Exhibit 2.1

PURCHASE AND ASSUMPTION AGREEMENT

WHOLE BANK

ALL DEPOSITS

AMONG

FEDERAL DEPOSIT INSURANCE CORPORATION,

RECEIVER OF IMPERIAL CAPITAL BANK,

LA JOLLA, CALIFORNIA

FEDERAL DEPOSIT INSURANCE CORPORATION

and

CITY NATIONAL BANK

DATED AS OF

DECEMBER 18, 2009

TABLE OF CONTENTS

ARTICLE I | DEFINITIONS | 2 |

| | |

ARTICLE II | ASSUMPTION OF LIABILITIES | 8 |

| | |

2.1 | Liabilities Assumed by Assuming Bank | 8 |

2.2 | Interest on Deposit Liabilities | 10 |

2.3 | Unclaimed Deposits | 10 |

2.4 | Employee Plans | 11 |

| | |

ARTICLE III | PURCHASE OF ASSETS | 11 |

| | |

3.1 | Assets Purchased by Assuming Bank | 11 |

3.2 | Asset Purchase Price | 11 |

3.3 | Manner of Conveyance; Limited Warranty; Nonrecourse; Etc. | 12 |

3.4 | Puts of Assets to the Receiver | 12 |

3.5 | Assets Not Purchased by Assuming Bank | 14 |

3.6 | Assets Essential to Receiver | 15 |

| | |

ARTICLE IV | ASSUMPTION OF CERTAIN DUTIES AND OBLIGATIONS | 16 |

| | |

4.1 | Continuation of Banking Business | 16 |

4.2 | Agreement with Respect to Credit Card Business | 17 |

4.3 | Agreement with Respect to Safe Deposit Business | 17 |

4.4 | Agreement with Respect to Safekeeping Business | 17 |

4.5 | Agreement with Respect to Trust Business | 17 |

4.6 | Agreement with Respect to Bank Premises | 18 |

4.7 | Agreement with Respect to Leased Data Processing Equipment | 21 |

4.8 | Agreement with Respect to Certain Existing Agreements | 21 |

4.9 | Informational Tax Reporting | 22 |

4.10 | Insurance | 22 |

4.11 | Office Space for Receiver and Corporation | 23 |

4.12 | Agreement with Respect to Continuation of Group Health Plan Coverage for Former Employees | 23 |

4.13 | Agreement with Respect to Interim Asset Servicing | 24 |

4.14 | Reserved | 24 |

4.15 | Agreement with Respect to Loss Sharing | 24 |

ii

ARTICLE V | DUTIES WITH RESPECT TO DEPOSITORS OF THE FAILED BANK | 25 |

| | |

5.1 | Payment of Checks, Drafts and Orders | 25 |

5.2 | Certain Agreements Related to Deposits | 25 |

5.3 | Notice to Depositors | 25 |

| | |

ARTICLE VI | RECORDS | 25 |

| | |

6.1 | Transfer of Records | 25 |

6.2 | Delivery of Assigned Records | 26 |

6.3 | Preservation of Records | 26 |

6.4 | Access to Records; Copies | 27 |

| | |

ARTICLE VII | FIRST LOSS TRANCHE | 27 |

| | |

ARTICLE VIII | ADJUSTMENTS | 27 |

| | |

8.1 | Pro Forma Statement | 27 |

8.2 | Correction of Errors and Omissions; Other Liabilities | 28 |

8.3 | Payments | 28 |

8.4 | Interest | 28 |

8.5 | Subsequent Adjustments | 28 |

| | |

ARTICLE IX | CONTINUING COOPERATION | 29 |

| | |

9.1 | General Matters | 29 |

9.2 | Additional Title Documents | 29 |

9.3 | Claims and Suits | 29 |

9.4 | Payment of Deposits | 29 |

9.5 | Withheld Payments | 30 |

9.6 | Proceedings with Respect to Certain Assets and Liabilities | 30 |

9.7 | Information | 31 |

| | |

ARTICLE X | CONDITION PRECEDENT | 31 |

| | |

ARTICLE XI | REPRESENTATIONS AND WARRANTIES OF THE ASSUMING BANK | 31 |

| | |

ARTICLE XII | INDEMNIFICATION | 32 |

| | |

12.1 | Indemnification of Indemnitees | 32 |

12.2 | Conditions Precedent to Indemnification | 35 |

12.3 | No Additional Warranty | 36 |

12.4 | Indemnification of Corporation and Receiver | 36 |

12.5 | Obligations Supplemental | 37 |

iii

12.6 | Criminal Claims | 37 |

12.7 | Limited Guaranty of the Corporation | 37 |

12.8 | Subrogation | 37 |

| | |

ARTICLE XIII | MISCELLANEOUS | 38 |

| | |

13.1 | Entire Agreement | 38 |

13.2 | Headings | 38 |

13.3 | Counterparts | 38 |

13.4 | Governing Law | 38 |

13.5 | Successors | 38 |

13.6 | Modification; Assignment | 38 |

13.7 | Notice | 39 |

13.8 | Manner of Payment | 39 |

13.9 | Costs, Fees and Expenses | 39 |

13.10 | Waiver | 40 |

13.11 | Severability | 40 |

13.12 | Term of Agreement | 40 |

13.13 | Survival of Covenants, Etc. | 40 |

| | |

SCHEDULES | | |

| | |

2.1 | Certain Liabilities Assumed | 42 |

2.1(a) | Excluded Deposit Liability Accounts | 43 |

3.1 | Certain Assets Purchased | 49 |

3.2 | Purchase Price of Assets or Assets | 50 |

3.5(l) | Excluded Private Label Assets-Backed Securities | 52 |

4.15A | Single Family Loss Share Loans | 56 |

4.15B | Non-Single Family Loss Share Loans | 57 |

7 | Calculation of Deposit Premium | 58 |

| | |

EXHIBITS | | |

| | |

2.3A | Final Notice Letter | 59 |

2.3B | Affidavit of Mailing | 61 |

3.2(c) | Valuation of Certain Qualified Financial Contracts | 62 |

4.13 | Interim Asset Servicing Arrangement | 64 |

4.15A | Single Family Loss Share Agreement | 66 |

4.15B | Commercial Loss Share Agreement | 102 |

PURCHASE AND ASSUMPTION AGREEMENT

WHOLE BANK

ALL DEPOSITS

THIS AGREEMENT, made and entered into as of the 18th day of December, 2009, by and among the FEDERAL DEPOSIT INSURANCE CORPORATION, RECEIVER of IMPERIAL CAPITAL BANK, LA JOLLA, CALIFORNIA (the “Receiver”), CITY NATIONAL BANK, organized under the laws of the United States of America, and having its principal place of business in LOS ANGELES, CALIFORNIA (the “Assuming Bank”), and the FEDERAL DEPOSIT INSURANCE CORPORATION, organized under the laws of the United States of America and having its principal office in Washington, D.C., acting in its corporate capacity (the “Corporation”).

WITNESSETH:

WHEREAS, on Bank Closing, the Chartering Authority closed IMPERIAL CAPITAL BANK (the “Failed Bank”) pursuant to applicable law and the Corporation was appointed Receiver thereof; and

WHEREAS, the Assuming Bank desires to purchase certain assets and assume certain deposit and other liabilities of the Failed Bank on the terms and conditions set forth in this Agreement; and

WHEREAS, pursuant to 12 U.S.C. Section 1823(c)(2)(A), the Corporation may provide assistance to the Assuming Bank to facilitate the transactions contemplated by this Agreement, which assistance may include indemnification pursuant to Article XII; and

WHEREAS, the Board of Directors of the Corporation (the “Board”) has determined to provide assistance to the Assuming Bank on the terms and subject to the conditions set forth in this Agreement; and

WHEREAS, the Board has determined pursuant to 12 U.S.C. Section 1823(c)(4)(A) that such assistance is necessary to meet the obligation of the Corporation to provide insurance coverage for the insured deposits in the Failed Bank.

NOW THEREFORE, in consideration of the mutual promises herein set forth and other valuable consideration, the parties hereto agree as follows:

1

ARTICLE I

DEFINITIONS

Capitalized terms used in this Agreement shall have the meanings set forth in this Article I, or elsewhere in this Agreement. As used herein, words imparting the singular include the plural and vice versa.

“Accounting Records” means the general ledger and subsidiary ledgers and supporting schedules which support the general ledger balances.

“Acquired Subsidiaries” means Subsidiaries of the Failed Bank acquired pursuant to Section 3.1.

“Affiliate” of any Person means any director, officer, or employee of that Person and any other Person (i) who is directly or indirectly controlling, or controlled by, or under direct or indirect common control with, such Person, or (ii) who is an affiliate of such Person as the term “affiliate” is defined in Section 2 of the Bank Holding Company Act of 1956, as amended, 12 U.S.C. Section 1841.

“Agreement” means this Purchase and Assumption Agreement by and among the Assuming Bank, the Corporation and the Receiver, as amended or otherwise modified from time to time.

“Assets” means all assets of the Failed Bank purchased pursuant to Section 3.1. Assets owned by Subsidiaries of the Failed Bank are not “Assets” within the meaning of this definition.

“Assumed Deposits” means Deposits.

“Bank Closing” means the close of business of the Failed Bank on the date on which the Chartering Authority closed such institution.

“Bank Premises” means the banking houses, drive-in banking facilities, and teller facilities (staffed or automated) together with adjacent parking, storage and service facilities and structures connecting remote facilities to banking houses, and land on which the foregoing are located, and unimproved land that are owned or leased by the Failed Bank and that have formerly been utilized, are currently utilized, or are intended to be utilized in the future by the Failed Bank as shown on the Accounting Record of the Failed Bank as of Bank Closing.

“Bid Valuation Date” means September 8, 2009.

“Book Value” means, with respect to any Asset and any Liability Assumed, the dollar amount thereof stated on the Accounting Records of the Failed Bank. The Book Value of any item shall be determined as of Bank Closing after adjustments made by the Receiver for differences in accounts, suspense items, unposted debits and credits, and other similar

2

adjustments or corrections and for setoffs, whether voluntary or involuntary. The Book Value of a Subsidiary of the Failed Bank acquired by the Assuming Bank shall be determined from the investment in subsidiary and related accounts on the “bank only” (unconsolidated) balance sheet of the Failed Bank based on the equity method of accounting. Without limiting the generality of the foregoing, (i) the Book Value of a Liability Assumed shall include all accrued and unpaid interest thereon as of Bank Closing, and (ii) the Book Value of a Loan shall reflect adjustments for earned interest, or unearned interest (as it relates to the “rule of 78s” or add-on-interest loans, as applicable), if any, as of Bank Closing, adjustments for the portion of earned or unearned loan-related credit life and/or disability insurance premiums, if any, attributable to the Failed Bank as of Bank Closing, and adjustments for Failed Bank Advances, if any, in each case as determined for financial reporting purposes. The Book Value of an Asset shall not include any adjustment for loan premiums, discounts or any related deferred income, fees or expenses, or general or specific reserves on the Accounting Records of the Failed Bank.

“Business Day” means a day other than a Saturday, Sunday, Federal legal holiday or legal holiday under the laws of the State where the Failed Bank is located, or a day on which the principal office of the Corporation is closed.

“Chartering Authority” means (i) with respect to a national bank, the Office of the Comptroller of the Currency, (ii) with respect to a Federal savings association or savings bank, the Office of Thrift Supervision, (iii) with respect to a bank or savings institution chartered by a State, the agency of such State charged with primary responsibility for regulating and/or closing banks or savings institutions, as the case may be, (iv) the Corporation in accordance with 12 U.S.C. Section 1821(c), with regard to self appointment, or (v) the appropriate Federal banking agency in accordance with 12 U.S.C. 1821(c)(9).

“Commitment” means the unfunded portion of a line of credit or other commitment reflected on the books and records of the Failed Bank to make an extension of credit (or additional advances with respect to a Loan) that was legally binding on the Failed Bank as of Bank Closing, other than extensions of credit pursuant to the credit card business and overdraft protection plans of the Failed Bank, if any.

“Credit Documents” mean the agreements, instruments, certificates or other documents at any time evidencing or otherwise relating to, governing or executed in connection with or as security for, a Loan, including without limitation notes, bonds, loan agreements, letter of credit applications, lease financing contracts, banker’s acceptances, drafts, interest protection agreements, currency exchange agreements, repurchase agreements, reverse repurchase agreements, guarantees, deeds of trust, mortgages, assignments, security agreements, pledges, subordination or priority agreements, lien priority agreements, undertakings, security instruments, certificates, documents, legal opinions, participation agreements and intercreditor agreements, and all amendments, modifications, renewals, extensions, rearrangements, and substitutions with respect to any of the foregoing.

“Credit File” means all Credit Documents and all other credit, collateral, or insurance documents in the possession or custody of the Assuming Bank, or any of its

3

Subsidiaries or Affiliates, relating to an Asset or a Loan included in a Put Notice, or copies of any thereof.

“Data Processing Lease” means any lease or licensing agreement, binding on the Failed Bank as of Bank Closing, the subject of which is data processing equipment or computer hardware or software used in connection with data processing activities. A lease or licensing agreement for computer software used in connection with data processing activities shall constitute a Data Processing Lease regardless of whether such lease or licensing agreement also covers data processing equipment.

“Deposit” means a deposit as defined in 12 U.S.C. Section 1813(l), including without limitation, outstanding cashier’s checks and other official checks and all uncollected items included in the depositors’ balances and credited on the books and records of the Failed Bank; provided, that the term “Deposit” shall not include all or any portion of those deposit balances which, in the discretion of the Receiver or the Corporation, (i) may be required to satisfy it for any liquidated or contingent liability of any depositor arising from an unauthorized or unlawful transaction, or (ii) may be needed to provide payment of any liability of any depositor to the Failed Bank or the Receiver, including the liability of any depositor as a director or officer of the Failed Bank, whether or not the amount of the liability is or can be determined as of Bank Closing.

“Deposit Secured Loan” means a loan in which the only collateral securing the loan is Assumed Deposits or deposits at other insured depository institutions

“Equity Adjustment” means the dollar amount resulting by subtracting the Book Value, as of Bank Closing, of all Liabilities Assumed under this Agreement by the Assuming Bank from the purchase price, as determined in accordance with this Agreement, as of Bank Closing, of all Assets acquired under this Agreement by the Assuming Bank, which may be a positive or a negative number.

“Failed Bank Advances” means the total sums paid by the Failed Bank to (i) protect its lien position, (ii) pay ad valorem taxes and hazard insurance, and (iii) pay credit life insurance, accident and health insurance, and vendor’s single interest insurance.

“Fair Market Value” means (i)(a) “Market Value” as defined in the regulation prescribing the standards for real estate appraisals used in federally related transactions, 12 C.F.R. § 323.2(g), and accordingly shall mean the most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby:

(1) Buyer and seller are typically motivated;

(2) Both parties are well informed or well advised, and acting in what they consider their own best interests;

(3) A reasonable time is allowed for exposure in the open market;

4

(4) Payment is made in terms of cash in U.S. dollars or in terms of financial arrangements comparable thereto; and

(5) The price represents the normal consideration for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale;

as determined as of Bank Closing by an appraiser chosen by the Assuming Bank from a list of acceptable appraisers provided by the Receiver; any costs and fees associated with such determination shall be shared equally by the Receiver and the Assuming Bank, and (b) which, with respect to Bank Premises (to the extent, if any, that Bank Premises are purchased utilizing this valuation method), shall be determined not later than sixty (60) days after Bank Closing by an appraiser selected by the Receiver and the Assuming Bank within seven (7) days after Bank Closing; or (ii) with respect to property other than Bank Premises purchased utilizing this valuation method, the price therefore as established by the Receiver and agreed to by the Assuming Bank, or in the absence of such agreement, as determined in accordance with clause (i)(a) above.

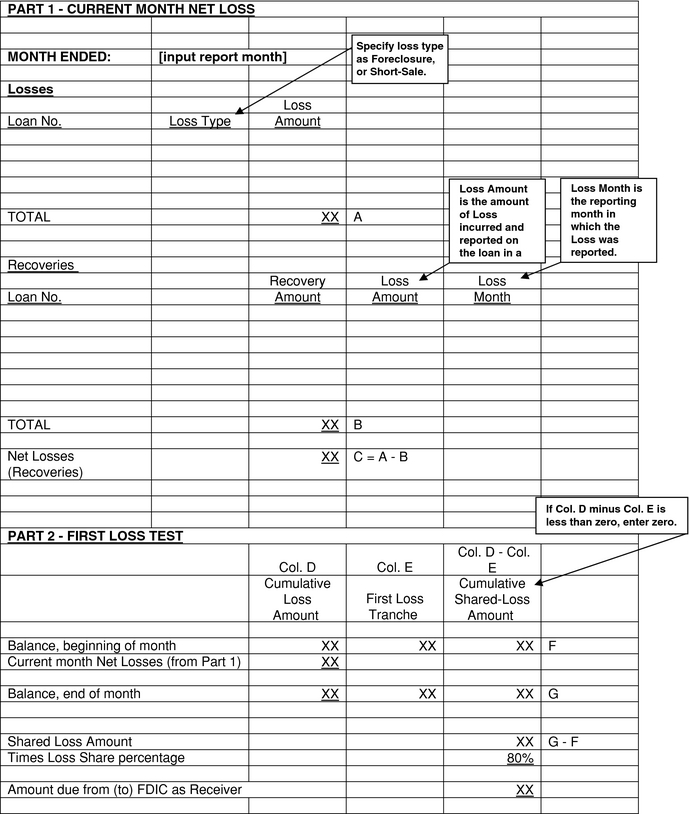

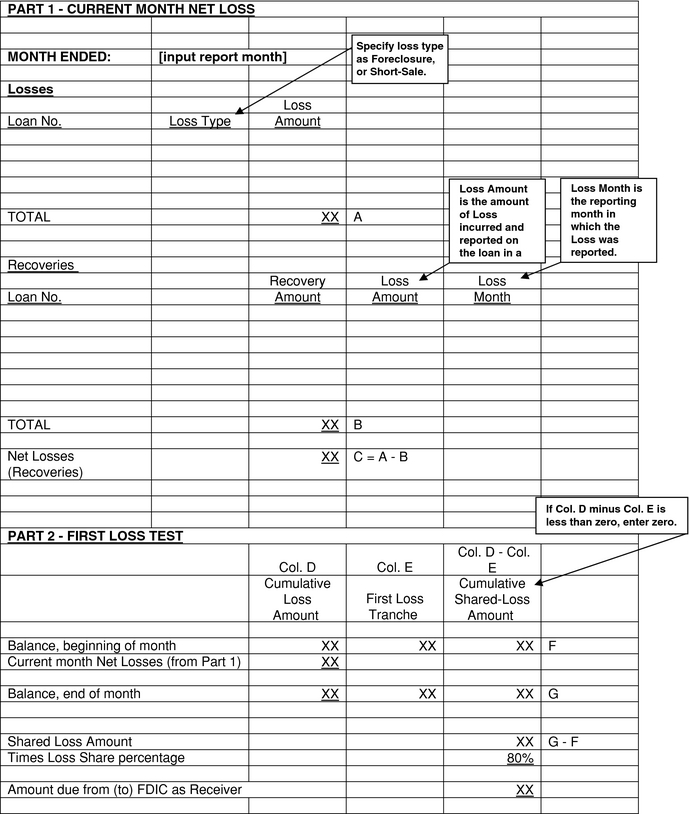

“First Loss Tranche” means the dollar amount of liability that the Assuming Bank will incur prior to the commencement of loss sharing, which is the sum of (i) the Assuming Bank’s asset premium (discount) bid, as reflected on the Assuming Bank’s bid form, plus (ii) the Assuming Bank’s Deposit premium bid, as reflected on the Assuming Bank’s bid form, plus (iii) the Equity Adjustment. The First Loss Tranche may be a positive or negative number.

“Fixtures” means those leasehold improvements, additions, alterations and installations constituting all or a part of Bank Premises and which were acquired, added, built, installed or purchased at the expense of the Failed Bank, regardless of the holder of legal title thereto as of Bank Closing.

“Furniture and Equipment” means the furniture and equipment, other than motor vehicles, leased or owned by the Failed Bank and reflected on the books of the Failed Bank as of Bank Closing and located on or at Bank Premises, including without limitation automated teller machines, carpeting, furniture, office machinery (including personal computers), shelving, office supplies, telephone, surveillance, security systems and artwork. Motor vehicles shall be considered other assets and pass at Book Value. Furniture and equipment located at a storage facility not adjacent to a Bank Premises are excluded from this definition.

“Indemnitees” means, except as provided in paragraph (11) of Section 12.1, (i) the Assuming Bank, (ii) the Subsidiaries and Affiliates of the Assuming Bank other than any Subsidiaries or Affiliates of the Failed Bank that are or become Subsidiaries or Affiliates of the Assuming Bank, and (iii) the directors, officers, employees and agents of the Assuming Bank and its Subsidiaries and Affiliates who are not also present or former directors, officers, employees or agents of the Failed Bank or of any Subsidiary or Affiliate of the Failed Bank.

5

“Legal Balance” means the amount of indebtedness legally owed by an Obligor with respect to a Loan, including principal and accrued and unpaid interest, late fees, attorneys’ fees and expenses, taxes, insurance premiums, and similar charges, if any.

“Liabilities Assumed” has the meaning provided in Section 2.1.

“Lien” means any mortgage, lien, pledge, charge, assignment for security purposes, security interest, or encumbrance of any kind with respect to an Asset, including any conditional sale agreement or capital lease or other title retention agreement relating to such Asset.

“Loans” means all of the following owed to or held by the Failed Bank as of Bank Closing:

(i) loans (including loans which have been charged off the Accounting Records of the Failed Bank in whole or in part prior to and including the Bid Valuation Date), participation agreements, interests in participations, overdrafts of customers (including but not limited to overdrafts made pursuant to an overdraft protection plan or similar extensions of credit in connection with a deposit account), revolving commercial lines of credit, home equity lines of credit, Commitments, United States and/or State-guaranteed student loans, and lease financing contracts;

(ii) all Liens, rights (including rights of set-off), remedies, powers, privileges, demands, claims, priorities, equities and benefits owned or held by, or accruing or to accrue to or for the benefit of, the holder of the obligations or instruments referred to in clause (i) above, including but not limited to those arising under or based upon Credit Documents, casualty insurance policies and binders, standby letters of credit, mortgagee title insurance policies and binders, payment bonds and performance bonds at any time and from time to time existing with respect to any of the obligations or instruments referred to in clause (i) above; and

(iii) all amendments, modifications, renewals, extensions, refinancings, and refundings of or for any of the foregoing.

“Obligor” means each Person liable for the full or partial payment or performance of any Loan, whether such Person is obligated directly, indirectly, primarily, secondarily, jointly, or severally.

“Other Real Estate” means all interests in real estate (other than Bank Premises and Fixtures), including but not limited to mineral rights, leasehold rights, condominium and cooperative interests, air rights and development rights that are owned by the Failed Bank.

“Person” means any individual, corporation, partnership, joint venture, association, joint-stock company, trust, unincorporated organization, or government or any agency or political subdivision thereof, excluding the Corporation.

6

“Primary Indemnitor” means any Person (other than the Assuming Bank or any of its Affiliates) who is obligated to indemnify or insure, or otherwise make payments (including payments on account of claims made against) to or on behalf of any Person in connection with the claims covered under Article XII, including without limitation any insurer issuing any directors and officers liability policy or any Person issuing a financial institution bond or banker’s blanket bond.

“Proforma” means producing a balance sheet that reflects a reasonably accurate financial statement of the Failed bank through the date of closing. The Proforma financial statements serve as a basis for the opening entries of both the Assuming Bank and the Receiver.

“Put Date” has the meaning provided in Section 3.4.

“Put Notice” has the meaning provided in Section 3.4.

“Qualified Financial Contract” means a qualified financial contract as defined in 12 U.S.C. Section 1821(e)(8)(D).

“Record” means any document, microfiche, microfilm and computer records (including but not limited to magnetic tape, disc storage, card forms and printed copy) of the Failed Bank generated or maintained by the Failed Bank that is owned by or in the possession of the Receiver at Bank Closing.

“Related Liability” with respect to any Asset means any liability existing and reflected on the Accounting Records of the Failed Bank as of Bank Closing for (i) indebtedness secured by mortgages, deeds of trust, chattel mortgages, security interests or other liens on or affecting such Asset, (ii) ad valorem taxes applicable to such Asset, and (iii) any other obligation determined by the Receiver to be directly related to such Asset.

“Related Liability Amount” with respect to any Related Liability on the books of the Assuming Bank, means the amount of such Related Liability as stated on the Accounting Records of the Assuming Bank (as maintained in accordance with generally accepted accounting principles) as of the date as of which the Related Liability Amount is being determined. With respect to a liability that relates to more than one asset, the amount of such Related Liability shall be allocated among such assets for the purpose of determining the Related Liability Amount with respect to any one of such assets. Such allocation shall be made by specific allocation, where determinable, and otherwise shall be pro rata based upon the dollar amount of such assets stated on the Accounting Records of the entity that owns such asset.

“Repurchase Price” means, with respect to any Loan the Book Value, adjusted to reflect changes to Book Value after Bank Closing, plus (i) any advances and interest on such Loan after Bank Closing, minus (ii) the total of amounts received by the Assuming Bank for such Loan, regardless of how applied, after Bank Closing, plus (iii) advances made by Assuming Bank, plus (iv) total disbursements of principal made by Receiver that are not included in the Book Value.

7

“Safe Deposit Boxes” means the safe deposit boxes of the Failed Bank, if any, including the removable safe deposit boxes and safe deposit stacks in the Failed Bank’s vault(s), all rights and benefits under rental agreements with respect to such safe deposit boxes, and all keys and combinations thereto.

“Settlement Date” means the first Business Day immediately prior to the day which is one hundred eighty (180) days after Bank Closing, or such other date prior thereto as may be agreed upon by the Receiver and the Assuming Bank. The Receiver, in its discretion, may extend the Settlement Date.

“Settlement Interest Rate” means, for the first calendar quarter or portion thereof during which interest accrues, the rate determined by the Receiver to be equal to the equivalent coupon issue yield on twenty-six (26)-week United States Treasury Bills in effect as of Bank Closing as published in The Wall Street Journal; provided, that if no such equivalent coupon issue yield is available as of Bank Closing, the equivalent coupon issue yield for such Treasury Bills most recently published in The Wall Street Journal prior to Bank Closing shall be used. Thereafter, the rate shall be adjusted to the rate determined by the Receiver to be equal to the equivalent coupon issue yield on such Treasury Bills in effect as of the first day of each succeeding calendar quarter during which interest accrues as published in The Wall Street Journal.

“Subsidiary” has the meaning set forth in Section 3(w)(4) of the Federal Deposit Insurance Act, 12 U.S.C. Section 1813(w)(4), as amended.

ARTICLE II

ASSUMPTION OF LIABILITIES

2.1 Liabilities Assumed by Assuming Bank. The Assuming Bank expressly assumes at Book Value (subject to adjustment pursuant to Article VIII) and agrees to pay, perform, and discharge all of the following liabilities of the Failed Bank as of Bank Closing, except as otherwise provided in this Agreement (such liabilities referred to as “Liabilities Assumed”):

(a) Assumed Deposits, except those Deposits specifically listed on Schedule 2.1(a); provided, that as to any Deposits of public money which are Assumed Deposits, the Assuming Bank agrees to properly secure such Deposits with such Assets as appropriate which, prior to Bank Closing, were pledged as security by the Failed Bank, or with assets of the Assuming Bank, if such securing Assets, if any, are insufficient to properly secure such Deposits;

(b) liabilities for indebtedness secured by mortgages, deeds of trust, chattel mortgages, security interests or other liens on or affecting any Assets, if any; provided, that the assumption of any liability pursuant to this paragraph shall be limited to the market value of the Assets securing such liability as determined by the Receiver;

8

(c) borrowings from Federal Reserve Banks and Federal Home Loan Banks, if any, provided, that the assumption of any liability pursuant to this paragraph shall be limited to the market value of the assets securing such liability as determined by the Receiver; and overdrafts, debit balances, service charges, reclamations, and adjustments to accounts with the Federal Reserve Banks as reflected on the books and records of any such Federal Reserve Bank within ninety (90) days after Bank Closing, if any;

(d) ad valorem taxes applicable to any Asset, if any; provided, that the assumption of any ad valorem taxes pursuant to this paragraph shall be limited to an amount equal to the market value of the Asset to which such taxes apply as determined by the Receiver;

(e) liabilities, if any, for federal funds purchased, repurchase agreements and overdrafts in accounts maintained with other depository institutions (including any accrued and unpaid interest thereon computed to and including Bank Closing); provided, that the assumption of any liability pursuant to this paragraph shall be limited to the market value of the Assets securing such liability as determined by the Receiver;

(f) United States Treasury tax and loan note option accounts, if any;

(g) liabilities for any acceptance or commercial letter of credit (other than “standby letters of credit” as defined in 12 C.F.R. Section 337.2(a)); provided, that the assumption of any liability pursuant to this paragraph shall be limited to the market value of the Assets securing such liability as determined by the Receiver;

(h) duties and obligations assumed pursuant to this Agreement including without limitation those relating to the Failed Bank’s Records, credit card business, overdraft protection plans, safe deposit business, safekeeping business or trust business, if any;

(i) liabilities, if any, for Commitments;

(j) liabilities, if any, for amounts owed to any Subsidiary of the Failed Bank acquired under Section 3.1;

(k) liabilities, if any, with respect to Qualified Financial Contracts;

(l) duties and obligations under any contract pursuant to which the Failed Bank provides mortgage servicing for others, or mortgage servicing is provided to the Failed Bank by others; and

(m) all asset-related offensive litigation liabilities and all asset-related defensive litigation liabilities, but only to the extent such liabilities relate to assets

9

subject to a loss share agreement, and provided that all other defensive litigation and any class actions with respect to credit card business are retained by the Receiver.

Schedule 2.1 attached hereto and incorporated herein sets forth certain categories of Liabilities Assumed and the aggregate Book Value of the Liabilities Assumed in such categories. Such schedule is based upon the best information available to the Receiver and may be adjusted as provided in Article VIII.

2.2 Interest on Deposit Liabilities. The Assuming Bank agrees that, from and after Bank Closing, it will accrue and pay interest on Deposit liabilities assumed pursuant to Section 2.1 at a rate(s) it shall determine; provided, that for non-transaction Deposit liabilities such rate(s) shall not be less than the lowest rate offered by the Assuming Bank to its depositors for non-transaction deposit accounts. The Assuming Bank shall permit each depositor to withdraw, without penalty for early withdrawal, all or any portion of such depositor’s Deposit, whether or not the Assuming Bank elects to pay interest in accordance with any deposit agreement formerly existing between the Failed Bank and such depositor; and further provided, that if such Deposit has been pledged to secure an obligation of the depositor or other party, any withdrawal thereof shall be subject to the terms of the agreement governing such pledge. The Assuming Bank shall give notice to such depositors as provided in Section 5.3 of the rate(s) of interest which it has determined to pay and of such withdrawal rights.

2.3 Unclaimed Deposits. Fifteen (15) months following the Bank Closing Date, the Assuming Bank will provide the Receiver a listing of all deposit accounts, including the type of account, not claimed by the depositor. The Receiver will review the list and authorize the Assuming Bank to act on behalf of the Receiver to send a “Final Legal Notice” in a form substantially similar to Exhibit 2.3A to the owner(s) of the unclaimed deposits reminding them of the need to claim or arrange to continue their account(s) with the Assuming Bank. The Assuming Bank will send the “Final Legal Notice” to the depositors within thirty (30) days following notification of the Receiver’s authorization. The Assuming Bank will prepare an Affidavit of Mailing and will forward the Affidavit of Mailing to the Receiver after mailing out the “Final Legal Notice” in a form substantially similar to Exhibit 2.3B to the owner(s) of unclaimed deposit accounts.

If, within eighteen (18) months after Bank Closing, any depositor of the Failed Bank does not claim or arrange to continue such depositor’s Deposit assumed pursuant to Section 2.1 at the Assuming Bank, the Assuming Bank shall, within fifteen (15) Business Days after the end of such eighteen (18) month period, (i) refund to the Receiver the full amount of each such deposit (without reduction for service charges), (ii) provide to the Receiver a schedule of all such refunded Deposits in such form as may be prescribed by the Receiver, and (iii) assign, transfer, convey, and deliver to the Receiver, all right, title, and interest of the Assuming Bank in and to the Records previously transferred to the Assuming Bank and other records generated or maintained by the Assuming Bank pertaining to such Deposits. During such eighteen (18) month period, at the request of the Receiver, the Assuming Bank promptly shall provide to the Receiver schedules of unclaimed deposits in such form as may be prescribed by the Receiver.

10

2.4 Employee Plans. Except as provided in Section 4.12, the Assuming Bank shall have no liabilities, obligations or responsibilities under the Failed Bank’s health care, bonus, vacation, pension, profit sharing, deferred compensation, 401K or stock purchase plans or similar plans, if any, unless the Receiver and the Assuming Bank agree otherwise subsequent to the date of this Agreement.

ARTICLE III

PURCHASE OF ASSETS

3.1 Assets Purchased by Assuming Bank. With the exception of certain assets expressly excluded in Sections 3.5 and 3.6, the Assuming Bank hereby purchases from the Receiver, and the Receiver hereby sells, assigns, transfers, conveys, and delivers to the Assuming Bank, all right, title, and interest of the Receiver in and to all of the assets (real, personal and mixed, wherever located and however acquired) including all subsidiaries, joint ventures, partnerships, and any and all other business combinations or arrangements, whether active, inactive, dissolved or terminated, of the Failed Bank whether or not reflected on the books of the Failed Bank as of Bank Closing. Schedule 3.1 attached hereto and incorporated herein sets forth certain categories of Assets purchased hereunder. Such schedule is based upon the best information available to the Receiver and may be adjusted as provided in Article VIII. Assets are purchased hereunder by the Assuming Bank subject to all liabilities for indebtedness collateralized by Liens affecting such Assets to the extent provided in Section 2.1. Notwithstanding Section 4.8, the Assuming Bank specifically purchases all mortgage servicing rights and obligations of the Failed Bank.

3.2 Asset Purchase Price.

(a) All Assets and assets of the Failed Bank subject to an option to purchase by the Assuming Bank shall be purchased for the amount, or the amount resulting from the method specified for determining the amount, as specified on Schedule 3.2, except as otherwise may be provided herein. Any Asset, asset of the Failed Bank subject to an option to purchase or other asset purchased for which no purchase price is specified on Schedule 3.2 or otherwise herein shall be purchased at its Book Value. Loans or other assets charged off the Accounting Records of the Failed Bank before the Bid Valuation Date shall be purchased at a price of zero.

(b) The purchase price for securities (other than the capital stock of any Acquired Subsidiary and FRB and FHLB stock) purchased under Section 3.1 by the Assuming Bank shall be the market value thereof as of Bank Closing, which market value shall be (i) the market price for each such security quoted at the close of the trading day effective on Bank Closing as published electronically by Bloomberg, L.P., or alternatively, at the discretion of the Receiver, IDC/Financial Times (FT) Interactive Data; (ii) provided, that if such market price is not available for any such security, the Assuming Bank will submit a bid for each such security within three days of notification/bid request by the Receiver (unless a different time period is agreed to by the Assuming Bank and the Receiver) and the Receiver, in its sole discretion will accept or reject each such bid; and (iii) further provided in the absence of an acceptable bid from

11

the Assuming Bank, each such security shall not pass to the Assuming Bank and shall be deemed to be an excluded asset hereunder.

(c) Qualified Financial Contracts shall be purchased at market value determined in accordance with the terms of Exhibit 3.2(c). Any costs associated with such valuation shall be shared equally by the Receiver and the Assuming Bank.

3.3 Manner of Conveyance; Limited Warranty; Nonrecourse; Etc. THE CONVEYANCE OF ALL ASSETS, INCLUDING REAL AND PERSONAL PROPERTY INTERESTS, PURCHASED BY THE ASSUMING BANK UNDER THIS AGREEMENT SHALL BE MADE, AS NECESSARY, BY RECEIVER’S DEED OR RECEIVER’S BILL OF SALE, “AS IS”, “WHERE IS”, WITHOUT RECOURSE AND, EXCEPT AS OTHERWISE SPECIFICALLY PROVIDED IN THIS AGREEMENT, WITHOUT ANY WARRANTIES WHATSOEVER WITH RESPECT TO SUCH ASSETS, EXPRESS OR IMPLIED, WITH RESPECT TO TITLE, ENFORCEABILITY, COLLECTIBILITY, DOCUMENTATION OR FREEDOM FROM LIENS OR ENCUMBRANCES (IN WHOLE OR IN PART), OR ANY OTHER MATTERS.

3.4 Puts of Assets to the Receiver.

(a) Puts Within 30 Days After Bank Closing. During the thirty (30)-day period following Bank Closing and only during such period (which thirty (30)-day period may be extended in writing in the sole absolute discretion of the Receiver for any Loan), in accordance with this Section 3.4, the Assuming Bank shall be entitled to require the Receiver to purchase any Deposit Secured Loan transferred to the Assuming Bank pursuant to Section 3.1 which is not fully secured by Assumed Deposits or deposits at other insured depository institutions due to either insufficient Assumed Deposit or deposit collateral or deficient documentation regarding such collateral; provided with regard to any Deposit Secured Loan secured by an Assumed Deposit, no such purchase may be required until any Deposit setoff determination, whether voluntary or involuntary, has been made; and,

at the end of the thirty (30)-day period following Bank Closing and at that time only, in accordance with this Section 3.4, the Assuming Bank shall be entitled to require the Receiver to purchase any remaining overdraft transferred to the Assuming Bank pursuant to 3.1 which both was made after the Bid Valuation Date and was not made pursuant to an overdraft protection plan or similar extension of credit.

Notwithstanding the foregoing, the Assuming Bank shall not have the right to require the Receiver to purchase any Loan if (i) the Obligor with respect to such Loan is an Acquired Subsidiary, or (ii) the Assuming Bank has:

(A) made any advance in accordance with the terms of a Commitment or otherwise with respect to such Loan;

12

(B) taken any action that increased the amount of a Related Liability with respect to such Loan over the amount of such liability immediately prior to the time of such action;

(C) created or permitted to be created any Lien on such Loan which secures indebtedness for money borrowed or which constitutes a conditional sales agreement, capital lease or other title retention agreement;

(D) entered into, agreed to make, grant or permit, or made, granted or permitted any modification or amendment to, any waiver or extension with respect to, or any renewal, refinancing or refunding of, such Loan or related Credit Documents or collateral, including, without limitation, any act or omission which diminished such collateral; or

(E) sold, assigned or transferred all or a portion of such Loan to a third party (whether with or without recourse).

The Assuming Bank shall transfer all such Assets to the Receiver without recourse, and shall indemnify the Receiver against any and all claims of any Person claiming by, through or under the Assuming Bank with respect to any such Asset, as provided in Section 12.4.

(b) Notices to the Receiver. In the event that the Assuming Bank elects to require the Receiver to purchase one or more Assets, the Assuming Bank shall deliver to the Receiver a notice (a “Put Notice”) which shall include:

(i) a list of all Assets that the Assuming Bank requires the Receiver to purchase;

(ii) a list of all Related Liabilities with respect to the Assets identified pursuant to (i) above; and

(iii) a statement of the estimated Repurchase Price of each Asset identified pursuant to (i) above as of the applicable Put Date.

Such notice shall be in the form prescribed by the Receiver or such other form to which the Receiver shall consent. As provided in Section 9.6, the Assuming Bank shall deliver to the Receiver such documents, Credit Files and such additional information relating to the subject matter of the Put Notice as the Receiver may request and shall provide to the Receiver full access to all other relevant books and records.

(c) Purchase by Receiver. The Receiver shall purchase Assets that are specified in the Put Notice and shall assume Related Liabilities with respect to such Assets, and the transfer of such Assets and Related Liabilities shall be effective as of a date determined by the Receiver which date shall not be later than thirty (30) days after receipt by the Receiver of the Put Notice (the “Put Date”).

13

(d) Purchase Price and Payment Date. Each Asset purchased by the Receiver pursuant to this Section 3.4 shall be purchased at a price equal to the Repurchase Price of such Asset less the Related Liability Amount applicable to such Asset, in each case determined as of the applicable Put Date. If the difference between such Repurchase Price and such Related Liability Amount is positive, then the Receiver shall pay to the Assuming Bank the amount of such difference; if the difference between such amounts is negative, then the Assuming Bank shall pay to the Receiver the amount of such difference. The Assuming Bank or the Receiver, as the case may be, shall pay the purchase price determined pursuant to this Section 3.4(d) not later than the twentieth (20th) Business Day following the applicable Put Date, together with interest on such amount at the Settlement Interest Rate for the period from and including such Put Date to and including the day preceding the date upon which payment is made.

(e) Servicing. The Assuming Bank shall administer and manage any Asset subject to purchase by the Receiver in accordance with usual and prudent banking standards and business practices until such time as such Asset is purchased by the Receiver.

(f) Reversals. In the event that the Receiver purchases an Asset (and assumes the Related Liability) that it is not required to purchase pursuant to this Section 3.4, the Assuming Bank shall repurchase such Asset (and assume such Related Liability) from the Receiver at a price computed so as to achieve the same economic result as would apply if the Receiver had never purchased such Asset pursuant to this Section 3.4.

3.5 Assets Not Purchased by Assuming Bank. The Assuming Bank does not purchase, acquire or assume, or (except as otherwise expressly provided in this Agreement) obtain an option to purchase, acquire or assume under this Agreement:

(a) any financial institution bonds, banker’s blanket bonds, or public liability, fire, extended coverage insurance policy, bank owned life insurance or any other insurance policy of the Failed Bank, or premium refund, unearned premium derived from cancellation, or any proceeds payable with respect to any of the foregoing;

(b) any interest, right, action, claim, or judgment against (i) any officer, director, employee, accountant, attorney, or any other Person employed or retained by the Failed Bank or any Subsidiary of the Failed Bank on or prior to Bank Closing arising out of any act or omission of such Person in such capacity, (ii) any underwriter of financial institution bonds, banker’s blanket bonds or any other insurance policy of the Failed Bank, (iii) any shareholder or holding company of the Failed Bank, or (iv) any other Person whose action or inaction may be related to any loss (exclusive of any loss resulting from such Person’s failure to pay on a Loan made by the Failed Bank) incurred by the Failed Bank; provided, that for the purposes hereof, the acts, omissions or other events giving rise to any such claim shall have occurred on or before Bank Closing, regardless of when any such claim is discovered and regardless of whether any such claim is made with respect to a financial institution bond, banker’s blanket bond, or any other insurance policy of the Failed Bank in force as of Bank Closing;

(c) prepaid regulatory assessments of the Failed Bank, if any;

14

(d) legal or equitable interests in tax receivables of the Failed Bank, if any, including any claims arising as a result of the Failed Bank having entered into any agreement or otherwise being joined with another Person with respect to the filing of tax returns or the payment of taxes;

(e) amounts reflected on the Accounting Records of the Failed Bank as of Bank Closing as a general or specific loss reserve or contingency account, if any;

(f) leased or owned Bank Premises and leased or owned Furniture and Equipment and Fixtures and data processing equipment (including hardware and software) located on leased or owned Bank Premises, if any; provided, that the Assuming Bank does obtain an option under Section 4.6, Section 4.7 or Section 4.8, as the case may be, with respect thereto;

(g) owned Bank Premises which the Receiver, in its discretion, determines may contain environmentally hazardous substances;

(h) any “goodwill,” as such term is defined in the instructions to the report of condition prepared by banks examined by the Corporation in accordance with 12 C.F.R. Section 304.4, and other intangibles;

(i) any criminal restitution or forfeiture orders issued in favor of the Failed Bank;

(j) reserved;

(k) assets essential to the Receiver in accordance with Section 3.6;

(l) the securities listed on the attached Schedule 3.5(l); and

(m) prepaid accounts associated with any contract or agreement that the Assuming Bank either does not directly assume pursuant to the terms of this Agreement nor has an option to assume under Section 4.8.

3.6 Retention or Repurchase of Assets Essential to Receiver.

(a) The Receiver may refuse to sell to the Assuming Bank, or the Assuming Bank agrees, at the request of the Receiver set forth in a written notice to the Assuming Bank, to assign, transfer, convey, and deliver to the Receiver all of the Assuming Bank’s right, title and interest in and to, any Asset or asset essential to the Receiver as determined by the Receiver in its discretion (together with all Credit Documents evidencing or pertaining thereto), which may include any Asset or asset that the Receiver determines to be:

(i) made to an officer, director, or other Person engaging in the affairs of the Failed Bank, its Subsidiaries or Affiliates or any related entities of any of the foregoing;

15

(ii) the subject of any investigation relating to any claim with respect to any item described in Section 3.5(a) or (b), or the subject of, or potentially the subject of, any legal proceedings;

(iii) made to a Person who is an Obligor on a loan owned by the Receiver or the Corporation in its corporate capacity or its capacity as receiver of any institution;

(iv) secured by collateral which also secures any asset owned by the Receiver; or

(v) related to any asset of the Failed Bank not purchased by the Assuming Bank under this Article III or any liability of the Failed Bank not assumed by the Assuming Bank under Article II.

(b) Each such Asset or asset purchased by the Receiver shall be purchased at a price equal to the Repurchase Price thereof less the Related Liability Amount with respect to any Related Liabilities related to such Asset or asset, in each case determined as of the date of the notice provided by the Receiver pursuant to Section 3.6(a). The Receiver shall pay the Assuming Bank not later than the twentieth (20th) Business Day following receipt of related Credit Documents and Credit Files together with interest on such amount at the Settlement Interest Rate for the period from and including the date of receipt of such documents to and including the day preceding the day on which payment is made. The Assuming Bank agrees to administer and manage each such Asset or asset in accordance with usual and prudent banking standards and business practices until each such Asset or asset is purchased by the Receiver. All transfers with respect to Asset or assets under this Section 3.6 shall be made as provided in Section 9.6. The Assuming Bank shall transfer all such Asset or assets and Related Liabilities to the Receiver without recourse, and shall indemnify the Receiver against any and all claims of any Person claiming by, through or under the Assuming Bank with respect to any such Asset or asset, as provided in Section 12.4.

ARTICLE IV

ASSUMPTION OF CERTAIN DUTIES AND OBLIGATIONS

The Assuming Bank agrees with the Receiver and the Corporation as follows:

4.1 Continuation of Banking Business. For the period commencing the first banking Business Day after Bank Closing and ending no earlier than the first anniversary of Bank Closing, the Assuming Bank will provide full service banking in the trade area of the Failed Bank. Thereafter, the Assuming Bank may cease providing such banking services in the trade area of the Failed Bank, provided the Assuming Bank has received all necessary regulatory approvals. At the option of the Assuming Bank, such banking services may be provided at any or all of the Bank Premises, or at other premises within such trade area. The trade area shall be determined by the Receiver. For the avoidance of doubt, the foregoing shall not restrict the Assuming Bank from opening, closing or selling branches upon receipt of the necessary regulatory approvals, if the Assuming Bank or its successors continue to provide banking

16

services in the trade area. Assuming Bank will pay to the Receiver, upon the sale of a branch or branches within the year following the date of this agreement, fifty percent (50%) of any franchise premium in excess of the franchise premium paid by the Assuming Bank with respect to such branch or branches.

4.2 Agreement with Respect to Credit Card Business. The Assuming Bank agrees to honor and perform, from and after Bank Closing, all duties and obligations with respect to the Failed Bank’s credit card business, and/or processing related to credit cards, if any, and assumes all outstanding extensions of credit with respect thereto.

4.3 Agreement with Respect to Safe Deposit Business. The Assuming Bank assumes and agrees to discharge, from and after Bank Closing, in the usual course of conducting a banking business, the duties and obligations of the Failed Bank with respect to all Safe Deposit Boxes, if any, of the Failed Bank and to maintain all of the necessary facilities for the use of such boxes by the renters thereof during the period for which such boxes have been rented and the rent therefore paid to the Failed Bank, subject to the provisions of the rental agreements between the Failed Bank and the respective renters of such boxes; provided, that the Assuming Bank may relocate the Safe Deposit Boxes of the Failed Bank to any office of the Assuming Bank located in the trade area of the Failed Bank. The Safe Deposit Boxes shall be located and maintained in the trade area of the Failed Bank for a minimum of one year from Bank Closing. The trade area shall be determined by the Receiver. Fees related to the safe deposit business earned prior to the Bank Closing Date shall be for the benefit of the Receiver and fees earned after the Bank Closing Date shall be for the benefit of the Assuming Bank.

4.4 Agreement with Respect to Safekeeping Business. The Receiver transfers, conveys and delivers to the Assuming Bank and the Assuming Bank accepts all securities and other items, if any, held by the Failed Bank in safekeeping for its customers as of Bank Closing. The Assuming Bank assumes and agrees to honor and discharge, from and after Bank Closing, the duties and obligations of the Failed Bank with respect to such securities and items held in safekeeping. The Assuming Bank shall be entitled to all rights and benefits heretofore accrued or hereafter accruing with respect thereto. The Assuming Bank shall provide to the Receiver written verification of all assets held by the Failed Bank for safekeeping within sixty (60) days after Bank Closing. The assets held for safekeeping by the Failed Bank shall be held and maintained by the Assuming Bank in the trade area of the Failed Bank for a minimum of one year from Bank Closing. At the option of the Assuming Bank, the safekeeping business may be provided at any or all of the Bank Premises, or at other premises within such trade area. The trade area shall be determined by the Receiver. Fees related to the safekeeping business earned prior to the Bank Closing Date shall be for the benefit of the Receiver and fees earned after the Bank Closing Date shall be for the benefit of the Assuming Bank.

4.5 Agreement with Respect to Trust Business.

(a) The Assuming Bank shall, without further transfer, substitution, act or deed, to the full extent permitted by law, succeed to the rights, obligations, properties, assets, investments, deposits, agreements, and trusts of the Failed Bank under trusts, executorships, administrations, guardianships, and agencies, and other fiduciary or representative capacities, all to the same

17

extent as though the Assuming Bank had assumed the same from the Failed Bank prior to Bank Closing; provided, that any liability based on the misfeasance, malfeasance or nonfeasance of the Failed Bank, its directors, officers, employees or agents with respect to the trust business is not assumed hereunder.

(b) The Assuming Bank shall, to the full extent permitted by law, succeed to, and be entitled to take and execute, the appointment to all executorships, trusteeships, guardianships and other fiduciary or representative capacities to which the Failed Bank is or may be named in wills, whenever probated, or to which the Failed Bank is or may be named or appointed by any other instrument.

(c) In the event additional proceedings of any kind are necessary to accomplish the transfer of such trust business, the Assuming Bank agrees that, at its own expense, it will take whatever action is necessary to accomplish such transfer. The Receiver agrees to use reasonable efforts to assist the Assuming Bank in accomplishing such transfer.

(d) The Assuming Bank shall provide to the Receiver written verification of the assets held in connection with the Failed Bank’s trust business within sixty (60) days after Bank Closing.

4.6 Agreement with Respect to Bank Premises.

(a) Option to Purchase. Subject to Section 3.5, the Receiver hereby grants to the Assuming Bank an exclusive option for the period of ninety (90) days commencing the day after Bank Closing to purchase any or all owned Bank Premises, including all Furniture, Fixtures and Equipment located on the Bank Premises. The Assuming Bank shall give written notice to the Receiver within the option period of its election to purchase or not to purchase any of the owned Bank Premises. Any purchase of such premises shall be effective as of the date of Bank Closing and such purchase shall be consummated as soon as practicable thereafter, and in no event later than the Settlement Date. If the Assuming Bank gives notice of its election not to purchase one or more of the owned Bank Premises within seven (7) days of Bank Closing, then, not withstanding any other provision of this Agreement to the contrary, the Assuming Bank shall not be liable for any of the costs or fees associated with appraisals for such Bank Premises.

(b) Option to Lease. The Receiver hereby grants to the Assuming Bank an exclusive option for the period of ninety (90) days commencing the day after Bank Closing to cause the Receiver to assign to the Assuming Bank any or all leases for leased Bank Premises, if any, which have been continuously occupied by the Assuming Bank from Bank Closing to the date it elects to accept an assignment of the leases with respect thereto to the extent such leases can be assigned; provided, that the exercise of this option with respect to any lease must be as to all premises or other property subject to the lease. If an assignment cannot be made of any such leases, the Receiver may, in its discretion, enter into subleases with the Assuming Bank containing the same terms and conditions provided under such existing leases for such leased Bank Premises or other property. The Assuming Bank shall give notice to the Receiver within the option period of its election to accept or not to accept an assignment of any or all leases (or

18

enter into subleases or new leases in lieu thereof). The Assuming Bank agrees to assume all leases assigned (or enter into subleases or new leases in lieu thereof) pursuant to this Section 4.6.

(c) Facilitation. The Receiver agrees to facilitate the assumption, assignment or sublease of leases or the negotiation of new leases by the Assuming Bank; provided, that neither the Receiver nor the Corporation shall be obligated to engage in litigation, make payments to the Assuming Bank or to any third party in connection with facilitating any such assumption, assignment, sublease or negotiation or commit to any other obligations to third parties.

(d) Occupancy. The Assuming Bank shall give the Receiver fifteen (15) days’ prior written notice of its intention to vacate prior to vacating any leased Bank Premises with respect to which the Assuming Bank has not exercised the option provided in Section 4.6(b). Any such notice shall be deemed to terminate the Assuming Bank’s option with respect to such leased Bank Premises.

(e) Occupancy Costs.

(i) The Assuming Bank agrees to pay to the Receiver, or to appropriate third parties at the direction of the Receiver, during and for the period of any occupancy by it of (x) owned Bank Premises the market rental value, as determined by the appraiser selected in accordance with the definition of Fair Market Value, and all operating costs, and (y) leased Bank Premises, all operating costs with respect thereto and to comply with all relevant terms of applicable leases entered into by the Failed Bank, including without limitation the timely payment of all rent. Operating costs include, without limitation all taxes, fees, charges, utilities, insurance and assessments, to the extent not included in the rental value or rent. If the Assuming Bank elects to purchase any owned Bank Premises in accordance with Section 4.6(a), the amount of any rent paid (and taxes paid to the Receiver which have not been paid to the taxing authority and for which the Assuming Bank assumes liability) by the Assuming Bank with respect thereto shall be applied as an offset against the purchase price thereof.

(ii) The Assuming Bank agrees during the period of occupancy by it of owned or leased Bank Premises, to pay to the Receiver rent for the use of all owned or leased Furniture and Equipment and all owned or leased Fixtures located on such Bank Premises for the period of such occupancy. Rent for such property owned by the Failed Bank shall be the market rental value thereof, as determined by the Receiver within sixty (60) days after Bank Closing. Rent for such leased property shall be an amount equal to any and all rent and other amounts which the Receiver incurs or accrues as an obligation or is obligated to pay for such period of occupancy pursuant to all leases and contracts with respect to such property. If the Assuming Bank purchases any owned Furniture and Equipment or owned Fixtures in accordance with Section 4.6(f) or 4.6(h), the amount of any rents paid by the Assuming Bank with respect thereto shall be applied as an offset against the purchase price thereof.

(f) Certain Requirements as to Furniture, Equipment and Fixtures. If the Assuming Bank purchases owned Bank Premises or accepts an assignment of the lease (or enters into a sublease or a new lease in lieu thereof) for leased Bank Premises as provided in Section

19

4.6(a) or 4.6(b), or if the Assuming Bank does not exercise such option but within twelve (12) months following Bank Closing obtains the right to occupy such premises (whether by assignment, lease, sublease, purchase or otherwise), other than in accordance with Section 4.6(a) or (b), the Assuming Bank shall (i) effective as of the date of Bank Closing, purchase from the Receiver all Furniture and Equipment and Fixtures owned by the Failed Bank at Fair Market Value and located thereon as of Bank Closing, (ii) accept an assignment or a sublease of the leases or negotiate new leases for all Furniture and Equipment and Fixtures leased by the Failed Bank and located thereon, and (iii) if applicable, accept an assignment or a sublease of any ground lease or negotiate a new ground lease with respect to any land on which such Bank Premises are located; provided, that the Receiver shall not have disposed of such Furniture and Equipment and Fixtures or repudiated the leases specified in clause (ii) or (iii).

(g) Vacating Premises.

(i) If the Assuming Bank elects not to purchase any owned Bank Premises, the notice of such election in accordance with Section 4.6(a) shall specify the date upon which the Assuming Bank’s occupancy of such premises shall terminate, which date shall not be later than ninety (90) days after the date of the Assuming Bank’s notice not to exercise such option. The Assuming Bank promptly shall relinquish and release to the Receiver such premises and the Furniture and Equipment and Fixtures located thereon in the same condition as at Bank Closing, normal wear and tear excepted. By occupying any such premises after the expiration of such ninety (90)-day period, the Assuming Bank shall, at the Receiver’s option, (x) be deemed to have agreed to purchase such Bank Premises, and to assume all leases, obligations and liabilities with respect to leased Furniture and Equipment and leased Fixtures located thereon and any ground lease with respect to the land on which such premises are located, and (y) be required to purchase all Furniture and Equipment and Fixtures owned by the Failed Bank and located on such premises as of Bank Closing.

(ii) If the Assuming Bank elects not to accept an assignment of the lease or sublease any leased Bank Premises, the notice of such election in accordance with Section 4.6(b) shall specify the date upon which the Assuming Bank’s occupancy of such leased Bank Premises shall terminate, which date shall not be later than the date which is one hundred eighty (180) days after Bank Closing. Upon vacating such premises, the Assuming Bank shall relinquish and release to the Receiver such premises and the Fixtures and the Furniture and Equipment located thereon in the same condition as at Bank Closing, normal wear and tear excepted. By failing to provide notice of its intention to vacate such premises prior to the expiration of the option period specified in Section 4.6(b), or by occupying such premises after the one hundred eighty (180)-day period specified above in this paragraph (ii), the Assuming Bank shall, at the Receiver’s option, (x) be deemed to have assumed all leases, obligations and liabilities with respect to such premises (including any ground lease with respect to the land on which premises are located), and leased Furniture and Equipment and leased Fixtures located thereon in accordance with this Section 4.6 (unless the Receiver previously repudiated any such lease), and (y) be required to purchase all Furniture and Equipment and Fixtures owned by the Failed Bank at Fair Market Value and located on such premises as of Bank Closing.

20

(h) Furniture and Equipment and Certain Other Equipment. The Receiver hereby grants to the Assuming Bank an option to purchase all Furniture and Equipment or any telecommunications, data processing equipment (including hardware and software) and check processing and similar operating equipment owned by the Failed Bank at Fair Market Value and located at any leased Bank Premises that the Assuming Bank elects to vacate or which it could have, but did not occupy, pursuant to this Section 4.6; provided, that, the Assuming Bank shall give the Receiver notice of its election to purchase such property at the time it gives notice of its intention to vacate such Bank Premises or within ten (10) days after Bank Closing for Bank Premises it could have, but did not, occupy.

4.7 Agreement with Respect to Leased Data Processing Equipment

(a) The Receiver hereby grants to the Assuming Bank an exclusive option for the period of ninety (90) days commencing the day after Bank Closing to accept an assignment from the Receiver of any or all Data Processing Leases to the extent that such Data Processing Leases can be assigned.

(b) The Assuming Bank shall (i) give written notice to the Receiver within the option period specified in Section 4.7(a) of its intent to accept or decline an assignment or sublease of any or all Data Processing Leases and promptly accept an assignment or sublease of such Data Processing Leases, and (ii) give written notice to the appropriate lessor(s) that it has accepted an assignment or sublease of any such Data Processing Leases.

(c) The Receiver agrees to facilitate the assignment or sublease of Data Processing Leases or the negotiation of new leases or license agreements by the Assuming Bank; provided, that neither the Receiver nor the Corporation shall be obligated to engage in litigation or make payments to the Assuming Bank or to any third party in connection with facilitating any such assumption, assignment, sublease or negotiation.

(d) The Assuming Bank agrees, during its period of use of any property subject to a Data Processing Lease, to pay to the Receiver or to appropriate third parties at the direction of the Receiver all operating costs with respect thereto and to comply with all relevant terms of the applicable Data Processing Leases entered into by the Failed Bank, including without limitation the timely payment of all rent, taxes, fees, charges, utilities, insurance and assessments.

(e) The Assuming Bank shall, not later than fifty (50) days after giving the notice provided in Section 4.7(b), (i) relinquish and release to the Receiver all property subject to the relevant Data Processing Lease, in the same condition as at Bank Closing, normal wear and tear excepted, or (ii) accept an assignment or a sublease thereof or negotiate a new lease or license agreement under this Section 4.7.

4.8 Agreement with Respect to Certain Existing Agreements.

(a) Subject to the provisions of Section 4.8(b), with respect to agreements existing as of Bank Closing which provide for the rendering of services by or to the Failed Bank, within thirty (30) days after Bank Closing, the Assuming Bank shall give the Receiver written notice

21

specifying whether it elects to assume or not to assume each such agreement. Except as may be otherwise provided in this Article IV, the Assuming Bank agrees to comply with the terms of each such agreement for a period commencing on the day after Bank Closing and ending on: (i) in the case of an agreement that provides for the rendering of services by the Failed Bank, the date which is ninety (90) days after Bank Closing, and (ii) in the case of an agreement that provides for the rendering of services to the Failed Bank, the date which is thirty (30) days after the Assuming Bank has given notice to the Receiver of its election not to assume such agreement; provided, that the Receiver can reasonably make such service agreements available to the Assuming Bank. The Assuming Bank shall be deemed by the Receiver to have assumed agreements for which no notification is timely given. The Receiver agrees to assign, transfer, convey, and deliver to the Assuming Bank all right, title and interest of the Receiver, if any, in and to agreements the Assuming Bank assumes hereunder. In the event the Assuming Bank elects not to accept an assignment of any lease (or sublease) or negotiate a new lease for leased Bank Premises under Section 4.6 and does not otherwise occupy such premises, the provisions of this Section 4.8(a) shall not apply to service agreements related to such premises. The Assuming Bank agrees, during the period it has the use or benefit of any such agreement, promptly to pay to the Receiver or to appropriate third parties at the direction of the Receiver all operating costs with respect thereto and to comply with all relevant terms of such agreement.

(b) The provisions of Section 4.8(a) regarding the Assuming Bank’s election to assume or not assume certain agreements shall not apply to (i) agreements pursuant to which the Failed Bank provides mortgage servicing for others or mortgage servicing is provided to the Failed Bank by others, (ii) agreements that are subject to Sections 4.1 through 4.7 and any insurance policy or bond referred to in Section 3.5(a) or other agreement specified in Section 3.5, and (iii) consulting, management or employment agreements, if any, between the Failed Bank and its employees or other Persons. Except as otherwise expressly set forth elsewhere in this Agreement, the Assuming Bank does not assume any liabilities or acquire any rights under any of the agreements described in this Section 4.8(b).

4.9 Informational Tax Reporting. The Assuming Bank agrees to perform all obligations of the Failed Bank with respect to Federal and State income tax informational reporting related to (i) the Assets and the Liabilities Assumed, (ii) deposit accounts that were closed and loans that were paid off or collateral obtained with respect thereto prior to Bank Closing, (iii) miscellaneous payments made to vendors of the Failed Bank, and (iv) any other asset or liability of the Failed Bank, including, without limitation, loans not purchased and Deposits not assumed by the Assuming Bank, as may be required by the Receiver.

4.10 Insurance. The Assuming Bank agrees to obtain insurance coverage effective from and after Bank Closing, including public liability, fire and extended coverage insurance acceptable to the Receiver with respect to owned or leased Bank Premises that it occupies, and all owned or leased Furniture and Equipment and Fixtures and leased data processing equipment (including hardware and software) located thereon, in the event such insurance coverage is not already in force and effect with respect to the Assuming Bank as the insured as of Bank Closing. All such insurance shall, where appropriate (as determined by the Receiver), name the Receiver as an additional insured.

22

4.11 Office Space for Receiver and Corporation. For the period commencing on the day following Bank Closing and ending on the one hundred eightieth (180th) day thereafter, the Assuming Bank agrees to provide to the Receiver and the Corporation, without charge, adequate and suitable office space (including parking facilities and vault space), furniture, equipment (including photocopying and telecopying machines), email accounts, network access and technology resources (such as shared drive) and utilities (including local telephone service and fax machines) at the Bank Premises occupied by the Assuming Bank for their use in the discharge of their respective functions with respect to the Failed Bank. In the event the Receiver and the Corporation determine that the space provided is inadequate or unsuitable, the Receiver and the Corporation may relocate to other quarters having adequate and suitable space and the costs of relocation and any rental and utility costs for the balance of the period of occupancy by the Receiver and the Corporation shall be borne by the Assuming Bank. Additionally, the Assuming Bank agrees to pay such bills and invoices on behalf of the Receiver and Corporation as the Receiver or Corporation may direct for the period beginning on the date of Bank Closing and ending on Settlement Date. Assuming Bank shall submit it requests for reimbursement of such expenditures pursuant to Article VIII of this Agreement.

4.12 Agreement with Respect to Continuation of Group Health Plan Coverage for Former Employees of the Failed Bank.

(a) The Assuming Bank agrees to assist the Receiver, as provided in this Section 4.12, in offering individuals who were employees or former employees of the Failed Bank, or any of its Subsidiaries, and who, immediately prior to Bank Closing, were receiving, or were eligible to receive, health insurance coverage or health insurance continuation coverage from the Failed Bank (“Eligible Individuals”), the opportunity to obtain health insurance coverage in the Corporation’s FIA Continuation Coverage Plan which provides for health insurance continuation coverage to such Eligible Individuals who are qualified beneficiaries of the Failed Bank as defined in Section 607 of the Employee Retirement Income Security Act of 1974, as amended (respectively, “qualified beneficiaries” and “ERISA”). The Assuming Bank shall consult with the Receiver and not later than five (5) Business Days after Bank Closing shall provide written notice to the Receiver of the number (if available), identity (if available) and addresses (if available) of the Eligible Individuals who are qualified beneficiaries of the Failed Bank and for whom a “qualifying event” (as defined in Section 603 of ERISA) has occurred and with respect to whom the Failed Bank’s obligations under Part 6 of Subtitle B of Title I of ERISA have not been satisfied in full, and such other information as the Receiver may reasonably require. The Receiver shall cooperate with the Assuming Bank in order to permit it to prepare such notice and shall provide to the Assuming Bank such data in its possession as may be reasonably required for purposes of preparing such notice.

(b) The Assuming Bank shall take such further action to assist the Receiver in offering the Eligible Individuals who are qualified beneficiaries of the Failed Bank the opportunity to obtain health insurance coverage in the Corporation’s FIA Continuation Coverage Plan as the Receiver may direct. All expenses incurred and paid by the Assuming Bank (i) in connection with the obligations of the Assuming Bank under this Section 4.12, and (ii) in providing health insurance continuation coverage to any Eligible Individuals who are hired by

23

the Assuming Bank and such employees’ qualified beneficiaries shall be borne by the Assuming Bank.

(c) No later than five (5) Business Days after Bank Closing, the Assuming Bank shall provide the Receiver with a list of all Failed Bank employees the Assuming Bank will not hire. Unless agreed to otherwise by the Assuming Bank and the Receiver, the Assuming Bank shall be responsible for all costs and expenses (i.e. salary, benefits, etc.) associated with all other employees not on that list from and after the date of delivery of the list to the Receiver. The Assuming Bank shall offer to the Failed Bank employees it retains employment benefits comparable to those the Assuming Bank offers its current employees.

(d) This Section 4.12 is for the sole and exclusive benefit of the parties to this Agreement, and for the benefit of no other Person (including any former employee of the Failed Bank or any Subsidiary thereof or qualified beneficiary of such former employee). Nothing in this Section 4.12 is intended by the parties, or shall be construed, to give any Person (including any former employee of the Failed Bank or any Subsidiary thereof or qualified beneficiary of such former employee) other than the Corporation, the Receiver and the Assuming Bank any legal or equitable right, remedy or claim under or with respect to the provisions of this Section.

4.13 Agreement with Respect to Interim Asset Servicing. At any time after Bank Closing, the Receiver may establish on its books an asset pool(s) and may transfer to such asset pool(s) (by means of accounting entries on the books of the Receiver) all or any assets and liabilities of the Failed Bank which are not acquired by the Assuming Bank, including, without limitation, wholly unfunded Commitments and assets and liabilities which may be acquired, funded or originated by the Receiver subsequent to Bank Closing. The Receiver may remove assets (and liabilities) from or add assets (and liabilities) to such pool(s) at any time in its discretion. At the option of the Receiver, the Assuming Bank agrees to service, administer, and collect such pool assets in accordance with and for the term set forth in Exhibit 4.13 “Interim Asset Servicing Arrangement”.

4.14 Reserved.

4.15 Agreement with Respect to Loss Sharing. The Assuming Bank shall be entitled to require reimbursement from the Receiver for loss sharing on certain loans in accordance with the Single Family Shared-Loss Agreement attached hereto as Exhibit 4.15A and the Non-SF Shared-Loss Agreement attached hereto as Exhibit 4.15B, collectively, the “Shared-Loss Agreements.” The Loans that shall be subject to the Shared-Loss Agreements are identified on the Schedule of Loans 4.15A and 4.15B attached hereto.

24

ARTICLE V

DUTIES WITH RESPECT TO DEPOSITORS OF THE FAILED BANK