The Property

The Property is currently being developed as a 76-unit luxury townhome development project. The Property addresses are to be issued throughout development. The Property is located on approximately 8.014 acres of land in Blaine, Minnesota, legally described as Lot 1, 2, 3, 4, 5, 6, 7 and 8, Block 1, Foxtail Hollow, Anoka County, Minnesota, more particularly legally described as follows:

Lot 1, 2, 3, 4, 5 and 6, Block 2, Foxtail Hollow, Anoka County, Minnesota.

Lot 1, 2, 3, 4, 5 and 6, Block 3, Foxtail Hollow, Anoka County, Minnesota.

Lot 1, 2, 3 and 4, Block 4, Foxtail Hollow, Anoka County, Minnesota.

Lot 1, 2, 3, 4 and 5, Block 5, Foxtail Hollow, Anoka County, Minnesota.

Lot 1, 2, 3 and 4, Block 6, Foxtail Hollow, Anoka County, Minnesota.

Lot 1, 2, 3, 4, 5, 6 and 7, Block 7, Foxtail Hollow, Anoka County, Minnesota.

Lot 1, 2, 3, 4, 5, 6, 7 and 8, Block 8, Foxtail Hollow, Anoka County, Minnesota.

Lot 1, 2, 3, 4, 5, 6 and 7, Block 9, Foxtail Hollow, Anoka County, Minnesota.

Lot 1, 2, 3, 4, 5, 6 and 7, Block 10, Foxtail Hollow, Anoka County, Minnesota.

Lot 1, 2, 3, 4, 5, 6 and 7, Block 11, Foxtail Hollow, Anoka County, Minnesota.

Lot 1, 2, 3, 4, 5, 6 and 7, Block 12, Foxtail Hollow, Anoka County, Minnesota.

Outlot A, Foxtail Hollow, Anoka County, Minnesota.

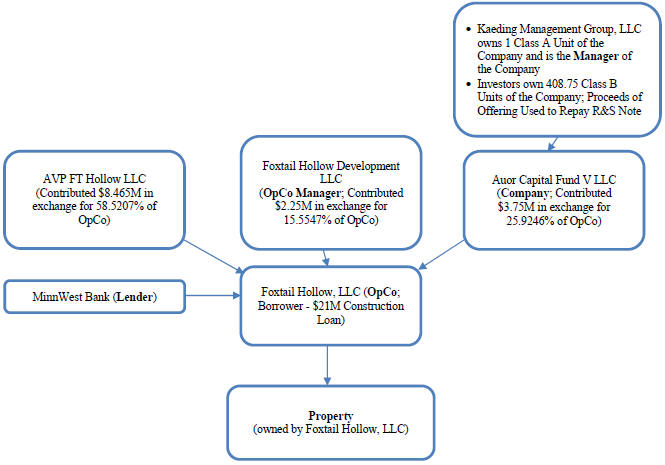

The Property is subject to a first lien mortgage securing repayment of a construction loan of up to $21,000,000, under which $3,069,906.02 has been drawn upon and is outstanding as of April 1, 2024 (the “Construction Loan”). The Construction Loan agreement was entered into by and between OpCo and Minnwest Bank (“Lender”) on or about January 24, 2024, and provides for interest-only monthly payments beginning on March 1st, 2024 on the then outstanding principal of all advances until February 1, 2027 (the “Maturity Date”), at which time the entire outstanding principal and accrued but unpaid interest shall be due and payable. No payments of principal are due until the Maturity Date. The Maturity Date of the construction loan may be extended for two consecutive one-year periods, during which time only interest payments shall continue to be due. The Construction Loan currently bears interest at the SOFR one month forward looking term rate plus 250 basis points per annum, calculated on a 360-day year. For a more complete description of OpCo’s existing indebtedness, see “Description of the Property—Existing Indebtedness” beginning on page 19.

Sale of Townhomes

This Project is a “build, lease, sell” project. As units in the Project are completed they will be made available for lease, and the leasing process will be managed by the Manager and Scott Management, Inc. (“Scott Management”) pursuant to a Lease Up and Management Agreement dated effective as of September 28th, 2023. We expect the first units to be completed in April of 2024, the last Class B Units to be completed in December of 2024, and the Project to be stabilized by mid-2025. Once the Project is stabilized the intent will be to list the entire Project for sale to a real estate operator who will continue to lease the units, with plans to sell between late 2025 and mid-2026. The Manager and Scott Management will manage the leasing and sale processes. These timelines are estimates only and are subject to acceleration or delay based on the success of the Project.

Acquisition of the Interest

The Company previously obtained a loan from R&S Corporate Holdings, Inc., a Minnesota corporation (“R&S”), in the original principal amount of $3,750,000, pursuant to a duly executed promissory note (the “R&S Note”). R&S also owns 8.89% of the issued and outstanding membership interest in and to the OpCo Manager. The Company contributed the proceeds of the R&S Note to OpCo as a capital contribution in exchange for the Interest, constituting 25.9246% of the issued and outstanding membership interest in and to OpCo. The Interest entitles the Company to receive a 25.9246% share of the profits and losses of OpCo. The Company will use the proceeds of this offering to repay the R&S Note and pay certain costs and expenses incurred in this offering. If we sell Class B Units equal to the total maximum offering amount set forth on the cover of this offering circular, the Company will have sufficient funds to repay the R&S Note in its entirety, including all outstanding principal and accrued but unpaid interest. If the proceeds raised pursuant to this offering are insufficient to fully and finally satisfy the R&S Note, R&S Corporate Holdings, Inc. will have the option to convert the unpaid portion into Class B Units of the Company at the same purchase price of the Class B Units sold pursuant to this offering. If R&S Corporate Holdings, Inc. does not elect to convert the unpaid obligations under the R&S Note, the Company will rely on the distributions from OpCo to repay the R&S Note pursuant to its terms.

2