| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-259741-08 | ||

|  |  | |

BANK5 2024-5YR7

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,146,205,970

(Approximate Total Mortgage Pool Balance)

$967,756,000

(Approximate Offered Certificates)

Morgan Stanley Capital I Inc.

as Depositor

Wells Fargo Bank, National Association

Bank of America, National Association

Morgan Stanley Mortgage Capital Holdings LLC

JPMorgan Chase Bank, National Association

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2024-5YR7

May 28, 2024

| MORGAN STANLEY Co-Lead Bookrunner Manager | BofA SECURITIES Co-Lead Bookrunner Manager | J.P. MORGAN Co-Lead Bookrunner Manager | WELLS FARGO SECURITIES Co-Lead Bookrunner Manager |

Academy Securities, Inc. Co-Manager | Siebert Williams Shank Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the SEC (File No. 333-259741) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the depositor or any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll free 1-866-718-1649 or by email to prospectus@ms.com.

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| BANK5 2024-5YR7 |

Neither this Term Sheet nor anything contained herein shall form the basis for any contract or commitment whatsoever. The information contained herein is preliminary as of the date hereof. This Term Sheet is subject to change, completion or amendment from time to time. The information contained herein supersedes information in any other communication relating to the securities described herein; provided, that the information contained herein will be superseded by similar information delivered to you as part of the Preliminary Prospectus. The information contained herein should be reviewed only in conjunction with the entire Preliminary Prospectus. All of the information contained herein is subject to the same limitations and qualifications contained in the Preliminary Prospectus. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described in the Preliminary Prospectus. The information contained herein will be more fully described in the Preliminary Prospectus. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Preliminary Prospectus in its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Term Sheet is truthful or complete. Any representation to the contrary is a criminal offense.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of the New York Stock Exchange, the Financial Industry Regulatory Authority (“FINRA”), the National Futures Association (“NFA”) and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, National Association. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

BofA Securities is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation, including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and member of FINRA and SIPC, and, in other jurisdictions, locally registered entities.

J.P. Morgan is a marketing name for investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by J.P. Morgan Securities LLC and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. J.P. Morgan Securities LLC is a member of the Securities Investor Protection Corporation (“SIPC”) and the NYSE.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of, or attached to, the email communication to which this Term Sheet may have been attached are not applicable to this Term Sheet and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this Term Sheet having been sent via Bloomberg or another email system.

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

THE ASSET-BACKED SECURITIES REFERRED TO IN THIS TERM SHEET ARE BEING OFFERED WHEN, AS AND IF ISSUED. IN PARTICULAR, YOU ARE ADVISED THAT THE ASSET-BACKED SECURITIES, AND THE ASSET POOL BACKING THEM, ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING, AMONG OTHER THINGS, THE POSSIBILITY THAT ONE OR MORE CLASSES OF SECURITIES MAY BE SPLIT, COMBINED OR ELIMINATED), AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS. AS A RESULT, YOU MAY COMMIT TO PURCHASE SECURITIES THAT HAVE CHARACTERISTICS THAT MAY CHANGE, AND YOU ARE ADVISED THAT ALL OR A PORTION OF THE SECURITIES MAY NOT BE ISSUED THAT HAVE THE CHARACTERISTICS DESCRIBED IN THIS TERM SHEET. OUR OBLIGATION TO SELL SECURITIES TO YOU IS CONDITIONED ON THE SECURITIES AND THE UNDERLYING TRANSACTION HAVING THE CHARACTERISTICS DESCRIBED IN THIS TERM SHEET. IF WE DETERMINE THAT THE FOREGOING CONDITION IS NOT SATISFIED IN ANY MATERIAL RESPECT, WE WILL NOTIFY YOU, AND NEITHER THE ISSUING ENTITY NOR ANY UNDERWRITER WILL HAVE ANY OBLIGATION TO YOU TO DELIVER ALL OR ANY PORTION OF THE SECURITIES WHICH YOU HAVE COMMITTED TO PURCHASE, AND THERE WILL BE NO LIABILITY BETWEEN US AS A CONSEQUENCE OF THE NON-DELIVERY.

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-2 | ||

| BANK5 2024-5YR7 | Structural Overview |

Offered Certificates

| Class | Expected Ratings (Fitch/Moody’s/ Morningstar DBRS)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Pass-Through Rate Description | Expected Weighted Average Life (Years)(4) | Expected Principal Window (Months)(4) | Certificate Principal UW NOI Debt Yield(5) | Certificate Principal to Value Ratio(6) | |

| Class A-1 | AAAsf/Aaa(sf)/AAA(sf) | $925,000 | 30.000% | (7) | 2.51 | 1 – 56 | 18.7% | 39.1% | |

| Class A-2(8) | AAAsf/Aaa(sf)/AAA(sf) | (8)(9) | 30.000% | (7)(8) | (9) | (9) | 18.7% | 39.1% | |

| Class A-3(8) | AAAsf/Aaa(sf)/AAA(sf) | (8)(9) | 30.000% | (7)(8) | (9) | (9) | 18.7% | 39.1% | |

| Class X-A | AAAsf/Aaa(sf)/AA(low)(sf) | $762,226,000 | (10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class X-B | A-sf/NR/AAA(sf) | $205,530,000 | (10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class A-S(8) | AAAsf/Aa2(sf)/AAA(sf) | $110,251,000 | (8) | 19.875% | (7)(8) | 5.01 | 60 – 60 | 16.3% | 44.7% |

| Class B(8) | AA-sf/NR/AA+(sf) | $53,084,000 | (8) | 15.000% | (7)(8) | 5.01 | 60 – 60 | 15.4% | 47.4% |

| Class C(8) | A-sf/NR/A+(sf) | $42,195,000 | (8) | 11.125% | (7)(8) | 5.01 | 60 – 60 | 14.7% | 49.6% |

Privately Offered Pooled Certificates(12)

| Class | Expected Ratings (Fitch/Moody’s/ Morningstar DBRS)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Pass-Through Rate Description | Expected Weighted Average Life (Years)(4) | Expected Principal Window (Months)(4) | Certificate Principal UW NOI Debt Yield(5) | Certificate Principal to Value Ratio(6) | |

| Class X-D | BBB-sf/NR/A-(sf) | $35,389,000 | (10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class X-F | BB-sf/NR/BBB(sf) | $23,139,000 | (10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class X-G | B-sf/NR/BBB-(sf) | $14,972,000 | (10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class X-J | NR/NR/NR | $47,639,671 | (10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class D | BBBsf/NR/A-(sf) | $23,139,000 | 9.000% | (7) | 5.01 | 60 – 60 | 14.4% | 50.8% | |

| Class E | BBB-sf/NR/BBB+(sf) | $12,250,000 | 7.875% | (7) | 5.01 | 60 – 60 | 14.2% | 51.4% | |

| Class F | BB-sf/NR/BBB-(sf) | $23,139,000 | 5.750% | (7) | 5.01 | 60 – 60 | 13.9% | 52.6% | |

| Class G | B-sf/NR/BB+(sf) | $14,972,000 | 4.375% | (7) | 5.01 | 60 – 60 | 13.7% | 53.4% | |

| Class J | NR/NR/NR | $47,639,671 | 0.000% | (7) | 5.01 | 60 – 60 | 13.1% | 55.8% | |

Privately Offered Loan-Specific Certificates(12)

| Class | Expected Ratings (Moody’s)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Pass-Through Rate Description | Expected Weighted Average Life (Years)(4) | Expected Principal Window (Months)(4) | Certificate Principal UW NOI Debt Yield(14) | Certificate Principal to Value Ratio(15) |

| Class CIRA-1 | Baa1(sf) | $5,035,000 | 29.407% | (13) | 5.01 | 60 – 60 | 120.6% | 5.4% |

| Class CIRA-2 | Baa3(sf) | $15,105,000 | 17.630% | (13) | 5.01 | 60 – 60 | 30.1% | 21.5% |

| Class CIRA-3 | Ba3(sf) | $22,610,000 | 0.000% | (13) | 5.01 | 60 – 60 | 14.2% | 45.7% |

Non-Offered Eligible Vertical Interests(12)

| Class or Interest | Expected Ratings (Fitch/Moody’s/ Morningstar DBRS)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Pass-Through Rate Description | Expected Weighted Average Life (Years)(4) | Expected Principal Window (Months)(4) | Certificate Principal UW NOI Debt Yield(5) | Certificate Principal to Value Ratio(6) |

| Class RR(16) | NR/NR/NR | $47,532,548.48 | N/A | (17) | 4.93 | 1 – 60 | N/A | N/A |

| RR Interest | NR/NR/NR | $9,777,750.01 | N/A | (17) | 4.93 | 1 – 60 | N/A | N/A |

| CIRA-RR Interest(16) | NR/NR/NR | $2,250,000 | N/A | (17) | 5.01 | 60 – 60 | N/A | N/A |

| (1) | Ratings shown are those of Fitch Ratings, Inc. (“Fitch”), Moody’s Investors Service, Inc. (“Moody’s”) and DBRS, Inc. (“Morningstar DBRS”). Certain nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the certificates. There can be no assurance as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus to be dated on or about |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-3 | ||

| BANK5 2024-5YR7 | Structural Overview |

the date hereof (the “Preliminary Prospectus”). Capitalized terms used but not defined herein have the meanings assigned to such terms in the Preliminary Prospectus.

| (2) | Approximate, subject to a permitted variance of plus or minus 5% and further subject to the discussion in footnote (9) below. In addition, the notional amounts of the Class X-A, Class X-B, Class X-D, Class X-F, Class X-G and Class X-J certificates may vary depending upon the final pricing of the classes of principal balance certificates or trust components whose certificate or principal balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of any class of the Class X-A, Class X-B, Class X-D, Class X-F, Class X-G or Class X-J certificates, as applicable, would be equal to zero at all times, such class of certificates will not be issued on the closing date of this securitization. |

| (3) | The approximate initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-2 and Class A-3 certificates, are presented in the aggregate, taking into account the principal balances of the Class A-2 and Class A-3 trust components. The approximate initial credit support percentage set forth for each class of the Class A-S, Class B and Class C certificates represents the approximate credit support for the underlying trust component with the same alphanumeric designation. The VRR Interest provides credit support only to the limited extent that it is allocated a portion of any losses incurred on the underlying mortgage loans, which such losses are allocated between it, on the one hand, and to the pooled certificates (other than the Class V certificates), on the other hand, pro rata in accordance with their respective Percentage Allocation Entitlements. The approximate initial credit support percentages shown in the table above for the pooled principal balance certificates do not include the subordination provided by the Cira Square subordinate companion loan (the “Trust Subordinate Companion Loan”) to the Cira Square mortgage loan. The Privately Offered Loan-Specific Certificates will not provide credit support to any class of pooled certificates except to the extent of the subordination of the Trust Subordinate Companion Loan (in which the Privately Offered Loan-Specific Certificates each represent an interest) to the Cira Square mortgage loan included in the mortgage pool. The CIRA-RR Interest provides credit support only to the limited extent that it is allocated 5.0% of any losses incurred on the Trust Subordinate Companion Loan. See “Credit Risk Retention” in the Preliminary Prospectus. |

| (4) | The Expected Weighted Average Life and Expected Principal Window during which distributions of principal would be received as set forth in the foregoing table with respect to each class of principal balance certificates and the VRR Interest are based on the assumptions set forth under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans. |

| (5) | Certificate Principal UW NOI Debt Yield for any class of pooled principal balance certificates shown in the table above is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the sum of the aggregate initial certificate balance of all the pooled principal balance certificates and the initial principal balance of the VRR Interest, and the denominator of which is the sum of (x) the aggregate initial certificate balance of the subject class of pooled principal balance certificates (or, with respect to the Class A-2, Class A-3, Class A-S, Class B or Class C certificates, the initial principal balance of the trust component with the same alphanumeric designation) and all other classes of pooled principal balance certificates, if any, that are senior to such class and (y) the outstanding principal balance of the VRR Interest, multiplied by the applicable VRR Interest Computation Percentage. The Certificate Principal UW NOI Debt Yields of the Class A-1, Class A-2 and Class A-3 certificates are calculated in the aggregate for those classes as if they were a single class. With respect to any class of pooled principal balance certificates, the “VRR Interest Computation Percentage” is equal to a fraction, expressed as a percentage, the numerator of which is the aggregate initial certificate balance of the subject class of pooled principal balance certificates (or, with respect to the Class A-2, Class A-3, Class A-S, Class B or Class C certificates, the initial principal balance of the trust component with the same alphanumeric designation) and all other classes of pooled principal balance certificates, if any, that are senior to such class, and the denominator of which is the aggregate initial certificate balance of all the pooled principal balance certificates. |

| (6) | Certificate Principal to Value Ratio for any class of pooled principal balance certificates shown in the table above is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the sum of (x) the aggregate initial certificate balance of the subject class of pooled principal balance certificates (or, with respect to the Class A-2, Class A-3, Class A-S, Class B or Class C certificates, the initial principal balance of the trust component with the same alphanumeric designation) and all other classes of pooled principal balance certificates, if any, that are senior to such class and (y) the outstanding principal balance of the VRR Interest, multiplied by the applicable VRR Interest Computation Percentage, and the denominator of which is the sum of the aggregate initial certificate balance of all the pooled principal balance certificates and the initial principal balance of the VRR Interest. The Certificate Principal to Value Ratios of the Class A-1, Class A-2 and Class A-3 certificates are calculated in the aggregate for those classes as if they were a single class. |

| (7) | The pass-through rate for each class of the Class A-1, Class A-2, Class A-3, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class J certificates (which, together with the other classes of Exchangeable Certificates with a certificate balance, are referred to as the “pooled principal balance certificates”) for any distribution date will be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (8) | The Class A-2-1, Class A-2-2, Class A-2-X1, Class A-2-X2, Class A-3-1, Class A-3-2, Class A-3-X1, Class A-3-X2, Class A-S-1, Class A-S-2, Class A-S-X1, Class A-S-X2, Class B-1, Class B-2, Class B-X1, Class B-X2, Class C-1, Class C-2, Class C-X1 and Class C-X2 certificates are also offered certificates. Such classes of certificates, together with the Class A-2, Class A-3, Class A-S, Class B and Class C certificates, constitute the “Exchangeable Certificates”. The Class A-1, Class D, Class E, Class F, Class G, Class J, Class CIRA-1, Class CIRA-2 and Class CIRA-3 certificates, together with the Exchangeable Certificates with a certificate balance and the CIRA-RR Interest, are referred to as the “principal balance certificates.” Each class of Exchangeable Certificates will have the certificate balance or notional amount and pass-through rate described below under “Exchangeable Certificates.” Each class of Class A-2, Class A-3, Class A-S, Class B and Class C Exchangeable Certificates will have the same ratings as the Class A-2, Class A-3, Class A-S, Class B and Class C certificates, respectively, shown in the table above. |

| (9) | The exact initial principal balances or notional amounts of the Class A-2, Class A-2-X1, Class A-2-X2, Class A-3, Class A-3-X1 and Class A-3-X2 trust components (and consequently, the exact aggregate initial certificate balances or notional amounts of the Exchangeable Certificates with an “A-2” or “A-3” designation) are unknown and will be determined based on the final pricing of the certificates. However, the initial principal balances, weighted average lives and principal windows of the Class A-2 and Class A-3 trust components are expected to be within the applicable ranges reflected in the chart below. The aggregate initial principal balance of the Class A-2 and Class A-3 trust components is expected to be approximately $761,301,000, subject to a variance of plus or minus 5%. The Class A-2-X1 and Class A-2-X2 trust components will have initial notional amounts equal to the initial principal balance of the Class A-2 trust component. The Class A-3-X1 and Class A-3-X2 trust components will have initial notional amounts equal to the initial principal balance of the Class A-3 trust component. In the event that the Class A-3 trust component is issued with an initial certificate balance of $761,301,000, the Class A-2 trust component (and, correspondingly, the Class A-2 Exchangeable Certificates) will not be issued. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-4 | ||

| BANK5 2024-5YR7 | Structural Overview |

| Trust Component | Expected Range of Initial Principal Balance | Expected Range of Weighted Average Life (Years) | Expected Range of Principal Window (Months) |

| Class A-2 trust component | $0 – $350,000,000 | N/A – 4.84 | N/A / 56 – 59 |

| Class A-3 trust component | $411,301,000 – $761,301,000 | 4.90 – 4.96 | 56 – 60 / 59 – 60 |

| (10) | The Class X-A, Class X-B, Class X-D, Class X-F, Class X-G and Class X-J certificates (collectively referred to as the “Class X certificates”) are notional amount certificates and will not be entitled to distributions of principal. The notional amount of the Class X-A certificates will be equal to the aggregate certificate or principal balance of the Class A-1 certificates and the Class A-2 and Class A-3 trust components outstanding from time to time. The notional amount of the Class X-B certificates will be equal to the aggregate principal balance of the Class A-S, Class B and Class C trust components outstanding from time to time. The notional amount of the Class X-D certificates will be equal to the aggregate certificate balance of the Class D and Class E certificates. The notional amount of each class of the Class X-F, Class X-G and Class X-J certificates will be equal to the certificate balance of the class of principal balance certificates that, with the addition of “X-,” has the same alphabetical designation as the subject class of Class X certificates. |

| (11) | The pass-through rate for the Class X-A certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1 certificates and the Class A-2, Class A-2-X1, Class A-2-X2, Class A-3, Class A-3-X1 and Class A-3-X2 trust components for the related distribution date, weighted on the basis of their respective certificate or principal balances or notional amounts outstanding immediately prior to that distribution date (but excluding trust components with a notional amount in the denominator of such weighted average calculation). The pass-through rate for the Class X-B certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, Class A-S-X1, Class A-S-X2, Class B, Class B-X1, Class B-X2, Class C, Class C-X1 and Class C-X2 trust components for the related distribution date, weighted on the basis of their respective principal balances or notional amounts outstanding immediately prior to that distribution date (but excluding trust components with a notional amount in the denominator of such weighted average calculation). The pass-through rate for the Class X-D certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class D and Class E certificates for the related distribution date, weighted on the basis of their respective certificate balances outstanding immediately prior to that distribution date. The pass-through rate for each class of the Class X-F, Class X-G and Class X-J certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate for the related distribution date on the class of principal balance certificates that, with the addition of “X-,” has the same alphabetical designation as the subject class of Class X certificates. For purposes of the calculations above, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (12) | Not offered pursuant to the Preliminary Prospectus or this Term Sheet. Information provided in this Term Sheet regarding the characteristics of these certificates and the VRR Interest is provided only to enhance your understanding of the offered certificates. The privately offered certificates also include the Class V and Class R certificates, which do not have a certificate balance, notional amount, credit support, pass-through rate, rating, assumed final distribution date or rated final distribution date, and which are not shown in the chart. The Class V certificates represent a beneficial ownership interest held through the grantor trust in a specified percentage of certain excess interest in respect of mortgage loans having anticipated repayment dates, if any. The Class R certificates represent the beneficial ownership of the residual interest in each of the real estate mortgage investment conduits, as further described in the Preliminary Prospectus. |

| (13) | The pass-through rate for each class of the Class CIRA-1, Class CIRA-2 and Class CIRA-3 certificates (which are referred to as the “loan-specific principal balance certificates”) will be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the net mortgage rate on the Trust Subordinate Companion Loan for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the net mortgage rate on the Trust Subordinate Companion Loan for the related distribution date, or (iv) a variable rate per annum equal to the net mortgage rate on the Trust Subordinate Companion Loan for the related distribution date minus a specified percentage. |

| (14) | Certificate Principal UW NOI Debt Yield for any class of loan-specific principal balance certificates shown in the table above is calculated as the product of (a) the UW NOI Debt Yield for the Cira Square whole loan, multiplied by (b) a fraction, the numerator of which is the aggregate initial certificate balance of all the loan-specific principal balance certificates, and the denominator of which is the sum of (x) the aggregate initial certificate balance of the subject class of loan-specific principal balance certificates and all other classes of loan-specific principal balance certificates, if any, that are senior to such class and (y) the outstanding principal balance of the CIRA-RR Interest, multiplied by the applicable CIRA-RR Interest Computation Percentage. With respect to any class of loan-specific principal balance certificates, the “CIRA-RR Interest Computation Percentage” is equal to a fraction, expressed as a percentage, the numerator of which is the aggregate initial certificate balance of the subject class of loan-specific principal balance certificates and all other classes of loan-specific principal balance certificates, if any, that are senior to such class, and the denominator of which is the aggregate initial certificate balance of all the loan-specific principal balance certificates. |

| (15) | Certificate Principal to Value Ratio for any class of loan-specific principal balance certificates shown in the table above is calculated as the product of (a) the Cut-off Date LTV Ratio of the Cira Square whole loan, multiplied by (b) a fraction, the numerator of which is the sum of (x) the aggregate initial certificate balance of the subject class of loan-specific principal balance certificates and all other classes of loan-specific principal balance certificates, if any, that are senior to such class and (y) the outstanding principal balance of the CIRA-RR Interest, multiplied by the applicable CIRA-RR Interest Computation Percentage, and the denominator of which is the aggregate initial certificate balance of all the loan-specific principal balance certificates. |

| (16) | The Class RR Certificates will be certificated but will not be “certificates” for purposes of this Term Sheet. The RR Interest will not be certificated and will not be a “certificate” for purposes of this Term Sheet. |

| (17) | Although they do not have a specified pass-through rate (other than for tax reporting purposes), the effective pass-through rate for each of the Class RR Certificates and the RR Interest will be a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months). Although it does not have a specified pass-through rate (other than for tax reporting purposes), the effective pass-through rate for the CIRA-RR Interest will be a variable rate per annum equal to the net mortgage interest rate on the Trust Subordinate Companion Loan for the related distribution date. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-5 | ||

| BANK5 2024-5YR7 | Structural Overview |

Issue Characteristics

| Offered Certificates: | $967,756,000 (approximate) monthly pay, multi-class, commercial mortgage pass-through certificates, consisting of 16 principal balance classes (Class A-1, Class A-2, Class A-2-1, Class A-2-2, Class A-3, Class A-3-1, Class A-3-2, Class A-S, Class A-S-1, Class A-S-2, Class B, Class B-1, Class B-2, Class C, Class C-1 and Class C-2) and 12 interest-only classes (Class A-2-X1, Class A-2-X2, Class A-3-X1, Class A-3-X2, Class X-A, Class X-B, Class A-S-X1, Class A-S-X2, Class B-X1, Class B-X2, Class C-X1 and Class C-X2) |

| Co-Lead Managers and Joint Bookrunners: | Morgan Stanley & Co. LLC, J.P. Morgan Securities LLC, Wells Fargo Securities, LLC and BofA Securities, Inc. |

| Co-Managers: | Academy Securities, Inc. and Siebert Williams Shank & Co., LLC |

| Mortgage Loan Sellers: | Wells Fargo Bank, National Association, Bank of America, National Association, Morgan Stanley Mortgage Capital Holdings LLC and JPMorgan Chase Bank, National Association. |

| Rating Agencies: | Fitch, Moody’s and Morningstar DBRS |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | KeyBank National Association |

| Trustee/Certificate Administrator/ Certificate Registrar/Custodian: | Computershare Trust Company, National Association |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| Initial Directing Certificateholder: | PFP CMBS BNK5 2024-5Y7, LLC or an affiliate thereof |

| Risk Retention Consultation Parties: | Morgan Stanley Mortgage Capital Holdings LLC, JPMorgan Chase Bank, National Association, Wells Fargo Bank, National Association and Bank of America, National Association. |

| U.S. Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements will be addressed by (i) JPMorgan Chase Bank, National Association, as the retaining sponsor with respect to the securitization of the mortgage loans, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU/UK Risk Retention: | None of the sponsors, the depositor or the underwriters or their respective affiliates, or any other person, intends to retain a material net economic interest in the securitization constituted by the issue of the certificates, or to take any other action in respect of such securitization, in a manner prescribed or contemplated by the EU Securitization Regulation or the UK Securitization Regulation. In particular, no such person undertakes to take any action which may be required by any potential investor or certificateholder for the purposes of its compliance with any requirement of the EU Securitization Regulation or the UK Securitization Regulation. In addition, the arrangements described under “Credit Risk Retention” in the Preliminary Prospectus have not been structured with the objective of ensuring compliance by any person with any requirement of the EU Securitization Regulation or the UK Securitization Regulation. Consequently, the Offered Certificates may not be a suitable investment for investors that are subject to any requirement of the EU Securitization Regulation or the UK Securitization Regulation. See “Risk Factors—Other Risks Relating to the Certificates—EU Securitization Regulation and UK Securitization Regulation” in the Preliminary Prospectus. |

| Cut-off Date: | The mortgage loans will be considered part of the trust fund as of their respective cut-off dates. The cut-off date with respect to each mortgage loan is the respective due date for the monthly debt service payment that is due in June 2024 (or, in the case of any mortgage loan that has its first due date after June 2024, the date that would have been its due date in June 2024 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| Expected Pricing Date: | Week of May 31, 2024 |

| Expected Closing Date: | June 13, 2024 |

| Determination Dates: | The 11th day of each month or, if the 11th day is not a business day, then the business day immediately following such 11th day. |

| Distribution Dates: | The 4th business day following each determination date. The first distribution date will be in July 2024. |

| Rated Final Distribution Date: | The distribution date in June 2057 |

| Interest Accrual Period: | Preceding calendar month |

| Payment Structure: | Sequential pay |

| Tax Treatment: | REMIC, except that the Exchangeable Certificates will evidence interests in a grantor trust |

| Optional Termination: | 1.00% clean-up call |

| Minimum Denominations: | $10,000 for each class of Offered Certificates (other than Class X-A and Class X-B certificates); $1,000,000 for the Class X-A and Class X-B certificates |

| Settlement Terms: | DTC, Euroclear and Clearstream |

| Legal/Regulatory Status: | Each class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. Until the SEC adopts rules establishing a different creditworthiness standard, the Class A-1 certificates, Class A-2 |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-6 | ||

| BANK5 2024-5YR7 | Structural Overview |

| Exchangeable Certificates, the Class A-3 Exchangeable Certificates, the Class X-A certificates, the Class X-B certificates, the Class A-S Exchangeable Certificates and the Class B Exchangeable Certificates will constitute “mortgage related securities” for purposes of SMMEA, so long as they are rated in one of the two highest rating categories by one of the rating agencies or another NRSRO, and the other classes of certificates will not constitute “mortgage related securities” for purposes of SMMEA. | |

| Analytics: | The certificate administrator is expected to make available all distribution date statements, CREFC® reports and supplemental notices received by it to certain modeling financial services as described in the Preliminary Prospectus. |

| Bloomberg Ticker: | BANK5 2024-5YR7<MTGE><GO> |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-7 | ||

| BANK5 2024-5YR7 | Structural Overview |

Structural Overview

| Allocation Between the VRR Interest and the Pooled Certificates: | The aggregate amount available for distributions to the holders of the pooled certificates and the VRR Interest on each distribution date (net of specified expenses of the issuing entity, including fees payable to, and costs and expenses reimbursable to, each applicable master servicer, primary servicer and special servicer, the certificate administrator, the trustee, the operating advisor, the asset representations reviewer and CREFC®) will be allocated between amounts available for distribution to the holders of the VRR Interest, on the one hand, and to the holders of the Class A-1, Class X-A, Class X-B, Class X-D, Class X-F, Class X-G, Class X-J, Class D, Class E, Class F, Class G and Class J certificates and the Exchangeable Certificates (such classes of certificates, together with the Class V certificates are referred to herein as the “pooled certificates”), on the other hand. The portion of such amount allocable to (a) the VRR Interest will at all times be the product of such amount multiplied by 5% and (b) the pooled certificates will at all times be the product of such amount multiplied by the difference between 100% and the percentage set forth in clause (a) (each, the respective “Percentage Allocation Entitlement”). The Class RR Certificates and the RR Interest collectively comprise the “VRR Interest” and will collectively constitute an “eligible vertical interest” (as such term is defined in the Credit Risk Retention Rules) with respect to the securitization of the mortgage loans. The VRR Interest is expected to be acquired and retained by certain of the sponsors as described under “Credit Risk Retention” in the Preliminary Prospectus. |

| Accrual: | Each class of Offered Certificates will accrue interest on a 30/360 basis. |

| Amount and Order of Distributions: | On each distribution date, the pooled certificates’ Percentage Allocation Entitlement of funds available for distribution from the mortgage loans, net of (i) any yield maintenance charges and prepayment premiums and (ii) any excess interest, will be distributed in the following amounts and order of priority: First, to the Class A-1, Class X-A, Class X-B, Class X-D, Class X-F, Class X-G and Class X-J certificates and the Class A-2, Class A-2-X1, Class A-2-X2, Class A-3, Class A-3-X1 and Class A-3-X2 trust components, in respect of interest, up to an amount equal to, and pro rata in accordance with, the interest entitlements for those classes of certificates and trust components; Second, to the Class A-1 certificates and the Class A-2 and Class A-3 trust components as follows, to the extent of applicable available funds allocated to principal: either (i)(a) first, to principal on (a) the Class A-1 certificates, (b) the Class A-2 trust component, and (c) the Class A-3 trust component, in that order, in each case until the certificate or principal balance of the applicable class of certificates or trust component has been reduced to zero, or (ii) if the certificate or principal balance of each class of pooled principal balance certificates and trust components other than the Class A-1 certificates and the Class A-2 and Class A-3 trust components has been reduced to zero as a result of the allocation of losses on the mortgage loans to those certificates and trust components, to principal on the Class A-1 certificates and the Class A-2 and Class A-3 trust components, pro rata, without regard to the distribution priorities described above; Third, to the Class A-1 certificates and the Class A-2 and Class A-3 trust components, first, up to an amount equal to, and pro rata based on, any previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by each such class or trust component and then in the amount of interest thereon; Fourth, to the Class A-S, Class A-S-X1 and Class A-S-X2 trust components, as follows: (a) to each such trust component in respect of interest, up to an amount equal to, and pro rata in accordance with, the interest entitlements for those trust components; (b) to the extent of applicable available funds allocable to principal remaining after distributions in respect of principal to each class of certificates or trust component with a higher priority (as set forth in prior enumerated clauses set forth above), to principal on the Class A-S trust component until its principal balance has been reduced to zero; and (c) to reimburse the Class A-S trust component, first, in the amount of any previously unreimbursed losses on the mortgage loans that were previously allocated thereto, then in the amount of interest thereon; Fifth, to the Class B, Class B-X1 and Class B-X2 trust components, as follows: (a) to each such trust component in respect of interest, up to an amount equal to, and pro rata in accordance with, the interest entitlements for those trust components; (b) to the extent of applicable available funds allocable to principal remaining after distributions in respect of principal to each class of certificates or trust component with a higher priority (as set forth in prior enumerated clauses set forth above), to principal on the Class B trust component until its principal balance has been reduced to zero; and (c) to reimburse the Class B trust component, first, in the amount of any previously unreimbursed losses on the mortgage loans that were previously allocated thereto, then in the amount of interest thereon; Sixth, to the Class C, Class C-X1 and Class C-X2 trust components, as follows: (a) to each such trust component in respect of interest, up to an amount equal to, and pro rata in accordance with, the interest entitlements for those trust components; (b) to the extent of applicable available funds allocable to principal remaining after distributions in respect of principal to each class of certificates or trust component with a higher priority (as set forth in prior enumerated clauses set forth above), to principal on the Class C trust component until its principal balance has been reduced to zero; and (c) to reimburse the Class C trust component, first, in the amount of any previously unreimbursed losses on the mortgage loans that were previously allocated thereto, then in the amount of interest thereon; Seventh, to the Class D, Class E, Class F, Class G and Class J certificates in the amounts and order of priority described in “Description of the Certificates—Distributions” in the Preliminary Prospectus; and |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-8 | ||

| BANK5 2024-5YR7 | Structural Overview |

Eighth, to the Class R certificates, any remaining amounts. Principal and interest payable on each trust component will be distributed pro rata to the corresponding classes of Exchangeable Certificates representing interests therein in accordance with their Class Percentage Interests therein as described below under “Exchangeable Certificates.” | |

| Interest and Principal Entitlements: | The interest entitlement of each class of Offered Certificates on each distribution date generally will be the interest accrued during the related interest accrual period on the related certificate balance or notional amount at the related pass-through rate, net of any prepayment interest shortfalls allocated to that class for such distribution date as described below. If prepayment interest shortfalls arise from voluntary prepayments on serviced mortgage loans during any collection period, the applicable master servicer is required to make a limited compensating interest payment to offset those shortfalls. See “Description of the Certificates—Prepayment Interest Shortfalls” in the Preliminary Prospectus. The remaining amount of prepayment interest shortfalls will be allocated between the VRR Interest, on one hand, and the pooled certificates, on the other hand, in accordance with their respective Percentage Allocation Entitlements. The prepayment interest shortfalls allocated to the pooled certificates will be allocated among such classes of certificates (other than the Exchangeable Certificates) and trust components that are entitled to interest, on a pro rata basis, based on their respective amounts of accrued interest for the related distribution date, to reduce the interest entitlement on each such class of certificates and trust components. For any distribution date, prepayment interest shortfalls allocated to a trust component will be allocated among the related classes of Exchangeable Certificates, pro rata, in accordance with their respective Class Percentage Interests for that distribution date. If a class of certificates or trust component receives less than the entirety of its interest entitlement on any distribution date, then the shortfall (excluding any shortfall due to prepayment interest shortfalls), together with interest thereon, will be added to its interest entitlement for the next succeeding distribution date. The aggregate principal distribution amount for each distribution date generally will be the aggregate amount of principal received or advanced in respect of the mortgage loans, net of any non-recoverable advances and interest thereon and any workout-delayed reimbursement amounts that are reimbursed to the applicable master servicer or the trustee during the related collection period. Non-recoverable advances and interest thereon are reimbursable from principal collections before reimbursement from other amounts. Workout-delayed reimbursement amounts will be reimbursable from principal collections. The pooled certificates and the VRR Interest will be entitled to their respective Percentage Allocation Entitlements of the aggregate principal distribution amount. No class of pooled certificates will be entitled to distributions from amounts paid or advanced on and allocable to the Trust Subordinate Companion Loan. The holders of the Privately Offered Loan-Specific Certificates will only be entitled to distributions from amounts paid or advances on and allocated to the Trust Subordinate Companion Loan in accordance with the intercreditor agreement relating to the Cira Square whole loan. |

| Exchangeable Certificates: | Certificates of each class of Exchangeable Certificates may be exchanged for certificates of the corresponding classes of Exchangeable Certificates set forth next to such class in the table below, and vice versa. Following any exchange of certificates of one or more classes of Exchangeable Certificates (the applicable “Surrendered Classes”) for certificates of one or more classes of other Exchangeable Certificates (the applicable “Received Classes”), the Class Percentage Interests (as defined below) of the outstanding principal balances or notional amounts of the Corresponding Trust Components that are represented by the Surrendered Classes (and consequently their related certificate balances or notional amounts) will be decreased, and those of the Received Classes (and consequently their related certificate balances or notional amounts) will be increased. The dollar denomination of the certificates of each of the Received Classes must be equal to the dollar denomination of the certificates of each of the Surrendered Classes. No fee will be required with respect to any exchange of Exchangeable Certificates. |

| Surrendered Classes (or Received Classes) of Certificates | Received Classes (or Surrendered Classes) of Certificates | |

| Class A-2 | Class A-2-1, Class A-2-X1 | |

| Class A-2 | Class A-2-2, Class A-2-X2 | |

| Class A-3 | Class A-3-1, Class A-3-X1 | |

| Class A-3 | Class A-3-2, Class A-3-X2 | |

| Class A-S | Class A-S-1, Class A-S-X1 | |

| Class A-S | Class A-S-2, Class A-S-X2 | |

| Class B | Class B-1, Class B-X1 | |

| Class B | Class B-2, Class B-X2 | |

| Class C | Class C-1, Class C-X1 | |

| Class C | Class C-2, Class C-X2 |

| On the closing date, the issuing entity will issue the following “trust components,” each with the initial principal balance (or, if such trust component has an “X” suffix, notional amount) and pass-through rate set forth next to it in the table below. Each trust component with an “X” suffix will not be entitled to distributions of principal. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-9 | ||

| BANK5 2024-5YR7 | Structural Overview |

| Trust Component | Initial Principal Balance or Notional Amount | Pass-Through Rate | |

| Class A-2 | See footnote (9) to the first table above under “Structural Overview” | Class A-2 certificate pass-through rate minus 1.00% | |

| Class A-2-X1 | Equal to Class A-2 trust component principal balance | 0.50% | |

| Class A-2-X2 | Equal to Class A-2 trust component principal balance | 0.50% | |

| Class A-3 | See footnote (9) to the first table above under “Structural Overview” | Class A-3 certificate pass-through rate minus 1.00% | |

| Class A-3-X1 | Equal to Class A-3 trust component principal balance | 0.50% | |

| Class A-3-X2 | Equal to Class A-3 trust component principal balance | 0.50% | |

| Class A-S | $110,251,000 | Class A-S certificate pass-through rate minus 1.00% | |

| Class A-S-X1 | Equal to Class A-S trust component principal balance | 0.50% | |

| Class A-S-X2 | Equal to Class A-S trust component principal balance | 0.50% | |

| Class B | $53,084,000 | Class B certificate pass-through rate minus 1.00% | |

| Class B-X1 | Equal to Class B trust component principal balance | 0.50% | |

| Class B-X2 | Equal to Class B trust component principal balance | 0.50% | |

| Class C | $42,195,000 | Class C certificate pass-through rate minus 1.00% | |

| Class C-X1 | Equal to Class C trust component principal balance | 0.50% | |

| Class C-X2 | Equal to Class C trust component principal balance | 0.50% |

| Each class of Exchangeable Certificates represents an undivided beneficial ownership interest in the trust components set forth next to it in the table below (the “Corresponding Trust Components”). Each class of Exchangeable Certificates has a pass-through rate equal to the sum of the pass-through rates of the Corresponding Trust Components and represents a percentage interest (the related “Class Percentage Interest”) in each Corresponding Trust Component, including principal and interest payable thereon (and reimbursements of losses allocable thereto), equal to (x) the certificate balance (or, if such class has an “X” suffix, notional amount) of such class of certificates, divided by (y) the principal balance of the Class A-2 trust component (if such class of Exchangeable Certificates has an “A-2” designation), the Class A-3 trust component (if such class of Exchangeable Certificates has an “A-3” designation), the Class A-S trust component (if such class of Exchangeable Certificates has an “A-S” designation), the Class B trust component (if such class of Exchangeable Certificates has a “B” designation), or the Class C trust component (if such class of Exchangeable Certificates has a “C” designation). |

| Group of Exchangeable Certificates | Class of Exchangeable Certificates | Corresponding Trust Components | |

| “Class A-2 Exchangeable Certificates” | Class A-2 | Class A-2, Class A-2-X1, Class A-2-X2 | |

| Class A-2-1 | Class A-2, Class A-2-X2 | ||

| Class A-2-2 | Class A-2 | ||

| Class A-2-X1 | Class A-2-X1 | ||

| Class A-2-X2 | Class A-2-X1, Class A-2-X2 | ||

| “Class A-3 Exchangeable Certificates” | Class A-3 | Class A-3, Class A-3-X1, Class A-3-X2 | |

| Class A-3-1 | Class A-3, Class A-3-X2 | ||

| Class A-3-2 | Class A-3 | ||

| Class A-3-X1 | Class A-3-X1 | ||

| Class A-3-X2 | Class A-3-X1, Class A-3-X2 | ||

| “Class A-S Exchangeable Certificates” | Class A-S | Class A-S, Class A-S-X1, Class A-S-X2 | |

| Class A-S-1 | Class A-S, Class A-S-X2 | ||

| Class A-S-2 | Class A-S | ||

| Class A-S-X1 | Class A-S-X1 | ||

| Class A-S-X2 | Class A-S-X1, Class A-S-X2 | ||

| “Class B Exchangeable Certificates” | Class B | Class B, Class B-X1, Class B-X2 | |

| Class B-1 | Class B, Class B-X2 | ||

| Class B-2 | Class B | ||

| Class B-X1 | Class B-X1 | ||

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-10 | ||

| BANK5 2024-5YR7 | Structural Overview |

| Class B-X2 | Class B-X1, Class B-X2 | ||

| “Class C Exchangeable Certificates” | Class C | Class C, Class C-X1, Class C-X2 | |

| Class C-1 | Class C, Class C-X2 | ||

| Class C-2 | Class C | ||

| Class C-X1 | Class C-X1 | ||

| Class C-X2 | Class C-X1, Class C-X2 |

The maximum certificate balance or notional amount of each class of Class A-2 Exchangeable Certificates, Class A-3 Exchangeable Certificates, Class A-S Exchangeable Certificates, Class B Exchangeable Certificates or Class C Exchangeable Certificates that could be issued in an exchange is equal to the principal balance of the Class A-2, Class A-3, Class A-S, Class B or Class C trust component, respectively. The maximum certificate balances of Class A-2, Class A-3, Class A-S, Class B and Class C certificates (subject to the constraint on the aggregate of the initial principal balances of the Class A-2 and Class A-3 trust components discussed in footnote (9) to the first table above under “Structural Overview”) will be issued on the closing date, and the certificate balance or notional amount of each other class of Exchangeable Certificates will be equal to zero on the closing date. Each class of Class A-2 Exchangeable Certificates, Class A-3 Exchangeable Certificates, Class A-S Exchangeable Certificates, Class B Exchangeable Certificates and Class C Exchangeable Certificates will have a certificate balance or notional amount equal to its Class Percentage Interest multiplied by the principal balance of the Class A-2, Class A-3, Class A-S, Class B or Class C trust component, respectively. Each class of Class A-2 Exchangeable Certificates, Class A-3 Exchangeable Certificates, Class A-S Exchangeable Certificates, Class B Exchangeable Certificates and Class C Exchangeable Certificates with a certificate balance will have the same approximate initial credit support percentage, Expected Weighted Average Life, Expected Principal Window, Certificate Principal UW NOI Debt Yield and Certificate Principal to Value Ratio as the Class A-2, Class A-3, Class A-S, Class B or Class C certificates, respectively, shown above. | |

| Special Servicer Compensation: | The principal compensation to be paid to a special servicer in respect of its special servicing activities will be the special servicing fee, the workout fee and the liquidation fee. The special servicing fee for each distribution date is calculated based on the outstanding principal balance of each serviced mortgage loan that is a specially serviced mortgage loan (and any related serviced companion loan) or as to which the related mortgaged property has become an REO property at the special servicing fee rate, which will be a rate equal to the greater of 0.25% per annum and the per annum rate that would result in a special servicing fee for the related month of $3,500. The special servicing fee will be payable monthly, first, from liquidation proceeds, insurance and condemnation proceeds, and other collections in respect of the related specially serviced mortgage loan or REO property and, then, from general collections on all the mortgage loans and any REO properties. Each applicable special servicer will also be entitled to (i) liquidation fees generally equal to 1.0% (or, in any case, if such rate would result in an aggregate liquidation fee less than $25,000, then the liquidation fee rate will be equal to the lesser of (i) 3.00% and (ii) such rate as would result in an aggregate liquidation fee equal to $25,000) of liquidation proceeds and certain other collections in respect of each non-specially serviced loan with respect to which it acts as the enforcing servicer or each specially serviced mortgage loan (and any related serviced companion loan) or related REO property and of amounts received in respect of mortgage loan repurchases by the related mortgage loan sellers and (ii) workout fees generally equal to 1.0% of interest (other than post-ARD excess interest on mortgage loans with anticipated repayment dates and other than default interest) and principal payments made in respect of a rehabilitated mortgage loan (and any related serviced companion loan), subject to a floor of $25,000 with respect to any mortgage loan, whole loan or related REO property, and in the case of each of clause (i) and (ii), subject to certain adjustments and exceptions as described in the Preliminary Prospectus under “Pooling and Servicing Agreement—Servicing and Other Compensation and Payment of Expenses—Special Servicing Compensation”. With respect to any non-serviced mortgage loan, the related special servicer under the related other pooling and servicing agreement pursuant to which such mortgage loan is being serviced will be entitled to similar compensation as that described above with respect to such non-serviced mortgage loan under such other pooling and servicing agreement as further described in the Preliminary Prospectus, although any related fees may accrue at a different rate and there may be a higher (or no) cap on liquidation and workout fees. |

| Prepayment Premiums/Yield Maintenance Charges: | If any yield maintenance charge or prepayment premium is collected during any collection period with respect to any mortgage loan, then on the immediately succeeding distribution date, the certificate administrator will pay: (1) to the classes of pooled certificates specified below, in the following amounts: (a) to the holders of each class of the Class A-1, Class A-2, Class A-2-1, Class A-2-2, Class A-3, Class A-3-1, Class A-3-2, Class A-S, Class A-S-1, Class A-S-2, Class B, Class B-1, Class B-2, Class C, Class C-1, Class C-2, Class D and Class E certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) the related Base Interest Fraction for such class and the applicable principal prepayment, and (z) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that distribution date, and the |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-11 | ||

| BANK5 2024-5YR7 | Structural Overview |

| (b) to the holders of the Class A-2-X1 certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-2-1 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-2 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-2-1 certificates and the applicable principal prepayment, (c) to the holders of the Class A-2-X2 certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-2-2 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-2 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-2-2 certificates and the applicable principal prepayment, (d) to the holders of the Class A-3-X1 certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-3-1 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-3 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-3-1 certificates and the applicable principal prepayment, (e) to the holders of the Class A-3-X2 certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-3-2 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-3 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-3-2 certificates and the applicable principal prepayment, (f) to the holders of the Class A-S-X1 certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-S-1 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-S certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-S-1 certificates and the applicable principal prepayment, (g) to the holders of the Class A-S-X2 certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-S-2 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-S certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-S-2 certificates and the applicable principal prepayment, (h) to the holders of the Class B-X1 certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class B-1 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class B certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class B-1 certificates and the applicable principal prepayment, (i) to the holders of the Class B-X2 certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class B-2 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class B certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class B-2 certificates and the applicable principal prepayment, (j) to the holders of the Class C-X1 certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class C-1 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class C certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class C-1 certificates and the applicable principal prepayment, (k) to the holders of the Class C-X2 certificates, the product of (x) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class C-2 certificates for that |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet. | ||

| T-12 | ||

| BANK5 2024-5YR7 | Structural Overview |

| distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class C certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class C-2 certificates and the applicable principal prepayment, (l) to the holders of the Class X-A certificates, the excess, if any, of (x) the product of (1) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium and (2) a fraction, the numerator of which is equal to the total amount of principal distributed to the Class A-1 certificates, the Class A-2 Exchangeable Certificates and the Class A-3 Exchangeable Certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, over (y) the total amount of such yield maintenance charge or prepayment premium distributed to the Class A-1 certificates, the Class A-2 Exchangeable Certificates and the Class A-3 Exchangeable Certificates as described above, (m) to the holders of the Class X-B certificates, the excess, if any, of (x) the product of (1) the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium and (2) a fraction, the numerator of which is equal to the total amount of principal distributed to the Class A-S Exchangeable Certificates, the Class B Exchangeable Certificates and the Class C Exchangeable Certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, over (y) the total amount of such yield maintenance charge or prepayment premium distributed to the Class A-S Exchangeable Certificates, the Class B Exchangeable Certificates and the Class C Exchangeable Certificates as described above, and (n) to the holders of the Class X-D certificates, any remaining portion of the pooled certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium not distributed as described above in this clause (1), and | |

| (2) to the VRR Interest (and, correspondingly, pro rata to the Class RR Certificates and the RR Interest based on their respective percentage interests in the VRR Interest), its Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium. “YM Denominator” means, for any distribution date, the total amount of principal distributed to the Class A-1, Class D and Class E certificates and the Class A-2 Exchangeable Certificates, the Class A-3 Exchangeable Certificates, the Class A-S Exchangeable Certificates, the Class B Exchangeable Certificates and the Class C Exchangeable Certificates. All yield maintenance charges and prepayment premiums referred to above will be net of any liquidation fees payable therefrom. Notwithstanding any of the foregoing in clause (1) to the contrary, if at any time the certificate balances of the pooled principal balance certificates (other than the Control Eligible Certificates) have been reduced to zero as a result of the allocation of principal payments on the mortgage loans, the certificate administrator will be required to pay to the holders of each remaining class of pooled principal balance certificates then entitled to distributions of principal on such distribution date the product of (a) the pooled certificates’ Percentage Allocation Entitlement of any yield maintenance charge or prepayment premium distributable on the subject distribution date (net of any liquidation fees payable therefrom) and (b) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that distribution date, and the denominator of which is the total amount of principal distributed to all pooled principal balance certificates for that distribution date. No yield maintenance charges or prepayment premiums will be distributed to the holders of the Class X-F, Class X-G, Class X-J, Class V or Class R Certificates. “Base Interest Fraction” means, with respect to any principal prepayment of any mortgage loan that provides for the payment of a yield maintenance charge or prepayment premium, and with respect to any class of pooled principal balance certificates, a fraction (A) the numerator of which is the greater of (x) zero and (y) the difference between (i) the pass-through rate on that class, and (ii) the applicable discount rate and (B) the denominator of which is the difference between (i) the mortgage interest rate on the related mortgage loan and (ii) the applicable discount rate; provided, that: under no circumstances will the Base Interest Fraction be greater than one; if the discount rate referred to above is greater than or equal to both the mortgage interest rate on the related mortgage loan and the pass-through rate on that class, then the Base Interest Fraction will equal zero; and if the discount rate referred to above is greater than or equal to the mortgage interest rate on the related mortgage loan and is less than the pass-through rate on that class, then the Base Interest Fraction will be equal to 1.0. Consistent with the foregoing, the Base Interest Fraction is equal to: |

| (Pass-Through Rate – Discount Rate) | |||

| (Mortgage Rate – Discount Rate) |

| Realized Losses: | On each distribution date, immediately following the distributions to be made to the certificateholders on that date, the certificate administrator is required to calculate the amount, if any, by which (i) the aggregate stated principal balance of the mortgage loans, including any successor REO loans, expected to be outstanding immediately following that distribution date is less than (ii) the sum of the then aggregate certificate balance of the pooled principal balance certificates and the principal balance of the VRR Interest after giving effect to distributions of principal on that distribution date. The pooled certificates’ Percentage Allocation Entitlement of |

| 13 |

| BANK5 2024-5YR7 | Structural Overview |

such amount will be applied to the Class J, Class G, Class F, Class E and Class D certificates and the Class C, Class B and Class A-S trust components, in that order, in each case until the related certificate or principal balance has been reduced to zero, and then to the Class A-1 certificates and the Class A-2 and Class A-3 trust components, pro rata based upon their respective certificate or principal balances, until their respective certificate or principal balances have been reduced to zero. The VRR Interest’s Percentage Allocation Entitlement of such amount will be applied to the VRR Interest until the related VRR Interest balance has been reduced to zero. Any portion of such amount applied to the Class A-2, Class A-3, Class A-S, Class B or Class C trust component will reduce the certificate balance or notional amount of each class of certificates in the related group of Exchangeable Certificates by an amount equal to the product of (x) its certificate balance or notional amount, divided by the principal balance of such trust component prior to the applicable reduction, and (y) the amount applied to such trust component. On each distribution date, immediately following the distributions to be made to the certificateholders on that date, the certificate administrator is required to calculate the amount, if any, by which (i) the stated principal balance of the Trust Subordinate Companion Loan, including any successor REO loan, expected to be outstanding immediately following that distribution date is less than (ii) the then aggregate certificate balance of the loan-specific principal balance certificates after giving effect to distributions of principal on that distribution date. The non-retained percentage of such amount will be applied to the Class CIRA-3, Class CIRA-2 and Class CIRA-1 certificates, in that order, in each case until the related certificate or principal balance has been reduced to zero. The remaining portion of such amount will be applied to the CIRA-RR Interest until the related CIRA-RR Interest balance has been reduced to zero. | |

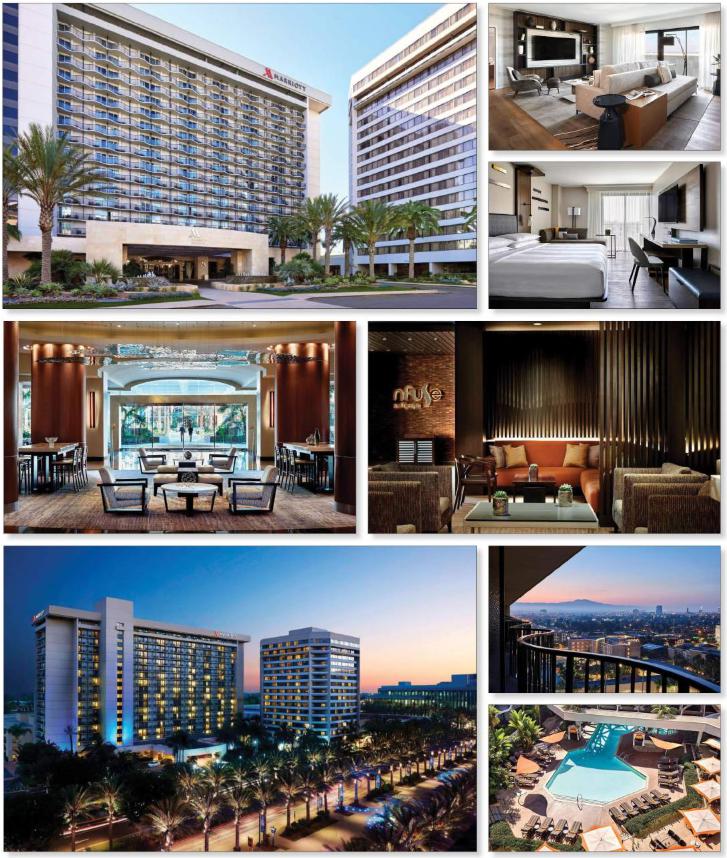

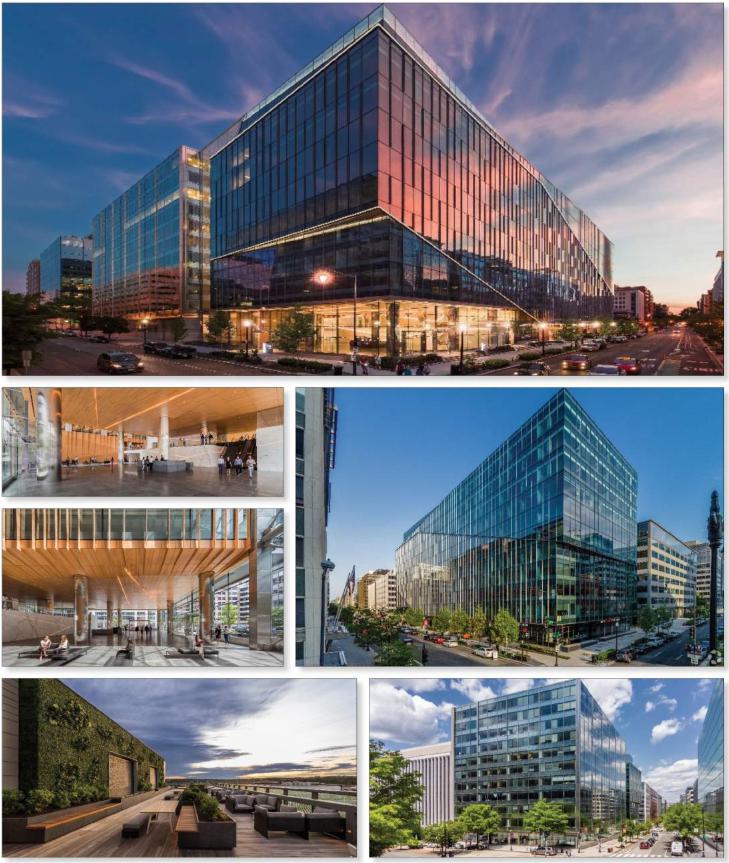

| Serviced Whole Loans: | Each of the following mortgaged properties or portfolios of mortgaged properties secures a mortgage loan, one or more pari passu promissory notes and/or, in some cases, one or more generally subordinate promissory notes (each, a “serviced companion loan”) that will be serviced pursuant to the related intercreditor agreement and the pooling and servicing agreement for this transaction: Marriott Anaheim, Cira Square, Saks Beverly Hills, 488 Madison, Pleasanton Corporate Commons (prior to the securitization of the related lead servicing note) and Gallup HQ (prior to the securitization of the related lead servicing note). With respect to each such mortgaged property or portfolio of mortgaged properties, the related mortgage loan, together with the related serviced companion loan(s), is referred to herein (for so long as it is serviced under the pooling and servicing agreement for this transaction) as a “serviced whole loan.” Each serviced companion loan is not part of the mortgage pool and may be contributed to one or more future securitization transactions (if not already securitized) or may be otherwise transferred at any time, subject to compliance with the related intercreditor agreement. See the tables below entitled “Mortgage Loans with Pari Passu Companion Loans” and “Mortgage Loans with Subordinate Debt,” as well as “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus, for additional information regarding each such whole loan. With respect to each “servicing shift whole loan”, the pooling and servicing agreement for this transaction will govern servicing of such whole loan until the securitization of the related lead servicing note; however, servicing of such whole loan will generally be directed by the holder of the related control note (which is not included in this securitization), and such holder will have the right to replace the special servicer with respect to the related whole loan with or without cause. After the securitization of the related lead servicing note, such whole loan will cease to be a serviced whole loan and will be serviced pursuant to the pooling and servicing agreement for another securitization transaction (see “—Non-Serviced Whole Loans” below). Each of the Pleasanton Corporate Commons mortgage loan and the Gallup HQ mortgage loan will be a servicing shift mortgage loan. |