Page 1 Investor Letter 2Q 2022 July 28, 2022

L3HARRIS INVESTOR LETTER 2Q 2022 Refer to endnotes on page 18 Page 2 When L3Harris was formed three years ago, our vision was to create a non-traditional defense prime focused on innovative solutions and also capable of enduring challenges in a range of geopolitical and macroeconomic environments. I’m proud to say that we are progressing on that vision. Our 47,000 employees continue to demonstrate an ability to deliver stable results while positioning the company for further value creation in the years ahead. Geopolitical tensions and the threat environment remain elevated globally, with relationships in the Pacific and hostilities in Eastern Europe evolving. As the conflict between Russia and Ukraine moves into its sixth month, the U.S. Government and our allies remain steadfast in our support of Ukraine and the Eastern European region. Likewise, L3Harris is committed to supporting Ukrainian citizens, as we provide necessary equipment in theater, including tactical communications, night vision goggles and ISR, among others. There is increased funding in support of Ukraine, which has surpassed $50 billion year-to-date, and U.S. defense budgets are on an upward trajectory. Following a definitized GFY22 DoD budget and a GFY23 request that point to growth of 6% and 4%, respectively, the U.S. Senate and House Armed Services Committees each recommended an over $35 billion plus-up. In addition, international markets, such as Europe, have made further commitments to raise defense spending, particularly within an expanding NATO. Our portfolio remains well-positioned for capabilities that span all domains, from responsive satellites to resilient communications. In recent months, we have seen a modest uptick in award and contract activity due to growing urgency among government customers, an improved budget backdrop and key appointments made within the U.S. DoD. This, combined with progress on our strategy, led to a book-to-bill3 of 1.14x for the quarter that reflected strength across all segments. Our second quarter results are consistent with prior commentary, which incorporated macroeconomic and other pressures. Revenue declined 11% and 6% organically1 from continued supply chain disruptions, award timing and airborne program transitions. Operating income margin and segment operating margin2 declined 30 basis points primarily due to the supply chain disruptions. EPS of $2.42 was up due to tax rate favorability and a lower share count from our ongoing share repurchase program, which more than offset the decline in revenue and margin, and led to flattish non-GAAP EPS2 of $3.23. We also reported cash flow from operating activities of $749 million and adjusted free cash flow2 of $712 million after a nearly break-even first quarter. As we consider the back half of 2022 and full-year guidance, we are shifting our outlook to incorporate program timing across several businesses and prolonged supply chain impacts. We now anticipate mid-single-digit topline growth in the back half of 2022, driven by moderating supply chain headwinds, international ISR aircraft awards and program ramps for maritime, cyber and precision weapon solutions. Accordingly for 2022, we expect to be at the low end of our range for revenue, margin, EPS and cash flow as we continue to navigate a dynamic and uncertain environment. Despite these near-term challenges, we’re encouraged by the improving backdrop and continued progress made with our strategy to invest in innovation, increase prime program positions and expand internationally, all of which were evident in the second quarter results and continue to support our medium-term outlook. Moreover, our focus on operational excellence has remained effective in combating rising inflation and, when combined with other actions, sustain our leading margin profile. Lastly, our balanced capital allocation plan, which pairs capital returns with opportunistic portfolio optimization, is another value-creation lever we continue to utilize for the benefit of shareholders. Our momentum is evident post quarter close. In July, we received several pivotal prime awards, including satellites for SDA’s National Defense Space Architecture and integrated networking systems for key U.S. Navy and Marine Corps programs. In addition, we elected Christina L. Zamarro to our Board of Directors. Christopher E. Kubasik Chair and Chief Executive Officer LETTER TO INVESTORS

L3HARRIS INVESTOR LETTER 2Q 2022 Refer to endnotes on page 18 Page 3 2Q22 Summary ........................................................ 4 Demand Environment ............................................... 5 Financial Results ...................................................... 9 Operational Update .................................................. 12 Capital Allocation ...................................................... 14 Financial Guidance ................................................... 15 ESG Highlights........................................................... 17 Endnotes ................................................................... 18 Non-GAAP Financial Measures ................................ 19 Forward-Looking Statements ................................... 20 Financial Tables ........................................................ 21 Reconciliation of Non-GAAP Financial Measures .... 27 Conference Call Information and Feedback............. 33 TABLE OF CONTENTS

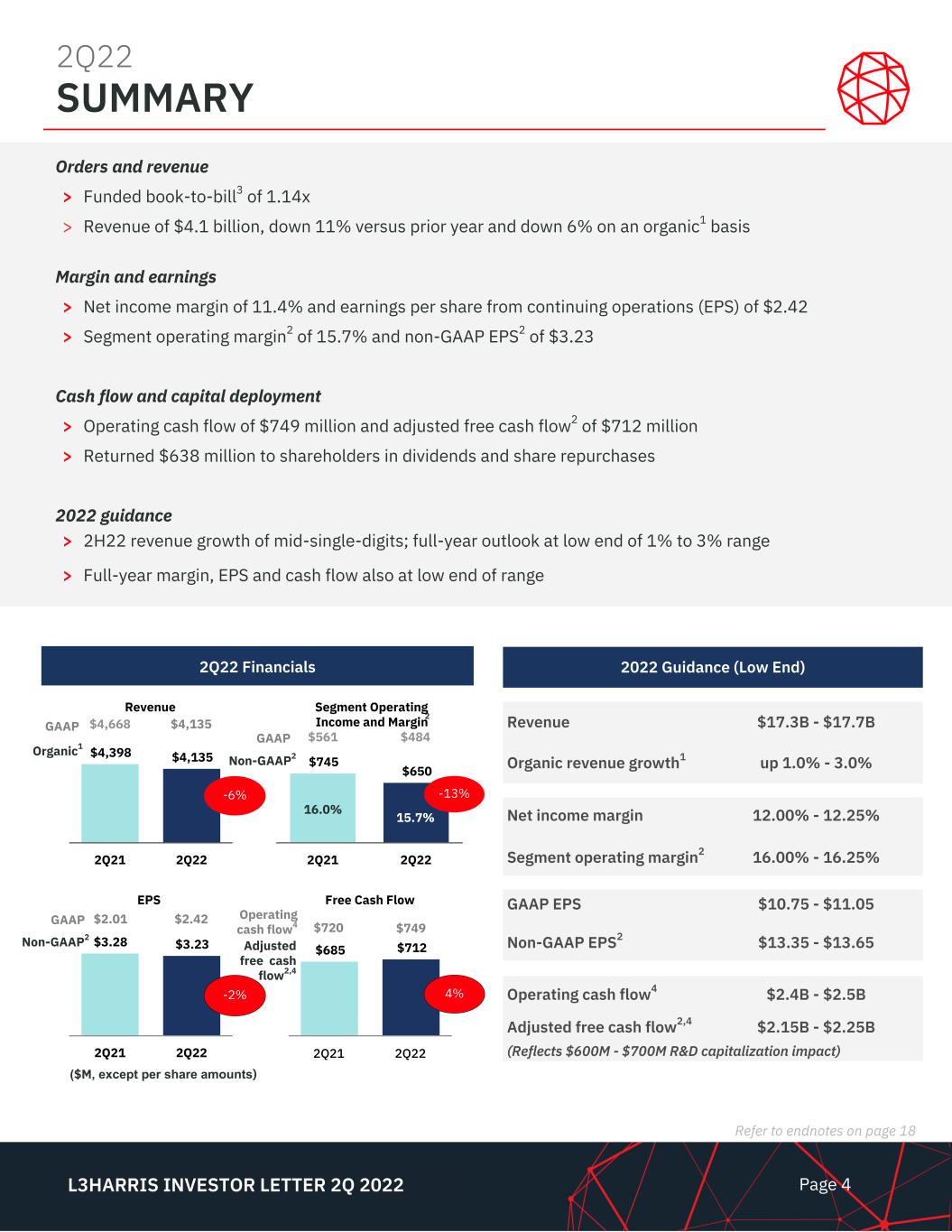

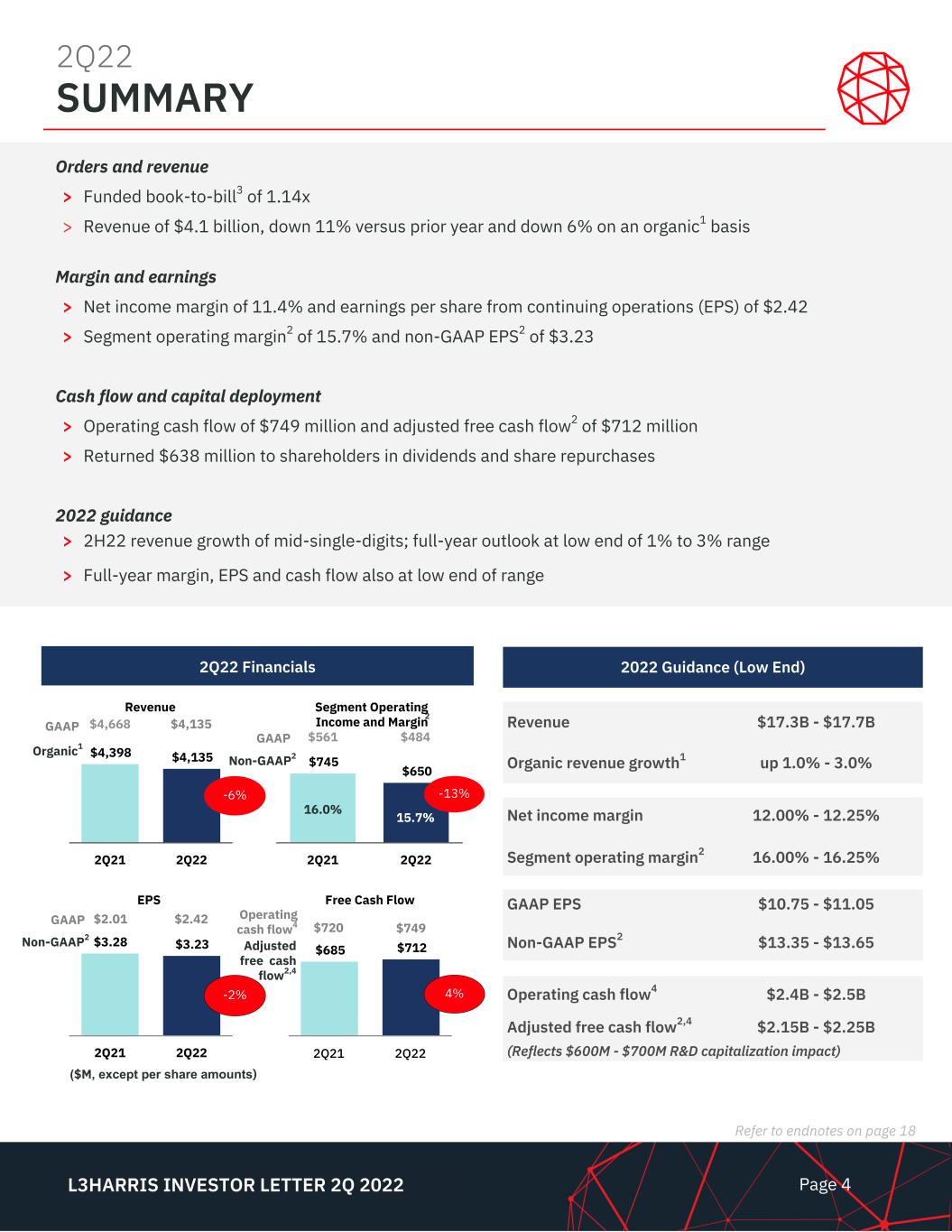

Page 4 Refer to endnotes on page 18 L3HARRIS INVESTOR LETTER 2Q 2022 Free Cash Flow $685 $712 2Q21 2Q22 2022 Guidance (Low End) Revenue $17.3B - $17.7B Organic revenue growth1 up 1.0% - 3.0% Net income margin 12.00% - 12.25% Segment operating margin2 16.00% - 16.25% GAAP EPS $10.75 - $11.05 Non-GAAP EPS2 $13.35 - $13.65 Operating cash flow4 $2.4B - $2.5B Adjusted free cash flow2,4 $2.15B - $2.25B (Reflects $600M - $700M R&D capitalization impact) Orders and revenue > Funded book-to-bill3 of 1.14x > Revenue of $4.1 billion, down 11% versus prior year and down 6% on an organic1 basis Margin and earnings > Net income margin of 11.4% and earnings per share from continuing operations (EPS) of $2.42 > Segment operating margin2 of 15.7% and non-GAAP EPS2 of $3.23 Cash flow and capital deployment > Operating cash flow of $749 million and adjusted free cash flow2 of $712 million > Returned $638 million to shareholders in dividends and share repurchases 2022 guidance > 2H22 revenue growth of mid-single-digits; full-year outlook at low end of 1% to 3% range > Full-year margin, EPS and cash flow also at low end of range EPS $3.28 $3.23 2Q21 2Q22 -2% Revenue $4,398 $4,135 2Q21 2Q22 4% -6% Segment Operating Income and Margin $745 $650 2Q21 2Q22 -13% 16.0% 15.7% $4,668GAAP $4,135 Organic1 $2.01 $2.42 GAAP Non-GAAP2 Operating cash flow4 $720 $749 Adjusted free cash flow2,4 ($M, except per share amounts) 2 2Q22 SUMMARY 2Q22 Financials $561 $484GAAP Non-GAAP2

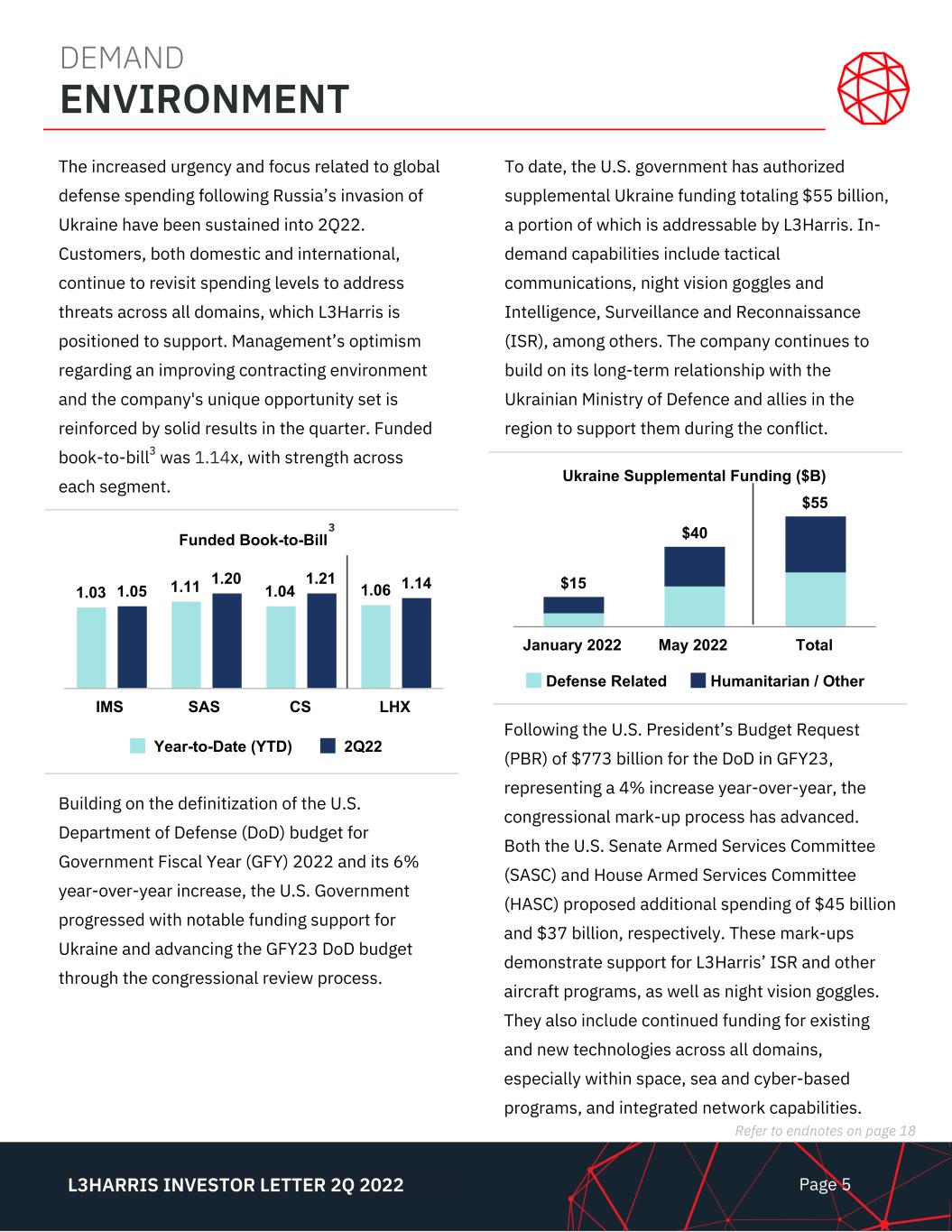

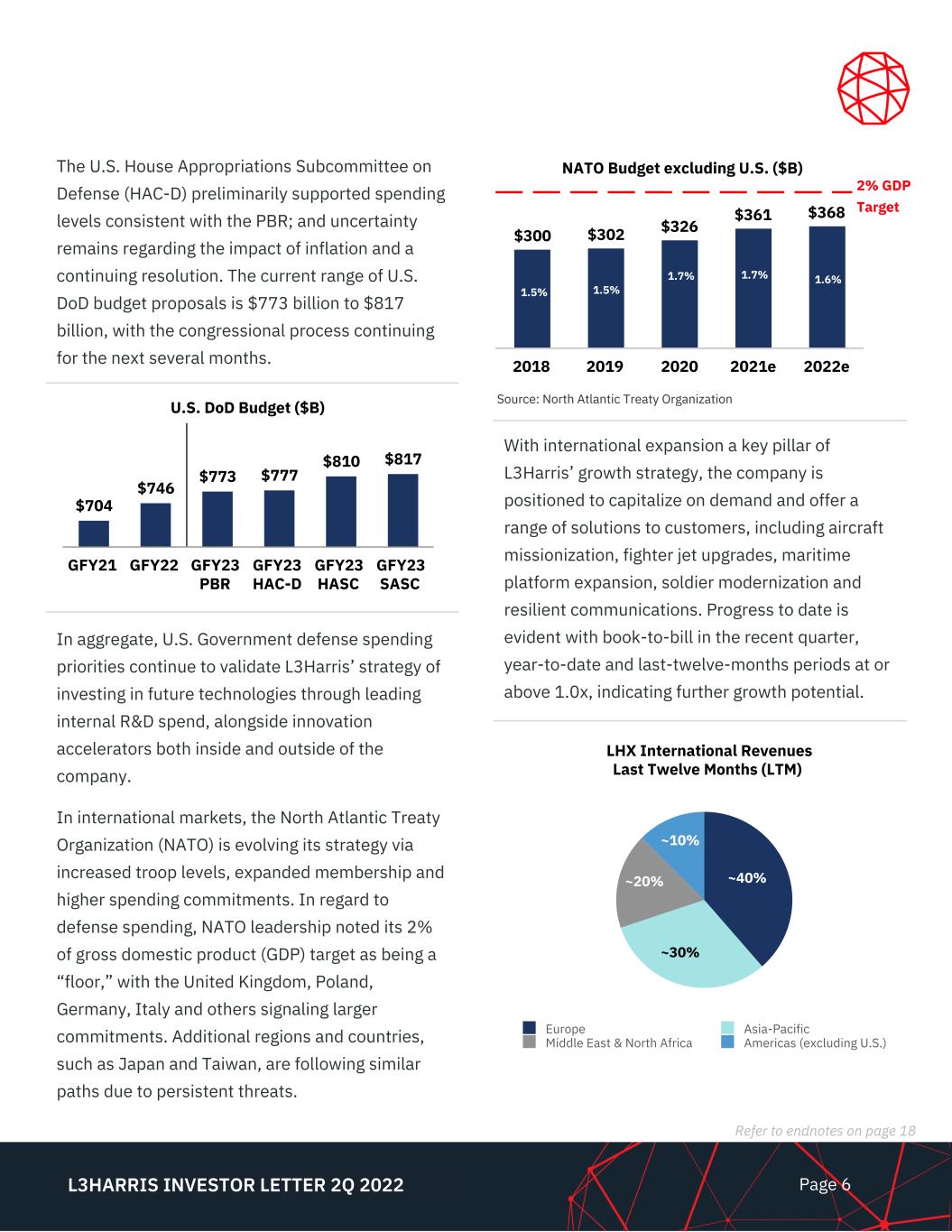

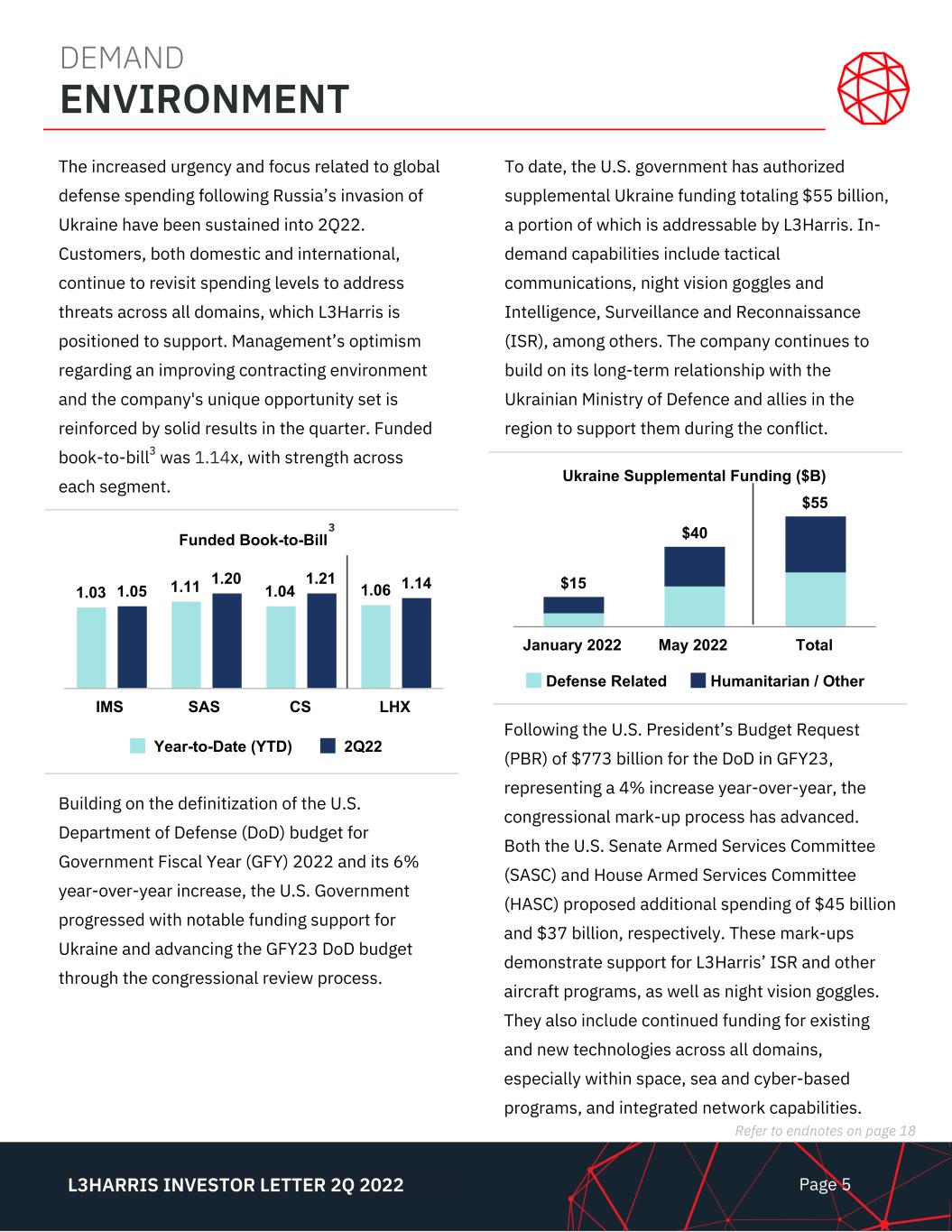

Page 5 Refer to endnotes on page 18 L3HARRIS INVESTOR LETTER 2Q 2022 The increased urgency and focus related to global defense spending following Russia’s invasion of Ukraine have been sustained into 2Q22. Customers, both domestic and international, continue to revisit spending levels to address threats across all domains, which L3Harris is positioned to support. Management’s optimism regarding an improving contracting environment and the company's unique opportunity set is reinforced by solid results in the quarter. Funded book-to-bill3 was 1.14x, with strength across each segment. To date, the U.S. government has authorized supplemental Ukraine funding totaling $55 billion, a portion of which is addressable by L3Harris. In- demand capabilities include tactical communications, night vision goggles and Intelligence, Surveillance and Reconnaissance (ISR), among others. The company continues to build on its long-term relationship with the Ukrainian Ministry of Defence and allies in the region to support them during the conflict. Funded Book-to-Bill 1.03 1.11 1.04 1.061.05 1.20 1.21 1.14 Year-to-Date (YTD) 2Q22 IMS SAS CS LHX 3 support DEMAND ENVIRONMENT Ukraine Supplemental Funding ($B) $15 $40 $55 Defense Related Humanitarian / Other January 2022 May 2022 Total Following the U.S. President’s Budget Request (PBR) of $773 billion for the DoD in GFY23, representing a 4% increase year-over-year, the congressional mark-up process has advanced. Both the U.S. Senate Armed Services Committee (SASC) and House Armed Services Committee (HASC) proposed additional spending of $45 billion and $37 billion, respectively. These mark-ups demonstrate support for L3Harris’ ISR and other aircraft programs, as well as night vision goggles. They also include continued funding for existing and new technologies across all domains, especially within space, sea and cyber-based programs, and integrated network capabilities. Building on the definitization of the U.S. Department of Defense (DoD) budget for Government Fiscal Year (GFY) 2022 and its 6% year-over-year increase, the U.S. Government progressed with notable funding support for Ukraine and advancing the GFY23 DoD budget through the congressional review process.

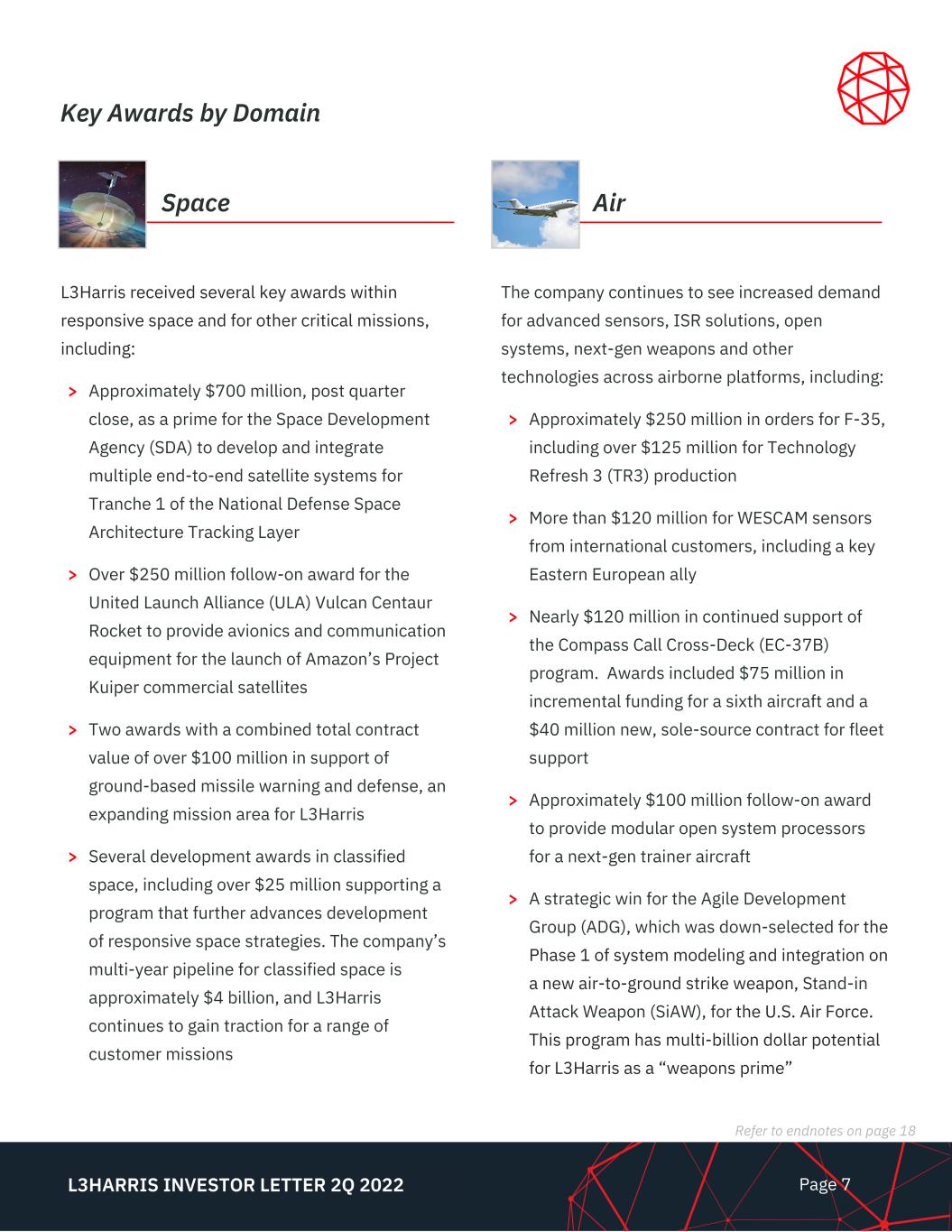

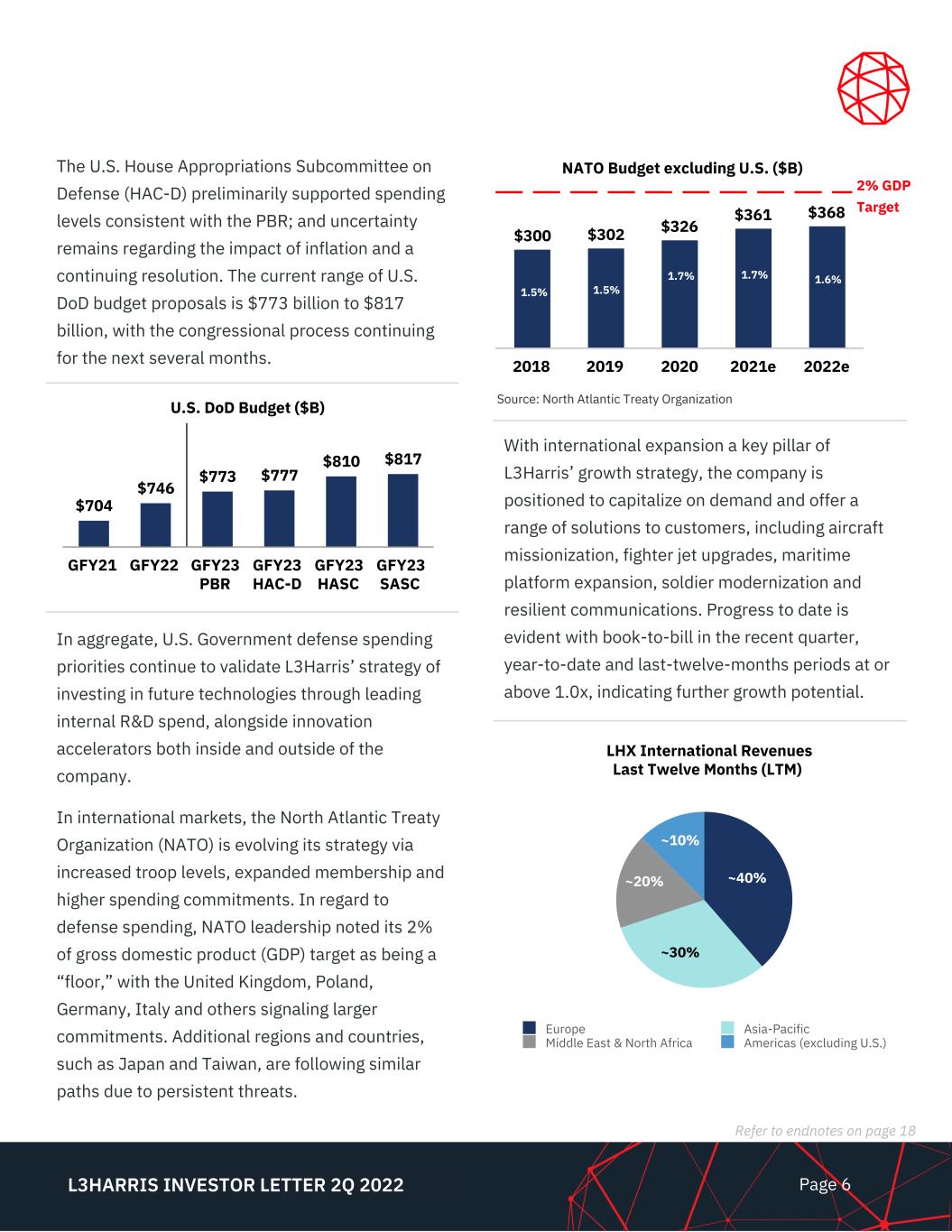

Page 6 L3HARRIS INVESTOR LETTER 2Q 2022 Refer to endnotes on page 18 U.S. DoD Budget ($B) $704 $746 $773 $777 $810 $817 GFY21 GFY22 GFY23 PBR GFY23 HAC-D GFY23 HASC GFY23 SASC The U.S. House Appropriations Subcommittee on Defense (HAC-D) preliminarily supported spending levels consistent with the PBR; and uncertainty remains regarding the impact of inflation and a continuing resolution. The current range of U.S. DoD budget proposals is $773 billion to $817 billion, with the congressional process continuing for the next several months. NATO Budget excluding U.S. ($B) $300 $302 $326 $361 $368 2018 2019 2020 2021e 2022e 2% GDP Target Source: North Atlantic Treaty Organization 1.5% 1.5% 1.7% 1.7% 1.6% support In aggregate, U.S. Government defense spending priorities continue to validate L3Harris’ strategy of investing in future technologies through leading internal R&D spend, alongside innovation accelerators both inside and outside of the company. In international markets, the North Atlantic Treaty Organization (NATO) is evolving its strategy via increased troop levels, expanded membership and higher spending commitments. In regard to defense spending, NATO leadership noted its 2% of gross domestic product (GDP) target as being a “floor,” with the United Kingdom, Poland, Germany, Italy and others signaling larger commitments. Additional regions and countries, such as Japan and Taiwan, are following similar paths due to persistent threats. LHX International Revenues Last Twelve Months (LTM) Europe Asia-Pacific Middle East & North Africa Americas (excluding U.S.) With international expansion a key pillar of L3Harris’ growth strategy, the company is positioned to capitalize on demand and offer a range of solutions to customers, including aircraft missionization, fighter jet upgrades, maritime platform expansion, soldier modernization and resilient communications. Progress to date is evident with book-to-bill in the recent quarter, year-to-date and last-twelve-months periods at or above 1.0x, indicating further growth potential. ~30% ~40%~20% ~10%

Page 7 L3HARRIS INVESTOR LETTER 2Q 2022 Refer to endnotes on page 18 Space Air L3Harris received several key awards within responsive space and for other critical missions, including: > Approximately $700 million, post quarter close, as a prime for the Space Development Agency (SDA) to develop and integrate multiple end-to-end satellite systems for Tranche 1 of the National Defense Space Architecture Tracking Layer > Over $250 million follow-on award for the United Launch Alliance (ULA) Vulcan Centaur Rocket to provide avionics and communication equipment for the launch of Amazon’s Project Kuiper commercial satellites > Two awards with a combined total contract value of over $100 million in support of ground-based missile warning and defense, an expanding mission area for L3Harris > Several development awards in classified space, including over $25 million supporting a program that further advances development of responsive space strategies. The company’s multi-year pipeline for classified space is approximately $4 billion, and L3Harris continues to gain traction for a range of customer missions The company continues to see increased demand for advanced sensors, ISR solutions, open systems, next-gen weapons and other technologies across airborne platforms, including: > Approximately $250 million in orders for F-35, including over $125 million for Technology Refresh 3 (TR3) production > More than $120 million for WESCAM sensors from international customers, including a key Eastern European ally > Nearly $120 million in continued support of the Compass Call Cross-Deck (EC-37B) program. Awards included $75 million in incremental funding for a sixth aircraft and a $40 million new, sole-source contract for fleet support > Approximately $100 million follow-on award to provide modular open system processors for a next-gen trainer aircraft > A strategic win for the Agile Development Group (ADG), which was down-selected for the Phase 1 of system modeling and integration on a new air-to-ground strike weapon, Stand-in Attack Weapon (SiAW), for the U.S. Air Force. This program has multi-billion dollar potential for L3Harris as a “weapons prime” Key Awards by Domain

Page 8 L3HARRIS INVESTOR LETTER 2Q 2022 Refer to endnotes on page 18 As a prime, L3Harris supported continued communications modernization demand for the U.S. DoD and international customers, including: > Nearly $300 million award for multi-channel tactical radios to a key NATO ally > A post-quarter close competitive award with a potential value of over $100 million for the U.S. Marine Corps’ Expeditionary Advanced Ground Link (EAGL) system, which will deliver improved transmission capabilities while maintaining secure communications > Approximately $60 million in awards for tactical radios from a key country in Eastern Europe > Nearly $50 million follow-on U.S. Army award for high frequency PRC-160 manpack radios, driven by an increased need for a fielded, modernized capability > More than $40 million in task orders from the U.S. Special Operations Command (SOCOM) for Next Generation Tactical Communications (NGTC), leveraging the nearly $300 million sole-source indefinite delivery, indefinite quantity (IDIQ) contract for multi-channel manpack radios received in 1Q22 L3Harris won prime positions across key maritime programs, including: > More than $200 million, with a potential value of up to $600 million, as the prime for the U.S. Navy’s Shipboard Panoramic Electro-Optic / Infrared (SPEIR) system. This system will detect and track anti-ship cruise missiles, attack craft and unmanned air systems as well as aid navigation > In July, the company received a contract worth up to $380 million for the U.S. Navy’s production, repair and sustainment of the Cooperative Engagement Capability (CEC) system, which enables high quality situational awareness and integrated fire control capability. CEC will also be the backbone of the Navy’s JADC2 architecture The company received more than $250 million in Intel & Cyber orders in 2Q22, including a multi- year contract, with a potential value of up to $1.5 billion, as the prime integrator for a classified solution SeaLand Cyber The appearance of U.S. Department of Defense (DoD) visual information does not imply or constitute DoD endorsement.

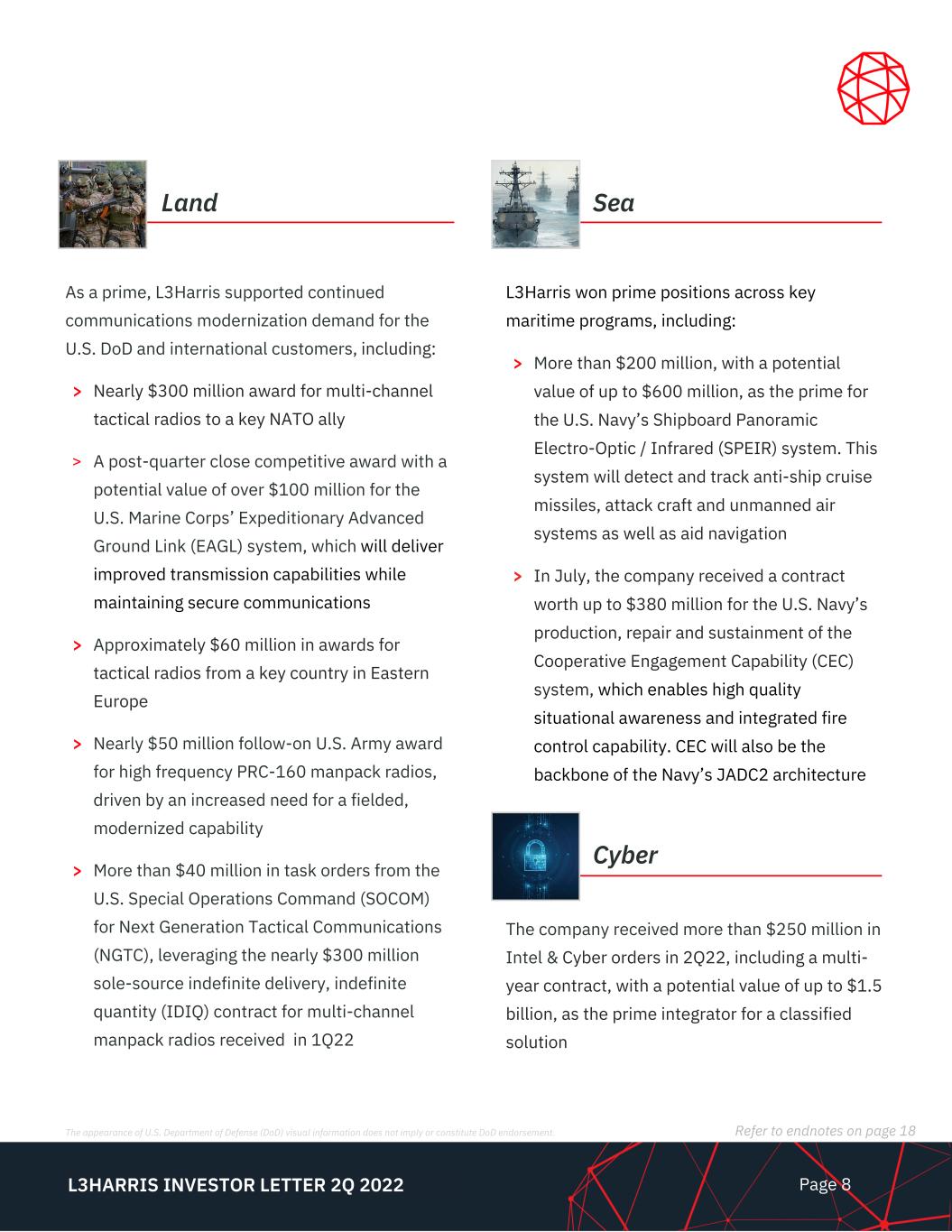

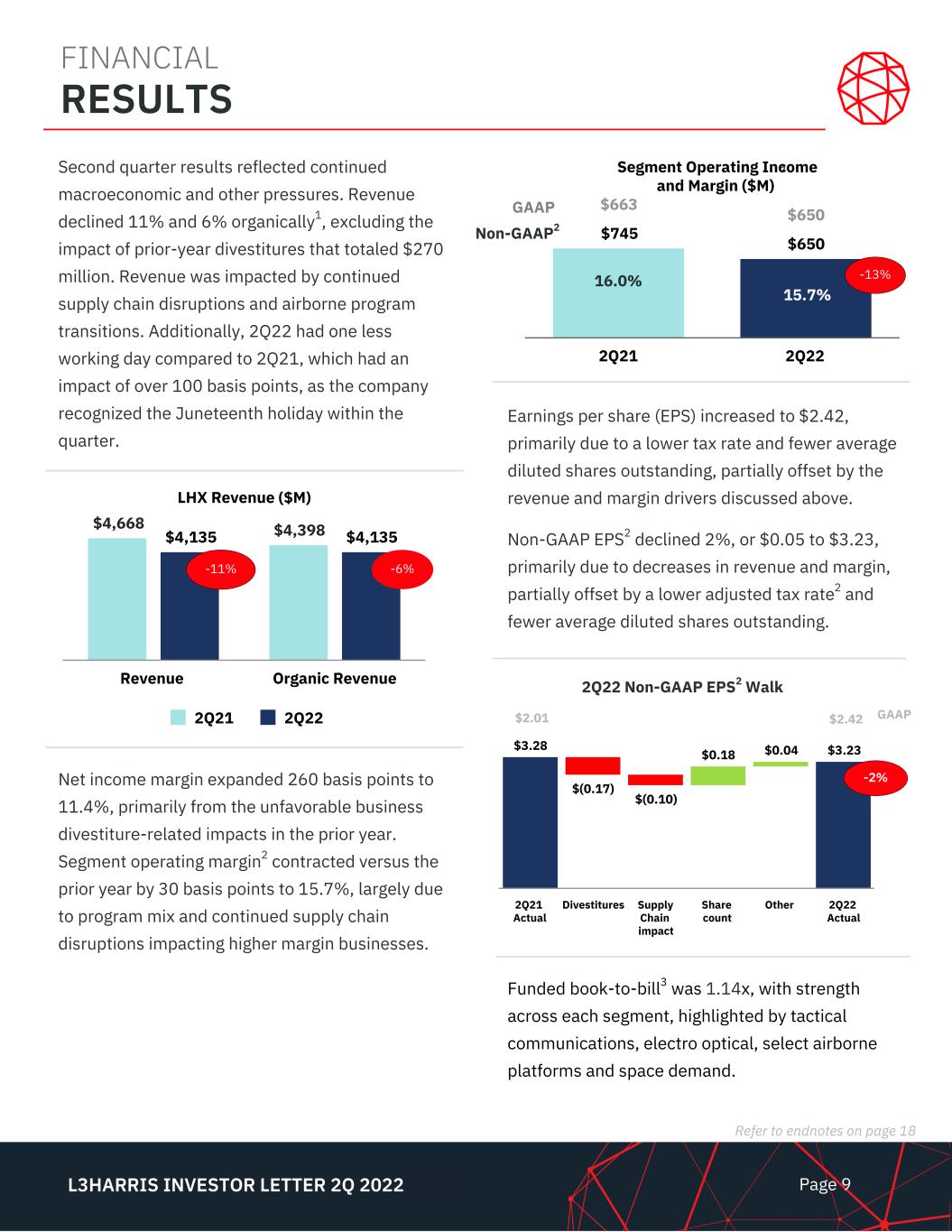

Page 9 Refer to endnotes on page 18 L3HARRIS INVESTOR LETTER 2Q 2022 Earnings per share (EPS) increased to $2.42, primarily due to a lower tax rate and fewer average diluted shares outstanding, partially offset by the revenue and margin drivers discussed above. Non-GAAP EPS2 declined 2%, or $0.05 to $3.23, primarily due to decreases in revenue and margin, partially offset by a lower adjusted tax rate2 and fewer average diluted shares outstanding. Second quarter results reflected continued macroeconomic and other pressures. Revenue declined 11% and 6% organically1, excluding the impact of prior-year divestitures that totaled $270 million. Revenue was impacted by continued supply chain disruptions and airborne program transitions. Additionally, 2Q22 had one less working day compared to 2Q21, which had an impact of over 100 basis points, as the company recognized the Juneteenth holiday within the quarter. LHX Revenue ($M) $4,668 $4,398$4,135 $4,135 2Q21 2Q22 Revenue Organic Revenue $3.28 $(0.17) $(0.10) $0.18 $0.04 $3.23 2Q21 Actual Divestitures Supply Chain impact Share count Other 2Q22 Actual 2Q22 Non-GAAP EPS2 Walk -2% 1 $2.42 GAAP$2.01 FINANCIAL RESULTS -6%-11% Segment Operating Income and Margin ($M) $745 $650 2Q21 2Q22 -13%16.0% 15.7% 2 $663 $650GAAP Non-GAAP2 Net income margin expanded 260 basis points to 11.4%, primarily from the unfavorable business divestiture-related impacts in the prior year. Segment operating margin2 contracted versus the prior year by 30 basis points to 15.7%, largely due to program mix and continued supply chain disruptions impacting higher margin businesses. Funded book-to-bill3 was 1.14x, with strength across each segment, highlighted by tactical communications, electro optical, select airborne platforms and space demand.

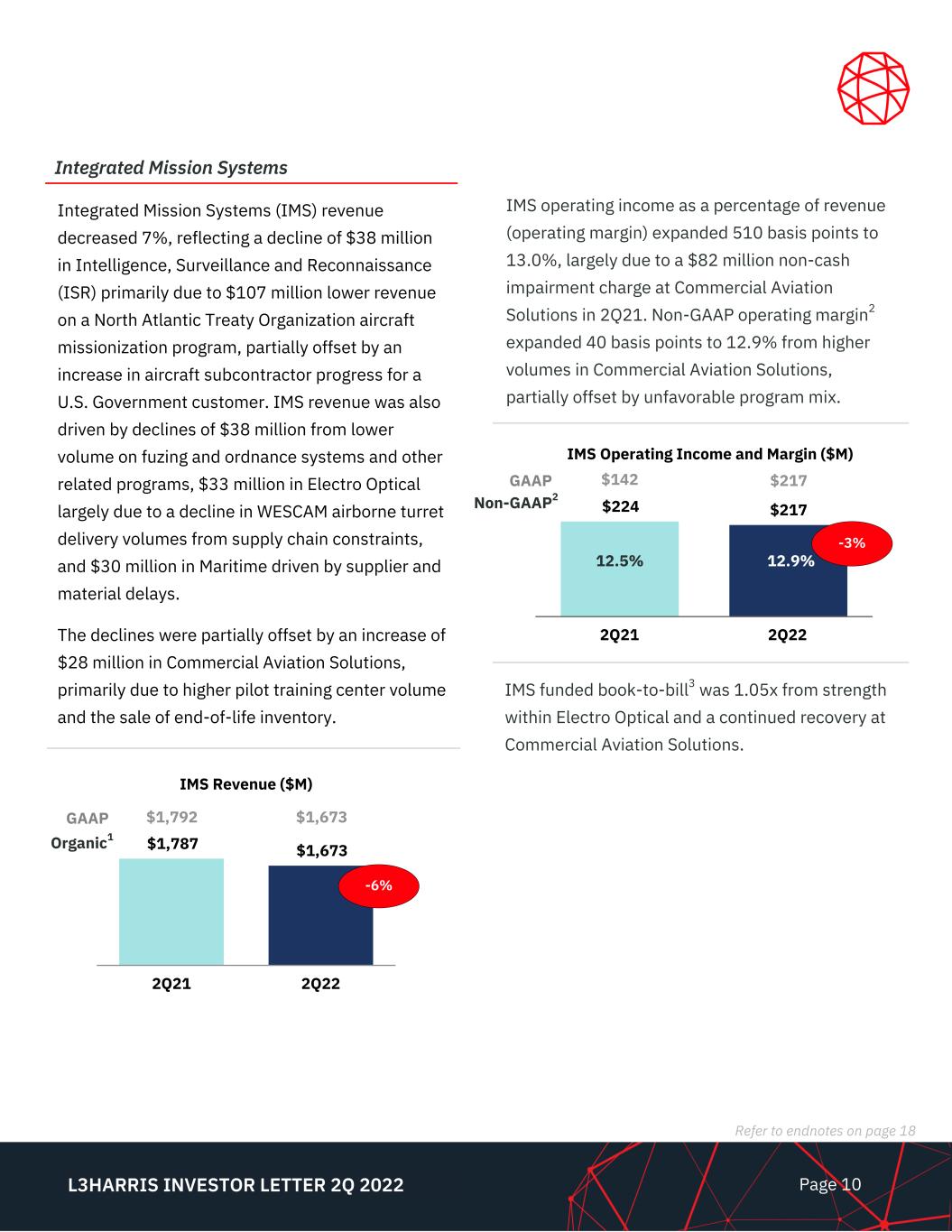

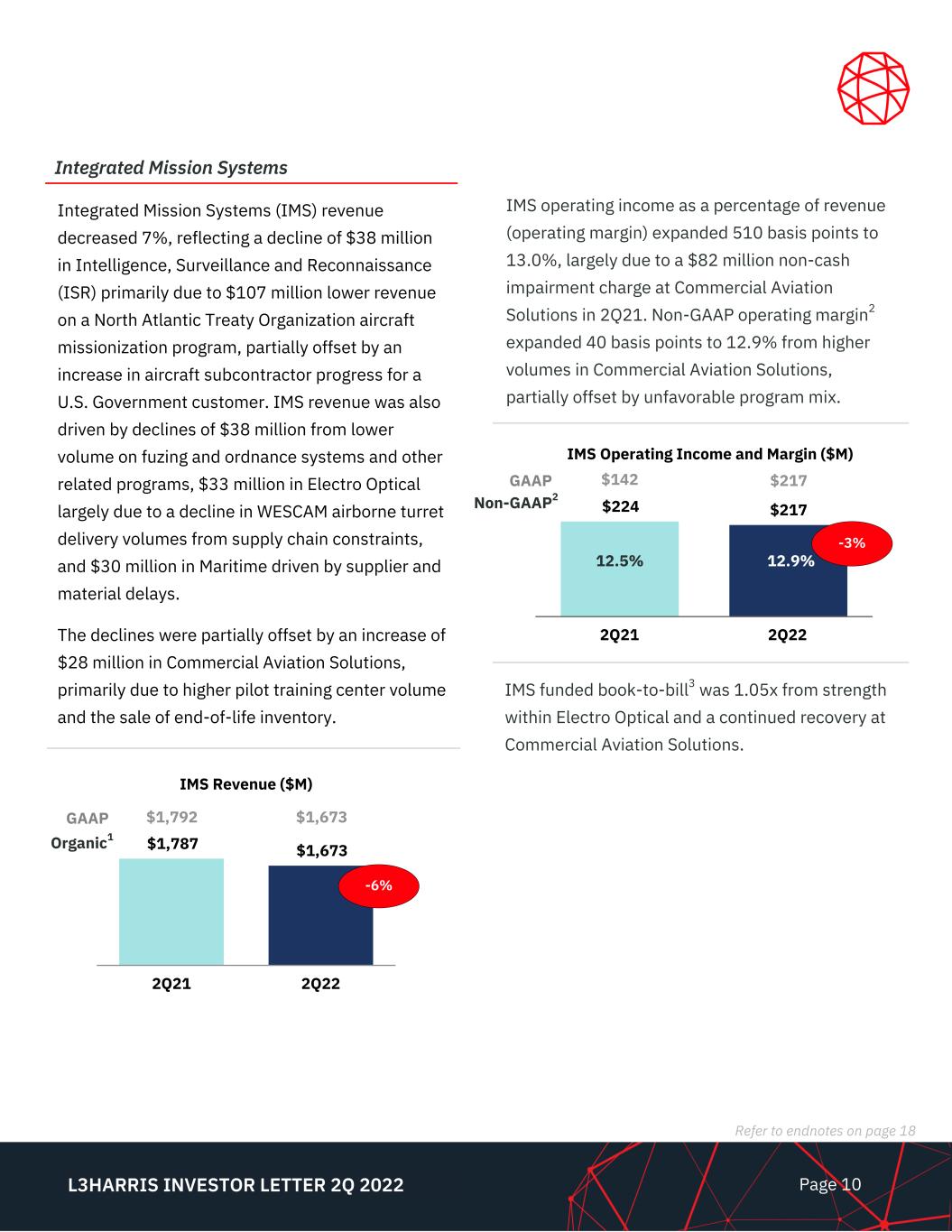

Page 10 L3HARRIS INVESTOR LETTER 2Q 2022 Refer to endnotes on page 18 IMS Operating Income and Margin ($M) $224 $217 2Q21 2Q22 -3% 12.5% IMS operating income as a percentage of revenue (operating margin) expanded 510 basis points to 13.0%, largely due to a $82 million non-cash impairment charge at Commercial Aviation Solutions in 2Q21. Non-GAAP operating margin2 expanded 40 basis points to 12.9% from higher volumes in Commercial Aviation Solutions, partially offset by unfavorable program mix. IMS funded book-to-bill3 was 1.05x from strength within Electro Optical and a continued recovery at Commercial Aviation Solutions. IMS Revenue ($M) $1,787 $1,673 2Q21 2Q22 -6% Integrated Mission Systems (IMS) revenue decreased 7%, reflecting a decline of $38 million in Intelligence, Surveillance and Reconnaissance (ISR) primarily due to $107 million lower revenue on a North Atlantic Treaty Organization aircraft missionization program, partially offset by an increase in aircraft subcontractor progress for a U.S. Government customer. IMS revenue was also driven by declines of $38 million from lower volume on fuzing and ordnance systems and other related programs, $33 million in Electro Optical largely due to a decline in WESCAM airborne turret delivery volumes from supply chain constraints, and $30 million in Maritime driven by supplier and material delays. The declines were partially offset by an increase of $28 million in Commercial Aviation Solutions, primarily due to higher pilot training center volume and the sale of end-of-life inventory. Integrated Mission Systems Organic1 GAAP $1,792 $1,673 12.9% GAAP $142 $217 Non-GAAP2

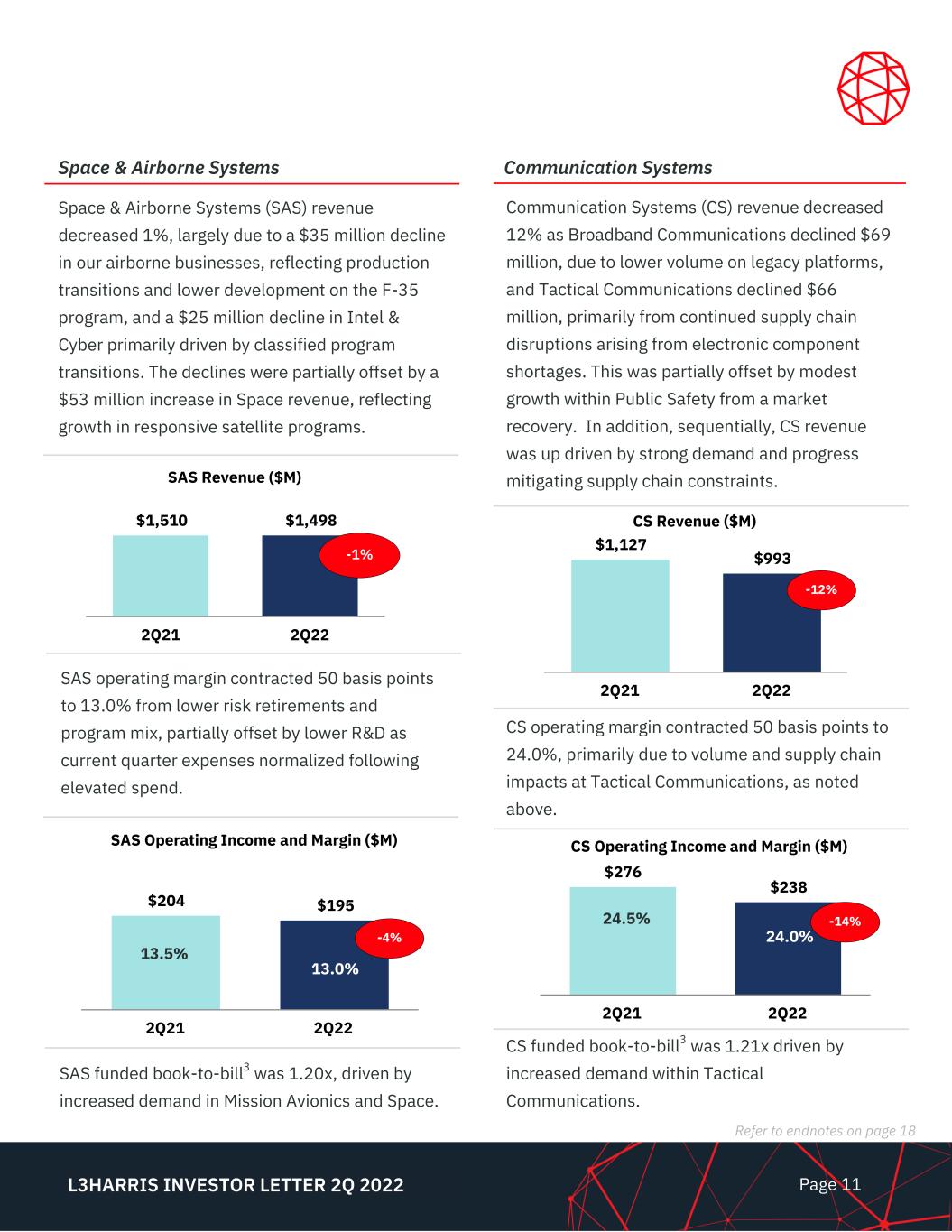

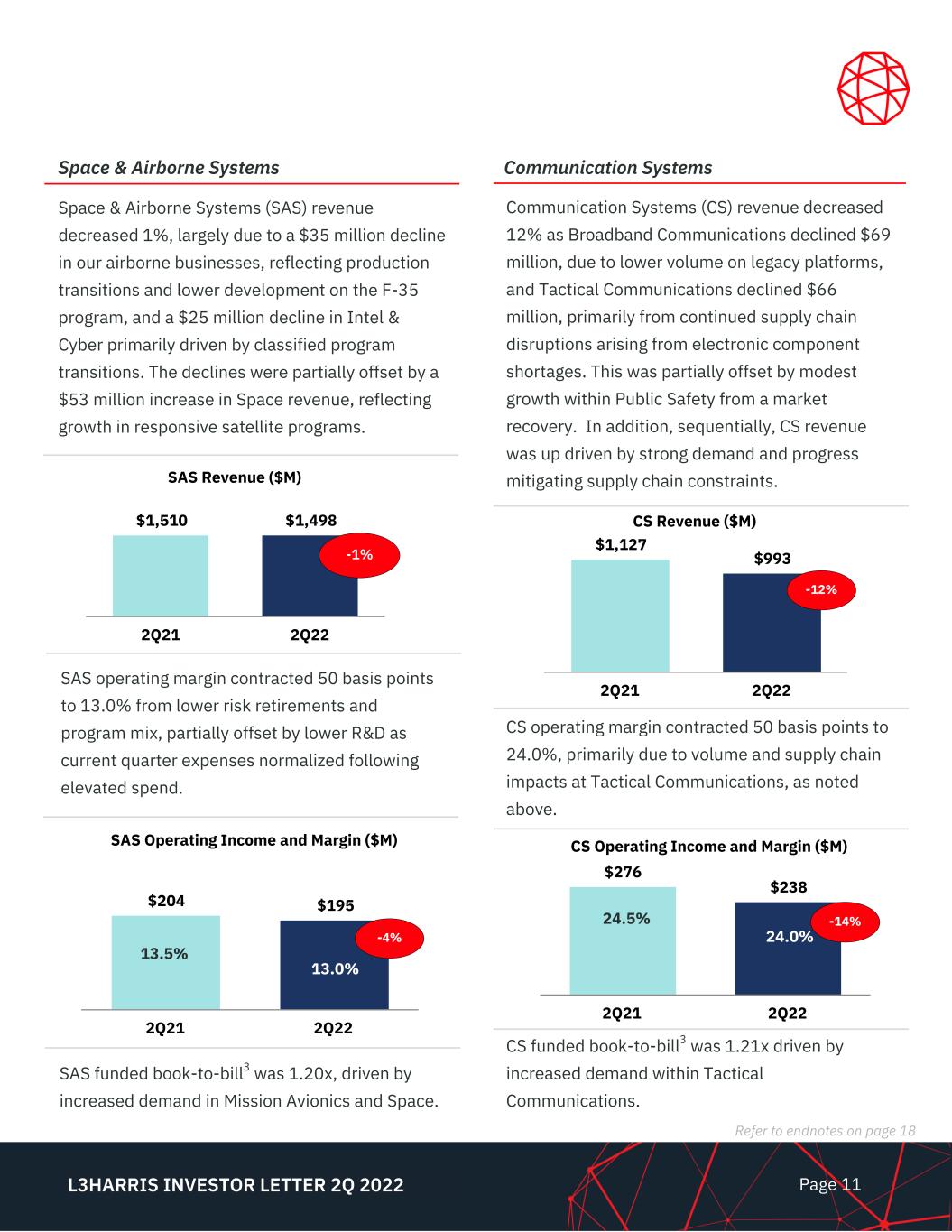

Page 11 L3HARRIS INVESTOR LETTER 2Q 2022 Refer to endnotes on page 18 CS Revenue ($M) $1,127 $993 2Q21 2Q22 CS Operating Income and Margin ($M) $276 $238 2Q21 2Q22 24.0% 24.5% -12% -14% Communication Systems (CS) revenue decreased 12% as Broadband Communications declined $69 million, due to lower volume on legacy platforms, and Tactical Communications declined $66 million, primarily from continued supply chain disruptions arising from electronic component shortages. This was partially offset by modest growth within Public Safety from a market recovery. In addition, sequentially, CS revenue was up driven by strong demand and progress mitigating supply chain constraints. CS operating margin contracted 50 basis points to 24.0%, primarily due to volume and supply chain impacts at Tactical Communications, as noted above. CS funded book-to-bill3 was 1.21x driven by increased demand within Tactical Communications. Communication Systems SAS Operating Income and Margin ($M) $204 $195 2Q21 2Q22 -4% 13.0% 13.5% SAS funded book-to-bill3 was 1.20x, driven by increased demand in Mission Avionics and Space. SAS Revenue ($M) $1,510 $1,498 2Q21 2Q22 -1% Space & Airborne Systems (SAS) revenue decreased 1%, largely due to a $35 million decline in our airborne businesses, reflecting production transitions and lower development on the F-35 program, and a $25 million decline in Intel & Cyber primarily driven by classified program transitions. The declines were partially offset by a $53 million increase in Space revenue, reflecting growth in responsive satellite programs. SAS operating margin contracted 50 basis points to 13.0% from lower risk retirements and program mix, partially offset by lower R&D as current quarter expenses normalized following elevated spend. Space & Airborne Systems

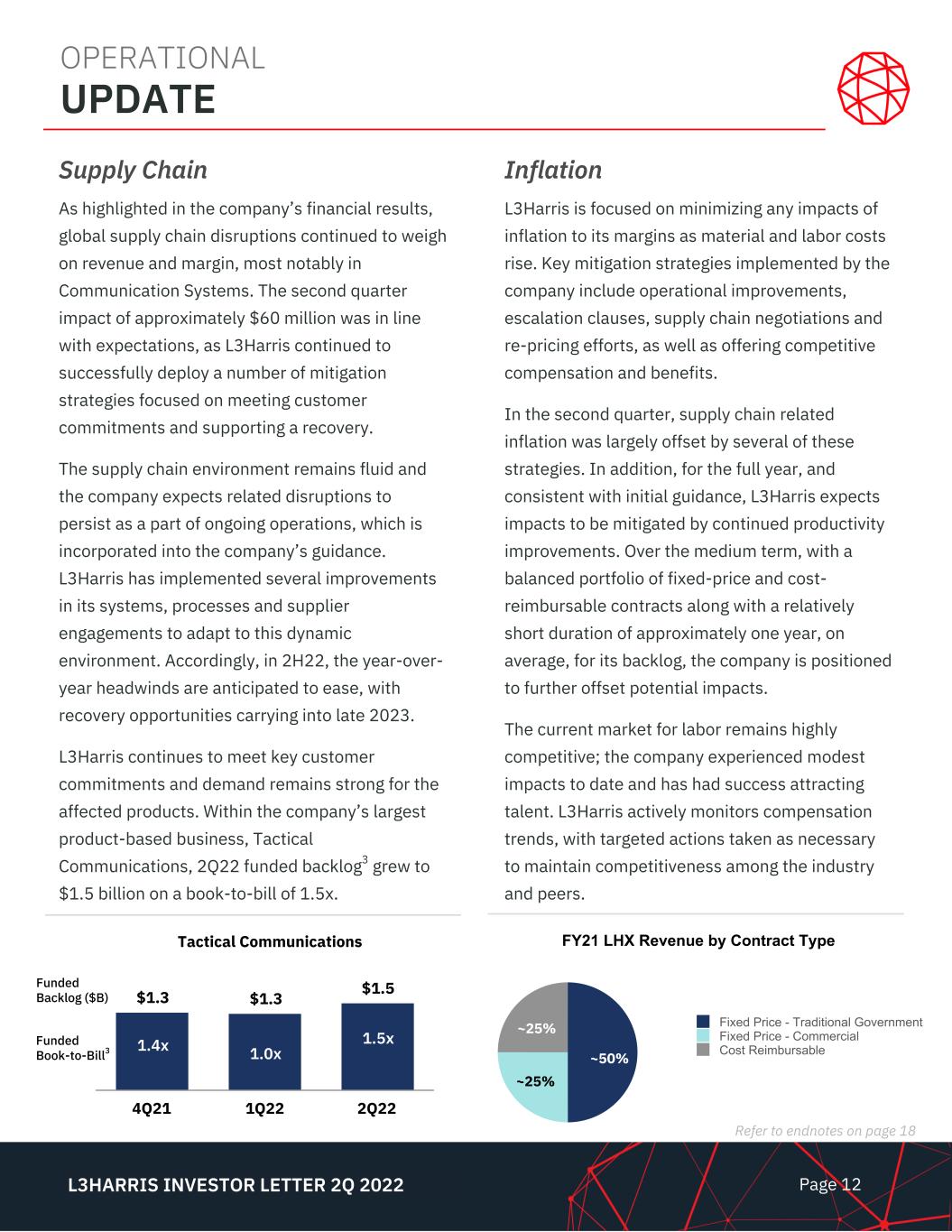

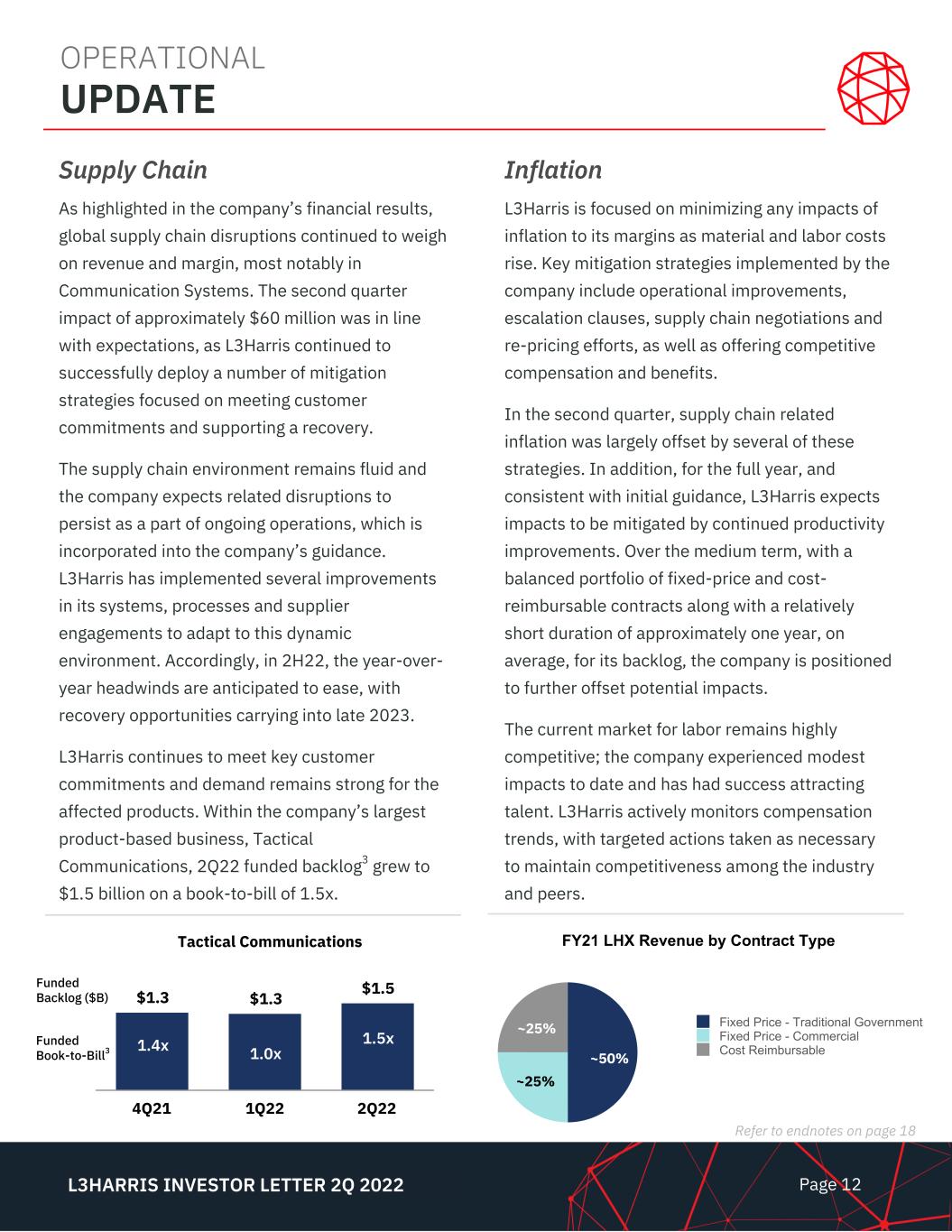

Page 12 Refer to endnotes on page 18 L3HARRIS INVESTOR LETTER 2Q 2022 Supply Chain As highlighted in the company’s financial results, global supply chain disruptions continued to weigh on revenue and margin, most notably in Communication Systems. The second quarter impact of approximately $60 million was in line with expectations, as L3Harris continued to successfully deploy a number of mitigation strategies focused on meeting customer commitments and supporting a recovery. The supply chain environment remains fluid and the company expects related disruptions to persist as a part of ongoing operations, which is incorporated into the company’s guidance. L3Harris has implemented several improvements in its systems, processes and supplier engagements to adapt to this dynamic environment. Accordingly, in 2H22, the year-over- year headwinds are anticipated to ease, with recovery opportunities carrying into late 2023. L3Harris continues to meet key customer commitments and demand remains strong for the affected products. Within the company’s largest product-based business, Tactical Communications, 2Q22 funded backlog3 grew to $1.5 billion on a book-to-bill of 1.5x. Inflation L3Harris is focused on minimizing any impacts of inflation to its margins as material and labor costs rise. Key mitigation strategies implemented by the company include operational improvements, escalation clauses, supply chain negotiations and re-pricing efforts, as well as offering competitive compensation and benefits. In the second quarter, supply chain related inflation was largely offset by several of these strategies. In addition, for the full year, and consistent with initial guidance, L3Harris expects impacts to be mitigated by continued productivity improvements. Over the medium term, with a balanced portfolio of fixed-price and cost- reimbursable contracts along with a relatively short duration of approximately one year, on average, for its backlog, the company is positioned to further offset potential impacts. The current market for labor remains highly competitive; the company experienced modest impacts to date and has had success attracting talent. L3Harris actively monitors compensation trends, with targeted actions taken as necessary to maintain competitiveness among the industry and peers. OPERATIONAL UPDATE 1.4x 1.0x Funded Book-to-Bill3 Funded Book-to-Bill3 0.9x Funded Book-to-Bill3 Tactical Communications $1.3 $1.3 $1.5 4Q21 1Q22 2Q22 1.0x 1.5x1.4xFunded Book-to-Bill3 Funded Backlog ($B) FY21 LHX Revenue by Contract Type Fixed Price - Traditional Government Fixed Price - Commercial Cost Reimbursable~50% ~25% ~25%

Page 13 L3HARRIS INVESTOR LETTER 2Q 2022 Refer to endnotes on page 18 2Q22 Highlights The Space business successfully completed its Production Readiness Review for the SDA Tranche 0 Tracking Layer program, a critical milestone in preparing the space vehicle for integration and test later this year, with a launch slated for 2023. The ISR business recently integrated and rapidly deployed the U.S. Army Airborne Reconnaissance and Electronic Warfare System (ARES) to the U.S. Indo-Pacific Command, with several noteworthy accomplishments. The team achieved a mission flight endurance record of 12.5 hours and initiated operations with a blended group of U.S. Army and contractor crew members in the ISR-configured high-altitude business jet. The Maritime business achieved several key undersea milestones, including the delivery of the next ship set for Advanced Modular Power Systems on the Virginia-class submarine and a successful Program Design Review (PDR) on the Undersea Warfare Training Range (USWTR) program domestically. Internationally, the unmanned undersea team participated in Australia’s Autonomous Warrior 2022 exercise, showcasing advanced capabilities in acoustic communications, which included a live link between the Autonomous Undersea Vehicle, IVER and Autonomous Surface Vehicle. As highlighted in 1Q22, the Mission Avionics business entered safety-of-flight testing for the F-35 Technology Refresh 3 (TR3) Integrated Core Processor (ICP). In 2Q22, the team successfully completed all safety-of-flight testing requirements and delivered the first flight ship set, achieving a critical milestone toward reaching production.

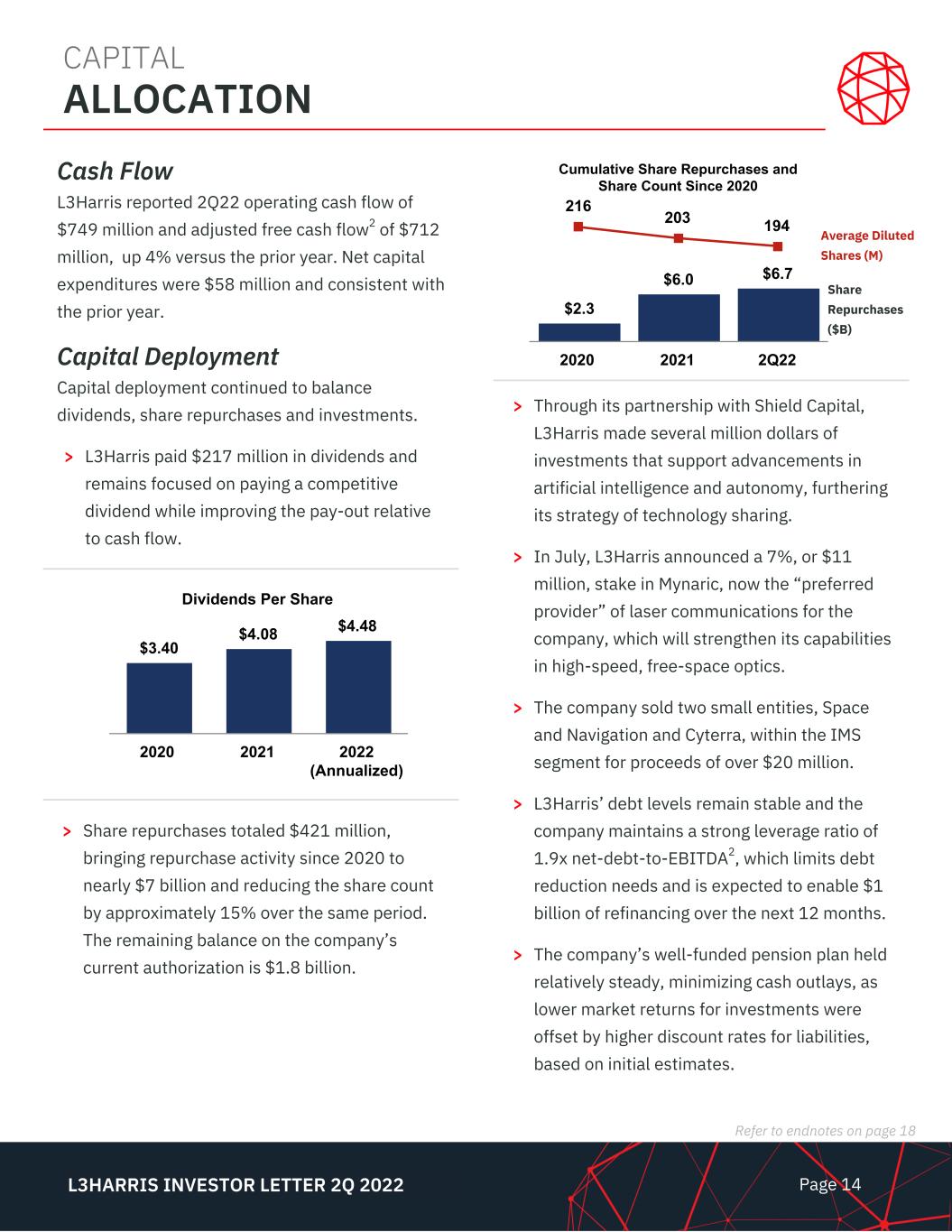

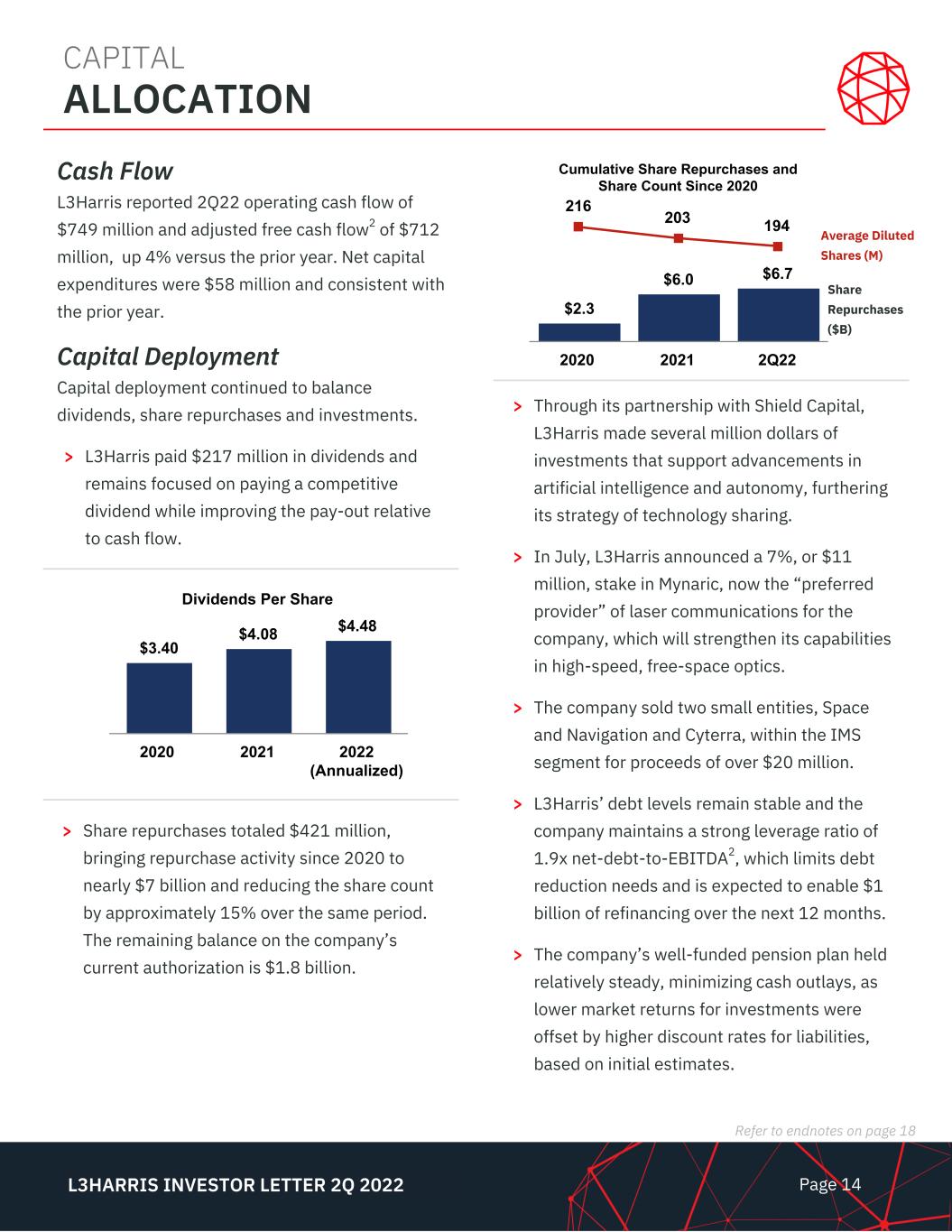

Page 14 Refer to endnotes on page 18 L3HARRIS INVESTOR LETTER 2Q 2022 216 203 194 > Through its partnership with Shield Capital, L3Harris made several million dollars of investments that support advancements in artificial intelligence and autonomy, furthering its strategy of technology sharing. > In July, L3Harris announced a 7%, or $11 million, stake in Mynaric, now the “preferred provider” of laser communications for the company, which will strengthen its capabilities in high-speed, free-space optics. > The company sold two small entities, Space and Navigation and Cyterra, within the IMS segment for proceeds of over $20 million. > L3Harris’ debt levels remain stable and the company maintains a strong leverage ratio of 1.9x net-debt-to-EBITDA2, which limits debt reduction needs and is expected to enable $1 billion of refinancing over the next 12 months. > The company’s well-funded pension plan held relatively steady, minimizing cash outlays, as lower market returns for investments were offset by higher discount rates for liabilities, based on initial estimates. Cumulative Share Repurchases and Share Count Since 2020 $2.3 $6.0 $6.7 2020 2021 2Q22 Cash Flow L3Harris reported 2Q22 operating cash flow of $749 million and adjusted free cash flow2 of $712 million, up 4% versus the prior year. Net capital expenditures were $58 million and consistent with the prior year. Capital Deployment Capital deployment continued to balance dividends, share repurchases and investments. > L3Harris paid $217 million in dividends and remains focused on paying a competitive dividend while improving the pay-out relative to cash flow. Dividends Per Share $3.40 $4.08 $4.48 2020 2021 2022 (Annualized) Average Diluted Shares (M) Share Repurchases ($B) CAPITAL ALLOCATION > Share repurchases totaled $421 million, bringing repurchase activity since 2020 to nearly $7 billion and reducing the share count by approximately 15% over the same period. The remaining balance on the company’s current authorization is $1.8 billion.

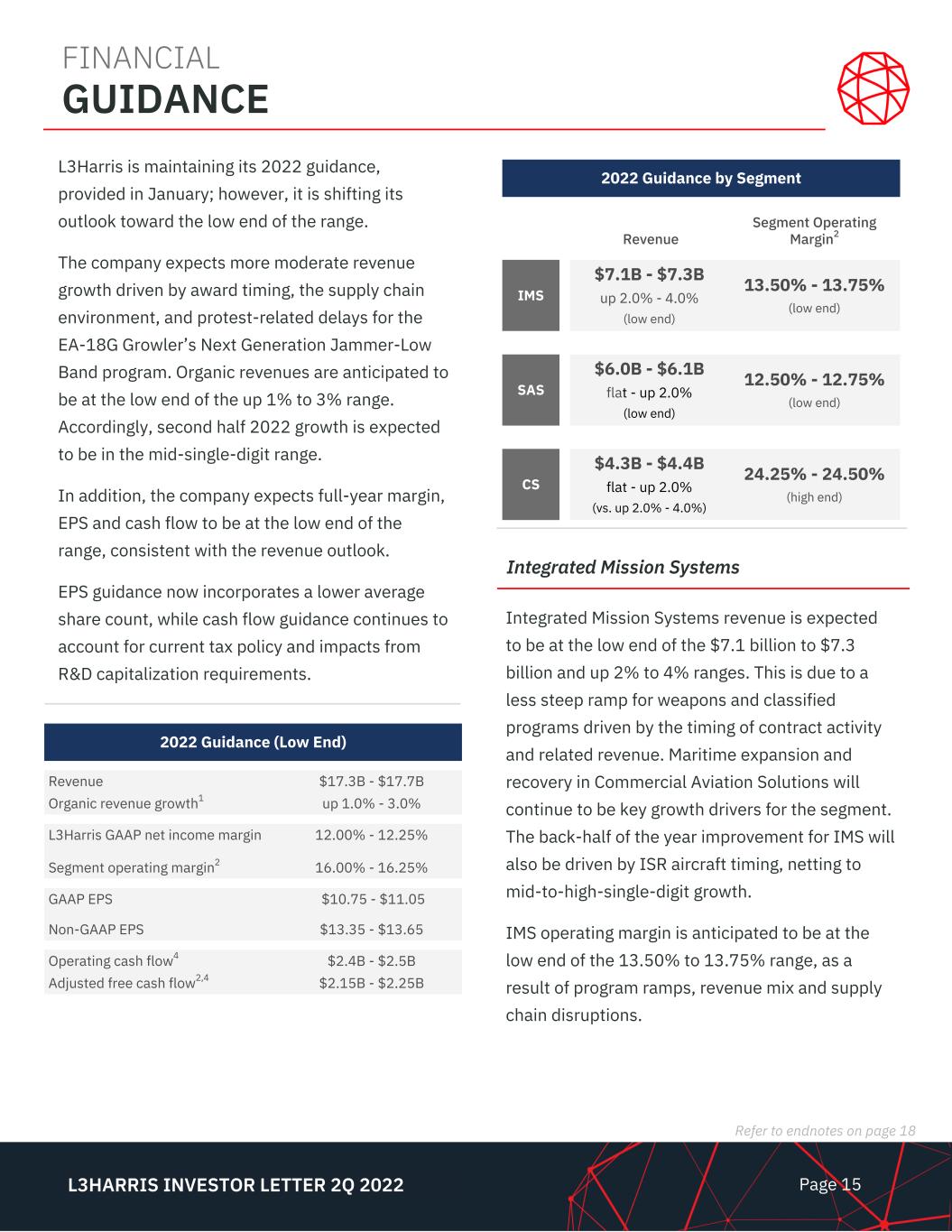

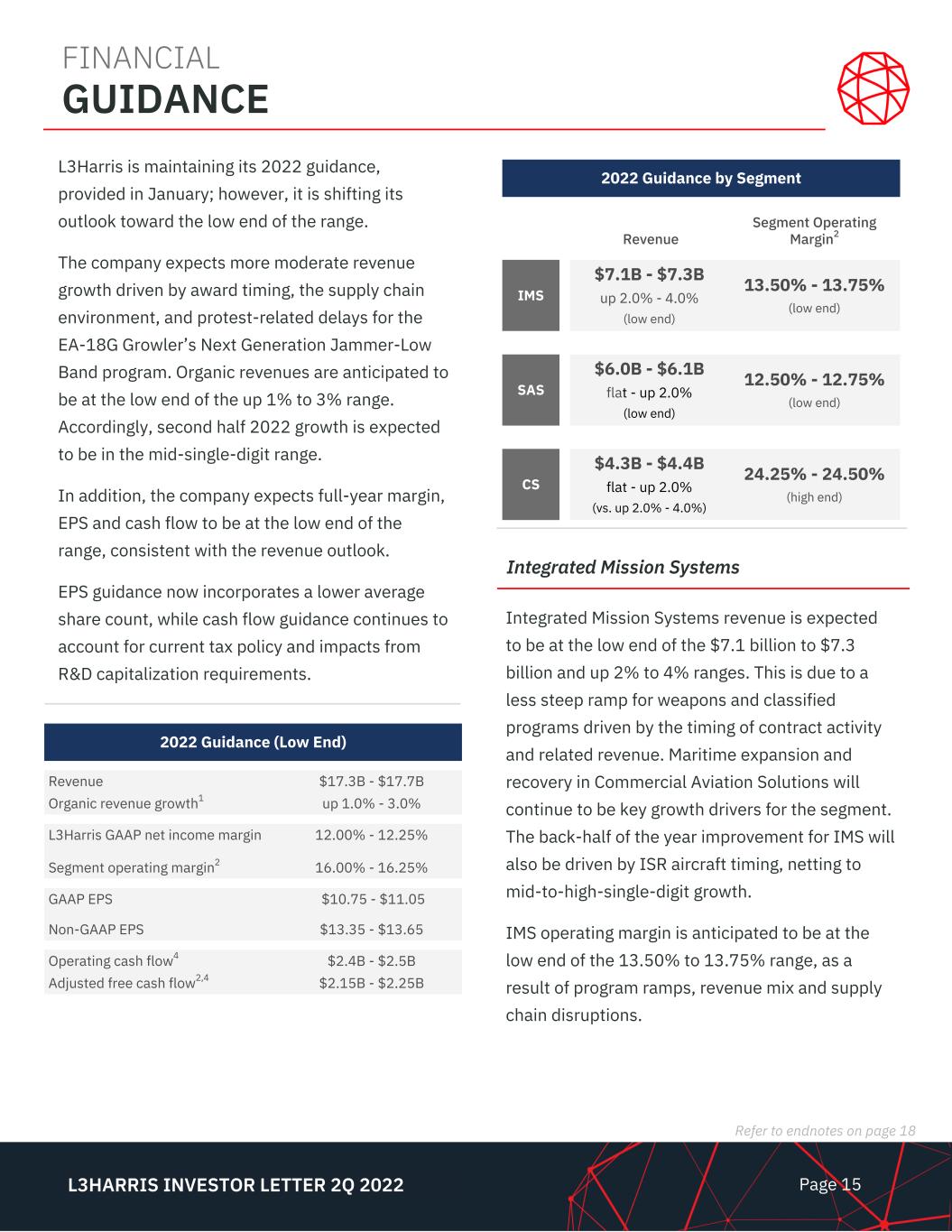

Page 15 Refer to endnotes on page 18 L3HARRIS INVESTOR LETTER 2Q 2022 Integrated Mission Systems L3Harris is maintaining its 2022 guidance, provided in January; however, it is shifting its outlook toward the low end of the range. The company expects more moderate revenue growth driven by award timing, the supply chain environment, and protest-related delays for the EA-18G Growler’s Next Generation Jammer-Low Band program. Organic revenues are anticipated to be at the low end of the up 1% to 3% range. Accordingly, second half 2022 growth is expected to be in the mid-single-digit range. In addition, the company expects full-year margin, EPS and cash flow to be at the low end of the range, consistent with the revenue outlook. EPS guidance now incorporates a lower average share count, while cash flow guidance continues to account for current tax policy and impacts from R&D capitalization requirements. Integrated Mission Systems revenue is expected to be at the low end of the $7.1 billion to $7.3 billion and up 2% to 4% ranges. This is due to a less steep ramp for weapons and classified programs driven by the timing of contract activity and related revenue. Maritime expansion and recovery in Commercial Aviation Solutions will continue to be key growth drivers for the segment. The back-half of the year improvement for IMS will also be driven by ISR aircraft timing, netting to mid-to-high-single-digit growth. IMS operating margin is anticipated to be at the low end of the 13.50% to 13.75% range, as a result of program ramps, revenue mix and supply chain disruptions. 2022 Guidance (Low End) Revenue $17.3B - $17.7B Organic revenue growth1 up 1.0% - 3.0% L3Harris GAAP net income margin 12.00% - 12.25% Segment operating margin2 16.00% - 16.25% GAAP EPS $10.75 - $11.05 Non-GAAP EPS $13.35 - $13.65 Operating cash flow4 $2.4B - $2.5B Adjusted free cash flow2,4 $2.15B - $2.25B 2022 Guidance by Segment Revenue Segment Operating Margin2 IMS $7.1B - $7.3B up 2.0% - 4.0% (low end) 13.50% - 13.75% (low end) SAS $6.0B - $6.1B flat - up 2.0% (low end) 12.50% - 12.75% (low end) CS $4.3B - $4.4B flat - up 2.0% (vs. up 2.0% - 4.0%) 24.25% - 24.50% (high end) FINANCIAL GUIDANCE

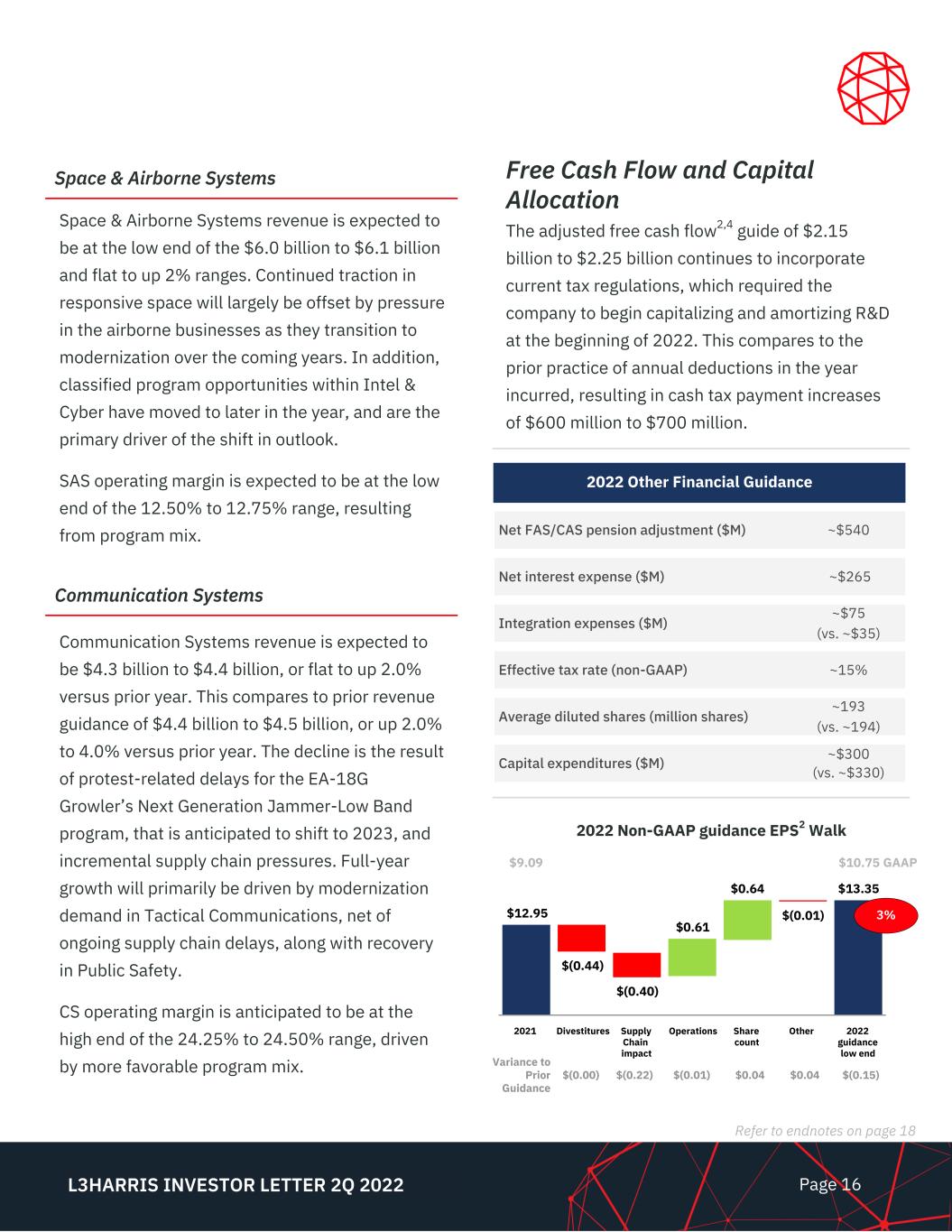

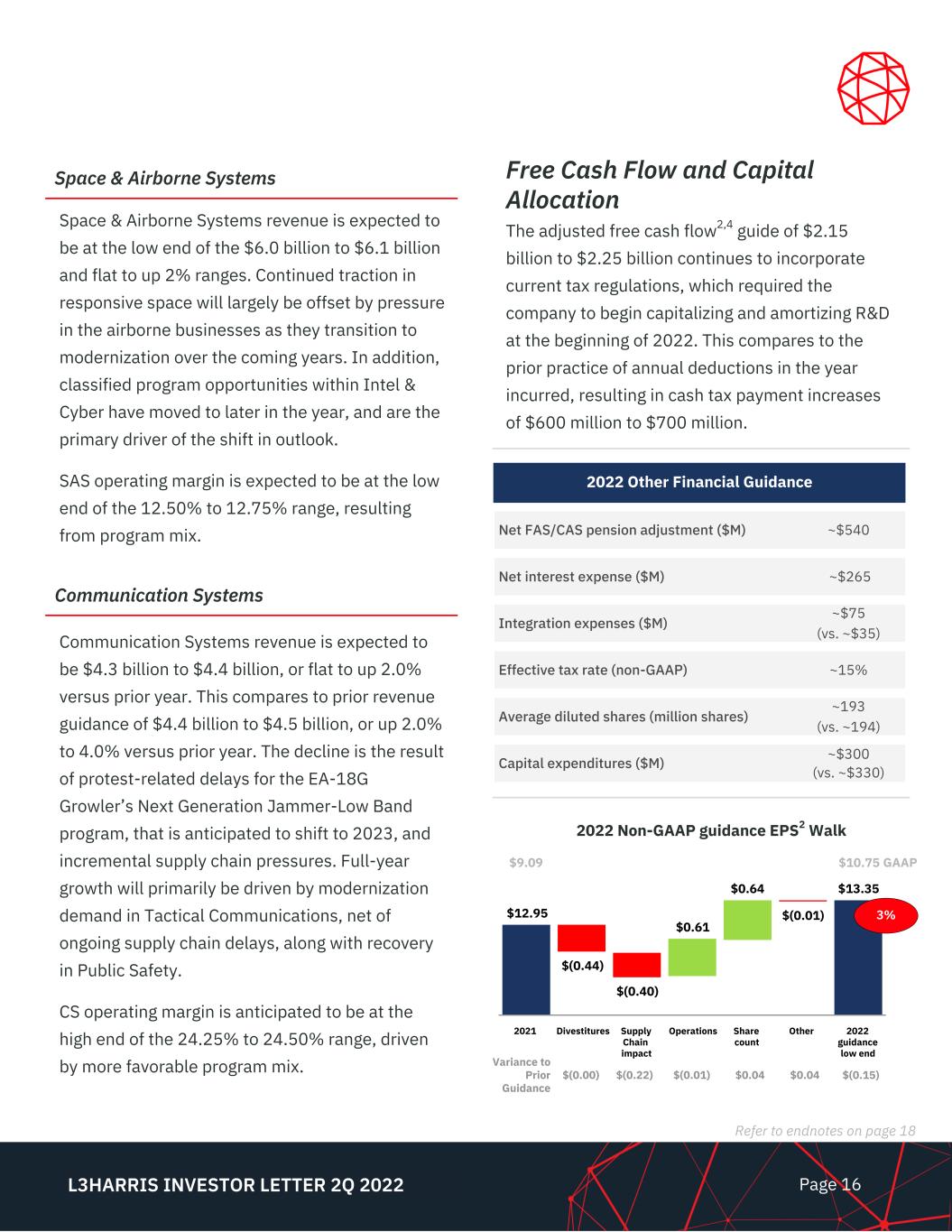

Page 16 L3HARRIS INVESTOR LETTER 2Q 2022 Refer to endnotes on page 18 Space & Airborne Systems revenue is expected to be at the low end of the $6.0 billion to $6.1 billion and flat to up 2% ranges. Continued traction in responsive space will largely be offset by pressure in the airborne businesses as they transition to modernization over the coming years. In addition, classified program opportunities within Intel & Cyber have moved to later in the year, and are the primary driver of the shift in outlook. SAS operating margin is expected to be at the low end of the 12.50% to 12.75% range, resulting from program mix. Free Cash Flow and Capital Allocation The adjusted free cash flow2,4 guide of $2.15 billion to $2.25 billion continues to incorporate current tax regulations, which required the company to begin capitalizing and amortizing R&D at the beginning of 2022. This compares to the prior practice of annual deductions in the year incurred, resulting in cash tax payment increases of $600 million to $700 million. Net FAS/CAS pension adjustment ($M) ~$540 Net interest expense ($M) ~$265 Integration expenses ($M) ~$75 (vs. ~$35) Effective tax rate (non-GAAP) ~15% Average diluted shares (million shares) ~193 (vs. ~194) Capital expenditures ($M) ~$300 (vs. ~$330) 2022 Other Financial Guidance Space & Airborne Systems Communication Systems Communication Systems revenue is expected to be $4.3 billion to $4.4 billion, or flat to up 2.0% versus prior year. This compares to prior revenue guidance of $4.4 billion to $4.5 billion, or up 2.0% to 4.0% versus prior year. The decline is the result of protest-related delays for the EA-18G Growler’s Next Generation Jammer-Low Band program, that is anticipated to shift to 2023, and incremental supply chain pressures. Full-year growth will primarily be driven by modernization demand in Tactical Communications, net of ongoing supply chain delays, along with recovery in Public Safety. CS operating margin is anticipated to be at the high end of the 24.25% to 24.50% range, driven by more favorable program mix. $12.95 $(0.44) $(0.40) $0.61 $0.64 $(0.01) $13.35 2021 Divestitures Supply Chain impact Operations Share count Other 2022 guidance low end 2022 Non-GAAP guidance EPS2 Walk 3% Variance to Prior Guidance $(0.00) $(0.22) $(0.01) $0.04 $0.04 $(0.15) $10.75 GAAP$9.09

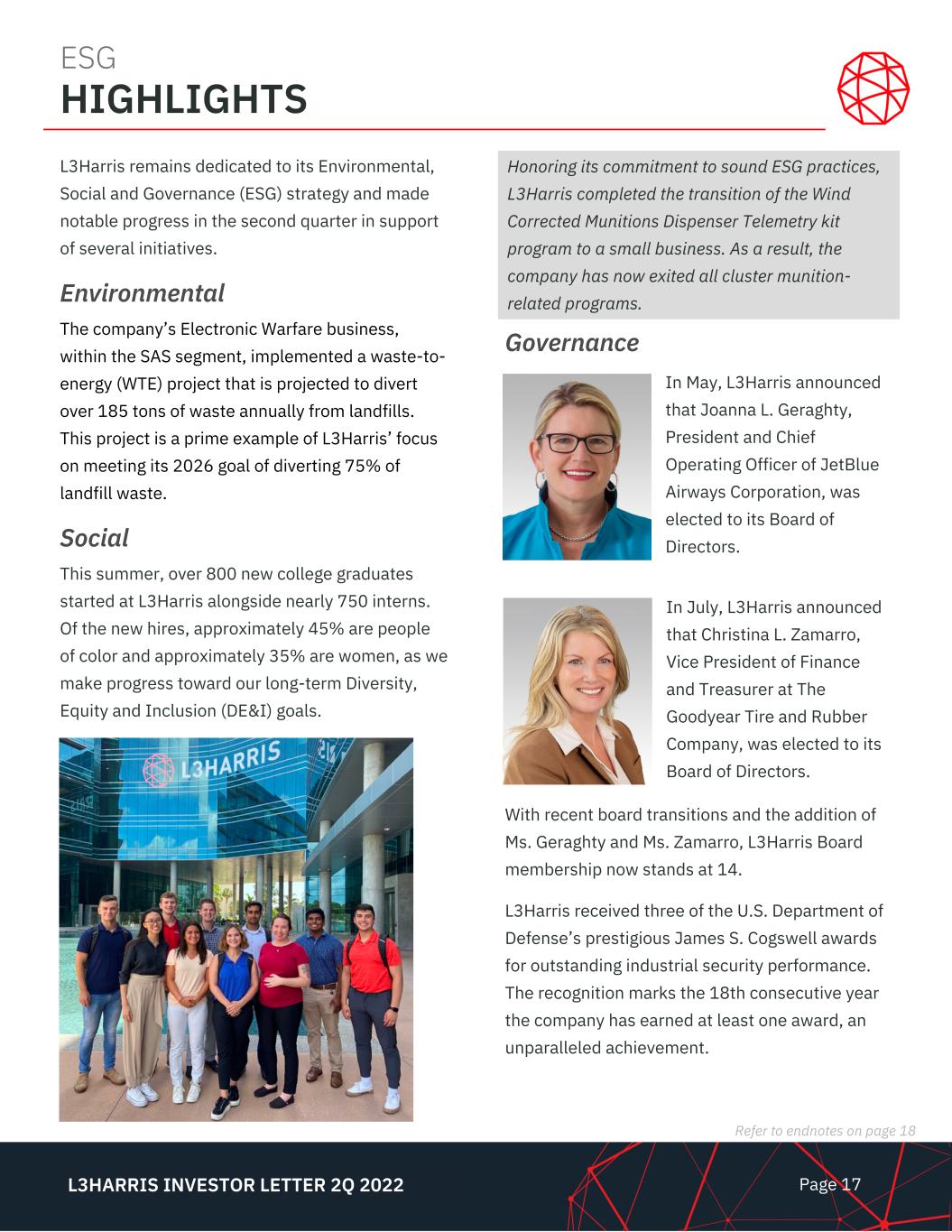

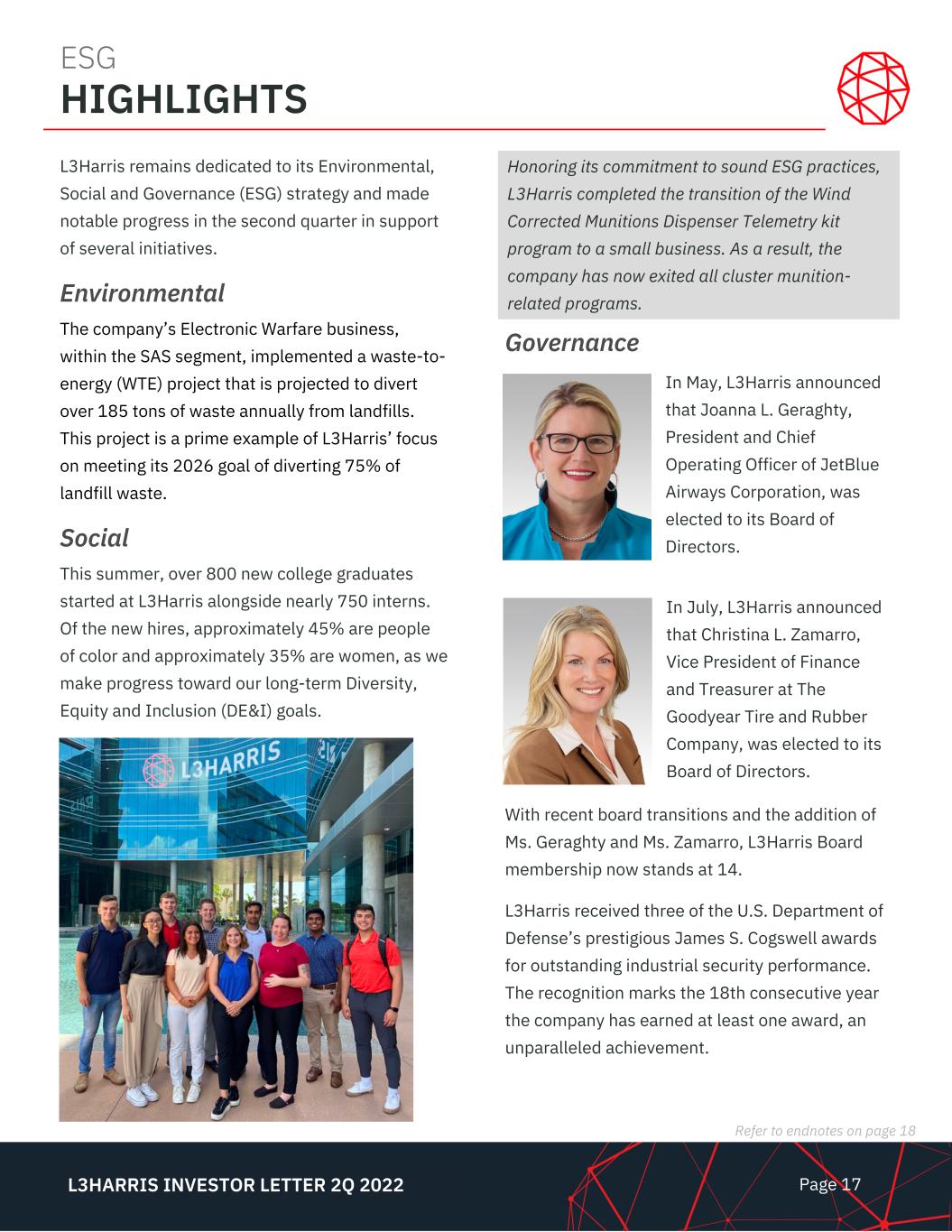

Page 17 Refer to endnotes on page 18 L3HARRIS INVESTOR LETTER 2Q 2022 Governance L3Harris remains dedicated to its Environmental, Social and Governance (ESG) strategy and made notable progress in the second quarter in support of several initiatives. Environmental The company’s Electronic Warfare business, within the SAS segment, implemented a waste-to- energy (WTE) project that is projected to divert over 185 tons of waste annually from landfills. This project is a prime example of L3Harris’ focus on meeting its 2026 goal of diverting 75% of landfill waste. Social This summer, over 800 new college graduates started at L3Harris alongside nearly 750 interns. Of the new hires, approximately 45% are people of color and approximately 35% are women, as we make progress toward our long-term Diversity, Equity and Inclusion (DE&I) goals. In May, L3Harris announced that Joanna L. Geraghty, President and Chief Operating Officer of JetBlue Airways Corporation, was elected to its Board of Directors. ESG HIGHLIGHTS In July, L3Harris announced that Christina L. Zamarro, Vice President of Finance and Treasurer at The Goodyear Tire and Rubber Company, was elected to its Board of Directors. With recent board transitions and the addition of Ms. Geraghty and Ms. Zamarro, L3Harris Board membership now stands at 14. L3Harris received three of the U.S. Department of Defense’s prestigious James S. Cogswell awards for outstanding industrial security performance. The recognition marks the 18th consecutive year the company has earned at least one award, an unparalleled achievement. Honoring its commitment to sound ESG practices, L3Harris completed the transition of the Wind Corrected Munitions Dispenser Telemetry kit program to a small business. As a result, the company has now exited all cluster munition- related programs.

Page 18 L3HARRIS INVESTOR LETTER 2Q 2022 1Organic revenue and organic revenue growth (decline) exclude the impact of completed divestitures; refer to non- GAAP financial measure (NGFM) reconciliations in the tables accompanying this Investor Letter and to the disclosures in the non-GAAP section of this Investor Letter for more information. 2Segment operating margin, non-GAAP segment operating margin, non-GAAP operating income, non-GAAP EPS, net- debt-to-EBITDA, non-GAAP tax rate and adjusted free cash flow (FCF) are NGFMs; refer to NGFM reconciliations in the tables accompanying this Investor Letter for applicable adjustments and/or exclusions and to the disclosures in the non-GAAP section of this Investor Letter for more information. 3Funded book-to-bill is calculated as the value of new contract awards received from the U.S. Government, for which the U.S. Government has appropriated funds, plus the value of new contract awards and orders received from customers other than the U.S. Government, divided by revenue. This includes incremental funding and adjustments to previous awards, and excludes unexercised contract options or potential orders under indefinite delivery, indefinite quantity contracts. The funded book-to-bill ratio is considered a key performance indicator in the Aerospace and Defense industry as it measures how much backlog is utilized in a certain period. 4Operating cash flow and adjusted FCF results and guidance (2022) assumes a provision in the Tax Cuts and Jobs Act of 2017 that went into effect on January 1, 2022 requiring companies to capitalize and amortize R&D expenditures over five years rather than deducting such expenditures in the year incurred is not modified, repealed or deferred beyond 2022, resulting in additional cash income tax payments of $600 million to $700 million in fiscal 2022. Adjusted FCF excludes cash income taxes paid or avoided related to taxable gains and losses resulting from sales of businesses, and also reflects the types of adjustments and/or exclusions presented in the FCF and adjusted FCF NGFM reconciliation in the tables accompanying this Investor Letter; refer to the disclosures in the non-GAAP section of this Investor Letter for more information. ENDNOTES

Page 19 L3HARRIS INVESTOR LETTER 2Q 2022 This Investor Letter contains non-GAAP financial measures within the meaning of Regulation G promulgated by the Securities and Exchange Commission (“SEC”), including non-GAAP earnings per diluted share from continuing operations (“EPS”), segment operating margin, non-GAAP segment operating margin, non-GAAP segment operating income and adjusted free cash flow for the second quarters of 2022 and 2021; organic revenue growth for L3Harris and for its Integrated Mission Systems segment the second quarter of 2022; segment operating income and margin for the Integrated Mission Systems segment for second quarter of 2022; debt to net-debt-to-EBITDA (adjusted earnings before interest, taxes, depreciation and amortization ratio); non-GAAP effective tax rate and expected organic revenue growth, segment operating margin, EPS, and adjusted free cash flow, non-GAAP effective tax rate for 2022; in each case, adjusted for certain costs, charges, expenses, losses or other amounts as set forth in the reconciliations of non-GAAP financial measures included in the financial statement tables accompanying this Investor Letter. A “non-GAAP financial measure” is generally defined as a numerical measure of a company’s historical or future performance that excludes or includes amounts, or is subject to adjustments, so as to be different from the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles (“GAAP”). L3Harris management believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. L3Harris management also believes that these non-GAAP financial measures enhance the ability of investors to analyze L3Harris business trends and to understand L3Harris performance. In addition, L3Harris may utilize non-GAAP financial measures as guides in forecasting, budgeting and long-term planning processes and to measure operating performance for some management compensation purposes. Non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures presented in accordance with GAAP. In addition, L3Harris may utilize non-GAAP financial measures as guides in forecasting, budgeting and long-term planning processes and to measure operating performance for some management compensation purposes. Non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures presented in accordance with GAAP. NON-GAAP FINANCIAL MEASURES

Page 20 L3HARRIS INVESTOR LETTER 2Q 2022 Statements in this Investor Letter that are not historical facts are forward-looking statements that reflect management's current expectations, assumptions and estimates of future performance and economic conditions. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements in this Investor Letter include but are not limited to: revenue, organic revenue growth, segment revenue, segment revenue growth and segment operating margin, GAAP net income margin, adjusted EBIT margin, GAAP EPS, non-GAAP EPS, operating cash flow, adjusted free cash flow, R&D tax impact, net FAS/CAS pension adjustment, net interest expense, L3Harris merger-related integration expenses, non-GAAP effective tax rate, average diluted shares outstanding and capital expenditure guidance for 2022; statements regarding the domestic and international demand environment, including the expansion of NATO, the U.S. DoD, non-U.S. NATO and other international budget sizes and spending commitments; capitalizing on growing international demand; program, contract and order opportunities, awards and program ramps and the value or potential value and timing thereof; the timing of a recovery from supply chain and the improving contracting environment; the utilization of the balanced capital allocation plan; the expected impacts of inflation and the ability to offset such impacts; the effects of investments on the company’s capabilities; paying competitive dividends, with improvement in payout related to cash flow; continued strong leverage ratio and other statements regarding outlook and financial performance guidance that are not historical facts. The company cautions investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward-looking statements. The company's consolidated results, future trends and forward-looking statements could be affected by many factors, risks and uncertainties, including but not limited to: the loss of the company’s relationship with the U.S. Government or a change or reduction in U.S. Government funding; potential changes in U.S. Government or customer priorities and requirements (including potential deferrals of awards, terminations, reductions of expenditures, changes to respond to the priorities of Congress and the Administration, debt ceiling implications, budgetary constraints, government shut down and continuing resolution impacts, sequestration, and cost-cutting initiatives); a security breach, through cyberattack or otherwise, or other significant disruptions of the company’s IT networks and systems or those the company operates for customers; the level of returns on defined benefit plan assets and changes in interest rates; risks inherent with large long-term fixed-price contracts, particularly the ability to contain cost overruns, fluctuations in the price of raw materials, or a significant increase in or sustained period of inflation; changes in estimates used in accounting for the company’s programs; financial and government and regulatory risks relating to international sales and operations; effects of any non-compliance with laws; the company’s ability to continue to develop new products that achieve market acceptance; the consequences of uncertain economic conditions and future geopolitical events; strategic transactions, including mergers, acquisitions, divestitures, spin-offs and the risks and uncertainties related thereto, including the company’s ability to manage and integrate acquired businesses and realize expected benefits, the potential disruption to relationships with employees, suppliers and customers, including the U.S. Government, and to the company’s business generally, and potential tax, indemnification and other liabilities and exposures; performance of the company’s subcontractors and suppliers, including supply chain disruption impacts and resource shortages; potential claims related to infringement of intellectual property rights or environmental remediation or other contingencies, litigation and legal matters and the ultimate outcome thereof; downturns in global demand for air travel and other economic factors impacting the company’s commercial aviation products, systems and services business; risks inherent in developing new and complex technologies and/or that may not be covered adequately by insurance or indemnity; changes in the company’s effective tax rate, including due to the U.S. Government’s failure to modify or repeal the provisions in the Tax Cuts and Jobs Act of 2017 that eliminate the option to immediately deduct research and development expenditures in the period incurred; significant indebtedness and unfunded pension liability and potential downgrades in the company’s credit ratings; unforeseen environmental matters; natural disasters or other disruptions affecting the company’s operations; changes in future business or other market conditions that could cause business investments and/or recorded goodwill or other long-term assets to become impaired; and the company’s ability to attract and retain key employees and maintain reasonable relationships with unionized employees. The level and timing of share repurchases will depend on a number of factors, including the company’s financial condition, capital requirements, cash flow, results of operations, future business prospects and other factors. The timing, volume and nature of share repurchases also are subject to business and market conditions, applicable securities laws, and other factors, and are at the discretion of the company and may be suspended or discontinued at any time without prior notice. Further information relating to these and other factors that may impact the company's results, future trends and forward-looking statements are disclosed in the company's filings with the SEC. The forward-looking statements contained in this Investor Letter are made as of the date of this Investor Letter, and the company disclaims any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Persons reading this Investor Letter are cautioned not to place undue reliance on forward-looking statements. FORWARD-LOOKING STATEMENTS

L3HARRIS INVESTOR LETTER 2Q 2022 Refer to endnotes on page 18 Page 21 Table 1 - Consolidated Statement of Income ............................ 22 Table 2 - Business Segment Information .................................. 23 Table 3 - Consolidated Statement of Cash Flows ...................... 24 Table 4 - Consolidated Balance Sheet ....................................... 25 Table 5 - Other Financial Information and Pension .................. 26 Table 6 - Organic Revenue ......................................................... 28 Table 7 - Segment Operating Margin and Income ..................... 29 Table 8 - Free Cash Flow and Adjusted Free Cash Flow ........... 30 Table 9 - Net Debt to Adjusted EBITDA Ratio ............................ 31 Table 10 - 2022 Guidance .......................................................... 32 FINANCIAL TABLES TABLE OF CONTENTS

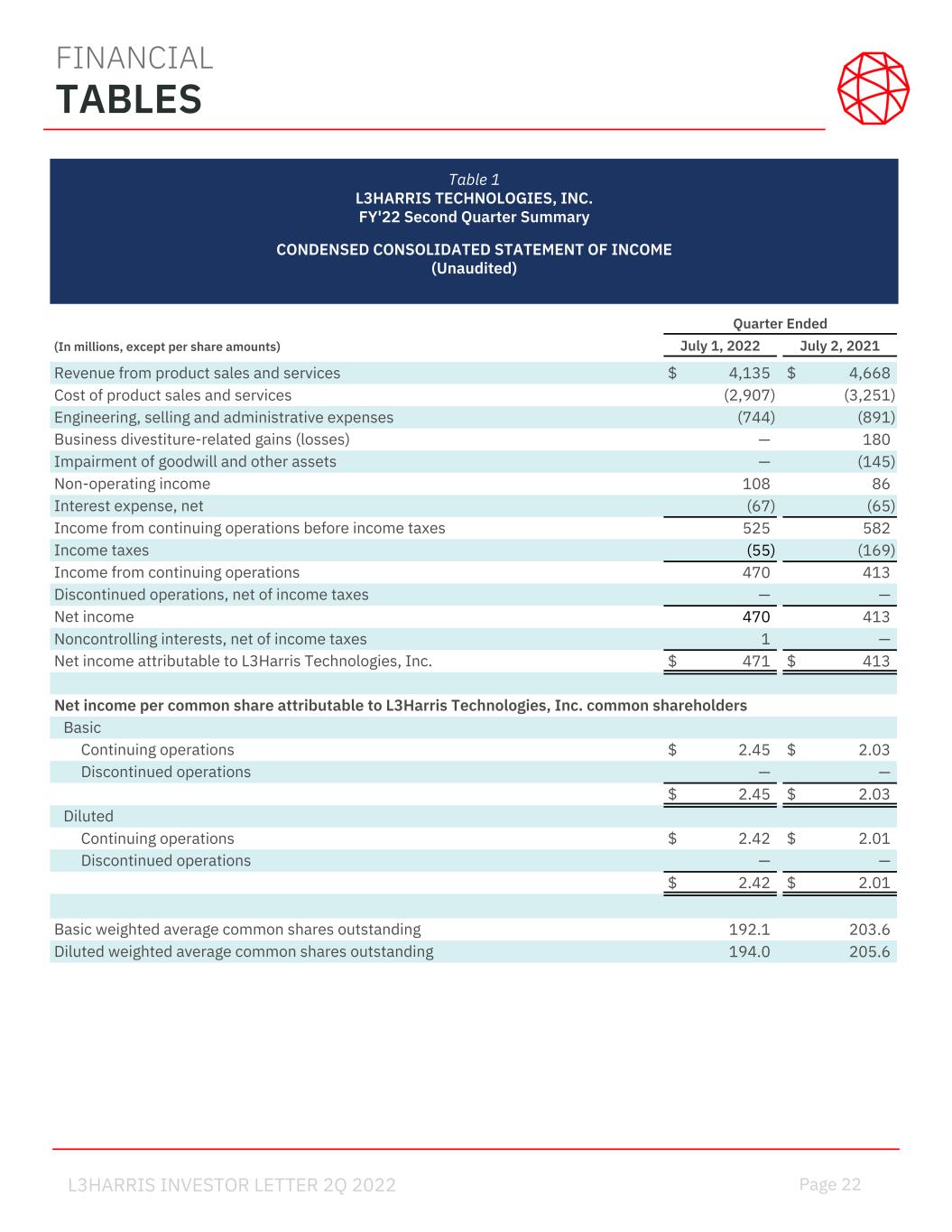

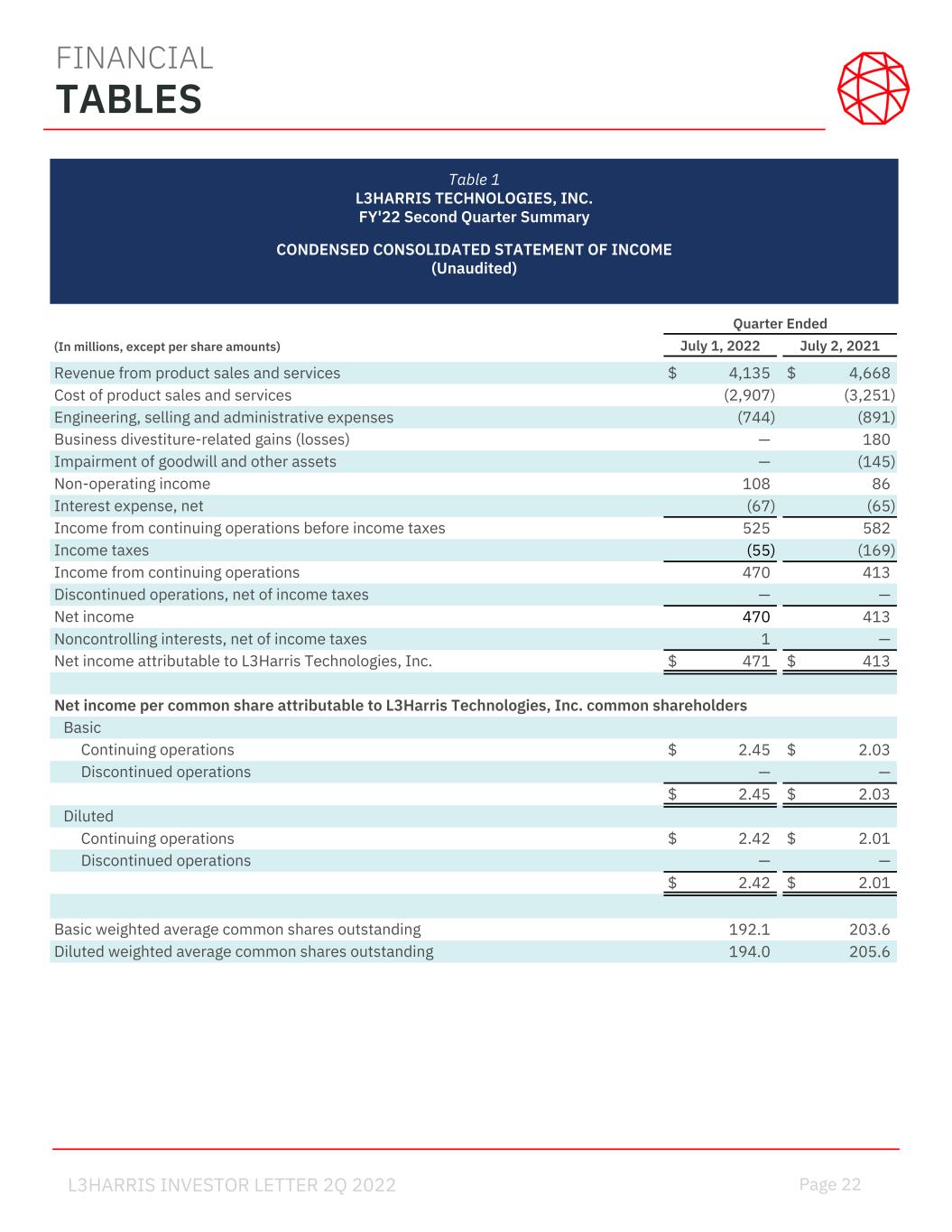

Page 22 L3HARRIS INVESTOR LETTER 2Q 2022 Quarter Ended (In millions, except per share amounts) July 1, 2022 July 2, 2021 Revenue from product sales and services $ 4,135 $ 4,668 Cost of product sales and services (2,907) (3,251) Engineering, selling and administrative expenses (744) (891) Business divestiture-related gains (losses) — 180 Impairment of goodwill and other assets — (145) Non-operating income 108 86 Interest expense, net (67) (65) Income from continuing operations before income taxes 525 582 Income taxes (55) (169) Income from continuing operations 470 413 Discontinued operations, net of income taxes — — Net income 470 413 Noncontrolling interests, net of income taxes 1 — Net income attributable to L3Harris Technologies, Inc. $ 471 $ 413 Net income per common share attributable to L3Harris Technologies, Inc. common shareholders Basic Continuing operations $ 2.45 $ 2.03 Discontinued operations — — $ 2.45 $ 2.03 Diluted Continuing operations $ 2.42 $ 2.01 Discontinued operations — — $ 2.42 $ 2.01 Basic weighted average common shares outstanding 192.1 203.6 Diluted weighted average common shares outstanding 194.0 205.6 FINANCIAL TABLES Table 1 L3HARRIS TECHNOLOGIES, INC. FY'22 Second Quarter Summary CONDENSED CONSOLIDATED STATEMENT OF INCOME (Unaudited)

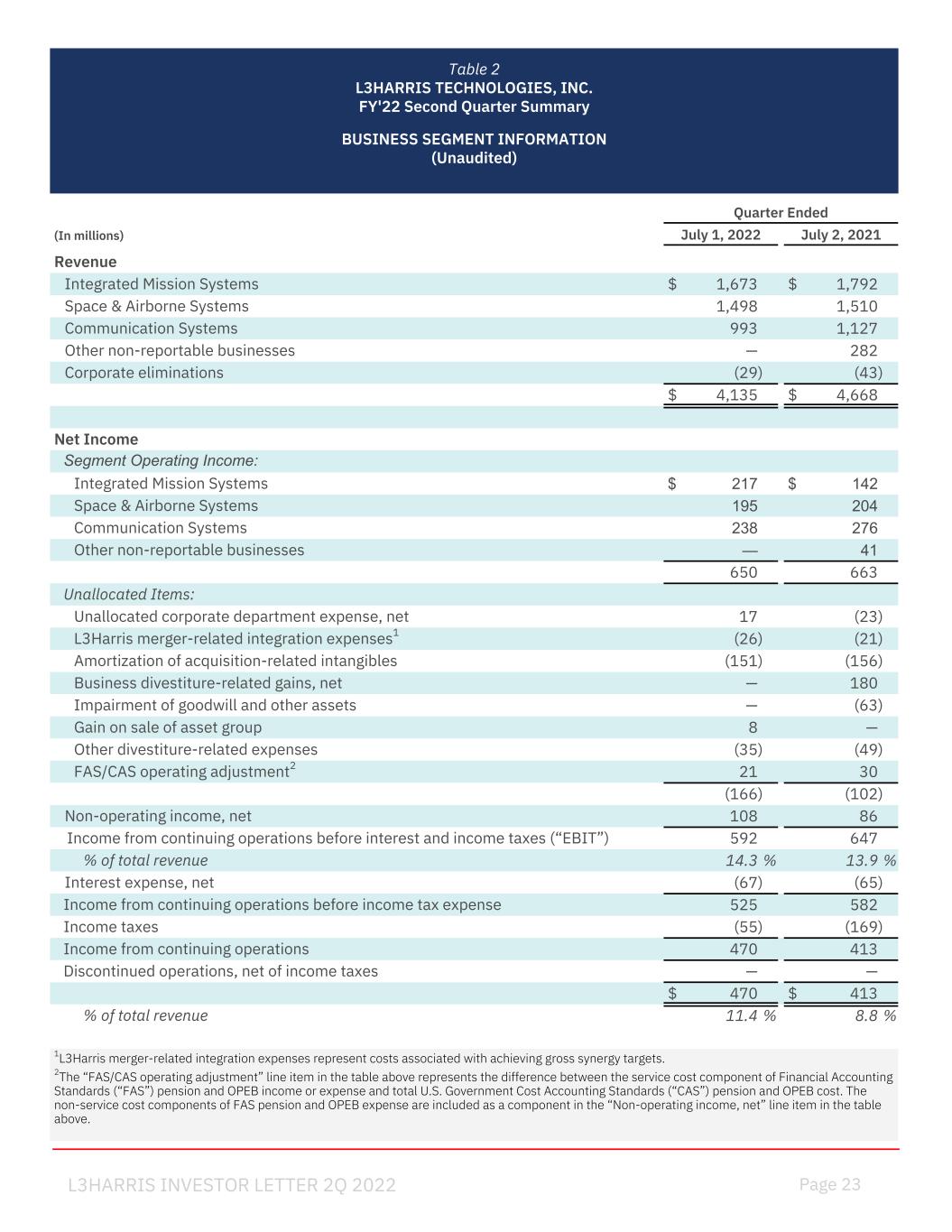

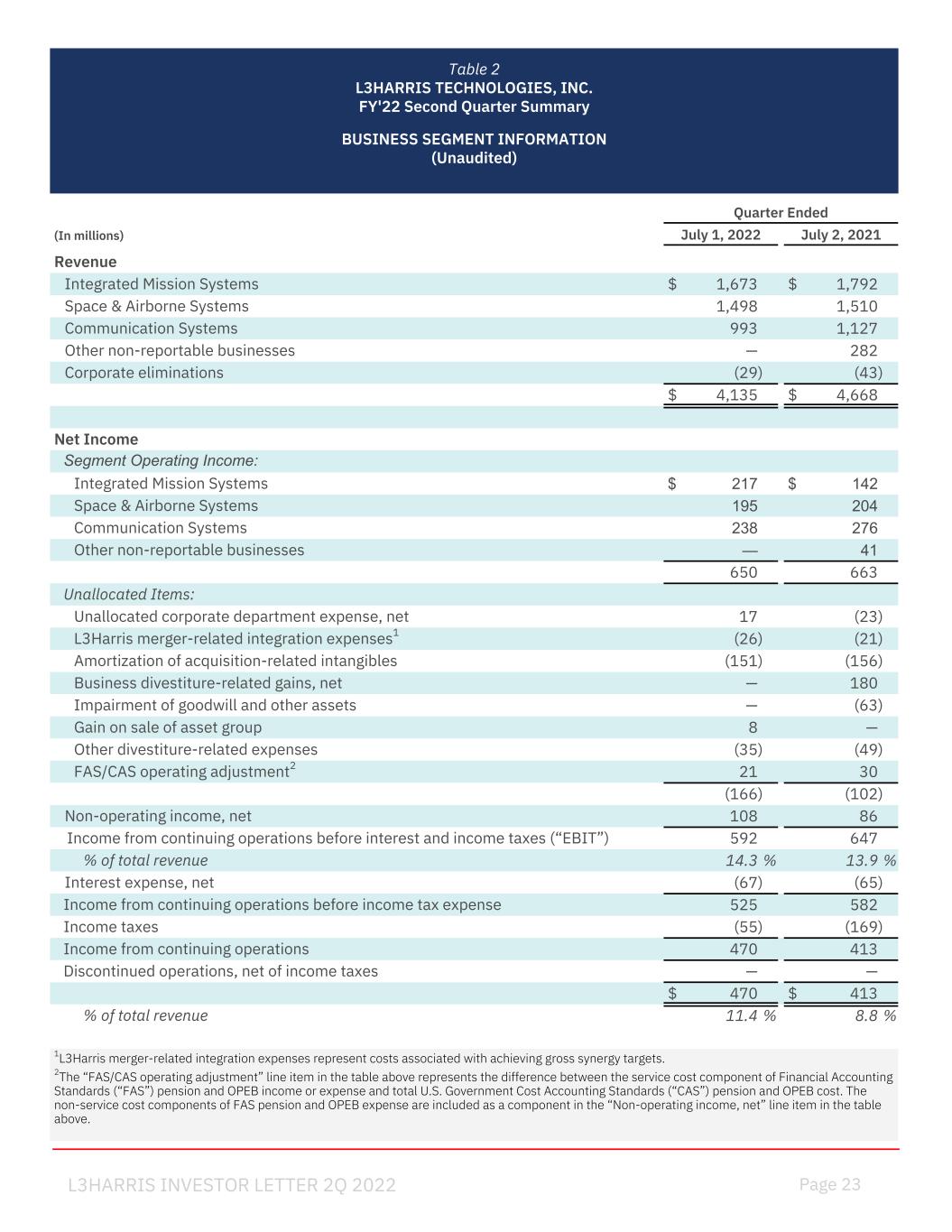

Page 23 L3HARRIS INVESTOR LETTER 2Q 2022 Quarter Ended (In millions) July 1, 2022 July 2, 2021 Revenue Integrated Mission Systems $ 1,673 $ 1,792 Space & Airborne Systems 1,498 1,510 Communication Systems 993 1,127 Other non-reportable businesses — 282 Corporate eliminations (29) (43) $ 4,135 $ 4,668 Net Income Segment Operating Income: Integrated Mission Systems $ 217 $ 142 Space & Airborne Systems 195 204 Communication Systems 238 276 Other non-reportable businesses — 41 650 663 Unallocated Items: Unallocated corporate department expense, net 17 (23) L3Harris merger-related integration expenses1 (26) (21) Amortization of acquisition-related intangibles (151) (156) Business divestiture-related gains, net — 180 Impairment of goodwill and other assets — (63) Gain on sale of asset group 8 — Other divestiture-related expenses (35) (49) FAS/CAS operating adjustment2 21 30 (166) (102) Non-operating income, net 108 86 Income from continuing operations before interest and income taxes (“EBIT”) 592 647 % of total revenue 14.3 % 13.9 % Interest expense, net (67) (65) Income from continuing operations before income tax expense 525 582 Income taxes (55) (169) Income from continuing operations 470 413 Discontinued operations, net of income taxes — — $ 470 $ 413 % of total revenue 11.4 % 8.8 % 1L3Harris merger-related integration expenses represent costs associated with achieving gross synergy targets. 2The “FAS/CAS operating adjustment” line item in the table above represents the difference between the service cost component of Financial Accounting Standards (“FAS”) pension and OPEB income or expense and total U.S. Government Cost Accounting Standards (“CAS”) pension and OPEB cost. The non-service cost components of FAS pension and OPEB expense are included as a component in the “Non-operating income, net” line item in the table above. Table 2 L3HARRIS TECHNOLOGIES, INC. FY'22 Second Quarter Summary BUSINESS SEGMENT INFORMATION (Unaudited)

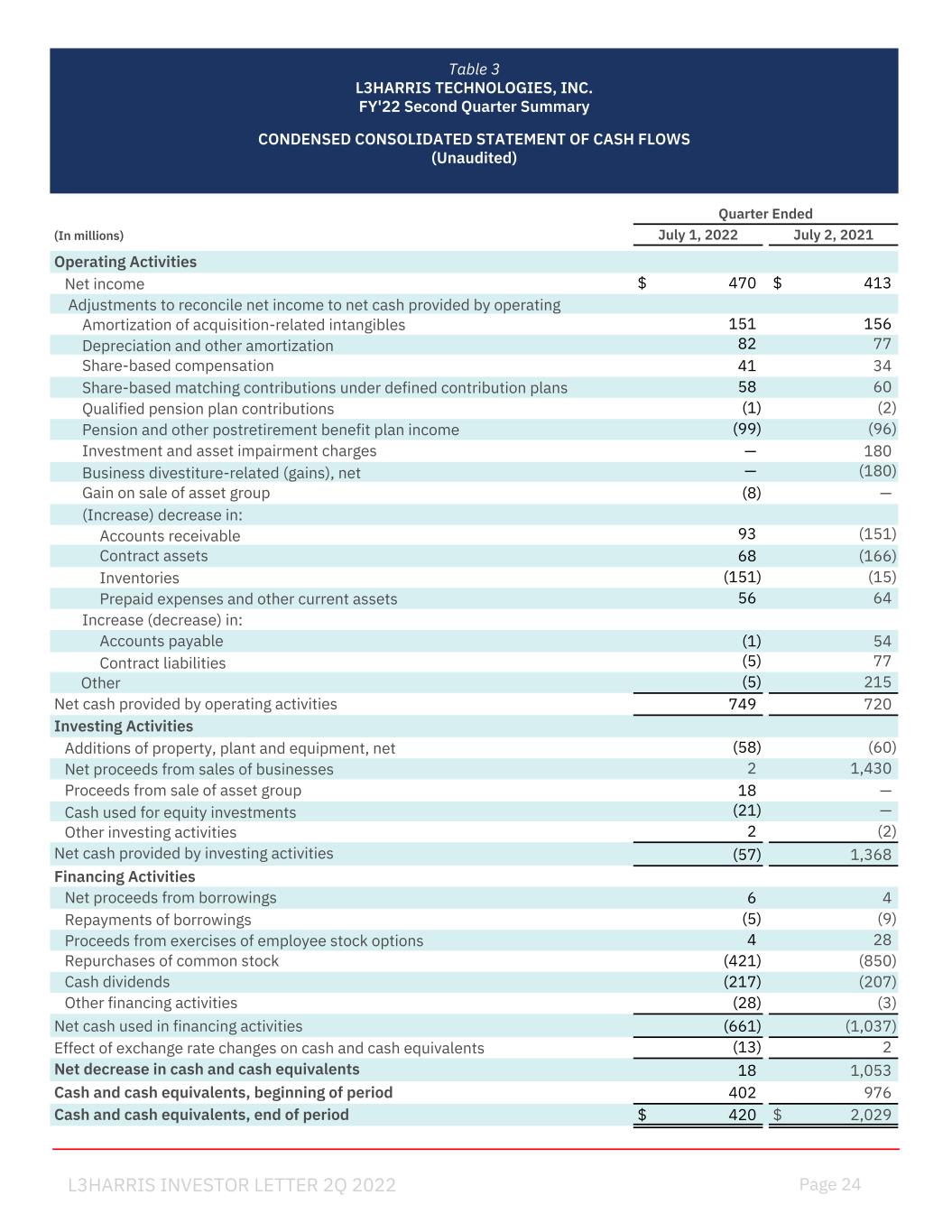

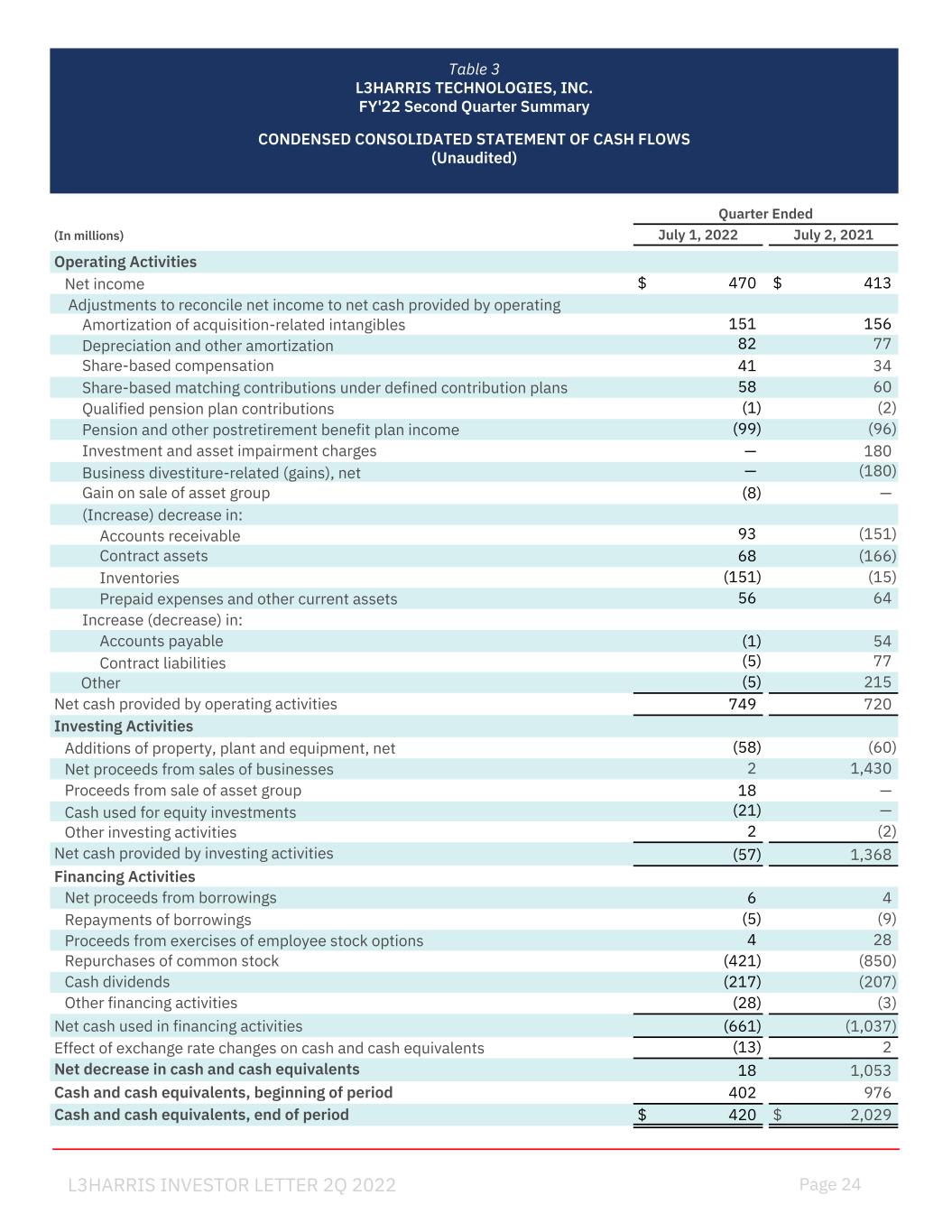

Page 24 L3HARRIS INVESTOR LETTER 2Q 2022 Quarter Ended (In millions) July 1, 2022 July 2, 2021 Operating Activities Net income $ 470 $ 413 Adjustments to reconcile net income to net cash provided by operating Amortization of acquisition-related intangibles 151 156 Depreciation and other amortization 82 77 Share-based compensation 41 34 Share-based matching contributions under defined contribution plans 58 60 Qualified pension plan contributions (1) (2) Pension and other postretirement benefit plan income (99) (96) Investment and asset impairment charges — 180 Business divestiture-related (gains), net — (180) Gain on sale of asset group (8) — (Increase) decrease in: Accounts receivable 93 (151) Contract assets 68 (166) Inventories (151) (15) Prepaid expenses and other current assets 56 64 Increase (decrease) in: Accounts payable (1) 54 Contract liabilities (5) 77 Other (5) 215 Net cash provided by operating activities 749 720 Investing Activities Additions of property, plant and equipment, net (58) (60) Net proceeds from sales of businesses 2 1,430 Proceeds from sale of asset group 18 — Cash used for equity investments (21) — Other investing activities 2 (2) Net cash provided by investing activities (57) 1,368 Financing Activities Net proceeds from borrowings 6 4 Repayments of borrowings (5) (9) Proceeds from exercises of employee stock options 4 28 Repurchases of common stock (421) (850) Cash dividends (217) (207) Other financing activities (28) (3) Net cash used in financing activities (661) (1,037) Effect of exchange rate changes on cash and cash equivalents (13) 2 Net decrease in cash and cash equivalents 18 1,053 Cash and cash equivalents, beginning of period 402 976 Cash and cash equivalents, end of period $ 420 $ 2,029 Table 3 L3HARRIS TECHNOLOGIES, INC. FY'22 Second Quarter Summary CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited)

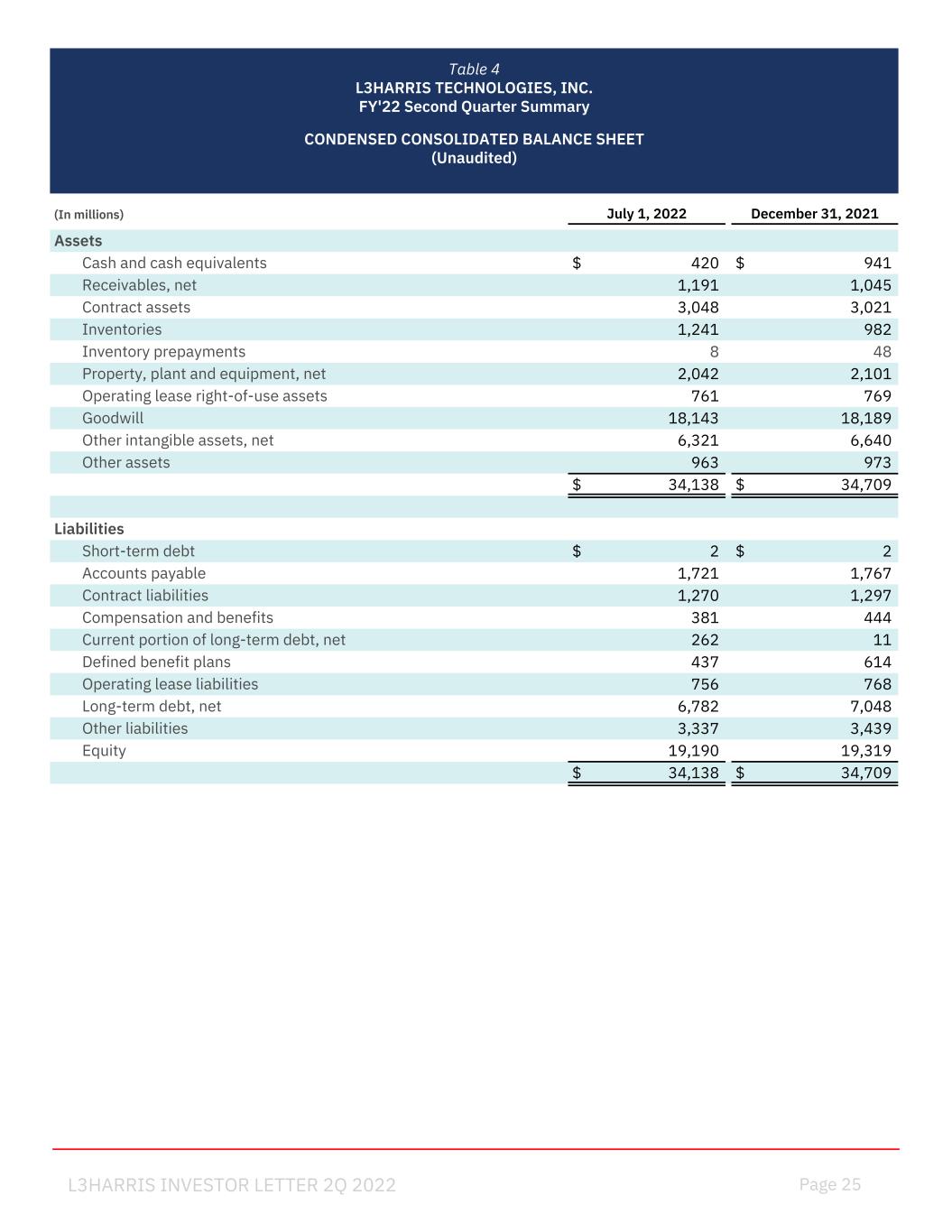

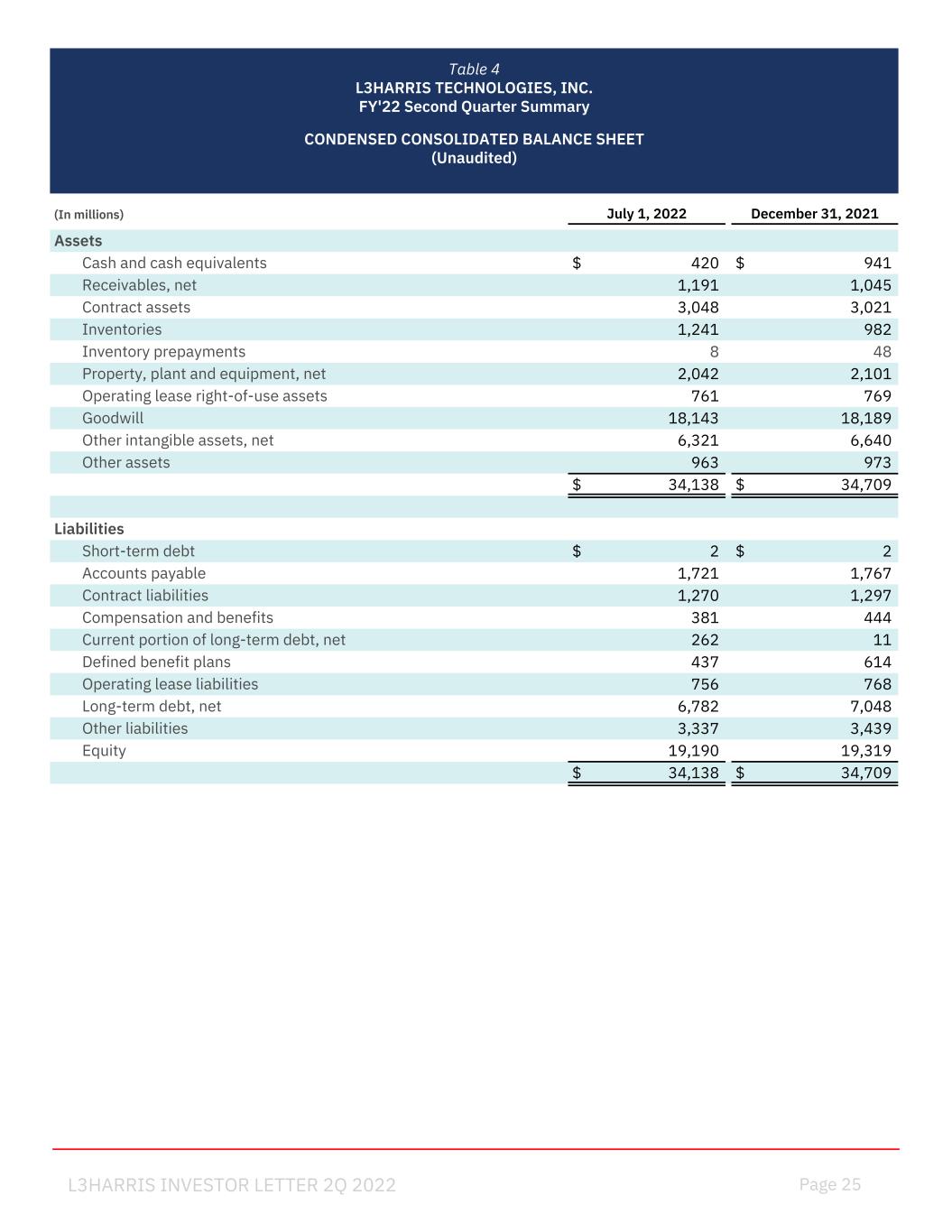

Page 25 L3HARRIS INVESTOR LETTER 2Q 2022 (In millions) July 1, 2022 December 31, 2021 Assets Cash and cash equivalents $ 420 $ 941 Receivables, net 1,191 1,045 Contract assets 3,048 3,021 Inventories 1,241 982 Inventory prepayments 8 48 Property, plant and equipment, net 2,042 2,101 Operating lease right-of-use assets 761 769 Goodwill 18,143 18,189 Other intangible assets, net 6,321 6,640 Other assets 963 973 $ 34,138 $ 34,709 Liabilities Short-term debt $ 2 $ 2 Accounts payable 1,721 1,767 Contract liabilities 1,270 1,297 Compensation and benefits 381 444 Current portion of long-term debt, net 262 11 Defined benefit plans 437 614 Operating lease liabilities 756 768 Long-term debt, net 6,782 7,048 Other liabilities 3,337 3,439 Equity 19,190 19,319 $ 34,138 $ 34,709 Table 4 L3HARRIS TECHNOLOGIES, INC. FY'22 Second Quarter Summary CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited)

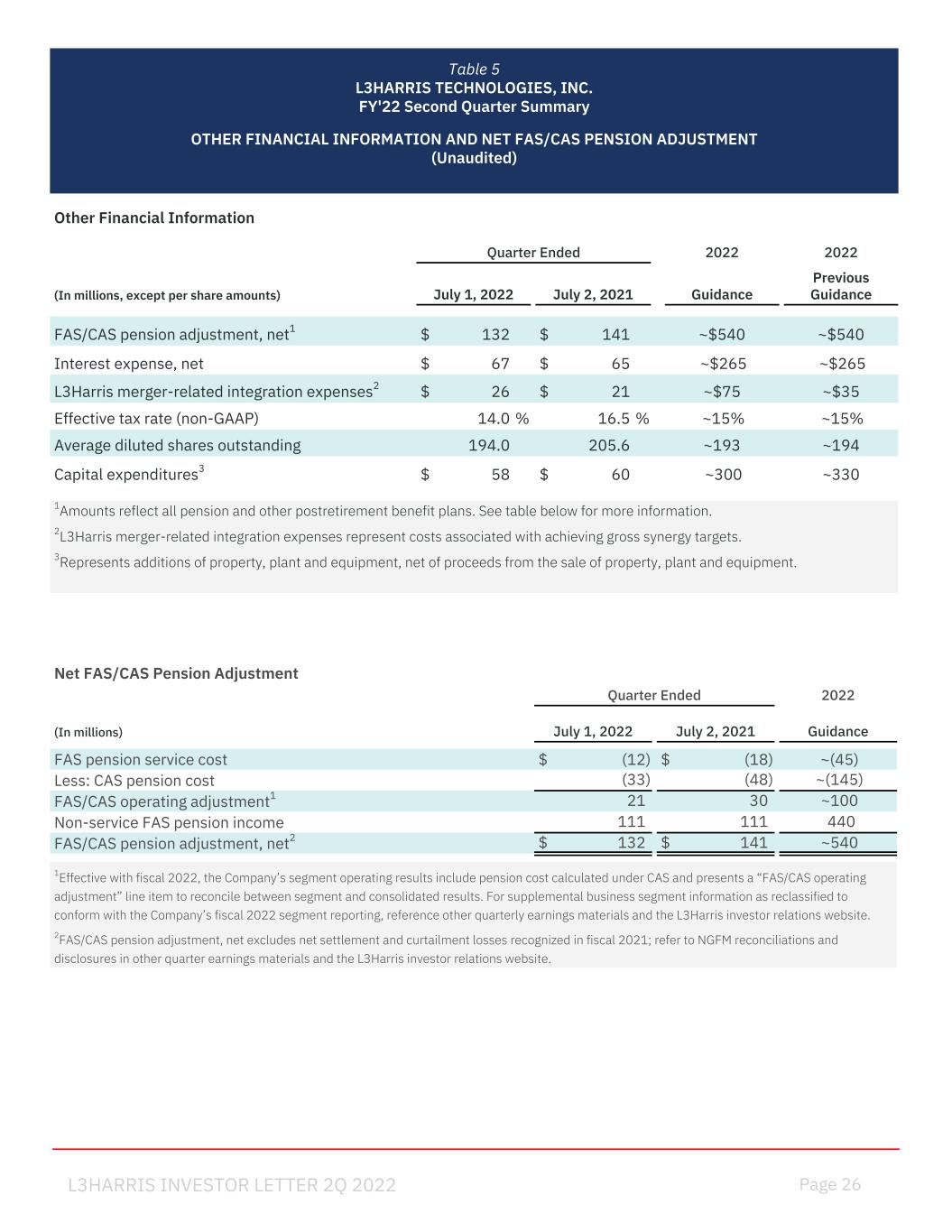

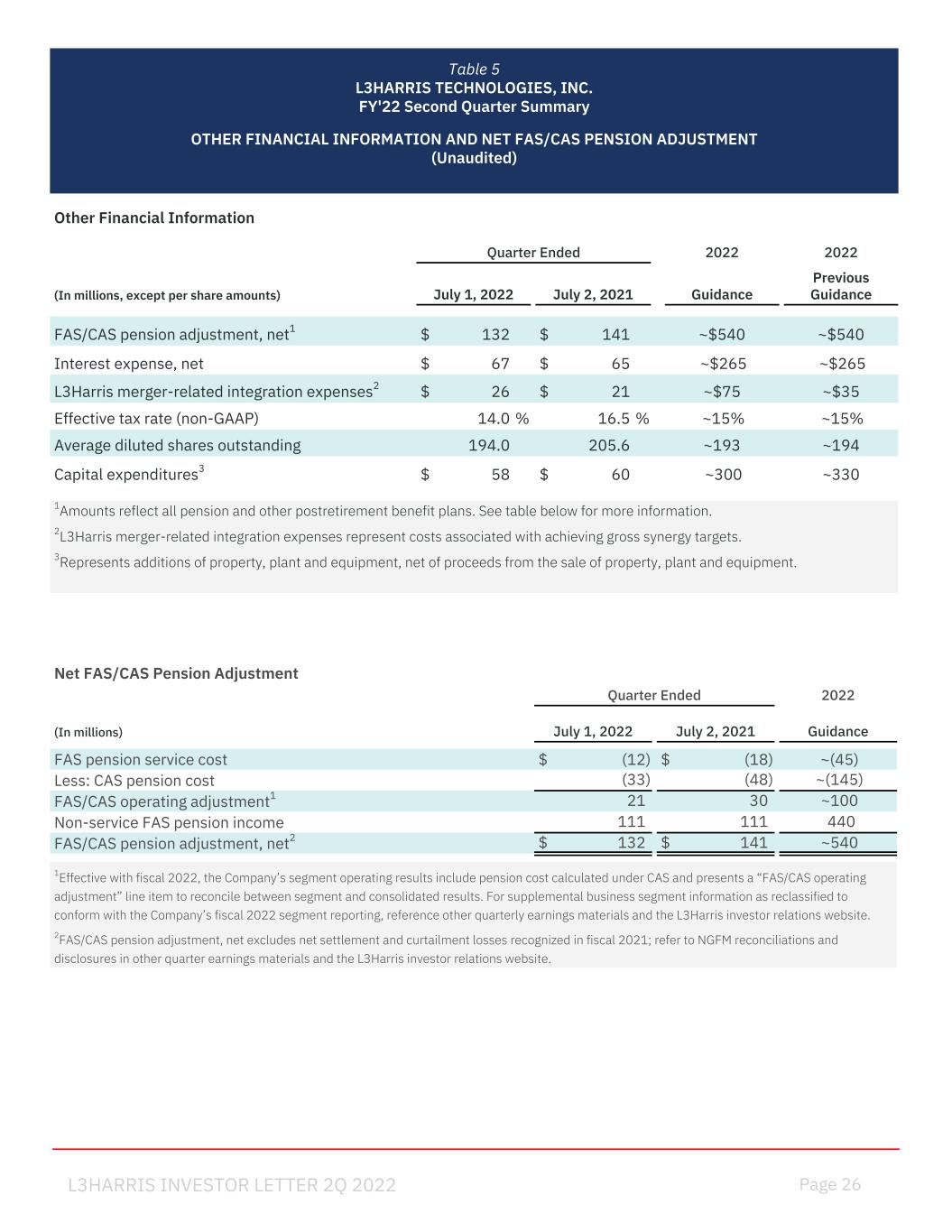

Page 26 L3HARRIS INVESTOR LETTER 2Q 2022 Net FAS/CAS Pension Adjustment Quarter Ended 2022 (In millions) July 1, 2022 July 2, 2021 Guidance FAS pension service cost $ (12) $ (18) ~(45) Less: CAS pension cost (33) (48) ~(145) FAS/CAS operating adjustment1 21 30 ~100 Non-service FAS pension income 111 111 440 FAS/CAS pension adjustment, net2 $ 132 $ 141 ~540 1Effective with fiscal 2022, the Company’s segment operating results include pension cost calculated under CAS and presents a “FAS/CAS operating adjustment” line item to reconcile between segment and consolidated results. For supplemental business segment information as reclassified to conform with the Company’s fiscal 2022 segment reporting, reference other quarterly earnings materials and the L3Harris investor relations website. 2FAS/CAS pension adjustment, net excludes net settlement and curtailment losses recognized in fiscal 2021; refer to NGFM reconciliations and disclosures in other quarter earnings materials and the L3Harris investor relations website. Other Financial Information Quarter Ended 2022 2022 (In millions, except per share amounts) July 1, 2022 July 2, 2021 Guidance Previous Guidance FAS/CAS pension adjustment, net1 $ 132 $ 141 ~$540 ~$540 Interest expense, net $ 67 $ 65 ~$265 ~$265 L3Harris merger-related integration expenses2 $ 26 $ 21 ~$75 ~$35 Effective tax rate (non-GAAP) 14.0 % 16.5 % ~15% ~15% Average diluted shares outstanding 194.0 205.6 ~193 ~194 Capital expenditures3 $ 58 $ 60 ~300 ~330 1Amounts reflect all pension and other postretirement benefit plans. See table below for more information. 2L3Harris merger-related integration expenses represent costs associated with achieving gross synergy targets. 3Represents additions of property, plant and equipment, net of proceeds from the sale of property, plant and equipment. Table 5 L3HARRIS TECHNOLOGIES, INC. FY'22 Second Quarter Summary OTHER FINANCIAL INFORMATION AND NET FAS/CAS PENSION ADJUSTMENT (Unaudited)

Page 27 L3HARRIS INVESTOR LETTER 2Q 2022 To supplement our condensed consolidated financial statements presented in accordance with U.S. generally accepted accounting principles (GAAP), we provide additional measures of income from continuing operations per diluted common share, net income, net income margin, net cash provided by operating activities, revenue and segment operating income (loss), adjusted to exclude certain costs, charges, expenses and losses or other amounts. L3Harris management believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. L3Harris management also believes that these non-GAAP financial measures enhance the ability of investors to analyze L3Harris’ business trends and to understand L3Harris’ performance. In addition, L3Harris may utilize non-GAAP financial measures as guides in its forecasting, budgeting, and long-term planning processes and to measure operating performance for some management compensation purposes. Any analysis of non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. A reconciliation of these non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP follows: RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

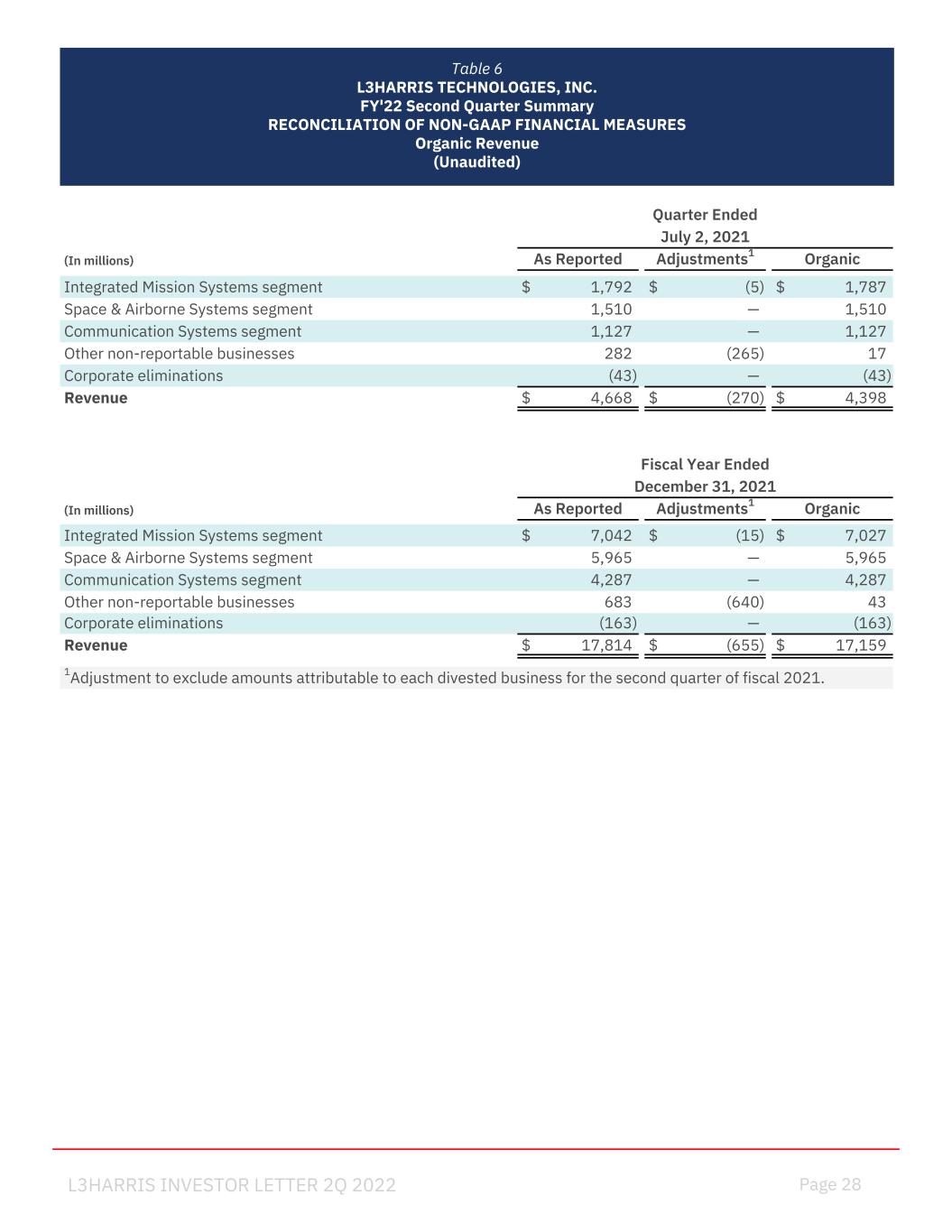

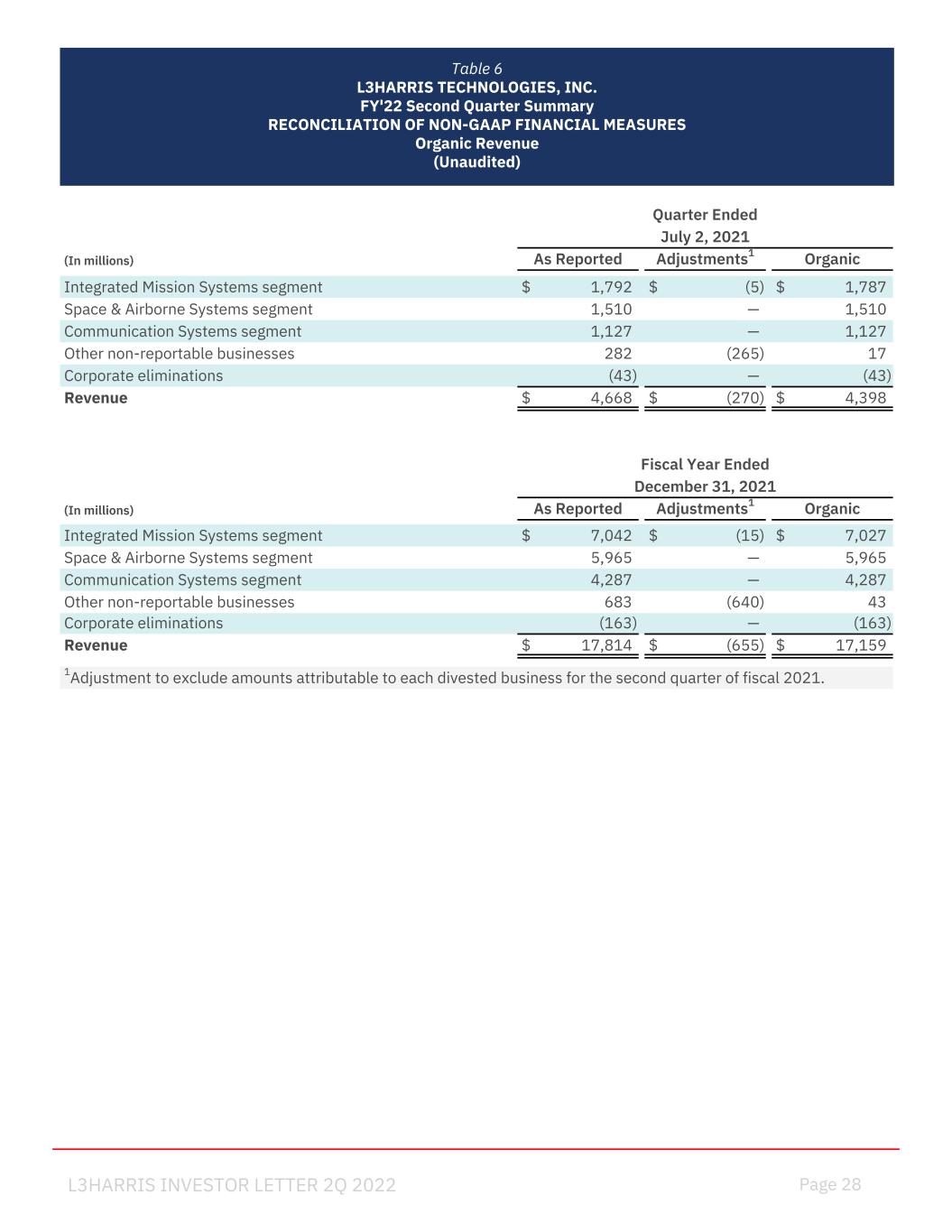

Page 28 L3HARRIS INVESTOR LETTER 2Q 2022 Table 6 L3HARRIS TECHNOLOGIES, INC. FY'22 Second Quarter Summary RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Organic Revenue (Unaudited) Quarter Ended July 2, 2021 (In millions) As Reported Adjustments1 Organic Integrated Mission Systems segment $ 1,792 $ (5) $ 1,787 Space & Airborne Systems segment 1,510 — 1,510 Communication Systems segment 1,127 — 1,127 Other non-reportable businesses 282 (265) 17 Corporate eliminations (43) — (43) Revenue $ 4,668 $ (270) $ 4,398 Fiscal Year Ended December 31, 2021 (In millions) As Reported Adjustments1 Organic Integrated Mission Systems segment $ 7,042 $ (15) $ 7,027 Space & Airborne Systems segment 5,965 — 5,965 Communication Systems segment 4,287 — 4,287 Other non-reportable businesses 683 (640) 43 Corporate eliminations (163) — (163) Revenue $ 17,814 $ (655) $ 17,159 1Adjustment to exclude amounts attributable to each divested business for the second quarter of fiscal 2021.

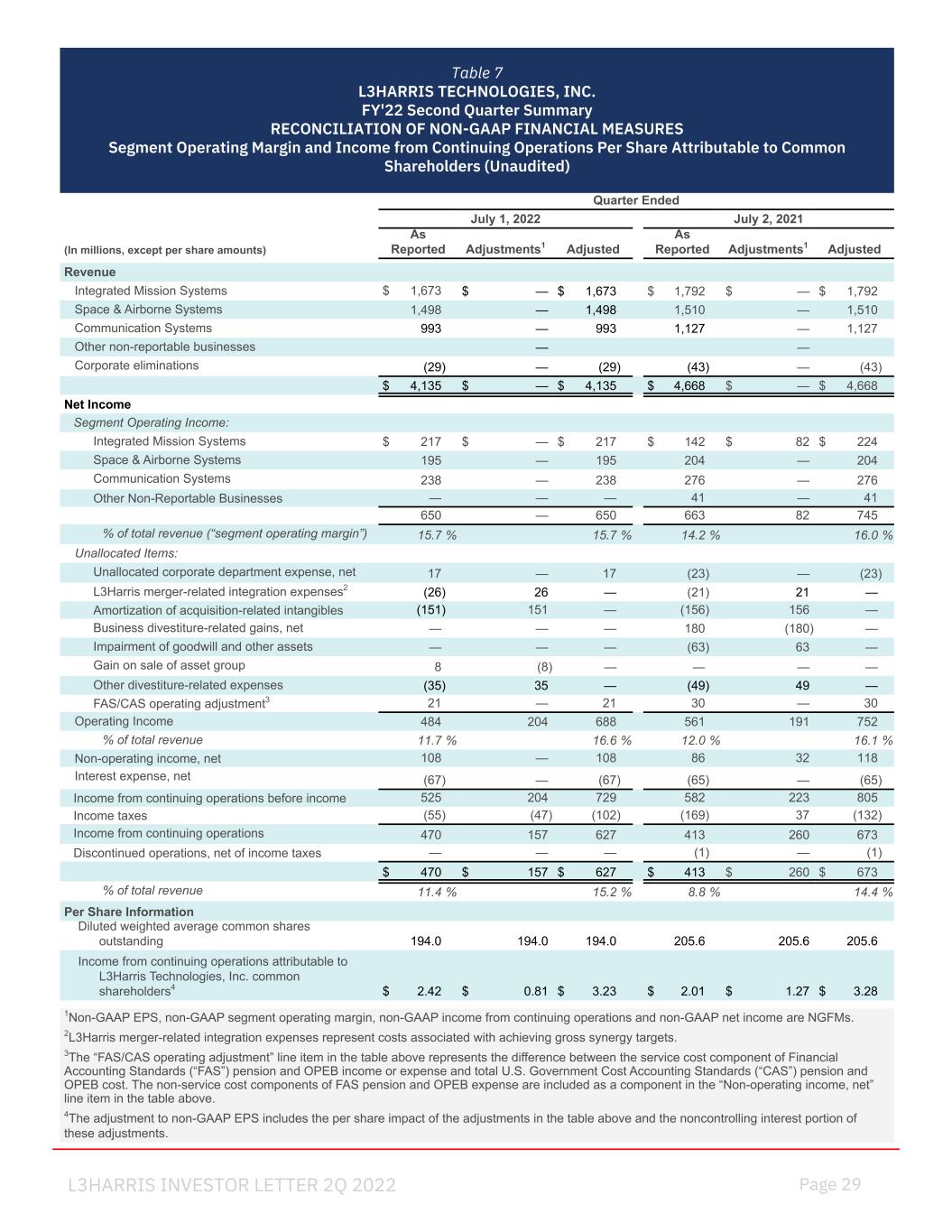

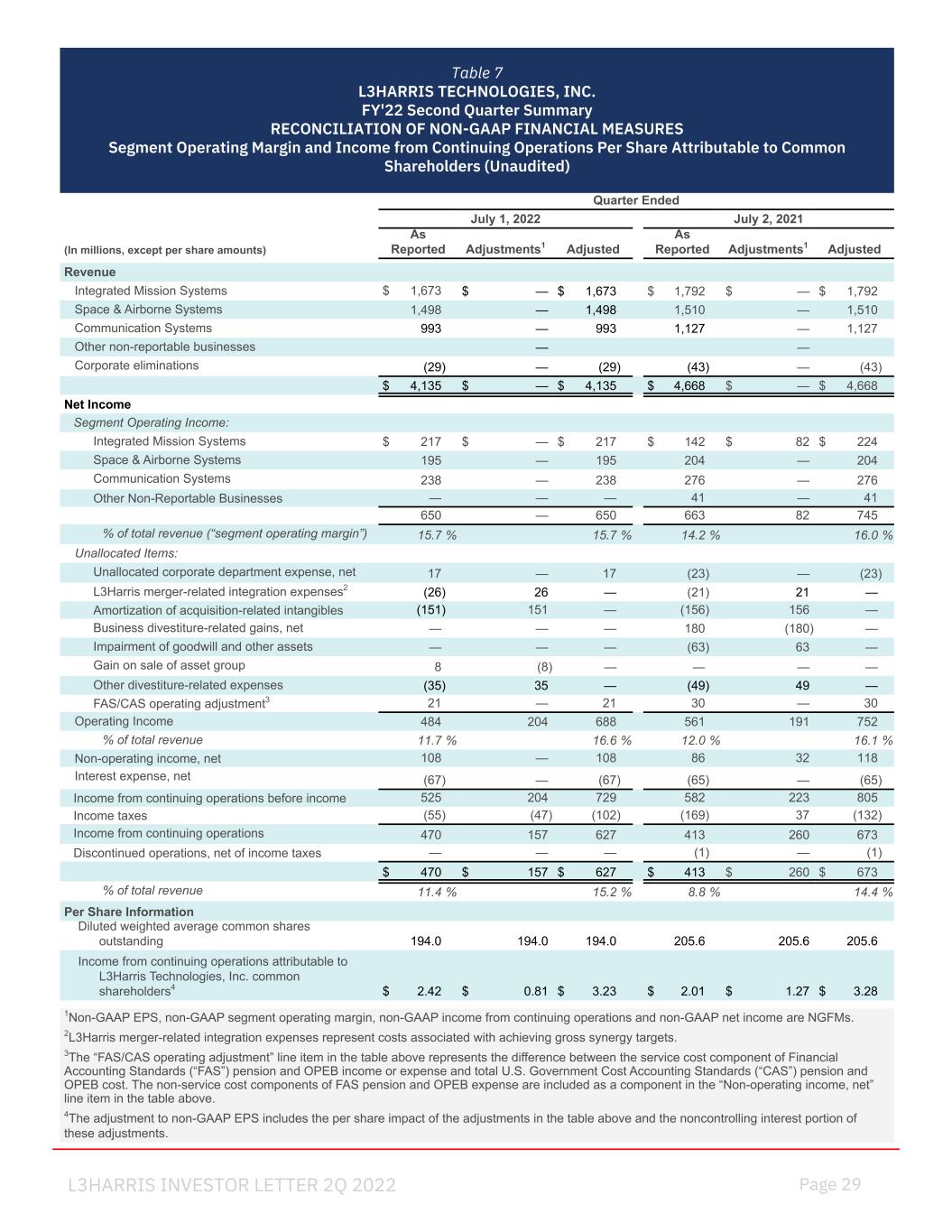

Page 29 L3HARRIS INVESTOR LETTER 2Q 2022 Table 7 L3HARRIS TECHNOLOGIES, INC. FY'22 Second Quarter Summary RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Segment Operating Margin and Income from Continuing Operations Per Share Attributable to Common Shareholders (Unaudited) Quarter Ended July 1, 2022 July 2, 2021 (In millions, except per share amounts) As Reported Adjustments1 Adjusted As Reported Adjustments1 Adjusted Revenue Integrated Mission Systems $ 1,673 $ — $ 1,673 $ 1,792 $ — $ 1,792 Space & Airborne Systems 1,498 — 1,498 1,510 — 1,510 Communication Systems 993 — 993 1,127 — 1,127 Other non-reportable businesses — — Corporate eliminations (29) — (29) (43) — (43) $ 4,135 $ — $ 4,135 $ 4,668 $ — $ 4,668 Net Income Segment Operating Income: Integrated Mission Systems $ 217 $ — $ 217 $ 142 $ 82 $ 224 Space & Airborne Systems 195 — 195 204 — 204 Communication Systems 238 — 238 276 — 276 Other Non-Reportable Businesses — — — 41 — 41 650 — 650 663 82 745 % of total revenue (“segment operating margin”) 15.7 % 15.7 % 14.2 % 16.0 % Unallocated Items: Unallocated corporate department expense, net 17 — 17 (23) — (23) L3Harris merger-related integration expenses2 (26) 26 — (21) 21 — Amortization of acquisition-related intangibles (151) 151 — (156) 156 — Business divestiture-related gains, net — — — 180 (180) — Impairment of goodwill and other assets — — — (63) 63 — Gain on sale of asset group 8 (8) — — — — Other divestiture-related expenses (35) 35 — (49) 49 — FAS/CAS operating adjustment3 21 — 21 30 — 30 Operating Income 484 204 688 561 191 752 % of total revenue 11.7 % 16.6 % 12.0 % 16.1 % Non-operating income, net 108 — 108 86 32 118 Interest expense, net (67) — (67) (65) — (65) Income from continuing operations before income 525 204 729 582 223 805 Income taxes (55) (47) (102) (169) 37 (132) Income from continuing operations 470 157 627 413 260 673 Discontinued operations, net of income taxes — — — (1) — (1) $ 470 $ 157 $ 627 $ 413 $ 260 $ 673 % of total revenue 11.4 % 15.2 % 8.8 % 14.4 % Per Share Information Diluted weighted average common shares outstanding 194.0 194.0 194.0 205.6 205.6 205.6 Income from continuing operations attributable to L3Harris Technologies, Inc. common shareholders4 $ 2.42 $ 0.81 $ 3.23 $ 2.01 $ 1.27 $ 3.28 1Non-GAAP EPS, non-GAAP segment operating margin, non-GAAP income from continuing operations and non-GAAP net income are NGFMs. 2L3Harris merger-related integration expenses represent costs associated with achieving gross synergy targets. 3The “FAS/CAS operating adjustment” line item in the table above represents the difference between the service cost component of Financial Accounting Standards (“FAS”) pension and OPEB income or expense and total U.S. Government Cost Accounting Standards (“CAS”) pension and OPEB cost. The non-service cost components of FAS pension and OPEB expense are included as a component in the “Non-operating income, net” line item in the table above. 4The adjustment to non-GAAP EPS includes the per share impact of the adjustments in the table above and the noncontrolling interest portion of these adjustments.

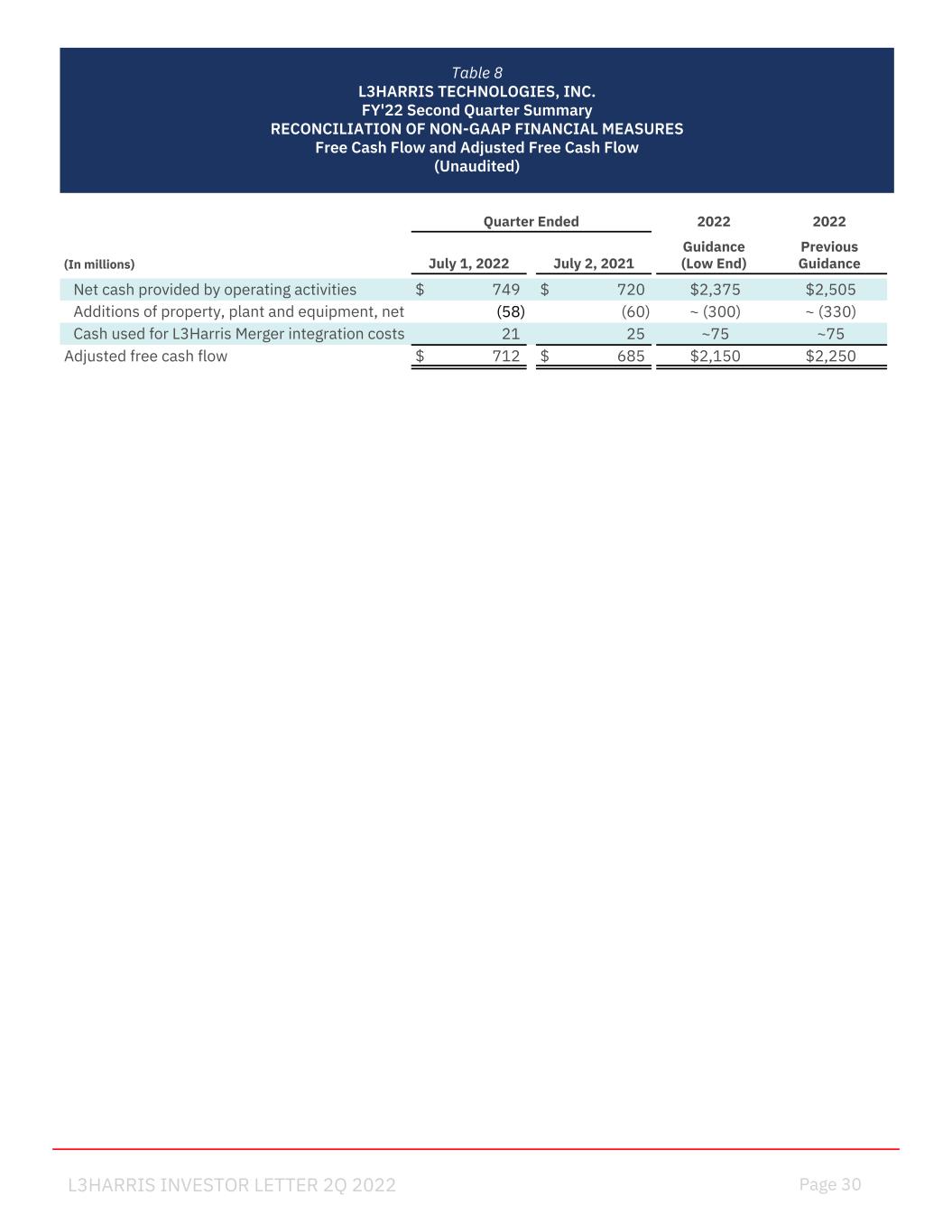

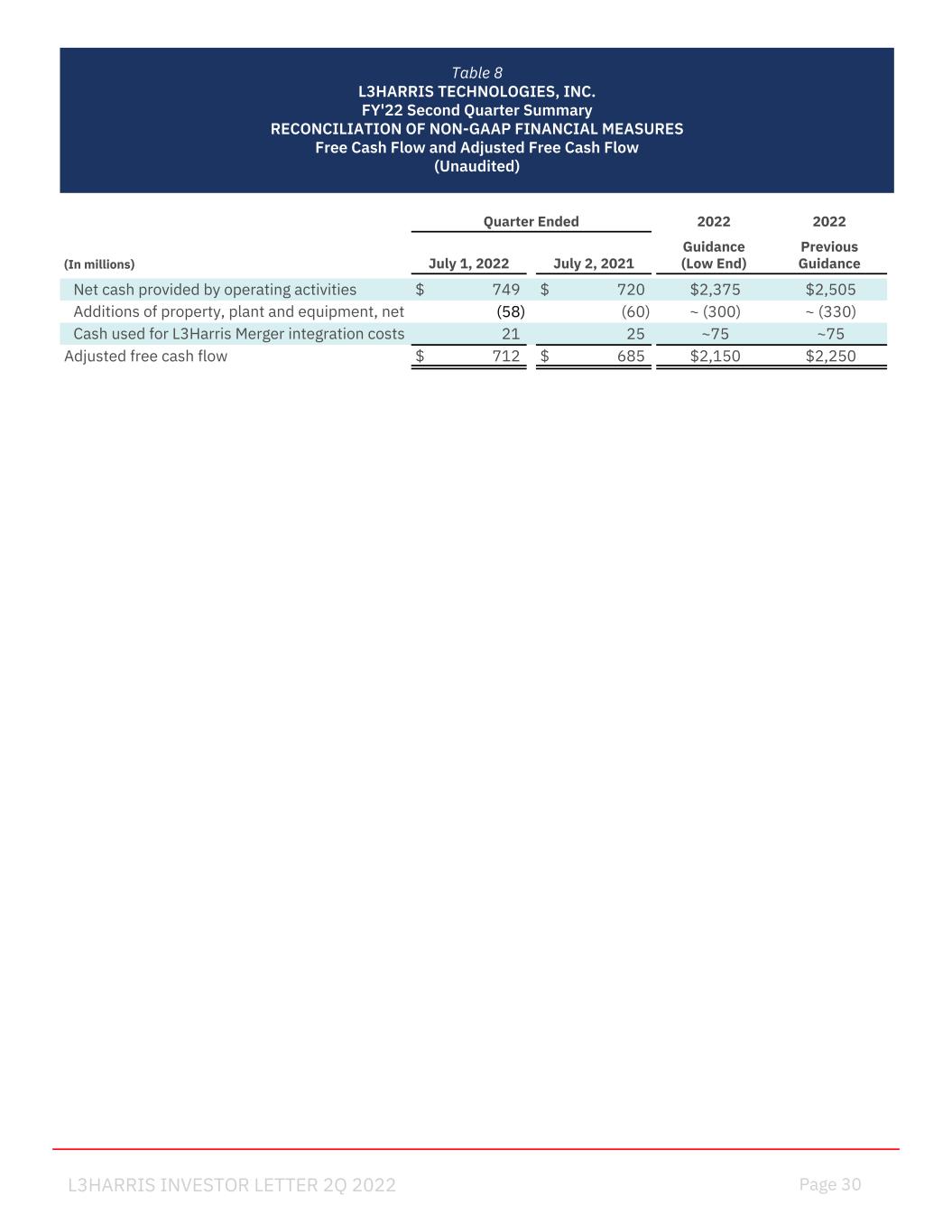

Page 30 L3HARRIS INVESTOR LETTER 2Q 2022 Table 8 L3HARRIS TECHNOLOGIES, INC. FY'22 Second Quarter Summary RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Free Cash Flow and Adjusted Free Cash Flow (Unaudited) Quarter Ended 2022 2022 (In millions) July 1, 2022 July 2, 2021 Guidance (Low End) Previous Guidance Net cash provided by operating activities $ 749 $ 720 $2,405 - $2,375 $2,405 - $2,505 Additions of property, plant and equipment, net (58) (60) ~ (300) ~ (330) Cash used for L3Harris Merger integration costs 21 25 ~75 ~75 Adjusted free cash flow $ 712 $ 685 $2,150 - $2,150 $2,150 - $2,250

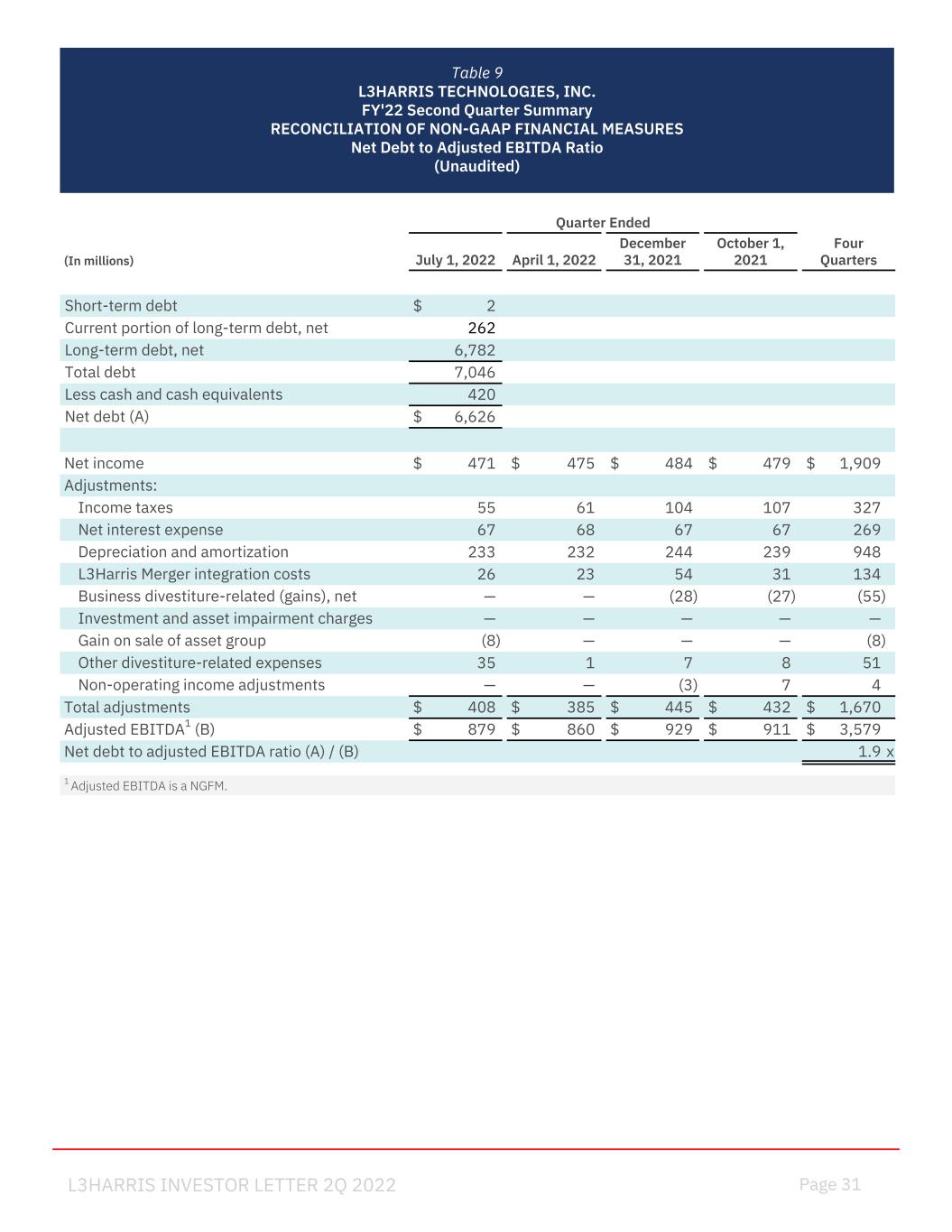

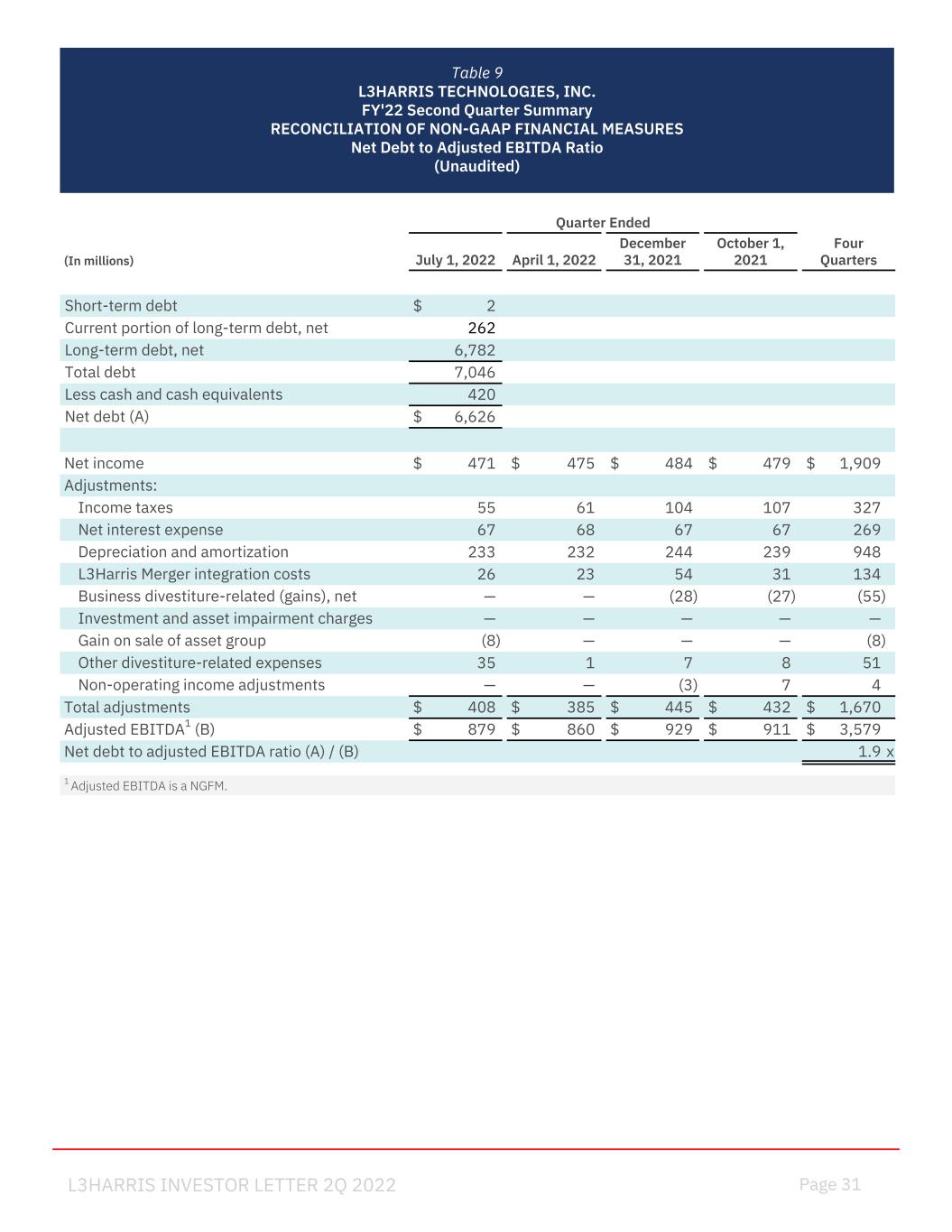

Page 31 L3HARRIS INVESTOR LETTER 2Q 2022 Quarter Ended (In millions) July 1, 2022 April 1, 2022 December 31, 2021 October 1, 2021 Four Quarters Short-term debt $ 2 Current portion of long-term debt, net 262 Long-term debt, net 6,782 Total debt 7,046 Less cash and cash equivalents 420 Net debt (A) $ 6,626 Net income $ 471 $ 475 $ 484 $ 479 $ 1,909 Adjustments: Income taxes 55 61 104 107 327 Net interest expense 67 68 67 67 269 Depreciation and amortization 233 232 244 239 948 L3Harris Merger integration costs 26 23 54 31 134 Business divestiture-related (gains), net — — (28) (27) (55) Investment and asset impairment charges — — — — — Gain on sale of asset group (8) — — — (8) Other divestiture-related expenses 35 1 7 8 51 Non-operating income adjustments — — (3) 7 4 Total adjustments $ 408 $ 385 $ 445 $ 432 $ 1,670 Adjusted EBITDA1 (B) $ 879 $ 860 $ 929 $ 911 $ 3,579 Net debt to adjusted EBITDA ratio (A) / (B) 1.9 x 1 Adjusted EBITDA is a NGFM. Table 9 L3HARRIS TECHNOLOGIES, INC. FY'22 Second Quarter Summary RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Net Debt to Adjusted EBITDA Ratio (Unaudited)

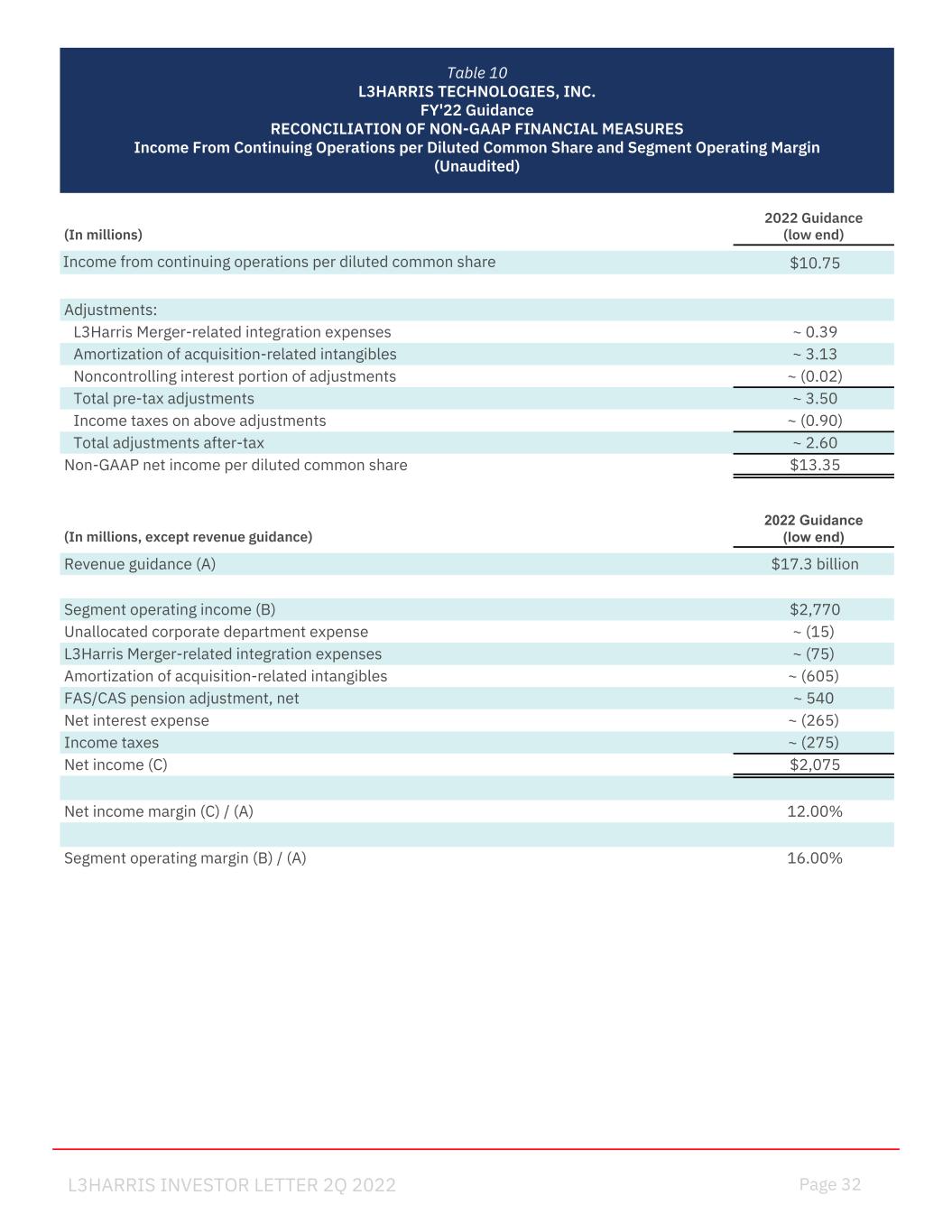

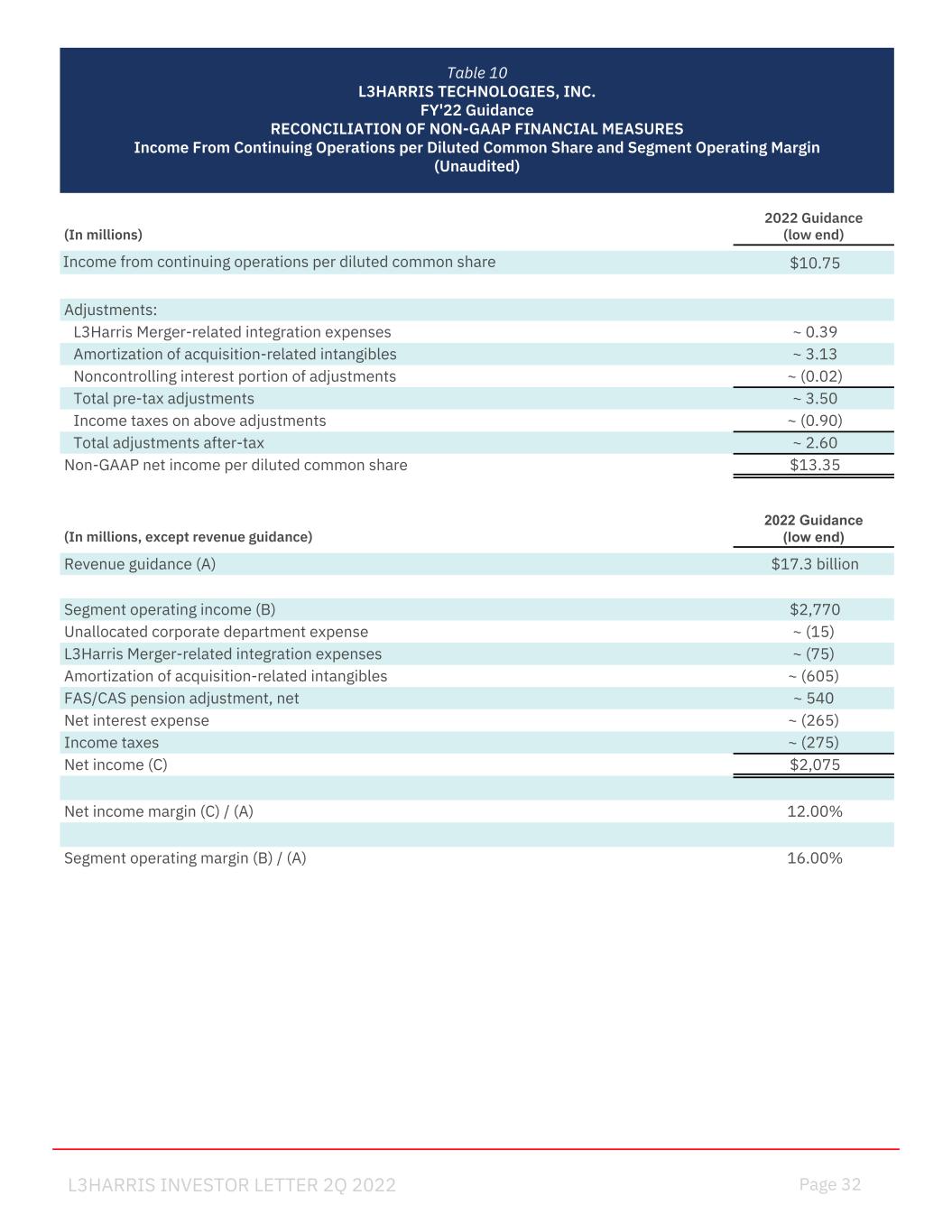

Page 32 L3HARRIS INVESTOR LETTER 2Q 2022 (In millions, except revenue guidance) 2022 Guidance (low end) Revenue guidance (A) $17.3 billion Segment operating income (B) $2,770 Unallocated corporate department expense ~ (15) L3Harris Merger-related integration expenses ~ (75) Amortization of acquisition-related intangibles ~ (605) FAS/CAS pension adjustment, net ~ 540 Net interest expense ~ (265) Income taxes ~ (275) Net income (C) $2,075 Net income margin (C) / (A) 12.00% Segment operating margin (B) / (A) 16.00% (In millions) 2022 Guidance (low end) Income from continuing operations per diluted common share $10.75 Adjustments: L3Harris Merger-related integration expenses ~ 0.39 Amortization of acquisition-related intangibles ~ 3.13 Noncontrolling interest portion of adjustments ~ (0.02) Total pre-tax adjustments ~ 3.50 Income taxes on above adjustments ~ (0.90) Total adjustments after-tax ~ 2.60 Non-GAAP net income per diluted common share $13.35 Table 10 L3HARRIS TECHNOLOGIES, INC. FY'22 Guidance RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Income From Continuing Operations per Diluted Common Share and Segment Operating Margin (Unaudited)

Page 33 L3HARRIS INVESTOR LETTER 2Q 2022 Conference Call Information L3Harris Technologies will host a Q&A focused conference call tomorrow, July 29, 2022, at 8:30 a.m. Eastern Time (ET). The dial-in numbers for the teleconference are (U.S.) 877-407-6184 and (International) 201-389-0877, and participants will be directed to an operator. Please allow at least 10 minutes before the scheduled start time to connect to the teleconference. Participants are encouraged to listen via webcast, which will be broadcast live at L3Harris.com/investors. A recording of the call will be available on the L3Harris website, beginning at approximately 12 p.m. ET on July 29, 2022. Feedback This marks the company’s second quarterly Investor Letter. Continuous improvement is at the forefront of the L3Harris culture and management encourages feedback. If you wish to provide feedback, please email LHXInvestorFeedback@L3Harris.com. CONFERENCE CALL INFORMATION AND FEEDBACK