Issuer Free Writing Prospectus dated October 30, 2024

Filed pursuant to Rule 433 under the Securities Act of 1933, as amended

Relating to the Preliminary Prospectus dated October 25, 2024

Registration Statement No. 333-281774

HTL Capital Ltd. We kindly ask you to Use full names Please join the Zoom call with your full name displayed for easy identification. Questions in the ZOOM chat box Kindly type any questions in the chat box. They will be addressed during the Q&A session.

(Nasdaq: NCG) HTL Capital Ltd. Corporate Presentation – October 2024

Important Notices and Disclaimers 3 This presentation relates to the proposed public offering (the “Offering”) of ordinary shares ("Shares") of HTL Capital Ltd . , a holding company incorporated in the British Virgin Islands (the “Company,” "we", "us“, or "our") . A Registration Statement on Form F - 1 (the “Registration Statement”), including a prospectus, relating to the Offering has been filed with the U . S . Securities and Exchange Commission (“SEC”) but has not yet become effective . The Shares may not be sold nor may offers to buy be accepted prior to the time the Registration Statement becomes effective . This presentation should be read together with the Registration Statement, which may be accessed through the following web link : https : // www . sec . gov/Archives/edgar/data/ 2021364 / 000121390024090801 /ea 0204466 - 06 . htm Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more complete information about us and the Offering . You may get these documents for free by visiting EDGAR on the SEC website at http : //www . sec . gov . Alternatively, we or our underwriter will arrange to send you the prospectus if you contact US Tiger Securities, Inc by mail at 437 Madison Avenue, FL 27 , New York, NY 10022 , by telephone at + 1 - 646 - 978 - 5188 , or by email at ECM@ustigersecurities . com , or contact HTL Capital Ltd . by telephone at + 91 77382 68072 , by mail at 5 /F, Sattva Galleria BBMP Khata No . 277 / 278 / 316 Byatarayanapura, Virupakshapura Ward No . 277 , Bengaluru, Karnataka 560092 , India . This presentation does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with the Company or its affiliates . The information in this presentation is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation .

Forward - looking Statements This presentation contains forward - looking statements that reflect our current expectations and views of future events . These forward - looking statements relate to events that involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from those expressed or implied by these statements . You can identify some of these forward - looking statements by words or phrases such as "may," “will," "could," "expect," "anticipate," "aim," "estimate," "intend," "plan," "believe," "is/are likely to," "propose," "potential," “continue," or other similar expressions . We have based these forward - looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, and financial needs . The forward - looking statements relate to, among other things : our goals and strategies ; our business and operating strategies and plans for the development of existing and new businesses ; ability to implement such strategies and plans and expected time ; our future business development, financial condition, and results of operations ; expected changes in our revenues, costs, or expenditures ; our dividend policy ; our expectations regarding demand for and market acceptance of our products and services ; our expectations regarding our relationships with our clients, business partners, and third parties ; the trends in, expected growth in, and market size of the upholstered furniture industry in India ; our ability to maintain and enhance our market position ; our ability to continue to develop new products - and/or upgrade our existing products ; developments in, or changes to, laws, regulations, governmental policies, incentives, and taxation affecting our operations ; relevant govermental policies and regulations relating to our businesses and industry ; competitive environment ; competitive landscape and potential competitor behaviours in our industry ; overall industry outlook in our industry ; our ability to attract, train, and retain executives and other employees ; our proposed use of proceeds from this offering ; the development of the global financial and capital markets ; fluctuations in inflation, interest rates, and exchange rates ; general business,political, social, and economic conditions in India and the overseas markets we have business ; and assumptions underlying or related to any of the foregoing . These forward - looking statements involve various risks and uncertainties . Although we believe that our expectations expressed in these forward - looking statements are reasonable, our expectations and our actual results could be materially different from our expectations . For more detailed risk disclosures, please refer to the prospectus in the Registration Statement . Statistical data referenced in this presentation may also include projections based on a number of assumptions . The upholstered furniture industry in India may not grow at the rate projected by market data, or at all . Failure of such markets to grow at the projected rate may have a material and adverse effect on our business and the market price of the Shares or our other securities . In addition, the evolving nature of the upholstered furniture industry results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our market . Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions . You should not rely upon forward - looking statements as predictions of future events . The forward - looking statements in this presentation are based on events and information as of the date of this presentation . Except as required by law, we undertake no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events, or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events . You should read this presentation and the documents that we refer to herein with the understanding that our actual future results or performance may materially differ from what we expect . 4

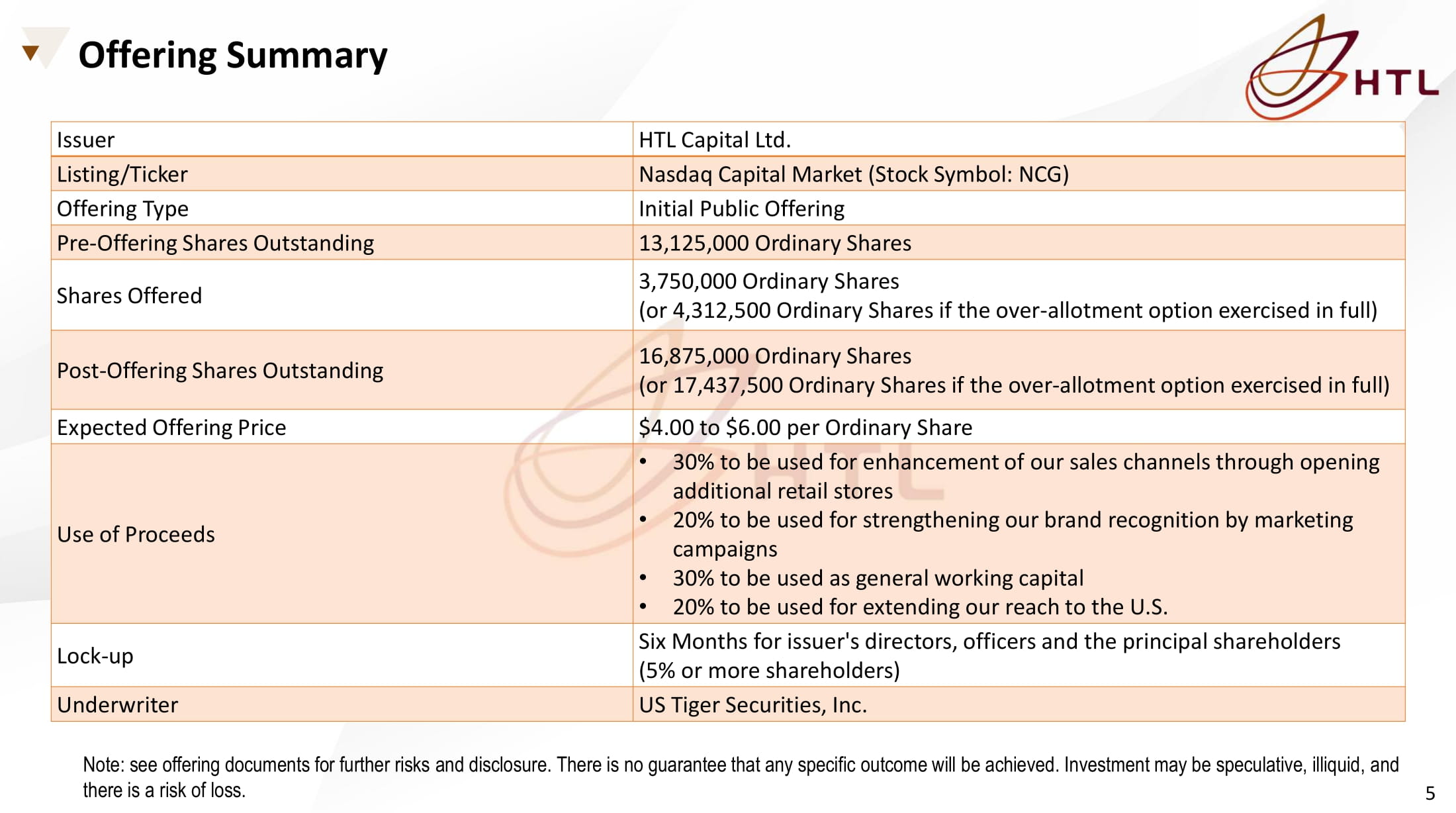

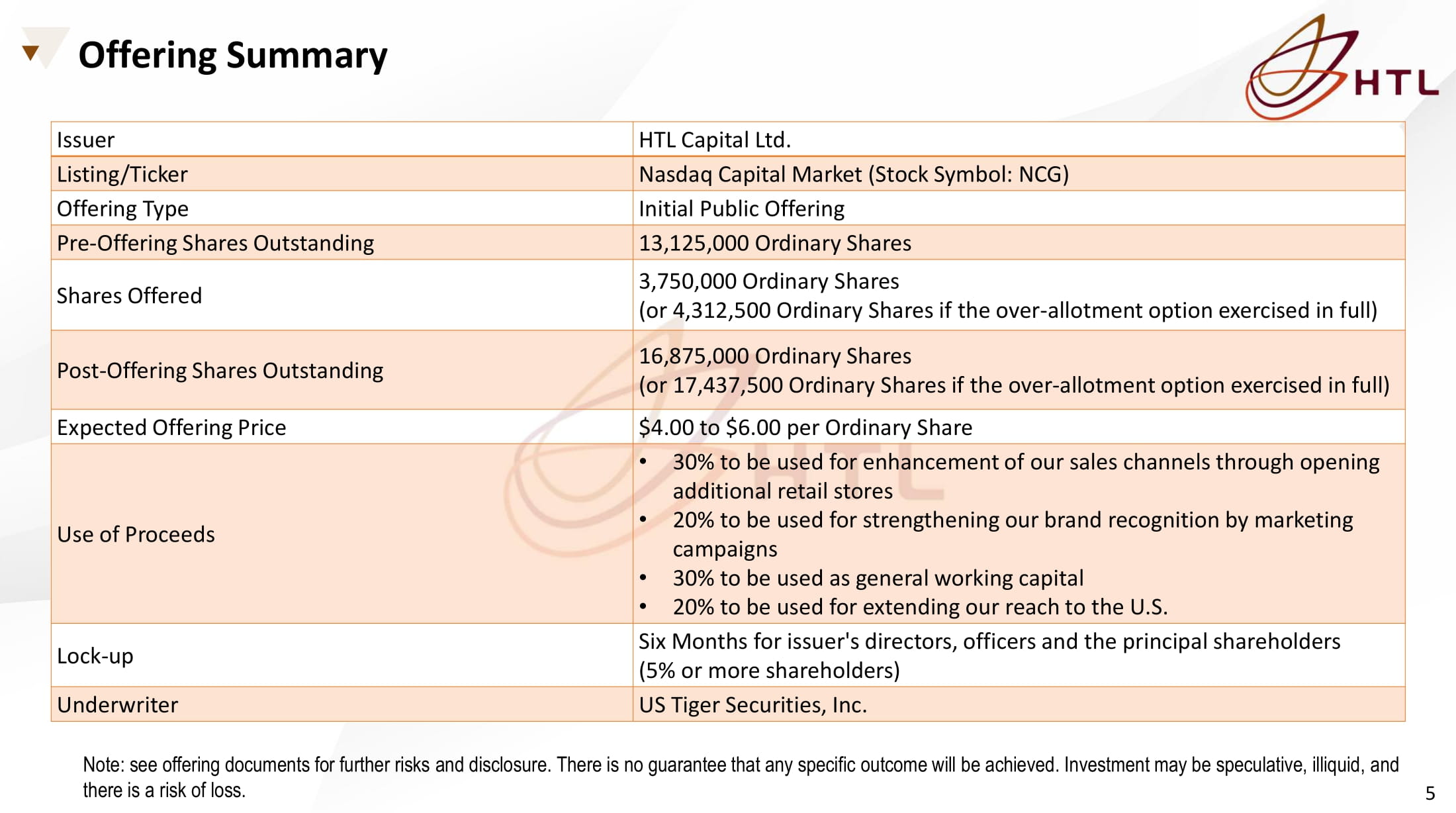

5 Offering Summary HTL Capital Ltd. Issuer Nasdaq Capital Market (Stock Symbol: NCG) Listing/Ticker Initial Public Offering Offering Type 13,125,000 Ordinary Shares Pre - Offering Shares Outstanding 3,750,000 Ordinary Shares (or 4,312,500 Ordinary Shares if the over - allotment option exercised in full) Shares Offered 16,875,000 Ordinary Shares (or 17,437,500 Ordinary Shares if the over - allotment option exercised in full) Post - Offering Shares Outstanding $4.00 to $6.00 per Ordinary Share Expected Offering Price • 30% to be used for enhancement of our sales channels through opening additional retail stores • 20% to be used for strengthening our brand recognition by marketing campaigns • 30% to be used as general working capital • 20% to be used for extending our reach to the U.S. Use of Proceeds Six Months for issuer's directors, officers and the principal shareholders (5% or more shareholders) Lock - up US Tiger Securities, Inc. Underwriter Note: see offering documents for further risks and disclosure. There is no guarantee that any specific outcome will be achieved. Investment may be speculative, illiquid, and there is a risk of loss.

Company Overview Key Investment Highlights Industry Overview Financial Highlights Future Strategies

Company Overview

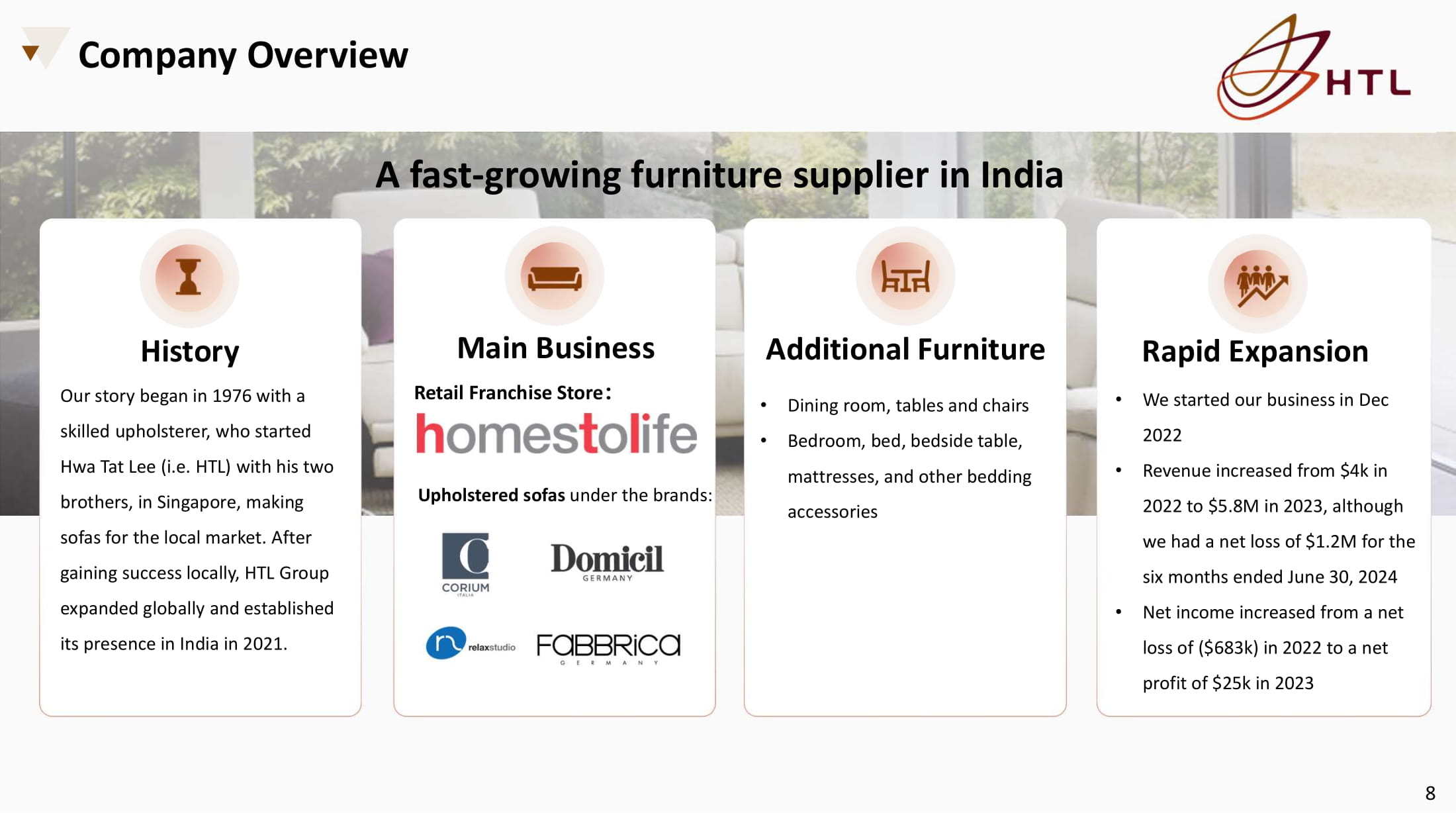

Company Overview History Our story began in 1976 with a skilled upholsterer, who started Hwa Tat Lee (i.e. HTL) with his two brothers, in Singapore, making sofas for the local market. After gaining success locally, HTL Group expanded globally and established its presence in India in 2021. A fast - growing furniture supplier in India Upholstered sofas under the brands: Main Business Retail Franchise Store ͵ Additional Furniture • Dining room, tables and chairs • Bedroom, bed, bedside table, mattresses, and other bedding accessories 8 Rapid Expansion • We started our business in Dec 2022 • Revenue increased from $4k in 2022 to $5.8M in 2023, although we had a net loss of $1.2M for the six months ended June 30, 2024 • Net income increased from a net loss of ($683k) in 2022 to a net profit of $25k in 2023

Business Overview We sell our products to India’s growing middle and upper class and the premium mass market . We focus on business - to - business sales and also engage in business - to - customer sales. We do our business through different channels including: Furniture retail partners Dealers Our retail stores 9

Business Model We provide one - stop furniture solution. Our main business model is as follows: Receipt of purchase order from customer Procurement from our supplier Delivery After - sales services 10

d Our Mission T o become the leading upholstered furniture supplier in India and the Middle East. 11

Our Values Conducting our business with fairness and integrity Maintaining a high level of expertise in the sale and distribution of upholstered furniture Listening and responding to our customers’ needs Offering high - quality and stylishly designed furniture to our customers 12

Key Investment Highlights

A Diversified Portfolio of Brands and Full Range of Products We believe we are the trend - setter in India and that our wide spectrum of brands in different styles and price ranges enable us to enlarge our customer base and expand our market share. Targeting middle class customers who prioritize functionality, comfort and quality European brands designed by top - class designers from all over the world and offer premium and luxury products targeting the middle and upper class Marketed to the premium mass market to provide affordable, reliable and customizable options 14 Note: the trademarks “Domicil,”“Fabbrica”and “Corium Italia” are registered under a related party and licensed for use to Newcentury Trading (India) Private Limited.

Established Track Record and Market Leadership in India 1976 Hw fou Mr . Cha bro 2021 HTL Group establishes 2023 Onward We believe that our relationships with our partners, together with our marketing efforts through own retail stores, differentiate us from our competitors in India. 15 Partnered with 17 furniture retail partners and dealers across India. Four a Tat Lee (HTL) nded in Singapore by presence in India. HomesToLife retail outlets Yong Pin Phua, our located in major cities. irman, alongside his thers. We actively promote our brands through own retail stores in India. Note : see offering documents for further risks and disclosure . There is no guarantee that any specific outcome will be achieved . Investment may be speculative, illiquid, and there is a risk of loss .

We support our furniture retail partners and dealers by providing them with: Store Design Product and Sales Training We engage various furniture retail partners and dealers in India under our distributorship arm to extend our reach to a larger base of customers. Strategic Selection of Furniture Retail Partners and Dealers Merchandize Planning Shop Setup Marketing Supports 16

Experienced and Dedicated Management Team • Mr. Phua oversees the general corporate strategy and brand promotion management and business expansion. • Since September 2020, Mr. Phua has been the chief executive officer of HTL Group. From April 2020 to June 2022, Mr. Phua was a consultant of HTL Group. From September 2016 to March 2020, Mr. Phua was the chief executive officer of HTL Group. • Mr. Phua is also the vice - chairman and a director of HomesToLife Ltd., a Cayman Islands holding company, the operating subsidiary of which principally engages in offering and selling customized furniture solutions in Singapore. 17 Mr. Yong Tat, PHUA Chief Executive Officer & Director • Mr. Phua is responsible for the Group’s overall management, merger and acquisition and corporate/commercial transaction matters. • Since September 2020, Mr. Phua has been the Chairman of HTL Group. From April 2020 to September 2022, Mr. Phua was a consultant of HTL Group. • From April 2010 to March 2020, Mr. Phua was the chairman of the HTL Group. Mr. Phua has been responsible for overseeing the PRC - based manufacturing and retail operations of HTL Group. Mr. Phua is also the chairman and a director of HomesToLife Ltd. Mr. Yong Pin, PHUA Chairman & Director The Company is founded by the Phua brothers, they also co - founded HTL Group in the 1970s as a sofa maker in Singapore and have overseen the development ever since. They have over 40 years of experience in the furniture industry.

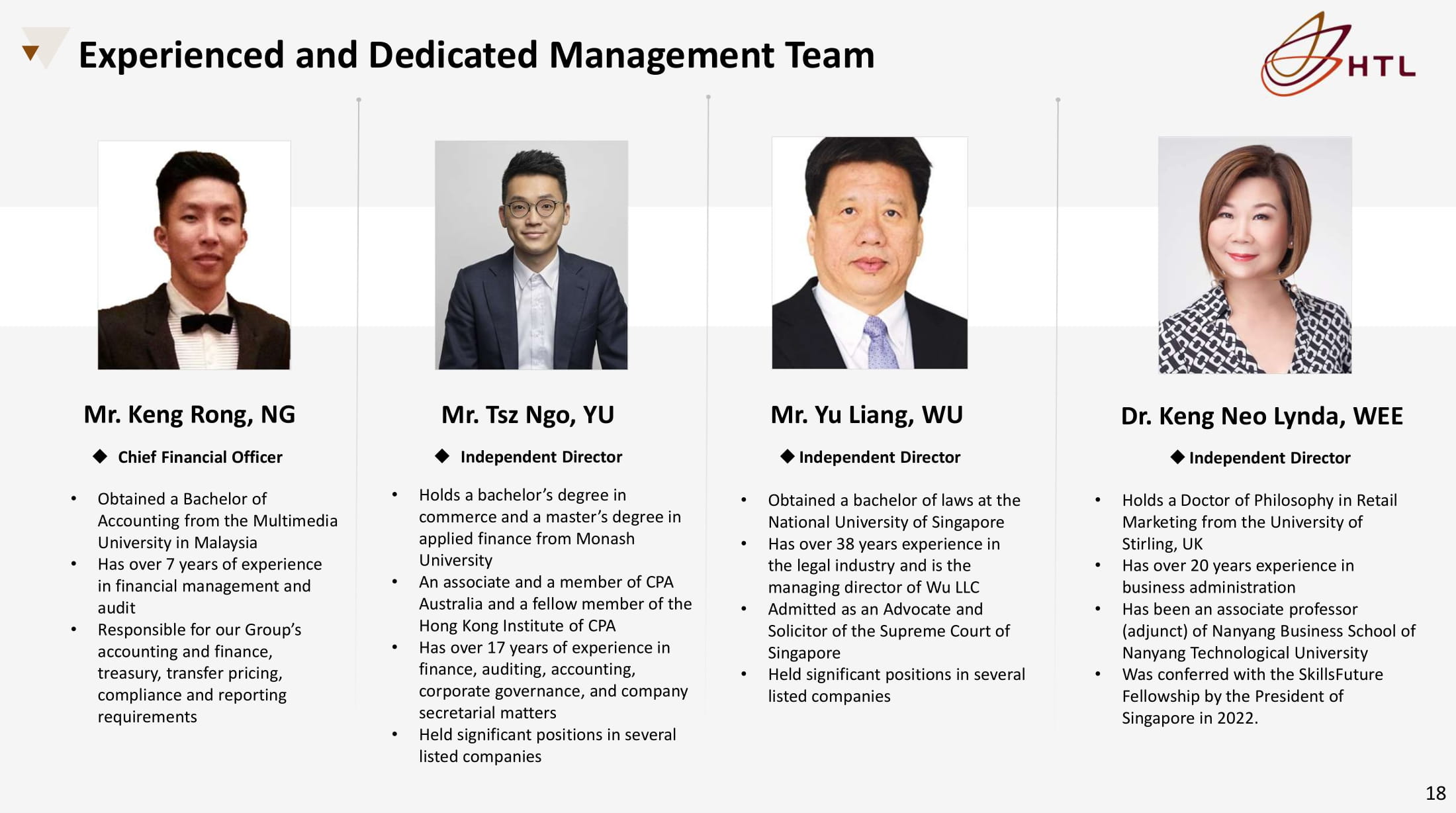

Experienced and Dedicated Management Team • Obtained a Bachelor of Accounting from the Multimedia University in Malaysia • Has over 7 years of experience in financial management and audit • Responsible for our Group’s accounting and finance, treasury, transfer pricing, compliance and reporting requirements Mr. Keng Rong, NG Chief Financial Officer Mr. Tsz Ngo, YU Independent Director • Holds a bachelor’s degree in commerce and a master’s degree in applied finance from Monash University • An associate and a member of CPA Australia and a fellow member of the Hong Kong Institute of CPA • Has over 17 years of experience in finance, auditing, accounting, corporate governance, and company secretarial matters • Held significant positions in several listed companies • Obtained a bachelor of laws at the National University of Singapore • Has over 38 years experience in the legal industry and is the managing director of Wu LLC • Admitted as an Advocate and Solicitor of the Supreme Court of Singapore • Held significant positions in several listed companies Mr. Yu Liang, WU Independent Director • Holds a Doctor of Philosophy in Retail Marketing from the University of Stirling, UK • Has over 20 years experience in business administration • Has been an associate professor (adjunct) of Nanyang Business School of Nanyang Technological University • Was conferred with the SkillsFuture Fellowship by the President of Singapore in 2022. Dr. Keng Neo Lynda, WEE Independent Director 18

Industry Overview

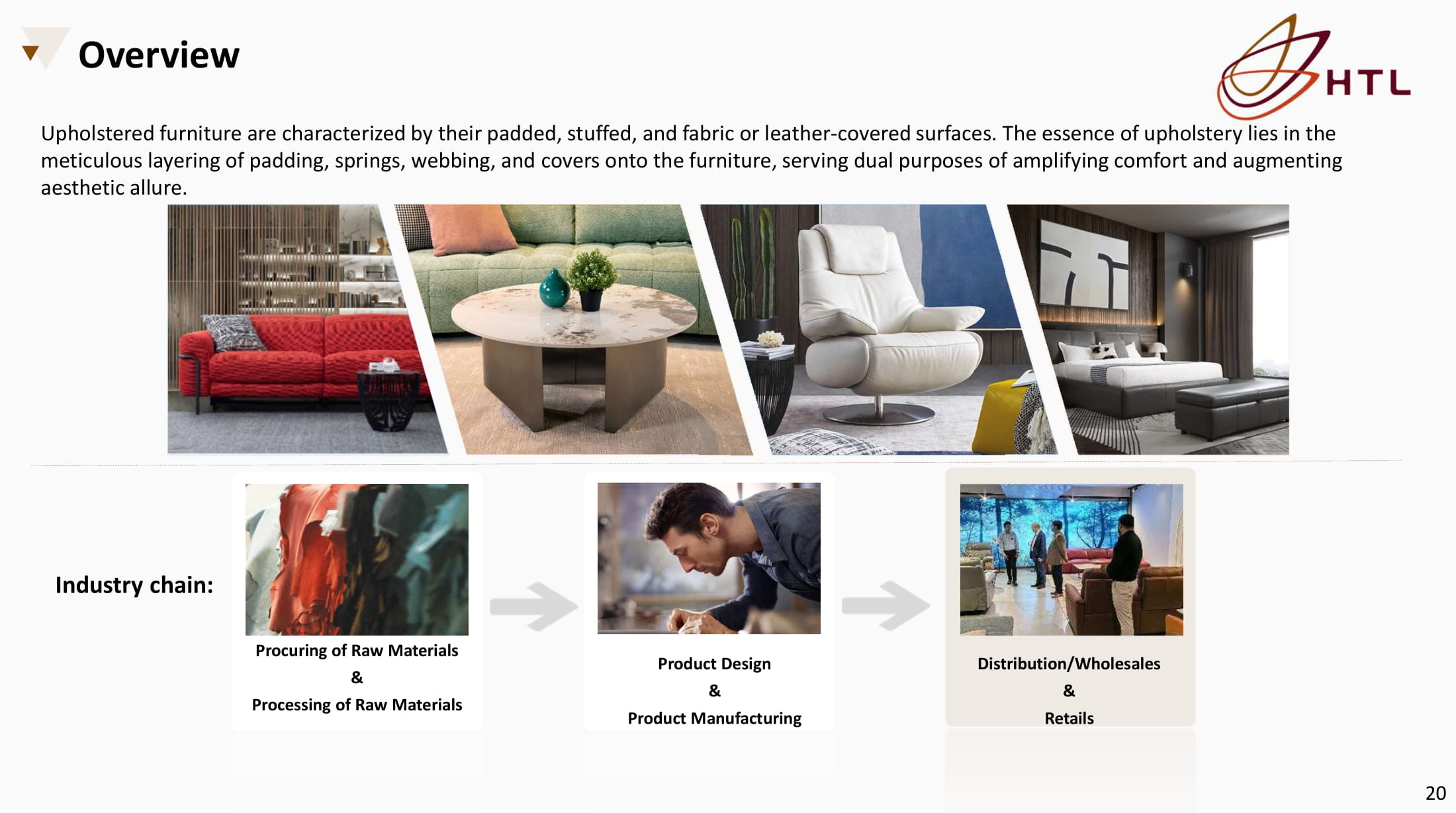

Overview Upholstered furniture are characterized by their padded, stuffed, and fabric or leather - covered surfaces . The essence of upholstery lies in the meticulous layering of padding, springs, webbing, and covers onto the furniture, serving dual purposes of amplifying comfort and augmenting aesthetic allure . Procuring of Raw Materials & Processing of Raw Materials Industry chain: Product Design & Product Manufacturing Distribution/Wholesales & Retails 20

India Upholstered Furniture Industry The Indian upholstered furniture market has been experiencing remarkable growth in recent years, primarily driven by: Indian Upholstered Furniture Market Size (2023 - 2027E) (i) 3,481 3,725 3,985 4,264 4.18% 4.29% 4.40% 4.51% 4,563 4.63% 0.03 0.032 0.034 0.036 0.038 0.04 0.042 0.044 0.046 0.048 0 500 1000 1500 2000 2500 3000 3500 4000 4500 5000 2023 2024E 2026E 2027E 2025E Market Size Indian/Global USD Million the increasing disposable household income the rise in the number of middle - class households rapid urbanization (i) Due to the lack of specific data on the upholstered furniture market in India, this presentation adopts a simulation and forecasting approach. It utilizes the proportion of global upholstered furniture within the global furniture market as a reference point to arrive at the estimated and projected data for the Indian upholstered furniture market. Source of Information: “Indian Upholstered Furniture Industry Report” by China Research and Intelligence Co., Ltd. 21 Note: see offering documents for further risks and disclosure. There is no guarantee that any specific outcome will be achieved. Investment may be speculative, illiquid, and there is a risk of loss.

Driving Forces and Opportunities in India Market • Labor cost is a very important part of the operating cost. • Lower labor cost will benefit retailers, leaving more budget for other business activities and also less prone to liquidity problems. Low - cost Labor Advantage The Growth in Estate Industry of India • According to the India Equity Brand Foundation (IBEF) report, India’s real estate sector contributes 7 .3% to the country’s total GDP. • It is expected to reach US$1 trillion by 2030, accounting for 18% - 20% of India’s GDP. the Indian Middle Class • India’s middle class is a significant consumer base for our product. • Their growing aspiration for quality and branded products can drive domestic demand of upholstered furniture. Strong Purchasing Power amongst Rising Demand for International Standard Products • There is a growing demand for upholstered furniture that meets international standards. • Indian manufacturers have the opportunity to meet this demand by upgrading their products, adopting international best practices, and focusing on quality assurance. 22 Source of Information: “Indian Upholstered Furniture Industry Report” by China Research and Intelligence Co., Ltd. & https:// www.ibef.org/industry/real - estate - india

Financial Highlights

Rapid Growth in Revenue and Net Profit 24 - 683,721 24,860 - 1,180,080 - 1,400,000 - 1,200,000 - 1,000,000 - 800,000 - 600,000 - 400,000 - 200,000 0 200,000 2022 2023 6M 2024 Net Profit/Loss USD For financial years ended December 31, 2022 and 2023, for six months ended June 30, 2024 5,786,596 4,739,610 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 2022 3,987 2023 6M 2024 Revenue USD Note: see offering documents for further risks and disclosure. There is no guarantee that any specific outcome will be achieved. Investment may be speculative, illiquid, and there is a risk of loss .

Healthy Balance Sheet 25 4,423,986 6,199,413 0 1,000,000 773,911 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 2022 2023 June 2024 Total Current Assets USD 7,000,000 1,155,104 1,374,380 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 2022 2023 June 2024 Total Shareholders’ Equity 2,559,939 USD 3,000,000 As of December 31, 2022 and 2023, as of June 30, 2024 904,020 3,889,820 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 6,783,888 2022 2023 June 2024 Total Current Liabilities USD 8,000,000 Note: see offering documents for further risks and disclosure. There is no guarantee that any specific outcome will be achieved. Investment may be speculative, illiquid, and there is a risk of loss .

Future Strategies

Our Growth Strategies 27 Extend Our Reach in the Overseas Upholstered Furniture Market: • Establish presence in the U.S. within 18 to 24 months from the Offering • Expand business network through exhibitions, trade fairs, and site visits • Establish regional offices in major U.S. cities • Open "HomesToLife" stores in the U.S. to market products • Consider collaboration with local U.S. furniture retail partners in a "shop - in - shop" model Enhancement of Our Sales Channels Through Opening Additional Retail Stores: • Keep operating retail stores under "HomesToLife" brand • Provide one - stop solution for furniture needs • Target areas with high market potential and customer demand • Consider geographic coverage, population density, average income, purchasing power, and related trade mix presence for store locations Strengthen Our Brand Recognition Through Marketing Campaigns: • Enhance brand image and promote products to industry players and retail customers • Utilize traditional mass media like advertising • Utilize modern mass media like social media and applications • Conduct regular marketing campaigns to increase brand exposure and elevate brand status

Use of Proceeds 20% 30% 20% 30% 4. 20% to be used for extending our reach to the U.S. 1. 30% to be used for enhancement of our sales channels through opening additional retail stores 3. 30% to be used as general working capital We intend to use the net proceeds of this Offering as follows: 2. 20% to be used for strengthening our brand recognition by marketing campaigns 28 Note : see offering documents for further risks and disclosure . There is no guarantee that any specific outcome will be achieved . Investment may be speculative, illiquid, and there is a risk of loss .