Issuer Free Writing Prospectus dated, January 13, 2025

Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended

Relating to Preliminary Prospectus dated January 3, 2025

Registration Statement No. 333-283046

Masonglory Limited January 2025 Issuer Free Writing Prospectus dated, January 13, 2025 Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended Relating to Preliminary Prospectus dated January 3, 2025 Registration Statement No. 333 - 283046

Disclaimer This presentation relates to the proposed public offering of the ordinary shares, par value of US$0.0001 per share (the “Offe rin g”) of Masonglory Limited, an exempted company incorporated under the laws of the Cayman Islands (the “Company”). This presentation has been prepared by the Company solely for informational purposes. The information includ ed herein in this presentation has not been independently verified. No representations, warranties or undertakings, express or implied, are made by the Company or any of its affiliates, advisers or representatives or the underw rit ers as to, and no reliance should be placed upon, the accuracy, fairness, completeness or correctness of the information or opinions presented or contained in this presentation. By viewing or accessing the information contained in thi s p resentation, you acknowledge and agree that none of the Company or any of its affiliates, advisers or representatives or the underwriters accept any responsibility whatsoever (in negligence or otherwise) for any loss howsoever ari sing from any information presented or contained in this presentation or otherwise arising in connection with the presentation. The information presented or contained in this presentation is subject to change without notice and it s a ccuracy is not guaranteed. None of the Company or any of its affiliates, advisers or representatives or the underwriters make any undertaking to update any such information subsequent to the date hereof. This presentation should not be construed as legal, tax, investment or other advice. The Company has filed a registration statement on Form F1 with the SEC relating to the Offering in the United States, but the re gistration statement has not yet become effective. The Offering to be made in the United States will be made solely on the basis of the information contained in the prospectus included in such registration statement, as amended. Any d eci sion to purchase the Company’s securities in the Offering should be made solely on the basis of the information contained in the prospectus. Before you invest, you should read the preliminary prospectus in the registration statement (including the risk factors descr ibe d therein) and other documents we have filed with the SEC for more complete information about our company and the offering. You may get these documents for free by visiting EAGAR on the SEC website at https://www.sec.gov/Archives/edgar/data/2020228/000121390025000584/ea0207245 - 11.htm . This presentation contains market and industry data related statements that reflect the Company’s intent, beliefs or current exp ectations about the future. These statements can be recognized by the use of words such as “expects,” “plans,” “will,” “estimates,” “projects,” “intends,” or words of similar meaning. These forward - looking statements are not guarantees of future performance and are based on a number of assumptions about the Company’s operations and other factors, many of which are beyond the Company’s control, and accordingly, actual results may differ materially from these for war d - looking statements. Caution should be taken with respect to such statements and you should not place undue reliance on any such forward - looking statements. The Company or any of its affiliates, advisers or representatives or the underwriters has no obligation and does not undertake to revise forward - looking statements to reflect newly available information, future events or circumstances. This presentation does not constitute an offer to sell or an invitation to purchase or subscribe for any securities of the Co mpa ny for sale in the United States or anywhere else. No part of this presentation shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. Specifically, these materials do not constitute a “prospectus” wi thin the meaning of the U.S. Securities Act of 1933, as amended, and the regulations enacted thereunder. This presentation does not contain all relevant information relating to the Company or its securities, particularly with resp ect to the risks and special considerations involved with an investment in the securities of the Company and is qualified in its entirety by reference to the detailed information in the prospectus relating to the Offering. Any decision t o p urchase the Company’s securities in the Offering should be made solely on the basis of the information contained in the prospectus relating to the Offering. The Company currently reports financial results under U.S. GAAP. The preparation of our consolidated financial statements req uir es us to make estimates, assumptions and judgments that affect the reported amounts of assets, liabilities, costs and expenses. We base our estimates and assumptions on historical experience and other factors that we believe to be re aso nable under the circumstances. We evaluate our estimates and assumptions on an ongoing basis. Our actual results may differ from these estimates. Please refer to the prospectus where necessary for a description of our significant acc ounting policies. THE INFORMATION CONTAINED IN THIS DOCUMENT IS HIGHLY CONFIDENTIAL AND IS BEING GIVEN SOLELY FOR YOUR INFORMATION AND ONLY FOR YO UR USE IN CONNECTION WITH THIS PRESENTATION. THE INFORMATION CONTAINED HEREIN MAY NOT BE COPIED, REPRODUCED, REDISTRIBUTED, OR OTHERWISE DISCLOSED, IN WHOLE OR IN PART, T O A NY OTHER PERSON IN ANY MANNER. Any forwarding, distribution or reproduction of this presentation in whole or in part is unauthorized. By viewing, accessing or attending this presentation, you agree not to remove these materials, or any materials provided in c onn ection herewith, from the conference room where such documents are provided. You agree further not to photograph, copy or otherwise reproduce this presentation in any form or pass on this presentation to any other person for an y p urpose, during the presentation or while in the conference room. You must return this presentation and all other materials provided in connection herewith to the Company upon completion of the presentation. Masonglory Limited | Page 2

Preliminary Offering Summary • Masonglory Limited Issuer • Nasdaq Capital Market / MSGY Listing / Ticker • Initial Public Offering Offering Type • 1,500,000 o rdinary shares Shares Offered • 225,000 ordinary shares (15% of base offering) Over - Allotment Option • $4.00 - $6.00 per ordinary share Price Range • Approximately 15% for expanding the Company’s workforce; • Approximately 15% for acquisition of additional machineries; • Approximately 15% for diversifying the Company’s project portfolio; • Approximately 15% for strengthening the Company’s marketing efforts; and • The remaining 40% to fund the Company’s working capital and for other general corporate purposes. Use of Proceeds • 180 days (for directors and officers, owners of at least 5% of the Company’s outstanding ordinary shares, e xcept for the Selling Shareholder with respect to its ordinary shares sold in the Offering) Lock - up Benjamin Securities, Inc.; D. Boral Capital LLC Book Running Managers Masonglory Limited | Page 3 Please see offering documents for further risks and disclosure. There is no guarantee that any specific outcome will be achie ved . Investment may be speculative, illiquid and there a risk of loss.

Table of Contents Company Overview Industry Overview Investment Highlight Growth Strategies Masonglory Limited | Page 4 Financials

Cutting and laying marble tiles 5. Marble Works Laying of brick blocks 3. Brick Laying Applying cement mixtures to floor bases 4. Floor Screeding Installing tiles on floors and walls 2.Tile Laying Applying layers of plaster to walls and to create smooth surface 1. Plastering Works • Wet Trades Services Subcontractor in Hong Kong Since 2018 • Registered Specialist Trade Contractor (Plastering – Group 2) since 2020 Clientele • Main contractors in Hong Kong which include property developers and the Hong Kong government • Majority of clients belong to renowned construction groups listed on HKEX About Us Masonglory Limited | Page 5 Company Overview Industry Overview Investment Highlights Growth Strategies Financials Project Portfolio • Primary: Private sector projects (private residential development) • Secondary: Public sector projects (commercial and infrastructure) Overview of wet trade services we provide:

• 6 projects on hand as of the date of this presentation. • 2 projects completed in fiscal years ended March 31 2023 and 2024. Projects Status • Cost plus pricing based on project complexity, labor and material estimates, completion timelines, and customer financials. • Accurate cost estimation crucial for fixed price contracts to avoid losses from unexpected costs or delays. Pricing Strategy • Strong network of pre - approved suppliers consisting of both subcontractor workers and suppliers of tooling and materials • Collaborated with over 380 subcontractors and 25 suppliers in fiscal year ended March 31, 2024. Supplier and Subcontractor Relationships Business Operation Flow Masonglory Limited | Page 6 Company Overview Industry Overview Investment Highlights Growth Strategies Financials

Overview of Wet Trades Industry in Hong Kong Key Demand Drivers : Primarily from residential, commercial, industrial, and government projects. Operational Dynamics : Main contractors subcontract wet trades works to leverage specialized skills and optimize labor costs. Masonglory Limited | Page 7 Company Overview Industry Overview Investment Highlights Growth Strategies Financials In Hong Kong, wet trades work encompasses various activities such as plastering, brickwork, wall and floor tiling, painting and decoration, floor screeding, and marble works carried out in various types of buildings and facilities

• Market Fragmentation • Entry Barriers • Competitive Landscape • Market Trend • Over 500 registered contractors in Hong Kong under trade specialties of "Finishing Wet Trades" (Construction Industry Council). • Main competitors include private and listed wet trades subcontractors in HK. • Our stable relationship with renowned property developers and status as a registered specialist trade contractor (Group 2) gives us significant competitive advantages. • Potential expansion into ancillary construction services and potential growth in Asia Pacific markets. • Increasing demand driven by urban renewal projects and development of commercial areas . • Replacement of manual labor with machinery and equipment . • Elevated industry standards and customer requirements . • Increased training and revitalization of manpower . • Reputation and Experience • Industry Connections • Working Capital Wet Trades Industry in Hong Kong • Masonglory Limited | Page 8 Company Overview Industry Overview Investment Highlights Growth Strategies Financials • Technical Expertise

Key Market Drivers Elevated Standard o Shift To Machinery Utilization o Workforce Upskill o Urban Renewal with Funding Support From Government Market Trend • Public Housing Expansion : Increased government focus on enhancing public housing supply. • Mortgage Support : Extended mortgage default guarantee from 30 to 50 years for subsidized flats. • Tech Integration : Pilot smart estate management using IoT and AI in public housing estates. • Innovative Construction : Optimization of Modular Integrated Construction ( MiC ) for efficiency and quality. • Private Housing Initiatives : Hong Kong Government plans for 80,000 new private housing units. • Stamp Duty Reductions : Special Stamp Duty (SSD) period shortened from 3 to 2 years; BSD and NRSD rates halved to 7.5%. • Talent Incentives : Stamp duty suspension for incoming talents acquiring residential properties. Market Opportunities in Wet Trades Masonglory Limited | Page 9 Company Overview Industry Overview Investment Highlights Growth Strategies Financials Growing demand for high - quality materials and craftsmanship as living standards rise, pushing property developers to seek reputable contractors.

Established Expertise Since 2018 • Over five years of experience in providing comprehensive wet trades solutions. • Registered specialist trade contractor (Group 2). Healthy Project Pipeline & high quality • As of now, managing 6 construction projects, enhancing our growth potential. • Extensive experience meeting stringent safety and quality standards, enhancing our market position. Stable Customer Relationships • Long - standing partnerships with major customers since 2018. • Major clients include reputable main contractors from renowned construction groups. Experienced & professional management team • Extensive industry knowledge and project experience in the wet trades work industry in Hong Kong. • Efficient management of project work facilitated by years of technical and industry know - how. o We are the preferred partner of major contractors in Hong Kong thanks to our ability to consistently delivery quality service s. o We are well - versed in meeting the various stringent safety and quality standards of our customers. Strong network of pre - approved suppliers • Allow us to quickly and efficiently source the required materials, equipment, or services for our customers’ projects. • Good track record of timely payment helps us to attract and retain high quality suppliers and subcontractors. Client Satisfaction & Engagement • Consistent achievement of customer satisfaction leading to increased project opportunities. • Awarded medium to large - scale projects from leading property developers across various sectors. Competitive Strengths Masonglory Limited | Page 10 Company Overview Industry Overview Investment Highlights Growth Strategies Financials

Tse Shing Fung Chairman of the Board of Directors Tse Tsz Tun Director and Chief Executive Officer Tsoi Chi Hei Chief Financial Officer Experienced Management Team Company Overview Industry Overview Investment Highlights Growth Strategies Financials Masonglory Limited | Page 11 • Over 20 years of experience in the wet trades work industry in Hong Kong. • Founder member of our operating subsidiary ( Masontech Limited). • Former project manager at Eric Tse Cement Works Co., Ltd. • Over 10 years of experience in the wet trades work industry in Hong Kong. • Former quantity surveyor manager at Eric Tse Cement Works Co., Ltd. • BA in Business Management, University of Winchester. • Over 10 years of experience in auditing, accounting and financial management. • Formerly worked as auditor at various accounting firms including KPMG. • Bachelor of Accountancy, Hong Kong Polytechnic University.

• Independent director, chairman of the audit committee of the board of directors of the Company. • Member of other committees of the board of directors of the Company . • 10+ years in auditing and financial management; senior positions in major Hong Kong accounting firms. • BBA in Accountancy, Fellow of HKICPA, CFA Charterholder . Independent Directors Masonglory Limited | Page 12 Company Overview Industry Overview Investment Highlights Growth Strategies Financials Lui Po Yuen • Independent director, chairman of the compensation committee of the Company. • Member of other committees of the board of directors of the Company. • 10+ years in the wet trades industry; quantity surveyor manager at Eric Tse Cement Works. • BBA in Management, completed Construction Safety Supervisor Course. Man Wing Wa • Independent director, chairman of the nominating committee of the Company. • Member of other committees of the board of directors of the Company. • 20+ years in auditing and financial management; senior roles in major accounting firms. • Fellow of HKICPA and other professional organizations. Cheng Shing Yan *Each of Mr. Yuen, Mr. Wa , and Ms. Cheng has accepted appointment as a director, their appointment of which will be immediately effective upon the declaration of the effectiveness of the Company’s registration statement on Form F - 1 by the SEC

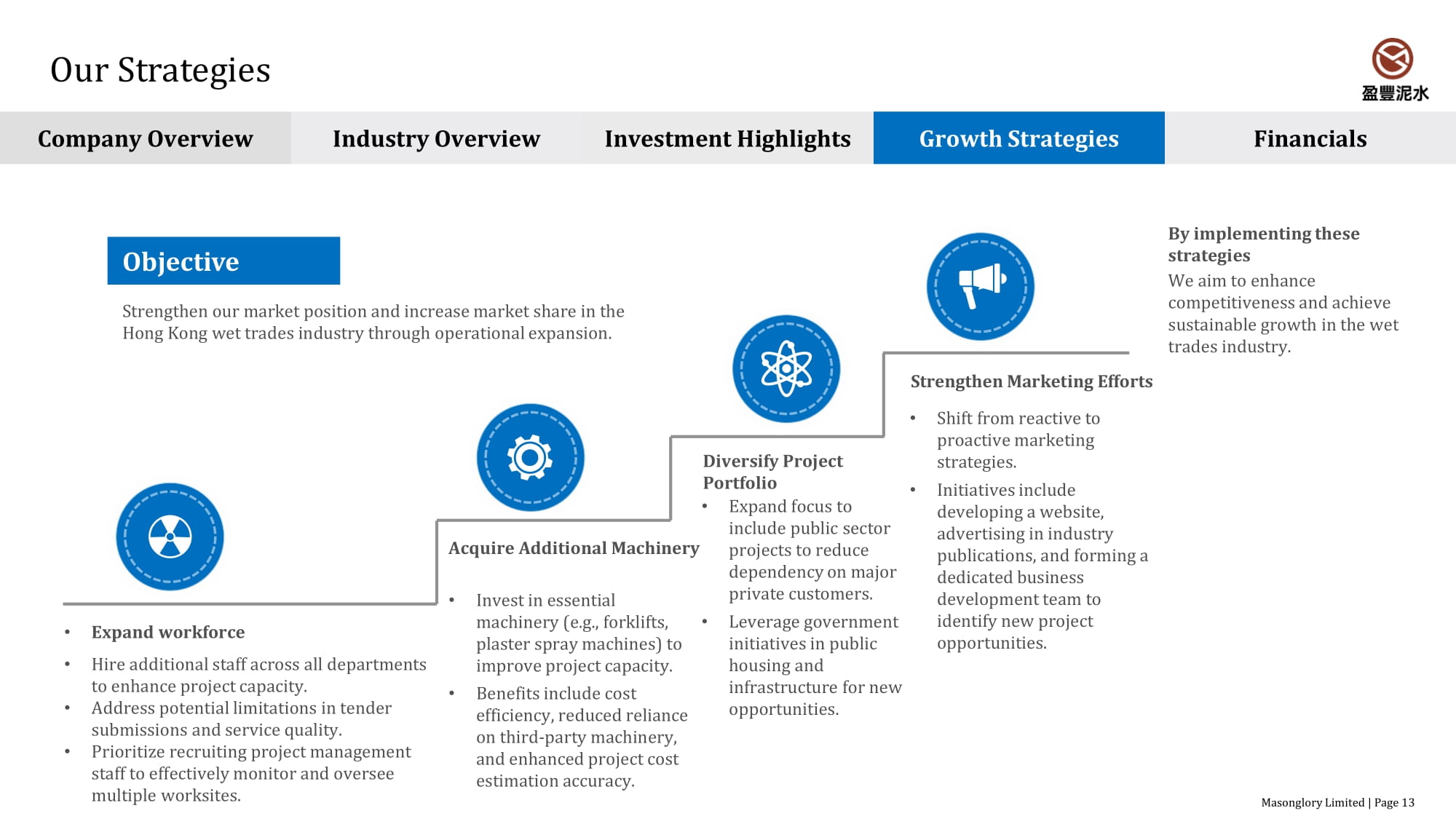

• Expand workforce • Hire additional staff across all departments to enhance project capacity. • Address potential limitations in tender submissions and service quality. • Prioritize recruiting project management staff to effectively monitor and oversee multiple worksites. Strengthen Marketing Efforts • Shift from reactive to proactive marketing strategies. • Initiatives include developing a website, advertising in industry publications, and forming a dedicated business development team to identify new project opportunities. Diversify Project Portfolio • Expand focus to include public sector projects to reduce dependency on major private customers. • Leverage government initiatives in public housing and infrastructure for new opportunities. Acquire Additional Machinery • Invest in essential machinery (e.g., forklifts, plaster spray machines) to improve project capacity. • Benefits include cost efficiency, reduced reliance on third - party machinery, and enhanced project cost estimation accuracy. By implementing these strategies We aim to enhance competitiveness and achieve sustainable growth in the wet trades industry. Objective Strengthen our market position and increase market share in the Hong Kong wet trades industry through operational expansion. Our Strategies Masonglory Limited | Page 13 Company Overview Industry Overview Investment Highlights Growth Strategies Financials

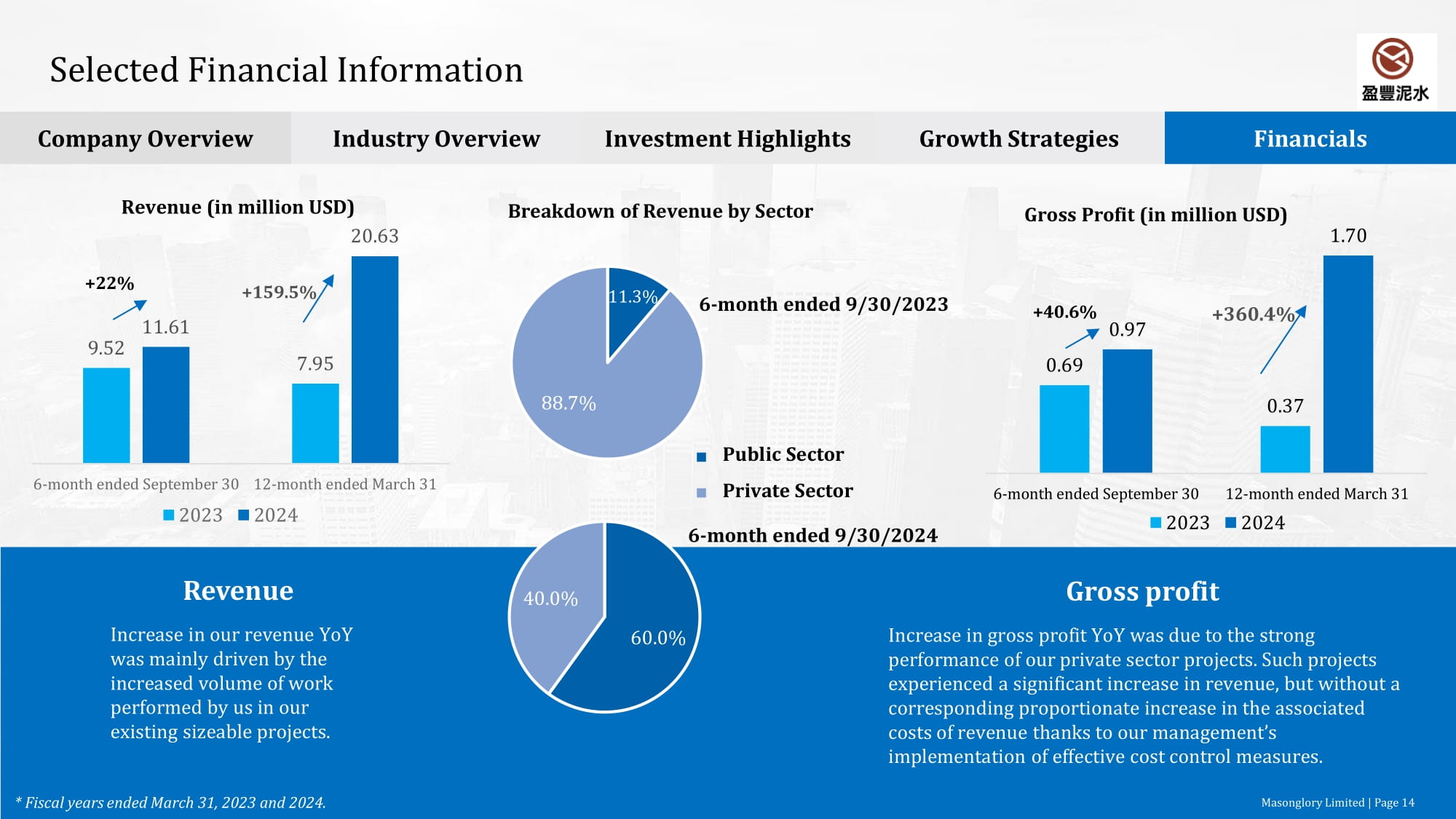

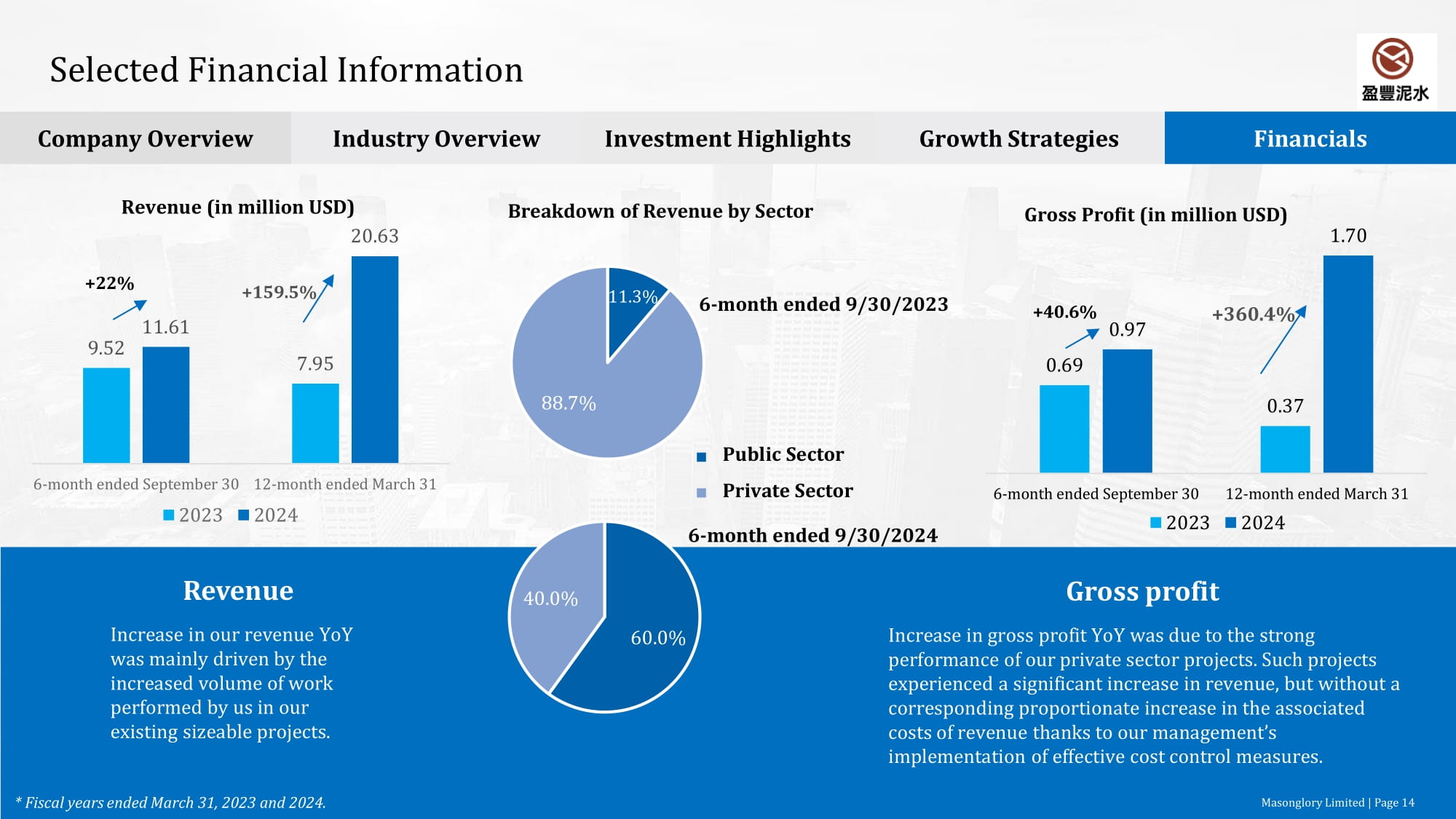

10% 20% 15% Gross profit Increase in gross profit YoY was due to the strong performance of our private sector projects. Such projects experienced a significant increase in revenue, but without a corresponding proportionate increase in the associated costs of revenue thanks to our management’s implementation of effective cost control measures. Selected Financial Information Masonglory Limited | Page 14 Company Overview Industry Overview Investment Highlights Growth Strategies Financials * Fiscal years ended March 31, 2023 and 2024. 11.3% 88.7% Breakdown of Revenue by Sector 60.0% 40.0% 6 - month ended 9/30/2023 6 - month ended 9/30/2024 Public Sector Private Sector +360.4% Revenue Increase in our revenue YoY was mainly driven by the increased volume of work performed by us in our existing sizeable projects. 9.52 7.95 11.61 20.63 6-month ended September 30 12-month ended March 31 Revenue (in million USD) 2023 2024 +22% 0.69 0.37 0.97 1.70 6-month ended September 30 12-month ended March 31 Gross Profit (in million USD) 2023 2024 +159.5% +40.6%

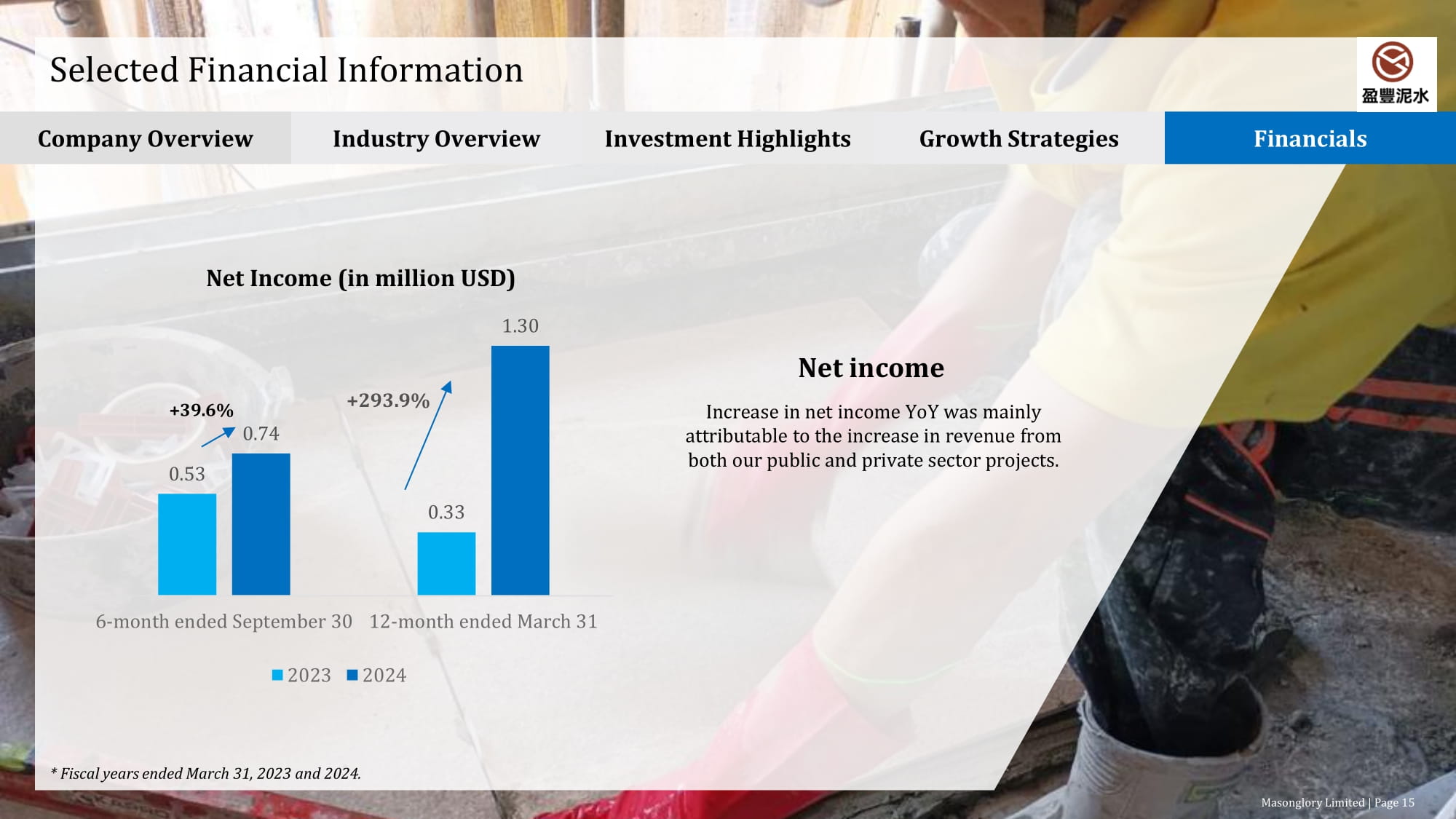

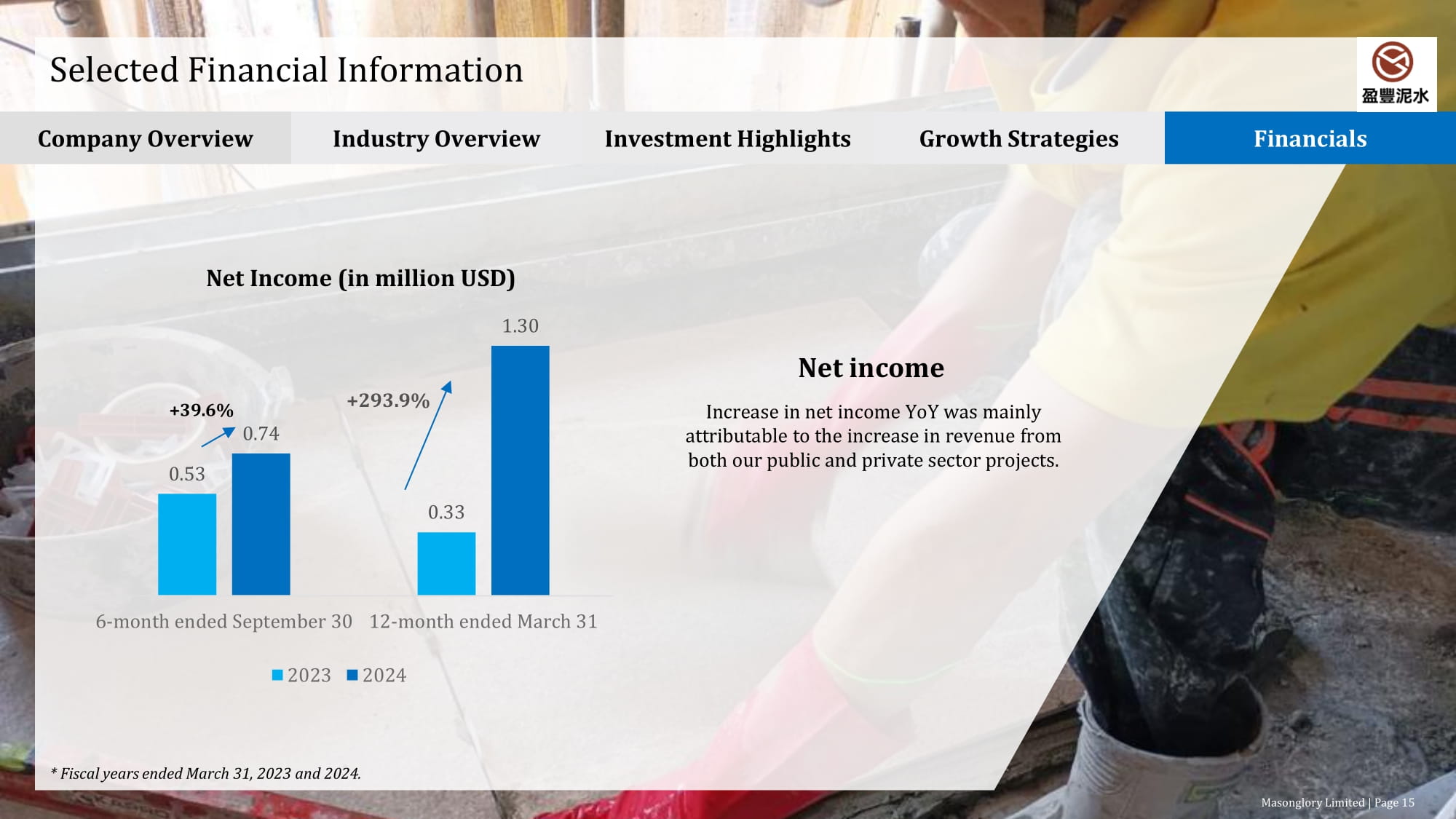

Selected Financial Information Company Overview Industry Overview Investment Highlights Growth Strategies Financials +293.9% * Fiscal years ended March 31, 2023 and 2024. Net income Increase in net income YoY was mainly attributable to the increase in revenue from both our public and private sector projects. Masonglory Limited | Page 15 0.53 0.33 0.74 1.30 6-month ended September 30 12-month ended March 31 Net Income (in million USD) 2023 2024 +39.6%

Thank you Masonglory Limited +852 2114 3424 ROOM 8, 25/F., CRE CENTRE 889 CHEUNG SHA WAN ROAD KOWLOON, HONG KONG Investor Relations services@wealthfsllc.com +86 138 117 68599 +1 628 283 9214 Underwriter info@benjaminsecurities.com +1 (516) 931 - 1090 https://www.benjaminsecurities.com Underwriter info@dboralcapital.com +1 (212) 970 - 5150 https://dboralcapital.com