Montana Renewables Awarded DOE Conditional Loan Commitment October 22, 2024 Exhibit 99.2

Forward looking statements / safe harbor This presentation has been prepared by Montana Renewables, LLC (“MRL”, “we”, “our” or like terms) as of October 22, 2024.This presentation has been prepared for information purposes and convenient reference only and is not intended to be complete. The information contained herein is subject to change, completion, or amendment from time to time without notice. Some of the statements contained herein, including information incorporated by reference, discuss future expectations, or state other forward-looking information. The words “will,” “may,” “intend,” “believe,” “expect,” “outlook,” “forecast,” “anticipate,” “estimate,” “continue,” “plan,” “should,” “could,” “would,” or other similar expressions are intended to identify forward-looking statements. The statements and information herein that are not purely historical data are forward-looking statements, including, but not limited to, the statements regarding (i) our expectations regarding the proposed loan facility (the “Proposed DOE Facility”) that MRL expects to receive from the U.S. Department of Energy (“DOE”) Loan Programs Office (“LPO”), including the timing, size and intended use of borrowings under such facility, (ii) our expectation that the Proposed DOE Facility will enable MRL to complete the MaxSAFTM construction and that such project will be completed on time and on budget, (iii) whether and when the Proposed DOE Facility will be funded, including whether and when certain conditions such as negotiation of definitive financing documents will be satisfied, (iv) our expectation regarding our business outlook and cash flows, including with respect to the MRL business, and (v) our ability to meet our financial commitments, debt service obligations, debt instrument covenants, contingencies and anticipated capital expenditures. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us and should not be regarded as a representation by us that any of our expectations or beliefs will be achieved. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause our actual results to differ materially from our historical experience and our present expectations or projections. Known material factors that could cause actual results to differ materially from those in the forward-looking statements include, but not limited to: the overall demand for renewable fuels, including Sustainable Aviation Fuel and renewable diesel; our ability to produce renewable fuel products that meet our customers’ unique and precise specifications; the marketing of alternative and competing products; the impact of fluctuations and rapid increases or decreases in renewable fuel margins, including the resulting impact on our liquidity; our ability to comply with financial covenants contained in our debt instruments; labor relations; our access to capital to fund expansions, acquisitions and our working capital needs and our ability to obtain debt or equity financing on satisfactory terms; environmental liabilities or events that are not covered by an indemnity, insurance or existing reserves; maintenance of our credit ratings and ability to receive open credit lines from our suppliers; demand for various feedstocks and resulting changes in pricing conditions; fluctuations in refinery capacity; our ability to access sufficient feedstocks; the effects of competition; continued creditworthiness of, and performance by, counterparties; the impact of current and future laws, rulings and governmental regulations shortages or cost increases of power supplies, natural gas, materials or labor; weather interference with business operations; our ability to access the debt and equity markets; the occurrence of any event, change or other circumstance that could give rise to the termination of DOE’s conditional commitment; accidents or other unscheduled shutdowns; and general economic, market, business or political conditions, including inflationary pressures, instability in financial institutions, general economic slowdown or a recession, political tensions, conflicts and war (such as the ongoing conflicts in Ukraine and the Middle East and their regional and global ramifications). For additional information regarding factors that could cause our actual results to differ from our projected results, please see our filings with the SEC, including the risk factors and other cautionary statements in the latest Annual Report on Form 10-K of Calumet Specialty Products Partners, L.P. (the “Partnership”) and other filings with the SEC by Calumet, Inc. and the Partnership. We caution that these statements are not guarantees of future performance and you should not rely unduly on them, as they involve risks, uncertainties, and assumptions that we cannot predict. In addition, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. While our management considers these assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Accordingly, our actual results may differ materially from the future performance that we have expressed or forecast in our forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except to the extent required by applicable law. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. Certain public statements made by us and our representatives on the date hereof may also contain forward-looking statements, which are qualified in their entirety by the cautionary statements contained above.

Strategic vision MaxSAFTM Montana Renewables, Inc (“MRL”) expects to execute a sequence of discrete individual projects, including: a second renewable fuels reactor (allowing approximately half of the 300 million gallon SAF capability to be online by 2026); debottlenecking of the existing renewable fuels and feedstock pretreatment units; installation of SAF blending and logistics assets; increased renewable hydrogen production; addition of cogeneration for renewable electricity and steam; on-site water treatment and recycling capabilities; and other site enhancements. Our planned expansion is fully aligned with strategic national interest in low-emission sustainable alternatives. The expansion will directly replace fossil jet and diesel; reduce MRL’s carbon footprint by producing more renewable hydrogen and electricity; and contribute to regional economic development. Regional Development An economic impact study produced by the University of Montana Bureau of Business and Economic Research (BBER) measured the substantial benefit to Montana in the form of jobs, income, government revenues, economic output and population. By 2028, the economic footprint of the Great Falls site is expected to support a population of 4,400 Montanans, consisting primarily of working-aged families and their children. MRL expects the expansion to catalyze other regional development, particularly for renewable feedstocks sourced from farms and ranches. By driving a localized value chain of transportation, agricultural and energy related businesses similar to the Minnesota SAF Hub, MRL will create a large-scale, end-to-end SAF industry including public and private partners in Montana and the Pacific Northwest. The MRL expansion is expected to create approximately 1,000 additional jobs during peak construction while increasing permanent Calumet employment to approximately 415 employees in Great Falls of whom about half are MRL employees. https://www.bber.umt.edu/pubs/Econ/Calumet-Impact-Report.pdf First Mover Already a first mover in the evolving SAF sector, the MaxSAFTM expansion would position Montana Renewables as one of the largest Sustainable Aviation Fuel (“SAF”) producers globally with production capacity of ~300 million gallons of SAF and 330 million gallons of combined SAF and renewable diesel (“RD”). DOE LPO support followed a rigorous due diligence process and MRL is pleased to have been selected to drive national goals under the Grand SAF Challenge.

Conditional commitment approved 10/16/24 Up to $1.44 billion conditional commitment DOE to be loan guarantor and senior secured lender Flexibility to add a 3rd party loan ranked pari passu Funds provided by Federal Financing Bank Approved under Title XVII Section 1706 Target deliverables 4Q 2024—1Q 2025: Finalize the Loan Guarantee Agreement Close and receive Tranche 1 funding 4 DOE Selected Metrics Borrower Guarantor Montana Renewables, LLC US Department of Energy Amount Up to $1.44bn in two tranches Tranche 1: Up to $778mm funded at closing (est 4Q 2024) Tranche 2: Up to $662mm delay draw term loan ~2025-28 Use of Proceeds Tranche 1 : Funding MRL eligible expenses incurred to date Tranche 2 : Funding MAX SAFTM construction going forward Security First-priority lien on all collateral Maturity 15 years from the Closing Date Amortization None, during the Availability Period(1) After the end of the Availability Period(1): quarterly payments until the Maturity Date Rate Treasury of same maturity plus 3/8% FFB Spread Currently ~ 4 3/8% (2) During MaxSAF construction(1) : Paid-in-kind Availability Period means the earliest to occur of (a) the date the loan is fully disbursed; (b) a date certain to be agreed; and (c) the date on which final completion of MaxSAFTM construction occurs. Final completion of MaxSAFTM construction is expected to occur 46 months following the Closing Date per DOE term sheet. As of October 16, 2024, the date the DOE conditional commitment was received.

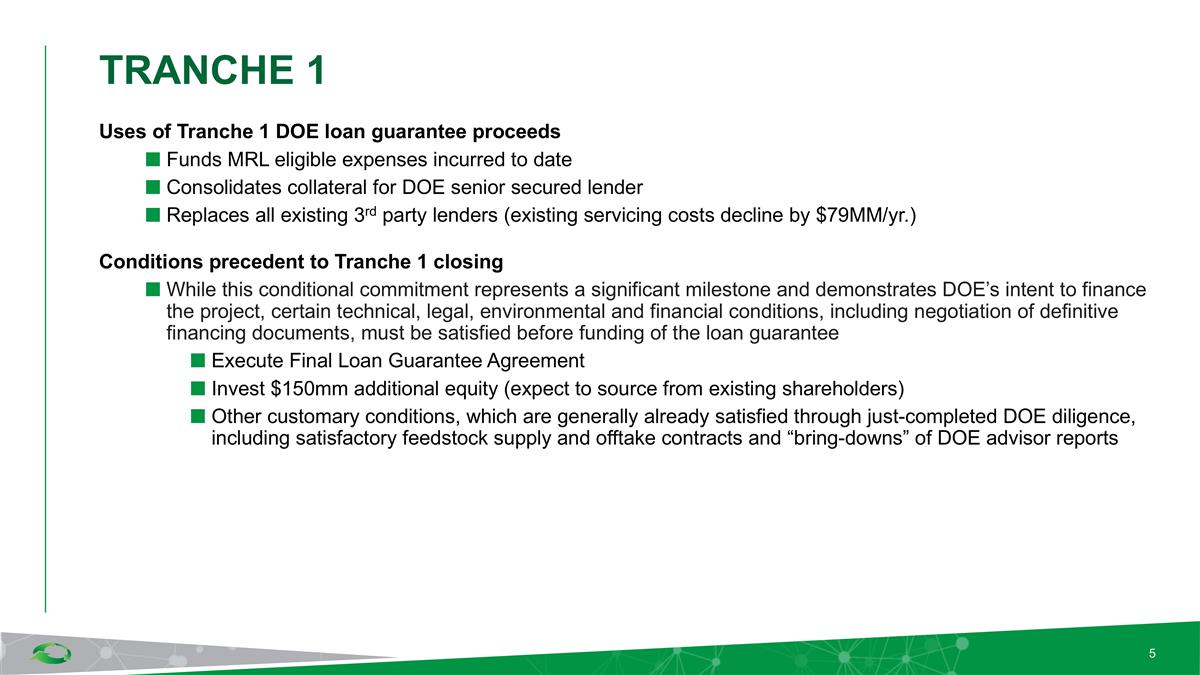

Tranche 1 Uses of Tranche 1 DOE loan guarantee proceeds Funds MRL eligible expenses incurred to date Consolidates collateral for DOE senior secured lender Replaces all existing 3rd party lenders (existing servicing costs decline by $79MM/yr.) Conditions precedent to Tranche 1 closing While this conditional commitment represents a significant milestone and demonstrates DOE’s intent to finance the project, certain technical, legal, environmental and financial conditions, including negotiation of definitive financing documents, must be satisfied before funding of the loan guarantee Execute Final Loan Guarantee Agreement Invest $150mm additional equity (expect to source from existing shareholders) Other customary conditions, which are generally already satisfied through just-completed DOE diligence, including satisfactory feedstock supply and offtake contracts and “bring-downs” of DOE advisor reports

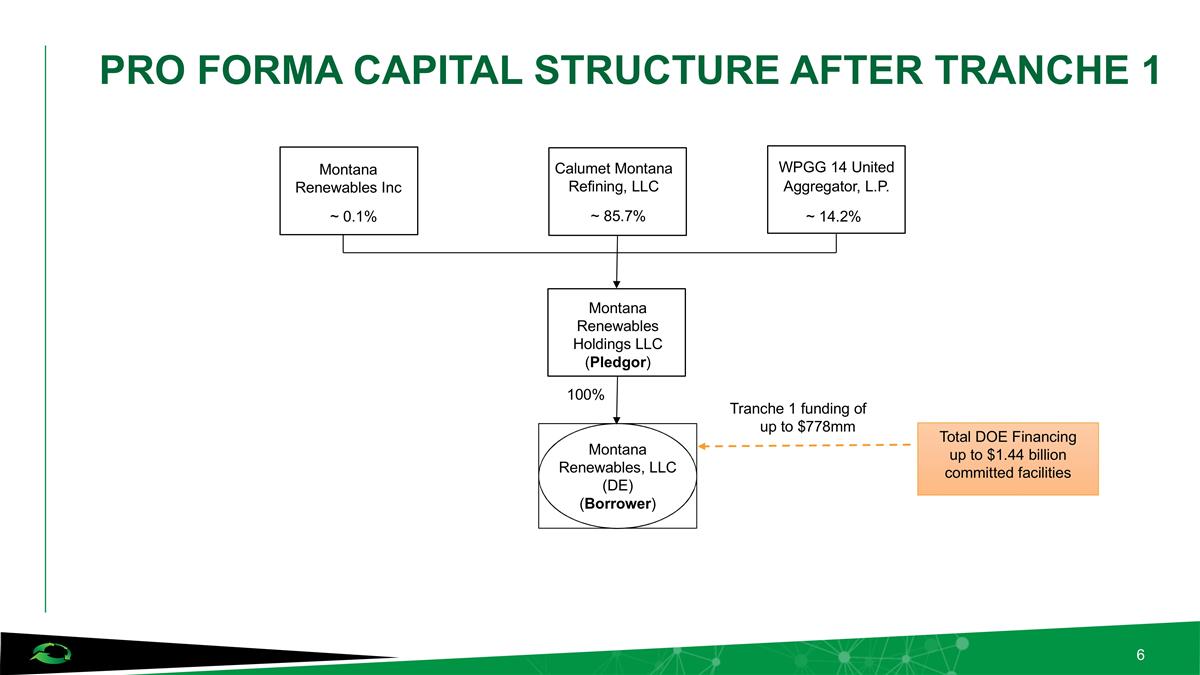

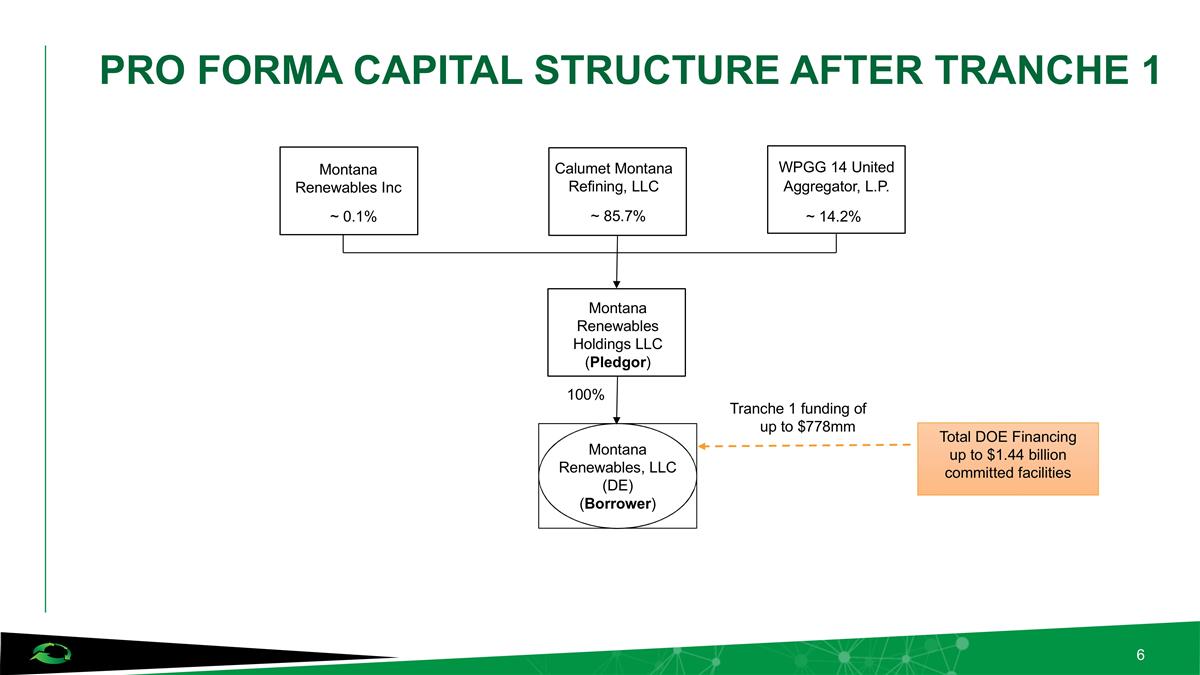

Pro forma Capital Structure after tranche 1 Montana Renewables Holdings LLC (Pledgor) Montana Renewables, LLC (DE) (Borrower) Montana Renewables Inc Calumet Montana Refining, LLC WPGG 14 United Aggregator, L.P. ~ 0.1% ~ 14.2% ~ 85.7% 100% Total DOE Financing up to $1.44 billion committed facilities Tranche 1 funding of up to $778mm

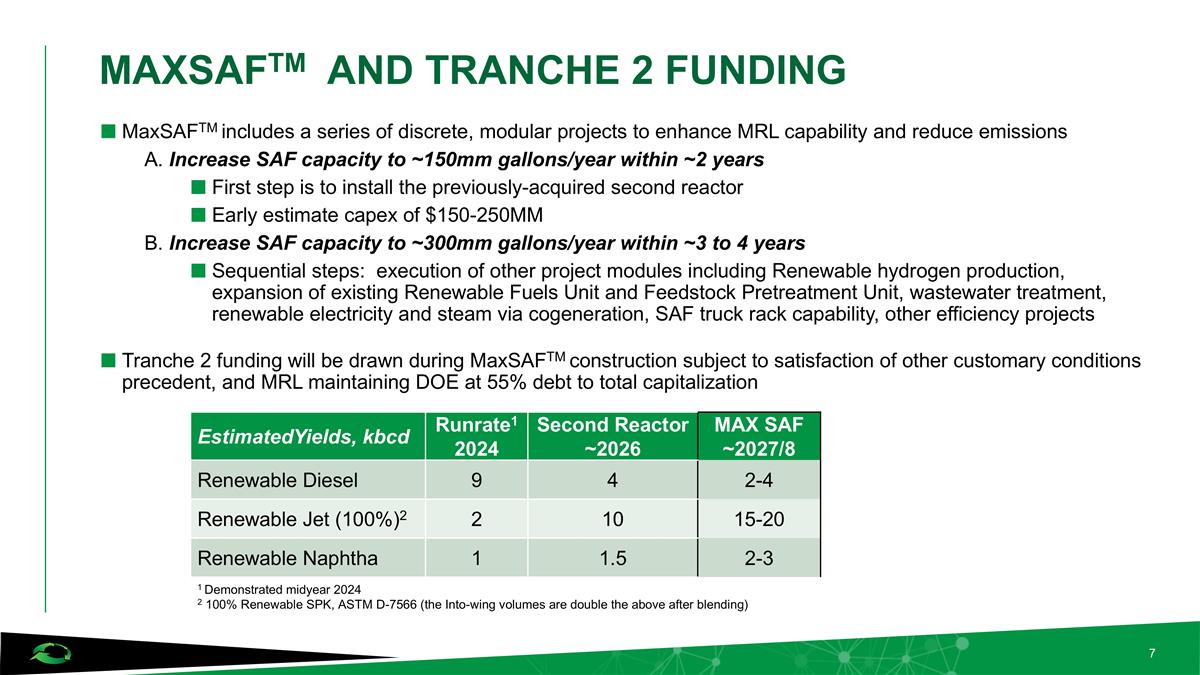

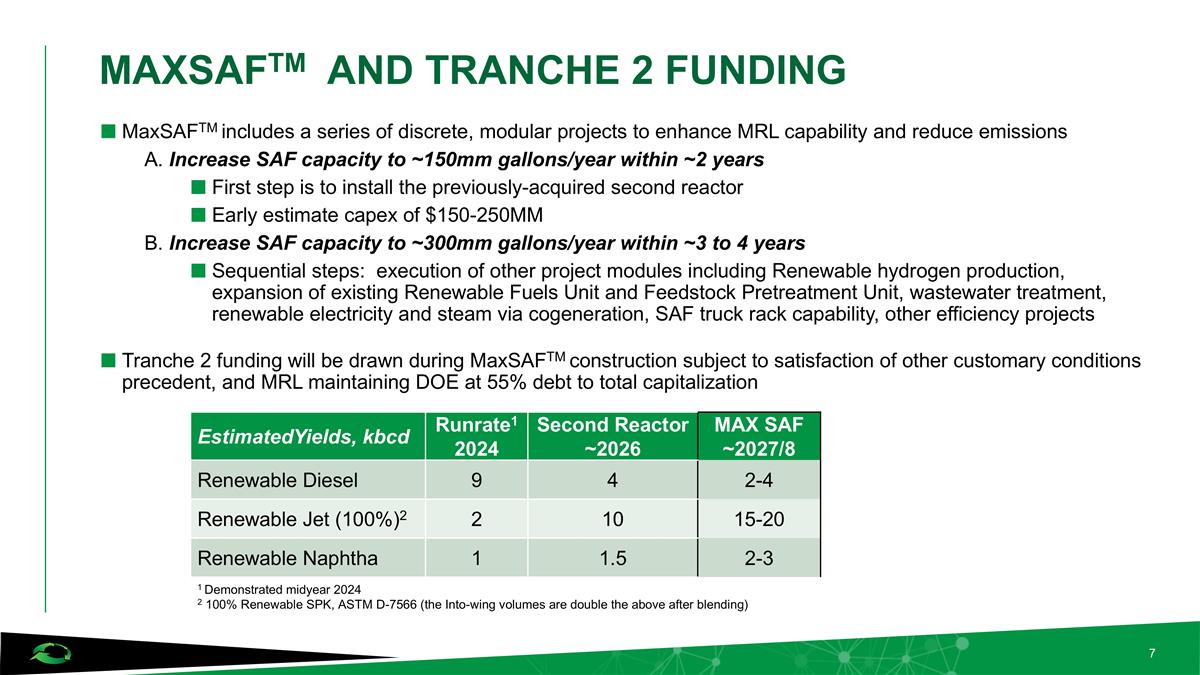

MaxSAFtm and tranche 2 funding MaxSAFTM includes a series of discrete, modular projects to enhance MRL capability and reduce emissions A. Increase SAF capacity to ~150mm gallons/year within ~2 years First step is to install the previously-acquired second reactor Early estimate capex of $150-250MM B. Increase SAF capacity to ~300mm gallons/year within ~3 to 4 years Sequential steps: execution of other project modules including Renewable hydrogen production, expansion of existing Renewable Fuels Unit and Feedstock Pretreatment Unit, wastewater treatment, renewable electricity and steam via cogeneration, SAF truck rack capability, other efficiency projects Tranche 2 funding will be drawn during MaxSAFTM construction subject to satisfaction of other customary conditions precedent, and MRL maintaining DOE at 55% debt to total capitalization EstimatedYields, kbcd Runrate1 2024 Second Reactor ~2026 MAX SAF ~2027/8 Renewable Diesel 9 4 2-4 Renewable Jet (100%)2 2 10 15-20 Renewable Naphtha 1 1.5 2-3 1 Demonstrated midyear 2024 2 100% Renewable SPK, ASTM D-7566 (the Into-wing volumes are double the above after blending)