As filed with the U.S. Securities and Exchange Commission on November 27, 2024.

Registration No. 333-283152

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

AMENDMENT NO. 1

TO

FORM F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

____________________

Smart Digital Group Limited

(Exact name of registrant as specified in its charter)

____________________

Not Applicable

(Translation of Registrant’s name into English)

Cayman Islands | | 7380 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

150 Beach Road #2805/06 Gateway

West Singapore 189720

+65 69509495

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

____________________

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

____________________

With a Copy to:

Ying Li, Esq.

Brian B. Margolis, Esq.

Hunter Taubman Fischer & Li LLC

950 Third Avenue, 19th Floor

New York, NY 10022

212-530-2206 | | Fang Liu, Esq.

VCL Law LLP

1945 Old Gallows Road, Suite 260

Vienna, VA 22182

703-919-7285 |

____________________

Approximate date of commencement of proposed sale to the public: Promptly after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. | | ☒ |

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | | ☐ |

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | | ☐ |

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | | ☐ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. | | |

Emerging growth company | | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. | | ☐ |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED [•], 2024

Smart Digital Group Limited

1,500,000 Ordinary Shares

This is an initial public offering of our ordinary shares, par value $0.001 per share (“Ordinary Shares”). We are offering 1,500,000 Ordinary Shares. We expect the initial public offering price to be in the range of $4.00 to $6.00 per share. Prior to this offering, there has been no public market for our Ordinary Shares.

We will apply to list the Ordinary Shares on the Nasdaq Capital Market (“Nasdaq”) under the symbol “SDM.” It is a condition to the closing of this offering that the Ordinary Shares qualify for listing on a national securities exchange, however there is no guarantee or assurance that our Ordinary Shares will be approved for listing on the Nasdaq or another national exchange.

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 13 to read about factors you should consider before buying our Ordinary Shares.

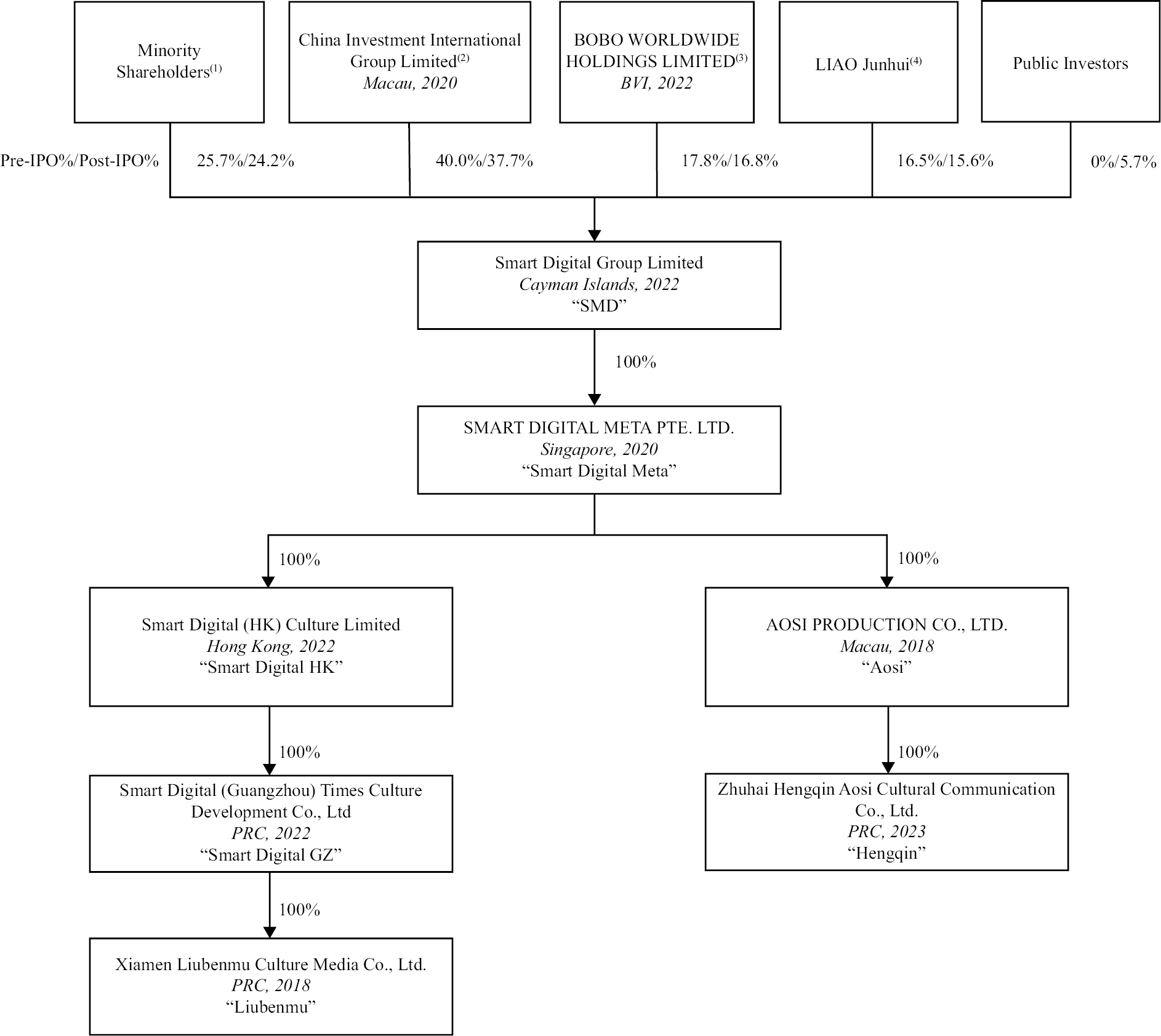

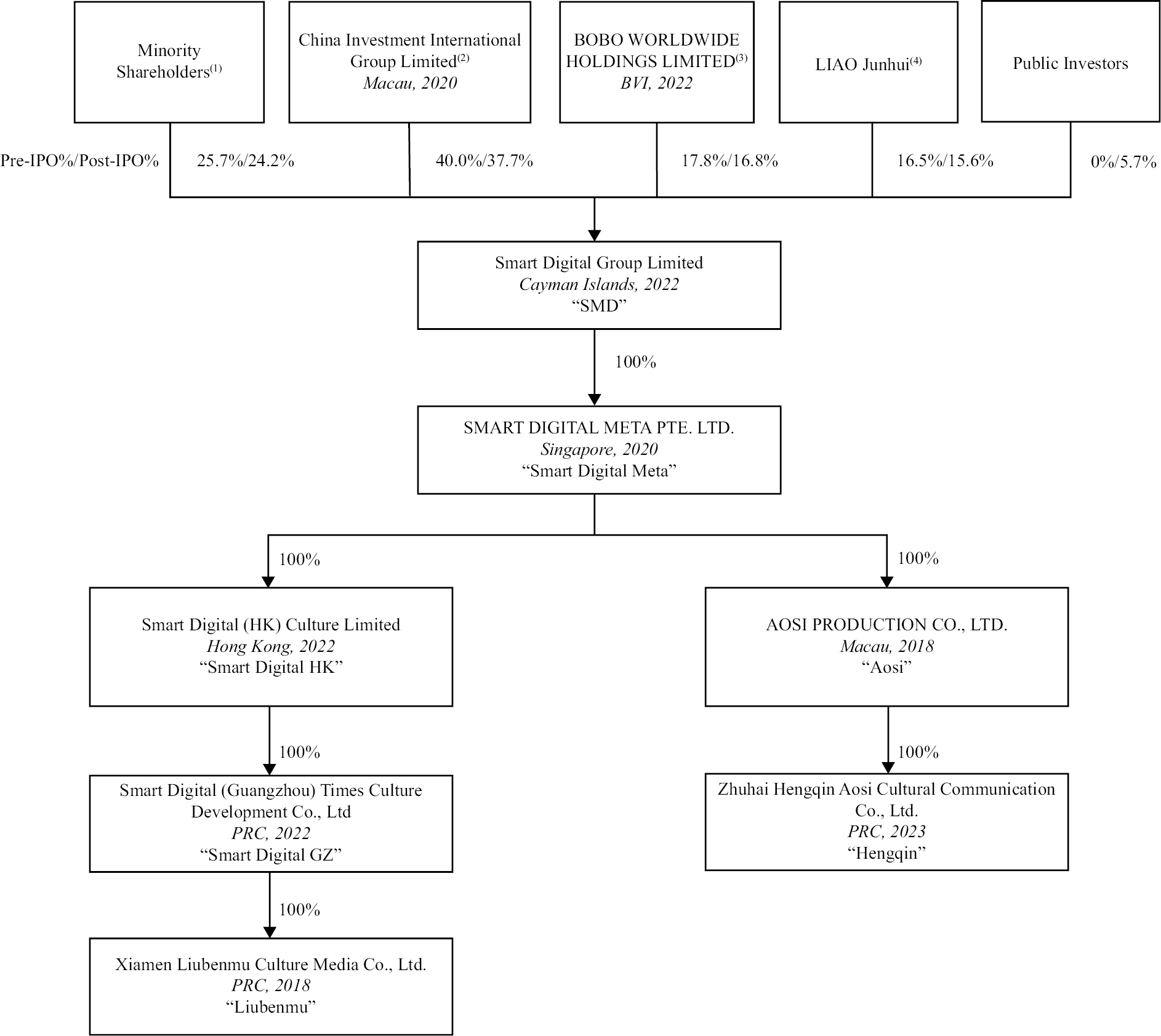

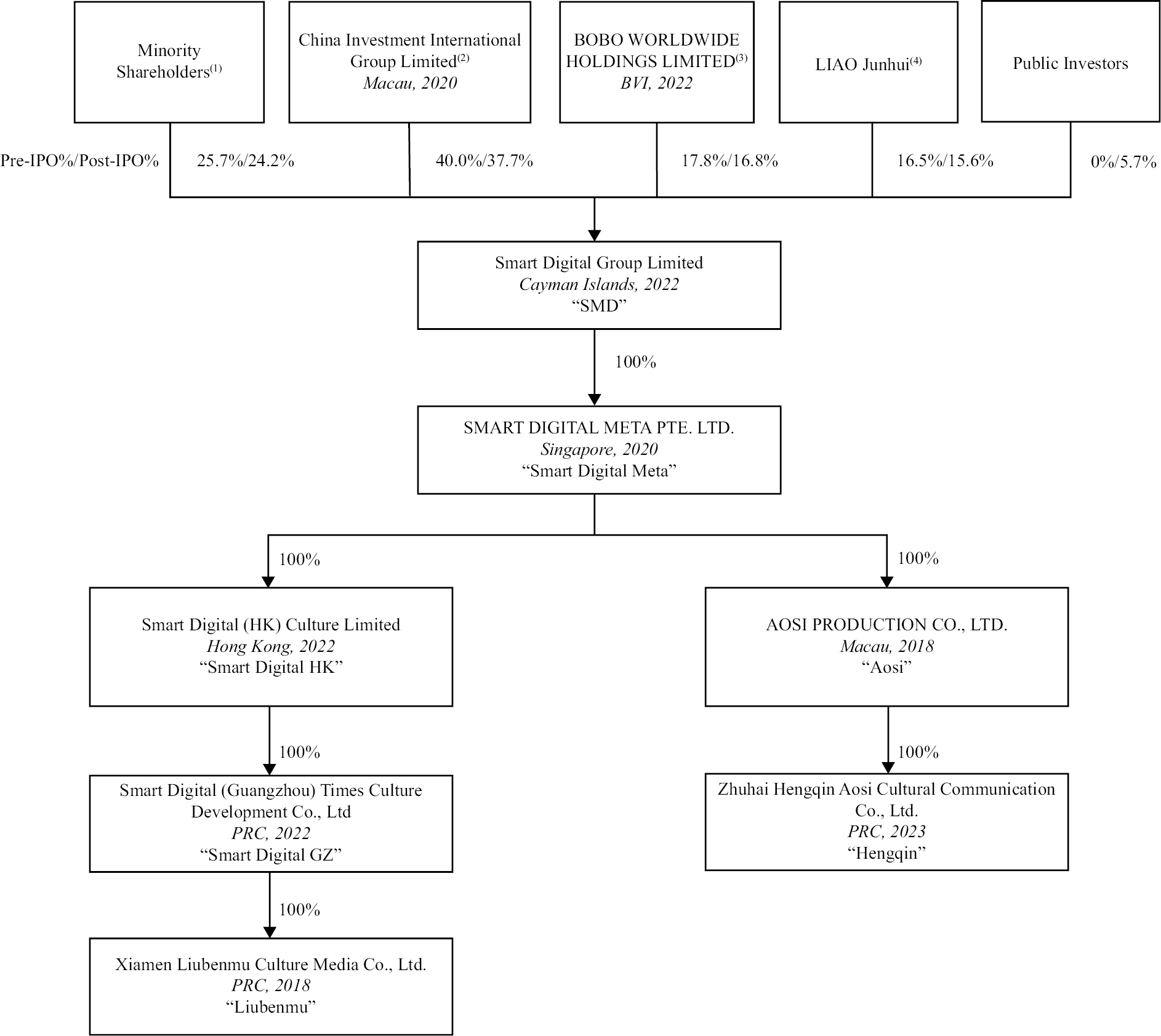

Unless otherwise stated, as used in this prospectus, the terms “we,” “us,” “our,” “SMD,” “our Company,” and the “Company” refer to Smart Digital Group Limited, a Cayman Islands exempted company; “Smart Digital Meta” refers to SMART DIGITAL META PTE. LTD., a Singapore corporation and a wholly owned subsidiary of SMD; “Aosi” refers to AOSI PRODUCTION CO., LTD., a Macau company and a wholly owned subsidiary of Smart Digital Meta; “Hengqin” refers to Zhuhai Hengqin Aosi Cultural Communication Co., Ltd., a limited liability company organized under the laws of the People’s Republic of China (the “PRC”), which is 100% owned by Aosi; “Smart Digital HK” refers to Smart Digital (HK) Culture Limited, a Hong Kong corporation and a wholly owned subsidiary of Smart Digital Meta; “Smart Digital GZ” refers to Smart Digital (Guangzhou) Times Culture Development Co., Ltd, a limited liability company organized under the laws of the PRC, which is 100% owned by Smart Digital HK; “Liubenmu” refers to Xiamen Liubenmu Culture Media Co., Ltd., a limited liability company organized under the laws of the PRC, which is 100% owned by Smart Digital GZ; “the operating entities” refers to Smart Digital Meta, Aosi and Liubenmu, collectively; and “the PRC subsidiaries” refers to Hengqin, Smart Digital GZ and Liubenmu, collectively.

We are a holding company incorporated in the Cayman Islands with no material operations of our own. Our operations are conducted through the operating entities in Macau, Singapore and mainland China. The Ordinary Shares offered in this prospectus are shares of the Cayman Islands holding company instead of shares of the operating entities in Macau, Singapore and mainland China. Holders of our Ordinary Shares do not directly own any equity interests in our subsidiaries, including the equity interests in the operating entities in Macau, Singapore and mainland China, but will instead own shares of a Cayman Islands holding company. We directly hold 100% equity interests in the operating entities, and we do not currently use a variable interest entity (“VIE”) structure. Our corporate structure involves unique risks to investors. We are not a Chinese operating company. Chinese regulatory authorities could disallow our corporate structure, which would likely result in a material change in our operations and/or a material change in the value of the securities we are registering for sale, including that it could cause the value of such securities to decline significantly or become worthless. See “Risk Factors — Risks Relating to Doing Business in the PRC — Any actions by the Chinese government, including any decision to intervene or influence the operations of the PRC subsidiaries, may cause us to make material changes to the operations of the PRC subsidiaries, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the value of such securities to decline significantly or be worthless.”

We are subject to certain legal and operational risks associated with the operations of our PRC subsidiaries being based in China, which could cause the value of our securities to decline significantly or become worthless. Applicable PRC laws and regulations governing such current operations are sometimes vague and uncertain, and as a result these risks may result in material changes in the operations of our PRC subsidiaries, significant depreciation

Table of Contents

or a complete loss of the value of our Ordinary Shares, or a complete hindrance of our ability to offer, or continue to offer, our securities to investors. Recently, the PRC government adopted a series of regulatory actions and issued statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On December 28, 2021, 13 governmental departments of the PRC, including the Cyberspace Administration of China (the “CAC”), issued the Cybersecurity Review Measures, which became effective on February 15, 2022. As of the date of this prospectus, we have not received any notice from any authorities identifying the PRC subsidiaries as critical information infrastructure operators (“CIIOs”) or requiring us to go through cybersecurity review or network data security review by the CAC. In the opinion of our PRC counsel, AllBright Law Offices (Xiamen), neither the operations of the PRC subsidiaries, nor our listing will be affected, and that we and the PRC subsidiaries are not subject to cybersecurity review by the CAC under the Cybersecurity Review Measures, because the PRC subsidiaries are not CIIOs or online platform operators that possess personal information of at least one million users or engage in data processing activities that affect or may affect national security. See “Risk Factors — Risks Relating to Doing Business in the PRC — Recent greater oversight by the CAC over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact the PRC subsidiaries’ business and our offering.” On February 17, 2023, the China Securities Regulatory Commission (the “CSRC”) promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the “Trial Measures,” and five supporting guidelines, which became effective on March 31, 2023. Pursuant to the Trial Measures, PRC domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following their submission of initial public offerings or listing applications. If a domestic company fails to complete required filing procedures or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject to administrative penalties, such as an order to rectify, warnings, and fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines. In the opinion of our PRC counsel, AllBright Law Offices (Xiamen), we will not be required to complete the filing procedure since (i) we are not a PRC domestic company; and (ii) our offering and listing is not an indirect overseas offering or listing, because the operating revenue, total profit, total assets, or net assets, as documented in our audited consolidated financial statements for the most recent accounting year, accounted for by the PRC subsidiaries are all under 50%. See “Risk Factors — Risks Relating to Doing Business in the PRC — The Opinions on Severely Cracking Down on Illegal Securities Activities According to Law (the “Opinions”), the Trial Measures, and the Archive Provisions recently issued by the PRC authorities may subject us to additional compliance requirements in the future.” As of the date of this prospectus, neither we nor our PRC subsidiaries have received any inquiry, notice, warning, or sanction regarding our overseas listing from any other PRC governmental authorities. Since these statements and regulatory actions are newly published, however, official guidance and related implementation rules have not been issued. It is highly uncertain what the potential impact such modified or new laws and regulations will have on the daily business operations of our PRC subsidiaries, our ability to accept foreign investments, and our listing on a U.S. exchange. The Standing Committee of the National People’s Congress (the “SCNPC”), the CSRC, the CAC, or other PRC regulatory authorities may in the future promulgate additional laws, regulations, or implementing rules that require us and our subsidiaries to obtain regulatory approval from Chinese authorities before listing or offering of our securities in the U.S or operating our business. If we do not receive or maintain the approval as mandated by current or future laws and regulations, or inadvertently conclude that such approval is not required, or applicable laws, regulations, or interpretations change such that we are required to obtain approval in the future, we may be subject to an investigation by competent regulators, fines or penalties, or an order prohibiting us from conducting an offering, and these risks could result in a material adverse change in our operations and the value of our Ordinary Shares, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to decline significantly in value or become worthless.

In addition, our Ordinary Shares may be prohibited from trading on a national exchange under the Holding Foreign Companies Accountable Act, as amended (the “HFCA Act”) if the Public Company Accounting Oversight Board (United States) (the “PCAOB”) is unable to inspect our auditors for two consecutive years beginning in 2022. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act, which reduced the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years

Table of Contents

to two, thus reducing the time period for triggering the delisting of our Company and the prohibition of trading in our securities if the PCAOB is unable to inspect our accounting firm at such future time. Our auditor, Enrome LLP, is headquartered in Singapore, and subject to inspection by the PCAOB on a regular basis. Our auditor is not subject to the determinations announced by the PCAOB on December 16, 2021. If trading in our Ordinary Shares is prohibited under the HFCA Act in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, Nasdaq may determine to delist our Ordinary Shares and trading in our Ordinary Shares could be prohibited. On August 26, 2022, the CSRC, the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”) governing inspections and investigations of audit firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the U.S. Securities and Exchange Commission (the “SEC”), the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB will consider the need to issue a new determination. See “Risk Factors — Risks Relating to Doing Business in the PRC — Recent joint statement by the SEC and the PCAOB, rule changes by Nasdaq, and the HFCA Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors. These developments could add uncertainties to our continued listing or future offerings of our securities in the U.S.”

In the opinion of Lektou — Advogados e Notários, our counsel as to Macau law, given that Macau is a Special Administrative Region of the PRC, the legal and operational risks associated with operating in China apply to our operations in Macau. While Macau currently operates under a different set of laws from mainland China, there can be no assurance as to whether the government of Macau will enact laws and regulations similar to mainland China, or whether any laws or regulations of mainland China will become applicable to our operations in Macau in the future, which could happen at any time and with no advance notice. In the opinion of our counsel as to Macau law, the regulatory requirements related to data security in Macau are stipulated by Law no. 8/2005 “Personal Data Protection Act”, Law no. 11/2009 “Law on Combatting Computer Crime” (amended by Law no. 4/2020) and Law no. 13/2019 “Cybersecurity law,” the relevant provisions for anti-monopoly practices in Macau are stipulated in the Macau Commercial Code, which addresses “Unfair Competition,” as well as in Law no. 9/2021 “Consumer Rights and Interests Protection Law,” and none of the abovementioned regulatory requirements related to data security or anti-monopoly concerns in Macau will fundamentally affect the Aosi’s or our ability to conduct business, accept foreign investments or list on U.S./foreign exchanges, unless under certain circumstances. For instance, violations of provisions in Law no. 11/2009 could potentially lead to the court ordering the dissolution of the company, or Public Ministry may request the judicial liquidation of the company under the specific circumstances specified in Article 329 of the Macau Commercial Code. However, the usual penalties for regulatory infractions, while disruptive, would not permanently or fundamentally impact Aosi’s capacity to perform its business activities or seek foreign investment, except in the event of these more severe legal consequences like company dissolution or liquidation. See “Risk Factors — Risks Relating to Doing Business in Macau and Singapore — We are subject to Macau laws and regulations that are generally applicable to Macau entities, including Macau laws and regulations that result in oversight over data security.”

As of the date of this prospectus, none of our subsidiaries has made any dividends or distributions to our Company and our Company has not made any dividends or distributions to our shareholders. We intend to keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future. If we determine to pay dividends on any of our Ordinary Shares in the future, as a holding company, we will be dependent on the receipt of dividends and other distributions from our subsidiary, Smart Digital Meta. Smart Digital Meta will rely on payments made from its subsidiaries, Smart Digital HK and Aosi. Smart Digital HK will rely on payments made from its subsidiary, Smart Digital GZ, which in turn will rely on payments made from its subsidiary, Liubenmu. Aosi will rely on payments made from its subsidiary, Hengqin. However, as the PRC government imposes control over currency conversion, it has the authority to conduct exchange transfer reviews, which may impose certain limitations on our ability to transfer cash between our Company, our PRC subsidiaries, and our investors, primarily reflected in the following aspects: (i) we are restricted from providing capital or loans to our PRC subsidiaries, which may adversely affect the operations of our PRC subsidiaries; (ii) our PRC subsidiaries may be restricted from paying dividends to us; and (iii) if we are

Table of Contents

unable to obtain dividends from our PRC subsidiaries, it may adversely impact our ability to distribute dividends to our investors. Further, to the extent cash or assets in the business are in the PRC/Hong Kong/Macau or a PRC/Hong Kong/Macau entity, the funds or assets may not be available to fund operations or for other use outside of the PRC/Hong Kong/Macau, due to interventions in or the imposition of restrictions and limitations on the ability of our Company or our subsidiaries by the PRC government to transfer cash or assets. There is no assurance the PRC government will not intervene in or impose restrictions on the ability of our Company or our subsidiaries to transfer cash or assets. See “Risk Factors — Risks Relating to Doing Business in the PRC — PRC regulations relating to offshore investment activities by PRC residents may subject our PRC resident beneficial owners or the PRC subsidiaries to liability or penalties, limit our ability to inject capital into the PRC subsidiaries, limit the PRC subsidiaries’ ability to increase their registered capital or distribute profits to us, or may otherwise adversely affect us,” “Risk Factors — Risks Relating to Doing Business in the PRC — The PRC subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may have a material adverse effect on our ability to conduct our business,” and “Risk Factors — Risks Relating to Doing Business in the PRC — Governmental control of currency conversion may affect the value of your investment and our payment of dividends.” As of the date of this prospectus, we do not have cash management policies or procedures that dictate how funds are transferred. As of the date of this prospectus, no cash transfer or transfer of other assets has occurred between our Company and our subsidiaries. See “Prospectus Summary — Asset Transfers Between the Holding Company and Our Subsidiaries,” “Dividend Policy,” and our audited consolidated financial statements included elsewhere in this prospectus.

We are an “emerging growth company” as defined under the federal securities laws and will be subject to reduced public company reporting requirements. Please read the disclosures beginning on page 10 of this prospectus for more information.

| | Per Share | | Total |

Initial public offering price(1) | | $ | | | $ | |

Underwriters’ discounts(2) | | $ | | | $ | |

Proceeds to our Company before expenses(3) | | $ | | | $ | |

This offering is being conducted on a firm commitment basis. The underwriters have agreed to purchase and pay for all of the Ordinary Shares offered by this prospectus if they purchase any Ordinary Shares.

We have agreed to issue to Network 1 Financial Securities, Inc. warrants, exercisable for a period of three years from the date of closing of the offering, to purchase such number of Ordinary Shares as equals 7% of the total number of Ordinary Shares sold in this offering at a price per share equal to 115% of the public offering price (the “Representative’s Warrants”). The registration statement of which this prospectus forms a part also covers the Representative’s Warrants and the Ordinary Shares issuable upon the exercise thereof.

The underwriters expect to deliver the Ordinary Shares against payment in U.S. dollars in [•] on or about [•], 2024.

Neither the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated [•], 2024

Table of Contents

i

Table of Contents

About this Prospectus

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We, and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only Ordinary Shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We, and the underwriters are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is current only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations, and prospects may have changed since that date.

Conventions that Apply to this Prospectus

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

• “Aosi” are to AOSI PRODUCTION CO., LTD., a private company limited by shares organized under the laws of Macau, which is a wholly owned subsidiary of Smart Digital Meta (as defined below).

• “Hengqin” are to Zhuhai Hengqin Aosi Cultural Communication Co., Ltd., a private company limited by shares organized under the laws of PRC, which is a wholly owned subsidiary of Aosi;

• “Hong Kong” are to the Hong Kong Special Administrative Region of the People’s Republic of China;

• “Hong Kong dollars” are to the legal currency of Hong Kong;

• “IPO” and “Offering” are to this initial public offering;

• “Liubenmu” are to Xiamen Liubenmu Culture Media Co., Ltd., a private company limited by shares organized under the laws of PRC, which is a wholly owned subsidiary of Smart Digital GZ (as defined below);

• “Macanese Pataca” and “MOP” are to the legal currency of Macau;

• “Macau” are to the Macau Special Administrative Region of the People’s Republic of China;

• “mainland China” or “Mainland China” are to the People’s Republic of China, excluding the special administrative regions of Hong Kong and Macau, and Taiwan, for the purposes of this prospectus only;

• “Ordinary Shares” are to the ordinary shares of SMD (as defined below), par value $0.001 per share;

• “PRC” or “China” are to the People’s Republic of China, including the special administrative regions of Hong Kong and Macau and excluding Taiwan for the purposes of this prospectus only;

• “PRC government”, “PRC governmental authorities”, or “PRC courts” are to the government, government authorities, or courts of mainland China, for the purposes of this prospectus only;

• “PRC laws” or “PRC laws and regulations” are to the laws and regulations of mainland China, for the purposes of this prospectus only;

• “PRC subsidiaries” are to Hengqin, Smart Digital GZ (as defined below) and Liubenmu, collectively.

• “Renminbi” and “RMB” are to the legal currency of the PRC;

• “Singapore” means the Republic of Singapore;

• “Singapore dollars” and “S$” are to the legal currency of Singapore;

ii

Table of Contents

• “Smart Digital GZ” are to Smart Digital (Guangzhou) Times Culture Development Co., Ltd, a private company limited by shares organized under the laws of PRC, which is a wholly owned subsidiary of Smart Digital HK (as defined below);

• “Smart Digital HK” are to Smart Digital (HK) Culture Limited, a private company limited by shares incorporated under the laws of Hong Kong, which is a wholly owned subsidiary of Smart Digital Meta (as defined below);

• “Smart Digital Meta” are to SMART DIGITAL META PTE. LTD., a private company limited by shares incorporated under the laws of Singapore, which is a wholly owned subsidiary of SMD (as defined below);

• “SMD” are to Smart Digital Group Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands;

• “the operating entities” are to Smart Digital Meta, Aosi and Liubenmu, collectively;

• “U.S. dollars,” “U.S. Dollars,” “US$,” “$,” and “dollars” are to the legal currency of the United States; and

• “we,” “us,” “our,” “our Company,” or the “Company” are to one or more of SMD and its subsidiaries, as the case may be.

Our business operations are conducted by the three operating entities: Aosi in Macau, using Macanese Pataca; Smart Digital Meta in Singapore, using Singapore dollars, and Liubenmu in Mainland China, using RMB. Our consolidated financial statements are presented in U.S. dollars. In this prospectus, we refer to assets, obligations, commitments, and liabilities in our consolidated financial statements in U.S. dollars. Certain dollar references are based on the exchange rate of other currencies to U.S. dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of U.S. dollars which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

iii

Table of Contents

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements included elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our Ordinary Shares, discussed under “Risk Factors,” before deciding whether to buy our Ordinary Shares.

Overview

Our Company is an exempted company incorporated in the Cayman Islands. Our Company has no material operations of its own and conducts its business operations through three operating entities: SMART DIGITAL META PTE. LTD., AOSI PRODUCTION CO., LTD., and Xiamen Liubenmu Culture Media Co., Ltd. The afore-mentioned operating entities conduct their business activities in Singapore, Macau, and Mainland China, respectively. In the fiscal year ended September 30, 2022, the operating entities provided only event planning and execution services. In the fiscal year ended September 30, 2023, the operating entities expanded the scope of their business and began to provide a broader range of services including: (1) event planning and execution services, which consist of drafting event planning proposals, customizing event marketing strategies, engaging event sponsors and other related services; (2) internet media services, which include developing marketing strategies, designing marketing content, distributing such marketing content on select internet platforms and other related services; (3) software customization and marketing services, which enable customers to formulate and implement marketing activities through our AOSI PRODUCTION CO., LTD.’s proprietary software; and (4) business planning and consulting services, which include business development planning, business data analysis and other related services.

Our Company’s revenue has demonstrated significant growth in the previous two fiscal years. In the fiscal years ended September 30, 2023 and 2022, our revenue was $9,702,145 and $1,834,193, respectively, representing a growth rate of approximately 429.0%. For the same fiscal years, event planning and execution services accounted for approximately 30.41% and 100% of our total revenue, respectively; internet media services accounted for approximately 21.47% and 0% of our total revenue, respectively; software customization and marketing services accounted for approximately 9.61% and 0% of our total revenue, respectively; and business planning and consulting services accounted for approximately 38.51% and 0% of our total revenue, respectively. For the same fiscal years, our net income was $1,993,262 and $132,455, respectively, representing a growth rate of approximately 1,404.9%. Our growth in the same fiscal years was primarily due to the expansion of the scope of the operating entities’ business in 2023, with the addition of internet media services, software customization and marketing services, and business planning and consulting services. Approximately 69.59% of the increase in revenue was due to the addition of the aforementioned services, and we may not experience similar significant growth rates in future periods. In the six months ended March 31, 2024 and 2023, our revenue was $8,218,541 and $1,786,639, respectively, and our net income was $173,415 and $314,601, respectively. See “Risk Factors — Risks Relating to Our Business and Industry — Our historical financial and operating results are not indicative of our future performance and our financial and operating results may fluctuate.”

Competitive Strengths

We believe that we are well-positioned to achieve our strategic goals through several key business strengths, including the ability to retain and attract customers, the ability to meet customer demands, our visionary operating teams, and our experienced management team. See “Business — Our Strengths.”

Growth Strategies

We intend to develop our business and strengthen brand loyalty by staying informed about market demands, securing skilled human resources, and continuously seeking new ways to enhance service efficiency. For further details on our growth strategies. See “Business — Growth Strategies.”

Summary of Risk Factors

Investing in our Ordinary Shares involves significant risks. You should carefully consider all of the information in this prospectus before making an investment in our Ordinary Shares. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more fully in the section titled “Risk Factors.”

Risks Relating to Our Business and Industry (for a more detailed discussion, see “Risk Factors — Risks Relating to Our Business and Industry” from page 13 to page 25 of this prospectus)

1

Table of Contents

We face risks and uncertainties relating to our business and industry, including, but not limited to, the following:

• If the operating entities are unable to retain the customers for their event planning and execution business, our results of operations will be materially and adversely affected. See “Risk Factors — Risks Relating to Our Business and Industry — If the operating entities are unable to retain the customers for their event planning and execution business, our results of operations will be materially and adversely affected” on page 13;

• Events that are planned by the operating entities are inherently susceptible to risks. See “Risk Factors — Risks Relating to Our Business and Industry — Events that are planned by the operating entities are inherently susceptible to risks” on page 13;

• The operating entities may suffer reputational harm due to factors adversely impacting the events. See “Risk Factors — Risks Relating to Our Business and Industry — The operating entities may suffer reputational harm due to factors adversely impacting the events” on page 13;

• The operating entities’ event planning and execution business could be harmed if the relationships on which they depend were to change adversely or terminate. See “Risk Factors — Risks Relating to Our Business and Industry — The operating entities’ event planning and execution business could be harmed if the relationships on which they depend were to change adversely or terminate” on page 14;

• Failure to maintain the quality of the operating entities’ internet media services may materially and adversely impact their business and financial condition. See “Risk Factors — Risks Relating to Our Business and Industry — Failure to maintain the quality of the operating entities’ internet media services may materially and adversely impact their business and financial condition” on page 14;

• Changes in Internet search engine algorithms and dynamics could have a negative impact on traffic for the operating entities’ sites and ultimately, their business and results of operations. See “Risk Factors — Risks Relating to Our Business and Industry — Changes in Internet search engine algorithms and dynamics could have a negative impact on traffic for the operating entities’ sites and ultimately, their business and results of operations” on page 15;

• The operating entities may be unable to maintain or raise the quality of their software customization and marketing services. See “Risk Factors — Risks Relating to Our Business and Industry — The operating entities may be unable to maintain or raise the quality of their software customization and marketing services” on page 15;

• Our financial condition and results of operations could be materially and adversely affected if the operating entities face interruptions associated with their software solutions. See “Risk Factors — Risks Relating to Our Business and Industry — Our financial condition and results of operations could be materially and adversely affected if the operating entities face interruptions associated with their software solutions” on page 15;

• The operating entities’ business planning and consulting business depends on non-recurring engagements and failure to secure new engagements could lead to a decrease in our revenues. See “Risk Factors — Risks Relating to Our Business and Industry — The operating entities’ business planning and consulting business depends on non-recurring engagements and failure to secure new engagements could lead to a decrease in our revenues” on page 16;

• We expect competition from existing competitors and other companies that may enter the market or introduce new services in the future, which could result in pricing pressures and a decline in both our market share and revenue. See “Risk Factors — Risks Relating to Our Business and Industry — We expect competition from existing competitors and other companies that may enter the market or introduce new services in the future, which could result in pricing pressures and a decline in both our market share and revenue” on page 18;

• The operating entities’ business may rely on a few customers that account for more than 10% of their total revenue, and interruption in their operations may have an adverse effect on our financial condition and results of operations. See “Risk Factors — Risks Relating to Our Business and Industry — The operating entities’ business may rely on a few customers that account for more than 10% of their total revenue, and interruption in their operations may have an adverse effect on our financial condition and results of operations” on page 18;

2

Table of Contents

• The operating entities may be dependent on a limited number of suppliers and any disruption to the relationships with the major suppliers may have material adverse effects on the operating entities’ business. See “Risk Factors — Risks Relating to Our Business and Industry — The operating entities may be dependent on a limited number of suppliers and any disruption to the relationships with the major suppliers may have material adverse effects on the operating entities’ business” on page 19; and

• Fluctuation in the exchange rate between the US$ and foreign currencies may have an adverse effect on our business. See “Risk Factors — Risks Relating to Our Business and Industry — Fluctuation in the exchange rate between the US$ and foreign currencies may have an adverse effect on our business” on page 22.

Risks Relating to Doing Business in the PRC (for a more detailed discussion, see “Risk Factors — Risks Relating to Doing Business in the PRC” from page 25 to page 34 of this prospectus)

We face risks and uncertainties relating to doing business in the PRC, including, but not limited to, the following. In the opinion of Lektou — Advogados e Notários, our counsel as to Macau law, given that Macau is a Special Administrative Region of the PRC, the legal and operational risks associated with operating in China apply to our operations in Macau. While Macau currently operates under a different set of laws from mainland China, there can be no assurance as to whether the government of Macau will enact laws and regulations similar to mainland China, or whether any laws or regulations of mainland China will become applicable to our operations in Macau in the future, which could happen at any time and with no advance notice. See “Risk Factors — Risks Relating to Doing Business in Macau and Singapore — We are subject to Macau laws and regulations that are generally applicable to Macau entities, including Macau laws and regulations that result in oversight over data security.”

• Advertisements shown during the PRC subsidiaries’ events may subject them to penalties and other administrative actions. See “Risk Factors — Risks Relating to Doing Business in the PRC — Advertisements shown during the PRC subsidiaries’ events may subject them to penalties and other administrative actions” on page 25;

• Content produced and/or distributed by the PRC subsidiaries may be found objectionable by PRC regulatory authorities, which may have an adverse effect on their business. See “Risk Factors — Risks Relating to Doing Business in the PRC — Content produced and/or distributed by the PRC subsidiaries may be found objectionable by PRC regulatory authorities, which may have an adverse effect on their business” on page 26;

• The PRC subsidiaries may fail to comply with the regulations that govern their business operations. See “Risk Factors — Risks Relating to Doing Business in the PRC — The PRC subsidiaries may fail to comply with the regulations that govern their business operations” on page 26;

• Recent greater oversight by the Cyberspace Administration of China (the “CAC”) over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact the PRC subsidiaries’ business and our offering. See “Risk Factors — Risks Relating to Doing Business in the PRC — Recent greater oversight by the CAC over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact the PRC subsidiaries’ business and our offering” on page 26;

• The Opinions on Severely Cracking Down on Illegal Securities Activities According to Law (the “Opinions”), the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”), and the Archive Provisions recently issued by the PRC authorities may subject us to additional compliance requirements in the future. See “Risk Factors — Risks Relating to Doing Business in the PRC — The Opinions, the Trial Measures, and the Archive Provisions recently issued by the PRC authorities may subject us to additional compliance requirements in the future” on page 27;

• Changes in China’s economic, political, or social conditions or government policies could have a material adverse effect on the PRC subsidiaries’ business and operations. See “Risk Factors — Risks Relating to Doing Business in the PRC — Changes in China’s economic, political, or social conditions or government policies could have a material adverse effect on the PRC subsidiaries’ business and operations” on page 28;

3

Table of Contents

• Uncertainties in the interpretation and enforcement of PRC laws and regulations and changes in policies, rules, and regulations in China, which may be quick with little advance notice, could limit the legal protection available to you and us. See “Risk Factors — Risks Relating to Doing Business in the PRC — Uncertainties in the interpretation and enforcement of PRC laws and regulations and changes in policies, rules, and regulations in China, which may be quick with little advance notice, could limit the legal protection available to you and us” on page 29;

• Given the Chinese government’s significant oversight and control over the conduct of the PRC subsidiaries’ business, the Chinese government may intervene or influence their operations at any time, which could result in a material change in the PRC subsidiaries’ operations and/or the value of our Ordinary Shares. See “Risk Factors — Risks Relating to Doing Business in the PRC — Given the Chinese government’s significant oversight and control over the conduct of the PRC subsidiaries’ business, the Chinese government may intervene or influence their operations at any time, which could result in a material change in the PRC subsidiaries’ operations and/or the value of our Ordinary Shares” on page 29;

• Any actions by the Chinese government, including any decision to intervene or influence the operations of the PRC subsidiaries, may cause us to make material changes to the operations of the PRC subsidiaries, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the value of such securities to decline significantly or be worthless. See “Risk Factors — Risks Relating to Doing Business in the PRC — Any actions by the Chinese government, including any decision to intervene or influence the operations of the PRC subsidiaries, may cause us to make material changes to the operations of the PRC subsidiaries, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the value of such securities to decline significantly or be worthless” on page 29;

• The PRC subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may have a material adverse effect on our ability to conduct our business. See “Risk Factors — Risks Relating to Doing Business in the PRC — The PRC subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may have a material adverse effect on our ability to conduct our business” on page 33; and

• You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against our Company or our management based on foreign laws. See “Risk Factors — Risks Relating to Doing Business in the PRC — You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against our Company or our management based on foreign laws” on page 34.

Risks Relating to Doing Business in Macau and Singapore (for a more detailed discussion, see “Risk Factors — Risks Relating to Doing Business in Macau and Singapore” starting from page 34 of this prospectus)

We face risks and uncertainties relating to doing business in Macau and Singapore, including, but not limited to, the following:

• Conducting business in Macau has certain risks relating to political, economic, and social changes in Macau and China. See “Risk Factors — Risks Relating to Doing Business in Macau and Singapore — Conducting business in Macau has certain risks relating to political, economic, and social changes in Macau and China” on page 34;

• We are subject to Macau laws and regulations that are generally applicable to Macau entities, including Macau laws and regulations that result in oversight over data security. See “Risk Factors — Risks Relating to Doing Business in Macau and Singapore — We are subject to Macau laws and regulations that are generally applicable to Macau entities, including Macau laws and regulations that result in oversight over data security” on page 35; and

• Developments in the social, political, regulatory and economic environment in Singapore, may have a material and adverse impact on us. See “Risk Factors — Risks Relating to Doing Business in Macau and Singapore — Developments in the social, political, regulatory and economic environment in Singapore, may have a material and adverse impact on us” on page 35.

4

Table of Contents

Risks Relating to This Offering and the Trading Market (for a more detailed discussion, see “Risk Factors — Risks Relating to This Offering and the Trading Market” from page 35 to page 44 of this prospectus)

We face risks and uncertainties relating to this offering and the trading market, including, but not limited to, the following:

• There has been no public market for our Ordinary Shares prior to the completion of this offering, and you may not be able to resell our Ordinary Shares at or above the price you pay for them, or at all. See “Risk Factors — Risks Relating to This Offering and the Trading Market — There has been no public market for our Ordinary Shares prior to the completion of this offering, and you may not be able to resell our Ordinary Shares at or above the price you pay for them, or at all” on page 35;

• Certain recent initial public offerings of companies with public floats comparable to our anticipated public float have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company. We may experience similar volatility, which may make it difficult for prospective investors to assess the value of our Ordinary Shares. See “Risk Factors — Risks Relating to This Offering and the Trading Market — Certain recent initial public offerings of companies with public floats comparable to our anticipated public float have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company. We may experience similar volatility, which may make it difficult for prospective investors to assess the value of our Ordinary Shares” on page 35;

• You will experience immediate and substantial dilution in the net tangible book value of Ordinary Shares purchased. See “Risk Factors — Risks Relating to This Offering and the Trading Market — You will experience immediate and substantial dilution in the net tangible book value of Ordinary Shares purchased” on page 36;

• As an “emerging growth company” under applicable law, we will be subject to reduced disclosure requirements. Such reduced disclosure may make our Ordinary Shares less attractive to investors. See “Risk Factors — Risks Relating to This Offering and the Trading Market — As an ‘emerging growth company’ under applicable law, we will be subject to reduced disclosure requirements. Such reduced disclosure may make our Ordinary Shares less attractive to investors” on page 37;

• We will incur substantial increased costs as a result of being a public company, particularly after we cease to qualify as an emerging growth company. See “Risk Factors — Risks Relating to This Offering and the Trading Market — We will incur substantial increased costs as a result of being a public company, particularly after we cease to qualify as an emerging growth company” on page 38; and

• We do not intend to pay dividends for the foreseeable future and you must rely on price appreciation of our Ordinary Shares for a return on your investment. See “Risk Factors — Risks Relating to This Offering and the Trading Market — We do not intend to pay dividends for the foreseeable future and you must rely on price appreciation of our Ordinary Shares for a return on your investment” on page 38.

Permissions and Approvals in Macau, Singapore and Mainland China

In the opinion of Lektou — Advogados e Notários, our counsel as to Macau law, Aosi has not received any notifications from government authorities or regulators in Macau regarding non-compliance with any laws and regulations that have not been cured as of the date of this prospectus, and that Aosi is not required to obtain any special permissions or approvals from Macau authorities to conduct its business in Macau or offer the securities being registered to foreign investors. As such, Aosi possesses all necessary permissions and approvals to conduct its business in Macau, and no permissions or approvals have been denied with respect to Aosi’s operations in Macau.

According to Bird & Bird ATMD LLP (“Bird”), our counsel with respect to the laws of Singapore, Smart Digital Meta Pte. Ltd. is in good standing in Singapore and there have been no notifications received by Smart Digital Meta Pte. Ltd. from any government authorities or regulators of any non-compliance with any laws and regulations in Singapore as of the date of this prospectus. Smart Digital Meta Pte. Ltd. is not required to obtain any special permissions or approvals from Singapore authorities to conduct its current business in Singapore.

In the opinion of AllBright Law Offices (Xiamen), our PRC legal counsel, as of the date of this prospectus, neither our Company nor the PRC subsidiaries are required to obtain any approvals or permissions from the CSRC or any other Chinese authorities under the current PRC laws, rules and regulations for the listing and offering of our securities

5

Table of Contents

to foreign investors on Nasdaq. In order to operate our business activities as currently conducted in China, the PRC subsidiaries are required to obtain a business license from the State Administration for Market Regulation (“SAMR”). As of the date of this prospectus, each of our PRC subsidiaries has obtained and maintained a valid business license from the SAMR and no application for any such license has been denied. The business license is the permission to engage in a business activity for a PRC company. If our PRC subsidiaries cannot maintain such business license, they will not be able to continue to operate their business activities in the PRC. Our PRC legal counsel confirms that in addition to the business license, the PRC subsidiaries are not required to obtain any other special permissions or approvals from PRC authorities to operate their business in mainland China or offer the securities being registered to foreign investors. However, it is uncertain whether we or our PRC subsidiaries will be required to obtain additional approvals, licenses, or permits in connection with our offering of securities to foreign investors and our business operations pursuant to evolving PRC laws and regulations in the future. If we inadvertently conclude that such additional permissions or approvals are not required, or if applicable laws, regulations, or interpretations change and we are required to obtain such permissions or approvals in the future, any such event could result in a material change in our operations, and the value of our Ordinary Shares could depreciate significantly or become worthless.

We are subject to certain legal and operational risks associated with the operations of our PRC subsidiaries being based in China, which could cause the value of our securities to decline significantly or become worthless. Applicable PRC laws and regulations governing such current operations are sometimes vague and uncertain, and as a result these risks may result in material changes to the operations of our PRC subsidiaries, significant depreciation or a complete loss of the value of our Ordinary Shares, or a complete loss of our ability to offer, or continue to offer, our securities to investors. In the opinion of Lektou – Advogados e Notários, our counsel as to Macau law, given that Macau is a Special Administrative Region of the PRC, the legal and operational risks associated with operating in China apply to our operations in Macau. While Macau currently operates under a different set of laws from mainland China, there can be no assurance as to whether the government of Macau will enact laws and regulations similar to mainland China, or whether any laws or regulations of mainland China will become applicable to our operations in Macau in the future, which could happen at any time and with no advance notice. Recently, the PRC government enacted a series of regulatory actions and issued statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in the area of anti-monopoly enforcement. On December 28, 2021, 13 governmental departments of the PRC, including the CAC, issued the Cybersecurity Review Measures, which became effective on February 15, 2022. As of the date of this prospectus, we have not received any notice from any authorities identifying the PRC subsidiaries as CIIOs or requiring us to go through cybersecurity review or network data security review by the CAC. In the opinion of our PRC counsel, AllBright Law Offices (Xiamen), neither the operations of us or the PRC subsidiaries, nor our listing will be affected, and that we and the PRC subsidiaries are not subject to cybersecurity review by the CAC under the Cybersecurity Review Measures, because the PRC subsidiaries are not CIIOs or online platform operators that possess personal information of at least one million users or engage in data processing activities that affect or may affect national security. See “Risk Factors — Risks Relating to Doing Business in the PRC — Recent greater oversight by the CAC over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact the PRC subsidiaries’ business and our offering.” On February 17, 2023, the CSRC promulgated the Trial Measures and five supporting guidelines, which became effective on March 31, 2023. Pursuant to the Trial Measures, PRC domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following their submission of initial public offerings or listing applications. If a domestic company fails to complete the required filing procedures or conceals any material fact or falsifies any material information in its filing documents, such domestic company may be subject to administrative penalties, such as an order to rectify, warnings, and fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines. In the opinion of our PRC counsel, AllBright Law Offices (Xiamen), the term “actual controllers” refers to those who are not shareholders but are able to substantially control the domestic company through certain contractual arrangements, investment relationships or other measures; the term “the person directly in charge” refers to a person who generally leads the enterprise, institution or group and plays a decisive role, and, therefore, is responsible for his or her organizing, decision-making and commanding with respect to the aforementioned illegal activities; and the term “other directly liable persons” refers to those who are neither general leaders nor play any decisive role, but are responsible for partially organizing and actively participating in the illegal activities. In the opinion of our PRC counsel, AllBright Law Offices (Xiamen), we will not be required to complete the filing procedure since (i) we are not a PRC domestic company; and (ii) our offering and listing is not an indirect overseas offering or listing within the meaning of these terms as defined in the PRC regulations, because the operating revenue, total profit, total assets, or net assets, as documented in our audited consolidated financial statements for the most recent accounting year, accounted for by

6

Table of Contents

the PRC subsidiaries are all under 50%. See “Risk Factors — Risks Relating to Doing Business in the PRC — The Opinions on Severely Cracking Down on Illegal Securities Activities According to Law (the “Opinions”), the Trial Measures, and the Archive Provisions recently issued by the PRC authorities may subject us to additional compliance requirements in the future.” As of the date of this prospectus, neither we nor our PRC subsidiaries have received any inquiry, notice, warning, or sanction with respect to our overseas listing from any other PRC governmental authorities. Since these statements and regulatory actions are newly published, however, official guidance and related implementation rules have not been issued. The potential impact of such modified or new laws and regulations on the daily business operations of our PRC subsidiaries, our ability to accept foreign investments, and our listing on a U.S. exchange is highly uncertain. The SCNPC, the CSRC, the CAC, or other PRC regulatory authorities may in the future promulgate additional laws, regulations, or implement rules that will require us and our subsidiaries to obtain regulatory approval from Chinese authorities in order to list or offer our securities in the U.S or operate our business. If we do not receive or maintain any approval or permit mandated by current or future laws and regulations, or inadvertently conclude that such approval or permit is not required, or the applicable laws, regulations, or interpretations change in such a way as to require us to obtain any approvals or permits in the future, we may be subject to an investigation by competent regulators, fines or penalties, or an order prohibiting us from conducting an offering. These risks could result in a material adverse effect upon our operations and the value of our Ordinary Shares, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to decline significantly in value or become worthless.

In addition, our Ordinary Shares may be prohibited from trading on a national exchange under the HFCA Act if the PCAOB is unable to inspect our auditors for two consecutive years beginning in 2022. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled “Consolidated Appropriations Act” was signed into law by President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act, which reduced the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two, thus reducing the time period for triggering the delisting of our Company and the prohibition of trading in our securities if the PCAOB is unable to inspect our accounting firm at such future time. Our auditor, Enrome LLP, is headquartered in Singapore, and subject to inspection by the PCAOB on a regular basis. Our auditor is not subject to the determinations announced by the PCAOB on December 16, 2021. If trading in our Ordinary Shares is prohibited under the HFCA Act in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, Nasdaq may determine to delist our Ordinary Shares and trading in our Ordinary Shares could be prohibited. On August 26, 2022, the CSRC, the MOF, and the PCAOB signed the Protocol governing inspections and investigations of audit firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB will consider the need to issue a new determination. See “Risk Factors — Risks Relating to Doing Business in the PRC — Recent joint statement by the SEC and the PCAOB, rule changes by Nasdaq, and the HFCA Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors. These developments could add uncertainties to our continued listing or future offerings of our securities in the U.S.”

Asset Transfers Between the Holding Company and Our Subsidiaries

As of the date of this prospectus, none of our subsidiaries has paid any dividends or made any distributions to our Company and our Company has not paid any dividends or made any distributions to our shareholders. We intend to keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future. If we determine to pay dividends on any of our Ordinary Shares in the future, as a holding company, we will be dependent on the receipt of dividends and other distributions from our subsidiary, Smart Digital Meta. Smart Digital Meta will rely on payments made from its subsidiaries, Smart Digital HK and Aosi. Smart Digital HK will rely on payments made from its subsidiary, Smart Digital GZ, which in turn will rely on payments made from its subsidiary, Liubenmu. Aosi will rely on payments made from its subsidiary, Hengqin. However, as the PRC government imposes control over currency conversion, it has the authority to conduct exchange transfer reviews, which may impose certain limitations on our ability to transfer cash between our Company, our PRC subsidiaries, and

7

Table of Contents

our investors, primarily reflected in the following aspects: (i) we are restricted from providing capital or loans to our PRC subsidiaries, which may adversely affect the operations of our PRC subsidiaries; (ii) our PRC subsidiaries may be restricted from paying dividends to us; and (iii) if we are unable to obtain dividends from our PRC subsidiaries, it may adversely impact our dividends distribution to investors. Further, to the extent cash or assets in the business are in the PRC/Hong Kong/Macau or a PRC/Hong Kong/Macau entity, the funds or assets may not be available to fund operations or for other use outside of the PRC/Hong Kong/Macau, due to interventions in or the imposition of restrictions and limitations on the ability of our Company or our subsidiaries by the PRC government to transfer cash or assets. There is no assurance the PRC government will not intervene in or impose restrictions on the ability of our Company or our subsidiaries to transfer cash or assets. See “Risk Factors — Risks Relating to Doing Business in the PRC — PRC regulations relating to offshore investment activities by PRC residents may subject our PRC resident beneficial owners or the PRC subsidiaries to liability or penalties, limit our ability to inject capital into the PRC subsidiaries, limit the PRC subsidiaries’ ability to increase their registered capital or distribute profits to us, or may otherwise adversely affect us,” “Risk Factors — Risks Relating to Doing Business in the PRC — The PRC subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may have a material adverse effect on our ability to conduct our business,” and “Risk Factors — Risks Relating to Doing Business in the PRC — Governmental control of currency conversion may affect the value of your investment and our payment of dividends.” As of the date of this prospectus, we do not have cash management policies or procedures that dictate how funds are transferred. As of the date of this prospectus, no cash transfer or transfer of other assets has occurred between our Company and our subsidiaries. See “Prospectus Summary — Asset Transfers Between the Holding Company and Our Subsidiaries,” “Dividend Policy,” and our audited consolidated financial statements included elsewhere in this prospectus.

Corporate Information

Our principal executive offices are located at 150 Beach Road #2805/06 Gateway, West Singapore 189720, and our phone number is +65 69509495. Our registered office in the Cayman Islands is located at Harneys Fiduciary (Cayman) Limited, 4th Floor, Harbour Place, 103 South Church Street, P.O. Box 10240, Grand Cayman KY1-1002, Cayman Islands. Our website address is www.smdmeta.com. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus or the registration statement of which it forms a part. Our agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, NY 10168.

Corporate Structure

We are a holding company incorporated in the Cayman Islands with no material operations of our own. We are not a Chinese operating company. Our operations are conducted through the operating entities in Macau, Singapore and mainland China. Our corporate structure involves unique risks to investors. Chinese regulatory authorities could disallow our corporate structure, which would likely result in a material change in our operations and/or a material change in the value of the securities we are registering for sale, including that it could cause the value of such securities to decline significantly or become worthless. The Ordinary Shares offered in this prospectus are shares of the Cayman Islands holding company instead of shares of the operating entities in Macau, Singapore and mainland China. Holders of our Ordinary Shares do not directly own any equity interests in our subsidiaries, including the equity interests in the operating entities in Macau, Singapore and mainland China, but will instead own shares of a Cayman Islands holding company.

8

Table of Contents

The following diagram illustrates the ownership structure of the Company, as of the date of this prospectus, and upon completion of this offering, excluding the number of Ordinary Shares issuable upon the exercise of the Representative’s Warrants. We directly hold 100% equity interests in the operating entities, and we do not currently use a VIE structure. For more details on our corporate history, please refer to “Corporate History and Structure.”

(1) Represents an aggregate of 6,416,052 Ordinary Shares held by 20 minority shareholders, each one of which holds less than 5% of our Ordinary Shares, as of the date of this prospectus. Among such minority shareholders is Winwin Asia Group Co., Ltd, which holds 500,000 Ordinary Shares and is 100% owned by SAM WAI HONG, our Chairman of the Board of Directors, as of the date of this prospectus.

(2) Represents 10,000,000 Ordinary Shares held by CHINAINVEST INTERNATIONAL GROUP CO., LTD., which is 100% owned by SAM WAI HONG, our Chairman of the Board of Directors, as of the date of this prospectus.

(3) Represents 4,448,948 Ordinary Shares held by BOBO WORLDWIDE HOLDINGS LIMITED, which is 100% owned by WEI LIYA, as of the date of this prospectus.

(4) Represents 4,135,000 Ordinary Shares held by LIAO Junhui, as of the date of this prospectus. LIAO Junhui is the legal representative, executive director, and manager of Smart Digital GZ. See “Related Party Transactions.”

9

Table of Contents

Impact of COVID-19 on Our Operations and Financial Performance

During the years ended September 30, 2023 and 2022, COVID-19 has adversely affected the operating entities’ business operations. As of the date of this prospectus, the operating entities have generally recovered from the adverse impact of COVID-19 and COVID-19 has had minimal impact on the operating entities’ business and operations. See “Risk Factors — Risks Relating to Our Business and Industry — The operating entities face risks related to natural disasters, health epidemics, and other outbreaks, which could significantly disrupt their operations” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — COVID-19 Affecting Our Results of Operations.”

Implications of Our Being an “Emerging Growth Company”

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

• may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations;

• are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as the “compensation discussion and analysis”;

• are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

• are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency,” and “say-on-golden-parachute” votes);

• are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure;

• are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and

• will not be required to conduct an evaluation of our internal control over financial reporting until our second annual report on Form 20-F following the completion of this IPO.

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions until we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an “emerging growth company” at the end of the fiscal year in which the fifth anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended (the “Securities Act”) occurred, if we have more than $1.235 billion in annual revenue, have more than $700 million in market value of our Ordinary Shares held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

10

Table of Contents

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

• we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company;

• for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies;

• we are not required to provide the same level of disclosure on certain issues, such as executive compensation;

• we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material non-public information;

• we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and

• we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction.

We intend to take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States or (iii) our business is administered principally in the United States

11

Table of Contents

THE OFFERING

Securities offered by us | | 1,500,000 Ordinary Shares |

Price per share | | We currently estimate that the initial public offering price will be between $4.00 to $6.00 per Ordinary Share. |

Ordinary Shares issued and outstanding prior to completion of this offering | |

25,000,000 Ordinary Shares

|

Ordinary Shares issued and outstanding immediately after this offering | |

26,500,000 Ordinary Shares, excluding the number of Ordinary Shares issuable upon the exercise of the Representative’s Warrants

|

Representative’s Warrants | | We have agreed to issue to Network 1 Financial Securities, Inc. warrants, exercisable for a period of three years from the date of closing of the offering, to purchase Ordinary Shares equal to 7% of the total number of Ordinary Shares sold in this offering at a per share price equal to 115% of the public offering price. |

Listing | | We will apply to have the Ordinary Shares listed on the Nasdaq Capital Market. At this time, Nasdaq has not yet approved our application to list our Ordinary Shares. The closing of this offering is conditioned upon Nasdaq’s final approval of our listing application, and there is no guarantee or assurance that our Ordinary Shares will be approved for listing on Nasdaq. |

Proposed ticker symbol | | “SDM” |

Transfer Agent | | Transhare Corporation |