Exhibit 99.1

|

CMS ENERGY

CMS

LISTED

NYSE

Investor Meetings

November 30 – December 1, 2015

Ludington Pumped Storage

Fourth largest in the world

Ray Compressor Station

#1 LDC in gas storage

Cross Winds ®Energy Park

#2 in renewable sales in the Great Lakes area

CMS ENERGY

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the

Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND

INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended

December 31, 2014 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING

STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides historical financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis and provides forward-looking guidance on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. These items have the potential to impact, favorably or unfavorably, the company’s reported earnings in future periods.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

1

CMS ENERGY

We Cross The Finish Line Together

CMS ENERGY

THANK YOU

For your support

BETTER THAN WE FOUND IT

CMS ENERGY

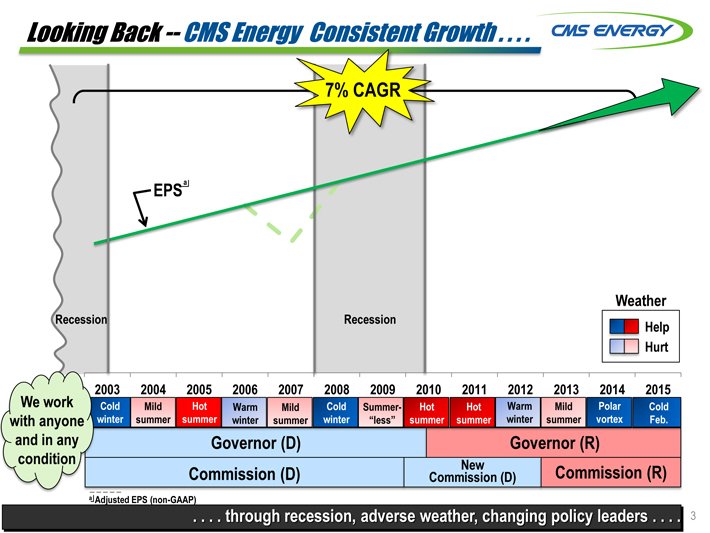

Looking Back — CMS Energy Consistent Growth . . . .

7% CAGR

a

EPS

Recession

Recession

Weather Help Hurt

We work with anyone and in any condition

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Cold winter Mild summer Hot summer Warm winter Mild summer Cold winter Summer- “less” Hot summer Hot summer

Warm winter Mild summer Polar vortex Cold Feb.

Governor (D) Governor (R) Commission (R) New Commission (D) Commission (D)

a Adjusted EPS (non-GAAP)

. . . . through recession, adverse weather, changing policy leaders . . . . 3

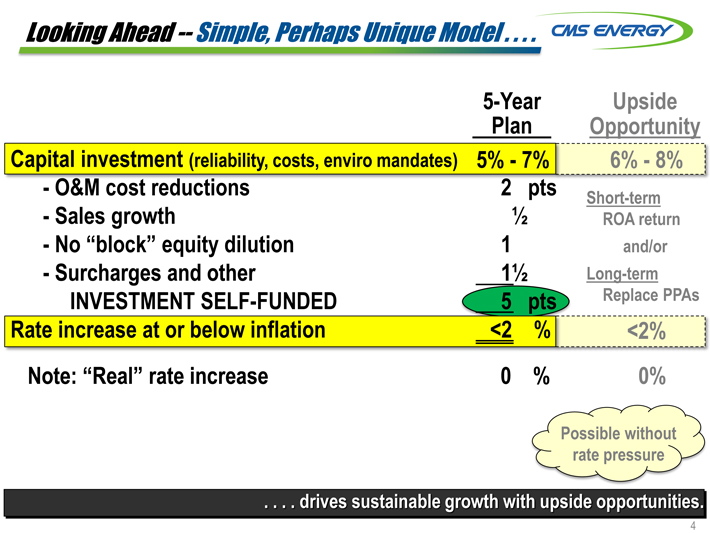

Looking Ahead -- Simple, Perhaps Unique Model . . . . CMS ENERGY

5-Year Plan Upside Opportunity

Capital investment (reliability, costs, enviro mandates) 5% - 7% 6% - 8%

- O&M cost reductions 2 pts Short-term

- Sales growth 1/2 ROA return

- No “block” equity dilution 1 and/or

- Surcharges and other 1 1/2 Long-term

INVESTMENT SELF-FUNDED 5pts Replace PPAs

Rate increase at or below inflation <2 % <2%

Note: “Real” rate increase 0 % 0%

Possible without rate pressure

. . . . drives sustainable growth with upside opportunities.

4

CMS ENERGY

We Earn Our Customers’ Business 24/7

CMS ENERGY

THANK YOU

for your support

BETTER THAN WE FOUND IT

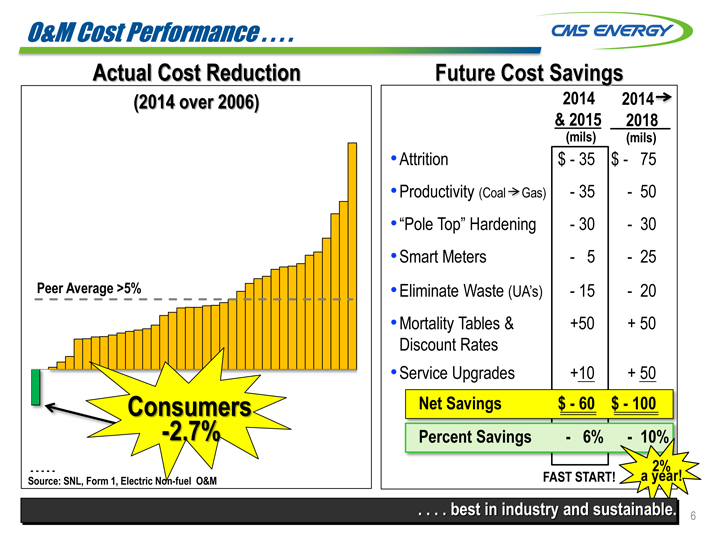

O&M Cost Performance . . . . CMS ENERGY

Actual Cost Reduction

(2014 over 2016)

Peer Average >5%

Consumers -2.7%

- - - - -

Source: SNL, Form 1, Electric Non-fuel O&M

Future Cost Savings

2014 & 2015 (mils)

2014 2018 (mils)

Attrition $ - 35 $- 75

Productivity (Coal Gas) - 35 - 50

“Pole Top” Hardening - 30 - 30

Smart Meters - 5 - 25

Eliminate Waste (UA’s) - 15 - 20

Mortality Tables & Discount Rates +50 + 50

Service Upgrades +10 +50

Net Savings $ - 60 $ - 100

Percent Savings -6% - 10%

FAST START! 2% a year!

. . . . best in industry and sustainable. 6

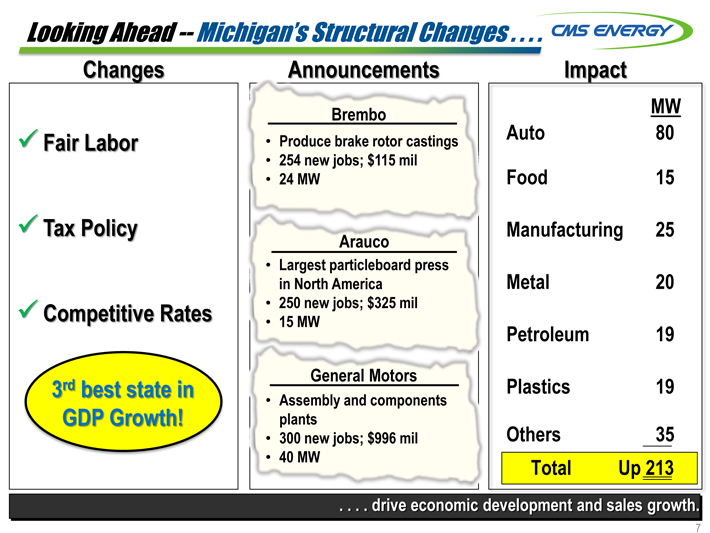

Looking Ahead -- Michigan’s Structural Changes . . . . CMS ENERGY

Changes Announcements Impact

Brembo MW

ü Fair Labor

Produce brake rotor castings

Auto

254 new jobs; $115 mil

Food

24 MW

ü Tax Policy

Arauco

Manufacturing

Largest particleboard press in North America

Metal

ü Competitive Rates

15 250 MW new jobs; $325 mil

Petrolem

General Motors

Plastic

3rd best state in

Assembly and components

GDP Growth!

plants

Other

300 new jobs; $996 mil

40 MW

Total Up

80 15 25 20 19 19 35 213

. . . . drive economic development and sales growth.

7

CMS ENERGY

We Leave It Better Than We Found It

CMS ENERGY

THANK YOU

for your support

BETTER THAN WE FOUND IT

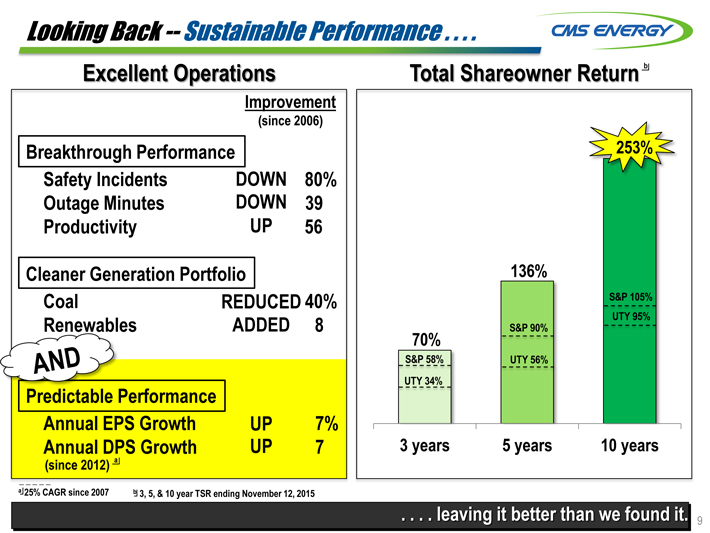

Looking Back -- Sustainable Performance . . . . CMS ENERGY

Excellent Operations

Improvement (since 2006)

Breakthrough Performance

Safety Incidents DOWN 80%

Outage Minutes DOWN 39

Productivity UP 56

Cleaner Generation Portfolio

Coal REDUCED 40%

Renewables ADDED 8

AND

Predictable Performance

Annual EPS Growth UP 7%

Annual DPS Growth UP 7

(since 2012) a

b

Total Shareowner Return

253%

136%

S&P 105%

UTY 95%

S&P 90%

70%

S&P 58%

UTY 56%

UTY 34%

3 years

5 years

10 years

a 25% CAGR since 2007 b 3, 5, & 10 year TSR ending November 12, 2015

. . . . leaving it better than we found it. 9

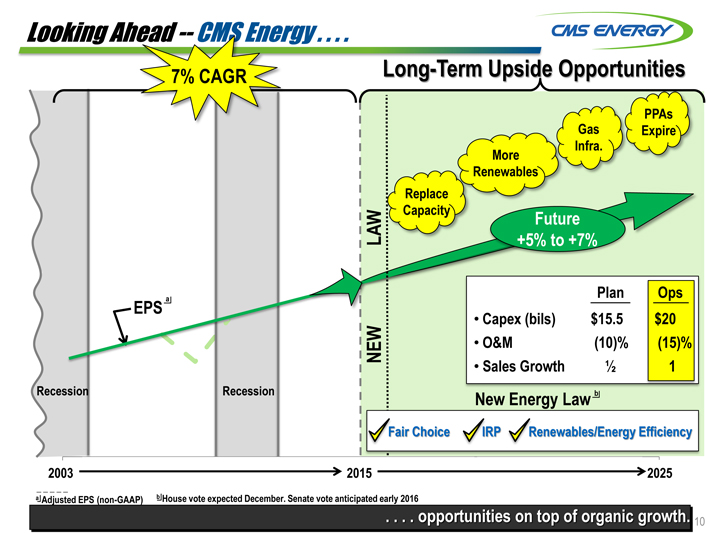

Looking Ahead -- CMS Energy . . . . CMS ENERGY

7% CAGR

EPSa

Recession Recession

Long-Term Upside Opportunities

NEW LAW

Replace Capacity

More Renewables

Gas Infra.

PPAs Expire

Future

+5% to +7%

Plan Ops

Capex (bils) $15.5 $20

O&M (10)% (15)%

Sales Growth 1/2 1

New Energy Law b

Fair Choice IRP Renewables/Energy Efficiency

2003 2015 2025

-----

a Adjusted EPS (non-GAAP) b House vote expected December. Senate vote anticipated early 2016

. . . . opportunities on top of organic growth. 10

GAAP Reconciliation

CMS ENERGY

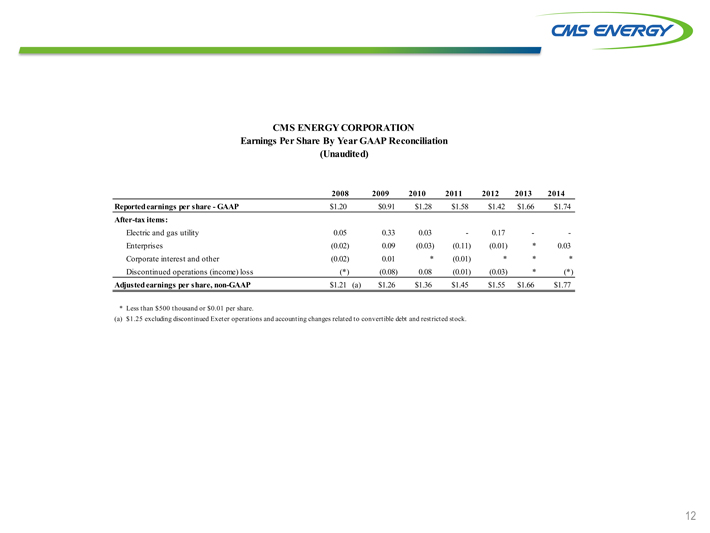

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

2008 2009 2010 2011 2012 2013 2014

Reported earnings per share - GAAP $1.20 $0.91 $1.28 $1.58 $1.42 $1.66 $1.74

After-tax items:

Electric and gas utility 0.05 0.33 0.03 — 0.17 — —

Enterprises (0.02) 0.09 (0.03) (0.11) (0.01) * 0.03

Corporate interest and other (0.02) 0.01 * (0.01) * * *

Discontinued operations (income) loss (*) (0.08) 0.08 (0.01) (0.03) * (*)

Adjusted earnings per share, non-GAAP $1.21 (a) $1.26 $1.36 $1.45 $1.55 $1.66 $1.77

* Less than $500 thousand or $0.01 per share.

(a) $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock.

12

CMS ENERGY

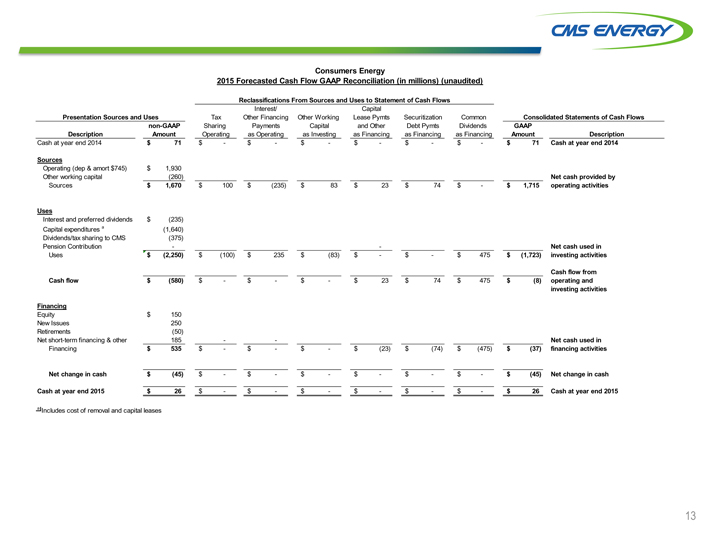

Consumers Energy

2015 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

Reclassifications From Sources and Uses to Statement of Cash Flows

Presentation Sources and Uses Description Cash at year end 2014 Sources Operating (dep & amort $745) Other working capital Sources Uses Interest and preferred dividends Capital expenditures a Dividends/tax sharing to CMS Pension Contribution Uses Cash flow Financing Equity New Issues Retirements Net short-term financing & other Financing Net change in cash Cash at year end 2015 non-GAAP Amount

$71 $1,930 (260) $1,670 $(235) (1,640) (375) — $(2,250) $(580) $150 250 (50) 185 $535 $(45) $26

Tax Sharing Operating

$— $100 $(100) $— — $— $— $—

Interest/ Other Financing Payments as Operating

$— $(235) $235 $— — $— $— $—

Other Working Capital as Investing

$— $83 $(83) $— $— $— $—

Capital Lease Pymts and Other as Financing

$— $23 — $— $23 $(23) $— $—

Securitization Debt Pymts as Financing

$— $74 $— $74 $(74) $— $—

Common Dividends as Financing

$— $— $475 $475 $(475) $— $—

Consolidated Statements of Cash Flows

GAAP Amount $71 $1,715 $(1,723) $(8) $(37) $(45) $26

Description Cash at year end 2014 Net cash provided by operating activities Net cash used in investing activities Cash flow from operating and investing activities Net cash used in financing activities Net change in cash Cash at year end 2015

a Includes cost of removal and capital leases

13

CMS ENERGY

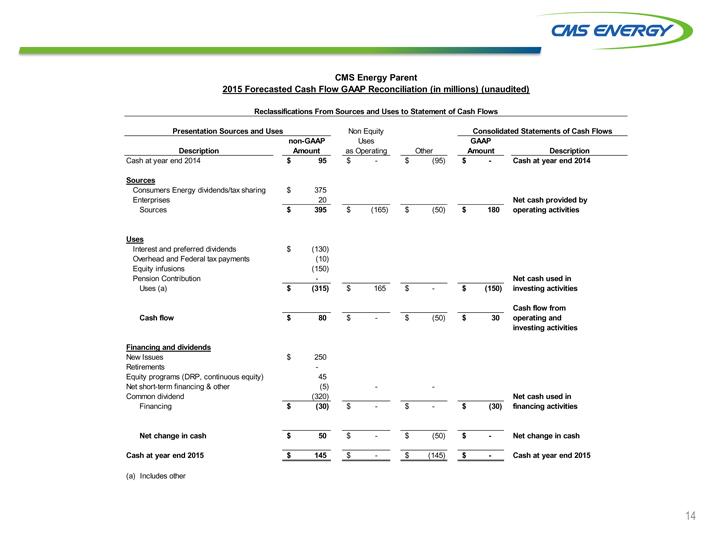

CMS Energy Parent

2015 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

Reclassifications From Sources and Uses to Statement of Cash Flows

Presentation Sources and Uses

Description

Cash at year end 2014

Sources

Consumers Energy dividends/tax sharing

Enterprises

Sources

Uses

Interest and preferred dividends

Overhead and Federal tax payments

Equity infusions

Pension Contribution

Uses (a)

Cash flow

Financing and dividends

New Issues

Retirements

Equity programs (DRP, continuous equity)

Net short-term financing & other

Common dividend

Financing

Net change in cash

Cash at year end 2015

non-GAAP Amount Non Equity Uses as Operating Other GAAP Amount Consolidated Statements of Cash Flows

Description

$ 95 $—$ (95) $— Cash at year end 2014

$ 375 20 Net cash provided by operating activities

$ 395 $ (165) $ (50) $180

$ (130) (10) (150) — Net cash used in investing activities

$ (315) $165 $— $ (150)

Cash flow from operating and investing activities

$ 80 $— $ (50) $ 30 $ 250 — 45

(5) — — (320) Net cash used in financing activities

$ (30) $— $— $ (30) $ 50$— $ (50) $— Net change in cash

$ 145 $— $ (145) $— Cash at year end 2015

(a) Includes other

14

CMS ENERGY

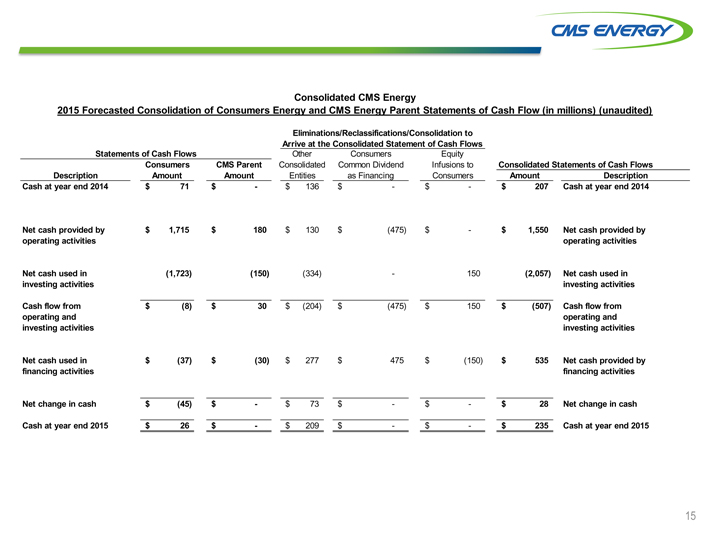

Consolidated CMS Energy

2015 Forecasted Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

Eliminations/Reclassifications/Consolidation to

Arrive at the Consolidated Statement of Cash Flows

Statements of Cash Flows

Description

Cash at year end 2014

Net cash provided by operating activities

Net cash used in investing activities

Cash flow from operating and investing activities

Net cash used in financing activities

Net change in cash

Cash at year end 2015

Consumers Amount

$71 $1,715 (1,723) $(8) $(37) $(45) $26

CMS Parent Amount

$— $180 (150) $30 $(30) $— $—

Other Consolidated Entities

$136 $130 (334) $(204) $277 $73 $209

Consumers Common Dividend as Financing

$— $(475) — $(475) $475 $— $—

Equity Infusions to Consumers

$— $— 150 $150 $(150) $— $—

Consolidated Statements of Cash Flows

Amount

$207 $1,550 (2,057) $(507) $535 $28 $235

Description

Cash at year end 2014

Net cash provided by operating activities

Net cash used in investing activities

Cash flow from operating and investing activities

Net cash provided by financing activities

Net change in cash

Cash at year end 2015

15

CMS ENERGY

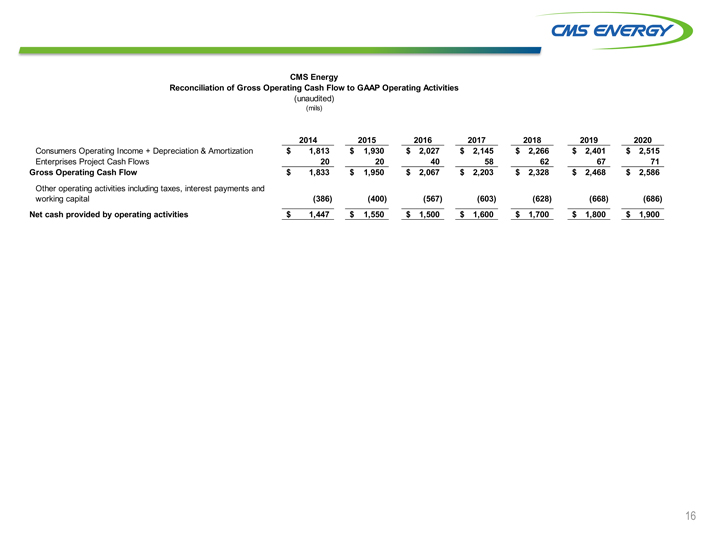

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

2014 2015 2016 2017 2018 2019 2020

Consumers Operating Income + Depreciation & Amortization $1,813 $1,930 $2,027 $2,145 $2,266 $2,401 $2,515

Enterprises Project Cash Flows 20 20 40 58 62 67 71

Gross Operating Cash Flow $1,833 $1,950 $2,067 $2,203 $2,328 $2,468 $2,586

Other operating activities including taxes, interest payments and working capital (386) (400) (567) (603) (628) (668) (686)

Net cash provided by operating activities $1,447 $1,550 $1,500 $1,600 $1,700 $1,800 $1,900

16

INVESTORS

CUSTOMERS

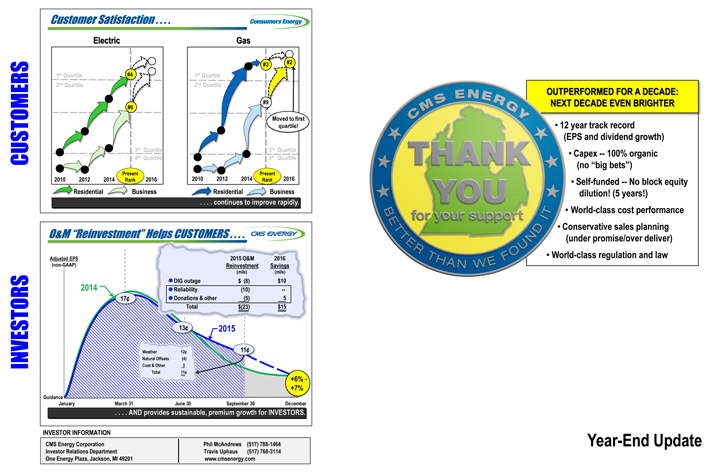

Customer Satisfaction . . . .

Consumers Energy

Electric

1st Quartile #4 2nd Quartile #6 3rd Quartile 4th Quartile 2010 2012 2014 Present Rank 2016

Residential Business

Gas

#3 #2 1st Quartile 2nd Quartile #9 Moved to first quartile! 3rd Quartile 4th Quartile

2010 2012 2014 Present Rank 2016

Residential Business

. . . . continues to improve rapidly.

O&M “Reinvestment” Helps CUSTOMERS . . . .

CMS ENERGY

Adjusted EPS (non-GAAP)

2015 O&M Reinvestment 2016 Savings

(mils) (mils)

DIG outage $(8) $10

Reliability (10) —

Donations & other (5) 5

Total $(23) $15

2014 17¢ 13¢ 2015 11¢

Weather 12¢

Natural Offsets (4)

Cost & Other 3

Total 11¢

+6% - +7%

Guidance

January March 31 June 30 September 30 December

. . . . AND provides sustainable, premium growth for INVESTORS.

INVESTOR INFORMATION CMS Energy Corporation Investor Relations Department One Energy Plaza, Jackson, MI 49201

Phil McAndrews Travis Uphaus www.cmsenergy.com

(517) 788-1464 (517) 768-3114

CMS ENERGY

THANK YOU

For your support

BETTER THAN WE FOUND IT

OUTPERFORMED FOR A DECADE: NEXT DECADE EVEN BRIGHTER

• 12 year track record (EPS and dividend growth)

• Capex — 100% organic (no “big bets”)

• Self-funded — No block equity dilution! (5 years!)

• World-class cost performance

• Conservative sales planning (under promise/over deliver)

• World-class regulation and law

Year-End Update

CMS ENERGY

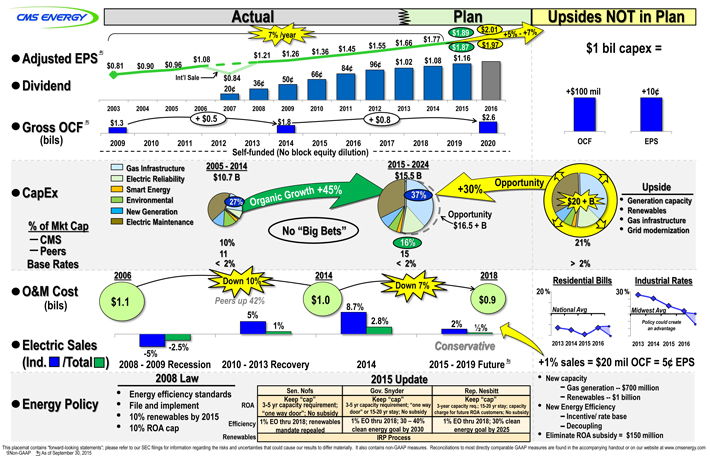

Actual Plan

7% /year

+5% — +7%

Adjusted EPS a Dividend Gross OCF a (bils)

$0.81 2003 $1.3 2009

$0.90 2004 2010

$0.96 Int’l Sale 2005 2011

$1.08 2006 + $0.5

$0.84 20¢ 2007 2012

$1.21 36¢ 2008 2013

$1.26 50¢ 2009 $1.8 2014

$1.36 66¢ 2010 2015

$1.45 84¢ 2011 2016

$1.55 96¢ 2012 + $0.8 2017

$1.66 $1.02 2013

$1.77 $1.08 2014 2018

$1.89 $1.87 $1.16 2015 2019

$2.01 $1.97 2016 $2.6 2020

Self-funded (No block equity dilution)

Upsides NOT in Plan

$1 bil capex =

+$100 mil +10¢

OCF EPS

CapEx

% of Mkt Cap

- CMS

- Peers

Base Rates

Gas Infrastructure

Electric Reliability

Smart Energy

Environmental

New Generation

Electric Maintenance

2005 — 2014 $10.7 B

27% Organic Growth +45%

10%

11

< 2%

No “Big Bets”

2015 — 2024 $15.5 B

37%

16% 15 < 2%

Opportunity $16.5 + B

Opportunity

+30%

$20 + B

21%

> 2%

Upside

• Generation capacity

• Renewables

• Gas infrastructure

• Grid modernization

O&M Cost (bils)

Electric Sales (Ind. /Total)

2006

$1.1

-2.5%

-5%

Down 10%

Peers up 42%

5%

1%

2014

$1.0

8.7%

2.8%

Down 7%

2018

$0.9

2% 1/2%

Conservative

2008 — 2009 Recession 2010 — 2013 Recovery 2014 2015 — 2019 Future b

Residential Bills Industrial Rates

20 % 30 %

National Avg Midwest Avg

Policy could create an advantage

2013 2014 2015 2016 2013 2014 2015 2016

+1% sales = $20 mil OCF = 5¢ EPS

Energy Policy

2008 Law

• Energy efficiency standards

• File and implement

• 10% renewables by 2015

• 10% ROA cap

ROA

Efficiency

Renewables

2015 Update

Sen. Nofs Gov. Snyder Rep. Nesbitt

Keep “cap” 3-5 yr capacity requirement; “one way door”; No subsidy Keep “cap” 3-5 yr capacity requirement; “one way door” or 15-20 yr stay; No subsidy Keep “cap” 3-year capacity req.; 15-20 yr stay; capacity charge for future ROA customers; No subsidy

1% EO thru 2018; renewables mandate repealed 1% EO thru 2018; 30 – 40% clean energy goal by 2030 1% EO thru 2018; 30% clean energy goal by 2025

IRP Process

• New capacity

— Gas generation — $700 million

— Renewables — $1 billion

• New Energy Efficiency

— Incentive/ rate base

— Decoupling

• Eliminate ROA subsidy = $150 million

This placemat contains “forward-looking statements”; please refer to our SEC filings for information regarding the risks and uncertainties that could cause our results to differ materially. It also contains non-GAAP measures. Reconciliations to most directly comparable GAAP measures are found in the accompanying handout or on our website at www.cmsenergy.com

a Non-GAAP b As of September 30, 2015