- LHX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

L3Harris (LHX) 425Business combination disclosure

Filed: 6 May 15, 12:00am

Management Briefing Proposed Exelis merger May 7, 2015 Filed by: Harris Corporation Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Exelis Inc. Commission File No.: 001-35228 |

| 2 Pre-close Manager Briefing | Harris Proprietary Information Summary Transaction overview About Exelis Acquisition process / Legal do’s and don’ts Integration approach Pre-close communications plan Your role as manager Where to get additional information |

| 3 Pre-close Manager Briefing | Harris Proprietary Information Strengthens core franchises Builds stronger platform for growth Creates scale and more balanced earnings Generates meaningful cost synergies Creates significant value for all stakeholders Highly strategic and complementary acquisition Combination creates a significantly stronger and more competitive company that is better positioned with its key customers to compete for and win new contracts |

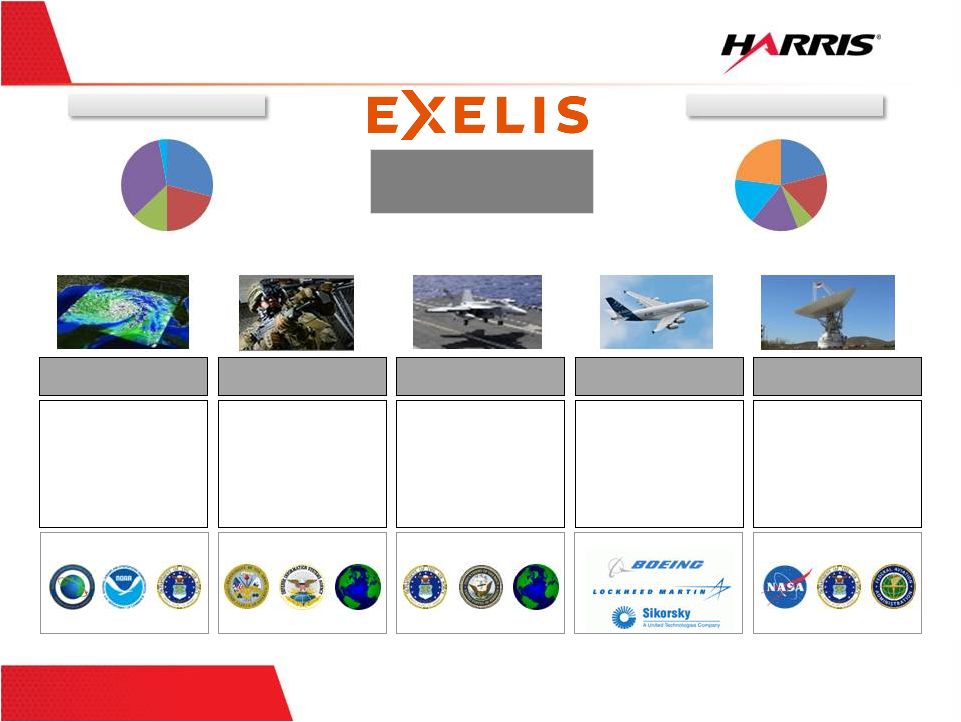

| 4 Pre-close Manager Briefing | Harris Proprietary Information Exelis overview 2014E Revenue: ~$3.25 Billon HQ: McLean, VA Geospatial (GS) • Electro-optic / Infrared Sensors • GPS Solutions • Weather Sensor and Payloads • Processing, Analytics and Dissemination Night Vision & Comms • Networked Communications • Night Vision Electronic Systems (ES) • Electronic Warfare • Radar & Sonar Systems • Carriage & Release • Command and Control Systems Aerostructures • Commercial Aerostructures • Military Aerostructures Information Systems (IS) • Civil & Aerospace Systems • Command, Control, and Communication Systems (C3S) • Advanced Information Solutions Top Customers Top Customers NRO NOAA USAF USAF NASA FAA HQ: Rochester, NY Top Customers Army HQ: Fort Wayne, IN Top Customers USAF Navy HQ: Clifton, NJ HQ: Salt Lake City, UT Top Customers HQ: Herndon, VA Navy & Marines Army Other DoD & Intel Civil U.S. Int’l & Commercial 2014E Segment Revenue Air Force 2014E Customer Revenue Information Systems Night Vision & Comms Electronic Systems Geospatial Aerostructures DISA |

| 5 Pre-close Manager Briefing | Harris Proprietary Information Our values We share similar values….a strong foundation |

| 6 Pre-close Manager Briefing | Harris Proprietary Information General guidelines • Harris and Exelis are independent companies until closing and should not take any action that reduces that independence or any competition between them. Consult legal team when in doubt about whether conduct is appropriate Legal Do’s and Don’ts Do • DO continue to operate as a separate and independent business. • DO continue to compete in any and all business activities in which we have been competitors before the merger was announced. • DO continue to deal with each other as a supplier, potential customer or teammate, but only in the ordinary course of business as you would before the merger was announced and like you do other independent companies. Don’t • DON’T seek to influence or control the other company’s business behavior prior to closing and be sensitive to creating that appearance – the prohibition applies to all areas of the business and is not limited to competitively sensitive areas. • DON’T share competitively sensitive business information. • DON’T contact employees from the other company outside the ordinary course of business unless such contacts are approved in advance by the Legal Department. |

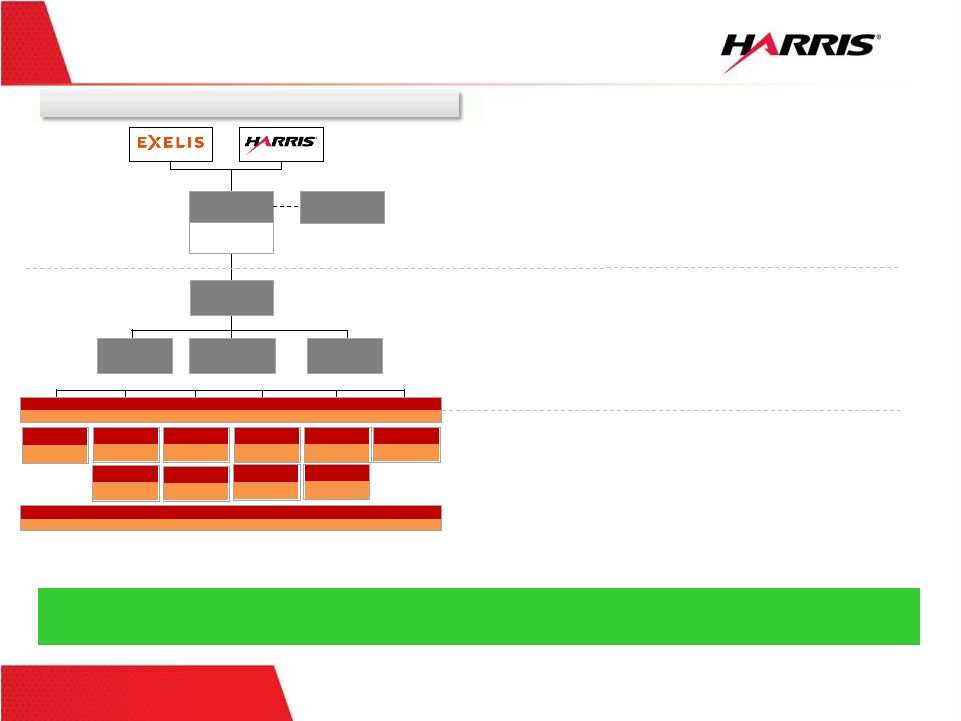

| 7 Pre-close Manager Briefing | Harris Proprietary Information Integration approach and progress • Ensure day 1 business continuity • Baseline organization operating models • Detail structural and operating model changes • Prioritize synergy opportunities and initiatives • Drive synergy capture • Review priorities, recommendations and results • Create and ensure ongoing process discipline • Drive results and accountability • Monitor change and capture synergies • Manage risks and track financial results Steering Committee CEO Executive Leadership Team Communications Legal, Contracts, Ethics & Compliance Finance & Accounting Technology & Engineering Manufacturing IT HR Board of Directors Integration Management Office Project Tracking & Reporting Communications & Change Management Government / Customer Engagement Integration Team Structure Global Security Supply Chain Functional Integration Project Teams Business Development Synergy Capture Project Teams Detailed planning underway with joint project teams - on track for day 1 continuity Responsibilities and objectives |

| 8 Pre-close Manager Briefing | Harris Proprietary Information Close Employee update: Email blog ex Brown Employee Update: Email blog ex Fox Employee update: Email blog ex Fox Employee update: Email blog ex Fox Employee update: Email blog ex Fox End April Lync Management Briefing Lync Management Briefing: Fox w/mgmt team D - 1 Press release Employee Day 1 Communications Employee microsite live Pre close communications plan Parallel but separate pre-close communications Build confidence in the future Ensure business continuity D -2 Employee town halls with segment leaders (content will be provided) D +1 1 st Employee weekly Integration newsletter published D +3 |

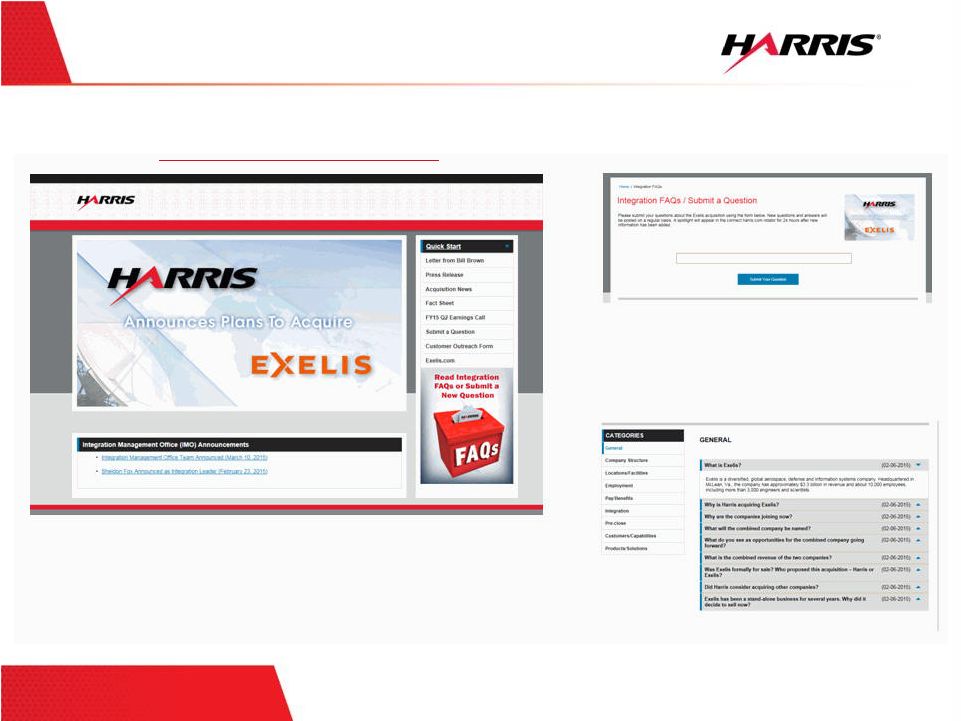

| 9 Pre-close Manager Briefing | Harris Proprietary Information Additional References Internal Employee Microsite http://my.harris.com/harriscom/ Submit a Question Review Questions Already Submitted |

| 10 Pre-close Manager Briefing | Harris Proprietary Information Your role as a leader Understand key messages and over communicate Be available to your teams more than ever Acknowledge that with change comes uncertainty and we do not have all of the answers Flow up questions and concerns to your leadership Ensure focus remains on serving our customers and meeting our commitments |

11 Pre-close Manager Briefing | Harris Proprietary Information |

| 12 Pre-close Manager Briefing | Harris Proprietary Information Legend Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed transaction between Harris and Exelis. In connection with the proposed acquisition of Exelis, Harris has filed with the SEC a registration statement on Form S-4 that includes a proxy statement of Exelis and a prospectus of Harris. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Harris or Exelis or may file with the SEC or send to shareholders in connection with the proposed acquisition of Exelis. INVESTORS AND SHAREHOLDERS OF EXELIS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ACQUISITION OF EXELIS. Investors and security holders will be able to obtain copies of the proxy statement/prospectus and other documents filed with the SEC (when available) in relation to the acquisition of Exelis free of charge at the SEC's website, www.sec.gov. Copies of documents filed with the SEC by Harris will be made available free of charge on Harris' website at http://harris.com/investors. Copies of documents filed with the SEC by Exelis will be made available free of charge on Exelis' website at http://investors.exelisinc.com/. Participants in Solicitation Harris and its directors and executive officers, and Exelis and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Exelis common stock in respect of the proposed transaction between Harris and Exelis. Information about the directors and executive officers of Harris is set forth in the proxy statement for Harris' 2014 Annual Meeting of Shareholders, which was filed with the SEC on September 9, 2014. Information about the directors and executive officers of Exelis is set forth in Exelis' Amendment No. 1 to Annual Report on Form 10-K, which was filed with the SEC on April 6, 2015, as well as in the proxy statement for Exelis' 2014 Annual Meeting of Shareholders, which was filed with the SEC on March 26, 2014. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the proposed acquisition of Exelis when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph. |