QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: | ||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 | |

City National Corporation | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| /x/ | No fee required. | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

/ / | Fee paid previously with preliminary materials. | |||

/ / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| Reg. § 240.14a-101. Notes: | ||||

| A. | Where any item calls for information with respect to any matter to be acted upon and such matter involves other matters with respect to which information is called for by other items of this schedule, the information called for by such other items shall also be given. For example, where a solicitation of security holders is for the purpose of approving the authorization of additional securities which are to be used to acquire another specified company, and the registrants' security holders will not have a separate opportunity to vote upon the transaction, the solicitation to authorize the securities is also a solicitation with respect to the acquisition. Under those facts, information required by Items 11, 13 and 14. | |||

CITY NATIONAL CORPORATION

City National Center

400 North Roxbury Drive

Beverly Hills, California 90210

(310) 888-6000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 23, 2003

TO THE STOCKHOLDERS:

City National Corporation (the "Corporation") will hold its Annual Meeting of Stockholders at City National Center, 400 North Roxbury Drive, Beverly Hills, California on Wednesday, April 23, 2003, at 4:30 p.m.

At the annual meeting, we will consider the following proposals:

1. Election of Directors. The election of directors to hold office for three years, or until their respective successors have been elected and qualified; and

2. Other Business. The transaction of such other business as may properly come before the annual meeting or any postponement or adjournment of the annual meeting.

The Board of Directors has fixed the close of business on February 28, 2003 as the record date for determining stockholders entitled to notice of and to vote at the annual meeting or any postponement or adjournment of the annual meeting.

You are cordially invited to attend the 2003 Annual Meeting of Stockholders of City National Corporation.Whether you plan to attend the annual meeting or not, we urge you to sign, date and return the enclosed proxy card in the postage paid envelope provided, so that as many shares as possible may be represented at the annual meeting. The vote of every stockholder is important and your cooperation in returning your executed proxy promptly will be appreciated. Each proxy is revocable and will not affect your right to vote in person if you attend the annual meeting.

We appreciate your continuing support and look forward to seeing you at City National Corporation's Annual Meeting.

Sincerely,

|  | |

BRAM GOLDSMITH | RUSSELL GOLDSMITH | |

| Chairman of the Board | Vice Chairman and Chief Executive Officer |

Beverly Hills, California

March 24, 2003

CITY NATIONAL CORPORATION

City National Center

400 North Roxbury Drive

Beverly Hills, California 90210

(310) 888-6000

| INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | 1 | ||

| ELECTION OF DIRECTORS | 4 | ||

| BOARD OF DIRECTORS COMMITTEES | 6 | ||

| PRINCIPAL HOLDERS OF COMMON STOCK | 7 | ||

| SECURITY OWNERSHIP OF MANAGEMENT | 9 | ||

| City National Corporation | 9 | ||

| CN Real Estate Investment Corporation | 11 | ||

| CN Real Estate Investment Corporation II | 12 | ||

| COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS | 13 | ||

| Summary Compensation Table | 13 | ||

| Employment Contracts, Change of Control Agreements and Termination Arrangements | 14 | ||

| Stock Option Plans | 17 | ||

| COMPENSATION OF DIRECTORS | 19 | ||

| EQUITY COMPENSATION PLAN INFORMATION | 20 | ||

| COMPENSATION, NOMINATING & GOVERNANCE COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 21 | ||

| REPORT ON EXECUTIVE COMPENSATION BY THE COMPENSATION, NOMINATING & GOVERNANCE COMMITTEE | 21 | ||

| Overall Philosophy | 21 | ||

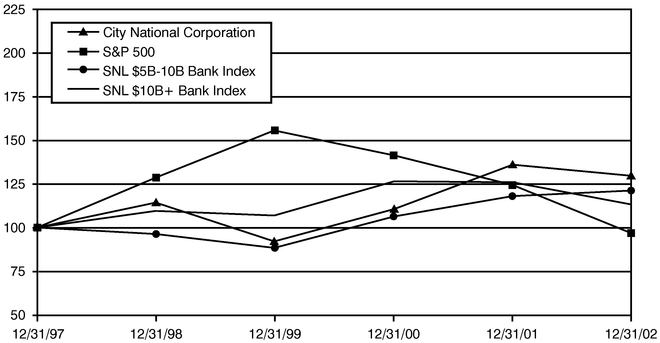

| Stockholder Return Graph | 22 | ||

| Chief Executive Officer | 23 | ||

| Other Executive Officers | 23 | ||

| Statement Regarding Deductibility | 24 | ||

| Additional Corporate Governance Developments | 25 | ||

| REPORT BY THE AUDIT COMMITTEE | 26 | ||

| CERTAIN TRANSACTIONS | 27 | ||

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 28 | ||

| INDEPENDENT AUDITORS | 28 | ||

| STOCKHOLDER PROPOSALS | 29 | ||

| APPENDIX A CITY NATIONAL CORPORATION COMPENSATION, NOMINATING & GOVERNANCE COMMITTEE CHARTER | A-1 | ||

| APPENDIX B CITY NATIONAL CORPORATION AUDIT COMMITTEE CHARTER | B-1 | ||

CITY NATIONAL CORPORATION

City National Center

400 North Roxbury Drive

Beverly Hills, California 90210

(310) 888-6000

ANNUAL MEETING OF STOCKHOLDERS ON APRIL 23, 2003

PROXY STATEMENT

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

This proxy statement is being provided in connection with the Annual Meeting of Stockholders of City National Corporation (the "Corporation"). We believe our question and answer format facilitates understanding of the general information about the annual meeting and voting procedures.

| 1. | Q. | Why did you send me this proxy statement? | ||

A. | We sent you this proxy statement because the Board of Directors of the Corporation is soliciting your proxy to vote at the 2003 Annual Meeting of Stockholders. | |||

2. | Q. | When is this proxy statement being mailed to stockholders? | ||

A. | This proxy statement and the accompanying proxy card are first being mailed to stockholders on or about March 24, 2003. | |||

3. | Q. | Who is paying for this solicitation? | ||

A. | The Corporation will pay the cost of preparing, assembling and mailing the notice of the annual meeting, the proxy statement and the accompanying proxy card and for the solicitation of proxies. In addition to our solicitation by mail, certain directors, officers and employees who will receive no additional compensation for their services may solicit proxies in person or by telephone, telegraph or facsimile. We will pay brokers and others who hold our common stock in their name for the expenses of forwarding the proxy materials to their principals. | |||

4. | Q. | What may I vote on? | ||

A. | You are being asked to vote on the election of nominees to serve on the Corporation's Board of Directors. | |||

5. | Q. | How does the Board of Directors recommend I vote? | ||

A. | The Board of Directors recommends a vote FOR each of the nominees. | |||

6. | Q. | Who is entitled to vote? | ||

A. | Only stockholders of record on the Record Date, February 28, 2003, may vote at the annual meeting. | |||

7. | Q. | How many shares can vote? | ||

A. | At the close of business on the Record Date, there were 48,720,375 shares of the Corporation's common stock outstanding. Each stockholder is entitled to one vote for each share of common stock owned. | |||

1

8. | Q. | How many shares must be represented at the annual meeting to constitute a "quorum"? | ||

A. | A majority of the outstanding shares must be present at the annual meeting, either in person or represented by proxy, to constitute a "quorum." There must be a quorum for the Annual Meeting to be held. If you return a signed proxy card, you will be counted as being present, even if you abstain from voting. Broker non-votes will also be counted as being present for purposes of determining a quorum. | |||

9. | Q. | How are matters approved or disapproved? | ||

A. | The four nominees for election as a director who receive the highest number of affirmative votes will be elected. | |||

10. | Q. | What do I have to do to vote? | ||

A. | You may vote by signing and dating each proxy card you receive and returning it in the enclosed postage paid envelope. If you mark the proxy card to show how you wish to vote, your shares will be voted as you direct. If you return a signed proxy card but do not mark the proxy card to show how you wish to vote, your shares will be voted FOR each of the Board of Directors' nominees for election as directors. You may change or revoke your vote at any time before it is counted at the annual meeting by: | |||

(i) notifying our Secretary at the address shown above; (ii) attending the annual meeting and voting in person; or (iii) submitting a later dated proxy card. | ||||

11. | Q. | What do I have to do to vote my shares if they are held in the name of my broker? | ||

A. | If your shares are held by your broker, sometimes called "street name" shares, you should receive a form from your broker asking you how you want to vote your shares. If you do not give instructions to your broker, your broker will vote your shares at its discretion on your behalf. | |||

12. | Q. | How will voting on any other business be conducted? | ||

A. | We do not know of any business to be considered at the annual meeting other than the election of directors described in this proxy statement. Because we were not notified of any other business to be presented at the annual meeting on or before February 7, 2003, if any other business is presented at the annual meeting, the person named on the proxy card, your designated proxy will vote on such matter at his discretion. Any matter other than the election of directors must receive affirmative votes from at least a majority of the shares voting in order to be approved. | |||

13. | Q. | Who can attend the annual meeting? | ||

A. | Any stockholders entitled to vote at the annual meeting may attend the annual meeting. If you hold "street name" shares and would like to attend the annual meeting, please write to our Secretary at the address shown above or e-mail to Martha.Drain@cnb.com, identifying yourself as a beneficial owner of our common stock, and we will add your name to the guest list. | |||

14. | Q. | How do I get more information about you? | ||

A. | With this proxy statement, we are also sending you our 2002 Summary Annual Report and our Annual Report for the year ended December 31, 2002, which includes our financial statements. If you did not receive them, we will send them to you without charge. The Annual Report includes a list of exhibits filed with the Securities and Exchange Commission, but does not include the exhibits. If you wish to receive copies of the exhibits, we will send them to you. Expenses for copying and mailing them will be your responsibility. Please write to: | |||

Stephen McAvoy City National Bank City National Center 400 North Roxbury Drive Beverly Hills, California 90210 | ||||

You may also send your request by facsimile to (213) 347-2645 or by e-mail toSteve.McAvoy@cnb.com. | ||||

2

In addition, we maintain a home page on the Internet atwww.cnb.com. We make our web site available for information purposes only and it should not be relied upon for investment purposes, nor is it incorporated by reference into this proxy statement. We make our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports available free of charge through our web site as soon as reasonably practicable after we electronically file that material with, or furnish it to, the SEC. You can learn more about us by reviewing our SEC filings on our web site. Our SEC reports can be accessed through the investor relations page of our web site. The SEC also maintains a web site atwww.sec.gov that contains reports, proxy statements and other information regarding SEC registrants. |

3

As of the date of this Proxy Statement, the Board of Directors of the Corporation currently consists of twelve members, who are divided into three classes. Directors are elected for terms ending at the third annual meeting following the directors' election. Kenneth L. Coleman was appointed by the Board of Directors as a new Class I director and commenced service as of February 28, 2003. He fills a vacancy on the Board of Directors created by the resignation of Director Bill Richardson on June 4, 2002. Bill Richardson resigned from the Board of Directors in order to dedicate his undivided time and attention to his gubernatorial campaign in New Mexico. Mr. Richardson was elected governor of New Mexico on November 5, 2002 and took office January 1, 2003. Peter M. Thomas was appointed by the Board of Directors as a new Class I director effective March 24, 2003. Kenneth L. Coleman and Peter M. Thomas are included among the directors nominated for election as Class I directors at the April 2003 annual meeting. The term of office of the current Class I directors will expire upon election and qualification of their successors. At the annual meeting, four nominees will be elected to serve as Class I directors.

The four nominees recommended by the Board of Directors for election as directors (all of whom are currently directors) are set forth below. If one or more of such nominees unexpectedly becomes unavailable to serve as a director, the proxies may be voted for one or more substitute nominees selected by the Board of Directors, or the authorized number of directors may be reduced. If the authorized number of directors is reduced for any reason, the proxies will be voted for the election of the remaining nominees named in this proxy statement. To the best of the Corporation's knowledge, all nominees are and will be available to serve as directors.

Nominations for the election of directors may be made by a stockholder entitled to vote for the election of directors by submitting a notice in writing, delivered or mailed by first class United States mail, postage prepaid, to the Secretary of the Corporation not less than 60 days prior to the first anniversary of the date of the last meeting of the stockholders of the Corporation called for the election of directors. For the 2004 Annual Meeting of Stockholders, nominations must be received by February 21, 2004. The notice must include: (i) the name, age, business address and, if known, the residence address of the nominee, (ii) the principal occupation or employment of the nominee, (iii) the number of shares of stock of the Corporation beneficially owned by the nominee and (iv) other information that would be required by federal securities laws and regulations for an individual nominated by the Board of Directors. The Corporation did not receive any such nominations for the 2003 annual meeting.

Each of the current directors is also a director of City National Bank (the "Bank"), a wholly owned subsidiary of the Corporation.

The nominees for election as Class I directors, and the Class II and Class III directors who will continue in office after the annual meeting until the expiration of their respective terms, and information about them as of March 24, 2003, are as follows:

Nominees for Election as Class I Directors

| Name | Age | Principal Occupation and Other Directorships | Director of Bank Since | Director of Corporation Since | ||||

|---|---|---|---|---|---|---|---|---|

| Class I Directors | ||||||||

| George H. Benter, Jr. | 61 | President, City National Corporation since 1993; President and Chief Operating Officer, City National Bank since 1992; Director, The Wet Seal, Inc. | 1992 | 1993 | ||||

| Kenneth L. Coleman | 60 | Founder, Chairman and Chief Executive Officer, ITM Software Corporation since May 2002; From 1987 until June 2001, held various positions including Executive Vice President of Global Sales, Servicing and Marketing with Silicon Graphics, Inc.; Director, MIPS Technologies, and United Online. | 2003 | 2003 |

4

| Peter M. Thomas | 53 | Managing Partner, Thomas & Mack Co., a commercial real estate development company; From 1992 to 1995 served as President and Chief Operating Officer of Bank of America-Nevada; from 1982 to 1992 served as President and Chief Operating Officer of Valley Bank of Nevada; Director, Coast Casinos Inc. | 2003 | 2003 | ||||

| Andrea L. Van de Kamp | 59 | Senior Vice President and Chairman, West Coast Operations, Sotheby's, auction house, since January 1997 | 1994 | 1994 |

Directors Continuing in Office

| Name | Age | Principal Occupation and Other Directorships | Director of Bank Since | Director of Corporation Since | ||||

|---|---|---|---|---|---|---|---|---|

| Class II Directors | ||||||||

| Russell Goldsmith(1) | 53 | Vice Chairman and Chief Executive Officer, City National Corporation since October 1995; Chairman of the Board and Chief Executive Officer, City National Bank since October 1995. | 1978 | 1979 | ||||

| Michael L. Meyer | 64 | Chief Executive Officer, Michael L. Meyer Company, real estate consulting and investment company, since October 1999; Managing Partner, Orange County, Ernst & Young LLP Real Estate Group, 1974 to 1998; Director, William Lyon Homes and Cornerstone Ventures | 1999 | 1999 | ||||

| Ronald L. Olson | 61 | Partner, Munger, Tolles & Olson, law firm, for more than the past five years; Director, Edison International, Berkshire Hathaway, Inc., Pacific American Income Shares, and Western Asset Investment Trust. | 2001 | 2001 | ||||

| Class III Directors | ||||||||

| Richard L. Bloch | 73 | President, Piñon Farm, Inc., for more than the past five years; real estate investor and former Chairman of the Board, Columbus Realty Trust from December 1993 through October 1997; Co-management partner CLB Partners from 1997 to present. | 1974 | 1979 | ||||

| Bram Goldsmith(1) | 80 | Chairman of the Board, City National Corporation, for more than the past five years. | 1964 | 1969 | ||||

| Bob Tuttle | 59 | Managing Partner, Tuttle-Click Automotive Group since 1989; formerly, Director of Arizona Bank, 1989-1999, and Assistant to the President and Director of Presidential Personnel, The White House, 1985-1989. | 2002 | 2002 | ||||

| Kenneth Ziffren | 62 | Senior Partner, Ziffren, Brittenham, Branca, Fischer, Gilbert-Lurie & Stiffelman LLP, law firm, for more than the past five years; Director, Panavision, Inc. | 1989 | 1989 |

- (1)

- Russell Goldsmith is the son of Bram Goldsmith.

The Board of Directors held ten meetings during 2002. All directors attended at least 75 percent of the meetings held during 2002 by the Board of Directors and the committees on which they served with the exception of Bob Tuttle who attended seven of the ten Board meetings.

5

The Board of Directors has the following committees: a Compensation, Nominating & Governance Committee; an Audit Committee; a Directors Trust Committee; and a Community Reinvestment Act Committee. By resolution of the Board of Directors on October 23, 2002, the scope of the former Compensation and Directors' Nominating Committee was expanded to include Governance issues. This action was taken by the Board of Directors consistent with the spirit of recent developments and proposals for improved governance recommended by the New York Stock Exchange ("NYSE") and because the Board believes that corporate governance and the highest standards of business ethics and practices are vital to the success of the Corporation. As a result of this action by the Board of Directors, the Compensation and Directors' Nominating Committee became the Compensation, Nominating & Governance Committee. The expansion of the scope of the Committee is reflected in the revised Charter of the Committee attached as Appendix A.

At the beginning of January 2002 the Compensation, Nominating & Governance Committee, as it is now known, was composed of Charles E. Rickershauser (Chairman), Michael L. Meyer and Ronald L. Olson. In February of 2002, Richard L. Bloch became a member of the Committee and Ronald L. Olson ceased being a member. On April 24, 2002, Charles E. Rickershauser retired, and Richard L. Bloch and Michael L. Meyer were re-appointed to the Committee and Mr. Bloch was named as Chairman. The Compensation, Nominating & Governance Committee acts upon matters of compensation, selects and recommends to the Board of Directors nominees for positions on the Corporation's Board of Directors, and is responsible for oversight of all director and officer governance matters. The Compensation, Nominating & Governance Committee of the Bank is composed of the same individuals and acts jointly as the Compensation, Nominating & Governance Committee of the Corporation. The Committees met jointly 3 times during 2002.

The Audit Committee is composed of Kenneth Ziffren (Chairman), Richard L. Bloch, Stuart D. Buchalter, and Michael L. Meyer. By action of the Board of Directors, Michael L. Meyer became a member of the Committee on October 23, 2002. The Audit Committee monitors significant accounting and financial reporting policies, approves services rendered by the Corporation's independent auditors, reviews audit and management reports and is responsible for approving the appointment of independent auditors and the fees payable for their services. The Audit Committee also functions as the audit and examining committee of the Bank. The Committee met eighteen times during 2002. The Audit Committee has identified Michael L. Meyer as the "Audit Committee Financial Expert" as defined in the Securities and Exchange Commission's (the "SEC's") rulemaking in accordance with Section 407 of the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act"). The Board of Directors, in its business judgment, has determined that Mr. Meyer is an "independent director" in accordance with the current and proposed listing standards of the NYSE and Section 301 of the Sarbanes-Oxley Act and proposed rules thereunder. Recent changes in the law as a result of the Sarbanes-Oxley Act, and various orders issued by the Securities and Exchange Commission, as well as proposed changes to the NYSE Listing Standards, have resulted in the need for changes to the Audit Committee Charter. The Board of Directors revised the Charter of the Audit Committee on March 19, 2003. A copy of the revised Charter is attached as Appendix B. A more complete description of the powers and responsibilities of these Committees is set forth in the revised Charters.

6

PRINCIPAL HOLDERS OF COMMON STOCK

The following table sets forth information as of January 31, 2003 regarding the beneficial owners of more than five percent of the outstanding shares of the Corporation's common stock. To the Corporation's knowledge, based on the absence of filings which beneficial owners of more than five percent of the outstanding shares of the Corporation's common stock are required to make with the Securities and Exchange Commission, there are no other beneficial owners of more than five percent of the outstanding shares of the Corporation's common stock. Except as otherwise noted in the footnotes below, each of these persons or entities had sole voting and investment power with respect to the Common Stock beneficially owned by them.

| Name and Address of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned (1) | Percent of Class (2) | ||||

|---|---|---|---|---|---|---|

| Bram Goldsmith: 400 North Roxbury Drive Beverly Hills, CA 90210 | 6,745,725 | 13.78 | % | |||

| Goldsmith Family Partnership | 2,920,113 | (3) | ||||

| Bram and Elaine Goldsmith, Trustees of the Bram and Elaine Goldsmith Family Trust | 2,943,713 | (4) | ||||

| Elaine and Bram Goldsmith, Trustees of the Elaine Goldsmith Revocable Trust | 567,989 | |||||

| Bram Goldsmith | 60,399 | (5) | ||||

| Goldsmith Family Foundation | 239,780 | (6) | ||||

| Oak Trust A | 13,731 | (7) | ||||

Russell Goldsmith: 400 North Roxbury Drive Beverly Hills, CA 90210 | 4,999,489 | 10.21 | % | |||

| Goldsmith Family Partnership | 2,920,113 | (3) | ||||

| The Russell Goldsmith Trust | 424,293 | (4) | ||||

| Russell Goldsmith, Trustee of Maple Trusts I and II, Pine Trusts I and II | 310,148 | |||||

| Goldsmith Family Foundation | 239,780 | (6) | ||||

| Russell Goldsmith | 1,039,160 | (8) | ||||

| B.N. Maltz Foundation | 58,495 | (9) | ||||

| MKB Co. Ltd. | 7,500 | (10) | ||||

FMR Corp: 82 Devonshire Street Boston, MA 02109 | 2,883,629 | (11) | 5.89 | % | ||

- (1)

- Includes shares subject to options which are presently exercisable or which will become exercisable within 60 days after January 31, 2003.

- (2)

- Based on 48,953,498 shares of Common Stock issued and outstanding at January 31, 2003.

- (3)

- The Goldsmith Family Partnership is a limited partnership of which the general partners include the Bram and Elaine Goldsmith Family Trust and the Russell Goldsmith Trust, of which Russell

7

Goldsmith is the sole trustee. The Bram Goldsmith Group and the Russell Goldsmith Group disclaim beneficial ownership of the shares held by the Goldsmith Family Partnership except to the extent of Bram Goldsmith's and Russell Goldsmith's respective pecuniary interest in the partnership.

- (4)

- Excludes the 2,920,113 shares identified as being held by the Goldsmith Family Partnership which the Bram and Elaine Goldsmith Family Trust and the Russell Goldsmith Trust respectively may be deemed to beneficially own as a general partner of the Goldsmith Family Partnership.

- (5)

- Shares allocated to Bram Goldsmith's account under the City National Corporation Profit Sharing Plan.

- (6)

- The Goldsmith Family Foundation is a tax-exempt charitable foundation of which Bram Goldsmith and Russell Goldsmith are directors. Bram Goldsmith and Russell Goldsmith each disclaims beneficial ownership of these shares.

- (7)

- Represents shares held in a trust for the benefit of a member of the family of Bram Goldsmith for which Bram Goldsmith is the sole trustee.

- (8)

- Includes 2,326 shares allocated to Russell Goldsmith's account under the City National Corporation Profit Sharing Plan and 1,036,834 stock options exercisable within 60 days after January 31, 2003.

- (9)

- The B. N. Maltz Foundation is a tax-exempt charitable foundation of which Russell Goldsmith is a director. Russell Goldsmith disclaims beneficial ownership of these shares.

- (10)

- The MKB Co. Ltd., is a limited liability company of which Russell Goldsmith's spouse is the managing member. The number of shares of City National Corporation held by MKB Co. Ltd. exceeds her pecuniary interest therein. Russell Goldsmith disclaims beneficial ownership of these shares.

- (11)

- Based solely upon information contained in a Form 13G filing with the Securities and Exchange Commission on February 13, 2003. Of the 2,883,629 shares beneficially owned by FMR Corp, it has sole voting power only as to 1,439,129 shares. The Schedule 13G states that Fidelity Management & Research Company ("Fidelity"), a wholly owned subsidiary of FMR Corp., and an investment advisor registered under the Investment Advisors Act of 1940, is the beneficial owner of 1,444,800 shares as a result of acting as investment advisor to various companies registered under the Investment Company Act of 1940 and that FMR Corp. does not have the sole power to vote or direct the voting of shares owned directly by the Fidelity Funds. The "Percent of Class" calculation in the table was made using the 2,883,629 shares reported as beneficially owned in the Form 13G filing, and the 48,953,498 shares of Corporation stock outstanding as of January 31, 2003.

8

SECURITY OWNERSHIP OF MANAGEMENT

City National Corporation

The information below sets forth the number of shares of the Corporation's common stock beneficially owned as of January 31, 2003 by each of the current directors, the nominees recommended by the Board of Directors for election as directors, each of the individuals included in the "Summary Compensation Table" below and all current directors, nominees and executive officers as a group. Except as otherwise noted in the footnotes below, each of these persons had sole voting and investment power with respect to the Common Stock beneficially owned by him or her.

| | (a) | (b) | (c) | | |||||

|---|---|---|---|---|---|---|---|---|---|

| Name or Number of Persons in Group | Number of Shares of Common Stock Beneficially Owned(1) | Options(2) | Total | Percent of Class | |||||

| George H. Benter, Jr. | 63,614 | (3) | 250,628 | 314,242 | * | ||||

| Richard L. Bloch | 151,805 | (4) | — | 151,805 | * | ||||

| Stuart D. Buchalter | 15,054 | (5) | — | 15,054 | * | ||||

| Jan R. Cloyde | 26,805 | (6) | 49,562 | 76,367 | * | ||||

| Kenneth L. Coleman | — | (7) | — | — | — | ||||

| Bram Goldsmith | 6,745,725 | (8) | — | 6,745,725 | 13.78 | % | |||

| Russell Goldsmith | 3,962,655 | (9) | 1,036,834 | 4,999,489 | 10.21 | % | |||

| Michael L. Meyer | 3,500 | 1,000 | 4,500 | * | |||||

| Ronald L. Olson | 10,000 | (10) | 1,000 | 11,000 | * | ||||

| Frank P. Pekny | 73,620 | (11) | 141,224 | 214,844 | * | ||||

| Peter M. Thomas | 2,500 | — | 2,500 | * | |||||

| Bob Tuttle | 1,000 | 500 | 1,500 | * | |||||

| Andrea L. Van de Kamp | 5,108 | (12) | — | 5,108 | * | ||||

| Kenneth Ziffren | 22,048 | (13) | — | 22,048 | * | ||||

| All Directors, Nominees and Executive Officers as a group (18 persons) | 7,969,584 | (1,3-15) | 1,573,248 | (2,14) | 9,542,832 | (1-15) | 19.49 | % |

- *

- Percentage information is omitted for those individuals whose beneficially owned shares represent less than one percent of the outstanding shares of the Corporation's common stock.

- (1)

- Excludes shares subject to options that are referred to in the adjacent column.

- (2)

- Represents shares subject to options which are presently exercisable or which will become exercisable within 60 days after January 31, 2003.

- (3)

- George Benter has shared voting and investment power in these shares that are held in a trust of which he is a co-trustee.

- (4)

- Richard Bloch has shared voting and investment power in these shares that are held in a trust of which he is a co-trustee.

- (5)

- Includes 375 shares owned by Stuart Buchalter's wife individually. Mr. Buchalter disclaims beneficial ownership of these shares.

- (6)

- Includes 3,505 shares allocated to Jan Cloyde's account under the City National Corporation Profit Sharing Plan.

- (7)

- Kenneth Coleman owned no shares as of January 31, 2003, but acquired 50 shares on February 13 2003. His service commenced on February 28, 2003.

9

- (8)

- Includes 13,731 shares owned by Oak Trust A, of which a member of the family of Bram Goldsmith is the beneficiary and Bram Goldsmith is the sole trustee and shared voting and investment power as follows: (i) 2,920,113 shares owned by the Goldsmith Family Partnership, (ii) 2,943,713 shares owned by the Bram and Elaine Goldsmith Family Trust, of which Bram Goldsmith is a co-trustee (excluding the 2,920,113 shares owned by the Goldsmith Family Partnership of which the Bram and Elaine Goldsmith Family Trust is a general partner), (iii) 567,989 shares owned by the Elaine Goldsmith Revocable Trust, of which Bram Goldsmith is a co-trustee, (iv) 239,780 shares owned by the Goldsmith Family Foundation, a charitable foundation of which Bram Goldsmith is a director, and (v) 60,399 shares allocated to Bram Goldsmith's account under the City National Corporation Profit Sharing Plan. Shares owned by the Goldsmith Family Partnership and the Goldsmith Family Foundation are also shown as being beneficially owned by Russell Goldsmith. Bram Goldsmith disclaims beneficial ownership of the shares owned by the Goldsmith Family Partnership except to the extent of his pecuniary interest therein, and the Goldsmith Family Foundation.

- (9)

- Includes 424,293 shares owned by the Russell Goldsmith Trust, of which Russell Goldsmith is the sole trustee (excluding the 2,920,113 shares owned by the Goldsmith Family Partnership of which the Russell Goldsmith Trust is a general partner) and 310,148 shares owned by other trusts of which Russell Goldsmith is the sole trustee, and shared voting and investment power as follows: (i) 2,920,113 shares owned by the Goldsmith Family Partnership, (ii) 239,780 shares owned by the Goldsmith Family Foundation, a charitable foundation of which Russell Goldsmith is a director, (iii) 58,495 shares owned by the B.N. Maltz Foundation, a charitable foundation of which Russell Goldsmith is a director, (iv) 2,326 shares allocated to Russell Goldsmith's account under the City National Corporation Profit Sharing Plan, and (v) 7,500 shares owned by MKB Co. Ltd, a limited liability company of which Russell Goldsmith's spouse is the managing member; the number of shares of City National Corporation held by MKB Co. Ltd. exceeds her pecuniary interest therein. Shares owned by the Goldsmith Family Partnership and the Goldsmith Family Foundation are also shown as being beneficially owned by Bram Goldsmith. Russell Goldsmith disclaims beneficial ownership of the shares owned by the Goldsmith Family Partnership except to the extent of his pecuniary interest therein, the Goldsmith Family Foundation, the B.N. Maltz Foundation and the MKB Co. Ltd.

- (10)

- Ronald Olson has shared voting and investment power in these shares that are held in a trust of which he is a co-trustee.

- (11)

- Frank Pekny has shared voting and investment power in 67,482 of these shares that are held in joint tenancy with his wife. Also includes 6,138 shares allocated to Frank Pekny's account under the City National Corporation Profit Sharing Plan.

- (12)

- Andrea Van de Kamp has shared voting and investment power in 4,008 of these shares that are held in a trust of which she is a co-trustee.

- (13)

- Kenneth Ziffren has shared voting and investment power in 15,786 of these shares that are held in joint tenancy.

- (14)

- In addition to the ownership disclosed for the persons identified in the Security Ownership of Management table, the beneficial ownership by four additional officers of the Bank who are designated as "Executive Officers" of the Corporation is disclosed in the totals for Columns (a), (b) and (c) of the table. "Executive Officers" means those individuals designated as such for purposes of Section 16 of the Securities Exchange Act of 1934. The number of shares beneficially owned by the Executive Officers is as follows: Column (a) 43,076 solely owned shares, plus 2,967 shares allocated to the officers' accounts under the City National Corporation Profit Sharing Plan; Column (b) 92,500 shares subject to options (see footnote 2; and Column (c) the 138,543 shares included in the Column (a) and Column (b) totals for the Executive Officers.

10

- (15)

- The sum total for this column reflects appropriate elimination of duplicates attributable to both Russell and Bram Goldsmith under the Goldsmith Family Partnership and the Goldsmith Family Foundation (See footnotes 8 and 9).

CN Real Estate Investment Corporation

In 2001, CN Real Estate Investment Corporation, an indirect wholly-owned subsidiary of the Corporation ("Subsidiary I"), sold in a private placement 33,933 shares of its 8.5% Series A Non-Cumulative Preferred Shares (the "Series A Shares") for $100 per share. In 2002, Subsidiary I, sold in a private placement 6,828 shares of its 8.5% Series B Non-Cumulative Preferred Shares (the "Series B Shares") for $1,000 per share. The Series A and Series B Shares vote on a share for share basis with the common shares of Subsidiary I and are not convertible into common stock of Subsidiary I. Subsidiary I intends to continue to operate as a Real Estate Investment Trust under the Internal Revenue Code of 1986, as amended, by investing primarily in participation interests in a portion of the Bank's portfolio of loans secured, in whole or in part, by real estate and leasehold improvements which generate net income.

The information below sets forth the number of Series A Shares and of Series B Shares beneficially owned as of January 31, 2003 by each of the current directors, the nominees recommended by the Board of Directors for election as directors, each of the individuals included in the "Summary Compensation Table" below and all current directors, nominees and executive officers as a group. Except as otherwise noted in the footnotes below, each of these persons had sole voting and investment power with respect to the Series A and Series B Shares owned by him or her.

| Name or Number of Persons in Group | Series A Shares Beneficially Owned | Series A Percent Of Class * | Series B Shares Beneficially Owned | Series B Percent Of Class * | |||||

|---|---|---|---|---|---|---|---|---|---|

| Bram Goldsmith | 1,100 | (1) | 3.24 | % | 800 | (2) | 11.72 | % | |

| Russell Goldsmith | 800 | (3) | 2.36 | % | 250 | (4) | 3.66 | % | |

| Frank P. Pekny | 30 | (5) | * | — | * | ||||

| All Directors, Nominees and Executive Officers as a group (6 persons) | 1,928 | (1,3,5,6) | 5.68 | % | 1,210 | (2,4) | 17.72 | % |

- *

- Percentage information is omitted for those individuals whose beneficially owned shares represent less than one percent of the outstanding shares of the Subsidiary's preferred stock.

- (1)

- Includes 500 Series A shares owned by the Goldsmith Family Foundation, a charitable foundation of which Bram Goldsmith is a director and 600 Series A shares owned by trusts of which members of the family of Bram Goldsmith are the beneficiaries and Bram Goldsmith is the sole trustee. Shares owned by the Goldsmith Family Foundation are also shown as being beneficially owned by Russell Goldsmith. Bram Goldsmith disclaims beneficial ownership of the shares owned by the Goldsmith Family Foundation.

- (2)

- Includes 500 Series B shares owned by the Bram and Elaine Goldsmith Trust and 300 Series B shares owned by the Elaine Goldsmith Revocable Trust, of which trusts Bram Goldsmith is a co-trustee.

- (3)

- Includes 500 Series A shares owned by the Goldsmith Family Foundation, a charitable foundation of which Russell Goldsmith is a director. Shares owned by the Goldsmith Family Foundation are also shown as being beneficially owned by Bram Goldsmith. Russell Goldsmith disclaims beneficial ownership of the shares owned by the Goldsmith Family Foundation. Also includes 300 Series A shares owned by trusts of which members of the family of Russell Goldsmith are the beneficiaries and Russell Goldsmith is the sole trustee.

11

- (4)

- Includes 150 Series B shares owned by trusts of which members of the family of Russell Goldsmith are the beneficiaries and Russell Goldsmith is the sole trustee.

- (5)

- The shares are jointly owned by Frank Pekny and his wife.

- (6)

- Includes 46 Series A shares owned by a spouse of an officer with respect to which the officer disclaims beneficial ownership. The sum total for this column reflects appropriate elimination of duplicates attributable to both Russell and Bram Goldsmith under the Goldsmith Family Foundation (See footnotes (1) and (3).

CN Real Estate Investment Corporation II

In 2002, CN Real Estate Investment Corporation II, an indirect wholly-owned subsidiary of the Corporation ("Subsidiary II"), sold in a private placement 121,530 shares of its 8.5% Series A Non-Cumulative Preferred Shares (the "Subsidiary II Series A Shares") for $100 per share. The Subsidiary II Series A Shares vote on a share for share basis with the common shares of Subsidiary II and are not convertible into common stock of Subsidiary II. Subsidiary II intends to continue to operate as a Real Estate Investment Trust under the Internal Revenue Code of 1986, as amended, by investing primarily in participation interests in a portion of the Bank's portfolio of loans secured, in whole or in part, by real estate and leasehold improvements which generate net income.

The information below sets forth the number of Subsidiary II Series A Shares beneficially owned as of January 31, 2003 by each of the current directors, the nominees recommended by the Board of Directors for election as directors, each of the individuals included in the "Summary Compensation Table" below and all current directors, nominees and executive officers as a group. Except as otherwise noted in the footnotes below, each of these persons had sole voting and investment power with respect to the Preferred Shares owned by him or her.

| Name or Number of Persons in Group | Subsidiary II Series A Shares Beneficially Owned | Subsidiary II Series A Percent Of Class * | |||

|---|---|---|---|---|---|

| Bram Goldsmith | 200 | (1) | * | ||

| Russell Goldsmith | 500 | (2) | * | ||

| All Directors, Nominees and Executive Officers as a group (4 persons) | 1,245 | (1, 2, 3) | 1.02 | % |

- *

- Percentage information is omitted for those individuals whose beneficially owned shares represent less than one percent of the outstanding shares of the Subsidiary's preferred stock.

- (1)

- Includes 100 shares owned by Bram Goldsmith's spouse. Bram Goldsmith disclaims beneficial ownership of the shares held by his spouse.

- (2)

- These shares are owned by trusts of which members of the family of Russell Goldsmith are the beneficiaries and Russell Goldsmith is the sole trustee.

- (3)

- Includes 2 shares owned by a spouse of an officer with respect to which the officer disclaims beneficial ownership.

12

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Summary Compensation Table

The following table sets forth the compensation for services rendered in all capacities to the Corporation and its subsidiaries earned during or, in the case of bonuses, on account of, the years indicated by each of the Corporation's Chief Executive Officer and the four most highly compensated officers of the Corporation during 2002 (including, in some cases, officers of the Bank who were deemed executive officers of the Corporation) who were employed by the Corporation or the Bank at December 31, 2002 (collectively, the "Named Executive Officers").

| | | | | | Long Term Compensation(1) | | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | | ||||||||||||||

| | | | Securities Underlying Options Granted | | |||||||||||||

| Name and Position with the Corporation and the Bank | Year | Salary | Bonus | Other Annual Compensation(2) | Restricted Stock Awards | All Other Compensation(3)(4) | |||||||||||

| Russell Goldsmith Vice Chairman and Chief Executive Officer, City National Corporation; Chairman of the Board and Chief Executive Officer, City National Bank | 2002 2001 2000 | $ $ $ | 844,743 807,709 751,526 | $ $ $ | 1,088,609 895,665 1,017,359 | — — — | — — — | 375,000 125,000 83,000 | $ $ $ | 23,500 20,308 20,955 | |||||||

| Bram Goldsmith Chairman of the Board, City National Corporation | 2002 2001 2000 | $ $ $ | 540,000 540,000 540,000 | $ $ $ | 385,000 385,000 385,000 | — — — | — — — | — — — | $ $ $ | 83,500 80,308 80,955 | |||||||

| George H. Benter, Jr. President, City National Corporation; President and Chief Operating Officer, City National Bank | 2002 2001 2000 | $ $ $ | 471,733 460,000 435,003 | $ $ $ | 302,343 244,800 280,000 | — — — | — — — | 50,000 50,000 50,000 | $ $ $ | 23,500 20,308 20,955 | |||||||

| Frank P. Pekny Executive Vice President and Chief Financial Officer/Treasurer, City National Corporation; Vice Chairman and Chief Financial Officer, City National Bank | 2002 2001 2000 | $ $ $ | 426,187 416,000 395,669 | $ $ $ | 285,028 221,400 242,500 | — — — | — — — | 50,000 50,000 50,000 | $ $ $ | 23,500 20,308 20,955 | |||||||

| Jan R. Cloyde Executive Vice President and Manager, Banking Services, City National Bank | 2002 2001 2000 | $ $ $ | 362,543 353,000 327,503 | $ $ $ | 242,465 188,300 210,000 | — — — | 25,000 17,500 12,700 | $ $ $ | 23,500 20,308 19,582 | ||||||||

- (1)

- The Corporation did not award restricted stock to any of the Named Executive Officers during the periods shown.

- (2)

- There were no perquisites or other personal benefits which, in the aggregate, exceeded the lesser of $50,000 or 10% of total salary and bonus for any of the Named Executive Officers.

- (3)

- Reflects the contribution to the Profit Sharing Plan allocable to the Named Executive Officer, including any matching contribution to the Section 401(k) deferred compensation feature of that Plan.

- (4)

- For Bram Goldsmith, also includes $60,000 in each of 2000, 2001 and 2002 for the premium paid on a life insurance policy originally purchased in 1980 which policy is owned by a trust of which Russell Goldsmith is one of the beneficiaries. See "—Employment Contracts, Change of Control Agreements and Termination Arrangements—Bram Goldsmith Agreement".

13

Employment Contracts, Change of Control Agreements and Termination Arrangements

Russell Goldsmith Agreement. Effective July 15, 1998, the Corporation and the Bank entered into an Employment Agreement (the "1998 Russell Goldsmith Agreement") with Russell Goldsmith pursuant to which he has served as Chairman of the Board and Chief Executive Officer of the Bank and Vice Chairman and Chief Executive Officer of the Corporation. The 1998 Russell Goldsmith Agreement remained in effect until July 15, 2002. The 1998 Russell Goldsmith Agreement provided for an annual salary of $675,000 for the first year, increasing each successive year by the lesser of (i) five percent (5%) plus a cost of living index and (ii) 10%. Russell Goldsmith was also entitled to an annual bonus equal to not less than 125% of his base compensation if plan goals for the year were achieved, scaled up ratably, to 200% of his base compensation, if 130% of plan goals were achieved, and scaled down ratably to 35% if 85% of plan goals were achieved.

At their July and September 2002 meetings, the Board of Directors approved a new employment agreement for Russell Goldsmith (the "2002 Russell Goldsmith Agreement"), which was executed on March 20, 2003, with all terms and conditions effective as of July 15, 2002 and pursuant to which Russell Goldsmith has served and will continue to serve as Chairman of the Board and Chief Executive Officer of the Bank and Vice Chairman and Chief Executive Officer of the Corporation. The 2002 Russell Goldsmith Agreement, which will remain in effect until July 15, 2006, provides for an annual salary of $853,811 from July 15, 2002 until February 28, 2003, at which time the Agreement provides for a two percent (2%) increase in annual salary, effective until the next review date which is March 1, 2004. Thereafter, annual salary increases for each successive year will increase by a minimum of six percent (6%) per year on each of the following March 1 review dates, subject to voluntary reduction by Russell Goldsmith. Consistent with benefits provided to all Executive Committee members, Russell Goldsmith will receive an automobile allowance of $1,000 per month. Annual bonus incentive remained unchanged from the prior agreement. Russell Goldsmith is entitled to an annual bonus equal to not less than 125% of his base compensation if plan goals for the year are achieved, scaled up ratably, to 200% of his base compensation, if 130% of plan goals are achieved, and scaled down ratably to 35% if 85% of plan goals are achieved.

The 2002 Russell Goldsmith Agreement also provides for the implementation of a Supplemental Executive Retirement Plan for Russell Goldsmith (the "SERP Benefits"). The SERP Benefits equal approximately 1.54% of his final average pay (the average of the highest three years of Russell Goldsmith's final five years salary and bonus) per year of service, up to a 25.2% maximum after 16.33 years of service, on February 14, 2012. The projected benefit after 16.33 years of service at age sixty-two (the normal retirement date) is $650,000. The SERP Benefits include provisions for (i) actuarial reduction for early retirement; (ii) actuarially increased benefit for delayed retirement; (iii) payment of vested benefits upon retirement, death or disability (lump sum option); (iv) elective provision for joint and survivor annuity for his spouse, with actuarially reduced pension; (v) death benefits for his spouse; and (vi) five years extra service credit, but no change in maximum benefit, in event of a change of control. The SERP Benefit becomes fully vested upon eight years of service, on October 16, 2003.

The 2002 Russell Goldsmith Agreement also provided for the grant to Russell Goldsmith on July 24, 2002 of 250,000 non-qualified stock options to acquire the Corporation's common stock at an exercise price of $47.12 per share (the fair market value on that date) pursuant to the Corporation's 2002 Omnibus Plan. The option was immediately exercisable as to 83,334 shares; exercisable as to 83,333 shares on July 24, 2003; and exercisable as to the remaining 83,333 shares on July 24, 2004. The options will expire on July 23, 2012.

The 2002 Russell Goldsmith Agreement provides that in the event the Corporation or the Bank terminates Russell Goldsmith's employment without good cause, Russell Goldsmith will be entitled to receive an amount equal to (i) the base compensation and bonus he would have received during the three years following the date of termination (assuming for purposes of the calculation that the term of the 2002 Russell Goldsmith Agreement had extended for a period of three years from the date of termination) and

14

(ii) the cost of all other employee benefits Russell Goldsmith would have received had he remained employed for three years following the date of termination. In addition, the stock options granted pursuant to the 2002 Russell Goldsmith Agreement, if not then exercisable in full, will become fully exercisable. For purposes of the 2002 Russell Goldsmith Agreement, "good cause" is defined as (i) conviction of a crime directly related to Russell Goldsmith's employment, (ii) conviction of a felony involving moral turpitude, (iii) willful and gross mismanagement of the Corporation's or the Bank's business and affairs or (iv) breach of a material provision of the 2002 Russell Goldsmith Agreement.

If Russell Goldsmith's employment is terminated because of injury or physical or mental illness or due to Russell Goldsmith's death, he (or, in the event of his death, his beneficiary or estate) will be entitled to receive the same amounts and benefits as if his employment had been terminated without cause.

Any dispute relating to the 2002 Russell Goldsmith Agreement will be resolved by binding arbitration. See "Change of Control Agreements" below, for information relating to change of control arrangements for Russell Goldsmith.

Bram Goldsmith Agreement. In March 1998, the Corporation and the Bank entered into an Employment Agreement (the "1998 Agreement") with Bram Goldsmith pursuant to which he served as Chairman of the Board of the Corporation and an officer of the Bank from May 15, 1998, to May 14, 2001. In March 2001, the Corporation and the Bank entered into an Employment Agreement (the "2001 Agreement") with Bram Goldsmith which provided for him to serve as Chairman of the Board of the Corporation and an officer of the Bank from May 15, 2001, to May 14, 2003. Both the 1998 Agreement and the 2001 Agreement provided for an annual salary of $540,000, as well as an annual incentive bonus, which bonus shall be no less a percentage of Bram Goldsmith's annual salary than the mean between the high and low percentage of annual salary paid as a bonus to any other member of the Corporation's or the Bank's Strategy and Planning Committee (both of which currently consist of Russell Goldsmith, Bram Goldsmith, George Benter, Frank Pekny and Jan Cloyde). The 1998 Agreement and the 2001 Agreement also provided that in no event shall the total employee remuneration (as that term is defined in Section 162(m) of the Internal Revenue Code) paid to Bram Goldsmith with regard to any one tax year of the Corporation total more than $925,000.

On March 19, 2003, the Board of Directors of the Corporation and the Bank approved entering into a new employment agreement with Bram Goldsmith, who has agreed to the following terms (the "2003 Bram Goldsmith Agreement"). Under this new agreement, he will continue to serve as Chairman of the Board of the Corporation and in all current officer capacities until May 14, 2005. The 2003 Bram Goldsmith Agreement will provide that he will receive an annual salary of $350,000 commencing May 15, 2003. He will also receive an annual bonus for the performance year 2003 and each year thereafter, in an amount not to exceed $150,000. Like all other Executive Committee members, Bram Goldsmith will also receive a monthly automobile allowance of $1,000. He will receive title to a 1987 Mercedes valued at $6,000 which has been his Company car for the past fifteen years. All other provisions of the 2001 Agreement will remain in effect for the term of the 2003 Bram Goldsmith Agreement. The 2003 Bram Goldsmith Agreement was not yet executed as of the date of this Proxy Statement and is expected to be executed prior to the 2003 Annual Meeting of Stockholders. All other provisions of the 2001 Agreement remain in effect for the term of the 2003 Bram Goldsmith Agreement.

Since 1980, employment arrangements between the Corporation and Bram Goldsmith have provided for various policies of life insurance. Since 1990, and continuing under the 1998 Agreement and the 2001 Agreement, an insurance policy on the joint lives of Bram and Elaine Goldsmith in the amount of $7,000,000 has been provided by the Bank, and will continue to be provided by the Bank while either Bram or Elaine Goldsmith remains alive. The Bank is currently obligated to pay an annual premium equal to the greater of $60,000 or the amount necessary to maintain a $7,000,000 death benefit. The Bank will receive from the death benefit of the policy, before any payments are made to the beneficiaries, a sum equal to the aggregate amount of premiums paid on the policy since its inception, without interest. The total premiums

15

paid between 1980 and 2002 on the existing policy and its predecessor policy total approximately $840,842. There is no arrangement or understanding, formal or informal, that Bram Goldsmith has or will receive or be allocated an interest in the cash surrender value of the insurance policy. The Corporation is considering its obligation to continue to make the annual premium on this policy in light of Section 402 of the Sarbanes-Oxley Act which, with certain exceptions, prohibits publicly traded companies from making personal loans to directors and executive officers. It is not clear whether the arrangement between Bram Goldsmith and the Corporation with respect to the payment of premiums under this policy would constitute a loan within the meaning of the section and, if it is a loan, whether future payments of premiums which the Corporation was obligated to make at the date of enactment of the prohibition are subject to the section.

The 2003 Bram Goldsmith Agreement will provide that in the event the Corporation terminates Bram Goldsmith's employment without good cause, Bram Goldsmith will be entitled to receive all compensation payable for the balance of the term as if it had not been terminated. For this purpose, "good cause" is defined as (i) conviction of a crime directly related to Bram Goldsmith's employment, (ii) conviction of a felony involving moral turpitude, (iii) willful and gross mismanagement of the Corporation's or the Bank's business and affairs, or (iv) breach of any material provision of the applicable agreement. If Bram Goldsmith's employment is terminated because of injury or physical or mental illness, the Corporation will be obligated to continue paying Bram Goldsmith's salary and bonus as if he continued to be employed by the Corporation, less any amount paid in lieu of salary under any private or governmental insurance program. If Bram Goldsmith's employment is terminated due to his death, his annual salary will be paid to his wife, if she is living, or his Revocable Living Trust, if she is not, for the lesser of two years or the remaining term of the 2003 Bram Goldsmith Agreement.

Any dispute relating to the 1998 Agreement, the 2001 Agreement, or the 2003 Bram Goldsmith Agreement will be resolved through binding arbitration. See "Change of Control Agreements" below for information relating to change of control arrangements for Bram Goldsmith.

Change of Control Agreements. Each officer who is a member of the Bank's Executive Committee, including each of the five Named Executive Officers, has entered into a Change of Control Agreement (the "Change of Control Agreement"). The Change of Control Agreement provides that each officer shall be employed for a period of two years (three years for Russell Goldsmith, Bram Goldsmith, George Benter, Frank Pekny and Jan Cloyde) from the date of a change in control. The compensation, benefits, title, duties and other attributes of the officer's employment generally will be at least equal to that which was provided prior to the change in control.

If, after a change of control (as defined in the Change of Control Agreement), the officer's employment is terminated other than for "cause" or the officer resigns for "good reason," the officer will be paid an amount equal to two times (three times for Russell Goldsmith, Bram Goldsmith, George Benter, Frank Pekny and Jan Cloyde) such officer's base salary and annual bonus plus the value of certain other benefits and payments foregone due to the termination and will continue to receive all employee benefits for two years (three years for Russell Goldsmith, Bram Goldsmith, George Benter, Frank Pekny and Jan Cloyde) after the date of termination. For purposes of the Change of Control Agreements, "cause" is defined to mean (i) a willful and continued failure to perform the officer's duties or (ii) willfully engaging in illegal conduct or gross misconduct materially and demonstrably injurious to the Corporation, and "good reason" is defined to include (i) an action which diminishes the officer's position, authority, duties or responsibilities or (ii) a failure by the Corporation to comply with the compensation provisions of the agreement. In addition, any resignation by the officer during the 30 day period immediately following the first anniversary of a change of control is deemed to be for "good reason."

If it is determined that any payments made to an officer pursuant to the Change of Control Agreement would subject such officer to an excise tax pursuant to Section 4999 of the Internal Revenue Code of 1986, under certain circumstances such officer will also be paid an additional amount sufficient to

16

put such officer in the same tax position as the officer would have been in had no excise tax been imposed on such payment.

Stock Option Plans. The 1995 Omnibus Plan, the 1999 Omnibus Plan and the 2002 Omnibus Plan, each contain provisions that take effect upon a change of control (as defined in each of the plans) of the Corporation. If a change of control occurs, all options held by employees vest in full unless the Compensation, Nominating & Governance Committee determines otherwise, in which event the Board of Directors or the Compensation, Nominating & Governance Committee, as applicable, will make provision for continuation and assumption of the plans and outstanding awards or for the substitution of new awards. Although the 1985 Stock Option Plan, under which no more options may be granted but under which there are still options outstanding, contains similar provisions, such provisions are no longer operative because all remaining options under the 1985 Stock Option Plan are fully vested.

Executive Deferred Compensation Plan. The Bank's 2000 Executive Deferred Compensation Plan allows officers who are senior vice presidents or above to elect each year to defer up to 100% of their salary, including commissions, and up to 100% of their annual bonus. Each officer's deferral account is credited with an amount equal to the net investment return of one or more equity or bond funds selected by the officer. Amounts in an officer's deferral account represent an unsecured claim against the Bank's assets and are paid, pursuant to the officer's election, in a lump-sum or in quarterly installments at a specified date during the officer's employment or upon the officer's termination of employment with the Bank. Under the prior executive deferred compensation plan, a participating officer may have used amounts deferred to purchase a split-dollar life insurance policy. Under the 2000 Executive Deferred Compensation Plan, the Bank provides a specified amount of life insurance coverage to each such eligible officer beginning on the date the officer executes an "Agreement for Transfer of Policy and Termination of Split-Dollar Life Insurance Agreement" and ending on December 31, 2009. The officer is entitled to name a beneficiary to receive the portion of the death benefit under the life insurance policy that is equal to the amount set forth in the 2000 Executive Deferred Compensation Plan.

Stock Option Plans

Option Grants in Last Fiscal Year

The following table sets forth information regarding stock options granted to the Named Executive Officers during 2002. Bram Goldsmith was not granted options during 2002. No stock appreciation rights were granted during 2002.

| | Individual Grants | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Number of Securities Underlying Options Granted | Percent of Total Options Granted to Employees | Exercise Price (per share) (1) | Market Price on Grant Date (per share) (1) | Expiration Date | Grant Date Present Value (3) | |||||||||

| Russell Goldsmith | 125,000 | 7.59 | % | $ | 50.30 | $ | 50.30 | 2/26/2012 | $ | 2,248,750 | |||||

| 250,000 | (2) | 15.18 | % | $ | 47.12 | $ | 47.12 | 7/23/2012 | $ | 4,060,000 | |||||

| George H. Benter, Jr. | 50,000 | 3.04 | % | $ | 50.30 | $ | 50.30 | 2/26/2012 | $ | 899,500 | |||||

| Frank P. Pekny | 50,000 | 3.04 | % | $ | 50.30 | $ | 50.30 | 2/26/2012 | $ | 899,500 | |||||

| Jan R. Cloyde | 25,000 | 1.52 | % | $ | 50.30 | $ | 50.30 | 2/26/2012 | $ | 449,750 | |||||

- (1)

- Closing price on the grant date as reported on the NYSE.

- (2)

- Options were granted in connection with the approval of the 2002 Russell Goldsmith Agreement.

- (3)

- "Grant Date Present Values" were calculated using the Black-Scholes option valuation model described below, which at the date of grant of the options were: a) $17.99 per option for the options with an exercise price of $50.30, and b) $16.24 per option for the options with an exercise price of

17

$47.12. Present values were calculated using the Black-Scholes option valuation model with the following assumptions:

| Expected Life | 7.5 years | |

| Volatility | 30.97% | |

| Dividend yield | 1.75% | |

| Risk-free investment rate | 4.76% |

The expected life is based upon the pattern of exercises of options granted by the Corporation in the past. Volatility, a measure of the variability in the Corporation's stock price, is based on changes in the price of the Corporation's common stock during the past ten years, measured monthly. The dividend yield is an assumed rate. Actual dividend payments will depend upon a number of factors, including future financial results, and may differ substantially from the assumption. The risk-free investment rate is based on the yield on ten year U.S. Treasury Notes on the grant date.

The actual value, if any, which a Named Executive Officer may realize will depend upon the difference between the option exercise price and the market price of the Corporation's common stock on the date of exercise.

The options which expire on February 26, 2012 were granted on February 27, 2002 and the options which expire on July 23, 2012 were granted on July 24, 2002. The February 27, 2002 options become exercisable 25% on each anniversary date of the grant until fully exercisable. The July 24, 2002 options were immediately exercisable as to 83,334 shares, and thereafter exercisable as to an additional 83,333 shares on each of the following two anniversary dates of the grant. The options may become exercisable in full upon a change of control of the Corporation. See "—Employment Contracts, Change of Control Agreements and Termination Arrangements—Stock Option Plans".

Aggregated Option Exercises and Year-End Option Values

The following table sets forth information regarding exercises of stock options by the Named Executive Officers during 2002 and the value of all unexercised in-the-money stock options held by the Named Executive Officers as of December 31, 2002. Bram Goldsmith did not exercise any stock options during 2002 and held no unexercised stock options at December 31, 2002. There were no exercises of stock appreciation rights during 2002 and no unexercised stock appreciation rights at December 31, 2002.

| | | | Number of Shares Underlying Unexercised Options | Value of Unexercised in-the-money Options at Year-End(1) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Shares Acquired upon Exercise | | |||||||||||||

| Name | Value Realized | ||||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

| Russell Goldsmith | 90,000 | $ | 3,700,275 | 953,584 | 426,916 | $ | 15,154,829 | $ | 1,389,679 | ||||||

| George H. Benter, Jr. | 79,526 | $ | 3,236,234 | 213,128 | 126,875 | $ | 3,123,943 | $ | 803,036 | ||||||

| Frank P. Pekny | 77,625 | $ | 1,559,823 | 103,724 | 126,875 | $ | 1,944,588 | $ | 803,036 | ||||||

| Jan R. Cloyde | — | — | 35,750 | 44,500 | $ | 441,282 | $ | 204,119 | |||||||

- (1)

- Values are based on the $43.99 closing price of the Corporation's common stock on December 31, 2002, as reported on the NYSE. The actual amount which a Named Executive Officer may realize will depend upon the market price of the Corporation's common stock at the time shares obtained upon exercise of such options are sold.

18

The Corporation does not pay cash fees to its directors for attendance at meetings of the Board of Directors. However, the Bank, whose Board of Directors consists of the same individuals as the Corporation's Board of Directors and generally meets jointly with the Corporation's Board of Directors, pays a fee of $1,500 to each non-employee director for attendance at each meeting of its Board of Directors. Non-employee directors serving on committees appointed by the Board of Directors receive a fee of $1,000 for each committee meeting attended. In addition, the chair of each committee appointed by the Board of Directors receives an annual fee of $3,000.

The Corporation's 1999 Omnibus Plan provides for the automatic annual grant of 500 discounted stock options to each non-employee director on the date of the annual meeting of stockholders ("Director Stock Options"). The exercise price of Director Stock Options is $1.00 per share, payable in cash, by surrender of Corporation common stock held by the director or a combination of the two. Director Stock Options vest six months after the date of grant or upon the earlier termination without cause of the option holder's directorship and expire ten years after the date of grant.

The Bank's 2000 Director Deferred Compensation Plan allows non-employee directors to elect each year to defer up to 100% of their director fees. Each director's deferral account is credited with an amount equal to the net investment return of one or more equity or bond funds selected by the director. Amounts in a director's deferral account represent an unsecured claim against the Bank's assets and are paid, pursuant to the director's election, in a lump sum or in quarterly installments at a specified date during the director's service on the board or upon the termination of service as a director. Prior to 2000, the Corporation maintained a Director Deferred Compensation Plan which the Corporation terminated effective December 31, 1999. Under the Corporation's Director Deferred Compensation Plan, a participating director may have used amounts to purchase a split-dollar life insurance policy. Under the Bank's 2000 Director Deferred Compensation Plan, the Bank provides a specified amount of life insurance coverage to each such eligible director beginning on the date the director executes an "Agreement for Transfer of Policy and Termination of Split-Dollar Life Insurance Agreement" and ending on December 31, 2009. The director is entitled to name a beneficiary to receive the portion of the death benefit under the life insurance policy that is equal to the amount set forth in the Bank's 2000 Director Deferred Compensation Plan.

19

EQUITY COMPENSATION PLAN INFORMATION

The following table summarizes information, as of December 31, 2002, relating to equity compensation plans of the Company pursuant to which grants of options and restricted stock may be granted from time to time.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights. | Weighted-average exercise price of outstanding options, warrants and rights. | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in first column). | |||||

|---|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders | 4,094,706(1 | ) | $ | 32.46 | 5,049,211(2 | ) | ||

| Equity compensation plans not approved by security holders | 1,881,912 | $ | 44.17 | 69,339 | ||||

| Total | 5,976,618(3 | ) | $ | 36.15 | 5,118,550(4 | ) | ||

- (1)

- Includes 133,782 shares assumed in the acquisition of Civic Bancorp with a weighted-average exercise price of $26.75. Civic Bancorp shareholders had approved these stock option plans.

- (2)

- Includes 353,211 shares under the 1995 Omnibus Plan available for the issuance of restricted stock.

- (3)

- Includes 11,667 shares of restricted stock and 5,964,951 of stock options.

- (4)

- There are no formula used to calculate the number of securities available for issuance under the plans.

In March 2001, the Board of Directors adopted the 2001 Stock Option Plan, which is a broadly-based stock option plan under which options may only be granted to employees of the Corporation and the subsidiaries who are neither directors or executive officers. The 2001 Stock Option Plan was not submitted to the stockholders for their approval. By action of the Board of Directors, as disclosed in the 2002 Proxy Statement, there are only 69,339 shares remaining available for issuance under the 2001 Stock Option Plan.

Under the 2001 Stock Option Plan, the Committee may from time to time grant Nonqualified Stock Options ("NSOs"), (but not Incentive Stock Options or Director Stock Options), to "eligible employees." "Eligible employees" means full-time employees of the Corporation who are "exempt employees" under the Fair Labor Standards Act of 1938 and who are neither members of the Board nor "officers". "Officers" means those individuals determined by the Board of Directors to be officers of the Corporation who provide significant policy-making functions to the Corporation for purposes of Section 16 of the Securities Exchange Act of 1934.

The 2001 Stock Option Plan contains a provision that takes effect upon a change in control (as defined in the plan) of the Corporation. If a change of control occurs, all options held by employees vest in full unless the Compensation, Nominating and Governance Committee determines otherwise, in which event the Board of Directors or the Compensation, Nominating & Governance Committee, as applicable, will make provision for continuation and assumption of the plans and outstanding awards or for the substitution of new awards, provided, however, that in no event shall any option be accelerated as to any Section 16 Person to a date less than six months after the Option Date of such option (as such terms are defined in the plan).

20

COMPENSATION, NOMINATING & GOVERNANCE COMMITTEE

INTERLOCKS AND INSIDER PARTICIPATION

The Compensation, Nominating & Governance Committee during 2002 consisted of Richard L. Bloch (Chairman) and Michael L. Meyer. None of the members of the Compensation, Nominating & Governance Committee has ever been an officer or employee of the Corporation or any subsidiary of the Corporation.

Both of the members of the Compensation, Nominating & Governance Committee were customers of the Bank in the ordinary course of business during 2002. Similar transactions are expected to occur in the future. In the opinion of management, all such transactions were effected on substantially the same terms as those prevailing at the time for comparable transactions with other persons, including, as to any loans, interest rates, fees and collateral, and any loans did not involve more than the normal risk of collection or present any other unfavorable terms.

REPORT ON EXECUTIVE COMPENSATION

BY THE COMPENSATION, NOMINATING & GOVERNANCE COMMITTEE

Decisions regarding compensation of the Corporation's chief executive officer, the members of the Corporation's Strategy and Planning Committee and any other officers of the Corporation earning an annual base salary of $200,000 or more, all of whom are employees of the Bank, are made by the Compensation, Nominating & Governance Committee of the Corporation, which acts jointly as the Compensation, Nominating & Governance Committee of the Bank (collectively the "Compensation, Nominating & Governance Committee"). The executive officers of the Corporation are compensated by the Bank and receive benefits under various Bank employee benefit plans. The Corporation provides incentive based compensation benefits to its executive officers pursuant to the Corporation's Profit Sharing Plan, the Executive Management Bonus Plan, the 1999 Variable Bonus Plan, the Executive Deferred Compensation Plan, the 1995 Omnibus Plan, the 1999 Omnibus Plan and the 2002 Omnibus Plan. The Compensation, Nominating & Governance Committee, administers the 1999 Variable Bonus Plan, the 1995 Omnibus Plan, the 1999 Omnibus Plan, the 2001 Stock Option Plan and the 2002 Omnibus Plan and grants options and other stock-based awards thereunder. The Compensation, Nominating & Governance Committee also administers outstanding options issued under the 1985 Stock Option Plan. No new options can be granted under the 1985 Stock Option Plan. References in the following report to the Corporation shall be deemed to include the Bank, unless otherwise noted.

The Compensation, Nominating & Governance Committee presents the following report.

Overall Philosophy

The Corporation's compensation and benefit programs provide systematic ways of rewarding employee-colleagues both as individuals and as members of a team for achieving or contributing meaningfully to the Corporation's strategic goals. Rewards are determined in accordance with the Corporation's "pay for performance" philosophy and are based on an evaluation process that periodically assesses performance against established goals. The compensation and benefit programs are reassessed annually for suitability with corporate growth strategies and competitiveness within the marketplace. Consistent with the Corporation's mission statement, these programs are designed to build, train, retain, reward and support the best team of professionals in the financial industry. They are designed to:

- •

- Reward achievement of corporate and individual goals in a fair, objective and consistent way;

- •

- Effectively motivate continued achievement of increasingly higher goals;

- •

- Attract and retain the best team of professionals;

- •

- Balance short and long-term objectives for both the Corporation and employee-colleagues;

21

- •

- Recognize behaviors that are consistent with the Corporation's values and culture;

- •

- Properly value and blend teamwork and individual effort; and

- •

- Provide appropriate levels of rewards using one or more of the following program components: base pay, bonus, stock options, benefit and retirement programs and training programs.