Exhibit 99.1

Exhibit 99.1

CMS ENERGY

Growing Forward

Wells Fargo Securities

10th Annual Pipeline, MLP and E&P

Services and Utilities Symposium

December 7, 2011

CMS ENERGY

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, as amended, Rule 175 of the Securities Act of 1933, as amended, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. They should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING

STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

Reported earnings could vary because of several factors, such as legacy issues associated with prior asset sales. Because of those uncertainties, the company is not providing reported earnings guidance.

1

CMS ENERGY

Investment Consideration . . . .

• Dividend yield (4%) and EPS growth (5% to 7%) provide attractive total return

• “Needed” Utility investment with transparent, long-term earnings growth

• Constructive regulatory environment and good energy law support Utility investment in Michigan

. . . . predictable,redictable, affordable, and sustainable.

2

CMS ENERGY

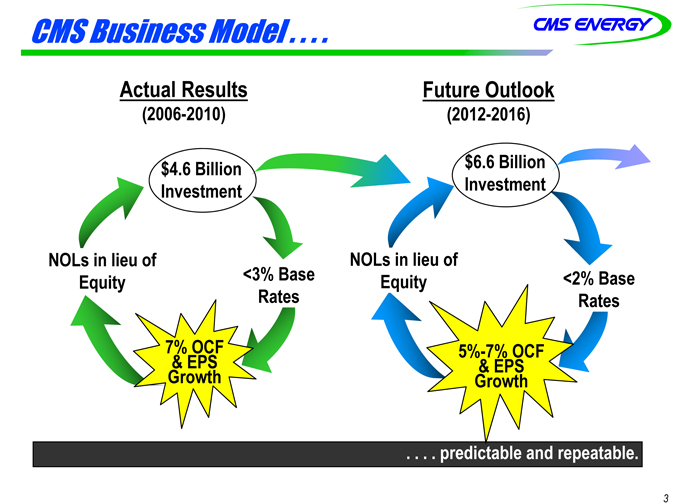

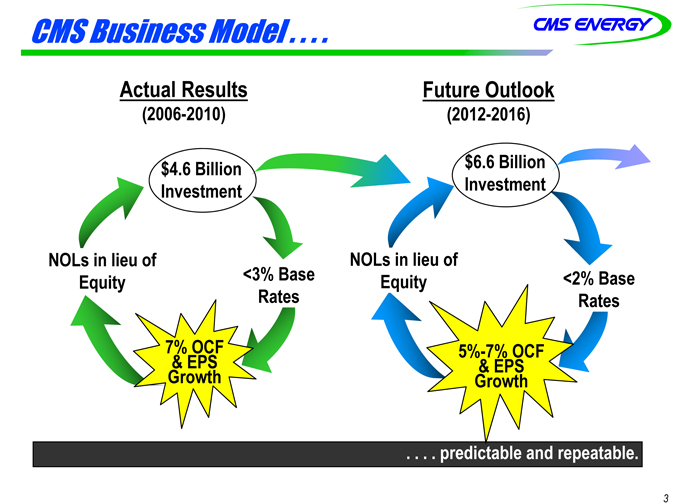

CMS Business Model . . . .

Actual Results

(2006-2010)

$4.6 Billion Investment

NOLs in lieu of Equity

<3% Base Rates

7% OCF

& EPS

Growth

Future Outlook

(2012-2016)

$6.6 Billion Investment

NOLs in lieu of Equity

5%-7% OCF

& EPS

Growth

<2% Base Rates

. . . . predictable and repeatable.

3

CMS ENERGY

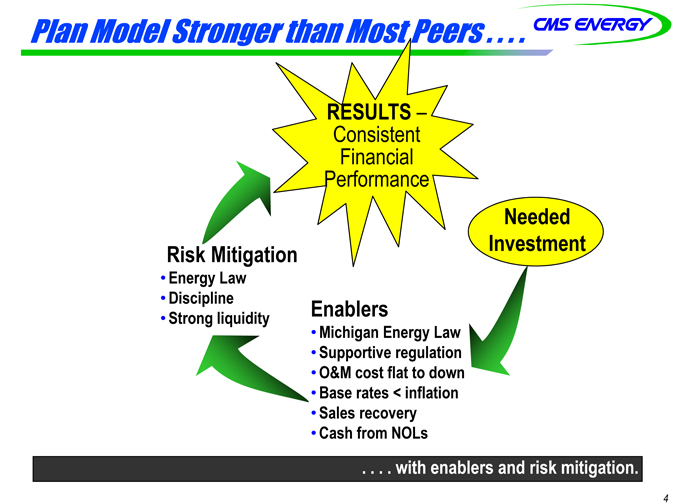

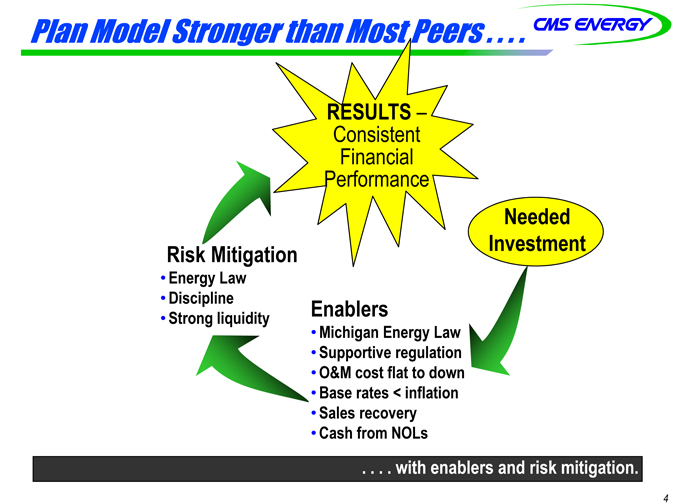

Plan Model Stronger than Most Peers . . . .

RESULTS –

Consistent Financial Performance

Risk Mitigation

• Energy Law

• Discipline

• Strong liquidity

Enablers

• Michigan Energy Law

• Supportive regulation

• O&M cost flat to down

• Base rates < inflation

• Sales recovery

• Cash from NOLs

Needed Investment

. . . . with enablers and risk mitigation.

4

CMS ENERGY

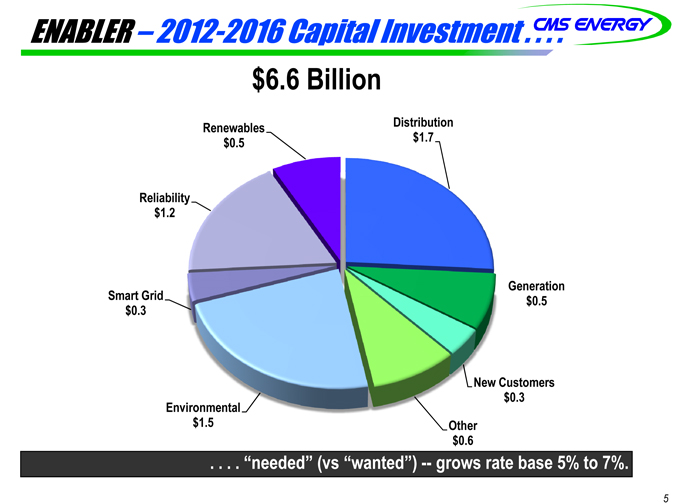

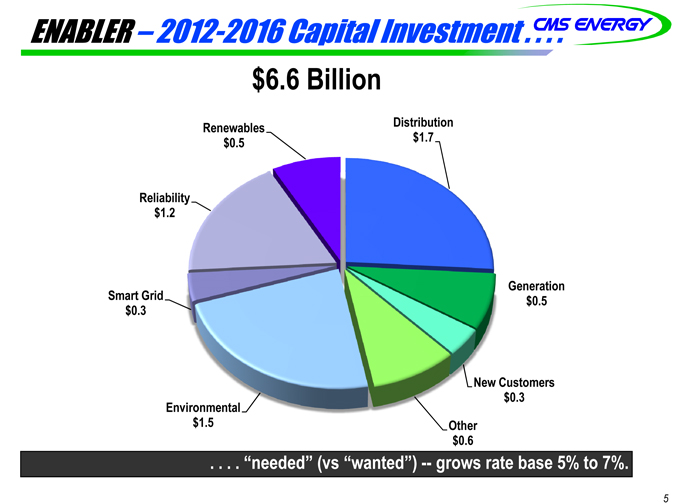

ENABLER – 2012-2016 Capital Investment . . . .

$6.6 Billion

Renewables $0.5

Reliability $1.2

Smart Grid $0.3

Environmental $1.5

Distribution $1.7

Generation $0.5

New Customers $0.3

Other $0.6

. . . . “needed” (vsvs “wanted”) — grows rate base 5% to 7%.

5

CMS ENERGY

INVESTMENT – Clean Air Standards . . . .

• Cross-state Air Pollution Rule mandates SO2 and NOx reductions by January 2012

• Plan in place to achieve compliance

• Maximum Achievable Control Technology (MACT)

• Largest five coal units planned to be controlled – 2,000 MW

• Could result in retirement or mothballing of smaller coal plants – 950 MW

. . . . fullyully addressed in five-year plan.

6

CMS ENERGY

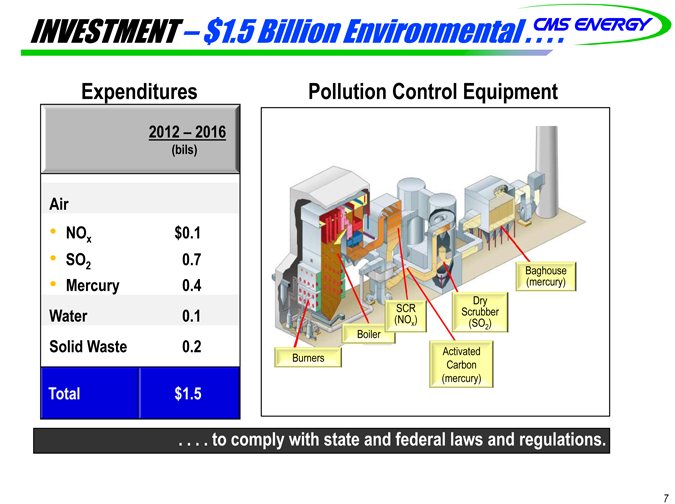

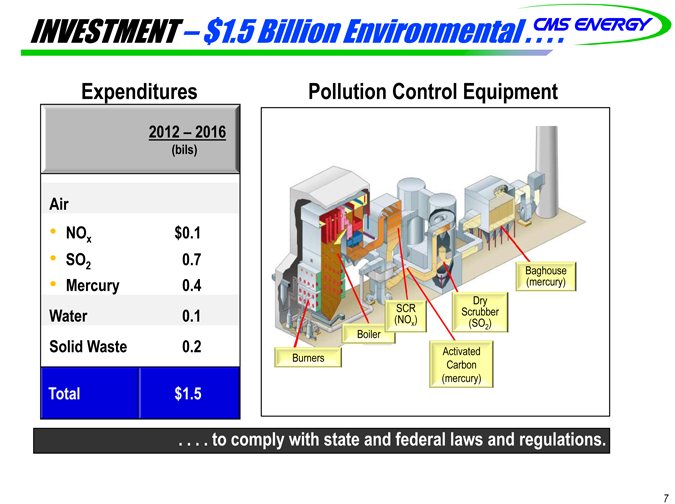

INVESTMENT – $1.5 Billion Environmental . . . .

Expenditures

2012 – 2016

(bils)

Air

• NOx $0.1

• SO2 0.7

• Mercury 0.4

Water 0.1

Solid Waste 0.2

Total $1.5

Pollution Control Equipment

Burners

Boiler

SCR

(NO NOx)

Activated Carbon (mercury)

Dry Scrubber (SO2)

Baghouse (mercury)

. . . . to comply with state and federal laws and regulations.

7

CMS ENERGY

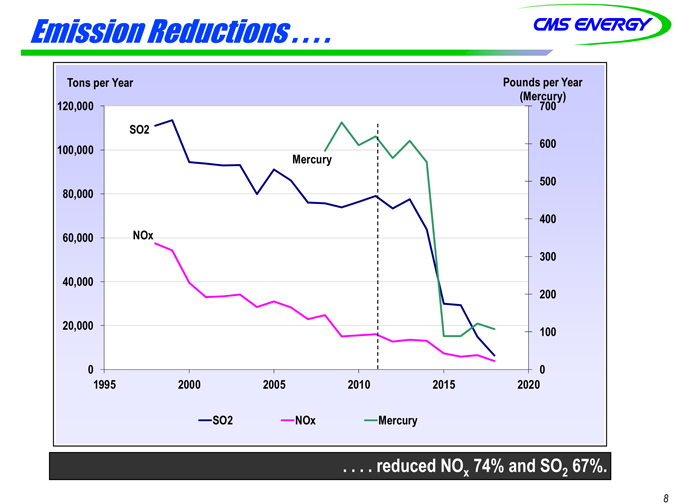

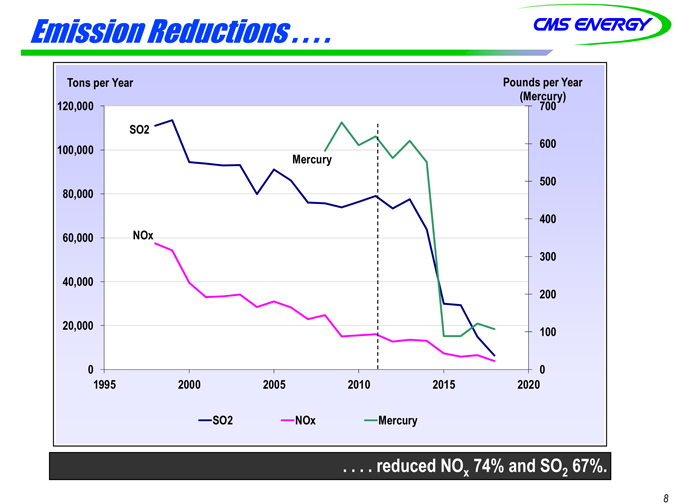

Emission Reductions . . . .

Tons per Year

120,000 100,000 80,000 60,000 40,000 20,000 0

SO2

NOx

Mercury

1995 2000 2005 2010 2015 2020

Pounds per Year (Mercury) 700

600 500 400 300 200 100 0

SO2

NOx

Mercury

. . . . reduced NOx 74% and SO2 67%.

8

CMS ENERGY

INVESTMENT – Distribution . . . .

• Electric—$1.0 billion

• Reliability improvements

• Capacity enhancements

• Gas—$700 million

• Capacity and deliverability

• Pipeline integrity

. . . . essential investments to maintain safe and excellent service.

9

INVESTMENT – Reliability . . . .

Electric—$800 million

• Strengthen circuits and substations

• Replace poles

• Upgrade Ludington Pumped Storage Plant

Gas—$400 million

• Main replacement program

• Enhance transmission and storage systems

. .. . . reduces outages and improves customer satisfaction.

10

INVESTMENT – Renewable Energy Plans . . . .

Michigan energy law requires:

• 10% renewables by 2015

• Purchase 50% and build 50% Renewable energy surcharge reduced by $54 million annually; further reduction expected Plan to invest about $500 million over next five years, primarily in wind power $232 million, Lake Winds Energy Park under construction

. . . . at lower customer costs while maintaining investment.

11

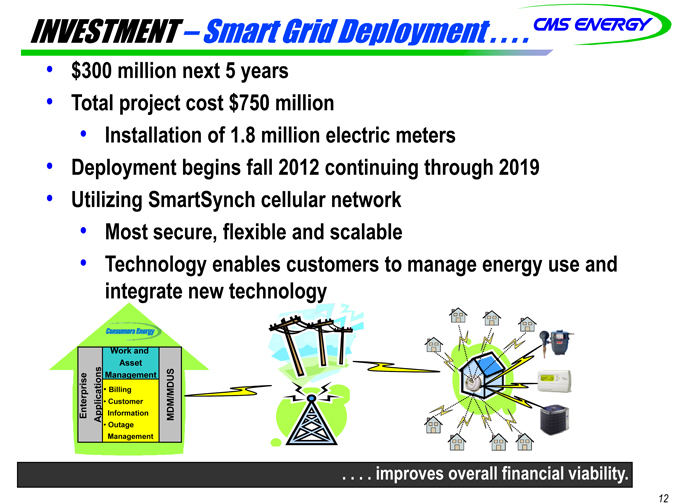

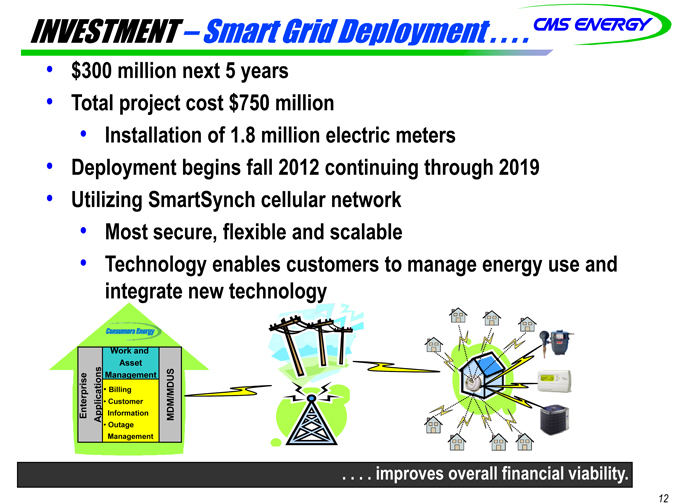

INVESTMENT – Smart Grid Deployment . . . .

$300 million next 5 years Total project cost $750 million

• Installation of 1.8 million electric meters

Deployment begins fall 2012 continuing through 2019 Utilizing SmartSynch cellular network

• Most secure, flexible and scalable

• Technology enables customers to manage energy use and integrate new technology

. . . . improves overall financial viability.

12

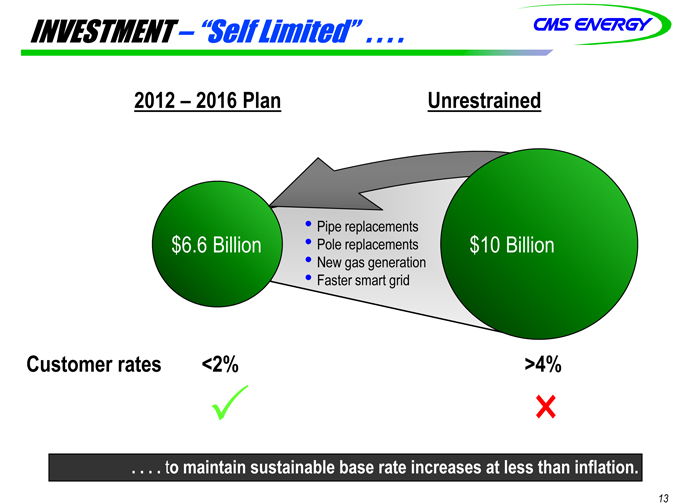

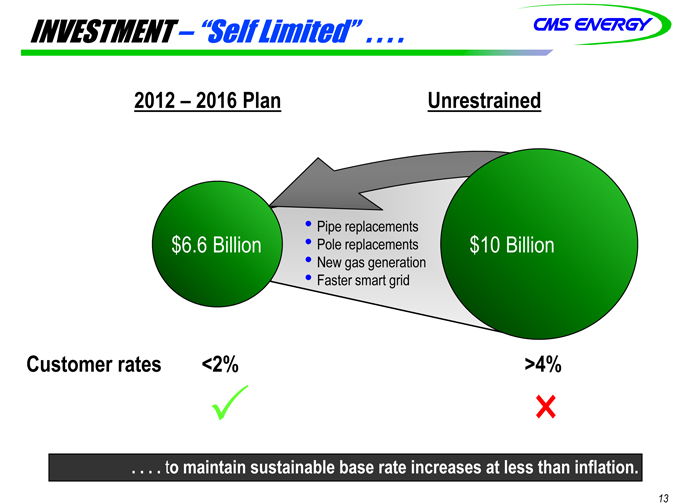

NVESTMENT – “Self Limited” . . . .

2012 – 2016 Plan

Unrestrained

$6.6 Billion

Pipe replacements Pole replacements New gas generation

Faster smart grid

$10 Billion

Customer rates <2% >4%

. . . . tto maintain sustainable base rate increases at less than inflation.

13

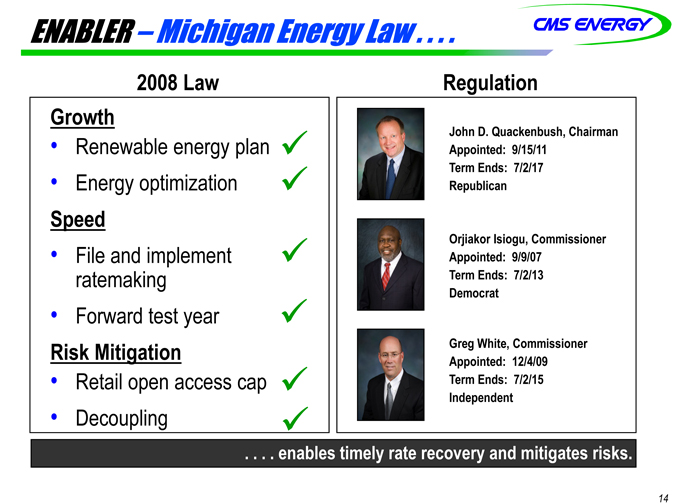

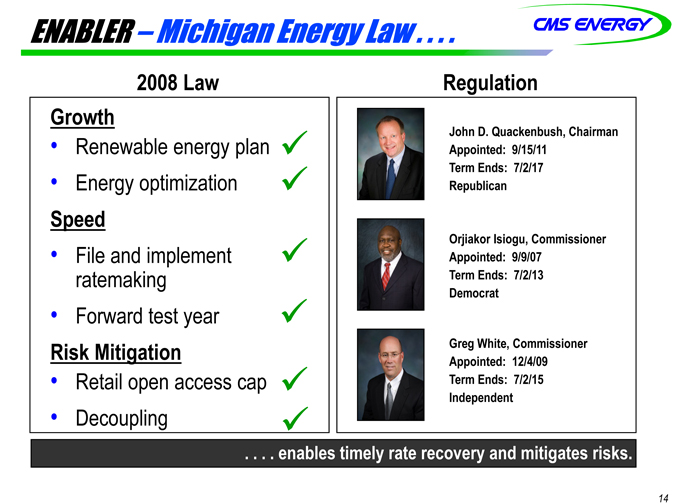

ENABLER – Michigan Energy Law . . . .

2008 Law

Growth

• Renewable energy plan

• Energy optimization

Speed

• File and implement ratemaking

• Forward test year

Risk Mitigation

• Retail open access cap

• Decoupling

Regulation

John D. Quackenbush, Chairman Appointed: 9/15/11 Term Ends: 7/2/17 Republican

Orjiakor Isiogu, Commissioner Appointed: 9/9/07 Term Ends: 7/2/13 Democrat

Greg White, Commissioner Appointed: 12/4/09 Term Ends: 7/2/15 Independent

. . . . enables timely rate recovery and mitigates risks.

14

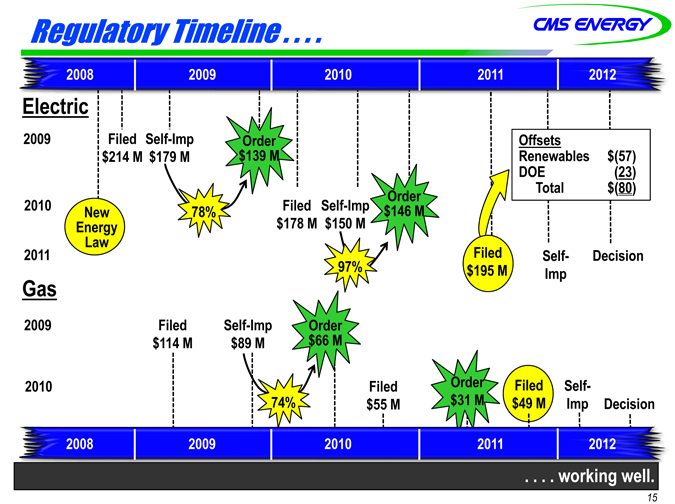

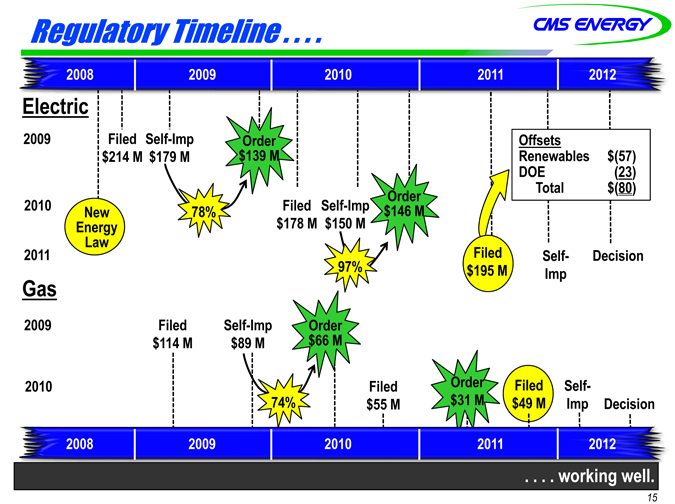

Regulatory Timeline . . . .

2008 2009 2010 2011 2012

Electric

2009

Filed Self-Imp $214 M $179 M

Order $139 M

2010

2011

New Energy Law

78%

Filed Self-Imp $178 M $150 M

Order $146 M

Offsets

Renewables $(57) DOE (23) Total $(80)

97%%

Filed Self- Decision $195 M Imp

Gas

2009

2010

Filed Self-Imp $114 M $89 M

Order

$66 M

74%

Filed

$55 M

Order

$31 M

Filed

$49 M

Self-

Imp Decision

2008 2009 2010 2011 2012

. . . . working well.

15

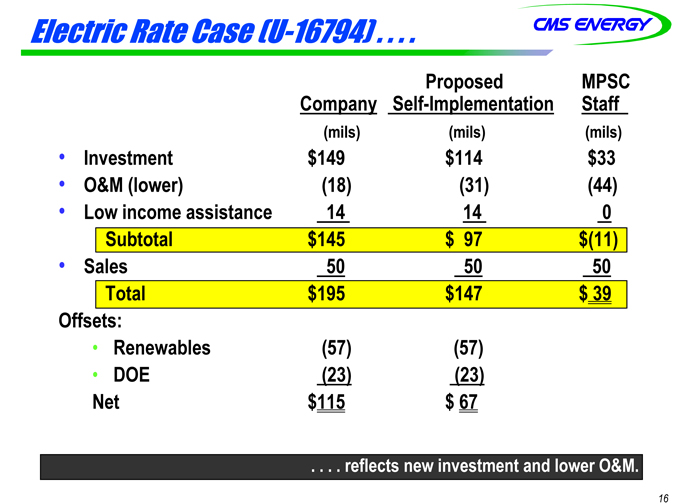

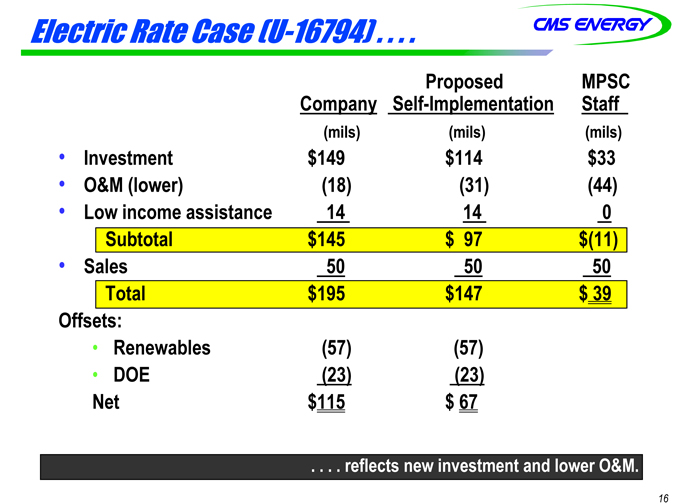

Electric Rate Case (U-16794) . . . .

Proposed MPSC

Company Self-Implementation Staff

(mils) (mils) (mils)

Investment $149 $114 $33

O&M (lower) (18) (31) (44)

Low income assistance 14 14 0

Subtotal $145 $ 97 $(11)

Sales 50 50 50

Total $195 $147 $ 39

Offsets:

• Renewables (57) (57)

• DOE (23) (23) Net $115 $ 67

. . . . reflects new investment and lower O&M.

16

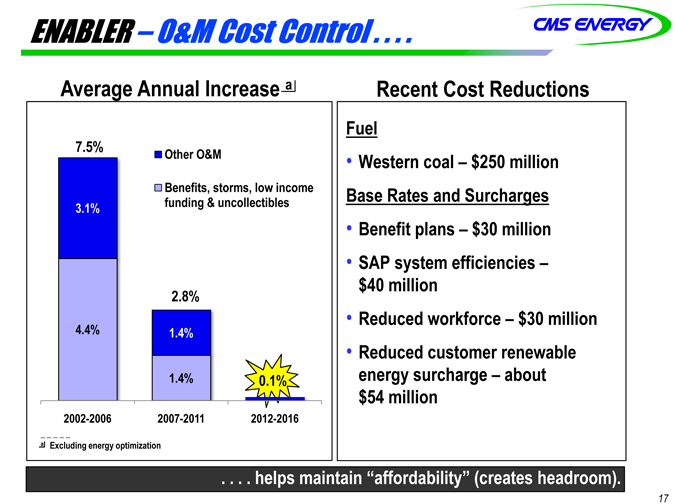

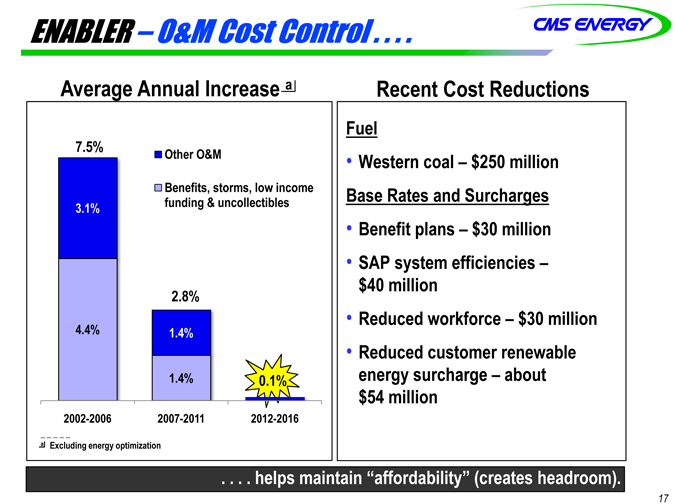

ENABLER – O&M Cost Control . . . .

Average Annual Increase a

Recent Cost Reductions

7.5%

3.1%

4.4%

Other O&M

Benefits, storms, low income funding & uncollectibles

2.8%

1.4%

1.4%

0.1%

2002-2006 2007-2011 2012-2016

a Excluding energy optimization

Fuel

• Western coal – $250 million Base Rates and Surcharges

• Benefit plans – $30 million

• SAP system efficiencies –$40 million

• Reduced workforce – $30 million

• Reduced customer renewable energy surcharge – about $54 million

. . . . helps maintain “affordability” (creates headroom).

17

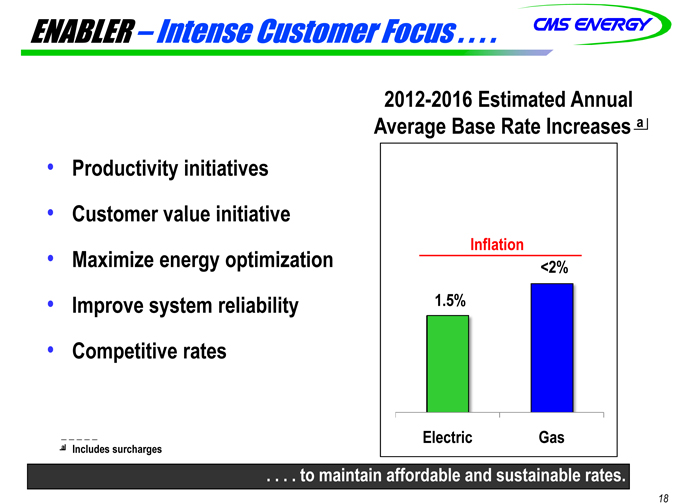

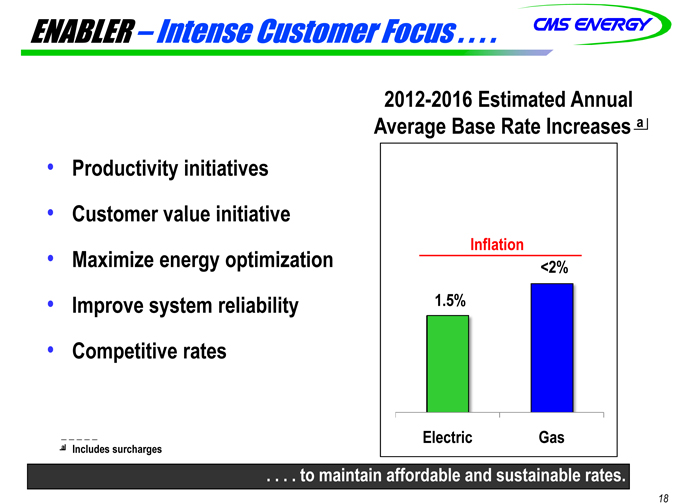

ENABLER – Intense Customer Focus . . . .

Productivity initiatives Customer value initiative Maximize energynergy optimization Improve system reliability Competitive rates

2012-2016 Estimated Annual

Average Base Rate Increases a

Inflation

1.5%

<2%

Electric Gas

a Includes surcharges

. . . . to maintain affordable and sustainable rates.

18

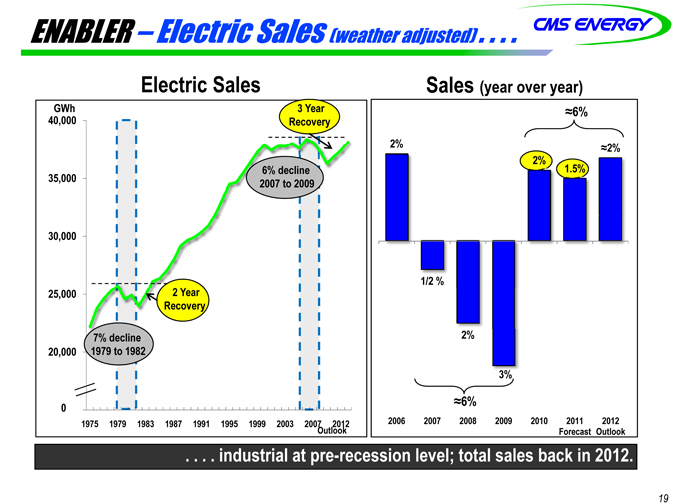

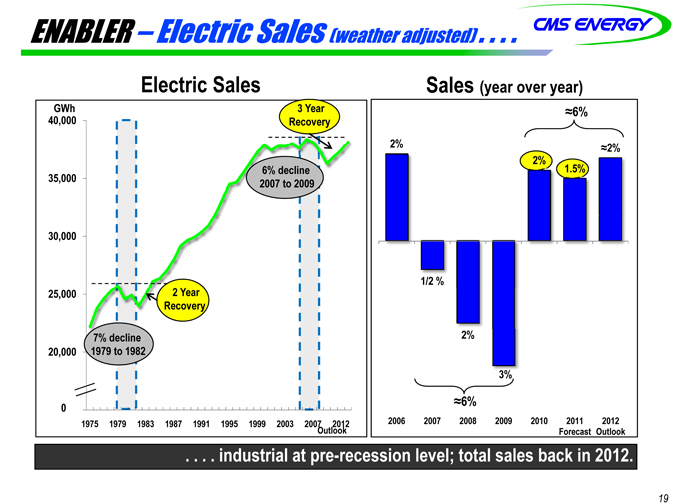

ENABLER – Electric Sales (weather adjusted) . . . .

Electric Sales

Sales (year over year)

GWh 40,000

35,000 30,000 25,000 20,000 15,000 0

7% decline 1979 to 1982

2 Year Recovery

3 Year Recovery

6% decline 2007 to 2009

1975 1979 1983 1987 1991 1995 1999 2003 2007 2012

Outlook

6%

2%

2%

1.5%

2%

1/2 %

2%

3%

6%

2006 2007 2008 2009 2010 2011 2012

Forecast Outlook

. . . . iindustrialndustrial at pre-recession level; total sales back in 2012.

19

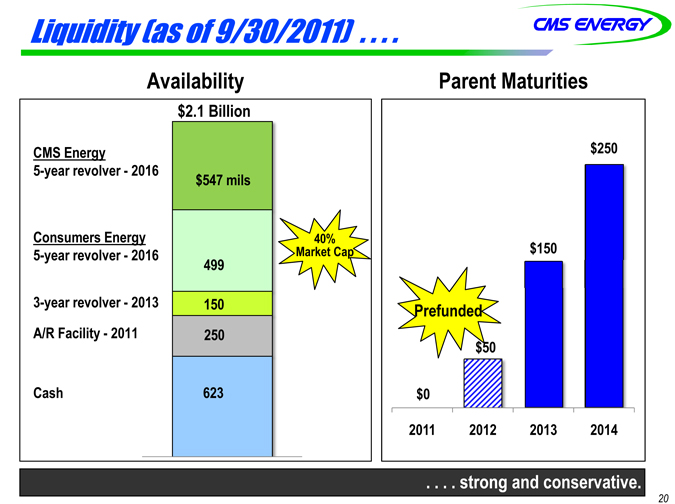

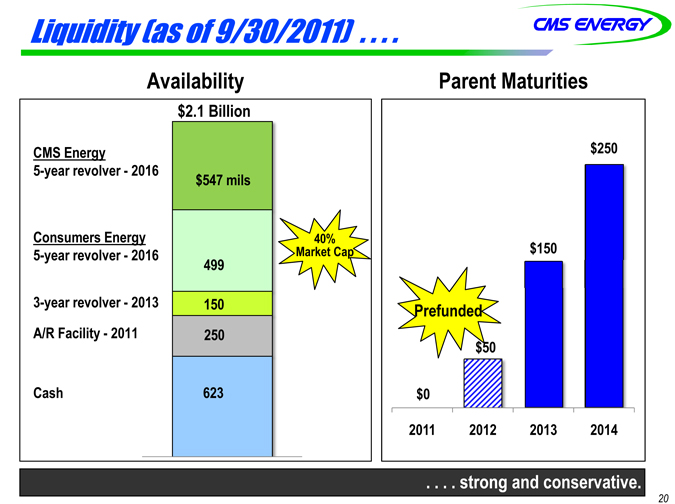

Liquidity (as of 9/30/2011) . . . .

Availability

Parent Maturities

CMS Energy

5-year revolver—2016

Consumers Energy 5-year revolver—2016

3-year revolver—2013 A/R Facility—2011

Cash

$2.1 Billion

$547 mils

499

150 250

623

40% Market Cap

Prefunded

$150

$250

$0

$50

2011 2012 2013 2014

. . . . strong and conservative.

20

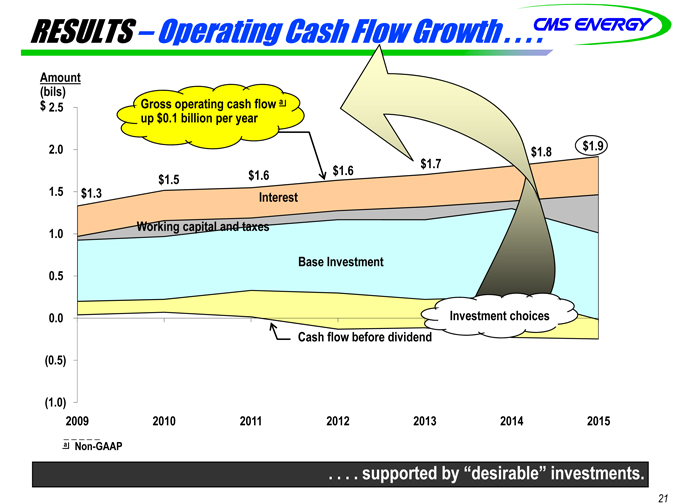

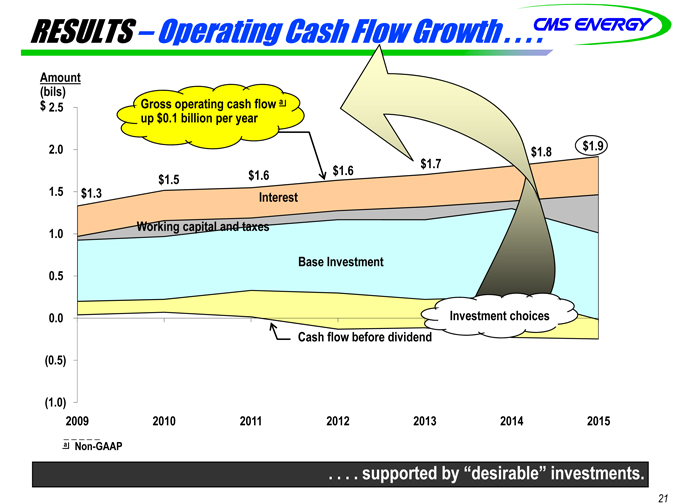

RESULTS – Operating Cash Flow Growth . . . .

Amount (bils) $ 2.5

2.0 1.5 1.0 0.5 0.0

(0.5)

(1.0)

Gross operating cash flow a up $0.1 billion per year

$1.8 $1.9 $1.7 $1.6 $1.6 $1.5 $1.3 Interest

Working capital and taxes

Base Investment

Investment choices

Cash flow before dividend

2009 2010 2011 2012 2013 2014 2015

a Non-GAAP

. . . . supported by “desirable” investments.

21

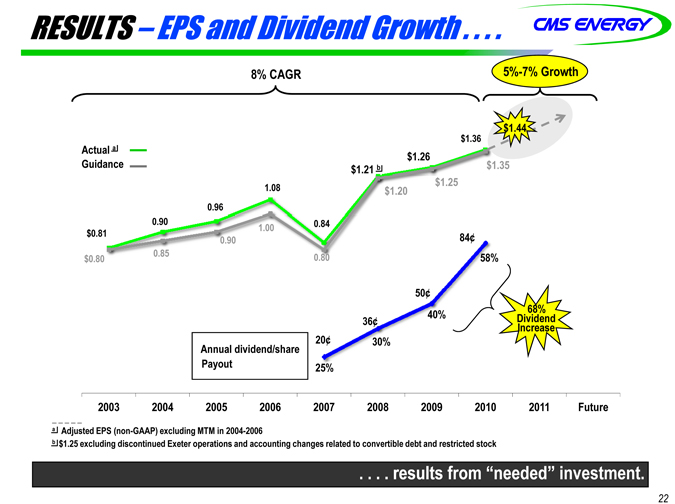

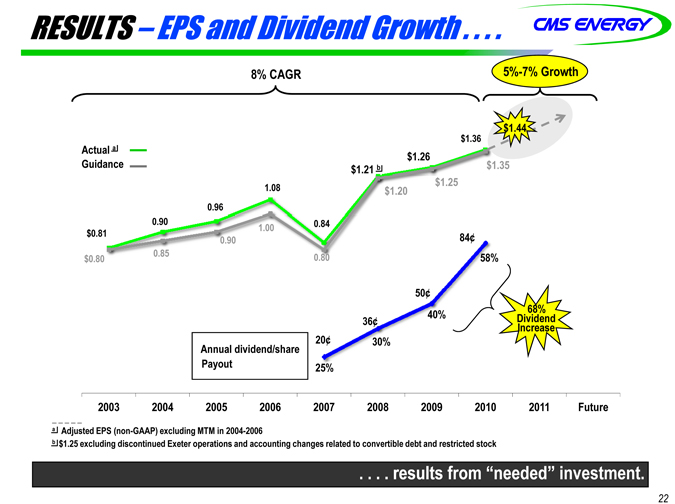

RESULTS – EPS and Dividend Growth . . . .

8% CAGR

5%-7% Growth

Actual a Guidance

1.08 0.96

0.90 0.84 1.00 $0.81 0.90 0.85 0.80 $0.80

$1.44 $1.36 $1.26 $1.21 b $1.35 $1.25 $1.20

Annual dividend/share Payout

84¢ 58%

50¢ 40%

36¢ 20¢ 30%

25%

68% Dividend Increase

2003 2004 2005 2006 2007 2008 2009 2010 2011 Future

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006 b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

. . . . results from “needed” investment.

22

Investment Consideration . . . .

Dividend yield (4%) and EPS growth (5% to 7%) provide attractive total return

“Needed” Utility investment with transparent, long-term earnings growth Constructive regulatory environment and good energy law support Utility investment in Michigan

. . . . predictable,redictable, affordable, and sustainable.

23

Appendix

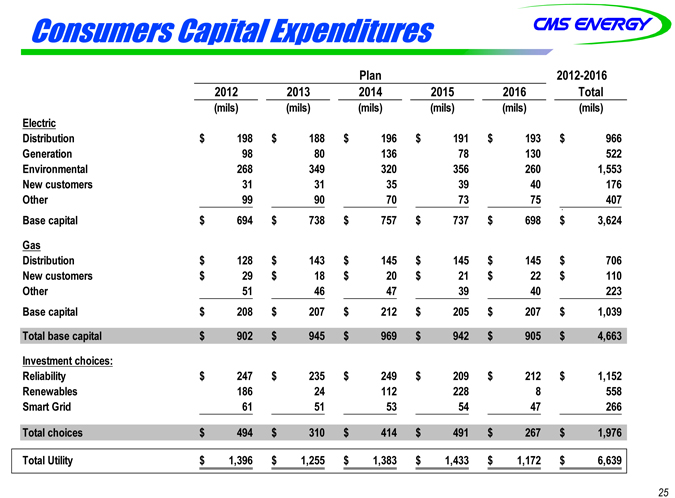

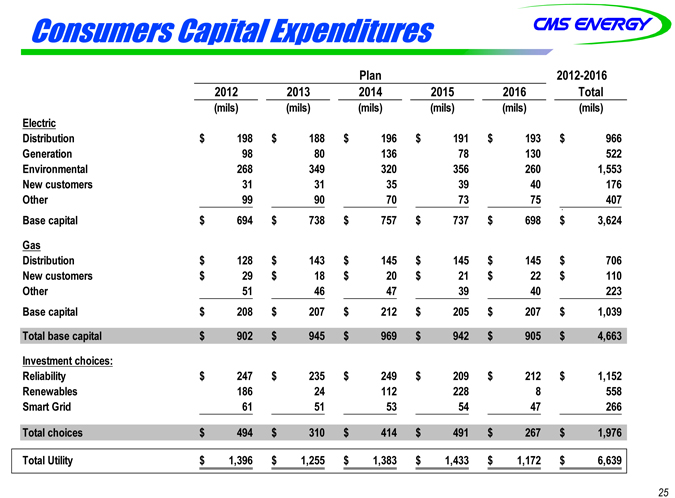

Consumers Capital Expenditures

Plan 2012-2016

2012 2013 2014 2015 2016 Total

(mils) (mils) (mils) (mils) (mils) (mils)

Electric

Distribution $ 198 $ 188 $ 196 $ 191 $ 193 $ 966

Generation 98 80 136 78 130 522

Environmental 268 349 320 356 260 1,553

New customers 31 31 35 39 40 176

Other 99 90 70 73 75 $ 407

Base capital $ 694 $ 738 $ 757 $ 737 $ 698 $ 3,624

Gas

Distribution $ 128 $ 143 $ 145 $ 145 $ 145 $ 706

New customers $ 29 $ 18 $ 20 $ 21 $ 22 $ 110

Other 51 46 47 39 40 223

Base capital $ 208 $ 207 $ 212 $ 205 $ 207 $ 1,039

Total base capital $ 902 $ 945 $ 969 $ 942 $ 905 $ 4,663

Investment choices:

Reliability $ 247 $ 235 $ 249 $ 209 $ 212 $ 1,152

Renewables 186 24 112 228 8 558

Smart Grid 61 51 53 54 47 266

Total choices $ 494 $ 310 $ 414 $ 491 $ 267 $ 1,976

Total Utility $ 1,396 $ 1,255 $ 1,383 $ 1,433 $ 1,172 $ 6,639

25

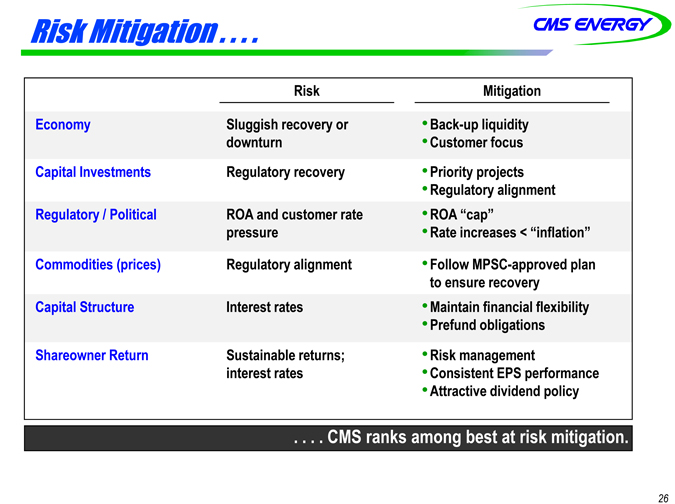

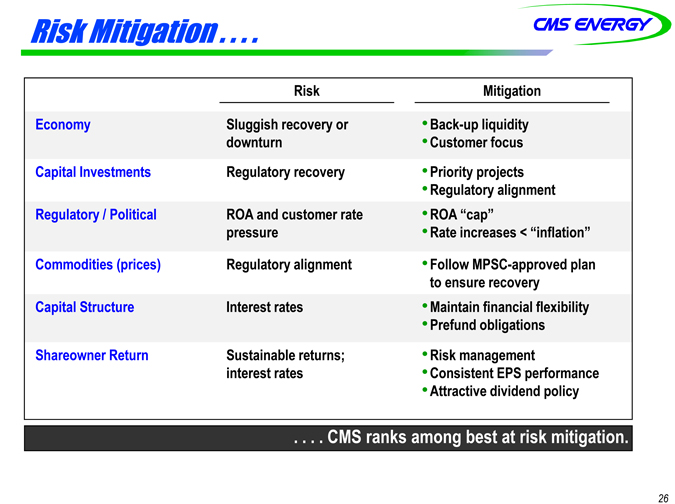

Risk Mitigation . . . .

Risk Mitigation

Economy Sluggish recovery or • Back-up liquidity

downturn • Customer focus

Capital Investments Regulatory recovery • Priority projects

• Regulatory alignment

Regulatory / Political ROA and customer rate • ROA “cap”

pressure • Rate increases < “inflation”

Commodities (prices) Regulatory alignment • Follow MPSC-approved plan

to ensure recovery

Capital Structure Interest rates • Maintain financial flexibility

• Prefund obligations

Shareowner Return Sustainable returns; • Risk management

interest rates • Consistent EPS performance

• Attractive dividend policy

. . . . CMS ranks among best at risk mitigation.

26

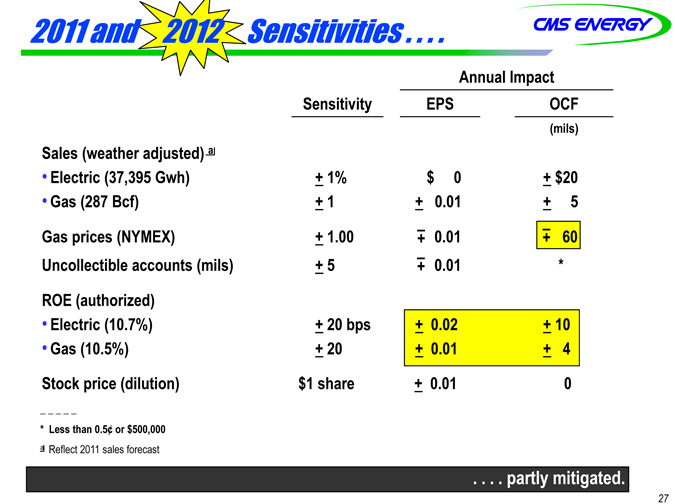

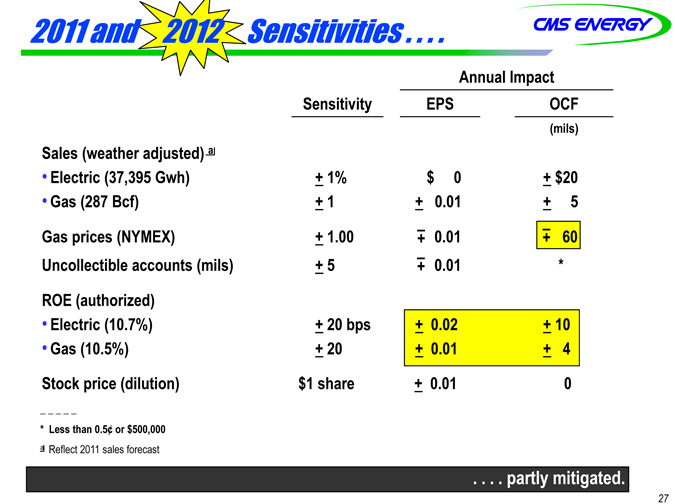

2011 and 2012 Sensitivities . . . .

Annual Impact

Sensitivity EPS OCF

(mils)

Sales (weather adjusted) a

• Electric (37,395 Gwh) + 1% $ 0 + $20

• Gas (287 Bcf) + 1 + 0.01 + 5

– –

Gas prices (NYMEX) + 1.00 + 0.01 + 60

–

Uncollectible accounts (mils) + 5 + 0.01*

ROE (authorized)

• Electric (10.7%) + 20 bps + 0.02 + 10

• Gas (10.5%) + 20 + 0.01 + 4

_ Stock price (dilution) $1 share + 0.01 0

* Less than 0.5¢ or $500,000 a Reflect 2011 sales forecast

. . . . partly mitigated.

27

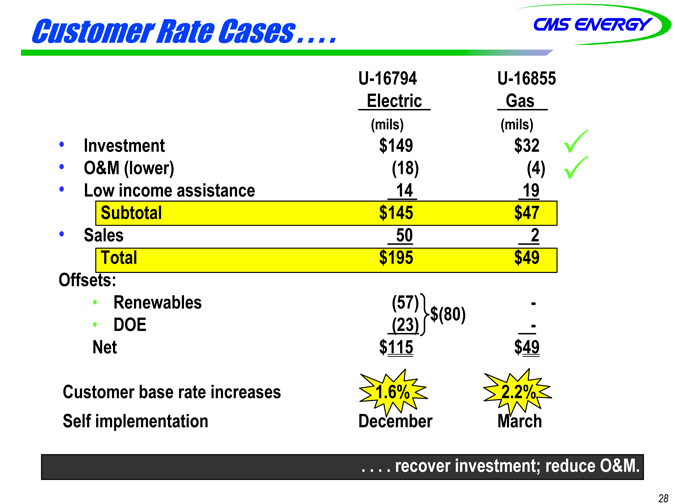

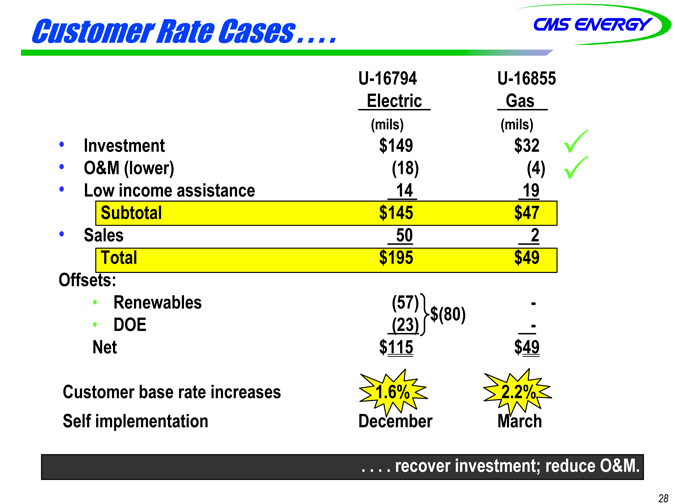

Customer Rate Cases . . . .

U-16794 U-16855

Electric Gas

(mils)(mils)

• Investment $149 $32

• O&M (lower)(18)(4)

• Low income assistance 14 19

Subtotal $145 $47

• Sales 50 2

Total $195 $49

Offsets:

• Renewables(57) -

$(80)

• DOE(23) -

Net $115 $49

Customer base rate increases 1.6% 2.2%

Self implementation December March

. . . . recove investment; reduce O&M.

28

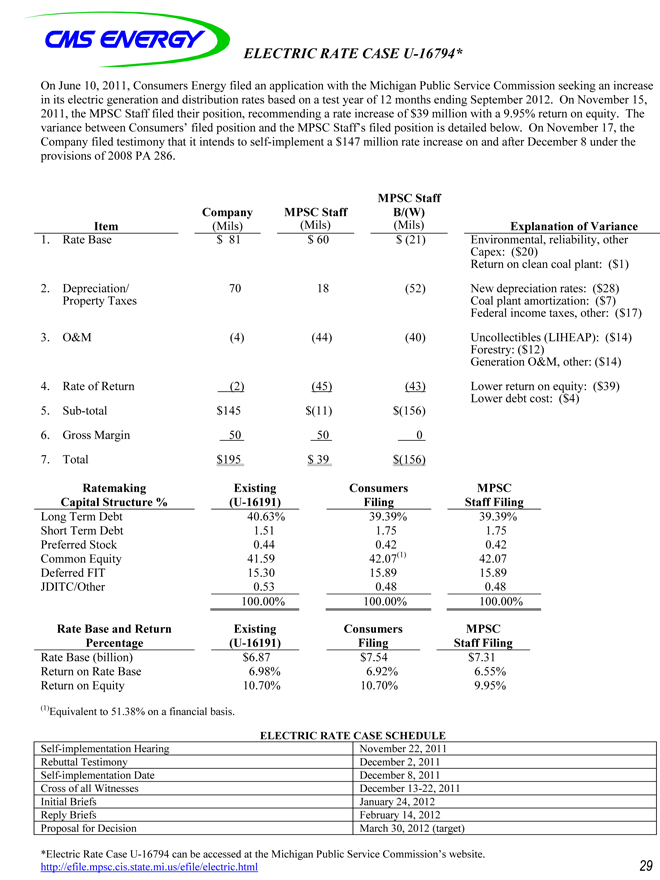

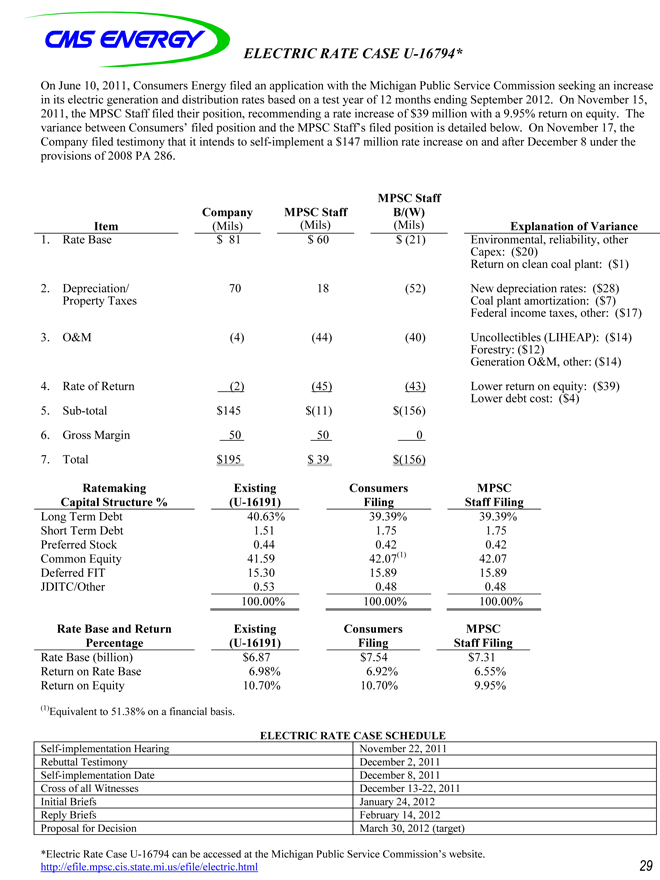

ELECTRIC RATE CASE U-16794*

On June 10, 2011, Consumers Energy filed an application with the Michigan Public Service Commission seeking an increase in its electric generation and distribution rates based on a test year of 12 months ending September 2012. On November 15, 2011, the MPSC Staff filed their position, recommending a rate increase of $39 million with a 9.95% return on equity. The variance between Consumers’ filed position and the MPSC Staff’s filed position is detailed below. On November 17, the Company filed testimony that it intends to self-implement a $147 million rate increase on and after December 8 under the provisions of 2008 PA 286.

MPSC Staff

Company MPSC Staff B/(W)

Item(Mils)(Mils)(Mils) Explanation of Variance

1. Rate Base $ 81 $ 60 $ (21) Environmental, reliability, other

Capex: ($20)

Return on clean coal plant: ($1)

2. Depreciation/ 70 18(52) New depreciation rates: ($28)

Property Taxes Coal plant amortization: ($7)

Federal income taxes, other: ($17)

3. O&M(4)(44)(40) Uncollectibles (LIHEAP): ($14)

Forestry: ($12)

Generation O&M, other: ($14)

4. Rate of Return(2)(45)(43) Lower return on equity: ($39)

Lower debt cost: ($4)

5. Sub-total $145 $(11) $(156)

6. Gross Margin 50 50 0

7. Total $195 $ 39 $(156)

Ratemaking Existing Consumers MPSC

Capital Structure %(U-16191) Filing Staff Filing

Long Term Debt 40.63% 39.39% 39.39%

Short Term Debt 1.51 1.75 1.75

Preferred Stock 0.44 0.42 0.42

Common Equity 41.59 42.07(1) 42.07

Deferred FIT 15.30 15.89 15.89

JDITC/Other 0.53 0.48 0.48

100.00% 100.00% 100.00%

Rate Base and Return Existing Consumers MPSC

Percentage(U-16191) Filing Staff Filing

Rate Base (billion) $6.87 $7.54 $7.31

Return on Rate Base 6.98% 6.92% 6.55%

Return on Equity 10.70% 10.70% 9.95%

(1)Equivalent to 51.38% on a financial basis.

ELECTRIC RATE CASE SCHEDULE

Self-implementation Hearing November 22, 2011

Rebuttal Testimony December 2, 2011

Self-implementation Date December 8, 2011

Cross of all Witnesses December 13-22, 2011

Initial Briefs January 24, 2012

Reply Briefs February 14, 2012

Proposal for Decision March 30, 2012 (target)

*Electric Rate Case U-16794 can be accessed at the Michigan Public Service Commission’s website. http://efile.mpsc.cis.state.mi.us/efile/electric.html

29

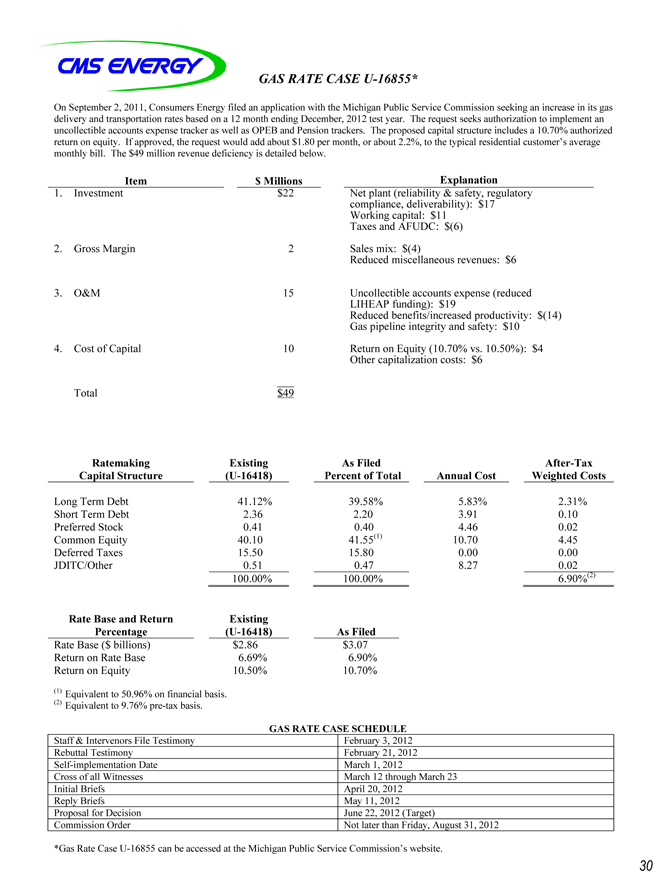

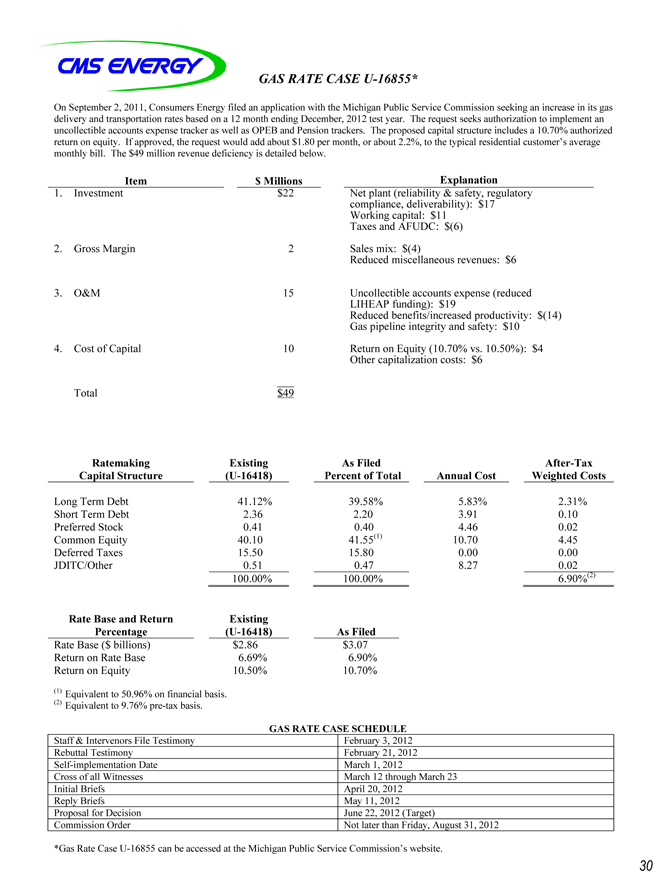

GAS RATE CASE U-16855*

On September 2, 2011, Consumers Energy filed an application with the Michigan Public Service Commission seeking an increase in its gas delivery and transportation rates based on a 12 month ending December, 2012 test year. The request seeks authorization to implement an uncollectible accounts expense tracker as well as OPEB and Pension trackers. The proposed capital structure includes a 10.70% authorized return on equity. If approved, the request would add about $1.80 per month, or about 2.2%, to the typical residential customer’s average monthly bill. The $49 million revenue deficiency is detailed below.

Item $ Millions Explanation

1. Investment $22 Net plant (reliability & safety, regulatory

compliance, deliverability): $17

Working capital: $11

Taxes and AFUDC: $(6)

2. Gross Margin 2 Sales mix: $(4)

Reduced miscellaneous revenues: $6

3. O&M 15 Uncollectible accounts expense (reduced

LIHEAP funding): $19

Reduced benefits/increased productivity: $(14)

Gas pipeline integrity and safety: $10

4. Cost of Capital 10 Return on Equity (10.70% vs. 10.50%): $4

Other capitalization costs: $6

Total $49

Ratemaking Existing As Filed After-Tax

Capital Structure(U-16418) Percent of Total Annual Cost Weighted Costs

Long Term Debt 41.12% 39.58% 5.83% 2.31%

Short Term Debt 2.36 2.20 3.91 0.10

Preferred Stock 0.41 0.40 4.46 0.02

Common Equity 40.10 41.55(1) 10.70 4.45

Deferred Taxes 15.50 15.80 0.00 0.00

JDITC/Other 0.51 0.47 8.27 0.02

100.00% 100.00% 6.90%(2)

Rate Base and Return Existing

Percentage(U-16418) As Filed

Rate Base ($ billions) $2.86 $3.07

Return on Rate Base 6.69% 6.90%

Return on Equity 10.50% 10.70%

(1) Equivalent to 50.96% on financial basis.

(2) Equivalent to 9.76% pre-tax basis.

GAS RATE CASE SCHEDULE

Staff & Intervenors File Testimony February 3, 2012

Rebuttal Testimony February 21, 2012

Self-implementation Date March 1, 2012

Cross of all Witnesses March 12 through March 23

Initial Briefs April 20, 2012

Reply Briefs May 11, 2012

Proposal for Decision June 22, 2012 (Target)

Commission Order Not later than Friday, August 31, 2012

*Gas Rate Case U-16855 can be accessed at the Michigan Public Service Commission’s website.

30

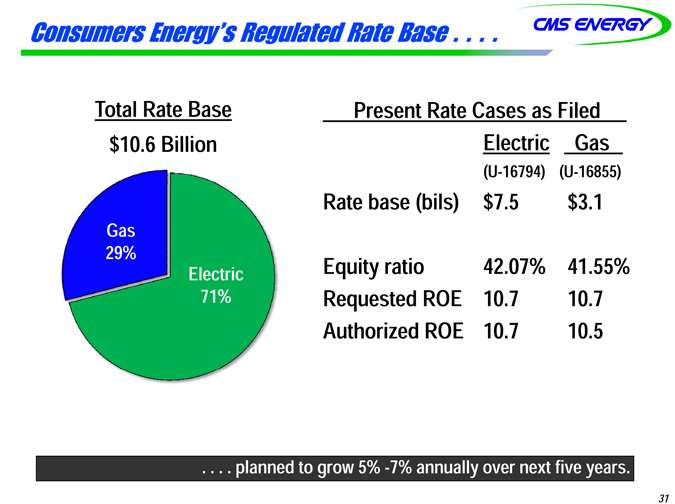

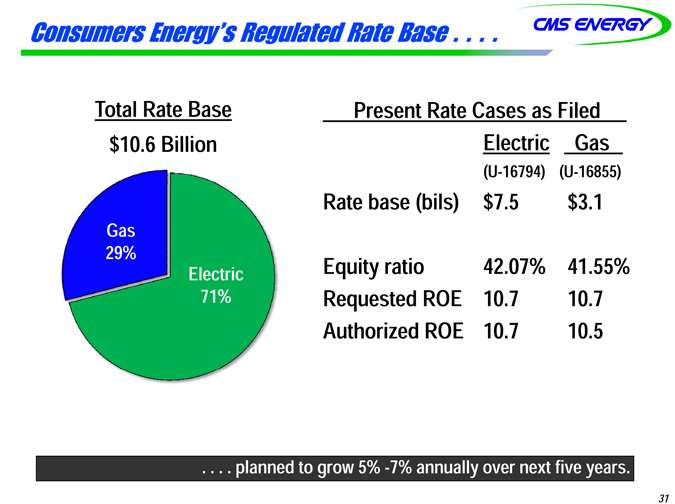

Consumers Energy’s Regulated Rate Base . . . .

Total Rate Base

$10.6 Billion

Gas 29%

Electric 71%

Present Rate Cases as Filed

Electric Gas

(U-16794)(U-16855)

Rate base (bilsbils)) $7.5 $3.1

Equity ratio 42.07% 41.55%

Requested ROE 10.7 10.7

Authorized ROE 10.7 10.5

. . . . planned to grow 5% -7% annually over next five years.

31

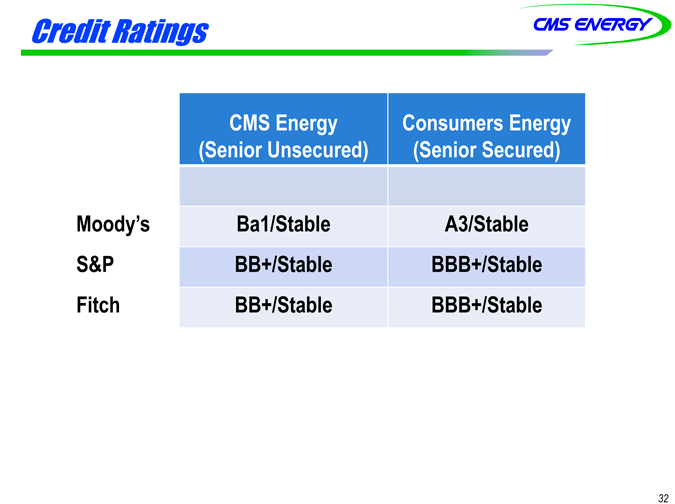

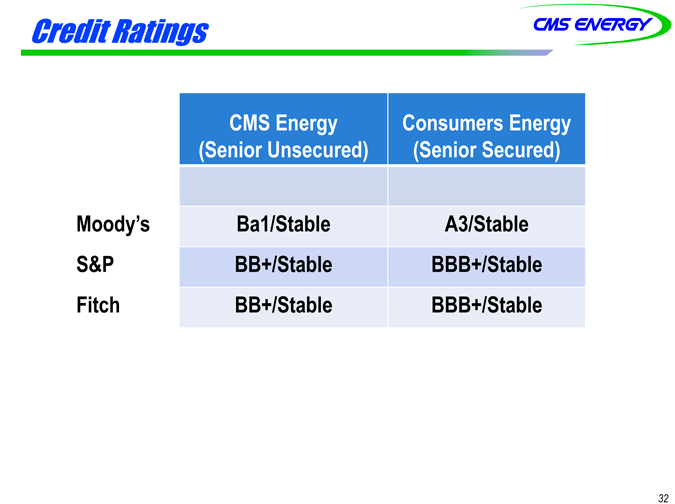

Credit Ratings

CMS Energy Consumers Energy

(Senior Unsecured)(Senior Secured)

Moody’s Ba1/Stable A3/Stable

S&P BB+/Stable BBB+/Stable

Fitch BB+/Stable BBB+/Stable

32

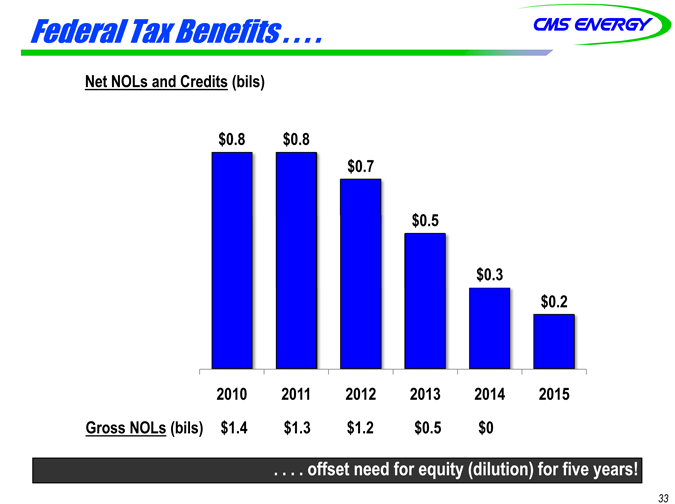

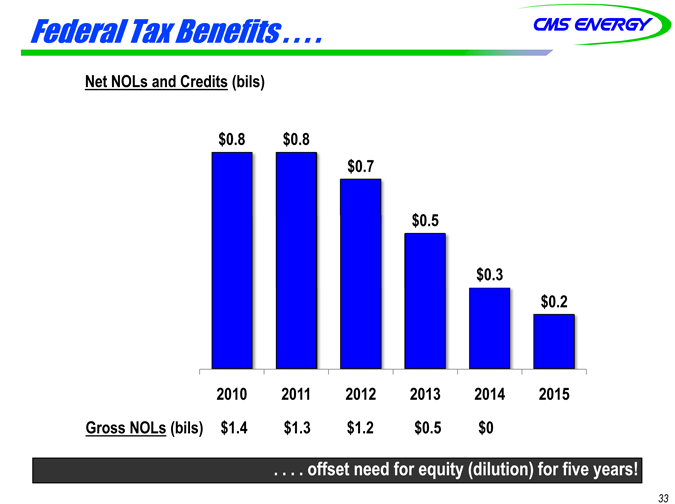

Federal Tax Benefits . . . .

Net NOLs and Credits (bils)

$0.8 $0.8 $0.7

$0.5

$0.3 $0.2

2010 2011 2012 2013 2014 2015

Gross NOLs (bils) $1.4 $1.3 $1.2 $0.5 $0

. . . . offset need for equity (dilution) for five years!

33

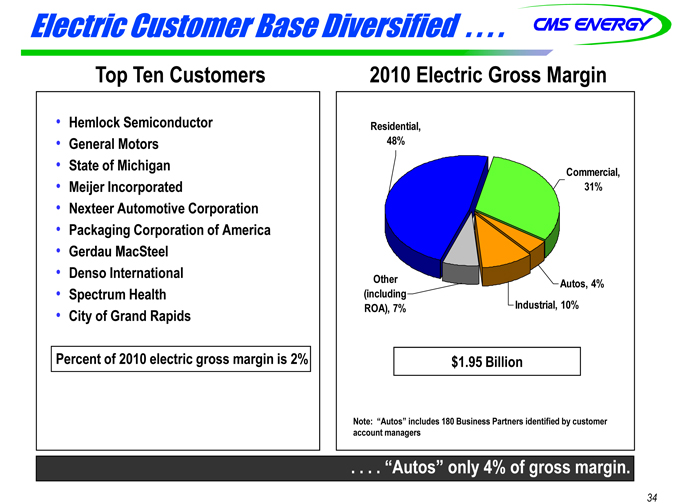

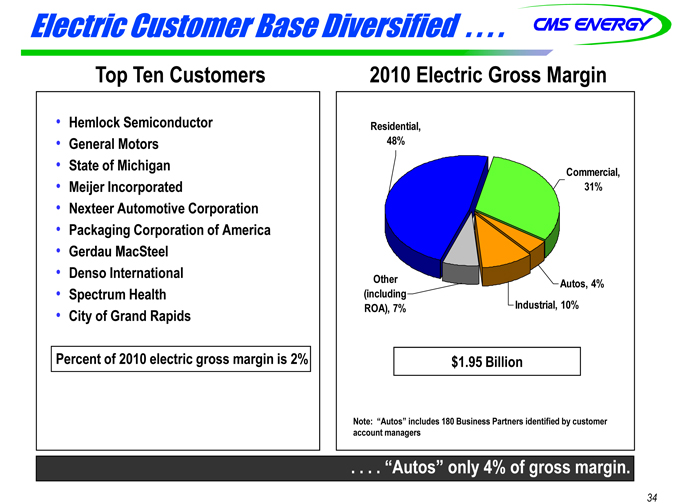

Electric Customer Base Diversified . . . .

Top Ten Customers

2010 Electric Gross Margin

Hemlock Semiconductor General Motors State of Michigan Meijer Incorporated Nexteer Automotive Corporation Packaging Corporation of America Gerdau MacSteel Denso International Spectrum Health City of Grand Rapids

Percent of 2010 electric gross margin is 2%

Residential, 48%

Commercial, 31%

Other (including ROA), 7%

Autos, 4%

Industrial, 10%

$1.95 Billion

Note: “Autos” includes 180 Business Partners identified by customer account managers

. . . . “Autos” only 4% of gross margin.

34

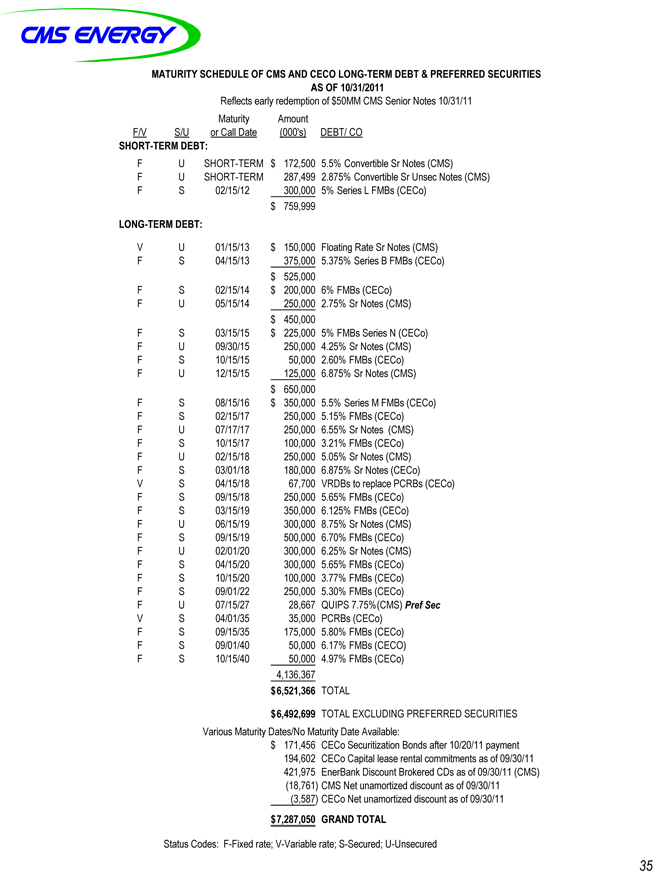

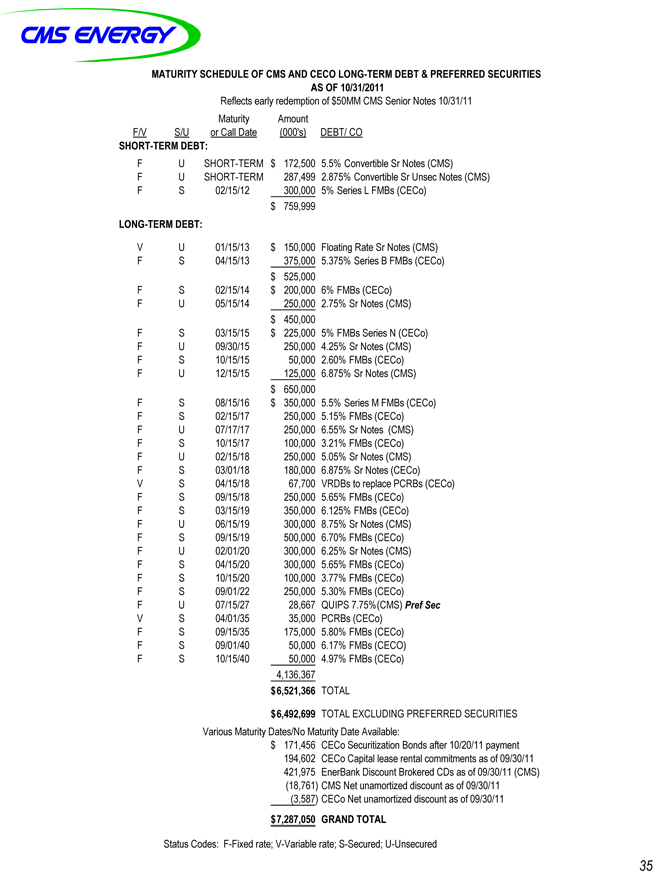

MATURITY SCHEDULE OF CMS AND CECO LONG-TERM DEBT & PREFERRED SECURITIES AS OF 10/31/2011

Reflects early redemption of $50MM CMS Senior Notes 10/31/11

Maturity Amount

F/V S/U or Call Date (000’s) DEBT/ CO

SHORT-TERM DEBT:

F U SHORT-TERM $ 172,500 5.5% Convertible Sr Notes (CMS)

F U SHORT-TERM 287,499 2.875% Convertible Sr Unsec Notes (CMS)

F S 02/15/12 300,000 5% Series L FMBs (CECo)

$ 759,999

LONG-TERM DEBT:

V U 01/15/13 $ 150,000 Floating Rate Sr Notes (CMS)

F S 04/15/13 375,000 5.375% Series B FMBs (CECo)

$ 525,000

F S 02/15/14 $ 200,000 6% FMBs (CECo)

F U 05/15/14 250,000 2.75% Sr Notes (CMS)

$ 450,000

F S 03/15/15 $ 225,000 5% FMBs Series N (CECo)

F U 09/30/15 250,000 4.25% Sr Notes (CMS)

F S 10/15/15 50,000 2.60% FMBs (CECo)

F U 12/15/15 125,000 6.875% Sr Notes (CMS)

$ 650,000

F S 08/15/16 $ 350,000 5.5% Series M FMBs (CECo)

F S 02/15/17 250,000 5.15% FMBs (CECo)

F U 07/17/17 250,000 6.55% Sr Notes (CMS)

F S 10/15/17 100,000 3.21% FMBs (CECo)

F U 02/15/18 250,000 5.05% Sr Notes (CMS)

F S 03/01/18 180,000 6.875% Sr Notes (CECo)

V S 04/15/18 67,700 VRDBs to replace PCRBs (CECo)

F S 09/15/18 250,000 5.65% FMBs (CECo)

F S 03/15/19 350,000 6.125% FMBs (CECo)

F U 06/15/19 300,000 8.75% Sr Notes (CMS)

F S 09/15/19 500,000 6.70% FMBs (CECo)

F U 02/01/20 300,000 6.25% Sr Notes (CMS)

F S 04/15/20 300,000 5.65% FMBs (CECo)

F S 10/15/20 100,000 3.77% FMBs (CECo)

F S 09/01/22 250,000 5.30% FMBs (CECo)

F U 07/15/27 28,667 QUIPS 7.75%(CMS) Pref Sec

V S 04/01/35 35,000 PCRBs (CECo)

F S 09/15/35 175,000 5.80% FMBs (CECo)

F S 09/01/40 50,000 6.17% FMBs (CECO)

F S 10/15/40 50,000 4.97% FMBs (CECo)

4,136,367

$ 6,521,366 TOTAL

$ 6,492,699 TOTAL EXCLUDING PREFERRED SECURITIES

Various Maturity Dates/No Maturity Date Available:

$ 171,456 CECo Securitization Bonds after 10/20/11 payment

194,602 CECo Capital lease rental commitments as of 09/30/11

421,975 EnerBank Discount Brokered CDs as of 09/30/11 (CMS)

(18,761) CMS Net unamortized discount as of 09/30/11

(3,587) CECo Net unamortized discount as of 09/30/11

$ 7,287,050 GRAND TOTAL

Status Codes: F-Fixed rate; V-Variable rate; S-Secured; U-Unsecured

35

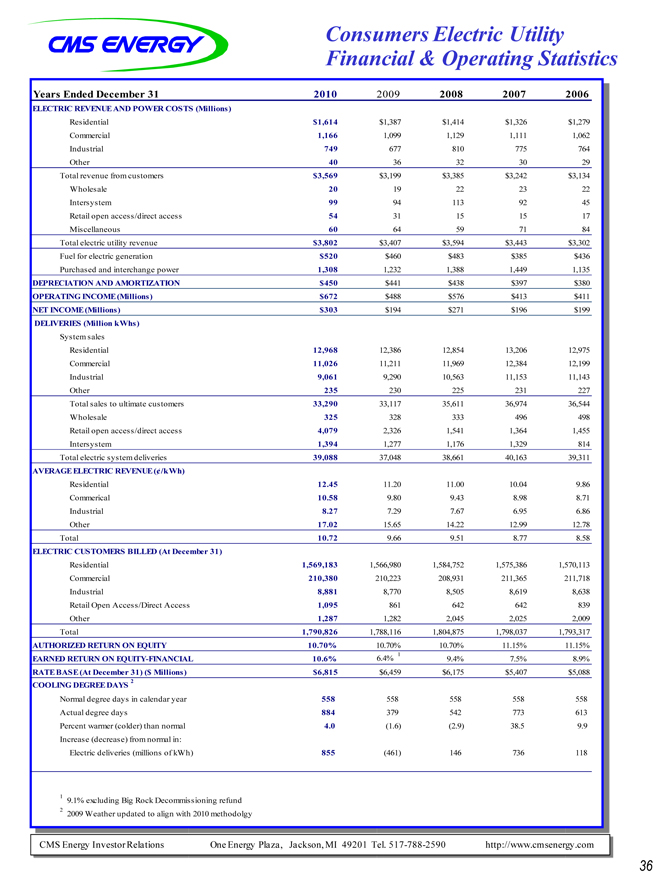

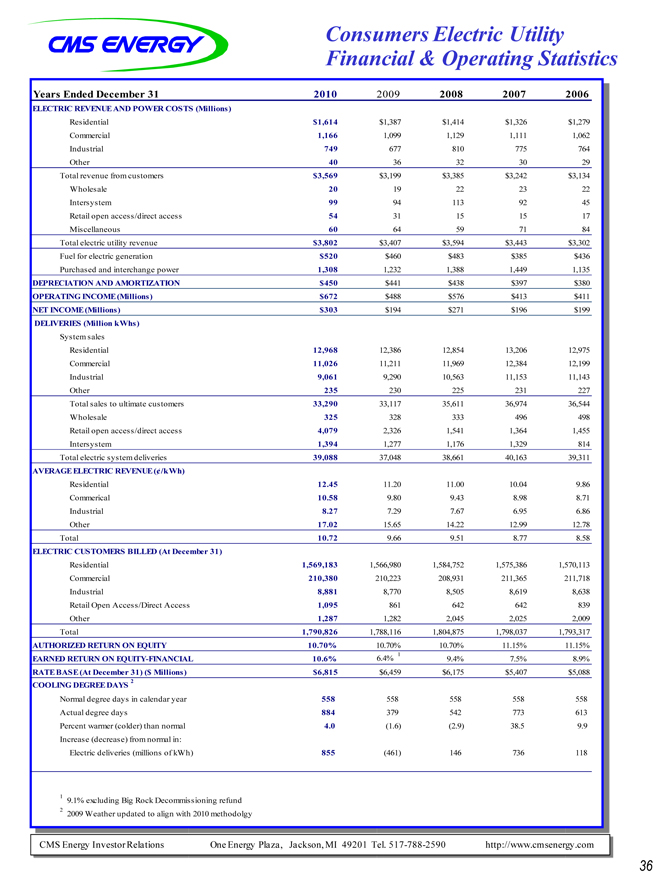

Consumers Electric Utility Financial & Operating Statistics

Years Ended December 31 2010 2009 2008 2007 2006

ELECTRIC REVENUE AND POWER COSTS (Millions)

Residential $1,614 $1,387 $1,414 $1,326 $1,279

Commercial 1,166 1,099 1,129 1,111 1,062

Industrial 749 677 810 775 764

Other 40 36 32 30 29

Total revenue from customers $3,569 $3,199 $3,385 $3,242 $3,134

Wholesale 20 19 22 23 22

Intersystem 99 94 113 92 45

Retail open access/direct access 54 31 15 15 17

Miscellaneous 60 64 59 71 84

Total electric utility revenue $3,802 $3,407 $3,594 $3,443 $3,302

Fuel for electric generation $520 $460 $483 $385 $436

Purchased and interchange power 1,308 1,232 1,388 1,449 1,135

DEPRECIATION AND AMORTIZATION $450 $441 $438 $397 $380

OPERATING INCOME (Millions) $672 $488 $576 $413 $411

NET INCOME (Millions) $303 $194 $271 $196 $199

DELIVERIES (Million kWhs)

System sales

Residential 12,968 12,386 12,854 13,206 12,975

Commercial 11,026 11,211 11,969 12,384 12,199

Industrial 9,061 9,290 10,563 11,153 11,143

Other 235 230 225 231 227

Total sales to ultimate customers 33,290 33,117 35,611 36,974 36,544

Wholesale 325 328 333 496 498

Retail open access/direct access 4,079 2,326 1,541 1,364 1,455

Intersystem 1,394 1,277 1,176 1,329 814

Total electric system deliveries 39,088 37,048 38,661 40,163 39,311

AVERAGE ELECTRIC REVENUE (¢/kWh)

Residential 12.45 11.20 11.00 10.04 9.86

Commerical 10.58 9.80 9.43 8.98 8.71

Industrial 8.27 7.29 7.67 6.95 6.86

Other 17.02 15.65 14.22 12.99 12.78

Total 10.72 9.66 9.51 8.77 8.58

ELECTRIC CUSTOMERS BILLED (At December 31)

Residential 1,569,183 1,566,980 1,584,752 1,575,386 1,570,113

Commercial 210,380 210,223 208,931 211,365 211,718

Industrial 8,881 8,770 8,505 8,619 8,638

Retail Open Access/Direct Access 1,095 861 642 642 839

Other 1,287 1,282 2,045 2,025 2,009

Total 1,790,826 1,788,116 1,804,875 1,798,037 1,793,317

AUTHORIZED RETURN ON EQUITY 10.70% 10.70% 10.70% 11.15% 11.15%

EARNED RETURN ON EQUITY-FINANCIAL 10.6% 6.4% 1 9.4% 7.5% 8.9%

RATE BASE (At December 31) ($ Millions) $6,815 $6,459 $6,175 $5,407 $5,088

COOLING DEGREE DAYS 2

Normal degree days in calendar year 558 558 558 558 558

Actual degree days 884 379 542 773 613

Percent warmer (colder) than normal 4.0 (1.6) (2.9) 38.5 9.9

Increase (decrease) from normal in:

Electric deliveries (millions of kWh) 855 (461) 146 736 118

1 9.1% excluding Big Rock Decommissioning refund

2 2009 Weather updated to align with 2010 methodolgy

36

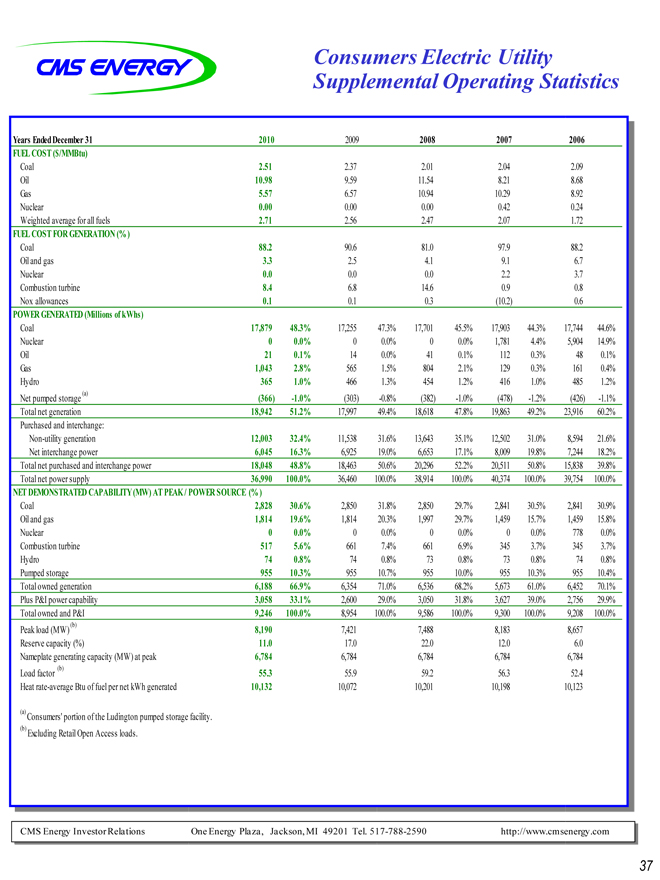

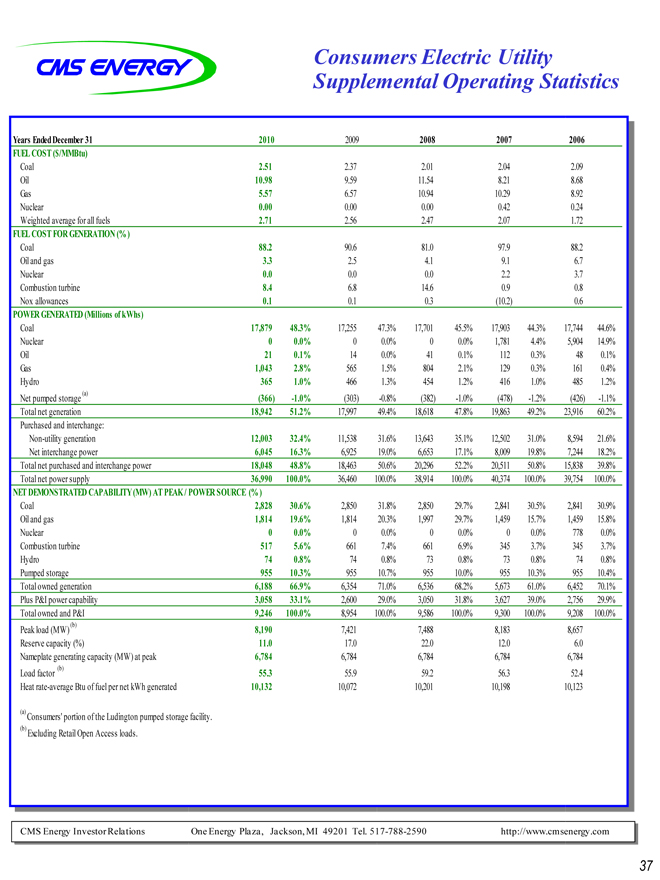

Consumers Electric Utility Supplemental Operating Statistics

Years Ended December 31 2010 2009 2008 2007 2006

FUEL COST ($/MMBtu)

Coal 2.51 2.37 2.01 2.04 2.09

Oil 10.98 9.59 11.54 8.21 8.68

Gas 5.57 6.57 10.94 10.29 8.92

Nuclear 0.00 0.00 0.00 0.42 0.24

Weighted average for all fuels 2.71 2.56 2.47 2.07 1.72

FUEL COST FOR GENERATION (%)

Coal 88.2 90.6 81.0 97.9 88.2

Oil and gas 3.3 2.5 4.1 9.1 6.7

Nuclear 0.0 0.0 0.0 2.2 3.7

Combustion turbine 8.4 6.8 14.6 0.9 0.8

Nox allowances 0.1 0.1 0.3 (10.2) 0.6

POWER GENERATED (Millions of kWhs)

Coal 17,879 48.3% 17,255 47.3% 17,701 45.5% 17,903 44.3% 17,744 44.6%

Nuclear 0 0.0% 0 0.0% 0 0.0% 1,781 4.4% 5,904 14.9%

Oil 21 0.1% 14 0.0% 41 0.1% 112 0.3% 48 0.1%

Gas 1,043 2.8% 565 1.5% 804 2.1% 129 0.3% 161 0.4%

Hydro 365 1.0% 466 1.3% 454 1.2% 416 1.0% 485 1.2%

Net pumped storage (a) (366) -1.0% (303) -0.8% (382) -1.0% (478) -1.2% (426) -1.1%

Total net generation 18,942 51.2% 17,997 49.4% 18,618 47.8% 19,863 49.2% 23,916 60.2%

Purchased and interchange:

Non-utility generation 12,003 32.4% 11,538 31.6% 13,643 35.1% 12,502 31.0% 8,594 21.6%

Net interchange power 6,045 16.3% 6,925 19.0% 6,653 17.1% 8,009 19.8% 7,244 18.2%

Total net purchased and interchange power 18,048 48.8% 18,463 50.6% 20,296 52.2% 20,511 50.8% 15,838 39.8%

Total net power supply 36,990 100.0% 36,460 100.0% 38,914 100.0% 40,374 100.0% 39,754 100.0%

NET DEMONSTRATED CAPABILITY (MW) AT PEAK / POWER SOURCE (%)

Coal 2,828 30.6% 2,850 31.8% 2,850 29.7% 2,841 30.5% 2,841 30.9%

Oil and gas 1,814 19.6% 1,814 20.3% 1,997 29.7% 1,459 15.7% 1,459 15.8%

Nuclear 0 0.0% 0 0.0% 0 0.0% 0 0.0% 778 0.0%

Combustion turbine 517 5.6% 661 7.4% 661 6.9% 345 3.7% 345 3.7%

Hydro 74 0.8% 74 0.8% 73 0.8% 73 0.8% 74 0.8%

Pumped storage 955 10.3% 955 10.7% 955 10.0% 955 10.3% 955 10.4%

Total owned generation 6,188 66.9% 6,354 71.0% 6,536 68.2% 5,673 61.0% 6,452 70.1%

Plus P&I power capability 3,058 33.1% 2,600 29.0% 3,050 31.8% 3,627 39.0% 2,756 29.9%

Total owned and P&I 9,246 100.0% 8,954 100.0% 9,586 100.0% 9,300 100.0% 9,208 100.0%

Peak load (MW) (b) 8,190 7,421 7,488 8,183 8,657

Reserve capacity (%) 11.0 17.0 22.0 12.0 6.0

Nameplate generating capacity (MW) at peak 6,784 6,784 6,784 6,784 6,784

Load factor (b) 55.3 55.9 59.2 56.3 52.4

Heat rate-average Btu of fuel per net kWh generated 10,132 10,072 10,201 10,198 10,123

(a) Consumers’ portion of the Ludington pumped storage facility.

(b) Excluding Retail Open Access loads.

37

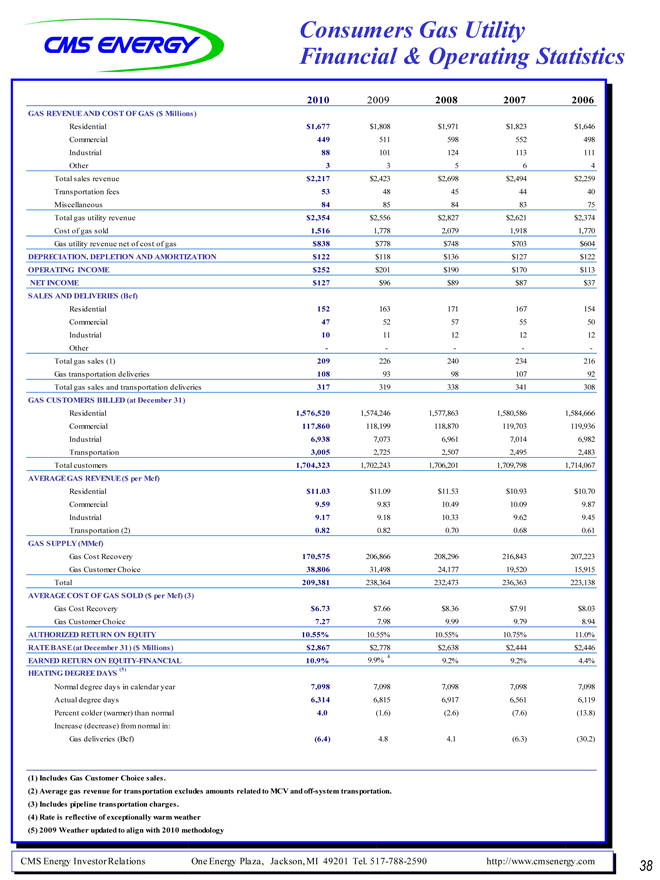

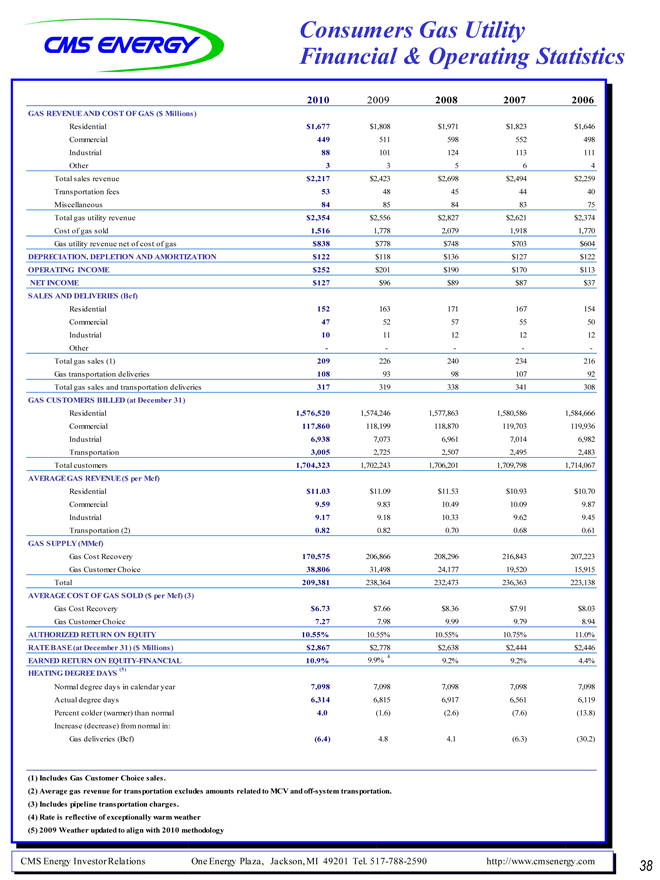

Consumers Gas Utility

Financial & Operating Statistics

2010 2009 2008 2007 2006

GAS REVENUE AND COST OF GAS ($ Millions)

Residential $1,677 $1,808 $1,971 $1,823 $1,646

Commercial 449 511 598 552 498

Industrial 88 101 124 113 111

Other 3 3 5 6 4

Total sales revenue $2,217 $2,423 $2,698 $2,494 $2,259

Transportation fees 53 48 45 44 40

Miscellaneous 84 85 84 83 75

Total gas utility revenue $2,354 $2,556 $2,827 $2,621 $2,374

Cost of gas sold 1,516 1,778 2,079 1,918 1,770

Gas utility revenue net of cost of gas $838 $778 $748 $703 $604

DEPRECIATION, DEPLETION AND AMORTIZATION $122 $118 $136 $127 $122

OPERATING INCOME $252 $201 $190 $170 $113

NET INCOME $127 $96 $89 $87 $37

SALES AND DELIVERIES (Bcf)

Residential 152 163 171 167 154

Commercial 47 52 57 55 50

Industrial 10 11 12 12 12

Other———-

Total gas sales (1) 209 226 240 234 216

Gas transportation deliveries 108 93 98 107 92

Total gas sales and transportation deliveries 317 319 338 341 308

GAS CUSTOMERS BILLED (at December 31)

Residential 1,576,520 1,574,246 1,577,863 1,580,586 1,584,666

Commercial 117,860 118,199 118,870 119,703 119,936

Industrial 6,938 7,073 6,961 7,014 6,982

Transportation 3,005 2,725 2,507 2,495 2,483

Total customers 1,704,323 1,702,243 1,706,201 1,709,798 1,714,067

AVERAGE GAS REVENUE ($ per Mcf)

Residential $11.03 $11.09 $11.53 $10.93 $10.70

Commercial 9.59 9.83 10.49 10.09 9.87

Industrial 9.17 9.18 10.33 9.62 9.45

Transportation (2) 0.82 0.82 0.70 0.68 0.61

GAS SUPPLY (MMcf)

Gas Cost Recovery 170,575 206,866 208,296 216,843 207,223

Gas Customer Choice 38,806 31,498 24,177 19,520 15,915

Total 209,381 238,364 232,473 236,363 223,138

AVERAGE COST OF GAS SOLD ($ per Mcf) (3)

Gas Cost Recovery $6.73 $7.66 $8.36 $7.91 $8.03

Gas Customer Choice 7.27 7.98 9.99 9.79 8.94

AUTHORIZED RETURN ON EQUITY 10.55% 10.55% 10.55% 10.75% 11.0%

RATE BASE (at December 31) ($ Millions) $2,867 $2,778 $2,638 $2,444 $2,446

EARNED RETURN ON EQUITY-FINANCIAL 10.9% 9.9% 4 9.2% 9.2% 4.4%

HEATING DEGREE DAYS (5)

Normal degree days in calendar year 7,098 7,098 7,098 7,098 7,098

Actual degree days 6,314 6,815 6,917 6,561 6,119

Percent colder (warmer) than normal 4.0 (1.6) (2.6) (7.6) (13.8)

Increase (decrease) from normal in:

Gas deliveries (Bcf) (6.4) 4.8 4.1 (6.3) (30.2)

(1) Includes Gas Customer Choice sales.

(2) Average gas revenue for transportation excludes amounts related to MCV and off-system transportation.

(3) Includes pipeline transportation charges.

(4) Rate is reflective of exceptionally warm weather

(5) 2009 Weather updated to align with 2010 methodology

38

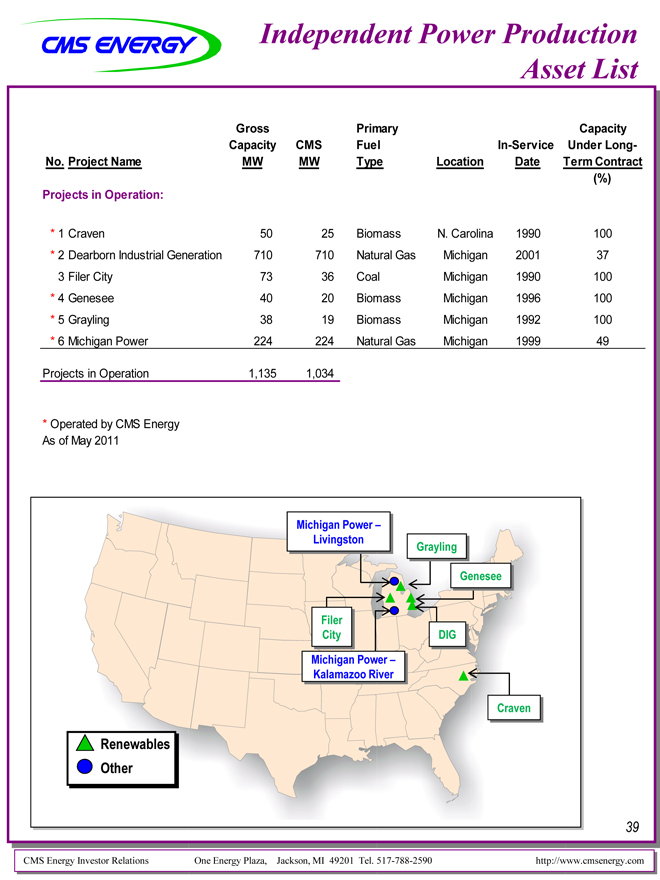

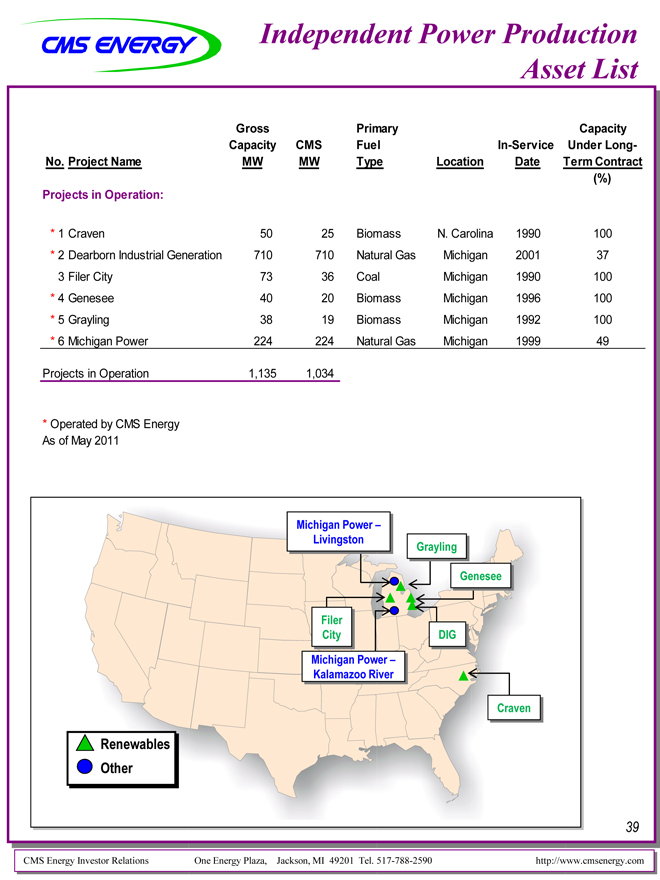

Independent Power Production

Asset List

Gross Primary Capacity

Capacity CMS Fuel In-Service Under Long-

No. Project Name MW MW Type Location Date Term Contract

(%)

Projects in Operation:

* 1 Craven 50 25 Biomass N. Carolina 1990 100

* 2 Dearborn Industrial Generation 710 710 Natural Gas Michigan 2001 37

3 Filer City 73 36 Coal Michigan 1990 100

* 4 Genesee 40 20 Biomass Michigan 1996 100

* 5 Grayling 38 19 Biomass Michigan 1992 100

* 6 Michigan Power 224 224 Natural Gas Michigan 1999 49

Projects in Operation 1,135 1,034

* Operated by CMS Energy As of May 2011

Michigan Power –Livingston

Grayling

Genesee

Filer City

DIG

Michigan Power –Kalamazoo River

Craven

Renewables Other

39

GAAP Reconciliation

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

Consumers Operating Income + Depreciation & Amortization | | $ | 1,248 | | | $ | 1,498 | | | $ | 1,530 | | | $ | 1,601 | | | $ | 1,657 | | | $ | 1,757 | | | $ | 1,872 | |

Enterprises Project Cash Flows | | | 16 | | | | 39 | | | | 25 | | | | 35 | | | | 47 | | | | 47 | | | | 46 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross Operating Cash Flow | | $ | 1,264 | | | $ | 1,537 | | | $ | 1,555 | | | $ | 1,636 | | | $ | 1,704 | | | $ | 1,804 | | | $ | 1,918 | |

| | | | | | | |

Other operating activities including taxes, interest payments and working capital | | | (416 | ) | | | (578 | ) | | | (310 | ) | | | (406 | ) | | | (472 | ) | | | (439 | ) | | | (835 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 848 | | | $ | 959 | | | $ | 1,170 | | | $ | 1,230 | | | $ | 1,232 | | | $ | 1,365 | | | $ | 1,083 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2009-15 OCF

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

Reported earnings (loss) per share - GAAP | | ($ | 0.30 | ) | | $ | 0.64 | | | ($ | 0.44 | ) | | ($ | 0.41 | ) | | ($ | 1.02 | ) | | $ | 1.20 | | | $ | 0.91 | | | $ | 1.28 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

After-tax items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.21 | | | | (0.39 | ) | | | — | | | | — | | | | (0.07 | ) | | | 0.05 | | | | 0.33 | | | | 0.03 | |

Enterprises | | | 0.74 | | | | 0.62 | | | | 0.04 | | | | (0.02 | ) | | | 1.25 | | | | (0.02 | ) | | | 0.09 | | | | (0.03 | ) |

Corporate interest and other | | | 0.16 | | | | (0.03 | ) | | | 0.04 | | | | 0.27 | | | | (0.32 | ) | | | (0.02 | ) | | | 0.01 | | | | * | |

Discontinued operations (income) loss | | | (0.16 | ) | | | 0.02 | | | | (0.07 | ) | | | (0.03 | ) | | | 0.40 | | | | (* | ) | | | (0.08 | ) | | | 0.08 | |

Asset impairment charges, net | | | — | | | | — | | | | 1.82 | | | | 0.76 | | | | 0.60 | | | | — | | | | — | | | | — | |

Cumulative accounting changes | | | 0.16 | | | | 0.01 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted earnings per share, including MTM - non-GAAP | | $ | 0.81 | | | $ | 0.87 | | | $ | 1.39 | | | $ | 0.57 | | | $ | 0.84 | | | $ | 1.21 | (a) | | $ | 1.26 | | | $ | 1.36 | |

Mark-to-market impacts | | | | | | | 0.03 | | | | (0.43 | ) | | | 0.51 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted earnings per share, excluding MTM - non-GAAP | | | NA | | | $ | 0.90 | | | $ | 0.96 | | | $ | 1.08 | | | | NA | | | | NA | | | | NA | | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Less than $500 thousand or $0.01 per share. |

| (a) | $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. |

2003-10 EPS