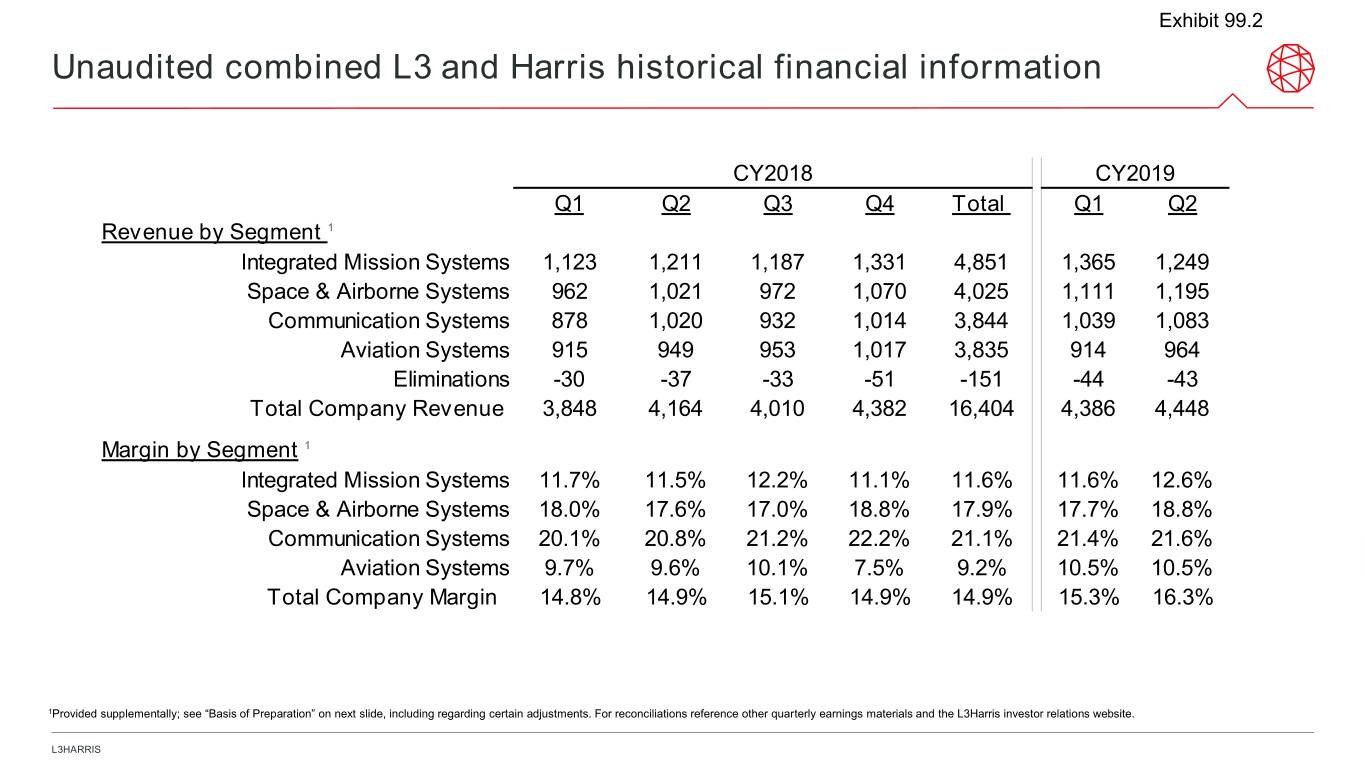

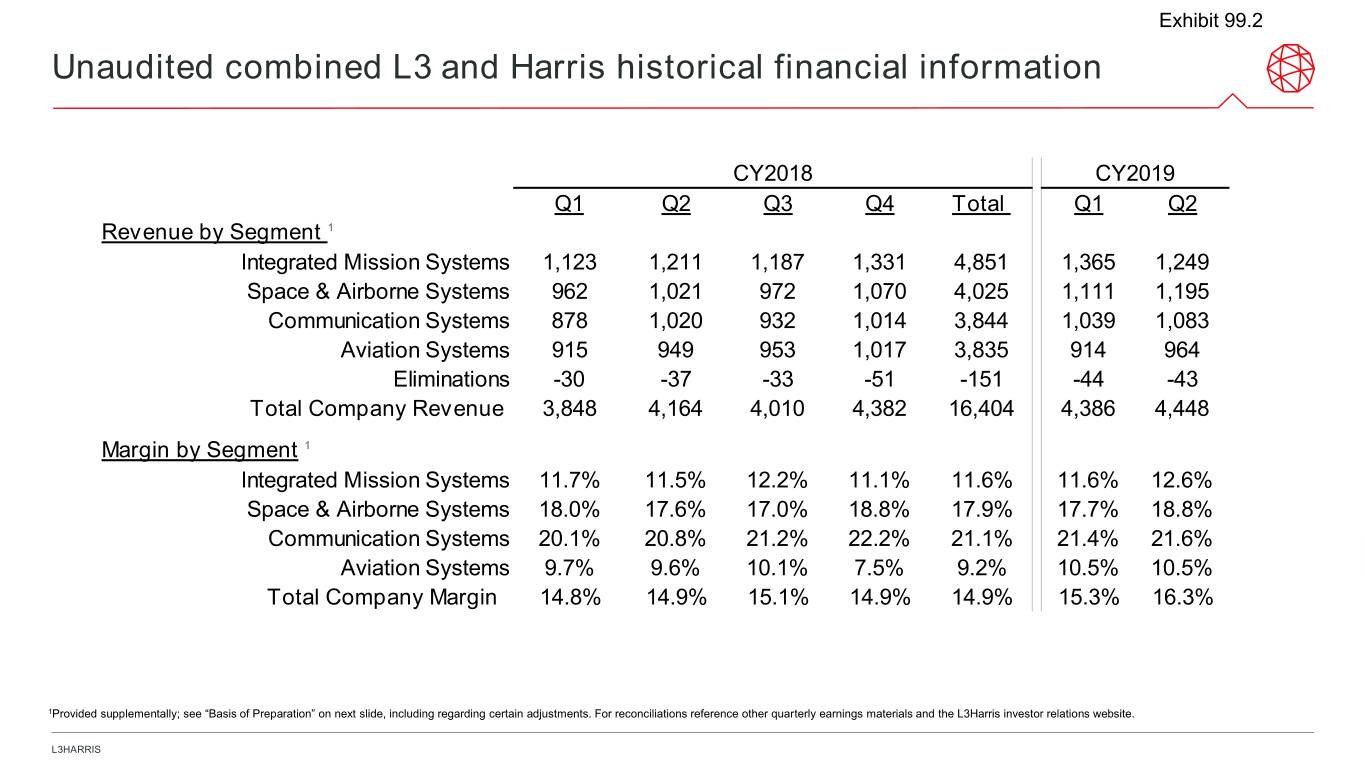

Exhibit 99.2 Unaudited combined L3 and Harris historical financial information CY2018 CY2019 Q1 Q2 Q3 Q4 Total Q1 Q2 Revenue by Segment 1 Integrated Mission Systems 1,123 1,211 1,187 1,331 4,851 1,365 1,249 Space & Airborne Systems 962 1,021 972 1,070 4,025 1,111 1,195 Communication Systems 878 1,020 932 1,014 3,844 1,039 1,083 Aviation Systems 915 949 953 1,017 3,835 914 964 Eliminations -30 -37 -33 -51 -151 -44 -43 Total Company Revenue 3,848 4,164 4,010 4,382 16,404 4,386 4,448 Margin by Segment 1 Integrated Mission Systems 11.7% 11.5% 12.2% 11.1% 11.6% 11.6% 12.6% Space & Airborne Systems 18.0% 17.6% 17.0% 18.8% 17.9% 17.7% 18.8% Communication Systems 20.1% 20.8% 21.2% 22.2% 21.1% 21.4% 21.6% Aviation Systems 9.7% 9.6% 10.1% 7.5% 9.2% 10.5% 10.5% Total Company Margin 14.8% 14.9% 15.1% 14.9% 14.9% 15.3% 16.3% 1Provided supplementally; see “Basis of Preparation” on next slide, including regarding certain adjustments. For reconciliations reference other quarterly earnings materials and the L3Harris investor relations website. L3HARRIS

Exhibit 99.2 Basis of Preparation As supplemental information for investors, L3Harris has provided unaudited combined L3 and Harris historical financial information, which combines L3 and Harris historical operating results as if the businesses had been operated together on the basis of the newly announced four segment structure during prior periods, but excluding the operating results of Harris’ night vision business and L3's divested businesses, allocating Harris’ corporate department expense to the new segment structure and excluding Harris historical deal amortization (primarily related to Exelis) (the “Supplemental Unaudited Combined Financial Information”). L3Harris intends to exclude all deal amortization (including L3 historical deal amortization) for future periods. The new segment structure and the Supplemental Unaudited Combined Financial Information have no impact on L3’s or Harris’ previously reported consolidated balance sheets or statements of income, comprehensive income, cash flows or equity. For avoidance of doubt, the Supplemental Unaudited Combined Financial Information also was not intended to be, and was not, prepared on a basis consistent with the unaudited pro forma condensed combined financial information in Exhibit 99.7 to L3Harris’ Current Report on Form 8-K filed July 1, 2019 with the U.S. Securities and Exchange Commission (the “Pro Forma 8-K Filing”), which provides the pro forma financial information required by Item 9.01(b) of Form 8-K. For instance, the Supplemental Unaudited Combined Financial Information does not give effect to the L3Harris merger under the acquisition method of accounting in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 805, Business Combinations (“ASC Topic 805”), with Harris treated as the legal and accounting acquirer, and was not prepared to reflect the merger as if it occurred on the first day of any of the fiscal periods presented. The Supplemental Unaudited Combined Financial Information has not been adjusted to give effect to pro forma events that are (1) directly attributable to the merger, (2) factually supportable, or (3) expected to have a continuing impact on the combined results of L3 and Harris. More specifically, other than excluding the operating results of Harris’ night vision business and L3's divested business, allocating Harris’ corporate department expense to the new segment structure and excluding Harris historical deal amortization (primarily related to Exelis), the Supplemental Unaudited Combined Financial Information does not reflect the types of pro forma adjustments set forth in Exhibit 99.7 to the Pro Forma 8-K Filing. Consequently, the Supplemental Unaudited Combined Financial Information is intentionally different from, but does not supersede, the pro forma financial information set forth in Exhibit 99.7 to the Pro Forma 8-K Filing. In addition, the Supplemental Unaudited Combined Financial Information does not purport to indicate the results that actually would have been obtained had the L3 and Harris businesses been operated together on the basis of the new segment structure during the periods presented, or which may be realized in the future. Amounts Adjusted for Certain Non-Recurring Items - The Supplemental Unaudited Combined Financial Information includes amounts adjusted for certain non-recurring items, including revenue and margin, as adjusted to exclude merger-related deal and integration costs and other non-recurring items previously reported by L3 or Harris, as applicable, for prior periods. Such amounts should be viewed in addition to, and not in lieu of, revenue, margin and other financial measures on an unadjusted basis. Other quarterly earnings materials and the L3Harris investor relations website provide a reconciliation of adjusted amounts with the most directly comparable unadjusted amount. L3Harris management believes that these adjusted amounts, when considered together with the unadjusted amounts, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on results in any particular period. L3Harris management also believes that these adjusted amounts enhance the ability of investors to analyze trends in L3Harris’ business and to understand L3Harris’ performance. In addition, L3Harris may utilize adjusted amounts as guides in forecasting, budgeting and long- term planning processes and to measure operating performance for some management compensation purposes. Adjusted amounts should be considered in addition to, and not as a substitute for, or superior to, unadjusted amounts. L3HARRIS