Filed by Harris Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Harris Corporation

(Commission File No. 001-3863)

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Harris Corporation

(Commission File No. 001-3863)

This filing consists of certain communications made in connection with the announcement of a Formation, Contribution and Merger Agreement, dated as of September 5, 2006, between Harris Corporation and Stratex Networks, Inc.:

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this communication constitute “forward-looking statements.” Forward-looking statements in this release include, but are not limited to, the expected benefits and costs of the transaction; the anticipated timing of completion of the transaction; any projections of earnings, revenues, cost of goods sold, expenses, synergy, accretion, margins or other financial terms; any statements of plans, strategies, objectives, market penetration, and any statements of expectation or belief. Such statements are made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Actual results could differ materially from those projected or forecast in the forward-looking statements. The factors that could cause actual results to differ materially include the following: the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the proposed transaction within the expected time-frames or at all; integration of the operations of Harris’ Microwave Communications Division with those of Stratex Networks now may be more difficult, time-consuming or costly than expected and may not be as successful as the parties anticipate; revenues of the combined business following the transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) of the combined business may be greater than expected following the transaction; the ability to retain key employees in Harris’ Microwave Communications Division and at Stratex Networks subsequent to the completion of the transaction; the conditions to the completion of the transaction may not be satisfied; regulatory approvals that might be required for the transaction might not be obtained on the terms expected and obtaining any such approvals or any other necessary regulatory reviews may not occur on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction; Harris’ Microwave Communications Division and Stratex Networks are subject to intense competition; the failure of either Harris’ Microwave Communication Division or Stratex Networks to protect its intellectual property rights may weaken the competitive position of the combined company; in the future third parties may assert claims, including intellectual property infringement claims that could materially adversely affect the operating results of the combined company; as well as other factors discussed in “Risk Factors” under Item 1A. of Stratex Networks’ Annual Report on Form 10-K for the most recently ended fiscal year and Stratex Networks’ other filings with the SEC (which may also be applicable to Harris’ Microwave Communication Division), which are available at http://www.sec.gov. No person assumes any obligation to update the information in this document, except as otherwise required by law. Investors are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Additional information and Where to Find It

This communication is for informational purposes only. In connection with the transaction, the parties will file a proxy statement/prospectus with the Securities and Exchange Commission (“SEC”).

This communication may be deemed to be solicitation material in respect of the proposed combination of Harris’ Microwave Communications Division with Stratex Networks.INVESTORS AND SECURITY HOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, INCLUDING THE PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site,http://www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus may also be obtained when available, without charge, by directing a request to Stratex Networks, Inc., 120 Rose Orchard Way, San Jose, CA 95134, Attention: Office of the Secretary, or to Harris Corporation, 1025 West NASA Blvd., Melbourne, FL 32919, Attention: Office of the Corporate Secretary.

Participants in Solicitation

Stratex Networks, Harris and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the Stratex Networks stockholders in respect of the proposed transaction. Information about the directors and executive officers of Stratex Networks is set forth in the proxy statement for Stratex Networks’ 2006 Annual Meeting of Stockholders, which was filed with the SEC on July 10, 2006. Information about the directors and executive officers of Harris is set forth in the proxy statement for Harris’ 2005 Annual Meeting of Stockholders, which was filed with the SEC on September 14, 2005. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the transaction when it becomes available.

Set forth below is the text of an e-mail communication from Howard L. Lance to employees of Harris Corporation delivered on September 5, 2006:

| DATE: | September 5, 2006 | |

| TO: | All Harris Employees | |

| FROM: | Howard L. Lance, Harris Chairman, President and CEO | |

| SUBJECT: | Harris Microwave Communications Division and Stratex | |

Networks To Merge |

Dear Fellow Employees:

As you know, Harris Corporation and Stratex Networks announced this afternoon that we have signed a definitive agreement to combine the Harris Microwave Communications Division with Stratex Networks, Inc., to create the world’s largest independent provider of wireless transmission network solutions. This new company will be called Harris Stratex Networks, Inc., and it allows us to achieve economies of scale that would not have been available to either stand-alone company for years to come. This combination of industry-leading products and technology, complementary geographic and customer coverage, and the best employees in the industry will be a formidable competitor in the global marketplace. We believe this merger of two industry leaders is good for Harris Corporation, our shareholders, our customers, and Harris employees, particularly those employees in our Microwave Communications Division.

Legal headquarters of the new company will be at the current headquarters site of the Harris Microwave Communications Division (MCD) in Research Triangle Park, North Carolina, with headquarters functions both there and at the current site of Stratex Networks headquarters in San Jose, California. The new management team will include a combination of executives from both companies. Harris MCD President Guy Campbell will be the chief executive officer of the new company, Sally Dudash will be the chief financial officer, and Thomas Waechter, current CEO of Stratex Networks, will be the chief operating officer. Harris Stratex Networks will be a publicly traded company on NASDAQ with its own board of directors.

Harris is contributing its Microwave Communications Division and $25 million of cash in exchange for approximately 56 percent ownership of the combined company. Stratex Networks shareholders will exchange their existing stock for approximately 44 percent ownership. Harris will consolidate the financial results of the new company into its own financial results, then eliminate the portion of the new company that it doesn’t own as minority interest. Additional information about the terms and structure of the transaction can be found in our joint press release, which can be accessed at www.harris.com.

The Microwave Communications Division has done an excellent job over the past three years in reducing costs, developing new products, expanding market reach, and returning the division to solid profitability. In the most recent quarter, revenue increased 21 percent and operating income more than tripled, excluding charges, compared to the prior-year quarter. More importantly, orders in the fourth quarter exceeded sales for the sixth consecutive quarter, giving this business great momentum in the new fiscal year. And the introduction of our new TRuepoint™ microwave radio platform three years ago has given this division a family of new products that has been very well received by customers worldwide. We have achieved market leadership in North America as well as much of the Middle East and Africa. However, we have struggled to achieve growth on

our own in the important markets of Europe, Asia and Latin America. Stratex Networks has significant revenues in these regions and also in the Middle East and Africa.

Some of you may be surprised by the decision to take a Harris operating division and separate it from the company in this way. The overriding strategy in this combination is value creation for our shareholders through the formation of a new company better able to compete, to generate increased revenue and to lower costs. The combination of the two operations enhances the value of the investment we have made in our Microwave Communications business and builds on the accomplishments of the past three years. This should benefit the shareholders of Harris and Stratex Networks, our mutual customers, and our employees.

We understand that mixed with the excitement of creating a new company is the prospect of the unknown that comes with combining the two workforces. An integration planning team will be formed comprised of leadership from all functional areas from both companies. This team will develop specific action plans to align the combined workforce with the needs of the new company to take advantage of the available business synergies. In addition, Human Resources and senior leadership from both companies will be developing a harmonized employee benefits and retirement program for the new company. It is hoped that all of this planning will be completed during the 3-4 months between signing and closing.

I am very excited about this combination of two industry leaders that share a common vision of the future. Two talented teams will be joining forces, and I think this combination will be a success.

Sincerely,

Additional information and where to find it

This letter is for informational purposes only. In connection with the transaction, the parties will file a registration statement on Form S-4, which will include a proxy statement/prospectus, with the Securities and Exchange Commission (“SEC”).

This communication may be deemed to be solicitation material in respect of the proposed combination of Harris’ Microwave Communications Division with Stratex Networks.INVESTORS AND SECURITY HOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, INCLUDING THE PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.The definitive proxy statement/prospectus will be mailed to the stockholders of Stratex Networks. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site,http://www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference

in the proxy statement/prospectus may also be obtained when available, without charge, by directing a request to Stratex Networks, Inc., 120 Rose Orchard Way, San Jose, CA 95134, Attention: Office of the Secretary, or to Harris Corporation, 1025 West NASA Blvd., Melbourne, FL 32919, Attention: Office of the Corporate Secretary.

Participants in solicitation

Stratex Networks, Harris Corporation and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the Stratex Networks Networks’ stockholders in respect of the proposed transaction. Information about the directors and executive officers of Stratex Networks is set forth in the proxy statement for Stratex Networks’ 2006 Annual Meeting of Stockholders, which was filed with the SEC on July 10, 2006. Information about the directors and executive officers of Harris is set forth in the proxy statement for Harris’ 2005 Annual Meeting of Stockholders, which was filed with the SEC on September 14, 2005. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the transaction when it becomes available.

SOURCES: Harris Corporation and Stratex Networks Inc.

Set forth below is the text of form e-mail communication from Guy Campbell to employees of the Microwave Communications Division of Harris Corporation delivered on September 5, 2006:

Distribution: MCD Employees via E-mail

Dear [Personalized with First Name],

We are pleased to share with you some very exciting news. As the attached press release outlines, Harris Corporation and Stratex Networks, Inc. today announced the signing of a definitive agreement under which Harris’ Microwave Communications Division and Stratex Networks will combine operations to form a new publicly traded company named Harris Stratex Networks, Inc. With combined annual revenue of approximately $600 million, Harris Stratex Networks will be the largest independent provider of wireless transmission network solutions with global reach to customers in over 150 countries.

Harris and Stratex Networks are a potent combination, sharing a legacy of innovation and customer focus. With this transaction, we combine critical resources and enhanced operating scale to further our industry leadership, drive product innovation and maximize our efficiency. Harris Stratex Networks brings together complementary global distribution channels and product offerings with minimal customer overlap creating a much broader and more effective geographic footprint. Both companies have a reputation for quality and innovation as evidenced by two of the most technologically advanced product families in the industry— the Harris TRuepoint™ and the Stratex Networks Eclipse™. Our network management solution NetBoss®, further strengthens our product offering. Going forward, Harris Stratex Networks will provide an end-to-end product portfolio with best-in-class transport, access, and network management solutions. The new company’s solutions offering will be the broadest in the industry including microwave radio and IP-based transmission systems, nodal processors, network management software and turnkey services that include network planning, engineering and implementation.

For you, as a Harris MCD employee, our actions today are expected to create more promise and potential. The formation of the new company nearly doubles the size of our current business the day the deal closes giving us access to new technologies, markets and products. Harris Stratex Networks will be a new, publicly traded company with its own stock, its own management team, and control of its own destiny. We are confident that Harris Stratex Networks will lead the industry and allow us to maximize opportunities for our employees in a marketplace that becomes increasingly competitive by the day. Before us stands a great opportunity!

As we create the new company, we make the following commitment to MCD employees:

| • | To communicate with you throughout this process as we create the new company | ||

| • | To make this transition as smooth as possible as we progress | ||

| • | To place a high priority on the design of a competitive Total Rewards package for employees of the new company |

To help answer questions you may have regarding the merger and the integration process, a special website has been created for you. The site includes Frequently Asked Questions (FAQs) as well as other useful information. You can access this special area on the MCD intranet athttp://webapps.harris.com/mcd-intranet. The FAQs will be updated periodically as additional questions are received. Your questions can be sent via email to:mcdnews@Harris.com. Questions submitted will be forwarded to the appropriate individual for a timely reply.

Our congratulations and thanks go out to Harris MCD employees worldwide. Your performance has helped prepare us for the next chapter in our company’s history, and we enter this merger with demonstrated momentum. Over the past three years, we have done what it takes to return to profitability. In the most recent fourth quarter, sales of our Microwave Communications Division were up 21 percent and operating income, excluding charges, more than tripled, compared with the prior-year quarter. More important, orders in the fourth quarter exceeded sales for the sixth consecutive quarter, which has given this business great momentum in the current fiscal year. TRuepoint™ has given us a breakthrough product that has been very well received by customers worldwide. We are ready to take full advantage of the accelerated growth in the telecom market as Harris Stratex Networks becomes the global independent wireless network solutions leader and reshapes the industry.

We recognize that you will have questions, so we have scheduled employee meetings over the next two days to further discuss this announcement and to answer your questions. We anticipate some workforce reductions as well as new opportunities within the new company, but it is too soon to provide specifics until the transaction closes.

Until the transaction closes, we are required by law to act as separate companies. Certain planning activities can occur, but there can be no implementation of these plans. In particular, collaboration of any kind on sales opportunities is prohibited, and there can be no exchange of sensitive information such as prices, costs, market or product strategies. Guidance on which planning activities are allowable will be provided by legal counsel. Your continued performance will help us create a new company positioned for continuing profitable growth. Please stay

focused on executing your personal objectives, serving our customers, and growing the business. In the weeks ahead, we will provide you with regular updates on the progress of the integration team’s activities, and we will work hard to keep the lines of communication open and to be responsive.

Guy

President

[Attachment: final press release] [omitted]

Additional information and where to find it

This letter is for informational purposes only. In connection with the transaction, the parties will file a registration statement on Form S-4, which will include a proxy statement/prospectus, with the Securities and Exchange Commission (“SEC”).

This communication may be deemed to be solicitation material in respect of the proposed combination of Harris’ Microwave Communications Division with Stratex Networks.INVESTORS AND SECURITY HOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, INCLUDING THE PROXY STATEMENT/ PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.The definitive proxy statement/prospectus will be mailed to the stockholders of Stratex Networks. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site,http://www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus may also be obtained when available, without charge, by directing a request to Stratex Networks, Inc., 120 Rose Orchard Way, San Jose, CA 95134, Attention: Office of the Secretary, or to Harris Corporation, 1025 West NASA Blvd., Melbourne, FL 32919, Attention: Office of the Corporate Secretary.

Participants in solicitation

Stratex Networks, Harris Corporation and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the Stratex Networks Networks’ stockholders in respect of the proposed transaction. Information about the directors and executive officers of Stratex Networks is set forth in the proxy statement for Stratex Networks’ 2006 Annual Meeting of Stockholders, which was filed with the SEC on July 10, 2006. Information about the directors and executive officers of Harris is set forth in the proxy statement for Harris’ 2005 Annual Meeting of Stockholders, which was filed with the SEC on September 14, 2005. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the transaction when it becomes available.

SOURCES: Harris Corporation and Stratex Networks Inc.

Set forth below is the text of “frequently asked questions” made available to employees of the Microwave Communications Division of Harris Corporation via intranet on September 5, 2006:

Distribution: MCD Employees via intranet

MCD Employee FAQs

Q. What is the deal?

A. Harris and Stratex Networks have signed an agreement to combine the Harris Microwave Communications Division with Stratex Networks (signing and public announcement occurred on Sept 5, 2006).

A. Harris and Stratex Networks have signed an agreement to combine the Harris Microwave Communications Division with Stratex Networks (signing and public announcement occurred on Sept 5, 2006).

Q. Why is Harris doing this deal?

A. The combination will create the world’s largest independent provider of wireless transmission network solutions. The new company, called Harris Stratex Networks, will be a larger, more competitive, pure-play wireless technology company capable of achieving stronger financial performance than as two stand-alone companies. The combination creates significantly greater scale; it delivers complementary distribution channels with minimal customer overlap; it serves a large market with expected strong growth; and offers customers an unmatched product portfolio. Harris will be the majority shareholder in the new company.

A. The combination will create the world’s largest independent provider of wireless transmission network solutions. The new company, called Harris Stratex Networks, will be a larger, more competitive, pure-play wireless technology company capable of achieving stronger financial performance than as two stand-alone companies. The combination creates significantly greater scale; it delivers complementary distribution channels with minimal customer overlap; it serves a large market with expected strong growth; and offers customers an unmatched product portfolio. Harris will be the majority shareholder in the new company.

Q. What is the impact on MCD?

A. MCD employees will become part of a new company called Harris Stratex Networks. The new company will be publicly traded on the NASDAQ Global Market and will have combined revenue of approximately $600 million and customers in 150 countries. As a public company, Harris Stratex Networks will have its own management team, which will include a combination of both MCD and Stratex Networks management, their own Board of Directors, and their own shareholders.

A. MCD employees will become part of a new company called Harris Stratex Networks. The new company will be publicly traded on the NASDAQ Global Market and will have combined revenue of approximately $600 million and customers in 150 countries. As a public company, Harris Stratex Networks will have its own management team, which will include a combination of both MCD and Stratex Networks management, their own Board of Directors, and their own shareholders.

Q. Why is it a good deal for MCD employees?

A. Many reasons.

A. Many reasons.

| • | MCD employees will become part of a new, publicly traded company with it own stock, its own management team and its own board of directors. | ||

| • | You will be on the ground floor of a newly created company that will chart its own future. | ||

| • | You will be creating your own framework for growth. | ||

| • | You will be in control of your own destiny, and every action you take will have an impact on the success of this new business. |

| • | You will witness the excitement of seeing your new company’s stock trade on the NASDAQ, beginning the first day following the close of the deal. The success achieved by your new company will be reflected directly in the price of that stock. | ||

| • | All of the energies of the new company will be focused on leadership in a single market — wireless transmission network solutions. | ||

| • | You will be part of a pure play wireless communications supplier with leading products and market coverage that is truly global. | ||

| • | This deal is a great match. Between the two companies, there is little customer overlap and the global distribution channels are complementary. | ||

| • | You will truly have the best of both world’s — the agility, quick decision making, rapid market response, as well as the stability of a larger company (Harris), which will have a majority shareholder position in the new company. | ||

| • | The size of the new company will be almost double that of our current business the day the deal closes, and you will have access to a broader product portfolio, additional R&D resources, as well as new markets and customers. | ||

| • | This is a very exciting venture for employees of both entities. |

Q. When will this deal happen?

A. The transaction is subject to Stratex Networks shareholder approval, regulatory approvals, and customary closing conditions and is expected to close in 3-4 months.

A. The transaction is subject to Stratex Networks shareholder approval, regulatory approvals, and customary closing conditions and is expected to close in 3-4 months.

Q. Are we still considered part of Harris?

A. Until the deal closes, yes. After the deal is signed, Harris Stratex Networks will be a majority-owned subsidiary of Harris Corporation, but will be a separate, publicly traded company.

A. Until the deal closes, yes. After the deal is signed, Harris Stratex Networks will be a majority-owned subsidiary of Harris Corporation, but will be a separate, publicly traded company.

Q. Who will run the new company?

A. Guy Campbell, president of Harris Microwave Communications Division, will be appointed chief executive officer and will lead a combined team of executives from both companies. Thomas Waechter, chief executive officer of Stratex Networks, will be appointed chief operating officer. Sally Dudash, vice president and controller for Harris MCD will be appointed chief financial officer. The Harris Stratex Networks nine-member Board of Directors will consist of a majority of independent directors, including four current directors of Stratex Networks. Harris will nominate five of the nine directors. The Board will include Guy Campbell; Howard L. Lance, chairman, president and CEO of Harris; and Charles D. Kissner, executive chairman of Stratex, who will serve as non-executive chairman.

A. Guy Campbell, president of Harris Microwave Communications Division, will be appointed chief executive officer and will lead a combined team of executives from both companies. Thomas Waechter, chief executive officer of Stratex Networks, will be appointed chief operating officer. Sally Dudash, vice president and controller for Harris MCD will be appointed chief financial officer. The Harris Stratex Networks nine-member Board of Directors will consist of a majority of independent directors, including four current directors of Stratex Networks. Harris will nominate five of the nine directors. The Board will include Guy Campbell; Howard L. Lance, chairman, president and CEO of Harris; and Charles D. Kissner, executive chairman of Stratex, who will serve as non-executive chairman.

Q. Where will the new company be headquartered?

A. Legal headquarters of the new company will be at the current headquarters site of the Harris Microwave Communications Division in Research Triangle Park, North Carolina, with headquarters functions both there and at the current site of Stratex Networks headquarters in San Jose, California.

A. Legal headquarters of the new company will be at the current headquarters site of the Harris Microwave Communications Division in Research Triangle Park, North Carolina, with headquarters functions both there and at the current site of Stratex Networks headquarters in San Jose, California.

Q. Will my facility and my position be affected by the proposed merger?

A. We have made no decisions about facilities or employee positions, and no decisions will be made until the transaction closes. However, following the close of the deal, some workforce reductions will be required. As noted in the press release, we have committed to achieving $35 million in annual pre-tax product cost and expense synergies. Much of those synergies will come from the reduction of product costs, but some will also come from operational efficiencies, including any overlap in functions. An integration team comprised of leadership from all functional areas from both companies to address these issues will be formed. The integration team will be working diligently on plans to align the combined workforce with the needs of the new company and how to address duplication of resources. Fortunately, the two businesses bring together complementary global distribution channels and product offerings with minimal existing customer overlap.

A. We have made no decisions about facilities or employee positions, and no decisions will be made until the transaction closes. However, following the close of the deal, some workforce reductions will be required. As noted in the press release, we have committed to achieving $35 million in annual pre-tax product cost and expense synergies. Much of those synergies will come from the reduction of product costs, but some will also come from operational efficiencies, including any overlap in functions. An integration team comprised of leadership from all functional areas from both companies to address these issues will be formed. The integration team will be working diligently on plans to align the combined workforce with the needs of the new company and how to address duplication of resources. Fortunately, the two businesses bring together complementary global distribution channels and product offerings with minimal existing customer overlap.

Q. What about MCD employees located at other Harris facilities?

A. As noted above, we have made no decisions about facilities, and no decisions will be made until the transaction closes.

A. As noted above, we have made no decisions about facilities, and no decisions will be made until the transaction closes.

Q. Will the new company continue to offer the current product lines?

A. All current products from both companies will continue to be supported and maintained.

A. All current products from both companies will continue to be supported and maintained.

Q. Will MCD employees still work on the same projects/products, and have the same roles?

A. Until the deal is closed, we will continue to operate as separate entities. You will continue working in the same capacity and area in which you currently work. Looking ahead, you can expect to have new projects and even broader opportunities as part of the combined new company.

A. Until the deal is closed, we will continue to operate as separate entities. You will continue working in the same capacity and area in which you currently work. Looking ahead, you can expect to have new projects and even broader opportunities as part of the combined new company.

Q. Will my pay or benefits remain the same?

A. There will be no change to your pay and benefits before the close of the deal. As you would imagine, the pay and benefit practices of the two entities — MCD and Stratex — have some

A. There will be no change to your pay and benefits before the close of the deal. As you would imagine, the pay and benefit practices of the two entities — MCD and Stratex — have some

differences. A team of MCD and Stratex HR personnel are currently considering designs for a new “Total Rewards” package that will be the basis for the new Harris Stratex Networks benefits program. We understand this particular program will be of high interest to all employees of the new company, and it will receive the highest priority in the integration process.

Q. Will my Harris years of service carry over to the new company?

A. Yes. Your time of service will be fully honored by Harris Stratex Networks.

A. Yes. Your time of service will be fully honored by Harris Stratex Networks.

Q. Is there an integration plan and a transition timeline?

A. The integration team, which will include employees from both MCD and Stratex, and from all functional areas, will be working on plans for combining the two companies. No formal actions on the integration can begin until the deal closes. Integration efforts will focus on planning to ensure that employee issues, customer sales, marketing and service, and on-going business operations proceed as seamlessly as possible after the close.

A. The integration team, which will include employees from both MCD and Stratex, and from all functional areas, will be working on plans for combining the two companies. No formal actions on the integration can begin until the deal closes. Integration efforts will focus on planning to ensure that employee issues, customer sales, marketing and service, and on-going business operations proceed as seamlessly as possible after the close.

Q. How long will integration last?

A. A significant portion of integration will take place in the first 100 days after the close of the deal. All employees will receive ongoing updates regarding the integration team’s progress during that time as well as changes that might occur subsequent to integration beyond the first 100-day period.

A. A significant portion of integration will take place in the first 100 days after the close of the deal. All employees will receive ongoing updates regarding the integration team’s progress during that time as well as changes that might occur subsequent to integration beyond the first 100-day period.

Q. Where can I send questions regarding the deal and the integration?

A. A special e-mail account has been established to help address your questions. Any questions sent to mcd-news@harris.com will be forwarded to the integration team for a timely reply. Certain questions and answers will be posted in this FAQ document posted on the Intranet.

A. A special e-mail account has been established to help address your questions. Any questions sent to mcd-news@harris.com will be forwarded to the integration team for a timely reply. Certain questions and answers will be posted in this FAQ document posted on the Intranet.

Q. What should I do if approached by the media?

A. If you are approached by the national or trade media, please forward all inquiries to these representatives in Marketing Communications:

A. If you are approached by the national or trade media, please forward all inquiries to these representatives in Marketing Communications:

Harris Public Relations: Brent Dietz — 321-724-3554

Additional information and where to find it

These Frequently Asked Questions are for informational purposes only. In connection with the transaction, the parties will file a registration statement on Form S-4, which will include a proxy statement/prospectus, with the Securities and Exchange Commission (“SEC”).

This communication may be deemed to be solicitation material in respect of the proposed combination of Harris’ Microwave Communications Division with Stratex Networks.INVESTORS AND SECURITY HOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, INCLUDING THE PROXY STATEMENT/ PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.The definitive proxy statement/prospectus will be mailed to the stockholders of Stratex Networks. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site,http://www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus may also be obtained when available, without charge, by directing a request to Stratex Networks, Inc., 120 Rose Orchard Way, San Jose, CA 95134, Attention: Office of the Secretary, or to Harris Corporation, 1025 West NASA Blvd., Melbourne, FL 32919, Attention: Office of the Corporate Secretary.

Participants in solicitation

Stratex Networks, Harris Corporation and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the Stratex Networks Networks’ stockholders in respect of the proposed transaction. Information about the directors and executive officers of Stratex Networks is set forth in the proxy statement for Stratex Networks’ 2006 Annual Meeting of Stockholders, which was filed with the SEC on July 10, 2006. Information about the directors and executive officers of Harris is set forth in the proxy statement for Harris’ 2005 Annual Meeting of Stockholders, which was filed with the SEC on September 14, 2005. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the transaction when it becomes available.

SOURCES: Harris Corporation and Stratex Networks Inc.

Set forth below is the text of “Talking Points” distributed to certain employees of the Microwave Communications Division of Harris Corporation via e-mail on September 5, 2006:

Distribution: MCD Executive Management

Talking Points

The What — Harris MCD and Stratex Networks to Merge

| • | Harris Corporation and Stratex Networks have signed an agreement to combine the Harris Microwave Communications Division with Stratex Networks (signing and public announcement occurred on Sept 5, 2006). | ||

| • | The combination will create a new publicly traded company with combined revenue of approximately $600 million and customers in 150 countries. | ||

| • | The new company will be called Harris Stratex Networks, Inc., and its shares will be listed on the NASDAQ Global Market. | ||

| • | Harris Stratex Networks will be the world’s largest independent provider of wireless transmission network solutions, including transport and access microwave radios, carrier-grade Ethernet transmission systems, network management software, and turnkey field services that include network planning, engineering and implementation. | ||

| • | The transaction is subject to Stratex shareholder approval, regulatory approvals, and customary closing conditions and is expected to close in 3-4 months. | ||

| • | In the interim, we will continue to operate on a business as usual basis, with both companies operating their businesses independently. |

Strategic Rationale

| • | The combination creates a larger, more competitive, pure-play wireless technology company capable of achieving stronger financial performance than two stand-alone companies. | ||

| • | Combination will create a global communications company offering end-to-end wireless transmission solutions for mobile and fixed-wireless service providers and private networks. | ||

| • | Product offering will be the broadest in the industry. | ||

| • | Both companies have a reputation for quality and innovation |

| • | The Harris TRuepoint™ and Stratex Eclipse™ are industry leaders | ||

| • | NetBoss® is the industry’s only integrated communications management platform |

| • | Larger scale of the company will allow greater leverage of investments in technology development, new products, and sales and marketing |

| • | The combination creates significantly greater scale — Harris Stratex Networks will be the #1 provider in North America and #3 in the Global market |

| • | The two companies currently have little overlap in customers, so the combined company will have a significantly expanded customer and geographic footprint. |

Organization

| • | Guy Campbell, president of Harris’ Microwave Communications Division, will be appointed Chief Executive Officer of the combined company. | ||

| • | Thomas Waechter, chief executive officer of Stratex Networks, will be appointed chief operating officer. | ||

| • | Sally Dudash, vice president and controller of Harris’ Microwave Communications Division, will be appointed chief financial officer. | ||

| • | The Harris Stratex Networks nine-member Board of Directors will consist of a majority of independent directors and will include four current directors of Stratex Networks, including Charles D. Kissner, executive chairman of Stratex Networks, who will serve as non-executive chairman. Five of the directors will be nominated by Harris and will include Guy Campbell and Howard Lance | ||

| • | Legal headquarters of the new company will be at the current headquarters site of the Harris Microwave Communications Division in Research Triangle Park, North Carolina, with headquarters functions both there and at the current site of Stratex Networks headquarters in San Jose, California. |

Terms of Transaction

| • | Harris Corporation will contribute its Microwave Communications Division and $25 million of cash in exchange for approximately 56 percent ownership of the combined company. | ||

| • | Stratex Networks shareholders will exchange their existing stock for approximately 44 percent ownership of the combined company. |

Additional information and where to find it

These Talking Points are for informational purposes only. In connection with the transaction, the parties will file a registration statement on Form S-4, which will include a proxy statement/prospectus, with the Securities and Exchange Commission (“SEC”).

This communication may be deemed to be solicitation material in respect of the proposed combination of Harris’ Microwave Communications Division with Stratex Networks.INVESTORS AND SECURITY HOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, INCLUDING THE PROXY STATEMENT/ PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.The definitive proxy statement/prospectus will be mailed to the stockholders of Stratex Networks. Investors and security holders will be able to obtain the documents free of charge at the

SEC’s web site,http://www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus may also be obtained when available, without charge, by directing a request to Stratex Networks, Inc., 120 Rose Orchard Way, San Jose, CA 95134, Attention: Office of the Secretary, or to Harris Corporation, 1025 West NASA Blvd., Melbourne, FL 32919, Attention: Office of the Corporate Secretary.

Participants in solicitation

Stratex Networks, Harris Corporation and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the Stratex Networks Networks’ stockholders in respect of the proposed transaction. Information about the directors and executive officers of Stratex Networks is set forth in the proxy statement for Stratex Networks’ 2006 Annual Meeting of Stockholders, which was filed with the SEC on July 10, 2006. Information about the directors and executive officers of Harris is set forth in the proxy statement for Harris’ 2005 Annual Meeting of Stockholders, which was filed with the SEC on September 14, 2005. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the transaction when it becomes available.

SOURCES: Harris Corporation and Stratex Networks Inc.

Set forth below is the slide presentation used by Harris Corporation in presentations to employees of the Microwave Communications Division commencing on September 5, 2006:

| Harris Stratex Networks, Inc. Creating a Leading Global Wireless Transmission Networks Solutions Provider MCD Employees |

| Forward Looking Statements Certain statements in this presentation constitute "forward-looking statements." Forward-looking statements in this presentation include, but are not limited to, the expected benefits and costs of the transaction; the anticipated timing of completion of the transaction; any projections of earnings, revenues, cost of goods sold, expenses, synergy, accretion, margins or other financial terms; any statements of plans, strategies, objectives, market penetration, and any statements of expectation or belief. Such statements are made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Actual results could differ materially from those projected or forecast in the forward-looking statements. The factors that could cause actual results to differ materially include the following: the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the proposed transaction within the expected time-frames or at all; integration of the operations of Harris' Microwave Communications Division with those of Stratex Networks now may be more difficult, time-consuming or costly than expected and may not be as successful as the parties anticipate; revenues of the combined business following the transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) of the combined business may be greater than expected following the transaction; the ability to retain key employees in Harris' Microwave Communications Division and at Stratex Networks subsequent to the completion of the transaction; the conditions to the completion of the transaction may not be satisfied; regulatory approvals that might be required for the transaction might not be obtained on the terms expected and obtaining any such approvals or any other necessary regulatory reviews may not occur on the anticipated schedule; the parties' ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction; Harris' Microwave Communications Division and Stratex Networks are subject to intense competition; the failure of either Harris' Microwave Communication Division or Stratex Networks to protect its intellectual property rights may weaken the competitive position of the combined company; in the future third parties may assert claims, including intellectual property infringement claims that could materially adversely affect the operating results of the combined company; as well as other factors discussed in "Risk Factors" under Item 1A. of Stratex Networks' Annual Report on Form 10-K for the most recently ended fiscal year and Stratex Networks' other filings with the SEC (which may also be applicable to Harris' Microwave Communication Division), which are available at http://www.sec.gov. No person assumes any obligation to update the information in this document, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. |

| Additional Information and Where to Find it Additional Information and Where to Find It This presentation is for informational purposes only. In connection with the transaction, the parties will file a registration statement on Form S-4, which will include a proxy statement/prospectus, with the Securities and Exchange Commission ("SEC"). This communication may be deemed to be solicitation material in respect of the proposed combination of Harris' Microwave Communications Division with Stratex Networks. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, INCLUDING THE PROXY STATEMENT/ PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The definitive proxy statement/prospectus will be mailed to the stockholders of Stratex Networks. Investors and security holders will be able to obtain the documents free of charge at the SEC's web site, http://www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus may also be obtained when available, without charge, by directing a request to Stratex Networks, Inc., 120 Rose Orchard Way, San Jose, CA 95134, Attention: Office of the Secretary, or to Harris Corporation, 1025 West NASA Blvd., Melbourne, FL 32919, Attention: Office of the Corporate Secretary. Participants in Solicitation Stratex Networks, Harris Corporation and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the Stratex Networks stockholders in respect of the proposed transaction. Information about the directors and executive officers of Stratex Networks is set forth in the proxy statement for Stratex Networks' 2006 Annual Meeting of Stockholders, which was filed with the SEC on July 10, 2006. Information about the directors and executive officers of Harris is set forth in the proxy statement for Harris' 2005 Annual Meeting of Stockholders, which was filed with the SEC on September 14, 2005. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the acquisition when it becomes available. |

| What Was Announced? Harris Corporation and Stratex Networks have signed a definitive agreement to combine operations to form a new publicly-traded company named Harris Stratex Networks, Inc. Harris to contribute its Microwave Communications Division assets and $25 million in cash in exchange for approximately 56% ownership in the combined company Stratex shareholders to exchange their existing stock for approximately 44% ownership in the combined company Transaction is expected to close within the next three to four months The newly-created public company, Harris Stratex Networks, Inc., is expected to trade on the NASDAQ Global Market |

| Who Is Stratex Networks, Inc.? NASDAQ-listed (STXN) company based San Jose, CA with 450 employees worldwide Designs, manufactures and markets advanced wireless solutions for mobile applications and broadband access One of the world's leading providers of high-speed wireless transmission solutions, serving markets for mobile, fixed and private networks Founded in January 1984 (formerly known as DMC Stratex Networks, Inc. and Digital Microwave Corporation) |

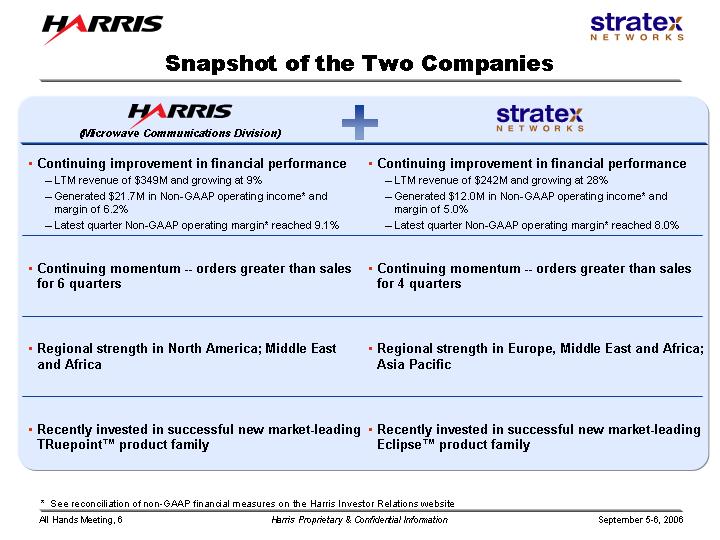

| Snapshot of the Two Companies (Microwave Communications Division) Continuing improvement in financial performance LTM revenue of $349M and growing at 9% Generated $21.7M in Non-GAAP operating income* and margin of 6.2% Latest quarter Non-GAAP operating margin* reached 9.1% Continuing improvement in financial performance LTM revenue of $242M and growing at 28% Generated $12.0M in Non-GAAP operating income* and margin of 5.0% Latest quarter Non-GAAP operating margin* reached 8.0% Continuing momentum -- orders greater than sales for 6 quarters Continuing momentum -- orders greater than sales for 4 quarters Regional strength in North America; Middle East and Africa Regional strength in Europe, Middle East and Africa; Asia Pacific Recently invested in successful new market-leading TRuepoint(tm) product family Recently invested in successful new market-leading Eclipse(tm) product family * See reconciliation of non-GAAP financial measures on the Harris Investor Relations website |

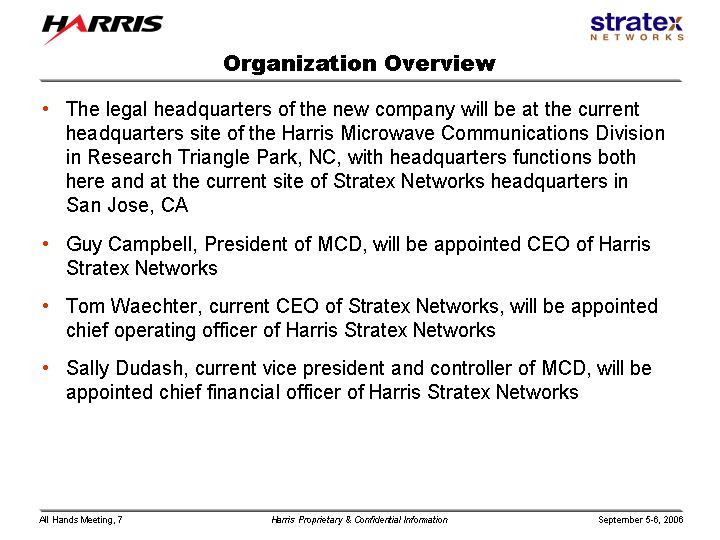

| Organization Overview The legal headquarters of the new company will be at the current headquarters site of the Harris Microwave Communications Division in Research Triangle Park, NC, with headquarters functions both here and at the current site of Stratex Networks headquarters in San Jose, CA Guy Campbell, President of MCD, will be appointed CEO of Harris Stratex Networks Tom Waechter, current CEO of Stratex Networks, will be appointed chief operating officer of Harris Stratex Networks Sally Dudash, current vice president and controller of MCD, will be appointed chief financial officer of Harris Stratex Networks |

| What Does It Mean For Us? Become part of a new, publicly traded company with its own stock, traded on the NASDAQ Global Market Harris Stratex Networks will have its own management team and will control its own destiny Harris Stratex Networks will be a leading global player with over $600 million in annual sales |

| What Does It Mean For You? Harris Stratex Networks employees will be part of a focused, agile, standalone company that has the backing and support of Harris, the majority shareholder You will be part of a business nearly double the size of MCD the day the deal closes, giving you access to: New technologies New products Additional engineering and R&D resources Access to new international markets This is a very exciting venture for MCD employees |

| Global Market Harris Stratex 15% Stratex 6% Harris 9% A Leading Global Provider of Wireless Transmission Network Solutions North American Market Harris Stratex 48% Estimated based on calendar year 2005 global market of $3.5 billion Source: Management estimates Harris 46% Stratex 2% |

| Complementary Global Distribution Channels With Less Than 5% Overlap $ 175 $ 11 $ 186 $ 29 $ 22 $ 51 $ 21 $ 56 $ 77 $ 100 $ 81 $ 181 $ 24 $ 72 $ 96 North America Latin America Middle East/Africa Europe (incl. Russia) Asia Pacific * Based on the latest twelve months ended June 30, 2006 Revenue by Region* ($ in millions) Harris $349 Stratex $242 Total $591 #3 Globally, #1 in North America, #2 in Middle East and Africa, and an expanded footprint across Europe, Asia, Latin America, and emerging growth markets of Russia and India |

| Microwave Market Growth Expected Total Global Market Growth of 8%; Strong Positioning in Higher Growth Segments Source: Management estimates 2006 2007 2008 2009 PDH access 2317 2461 2608 2859 PDH Transport 200 210 210 215 SDH Access (incl Ethernet) 713 847 976 1083 SDH Transport 705 711 750 780 ($ in millions) CAGR: 7% Eclipse E300SP; TRuepoint 4000 CAGR: 3% TRuepoint 6500 CAGR: 15% Eclipse E300HP; TRuepoint 5000 TRuepoint 6000 |

| Unmatched End-to-End Product Portfolio Other Independent Suppliers Transport SDH PDH Access SDH PDH Network management solutions IP Turnkey planning, engineering, and implementation Source: Management estimates |

| A Strong Combined Offering Transport and access microwave radios Carrier-grade Ethernet transmission systems Network management software Turnkey field services Network planning Engineering Network implementation TRuepoint(tm) NetBoss(r) |

| Our Commitment to You To place a high priority on the design of a competitive Total Rewards package To communicate with you regularly throughout this process Intranet web page is up and running You may submit questions via the intranet A list of FAQs is posted and will be updated for all to review To make this transition as smooth as possible as we create a new company |

| Continue Our Day-to-Day Operations We will continue providing high quality products to our customers as efficiently and cost effectively as possible We will continue to deliver superior results to our customers We will operate as separate businesses until the close of the transaction, which is expected in 3-4 months We must receive customary regulatory approvals Stratex shareholders must approve the transaction |

| Next Steps September 5 & 6: Presentations by members of the leadership team To facilitate the creation of the new company, we will form an integration team comprised of leadership from all functional areas of both Harris and Stratex Following the close, we will emerge as a new company and market leader |

| Remember Change is never easy, but it is inevitable Your performance is the reason we can achieve this significant milestone in our growth Your continued performance will help us create a new company positioned for profitable growth |

| Thank You |