Exhibit 99.1

Investor Meeting

February 29, , 2012

Foote Hydro 1918

Zeeland 2007

Lake Winds 2012

This presentation is made as of the date hereof and contains “forward? looking statements” as defined in Rule 3b? 6 of the Securities Exchange Act of 1934, as amended, Rule 175 of the Securities Act of 1933, as amended, and relevant legal decisions. The forward? looking statements are subject to risks and uncertainties. They should be read in conjunction with “FORWARD? LOOKING STATEMENTS AND

INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10? K for the year ended December 31 and as updated in subsequent 10? Qs. CMS Energy’s and Consumers Energy’s “FORWARD? LOOKING STATEMENTS AND

INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non? GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

Reported earnings could vary because of several factors, such as legacy issues associated with prior asset sales. Because of those uncertainties, the company is not providing reported earnings guidance.

Agenda

• Welcome Tom Webb

• CMS Energy Overview John Russell

• Consumers Energy Overview

• Distribution & Customer Operations Dan Malone

• Customer Experience & Operations Patti Poppe

• Electric Generation & Energy Supply Jack Hanson

• Rates & Regulation Ronn Rasmussen

• Financial Overview Tom Webb

• Q&A

CMS Energy Overview

John Russell President and CEO

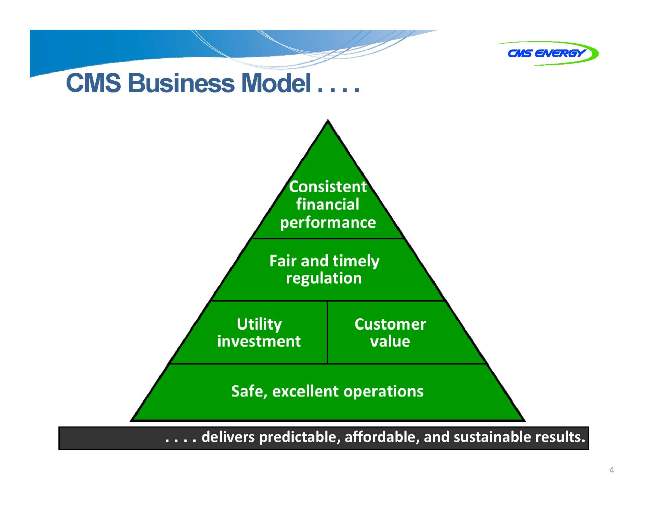

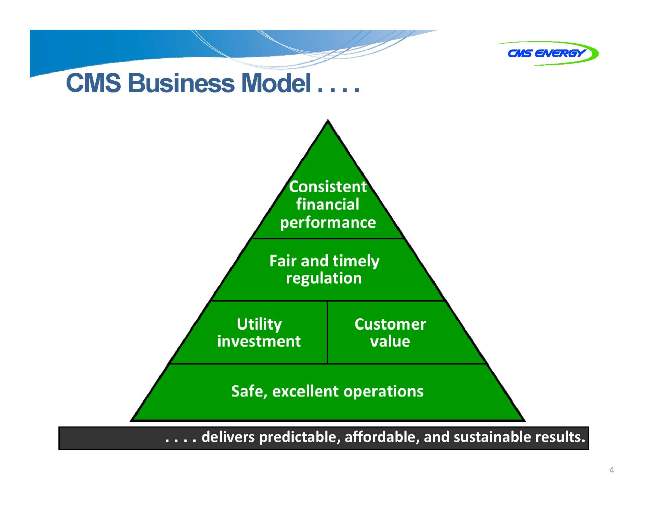

CMS Business Model . . . .

. . . . delivers predictable, affordable, and sustainable results.

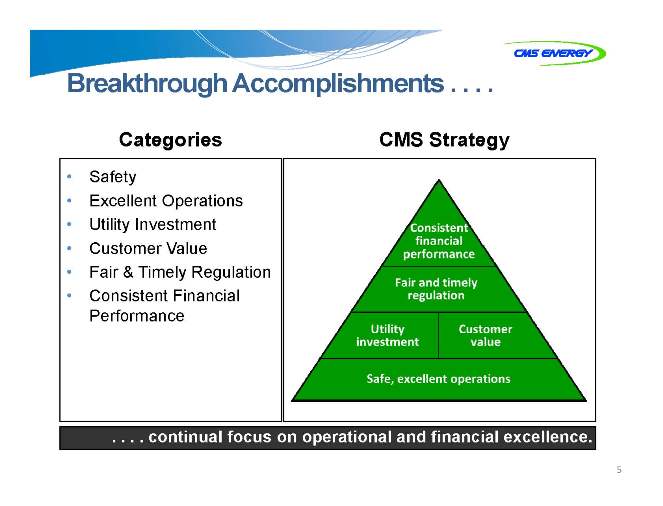

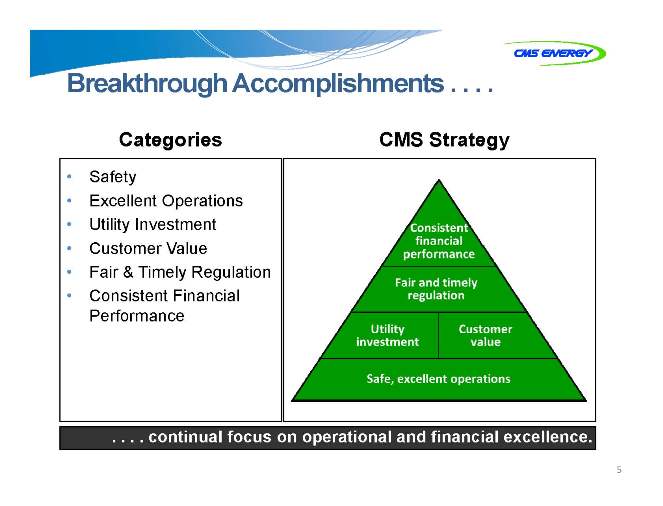

Breakthrough Accomplishments . . . .

Categories

CMS Strategy

Safety

Excellent Operations Utility Investment Customer Value Fair & Timely Regulation Consistent Financial Performance

. . . . continual focus on operational and financial excellence.

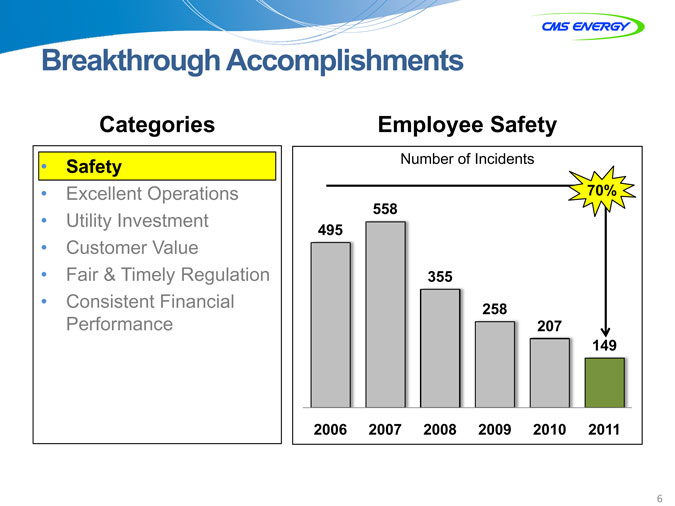

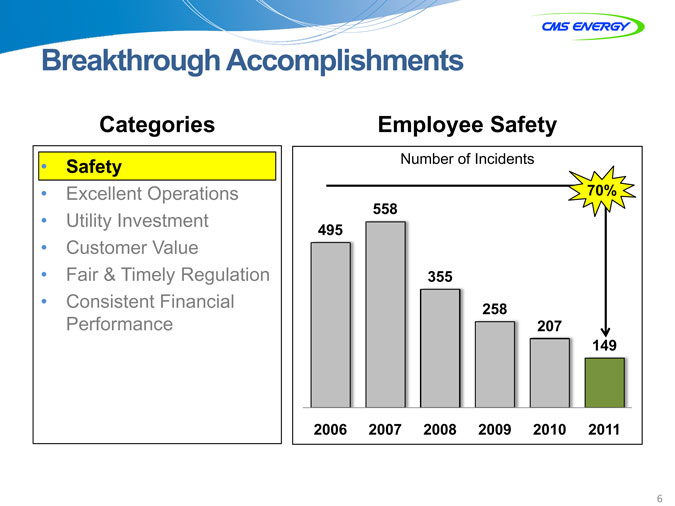

Breakthrough Accomplishments

Categories

Safety

Excellent Operations

Utility Investment

Customer Value Fair & Timely Regulation Consistent Financial Performance

Employee Safety

Number of Incidents

70%

558 495

355

258 207 149

2006 2007 2008 2009 2010 2011

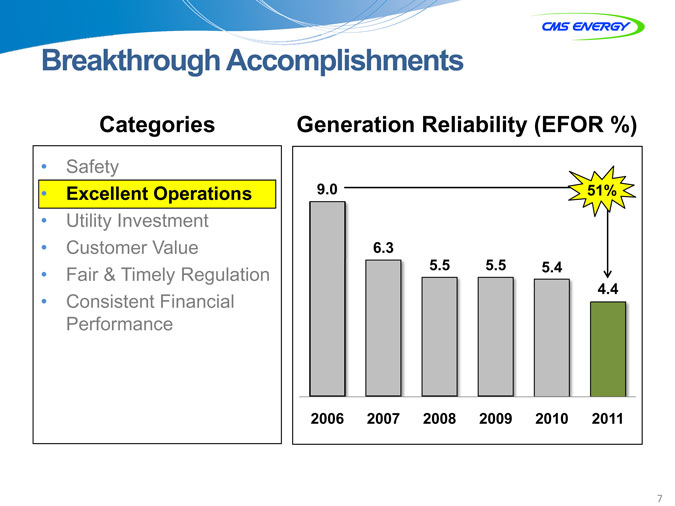

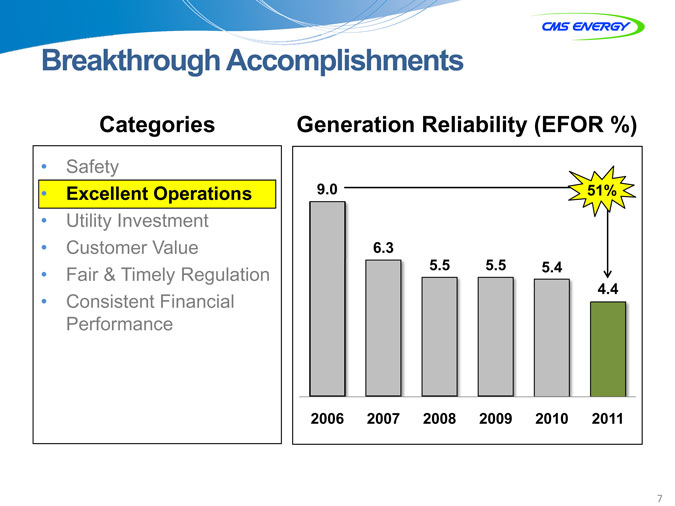

Breakthrough Accomplishments

Categories

Safety

Excellent Operations

Utility Investment Customer Value Fair & Timely Regulation Consistent Financial Performance

Generation Reliability (EFOR %)

9.0 51%

6.3

5.5 5.5 5.4 4.4

2006 2007 2008 2009 2010 2011

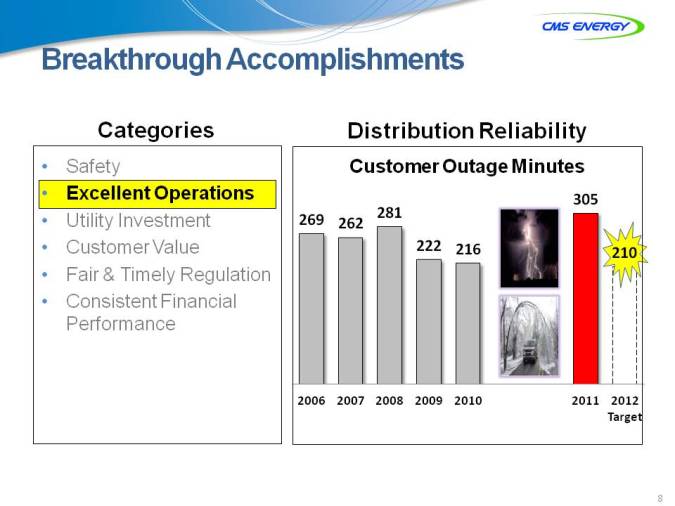

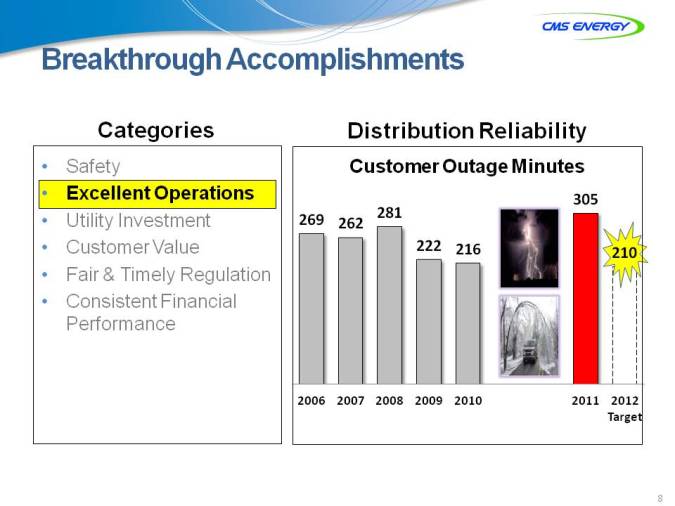

Breakthrough Accomplishments

Categories

Safety

Excellent Operations

Utility Investment Customer Value Fair & Timely Regulation Consistent Financial Performance

Distribution Reliability

Customer Outage Minutes

305 281 269 262 222 216 210 210

2006 2007 2008 2009 2010 20112012 Targe

Breakthrough Accomplishments

Categories

Safety

Excellent Operations

Utility Investment Customer Value Fair & Timely Regulation Consistent Financial Performance

Employee Engagement

U.S. Utility Peer High Performing Average Companies (HPCs)

Plan to stay CE = 84% +19 +8

Proud to work CE = 78% +18 -5 here

Career goals CE = 62% +17 +4 can be met

Discretionary

CE = 93% +10 +1 effort

Overall CE = 79% +16 +2

9

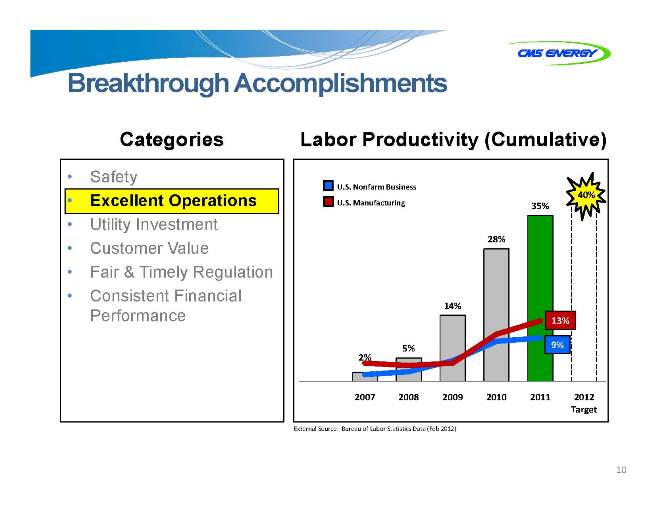

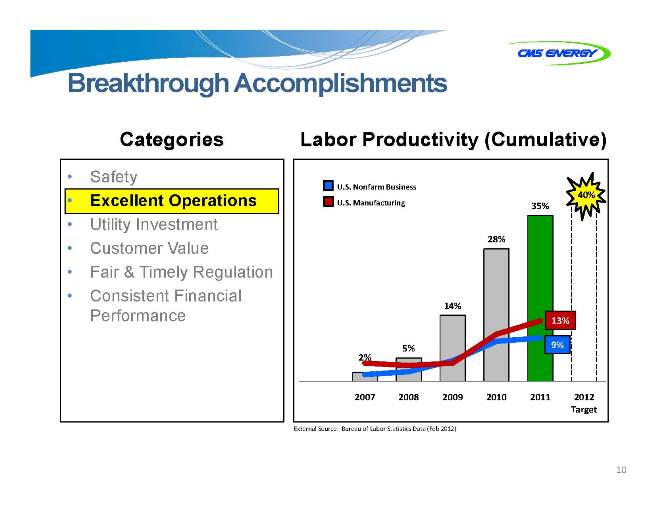

Breakthrough Accomplishments

Categories

Safety

Excellent Operations

Utility Investment Customer Value Fair & Timely Regulation Consistent Financial Performance

Labor Productivity (Cumulative)

U.S. Nonfarm Business

40% U.S. Manufacturing 35%

28%

14%

13%

9% 5% 2%

2007 2008 2009 2010 2011 2012 Target

External Source: Bureau of Labor Statistics Data (Feb 2012)

10

Breakthrough Accomplishments . . . .

Categories

Safety

Excellent Operations

Utility Investment

Customer Value Fair & Timely Regulation Consistent Financial Performance

5 | | Year, $6.6 Billion Plan |

Bils Planned Rate Base Growth

$15 14

13 5%-7% 12 11 10 9

8 | | Reliability/Deliverability Renewables |

7 | | Smart Grid Environmental |

6 | | Maintenance Depreciation |

2011 2012 2013 2014 2015 2016 Average Base Rate (bils) $10.9 $11.5 $12.3 $13.2 $14.0

. . . . planned investment grows rate base.

11

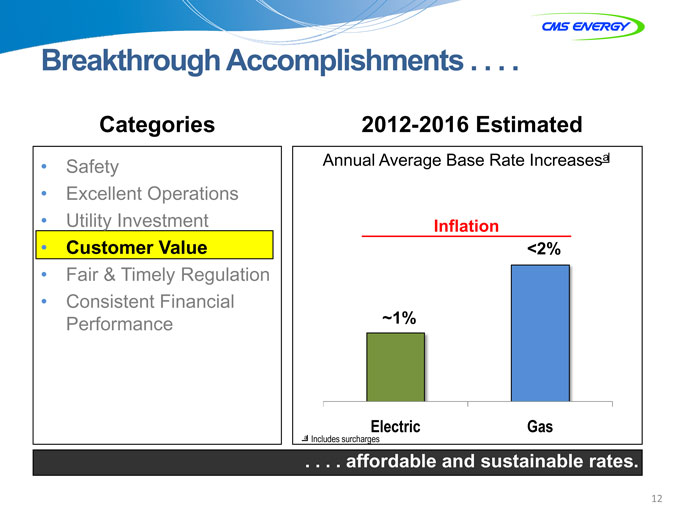

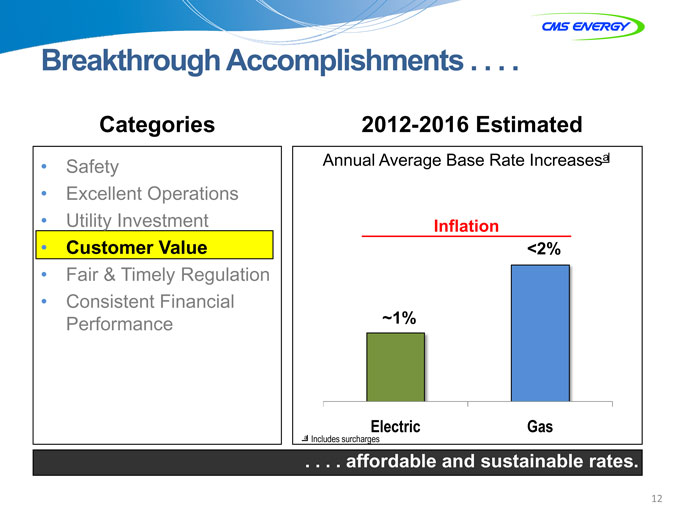

Breakthrough Accomplishments . . . .

Categories

Safety

Excellent Operations

Utility Investment

Customer Value

Fair & Timely Regulation Consistent Financial Performance

2012-2016 Estimated

Annual Average Base Rate Increasesa

Inflation <2%

~1%

Electric Gas

a Includes surcharges

. . . . affordable and sustainable rates.

12

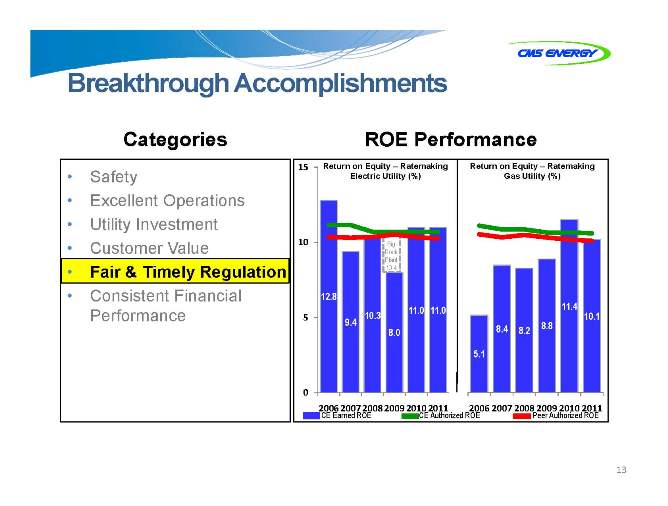

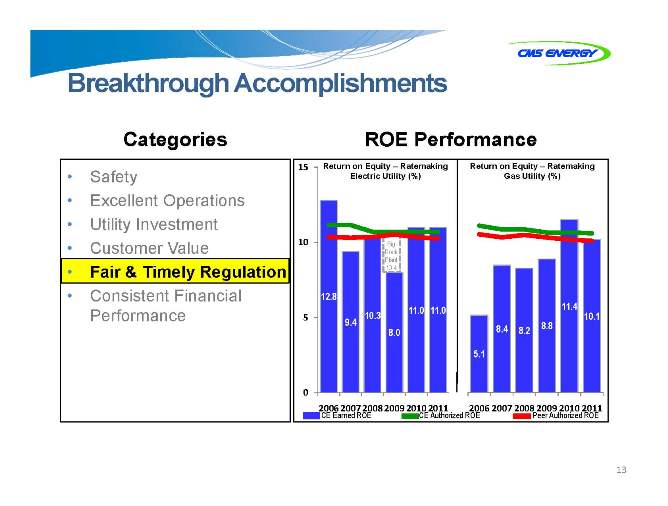

Breakthrough Accomplishments

Categories

Safety

Excellent Operations Utility Investment Customer Value

Fair & Timely Regulation

Consistent Financial Performance

ROE Performance

15 Return on Equity – Ratemaking Return on Equity – Ratemaking Electric Utility (%) Gas Utility (%)

10 Big Rock Plant 10.4

12.8 11.4 11.0 11.0

5 | | 10.3 10.1 9.4 8.8 8.0 8.4 8.2 5.1 |

0

2006 2007 2008 2009 2010 2011 2006 2007 2008 2009 2010 2011

CE Earned ROE CE Authorized ROE Peer Authorized ROE

13

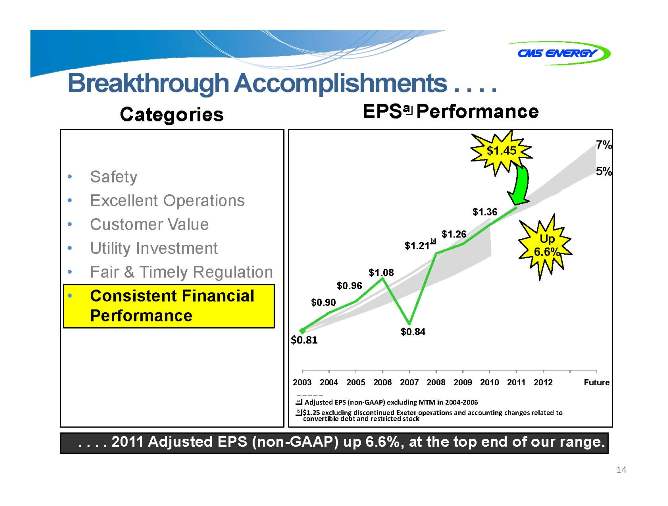

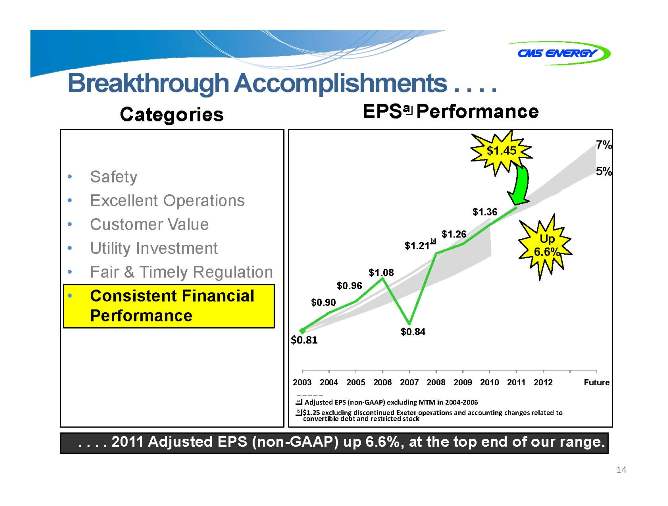

Breakthrough Accomplishments . . . .

Categories

Safety

Excellent Operations Customer Value Utility Investment Fair & Timely Regulation

Consistent Financial Performance

EPS Performance

7% $1.45 5%

$1.36

b $1.26 Up $1.21 6.6% $1.08 $0.96 $0.90

$0.84

0.81

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Future

a Adjusted EPS (non? GAAP) excluding MTM in 2004? 2006 b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

. . . . 2011 Adjusted EPS (non-GAAP) up 6.6%, at the top end of our range.

14

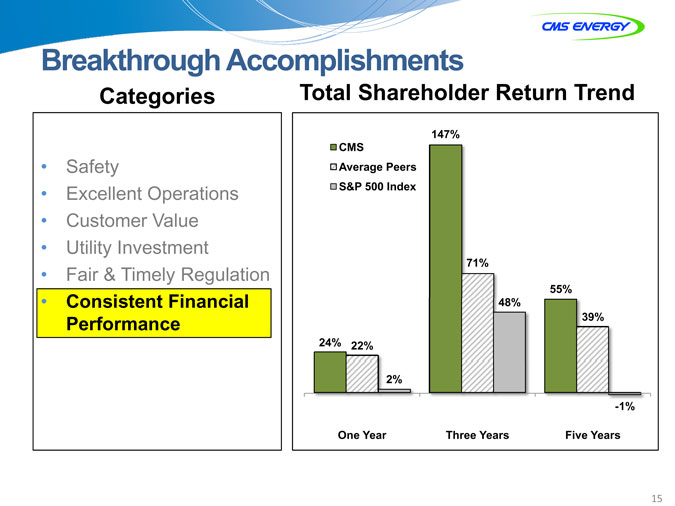

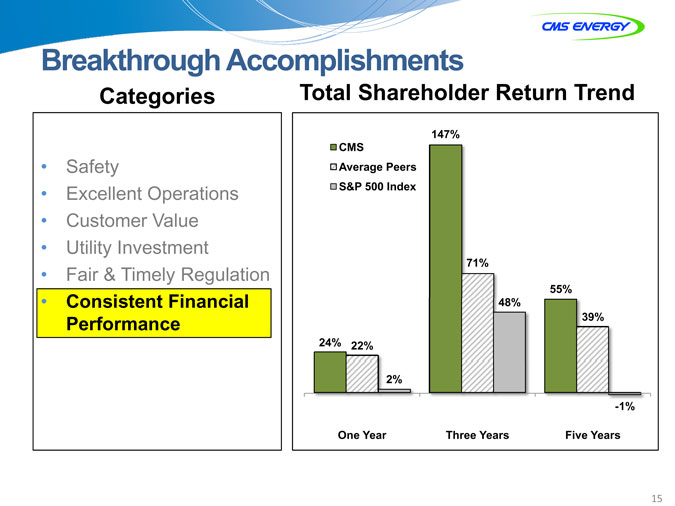

Breakthrough Accomplishments

Categories

Safety

Excellent Operations Customer Value Utility Investment Fair & Timely Regulation

Consistent Financial Performance

Total Shareholder Return Trend

147% CMS

Average Peers S&P 500 Index

71%

55% 48% 39%

24% 22%

2%

-1%

One Year Three Years Five Years

15

Our Top Priorities . . . .

New Breakthrough goals

Unrelenting customer focus

Strong investor alignment

Supportive regulatory compact

World class risk mitigation

Consistent financial performance

. . . . with predictable, sustainable growth.

16

Consumers Energy Overview

Consistent financial performance

Fair and timely regulation

Utility Customer Dan Malone investment value

Safe, excellent operations Senior Vice President

Distribution & Customer Operations

Safety, Reliability and Customer Value . . . .

• Safety

– Employee safety

– Public safety

• Productivity

• Reliability

– Gas infrastructure

– Electric infrastructure

– Smart Grid infrastructure

• Customer Value

. . . . 125 years of service.

18

Productivity . . . .

Cumulative Productivity

60%

49%

50% 43%

6%

40% 22%

30%

21%

20%

21%

10% Year

0% Total

0% Target

2009 2010 2011 2012 Target

Headcount

4,806

4,595

4,532

4,431

2009 2010 2011 2012 Target

. . . . improving operational performance.

19

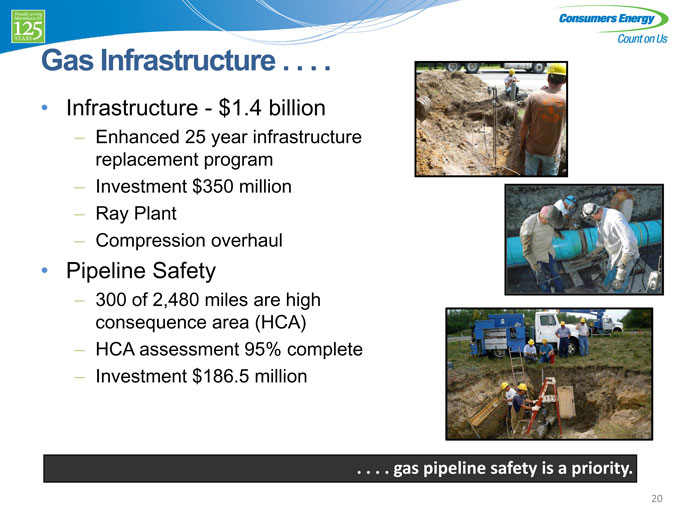

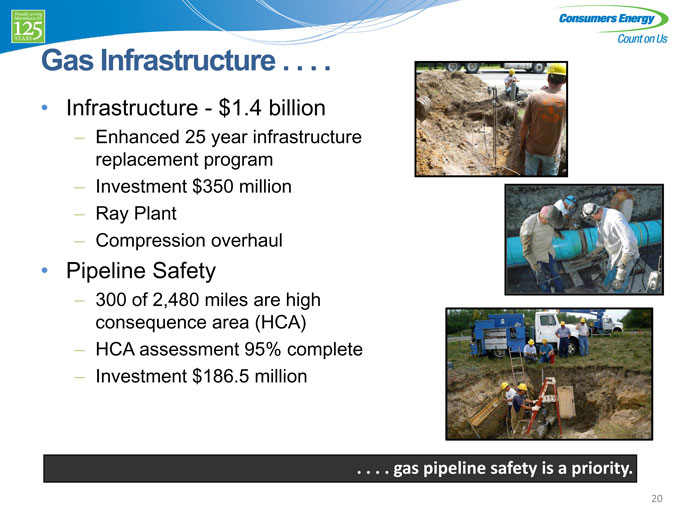

Gas Infrastructure . . . .

• Infrastructure—$1.4 billion

– Enhanced 25 year infrastructure replacement program

– Investment $350 million

– Ray Plant

– Compression overhaul

• Pipeline Safety

– 300 of 2,480 miles are high consequence area (HCA)

– HCA assessment 95% complete

– Investment $186.5 million

. . . . gas pipeline safety is a priority.

20

Electric Infrastructure . . . .

• Investment—$2.4 billion

– Circuits and substations

– Replace poles

– Low voltage substation automation

– ~14,400 Low Voltage Distribution Projects

– ~270 High Voltage Distribution Projects

. . . . reduces outages and maintains safe and excellent service.

21

System Investment Results . . . .

Peak Load

Previous Record Aug 2006

8883 MW

New Record July 2011

8930 MW

2006 2007 2008 2009 2010 2011

Performance

Time in 70%-90% Load Number of Customers

25 % 20

15 10 5 0

2006 2011

30,000 25,000 20,000 15,000 10,000 5,000 0

. . . . minimize risk of failure during peak conditions.

22

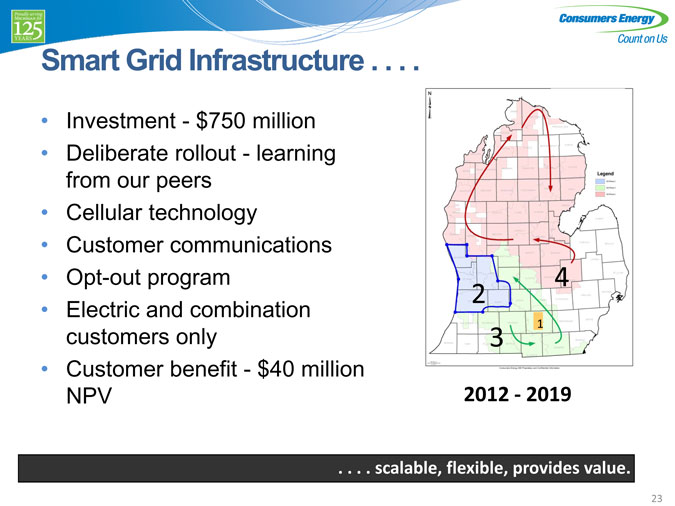

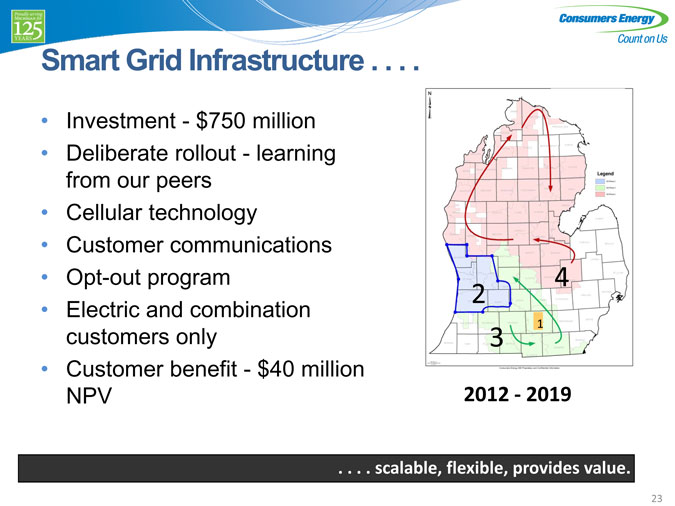

Smart Grid Infrastructure . . . .

Investment—$750 million Deliberate rollout—learning from our peers Cellular technology Customer communications Opt-out program Electric and combination customers only Customer benefit—$40 million NPV

2012 2019 ?

. . . . scalable,calable, flexible, provides value.

23

Enhance Customer Value . . . .

Continue to improve safety Increase system reliability Electric and Gas infrastructure projects…not enough

J.D. Power Surveys

New Vice President of Customer Experience and Operations

. . . . customer value focused .

24

Consumers Energy Overview

Patti Poppe Vice President

Customer Experience & Operations

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

Customer-Centric Organization

Core competency in customer insights “Count on Us” customer experience Employee and customer engagement Commodity to value

26

So What?

Regulatory and political risk mitigation Operational cost efficiency

Foundation for growth

27

Customer Insights . . . .

Qualitative and quantitative research studies Organization design Operational response

. . . . mustust become a core competency.

28

“Count on Us” Customer Experience

Getting it right the first time

Operational improvements for all customer touch points Providing a total experience that makes customers want to choose us

More than 90,000,000 opportunities to serve our customers well.

29

Customer & Employee Engagement . . . .

• Community engagement

– Charitable giving

– Grassroots effort

– 125 Year celebrations

• Strategic business customer engagement

• Low-income customer experience project

. . . . improves the perception of value.

30

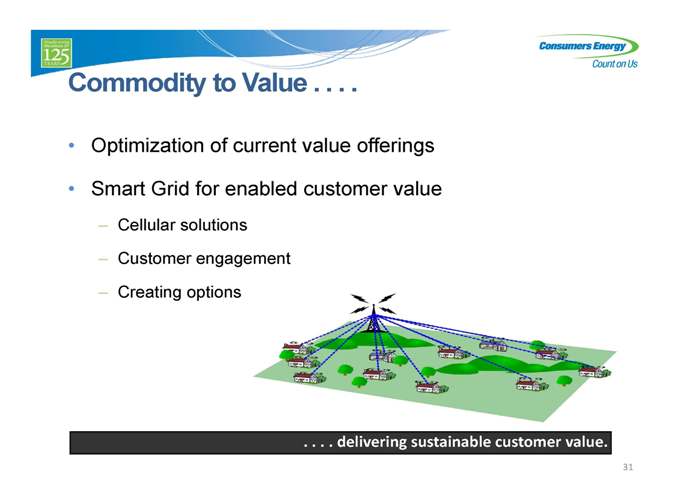

Commodity to Value . . . .

• Optimization of current value offerings

• Smart Grid for enabled customer value

– Cellular solutions

– Customer engagement

– Creating options

. . . . deliveringelivering sustainable customer value.

31

Count on Us

32

Consumers Energy Overview

Jack Hanson Senior Vice President Electric Generation & Energy Supply

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

Overview

Environmental compliance

Investment

– Environmental

– Renewable

Balanced portfolio

34

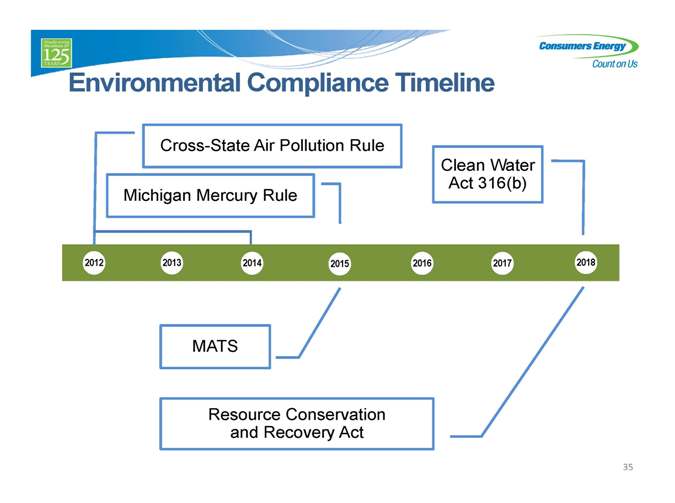

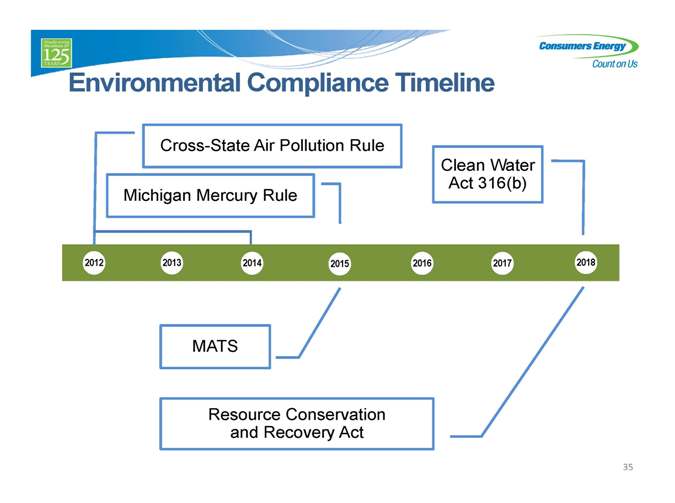

Environmental Compliance Timeline

Cross-State Air Pollution Rule

Clean Water Act 316(b) Michigan Mercury Rule

2012 2013 2014 2015 2016 2017 2018

MATS

Resource Conservation and Recovery Act

35

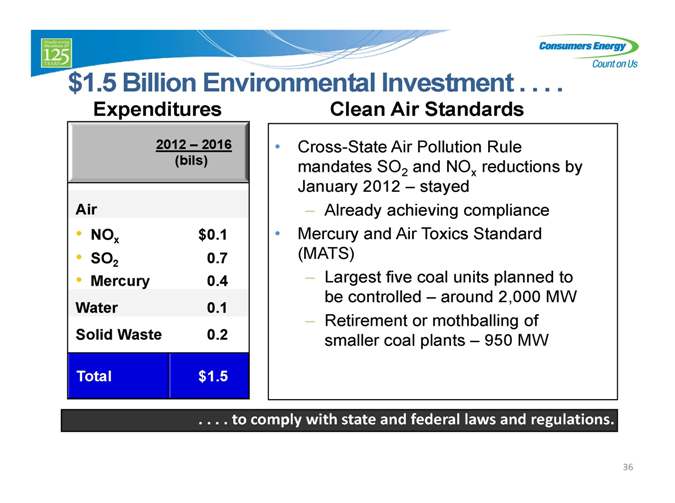

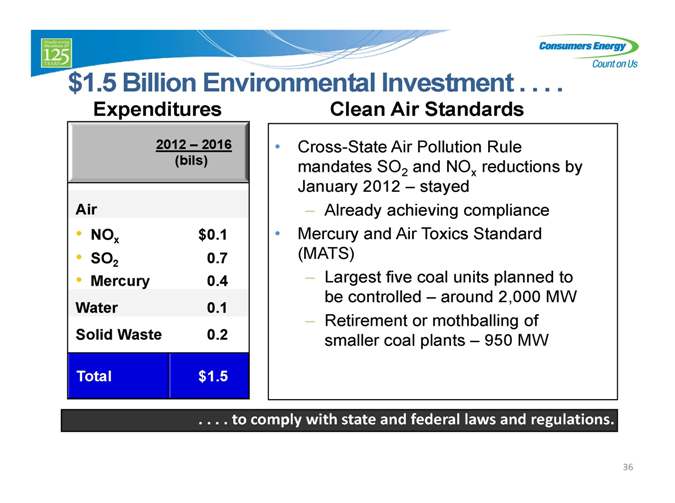

$1.5 Billion Environmental Investment . . . .

Expenditures

2012 – 2016 (bils)

Air

• NOx $0.1

• SO2 0.7

• Mercury 0.4 Water 0.1 Solid Waste 0.2

Total $1.5

Clean Air Standards

• Cross-State Air Pollution Rule mandates SO2 and NOx reductions by January 2012 – stayed

– Already achieving compliance

• Mercury and Air Toxics Standard (MATS)

– Largest five coal units planned to be controlled – around 2,000 MW

– Retirement or mothballing of smaller coal plants – 950 MW

. . . . to comply with state and federal laws and regulations.

36

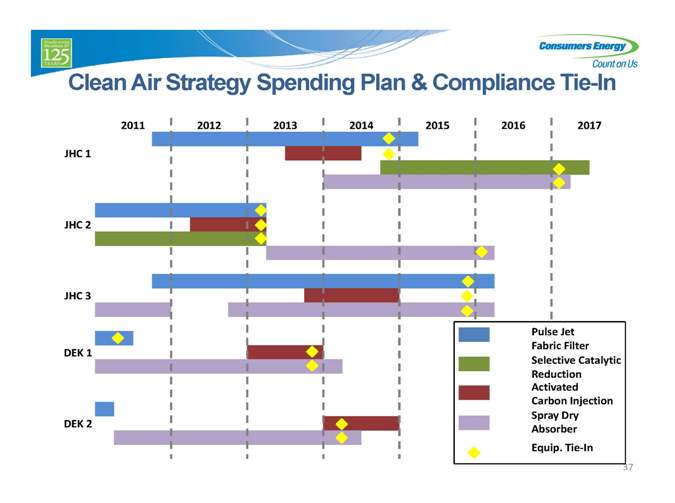

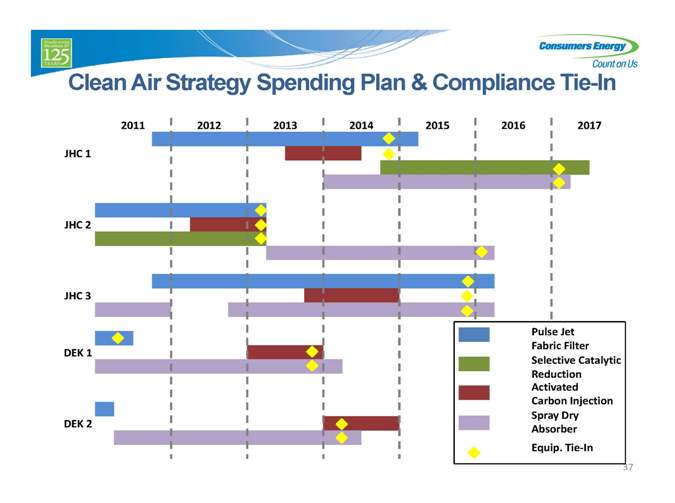

Clean Air Strategy Spending Plan & Compliance Tie-In

2011 2012 2013 2014 2015 2016 2017

JHC 1

JHC 2

JHC 3

Pulse Jet Fabric Filter

Selective Catalytic Reduction Activated Carbon Injection Spray Dry Absorber Equip. Tie? In

37

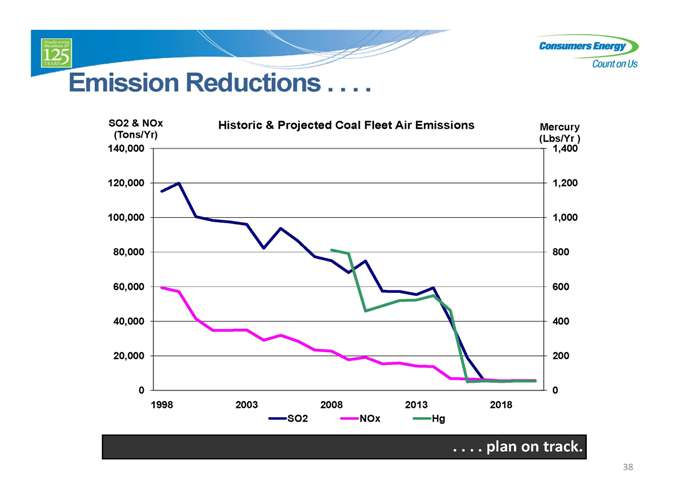

Emission Reductions . . . .

SO2 & NOx (Tons/Yr) 140,000

120,000 100,000 80,000 60,000 40,000 20,000 0

Historic & Projected Coal Fleet Air Emissions

Mercury (Lbs/Yr ) 1,400

1,200 1,000 800 600 400 200 0

1998 2003 2008 2013 2018 SO2 NOx Hg

. . . . plan on track.

38

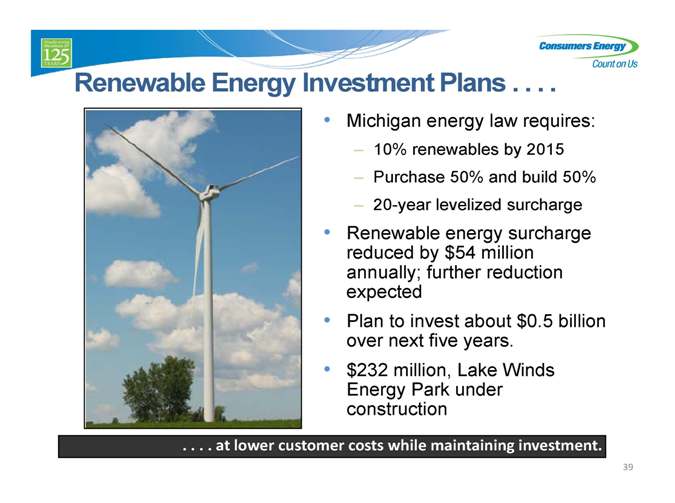

Renewable Energy Investment Plans . . . .

Michigan energy law requires:

– 10% renewables by 2015

– Purchase 50% and build 50%

– 20-year levelized surcharge

Renewable energy surcharge reduced by $54 million annually; further reduction expected Plan to invest about $0.5 billion over next five years. $232 million, Lake Winds Energy Park under construction

. . . . at lower customer costs while maintaining investment.

39

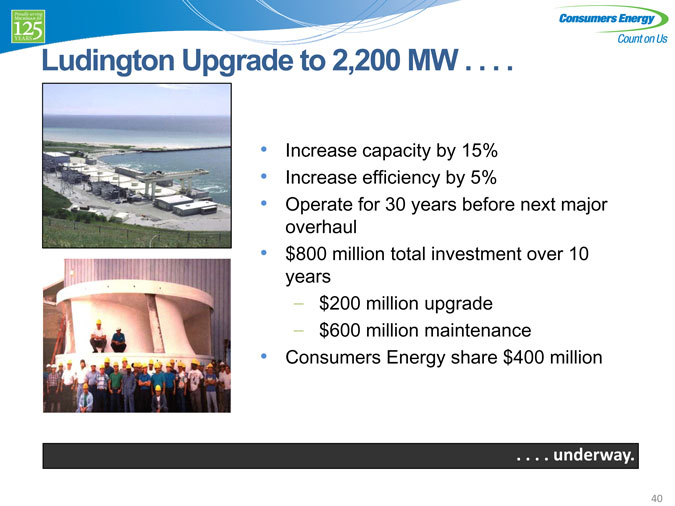

Ludington Upgrade to 2,200 MW . . . .

Increase capacity by 15% Increase efficiency by 5%

Operate for 30 years before next major overhaul $800 million total investment over 10 years

– $200 million upgrade

– $600 million maintenance

Consumers Energy share $400 million

. . . . underway.

40

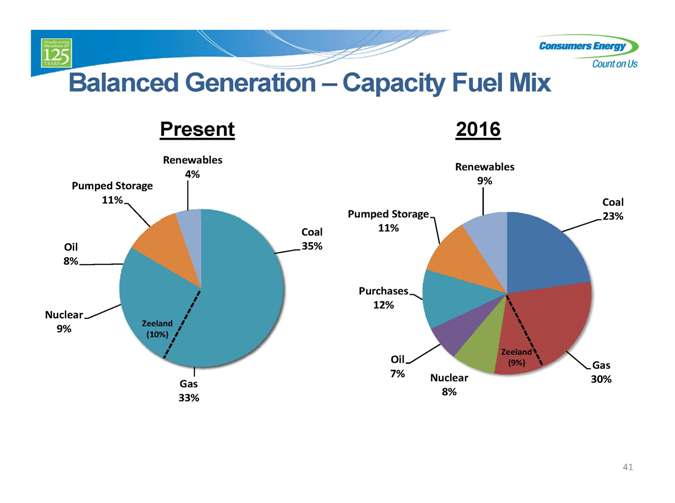

Balanced Generation – Capacity Fuel Mix

Present

Renewables 4% Pumped Storage 11%

Coal Oil 35% 8%

Nuclear

Zeeland

9%

(10%)

Gas 33%

2016

Renewables 9%

Coal Pumped Storage 23% 11%

Purchases 12%

Oil Zeeland

(9%) Gas

7% Nuclear

30% 8%

41

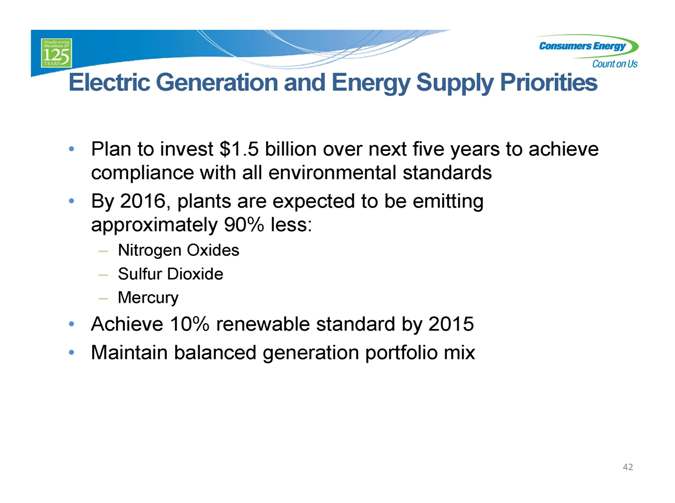

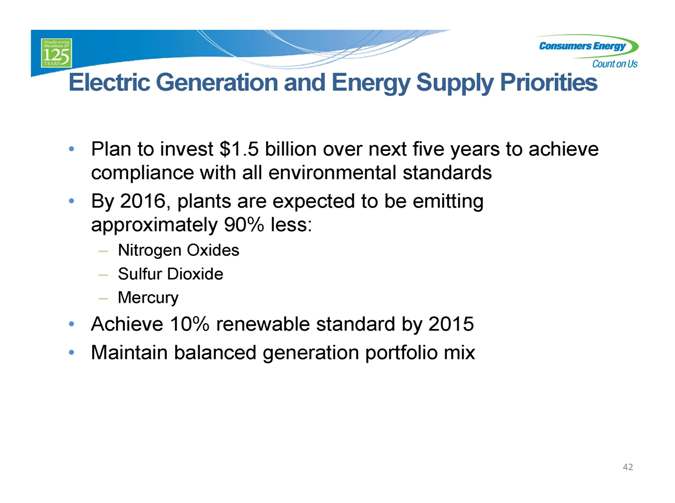

Electric Generation and Energy Supply Priorities

Plan to invest $1.5 billion over next five years to achieve compliance with all environmental standards By 2016, plants are expected to be emitting approximately 90% less:

– Nitrogen Oxides

– Sulfur Dioxide

– Mercury

Achieve 10% renewable standard by 2015 Maintain balanced generation portfolio mix

42

��

Consumers Energy Overview

Ronn Rasmussen Vice President Rates & Regulation

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

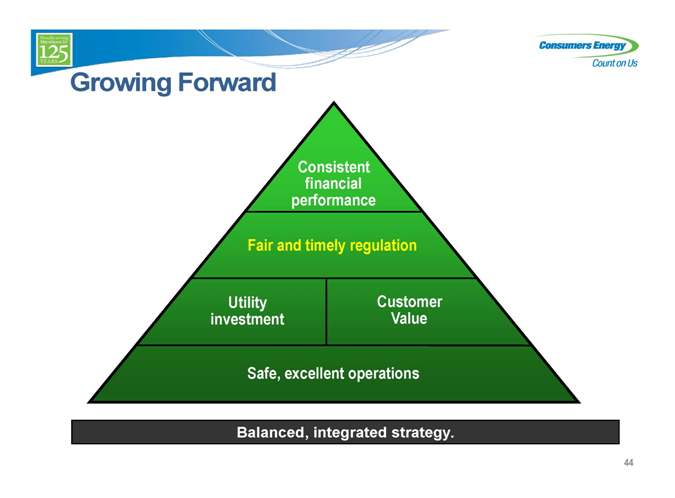

Growing Forward

Consistent financial performance

Fair and timely regulation

Utility Customer Customer investment value Value

Safe, excellent operations

Balanced, integrated strategy.

44

A Look Back

Traditional Regulatory Model

• Cumbersome process

• Historically based

• Lag: File – Order timeline typically 18-24 months

• Rates not cost based

• Unlimited ROA load

45

Michigan Energy Legislation . . . .

Forward looking Reduced “Lag”

– File and implement

– 12 month “hard stop”

Transition to cost based rates

ROA “Cap”

. . . . enhanced regulatory certainty.

46

ROE Performance – Ratemaking

Combined ROE

11.1% 10.8%

10.3% 9.9% 9.7% 9.1%

2006 2007 2008 2009 2010 2011

Actual ROE Authorized ROE

Actual ROE vs Authorized

104% 101% 93% 98% 99% 93% 91% 91% 92% 82% 86%

2006 2007 2008 2009 2010 2011

CMS Peers

Peer data NA for 2011

47

Rate Case Timeline

2008 2009 2010 2011 2012

ELECTRIC Offsets

Filed $214 M Filed $178 M Filed $195 M Renewables $(57) DOE (23) Increase Increase Increase Total $(80)

Self- Final Self- Final implement Self- implement $Order 139 M implement Order $118 M $179 M $150 M $146 M

New Decision

Energy 78% 97%%

Law

GAS Filed Filed Filed $114 M $55 M $49 M

Increase 74% Increase Increase

Self- Order Final Final Self-implement $89 M $66 M $ Order 31 M implement $23 M Decision

2008 2009 2010 2011 2012

Frequent and streamlined rate case strategy continues.

9

48

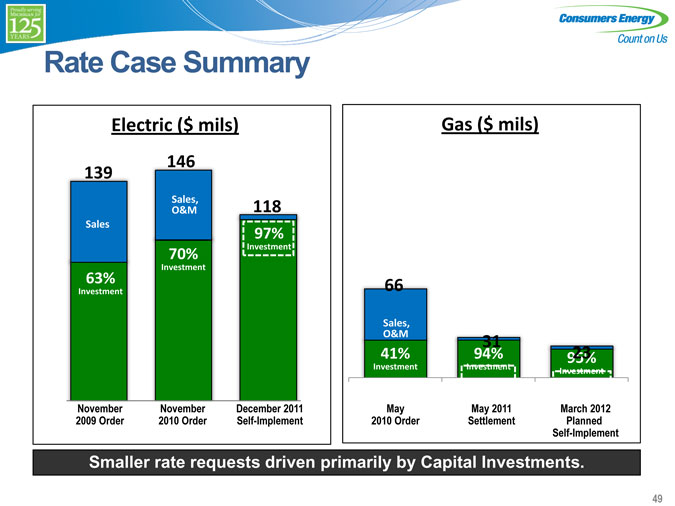

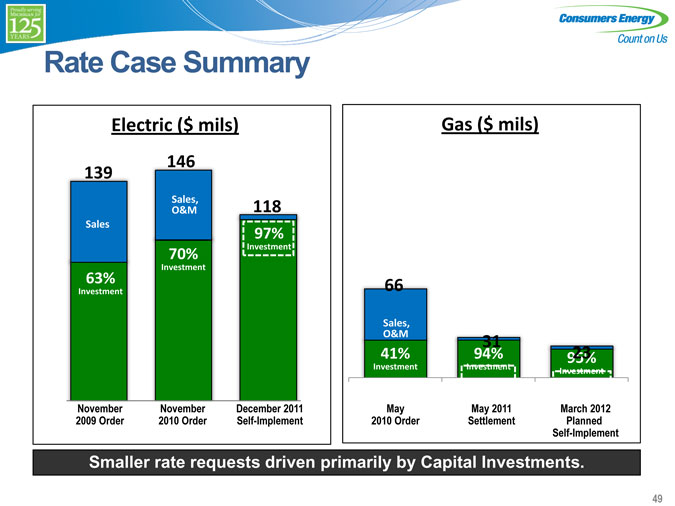

Rate Case Summary

Electric ($ mils)

146 139

Sales, 118 O&M

Sales

97%

Investment

70%

Investment

63%

Investment

November 2009 Order

November 2010 Order

December 2011 Self-Implement

Gas ($ mils)

66

Sales, O&M

41%

Investment

31 94%

Investment

95% 23

Investment

May 2010 Order

May 2011 Settlement

March 2012 Planned Self-Implement

Smaller rate requests driven primarily by Capital Investments.

49

Challenges

• ROA “Cap”

• Michigan economy

• Rate fatigue

50

Ongoing Regulatory Strategy . . . .

Michigan investment

Base rate increases at or below rate of inflation Rate “offset tactics” Maximize communication and alignment

. . . . balances customer interests and investor certainty.

51

Strategic Enhancements

Process improvement

– Limiting “issues”

– Focus on important items

Customer Value Initiative

– Performance based rates

Reduce volatility

– Decoupling mechanisms

– Capital Investment tracker

– Expenses (UAs, Storms, Benefits)

Plan execution drives results.

RJR 9

52

Financial Overview

Tom Webb

Executive Vice President & CFO

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

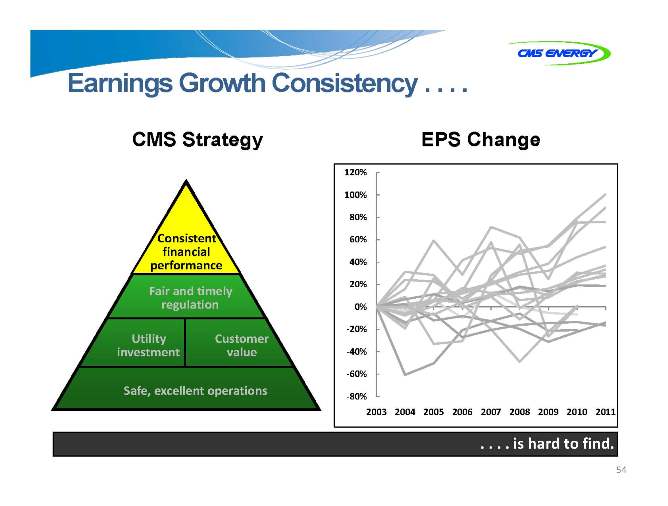

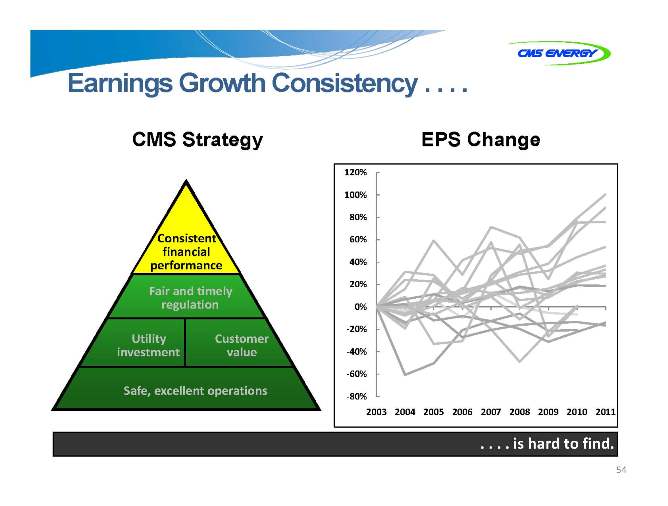

Earnings Growth Consistency . . . .

CMS Strategy

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

EPS Change

120% 100% 80% 60% 40% 20% 0% ? 20% ? 40% ? 60%

? 80%

2003 2004 2005 2006 2007 2008 2009 2010 2011

. . . . iss hard to find.

54

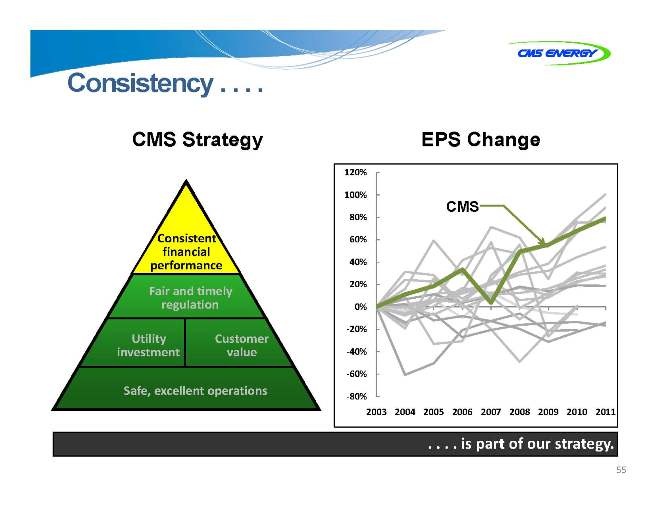

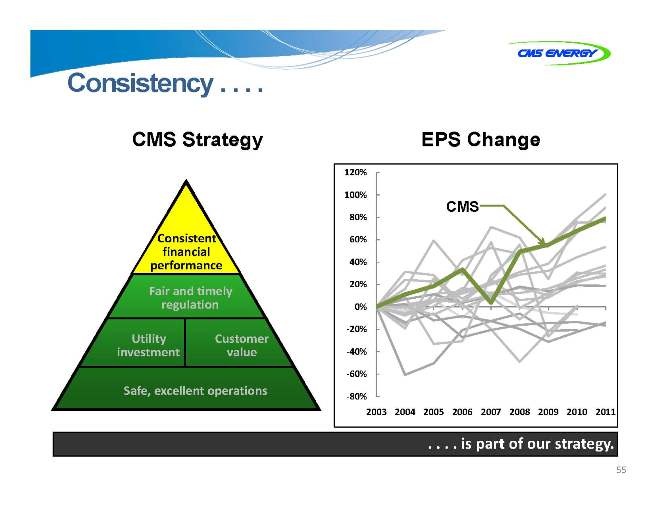

Consistency . . . .

CMS Strategy

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

EPS Change

120%

100%

CMS

80% 60% 40% 20% 0% ? 20% ? 40% ? 60%

? 80%

2003 2004 2005 2006 2007 2008 2009 2010 2011

. . . . is partart of our strategy.

55

Established Tough Goals . . . .

CMS Strategy

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

Adjusted EPSa

$1.36 8%

$1.26

$1.21

b 6%

$1.08

$0.96

$0.90

$0.84

$0.81

a Adjusted EPS (non? GAAP) excluding MTM in 2004? 2006 b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

. . . . andnd delivered.

56

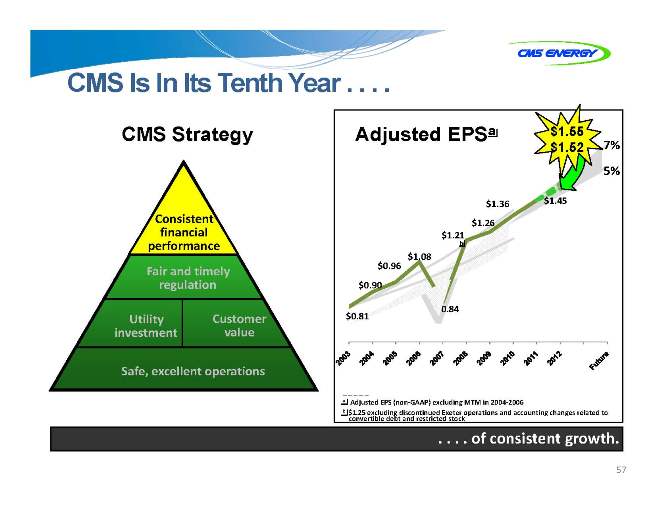

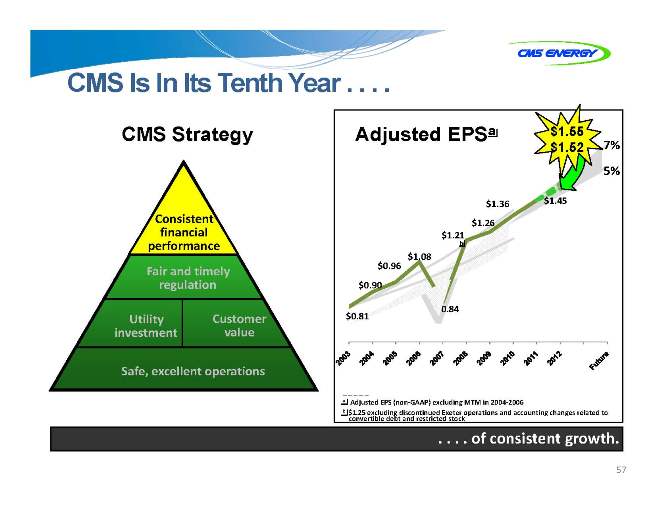

CMS Is In Its Tenth Year . . . .

CMS Strategy

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

Adjusted EPSa $1.55

$1.52 7% 5%

$1.36 $1.45

$1.26

$1.21

b

$1.08

$0.96

$0.90

$0.81 $0.84

a Adjusted EPS (non? GAAP) excluding MTM in 2004? 2006 b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

. . . . off consistent growth.

57

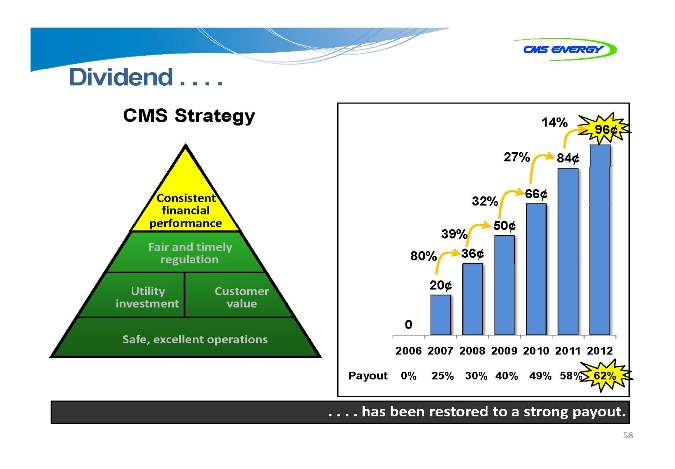

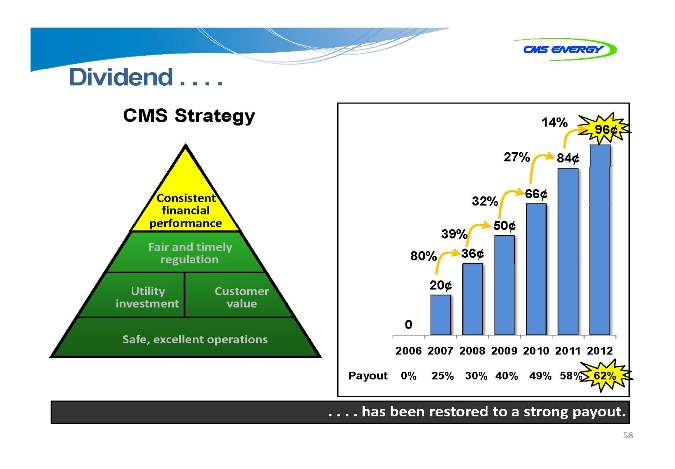

Dividend . .. . .

CMS Strategy

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

14% 96¢

27% 84¢

66¢ 32% 50¢ 39% 80% 36¢

20¢

0

2006 2007 2008 2009 2010 2011 2012

Payout 0% 25% 30% 40% 49% 58% 62%

. . . . hasas been restored to a strong payout.

58

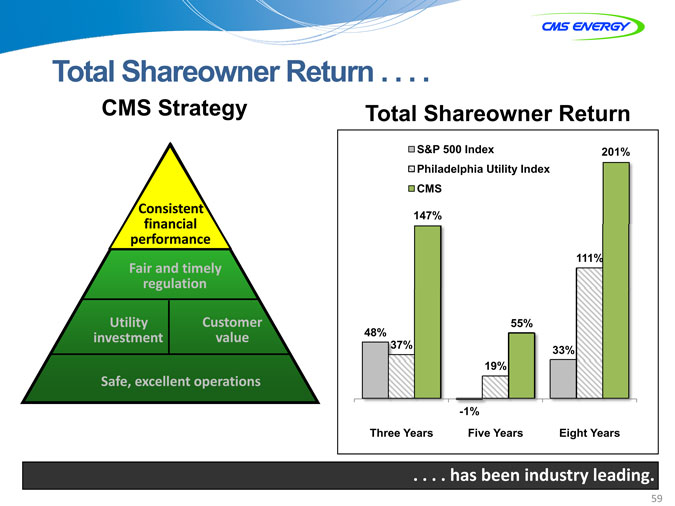

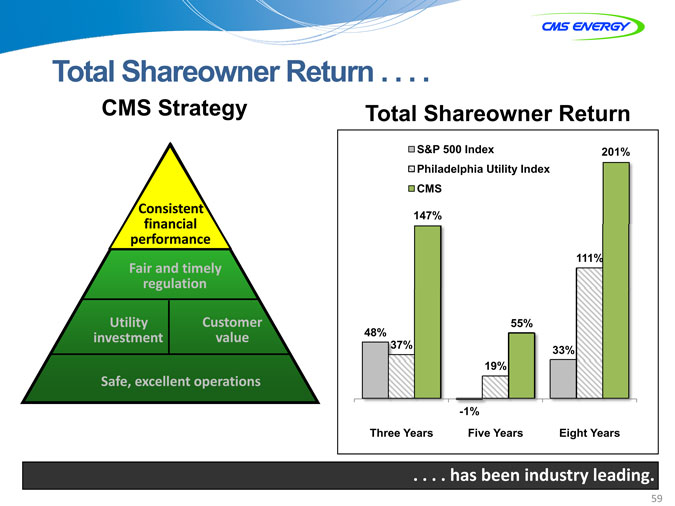

Total Shareowner Return . . . .

CMS Strategy

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

Total Shareowner Return

S&P 500 Index 201% Philadelphia Utility Index CMS

147%

111%

55% 48% 37% 33% 19%

-1%

Three Years Five Years Eight Years

. . . . hasas been industry leading.

59

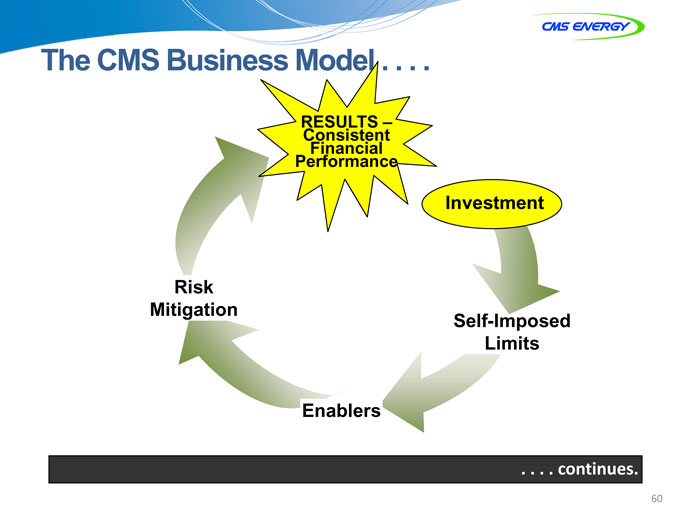

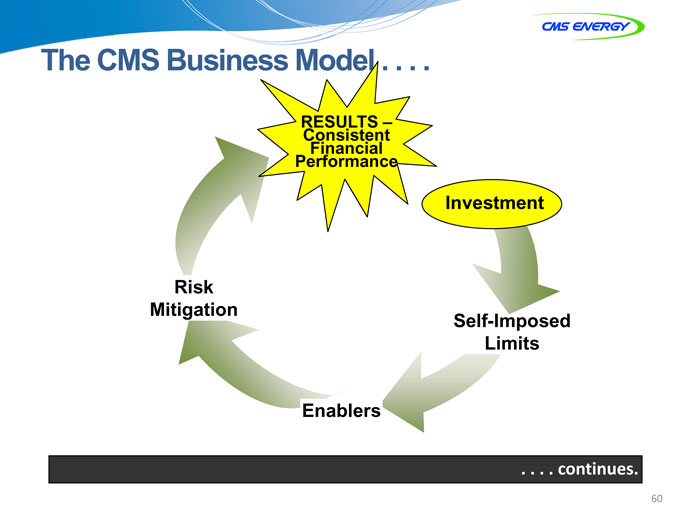

The CMS Business Model . . . .

RESULTS –Consistent Financial Performance

Investment

Risk Mitigation

Self-Imposed Limits

Enablers

. . . . continuesontinues.

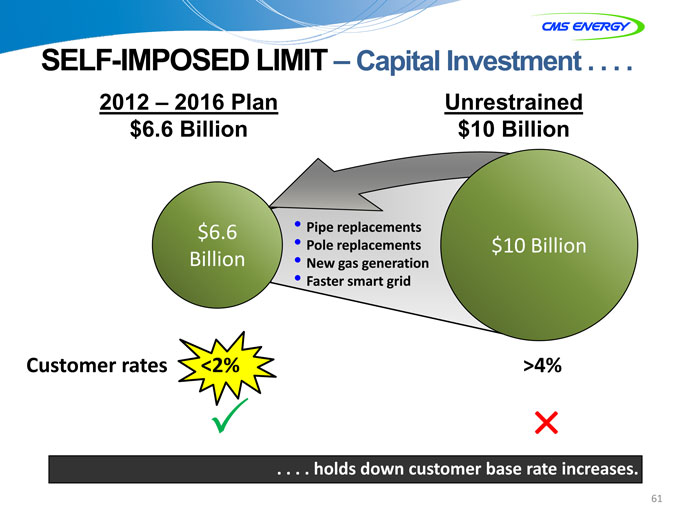

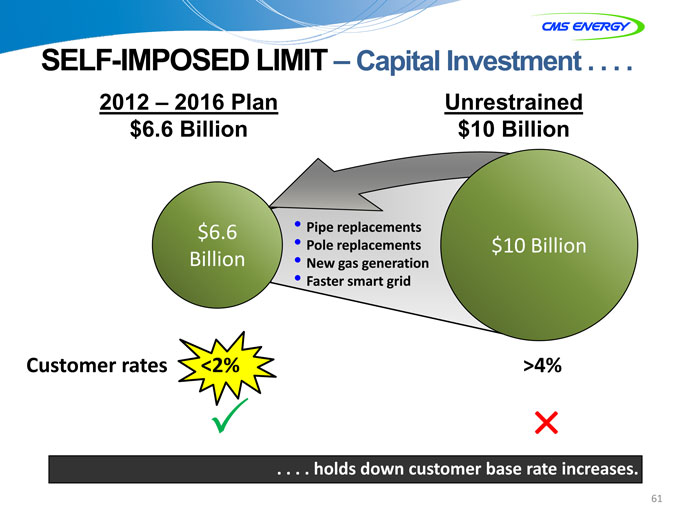

SELF-IMPOSED LIMIT – Capital Investment . . . .

2012 – 2016 Plan $6.6 Billion

Unrestrained

$10 Billion

$6.6 Billion

Pipe replacements Pole replacements New gas generation Faster smart grid

$10 Billion

Customer rates <2%

>4%

. . . . holdsolds down customer base rate increases.

61

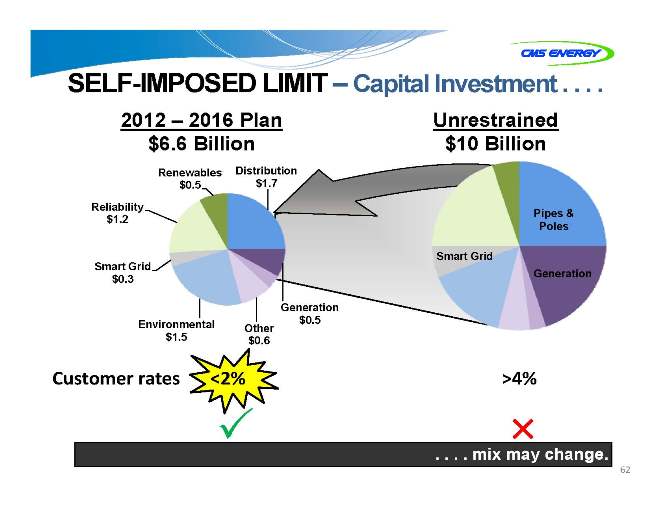

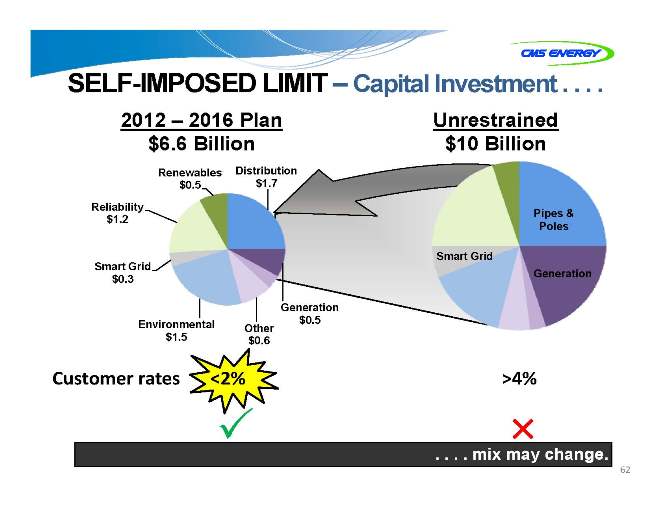

SELF-IMPOSED LIMIT – Capital Investment . . . .

2012 – 2016 Plan $6.6 Billion

Unrestrained

$10 Billion

Renewables Distribution $0.5 $1.7 Reliability $1.2

Smart Grid $0.3

Generation Environmental $0.5 Other $1.5 $0.6

Pipes & Poles

Smart Grid

Generation

Customer rates <2%

>4%

. . . . mixix may change.

62

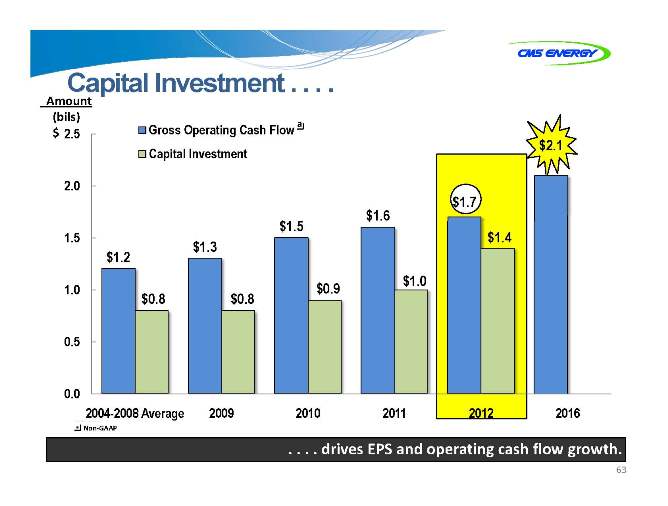

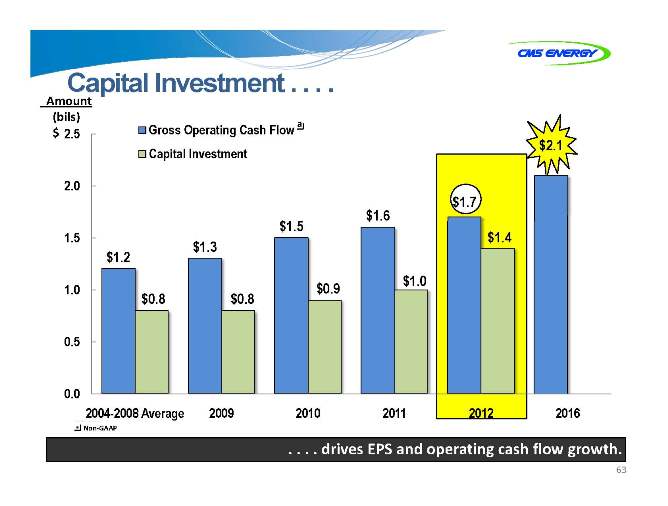

Capital Investment . . . .

Amount (bils) $ 2.5

2.0 1.5 1.0 0.5 0.0

Gross Operating Cash Flow a $2.1 Capital Investment

$1.6 $1.7 $1.5 $1.4 $1.3 $1.2 $1.0 $0.9 $0.8 $0.8

2004-2008 Average 2009 2010 2011 2012 2016

a Non? GAAP

. . . . drives EPS and operating cash flow growth.

63

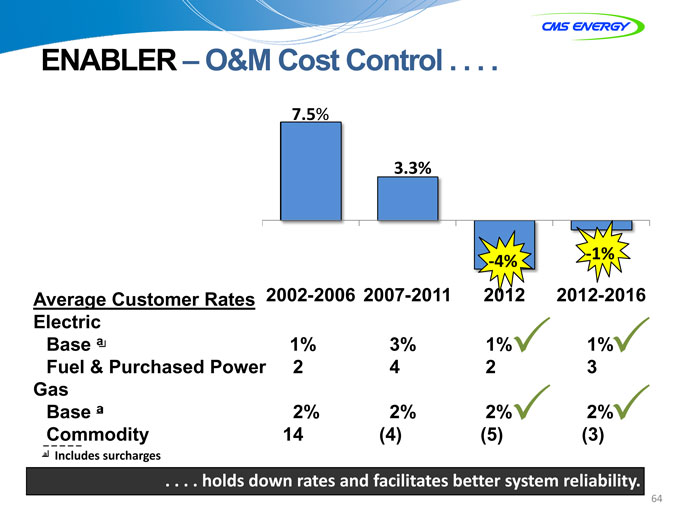

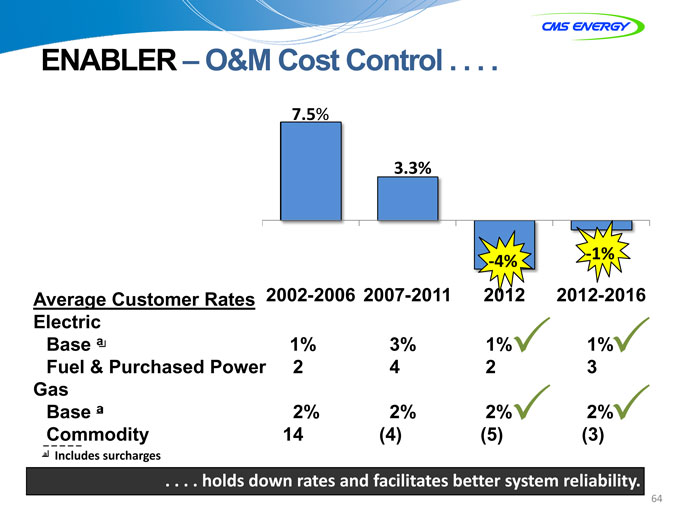

ENABLER – O&M Cost Control . . . .

? 1% ? 4%

Average Customer Rates 2002-2006 2007-2011 2012 2012-2016 Electric Base a 1% 3% 1%31% 3 Fuel & Purchased Power 2 4 2 3 Gas Base a 2% 2% 2%32% 3 _Commodity 14 (4) (5) (3)

a Includes surcharges

. . . . holds down rates and facilitates better system reliability.

64

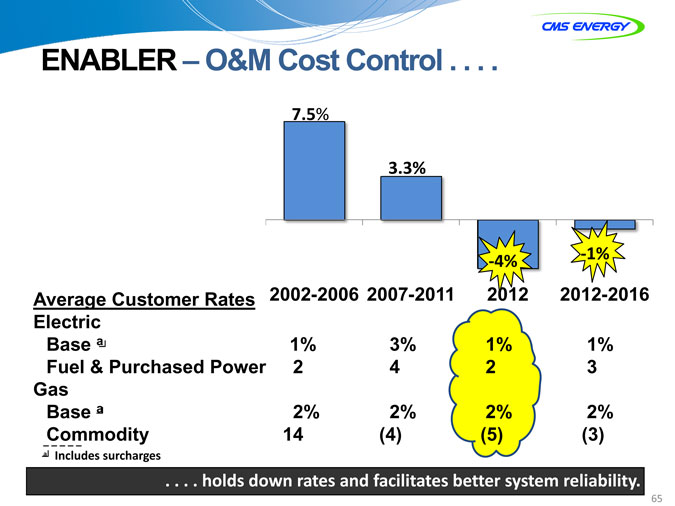

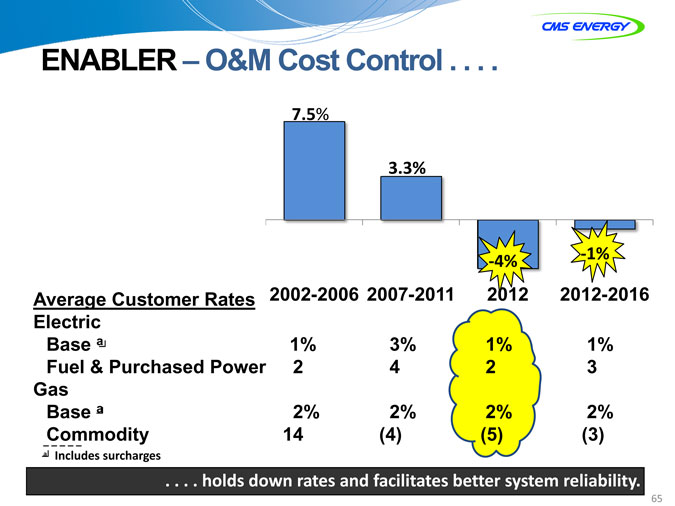

ENABLER – O&M Cost Control . . . .

7.5%

3.3%

? 1% ? 4%

Average Customer Rates 2002-2006 2007-2011 2012 2012-2016 Electric Base a 1% 3% 1% 1% Fuel & Purchased Power 2 4 2 3 Gas Base a 2% 2% 2% 2% _Commodity 14 (4) (5) (3)

a Includes surcharges

. . . . holds down rates and facilitates better system reliability.

65

ENABLER – Sales Recovery . . . .

Electric Salesa

GWh

Up 5% 40,000 2010 to 2012

6% decline

35,000

2007 to 2009

30,000

25,000 Up 9% 1983 &1984

7% decline 20,000 1979 to 1982

15,000 0

1975 1979 1983 1987 1991 1995 1999 2003 2007 2012 2011

Electric Salesa vs Prior Years

+2.1% +2.2%

+1.7%

+1.3%

? 0.7%

+5% ? 2.0% ? 3.0%

? 6%

2006 2007 2008 2009 2010 2011 2012

a Weather adjusted

. . . . adds rate “headroom”.

66

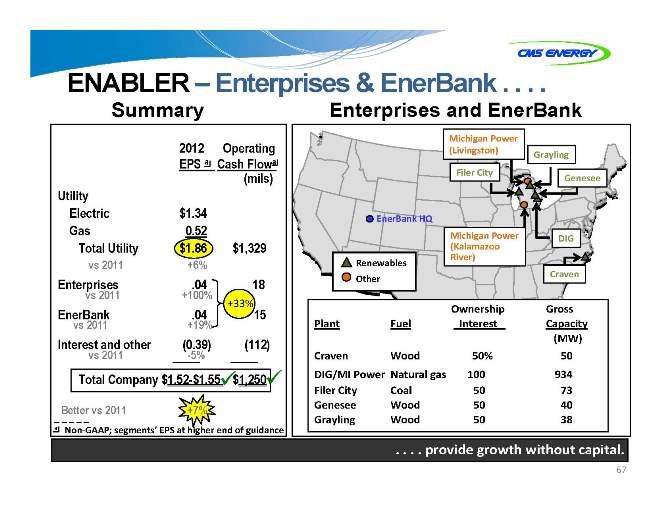

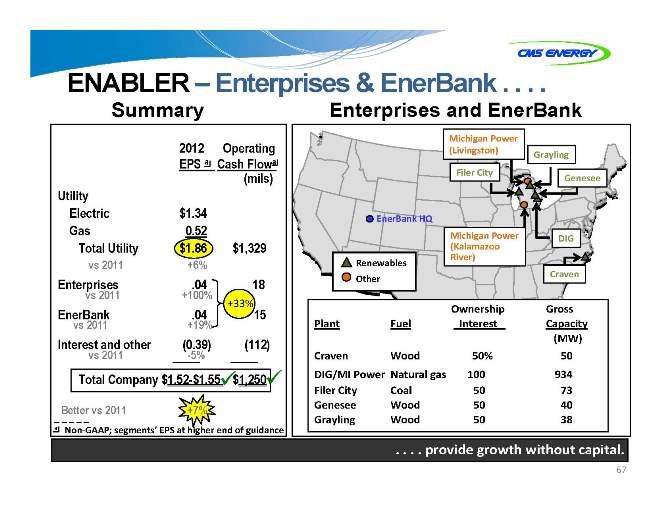

ENABLER – Enterprises & EnerBank . . . .

Summary Enterprises and EnerBank

2012 Operating EPS a Cash Flowa (mils) Utility Electric $1.34 Gas 0.52 Total Utility $1.86 $1,329

vs 2011 +6%

Enterprises .04 18

vs 2011 +100%

EnerBank .04 +33%15

vs 2011 +19%

Interest and other (0.39) (112)

vs 2011 -5%

Total Company $1.52-$1.55?$1,250?

_ Better vs 2011 +7% a Non? GAAP; segments’ EPS at higher end of guidance

Michigan Power

(Livingston)

Grayling

Filer City

Genesee

EnerBank HQ

Michigan Power DIG (Kalamazoo River) Renewables Craven Other

Ownership Gross Plant Fuel Interest Capacity (MW) Craven Wood 50% 50 DIG/MI Power Natural gas 100 934 Filer City Coal 50 73 Genesee Wood 50 40 Grayling Wood 50 38

. . . . provide growth without capital.

67

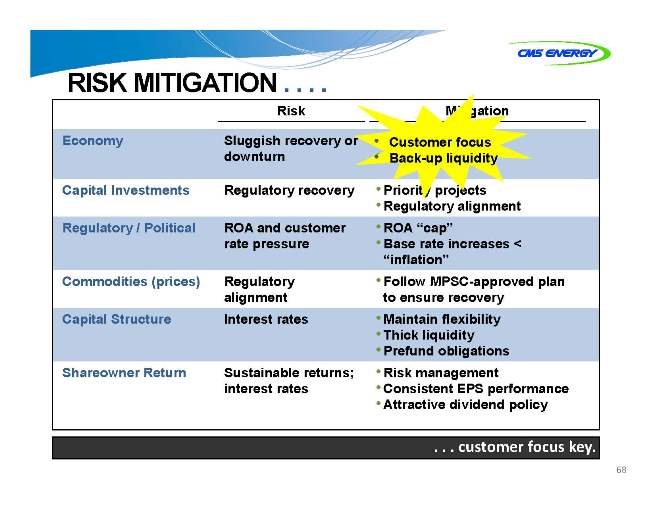

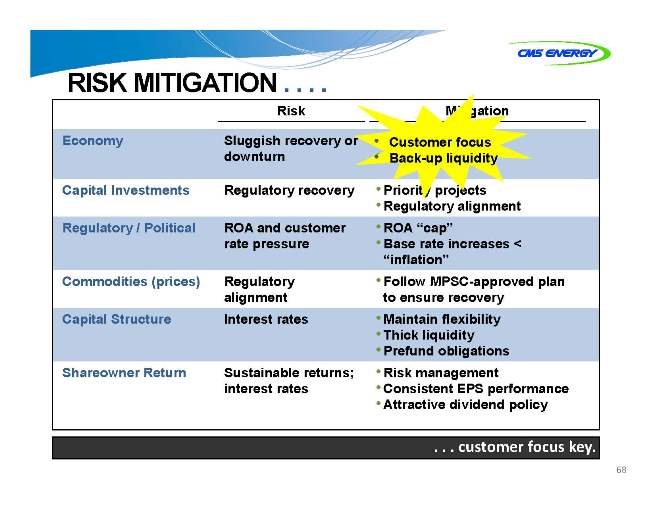

RISK MITIGATION . . . .

Risk Mitigation Economy Sluggish recovery or •• Customer focus downturn •• Back -up -up liquidity Capital Investments Regulatory recovery •Priority projects •Regulatory alignment Regulatory / Political ROA and customer •ROA “cap” rate pressure •Base rate increases < “inflation” Commodities (prices) Regulatory •Follow MPSC-approved plan alignment to ensure recovery Capital Structure Interest rates •Maintain flexibility •Thick liquidity •Prefund obligations Shareowner Return Sustainable returns; •Risk management interest rates •Consistent EPS performance •Attractive dividend policy

. . . customerustomer focus key.

68

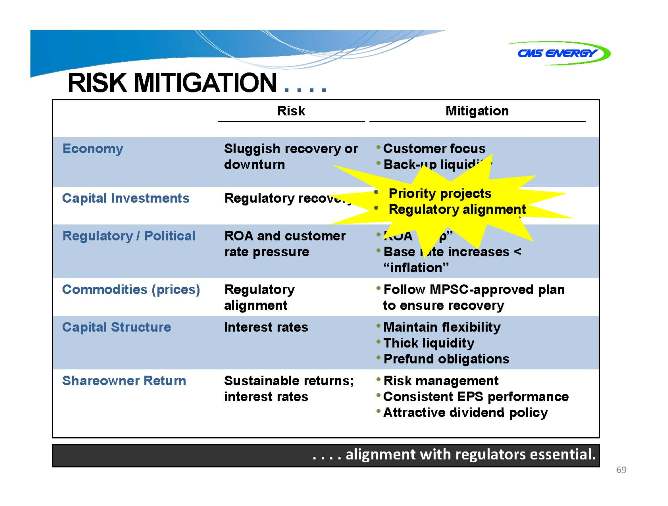

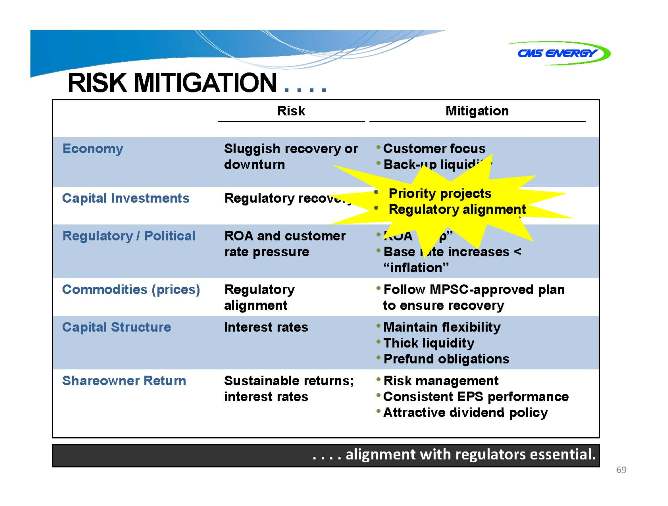

RISK MITIGATION . . . .

Risk Mitigation

Economy Sluggish recovery or •Customer focus downturn •Back-up liquidity Capital Investments Regulatory recovery ••Priority Priorityprojects projects ••Re Regulatory gulatory ali alignment gnment Regulatory / Political ROA and customer •ROA “cap” rate pressure •Base rate increases < “inflation” Commodities (prices) Regulatory •Follow MPSC-approved plan alignment to ensure recovery Capital Structure Interest rates •Maintain flexibility •Thick liquidity •Prefund obligations Shareowner Return Sustainable returns; •Risk management interest rates •Consistent EPS performance •Attractive dividend policy

. . . . alignmentlignment with regulators essential.

69

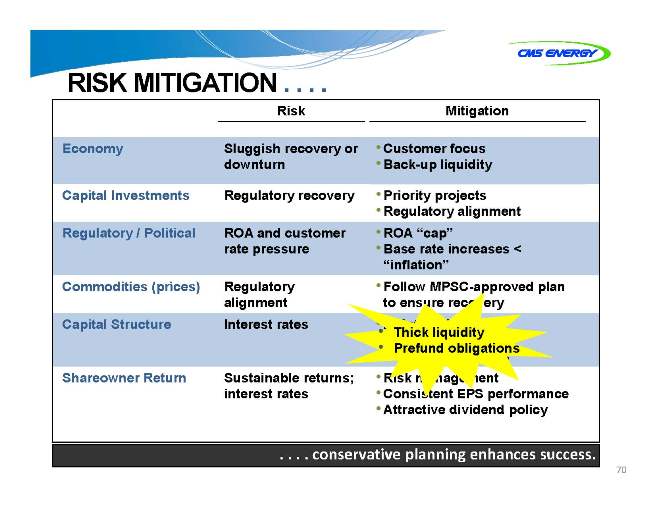

RISK MITIGATION . . . .

Risk Mitigation

Economy Sluggish recovery or •Customer focus downturn •Back-up liquidity Capital Investments Regulatory recovery •Priority projects •Regulatory alignment Regulatory / Political ROA and customer •ROA “cap” rate pressure •Base rate increases < “inflation” Commodities (prices) Regulatory •Follow MPSC-approved plan alignment to ensure recovery Capital Structure Interest rates •Maintain flexibility •• Thick liquidity •Thick liquidity Prefund obligations •Prefund obligations Shareowner Return Sustainable returns; •Risk management interest rates •Consistent EPS performance •Attractive dividend policy

. . . . conservativeonservative planning enhances success.

70

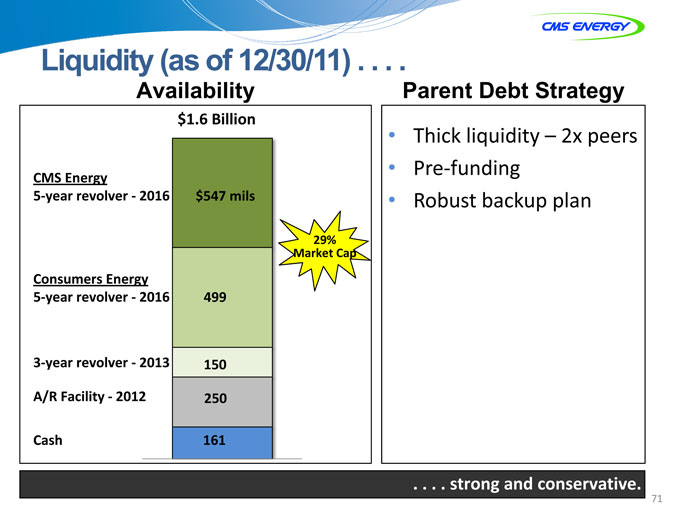

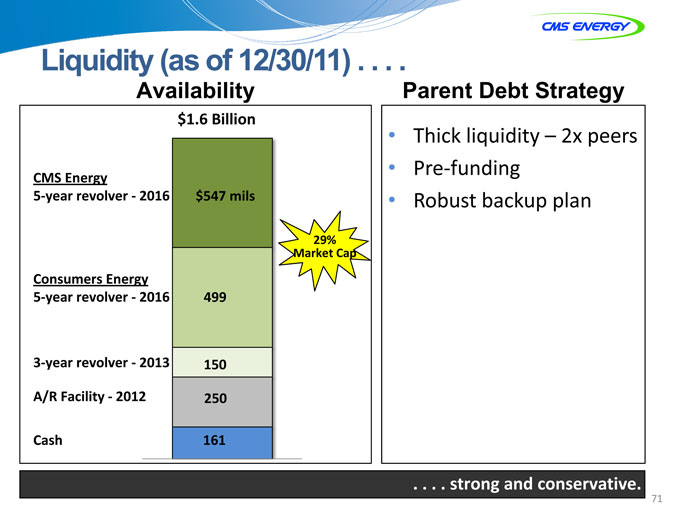

Liquidity (as of 12/30/11) .

Availability

$1.6 Billion

CMS Energy

5? year revolver 2016 ? $547 mils

29% Market Cap

Consumers Energy

5? year revolver 2016 ? 499

3? year revolver 2013 ? 150

A/R Facility 2012 ? 250

Cash 161

Parent Debt Strategy

Thick liquidity – 2x peers Pre? funding Robust backup plan

. . . . strongtrong and conservative.

71

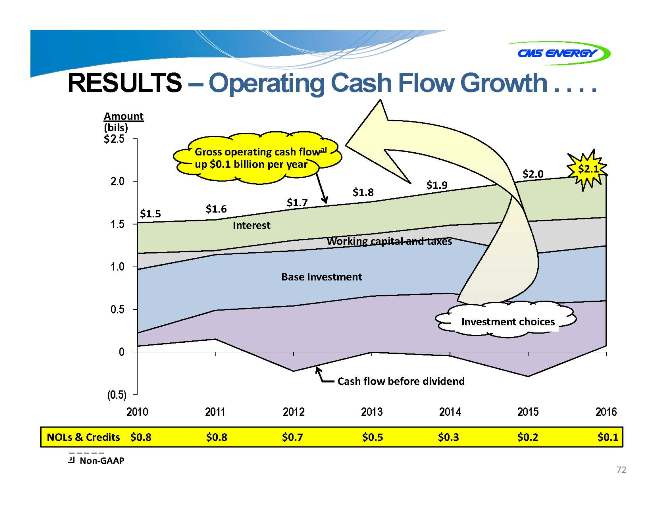

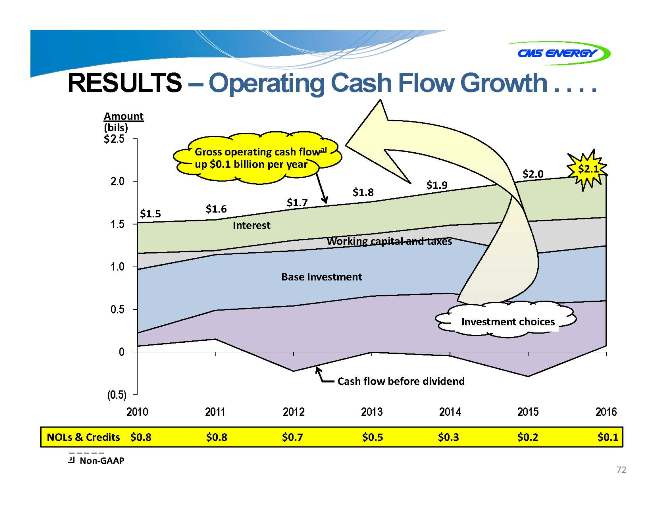

RESULTS – Operating Cash Flow Growth . . . .

Amount (bils) $2.5

Gross operating cash flowa up $0.1 billion per year

$2.1

$2.0

2.0 $1.9

$1.8

$1.7

$1.6

1.5 $1.5

Interest

Working capital and taxes

1.0

Base Investment

0.5

Investment choices

0.0

Cash flow before dividend

(0.5)

2010 2011 2012 2013 2014 2015 2016

NOLs & Credits $0.8 $0.8 $0.7 $0.5 $0.3 $0.2 $0.1

a Non? GAAP

72

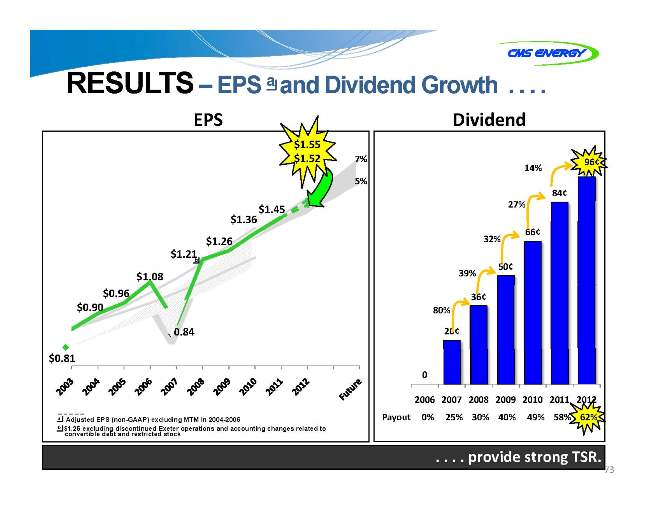

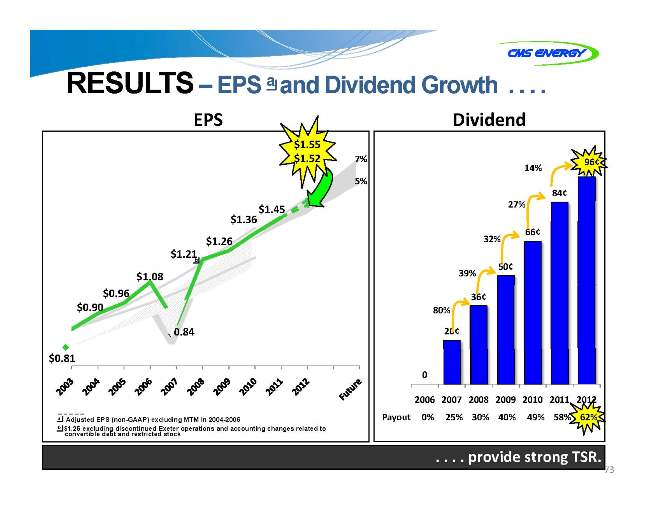

RESULTS– EPS a and Dividend Growth . . . .

EPS

$1.55

$1.52 7% 5%

$1.45

$1.36

$1.26

$1.21

b

$1.08

$0.96

$0.90

$0.84

$0.81

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006 b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

Dividend

96¢ 14%

84¢ 27%

32% 66¢

50¢ 39%

36¢ 80%

20¢

0

2006 2007 2008 2009 2010 2011 2012

Payout 0% 25% 30% 40% 49% 58% 62%

. . . . providerovide strong TSR.

73

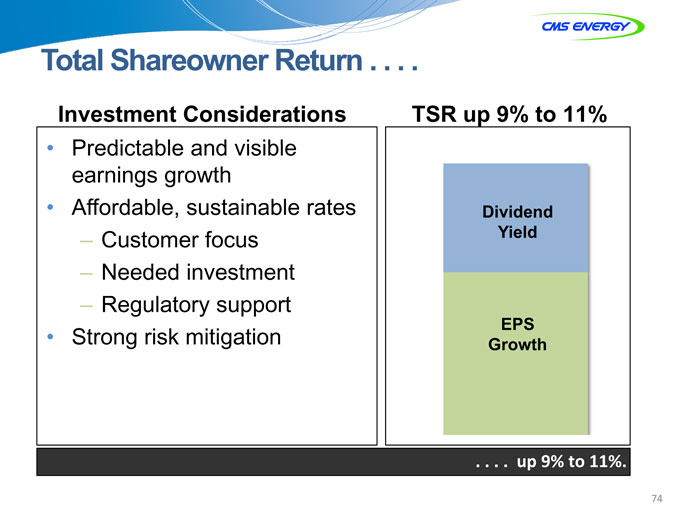

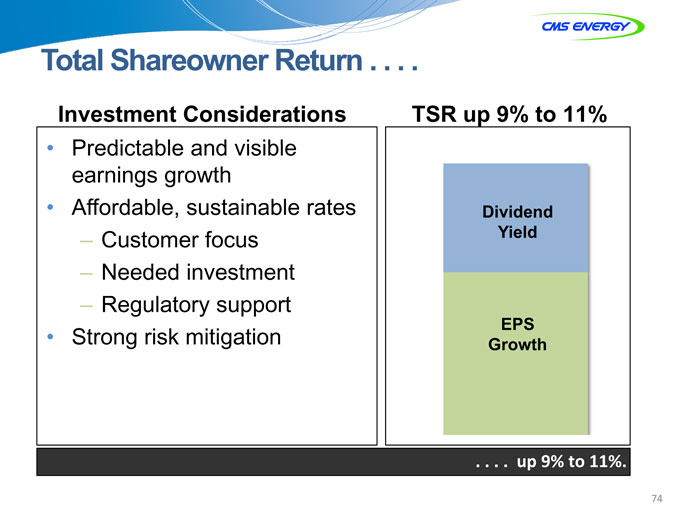

Total Shareowner Return . . . .

Investment Considerations

Predictable and visible earnings growth Affordable, sustainable rates

– Customer focus

– Needed investment

– Regulatory support Strong risk mitigation

TSR up 9% to 11%

Dividend Yield

EPS Growth

. . . . upp 9% to 11%.

74

APPENDIX

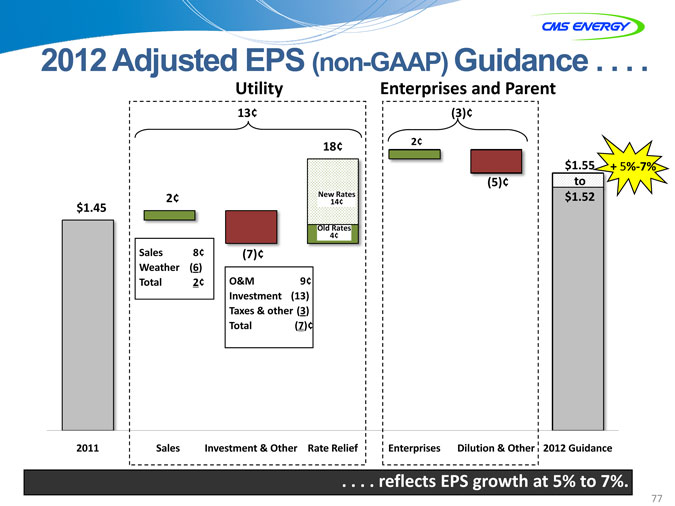

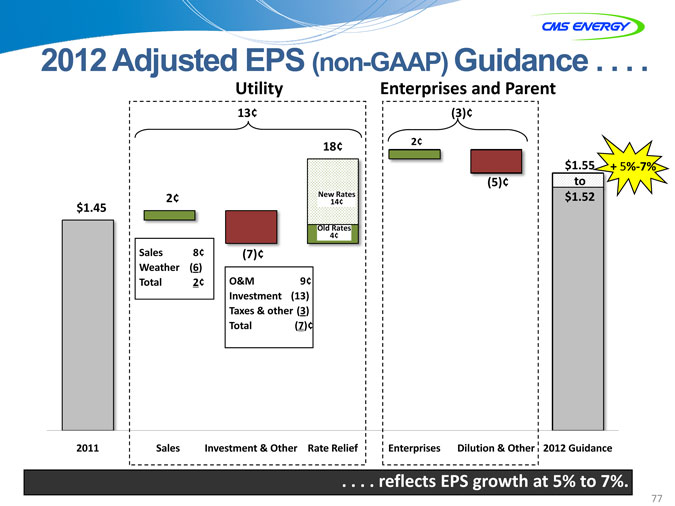

2012 Adjusted EPS (non-GAAP) Guidance . . . .

Utility Enterprises and Parent

13¢

18¢

$1.45

Old Rates 4¢

Sales 8¢ (7)¢ Weather (6)

Total 2¢ O&M 9¢ Investment (13) Taxes & other (3) Total (7)¢

2011 Sales Investment & Other Rate Relief

$1.55 + 5%? 7% (5)¢ to

$1.52

Enterprises Dilution & Other 2012 Guidance

. . . . reflects EPS growth at 5% to 7%.

77

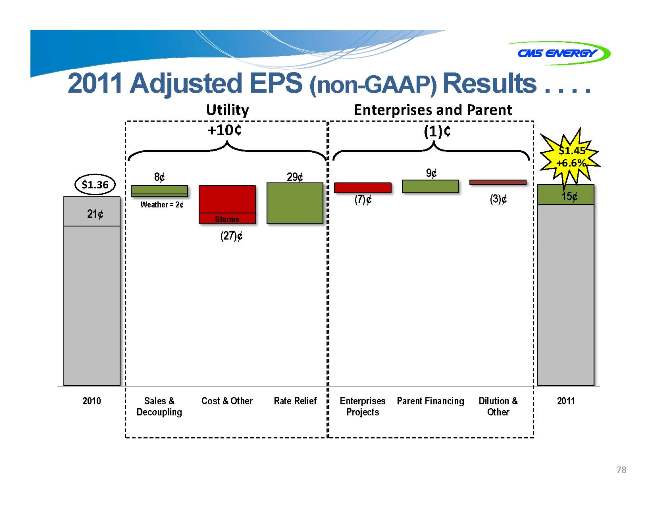

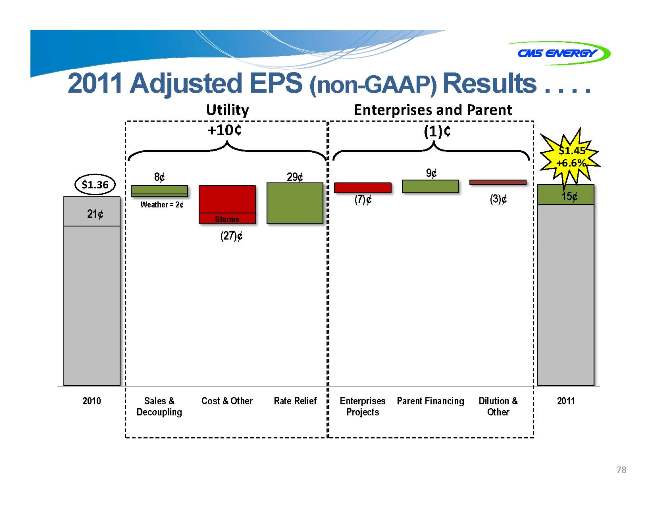

2011 Adjusted EPS (non-GAAP) Results . . . .

Utility +10¢

$1.36

Weather = 2¢

21¢

Storms

2010 Sales & Cost & Other Rate Relief Decoupling

Enterprises and Parent (1)¢

$1.45

9¢ +6.6%

Enterprises Parent Financing Dilution & 2011 Projects Other

78

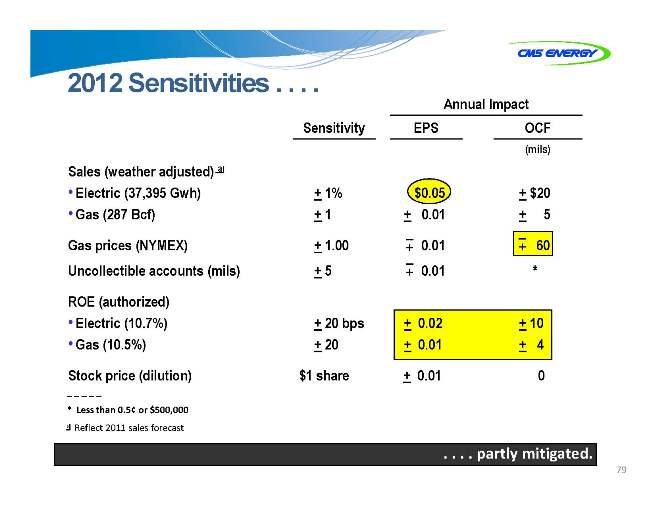

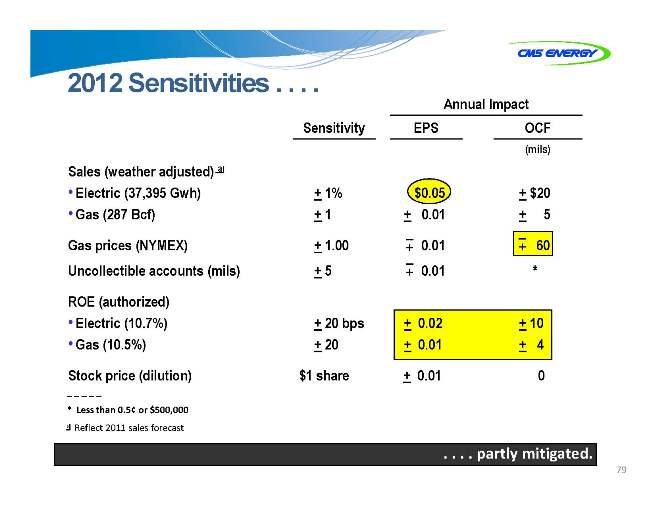

2012 Sensitivities . . . .

Annual Impact Sensitivity EPS OCF

(mils)

Sales (weather adjusted) a

• Electric (37,395 Gwh) + 1% $0.05 + $20

• Gas (287 Bcf) + 1 + 0.01 + 5 Gas prices (NYMEX) + 1.00 –+ 0.01 –+ 60 Uncollectible accounts (mils) + 5 –+ 0.01 * ROE (authorized)

• Electric (10.7%) + 20 bps + 0.02 + 10

• Gas (10.5%) + 20 + 0.01 + 4 Stock price (dilution) $1 share + 0.01 0

* | | Less than 0.5¢ or $500,000 a Reflect 2011 sales forecast |

. . . . partly mitigated.

79

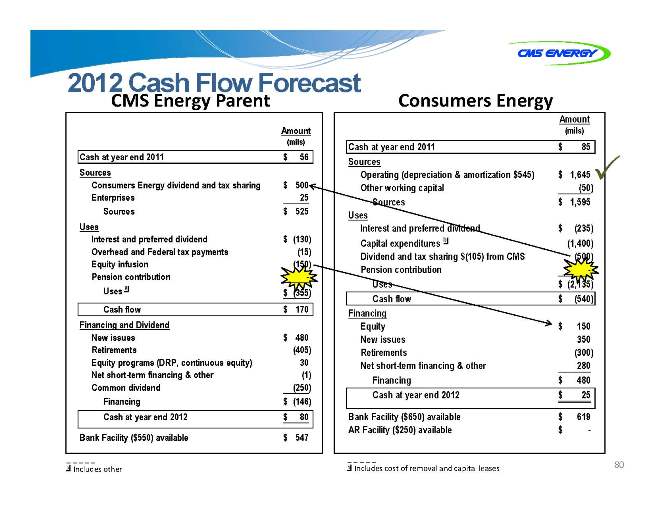

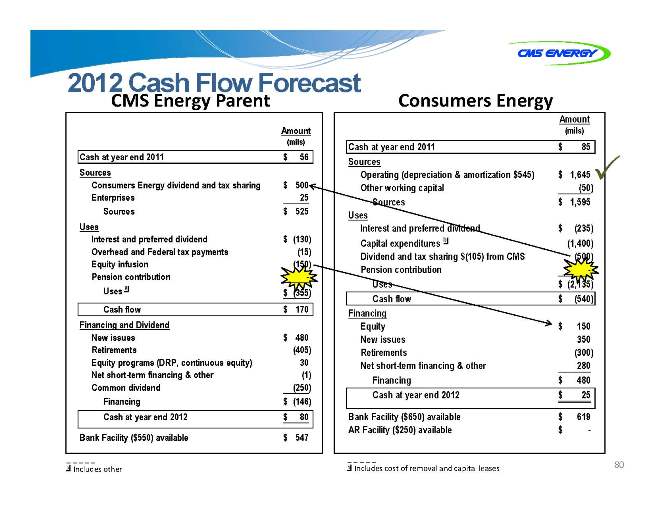

2012 CMS Cash Energy Flow Parent Forecast

Consumers Energy

Amount (mils) Cash at year end 2011 $ 56 Sources Consumers Energy dividend and tax sharing $ 500 Enterprises 25 Sources $ 525 Uses Interest and preferred dividend $ (130) Overhead and Federal tax payments (15) Equity infusion (150) Pension contribution -Uses a $ (355) Cash flow $ 170 Financing and Dividend New issues $ 480 Retirements (405) Equity programs (DRP, continuous equity) 30 Net short-term financing & other (1) Common dividend (250) Financing $ (146) Cash at year end 2012 $ 80

Bank Facility ($550) available $ 547

a Includes other

Amount (mils) Cash at year end 2011 $ 85 Sources Operating (depreciation & amortization $545) $ 1,645 Other working capital (50) Sources $ 1,595 Uses Interest and preferred dividend $ (235) Capital expenditures b (1,400) Dividend and tax sharing $(105) from CMS (500) Pension contribution -Uses $ (2,135) Cash flow $ (540) Financing Equity $ 150 New issues 350 Retirements (300) Net short-term financing & other 280 Financing $ 480 Cash at year end 2012 $ 25

Bank Facility ($650) available $ 619 AR Facility ($250) available $ -

b Includes cost of removal and capital leases

80

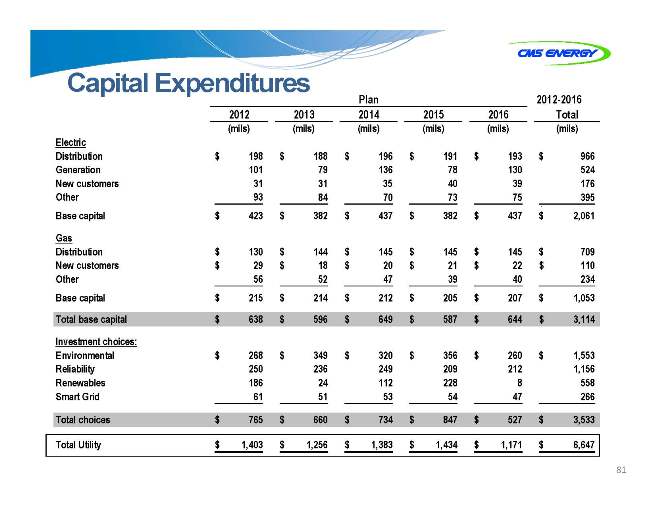

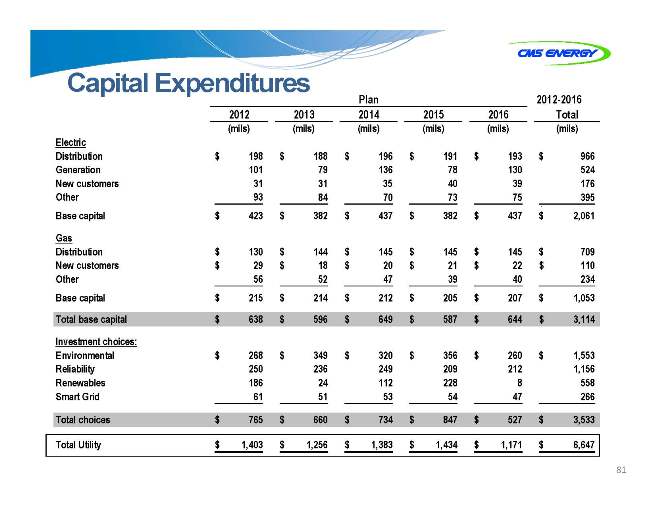

Capital Expenditures

Plan 2012-2016 2012 2013 2014 2015 2016 Total (mils) (mils) (mils) (mils) (mils) (mils) Electric Distribution $ 198 $ 188 $ 196 $ 191 $ 193 $ 966 Generation 101 79 136 78 130 524 New customers 31 31 35 40 39 176 Other 93 84 70 73 75 $ 395 Base capital $ 423 $ 382 $ 437 $ 382 $ 437 $ 2,061 Gas Distribution $ 130 $ 144 $ 145 $ 145 $ 145 $ 709 New customers $ 29 $ 18 $ 20 $ 21 $ 22 $ 110 Other 56 52 47 39 40 234 Base capital $ 215 $ 214 $ 212 $ 205 $ 207 $ 1,053 Total base capital $ 638 $ 596 $ 649 $ 587 $ 644 $ 3,114 Investment choices: Environmental $ 268 $ 349 $ 320 $ 356 $ 260 $ 1,553 Reliability 250 236 249 209 212 1,156 Renewables 186 24 112 228 8 558 Smart Grid 61 51 53 54 47 266

Total choices $ 765 $ 660 $ 734 $ 847 $ 527 $ 3,533

Total Utility $ 1,403 $ 1,256 $ 1,383 $ 1,434 $ 1,171 $ 6,647

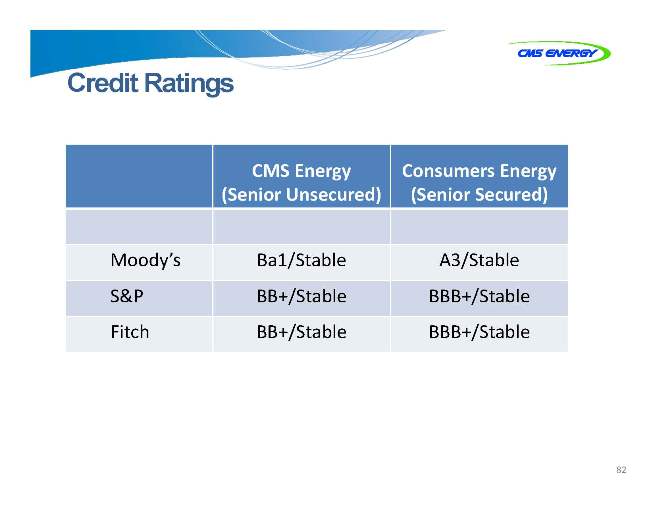

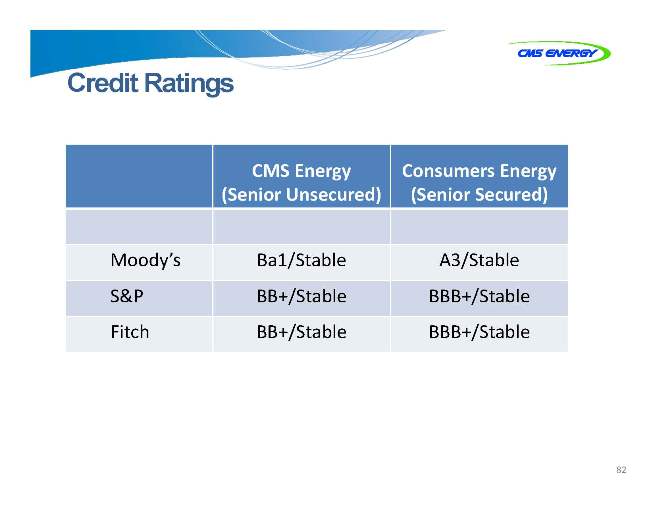

Credit Ratings

CMS Energy Consumers Energy (Senior Unsecured) (Senior Secured)

Moody’s Ba1/Stable A3/Stable S&P BB+/Stable BBB+/Stable Fitch BB+/Stable BBB+/Stable

82

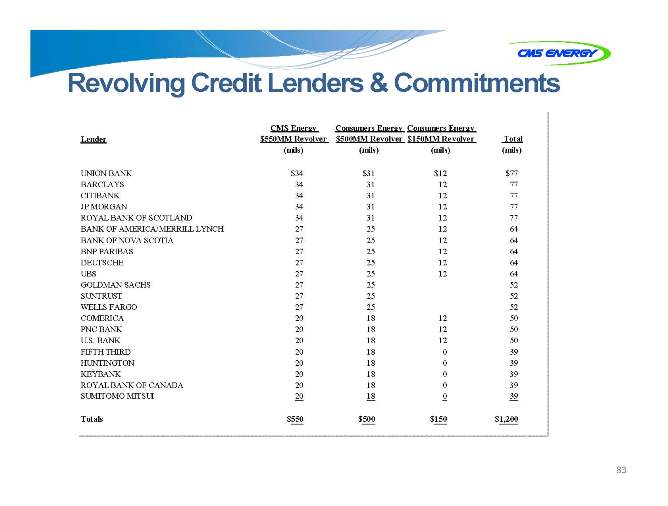

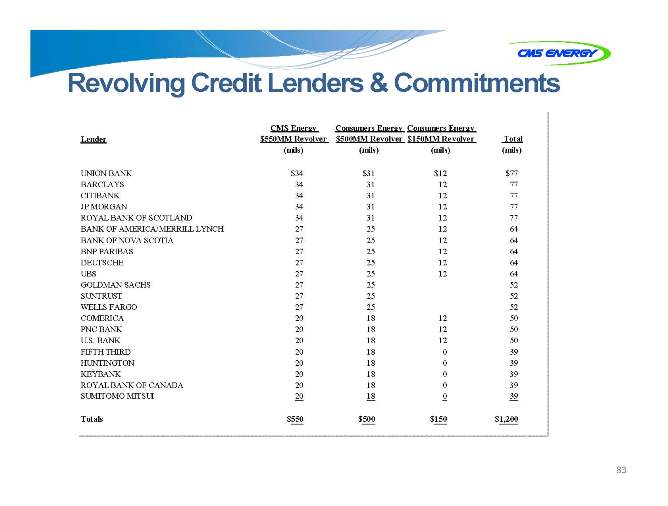

Revolving Credit Lenders & Commitments

CMS Energy Consumers Energy Consumers Energy

Lender $550MM Revolver $500MM Revolver $150MM Revolver Total (mils) (mils) (mils) (mils)

UNION BANK $34 $31 $12 $77 BARCLAYS 34 31 12 77 CITIBANK 34 31 12 77 JP MORGAN 34 31 12 77 ROYAL BANK OF SCOTLAND 34 31 12 77 BANK OF AMERICA/MERRILL LYNCH 27 25 12 64 BANK OF NOVA SCOTIA 27 25 12 64 BNP PARIBAS 27 25 12 64 DEUTSCHE 27 25 12 64 UBS 27 25 12 64

GOLDMAN SACHS 27 25 52 SUNTRUST 27 25 52 WELLS FARGO 27 25 52 COMERICA 20 18 12 50 PNC BANK 20 18 12 50 U.S. BANK 20 18 12 50 FIFTH THIRD 20 18 0 39 HUNTINGTON 20 18 0 39 KEYBANK 20 18 0 39 ROYAL BANK OF CANADA 20 18 0 39 SUMITOMO MITSUI 20 18 0 39

Totals $550 $500 $150 $1,200

83

GAAP RECONCILIATION

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2009

| | | 2010

| | | 2011

| | | 2012

| | | 2013

| | | 2014

| | | 2015

| | | 2016

| |

Consumers Operating Income + Depreciation & Amortization | | $ | 1,248 | | | $ | 1,498 | | | $ | 1,527 | | | $ | 1,645 | | | $ | 1,735 | | | $ | 1,860 | | | $ | 1,976 | | | $ | 2,051 | |

Enterprises Project Cash Flows | | | 16 | | | | 39 | | | | 24 | | | | 25 | | | | 27 | | | | 33 | | | | 35 | | | | 35 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross Operating Cash Flow | | $ | 1,264 | | | $ | 1,537 | | | $ | 1,551 | | | $ | 1,670 | | | $ | 1,762 | | | $ | 1,893 | | | $ | 2,011 | | | $ | 2,086 | |

Other operating activities including taxes, interest payments and working capital | | | (416 | ) | | | (578 | ) | | | (382 | ) | | | (420 | ) | | | (412 | ) | | | (443 | ) | | | (756 | ) | | | (776 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net cash provided by operating activities | | $ | 848 | | | $ | 959 | | | $ | 1,169 | | | $ | 1,250 | | | $ | 1,350 | | | $ | 1,450 | | | $ | 1,255 | | | $ | 1,310 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

2009-16 OCF

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | | 2004

| | | 2005

| | | 2006

| | | 2007

| | | 2008

| | | 2009

| | | 2010

| | | 2011

| |

Reported earnings (loss) per share - GAAP | | | ($0.30 | ) | | | $0.64 | | | | ($0.44 | ) | | | ($0.41 | ) | | | ($1.02 | ) | | $ | 1.20 | | | $ | 0.91 | | | $ | 1.28 | | | $ | 1.58 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.21 | | | | (0.39 | ) | | | — | | | | — | | | | (0.07 | ) | | | 0.05 | | | | 0.33 | | | | 0.03 | | | | 0.00 | |

Enterprises | | | 0.74 | | | | 0.62 | | | | 0.04 | | | | (0.02 | ) | | | 1.25 | | | | (0.02 | ) | | | 0.09 | | | | (0.03 | ) | | | (0.11 | ) |

Corporate interest and other | | | 0.16 | | | | (0.03 | ) | | | 0.04 | | | | 0.27 | | | | (0.32 | ) | | | (0.02 | ) | | | 0.01 | | | | * | | | | (0.01 | ) |

Discontinued operations (income) loss | | | (0.16 | ) | | | 0.02 | | | | (0.07 | ) | | | (0.03 | ) | | | 0.40 | | | | (* | ) | | | (0.08 | ) | | | 0.08 | | | | (0.01 | ) |

Asset impairment charges, net | | | — | | | | — | | | | 1.82 | | | | 0.76 | | | | 0.60 | | | | — | | | | — | | | | — | | | | — | |

Cumulative accounting changes | | | 0.16 | | | | 0.01 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, including MTM - non-GAAP | | $ | 0.81 | | | $ | 0.87 | | | $ | 1.39 | | | $ | 0.57 | | | $ | 0.84 | | | $ | 1.21 | (a) | | $ | 1.26 | | | $ | 1.36 | | | $ | 1.45 | |

Mark-to-market impacts | | | | | | | 0.03 | | | | (0.43 | ) | | | 0.51 | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, excluding MTM - non-GAAP | | | NA | | | $ | 0.90 | | | $ | 0.96 | | | $ | 1.08 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | | Less than $500 thousand or $0.01 per share. |

| (a) | | $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. |

2003-11 EPS

CMS ENERGY CORPORATION

Earnings By Quarter and Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

(In millions, except per share amounts)

| | 2010

| |

| | | 1Q

| | | 2Q

| | | 3Q

| | | 4Q

| | | YTD Dec

| |

Reported net income - GAAP | | $ | 85 | | | $ | 80 | | | $ | 134 | | | $ | 25 | | | $ | 324 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 6 | | | | * | | | | — | | | | — | | | | 6 | |

Enterprises | | | 1 | | | | (31 | ) | | | (2 | ) | | | 24 | | | | (8 | ) |

Corporate interest and other | | | * | | | | * | | | | — | | | | * | | | | * | |

Discontinued operations loss | | | 1 | | | | 16 | | | | * | | | | 6 | | | | 23 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted income - non-GAAP | | $ | 93 | | | $ | 65 | | | $ | 132 | | | $ | 55 | | | $ | 345 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Average shares outstanding, basic | | | 228.0 | | | | 228.2 | | | | 229.0 | | | | 240.7 | | | | 231.5 | |

Average shares outstanding, diluted | | | 246.5 | | | | 247.6 | | | | 254.7 | | | | 258.4 | �� | | | 252.9 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Reported earnings per share - GAAP | | $ | 0.34 | | | $ | 0.32 | | | $ | 0.53 | | | $ | 0.09 | | | $ | 1.28 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.03 | | | | * | | | | — | | | | — | | | | 0.03 | |

Enterprises | | | * | | | | (0.13 | ) | | | (0.01 | ) | | | 0.10 | | | | (0.03 | ) |

Corporate interest and other | | | * | | | | * | | | | — | | | | * | | | | * | |

Discontinued operations loss | | | 0.01 | | | | 0.07 | | | | * | | | | 0.02 | | | | 0.08 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share - non-GAAP | | $ | 0.38 | | | $ | 0.26 | | | $ | 0.52 | | | $ | 0.21 | | | $ | 1.36 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| |

(In millions, except per share amounts)

| | 2011

| |

| | | 1Q

| | | 2Q

| | | 3Q

| | | 4Q

| | | YTD Dec

| |

Reported net income - GAAP | | $ | 135 | | | $ | 100 | | | $ | 139 | | | $ | 41 | | | $ | 415 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | — | | | | — | | | | — | | | | — | | | | — | |

Enterprises | | | * | | | | (28 | ) | | | * | | | | 1 | | | | (27 | ) |

Corporate interest and other | | | — | | | | (4 | ) | | | — | | | | * | | | | (4 | ) |

Discontinued operations income | | | (2 | ) | | | * | | | | * | | | | * | | | | (2 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted income - non-GAAP | | $ | 133 | | | $ | 68 | | | $ | 139 | | | $ | 42 | | | $ | 382 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Average shares outstanding, basic | | | 250.0 | | | | 250.3 | | | | 251.3 | | | | 251.7 | | | | 250.8 | |

Average shares outstanding, diluted | | | 261.7 | | | | 261.9 | | | | 263.9 | | | | 265.5 | | | | 263.4 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Reported earnings per share - GAAP | | $ | 0.52 | | | $ | 0.38 | | | $ | 0.53 | | | $ | 0.15 | | | $ | 1.58 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | — | | | | — | | | | — | | | | — | | | | — | |

Enterprises | | | * | | | | (0.11 | ) | | | * | | | | * | | | | (0.11 | ) |

Corporate interest and other | | | — | | | | (0.01 | ) | | | — | | | | * | | | | (0.01 | ) |

Discontinued operations income | | | (0.01 | ) | | | * | | | | * | | | | * | | | | (0.01 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share - non-GAAP | | $ | 0.51 | | | $ | 0.26 | | | $ | 0.53 | | | $ | 0.15 | | | $ | 1.45 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Note: Year-to-date (YTD) EPS may not equal sum of quarters due to share count differences.

* | | Less than $500 thousand or $0.01 per share. |

2011 A-1

CMS Energy Corporation

Earnings Segment Results GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

| | | Twelve Months Ended

| |

December 31

| | 2011

| | | 2010

| | | 2011

| | | 2010

| |

Electric Utility | | | | | | | | | | | | | | | | |

Reported | | $ | 0.09 | | | $ | 0.08 | | | $ | 1.27 | | | $ | 1.20 | |

Downsizing Program | | | — | | | | — | | | | — | | | | 0.02 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | 0.09 | | | $ | 0.08 | | | $ | 1.27 | | | $ | 1.22 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gas Utility | | | | | | | | | | | | | | | | |

Reported | | $ | 0.16 | | | $ | 0.22 | | | $ | 0.49 | | | $ | 0.50 | |

Downsizing Program | | | — | | | | — | | | | — | | | | 0.01 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | 0.16 | | | $ | 0.22 | | | $ | 0.49 | | | $ | 0.51 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Enterprises | | | | | | | | | | | | | | | | |

Reported | | $ | (0.01 | ) | | $ | (0.07 | ) | | $ | 0.13 | | | $ | 0.14 | |

Tax Changes | | | — | | | | — | | | | (0.11 | ) | | | — | |

Asset Sales (Gains) Losses and Other | | | * | | | | 0.10 | | | | * | | | | (0.03 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | (0.01 | ) | | $ | 0.03 | | | $ | 0.02 | | | $ | 0.11 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Corporate Interest and Other | | | | | | | | | | | | | | | | |

Reported | | $ | (0.09 | ) | | $ | (0.12 | ) | | $ | (0.32 | ) | | $ | (0.48 | ) |

Tax Changes | | | — | | | | — | | | | (0.01 | ) | | | — | |

Asset Sales Gains and Other | | | * | | | | * | | | | * | | | | * | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | (0.09 | ) | | $ | (0.12 | ) | | $ | (0.33 | ) | | $ | (0.48 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Discontinued Operations | | | | | | | | | | | | | | | | |

Reported | | $ | * | | | $ | (0.02 | ) | | $ | 0.01 | | | $ | (0.08 | ) |

Discontinued Operations (Income) Loss | | | ( | *) | | | 0.02 | | | | (0.01 | ) | | | 0.08 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Totals | | | | | | | | | | | | | | | | |

Reported | | $ | 0.15 | | | $ | 0.09 | | | $ | 1.58 | | | $ | 1.28 | |

Discontinued Operations (Income) Loss | | | ( | *) | | | 0.02 | | | | (0.01 | ) | | | 0.08 | |

Downsizing Program | | | — | | | | — | | | | — | | | | 0.03 | |

Tax Changes | | | — | | | | — | | | | (0.12 | ) | | | — | |

Asset Sales (Gains) Losses and Other | | | * | | | | 0.10 | | | | * | | | | (0.03 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | 0.15 | | | $ | 0.21 | | | $ | 1.45 | | | $ | 1.36 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Average Common Shares Outstanding - Diluted (in millions) | | | 265.5 | | | | 258.4 | | | | 263.4 | | | | 252.9 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

* | | Less than $0.01 per share. |

2011 A-2

Consumers Energy

2011 Cash Flow GAAP Reconciliation (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Reclassifications From Sources and Uses to Statement of Cash Flows

| | | Consolidated Statements of Cash Flows

|

Presentation Sources and Uses

| | | Tax

Sharing

Operating

| | | Interest

Payments

as Operating

| | | Other Working

Capital

as Investing

| | | Capital

Lease Pymts

as Financing

| | | Securitization

Debt Pymts

as Financing

| | | Preferred

Dividends

as Financing

| | | Common

Dividends

as Financing

| | |

Description

| | non-GAAP

Amount

| | | | | | | | | | GAAP

Amount

| | | Description

|

Cash at year end 2010 | | $ | 71 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 71 | | | Cash at year end 2010 |

Sources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating | | $ | 1,527 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other working capital | | | 219 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by operating activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Sources | | $ | 1,746 | | | $ | 23 | | | $ | (231 | ) | | $ | (276 | ) | | $ | 24 | | | $ | 37 | | | $ | — | | | $ | — | | | $ | 1,323 | | |

Uses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest and preferred dividends | | $ | (233 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pension Contribution | | | (242 | ) | | | | | | | | | | | — | | | | | | | | | | | | | | | | | | | | | | | |

Capital expenditures | | | (985 | ) | | | | | | | | | | | — | | | | | | | | | | | | | | | | | | | | | | | |

Dividends/tax sharing to CMS | | | (351 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by investing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Uses | | $ | (1,811 | ) | | $ | (23 | ) | | $ | 231 | | | $ | 276 | | | $ | — | | | $ | — | | | $ | 2 | | | $ | 374 | | | $ | (951 | ) | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash flow | | $ | (65 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | 24 | | | $ | 37 | | | $ | 2 | | | $ | 374 | | | $ | 372 | | | Cash flow from operating and investing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financing | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity | | $ | 125 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Issues | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retirements | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net short-term financing & other | | | (46 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by financing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Financing | | $ | 79 | | | $ | — | | | $ | — | | | $ | — | | | $ | (24 | ) | | $ | (37 | ) | | $ | (2 | ) | | $ | (374 | ) | | $ | (358 | ) | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Net change in cash | | $ | 14 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 14 | | | Net change in cash |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash at year end 2011 | | $ | 85 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 85 | | | Cash at year end 2011 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

2011 A-3

CMS Energy Parent

2011 Cash Flow GAAP Reconciliation (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Reclassifications From Sources and Uses to Statement of Cash Flows

| | | | | | |

Presentation Sources and Uses

| | | Interest

Payments

as Operating

| | | Overheads &

Tax Payments

as Operating

| | | Other

Uses (a)

as Operating

| | | Financing

as Operating

and

Investing

| | | Other

and

Rounding

| | | Cash From

Consolidated

Companies

| | | Consolidated Statements of Cash Flows

|

Description

| | non-GAAP

Amount

| | | | | | | | | GAAP

Amount

| | | Description

|

Cash at year end 2010 | | $ | 163 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 13 | | | $ | 176 | | | Cash at year end 2010 |

Sources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consumers Energy dividends/tax sharing | | $ | 351 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Enterprises | | | 24 | | | | | | | | | | | | | | | | — | | | | — | | | | | | | | | | | Net cash provided by operating activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Sources | | $ | 375 | | | $ | (127 | ) | | $ | (23 | ) | | $ | (7 | ) | | $ | (9 | ) | | $ | — | | | $ | 11 | | | $ | 220 | | |

Uses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest and preferred dividends | | $ | (127 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Overhead and Federal tax payments | | | (23 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity infusions | | | (125 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pension contribution | | | (8 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by investing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Uses (a) | | $ | (283 | ) | | $ | 127 | | | $ | 23 | | | $ | 7 | | | $ | (4 | ) | | $ | — | | | $ | (102 | ) | | $ | (232 | ) | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash flow | | $ | 92 | | | $ | — | | | $ | — | | | $ | — | | | $ | (13 | ) | | $ | — | | | $ | (91 | ) | | $ | (12 | ) | | Cash flow from operating and investing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financing and dividends | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Issues | | $ | 250 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retirements | | | (262 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity programs (DRP, continuous equity) | | | 29 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net short-term financing & other | | | (5 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Common dividend | | | (211 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by financing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Financing | | $ | (199 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | 13 | | | $ | (2 | ) | | $ | 98 | | | $ | (90 | ) | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Net change in cash | | $ | (107 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | (2 | ) | | $ | 7 | | | $ | (102 | ) | | Net change in cash |

Change in Cash and Cash Equivalents | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2 | | | | — | | | | 2 | | | Change in Cash and Cash Equivalents |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash at year end 2011 | | $ | 56 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 20 | | | $ | 76 | | | Cash at year end 2011 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

| (a) | | Includes other and roundings |

2011 A-4

Consolidated CMS Energy

2011 Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Eliminations/Reclassifications

to Arrive at the Consolidated

Statement of Cash Flows

| | | | | | |

Statements of Cash Flows

| | | Consumers Common Dividend as Financing

| | | Equity Infusions to Consumers

| | | | | | |

| | | Consumers Amount

| | | CMS Parent Amount

| | | | | Consolidated Statements of Cash Flows

|

Description

| | | | | | Amount

| | | Description

|

Cash at year end 2010 | | $ | 71 | | | $ | 176 | | | $ | — | | | $ | — | | | $ | 247 | | | Cash at year end 2010 |

Net cash provided by operating activities | | $ | 1,323 | | | $ | 220 | | | $ | (374 | ) | | $ | — | | | $ | 1,169 | | | Net cash provided by operating activities |

Net cash provided by investing activities | | | (951 | ) | | | (232 | ) | | | — | | | | 125 | | | | (1,058 | ) | | Net cash provided by investing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash flow from operating and investing activities | | $ | 372 | | | $ | (12 | ) | | $ | (374 | ) | | $ | 125 | | | $ | 111 | | | Cash flow from operating and investing activities |

Net cash provided by financing activities | | $ | (358 | ) | | $ | (90 | ) | | $ | 374 | | | $ | (125 | ) | | $ | (199 | ) | | Net cash provided by financing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Net change in cash | | $ | 14 | | | $ | (102 | ) | | $ | — | | | $ | — | | | $ | (88 | ) | | Net change in cash |

Change in Cash and Cash Equivalents | | | — | | | | 2 | | | | — | | | | — | | | | 2 | | | Decrease (Increase) in Cash and Cash Equivalents |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash at year end 2011 | | $ | 85 | | | $ | 76 | | | $ | — | | | $ | — | | | $ | 161 | | | Cash at year end 2011 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

2011 A-5

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2004

| | | 2005

| | | 2006

| | | 2007

| | | 2008

| | | Five Year

Average

| |

Utility Operating Income + Depreciation & Amortization | | $ | 1,022 | | | $ | 899 | | | $ | 1,021 | | | $ | 1,085 | | | $ | 1,317 | | | $ | 1,069 | |

Enterprises Project Cash Flows | | | 131 | | | | 294 | | | | 154 | | | | (30 | ) | | | 28 | | | | 115 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross Operating Cash Flow | | $ | 1,153 | | | $ | 1,193 | | | $ | 1,175 | | | $ | 1,055 | | | $ | 1,345 | | | $ | 1,184 | |

Other operating activies including taxes, interest payments and working capital | | | (800 | ) | | | (595 | ) | | | (487 | ) | | | (1,032 | ) | | | (788 | ) | | | (740 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net cash provided by operating activites | | $ | 353 | | | $ | 598 | | | $ | 688 | | | $ | 23 | | | $ | 557 | | | $ | 444 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

2004-2008 OCF

Consumers Energy

2012 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Reclassifications From Sources and Uses to Statement of Cash Flows

| | | | | | |

Presentation Sources and Uses

| | | Tax

Sharing

Operating

| | | Interest

Payments

as Operating

| | | Other

Working

Capital

as Investing

| | | Capital

Lease Pymts

as Financing

| | | Securitization

Debt Pymts

as Financing

| | | Preferred

Dividends

as Financing

| | | Common

Dividends

as Financing

| | | Consolidated Statements of Cash Flows

|

| | | non-GAAP | | | | | | | | | | GAAP | | | |

Description

| | Amount

| | | | | | | | | | Amount

| | | Description

|

Cash at year end 2011 | | $ | 85 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 85 | | | Cash at year end 2011 |

Sources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating | | $ | 1,645 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other working capital | | | (50 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by operating activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Sources | | $ | 1,595 | | | $ | (105 | ) | | $ | (233 | ) | | $ | 9 | | | $ | 30 | | | $ | 39 | | | $ | — | | | $ | — | | | $ | 1,335 | | |

Uses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest and preferred dividends | | $ | (235 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital expenditures | | | (1,400 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends/tax sharing to CMS | | | (500 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by investing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Uses | | $ | (2,135 | ) | | $ | 105 | | | $ | 233 | | | $ | (9 | ) | | $ | — | | | $ | — | | | $ | 2 | | | $ | 395 | | | $ | (1,409 | ) | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash flow | | $ | (540 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | 30 | | | $ | 39 | | | $ | 2 | | | $ | 395 | | | $ | (74 | ) | | Cash flow from operating andinvesting activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financing | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity | | $ | 150 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Issues | | | 350 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retirements | | | (300 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net short-term financing & other | | | 280 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by financing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Financing | | $ | 480 | | | $ | — | | | $ | — | | | $ | — | | | $ | (30 | ) | | $ | (39 | ) | | $ | (2 | ) | | $ | (395 | ) | | $ | 14 | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Net change in cash | | $ | (60 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | (60 | ) | | Net change in cash |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash at year end 2012 | | $ | 25 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 25 | | | Cash at year end 2012 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

2012 B-1

CMS Energy Parent

2012 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Reclassifications From Sources and Uses to Statement of Cash

Flows

| | | | | | |

Presentation Sources and Uses

| | | Interest

Payments

as Operating

| | | Overheads &

Tax

Payments

as Operating

| | | Other

Uses (a)

as Operating

| | | Financing

as Operating

| | | Cash From

Consolidated

Companies

| | | Consolidated Statements of Cash

Flows

|

Description

| | non-GAAP

Amount

| | | | | | | | GAAP

Amount

| | | Description

|

Cash at year end 2011 | | $ | 56 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 20 | | | $ | 76 | | | Cash at year end 2011 |

Sources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consumers Energy dividends/tax sharing | | $ | 500 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Enterprises | | | 25 | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided byoperating activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Sources | | $ | 525 | | | $ | (130 | ) | | $ | (15 | ) | | $ | (48 | ) | | $ | (35 | ) | | $ | 15 | | | $ | 312 | | |

Uses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest and preferred dividends | | $ | (130 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Overhead and Federal tax payments | | | (15 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity infusions | | | (150 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by investing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Uses (a) | | $ | (355 | ) | | $ | 130 | | | $ | 15 | | | $ | 48 | | | $ | — | | | $ | (141 | ) | | $ | (303 | ) | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash flow | | $ | 170 | | | $ | — | | | $ | — | | | $ | — | | | $ | (35 | ) | | $ | (126 | ) | | $ | 9 | | | Cash flow from operating and investing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financing and dividends | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Issues | | $ | 480 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retirements | | | (405 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity programs (DRP, continuous equity) | | | 30 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net short-term financing & other | | | (1 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Common dividend | | | (250 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by financing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Financing | | $ | (146 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | 35 | | | $ | 155 | | | $ | 44 | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Net change in cash | | $ | 24 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 29 | | | $ | 53 | | | Net change in cash |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash at year end 2012 | | $ | 80 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 49 | | | $ | 129 | | | Cash at year end 2012 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

(a) | | Includes other and roundings |

2012 B-2

Consolidated CMS Energy

2012 Forecasted Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Eliminations/Reclassifications to Arrive at

the Consolidated Statement of Cash Flows

| | | | | | |

Statements of Cash Flows

| | | Consumers

Common

Dividend

as Financing

| | | Consumers

Preferred

Dividend

as Operating

| | | Equity

Infusions to

Consumers

| | | | | | |

| | | Consumers

Amount

| | | CMS Parent

Amount

| | | | | | Consolidated Statements of Cash Flows

|

Description

| | | | | | | Amount

| | | Description

|

Cash at year end 2011 | | $ | 85 | | | $ | 76 | | | $ | — | | | $ | — | | | $ | — | | | $ | 161 | | | Cash at year end 2011 |

Net cash provided by operating activities | | $ | 1,335 | | | $ | 312 | | | $ | (395 | ) | | $ | (2 | ) | | $ | — | | | $ | 1,250 | | | Net cash provided by operating activities |

Net cash provided by investing activities | | | (1,409 | ) | | | (303 | ) | | | — | | | | — | | | | 150 | | | | (1,562 | ) | | Net cash provided by investing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash flow from | | $ | (74 | ) | | $ | 9 | | | $ | (395 | ) | | $ | (2 | ) | | $ | 150 | | | $ | (312 | ) | | Cash flow from |

operating and | | | | | | | | | | | | | | | | | | | | | | | | | | operating and |

investing activities | | | | | | | | | | | | | | | | | | | | | | | | | | investing activities |

Net cash provided by financing activities | | $ | 14 | | | $ | 44 | | | $ | 395 | | | $ | 2 | | | $ | (150 | ) | | $ | 305 | | | Net cash provided by financing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Net change in cash | | $ | (60 | ) | | $ | 53 | | | $ | — | | | $ | — | | | $ | — | | | $ | (7 | ) | | Net change in cash |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash at year end 2012 | | $ | 25 | | | $ | 129 | | | $ | — | | | $ | — | | | $ | — | | | $ | 154 | | | Cash at year end 2012 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

2012 B-3

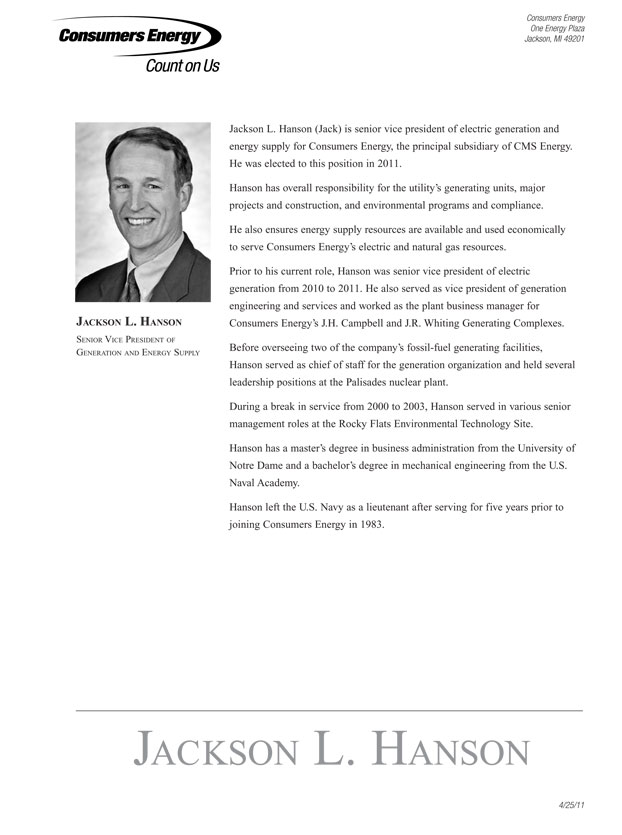

BIOGRAPHIES

Consumers Energy

One Energy Plaza

Jackson, MI 49201

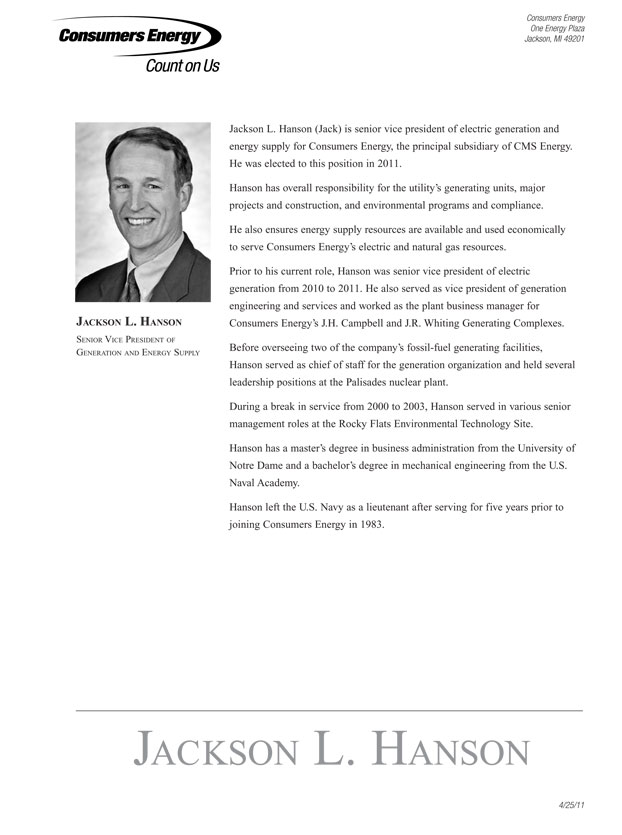

Jackson L. Hanson (Jack) is senior vice president of electric generation and

energy supply for Consumers Energy, the principal subsidiary of CMS Energy.

He was elected to this position in 2011.

Hanson has overall responsibility for the utility’s generating units, major

projects and construction, and environmental programs and compliance.

He also ensures energy supply resources are available and used economically

to serve Consumers Energy’s electric and natural gas resources.

Prior to his current role, Hanson was senior vice president of electric

generation from 2010 to 2011. He also served as vice president of generation

engineering and services and worked as the plant business manager for

Consumers Energy’s J.H. Campbell and J.R. Whiting Generating Complexes.

Before overseeing two of the company’s fossil-fuel generating facilities,

Hanson served as chief of staff for the generation organization and held several

leadership positions at the Palisades nuclear plant.

During a break in service from 2000 to 2003, Hanson served in various senior

management roles at the Rocky Flats Environmental Technology Site.

Hanson has a master’s degree in business administration from the University of

Notre Dame and a bachelor’s degree in mechanical engineering from the U.S.

Naval Academy.

Hanson left the U.S. Navy as a lieutenant after serving for five years prior to

joining Consumers Energy in 1983.

Jackson L. Hanson

Senior Vice President of

Generation and Energy Supply

Jackson L. Hanson

4/25/11

Consumers Energy

One Energy Plaza

Jackson, MI 49201

Daniel J. Malone

Senior Vice President of

Distribution and Customer

Operations

Daniel J. Malone is senior vice president of distribution and customer operations

for Consumers Energy, the principal subsidiary of CMS Energy. He was

elected to the position in May 2010.

Malone has overall responsibility for the company’s electric and gas distribution

systems, energy operations, customer operations, gas transmission and storage,

employee development and skilling, Smart Grid program implementation and

industrial safety. Energy operations is responsible for operating and maintaining

the electric and natural gas delivery systems that serve the utility’s customers.

Customer operations is responsible for the company’s revenue recovery,

customer services and energy optimization programs.

Malone joined Consumers Energy in 1984 as a graduate health physicist in the

radiological services department and has spent the majority of his career with

the company. From 2001 to 2006, he held leadership positions with Nuclear

Management Co., which operated Consumers Energy’s Palisades nuclear plant