Exhibit 99.1

CMS ENERGY

CMS

LISTED

NYSE.

EEI Financial Conference

November 8 - 11, 2015

Ludington Pumped Storage Ray Compressor Station Cross Winds® Energy Park

Fourth largest in the world #1 LDC in gas storage #2 in renewable sales in the Great Lakes area

CMS ENERGY

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31, 2014 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides historical financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis and provides forward-looking guidance on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. These items have the potential to impact, favorably or unfavorably, the company’s reported earnings in future periods.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

1

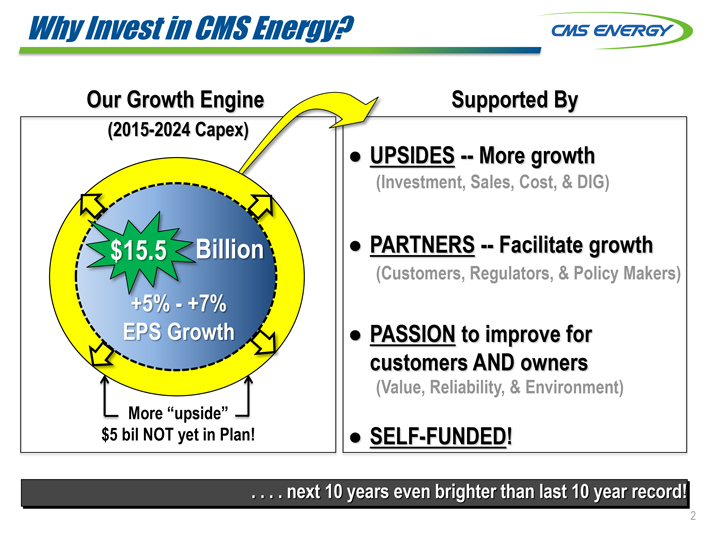

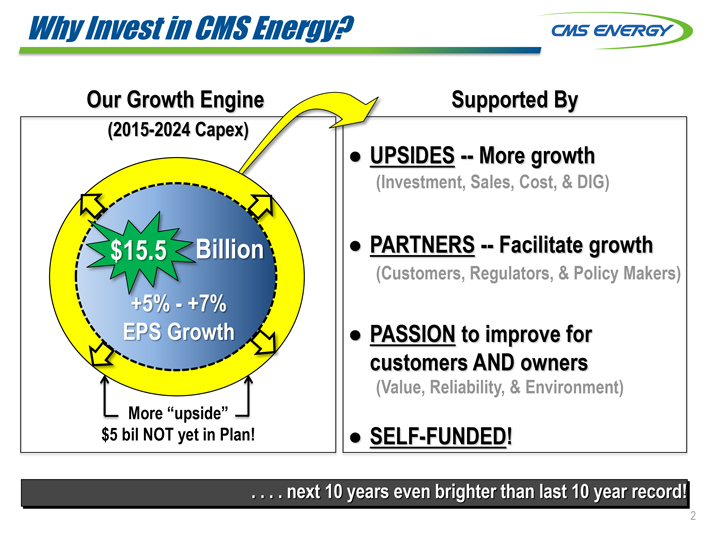

Why Invest in CMS Energy?

CMS ENERGY

Our Growth Engine

(2015-2024 Capex)

$15.5 Billion

+5% - +7%

EPS Growth

More “upside”

$5 bil NOT yet in Plan!

Supported By

UPSIDES -- More growth

(Investment, Sales, Cost, & DIG)

PARTNERS -- Facilitate growth

(Customers, Regulators, & Policy Makers)

PASSION to improve for customers AND owners

(Value, Reliability, & Environment)

SELF-FUNDED!

. . . . next 10 years even brighter than last 10 year record!

2

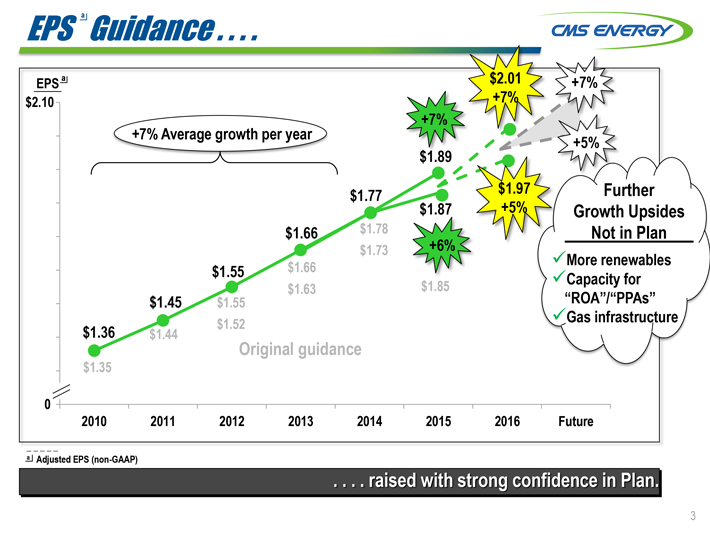

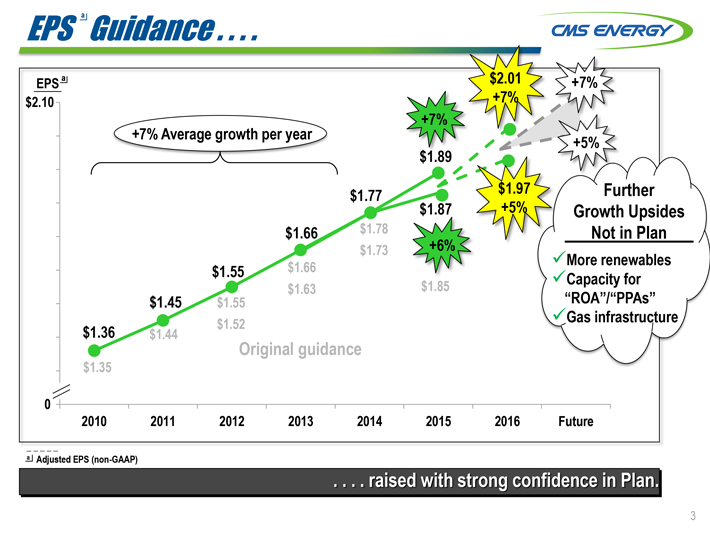

EPSa Guidance . . . .

CMS ENERGY

EPS a

$2.01

0

2010 2011 2012 2013 2014 2015 2016 Future

+7% Average growth per year

$1.36 $1.35

$1.45 $1.44

$1.55 $1.55 $1.52

$1.66 $1.66 $1.63

$1.77 $1.78 $1.73

+7% $1.89 $1.87 +6% $1.85

$2.01 +7% $1.97 +5%

+7% +5%

Further Growth Upsides Not in Plan

More renewables

Capacity for “ROA”/“PPAs”

Gas infrastructure

Original guidance

a Adjusted EPS (non-GAAP)

. . . . raised with strong confidence in Plan.

3

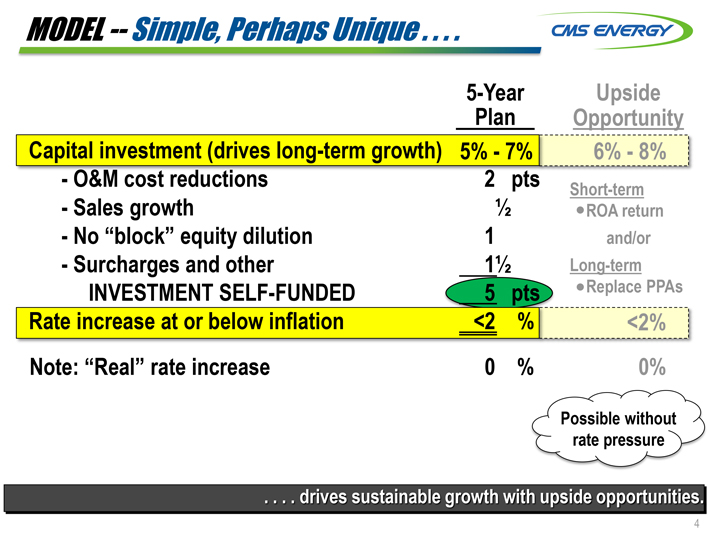

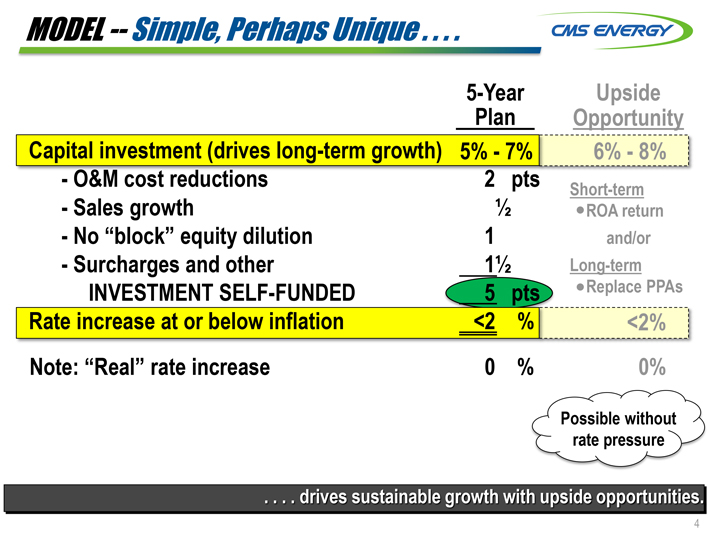

MODEL — Simple, Perhaps Unique . . . .

CMS ENERGY

5-Year Plan

Upside Opportunity

Capital investment (drives long-term growth) 5% - 7% 6% - 8%

- O&M cost reductions 2 pts Short-term ROA return and/or

- Sales growth 1/2

- No “block” equity dilution 1

- Surcharges and other1 1/2 Long-term Replace PPAs

INVESTMENT SELF-FUNDED 5pts

Rate increase at or below inflation <2 % <2%

Note: “Real” rate increase 0% 0%

Possible without rate pressure

. . . . drives sustainable growth with upside opportunities.

4

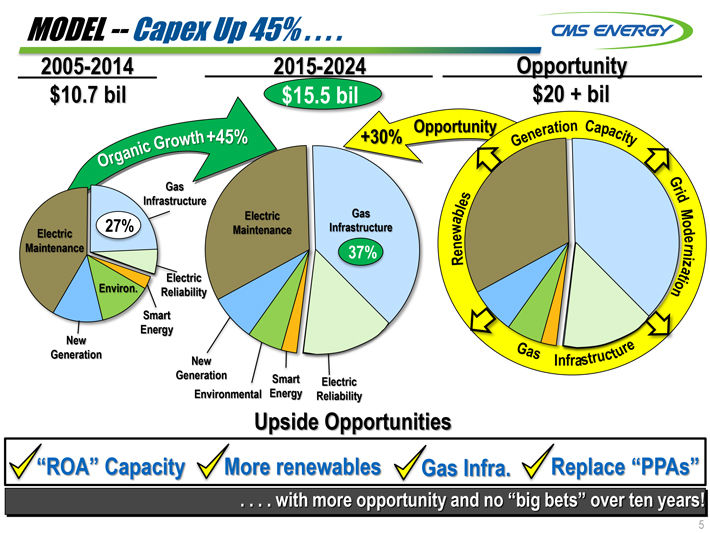

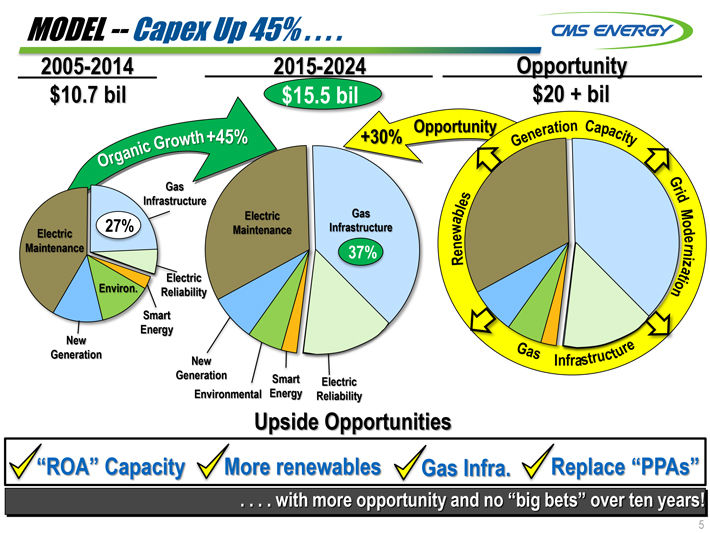

MODEL — Capex Up 45% . . . .

CMS ENERGY

2005-2014

$10.7 bil

Organic Growth +45%

Electric Maintenance 27%

Environ.

Gas Infrastructure

Electric Reliability

Smart Energy

New Generation

2015-2024

$15.5 bil

+30% Opportunity

Electric Maintenance

Gas Infrastructure 37%

New Generation

Environmental

Smart Energy

Electric Reliability

Opportunity

$20 + bil

Renewables

Generation Capacity

Grid Modernization

Gas Infrastructure

Upside Opportunities

“ROA” Capacity

More renewables

Gas Infra.

Replace “PPAs”

. . . . with more opportunity and no “big bets” over ten years!

5

MODEL — O&M Cost Reductions . . . .

CMS ENERGY

2006

Down 10%

$1.1 bil

2014

Down 7% or 2%/yr

$1.0 bil

Inflation ≈2%

2018

$0.9 bil

Inflation ≈2%

Coal to Gas Switching (Zeeland)

Smarter benefit plans

Productivity/Attrition

Coal to Gas Switching (Jackson)

“Pole Top” Hardening

Productivity/Smart Energy

. . . . provide more “headroom” for more capital investment.

6

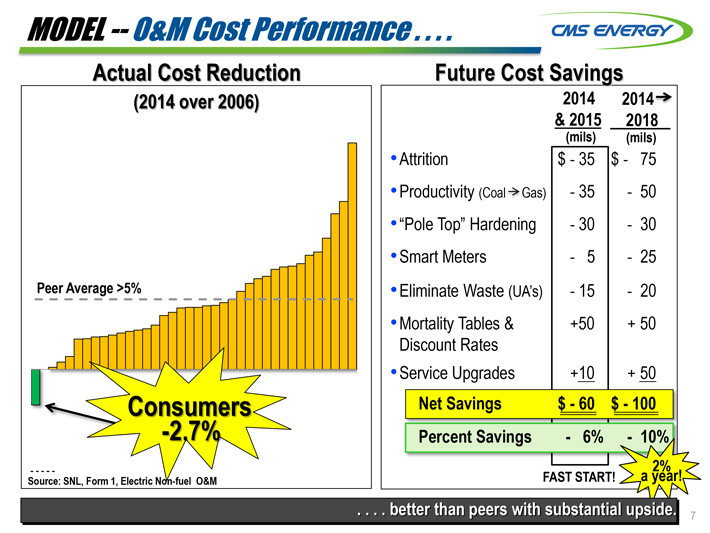

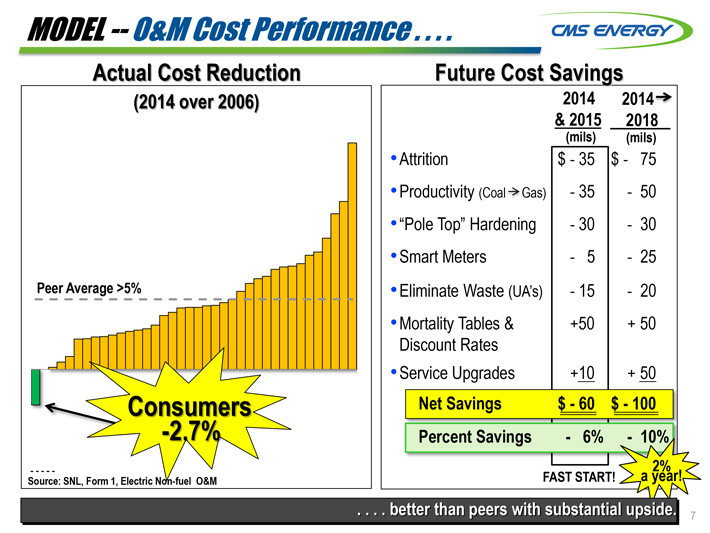

MODEL — O&M Cost Performance . . . .

CMS ENERGY

Actual Cost Reduction

(2014 over 2006)

Peer Average >5%

Consumers

-2.7%

Source: SNL, Form 1, Electric Non-fuel O&M

Future Cost Savings

2014 & 2015 (mils) 2014 2018 (mils)

Attrition $-35 $-75

Productivity (Coal Gas) -35 -50

“Pole Top” Hardening -30 -30

Smart Meters -5 -25

Eliminate Waste (UA’s) -15 -20

Mortality Tables & Discount Rates +50 +50

Service Upgrades +10 +50

Net Savings $-60 $-100

Percent Savings -6% -10%

FAST START! 2% a year!

. . . . better than peers with substantial upside.

7

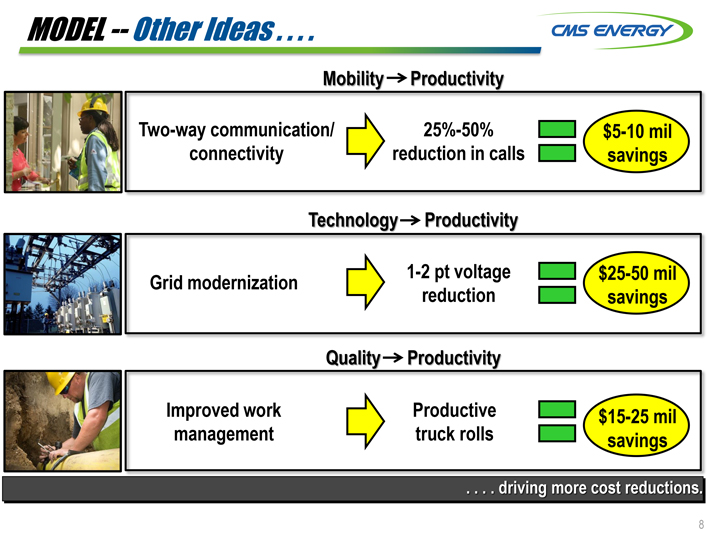

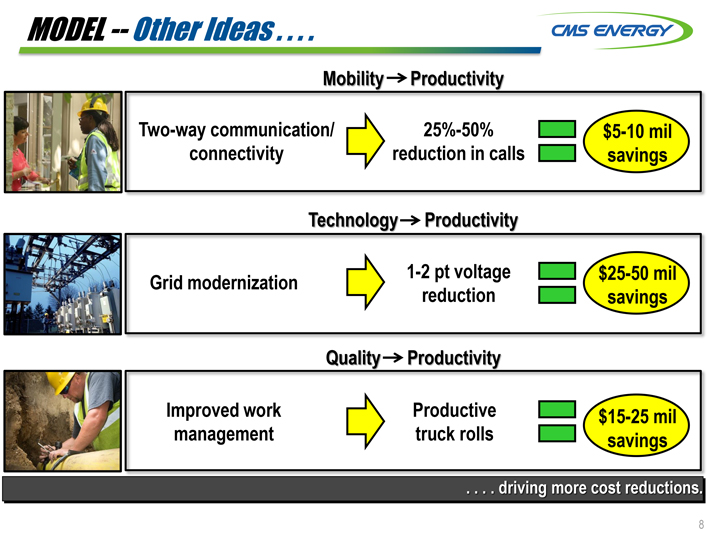

MODEL — Other Ideas . . . .

CMS ENERGY

Mobility Productivity

Two-way communication/Connectivity 25%-50% reduction in calls $5-10 mil savings

Technology Productivity

Grid modernization 1-2 pt voltage reduction $25-50 mil savings

Quality Productivity

Improved work management Productive truck rolls $15-25 mil savings

. . . . driving more cost reductions.

8

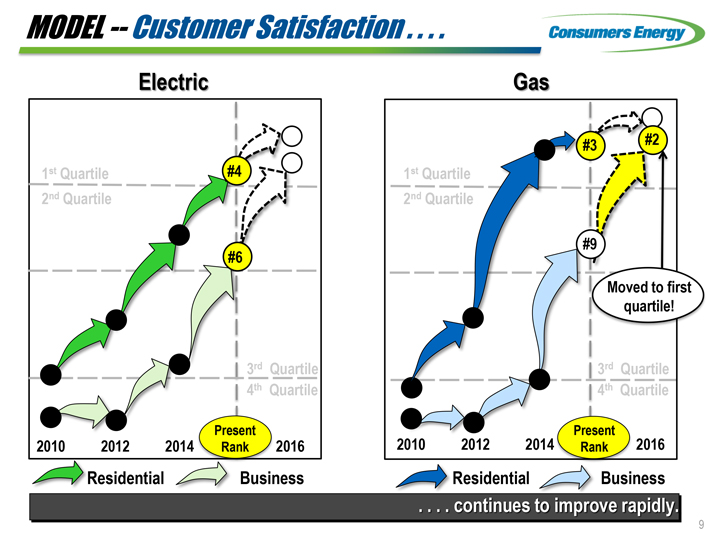

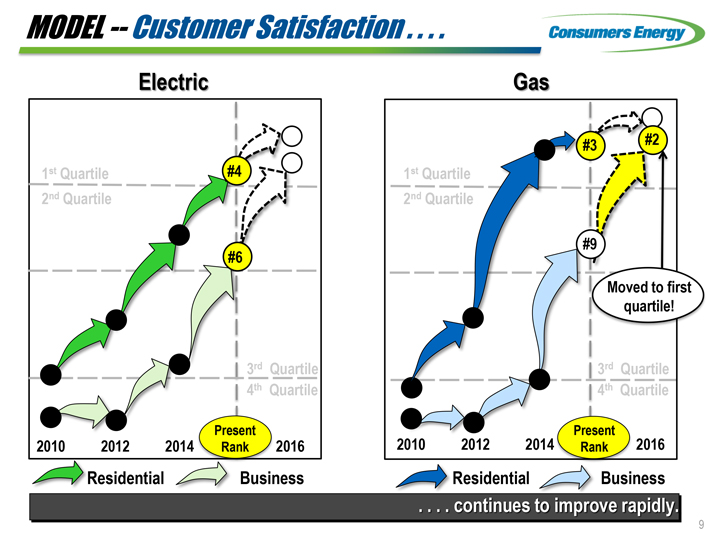

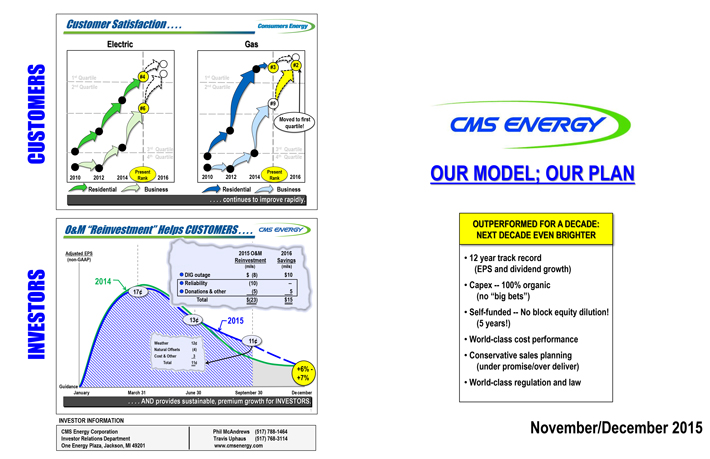

MODEL — Customer Satisfaction . . . .

Consumers Energy

Electric

1st Quartile

2nd Quartile #4 #6

3rd Quartile

4th Quartile

2010 2012 2014 Present Rank 2016

Residential

Business

Gas

1st Quartile

2nd Quartile #3 #2 #9

Moved to first quartile!

3rd Quartile

4th Quartile

2010 2012 2014 Present Rank 2016

Residential

Business

. . . . continues to improve rapidly.

9

MODEL — Interest Rates Increases . . . .

CMS ENERGY

Amount (bils) Sensitivities (bps) Pre-Tax Earnings Impact

Interest Expense $1.0 +100 (3)¢

Benefit Liability (discounted) 3.0 +100 4

Total 1¢

Note: ROE ?

. . . . mitigated.

10

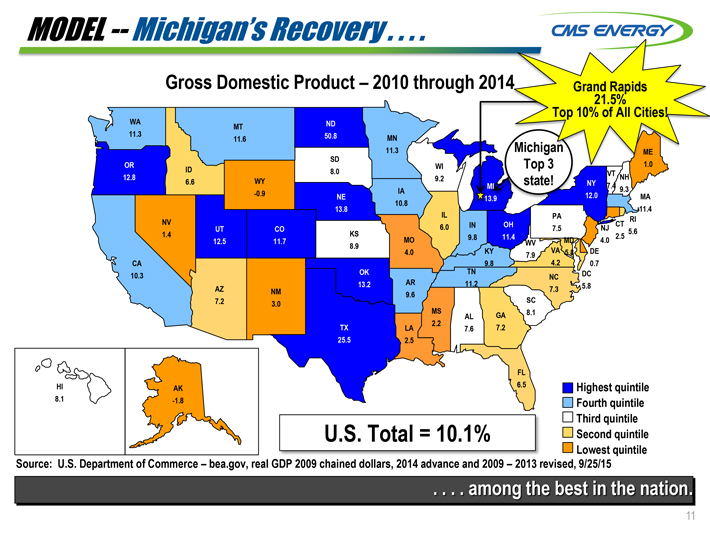

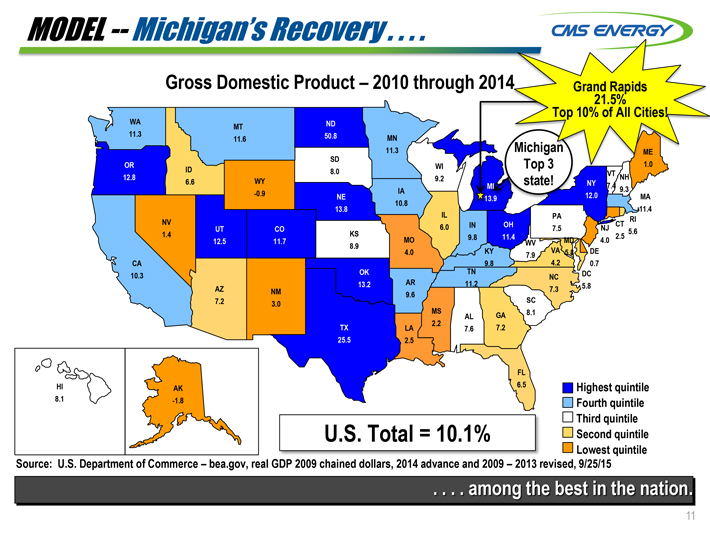

MODEL — Michigan’s Recovery . . . .

CMS ENERGY

Gross Domestic Product – 2010 through 2014

Grand Rapids 21.5%

Top 10% of All Cities!

WA 11.3 MT 11.6 ND 50.8 MN 11.3 Michigan Top 3 state! ME 1.0

OR 12.8 ID 6.6 WY -0.9 SD 8.0 WI 9.2 MI 13.9 NY 12.0 VT 7.4 NH 9.3 MA 11.4

CA 10.3 NV 1.4 UT 12.5 AZ 7.2 CO 11.7 NM 3.0 NE 13.8 KS 8.9 OK 13.2 TX 25.5 IA 10.8 MO 4.0 AR 9.6 LA 2.5

IL 6.0 MS 2.2 IN 9.8 TN 11.2 AL 7.6 KY 9.8 OH 11.4 GA 7.2 WV 7.9 SC 8.1 FL 6.5 PA 7.5 MD 5.8 VA 4.2 NC 7.3

DE 0.7 DC 5.8 NJ 4.0 CT 2.5 RI 5.6

HI 8.1 AK -1.8

U.S. Total = 10.1%

Highest quintile

Fourth quintile

Third quintile

Second quintile

Lowest quintile

Source: U.S. Department of Commerce – bea.gov, real GDP 2009 chained dollars, 2014 advance and 2009—2013 revised, 9/25/15

. . . .. among the best in the nation.

11

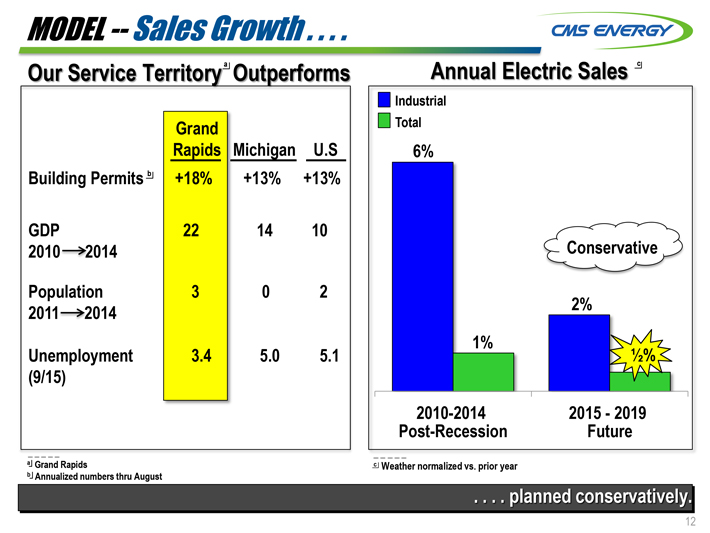

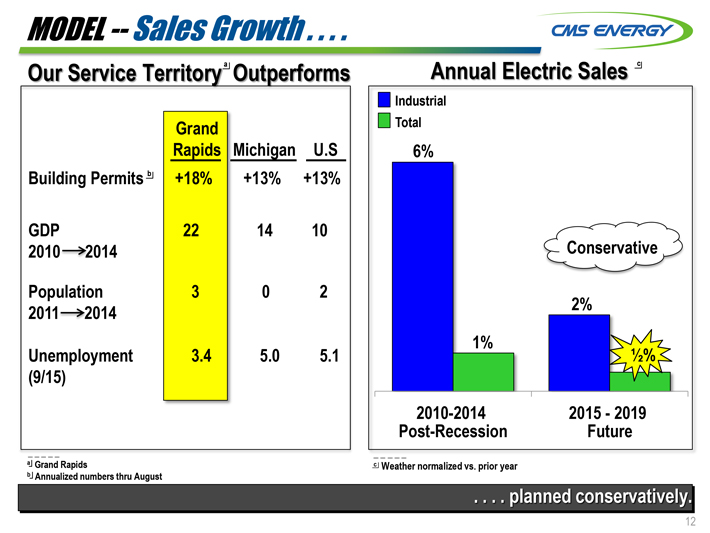

Model -- Sales Growth . . . .

CMS ENERGY

Our Service Territorya Outperforms

Grand Rapids

Michigan

U.S

Building Permitsb

+18%

+13%

+13%

GDP

2010—>2014

22

14

10

Population 2011—>2014

3

0

2

Unemployment

(9/15)

3.4

5.0

5.1

a Grand Rapids

b Annualized numbers thru August

Annual Electric Sales c

Industrial

Total

6%

2%

Conservative

1% 1/2%

2010-2014

Post-Recession

2015-2019 Future

C Weather normalized vs. prior year

. . . . planned conservatively.

12

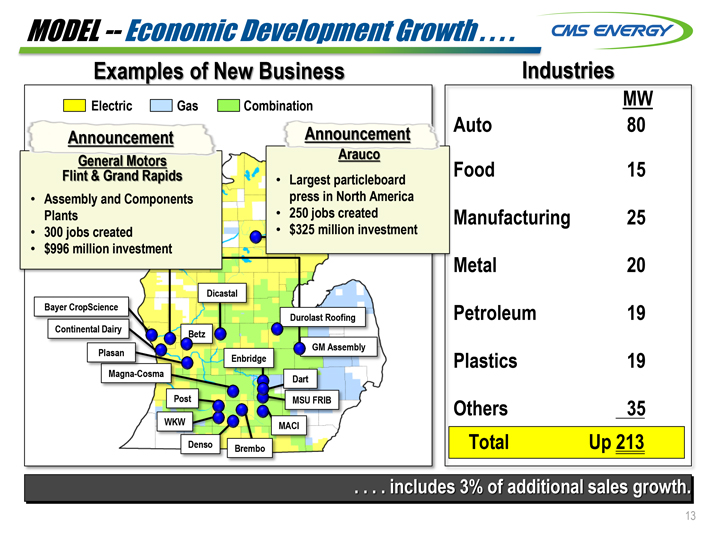

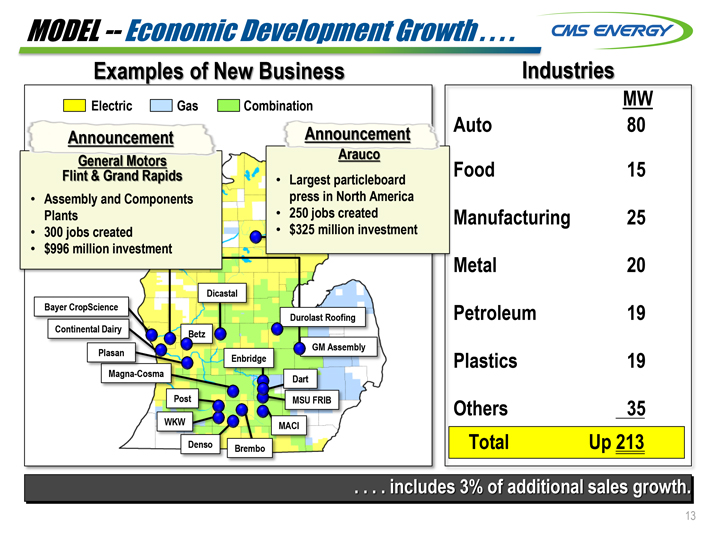

MODEL -- Economic Development Growth . . . .

CMS ENERGY

Examples of New Business

Electric Gas Combination

Announcement

General Motors

Flint & Grand Rapids

Assembly and Components

Plants

300 jobs created

$996 million investment

Announcement

Arauco

Largest particleboard

press in North America

250 jobs created

$325 million investment

Dicastal

Bayer CropScience

Durolast Roofing

Continental Dairy

Betz

GM Assembly

Plasan

Enbridge

Magna-Cosma

Dart

Post

MSU FRIB

WKW

MACI

Denso

Brembo

Industries

MW

Auto 80

Food 15

Manufacturing 25

Metal 20

Petroleum 19

Plastics 19

Others 35

Total Up 213

. . . . includes 3% of additional sales growth.

13

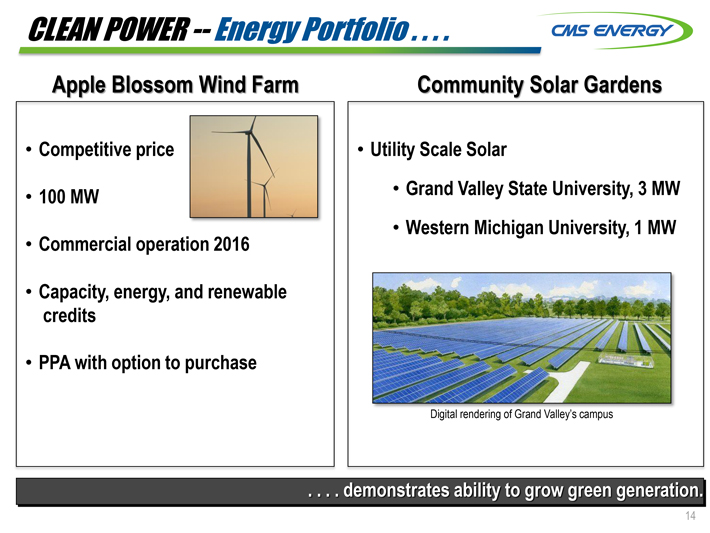

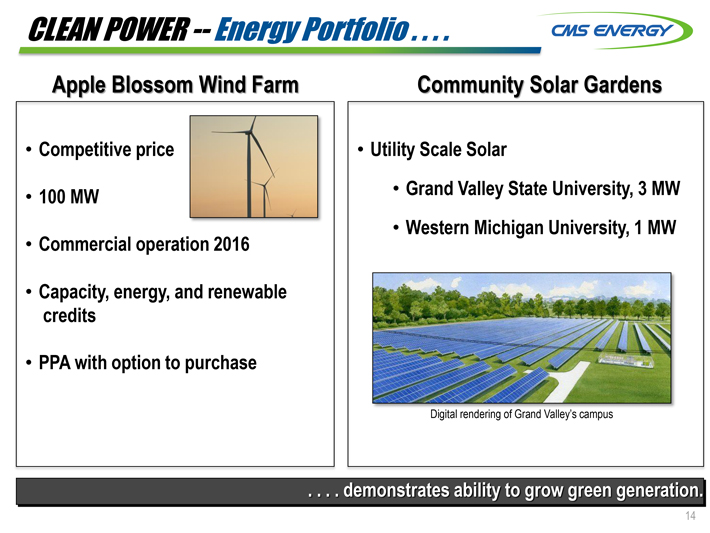

CLEAN POWER -- Energy Portfolio . . . .

CMS ENERGY

Apple Blossom Wind Farm

Competitive price

100 MW

Commercial operation 2016

Capacity, energy, and renewable credits

PPA with option to purchase

Community Solar Gardens

Utility Scale Solar

Grand Valley State University, 3 MW

Western Michigan University, 1 MW

Digital rendering of Grand Valley’s campus

. . . . demonstrates ability to grow green generation.

14

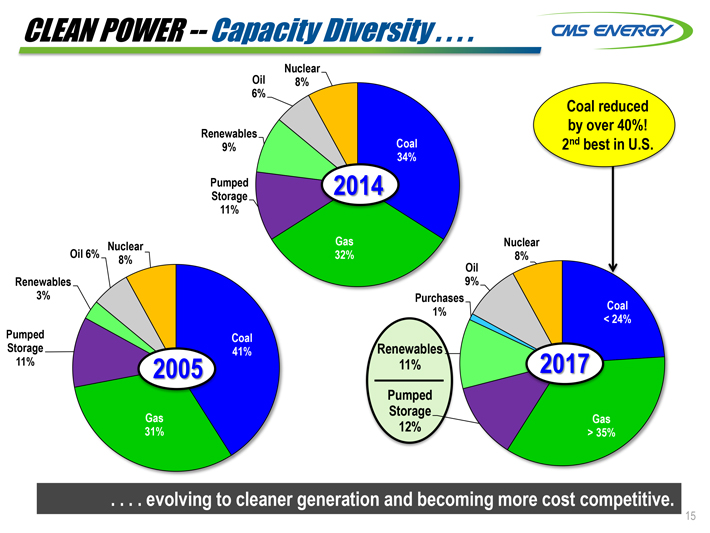

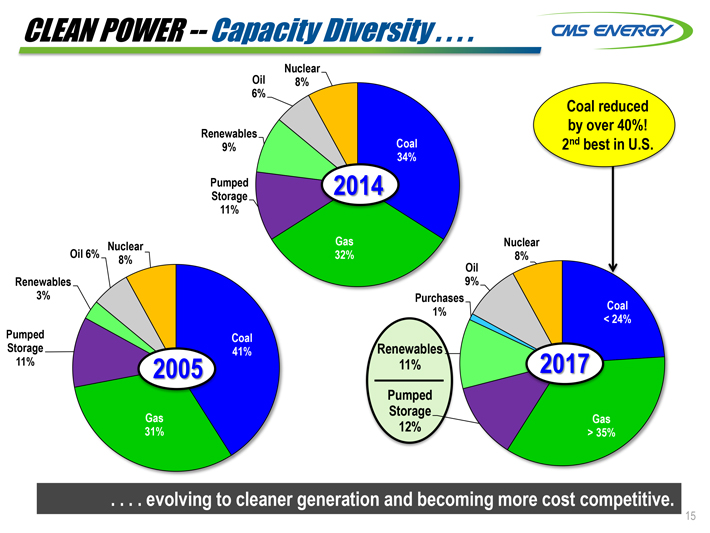

CLEAN POWER -- Capacity Diversity . . . .

CMS ENERGY

Nuclear

Oil

8%

6%

Renewables

9%

Coal

34%

Pumped Storage

2014

11%

Gas

32%

Oil 6%

Nuclear 8%

Renewables

3%

Pumped

Coal

Storage

41%

11%

2005

Gas

31%

Coal reduced

by over 40%!

2nd best in U.S.

Nuclear

8%

Oil

9%

Purchases

1%

Coal

< 24%

Renewables

11%

2017

Pumped

Storage

12%

> Gas 35%

. . . . evolving to cleaner generation and becoming more cost competitive.

15

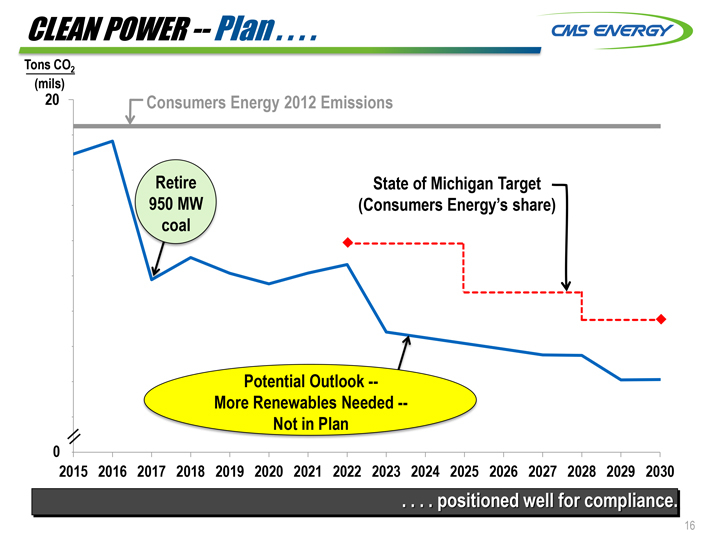

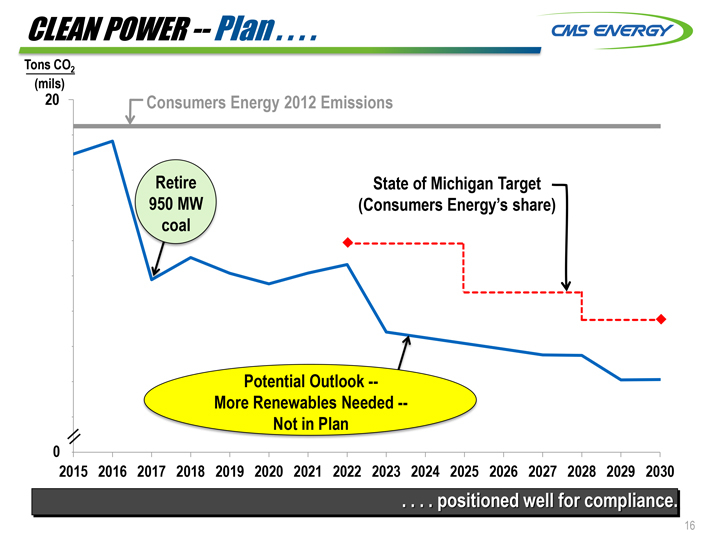

CLEAN POWER -- Plan . . . .

CMS ENERGY

Tons CO2

(mils)

20

Consumers Energy 2012 Emissions

Retire

950 MW

coal

State of Michigan Target

(Consumers Energy’s share)

Potential Outlook --

More Renewables Needed --

Not in Plan

0

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

. . . . positioned well for compliance.

16

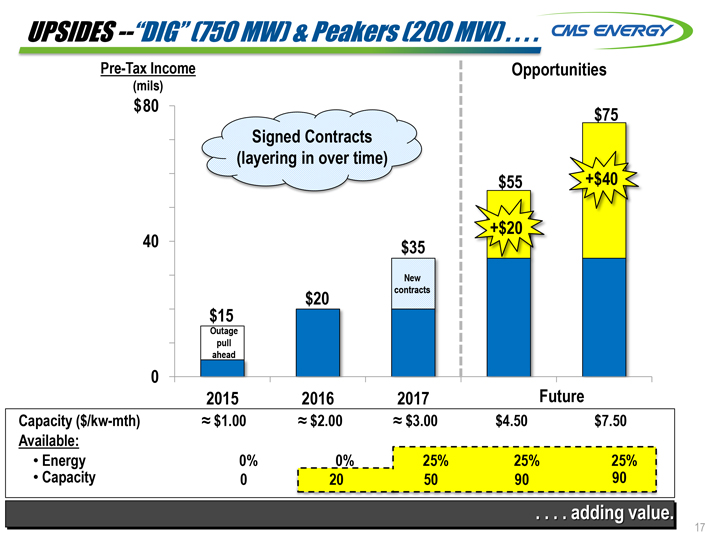

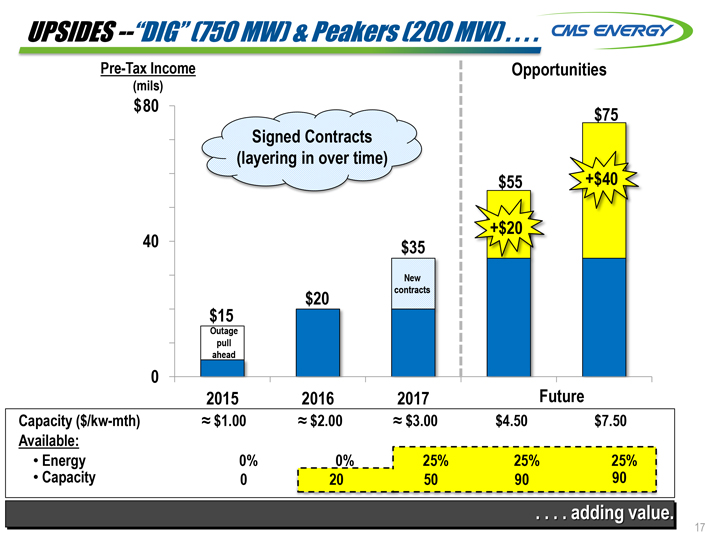

UPSIDES -- “DIG” (750 MW) & Peakers (200 MW) . . . .

CMS ENERGY

Pre-Tax Income

(mils)

$80

40

0

Opportunities

$75

Signed Contracts

(layering in over time)

$55

+$40

+$20

$35

$20

New contracts

$15

Outage pull ahead

2015

2016

2017

Future

Capacity ($/kw-mth)

≈ $1.00

≈ $2.00

≈ $3.00

$4.50

$7.50

Available:

Energy

0%

0%

25%

25%

25%

Capacity

0

20

50

90

90

. . . . adding value.

17

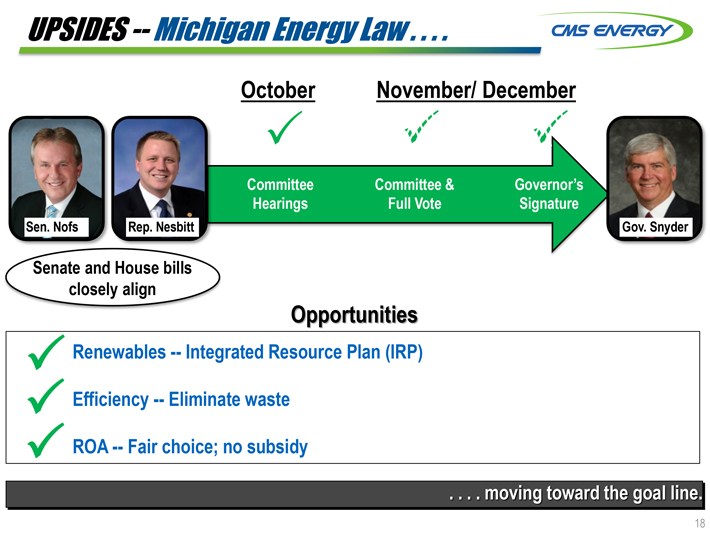

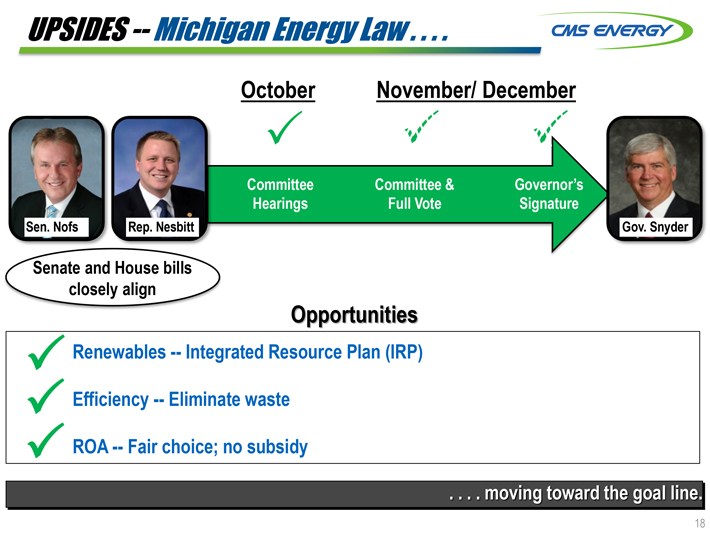

UPSIDES -- Michigan Energy Law . . . .

CMS ENERGY

October

November/ December

Committee Hearings

Committee & Full Vote

Governor’s Signature

Sen. Nofs

Rep. Nesbitt

Gov. Snyder

Senate and House bills closely align

Opportunities

Renewables -- Integrated Resource Plan (IRP)

Efficiency -- Eliminate waste

ROA -- Fair choice; no subsidy

. . . . moving toward the goal line.

18

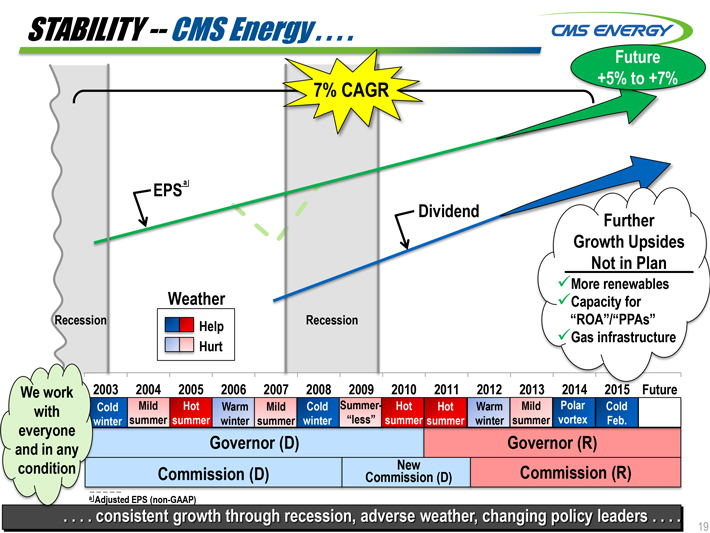

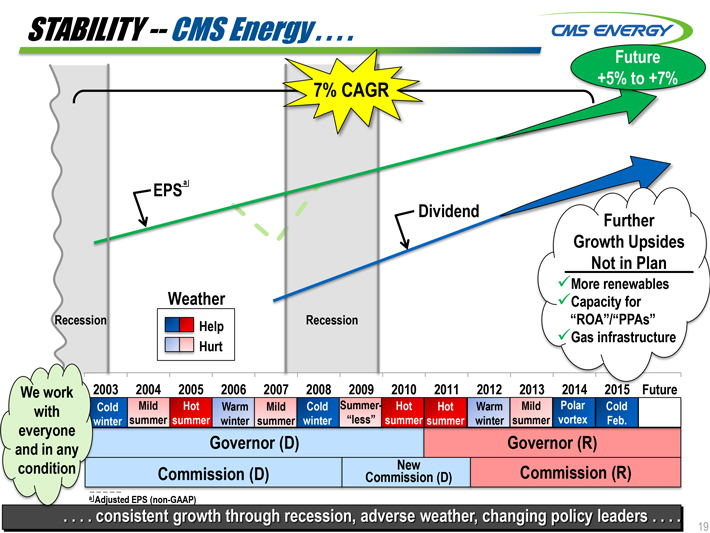

STABILITY -- CMS Energy . . . .

CMS ENERGY

7% CAGR

Future +5% to +7%

EPSa

Dividend

Further Growth Upsides Not in Plan A

Recession

Weather

Help

Hurt

Recession

More renewables Capacity for “ROA”/“PPAs” Gas infrastructure

We work with everyone and in any condition

2003

Cold winter

2004

Mild summer

2005

Hot summer

2006

Warm winter

2007

Mild summer

2008

Cold winter

2009

Summer- “less”

2010

Hot summer

2011

Hot summer

2012

Warm winter

2013

Mild summer

2014

Polar vortex

2015

Cold Feb.

Future

Governor (D)

Governor (R)

Commission (D)

New Commission (D)

Commission (R)

a Adjusted EPS (non-GAAP)

. . . . consistent growth through recession, adverse weather, changing policy leaders . . . .

19

Happy 50th Anniversary, EEI!

CMS ENERGY

THANK YOU for your support

BETTER THAN WE FOUND IT

Q & A

20

Appendix

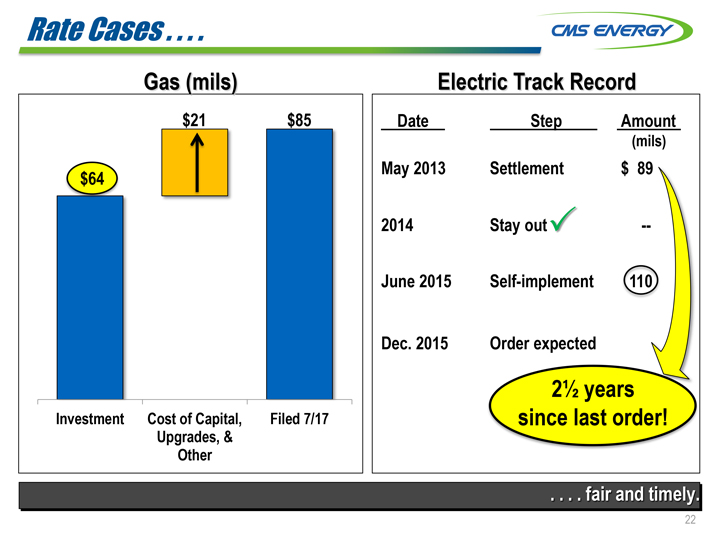

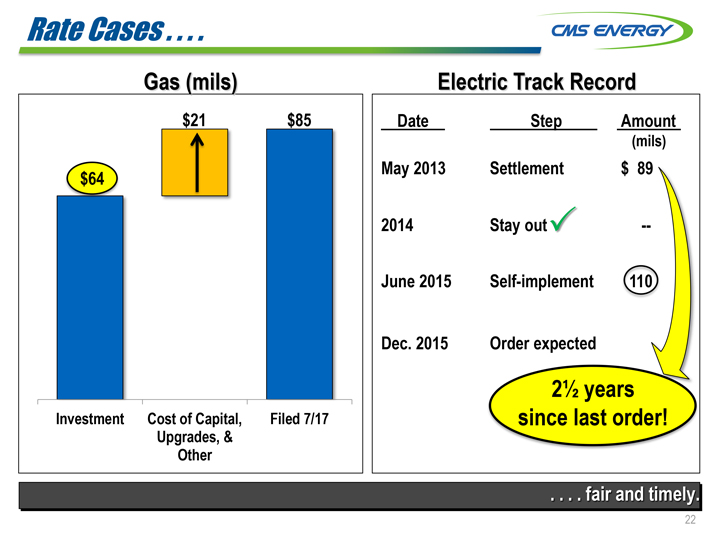

Rate Cases.... CMS ENERGY

Gas (mils) Electric Track Record

$21 $85 Date Step Amount

(mils)

$64 May 2013 Settlement $89

2014 Stay out —

June 2015 Self-implement 110

Dec. 2015 Order expected

Investment Cost of Capital, Upgrades, & Other Filed 7/17 2 1/2 since last order! years

. . . . fair and timely.

22

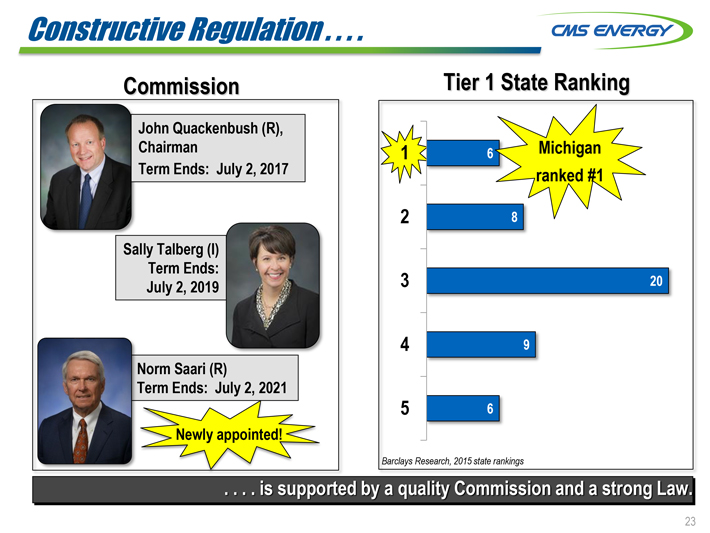

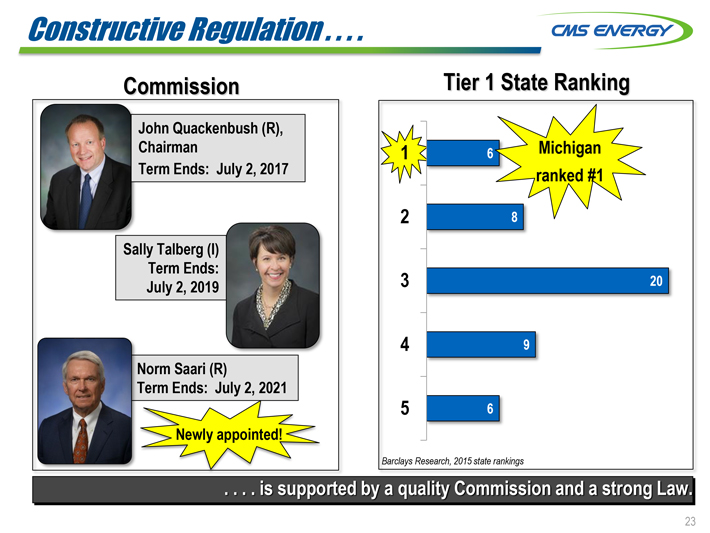

Constructive Regulation CMS ENERGY

Commission Tier 1 State Ranking

John Quackenbush (R), 1 6 Michigan ranked #1

Chairman

Term Ends: July 2, 2017 2 8

Sally Talberg (I)

Term Ends: 3 20

July 2, 2019

Norm Saari (R) 4 9

Term Ends: July 2, 2021

Newly appointed! 5 6

Baclays Research, 2015 state rankings

. . . . is supported by a quality Commission and a strong Law.

23

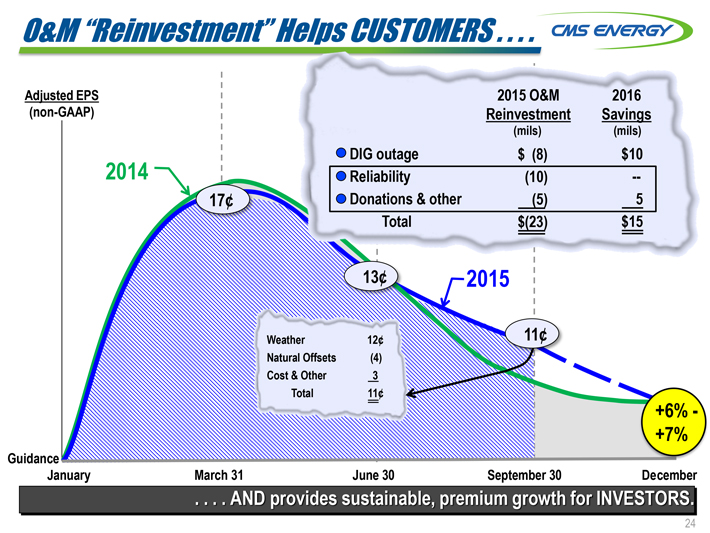

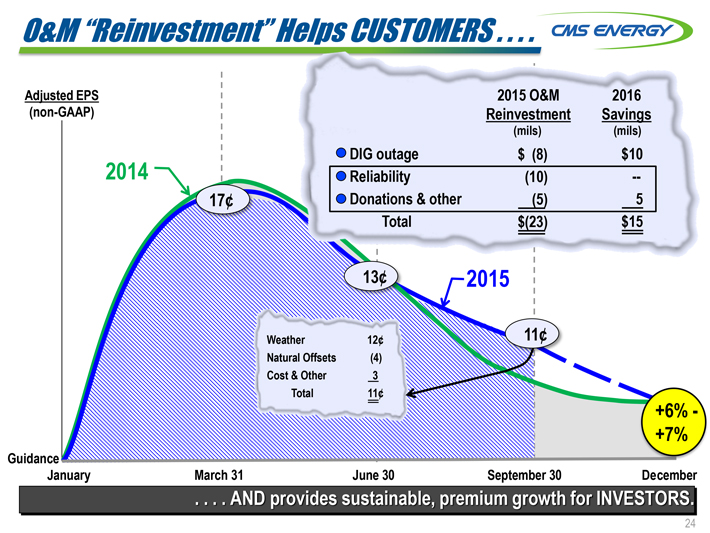

O&M “Reinvestment” Helps CUSTOMERS.... CMS ENERGY

Adjusted EPS 2015 O&M 2016

(non-GAAP) Reinvestment Savings

(mils) (mils)

DIG outage $(8) $10

2014 Reliability (10) —

17¢ Donations & other (5) 5

Total $(23) $15

Weather 12¢ 11¢ 13¢ 2015

Natural Offsets (4)

Cost & Other 3

Total 11¢

+6% -

+7%

Guidance

January March 31 June 30 September 30 December

. . . . AND provides sustainable, premium growth for INVESTORS.

24

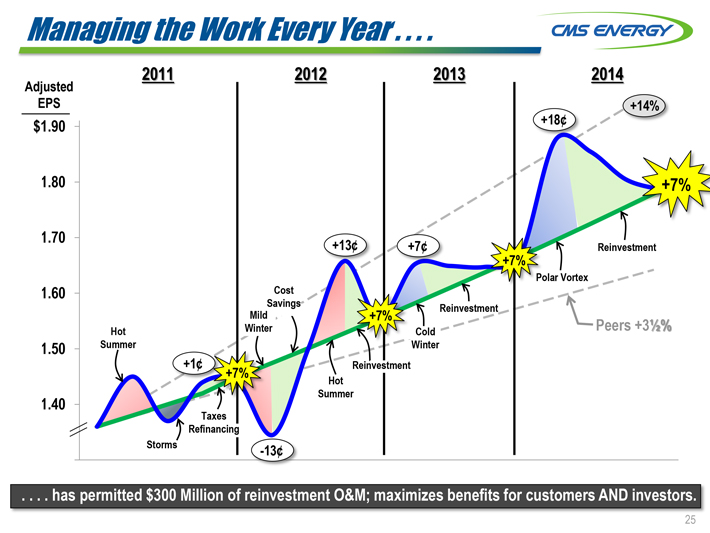

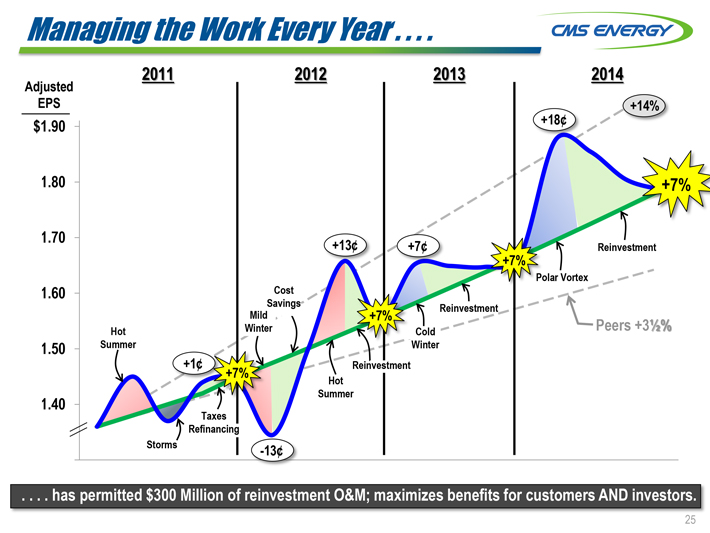

Managing the Work Every Year....

CMS ENERGY

2011 2012 2013 2014

Adjusted

EPS +14%

$1.90 +18¢

1.80 +7%

1.70 +13¢ +7¢ Reinvestment

+7%

Polar Vortex

1.60 Cost

Savings Reinvestment

Mild +7%

Hot Winter Cold Peers +3 1/2%

1.50 Summer Winter

+1¢ Reinvestment

+7% Hot Summer

1.40

Taxes

Refinancing

Storms -13¢

. . . . has permitted $300 Million of reinvestment O&M; maximizes benefits for customers AND investors.

25

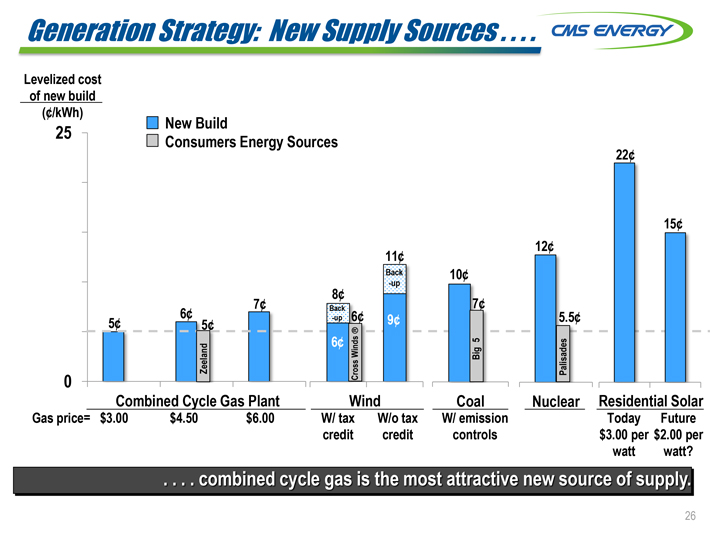

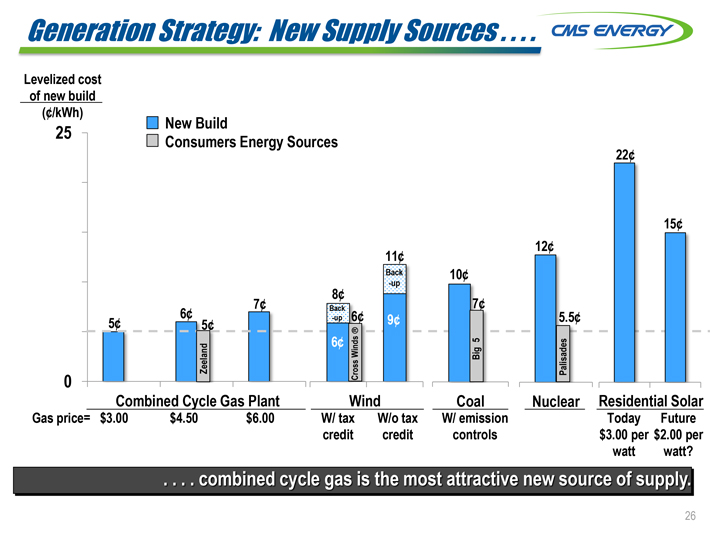

Generation Strategy: New Supply Sources....

CMS ENERGY

Levelized cost of new build

(¢/kWh)

25 New Build

Consumers Energy Sources

22¢

15¢

12¢

11¢

Back 10¢

-up

7¢8¢7¢

5¢ 6¢ 5¢ Back -up 6¢ 9¢ 5.5¢

Zeeland 6¢ Cross Winds® Big 5 Palisades

0

Combined Cycle Gas Plant Wind Coal Nuclear Residential Solar

Gas price= $3.00 $4.50 $6.00 W/ tax credit W/o tax credit W/ emission controls Today $3.00 per watt Future $2.00 per watt?

. . . . combined cycle gas is the most attractive new source of supply.

26

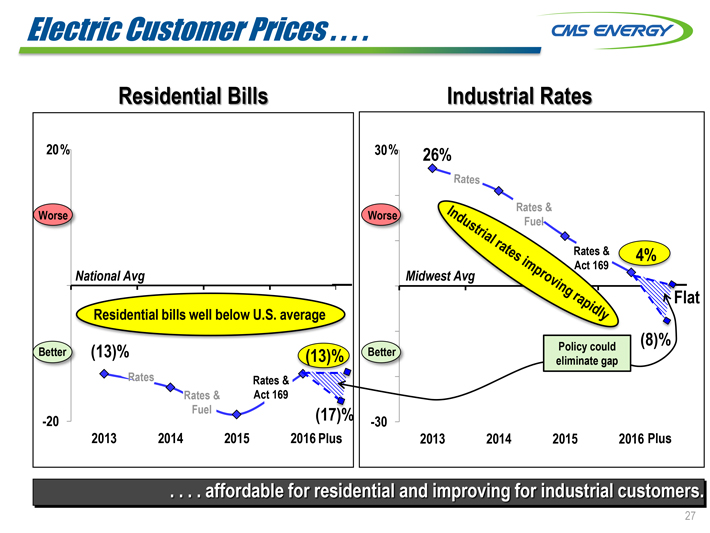

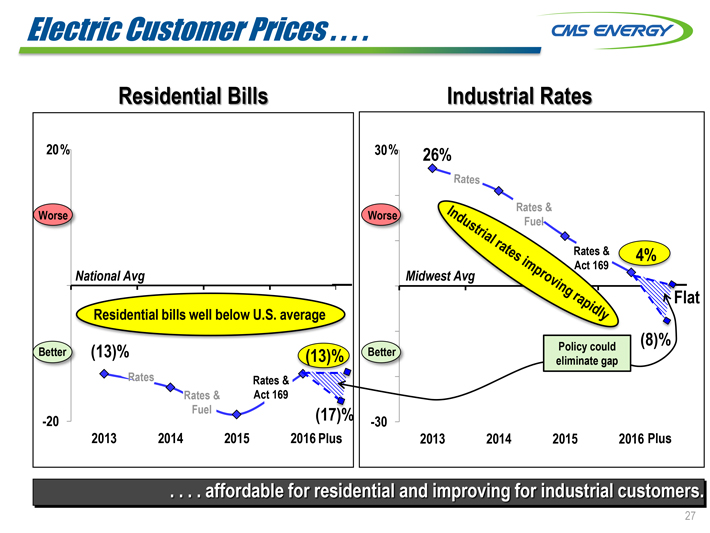

Electric Customer Prices

CMS ENERGY

Residential Bills Industrial Rates

20% 30% 26%

Worse Worse Rates

Rates & Fuel

National Avg Rates & Act 169 4%

Midwest Avg Industrial rates improving rapidly Flat

Residential bills well below U.S. average

(8)%

Better (13)% (13)% Better Policy could eliminate gap

Rates Rates & Act 169

Rates & Fuel

(17)%

-20 -30

2013 2014 2015 2016 Plus 2013 2014 2015 2016 Plus

. . . . affordable for residential and improving for industrial customers.

27

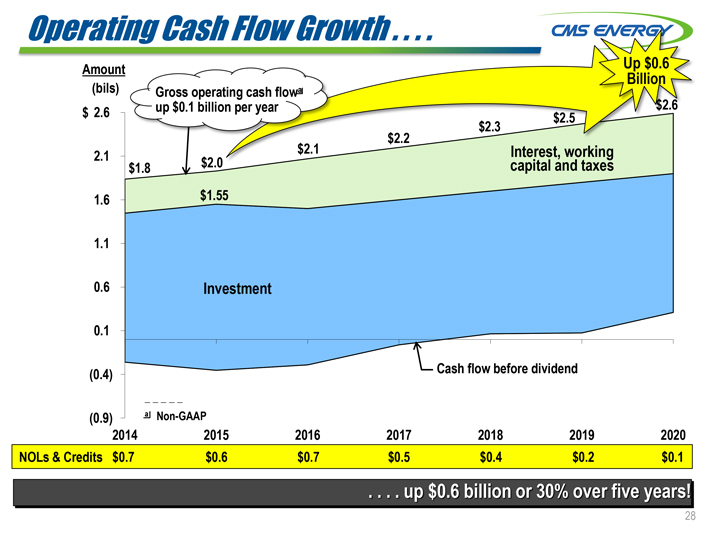

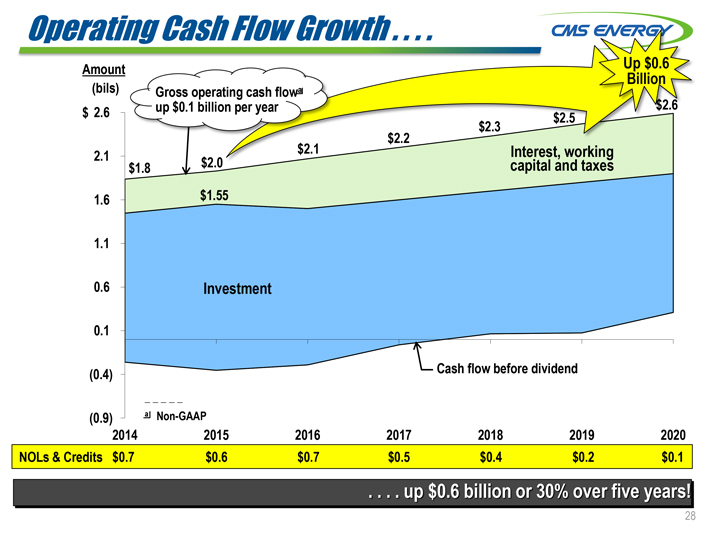

Operating Cash Flow Growth

CMS ENERGY

Amount Up $0.6 Billion

(bils) Gross operating cash flowa up $0.1 billion per year $2.6

$2.6 $2.2 $2.3 $2.5

2.1 $2.1 Interest, working capital and taxes

$1.8 $2.0

1.6 $1.55

1.1

0.6 Investment

0.1

Cash flow before dividend

(0.4)

(0.9) a Non-GAAP

2014 2015 2016 2017 2018 2019 2020

NOLs & Credits $0.7 $0.6 $0.7 $0.5 $0.4 $0.2 $0.1

. . . . up $0.6 billion or 30% over five years!

28

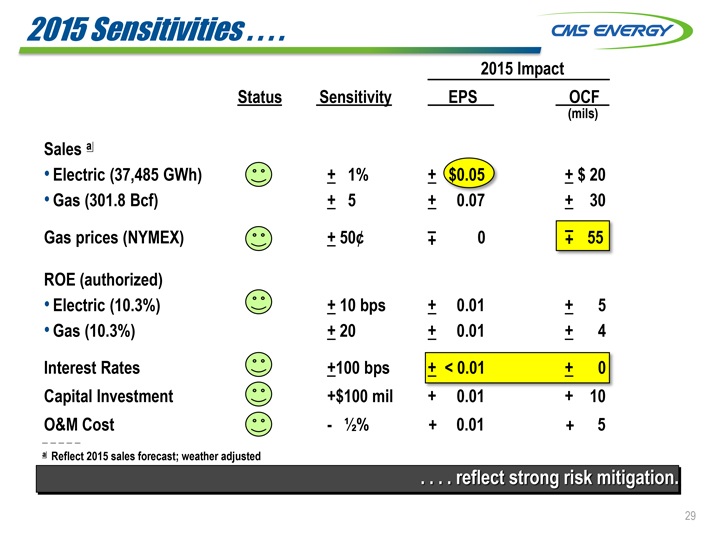

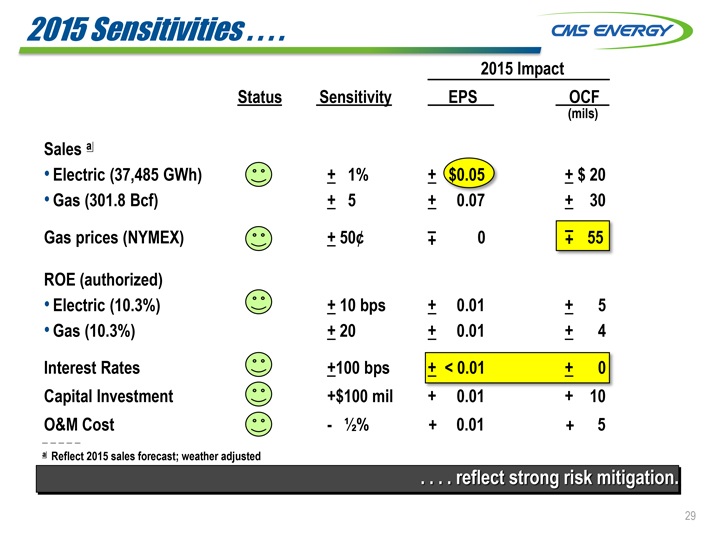

2015 Sensitivities...

CMS ENERGY

2015 Impact

Status Sensitivity EPS OCF

(mils)

Sales a

Electric (37,485 GWh) ±1% ±$0.05 ±$20

Gas (301.8 Bcf) ±5 ±0.07 ±30

Gas prices (NYMEX) ±50¢ ± 0 +55

ROE (authorized)

Electric (10.3%) ± 10 bps ± 0.01 ± 5

Gas (10.3%) ±20 ± 0.01 ± 4

Interest Rates ±100 bps ± < 0.01 ± 0

Capital Investment +$100 mil + 0.01 + 10

O&M Cost - 1/2% + 0.01 + 5

a Reflect 2015 sales forecast; weather adjusted

. . . . reflect strong risk mitigation.

29

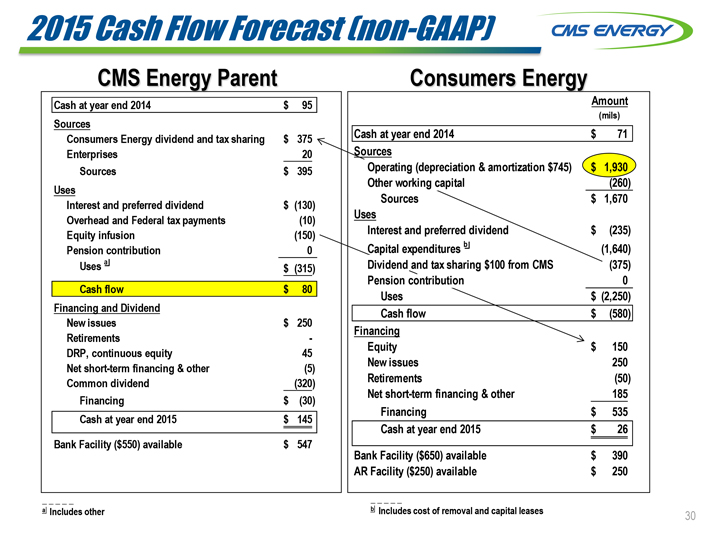

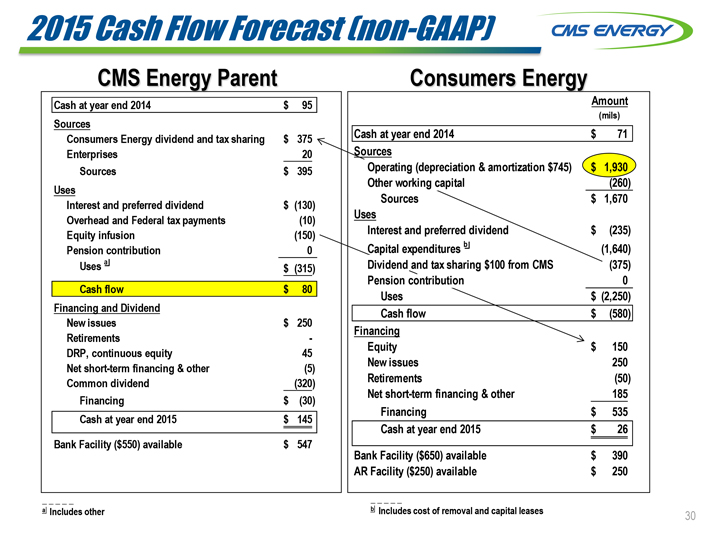

2015 Cash Flow Forecast (non-GAAP) CMS ENERGY

CMS Energy Parent

Cash at year end 2014 $95

Sources

Consumers Energy dividend and tax sharing $375

Enterprises 20

Sources $395

Uses

Interest and preferred dividend $(130)

Overhead and Federal tax payments (10)

Equity infusion (150)

Pension contribution 0

Uses a $(315)

Cash flow $80

Financing and Dividend

New issues $250

Retirements -

DRP, continuous equity 45

Net short-term financing & other (5)

Common dividend (320)

Financing $(30)

Cash at year end 2015 $145

Bank Facility ($550) available $547

Consumers Energy Amount (mils)

Cash at year end 2014 $71

Sources

Operating (depreciation & amortization $745) $1,930

Other working capital (260)

Sources $1,670

Uses

Interest and preferred dividend $(235)

Capital expenditures b (1,640)

Dividend and tax sharing $100 from CMS (375)

Pension contribution 0

Uses $(2,250)

Cash flow $(580)

Financing

Equity $150

New issues 250

Retirements (50)

Net short-term financing & other 185

Financing $535

Cash at year end 2015 $26

Bank Facility ($650) available $390

AR Facility ($250) available $250

a Includes other

b Includes cost of removal and capital leases

30

GAAP Reconciliation

CMS ENERGY

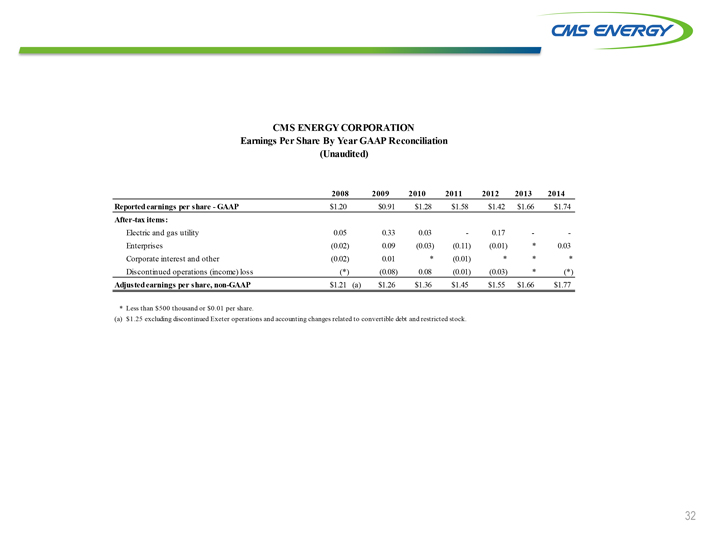

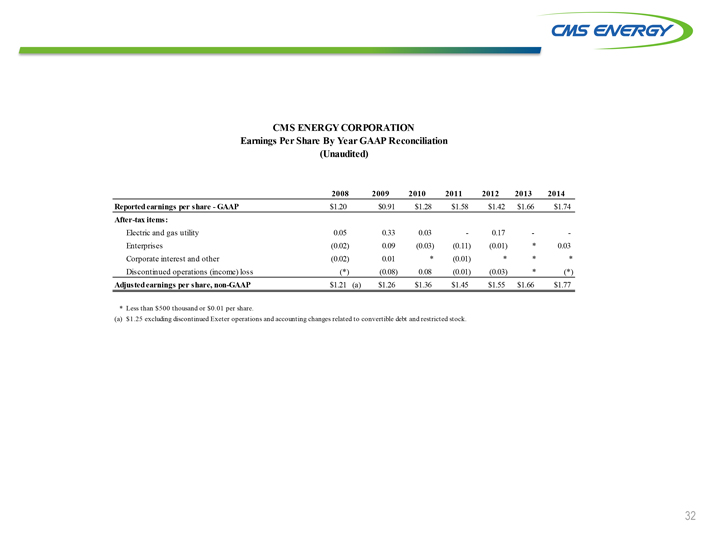

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

2008 2009 2010 2011 2012 2013 2014

Reported earnings per share - GAAP $1.20 $0.91 $1.28 $1.58 $1.42 $1.66 $1.74

After-tax items:

Electric and gas utility 0.05 0.33 0.03 - 0.17 - -

Enterprises (0.02) 0.09 (0.03) (0.11) (0.01) * 0.03

Corporate interest and other (0.02) 0.01 * (0.01) * * *

Discontinued operations (income) loss (*) (0.08) 0.08 (0.01) (0.03) * (*)

Adjusted earnings per share, non-GAAP $1.21 (a) $1.26 $1.36 $1.45 $1.55 $1.66 $1.77

* Less than $500 thousand or $0.01 per share.

(a) $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock.

32

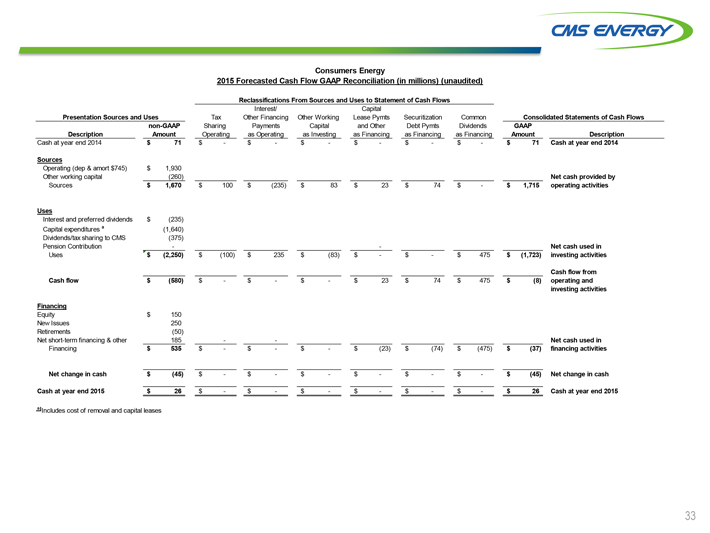

CMS ENERGY

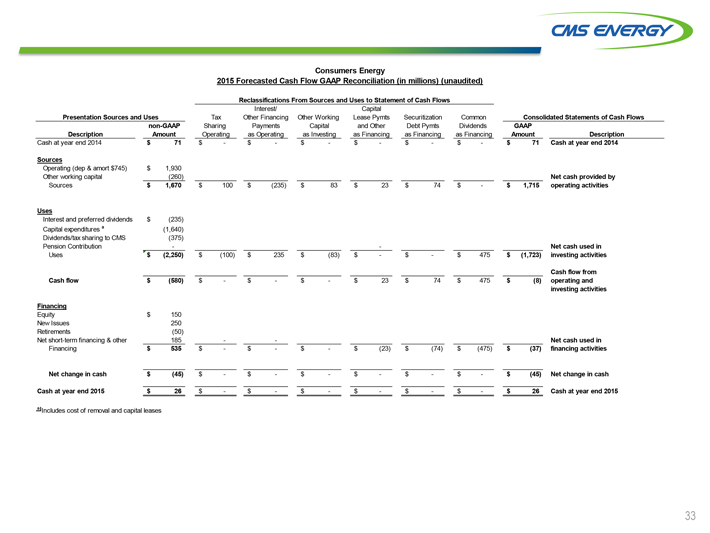

Consumers Energy

2015 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

Reclassifications From Sources and Uses to Statement of Cash Flows

Presentation Sources and Uses Tax Sharing Operating Interest/ Other Financing Payments as Operating Other Working Capital as Investing Capital Lease Pymts and Other as Financing Securitization Debt Pymts as Financing Common Dividends as Financing Consolidated Statements of Cash Flows

Description non-GAAP Amount GAAP Amount Description

Cash at year end 2014 $71 $- $- $- $- $- $- $71 Cash at year end 2014

Sources

Operating (dep & amort $745) $1,930

Other working capital (260) Net cash provided by operating activities

Sources $1,670 $100 $(235) $83 $23 $74 $- $1,715

Uses

Interest and preferred dividends $(235)

Capital expenditures a (1,640)

Dividends/tax sharing to CMS (375)

Pension Contribution - - Net cash used in investing activities

Uses $(2,250) $(100) $235 $(83) $- $- $475 $(1,723)

Cash flow from operating and investing activities

Cash flow $(580) $- $- $- $23 $74 $475 $(8)

Financing

Equity $150

New Issues 250

Retirements (50)

Net short-term financing & other 185 - - Net cash used in financing activities

Financing $535 $- $- $- $(23) $(74) $(475) $(37)

Net change in cash $(45) $- $- $- $- $- $- $(45) Net change in cash

Cash at year end 2015 $26 $- $- $- $- $- $- $26 Cash at year end 2015

a Includes cost of removal and capital leases

33

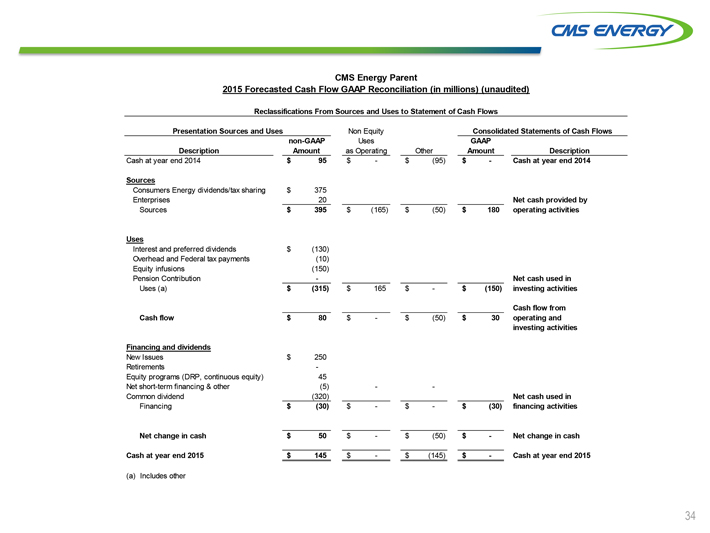

CMS ENERGY

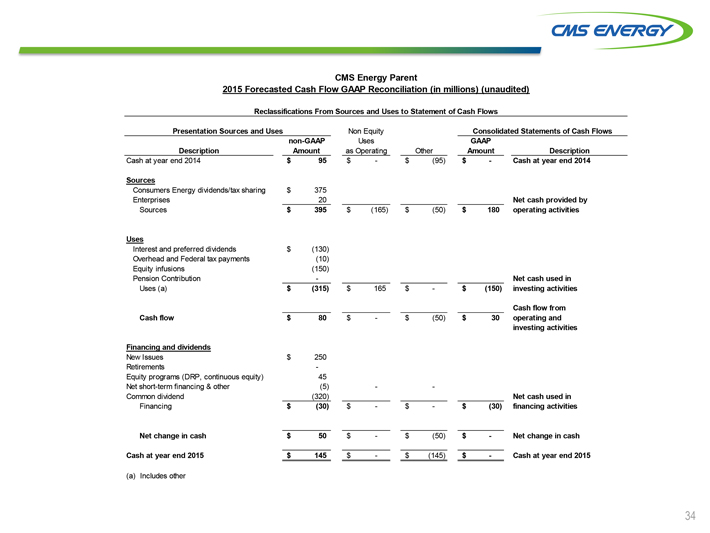

CMS Energy Parent

2015 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

Reclassifications From Sources and Uses to Statement of Cash Flows

Presentation Sources and Uses non-GAAP Amount Non Equity Uses as Operating Other Consolidated Statements of Cash Flows

Description GAAP Amount Description

Cash at year end 2014 $95 $- $(95) $- Cash at year end 2014

Sources

Consumers Energy dividends/tax sharing $375

Enterprises 20

Net cash provided by operating activities

Sources $395 $(165) $(50) $180

Uses

Interest and preferred dividends $(130)

Overhead and Federal tax payments (10)

Equity infusions (150)

Pension Contribution -

Net cash used in investing activities

Uses (a) $(315) $165 $- $(150)

Cash flow from operating and investing activities

Cash flow $80 $- $(50) $30

Financing and dividends

New Issues $250

Retirements -

Equity programs (DRP, continuous equity) 45

Net short-term financing & other (5) - -

Common dividend (320)

Net cash used in financing activities

Financing $(30) $- $- $(30)

Net change in cash $50 $- $(50) $-

Net change in cash

Cash at year end 2015 $145 $- $(145) $-

Cash at year end 2015

(a) Includes other

34

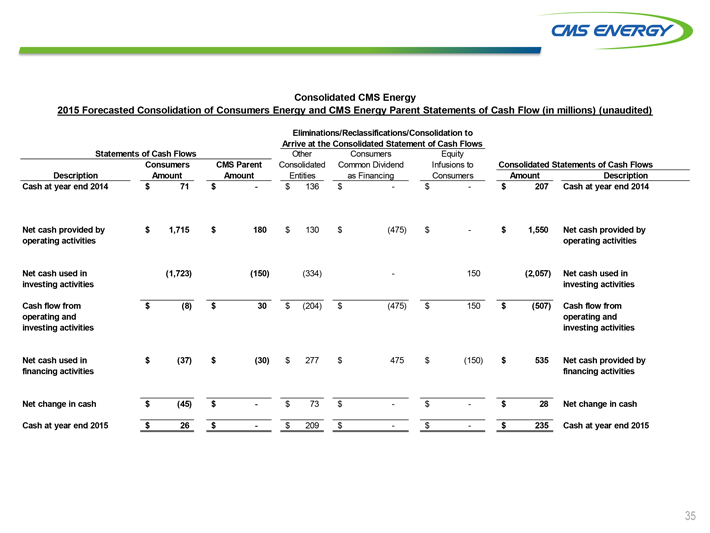

CMS ENERGY

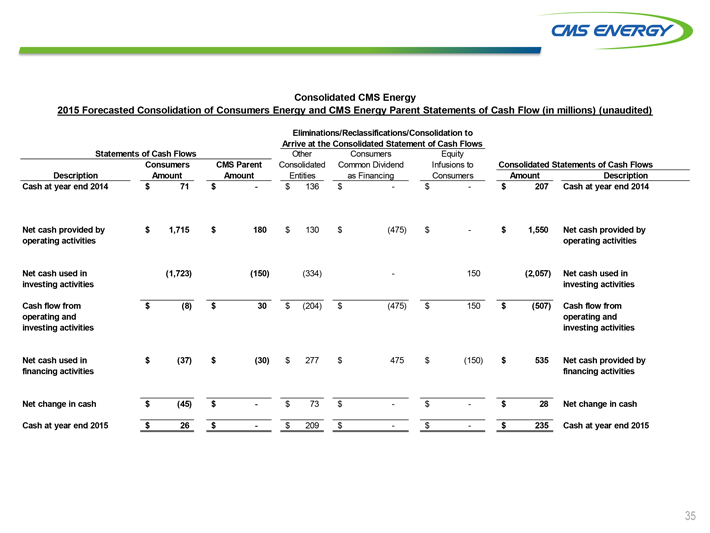

Consolidated CMS Energy

2015 Forecasted Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

Eliminations/Reclassifications/Consolidation to Arrive at the Consolidated Statement of Cash Flows

Statements of Cash Flows

Other Consolidated Entities Consumers Common Dividend as Financing Equity Infusions to Consumers

Consolidated Statements of Cash Flows

Description Consumers Amount CMS Parent Amount Amount Description

Cash at year end 2014 $71 $- $136 $- $- $207 Cash at year end 2014

Net cash provided by operating activities

$1,715 $180 $130 $(475) $- $1,550

Net cash provided by operating activities

Net cash used in investing activities

(1,723) (150) (334) - 150 (2,057)

Net cash used in investing activities

Cash flow from operating and investing activities

$(8) $30 $(204) $(475) $150 $(507)

Cash flow from operating and investing activities

Net cash used in financing activities

$(37) $(30) $277 $475 $(150) $535

Net cash provided by financing activities

Net change in cash $(45) $- $73 $- $- $28

Net change in cash

Cash at year end 2015

$26 $- $209 $- $- $235

Cash at year end 2015

35

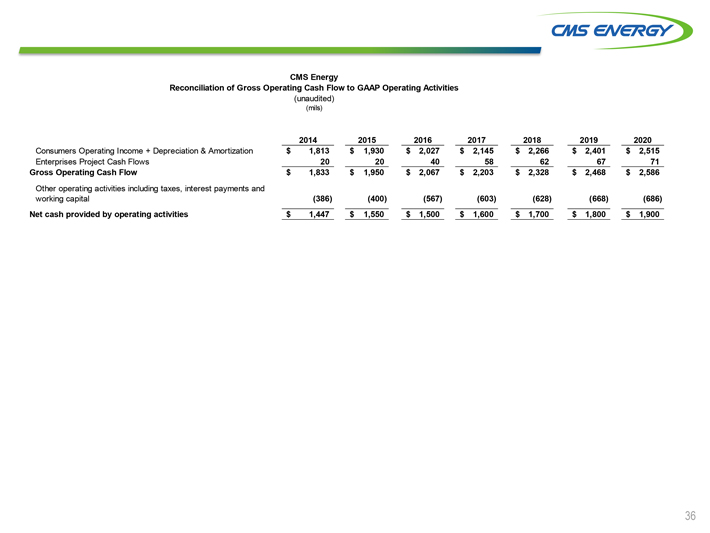

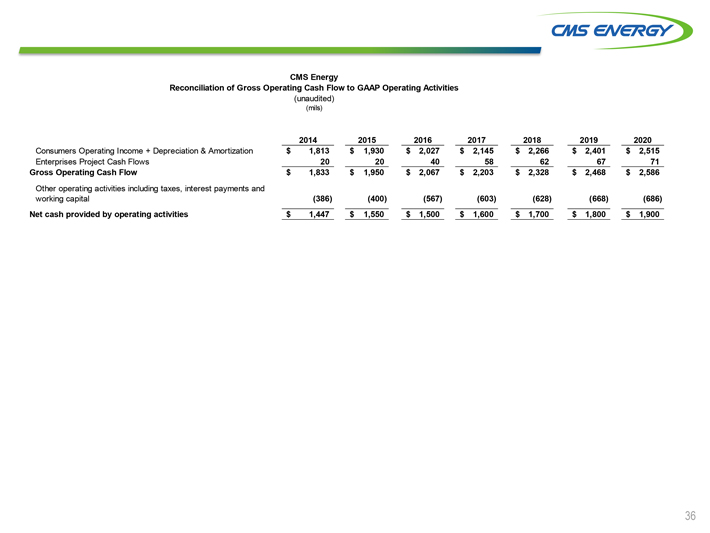

CMS ENERGY

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

2014 2015 2016 2017 2018 2019 2020

Consumers Operating Income + Depreciation & Amortization $1,813 $1,930 $2,027 $2,145 $2,266 $2,401 $2,515

Enterprises Project Cash Flows 20 20 40 58 62 67 71

Gross Operating Cash Flow $1,833 $1,950 $2,067 $2,203 $2,328 $2,468 $2,586

Other operating activities including taxes, interest payments and working capital (386) (400) (567) (603) (628) (668) (686)

Net cash provided by operating activities $1,447 $1,550 $1,500 $1,600 $1,700 $1,800 $1,900

36

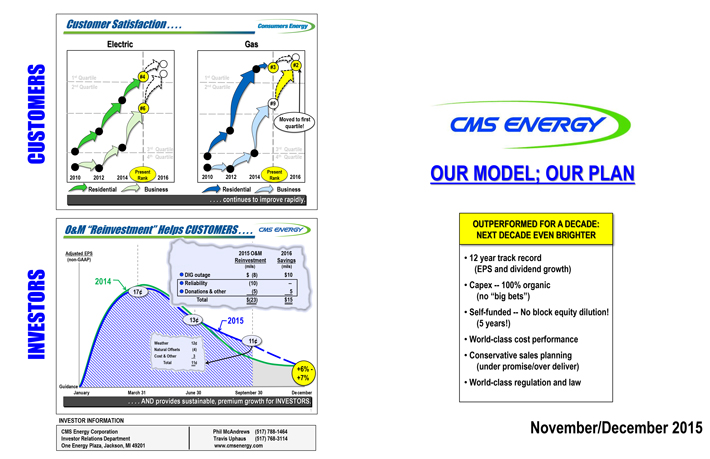

Customer Satisfaction.... Consumers Energy

Electric Gas

#3 #2

1st Quartile #4 1st Quartile

2nd Quartile 2nd Quartile

#9

#6

Moved to first quartile!

3rd Quartile 3rd Quartile

CUSTOMERS 4th Quartile 4th Quartile

2010 2012 2014 Present Rank 2016 2010 2012 2014 Present Rank 2016

Residential Business Residential Business

....continues to improve rapidly.

O&M “Reinvestment” Helps CUSTOMERS.... CMS ENERGY

Adjusted EPS (non-GAAP) 2015 O&M Reinvestment (mils) 2016 Savings (mils)

DIG outage $(8) $10

2014 Reliability (10) -

17¢ Donations & other (5) 5

Total $(23) $ 15

2015

INVESTORS 13¢ 11¢

Weather 12¢

Natural Offsets (4)

Guidance Cost & Other 3

Total 11¢

+7% +6% -

January March 31 June 30 September 30 December

....AND provides sustainable, premium growth for INVESTORS.

INVESTOR INFORMATION

CMS Energy Corporation

Phil McAndrews (517) 788-1464

Investor Relations Department

Travis Uphaus (517) 768-3114

One Energy Plaza, Jackson, MI 49201

www.cmsenergy.com

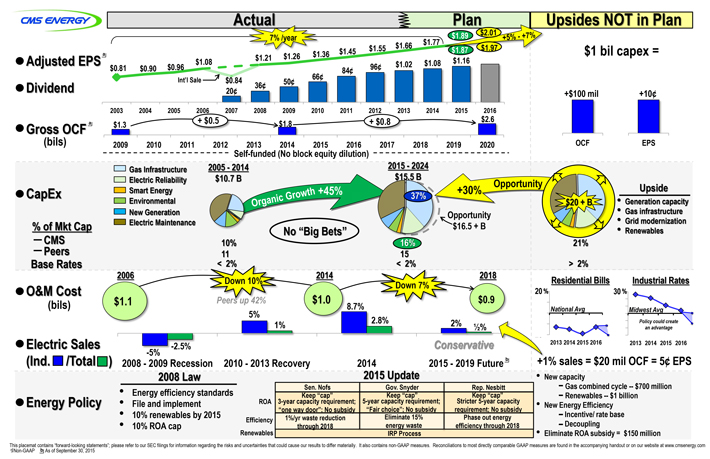

CMS ENERGY

OUR MODEL; OUR PLAN

OUTPERFORMED FOR A DECADE:

NEXT DECADE EVEN BRIGHTER

12 year track record

(EPS and dividend growth)

Capex -- 100% organic

(no “big bets”)

Self-funded -- No block equity dilution!

(5 years!)

World-class cost performance

Conservative sales planning

(under promise/over deliver)

World-class regulation and law

November/December 2015

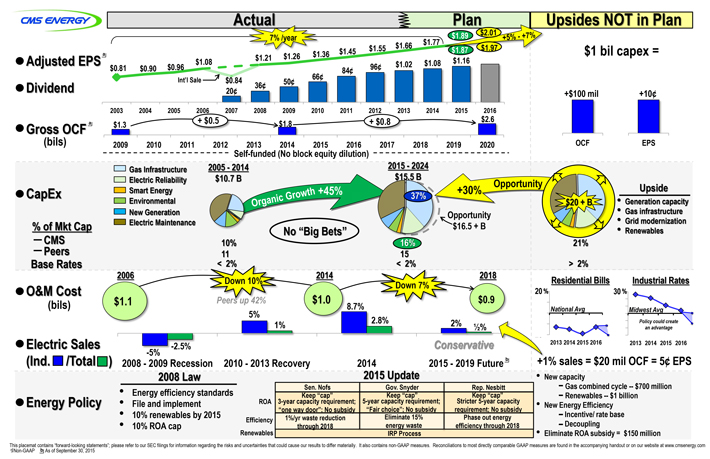

CMS ENERGY

Actual

Plan

Upsides NOT in Plan

7% /year $1.89 $2.01 +5% - +7% $1 bil capex =

$1.87 $1.97

Adjusted EPS a $0.81 $0.90 $0.96 $1.08 $1.21 $1.26 $1.36 $1.45 $1.55 1.66 $1.77

Dividend Int’l Sale $0.84

20¢ 36¢ 50¢ 66¢ 84¢ 96¢ $1.02 $1.08 $1.16 +$100 mil +10¢

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 OCF EPS

Gross OCF a (bils) $1.3 +$0.5 $1.8 +$0.8 $2.6

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Self-funded (No block equity dilution)

CapEx

Gas Infrastructure

2005 - 2014 $10.7 B 2015 - 2024 $15.5 B

Electric Reliability

Smart Energy

37% +30% Opportunity

Environmental

$20 + B

New Generation

Opportunity $16.5 + B

Electric Maintenance

Organic Growth +45%

No “Big Bets”

Upside

Generation capacity

Gas infrastructure

Grid modernization

Renewables

% of Mkt Cap

— CMS

— Peers

Base Rates

10% 11 < 2% 16% 15 < 2% 21% > 2%

O&M Cost (bils)

2006 2014 2018 Residential Bills Industrial Rates

$1.1 Down 10% Peers up 42% $1.0 Down 7% 20% National Avg 30% Midwest Avg

5% 1% 8.7% 2.8% $0.9 2% 1/2% Policy could create an advantage

Electric Sales

(Ind. /Total) -2.5% -5% Conservative 2013 2014 2015 2016 2013 2014 2015 2016

2008 - 2009 Recession 2010 - 2013 Recovery 2014 2015 - 2019 Future b +1% sales = $20 mil OCF = 5¢ EPS

Energy Policy 2008 Law 2015 Update

Energy efficiency standards

File and implement

10% renewables by 2015

10% ROA cap

Sen. Nofs Gov. Snyder Rep. Nesbitt

ROA

Keep “cap” 3-year capacity requirement; “one way door”; No subsidy

Keep “cap” 5-year capacity requirement; “Fair choice”; No subsidy

Keep “cap” Stricter 5-year capacity requirement; No subsidy

Efficiency

1%/yr waste reduction through 2018

Eliminate 15% energy waste

Phase out energy efficiency through 2018

Renewables IRP Process

New capacity

– Gas combined cycle -- $700 million

– Renewables -- $1 billion

New Energy Efficiency

– Incentive/ rate base

– Decoupling

Eliminate ROA subsidy = $150 million

This placemat contains “forward-looking statements”; please refer to our SEC filings for information regarding the risks and uncertainties that could cause our results to differ materially. It also contains non-GAAP measures. Reconciliations to most directly comparable GAAP measures are found in the accompanying handout or on our website at www.cmsenergy.com

a Non-GAAP

b As of September 30, 2015