- LHX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

L3Harris (LHX) 425Business combination disclosure

Filed: 3 Mar 15, 12:00am

Filed by: Harris Corporation Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Exelis Inc. Commission File No.: 001-35228 J.P. Morgan Aviation, Transportation and Industrials Conference March 3, 2015 |

2 Investor briefing Forward-looking statements Statements in this presentation that are not historical facts are forward-looking statements that reflect management's current expectations, assumptions and estimates of future performance and economic conditions. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements in this presentation include but are not limited to: earnings, revenue, operating margin, free cash flow, tax rate and other guidance for fiscal 2015; potential contract opportunities and awards; the potential value and timing of contract awards; the value of opportunity pipelines; statements regarding the U.S. Government budget; statements regarding outlook, including expected revenue, orders, cash flow, share repurchases and dividends and potential growth and expansion; statements regarding the expected timing and completion of the proposed acquisition of Exelis Inc.; the anticipated benefits of the proposed acquisition of Exelis, including estimated synergies; the estimated financial results of Exelis for 2014; the effects of the proposed acquisition of Exelis, including effects on future financial and operating results, and other statements that are not historical facts. The company cautions investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward-looking statements. The company's consolidated results, the actual results related to the proposed acquisition of Exelis and the forward-looking statements could be affected by many factors, risks and uncertainties, including but not limited to: the loss of the company’s relationship with the U.S. Government or a reduction in U.S. Government funding; potential changes in U.S. Government or customer priorities and requirements (including potential deferrals of awards, terminations, reductions of expenditures, changes to respond to the priorities of Congress and the Administration, budgetary constraints, debt ceiling implications, sequestration and cost-cutting initiatives); the potential impact of a security breach, through cyber attack or otherwise, or other significant disruptions of the company’s IT networks and systems or those the company operates for customers; risks inherent with large long-term fixed-price contracts, particularly the ability to contain cost overruns; financial and government and regulatory risks relating to international sales and operations; the continued effects of the general weakness in the global economy and U.S. Government’s budget deficits, national debt and sequestration; the company’s ability to continue to develop new products that achieve market acceptance; the consequences of future geo-political events; strategic acquisitions and the risks and uncertainties related thereto, including the company’s ability to manage and integrate acquired businesses; performance of the company’s subcontractors and suppliers; potential claims that the company is infringing the intellectual property rights of third parties; the successful resolution of patent infringement claims and the ultimate outcome of other contingencies, litigation and legal matters; risks inherent in developing new technologies; changes in the company’s effective tax rate; the potential impact of natural disasters or other disruptions on the company’s operations; the potential impact of changes in the regulatory framework that applies to, or of satellite bandwidth constraints on, the company’s managed satellite and terrestrial communications solutions; changes in future business or other market conditions that could cause business investments and/or recorded goodwill or other long-term assets to become impaired; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement with Exelis; the possibility that Exelis shareholders may not approve the merger agreement; the risk that the company and Exelis may not be able to obtain the necessary regulatory approvals or to satisfy any of the other conditions to the proposed acquisition in a timely manner or at all; the risk that financing for the proposed acquisition may not be obtained on anticipated terms or at all; risks related to disruption of management time from ongoing business operations due to the proposed acquisition; the risk that Harris may fail to realize the benefits expected from the proposed acquisition; the risk that any announcements relating to the proposed acquisition could have adverse effects on the market price of the company’s common stock; and the risk that the proposed acquisition and its announcement could have an adverse effect on the ability of the company and Exelis to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers, including the U.S. Government, and on their operating results and businesses generally. Further information relating to factors that may impact the company's and Exelis’ results and forward-looking statements are disclosed in their respective filings with the SEC. The forward-looking statements contained in this presentation are made as of the date of this presentation, and the company and Exelis disclaim any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Investors are cautioned not to place undue reliance on these forward- looking statements. |

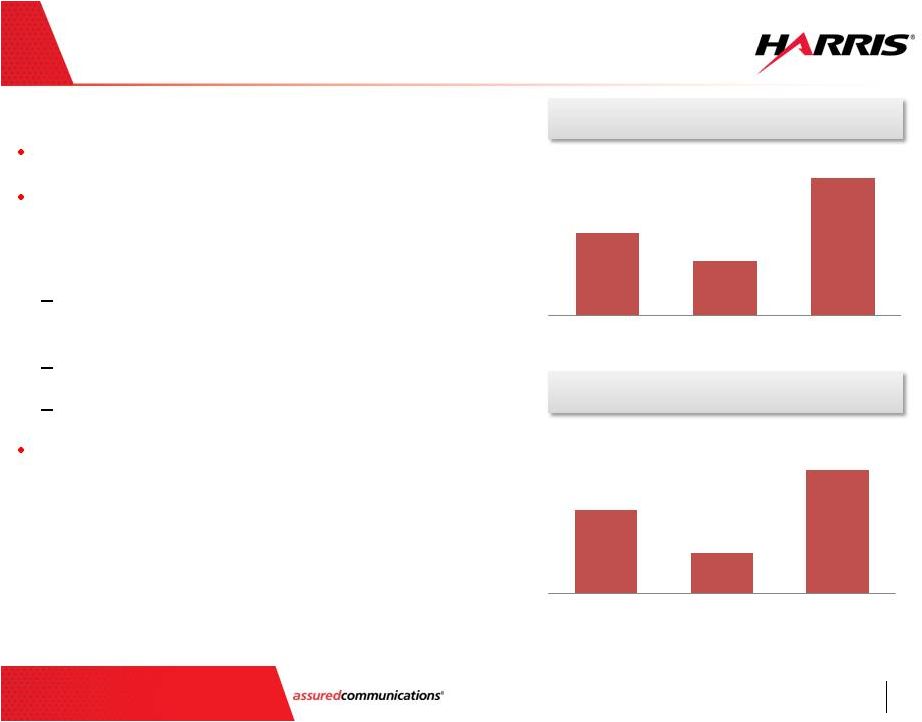

3 Investor briefing ($million except EPS) Based on guidance provided February 6, 2015. EPS Operating income margin Revenue $4.95 to $5.05 Harris overview 3,956 4,431 4,725 5,418 5,451 5,112 5,012 Down 1 to 3% $3.16 $3.78 $4.57 $4.98 $5.20 $4.90 $5.00 17% 18% 21% 19% 18% 18% 18% FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 Guid |

4 Investor briefing Recent highlights Continued strength in Government Communications and international tactical radios International now 31% of total revenue, up from 24% in 2012 Robust operating margins… while raising R&D to 5.3% of revenue, up from 4.0% in 2012 U.S. budget bottoming U.S. tactical radio procurement activity picking up |

• Strong core franchises • $770M NGA geospatial content management • $495M Air Force Hosted Payload Solutions • $300M to integrate various intelligence systems Government Communications Systems ongoing strength Geospatial Imagery Air Traffic Management Space & Intelligence Weather Avionics Revenue Operating margin +1% +11% +2% +12% +5% Based on guidance provided February 6, 2015. • Outstanding operating performance • Strategic recent wins… and $18.5B pipeline, up 36% y/y • 5 consecutive quarters of revenue growth 15 – 15.5% 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 Prior Yr Current Yr 12.9% 14.2% 14.7% 15.4% FY11 FY12 FY13 FY14 FY15 5 Investor briefing |

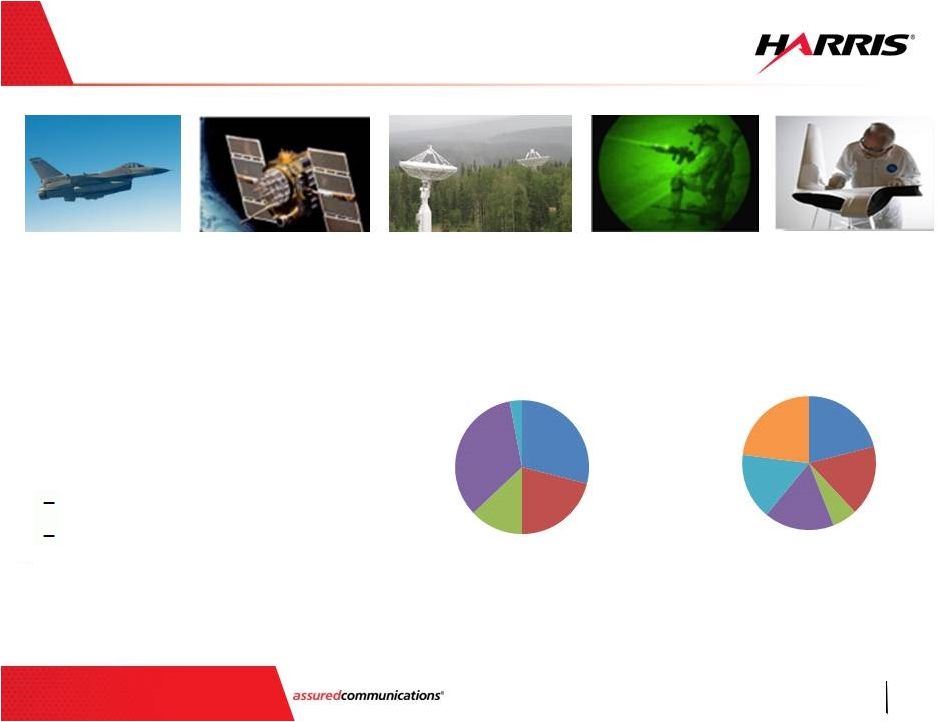

6 Investor briefing Recently announced acquisition of Exelis A transformational acquisition Powerful combination of two culturally- aligned, technology-focused, highly complementary companies Revenue EBITDA Notes: (1) Trailing 12 months as of quarter ending January 2, 2015 (2) Represents 2014 Exelis guidance as of February 6, 2015 (1) (2) (1) (2) $ Billions $ Billions 4.96 3.25 8.21 Harris Exelis Harris Pro forma 1.07 0.51 1.58 Harris Exelis Creates an industry innovator with much greater scale providing a broad spectrum of technology-based advanced communication systems ~23,000 employees including ~9,000 engineers/scientists ~$8.2 billion revenue ~$1.6 billion EBITDA Harris Pro forma |

7 Investor briefing Exelis overview • Spun out of ITT in 2011 • Headquartered in McLean, VA • ~10,000 employees, 3,000 engineers and scientists • 2014 revenue of ~$3.25 billion / EBITDA of ~$511 million (1) Prime: 71%; Sub: 29% Fixed price: 53%; Cost plus: 47% • Funded backlog of ~$2.8 billion as of 12/31/14 (1) Electronic Systems Segment revenue Geospatial Night Vision & Comms Information Systems Aerostructures Air Force Customer revenue Army Other DoD & Intel Civil U.S. International & Commercial Navy & Marines Night Vision and Communications Geospatial Systems Electronic Systems Information Systems Aerostructures Note: (1) Represents 2014 Exelis guidance as of February 6, 2015 29% 21% 13% 34% 3% 21% 17% 6% 17% 16% 23% |

8 Investor briefing Transaction overview Consideration Financing Valuation and accretion • Total purchase price of $23.75 per share or $4.75 billion enterprise value • 70% cash / 30% equity • Exelis’ shareholders will receive $16.625 in cash and 0.1025 Harris shares • Fully committed bridge financing in place • Historically low rate financing environment • Strong balance sheet providing flexibility and ability to invest for growth • Pro-forma leverage of ~2.9x net debt to adjusted EBITDA (1) at closing • Rapid de-leveraging with net leverage of ~1.5x in year 3 • 9.3x 2014 EBITDA (2) • 8.0x 2014 adjusted EBITDA (1)(2) • GAAP EPS accretive in 1 full year and a significant contributor thereafter • Expected pro forma FCF approaching $1 billion in year 4 Notes: (1) (2) Based on 2014 Exelis guidance as of February 6, 2015 Exelis’ standalone EBITDA adjusted for the purchase accounting reset of its net actuarial pension losses to zero st |

9 Investor briefing Highly strategic acquisition Strengthens core franchises and provides optionality for portfolio shaping Builds stronger platform for growth Creates scale and more balanced earnings Generates meaningful cost synergies Creates significant value for all stakeholders Timing perfect, internally and externally Combination creates a significantly stronger, more diversified and more competitive company that is better positioned with its key customers to compete for and win new contracts |

10 Investor briefing Strengthens core franchises and provides optionality for portfolio shaping Highly complementary core franchises Enhanced scale across platforms to drive efficiency and better address customer needs Optimized R&D portfolio to drive innovation Deep customer relationships Similar cultures and shared values Space & Intelligence Weather Air Traffic Management Tactical Communications |

11 Investor briefing Generates meaningful cost synergies • Significant work done to fully diligence synergy opportunity • Sources of cost synergies HQ consolidation and public company costs Manufacturing / supply chain / program efficiencies Functional efficiencies / overhead reductions • Run-rate synergies net of flow-through savings to customers • No revenue synergies included but opportunities exist $ Millions Cash Investment Cost 130 – 150 100 – 120 Run-Rate Savings A focused and highly experienced management team to drive the integration Note: (1) Excludes deal related costs |

12 Investor briefing Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed transaction between Harris Corporation and Exelis. In connection with the proposed transaction, Harris Corporation intends to file a registration statement on Form S-4, that will include a proxy statement of Exelis and a prospectus of Harris with the Securities and Exchange Commission (“SEC”). This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Exelis or Harris Corporation may file with the SEC or send to shareholders in connection with the proposed transaction. INVESTORS AND SHAREHOLDERS OF EXELIS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain copies of the proxy statement/prospectus and other documents filed with the SEC (when available) free of charge at the SEC’s website, http://www.sec.gov. Copies of documents filed with the SEC by Harris Corporation will be made available free of charge on Harris Corporation’s website at http://harris.com/investors/. Copies of documents filed with the SEC by Exelis will be made available free of charge on Exelis’s website at http://investors.exelisinc.com/. Participants in Solicitation Harris Corporation and its directors and executive officers, and Exelis and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Exelis common stock in respect of the proposed transaction. Information about the directors and executive officers of Harris Corporation is set forth in the proxy statement for Harris Corporation’s 2014 Annual Meeting of Shareholders, which was filed with the SEC on September 9, 2014. Information about the directors and executive officers of Exelis is set forth in the proxy statement for Exelis’s 2014 Annual Meeting of Shareholders, which was filed with the SEC on March 26, 2014. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph. |