Exhibit 99.1

Investor Meeting

Grand Rapids, Michigan October 24, 2013

Cross Winds® Energy Park

Gas Combined Cycle Plant

Consumers Smart Energy Program

John Russell

President & CEO

Welcome

Grand Rapids

#2 Largest city in Michigan

1,000,000 people

#1 City in the US to raise a

family (Forbes, April 2012)

#2 Job growth for a US metro area since 2010

(CareerBuilder, September 2013)

#4 Best city in the US to

find a job (Forbes, April 2013)

JGR 1

Agenda

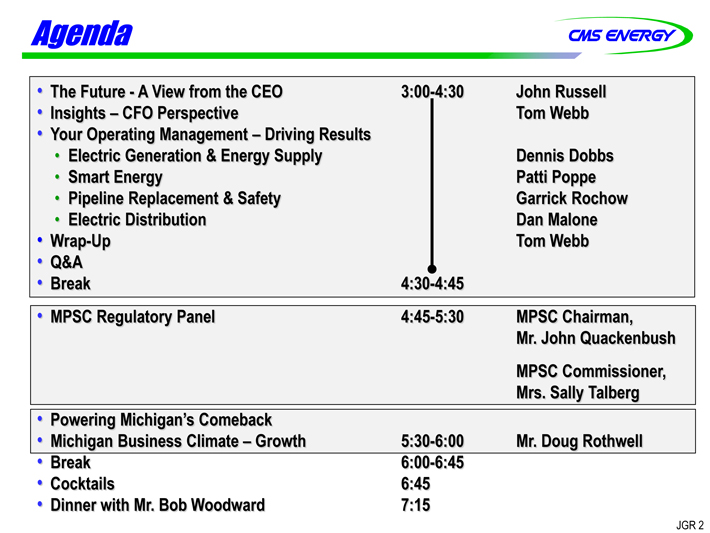

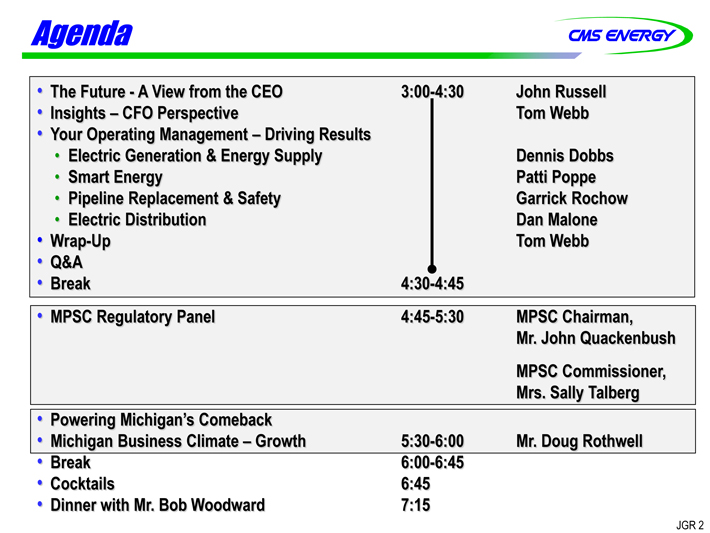

The Future - A View from the CEO 3:00-4:30 John Russell

Insights – CFO Perspective Tom Webb

Your Operating Management – Driving Results

Electric Generation & Energy Supply Dennis Dobbs

Smart Energy Patti Poppe

Pipeline Replacement & Safety Garrick Rochow

Electric Distribution Dan Malone

Wrap-Up Tom Webb

Q&A

Break 4:30-4:45

MPSC Regulatory Panel 4:45-5:30 MPSC Chairman,

Mr. John Quackenbush

MPSC Commissioner,

Mrs. Sally Talberg

Powering Michigan’s Comeback

Michigan Business Climate – Growth 5:30-6:00 Mr. Doug Rothwell

Break 6:00-6:45

Cocktails 6:45

Dinner with Mr. Bob Woodward 7:15

JGR 2

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND

INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31, 2012 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides historical financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis and provides forward-looking guidance on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. These items have the potential to impact, favorably or unfavorably, the company’s reported earnings in future periods. Because the company is not able to estimate the impact of these matters, the company is not providing a reconciliation to the comparable future period reported earnings.

JGR 3

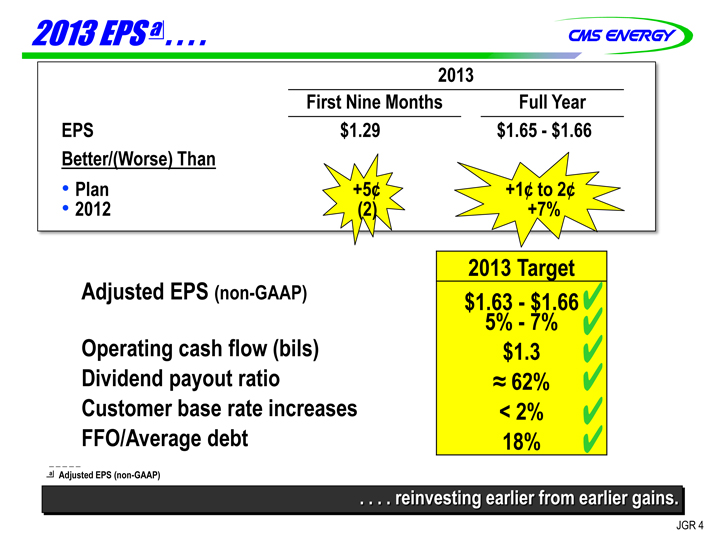

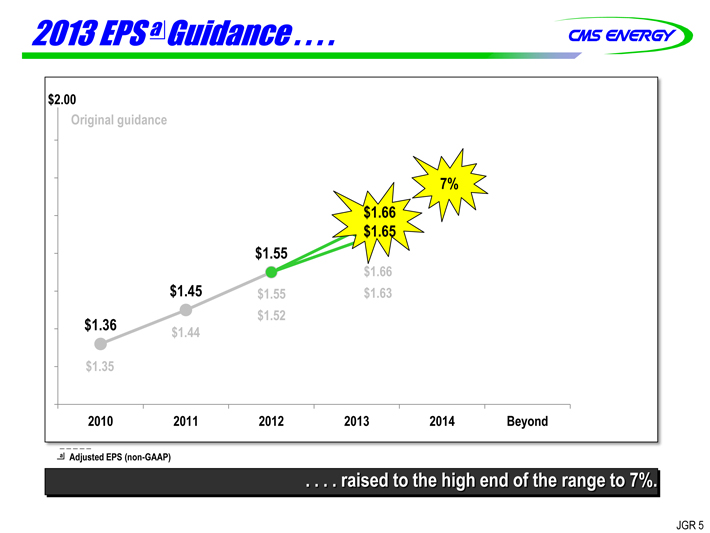

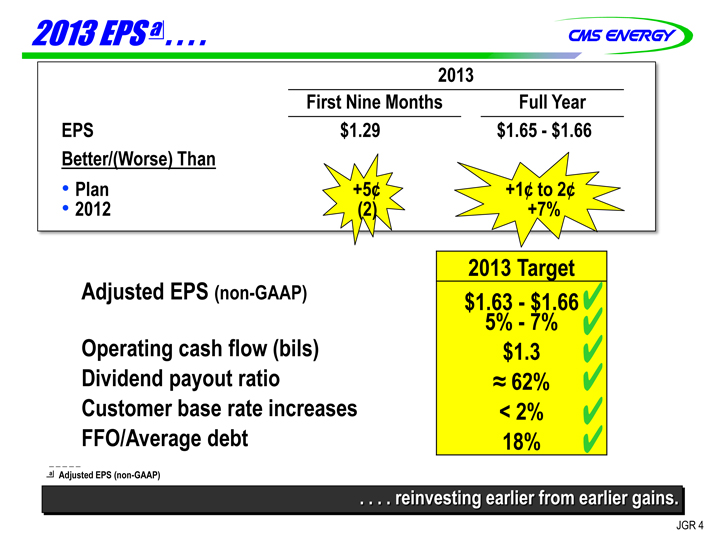

2013 EPS a .. . . .

2013

First Nine Months Full Year

EPS $1.29 $1.65 -$1.66

Better/(Worse) Than

Plan +5¢ +1¢ to 2¢

2012 (2) +7%

Adjusted EPS (non-GAAP) Operating cash flow (bils) Dividend payout ratio Customer base rate increases FFO/Average debt

a Adjusted EPS (non-GAAP)

2013 Target

$1.63 -$1.66

5% -7%

$1.3

62%

< 2%

18%

. . . . reinvesting earlier from earlier gains.

JGR 4

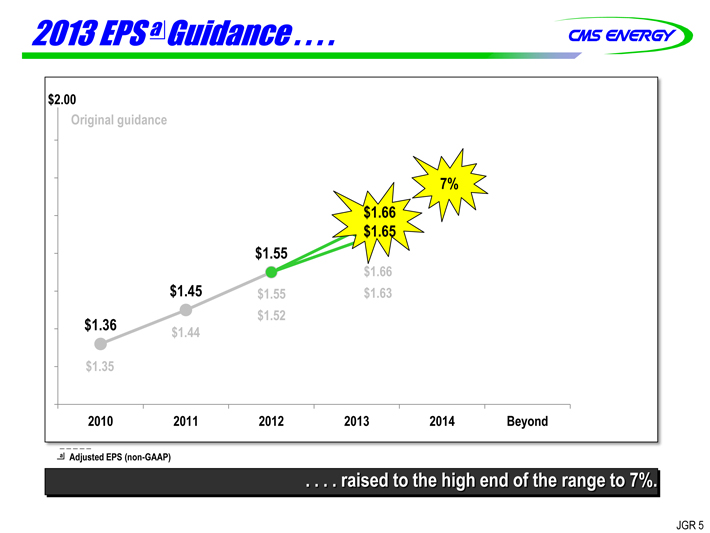

2013 EPS a Guidance . . . .

$2.00

Original guidance

7%

$1.66

$1.65

$1.55

$1.66

$1.45 $1.55 $1.63

$1.52

$1.36 $1.44

$1.35

2010 2011 2012 2013 2014 Beyond

a Adjusted EPS (non-GAAP)

. . . . raised to the high end of the range to 7%.

JGR 5

Vision

Best in Class

Best Value

Proud to Wear the Colors

JGR 6

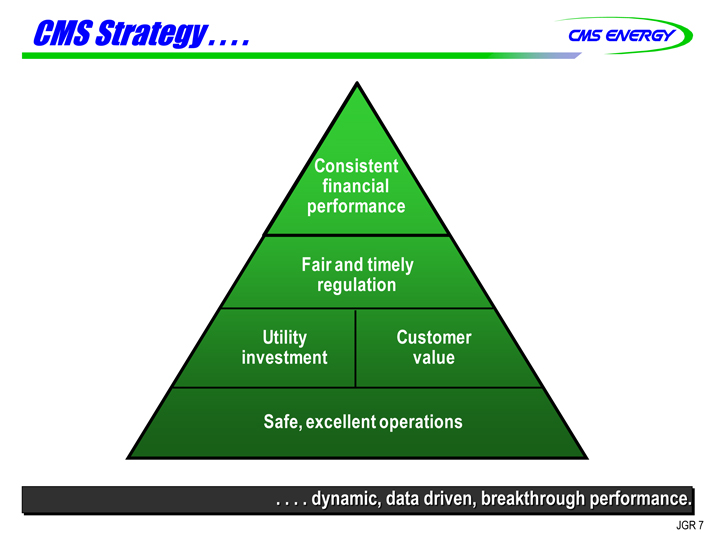

CMS Strategy . . . .

Consistent

financial

performance

Fair and timely

regulation

Utility

Customer

investment

value

Safe, excellent operations

. . . . dynamic, data driven, breakthrough performance.

JGR 7

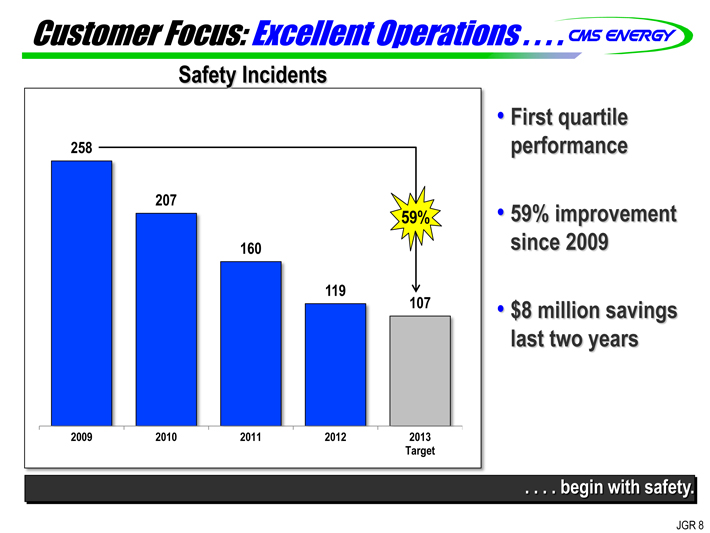

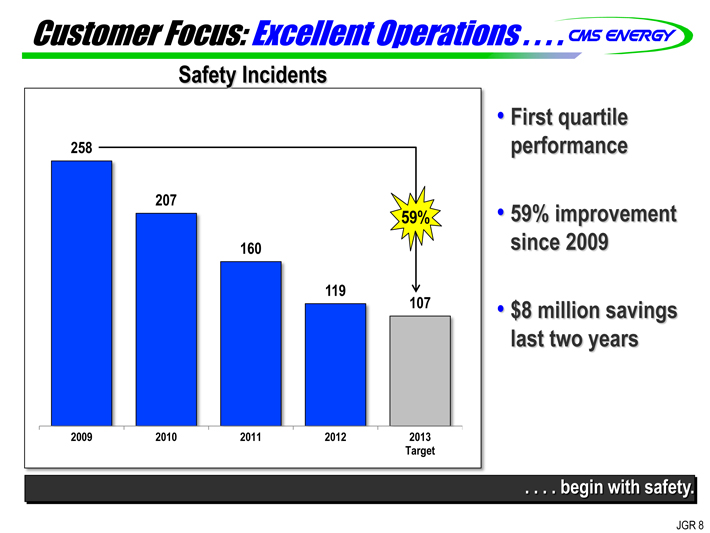

Customer Focus: Excellent Operations . . . .

Safety Incidents

258

207

59%

160

119 107

2009 2010 2011 2012 2013

Target

First quartile

performance

59% improvement

since 2009

$8 million savings

last two years

. . . . begin with safety.

JGR 8

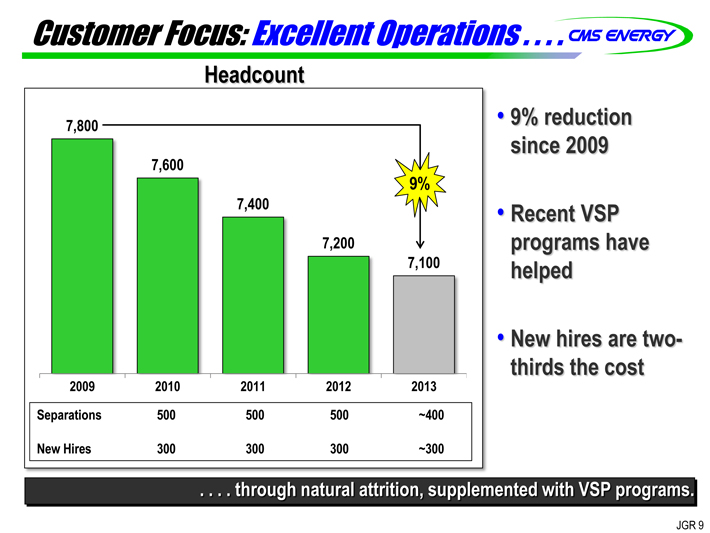

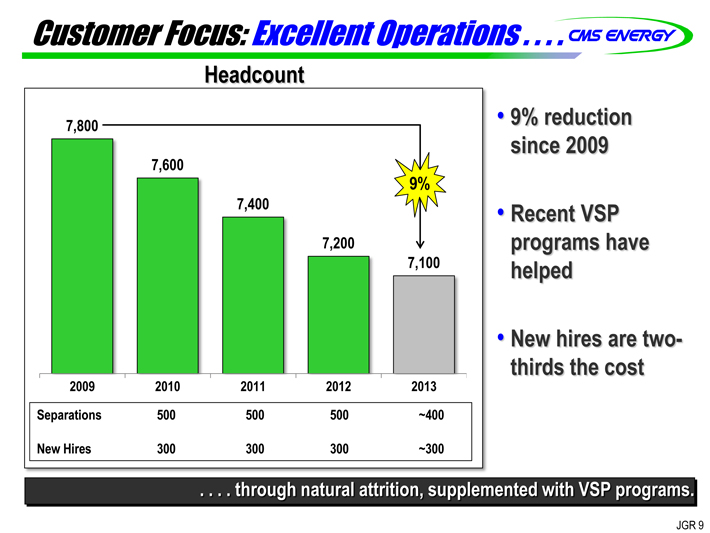

Customer Focus: Excellent Operations . . . .

Headcount

7,800

7,600

9%

7,400

7,200

7,100

2009 2010 2011 2012 2013

Separations 500 500 500 ~400

New Hires 300 300 300 ~300

9% reduction since 2009

Recent VSP programs have helped

New hires are two-thirds the cost

. . . . through natural attrition, supplemented with VSP programs.

JGR 9

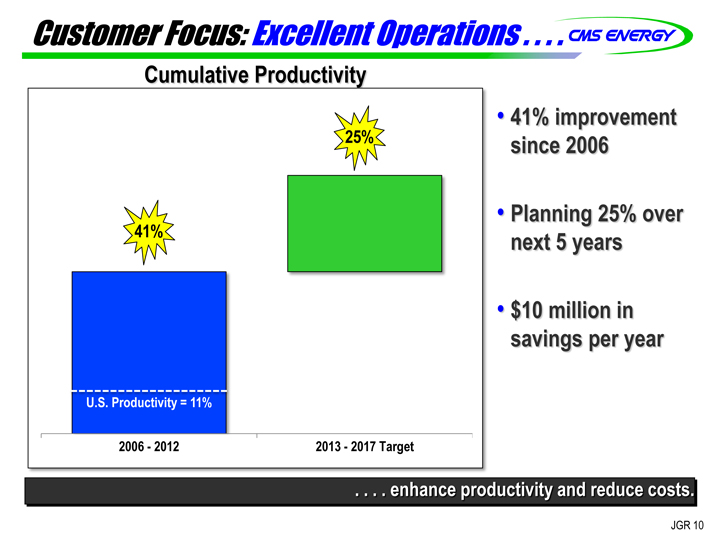

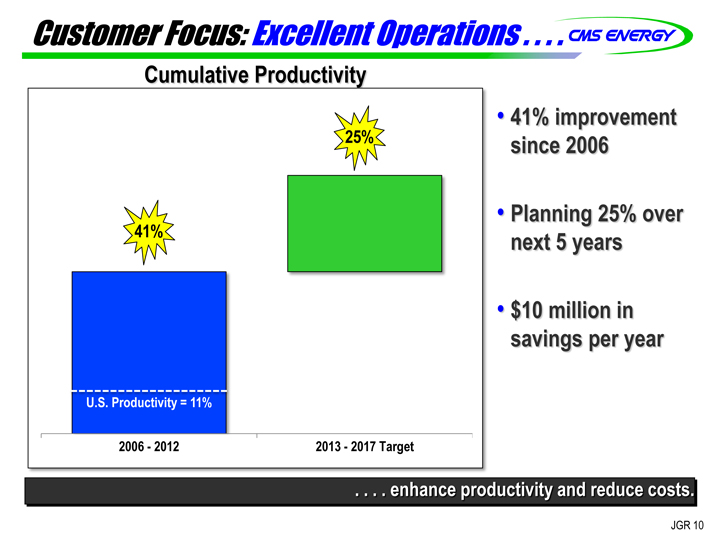

Customer Focus: Excellent Operations . . . .

Cumulative Productivity

25%

41%

U.S. Productivity = 11%

2006-2012 2013-2017 Target

41% improvement since 2006

Planning 25% over next 5 years

$10 million in savings per year

. . . . enhance productivity and reduce costs.

JGR 10

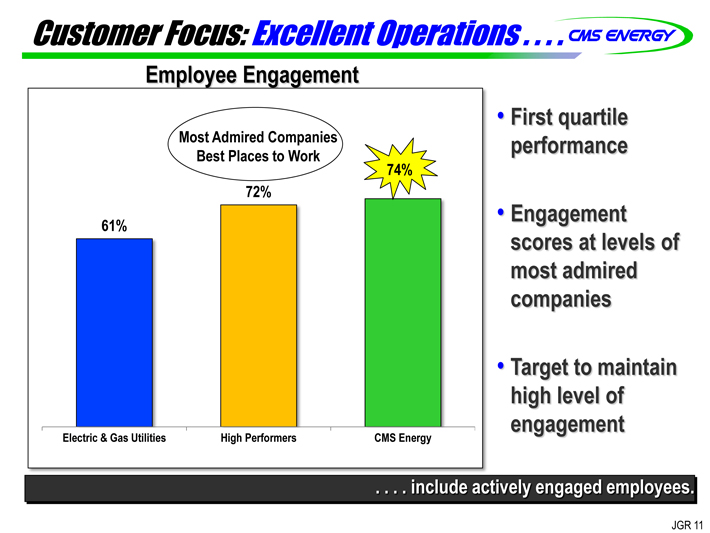

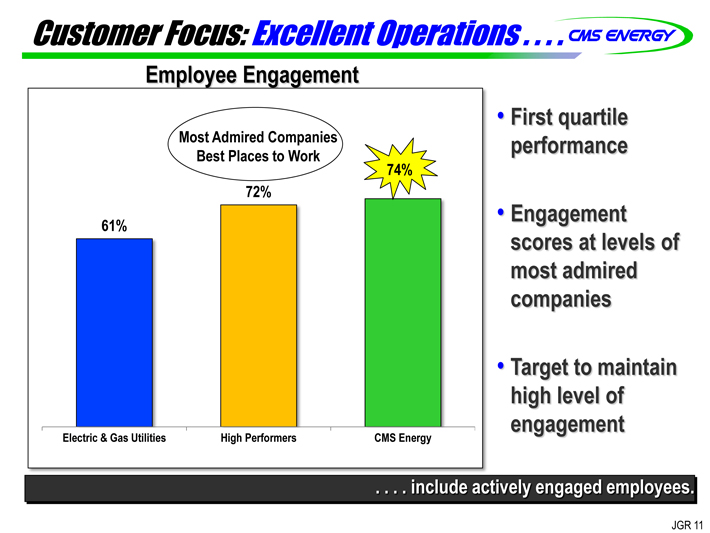

Customer Focus: Excellent Operations . . . .

Employee Engagement

Most Admired Companies

Best Places to Work

74%

72%

61%

Electric & Gas Utilities High Performers CMS Energy

First quartile performance

Engagement scores at levels of most admired companies

Target to maintain high level of engagement

. . . . include actively engaged employees.

JGR 11

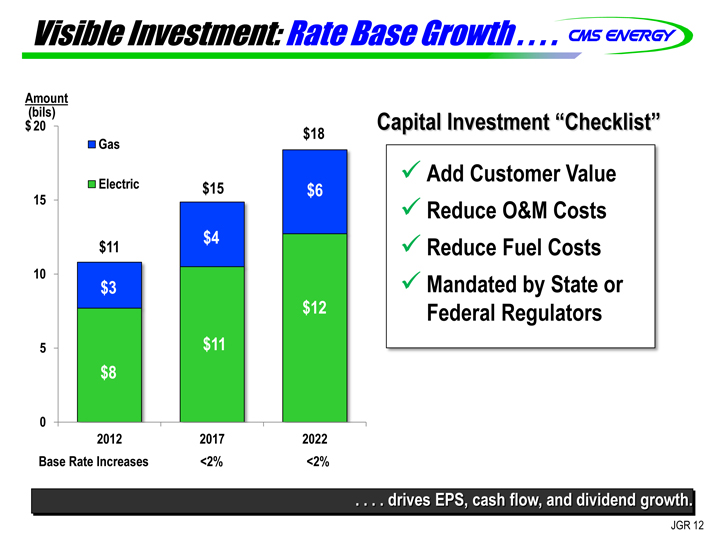

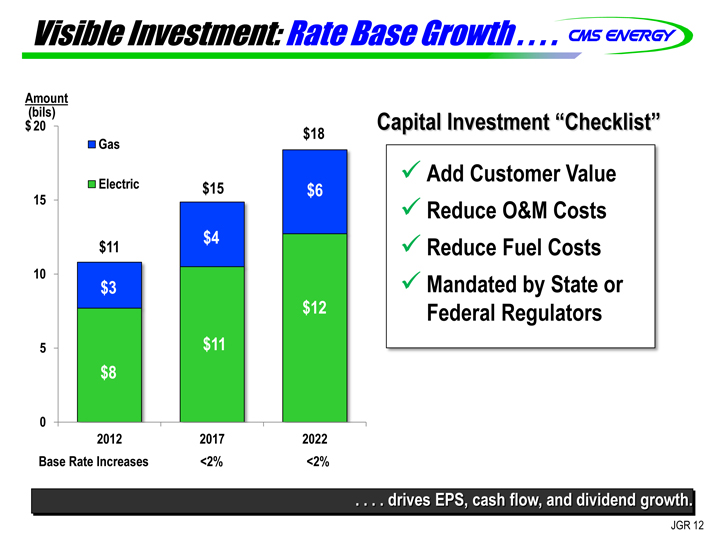

Visible Investment: Rate Base Growth . . . .

Amount

(bils)

$20 $18

Gas

15 Electric $15 $6

$11 $4

10

$3

$12

5 $11

$8

0

2012 2017 2022

Base Rate Increases <2% <2%

Capital Investment “Checklist”

Add Customer Value

Reduce

O&M Costs

Reduce

Fuel Costs

Mandated by State or

Federal

Regulators

. . . . drives EPS, cash flow, and dividend growth.

JGR 12

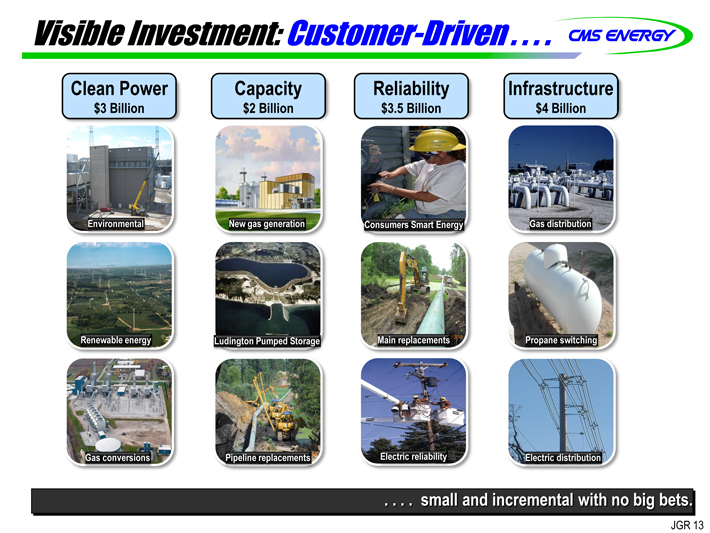

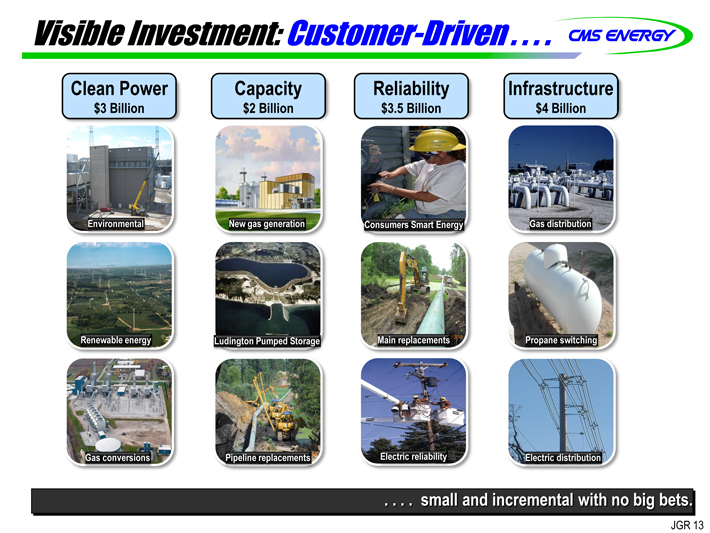

Visible Investment: Customer-Driven . . . .

Clean Power Capacity Reliability Infrastructure

$3 Billion $2 Billion $3.5 Billion $4 Billion

Environmental New gas generation Consumers Smart Energy Gas distribution

Renewable energy Ludington Pumped Storage Main replacements Propane switching

Gas conversions Pipeline replacements Electric reliability Electric distribution

. . . . small and incremental with no big bets.

JGR 13

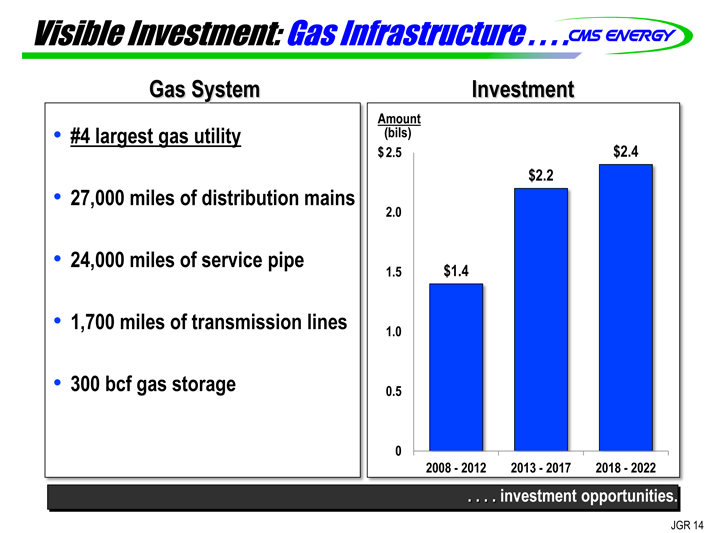

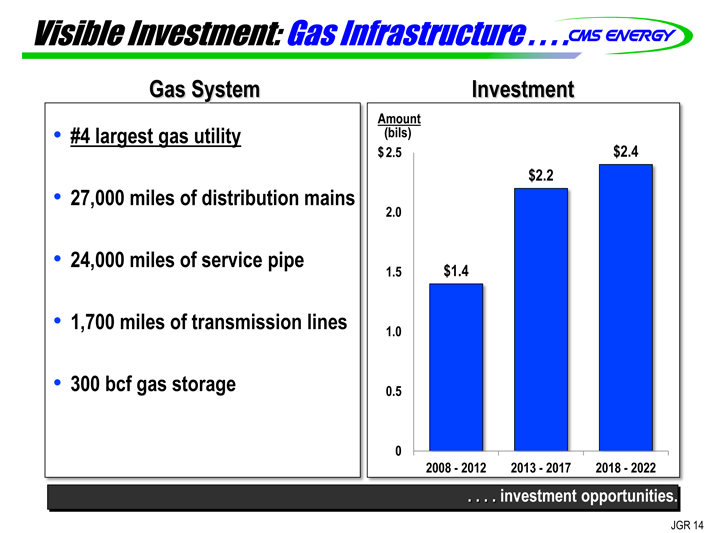

Visible Investment: Gas Infrastructure . . . .

Gas System

#4 largest gas utility

27,000 miles of distribution mains

24,000 miles of service pipe

1,700 miles of transmission lines

300 bcf gas storage

Investment

Amount

(bils)

$2.5 $2.4

$2.2

2.0

1.5 $1.4

1.0

0.5

0

2008-2012 2013-2017 2018-2022

. . . . investment opportunities.

JGR 14

Visible Investment: Transmission . . . .

Exited transmission in 2002

Recent developments

ReliabilityFirst Corporation interpretation

FERC orders

Opportunity to reclassify and register as transmission owner / operator

. . . . opportunity; better for our customers.

JGR 15

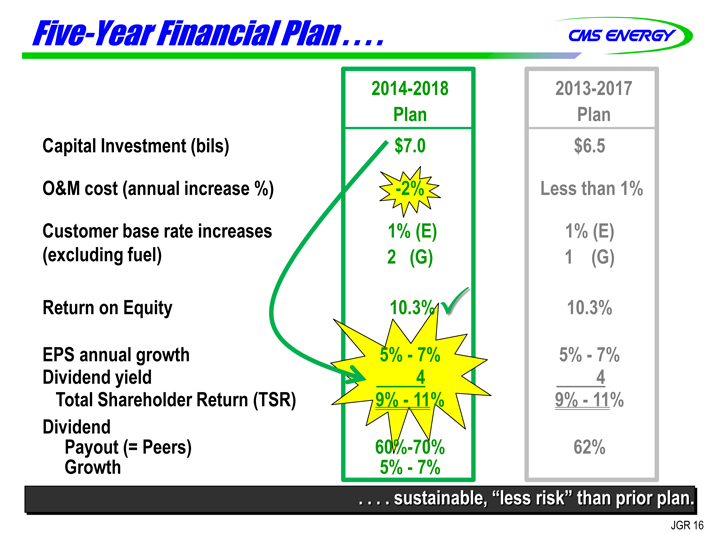

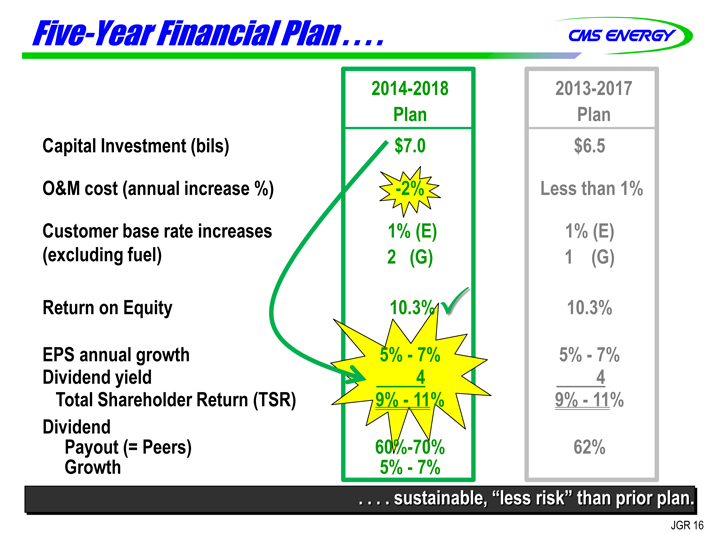

Five-Year Financial Plan . . . .

Capital Investment (bils) O&M cost (annual increase %) Customer base rate increases (excluding fuel)

Return on Equity EPS annual growth Dividend yield

Total Shareholder Return (TSR) Dividend Payout (= Peers) Growth

2014-2018 2013-2017

Plan Plan

$7.0 $6.5

-2% Less than 1%

1% (E) 1% (E)

2 (G) 1 (G)

10.3% 10.3%

5%-7% 5%-7%

4 4

9%-11% 9%-11%

60%-70% 62%

5%-7%

. . . . sustainable, “less risk” than prior plan.

JGR 16

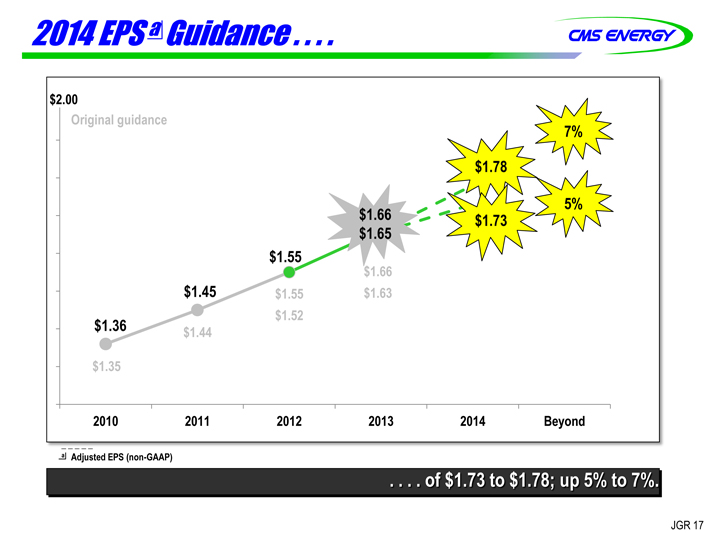

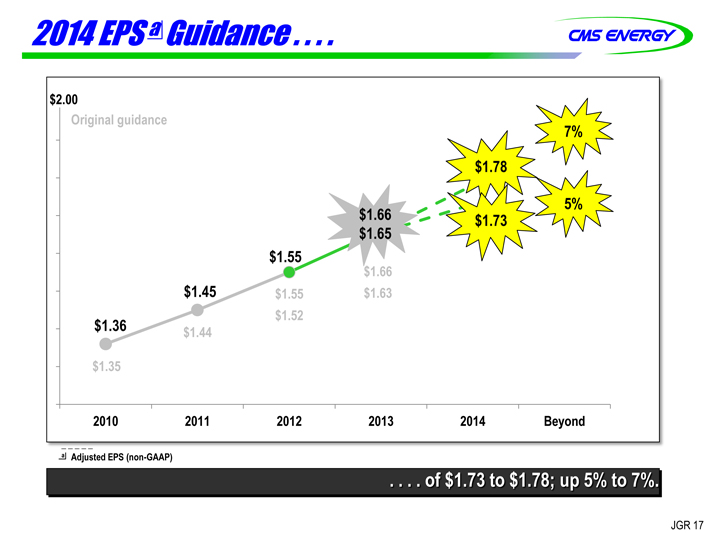

2014 EPS a Guidance . . . .

$2.00

Original guidance 7%

$1.78

5%

$ 1.65 $ 1.66 $1.73

$1.55

$1.66

$1.45 $1.55 $1.63

$1.36 $1.44

$1.35

2010 2011 2012 2013 2014 Beyond

a Adjusted EPS (non-GAAP)

. . . . of $1.73 to $1.78; up 5% to 7%.

JGR 17

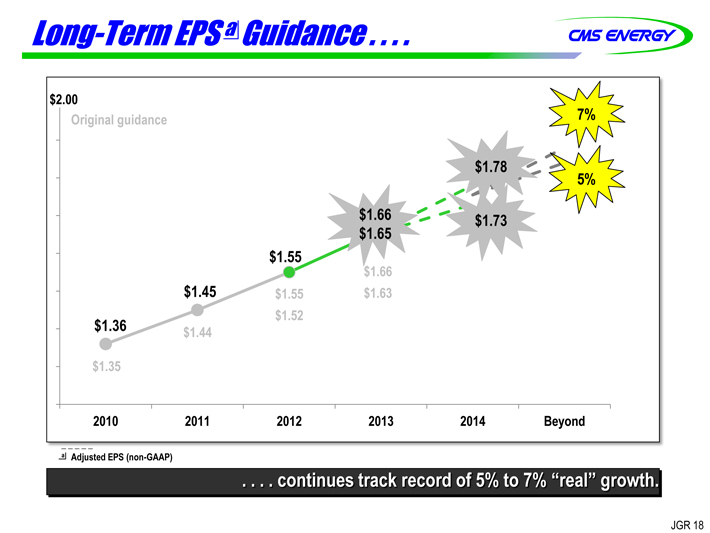

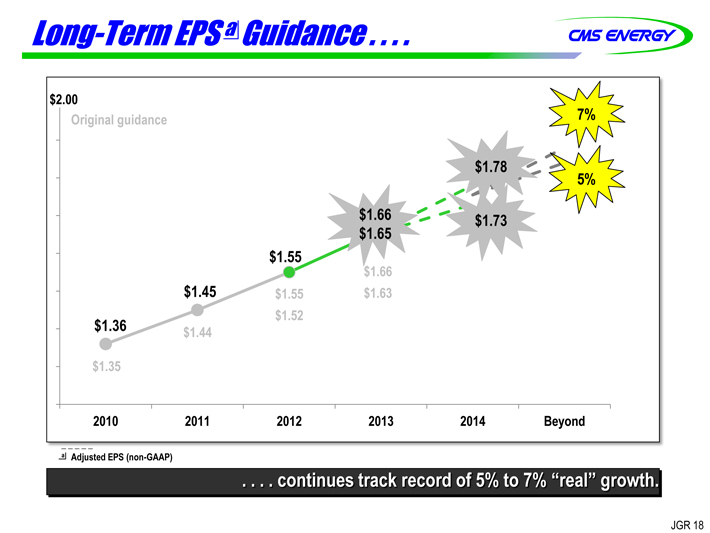

Long-Term EPS a Guidance . . . .

$2.00

Original guidance 7%

$1.78 5%

$1.66 $1.73

$1.65

$1.55

$1.66

$1.45 $1.55 $1.63

$1.52

$1.36 $1.44

$1.35

2010 2011 2012 2013 2014 Beyond

a Adjusted EPS (non-GAAP)

. . . . continues track record of 5% to 7% “real” growth.

JGR 18

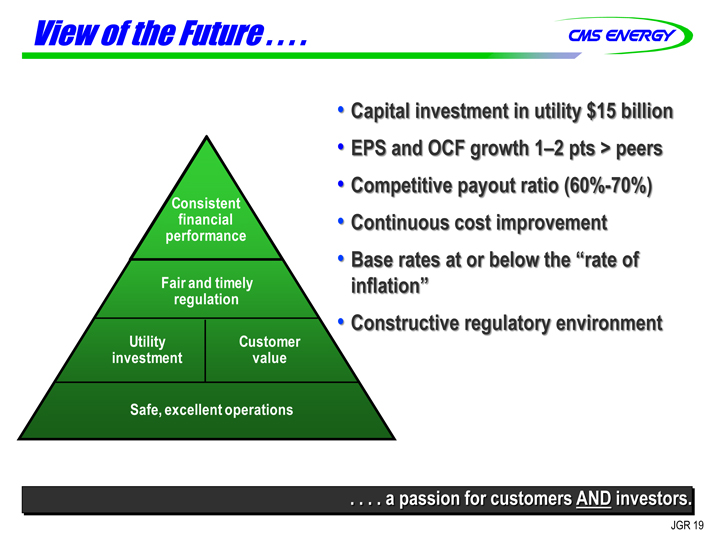

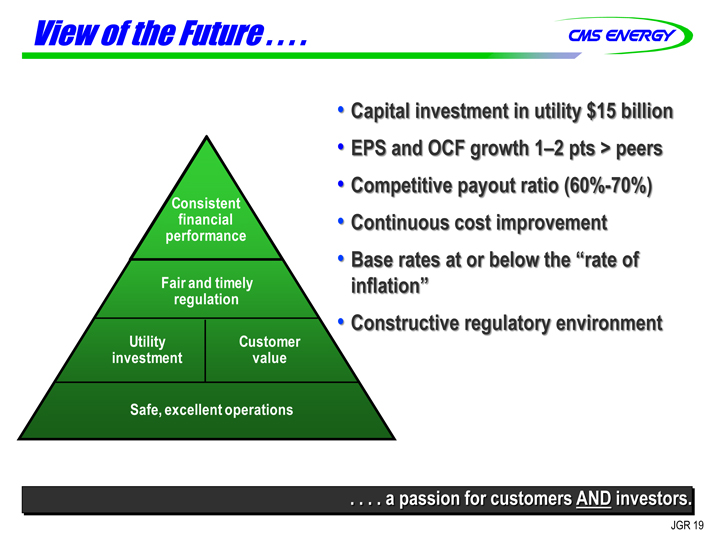

View of the Future . . . .

Consistent

financial

performance

Fair and timely

regulation

Utility

Customer

investment

value

Safe, excellent operations

Capital investment in utility $15 billion

EPS and OCF growth 1–2 pts > peers

Competitive payout ratio (60%-70%)

Continuous cost improvement

Base rates at or below the “rate of inflation”

Constructive regulatory environment

. . . . a passion for customers AND investors.

JGR 19

Tom Webb

Executive Vice President & CFO

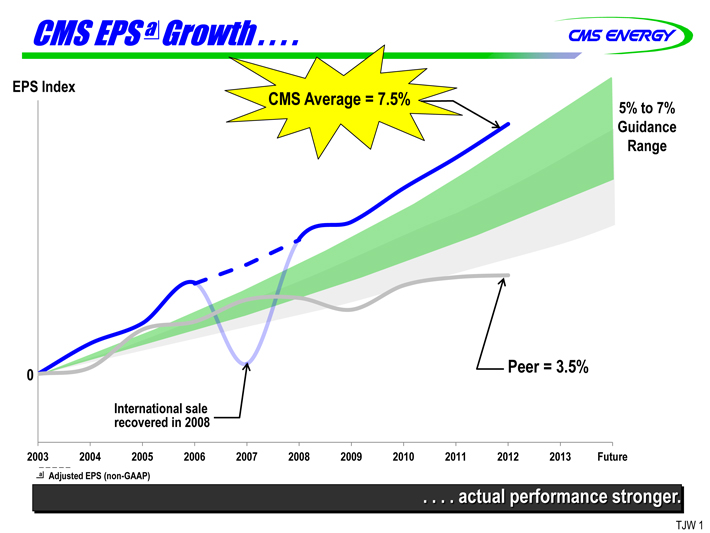

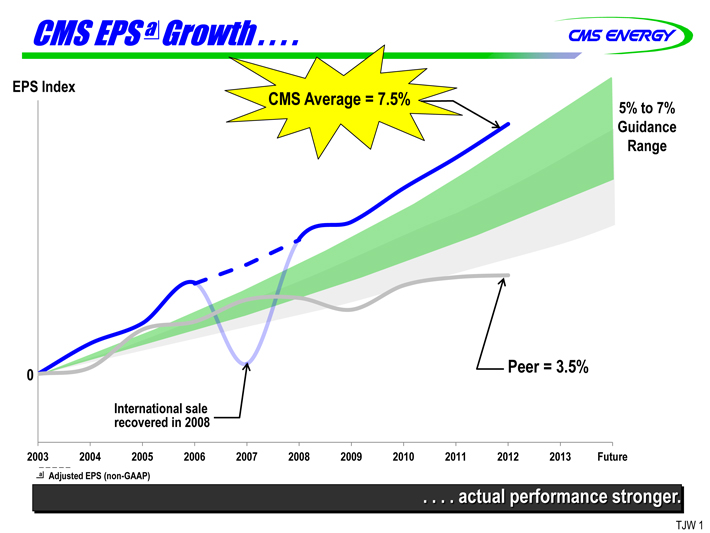

CMS EPS a Growth . . . .

EPS Index

CMS Average = 7.5% 5% to 7%

Guidance

Range

0 Peer = 3.5%

International sale

recovered in 2008

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Future

a Adjusted EPS (non-GAAP)

. . . . actual performance stronger.

TJW 1

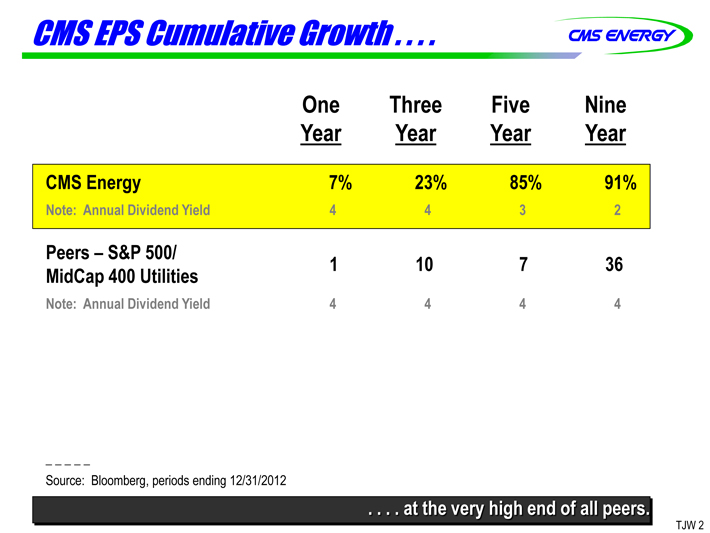

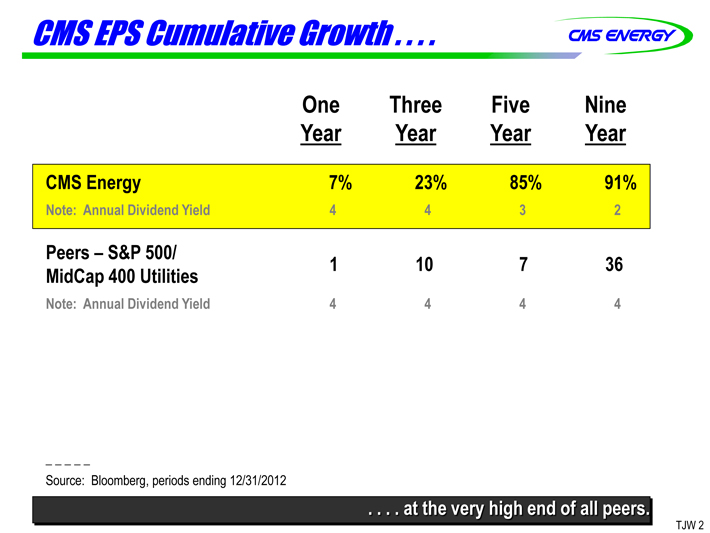

CMS EPS Cumulative Growth . . . .

One Three Five Nine

Year Year Year Year

CMS Energy 7% 23% 85% 91%

Note: Annual Dividend Yield 4 4 3 2

Peers – S&P 500/

MidCap 400 Utilities 1 10 7 36

Note: Annual Dividend Yield 4 4 4 4

Source: Bloomberg, periods ending 12/31/2012

. . . . at the very high end of all peers.

TJW 2

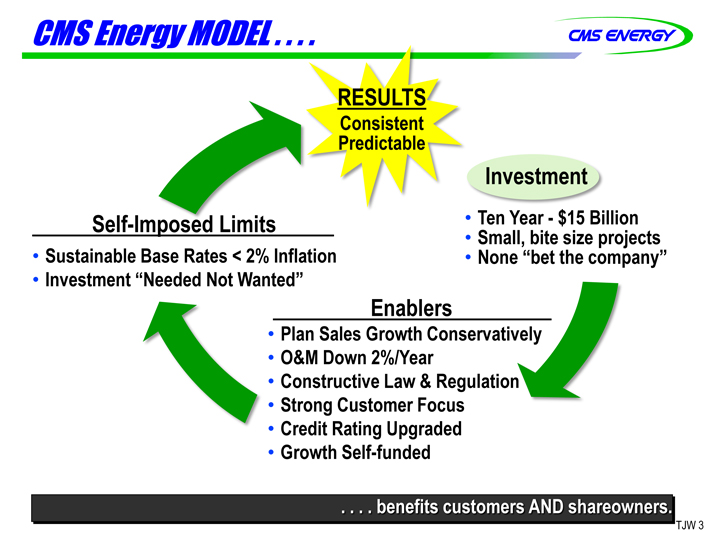

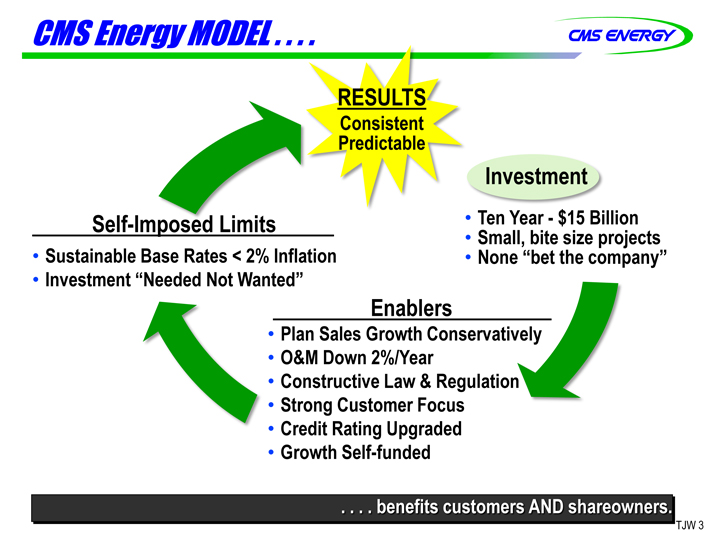

CMS Energy MODEL . . . .

RESULTS

Consistent

Predictable

Investment

Self-Imposed Limits • Ten Year - $15 Billion

• Small, bite size projects

Sustainable Base Rates < 2% Inflation None “bet the company”

Investment “Needed Not Wanted”

Enablers

• Plan Sales Growth Conservatively

• O&M Down 2%/Year

• Constructive Law & Regulation

• Strong Customer Focus

• Credit Rating Upgraded

• Growth Self-funded

. . . . benefits customers AND shareowners.

TJW 3

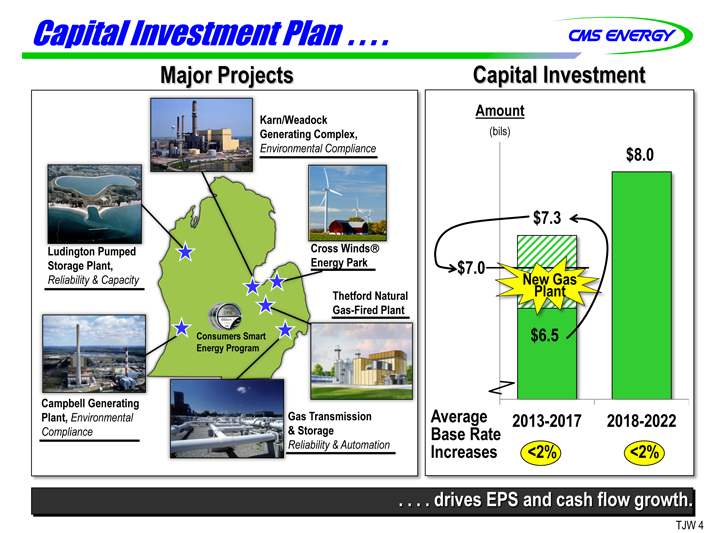

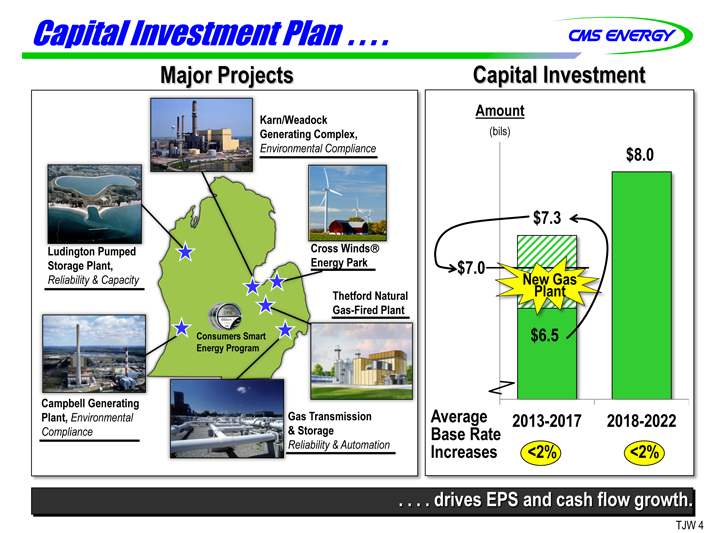

Capital Investment Plan . . . .

Major Projects

Karn/Weadock

Generating Complex,

Environmental Compliance

Ludington Pumped

Cross Winds®

Storage Plant, Energy Park

Reliability & Capacity

Thetford Natural

Gas-Fired Plant

Consumers Smart

Energy Program

Campbell Generating

Plant, Environmental Gas Transmission

Compliance & Storage

Reliability & Automation

Capital Investment

Amount

(bils)

$8.0

$7.3

$7.0

New Gas

Plant

$6.5

Average

2013-2017

2018-2022

Base Rate

Increases

<2%

<2%

. . . . drives EPS and cash flow growth.

TJW 4

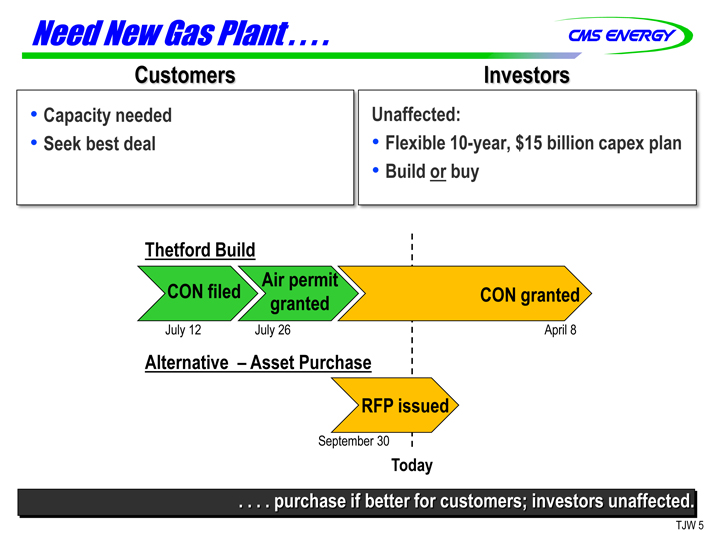

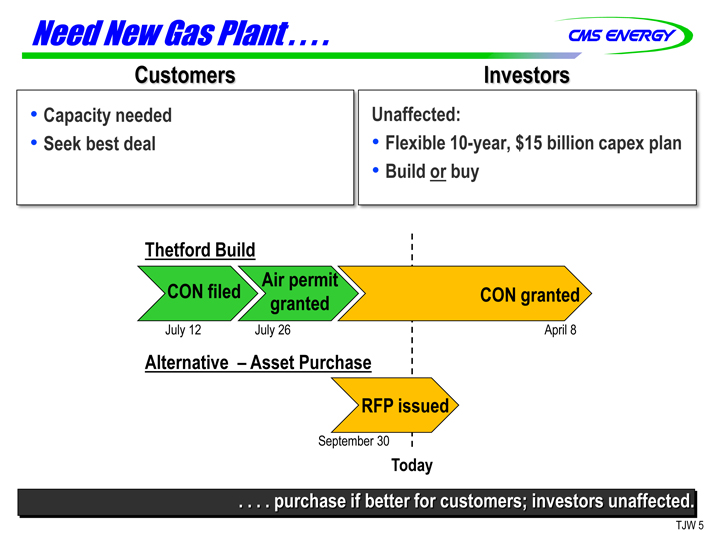

Need New Gas Plant . . . .

Customers Investors

Capacity needed Unaffected:

Seek best deal • Flexible 10-year, $15 billion capex plan • Build or buy

Thetford Build

Air permit

CON filed granted CON granted

July 12 July 26 April 8

Alternative – Asset Purchase

RFP issued

September 30

Today

. . . . purchase if better for customers; investors unaffected.

TJW 5

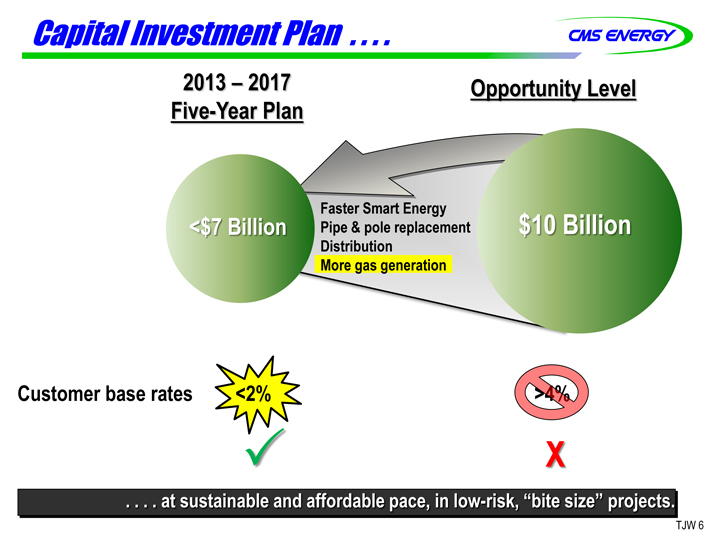

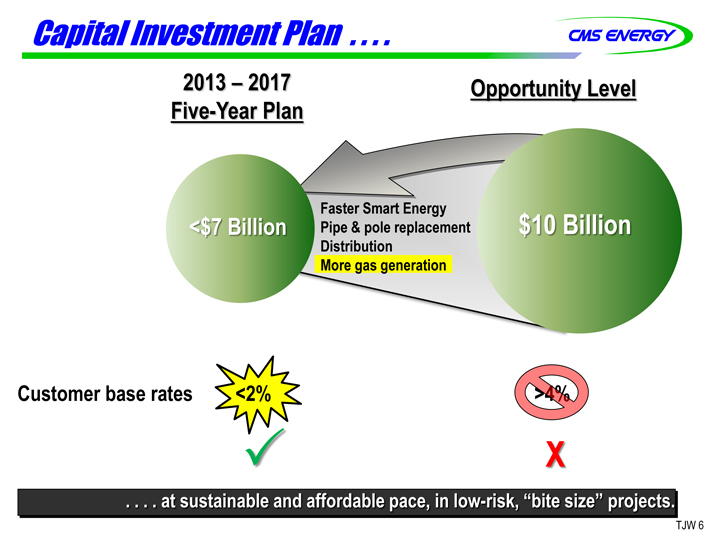

Capital Investment Plan . . . .

2013 – 2017 Opportunity Level

Five-Year Plan

<$7 Billion Pipe Faster & Smart pole replacement Energy $10 Billion

Distribution

More gas generation

Customer base rates <2% >4%

X

. . . . at sustainable and affordable pace, in low-risk, “bite size” projects.

TJW 6

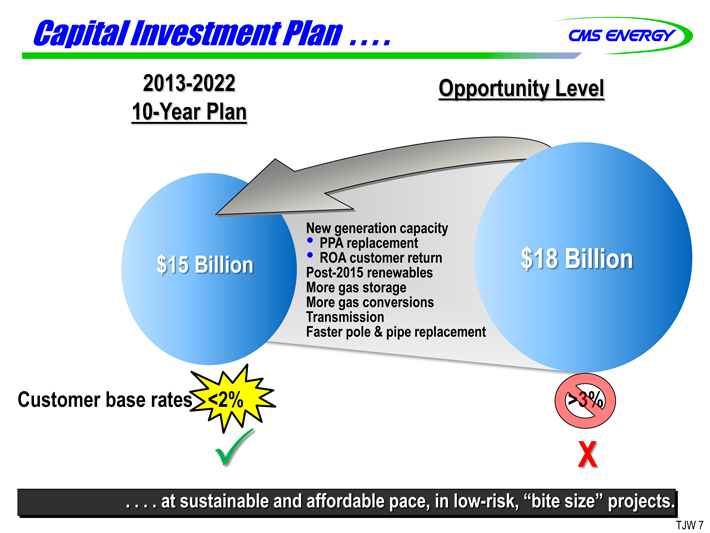

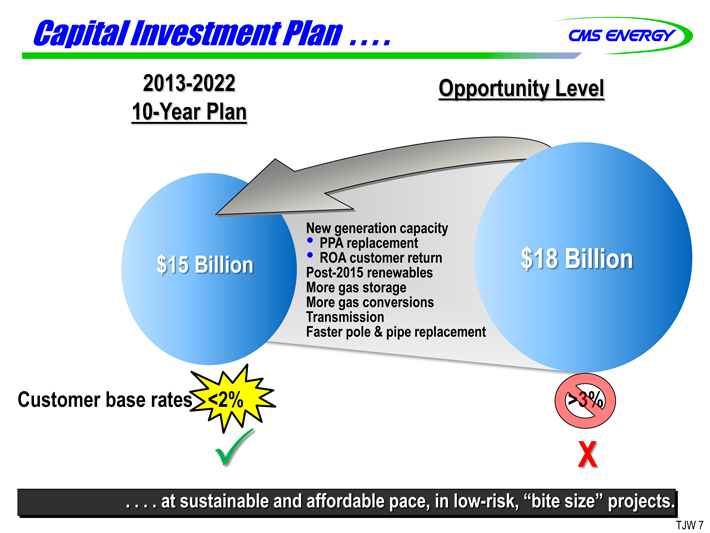

Capital Investment Plan . . . .

2013-2022 Opportunity Level

10-Year Plan

New generation capacity

• PPA replacement

$15 Billion • ROA customer return $18 Billion

Post-2015 renewables

More gas storage

More gas conversions

Transmission

Faster pole & pipe replacement

Customer base rates <2% >3%

X

. . . . at sustainable and affordable pace, in low-risk, “bite size” ojects.

TJW 7

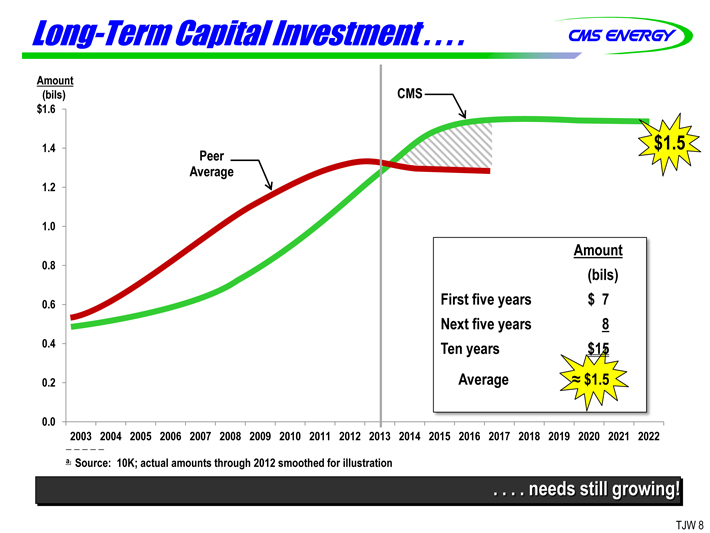

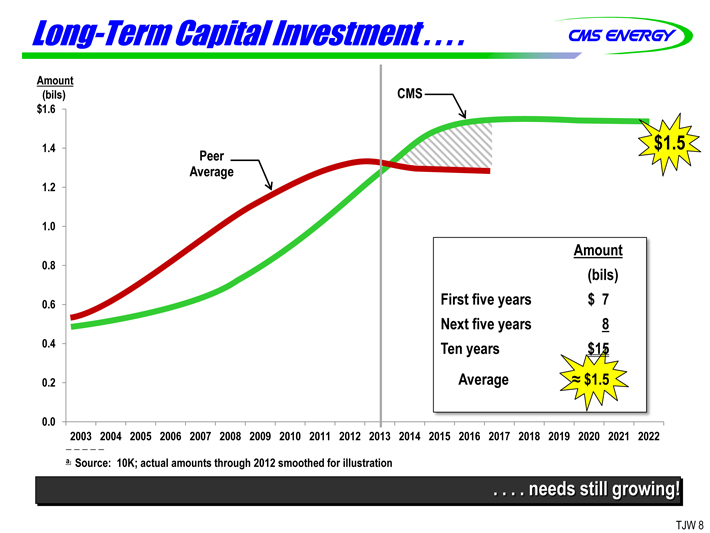

Long-Term Capital Investment . . . .

Amount

(bils) CMS

$1.6

1.4 $1.5

Peer

Average

1.2

1.0

Amount

0.8 (bils)

0.6 First five years $ 7

Next five years 8

0.4 Ten years $15

0.2 Average $1.5

0.0

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

a Source: 10K; actual amounts through 2012 smoothed for illustration

. . . . needs still growing!

TJW 8

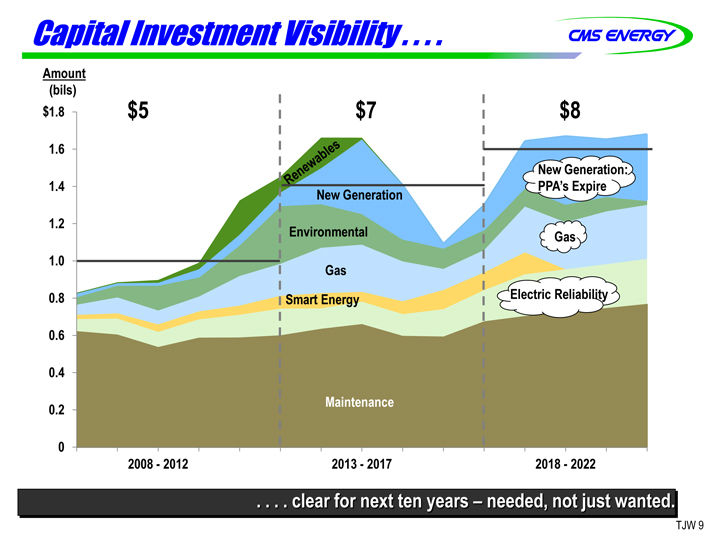

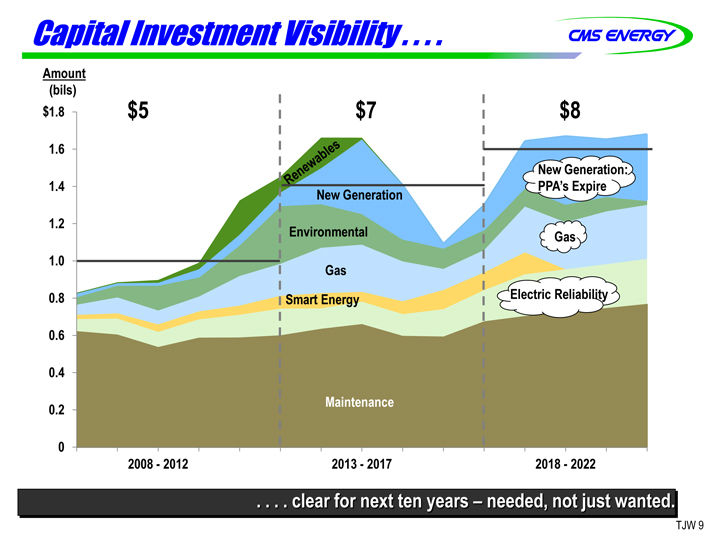

Capital Investment Visibility . . . .

Amount

(bils)

$1.8 $5 $7 $8

1.6

New Generation:

1.4 PPA’s Expire

New Generation

1.2 Environmental Gas

1.0 Gas

0.8 Smart Energy Electric Reliability

0.6

0.4

0.2 Maintenance

0

2008 - 2012 2013 - 2017 2018 - 2022

. . . . clear for next ten years – needed, not just wanted.

TJW 9

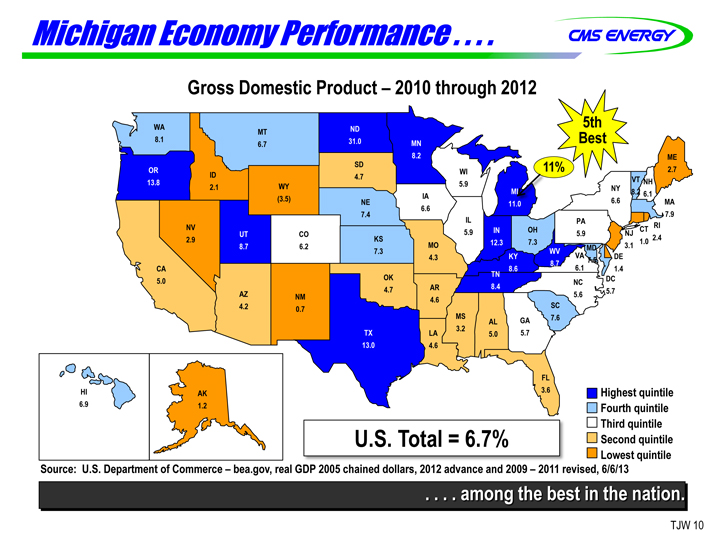

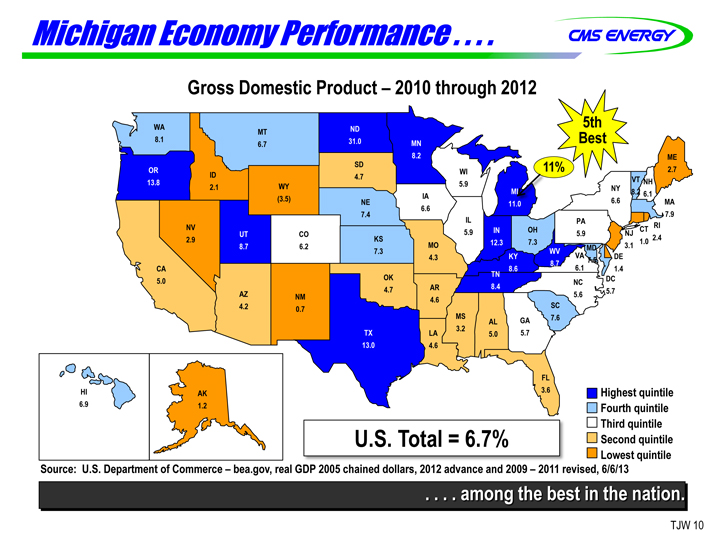

Michigan Economy Performance . . . .

Gross Domestic Product – 2010 through 2012

WA ND 5th

MT

8.1 6.7 31.0 MN Best

8.2 ME

OR SD WI 11% 2.7

13.8 ID 4.7 5.9 VT NH

2.1 (3.5) WY IA MI 6.6 NY 8.2 6.1 MA

NE 11.0

6.6

7.4 7.9

IL PA

NV UT CO 5.9 IN OH 5.9 NJ CT RI

2.9 8.7 6.2 KS MO 12.3 7.3 MD 3.1 1.0 2.4

7.3 4.3 KY WV VA 7.5 DE

8.7

CA 8.6 6.1 1.4

OK TN

5.0 NC DC

4.7 AR 8.4 5.7

AZ NM 4.6 5.6

4.2 0.7 SC

MS AL GA 7.6

TX LA 3.2 5.0 5.7

13.0 4.6

FL

HI AK 3.6 Highest quintile

6.9 1.2 Fourth quintile

Third quintile

U.S. Total = 6.7% Second quintile

Lowest quintile

Source: U.S. Department of Commerce – bea.gov, real GDP 2005 chained dollars, 2012 advance and 2009 – 2011 revised, 6/6/13

. . . . among the best in the nation.

TJW 10

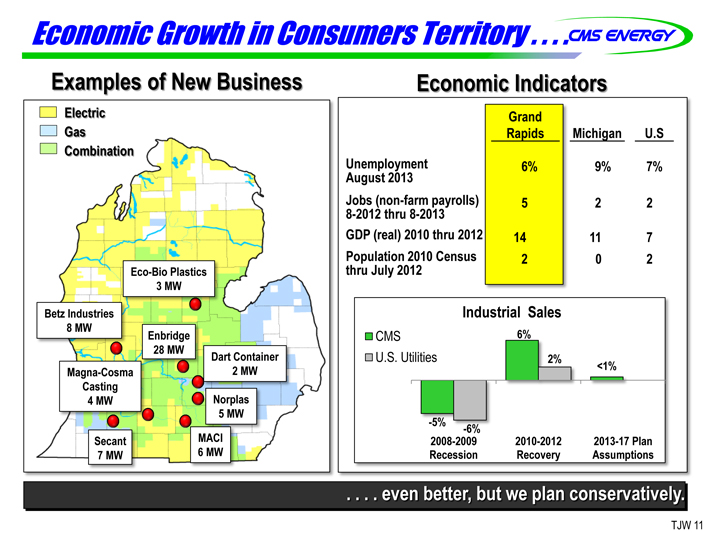

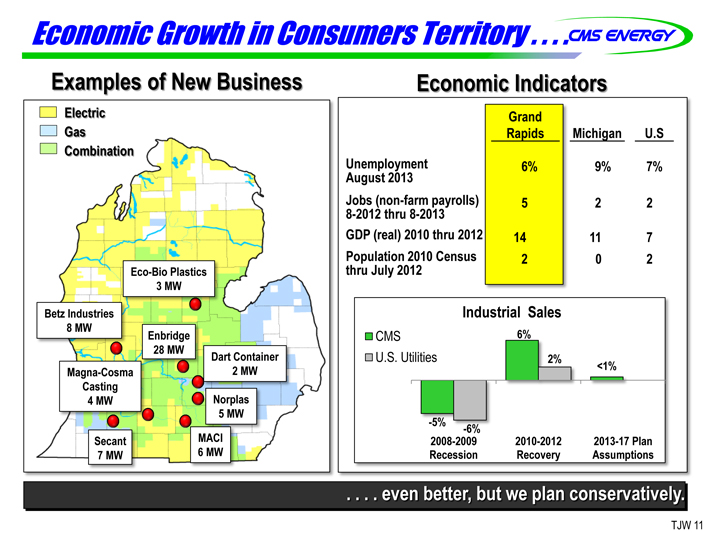

Economic Growth in Consumers Territory . . . .

Examples of New Business

Electric

Gas

Combination

Eco-Bio Plastics

3 MW

Betz Industries

8 MW

Enbridge

28 MW

Dart Container

Magna-Cosma

2 MW

Casting

4 MW

Norplas

5 MW

Secant

MACI

7 MW

6 MW

Economic Indicators

Grand

Rapids Michigan U.S

Unemployment 6% 9% 7%

August 2013

Jobs (non-farm payrolls) 5 2 2

8-2012 thru 8-2013

GDP (real) 2010 thru 2012 14 11 7

Population 2010 Census 2 0 2

thru July 2012

Industrial Sales

CMS 6%

U.S. Utilities 2% <1%

-5% -6%

2008-2009 2010-2012 2013-17 Plan

Recession Recovery Assumptions

. . . . even better, but we plan conservatively.

TJW 11

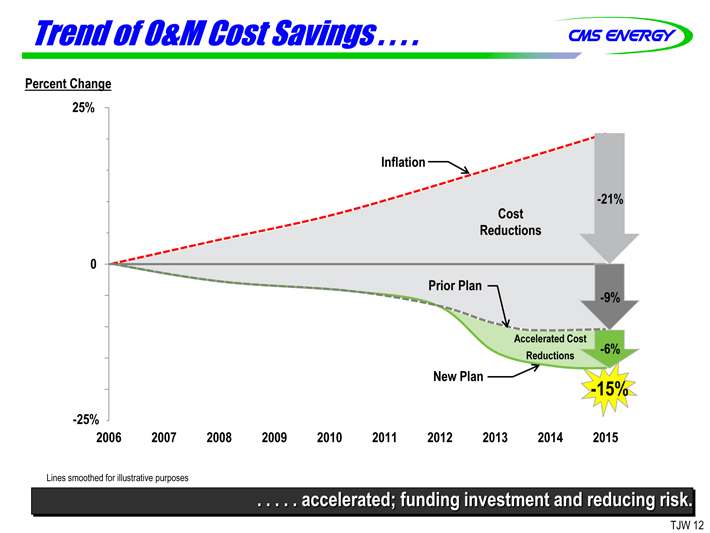

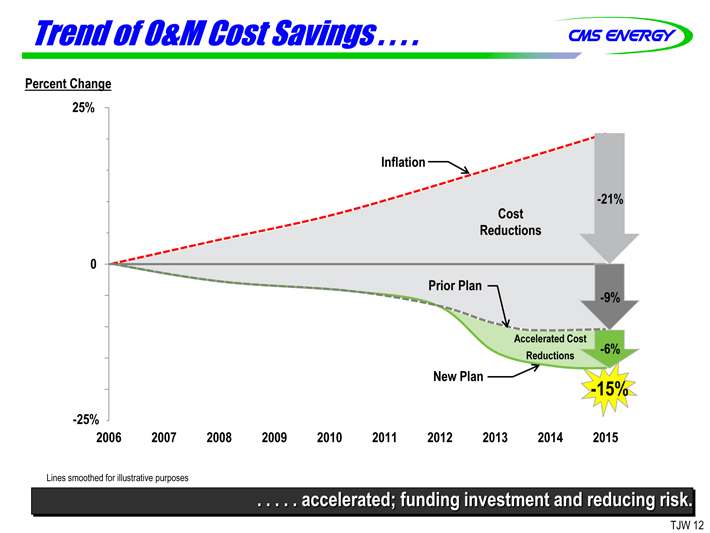

Trend of O&M Cost Savings . . . .

Percent Change

25%

Inflation

-21%

Cost

Reductions

0

Prior Plan

-9%

Accelerated Cost

Reductions -6%

New Plan -15%

-25%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Lines smoothed for illustrative purposes

. . . . .. accelerated; funding investment and reducing risk.

TJW 12

Continuous Cost Reduction . . . .

2012 over 2006 Electric Non-fuel

O&M Cost

Peer Average up 6%

-0.4%

Consumers

Source: SNL data service

How – One Example

Headcount

7,600

7,200

$100k

Each

600

$60k

1,000

Each

2010

2012

People Productivity = $64 Million

. . . . . part of CMS mindset.

TJW 13

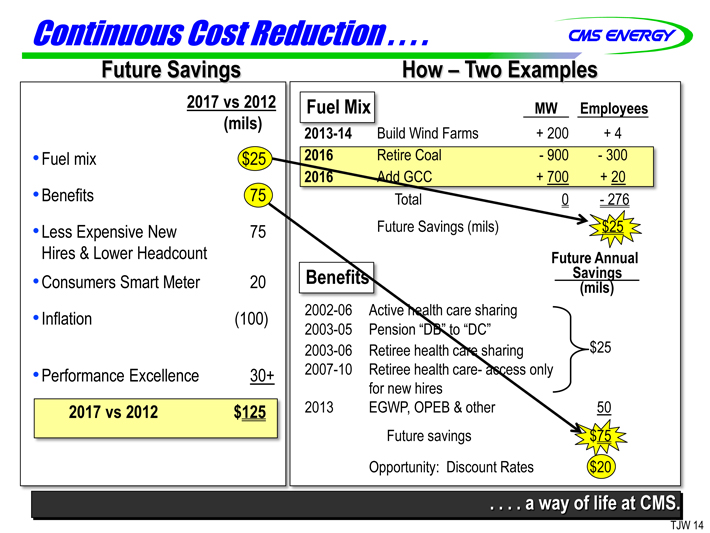

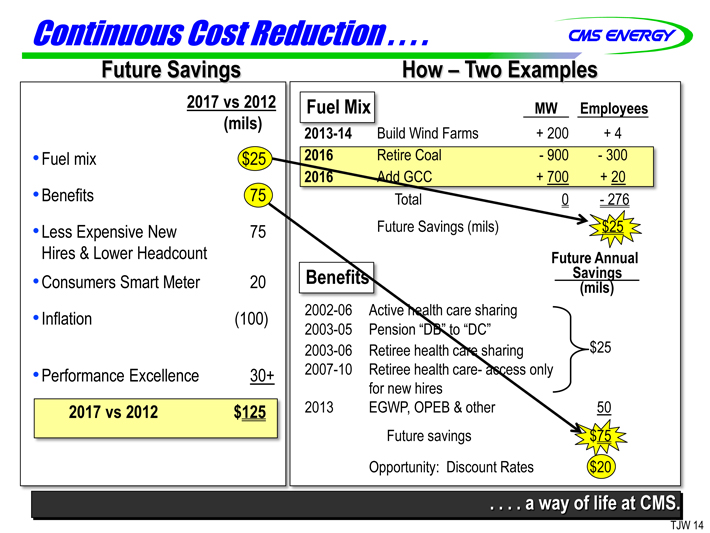

Continuous Cost Reduction . . . .

Future Savings

2017 vs 2012

(mils)

Fuel mix

$25

Benefits

75

Less Expensive New

75

Hires & Lower Headcount

Consumers Smart Meter

20

Inflation

(100)

Performance Excellence

30+

2017 vs 2012

$125

How – Two Examples

Fuel Mix MW Employees

2013-14 Build Wind Farms + 200 + 4

2016 Retire Coal - 900 - 300

2016 Add GCC + 700 + 20

Total 0 - 276

Future Savings (mils) $25

Future Annual

Benefits Savings

(mils)

2002-06 Active health care sharing

2003-05 Pension “DB” to “DC”

2003-06 Retiree health care sharing $25

2007-10 Retiree health care- access only

for new hires

2013 EGWP, OPEB & other 50

Future savings $75

Opportunity: Discount Rates $20

. . . . a way of life at CMS.

TJW 14

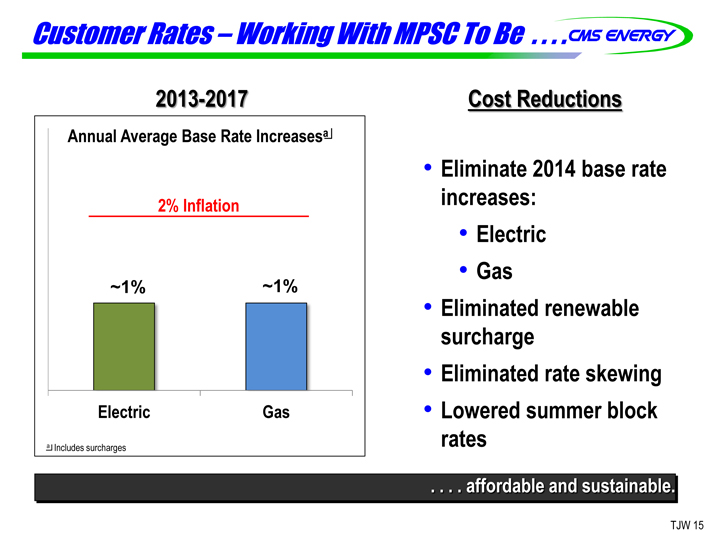

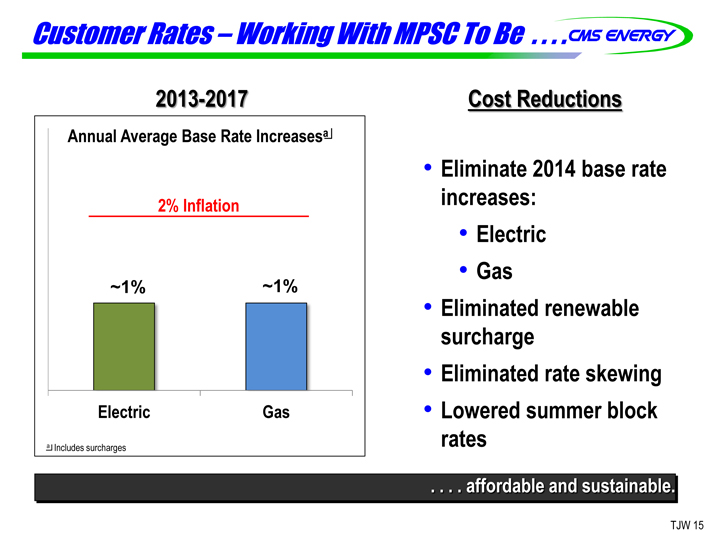

Customer Rates – Working With MPSC To Be . . . .

2013-2017

Annual Average Base Rate Increases a

2% Inflation

~1% ~1%

Electric Gas

a Includes surcharges

Cost Reductions

Eliminate 2014 base rate increases:

Electric

Gas

Eliminated renewable surcharge

Eliminated rate skewing

Lowered summer block rates

. . . . affordable and sustainable.

TJW 15

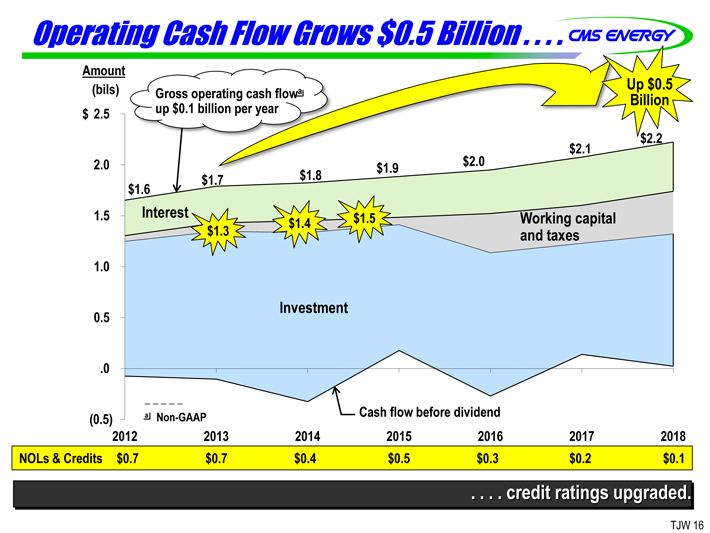

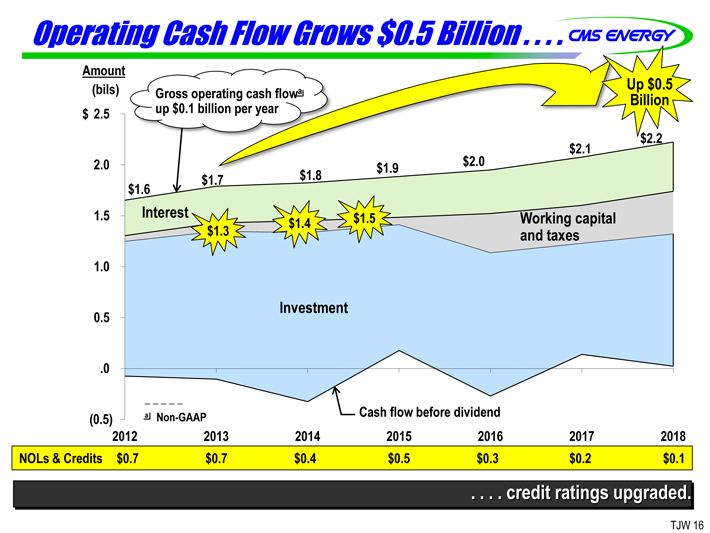

Operating Cash Flow Grows $0.5 Billion . . . .

Amount

(bils) Gross operating cash flow a Up $0.5

Billion

$ 2.5 up $0.1 billion

$2.2

2.0

$1.6 $1.7 $1.8 $1.9 $2.1

1.5 Interest $1.4 $1.5 Working capital

$1.3 and taxes

1.0

0.5 Investment

.0

(0.5) a Non-GAAP Cash flow before dividend

2012 2013 2014 2015 2016 2017 2018

NOLs & Credits $0.7 $0.7 $0.4 $0.5 $0.3 $0.2 $0.1

. . . . credit ratings upgraded.

TJW 16

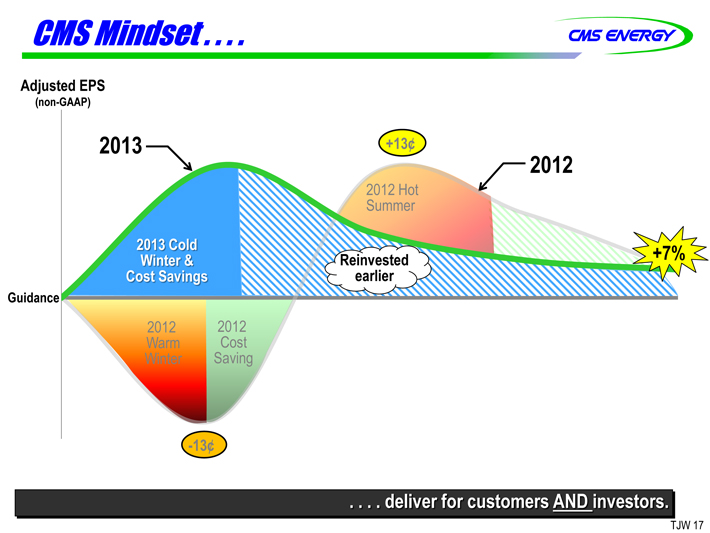

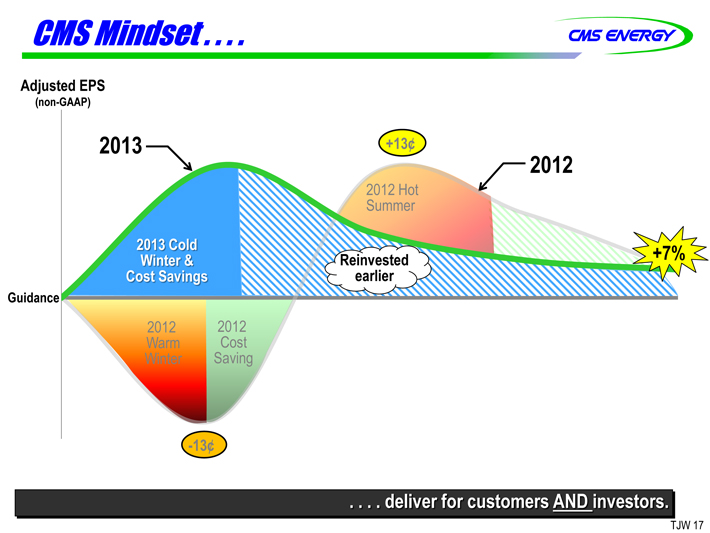

CMS Mindset . . . .

Adjusted EPS

(non-GAAP)

2013 +13¢ 2012

2012 Hot

Summer

2013 Cold +7%

Winter & Reinvested

Cost Savings earlier

Guidance

2012 2012

Warm Cost

Winter Saving

-13¢

. . . . deliver for customers AND investors.

TJW 17

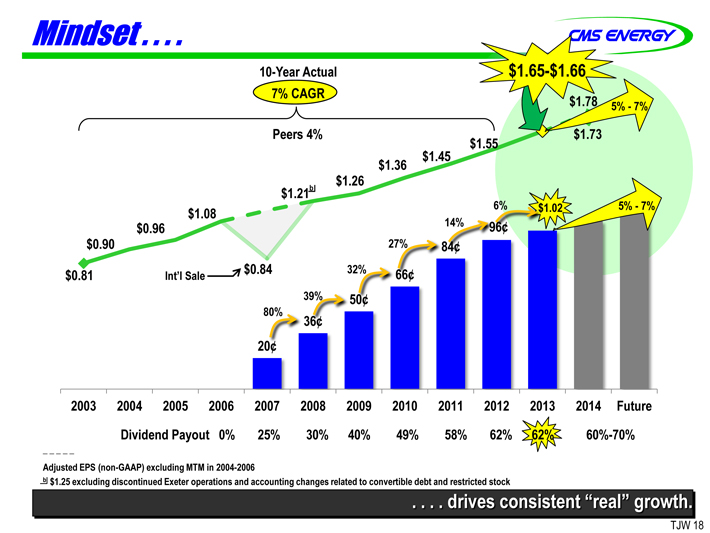

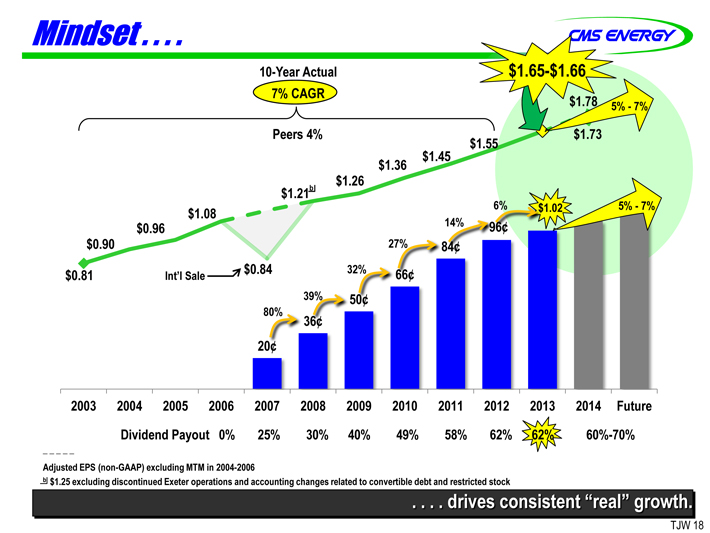

Mindset . .. . .

10-Year Actual $1.65-$1.66

7% CAGR $1.78 5% -7%

Peers 4% $1.73

$1.55

$1.36 $1.45

$1.26

$1.21b

$1.08 6% 5% -7%

$0.96 14%

$0.90

$0.81 Int’l Sale $0.84 32%

80%

20

39% 36 50 27 66 84 96 $1.02

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Future

Dividend Payout 0% 25% 30% 40% 49% 58% 62% 62% 60%-70%

Adjusted EPS (non-GAAP) excluding MTM in 2004-2006

b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

. . . . drives consistent “real” growth.

TJW 18

Electric Generation & Energy Supply

Dennis Dobbs Vice President Generation Engineering & Services

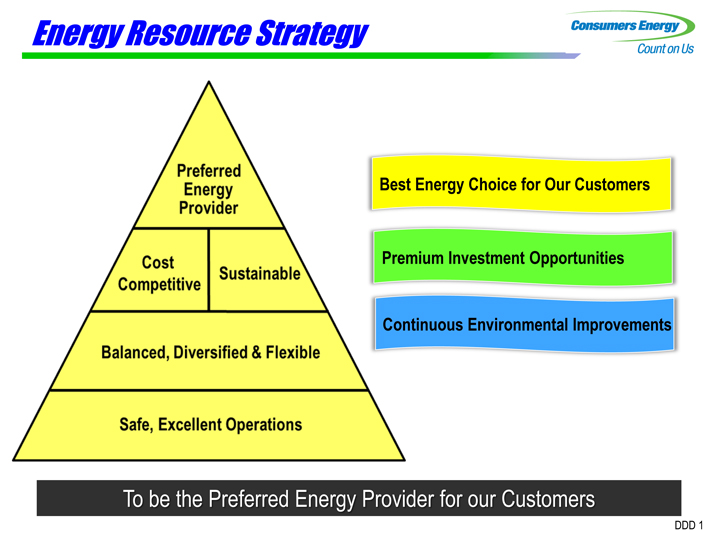

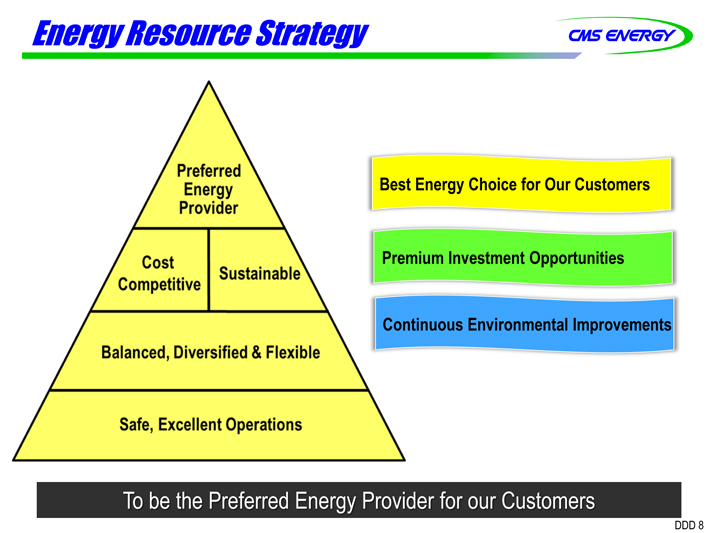

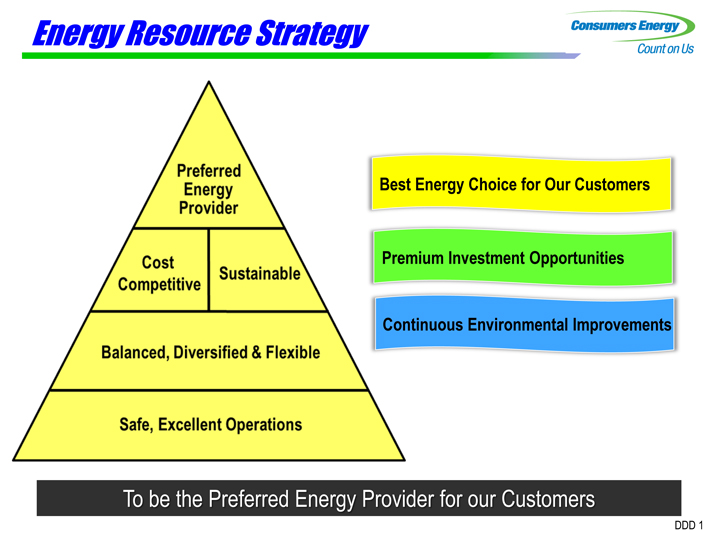

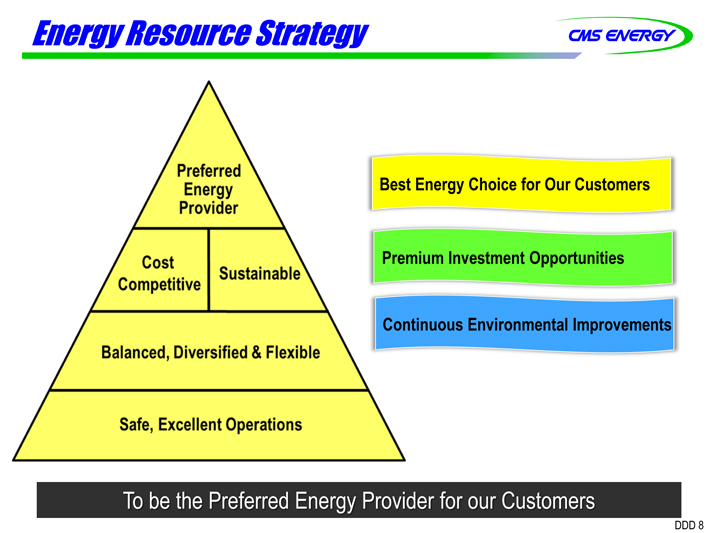

Energy Resource Strategy

Best Energy Choice for Our Customers Premium Investment Opportunities Continuous Environmental Improvements

To be the Preferred Energy Provider for our Customers

Preferred Energy Provider

Cost Competitive Sustainable Balanced, Diversified & Flexible

Safe, Excellent Operations

DDD 1

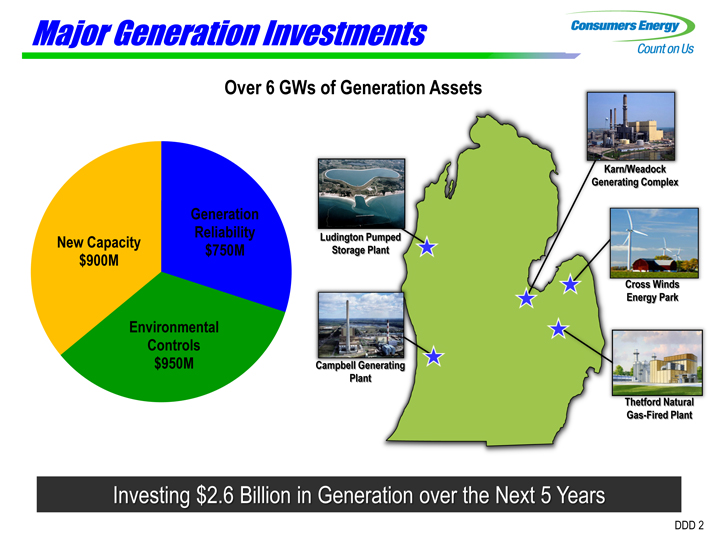

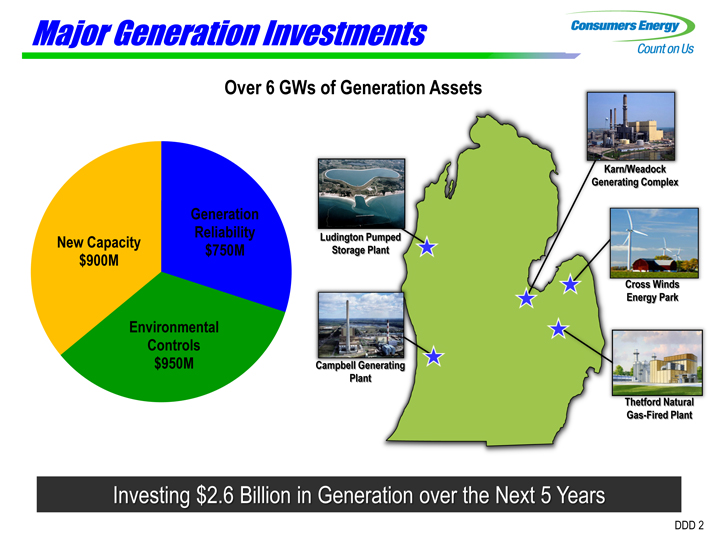

Major Generation Investments

Over 6 GWs of Generation Assets

Generating Complex

Generation

Reliability

New Capacity $750M Storage Plant

$900M

Energy Park

Environmental

Controls

$950M

Plant

Gas-Fired Plant

Ludington Pumped Cambell Generating Kam/Weadock Cross Winds Thetford Natural

Investing $2.6 Billion in Generation over the Next 5 Years

DDD 2

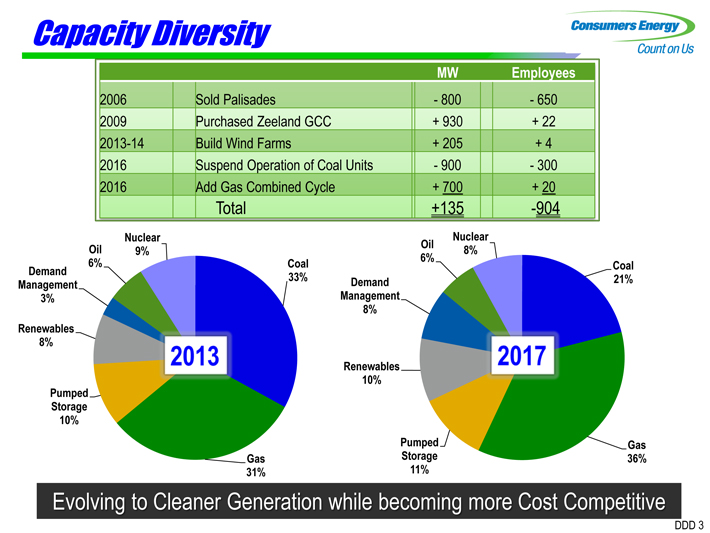

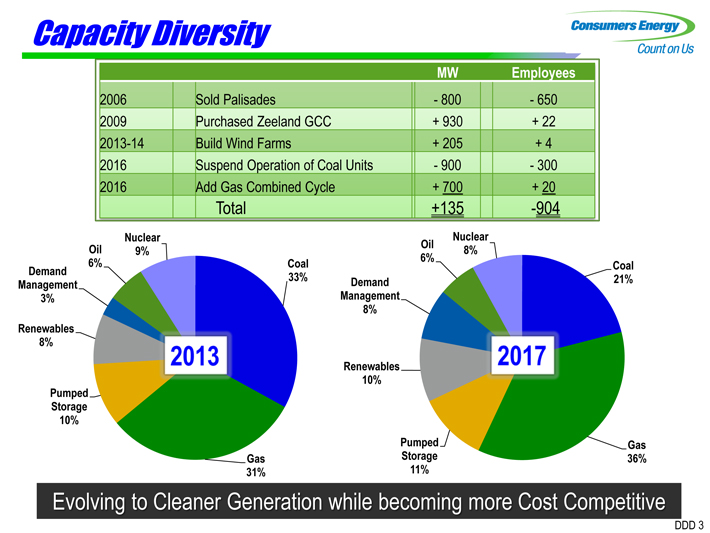

Capacity Diversity

MW Employees

2006 Sold Palisades - 800 -650

2009 Purchased Zeeland GCC + 930 + 22

2013-14 Build Wind Farms + 205 + 4

2016 Suspend Operation of Coal Units - 900 -300

2016 Add Gas Combined Cycle + 700 + 20

Total +135 -904

Nuclear Nuclear

Oil 9% Oil 8%

6% Coal 6% Coal

Demand

Management 33% Demand 21%

3% Management

8%

Renewables

8%

Renewables

10%

Pumped

Storage

10%

Pumped Gas

Gas Storage 36%

31% 11%

Evolving to Cleaner Generation while becoming more Cost Competitive

DDD 3

Projected CO2 Intensity

2,500

Existing Coal

2,000

Range for Potential Regulation on Existing Sources

MWh 1,500

per Consumers Energy Projected CO2 Intensity

2

CO 1,000

of Natural Gas Combined Cycle

Pounds

500

0 Nuclear, Wind & Solar

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Positioned well for potential CO2 regulations

DDD 4

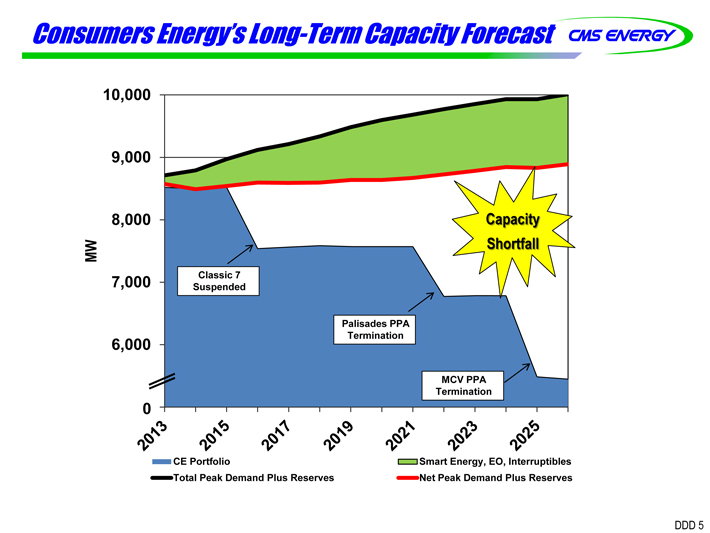

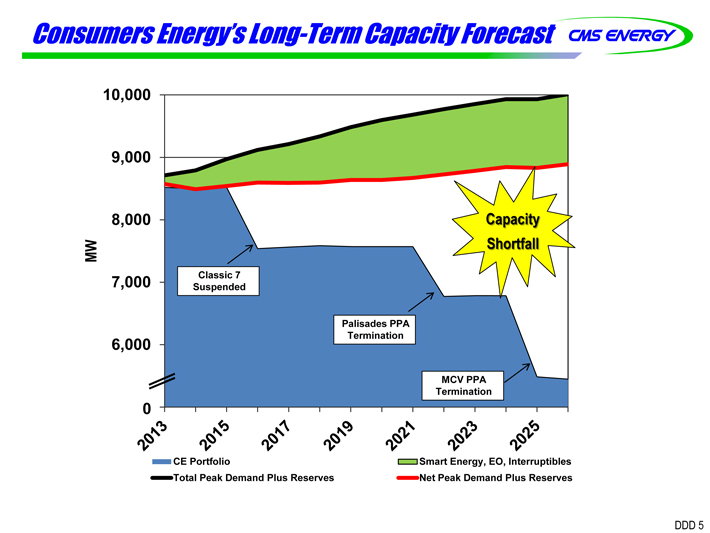

Consumers Energy’s Long-Term Capacity Forecast

10,000

9,000

8,000 Capacity

MW Shortfall

7,000 Suspended Classic 7

Palisades PPA

6,000 Termination

MCV PPA

Termination

0

2013 2015 2017 2019 2021 2023 2025

CE Portfolio Smart Energy, EO, Interruptibles

Total Peak Demand Plus Reserves Net Peak Demand Plus Reserves

DDD 5

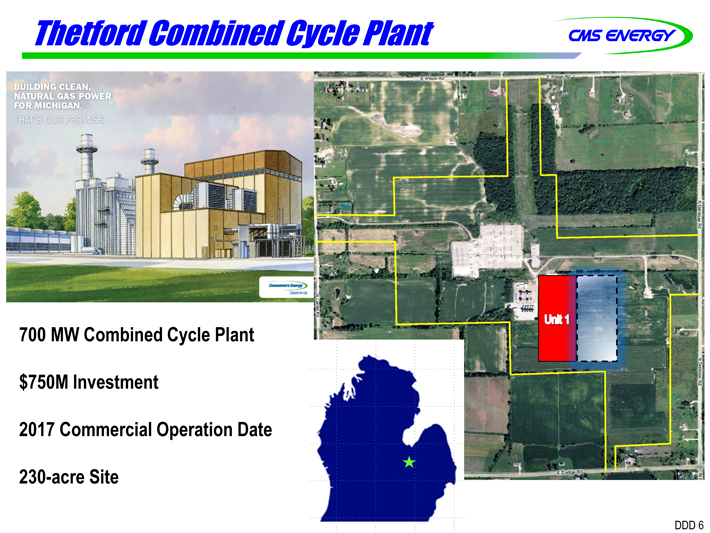

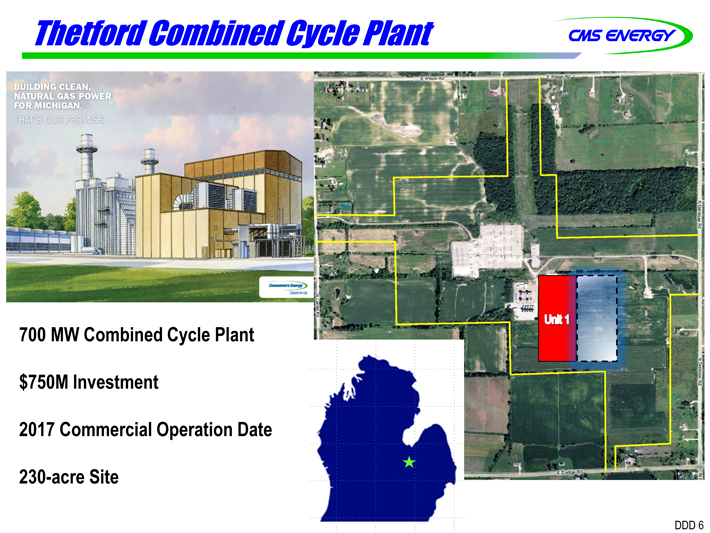

Thetford Combined Cycle Plant

700 MW Combined Cycle Plant $750M Investment 2017 Commercial Operation Date 230-acre Site

BUILDING CLEAN, NATURAL GAS POWER FOR MICHIGAN THAT’S OUR PROMISE

DDD 6

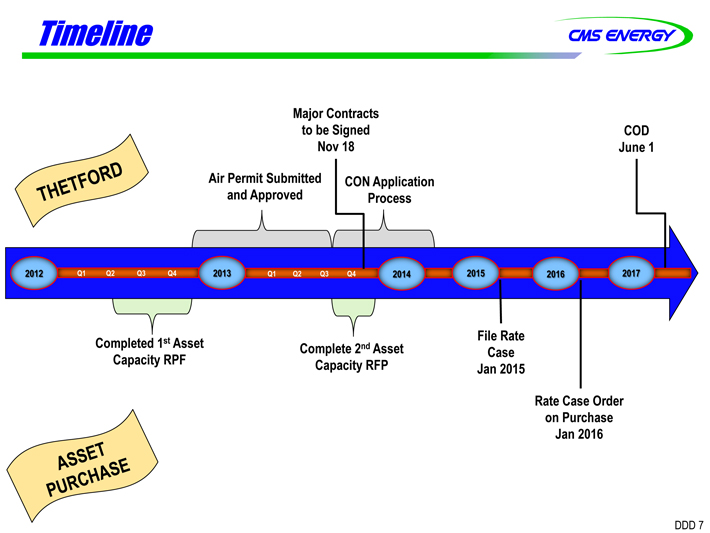

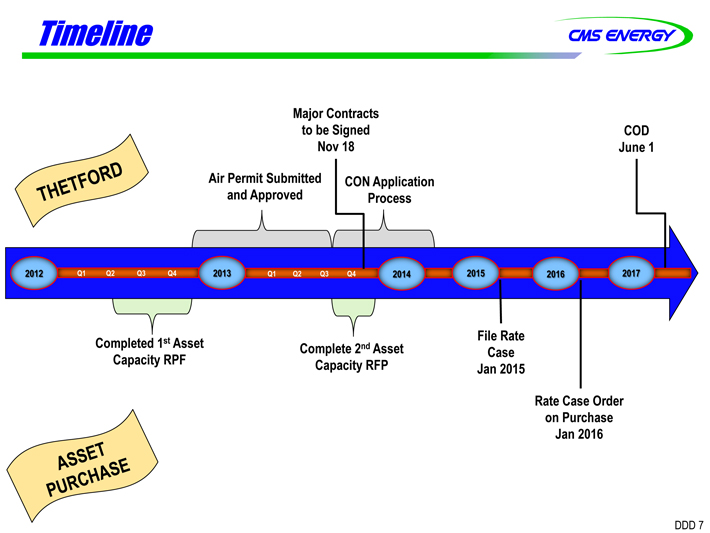

Timeline

Major Contracts

to be Signed COD

Nov 18 June 1

Air Permit Submitted CON Application

and Approved Process

2012 Q1 Q2 Q3 Q4 2013 Q1 Q2 Q3 Q4 2014 2015 2016 2017

File Rate

Completed Capacity 1st RPF Asset Complete 2nd Asset Case

Capacity RFP Jan 2015

Rate Case Order

on Purchase

Jan 2016

THETFORD ASSET PURCHASE

DDD 7

Energy Resource Strategy

Best Energy Choice for Our Customers Premium Investment Opportunities Continuous Environmental Improvements

To be the Preferred Energy Provider for our Customers

Preferred Energy Provider Cost Competitive Sustainable Balanced, Diversified & Flexible Safe, Excellent Operations

DDD 8

State of the Business Smart Energy

Patti Poppe

Vice President Customer Experience

& Operations

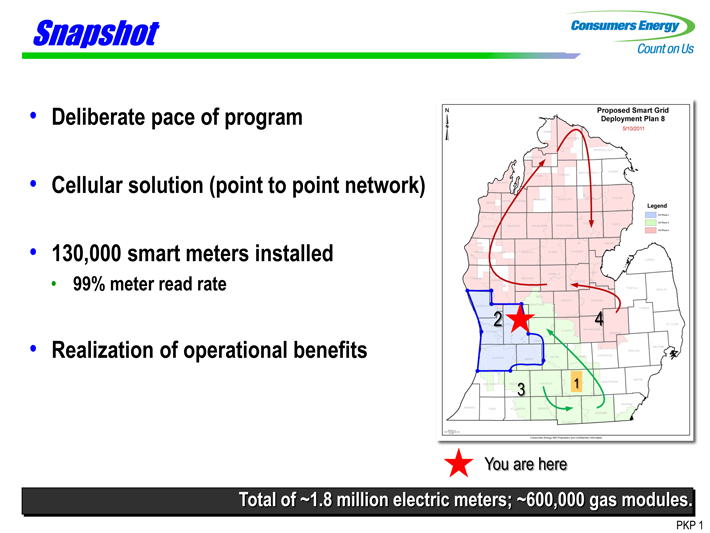

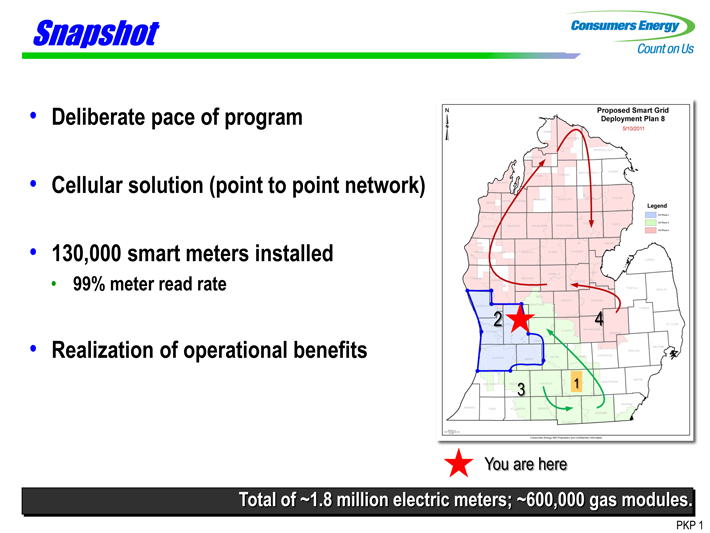

Snapshot

Deliberate pace of program

Cellular solution (point to point network)

130,000 smart meters installed

99% meter read rate

Realization of operational benefits

2 4

3 1

You are here Proposed Smart Grid Deployment Plan8 5/10/2011

Total of ~1.8 million electric meters; ~600,000 gas modules.

PKP 1

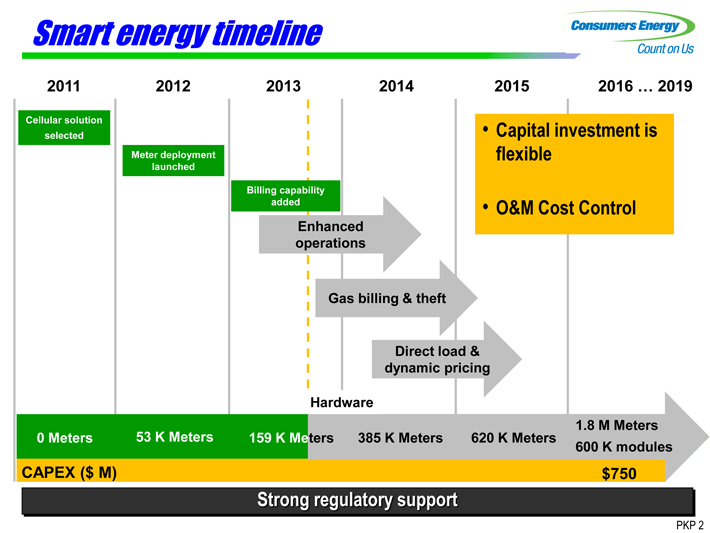

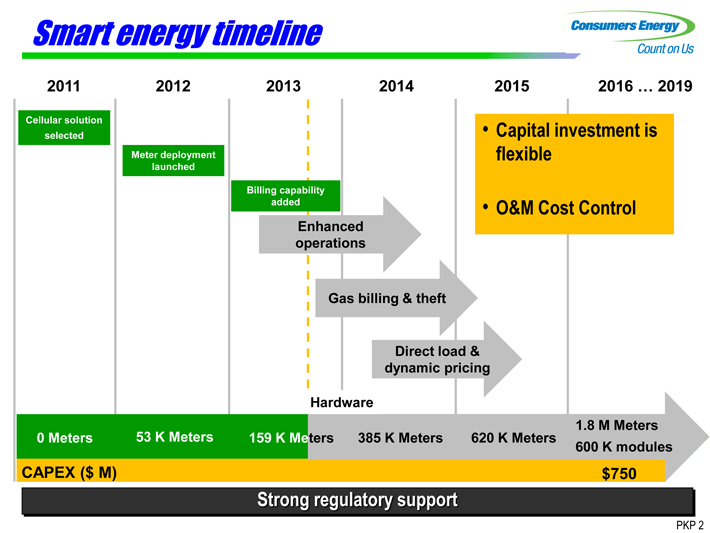

Smart energy timeline

2011 2012 2013 2014 2015 2016 … 2019

Cellular solution • Capital investment is

selected

Meter deployment flexible

launched

Billing capability

added • O&M Cost Control

Enhanced

operations

Gas billing & theft

Direct load &

dynamic pricing

Hardware

1.8 M Meters

0 Meters 53 K Meters 159 K Meters 385 K Meters 620 K Meters 600 K modules

CAPEX ($ M) $750

Strong regulatory support

PKP 2

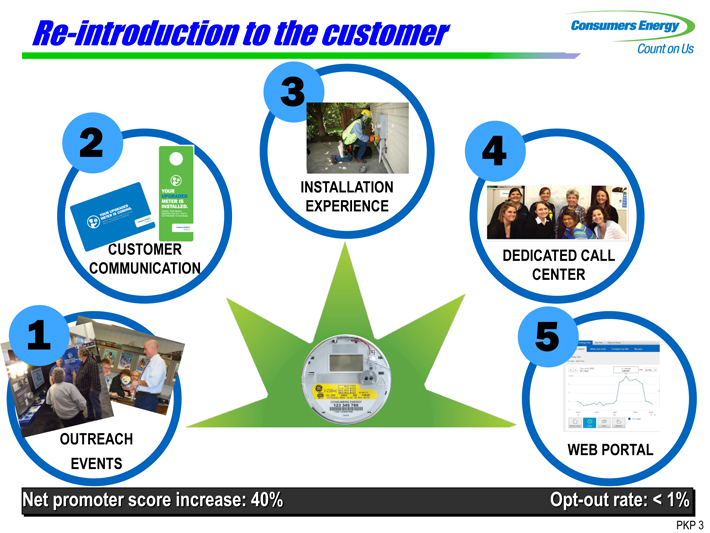

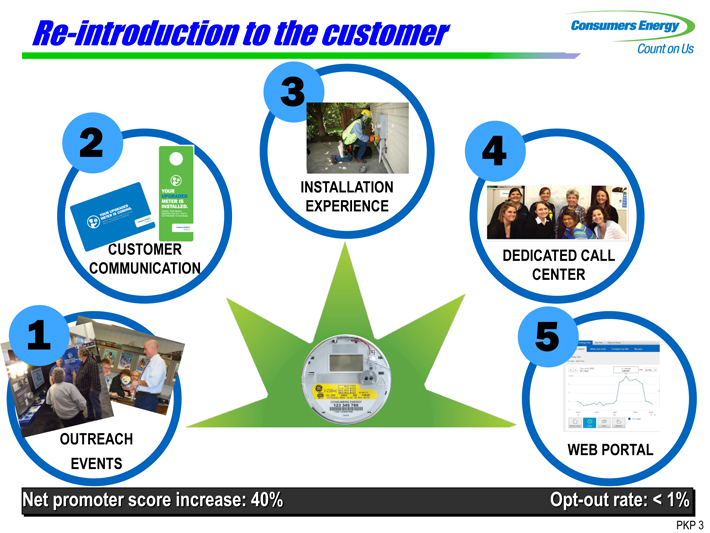

Re-introduction to the customer

3

2 4

INSTALLATION

EXPERIENCE

CUSTOMER DEDICATED CALL

COMMUNICATION CENTER

1 5

OUTREACH WEB PORTAL

EVENTS

Net promoter score increase: 40%

Opt-out rate: < 1%

PKP 3

Platform for future investment

Commitment to financial goals

New smart “Grid” investments

Platform for future investments in new products and services

Additional smart meter investments for gas only customers

PKP 4

Pipeline Replacement & Safety

Garrick Rochow

Vice President of Energy Delivery

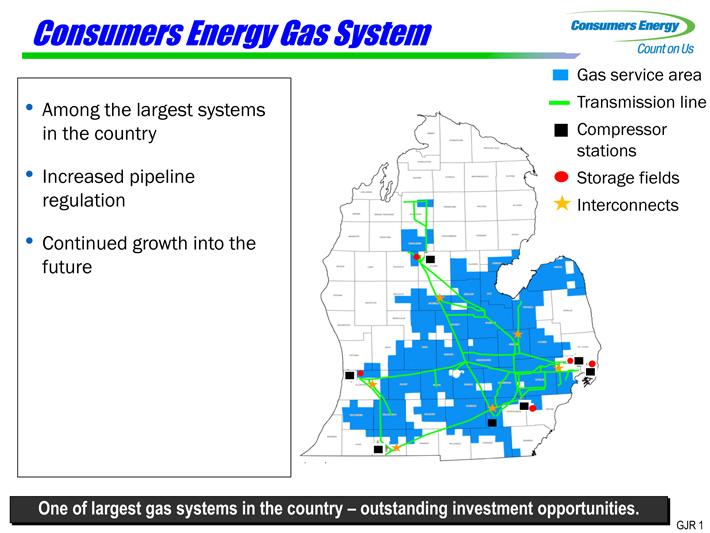

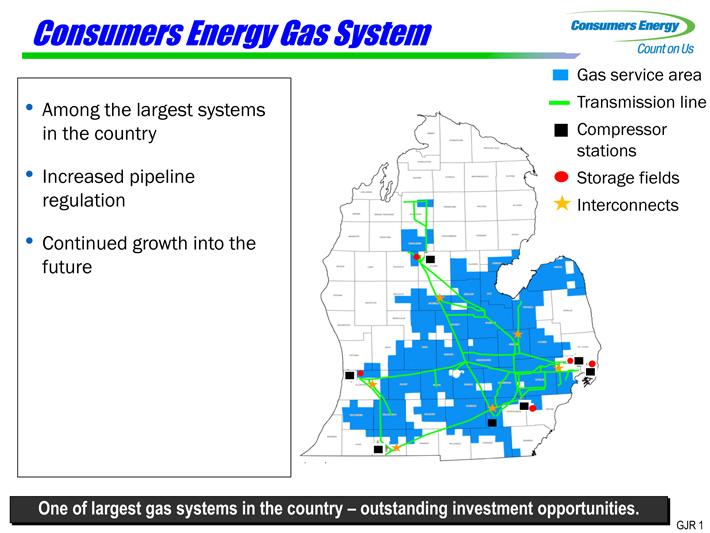

Consumers Energy Gas System

Among the largest systems in the country

Increased pipeline regulation

Continued growth into the future

Gas service area Transmission line Compressor stations Storage fields Interconnects

One of largest gas systems in the country – outstanding investment opportunities.

GJR 1

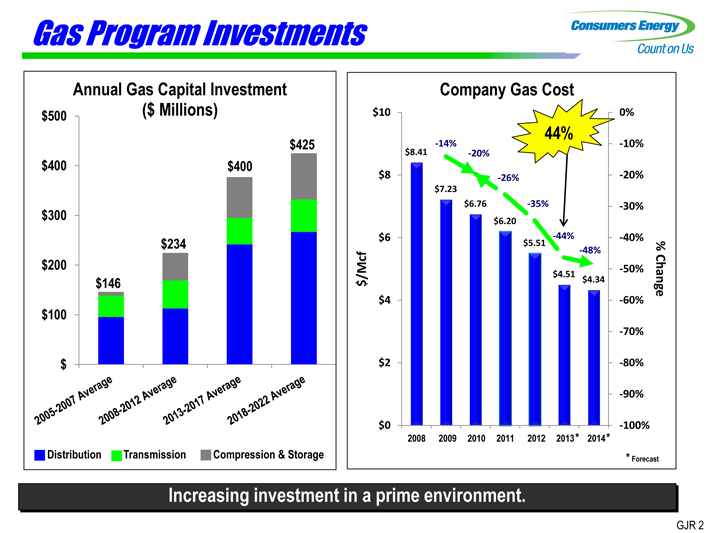

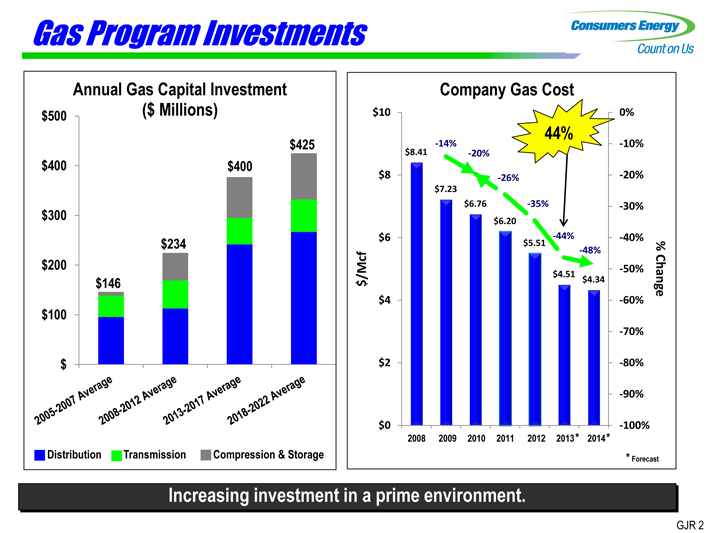

Gas Program Investments

Annual Gas Capital Investment

$500

($ Millions)

$425

$400

$400

$300

$234

$200

$146

$100

$

Distribution

Transmission

Compression & Storage

Company Gas Cost

$10 0%

44%

-14% -10%

$8.41 -20%

$8 -26% -20%

$7.23

$6.76 -35% -30%

$6.20

$6 -44% -40%

$5.51 -48%

$/Mcf $4.51 -50%

$4.34% Change

$4 -60%

-70%

$2 -80%

-90%

$0 -100%

2008 2009 2010 2011 2012 2013 * 2014 *

* Forecast 2005-2007 Average 2008-2012 Average 2013-2017 Average 2018-2022 Average

Increasing investment in a prime environment.

GJR 2

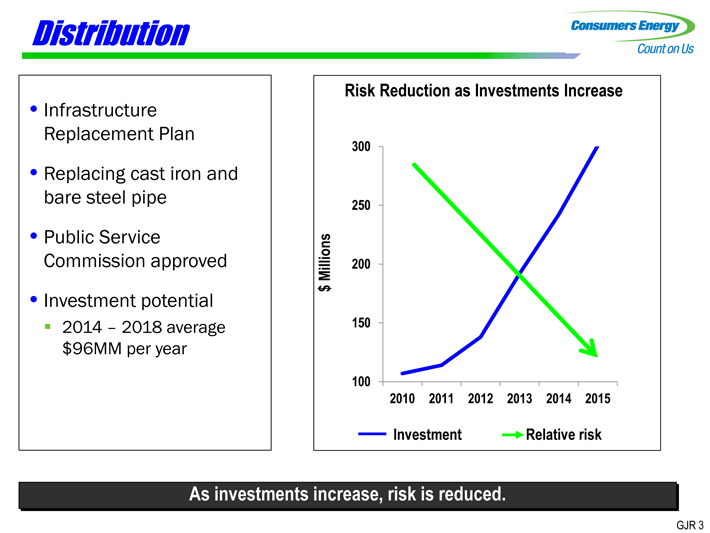

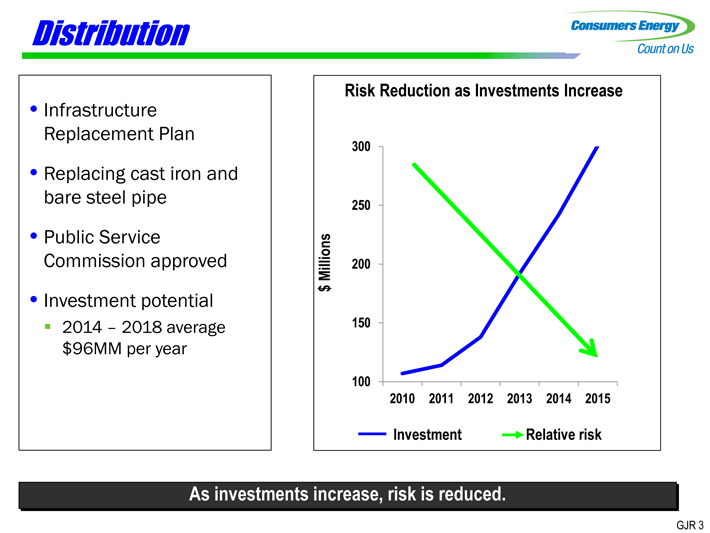

Distribution

Infrastructure Replacement Plan

Replacing cast iron and bare steel pipe

Public Service Commission approved

Investment potential

2014 – 2018 average $96MM per year

Risk Reduction as Investments Increase

300

250

Millions 200

$

150

100

2010 2011 2012 2013 2014 2015

Investment Relative risk

As investments increase, risk is reduced.

GJR 3

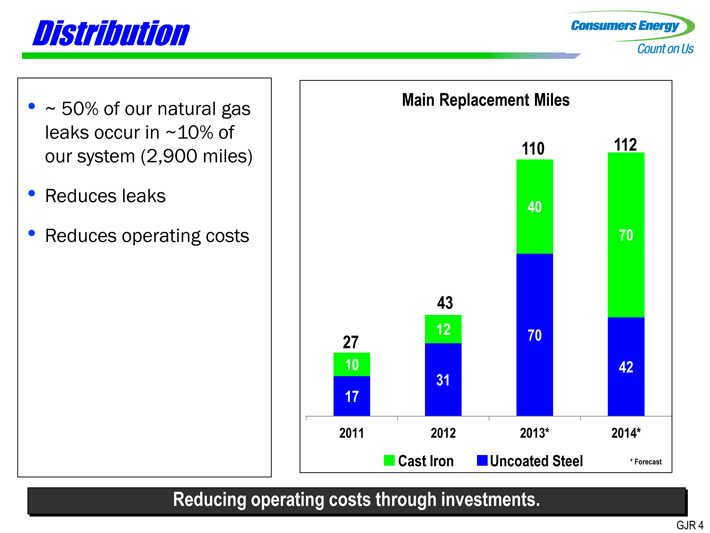

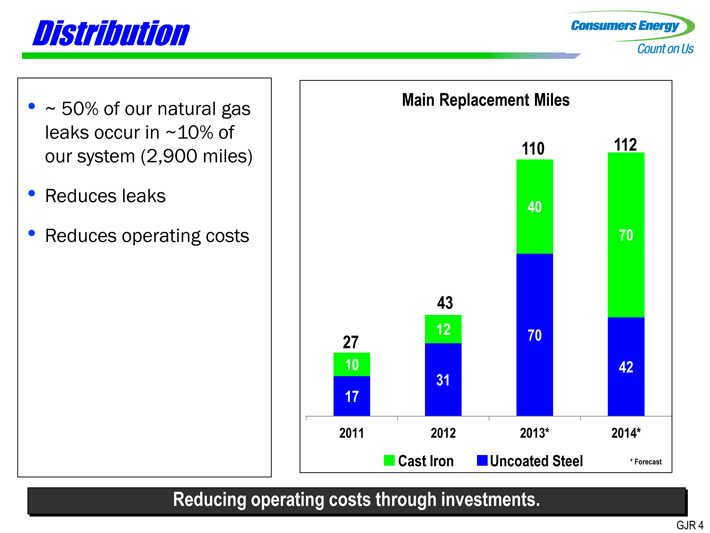

Distribution

~ 50% of our natural gas leaks occur in ~10% of our system (2,900 miles)

Reduces leaks

Reduces operating costs

Main Replacement Miles

110 112

40

70

43

27 12 70

10 42

31

17

2011 2012 2013* 2014*

Cast Iron Uncoated Steel *Forecast

Reducing operating costs through investments.

GJR 4

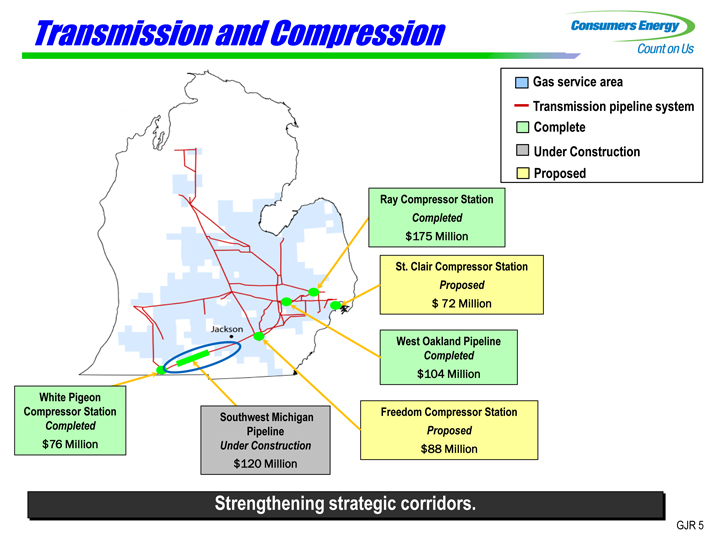

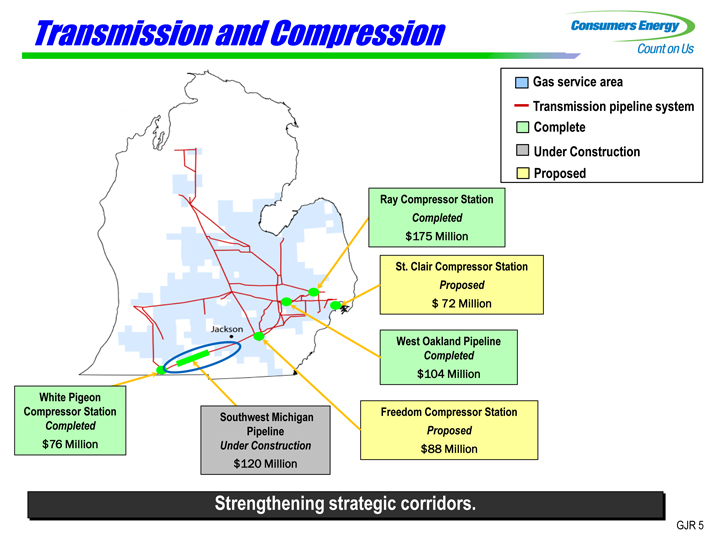

Transmission and Compression

Gas service area

Transmission pipeline system

Complete

Under Construction

Proposed

Ray Compressor Station

Completed

$175 Million

St. Clair Compressor Station

Proposed

$ 72 Million

West Oakland Pipeline

Completed

$104 Million

White Pigeon

Compressor Station Southwest Michigan Freedom Compressor Station

Completed Pipeline Proposed

$76 Million Under Construction $88 Million

$120 Million

Strengthening strategic corridors.

Jackson

GJR 5

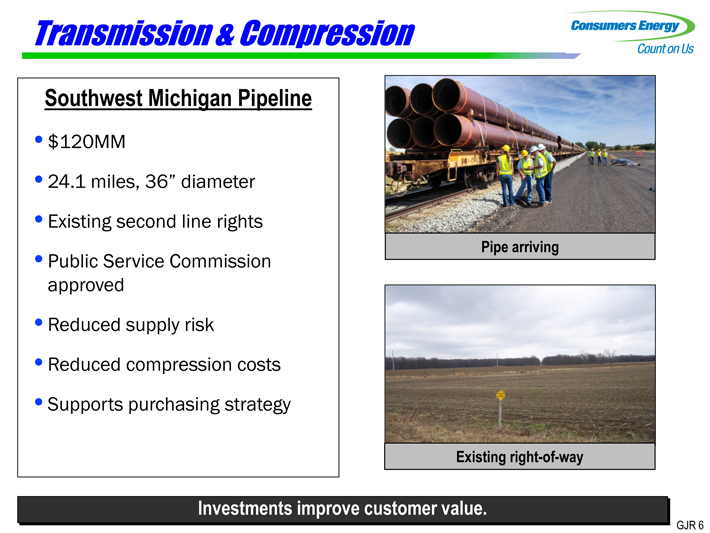

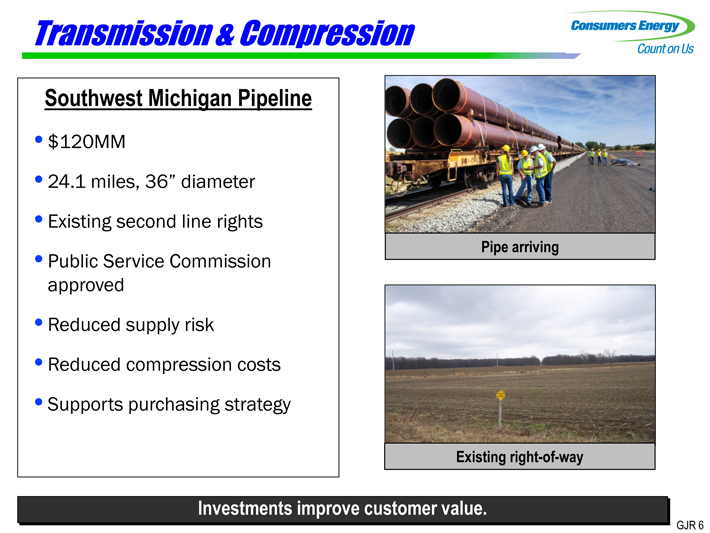

Transmission & Compression

Southwest Michigan Pipeline

$120MM

24.1 miles, 36” diameter

Existing second line rights

Public Service Commission

approved

Reduced supply risk

Reduced compression costs

Supports purchasing strategy

Pipe arriving

Existing right-of-way

Investments improve customer value.

GJR 6

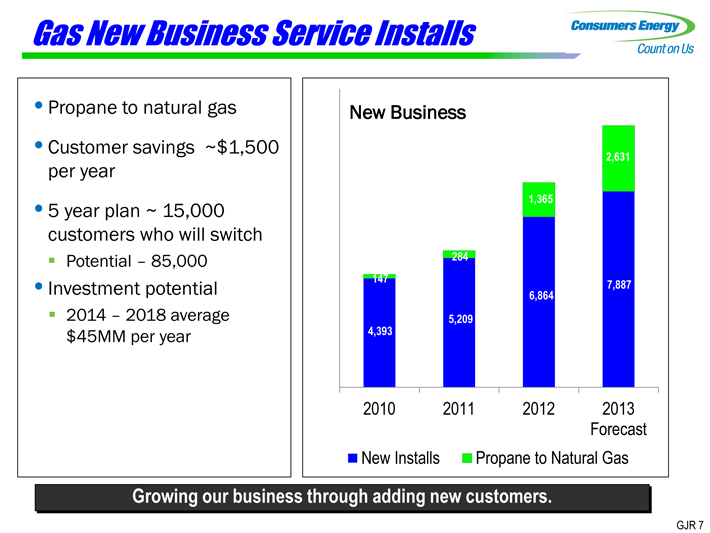

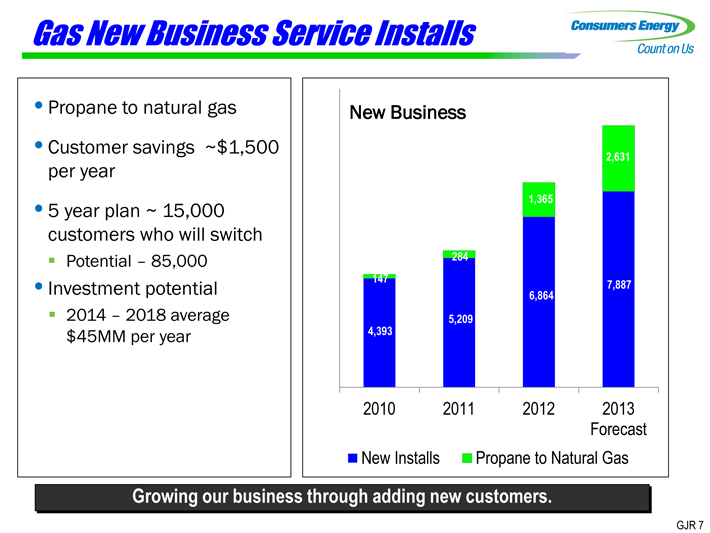

Gas New Business Service Installs

Propane to natural gas

Customer savings ~$1,500 per year

5 year plan ~ 15,000 customers who will switch

Potential – 85,000

Investment potential

2014 – 2018 average $45MM per year

New Business

2,631

1,365

284

147 7,887

6,864

5,209

4,393

2010 2011 2012 2013

Forecast

New Installs Propane to Natural Gas

Growing our business through adding new customers.

GJR 7

Summary - Investing in the Future

One of the largest gas systems in the country

Reducing risk

Committed to O&M reduction

Contributing to financial targets

Poised for continued growth

Outstanding investment opportunities.

GJR 8

Electric Transmission & Distribution

Dan Malone

Senior Vice President of Distribution & Customer Operations

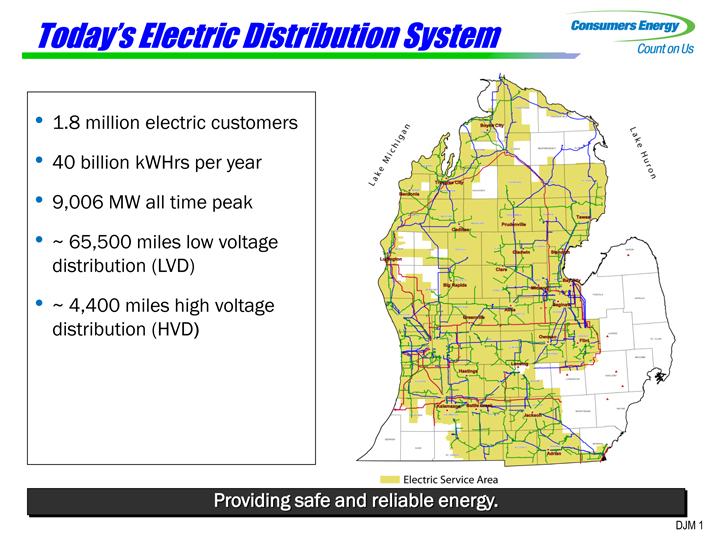

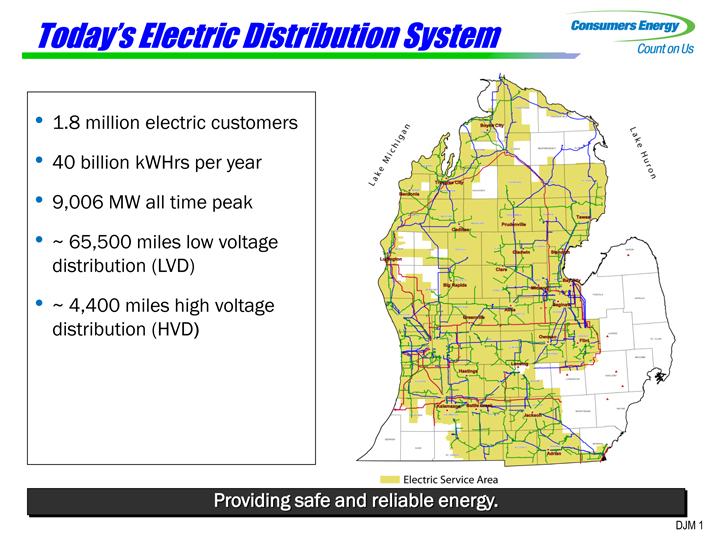

Today’s Electric Distribution System

1.8 million electric customers

40 billion kWHrs per year

9,006 MW all time peak

~ 65,500 miles low voltage distribution (LVD)

~ 4,400 miles high voltage distribution (HVD)

Providing safe and reliable energy. Lake Michigan Lake Huron Electric Service Area

DJM 1

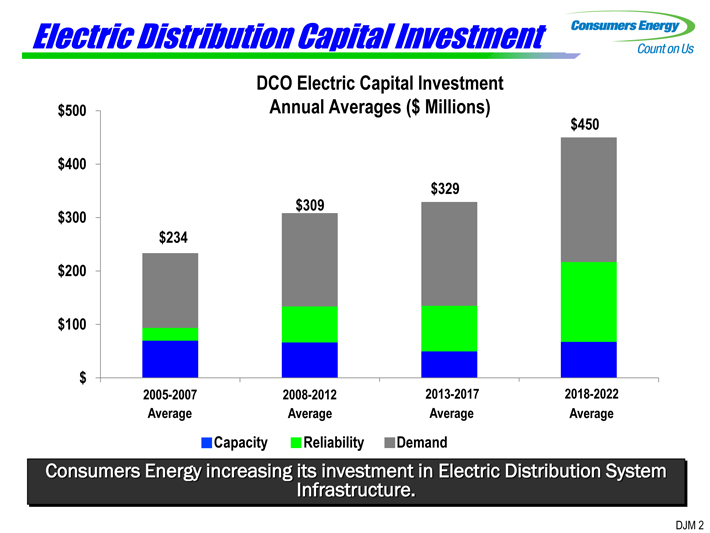

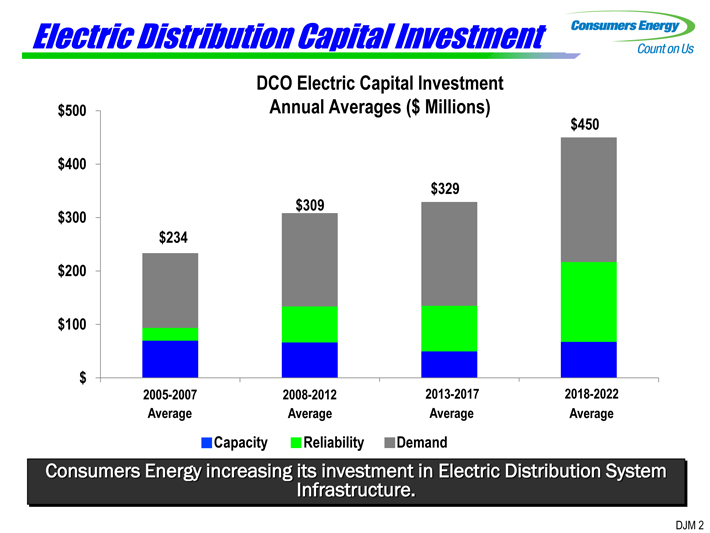

Electric Distribution Capital Investment

DCO Electric Capital Investment

$500 Annual Averages ($ Millions)

$450

$400

$329

$300 $309

$234

$200

$100

$

2005-2007 2008-2012 2013-2017 2018-2022

Average Average Average Average

Capacity Reliability Demand

Consumers Energy increasing Infrastructure. its investment in Electric Distribution System

DJM 2

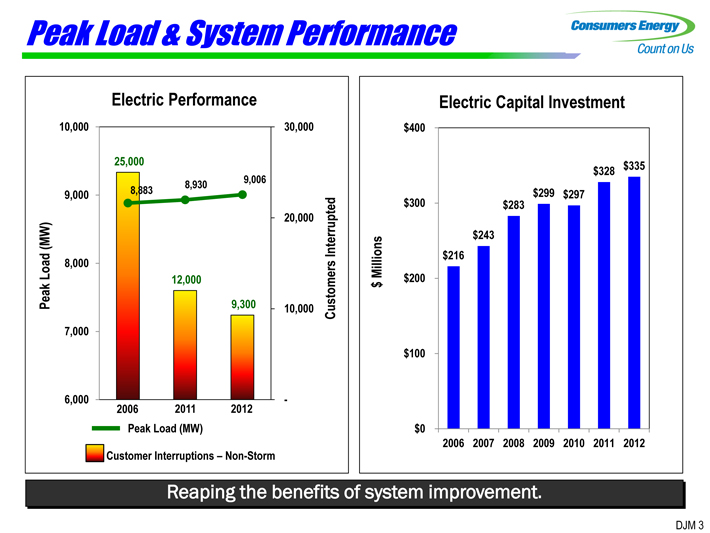

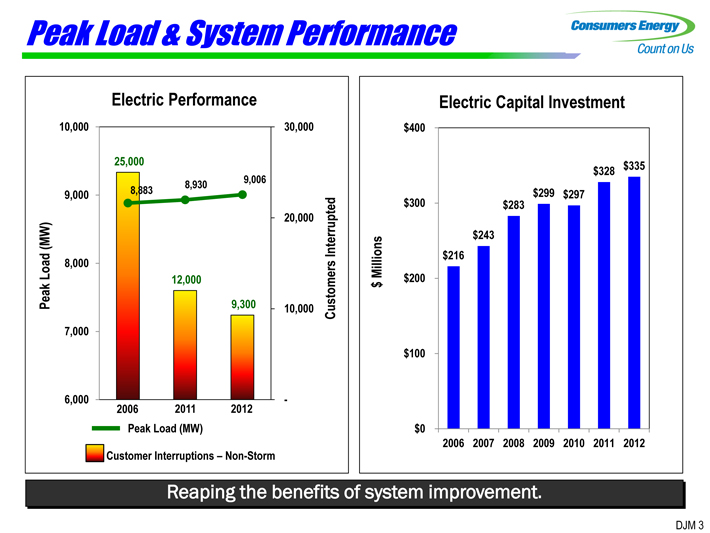

Peak Load & System Performance

Electric Performance

10,000 30,000

25,000

8,930 9,006

9,000 8,883

20,000

(MW) Interrupted

Load 8,000

12,000

Peak 9,300 10,000 Customers

7,000

6,000

2006 2011 2012

Peak Load (MW)

Customer Interruptions – Non-Storm

Electric Capital Investment

$400

$328 $335

$300 $283 $299 $297

$243

Millions $216

$200

$

$100

$0

2006 2007 2008 2009 2010 2011 2012

Reaping the benefits of system improvement.

DJM 3

Move into Transmission

Consumers Energy exited the transmission business in 2002

Planning to register as

Transmission Owner/Operator by 2016

Opportunity to reclassify some assets

Customers and shareholders benefits

Positions Consumers Energy for potential future growth in an adjacent business.

DJM 4

Norplas – New Customer Acquisition

New industrial customer -4.8 MW

Competition with neighboring utility

Met customer requirements

Project completion – 2013

Full Revenue -$4MM

More competitive.

DJM 5

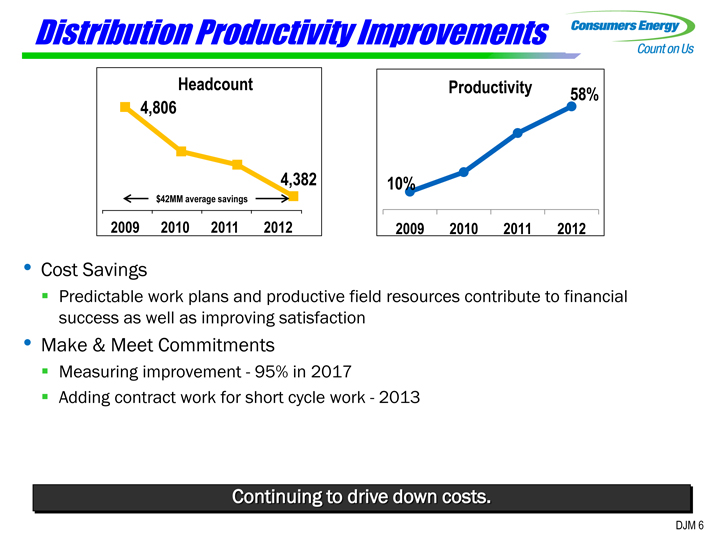

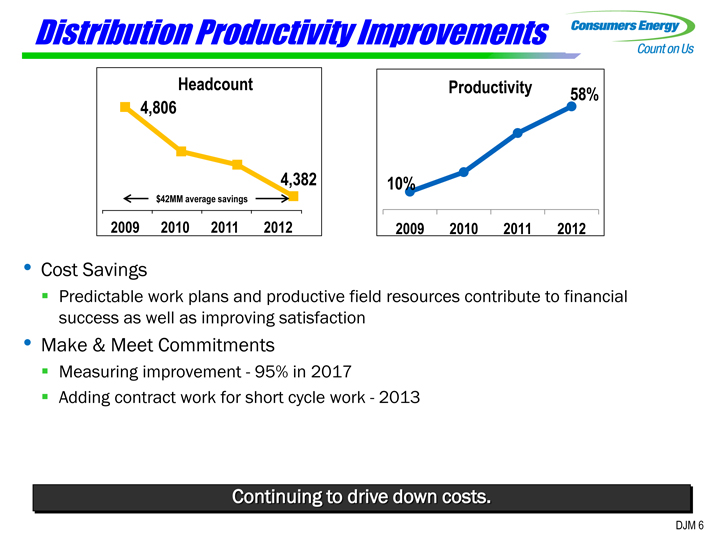

Distribution Productivity Improvements

Headcount Productivity 58%

4,806

4,382 10%

$42MM average savings

2009 2010 2011 2012 2009 2010 2011 2012

Cost Savings

Predictable work plans and productive field resources contribute to financial success as well as improving satisfaction

Make & Meet Commitments

Measuring improvement -95% in 2017

Adding contract work for short cycle work -2013

Continuing to drive down costs.

DJM 6

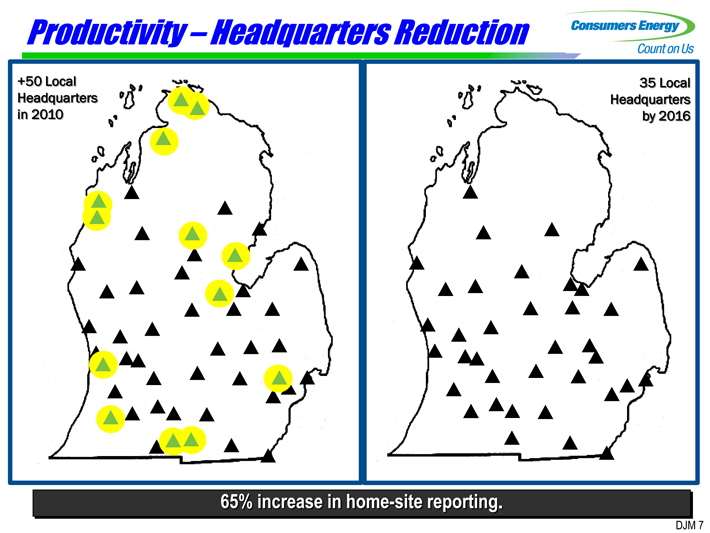

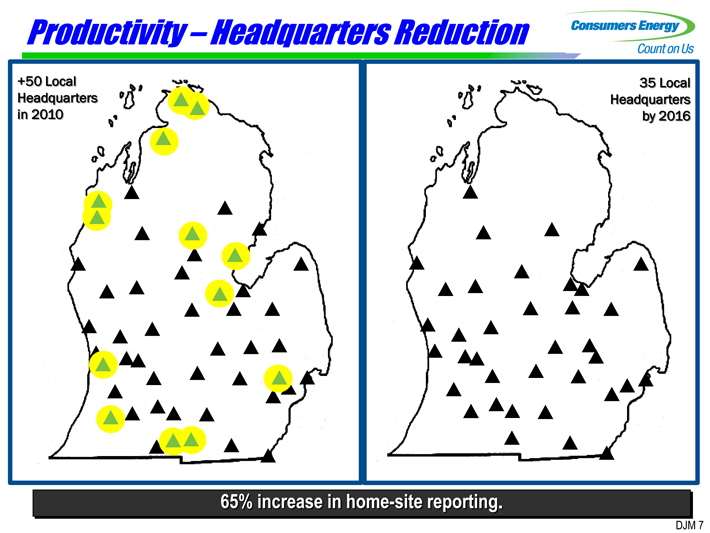

Productivity – Headquarters Reduction

+50 Local 35 Local Headquarters Headquarters in 2010 by 2016

65% increase in home-site reporting.

DJM 7

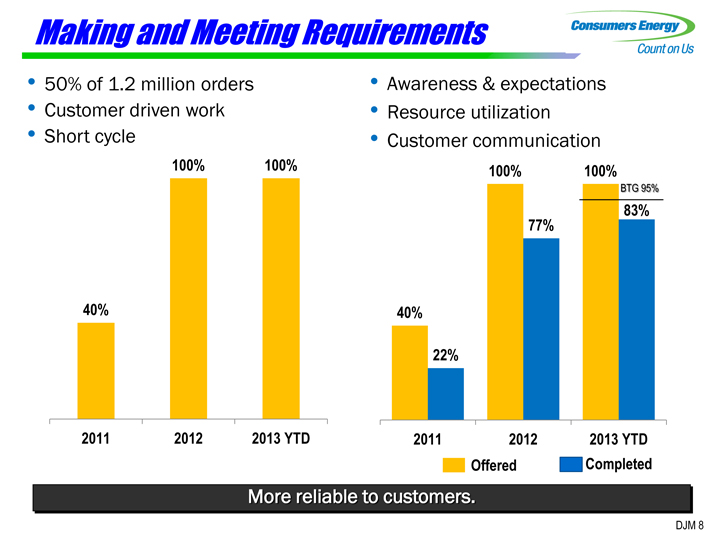

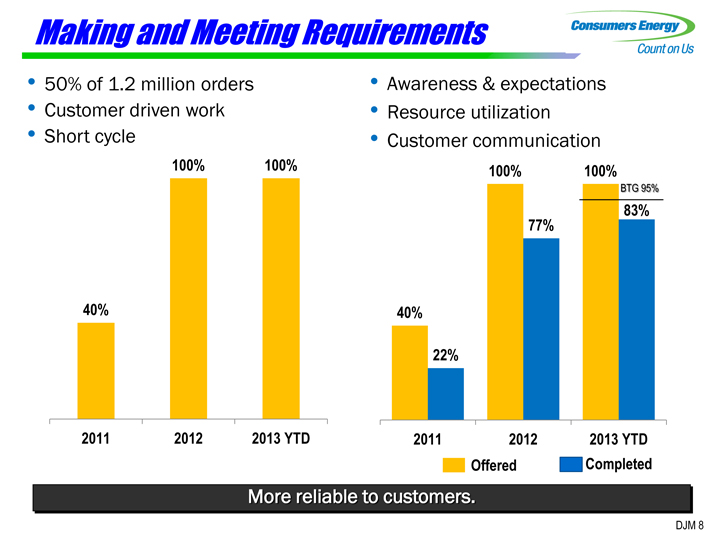

Making and Meeting Requirements

50% of 1.2 million orders • Awareness & expectations

Customer driven work • Resource utilization

Short cycle • Customer communication

100% 100% 100% 100%

BTG 95%

83%

77%

40% 40%

22%

2011 2012 2013 YTD 2011 2012 2013 YTD

Offered Completed

More reliable to customers.

DJM 8

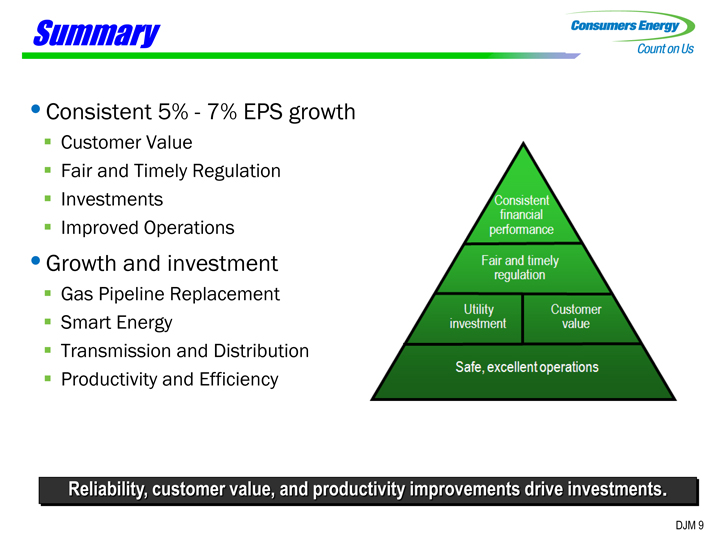

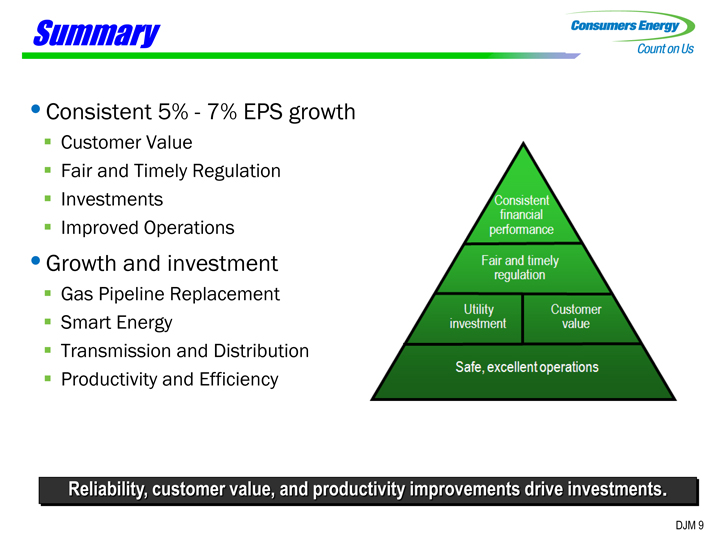

Summary

Consistent 5% -7% EPS growth

Customer Value

Fair and Timely Regulation

Investments

Improved Operations

Growth and investment

Gas Pipeline Replacement

Smart Energy

Transmission and Distribution

Productivity and Efficiency

Reliability, customer value, and productivity improvements drive investments.

Consistent financial performance Fair and timely regulation Utility investment Customer value Safe, excellent operations

DJM 9

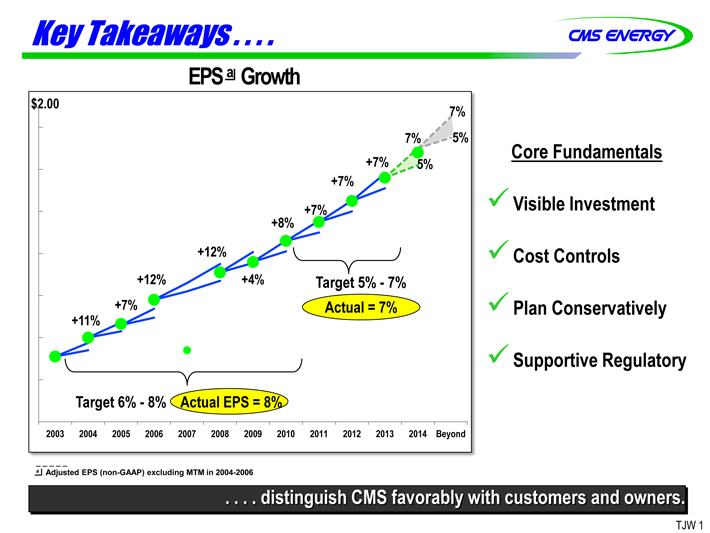

Wrap-Up

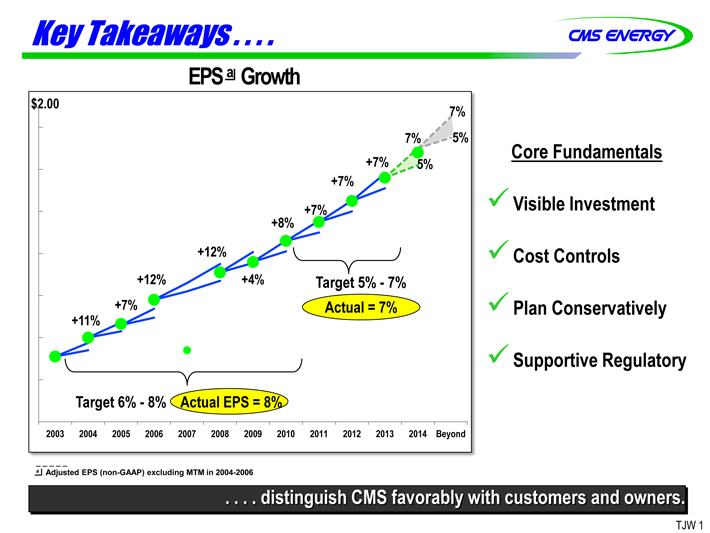

Key Takeaways . . . .

EPS a Growth

$2.00 7%

7% 5%

+7% 5%

+7%

+8% +7%

+12%

+12% +4% Target 5% -7%

+7% Actual = 7%

+11%

Target 6% -8% Actual EPS = 8%

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Beyond

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006

Core Fundamentals

Visible Investment

Cost Controls

Plan Conservatively

Supportive Regulatory

. . . . distinguish CMS favorably with customers and owners.

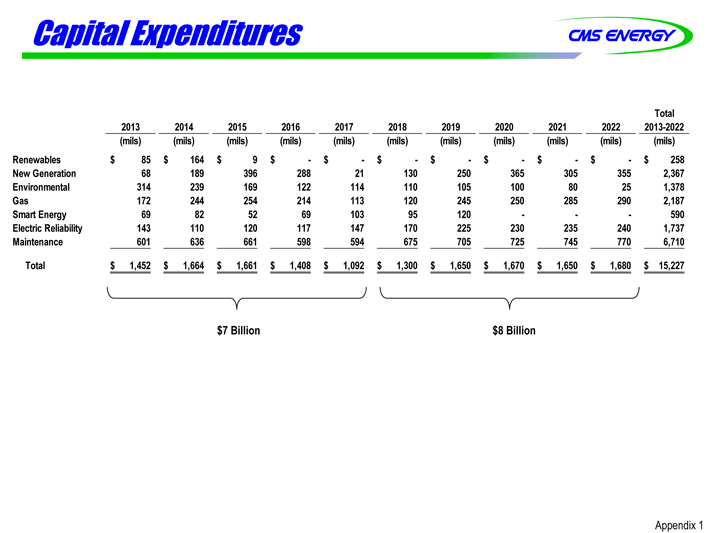

Appendix

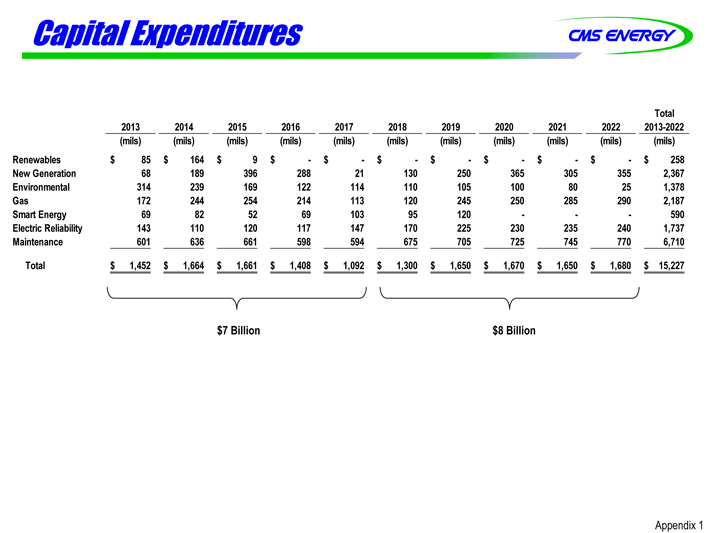

Capital Expenditures

Total

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2013-2022

(mils) (mils) (mils) (mils) (mils) (mils) (mils) (mils) (mils) (mils) (mils)

Renewables $ 85 $ 164 $ 9 $ - $ - $ - $ - $ - $ - $ - $ 258

New Generation 68 189 396 288 21 130 250 365 305 355 2,367

Environmental 314 239 169 122 114 110 105 100 80 25 1,378

Gas 172 244 254 214 113 120 245 250 285 290 2,187

Smart Energy 69 82 52 69 103 95 120 - - - 590

Electric Reliability 143 110 120 117 147 170 225 230 235 240 1,737

Maintenance 601 636 661 598 594 675 705 725 745 770 6,710

Total $ 1,452 $ 1,664 $ 1,661 $ 1,408 $ 1,092 $ 1,300 $ 1,650 $ 1,670 $ 1,650 $ 1,680 $ 15,227

$ 7 Billion $ 8 Billion

Appendix 1

GAAP Reconciliation

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | | 2004

| | | 2005

| | | 2006

| | | 2007

| | | 2008

| | | 2009

| | | 2010

| | | 2011

| | | 2012

| |

Reported earnings (loss) per share - GAAP | | ($ | 0.30 | ) | | $ | 0.64 | | | ($ | 0.44 | ) | | ($ | 0.41 | ) | | ($ | 1.02 | ) | | $ | 1.20 | | | $ | 0.91 | | | $ | 1.28 | | | $ | 1.58 | | | $ | 1.42 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.21 | | | | (0.39 | ) | | | — | | | | — | | | | (0.07 | ) | | | 0.05 | | | | 0.33 | | | | 0.03 | | | | 0.00 | | | | 0.17 | |

Enterprises | | | 0.74 | | | | 0.62 | | | | 0.04 | | | | (0.02 | ) | | | 1.25 | | | | (0.02 | ) | | | 0.09 | | | | (0.03 | ) | | | (0.11 | ) | | | (0.01 | ) |

Corporate interest and other | | | 0.16 | | | | (0.03 | ) | | | 0.04 | | | | 0.27 | | | | (0.32 | ) | | | (0.02 | ) | | | 0.01 | | | | * | | | | (0.01 | ) | | | * | |

Discontinued operations (income) loss | | | (0.16 | ) | | | 0.02 | | | | (0.07 | ) | | | (0.03 | ) | | | 0.40 | | | | (* | ) | | | (0.08 | ) | | | 0.08 | | | | (0.01 | ) | | | (0.03 | ) |

Asset impairment charges, net | | | — | | | | — | | | | 1.82 | | | | 0.76 | | | | 0.60 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Cumulative accounting changes | | | 0.16 | | | | 0.01 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, including MTM - non-GAAP | | $ | 0.81 | | | $ | 0.87 | | | $ | 1.39 | | | $ | 0.57 | | | $ | 0.84 | | | $ | 1.21 | (a) | | $ | 1.26 | | | $ | 1.36 | | | $ | 1.45 | | | $ | 1.55 | |

Mark-to-market impacts | | | | | | | 0.03 | | | | (0.43 | ) | | | 0.51 | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, excluding MTM - non-GAAP | | | NA | | | $ | 0.90 | | | $ | 0.96 | | | $ | 1.08 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | | Less than $500 thousand or $0.01 per share. |

| (a) | | $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. |

CMS ENERGY CORPORATION

Earnings By Quarter and Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

(In Millions, Except Per Share Amounts)

| | 2012

| |

| | | 1Q

| | | 2Q

| | | 3Q

| | | 4Q

| | | YTD Dec

| |

Reported net income - GAAP | | $ | 67 | | | $ | 100 | | | $ | 148 | | | $ | 67 | | | $ | 382 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 36 | | | | 7 | | | | * | | | | (* | ) | | | 43 | |

Enterprises | | | 1 | | | | 1 | | | | (3 | ) | | | (* | ) | | | (1 | ) |

Corporate interest and other | | | — | | | | — | | | | — | | | | * | | | | * | |

Discontinued operations income | | | (7 | ) | | | * | | | | * | | | | * | | | | (7 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted income - non-GAAP | | $ | 97 | | | $ | 108 | | | $ | 145 | | | $ | 67 | | | $ | 417 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Average shares outstanding, basic | | | 255.6 | | | | 261.2 | | | | 262.9 | | | | 263.0 | | | | 260.7 | |

Average shares outstanding, diluted | | | 266.8 | | | | 268.2 | | | | 269.0 | | | | 269.5 | | | | 268.6 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Reported earnings per share - GAAP | | $ | 0.25 | | | $ | 0.37 | | | $ | 0.55 | | | $ | 0.25 | | | $ | 1.42 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.14 | | | | 0.03 | | | | * | | | | (* | ) | | | 0.17 | |

Enterprises | | | 0.01 | | | | * | | | | (0.01 | ) | | | (* | ) | | | (0.01 | ) |

Corporate interest and other | | | — | | | | — | | | | — | | | | * | | | | * | |

Discontinued operations income | | | (0.03 | ) | | | * | | | | * | | | | * | | | | (0.03 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share - non-GAAP | | $ | 0.37 | | | $ | 0.40 | | | $ | 0.54 | | | $ | 0.25 | | | $ | 1.55 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | |

(In Millions, Except Per Share Amounts)

| | 2013

| |

| | | 1Q

| | | 2Q

| | | 3Q

| |

Reported net income - GAAP | | $ | 144 | | | $ | 80 | | | $ | 126 | |

| | |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | |

Electric and gas utility | | | — | | | | — | | | | — | |

Enterprises | | | * | | | | * | | | | — | |

Corporate interest and other | | | — | | | | * | | | | * | |

Discontinued operations loss | | | * | | | | * | | | | * | |

| | |

|

|

| |

|

|

| |

|

|

|

Adjusted income - non-GAAP | | $ | 144 | | | $ | 80 | | | $ | 126 | |

| | |

|

|

| |

|

|

| |

|

|

|

Average shares outstanding, basic | | | 263.6 | | | | 264.5 | | | | 264.8 | |

Average shares outstanding, diluted | | | 270.9 | | | | 272.2 | | | | 272.0 | |

| | |

|

|

| |

|

|

| |

|

|

|

Reported earnings per share - GAAP | | $ | 0.53 | | | $ | 0.29 | | | $ | 0.46 | |

| | |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | |

Electric and gas utility | | | — | | | | — | | | | — | |

Enterprises | | | * | | | | * | | | | — | |

Corporate interest and other | | | — | | | | * | | | | * | |

Discontinued operations loss | | | * | | | | * | | | | * | |

| | |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share - non-GAAP | | $ | 0.53 | | | $ | 0.29 | | | $ | 0.46 | |

| | |

|

|

| |

|

|

| |

|

|

|

| Note: | | Year-to-date (YTD) EPS may not equal sum of quarters due to share count differences. |

| * | | Less than $500 thousand or $0.01 per share. |

CMS Energy Corporation

Earnings Segment Results GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

| | | Nine Months Ended

| |

September 30

| | 2013

| | | 2012

| | | 2013

| | | 2012

| |

Electric Utility | | | | | | | | | | | | | | | | |

Reported | | $ | 0.57 | | | $ | 0.61 | | | $ | 1.16 | | | $ | 1.10 | |

Electric Decoupling Court Order | | | — | | | | — | | | | — | | | | 0.14 | |

Downsizing Program | | | — | | | | * | | | | — | | | | 0.02 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | 0.57 | | | $ | 0.61 | | | $ | 1.16 | | | $ | 1.26 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gas Utility | | | | | | | | | | | | | | | | |

Reported | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | 0.36 | | | $ | 0.23 | |

Downsizing Program | | | — | | | | * | | | | — | | | | 0.01 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | 0.36 | | | $ | 0.24 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Enterprises | | | | | | | | | | | | | | | | |

Reported | | $ | (0.01 | ) | | $ | 0.02 | | | $ | — | | | $ | 0.03 | |

Downsizing Program | | | — | | | | (* | ) | | | — | | | | * | |

Restructuring Costs and other | | | — | | | | (0.01 | ) | | | * | | | | (* | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | (0.01 | ) | | $ | 0.01 | | | $ | — | | | $ | 0.03 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Corporate Interest and Other | | | | | | | | | | | | | | | | |

Reported | | $ | (0.09 | ) | | $ | (0.07 | ) | | $ | (0.23 | ) | | $ | (0.22 | ) |

Restructuring Costs and other | | | * | | | | — | | | | * | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | (0.09 | ) | | $ | (0.07 | ) | | $ | (0.23 | ) | | $ | (0.22 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Discontinued Operations | | | | | | | | | | | | | | | | |

Reported | | $ | (* | ) | | $ | (* | ) | | $ | (* | ) | | $ | 0.03 | |

Discontinued Operations Income | | | * | | | | * | | | | * | | | | (0.03 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Totals | | | | | | | | | | | | | | | | |

Reported | | $ | 0.46 | | | $ | 0.55 | | | $ | 1.29 | | | $ | 1.17 | |

Discontinued Operations Income | | | * | | | | * | | | | * | | | | (0.03 | ) |

Electric Decoupling Court Order | | | — | | | | — | | | | — | | | | 0.14 | |

Downsizing Program | | | — | | | | (* | ) | | | — | | | | 0.03 | |

Restructuring Costs and other | | | * | | | | (0.01 | ) | | | * | | | | (* | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted | | $ | 0.46 | | | $ | 0.54 | | | $ | 1.29 | | | $ | 1.31 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Average Common Shares Outstanding - Diluted (in millions) | | | 272.0 | | | | 269.0 | | | | 271.6 | | | | 268.1 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | | Less than $0.01 per share. |

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2012

| | | 2013

| | | 2014

| | | 2015

| | | 2016

| | | 2017

| | | 2018

| |

Consumers Operating Income + Depreciation & Amortization | | $ | 1,635 | | | $ | 1,729 | | | $ | 1,775 | | | $ | 1,830 | | | $ | 1,925 | | | $ | 2,020 | | | $ | 2,165 | |

Enterprises Project Cash Flows | | | 17 | | | | 20 | | | | 29 | | | | 36 | | | | 31 | | | | 39 | | | | 39 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross Operating Cash Flow | | $ | 1,652 | | | $ | 1,749 | | | $ | 1,804 | | | $ | 1,866 | | | $ | 1,956 | | | $ | 2,059 | | | $ | 2,204 | |

Other operating activities including taxes, interest payments and working capital | | | (411 | ) | | | (399 | ) | | | (354 | ) | | | (316 | ) | | | (706 | ) | | | (709 | ) | | | (754 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net cash provided by operating activities | | $ | 1,241 | | | $ | 1,350 | | | $ | 1,450 | | | $ | 1,550 | | | $ | 1,250 | | | $ | 1,350 | | | $ | 1,450 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Biographies

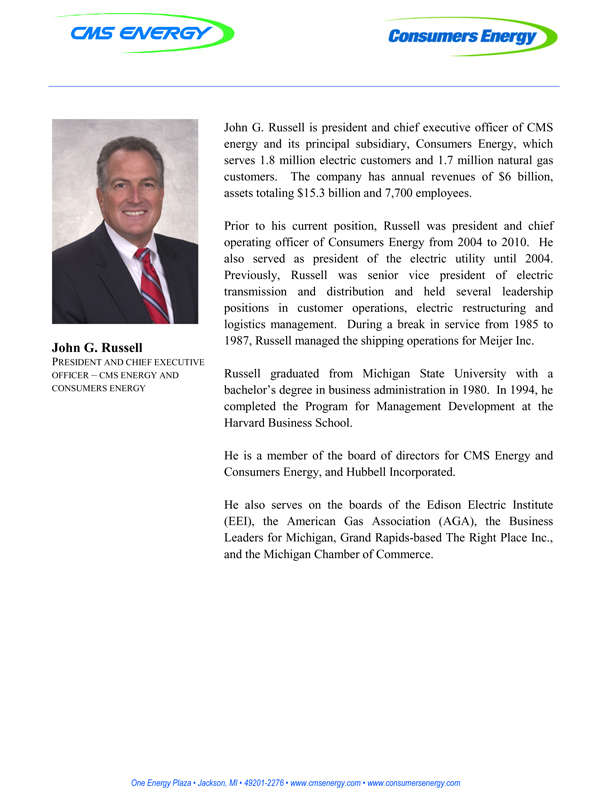

John G. Russell is president and chief executive officer of CMS

energy and its principal subsidiary, Consumers Energy, which

serves 1.8 million electric customers and 1.7 million natural gas

customers. The company has annual revenues of $6 billion,

assets totaling $15.3 billion and 7,700 employees.

Prior to his current position, Russell was president and chief

operating officer of Consumers Energy from 2004 to 2010. He

also served as president of the electric utility until 2004.

Previously, Russell was senior vice president of electric

transmission and distribution and held several leadership

positions in customer operations, electric restructuring and

logistics management. During a break in service from 1985 to

John G. Russell 1987, Russell managed the shipping operations for Meijer Inc.

PRESIDENT AND CHIEF EXECUTIVE

OFFICER – CMS ENERGY AND Russell graduated from Michigan State University with a

CONSUMERS ENERGY bachelor’s degree in business administration in 1980. In 1994, he

completed the Program for Management Development at the

Harvard Business School.

He is a member of the board of directors for CMS Energy and

Consumers Energy, and Hubbell Incorporated.

He also serves on the boards of the Edison Electric Institute

(EEI), the American Gas Association (AGA), the Business

Leaders for Michigan, Grand Rapids-based The Right Place Inc.,

and the Michigan Chamber of Commerce.

One Energy Plaza • Jackson, MI • 49201-2276 • www.cmsenergy.com • www.consumersenergy.com

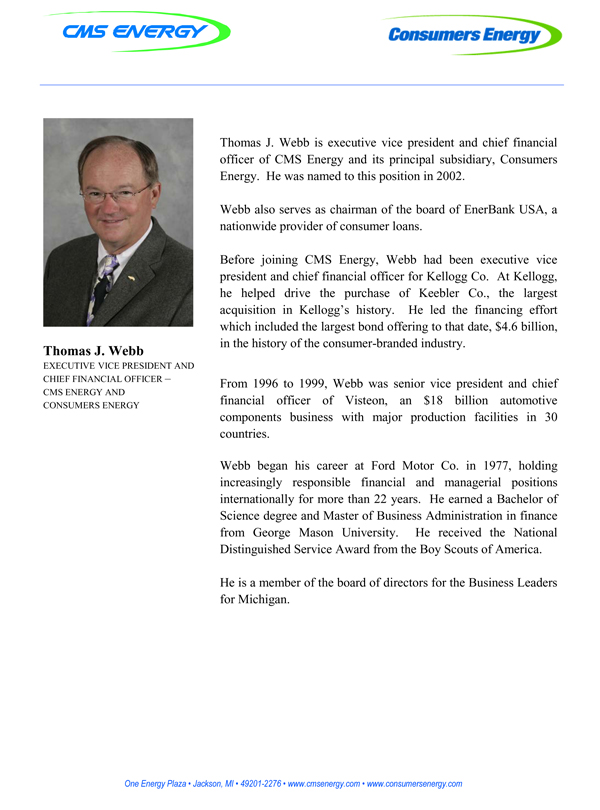

Thomas J. Webb is executive vice president and chief financial

officer of CMS Energy and its principal subsidiary, Consumers

Energy. He was named to this position in 2002.

Webb also serves as chairman of the board of EnerBank USA, a

nationwide provider of consumer loans.

Before joining CMS Energy, Webb had been executive vice

president and chief financial officer for Kellogg Co. At Kellogg,

he helped drive the purchase of Keebler Co., the largest

acquisition in Kellogg’s history. He led the financing effort

which included the largest bond offering to that date, $4.6 billion,

Thomas J. Webb in the history of the consumer-branded industry.

EXECUTIVE VICE PRESIDENT AND

CHIEF FINANCIAL OFFICER – From 1996 to 1999, Webb was senior vice president and chief

CMS ENERGY AND

CONSUMERS ENERGY financial officer of Visteon, an $18 billion automotive

components business with major production facilities in 30

countries.

Webb began his career at Ford Motor Co. in 1977, holding

increasingly responsible financial and managerial positions

internationally for more than 22 years. He earned a Bachelor of

Science degree and Master of Business Administration in finance

from George Mason University. He received the National

Distinguished Service Award from the Boy Scouts of America.

He is a member of the board of directors for the Business Leaders

for Michigan.

One Energy Plaza • Jackson, MI • 49201-2276 • www.cmsenergy.com • www.consumersenergy.com

Dennis D. Dobbs is vice president of generation engineering and

services for Consumers Energy, the principal subsidiary of CMS

Energy.

He is responsible for the engineering support of Consumers

Energy’s generating fleet along with the development of

renewable and conventional generating units.

Dobbs also oversees environmental compliance and strategy, and

administrative support and strategic planning for the generating

plants. He was named to this position in 2011.

DENNIS D. DOBBS Prior to his current position, Dobbs servesd as the site business

VICE PRESIDENT OF manager of the Karn/Weadock Generating Complex in

GENERATION ENGINEERING Essexville, Michigan from 2008 to 2011.

AND SERVICES

He joined Consumers Energy as a senior engineer in 1999 and

has held a series of increasingly responsible positions at the

company, including Karn/Weadock site production manager, and

Weadock plant business manager, site economic-based reliability

manager and economic-based reliability lead.

Dobbs began his utility career at Illinois Power in 1991 after

serving in the U.S. Army during Operation Desert Storm.

He earned a master’s of business administration degree from

Illinois State University and a bachelor’s degree in civil

engineering from the Rose-Hulman Institute of Technology.

One Energy Plaza • Jackson, MI • 49201-2276 • www.cmsenergy.com • www.consumersenergy.com

Patricia K. Poppe is vice president of customer experience and

operations for Consumers Energy, the principal subsidiary of

CMS Energy. She was elected to this position in January 2011.

Poppe leads Consumers Energy’s customer experience and

operations department, which includes customer call centers,

billing and revenue recovery, energy efficiency, the Smart Energy

program, customer insights and quality, and customer experience

design and marketing.

Before joining Consumers Energy, Poppe served as director of

regulated marketing and energy optimization at DTE Energy.

PATRICIA K. POPPE She also worked as director of DTE Energy’s North Region

VICE PRESIDENT OF Power Plants, overseeing 3000 MWs at five generating facilities.

CUSTOMER EXPERIENCE

AND OPERATIONS Prior to working for DTE Energy, Poppe held a variety of plant

management positions during her 15-year career at General

Motors Company.

Poppe earned a master’s degree in management from the Stanford

University Graduate School of Business and received a

bachelor’s degree and master’s degree in industrial engineering

from Purdue University.

One Energy Plaza • Jackson, MI • 49201-2276 • www.cmsenergy.com • www.consumersenergy.com

Garrick J. Rochow is vice president of energy delivery for

Consumers Energy, the principal subsidiary of CMS Energy. He

was named to this position in 2010.

Rochow is responsible for the engineering and planning of the

company’s electric and natural gas, transmission and distribution

systems. He heads the development and execution of plans to

maintain, upgrade and expand the distribution systems that

provide safe, reliable and affordable energy service to the

company’s 2.9 million customers.

Prior to his current position, Rochow served as the combustion

GARRICK J. ROCHOW turbine business manager and oversaw the operation and

VICE PRESIDENT OF maintenance of the 930-megawatt Zeeland generating facility and

ENERGY DELIVERY other combustion turbine units with a total capacity of 400

megawatts. He was responsible for the transition of Zeeland into

Consumers Energy’s generation fleet and strategy development

for the combustion turbine fleet.

He joined Consumers Energy in 2003 and has held several

leadership positions, including site production manager at the

Campbell Generating Complex. Rochow began his utility career

at the Holland Board of Public Works where he served as a

maintenance superintendent at that municipal utility and handled

steam turbine and boiler outage responsibilities.

Rochow graduated from Michigan Technological University with

a bachelor’s degree in environmental engineering and earned a

master’s degree in business administration from Western

Michigan University. He also has attended an Executive

Education program at the University of Wisconsin-Madison’s

Wisconsin School of Business.

One Energy Plaza • Jackson, MI • 49201-2276 • www.cmsenergy.com • www.consumersenergy.com

Daniel J. Malone is senior vice president of distribution and

customer operations for Consumers Energy, the principal

subsidiary of CMS Energy. He was elected to the position in

May 2010.

Malone has overall responsibility for the company’s electric and

gas distribution systems, energy operations, customer operations,

gas transmission and storage, Smart Energy program

implementation and industrial safety. Energy operations is

responsible for operating and maintaining the electric and natural

gas delivery systems that serve the utility’s customers. Customer

operations is responsible for the company’s revenue recovery,

Daniel J Malone customer services and energy optimization programs.

SENIOR VICE PRESIDENT OF

DISTRIBUTION AND Malone joined Consumers Energy in 1984 as a graduate health

CUSTOMER OPERATIONS physicist in the radiological services department and has spent the

majority of his career with the company. From 2001 to 2006, he

held leadership positions with Nuclear Management Co., which

operated Consumers Energy’s Palisades nuclear plan in Covert,

Michigan.

In 2006, Malone rejoined Consumers energy as manager of the

equipment services department. Later the same year, he was

named site business manager for the utility’s J.H. Campbell

Generating Complex in Port Sheldon Township, west of Grand

Rapids, Michigan.

Malone earned a bachelor’s degree in environmental science from

Purdue University and holds a nuclear senior reactor operator

certification. In 2008, he completed the Advanced Management

Program at the Harvard Business School.

One Energy Plaza • Jackson, MI • 49201-2276 • www.cmsenergy.com • www.consumersenergy.com