UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[X] Definitive Additional Materials

[ ] Soliciting Material Pursuant to § 240.14a-12

| CHYRONHEGO CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate Number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

April 3, 2014

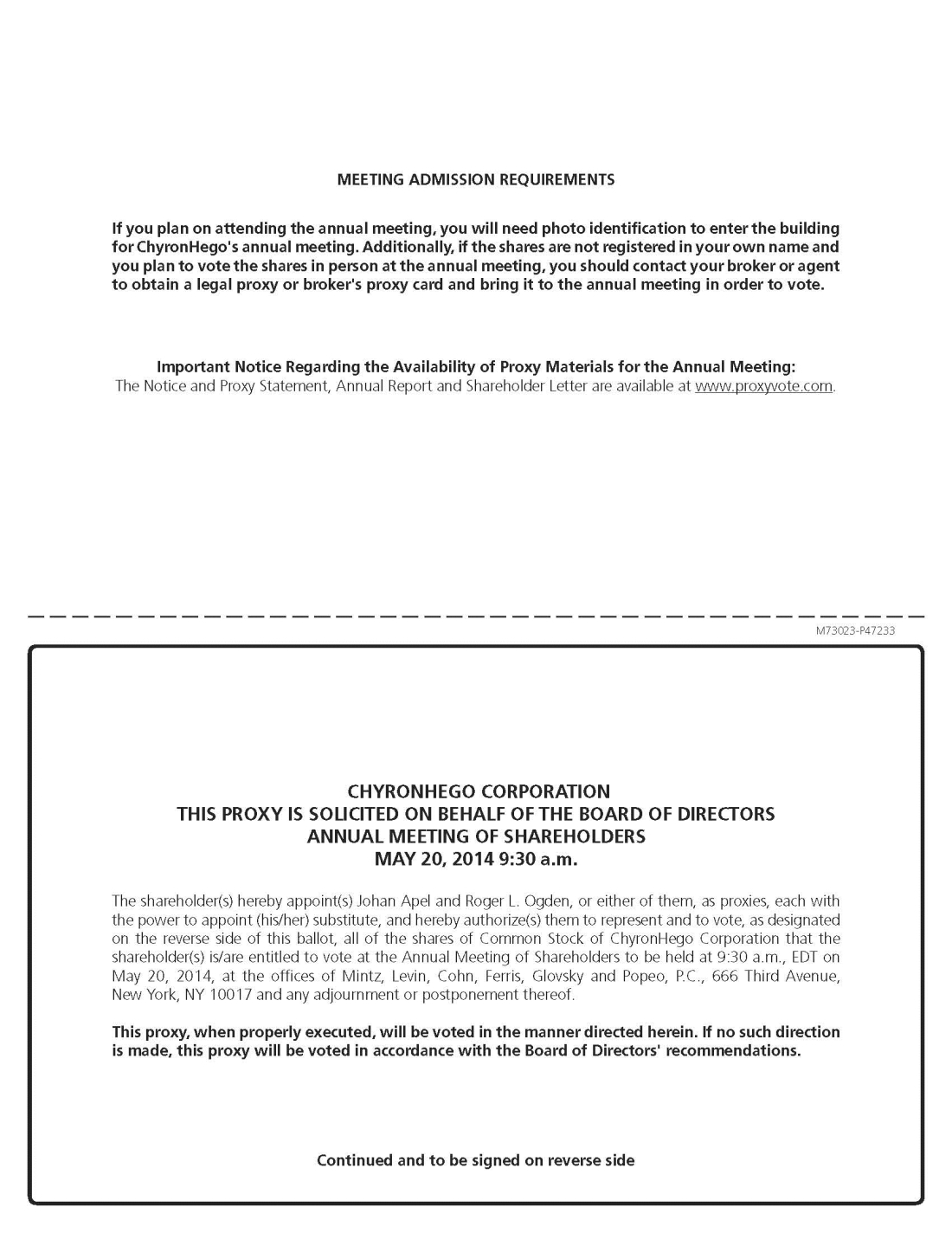

Dear Shareholders:

2013 was a year of positive change, accomplishment and a major milestone - the successful merger between Chyron and Hego. Having completed the integration of the two companies with great effort and results, we are now proudly offering the complete ChyronHego portfolio of products and services to customers worldwide.

We believe that we are now well positioned and on the road to profitability for 2014. Our revenue line is growing year-over-year and we have changed the cost structure - a very important step in building value for shareholders and further opportunity for employees, many of whom are also shareholders. Our objectives are aligned: to make ChyronHego a true success.

In today's media landscape, live content is the big value driver. ChyronHego's products and services for the sports and news markets are designed for the live content creation environment. And an increase in video consumption is requiring more content creation - a demand that our world-class team is ready and eager to help our customers meet.

Moving forward, our talented development and engineering teams will continue to innovate powerful solutions using the combined ChyronHego technology. Our goal is to put the best products on the market to help our customers create, enhance and deliver more quality content to air.

In closing, we remain confident in the strength of ChyronHego's robust business model and it is our mission to protect and grow the value of your investment in ChyronHego over time.

I look forward to the future and I thank you for your confidence - let's make 2014 a ChyronHego win!

Yours sincerely,

Johan Apel

CEO

Special Note Regarding Forward-looking Statements

This letter contains "forward‐looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to: our belief that live content is and will continue to be valuable; and our belief that we will be successful in the marketplace. These forward‐looking statements are based on management's current expectations and are subject to certain risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by such forward‐looking statements. These risks and uncertainties include, but are not limited to, certain factors discussed under the heading "Risk Factors" contained in Item 1A in ChyronHego's Annual Report on Form 10‐K for the year ended December 31, 2013, which has been filed with the Securities and Exchange Commission, as well as any updates to those risk factors filed from time to time. All information in this letter is as of the date of the letter, and ChyronHego undertakes no duty to update this information unless required by law.

| 5 Hub Drive, Melville, NY 11747 USA | www.chyronhego.com | 631.845.2000 |