Peninsula Pacific Entertainment, LLC Condensed Consolidated Financial Statements as of September 30, 2022 and for the Nine Months Ended September 30, 2022

PENINSULA PACIFIC ENTERTAINMENT, LLC TABLE OF CONTENTS Page Condensed Consolidated Balance Sheet as of September 30, 2022 1 Condensed Consolidated Statement of Operations for the nine months ended September 30, 2022 2 Condensed Consolidated Statement of Changes in Member’s Equity (Deficit) for the nine months ended September 30, 2022 3 Condensed Consolidated Statement of Cash Flows for the nine months ended September 30, 2022 4 Notes to Condensed Consolidated Financial Statements 5

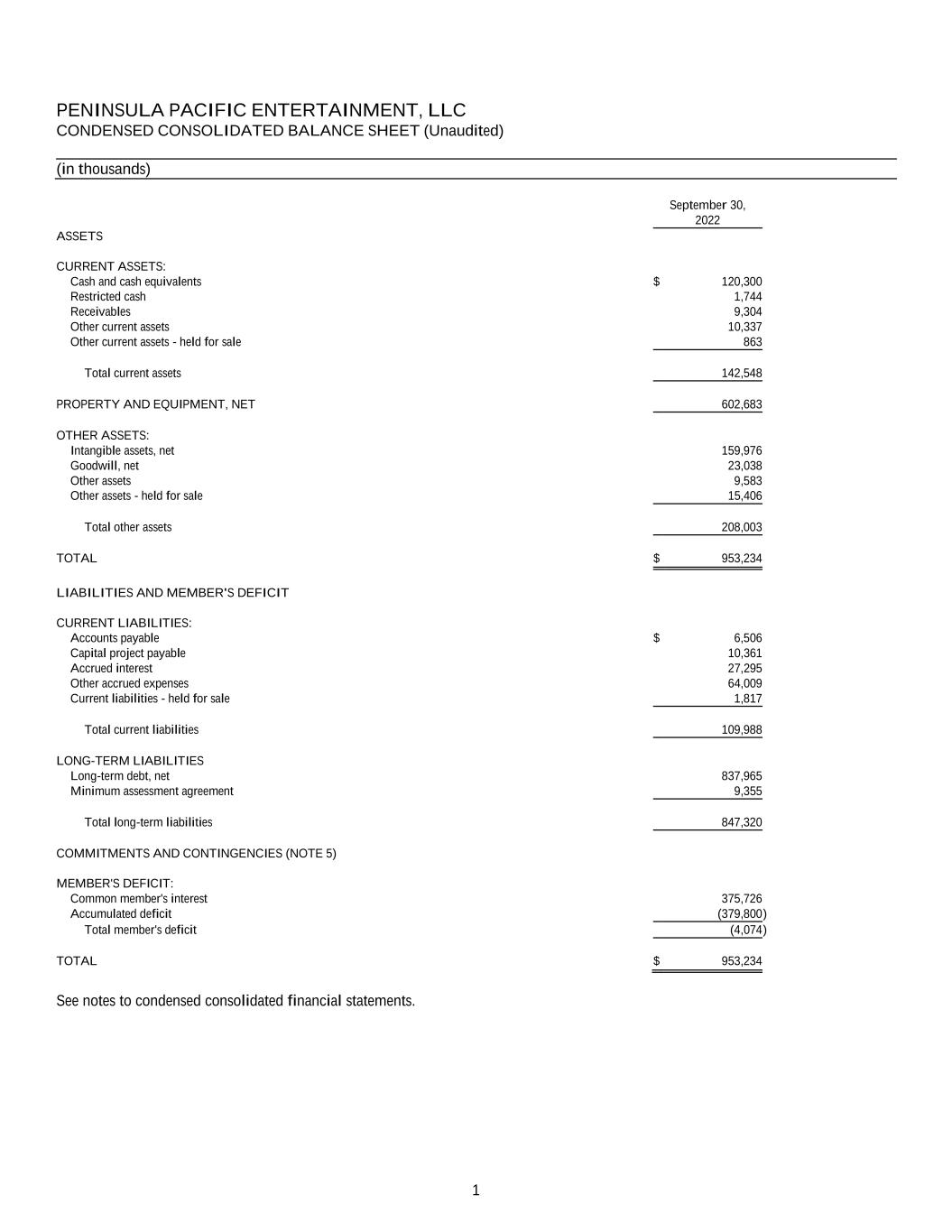

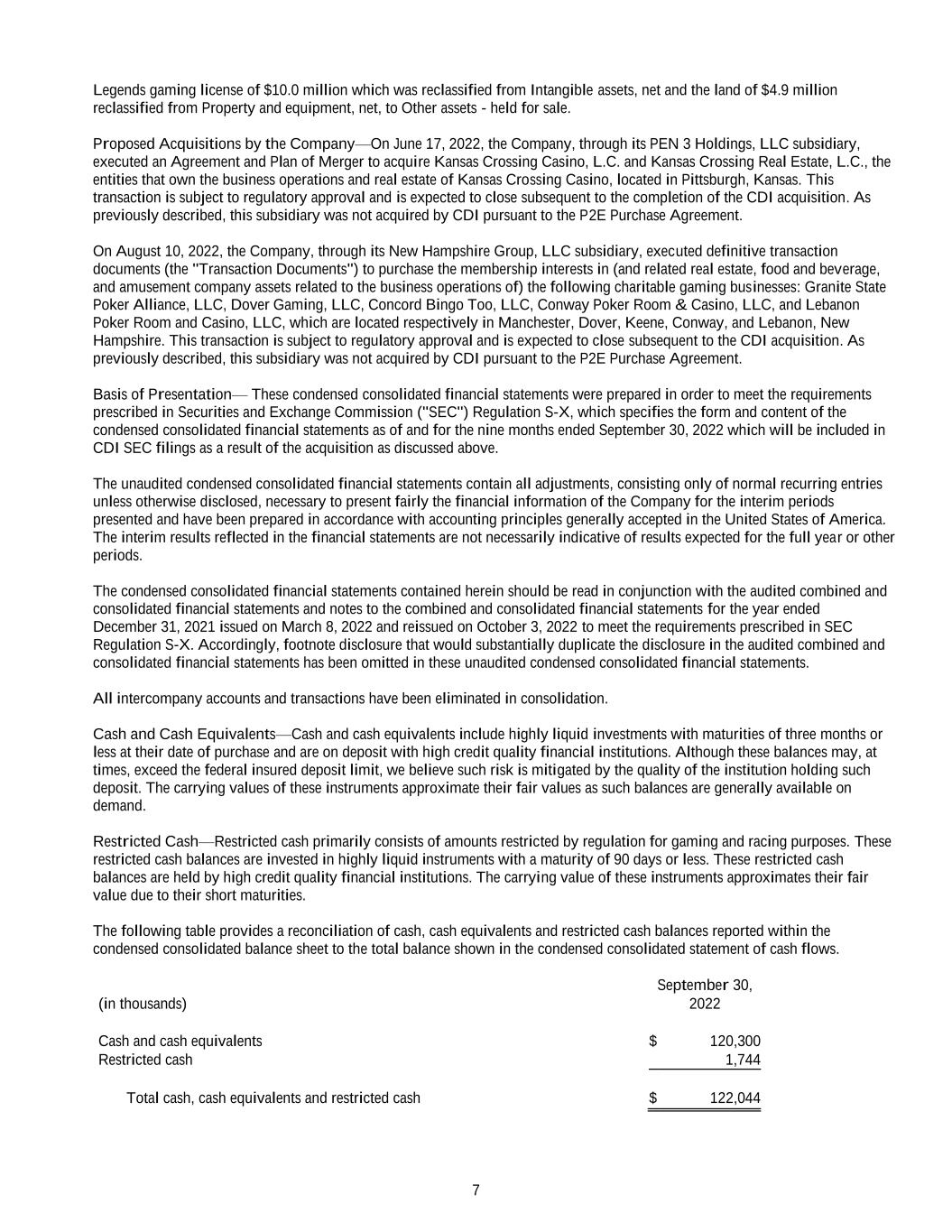

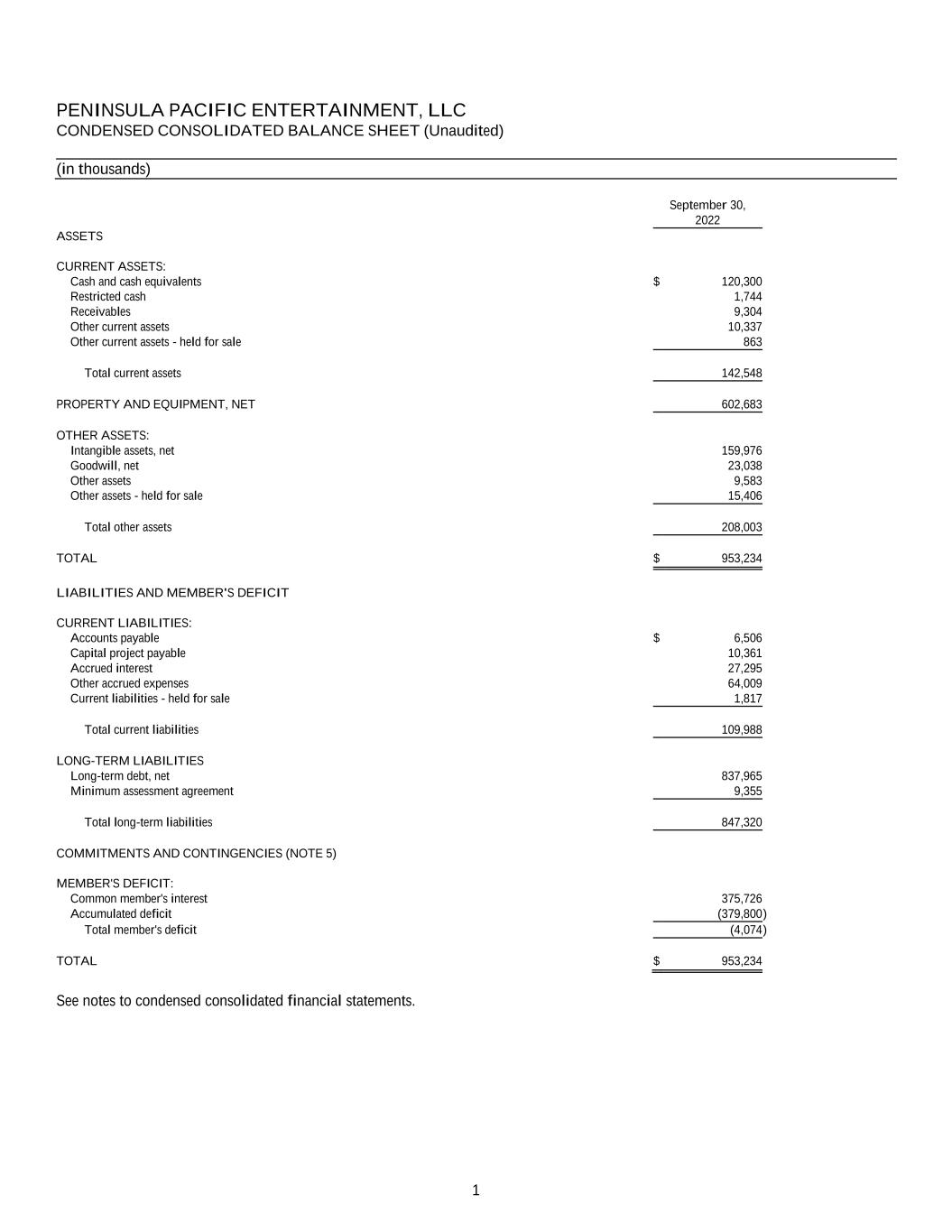

1 PENINSULA PACIFIC ENTERTAINMENT, LLC CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited) (in thousands) September 30, 2022 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 120,300 Restricted cash 1,744 Receivables 9,304 Other current assets 10,337 Other current assets - held for sale 863 Total current assets 142,548 PROPERTY AND EQUIPMENT, NET 602,683 OTHER ASSETS: Intangible assets, net 159,976 Goodwill, net 23,038 Other assets 9,583 Other assets - held for sale 15,406 Total other assets 208,003 TOTAL $ 953,234 LIABILITIES AND MEMBER'S DEFICIT CURRENT LIABILITIES: Accounts payable $ 6,506 Capital project payable 10,361 Accrued interest 27,295 Other accrued expenses 64,009 Current liabilities - held for sale 1,817 Total current liabilities 109,988 LONG-TERM LIABILITIES Long-term debt, net 837,965 Minimum assessment agreement 9,355 Total long-term liabilities 847,320 COMMITMENTS AND CONTINGENCIES (NOTE 5) MEMBER'S DEFICIT: Common member's interest 375,726 Accumulated deficit (379,800 ) Total member's deficit (4,074 ) TOTAL $ 953,234 See notes to condensed consolidated financial statements.

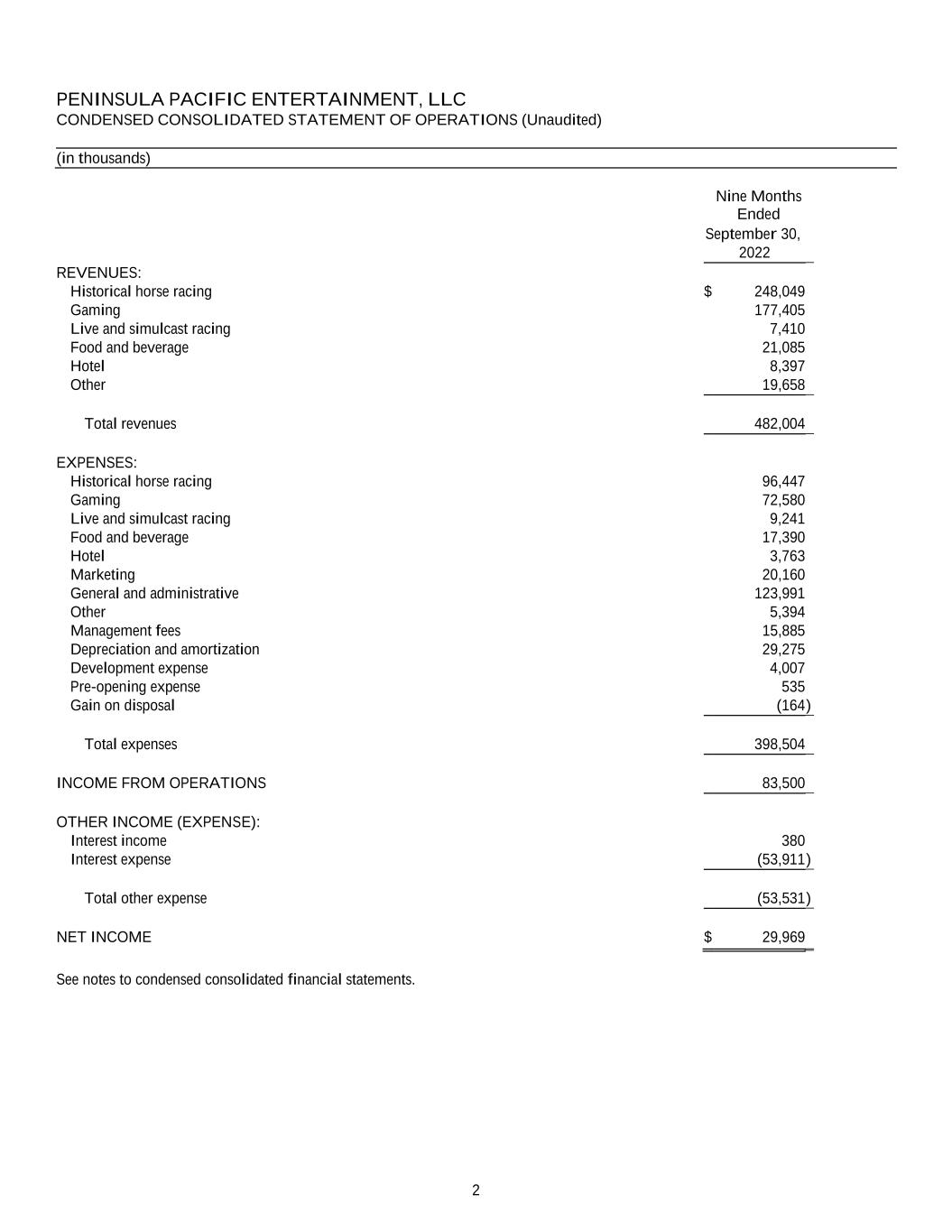

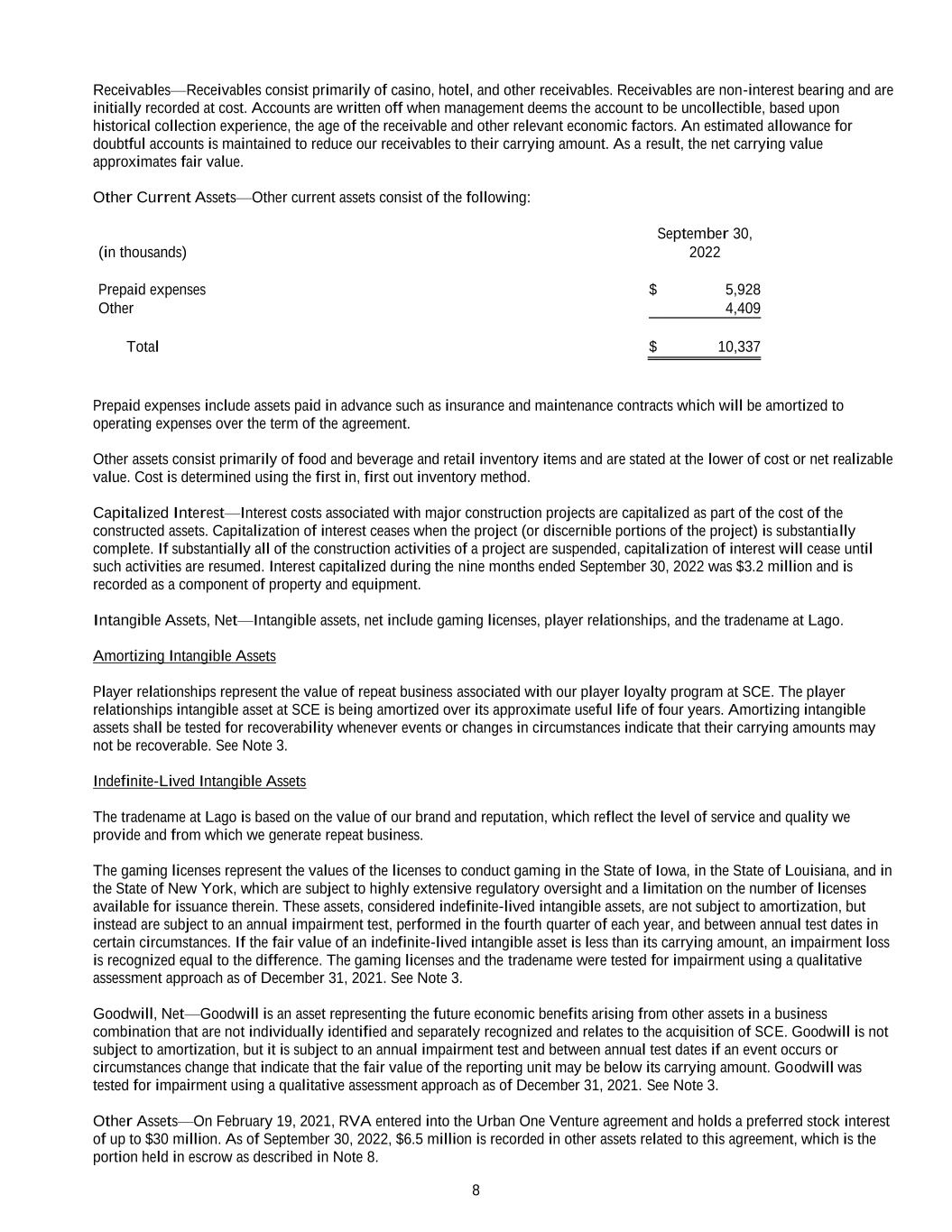

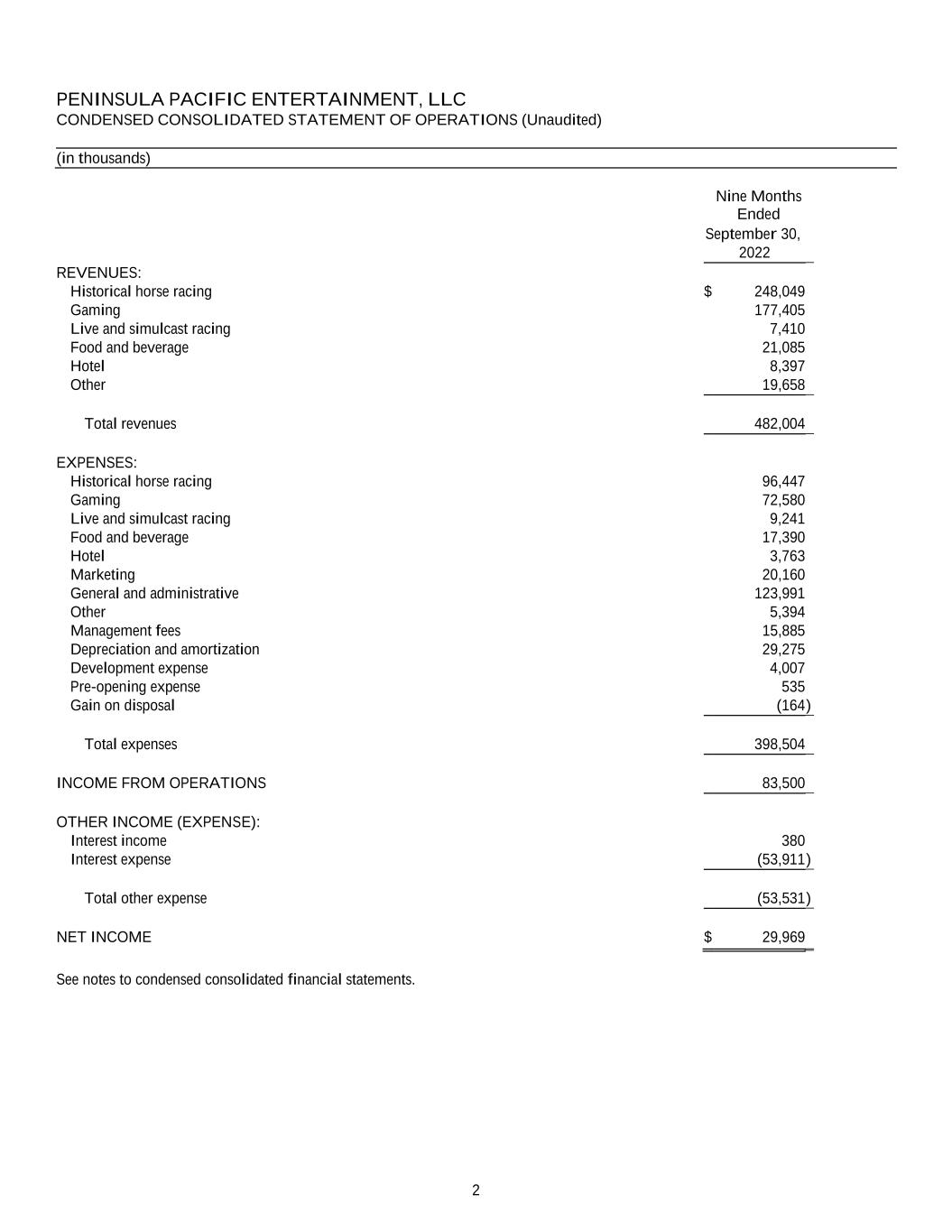

2 PENINSULA PACIFIC ENTERTAINMENT, LLC CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited) (in thousands) Nine Months Ended September 30, 2022 REVENUES: Historical horse racing $ 248,049 Gaming 177,405 Live and simulcast racing 7,410 Food and beverage 21,085 Hotel 8,397 Other 19,658 Total revenues 482,004 EXPENSES: Historical horse racing 96,447 Gaming 72,580 Live and simulcast racing 9,241 Food and beverage 17,390 Hotel 3,763 Marketing 20,160 General and administrative 123,991 Other 5,394 Management fees 15,885 Depreciation and amortization 29,275 Development expense 4,007 Pre-opening expense 535 Gain on disposal (164 ) Total expenses 398,504 INCOME FROM OPERATIONS 83,500 OTHER INCOME (EXPENSE): Interest income 380 Interest expense (53,911 ) Total other expense (53,531 ) NET INCOME $ 29,969 See notes to condensed consolidated financial statements.

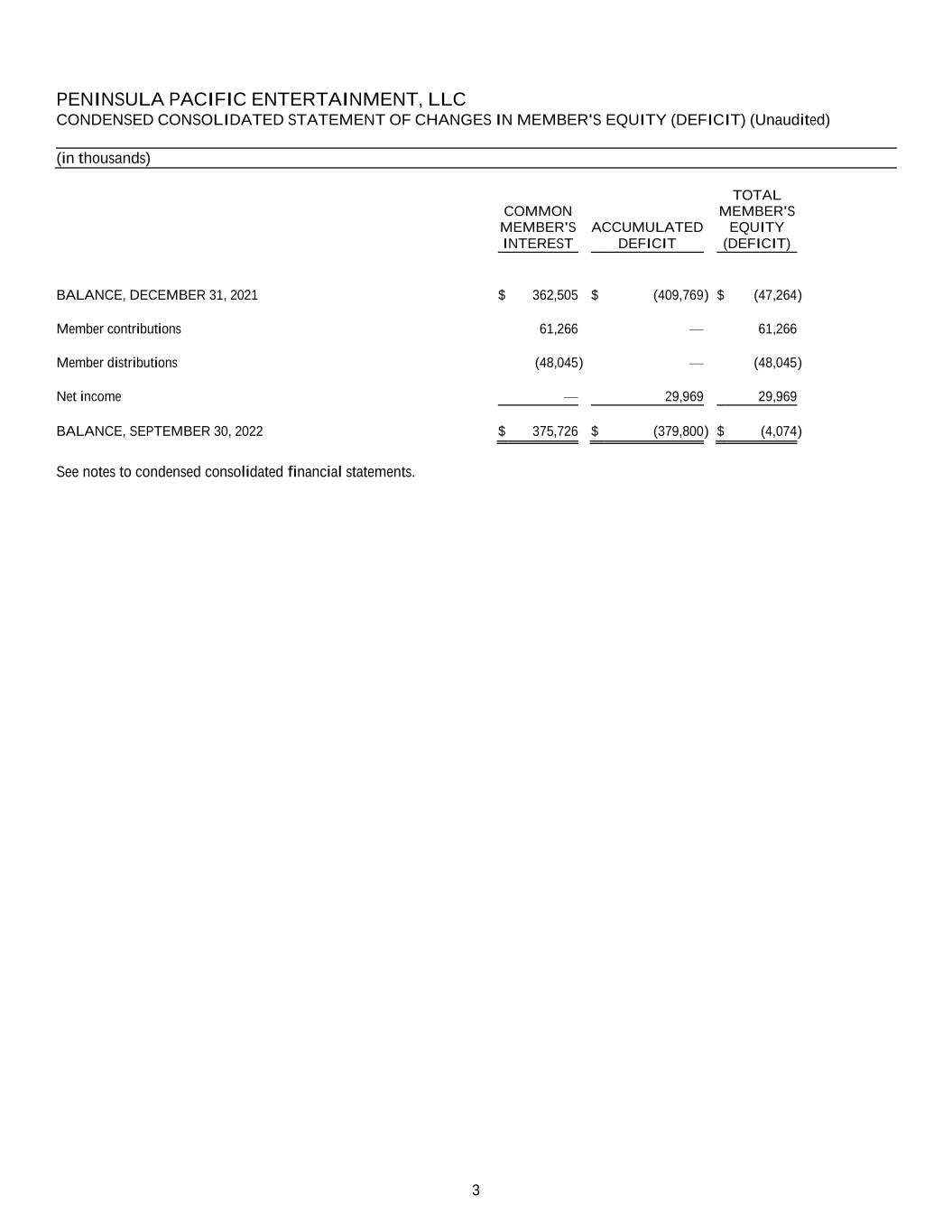

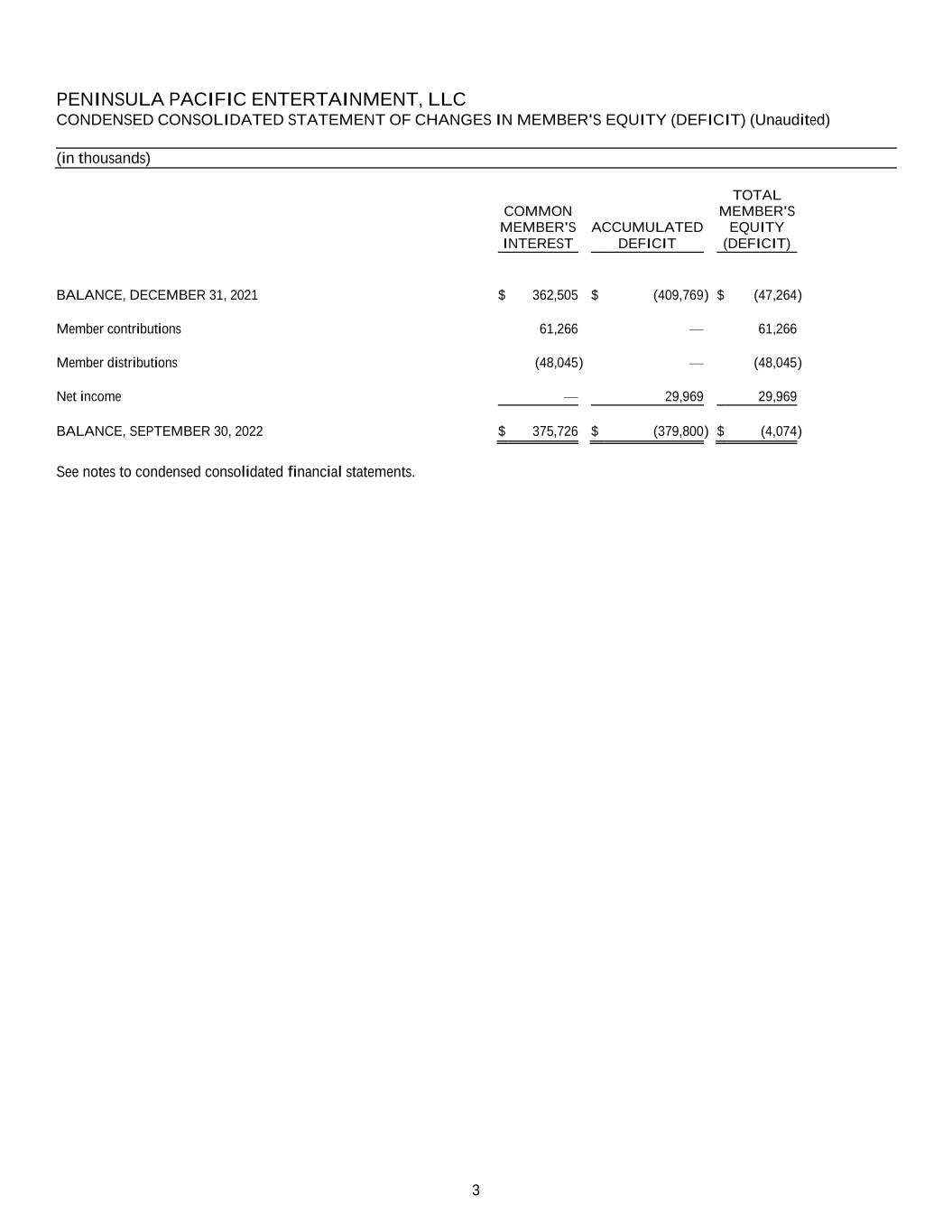

3 PENINSULA PACIFIC ENTERTAINMENT, LLC CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN MEMBER'S EQUITY (DEFICIT) (Unaudited) (in thousands) COMMON MEMBER'S INTEREST ACCUMULATED DEFICIT TOTAL MEMBER'S EQUITY (DEFICIT) BALANCE, DECEMBER 31, 2021 $ 362,505 $ (409,769 ) $ (47,264 ) Member contributions 61,266 — 61,266 Member distributions (48,045 ) — (48,045 ) Net income — 29,969 29,969 BALANCE, SEPTEMBER 30, 2022 $ 375,726 $ (379,800 ) $ (4,074 ) See notes to condensed consolidated financial statements.

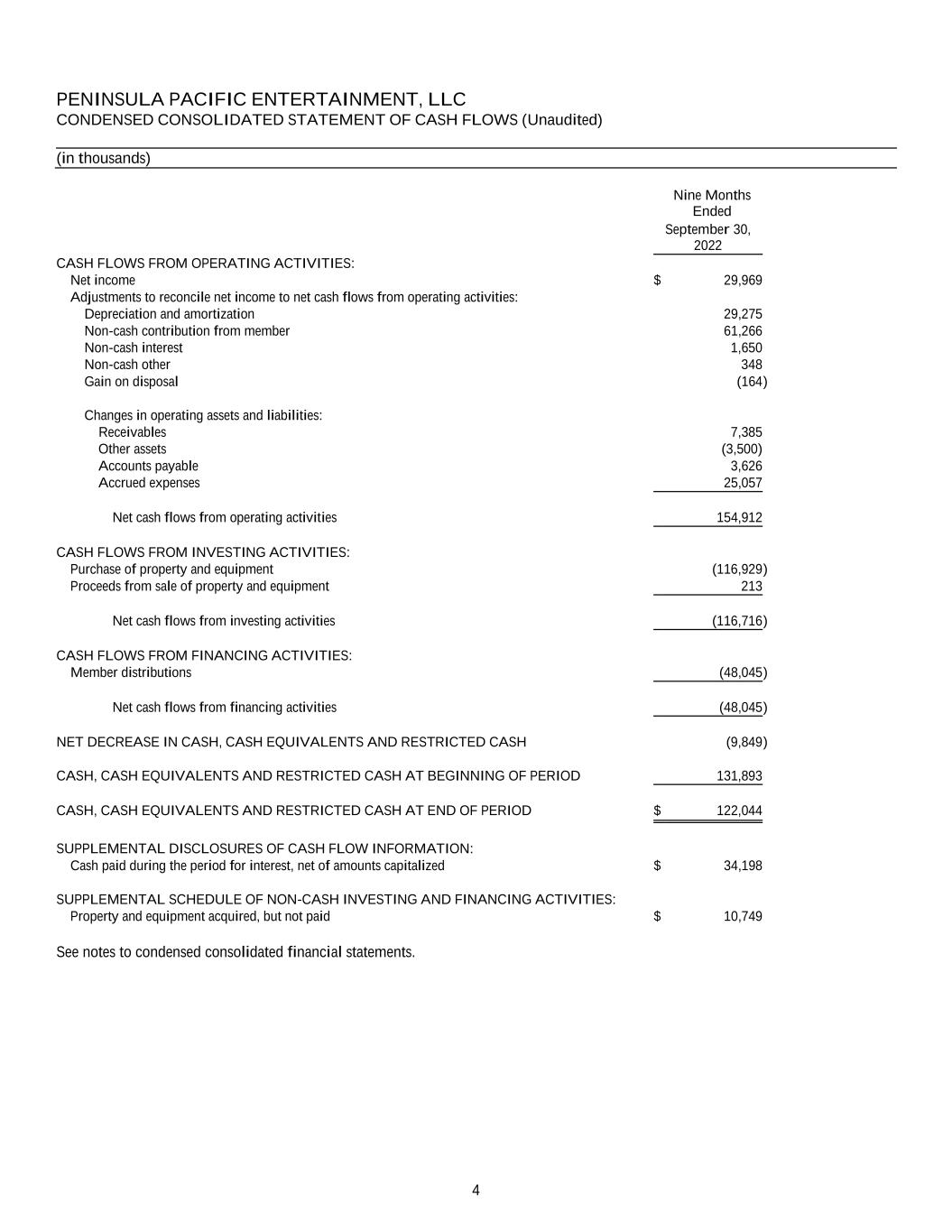

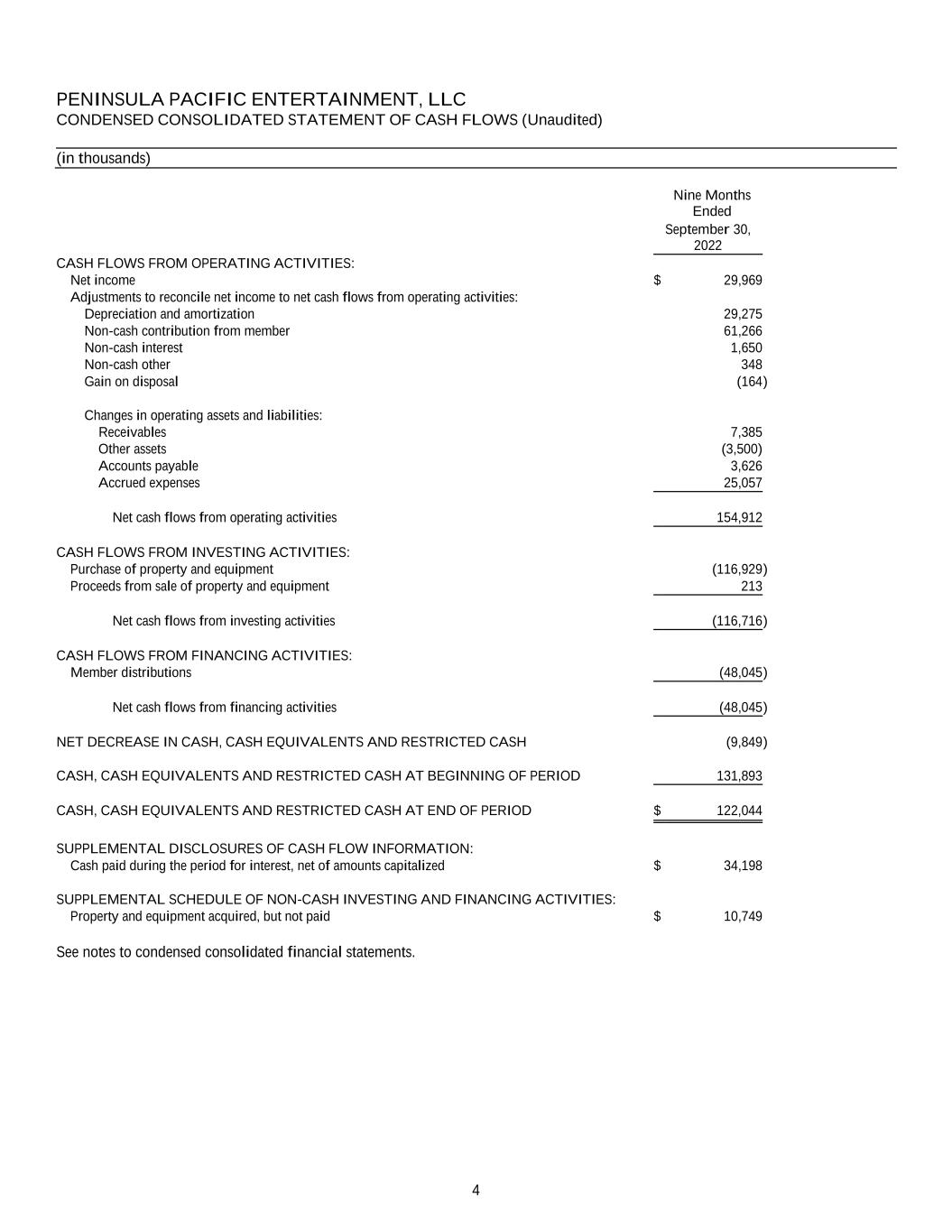

4 PENINSULA PACIFIC ENTERTAINMENT, LLC CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited) (in thousands) Nine Months Ended September 30, 2022 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 29,969 Adjustments to reconcile net income to net cash flows from operating activities: Depreciation and amortization 29,275 Non-cash contribution from member 61,266 Non-cash interest 1,650 Non-cash other 348 Gain on disposal (164 ) Changes in operating assets and liabilities: Receivables 7,385 Other assets (3,500) Accounts payable 3,626 Accrued expenses 25,057 Net cash flows from operating activities 154,912 CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of property and equipment (116,929 ) Proceeds from sale of property and equipment 213 Net cash flows from investing activities (116,716 ) CASH FLOWS FROM FINANCING ACTIVITIES: Member distributions (48,045 ) Net cash flows from financing activities (48,045 ) NET DECREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH (9,849 ) CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF PERIOD 131,893 CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD $ 122,044 SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: Cash paid during the period for interest, net of amounts capitalized $ 34,198 SUPPLEMENTAL SCHEDULE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: Property and equipment acquired, but not paid $ 10,749 See notes to condensed consolidated financial statements.

5 PENINSULA PACIFIC ENTERTAINMENT, LLC NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) SEPTEMBER 30, 2022, FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2022 (in thousands) 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Organization—Peninsula Pacific Entertainment, LLC (the "Company", "P2E", "we", "us" or "our"), a Delaware limited liability company, was formed on February 7, 2018. As of September 30, 2022, the Company was an indirect wholly owned subsidiary of Peninsula Pacific Entertainment Holdings, LLC ("P2E Holdings"). P2E Holdings is 100% owned by PGP Investors, LLC ("PGPI"), subject to profits interests equal to approximately 18% of the profits above certain distribution thresholds. The Company’s significant wholly owned subsidiaries included (i) Colonial Downs Group, LLC, (ii) SCE Partners, LLC, (iii) Lago Resort & Casino, LLC, (iv) AZD Holdings, LLC, (v) Richmond VA Development, LLC, (vi) RVA Holdings Group, LLC, (vii) Legends Holding, LLC, (viii) Cedar Rapids Funding, LLC, (ix) PEN 3 Holdings, LLC, (x) New Hampshire Group, LLC and (xi) Peninsula Pacific Entertainment Finance, Inc. Colonial Downs Group, LLC ("CDG"), a Delaware limited liability company acquired the Colonial Downs Racetrack in New Kent, Virginia ("Colonial Downs") on April 25, 2018. Operations include the following facilities as of September 30, 2022: Colonial Downs Racetrack and Rosie’s Gaming Emporium Vinton Rosie's Gaming Emporium Richmond Rosie's Gaming Emporium Hampton Rosie's Gaming Emporium Dumfries Rosie's Gaming Emporium Collinsville Rosie's Game Room The CDG facilities collectively include 2,606 historical horse racing ("HHR") machines, pari-mutual simulcast wagering and live racing at Colonial Downs. Each facility has a casual dining restaurant and a casino bar. SCE Partners, LLC ("SCE"), an Iowa limited liability company, owns and operates the Hard Rock Hotel and Casino Sioux City in Sioux City, Iowa ("HRSC"). As of September 30, 2022, HRSC included approximately 639 slot machines, 20 table games, a sports book, a 54-room AAA-rated Four Diamond hotel, indoor and outdoor entertainment venues, and several food, beverage and retail outlets. Lago Resort & Casino, LLC ("Lago"), a Delaware limited liability company, owns and operates del Lago Resort & Casino in Tyre, New York ("del Lago"). As of September 30, 2022, Lago includes 1,669 slot machines, 66 table games, 14 poker tables, a sportsbook, a 205-room hotel, a 1,600 seat entertainment venue, and several food, beverage and retail outlets. AZD Holdings, LLC ("AZD"), a Delaware limited liability company, was formed on January 26, 2021, and held an option to acquire all the equity interests in, or all or substantially all of the assets of Arizona Downs, LLC, which owns and operates the Arizona Downs Racetrack in Prescott, Arizona. Under the Sale and Purchase Option Agreement (which can be terminated by AZD at any time), AZD was obligated to provide funding for mutually agreed expenses of the annual race meets to be held at the Arizona Downs Racetrack (not to exceed $3.5 million per meet for the 2021 meet and $2.0 million thereafter) as well as certain other operating and other expenses. In March 2022, the Sale and Purchase Option Agreement was terminated and in June 2022, AZD was dissolved. Richmond VA Development, LLC ("RVA DEV"), a Delaware limited liability company, was formed on January 15, 2021, and has entered into an agreement to provide development services to the casino development in Richmond, Virginia which is associated with the Urban One Venture (as defined below).

6 RVA Holdings Group, LLC ("RVA"), a Delaware limited liability company, was formed on March 10, 2020. RVA holds a preferred stock interest in an entity controlled by Urban One, Inc. (the "Urban One Venture") which was formed to pursue a gaming development in the city of Richmond, Virginia. On November 2, 2021, the referendum required for this development opportunity to move forward did not pass. In January 2022, the Richmond City Council voted to re-select the Urban One Venture as the preferred casino operator which was subject to recertification by the Virginia Lottery Board ("VLB"). The VLB has completed their review and approval of the pre-certification materials for the owner and its subsidiaries. Upon receipt of the VLB approval, the City of Richmond petitioned the courts to order the referendum question for the Urban One Venture be added to the November 2022 ballot. The court ordered the referendum which became final and unappealable on April 18, 2022. Subsequently, the Virginia General Assembly enacted legislation that would prevent the VLB from issuing a casino license unless it was pursuant to a successful referendum held in November 2023 and included a provision that may result in the relocation of the fifth casino license to the City of Petersburg, Virginia. Due to the legislative action taken by the General Assembly, the referendum will not be placed on the November 2022 ballot and the $6.5 million in escrow (as described in Note 8) is eligible to be returned to the Company. Legends Holding, LLC ("Legends"), a Delaware limited liability company, owns (and operated until its closure in March 2020) the Louisiana Riverboat Gaming Partnership d/b/a DiamondJacks Casino & Resort ("DiamondJacks") in Bossier City, Louisiana. Legends also owns NS-LA Properties, LLC ("NS-LA"), a Delaware limited liability company, which together with its subsidiaries, owns real property in Louisiana. Cedar Rapids Funding, LLC ("CRF"), a Delaware limited liability company, was formed on August 23, 2013. CRF had no significant assets or operations and was formed to pursue a casino development opportunity in Cedar Rapids, Iowa. Towards the end of December 2019, an outbreak of a novel strain of coronavirus (COVID-19) emerged globally and on March 11, 2020 the World Health Organization declared the outbreak to be a global pandemic. As a result, there have been directives from federal, state and local authorities resulting in the closure of the Company’s properties in mid-March 2020, which negatively impacted the Company's business. As of September 30, 2022, the Company’s properties are all operating with minimal restrictions. Although the Company is experiencing positive trends as a result of the reopening of its properties, the COVID-19 pandemic is ongoing and future developments, which are uncertain and cannot be predicted at this time, could have a material negative impact on operations. On September 21, 2021, the Dumfries Town Council approved The Rose Gaming Resort. The property, which will replace Rosie’s Dumfries, will feature 50,000 square-feet of gaming space, up to a 305-room hotel, food and beverage offerings, a 1,500 seat theater, and a parking garage. The Company broke ground on the development on January 11, 2022 and expects the first phase to open in 2023 with all construction completed by 2026. Company Sale to Churchill Downs Incorporated—On February 18, 2022, Peninsula Pacific Entertainment Intermediate Holdings, LLC ("P2EIH"), the Company’s direct parent, entered into a definitive purchase agreement with Churchill Downs Incorporated ("CDI") to acquire the Company’s operations in Virginia, New York and Iowa for total consideration of approximately $2.75 billion (subject to customary purchase price adjustments at closing) (the "P2E Purchase Agreement"). On November 1, 2022, CDI completed the acquisition of the Company’s assets as contemplated in the P2E Purchase Agreement subject to certain working capital and other purchase price adjustments. During the nine months ended September 30, 2022, the Company incurred $8.2 million in expenses related to the P2E Purchase Agreement and such expenses are recorded in General and administrative expenses on the condensed consolidated statement of operations. The P2E Purchase Agreement excludes the acquisition by CDI of AZD Holdings, LLC, Legends Holding, LLC, Cedar Rapids Funding, LLC, PEN 3 Holdings, LLC, and New Hampshire Group, LLC. Sale of Legends—On May 15, 2020, Legends announced the DiamondJacks facility would not reopen due to business circumstances caused by the unexpected impact of the COVID-19 pandemic. On April 13, 2022, Legends Holding, LLC entered into a definitive purchase agreement to sell 100% of its equity interests in Legends Gaming, LLC and its subsidiaries, including the entity that owns DiamondJacks and the related gaming license, to a third party for consideration of approximately $15.0 million (subject to customary purchase price adjustments at closing) (the "Legends Purchase Agreement"). The Legends Purchase Agreement is dependent on usual and customary closing conditions, including the Company obtaining approvals from the Louisiana Gaming Control Board. The transaction is expected to close subsequent to the completion of the CDI acquisition. As previously described, this subsidiary was not acquired by CDI pursuant to the P2E Purchase Agreement. As of March 31, 2022, Legends met the criteria to be classified as held for sale. As such the assets and liabilities related to the transaction are included in Other current assets - held for sale, Other assets - held for sale, and Other current liabilities - held for sale on the condensed consolidated balance sheet as of September 30, 2022. The assets and liabilities of significance include the

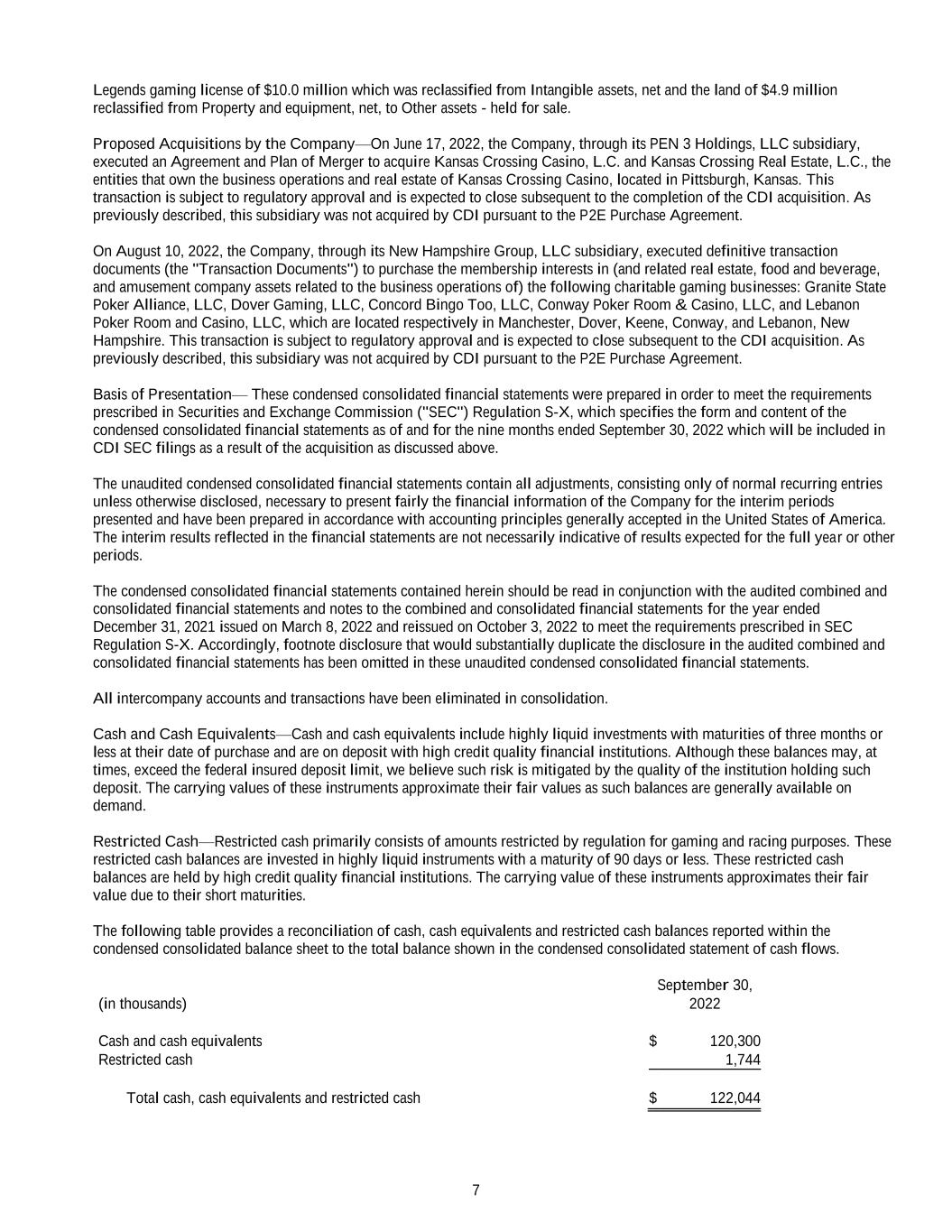

7 Legends gaming license of $10.0 million which was reclassified from Intangible assets, net and the land of $4.9 million reclassified from Property and equipment, net, to Other assets - held for sale. Proposed Acquisitions by the Company—On June 17, 2022, the Company, through its PEN 3 Holdings, LLC subsidiary, executed an Agreement and Plan of Merger to acquire Kansas Crossing Casino, L.C. and Kansas Crossing Real Estate, L.C., the entities that own the business operations and real estate of Kansas Crossing Casino, located in Pittsburgh, Kansas. This transaction is subject to regulatory approval and is expected to close subsequent to the completion of the CDI acquisition. As previously described, this subsidiary was not acquired by CDI pursuant to the P2E Purchase Agreement. On August 10, 2022, the Company, through its New Hampshire Group, LLC subsidiary, executed definitive transaction documents (the "Transaction Documents") to purchase the membership interests in (and related real estate, food and beverage, and amusement company assets related to the business operations of) the following charitable gaming businesses: Granite State Poker Alliance, LLC, Dover Gaming, LLC, Concord Bingo Too, LLC, Conway Poker Room & Casino, LLC, and Lebanon Poker Room and Casino, LLC, which are located respectively in Manchester, Dover, Keene, Conway, and Lebanon, New Hampshire. This transaction is subject to regulatory approval and is expected to close subsequent to the CDI acquisition. As previously described, this subsidiary was not acquired by CDI pursuant to the P2E Purchase Agreement. Basis of Presentation— These condensed consolidated financial statements were prepared in order to meet the requirements prescribed in Securities and Exchange Commission ("SEC") Regulation S-X, which specifies the form and content of the condensed consolidated financial statements as of and for the nine months ended September 30, 2022 which will be included in CDI SEC filings as a result of the acquisition as discussed above. The unaudited condensed consolidated financial statements contain all adjustments, consisting only of normal recurring entries unless otherwise disclosed, necessary to present fairly the financial information of the Company for the interim periods presented and have been prepared in accordance with accounting principles generally accepted in the United States of America. The interim results reflected in the financial statements are not necessarily indicative of results expected for the full year or other periods. The condensed consolidated financial statements contained herein should be read in conjunction with the audited combined and consolidated financial statements and notes to the combined and consolidated financial statements for the year ended December 31, 2021 issued on March 8, 2022 and reissued on October 3, 2022 to meet the requirements prescribed in SEC Regulation S-X. Accordingly, footnote disclosure that would substantially duplicate the disclosure in the audited combined and consolidated financial statements has been omitted in these unaudited condensed consolidated financial statements. All intercompany accounts and transactions have been eliminated in consolidation. Cash and Cash Equivalents—Cash and cash equivalents include highly liquid investments with maturities of three months or less at their date of purchase and are on deposit with high credit quality financial institutions. Although these balances may, at times, exceed the federal insured deposit limit, we believe such risk is mitigated by the quality of the institution holding such deposit. The carrying values of these instruments approximate their fair values as such balances are generally available on demand. Restricted Cash—Restricted cash primarily consists of amounts restricted by regulation for gaming and racing purposes. These restricted cash balances are invested in highly liquid instruments with a maturity of 90 days or less. These restricted cash balances are held by high credit quality financial institutions. The carrying value of these instruments approximates their fair value due to their short maturities. The following table provides a reconciliation of cash, cash equivalents and restricted cash balances reported within the condensed consolidated balance sheet to the total balance shown in the condensed consolidated statement of cash flows. September 30, (in thousands) 2022 Cash and cash equivalents $ 120,300 Restricted cash 1,744 Total cash, cash equivalents and restricted cash $ 122,044

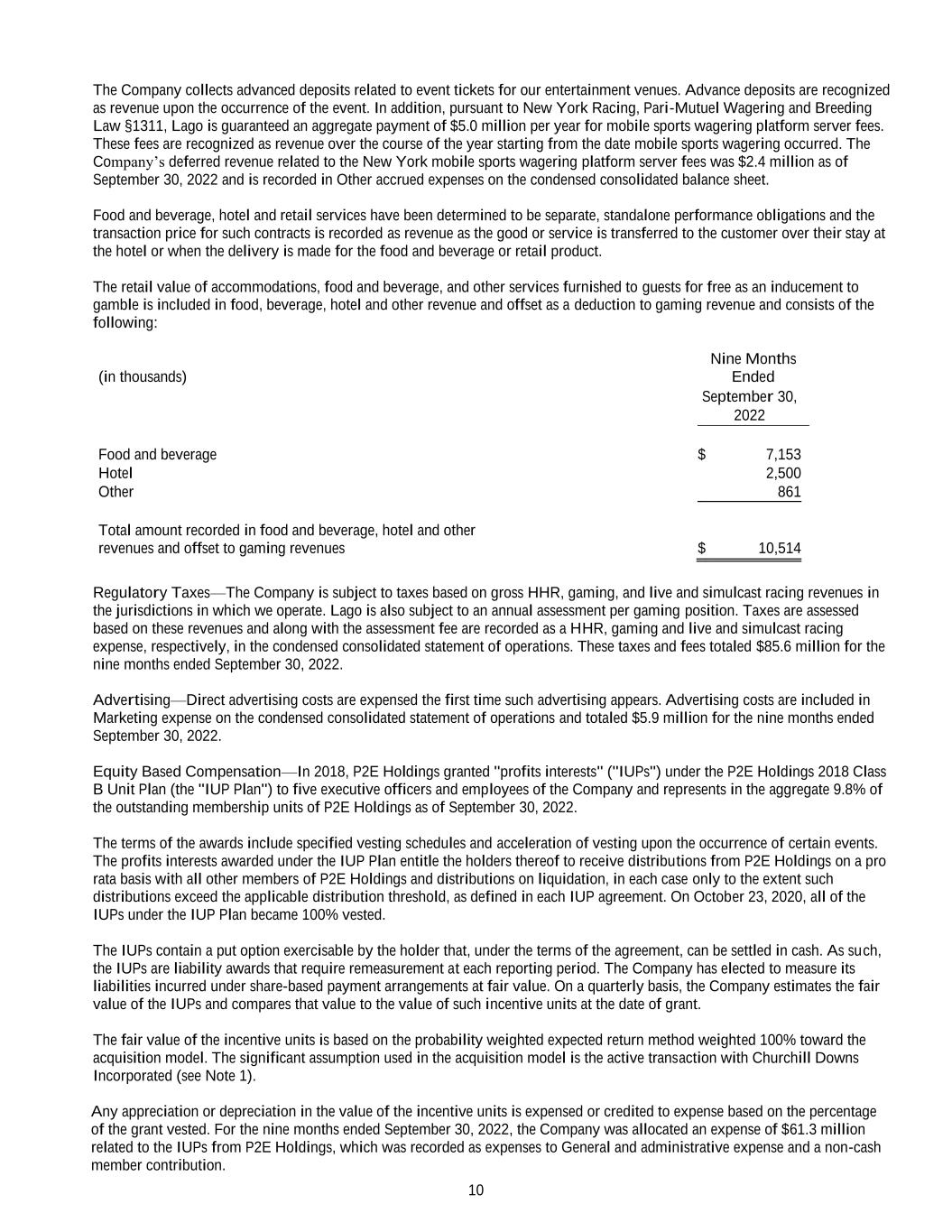

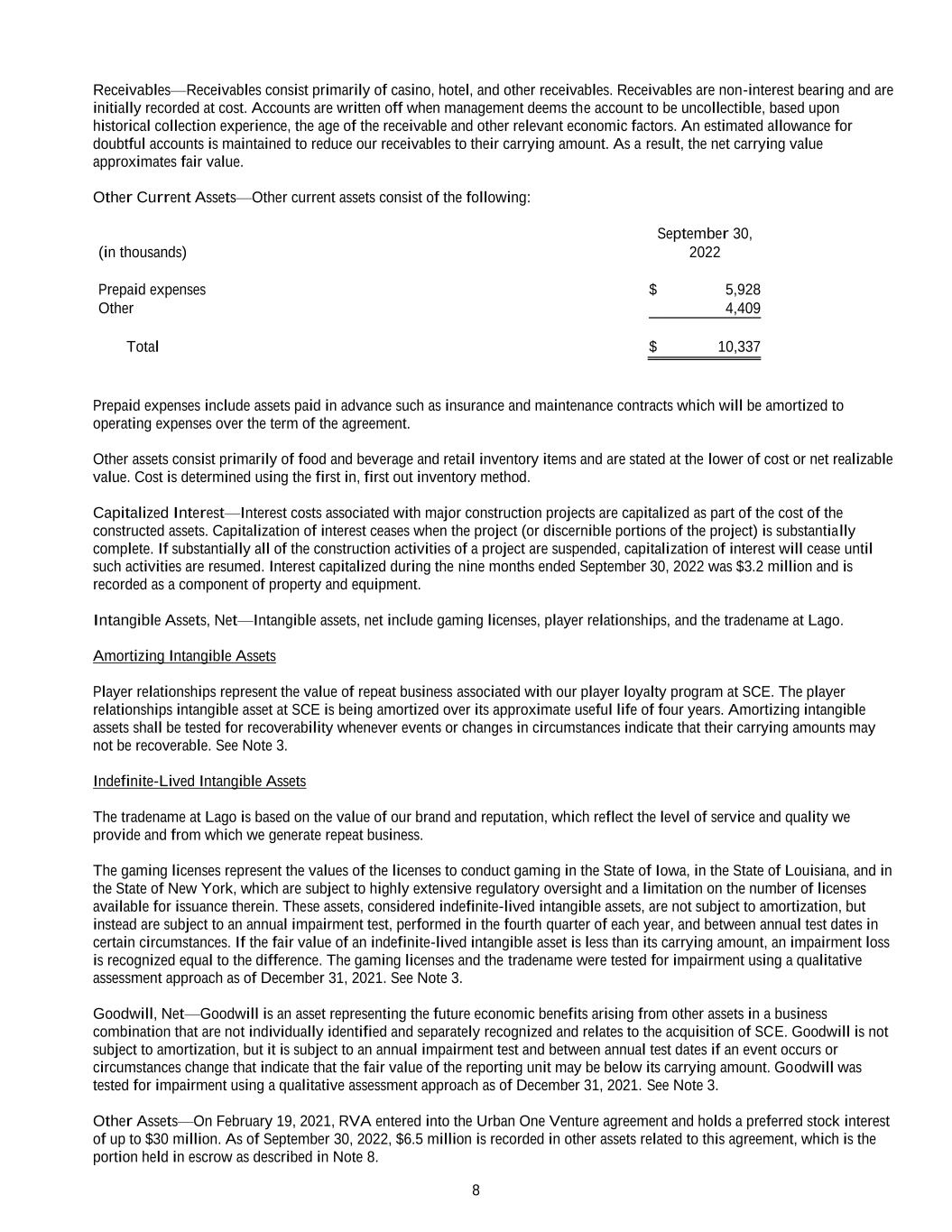

8 Receivables—Receivables consist primarily of casino, hotel, and other receivables. Receivables are non-interest bearing and are initially recorded at cost. Accounts are written off when management deems the account to be uncollectible, based upon historical collection experience, the age of the receivable and other relevant economic factors. An estimated allowance for doubtful accounts is maintained to reduce our receivables to their carrying amount. As a result, the net carrying value approximates fair value. Other Current Assets—Other current assets consist of the following: September 30, (in thousands) 2022 Prepaid expenses $ 5,928 Other 4,409 Total $ 10,337 Prepaid expenses include assets paid in advance such as insurance and maintenance contracts which will be amortized to operating expenses over the term of the agreement. Other assets consist primarily of food and beverage and retail inventory items and are stated at the lower of cost or net realizable value. Cost is determined using the first in, first out inventory method. Capitalized Interest—Interest costs associated with major construction projects are capitalized as part of the cost of the constructed assets. Capitalization of interest ceases when the project (or discernible portions of the project) is substantially complete. If substantially all of the construction activities of a project are suspended, capitalization of interest will cease until such activities are resumed. Interest capitalized during the nine months ended September 30, 2022 was $3.2 million and is recorded as a component of property and equipment. Intangible Assets, Net—Intangible assets, net include gaming licenses, player relationships, and the tradename at Lago. Amortizing Intangible Assets Player relationships represent the value of repeat business associated with our player loyalty program at SCE. The player relationships intangible asset at SCE is being amortized over its approximate useful life of four years. Amortizing intangible assets shall be tested for recoverability whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. See Note 3. Indefinite-Lived Intangible Assets The tradename at Lago is based on the value of our brand and reputation, which reflect the level of service and quality we provide and from which we generate repeat business. The gaming licenses represent the values of the licenses to conduct gaming in the State of Iowa, in the State of Louisiana, and in the State of New York, which are subject to highly extensive regulatory oversight and a limitation on the number of licenses available for issuance therein. These assets, considered indefinite-lived intangible assets, are not subject to amortization, but instead are subject to an annual impairment test, performed in the fourth quarter of each year, and between annual test dates in certain circumstances. If the fair value of an indefinite-lived intangible asset is less than its carrying amount, an impairment loss is recognized equal to the difference. The gaming licenses and the tradename were tested for impairment using a qualitative assessment approach as of December 31, 2021. See Note 3. Goodwill, Net—Goodwill is an asset representing the future economic benefits arising from other assets in a business combination that are not individually identified and separately recognized and relates to the acquisition of SCE. Goodwill is not subject to amortization, but it is subject to an annual impairment test and between annual test dates if an event occurs or circumstances change that indicate that the fair value of the reporting unit may be below its carrying amount. Goodwill was tested for impairment using a qualitative assessment approach as of December 31, 2021. See Note 3. Other Assets—On February 19, 2021, RVA entered into the Urban One Venture agreement and holds a preferred stock interest of up to $30 million. As of September 30, 2022, $6.5 million is recorded in other assets related to this agreement, which is the portion held in escrow as described in Note 8.

9 Other assets also include favorable leasehold interests which represent the rental rates for assumed land leases that are favorable to comparable market rates at SCE which were recorded at fair value as part of the acquisition. The fair value was determined on a technique whereby the difference between the lease rate and the then current market rate for the remaining contractual term is discounted to present value. The assumptions underlying this computation include the actual lease rates, the expected remaining lease term, including renewal options, based on the existing lease; current rates of rent for leases on comparable properties with similar terms obtained from market data and analysis; and an assumed discount rate. The resulting difference between the lease rate and the then current market value rate is recognized as rent expense and the associated discount is accreted to interest income using the effective interest method over the term of the underlying lease which cover a term of 20 to 40 years. In addition, other assets include the fair value of the payment in lieu of property taxes agreement determined as part of the Lago purchase accounting performed in August 2019. This other asset is being amortized over the remaining life of the agreement with the Seneca County Industrial Development Agency ("IDA"). Player Loyalty Point Program—The Company has established promotional programs to encourage repeat business from frequent and active HHR and slot machine customers and other patrons. Members earn points based on gaming and HHR activity and such points can be redeemed for free slot play, food and beverage, and other free goods and services. The player loyalty point program accrual is included in Other accrued expenses on the Company’s condensed consolidated balance sheet. This is the primary type of liability associated with contracts with customers and represents a deferral of HHR and gaming revenue until the customer redeems the incentives earned, and are typically expected to be redeemed and recognized within one year or sooner of being earned. The program liabilities are recorded net of an estimated "breakage" factor, which assumes that some points will expire without being redeemed; the breakage is estimated based on historical redemption rates. The Company’s loyalty program liabilities were $3.5 million as of September 30, 2022. Revenue Recognition—The Company’s revenue from contracts with customers consists of gaming wagers, pari-mutuel wagers, food and beverage transactions, retail transactions, hotel room sales, and revenues from our Strategic Gaming Agreement. The transaction price for a gaming wagering contract is the difference between gaming wins and losses, not the total amount wagered. The transaction price for our pari-mutuel operations, inclusive of HHR operations, live racing events conducted at our racing facility and our import and export arrangements, is the commission received from the pari-mutuel pool. The transaction price for food and beverage, hotel and retail contracts is the net amount collected from the customer for such goods and services. Sales tax and other taxes collected on behalf of governmental authorities are accounted for on the net basis and are not included in revenues or expenses. Gaming and HHR revenue contracts involve two performance obligations for those customers earning points under the Company’s loyalty reward programs and a single performance obligation for customers that do not participate in the program. Our pari-mutuel operations contracts involve one performance obligation. The Company applies a practical expedient by accounting for its gaming and HHR contracts on a portfolio basis as such wagers have similar characteristics and the Company reasonably expects the effects on the financial statements of applying the revenue recognition guidance to the portfolio to not differ materially from that which would result if applying the guidance to an individual wagering contract. For purposes of allocating the transaction price in a wagering contract between the wagering performance obligation and the obligation associated with the loyalty points earned, the Company allocates an amount to the loyalty point contract liability based on the stand-alone selling price of the points earned, which is determined by the value of a point that can be redeemed for slot play, HHR play and complimentaries such as food and beverage at our restaurants, lodging at our hotel and products offered at our retail stores, less estimated breakage. The allocated revenue for gaming wagers is recognized when the wagering occurs as all such wagers settle immediately. The loyalty reward contract liability amount is deferred and recognized as revenue when the customer redeems the loyalty points for slot play, HHR play and complimentaries and such goods and services are delivered to the customer. Pari-mutuel revenue contracts are inclusive of the Company’s (i) HHR, (ii) host racing facility, (iii) import arrangements that permit the Company to simulcast in live racing events occurring at other racetracks, and (iv) export arrangements that permit the Company’s live racing event to be simulcast at other racetracks. Host racing facility, import and export revenues are recognized once the race event is made official by the relevant racing body. HHR revenue is recognized once the historical race has been completed on the HHR machine. The Company has concluded it is the controlling entity to the HHR, host racing facility, and export arrangements as it functions as the principal in the arrangement and is not the controlling entity to the import arrangements as it functions as the agent. Commissions earned from the pari-mutuel pool less import arrangement fees are recognized on a net-basis, which is included within live and simulcast racing revenues. Any other fees associated with these arrangements are recorded in live and simulcast racing expenses.

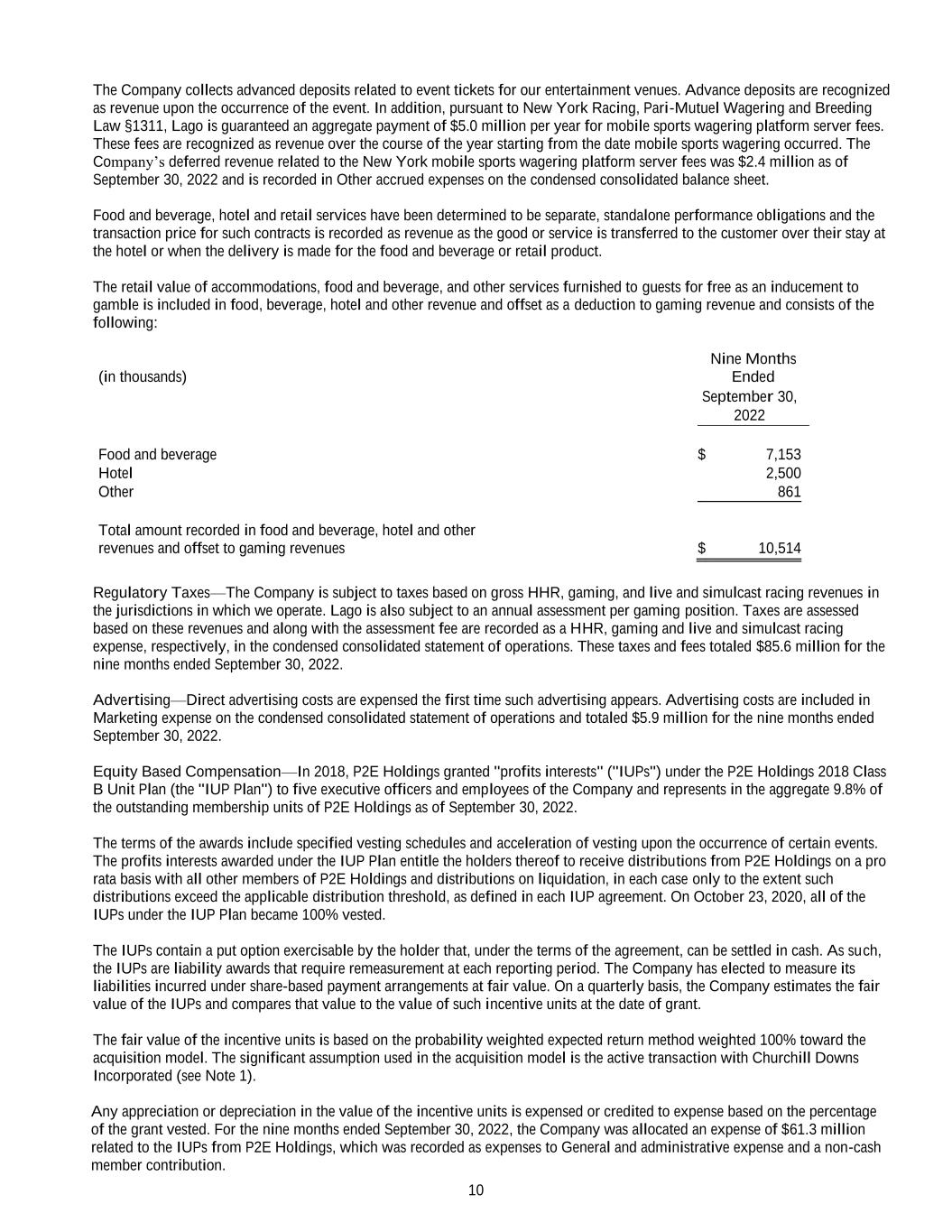

10 The Company collects advanced deposits related to event tickets for our entertainment venues. Advance deposits are recognized as revenue upon the occurrence of the event. In addition, pursuant to New York Racing, Pari-Mutuel Wagering and Breeding Law §1311, Lago is guaranteed an aggregate payment of $5.0 million per year for mobile sports wagering platform server fees. These fees are recognized as revenue over the course of the year starting from the date mobile sports wagering occurred. The Company’s deferred revenue related to the New York mobile sports wagering platform server fees was $2.4 million as of September 30, 2022 and is recorded in Other accrued expenses on the condensed consolidated balance sheet. Food and beverage, hotel and retail services have been determined to be separate, standalone performance obligations and the transaction price for such contracts is recorded as revenue as the good or service is transferred to the customer over their stay at the hotel or when the delivery is made for the food and beverage or retail product. The retail value of accommodations, food and beverage, and other services furnished to guests for free as an inducement to gamble is included in food, beverage, hotel and other revenue and offset as a deduction to gaming revenue and consists of the following: (in thousands) Nine Months Ended September 30, 2022 Food and beverage $ 7,153 Hotel 2,500 Other 861 Total amount recorded in food and beverage, hotel and other revenues and offset to gaming revenues $ 10,514 Regulatory Taxes—The Company is subject to taxes based on gross HHR, gaming, and live and simulcast racing revenues in the jurisdictions in which we operate. Lago is also subject to an annual assessment per gaming position. Taxes are assessed based on these revenues and along with the assessment fee are recorded as a HHR, gaming and live and simulcast racing expense, respectively, in the condensed consolidated statement of operations. These taxes and fees totaled $85.6 million for the nine months ended September 30, 2022. Advertising—Direct advertising costs are expensed the first time such advertising appears. Advertising costs are included in Marketing expense on the condensed consolidated statement of operations and totaled $5.9 million for the nine months ended September 30, 2022. Equity Based Compensation—In 2018, P2E Holdings granted "profits interests" ("IUPs") under the P2E Holdings 2018 Class B Unit Plan (the "IUP Plan") to five executive officers and employees of the Company and represents in the aggregate 9.8% of the outstanding membership units of P2E Holdings as of September 30, 2022. The terms of the awards include specified vesting schedules and acceleration of vesting upon the occurrence of certain events. The profits interests awarded under the IUP Plan entitle the holders thereof to receive distributions from P2E Holdings on a pro rata basis with all other members of P2E Holdings and distributions on liquidation, in each case only to the extent such distributions exceed the applicable distribution threshold, as defined in each IUP agreement. On October 23, 2020, all of the IUPs under the IUP Plan became 100% vested. The IUPs contain a put option exercisable by the holder that, under the terms of the agreement, can be settled in cash. As such, the IUPs are liability awards that require remeasurement at each reporting period. The Company has elected to measure its liabilities incurred under share-based payment arrangements at fair value. On a quarterly basis, the Company estimates the fair value of the IUPs and compares that value to the value of such incentive units at the date of grant. The fair value of the incentive units is based on the probability weighted expected return method weighted 100% toward the acquisition model. The significant assumption used in the acquisition model is the active transaction with Churchill Downs Incorporated (see Note 1). Any appreciation or depreciation in the value of the incentive units is expensed or credited to expense based on the percentage of the grant vested. For the nine months ended September 30, 2022, the Company was allocated an expense of $61.3 million related to the IUPs from P2E Holdings, which was recorded as expenses to General and administrative expense and a non-cash member contribution.

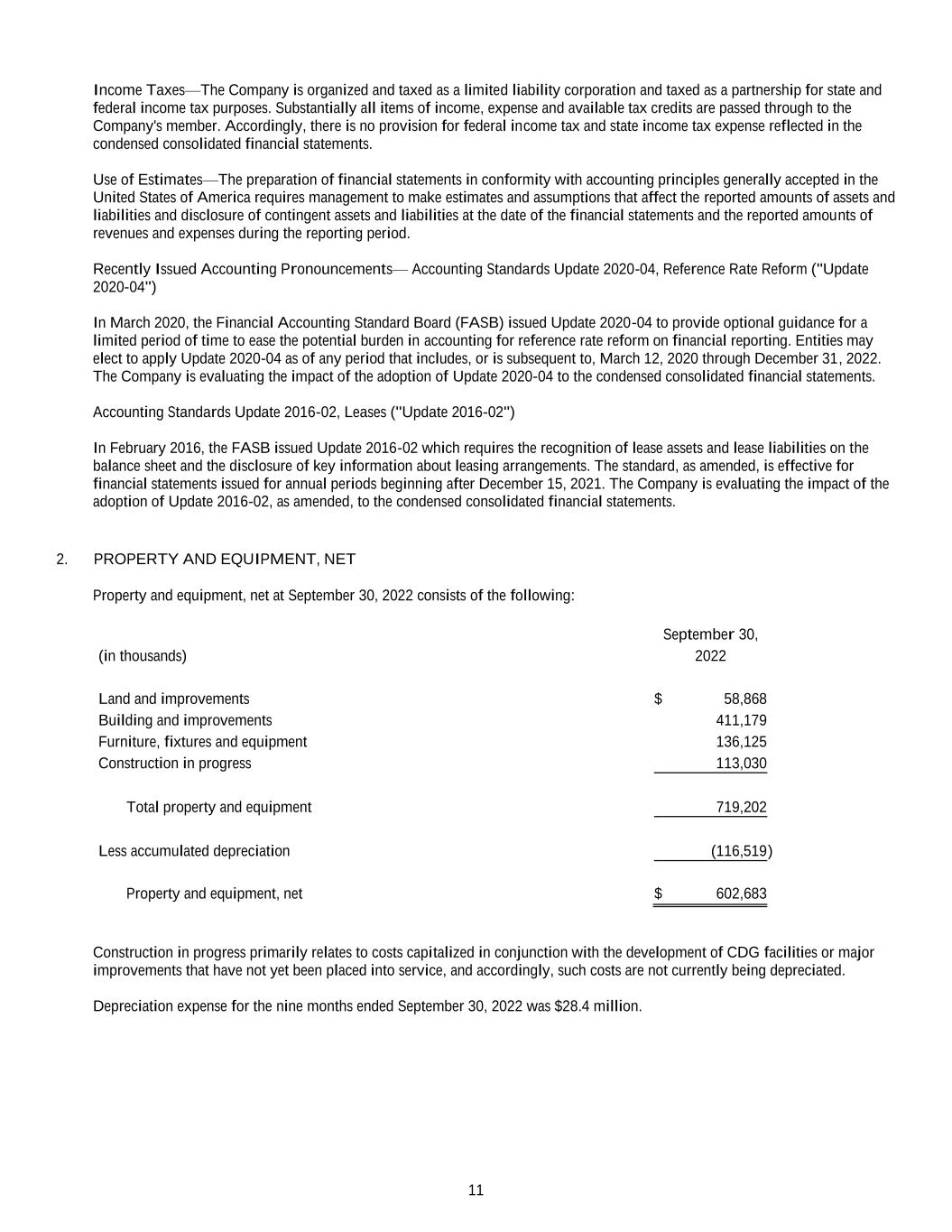

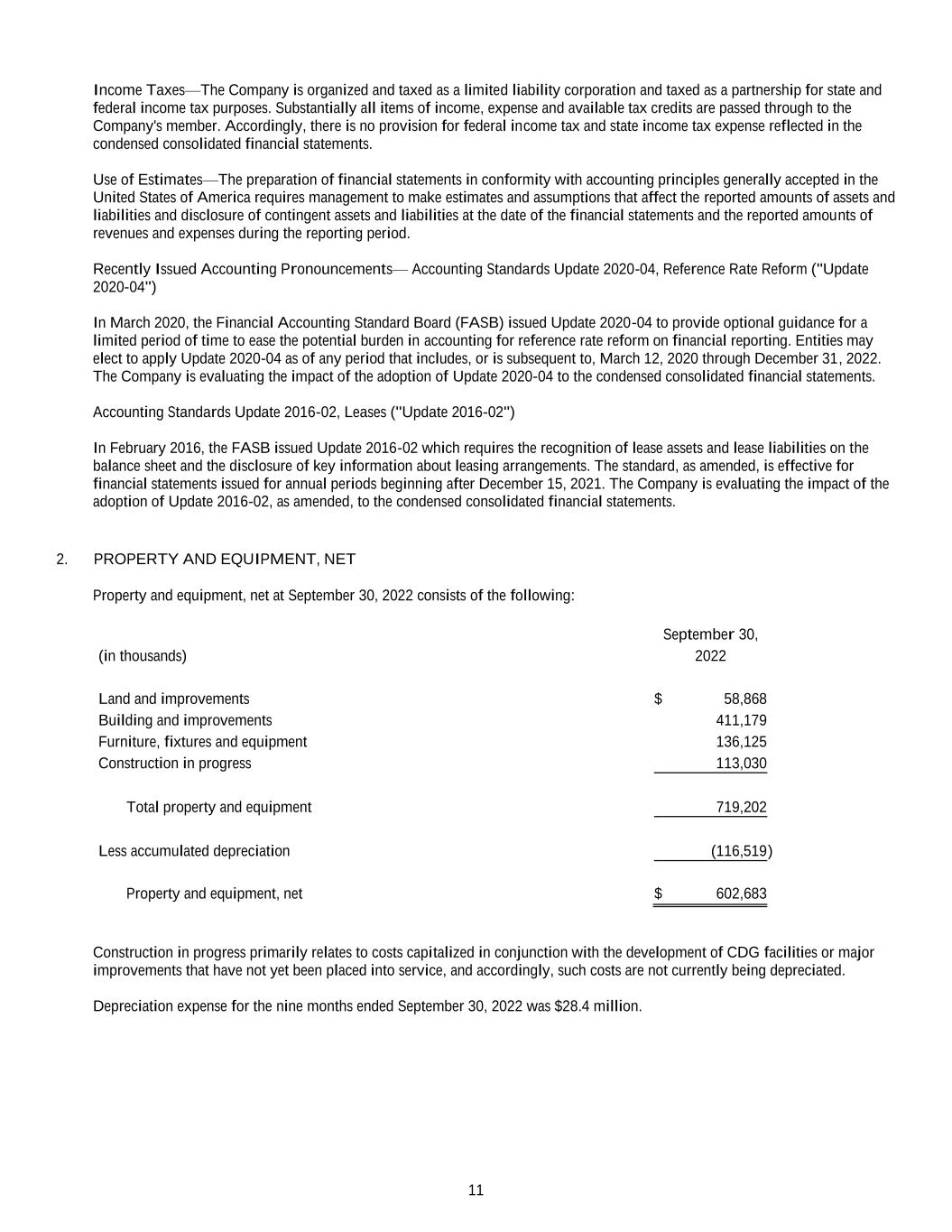

11 Income Taxes—The Company is organized and taxed as a limited liability corporation and taxed as a partnership for state and federal income tax purposes. Substantially all items of income, expense and available tax credits are passed through to the Company's member. Accordingly, there is no provision for federal income tax and state income tax expense reflected in the condensed consolidated financial statements. Use of Estimates—The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Recently Issued Accounting Pronouncements— Accounting Standards Update 2020-04, Reference Rate Reform ("Update 2020-04") In March 2020, the Financial Accounting Standard Board (FASB) issued Update 2020-04 to provide optional guidance for a limited period of time to ease the potential burden in accounting for reference rate reform on financial reporting. Entities may elect to apply Update 2020-04 as of any period that includes, or is subsequent to, March 12, 2020 through December 31, 2022. The Company is evaluating the impact of the adoption of Update 2020-04 to the condensed consolidated financial statements. Accounting Standards Update 2016-02, Leases ("Update 2016-02") In February 2016, the FASB issued Update 2016-02 which requires the recognition of lease assets and lease liabilities on the balance sheet and the disclosure of key information about leasing arrangements. The standard, as amended, is effective for financial statements issued for annual periods beginning after December 15, 2021. The Company is evaluating the impact of the adoption of Update 2016-02, as amended, to the condensed consolidated financial statements. 2. PROPERTY AND EQUIPMENT, NET Property and equipment, net at September 30, 2022 consists of the following: September 30, (in thousands) 2022 Land and improvements $ 58,868 Building and improvements 411,179 Furniture, fixtures and equipment 136,125 Construction in progress 113,030 Total property and equipment 719,202 Less accumulated depreciation (116,519 ) Property and equipment, net $ 602,683 Construction in progress primarily relates to costs capitalized in conjunction with the development of CDG facilities or major improvements that have not yet been placed into service, and accordingly, such costs are not currently being depreciated. Depreciation expense for the nine months ended September 30, 2022 was $28.4 million.

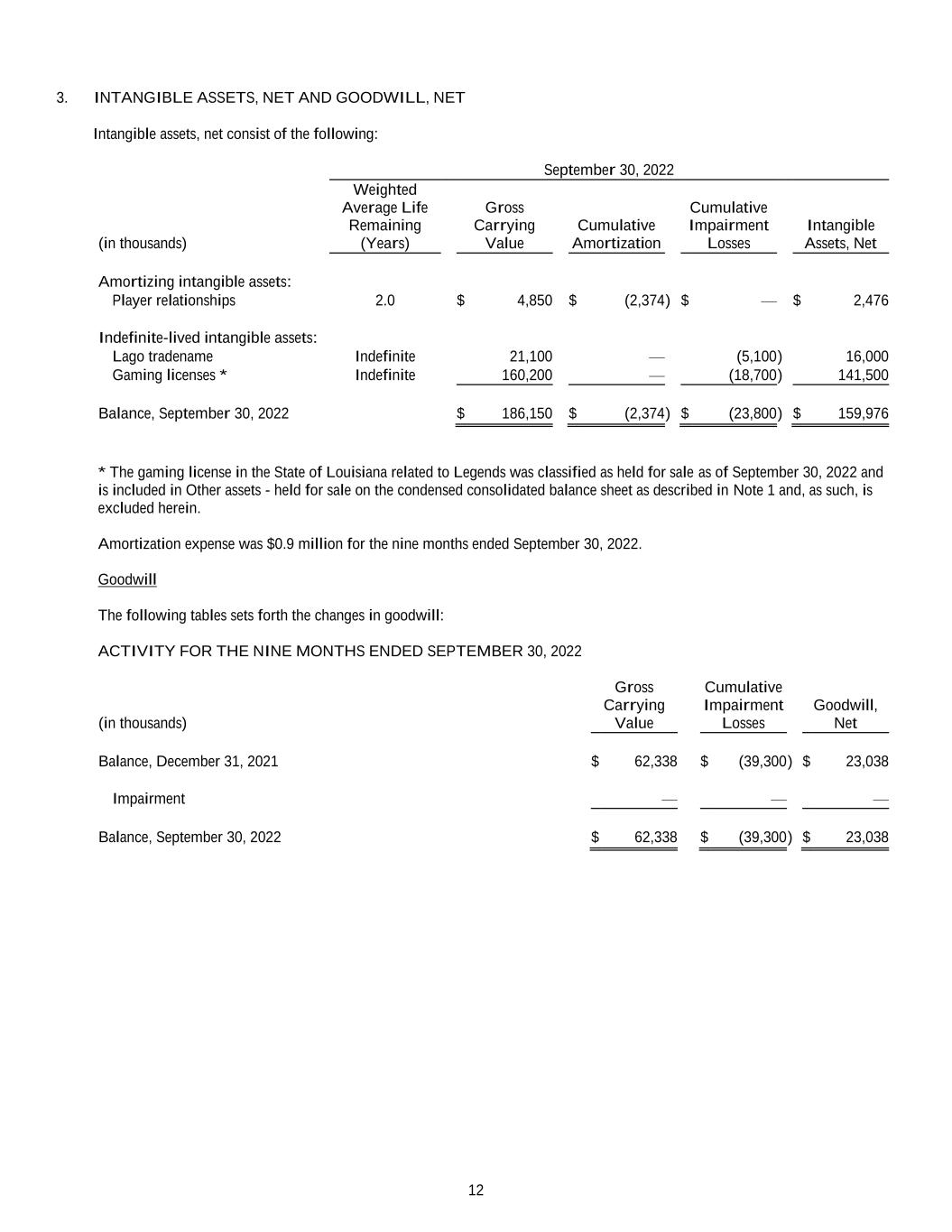

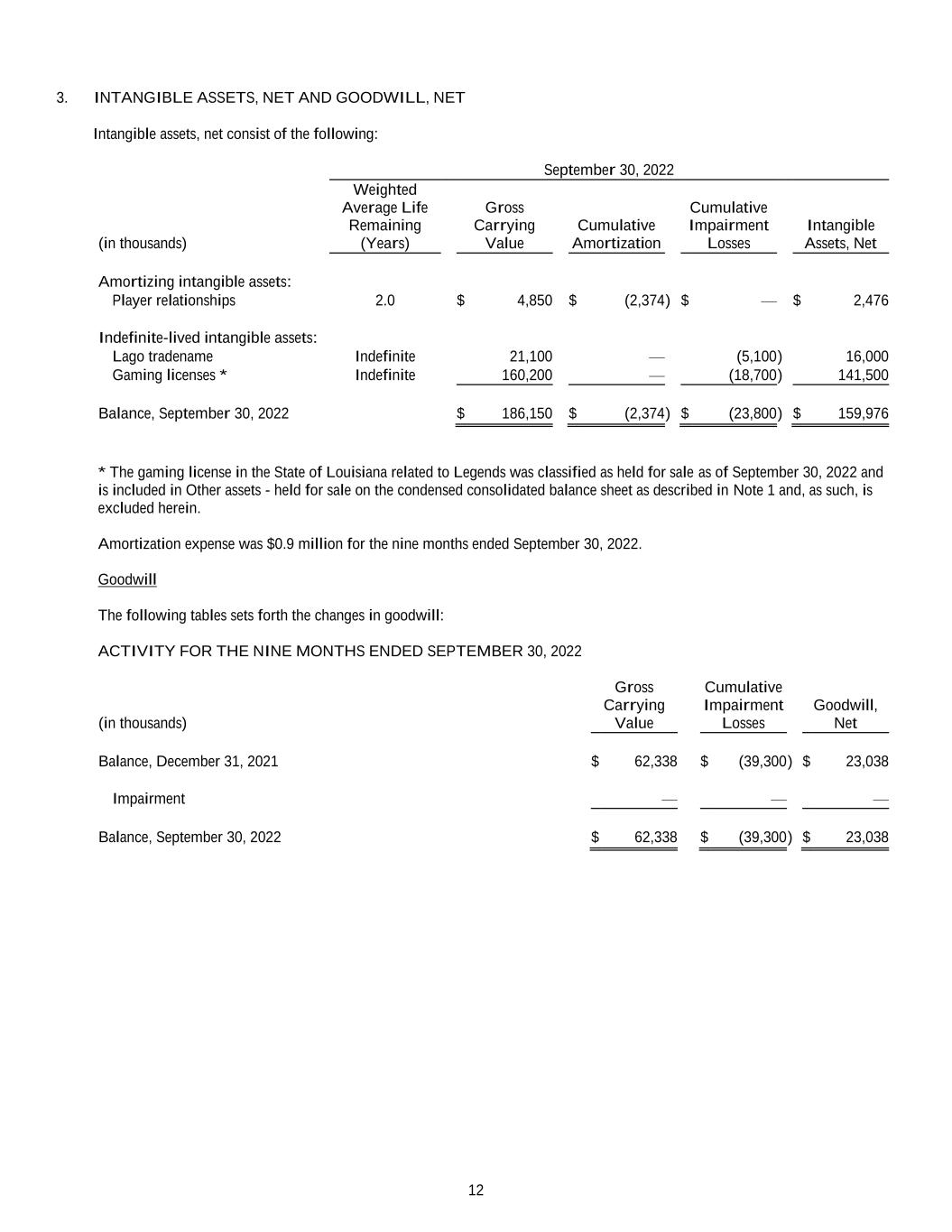

12 3. INTANGIBLE ASSETS, NET AND GOODWILL, NET Intangible assets, net consist of the following: September 30, 2022 (in thousands) Weighted Average Life Remaining (Years) Gross Carrying Value Cumulative Amortization Cumulative Impairment Losses Intangible Assets, Net Amortizing intangible assets: Player relationships 2.0 $ 4,850 $ (2,374 ) $ — $ 2,476 Indefinite-lived intangible assets: Lago tradename Indefinite 21,100 — (5,100 ) 16,000 Gaming licenses * Indefinite 160,200 — (18,700 ) 141,500 Balance, September 30, 2022 $ 186,150 $ (2,374 ) $ (23,800 ) $ 159,976 * The gaming license in the State of Louisiana related to Legends was classified as held for sale as of September 30, 2022 and is included in Other assets - held for sale on the condensed consolidated balance sheet as described in Note 1 and, as such, is excluded herein. Amortization expense was $0.9 million for the nine months ended September 30, 2022. Goodwill The following tables sets forth the changes in goodwill: ACTIVITY FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2022 (in thousands) Gross Carrying Value Cumulative Impairment Losses Goodwill, Net Balance, December 31, 2021 $ 62,338 $ (39,300 ) $ 23,038 Impairment — — — Balance, September 30, 2022 $ 62,338 $ (39,300 ) $ 23,038

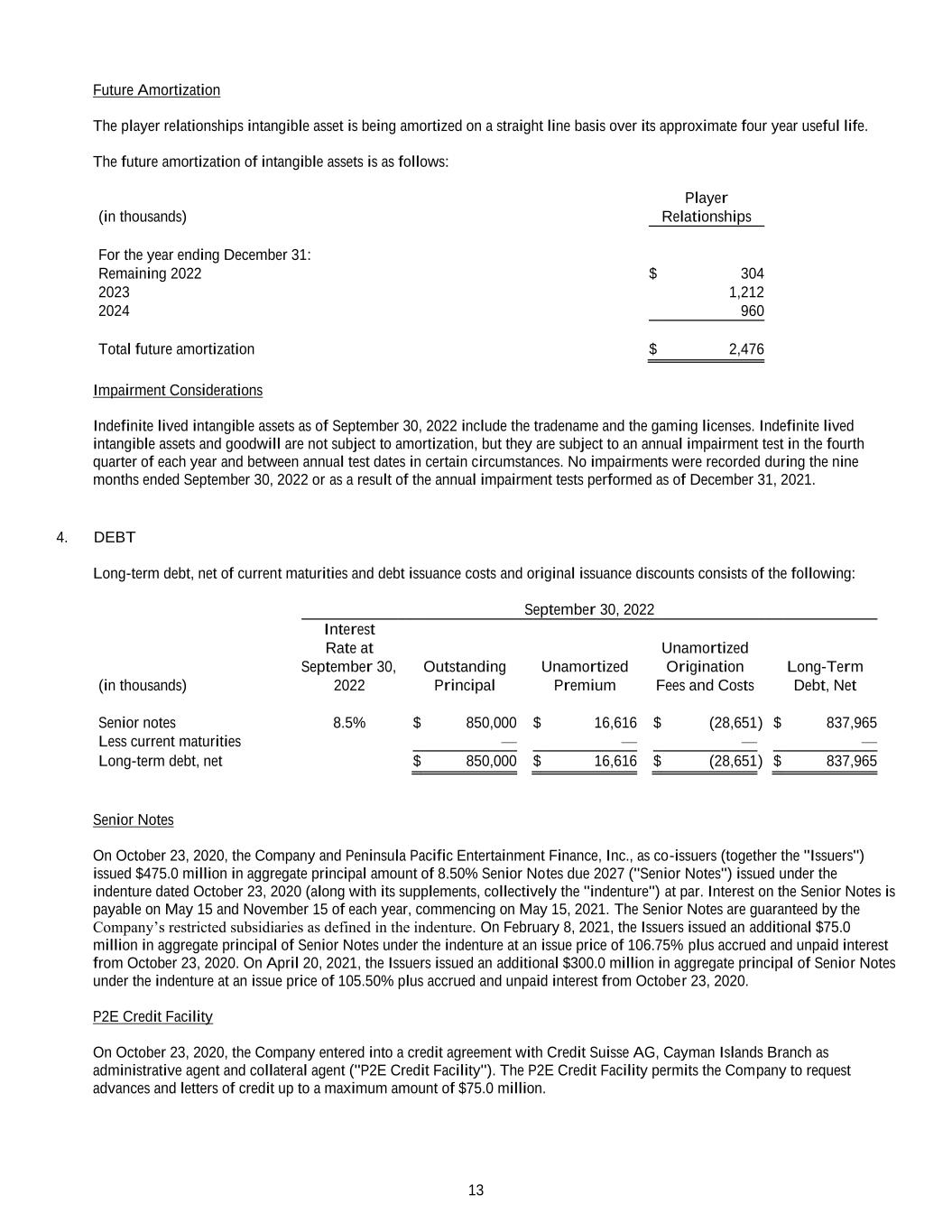

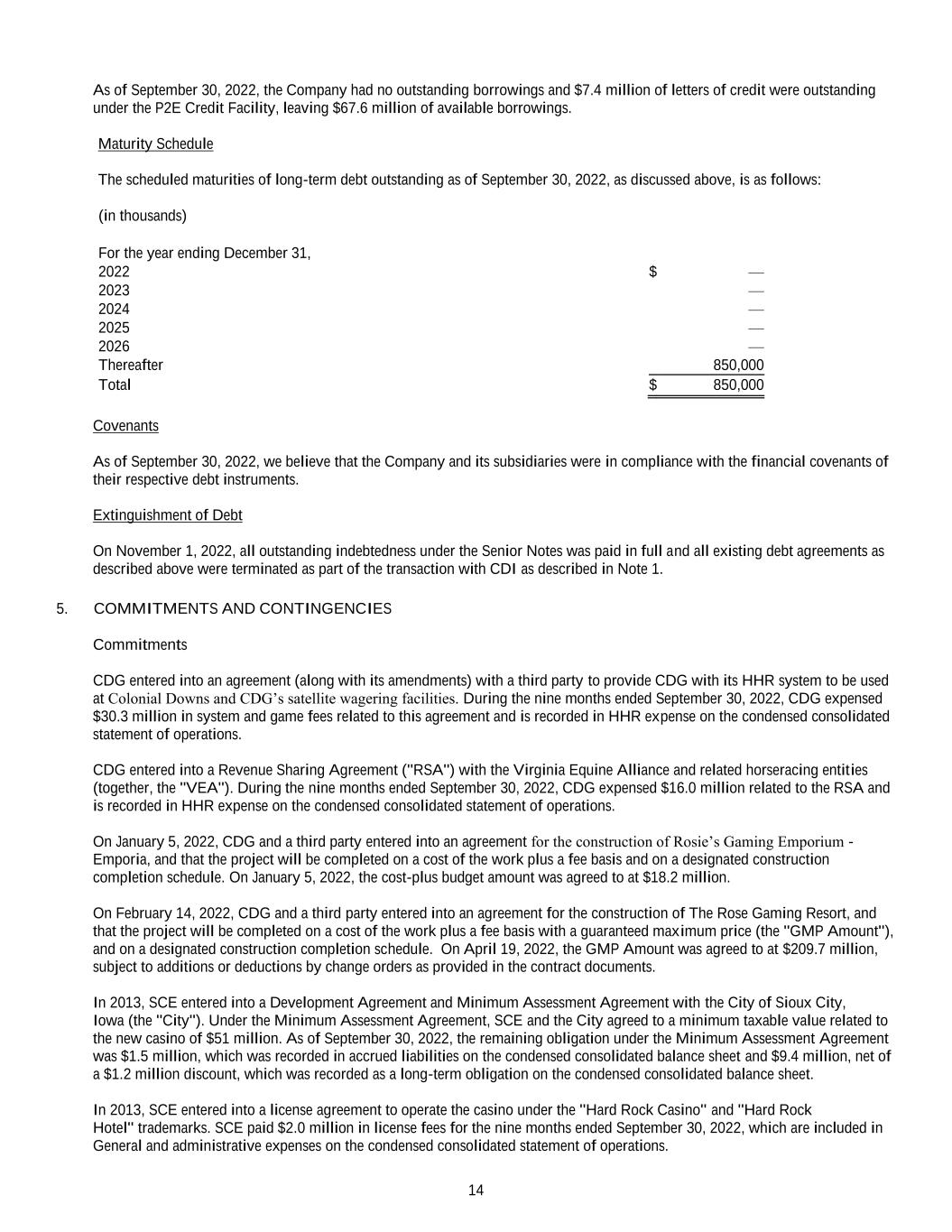

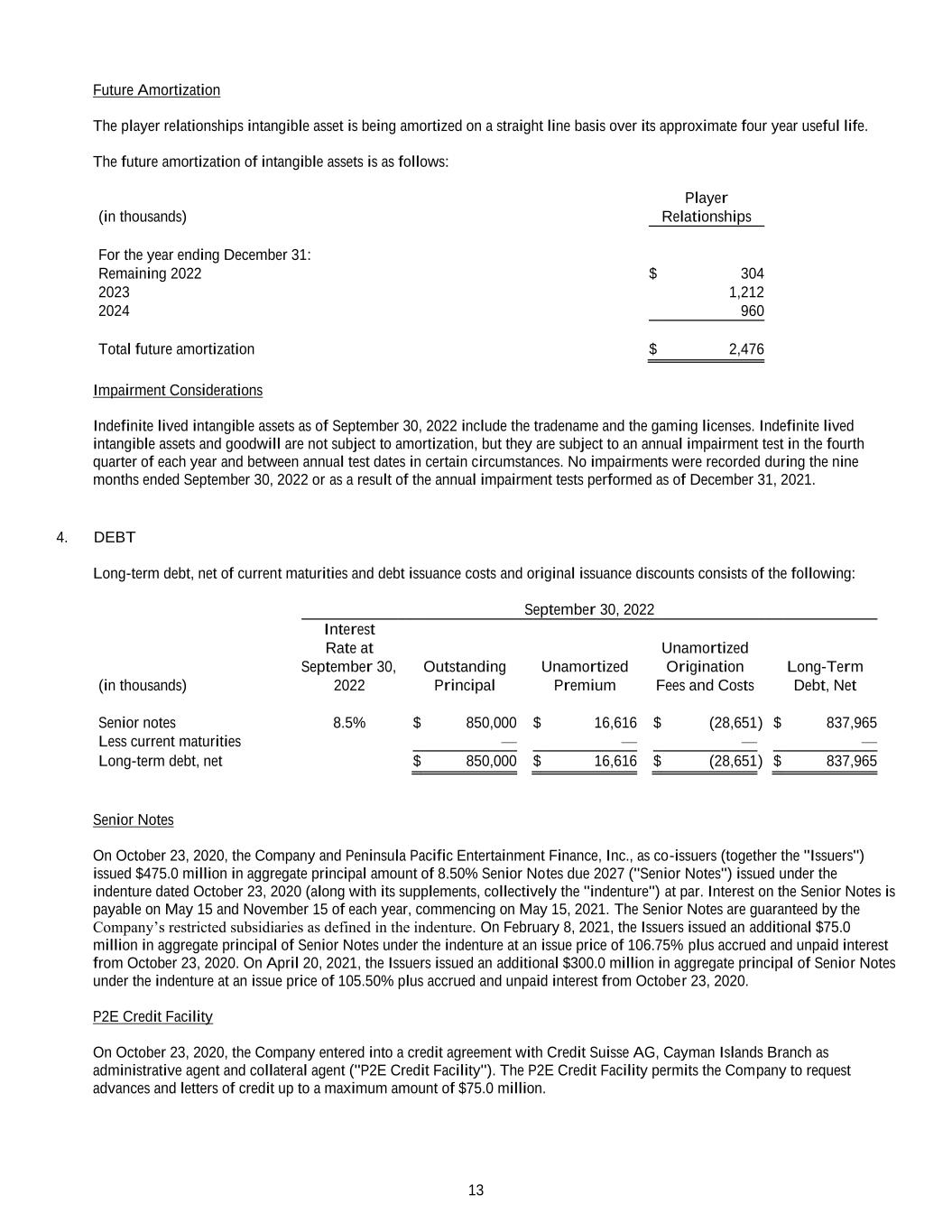

13 Future Amortization The player relationships intangible asset is being amortized on a straight line basis over its approximate four year useful life. The future amortization of intangible assets is as follows: Player (in thousands) Relationships For the year ending December 31: Remaining 2022 $ 304 2023 1,212 2024 960 Total future amortization $ 2,476 Impairment Considerations Indefinite lived intangible assets as of September 30, 2022 include the tradename and the gaming licenses. Indefinite lived intangible assets and goodwill are not subject to amortization, but they are subject to an annual impairment test in the fourth quarter of each year and between annual test dates in certain circumstances. No impairments were recorded during the nine months ended September 30, 2022 or as a result of the annual impairment tests performed as of December 31, 2021. 4. DEBT Long-term debt, net of current maturities and debt issuance costs and original issuance discounts consists of the following: September 30, 2022 Interest Rate at Unamortized September 30, Outstanding Unamortized Origination Long-Term (in thousands) 2022 Principal Premium Fees and Costs Debt, Net Senior notes 8.5% $ 850,000 $ 16,616 $ (28,651 ) $ 837,965 Less current maturities — — — — Long-term debt, net $ 850,000 $ 16,616 $ (28,651 ) $ 837,965 Senior Notes On October 23, 2020, the Company and Peninsula Pacific Entertainment Finance, Inc., as co-issuers (together the "Issuers") issued $475.0 million in aggregate principal amount of 8.50% Senior Notes due 2027 ("Senior Notes") issued under the indenture dated October 23, 2020 (along with its supplements, collectively the "indenture") at par. Interest on the Senior Notes is payable on May 15 and November 15 of each year, commencing on May 15, 2021. The Senior Notes are guaranteed by the Company’s restricted subsidiaries as defined in the indenture. On February 8, 2021, the Issuers issued an additional $75.0 million in aggregate principal of Senior Notes under the indenture at an issue price of 106.75% plus accrued and unpaid interest from October 23, 2020. On April 20, 2021, the Issuers issued an additional $300.0 million in aggregate principal of Senior Notes under the indenture at an issue price of 105.50% plus accrued and unpaid interest from October 23, 2020. P2E Credit Facility On October 23, 2020, the Company entered into a credit agreement with Credit Suisse AG, Cayman Islands Branch as administrative agent and collateral agent ("P2E Credit Facility"). The P2E Credit Facility permits the Company to request advances and letters of credit up to a maximum amount of $75.0 million.

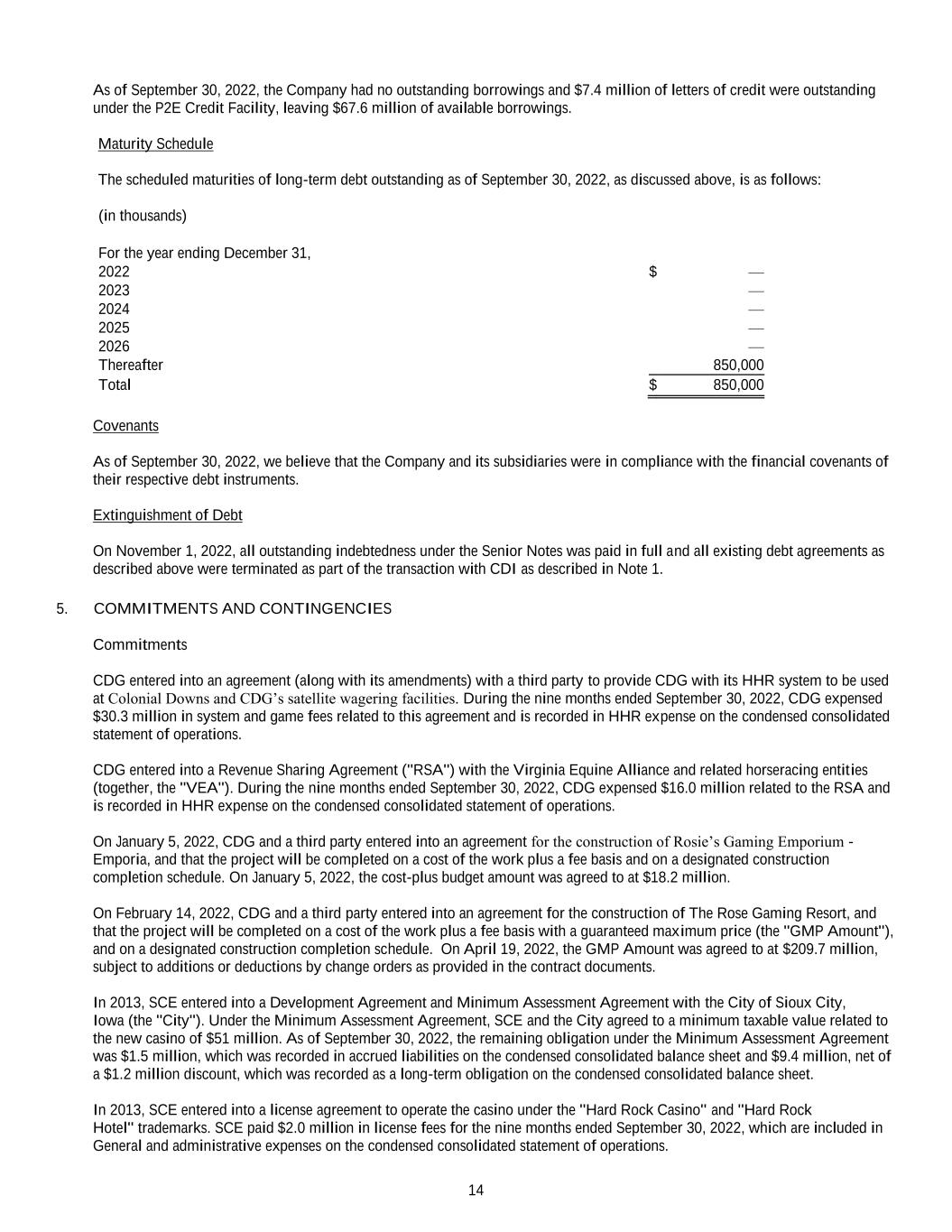

14 As of September 30, 2022, the Company had no outstanding borrowings and $7.4 million of letters of credit were outstanding under the P2E Credit Facility, leaving $67.6 million of available borrowings. Maturity Schedule The scheduled maturities of long-term debt outstanding as of September 30, 2022, as discussed above, is as follows: (in thousands) For the year ending December 31, 2022 $ — 2023 — 2024 — 2025 — 2026 — Thereafter 850,000 Total $ 850,000 Covenants As of September 30, 2022, we believe that the Company and its subsidiaries were in compliance with the financial covenants of their respective debt instruments. Extinguishment of Debt On November 1, 2022, all outstanding indebtedness under the Senior Notes was paid in full and all existing debt agreements as described above were terminated as part of the transaction with CDI as described in Note 1. 5. COMMITMENTS AND CONTINGENCIES Commitments CDG entered into an agreement (along with its amendments) with a third party to provide CDG with its HHR system to be used at Colonial Downs and CDG’s satellite wagering facilities. During the nine months ended September 30, 2022, CDG expensed $30.3 million in system and game fees related to this agreement and is recorded in HHR expense on the condensed consolidated statement of operations. CDG entered into a Revenue Sharing Agreement ("RSA") with the Virginia Equine Alliance and related horseracing entities (together, the "VEA"). During the nine months ended September 30, 2022, CDG expensed $16.0 million related to the RSA and is recorded in HHR expense on the condensed consolidated statement of operations. On January 5, 2022, CDG and a third party entered into an agreement for the construction of Rosie’s Gaming Emporium - Emporia, and that the project will be completed on a cost of the work plus a fee basis and on a designated construction completion schedule. On January 5, 2022, the cost-plus budget amount was agreed to at $18.2 million. On February 14, 2022, CDG and a third party entered into an agreement for the construction of The Rose Gaming Resort, and that the project will be completed on a cost of the work plus a fee basis with a guaranteed maximum price (the "GMP Amount"), and on a designated construction completion schedule. On April 19, 2022, the GMP Amount was agreed to at $209.7 million, subject to additions or deductions by change orders as provided in the contract documents. In 2013, SCE entered into a Development Agreement and Minimum Assessment Agreement with the City of Sioux City, Iowa (the "City"). Under the Minimum Assessment Agreement, SCE and the City agreed to a minimum taxable value related to the new casino of $51 million. As of September 30, 2022, the remaining obligation under the Minimum Assessment Agreement was $1.5 million, which was recorded in accrued liabilities on the condensed consolidated balance sheet and $9.4 million, net of a $1.2 million discount, which was recorded as a long-term obligation on the condensed consolidated balance sheet. In 2013, SCE entered into a license agreement to operate the casino under the "Hard Rock Casino" and "Hard Rock Hotel" trademarks. SCE paid $2.0 million in license fees for the nine months ended September 30, 2022, which are included in General and administrative expenses on the condensed consolidated statement of operations.

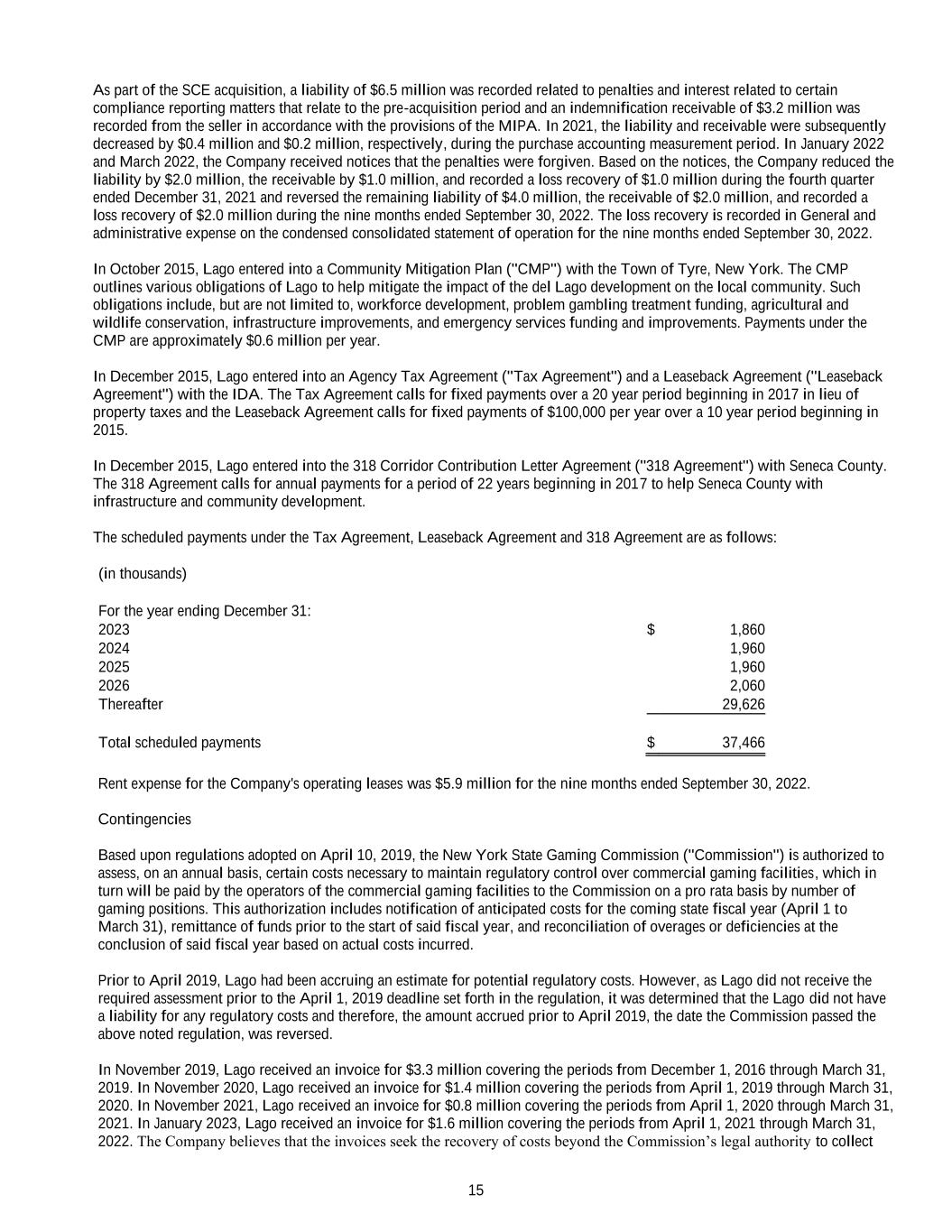

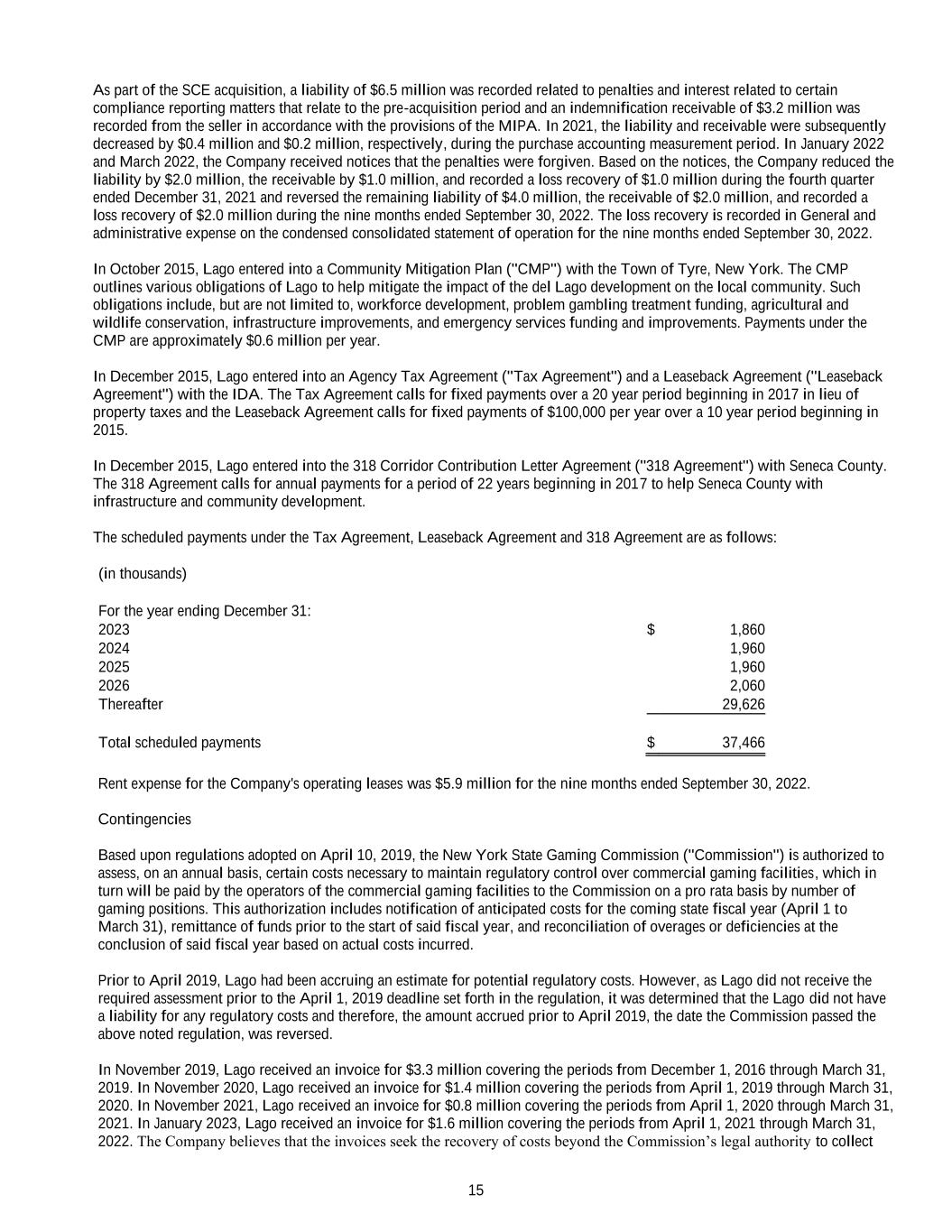

15 As part of the SCE acquisition, a liability of $6.5 million was recorded related to penalties and interest related to certain compliance reporting matters that relate to the pre-acquisition period and an indemnification receivable of $3.2 million was recorded from the seller in accordance with the provisions of the MIPA. In 2021, the liability and receivable were subsequently decreased by $0.4 million and $0.2 million, respectively, during the purchase accounting measurement period. In January 2022 and March 2022, the Company received notices that the penalties were forgiven. Based on the notices, the Company reduced the liability by $2.0 million, the receivable by $1.0 million, and recorded a loss recovery of $1.0 million during the fourth quarter ended December 31, 2021 and reversed the remaining liability of $4.0 million, the receivable of $2.0 million, and recorded a loss recovery of $2.0 million during the nine months ended September 30, 2022. The loss recovery is recorded in General and administrative expense on the condensed consolidated statement of operation for the nine months ended September 30, 2022. In October 2015, Lago entered into a Community Mitigation Plan ("CMP") with the Town of Tyre, New York. The CMP outlines various obligations of Lago to help mitigate the impact of the del Lago development on the local community. Such obligations include, but are not limited to, workforce development, problem gambling treatment funding, agricultural and wildlife conservation, infrastructure improvements, and emergency services funding and improvements. Payments under the CMP are approximately $0.6 million per year. In December 2015, Lago entered into an Agency Tax Agreement ("Tax Agreement") and a Leaseback Agreement ("Leaseback Agreement") with the IDA. The Tax Agreement calls for fixed payments over a 20 year period beginning in 2017 in lieu of property taxes and the Leaseback Agreement calls for fixed payments of $100,000 per year over a 10 year period beginning in 2015. In December 2015, Lago entered into the 318 Corridor Contribution Letter Agreement ("318 Agreement") with Seneca County. The 318 Agreement calls for annual payments for a period of 22 years beginning in 2017 to help Seneca County with infrastructure and community development. The scheduled payments under the Tax Agreement, Leaseback Agreement and 318 Agreement are as follows: (in thousands) For the year ending December 31: 2023 $ 1,860 2024 1,960 2025 1,960 2026 2,060 Thereafter 29,626 Total scheduled payments $ 37,466 Rent expense for the Company's operating leases was $5.9 million for the nine months ended September 30, 2022. Contingencies Based upon regulations adopted on April 10, 2019, the New York State Gaming Commission ("Commission") is authorized to assess, on an annual basis, certain costs necessary to maintain regulatory control over commercial gaming facilities, which in turn will be paid by the operators of the commercial gaming facilities to the Commission on a pro rata basis by number of gaming positions. This authorization includes notification of anticipated costs for the coming state fiscal year (April 1 to March 31), remittance of funds prior to the start of said fiscal year, and reconciliation of overages or deficiencies at the conclusion of said fiscal year based on actual costs incurred. Prior to April 2019, Lago had been accruing an estimate for potential regulatory costs. However, as Lago did not receive the required assessment prior to the April 1, 2019 deadline set forth in the regulation, it was determined that the Lago did not have a liability for any regulatory costs and therefore, the amount accrued prior to April 2019, the date the Commission passed the above noted regulation, was reversed. In November 2019, Lago received an invoice for $3.3 million covering the periods from December 1, 2016 through March 31, 2019. In November 2020, Lago received an invoice for $1.4 million covering the periods from April 1, 2019 through March 31, 2020. In November 2021, Lago received an invoice for $0.8 million covering the periods from April 1, 2020 through March 31, 2021. In January 2023, Lago received an invoice for $1.6 million covering the periods from April 1, 2021 through March 31, 2022. The Company believes that the invoices seek the recovery of costs beyond the Commission’s legal authority to collect

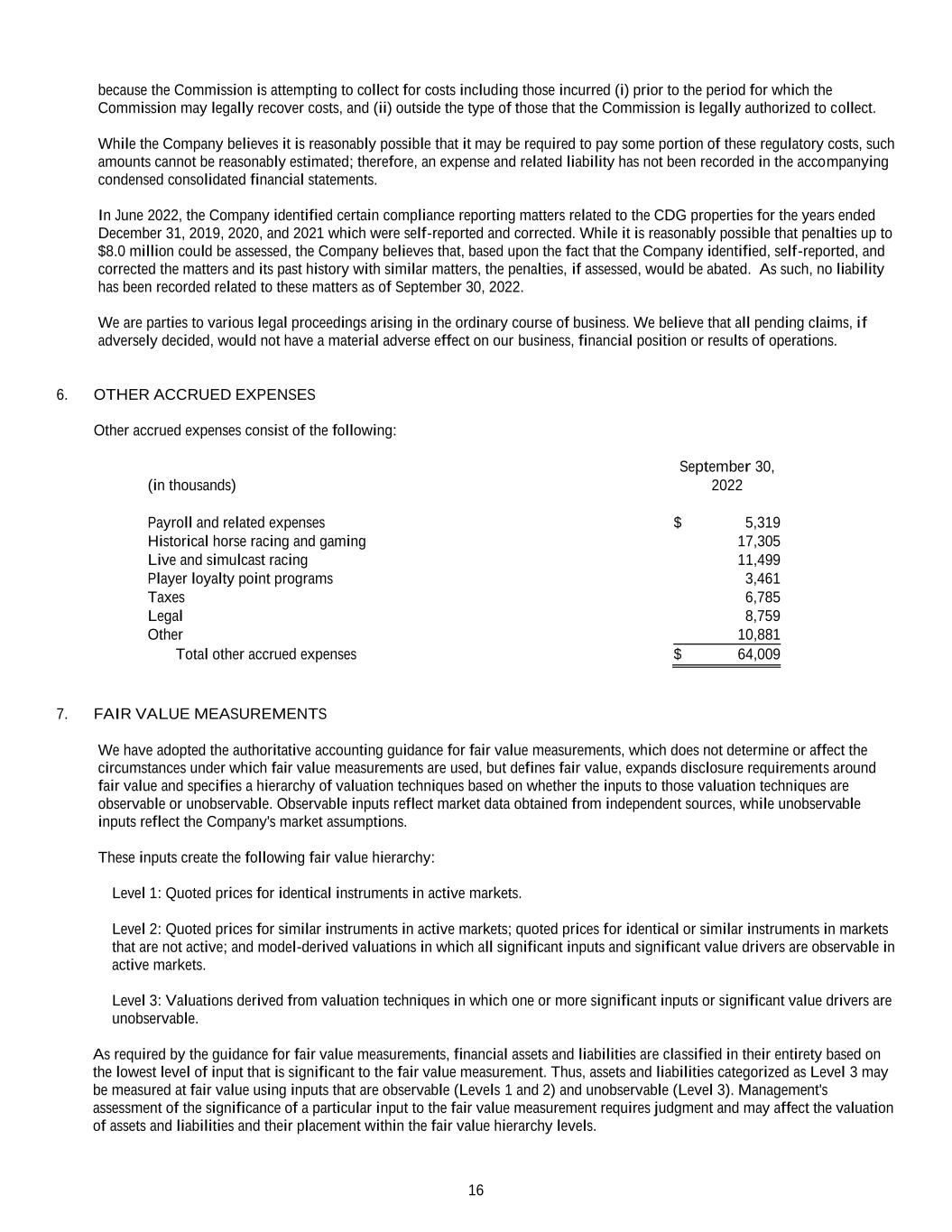

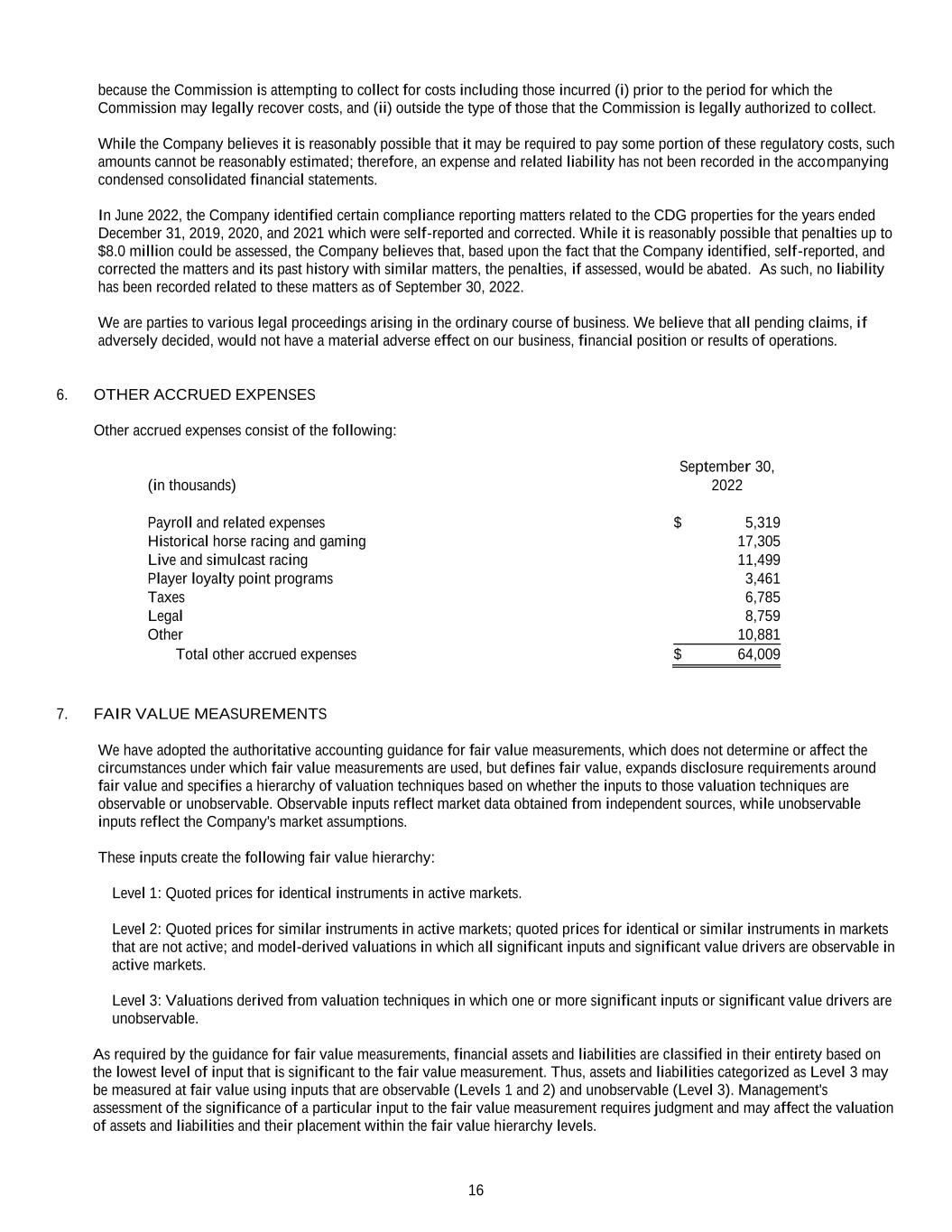

16 because the Commission is attempting to collect for costs including those incurred (i) prior to the period for which the Commission may legally recover costs, and (ii) outside the type of those that the Commission is legally authorized to collect. While the Company believes it is reasonably possible that it may be required to pay some portion of these regulatory costs, such amounts cannot be reasonably estimated; therefore, an expense and related liability has not been recorded in the accompanying condensed consolidated financial statements. In June 2022, the Company identified certain compliance reporting matters related to the CDG properties for the years ended December 31, 2019, 2020, and 2021 which were self-reported and corrected. While it is reasonably possible that penalties up to $8.0 million could be assessed, the Company believes that, based upon the fact that the Company identified, self-reported, and corrected the matters and its past history with similar matters, the penalties, if assessed, would be abated. As such, no liability has been recorded related to these matters as of September 30, 2022. We are parties to various legal proceedings arising in the ordinary course of business. We believe that all pending claims, if adversely decided, would not have a material adverse effect on our business, financial position or results of operations. 6. OTHER ACCRUED EXPENSES Other accrued expenses consist of the following: September 30, (in thousands) 2022 Payroll and related expenses $ 5,319 Historical horse racing and gaming 17,305 Live and simulcast racing 11,499 Player loyalty point programs 3,461 Taxes 6,785 Legal 8,759 Other 10,881 Total other accrued expenses $ 64,009 7. FAIR VALUE MEASUREMENTS We have adopted the authoritative accounting guidance for fair value measurements, which does not determine or affect the circumstances under which fair value measurements are used, but defines fair value, expands disclosure requirements around fair value and specifies a hierarchy of valuation techniques based on whether the inputs to those valuation techniques are observable or unobservable. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Company's market assumptions. These inputs create the following fair value hierarchy: Level 1: Quoted prices for identical instruments in active markets. Level 2: Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 3: Valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable. As required by the guidance for fair value measurements, financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Thus, assets and liabilities categorized as Level 3 may be measured at fair value using inputs that are observable (Levels 1 and 2) and unobservable (Level 3). Management's assessment of the significance of a particular input to the fair value measurement requires judgment and may affect the valuation of assets and liabilities and their placement within the fair value hierarchy levels.

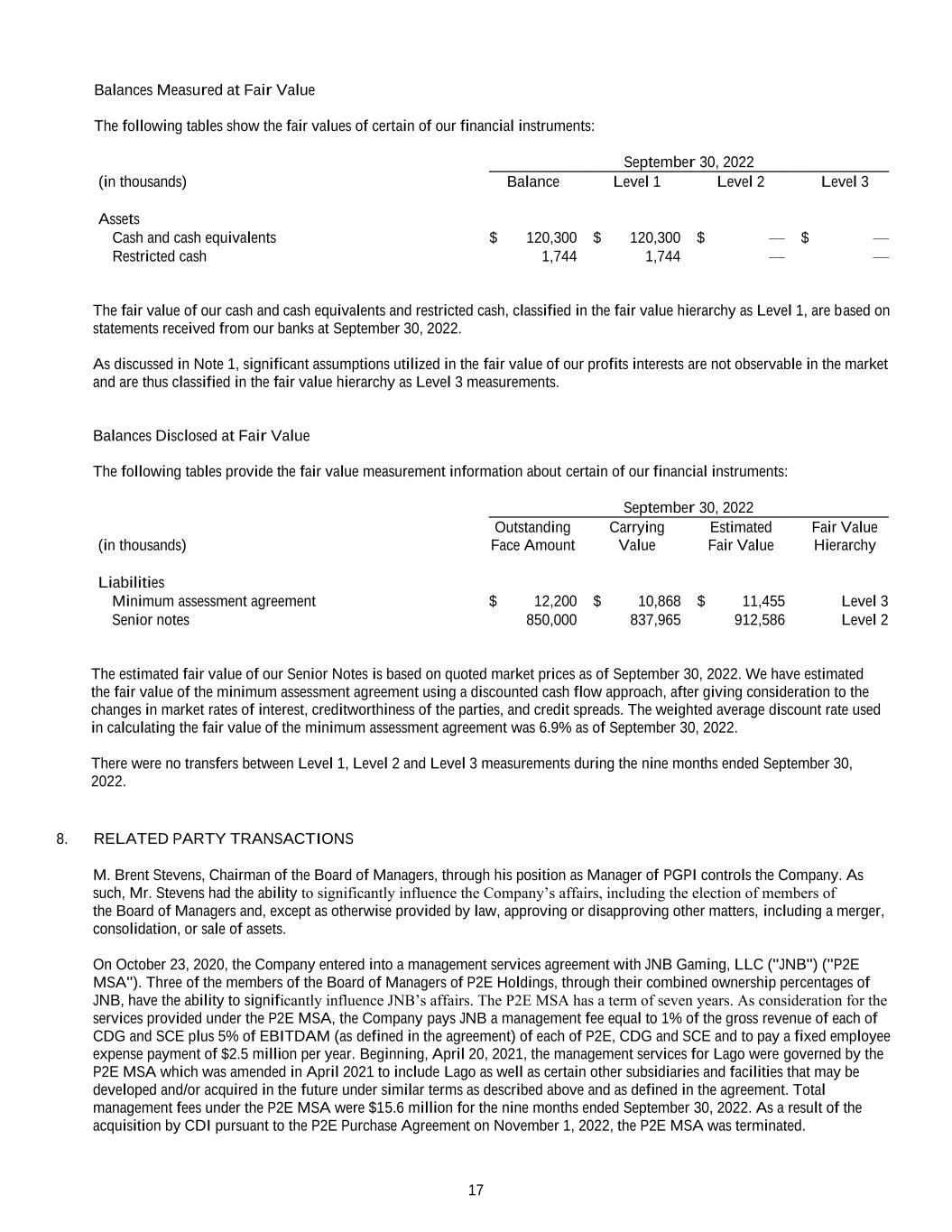

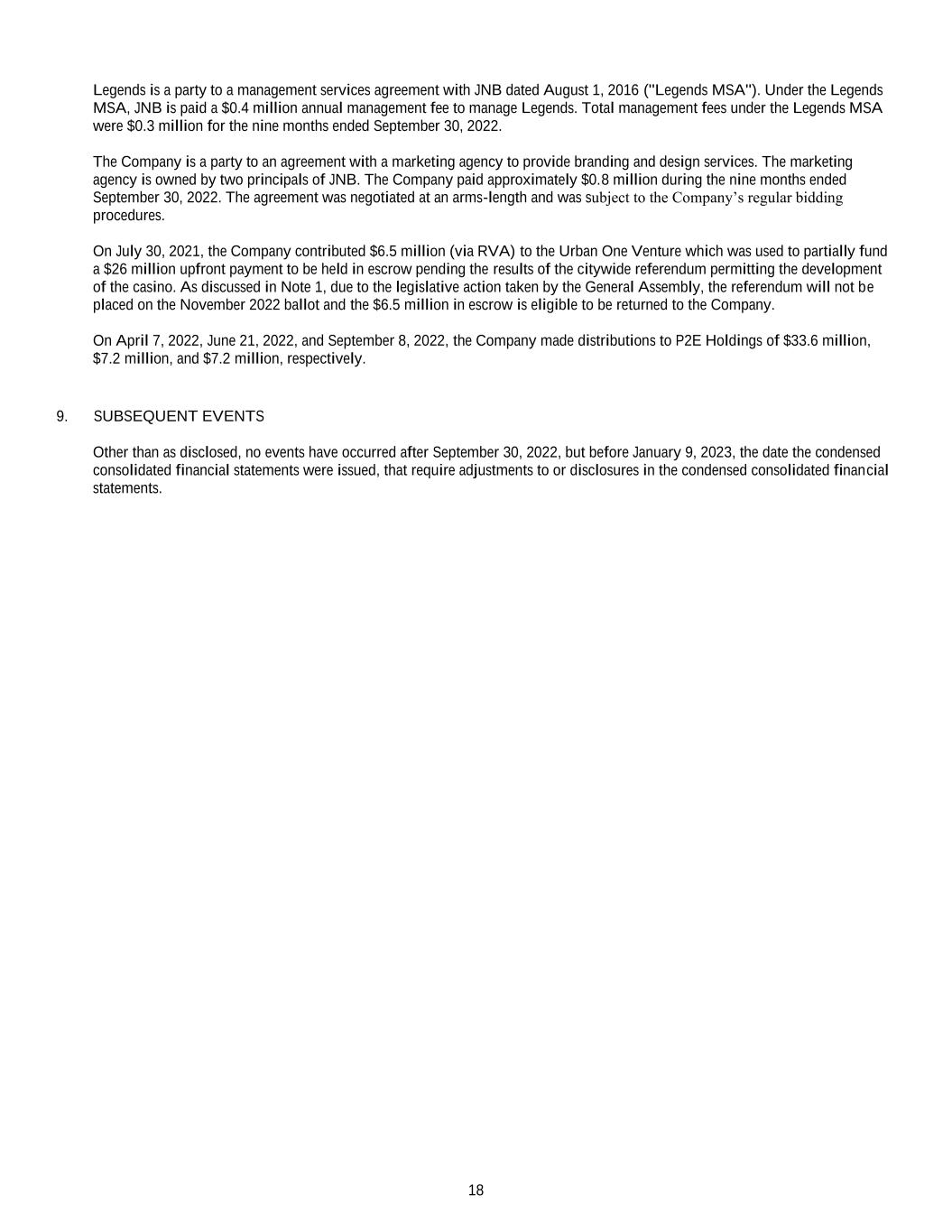

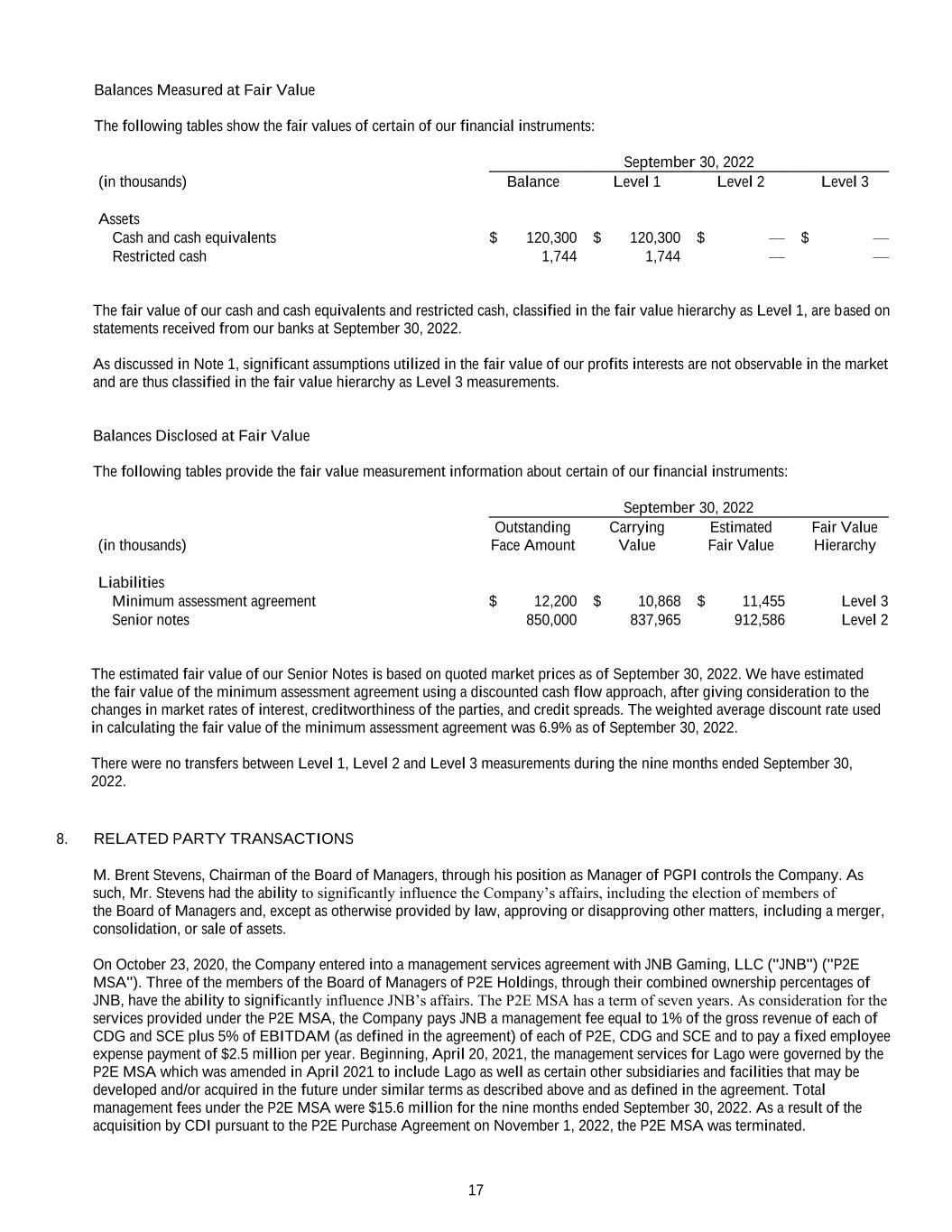

17 Balances Measured at Fair Value The following tables show the fair values of certain of our financial instruments: September 30, 2022 (in thousands) Balance Level 1 Level 2 Level 3 Assets Cash and cash equivalents $ 120,300 $ 120,300 $ — $ — Restricted cash 1,744 1,744 — — The fair value of our cash and cash equivalents and restricted cash, classified in the fair value hierarchy as Level 1, are based on statements received from our banks at September 30, 2022. As discussed in Note 1, significant assumptions utilized in the fair value of our profits interests are not observable in the market and are thus classified in the fair value hierarchy as Level 3 measurements. Balances Disclosed at Fair Value The following tables provide the fair value measurement information about certain of our financial instruments: September 30, 2022 (in thousands) Outstanding Face Amount Carrying Value Estimated Fair Value Fair Value Hierarchy Liabilities Minimum assessment agreement $ 12,200 $ 10,868 $ 11,455 Level 3 Senior notes 850,000 837,965 912,586 Level 2 The estimated fair value of our Senior Notes is based on quoted market prices as of September 30, 2022. We have estimated the fair value of the minimum assessment agreement using a discounted cash flow approach, after giving consideration to the changes in market rates of interest, creditworthiness of the parties, and credit spreads. The weighted average discount rate used in calculating the fair value of the minimum assessment agreement was 6.9% as of September 30, 2022. There were no transfers between Level 1, Level 2 and Level 3 measurements during the nine months ended September 30, 2022. 8. RELATED PARTY TRANSACTIONS M. Brent Stevens, Chairman of the Board of Managers, through his position as Manager of PGPI controls the Company. As such, Mr. Stevens had the ability to significantly influence the Company’s affairs, including the election of members of the Board of Managers and, except as otherwise provided by law, approving or disapproving other matters, including a merger, consolidation, or sale of assets. On October 23, 2020, the Company entered into a management services agreement with JNB Gaming, LLC ("JNB") ("P2E MSA"). Three of the members of the Board of Managers of P2E Holdings, through their combined ownership percentages of JNB, have the ability to significantly influence JNB’s affairs. The P2E MSA has a term of seven years. As consideration for the services provided under the P2E MSA, the Company pays JNB a management fee equal to 1% of the gross revenue of each of CDG and SCE plus 5% of EBITDAM (as defined in the agreement) of each of P2E, CDG and SCE and to pay a fixed employee expense payment of $2.5 million per year. Beginning, April 20, 2021, the management services for Lago were governed by the P2E MSA which was amended in April 2021 to include Lago as well as certain other subsidiaries and facilities that may be developed and/or acquired in the future under similar terms as described above and as defined in the agreement. Total management fees under the P2E MSA were $15.6 million for the nine months ended September 30, 2022. As a result of the acquisition by CDI pursuant to the P2E Purchase Agreement on November 1, 2022, the P2E MSA was terminated.

18 Legends is a party to a management services agreement with JNB dated August 1, 2016 ("Legends MSA"). Under the Legends MSA, JNB is paid a $0.4 million annual management fee to manage Legends. Total management fees under the Legends MSA were $0.3 million for the nine months ended September 30, 2022. The Company is a party to an agreement with a marketing agency to provide branding and design services. The marketing agency is owned by two principals of JNB. The Company paid approximately $0.8 million during the nine months ended September 30, 2022. The agreement was negotiated at an arms-length and was subject to the Company’s regular bidding procedures. On July 30, 2021, the Company contributed $6.5 million (via RVA) to the Urban One Venture which was used to partially fund a $26 million upfront payment to be held in escrow pending the results of the citywide referendum permitting the development of the casino. As discussed in Note 1, due to the legislative action taken by the General Assembly, the referendum will not be placed on the November 2022 ballot and the $6.5 million in escrow is eligible to be returned to the Company. On April 7, 2022, June 21, 2022, and September 8, 2022, the Company made distributions to P2E Holdings of $33.6 million, $7.2 million, and $7.2 million, respectively. 9. SUBSEQUENT EVENTS Other than as disclosed, no events have occurred after September 30, 2022, but before January 9, 2023, the date the condensed consolidated financial statements were issued, that require adjustments to or disclosures in the condensed consolidated financial statements.