As filed with the U.S. Securities and Exchange Commission on November 12, 2024

Registration No. 333-281774

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

AMENDMENT NO. 2

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_________________________

HTL Capital Ltd.

(Exact Name of Registrant as Specified in its Charter)

_________________________

British Virgin Islands | | 5712 | | Not Applicable |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

HTL Capital Ltd.

5/F, Sattva Galleria

BBMP Khata No. 277/278/316

Byatarayanapura, Virupakshapura

Ward No.277, Bengaluru,

Karnataka 560092 India

+91 77382 68072

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive office)

_________________________

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

Telephone: +1 (800) 221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_________________________

Copies to:

Daniel D. Nauth

Nauth LPC

217 Queen Street West, Suite 401

Toronto, Ontario, Canada

M5V 0R2

Tel: (416) 477-6031 | | Mitchell Nussbaum

Henry Yin

Alex Weniger-Araujo

Loeb & Loeb LLP

345 Park Avenue

New York, New York 10154

Tel: (212) 407-4000

Fax: (212) 407-4990 |

_________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED NOVEMBER 12, 2024,

3,750,000 Ordinary Shares

HTL Capital Ltd.

This is an initial public offering (this “Offering”) of our ordinary shares with no par value (“Ordinary Shares”). We are offering on a firm commitment basis, 3,750,000 Ordinary Shares. We expect the initial public offering (“IPO”) price will be between US$4.00 to US$6.00 per Ordinary Share. Prior to this Offering, there has been no public market for our Ordinary Shares.

We applied to list our Ordinary Shares on the Nasdaq Capital Market under the symbol “NCG”. This Offering is contingent upon us listing our Ordinary Shares on the Nasdaq Capital Market or another U.S. national securities exchange. There is no guarantee or assurance that our Ordinary Shares will be approved for listing on the Nasdaq Capital Market or another U.S. national securities exchange.

HTL Capital Ltd. is a holding company incorporated in the BVI that conducts all of its operations through its Operating Subsidiary in India, Newcentury Trading (India) Private Limited. Investors are cautioned that they are not buying shares of the Operating Subsidiary in India but instead are buying shares of the holding company in the BVI. See “Prospectus Summary — Our Corporate Structure” and “Business — Our Corporate History and Structure” for additional information regarding our corporate structure prior to, and immediately after, this Offering. Our structure involves certain risks to investors, as more particularly discussed in the “Risk Factors” section of this prospectus.

Unless otherwise stated, as used in this prospectus, the terms “we,” “us,” “our Company,” and the “Company” refer to HTL Capital Ltd., a business company limited by shares incorporated under the laws of BVI, and in the context of describing its operation and business, its subsidiaries. We conduct all of our operations through our Operating Subsidiary in India, Newcentury Trading (India) Private Limited, established under the laws of India.

We are, and upon consummation of this Offering, will continue to be, a “controlled company” as defined under Rule 5615(c)(1) of the Nasdaq Stock Market LLC (“Nasdaq”) rules (“Nasdaq Rules”). Mr. Yong Tat Phua, our Chief Executive Officer, and Mr. Yong Pin Phua, our Chairman, will together, through GHI Capital Limited, beneficially own 59.33% of our then-issued and outstanding Ordinary Shares and will be able to exercise 59.33% of the total voting power of our issued and outstanding Ordinary Shares immediately after the consummation of this Offering, assuming the underwriters do not exercise their option to purchase additional Ordinary Shares. For further information, see “Principal Shareholders.” Although we do not intend to rely on the “controlled company” exemption under Rule 5615(c)(2) of the Nasdaq Rules, we could elect to rely on such exemption in the future. See “Prospectus Summary — Implications of Being a Controlled Company” for more information.

We are an “emerging growth company” and a “foreign private issuer” as defined under U.S. federal securities laws, and, as such, are eligible for reduced public company reporting requirements and exemptions from certain Nasdaq governance rules. See “Prospectus Summary — Implications of Being an Emerging Growth Company” and “Prospectus Summary — Implications of Being a Foreign Private Issuer” for more information.

Investing in our Ordinary Shares involves a high degree of risk. Please see “Risk Factors” beginning on page 15 of this prospectus for more information.

Neither the U.S. Securities and Exchange Commission (“SEC”) nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | Per Share | | Total(3) |

Initial public offering price(1) | | $ | | | $ | |

Underwriting discount(2) | | $ | | | $ | |

Proceeds to us, before expenses(3) | | $ | | | $ | |

This Offering is being conducted on a firm commitment basis. The underwriters are obligated to take and pay for all of the Ordinary Shares if any Ordinary Shares are taken. We granted the underwriters an option for 45 days after the closing date of this Offering to purchase up to 15% of the total number of the Ordinary Shares to be offered by us pursuant to this Offering (excluding Ordinary Shares subject to this option), solely for the purpose of covering over-allotments, if any, at the public offering price less the underwriting discount. If the underwriters exercise their option in full, assuming an offering price of US$5.00 per Ordinary Share (the midpoint of the range set forth on the cover page of this prospectus), the total gross proceeds us, before underwriting discounts and expenses, will be US$21,562,500.

The underwriters expect to deliver the Ordinary Shares against payment on about [ ], 2024.

US Tiger Securities Inc.

The date of this prospectus is November 12, 2024.

Table of Contents

i

Table of Contents

ABOUT THIS PROSPECTUS

We and the underwriters have not authorized anyone to provide you with information different from that contained in this prospectus or in any free-writing prospectuses prepared by us or on our behalf or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, the Ordinary Shares offered hereby, but only under circumstances and in jurisdictions where offers and sales are permitted and lawful to do so. The information contained in this prospectus is current only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States (“U.S.”): Neither we nor the underwriters have taken any action that would permit a public offering of the Ordinary Shares outside the U.S. or permit the possession or distribution of this prospectus or any related free writing prospectus outside the U.S. Persons outside the U.S. who come into possession of this prospectus or any related free writing prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the U.S.

We obtained the statistical data, market data and other industry data and forecasts described in this prospectus from market research, publicly available information and industry publications, including from CRI, an independent market research and consulting firm with respect to information on the upholstered furniture industry in India. While we believe that the statistical data, industry data and forecasts and market research are reliable, we have not independently verified the data.

All trademarks, trade names or service marks referred to in this prospectus are the property of their respective owners. Solely for convenience, trademarks, trade names or service marks in this prospectus may be referred to without the symbols ® or ™, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

We are incorporated as a business company limited by shares under the BVI Business Companies Act and a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the SEC, we currently qualify for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. domestic registrants whose securities are registered under the Exchange Act.

ii

Table of Contents

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

• “Amended Memorandum and Articles” refers to our memorandum and articles of association to be in effect upon completion of this Offering;

• “BVI” refers to the British Virgin Islands;

• “BVI Business Companies Act” refers to the BVI Business Companies Act of the BVI, as amended, supplemented or otherwise modified from time to time;

• “China” or the “PRC” refers to the People’s Republic of China;

• “CRI” refers to China Research and Intelligence Co., Ltd. an independent market research agency, which is an independent third party;

• “Exchange Act” refers to the U.S. Securities Exchange Act of 1934, as amended.

• “Indian Rupee”, “INR” or “₹” refers to the legal currency of India;

• “Offering” refers to the initial public offering of HTL Capital Ltd.;

• “Operating Subsidiary” or “Newcentury Trading” refers to Newcentury Trading (India) Private Limited, our subsidiary incorporated in India;

• “our Group” or “the Group” refers to HTL Capital Ltd. and its subsidiaries;

• “premium mass market” refers to the market between the mass market, which consist of lower-income individuals, and the middle class, which consist of middle-or-higher-income individuals. The Company recognizes that premium mass market individuals are inclined to purchase affordable and low-priced products but are more willing to pay extra for reliability and personal customization, in comparison with the mass market.

• “SEC” refers to the U.S. Securities and Exchange Commission;

• “Securities Act” refers to the U.S. Securities Act of 1933, as amended.

• “shares,” “Share” or “Ordinary Shares” refers to the ordinary shares of HTL Capital Ltd., with no par value;

• “U.S. dollars,” “dollars,” “USD,” “US$” or “$” refers to the legal currency of the U.S.

• “we,” “us,” “our Company,” “our” or “the Company” refers to HTL Capital Ltd., and in the context of describing its operation and business, its subsidiaries.

Our business is conducted by our indirectly wholly-owned Operating Subsidiary in India. Our functional currencies are the local currencies of the countries in which our subsidiaries operate. Since we operate primarily in India, our functional currency is the Indian Rupee. Our audited consolidated financial statements (“CFS”) and unaudited condensed CFS (if applicable) are presented in U.S. dollars. In this prospectus, we refer to assets, obligations, commitments, and liabilities in our audited CFS and unaudited condensed CFS (if applicable) in U.S. dollars. These U.S. dollar references are based on the exchange rate of Indian Rupees to U.S. dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of U.S. dollars which may result in an increase or decrease in the amount of our obligations (expressed in U.S. dollars) and the value of our assets, including accounts receivable (expressed in U.S. dollars). We make no representation that the Indian Rupee amounts referred to in this prospectus could have been or could be converted into U.S. dollars at any particular rate.

iii

Table of Contents

EXCHANGE RATE INFORMATION

The Company’s principal country of operations is India. The financial position and results of its operations are determined using Indian Rupee (“INR”), the local currency, as the functional currency. The Company’s consolidated financial statements are reported using in U.S. dollars. The following table outlines the currency exchange rates that were used in creating the Company’s consolidated financial statements included in this prospectus.

| | Six Months

Ended

June 30, 2024 | | Six Months

Ended

June 30, 2023 |

Period-end spot rate | | $1 = INR83.3820 | | $1 = INR82.0277 |

Average rate | | $1 = INR83.2016 | | $1 = INR82.2774 |

| | Year Ended

December 31,

2023 | | Year Ended

December 31,

2022 |

Period-end spot rate | | $1 = INR83.1463 | | $1 = INR82.7609 |

Average rate | | $1 = INR82.5287 | | $1 = INR78.1494 |

iv

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of U.S. securities laws that involve risks and uncertainties, such as statements related to future events, business strategy, future performance, future operations, backlog, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “aim,” “anticipate,” “believe,” “could,” “estimate,” “expect,” “going forward,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “propose,” “seek,” “should,” “target,” “will,” “would” and similar expressions or their negatives. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on management’s belief, based on currently available information, as to the outcome and timing of future events. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed in, or implied by, such forward-looking statements. When evaluating forward-looking statements, you should consider the risk factors, uncertainties and other cautionary statements described in the section titled “Risk Factors.” We believe the expectations reflected in the forward-looking statements contained in this prospectus are reasonable, but no assurance can be given that these expectations will prove to be correct. Accordingly, forward-looking statements should not be unduly relied upon.

Important factors that could cause actual results or events to differ materially from those expressed in, or implied by, forward-looking statements include, but are not limited to:

• our business and operating strategies and plans of operation;

• the amount and nature of, and potential for, future development of our business;

• our dividend distribution plans;

• the regulatory environment as well as the general industry outlook for the industry in which we operate;

• future developments in the industry in which we operate; and

• the trend of the economy of India and the world in general.

These factors are not necessarily all of the important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements. Other unknown or unpredictable factors could also cause actual results or events to differ materially from those expressed in the forward-looking statements. Further, additional risks and uncertainties not presently known to us, or that we currently deem to be immaterial, may also materially adversely affect our business, financial condition, results of operations and future growth prospects. Our future results will depend upon various other risks and uncertainties, including those described in the section titled “Risk Factors.” All forward-looking statements in this prospectus are qualified in their entirety by this cautionary statement. Forward-looking statements speak only as of the date hereof. We undertake no obligation to update or revise any forward-looking statements after the date on which any such statement is made, whether as a result of new information, future events or otherwise.

v

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information contained in greater details elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. This summary is qualified in its entirety by the more detailed information included elsewhere in this prospectus. You should read the entire prospectus carefully before making an investment in our Company or the Ordinary Shares. You should carefully consider, among other things, our consolidated financial statements and the related notes and the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

This prospectus contains information from a report commissioned by us and prepared by CRI, an independent market research firm, to provide information on the upholstered furniture industry in India.

Our Mission

Our mission is to become the leading upholstered furniture supplier in India and the Middle East.

Overview

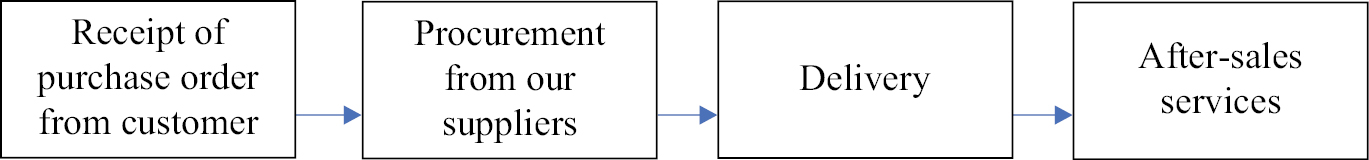

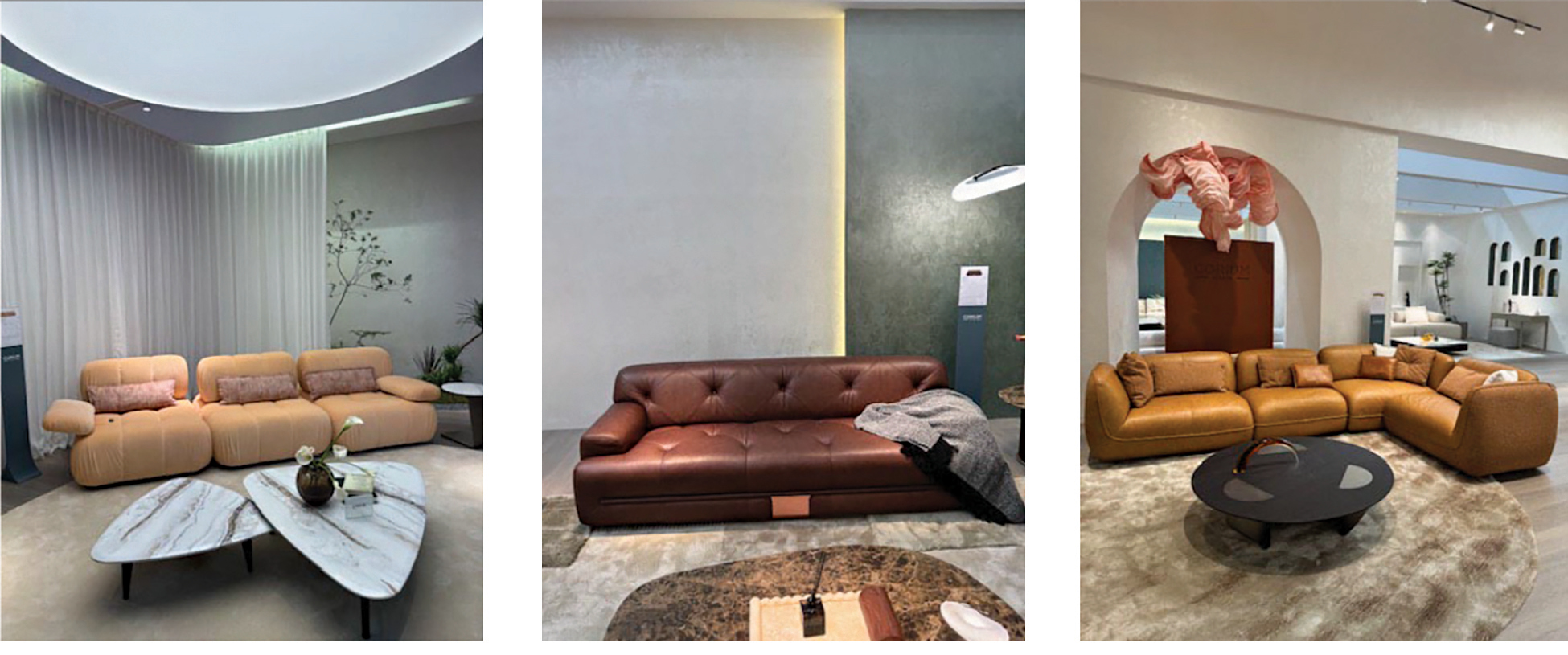

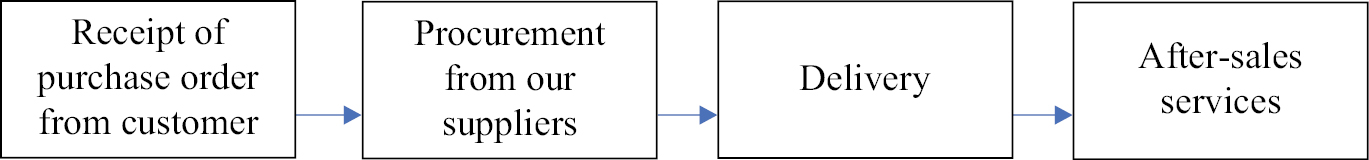

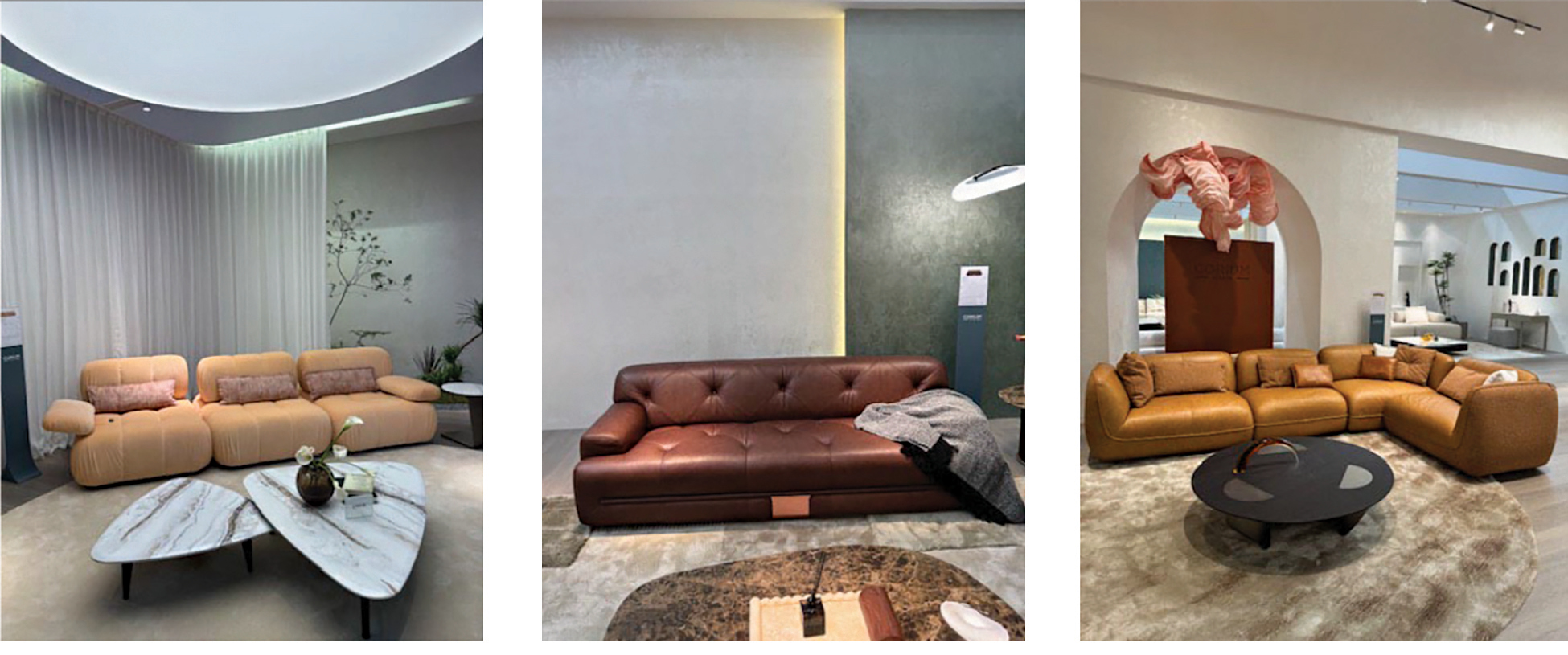

We are a fast-growing furniture supplier principally engaged in the sale and distribution of upholstered furniture in India through Newcentury Trading, our Operating Subsidiary. We are engaged in the sales and distribution of (i) mainly upholstered sofas made in the PRC or India under the brands “Domicil,” “Fabbrica,” “Corium Italia,” “Relax Studio by HTL” and “HomesToLife” or under the customer’s retail brand, and (ii) to a lesser extent, other furniture in the living room, dining room and bedroom such as case goods, mattresses, tables and chairs. “Domicil,” “Fabbrica” and “Corium Italia” are European brands designed by top-class designers from all over the world and offer premium and luxury products targeting the middle and upper class. “Domicil,” “Fabbrica,” and “Corium Italia,” are registered trademarks under related parties of the Company licensed for use to Newcentury Trading. “Relax Studio by HTL” is a brand targeting middle class customers who prioritize functionality, comfort and quality. “HomesToLife” is marketed to the premium mass market to provide customers with affordable, reliable and customizable options. We sell our products in India through (i) furniture retail partners, (ii) dealers, and (iii) our retail stores to India’s growing middle and upper class and the premium mass market.

We believe we are the trend-setter in India and offer high-quality and stylishly designed furniture to our customers. In order to capture the middle and upper class markets in India, we have marketed distinct furniture brands and product collections since our establishment targeting different segments of India’s middle and upper class and leveraged the expanding network of our furniture retail partners, franchise stores and our retail stores. We also provide the premium mass market with affordable, yet stylish, products, setting ourselves apart from our competitors. We believe as India consumers’ living standards continue to improve, our brands will grow significantly as the demand for high quality and stylish furniture by consumers increases. We plan to further penetrate the India market by opening additional retail stores in the near future.

We broadened our sales channels and achieved significant growth in our business in 2023. Our revenue increased from US$0.004 million for the year ended December 31, 2022 to US$5.8 million for the year ended December 31, 2023. Our net income increased from net loss of US$683,721 for the year ended December 31, 2022 to net income of US$24,860 for the year ended December 31, 2023. The increase in revenue primarily resulted from extending our reach to a larger base of customers through the expansion of distribution network, which we do not expected to recur. We started the business in 2022 and there were only two retail partners and dealers in the year ended December 31, 2022, which we broaden the sales channels to 17 furniture retail partners and dealers and a number of independent retail customers as at June 30, 2024. Our revenue increased from US$0.6 million for the six months ended June 30, 2023 to US$4.7 million for the six months ended June 30, 2024. Our net loss increased from US$736,822 for the six months ended June 30, 2023 to US$1,180,080 for the six months ended June 30, 2024. While we expect growth in future years, we do not, and prospective investors should not, expect such rate of growth to be recurring, and our past results should not be deemed, or used as, an indication of our future business performance or results.

To date, we generated the majority of our sales through sales to our furniture retail partners and dealers. We market our sofas under the brands “Domicil,” “Fabbrica,” “Corium Italia,” “Relax Studio by HTL” and “HomesToLife” through selling to furniture retail partners and dealers. We engage various furniture retail partners and dealers in India under our distributorship arms to extend our reach to a larger base of customers. Our network of furniture retail partners

1

Table of Contents

and dealers are located in major shopping malls and furniture shops in India. We enter into written agreements with furniture retail partners to operate in a “shop-in-shop” model which requires our furniture retail partners to reserve an exclusive space of their store dedicated for marketing and selling our products. We enter into written agreements with our dealers to which the dealers are authorized to establish and operate the designated dealer store under our brand name to sell our products. As at June 30, 2024, we entered into written agreements with 17 furniture retail partners and dealers to market our products in India.

We also operate our own retail stores under the brand “HomesToLife” by offering a one-stop solution to retail customers to address their furniture needs. We sell sofas and other furniture through our retail stores tailored to the needs of our customers. As at June 30, 2024, we have four retail stores, operated either directly by our Operating Subsidiary in India or through our dealers in India, under our brand “HomesToLife,” located in Mumbai, Bengaluru and Hyderabad, India.

We source our products from different furniture suppliers in the PRC and India based on various factors including design of the furniture, market trends, cost and demand anticipated by our management and procurement team, as well as specific customer orders.

Our Values

At our Company, we stand by our core values, which are essential to our success. We believe these values not only guide our business and define our brand, but also deliver real financial and operational benefits for us and our customers.

Our core values include:

• Conducting our business with fairness and integrity;

• Maintaining a high level of expertise in the sale and distribution of upholstered furniture;

• Listening and responding to our customers’ needs; and

• Offering high-quality and stylishly designed furniture to our customers.

Our Competitive Strengths

Our story began in 1976 with Mr. Yong Pin Phua, our Chairman and a skilled upholsterer, who started Hwa Tat Lee (i.e. HTL) with his two brothers, including Mr. Yong Tat Phua, our chief executive officer, in Singapore. HTL Group started by making sofas for the Singapore market and soon turned their attention to overseas market after gaining success locally in Singapore. HTL Group expanded globally and established presence in India in 2021. We believe that the following strengths have contributed to our success and are differentiating factors that set us apart from our competitors.

• Established Track Record and Market Leadership in India’s Upholstered Furniture Industry: Since the incorporation of our Operating Subsidiary in 2021, we have focused on the sale and distribution of upholstered furniture in India. We have devoted substantial efforts in expanding our network of furniture retail partners and dealers. We maintain strong business relationships with our furniture retail partners and dealers in India while also actively promoting our brands through our own retail stores. We believe that such relationships with our partners, together with our marketing efforts through our own retail stores, differentiate us from our competitors in India.

• A Diversified Portfolio of Brands and Full Range of Products to Meet our Customers’ Needs: We offer upholstered sofas under our brands “Domicil,” “Fabbrica,” “Corium Italia,” “Relax Studio by HTL” and “HomesToLife” and under the customer’s retail brand. To a lesser extent, we also offer other furniture in the living room, dining room and bedroom such as case goods, mattresses, tables and chairs. We believe that our wide spectrum of brands in different styles and price ranges enable us to expand our customer base and our market share.

• Strategic Selection of Furniture Retail Partners and Dealers and Carefully Selected Location of Retail Stores: We engage various furniture retail partners and dealers in India under our distributorship arms to extend our reach to a larger base of customers. We support our furniture retail partners and dealers by providing them with store design, merchandize planning, shop setup, training and marketing supports. Our network of furniture retail partners and dealers are located in major shopping malls and furniture

2

Table of Contents

shops in India. We carefully select our furniture retail partners and dealers by considering their location, track record, payment records, managerial capabilities, reputation and number of comparable furniture retail partners/dealers in nearby districts. We believe our strategic selection of furniture retail partners and dealers and the location of our retails stores enable us to effectively market our brands, and in turn, attract a larger number of customers and contribute to our success.

• Experienced and Dedicated Management Team: Our management team has extensive knowledge and experience in the upholstered furniture industry globally. Each of Mr. Yong Tat Phua, our Chief Executive Officer, and Mr. Yong Pin Phua, our Chairman, has over 40 years of experience in the furniture industry. We benefit from the extensive experience of our management in the industry, which has enabled us to understand market trends and develop strong business relationships with our customers and suppliers. We believe that the commitment of our management team has been, and will continue to be, one of the key factors to our success and provide us a competitive edge in our continuing expansion.

Our Growth Strategies

Our principal growth strategies are to further strengthen our market position, increase our market share and capture the growth in the upholstered furniture industry in India. We intend to achieve our business objectives by expanding our scale of operation through actively seeking opportunities in expanding our market presence and expanding our customer base. To achieve these goals, we plan to implement the following strategies:

• Extend Our Reach in the Overseas Upholstered Furniture Market: We will further harness our competitive advantage as a fast-growing furniture supplier in India to extend our reach to the U.S. by strengthening our sales and marketing network. We plan to expand our business network by attending exhibitions and trade fairs and conducting site visits in the U.S. We plan to establish our presence in the U.S. by setting up regional office(s) in major cities in the U.S. We plan to open “HomesToLife” stores in the U.S. and market our products. We will also consider co-operating with local U.S. furniture retail partners to operate in “shop-in-shop” model and market our “Domicil,” “Fabbrica,” “Corium Italia,” “Relax Studio by HTL” and “HomesToLife” products. We plan to establish our presence in the U.S. in 18 to 24 months from the Offering. We plan to utilize part of our proceeds from the Offering and our internal resources, and if necessary, obtain bank borrowings, to finance our expansion to the U.S. market. As the Company is still exploring its options, we are unable to provide an estimate of the capital requirements at this time. See “Use of Proceeds” for additional information.

• Enhancement of Our Sales Channels Through Opening Additional Retail Stores: We operate our own retail stores under the brand “HomesToLife” by offering a one-stop solution to retail customers to address their furniture needs. In light of the increasing demand of our “HomesToLife” products, we plan to open additional “HomesToLife” stores in India. Our plan is to open our retail stores in areas with good market potential or customer demand, with reference to geographic coverage, population density, average income of residents, purchasing power and the presence of related trade mix in proximity.

• Strengthen Our Brand Recognition Through Marketing Campaigns: We will continue to reinforce our brand recognition by conducting marketing and promotional activities to enhance our brand image and promote our products to industry players and retail customers. We intend to continue promoting our brands and products through traditional mass media such as advertising and through modern mass media such as social media and applications on a regular basis. These marketing campaigns will increase exposure of our brands and elevate our brands’ status, thereby enabling us to capture the potential target customer groups and increase our market presence.

Threats and Challenges

According to CRI, we face the following threats and challenges:

• Inefficient Supply Chains and High Logistics Costs: The supply chains in the upholstered furniture industry are not streamlined, resulting in inefficiencies and delays. The cost of transportation and logistics accounts for about 6%-8% of the total manufacturing cost in India, compared to China’s 4%, making the industry uncompetitive. The difference in costs make our products less competitive in terms of price compared to products from China’s furniture suppliers and consumers who are price-sensitive may choose products from our competitors instead of our products.

3

Table of Contents

• High Import Tax Tariff: The duty-free features of the India’s Export Promotion Capital Goods Scheme (“EPCG Scheme”) do not apply to imported upholstered furniture for furniture retailers in India. India’s import duty rate on upholstered furniture has been steadily rising. The base rate of import duty was raised from 10% to 20% in February 2018 and then to 25% in February 2020, and we cannot predict the timing or rate of future increases. The continuous increase in tax tariff poses a burden to our profit margin and our profit margin may shrink if the tax tariff increase further.

• Intense and Fragmented Competition Landscape: In the retail market, the competition for upholstered furniture in India is intense and fragmented, with no leading giants emerging. Due to this, the market has low barriers to entry and a number of new players are expected to enter the market in the future. In the event that new players enter the market in the future, we may face strong competition and may have to lower the price of our products, which may have an adverse effect on our profit margin.

Market and Competition

Market

According to CRI, the Indian upholstered furniture market is a significant segment of the broader Indian furniture market. It has been experiencing remarkable growth in recent years, primarily driven by the increasing disposable household income, the rise in the number of middle-class households, and rapid urbanization. This growth is also reflected in the export and import data of furniture and related products, indicating a substantial rise in the upholstered furniture market in India. Before the COVID-19 pandemic, both the import and export of furniture and related products were on the rise, making Indian furniture sizeable and attractive to organized global market players. According to CRI, the upholstered furniture market of India is projected to expand at a compound annual growth rate (CAGR) of 7.0%, reaching US$6,848 million by 2033.

According to CRI, the rapid urbanization and advancements in lifestyle have created numerous growth opportunities for the real estate industry, which is expected to boom in the forthcoming years. According to the India Equity Brand Foundation (IBEF) report, India’s real estate sector is contributing 6-7% to the country’s total Gross Domestic Product (GDP). It is expected to reach a market size of USD$1 trillion by 2030 and contribute 13% to the India’s GDP by 2025. We believe the expected growth in the number of housings in towns and cities will increase the demand for home furnishing. The increasing purchasing power of India’s middle class represents a significant consumer base for the upholstered furniture. This demographic’s growing aspiration for quality and branded products can drive domestic demand of upholstered furniture and encourage manufacturers to innovate and improve their products.

Competition

The upholstered furniture industry in India is characterized by intense competition, fragmentation and low barriers to entry. Elements of competition include, but are not limited to, price, quality and design of the products, reputation and market perception of the brand and comprehensive after-sales services.

Generally, players in the Indian upholstered furniture retail market are categorized as offline retailers and online retailers. However, with the growth of e-commerce, currently, most retailers are adopting a business model that combines online and offline channels, with offline retailing as the main focus, while supporting online sales.

Major retail brands in the Indian market include IKEA, Royaloak, Home Center, HomeTown, At Home, Dashsquare, Stanley Lifestyles, and Damro, among others. There are also some companies such as Pepperfry that have built their business model around online platforms by opening offline studios to help online selling and provide value-added services for online products. There are also other companies, such as TheHomeOffice and FabFurnish, that only sell furniture online.

Ranked by annual sales, IKEA tops the list of retailers in India’s upholstered furniture market, followed by Royaloak. HomeCenter, StanleyLifestyles and Pepperfry round out the top five. The combined market share of the top five retailers in India’s upholstered furniture market is 11.8% in 2023, which means the retail segment of the upholstered furniture market in India is extremely competitive and fragmented, with no retailer or manufacturer currently holding a sizable market share. While the fragmented nature of the market creates opportunities, the confluence of such opportunities and the low barriers to entry attracts, and will continue to attract, many new players to the industry,

4

Table of Contents

ensuring that competition will remain intense for the foreseeable future. Additionally, some of our competitors have significantly greater financial resources and expertise in marketing, sales and distribution than we do. Our success will depend, in part, on our ability to successfully compete.

While we expect competition to intensify, we believe our competitive strengths distinguish us from our competitors.

For additional information regarding our competition, see the “Industry Data and Forecast — Competition Landscape.”

Significant Risk Factors

Our business is subject to numerous risks and uncertainties that you should be aware of before making an investment decision, including those highlighted in the section entitled “Risk Factors” in this prospectus. These risks include, but are not limited to, the following:

Risks Related to our Business and Industry

• We have a limited operating history, which may make it difficult for you to evaluate our business may and predict our future success. (see page 15 of this prospectus).

• Our business may be affected by increase in rental expenses or the termination of leases of our retail stores (see page 15 of this prospectus).

• We substantially rely on our reputation and brand name and failure to sustain our goodwill may harm our business and financial condition (see page 15 of this prospectus).

• We rely on the India market and unfavorable changes in India’s economy may harm our profitability and performance (see page 16 of this prospectus).

• The upholstered furniture industry is highly competitive and pricing pressure from our competitors may harm our revenues and profitability (see page 16 of this prospectus).

• Adverse changes in government regulations may materially and adversely affect our operations and financial condition (see page 16 of this prospectus).

• We materially rely on two sofa manufacturers from India and the PRC, both of which are related parties to us. Such arrangement materially and adversely exposes us to unique risks. (see page 16 of this prospectus).

• The supply and prices of our products are influenced by a number of factors, some of which are beyond our control, and may adversely affect our business (see page 17 of this prospectus).

• We may not be able to achieve the same level of success in foreign markets as we have in the India market (see page 17 of this prospectus).

• Potential exposure to product liability and quality issues may adversely affect our business and financial performance (see page 18 of this prospectus).

• Our furniture retail partners and dealers may engage in price competition and market cannibalization among themselves, which may have a material adverse effect on our results of operations and financial condition (see page 18 of this prospectus).

• Failure to manage our inventory effectively could increase our loss rate, lower our profit margins, or cause us to lose sales, each or all of which could have a material adverse effect on our business, financial conditions and results of operations (see page 18 of this prospectus).

• We are subject to credit risk in relation to the collectability of our trade receivables from customers and if our collection periods lengthen further or if we encounter any material defaults of payment, our liquidity and cash flows may be adversely affected (see page 18 of this prospectus).

• Our operating results are affected by seasonality and any unpredictable and material changes in the market during our peak seasons may materially and adversely affect our financial condition and profitability (see page 18 of this prospectus).

5

Table of Contents

• We may be subject to anti-corruption, anti-bribery, anti-money laundering, financial and economic sanctions, and similar laws, and noncompliance with such laws can subject us to administrative, civil, and criminal penalties, collateral consequences, remedial measures, and legal expenses (see page 19 of this prospectus).

• We may not be able to adequately protect our intellectual property rights and there may be copycat counterfeit competition and an inability to protect or use our intellectual property rights may adversely affect our business (see page 19 of this prospectus).

• Our products may be subject to third party intellectual property rights and may lead to infringement liability and litigation, which may negatively affect our reputation, profitability and prospects (see page 20 of this prospectus).

• There is no assurance on the continuity of our relationship with major suppliers and failure to renew contracts with major suppliers may affect our business (see page 20 of this prospectus).

• There is no assurance on the continuity of our relationship with major furniture retail partners and dealers and failure to renew contracts with major furniture retail partners and dealers may adversely affect our business. (see page 20 of this prospectus).

• We are exposed to foreign exchange fluctuations and significant fluctuations in foreign exchange rates may adversely affect our profit margin and profitability. (see page 20 of this prospectus).

• We may not succeed in implementing our business strategies and future expansion plans and failure to successfully implement or manage our business expansion may adversely affect our financial condition (see page 20 of this prospectus).

Risks of Doing Business in India

• A substantial portion of our business and operations are located in India and we are subject to regulatory, economic, social and political uncertainties in India which could adversely affect India and our business (see page 21 of this prospectus).

• As the domestic Indian market constitutes a significant source of our revenue, a slowdown in economic growth in India could cause our business to suffer (see page 21 of this prospectus).

• Restrictions on foreign investment in India may prevent us from making future acquisitions or investments in India, which may adversely affect our results of operations, financial condition and financial performance (see page 22 of this prospectus).

• Changes in the taxation system in India could have a negative impact on our business (see page 22 of this prospectus).

• Our ability to receive dividends and other payouts from our Operating Subsidiary in India is subject to Indian legal restrictions and withholding tax (see page 23 of this prospectus).

• We may be subject to various changing laws, regulations, and standards in India, and non-compliance with or changes in these laws may adversely affect our business, results of operations, and financial condition (see page 23 of this prospectus).

Risks Related to this Offering and Ownership of Our Ordinary Shares

• We will incur additional costs as a result of becoming a public company, which could negatively impact our net income and liquidity, and the requirements of being a public company may strain our resources and divert management’s attention (see page 23 of this prospectus).

• Our management team has limited experience managing a public company and our management team’s attention could be diverted to compliance of securities law and away from the day-to-day management of our Company (see page 24 of this prospectus).

6

Table of Contents

• If we fail to meet applicable Nasdaq listing requirements, Nasdaq may delist our Ordinary Shares from trading, in which case the liquidity and market price of our Ordinary Shares could decline (see page 25 of this prospectus).

• We are a “controlled company” as defined under the Nasdaq Rules. Although we do not intend to rely on the “controlled company” exemption under the Nasdaq Rules, we could elect to rely on such exemption in the future and you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements (see page 26 of this prospectus).

• Our significant shareholders have considerable influence over our corporate matters, which may limit our other shareholders’ ability to influence the Company (see page 27 of this prospectus).

• The market price of our Ordinary Shares may be volatile or may decline regardless of our operating performance, and you may not be able to resell your shares at or above the price you paid for such shares in this Offering. We may experience extreme stock price volatility unrelated to our actual or expected operating performance (see page 28 of this prospectus).

• There may not be an active, liquid trading market for our Ordinary Shares, and we do not know if a more liquid market for our Ordinary Shares will develop to provide you with adequate liquidity (see page 29 of this prospectus).

• You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under BVI law (see page 30 of this prospectus).

• It may be difficult to enforce a judgment of U.S. courts for civil liabilities under U.S. federal securities laws against us, our directors or officers in the BVI, Singapore and Hong Kong (see page 31 of this prospectus).

• We could become a passive foreign investment company for U.S. federal income tax purposes for any taxable year, which could subject U.S. investors in our shares to significant adverse U.S. income tax consequences (see page 33 of this prospectus).

• We do not expect to pay dividends in the foreseeable future after this Offering. You must rely on price appreciation of the Ordinary Shares for return on your investment (see page 33 of this prospectus).

Approvals or Permits

As of the date of this prospectus, our Operating Subsidiary has made an application with the relevant authority in India which has been approved by such authority, for renewal of trade license for the Operating Subsidiary’s Office situated at Virupakshapura, Bengaluru. Except as stated above, our Operating Subsidiary has obtained all material licenses, certificates and approvals required for carrying on our business activities in India for the year ended December 31, 2023, the six month ended June 30, 2024 and up to the date of this prospectus.

Our Corporate Structure

We are a BVI company that wholly owns our BVI subsidiary, New Century Trading Holding Co., Ltd., which in turn, wholly owns our Operating Subsidiary in India.

The following diagram illustrates our corporate structure as of the date of this prospectus and on completion of the Offering. For further details on our corporate history, please refer to the section titled “Our Corporate History and Structure” appearing on page 70 of this prospectus.

7

Table of Contents

The following diagrams illustrate our corporate structure (i) immediately prior to this Offering, and (ii) immediately upon completion of this Offering. For further details on our corporate history, please refer to the section titled “Our Corporate History and Structure” appearing on page 70 of this prospectus.

8

Table of Contents

The following diagram illustrates our corporate structure immediately after the Offering:

Corporate Information

Our Company was incorporated in the BVI on January 10, 2024. Our registered office in the BVI is located at Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, BVI. Our principal executive office is located at 5/F, Sattva Galleria, BBMP Khata No. 277/278/316, Byatarayanapura, Virupakshapura, Ward No.277, Bengaluru, Karnataka 560092 India and our telephone number is +91 77382 68072. We maintain corporate websites at www.homestolife.in. The information contained in, or accessible from, our website or any other website is not incorporated into, and does not constitute a part of, this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Our agent for service of process in the U.S. is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, NY 10168, with the telephone number +1 (800) 221-0102.

Because we are incorporated under the laws of the BVI, you may encounter difficulty protecting your interests as a shareholder, and your ability to protect your rights through the U.S. federal court system may be limited. Please refer to the sections entitled “Risk Factors” and “Enforcement of Civil Liabilities” for more information.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”), and we are eligible to take, have taken, and intend to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, (i) presenting only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in this prospectus, (ii) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), (iii) reduced disclosure obligations

9

Table of Contents

regarding executive compensation in our periodic reports, and (iv) exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We have taken advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. We have also elected to avail ourselves of the extended transition period for implementing new or revised financial accounting standards. As a result, the information we provide to our shareholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company.

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year during which we have total annual gross revenues of at least US$1.235 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion of this Offering; (iii) the date on which we have, during the preceding three-year period, issued more than US$1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which would occur if the market value of our Ordinary Shares that are held by non-affiliates is US$700 million or more as of the last business day of our most recently completed second fiscal quarter. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

Implications of Being a Foreign Private Issuer

We are a “foreign private issuer” within the meaning of the rules under the Exchange Act. As such, we are exempt from certain provisions applicable to U.S. domestic public companies. For example:

• we are not required to provide as many Exchange Act reports, or as frequently, as a U.S. domestic public company;

• for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to U.S. domestic public companies;

• we are not required to provide the same level of disclosure on certain issues, such as executive compensation;

• we are exempt from the provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information;

• we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and

• we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction.

In addition, the Nasdaq Rules permit foreign private issuers to follow the corporate governance practices of their home countries in lieu of certain Nasdaq corporate governance requirements. Certain corporate governance practices in the BVI, which will be our home country, differ significantly from Nasdaq corporate governance listing standards. Among other things, we will not be required to have:

• a majority of our board of directors (“BOD”) consist of independent directors;

• a compensation committee consisting of independent directors;

• a nominating committee consisting of independent directors; or

• regularly scheduled executive sessions with only independent directors each year.

10

Table of Contents

We do not currently plan to rely on home country practice with respect to any corporate governance matters. However, should we, in the future, choose to follow home country practices with respect to certain Nasdaq corporate governance rules, our shareholders may not be provided with the benefits of certain corporate governance requirements of Nasdaq applicable to U.S. domestic public companies.

Implications of Being a Controlled Company

Upon the completion of this Offering, we will be a “controlled company” as defined under the Nasdaq Rules because we expect that Mr. Yong Tat Phua, our Chief Executive Officer, and Mr. Yong Pin Phua, our Chairman, will, through GHI Capital Limited, hold 59.33% of our total issued and outstanding Ordinary Shares, i.e., they will own a majority of our total issued and outstanding Ordinary Shares and will be able to exercise 59.33% of the total voting power of our issued and outstanding share capital. For so long as we remain a “controlled company,” we are permitted to elect to rely, and may so rely, on certain exemptions from corporate governance rules, including:

• an exemption from the rule that a majority of our BOD must be independent directors;

• an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and

• an exemption from the rule that our director nominees must be selected or recommended solely by independent directors.

As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements.

Although we do not intend to rely on the “controlled company” exemption under the Nasdaq Rules, we could elect to rely on it in the future. If we elected to rely on the “controlled company” exemption, a majority of the members of our BOD might not be independent directors and our nominating and corporate governance and compensation committees might not consist entirely of independent directors. Our status as a “controlled company” could cause our Ordinary Shares to look less attractive to certain investors or otherwise harm our trading price. As a result, investors will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. Please refer to the paragraph titled “Risk Factors — Our significant shareholder has considerable influence over our corporate matters.”

Offering Summary

Following completion of this Offering, ownership of the Company, will be as follows:

| | Ordinary Shares purchased |

| | | Number | | Percent |

Existing shareholders | | 13,125,000 | | 77.78 | % |

New investors | | 3,750,000 | | 22.22 | % |

| | | 16,875,000 | | 100.00 | % |

11

Table of Contents

THE OFFERING

Issuer | | HTL Capital Ltd. |

Ordinary Shares offered by us | | 3,750,000 Ordinary Shares. |

Ordinary Shares Outstanding Immediately Prior to Completion of this Offering | |

13,125,000 Ordinary Shares.

|

Ordinary Shares outstanding immediately after this Offering | |

16,875,000 Ordinary Shares (or 17,437,500 Ordinary Shares assuming the underwriters exercise in full their over-allotment option).

|

Over-allotment option | | We granted the underwriters the right to purchase up to an additional 562,500 Ordinary Share from us within 45 days after the closing date of this Offering, to cover over-allotments, if any, in connection with this Offering. |

Listing and Proposed Symbol | | We applied to list our Ordinary Shares on the Nasdaq Capital Market under the symbol “NCG”. |

Use of Proceeds | | We estimate we will receive net proceeds from this Offering, after deducting underwriting discounts and commissions and estimated offering expenses, of approximately US$15,617,330 (or approximately US$18,218,892 if the underwriters exercise in full their over-allotment option), assuming an IPO price of US$5.00 per Ordinary Share (the midpoint of the range set forth on the cover page of this prospectus). We currently intend to use the net proceeds from this Offering for pursuing acquisitions, establishing our presence in North America, enhancing our sales channels, strengthening our brand recognition and for working capital and general corporate purposes. Please refer to the section titled “Use of Proceeds”. |

Risk Factors | | Investing in our Ordinary Shares involves a high degree of risk and purchasers of our Ordinary Shares may lose part or all of their investment. Please refer to the section titled “Risk Factors” beginning on page 15 for a discussion of factors you should carefully consider before deciding to invest in our Ordinary Shares. |

Lock-Up | | We, our directors, executive officers, and all existing shareholders who own 5% or more of our issued and outstanding Ordinary Shares prior to this Offering are expected to enter into lock-up agreements with the underwriters not to sell, transfer or dispose of any Ordinary Shares for up to six months after completion of this Offering. Please refer to the sections titled “Shares Eligible for Future Sale” and “Underwriting”. |

Dividend Policy | | We have no present plans to declare dividends and plan to retain our earnings to continue to grow our business. |

12

Table of Contents

SUMMARY FINANCIAL DATA

The following summary presents our consolidated statements of operations and cash flow data for the six months ended June 30, 2024 and the fiscal years ended December 31, 2023 and 2022 and our summary consolidated balance sheet data as of June 30, 2024 and December 31, 2023 and 2022, which were derived from our CFS included elsewhere in this prospectus. You should read this section in conjunction with our audited financial statements and the accompanying notes and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. Our CFS are prepared and presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). Our CFS have been prepared as if the current corporate structure has been in existence throughout the periods presented. Our historical results are not necessarily indicative of results that may be expected in the future.

Results of Operations Data:

| | For the

Six Months

Ended

June 30,

2024

(Unaudited) | |

For the Years Ended

December 31,

|

2023 | | 2022 |

| | | USD | | USD | | USD |

Revenue | | | | | | | | | |

Sales of sofa | | 4,739,610 | | | 5,786,596 | | | 3,987 | |

Cost of revenues | | (3,740,438 | ) | | (4,611,890 | ) | | (1,794 | ) |

Gross profit | | 999,172 | | | 1,174,706 | | | 2,193 | |

| | | | | | | | | | |

Operating expenses: | | | | | | | | | |

Selling and marketing | | (1,200,358 | ) | | (1,394,856 | ) | | (379,712 | ) |

General and administrative | | (1,059,468 | ) | | (961,716 | ) | | (268,283 | ) |

Total operating expenses | | (2,259,826 | ) | | (2,356,572 | ) | | (647,995 | ) |

Operating loss | | (1,260,654 | ) | | (1,181,866 | ) | | (645,802 | ) |

| | | | | | | | | | |

Other (expenses) income | | | | | | | | | |

Finance income | | — | | | 1,510 | | | — | |

Finance expense | | (53,306) | | | (105,867 | ) | | (39,806 | ) |

Other income | | 163,740 | | | 1,327,333 | | | 1,887 | |

Other expenses | | (29,860 | ) | | (16,250 | ) | | — | |

Total other income/(expenses), net | | 80,574 | | | 1,206,726 | | | (37,919 | ) |

| | | | | | | | | | |

Income/(Loss) before income tax | | (1,180,080 | ) | | 24,860 | | | (683,721 | ) |

Income tax expense | | — | | | — | | | — | |

Net income/(loss) | | (1,180,080 | ) | | 24,860 | | | (683,721 | ) |

| | | | | | | | | | |

Other comprehensive income: | | | | | | | | | |

Foreign currency translation adjustments | | (5,479) | | | 2,810 | | | 38,096 | |

Comprehensive Income (expense) | | (1,185,559 | ) | | 27,670 | | | (645,625 | ) |

Earning (loss) per share – basic and diluted | | (0.090 | ) | | 0.002 | | | (0.052 | ) |

Weighted average number of Ordinary Shares | | 13,125,000 | | | 13,125,000 | | | 13,125,000 | |

13

Table of Contents

Balance Sheet Data:

| | As of

June 30,

2024

(Unaudited) | | As of

December 31,

2023 | | As of

December 31,

2022 |

| | | USD | | USD | | USD |

Cash and cash equivalents | | 1,064,002 | | 1,149,607 | | 128,658 |

Total current assets | | 6,199,413 | | 4,423,986 | | 773,911 |

Total non-current assets | | 3,010,252 | | 3,511,686 | | 2,889,508 |

Total assets | | 9,209,665 | | 7,935,672 | | 3,663,419 |

Total current liabilities | | 6,783,888 | | 3,889,820 | | 904,020 |

Lease liabilities-non-current portion | | 1,051,397 | | 1,485,913 | | 1,604,295 |

Total liabilities | | 7,835,285 | | 5,375,733 | | 2,508,315 |

Total shareholders’ equity | | 1,374,380 | | 2,559,939 | | 1,155,104 |

Statements of Cash Flows Data:

| | Six Months

Ended

June 30,

2024

(Unaudited) | |

For the Years Ended

December 31

|

| | | 2023 | | 2022 |

| | | USD | | USD | | USD |

Net cash provided by (used in) operating activities | | 1,199,870 | | | 80,733 | | | (741,648 | ) |

Net cash used in investing activities | | (12,654 | ) | | (436,479 | ) | | (810,238 | ) |

Net cash provided by financing activities | | (1,267,342 | ) | | 1,377,165 | | | 1,654,368 | |

Effect of exchange rate changes | | (5,479 | ) | | (470 | ) | | 26,176 | |

Net change in cash and restricted cash | | (85,605 | ) | | 1,020,949 | | | 128,658 | |

Cash and restricted cash in bank, beginning of year/period | | 1,149,607 | | | 128,658 | | | — | |

Cash and restricted cash in bank, end of year/period | | 1,064,002 | | | 1,149,607 | | | 128,658 | |

14

Table of Contents

RISK FACTORS

Investment in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information included in this prospectus, including our financial statements and related notes and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus” before making an investment decision. The risks and uncertainties described below represent our known material risks to our business. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, you may lose all or part of your investment. Additional risks that we currently do not know about or that we currently believe to be immaterial may also impair our business, financial condition, operating results and prospects. You should not invest in this Offering unless you can afford to lose your entire investment.

Risks Related to our Business and Industry

We have a limited operating history, which may make it difficult for you to evaluate our business and predict our future success.

Our Operating Subsidiary was formed in 2021 and we commenced operations in 2022. During fiscal year ended December 31, 2022, we had only two retail partners and dealers, which we broaden the sales channels to 17 furniture retail partners and dealers and a number of independent retail customers as at December 31, 2023. Our revenue increased from US$0.004 million for the year ended December 31, 2022 to US$5.8 million for the year ended December 31, 2023. Our net income increased from net loss of US$683,721 for the year ended December 31, 2022 to net income of US$24,860 for the year ended December 31, 2023. The significant increase in revenue was primarily resulted from extending our reach to a larger base of customers through the expansion of distribution network, which we do not expected to recur. Our revenue increased from US$0.6 million for the six months ended June 30, 2023 to US$4.7 million for the six months ended June 30, 2024. Our net loss increased from US$736,822 for the six months ended June 30, 2023 to US$1,180,080 for the six months ended June 30, 2024. While we expect growth in future years, we do not, and prospective investors should not, expect the rate of growth achieved in 2023 to recur, and our past results should not be deemed, or used as, an indication of our future business performance or results. Our limited operating history makes it difficult for you to evaluate our business and prospects. We may encounter unforeseen expenses, difficulties, and other known and unknown risks frequently experienced by new companies. If we do not adequately address these risks and difficulties, our business may suffer.

Our business may be affected by increase in rental expenses or the termination of leases of our retail stores.

We operate retail stores under the brand “HomesToLife” by offering one-stop solution to retail customers to address their furniture needs. As at June 30, 2024, we have four retail stores, operated either directly by our Operating Subsidiary in India or through our dealers in India, under our brand “HomesToLife,” located in Mumbai, Bengaluru and Hyderabad, India. The retail stores are essential to our business as they are an important distribution channel of our products. However, there is no assurance we could renew the existing tenancies upon their respective expiration dates or could renew the same on terms and conditions no less favorable to us than the existing ones. Failure to renew the existing tenancies on terms and conditions acceptable to us may lead to disruption of our business and additional costs being incurred for relocation and renovation. If we are unable to find alternative locations that are suitable or on commercially acceptable terms in a timely manner, it may lead to reduction in the number of retail stores and our business, results of operation and financial condition may be adversely affected.

Furthermore, rental expenditure is one of the major costs in our business operation. Any substantial increase in rental expenses of our retail venues may increase our cost of operation and may adversely affect our profitability and financial positions.

We substantially rely on our reputation and brand name and failure to sustain our goodwill may harm our business and financial condition.

We mainly engage in the sales and distribution of (i) upholstered sofas made in the PRC or India under the brands “Domicil,” “Fabbrica,” “Corium Italia”, “Relax Studio by HTL” and “HomesToLife” or under the customer’s retail brand, and (ii) to a lesser extent, other furniture in the living room, dining room and bedroom such as case goods, mattress, tables and chairs. We believe the reputation of our brands is one of the most important factors for our success.

15

Table of Contents

The market perception and recognition of our brands is built on our pursuit of high-quality and stylishly designed furniture products. Failure to manage any of these elements could adversely affect the value of our brands. If we are unable to sustain our goodwill or promote and further strengthen our name, our business, financial condition, results of operations and business prospect could be adversely affected.

We rely on the India market and unfavorable changes in India’s economy may harm our profitability and performance.

India is our principal market. For the six months ended June 30, 2024 and the two years ended December 31, 2023, we derived substantially all of our revenue from India. We anticipate that income derived from sales in India will continue to be our principal source of income in the near future. Our performance therefore depends significantly on the economic and market conditions in India. In the event of any unfavorable changes in the India economy, adverse change of condition of the property market, reduced consumer confidence or factors affecting consumer spending, such as epidemics and deterioration of the global financial situation, we may not be able to increase or maintain our sales levels and our profitability and performance could be adversely affected.

The upholstered furniture industry is highly competitive and pricing pressure from our competitors may harm our revenues and profitability.

The upholstered furniture industry in India is highly competitive due to the low entry barriers for the industry. Elements of competition include, but are not limited to, price, quality and design of the products, reputation and market perception of the brand and comprehensive after-sales services. The pricing of similar products by competitors may adversely affect the pricing of our products. If our competitors reduce their prices significantly, we may have to reduce our selling prices or adjust our business strategies in order to maintain our competitiveness which could adversely affect our business, revenues and profitability. There is no assurance that we will be able to compete with our competitors in the industry in light of the changing and competitive market environment. See “Business — Competitive Strengths” and “Business — Competition” for additional information.

Adverse changes in government regulations may materially and adversely affect our operations and financial condition.

Our principal business operations are in India. Our operations are subject to laws and government regulations of India. In addition, we are required to obtain and maintain several statutory and regulatory permits and approvals under central, state and local rules in India, generally for carrying out our business. Some of these approvals are granted for a limited duration and require renewal. For instance, in states where our offices and stores are located, we obtain registrations under the respective shops and establishment Acts of those states, wherever enacted or in force. Our Operating Subsidiary has made an application with the relevant authority in India which has been approved by such authority, for renewal of trade license for the Operating Subsidiary’s Office situated at Virupakshapura, Bengaluru. Except as stated above, our Operating Subsidiary in India currently has all licenses necessary for carrying on its businesses in the current scope. Should there be any changes in the regulatory requirements and we are not able to comply with them in a timely manner or if compliance of these requirements involves substantial costs, our business, results of operation and financial position may be adversely affected. See “Regulations” for additional information.

We materially rely on two sofa manufacturers from India and the PRC, both of which are related parties to us. Such arrangement materially and adversely exposes us to unique risks. Any disruption in our relationship with our suppliers could have a material adverse effect on our business. Any disruption in the manufacturing of sofas and our inability to identify alternative sofa manufacturers may materially and adversely affect our business operations and financial results.

We materially rely on New Century Sofa India Private Limited and HTL Furniture (China) Co., Ltd, our sofa manufacturers in India and the PRC, respectively, which are related parties to us. During the six months ended June 30, 2024 and the years ended December 31, 2023 and 2022, our purchases from the two suppliers were US$2.9 million, US$4.0 million and US$0.2 million, or 89.3%, 92.3% and 29.7% of our purchases, respectively. We entered into long-term written contracts with the sofa manufacturers for a term of 20 years, expiring in 2042.

Such arrangements materially and adversely expose us to unique risks. Our business relies solely on a stable and adequate supply of sofas from the sofa manufacturers. If our business relationships with the sofa manufacturers is interrupted or terminated, or if for any reason lead to a material interruption of our operation, or suspensions in our

16

Table of Contents

ability to procure sofa or fulfil customer orders, until we find another supplier that could supply our product, our business operation and financial results may be materially and adversely affected. Although we entered into long written term agreements with the sofa manufacturers, there is no assurance that the agreements can be renewed on commercially favorable terms upon their expiration.

Any disruption in our supplier relationships could have a material adverse effect on our business. Events that adversely affect our suppliers could impair our ability to obtain sofa supply that we desire. Such events include problems with our suppliers’ businesses, finances, labor relations, ability to obtain raw materials, costs, production, quality control, insurance and reputation, as well as natural disasters, pandemics, or other catastrophic occurrences. A failure by any current or future supplier to comply with the environmental, safety or other laws and regulations, meet required timelines, and hire and retain qualified employees may disrupt our supply of products.

In the event of any early termination or non-renewal of our agreements with the sofa manufacturers, or in the event of any disruption, delay or inability on the part of our suppliers in manufacturing sufficient and quality supply to us, we cannot assure you that we would be able to identify alternative suppliers in a timely fashion and/or on commercially acceptable terms which may thereby result in material and adverse effects on our business, financial condition and operating results. Failure to find a suitable replacement, even on temporary basis, would have an adverse effect on our brand image, financial condition, and the result of operations.