Fixed income mutual funds

Delaware Tax-Free Arizona Fund

Delaware Tax-Free California Fund

Delaware Tax-Free Colorado Fund

Delaware Tax-Free Idaho Fund

Delaware Tax-Free New York Fund

Delaware Tax-Free Pennsylvania Fund

August 31, 2018

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus and their summary prospectuses, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Experience Delaware Funds® by Macquarie

Macquarie Investment Management (MIM) is a global asset manager with offices throughout the United States, Europe, Asia, and Australia. We are active managers who prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for our clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 75 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Tax-Free Arizona Fund, Delaware Tax-Free California Fund, Delaware Tax-Free Colorado Fund, Delaware Tax-Free Idaho Fund, Delaware Tax-Free New York Fund, and Delaware Tax-Free Pennsylvania Fund at delawarefunds.com/literature.

Manage your account online

| ● | | Check your account balance and transactions |

| ● | | View statements and tax forms |

| ● | | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. Macquarie Investment Management (MIM) is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following registered investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Capital Investment Management LLC.

The Funds are distributed by Delaware Distributors, L.P.

(DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Funds are governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of Aug. 31, 2018, and subject to change for events occurring after such date.

The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2018 Macquarie Management Holdings, Inc.

Portfolio management review

| | |

| Delaware Funds® by Macquarie state tax-free funds | | September 11, 2018 |

| | | | | | | | |

Performance preview (for the year ended August 31, 2018) | | | | | | | | |

| Delaware Tax-Free Arizona Fund (Institutional Class shares) | | | 1-year return | | | | +1.36% | |

| Delaware Tax-Free Arizona Fund (Class A shares) | | | 1-year return | | | | +1.11% | |

| Bloomberg Barclays Municipal Bond Index (benchmark) | | | 1-year return | | | | +0.49% | |

| Lipper Other States Municipal Debt Funds Average | | | 1-year return | | | | +0.17% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Arizona Fund, please see the table on page 9. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Other States Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation on a specified city or state basis.

Please see page 12 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| | | | | | | | |

Delaware Tax-Free California Fund (Institutional Class shares) | | | 1-year return | | | | +1.26% | |

Delaware Tax-Free California Fund (Class A shares) | | | 1-year return | | | | +1.00% | |

Bloomberg Barclays Municipal Bond Index (benchmark) | | | 1-year return | | | | +0.49% | |

Lipper California Municipal Debt Funds Average | | | 1-year return | | | | +0.99% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free California Fund, please see the table on page 13. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper California Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in California (double tax-exempt) or a city in California (triple tax-exempt).

Please see page 16 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| | | | | | | | |

Delaware Tax-Free Colorado Fund (Institutional Class shares) | | | 1-year return | | | | +1.47% | |

Delaware Tax-Free Colorado Fund (Class A shares) | | | 1-year return | | | | +1.22% | |

Bloomberg Barclays Municipal Bond Index (benchmark) | | | 1-year return | | | | +0.49% | |

Lipper Other States Municipal Debt Funds Average | | | 1-year return | | | | +0.17% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Colorado Fund, please see the table on page 17. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Other States Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation on a specified city or state basis.

Please see page 20 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

1

Portfolio management review

Delaware Funds® by Macquarie state tax-free funds

| | | | | | | | |

Delaware Tax-Free Idaho Fund (Institutional Class shares) | | | 1-year return | | | | +0.82% | |

Delaware Tax-Free Idaho Fund (Class A shares) | | | 1-year return | | | | +0.56% | |

Bloomberg Barclays Municipal Bond Index (benchmark) | | | 1-year return | | | | +0.49% | |

Lipper Other States Municipal Debt Funds Average | | | 1-year return | | | | +0.17% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Idaho Fund, please see the table on page 21. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Other States Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation on a specified city or state basis.

Please see page 24 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| | | | | | | | |

Delaware Tax-Free New York Fund (Institutional Class shares) | | | 1-year return | | | | +0.93% | |

Delaware Tax-Free New York Fund (Class A shares) | | | 1-year return | | | | +0.60% | |

Bloomberg Barclays Municipal Bond Index (benchmark) | | | 1-year return | | | | +0.49% | |

Lipper New York Municipal Debt Funds Average | | | 1-year return | | | | +0.55% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free New York Fund, please see the table on page 25. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper New York Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in New York (double tax-exempt) or a city in New York (triple tax-exempt).

Please see page 28 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| | | | | | | | |

Delaware Tax-Free Pennsylvania Fund (Institutional Class shares) | | | 1-year return | | | | +1.16% | |

Delaware Tax-Free Pennsylvania Fund (Class A shares) | | | 1-year return | | | | +0.93% | |

Bloomberg Barclays Municipal Bond Index (benchmark) | | | 1-year return | | | | +0.49% | |

Lipper Pennsylvania Municipal Debt Funds Average | | | 1-year return | | | | +0.82% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Pennsylvania Fund, please see the table on page 29. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Pennsylvania Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in Pennsylvania (double tax-exempt) or a city in Pennsylvania (triple tax-exempt).

Please see page 32 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

2

Economic backdrop

US economic data remained healthy throughout the Funds’ fiscal year ended Aug. 31, 2018, although concern about the longer-term impact of global trade conflict emerged toward period end.

US gross domestic product (GDP), a measure of the goods and services the nation produces, increased throughout the 12-month time frame. In the third quarter of 2017, for example, US GDP expanded by an annualized 2.8% rate, followed by a 2.3% increase in the final three months of 2017. US GDP grew by 2.2% in the first quarter of 2018 and an estimated 4.2% in the second quarter. That 4.2% annual pace was the largest quarterly gain in nearly four years. Employment trends also remained healthy, with the US jobless rate finishing August 2018 at 3.9%, down half a percentage point from a year earlier. (Sources: US Bureau of Economic Analysis and US Bureau of Labor Statistics.)

Against this backdrop of steady economic expansion, job growth, and manageable inflation, the US Federal Reserve continued to gradually raise interest rates. The Fed increased its target short-term interest rate by 0.25 percentage points on three separate occasions during the Funds’ fiscal year – in December 2017 and in March and June 2018. On Aug. 31, 2018, the federal funds rate ranged from 1.75% to 2.00%, up from 1.00% to 1.25% a year earlier. (Source: Bloomberg.)

Municipal bond market conditions

In this strong economic environment, the US municipal bond market, as measured by the Bloomberg Barclays Municipal Bond Index, returned +0.49% for the year ended Aug. 31, 2018. Longer-term municipal bonds outpaced their shorter-term counterparts as the yield curve flattened, meaning yields on short-term bonds rose more than those on long-term issues. Short-term yields rose in line with the Fed’s interest rate increases, while fairly benign inflation kept a lid on long-term municipal yields.

To indicate the outperformance of longer-dated municipal debt relative to shorter-maturity municipal debt, the following table shows municipal bond returns by maturity for the 12 months ended Aug. 31, 2018:

Returns by maturity

| | | | |

5 years | | | – 0.74 | % |

10 years | | | – 0.10 | % |

22+ years | | | 1.28 | % |

Source: Bloomberg.

Much of the yield curve’s flattening took place in the fourth quarter of 2017, as investors sought to understand the potential market impact of federal tax reform legislation, which ultimately passed in late December. During this time, the supply of municipal bonds increased sharply, as issuers, anticipating unfavorable tax-policy changes, rushed debt to market. One of these expected changes – the ability to issue so-called private-activity bonds, a broad category that includes healthcare, private education, and toll road bonds, among others – didn’t make it into the final legislation.

However, another proposed change did come to pass: the elimination of advance refundings. Under the new legislation, issuers wishing to refinance bonds through the issuance of newer debt must do so within 90 days of the bonds’ call dates. Many issuers ultimately opted to bring their debt to market ahead of the law’s passage. This led to tighter bond supply in the second half of the Funds’ fiscal year, which, coupled with solid investor demand, provided a tailwind for the municipal bond market.

Continuing a trend in place for several years, bonds of lower-rated municipal issuers again outperformed bonds of higher-quality issuers – a situation known as credit spread narrowing. As investors anticipated that interest rates would continue to rise slowly, lower-rated, higher yielding municipal bonds remained attractive to investors in a continued low-rate environment. Bonds rated

3

Portfolio management review

Delaware Funds® by Macquarie state tax-free funds

below investment grade (below BBB) performed especially well amid strong demand coupled with limited supply of the securities.

The following table, which provides municipal bond performance by credit quality rating for the Funds’ fiscal year, further highlights this trend:

Returns by credit rating

| | | | |

AAA | | | – 0.23 | % |

AA | | | 0.22 | % |

A | | | 0.78 | % |

BBB | | | 2.76 | % |

BB and below | | | 6.21 | % |

Source: Bloomberg. | | | | |

Economic backdrop in the states

Arizona’s diverse state economy is still recovering from the global financial crisis. The rise in population overly exposed its real estate market and construction industry. July 2018 nonfarm employment of 2.78 million grew 2.7% from a year earlier. Despite improvement over prior years, the state’s unemployment rate as of July 2018 remained elevated at 4.6%, above the national average rate of 3.9%. Arizona’s per capita personal income levels are also well below average at only 82% of the national level. Fiscal 2018 General Fund revenues totaled $10.1 billion, which were 6.4% higher than 2017 and 4.2% above budget estimates. Individual income tax revenue grew 10.0% in 2018, sales tax revenue increased 6.2%, and corporate tax revenue rose 1.3%. The state ended fiscal 2018 with an operating fund balance of $2.8 billion and Budget Stabilization Fund balance of $457 million. Arizona enacted a $10.4 billion fiscal 2019 General Fund budget, a 5.5% increase over 2018. Revenues are expected to grow 3.4 % to total $10.2 billion. The budget includes increased funding for education and healthcare. (Sources: bls.gov, bea.gov, ncsl.org, Arizona Office of Strategic Planning Budgeting, Arizona Joint Legislative Budget Committee.)

California enjoys a large, diverse, and wealthy economy that mirrors that of the US. In 2015, California’s real GDP was $2.6 trillion, making California the sixth largest economy in the world. The July 2018 nonfarm employment of 17.1 million grew 2.0% from a year earlier. The unemployment rate fell to 4.2% in July 2018 but remains slightly above the national rate of 3.9%. California’s per capita personal income remained strong at 10% higher than the national average. Fiscal 2018 General Fund revenues rose by 11.5% year over year to total $136 billion, which was 1.1% above the budget forecasts. Personal income taxes rose 13.1% in fiscal 2018 to total $93.5 billion and were 1.3% above budget. Sales-and-use tax receipts were 1.5% below budget, but corporate income tax revenues were 4.4% above budget. California ended fiscal 2018 with a $8.4 billion General Fund balance and a $9.4 billion Rainy Day Fund. The California legislature enacted a $138.7 billion General Fund budget for fiscal 2019, a 9.2% increase over 2018. General Fund revenues are expected to total $133.3 billion, 2.7% more than 2018. The budget calls for personal income and corporate taxes to rise 3.3% and 9.0%, respectively. It calls for a 5.1% increase in sales tax revenues. The state expects to end fiscal 2018 with a General Fund balance of $3.1 billion and a Rainy Day Fund of $13.8 billion. (Sources: bls.gov, bea.gov, ncsl.org, ebudget.ca.gov.)

Colorado’s economy is diverse, with below-average employment concentration in manufacturing and a variety of service sector strengths. July 2018 nonfarm employment of 2.75 million grew 3.1% from a year earlier. Colorado’s unemployment rate in July 2018 was 2.8%, far below the national rate of 3.9% but up slightly from a year earlier. Colorado is a relatively wealthy state, with per capita personal income levels equal to 106% of the US average. Total estimated General Fund revenues for fiscal year 2018 were $11.6 billion, a 12.6% increase over fiscal 2017. Individual income tax revenues rose

4

by 11.5% in fiscal 2018. Corporate income taxes increased 44.6% while sales and use taxes rose 9.8%. Colorado’s legislature enacted a $11.4 billion General Fund budget for 2019, a 7.6% increase over the prior year. Income tax collections are expected to increase at a more moderate rate of 4.3% in 2019, while sales-and-use tax revenue is forecast to increase 4.8%. The budget includes increased funding for education, healthcare, and transportation. The budget estimates an ending fund balance in the General Fund reserve of $943.8 million – $130.6 million above the statutory required reserve. (Sources: bls.gov, bea.gov, ncsl.org, Colorado Office of State Planning and Budgeting, Colorado Joint Budget Committee.)

Idaho’s economy has expanded and diversified in recent years, benefiting from population growth. However, an above-average dependence on the natural resource sector remains. The July 2018 nonfarm employment of 746,000 was up 3.3% from a year earlier. The unemployment rate in July 2018 held steady at 2.9%, well below the national rate of 3.9%. Per capita income levels are 79% of national levels. Idaho’s General Fund fiscal 2018 revenues totaled $3.73 billion. Total revenues came in 2.8% above budget and 8.2% higher than the prior year. Individual income taxes were 3.9% above budget while corporate and sales taxes were 10.6% and 1.3% above budget, respectively. The Idaho legislature enacted a $3.65 billion fiscal 2019 General Fund budget, a 5.9% increase over fiscal 2018. The three largest portions of the budget are public school support, Medicaid, and higher education. Total General Fund revenues are expected to rise by 4.6% to total $3.8 billion in fiscal 2019. (Sources: bls.gov, bea.gov, ncsl.org, Idaho Division of Financial Management.)

New York has a mature, broad-based, and wealthy economy that attracts a highly educated and global workforce. July 2018 nonfarm employment of 9.7 million grew 1.6% from a year earlier. The unemployment rate in July 2018 was

4.3%, slightly above the national rate of 3.9%. Per capita income levels are among the highest in the nation, 21% above national levels. Total receipts for the General Fund for fiscal 2018 were $71.4 billion, up 6.7% from fiscal 2017 but 0.02% below budget. Personal income tax receipts were $46.9 billion in fiscal 2018, 0.7% above budget forecasts. Sales tax revenues totaled $13.2 billion in 2018, about 0.08% below consensus projections. Corporate income taxes were the largest drag on General Fund revenues, coming in at $4.9 billion in fiscal 2018, short of budget projections of $5.1 billion. General Fund expenditures totaled $69.7 billion in fiscal 2018, 0.4% below the revised budget forecast. The state ended fiscal 2018 with a Budgetary General Fund balance of $9.4 billion, up from $7.7 billion in fiscal 2017. New York’s legislature enacted a $76.6 billion General Fund budget for 2019, a 9% increase over the prior year’s budget. Through the first four months of fiscal 2019, revenues totaled $31.9 billion, which was 0.2% above estimates.

Expenditures ran 0.2% below budget. (Sources: bls.gov, bea.gov, ncsl.org, New York Division of the Budget, Office of the New York State Comptroller.)

Pennsylvania has a diverse, broad, and relatively stable economy, with per capita personal income levels slightly above the national average (103%), supported by its large health and higher education sectors. July 2018 nonfarm employment of 6.02 million grew 1.7% from a year earlier. The monthly unemployment rate in July 2018 was 4.2%, higher than the national rate of 3.9% but down from the prior year. Per capital personal income levels have averaged 103% of national levels. Pennsylvania’s General Fund tax collections totaled $34.6 billion in fiscal 2018, 9.1% above the prior year. Sales tax receipts were 0.4% above budget, personal income collections were 0.7% above budget, and corporate tax revenues were 4.3% below budget projections. For the first time in a decade, the commonwealth

5

Portfolio management review

Delaware Funds® by Macquarie state tax-free funds

is projected to make a $22 million deposit into the Budget Stabilization Reserve Fund. Pennsylvania enacted a $32.7 billion fiscal 2019 budget, a 2.2% increase over 2018. It includes increases in spending for education, higher education, the corrective system, and healthcare. (Sources: bls.gov, bea.gov, ncsl.org, Pennsylvania Office of the Budget, Pennsylvania Department of Revenue.)

Focused on credit research

For all six Funds discussed in this report, we maintained a consistent management strategy, which we do regardless of market conditions. We have a bottom-up investment approach, meaning we evaluate individual securities one at a time. We rely on individual credit research to find securities that we believe provide a desirable risk-reward balance.

This approach often leads to substantial allocations within the Funds to bonds in the lower-investment-grade or below-investment-grade credit tiers, where we seek to add value for shareholders through higher yielding bonds that, in our view, display solid underlying credit.

As of the fiscal year end on Aug. 31, 2018, approximately 41% of the net assets of

Delaware Tax-Free Arizona Fund was invested in bonds with credit ratings of A and BBB, the two lowest credit tiers of the investment grade bond universe. Roughly 47% of the net assets of Delaware Tax-Free California Fund was held in these credit segments, while Delaware Tax-Free Colorado Fund’s allocation to bonds with lower-investment-grade credit ratings stood at about 46% of net assets. Meanwhile, Delaware Tax-Free Idaho Fund’s lower-investment-grade bond allocation was just 34%, as Idaho is a relatively small municipal bond market offering fewer opportunities to buy lower-rated, higher yielding bonds. In Delaware Tax-Free New York Fund and Delaware Tax-Free Pennsylvania Fund, whose investment universes include a greater

variety of lower-rated bonds, we allocated to these types of securities as of fiscal year end.

In addition, all of the Funds had allocations to high yield municipal bonds, securities with credit ratings below BBB. By prospectus, all six Funds have the latitude to invest a portion of the portfolio in these credit tiers. When investing in high yield bonds, we pay close attention to credit risk, focusing on securities that offer sufficiently attractive income, in our view, relative to the added risk.

Portfolio positioning

We entered this fiscal year generally comfortable with the Funds’ positioning. As a result, we were highly selective about making new purchases, seeking securities that provided what we saw as a compelling risk-reward trade-off.

In all six Funds, many of our holdings were originally purchased a decade or more ago when significantly higher yields were available. Thus, we have tended not to replace many existing positions with newer bonds, unless we believe they offer sufficient value to justify such an exchange. Once again, that remained our strategy over the past 12 months, and we expect to continue this approach as long as most of the Funds’ existing holdings remain more attractive to us than the new bonds available for purchase.

During the fiscal year, we periodically saw bonds exit the portfolios, either via bond calls or advance refundings. Some of these bonds were of lower credit quality, and we sought to replace them with other lower-quality issues. However, because we remained highly selective in our purchases – we will not invest in higher yielding bonds that we do not find sufficiently creditworthy – we sometimes found this strategy difficult to execute, particularly in smaller municipal bond markets with limited supply of lower-rated bonds. (Larger municipal markets, such as California, regularly offer portfolio managers a wider assortment of

6

lower- and below-investment-grade investment opportunities.)

Accordingly, our approach was to temporarily invest in higher-quality, liquid municipal bonds offering maturities comparable to the bonds exiting the portfolios. We expect that when suitable lower-rated bonds become available, these higher-rated issues will become attractive sales candidates to finance new purchases more suited to our long-term criteria.

Individual performance contributors

As we indicated earlier, bonds with longer maturities tended to outperform shorter-maturity bonds, while lower-rated issues generally performed better than bonds of higher credit quality. Accordingly, many of our strongest- and weakest-performing securities this fiscal year followed this trend.

In Delaware Tax-Free Arizona Fund, for example, the leading individual performer was a position in Pima County Arizona Industrial Development Authority bonds for Edkey charter schools. These securities gained close to 19% for the fiscal year, benefiting from their below-investment-grade credit ratings and 30-year maturities. Bonds for Christian Care Surprise, a Phoenix-based operator of senior-housing facilities also lifted performance. These nonrated bonds with a 30-year maturity returned close to 8% for the Fund.

The strongest performer for Delaware Tax-Free California Fund was a position in zero-coupon Golden State tobacco-securitization bonds. These below-investment-grade issues returned 37%, benefiting from continued strong demand coupled with a shrinking national supply of tobacco bonds as several states opted to refund their tobacco-securitization issues during the period. Investors began to anticipate that the Golden State tobacco bonds would be refunded, boosting their price. Another strong performer for this Fund was a

position in nonrated education bonds for the Creative Center of Los Altos.

In Delaware Tax-Free Colorado Fund, BB+ rated bonds of the Colorado Educational and Cultural Facilities Authority for the University Lab School, maturing in 2045, performed well, returning near 8%, as did a position in nonrated water-and-sewer bonds for the Dominion Water and Sanitation District, returning more than 7.5%.

In Delaware Tax-Free Idaho Fund, zero-coupon bonds for the North Star Charter School in Eagle, Idaho, performed well, benefiting from their long maturities and lower credit rating, as well as the school’s improved financial performance relative to past years. Corporate-backed industrial development revenue bonds for chemical manufacturer FMC Corporation also contributed. The lower-investment-grade credit rating of these bonds and their relatively high yield proved attractive to investors.

In Delaware Tax-Free New York Fund, the leading individual performers were BBB-rated airport bonds for JFK International Terminal and nonrated Glen Cove Local Economic Assistance Corporation tax-increment-financing bonds.

The strongest-performing securities in Delaware Tax-Free Pennsylvania Fund consisted of similarly structured higher-education bond issues for Carlow University and St. Francis University. Both featured a BBB credit rating, relatively high yields and long-term maturities.

Individual performance detractors

In Delaware Tax-Free Arizona Fund, the biggest individual detractors were high-quality, shorter-maturity bonds: dedicated-tax issues of the Regional Public Transportation Authority for Maricopa County and water-and-sewer bonds for the City of Phoenix Civic Improvement Corporation. Both bonds declined more than 1.5%.

7

Portfolio management review

Delaware Funds® by Macquarie state tax-free funds

Performance for Delaware Tax-Free California Fund was hampered by a position in Encore Education charter school bonds. Despite their relatively lower credit rating and longer maturity, the issuer fell short of meeting certain academic standards, causing the bonds to lag during the period, declining more than 3%. We continued to see the issuer as creditworthy, however, and maintained the Fund’s position, anticipating better results in the future. Anaheim City School District bonds, whose credit rating of AA- and near-term maturity date proved less attractive to investors, also detracted from performance.

In Delaware Tax-Free Colorado Fund, a pair of highly rated, short-maturity issues detracted from performance: Jefferson County School District bonds (rated AA- and maturing in 2024) and Platte River Power Authority public power bonds (rated AA and maturing in 2027).

In Delaware Tax-Free Idaho Fund, a pair of highly rated, short-maturity school district bonds for Canyon County School District 131 and Madison County School District 321 declined modestly.

A couple of higher-quality, shorter-maturity bonds were notable laggards for Delaware Tax-Free New York Fund: New York State Dormitory Authority bonds and pre-refunded Onondaga Civic Development Corporation bonds for the St. Joseph’s Hospital Health Center.

Of final note, bonds for the University of Pittsburgh Medical Center, whose relatively high credit rating and 2025 maturity proved unattractive to investors, hampered performance for

Delaware Tax-Free Pennsylvania Fund.In addition, the Fund’s position in pre-refunded bonds for the Pocono Medical Center detracted from performance.

8

| | |

| Performance summaries | | |

| Delaware Tax-Free Arizona Fund | | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| | | | | | | | | | | | | | | | |

| Fund and benchmark performance1,2 | | Average annual total returns through August 31, 2018 | |

| | | | |

| | | 1 year | | | 5 years | | | 10 years | | | Lifetime | |

Class A (Est. April 1, 1991) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +1.11% | | | | +4.50% | | | | +4.15% | | | | +5.16% | |

Including sales charge | | | -3.43% | | | | +3.55% | | | | +3.67% | | | | +4.98% | |

Class C (Est. May 26, 1994) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.36% | | | | +3.72% | | | | +3.37% | | | | +3.95% | |

Including sales charge | | | -0.62% | | | | +3.72% | | | | +3.37% | | | | +3.95% | |

Institutional Class (Est. Dec. 31, 2013) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +1.36% | | | | n/a | | | | n/a | | | | +4.62% | |

Including sales charge | | | +1.36% | | | | n/a | | | | n/a | | | | +4.62% | |

Bloomberg Barclays Municipal Bond Index | | | +0.49% | | | | +4.12% | | | | +4.32% | | | | +3.87%* | |

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 10. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service fee of 0.25% of average daily net assets. Performance for Class A shares,

excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

9

Performance summaries

Delaware Tax-Free Arizona Fund

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, regional, and other factors of that state than geographically diversified funds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s,

Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.59% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | | | |

| Fund expense ratios | | Class A | | | | Class C | | | | Institutional Class |

Total annual operating expenses | | 0.97% | | | | 1.72% | | | | 0.72% |

(without fee waivers) | | | | | | | | | | |

Net expenses | | 0.84% | | | | 1.59% | | | | 0.59% |

(including fee waivers, if any) | | | | | | | | | | |

Type of waiver | | Contractual | | | | Contractual | | | | Contractual |

*The aggregate contractual waiver period covering this report is from Dec. 29, 2016 through Dec. 29, 2018.

10

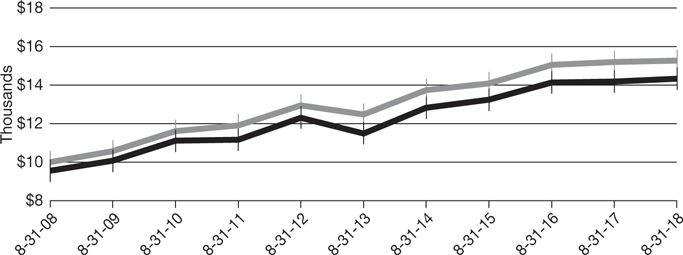

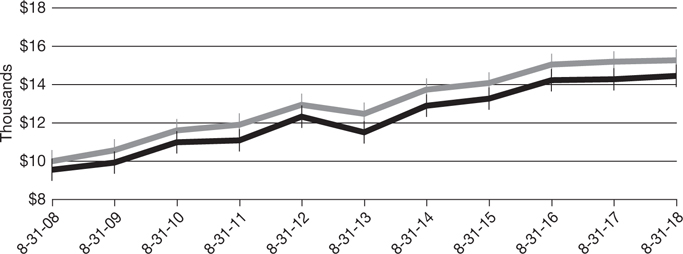

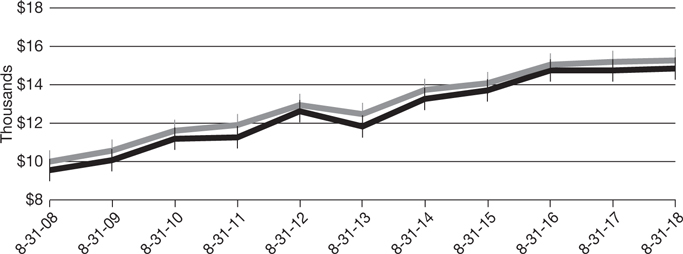

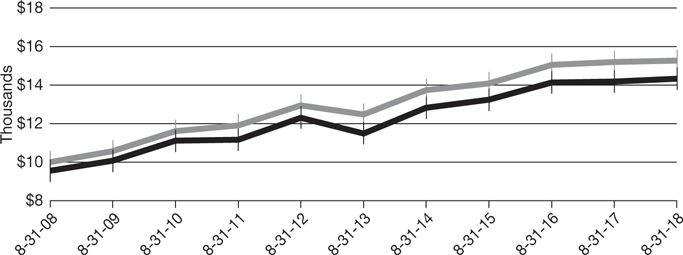

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2008 through Aug. 31, 2018

| | | | | | | | |

For period beginning Aug. 31, 2008 through Aug. 31, 2018 | | Starting value | | | Ending value | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index

| | | $10,000 | | | | $15,263 | |

Delaware Tax-Free Arizona Fund — Class A shares Delaware Tax-Free Arizona Fund — Class A shares

| | | $9,550 | | | | $14,336 | |

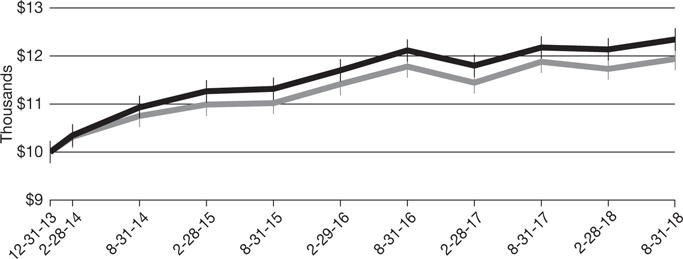

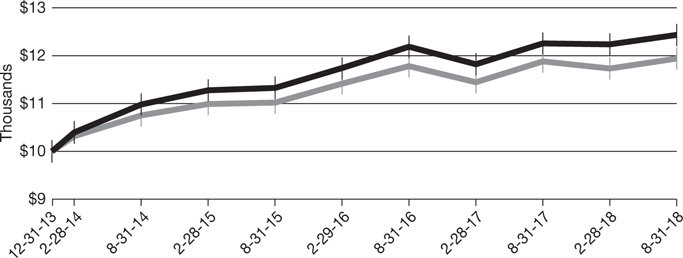

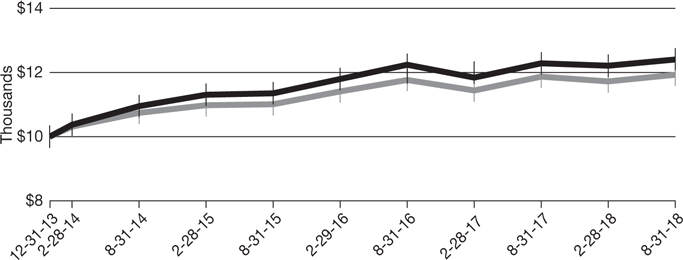

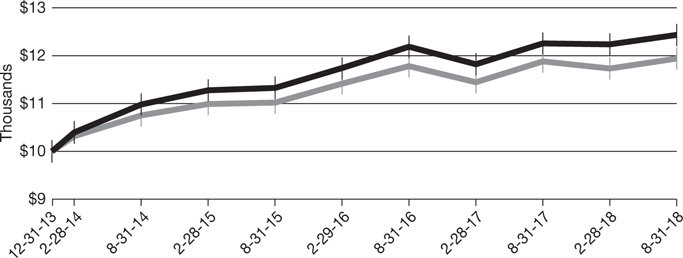

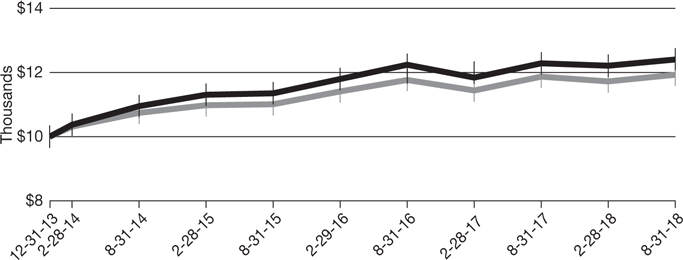

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2018

| | | | | | | | |

For period beginning Dec. 31, 2013 through Aug. 31, 2018 | | Starting value | | | Ending value | |

Delaware Tax-Free Arizona Fund — Institutional Class shares Delaware Tax-Free Arizona Fund — Institutional Class shares

| | | $10,000 | | | | $12,344 | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index

| | | $10,000 | | | | $11,936 | |

11

Performance summaries

Delaware Tax-Free Arizona Fund

1The “Performance of a $10,000 investment” graph for Class A shares assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2008, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Aug. 31, 2008.

The “Performance of a $10,000 investment” graph for Institutional Class shares assumes $10,000 invested in Institutional Class shares of the Fund on Dec. 31, 2013, and includes the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Dec. 31, 2013.

The graphs do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in

effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 10. Please note additional details on pages 9 through 12.

The Bloomberg Barclays Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund share classes will vary due to different charges and expenses.

| | | | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | VAZIX | | 928916204 | | |

Class C | | DVACX | | 928916501 | | |

Institutional Class | | DAZIX | | 928916873 | | |

|

|

12

| | |

| Performance summaries | | |

| Delaware Tax-Free California Fund | | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| | | | | | | | | | | | | | | | |

| Fund and benchmark performance1,2 | | Average annual total returns through August 31, 2018 | |

| | | | |

| | | 1 year | | | 5 years | | | 10 years | | | Lifetime | |

Class A (Est. March 2, 1995) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +1.00% | | | | +5.07% | | | | +4.97% | | | | +5.38% | |

Including sales charge | | | -3.56% | | | | +4.11% | | | | +4.48% | | | | +5.18% | |

Class C (Est. April 9, 1996) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.25% | | | | +4.30% | | | | +4.19% | | | | +4.52% | |

Including sales charge | | | -0.72% | | | | +4.30% | | | | +4.19% | | | | +4.52% | |

Institutional Class (Est. Dec. 31, 2013) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +1.26% | | | | n/a | | | | n/a | | | | +5.12% | |

Including sales charge | | | +1.26% | | | | n/a | | | | n/a | | | | +5.12% | |

Bloomberg Barclays Municipal Bond Index | | | +0.49% | | | | +4.12% | | | | +4.32% | | | | +3.87%* | |

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 14. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service fee of 0.25% of average daily net assets.

Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

13

Performance summaries

Delaware Tax-Free California Fund

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, regional, and other factors of that state than geographically diversified funds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s,

Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.57% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | | | |

| Fund expense ratios | | Class A | | | | Class C | | | | Institutional Class |

Total annual operating expenses (without fee waivers) | | 1.01% | | | | 1.76% | | | | 0.76% |

Net expenses (including fee waivers, if any) | | 0.82% | | | | 1.57% | | | | 0.57% |

Type of waiver | | Contractual | | | | Contractual | | | | Contractual |

*The aggregate contractual waiver period covering this report is from Dec. 29, 2016 through Dec. 29, 2018.

14

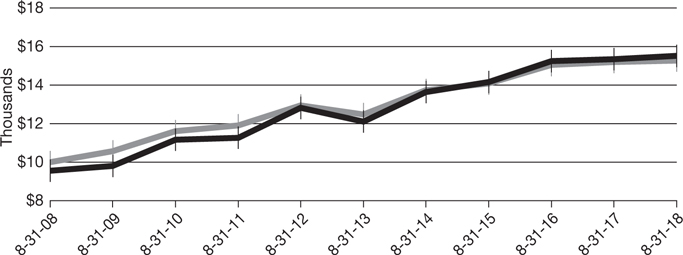

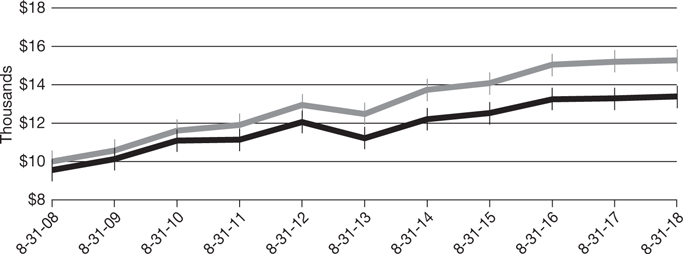

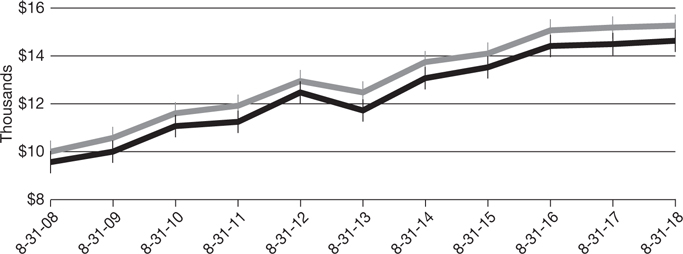

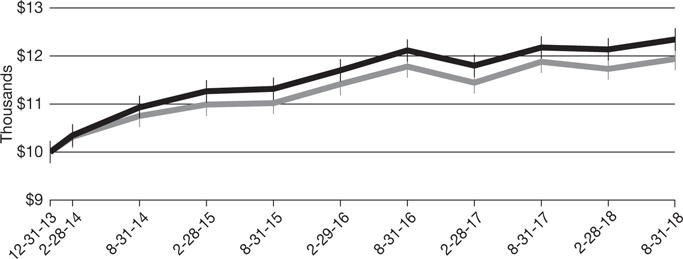

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2008 through Aug. 31, 2018

| | | | | | | | |

For period beginning Aug. 31, 2008 through Aug. 31, 2018 | | Starting value | | | Ending value | |

Delaware Tax-Free California Fund — Class A shares Delaware Tax-Free California Fund — Class A shares

| | | $9,550 | | | | $15,505 | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index

| | | $10,000 | | | | $15,263 | |

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2018

| | | | | | | | |

For period beginning Dec. 31, 2013 through Aug. 31, 2018 | | Starting value | | | Ending value | |

Delaware Tax-Free California Fund — Institutional Class shares Delaware Tax-Free California Fund — Institutional Class shares

| | | $10,000 | | | | $12,623 | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index

| | | $10,000 | | | | $11,936 | |

15

Performance summaries

Delaware Tax-Free California Fund

1The “Performance of a $10,000 investment” graph for Class A shares assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2008, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Aug. 31, 2008.

The “Performance of a $10,000 investment” graph for Institutional Class shares assumes $10,000 invested in Institutional Class shares of the Fund on Dec. 31, 2013, and includes the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Dec. 31, 2013.

The graphs do not reflect the deduction of taxes the shareholders would pay on Fund distributions or

redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 14. Please note additional details on pages 13 through 16.

The Bloomberg Barclays Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund share classes will vary due to different charges and expenses.

| | | | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | DVTAX | | 928928829 | | |

Class C | | DVFTX | | 928928795 | | |

Institutional Class | | DCTIX | | 928928167 | | |

16

| | |

| Performance summaries | | |

| Delaware Tax-Free Colorado Fund | | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| | | | | | | | | | | | | | | | |

| Fund and benchmark performance1,2 | | Average annual total returns through August 31, 2018 | |

| | | | |

| | | 1 year | | | 5 years | | | 10 years | | | Lifetime | |

Class A (Est. April 23, 1987) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +1.22% | | | | +4.64% | | | | +4.23% | | | | +5.62% | |

Including sales charge | | | -3.32% | | | | +3.68% | | | | +3.75% | | | | +5.47% | |

Class C (Est. May 6, 1994) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.47% | | | | +3.85% | | | | +3.46% | | | | +4.04% | |

Including sales charge | | | -0.51% | | | | +3.85% | | | | +3.46% | | | | +4.04% | |

Institutional Class (Est. Dec. 31, 2013) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +1.47% | | | | n/a | | | | n/a | | | | +4.78% | |

Including sales charge | | | +1.47% | | | | n/a | | | | n/a | | | | +4.78% | |

Bloomberg Barclays Municipal Bond Index | | | +0.49% | | | | +4.12% | | | | +4.32% | | | | +3.87%* | |

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 18. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service fee of 0.25% of average daily net assets. Performance for Class A shares,

excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

17

Performance summaries

Delaware Tax-Free Colorado Fund

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, regional, and other factors of that state than geographically diversified funds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s,

Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.59% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | | | | | | | | | |

| Fund expense ratios | | Class A | | | | | Class C | | | | | Institutional Class | |

Total annual operating expenses | | | 0.96% | | | | | | 1.71% | | | | | | 0.71% | |

(without fee waivers) | | | | | | | | | | | | | | | | |

Net expenses | | | 0.84% | | | | | | 1.59% | | | | | | 0.59% | |

(including fee waivers, if any) | | | | | | | | | | | | | | | | |

Type of waiver | | | Contractual | | | | | | Contractual | | | | | | Contractual | |

*The aggregate contractual waiver period covering this report is from Dec. 29, 2016 through Dec. 29, 2018.

18

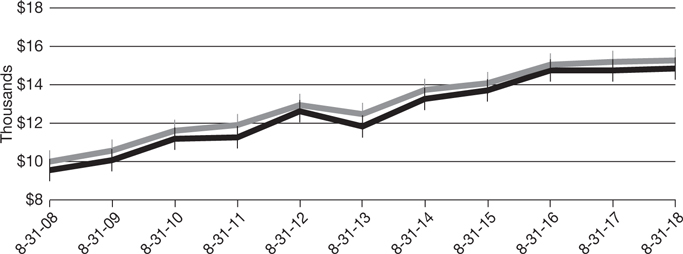

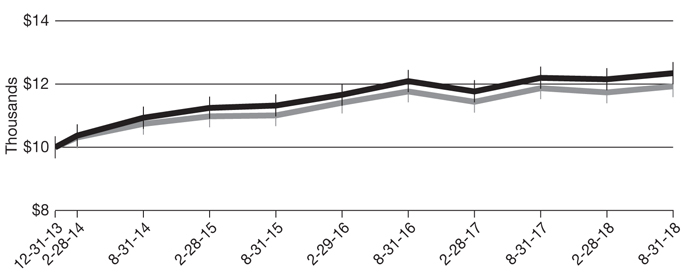

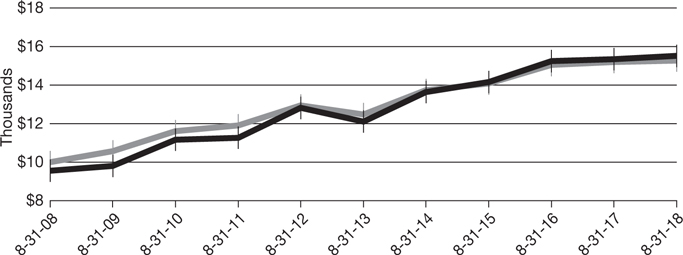

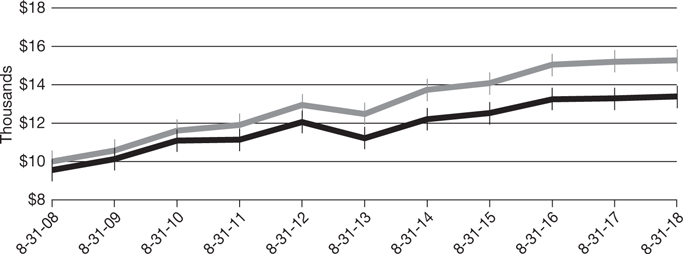

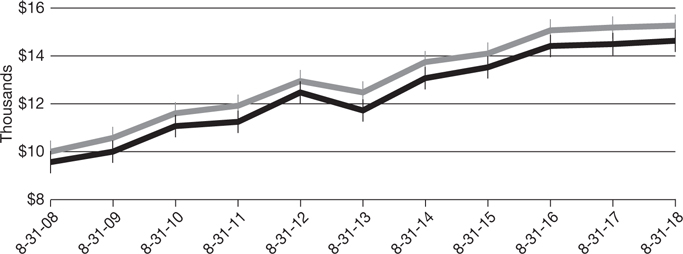

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2008 through Aug. 31, 2018

| | | | | | | | |

For period beginning Aug. 31, 2008 through Aug. 31, 2018 | | Starting value | | | Ending value | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index

| | | $10,000 | | | | $15,263 | |

Delaware Tax-Free Colorado Fund — Class A shares Delaware Tax-Free Colorado Fund — Class A shares

| | | $9,550 | | | | $14,456 | |

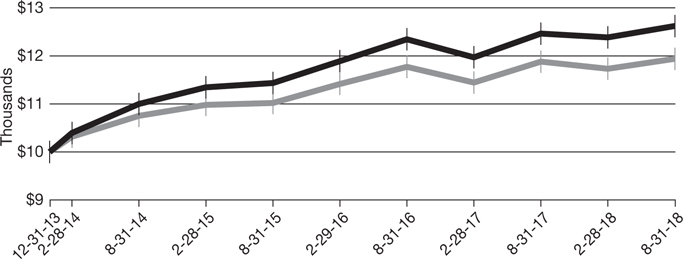

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2018

| | | | | | | | |

For period beginning Dec. 31, 2013 through Aug. 31, 2018 | | Starting value | | | Ending value | |

Delaware Tax-Free Colorado Fund — Institutional Class shares Delaware Tax-Free Colorado Fund — Institutional Class shares

| | | $10,000 | | | | $12,436 | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index

| | | $10,000 | | | | $11,936 | |

19

Performance summaries

Delaware Tax-Free Colorado Fund

1The “Performance of a $10,000 investment” graph for Class A shares assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2008, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Aug. 31, 2008.

The “Performance of a $10,000 investment” graph for Institutional Class shares assumes $10,000 invested in Institutional Class shares of the Fund on Dec. 31, 2013, and includes the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Dec. 31, 2013.

The graphs do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense

limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 18. Please note additional details on pages 17 through 20.

The Bloomberg Barclays Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund share classes will vary due to different charges and expenses.

| | | | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | VCTFX | | 928920107 | | |

Class C | | DVCTX | | 92907R101 | | |

Institutional Class | | DCOIX | | 92907R200 | | |

|

|

20

| | |

| Performance summaries | | |

| Delaware Tax-Free Idaho Fund | | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| | | | | | | | | | | | | | | | |

| Fund and benchmark performance1,2 | | Average annual total returns through August 31, 2018 | |

| | | | |

| | | 1 year | | | 5 years | | | 10 years | | | Lifetime | |

Class A (Est. Jan. 4, 1995) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.56% | | | | +3.58% | | | | +3.43% | | | | +4.71% | |

Including sales charge | | | -3.95% | | | | +2.63% | | | | +2.96% | | | | +4.51% | |

Class C (Est. Jan. 11, 1995) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | -0.19% | | | | +2.81% | | | | +2.66% | | | | +3.90% | |

Including sales charge | | | -1.17% | | | | +2.81% | | | | +2.66% | | | | +3.90% | |

Institutional Class (Est. Dec. 31, 2013) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.82% | | | | n/a | | | | n/a | | | | +3.76% | |

Including sales charge | | | +0.82% | | | | n/a | | | | n/a | | | | +3.76% | |

Bloomberg Barclays Municipal Bond Index | | | +0.49% | | | | +4.12% | | | | +4.32% | | | | +3.87%* | |

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 22. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service fee of 0.25% of average daily net assets. Performance for Class A shares,

excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

21

Performance summaries

Delaware Tax-Free Idaho Fund

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, regional, and other factors of that state than geographically diversified funds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s,

Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.61% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | | | |

| Fund expense ratios | | Class A | | | | Class C | | | | Institutional Class |

Total annual operating expenses (without fee waivers) | | 1.00% | | | | 1.75% | | | | 0.75% |

Net expenses (including fee waivers, if any) | | 0.86% | | | | 1.61% | | | | 0.61% |

Type of waiver | | Contractual | | | | Contractual | | | | Contractual |

*The aggregate contractual waiver period covering this report is from Dec. 29, 2016 through Dec. 29, 2018.

22

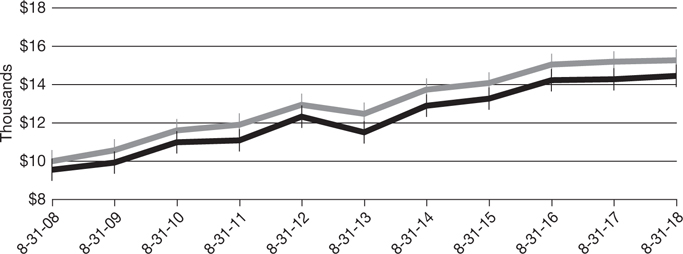

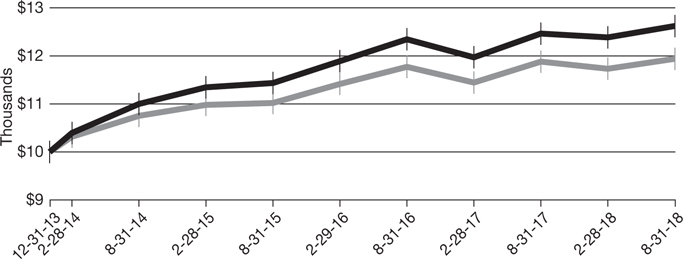

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2008 through Aug. 31, 2018

| | | | | | | | |

For period beginning Aug. 31, 2008 through Aug. 31, 2018 | | Starting value | | | Ending value | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index

| | | $10,000 | | | | $15,263 | |

Delaware Tax-Free Idaho Fund — Class A shares Delaware Tax-Free Idaho Fund — Class A shares

| | | $9,550 | | | | $13,384 | |

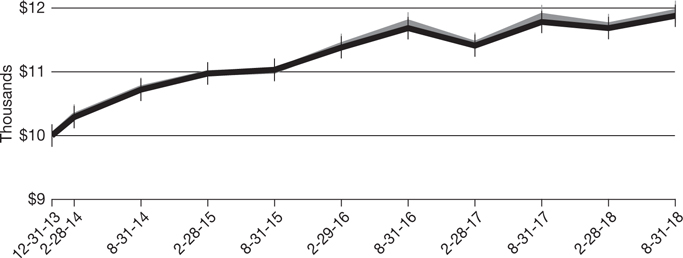

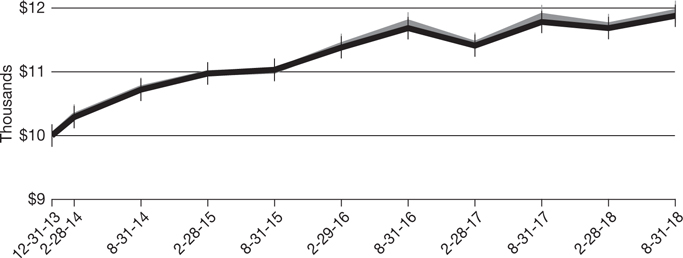

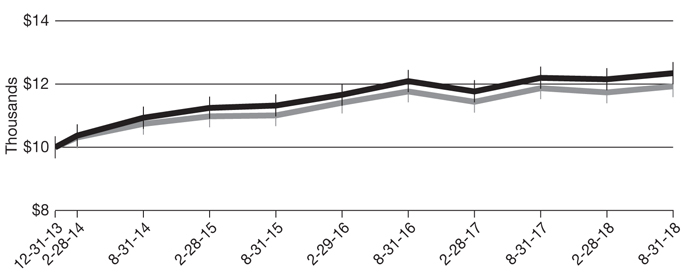

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2018

| | | | | | | | |

For period beginning Dec. 31, 2013 through Aug. 31, 2018 | | Starting value | | | Ending value | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index

| | | $10,000 | | | | $11,936 | |

Delaware Tax-Free Idaho Fund — Institutional Class shares Delaware Tax-Free Idaho Fund — Institutional Class shares

| | | $10,000 | | | | $11,878 | |

23

Performance summaries

Delaware Tax-Free Idaho Fund

1The “Performance of a $10,000 investment” graph for Class A shares assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2008, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Aug. 31, 2008.

The “Performance of a $10,000 investment” graph for Institutional Class shares assumes $10,000 invested in Institutional Class shares of the Fund on Dec. 31, 2013, and includes the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Dec. 31, 2013.

The graphs do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense

limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 22. Please note additional details on pages 21 through 24.

The Bloomberg Barclays Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund share classes will vary due to different charges and expenses.

| | | | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | VIDAX | | 928928704 | | |

Class C | | DVICX | | 928928803 | | |

Institutional Class | | DTIDX | | 928928159 | | |

24

| | |

| Performance summaries | | |

| Delaware Tax-Free New York Fund | | August 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| | | | | | | | | | | | | | | | |

| Fund and benchmark performance1,2 | | Average annual total returns through August 31, 2018 | |

| | | | |

| | | 1 year | | | 5 years | | | 10 years | | | Lifetime | |

Class A (Est. Nov. 6, 1987) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.60% | | | | +4.64% | | | | +4.53% | | | | +5.50% | |

Including sales charge | | | -3.95% | | | | +3.68% | | | | +4.04% | | | | +5.34% | |

Class C (Est. April 26, 1995) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | -0.16% | | | | +3.86% | | | | +3.75% | | | | +3.87% | |

Including sales charge | | | -1.14% | | | | +3.86% | | | | +3.75% | | | | +3.87% | |

Institutional Class (Est. Dec. 31, 2013) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.93% | | | | n/a | | | | n/a | | | | +4.72% | |

Including sales charge | | | +0.93% | | | | n/a | | | | n/a | | | | +4.72% | |

Bloomberg Barclays Municipal Bond Index | | | +0.49% | | | | +4.12% | | | | +4.32% | | | | +3.87%* | |

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 26. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service fee of 0.25% of average daily net assets. Performance for Class A shares,

excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

25

Performance summaries

Delaware Tax-Free New York Fund

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, regional, and other factors of that state than geographically diversified funds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s,

Moody’s Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.55% of the Fund’s average daily net assets during the period from Sept. 1, 2017 to Aug. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | | | | | | | | | |