As filed with the U.S. Securities and Exchange Commission on October 31, 2024

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PicoCELA Inc.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Japan | 3640 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

2-34-5 Ningyocho, SANOS Building, Nihonbashi

Chuo-ku, Tokyo 103-0013 Japan

+81 03-6661-2780

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

Ying Li, Esq. Brian B. Margolis, Esq. Hunter Taubman Fischer & Li LLC 950 Third Avenue, 19th Floor New York, NY 10022 212-530-2206 | Michael Blankenship, Esq. Winston & Strawn LLP 800 Capitol St., Suite 2400 Houston, TX 77002 713 651-2678 |

Approximate date of commencement of proposed sale to the public: Promptly after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement on Form F-1 (File No. 333-[ ]) contains disclosure that will be circulated as two separate final prospectuses, as set forth below.

| ● | Public offering prospectus. A prospectus (the “Public Offering Prospectus”) to be used for the public offering of 2,000,000 American depositary shares representing 2,000,000 Common Shares of the Company (the “Public Offering ADSs”), based on an assumed initial public offering price of $[ ], through the underwriters named on the cover page of the Public Offering Prospectus. |

| ● | Resale prospectus. A prospectus (the “Resale Prospectus”) to be used for the offer and potential resale by the selling shareholders identified in this registration statement (the “Selling Shareholders”) of 2,000,040 American depositary shares representing 2,000,040 Common Shares of the Company (the “Shareholder ADSs”), based on an assumed initial public offering price of $[ ]. The Selling Shareholders own Common Shares of the Registrant prior to this offering, which will be converted into Shareholder ADSs effective immediately following the effective time of this registration statement. |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | it contains different outside and inside front covers and back cover pages; among other things, the identification of the underwriters and related compensation for the Public Offering ADSs will only be included in the Public Offering Prospectus and the Shareholder ADSs will be listed on the outside and inside front covers of the Resale Prospectus without identification of the underwriters and related compensation information; |

| ● | it contains different “Offering” sections in the Prospectus Summary section relating to the offering of the Public Offering ADSs and the Shareholder ADSs, as applicable; such Offering section included in the Public Offering Prospectus will summarize the offering of the Public Offering ADSs and such Offering section included in the Resale Prospectus will summarize the offering of the Shareholder ADSs; |

| ● | it contains different “Use of Proceeds” sections, with the Use of Proceeds section included in the Resale Prospectus only indicating that the Registrant will not receive any proceeds from the sale of the Shareholder ADSs by the Selling Shareholders that occur pursuant to this registration statement; |

| ● | it does not contain the Capitalization and Dilution sections included in the Public Offering Prospectus; |

| ● | a “Selling Shareholders” section is only included in the Resale Prospectus; |

| ● | the “Underwriting” section from the Public Offering Prospectus is not included in the Resale Prospectus and the “Plan of Distribution” section is included only in the Resale Prospectus; and |

| ● | it does not contain the Legal Matters section and does not include a reference to counsel for the underwriters. |

The Company has included in this registration statement a set of alternate pages after the back-cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the Selling Shareholders.

The Selling Shareholders have represented to the Company that they will consider selling some or all of their respective Shareholder ADSs registered pursuant to this registration statement immediately after the pricing of the public offering, as requested by the underwriters for the public offering in order to create an orderly, liquid market for the American depositary shares (“ADSs”). As a result, the sales of our ADSs registered in this registration statement will result in two offerings by the Registrant taking place concurrently or sequentially, which could affect the price and liquidity of, and demand for, our ADSs. This risk and other risks are included in “Risk Factors” in each of the Public Offering Prospectus and the Resale Prospectus.

The information in this prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

| SUBJECT TO COMPLETION | PRELIMINARY PROSPECTUS DATED [●], 2024 |

PicoCELA Inc.

2,000,000 American Depositary Shares

Representing 2,000,000 Common Shares

This is an initial public offering of the American depositary shares (the “ADSs”) representing our common shares (“Common Shares”), no par value. We are offering 2,000,000 ADSs and each ADS represents one Common Share. Prior to this offering, there has been no public market for the ADSs or our Common Shares. We expect the initial public offering price of the ADSs to be in the range of $4.00 to $6.00 per ADS.

The number of our authorized shares is 91,735,440 Common Shares. We have 22,933,860 Common Shares issued and outstanding as of the date of this prospectus. In addition, we issued to two shareholders convertible bonds which were convertible into 2,085,120 Common Shares and 1,042,560 Common Shares, respectively. The right to convert to Common Shares underlying the convertible bonds granted to both shareholders expired on August 30, 2024 and neither of them exercised such right before it expired. See “Prospectus Summary—Recent Development—Convertible Bond Agreement” and “Principal Shareholders.” Each Common Share represent one vote. We have agreed to issue warrants to Spirit Advisors LLC (“Spirit Advisors”), which provides advisory consulting services to us. The warrants are automatically exercisable upon this offering. See “Prospectus Summary—Recent Development—Consulting Agreement.” We have historically awarded stock options to various officers, directors and employees of the Company to purchase Common Shares of the Company (the “Plan”). See “Management—Stock Based Compensation Plan.”

We intend to apply to list the ADSs on the Nasdaq Capital Market (“Nasdaq”) under the symbol “PCLA.” At this time, Nasdaq has not yet approved our application to list the ADSs. The closing of this offering is conditioned upon Nasdaq’s final approval of our listing application, and there is no guarantee or assurance that the ADSs will be approved for listing on Nasdaq.

Investing in the ADSs involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 9 to read about factors you should consider before buying the ADSs.

We are an “emerging growth company” as defined under the federal securities laws and will be subject to reduced public company reporting requirements. Please read the disclosures beginning on page 7 of this prospectus for more information.

| Per ADS | Total Without Over-Allotment Option | Total With Over-Allotment Option | ||||||||||

| Initial public offering price | $ | $ | $ | |||||||||

| Underwriter’s discounts(1) | $ | $ | $ | |||||||||

| Proceeds to our company before expenses(2) | $ | $ | $ | |||||||||

| (1) | Represents underwriting discounts equal to 8.5% per ADS. For a description of the compensation to be received by the underwriters, see “Underwriting” beginning on page 109. |

| (2) | We expect our total cash expenses for this offering (including cash expenses payable to the Representatives for their out-of-pocket expenses) to be approximately $[●], exclusive of the above discounts. |

| The underwriters are selling 2,000,000 ADSs (or 2,300,000 ADSs if the underwriters exercise the over-allotment option in full) in this offering on a firm commitment basis. The underwriters are obligated to take and pay for all of the ADSs if any such ADSs are taken. We have granted the underwriters an option for a period of 45 days after the effective date of the registration statement of which this prospectus forms a part to purchase up to 15% of the total number of the ADSs to be offered by us in the offering, solely for the purpose of covering over-allotments, if any, at the IPO price less the underwriting discounts. If the underwriters exercise the option in full, the total underwriting discounts payable will be $[ ], based on an assumed IPO price of $[ ] per ADS, and the total gross proceeds to us, before underwriting discounts and expenses, will be $[ ]. |

The underwriters expect to deliver the ADSs against payment in U.S. dollars in New York, New York on or about , 2024.

Neither the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|  |

Prospectus dated , 2024

TABLE OF CONTENTS

| I |

About this Prospectus

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the ADSs offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is current only as of the date on the cover page of this prospectus. Our business, financial condition, results of operations, and prospects may have changed since that date.

Our functional currency and reporting currency are the Japanese yen (“JPY” or “¥”), the legal currency of Japan. The terms “dollar” or “$” refer to U.S. dollars, the legal currency of the United States. Convenience translations included in this prospectus of Japanese yen into U.S. dollars have been made at the exchange rates of ¥151.22=$1.00, which was the foreign exchange rate on March 29, 2024 (Friday) as reported by the Board of Governors of the Federal Reserve System (the “U.S. Federal Reserve”) in its weekly release on April 1, 2024. Historical and current exchange rate information may be found at https://www.federalreserve.gov/releases/h10/.

Conventions that Apply to this Prospectus

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| ● | “ADRs” are to the American Depositary Receipts that may evidence the ADSs; | |

| ● | “ADSs” are to the American Depositary Shares, each of which represents one Common Share; | |

| ● | “JPY” or “¥” are to Japanese yen, the legal currency of Japan. | |

| ● | “SEC” are to the U.S. Securities and Exchange Commission; and | |

| ● | “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States. | |

| ● | “we,” “us,” “our,” “our Company,” “PicoCELA,” or the “Company” are to PicoCELA Inc. and its subsidiaries, as the case may be. |

Unless the context indicates otherwise, all information in this prospectus assumes no exercise by the underwriters of their over-allotment option.

Glossary of Technical Terms

This glossary contains explanations of certain terms used in this prospectus. Unless we indicate otherwise, references in this prospectus to:

| ● | “access network” are to wireless links between Wi-Fi access points and user terminals such as smartphones and personal computers (“PCs”); | |

| ● | “application programming interface” or “API” are to a way for two or more computer programs or components to communicate with each other; | |

| ● | “backhaul” are to the portion of a hierarchical telecommunication network which relay links connecting each wireless base station to the Internet; | |

| ● | “Bluetooth” are to a short-range wireless technology standard that is used for exchanging data between fixed and mobile devices over short distances and building personal area networks (PANs). In the most widely used mode, transmission power is limited to 2.5 milliwatts, giving it a very short range of up to 10 meters (33 ft). It employs UHF radio waves in the ISM bands, from 2.402 GHz to 2.48 GHz. It is mainly used as an alternative to wired connections to exchange files between nearby portable devices and connect cell phones and music players with wireless headphones; | |

| ● | “Bluetooth gateway” are to a wireless base station that connects to multiple Bluetooth-compatible devices, such as remote sensors, to connect them to the Internet; | |

| ● | “captive portal” are to a web page accessed with a web browser that is displayed to newly connected users of a Wi-Fi network before they are granted broader access to network resources. It is typically used at a public network by business centers, airports, hotel lobbies, coffee shops and other public venues that offer free Wi-Fi hotspots for internet users. | |

| ● | “cloud-computing” are to a practice of using a network of remote servers hosted on the internet to store, manage, and process data, rather than a local server, a personal computer or a local newt work device. | |

| ● | “demodulation” are to extracting the original information-bearing signal from a carrier wave; | |

| ● | “digital goods” are software programs, music, videos or other electronic files that users download exclusively from the Internet. | |

| ● | “digital taxation” are to a taxation of digital goods imposed on the profit generated by sale of digital goods by national tax jurisdictions; and |

| 1 |

| ● | “edge-computer” are to a computing device that is ubiquitously deployed in places where people live and engage in activities such as buildings, public spaces, parks, and so on. The edge computer is equipped with a main processor, data memory, data storage, operating system, application software, wired or wireless interfaces. The wireless interface of an edge computer allows mobile devices such as smartphones, tablets or laptops to connect to the edge computer to provide not only Internet connectivity but also various services such as image recognition, web portal, data cache. | |

| ● | “edge computing” are to a distributed computing model that brings computation and data storage closer to the sources of data, such as mobile devices. That distinguishes edge computing from cloud computing, where hosted services, such as data storage, servers, databases, networking, and software, are processed in a centralized cloud data center, with other computers and mobile devices connected remotely. Generally, edge computing refers to any design that moves computation physically closer to a user, so as to reduce the latency compared to the situation when an application runs on a single data center. Edge-computing is effective in reducing the data traffic from the edge-computer to the remote cloud data center, compared to the case that mobile devices must communicate to the remote cloud data center. | |

| ● | “graphical user interface” or “GUI,” are to a form of user interface that allows users to interact with electronic devices through graphical icons and visual indicators such as secondary notation; | |

| ● | “hop” are to a wireless relay link between two nodes. One node relays data packets wirelessly to the other node or vice versa; | |

| ● | “integrated circuit,” or “IC chip,” are to a small electronic device made up of multiple interconnected electronic components such as transistors, resistors, and capacitors. These components are etched onto a small piece of semiconductor material, usually silicon; | |

| ● | “internet of things” or “IoT” are to devices with sensors, processing ability, software and other technologies that connect and exchange data with other devices and systems over the Internet or other communications networks; | |

| ● | “LAN” are to a local area network that includes local client devices and local servers connected by network switches. The client devices and servers are connected to each other by means of an electrical cable, fiber optic cable or radio waves. | |

| ● | “low-power wide-area network” or “LPWA network” are to a type of wireless telecommunication wide area network designed to allow long-range communication at a low bit rate between IoT (Internet of Things) devices, such as sensors operated on a battery; | |

| ● | “mesh Wi-Fi access point” are to a wireless device that is capable of wirelessly connecting to other mesh Wi-Fi access points as well as wirelessly connecting to mobile station devices. The mesh Wi-Fi access point is equipped with different radio modules, i.e. one for wireless connection to the other mesh Wi-Fi access points and one for connection to the mobile station devices. | |

| ● | “mesh link” are to a wireless link that connects two mesh Wi-Fi access points in a mesh Wi-Fi access points network. Mesh Wi-Fi access points network is organized by multiple mesh links; | |

| ● | “mesh cluster by PBE” is a cluster consisting of a single parent unit connected by LAN cable and multiple child units connected by wireless multi-hop relay under the said parent unit; | |

| ● | “middleware” are to a type of computer software program that provides services to software applications beyond those available from the operating system; | |

| ● | “modulation” are to the process of varying one or more properties of a periodic waveform, called the carrier signal, with a separate signal called the modulation signal that typically contains information to be transmitted; | |

| ● | “multi-hop routing” are to a type of communication in radio networks in which network coverage area is larger than radio range of single nodes. Therefore, to reach some destination a node can use other nodes as relays; |

| 2 |

| ● | “multi-hop relay” are to a multi-stage relay of data packets between a source node and a destination node via intermediate relay nodes; | |

| ● | “network throughput” are to the rate of message delivery over a communication channel, such as Ethernet or packet radio, in a communication network; | |

| ● | “node” are to a wireless device that transmits and receives data packets; | |

| ● | “open systems interconnection reference model” or “OSI reference model” are to a reference model from the International Organization for Standardization (ISO) that provides a common basis for the coordination of standards development for the purpose of systems interconnection. In the OSI reference model, the communications between systems are split into seven different abstraction layers: Physical, Data Link, Network, Transport, Session, Presentation, and Application; | |

| ● | “packets” are to a protocol data unit at layer 3, the network layer, in the seven-layer OSI model of computer networking; | |

| ● | “proprietary protocol” are to a communications protocol owned by a single organization or individual. A communication protocol is a system of rules that allows two or more entities of a communications system to transmit information via any variation of a physical quantity. The protocol defines the rules, syntax, semantics, and synchronization of communication and possible error recovery methods. Protocols may be implemented by hardware, software, or a combination of both; | |

| ● | “protocol stack” are to an implementation of a computer networking protocol suite or protocol family; | |

| ● | “radio propagation” are to the behavior of radio waves as they travel, or are propagated, from one point to another in vacuum, or into various parts of the atmosphere; | |

| ● | “received signal strength indicator” or “RSSI” are to a measurement of the power present in a received radio signal; | |

| ● | “routing” are to the process of selecting a path for traffic in a network or between or across multiple networks; |

| ● | “SaaS” or “Software as a service” are to a software licensing and delivery model in which software is licensed on a subscription basis and is centrally hosted; | |

| ● | “tree routing” are to a low-overhead routing protocol designated for simple, low-cost and low-power wireless sensor networks. It avoids flooding the network with path search and update messages in order to conserve bandwidth and energy by using only parent–child links for packet forwarding; | |

| ● | “Wi-Fi access point” are to a device that creates a wireless local area network, or WLAN, usually in an office or large building. An access point connects to a wired router, switch, or hub via an Ethernet cable, and projects a Wi-Fi signal to a designated area. | |

| ● | “Wi-Fi Chips” are to an integrated circuit made of semiconductors, which are designed to process Wi-Fi radio activities and are installed in Wi-Fi access points device as its integral electronic components | |

| ● | “Wi-Fi frequency channel” are to a frequency range within which wireless devices can communicate; | |

| ● | “Wi-Halow” are to a global radio standard for low power and wide area network; | |

| ● | “wireless mesh network” are to a communications network made up of radio nodes organized in a mesh topology. A mesh refers to rich wireless interconnection among devices or nodes; | |

| ● | “virtual local area network” or “VLAN” are to a virtualized connection that connects multiple devices and network nodes from different LANs into one logical network; | |

| ● | “802.1 X authentication” are to an authentication process making sure something interfacing with the system is actually what it claims it is. When someone wants to gain access to a network using 802.11 and variants like 802.11n, b, or g, 802.1x authentication acts as a protocol that verifies the person connecting is who they say they are. It works for both wireless and wired devices; |

| 3 |

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements included elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in the ADSs, discussed under “Risk Factors,” before deciding whether to buy the ADSs.

Unless otherwise indicated, all share amounts and per share amounts in this prospectus have been presented giving effect to a forward split of our Common Shares at a ratio of 60-for-1 share approved by our board of directors on October 6, 2024.

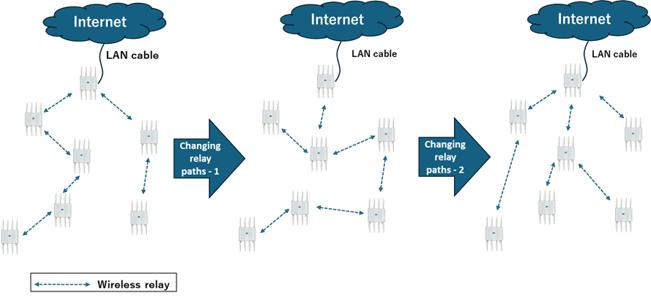

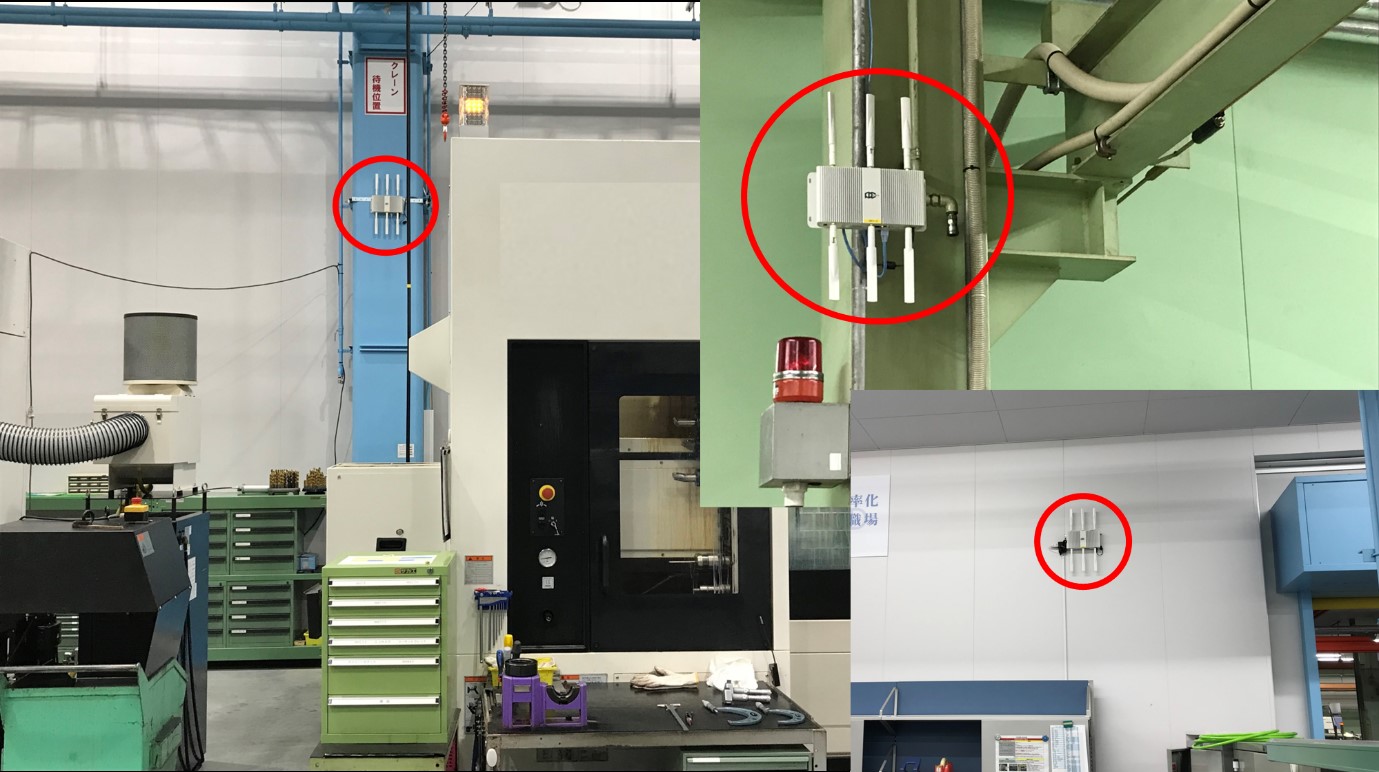

Overview

We are engaged in the manufacturing, installation, and services for enterprise wireless mesh solutions. We derive our revenues mainly from two sources: (1) sales of product equipment, and (2) SaaS, maintenance and others. Under the first revenue source, we develop mesh Wi-Fi access point devices, PCWL series, adopting our proprietary patented wireless mesh communication technology software PicoCELA Backhaul Engine (“PBE”), which enables wireless Wi-Fi and mesh communication by linking a chain of multiple wireless Wi-Fi access points by radio communication not by cabling. We outsource the manufacturing of PCWL series, our mesh Wi-Fi access point devices incorporating the technology, and sell PCWL series both through distributors and to end customers directly. Under the second revenue source, we provide a cloud portal service in a SaaS model, which enables users to monitor connectivity and communication traffic at each of our mesh Wi-Fi access points. Our cloud portal service also serves as a platform for customers to install their proprietary edge-computing software into our mesh Wi-Fi access point devices. We also license our patented wireless mesh technology to third-party manufacturers which utilize our wireless mesh technology. Please see further details in Business starting at page 47 of this prospectus.

Our business is geographically concentrated. We operate solely in Japan and generate revenue from this market as of the date of this prospectus. Due to this geographic concentration, our results of operations and financial conditions are subject to greater risks from changes in general economic and other conditions in Japan, than the operations of more geographically diversified competitors. See “Risk Factors—Risks Related to Our Business and Industry—Our business is geographically concentrated, which subjects us to greater risks from changes in local or regional conditions” and “Business.”

Some of the technologies used in our products are licensed from Kyushu University, and the termination of these licenses could have a material adverse effect on our business. See “Risk Factors—Risks Related to Our Business and Industry—Some of the components used in our products are purchased from a limited number of sources. Some of the technologies we used are licensed from Kyushu University. The loss of any of these suppliers or licenses may cause us to incur additional transition costs, result in delays in the manufacturing and delivery of our products, or cause us to carry excess or obsolete inventory and could cause us to redesign our products” and “Business—Intellectual Property.”

We outsource the manufacturing of all hardware products, PCWL series, and our mesh Wi-Fi access points devices, and are therefore subject to certain risks if our third-party manufacturers do not provide our end-customers with the quality and performance that they expect from our products. As of the date of this prospectus, we maintain a stable relationship with our major manufacturers. While we may have certain contractual remedies against them, if any of our major manufacturers becomes unable or unwilling to continue to manufacture our PCWL series, such remedies may not be sufficient in scope, we may not be able to effectively enforce such remedies, and we may incur significant costs in enforcing such remedies. See “Risk Factors—Risks Related to Our Business and Industry—We rely on third parties to manufacture our mesh Wi-Fi access points devices we offer and depend on them for the supply and quality of our products” and “Business—Manufacturing and Suppliers.”

For the six months ended March 31, 2024 and 2023, we had a total revenue of JPY278,481 thousand (approximately $1,842 thousand), and JPY117,421 thousand, respectively. Revenue generated from the sales of product equipment was JPY231,069 thousand (approximately $1,528 thousand) and JPY83,238 thousand for the six months ended March 31, 2024 and 2023, respectively. Revenue derived from SaaS, maintenance and others was JPY47,412 thousand (approximately $314 thousand) and JPY34,183 thousand for the six months ended March 31, 2024 and 2023, respectively. For the fiscal years ended September 30, 2023 and 2022, we had a total revenue of JPY559,521 thousand (approximately $3,700 thousand), and JPY682,121 thousand, respectively. Revenue generated from the sales of product equipment was JPY465,691 thousand (approximately $3,080 thousand) and JPY540,857 thousand for the fiscal years ended September 2023 and 2022, respectively. Revenue derived from SaaS, maintenance and others was JPY93,830 thousand (approximately $620 thousand) and JPY141,264 thousand for the fiscal years ended September 2023 and 2022, respectively.

However, our revenues have been uncertain and volatile, subject to the condition of our supply chain of Wi-Fi Chips. See “Impact of the COVID-19 Pandemic on Our Operations and Financial Performance,” “Risk Factors—Risks Related to Our Business and Industry—Revenue generated from our development and sales of mesh Wi-Fi access points, PCWL series, have been uncertain and volatile, subject to our supply chain of Wi-Fi Chips,” “Risk Factors—Risks Related to Our Business and Industry—A shortage of Wi-Fi Chips or labor, or increases in their costs, could delay delivery and launch of our mesh Wi-Fi access points or increase its cost, which could materially and adversely affect us,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Factors Impacting Our Operating Results—Changes in supply or price of Wi-Fi Chips or labor costs.” Moreover, during the six months ended March 31, 2024 and 2023, and the fiscal years ended September 30, 2023 and 2022, we recorded a net loss. During the six months ended March 31, 2024 and 2023, the net loss was JPY317,817 thousand (approximately $2,102 thousand) and JPY331,048 thousand, respectively. During the fiscal year ended September 30, 2023 and 2022, the net loss was JPY633,956 thousand (approximately $4,242 thousand) and JPY5,180 thousand, respectively. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations” and our unaudited financial statements for the six months ended March 31, 2024 and 2023 and audited financial statements for the fiscal year ended September 30, 2023 and 2022. As of September 30, 2023 and September 30, 2022, the Company has net operating loss carryforwards in Japan of approximately JPY1,748 million (approximately $12 million) and JPY1,091 million, respectively, which can be carried forward to offset future taxable income. In addition, as of March 31, 2024 and 2023, we had accumulated deficit of JPY2,040,564 thousand (approximately $13,494 thousand) and JPY1,722,747 thousand, respectively. As of September 30, 2023 and 2022, we had accumulated deficit of JPY1,722,747 thousand (approximately $11,392 thousand) and JPY1,088,791 thousand, respectively. See “Risk Factors—Risks Related to Our Business and Industry—We have not been profitable and have incurred negative cash flows in operating activities, both of which may continue in the future” and our unaudited financial statements for the six months ended March 31, 2024 and 2023 and audited financial statements for the fiscal year ended September 30, 2023 and 2022.

Competitive Strengths

We believe that the following competitive strengths have contributed to our success and differentiated us from our competitors:

| ● | Specialty and experience in industrial-use mesh Wi-Fi network in demanding environments; | |

| ● | Extensive product offerings with diverse application use cases; and | |

| ● | A founder-led management team with strong technology, operational, and financial backgrounds and track records. |

Growth Strategies

We intend to develop our business and strengthen brand loyalty by implementing the following strategies:

| ● | Integrating enterprise edge-computing software into our mesh Wi-Fi access points; | |

| ● | Expanding PicoManager, our SaaS model; | |

| ● | Offering a cost-effective alternative built on customers’ existing hardware; and | |

| ● | Global expansion and partnering with local distributors. |

Our Securities

On October 6, 2024, our board of directors approved a forward split of our outstanding Common Shares at a ratio of 60-for-1 share. Unless otherwise indicated, all references to Common Shares, options to purchase Common Shares, share data, per share data, and related information have been retroactively adjusted, where applicable, in this prospectus to reflect the forward split of our Common Shares and the additional share issuances to our existing shareholders as if they had occurred at the beginning of the earliest period presented.

Summary of Risk Factors

Investing in the ADSs involves significant risks. You should carefully consider all of the information in this prospectus before making an investment in the ADSs. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more fully in the section titled “Risk Factors” starting from page 9 of this prospectus.

| 4 |

Risks Related to Our Business and Industry

Risks and uncertainties related to our business include the following:

| ● | the enterprise mesh Wi-Fi access points market in Japan is highly competitive and if we cannot continue to remain competitive, our operations could be adversely impacted (see the risk factor beginning on page 9 of this prospectus); | |

| ● | revenue generated from our development and sales of mesh Wi-Fi access points, PCWL series, have been uncertain and volatile, subject to our supply chain of Wi-Fi Chips (see the risk factor beginning on page 9 of this prospectus); | |

| ● | we have not been profitable and have incurred negative cash flows in operating activities, both of which may continue in the future (see the risk factor beginning on page 9 of this prospectus); | |

| ● | we rely substantially on short-term borrowings to fund our operations, and the failure to renew these short-term borrowings or the failure to continue to obtain financing on favorable terms, if at all, may adversely affect our ability to operate our business (see the risk factor beginning on page 9 of this prospectus); | |

| ● | our substantial indebtedness could materially and adversely affect our business, financial condition, results of operations, and cash flows (see the risk factor beginning on page 10 of this prospectus); | |

| ● | we rely on key relationships with cloud service providers and agencies across the enterprise mesh Wi-Fi access points industry, and to the extent they experience pressures in Internet communication load, labor, or timely delivery of service, it could in turn have an adverse impact on our business, prospect, liquidity, financial condition, and results of operations (see the risk factor beginning on page 10 of this prospectus); | |

| ● | a shortage of Wi-Fi Chips or labor, or increases in their costs, could delay delivery and launch of our mesh Wi-Fi access points or increase its cost, which could materially and adversely affect us (see the risk factor beginning on page 11 of this prospectus); | |

| ● | our enterprise mesh Wi-Fi access points operations are subject to the business, financial, and operating risks inherent to the enterprise mesh Wi-Fi access points industry, any of which could reduce our revenue and limit opportunities for growth (see the risk factor beginning on page 12 of this prospectus); | |

| ● | if we are unable to attract, train, assimilate, and retain employees that embody our culture, including engineers, researchers, product and service developers, and quality assurance professionals in the field of radio and Internet communication and senior managers, we may not be able to grow or successfully operate our business (see the risk factor beginning on page 14 of this prospectus); | |

| ● | we do not have sufficient insurance to cover potential losses and claims (see the risk factor beginning on page 15 of this prospectus); | |

| ● | in Japan, where we currently sell our products, we are required to obtain technical certification on all of our mesh Wi-Fi access point products under Radio Act and Telecommunications Business Act and violations of, or changes to, such laws and regulations may adversely affect our business. We will be required to obtain similar technical and product quality certifications from governmental authorities of the overseas markets where we plan to enter. (see the risk factor beginning on page 15 of this prospectus) | |

| ● | our business is geographically concentrated, which subjects us to greater risks from changes in local or regional conditions (see the risk factor beginning on page 16 of this prospectus); | |

| ● | we may be unsuccessful in selling our products internationally, which could adversely affect our results of operations (see the risk factor beginning on page 16 of this prospectus); | |

| ● | changes in the policies of the Japanese government that affect demand for enterprise mesh Wi-Fi access points may adversely affect the ability or willingness of prospective customers to purchase our Wi-Fi access points devices (see the risk factor beginning on page 18 of this prospectus); | |

| ● | we rely on third parties to manufacture our mesh Wi-Fi access points devices we offer, and depend on them for the supply and quality of our products (see the risk factor beginning on page 19 of this prospectus); | |

| ● | some of the components used in our products are purchased from a limited number of sources. Some of the technologies we used are licensed from Kyushu University. The loss of any of these suppliers or licenses may cause us to incur additional transition costs, result in delays in the manufacturing and delivery of our products, or cause us to carry excess or obsolete inventory and could cause us to redesign our products (see the risk factor beginning on page 19 of this prospectus); and | |

| ● | our continuing development largely depends upon our strong working relationships with our distributors (see the risk factor beginning on page 21 of this prospectus). |

Risks Relating to this Offering and the Trading Market

In addition to the risks described above, we are subject to general risks and uncertainties related to this offering and the trading market of the ADSs, including the following:

| ● | an active trading market for our Common Shares or the ADSs may not develop (see the risk factor beginning on page 22 of this prospectus); | |

| ● | you will experience immediate and substantial dilution in the net tangible book value of ADSs purchased (see the risk factor beginning on page 22 of this prospectus); |

| 5 |

| ● | the sale or availability for sale of substantial amounts of the ADSs could adversely affect their market price (see the risk factor beginning on page 22 of this prospectus); | |

| ● | the market price of the ADSs may be volatile or may decline regardless of our operating performance, and you may not be able to resell your ADSs at or above the initial public offering price (see the risk factor beginning on page 23 of this prospectus); | |

| ● | the price of the ADSs could be subject to rapid and substantial volatility. Such volatility, including any stock run-ups, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of the ADSs (see the risk factor beginning on page 23 of this prospectus); | |

| ● | we will incur substantial increased costs as a result of being a public company (see the risk factor beginning on page 24 of this prospectus); | |

| ● | our management has broad discretion to determine how to use the net proceeds raised in this offering and may use them in ways that may not enhance our results of operations or the price of the ADSs (see the risk factor beginning on page 25 of this prospectus); | |

| ● | rights of shareholders under Japanese law may be different from rights of shareholders in other jurisdictions (see the risk factor beginning on page 25 of this prospectus); | |

| ● | as holders of ADSs, you may have fewer rights than holders of our Shares and must act through the depositary to exercise those rights (see the risk factor beginning on page 25 of this prospectus); | |

| ● | we are incorporated in Japan, and it may be more difficult to enforce judgments obtained in courts outside Japan (see the risk factor beginning on page 27 of this prospectus); and | |

| ● | if we cannot satisfy, or continue to satisfy, the initial listing requirements and other rules of Nasdaq, the ADSs may not be listed or may be delisted, which could negatively impact the price of the ADSs and your ability to sell them (see the risk factor beginning on page 28 of this prospectus). |

Corporate Information

Our headquarters are located at 2-34-5 Ningyocho, SANOS Building, Nihonbashi, Chuo-ku, Tokyo 103-0013 Japan, and our phone number is +81 03-6661-2780. Our website address is https://picocela.com/en/. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus or the registration statement of which it forms a part. Our agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, NY 10168.

Corporate Structure

PicoCELA was incorporated in Tokyo, Japan in 2008 as a joint-stock corporation (kabushiki kaisha) with limited liability.

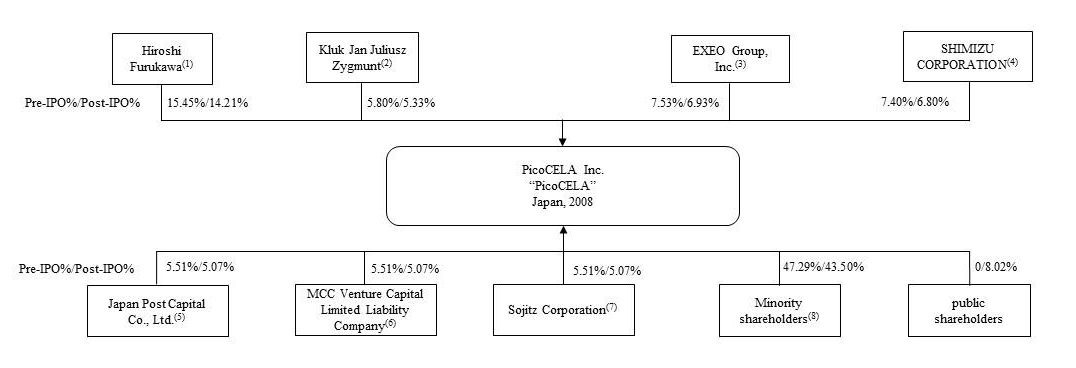

The following chart illustrates our corporate structure as of the date of this prospectus and upon completion of this IPO, assuming no exercise of the underwriter’s over-allotment options and not including an aggregate of 2,000,040 Shareholder ADSs. Each ADS represents one Common Share and each Common Share represents one vote.

| (1) | Representing 3,543,960 Common Shares held by our founder and CEO, Hiroshi Furukawa, as of the date of this prospectus. |

| (2) | Representing 1,330,140 Common Shares held by Kluk Jan Juliusz Zygmunt, with business address at Warsaw 00-116, ul.Swietokrzyska 30m65, Poland, as of the date of this prospectus. |

| (3) | Representing 1,727,820 Common Shares held by EXEO Group, a joint-stock corporation (Kabushiki kaisha) with limited liability incorporated in Japan, as of the date of this prospectus. Its business address is at 29-20, Shibuya 3-chome, Shibuya-ku, Tokyo. |

| (4) | Representing 1,696,440 Common Shares held by SHIMIZU CORPORATION (TYO: 1803; NAG: 1803), a joint-stock corporation (Kabushiki kaisha) with limited liability incorporated in Japan, as of the date of this prospectus. Its business address is at 2-16-1 Kyobashi, Chuo-ku, Tokyo.

|

| (5) | Representing 1,264,500 Common Shares held by Japan Post Capital Co., Ltd. as of the date of this prospectus. Japan Post Capital Co., Ltd. is a joint-stock corporation (Kabushiki kaisha) with limited liability incorporated in Japan. Its business address is at Otemachi 2 chome 3-1, Chiyoda-ku, Tokyo, Japan. It is a wholly-owned subsidiary of Japan Post Holdings Co., Ltd. (TYO: 6178), whose beneficial owner is the Japanese Government. |

| (6) | Representing 1,264,500 Common Shares held by MCC Venture Capital Limited Liability Company as of the date of this prospectus. MCC Venture Capital Limited Liability Company is a limited liability company (godo kaisha) and its business address is at 1-10-15 Jonouchi Chuo-ku, Osaka City, Osaka, Japan. The beneficial owner of MCC Venture Capital Limited Liability Company is Jikei Co. Ltd and its business address is 1-10-15 Jonouchi Chuo-ku, Osaka City, Osaka Japan. |

| (7) | Representing 1,264,500 Common Shares held by Sojitz Corporation (TYO: 2768), a joint-stock corporation (Kabushiki kaisha) with limited liability incorporated in Japan, as of the date of this prospectus. Its business address is at 1-1, Uchisaiwaicho 2-chome, Chiyoda-ku, Tokyo. |

| (8) | Representing an aggregate of 10,842,000 Common Shares held by 31 holders, each one of which holds less than 5% of our voting interest, as of the date of this prospectus. |

| 6 |

Impact of the COVID-19 Pandemic on Our Operations and Financial Performance

The COVID-19 pandemic has materially impacted our business operations and operating results. During the COVID-19 pandemic, production and supply chain of Wi-Fi Chips, the key materials to manufacture our mesh Wi-Fi devices, were materially impeded. The COVID-19 pandemic has materially impacted our business operations and operating results since our corporate customers shut down their facilities, such as plants, offices and retail chain stores, where our products would have been installed. This has materially impacted our revenue generated from product equipment sales. In addition to the impact on our sales of products, COVID-19 disrupted our supply chain in overseas outsourced manufacturing companies because many of our manufacturers shut down their assembly lines. Immediately after the COVID-19 pandemic, our overseas outsourced manufacturing companies resumed their factory operations, but they were faced with the global supply shortage of electrical components, including certain semiconductor chips such as Wi-Fi Chips, which were integral parts of our products. Our third-party manufacturers could not source the Wi-Fi Chips we specified at an affordable price, and, as a result, they could not complete our manufacturing orders on time. This not only adversely affected our ability to complete our existing customers’ orders, but also made it hard for us to sell our products to potential customers since we could not commit to a specific delivery date. The shortage of Wi-Fi Chips had a lingering adverse impact on our revenue even after the COVID-19 pandemic because we did not have sufficient financial resources and ability to purchase and capture the supply of Wi-Fi Chips. As a result, we were unable to bid for Wi-Fi Chips at a competitive price, and we had to wait until the supply of Wi-Fi Chips resumed and the price dropped back to an affordable level.

As the economy started recovering from the COVID-19 pandemic, the demand for Wi-Fi Chips surged which caused a shortage of Wi-Fi Chips worldwide and our supply chain was disrupted. As a result, the launch of our new mesh Wi-Fi devices was delayed significantly, leading to lower revenue in the fiscal year ended September 30, 2023. As of the date of this prospectus, the shortage of Wi-Fi Chips has been alleviated and our supply chain has resumed normal activities. However, we are unable to predict the possibility of Wi-Fi IC chip shortage’s happening again and, if so, the impact on the revenue and operating costs of our business in the future. Raw material supply shortages and supply chain constraints, including cost inflation, have impacted and could continue to negatively impact our ability to meet increased demand, which in turn could impact our net sales revenues and market share.

See “Risk Factors—Risks Related to Our Business and Industry—Our business could be materially and adversely disrupted by an epidemic or pandemic (such as the current COVID-19 pandemic), or similar public threat, or fear of such an event, and the measures that the governmental authorities implement to address it” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—The COVID-19 Pandemic Affecting Our Results of Operations.”

Implications of Our Being an “Emerging Growth Company”

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; | |

| ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as the “compensation discussion and analysis”; | |

| ● | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; | |

| ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency,” and “say-on-golden-parachute” votes); | |

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for- performance graph and chief executive officer pay ratio disclosure; | |

| ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and | |

| ● | will not be required to conduct an evaluation of our internal control over financial reporting until our second annual report on Form 20-F following the completion of this IPO. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions until we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an “emerging growth company” at the end of the fiscal year in which the fifth anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended (the “Securities Act”) occurred, if we have more than $1.235 billion in annual revenue, have $700 million or more in market value of the ADSs held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; | |

| ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; | |

| ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; | |

| ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material non-public information; | |

| ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and | |

| ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

| 7 |

THE OFFERING

| Securities offered by us | 2,000,000 ADSs. | |

| Over-allotment option | We have granted to the underwriters an option, exercisable within 45 days after the closing of this offering, to purchase up to an aggregate of 300,000 additional ADSs, or 15% of the total number of the ADSs to be offered by us in the offering. | |

| Price per ADS | We currently estimate that the initial public offering price will be in the range of $4.00 to $6.00 per ADS. | |

| Shares issued and outstanding prior to completion of this offering | 22,933,860 Common Shares | |

| Shares issued and outstanding immediately after this offering(1) | 24,933,860 Common Shares, assuming no exercise of the Representative’s over-allotment option

25,233,860 Common Shares, assuming full exercise of the Representative’s over-allotment option | |

| Shares issuable upon exercise of the warrants at the offering | 716,146 Common Shares are issuable to our financial advisor, Spirit Advisors, upon exercise of the warrants granted to them at the offering. The Common Shares issued to Spirit Advisors are not subject to lock up nor bear any registration rights. | |

ADSs outstanding immediately after this offering(2) | 2,000,000 ADSs assuming no exercise of the underwriters’ over-allotment option 2,300,000 ADSs assuming full exercise of the underwriters’ over- allotment option | |

| Listing | We have applied to list the ADSs on the Nasdaq. At this time, Nasdaq has not yet approved our application to list the ADSs. The closing of this offering is conditioned upon Nasdaq’s final approval of our listing application, and there is no guarantee or assurance that the ADSs will be approved for listing on Nasdaq. | |

| Proposed Ticker symbol | “PCLA” | |

| The ADSs | Each ADS represents one Common Share.

The depositary or its nominee will be the holder of the Common Shares underlying the ADSs and you will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary, and all beneficial owners and holders of ADSs issued thereunder.

Our board of directors may suggest to the shareholders meeting in the future that it resolves to pay dividends. Any decision to make such a suggestion in the future will be subject to a number of factors, including our financial condition, results of operations, the level of our retained earnings, capital demands, general business conditions, and other factors our board of directors may deem relevant. If we declare dividends on our Common Shares, the depositary will distribute the cash dividends and other distributions it receives on our Common Shares after deducting its fees and expenses in accordance with the terms set forth in the deposit agreement.

You may surrender your ADSs to the depositary for cancellation to withdraw the Common Shares underlying your ADSs. The depositary will charge you a fee for such cancellation.

We may amend or terminate the deposit agreement for any reason without your consent. Any amendment that imposes or increases fees or charges or which materially prejudices any substantial existing right you have as an ADS holder will not become effective as to outstanding ADSs until 30 days after notice of the amendment is given to ADS owners. If an amendment becomes effective, you will be bound by the deposit agreement as amended if you continue to hold your ADSs.

To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, which has been filed as an exhibit to the registration statement of which this prospectus forms a part. | |

| Depositary | Citibank, N.A. | |

| Use of proceeds | We intend to use the net proceeds from this offering for working capital for inventory production, product and service improvement, and R&D for new product and services. See “Use of Proceeds” on page 32 for more information. | |

| Lock-up | All of our directors, executive officers, and holders of more than 1% the outstanding Common Shares have agreed with the underwriters not to offer, pledge, sell, directly or indirectly, any of the ADSs, our Common Shares, or securities convertible into or exercisable or exchangeable for the ADSs or our Common Shares for a period of 180 days from the date of this offering. See “Shares Eligible for Future Sale” and “Underwriting” for more information. | |

| Risk Factors | The ADSs offered hereby involve a high degree of risk. You should read “Risk Factors,” beginning on page 9 for a discussion of factors to consider before deciding to invest in the ADSs. | |

| Payment and Settlement | The underwriters expect to deliver the ADSs against payment therefor through the facilities of The Depository Trust Company (“DTC”) on [●], 2024. |

| (1) | Unless otherwise indicated, the number of Common Shares outstanding prior to and after this offering is based on (i) 22,933,860 Common Shares issued and outstanding as of the date of this prospectus, and (ii) 2,000,000 ADSs to be sold in this IPO, assuming no exercise of the Representative’s over-allotment option or the warrants granted to Spirit Advisors. | |

| (2) | The number of ADSs to be outstanding immediately after this offering does not include an aggregate of 2,000,040 Shareholder ADSs, based on an assumed initial public offering price of $[]. The actual number of ADSs to be outstanding following this offering will be determined based on the actual initial public offering price. |

| 8 |

An investment in the ADSs involves a high degree of risk. Before deciding whether to invest in the ADSs, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of the ADSs to decline, resulting in a loss of all or part of your investment. The risks described below and discussed in other parts of this prospectus are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in the ADSs if you can bear the risk of loss of your entire investment.

Risks Related to Our Business and Industry

The enterprise mesh Wi-Fi access points market in Japan is highly competitive and if we cannot continue to remain competitive, our operations could be adversely impacted.

The enterprise mesh Wi-Fi access points market in Japan is highly competitive. Our industry of enterprise mesh Wi-Fi access points in Japan are dominated by a few global market leaders, such as Cisco’s Meraki and Hewlett Packard’s Aruba. The competitive factors influencing our market position include product innovation, price competitiveness, brand strength, customer service excellence, and the timely introduction of new technologies. In response to these market dynamics, we prioritize the security, reliability, and performance of our solutions to meet the growing demands of our customers and to navigate the complexities of the global mobile and wireless backhaul market. However, we cannot assure you that our strategies will remain competitive or that they will continue to be successful in the future. Increasing competition could result in pricing pressure and loss of our market share, either of which could have a material adverse effect on our financial condition and results of operations.

Revenue generated from our development and sales of mesh Wi-Fi access points, PCWL series, have been uncertain and volatile, subject to our supply chain of Wi-Fi Chips.

The revenue generated from our development and sales of our mesh Wi-Fi access points, PCWL series, have been uncertain and volatile, depending on our ability to obtain stable supply of Wi-Fi Chips sufficient to meet our manufacturing need. For the six months ended March 31, 2024, the supply of our Wi-Fi Chips have resumed normal activities and the price for Wi-Fi Chips has returned to our affordable level. Revenues increased by JPY161,060 thousand or 137.2% from JPY117,421 thousand for the six months ended March 31, 2023 to JPY278,481 thousand (approximately $1,842 thousand) for the six months ended March 31, 2024. This is mainly because our ability to manufacture and deliver our products to the market has recovered from the shortage of Wi-Fi Chips which caused a delay to our product launch and delivery of our products to the market. Revenues decreased by JPY122,600 thousand or 18.0% from JPY682,121 thousand for the fiscal year ended September 30, 2022 to JPY559,521 thousand (approximately $3,700 thousand) for the fiscal year ended September 30, 2023. Specifically, revenue from product equipment decreased by JPY75,166 thousand mainly due to significant delay in our new product launch, which resulted from a shortage of Wi-Fi Chips affecting our third-party manufacturers. Although we do not source Wi-Fi Chips directly, our third-party manufacturers need to source the Wi-Fi Chips designated by us to fulfill the requirements of our product design, and they have no discretion of choosing replacement chips if Wi-Fi Chips are unavailable in the required quantities or not available at all. If there is shortage of Wi-Fi Chips, our revenue would be negatively affected. See also “Prospectus Summary—Impact of the COVID-19 Pandemic on Our Operations and Financial Performance,” “—A shortage of Wi-Fi Chips or labor, or increases in their costs, could delay delivery and launch of our mesh Wi-Fi access points or increase their cost, which could materially and adversely affect us,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Factors Impacting Our Operating Results—Changes in supply or price of Wi-Fi Chips or labor costs.”

In addition, because our enterprise customers’ orders for our industrial use products are subject to cyclical capital investment decisions and budgeting considerations at the customers business enterprises, our revenue may be uneven during a customer’s fiscal year as well as over the years of investment cycle. If we fail to predict the revenue generated from sales of mesh Wi-Fi access points in the future or if such revenue continues to be uncertain and volatile, it could adversely impact our business, prospects, liquidity, financial condition, and results of operations.

We have not been profitable and have incurred negative cash flows in operating activities, both of which may continue in the future.

During the six months ended March 31, 2024 and 2023, and the fiscal years ended September 30, 2023 and 2022, we recorded a net loss. During the six months ended March 31, 2024 and 2023, the net loss was JPY317,817 thousand (approximately $2,102 thousand) and JPY331,048 thousand, respectively. During the fiscal year ended September 30, 2023 and 2022, the net loss was JPY633,956 thousand (approximately $4,242 thousand) and JPY5,180 thousand, respectively. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations” and our unaudited financial statements for the six months ended March 31, 2024 and 2023 and audited financial statements for the fiscal year ended September 30, 2023 and 2022. In addition, as of March 31, 2024 and 2023, we had accumulated deficit of JPY2,040,564 thousand (approximately $13,494 thousand) and JPY1,722,747 thousand, respectively. As of September 30, 2023 and 2022, we had accumulated deficit of JPY1,722,747 thousand (approximately $11,392) and JPY1,088,791 thousand, respectively.

As of September 30, 2023 and September 30, 2022, the Company has net operating loss carryforwards in Japan of approximately JPY1,748 million (approximately $12 million) and JPY1,091 million, respectively, which can be carried forward to offset future taxable income. Any available net operating loss carryforwards would have value only to the extent there is income in the future against which such net operating loss carryforwards may be offset. In addition, limitations imposed by applicable law on our ability to utilize net operating loss carryforwards could cause income taxes to be paid earlier than these taxes would be paid if such limitations were not in effect, thereby reducing or eliminating the benefit of such net operating loss carryforwards.

We expect to continue the development and expansion of our business, particularly to invest significantly in upgrading our Wi-Fi access point hardware products to meet various industrial needs, and these investments may not result in an increase in revenue or positive cash flow on a timely basis, or at all. We anticipate additional costs in connection with legal, accounting and other administrative expenses related to operating as a public company. Accordingly, we cannot assure you that we will ever achieve profitability or that, if we do become profitable, we will sustain profitability. Our failure to achieve or sustain profitability in the future would make it more difficult to finance our business and accomplish our strategic objectives, which would have a material adverse effect on our business, financial condition and results of operations. In addition, failure to expand our business would negatively affect our business, financial condition and results of operations.

We rely substantially on short-term borrowings to fund our operations, and the failure to renew these short-term borrowings or the failure to continue to obtain financing on favorable terms, if at all, may adversely affect our ability to operate our business.

To date, we have funded our investment in our third-party manufactured inventory of products primarily through short-term bank loans, typically with terms ranging from one to four months, and we have funded our general and administrative expenses using cash generated from our operations.

As of March 31, 2024, we had approximately JPY122,342 thousand (approximately $809 thousand) in short-term borrowings outstanding. During the six months ended March 31, 2024, we repaid JPY153,344 thousand (approximately $1,014 thousand) and renewed JPY60,686 thousand (approximately $401 thousand) of our short-term borrowings. As of March 31, 2023, we had approximately JPY111,118 thousand in short-term borrowings outstanding. During the six months ended March 31, 2023, we repaid JPY3,294 thousand and renewed JPY18,684 thousand of our short-term borrowings.

As of September 30, 2023, we had approximately JPY215,000 thousand (approximately $1,422 thousand) in short-term borrowings outstanding. During the fiscal year ended September 30, 2023, we repaid JPY100,728 thousand (approximately $666 thousand) and renewed JPY220,000 thousand (approximately $1,455 thousand) of our short-term borrowings.

| 9 |

As of September 30, 2022, we had approximately JPY95,728 thousand in short-term borrowings outstanding. During the fiscal year ended September 30, 2022, we repaid JPY6,588 thousand and renewed JPY5,728 thousand of our short-term borrowings. We expect that we will be able to renew all of the existing bank loans upon their maturity based on our past experience and credit history. However, we cannot assure you that we will be able to renew these loans in the future as they mature. If we are unable to renew these bank loans in the future, our liquidity position would be adversely affected, and we may be required to seek more expensive sources of short-term or long-term funding to finance our operations.

Our ability to secure sufficient financing for working capital for our operations depends on a number of factors that are beyond our control, including market conditions in the capital markets, lenders’ perceptions of our creditworthiness, the Japanese economy, and the Japanese government regulations that affect the availability and cost of financing for mesh Wi-Fi access point companies. Further financing may not be available to us on favorable terms, if at all. If we are unable to obtain short-term financing in an amount sufficient to support our operations, it may be necessary, to suspend or curtail our operations, which would have a material adverse effect on our business and financial condition. In that event, current shareholders would likely experience a loss of most of or all of their investment.

Our substantial indebtedness could materially and adversely affect our business, financial condition, results of operations, and cash flows.

As of March 31, 2024, we had approximately JPY122,342 thousand (approximately $809 thousand) in short-term borrowings, JPY299,997 thousand (approximately $1,984 thousand) of convertible bonds and JPY43,590 thousand (approximately $288 thousand) in long-term borrowings outstanding. As of September 30, 2023, we had approximately JPY215,000 thousand (approximately $1,422 thousand) in short-term borrowings and JPY 26,276 thousand (approximately $174 thousand) in long-term borrowings outstanding.

The amount of our debt could have significant consequences on our operations, including:

| ● | reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions, and other general corporate purposes as a result of our debt service obligations; | |

| ● | limiting our ability to obtain additional financing; | |

| ● | limiting our flexibility in planning for, or reacting to, changes in our business, the industry in which we operate, and the general economy; | |

| ● | increasing the cost of any additional financing; and | |

| ● | limiting the ability of our subsidiaries to pay dividends to us for working capital or return on our investment. |

Our ability to meet our payment obligations under our outstanding indebtedness depends on our ability to generate significant cash flow in the future. This, to some extent, is subject to general economic, financial, competitive, legislative, and regulatory factors as well as other factors that are beyond our control. Any of the aforementioned factors and other possible consequences that of our substantial indebtedness could have a material adverse effect on our business, financial condition, results of operations, and cash flows, impacting our ability to meet our payment obligations with respect to our debts.

We rely on key relationships with cloud service providers and agencies across the enterprise mesh Wi-Fi access points industry, and to the extent they experience pressures in Internet communication load, labor, or timely delivery of service, it could in turn have an adverse impact on our business, prospect, liquidity, financial condition, and results of operations.

We currently use various third-party cloud service providers such as Amazon Web Services to provide cloud infrastructure and cloud platform services for PicoManager. PicoManager relies on the operations of this infrastructure. End-users of PicoManager need to be able to access it at any time, without interruption or decline in performance, and we provide some end-users with service-level commitments with respect to uptime. We collaborate with various cloud hosting providers as mentioned above to reduce the reliance on one single provider. However, we cannot guarantee that there will be no disruption in the operations of these third-party providers, or limitations of capacity of the cloud infrastructure and platform services or interference with our use of those. Any limitation on the capacity of our cloud infrastructure could impede our ability to onboard new end-users of PicoManager, expand the usage of our existing users, or advance the development of PicoManager, any of which could materially and adversely affect our business, financial condition and results of operations. In addition, any incident affecting our cloud infrastructure that may be caused by cyber-attacks, natural disasters, fire, flood, severe storm, earthquake, power loss, outbreaks of contagious diseases, telecommunications failures, terrorist or other attacks and other similar events beyond our control could materially and adversely affect the cloud-based portion of our platform. A prolonged service disruption affecting our cloud-based services for any of the foregoing reasons would materially and adversely impact our ability to serve our end-users and could damage our reputation with current and potential end-users, expose us to liability, cause us to lose customers or otherwise harm our business. We may also incur significant costs for using alternative providers or taking other actions in preparation for, or in response to, events that damage the third-party hosting services we use.

| 10 |

In the event our service agreements relating to our cloud infrastructure are terminated, or there is a lapse of service, elimination of services or features that we utilize, interruption of internet service provider connectivity or damage to such facilities, we could experience interruptions in access to PicoManager, loss of revenue from cloud platform services for PicoManager, as well as significant delays and additional expense in arranging or creating new facilities and services or re-architecting PicoManager for deployment on a different cloud infrastructure service provider, any of which could materially and adversely affect our business, financial condition and results of operations.

A shortage of Wi-Fi Chips or labor, or increases in their costs, could delay delivery and launch of our mesh Wi-Fi access points or increase its cost, which could materially and adversely affect us.

The enterprise mesh Wi-Fi access points industry experiences labor and raw material shortages from time to time. Shortages in Wi-Fi Chips, in particular, could result in an increase in our production cost paid to the manufacturers and could result in delay in the delivery of our products to customers, which in turn could have a material adverse effect on our business, prospects, financial condition, and results of operations. Although we do not source Wi-Fi Chips directly, our third-party manufacturers need to source the Wi-Fi Chips designated by us to fulfill the requirements of our product design, and they have no discretion of choosing replacement chips if Wi-Fi Chips are short in demand. Once there is shortage of Wi-Fi Chips, our revenue would be negatively affected. For example, the price of Wi-Fi Chips has been increasing since 2020, which has in turn increased the payments to our manufacturers. These labor and raw material shortages can be more severe during economic booming periods, natural disasters, and global pandemics, such as the COVID-19 pandemic. In addition, our success in our existing market in Japan substantially on our ability to source labor on terms that are favorable to us. We might face difficulties in sourcing skilled laborers to meet the increasing demand of mesh Wi-Fi access point devices in Japan. Labor and raw material shortages and related price increases could cause delays in the delivery of mesh Wi-Fi access point devices and increase in our costs of manufacturing mesh Wi-Fi access point devices, which in turn could have a material adverse effect on our business, prospects, financial condition, and results of operations.

Our business could be materially and adversely disrupted by an epidemic or pandemic (such as the COVID-19 pandemic), or similar public threat, or fear of such an event, and the measures that the governmental authorities implement to address it.

An epidemic, a pandemic, or similar serious public health issue, and the measures undertaken by governmental authorities to address it, could significantly disrupt or prevent us from operating our business in the ordinary course for an extended period, and thereby, along with any associated economic and social instability or distress, have a material adverse impact on our business, prospects, liquidity, financial condition, and results of operations.