- LHX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

L3Harris (LHX) DEF 14ADefinitive proxy

Filed: 11 Mar 21, 5:18pm

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

☒ | No fee required |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: ____________________________________________________ |

| 2) | Aggregate number of securities to which transaction applies:____________________________________________________ |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| 4) | Proposed maximum aggregate value of transaction: ___________________________________________________________ |

| 5) | Total fee paid: ________________________________________________________________________________________ |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: _______________________________________________________________________________ |

| 2) | Form, Schedule or Registration Statement No.: ______________________________________________________________ |

| 3) | Filing Party: _________________________________________________________________________________________ |

| 4) | Date Filed: __________________________________________________________________________________________ |

| OUR |  |

| VALUES |

When: Friday, April 23, 2021 9:00 AM Eastern Time | Meeting Agenda Proposal 1: To elect as directors the 12 nominees named in the accompanying proxy statement for a one-year term expiring at the 2022 Annual Meeting of Shareholders. Proposal 2: To approve, in an advisory vote, the compensation of our named executive officers as disclosed in the accompanying proxy statement. Proposal 3: To ratify our Audit Committee's appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year 2021. The accompanying proxy statement more fully describes these matters. Shareholders also will act on any other business matters that may properly come before the meeting, but we have not received notice of any such matters. All holders of common stock of record at the close of business on February 26, 2021 are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. The Annual Meeting will be virtual-only, held exclusively online, due to the public health impact of COVID and to protect the health and well-being of our shareholders, employees and board of directors. The platform for the virtual Annual Meeting includes functionality that affords authenticated shareholders the same meeting participation rights and opportunities they would have at an in-person meeting. Instructions to access and log-in to the virtual Annual Meeting are provided under “Attending the Virtual Annual Meeting” on page 95 in the accompanying proxy statement, and once admitted, shareholders may view reference materials such as our list of shareholders as of the record date, submit questions and vote their shares by following the instructions that will be available on the meeting website. By Order of the Board of Directors,  Scott T. Mikuen Senior Vice President, General Counsel and Secretary Melbourne, Florida March 11, 2021 Important notice regarding the availability of proxy materials for the annual meeting of shareholders to be held on Friday, April 23, 2021: The Proxy Statement and 2021 Annual Report to Shareholders are available at: www.l3harris.com/company/environmental-social-and-governance. | |

Where: The Annual Meeting will be held exclusively online at www.virtualshareholdermeeting .com/LHX2021. | ||

YOUR VOTE IS IMPORTANT | ||

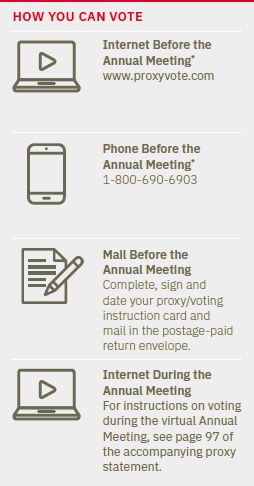

Even if you plan to attend the virtual Annual Meeting, we encourage you to vote your shares before the meeting to ensure they are counted. | ||

|

L3HARRIS 2021 PROXY STATEMENT i |

DEAR FELLOW SHAREHOLDERS |  L3HARRIS TECHNOLOGIES, INC. 1025 West NASA Boulevard Melbourne, Florida 32919 |

March 11, 2021 | ||

William M. Brown Chair & CEO | I am proud to convey the tremendous progress L3Harris made in the past year, despite unforeseen challenges, due to the heroic efforts of our employees, suppliers and customers. Thanks to them, we were able to address the global health, economic and social challenges, while meeting our stakeholder commitments and achieving our merger integration goals ahead of schedule. In the first 18 months since the merger, we made significant progress integrating two large organizations into a single high-performance, technology-focused operating company – establishing a culture anchored on shared values, embedding operational excellence throughout the company, and improving efficiencies across the enterprise by harmonizing multiple human resource and IT systems under common platforms. These actions helped foster collaboration throughout the company, leading to both cost and revenue synergies. These are substantial accomplishments even under ideal circumstances – which 2020 was not – and highlighted the resiliency and dedication of our 48,000 employees, as well as our leadership team and your Board of Directors. On behalf of your Board, I am pleased to invite you to attend the 2021 Annual Meeting of Shareholders of L3Harris Technologies, Inc. to be held on Friday, April 23, 2021. The meeting will be virtual-only, held exclusively online, due to the public health impact of COVID and to protect the health and well-being of you and our employees and directors. You therefore will not be able to attend the meeting in person. The live, interactive audio webcast of the meeting at www.virtualshareholdermeeting.com/LHX2021 will provide the ability for you to vote and submit questions online, in addition to facilitating shareholder attendance and providing a consistent experience to all shareholders regardless of location. The accompanying Notice of 2021 Annual Meeting of Shareholders and Proxy Statement describe the matters to be acted on at the meeting, which include: > election of the 12 nominees for director named in the accompanying Proxy Statement for a one-year term expiring at the 2022 Annual Meeting of Shareholders; > approval, in an advisory vote, of the compensation of our named executive officers; > ratification of the appointment of our independent registered public accounting firm for our fiscal year 2021; and > such other business as may properly come before the meeting or any adjournments or postponements thereof. | |

| ||

| Your Board unanimously recommends that you vote FOR election of its nominees for director, FOR approval, in an advisory vote, of the compensation of our named executive officers and FOR ratification of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year 2021. | ||

| It is important that your shares be represented and voted at the meeting, even if you are unable to attend. You can ensure that your shares are represented and voted at the meeting by submitting your proxy/voting instruction over the Internet or by telephone, or by mail by using the traditional proxy/voting instruction if you received your proxy materials by mail. You can find instructions for these convenient ways to vote on both the Notice of Internet Availability of Proxy Materials and the proxy/voting instruction card, as well as in the accompanying Notice of 2021 Annual Meeting of Shareholders and Proxy Statement. | ||

| Sincerely, | ||

| ||

William M. Brown Chair and Chief Executive Officer |

ii L3HARRIS 2021 PROXY STATEMENT |

| PROXY SUMMARY | 1 |

| 7 | |

| 7 | |

| 8 | |

| 9 | |

| 17 | |

| 18 | |

| 18 | |

| 22 | |

| 22 | |

| 25 | |

| 28 | |

| 29 | |

| 32 | |

| 34 | |

34 | |

| 38 | |

| 43 | |

| 46 | |

| 52 | |

| 55 | |

| 58 | |

| 60 | |

| 61 | |

| 62 | |

| CEO PAY RATIO | 87 |

| 88 | |

| 90 |

| 91 | |

| 91 | |

| 92 | |

| 92 | |

| 93 | |

| 93 | |

| 94 | |

| 95 | |

| A-1 |

L3HARRIS 2021 PROXY STATEMENT iii |

PROXY SUMMARY | 2021 Annual Meeting of Shareholders Friday, April 23, 2021 9:00 AM Eastern Time The Annual Meeting will be held exclusively online at www.virtualshareholdermeeting. com/LHX2021. Record Date: February 26, 2021 |

VOTING MATTERS | For more information | Board’s recommendation | |

Proposal 1 | Elect our Board’s 12 nominees for director for a one-year term expiring at the 2022 Annual Meeting of Shareholders | Page 7 | FOR each nominee |

| Proposal 2 | Approve, in an advisory vote, the compensation of our named executive officers as disclosed in this proxy statement | Page 33 | FOR the proposal |

| Proposal 3 | Ratify appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2021 | Page 90 | FOR the proposal |

| > | “Merger” refers to the all-stock merger completed on June 29, 2019 involving Harris Corporation (“Harris”) and L3 Technologies, Inc. (“L3”), with Harris changing its name to “L3Harris Technologies, Inc.” (“L3Harris” or “Company”); |

| > | “Harris Board,” “L3 Board” and “Harris Compensation Committee” refer to the Harris Board of Directors, the L3 Board of Directors and the Harris Management Development and Compensation Committee, respectively, prior to the completion of the Merger; |

| > | “fiscal 2020” refers to our fiscal year ended January 1, 2021; |

| > | “fiscal transition period” refers to our abbreviated six-month fiscal transition period of June 29, 2019 through January 3, 2020; and |

| > | “fiscal 2019” and “fiscal 2018” refer to our full fiscal years ended June 28, 2019 and June 29, 2018, respectively. |

L3HARRIS 2021 PROXY STATEMENT 1 |

PROXY SUMMARY BOARD AND GOVERNANCE HIGHLIGHTS |

| > | William M. Brown, Chair and CEO; |

| > | Christopher E. Kubasik, Vice Chair, President and COO; and |

| > | Ten independent directors (Sallie B. Bailey, Peter W. Chiarelli, Thomas A. Corcoran, Thomas A. Dattilo, Roger B. Fradin, Lewis Hay III, Lewis Kramer, Rita S. Lane, Robert B. Millard and Lloyd W. Newton). |

Other Current Public Company Boards | L3Harris Committee Memberships | ||||||||

Director nominee | Age | Director Since* | Principal Occupation/Experience | Audit | Compensation | Finance | Nominating and Governance | Ad Hoc Technology | |

Sallie B. Bailey | 61 | 2018 | Former EVP and CFO of Louisiana- Pacific Corporation | 2 | ■ | ■ | |||

William M. Brown | 58 | 2011 | Chair and CEO of L3Harris | 1 | |||||

Peter W. Chiarelli | 70 | 2012 | General, U.S. Army (Retired) | — | ■ | ■ | |||

Thomas A. Corcoran | 76 | 1997 | President of Corcoran Enterprises, LLC; former Senior Advisor for The Carlyle Group | 1 | ■ | ■ | |||

Thomas A. Dattilo | 69 | 2001 | Advisor for private investment firms; former Chairman and CEO of Cooper Tire & Rubber Company | 1 | ■ | ■ | |||

Roger B. Fradin | 67 | 2016 | Consultant for The Carlyle Group; former Vice Chairman of Honeywell International Inc. | 3 | ■ | ■ | |||

Lewis Hay III | 65 | 2002 | Operating Advisor for Clayton Dubilier & Rice, LLC; former Chairman and CEO of NextEra Energy, Inc. | 1 | ■ | ■ | |||

Lewis Kramer | 73 | 2009 | Former Global Client Service Partner and National Director of Audit Services of Ernst & Young LLP | 1 | ■ | ■ | |||

| Christopher E. Kubasik | 59 | 2018 | Vice Chair, President and COO of L3Harris | — | |||||

Rita S. Lane | 58 | 2018 | Former VP, Operations of Apple Inc. | 3 | ■ | ■ | |||

Robert B. Millard Lead Independent Director | 70 | 1997 | Retired Chairman of Massachusetts Institute of Technology Corporation | 1 | ■ | ■ | |||

Lloyd W. Newton | 78 | 2012 | General, U.S. Air Force (Retired); former EVP of Pratt & Whitney Military Engines | — | ■ | ■ |

*Reflects tenure with L3 or Harris board of directors, as applicable. | ■ Member | ■ Chair |

2 L3HARRIS 2021 PROXY STATEMENT |

PROXY SUMMARY BOARD AND GOVERNANCE HIGHLIGHTS |

4 UNDER 5 YEARS | 3 5 – 10 YEARS | 5 MORE THAN 10 YEARS |

| Nominee Skills and Background | of 12 nominees |

Senior P&L Experience | 9 | |||||||||||||||||||||||

Public Company Board | 11 | |||||||||||||||||||||||

M&A/Post Merger Integration | 9 | |||||||||||||||||||||||

Aerospace & Defense | 7 | |||||||||||||||||||||||

| Military Service | 3 | |||||||||||||||||||||||

| Diverse | 3 | |||||||||||||||||||||||

| Technology | 7 | |||||||||||||||||||||||

| Finance Expertise | 8 | |||||||||||||||||||||||

| Global Operations | 10 |

| > | Independent directors make up approximately 83% of the Board and 100% of each committee. |

| > | All directors elected annually; majority voting standard in uncontested elections. |

| > | Lead Independent Director broadly empowered with defined responsibilities and authority. |

| > | Independent directors regularly hold executive sessions led by Lead Independent Director. |

| > | Our Board and all standing committees conduct annual self-evaluations for continuous improvement in performance and effectiveness. |

| > | Our Board membership criteria take into account diversity of viewpoints, background, experience, personal characteristics, including gender, race, ethnicity, age, |

| > | Policy requiring directors to retire at age 75 (exception for three years for directors designated pursuant to Merger-related provisions of our governing documents). |

| > | Board reviews and evaluates management development and succession plans. |

| > | Strong ethics and business conduct program, reflecting our commitment to our Code of Conduct and broader compliance principles, to responsible corporate citizenship and sustainability and to our belief that we should conduct all business dealings with honesty, integrity and responsibility. |

L3HARRIS 2021 PROXY STATEMENT 3 |

PROXY SUMMARY PERFORMANCE HIGHLIGHTS |

| > | Meaningful stock ownership guidelines for non-employee directors. |

| > | Prohibition on short sales, hedging, other derivative transactions and pledging of our common stock by directors and executive officers. |

| > | Robust proxy access By-Law provision allowing eligible shareholders to nominate and include in our proxy materials candidates for election to our Board. |

| > | Shareholders holding at least 25% of our common stock can call a special meeting. |

| > | Annual “say-on-pay” advisory vote. |

| > | Engagement with large shareholders on key aspects of our executive compensation program and on enviromental, social and governance matters. |

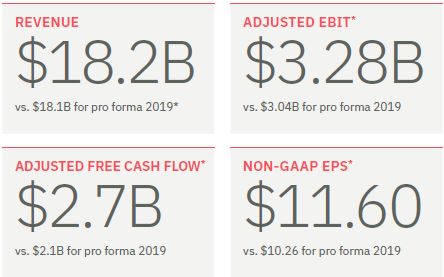

Key Fiscal 2020 Financial Results Revenue, adjusted EBIT and adjusted free cash flow results are important because they are components of performance measures used in incentive compensation. |  |

| |

In 2019, we changed our fiscal year end from the Friday nearest June 30 to the Friday nearest December 31. As a result, some of the information in this proxy statement, particularly relating to executive compensation matters, relates to the abbreviated six-month transition period of June 29, 2019 through January 3, 2020 (which we sometimes refer to as our “fiscal transition period”). |

4 L3HARRIS 2021 PROXY STATEMENT |

PROXY SUMMARY EXECUTIVE COMPENSATION HIGHLIGHTS |

| > | Executing seamless integration of L3 and Harris, including achieving at least $500 million in gross cost synergies from the Merger by the end of 2021; |

| > | Driving flawless execution and margin expansion through our e3 (excellence everywhere every day) operational excellence program; |

| > | Growing revenue through a well-aligned business portfolio and investments in innovation; |

| > | Maximizing cash flow with shareholder friendly capital deployment; and |

| > | Reshaping our portfolio to focus on high margin, high growth businesses. |

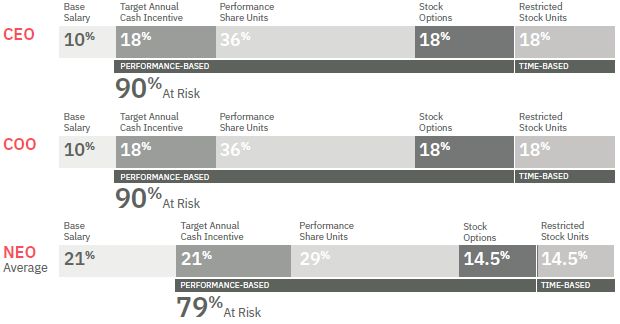

OVERALL OBJECTIVE Encourage and reward creation of sustainable, long-term shareholder value | GUIDING PRINCIPLES > Align with shareholders’ interests > Be competitive at target performance level | > Motivate achievement of financial goals and strategic objectives > Align realized pay with performance |

L3HARRIS 2021 PROXY STATEMENT 5 |

PROXY SUMMARY EXECUTIVE COMPENSATION HIGHLIGHTS |

Base Salary Level | Annual Cash Incentive Payout | Target Value of Annual Cycle Awards (Equity-Based) | |||||||

| Mr. Brown | $1,500,000 | $2,850,000 110.5% of target | $10,250,000 | ||||||

| Mr. Kubasik | $1,500,000 | $2,850,000 110.5% of target | $10,250,000 | ||||||

| Mr. Malave | $700,000 | $775,000 110.7% of target | $2,100,000 | ||||||

| Mr. Gautier | $620,000 | $575,000 92.7% of target | $1,600,000 | ||||||

| Mr. Zoiss | $620,000 | $720,000 116.1% of target | $1,600,000 | ||||||

6 L3HARRIS 2021 PROXY STATEMENT |

Our Board unanimously recommends voting FOR election of its 12 nominees for director for a one- year term expiring at the 2022 Annual Meeting of Shareholders. | > With a diverse mix of backgrounds, skills and experience and a track record of driving long-term shareholder value, as well as a deep and unique understanding of our business and the challenges and opportunities L3Harris faces, our Board is well positioned to discharge its responsibilities. > Nominees collectively have broad and diverse leadership experience and many other qualifications, skills and attributes that our Board views as valuable to L3Harris. > Healthy balance of shorter and longer tenures among nominees, all of whom are independent, except Mr. Brown, our Chair and CEO, and Mr. Kubasik, our Vice Chair, President and COO. |

| > | William M. Brown, Chair and Chief Executive Officer; |

| > | Christopher E. Kubasik, Vice Chair, President and Chief Operating Officer; and |

| > | Ten independent directors (Sallie B. Bailey, Peter W. Chiarelli, Thomas A. Corcoran, Thomas A. Dattilo, Roger B. Fradin, Lewis Hay III, Lewis Kramer, Rita S. Lane, Robert B. Millard and Lloyd W. Newton). |

L3HARRIS 2021 PROXY STATEMENT 7 |

| > | Demonstrated ability and sound judgment; |

| > | Personal qualities and characteristics, accomplishments and reputation in the business community or in the individual’s profession, professional integrity, educational background, business experience and related experience; |

| > | Willingness to objectively appraise management performance; |

| > | Current knowledge and contacts in the markets in which we do business and in our industry or other relevant industries, giving due consideration to potential conflicts of interest; |

| > | Ability and willingness to commit adequate time to Board and committee matters, including attendance at Board, committee and annual shareholder meetings; |

| > | Diversity of viewpoints, background, experience, personal characteristics, including gender, race, ethnicity, age, sexual orientation and similar demographics; |

| > | The number of other boards of which the individual is a member; and |

| > | Compatibility of the individual’s experience, qualifications, attributes or skills and personality with those of other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of L3Harris and the interests of our shareholders. |

8 L3HARRIS 2021 PROXY STATEMENT |

PROPOSAL 1: ELECTION OF DIRECTORS NOMINEE BIOGRAPHIES |

| > | Prior to each annual meeting of shareholders, each current director discusses his or her participation on our Board and its committees and other relevant matters with our Chair. |

| > | Each current director also is requested to discuss any concerns or issues regarding continued membership on our Board with the Chair of our Nominating and Governance Committee. |

| > | In addition, our Nominating and Governance Committee reviews each current director’s experience, qualifications, attributes, skills, tenure, contributions, other directorships, meeting attendance record, any changes in employment status and other information it deems helpful in considering and evaluating the director for nomination. |

L3HARRIS 2021 PROXY STATEMENT 9 |

PROPOSAL 1: ELECTION OF DIRECTORS NOMINEES FOR ELECTION |

L3Harris Committees > Audit > Finance | Sallie B. Bailey | Age: 61 Director since Apr. 2018 | Independent Director | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Knowledge of corporate finance, capital raising, strategic planning, banking relationships, operations, complex information technology and other systems, enterprise risk management and investor relations > Knowledge and experience with complex financial and accounting functions and internal controls > Knowledge of complex financial, operational, management and strategic issues faced by a large global company > Public company board and corporate governance experience | |||||

| > | Executive Vice President and Chief Financial Officer of Louisiana-Pacific Corporation (Dec. 2011 - July 2018) |

| > | Vice President and Chief Financial Officer of Ferro Corporation (Jan. 2007 - July 2010) |

| > | 11-year career at The Timken Company in various senior management positions of increasing responsibility (1995 - 2006), lastly as Senior Vice President, Finance and Controller |

| > | Previously with Tenneco Inc. in various finance organization roles (1988 - 1995), lastly as Assistant Treasurer |

| > | Previously with Deloitte and Touche LLP as an audit supervisor |

| > | NVR, Inc. (since 2020) |

| > | The AZEK Company Inc. (since 2020) |

| > | General Cable Corporation (2013 - 2018) |

L3Harris Committees > None | William M. Brown | Age: 58 Director since Dec. 2011 | Employee Director (not independent) | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Current role as our Chief Executive Officer and his leadership and management skills > Knowledge of complex strategic, operational, management and financial issues faced by a large company with international operations > Knowledge and expertise related to strategic planning, global supply chain and procurement, productivity and lean manufacturing initiatives, international sales, marketing and operations, domestic and international mergers and acquisitions, regulatory challenges, and enterprise risk management > Public company board and governance experience | |||||

| > | Chair of the Board and Chief Executive Officer of L3Harris Technologies, Inc. (since June 29, 2019) |

| > | Chairman of the Board, President and Chief Executive Officer of Harris Corporation (April 2014 - June 28, 2019) |

| > | President and Chief Executive Officer of Harris Corporation (Nov. 2011 - April 2014) |

| > | 14-year career in U.S. and international roles at United Technologies Corporation (“UTC” and now known as Raytheon Technologies Corporation), a diversified global building and aerospace company (1997 - 2011), including Senior Vice President, Corporate Strategy and Development; 5 years as President of UTC’s Fire & Security Division; and President of Asia Pacific Operations of UTC’s Carrier Corporation |

| > | Previously with McKinsey & Company as senior engagement manager and with Air Products and Chemicals, Inc. as project engineer |

| > | Celanese Corporation (since 2016) |

10 L3HARRIS 2021 PROXY STATEMENT |

PROPOSAL 1: ELECTION OF DIRECTORS NOMINEES FOR ELECTION |

L3Harris Committees > Ad Hoc Technology (Chair) > Audit | Peter W. Chiarelli | Age: 70 Director since Aug. 2012 | Independent Director | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Knowledge and expertise in complexities of both U.S. and international militaries, defense communities and defense industries > Extensive background in military operations and national security > Experience addressing complex operational and strategic issues, managing significant operating budgets, and handling legislative and public affairs | |||||

| > | Chief Executive Officer, 1560 LLC, a company engaged in public policy and electoral research and analysis (2018 - 2019) |

| > | Chief Executive Officer of One Mind, a non-profit organization bringing together healthcare providers, researchers and academics to cure brain disorders (April 2012 - Jan. 2018) |

| > | General, U.S. Army (Retired), retired in March 2012 after nearly 40 years of service with U.S. Army, commanding troops at all levels from platoon to Multi-National Corps and holding various senior officer positions, including: |

| ■ | Vice Chief of Staff (Army’s second-highest-ranking officer), with responsibility for oversight of day-to-day operations and for leading budget planning and execution and efforts to modernize equipment, procedures and formations |

| ■ | Senior Military Assistant, Secretary of Defense |

| ■ | Commander of Multi-National Corps - Iraq |

| ■ | Division Commander, Fort Hood, Texas and Baghdad, Iraq |

| ■ | U.S. Army Chief of Operations, Training and Mobilization |

| ■ | Executive Officer, Supreme Allied Commander, Europe |

L3Harris Committees > Audit > Finance | Thomas A. Corcoran | Age: 76 Director since June 29, 2019 (1997 including L3 service) | Independent Director | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Knowledge of complex operational, management, financial, strategic and governance issues faced by large public companies > Knowledge and expertise related to global supply chain, manufacturing, human resources, accounting and internal controls, finance and economic analysis and mergers and acquisitions > Knowledge of, and management experience with, aerospace and defense and technology industries and with the government procurement process, including with major U.S. Department of Defense programs > Public company board and governance experience | |||||

| > | President, Corcoran Enterprises, LLC, a private management consulting firm (since 2001) |

| > | Senior Advisor, The Carlyle Group, a global alternative asset manager (2001 - 2017) |

| > | President and Chief Executive Officer, Gemini Air Cargo, an aircraft, crew, maintenance and insurance cargo airline (March 2001 - April 2004) |

| > | President and Chief Executive Officer, Allegheny Teledyne Incorporated, a global manufacturer of technically advanced specialty materials and complex components (Oct. 1999 - Dec. 2000) |

| > | President and Chief Operating Officer, Electronic Systems Sector and Space & Strategic Missiles Sector, Lockheed Martin Corporation, a global aerospace, defense, security and advanced technologies company (April 1993 - Sept. 1999) |

| > | 26-year career at General Electric in various management positions |

| > | Aerojet Rocketdyne Holdings, Inc. (since 2008) |

| > | L3 Technologies, Inc. (1997 - June 28, 2019) |

L3HARRIS 2021 PROXY STATEMENT 11 |

PROPOSAL 1: ELECTION OF DIRECTORS NOMINEES FOR ELECTION |

L3Harris Committees > Compensation > Nominating and Governance | Thomas A. Dattilo | Age: 69 Director since Aug. 2001 | Independent Director | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Knowledge of complex operational, management, financial, strategic and governance issues faced by a large global public company > Knowledge and expertise related to global supply chain and distribution, mergers and acquisitions, lean manufacturing and related initiatives, international operations, human resources and talent management, accounting and internal controls, and investor relations > Experience and knowledge related to strategic planning, capital raising, mergers and acquisitions, and economic analysis > Public company board, governance and executive compensation experience | |||||

| > | Advisor to various private investment firms (currently) |

| > | Chairman and Senior Advisor to Portfolio Group, a privately-held provider of outsourced financial services to automobile dealerships specializing in aftermarket extended warranty and vehicle service contract programs (Jan. 2013 - June 2016) |

| > | Senior Advisor for Cerberus Operations and Advisory Company, LLC, a unit of Cerberus Capital Management, a private investment firm (2007 - 2009) |

| > | Chairman, President and Chief Executive Officer of Cooper Tire & Rubber Company (“Cooper”), which specializes in design, manufacture and sale of passenger car and truck tires (2000 - 2006) |

| > | President and Chief Operating Officer of Cooper (1999 - 2000) |

| > | Previously held senior positions with Dana Corporation, including President of its sealing products group |

| > | Canoo Inc. (since 2020) |

| > | Solera Holdings, Inc. (2013 - 2016) |

L3Harris Committees > Ad Hoc Technology > Finance (Chair) | Roger B. Fradin | Age: 67 Director since Oct. 2016 | Independent Director | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Knowledge of complex strategic, operational, financial, management and governance issues faced by a large public company > Knowledge of domestic and international operations, business development, strategic planning, product development and marketing, technology innovation, corporate finance, mergers and acquisitions, human resources and talent management, accounting and internal controls > Entrepreneurial background, with experience in driving growth for business and entering new markets, both organically and through acquisitions > Knowledge and experience in capital markets and finance matters > Public company board and governance experience | |||||

| > | Chairman of Resideo Technologies, Inc., a residential comfort, thermal and security solutions provider (since 2018) |

| > | Chief Executive Officer of Juniper Industrial Holdings, Inc., a special purpose acquisition company focused on industrial and aerospace acquisitions (Oct. 2019 - Jan. 2020) |

| > | Consultant (since 2020) and Operating Executive (Feb. 2017 - 2020) for The Carlyle Group, a global alternative asset manager |

| > | 17-year career in senior positions with Honeywell International Inc., a diversified technology and manufacturing company (2000 - 2017), including: |

| ■ | Vice Chairman (2014 - 2017) |

| ■ | President and Chief Executive Officer, Automation and Controls business unit (2004 - 2014) |

| ■ | President and Chief Executive Officer, Security and Fire Solutions business unit |

| > | Juniper Industrial Holdings, Inc. (since 2019) |

| > | Resideo Technologies, Inc. (since 2018) |

| > | Vertiv Holdings Co (formerly GS Acquisition Holdings Corp) (since 2018) |

| > | Pitney Bowes Inc. (2012 - 2019) |

| > | MSC Industrial Direct Co., Inc. (1998 - 2019) |

12 L3HARRIS 2021 PROXY STATEMENT |

PROPOSAL 1: ELECTION OF DIRECTORS NOMINEES FOR ELECTION |

L3Harris Committees > Compensation (Chair) > Nominating and Governance | Lewis Hay III | Age: 65 Director since Feb. 2002 | Independent Director | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Knowledge of complex strategic, operational, management, regulatory, financial and governance issues faced by a large public company > Knowledge and expertise related to strategic planning, capital raising, financial planning, enterprise risk management, accounting and internal controls, mergers and acquisitions, investor relations and renewable energy and other environmental matters > Public company board, governance and executive compensation experience | |||||

| > | Operating Advisor for Clayton, Dubilier & Rice, LLC, a private equity investment firm (since Jan. 2014) |

| > | 14-year career in senior positions with NextEra Energy, Inc. (formerly FPL Group, Inc.) (“NextEra”), one of the nation’s leading electricity-related services companies and the largest renewable energy generator in North America (1999 - 2013), including: |

| ■ | Chief Executive Officer of NextEra (June 2001 - July 2012) |

| ■ | Chairman of NextEra (Jan. 2002 - Dec. 2013) |

| > | Anthem, Inc. (since 2013) |

| > | Capital One Financial Corporation (2003 - 2019) |

L3Harris Committees > Audit (Chair) > Compensation | Lewis Kramer | Age: 73 Director since June 29, 2019 (2009 including L3 service) | Independent Director | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Knowledge and experience with complex financial, audit and accounting matters and complex information technology and other systems > Knowledge of capital structure and related credit and finance matters, enterprise risk management and mergers and acquisitions > Extensive financial and business knowledge gained while serving as an independent auditor for numerous organizations across many industries > Public company board, governance and executive compensation experience > Expertise on functioning of audit committees and internal-control related matters | |||||

| > | Retired from Ernst & Young LLP, a multinational professional services firm, in June 2009 after a nearly 40-year career during which he served on the firm’s U.S. Executive Board and held various senior positions including: |

| ■ | Global Client Service Partner for worldwide external audit and all other services for major clients |

| ■ | National Director of Audit Services |

| > | Las Vegas Sands Corp. (since 2017) |

| > | L3 Technologies, Inc. (2009 - June 28, 2019) |

L3HARRIS 2021 PROXY STATEMENT 13 |

PROPOSAL 1: ELECTION OF DIRECTORS NOMINEES FOR ELECTION |

L3Harris Committees > None | Christopher E. Kubasik | Age: 59 Director since June 29, 2019 (2018 including L3 service) | Employee Director (not independent) | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Current role as our President and Chief Operating Officer and his leadership and management skills > Knowledge and experience with complex strategic, operational, management and financial issues faced by a large aerospace and defense company with international operations > Knowledge and experience with complex financial and accounting functions and internal controls, mergers and acquisitions, human resources and talent development > Broad experience in aerospace, defense, and technology industries and with business development and the government procurement process, as well as deep knowledge of Department of Defense customers > Public company board and governance experience | |||||

| > | Vice Chair, President and Chief Operating Officer of L3Harris Technologies, Inc. (since June 29, 2019) |

| > | Chairman, Chief Executive Officer and President of L3 Technologies, Inc. (May 2018 - June 28, 2019) |

| > | Chief Executive Officer and President of L3 Technologies, Inc. (Jan. 2018 - April 2018) |

| > | President and Chief Operating Officer of L3 Technologies, Inc. (Oct. 2015 - Dec. 2017) |

| > | 13-year career in various senior executive positions with Lockheed Martin Corporation, a global aerospace, defense, security and advanced technologies company, including 3 years as Vice Chairman, President and Chief Operating Officer |

| > | 17-year career with Ernst & Young LLP, where he was named partner in 1996 |

| > | L3 Technologies, Inc. (2018 - June 28, 2019) |

| > | Spirit AeroSystems Holdings, Inc. (2013 - 2016) |

L3Harris Committees > Compensation > Finance | Rita S. Lane | Age: 58 Director since June 29, 2019 (2018 including L3 service) | Independent Director | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Knowledge and expertise related to global supply chain and distribution, manufacturing, sales and marketing and complex information technology and related systems > Knowledge and expertise related to strategic planning, technology innovation and research and development > Knowledge of complex operational, management, financial and operational issues faced by large global companies > Public company board and governance experience | |||||

| > | Vice President, Operations of Apple Inc., where she oversaw the launch of the iPad® and manufacturing of the Mac® Desktop & Accessories product lines (July 2008 - Jan. 2014) |

| > | Senior Vice President, Integrated Supply Chain and Chief Procurement Officer of Motorola Solutions, Inc. (June 2006 - July 2008) |

| > | 14-year career with International Business Machines Corporation serving within the Systems & Personal Computer division and as Vice President, Integrated Supply Chain |

| > | Served for 5 years in the U.S. Air Force, ultimately as a Captain |

| > | Amphenol Corporation (since 2020) |

| > | Sanmina Corporation (since 2016) |

| > | Signify N.V. (since 2016) |

| > | L3 Technologies, Inc. (2018 - June 28, 2019) |

14 L3HARRIS 2021 PROXY STATEMENT |

PROPOSAL 1: ELECTION OF DIRECTORS NOMINEES FOR ELECTION |

L3Harris Committees > Ad Hoc Technology > Nominating and Governance | Robert B. Millard | Age: 70 Director since June 29, 2019 (1997 including L3 service) | Lead Independent Director (since June 29, 2019) | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Knowledge and expertise related to corporate finance, capital raising, financial planning, accounting, mergers and acquisitions, and economic analysis > Experience and knowledge related to strategic planning, product development, technology innovation, and talent management > Public company board, governance and executive compensation experience | |||||

| > | Chairman of the Massachusetts Institute of Technology Corporation (2014-2020; now Chairman Emeritus) |

| > | Held various positions in business, including: |

| ■ | Managing Director at Lehman Brothers and its predecessors (1976 - 2008) |

| ■ | Chairman of Realm Partners L.L.C. (2009 - 2014) |

| > | Evercore Inc. (since 2012) |

| > | L3 Technologies, Inc. (1997 - June 28, 2019) |

L3Harris Committees > Ad Hoc Technology > Nominating and Governance (Chair) | Lloyd W. Newton | Age: 78 Director since June 29, 2019 (2012 including L3 service) | Independent Director | ||

Qualifications, Skills and Attributes Valuable to L3Harris | |||||

> Knowledge and expertise in complexities of U.S. military and defense industry and extensive background in U.S. Department of Defense operations and human resources > Experience addressing complex organizational and strategic issues, managing significant operating budgets and handling legislative and public affairs > Knowledge of, and experience with, large aerospace and defense government projects and with the procurement process, including with major U.S. Department of Defense programs, and with complex operations, business development and technology-driven business environments > Public company board and governance experience | |||||

| > | Executive Vice President, Pratt & Whitney Military Engines, an aerospace manufacturer (Sept. 2000 - March 2006) |

| > | Four-Star General and Commander, U.S. Air Force (Retired), retired in August 2000, after 34 years of service. Responsible for the recruiting, training and education of all Air Force personnel from 1997 until his retirement. Also served as an Air Force congressional liaison officer with the U.S. House of Representatives and was a member of the Air Force’s Air Demonstration Squadron, the Thunderbirds |

| > | L3 Technologies, Inc. (2012 - June 28, 2019) |

| > | Torchmark Corporation (2006 - 2018) |

L3HARRIS 2021 PROXY STATEMENT 15 |

PROPOSAL 1: ELECTION OF DIRECTORS DIRECTOR NOMINATION PROCESS |

| > | The shareholder or shareholder group must have owned 3% or more of the outstanding shares of our common stock continuously for at least three years. |

| > | The maximum number of proxy access nominees permitted is the greater of two or 20% of our Board (rounded down to the nearest whole number). |

| > | The shareholder(s) and the nominee(s) must satisfy additional eligibility and procedural requirements set forth in Article II, Section 11 of our By-Laws, including that a proxy access nomination notice must be delivered to us within a prescribed time period in advance of our Annual Meeting of Shareholders (see page 94 for the specific timeframe that applies to nominations for our 2022 Annual Meeting of Shareholders) and that all nominees and nominating shareholder(s) provide certain information, representations and agreements to us. |

16 L3HARRIS 2021 PROXY STATEMENT |

PROPOSAL 1: ELECTION OF DIRECTORS BOARD REFRESHMENT POLICY |

| > | William M. Brown, Chair and Chief Executive Officer (formerly Harris’ Chairman, President and Chief Executive Officer); |

| > | Christopher E. Kubasik, Vice Chair, President and Chief Operating Officer (formerly L3’s Chairman, Chief Executive Officer and President); |

| > | Five independent directors from the Harris Board (Sallie B. Bailey, Peter W. Chiarelli, Thomas A. Dattilo, Roger B. Fradin and Lewis Hay III); and |

| > | Five independent directors from the L3 Board (Thomas A. Corcoran, Lewis Kramer, Rita S. Lane, Robert B. Millard and Lloyd W. Newton). |

L3HARRIS 2021 PROXY STATEMENT 17 |

| > | Board composition |

| > | Director independence |

| > | Selection of Chair |

| > | Designation and responsibilities of Lead Independent Director |

| > | Selection of Board nominees |

| > | Board membership criteria |

| > | Majority voting for directors |

| > | Director retirement policy |

| > | Other directorships |

| > | Director compensation |

| > | Stock ownership guidelines |

| > | Prohibitions on hedging |

| > | Prohibition on margin accounts and pledging transactions |

| > | Meeting schedules and agenda |

| > | Executive sessions of independent directors |

| > | Access to management |

| > | Board committees and membership |

| > | Board and director responsibilities |

| > | Director orientation and continuing education |

| > | CEO performance evaluation and compensation |

| > | Succession planning |

| > | Board and committee self-evaluations |

| > | overseeing the conduct of our business and reviewing and approving our long-term strategy, key strategic and financial objectives and operating plans and other significant actions; |

| > | overseeing the management of our business and other enterprise risks and our enterprise risk management process; |

| > | establishing and maintaining an effective governance structure, including appropriate board composition; |

| > | planning for board succession and appointing directors to fill Board vacancies between annual meetings of shareholders; |

| > | selecting our CEO and COO, electing our corporate officers, evaluating the performance of our CEO, COO and other executive officers, planning for CEO succession and monitoring management’s succession planning for other executive officers; |

| > | determining CEO and COO compensation and overseeing the determination of other executive officer compensation; |

| > | overseeing our ethics and compliance programs and periodically assessing our culture; and |

| > | overseeing our systems of control which promote accurate and timely reporting of financial information to shareholders and our processes for maintaining the integrity of our financial statements and other public disclosures. |

18 L3HARRIS 2021 PROXY STATEMENT |

CORPORATE GOVERNANCE OUR BOARD'S ROLE AND RESPONSIBILITIES |

| > | Full Board – elements of risk related to Company-wide and business unit annual operating plans, three-year strategic plans, cybersecurity, merger, acquisition and portfolio shaping opportunities, market environment updates, regular financial and operations updates and other strategic discussions. |

| > | Audit Committee – elements of risk related to financial reporting, internal audit, internal control over financial reporting, auditor independence and related areas of accounting, taxation, law and regulation. |

| > | Compensation Committee – elements of risk related to compensation policies and practices and talent management and succession planning. |

| > | Finance Committee – elements of risk related to liquidity, financial arrangements, capital structure, ability to access capital markets and the financial and investment aspects of our defined contribution and defined benefit plans. |

| > | Nominating and Governance Committee – elements of risk related to corporate governance issues and various aspects of U.S. and international regulatory compliance, ethics, business conduct, social responsibility, environmental, health and safety matters and export/import controls. |

L3HARRIS 2021 PROXY STATEMENT 19 |

CORPORATE GOVERNANCE OUR BOARD'S ROLE AND RESPONSIBILITIES |

| > | consideration and assessment of key leadership talent throughout our Company; |

| > | our talent strategy for critical positions, including roles for which it may be necessary to consider external candidates; and |

| > | contingency plans in the event the CEO or another executive officer unexpectedly is unable to serve for any reason, including death or disability. |

| > | Respect in the workplace |

| > | Health and safety |

| > | Privacy of personally identifiable information |

| > | Avoiding conflicts of interest |

| > | Working with governments |

| > | Commitment to quality |

| > | Preventing bribery and corruption |

| > | Business courtesies |

| > | Fair competition |

| > | Exports, imports and trade compliance |

| > | Confidential information and intellectual property |

| > | Material non-public information and insider trading |

| > | Communicating L3Harris information |

| > | Social media |

| > | Business records and record management |

| > | Protecting L3Harris and customer assets |

| > | Political activities and lobbying |

| > | Human rights |

| > | Corporate responsibility |

20 L3HARRIS 2021 PROXY STATEMENT |

CORPORATE GOVERNANCE OUR BOARD'S ROLE AND RESPONSIBILITIES |

L3HARRIS 2021 PROXY STATEMENT 21 |

CORPORATE GOVERNANCE STOCK OWNERSHIP GUIDELINES FOR NON-EMPLOYEE DIRECTORS |

| > | Our non-employee directors are expected to own L3Harris stock or stock equivalent units having a minimum value equal to five times the annual cash retainer for service as a member of our Board. |

| > | Directors are expected to meet these levels within five years after election or appointment to our Board (or five years from the closing of the Merger, in the case of non-employee directors designated by Harris or L3 in connection with the Merger). |

| > | a combined position of Chair of the Board (“Chair”) and CEO; |

| > | a Vice Chair of the Board (“Vice Chair”); |

| > | a Lead Independent Director with well-defined duties that support our Board’s oversight responsibilities; |

| > | a robust committee structure comprised solely of independent directors; and |

| > | engaged Board members who are independent (other than our current Chair and CEO and our current Vice Chair, President and COO) and who conduct candid and constructive discussions and deliberations. |

22 L3HARRIS 2021 PROXY STATEMENT |

CORPORATE GOVERNANCE BOARD LEADERSHIP STRUCTURE |

| > | the Lead Independent Director structure; |

| > | the independence of each director, other than Messrs. Brown and Kubasik; |

| > | the ability of independent directors to participate in the agenda-setting process for our Board and committee meetings; |

| > | regularly scheduled executive sessions of independent directors; and |

| > | our directors’ access to management. |

| > | Mr. Brown will serve as our Chair and CEO through the second anniversary of the Merger (June 29, 2021), then step down as CEO and continue to serve for one additional year as Chair. On the third anniversary of the Merger (June 29, 2022), he will retire as an officer and employee of L3Harris and resign as a member of our Board. |

| > | Mr. Kubasik will serve as Vice Chair, President and COO through the second anniversary of the Merger (June 29, 2021, or, if earlier, the date that Mr. Brown ceases to serve as our CEO), at which point he will become our CEO. On the third anniversary of the Merger (June 29, 2022), Mr. Kubasik will become our Chair. |

L3HARRIS 2021 PROXY STATEMENT 23 |

CORPORATE GOVERNANCE BOARD LEADERSHIP STRUCTURE |

Role of Lead Independent Director When our Chair is not an independent director, our independent directors (by affirmative majority vote) designate one independent Board member to serve as Lead Independent Director. Service as Lead Independent Director generally is for a one-year term commencing on the date of our Annual Meeting of Shareholders. Until the third anniversary of the completion of the Merger, our Lead Independent Director must be a director designated by L3 prior to the Merger, who may be removed as Lead Independent Director prior to that anniversary only with the approval of at least 75% of the other then-serving independent directors. The responsibilities and authority of our Lead Independent Director include: | ||||

> Presiding at all meetings of our Board at which our Chair is not present, including executive sessions of our independent directors; > Serving as liaison between our Chair and our independent directors; > Approving the information sent to our Board and the meeting agendas for our Board; > Approving our Board meeting schedules to assure sufficient time for discussion of all agenda items; > Calling meetings of our independent directors; > Being available for consultation and direct communication with major shareholders, if they request and consistent with our policies regarding shareholder communications; > Providing timely feedback from executive sessions of our independent directors to our CEO or other members of senior management; | > Playing a key role in the annual CEO and COO evaluation process, together with the Chair of our Compensation Committee (or the Chair of our Nominating and Governance Committee if the same individual is serving as Lead Independent Director and Chair of our Compensation Committee); > Playing a key role in our Board’s annual self-evaluation process and related matters, together with the Chair of our Nominating and Governance Committee (or the Chair of our Compensation Committee if the same individual is serving as Lead Independent Director and Chair of our Nominating and Governance Committee); > Guiding and playing a key role in the CEO succession planning process; and > Other responsibilities and authority as our Board may determine from time to time. | |||

The designation of a Lead Independent Director is not intended to inhibit communications among our directors or between any of them and our Chair. | ||||

24 L3HARRIS 2021 PROXY STATEMENT |

CORPORATE GOVERNANCE BOARD COMMITTEES |

| Audit Committee | Chair Lewis Kramer | Members Sallie B. Bailey Peter W. Chiarelli Thomas A. Corcoran |

Key responsibilities

| > | Assisting our Board in overseeing, among other things: the quality and integrity of our financial statements; our compliance with relevant legal and regulatory requirements; our internal control over financial reporting; our independent registered public accounting firm’s qualifications and independence; and the performance of our internal audit function and our independent registered public accounting firm. |

> | Directly appointing, compensating, retaining, terminating and overseeing the work of our independent registered public accounting firm. |

| > | Pre-approving all audit services, internal control-related services and non-audit services to be provided by our independent registered public accounting firm. |

> | Reviewing and discussing with our independent registered public accounting firm, our internal audit department and our management any major issues regarding accounting principles and financial statement presentations, the effect of regulatory |

> | Discussing guidelines and policies governing management’s risk assessment process. |

> | Reviewing and discussing our earnings press releases, the types of financial information and earnings guidance we provide, and the types of presentations made by us to analysts and rating agencies. |

> | Reviewing and discussing quarterly and year-end operating results with our independent registered public accounting firm, our internal audit department and our management; reviewing our interim financial statements prior to their inclusion in our Form 10-Q filings; and recommending to our Board the inclusion of our annual financial statements in our Annual Reports on Form 10-K. |

> | is independent within the meaning of NYSE listing standards, applicable laws and rules and our Director Independence Standards; and |

> | satisfies the “financial literacy” requirements of NYSE listing standards and has “accounting or related financial management expertise.” |

L3HARRIS 2021 PROXY STATEMENT 25 |

CORPORATE GOVERNANCE BOARD COMMITTEES |

| Compensation Committee | Chair Lewis Hay III | Members Thomas A. Dattilo Lewis Kramer Rita S. Lane |

| ➢ | Reviewing management training, development, organizational structure and succession plans, and recommending to our Board individuals for election as officers, including executive officers. |

| ➢ | Overseeing and reviewing our overall compensation philosophy, establishing the compensation and benefits of our executive officers and administering our equity-based compensation plans. |

| ➢ | Reviewing and approving corporate goals and objectives relevant to the compensation of our CEO and COO, evaluating our CEO’s and COO’s respective performance against those goals and objectives, and together with all independent directors of our Board, determining and approving annual salary, cash and equity incentives and other executive benefits for our CEO and COO based on this evaluation. |

| ➢ | Reviewing and approving the annual salary, cash and equity incentives and other benefits for our other executive officers. |

| ➢ | Reviewing and approving employment, separation, severance and change in control agreements and plans and terms and any special arrangements in the event of termination of employment, death or retirement of executive officers. |

| ➢ | Determining stock ownership guidelines for our CEO, COO, executive officers and other corporate officers and overseeing compliance with such guidelines. |

| ➢ | Overseeing regulatory compliance with applicable executive compensation laws, rules and regulations and with NYSE listing standards regarding shareholder approval of equity compensation plans. |

| ➢ | Reviewing, in consultation with our Nominating and Governance Committee, responses to shareholder proposals regarding matters falling within the responsibilities and duties of our Compensation Committee. |

| ➢ | Reviewing management’s assessment of the effect on our business of risks from our compensation policies and practices and periodically discussing such matters with management. |

| ➢ | Reviewing our diversity and inclusion efforts. |

| ➢ | Reviewing and discussing the “Compensation Discussion and Analysis” section of our proxy statement with management and making a recommendation to our Board on the inclusion of such section in our proxy statement. |

| ➢ | Retaining and terminating independent executive compensation consultants, including approving such consultants’ fees and other retention terms. |

| Finance Committee | Chair Roger B. Fradin | Members Sallie B. Bailey Thomas A. Corcoran Rita S. Lane |

> | Periodically reviewing our financial position, capital structure, working capital, capital transactions, equity investments, debt ratings and other matters relating to our financial condition. |

> | Reviewing our dividend policy, capital asset plan and share repurchase policy and making recommendations to our Board relating to such policies. |

| > | Overseeing the financial and investment policies and objectives applicable to our material benefit plans. |

26 L3HARRIS 2021 PROXY STATEMENT |

CORPORATE GOVERNANCE BOARD COMMITTEES |

| Nominating and Governance Committee | Chair Lloyd W. Newton | Members Thomas A. Dattilo Lewis Hay III Robert B. Millard |

| > | Identifying and recommending qualified individuals for election or re-election to our Board and filling vacancies on our Board. |

| > | Adopting a policy and procedures for considering director candidates recommended by our shareholders. |

| > | Developing, reviewing and recommending to our Board our Corporate Governance Guidelines and monitoring trends and evolving practices in corporate governance. |

| > | Periodically assessing the adequacy of our corporate governance framework, including our Restated Certificate of Incorporation and By-Laws, and recommending changes to our Board for approval, as appropriate. |

| > | Developing, reviewing and recommending to our Board director compensation and benefit plans. |

| > | Reviewing, and making recommendations to our Board concerning, the structure, size, composition and operation of our Board and its committees, including recommending committee assignments. |

| > | Developing, reviewing and recommending to our Board the meeting schedule for our Board and its committees, in consultation with our Lead Independent Director and each committee chair. |

| > | Reviewing, and approving or ratifying, related person transactions in accordance with relevant policies. |

| > | Reviewing and making recommendations to our Board regarding shareholder proposals and a process for shareholder communications with our Board. |

| > | Facilitating our Board’s annual self-evaluation of its performance and effectiveness. |

| > | Retaining and terminating independent director compensation consultants, including approving such consultants’ fees and other retention terms. |

| > | Assisting our Board in overseeing our ethics and business conduct program consistent with sound, ethical business practices and legal requirements. |

| > | Assisting our Board in overseeing our environmental, health and safety programs and charitable, civic, educational and philanthropic activities. |

| > | Reviewing and taking appropriate action concerning strategic issues and trends relating to corporate citizenship and responsibility, including social and political trends and public policy issues that may have an impact on our operations, financial performance or public image. |

| Ad Hoc Technology Committee | Chair Peter W. Chiarelli | Members Roger B. Fradin Robert B. Millard Lloyd W. Newton |

L3HARRIS 2021 PROXY STATEMENT 27 |

CORPORATE GOVERNANCE OTHER GOVERNANCE MATTERS |

| Board / Committee | Number of Meetings Held | Average Meeting Attendance |

Board of Directors | 10 | 100% |

| Audit Committee | 8 | 100% |

| Compensation Committee | 6 | 100% |

| Finance Committee | 2 | 100% |

| Nominating and Governance Committee | 5 | 100% |

| Ad Hoc Technology Committee | 2 | 100% |

28 L3HARRIS 2021 PROXY STATEMENT |

CORPORATE GOVERNANCE DIRECTOR COMPENSATION AND BENEFITS |

> | Board member: $130,000 annual cash retainer and $165,000 annual equity-based retainer in the form of director share units (described in more detail below) |

> | Lead Independent Director: $35,000 annual cash retainer |

> | Chair of Audit Committee: $30,000 annual cash retainer |

> | Chair of any other committee: $20,000 annual cash retainer |

L3HARRIS 2021 PROXY STATEMENT 29 |

CORPORATE GOVERNANCE DIRECTOR COMPENSATION AND BENEFITS |

30 L3HARRIS 2021 PROXY STATEMENT |

CORPORATE GOVERNANCE DIRECTOR COMPENSATION AND BENEFITS |

| Non-Employee Director | Fees Earned or Paid in Cash $(1) | Stock Awards $(2) | Option Awards $(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings $(4) | All Other Compensation $(5) | Total $ | ||||||||||||||||||

| Sallie B. Bailey | $ | 130,000 | $ | 164,980 | $ | 0 | $ | 0 | $ | 7,500 | $ | 302,480 | ||||||||||||

| Peter W. Chiarelli | $ | 150,000 | $ | 164,980 | $ | 0 | $ | 0 | $ | 0 | $ | 314,980 | ||||||||||||

| Thomas A. Corcoran | $ | 130,000 | $ | 164,980 | $ | 0 | $ | 0 | $ | 0 | $ | 294,980 | ||||||||||||

| Thomas A. Dattilo | $ | 130,000 | $ | 164,980 | $ | 0 | $ | 0 | $ | 10,000 | $ | 304,980 | ||||||||||||

| Roger B. Fradin | $ | 150,000 | $ | 164,980 | $ | 0 | $ | 0 | $ | 10,000 | $ | 324,980 | ||||||||||||

| Lewis Hay III | $ | 150,000 | $ | 164,980 | $ | 0 | $ | 0 | $ | 0 | $ | 314,980 | ||||||||||||

| Lewis Kramer | $ | 160,000 | $ | 164,980 | $ | 0 | $ | 0 | $ | 0 | $ | 324,980 | ||||||||||||

| Rita S. Lane | $ | 130,000 | $ | 164,980 | $ | 0 | $ | 0 | $ | 10,000 | $ | 304,980 | ||||||||||||

| Robert B. Millard | $ | 165,000 | $ | 164,980 | $ | 0 | $ | 0 | $ | 0 | $ | 329,980 | ||||||||||||

| Lloyd W. Newton | $ | 150,000 | $ | 164,980 | $ | 0 | $ | 0 | $ | 10,000 | $ | 324,980 | ||||||||||||

| (1) | Reflects total cash compensation earned in fiscal 2020 for Board, committee, committee chair and Lead Independent Director retainers. |

| (2) | Reflects the aggregate grant date fair value computed in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, Compensation — Stock Compensation (“ASC 718”) with respect to director share units awarded in fiscal 2020. |

| (3) | Stock options were not an element of compensation for our non-employee directors, and consequently, non-employee directors held no stock options as of January 1, 2021. |

| (4) | There were no above-market or preferential earnings in the L3Harris Director Deferred Compensation Plan, which became effective December 31, 2019. |

| (5) | As noted above, our non-employee directors were eligible to participate in our foundation’s charitable gift matching program up to an annual maximum of $10,000 per director, and the amounts shown reflect charitable gift matching payments made during fiscal 2020. Although directors participated on the same basis as our employees, SEC rules require disclosure of the amount of a director’s participation in a gift matching program. |

L3HARRIS 2021 PROXY STATEMENT 31 |

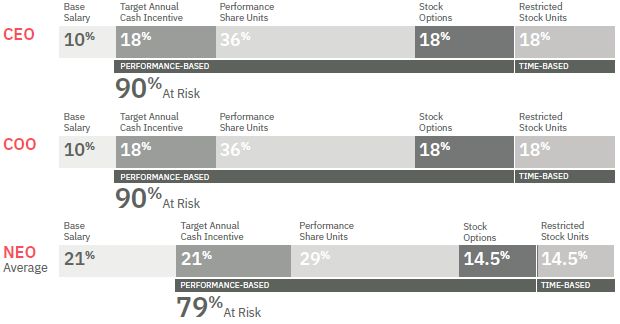

Our Board unanimously recommends voting FOR approval of the compensation of our named executive officers as disclosed in this proxy statement. | > Executive compensation decisions were made by independent members of our Board and Compensation Committee. > Executive compensation for fiscal 2020 reflected pay-for-performance alignment, with solid fiscal 2020 financial results and solid 3-year and strong 5-year total shareholder return (“TSR”) results. | ||||

| > | Directly align the interests of our executives with those of our shareholders. |

| > | Provide competitive compensation and benefits to attract, motivate and retain executives that drive our desired business results. |

| > | Ensure that a significant portion of compensation is at-risk and based on company and personal performance so as to motivate achievement of our financial goals and strategic objectives. |

> | Align an executive’s realized pay with his or her performance through above-target compensation for above-target performance and below-target compensation for below-target performance. |

32 L3HARRIS 2021 PROXY STATEMENT |

| PROPOSAL 2: TO APPROVE, IN AN ADVISORY VOTE, THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

L3HARRIS 2021 PROXY STATEMENT 33 |

| Executive Summary | 34 |

Our Executive Compensation Philosophy and Practices | 38 |

| Overview of Our Main Executive Compensation Elements | 43 |

Executive Compensation Decisions for Fiscal 2020 | 46 |

| Employment Agreements | 52 |

| Other Compensation Elements | 55 |

| Other Compensation Policies | 58 |

34 L3HARRIS 2021 PROXY STATEMENT |

| COMPENSATION DISCUSSION AND ANALYSIS EXECUTIVE SUMMARY |

William M. Brown | Christopher E. Kubasik | Jesus Malave, Jr. | Todd W. Gautier | Edward J. Zoiss |

Chair and CEO | Vice Chair, President and COO | Senior Vice President and Chief Financial Officer | President, Aviation Systems | President, Space and Airborne Systems |

| > | Executing seamless integration of L3 and Harris, including achieving at least $500 million in gross cost synergies from the Merger by the end of 2021; |

| > | Driving flawless execution and margin expansion through our e3 (excellence everywhere every day) operational excellence program; |

L3HARRIS 2021 PROXY STATEMENT 35 |

COMPENSATION DISCUSSION AND ANALYSIS EXECUTIVE SUMMARY |

| > | Growing revenue through a well-aligned business portfolio and investments in innovation; |

| > | Maximizing cash flow with shareholder friendly capital deployment; and |

| > | Reshaping our portfolio to focus on high margin, high growth businesses. |

| (in millions, except per share amounts) | Fiscal 2020 ($) | Pro Forma 2019 ($)*** | Fiscal Transition Period ($) | |||||||||

| Revenue | $ | 18,194 | $ | 18,097 | $ | 9,263 | ||||||

| Net income | $ | 1,086 | $ | 1,650 | $ | 834 | ||||||

| Adjusted EBIT* | $ | 3,280 | $ | 3,039 | $ | 1,601 | ||||||

| Operating cash flow | $ | 2,790 | $ | 1,655 | $ | 939 | ||||||

| Adjusted free cash flow* | $ | 2,686 | $ | 2,095 | $ | 1,449 | ||||||

| Cash used to repurchase shares of our common stock | $ | 2,290 | $ | 1,500 | $ | 1,500 | ||||||

| Annualized cash dividend rate per share** | $ | 3.40 | $ | 2.87 | $ | 3.00 | ||||||

| * | See Appendix A for reconciliations of GAAP to non-GAAP financial measures. |

| ** | In January 2021, our Board increased our quarterly cash dividend rate from $.85 per share to $1.02 per share, for an annualized cash dividend rate of $4.08 per share. |

| *** | Refer to supplemental unaudited pro forma condensed combined income statement information for the four quarters ended January 3, 2020 prepared in accordance with the requirements of Article 11 of Regulation S-X included in L3Harris' Annual Report on Form 10-K for the fiscal year ended January 1, 2021. |

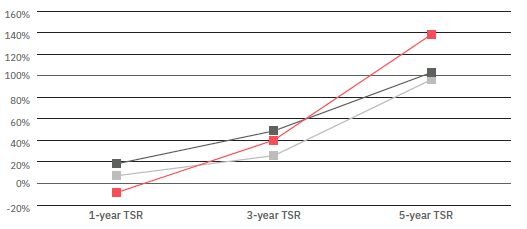

| ■ | L3Harris Technologies, Inc. |

| ■ | S&P 500 |

| ■ | Compensation Comparison Peer Group, Median |

| (1) | TSR results reflect reinvestment of dividends. As noted above, the closing of the Merger occurred on June 29, 2019, and our TSR results reflect L3Harris results for fiscal 2020 and our fiscal transition period and Harris standalone results for prior periods. |

36 L3HARRIS 2021 PROXY STATEMENT |

COMPENSATION DISCUSSION AND ANALYSIS EXECUTIVE SUMMARY |

L3HARRIS 2021 PROXY STATEMENT 37 |

COMPENSATION DISCUSSION AND ANALYSIS OUR EXECUTIVE COMPENSATION PHILOSOPHY AND PRACTICES |

Align with Shareholders’ Interests We believe an executive’s interests are directly aligned with our shareholders’ interests when our compensation programs appropriately balance short- and long-term financial performance, create a “pay for profitable growth” environment, are impacted by our stock price performance and require meaningful ownership of our stock. | Be Competitive at Target Performance Level We believe an executive’s total compensation should be competitive at the target performance level to motivate performance and to attract, retain, develop and reward executives who possess the abilities and skills to build long- term shareholder value. | |||||

Motivate Achievement of Financial Goals and Strategic Objectives We believe an effective way to incentivize an executive to create long-term shareholder value is to make a significant portion of overall compensation dependent on the achievement of our short- and long-term financial goals and strategic objectives and on the value of our stock. | Align Realized Pay with Performance We believe that although an executive’s total compensation should be tied to achievement of financial goals and strategic objectives and should be competitive at the target performance level, above-target performance should be appropriately rewarded and there should be downside risk of below-target compensation if we do not achieve our financial goals and strategic objectives. | |||||

38 L3HARRIS 2021 PROXY STATEMENT |

COMPENSATION DISCUSSION AND ANALYSIS OUR EXECUTIVE COMPENSATION PHILOSOPHY AND PRACTICES |

|  | |||||

WHAT WE DO | WHAT WE DON’T DO | |||||

> Place executive compensation decisions in the hands of independent directors > Retain an independent executive compensation consulting firm > Regularly review and evaluate plans for management development, succession and diversity > Periodically review and change composition of compensation comparison peer group, as appropriate > Make a significant portion of each executive’s overall compensation opportunity equity-based to establish a strong link between compensation and our stock price performance and to provide rewards in alignment with shareholder returns > Align performance share unit award payouts with our stock price performance through a relative TSR adjustment metric > Have meaningful stock ownership guidelines to maintain alignment of executives’ interests with those of our shareholders > Hold annual “say-on-pay” advisory vote and seek input of large shareholders on key aspects of our executive compensation program > Pay cash severance under executive change in control severance agreements or plans only on a “double trigger” basis > Have a “clawback” policy to recover cash and equity incentive payments from executives if our financial statements are restated due to errors, omissions or fraud > Provide for accelerated vesting of equity-based compensation granted after fiscal 2019 only on a “double trigger” basis > Maintain a 12-month minimum vesting period for annual cycle awards of equity-based compensation, except in the case of death, disability or a qualifying termination after a change in control > Require executives to agree to non-competition, non-solicitation, customer non-interference and other covenants as part of equity-based compensation awards > Annually assess whether our compensation strategies, plans, programs, policies or procedures encourage undertaking unnecessary or excessive risks reasonably likely to have a material adverse effect on us | > Provide excessive perquisites > Permit repricing or back-dating of options > Provide excise tax gross-ups under executive change in control severance agreements or plans > Pay dividend equivalents to executive officers on performance share unit and restricted stock unit awards (except to extent earned at end of the applicable period) > Permit directors, executives or other employees to engage in short sales or enter into hedging, puts, calls or other “derivative” transactions with respect to our securities > Permit directors or executives to hold or purchase our stock on margin or in a margin account or otherwise pledge our stock as collateral for margin accounts, loans or any other purpose > Provide guaranteed incentive payouts over multi-year periods |

L3HARRIS 2021 PROXY STATEMENT 39 |

COMPENSATION DISCUSSION AND ANALYSIS OUR EXECUTIVE COMPENSATION PHILOSOPHY AND PRACTICES |

40 L3HARRIS 2021 PROXY STATEMENT |

COMPENSATION DISCUSSION AND ANALYSIS OUR EXECUTIVE COMPENSATION PHILOSOPHY AND PRACTICES |

WHAT WE DO PRIOR TO OR EARLY IN A NEW FISCAL YEAR | ||||||

Consider program design changes  | Determine what changes, if any, should be made to the executive compensation program for the new fiscal year (after receiving input from our CEO and independent compensation consultant, and an assessment of compensation trends and competitive market data). | |||||

Set target compensation values  | The process for setting target compensation values includes a review of: > the executive’s three-year compensation history, including base salary level and annual cash incentive and equity awards; > the types and levels of other benefits available to the executive, such as change in control severance agreements; and > compensation comparison peer group data or broad compensation market data, including surveys. | |||||

Establish performance measures and targets and individual performance objectives  | Establish: > short- and long-term financial performance measures and their relative weighting and associated targets for performance-based, at-risk elements of compensation for the new fiscal year; and > individual performance objectives for each executive and for his or her business unit or organization. These measures, weightings and targets and performance objectives are intended to align with our Board-approved annual operating plan and long-term strategic plan and create a “pay for profitable growth environment” and thereby encourage and reward the creation of sustainable, long-term value for our shareholders. | |||||

Make equity grants | Annual equity award grants to executive officers are made at Board or Compensation Committee meetings, the dates for which usually are set one year or more in advance, and annual equity award grants to our other eligible employees typically are made on the same date. We do not time equity grants to take advantage of information, either positive or negative, about us that has not been publicly disclosed. In special circumstances, such as new hires or promotions or for retention or recognition, grants may occur outside of the typical cycle. | |||||

WHAT WE DO AFTER THAT FISCAL YEAR ENDS | ||||||

Conduct performance reviews  | > For our CEO and COO, the independent directors of our Board conduct a performance review, evaluating such executive officer’s achievement of objectives established early in the fiscal year, other accomplishments, overall company performance and such executive officer’s self- evaluation of performance for the fiscal year. This review occurs in executive session, under the leadership of our Compensation Committee Chair and without our CEO, COO or other members of management present. > For our other executive officers, our CEO, with input from our COO, provides our Compensation Committee with specific compensation recommendations based on a review and assessment of each executive officer’s performance, including achievement of objectives established early in the fiscal year for the executive and his or her business unit or organization, contribution to company performance and other accomplishments. | |||||

Determine payouts | Payouts of performance-based, at-risk elements of compensation to executives are determined based on performance reviews relative to pre-determined objectives and formulaic calculations of our financial results for the fiscal year against pre-determined targets, typically after audited financial statements become available after the fiscal year end. | |||||

L3HARRIS 2021 PROXY STATEMENT 41 |

COMPENSATION DISCUSSION AND ANALYSIS OUR EXECUTIVE COMPENSATION PHILOSOPHY AND PRACTICES |

| Eaton Corporation plc | Lockheed Martin Corporation | Rockwell Automation, Inc. |

| Emerson Electric Co. | Motorola Solutions, Inc. | Spirit AeroSystems Holdings, Inc. |

| General Dynamics Corporation | Northrop Grumman Corporation | Textron Inc. |

| Honeywell International Inc. | Parker Hannifin Corporation | United Technologies Corporation |

| Leidos Holdings, Inc. | Raytheon Company |

42 L3HARRIS 2021 PROXY STATEMENT |

COMPENSATION DISCUSSION AND ANALYSIS OVERVIEW OF OUR MAIN EXECUTIVE COMPENSATION ELEMENTS |

| > | base salary; |

| > | annual cash incentive award compensation; and |

| > | equity-based long-term incentive compensation (for fiscal 2020, performance share units, stock options and restricted stock units). |

| > | our performance against specific pre-determined financial performance measures; and |

| > | named executive officer performance against pre-determined individual objectives and contribution to our overall results. |

| > | the upside potential of above-target payouts if our financial performance is above target; and |

| > | the downside risk of below-target payouts if our financial performance is below target. |

L3HARRIS 2021 PROXY STATEMENT 43 |

COMPENSATION DISCUSSION AND ANALYSIS OVERVIEW OF OUR MAIN EXECUTIVE COMPENSATION ELEMENTS |

| > | Performance share units. Performance share unit awards motivate our executives to achieve our multi-year financial and operating goals because the number of units ultimately earned depends on how we perform, generally over a three-year performance period, against financial performance measures and their relative weighting and associated targets established early in the first fiscal year of each performance period. As with all forms of equity-based compensation, the value of performance share units also is impacted directly by increases or decreases in our stock price. |

| > | Stock options. Stock options motivate our executives to increase shareholder value because the options have value, and compensation can be realized, only to the extent the price of our common stock increases between the grant date and the date of exercise. |

| > | Restricted stock units. Restricted stock unit awards primarily facilitate retention and succession planning because they carry restrictions that typically expire only if the executive is still employed with us at the end of a three-year period. |

44 L3HARRIS 2021 PROXY STATEMENT |

COMPENSATION DISCUSSION AND ANALYSIS OVERVIEW OF OUR MAIN EXECUTIVE COMPENSATION ELEMENTS |