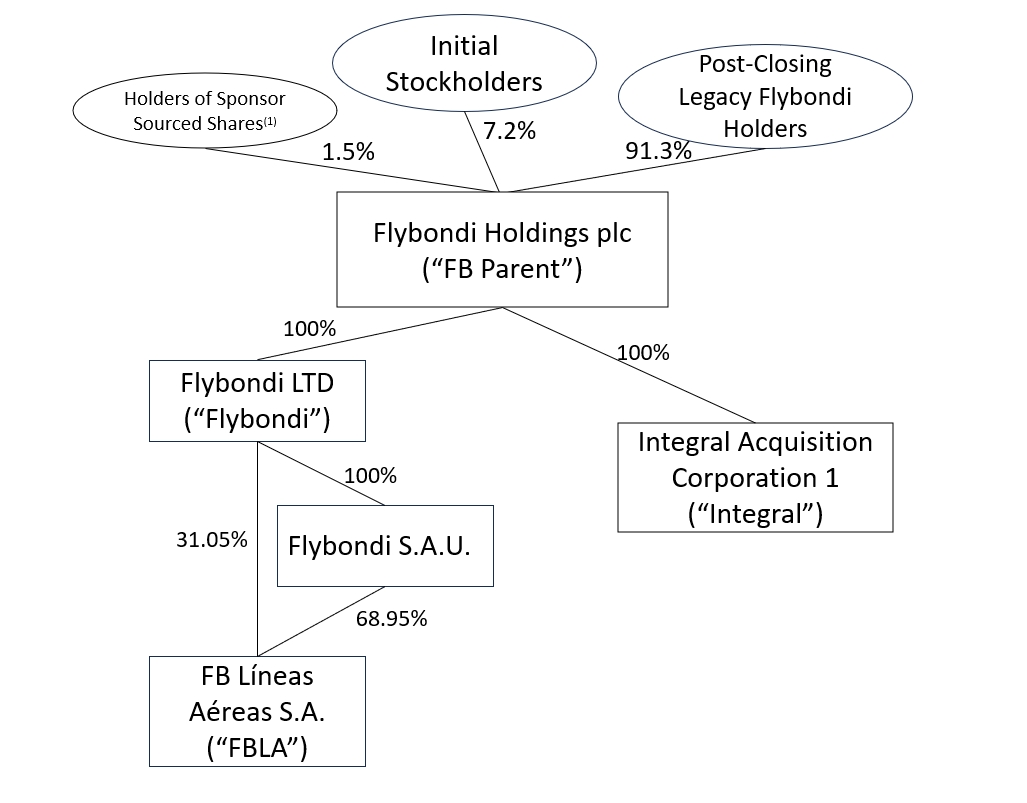

The Business Combination Agreement provides for, among other things, the following transactions: (i) FB Parent will acquire the shares of Flybondi (the “Flybondi Shares”) held by the Sellers in exchange for the issuance by FB Parent of new ordinary shares of FB Parent (the “Share Exchange”), and (ii) Integral will merge with and into Merger Sub (the “Merger”), with Integral continuing as the surviving entity and as a wholly-owned subsidiary of FB Parent, and each issued and outstanding security of Integral immediately prior to the Merger will be canceled and converted into the right of the holder thereof to receive a substantially equivalent security of FB Parent. In connection with the closing of the Business Combination (the “Closing”), (i) FB Parent and certain holders of FB Parent securities upon the Closing, including Integral Sponsor, LLC (the “Sponsor”), certain Integral directors and executive officers and certain Sellers will enter into a lock-up agreement (the “Lock-Up Agreement”) with respect to certain equity or equity-linked securities of FB Parent as set forth in the Lock-Up Agreement (the “Lock-Up Securities”), and (ii) FB Parent and certain holders of FB Parent securities upon the Closing, including the Sponsor and certain Sellers, will enter into a registration rights agreement (the “Registration Rights Agreement”) with respect to certain equity or equity-linked securities of FB Parent as set forth in the Registration Rights Agreement (the “Covered Securities”), in each case as further described in this proxy statement/prospectus.

At the effective time of the Share Exchange, the total consideration to be paid by FB Parent to the Sellers for their Flybondi Shares shall be an aggregate number of FB Parent Ordinary Shares valued at $10.00 per share, with an aggregate value of up to $300,000,000, with such amount equaling $300,000,000 if all holders of Flybondi Shares that are not Signing Sellers participate in the transactions by executing Seller Joinders by the Business Combination Agreement. Each Flybondi Share outstanding immediately prior to the effective time of the Share Exchange and held by a Seller will be exchanged for the number of FB Parent Ordinary Shares equal to the Per Share Exchange Ratio as provided in the Business Combination Agreement. All of the in-the-money vested Flybondi Options outstanding immediately prior to the Share Exchange will be exercised and converted into the right to receive the number of FB Parent Ordinary Shares equal to the Per Share Exchange Ratio as provided in the Business Combination Agreement. All unvested and/or out-of-the-money Flybondi Options outstanding immediately prior to the Share Exchange will be converted into options to purchase ordinary shares of FB Parent equal to the Per Share Exchange Ratio as provided in the Business Combination Agreement. Any entitlements under the Deferred Incentive Plans may (at Flybondi’s discretion) be converted into the right to receive a number of FB Parent Ordinary Shares equal to the Per Share Exchange Ratio as

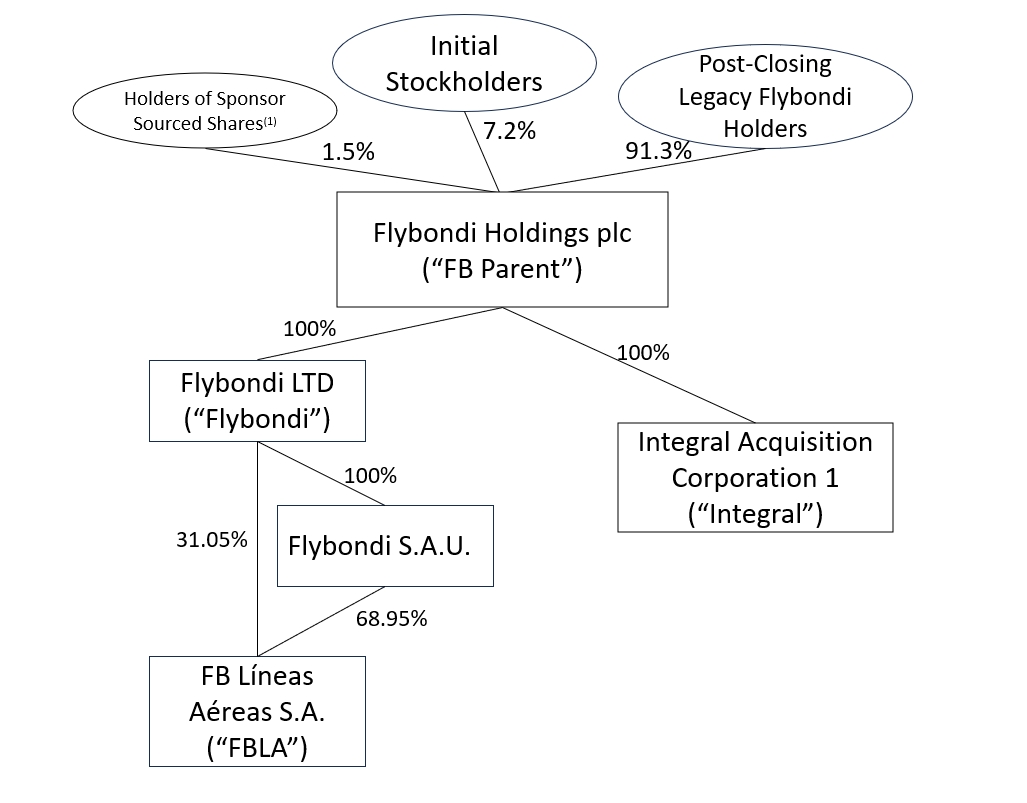

provided in the Business Combination Agreement. At the effective time of the Merger (“Merger Effective Time”), each issued and outstanding share of Integral common stock will be automatically converted into and exchanged for one FB Parent Ordinary Share, and each issued and outstanding Integral warrant will be automatically converted into and become one FB Parent warrant to purchase FB Parent Ordinary Shares.

Integral retained Marshall & Stevens to act as its fairness opinion provider in connection with the Business Combination and to provide an independent fairness opinion to the Integral Board. On October 18, 2023, at a meeting of the Integral Board held to evaluate the Business Combination, Marshall & Stevens delivered to the Integral Board an oral opinion, which was later confirmed by delivery of a written opinion, dated October 18, 2023, to the effect that, as of the date of the opinion and based on and subject to various assumptions and limitations described in its written opinion, the Flybondi Shareholder Transaction Consideration is fair, from a financial point of view, to Integral and through their ownership interest in the Company, Integral’s unaffiliated Public Stockholders. Marshall & Stevens’s written opinion is attached to this proxy statement/prospectus as Annex C. For more information with respect to the opinion of Marshall & Stevens, please see the section entitled “The Business Combination — Fairness Opinion of Marshall & Stevens.”

In connection with Integral's initial public offering, Integral entered into a letter agreement with the Initial Stockholders (as defined in the proxy statement/prospectus) and Integral’s directors and officers, pursuant to which each agreed to vote all of their shares of Integral Common Stock in favor of the Business Combination Proposal. As of the record date, such holders beneficially own an aggregate of approximately 88.8% of the issued and outstanding shares of Integral Common Stock. As such ownership represents greater than a majority of the shares of Integral Common Stock issued and outstanding, Integral does not expect to need any of the Public Shares to be voted in favor of any of the proposals set forth in this proxy statement/prospectus for such proposals to be approved.

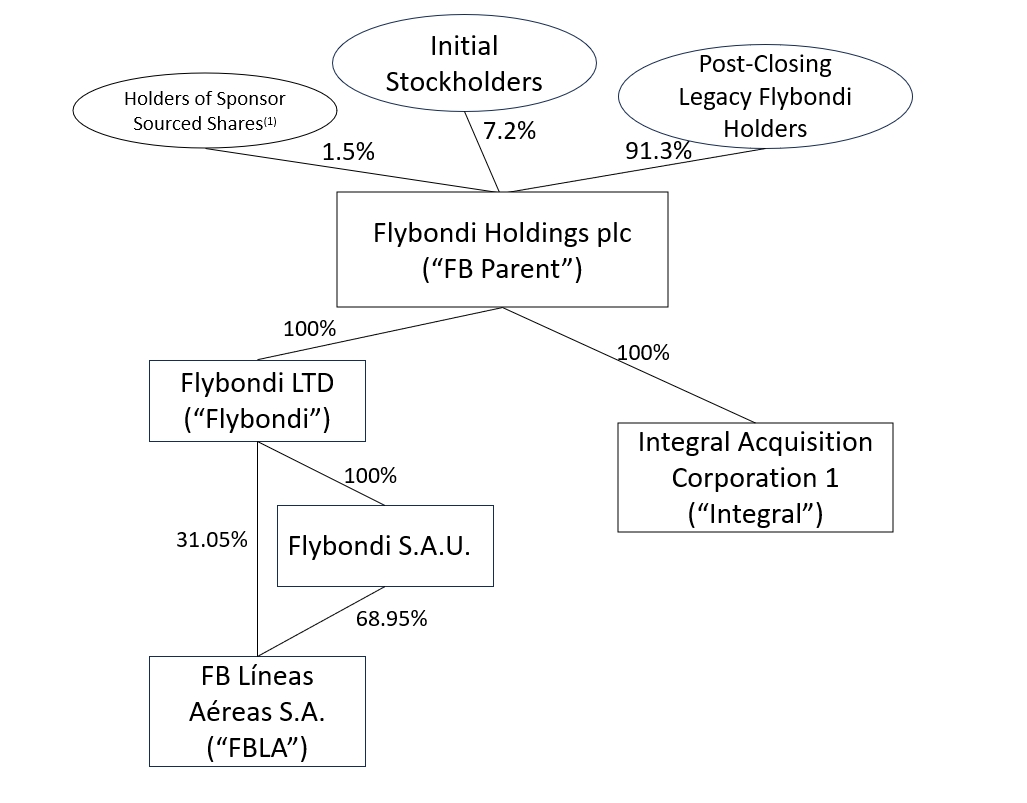

Upon consummation of the Business Combination and subject to the assumptions set forth in this proxy statement/prospectus, including no additional redemptions by Integral’s public stockholders, FB Parent is expected to have up to 33,237,670 FB Parent Ordinary Shares, 13,993 FB Parent options (representing solely the out-of-the-money Flybondi Options) and 10,700,000 FB Parent warrants issued and outstanding. For additional information, see the section entitled “The Business Combination Agreement —Consideration” beginning on page 127 of this proxy statement/prospectus.

The following table summarizes the pro forma ownership of FB Parent immediately following the Business Combination under two redemption scenarios.

| | | | | | | | | | |

| | Share ownership in combined company |

| | Pro Forma Combined | | Pro Forma Combined |

| | (Assuming No | | (Assuming Maximum |

| | Redemptions Scenario) | | Redemptions Scenario) |

Stockholder | | Shares | | % | | Shares | | % |

Flybondi Shareholders (1) | | | 30,000,000 | | 90.3% | | | 30,000,000 | | 91.3% |

Sponsor Sourced Shares (2) | | | 500,000 | | 1.5% | | | 500,000 | | 1.5% |

Integral Public Stockholders (6) | | | 362,670 | | 1.1% | | | - | | - |

Sponsor Related Parties | | | 2,375,000 | | 7.1% | | | 2,375,000 | | 7.2% |

Total FB Parent ordinary shares outstanding at Closing, not reflecting potential sources of dilution | | | 33,237,670 | | 100.0% | | | 32,875,000 | | 100.0% |

| | | | | | | | | | |

Total Pro Forma Book Value (USD) (3) | | $ | (139,758,596) | | | | $ | (143,499,161) | | |

Pro Forma Book Value Per Share (USD) (4) | | $ | (4.20) | | | | $ | (4.36) | | |

| | | | | | | | |

| | Pro Forma Combined | | Pro Forma Combined |

| | (Assuming No | | (Assuming Maximum |

| | Redemptions Scenario) | | Redemptions Scenario |

Stockholder | | Shares | | % | | Shares | | % |

Total FB Parent ordinary shares outstanding at Closing, not reflecting potential sources of dilution | | 33,237,670 | | 75.6% | | 32,875,000 | | 75.4% |

Potential sources of dilution: | | | | | | | | |

Integral Warrants - Public | | 5,750,000 | | 13.1% | | 5,750,000 | | 13.2% |

Integral Warrants - Private (to be held by the Sponsor) (5) | | 3,300,000 | | 7.5% | | 3,300,000 | | 7.6% |

Integral Warrants - Private (to be held by the Cartesian Escrow Parties) | | 1,650,000 | | 3.8% | | 1,650,000 | | 3.8% |

Total FB Parent ordinary shares outstanding at Closing | | 43,937,670 | | 100.0% | | 43,575,000 | | 100.0% |

(1)Assumes that all shareholders of Flybondi Limited exchange their shares in Flybondi Limited for FB Parent Ordinary Shares in connection with the Closing.

(2)Flybondi will allocate these shares, at its discretion, to other parties after completion of the transaction.

(3)Total Pro Forma Book Value is Total shareholders' deficit, see “Unaudited Pro Forma Condensed Combined Financial Information” for pro forma book value in the different scenarios.

(4)Pro forma book value per share is a result of pro forma book value divided by total shares outstanding, excluding potential sources of dilution.

(5)Does not include up to 1,500,000 Conversion Warrants that may be issued at Closing, at the election of the Sponsor, to the Sponsor in satisfaction of up to $1,500,000 of the unpaid principal amount of the Working Capital Loan Note.

(6)Assuming no redemptions scenario, 362,670 Integral Public Shares are calculated as follows: 1,198,342 Integral Public Shares outstanding as of June 30, 2024 less 835,672 Integral Public Shares redeemed in November 2024.

Integral’s units, Class A common stock and warrants are currently quoted on the OTC Markets under the symbols “INTEU,” “INTE” and “INTEW,” respectively. Any outstanding units will be separated into their component securities, consisting of one share of Class A common stock and one-half of one redeemable warrant, immediately prior to the Merger Effective Time and exchanged for FB Parent Ordinary Shares and FB Parent Warrants, respectively. FB Parent intends to apply to list the FB Parent Ordinary Shares and FB Parent Warrants on the Nasdaq Stock Market ("Nasdaq") under the symbols “FLYB” and “FLYBW,” respectively, in connection with the Closing. There can be no assurance that the FB Parent Ordinary Shares or FB Parent Warrants will be approved for listing on Nasdaq.

FB Parent is a “foreign private issuer” and an “emerging growth company” under the applicable Securities and Exchange Commission rules and will be eligible for reduced public company disclosure requirements. In addition, upon the consummation of the Business Combination, Pangaea will hold approximately 58.3% of FB Parent’s voting power assuming no redemption of any outstanding share of Integral Class A Common Stock. Peter Yu, Flybondi and FB Parent's chairman, will have ultimate voting and investment discretion of FB Parent Ordinary Shares that will be held by Pangaea. As a result, we will be a “controlled company” within the meaning of the Nasdaq listing rules. Under these rules, a listed company of which more than 50% of the voting power is held by an individual, Company, or another company is a “controlled company” and is permitted to elect to not comply with certain corporate governance requirements. See "Risk Factors—Risks Related to FB Parent and Its Securities Following the Business Combination—Upon the consummation of the Business Combination, FB Parent will be a “controlled company” within the meaning of the Nasdaq listing rules and, as a result, can rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies."

Compensation Received by the Sponsor

Set forth below is a summary of the terms and amounts of the compensation received or to be received by the Sponsor and its affiliates in connection with the Business Combination or any related financing transaction, the number of securities issued or to be issued by Integral to the Sponsor and its affiliates and the price paid or to be paid for such securities or any related financing transaction.

| | | | |

| | Interest in Securities | | Other Compensation |

Sponsor | | The Sponsor currently holds 2,824,999 shares of Integral Class A Common Stock and one share of Integral Class B Common Stock. At Closing, Sponsor shall deliver for transfer and/or cancellation 500,000 shares of such Integral Class A Common Stock, and upon the completion of the Business Combination, Sponsor shall hold a total of 2,325,000 FB Parent Ordinary Shares. In addition, an Anchor Investor currently holds 50,000 Integral Class A Ordinary Shares and, at Closing, shall directly hold 50,000 FB Parent Ordinary Shares. | | In addition, upon Closing, FB Parent shall pay, or cause to be paid, all Unpaid Company Transaction Expenses (including seventy-five percent (75%) or such larger necessary portion of the premium and other costs and expenses associated with the D&O Tail (as defined in the Business Combination Agreement)) and all Unpaid SPAC Transaction Expenses (each as defined in the Business Combination Agreement); provided, that at the Closing and after disbursement of any amounts from the Trust Account to redeeming Public Stockholders with respect to all Public Share Redemptions as directed by Integral, the cash disbursed from the Trust Account shall be used (x) first, to pay any Unpaid SPAC Transaction Expenses, which shall be no more than an aggregate amount of $800,000, and (y) second, to the extent any cash remains, for working capital and general corporate purposes of FB Parent; provided, further, that (i) if the cash available from the Trust Account is less than $800,000, Flybondi shall pay, or cause to be paid, the difference between $800,000 and the cash available from the Trust Account to the payees of Unpaid SPAC Transaction Expenses and (ii) if the Unpaid SPAC Transaction Expenses exceed $800,000, Sponsor shall bear such excess Unpaid SPAC Transaction Expenses. |

The retention of FB Parent Ordinary Shares by the Sponsor and an Anchor Investor at Closing will not result in a material dilution of the equity interests of non-redeeming Public Stockholders. See “Questions and Answers - What equity stake will Integral Stockholders and Flybondi shareholders have in FB Parent after the Closing?”

Conflicts of Interest

When you consider the recommendation of the Integral Board to vote in favor of approval of the Business Combination Proposal and the other proposals described in this proxy statement/prospectus, you should keep in mind that the Initial Stockholders and certain of Integral’s directors and officers have interests in the Business Combination that are different from, in addition to, or in conflict with, your interests as a stockholder. These interests include, among other things:

•the beneficial ownership interests that the Initial Stockholders, including each of Integral’s directors and officers and certain Anchor Investors, have in the 2,875,000 Founder Shares, acquired prior to the IPO for an aggregate purchase price of $25,000, which shares would become worthless if Integral does not complete a business combination within the applicable time period, as the holders have waived liquidation rights with respect to such shares. The Sponsor holds 2,825,000 Founder Shares, and each of Integral’s officers, directors and Anchor Investors have an indirect interest in such shares by virtue of their membership in the Sponsor. In addition, an Anchor Investor directly holds 50,000 Founder Shares. The Founder Shares have an aggregate market value of approximately $31.8 million, based on the closing price of the shares of Integral Class A Common Stock of $11.07 on the OTC Markets on February 19, 2025;

•the beneficial ownership interests that the Initial Stockholders, including each of Integral’s directors and officers (but excluding the Anchor Investors), have in the 4,950,000 Private Warrants, acquired for an aggregate purchase price of $4,950,000, which warrants would become worthless if Integral does not complete a business combination within the applicable time period, as the holders of the Private Warrants have waived liquidation rights with respect to the component Private Shares and there will be no distribution from the Trust Account with respect to Integral Warrants.

Such Private Warrants have an aggregate market value of $99,495, based on the closing price of the Integral Warrants of $0.0201 on the OTC Markets on February 19, 2025;

•even if the trading price of the FB Parent Ordinary Shares following the consummation of the Business Combination was as low as $2.09 per share, the aggregate market value of the FB Parent Ordinary Shares issued in exchange for the Founder Shares alone, would be approximately equal to the initial investment in Integral by the Initial Stockholders. As a result, if the Business Combination is completed, the Initial Stockholders are likely to be able to make a substantial profit on their investment in Integral even at a time when the FB Parent Ordinary Shares have lost significant value. On the other hand, if the Business Combination Proposal is not approved and Integral does not consummate an initial business combination by November 5, 2025, or such later date as may be approved by Integral Stockholders, the Initial Stockholders will lose their entire investment in Integral (except as to any liquidating distributions to which they may be entitled as holders of Public Shares);

•the fact that the Sponsor holds (i) a promissory note in the aggregate principal amount of up to $630,000 (the “First Extension Promissory Note”), issued on May 8, 2023 by Integral in connection with the First Extension, pursuant to which the Sponsor agreed to loan to Integral up to such amount to be deposited in the Trust Account; (ii) a promissory note in the aggregate principal amount of up to $359,503 (the “Second Extension Promissory Note”), issued on November 8, 2023 by Integral in connection with the Second Extension, pursuant to which the Sponsor agreed to loan to Integral up to such amount to be deposited in the Trust Account ($29,959 per month following the 5th of each month from November 8, 2023 through November 5, 2024); and (iii) a promissory note in the aggregate principal amount of up to $130,561.20 (the "Third Extension Promissory Note"), issued on November 6, 2024 by Integral in connection with the Third Extension, pursuant to which the Sponsor agreed to loan to Integral up to such amount to be deposited in the Trust Account ($10,880.10 per month following the 5th of each month from November 6, 2024 through November 5, 2025). The Extension Promissory Notes bear no interest and are repayable in full upon the earlier of (a) the date of the consummation of the Business Combination, and (b) the date of the liquidation of Integral. As of December 31, 2024, $355,000 had been borrowed under the First Extension Promissory Note, $359,503 had been borrowed under the Second Extension Promissory Note and $21,760 had been borrowed under the Third Extension Promissory Note. In the event an initial business combination is consummated, the Extension Notes may be repaid out of the proceeds of the Trust Account released to the post-combination company. Otherwise, the Extension Notes would be repaid only out of funds held outside the Trust Account. In the event that a business combination does not close, Integral may use a portion of proceeds held outside the Trust Account to repay the Extension Notes, but no proceeds held in the Trust Account would be used to repay the Extension Notes;

•the fact that the Sponsor holds a promissory note in the principal amount of up to $1,500,000 (“Working Capital Loan Note”), issued by Integral in connection with advances the Sponsor has made, and may make in the future, to Integral for working capital expenses. The Working Capital Loan Note bears no interest and is due and payable upon the earlier to occur of (i) the date on which Integral consummates its initial business combination and (ii) the date that the winding up of Integral is effective. At the election of the Sponsor, up to $1,500,000 of the unpaid principal amount of the Working Capital Loan Note may, in the event an initial business combination is consummated, be converted into Conversion Warrants of the post-combination company, in a number equal to: (x) the portion of the principal amount of the note being converted, divided by (y) $1.00, rounded up to the nearest whole number of warrants. The Conversion Warrants will be identical to the FB Parent Warrants. The Conversion Warrants and their underlying securities are entitled to the registration rights set forth in the note. By contrast, if Integral is unable to consummate an initial business combination and is forced to liquidate, the Working Capital Loan Note would be due upon the winding up of Integral, and Integral may use a portion of proceeds held outside the Trust Account to repay the Working Capital Loan Note but no proceeds held in the Trust Account would be used to repay the Working Capital Loan Note. As of December 31, 2024, there was $1,500,000 outstanding under the Working Capital Loan Note;

•the fact that the Sponsor holds a promissory note in the principal amount of up to $3,000,000 (the “Second Working Capital Loan Note”), issued by Integral in connection with advances the Sponsor has made, and may make in the future, to Integral for working capital expenses. The Second Working Capital Loan Note bears no interest and is due and payable upon the earlier to occur of (i) the date on which the Company consummates its initial Business Combination and (ii) the date that the winding up of the Company is effective. At December 31, 2024, the Company had $531,493 of borrowings under the Second Working Capital Loan Note;

•the Anchor Investors have acquired from the Sponsor an indirect economic interest in an aggregate of 500,000 Founder Shares at an aggregate purchase price of $5,000 (or $0.01 per Founder Share). The Sponsor has agreed to distribute such Founder Shares to the Anchor Investors after the completion of Integral’s initial business combination. As a result, if the Business Combination is consummated, the Anchor Investors may make a substantial profit on their investment in Integral, even at a time when the FB Parent Ordinary Shares have lost significant value. The Anchor Investors may therefore have different interests with respect to a vote on the Business Combination Proposal than

other Public Stockholders and an incentive to vote any Public Shares they own in favor of such proposals. However, Integral is not aware of any arrangements or understandings among the Anchor Investors with regard to voting, including voting with respect to the Business Combination Proposal, other than the agreement by one Anchor Investor to vote the 50,000 Founder Share directly held by such Anchor Investor in favor of Integral’s initial business combination;

•in connection with the IPO, the Sponsor agreed that it will be liable under certain circumstances to ensure that the proceeds in the Trust Account are not reduced by any claims by a third party for services rendered or products sold to Integral, or a prospective target business with which Integral has entered into a written letter of intent, confidentiality or other similar agreement or business combination agreement;

•Integral’s directors and officers will not receive reimbursement for any out-of-pocket expenses incurred by them on Integral’s behalf incident to identifying, investigating and consummating a business combination to the extent such expenses exceed the amount not required to be retained in the Trust Account, unless a business combination is consummated;

•the anticipated election of Enrique Klix, Integral’s Chief Executive Officer and director, as a director of FB Parent following the consummation of the Business Combination; and

•the continued indemnification of current directors and officers of Integral and the continuation of directors’ and officers’ liability insurance after the Business Combination.

These interests may influence Integral’s directors in making their recommendation to vote in favor of the approval of the Business Combination Proposal and the other proposals described in this proxy statement/prospectus. You should also read the section entitled “The Business Combination — Integral Board’s Reasons for the Approval of the Business Combination.”

Integral is providing this proxy statement/prospectus and accompanying proxy card to its stockholders in connection with the solicitation of proxies to be voted at the Special Meeting and at any adjournments or postponements of the Special Meeting. More information about Integral, Flybondi, FB Parent and the Business Combination is contained in this proxy statement/prospectus. Whether or not you plan to attend the Special Meeting (via the virtual meeting platform), Integral urges you to carefully read the entire proxy statement/prospectus (including the financial statements and annexes attached hereto and any documents incorporated into this proxy statement/prospectus by reference). Please pay particular attention to the section entitled “Risk Factors,” beginning on page 44 of this proxy statement/prospectus.

After careful consideration, Integral’s board of directors has unanimously approved and adopted the Business Combination Agreement and unanimously recommends that Integral Stockholders vote FOR all of the proposals presented to Integral Stockholders in this proxy statement/prospectus. When you consider the Integral board of directors’ recommendation of these proposals, you should keep in mind that certain of Integral’s Initial Stockholders, directors and officers have interests in the Business Combination that may conflict with your interests as a stockholder. See the section entitled “The Business Combination — Interests of Integral’s Initial Stockholders, Directors and Officers in the Business Combination.”

Your vote is important regardless of the number of shares you hold. Please vote as soon as possible to ensure that your vote is counted, regardless of whether you expect to attend the Special Meeting (via the virtual meeting platform). Please complete, sign, date and return the enclosed proxy card in the postage-paid envelope provided. If you hold your shares in “street name” through a bank, broker or other nominee, you will need to follow the instructions provided to you by your bank, broker or other nominee to ensure that your shares are represented and voted at the Special Meeting.

On behalf of Integral’s board of directors, I thank you for your support and look forward to the successful completion of the Business Combination.

| | | |

| | | Sincerely, |

| | | |

| | | |

| | | Enrique Klix |

, 2025 | | | Chief Executive Officer and Director |

This proxy statement/prospectus is dated [●], 2025 and is first being mailed to the stockholders of Integral on or about that date.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS OR ANY OF THE SECURITIES TO BE ISSUED IN THE BUSINESS

COMBINATION, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

INTEGRAL ACQUISITION CORPORATION 1

1330 Avenue of the Americas, 23rd Floor

New York, NY 10019

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [●], 2025

To the Stockholders of Integral Acquisition Corporation 1:

NOTICE IS HEREBY GIVEN that a special meeting of stockholders (the “Special Meeting”) of Integral Acquisition Corporation 1, a Delaware corporation (“Integral”), will be held via live webcast on [●], 2025, at [●], Eastern time. The Special Meeting can be accessed by visiting https://www.cstproxy.com/[●], where you will be able to listen to the meeting live and vote during the meeting. Please note that you will only be able to access the Special Meeting by means of remote communication. Please have your control number, which can be found on your proxy card, to join the Special Meeting. If you do not have a control number, please contact Continental Stock Transfer and Trust Company, Integral’s transfer agent. You are cordially invited to attend the Special Meeting for the following purposes:

•Proposal No. 1 — The Business Combination Proposal — to consider and vote upon a proposal to approve and adopt the Business Combination Agreement, dated as of October 19, 2023 (as may be amended, supplemented, or otherwise modified from time to time, the “Business Combination Agreement”), by and among Integral, Flybondi Holdings plc, a public limited company incorporated under the laws of England and Wales (“FB Parent”), Gaucho MS, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of FB Parent (“Merger Sub”), and Flybondi Limited, a limited company incorporated under the laws of England and Wales (“Flybondi”), and certain holders of Flybondi’s outstanding shares that have executed the Business Combination Agreement (the “Signing Sellers”), and the business combination contemplated thereby (together with the other transactions related thereto, the “Business Combination,” and collectively, the “Business Combination Proposal”), pursuant to which each of the following transactions will occur in the following order:

(i)FB Parent will acquire the shares of Flybondi (the “Flybondi Shares”) held by the Sellers in exchange for the issuance by FB Parent of new ordinary shares of FB Parent (the “Share Exchange”). At the effective time of the Share Exchange, the total consideration to be paid by FB Parent to the Sellers for their Flybondi Shares shall be an aggregate number of FB Parent Ordinary Shares valued at $10.00 per share, with an aggregate value of up to $300,000,000, with such amount equaling $300,000,000 if all holders of Flybondi Shares that are not Signing Sellers participate in the transactions by executing Seller Joinders by the Business Combination Agreement. Each Flybondi Share outstanding immediately prior to the effective time of the Share Exchange and held by a Seller will be exchanged for the number of FB Parent Ordinary Shares equal to the Per Share Exchange Ratio as provided in the Business Combination Agreement. All of the in-the-money vested Flybondi Options outstanding immediately prior to the Share Exchange will be exercised and converted into the right to receive the number of FB Parent Ordinary Shares equal to the Per Share Exchange Ratio as provided in the Business Combination Agreement. All unvested and/or out-of-the-money Flybondi Options outstanding immediately prior to the Share Exchange will be converted into options to purchase ordinary shares of FB Parent equal to the Per Share Exchange Ratio as provided in the Business Combination Agreement. Any entitlements under the Deferred Incentive Plans may (at Flybondi's discretion) be converted into the right to receive a number of FB Parent Ordinary Shares equal to the Per Share Exchange Ratio as provided in the Business Combination Agreement.

(ii)Integral will merge with and into Merger Sub (the “Merger”), with Integral continuing as the surviving entity and as a wholly-owned subsidiary of FB Parent, and each issued and outstanding security of Integral immediately prior to the Merger will be canceled and converted into the right of the holder thereof to receive a substantially equivalent security of FB Parent.

•Proposal Nos. 2A through 2E — The Advisory Governance Proposals — to consider and vote upon, on a non-binding advisory basis, five separate governance proposals relating to the following material changes between Integral’s amended and restated certificate of incorporation (as amended, the “Integral Charter”) and bylaws and the amended and restated articles of FB Parent to be in effect following the Business Combination, substantially in the form attached to this proxy statement/prospectus as Annex B (“FB Parent Articles”) (collectively, the “Advisory Governance Proposals”):

(A)The FB Parent Articles would grant the directors of FB Parent the authority to allot FB Parent Ordinary Shares, up to a maximum nominal amount of £1,000,000, free of any rights of pre-emption (Proposal No. 2A);

(B)The FB Parent Articles would provide for a declassified board of directors with the result being that each director will be elected annually for a term of one year (Proposal No. 2B);

(C)The FB Parent Articles would reduce the requisite quorum for a meeting of shareholders from a majority of outstanding voting power to two persons who are, or who represent by proxy, shareholders (Proposal No. 2C);

(D)The FB Parent Articles would include an advance notice provision that requires a nominating shareholder to provide notice to FB Parent in advance of a meeting of shareholders should such nominating shareholder wish to nominate a person for election to the board of directors (Proposal No. 2D); and

(E)The FB Parent Articles would not include provisions relating to Integral’s status as a special purpose acquisition company that will no longer be relevant following the Closing (Proposal No. 2E).

•Proposal No. 3 — The NTA Requirement Amendment Proposal— to consider and vote upon a proposal to amend the Integral Charter, in the form attached to this proxy statement/prospectus as Annex F (the “Integral Charter Amendment”), to eliminate (i) the limitation that Integral shall not redeem Public Shares (as defined below) to the extent that such redemption would result in Integral’s failure to have net tangible assets of at least $5,000,001, upon consummation of Integral’s initial business combination (such limitation, the “Redemption Limitation”), and (ii) the requirement that Integral shall not consummate an initial business combination unless the Redemption Limitation is not exceeded (together, the “NTA Requirement Amendment Proposal”).

•Proposal No. 4 — The Adjournment Proposal — to consider and vote upon a proposal to authorize the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve one or more proposals presented to stockholders for vote or if certain conditions under the Business Combination Agreement are not satisfied or waived (the “Adjournment Proposal”).

Only holders of record of Integral common stock (“Integral Common Stock”) at the close of business on February 7, 2025, the record date for the Special Meeting, are entitled to notice of the Special Meeting and to vote at the Special Meeting and any adjournments or postponements of the Special Meeting. A complete list of Integral’s stockholders (“Integral Stockholders”) of record entitled to vote at the Special Meeting will be available for ten days before the Special Meeting at Integral’s principal executive offices for inspection by stockholders during ordinary business hours for any purpose germane to the Special Meeting.

Pursuant to the Integral Charter, Integral is providing the holders (the “Public Stockholders”) of the shares (the “Public Shares”) of Class A common stock, par value $0.0001 per share, of Integral (“Integral Class A Common Stock”) issued in Integral’s initial public offering (the “IPO”) with the opportunity to redeem their Public Shares for cash equal to their pro rata share of the aggregate amount on deposit in the trust account established for the benefit of the Public Stockholders in connection with the IPO (the “Trust Account”) as of two business days prior to the consummation of the Business Combination, including interest earned on the funds held in the Trust Account and not previously released to Integral (net of taxes payable, other than excise tax liabilities arising in connection with redemptions), upon the consummation of the Business Combination. For illustrative purposes, based on funds in the Trust Account of approximately $4.1 million as of December 31, 2024, the estimated per share redemption price would have been approximately $11.22 (after taking into account the removal of a portion of the accrued interest in the Trust Account to pay taxes, other than excise tax liabilities arising in connection with redemptions). Public Stockholders may elect to redeem their Public Shares even if they vote for the Business Combination Proposal or any of the other proposals presented at the Special Meeting. A Public Stockholder, together with any of his, her or its affiliates or any other person with whom he, she or it is acting in concert or as a “group” (as defined under Section 13 of the Securities Exchange Act of 1934, as amended), will be restricted from redeeming his, her or its shares with respect to more than an aggregate of 15% of the Public Shares without Integral’s prior consent. Holders of Integral’s outstanding warrants to purchase shares of Integral Class A Common Stock do not have redemption rights with respect to such warrants in connection with the Business Combination.

Integral’s Initial Stockholders (as defined in the proxy statement/prospectus), officers and directors collectively beneficially own an aggregate of (i) one share of Class B common stock, par value $0.0001 per share, of Integral (“Class B Common Stock”) issued prior to the IPO and (ii) 2,874,999 shares of Integral Class A Common Stock, which were converted (the “Class B Conversion”) on a one-for-one basis from shares of Class B Common Stock (as converted, and together with (i), the “Founder Shares”), collectively representing approximately 88.8% of Integral’s issued and outstanding shares of common stock. Integral’s Initial Stockholders, officers and directors have agreed to (i) waive their redemption rights with respect to any shares of Integral Common Stock that they may hold in connection with the completion of the Business Combination and (ii) vote any such shares in favor of the Business Combination Proposal. The Founder Shares will be excluded from the pro rata calculation used to determine the per-share redemption price. Notwithstanding the Class B Conversion, the holders of Founder Shares will not be entitled to receive any funds held in the Trust Account with respect to any such converted shares.

The approval of the Business Combination Proposal requires the affirmative vote of the holders of at least a majority of the outstanding shares of Integral Common Stock entitled to vote thereon at the Special Meeting. The approval of the NTA Requirement Amendment Proposal requires the affirmative vote of the holders of at least sixty-five percent (65%) of the outstanding shares of Integral Common Stock entitled to vote thereon at the Special Meeting. The approval of, if presented, the Adjournment Proposal requires the affirmative vote of the holders of at least a majority of the shares of Integral Common Stock entitled to vote thereon and voted, in person (via the virtual meeting platform) or by proxy, at the Special Meeting. Accordingly, a stockholder’s failure to vote in person (via the virtual meeting platform) or by proxy at the Special Meeting, an abstention from voting or a broker non-vote will have the same effect as a vote “AGAINST” the Business Combination Proposal and the NTA Requirement Amendment Proposal and, if a valid quorum is otherwise established, no effect on the outcome of any vote on, if presented, the Adjournment Proposal.

The approval of each of the Advisory Governance Proposals requires the affirmative vote of the holders of at least a majority of the shares of Integral Common Stock entitled to vote thereon and voted, in person (via the virtual meeting platform) or by proxy, at the Special Meeting. A vote to approve each of the Advisory Governance Proposals is an advisory vote, and therefore, is not binding on Integral, Flybondi, FB Parent or their respective boards of directors. Accordingly, regardless of the outcome of the non-binding advisory votes on the Advisory Governance Proposals, Integral, Flybondi and FB Parent intend that the FB Parent Articles, in the form attached to this proxy statement/prospectus as Annex B and containing the provisions noted in the Advisory Governance Proposals, will take effect at the Closing, assuming approval of the Business Combination Proposal.

The Closing is conditioned on the adoption of the Business Combination Proposal. The NTA Requirement Amendment Proposal is also conditioned on the adoption of the Business Combination Proposal. The Business Combination Proposal, the Advisory Governance Proposals and the Adjournment Proposal are not conditioned on the adoption of any other proposal set forth in this proxy statement/prospectus. If the NTA Requirement Amendment Proposal is approved, subject to the approval of the Business Combination Proposal, and if Integral’s board of directors determines to implement the Integral Charter Amendment, such amendment will be filed with the Secretary of State of the State of Delaware substantially concurrently with the Closing.

Your vote is important regardless of the number of shares you hold. Please vote as soon as possible to ensure that your vote is counted, regardless of whether you expect to attend the Special Meeting in person (via the virtual meeting platform). Please complete, sign, date and return the enclosed proxy card in the postage-paid envelope provided. If you hold your shares in “street name” through a bank, broker or other nominee, you will need to follow the instructions provided to you by your bank, broker or other nominee to ensure that your shares are represented and voted at the Special Meeting.

If you sign and return your proxy card without indicating how you wish to vote, your proxy will be voted in favor of each of the proposals presented at the Special Meeting. If you fail to return your proxy card or fail to instruct your bank, broker or other nominee how to vote, and do not attend the Special Meeting in person (via the virtual meeting platform), the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the Special Meeting and will have the same effect as a vote “AGAINST” the Business Combination Proposal and the NTA Requirement Amendment Proposal and, if a valid quorum is otherwise established, no effect on the outcome of any vote on the other proposals set forth in this proxy statement/prospectus. However, if Integral Stockholders do not approve the Business Combination Proposal, the Business Combination may not be consummated. If you are a stockholder of record and you attend the Special Meeting and wish to vote in person (via the virtual meeting platform), you may withdraw your proxy and vote in person (via the virtual meeting platform).

Your attention is directed to the proxy statement/prospectus accompanying this notice (including the financial statements and annexes attached thereto and any documents incorporated into the proxy statement/prospectus by reference) for a more complete description of the Business Combination and related transactions and each of the proposals. Integral urges you to carefully read the entire proxy statement/prospectus. If you have any questions or need assistance voting your shares, please call Integral’s proxy solicitor, Advantage Proxy, Inc, (“Advantage Proxy”), at (877) 870-8565 (toll free). Banks and brokers may reach Advantage Proxy at (206) 870-8565. This notice of meeting and the accompanying proxy statement/prospectus are available at https://www.cstproxy.com/[●].

| | |

| | By Order of the Board of Directors, |

| | |

| | Enrique Klix |

| | Chief Executive Officer and Director |

[●], 2025

IF YOU SIGN AND RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS.

TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST (1) IF YOU HOLD SHARES OF INTEGRAL CLASS A COMMON STOCK THROUGH UNITS, ELECT TO SEPARATE YOUR UNITS INTO THE UNDERLYING PUBLIC SHARES AND PUBLIC WARRANTS PRIOR TO EXERCISING YOUR REDEMPTION RIGHTS WITH RESPECT TO THE PUBLIC SHARES, (2) SUBMIT A WRITTEN REQUEST TO THE TRANSFER AGENT, AT LEAST TWO BUSINESS DAYS PRIOR TO THE VOTE AT THE SPECIAL MEETING, THAT YOUR PUBLIC SHARES BE REDEEMED FOR CASH, AND (3) DELIVER YOUR PUBLIC SHARES TO THE TRANSFER AGENT, PHYSICALLY OR ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT/WITHDRAWAL AT CUSTODIAN) SYSTEM, IN EACH CASE IN ACCORDANCE WITH THE PROCEDURES AND DEADLINES DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS. IF THE BUSINESS COMBINATION IS NOT CONSUMMATED, THEN THE PUBLIC SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD THE PUBLIC SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS. SEE “THE SPECIAL MEETING OF INTEGRAL STOCKHOLDERS” IN THIS PROXY STATEMENT/PROSPECTUS FOR MORE SPECIFIC INSTRUCTIONS.

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This document, which forms part of a registration statement on Form F-4 (File No. 333- 284446) filed with the SEC by FB Parent, constitutes a prospectus of FB Parent under Section 5 of the Securities Act with respect to the FB Parent Ordinary Shares to be issued to Integral Stockholders, as well as the FB Parent Warrants to acquire FB Parent Ordinary Shares to be issued upon conversion of the Integral Warrants and the FB Parent Ordinary Shares underlying such warrants, if the Business Combination described herein is consummated. This document also constitutes a notice of meeting and a proxy statement under Section 14(a) of the Exchange Act with respect to the Special Meeting at which Integral Stockholders will be asked to consider and vote upon a proposal to approve and adopt the Business Combination Agreement and the Business Combination contemplated thereby, among other matters.

This document does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction or to any person to whom it would be unlawful to make such offer.

Integral files reports, proxy statements/prospectuses and other information with the SEC as required by the Exchange Act. For information on how to obtain copies of these materials, see the section of this proxy statement/prospectus entitled “Where You Can Find More Information.”

IMPORTANT INFORMATION ABOUT IFRS ACCOUNTING STANDARDS

Flybondi’s audited consolidated financial statements included in this proxy statement/prospectus as of and for the years ended December 31, 2023 and 2022 (hereinafter referred to as the “Audited Consolidated Financial Statements”) have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (“IASB”) and referred to in this proxy statement/prospectus as “IFRS”.

Flybondi's unaudited interim condensed consolidated financial statements included in this proxy statement/prospectus as of June 30, 2024 and for the six months ended June 30, 2024 and 2023 (herein after referred to as the "Unaudited Interim Financial Statements") have been prepared in accordance with IAS 34 “Interim Financial Reporting” and they should be read in conjunction with the Audited Consolidated Financial Statements.

The Audited Consolidated Financial Statements and Unaudited Interim Financial Statements are referred to as the “Flybondi Financial Statements”. FB Parent’s audited financial statements included in this proxy statement/prospectus as of June 30, 2024 and February 28, 2024 (inception) and for the period from February 28, 2024 (inception) through June 30, 2024 (hereinafter referred to as the “FB Parent Audited Financial Statements”) have been prepared in accordance with IFRS.

FINANCIAL STATEMENT PRESENTATION

Integral

The financial statements of Integral included in this proxy statement/prospectus have been prepared in accordance with generally accepted accounting standards in the United States of America (“U.S. GAAP”) and are presented in U.S. dollars.

Flybondi

The Audited Consolidated Financial Statements and the FB Parent Audited Financial Statements included in this proxy statement/prospectus have been prepared in accordance with IFRS and are presented in U.S. dollars. The Unaudited Interim Financial Statements have been prepared in accordance with IAS 34 and are presented in U.S. dollars

Segment Information

Flybondi manages its business as a single operating segment which is the air transportation services to passengers. Flybondi has adopted IFRS 8 (Operating Segments), which requires operating segments to be identified on the basis of internal reports regarding components of the business that are regularly reviewed by management, including Flybondi’s Chief Operating Decision

Maker, in order to allocate resources and to assess Flybondi’s business performance. See Note 32 to the Audited Consolidated Financial Statements and Note 23 to the Unaudited Interim Financial Statements.

Special Note Regarding Adjusted EBIT

Adjusted EBIT

Flybondi measures its operating segment’s performance by its Adjusted EBIT, and uses this metric to make decisions about allocating resources and to evaluate the financial performance of Flybondi’s business.

Flybondi defines Adjusted EBIT as the consolidated net profit or loss for the year or period before interest expense and taxation, and further excluding other financial expenses, financial income, impairment losses on tax credits, net foreign currency exchange results (gain or losses), net results on monetary position (gain or losses), shared-based compensation expenses and dispute settlement charges. Although Adjusted EBIT may be commonly viewed as a non-IFRS measure in other contexts, pursuant to IFRS 8, “Operating Segments”, Adjusted EBIT is herein treated as an IFRS measure in the manner in which Flybondi utilizes this measure. Nevertheless, Flybondi’s Adjusted EBIT metric should not be viewed in isolation or as a substitute for operating profit or loss or net profit or loss or any IFRS measures of earnings for the years or periods presented under IFRS. Flybondi also believes that its Adjusted EBIT metric is a useful metric used by analysts and investors, although this measure is not explicitly defined under IFRS. Additionally, the way Flybondi calculates its segment’s performance measure may be different from the calculations used by other companies, including competitors, and therefore, Flybondi’s performance measure may not be comparable to those of other companies or competitors.

Adjusted EBIT has limitations as an analytical measure, and you should not consider it in isolation or as a substitute for analysis of Flybondi’s results as reported under IFRS.

See “Selected Historical Financial Information of Flybondi” for a reconciliation of Flybondi’s Adjusted EBIT to net loss for the years or periods presented.

Special Note Regarding Non-IFRS Measures

Adjusted EBITDA

Flybondi compares its financial performance to other airlines using Adjusted EBITDA, which is common practice in the industry.

Flybondi defines Adjusted EBITDA as Adjusted EBIT, excluding aircraft right-of-use depreciation, and depreciation and amortization.

Flybondi believes that Adjusted EBITDA is a useful metric used by analysts, investors, and other interested parties in the aviation industry, although it is not a measure explicitly defined in IFRS. Adjusted EBITDA should not be considered as a substitute for operating loss or net loss or any IFRS measures of earnings for the years or periods presented under IFRS. Additionally, Flybondi’s calculation of Adjusted EBITDA may be different from the calculations used by other companies, including its competitors in the aviation industry, and, therefore, Flybondi’s measure may not be comparable to those of other companies or competitors. Adjusted EBITDA does not reflect historical expenditures, expenditures for major maintenance or future requirements for capital expenditures or contractual commitments.

Adjusted EBITDA has limitations as an analytical measure, and you should not consider it in isolation or as a substitute for analysis of Flybondi’s results as reported under IFRS.

See “Selected Historical Financial Information of Flybondi” for a reconciliation of Flybondi’s Adjusted EBITDA to net loss for the years or periods presented.

INDUSTRY AND MARKET DATA

In this proxy statement/prospectus, Flybondi relies on and refers to industry data, information and statistics regarding the markets in which it competes from research as well as from publicly available information, industry and general publications and research and studies conducted by third parties. Flybondi has supplemented this information where necessary with its own internal estimates, considering publicly available information about other industry participants and its management’s best view as to information that is not publicly available. This information appears in “Information About Flybondi,” “Flybondi Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and other sections of this proxy statement/prospectus. Flybondi has taken such care as it considers reasonable in the extraction and reproduction of information from such data from third party sources.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this proxy statement/prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates. See “Cautionary Note Regarding Forward-Looking Statements.”

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

Flybondi, FB Parent, Integral and their respective subsidiaries own or have rights to trademarks, trade names and service marks that they use in connection with the operation of their respective businesses. In addition, their names, logos and website names and addresses are their trademarks or service marks. Other trademarks, trade names and service marks appearing in this proxy statement/prospectus are the property of their respective owners. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this proxy statement/prospectus are listed without the applicable ®, ™ and SM symbols, but the applicable owners will assert, to the fullest extent under applicable law, their rights to these trademarks, trade names and service marks. The use or display of other parties’ trademarks, trade names or service marks in this proxy statement/prospectus is not intended to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of Flybondi, FB Parent or Integral by, these other parties.

FREQUENTLY USED TERMS

In this document, unless the context otherwise requires:

"ACMI" means aircraft, crew, maintenance, and insurance contract.

“Adjournment Proposal” means a proposal to authorize the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve one or more proposals presented to stockholders for vote or if certain conditions under the Business Combination Agreement are not satisfied or waived.

“Advisory Governance Proposals” means the proposal to consider and vote upon, on a non-binding advisory basis, five separate governance proposals relating to certain material changes between the Integral Governing Documents and the FB Parent Articles, collectively.

“Aeroparque” means the Aeroparque Internacional Jorge Newbery, in the city of Buenos Aires, Argentina.

“Aircraft utilization” means the number of block hours (defined as the time from the moment the aircraft door closes at departure of a flight until the moment the aircraft door opens at the arrival gate following its landing) divided by the average number of active aircraft per day.

“Agreement End Date” means March 31, 2025.

“ANAC” means the Administración Nacional de Aviación Civil of Argentina.

“Anchor Investors” means the qualified institutional buyers or institutional accredited investors not affiliated with Integral, the Sponsor, Integral’s directors or any member of Integral’s management team, that participated in the IPO and an indirect beneficial interest in certain Founder Shares held by the Sponsor at the time of the IPO.

“Ancillary Agreements” means the Sponsor Support Agreement, the Lock-Up Agreement, the Registration Rights Agreement, the Warrant Amendment Agreement and all other agreements, certificates and instruments executed and delivered by Integral, FB Parent, Merger Sub or Flybondi in connection with the Business Combination and specifically contemplated by the Business Combination Agreement.

“ARS” means the Argentine peso, the national currency of Argentina.

“Assignment, Novation and Amendment Agreement” means the Assignment, Novation and Amendment Agreement, dated as of July 2, 2024, by and among Integral, Original Topco, Merger Sub, Flybondi FB Parent and the Sellers.

“Available seat kilometers” means the number of seats available for passengers multiplied by the number of kilometers, which is the length of flight, those seats are flown.

“BCRA” means the Banco Central de la República Argentina, the central bank of Argentina.

“Broker non-vote” means the failure of an Integral Stockholder, who holds his, her or its shares in “street name” through a broker or other nominee, to give voting instructions to such broker or other nominee.

“Business Combination” means the transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Business Combination Agreement, dated as of October 19, 2023, as it may be amended, supplemented, or otherwise modified from time to time, by and among Integral, FB Parent, Merger Sub and Flybondi.

“Business Combination Proposal” means the proposal to approve and adopt the Business Combination Agreement and the Business Combination contemplated thereby.

“Cartesian Escrow Parties” means Flybondi and Cartesian Capital Group, LLC.

“CASK” or “Cost per available seat kilometer” (US$ cent) means the total operating expenses, excluding C-check and maintenance reserves, both within aircraft right-of-use asset depreciation, divided by the available seat kilometers.

“CASK excluding fuel” (US$ cent) means the Total operating expenses, excluding C-check and maintenance reserves, both within Aircraft right-of-use asset depreciation, and excluding Aircraft Fuel, divided by the available seat kilometers.

“Change of Control” means any transaction or series of transactions the result of which is: (a) the acquisition by any Person or group (as defined under Section 13 of the Exchange Act) of Persons of direct or indirect beneficial ownership of securities representing 50% or more of the combined voting power of the then outstanding securities of a company; (b) a merger, consolidation, business combination, recapitalization, reorganization, or other similar transaction, however effected, resulting in any Person or group (as defined under Section 13 of the Exchange Act) acquiring more than 50% of the combined voting power of the then outstanding securities of a company or the surviving or successor entity immediately after such combination; or (c) a sale of all or substantially all of the assets of a company and its subsidiaries, taken as a whole; provided, however, that any securities of a company issued (i) in a bona fide financing transaction, (ii) in a series of bona fide financing transactions, (iii) in accordance with the Business Combination Agreement, or (iv) pursuant to the conversion of any securities issued in accordance with the Business Combination Agreement shall be excluded from the definition of “Change of Control.”

“Class B Conversion” means the conversions on November 3, 2023 (i) by the Sponsor, in connection with the implementation of the Extension, of 2,824,999 shares of Integral Class B Common Stock to shares of Integral Class A Common Stock on a one-for-one basis in accordance with the Integral Charter and (ii) by an Anchor Investor of 50,000 shares of Integral Class B Common Stock to shares of Integral Class A Common Stock on a one-for-one basis in accordance with the Integral Charter.

“Closing” means the consummation of the Business Combination.

“Closing Date” means the date upon which the Closing is to occur.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Combined Company” means FB Parent and its consolidated subsidiaries after giving effect to the Business Combination.

“Companies Act” means the United Kingdom Companies Act 2006 and the regulations made thereunder.

“Continental” means Continental Stock Transfer & Trust Company, as trustee of the Trust Account, Integral’s transfer agent and registrar and Integral’s warrant agent, as applicable.

“Conversion Warrants” means FB Parent Warrants issuable upon the conversion of the Working Capital Loan Note.

“DGCL” means the Delaware General Corporation Law.

“Effective Date” means the effective date of the registration statement on Form F-4 of which this proxy statement/prospectus forms a part.

“Escrow Agreement” means the Escrow Agreement, dated as of December 13, 2023, by and among Integral and the Cartesian Escrow Parties.

“Escrow Amount” means the $900,000 that was funded into an escrow account by the Cartesian Escrow Parties, pursuant to the Escrow Agreement, which was released to Integral on April 30, 2024, solely for the purpose of Integral paying its excise tax liability, which was paid on October 23, 2024.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Extension Promissory Notes” means the First Extension Promissory Note and the Second Extension Promissory Note, together.

“Extensions” means the First Extension, the Second Extension and Third Extension, collectively.

“Existing Registration Rights Agreement” means the Registration Rights Agreement, dated as of November 2, 2021, by and among Integral and certain Integral securityholders.

“Existing Warrant Agreement” means the Warrant Agreement, dated as of November 2, 2021, by and between Integral and Continental, as warrant agent, governing the outstanding Integral Warrants.

“Ezeiza” means the Aeropuerto Internacional Ministro Pistarini de Ezeiza, in the Province of Buenos Aires, Argentina.

“FB Parent” means Flybondi Holdings plc, a public limited company incorporated under the laws of England and Wales.

“FB Parent Articles” means the amended and restated articles of FB Parent to be in effect following the Business Combination, substantially in the form attached to this proxy statement/prospectus as Annex B.

“FB Parent Board” means the board of directors of FB Parent.

“FB Parent Ordinary Shares” means ordinary shares with a nominal value of £0.01 each in the capital of FB Parent.

“FB Parent Warrants” means the Integral Warrants as converted into warrants of FB Parent representing the right to purchase FB Parent Ordinary Shares, pursuant to the Warrant Amendment Agreement in connection with the Business Combination and on substantially the same terms as were in effect immediately prior to the Business Combination under the terms of the Existing Warrant Agreement.

“FBLA” means FB Líneas Aéreas S.A., a sociedad anónima organized under the laws of Argentina.

“FCPA” means the U.S. Foreign Corrupt Practices Act.

“First Extension” means the first extension of the date by which Integral must consummate an initial business combination from May 5, 2023 to November 3, 2023 (or such earlier date as determined by the Integral Board) that was approved by Integral’s stockholders at the First Extension Meeting.

“First Extension Meeting” means the special meeting of Integral held on May 3, 2023 at which Integral’s stockholders approved the First Extension, among other matters.

“First Extension Promissory Note” means the promissory note issued on May 8, 2023 by Integral to the Sponsor in an amount of up to $630,000 to be deposited into the Trust Account in connection with the First Extension;

“Flown load factor” means the number of flown passengers divided by the number of seats available on each flight.

“Flybondi” means Flybondi Limited, a limited company incorporated under the laws of England and Wales, and, as the context requires, its airline operating subsidiary, FB Líneas Aéreas S.A., a sociedad anónima organized under the laws of Argentina.

“Flybondi Board” means the board of directors of Flybondi.

“Flybondi Deferred Incentive Plans” means each of the ‘Política de incentivo extraordinario en acciones virtuales de Flybondi’ launched by FB Líneas Aéreas S.A. on April 11, 2022 and on March 3, 2023.

“Flybondi Option” means each option, whether vested or unvested, to purchase Flybondi Ordinary Shares that is outstanding and unexercised as of immediately prior to the effective time of the Share Exchange.

“Flybondi Ordinary Shares” means the ordinary shares, par value of $0.01 per share, of Flybondi.

“Flybondi Securities” means Flybondi Shares and Flybondi Options.

“Flybondi Series A Shares” means the series A shares, par value of $0.01 per share, of Flybondi.

“Flybondi Shareholder Transaction Consideration” means the number of FB Parent Ordinary Shares equal to $300,000,000 divided by $10.00 to be issued to Flybondi shareholders pursuant to the Business Combination Agreement.

“Flybondi Shares” means the Flybondi Ordinary Shares and the Flybondi Series A Shares.

“Founder Shares” means the shares of Integral Class B Common Stock issued to the Initial Stockholders prior to the IPO, including the shares of Integral Class A Common Stock issued in the Class B Conversion.

“IFRS” means the IFRS Accounting Standards, as issued by the International Accounting Standards Board, as in effect from time to time.

“Initial Stockholders” means the holders of the Founder Shares prior to the IPO and their permitted transferees, as applicable.

“Integral” means Integral Acquisition Corporation 1, a Delaware corporation.

“Integral Board” means the board of directors of Integral.

“Integral Bylaws” means the bylaws of Integral in effect as of the date of this proxy statement/prospectus.

“Integral Charter” means the amended and restated certificate of incorporation of Integral filed with the Delaware Secretary of State on November 3, 2021, as amended on May 3, 2023 and November 2, 2023.

“Integral Charter Amendment” means the proposed amendment to the Integral Charter in the form attached to this proxy statement/prospectus as Annex F.

“Integral Class A Common Stock” means the Class A common stock, par value $0.0001 per share, of Integral.

“Integral Class B Common Stock” means the Class B common stock, par value $0.0001 per share, of Integral.

“Integral Common Stock” means the Integral Class A Common Stock and the Integral Class B Common Stock, collectively.

“Integral Governing Documents” means the Integral Charter and the Integral Bylaws, in each case as amended, modified or supplemented from time to time.

“Integral Stockholders” means the Initial Stockholders and the Public Stockholders, collectively.

“Integral Units” means the units issued in the IPO, each of which consisted of one Public Share and one-half of one Public Warrant.

“Integral Warrants” means the Public Warrants and the Private Warrants, collectively.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“IPO” means Integral’s initial public offering of Integral Units, consummated on November 5, 2021, including the full exercise of the over-allotment option.

"IPO Promissory Note" means that certain unsecured promissory note in the principal amount of up to $300,000 issued to our Sponsor on February 16, 2021.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

“Joining Sellers” means the holders of Flybondi’s outstanding shares and/or options who are not Signing Sellers and who may join the Business Combination Agreement by executing and delivering to Integral, FB Parent and Flybondi a Seller Joinder.

“JST” means the Junta de Seguridad en el Transporte of Argentina.

“J.V.B.” means J.V.B. Financial Group, LLC.

“LCC” means low-cost carrier.

“Lock-Up Agreement” means the Lock-Up Agreement to be entered into in connection with the Closing by FB Parent and certain holders of FB Parent securities upon the Closing, substantially in the form attached as Exhibit A to the Business Combination Agreement.

“Marshall & Stevens” means Marshall & Stevens Transaction Advisory Services, LLC.

“Merger” means the merger of Integral with and into Merger Sub, with Integral continuing as the Surviving Company after such merger as a direct, wholly-owned subsidiary of FB Parent.

“Merger Effective Time” means the effective time of the Merger.

“Merger Sub” means Gaucho MS, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of FB Parent.

“Nasdaq” means The Nasdaq Stock Market LLC and, as the context may require, any of the capital markets which it operates.

"Non-Sellers" means certain holders of Flybondi’s outstanding shares that are not Signing Sellers or Joining Sellers as of the date of this prospectus/proxy statement.

“NTA Requirement Amendment Proposal” means the proposal to amend the Integral Charter pursuant to the Integral Charter Amendment to eliminate (i) the Redemption Limitation and (ii) the requirement that Integral shall not consummate an initial business combination unless the Redemption Limitation is not exceeded.

“Original Topco” means FB Parent Limited, a limited company incorporated under the laws of England and Wales.

“Pangaea” means Pangaea Two Acquisition Holdings XVII, Ltd.

“PCAOB” means the United States Public Company Accounting Oversight Board.

“Per Share Exchange Ratio” means (a) the Share Exchange Aggregate Consideration (as defined in the Business Combination Agreement) divided by (b) the Company Fully-Diluted Number (as defined in the Business Combination Agreement).

“Person” means an individual, partnership, corporation, limited liability company, joint stock company, unincorporated organization or association, trust, joint venture or other entity, whether or not a legal entity.