Moving fast requires trust, Moving forward requires disruption. Investor Letter 1Q 2023 April 27, 2023

Letter from the CEO PAGE 2 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 We’re excited about near-term opportunities, including... • Protecting national security by further progressing our pending acquisition of Aerojet Rocketdyne • Initiating an enterprise transformation program focused on strengthening the operational structure and processes across the company I’m proud of our first quarter results. I’d like to thank our investors for their continued support and recognize that our customers’ critical missions are reinforced by our employees prioritization of “Performance First”. Christopher E. Kubasik Chair and Chief Executive Officer Investors, Customers, and Employees, Performance First. It’s our priority. It’s our purpose. It’s our promise. Our “Performance First” imperative will guide us throughout the year. What this really means to me and our team is listening to our investors, our customers, and our employees and achieving our shared goals by deploying rapid and cost-effective innovation to support our warfighters. Being the Trusted Disruptor. Doing what we said we would do. We are off to a strong start… ...for Investors: • Generated $5.8B of orders - a quarterly record; Book-to-bill 1.31x ◦ Won >$1.5B in new prime space awards ◦ Secured >$550M for domestic ISR aircraft missionization • Drove revenue up 9%; third consecutive quarter of organic growth • Delivered solid EPS: $1.76 (GAAP); $2.86 (non-GAAP)1 • Produced $350M cash from ops; $314M adj free cash flow (FCF)1 • Returned >$600M of cash to shareholders ...for Customers: • Completed Preliminary Design Review for SDA’s Tracking Tranche 1 • Deployed Cross-Track Infrared Sounder instrument onboard NOAA-21 satellite - strengthening L3Harris’ weather franchise position • Exceeded expectations by delivering a Rivet Joint aircraft with zero inspection discrepancies - receiving rare Black-Letter status • Leveraged L3Harris-wide resources to improve schedule on F/A-18 electronic warfare program and position for the next-generation suite • Delivered ~15k radios in support of Ukraine since conflict start ...for Employees: • Absorbed inflation cost increases to employee benefits • Invested through expanded merit increases • Encouraged work/life flexibility including hybrid and 9/80 schedules • Increased training budgets to drive talent capabilities 1Q23 Fast. Facts. revenue / organic1 growth funded book-to-bill1 EPS / non-GAAP EPS1 cash from ops / adj FCF1 cash returned to shareholders $25B 9% / 7% $1.76 / $2.86 $350M / $314M $616M 1.31x total backlog, up 16%

PAGE 3 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 Consolidated Results................................................ 4 Segment Results....................................................... 5 Financial Guidance.................................................... 6 Demand Environment............................................... 7 Operational Update................................................... 9 Cash Flow & Capital Allocation................................ 11 Pending Aerojet Rocketdyne Acquisition................ 12 Environmental, Social & Governance...................... 13 Endnotes.................................................................... 14 Non-GAAP Financial Measures................................ 15 Forward-Looking Statements................................... 16 Financial Tables........................................................ 17 Reconciliation of Non-GAAP Financial Measures... 23 Conference Call Information.................................... 30 Table of Contents

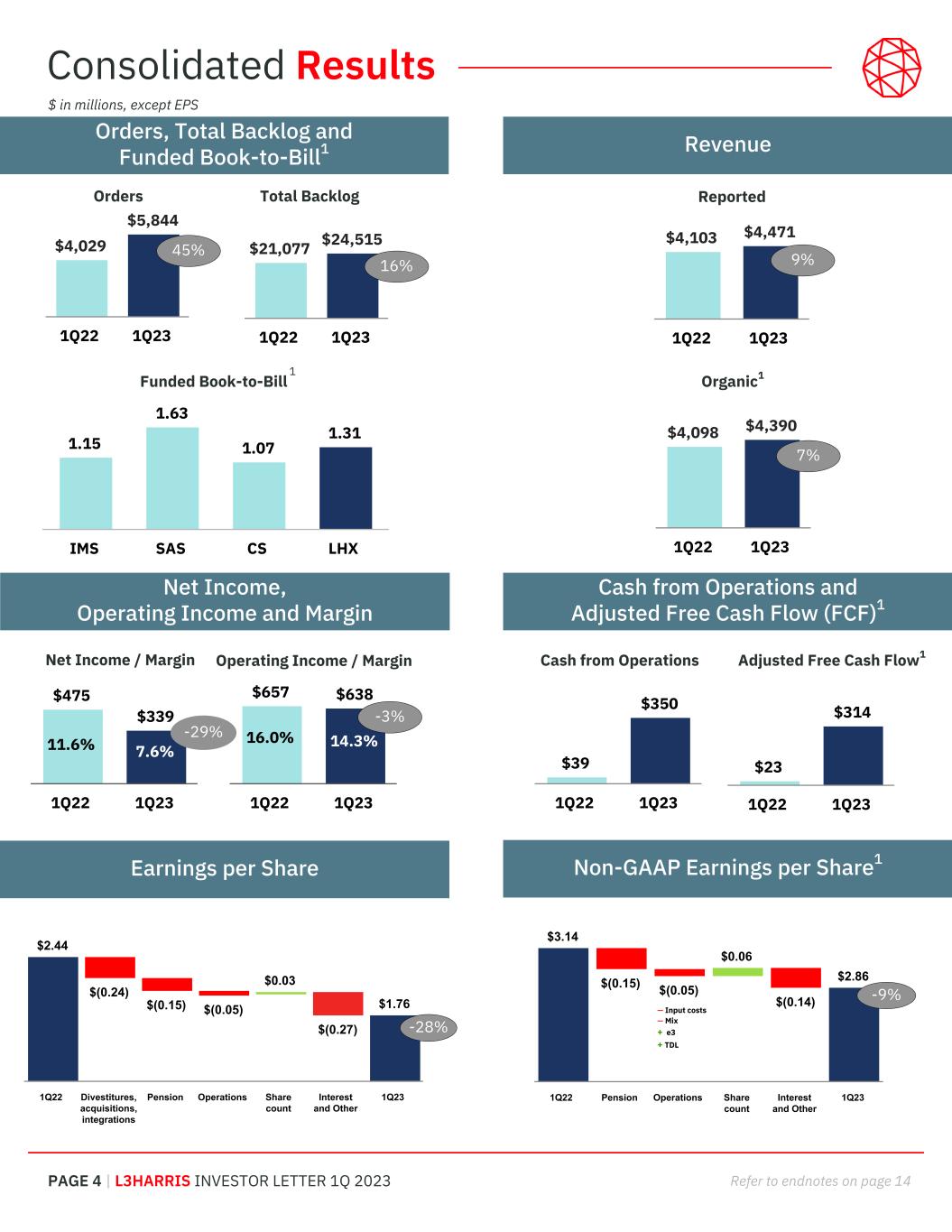

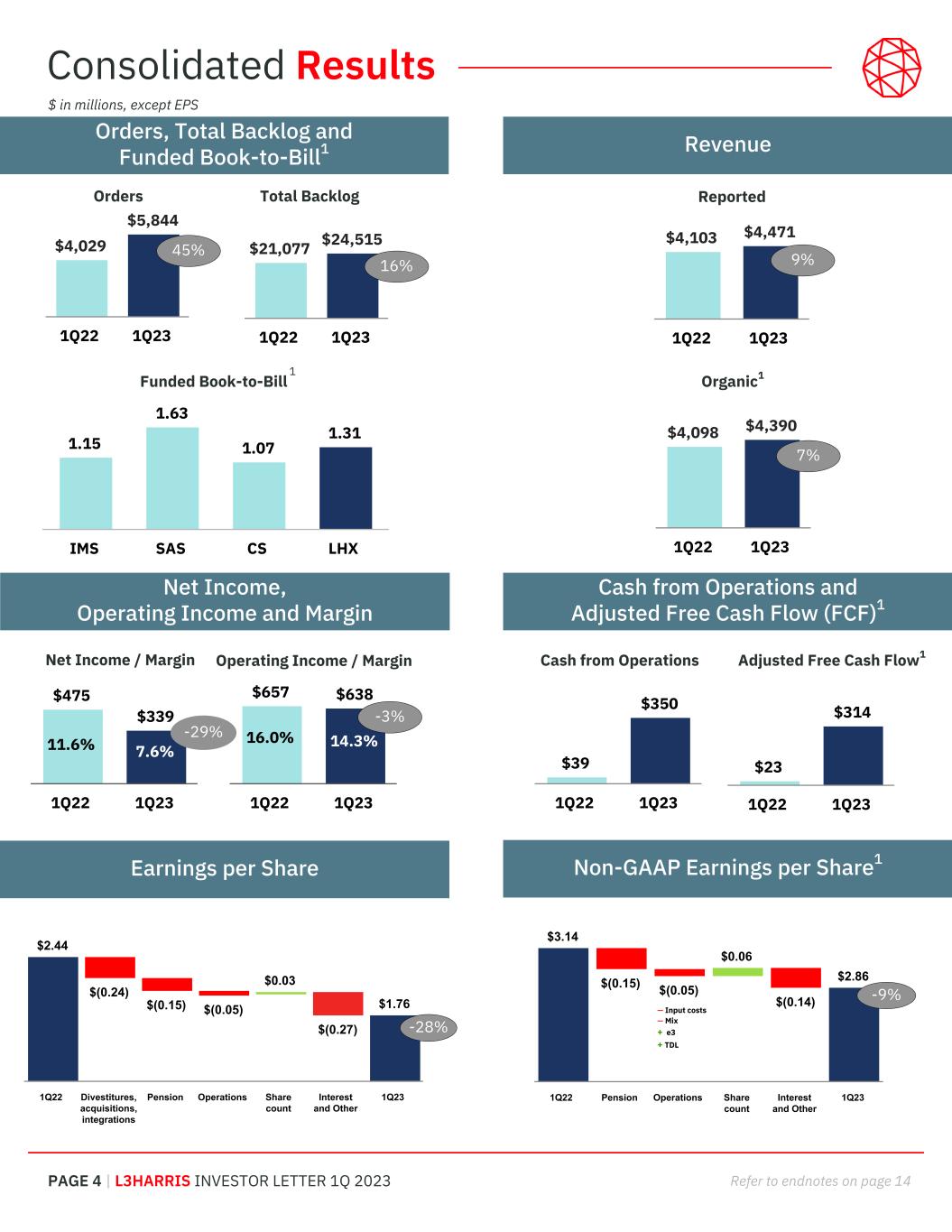

PAGE 4 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 Organic1 Adjusted Free Cash Flow1 Cash from Operations and Adjusted Free Cash Flow (FCF)1 Earnings per Share RevenueOrders, Total Backlog and Funded Book-to-Bill1 $3.14 $(0.15) $(0.05) $0.06 $(0.14) $2.86 1Q22 Pension Operations Share count Interest and Other 1Q23 -9% $2.44 $(0.24) $(0.15) $(0.05) $0.03 $(0.27) $1.76 1Q22 Divestitures, acquisitions, integrations Pension Operations Share count Interest and Other 1Q23 -28% Consolidated Results 1.15 1.63 1.07 1.31 IMS SAS CS LHX 1 $4,103 $4,471 1Q22 1Q23 9% $4,029 $5,844 1Q22 1Q23 45% $4,098 $4,390 1Q22 1Q23 7% $39 $350 1Q22 1Q23 $23 $314 1Q22 1Q23 Cash from Operations $475 $339 11.6% 7.6% 1Q22 1Q23 $657 $638 16.0% 14.3% 1Q22 1Q23 -29% Net Income / Margin Operating Income / Margin -3% Funded Book-to-Bill ReportedOrders $21,077 $24,515 1Q22 1Q23 Total Backlog Net Income, Operating Income and Margin 16% Non-GAAP Earnings per Share1 $ in millions, except EPS — Input costs — Mix + e3 + TDL

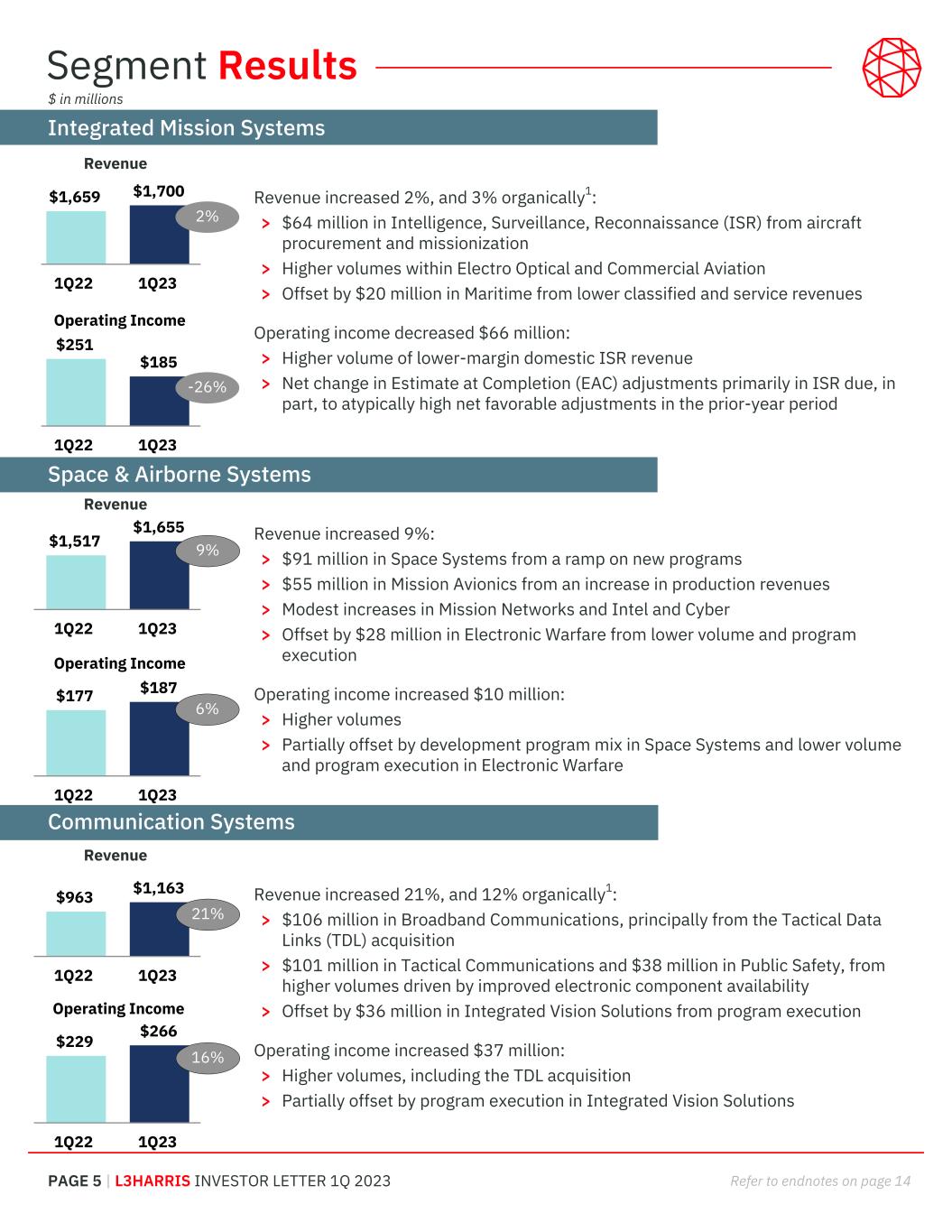

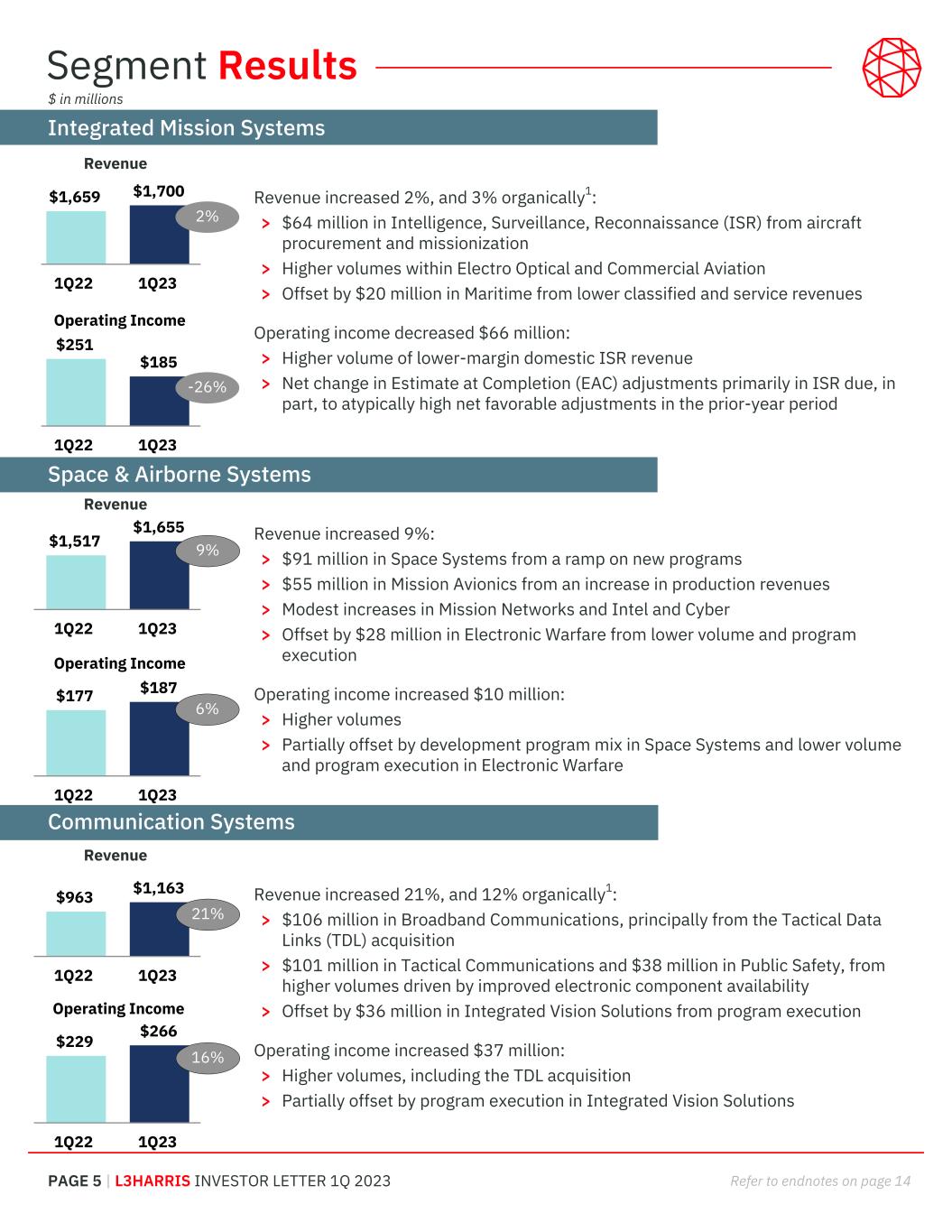

PAGE 5 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 $251 $185 1Q22 1Q23 Revenue increased 9%: > $91 million in Space Systems from a ramp on new programs > $55 million in Mission Avionics from an increase in production revenues > Modest increases in Mission Networks and Intel and Cyber > Offset by $28 million in Electronic Warfare from lower volume and program execution Operating income increased $10 million: > Higher volumes > Partially offset by development program mix in Space Systems and lower volume and program execution in Electronic Warfare $1,659 $1,700 1Q22 1Q23 $177 $187 1Q22 1Q23 $1,517 $1,655 1Q22 1Q23 $963 $1,163 1Q22 1Q23 9% 2% -26% Segment Results 6% Integrated Mission Systems Space & Airborne Systems Communication Systems 21% Revenue increased 21%, and 12% organically1: > $106 million in Broadband Communications, principally from the Tactical Data Links (TDL) acquisition > $101 million in Tactical Communications and $38 million in Public Safety, from higher volumes driven by improved electronic component availability > Offset by $36 million in Integrated Vision Solutions from program execution Operating income increased $37 million: > Higher volumes, including the TDL acquisition > Partially offset by program execution in Integrated Vision Solutions $229 $266 1Q22 1Q23 16% Revenue Operating Income Revenue Revenue Revenue increased 2%, and 3% organically1: > $64 million in Intelligence, Surveillance, Reconnaissance (ISR) from aircraft procurement and missionization > Higher volumes within Electro Optical and Commercial Aviation > Offset by $20 million in Maritime from lower classified and service revenues Operating income decreased $66 million: > Higher volume of lower-margin domestic ISR revenue > Net change in Estimate at Completion (EAC) adjustments primarily in ISR due, in part, to atypically high net favorable adjustments in the prior-year period Operating Income Operating Income $ in millions

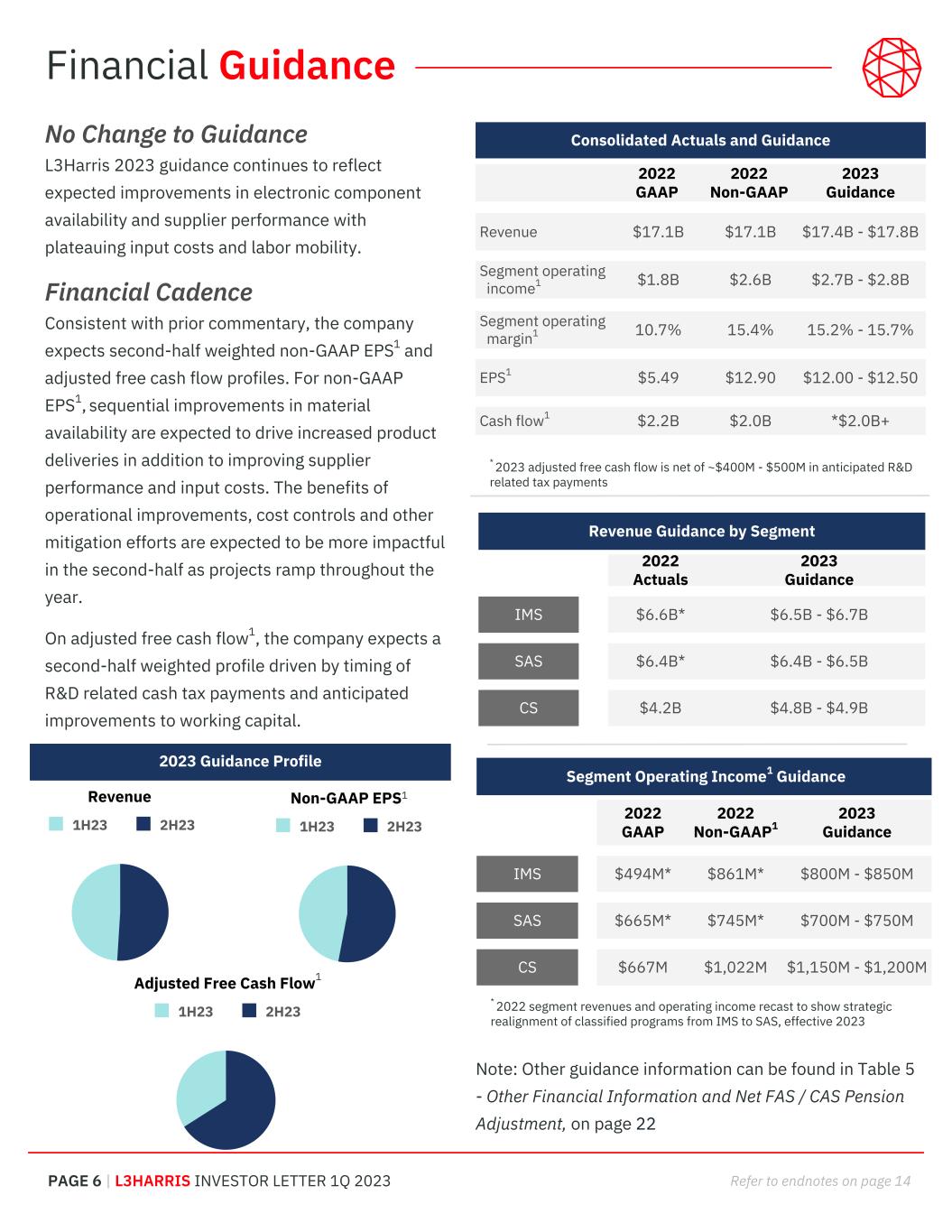

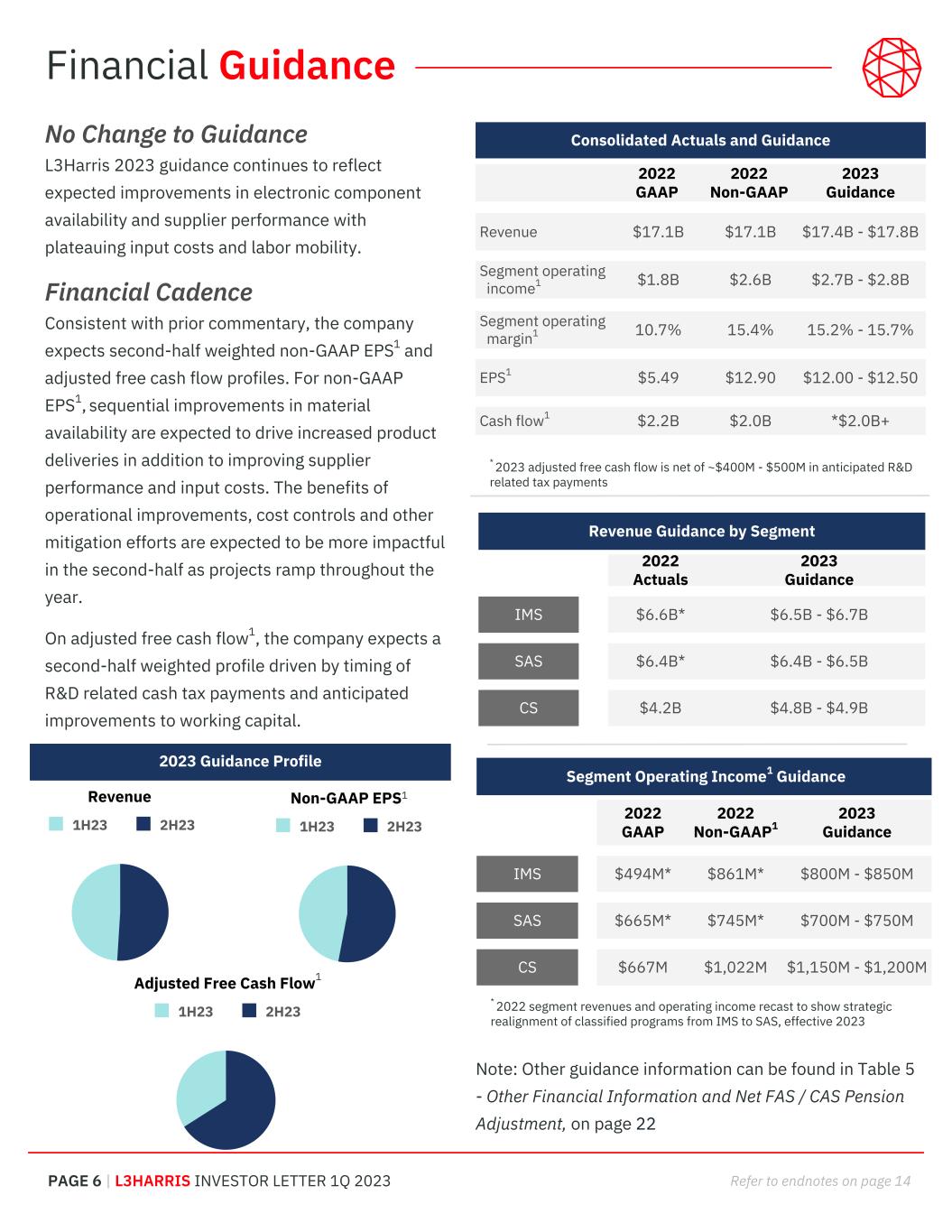

PAGE 6 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 * 2023 adjusted free cash flow is net of ~$400M - $500M in anticipated R&D related tax payments No Change to Guidance L3Harris 2023 guidance continues to reflect expected improvements in electronic component availability and supplier performance with plateauing input costs and labor mobility. Financial Cadence Consistent with prior commentary, the company expects second-half weighted non-GAAP EPS1 and adjusted free cash flow profiles. For non-GAAP EPS1, sequential improvements in material availability are expected to drive increased product deliveries in addition to improving supplier performance and input costs. The benefits of operational improvements, cost controls and other mitigation efforts are expected to be more impactful in the second-half as projects ramp throughout the year. On adjusted free cash flow1, the company expects a second-half weighted profile driven by timing of R&D related cash tax payments and anticipated improvements to working capital. Consolidated Actuals and Guidance 2022 GAAP 2022 Non-GAAP 2023 Guidance Revenue $17.1B $17.1B $17.4B - $17.8B Segment operating income1 $1.8B $2.6B $2.7B - $2.8B Segment operating margin1 10.7% 15.4% 15.2% - 15.7% EPS1 $5.49 $12.90 $12.00 - $12.50 Cash flow1 $2.2B $2.0B *$2.0B+ Revenue 1H23 2H23 Non-GAAP EPS 1H23 2H23 Financial Guidance 2023 Guidance Profile Revenue Guidance by Segment 2022 Actuals 2023 Guidance IMS $6.6B* $6.5B - $6.7B SAS $6.4B* $6.4B - $6.5B CS $4.2B $4.8B - $4.9B * 2022 segment revenues and operating income recast to show strategic realignment of classified programs from IMS to SAS, effective 2023 Segment Operating Income1 Guidance 2022 GAAP 2022 Non-GAAP1 2023 Guidance IMS $494M* $861M* $800M - $850M SAS $665M* $745M* $700M - $750M CS $667M $1,022M $1,150M - $1,200M Adjusted Free Cash Flow 1H23 2H23 1 1 Note: Other guidance information can be found in Table 5 - Other Financial Information and Net FAS / CAS Pension Adjustment, on page 22

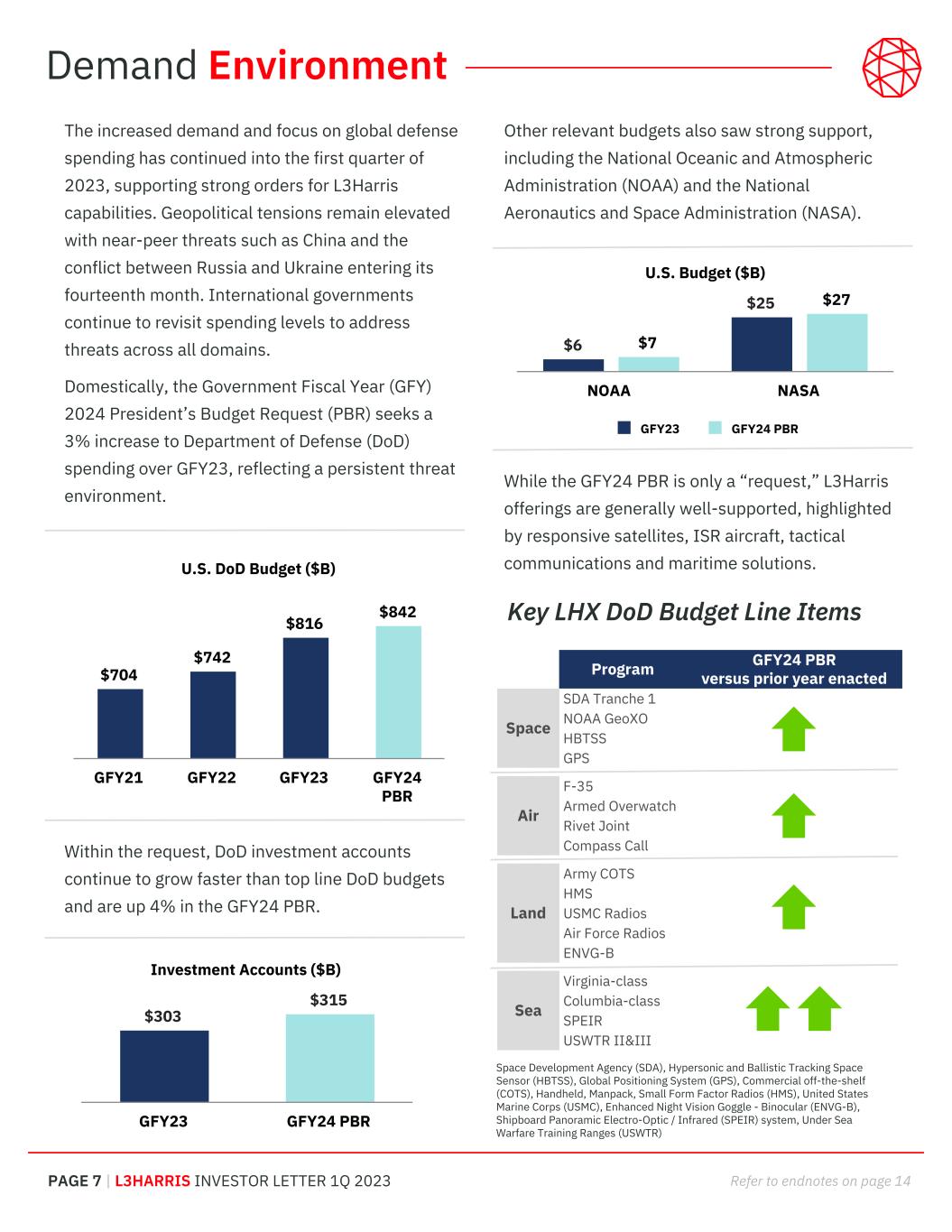

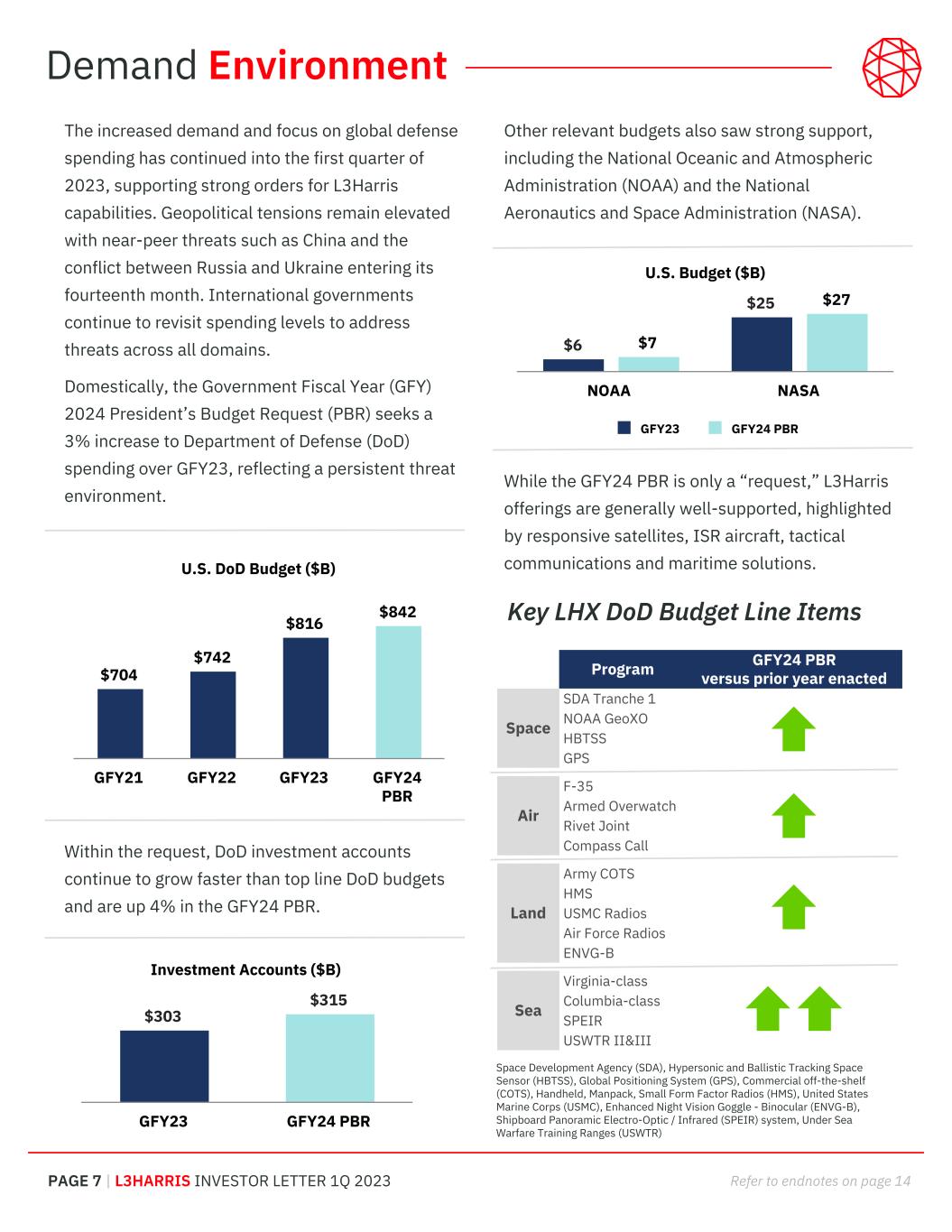

PAGE 7 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 U.S. DoD Budget ($B) $704 $742 $816 $842 GFY21 GFY22 GFY23 GFY24 PBR The increased demand and focus on global defense spending has continued into the first quarter of 2023, supporting strong orders for L3Harris capabilities. Geopolitical tensions remain elevated with near-peer threats such as China and the conflict between Russia and Ukraine entering its fourteenth month. International governments continue to revisit spending levels to address threats across all domains. Domestically, the Government Fiscal Year (GFY) 2024 President’s Budget Request (PBR) seeks a 3% increase to Department of Defense (DoD) spending over GFY23, reflecting a persistent threat environment. Demand Environment While the GFY24 PBR is only a “request,” L3Harris offerings are generally well-supported, highlighted by responsive satellites, ISR aircraft, tactical communications and maritime solutions. Program GFY24 PBR versus prior year enacted Space SDA Tranche 1 NOAA GeoXO HBTSS GPS Air F-35 Armed Overwatch Rivet Joint Compass Call Land Army COTS HMS USMC Radios Air Force Radios ENVG-B Sea Virginia-class Columbia-class SPEIR USWTR II&III Key LHX DoD Budget Line Items Within the request, DoD investment accounts continue to grow faster than top line DoD budgets and are up 4% in the GFY24 PBR. Space Development Agency (SDA), Hypersonic and Ballistic Tracking Space Sensor (HBTSS), Global Positioning System (GPS), Commercial off-the-shelf (COTS), Handheld, Manpack, Small Form Factor Radios (HMS), United States Marine Corps (USMC), Enhanced Night Vision Goggle - Binocular (ENVG-B), Shipboard Panoramic Electro-Optic / Infrared (SPEIR) system, Under Sea Warfare Training Ranges (USWTR) Investment Accounts ($B) $303 $315 GFY23 GFY24 PBR Other relevant budgets also saw strong support, including the National Oceanic and Atmospheric Administration (NOAA) and the National Aeronautics and Space Administration (NASA). U.S. Budget ($B) $6 $25 $7 $27 GFY23 GFY24 PBR NOAA NASA

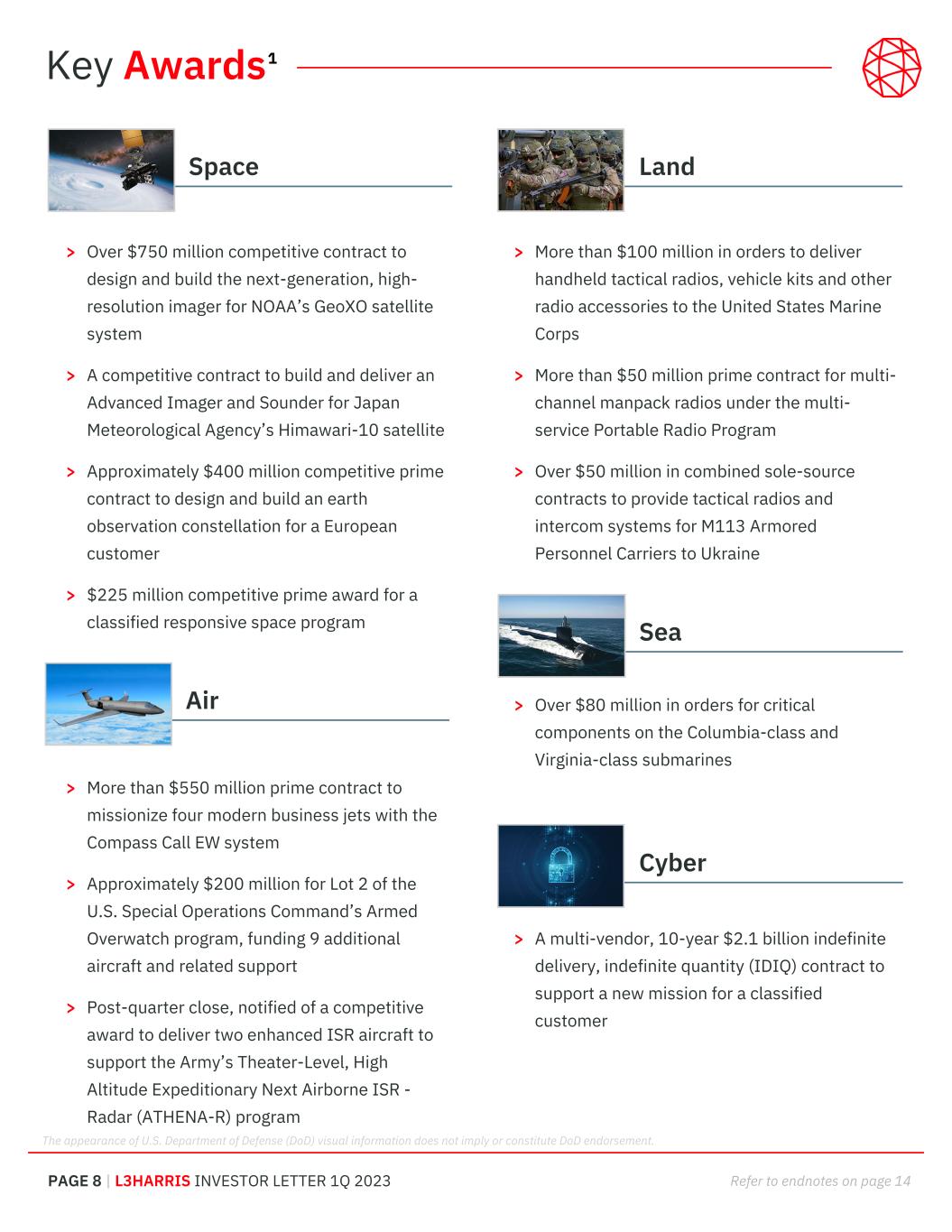

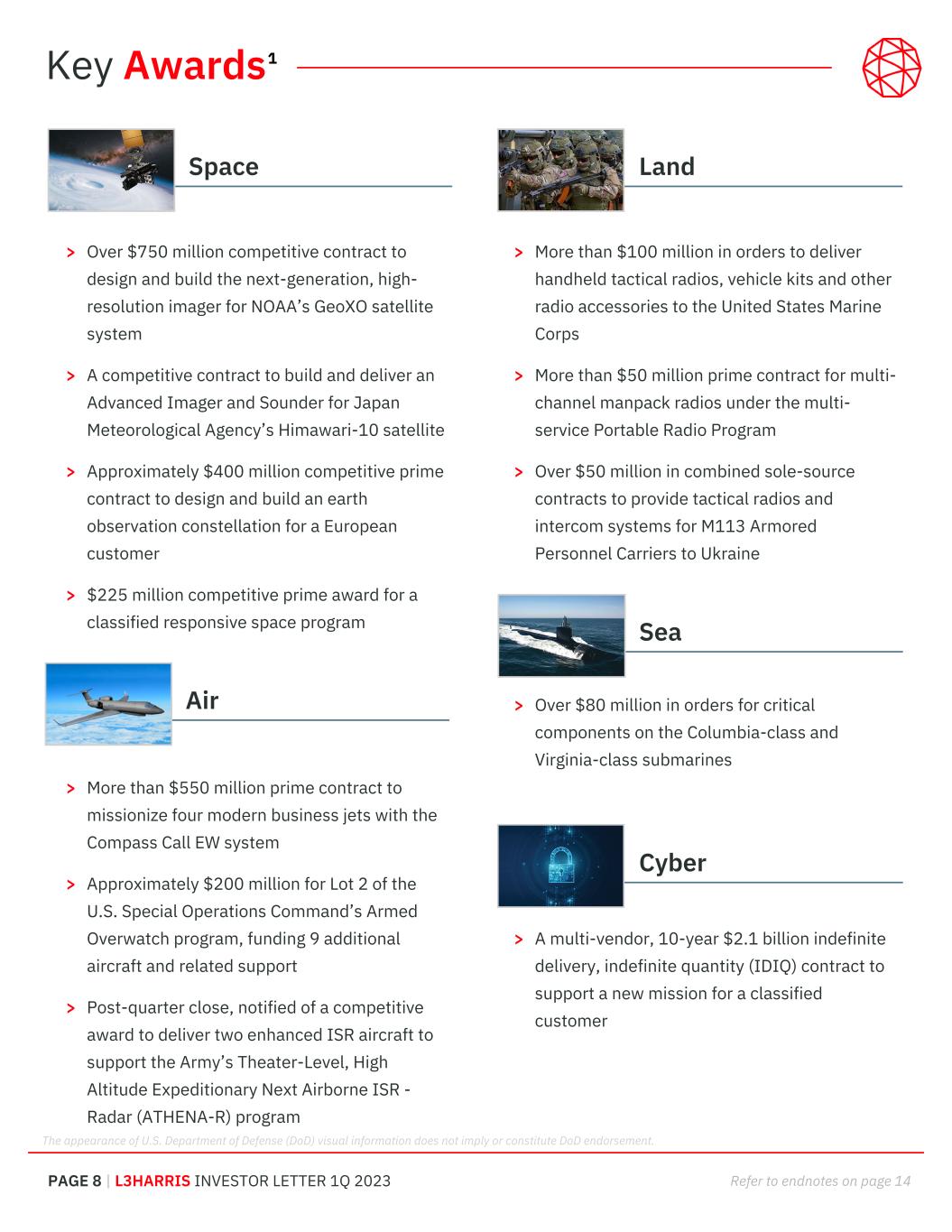

PAGE 8 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 > Over $750 million competitive contract to design and build the next-generation, high- resolution imager for NOAA’s GeoXO satellite system > A competitive contract to build and deliver an Advanced Imager and Sounder for Japan Meteorological Agency’s Himawari-10 satellite > Approximately $400 million competitive prime contract to design and build an earth observation constellation for a European customer > $225 million competitive prime award for a classified responsive space program > More than $550 million prime contract to missionize four modern business jets with the Compass Call EW system > Approximately $200 million for Lot 2 of the U.S. Special Operations Command’s Armed Overwatch program, funding 9 additional aircraft and related support > Post-quarter close, notified of a competitive award to deliver two enhanced ISR aircraft to support the Army’s Theater-Level, High Altitude Expeditionary Next Airborne ISR - Radar (ATHENA-R) program Key Awards Space Air Land > More than $100 million in orders to deliver handheld tactical radios, vehicle kits and other radio accessories to the United States Marine Corps > More than $50 million prime contract for multi- channel manpack radios under the multi- service Portable Radio Program > Over $50 million in combined sole-source contracts to provide tactical radios and intercom systems for M113 Armored Personnel Carriers to Ukraine > Over $80 million in orders for critical components on the Columbia-class and Virginia-class submarines > A multi-vendor, 10-year $2.1 billion indefinite delivery, indefinite quantity (IDIQ) contract to support a new mission for a classified customer Sea Cyber 1 The appearance of U.S. Department of Defense (DoD) visual information does not imply or constitute DoD endorsement.

PAGE 9 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 In the first quarter, the company continued to experience impacts from its supply chain. In general, the breadth of disruptions continued to dissipate, allowing L3Harris to focus resources on a smaller set of challenges. However, the depth of supplier challenges and inflation continued to contribute to unfavorable impacts in the quarter. Overall, L3Harris anticipates that supply chain will remain dynamic, with sequential, but uneven improvement in supplier performance, inflation and labor attrition through the balance of the year. Suppliers Market conditions for electronic components are improving as providers of Aerospace and Defense legacy components shift resources to add capacity in this market segment. Indicators are slowly trending positively for L3Harris. L3Harris is strengthening relationships with many of its key suppliers, including an agreement with a major chip provider to increase surety of supply and foster collaboration to develop differentiating technology in the future. Inflation Material and labor input costs continue to stabilize, but remain high on a relative historical basis. These higher-than-assumed costs continue to pressure certain fixed-price contracts, impacting the company’s ability to leverage positive EAC opportunities across a diverse portfolio and therefore impacting margins. We continue to proactively deploy operational improvement strategies combined with pricing opportunities to mitigate cost growth. Labor The national unemployment rate is near historic lows and labor remains competitive. L3Harris has implemented strategies to hire to our demand, and the company has experienced increasing stability through lower employee attrition, which peaked in the third quarter of 2022 in the low double-digits. Since then, the company’s rolling 12-month attrition rates have shown modest improvements, declining 20-40 basis points in both fourth quarter 2022 and first quarter 2023. While trending positively, these figures remain above historical levels. Enterprise Transformation As part of the company’s evolution and following the major integration activities from the L3 and Harris merger, we are launching an enterprise transformation program. This program is designed to harmonize and accelerate business enhancements to the next level, including as a result of portfolio changes, under one program office. This initiative magnifies L3Harris’ Trusted Disruptor strategy through a set of actions across functions, systems and processes and is anticipated to enable more agility and cost competitiveness. L3Harris is positioning for the future, which is expected to enable more capability and capacity and drive increased shareholder value. Operational Update 2Q22 3Q22 4Q22 1Q23 # parts Critical parts shortage Alternate parts ~35 ~65 ~1,300 ~900

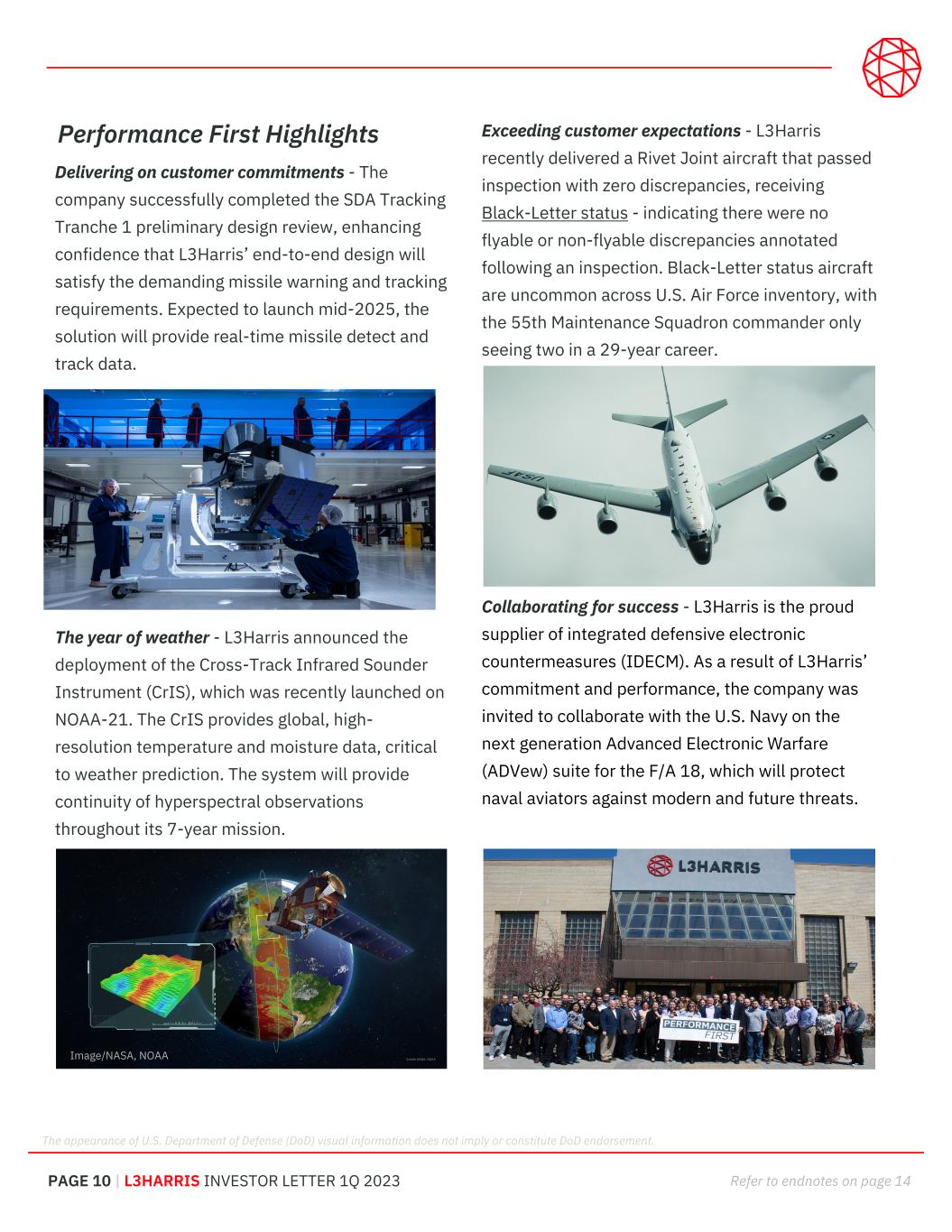

PAGE 10 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 The year of weather - L3Harris announced the deployment of the Cross-Track Infrared Sounder Instrument (CrIS), which was recently launched on NOAA-21. The CrIS provides global, high- resolution temperature and moisture data, critical to weather prediction. The system will provide continuity of hyperspectral observations throughout its 7-year mission. Delivering on customer commitments - The company successfully completed the SDA Tracking Tranche 1 preliminary design review, enhancing confidence that L3Harris’ end-to-end design will satisfy the demanding missile warning and tracking requirements. Expected to launch mid-2025, the solution will provide real-time missile detect and track data. Image/NASA, NOAA Performance First Highlights Exceeding customer expectations - L3Harris recently delivered a Rivet Joint aircraft that passed inspection with zero discrepancies, receiving Black-Letter status - indicating there were no flyable or non-flyable discrepancies annotated following an inspection. Black-Letter status aircraft are uncommon across U.S. Air Force inventory, with the 55th Maintenance Squadron commander only seeing two in a 29-year career. Collaborating for success - L3Harris is the proud supplier of integrated defensive electronic countermeasures (IDECM). As a result of L3Harris’ commitment and performance, the company was invited to collaborate with the U.S. Navy on the next generation Advanced Electronic Warfare (ADVew) suite for the F/A 18, which will protect naval aviators against modern and future threats. The appearance of U.S. Department of Defense (DoD) visual information does not imply or constitute DoD endorsement.

PAGE 11 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 > Over the long term, L3Harris remains committed to a balanced capital allocation strategy among capital returns, portfolio optimization and debt repayments Leverage > As of March 31, 2023, L3Harris’ net-debt-to- adjusted EBITDA1 leverage ratio was 2.4x > L3Harris intends to retire its 5-year $800 million bond maturing in June 2023 with cash on hand and commercial paper issuances > Over the long term, the company targets a leverage ratio of less than 3.0x net-debt-to- adjusted EBITDA1. When above this target, L3Harris expects to prioritize debt repayment to maintain solid investment grade credit ratings and achieve this through a moderation in share repurchases and proceeds from potential non- core asset divestitures Cash Flow 1Q23 cash flow from operations was $350 million, up significantly versus 1Q22 from less cash used to fund net working capital. Adjusted free cash flow1 was $314 million, also up significantly versus 1Q22 from less working capital cash usage noted above, which was partially offset by higher capital expenditures. > On April 6, 2023, L3Harris completed the sale of its Visual Information Solutions (VIS) business, consistent with the company’s portfolio optimization strategy Capital Deployment > In the first quarter, L3Harris returned $616 million to shareholders, including: > $220 million in dividends; and > $396 million in share repurchases > On April 21, the L3Harris Board of Directors declared a quarterly cash dividend of $1.14 per common share > The company’s pension plan is 99% funded Total Capital Deployment (mid-2019 to 2025E) Share Repurchases Acquisitions (Debt financed) Dividends Debt Repayments Cash Flow & Capital Allocation Cash Flow ($M) $39 $23 $350 $314 1Q22 1Q23 Operating Cash Flow Adjusted FCF 1

PAGE 12 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 GFY24 PBR & Defense Production Act Funding The GFY24 PBR for missiles and munitions procurement increased double-digits over GFY23 to support a heightened threat environment. The NASA budget request grew 7% over GFY23 with support for space propulsion. In April, AJRD entered into a $215.6 million Cooperative Agreement with the DoD to increase domestic rocket motor manufacturing capacity. Financial Highlights > $58 per share purchase price; transaction value of $4.7 billion > 2024E* adjusted EBITDA multiple of ~12x, including run rate cost synergies of $40 to $50 million anticipated within the first full year > 2022 Revenue / adjusted EBITDA Margins** ~$2.2 billion / ~11% > Improving earnings visibility via ~30% backlog increase to more than $30 billion** > Transaction expected to be accretive to non- GAAP EPS (in first full year) and adjusted free cash flow (in second full year) Update On March 15, L3Harris received a request for additional information from the Federal Trade Commission (FTC) as part of the regulatory review process. The request extends the waiting period until after L3Harris and Aerojet Rocketdyne (AJRD) have substantially complied with the request. L3Harris does not compete with Aerojet Rocketdyne, and therefore the pending acquisition does not change the competitive landscape for missiles and space. Further, on March 16, AJRD shareholders overwhelmingly approved L3Harris’ acquisition, representing a key process milestone. Strategic Rationale The pending acquisition supports the L3Harris Trusted Disruptor strategy, providing unique capabilities and technological leadership in growing markets. At closing, AJRD would also expand the company’s exposure to long-cycle programs, enhancing L3Harris earnings visibility and diversifying its program portfolio, as well as the company’s long- standing legacy as a merchant supplier. L3Harris expects the deal to close in 2023, subject to required regulatory approvals and customary closing conditions. Image/Aerojet Rocketdyne Artist Concept * EBITDA based on 2024 consensus figures at time of deal announcement and excluded synergies and included pension benefits ** Based on 2022 actuals reported by AJRD Pending Aerojet Rocketdyne Acquisition Image/NASA

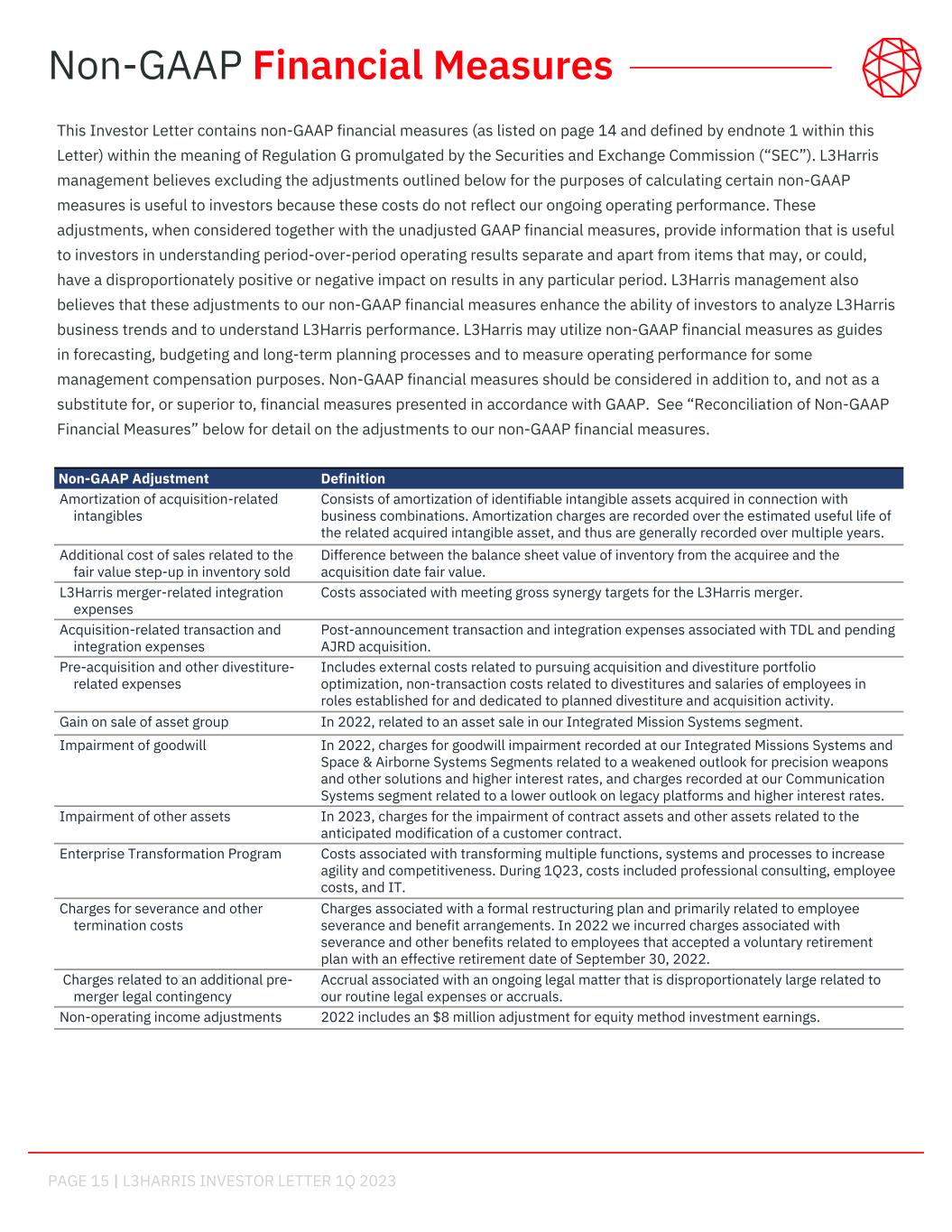

PAGE 13 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 Governance Environmental On March 14, L3Harris published its 2022 Sustainability Report1, which highlights the company’s progress toward its 2026 environmental objectives, including: > Surpassing a goal to reduce greenhouse gas (GHG) emissions by 30%, three years ahead of schedule > Completing third-party verification for Scope 1 and 2 GHG emissions > Reconfirming a commitment to reduce water usage by 20% and increase landfill diversion to 75% by 2026 Social The company’s 2022 Diversity, Equity and Inclusion Report1, released in February, highlights many key accomplishments, including increased participation in its Employee Resource Groups1. In addition, the following represent highlights of social progress for L3Harris: > 17% decrease in Total Recordable Injury Rate from 2021 to 2022 > 100% score on 2022 Disability Equality Index, a 10% increase from 2021 Environmental, Social & Governance In February, L3Harris elected retired Air Force General Edward A. Rice, Jr., former commander of the U.S. Air Force Air Education and Training Command, to its Board of Directors. At the annual shareholder meeting, the company recognized retiring board members Tom Corcoran, Lew Kramer and Lloyd Newton for their contributions. Further progress includes: > 100% of employees trained in anti-corruption policies / procedures and Global Trade Compliance Policy > Enhancement of L3Harris’ political activity disclosure and release of the company’s Human Rights Policy

PAGE 14 | L3HARRIS INVESTOR LETTER 1Q 2023 1 Key terms used throughout this Investor Letter are described below: Term Definition Funded book-to-bill Calculated as the value of new contract awards received from the U.S. Government, for which the U.S. Government has appropriated funds, plus the value of new contract awards and orders received from customers other than the U.S. Government, divided by revenue. This includes incremental funding and adjustments to previous awards, and excludes unexercised contract options or potential orders under indefinite delivery, indefinite quantity contracts. The funded book-to-bill ratio is considered a key performance indicator in the Aerospace and Defense industry as it measures how much backlog is utilized in a certain period. Funded backlog Calculated as the value of new contract awards received from the U.S. Government, for which the U.S. Government has appropriated funds, plus the value of new contract awards and orders received from customers other than the U.S. Government. This includes incremental funding and adjustments to previous awards, and excludes unexercised contract options or potential orders under indefinite delivery, indefinite quantity contracts. Organic revenue and organic basis Organic revenue and references to an organic basis exclude the impact of completed divestitures and exclude the impact of current years acquisitions; refer to non-GAAP financial measure (NGFM) reconciliations in the tables accompanying this Investor Letter and to the disclosures in the non-GAAP section of this Investor Letter for more information. Segment operating margin, non-GAAP operating income (loss), non-GAAP EPS, non- GAAP backlog, net-debt-to- adjusted-EBITDA, non-GAAP tax rate and adjusted free cash flow (FCF) Each measure is a NGFM; refer to description of adjustments on page 15 and NGFM reconciliations in the tables accompanying this Investor Letter for applicable adjustments and/or exclusions and to the disclosures in the non-GAAP section of this Investor Letter for more information. Operating cash flow and adjusted FCF results and guidance (2023) Assume a provision in the Tax Cuts and Jobs Act of 2017 that went into effect on January 1, 2022 requiring companies to capitalize and amortize R&D expenditures over five years rather than deducting such expenditures in the year incurred is not modified, repealed or deferred, resulting in additional cash income tax payments of ~$400 million to $500 million in fiscal 2023. Adjusted FCF excludes cash income taxes related to taxable gains and losses resulting from sales of businesses, and also reflects the types of adjustments and/or exclusions presented in the FCF and adjusted FCF NGFM reconciliation in the tables accompanying this Investor Letter; refer to the disclosures in the non-GAAP section of this Investor Letter for more information. 2022 Sustainability Report and 2022 Diversity, Equity, and Inclusion Report The 2022 Sustainability Report and 2022 Diversity, Equity, and Inclusion Report are not incorporated herein by reference. These reports are available on the Corporate Governance section of our website at https://www.l3harris.com/company/ environmental-social-and-governance. Key Awards Includes new contracts and funded orders on IDIQ contracts Employee Resource Groups (ERG) Asian Professionals for Excellence (APEX), Early Career Professionals (ECP), Advancing a Multigenerational Workforce (5GEN), Hispanic/Latino Organization for Leadership & Advancement (HOLA), Technology & Innovation Resource Group (Intrapreneurs), L3Harris Employees of African Descent (LEAD), Middle Eastern & North African Descent & Allies (MENA), LGBTQ+ Resource Group (PRIDE), Supporting Emergency Responders and Veterans Engagement (SERVE), Women Who Strive for Empowering, Enhancing, & Encouraging Other Women (WE3), Willing & Able (WILA) Endnotes

PAGE 15 | L3HARRIS INVESTOR LETTER 1Q 2023 Non-GAAP Adjustment Definition Amortization of acquisition-related intangibles Consists of amortization of identifiable intangible assets acquired in connection with business combinations. Amortization charges are recorded over the estimated useful life of the related acquired intangible asset, and thus are generally recorded over multiple years. Additional cost of sales related to the fair value step-up in inventory sold Difference between the balance sheet value of inventory from the acquiree and the acquisition date fair value. L3Harris merger-related integration expenses Costs associated with meeting gross synergy targets for the L3Harris merger. Acquisition-related transaction and integration expenses Post-announcement transaction and integration expenses associated with TDL and pending AJRD acquisition. Pre-acquisition and other divestiture- related expenses Includes external costs related to pursuing acquisition and divestiture portfolio optimization, non-transaction costs related to divestitures and salaries of employees in roles established for and dedicated to planned divestiture and acquisition activity. Gain on sale of asset group In 2022, related to an asset sale in our Integrated Mission Systems segment. Impairment of goodwill In 2022, charges for goodwill impairment recorded at our Integrated Missions Systems and Space & Airborne Systems Segments related to a weakened outlook for precision weapons and other solutions and higher interest rates, and charges recorded at our Communication Systems segment related to a lower outlook on legacy platforms and higher interest rates. Impairment of other assets In 2023, charges for the impairment of contract assets and other assets related to the anticipated modification of a customer contract. Enterprise Transformation Program Costs associated with transforming multiple functions, systems and processes to increase agility and competitiveness. During 1Q23, costs included professional consulting, employee costs, and IT. Charges for severance and other termination costs Charges associated with a formal restructuring plan and primarily related to employee severance and benefit arrangements. In 2022 we incurred charges associated with severance and other benefits related to employees that accepted a voluntary retirement plan with an effective retirement date of September 30, 2022. Charges related to an additional pre- merger legal contingency Accrual associated with an ongoing legal matter that is disproportionately large related to our routine legal expenses or accruals. Non-operating income adjustments 2022 includes an $8 million adjustment for equity method investment earnings. This Investor Letter contains non-GAAP financial measures (as listed on page 14 and defined by endnote 1 within this Letter) within the meaning of Regulation G promulgated by the Securities and Exchange Commission (“SEC”). L3Harris management believes excluding the adjustments outlined below for the purposes of calculating certain non-GAAP measures is useful to investors because these costs do not reflect our ongoing operating performance. These adjustments, when considered together with the unadjusted GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. L3Harris management also believes that these adjustments to our non-GAAP financial measures enhance the ability of investors to analyze L3Harris business trends and to understand L3Harris performance. L3Harris may utilize non-GAAP financial measures as guides in forecasting, budgeting and long-term planning processes and to measure operating performance for some management compensation purposes. Non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures presented in accordance with GAAP. See “Reconciliation of Non-GAAP Financial Measures” below for detail on the adjustments to our non-GAAP financial measures. Non-GAAP Financial Measures

PAGE 16 | L3HARRIS INVESTOR LETTER 1Q 2023 Statements in this Investor Letter that are not historical facts are forward-looking statements that reflect management's current expectations, assumptions and estimates of future performance and economic conditions. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements in this Investor Letter include but are not limited to: 2023 guidance; the enterprise transformation program and its impacts on future performance; weighting of 2023 revenue, non-GAAP EPS and Adjusted Free Cash Flow; the domestic and international demand environment, including the U.S. DoD, NOAA, and NASA budgets and budget line items and international spending levels; program, contract and order opportunities, awards and program ramps and the value or potential value and timing thereof; macroeconomic conditions, including the expected impacts of supply chain disruptions (including electronic component availability), supplier performance, inflation and labor attrition and the ability to offset such impacts; technology capabilities and program timing; estimated capital deployment and capital allocation strategy; leverage ratio targets; the pending AJRD acquisition, as well as financial projections related to AJRD; GHG and water usage goals; and other statements regarding the business outlook and financial performance guidance that are not historical facts. The company cautions investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward-looking statements. The company's consolidated results, future trends and forward-looking statements could be affected by many factors, risks and uncertainties, including but not limited to: in U.S. Government spending priorities; changes in the mix of fixed-price, cost-plus and time-and-material type contracts and the impact of a significant increase in or sustained period of increased inflation; risks relating to the pending acquisition of AJRD, including risks related to regulatory approval; the termination, failure to fund, or negative audit findings for U.S. Government contracts; the U.S. Government’s budget deficit and the national debt or any breach of the debt ceiling; uncertain economic conditions; the consequences of future geo-political events; the impact of government investigations; the risks of doing business internationally; disputes with our subcontractors or key suppliers, or their inability to perform or timely deliver our components, parts or services; the attraction and retention of key employees; the ability to develop new products and services and technologies that achieve market acceptance; natural disasters or other significant business disruptions; changes in accounting estimates; the Company’s level of indebtedness and ability to make payments on, repay or service indebtedness; unfunded defined benefit plans liability; any downgrade in credit ratings; the level of returns on defined benefit plan assets, changes in interest rates and other market factors; changes in effective tax rate or additional tax exposures; the ability to obtain export licenses or make sales to foreign governments; unforeseen environmental issues, including regulations related to GHG emissions or change in customer sentiment related to environmental sustainability, including in relation to the pending acquisition of AJRD; the impact of any improper conduct of employees, agents or business partners; the outcome of litigation or arbitration; potential claims related to infringement of intellectual property rights or environmental remediation or other contingencies; expanded operations from the acquisition of the TDL product line and the pending acquisition of AJRD; risks related to other strategic transactions, including mergers, acquisitions and divestitures. The level and timing of share repurchases will depend on a number of factors, including the company’s financial condition, capital requirements, cash flow, results of operations, future business prospects and other factors. The timing, volume and nature of share repurchases also are subject to business and market conditions, applicable securities laws, and other factors, and are at the discretion of the company and may be suspended or discontinued at any time without prior notice. Further information relating to these and other factors that may impact the company's results, future trends and forward-looking statements are disclosed in the company's filings with the SEC. The forward-looking statements contained in this Investor Letter are made as of the date of this Investor Letter, and the company disclaims any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Persons reading this Investor Letter are cautioned not to place undue reliance on forward-looking statements. Forward-Looking Statements

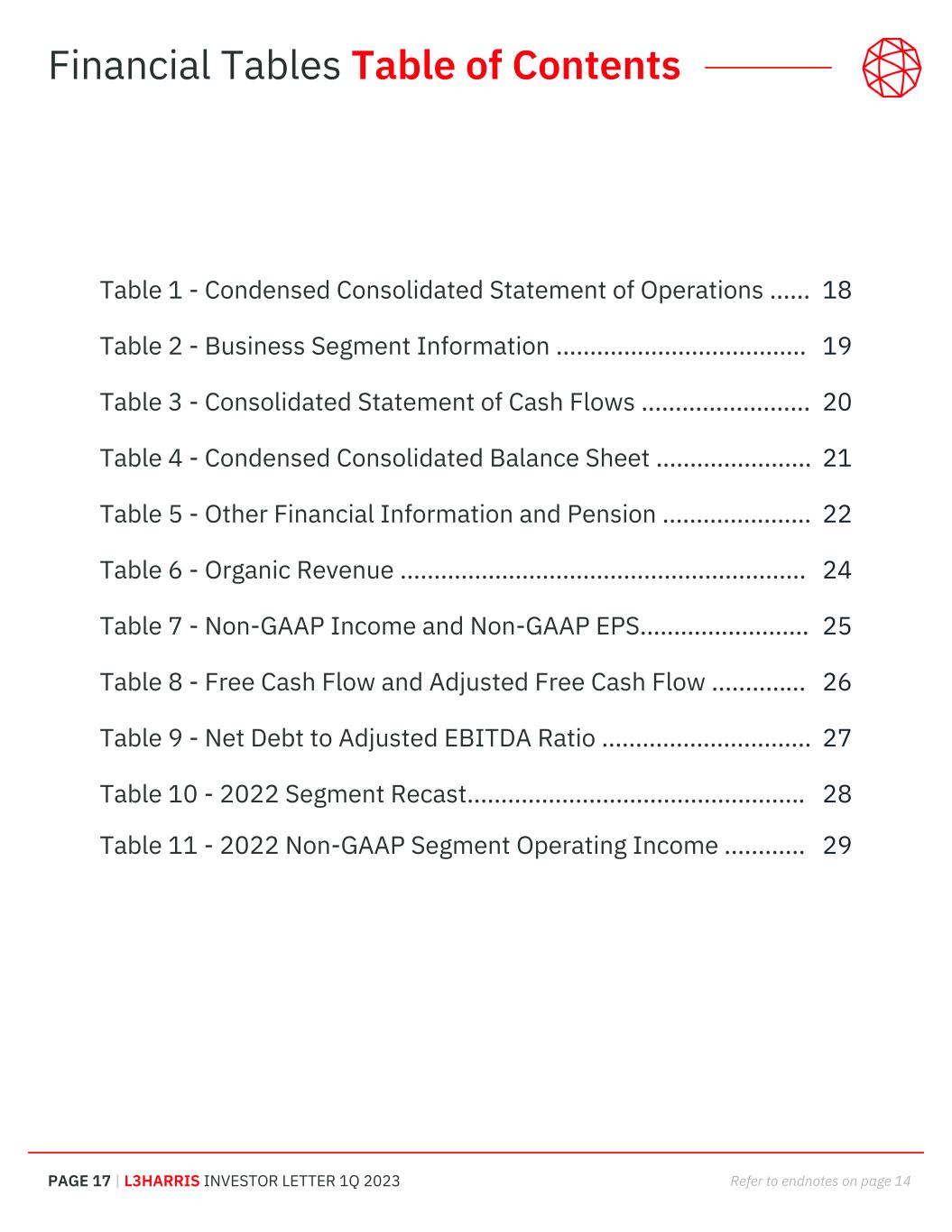

PAGE 17 | L3HARRIS INVESTOR LETTER 1Q 2023 Refer to endnotes on page 14 Table 1 - Condensed Consolidated Statement of Operations ...... 18 Table 2 - Business Segment Information ..................................... 19 Table 3 - Consolidated Statement of Cash Flows ......................... 20 Table 4 - Condensed Consolidated Balance Sheet ....................... 21 Table 5 - Other Financial Information and Pension ...................... 22 Table 6 - Organic Revenue ............................................................ 24 Table 7 - Non-GAAP Income and Non-GAAP EPS......................... 25 Table 8 - Free Cash Flow and Adjusted Free Cash Flow .............. 26 Table 9 - Net Debt to Adjusted EBITDA Ratio ............................... 27 Table 10 - 2022 Segment Recast.................................................. 28 Table 11 - 2022 Non-GAAP Segment Operating Income ............ 29 Financial Tables Table of Contents

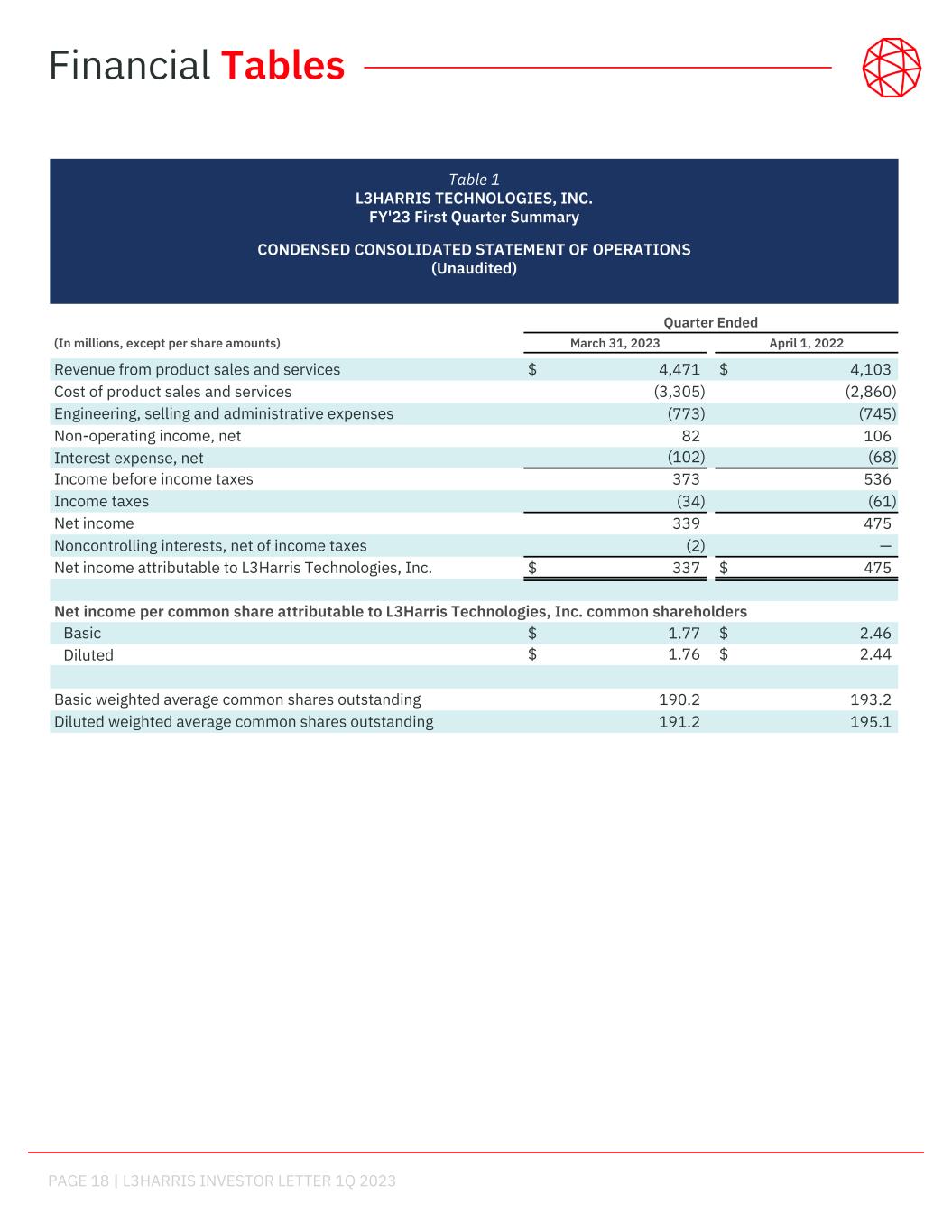

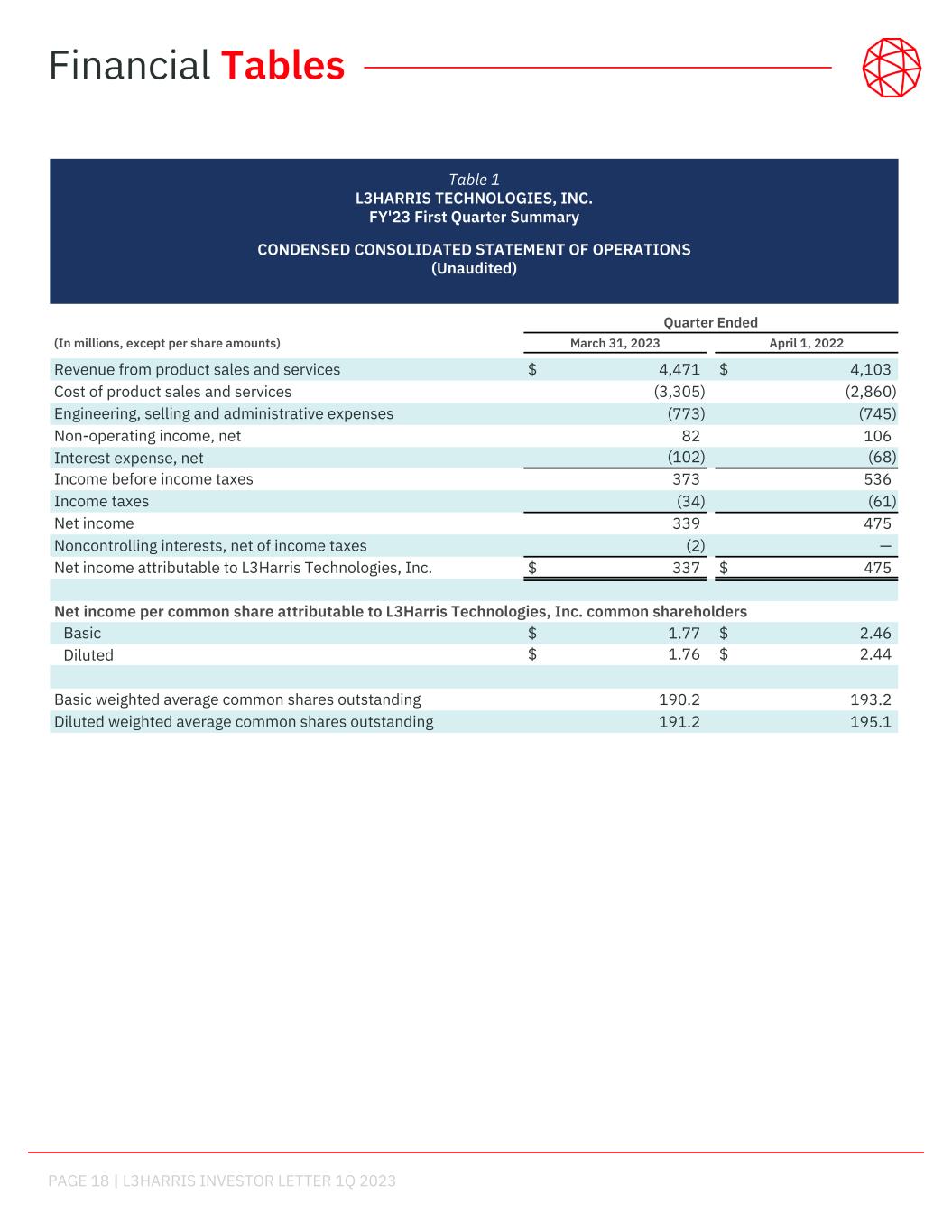

PAGE 18 | L3HARRIS INVESTOR LETTER 1Q 2023 Quarter Ended (In millions, except per share amounts) March 31, 2023 April 1, 2022 Revenue from product sales and services $ 4,471 $ 4,103 Cost of product sales and services (3,305) (2,860) Engineering, selling and administrative expenses (773) (745) Non-operating income, net 82 106 Interest expense, net (102) (68) Income before income taxes 373 536 Income taxes (34) (61) Net income 339 475 Noncontrolling interests, net of income taxes (2) — Net income attributable to L3Harris Technologies, Inc. $ 337 $ 475 Net income per common share attributable to L3Harris Technologies, Inc. common shareholders Basic $ 1.77 $ 2.46 Diluted $ 1.76 $ 2.44 Basic weighted average common shares outstanding 190.2 193.2 Diluted weighted average common shares outstanding 191.2 195.1 Table 1 L3HARRIS TECHNOLOGIES, INC. FY'23 First Quarter Summary CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited) support Financial Tables

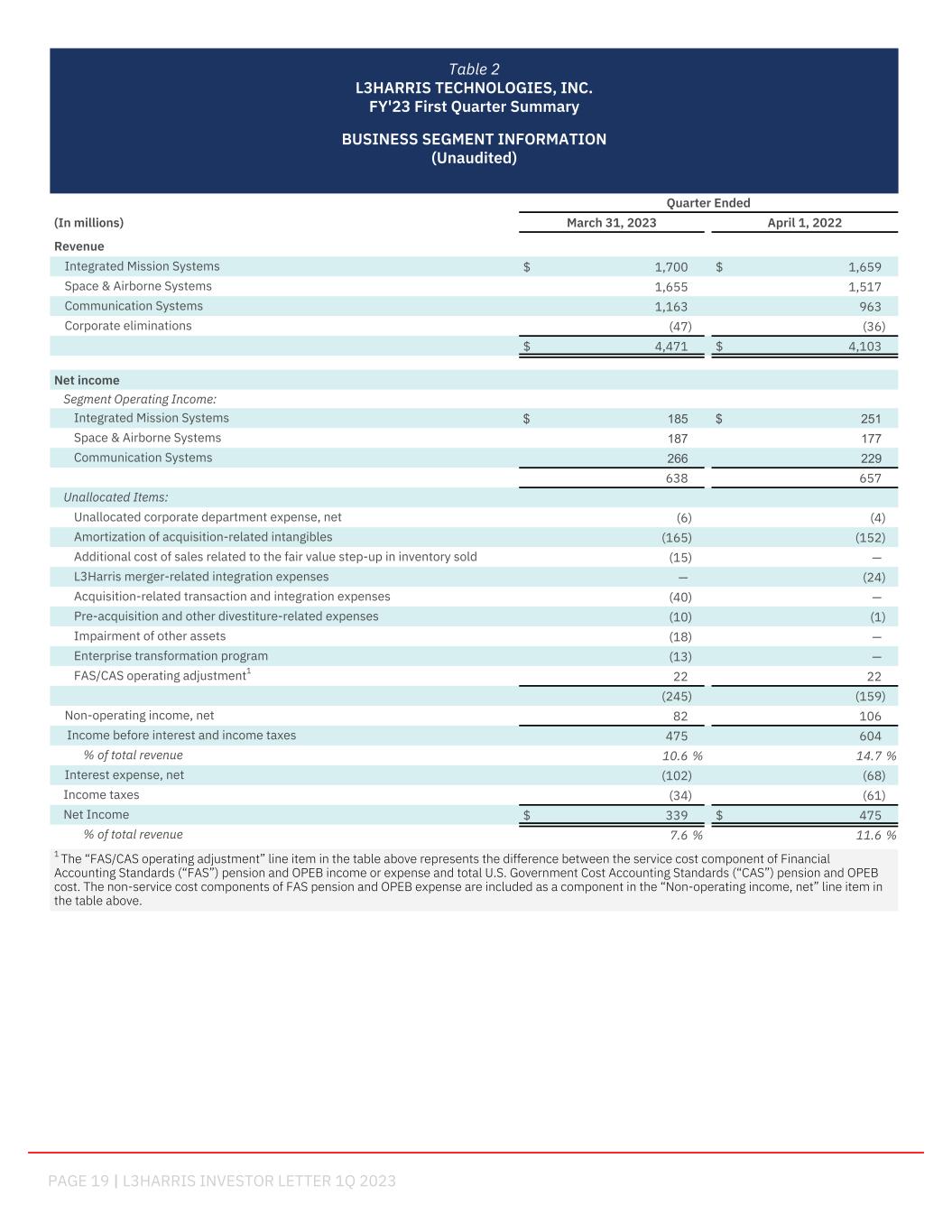

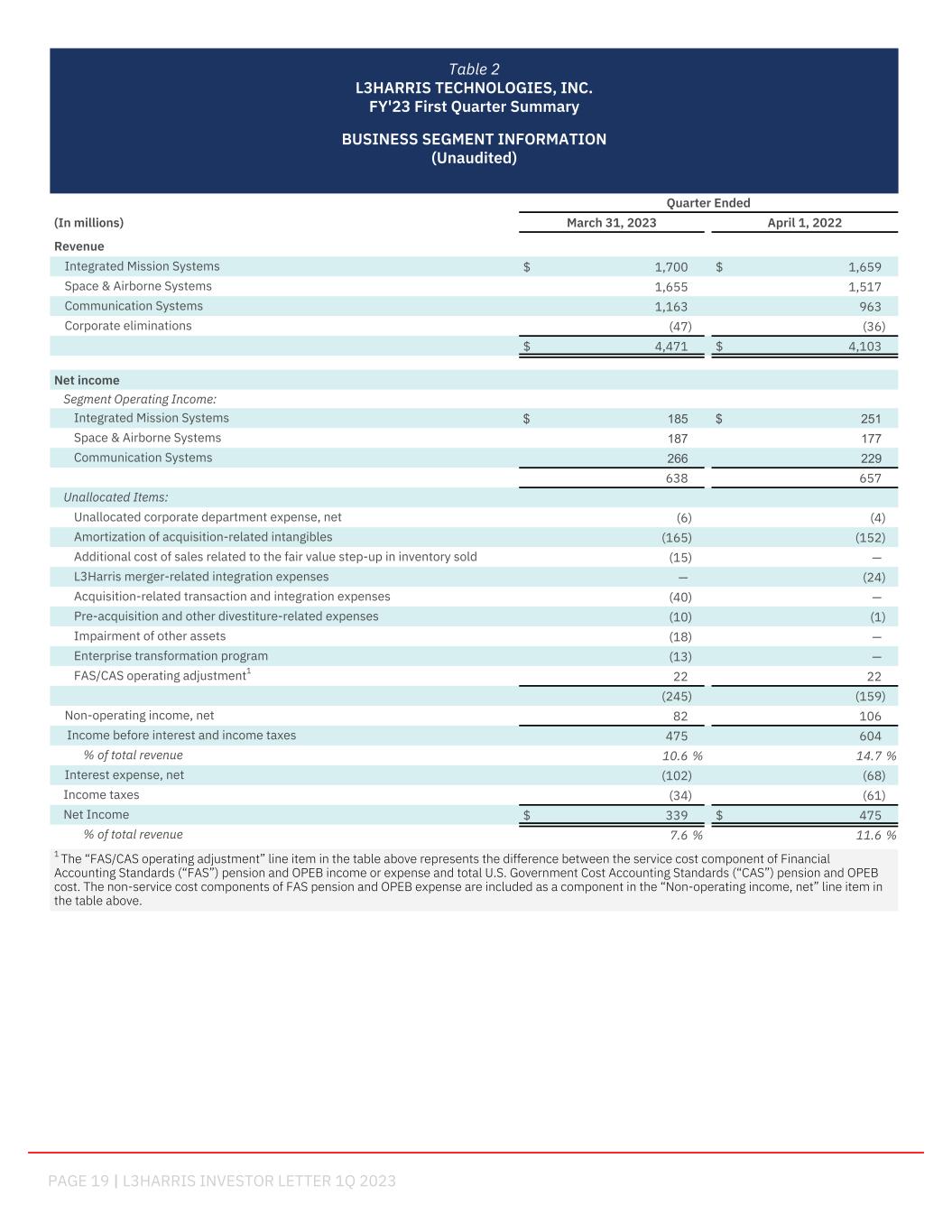

PAGE 19 | L3HARRIS INVESTOR LETTER 1Q 2023 Quarter Ended (In millions) March 31, 2023 April 1, 2022 Revenue Integrated Mission Systems $ 1,700 $ 1,659 Space & Airborne Systems 1,655 1,517 Communication Systems 1,163 963 Corporate eliminations (47) (36) $ 4,471 $ 4,103 Net income Segment Operating Income: Integrated Mission Systems $ 185 $ 251 Space & Airborne Systems 187 177 Communication Systems 266 229 638 657 Unallocated Items: Unallocated corporate department expense, net (6) (4) Amortization of acquisition-related intangibles (165) (152) Additional cost of sales related to the fair value step-up in inventory sold (15) — L3Harris merger-related integration expenses — (24) Acquisition-related transaction and integration expenses (40) — Pre-acquisition and other divestiture-related expenses (10) (1) Impairment of other assets (18) — Enterprise transformation program (13) — FAS/CAS operating adjustment1 22 22 (245) (159) Non-operating income, net 82 106 Income before interest and income taxes 475 604 % of total revenue 10.6 % 14.7 % Interest expense, net (102) (68) Income taxes (34) (61) Net Income $ 339 $ 475 % of total revenue 7.6 % 11.6 % 1 The “FAS/CAS operating adjustment” line item in the table above represents the difference between the service cost component of Financial Accounting Standards (“FAS”) pension and OPEB income or expense and total U.S. Government Cost Accounting Standards (“CAS”) pension and OPEB cost. The non-service cost components of FAS pension and OPEB expense are included as a component in the “Non-operating income, net” line item in the table above. Table 2 L3HARRIS TECHNOLOGIES, INC. FY'23 First Quarter Summary BUSINESS SEGMENT INFORMATION (Unaudited) support

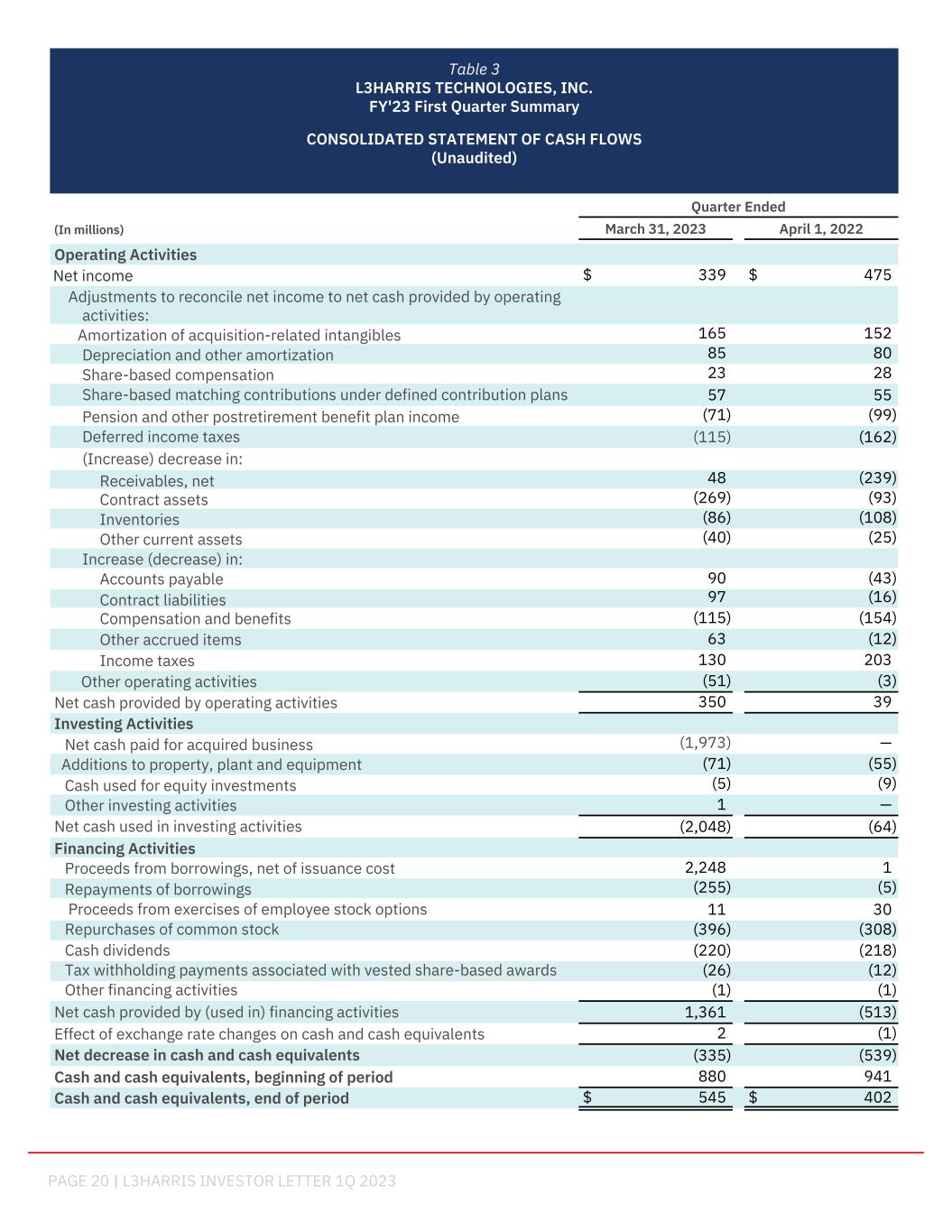

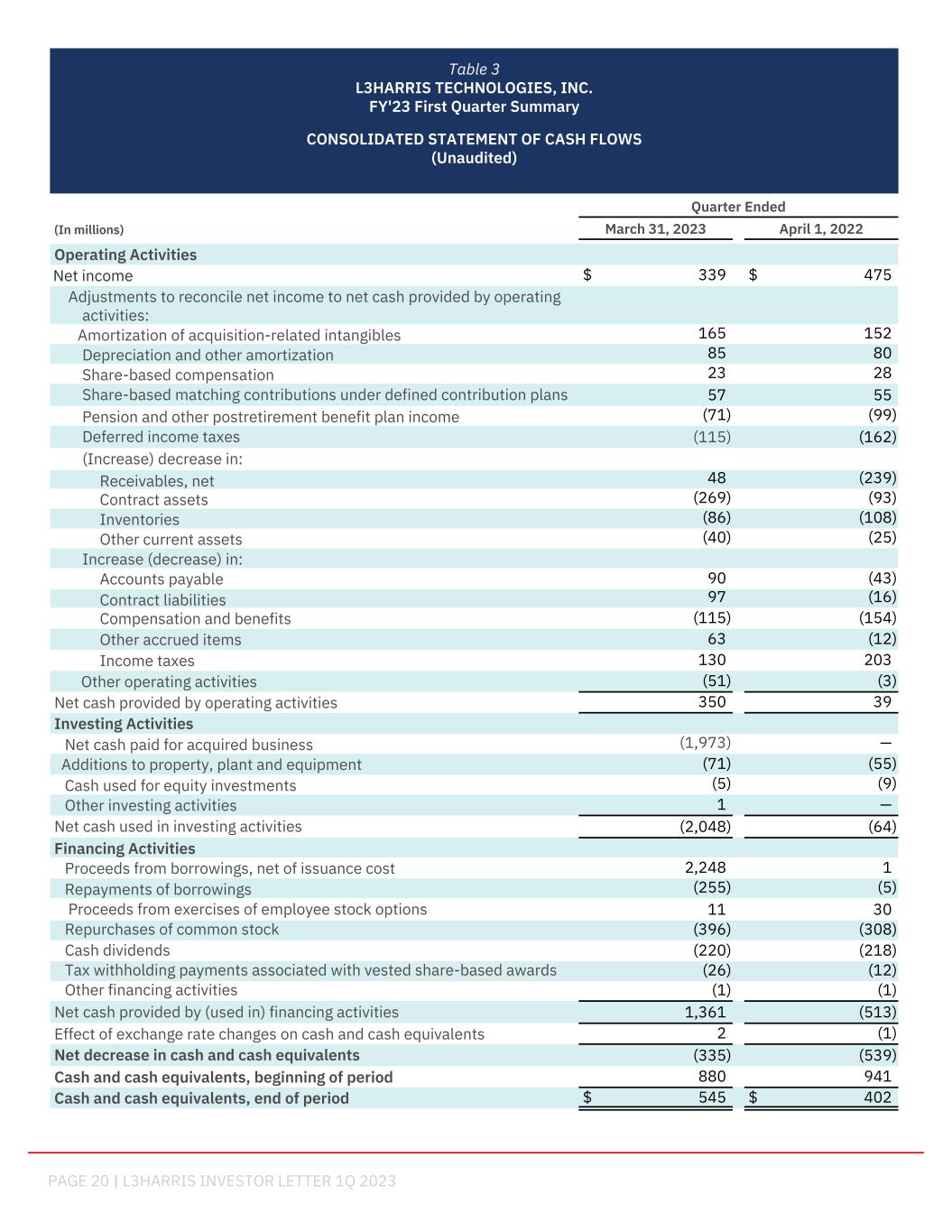

PAGE 20 | L3HARRIS INVESTOR LETTER 1Q 2023 Quarter Ended (In millions) March 31, 2023 April 1, 2022 Operating Activities Net income $ 339 $ 475 Adjustments to reconcile net income to net cash provided by operating activities: Amortization of acquisition-related intangibles 165 152 Depreciation and other amortization 85 80 Share-based compensation 23 28 Share-based matching contributions under defined contribution plans 57 55 Pension and other postretirement benefit plan income (71) (99) Deferred income taxes (115) (162) (Increase) decrease in: Receivables, net 48 (239) Contract assets (269) (93) Inventories (86) (108) Other current assets (40) (25) Increase (decrease) in: Accounts payable 90 (43) Contract liabilities 97 (16) Compensation and benefits (115) (154) Other accrued items 63 (12) Income taxes 130 203 Other operating activities (51) (3) Net cash provided by operating activities 350 39 Investing Activities Net cash paid for acquired business (1,973) — Additions to property, plant and equipment (71) (55) Cash used for equity investments (5) (9) Other investing activities 1 — Net cash used in investing activities (2,048) (64) Financing Activities Proceeds from borrowings, net of issuance cost 2,248 1 Repayments of borrowings (255) (5) Proceeds from exercises of employee stock options 11 30 Repurchases of common stock (396) (308) Cash dividends (220) (218) Tax withholding payments associated with vested share-based awards (26) (12) Other financing activities (1) (1) Net cash provided by (used in) financing activities 1,361 (513) Effect of exchange rate changes on cash and cash equivalents 2 (1) Net decrease in cash and cash equivalents (335) (539) Cash and cash equivalents, beginning of period 880 941 Cash and cash equivalents, end of period $ 545 $ 402 Table 3 L3HARRIS TECHNOLOGIES, INC. FY'23 First Quarter Summary CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited) support

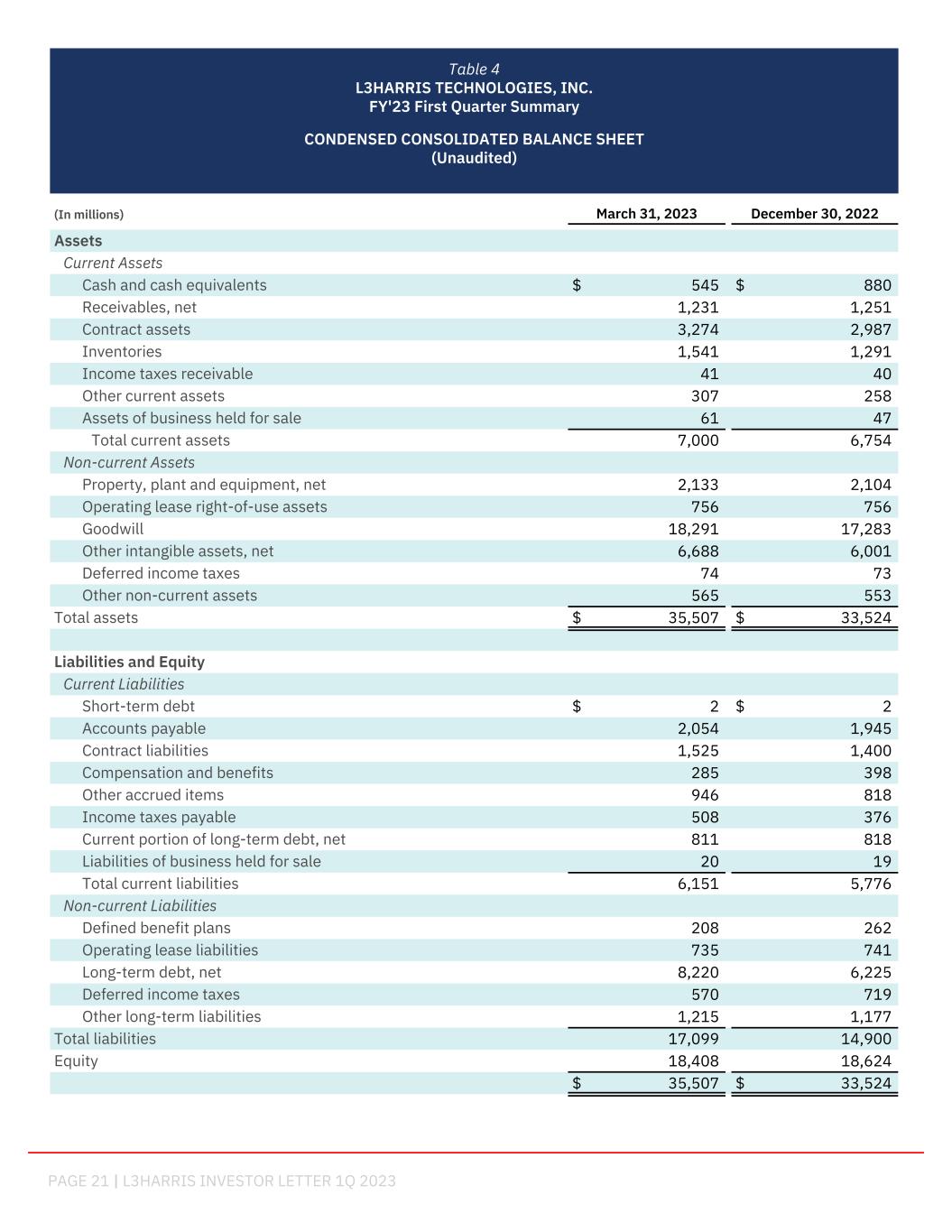

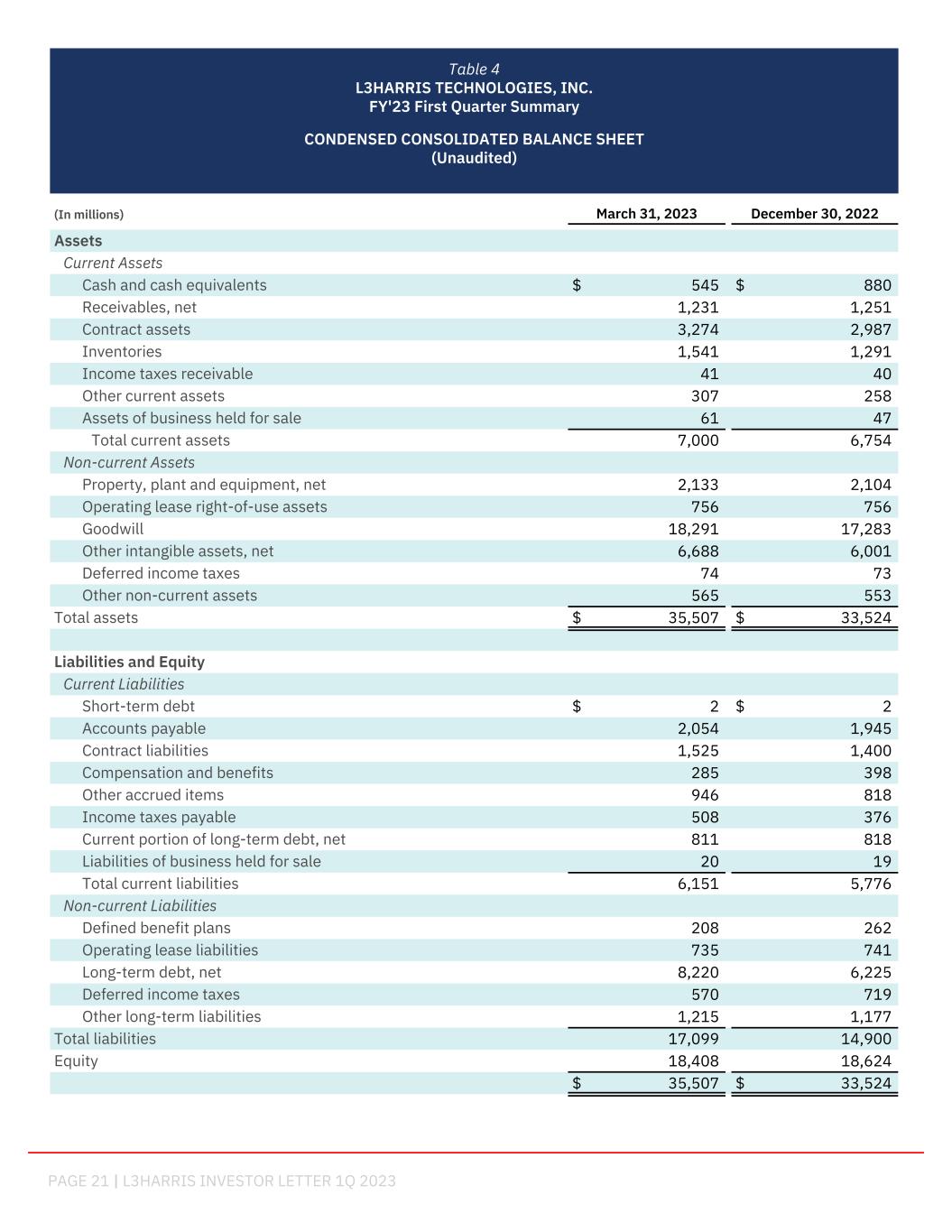

PAGE 21 | L3HARRIS INVESTOR LETTER 1Q 2023 (In millions) March 31, 2023 December 30, 2022 Assets Current Assets Cash and cash equivalents $ 545 $ 880 Receivables, net 1,231 1,251 Contract assets 3,274 2,987 Inventories 1,541 1,291 Income taxes receivable 41 40 Other current assets 307 258 Assets of business held for sale 61 47 Total current assets 7,000 6,754 Non-current Assets Property, plant and equipment, net 2,133 2,104 Operating lease right-of-use assets 756 756 Goodwill 18,291 17,283 Other intangible assets, net 6,688 6,001 Deferred income taxes 74 73 Other non-current assets 565 553 Total assets $ 35,507 $ 33,524 Liabilities and Equity Current Liabilities Short-term debt $ 2 $ 2 Accounts payable 2,054 1,945 Contract liabilities 1,525 1,400 Compensation and benefits 285 398 Other accrued items 946 818 Income taxes payable 508 376 Current portion of long-term debt, net 811 818 Liabilities of business held for sale 20 19 Total current liabilities 6,151 5,776 Non-current Liabilities Defined benefit plans 208 262 Operating lease liabilities 735 741 Long-term debt, net 8,220 6,225 Deferred income taxes 570 719 Other long-term liabilities 1,215 1,177 Total liabilities 17,099 14,900 Equity 18,408 18,624 $ 35,507 $ 33,524 Table 4 L3HARRIS TECHNOLOGIES, INC. FY'23 First Quarter Summary CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited) support

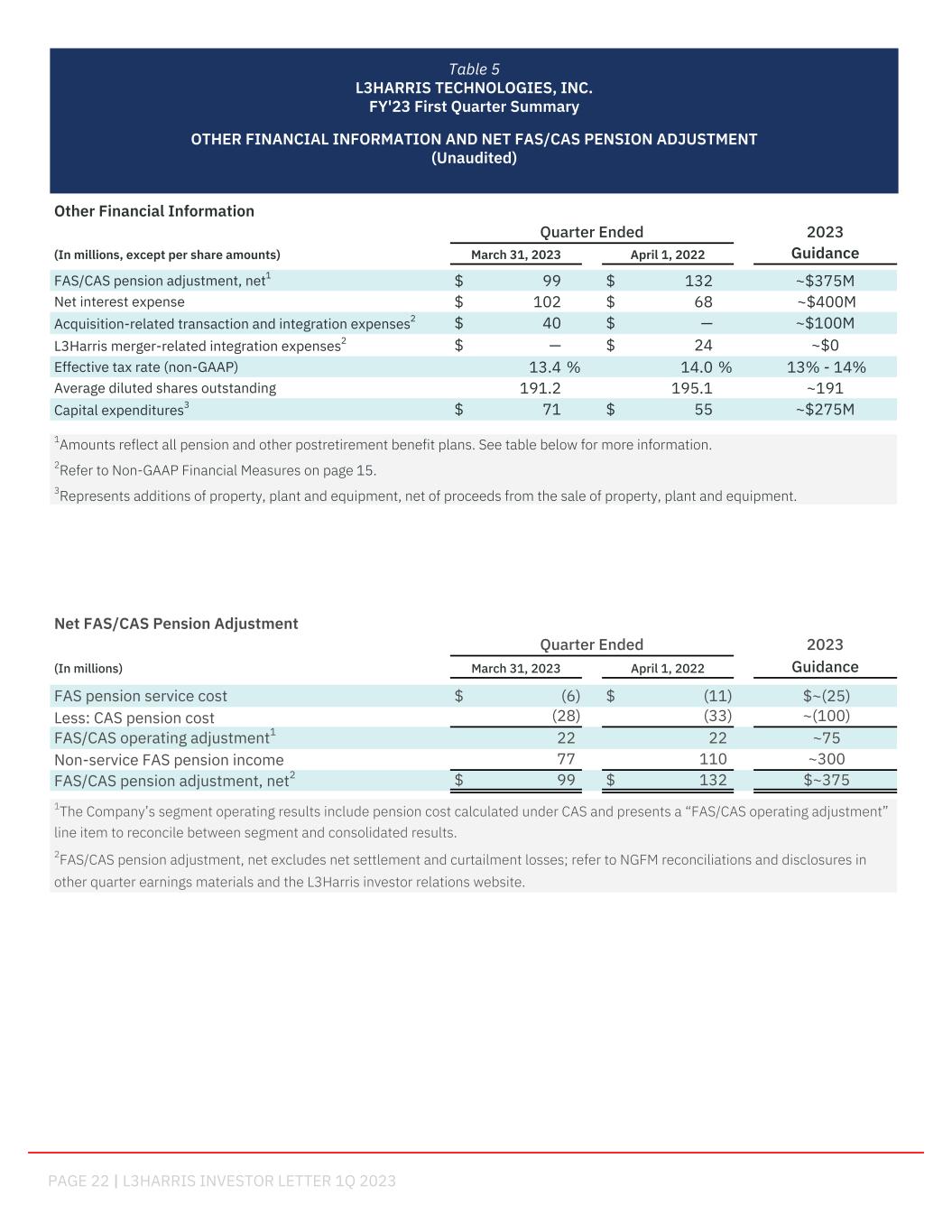

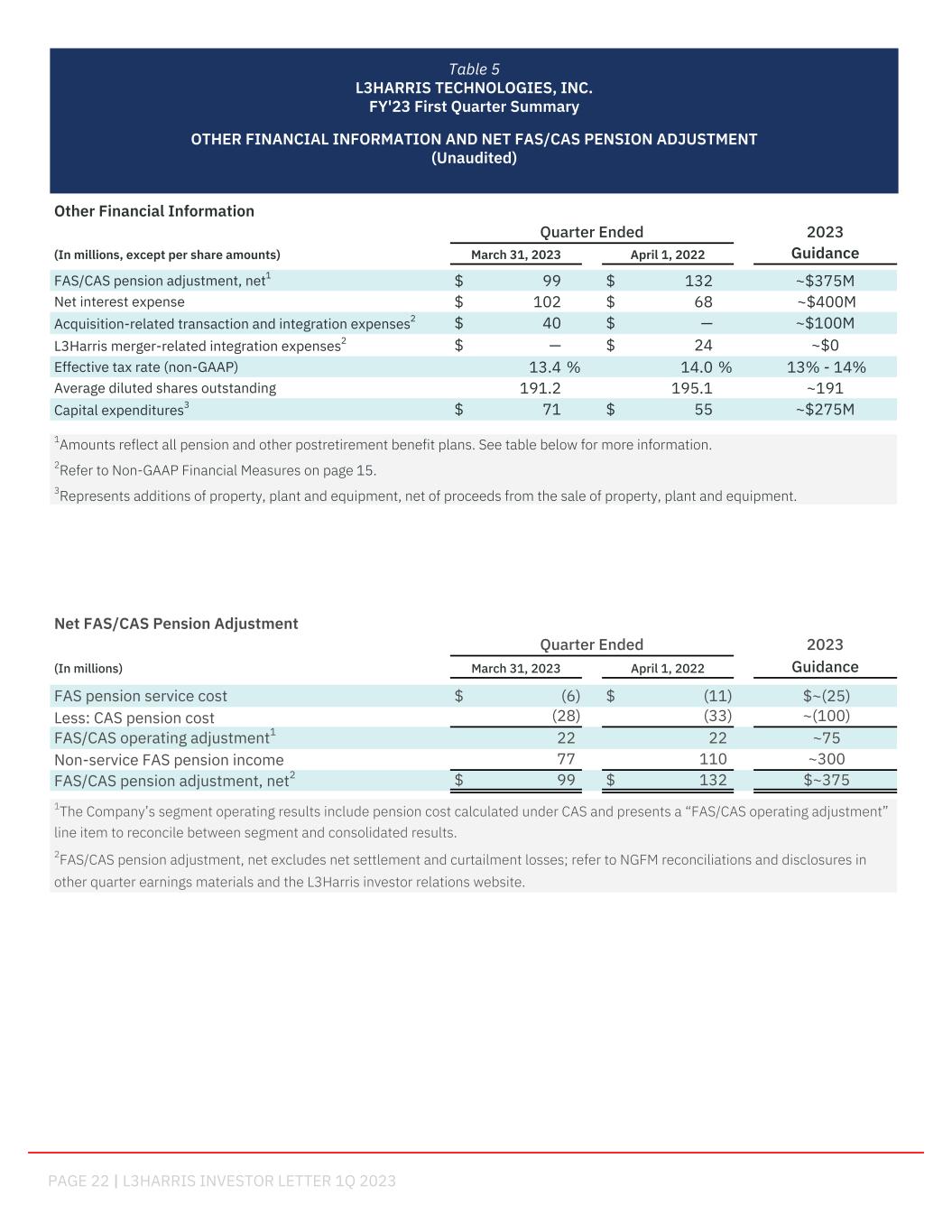

PAGE 22 | L3HARRIS INVESTOR LETTER 1Q 2023 Net FAS/CAS Pension Adjustment Quarter Ended 2023 (In millions) March 31, 2023 April 1, 2022 Guidance FAS pension service cost $ (6) $ (11) $~(25) Less: CAS pension cost (28) (33) ~(100) FAS/CAS operating adjustment1 22 22 ~75 Non-service FAS pension income 77 110 ~300 FAS/CAS pension adjustment, net2 $ 99 $ 132 $~375 1The Company’s segment operating results include pension cost calculated under CAS and presents a “FAS/CAS operating adjustment” line item to reconcile between segment and consolidated results. 2FAS/CAS pension adjustment, net excludes net settlement and curtailment losses; refer to NGFM reconciliations and disclosures in other quarter earnings materials and the L3Harris investor relations website. Other Financial Information Quarter Ended 2023 (In millions, except per share amounts) March 31, 2023 April 1, 2022 Guidance FAS/CAS pension adjustment, net1 $ 99 $ 132 ~$375M Net interest expense $ 102 $ 68 ~$400M Acquisition-related transaction and integration expenses2 $ 40 $ — ~$100M L3Harris merger-related integration expenses2 $ — $ 24 ~$0 Effective tax rate (non-GAAP) 13.4 % 14.0 % 13% - 14% Average diluted shares outstanding 191.2 195.1 ~191 Capital expenditures3 $ 71 $ 55 ~$275M 1Amounts reflect all pension and other postretirement benefit plans. See table below for more information. 2Refer to Non-GAAP Financial Measures on page 15. 3Represents additions of property, plant and equipment, net of proceeds from the sale of property, plant and equipment. Table 5 L3HARRIS TECHNOLOGIES, INC. FY'23 First Quarter Summary OTHER FINANCIAL INFORMATION AND NET FAS/CAS PENSION ADJUSTMENT (Unaudited) support

PAGE 23 | L3HARRIS INVESTOR LETTER 1Q 2023 To supplement our condensed consolidated financial statements presented in accordance with U.S. generally accepted accounting principles (GAAP), we provide additional non-GAAP measures, including organic revenue, segment operating income and margin, non-GAAP operating income, non-GAAP EPS, non-GAAP backlog, net-debt-to-adjusted-EBITDA, and adjusted free cash flow (FCF). L3Harris management believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. L3Harris management also believes that these non-GAAP financial measures enhance the ability of investors to analyze L3Harris’ business trends and to understand L3Harris’ performance. In addition, L3Harris may utilize non-GAAP financial measures as guides in its forecasting, budgeting, and long- term planning processes and to measure operating performance for some management compensation purposes. Any analysis of non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. A reconciliation of these non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP follows. We also provide our expectation of forward-looking non-GAAP financial measures, including expected non- GAAP EPS, segment operating income and margin, adjusted free cash flow and non-GAAP tax rate for the full-year 2023. We also present an expected non-GAAP EBITDA multiple of AJRD for 2024. A reconciliation of forward-looking non-GAAP financial measures to comparable GAAP measures is not available without unreasonable effort because of inherent difficulty in forecasting and quantifying the comparable GAAP measures and the applicable adjustments and other amounts that would be necessary for such a reconciliation, including due to potentially high variability, complexity and low visibility as to the applicable adjustments and other amounts, which may, or could, have a disproportionately positive or negative impact on the company's future GAAP results, such as the integration of TDL and the timing and impact of the potential acquisition of AJRD on our results and other potential business divestiture-related gains and losses, and other unusual gains and losses, or their probable significance and extent of tax deductibility. The variability of the applicable adjustments and other amounts may have a significant, unpredictable impact on our future GAAP results. Reconciliation of Non-GAAP Financial Measures

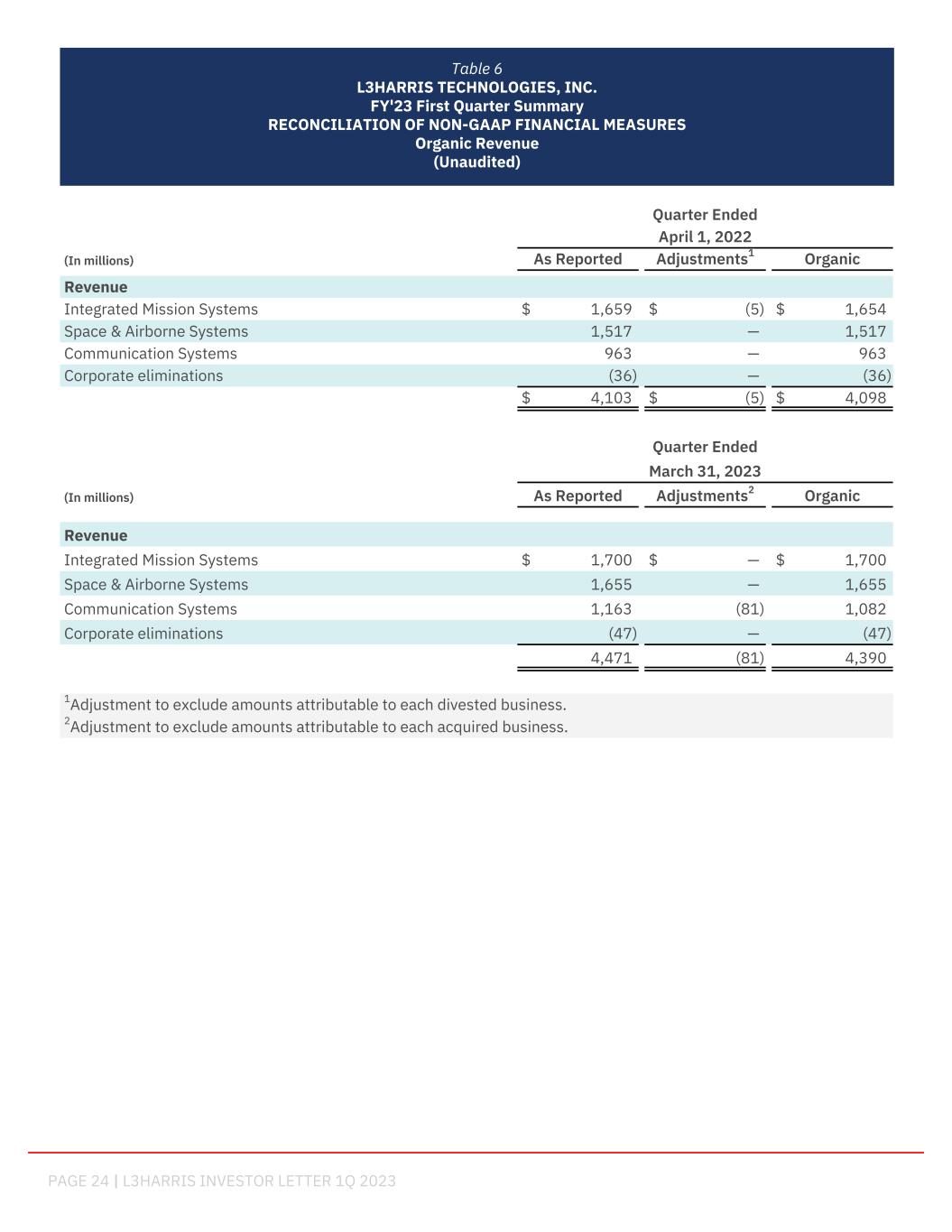

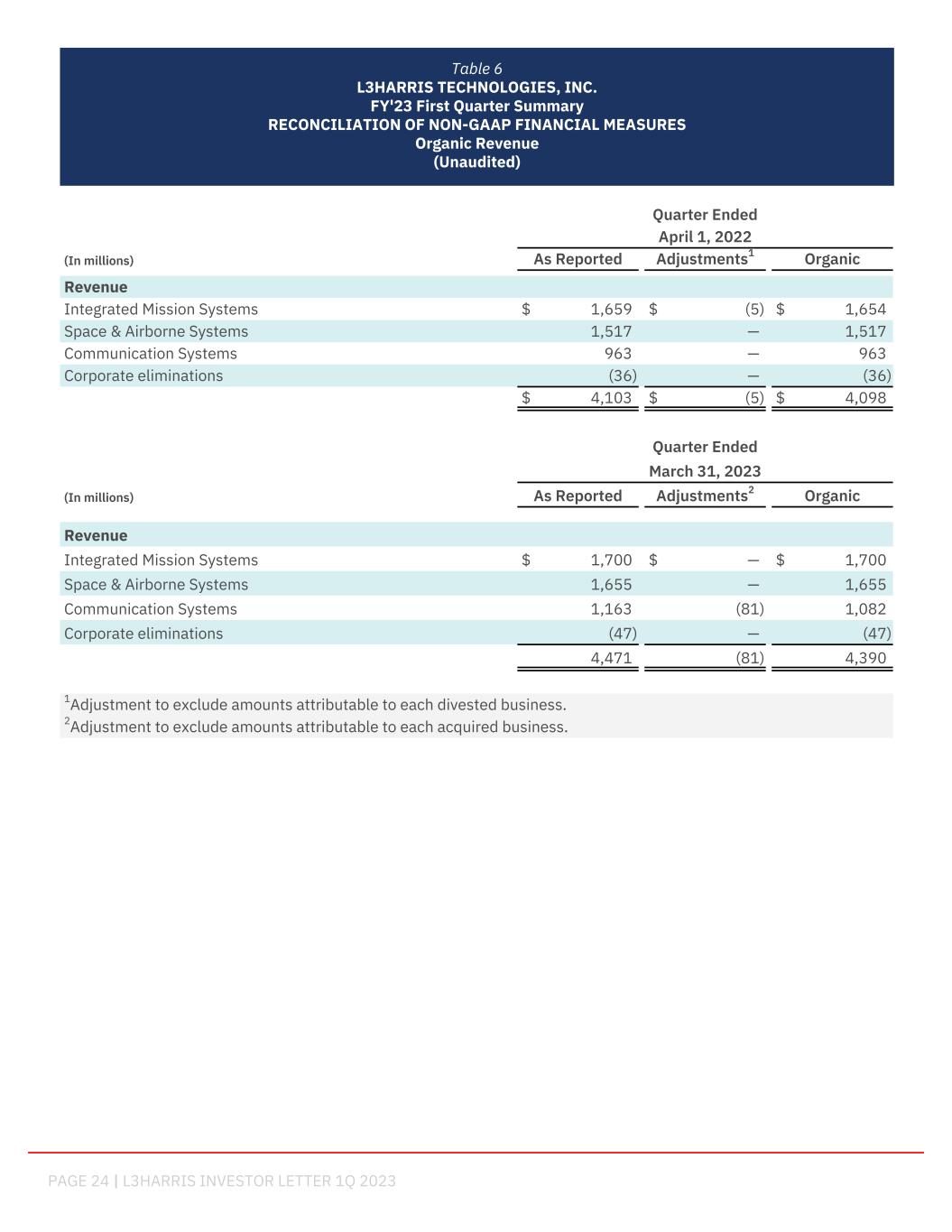

PAGE 24 | L3HARRIS INVESTOR LETTER 1Q 2023 Table 6 L3HARRIS TECHNOLOGIES, INC. FY'23 First Quarter Summary RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Organic Revenue (Unaudited) Quarter Ended April 1, 2022 (In millions) As Reported Adjustments1 Organic Revenue Integrated Mission Systems $ 1,659 $ (5) $ 1,654 Space & Airborne Systems 1,517 — 1,517 Communication Systems 963 — 963 Corporate eliminations (36) — (36) $ 4,103 $ (5) $ 4,098 Quarter Ended March 31, 2023 (In millions) As Reported Adjustments2 Organic Revenue Integrated Mission Systems $ 1,700 $ — $ 1,700 Space & Airborne Systems 1,655 — 1,655 Communication Systems 1,163 (81) 1,082 Corporate eliminations (47) — (47) 4,471 (81) 4,390 1Adjustment to exclude amounts attributable to each divested business. 2Adjustment to exclude amounts attributable to each acquired business. support

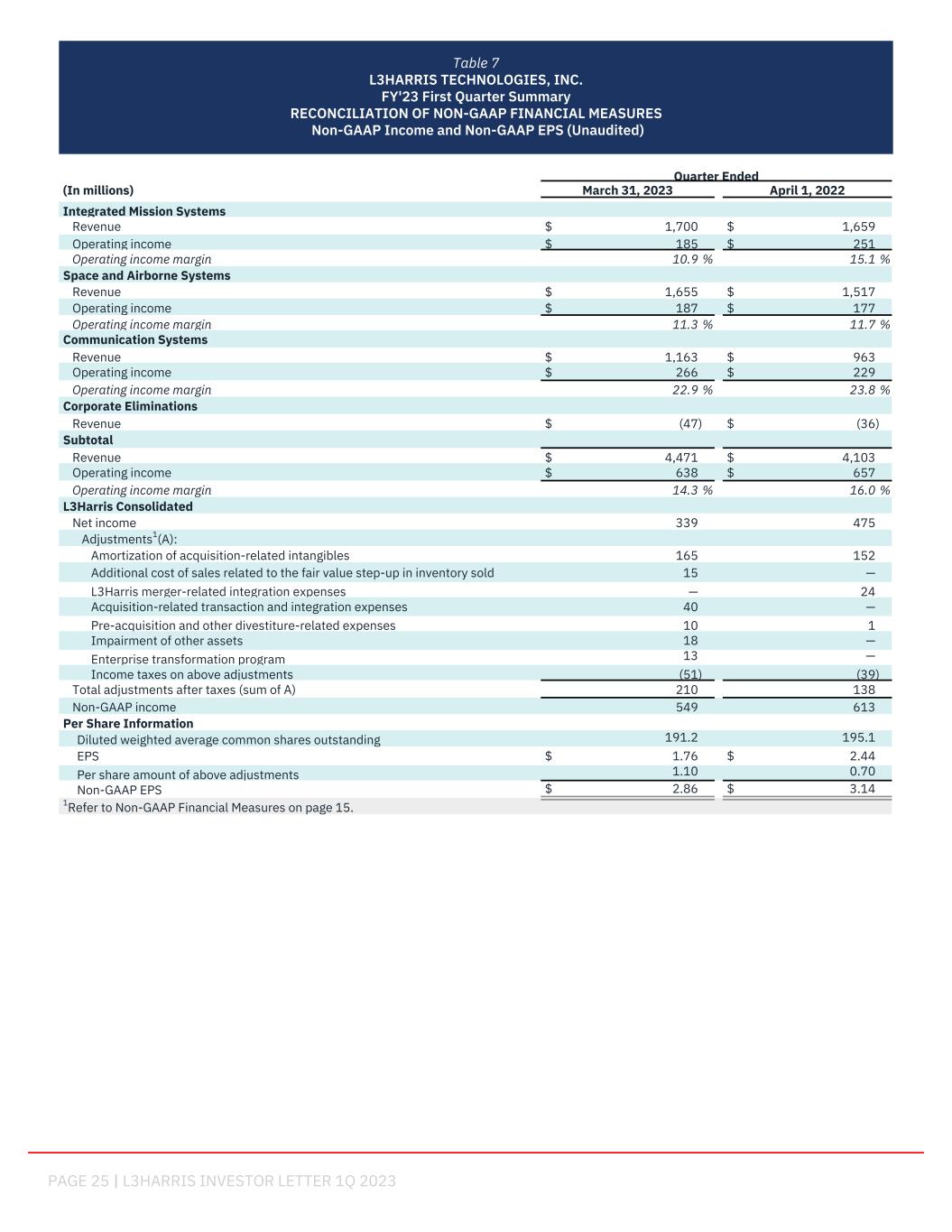

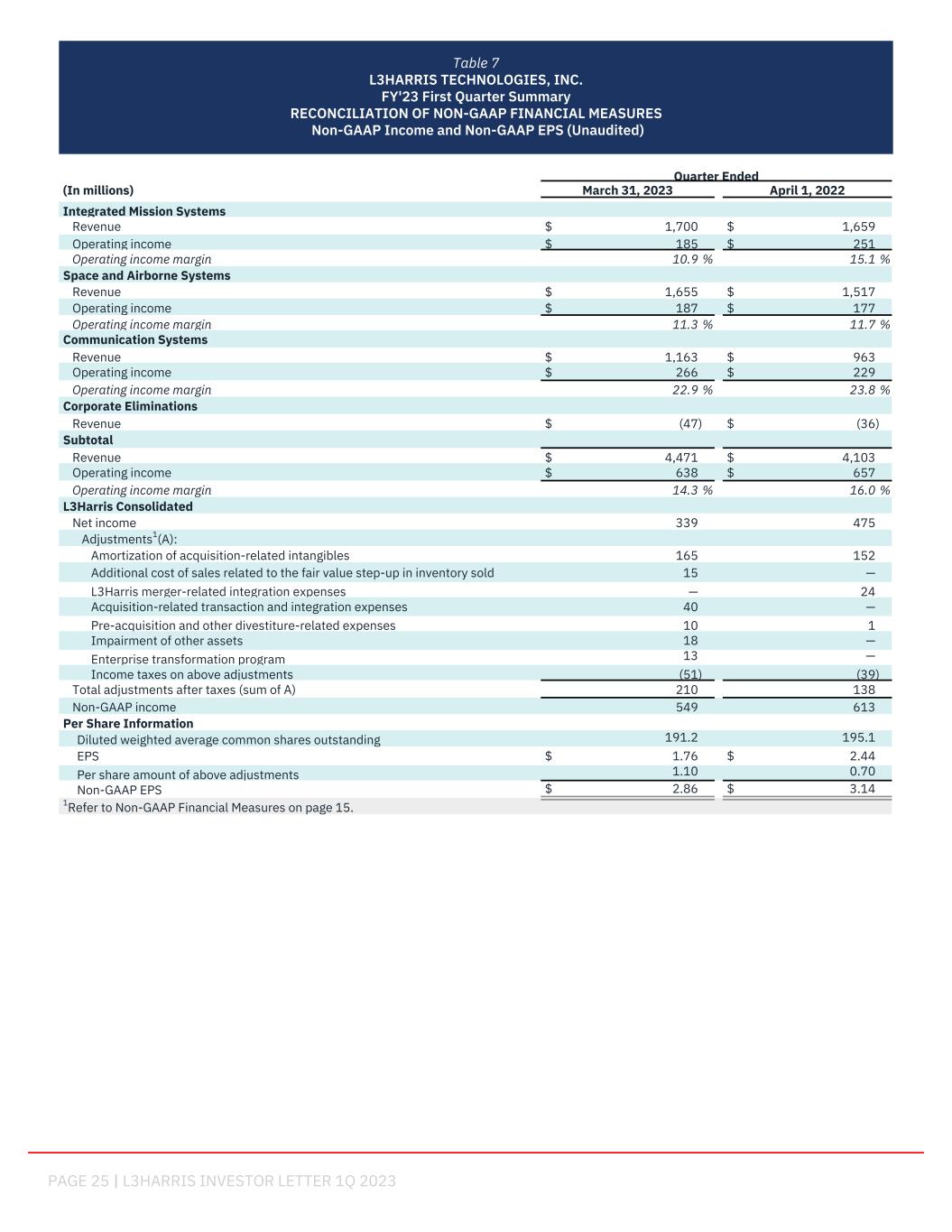

PAGE 25 | L3HARRIS INVESTOR LETTER 1Q 2023 Quarter Ended (In millions) March 31, 2023 April 1, 2022 Integrated Mission Systems Revenue $ 1,700 $ 1,659 Operating income $ 185 $ 251 Operating income margin 10.9 % 15.1 % Space and Airborne Systems Revenue $ 1,655 $ 1,517 Operating income $ 187 $ 177 Operating income margin 11.3 % 11.7 % Communication Systems Revenue $ 1,163 $ 963 Operating income $ 266 $ 229 Operating income margin 22.9 % 23.8 % Corporate Eliminations Revenue $ (47) $ (36) Subtotal Revenue $ 4,471 $ 4,103 Operating income $ 638 $ 657 Operating income margin 14.3 % 16.0 % L3Harris Consolidated Net income 339 475 Adjustments1(A): Amortization of acquisition-related intangibles 165 152 Additional cost of sales related to the fair value step-up in inventory sold 15 — L3Harris merger-related integration expenses — 24 Acquisition-related transaction and integration expenses 40 — Pre-acquisition and other divestiture-related expenses 10 1 Impairment of other assets 18 — Enterprise transformation program 13 — Income taxes on above adjustments (51) (39) Total adjustments after taxes (sum of A) 210 138 Non-GAAP income 549 613 Per Share Information Diluted weighted average common shares outstanding 191.2 195.1 EPS $ 1.76 $ 2.44 Per share amount of above adjustments 1.10 0.70 Non-GAAP EPS $ 2.86 $ 3.14 1Refer to Non-GAAP Financial Measures on page 15. Table 7 L3HARRIS TECHNOLOGIES, INC. FY'23 First Quarter Summary RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Non-GAAP Income and Non-GAAP EPS (Unaudited)

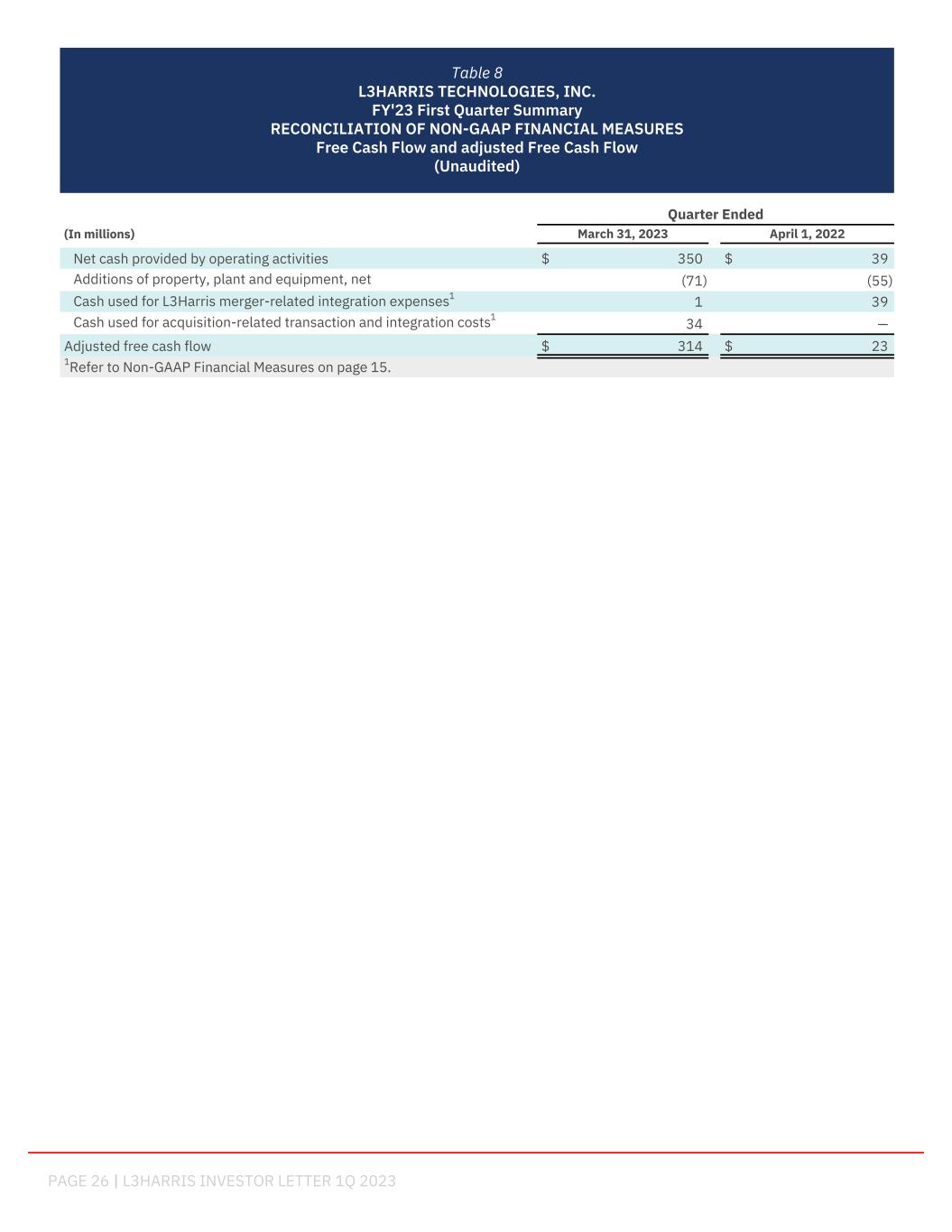

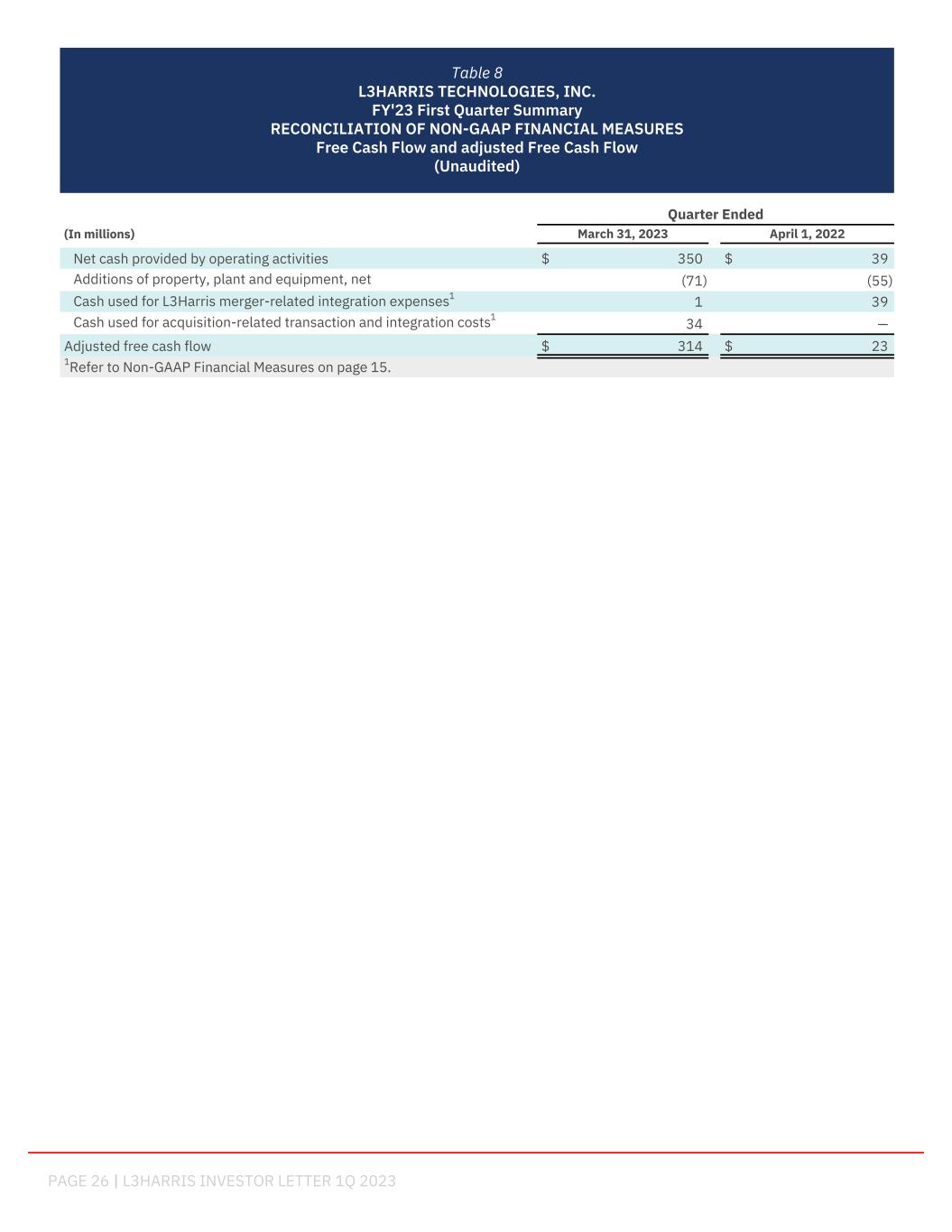

PAGE 26 | L3HARRIS INVESTOR LETTER 1Q 2023 Table 8 L3HARRIS TECHNOLOGIES, INC. FY'23 First Quarter Summary RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Free Cash Flow and adjusted Free Cash Flow (Unaudited) Quarter Ended (In millions) March 31, 2023 April 1, 2022 Net cash provided by operating activities $ 350 $ 39 Additions of property, plant and equipment, net (71) (55) Cash used for L3Harris merger-related integration expenses1 1 39 Cash used for acquisition-related transaction and integration costs1 34 — Adjusted free cash flow $ 314 $ 23 1Refer to Non-GAAP Financial Measures on page 15. support

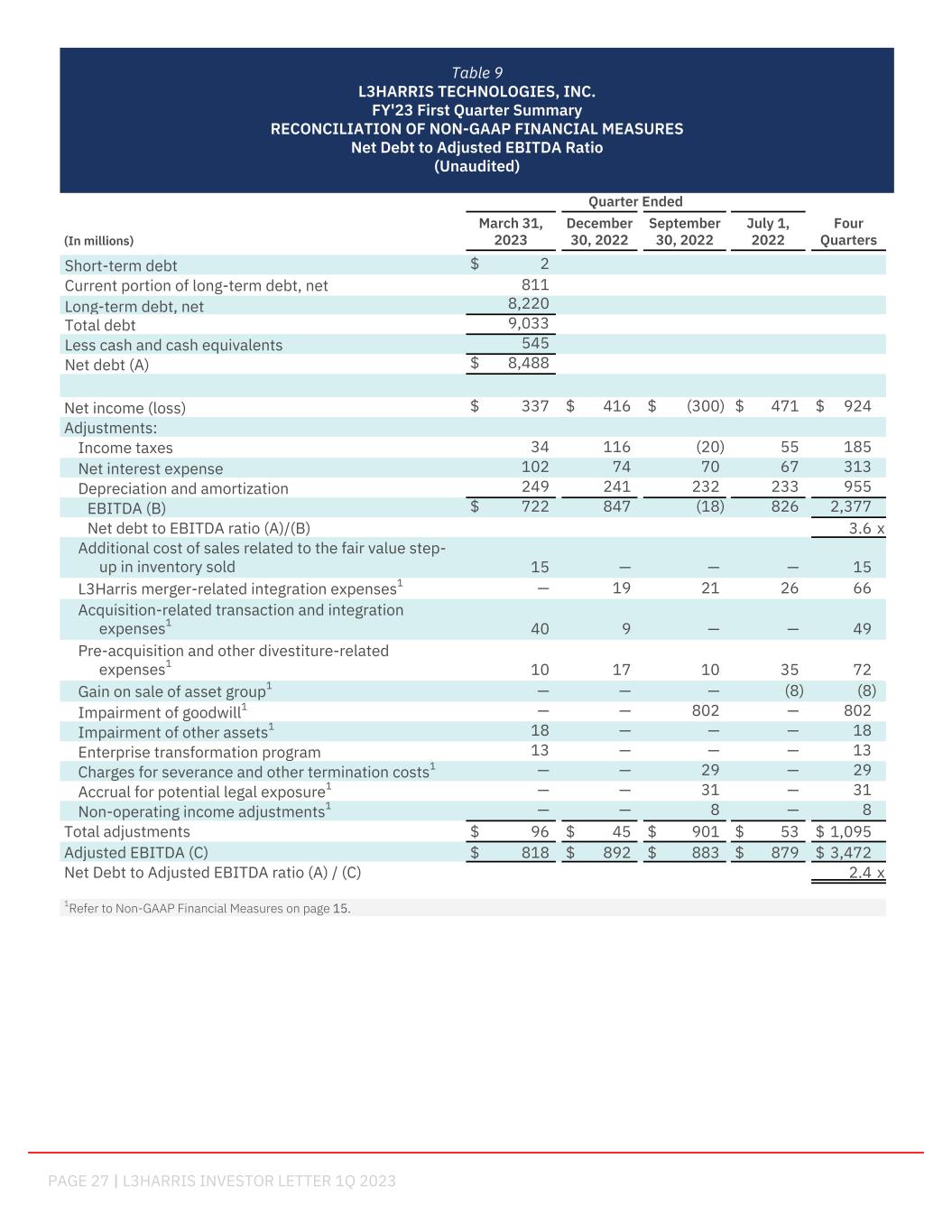

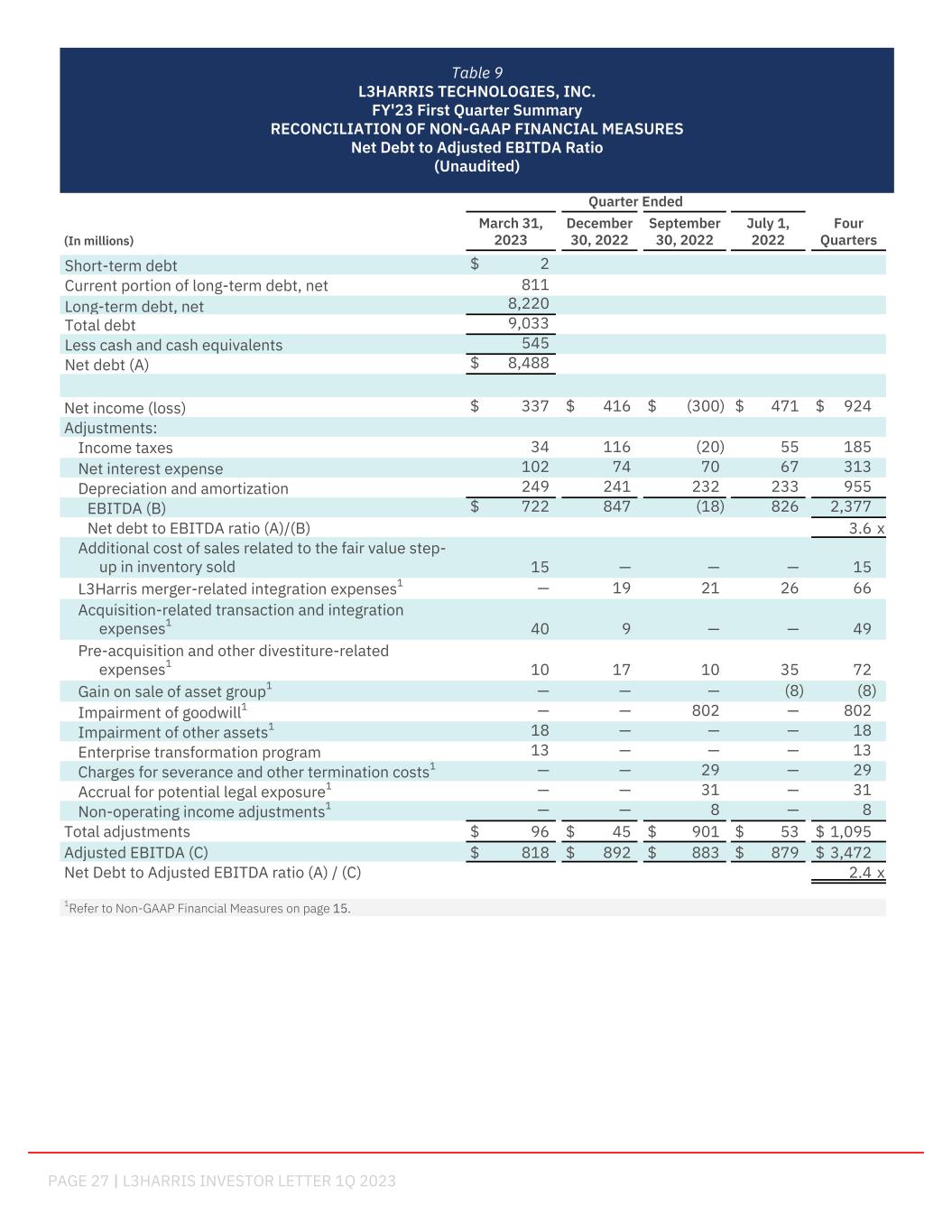

PAGE 27 | L3HARRIS INVESTOR LETTER 1Q 2023 Quarter Ended (In millions) March 31, 2023 December 30, 2022 September 30, 2022 July 1, 2022 Four Quarters Short-term debt $ 2 Current portion of long-term debt, net 811 Long-term debt, net 8,220 Total debt 9,033 Less cash and cash equivalents 545 Net debt (A) $ 8,488 Net income (loss) $ 337 $ 416 $ (300) $ 471 $ 924 Adjustments: Income taxes 34 116 (20) 55 185 Net interest expense 102 74 70 67 313 Depreciation and amortization 249 241 232 233 955 EBITDA (B) $ 722 847 (18) 826 2,377 Net debt to EBITDA ratio (A)/(B) 3.6 x Additional cost of sales related to the fair value step- up in inventory sold 15 — — — 15 L3Harris merger-related integration expenses1 — 19 21 26 66 Acquisition-related transaction and integration expenses1 40 9 — — 49 Pre-acquisition and other divestiture-related expenses1 10 17 10 35 72 Gain on sale of asset group1 — — — (8) (8) Impairment of goodwill1 — — 802 — 802 Impairment of other assets1 18 — — — 18 Enterprise transformation program 13 — — — 13 Charges for severance and other termination costs1 — — 29 — 29 Accrual for potential legal exposure1 — — 31 — 31 Non-operating income adjustments1 — — 8 — 8 Total adjustments $ 96 $ 45 $ 901 $ 53 $ 1,095 Adjusted EBITDA (C) $ 818 $ 892 $ 883 $ 879 $ 3,472 Net Debt to Adjusted EBITDA ratio (A) / (C) 2.4 x 1Refer to Non-GAAP Financial Measures on page 15. Table 9 L3HARRIS TECHNOLOGIES, INC. FY'23 First Quarter Summary RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Net Debt to Adjusted EBITDA Ratio (Unaudited)

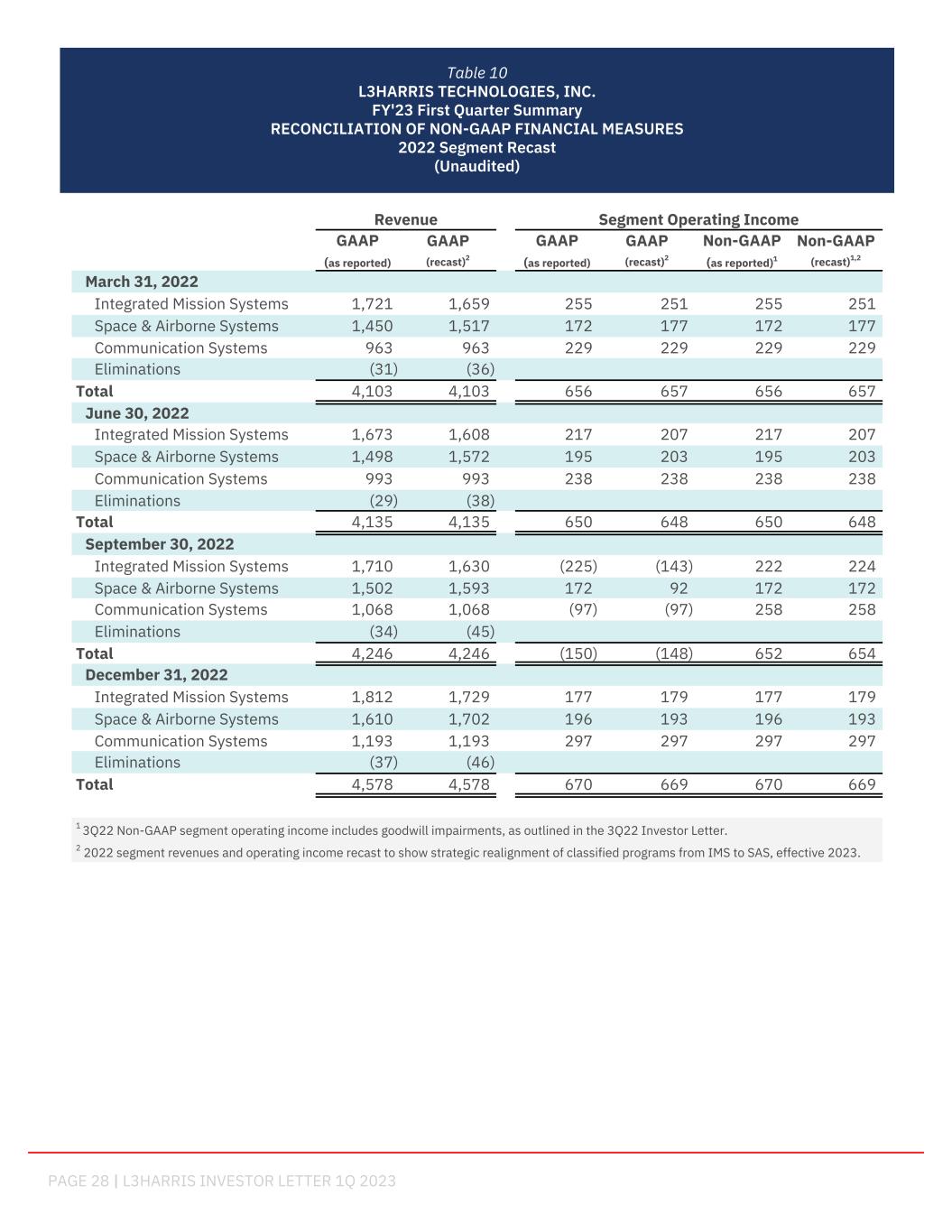

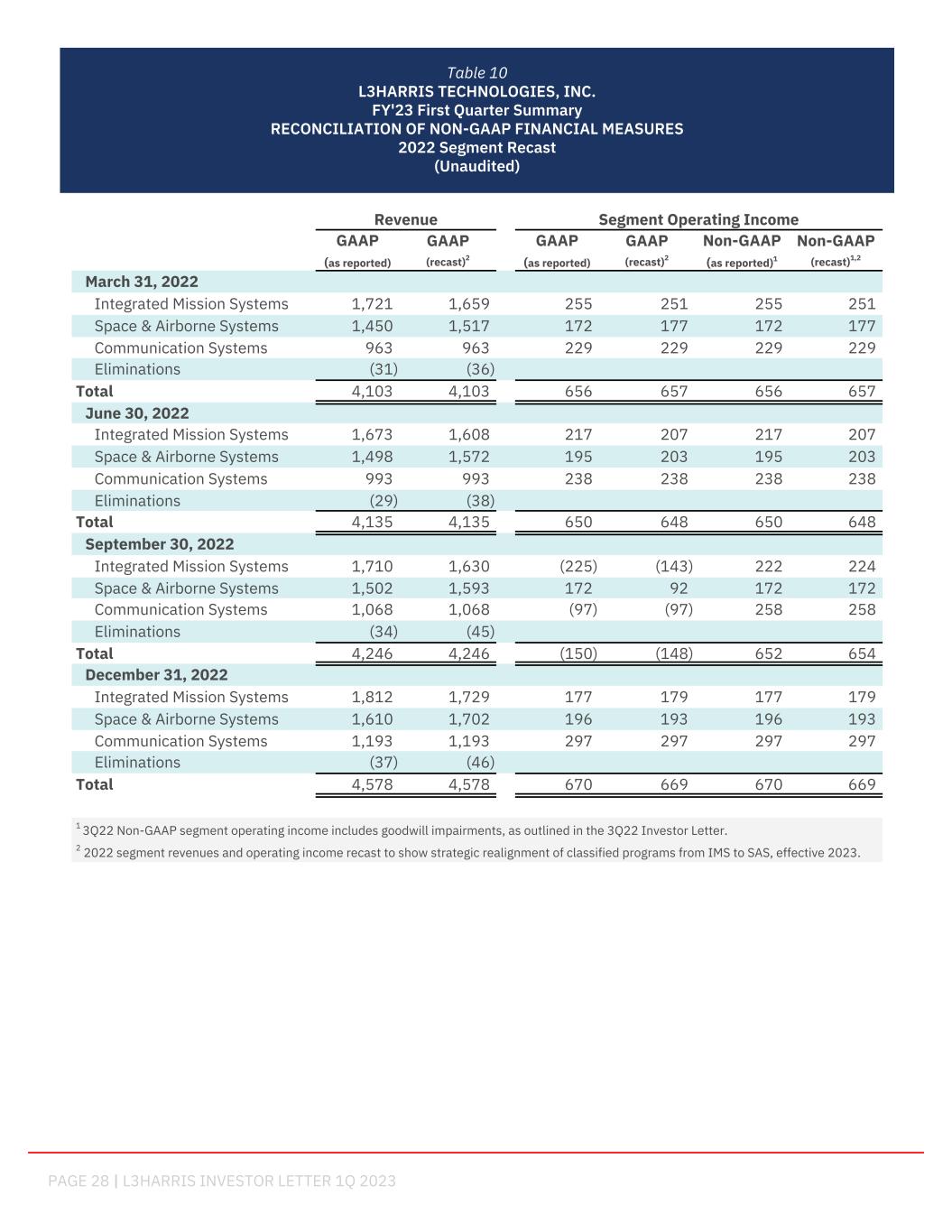

PAGE 28 | L3HARRIS INVESTOR LETTER 1Q 2023 Revenue Segment Operating Income GAAP (as reported) GAAP (recast)2 GAAP (as reported) GAAP (recast)2 Non-GAAP (as reported)1 Non-GAAP (recast)1,2 March 31, 2022 Integrated Mission Systems 1,721 1,659 255 251 255 251 Space & Airborne Systems 1,450 1,517 172 177 172 177 Communication Systems 963 963 229 229 229 229 Eliminations (31) (36) Total 4,103 4,103 656 657 656 657 June 30, 2022 Integrated Mission Systems 1,673 1,608 217 207 217 207 Space & Airborne Systems 1,498 1,572 195 203 195 203 Communication Systems 993 993 238 238 238 238 Eliminations (29) (38) Total 4,135 4,135 650 648 650 648 September 30, 2022 Integrated Mission Systems 1,710 1,630 (225) (143) 222 224 Space & Airborne Systems 1,502 1,593 172 92 172 172 Communication Systems 1,068 1,068 (97) (97) 258 258 Eliminations (34) (45) Total 4,246 4,246 (150) (148) 652 654 December 31, 2022 Integrated Mission Systems 1,812 1,729 177 179 177 179 Space & Airborne Systems 1,610 1,702 196 193 196 193 Communication Systems 1,193 1,193 297 297 297 297 Eliminations (37) (46) Total 4,578 4,578 670 669 670 669 1 3Q22 Non-GAAP segment operating income includes goodwill impairments, as outlined in the 3Q22 Investor Letter. 2 2022 segment revenues and operating income recast to show strategic realignment of classified programs from IMS to SAS, effective 2023. Table 10 L3HARRIS TECHNOLOGIES, INC. FY'23 First Quarter Summary RECONCILIATION OF NON-GAAP FINANCIAL MEASURES 2022 Segment Recast (Unaudited)

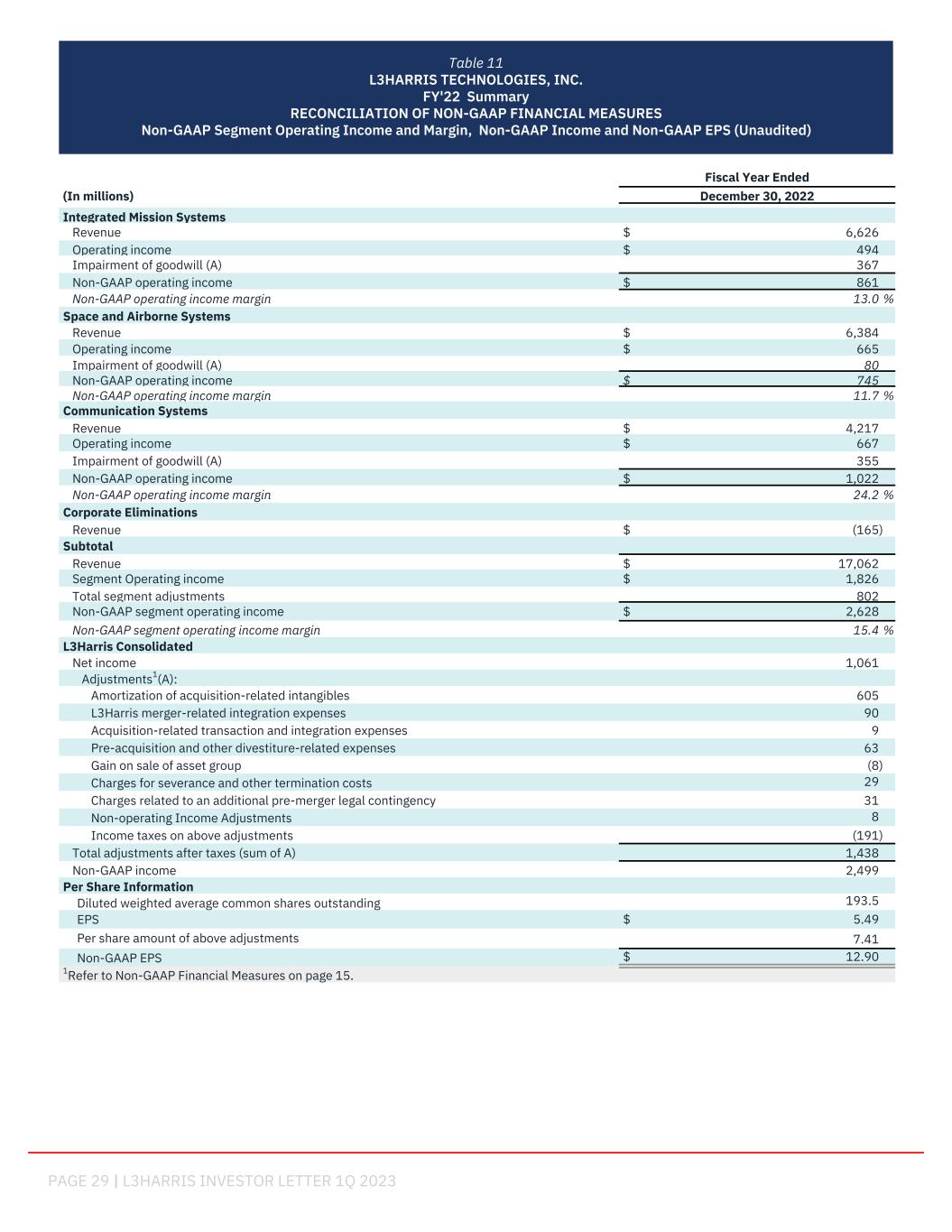

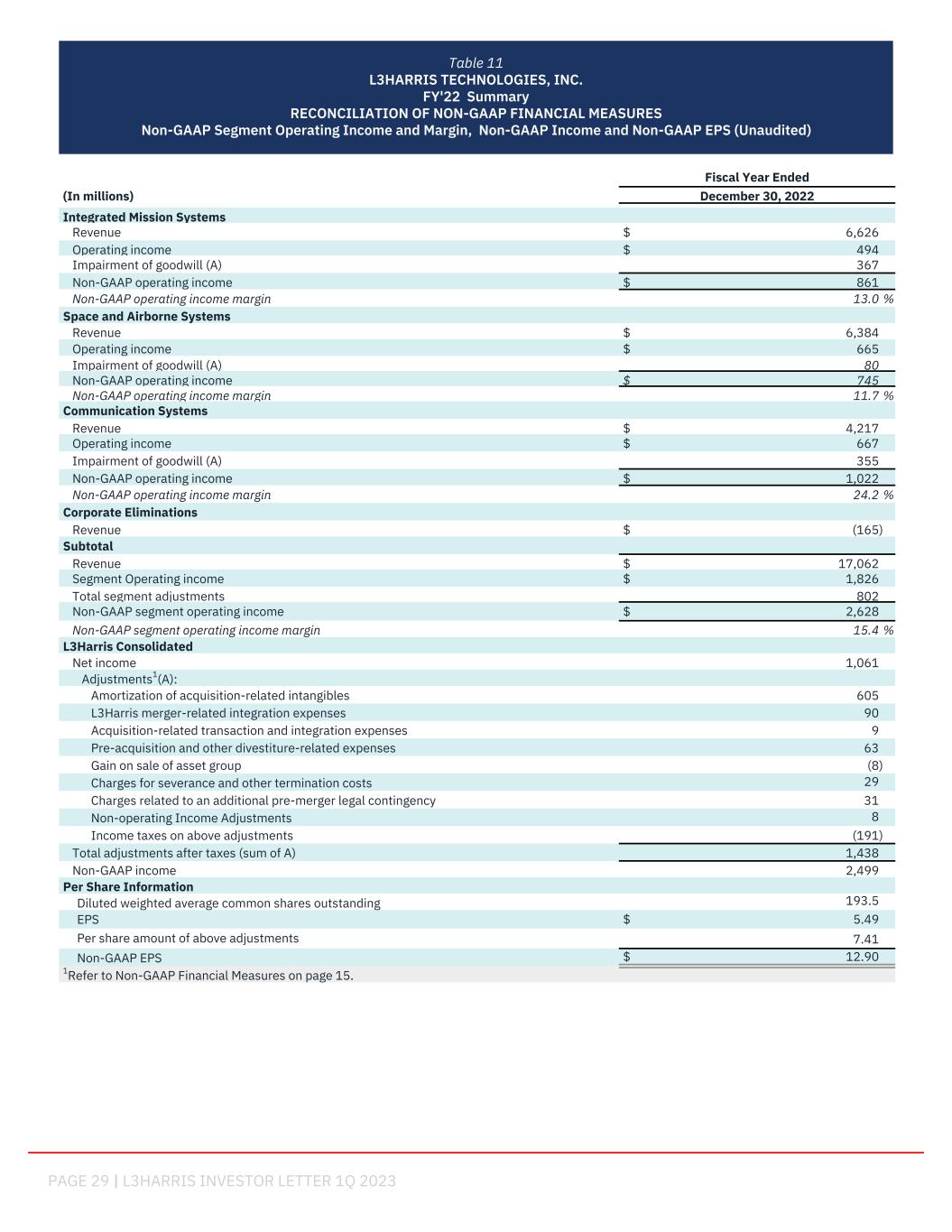

PAGE 29 | L3HARRIS INVESTOR LETTER 1Q 2023 Fiscal Year Ended (In millions) December 30, 2022 Integrated Mission Systems Revenue $ 6,626 Operating income $ 494 Impairment of goodwill (A) 367 Non-GAAP operating income $ 861 Non-GAAP operating income margin 13.0 % Space and Airborne Systems Revenue $ 6,384 Operating income $ 665 Impairment of goodwill (A) 80 Non-GAAP operating income $ 745 Non-GAAP operating income margin 11.7 % Communication Systems Revenue $ 4,217 Operating income $ 667 Impairment of goodwill (A) 355 Non-GAAP operating income $ 1,022 Non-GAAP operating income margin 24.2 % Corporate Eliminations Revenue $ (165) Subtotal Revenue $ 17,062 Segment Operating income $ 1,826 Total segment adjustments 802 Non-GAAP segment operating income $ 2,628 Non-GAAP segment operating income margin 15.4 % L3Harris Consolidated Net income 1,061 Adjustments1(A): Amortization of acquisition-related intangibles 605 L3Harris merger-related integration expenses 90 Acquisition-related transaction and integration expenses 9 Pre-acquisition and other divestiture-related expenses 63 Gain on sale of asset group (8) Charges for severance and other termination costs 29 Charges related to an additional pre-merger legal contingency 31 Non-operating Income Adjustments 8 Income taxes on above adjustments (191) Total adjustments after taxes (sum of A) 1,438 Non-GAAP income 2,499 Per Share Information Diluted weighted average common shares outstanding 193.5 EPS $ 5.49 Per share amount of above adjustments 7.41 Non-GAAP EPS $ 12.90 1Refer to Non-GAAP Financial Measures on page 15. Table 11 L3HARRIS TECHNOLOGIES, INC. FY'22 Summary RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Non-GAAP Segment Operating Income and Margin, Non-GAAP Income and Non-GAAP EPS (Unaudited)

PAGE 30 | L3HARRIS INVESTOR LETTER 1Q 2023 Conference Call Information L3Harris Technologies will host a Q&A focused conference call tomorrow, April 28, 2023, at 8:30 a.m. Eastern Time (ET). The dial-in numbers for the teleconference are (U.S.) 877-407-6184 and (International) 201-389-0877, and participants will be directed to an operator. Please allow at least 10 minutes before the scheduled start time to connect to the teleconference. Participants are encouraged to listen via webcast, which will be broadcast live at L3Harris.com/investors. A recording of the call will be available on the L3Harris website, beginning at approximately 12 p.m. ET on April 28, 2023. Conference Call Information